Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-4338

EAGLE CAPITAL APPRECIATION FUND

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 567-8143

RICHARD J. ROSSI, PRESIDENT

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

FRANCINE J. ROSENBERGER, ESQ.

K&L Gates LLP

1601 K Street, NW

Washington, D.C. 20006

Date of fiscal year end: October 31

Date of reporting period: April 30, 2011

Table of Contents

Item 1. Reports to Shareholders

Table of Contents

| Semiannual Report |

| and Investment Performance Review for the |

| six-month period ended April 30, 2011 (unaudited) |

| Eagle Capital Appreciation Fund |

| Eagle Growth & Income Fund |

| Eagle International Equity Fund |

| Eagle Investment Grade Bond Fund |

| Eagle Large Cap Core Fund |

| Eagle Mid Cap Growth Fund |

| Eagle Mid Cap Stock Fund |

| Eagle Small Cap Core Value Fund |

| Eagle Small Cap Growth Fund |

|

Go Paperless with eDelivery visit eagleasset.com/eDelivery For more information, see inside.

Table of Contents

Visit eagleasset.com/eDelivery to receive shareholder communications including prospectuses and fund reports with a service that helps protect the environment:

Environmentally friendly. Go green with eDelivery by reducing the number of trees used to produce paper.

Efficient. Stop waiting on regular mail. Your documents will be sent via email as soon as they are available.

Easy. Download and save files using your home computer with a few clicks of a mouse.

Table of Contents

Dear Fellow Shareholders:

I am pleased to present the semiannual report and investment performance review of the Eagle Family of Funds for the six-month reporting period that ended April 30, 2011.

During the period, signs of a global economic recovery remained in place. Although there have been some dramatic headlines—a devastating earthquake and tsunami in Japan, a wave of anti-government protests in the Middle East, concerns about rising commodity prices—the broad equity markets continued to climb through the end of April. Further, there are some signs that market trends that had hindered the performance of some of our Funds may be abating as we move further into 2011.

I hope you will take the time to read the commentaries that follow, in which each fund’s portfolio managers discuss the specific performance in their funds. As of the date of this report, a common theme amongst the managers is that the economy appears to be moving along, even if at a slow pace. There undoubtedly will be challenges—as there always are—but I believe it is safe to say that our portfolio managers would suggest those challenges represent opportunities. In the end, the common characteristic among our managers is the idea that the way to seek superior risk-adjusted returns for investors is through a disciplined approach to security selection that focuses on long-term fundamentals instead of short-term market behavior.

In addition to reading the managers’ commentaries in this report, the Eagle website is a tremendous resource for fund-related information and timely information from our portfolio managers.

It is an exciting time here at Eagle:

| • | Eagle Asset Management, Inc. assumed day-to-day responsibility of the Growth & Income Fund on June 1 from Thornburg Investment Management. |

We believe this change will continue to serve shareholders’ interests. I would invite you to read more about the new team’s investing discipline at eagleasset.com.

| • | Eagle is celebrating its 35th year. We know there are some firms that have been around longer but we also recognize that many more have been around for much shorter periods. And some have come and gone in the meantime. |

Eagle is as committed to seeking superior performance for our clients today as the day we were founded 35 years ago.

| • | In addition, Eagle intends to offer an R-6 class of shares this upcoming year. |

In an effort to save costs and reduce environmental impact, Eagle is able to offer many reports electronically. If you would like to begin receiving paperless reports from the Eagle Family of Funds, please visit eagleasset.com and sign up for electronic delivery. Doing so will reduce the amount of paper we consume, which saves the Funds (and their shareholders) money and will help the environment. Enrolling in this service will not affect the delivery of your account statements or other confidential communications.

I would like to remind you that investing in any mutual fund carries certain risks. The principal risk factors for each fund are described at the end of this report. Carefully consider the investment objectives, charges and expenses of any fund before you invest. Contact us at 800.421.4184 or eagleasset.com or your financial advisor for a prospectus, which contains this and other important information about the Eagle Family of Funds.

We are grateful for your continued support and confidence in the Eagle Family of Funds.

Sincerely,

Richard J. Rossi

President

June 15, 2011

| 1 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Capital Appreciation Fund | ||

Meet the managers | Steven M. Barry, David G. Shell, CFA®, and Timothy M. Leahy, CFA®, are Portfolio Managers of Goldman Sachs Asset Management, LP’s (“GSAM”) “Growth Team.” Messrs. Barry and Shell are Chief Investment Officers and have been responsible for the day-to-day management of the Eagle Capital Appreciation Fund (the “Fund”) since 2002. Mr. Leahy joined GSAM as a Managing Director in 2005, and has been responsible for the day-to-day management of the Fund’s investment portfolio since February 2011.

Investment highlights | The Fund invests primarily in common stocks. The Fund’s portfolio management team believes that wealth is created through the long-term ownership of a growing business. They take a “bottom-up” approach to investing based on in-depth, fundamental research. A bottom-up method of analysis typically emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers use an intensive research process and each company is analyzed as if they were going to own and operate that company indefinitely. Key characteristics of the companies in which the Fund currently seeks to invest may include: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management.

This Morningstar Style Box™ shows the Fund’s current investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 13.22% (excluding front-end sales charges) during the six-month period ended April 30, 2011, underperforming its benchmark index, the Russell 1000® Growth Index, which

returned 16.96%. The Russell 1000® Growth Index measures performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values and is representative of U.S. securities exhibiting growth characteristics. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | U.S. equities continued their positive momentum from late 2010 into 2011 and posted the best first quarter in more than a decade. While all sectors made gains, energy stocks dominated returns as the benchmark Brent Crude oil price reached almost $120 per barrel on supply disruption fears stemming from escalating unrest across North Africa and the Middle East. Strong returns from U.S. equities over the period reflected optimism on improving trends in labor, housing, manufacturing, and consumer confidence.

The Fund delivered positive absolute returns during the period. Positive stock selection in the financial sector and an underweight to utilities contributed to relative performance. The Fund lagged its benchmark, the Russell 1000 Growth Index (gross), during the period. Weakness in select telecommunication services and health care holdings detracted from relative returns.

Under performers | Teva Pharmaceutical Industries Ltd. ADR detracted from relative performance during the period. Shares fell after the company announced disappointing results in a drug trial for its new multiple sclerosis treatment. We continue to have conviction in the company and believe Teva is well positioned to benefit from the wave of patent expirations of branded drugs in the next few years and the political tailwinds promoting generic drugs. Moreover, Teva is cementing its dominance in the generics industry due to its ability to launch generics earlier than its competitors and its expanding global footprint.

Wireless tower companies American Tower Corp. (Class A) and Crown Castle International Corp. detracted from performance after AT&T announced it would acquire T-Mobile. The

| 2 |

Table of Contents

| Performance Summary and Commentary |

| Eagle Capital Appreciation Fund (cont’d) |

management for the AT&T/T-Mobile combined company announced the acquisition would lead to a number of cost savings synergies, including the reduction in the overall number of cell sites. In our view, this initiative may negatively impact the tower companies as leasing revenue is derived from the number of cell sites. However, we believe the overall impact to the company should be small and spread over several years; therefore, the potential drag on revenues may be relatively modest. While the acquisition may be an incremental near-term hurdle, we continue to have conviction in the tower companies over the long-term as demand for mobile content continues to grow and we believe wireless carriers will be required to add capacity in order to support increased usage, network upgrades and improved coverage.

CME Group Inc., the world’s largest futures and options exchange, detracted from relative returns due to uncertainty over volumes following the end of QE2 (the Federal Reserve’s asset purchasing initiative commonly referred to as “quantitative easing”). Despite this short-term pressure, we believe CME will benefit from the migration of over-the-counter (OTC) derivatives markets to exchanges. Furthermore, we believe CME Group’s interest rate OTC clearing platform will be a long-term growth driver for the company as it meets its customers’ demand for more transparency and less counterparty risk.

Within consumer staples, Avon Products Inc. detracted from performance during the period. Shares declined after Avon reported weaker-than-expected earnings which were driven by disappointing sales and softer margins due to higher input costs. In addition, management lowered its sales guidance for the 2011 calendar year. Despite these near-term setbacks, we continue to believe Avon is poised to deliver higher operating margins over the next few years as its broad geographic footprint, particularly in Latin America, provides exposure to numerous growing markets.

The Fund continues to hold each of the securities noted above as “under performers”.

Top performers | In the first quarter, CB Richard Ellis Group Inc., the world’s leading commercial real estate services firm, contributed to relative performance, as shares traded up in anticipation of the company’s fourth quarter earnings announcement. CB Richard Ellis has benefited from strong sales and leasing revenues as well as cost reductions during the recent downturn, which resulted in significant operating leverage. We continue to have conviction in the company given the strength of its franchise, its service-oriented business model, and its strong management team.

St. Jude Medical Inc., a global medical device company, contributed to relative performance during the quarter. Shares were weak in January after an article in the Journal of the American Medical Association suggested that ICDs (implantable cardioverter-defibrillators) may be overused. While we believe this evidence could be a headwind for sales, we believe the stock price reaction overstated the impact to the company’s end markets and we added to the position. Subsequently, the market began to have a greater appreciation for the company’s product pipeline and revenue potential causing the shares to rebound, thereby contributing to relative performance.

Oil well services companies Schlumberger Ltd. and Halliburton Company contributed to relative performance during the period. Shares rose as international activity has recovered faster than the market expected. We believe growth in global demand for oil will continue to grow as supply growth becomes more challenging, leading to significant opportunities for energy services companies.

Occidental Petroleum Corp., the oil and gas exploration and production company, contributed to performance as it continued to benefit from rising oil prices. In addition, the company announced management changes and new corporate governance measures that we believe are positive for long-term shareholder value.

The Fund continues to hold each of the securities noted above as “top performers.”

| 3 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Growth & Income Fund | ||

Meet the managers | William V. Fries, CFA®, Managing Director, and Cliff Remily, CFA®, of Thornburg Investment Management, Inc. were Co-Portfolio Managers of the Eagle Growth & Income Fund (the “Fund”). Mr. Fries had served as Co-Portfolio Manager from 2001 to 2011. Mr. Remily was named Co-Portfolio Manager in January 2009. Eagle Asset Management took over the day-to-day responsibility of the Investment Portfolio effective June 1, 2011. The commentary that follows is as of May 15, 2011.

Investment highlights | Prior to June 1, 2011, the Fund invested primarily in domestic equity securities (primarily common stocks) and can invest up to 30% of its net assets in direct foreign securities including up to 10% of its net assets in emerging market securities, including China. The Fund could also invest in fixed income securities. The Fund’s portfolio managers looked for promising investments that can be purchased at a discount to their estimate of each investment’s intrinsic value. The managers sought investments that deliver a competitive total return over multiple time horizons. Holdings are classified in three categories: basic value, consistent earners and emerging franchises as a means of structuring diversification. Dividends and dividend growth are a consideration in stock selection and may include stocks outside the traditional dividend paying areas.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund as of May 15, 2011.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 11.88% (excluding front-end sales charges) during the six-month period ended April 30, 2011, underperforming its benchmark index, the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”) which returned 16.36%. The S&P 500

Index is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | Returns in all sectors of the Fund were positive for the six-month period, with particular strength coming from the energy and consumer discretionary sectors. The Fund’s underperformance relative to the benchmark S&P 500 Index was due to both allocation and stock selection effects. Underweights in Industrials, Consumer Staples and Energy sectors as well as overweights in Health Care and Consumer Staples detracted from the relative performance, largely due to stock selection. Conversely, an underweight in Information Technology versus the S&P 500 aided performance. Stock selection was weakest in the Energy and Health Care sectors.

The small remaining exposure to fixed income securities (1.3% of the portfolio) was a net benefit to the fund for the six-month period, but did not help in overcoming the total shortfall against the benchmark. The Fund maintained a 70/30 split between U.S. and Non-U.S. companies, with nearly 2% in emerging markets. Those emerging market holdings produced better results than the rest of the portfolio’s developed market holdings, which is consistent with general market performance for the last six months. International exposure helped the portfolio, with developed countries in Europe, Asia and North America (Canada), by outperforming U.S.-based holdings. Cash levels remained low at less than 3% of total holdings.

The last six months have seen global stock markets in flux, though generally market returns have been positive. While there are some signs of economic recovery in the U.S., there are still headwinds: upward pricing pressure in commodities, particularly in oil and industrial materials, Federal fiscal policy moves, inflationary fears and lackluster job growth are still major concerns going into the second half of 2011 and 2012. However, strong corporate earnings and continued growth in emerging markets are helping to offset poor performance in many developed markets and valuations remain attractive. The

| 4 |

Table of Contents

| Performance Summary and Commentary |

| Eagle Growth & Income Fund (cont’d) |

Energy, Industrials and Materials sectors led the benchmark S&P 500’s performance, while the Utilities and Information Technology sectors lagged the group.

Under performers | Google Inc. (Class A) fell on 1Q earnings results as revenues were solid but operating expenses disappointed. Clearly returns were not as strong as the previous quarter and this set of results did not provide a hoped-for catalyst for Google shares.

Teva Pharmaceuticals Industries Ltd. is a global pharmaceutical company. Along with general pricing pressure due to Middle East tensions that were rampant in the first quarter of 2011, competition to Capaxone, one of Teva’s key drugs (42% of profits in 2010), pushed the Teva stock price lower. Its announcement that it would acquire Cephalon was met with market indifference, as this leader in generic pharmaceuticals has been the victim of negative market sentiment, although we believe the negativity is unwarranted.

Lorillard Inc. was sold in February after news that the FDA and other organizations will potentially pressure the government to either place onerous restrictions on Menthol products or possibly ban menthol cigarettes outright. We believe this risk outweighed the positive factors for owning Lorillard.

AllianceBernstein Holding LP has seen its market share, and subsequently its stock price, deteriorate due to continuing outflow problems. Concerns that it might not be able to turn itself around, despite a low valuation relative to its peers, resulted in the stock being sold in February.

Information technology vendor, Dell Inc, underperformed during the period. Due to a fundamental deterioration in the investment thesis, as well as perceived pricing pressures and disappointing PC sales, Dell was sold.

Top performers | Baidu Inc./China ADR is the leading online search provider in China. With Google leaving the Chinese market and no other real competition, Baidu continues to benefit from surging Chinese economic growth, which translated into strong first quarter earnings.

Canadian Oil Sands Ltd. benefited from rising oil prices, which was reflected in their fourth quarter 2010 and first quarter 2011 earnings. The positive results led the company to increase its 2011 guidance and dividend 50%. Also, as improved technology allows better and cleaner production capacity, consumer sentiment appears to be shifting in this stock’s favor.

Lower-than-expected loan loss provisions contributed to SVB Financial Group’s first quarter 2011 earnings beating estimates soundly, boosting share price. While loan demand remains lackluster, SVB Financial Group has posted three sequential positive quarters, and management states that the pipeline for new loans remains strong.

ConocoPhillips, the third largest integrated energy company in the U.S., profited from rising oil prices, which boosted the company’s first quarter earnings and stock price. The company also announced plans to sell between $5 to 10 billion of non-core assets over the next two years, using the proceeds to buy back stock and invest in growing its business.

Ensco PLC ADR, a global provider of offshore drilling services, benefited from rising oil prices. First quarter earnings were positive and the company continues to invest in its future with its proposed acquisition of Pride International Inc. Ensco also benefited from the U.S. government’s decision to end the moratorium on offshore drilling permits in the Gulf of Mexico.

| 5 |

Table of Contents

| Performance Summary and Commentary |

| Eagle International Equity Fund |

Meet the managers | Richard C. Pell is Chief Executive Officer at Artio Global Investors Inc. and Chief Investment Officer at its affiliate, Artio Global Management LLC (“Artio Global”). Rudolph-Riad Younes, CFA®, is Head of International Equities at Artio Global. Messrs. Pell and Younes have managed the Eagle International Equity Fund (the “Fund”) since 2002.

Investment highlights | The Fund invests primarily in foreign equity securities. The Fund’s portfolio managers seek investment opportunities within the developed and emerging markets. In the developed markets, a “bottom-up” approach is adopted. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. In the emerging markets, a “top-down” assessment consisting of currency/ interest rate risks, political environments/leadership assessment, growth rates, structural reforms and risk (liquidity) is applied. A top-down method of analysis emphasizes the significance of economy and market cycles. In Japan, given the highly segmented nature of this market comprised of both strong global competitors and protected domestic industries, a hybrid approach encompassing both bottom-up and top-down analyses is conducted.

This Morningstar Style Box™ shows the Fund’s current investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 10.20% (excluding front-end sales charges) during the six-month period ended April 30, 2011, underperforming its benchmark index, which returned 12.44%. The Fund’s benchmark index, the Morgan Stanley Capital International® All Country World Index ex-US (“MSCI® ACWI ex-US”), is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed

and emerging markets. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | For the six months ended April 30, 2011, international equity markets marched higher. Continued accommodative monetary policies in the developed world, trumped by a second round of quantitative easing by the U.S. Federal Reserve, added to the belief that the economic recovery will remain on course. However, periods of optimism were tested by the deteriorated fiscal positions of Greece, Ireland, Portugal and other peripheral members of the Euro zone. In spite of this, the euro managed to advance by approximately 6% versus the U.S. dollar, adding allure to dollar-based investors venturing into Euro zone investments. Elsewhere, fears over mounting inflationary pressures in Asia led to increased volatility in the Indian and Chinese markets as those countries’ Central Banks responded by hiking interest rates, leading to concerns over prospective economic growth. Topping the news headlines was the turmoil which erupted in the Middle East and North Africa, as well as the tragic and devastating effects of the Japanese earthquake and tsunami. Amid all of these major events, equities were surprisingly resilient.

The Fund underperformed the benchmark during the review period due to positioning in emerging markets as well as stock selection in developed markets, primarily within financials. Within emerging markets, the Fund’s overweight to, and stock selection in, India had the largest negative impact as did the overweight to China amid fears of inflation in the region. Stock selection in Russia also detracted from the Fund’s performance. The Fund benefited, however, from stock selection in Taiwan. Within developed markets, positions held in the financial sector in Hong Kong underperformed as hikes in interest rates in the region led to concerns over economic growth prospects. Contributing to results was the Fund’s positioning within Europe, specifically in industrials and healthcare. The Fund’s underweight to Japan also had a positive impact on results as the country underperformed amid

| 6 |

Table of Contents

| Performance Summary and Commentary |

| Eagle International Equity Fund (cont’d) |

the devastating effects of the earthquake, tsunami and nuclear reactor crisis. Another factor which had a negative impact on performance was cash and currency hedging. The decision to hedge a portion of the Fund’s exposure to the euro had a negative effect given the Euro’s strength during the review period.

Under performers | iShares MSCI India Index Fund, Larsen & Toubro Ltd GDR, India’s largest engineering company, and Hang Lung Properties Ltd., a real estate developer based in Hong Kong, underperformed amid concerns over mounting inflation and the effect that rising interest rates may have on economic growth in the Asian region. The Fund sold its position in iShares MSCI India Index Fund, but continues to hold Larsen & Toubro Ltd GDR and Hang Lung Properties Ltd.

Lloyds Banking Group PLC Britain underperformed amid concerns that rising funding costs may squeeze profit margins in 2011. As of the end of the period, the Fund continues to hold this position.

Hypermarcas SA, Brazil’s fourth-largest consumer goods company, also underperformed amid concerns over the dilutive effects of an announced acquisition by the company. Although it underperformed, the Fund continues to hold this position.

Top performers | HTC Corp., the Taiwanese Smartphone manufacturer, benefited from continued strong demand for Android-based phones.

BG Group PLC, the British oil and gas company, outperformed given its fast growing production profile amid a strong backdrop for energy. The company is active not only in the North Sea but also in Brazil and Australia.

Xstrata PLC, a global diversified mining group with operations in 19 countries, operates a world-wide portfolio of metals and mining businesses with the aim of delivering industry-leading returns. The stock has been a beneficiary of the ongoing strong demand for metals.

Fraport AG, the German owner and operator of Frankfurt Airport, is one of the leading companies in the airport business worldwide. The stock outperformed amid improved passenger figures and cargo volumes.

Baidu Inc./China ADR, a Chinese internet search engine company, outperformed on positive growth expectations for the company given its exposure to the growing Chinese consumer segment.

The Fund continues to hold each of the securities noted above as “top performers.”

| 7 |

Table of Contents

| Performance Summary and Commentary |

| Eagle Investment Grade Bond Fund |

Meet the managers | James C. Camp, CFA®, a Managing Director at Eagle Asset Management (“Eagle”) and Joseph Jackson, CFA®, are Co-Portfolio Managers of the Eagle Investment Grade Bond Fund (the “Fund”) and have been jointly responsible for the day-to-day management of the Fund’s investment portfolio since the Fund’s inception.

Investment highlights | The Fund invests primarily in investment grade fixed income securities. Investment grade is defined as securities rated [BBB-] or better by Standard & Poor’s Rating Services or an equivalent rating by at least one other nationally recognized statistical rating organization or, for unrated securities, those that are determined to be of equivalent quality by the Fund’s Portfolio Manager. The average portfolio duration of the Fund is expected to vary and may generally range anywhere from two to seven years based upon economic and market conditions. The Fund expects to invest in a variety of fixed income securities including, but not limited to corporate debt securities of U.S. and non-U.S. issuers, including corporate commercial paper; bank certificates of deposit; debt securities issued by states or local governments and their agencies; obligations of non-U.S. Governments and their subdivisions, agencies and government sponsored enterprises; obligations of international agencies or supranational entities (such as the European Union); obligations issued or guaranteed by the U.S. Government and its agencies; mortgage-backed securities and asset-backed securities; commercial real estate securities; and floating rate instruments.

This Morningstar Style Box™ shows the duration and credit quality of bonds held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned -1.03% (excluding front-end sales charges) during the six-month period ended April 30, 2011, underperforming its

benchmark index, which returned -0.47%. The Fund’s benchmark index, the Barclays Intermediate Government/Credit Bond Index, includes U.S. government and investment grade credit securities that have a greater than or equal to one year and less than ten years remaining to maturity and have $250 million or more of outstanding face value. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | Diverse global macroevents impacted the fixed income market over the last six months. The initiation of the Federal Reserve’s second round of quantitative easing provided additional liquidity to the market for risk assets and most definitely had the effect of driving prices higher. In addition, the extension of jobless benefits and payroll tax holiday provided a measure of stimulus to American consumers in the first half of 2011. Somewhat offsetting these factors were a slew of geo-political events that wreaked havoc on markets for brief periods. The most notable negative events were the earthquake, ensuing tsunami and partial nuclear meltdown in Japan. The earthquake and tsunami put pressure on tech companies with large manufacturing centers within Japan, and the meltdown called the future of nuclear power generation into question, affecting utility companies around the globe. Tensions in the Middle East erupted in Egypt, Libya, and elsewhere, helping to send oil prices to multi-year highs. The extended period of zero percent interest rates in the U.S. was blamed, in part, for escalating commodity prices and inflation at the producer level.

The Fund underperformed the Barclays Intermediate Government/Credit Index during the six-month period ended April 30, 2011. The largest contributor to Fund performance was a significant underweight in Treasuries. Riskier assets outperformed Treasuries by a large margin during the period. The positioning of the Fund in the corporate sector was the largest detractor from relative performance mainly due to being underweight in Financial Institutions and higher risk issuers. Other sector allocation returns were negligible with respect to relative performance.

| 8 |

Table of Contents

| Performance Summary and Commentary |

| Eagle Investment Grade Bond Fund (cont’d) |

Under performers | Exelon Generation Comp. LLC 5.20% 10/01/19 bonds declined on the news of a possible nuclear meltdown in Japan. Nuclear power is a key component of Excelon operations. The Fund continues to own this security.

eBay Inc. 1.63% 10/15/15 underperformed higher beta securities during the quarter as investors sought high-yielding investments. The Fund sold this security.

Both General Mills Inc. 5.65% 02/15/19 and PepsiCo Inc. 7.90% 11/01/18, and consumer products companies in general, were hurt by rising inflation and tightening margins due to the recent run-up in commodity prices. The Fund sold both of these securities.

Verizon Communications Inc. 6.35% 04/01/19 spreads widened due to the announcement of ATT’s agreement to purchase T-Mobile (a merger of Verizon’s two largest rivals). The Fund continues to own this security.

Top performers | Both CR Bard Inc. 4.40% 01/15/21 and Merck & Co., Inc. 2.25% 01/15/16 are issues that have benefited from outperformance in the healthcare and pharmaceutical industries.

Willis Group Holdings PLC 4.13% 03/15/16 (BBB-,Baa3) was an example of a lower-rated issue performing well. Generally speaking, risk rallied throughout the period; high-yield outperformed investment grade, Commercial Mortgage-Backed Securities outperformed Residential Mortgage-Backed Securities, and financials outperformed industrials and utilities.

PNC Funding Corp. 4.38% 08/11/20 and CME Group Index Services LLC 144A 4.40% 03/15/18 are good examples of high-grade financials that outperformed high-grade industrials and utilities during the period.

The Fund continues to hold each of the securities noted above as “top performers.”

| 9 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Large Cap Core Fund | ||

Meet the managers | Richard Skeppstrom, John “Jay” Jordan, CFA®, Craig Dauer, CFA®, and Robert Marshall at Eagle Asset Management, Inc. (“Eagle”) have been Co-Portfolio Managers of the Eagle Large Cap Core Fund (the “Fund”) since inception. Mr. Skeppstrom is a Managing Director at Eagle.

Investment highlights | The Fund invests primarily in common stocks. When identifying investments for the Fund, the portfolio managers use a “bottom-up” research process that is combined with a proprietary relative-valuation discipline. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. In general, the portfolio managers seek to select securities that, at the time of purchase, have above-average expected returns and at least one of the following characteristics: projected earnings growth rate at or above the benchmark index, above-average earnings quality and stability, or a price-to-earnings ratio comparable to the benchmark index.

This Morningstar Style Box™ shows the Fund’s current investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 16.95% (excluding front-end sales charges) during the six-month period ended April 30, 2011, outperforming its benchmark index, the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”), which returned 16.36%. The S&P 500 Index is an unmanaged index of 500 U.S stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and

principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | In recording the strongest first quarter in years for major indices—thirteen years for the S&P 500 and twelve years for the Dow Jones Industrials—investor sentiment was tested in volatile trading during mid-February through mid-March 2011 as turmoil swept through the Middle East, raising crude oil prices and fears of potential supply disruptions. Additionally, Japan experienced a devastating earthquake/tsunami with severe damage to nuclear power plants and the prospect of supply chain disruptions. But strong corporate earnings, the prospect of further Fed accommodation, and sufficient economic data to support continued growth carried the equity market higher through April 2011 along with crude oil, gold, and other commodity prices, while the dollar fell to its lowest level since mid-2008. S&P 500 performance during the reporting period was led by energy, industrials, and materials sectors. Below-average-performing sectors included utilities, information technology, consumer staples, telecommunication services, financials, and health care. The consumer discretionary sector matched the index performance.

The Fund outperformed its S&P 500 benchmark during the period, led by outperformance in overweighted healthcare, low allocation to the weak-performing utilities sector, stock selection in underweighted telecommunication services, and low allocation to the underperforming consumer staples sector. The Fund underperformed its benchmark in the following sectors: market-weighted energy; and market-weighted consumer discretionary.

Top performers | St. Jude Medical Inc. reported it has seen market share gains at a premium price in Europe for its new quadripolar CRT-D (ICD + cardiac resynchronization, for heart failure patients) leads. These new leads allow surgeons to get accurate electrical placement and secure physical placement in the heart, rather than having to tradeoff between the two. Having this temporary technology advantage may allow St. Jude to gain access to hospitals where it has previously been excluded.

Exxon Mobil Corp. remained a strong holding while the energy sector benefited from the increasing intensity of internal conflicts in the Middle East which, in turn, has sharply boosted oil prices on supply concerns. While we believe oil prices

| 10 |

Table of Contents

| Performance Summary and Commentary |

| Eagle Large Cap Core Fund (cont’d) |

remain below most theoretical estimates of demand destruction levels, rising energy prices bear attention as to their potential impact on global economic growth.

Tyco International Ltd., a leading provider of electronic security products and services, was a top performer as Schneider National Inc. held exploratory discussions with bankers regarding a potential acquisition of Tyco. While we believe the magnitude and complexity of the transaction makes a deal unlikely, we think Schneider’s interest highlights the strong free cash flow yield at Tyco as well as the improving business trends and operating leverage at Tyco’s subsidiary, ADT Security Services Inc.

UnitedHealth Group Inc., a provider of health services and benefits, investors are becoming increasingly comfortable that managed care companies can successfully navigate U.S. healthcare reform, reflected in rising earnings estimate revisions.

Management at EMC Corporation, a provider of storage hardware solutions, presented a very upbeat strategy during the company’s analyst day in February regarding the tenor of current business and the 3-5 year outlook for its cloud computing endeavors.

The Fund continues to hold each of the securities noted above as “top performers.”

Under performers | Cisco Systems Inc. issued disappointing guidance for fiscal third quarter earnings as weakness in government and consumer divisions carried over from last quarter’s disappointment. The company’s explanation for near-term margin pressure highlights the meaningful product transition across Cisco’s router and switch product lines with an expectation that margins will rebound as the transition matures. The rationale for owning Cisco is based in what we believe is broad, leading exposure to the strongest trends in technology spending (data growth, “the cloud”, data center development, and wireless).

Google Inc. (Class A) reported very strong revenue growth of 27% in the first quarter but expenses grew even faster, reducing earnings growth to the high teens. The market would rather not see explosive expense growth because of fears that many initiatives could be wasteful. However, considering Google’s high profitability and growth orientation, we believe strong spending growth is likely a sign of confidence, and the stock is still held.

EOG Resources Inc. was sold in December. While EOG remains in the top tier of exploration and production companies as it relates to future production growth, our thesis for owning it was based in a belief that modestly higher natural gas prices would support a level of cash flows capable of funding the meaningful capital program required to drive strong, oil-based production. Nevertheless, due to the persistently high levels of natural gas production and the resultant pressure on natural gas prices, EOG was forced to lower production growth rates while increasing debt and selling assets, and its qualitative characteristics were in decline while the valuation remained average versus its peer group.

The Goldman Sachs Group Inc. beat consensus first quarter earnings estimates, but revenue dropped 7% as the company is operating using low leverage, high capital and near-record liquidity due to its unwillingness to take big risks while waiting for yet-unwritten rules affecting areas such as derivatives and proprietary trading. We expect that cash should be put to work when the firm sees better market opportunities. The Fund continues to hold this stock.

Hewlett-Packard was sold in April. With higher energy costs and continued economic uncertainty weighing on the consumer, PC sales for the market have been weak. In addition, the Japanese earthquake created supply chain problems, causing concern regarding pricey acquisitions by new management to meet top-line growth expectations.

| 11 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Mid Cap Growth Fund | ||

Meet the managers | Bert L. Boksen, CFA®, a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”), is the Portfolio Manager of the Eagle Mid Cap Growth Fund (the “Fund”), and has managed the Fund since its inception. Eric Mintz, CFA®, has been Co-Portfolio Manager since 2011, and Christopher Sassouni, DMD, has served as Assistant Portfolio Manager of the Fund since 2006. Mr. Mintz served as Assistant Portfolio Manager from 2008 through 2011.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization companies. The Fund’s portfolio managers seek to capture the significant long-term capital appreciation potential of mid-cap, rapidly growing companies. The portfolio managers use a “bottom-up” investment approach through a proprietary research strategy that emphasizes the selection of mid-cap growth stocks that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The Fund’s portfolio managers believe that conducting extensive research on mid-cap companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

This Morningstar Style Box™ shows the Fund’s current investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 21.91% (excluding front-end sales charges) during the six-month period ended April 30, 2011, underperforming its benchmark index, which returned 22.62%. The Fund’s benchmark index, the Russell Midcap® Growth Index, measures the performance of those Russell Midcap® companies with higher price-to-book ratios and higher forecasted growth values. Please keep in mind that an index is

not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | On an absolute basis, the consumer discretionary, information technology and industrials sectors led the Fund’s returns during the reporting period, while all sectors except telecommunication services posted gains. In consumer discretionary, the Fund’s holdings in the hotels, restaurants and leisure and textiles apparel and luxury goods industries performed well. In information technology, stocks in the software and semiconductors and semiconductor equipment industries posted strong gains. In industrials, the Fund’s investments in the machinery industry had strong performance. In addition, the Fund’s holdings in the metals and mining industry, which is part of the materials sector, contributed to overall absolute performance. On an absolute basis, the telecommunications services, consumer staples and financials sectors lagged. In telecommunications, the Fund’s wireless telecommunication services holdings posted negative returns. In consumer staples, the Fund’s single holding in the food products industry traded down. In financials, holdings in the diversified financial services and real estate management and development industries lagged.

The Fund slightly underperformed its benchmark index for the reporting period. Relative to the benchmark, the Fund underperformed most significantly in telecommunication services and information technology. The Fund’s holdings in the telecommunication services sector, one of the smallest sectors in the portfolio, posted slightly negative returns. Despite solid absolute returns, the Fund lagged in information technology due to its holdings in the internet software and services and electronic equipment and instruments industries. Relative to the benchmark, stocks in the consumer discretionary sector outperformed due to an overweight position in the hotels, restaurants and leisure industry. In materials, the Fund outperformed the benchmark due to strong returns in the chemicals and metals and mining industries. The Fund also benefited from a lack of exposure to the airlines industry, as higher fuel costs hurt the benchmark constituents

| 12 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Mid Cap Growth Fund (cont’d) | ||

of this group. The airlines industry is a component of the industrials sector.

Under performers | Akamai Technologies Inc. provides technologies that improve the delivery of content over the internet. Shares of the stock pulled back when the company lowered first quarter earnings expectations. The Fund continues to hold its shares of the stock.

Shares of Thoratec Corp, the pioneer in left-ventricular-assist devices, traded down when a competitor released clinical data for its product that suggested a slightly better adverse event profile than Thoratec’s device. The Fund sold its shares.

Dean Foods Co. is the largest processor and distributor of milk in the U.S. We had expected the company would be able to improve profitability, however, this turnaround has yet to materialize. The company’s cost structure is highly sensitive to dairy prices, and milk prices have remained extremely competitive. The Fund sold the stock.

Chip designer NVIDIA Corp produces a processor that goes in tablet PCs. The stock traded down somewhat on speculation that there could be a supply glut of the processors. However, we believe the stock is attractively valued and continue to hold its shares in the Fund.

Dolby Laboratories Inc. (Class A) develops audio and surround-sound technologies. The stock traded down after the company revised its full year guidance to reflect slower growth in the PC market. The Fund sold the stock.

Top performers | ARM Holdings PLC ADR, a beneficiary of smartphone and tablet adoption, announced that a future version of the Windows operating system will run on ARM-based processors. This will enable the company to expand its addressable market to include Windows-based tablets and potentially servers, notebooks, and desktop PCs.

Chicago Bridge & Iron Co, N.V. is an engineering and construction firm with significant exposure to liquefied natural gas. Increase in the stock price is correlated to the rising price of oil. In addition, we believe the recent nuclear power issues in Japan may cause that country’s government to increase use of natural gas in power generation, which could ultimately benefit the company.

Continental Resources Inc. is an oil and gas producer and the largest acreage owner in the Bakken Shale. This stock also has benefited from rising oil prices.

Polycom Inc. is a supplier of voice and video communications equipment targeted to business users. The stock traded up after the company reported better-than-expected earnings growth.

Shares of metallurgical coal producer Walter Energy, Inc. traded up during the period. Similar to Chicago Bridge & Iron Co, N.V., the increase was correlated to the rising price of oil.

The Fund continues to hold each of the securities noted above as “top performers.”

| 13 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Mid Cap Stock Fund | ||

Meet the managers | Todd L. McCallister, Ph.D., CFA®, is a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”) and Co-Portfolio Manager of the Eagle Mid Cap Stock Fund (the “Fund”). Mr. McCallister has 23 years of investment experience and has managed the Fund since its inception. Stacey Serafini Thomas, CFA®, served as Assistant Portfolio Manager to the Fund from 2000 to 2005, before being named Co-Portfolio Manager.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization companies. The portfolio managers of the Fund employ a “bottom-up” stock-selection process to identify growing, mid-cap companies that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers seek to gain a comprehensive understanding of a company’s management, business plan, financials, real rate of growth and competitive threats and advantages.

This Morningstar Style Box™ shows the Fund’s current investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 15.92% (excluding front-end sales charges) during the six-month period ended April 30 2011, underperforming its benchmark index, the Standard & Poor’s MidCap 400 Index (“S&P MidCap 400”) which returned 23.25%. The S&P MidCap 400, is an unmanaged index that measures the performance of the mid-sized company segment of the U.S. market. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | Widespread market risk dominated returns until late in 2010 and stocks mostly traded together leaving company specific risk small. In early 2011, many were surprised that the stock market continued to produce strong returns in spite of headline news that was difficult to overlook: select European bond yields are at all-time highs; Japan, the world’s third-largest economy, suffered dual disasters; state and local cutbacks here in the United States; oil prices are at several-year highs; housing prices have fallen to a new post-bubble low; and developed nations have high debt burdens.

The Fund underperformed its benchmark index, the S&P Mid Cap 400, during this time period. On an absolute basis, energy and industrials contributed the most to the Fund while telecommunication services had negative performance. Information technology and consumer discretionary did not perform well on a relative basis. In technology, our electronic equipment holdings were up but not as much as the industry was in the benchmark. In consumer discretionary, our conservative overweight in media outperformed the index, yet it hurt on a relative basis. Furthermore, the underweight in specialty retailers hurt the Fund and our holdings were not up as much as those of the index, yet speciality retail is a cyclical industry that, by its nature, often does not meet our investment criterion. The Fund’s holdings in the utilities and financials sectors performed well. We remained underweight the index in utilities, a sector that lagged the broader index. In financials, the Fund performed well in real estate investment trusts and consumer finance.

Under performers | Dolby Laboratories Inc. (Class A), an innovator of audio, imaging, and voice technologies, traded lower, in spite of beating earnings, as it decreased its 2011 revenue guidance based on weakness in personal computer sales. We will continue to monitor the holding because—while it has a strong business model with cash generation, high margins and no debt—new devices, such as tablets, might begin to cannibalize existing sales.

Marvell Technology Group Ltd. traded lower after fourth quarter earnings were at the low end of guidance. We chose to sell the

| 14 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Mid Cap Stock Fund (cont’d) | ||

position as the communications component supplier gave estimates that the next quarter was also going to be challenging with higher research and development and new product costs.

Energizer Holdings, Inc. reported a weak first quarter and guided the rest of the year’s earnings lower. The company had less battery growth than expected and invested more than expected in its Schick Hydro launch. We chose to sell the holding as visibility on future earnings decreased and we were left with a lower upside.

We sold our holdings in DreamWorks Animation SKG, Inc. (Class A) because 2011 is proving to be more difficult than we expected for movie revenues and DVD sales. We continue to believe there is considerable franchise value in the holding but other media names are more compelling to us right now.

Lorillard, Inc. traded lower as increased business risks surrounded the potential menthol regulation from the Tobacco Products Scientific Advisory Committee (“Committee”). The Fund sold Lorillard as the Committee was considering recommending a full ban on menthol cigarettes that would severely impair sales. We still view Lorillard as one of the best domestic tobacco companies but the company is very dependent on its line of menthol cigarettes (e.g., Newport).

Top performers | National Oilwell Varco Inc., a worldwide leader in providing major mechanical components for land and offshore drilling rigs, saw an uptick in inbound orders as there has been a large change in the sentiment for contract drillers, causing them to increase their orders for rigs. New orders for capital equipment jumped to $2 billion during this period and it was the first time orders exceeded deliveries since 2008. With

the potential for a new offshore rig construction cycle beginning to unfold, we continue to hold National Oilwell Varco as we believe they stand to benefit the most from this situation.

St. Jude Medical Inc. traded higher as investors began to assign a higher value to its Quadra pacemaker. The Quadra uses four electronic leads to attach to the heart, thereby making it more likely that the pacemaker attachment will be successful. We believe there is still more upside to this holding because St. Jude has the leading technology in a non-discretionary healthcare area. The Fund continues to hold this stock.

Solutia Inc. is a specialty chemicals manufacturer of niche films and fibers. Solutia held an investor day during which the company raised expectations going forward and set lofty long term targets while unveiling a path to get there. The company expects to maintain the highest profit margins in the industry and leading positions in the markets where it competes. We continue to hold this position in the Fund.

Check Point Software Technologies Ltd., a leader in network security software, continues to cross sell its products after it acquired Nokia’s appliances business. It has had success migrating users to newer versions of the platform and these newer versions have additional functionality and higher average selling prices. The Fund continues to hold this stock.

Agilent Technologies Inc., manufacturer of a wide range of analytical instrumentation relating to mass spectrometry, spectroscopy, chromatography, and biotechnology, continued to execute well throughout the holding period. After its investor day, the company took on a premium valuation which provided the Fund an opportunity to exit the position at a good value.

| 15 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Small Cap Core Value Fund | ||

Meet the managers | David M. Adams, CFA®, Lead Portfolio Manager, and John “Jack” McPherson, CFA®, Co-Portfolio Manager, are Managing Directors at Eagle Boston Investment Management, Inc. (“EBIM”) and have been responsible for the day-to-day management of the Eagle Small Cap Core Value Fund (the “Fund”) since its inception.

Investment highlights | The Fund invests primarily in equity securities of small-capitalization companies. Using a value approach to investing, the Fund’s portfolio managers seek to capture capital growth by selecting securities that the portfolio managers believe are selling at a discount relative to their underlying value and then hold them until their market value reflects their intrinsic value. To assess value, a “bottom-up” method of analysis is utilized. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. Other factors that the portfolio managers may look for when selecting investments include: management with demonstrated ability and commitment to the company, above-average potential for earnings and revenue growth, low debt levels relative to total capitalization and strong industry fundamentals.

This Morningstar Style Box™ shows the Fund’s current investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 24.18% (excluding front-end sales charges) during the six-month period ended April 30, 2011, outperforming both benchmark indices, the Russell 2000® Index and Russell 2500® Index, which returned 23.73% and 23.71% respectively. The Russell 2000® Index is an unmanaged index comprised of the 2,000 smallest companies in the Russell 3000® Index, and the Russell 2500® Index is a market cap weighted index that includes the smallest 2,500 companies in

the Russell 3000® Index. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | The Fund realized a strong absolute return during the period. The energy, health care, material, industrial, consumer discretionary and staples sectors realized the best returns for the Fund during the period. Telecommunications services, utilities, financials and information technology lagged the overall return for the Fund as well as the benchmark.

The Fund outperformed the benchmarks during the reporting period. The primary factor was stock selection, particularly in the industrial, health care and materials sectors of the market. Secondarily, the Fund’s fundamentally-oriented focus on higher quality companies with below average balance sheet leverage combined with our value oriented approach was rewarded more fittingly than in the more recent higher beta-oriented markets. We believe that higher quality stocks tend to outperform higher beta stocks over longer periods of time and we remain committed to focusing on the higher quality segment of the market. Performance also was negatively impacted by being overweight the underperforming telecom service sector and by slight underperformance in the financial and information technology sectors.

Top performers | Rosetta Resources Inc., an oil and gas exploration and production company, appreciated 92% as a result of strong exploration results in its Eagle Ford Shale play in south Texas. We believe that this emerging development opportunity has the potential to add significant shareholder value over a multi-year time horizon.

AMERIGROUP Corp, a provider of Medicaid managed care services to state governments, appreciated 64% on the heels of a strong fourth quarter earnings report which capped off a year of strong earnings reports. With a favorable long-term outlook driven by tight state budgets looking for cost savings

| 16 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Small Cap Core Value Fund (cont’d) | ||

opportunities, we believe the long-term potential remains solidly intact for AGP.

Bottomline Technologies Inc., a provider of accounts payable automation solutions for corporations, appreciated 54% due to strong fundamental results reported during the period. We continue to believe the company is in the early stages of building a valuable franchise that capitalizes on an emerging market opportunity.

Dresser-Rand Group Inc., a manufacturer of industrial compressors, appreciated 54% as strong near-term earnings results combined with a strong pipeline of new business opportunities drove the stock higher. Our long-term thesis remains intact for Dresser-Rand.

On Assignment Inc., a temporary staffing firm, appreciated 95% as the company grew revenue and earnings (primarily in information technology and life sciences), while the staffing industry overall was negative during the period.

The Fund continues to hold each of the securities noted above as “top performers.”

Under performers | Net 1 UEPS Tech. Inc., a provider of transaction processing services to governmental agencies serving poor and unbanked populations globally, dropped 32%. The drop appears to be in reaction to the ongoing delay of the long anticipated contract renewal with their largest client. We view the uncertainty as being discounted in the share price and therefore continue to hold the position.

Crude Carriers Corp, an owner and operator of crude tank carriers, fell 26% as pricing for their services has remained weak throughout the past six months. We believe softness in day rates is unsustainable in the long-term, coupled with low valuations on the vessels. The Fund sold the stock.

Assured Guaranty Ltd., a provider of financial guaranty insurance, dropped 22% following the announcement by Standard and Poor’s that they were proposing a change to the credit rating criteria for bond insurers. The effect of this change would create a need to raise additional capital by Assured. With the stock selling at a significant discount to book value, we think this issue is discounted in the stock and that considerable upside exists if the rating agencies ease their initial proposal, which is a distinct possibility. We continue to own the stock.

LECG Corp., a provider of consulting services to large corporations, fell 85%. While the company was in the midst of negotiating a new line of credit to replace an existing line that was due to mature at the end of March 2011, the company announced it had been approached with an unsolicited offer from a competitor to buy a portion of the business. This had the effect of limiting the company’s re-financing options, which led to the decision to sell these businesses and liquidate the remaining pieces of the business. As a result of this announcement, we eliminated the position from the portfolio.

SWS Group Inc., a boutique investment bank and brokerage firm, dropped 11% during the quarter. Weak trading volumes at the brokerage business plus poor performance of the company’s loan portfolio continue to pressure results. A proposed convertible bond issuance contributed to the fall as investors viewed the offering as unnecessarily dilutive to existing shareholders. We continue to hold the position as we believe the share price overly discounts the weak fundamentals and we believe the troubled loan portfolio has been fully reflected on the balance sheet.

| 17 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Small Cap Growth Fund | ||

Meet the managers | Bert L. Boksen, CFA®, a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”), has been responsible for the management of the Eagle Small Cap Growth Fund (the “Fund”) since 1995. Eric Mintz, CFA®, has been Co-Portfolio Manager since 2011, and previously served as Assistant Portfolio Manager from 2008 through 2011.

Investment highlights | The Fund invests primarily in stocks of small-capitalization companies. Using a “bottom-up” approach, the Fund’s portfolio managers seek to capture the significant long-term capital appreciation potential of small, rapidly growing companies. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers also look for small-cap growth companies that are reasonably priced. Since small-cap companies often have narrower markets than large-cap companies, the portfolio managers believe that conducting extensive proprietary research on small-cap growth companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

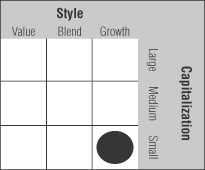

This Morningstar Style Box™ shows the Fund’s current investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s Class A shares returned 27.05% (excluding front-end sales charges) during the six-month period ended April 30, 2011, slightly underperforming its benchmark index, the Russell 2000® Growth Index, which returned 27.07%. The Fund’s benchmark index, the Russell 2000® Growth Index, is an unmanaged index comprised of Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000® Index is an unmanaged index comprised of the

2,000 smallest companies in the Russell 3000® Index. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | On an absolute basis, the energy, consumer discretionary and information technology sectors led the Fund’s returns during the reporting period, while all three sectors posted gains. In energy, the Fund’s investments in the energy equipment and services industry had strong performance. In consumer discretionary, the Fund’s holdings in the specialty retail and hotels, restaurants and leisure industries performed well. In information technology, the stocks in the semiconductors and semiconductor equipment and software industries posted strong gains. In addition, the Fund’s holdings in the chemicals industry, which is part of the materials sector, contributed to overall absolute performance. On an absolute basis, the industrials and health care sectors lagged. In industrials, the Fund’s airlines holdings posted negative returns, while holdings in the commercial services & supplies industry lagged. In health care, the Fund’s holdings in the health care technology industry lagged the index returns for the group.

The Fund performed comparably with its benchmark index for the reporting period. Relative to the benchmark, stocks in the energy sector outperformed due to an overweight posture and strong stock selection in the energy equipment and services industry. In the consumer discretionary sector, the Fund outperformed the benchmark due to strong returns and an overweight position in the specialty retail and auto components industries. The Fund underperformed most significantly in industrials and, to a lesser extent, in the health care and information technology sectors. Information technology was a relative laggard due to underperformance of the Fund’s holdings in the internet software and services and communications equipment industries.

| 18 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Small Cap Growth Fund (cont’d) | ||

Under performers | Dean Foods Co. is the largest processor and distributor of milk in the U.S. We expected the company to be able to improve profitability, however, a turnaround has yet to materialize. The company’s cost structure is highly sensitive to dairy prices, and milk prices have remained extremely competitive. The Fund sold the stock.

Shares of Thoratec Corp., the pioneer in left-ventricular-assist devices (LVADs), traded down when a competitor released clinical data for its product that suggested a slightly better adverse event profile than Thoratec’s device. We believe the resulting downward movement in the value of Thoratec’s shares was an overreaction as we expect the LVAD market will grow to be large enough to support more than one competitor. We believe that Thoratec will likely remain the leader in a market that could reach $3 to $5 billion over the next 5 to 10 years. The Fund continues to hold shares of Thoratec.

Shares of low-cost airline JetBlue Airways Corp. dipped slightly during the period due to short-term concerns over rising fuel costs. The Fund continues to own shares.

MedAssets Inc. provides software solutions that help hospitals and health systems improve their operating margins by lowering supply costs and increasing revenue capture. The company’s consulting services division has grown so quickly that they did not have the infrastructure in place to deliver on targets that would have earned them certain bonuses. Management has taken actions to slow the growth of this business until it has the proper infrastructure in place. We believe the stock is oversold at current levels and continue to hold shares in the Fund.

James River Coal Co. mines, processes, and sells coal to electric utility companies and industrial customers. The stock dipped slightly during the period on no significant news. The negative impact on the Fund was minimal. The Fund continues to hold its shares.

Top performers | Shares in oil equipment manufacturer Lufkin Industries, Inc. benefited from strong oil prices and an increase in the number of active drilling rigs.

Shares in chemical producer Huntsman Corporation appreciated as the economic outlook improved for this highly cyclical industry.

TIBCO Software, Inc., a provider of enterprise middleware software, has delivered solid execution as demand for its middleware, business process management, and predictive analytics software has remained robust.

OYO Geospace Corp. makes seismic equipment used by oil companies. During the period, the company announced strong earnings and several substantial new contracts for its newest wireless technology.