UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04347

GMO Trust

(Exact name of the registrant as specified in charter)

40 Rowes Wharf, Boston, MA02110

(Address of principal executive offices) (Zip Code)

Tara Pari, Chief Executive Officer, 40 Rowes Wharf, Boston, MA 02110

(Name and address of agent for services)

Registrant’s telephone number, including area code: 617-346-7646

Date of fiscal year end: 02/28/22

Date of reporting period: 02/28/22

Item 1. Reports to Stockholders.

The annual reports for each series of the registrant for the period ended February 28, 2022 are filed herewith.

GMO Trust

Annual Report

February 28, 2022

Climate Change Fund

Emerging Domestic Opportunities Fund

Emerging Markets ex-China Fund

Emerging Markets Fund

International Equity Fund

Japan Value Creation Fund

Quality Cyclicals Fund (formerly Cyclical Focus Fund)

Quality Fund

Resources Fund

Tax-Managed International Equities Fund

U.S. Equity Fund

U.S. Small Cap Value Fund

For a free copy of the Funds’ proxy voting guidelines, shareholders may call 1-617-346-7646 (collect), visit GMO’s website at www.gmo.com or visit the Securities and Exchange Commission’s website at www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 will be available without charge on GMO’s website at www.gmo.com and on the Securities and Exchange Commission’s website at www.sec.gov no later than August 31 of each year.

The Funds file their complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarter of each fiscal year on Form N-PORT, which is available on the Commission’s website at www.sec.gov. The Funds have a policy with respect to disclosure of portfolio holdings under which they may also make a complete schedule of portfolio holdings available on GMO’s website at www.gmo.com.

This report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a prospectus for the GMO Trust, which contains a complete discussion of the risks associated with an investment in these Funds and other important information. The GMO Trust prospectus can be obtained at www.gmo.com. The GMO Trust Statement of Additional Information includes additional information about the Trustees of GMO Trust and is available without charge, upon request, by calling 1-617-346-7646 (collect).

An investment in the Funds is subject to risk, including the possible loss of principal amount invested. There can be no assurance that the Funds will achieve their stated investment objectives. Please see the Funds’ prospectus regarding specific principal risks for each Fund. General risks may include: market risk-equities, management and operational risk, non-U.S. investment risk, small company risk and derivatives risk.

The Funds are distributed by Funds Distributor LLC. Funds Distributor LLC is not affiliated with GMO.

TABLE OF CONTENTS

GMO Climate Change Fund

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Focused Equity team at Grantham, Mayo, Van Otterloo & Co. LLC.

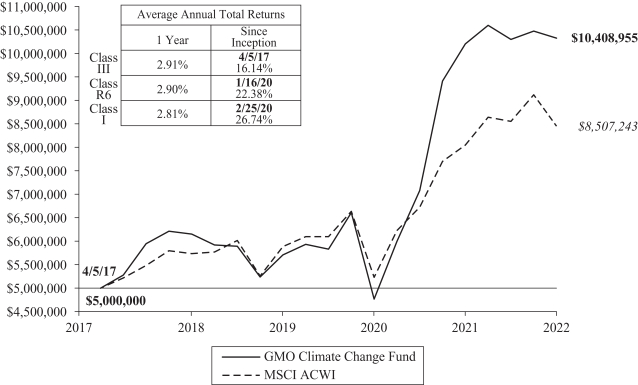

Management Discussion and Analysis of Fund Performance

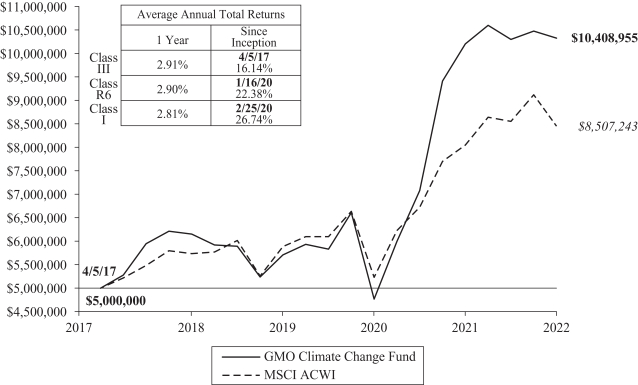

Although GMO does not manage the Fund to, or control the Fund’s risk relative to, any securities index or securities benchmark, a discussion of the Fund’s performance relative to the MSCI All Country World Index (“ACWI”) is included for comparative purposes.

Class III shares of GMO Climate Change Fund returned +2.91% (net) for the fiscal year ended February 28, 2022, as compared with +7.81% for the MSCI ACWI.

The Fund’s clean energy holdings declined about 7% during the year and held back performance relative to the index. Solar and wind companies were lower, while biofuels were essentially flat.

The Fund’s copper exposure gained approximately 36%. Ivanhoe Mines and Freeport- McMoRan Inc. were among the best performers.

The Fund’s agriculture exposure also performed well. The Mosaic Company, one of the world’s largest suppliers of phosphate and potash, was a strong contributor to performance.

Because some of the securities and instruments held directly or indirectly by the Fund had positive fair value adjustments at the beginning or end of the fiscal year (and the performance of indices are not fair valued), the Fund’s absolute and relative performance is higher than it otherwise would have been in the absence of such fair value adjustments.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments. All information is unaudited.

GMO Climate Change Fund

(A Series of GMO Trust)

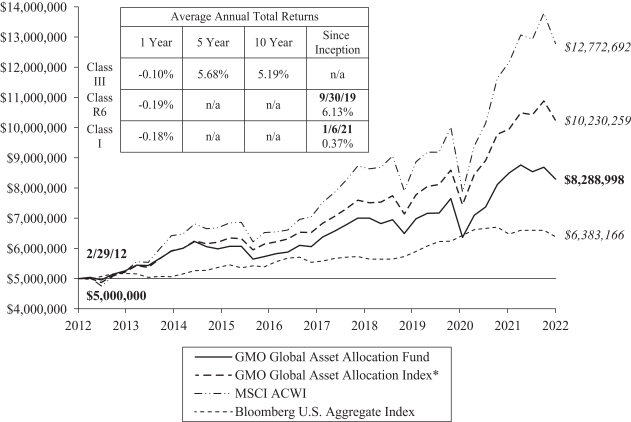

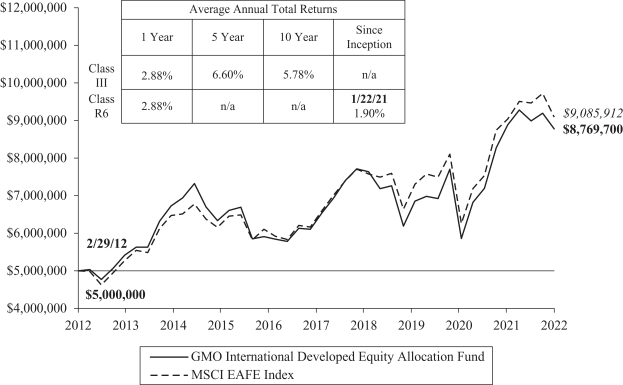

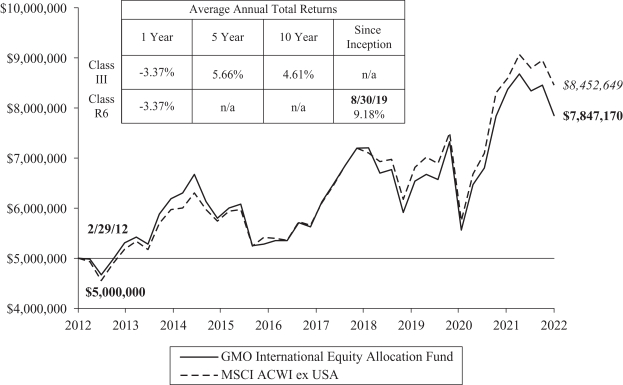

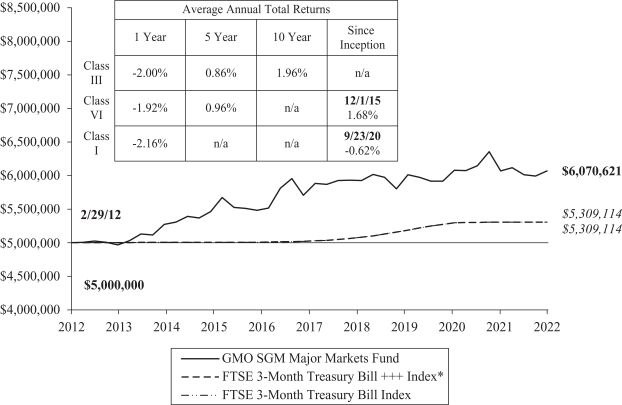

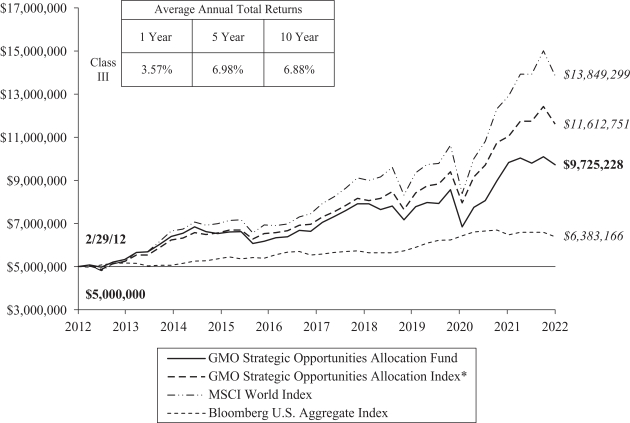

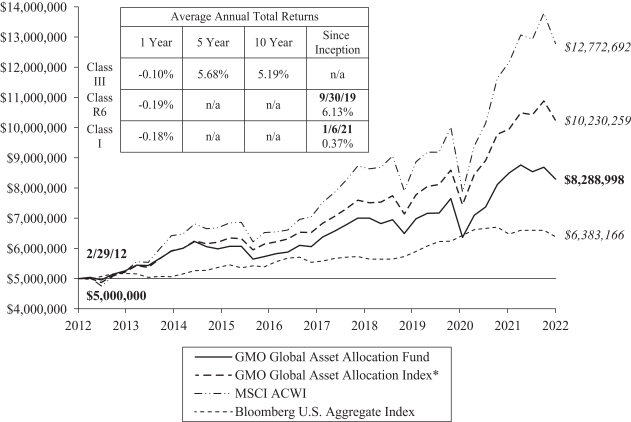

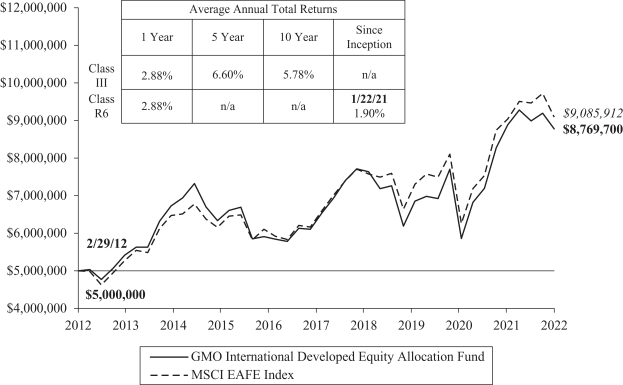

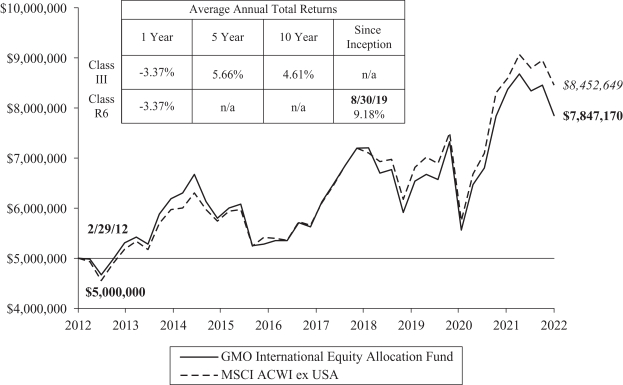

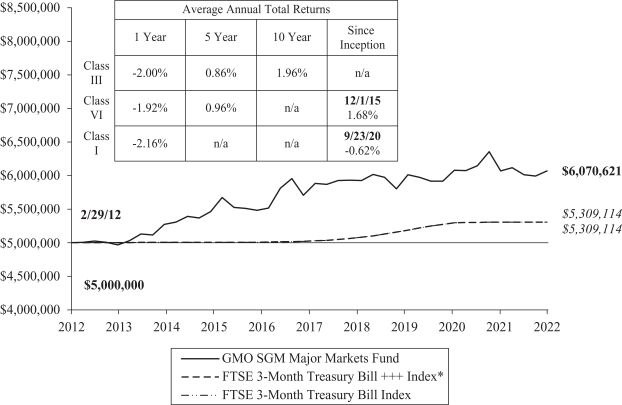

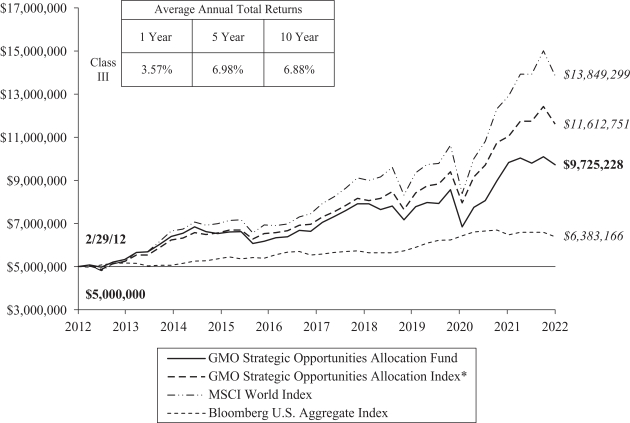

Comparison of Change in Value of a $5,000,000 Investment in

GMO Climate Change Fund Class III Shares and the MSCI ACWI

As of February 28, 2022

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. The performance information shown above only includes purchase premiums and/or redemption fees in effect as of February 28, 2022. All information is unaudited. Performance for classes may vary due to different fees.

MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder.

For Class III, R6 and I the gross expense ratio of 0.91%, 0.89% and 0.99%, respectively, is equal to the Fund’s Total Annual Operating Expenses set forth in the Fund’s most recent prospectus dated June 30, 2021. For the Classes listed above, the corresponding net expense ratio of 0.78%, 0.78% and 0.88% reflects the reduction of expenses from fee reimbursements. The fee reimbursements will continue until at least June 30, 2022. Elimination of this reimbursement will result in higher fees and lower performance.

GMO Climate Change Fund

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2022 (Unaudited)

| | | | |

| Asset Class Summary& | | % of Total Net Assets | |

Common Stocks | | | 97.9 | % |

Mutual Funds | | | 8.1 | |

Preferred Stocks | | | 1.7 | |

Short-Term Investments | | | 0.2 | |

Other | | | (7.9 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

| | | | |

| Country/Region Summary¤ | | % of Investments | |

United States | | | 56.4 | % |

Canada | | | 10.3 | |

Japan | | | 4.3 | |

China | | | 4.2 | |

France | | | 4.0 | |

Other Developed | | | 3.7 | ‡ |

South Korea | | | 2.9 | |

Mexico | | | 2.3 | |

Spain | | | 1.7 | |

Russia | | | 1.6 | |

United Kingdom | | | 1.6 | |

Chile | | | 1.6 | |

Norway | | | 1.5 | |

Brazil | | | 1.3 | |

Argentina | | | 1.0 | |

Australia | | | 1.0 | |

Other Emerging | | | 0.6 | † |

| | | | |

| | | 100.0 | % |

| | | | |

| | | | |

| Industry Group Summary | | % of Equity Investments# | |

Clean Energy | | | 59.1 | % |

Energy Efficiency | | | 13.4 | |

Agriculture | | | 9.7 | |

Copper | | | 7.4 | |

Water | | | 6.1 | |

Electric Grid | | | 4.3 | |

| | | | |

| | | 100.0 | % |

| | | | |

| & | In the table, derivative financial instruments, if any, are based on market values, rather than the notional amounts of derivatives, except for forward currency contracts which are based on unrealized appreciation/(depreciation). |

| ¤ | The table shows country exposure in the Fund. The table excludes short-term investments. The table excludes exposure through forward currency contracts and includes exposure through other derivative financial instruments, if any. The table takes into account the market value of securities and options and the notional amounts of swap contracts and other derivative financial instruments, if any. |

| ‡ | “Other Developed” is comprised of developed countries that each represent between (1.0)% and 1.0% of Investments. |

| † | “Other Emerging” is comprised of emerging countries that each represent between (1.0)% and 1.0% of Investments. |

| # | Equity investments may consist of common stocks and other stock-related securities, such as preferred stocks, if any. This table excludes exposure to derivative contracts, short-term investments, mutual funds and investment funds, if any. For a summary of these exposures, if any, see the Schedule of Investments. |

GMO Climate Change Fund

(A Series of GMO Trust)

Schedule of Investments

(showing percentage of total net assets)

February 28, 2022

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | COMMON STOCKS — 97.9% | |

| | |

| | | | | | Argentina — 1.1% | |

| | | |

| | | 832,015 | | | Adecoagro SA * (a) | | | 7,954,063 | |

| | | | | | | | | | |

| | |

| | | | | | Australia — 1.1% | |

| | | |

| | | 320,055 | | | Clean TeQ Water Ltd * (a) | | | 141,301 | |

| | | |

| | | 668,367 | | | Sandfire Resources Ltd | | | 3,295,007 | |

| | | |

| | | 1,134,203 | | | Sunrise Energy Metals Ltd * (a) | | | 1,494,320 | |

| | | |

| | | 1,189,773 | | | Western Areas Ltd * | | | 2,973,190 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Australia | | | 7,903,818 | |

| | | | | | | | | | |

| | |

| | | | | | Belgium — 0.1% | |

| | | |

| | | 232 | | | Elia Group SA/NV | | | 33,400 | |

| | | |

| | | 11,245 | | | Umicore SA | | | 460,029 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Belgium | | | 493,429 | |

| | | | | | | | | | |

| | |

| | | | | | Brazil — 1.4% | |

| | | |

| | | 865,578 | | | Sao Martinho SA | | | 6,691,416 | |

| | | |

| | | 438,360 | | | SLC Agricola SA | | | 3,723,973 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Brazil | | | 10,415,389 | |

| | | | | | | | | | |

| | |

| | | | | | Canada — 11.1% | |

| | | |

| | | 351,200 | | | Anaergia Inc * | | | 3,449,657 | |

| | | |

| | | 1,263,185 | | | Canadian Solar Inc * (a) | | | 39,992,437 | |

| | | |

| | | 353,348 | | | First Quantum Minerals Ltd (a) | | | 10,362,087 | |

| | | |

| | | 1,925,700 | | | Greenlane Renewables Inc * (a) | | | 1,656,026 | |

| | | |

| | | 780,070 | | | Ivanhoe Mines Ltd – Class A * | | | 7,939,174 | |

| | | |

| | | 876,815 | | | Largo Inc * (a) | | | 9,013,727 | |

| | | |

| | | 12,900 | | | Largo Resources Ltd * | | | 132,613 | |

| | | |

| | | 353,200 | | | Li-Cycle Holdings Corp * (a) | | | 2,744,364 | |

| | | |

| | | 398,300 | | | Lundin Mining Corp | | | 3,843,163 | |

| | | |

| | | 119,400 | | | NFI Group Inc (a) | | | 1,786,055 | |

| | | |

| | | 700 | | | Northland Power Inc (a) | | | 22,256 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Canada | | | 80,941,559 | |

| | | | | | | | | | |

| | |

| | | | | | China — 4.5% | |

| | | |

| | | 408,000 | | | Beijing Energy International Holding Co Ltd * | | | 13,612 | |

| | | |

| | | 1,223,000 | | | Canvest Environmental Protection Group Co Ltd (a) | | | 595,294 | |

| | | |

| | | 1,746,000 | | | Chaowei Power Holdings Ltd (a) | | | 437,664 | |

| | | |

| | | 7,949,919 | | | China High Speed Transmission Equipment Group Co Ltd * (a) | | | 6,031,472 | |

| | | |

| | | 2,275,000 | | | China Longyuan Power Group Corp Ltd – Class H | | | 4,694,666 | |

| | | |

| | | 2,856,000 | | | China Water Affairs Group Ltd (a) | | | 3,155,207 | |

| | | |

| | | 210,400 | | | Hollysys Automation Technologies Ltd * | | | 2,962,432 | |

| | | |

| | | 135,622 | | | Sungrow Power Supply Co Ltd – Class A | | | 2,628,577 | |

| | | |

| | | 2,430,000 | | | Tianneng Power International Ltd (a) | | | 2,229,251 | |

| | | |

| | | 2,640,000 | | | Wasion Holdings Ltd | | | 1,022,145 | |

| | | |

| | | 2,451,800 | | | Xinjiang Goldwind Science & Technology Co Ltd – Class H | | | 4,011,586 | |

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | China — continued | |

| | | |

| | | 5,600 | | | Xuji Electric Co Ltd – Class A | | | 19,776 | |

| | | |

| | | 1,226,576 | | | Yutong Bus Co Ltd – Class A | | | 1,899,885 | |

| | | |

| | | 577,685 | | | Zhuzhou CRRC Times Electric Co Ltd | | | 3,011,195 | |

| | | | | | | | | | |

| | | |

| | | | | | Total China | | | 32,712,762 | |

| | | | | | | | | | |

| | |

| | | | | | Denmark — 0.7% | |

| | | |

| | | 155,168 | | | Vestas Wind Systems A/S | | | 5,003,655 | |

| | | | | | | | | | |

| | |

| | | | | | Finland — 0.9% | |

| | | |

| | | 270,589 | | | Kemira Oyj | | | 3,578,248 | |

| | | |

| | | 69,325 | | | Neste Oyj | | | 2,703,302 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Finland | | | 6,281,550 | |

| | | | | | | | | | |

| | |

| | | | | | France — 4.3% | |

| | | |

| | | 391,204 | | | Electricite de France SA (a) | | | 3,536,690 | |

| | | |

| | | 140,489 | | | Nexans SA | | | 13,552,187 | |

| | | |

| | | 272,834 | | | Veolia Environnement SA | | | 9,512,817 | |

| | | |

| | | 17,193 | | | Vilmorin & Cie SA | | | 889,166 | |

| | | |

| | | 114,522 | | | Waga Energy SA * (a) | | | 3,822,420 | |

| | | | | | | | | | |

| | | |

| | | | | | Total France | | | 31,313,280 | |

| | | | | | | | | | |

| | |

| | | | | | Germany — 1.0% | |

| | | |

| | | 225,513 | | | E.ON SE | | | 3,067,324 | |

| | | |

| | | 70,764 | | | Infineon Technologies AG | | | 2,394,364 | |

| | | |

| | | 15,139 | | | Siemens AG (Registered) | | | 2,132,818 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Germany | | | 7,594,506 | |

| | | | | | | | | | |

| | |

| | | | | | India — 0.1% | |

| | | |

| | | 112,239 | | | VA Tech Wabag Ltd * | | | 449,798 | |

| | | | | | | | | | |

| | |

| | | | | | Japan — 4.6% | |

| | | |

| | | 40,100 | | | Daiseki Co Ltd | | | 1,633,599 | |

| | | |

| | | 151,000 | | | Ebara Corp | | | 7,880,875 | |

| | | |

| | | 161,500 | | | GS Yuasa Corp | | | 3,477,582 | |

| | | |

| | | 97,000 | | | Kurita Water Industries Ltd | | | 4,008,506 | |

| | | |

| | | 38,700 | | | METAWATER Co Ltd | | | 714,379 | |

| | | |

| | | 23,800 | | | Organo Corp | | | 1,694,036 | |

| | | |

| | | 310,500 | | | Panasonic Corp | | | 3,242,647 | |

| | | |

| | | 614,700 | | | Renesas Electronics Corp * | | | 7,241,593 | |

| | | |

| | | 39,300 | | | Takuma Co Ltd (a) | | | 499,455 | |

| | | |

| | | 46,400 | | | Tsukishima Kikai Co Ltd | | | 422,908 | |

| | | |

| | | 156,500 | | | Yokogawa Electric Corp | | | 2,525,021 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Japan | | | 33,340,601 | |

| | | | | | | | | | |

| | |

| | | | | | Mexico — 2.5% | |

| | | |

| | | 3,513,218 | | | Grupo Mexico SAB de CV – Series B | | | 17,946,041 | |

| | | |

| | | 355,516 | | | Grupo Rotoplas SAB de CV * | | | 449,928 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Mexico | | | 18,395,969 | |

| | | | | | | | | | |

| | |

| | | | | | Netherlands — 0.7% | |

| | | |

| | | 121,061 | | | Arcadis NV | | | 5,532,902 | |

| | | | | | | | | | |

| | | | |

| | |

| | | See accompanying notes to the financial statements. | | 5 |

GMO Climate Change Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2022

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | Norway — 1.6% | |

| | | |

| | | 850,037 | | | Austevoll Seafood ASA | | | 12,002,370 | |

| | | | | | | | | | |

| | |

| | | | | | Pakistan — 0.1% | |

| | | |

| | | 1,233,094 | | | Fauji Fertilizer Co Ltd | | | 765,469 | |

| | | | | | | | | | |

| | |

| | | | | | Philippines — 0.1% | |

| | | |

| | | 4,867,900 | | | Nickel Asia Corp | | | 737,408 | |

| | | | | | | | | | |

| | |

| | | | | | Russia — 1.8% | |

| | | |

| | | 722,153 | | | MMC Norilsk Nickel PJSC ADR | | | 9,915,394 | |

| | | |

| | | 364,903 | | | PhosAgro PJSC GDR (Registered) | | | 2,232,440 | |

| | | |

| | | 169,638 | | | Ros Agro Plc GDR (Registered) | | | 748,449 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Russia | | | 12,896,283 | |

| | | | | | | | | | |

| | |

| | | | | | South Korea — 3.1% | |

| | | |

| | | 47,564 | | | LG Chem Ltd | | | 22,571,215 | |

| | | | | | | | | | |

| | |

| | | | | | Spain — 1.9% | |

| | | |

| | | 28,134 | | | Acciona SA (a) | | | 4,807,930 | |

| | | |

| | | 231,084 | | | Endesa SA | | | 5,079,554 | |

| | | |

| | | 77,110 | | | Fomento de Construcciones y Contratas SA | | | 876,833 | |

| | | |

| | | 143,408 | | | Red Electrica Corp SA | | | 2,840,978 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Spain | | | 13,605,295 | |

| | | | | | | | | | |

| | |

| | | | | | Switzerland — 0.5% | |

| | | |

| | | 2,333 | | | Gurit Holding AG (a) | | | 3,834,836 | |

| | | | | | | | | | |

| | |

| | | | | | Thailand — 0.2% | |

| | | |

| | | 2,291,100 | | | SPCG Pcl | | | 1,250,071 | |

| | | |

| | | 908,900 | | | Super Energy Corp Plc NVDR | | | 25,647 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Thailand | | | 1,275,718 | |

| | | | | | | | | | |

| | |

| | | | | | Ukraine — 0.2% | |

| | | |

| | | 219,994 | | | Kernel Holding SA | | | 1,616,678 | |

| | | | | | | | | | |

| | |

| | | | | | United Kingdom — 1.7% | |

| | | |

| | | 668,883 | | | Drax Group Plc | | | 6,310,748 | |

| | | |

| | | 171,070 | | | Go-Ahead Group Plc * | | | 1,515,332 | |

| | | |

| | | 341,837 | | | Renewi Plc * | | | 2,812,282 | |

| | | |

| | | 1,760,877 | | | Stagecoach Group Plc * | | | 2,025,828 | |

| | | | | | | | | | |

| | | |

| | | | | | Total United Kingdom | | | 12,664,190 | |

| | | | | | | | | | |

| | |

| | | | | | United States — 52.6% | |

| | | |

| | | 366,820 | | | Aemetis, Inc. * (a) | | | 4,702,632 | |

| | | |

| | | 140,400 | | | AGCO Corp. | | | 16,870,464 | |

| | | |

| | | 688,087 | | | Ameresco, Inc. – Class A * | | | 44,209,590 | |

| | | |

| | | 326,000 | | | Archaea Energy, Inc. * | | | 5,978,840 | |

| | | |

| | | 279,886 | | | BorgWarner, Inc. | | | 11,478,125 | |

| | | |

| | | 3,725,819 | | | Clean Energy Fuels Corp. * | | | 27,086,704 | |

| | | |

| | | 30,421 | | | Constellation Energy Corp. | | | 1,398,758 | |

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | United States — continued | |

| | | |

| | | 18,500 | | | Corteva, Inc. | | | 962,555 | |

| | | |

| | | 486,196 | | | Darling Ingredients, Inc. * | | | 35,239,486 | |

| | | |

| | | 21,900 | | | Deere & Co. | | | 7,884,438 | |

| | | |

| | | 50,900 | | | Edison International | | | 3,228,078 | |

| | | |

| | | 30,200 | | | Emerson Electric Co. | | | 2,806,184 | |

| | | |

| | | 52,600 | | | EnerSys | | | 3,825,598 | |

| | | |

| | | 94,664 | | | Exelon Corp. | | | 4,028,900 | |

| | | |

| | | 56,730 | | | First Solar, Inc. * | | | 4,271,202 | |

| | | |

| | | 221,899 | | | Freeport-McMoRan, Inc. | | | 10,418,158 | |

| | | |

| | | 732,100 | | | Gevo, Inc. * (a) | | | 2,598,955 | |

| | | |

| | | 2,732,356 | | | GrafTech International Ltd. | | | 27,542,149 | |

| | | |

| | | 171,000 | | | Green Plains, Inc. * | | | 5,598,540 | |

| | | |

| | | 85,500 | | | Infrastructure and Energy Alternatives, Inc. * | | | 930,240 | |

| | | |

| | | 70,400 | | | Johnson Controls International Plc | | | 4,573,184 | |

| | | |

| | | 454,024 | | | Livent Corp. * (a) | | | 10,692,265 | |

| | | |

| | | 552,218 | | | Montauk Renewables, Inc. * | | | 5,709,934 | |

| | | |

| | | 153,647 | | | Mosaic Co. (The) | | | 8,055,712 | |

| | | |

| | | 255,600 | | | Mueller Water Products, Inc. – Class A | | | 3,243,564 | |

| | | |

| | | 28,500 | | | MYR Group, Inc. * | | | 2,557,875 | |

| | | |

| | | 73,433 | | | Owens Corning | | | 6,843,221 | |

| | | |

| | | 33,800 | | | Pentair Plc | | | 1,957,358 | |

| | | |

| | | 46,600 | | | Quanta Services, Inc. | | | 5,076,604 | |

| | | |

| | | 552,360 | | | Renewable Energy Group, Inc. * | | | 33,970,140 | |

| | | |

| | | 100 | | | Rockwell Automation, Inc. | | | 26,658 | |

| | | |

| | | 51,600 | | | Sensata Technologies Holding Plc * | | | 2,988,156 | |

| | | |

| | | 99,234 | | | SolarEdge Technologies, Inc. * | | | 31,697,324 | |

| | | |

| | | 1,339,537 | | | Sunrun, Inc. * (a) | | | 36,542,569 | |

| | | |

| | | 27,329 | | | TE Connectivity Ltd. | | | 3,892,470 | |

| | | |

| | | 15,500 | | | Valmont Industries, Inc. | | | 3,354,975 | |

| | | |

| | | 63,100 | | | Zurn Water Solutions Corp. | | | 2,052,012 | |

| | | | | | | | | | |

| | | |

| | | | | | Total United States | | | 384,293,617 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL COMMON STOCKS

(COST $704,677,489) | | | 714,596,360 | |

| | | | | | | | | | |

| | |

| | | | | | PREFERRED STOCKS (b) — 1.7% | |

| | |

| | | | | | Chile — 1.7% | |

| | | |

| | | 190,738 | | | Sociedad Quimica y Minera de Chile SA Sponsored ADR | | | 12,623,041 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL PREFERRED STOCKS

(COST $8,475,796) | | | 12,623,041 | |

| | | | | | | | | | |

| | |

| | | | | | MUTUAL FUNDS — 8.1% | |

| | |

| | | | | | United States — 8.1% | |

| | |

| | | | | | Affiliated Issuers — 8.1% | |

| | | |

| | | 11,771,966 | | | GMO U.S. Treasury Fund (c) | | | 58,977,551 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL MUTUAL FUNDS

(COST $59,022,760) | | | 58,977,551 | |

| | | | | | | | | | |

| | | | |

| | |

| 6 | | See accompanying notes to the financial statements. | | |

GMO Climate Change Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2022

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | SHORT-TERM INVESTMENTS — 0.2% | |

| | |

| | | | | | Money Market Funds — 0.2% | |

| | | |

| | | 1,374,129 | | | State Street Institutional Treasury Money Market Fund – Premier Class, 0.01% (d) | | | 1,374,129 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL SHORT-TERM INVESTMENTS

(COST $1,374,129) | | | 1,374,129 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL INVESTMENTS — 107.9%

(Cost $773,550,174) | | | 787,571,081 | |

| | | |

| | | | | | Other Assets and Liabilities (net) — (7.9%) | | | (57,418,211 | ) |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL NET ASSETS — 100.0% | | | $730,152,870 | |

| | | | | | | | | | |

Notes to Schedule of Investments:

| * | Non-income producing security. |

| (a) | All or a portion of this security is out on loan (Note 2). |

| (b) | Preferred dividend rates are disclosed to the extent that a stated rate exists. |

| (c) | All or a portion of this security is purchased with collateral from securities loaned (Note 2). |

| (d) | The rate disclosed is the 7 day net yield as of February 28, 2022. |

For a listing of definitions of acronyms, counterparty abbreviations and currency abbreviations used throughout the Schedule of Investments as well as the derivative tables, if any, please refer to page 87.

| | | | |

| | |

| | | See accompanying notes to the financial statements. | | 7 |

GMO Emerging Domestic Opportunities Fund

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Emerging Markets Equity team at Grantham, Mayo, Van Otterloo & Co. LLC and GMO Singapore Pte. Limited.

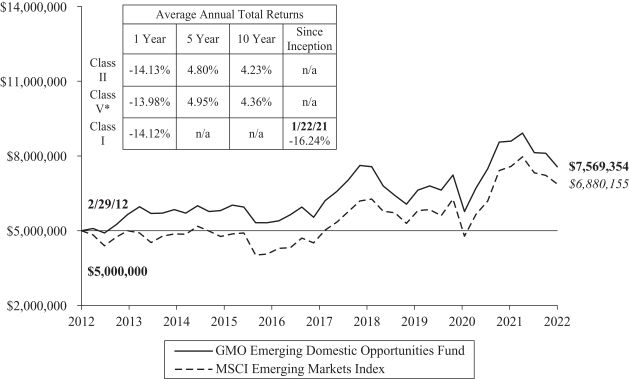

Management Discussion and Analysis of Fund Performance

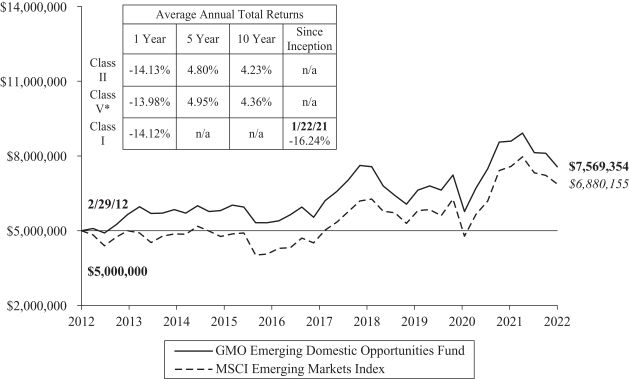

Although GMO does not manage the Fund to, or control the Fund’s risk relative to, any securities index or securities benchmark, a discussion of the Fund’s performance relative to the MSCI Emerging Markets Index is included for comparative purposes.

Class II shares of GMO Emerging Domestic Opportunities Fund returned -14.13% (net) for the fiscal year ended February 28, 2022, as compared with -10.69% for the MSCI Emerging Markets Index.

Country-sector allocation detracted from the Fund’s relative returns for the fiscal year. The Fund’s overweight in China Communication Services and overweight in Russia Communication Services hurt relative performance.

Stock selection contributed to the Fund’s relative returns for the fiscal year. The Fund’s stock selection in China Consumer Discretionary and China Information Technology helped performance.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments. All information is unaudited.

GMO Emerging Domestic Opportunities Fund

(A Series of GMO Trust)

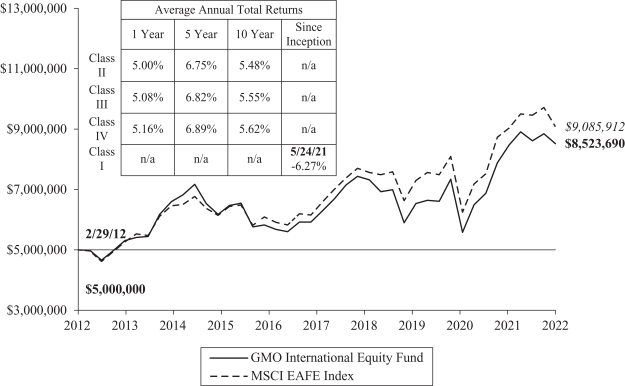

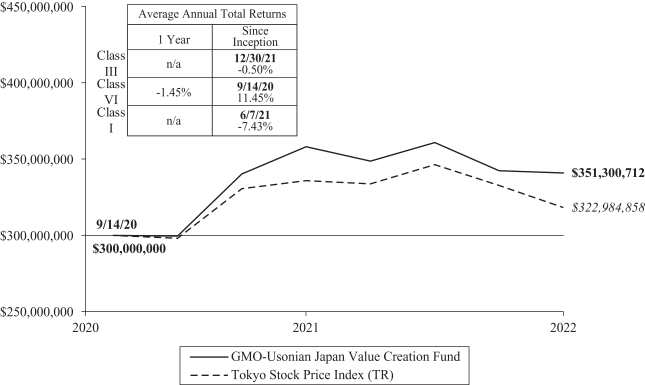

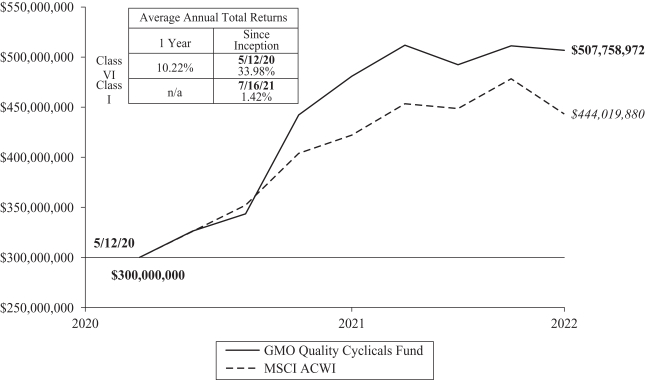

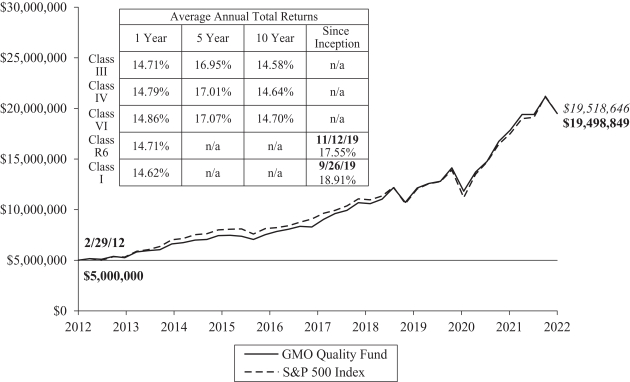

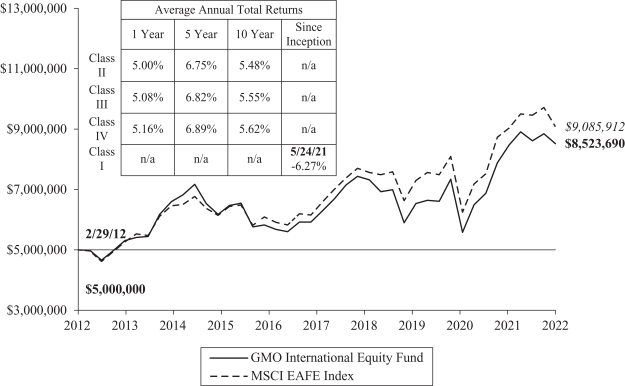

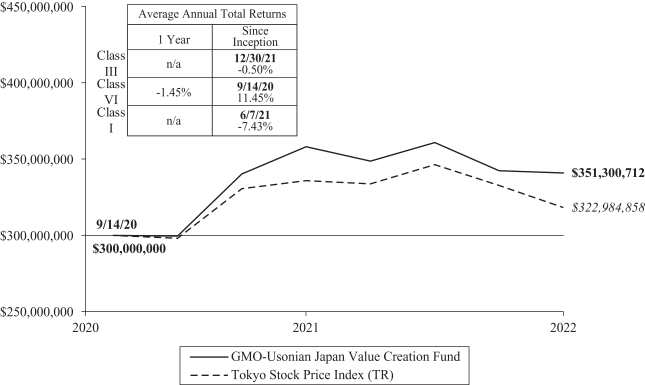

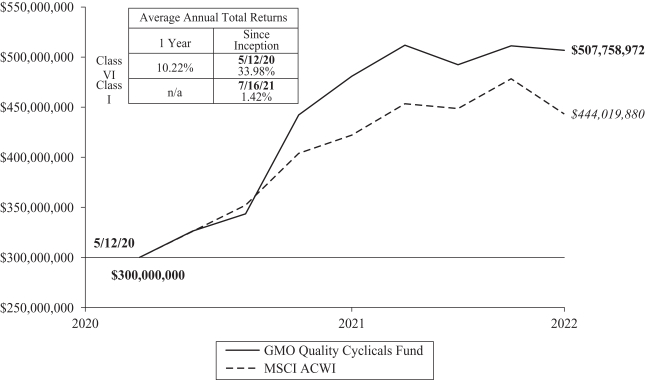

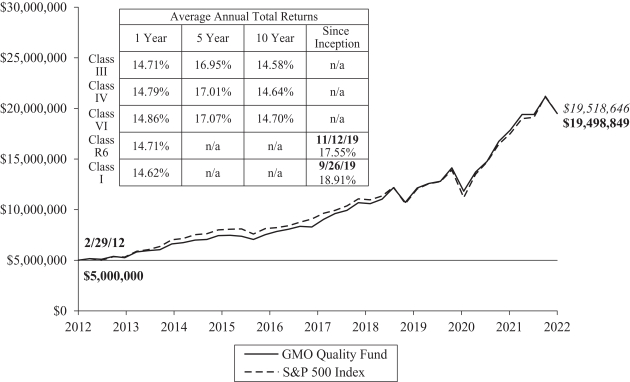

Comparison of Change in Value of a $5,000,000 Investment in

GMO Emerging Domestic Opportunities Fund Class II Shares and the MSCI Emerging Markets Index

As of February 28, 2022

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. The performance information shown above only includes purchase premiums and/or redemption fees in effect as of February 28, 2022. All information is unaudited. Performance for classes may vary due to different fees.

| | * | For the period from October 27, 2011 to November 29, 2013, no Class V shares were outstanding. Performance for that period is that of Class II, which has higher expenses. Therefore, the performance shown is lower than it would have been if Class V expenses had been applied throughout. |

| | | MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. |

| | | For Class II, V and I the gross expense ratio of 1.15%, 1.02% and 1.25%, respectively, is equal to the Fund’s Total Annual Operating Expenses set forth in the Fund’s most recent prospectus dated June 30, 2021. For the Classes listed above, the corresponding net expense ratio of 1.13%, 1.00% and 1.16% reflects the reduction of expenses from fee reimbursements. The fee reimbursements will continue until at least June 30, 2022. Elimination of this reimbursement will result in higher fees and lower performance. |

GMO Emerging Domestic Opportunities Fund

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2022 (Unaudited)

| | | | |

| Asset Class Summary& | | % of Total Net Assets | |

Common Stocks | | | 87.9 | % |

Investment Funds | | | 5.6 | |

Short-Term Investments | | | 4.7 | |

Mutual Funds | | | 0.3 | |

Preferred Stocks | | | 0.2 | |

Other | | | 1.3 | |

| | | | |

| | | 100.0 | % |

| | | | |

| | | | |

| Country/Region Summary¤ | | % of Investments | |

China | | | 26.1 | % |

Taiwan | | | 18.3 | |

India | | | 13.7 | |

South Korea | | | 9.0 | |

Saudi Arabia | | | 4.4 | |

Brazil | | | 4.2 | |

Indonesia | | | 3.6 | |

Mexico | | | 3.4 | |

United States | | | 3.0 | |

South Africa | | | 2.9 | |

Thailand | | | 1.7 | |

Qatar | | | 1.5 | |

Vietnam | | | 1.5 | |

Greece | | | 1.3 | |

Switzerland | | | 1.0 | |

Russia | | | 1.0 | |

United Arab Emirates | | | 0.9 | |

Hong Kong | | | 0.8 | |

Philippines | | | 0.4 | |

Netherlands | | | 0.4 | |

Malaysia | | | 0.4 | |

Poland | | | 0.2 | |

Singapore | | | 0.2 | |

Peru | | | 0.1 | |

| | | | |

| | | 100.0 | % |

| | | | |

| | | | |

| Industry Group Summary | | % of Equity Investments# | |

Banks | | | 26.2 | % |

Semiconductors & Semiconductor Equipment | | | 14.0 | |

Technology Hardware & Equipment | | | 10.5 | |

Food, Beverage & Tobacco | | | 5.6 | |

Diversified Financials | | | 5.5 | |

Retailing | | | 5.5 | |

Media & Entertainment | | | 5.2 | |

Telecommunication Services | | | 3.5 | |

Software & Services | | | 3.4 | |

Capital Goods | | | 2.8 | |

Consumer Durables & Apparel | | | 2.7 | |

Food & Staples Retailing | | | 2.7 | |

Materials | | | 2.3 | |

Transportation | | | 2.3 | |

Insurance | | | 2.1 | |

Automobiles & Components | | | 1.5 | |

Pharmaceuticals, Biotechnology & Life Sciences | | | 1.3 | |

Consumer Services | | | 0.7 | |

Utilities | | | 0.5 | |

Household & Personal Products | | | 0.5 | |

Commercial & Professional Services | | | 0.4 | |

Health Care Equipment & Services | | | 0.4 | |

Real Estate | | | 0.3 | |

Energy | | | 0.1 | |

| | | | |

| | | 100.0 | % |

| | | | |

| & | In the table, derivative financial instruments, if any, are based on market values, rather than the notional amounts of derivatives, except for forward currency contracts which are based on unrealized appreciation/(depreciation). |

| ¤ | The table shows country exposure in the Fund. The table excludes short-term investments. The table excludes exposure through forward currency contracts and includes exposure through other derivative financial instruments, if any. The table takes into account the market value of securities and options and the notional amounts of swap contracts and other derivative financial instruments, if any. |

| # | Equity investments may consist of common stocks and other stock-related securities, such as preferred stocks, if any. This table excludes exposure to derivative contracts, short-term investments, mutual funds and investment funds, if any. For a summary of these exposures, if any, see the Schedule of Investments. |

GMO Emerging Domestic Opportunities Fund

(A Series of GMO Trust)

Schedule of Investments

(showing percentage of total net assets)

February 28, 2022

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | COMMON STOCKS — 87.9% | |

| | |

| | | | | | Brazil — 2.7% | |

| | | |

| | | 736,900 | | | Atacadao SA | | | 2,716,326 | |

| | | |

| | | 1,068,100 | | | B3 SA – Brasil Bolsa Balcao | | | 3,004,976 | |

| | | |

| | | 579,800 | | | Banco BTG Pactual SA | | | 2,880,613 | |

| | | |

| | | 282,600 | | | Blau Farmaceutica SA | | | 1,629,876 | |

| | | |

| | | 572,800 | | | Cyrela Brazil Realty SA Empreendimentos e Participacoes | | | 1,672,442 | |

| | | |

| | | 280,400 | | | Localiza Rent a Car SA | | | 3,121,509 | |

| | | |

| | | 983,200 | | | Movida Participacoes SA | | | 3,105,227 | |

| | | |

| | | 1,256,700 | | | Vamos Locacao de Caminhoes Maquinas e Equipamentos SA | | | 2,673,699 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Brazil | | | 20,804,668 | |

| | | | | | | | | | |

| | |

| | | | | | China — 24.5% | |

| | | |

| | | 785,688 | | | Alibaba Group Holding Ltd * | | | 10,342,698 | |

| | | |

| | | 3,300 | | | Bafang Electric Suzhou Co Ltd – Class A | | | 105,491 | |

| | | |

| | | 217,300 | | | Baidu Inc – Class A * | | | 4,101,716 | |

| | | |

| | | 154,500 | | | BYD Co Ltd – Class H | | | 4,787,545 | |

| | | |

| | | 87,477 | | | Changzhou Xingyu Automotive Lighting Systems Co Ltd – Class A | | | 2,148,410 | |

| | | |

| | | 15,277,000 | | | China Construction Bank Corp – Class H | | | 11,457,208 | |

| | | |

| | | 4,006,400 | | | China International Capital Corp Ltd – Class H | | | 9,747,258 | |

| | | |

| | | 804,000 | | | China Mengniu Dairy Co Ltd * | | | 5,227,944 | |

| | | |

| | | 2,164,002 | | | China Merchants Bank Co Ltd – Class H | | | 18,241,035 | |

| | | |

| | | 7,090,000 | | | China Modern Dairy Holdings Ltd | | | 1,310,244 | |

| | | |

| | | 577,200 | | | China Yangtze Power Co Ltd – Class A | | | 2,125,519 | |

| | | |

| | | 25,900 | | | Contemporary Amperex Technology Co Ltd – Class A | | | 2,220,597 | |

| | | |

| | | 526,500 | | | GoerTek Inc – Class A | | | 3,689,623 | |

| | | |

| | | 1,156,355 | | | Haier Smart Home Co Ltd – Class A | | | 4,692,175 | |

| | | |

| | | 322,000 | | | Hua Hong Semiconductor Ltd * | | | 1,677,546 | |

| | | |

| | | 482,727 | | | JD.com Inc – Class A * | | | 17,242,729 | |

| | | |

| | | 178,697 | | | Jiangsu Hengli Hydraulic Co Ltd – Class A | | | 1,906,467 | |

| | | |

| | | 9,286 | | | Kweichow Moutai Co Ltd – Class A | | | 2,643,245 | |

| | | |

| | | 444,000 | | | Longfor Group Holdings Ltd | | | 2,374,300 | |

| | | |

| | | 236,900 | | | Meituan – Class B * | | | 5,262,771 | |

| | | |

| | | 338,200 | | | Midea Group Co Ltd – Class A | | | 3,596,001 | |

| | | |

| | | 190,600 | | | NARI Technology Co Ltd | | | 1,076,764 | |

| | | |

| | | 128,675 | | | NetEase Inc | | | 2,488,793 | |

| | | |

| | | 35,800 | | | Pinduoduo Inc ADR * | | | 1,856,588 | |

| | | |

| | | 971,800 | | | Ping An Bank Co Ltd – Class A | | | 2,433,975 | |

| | | |

| | | 1,068,000 | | | Ping An Insurance Group Co of China Ltd – Class H | | | 8,280,911 | |

| | | |

| | | 13,076,000 | | | Postal Savings Bank of China Co Ltd – Class H | | | 10,736,493 | |

| | | |

| | | 46,400 | | | Proya Cosmetics Co Ltd – Class A | | | 1,370,506 | |

| | | |

| | | 215,800 | | | SF Holding Co Ltd – Class A | | | 2,072,376 | |

| | | |

| | | 213,085 | | | Shanghai Baosight Software Co Ltd – Class A | | | 1,824,414 | |

| | | |

| | | 134,272 | | | Shenzhen Inovance Technology Co Ltd – Class A | | | 1,367,841 | |

| | | |

| | | 97,600 | | | Shenzhou International Group Holdings Ltd | | | 1,639,349 | |

| | | |

| | | 111,300 | | | Sunny Optical Technology Group Co Ltd | | | 2,667,188 | |

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | China — continued | |

| | | |

| | | 418,784 | | | Tencent Holdings Ltd | | | 22,598,134 | |

| | | |

| | | 890,000 | | | Tingyi Cayman Islands Holding Corp | | | 1,969,038 | |

| | | |

| | | 514,000 | | | Tsingtao Brewery Co Ltd – Class H | | | 4,945,112 | |

| | | |

| | | 896,000 | | | Weichai Power Co Ltd – Class H | | | 1,516,147 | |

| | | |

| | | 76,585 | | | Wuliangye Yibin Co Ltd – Class A | | | 2,320,432 | |

| | | |

| | | 7,100 | | | Yum China Holdings Inc | | | 369,342 | |

| | | | | | | | | | |

| | | |

| | | | | | Total China | | | 186,433,925 | |

| | | | | | | | | | |

| | |

| | | | | | Greece — 1.3% | |

| | | |

| | | 8,611,019 | | | Eurobank Ergasias Services and Holdings SA * | | | 9,432,774 | |

| | | | | | | | | | |

| | |

| | | | | | Hong Kong — 0.7% | |

| | | |

| | | 528,000 | | | AIA Group Ltd | | | 5,482,670 | |

| | | | | | | | | | |

| | |

| | | | | | India — 12.9% | |

| | | |

| | | 579,586 | | | Allcargo Logistics Ltd | | | 2,497,362 | |

| | | |

| | | 77,216 | | | Angel One Ltd | | | 1,373,070 | |

| | | |

| | | 38,646 | | | Apollo Hospitals Enterprise Ltd | | | 2,461,869 | |

| | | |

| | | 48,105 | | | Asian Paints Ltd | | | 2,031,274 | |

| | | |

| | | 335,187 | | | Axis Bank Ltd * | | | 3,322,304 | |

| | | |

| | | 490,511 | | | Canara Bank * | | | 1,439,188 | |

| | | |

| | | 78,909 | | | Central Depository Services India Ltd | | | 1,434,113 | |

| | | |

| | | 970,239 | | | Devyani International Ltd * | | | 2,015,108 | |

| | | |

| | | 99,539 | | | Escorts Ltd | | | 2,452,628 | |

| | | |

| | | 2,085,888 | | | Gayatri Projects Ltd * | | | 678,758 | |

| | | |

| | | 167,908 | | | Godrej Consumer Products Ltd * | | | 1,715,059 | |

| | | |

| | | 191,399 | | | Gujarat Gas Ltd | | | 1,497,407 | |

| | | |

| | | 209,736 | | | HCL Technologies Ltd | | | 3,151,189 | |

| | | |

| | | 64,779 | | | HDFC Bank Ltd | | | 1,231,883 | |

| | | |

| | | 37,292 | | | Housing Development Finance Corp Ltd | | | 1,177,323 | |

| | | |

| | | 935,127 | | | ICICI Bank Ltd | | | 9,249,713 | |

| | | |

| | | 387,424 | | | Infosys Ltd | | | 8,846,839 | |

| | | |

| | | 77,197 | | | JB Chemicals & Pharmaceuticals Ltd | | | 1,657,199 | |

| | | |

| | | 105,045 | | | Kajaria Ceramics Ltd | | | 1,519,838 | |

| | | |

| | | 44,708 | | | L&T Technology Services Ltd | | | 2,698,756 | |

| | | |

| | | 192,606 | | | Larsen & Toubro Ltd | | | 4,666,074 | |

| | | |

| | | 1,094,319 | | | Laxmi Organic Industries Ltd (a) (b) | | | 5,986,759 | |

| | | |

| | | 82,200 | | | MakeMyTrip Ltd * | | | 2,308,176 | |

| | | |

| | | 13,733 | | | Maruti Suzuki India Ltd | | | 1,520,384 | |

| | | |

| | | 270,539 | | | Metro Brands Ltd * | | | 1,946,078 | |

| | | |

| | | 186,033 | | | Muthoot Finance Ltd | | | 3,409,138 | |

| | | |

| | | 17,763 | | | Reliance Industries Ltd | | | 558,131 | |

| | | |

| | | 555,938 | | | Rupa & Co Ltd | | | 3,394,989 | |

| | | |

| | | 246,970 | | | Satin Creditcare Network Ltd * | | | 288,458 | |

| | | |

| | | 73,766 | | | SRF Ltd | | | 2,352,824 | |

| | | |

| | | 584,573 | | | State Bank of India | | | 3,780,369 | |

| | | |

| | | 183,005 | | | Sun Pharmaceutical Industries Ltd | | | 2,056,504 | |

| | | |

| | | 72,295 | | | Tata Consultancy Services Ltd | | | 3,420,836 | |

| | | |

| | | 298,234 | | | Tata Motors Ltd * | | | 1,807,550 | |

| | | |

| | | 84,851 | | | Tech Mahindra Ltd | | | 1,596,425 | |

| | | | |

| | |

| | | See accompanying notes to the financial statements. | | 11 |

GMO Emerging Domestic Opportunities Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2022

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | India — continued | |

| | | |

| | | 244,952 | | | UPL Ltd | | | 2,177,495 | |

| | | |

| | | 350,350 | | | Wipro Ltd | | | 2,593,080 | |

| | | |

| | | 590,770 | | | Zee Entertainment Enterprises Ltd | | | 1,834,551 | |

| | | | | | | | | | |

| | | |

| | | | | | Total India | | | 98,148,701 | |

| | | | | | | | | | |

| | |

| | | | | | Indonesia — 3.4% | |

| | | |

| | | 26,102,600 | | | Bank Central Asia Tbk PT | | | 14,736,633 | |

| | | |

| | | 34,136,000 | | | Bank Rakyat Indonesia Persero Tbk PT | | | 10,915,332 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Indonesia | | | 25,651,965 | |

| | | | | | | | | | |

| | |

| | | | | | Malaysia — 0.3% | |

| | | |

| | | 1,877,100 | | | CIMB Group Holdings Bhd | | | 2,556,974 | |

| | | | | | | | | | |

| | |

| | | | | | Mexico — 3.2% | |

| | | |

| | | 5,874,200 | | | America Movil SAB de CV – Series L | | | 5,340,443 | |

| | | |

| | | 1,360,500 | | | Banco del Bajio SA | | | 3,308,085 | |

| | | |

| | | 126,000 | | | Grupo Aeroportuario del Pacifico SAB de CV – Class B * | | | 1,845,367 | |

| | | |

| | | 722,500 | | | Grupo Financiero Banorte SAB de CV – Class O | | | 4,903,094 | |

| | | |

| | | 2,366,124 | | | Wal-Mart de Mexico SAB de CV | | | 9,011,165 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Mexico | | | 24,408,154 | |

| | | | | | | | | | |

| | |

| | | | | | Netherlands — 0.4% | |

| | | |

| | | 4,435 | | | ASML Holding NV | | | 2,967,121 | |

| | | | | | | | | | |

| | |

| | | | | | Peru — 0.1% | |

| | | |

| | | 3,100 | | | Credicorp Ltd | | | 468,875 | |

| | | | | | | | | | |

| | |

| | | | | | Philippines — 0.4% | |

| | | |

| | | 60,245 | | | Globe Telecom Inc | | | 3,027,121 | |

| | | | | | | | | | |

| | |

| | | | | | Poland — 0.2% | |

| | | |

| | | 50,313 | | | Bank Polska Kasa Opieki SA | | | 1,380,288 | |

| | | | | | | | | | |

| | |

| | | | | | Qatar — 1.4% | |

| | | |

| | | 1,812,687 | | | Qatar National Bank QPSC | | | 10,877,575 | |

| | | | | | | | | | |

| | |

| | | | | | Russia — 0.5% | |

| | | |

| | | 34,988 | | | Magnit PJSC | | | 842,160 | |

| | | |

| | | 546,960 | | | Mobile TeleSystems PJSC | | | 1,083,873 | |

| | | |

| | | 132,504 | | | Sberbank of Russia PJSC Sponsored ADR | | | 138,475 | |

| | | |

| | | 46,548 | | | TCS Group Holding Plc GDR (Registered) | | | 445,040 | |

| | | |

| | | 69,200 | | | Yandex NV – Class A * (c) | | | 911,572 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Russia | | | 3,421,120 | |

| | | | | | | | | | |

| | |

| | | | | | Singapore — 0.2% | |

| | | |

| | | 77,800 | | | TDCX Inc ADR * | | | 1,174,780 | |

| | | | | | | | | | |

| | |

| | | | | | South Africa — 2.7% | |

| | | |

| | | 235,274 | | | Aspen Pharmacare Holdings Ltd | | | 3,081,955 | |

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | South Africa — continued | |

| | | |

| | | 44,411 | | | Capitec Bank Holdings Ltd | | | 5,996,048 | |

| | | |

| | | 433,945 | | | MTN Group Ltd * | | | 5,416,738 | |

| | | |

| | | 432,685 | | | Nedbank Group Ltd | | | 6,160,483 | |

| | | | | | | | | | |

| | | |

| | | | | | Total South Africa | | | 20,655,224 | |

| | | | | | | | | | |

| | |

| | | | | | South Korea — 8.4% | |

| | | |

| | | 19,430 | | | Iljin Materials Co Ltd | | | 1,487,302 | |

| | | |

| | | 222,427 | | | KB Financial Group Inc | | | 10,973,312 | |

| | | |

| | | 2,915 | | | LG Chem Ltd | | | 1,383,296 | |

| | | |

| | | 775,562 | | | Samsung Electronics Co Ltd | | | 46,730,229 | |

| | | |

| | | 17,690 | | | SK Hynix Inc | | | 1,844,262 | |

| | | |

| | | 36,839 | | | SK Telecom Co Ltd | | | 1,681,077 | |

| | | | | | | | | | |

| | | |

| | | | | | Total South Korea | | | 64,099,478 | |

| | | | | | | | | | |

| | |

| | | | | | Switzerland — 1.0% | |

| | | |

| | | 57,940 | | | Nestle SA (Registered) | | | 7,549,334 | |

| | | | | | | | | | |

| | |

| | | | | | Taiwan — 17.2% | |

| | | |

| | | 189,000 | | | Allied Supreme Corp | | | 1,705,372 | |

| | | |

| | | 558,450 | | | Chailease Holding Co Ltd | | | 5,068,219 | |

| | | |

| | | 4,702,000 | | | CTBC Financial Holding Co Ltd | | | 4,596,099 | |

| | | |

| | | 719,000 | | | Delta Electronics Inc | | | 6,407,805 | |

| | | |

| | | 3,727,724 | | | E.Sun Financial Holding Co Ltd | | | 3,940,401 | |

| | | |

| | | 314,000 | | | Giant Manufacturing Co Ltd | | | 3,259,885 | |

| | | |

| | | 963,000 | | | Hotai Finance Co Ltd | | | 4,279,610 | |

| | | |

| | | 337,000 | | | MediaTek Inc | | | 13,316,834 | |

| | | |

| | | 3,090,000 | | | Mega Financial Holding Co Ltd | | | 4,164,087 | |

| | | |

| | | 109,000 | | | Realtek Semiconductor Corp | | | 1,797,187 | |

| | | |

| | | 16,000 | | | Silergy Corp | | | 2,132,018 | |

| | | |

| | | 502,000 | | | Sinbon Electronics Co Ltd | | | 4,826,067 | |

| | | |

| | | 2,896,800 | | | Taiwan Semiconductor Manufacturing Co Ltd | | | 62,279,914 | |

| | | |

| | | 1,958,000 | | | United Microelectronics Corp | | | 3,689,560 | |

| | | |

| | | 375,000 | | | Vanguard International Semiconductor Corp | | | 1,701,886 | |

| | | |

| | | 119,779 | | | VisEra Technologies Co Ltd | | | 2,198,080 | |

| | | |

| | | 6,334,000 | | | Yuanta Financial Holding Co Ltd | | | 5,658,115 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Taiwan | | | 131,021,139 | |

| | | | | | | | | | |

| | |

| | | | | | Thailand — 1.6% | |

| | | |

| | | 1,018,900 | | | Advanced Info Service Pcl (Foreign Registered) | | | 7,172,360 | |

| | | |

| | | 2,517,500 | | | CP ALL Pcl (Foreign Registered) | | | 5,259,601 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Thailand | | | 12,431,961 | |

| | | | | | | | | | |

| | |

| | | | | | United Arab Emirates — 0.9% | |

| | | |

| | | 1,178,501 | | | First Abu Dhabi Bank PJSC | | | 6,641,146 | |

| | | | | | | | | | |

| | |

| | | | | | United States — 2.5% | |

| | | |

| | | 1,000 | | | Alphabet, Inc. – Class A * | | | 2,701,140 | |

| | | |

| | | 26,800 | | | Apple, Inc. | | | 4,425,216 | |

| | | |

| | | 72,200 | | | PepsiCo, Inc. | | | 11,822,028 | |

| | | | | | | | | | |

| | | |

| | | | | | Total United States | | | 18,948,384 | |

| | | | | | | | | | |

| | | | |

| | |

| 12 | | See accompanying notes to the financial statements. | | |

GMO Emerging Domestic Opportunities Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2022

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | Vietnam — 1.4% | |

| | | |

| | | 2,833,368 | | | Bank for Foreign Trade of Vietnam JSC | | | 10,507,613 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL COMMON STOCKS

(COST $658,820,397) | | | 668,090,990 | |

| | | | | | | | | | |

| | |

| | | | | | PREFERRED STOCKS (d) — 0.2% | |

| | |

| | | | | | Brazil — 0.2% | |

| | | |

| | | 839,000 | | | Randon SA Implementos e Participacoes | | | 1,712,499 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL PREFERRED STOCKS

(COST $1,766,654) | | | 1,712,499 | |

| | | | | | | | | | |

| | |

| | | | | | INVESTMENT FUNDS — 5.6% | |

| | |

| | | | | | Brazil — 1.0% | |

| | | |

| | | 231,100 | | | iShares MSCI Brazil ETF | | | 7,600,879 | |

| | | | | | | | | | |

| | |

| | | | | | Russia — 0.5% | |

| | | |

| | | 352,300 | | | VanEck Russia ETF | | | 3,822,455 | |

| | | | | | | | | | |

| | |

| | | | | | Saudi Arabia — 4.1% | |

| | | |

| | | 670,300 | | | iShares MSCI Saudi Arabia ETF | | | 31,229,277 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL INVESTMENT FUNDS

(COST $43,515,971) | | | 42,652,611 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | Shares /

Par Value† | | | Description | | Value ($) | |

| | |

| | | | | | MUTUAL FUNDS — 0.3% | |

| | |

| | | | | | United States — 0.3% | |

| | |

| | | | | | Affiliated Issuers — 0.3% | |

| | | |

| | | 465,374 | | | GMO U.S. Treasury Fund | | | 2,331,522 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL MUTUAL FUNDS

(COST $2,340,826) | | | 2,331,522 | |

| | | | | | | | | | |

| | |

| | | | | | SHORT-TERM INVESTMENTS — 4.7% | |

| | |

| | | | | | Money Market Funds — 0.8% | |

| | | |

| | | 5,882,875 | | | State Street Institutional Treasury Money Market Fund – Premier Class, 0.01% (e) | | | 5,882,875 | |

| | | | | | | | | | |

| | |

| | | | | | U.S. Government — 3.9% | |

| | | |

| | | 800,000 | | | U.S. Treasury Bill, 0.58%, due 07/28/22 (f) | | | 798,113 | |

| | | |

| | | 27,000,000 | | | U.S. Treasury Bill, 0.64%, due 08/18/22 (f) | | | 26,918,825 | |

| | | |

| | | 2,000,000 | | | U.S. Treasury Bill, 0.63%, due 08/25/22 (f) | | | 1,993,631 | |

| | | | | | | | | | |

| | | |

| | | | | | Total U.S. Government | | | 29,710,569 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL SHORT-TERM INVESTMENTS

(COST $35,590,412) | | | 35,593,444 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL INVESTMENTS — 98.7%

(Cost $742,034,260) | | | 750,381,066 | |

| | | |

| | | | | | Other Assets and Liabilities (net) — 1.3% | | | 10,139,735 | |

| | | | | | | | | | |

| | | |

| | | | | | TOTAL NET ASSETS — 100.0% | | | $760,520,801 | |

| | | | | | | | | | |

Additional information on each restricted security is as follows:

| | | | | | | | | | | | |

Issuer Description | | Acquisition Date | | Acquisition

Cost | | | Value as a

Percentage

of Fund’s

Net Assets | | Value as of

February 28, 2022 | |

| | | | |

| Laxmi Organic Industries Ltd | | 03/02/21 | | $ | 1,924,110 | | | 0.79% | | $ | 5,986,759 | |

| | | | | | | | | | | | |

Notes to Schedule of Investments:

| † | Denominated in U.S. Dollar, unless otherwise indicated. |

| * | Non-income producing security. |

| (a) | The security is restricted as to resale. |

| (b) | Investment valued using significant unobservable inputs (Note 2). |

| (c) | Investment valued at fair value using methods determined in good faith by the Trustees of GMO Trust or persons acting at their direction pursuant to procedures approved by the Trustees. Investment valued using significant unobservable inputs(Note 2). |

| (d) | Preferred dividend rates are disclosed to the extent that a stated rate exists. |

| (e) | The rate disclosed is the 7 day net yield as of February 28, 2022. |

| (f) | The rate shown represents yield-to-maturity. |

For a listing of definitions of acronyms, counterparty abbreviations and currency abbreviations used throughout the Schedule of Investments as well as the derivative tables, if any, please refer to page 87.

| | | | |

| | |

| | | See accompanying notes to the financial statements. | | 13 |

GMO Emerging Markets ex-China Fund

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Emerging Markets Equity team at Grantham, Mayo, Van Otterloo & Co. LLC.

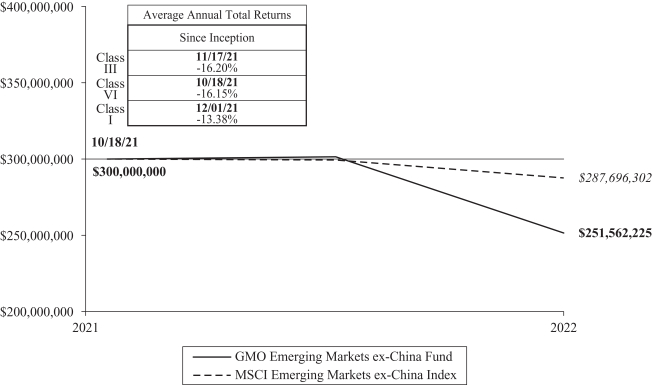

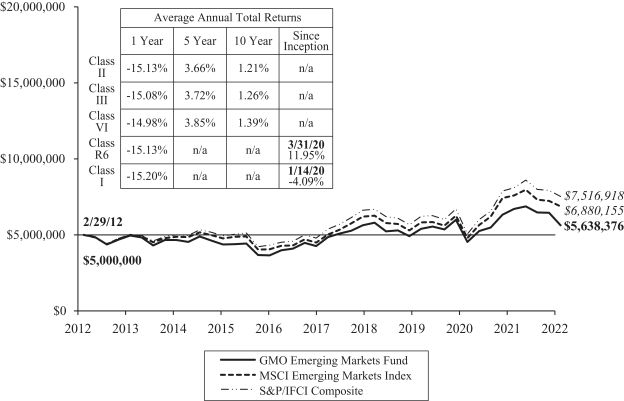

Management Discussion and Analysis of Fund Performance

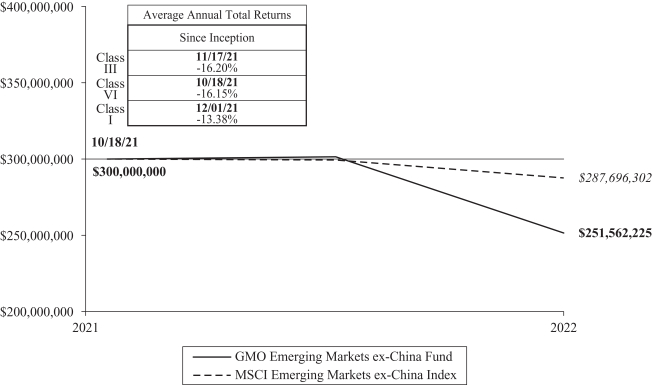

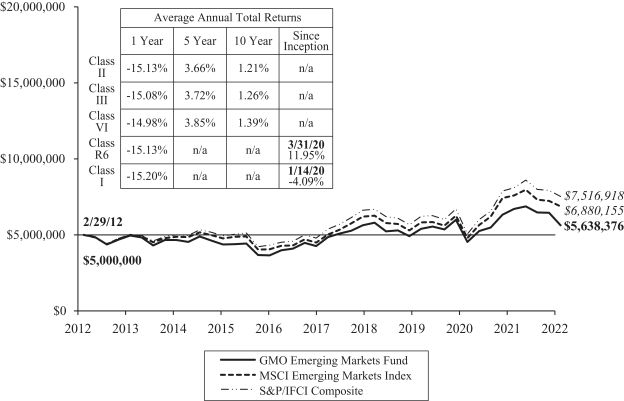

Class VI shares of GMO Emerging Markets ex-China Fund returned -16.15% (net) for the period from the Fund’s inception on October 18, 2021 until the end of fiscal year ended February 28, 2022, as compared with -4.10% for the MSCI Emerging Markets ex-China Index.

Country-sector allocation detracted from the Fund’s relative returns for the period. In particular, the Fund’s overweight positions in Russian Materials, Russian Energy, and Russian Financials hurt relative performance.

Stock selection detracted from the Fund’s relative returns for the period. The Fund’s stock selection in Russian Materials, Russian Energy, and Russian Financials hurt relative performance.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments. All information is unaudited.

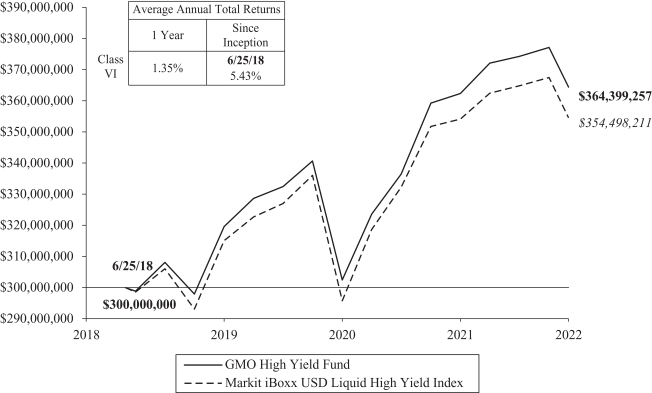

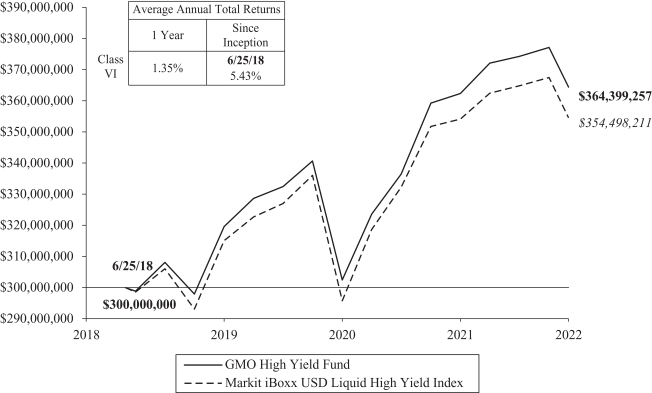

GMO Emerging Markets ex-China Fund

(A Series of GMO Trust)

Comparison of Change in Value of a $300,000,000 Investment in

GMO Emerging Markets ex-China Fund Class VI Shares and the MSCI Emerging Markets ex-China Index

As of February 28, 2022

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. The performance information shown above only includes purchase premiums and/or redemption fees in effect as of February 28, 2022. All information is unaudited. Performance for classes may vary due to different fees.

MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder.

For Class III, VI and I the gross expense ratio of 1.16%, 1.07 and 1.33%, respectively, is equal to the Fund’s Total Annual Operating Expenses set forth in the Fund’s most recent prospectus dated June 30, 2021. For the Classes listed above, the corresponding net expense ratio of 0.80%, 0.67% and 0.95% reflects the reduction of expenses from fee reimbursements. The fee reimbursements will continue until at least June 30, 2022. Elimination of this reimbursement will result in higher fees and lower performance.

GMO Emerging Markets ex-China Fund

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2022 (Unaudited)

| | | | |

| Asset Class Summary& | | % of Total Net Assets | |

Common Stocks | | | 92.8 | % |

Preferred Stocks | | | 5.1 | |

Short-Term Investments | | | 1.1 | |

Investment Funds | | | 0.5 | |

Mutual Funds | | | 0.0 | ^ |

Other | | | 0.5 | |

| | | | |

| | | 100.0 | % |

| | | | |

| | | | |

| Country/Region Summary¤ | | % of Investments | |

Taiwan | | | 37.1 | % |

South Korea | | | 24.1 | |

Mexico | | | 11.9 | |

Russia | | | 7.1 | |

Brazil | | | 6.6 | |

India | | | 4.5 | |

Indonesia | | | 2.5 | |

Turkey | | | 1.1 | |

Thailand | | | 0.9 | |

Chile | | | 0.7 | |

United Kingdom | | | 0.5 | * |

United States | | | 0.5 | * |

Egypt | | | 0.5 | |

South Africa | | | 0.4 | |

Philippines | | | 0.4 | |

Poland | | | 0.4 | |

Peru | | | 0.3 | |

Hungary | | | 0.3 | |

Czech Republic | | | 0.2 | |

Malaysia | | | 0.0 | ^ |

| | | | |

| | | 100.0 | % |

| | | | |

| | | | |

| Industry Group Summary | | % of Equity Investments# | |

Technology Hardware & Equipment | | | 19.4 | % |

Banks | | | 17.9 | |

Materials | | | 16.6 | |

Semiconductors & Semiconductor Equipment | | | 13.6 | |

Energy | | | 6.2 | |

Insurance | | | 5.4 | |

Food, Beverage & Tobacco | | | 5.2 | |

Telecommunication Services | | | 3.0 | |

Capital Goods | | | 2.5 | |

Food & Staples Retailing | | | 2.5 | |

Diversified Financials | | | 2.1 | |

Utilities | | | 1.9 | |

Software & Services | | | 1.2 | |

Household & Personal Products | | | 0.8 | |

Real Estate | | | 0.5 | |

Consumer Durables & Apparel | | | 0.5 | |

Media & Entertainment | | | 0.3 | |

Transportation | | | 0.2 | |

Automobiles & Components | | | 0.1 | |

Pharmaceuticals, Biotechnology & Life Sciences | | | 0.1 | |

Health Care Equipment & Services | | | 0.0 | ^ |

Commercial & Professional Services | | | 0.0 | ^ |

| | | | |

| | | 100.0 | % |

| | | | |

| & | In the table, derivative financial instruments, if any, are based on market values, rather than the notional amounts of derivatives, except for forward currency contracts which are based on unrealized appreciation/(depreciation). |

| ¤ | The table shows country exposure in the Fund. The table excludes short-term investments. The table excludes exposure through forward currency contracts and includes exposure through other derivative financial instruments, if any. The table takes into account the market value of securities and options and the notional amounts of swap contracts and other derivative financial instruments, if any. |

| * | Includes companies that derive more than 50% of their revenue or profits from emerging markets. |

| # | Equity investments may consist of common stocks and other stock-related securities, such as preferred stocks, if any. This table excludes exposure to derivative contracts, short-term investments, mutual funds and investment funds, if any. For a summary of these exposures, if any, see the Schedule of Investments. |

GMO Emerging Markets ex-China Fund

(A Series of GMO Trust)

Schedule of Investments

(showing percentage of total net assets)

February 28, 2022

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | COMMON STOCKS — 92.8% | |

| | |

| | | | | | Brazil — 2.0% | |

| | | |

| | | 156,500 | | | Ambev SA | | | 459,290 | |

| | | |

| | | 35,600 | | | Blau Farmaceutica SA | | | 205,321 | |

| | | |

| | | 12,100 | | | Cia de Saneamento Basico do Estado de Sao Paulo | | | 97,093 | |

| | | |

| | | 10,900 | | | Cia Siderurgica Nacional SA | | | 53,647 | |

| | | |

| | | 12,300 | | | Equatorial Energia SA | | | 60,827 | |

| | | |

| | | 112,200 | | | Transmissora Alianca de Energia Eletrica SA | | | 859,792 | |

| | | |

| | | 215,800 | | | Vale SA Sponsored ADR – Class B | | | 3,990,142 | |

| | | |

| | | 142,150 | | | Vamos Locacao de Caminhoes Maquinas e Equipamentos SA | | | 302,432 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Brazil | | | 6,028,544 | |

| | | | | | | | | | |

| | |

| | | | | | Chile — 0.6% | |

| | | |

| | | 56,089 | | | Aguas Andinas SA – Class A | | | 11,830 | |

| | | |

| | | 419,684 | | | Banco de Chile | | | 44,496 | |

| | | |

| | | 1,097,482 | | | Banco Santander Chile | | | 53,891 | |

| | | |

| | | 5,100 | | | Banco Santander Chile ADR | | | 99,552 | |

| | | |

| | | 28,622 | | | CAP SA | | | 331,308 | |

| | | |

| | | 24,755 | | | Cencosud SA | | | 45,514 | |

| | | |

| | | 55,591 | | | Cencosud Shopping SA | | | 59,656 | |

| | | |

| | | 24,100 | | | Cia Cervecerias Unidas SA Sponsored ADR | | | 385,118 | |

| | | |

| | | 3,402,440 | | | Colbun SA | | | 248,085 | |

| | | |

| | | 3,332 | | | Empresas COPEC SA | | | 25,838 | |

| | | |

| | | 526,587 | | | Enel Americas SA | | | 61,659 | |

| | | |

| | | 92,049 | | | Inversiones La Construccion SA | | | 368,661 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Chile | | | 1,735,608 | |

| | | | | | | | | | |

| | |

| | | | | | Czech Republic — 0.2% | |

| | | |

| | | 9,265 | | | Moneta Money Bank AS | | | 36,666 | |

| | | |

| | | 895 | | | Philip Morris CR AS | | | 647,519 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Czech Republic | | | 684,185 | |

| | | | | | | | | | |

| | |

| | | | | | Egypt — 0.5% | |

| | | |

| | | 216,835 | | | Commercial International Bank Egypt SAE * | | | 660,440 | |

| | | |

| | | 992,792 | | | Eastern Co SAE | | | 686,370 | |

| | | |

| | | 2,750 | | | Misr Fertilizers Production Co SAE | | | 15,558 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Egypt | | | 1,362,368 | |

| | | | | | | | | | |

| | |

| | | | | | Hungary — 0.3% | |

| | | |

| | | 30,675 | | | MOL Hungarian Oil & Gas Plc | | | 239,274 | |

| | | |

| | | 14,810 | | | OTP Bank Nyrt Plc * | | | 565,138 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Hungary | | | 804,412 | |

| | | | | | | | | | |

| | |

| | | | | | India — 4.4% | |

| | | |

| | | 20,000 | | | Axis Bank Ltd GDR (Registered) * | | | 979,313 | |

| | | |

| | | 118,500 | | | HDFC Bank Ltd ADR | | | 7,367,145 | |

| | | |

| | | 80,000 | | | ICICI Bank Ltd Sponsored ADR | | | 1,557,600 | |

| | | |

| | | 141,100 | | | Infosys Ltd Sponsored ADR | | | 3,169,106 | |

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | India — continued | |

| | | |

| | | 193 | | | Reliance Industries Ltd GDR | | | 12,114 | |

| | | | | | | | | | |

| | | |

| | | | | | Total India | | | 13,085,278 | |

| | | | | | | | | | |

| | |

| | | | | | Indonesia — 2.5% | |

| | | |

| | | 1,370,700 | | | Adaro Energy Tbk PT | | | 234,844 | |

| | | |

| | | 261,800 | | | AKR Corporindo Tbk PT | | | 13,849 | |

| | | |

| | | 3,813,300 | | | Bank Central Asia Tbk PT | | | 2,152,859 | |

| | | |

| | | 1,528,900 | | | Bank Mandiri Persero Tbk PT | | | 826,586 | |

| | | |

| | | 171,700 | | | Bank Negara Indonesia Persero Tbk PT | | | 96,206 | |

| | | |

| | | 10,242,300 | | | Bank Rakyat Indonesia Persero Tbk PT | | | 3,275,079 | |

| | | |

| | | 366,200 | | | Bukit Asam Tbk PT | | | 80,449 | |

| | | |

| | | 107,800 | | | Indika Energy Tbk PT * | | | 16,814 | |

| | | |

| | | 121,100 | | | Indo Tambangraya Megah Tbk PT | | | 225,230 | |

| | | |

| | | 1,515,600 | | | Telkom Indonesia Persero Tbk PT | | | 457,579 | |

| | | |

| | | 44,900 | | | United Tractors Tbk PT | | | 78,350 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Indonesia | | | 7,457,845 | |

| | | | | | | | | | |

| | |

| | | | | | Malaysia — 0.0% | |

| | | |

| | | 173,100 | | | Kossan Rubber Industries Bhd | | | 71,364 | |

| | | | | | | | | | |

| | |

| | | | | | Mexico — 11.7% | |

| | | |

| | | 153,900 | | | America Movil SAB de CV – Class L Sponsored ADR | | | 2,788,668 | |

| | | |

| | | 1,929,500 | | | America Movil SAB de CV – Series L | | | 1,754,177 | |

| | | |

| | | 119,100 | | | Arca Continental SAB de CV | | | 785,045 | |

| | | |

| | | 289,900 | | | Banco del Bajio SA | | | 704,898 | |

| | | |

| | | 13,100 | | | Bolsa Mexicana de Valores SAB de CV | | | 25,322 | |

| | | |

| | | 8,800 | | | Coca-Cola Femsa SAB de CV Sponsored ADR | | | 484,528 | |

| | | |

| | | 539,400 | | | Credito Real SAB de CV SOFOM ER * | | | 42,402 | |

| | | |

| | | 180,300 | | | Fomento Economico Mexicano SAB de CV | | | 1,448,756 | |

| | | |

| | | 69,700 | | | Fomento Economico Mexicano SAB de CV Sponsored ADR | | | 5,603,880 | |

| | | |

| | | 3,500 | | | GCC SAB de CV | | | 23,239 | |

| | | |

| | | 20,100 | | | Gentera SAB de CV * | | | 15,133 | |

| | | |

| | | 3,515 | | | Gruma SAB de CV – Class B | | | 47,599 | |

| | | |

| | | 300 | | | Grupo Aeroportuario del Centro Norte SAB de CV ADR | | | 17,439 | |

| | | |

| | | 4,500 | | | Grupo Aeroportuario del Centro Norte SAB de CV – Class B | | | 32,410 | |

| | | |

| | | 800 | | | Grupo Aeroportuario del Pacifico SAB de CV – Class B * | | | 11,717 | |

| | | |

| | | 15,535 | | | Grupo Aeroportuario del Sureste SAB de CV – Class B | | | 334,441 | |

| | | |

| | | 9,100 | | | Grupo Bimbo SAB de CV – Series A | | | 28,170 | |

| | | |

| | | 1,189,400 | | | Grupo Financiero Banorte SAB de CV – Class O | | | 8,071,613 | |

| | | |

| | | 11,100 | | | Grupo Financiero Inbursa SAB de CV – Class O * | | | 18,140 | |

| | | |

| | | 178,600 | | | Grupo Mexico SAB de CV – Series B | | | 912,315 | |

| | | |

| | | 206,100 | | | Industrias Bachoco SAB de CV – Series B | | | 690,120 | |

| | | |

| | | 1,100 | | | Industrias Penoles SAB de CV | | | 13,819 | |

| | | |

| | | 27,700 | | | Kimberly-Clark de Mexico SAB de CV – Class A | | | 38,721 | |

| | | |

| | | 6,900 | | | Megacable Holdings SAB de CV CPO | | | 20,298 | |

| | | | |

| | |

| | | See accompanying notes to the financial statements. | | 17 |

GMO Emerging Markets ex-China Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2022

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | Mexico — continued | |

| | | |

| | | 11,600 | | | Orbia Advance Corp SAB de CV | | | 29,633 | |

| | | |

| | | 84,500 | | | Qualitas Controladora SAB de CV | | | 462,912 | |

| | | |

| | | 99,600 | | | Regional SAB de CV | | | 591,492 | |

| | | |

| | | 99,700 | | | Ternium SA Sponsored ADR | | | 3,916,216 | |

| | | |

| | | 1,524,800 | | | Wal-Mart de Mexico SAB de CV | | | 5,807,060 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Mexico | | | 34,720,163 | |

| | | | | | | | | | |

| | |

| | | | | | Peru — 0.3% | |

| | | |

| | | 6,300 | | | Credicorp Ltd | | | 952,875 | |

| | | | | | | | | | |

| | |

| | | | | | Philippines — 0.4% | |

| | | |

| | | 64,460 | | | GT Capital Holdings Inc | | | 729,991 | |

| | | |

| | | 638,300 | | | Puregold Price Club Inc | | | 438,533 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Philippines | | | 1,168,524 | |

| | | | | | | | | | |

| | |

| | | | | | Poland — 0.4% | |

| | | |

| | | 1,122 | | | Grupa Lotos SA * | | | 14,396 | |

| | | |

| | | 5,774 | | | Polski Koncern Naftowy ORLEN SA | | | 97,533 | |

| | | |

| | | 49,619 | | | Polskie Gornictwo Naftowe i Gazownictwo SA | | | 65,393 | |

| | | |

| | | 120,881 | | | Powszechny Zaklad Ubezpieczen SA | | | 906,928 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Poland | | | 1,084,250 | |

| | | | | | | | | | |

| | |

| | | | | | Russia — 6.5% | |

| | | |

| | | 4,036,000 | | | Alrosa PJSC | | | 2,602,881 | |

| | | |

| | | 434,347 | | | Etalon Group Plc GDR (Registered) | | | 176,657 | |

| | | |

| | | 131,280 | | | Evraz Plc | | | 253,067 | |

| | | |

| | | 236,860,000 | | | Federal Grid Co Unified Energy System PJSC | | | 163,869 | |

| | | |

| | | 98,320 | | | Gazprom Neft PJSC | | | 320,626 | |

| | | |

| | | 787 | | | Gazprom Neft PJSC Sponsored ADR | | | 12,470 | |

| | | |

| | | 448,906 | | | Gazprom PJSC Sponsored ADR | | | 1,187,592 | |

| | | |

| | | 6,151,400 | | | Inter RAO UES PJSC | | | 137,400 | |

| | | |

| | | 122,088 | | | LUKOIL PJSC Sponsored ADR | | | 2,289,988 | |

| | | |

| | | 4,327,340 | | | Magnitogorsk Iron & Steel Works PJSC | | | 1,522,963 | |

| | | |

| | | 78,325 | | | MMC Norilsk Nickel PJSC ADR | | | 1,075,427 | |

| | | |

| | | 172,200 | | | Mobile TeleSystems PJSC ADR (a) | | | 658,720 | |

| | | |

| | | 88,090 | | | Moscow Exchange MICEX-RTS PJSC | | | 66,045 | |

| | | |

| | | 9,337 | | | Novatek PJSC Sponsored GDR (Registered) | | | 359,681 | |

| | | |

| | | 381,910 | | | Novolipetsk Steel PJSC | | | 549,508 | |

| | | |

| | | 102,160 | | | Novolipetsk Steel PJSC GDR | | | 783,245 | |

| | | |

| | | 14,846 | | | PhosAgro PJSC GDR (Registered) | | | 90,826 | |

| | | |

| | | 276,810 | | | Polymetal International Plc | | | 1,294,196 | |

| | | |

| | | 5,594 | | | Polyus PJSC | | | 588,423 | |

| | | |

| | | 12,617 | | | Polyus PJSC GDR (Registered) | | | 673,352 | |

| | | |

| | | 73,800 | | | QIWI Plc Sponsored ADR (a) | | | 291,035 | |

| | | |

| | | 55,866 | | | Raspadskaya OJSC | | | 126,262 | |

| | | |

| | | 4,917 | | | Ros Agro Plc GDR (Registered) | | | 21,694 | |

| | | |

| | | 48,335,000 | | | RusHydro PJSC | | | 269,370 | |

| | | |

| | | 17,394 | | | RusHydro PJSC ADR | | | 8,726 | |

| | | |

| | | 861,608 | | | Sberbank of Russia PJSC Sponsored ADR | | | 900,433 | |

| | | |

| | | 140,607 | | | Severstal PAO GDR (Registered) | | | 713,816 | |

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | Russia — continued | |

| | | |

| | | 2,387,800 | | | Surgutneftegas PJSC | | | 432,107 | |

| | | |

| | | 109,514 | | | Tatneft PJSC Sponsored ADR | | | 1,492,445 | |

| | | |

| | | 9,408 | | | TCS Group Holding Plc GDR (Registered) | | | 231,129 | |

| | | | | | | | | | |

| | | |

| | | | | | Total Russia | | | 19,293,953 | |

| | | | | | | | | | |

| | |

| | | | | | South Africa — 0.4% | |

| | | |

| | | 3,577 | | | AVI Ltd | | | 16,686 | |

| | | |

| | | 1,793 | | | Capitec Bank Holdings Ltd | | | 242,078 | |

| | | |

| | | 2,586 | | | Investec Ltd | | | 14,558 | |

| | | |

| | | 14,766 | | | Kumba Iron Ore Ltd | | | 583,682 | |

| | | |

| | | 4,804 | | | Ninety One Ltd | | | 15,672 | |

| | | |

| | | 467,495 | | | Old Mutual Ltd | | | 383,820 | |

| | | | | | | | | | |

| | | |

| | | | | | Total South Africa | | | 1,256,496 | |

| | | | | | | | | | |

| | |

| | | | | | South Korea — 23.8% | |

| | | |

| | | 152 | | | BGF retail Co Ltd | | | 21,533 | |

| | | |

| | | 40,422 | | | BNK Financial Group Inc | | | 266,100 | |

| | | |

| | | 10,335 | | | Cheil Worldwide Inc | | | 194,318 | |

| | | |

| | | 747 | | | CJ CheilJedang Corp | | | 236,616 | |

| | | |

| | | 349 | | | Coway Co Ltd | | | 20,960 | |

| | | |

| | | 81,095 | | | Daewoo Engineering & Construction Co Ltd * | | | 426,551 | |

| | | |

| | | 61,233 | | | Daou Data Corp | | | 708,418 | |

| | | |

| | | 738 | | | Daou Technology Inc | | | 13,296 | |

| | | |

| | | 5,932 | | | DB Insurance Co Ltd | | | 305,398 | |

| | | |

| | | 2,650 | | | DGB Financial Group Inc | | | 20,976 | |

| | | |

| | | 2,221 | | | DL E&C Co Ltd | | | 239,436 | |

| | | |

| | | 923 | | | Dongkuk Steel Mill Co Ltd | | | 12,826 | |

| | | |

| | | 149,218 | | | Dongwon Development Co Ltd | | | 606,816 | |

| | | |

| | | 88 | | | GOLFZON Co Ltd * | | | 11,192 | |

| | | |

| | | 26,809 | | | GS Engineering & Construction Corp | | | 963,491 | |

| | | |

| | | 1,469 | | | GS Holdings Corp | | | 49,122 | |

| | | |

| | | 75,044 | | | Hana Financial Group Inc | | | 3,048,875 | |

| | | |

| | | 423 | | | Hankook Tire & Technology Co Ltd | | | 12,463 | |

| | | |

| | | 14,205 | | | Hanwha Life Insurance Co Ltd * | | | 35,080 | |

| | | |

| | | 37,172 | | | HDC Hyundai Development Co-Engineering & Construction * | | | 500,264 | |

| | | |

| | | 1,045 | | | Huchems Fine Chemical Corp | | | 19,442 | |

| | | |

| | | 25,525 | | | Hyundai Engineering & Construction Co Ltd | | | 929,932 | |

| | | |

| | | 22,150 | | | Hyundai Marine & Fire Insurance Co Ltd | | | 532,023 | |

| | | |

| | | 407 | | | Hyundai Mobis Co Ltd | | | 76,421 | |

| | | |

| | | 3,812 | | | Industrial Bank of Korea | | | 34,245 | |

| | | |

| | | 2,291 | | | JB Financial Group Co Ltd | | | 15,692 | |

| | | |

| | | 95,959 | | | KB Financial Group Inc | | | 4,734,083 | |

| | | |

| | | 5,881 | | | KCC Glass Corp | | | 285,695 | |

| | | |

| | | 2,428 | | | Kia Corp | | | 150,525 | |

| | | |

| | | 617 | | | KIWOOM Securities Co Ltd * | | | 52,392 | |

| | | |

| | | 4,564 | | | Korea Investment Holdings Co Ltd * | | | 303,210 | |

| | | |

| | | 2,337 | | | Korea Petrochemical Ind Co Ltd * | | | 334,286 | |

| | | |

| | | 162,307 | | | Korea Real Estate Investment & Trust Co Ltd | | | 297,159 | |

| | | |

| | | 2,171 | | | Korea Zinc Co Ltd | | | 995,709 | |

| | | | |

| | |

| 18 | | See accompanying notes to the financial statements. | | |

GMO Emerging Markets ex-China Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2022

| | | | | | | | | | |

| | | Shares | | | Description | | Value ($) | |

| | |

| | | | | | South Korea — continued | |

| | | |

| | | 2,729 | | | Korean Reinsurance Co | | | 22,036 | |

| | | |

| | | 90,016 | | | KT Skylife Co Ltd | | | 639,205 | |

| | | |

| | | 48,732 | | | KT&G Corp | | | 3,239,535 | |

| | | |

| | | 6,649 | | | Kumho Petrochemical Co Ltd * | | | 897,021 | |

| | | |

| | | 270 | | | Kyung Dong Navien Co Ltd | | | 10,027 | |

| | | |

| | | 722 | | | LG Household & Health Care Ltd | | | 572,866 | |

| | | |

| | | 7,600 | | | Lotte Chemical Corp | | | 1,400,678 | |

| | | |

| | | 1,340 | | | LOTTE Fine Chemical Co Ltd | | | 89,144 | |

| | | |

| | | 388 | | | LS Electric Co Ltd | | | 13,988 | |

| | | |

| | | 3,335 | | | LX Semicon Co Ltd | | | 320,337 | |

| | | |

| | | 1,357 | | | Meritz Financial Group Inc | | | 41,727 | |

| | | |

| | | 2,381 | | | Meritz Fire & Marine Insurance Co Ltd | | | 81,828 | |

| | | |

| | | 16,935 | | | Meritz Securities Co Ltd | | | 82,930 | |

| | | |

| | | 11,697 | | | Namsun Aluminum Co Ltd * | | | 23,005 | |

| | | |

| | | 16,282 | | | NH Investment & Securities Co Ltd * | | | 157,560 | |

| | | |