UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04356

Franklin California Tax-Free Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code:__ 650 312-2000

Date of fiscal year end: 6/30

Date of reporting period:_6/30/10

Item 1. Reports to Stockholders.

Franklin California Tax-Free Trust’s annual report goes into greater detail about municipal bond market conditions during the period. In addition, you will find performance data, financial information and a discussion from the portfolio managers. Please remember that all securities markets fluctuate, as do mutual fund share prices. Municipal bonds can provide tax-free income and diversification from equities. Despite periods of volatility, municipal bonds have a solid long-term record of performance, driven mostly by their income component.

Please check our website at franklintempleton.com for special portfolio manager commentary. Although market conditions are constantly changing, we remain committed to our disciplined strategy as we manage the Funds, keeping in mind the trust you have placed in us. We appreciate your confidence and encourage you to contact us when you have questions about your Franklin Templeton tax-free investment.

Sincerely,

Charles B. Johnson

Chairman

Franklin California Tax-Free Trust

Rafael R. Costas Jr.

Senior Vice Presidents and Co-Directors Franklin Municipal Bond Department

This letter reflects our analysis and opinions as of June 30, 2010. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

Not part of the annual report | 3

Annual Report

State Update and Municipal Bond Market Overview

California’s large, diverse and wealthy economy — the eighth largest in the world — has a gross state product of $1.8 trillion and is responsible for 13% of U.S. gross domestic product.1 However, during the year under review, the state’s economy remained weak and was not expected to experience an economic rebound sooner than the nation as a whole. The state unemployment rate rose sharply from 11.6% in June 2009 to 12.3% by June 2010, well above the 9.5% national rate.2 Some positive trends that may bode well for California’s growth prospects are its well-edu cated workforce, capacity to attract venture capital, prominence in the growing biotechnology and alternative energy industries, and stabilizing real estate market. In addition, the state experienced a significant rebound in manufacturing activity in 2010’s first quarter, while construction activity picked up but did not return to prerecession levels.

Limited fiscal flexibility, a difficult political environment and weak revenue collections made the state financially vulnerable during the recent downturn. Approval by two-thirds of the legislature is required to pass a budget and the governor needs legislative consent to raise revenues or order spending cuts. Additionally, voter approval is required to issue general obligation or deficit bonds. In July 2009, Governor Schwarzenegger signed an amended budget passed by the California Senate and General Assembly. Since that time, the projected current-year budget gap increased. In response, the governor declared a state fiscal emergency and called the legislature into special sessions to address the gaps.

Despite a positive trend of higher-than-anticipated tax revenues from December 2009 through March 2010, revenues fell short of expectations again in April. As the budget moved further out of balance, by mid-May the governor sought to eliminate a revised, $19.1 billion budget gap for the 2010-11 fiscal year.3 Under a fresh round of austerity measures, he proposed elimination of the state’s welfare-to-work program (CalWORKS), slashing by 60% all mental health programs at the county level, the appropriation of $880 million from state transportation projects, and imposition of an across-the-board 10% wage cut for

1. Source: Moody’s Investors Service, “New Issue: Moody’s Assigns Baa1 to up to $2B State of California General Obligation Bonds; Outlook is Stable,” 2/24/10.

2. Source: Bureau of Labor Statistics.

3. Source: California State Controllers Office, www.sco.ca.gov.

4 | Annual Report

all state workers.4 State parks and K-12 education spending would be spared, and tax increases would not be implemented to bolster California’s finances under the new plan.

The Democrats in the Senate and Assembly countered with two competing plans that blocked the governor’s proposed elimination of CalWORKS and a wage cut for state workers. The Senate plan proposed higher income and alcohol taxes and an extended tax hike on vehicles. The Assembly plan proposed the sale of bonds to provide funding for education, local governments and business incentives. State lawmakers were unable to reconcile the three plans and missed the June 15, 2010, budget deadline. On June 28, lawmakers left Sacramento for a month-long summer recess without passing a budget for the upcoming fiscal year. They continued to work from their home districts during the recess and were expected to return to the capital if a budget agreement were reached.

California’s tax-supported debt increased substantially during the fiscal year and was seventh-highest among the 50 states at $2,362 per capita or 5.6% of personal income, compared with the $936 and 2.5% national medians.5 Moreover, with California implementing a long-term strategic plan including voter-authorized projects necessary to support ongoing economic growth, its debt burden is likely to rise in the next few years.

Although there were signs California’s recession was lifting, the negative impact on municipal credit continued in tandem with the state’s persistent revenue deterioration, increased spending pressures and depletion of reserve funds. During the period, independent credit rating agency Moody’s Investors Service assigned California’s general obligation bonds an A1 rating with a stable outlook.6 Although Moody’s judges obligations rated A1 as “upper-medium grade” and subject to “low credit risk,” it was nonetheless among the worst ratings assigned to any U.S. state, suggesting a susceptibility to credit impairment over the long term.6 The rating and outlook reflected the budgetary shortfalls the state faced, as well as possible liquidity strains resulting from such shortfalls, particularly if the legislature fails to enact timely solutions. In addition, Moody’s expects state legislators will address any further challenges to its budgetary balance and liquidity without another major cash crisis.

4. Source: The San Francisco Chronicle, “California’s Painful Budget Revision,” 5/15/10.

5. Source: Moody’s Investors Service, “Special Comment: 2010 State Debt Medians Report,” May 2010.

6. This does not indicate Moody’s rating of the Fund.

Annual Report | 5

During the 12 months ended June 30, 2010, the municipal bond market delivered solid returns to investors, as the Barclay’s Capital (BC) Municipal Bond Index posted a total return of +9.61%.7 The U.S. Treasury market trailed the tax-exempt market during this reporting period with a +6.67% total return as measured by the BC U.S. Treasury Index.8

Despite municipal bonds’ relative strength, many tax-free bonds retained their pre-tax yield advantage over Treasuries. As of June 30, 2010, the +5.00% yield of the BC Municipal Bond Index: Long Component exceeded the +3.68% yield of the BC U.S. Treasury Index: Long Component.9 Investors continued to purchase municipal bond mutual fund shares even though budgetary pressures at state and local levels and concerns regarding some issuers’ abilities to repay debt were well publicized. Many municipal bonds were re-rated during the period due to a changing economic landscape, rating downgrades of bond insurers, and reconciliation between corporate and municipal rating scales. Moody’s Investors Service and Fitch recalibrated ratings for many state and local government issuers to bring them in line with corporate and sovereign ratings. In some cases, these changes resulted in as much as a three-notch rating increase. Investor interest also increased for lower investment-grade and speculative-grade issues during the reporting period, which drove up the BC Baa Municipal Bond Index 15.34% and the BC Municipal Bond High Yield Index 21.90%, compared with the BC Aaa Municipal Bond Index’s +6.61% total return.10

7. Source: © 2010 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. The BC Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch.

8. Source: © 2010 Morningstar. The BC U.S. Treasury Index is the U.S. Treasury component of the U.S. Government Index and covers public obligations of the U.S. Treasury with a remaining maturity of one year or more.

9. Source: © 2010 Morningstar. The BC Municipal Bond Index: Long Component is the long (22+ years) component of the BC Municipal Bond Index. The BC U.S. Treasury Index: Long Component is the long component of the BC U.S. Treasury Index and covers public obligations of the U.S. Treasury with remaining maturity of 10 years or more.

10. Source: © 2010 Morningstar. The BC Baa Municipal Bond Index is the Baa credit quality component of the BC Municipal Bond Index. The BC Municipal Bond High Yield Index consists of bonds that are nonrated or rated Ba1 or below. They must have an outstanding par value of at least $3 million and be issued as part of a transaction of at least $20 million. The bonds must be dated after 12/31/90 and must be at least one year from their maturity date. The BC Aaa Municipal Bond Index is the Aaa credit quality component of the BC Municipal Bond Index.

6 | Annual Report

The American Recovery and Reinvestment Act of February 2009 allowed municipalities to issue taxable bonds and receive a 35% federal government subsidy for all coupon payments distributed to investors for the life of the bonds. This subsidy enabled municipalities to borrow significantly below their after-tax cost in the traditional tax-exempt municipal bond market. In May 2010, the House of Representatives modified and approved certain provisions of the Act. If these modifications become law, municipalities would continue to receive a subsidy for their taxable borrowing at 32% starting in 2011 and 30% in 2012. Municipal bond new-issue supply rose 3.9% in the first half of 2010 compared with the first half of 2009.11 Notably, issuance of taxable municipals surge d 157.8% while tax-free issuance fell 19.8% for the same period.11 This comparative shortage of tax-free supply, at a time when many observers believed taxes are likely to rise in the future, supported the municipal bond market’s performance. We continued to believe these new, subsidized, taxable municipal bonds, known as Build America Bonds, may suppress future supply of tax-exempt municipal bonds as long as the government permits their use.

Given the various ratings changes, the relatively steep yield curve, and the reduced tax-exempt supply during the reporting period, we looked for opportunities to keep the portfolio fully invested in longer term bonds.

The foregoing information reflects our analysis and opinions as of June 30, 2010, the end of the reporting period. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

11. Source: Thomson Reuters.

Annual Report | 7

Franklin California Insured Tax-Free Income Fund

Your Fund’s Goal and Main Investments: Franklin California Insured Tax-Free Income Fund seeks to provide as high a level of income exempt from federal and California personal income taxes as is consistent with prudent investment management and the preservation of capital by investing at least 80% of its net assets in insured municipal securities that pay interest free from such taxes.1, 2

Credit Quality Breakdown*

Franklin California Insured Tax-Free Income Fund

Based on Total Long-Term Investments as of 6/30/10**

| | |

| AAA | 46.1 | % |

| AA | 10.1 | % |

| A | 35.5 | % |

| BBB | 2.8 | % |

| Not Rated by S&P | 5.5 | % |

*Standard & Poor’s (S&P) is the primary independent rating agency; Moody’s is the secondary rating agency. Securities not rated by an independent rating agency are assigned comparable internal ratings. Ratings for securities not rated by S&P are in the table below. The letter ratings are provided to indicate the creditworthiness of the Fund’s bond holdings and generally can range from AAA or Aaa (highest) to Below Investment Grade (lowest).

**Does not include short-term investments and other net assets.

| | | | |

| Ratings | Moody’s | | Internal | |

| AAA or Aaa | 0.1 | % | 0.3 | % |

| AA or Aa | 1.6 | % | 0.1 | % |

| A | 0.7 | % | 2.3 | % |

| BBB or Baa | — | | 0.4 | % |

| Total | 2.4 | % | 3.1 | % |

We are pleased to bring you Franklin California Insured Tax-Free Income Fund’s annual report for the fiscal year ended June 30, 2010.

1. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

2. Fund shares are not insured by any U.S. or other government agency. They are subject to market risks and will fluctuate in value.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 36.

8 | Annual Report

| | | | |

| Dividend Distributions* | | | | |

| Franklin California Insured Tax-Free In come Fund | | |

| | | Dividend per Share | |

| Month | Class A | Class B | Class C | Advisor Class |

| July 2009 | 4.60 cents | 4.08 cents | 4.06 cents | 4.69 cents |

| August 2009 | 4.60 cents | 4.08 cents | 4.06 cents | 4.69 cents |

| September 2009 | 4.60 cents | 4.07 cents | 4.06 cents | 4.69 cents |

| October 2009 | 4.60 cents | 4.07 cents | 4.06 cents | 4.69 cents |

| November 2009 | 4.60 cents | 4.07 cents | 4.06 cents | 4.69 cents |

| December 2009 | 4.50 cents | 3.94 cents | 3.93 cents | 4.60 cents |

| January 2010 | 4.50 cents | 3.94 cents | 3.93 cents | 4.60 cents |

| February 2010 | 4.50 cents | 3.94 cents | 3.93 cents | 4.60 cents |

| March 2010 | 4.54 cents | 3.98 cents | 3.96 cents | 4.64 cents |

| April 2010 | 4.54 cents | 3.98 cents | 3.96 cents | 4.64 cents |

| May 2010 | 4.54 cents | 3.98 cents | 3.96 cents | 4.64 cents |

| June 2010 | 4.59 cents | 4.06 cents | 4.04 cents | 4.70 cents |

*Assumes shares were purchased and held for the entire accrual period, which differs from the calendar month. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

Performance Overview

The Fund’s Class A share price, as measured by net asset value, increased from $11.45 on June 30, 2009, to $12.07 on June 30, 2010. The Fund’s Class A shares paid dividends totaling 54.50 cents per share for the same period.3 The Performance Summary beginning on page 11 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was 4.37%, based on an annualization of the current 4.59 cent per share dividend and the maximum offering price of $12.61 on June 30, 2010. An investor in the 2010 maximum combined effective federal and California personal income tax bracket of 41.21% would need to earn a distribution rate of 7.43% from a taxable investment to match the Fund’s Class A tax-free distrib ution rate. For the Fund’s Class B, C and Advisor shares’ performance, please see the Performance Summary. During the year under review, renewed investor interest in municipal bonds and limited new-issue supply tended to reduce the Fund’s income, which caused dividends to decline slightly.

3. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Annual Report | 9

|

| Portfolio Breakdown |

| Franklin California Insured |

| Tax-Free Income Fund |

| 6/30/10 |

| |

| % of Total |

| Long-Term Investments* |

| | |

| General Obligation | 23.8 | % |

| Hospital & Health Care | 14.7 | % |

| Subject to Government Appropriations | 13.4 | % |

| Prerefunded | 12.6 | % |

| Transportation | 12.3 | % |

| Utilities | 8.7 | % |

| Tax-Supported | 6.9 | % |

| Higher Education | 3.1 | % |

| Other Revenue | 2.9 | % |

| Housing | 1.6 | % |

*Does not include short-term investments and other net assets.

Investment Strategy

We use a consistent, disciplined strategy in an effort to maximize tax-exempt income for our shareholders by seeking to maintain exposure to higher coupon securities. We generally employ a buy-and-hold approach and invest in securities that we believe should provide the most relative value in the market. As we invest during different interest rate environments, our portfolio becomes progressively more diversified with a broad range of securities. This broad diversification may help mitigate interest rate risk. We do not use leverage or exotic derivatives, nor do we use hedging techniques that could add volatility and contribute to underperformance in adverse markets. We generally stay fully invested to help maximize income distribution.

Manager’s Discussion

Consistent with our strategy, we sought to remain fully invested in bonds that maintain an average weighted maturity of 15 to 30 years with good call features. The combination of our value-oriented philosophy of investing primarily for income and a positive sloping municipal yield curve favored the use of longer term bonds. We also maintained our conservative, buy-and-hold investment strategy as we attempted to provide shareholders with high, current, tax-free income.

Thank you for your participation in Franklin California Insured Tax-Free Income Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of June 30, 2010, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

10 | Annual Report

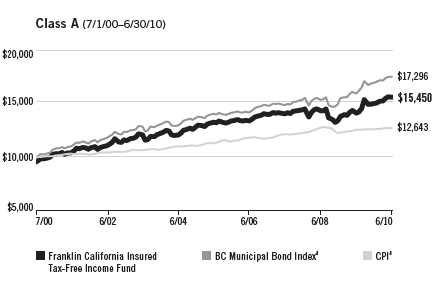

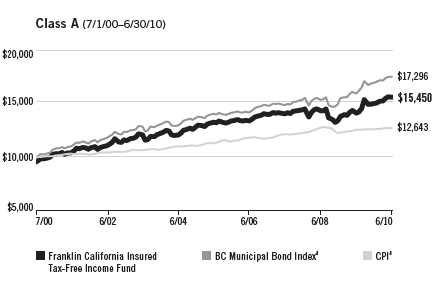

Performance Summary as of 6/30/10

Franklin California Insured Tax-Free Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Price and Distribution Information | | | | | | |

| Class A (Symbol: FRCIX) | | | | Change | | 6/30/10 | | 6/30/09 |

| Net Asset Value (NAV) | | | +$ | 0.62 | $ | 12.07 | $ | 11.45 |

| Distributions (7/1/09–6/30/10) | | | | | | | | |

| Dividend Income | $ | 0.5450 | | | | | | |

| Class B (Symbol: FRCBX) | | | | Change | | 6/30/10 | | 6/30/09 |

| Net Asset Value (NAV) | | | +$ | 0.63 | $ | 12.14 | $ | 11.51 |

| Distributions (7/1/09–6/30/10) | | | | | | | | |

| Dividend Income | $ | 0.4800 | | | | | | |

| Class C (Symbol: FRCAX) | | | | Change | | 6/30/10 | | 6/30/09 |

| Net Asset Value (NAV) | | | +$ | 0.64 | $ | 12.21 | $ | 11.57 |

| Distributions (7/1/09–6/30/10) | | | | | | | | |

| Dividend Income | $ | 0.4782 | | | | | | |

| Advisor Class (Symbol: n/a) | | | | Change | | 6/30/10 | | 6/30/09 |

| Net Asset Value (NAV) | | | +$ | 0.63 | $ | 12.08 | $ | 11.45 |

| Distributions (7/1/09–6/30/10) | | | | | | | | |

| Dividend Income | $ | 0.5566 | | | | | | |

Annual Report | 11

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Class A: 4.25% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only; Advisor Class: no sales charges.

| | | | | | | | | | | |

| Class A | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 10.33 | % | + | 17.19 | % | + | 61.33 | % |

| Average Annual Total Return2 | | | + | 5.62 | % | + | 2.33 | % | + | 4.45 | % |

| Distribution Rate3 | 4.37 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate4 | 7.43 | % | | | | | | | | | |

| 30-Day Standardized Yield5 | 3.78 | % | | | | | | | | | |

| Taxable Equivalent Yield4 | 6.43 | % | | | | | | | | | |

| Total Annual Operating Expenses6 | 0.61 | % | | | | | | | | | |

| Class B | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 9.77 | % | + | 14.06 | % | + | 54.81 | % |

| Average Annual Total Return2 | | | + | 5.77 | % | + | 2.33 | % | + | 4.47 | % |

| Distribution Rate3 | 4.01 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate4 | 6.82 | % | | | | | | | | | |

| 30-Day Standardized Yield5 | 3.40 | % | | | | | | | | | |

| Taxable Equivalent Yield4 | 5.78 | % | | | | | | | | | |

| Total Annual Operating Expenses6 | 1.16 | % | | | | | | | | | |

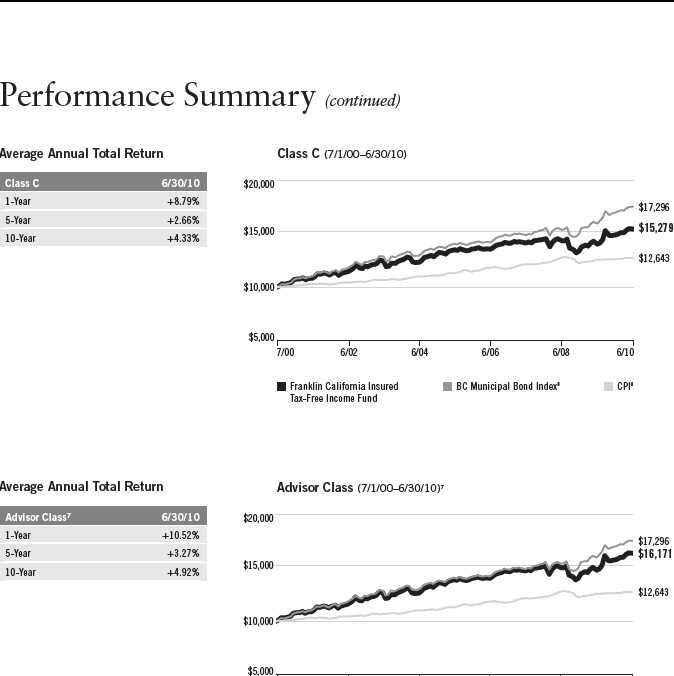

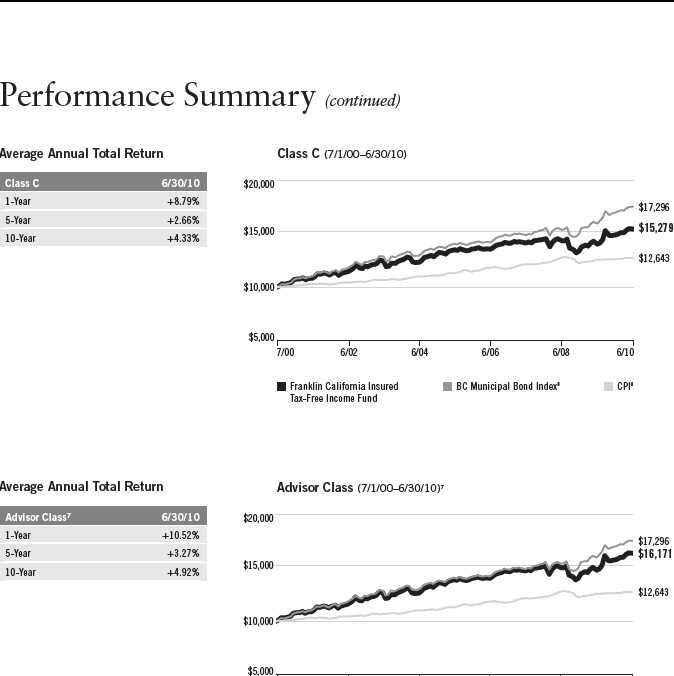

| Class C | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 9.79 | % | + | 14.02 | % | + | 52.79 | % |

| Average Annual Total Return2 | | | + | 8.79 | % | + | 2.66 | % | + | 4.33 | % |

| Distribution Rate3 | 3.97 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate4 | 6.75 | % | | | | | | | | | |

| 30-Day Standardized Yield5 | 3.43 | % | | | | | | | | | |

| Taxable Equivalent Yield4 | 5.83 | % | | | | | | | | | |

| Total Annual Operating Expenses6 | 1.16 | % | | | | | | | | | |

| Advisor Class7 | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 10.52 | % | + | 17.47 | % | + | 61.71 | % |

| Average Annual Total Return2 | | | + | 10.52 | % | + | 3.27 | % | + | 4.92 | % |

| Distribution Rate3 | 4.67 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate4 | 7.94 | % | | | | | | | | | |

| 30-Day Standardized Yield5 | 4.06 | % | | | | | | | | | |

| Taxable Equivalent Yield4 | 6.91 | % | | | | | | | | | |

| Total Annual Operating Expenses6 | 0.51 | % | | | | | | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ f rom figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

12 | Annual Report

Performance Summary (continued)

Total Return 10,000 Investment

Total return over the periods shown. It includes any current, account fees and reinvested distributions. income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

| | | |

| Average Annual Total Return | |

| |

| Class A | | 6/30/10 | |

| 1-Year | + | 5.62 | % |

| 5-Year | + | 2.33 | % |

| 10-Year | + | 4.45 | % |

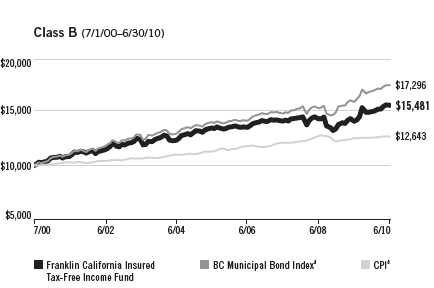

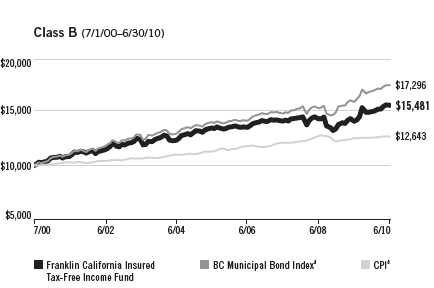

| | | |

| Average Annual Total Return | |

| |

| Class B | | 6/30/10 | |

| 1-Year | + | 5.77 | % |

| 5-Year | + | 2.33 | % |

| 10-Year | + | 4.47 | % |

| | | | | |

| 7/00 | 6/02 | 6/04 | 6/06 | 6/08 | 6/10 |

| |

| |

| Franklin California Insured | | BC Municipal Bond Index8 | CPI8 |

| Tax-Free Income Fund | | | | |

14 | Annual Report

Performance Summary (continued)

Endnotes

Because municipal bonds are sensitive to interest rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Since the Fund concentrates its investments in a single state, it is subject to greater risk of adverse economic and regulatory changes in that state than a geographically diversified fund. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. Distribution rate is based on an annualization of the respective class’s current monthly dividend and the maximum offering price (NAV for Classes B, C and Advisor) per share on 6/30/10.

4. Taxable equivalent distribution rate and yield assume the published rates as of 6/28/10 for the maximum combined effective federal and California personal income tax rate of 41.21%, based on the federal income tax rate of 35.00%.

5. The 30-day standardized yield for the 30 days ended 6/30/10 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

6. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

7. Effective 10/31/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 10/31/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 10/30/08, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 10/31/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +15.35% and +8.97%.

8. Source: © 2010 Morningstar. The BC Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch. The Consumer Price Index (CPI), calculated by the U.S. Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

Annual Report | 15

Your Fund’s Expenses

Franklin California Insured Tax-Free Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

16 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Class A | | Value 1/1/10 | | Value 6/30/10 | | Period* 1/1/10–6/30/10 |

| Actual | $ | 1,000 | $ | 1,039.20 | $ | 3.08 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.77 | $ | 3.06 |

| Class B | | | | | | |

| Actual | $ | 1,000 | $ | 1,037.00 | $ | 5.86 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.04 | $ | 5.81 |

| Class C | | | | | | |

| Actual | $ | 1,000 | $ | 1,036.70 | $ | 5.86 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.04 | $ | 5.81 |

| Advisor Class | | | | | | |

| Actual | $ | 1,000 | $ | 1,039.60 | $ | 2.58 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.27 | $ | 2.56 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.61%; B: 1.16%; C: 1.16%; and Advisor: 0.51%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

Annual Report | 17

Franklin California Intermediate-Term Tax-Free Income Fund

Your Fund’s Goal and Main Investments: Franklin California Intermediate-Term Tax-Free Income Fund seeks to provide as high a level of income exempt from federal and California personal income taxes as is consistent with prudent investment management and the preservation of capital by investing at least 80% of its total assets in securities that pay interest free from such taxes.1 The Fund maintains a dollar-weighted average portfolio maturity (the time at which the debt must be repaid) of 3 to 10 years.

| | |

| Credit Quality Breakdown* | | |

| Franklin California Intermediate-Term Tax-Free Income Fund | | |

| 6/30/10 | | |

| | % of Total | |

| Ratings | Long-Term Investments** | |

| AAA | 12.0 | % |

| AA | 29.0 | % |

| A | 36.2 | % |

| BBB | 13.8 | % |

| Below Investment Grade | 0.4 | % |

| Not Rated by S&P | 8.6 | % |

*Standard & Poor’s (S&P) is the primary independent rating agency; Moody’s is the secondary rating agency. Securities not rated by an independent rating agency are assigned comparable internal ratings. Ratings for securities not rated by S&P are in the table below. The letter ratings are provided to indicate the creditworthiness of the Fund’s bond holdings and generally can range from AAA or Aaa (highest) to Below Investment Grade (lowest).

**Does not include short-term investments and other net assets.

| | | | |

| Ratings | Moody’s | | Internal | |

| AAA or Aaa | — | | 0.9 | % |

| A | 1.3 | % | 2.3 | % |

| BBB or Baa | 1.9 | % | 2.2 | % |

| Total | 3.2 | % | 5.4 | % |

We are pleased to bring you Franklin California Intermediate-Term Tax-Free Income Fund’s annual report for the fiscal year ended June 30, 2010.

1. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 51.

18 | Annual Report

| | | |

| Dividend Distributions* | | | |

| Franklin California Intermediate-Term Tax-Free Income Fund | |

| | | Dividend per Share |

| Month | Class A | Class C | Advisor Class |

| July 2009 | 3.77 cents | 3.26 cents | 3.86 cents |

| August 2009 | 3.77 cents | 3.26 cents | 3.86 cents |

| September 2009 | 3.82 cents | 3.31 cents | 3.91 cents |

| October 2009 | 3.82 cents | 3.31 cents | 3.91 cents |

| November 2009 | 3.82 cents | 3.31 cents | 3.91 cents |

| December 2009 | 3.82 cents | 3.28 cents | 3.91 cents |

| January 2010 | 3.82 cents | 3.28 cents | 3.91 cents |

| February 2010 | 3.82 cents | 3.28 cents | 3.91 cents |

| March 2010 | 3.82 cents | 3.29 cents | 3.91 cents |

| April 2010 | 3.82 cents | 3.29 cents | 3.91 cents |

| May 2010 | 3.82 cents | 3.29 cents | 3.91 cents |

| June 2010 | 3.72 cents | 3.19 cents | 3.81 cents |

*Assumes shares were purchased and held for the entire accrual period, which differs from the calendar month. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

Performance Overview

The Fund’s Class A share price, as measured by net asset value, increased from $10.87 on June 30, 2009, to $11.42 on June 30, 2010. The Fund’s Class A shares paid dividends totaling 45.46 cents per share for the same period.2 The Performance Summary beginning on page 21 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was 3.82%, based on an annualization of the current 3.72 cent per share dividend and the maximum offering price of $11.68 on June 30, 2010. An investor in the 2010 maximum combined effective federal and California personal income tax bracket of 41.21% would need to earn a distribution rate of 6.50% from a taxable investment to match the Fund’s Class A tax-free distrib ution rate. For the Fund’s Class C and Advisor shares’ performance, please see the Performance Summary. During the year under review, renewed investor interest in municipal bonds and limited new-issue supply tended to reduce the Fund’s income, which caused dividends to decline slightly.

2. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Annual Report | 19

Portfolio Breakdown

Franklin California Intermediate-Term Tax-Free Income Fund 6/30/10

|

| % of Total |

| Long-Term Investments* |

| | |

| Subject to Government Appropriations | 20.8 | % |

| Tax-Supported | 16.3 | % |

| Hospital & Health Care | 15.8 | % |

| General Obligation | 15.1 | % |

| Utilities | 12.5 | % |

| Transportation | 6.1 | % |

| Other Revenue | 4.1 | % |

| Prerefunded | 3.7 | % |

| Housing | 3.4 | % |

| Higher Education | 2.2 | % |

*Does not include short-term investments and other net assets.

Investment Strategy

We use a consistent, disciplined strategy in an effort to maximize tax-exempt income for our shareholders by seeking to maintain exposure to higher coupon securities. We generally employ a buy-and-hold approach and invest in securities that we believe should provide the most relative value in the market. As we invest during different interest rate environments, our portfolio becomes progressively more diversified with a broad range of securities. This broad diversification may help mitigate interest rate risk. We do not use leverage or exotic derivatives, nor do we use hedging techniques that could add volatility and contribute to underperformance in adverse markets. We generally stay fully invested to help maximize income distribution.

Manager’s Discussion

Consistent with our strategy, we sought to remain fully invested in a portfolio of bonds that maintain an average weighted maturity of 3 to 10 years. We also maintained our conservative, buy-and-hold investment strategy as we attempted to provide shareholders with high, current, tax-free income.

Thank you for your participation in Franklin California Intermediate-Term Tax-Free Income Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of June 30, 2010, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

20 | Annual Report

Performance Summary as of 6/30/10

Franklin California Intermediate-Term Tax-Free Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Price and Distribution Information | | | | | | |

| Class A (Symbol: FKCIX) | | | | Change | | 6/30/10 | | 6/30/09 |

| Net Asset Value (NAV) | | | $ | 0.55 | $ | 11.42 | $ | 10.87 |

| Distributions (7/1/09–6/30/10) | | | | | | | | |

| Dividend Income | $ | 0.4546 | | | | | | |

| Class C (Symbol: FCCIX) | | | | Change | | 6/30/10 | | 6/30/09 |

| Net Asset Value (NAV) | | | $ | 0.56 | $ | 11.45 | $ | 10.89 |

| Distributions (7/1/09–6/30/10) | | | | | | | | |

| Dividend Income | $ | 0.3918 | | | | | | |

| Advisor Class (Symbol: FRCZX) | | | | Change | | 6/30/10 | | 6/30/09 |

| Net Asset Value (NAV) | | | $ | 0.57 | $ | 11.44 | $ | 10.87 |

| Distributions (7/1/09–6/30/10) | | | | | | | | |

| Dividend Income | $ | 0.4653 | | | | | | |

Annual Report | 21

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Class A: 2.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

| | | | | | | | | | | |

| Class A | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 9.36 | % | + | 18.67 | % | + | 55.21 | % |

| Average Annual Total Return2 | | | + | 6.90 | % | + | 3.01 | % | + | 4.26 | % |

| Distribution Rate3 | 3.82 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate4 | 6.50 | % | | | | | | | | | |

| 30-Day Standardized Yield5 | 3.26 | % | | | | | | | | | |

| Taxable Equivalent Yield4 | 5.54 | % | | | | | | | | | |

| Total Annual Operating Expenses6 | 0.66 | % | | | | | | | | | |

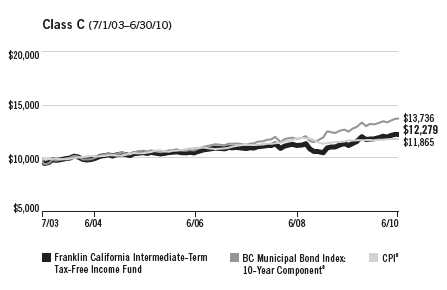

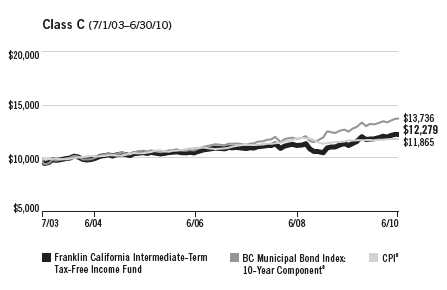

| Class C | | | | 1-Year | | | 5-Year | | | Inception (7/1/03) | |

| Cumulative Total Return1 | | | + | 8.83 | % | + | 15.54 | % | + | 22.79 | % |

| Average Annual Total Return2 | | | + | 7.83 | % | + | 2.93 | % | + | 2.98 | % |

| Distribution Rate3 | 3.34 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate4 | 5.68 | % | | | | | | | | | |

| 30-Day Standardized Yield5 | 2.80 | % | | | | | | | | | |

| Taxable Equivalent Yield4 | 4.76 | % | | | | | | | | | |

| Total Annual Operating Expenses6 | 1.21 | % | | | | | | | | | |

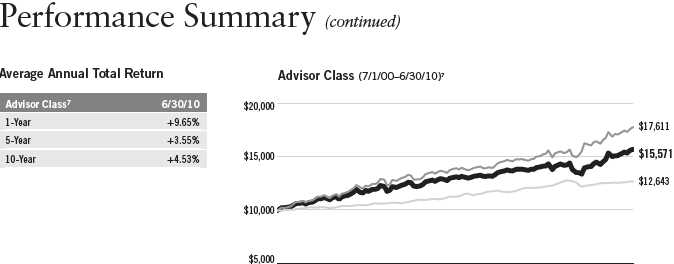

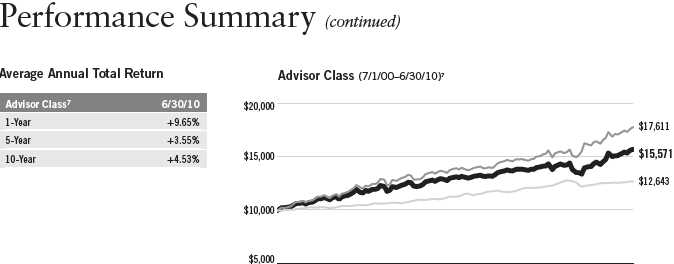

| Advisor Class7 | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 9.65 | % | + | 19.05 | % | + | 55.71 | % |

| Average Annual Total Return2 | | | + | 9.65 | % | + | 3.55 | % | + | 4.53 | % |

| Distribution Rate3 | 4.00 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate4 | 6.80 | % | | | | | | | | | |

| 30-Day Standardized Yield5 | 3.45 | % | | | | | | | | | |

| Taxable Equivalent Yield4 | 5.87 | % | | | | | | | | | |

| Total Annual Operating Expenses6 | 0.56 | % | | | | | | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ f rom figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

22 | Annual Report

Performance (continued)

Total Return 10,000 Investment

Total return over the periods shown. It includes any current, applicable, maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

| | | |

| Average Annual Total Return | |

| |

| Class A | | 6/30/10 | |

| 1-Year | + | 6.90 | % |

| 5-Year | + | 3.01 | % |

| 10-Year | + | 4.26 | % |

| | | |

| Average Annual Total Return | |

| |

| Class C | | 6/30/10 | |

| 1-Year | + | 7.83 | % |

| 5-Year | + | 2.93 | % |

| Since Inception (7/1/03) | + | 2.98 | % |

| | | | | |

| 7/00 | 6/02 | 6/04 | 6/06 | 6/08 | 6/10 |

| |

| |

| Franklin California Intermediate-Term | BC Municipal Bond Index: | CPI8 |

| Tax-Free Income Fund | | 10-Year Component8 | |

24 | Annual Report

Performance Summary (continued)

Endnotes

Because municipal bonds are sensitive to interest rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Since the Fund concentrates its investments in a single state, it is subject to greater risk of adverse economic and regulatory changes in that state than a geographically diversified fund. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: | Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

| |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. Distribution rate is based on an annualization of the respective class’s current monthly dividend and the maximum offering price (NAV for Classes C and Advisor) per share on 6/30/10.

4. Taxable equivalent distribution rate and yield assume the published rates as of 6/28/10 for the maximum combined effective federal and California personal income tax rate of 41.21%, based on the federal income tax rate of 35.00%.

5. The 30-day standardized yield for the 30 days ended 6/30/10 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

6. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

7. Effective 10/31/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 10/31/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 10/30/08, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 10/31/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +15.68% and +9.15%.

8. Source: © 2010 Morningstar. The BC Municipal Bond Index: 10-Year Component is the 10-year (8-12) component of the BC Municipal Bond Index, which is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch. The Consumer Price Index (CPI), calculated by the U.S. Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

Annual Report | 25

Your Fund’s Expenses

Franklin California Intermediate-Term Tax-Free Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

26 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Class A | | Value 1/1/10 | | Value 6/30/10 | | Period* 1/1/10–6/30/10 |

| Actual | $ | 1,000 | $ | 1,036.50 | $ | 3.28 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.57 | $ | 3.26 |

| Class C | | | | | | |

| Actual | $ | 1,000 | $ | 1,033.50 | $ | 6.00 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.89 | $ | 5.96 |

| Advisor Class | | | | | | |

| Actual | $ | 1,000 | $ | 1,037.80 | $ | 2.78 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.07 | $ | 2.76 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.65%; C: 1.19%; and Advisor: 0.55%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

Annual Report | 27

Franklin California Tax-Exempt Money Fund

Your Fund’s Goal and Main Investments: Franklin California Tax-Exempt Money Fund seeks to provide as high a level of income exempt from federal and California personal income taxes as is consistent with prudent investment management and the preservation of capital and liquidity.1 The Fund’s portfolio invests at least 80% of its total assets in securities that pay interest free from such taxes. The Fund tries to maintain a stable $1.00 share price.

Performance data represent past performance, which does not guarantee future results. Investment return will fluctuate. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

An investment in the Fund is not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

This annual report for Franklin California Tax-Exempt Money Fund covers the fiscal year ended June 30, 2010.

Performance Overview

In an effort to promote continued economic recovery, the Federal Reserve Board held short-term interest rates at a historically low level during the 12-month period under review, which affected money market portfolio yields. As a result, Franklin California Tax-Exempt Money Fund’s seven-day effective yield was unchanged at 0.00% from June 30, 2009, to June 30, 2010.

Investment Strategy

We invest at least 80% of the Fund’s total assets in high-quality, short-term municipal securities whose interest is free from federal and California state personal income taxes. Although the Fund tries to invest all of its assets in tax-free securities, it is possible, although not anticipated, that up to 20% of its assets may be in securities that pay taxable interest, including interest that may be subject to federal alternative minimum tax. We have maintained a dollar-weighted average portfolio maturity of 90 days or less (effective June 30, 2010, the Fund is required to maintain a dollar-weighted average portfolio maturity of no greater than 60 days).

1. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 61.

28 | Annual Report

Manager’s Discussion

During the year under review, short-term municipal bond yields remained relatively low. The Securities Industry and Financial Markets Association (SIFMA) Municipal Swap Index, a benchmark for variable rate securities, which make up a large portion of Franklin California Tax-Exempt Money Fund, also stayed at low levels. The rate ranged from a high of 0.43% in the middle of August 2009 to a low of 0.15% in the beginning of January 2010, and reached 0.25% at period-end.2 During the reporting period, issuance of variable rate demand notes (VRDNs) was extremely low compared to recent years, and demand for well-structured VRDNs supported low rates. Franklin California Tax-Exempt Money Fund continued to be very selective in purchasing high-quality securities. In this environment, the Fund’s yield remained at 0.00% for the reporting period. During the period under review, the Fund participated in several issues including Roseville Joint Union High School District tax and revenue anticipation notes (TRANs), Los Angeles Unified School District TRANs and VRDNs for California Education Facilities Authority Revenue for Stanford University and Metropolitan Water District of Southern California Waterworks Revenue.

Thank you for your continued participation in Franklin California Tax-Exempt Money Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of June 30, 2010, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

2. Source: Thomson Financial. The SIFMA Municipal Swap Index is a weekly high-grade market index composed of seven-day tax-exempt variable rate demand notes produced by the Municipal Market Data Group. Actual issues are selected from Municipal Market Data’s database of more than 10,000 active issues based on several specific criteria.

|

| Portfolio Breakdown |

| Franklin California Tax-Exempt Money Fund |

| 6/30/10 |

| | |

| | % of Total | |

| | Investments | |

| Variable Rate Notes | 91.7 | % |

| Notes & Bonds | 8.3 | % |

Performance Summary

Franklin California Tax-Exempt Money Fund

| | |

| Symbol: FCLXX | | |

| 6/30/10 | | |

| |

| Seven-day effective yield1 | 0.00 | % |

| Seven-day annualized yield | 0.00 | % |

| Taxable equivalent yield 2 | 0.00 | % |

| Total annual operating expenses 3 | 0.57 | % |

1. Seven-day effective yield assumes the compounding of daily dividends, if any.

2. Taxable equivalent yield assumes the published rates as of 6/28/10 for the maximum combined effective federal and California personal income tax rate of 41.21%, based on the federal income tax rate of 35.00%.

3. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown. To avoid a negative yield, the Fund administrator, investment manager and/or transfer agent have voluntarily agreed to waive or limit their respective fees, assume as their own expense certain expenses otherwise payable by the Fund, and if necessary, make a capital infusion into the Fund. These waivers, expense reimbursements and capital infusions, which are not reflected in the table above, are voluntary and may be modified or discontinued by the Fund administrator, investment manager and/or transfer agent at any time. There is no guarantee the Fund will be able to avoid a negative yield.

Annualized and effective yields are for the seven-day period ended 6/30/10. The Fund’s average weighted maturity was 19 days. Yield reflects Fund expenses and fluctuations in interest rates on portfolio investments.

Performance data represent past performance, which does not guarantee future results. Investment return will fluctuate. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Annual Report | 29

Your Fund’s Expenses

Franklin California Tax-Exempt Money Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) of the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the Fund’s actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

30 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| | | Value 1/1/10 | | Value 6/30/10 | | Period* 1/1/10–6/30/10 |

| Actual | $ | 1,000 | $ | 1,000.00 | $ | 1.19 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,023.60 | $ | 1.20 |

*Expenses are calculated using the most recent six-month annualized expense ratio, net of voluntary expense waivers, of 0.24%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

Annual Report | 31

| | | | | | | | | | | | | | | |

| Franklin California Tax-Free Trust | | | | | | | |

| Financial Highlights | | | | | | | | | | | | | | | |

| |

| Franklin California Insured Tax-Free Income Fund | | | | | | | | | | | | | | | |

| | | | | | Year Ended June 30, | | | | |

| Class A | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 11.45 | | $ | 12.19 | | $ | 12.48 | | $ | 12.43 | | $ | 12.85 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.55 | | | 0.55 | | | 0.54 | | | 0.54 | | | 0.55 | |

| Net realized and unrealized gains (losses) | | 0.62 | | | (0.75 | ) | | (0.29 | ) | | 0.05 | | | (0.43 | ) |

| Total from investment operations | | 1.17 | | | (0.20 | ) | | 0.25 | | | 0.59 | | | 0.12 | |

| Less distributions from net investment income | | (0.55 | ) | | (0.54 | ) | | (0.54 | ) | | (0.54 | ) | | (0.54 | ) |

| Redemption feesc | | — | | | —d | | | —d | | | —d | | | —d | |

| Net asset value, end of year | $ | 12.07 | | $ | 11.45 | | $ | 12.19 | | $ | 12.48 | | $ | 12.43 | |

| |

| Total returne | | 10.33 | % | | (1.54 | )% | | 1.98 | % | | 4.79 | % | | 0.96 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses | | 0.61 | % | | 0.61 | % | | 0.61 | % | | 0.61 | % | | 0.61 | % |

| Net investment income | | 4.60 | % | | 4.74 | % | | 4.33 | % | | 4.29 | % | | 4.34 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 1,899,692 | | $ | 1,780,448 | | $ | 1,875,898 | | $ | 1,810,358 | | $ | 1,751,279 | |

| Portfolio turnover rate | | 14.19 | % | | 13.04 | % | | 13.14 | % | | 6.77 | % | | 5.75 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund. bBased on average daily shares outstanding. cEffective September 1, 2008, the redemption fee was eliminated. dAmount rounds to less than $0.01 per share. eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

32 | The accompanying notes are an integral part of these financial statements. | Annual Report

| | | | | | | | | | | | | | | |

| Franklin California Tax-Free Trust | | | | | | | | | | |

| Financial Highlights (continued) | | | | | | | | | | | | | | | |

| |

| Franklin California Insured Tax-Free Income Fund | | | | | | | | | | | | | | | |

| | | | | | Year Ended June 30, | | | | |

| Class B | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 11.51 | | $ | 12.26 | | $ | 12.54 | | $ | 12.49 | | $ | 12.91 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.49 | | | 0.49 | | | 0.47 | | | 0.48 | | | 0.48 | |

| Net realized and unrealized gains (losses) | | 0.62 | | | (0.76 | ) | | (0.28 | ) | | 0.04 | | | (0.43 | ) |

| Total from investment operations | | 1.11 | | | (0.27 | ) | | 0.19 | | | 0.52 | | | 0.05 | |

| Less distributions from net investment income | | (0.48 | ) | | (0.48 | ) | | (0.47 | ) | | (0.47 | ) | | (0.47 | ) |

| Redemption feesc | | — | | | —d | | | —d | | | —d | | | —d | |

| Net asset value, end of year | $ | 12.14 | | $ | 11.51 | | $ | 12.26 | | $ | 12.54 | | $ | 12.49 | |

| |

| Total returne | | 9.77 | % | | (2.14 | )% | | 1.49 | % | | 4.20 | % | | 0.41 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses | | 1.15 | % | | 1.15 | % | | 1.16 | % | | 1.16 | % | | 1.16 | % |

| Net investment income | | 4.06 | % | | 4.20 | % | | 3.78 | % | | 3.74 | % | | 3.79 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 18,898 | | $ | 31,963 | | $ | 48,875 | | $ | 59,127 | | $ | 68,922 | |

| Portfolio turnover rate | | 14.19 | % | | 13.04 | % | | 13.14 | % | | 6.77 | % | | 5.75 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund. bBased on average daily shares outstanding. cEffective September 1, 2008, the redemption fee was eliminated. dAmount rounds to less than $0.01 per share. eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

Annual Report | The accompanying notes are an integral part of these financial statements. | 33

| | | | | | | | | | | | | | | |

| Franklin California Tax-Free Trust | | | | | | | | | | |

| Financial Highlights (continued) | | | | | | | | | | | | | | | |

| |

| Franklin California Insured Tax-Free Income Fund | | | | | | | | | | | | | | | |

| | | | | | Year Ended June 30, | | | | |

| Class C | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 11.57 | | $ | 12.32 | | $ | 12.60 | | $ | 12.55 | | $ | 12.97 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.49 | | | 0.49 | | | 0.47 | | | 0.48 | | | 0.48 | |

| Net realized and unrealized gains (losses) | | 0.63 | | | (0.76 | ) | | (0.28 | ) | | 0.04 | | | (0.43 | ) |

| Total from investment operations | | 1.12 | | | (0.27 | ) | | 0.19 | | | 0.52 | | | 0.05 | |

| Less distributions from net investment income | | (0.48 | ) | | (0.48 | ) | | (0.47 | ) | | (0.47 | ) | | (0.47 | ) |

| Redemption feesc | | — | | | —d | | | —d | | | —d | | | —d | |

| Net asset value, end of year | $ | 12.21 | | $ | 11.57 | | $ | 12.32 | | $ | 12.60 | | $ | 12.55 | |

| |

| Total returne | | 9.79 | % | | (2.15 | )% | | 1.48 | % | | 4.17 | % | | 0.40 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses | | 1.16 | % | | 1.16 | % | | 1.16 | % | | 1.16 | % | | 1.16 | % |

| Net investment income | | 4.05 | % | | 4.19 | % | | 3.78 | % | | 3.74 | % | | 3.79 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 252,630 | | $ | 186,238 | | $ | 163,407 | | $ | 139,476 | | $ | 133,560 | |

| Portfolio turnover rate | | 14.19 | % | | 13.04 | % | | 13.14 | % | | 6.77 | % | | 5.75 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund. bBased on average daily shares outstanding. cEffective September 1, 2008, the redemption fee was eliminated. dAmount rounds to less than $0.01 per share. eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

34 | The accompanying notes are an integral part of these financial statements. | Annual Report

| | | | | | |

| Franklin California Tax-Free Trust | | | | | | |

| Financial Highlights (continued) | | | | | | |

| |

| Franklin California Insured Tax-Free Income Fund | | | | | | |

| | | Year Ended | |

| | | June 30, | |

| Advisor Class | | 2010 | | | 2009 | a |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the year) | | | | | | |

| Net asset value, beginning of year | $ | 11.45 | | $ | 11.33 | |

| Income from investment operationsb: | | | | | | |

| Net investment incomec | | 0.56 | | | 0.37 | |

| Net realized and unrealized gains (losses) | | 0.63 | | | 0.12 | |

| Total from investment operations | | 1.19 | | | 0.49 | |

| Less distributions from net investment income | | (0.56 | ) | | (0.37 | ) |

| Net asset value, end of year | $ | 12.08 | | $ | 11.45 | |

| |

| Total returnd | | 10.52 | % | | 4.37 | % |

| |

| Ratios to average net assetse | | | | | | |

| Expenses | | 0.51 | % | | 0.51 | % |

| Net investment income | | 4.70 | % | | 4.84 | % |

| |

| Supplemental data | | | | | | |

| Net assets, end of year (000’s) | $ | 10,960 | | $ | 2,100 | |

| Portfolio turnover rate | | 14.19 | % | | 13.04 | % |

aFor the period October 31, 2008 (effective date) to June 30, 2009. bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund. cBased on average daily shares outstanding. dTotal return is not annualized for periods less than one year. eRatios are annualized for periods less than one year.

Annual Report | The accompanying notes are an integral part of these financial statements. | 35

| | | | |

| Franklin California Tax-Free Trust | | | | |

| |

| Statement of Investments, June 30, 2010 | | | | |

| |

| |

| Franklin California Insured Tax-Free Income Fund | | Principal Amount | | Value |

| Municipal Bonds 98.7% | | | | |

| California 98.7% | | | | |

| ABAG Finance Authority for Nonprofit Corps. California Health Facilities Revenue, Institute on | | | | |

| Aging, California Mortgage Insured, 5.65%, 8/15/38 | $ | 9,000,000 | $ | 8,668,530 |

| ABAG Finance Authority for Nonprofit Corps. COP, | | | | |

| Lincoln Child Center Inc., California Mortgage Insured, 6.125%, 11/01/24 | | 1,950,000 | | 1,956,630 |

| Lytton Gardens Inc., Refunding, California Mortgage Insured, 6.00%, 2/15/30 | | 3,005,000 | | 3,005,180 |

| Odd Fellows Home, California Mortgage Insured, 6.00%, 8/15/24 | | 5,000,000 | | 5,046,600 |

| ABAG Finance Authority for Nonprofit Corps. Revenue, | | | | |

| Casa De Las Campanas, California Mortgage Insured, 6.00%, 9/01/37 | | 8,000,000 | | 8,109,120 |

| Poway Retirement Housing Foundation Hou sing Inc. Project, Series A, California Mortgage | | | | |

| Insured, 5.375%, 11/15/25 | | 5,145,000 | | 5,149,476 |

| Sansum-Santa Barbara, Refunding, Series A, California Mortgage Insured, 5.60%, | | | | |

| 4/01/26 | | 2,750,000 | | 2,768,700 |

| Acalanes UHSD, GO, Capital Appreciation, Election of 2002, Series A, FGIC Insured, zero | | | | |

| cpn., 8/01/25 | | 9,045,000 | | 4,348,022 |

| Alameda Corridor Transportation Authority Revenue, Capital Appreciation, sub. lien, Refunding, | | | | |

| Series A, AMBAC Insured, zero cpn. to 10/01/12, | | | | |

| 5.25% thereafter, 10/01/21 | | 64,660,000 | | 54,869,183 |

| 5.45% thereafter, 10/01/25 | | 25,000,000 | | 20,345,500 |

| Alameda Power and Telecommunication Electric System Revenue COP, Refunding, Series A, | | | | |

| NATL Insured, 5.75%, 7/01/30 | | 3,305,000 | | 3,355,831 |

| Alhambra City Elementary School District GO, Capital Appreciation, Election of 1999, Series | | | | |

| B, NATL RE, FGIC Insured, zero cpn., 9/01/27 | | 3,035,000 | | 1,045,982 |

| Alisal USD, GO, Capital Appreciation, Election of 2006, Series B, Assured Guaranty, zero cpn., | | | | |

| 8/01/32 | | 3,355,000 | | 831,805 |

| 8/01/33 | | 3,610,000 | | 830,914 |

| 2/01/34 | | 3,345,000 | | 742,389 |

| Alum Rock Union Elementary School District GO, Election of 2008, Series A, Assured Guaranty, | | | | |

| 5.00%, 8/01/33 | | 12,595,000 | | 12,769,819 |

| Alvord USD, GO, Election of 2007, Series A, AGMC Insured, 5.00%, 8/01/32 | | 9,070,000 | | 9,165,688 |

| Anaheim PFAR, Distribution System, second lien, NATL Insured, 5.00%, 10/01/29 | | 5,000,000 | | 5,085,450 |

| Antelope Valley UHSD, GO, Series A, NATL Insured, 5.00%, 2/01/27 | | 5,000,000 | | 5,069,350 |

| Antioch USD, GO, Election of 2008, School Facilities Improvement No. 1-B, Assured Guaranty, | | | | |

| 5.375%, 8/01/36 | | 3,130,000 | | 3,226,122 |

| Arcadia USD, GO, Capital Appreciation, Election of 2006, Series A, AGMC Insured, zero cpn., | | | | |

| 8/01/46 | | 27,665,000 | | 2,559,012 |

| Atascadero CDA Tax Allocation, Redevelopment Project, XLCA Insured, 5.00%, 9/01/34 | | 4,315,000 | | 3,842,766 |

| Auburn PFA Wastewater Revenue, Assured Guaranty, 5.50%, 6/01/39 | | 1,880,000 | | 1,970,184 |

| Auburn USD, COP, Refinancing Project, Assured Guaranty, 5.00%, 6/01/38 | | 10,000,000 | | 10,040,100 |

| Bakersfield City School District GO, Series A, AGMC Insured, 5.00%, | | | | |

| 11/01/27 | | 2,415,000 | | 2,512,421 |

| 11/01/28 | | 2,535,000 | | 2,626,640 |