UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-4338

EAGLE CAPITAL APPRECIATION FUND

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 567-8143

SUSAN L. WALZER, PRINCIPAL EXECUTIVE OFFICER

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

FRANCINE J. ROSENBERGER, ESQ.

K&L Gates LLP

1601 K Street, NW

Washington, D.C. 20006

Date of fiscal year end: October 31

Date of reporting period: April 30, 2012

Item 1. Reports to Shareholders

EAGLE MUTUAL FUNDS

Semiannual Report

and Investment Performance Review for the

six-month period ended April 30, 2012 (unaudited)

Eagle Capital Appreciation Fund

Eagle Growth & Income Fund

Eagle International Equity Fund

Eagle Investment Grade Bond Fund

Eagle Mid Cap Growth Fund

Eagle Mid Cap Stock Fund

Eagle Small Cap Growth Fund

Eagle Smaller Company Fund

| | | | |

| Go Paperless with eDelivery | | visit eagleasset.com/eDelivery | | For more information, see inside. |

Table of Contents

Visit eagleasset.com/eDelivery to receive shareholder communications including prospectuses and fund reports with a service that helps protect the environment:

Environmentally friendly. Go green with eDelivery by reducing the number of trees used to produce paper.

Efficient. Stop waiting on regular mail. Your documents will be sent via email as soon as they are available.

Easy. Download and save files using your home computer with a few clicks of a mouse.

President’s Letter

Dear Fellow Shareholders:

I am pleased to present the semiannual report and investment-performance review of the Eagle Family of Funds for the six-month period ended April 30, 2012.

Major indices posted their strongest first-quarter gains in more than a decade—after a strong fourth quarter, as well—as encouraging economic data with rising consumer confidence offset worries over euro-zone sovereign debt, rising gasoline prices, slowing growth in China and other global concerns.

On the fixed-income side, the Federal Reserve (“Fed”) held the overnight rate at 0%, but effective rates moved up on the mostly positive news that buoyed equities. Consequently, bond indices’ returns were muted. The Fed appears to be in a holding pattern with its eyes simultaneously on any signs of inflation as well as any stumbling blocks for the economy.

I hope you will read the commentaries that follow in which our Portfolio Managers discuss their specific funds. The general consensus among the managers seems to be that the U.S. economy has found some traction in its recovery, though global forces (particularly recession in Europe and slowing growth in China) bear watching.

Here are a few highlights from the six-month period ended April 30, 2012:

| • | | The Eagle Growth & Income Fund has maintained its five-year five-star rating from Morningstar.1* We believe the Eagle team’s management will continue to deliver solid returns.2 |

| • | | The Investment Grade Bond Fund has posted solid numbers2 in its two years under the direction of Managers James Camp, CFA®, and Joseph Jackson, CFA®. |

| • | | The Eagle Smaller Company Fund is gaining traction in its fourth year. Co-Managers David Adams, CFA®, and Jack McPherson, CFA®, provided investors with positive returns in 2009 and 2010 and outperformed its benchmarks in a difficult-for-small-caps 2011.2 |

| • | | Bert Boksen, CFA®, Eric Mintz, CFA®, and their team have done a tremendous job guiding both the Mid Cap Growth3 and Small Cap Growth4 funds to five-year four-star ratings from Morningstar*. |

| • | | High-profile media outlets increasingly seek Eagle Managers. James Camp, CFA®, who Co-Manages the Investment Grade Bond Fund, has been on CNBC a few times recently. The Wall Street Journal has quoted Edmund Cowart, CFA®, a Co-Manager of the Growth & Income Fund, several times. |

I would like to remind you that investing in any mutual fund carries certain risks. The principal risk factors for each Fund are described at the end of this semi-annual report. Carefully consider the investment objectives, charges and expenses of any Fund before you invest. Contact us at 800.421.4184 or eagleasset.com or your financial advisor for a prospectus, which contains this and other important information about the Eagle Family of Funds.

We are grateful for your continued support of, and confidence in, the Eagle Family of Funds.

Sincerely,

Richard J. Rossi

President

June 14, 2012

1 For the period ended April 30, 2012, the Eagle Growth & Income Fund’s Class A shares are rated 5 stars for the five- and 10-year periods and for the overall and 3 stars for the three-year period among a total of 977, 571, 1,096 and 1,096 funds respectively, in the large-cap value category. Star ratings may be different for other share classes. Morningstar Rating® is based on risk-adjusted performance adjusted for fees and loads. Past performance is no guarantee of future results. Ratings are subject to change each month.

2 Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

3 For the period ended April 30, 2012, the Eagle Mid Cap Growth Fund’s Class A shares are rated 4 stars for the five-year period and 3 stars for the overall, 2 stars for the three-year period and 3 stars for the 10-year period among a total of 596, 658, 658 and 425 funds respectively, in the mid-cap growth category. Star ratings may be different for other share classes. Morningstar Rating® is based on risk-adjusted performance adjusted for fees and loads. Past performance is no guarantee of future results. Ratings are subject to change each month.

4 For the period ended April 30, 2012, the Eagle Small Cap Growth Fund’s Class A shares are rated 4 stars for the overall, three- and five-year periods and 3 stars for the 10-year period among a total of 663, 663, 573 and 367 funds respectively, in the small-cap growth category. Star ratings may be different for other share classes. Morningstar Rating® is based on risk-adjusted performance adjusted for fees and loads. Past performance is no guarantee of future results. Ratings are subject to change each month.

* The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Funds with at least three years of performance history are assigned ratings from the fund’s three-, five- and 10-year average annual returns (when available) and a risk factor that reflects fund performance relative to three-month Treasury bill monthly returns. Funds returns are adjusted for fees and sales loads. Ten percent of the funds in an investment category receive five stars, 22.5% receive four stars, 35% receive three stars, 22.5% receive two stars and the bottom 10% receive one star. Investment return and principal value will vary so that investors have a gain or loss when shares are sold. Funds are rated for up to three time periods (three-, five-, and 10-years) and these ratings are combined to produce an overall rating. Ratings may vary among share classes and are based on past performance. Past performance does not guarantee future results.

Performance Summary and Commentary

| | |

| Eagle Capital Appreciation Fund | | |

Meet the managers | Steven M. Barry, Joseph B. Hudepohl, CFA®, and Timothy M. Leahy, CFA®, are Portfolio Managers of Goldman Sachs Asset Management, LP’s (“GSAM”) “Growth Team.” Mr. Barry is Chief Investment Officer and has been responsible for the day-to-day management of the Eagle Capital Appreciation Fund (the “Fund”) since 2002. Mr. Hudepohl has been a member of GSAM’s Growth Team since 1999, and assumed day-to-day management of the Fund in December 2011. Mr. Leahy joined GSAM as a Managing Director in 2005, and has been responsible for the day-to-day management of the Fund’s investment portfolio since February 2011.

Investment highlights | The Fund invests primarily in common stocks. The Fund’s portfolio management team believes that wealth is created through the long-term ownership of a growing business. They take a “bottom-up” approach to investing based on in-depth, fundamental research. A bottom-up method of analysis typically emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The Portfolio Managers use an intensive research process and each company is analyzed as if they were going to own and operate that company indefinitely. Key characteristics of the companies in which the Fund currently seeks to invest may include: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management.

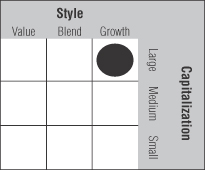

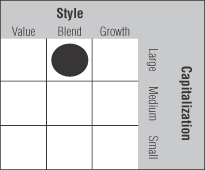

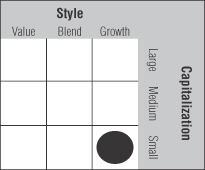

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 15.98% (excluding front-end sales charges) during the six-month period ended April 30, 2012, outperforming its benchmark index, the Russell 1000® Growth Index (“Russell 1000 Growth”), which returned 14.13%. The Russell 1000 Growth measures performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values and is representative of U.S. securities exhibiting growth characteristics. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | The Russell 1000 Growth delivered positive returns during the six-month reporting period as the U.S. economy continued to emerge from a recession and many U.S. companies continued to report earnings above market expectations. Consumer discretionary and information technology were the top performing sectors, while the utilities and energy sectors lagged.

The Fund delivered a positive absolute return during the period, outperforming its benchmark, the Russell 1000 Growth. Stock selection in the information technology and consumer discretionary sectors contributed positively to the Fund’s performance relative to the benchmark. Weakness in select healthcare and financials holdings detracted from relative returns. On the positive side, stock selection in the information technology and consumer discretionary sectors contributed to performance. Sector weights did not have a material impact on performance during the period, as relative performance was driven primarily by stock selection.

Top performers | Lowe’s Companies, Inc., a home improvement retailer, contributed to performance during the period. The company posted earnings that beat expectations due to improved traffic trends. The stock has also benefited from incrementally positive housing market data. Additionally, late last year, management announced a decision to take on more debt in order to fund incremental share buybacks over the next year, which will amount to approximately 10 to 15% of

Performance Summary and Commentary

| | |

| Eagle Capital Appreciation Fund (cont’d) | | |

the company. The Portfolio Managers view this positively, as it shows a clear commitment by management to increase return on invested capital. Furthermore, the Portfolio Managers have confidence in the management team, which is taking important steps to improve operational efficiency and differentiate the company from competitors on its implementation of technology. Management is very focused on more effective marketing techniques and improving in-store format, which the Portfolio Managers believe will further differentiate Lowe’s in the duopolistic home improvement market. In the Portfolio Managers’ view, the fundamentals of the home improvement industry should continue to improve and, with its enhanced execution and aggressive capital redeployment, Lowe’s should be able to continue to deliver strong results and shareholder value over the long-term.

Equinix, Inc., a data center solutions company, contributed to performance during the period. The company reported strong fiscal fourth quarter results and issued a solid outlook for 2012. Equinix continues to evaluate the potential to convert to a Real Estate Investment Trust (“REIT”), which would provide tax and valuation benefits. The market has begun to recognize that Equinix is trading at a discount to other data centers that are publicly traded REITs, and appreciate the growth and stability of Equinix’s revenue stream. Equinix remains a leader in operating data centers and the Portfolio Managers continue to have conviction in the company’s ability to drive revenue growth as it benefits from several secular growth drivers.

Apple, Inc., a designer and marketer of consumer electronics, computer software, and personal computers, contributed to performance during the period. The company’s shares climbed significantly as strong demand for the newly released iPad continues to validate the value of the Apple franchise and its growth profile. The company also recently announced plans to return capital to shareholders via a new dividend and share repurchase program beginning later this year. The Portfolio Managers believe there is still a long runway for growth as the company increases penetration of the smartphone and tablet markets and continues to innovate and enter new markets. Near term catalysts could include the release of the iPhone 5, the launch of an iOS-centric Apple television set, and expansion into emerging markets. The Portfolio Managers remain positive on Apple and believe the stock’s valuation remains attractive.

Crown Castle International Corp., a wireless tower owner and operator of shared wireless communications and broadcast infrastructures, contributed to performance during the period.

The company recently announced strong first quarter 2012 results, driven by better-than-expected revenues and a significant increase in new leases signed during the quarter compared to last year. The company also raised 2012 guidance, due in large part to the acquisition of outdoor distributed antennae systems (DAS) company NextG Networks. The Portfolio Managers continue to have conviction in the tower companies over the long term as demand for mobile content grows and wireless carriers are required to add capacity in order to support increased usage, network upgrades and improved coverage.

QUALCOMM, Inc., a semiconductor chip designer, contributed to performance during the period. Late last year the company reported better-than-expected quarterly results, driven by strength in its chipset business, and issued solid 2012 revenue guidance. In addition, the company reiterated that its long-term growth targets would be driven by its ramp-up into emerging markets and its recently expanded chipset roadmap. The Portfolio Managers continue to believe the company competitively is well-positioned given its recently expanded intellectual property portfolio of Code-Division Multiple Access (CDMA) technologies and significant growth opportunities in both developed and emerging markets as mobile phones transition to 3G and 4G.

The Fund continues to hold each of the securities noted above as “top performers.”

Underperformers | NetApp, Inc., a developer of data storage hardware and software for enterprise clients, detracted from relative performance during the period. In April, the company reported first quarter 2012 earnings that were impacted negatively by increased competitive pressures and disappointing sales of ONTAP 8.1, the company’s cutting-edge data solutions product. Despite these headwinds, the Portfolio Managers continue to believe NetApp has a strong competitive position in an industry that is benefiting from several secular growth trends, such as virtualization, which the Portfolio Managers believe will increase demand for the company’s storage products. NetApp specializes in external networked storage, which, in the Portfolio Managers’ view, should continue to take share away from direct attached products.

Shares of CME Group, Inc., the world’s largest futures and options exchange, detracted from relative performance during the period due to a challenged 2011. Shares declined due to negative sentiment surrounding the MF Global bankruptcy filing and the company’s association with MF Global’s alleged mishandling of segregated customer accounts. Additionally,

Performance Summary and Commentary

| | |

| Eagle Capital Appreciation Fund (cont’d) | | |

while the company reported fourth quarter 2011 earnings that missed consensus estimates on elevated expenses and weaker pricing in energy and commodities, investors reacted positively in 2012 to management’s announcement to raise the company’s regular quarterly dividend by 59%. Management also announced its plans to initiate a variable annual dividend based on excess cash available. The Portfolio Managers view these announcements positively and continue to believe CME Group will benefit from the migration of over-the-counter derivatives markets to exchanges due to increased customer demand for more transparency and less counterparty risk. Furthermore, the Portfolio Managers remain attracted to the company’s strong growth profile, profitability, recurring revenues and industry leading position.

Oracle Corporation, a company that engineers hardware and software, detracted from relative performance during the period. The company missed earnings late last year due to delays in closing contracts, sales execution issues and a decline in maintenance revenues. However, the company is expanding its strength in database and application software and gaining share in enterprise information technology. The Portfolio Managers believe the company should benefit from continued share gains as a result of enterprise information technology spending, expanding strength in database and application software, and leveraging the acquisition of Sun Microsystems Inc.

Halliburton Company, a leading oil services firm, detracted from relative performance during the period. Despite posting solid earnings during the period, Halliburton underperformed the broader equity market. Expectations of a global economic

slowdown last year and weaker oil prices pressured shares and contributed to the energy sector’s relative underperformance versus the broader market. The Portfolio Managers acknowledge the fears of an economic slowdown and Halliburton’s sensitivity to oil prices, but still believe the company’s risk/reward profile remains attractive. The Portfolio Managers also believe Halliburton is gaining share in key markets and can demonstrate pricing power and margin improvement in its North America pressure pumping business. In addition, the Portfolio Managers expect the shift in U.S. drilling activity toward oil/shale plays could mitigate volatility to the U.S. cycle.

Shares of St. Jude Medical, Inc., a global medical device company, detracted from relative performance during the period. Despite reporting first quarter 2012 revenues that exceeded analysts’ expectations, negative publicity surrounding the company’s Riata leads, used in its cardiac resynchronization devices, continued to be a significant overhang on the stock. In the Portfolio Managers’ view, investor concerns about mixed clinical data are overdone. The Portfolio Managers believe the company should continue to generate revenue growth through a series of new product launches, share gains and continued sales growth across most of its existing business segments. In addition, the Portfolio Managers believe St. Jude Medical has a portfolio of innovative products with attractive end markets and remains competitively well positioned in a growing industry.

The Fund continues to hold each of the securities noted above as “underperformers.”

Performance Summary and Commentary

| | |

| Eagle Growth & Income Fund |

Meet the managers | David Blount, CFA®, CPA , Edmund Cowart, CFA® and John Pandtle, CFA® are Co-Portfolio Managers of the Eagle Growth & Income Fund (the “Fund”), and have been jointly responsible for the day-to-day management of the Fund’s investment portfolio since June 2011.

Effective June 1, 2012, David Powers, CFA®, became a Co-Portfolio Manager of the Fund and, along with Messrs. Blount, Cowart and Pandtle, assumed day-to-day management of the Fund.

Investment highlights | The Fund invests primarily in domestic equity securities (predominantly common stocks) that the Portfolio Managers believe are high-quality, financially strong companies that pay above-market dividends, have cash resources (i.e. free cash flow) and a history of raising dividends. The Fund’s Portfolio Managers select companies based in part upon their belief that those companies have the following characteristics: (1) yield or dividend growth at or above the S&P 500® Index (“S&P 500”); (2) potential for growth; and (3) stock price below its estimated intrinsic value. The Fund can also own a variety of other securities, including fixed income securities, which, in the opinion of the Fund’s Portfolio Managers, offer prospects for meeting the Fund’s investment goals.

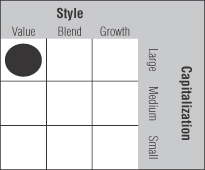

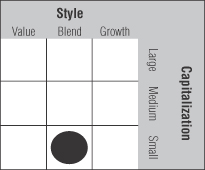

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 10.76% (excluding front-end sales charges) during the six-month period ended April 30, 2012, underperforming its benchmark index, the S&P 500 which returned 12.77%. The S&P 500 is an unmanaged index of 500 U.S. stocks and gives

a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | The equity market as measured by the S&P 500 rallied in the fourth quarter of 2011. Market volatility remained high during the quarter, as troubling European Union headlines and elevated levels of investor risk aversion continued to whipsaw stocks. From a global perspective, little changed since the third quarter as macroeconomic, political, and geopolitical risks lingered. In the United States, consumers continued to deleverage, and the housing market remained unhealed. The rally continued through the first quarter of 2012, followed by a period of consolidation during the month of April. The rally was led by sectors that included the beaten down financials sector, the usually volatile technology sector, and the somewhat unpredictable consumer discretionary sector. Forgotten were those stocks in categories such as utilities, telecommunications, and consumer staples.

The Fund enjoyed strong returns in the positive double digits during the six-month period ended April 30, 2012. The top performing sector in the portfolio was the consumer discretionary sector. However, due to a higher weighting, the financials sector had a larger overall contribution to Fund performance. The industrials sector was also a large contributor to performance. The rally was very broad, as only three of the Fund’s holdings recorded significant negative returns. The Fund underperformed the S&P 500 during the period. This is not uncommon for the Fund’s strategy during the strong bull markets like the ones experienced in the fourth quarter of 2011 and first quarter of 2012. During the first leg of a bull market, lower quality equity securities tend to run a little better than higher quality equity securities, which often makes it difficult for the Fund’s strategy to keep up with index performance.

There were some unique aspects of this particular bull market that helped keep Fund performance in line with the S&P 500’s performance, more so, than the Fund had experienced in past bull

Performance Summary and Commentary

| | |

| Eagle Growth & Income Fund (cont’d) | | |

markets. While the months of January, February and March featured strong and consistent positive returns, the months of November, December and April featured flatter consolidation periods in which the Fund could make up ground on the index through stock selection. During the months of November and December in particular, the market rotated solidly into higher dividend paying stocks. Even though the rotation away from high dividend paying stocks seen in January, February and March more than canceled the effects of that previous tailwind, it did help the Fund keep relatively apace of the S&P 500 overall during the six-month period.

From a sector standpoint, lack of investment in the information technology sector detracted from relative performance, as did the Fund’s stock selection in the consumer staples and healthcare sectors, as well as its very modest average cash position. On the other hand, the Fund’s stock selection within the materials, consumer discretionary and utilities sectors all benefited relative performance.

Underperformers | There were only three stocks that had significant negative returns in the Fund’s portfolio during the six-month period ended April 30, 2012.

Wells Fargo & Company, a diversified financial services company, was a stock that the Fund purchased after the bull market rally seen during the six-month period. The stock has traded down since purchase, but has traded in line with the rest of the financials sector in the S&P 500.

Total S.A., a global energy producer, was another stock the Fund purchased during the six-month period, which has traded down since purchase along with the broader energy sector. The company has a high and consistent dividend yield, and a tradition of returning shareholder wealth through dividends. The Fund’s Portfolio Managers believe the company is undergoing a turnaround which should benefit shareholders in the long term. Quarterly results came in at expectations, with positive signs of operational progress; however, project startups detracted from free cash flow and made investors a little shy on the stock price.

Regal Entertainment Group (Class A), the largest theater circuit in the U.S., was the only stock held in the Fund during the six-month period which suffered a significant negative return. The company trades along with box office trends, which were lackluster for the entire industry in the fourth quarter of 2011. However, box office trends in 2012 have improved and the stock has performed very well since the beginning of the new year.

The Fund continues to hold each of the securities noted above as “underperformers”.

Top performers | The Home Depot, Inc., the world’s largest home improvement specialty retailer, was the Fund’s top absolute contributor during the six-month period. The company continues to benefit from work it did during the period from 2007 to 2009, returning to customer service roots, re-investing in stores and supply chain. The company’s most recent quarterly earnings came in solid with good comps and good free cash flow generation. Investors are recognizing the business’ long term profitability and return potential, despite the uncertain outlook for home improvement demand in the coming quarters.

JPMorgan Chase & Co., a global financial services firm, was the Fund’s second best absolute contributor during the six-month period. Much of the uncertainty that resulted in a bottoming for the banking industry in 2011 has been lifting, and fixed income volumes appear to be going at a better-than-expected pace, lifting the outlook for capital markets revenue.

Mattel, Inc., the world’s largest toy company, is benefiting from a revamp of the company’s operational efficiency, which looks to keep margins high despite increasing raw material, transportation and Chinese labor costs. Management has also shown an ability to pass increased costs through to customers via price raises.

Abbott Laboratories, a leading global health care company, announced a breakup that would isolate and spin-off its pharmaceuticals business away from its diversified medical products business. This will help isolate risk from the looming patent expiration of the pharmaceutical business’ main product, Humira. Since announcement of the breakup, the company has continued to enjoy strong results with operational growth across all business segments in emerging markets.

Pfizer Inc., the world’s largest researched-based pharmaceutical company, has shown strong results in recent quarterly earnings releases that exceeded expectations, with the only significant negative being changes to guidance due to foreign exchange, which was expected. Ongoing cost control and rationalization measures continue to take root. The company’s pipeline is progressing well.

The Fund continues to hold each of the securities noted above as “top performers”.

Performance Summary and Commentary

| | |

| Eagle International Equity Fund | | |

Meet the managers | Richard C. Pell is Chief Executive Officer at Artio Global Investors Inc. and Chief Investment Officer at its affiliate, Artio Global Management LLC (“Artio Global”). Rudolph-Riad Younes, CFA®, is Head of International Equities at Artio Global. Messrs. Pell and Younes have managed the Eagle International Equity Fund (the “Fund”) since 2002.

Investment highlights | The Fund invests primarily in foreign equity securities. The Fund’s Portfolio Managers seek investment opportunities within the developed and emerging markets. In the developed markets, a “bottom-up” approach is adopted. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. In the emerging markets, a “top-down” assessment consisting of currency/interest rate risks, political environments/leadership assessment, growth rates, structural reforms and risk (liquidity) is applied. A top-down method of analysis emphasizes the significance of economy and market cycles. In Japan, given the highly segmented nature of this market comprised of both strong global competitors and protected domestic industries, a hybrid approach encompassing both bottom-up and top-down analyses is conducted.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 1.97% (excluding front-end sales charges) during the six-month period ended April 30, 2012, underperforming its benchmark index, which returned 2.73%. The Fund’s benchmark index, the Morgan Stanley Capital International® All Country World Index ex-US (“MSCI® ACWI ex-US”), is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed

and emerging markets. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | The six-month period ended April 30, 2012 was an uneven period for markets. November and December of 2011 saw international equity markets faced with continued volatility as the debt situation in Europe dominated news headlines and investor sentiment. November brought worries that the problems caused by high debt and slow growth that began in peripheral countries such as Greece and Portugal would spread to the Continent’s core. Italy, the euro zone’s third-largest economy, saw bond yields hit record highs and the country’s borrowing costs moved above the key financial and psychological barrier of 7%—levels that required those peripheral countries to seek bailout funds.

As December began, leaders of European Union nations worked overtime on a deal to save the euro. The treaty had multiple goals including a show of resolve to protect the larger economies of Italy and Spain, revise the economic governance of the euro zone and prevent further debt crises. While this was not the perfect solution, it would have required stricter fiscal and financial discipline in future budgets. However, Britain refused to participate without additional language providing extra protection for its financial sector and effectively caused the treaty’s prospects to collapse. As these events unfolded, market volatility began to subside as the year came to a close. Also providing some degree of hope for investors were some encouraging signs out of the U.S. suggesting that the world’s largest economy is perhaps more resilient amid the current global crisis than originally thought.

Moving into 2012, markets raced ahead in January and February, more than making up for the market declines at the end of 2011. Several more encouraging economic reports out of the world’s largest economy, the U.S., supported the more constructive tone along with less negative news generally. The final two months of the reporting period saw weakness in markets as the European debt situation coupled with the

Performance Summary and Commentary

| | |

| Eagle International Equity Fund (cont’d) | | |

upcoming French presidential election had investors concerned. For the full six-month period, emerging markets outperformed developed markets.

The Fund underperformed its benchmark for the review period largely due to its positioning within emerging markets. While the Fund has outperformed the benchmark for the 2012 year-to-date period ending April 30, underperformance during November and December of 2011 resulted in the Fund underperforming the benchmark for the full review period. Detracting from returns was stock selection in China and India. Within developed markets, stock selection in the materials and industrials sectors detracted. Positively contributing to returns in developed markets was the Fund’s overweight to consumer discretionary stocks, stock selection in healthcare, and stock selection within Japan’s consumer-oriented sectors. Positioning within these sectors has been targeted towards those companies positioned to benefit from growth in emerging market consumption, a theme which has been long held within the Fund.

Underperformers | Axis Bank Ltd., the India-based regional bank, saw steep declines in the second half of 2011 amid economic growth concerns. The position was sold toward the end of the year during a general risk reduction move within the Fund.

The Fund continues to hold Ivanhoe Mines Ltd., although the shares underperformed amid pressure on gold-related stocks. This Canadian mineral exploration and development company has a 66% interest in the Oyu Tolgoi Project, which is one of the world’s largest copper-gold-silver mines on track to begin initial production in southern Mongolia this year.

The Fund reduced its position in Ctrip.com International Ltd., as a risk reduction move. Reduced earnings estimates was a factor in the shares underperforming during the period. However, the Fund continues to maintain a position in this mainland-China-focused, online travel agency, as part of the Fund’s general strategy of tapping into growth in consumption by emerging market consumers.

The Fund’s holding in Larsen & Toubro Ltd., the India-based multinational conglomerate with business interests in engineering, construction, manufacturing, information technology and financial services, was sold toward the end of 2011 amid a general risk reduction move within the Fund. Concerns over the company’s order book growth added to general concerns.

The Fund’s entire position in Sydney Airport, formerly MAp Group, the only major airport serving Sydney and the busiest airport in Australia, was sold toward the end of the reporting period given a desire to reduce exposure to the airport sector.

Top performers | The Fund did some profit taking by selling a portion of its holding in Novo Nordisk AS (Class B), but continues to hold the position. As a leader in diabetes care, the Denmark-based company is addressing the growing needs for such treatments around the globe and increasingly across the developing world.

Samsung Electronics Company Ltd., the Seoul, South Korea-based consumer electronics company, has benefitted from its Smartphone and Android-powered tablets in addition to the company’s numerous offerings, which include flat-panel televisions and memory chips. Focusing on global leaders with strong brand recognition is an important part of the Fund’s strategy. The Fund continues to own this security.

As a risk reduction move the Fund has been trimming its overweight position in Sberbank, Russia’s largest lender, which was among the top performers over the period. Shares of Sberbank continue to be held.

Unicharm Corporation, the Japanese manufacturer of diapers, household cleaning wipes and other health care products, provides the Fund with additional exposure to an emerging market consumption story that the Portfolio Managers believe should continue to unfold for years to come. The Fund continues to own this security.

Toyota Motor Corporation, the major global automotive brand, has staged a comeback after several years of struggles in the U.S. The Fund increased its position and continues to hold the security.

Performance Summary and Commentary

| | |

| Eagle Investment Grade Bond Fund |

Meet the managers | James C. Camp, CFA®, a Managing Director at Eagle Asset Management (“Eagle”) and Joseph Jackson, CFA®, are Co-Portfolio Managers of the Eagle Investment Grade Bond Fund (the “Fund”) and have been jointly responsible for the day-to-day management of the Fund’s investment portfolio since the Fund’s inception.

Investment highlights | The Fund invests primarily in investment grade fixed income securities. Investment grade is defined as securities rated BBB- or better by Standard & Poor’s Rating Services or an equivalent rating by at least one other nationally recognized statistical rating organization or, for unrated securities, those that are determined to be of equivalent quality by the Fund’s Portfolio Managers. The average portfolio duration of the Fund is expected to vary and may generally range anywhere from two to seven years based upon economic and market conditions. The Fund expects to invest in a variety of fixed income securities including, but not limited to, corporate debt securities of U.S. and non-U.S. issuers, including corporate commercial paper; bank certificates of deposit; debt securities issued by states or local governments and their agencies; obligations of non-U.S. governments and their subdivisions, agencies and government sponsored enterprises; obligations of international agencies or supranational entities (such as the European Union); obligations issued or guaranteed by the U.S. Government and its agencies; mortgage-backed securities and asset-backed securities; commercial real estate securities; and floating rate instruments.

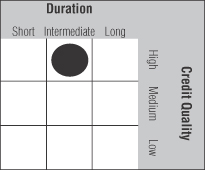

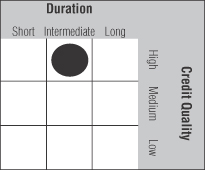

This Morningstar Style Box™ shows the duration and credit quality of bonds held in the Fund. Duration and credit quality are two main components of bond performance. The assessment reflects the Fund’s portfolio as of the date reported and is not a precise indication of risk or performance—past, present or future. Definitions of style assessments: Duration: Short, up to 3.5 years; Intermediate, more than 3.5 years to less than six years; Long, six years or greater. Credit quality:

High, AA or better; Medium, A or BBB; Low, BB or lower as rated by Standard & Poor’s or its equivalent, as reported to Morningstar. Source: Morningstar, Inc.

© Copyright 2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 1.88% (excluding front-end sales charges) during the six-month period ended April 30, 2012, underperforming its benchmark index, which returned 2.08%. The Fund’s benchmark index, the Barclays Intermediate Government/Credit Bond Index, includes U.S. Government and investment grade credit securities that have a greater than or equal to one year and less than ten years remaining to maturity and have $250 million or more of outstanding face value. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | The six-month period ended April 30, 2012 was sort of a “best of both worlds” environment for a fixed income market. The approval of a 130bn EUR aid package for Greece boosted risk assets after a proposed referendum threatened outright default. While the aid package was hardly a cure for the ongoing European debt crisis, it established a lifeline to its weakest link. Locally, a slew of improving fourth quarter economic releases helped ease concerns of a recession. Gross Domestic Product (“GDP”) growth accelerated from 1.8% in the third quarter to 3% in the fourth quarter—also providing a holiday boost to credit spreads and equity prices. It is important to note, however, that the economic momentum has slowed a bit in recent weeks. In the Treasury market, the Federal Reserve Board implemented “Operation Twist” during the period in which it essentially sold short Treasuries and bought longer Treasuries with the sale proceeds. This, while not having the dramatic effect of additional quantitative easing, helped keep long-term interest rates low and helped the Treasury market achieve positive

Performance Summary and Commentary

| | |

| Eagle Investment Grade Bond Fund (cont’d) |

absolute returns even as risky assets performed well. As far as the benchmark sectors were concerned, financial institutions outperformed industrials and utilities in the credit sector. The credit sector generally outperformed the government-related and Treasury sectors.

The Fund returned 1.88% during the period as all sectors contributed to positive total returns. Similar to the Fund’s benchmark index, financial institutions outperformed industrials and utilities within the credit sector. Credit in general outperformed the government-related, structured product and Treasury sectors.

The Fund underperformed its benchmark by a small margin in the period. The chief performance detractor relative to the Fund’s benchmark was the Fund’s underweight position in lower-rated investment grade corporate bonds. Additionally, large money-center financial institutions outperformed the investment grade corporate sector during the period, and the Fund was underweight these institutions relative to the benchmark index. Somewhat offsetting this factor was a large underweight in Treasuries in favor of corporate credit, as corporate credit outperformed Treasuries by a wide margin. The overweight structured products added a small contribution to relative performance.

Underperformers | U.S. Treasury Note, 2.13%, 8/15/21, was sold as the yield curve moved higher in March to shorten duration. The Fund no longer owns this security.

John Deere Capital Corporation FDIC, 2.88%, 6/19/12, a finance holding company with corporate credit issues guaranteed by the Temporary Liquidity Guarantee Program (“TLGP”), underperformed lower rated issues. The Fund continues to own this security.

Anheuser-Busch InBev Worldwide Inc., FRN, 1.20%, 3/26/13, the world’s largest brewer, and Hewlett-Packard Company, FRN, 0.60%, 9/13/12, an information technology corporation, as well as consumer products companies in general, underperformed longer-duration credits as the Federal Reserve forecast near-zero short term rates through late-2014. The Fund continues to own both securities.

Microsoft Corporation, 2.95%, 6/1/14, a world leader in developing, manufacturing, and licensing of a wide range of computer products, underperformed lower-rated issues during the period. The Fund continues to own this security.

Top performers | Tennessee Valley Authority, 5.50%, 7/18/17, the largest public power provider in the U.S., and Private Export Funding Corporation, 2.25% 12/15/17, a private entity that assists in financing of U.S. exports, both agency issues, have longer maturities than the average agency issues in the Fund’s benchmark.

The Fund owns General Electric Capital Corporation, 3.35%, 10/17/16, a company that offers commercial loans, leases and middle market finance solutions. During the reporting period, financials outperformed industrials and utilities industries.

Plum Creek Timberlands, L.P., 4.70%, 3/15/21, is the largest private timberland owner in the U.S.; its Standard & Poor’s BBB-rated issues outperformed A- and AA-rated issues during the period.

V.F. Corporation, 3.50%, 9/1/21, a leader in branded lifestyle apparel with a diverse variety of brands and products, is one of the Fund’s longest-duration corporate issues during a period when the end of the yield curve moved lower.

The Fund continues to hold each of the securities noted above as “top performers”.

Performance Summary and Commentary

| | |

| Eagle Mid Cap Growth Fund | | |

Meet the managers | Bert L. Boksen, CFA®, a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”), is the Portfolio Manager of the Eagle Mid Cap Growth Fund (the “Fund”), and has managed the Fund since its inception. Eric Mintz, CFA®, has been Co-Portfolio Manager since 2011, and Christopher Sassouni, DMD, has served as Assistant Portfolio Manager of the Fund since 2006. Mr. Mintz served as Assistant Portfolio Manager from 2008 through 2011.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization (“mid-cap”) companies. The Fund’s Portfolio Managers seek to capture the significant long-term capital appreciation potential of mid-cap, rapidly growing companies. The Portfolio Managers use a “bottom-up” investment approach through a proprietary research strategy that emphasizes the selection of mid-cap growth stocks that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The Fund’s Portfolio Managers believe that conducting extensive research on mid-cap companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

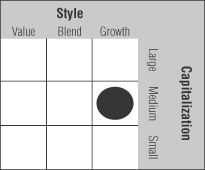

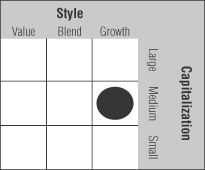

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 10.85% (excluding front-end sales charges) during the six-month period ended April 30, 2012, underperforming its benchmark index, which returned 12.26%. The Fund’s benchmark index, the Russell Midcap® Growth Index (“Russell Midcap”), measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. Please keep in mind that an index is

not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | All sectors within the benchmark posted positive returns for the period. Consumer discretionary, healthcare and industrials led benchmark performance with strong returns. In consumer discretionary, solid returns in the specialty retail and media industries boosted sector performance. The biotechnology and healthcare equipment and supplies industries reflected strong returns to bolster performance in the healthcare sector. In industrials, the machinery and electrical equipment industries performed well during the period. Consequently, all sectors within the Fund generated positive absolute returns for the period. Strong returns in the consumer discretionary and healthcare sectors contributed most to the Fund’s performance. In consumer discretionary, the specialty retail and hotels, restaurants and leisure industries boosted sector performance for the period. The Fund’s investments in the healthcare technology and healthcare equipment and supplies industries performed well to support healthcare sector returns. The information technology and materials sectors lagged for the period. The computers and peripherals and electronic equipment instruments and components industries pulled down returns in the information technology sector. In materials, negative returns in the metals and mining industry tempered sector performance for the period.

The Fund underperformed its benchmark index during the period. The information technology, industrials and materials sectors pulled returns relative to the Fund’s benchmark down for the period. A modest overweight in the underperforming software industry hurt relative returns in information technology. In industrials, underperformance in the electrical equipment industry damaged sector returns. In materials, the Fund’s returns were strong in the chemicals industry but trailed those of the corresponding benchmark for the period. The Fund did perform well against the index within the energy, consumer discretionary and telecommunications services sectors. Solid returns in the oil & gas and consumable fuels industry led to

Performance Summary and Commentary

| | |

| Eagle Mid Cap Growth Fund (cont’d) | | |

outperformance in the energy sector. In consumer discretionary, strong performance in the specialty retail and internet and catalog retail industries boosted relative returns for the period. Substantial returns in the wireless telecommunication services industry boosted relative performance in the telecommunication services sector.

Underperformers | Rovi Corporation is a provider of digital entertainment technology solutions to the consumer electronics industry as well as service providers. Feedback from cable and satellite providers reflected below-expected adoption rates for Rovi’s TotalGuide product line. The Portfolio Managers believe technology’s evolution towards networked devices does provide Rovi with an opportunity to take advantage of advertising trends in the near to mid-term. The Fund continues to own this security.

Polypore International, Inc. is a specialty filtration company that makes separation membranes used in lithium ion batteries, which have seen significant growth from both consumer electronics and hybrid electric vehicles. The stock underperformed due to concerns about waning sales for the all-electric Chevy Volt, which was the subject of a well-publicized investigation into engine fires that had occurred following crash tests. The investigation has since been resolved and high gasoline prices have helped boost sales of Volts to their highest levels during the month of March. The Fund no longer owns this security.

Deckers Outdoor Corporation produces and markets footwear and related accessories, most notably the UGG line of footwear, through several department store channels across the U.S. and internationally. An abnormally warm seasonal weather pattern tempered sales for the period, as the January through March timeframe is typically a strong period for Decker’s UGG boots line. The Fund no longer owns this security.

Gentex Corporation develops and manufactures automotive and fire protection products. Standards proposed to mandate the implementation of Rear Camera Displays (RCDs), one of the firm’s core offerings, on new vehicles have been postponed until the end of 2012. Despite this legislative delay, trends in the automotive industry continue to shift toward the use of backup cameras and technology-enhanced mirrors, which the Portfolio Managers expect to favor Gentex going forward. The Fund continues to own this security.

Riverbed Technology, Inc. is a vendor of wide area network (WAN) optimization appliances, driven by data center consolidation, cloud computing and data storage solutions. With several of the firm’s new products planned for release later this year, in some cases customers have re-evaluated their current orders ahead of the ensuing product offering transition, resulting in tempered sales for the period. The Fund continues to own this security.

Top performers | GNC Holdings, Inc. (Class A) is a global specialty retailer of health and wellness products including vitamins, sports nutrition and diet and herbal supplements. The stock continues to benefit from sustained growth trends in the space as the baby boomer generation adopts the daily-vitamin philosophy and the general public increases its health awareness.

SXC Health Solutions Corp. is a provider of pharmacy benefits management services and healthcare information technology solutions to the healthcare benefits management industry. As the wave of drug patent expirations begin to materialize, firms involved in the generic-drugs supply chain such as SXC Health Solutions are increasingly benefitting from associated tailwinds in the space. The stock also benefitted from the pending acquisition of Catalyst Health Solutions during the period.

Sally Beauty Holdings, Inc. is a retailer of cosmetics, hair care and skin care goods and styling appliances. The firm’s strength is reflected in its stores which have exhibited both consistent revenue and earnings growth while expanding margins and reducing debt levels in a difficult economic environment.

Priceline.com, Incorporated provides online reservations for hotels, car rentals, vacation packages and other travel services. Strength in the firm’s international bookings supported momentum during the period, due at least in part to successful advertising in regions of Europe and emerging markets.

Continental Resources, Inc. is an independent oil and natural gas exploration and production company with operations across the U.S. The production environment in the Bakken region has improved substantially after a stretch of extremely adverse weather conditions early on in the previous year, and the firm’s initial test results in the Three Forks region suggest production prospects for horizontal drilling activity in the area.

The Fund continues to hold each of the securities noted above as “top performers”.

Performance Summary and Commentary

Meet the managers | Todd L. McCallister, Ph.D., CFA®, is a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”) and Co-Portfolio Manager of the Eagle Mid Cap Stock Fund (the “Fund”). Dr. McCallister has managed the Fund since its inception. Scott Renner has been Co-Portfolio Manager since July 2011. Stacey Serafini Pittman, CFA®, served as Assistant Portfolio Manager to the Fund from 2000 to 2005, before being named Co-Portfolio Manager in 2005.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization (“mid-caps”) companies. The Portfolio Managers of the Fund employ a “bottom-up” stock-selection process to identify growing, mid-cap companies that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The Portfolio Managers seek to gain a comprehensive understanding of a company’s management, business plan, financials, real rate of growth and competitive threats and advantages.

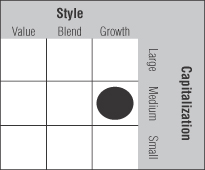

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 12.17% (excluding front-end sales charges) during the six-month period ended April 30, 2012, slightly underperforming its benchmark index, the S&P MidCap 400® Index (“S&P MidCap 400”) which returned 12.48%. The S&P MidCap 400 is an unmanaged index that measures the performance of the mid-sized company segment of the U.S. market. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | The market was up sharply during the six-month reporting period as investors returned to stocks after last summer’s decline. The S&P MidCap 400 was up 12.48% in this same time frame, led by industrials and materials. The energy sector was the only sector that was negative in the index. Overall, the daily correlations among stocks have come down from the record highs that were seen in 2011. The Portfolio Managers believe that the shift should cause stock selection to be rewarded, particularly in investments that are seen as growth names offering good risk/return profiles.

In the Fund, consumer discretionary was the largest contributor followed by financials on an absolute basis, while consumer staples and utilities contributed the least to performance. Although the Fund was underweight in consumer staples and utilities compared to the index, the impact to performance was still positive. The Fund was up almost as much as its index benchmark, the S&P MidCap 400, with energy and materials contributing the most to performance during the period. Industrials were a source of underperformance for the portfolio as machinery and professional services weighed on the portfolio. The Fund’s positions in the financial sector also held the portfolio back as its positions in diversified financial services, capital markets and real estate investment trusts underperformed.

Underperformers | QEP Resources, Inc., a leading independent natural gas and oil exploration and production company, underperformed during the past six months as the price of natural gas continued to fall. The Fund continues to own the holding for its natural gas liquids developments in the Rockies.

SanDisk Corporation, the world’s largest dedicated provider of flash memory storage solutions, traded off as it preannounced revenues that were lower than expected. The stock saw a pricing decline due to weakness in its end markets. The Fund chose to sell the position.

The price of Gardner Denver, Inc., a designer, manufacturer, and marketer of engineered industrial machinery and related parts and services, was down as the company had earnings results that were largely in line with estimates, and volumes in

Performance Summary and Commentary

| | |

| Eagle Mid Cap Stock Fund (cont’d) | | |

their natural gas pumps and fracking business were down. The stock traded lower again after one of its key pressure pumping customers negatively preannounced earnings due to falling demand in the natural gas fracking business. The Fund continues to hold the position at these prices as the Portfolio Managers believe that it has more than priced in the risk for this quarter of revenue.

Parametric Technology Corporation, a U.S.-based company that develops, markets and supports software for product development, traded lower as the result of the company negatively preannouncing results in the first quarter following the cancellation of a large licensing deal. The Fund continues to hold the stock because the Portfolio Managers feel that Parametric Technology’s software provides solutions for collaboration that will still be utilized for an entire lifecycle of product manufacturing.

Medicis Pharmaceutical Corporation (Class A), a medical cosmetics company, traded lower on concerns of generic competition around its drug Solodyn. The Fund chose to sell the security as it appears that generic competition would affect them more than some analysts initially thought.

Top performers | Crown Castle International Corporation is a leading independent owner and operator of shared wireless communications and broadcast infrastructures. The company has experienced a significant increase in site leasing and is planning to convert its structure to a real estate investment trust to give more cash back to its shareholders. Crown Castle also raised 2012 guidance, due in large part to the acquisition of outdoor distributed antennae systems (DAS) company NextG Networks. The Fund continues to own this security.

The price of Solutia, Inc., a maker of specialty chemicals and performance materials, was up significantly following the announcement, made in late January, that they would be

acquired by Eastman Chemical Company. Although the acquisition is not expected to close until the end of the second quarter of 2012, the deal is expected to be immediately accretive to earnings for Eastman and will expand Eastman’s emerging market business. Leading up to the acquisition announcement, Solutia had been experiencing wider profit margins after selling its lower profitability businesses during the downturn. The Fund sold the position prior to the acquisition.

Wyndham Worldwide Corporation, the holding company for Wyndham Hotels & Resorts, beat earnings again but surprised some investors with the strength of its share repurchases. Wyndham’s management has been putting the company’s strong free cash flow directly into the share repurchases. Furthermore, Wyndham’s segments lodging, vacation exchange and vacation ownership units outperformed. The Fund continues to own this security.

DISH Network Corporation (Class A), the second largest pay TV provider in the U.S., traded higher as it grew video subscriber additions and beat earnings expectations. With recent FCC rulings, the wireless spectrum that DISH Network currently owns has become more valuable. The Fund continues to own this security.

Sunoco, Inc., an American petroleum and petrochemical manufacturer and one of the largest gasoline distribution companies in the U.S., received a takeout offer from Energy Transfer Partners during the period. Although the Fund trimmed its position in Sunoco, it did not sell out of the position as there was the possibility of a higher takeout offer in the future. By the end of the six-month period, Sunoco had entered into a definitive merger agreement with Energy Transfer Partners, creating one of the largest and most diversified energy partnerships in the U.S.

Performance Summary and Commentary

| | |

| Eagle Small Cap Growth Fund | | |

Meet the managers | Bert L. Boksen, CFA®, a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”), has been responsible for the management of the Eagle Small Cap Growth Fund (the “Fund”) since 1995. Eric Mintz, CFA®, has been Co-Portfolio Manager since 2011, and previously served as Assistant Portfolio Manager from 2008 through 2011.

Investment highlights | The Fund invests primarily in stocks of small-capitalization (“small-cap”) companies. Using a “bottom-up” approach, the Fund’s Portfolio Managers seek to capture the significant long-term capital appreciation potential of small, rapidly growing companies. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The Portfolio Managers also look for small-cap growth companies that are reasonably priced. Since small-cap companies often have narrower markets than large-capitalization (“large-cap”) companies, the Portfolio Managers believe that conducting extensive proprietary research on small-cap growth companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

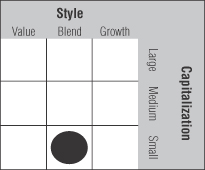

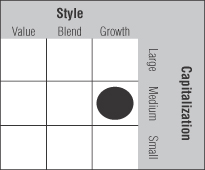

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 8.99% (excluding front-end sales charges) during the six-month period ended April 30, 2012, underperforming its benchmark index, the Russell 2000® Growth Index (“Russell 2000 Growth”), which returned 10.58%. The Russell 2000 Growth is an unmanaged index comprised of Russell 2000® Index (“Russell 2000”) companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 is an unmanaged index comprised of the 2,000 smallest

companies in the Russell 3000® Index (“Russell 3000”). The Russell 3000 measures the performance of the 3,000 largest U.S. companies based on total market capitalization. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | All sectors within the Fund generated positive returns for the period. Strong returns in the consumer discretionary, healthcare and energy sectors contributed most to the Fund’s performance. Consumer discretionary, specialty retail and hotels, restaurants and leisure industries boosted performance for the period. The Fund’s investment in the health care providers and services industry performed well to support healthcare sector returns. In energy, the energy equipment and services industry led with strong returns in the sector. The industrials, materials and financials sectors lagged for the period. In industrials, the electrical equipment industry pulled down returns in the sector. The metals and mining industry posted negative returns for the materials sector. Negative returns in the consumer finance industry tempered performance in the financials sector.

The Fund underperformed its benchmark index during the period. The industrials, healthcare, information technology and financials sectors pulled returns relative to the Fund’s benchmark down for the period. Weak performance in the electrical equipment and professional services industries dragged down relative returns in industrials. In healthcare, underperformance in the biotechnology and healthcare equipment and supplies industries damaged sector returns. Soft results in the software industry hurt relative returns in information technology. In the financials sector, underperformance in the consumer finance industry pulled down relative returns for the period. The Fund did perform well against the index within the energy, consumer discretionary and consumer staples sectors. Outperformance in the energy equipment and services industry boosted relative returns in the energy sector. Modest overweight positioning with strong performance in the specialty retail industry led to strong

Performance Summary and Commentary

| | |

| Eagle Small Cap Growth Fund (cont’d) | | |

consumer discretionary relative returns. In consumer staples, slight overweight posture coupled with solid performance in the food and staples retailing industry boosted sector returns for the period.

Underperformers | Rovi Corporation is a provider of digital entertainment technology solutions to the consumer electronics industry as well as service providers. Feedback from cable and satellite providers reflected below-expected adoption rates for Rovi’s TotalGuide product line. Technology’s evolution toward networked devices does provide Rovi with an opportunity to take advantage of advertising trends in the near to mid-term. The Fund no longer owns this security.

OPNET Technologies, Inc. provides application and network performance management solutions. The firm missed on earnings in part due to lighter utilization within its service segment, which in turn compressed margins during the quarter. OPNET did experience significant year-over-year bookings growth in its Application Performance Management (APM) offering, which represents the majority of OPNET’s total bookings revenue. The Fund continues to own this security.

BJ’s Restaurants, Inc. owns and operates casual dining restaurants across the U.S., with its menu including soups and salads, sandwiches, pasta and desserts as well as a variety of handcrafted beers. After having a strong run, BJ’s was hurt by its own success as a high valuation combined with difficult comps caused a stock price correction. The Portfolio Managers believe that BJ’s Restaurants remains a well-run concept with a very profitable box and a significant growth runway. The Fund continues to own this security.

Meritor, Inc. is a supplier of automotive components, including drive trains used in commercial trucking. The North American trucking cycle is showing signs of recovery and average fleet age is at historically high levels, which the Fund’s Portfolio Managers believe is likely to support near-term growth prospects in light of concerns over the current economic environment. The Fund continues to own this security.

Polypore International, Inc. is a specialty filtration company that makes separation membranes used in lithium ion batteries, which have seen significant growth from both consumer

electronics and hybrid electric vehicles. The stock underperformed due to concerns about waning sales for the all-electric Chevy Volt, which was the subject of a well-publicized investigation into engine fires that had occurred following crash tests. The investigation has since been resolved and high gasoline prices have helped boost sales of Volts to their highest levels during the month of March. The Fund continues to own this security.

Top performers | SuccessFactors, Inc. is a provider of cloud-based performance management, succession planning and learning management solutions to organizations. The firm was acquired during the period by SAP AG. The Fund sold its position prior to the acquisition at a significant premium.

Lufkin Industries, Inc. is a manufacturer of pump jacks utilized in the enhanced oil recovery process. The firm’s artificial lift segment is seeing increased application in part due to the continual rise in the U.S. oil rig count supported by favorable pricing in oil-based energy. The Fund continues to own this security.

GNC Holdings, Inc. (Class A) is a global specialty retailer of health and wellness products including vitamins, sports nutrition and diet and herbal supplements. The stock continues to benefit from sustained growth trends in the space as the baby boomer generation adopts the daily-vitamin philosophy and the general public increases its health awareness. The Fund continues to own this security.

Genesco Inc. is a retailer of headwear, footwear and clothing accessories. The firm continues to leverage its strong positioning in the Journeys footwear and Lids headwear lines to grow earnings, maintaining top market share in those spaces in the absence of direct competitors. The Fund continues to own this security.

Shuffle Master, Inc. develops and manufactures technology-based products for the gaming industry. Shuffler and slot machine revenue growth continue to impress, while the firm is also improving its balance sheet through the reduction of debt. The Fund continues to own this security.

Performance Summary and Commentary

| | |

| Eagle Smaller Company Fund | | |

Meet the managers | David M. Adams, CFA®, and John “Jack” McPherson, CFA®, Managing Directors at Eagle Boston Investment Management, Inc. (“EBIM”), are Co-Portfolio Managers of the Eagle Smaller Company Fund (the “Fund”), and have been jointly responsible for the day-to-day management of the Fund’s investment portfolio since its inception.

Investment highlights | The Fund invests primarily in equity securities of small-capitalization (“small-caps”) companies. Using a valuation sensitive approach to investing, the Fund’s Portfolio Managers seek to capture capital growth by selecting securities that the Portfolio Managers believe are selling at a discount relative to their underlying value and then hold them until their market value reflects their intrinsic value. To assess value, a “bottom-up” method of analysis is utilized. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. Other factors that the Portfolio Managers may look for when selecting investments include: management with demonstrated ability and commitment to the company, above-average potential for earnings and revenue growth, low debt levels relative to total capitalization and strong industry fundamentals.

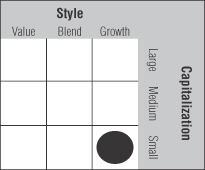

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.