UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04347

GMO Trust

(Exact name of the registrant as specified in charter)

40 Rowes Wharf, Boston, MA 02110

(Address of principal executive offices) (Zip Code)

Sheppard N. Burnett, Chief Executive Officer,

40 Rowes Wharf, Boston, MA 02110

(Name and address of agent for services)

Registrant’s telephone number, including area code: 617-346-7646

Date of fiscal year end: 02/28/17

Date of reporting period: 02/28/17

Item 1. Reports to Stockholders.

The annual reports for each series of the registrant for the period ended February 28, 2017 are filed herewith.

GMO Trust

Annual Report

February 28, 2017

Asset Allocation Bond Fund

Core Plus Bond Fund

Currency Hedged International Bond Fund

Emerging Country Debt Fund

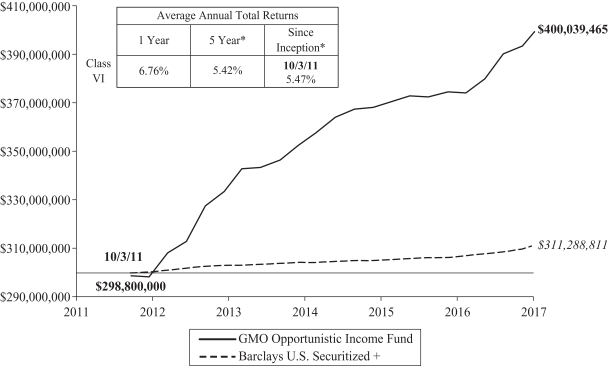

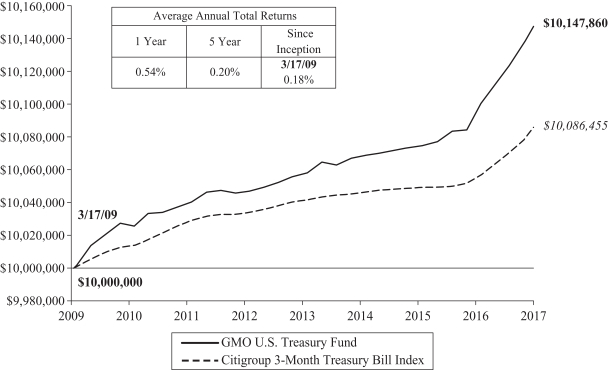

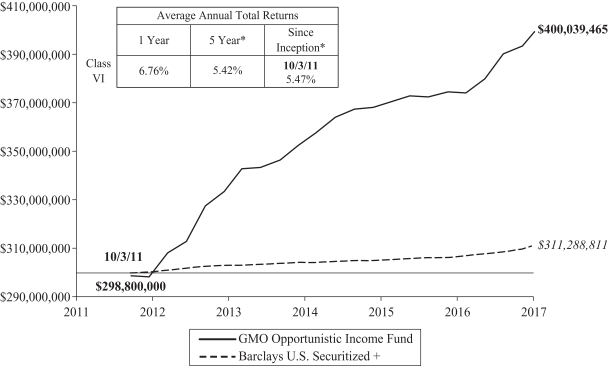

Opportunistic Income Fund (formerly Debt Opportunities Fund)

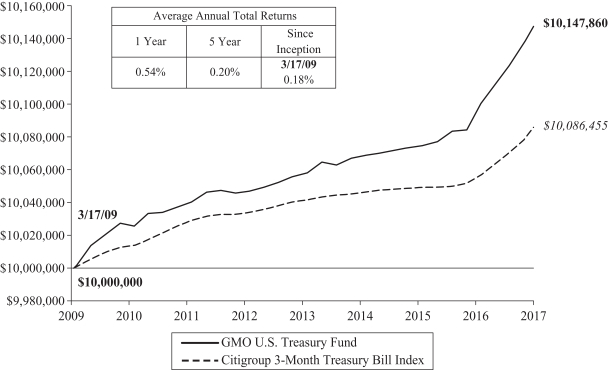

U.S. Treasury Fund

For a free copy of the Funds’ proxy voting guidelines, shareholders may call 1-617-346-7646 (collect) or visit the Securities and Exchange Commission’s website at www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on GMO’s website at www.gmo.com or on the Securities and Exchange Commission’s website at www.sec.gov.

The Funds file their complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarter of each fiscal year on Form N-Q, which is available on the Commission’s website at www.sec.gov. The Funds’ Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Funds have a policy with respect to disclosure of portfolio holdings under which they may also make a complete schedule of portfolio holdings available on GMO’s website at www.gmo.com.

This report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a prospectus for the GMO Trust, which contains a complete discussion of the risks associated with an investment in these Funds and other important information. The GMO Trust prospectus can be obtained at www.gmo.com.

An investment in the Funds is subject to risk, including the possible loss of principal amount invested. There can be no assurance that the Funds will achieve their stated investment objectives. Please see the Funds’ prospectus regarding specific principal risks for each Fund. General risks may include: market risk-fixed income investments, management and operational risk, market risk-asset backed securities, credit risk and derivatives risk.

The Funds are distributed by Funds Distributor LLC. Funds Distributor LLC is not affiliated with GMO.

TABLE OF CONTENTS

GMO Asset Allocation Bond Fund

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Developed Fixed Income and Asset Allocation teams at Grantham, Mayo, Van Otterloo & Co. LLC.

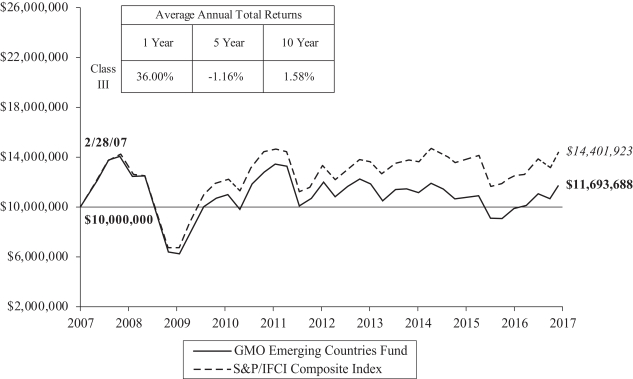

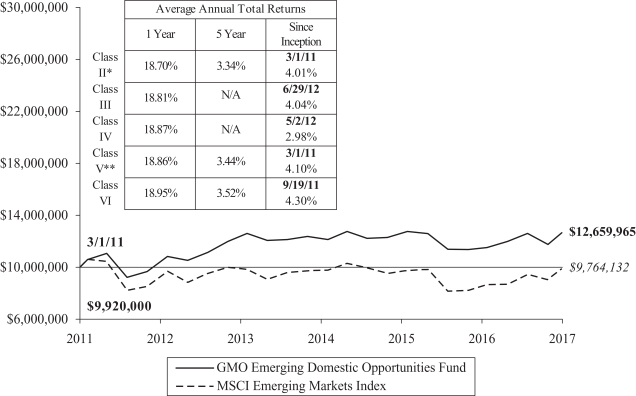

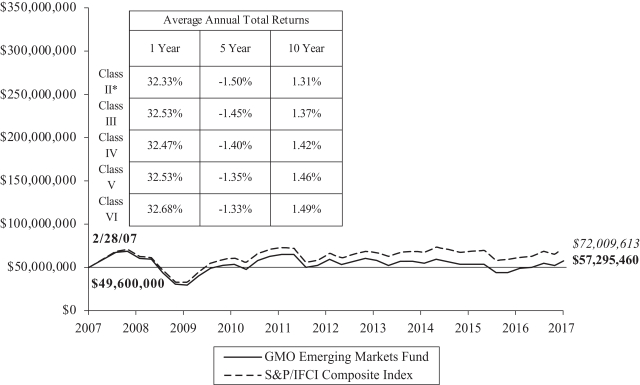

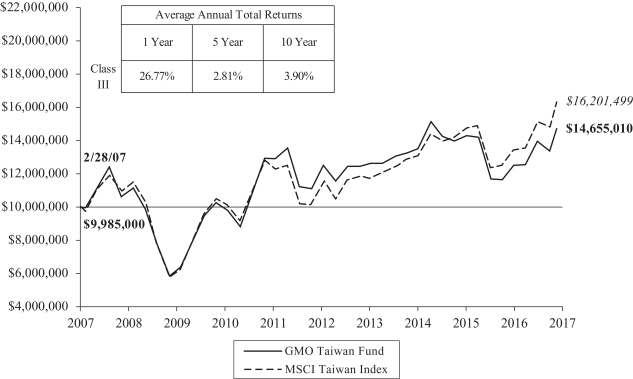

Management Discussion and Analysis of Fund Performance

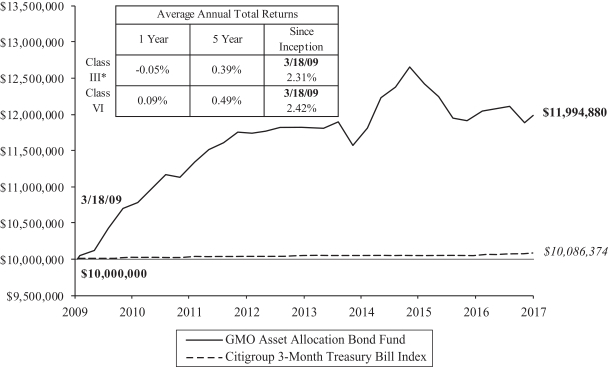

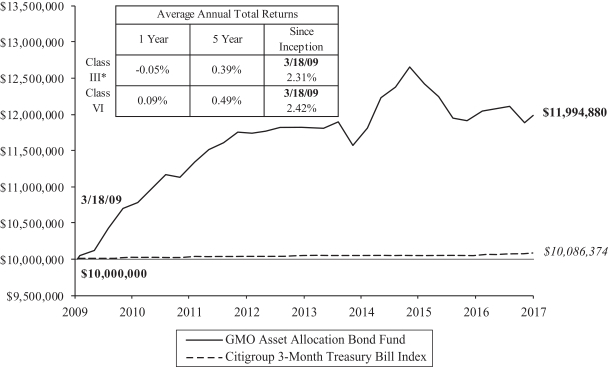

Class III shares of GMO Asset Allocation Bond Fund returned -0.05% (net) for the fiscal year ended February 28, 2017, as compared with +0.32% for the Citigroup 3-Month Treasury Bill Index.

The Fund underperformed the benchmark during the period by -0.36%. Developed markets interest-rate positioning detracted during the fiscal year. The Fund’s early year Eurozone steepener position drove losses, followed by losses from active positions in the U.K., Mexico, and New Zealand. These rates positions were implemented primarily using interest-rate swaps and options on interest-rate swaps. Gains from the Fund’s position in TIPS partly offset losses. In opportunistic strategies, cross-currency basis swap positions added value, as gains from yen cross-currency basis swap positions more than offset losses from euro cross-currency basis swap positions.

The Fund’s positions in developed market currencies added value, particularly its short positions in yen. These positions were implemented using both currency forwards and options.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments.

2

GMO Asset Allocation Bond Fund

(A Series of GMO Trust)

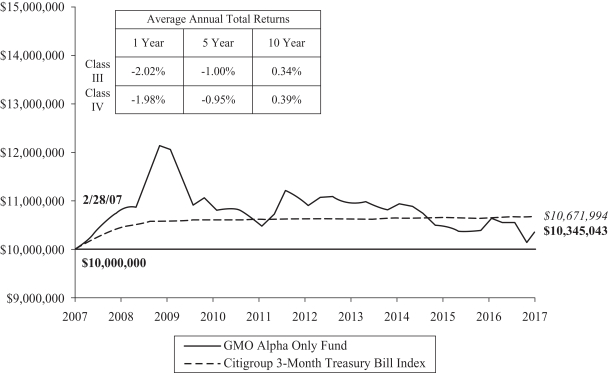

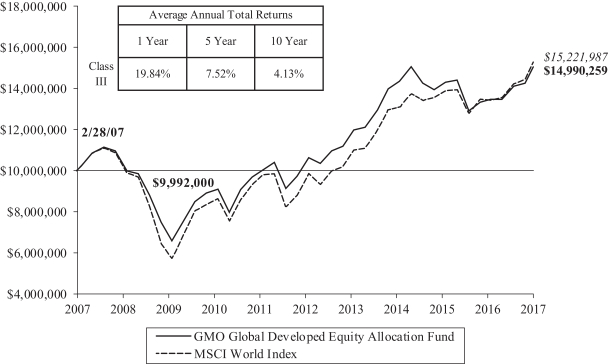

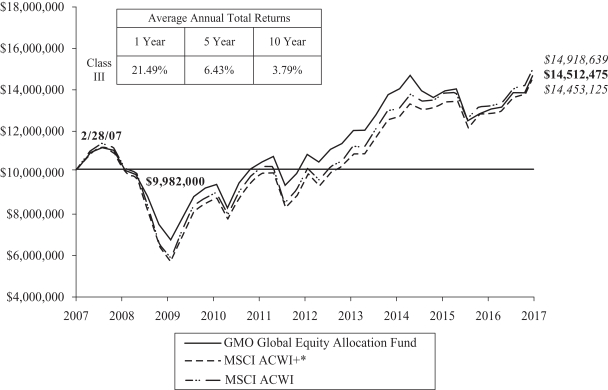

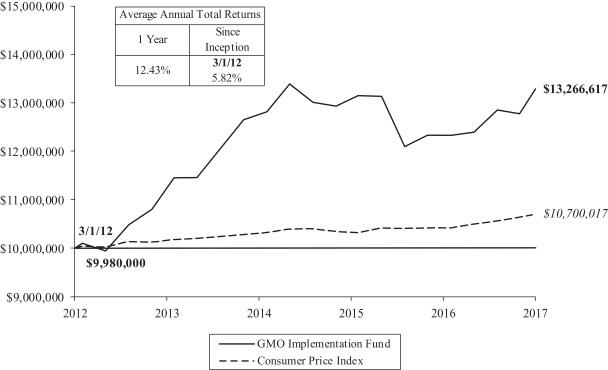

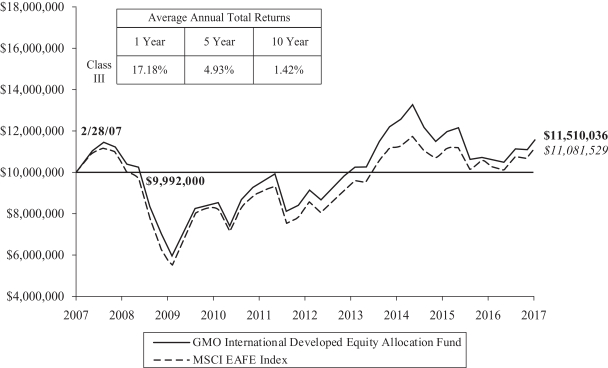

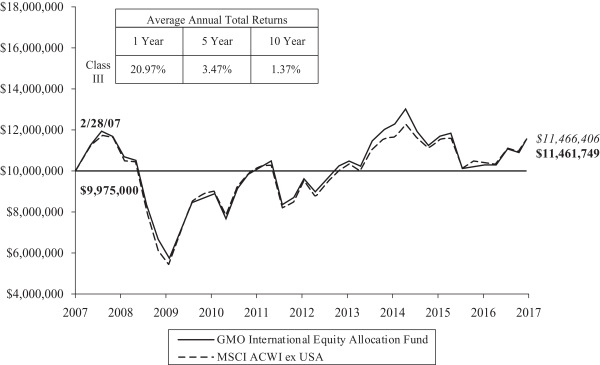

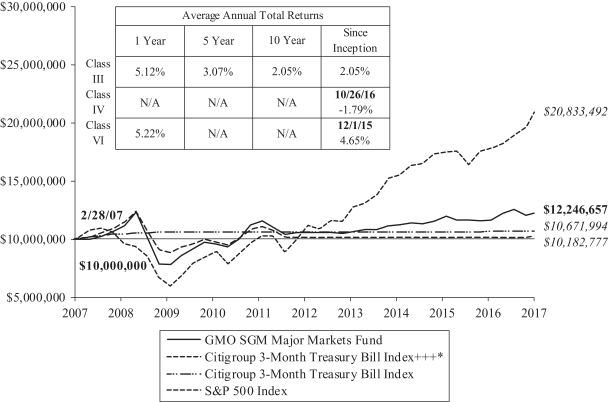

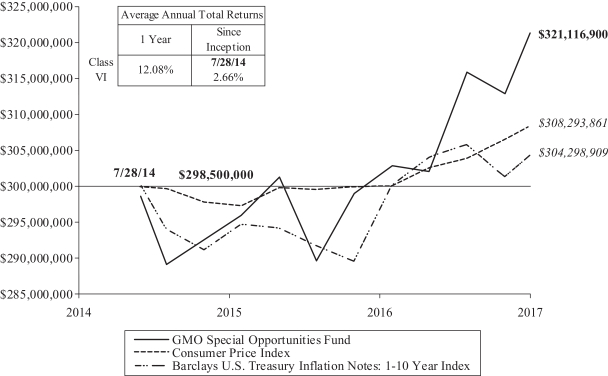

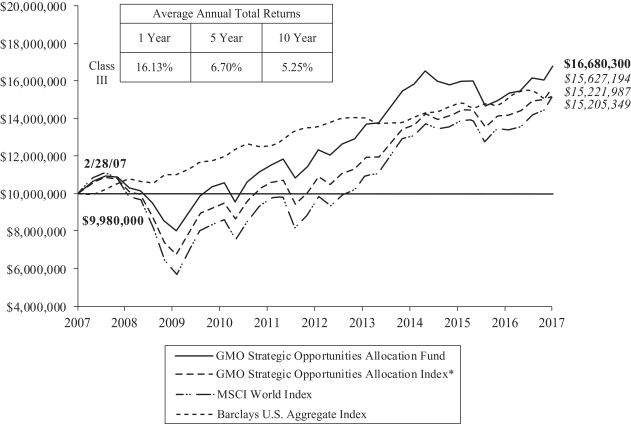

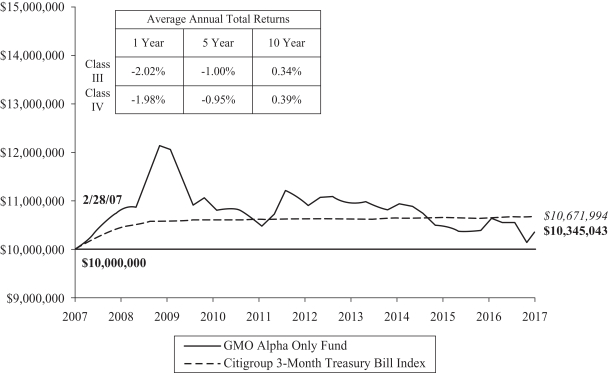

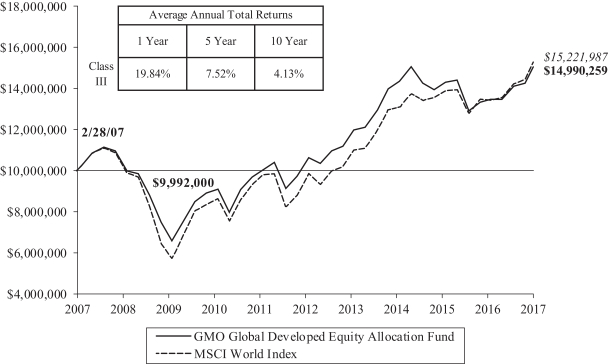

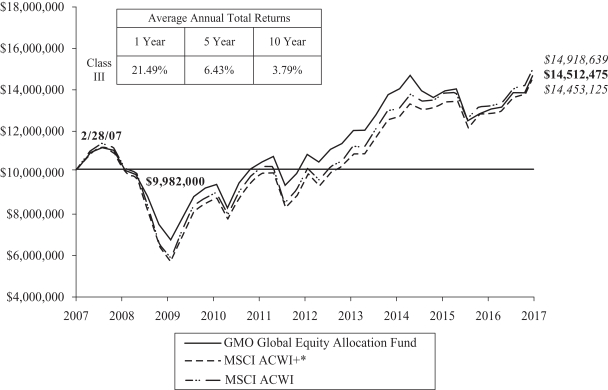

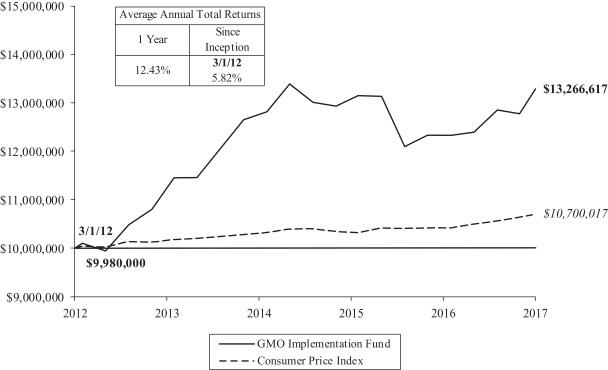

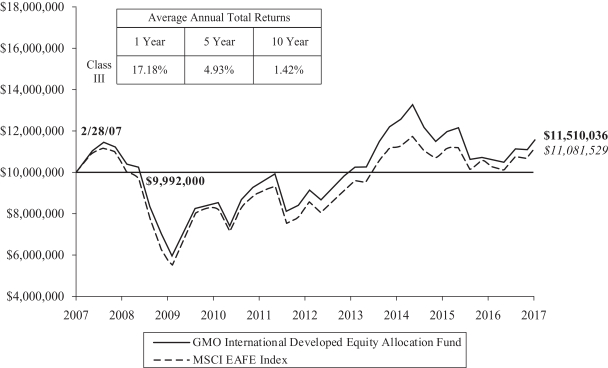

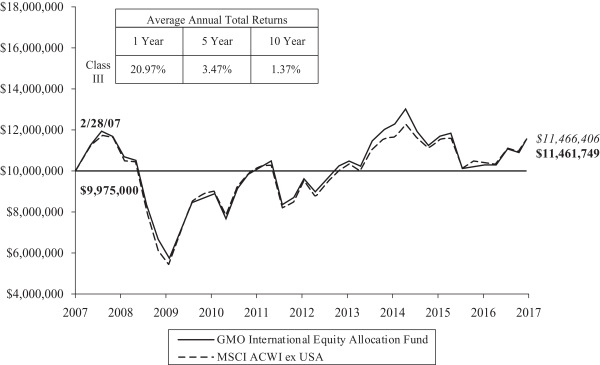

Comparison of Change in Value of a $10,000,000 Investment in

GMO Asset Allocation Bond Fund Class III Shares and the Citigroup 3-Month Treasury Bill Index

As of February 28, 2017

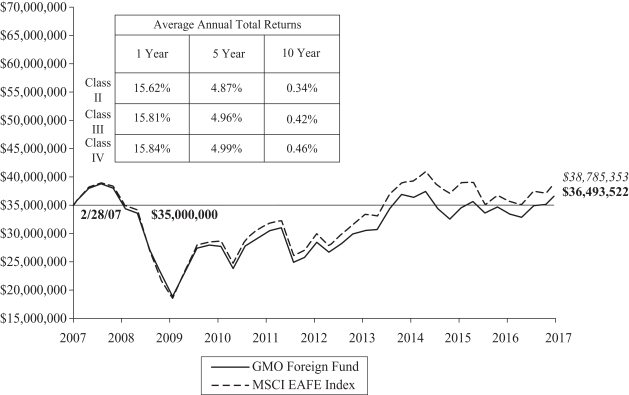

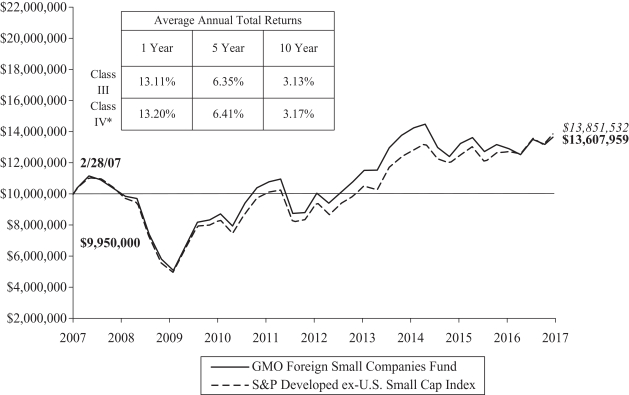

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. The performance information shown above only includes purchase premiums and/or redemption fees in effect as of February 28, 2017. All information is unaudited. Performance for classes may vary due to different fees.

| | * | For the period from March 18, 2009 to March 27, 2009, no Class III shares were outstanding. Performance for that period is that of Class VI, which has lower expenses. Therefore, the performance shown is higher than it would have been if Class III expenses had been applied throughout. |

3

GMO Asset Allocation Bond Fund

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2017 (Unaudited)

| | | | |

| Asset Class Summary& | | % of Total Net Assets | |

Debt Obligations | | | 90.0 | % |

Short-Term Investments | | | 9.6 | |

Options Purchased | | | 0.0 | ^ |

Forward Currency Contracts | | | (0.1 | ) |

Swap Contracts | | | (0.4 | ) |

Other | | | 0.9 | |

| | | | |

| | | 100.0 | % |

| | | | |

| & | In the table above, derivative financial instruments, if any, are based on market values or unrealized appreciation/depreciation rather than notional amounts. |

4

GMO Asset Allocation Bond Fund

(A Series of GMO Trust)

Schedule of Investments

(showing percentage of total net assets)

February 28, 2017

| | | | | | | | | | |

Par Value† /

Principal Amount | | | Description | | Value ($) | |

| | | | | | DEBT OBLIGATIONS — 90.0% | |

| | |

| | | | | | U.S. Government — 90.0% | |

| | | 211,246,935 | | | U.S. Treasury Inflation Indexed Bond, 0.25%, due 01/15/25 (a) | | | 210,648,683 | |

| | | 169,209,342 | | | U.S. Treasury Inflation Indexed Bond, 0.38%, due 07/15/25 (a) | | | 170,649,991 | |

| | | 94,073,247 | | | U.S. Treasury Inflation Indexed Bond, 0.63%, due 01/15/26 (a) | | | 96,385,192 | |

| | | 5,237,492 | | | U.S. Treasury Inflation Indexed Bond, 0.13%, due 07/15/26 (a) | | | 5,145,558 | |

| | | 65,158,392 | | | U.S. Treasury Inflation Indexed Bond, 1.75%, due 01/15/28 (a) | | | 74,270,012 | |

| | | 147,627,734 | | | U.S. Treasury Inflation Indexed Bond, 2.50%, due 01/15/29 (a) | | | 182,100,728 | |

| | | 12,189,463 | | | U.S. Treasury Inflation Indexed Bond, 3.88%, due 04/15/29 (a) | | | 17,020,610 | |

| | | 50,000,000 | | | U.S. Treasury Note, 1.00%, due 12/15/17 | | | 50,058,600 | |

| | | 80,000,000 | | | U.S. Treasury Note, 0.75%, due 02/28/18 | | | 79,837,520 | |

| | | 45,000,000 | | | U.S. Treasury Note, 0.75%, due 04/15/18 | | | 44,876,970 | |

| | | 20,000,000 | | | U.S. Treasury Note, 2.63%, due 04/30/18 | | | 20,372,660 | |

| | | 12,500,000 | | | U.S. Treasury Note, 1.00%, due 05/31/18 | | | 12,497,075 | |

| | | 12,500,000 | | | U.S. Treasury Note, 1.38%, due 07/31/18 | | | 12,553,713 | |

| | | 20,000,000 | | | U.S. Treasury Note, 1.38%, due 09/30/18 | | | 20,077,340 | |

| | | 40,000,000 | | | U.S. Treasury Note, 0.75%, due 10/31/18 | | | 39,729,680 | |

| | | 12,500,000 | | | U.S. Treasury Note, 1.00%, due 11/30/18 | | | 12,463,375 | |

| | | 25,000,000 | | | U.S. Treasury Note, 1.25%, due 12/31/18 | | | 25,020,500 | |

| | | 35,000,000 | | | U.S. Treasury Note, 1.13%, due 01/31/19 (b) | | | 34,934,375 | |

| | | 60,000,000 | | | U.S. Treasury Note, 1.50%, due 01/31/19 | | | 60,304,680 | |

| | | 20,000,000 | | | U.S. Treasury Note, 0.75%, due 02/15/19 | | | 19,811,720 | |

| | | 25,000,000 | | | U.S. Treasury Note, 1.13%, due 02/28/19 | | | 24,947,275 | |

| | | 20,000,000 | | | U.S. Treasury Note, 1.50%, due 02/28/19 | | | 20,098,440 | |

| | | 20,000,000 | | | U.S. Treasury Note, 3.13%, due 05/15/19 (c) | | | 20,784,380 | |

| | | 50,000,000 | | | U.S. Treasury Note, 3.63%, due 08/15/19 | | | 52,726,550 | |

| | | 35,000,000 | | | U.S. Treasury Note, USBM + 0.19%, 0.97%, due 04/30/18 | | | 35,059,990 | |

| | | | | | | | | | |

| | | | | | Total U.S. Government | | | 1,342,375,617 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL DEBT OBLIGATIONS (COST $1,328,482,486) | | | 1,342,375,617 | |

| | | | | | | | | | |

| | |

| | | | | | OPTIONS PURCHASED — 0.0% | |

| | |

| | | | | | Currency Options — 0.0% | |

EUR | | | 17,893,000 | | | EUR Call/USD Put, Expires 03/06/17, Strike 1.15, (OTC) (CP-GS) | | | — | |

USD | | | 19,881,000 | | | USD Call/CHF Put, Expires 03/06/17, Strike 1.00, (OTC) (CP-GS) | | | 188,293 | |

EUR | | | 17,897,000 | | | EUR Call/USD Put, Expires 03/06/17, Strike 1.15, (OTC) (CP-GS) | | | — | |

USD | | | 19,886,000 | | | USD Call/CHF Put, Expires 03/06/17, Strike 1.00, (OTC) (CP-BCLY) | | | 188,340 | |

| | | | | | | | | | |

| | | | | | Total Currency Options | | | 376,633 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL OPTIONS PURCHASED (COST $1,276,456) | | | 376,633 | |

| | | | | | | | | | |

| | | | | | | | | | |

Shares / Par Value† | | | Description | | Value ($) | |

| | | | | | SHORT-TERM INVESTMENTS — 9.6% | |

| | |

| | | | | | Money Market Funds — 0.3% | |

| | | 3,929,477 | | | State Street Institutional Treasury Money Market Fund-Premier Class, 0.42% (d) | | | 3,929,477 | |

| | | | | | | | | | |

| | |

| | | | | | Repurchase Agreements — 9.3% | |

| | | 138,689,018 | | | Nomura Securities International Inc. Repurchase Agreement, dated 02/28/17, maturing on 03/01/17 with a maturity value of $138,691,021 and an effective yield of 0.52%, collateralized by a U.S. Treasury Note with maturity date 8/15/24 and a market value of $141,263,220. | | | 138,689,018 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL REPURCHASE AGREEMENTS (COST $138,689,018) | | | 138,689,018 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL SHORT-TERM INVESTMENTS (COST $142,618,495) | | | 142,618,495 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL INVESTMENTS — 99.6% (Cost $1,472,377,437) | | | 1,485,370,745 | |

| | | | | | Other Assets and Liabilities (net) — 0.4% | | | 6,622,847 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL NET ASSETS — 100.0% | | | $1,491,993,592 | |

| | | | | | | | | | |

A summary of outstanding financial instruments at February 28, 2017 is as follows:

Forward Currency Contracts

| | | | | | | | | | | | | | | | | | | | | | |

Settlement

Date | | Counter

party | | Currency

Sold | | | Currency

Purchased | | | Net

Unrealized

Appreciation

(Depreciation) | |

| 03/09/2017 | | MSCI | | | CHF | | | | 21,590,746 | | | | USD | | | | 21,502,800 | | | $ | (1,499 | ) |

| 03/20/2017 | | MSCI | | | EUR | | | | 11,873,315 | | | | USD | | | | 12,672,864 | | | | 84,250 | |

| 11/07/2017 | | GS | | | EUR | | | | 238,995,000 | | | | USD | | | | 262,404,560 | | | | 5,921,451 | |

| 12/22/2017 | | JPM | | | EUR | | | | 62,184,000 | | | | USD | | | | 68,688,446 | | | | 1,771,868 | |

| 03/13/2017 | | BOA | | | JPY | | | | 1,651,106,537 | | | | USD | | | | 14,520,711 | | | | (181,147 | ) |

| 03/09/2017 | | BOA | | | USD | | | | 2,500,000 | | | | CHF | | | | 2,519,193 | | | | 9,106 | |

| 03/09/2017 | | GS | | | USD | | | | 6,422,063 | | | | CHF | | | | 6,400,000 | | | | (47,688 | ) |

| 03/09/2017 | | MSCI | | | USD | | | | 11,517,000 | | | | CHF | | | | 11,802,391 | | | | 238,135 | |

| 03/13/2017 | | JPM | | | USD | | | | 2,792,082 | | | | JPY | | | | 316,000,000 | | | | 21,660 | |

| 03/13/2017 | | MSCI | | | USD | | | | 1,000,000 | | | | JPY | | | | 114,823,600 | | | | 22,417 | |

| 03/13/2017 | | MSCI | | | USD | | | | 4,786,569 | | | | NZD | | | | 6,870,000 | | | | 160,142 | |

| 03/20/2017 | | BCLY | | | USD | | | | 2,756,164 | | | | EUR | | | | 2,580,000 | | | | (20,734 | ) |

| 11/07/2017 | | GS | | | USD | | | | 263,778,782 | | | | EUR | | | | 238,995,000 | | | | (7,295,672 | ) |

| 12/22/2017 | | JPM | | | USD | | | | 69,205,942 | | | | EUR | | | | 62,184,000 | | | | (2,289,363 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | $ | (1,607,074 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | See accompanying notes to the financial statements. | | 5 |

GMO Asset Allocation Bond Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2017

Reverse Repurchase Agreements (e)

| | | | | | | | | | |

Face Value | | | Description | | Market

Value | |

| USD | | | 34,939,753 | | | Nomura Securities International Inc, (0.25%), dated 02/15/17 (collateral: U.S. Treasury Note, 1.13%, due 01/31/19), to be repurchased on demand at face value plus accrued interest. | | $ | (34,936,599 | ) |

| | | | | | | | | | |

| | | | | | Average balance outstanding | | $ | (34,973,109 | ) |

| | | | | | Average interest rate | | | (0.58 | )% |

| | | | | | Maximum balance outstanding | | $ | (76,916,001 | ) |

Average balance outstanding was calculated based on daily face value balances outstanding during the period that the Fund had entered into reverse repurchase agreements.

Swap Contracts

Interest Rate Swaps

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Notional

Amount | | | Expiration

Date | | | Counterparty | | Receive

(Pay) # | | Fixed

Rate | | Variable Rate | | Net Unrealized

Appreciation/ (Depreciation) |

| | 54,130,000 | | | | MXN | | | | 1/22/2027 | | | JPMF (f) | | Receive | | 7.90% | | TIIE | | $14,753 |

| | 204,400,000 | | | | MXN | | | | 1/26/2027 | | | JPMF (f) | | Receive | | 7.87% | | TIIE | | 33,447 |

| | 191,400,000 | | | | MXN | | | | 1/26/2027 | | | JPMF (f) | | Receive | | 7.89% | | TIIE | | 45,279 |

| | 446,543,000 | | | | MXN | | | | 1/27/2027 | | | JPMF (f) | | Receive | | 7.91% | | TIIE | | 138,208 |

| | 32,618,000 | | | | CAD | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 1.86% | | 3 Month CAD LIBOR | | 40,820 |

| | 6,007,000 | | | | CAD | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 2.00% | | 3 Month CAD LIBOR | | (52,335) |

| | 15,757,000 | | | | CAD | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 1.97% | | 3 Month CAD LIBOR | | 100,938 |

| | 18,053,000 | | | | CHF | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 0.17% | | 6 Month CHF LIBOR | | (250,407) |

| | 20,835,000 | | | | EUR | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 0.77% | | 6 Month EURIBOR | | (203,279) |

| | 15,126,000 | | | | GBP | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 1.38% | | 6 Month GBP LIBOR | | (408,281) |

| | 10,407,000 | | | | GBP | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 1.42% | | 6 Month GBP LIBOR | | (336,035) |

| | 9,597,000 | | | | GBP | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 1.35% | | 6 Month GBP LIBOR | | (224,380) |

| | 42,912,000 | | | | GBP | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 1.43% | | 6 Month GBP LIBOR | | (1,416,598) |

| | 10,140,000 | | | | GBP | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 1.40% | | 6 Month GBP LIBOR | | (298,115) |

| | 47,079,000 | | | | NZD | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 2.68% | | 3 Month NZD Bank Bill Rate | | (2,296,990) |

| | 3,974,000 | | | | NZD | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 2.94% | | 3 Month NZD Bank Bill Rate | | (130,478) |

| | 16,672,000 | | | | NZD | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 2.93% | | 3 Month NZD Bank Bill Rate | | (556,343) |

| | 8,746,000 | | | | NZD | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 2.91% | | 3 Month NZD Bank Bill Rate | | (301,113) |

| | 9,047,000 | | | | NZD | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 3.47% | | 3 Month NZD Bank Bill Rate | | (5,532) |

| | 8,113,000 | | | | NZD | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 3.67% | | 3 Month NZD Bank Bill Rate | | 94,625 |

| | 27,827,000 | | | | SEK | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 0.90% | | 3 Month SEK STIBOR | | (52,722) |

| | 86,550,000 | | | | SEK | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 1.17% | | 3 Month SEK STIBOR | | 88,621 |

| | 98,458,000 | | | | SEK | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 1.18% | | 3 Month SEK STIBOR | | 114,023 |

| | 100,519,000 | | | | SEK | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 1.18% | | 3 Month SEK STIBOR | | 113,712 |

| | 174,020,000 | | | | SEK | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 1.14% | | 3 Month SEK STIBOR | | 123,403 |

| | 73,434,000 | | | | SEK | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 1.14% | | 3 Month SEK STIBOR | | (49,576) |

| | 64,704,000 | | | | SEK | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 1.14% | | 3 Month SEK STIBOR | | (47,155) |

| | 24,515,000 | | | | USD | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 2.22% | | 3 Month USD LIBOR | | (274,584) |

| | 12,092,000 | | | | USD | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 2.26% | | 3 Month USD LIBOR | | 86,266 |

| | 17,078,000 | | | | USD | | | | 3/17/2027 | | | JPMF (g) | | Receive | | 2.49% | | 3 Month USD LIBOR | | 240,232 |

| | 19,579,000 | | | | USD | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 2.35% | | 3 Month USD LIBOR | | (16,875) |

| | 4,985,000 | | | | USD | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 2.32% | | 3 Month USD LIBOR | | 6,864 |

| | 13,819,000 | | | | USD | | | | 3/17/2027 | | | JPMF (g) | | (Pay) | | 2.29% | | 3 Month USD LIBOR | | 68,279 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | $(5,611,328) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Premiums Paid (Received) | | $ (54,773) |

| | | | | | | | | | | | | | | | | | | | |

| # | Receive - Fund receives fixed rate and pays variable rate. |

| | (Pay) - Fund pays fixed rate and receives variable rate. |

| | | | |

| 6 | | See accompanying notes to the financial statements. | | |

GMO Asset Allocation Bond Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2017

As of February 28, 2017, for the above contracts and/or agreements, the Fund had sufficient cash and/or securities to cover commitments or collateral requirements, if any, of the relevant broker or exchange.

Notes to Schedule of Investments:

| † | Denominated in U.S. Dollar, unless otherwise indicated. |

| (a) | Indexed security in which price and/or coupon is linked to the price of a specific instrument or financial statistic (Note 2). |

| (b) | All or a portion of this security has been pledged to cover collateral requirements on reverse repurchase agreements (Note 2). |

| (c) | All or a portion of this security has been pledged to cover margin requirements on futures and/or cleared swap contracts, collateral on OTC swap contracts, forward currency contracts, and/or written options, if any (Note 4). |

| (d) | The rate disclosed is the 7 day net yield as of February 28, 2017. |

| (e) | Reverse repurchase agreements have an open maturity date and can be closed by either party on demand. |

| (f) | Swap was cleared through the CME Group Inc. |

| (g) | Swap was cleared through the LCH.Clearnet Group Ltd. |

For a listing of definitions of acronyms, counterparty abbreviations and currency abbreviations used throughout the Schedule of Investments as well as the derivative tables, if any, please refer to page 52.

| | | | |

| | See accompanying notes to the financial statements. | | 7 |

GMO Core Plus Bond Fund

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Developed Fixed Income team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

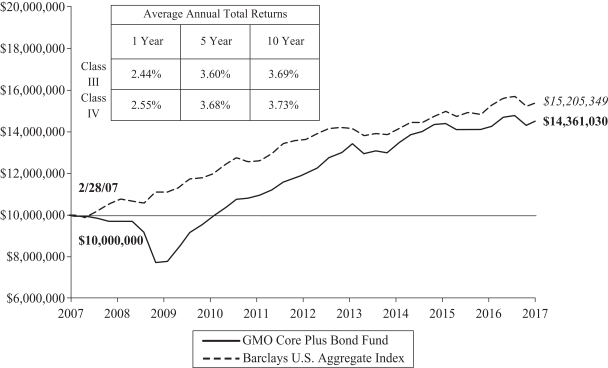

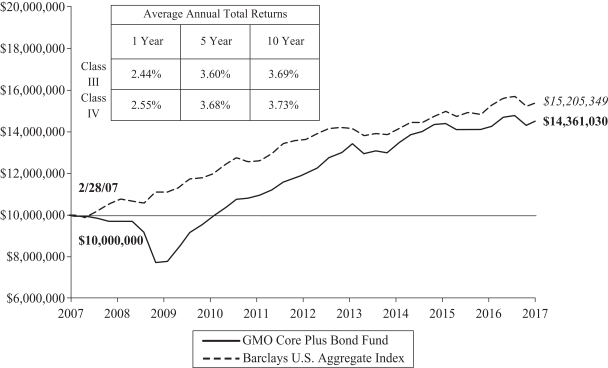

Class III shares of GMO Core Plus Bond Fund returned +2.44% (net) for the fiscal year ended February 28, 2017, as compared with +1.42% for the Barclays U.S. Aggregate Index. The Fund outperformed its benchmark during the fiscal year by +1.02%.

The Fund’s investment exposure was achieved directly through bonds, swaps, and futures and indirectly through investment in underlying GMO Trust mutual funds, including GMO Opportunistic Income Fund (OIF), GMO Emerging Country Debt Fund (ECDF), and GMO U.S. Treasury Fund (USTF).

Exposure to asset-backed securities contributed positively to performance, given tighter spreads across structured products in general.

A small exposure to emerging debt added value during the fiscal year, thanks to spread tightening on the asset class and positive contributions from both country selection and security selection.

Developed markets interest-rate positioning contributed positively during the fiscal year. The Fund’s duration positions in the U.S., Australia, and Sweden added value, while losses from active duration positions in Mexico, the U.K., and New Zealand partly offset gains. In opportunistic strategies, swap spread strategies added value as long end swap spreads in the U.S. went less negative.

The currency strategy contributed positively during the fiscal year. The Fund’s active short positions in the yen and Swiss franc were successful during the year, while positions in euros detracted.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments.

8

GMO Core Plus Bond Fund

(A Series of GMO Trust)

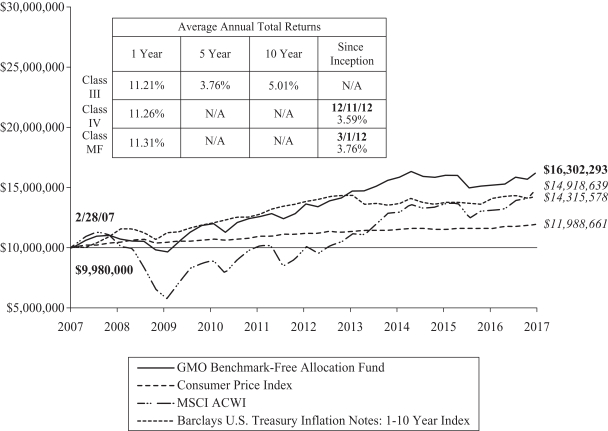

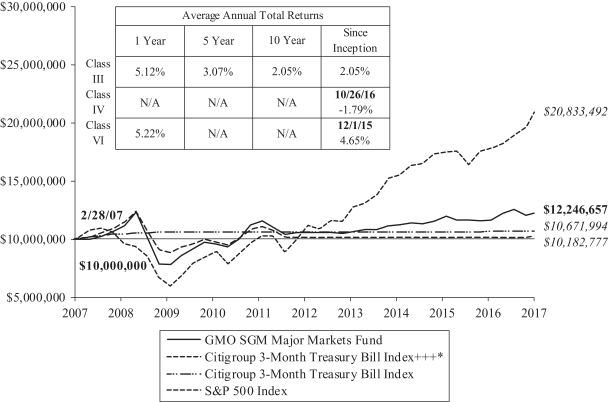

Comparison of Change in Value of a $10,000,000 Investment in

GMO Core Plus Bond Fund Class III Shares and the Barclays U.S. Aggregate Index

As of February 28, 2017

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. The performance information shown above only includes purchase premiums and/or redemption fees in effect as of February 28, 2017. All information is unaudited. Performance for classes may vary due to different fees.

9

GMO Core Plus Bond Fund

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2017 (Unaudited)

| | | | |

| Asset Class Summary† | | % of Total Net Assets | |

Debt Obligations | | | 81.9 | % |

Short-Term Investments | | | 16.4 | |

Mutual Funds | | | 15.1 | |

Swap Contracts | | | 0.1 | |

Loan Participations | | | 0.1 | �� |

Rights/Warrants | | | 0.1 | |

Futures Contracts | | | 0.1 | |

Options Purchased | | | 0.0 | ^ |

Loan Assignments | | | 0.0 | ^ |

Forward Currency Contracts | | | 0.0 | ^ |

Securities Sold Short | | | (0.0 | )^ |

Written Options/Credit Linked Options | | | (0.0 | )^ |

Reverse Repurchase Agreements | | | (0.0 | )^ |

Other | | | (13.8 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

| | | | |

| Country/Region Summary‡ | | % of Investments | |

United States | | | 96.0 | % |

Other Emerging | | | 4.8 | ¥ |

New Zealand | | | 4.0 | |

Mexico | | | 3.0 | |

Sweden | | | 2.3 | |

Canada | | | (1.0 | ) |

Switzerland | | | (1.0 | ) |

Euro Region | | | (1.3 | )§ |

United Kingdom | | | (6.8 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

| † | The table above incorporates aggregate indirect asset class exposure associated with investments in other funds of GMO Trust (“underlying funds”). Derivative financial instruments, if any, are based on market values or unrealized appreciation/depreciation rather than notional amounts. |

| ‡ | The table above incorporates aggregate indirect country exposure associated with investments in the underlying funds. The table is normalized to 100%, therefore the absolute exposure presented for each country may not be representative of the true exposure of the Fund. The table excludes short-term investments. The table includes exposure through the use of certain derivative financial instruments and excludes exposure through certain currency linked derivatives such as forward currency contracts and currency options. The table is based on duration adjusted net exposures (both investments and derivatives), taking into account the market value of securities and the notional amounts of swaps and other derivative financial instruments. For example, U.S. asset-backed securities may represent a relatively small percentage due to their short duration, even though they represent a large percentage of market value (direct and indirect). Duration is based on GMO’s models. The greater the duration of a bond, the greater its contribution to the concentration percentage. Credit default swap exposures are factored into the duration adjusted exposure using the reference security and applying the same methodology to that security. |

| ¥ | “Other Emerging” is associated with investments in GMO Emerging Country Debt Fund and is comprised of emerging countries that each represents between (1.0)% and 1.0% of Investments. |

| § | “Euro Region” is comprised of derivative financial instruments attributed to the Eurozone and not a particular country. |

10

GMO Core Plus Bond Fund

(A Series of GMO Trust)

Schedule of Investments

(showing percentage of total net assets)

February 28, 2017

| | | | | | | | | | |

Par Value† /

Shares | | | Description | | Value ($) | |

| | | | | | DEBT OBLIGATIONS — 58.9% | |

| | |

| | | | | | United States | |

| | | | | | U.S. Government — 44.3% | |

| | | 3,468,000 | | | U.S. Treasury Bond, 6.25%, due 05/15/30 | | | 4,937,159 | |

| | | 35,339,000 | | | U.S. Treasury Bond, 3.38%, due 05/15/44 (a) | | | 38,066,747 | |

| | | 79,956,000 | | | U.S. Treasury Note, 1.50%, due 02/28/19 | | | 80,349,543 | |

| | | 68,400,000 | | | U.S. Treasury Note, 2.00%, due 02/28/21 | | | 69,057,256 | |

| | | 39,004,000 | | | U.S. Treasury Note, 2.00%, due 02/15/23 | | | 38,848,608 | |

| | | 30,344,000 | | | U.S. Treasury Note, 2.00%, due 08/15/25 | | | 29,566,435 | |

| | | | | | | | | | |

| | | | | | | | | 260,825,748 | |

| | | | | | | | | | |

| | |

| | | | | | U.S. Government Agency — 14.6% | |

| | | 13,090,000 | | | Federal Home Loan Mortgage Corp., TBA, 3.50%, due 03/13/47 | | | 13,413,159 | |

| | | 22,550,000 | | | Federal National Mortgage Association, TBA, 2.50%, due 03/16/47 | | | 22,602,853 | |

| | | 8,830,000 | | | Federal National Mortgage Association, TBA, 3.00%, due 03/13/47 | | | 8,770,524 | |

| | | 18,830,000 | | | Federal National Mortgage Association, TBA, 4.00%, due 03/13/47 | | | 19,785,698 | |

| | | 20,690,000 | | | Government National Mortgage Association, TBA, 3.50%, due 03/21/47 | | | 21,505,478 | |

| | | | | | | | | | |

| | | | | | | | | 86,077,712 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL DEBT OBLIGATIONS (COST $345,436,276) | | | 346,903,460 | |

| | | | | | | | | | |

| |

| | | MUTUAL FUNDS — 54.4% | |

| | |

| | | | | | United States — 39.3% | |

| | | | | | Affiliated Issuers — 39.3% | |

| | | 992,130 | | | GMO Emerging Country Debt Fund, Class IV | | | 28,722,150 | |

| | | 4,418,935 | | | GMO Opportunistic Income Fund, Class VI | | | 113,920,146 | |

| | | 3,545,790 | | | GMO U.S. Treasury Fund | | | 88,644,748 | |

| | | | | | | | | | |

| | | | | | | | | 231,287,044 | |

| | | | | | | | | | |

| | |

| | | | | | Exchange-Traded Funds — 15.1% | |

| | | 749,650 | | | iShares iBoxx $ Investment Grade Corporate Bond ETF | | | 88,893,497 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL MUTUAL FUNDS (COST $318,860,603) | | | 320,180,541 | |

| | | | | | | | | | |

| | |

| | | | | | SHORT-TERM INVESTMENTS — 0.6% | |

| | |

| | | | | | Money Market Funds | |

| | | 3,598,275 | | | State Street Institutional Treasury Plus Money Market Fund-Premier Class, 0.41% (b) | | | 3,598,275 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL SHORT-TERM INVESTMENTS (COST $3,598,275) | | | 3,598,275 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL INVESTMENTS — 113.9%

(Cost $667,895,154) | | | 670,682,276 | |

| | | | | | Other Assets and Liabilities (net) — (13.9%) | | | (82,076,697 | ) |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL NET ASSETS — 100.0% | | | $588,605,579 | |

| | | | | | | | | | |

A summary of outstanding financial instruments at February 28, 2017 is as follows:

Forward Currency Contracts

| | | | | | | | | | | | | | | | | | | | | | |

Settlement

Date | | Counter-

party | | Currency

Sold | | | Currency

Purchased | | | Net

Unrealized

Appreciation

(Depreciation) | |

| 03/09/2017 | | GS | | | CHF | | | | 5,000,000 | | | | USD | | | | 5,017,237 | | | $ | 37,256 | |

| 03/09/2017 | | MSCI | | | CHF | | | | 1,331,916 | | | | USD | | | | 1,326,491 | | | | (93 | ) |

| 03/20/2017 | | BCLY | | | EUR | | | | 3,210,000 | | | | USD | | | | 3,429,181 | | | | 25,797 | |

| 03/20/2017 | | MSCI | | | EUR | | | | 320,023 | | | | USD | | | | 341,573 | | | | 2,271 | |

| 11/07/2017 | | GS | | | EUR | | | | 4,716,000 | | | | USD | | | | 5,177,932 | | | | 116,846 | |

| 03/13/2017 | | BOA | | | JPY | | | | 52,851,246 | | | | USD | | | | 464,802 | | | | (5,798 | ) |

| 03/13/2017 | | JPM | | | JPY | | | | 428,000,000 | | | | USD | | | | 3,781,681 | | | | (29,336 | ) |

| 03/09/2017 | | MSCI | | | USD | | | | 661,477 | | | | CHF | | | | 661,906 | | | | (2,221 | ) |

| 03/13/2017 | | MSCI | | | USD | | | | 125,412 | | | | NZD | | | | 180,000 | | | | 4,196 | |

| 11/07/2017 | | GS | | | USD | | | | 5,205,049 | | | | EUR | | | | 4,716,000 | | | | (143,963 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | $ | 4,955 | |

| | | | | | | | | | | | | | | | | | | | | | |

Futures Contracts

| | | | | | | | | | | | |

| | | | |

Number

of

Contracts + | | Type | | Expiration

Date | | Notional

Amount | | | Net

Unrealized

Appreciation

(Depreciation) | |

| Buys | | | | | | | | | | | | |

| 102 | | U.S. Long Bond (CBT) | | June 2017 | | $ | 15,468,937 | | | $ | 154,122 | |

| 349 | | U.S. Treasury Note 10 Yr. (CBT) | | June 2017 | | | 43,477,766 | | | | 122,168 | |

| 24 | | U.S. Treasury Note 2 Yr. (CBT) | | June 2017 | | | 5,193,750 | | | | 2,598 | |

| 39 | | U.S. Treasury Note 5 Yr. (CBT) | | June 2017 | | | 4,590,422 | | | | 5,126 | |

| | | | | | | | | | | | |

| | | | | | $ | 68,730,875 | | | $ | 284,014 | |

| | | | | | | | | | | | |

| + | Buys - Fund is long the futures contract. |

| | Sales - Fund is short the futures contract. |

| | | | |

| | See accompanying notes to the financial statements. | | 11 |

GMO Core Plus Bond Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2017

Swap Contracts

Interest Rate Swaps

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Notional

Amount | | | Expiration

Date | | Counterparty | | Receive

(Pay) # | | Fixed

Rate | | Variable Rate | | Net

Unrealized

Appreciation/

(Depreciation) | |

| | 330,867,000 | | | | MXN | | | 1/22/2027 | | CSS (c) | | Receive | | 7.90% | | TIIE | | $ | 90,164 | |

| | 430,000 | | | | CAD | | | 3/17/2027 | | CSS (d) | | Receive | | 1.97% | | 3 Month CAD LIBOR | | | 2,755 | |

| | 7,680,000 | | | | CAD | | | 3/17/2027 | | CSS (d) | | (Pay) | | 2.00% | | 3 Month CAD LIBOR | | | (66,911 | ) |

| | 962,000 | | | | CAD | | | 3/17/2027 | | CSS (d) | | (Pay) | | 1.86% | | 3 Month CAD LIBOR | | | 1,204 | |

| | 6,351,000 | | | | CHF | | | 3/17/2027 | | CSS (d) | | (Pay) | | 0.17% | | 6 Month CHF LIBOR | | | (88,093 | ) |

| | 7,311,000 | | | | EUR | | | 3/17/2027 | | CSS (d) | | (Pay) | | 0.77% | | 6 Month EURIBOR | | | (71,331 | ) |

| | 28,396,000 | | | | GBP | | | 3/17/2027 | | CSS (d) | | (Pay) | | 1.30% | | 6 Month GBP LIBOR | | | (499,806 | ) |

| | 1,335,000 | | | | GBP | | | 3/17/2027 | | CSS (d) | | (Pay) | | 1.40% | | 6 Month GBP LIBOR | | | (39,249 | ) |

| | 875,000 | | | | GBP | | | 3/17/2027 | | CSS (d) | | (Pay) | | 1.43% | | 6 Month GBP LIBOR | | | (28,885 | ) |

| | 445,000 | | | | GBP | | | 3/17/2027 | | CSS (d) | | (Pay) | | 1.38% | | 6 Month GBP LIBOR | | | (12,011 | ) |

| | 804,000 | | | | GBP | | | 3/17/2027 | | CSS (d) | | (Pay) | | 1.41% | | 6 Month GBP LIBOR | | | (24,702 | ) |

| | 29,223,000 | | | | NZD | | | 3/17/2027 | | CSS (d) | | Receive | | 3.67% | | 3 Month NZD Bank Bill Rate | | | 340,837 | |

| | 2,213,000 | | | | NZD | | | 3/17/2027 | | CSS (d) | | Receive | | 2.68% | | 3 Month NZD Bank Bill Rate | | | (107,973 | ) |

| | 987,000 | | | | NZD | | | 3/17/2027 | | CSS (d) | | Receive | | 2.94% | | 3 Month NZD Bank Bill Rate | | | (32,406 | ) |

| | 50,697,000 | | | | SEK | | | 3/17/2027 | | CSS (d) | | (Pay) | | 1.14% | | 3 Month SEK STIBOR | | | (34,226 | ) |

| | 173,460,000 | | | | SEK | | | 3/17/2027 | | CSS (d) | | Receive | | 1.17% | | 3 Month SEK STIBOR | | | 177,610 | |

| | 422,000 | | | | USD | | | 3/17/2027 | | CSS (d) | | (Pay) | | 2.29% | | 3 Month USD LIBOR | | | 2,085 | |

| | 9,544,000 | | | | USD | | | 3/17/2027 | | CSS (d) | | (Pay) | | 2.32% | | 3 Month USD LIBOR | | | 13,142 | |

| | 559,000 | | | | USD | | | 3/17/2027 | | CSS (d) | | (Pay) | | 2.35% | | 3 Month USD LIBOR | | | (482 | ) |

| | 6,964,000 | | | | USD | | | 3/17/2027 | | CSS (d) | | Receive | | 2.49% | | 3 Month USD LIBOR | | | 97,961 | |

| | 721,000 | | | | USD | | | 3/17/2027 | | CSS (d) | | Receive | | 2.22% | | 3 Month USD LIBOR | | | (8,076 | ) |

| | 368,000 | | | | USD | | | 3/17/2027 | | CSS (d) | | (Pay) | | 2.26% | | 3 Month USD LIBOR | | | 2,625 | |

| | | | | | | | | | | | | | | | | | | | |

| | | $ | (285,768 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | Premiums Paid (Received) | | $ | (191,458 | ) |

| | | | | | | | | | | | | | | | | | | | |

| # | Receive - Fund receives fixed rate and pays variable rate. |

| | (Pay) - Fund pays fixed rate and receives variable rate. |

As of February 28, 2017, for the above contracts and/or agreements, the Fund had sufficient cash and/or securities to cover commitments or collateral requirements, if any, of the relevant broker or exchange.

Notes to Schedule of Investments:

| † | Denominated in U.S. Dollar, unless otherwise indicated. |

| (a) | All or a portion of this security has been pledged to cover margin requirements on futures and/or cleared swap contracts, collateral on OTC swap contracts, forward currency contracts, and/or written options, if any (Note 4). |

| (b) | The rate disclosed is the 7 day net yield as of February 28, 2017. |

| (c) | Swap was cleared through the CME Group Inc. |

| (d) | Swap was cleared through the LCH.Clearnet Group Ltd. |

For a listing of definitions of acronyms, counterparty abbreviations and currency abbreviations used throughout the Schedule of Investments as well as the derivative tables, if any, please refer to page 52.

| | | | |

| 12 | | See accompanying notes to the financial statements. | | |

This page has been left blank intentionally.

GMO Currency Hedged International Bond Fund

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Developed Fixed Income team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

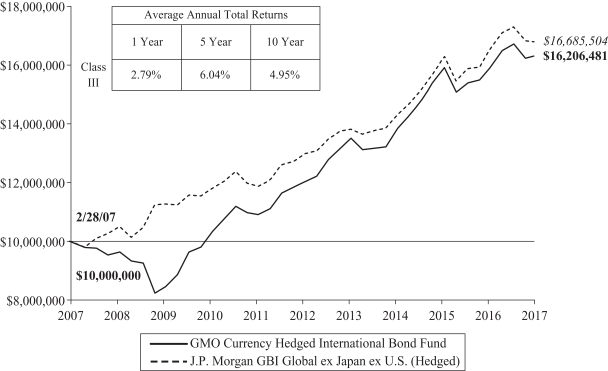

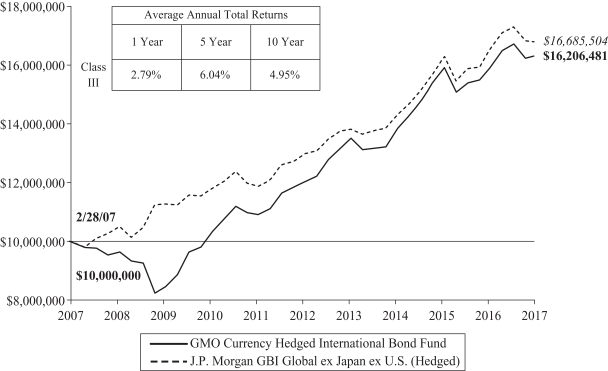

GMO Currency Hedged International Bond Fund returned +2.79% (net) for the fiscal year ended February 28, 2017, as compared with +1.77% for the J.P. Morgan GBI Global ex Japan ex-U.S. (Hedged). The Fund outperformed its benchmark during the fiscal year by +1.02%.

The Fund’s investment exposure was achieved directly through bonds, swaps, and futures and indirectly through investment in underlying GMO Trust mutual funds, including GMO Opportunistic Income Fund (OIF), GMO Emerging Country Debt Fund (ECDF), and GMO U.S. Treasury Fund (USTF).

A small exposure to emerging debt added value during the fiscal year, thanks to spread tightening on the asset class and positive contributions from both country selection and security selection.

Exposure to asset-backed securities also contributed positively to performance, given tighter spreads across structured products in general.

The currency strategy contributed positively during the fiscal year. The Fund’s active short positions in the yen and Swiss franc were successful during the year, while positions in euros detracted.

Developed markets interest-rate positioning detracted during the fiscal year. The Fund’s duration positions in Mexico, the U.K., and New Zealand, and an early year Eurozone steepener position detracted, while gains from duration positions in the U.S., Australia, and Sweden partly offset losses. In opportunistic strategies, cross-currency basis swap positions added value, as gains from yen cross-currency basis swap positions more than offset losses from euro cross-currency basis swap positions.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments.

14

GMO Currency Hedged International Bond Fund

(A Series of GMO Trust)

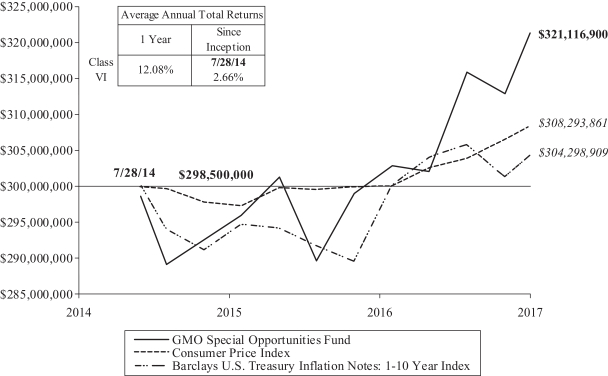

Comparison of Change in Value of a $10,000,000 Investment in

GMO Currency Hedged International Bond Fund Class III Shares and the

J.P. Morgan GBI Global ex Japan ex U.S. (Hedged)

As of February 28, 2017

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. The performance information shown above only includes purchase premiums and/or redemption fees in effect as of February 28, 2017. All information is unaudited.

For J.P. Morgan disclaimers please visit http://www.gmo.com/America/_Disclaimers/_BenchmarkDisclaimers.htm.

15

GMO Currency Hedged International Bond Fund

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2017 (Unaudited)

| | | | |

| Asset Class Summary† | | % of Total Net Assets | |

Debt Obligations | | | 66.7 | % |

Short-Term Investments | | | 31.6 | |

Futures Contracts | | | 0.4 | |

Forward Currency Contracts | | | 0.4 | |

Loan Participations | | | 0.1 | |

Rights/Warrants | | | 0.1 | |

Loan Assignments | | | 0.0 | ^ |

Options Purchased | | | 0.0 | ^ |

Securities Sold Short | | | (0.0 | )^ |

Written Options/Credit Linked Options | | | (0.0 | )^ |

Reverse Repurchase Agreements | | | (0.0 | )^ |

Swap Contracts | | | (0.4 | ) |

Other | | | 1.1 | |

| | | | |

| | | 100.0 | % |

| | | | |

Country/Region Summary‡ | | % of Investments | |

Germany | | | 20.8 | % |

France | | | 15.2 | |

Italy | | | 13.0 | |

United Kingdom | | | 11.9 | |

Spain | | | 7.4 | |

New Zealand | | | 7.3 | |

Other Emerging | | | 5.9 | ¥ |

Belgium | | | 4.3 | |

Australia | | | 3.7 | |

Netherlands | | | 3.3 | |

Sweden | | | 3.3 | |

Mexico | | | 2.9 | |

Canada | | | 1.9 | |

Other Developed | | | 0.5 | ☐ |

Euro Region | | | 0.4 | § |

Switzerland | | | (1.8 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

| † | The table above incorporates aggregate indirect asset class exposure associated with investments in other funds of GMO Trust (“underlying funds”). Derivative financial instruments, if any, are based on market values or unrealized appreciation/depreciation rather than notional amounts. |

| ‡ | The table above incorporates aggregate indirect country exposure associated with investments in the underlying funds. The table is normalized to 100%, therefore the absolute exposure presented for each country may not be representative of the true exposure of the Fund. The table excludes short-term investments. The table includes exposure through the use of certain derivative financial instruments and excludes exposure through certain currency linked derivatives such as forward currency contracts and currency options. The table is based on duration adjusted net exposures (both investments and derivatives), taking into account the market value of securities and the notional amounts of swaps and other derivative financial instruments. For example, U.S. asset-backed securities may represent a relatively small percentage due to their short duration, even though they represent a large percentage of market value (direct and indirect). Duration is based on GMO’s models. The greater the duration of a bond, the greater its contribution to the concentration percentage. Credit default swap exposures are factored into the duration adjusted exposure using the reference security and applying the same methodology to that security. |

| ¥ | “Other Emerging” is associated with investments in GMO Emerging Country Debt Fund and is comprised of emerging countries that each represent between (1.0)% and 1.0% of Investments. |

| ☐ | “Other Developed” is comprised of developed countries that each represent less than(1.0)% and 1.0% of Investments. |

| § | “Euro Region” is comprised of derivative financial instruments attributed to the Eurozone and not a particular country. |

16

GMO Currency Hedged International Bond Fund

(A Series of GMO Trust)

Schedule of Investments

(showing percentage of total net assets)

February 28, 2017

| | | | | | | | | | |

Par Value† | | | Description | | Value ($) | |

| | | DEBT OBLIGATIONS — 53.4% | |

| | | |

| | | | | | Belgium — 4.2% | | | | |

| | | | | | Foreign Government Obligations | | | | |

EUR | | | 1,130,000 | | | Belgium Government Bond, Reg S, 4.25%, due 09/28/21 | | | 1,455,209 | |

EUR | | | 590,000 | | | Belgium Government Bond, Reg S, 5.00%, due 03/28/35 | | | 1,019,757 | |

| | | | | | | | | | |

| | | | | | Total Belgium | | | 2,474,966 | |

| | | | | | | | | | |

| | | |

| | | | | | France — 3.4% | | | | |

| | | | | | Foreign Government Obligations | | | | |

EUR | | | 1,230,000 | | | France Government Bond OAT, Reg S, 4.50%, due 04/25/41 | | | 2,018,703 | |

| | | | | | | | | | |

| | | |

| | | | | | Germany — 4.5% | | | | |

| | | | | | Foreign Government Obligations | | | | |

EUR | | | 1,500,000 | | | Bundesrepublik Deutschland, Reg S, 4.75%, due 07/04/34 | | | 2,675,646 | |

| | | | | | | | | | |

| | | |

| | | | | | Italy — 15.3% | | | | |

| | | | | | Foreign Government Obligations | | | | |

EUR | | | 5,610,000 | | | Buoni Poliennali Del Tesoro, 3.75%, due 05/01/21 | | | 6,689,130 | |

EUR | | | 1,920,000 | | | Buoni Poliennali Del Tesoro, Reg S, 4.00%, due 02/01/37 | | | 2,389,281 | |

| | | | | | | | | | |

| | | | | | Total Italy | | | 9,078,411 | |

| | | | | | | | | | |

| | | |

| | | | | | Netherlands — 3.0% | | | | |

| | | | | | Foreign Government Obligations | | | | |

EUR | | | 1,050,000 | | | Netherlands Government Bond, 5.50%, due 01/15/28 | | | 1,711,139 | |

EUR | | | 70,000 | | | Netherlands Government Bond, Reg S, 4.00%, due 07/15/19 | | | 82,636 | |

| | | | | | | | | | |

| | | | | | Total Netherlands | | | 1,793,775 | |

| | | | | | | | | | |

| | | |

| | | | | | Spain — 9.6% | | | | |

| | | | | | Foreign Government Obligations | | | | |

EUR | | | 380,000 | | | Government of Spain, 2.10%, due 04/30/17 | | | 404,142 | |

EUR | | | 3,040,000 | | | Government of Spain, Reg S, 5.50%, due 04/30/21 | | | 3,929,693 | |

EUR | | | 1,010,000 | | | Government of Spain, Reg S, 4.20%, due 01/31/37 | | | 1,358,143 | |

| | | | | | | | | | |

| | | | | | Total Spain | | | 5,691,978 | |

| | | | | | | | | | |

| | | |

| | | | | | United Kingdom — 13.4% | | | | |

| | | | | | Foreign Government Obligations | | | | |

GBP | | | 510,000 | | | United Kingdom Gilt, Reg S, 1.25%, due 07/22/18 | | | 643,156 | |

GBP | | | 2,160,000 | | | United Kingdom Gilt, Reg S, 1.75%, due 07/22/19 | | | 2,786,447 | |

| | | | | | | | | | |

Par Value† / Shares | | | Description | | Value ($) | |

| | | | | | United Kingdom — continued | | | | |

| | | | | | Foreign Government Obligations — continued | |

GBP | | | 2,630,000 | | | United Kingdom Gilt, Reg S, 3.50%, due 01/22/45 | | | 4,481,396 | |

| | | | | | | | | | |

| | | | | | Total United Kingdom | | | 7,910,999 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL DEBT OBLIGATIONS (COST $34,481,686) | | | 31,644,478 | |

| | | | | | | | | | |

| | | |

| | | | | | MUTUAL FUNDS — 43.6% | | | | |

| | | |

| | | | | | United States — 43.6% | | | | |

| | | | | | Affiliated Issuers — 43.6% | | | | |

| | | 127,032 | | | GMO Emerging Country Debt Fund, Class IV | | | 3,677,564 | |

| | | 111,902 | | | GMO Opportunistic Income Fund, Class VI | | | 2,884,836 | |

| | | 769,947 | | | GMO U.S. Treasury Fund | | | 19,248,680 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL MUTUAL FUNDS

(COST $24,686,959) | | | 25,811,080 | |

| | | | | | | | | | |

| | | |

| | | | | | SHORT-TERM INVESTMENTS — 1.6% | | | | |

| | | |

| | | | | | Money Market Funds — 0.5% | | | | |

| | | 320,956 | | | State Street Institutional Treasury Plus Money Market Fund-Premier Class, 0.41% (a) | | | 320,956 | |

| | | | | | | | | | |

| | | |

| | | | | | U.S. Government — 1.1% | | | | |

| | | 650,000 | | | U.S. Treasury Bill, 0.55%, due 06/01/17 (b) (c) | | | 649,086 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL SHORT-TERM INVESTMENTS (COST $969,990) | | | 970,042 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL INVESTMENTS — 98.6%

(Cost $60,138,635) | | | 58,425,600 | |

| | | | | | Other Assets and Liabilities (net) — 1.4% | | | 807,023 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL NET ASSETS — 100.0% | | | $59,232,623 | |

| | | | | | | | | | |

A summary of outstanding financial instruments at February 28, 2017 is as follows:

Forward Currency Contracts

| | | | | | | | | | | | | | | | | | |

Settlement

Date | | Counter-

party | | Currency

Sold | | | Currency

Purchased | | | Net

Unrealized

Appreciation

(Depreciation) | |

| 03/09/2017 | | MSCI | | CHF | | | 1,229,012 | | | USD | | | 1,224,006 | | | $ | (85 | ) |

| 03/20/2017 | | MSCI | | EUR | | | 22,673,748 | | | USD | | | 24,200,598 | | | | 160,887 | |

| 11/07/2017 | | GS | | EUR | | | 1,404,000 | | | USD | | | 1,541,522 | | | | 34,786 | |

| 03/20/2017 | | GS | | GBP | | | 6,303,000 | | | USD | | | 7,882,942 | | | | 58,520 | |

| 03/13/2017 | | BOA | | JPY | | | 48,835,500 | | | USD | | | 429,485 | | | | (5,358 | ) |

| 03/09/2017 | | MSCI | | USD | | | 649,506 | | | CHF | | | 649,535 | | | | (2,572 | ) |

| 03/13/2017 | | MSCI | | USD | | | 118,445 | | | NZD | | | 170,000 | | | | 3,963 | |

| 11/07/2017 | | GS | | USD | | | 1,549,595 | | | EUR | | | 1,404,000 | | | | (42,859 | ) |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | $ | 207,282 | |

| | | | | | | | | | | | | | | | | | |

| | | | |

| | See accompanying notes to the financial statements. | | 17 |

GMO Currency Hedged International Bond Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2017

Futures Contracts

| | | | | | | | | | | | |

| | | | |

Number

of

Contracts + | | Type | | Expiration

Date | |

Notional

Amount | | | Net

Unrealized

Appreciation

(Depreciation) | |

| Buys | | | | | | | | | | | | |

| 14 | | Australian Government Bond 10 Yr. | | March 2017 | | $ | 1,376,566 | | | $ | 11,563 | |

| 15 | | Australian Government Bond 3 Yr. | | March 2017 | | | 1,283,708 | | | | (1,092 | ) |

| 18 | | Canadian Government Bond 10 Yr. | | June 2017 | | | 1,861,391 | | | | 14,197 | |

| 31 | | Euro BOBL | | March 2017 | | | 4,424,720 | | | | 62,974 | |

| 11 | | Euro Bund | | March 2017 | | | 1,935,046 | | | | 54,761 | |

| 7 | | Euro BUXL Bond 30 Yr. | | March 2017 | | | 1,287,530 | | | | 26,712 | |

| 29 | | Euro OATs | | March 2017 | | | 4,606,852 | | | | 8,883 | |

| 4 | | Short-term

Euro-BTP | | March 2017 | | | 477,450 | | | | 3,683 | |

| 23 | | UK Gilt Long Bond | | June 2017 | | | 3,631,088 | | | | 45,072 | |

| | | | | | | | | | | | |

| | | | | | $ | 20,884,351 | | | $ | 226,753 | |

| | | | | | | | | | | | |

| + | Buys - Fund is long the futures contract. |

| | Sales - Fund is short the futures contract. |

Swap Contracts

Interest Rate Swaps

| | | | | | | | | | | | | | | | | | | | |

Notional

Amount | | | Expiration

Date | | Counterparty | | Receive

(Pay) # | | Fixed

Rate | | Variable Rate | | Net

Unrealized

Appreciation/

(Depreciation) | |

| | 10,113,000 | | | | EUR | | | 3/21/2018 | | CSS (d) | | Receive | | (0.22)% | | 3 Month EURIBOR | | $ | 9,008 | |

| | 665,000 | | | | USD | | | 12/16/2020 | | CSS (d) | | (Pay) | | 1.92% | | 3 Month USD LIBOR | | | (1,102 | ) |

| | 1,066,000 | | | | USD | | | 12/17/2025 | | CSS (d) | | (Pay) | | 2.43% | | 3 Month USD LIBOR | | | (11,705 | ) |

| | 33,320,000 | | | | MXN | | | 1/22/2027 | | CSS (d) | | Receive | | 7.90% | | TIIE | | | 9,082 | |

| | 883,000 | | | | CAD | | | 3/17/2027 | | CSS (e) | | (Pay) | | 1.86% | | 3 Month CAD LIBOR | | | 1,105 | |

| | 420,000 | | | | CAD | | | 3/17/2027 | | CSS (e) | | (Pay) | | 2.00% | | 3 Month CAD LIBOR | | | (3,659 | ) |

| | 430,000 | | | | CAD | | | 3/17/2027 | | CSS (e) | | Receive | | 1.97% | | 3 Month CAD LIBOR | | | 2,755 | |

| | 598,000 | | | | CHF | | | 3/17/2027 | | CSS (e) | | (Pay) | | 0.17% | | 6 Month CHF LIBOR | | | (8,295 | ) |

| | 848,000 | | | | EUR | | | 3/17/2027 | | CSS (e) | | (Pay) | | 0.77% | | 6 Month EURIBOR | | | (8,274 | ) |

| | 266,000 | | | | GBP | | | 3/17/2027 | | CSS (e) | | (Pay) | | 1.30% | | 6 Month GBP LIBOR | | | (4,682 | ) |

| | 805,000 | | | | GBP | | | 3/17/2027 | | CSS (e) | | (Pay) | | 1.43% | | 6 Month GBP LIBOR | | | (26,574 | ) |

| | 1,067,000 | | | | GBP | | | 3/17/2027 | | CSS (e) | | (Pay) | | 1.40% | | 6 Month GBP LIBOR | | | (31,370 | ) |

| | 412,000 | | | | GBP | | | 3/17/2027 | | CSS (e) | | (Pay) | | 1.38% | | 6 Month GBP LIBOR | | | (11,121 | ) |

| | 727,000 | | | | GBP | | | 3/17/2027 | | CSS (e) | | (Pay) | | 1.41% | | 6 Month GBP LIBOR | | | (22,337 | ) |

| | 2,067,000 | | | | NZD | | | 3/17/2027 | | CSS (e) | | Receive | | 2.68% | | 3 Month NZD Bank Bill Rate | | | (100,849 | ) |

| | 875,000 | | | | NZD | | | 3/17/2027 | | CSS (e) | | Receive | | 2.94% | | 3 Month NZD Bank Bill Rate | | | (28,729 | ) |

| | 870,000 | | | | NZD | | | 3/17/2027 | | CSS (e) | | Receive | | 3.67% | | 3 Month NZD Bank Bill Rate | | | 10,147 | |

| | | | |

| 18 | | See accompanying notes to the financial statements. | | |

GMO Currency Hedged International Bond Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2017

Interest Rate Swaps — continued

| | | | | | | | | | | | | | | | | | | | |

Notional

Amount | | | Expiration

Date | | Counterparty | | Receive

(Pay) # | | Fixed

Rate | | Variable Rate | | Net

Unrealized

Appreciation/

(Depreciation) | |

| | 5,590,000 | | | | SEK | | | 3/17/2027 | | CSS (e) | | (Pay) | | 1.14% | | 3 Month SEK STIBOR | | $ | (3,774 | ) |

| | 18,050,000 | | | | SEK | | | 3/17/2027 | | CSS (e) | | Receive | | 1.17% | | 3 Month SEK STIBOR | | | 18,482 | |

| | 701,000 | | | | USD | | | 3/17/2027 | | CSS (e) | | Receive | | 2.49% | | 3 Month USD LIBOR | | | 9,861 | |

| | 513,000 | | | | USD | | | 3/17/2027 | | CSS (e) | | (Pay) | | 2.34% | | 3 Month USD LIBOR | | | (442 | ) |

| | 327,000 | | | | USD | | | 3/17/2027 | | CSS (e) | | (Pay) | | 2.32% | | 3 Month USD LIBOR | | | 450 | |

| | 353,000 | | | | USD | | | 3/17/2027 | | CSS (e) | | (Pay) | | 2.29% | | 3 Month USD LIBOR | | | 1,744 | |

| | 333,000 | | | | USD | | | 3/17/2027 | | CSS (e) | | (Pay) | | 2.26% | | 3 Month USD LIBOR | | | 2,376 | |

| | 668,000 | | | | USD | | | 3/17/2027 | | CSS (e) | | Receive | | 2.22% | | 3 Month USD LIBOR | | | (7,482 | ) |

| | 405,000 | | | | USD | | | 12/19/2035 | | CSS (d) | | (Pay) | | 2.72% | | 3 Month USD LIBOR | | | (8,649 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | (214,034 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Premiums Paid (Received) | | $ | (4,679 | ) |

| | | | | | | | | | | | | | | | | | | | |

| # | Receive - Fund receives fixed rate and pays variable rate. |

| | (Pay) - Fund pays fixed rate and receives variable rate. |

As of February 28, 2017, for the above contracts and/or agreements, the Fund had sufficient cash and/or securities to cover commitments or collateral requirements, if any, of the relevant broker or exchange.

Notes to Schedule of Investments:

| † | Denominated in U.S. Dollar, unless otherwise indicated. |

| (a) | The rate disclosed is the 7 day net yield as of February 28, 2017. |

| (b) | The rate shown represents yield-to-maturity. |

| (c) | All or a portion of this security has been pledged to cover margin requirements on futures and/or cleared swap contracts, collateral on OTC swap contracts, forward currency contracts, and/or written options, if any (Note 4). |

| (d) | Swap was cleared through the CME Group Inc. |

| (e) | Swap was cleared through the LCH.Clearnet Group Ltd. |

For a listing of definitions of acronyms, counterparty abbreviations and currency abbreviations used throughout the Schedule of Investments as well as the derivative tables, if any, please refer to page 52.

| | | | |

| | See accompanying notes to the financial statements. | | 19 |

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Emerging Country Debt team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

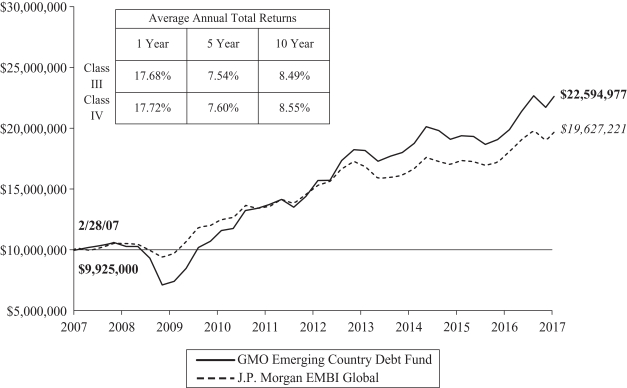

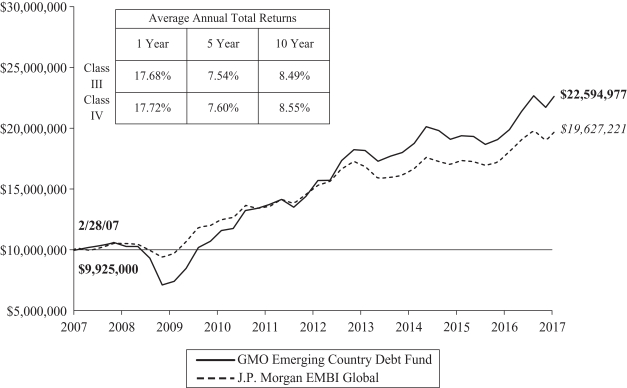

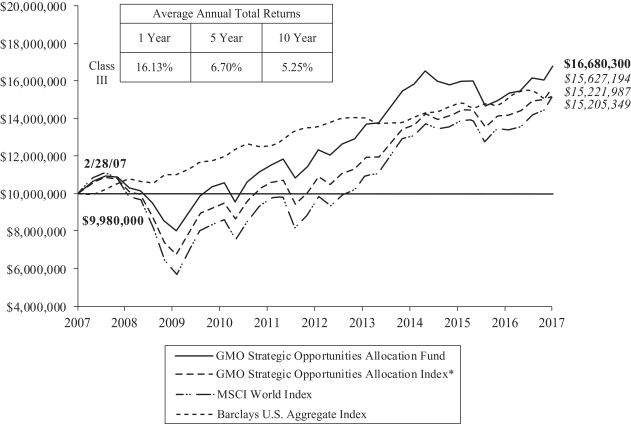

Class III shares of GMO Emerging Country Debt Fund returned +19.47% (net) for the fiscal year ended February 28, 2017, as compared with +12.06% for the J.P. Morgan EMBI Global (EMBIG). The Fund outperformed its benchmark during the fiscal year by +7.41%.

EMBIG spreads over U.S. Treasuries narrowed 149 basis points to 334 basis points, while the yield on the 10-year U.S. Treasury bond rose by 62 basis points to 2.36%.

The EMBIG index’s biggest gainers of the fiscal year were concentrated in low credit quality, commodity-reliant sovereigns, led by Venezuela (+75.2%), Zambia (+50.8%), and Ecuador (+49.3%). The worst performing countries featured two sovereigns in debt distress, namely Mozambique (-4.3%) and Belize (-3.0%). Slovak Republic, a high quality credit with very low yields, was the third worst performer on a total return basis.

Country selection added meaningfully to the Fund’s relative performance. Overweighting Venezuela had the largest positive impact, while overweight positions in Brazil, Angola, Iraq, Tunisia, and Pakistan also contributed. Underweight positions in China and the Philippines were also meaningful contributors to relative performance. A significant negative contribution from country selection came from overweighting Mexico.

Security selection also added to relative performance during the year. The Fund’s choice of holdings in Venezuela, Argentina, Colombia, Russia, and Brazil were meaningful contributors. These were partially offset by negative contributions from the Fund’s choice of holdings in Mexico and Tunisia.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments.

20

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

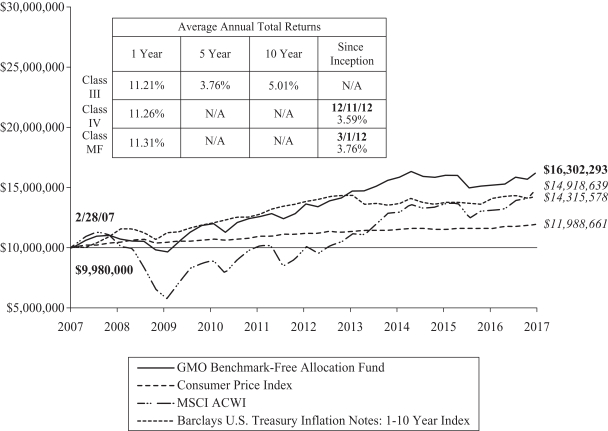

Comparison of Change in Value of a $10,000,000 Investment in

GMO Emerging Country Debt Fund Class III Shares and the J.P. Morgan EMBI Global

As of February 28, 2017

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Each performance figure assumes a purchase at the beginning and redemption at the end of the stated period and reflects a transaction fee of 0.75% on the purchase and 0.75% on the redemption. Transaction fees are retained by the Fund to cover trading costs. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. All information is unaudited. Performance for classes may vary due to different fees.

For J.P. Morgan disclaimers please visit http://www.gmo.com/America/_Disclaimers/_BenchmarkDisclaimers.htm.

21

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2017 (Unaudited)

| | | | |

| Asset Class Summary† | | % of Total Net Assets | |

Debt Obligations | | | 89.8 | % |

Short-Term Investments | | | 7.2 | |

Loan Participations | | | 1.6 | |

Rights/Warrants | | | 1.1 | |

Loan Assignments | | | 0.1 | |

Forward Currency Contracts | | | 0.0 | ^ |

Options Purchased | | | 0.0 | ^ |

Securities Sold Short | | | (0.0 | )^ |

Written Options/Credit Linked Options | | | (0.1 | ) |

Reverse Repurchase Agreements | | | (0.8 | ) |

Swap Contracts | | | (0.9 | ) |

Other | | | 2.0 | |

| | | | |

| | | 100.0 | % |

| | | | |

| | | | |

| Country/Region Summary‡ | | % of Investments | |

Other Emerging | | | 14.6 | %• |

Mexico | | | 12.4 | |

Russia | | | 7.1 | |

Venezuela | | | 6.8 | |

Brazil | | | 6.5 | |

Turkey | | | 6.0 | |

Argentina | | | 5.1 | |

Indonesia | | | 4.9 | |

China | | | 3.5 | |

Philippines | | | 2.7 | |

Pakistan | | | 2.1 | |

Dominican Republic | | | 2.0 | |

Kazakhstan | | | 2.0 | |

Colombia | | | 1.9 | |

Tunisia | | | 1.9 | |

Malaysia | | | 1.8 | |

South Africa | | | 1.8 | |

Costa Rica | | | 1.6 | |

Peru | | | 1.6 | |

Sri Lanka | | | 1.6 | |

Israel | | | 1.5 | |

Ukraine | | | 1.4 | |

Uruguay | | | 1.4 | |

Bahrain | | | 1.3 | |

Panama | | | 1.1 | |

Angola | | | 1.0 | |

Chile | | | 1.0 | |

Congo | | | 1.0 | |

Morocco | | | 1.0 | |

Hungary | | | 0.8 | |

Other Developed | | | 0.6 | ☐ |

| | | | |

| | | 100.0 | % |

| | | | |

| † | The table above incorporates aggregate indirect asset class exposure associated with investments in other funds of GMO Trust ( “underlying funds”). Derivative financial instruments, if any, are based on market values or unrealized appreciation/depreciaton rather than notional amounts. |

| ‡ | The table above incorporates aggregate indirect country exposure associated with investments in the underlying funds. The table excludes short-term investments. The table includes exposure through the use of certain derivative financial instruments and excludes exposure through certain currency linked derivatives such as forward currency contracts and currency options. The table is based on duration adjusted net exposures (both investments and derivatives), taking into account the market value of securities and the notional amounts of swaps and other derivative financial instruments. For example, U.S. asset-backed securities may represent a relatively small percentage due to their short duration, even though they represent a large percentage of market value (direct and indirect). Duration is based on GMO’s models. The greater the duration of a bond, the greater its contribution to the concentration percentage. Credit default swap exposures are factored into the duration adjusted exposure using a reference security and applying the same methodology to that security. |

| • | “Other Emerging” is comprised of emerging countries that each represent between (1.0)% and 1.0% of Investments. |

| ☐ | “Other Developed” is comprised of developed countries that each represent between (1.0)% and 1.0% of Investments. |

22

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments

(showing percentage of total net assets)

February 28, 2017

| | | | | | | | | | |

Par Value† | | | Description | | Value ($) | |

| | | | | | | | | | |

| | | DEBT OBLIGATIONS — 89.3% | |

| |

| | | Albania — 0.9% | |

| | | Foreign Government Obligations | |

| | | 49,649,849 | | | Republic of Albania Par Bond, Zero Coupon, due 08/31/25 (a) (b) | | | 36,318,756 | |

| | | | | | | | | | |

| |

| | | Angola — 0.6% | |

| | | Foreign Government Obligations | |

| | | 23,000,000 | | | Republic of Angola, Reg S, 9.50%, due 11/12/25 | | | 23,230,000 | |

| | | | | | | | | | |

| |

| | | Argentina — 4.4% | |

| | | Foreign Government Obligations | |

| | | 1,200,000 | | | Province of Buenos Aires, Reg S, Step Up, 4.00%, due 05/15/35 | | | 855,000 | |

| | | 11,100,000 | | | Republic of Argentina, Reg S, 7.63%, due 04/22/46 (c) | | | 11,155,500 | |

EUR | | | 8,008,646 | | | Republic of Argentina Discount Bond, 7.82%, due 12/31/33 | | | 8,717,675 | |

| | | 40,308,593 | | | Republic of Argentina Discount Bond, 8.28%, due 12/31/33 | | | 41,820,165 | |

| | | 10,786,557 | | | Republic of Argentina Discount Bond, 8.28%, due 12/31/33 | | | 11,390,604 | |

EUR | | | 67,050,000 | | | Republic of Argentina Par Bond, Step Up, 2.26%, due 12/31/38 | | | 43,152,386 | |

EUR | | | 96,430,000 | | | Republic of Argentina Par Bond, Step Up, 2.26%, due 12/31/38 | | | 61,294,734 | |

| | | | | | | | | | |

| | | Total Argentina | | | 178,386,064 | |

| | | | | | | | | | |

| |

| | | Armenia — 0.5% | |

| | | Foreign Government Obligations | |

| | | 21,300,000 | | | Republic of Armenia, Reg S, 7.15%, due 03/26/25 | | | 22,269,150 | |

| | | | | | | | | | |

| |

| | | Azerbaijan — 0.4% | |

| | | Foreign Government Agency — 0.3% | |

| | | 4,750,000 | | | Southern Gas Corridor CJSC, Reg S, 6.88%, due 03/24/26 | | | 5,230,938 | |

| | | 7,500,000 | | | State Oil Company of the Azerbaijan Republic, Reg S, 6.95%, due 03/18/30 | | | 8,043,750 | |

| | | | | | | | | | |

| | | 13,274,688 | |

| | | | | | | | | | |

| |

| | | Foreign Government Obligations — 0.1% | |

| | | 4,000,000 | | | Republic of Azerbaijan International Bond, Reg S, 4.75%, due 03/18/24 | | | 4,060,000 | |

| | | | | | | | | | |

| | | | | | Total Azerbaijan | | | 17,334,688 | |

| | | | | | | | | | |

| |

| | | Bahrain — 0.9% | |

| | | Foreign Government Obligations | |

| | | 40,750,000 | | | Bahrain Government International Bond, Reg S, 6.00%, due 09/19/44 | | | 35,248,750 | |

| | | | | | | | | | |

| | | | | | | | | | |

Par Value† | | | Description | | Value ($) | |

| | | Belize — 0.3% | |

| | | Foreign Government Obligations | |

| | | 32,486,300 | | | Republic of Belize, Reg S, Step Up, 4.94%, due 02/20/34 | | | 13,969,109 | |

| | | | | | | | | | |

| | | |

| | | | | | Bosnia & Herzegovina — 0.0% | | | | |

| | | Foreign Government Obligations | |

DEM | | | 2,694,160 | | | Bosnia & Herzegovina, Series A, Variable Rate, 0.56%, due 12/11/17 | | | 1,400,594 | |

| | | | | | | | | | |

| | | |

| | | | | | Brazil — 3.2% | | | | |

| | | Foreign Government Agency — 2.2% | |

GBP | | | 3,795,000 | | | Petrobras Global Finance BV, 6.25%, due 12/14/26 | | | 4,744,344 | |

GBP | | | 12,225,000 | | | Petrobras Global Finance BV, 6.63%, due 01/16/34 | | | 14,638,466 | |

| | | 81,900,000 | | | Petrobras Global Finance BV, 6.85%, due 06/05/2115 | | | 70,855,785 | |

| | | | | | | | | | |

| | | | | | | | | 90,238,595 | |

| | | | | | | | | | |

| |

| | | Foreign Government Obligations — 1.0% | |

| | | 4,435,000 | | | Republic of Brazil, 8.25%, due 01/20/34 | | | 5,421,788 | |

| | | 21,897,000 | | | Republic of Brazil, 7.13%, due 01/20/37 | | | 24,469,897 | |

| | | 10,000,000 | | | Republic of Brazil, 5.63%, due 02/21/47 | | | 9,525,000 | |

| | | | | | | | | | |

| | | | | | | | | 39,416,685 | |

| | | | | | | | | | |

| | | | | | Total Brazil | | | 129,655,280 | |

| | | | | | | | | | |

| | | |

| | | | | | Cameroon — 0.7% | | | | |

| | | Foreign Government Obligations | |

| | | 24,000,000 | | | Republic of Cameroon International Bond, Reg S, 9.50%, due 11/19/25 | | | 26,640,000 | |

| | | | | | | | | | |

| | | |

| | | | | | Chile — 0.9% | | | | |

| | | Corporate Debt — 0.5% | |

| | | 17,000,000 | | | Empresa Nacional de Electricidad SA, 8.13%, due 02/01/97 | | | 20,060,000 | |

| | | | | | | | | | |

| |

| | | Foreign Government Agency — 0.4% | |

| | | 16,500,000 | | | Corp Nacional del Cobre de Chile, Reg S, 4.50%, due 09/16/25 | | | 17,469,375 | |

| | | | | | | | | | |

| | | | | | Total Chile | | | 37,529,375 | |

| | | | | | | | | | |

| | | |

| | | | | | China — 0.8% | | | | |

| | | Foreign Government Agency | |

| | | 33,000,000 | | | Export-Import Bank of China via Avi Funding Co. Ltd. (The), Reg S, 3.80%, due 09/16/25 | | | 33,866,250 | |

| | | | | | | | | | |

| | | |

| | | | | | Colombia — 1.7% | | | | |

| | | Foreign Government Agency — 0.9% | |

| | | 36,500,000 | | | Ecopetrol SA, 7.38%, due 09/18/43 | | | 38,817,750 | |

| | | | | | | | | | |

| | | | |

| | See accompanying notes to the financial statements. | | 23 |

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2017

| | | | | | | | | | |

Par Value† | | | Description | | Value ($) | |

| | | | | | Colombia — continued | | | | |

| | | Foreign Government Obligations — 0.8% | |

| | | 25,000,000 | | | Colombia Government International Bond, 5.63%, due 02/26/44 | | | 27,025,000 | |

| | | 3,800,000 | | | Republic of Colombia, 11.85%, due 03/09/28 (a) | | | 5,677,043 | |

| | | | | | | | | | |

| | | | | | | | | 32,702,043 | |

| | | | | | | | | | |

| | | | | | Total Colombia | | | 71,519,793 | |

| | | | | | | | | | |

| |

| | | Congo Republic (Brazzaville) — 1.5% | |

| | | Foreign Government Obligations | |

| | | 88,901,798 | | | Republic of Congo, Reg S, Step Up, 4.00%, due 06/30/29 | | | 60,008,714 | |

| | | | | | | | | | |

| |

| | | Costa Rica — 1.2% | |

| | | Foreign Government Agency — 0.3% | |

| | | 15,045,000 | | | Instituto Costarricense de Electricidad, Reg S, 6.38%, due 05/15/43 | | | 12,731,831 | |

| | | | | | | | | | |

| |

| | | Foreign Government Obligations — 0.9% | |

| | | 37,000,000 | | | Costa Rica Government International Bond, Reg S, 7.16%, due 03/12/45 | | | 36,815,000 | |

| | | | | | | | | | |

| | | | | | Total Costa Rica | | | 49,546,831 | |

| | | | | | | | | | |

| |

| | | Croatia — 0.6% | |

| | | Foreign Government Obligations | |

| | | 21,000,000 | | | Croatia Government International Bond, Reg S, 5.50%, due 04/04/23 | | | 22,554,000 | |

| | | | | | | | | | |

| |

| | | Dominican Republic — 3.0% | |

| | | Asset-Backed Securities — 0.5% | |

| | | 22,246,187 | | | Autopistas Del Nordeste Ltd., Reg S, 9.39%, due 04/15/24 (a) | | | 22,085,437 | |

| | | | | | | | | | |

| |

| | | Foreign Government Agency — 0.2% | |

| | | 7,370,000 | | | Banco de Reservas de la Republica Dominicana, Reg S, 7.00%, due 02/01/23 | | | 7,440,199 | |

| | | | | | | | | | |

| |

| | | Foreign Government Obligations — 2.3% | |

| | | 38,607,000 | | | Dominican Republic Discount Bond, Variable Rate, 2.13%, due 08/30/24 | | | 36,087,893 | |

| | | 15,200,000 | | | Dominican Republic International Bond, Reg S, 8.63%, due 04/20/27 | | | 17,784,000 | |

| | | 10,000,000 | | | Dominican Republic International Bond, Reg S, 7.45%, due 04/30/44 | | | 10,925,000 | |

| | | 28,000,000 | | | Dominican Republic International Bond, Reg S, 6.85%, due 01/27/45 | | | 28,910,000 | |

| | | | | | | | | | |

| | | | | | | | | 93,706,893 | |

| | | | | | | | | | |

| | | | | | Total Dominican Republic | | | 123,232,529 | |

| | | | | | | | | | |

| | | | | | | | | | |

Par Value† | | | Description | | Value ($) | |

| | | Ecuador — 0.6% | |

| | | Foreign Government Obligations | |

| | | 17,500,000 | | | Ecuador Government International Bond, Reg S, 7.95%, due 06/20/24 | | | 17,500,000 | |

| | | 7,000,000 | | | Ecuador Government International Bond, Reg S, 9.65%, due 12/13/26 | | | 7,595,000 | |

| | | | | | | | | | |

| | | | | | Total Ecuador | | | 25,095,000 | |

| | | | | | | | | | |

| |

| | | Egypt — 0.2% | |

| | | Foreign Government Obligations | |

| | | 7,100,000 | | | Egypt Government International Bond, Reg S, 8.50%, due 01/31/47 (c) | | | 7,696,400 | |

| | | | | | | | | | |

| |

| | | El Salvador — 0.6% | |

| | | Foreign Government Obligations | |

| | | 14,000,000 | | | El Salvador Government International Bond, Reg S, 7.65%, due 06/15/35 | | | 12,862,500 | |

| | | 13,203,000 | | | El Salvador Government International Bond, Reg S, 7.63%, due 02/01/41 | | | 11,981,722 | |

| | | | | | | | | | |

| | | | | | Total El Salvador | | | 24,844,222 | |

| | | | | | | | | | |

| |

| | | Ethiopia — 0.3% | |

| | | Foreign Government Obligations | |

| | | 14,000,000 | | | Federal Democratic Republic of Ethiopia, Reg S, 6.63%, due 12/11/24 | | | 13,212,500 | |

| | | | | | | | | | |

| |

| | | Gabon — 1.0% | |

| | | Foreign Government Obligations | |

| | | 37,500,000 | | | Gabonese Republic, Reg S, 6.38%, due 12/12/24 | | | 35,906,250 | |

| | | 4,500,000 | | | Gabonese Republic, Reg S, 6.95%, due 06/16/25 | | | 4,342,500 | |

| | | | | | | | | | |

| | | | | | Total Gabon | | | 40,248,750 | |

| | | | | | | | | | |

| |

| | | Ghana — 0.9% | |

| | | Foreign Government Agency — 0.4% | |

| | | 15,761,356 | | | Saderea, Ltd., Reg S, 12.50%, due 11/30/26 | | | 15,918,969 | |

| | | | | | | | | | |

| |

| | | Foreign Government Obligations — 0.5% | |

| | | 16,800,000 | | | Republic of Ghana, Reg S, 10.75%, due 10/14/30 | | | 19,698,000 | |

| | | | | | | | | | |

| | | | | | Total Ghana | | | 35,616,969 | |

| | | | | | | | | | |

| |

| | | Greece — 0.5% | |

| | | Foreign Government Obligations | |

EUR | | | 28,882,000 | | | Hellenic Republic Government Bond, Reg S, Step Up, 3.00%, due 02/24/36 | | | 19,257,747 | |

| | | | | | | | | | |

| | | | |

| 24 | | See accompanying notes to the financial statements. | | |

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2017

| | | | | | | | | | |

Par Value† | | | Description | | Value ($) | |

| | | Grenada — 0.2% | |

| | | Foreign Government Obligations | |

| | | 12,043,610 | | | Grenada Government International Bond, Reg S, Step Up, 7.00%, due 05/12/30 | | | 6,486,267 | |

| | | | | | | | | | |

| |

| | | Guatemala — 0.5% | |

| | | Foreign Government Obligations | |

| | | 15,500,000 | | | Republic of Guatemala, Reg S, 8.13%, due 10/06/34 | | | 19,491,250 | |

| | | | | | | | | | |

| |

| | | Honduras — 0.6% | |

| | | Foreign Government Obligations | |

| | | 20,875,000 | | | Honduras Government International Bond, Reg S, 7.50%, due 03/15/24 | | | 22,962,500 | |

| | | 3,500,000 | | | Honduras Government International Bond, Reg S, 6.25%, due 01/19/27 | | | 3,539,375 | |

| | | | | | | | | | |

| | | | | | Total Honduras | | | 26,501,875 | |

| | | | | | | | | | |

| |

| | | Hungary — 0.4% | |

| | | Foreign Government Obligations | |

| | | 11,792,000 | | | Hungary Government International Bond, 7.63%, due 03/29/41 | | | 16,877,300 | |

| | | | | | | | | | |

| |

| | | Iceland — 0.2% | |

| | | Foreign Government Obligations | |

| | | 8,000,000 | | | Iceland Government International Bond, Reg S, 5.88%, due 05/11/22 | | | 9,055,552 | |

| | | | | | | | | | |

| |

| | | Indonesia — 3.5% | |

| | | Foreign Government Agency — 1.3% | |

| | | 28,200,000 | | | Majapahit Holding BV, Reg S, 7.88%, due 06/29/37 | | | 35,770,045 | |

| | | 14,400,000 | | | Pertamina Persero PT, Reg S, 6.50%, due 05/27/41 | | | 15,912,000 | |

| | | | | | | | | | |

| | | | | | | | | 51,682,045 | |

| | | | | | | | | | |

| |