UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-04363 |

| | |

| | |

| | |

| AMERICAN CENTURY GOVERNMENT INCOME TRUST |

| (Exact name of registrant as specified in charter) |

| | |

| | |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

| | |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| | |

| Date of fiscal year end: | 03-31 |

| | |

| | |

| Date of reporting period: | 03-31-09 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| Annual Report |

| March 31, 2009 |

|

| American Century Investments |

Ginnie Mae Fund

Government Bond Fund

Inflation-Adjusted Bond Fund

Short-Term Government Fund

Dear Investor:

Thank you for investing with us during the financial reporting period ended March 31, 2009. We appreciate your trust in American Century Investments® during these challenging times.

As the calendar changed from 2008 to 2009, the financial markets continued to struggle to digest the subprime-initiated credit crisis. The ensuing global economic downturn and market turmoil affected everyone—from first-time individual investors to hundred-year-old financial institutions. During the period, risk aversion was a key theme, with performance generally favoring assets with lower risk levels and those that showed signs of stability. Effective risk management by portfolio managers delivered above-average returns, albeit still negative in many cases under these challenging market conditions.

Effective risk management requires a commitment to disciplined investment approaches that balance risk and reward, with the goal of setting and maintaining risk levels that are appropriate for portfolio objectives. At American Century Investments, we’ve stayed true to the principles that have guided us for over 50 years, including our commitments to delivering superior investment performance and helping investors reach their financial goals. Risk management is part of that commitment—we offer portfolios that can help diversify and stabilize investment returns.

As discussed by the investment team leaders in this report, 2009 is likely to be another challenging year, but I’m certain that we have the investment professionals and processes in place to provide competitive and compelling long-term results for you. Thank you for your continued confidence in us.

Sincerely,

Jonathan S. Thomas

President and Chief Executive Officer

American Century Investments

| |

| Market Perspective | 2 |

| U.S. Fixed-Income Total Returns | 2 |

| |

| Ginnie Mae | |

| Performance | 3 |

| Portfolio Commentary | 5 |

| Portfolio at a Glance, Yields and | |

| Types of Investments in Portfolio | 7 |

| |

| Government Bond | |

| Performance | 8 |

| Portfolio Commentary | 10 |

| Portfolio at a Glance, Yields and | |

| Types of Investments in Portfolio | 12 |

| |

| Inflation-Adjusted Bond | |

| Performance | 13 |

| Portfolio Commentary | 15 |

| Portfolio at a Glance, Yields and | |

| Portfolio Composition by Weighted Average Life | 17 |

| |

| Short-Term Government | |

| Performance | 18 |

| Portfolio Commentary | 20 |

| Portfolio at a Glance, Yields and | |

| Types of Investments in Portfolio | 22 |

| |

| Shareholder Fee Examples | 23 |

| |

| Financial Statements | |

| Schedule of Investments | 26 |

| Statement of Assets and Liabilities | 43 |

| Statement of Operations | 45 |

| Statement of Changes in Net Assets | 46 |

| Notes to Financial Statements | 48 |

| Financial Highlights | 59 |

| Report of Independent Registered Public Accounting Firm | 70 |

| |

| Other Information | |

| Management | 71 |

| Additional Information | 74 |

| Index Definitions | 75 |

The opinions expressed in the Market Perspective and each of the Portfolio Commentaries reflect those of the portfolio management team as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

By David MacEwen, Chief Investment Officer, Fixed Income

Unprecedented Events

The spiraling subprime credit crisis took an incredible toll on U.S. financial institutions, the economy, and financial markets in the 12 months ended March 31, 2009. By period-end, the resulting recession had spread globally, unemployment in the U.S. reached 8.5%, and many measures of consumer strength were at record lows. On the inflation front, the government’s Consumer Price Index fell by 0.4% for the year ended in March. That was the first 12-month decline since August 1955.

In that environment, the Federal Reserve (the Fed) took dramatic steps, effectively cutting its short-term rate target to 0%, intervening in the mortgage, commercial, and consumer debt markets, while Congress passed a massive economic stimulus package and the $700 billion Troubled Asset Relief Program (TARP).

High-Quality Outperformed Low-Quality

In the fixed-income markets, risk aversion, deleveraging, and worries about the economy and deflation sent Treasury bonds to big gains, while credit-sensitive securities endured historic underperformance (see accompanying table). High-quality, higher-yielding government-backed securities such as government agency and mortgage-backed securities (MBS) also did well. Inflation-linked securities had negative returns overall, though they performed much better late in the period because of worry that the government’s fiscal and monetary policies will prove inflationary down the road. The Fed’s rate cuts also had important implications for money market securities, whose yields and returns are closely tied to the level of short-term interest rates.

Rates Tumbled Amid Volatility

Dramatic Fed rate cuts, safe-haven buying, and competing inflation/deflation concerns meant bond yields were volatile, but finished the 12 months significantly lower. The yield on the two-year Treasury note, which is most sensitive to Fed rate policy, went from 1.59% to 0.80%. Yields on longer-term notes and bonds fell a similar amount, with the benchmark 10-year Treasury yield down from 3.41% to 2.67%, while 30-year bond yields went from 4.29% to 3.54%. In that environment, the shape of the yield curve (a graphic representation of Treasury yields at different maturities) shifted considerably, but ultimately ended the period little changed.

| | | | |

| U.S. Fixed-Income Total Returns | | | | |

| For the 12 months ended March 31, 2009 | | | | |

| Treasury Securities | | | Citigroup U.S. Bond Market Indices | |

| 3-Month Bill | 1.13% | | Mortgage (mortgage-backed) | 8.26% |

| 2-Year Note | 4.67% | | Treasury | 7.50% |

| 10-Year Note | 10.52% | | Agency | 6.16% |

| 30-Year Bond | 18.08% | | Broad Investment-Grade (multi-sector) | 4.52% |

| | | | Inflation-Linked Securities | –2.05% |

| | | | Credit (investment-grade corporate) | –4.61% |

| | | | High-Yield Market (corporate) | –19.88% |

2

| | | | | |

| Ginnie Mae | | | | | |

| |

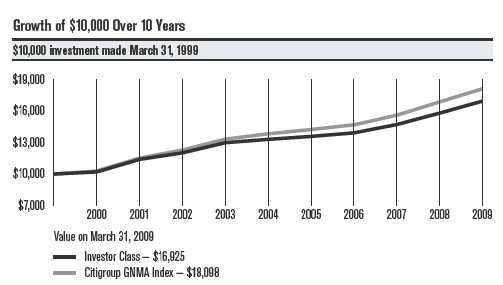

| Total Returns as of March 31, 2009 | | | | |

| | | Average Annual Returns | |

| | | | | Since | Inception |

| | 1 year | 5 years | 10 years | Inception | Date |

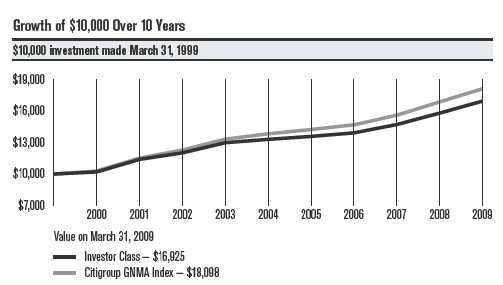

| Investor Class | 7.22%(1) | 4.95% | 5.40% | 7.22% | 9/23/85 |

| Citigroup GNMA Index | 7.41% | 5.54% | 6.11% | 8.04%(2) | — |

| Institutional Class | 7.44%(1) | — | — | 8.64%(1) | 9/28/07 |

| Advisor Class | 6.96%(1) | 4.69% | 5.14% | 5.24% | 10/9/97 |

| R Class | 6.69%(1) | — | — | 7.88%(1) | 9/28/07 |

| (1) | Class returns would have been lower if American Century Investments had not voluntarily waived a portion of its management fee. |

| (2) | Since 9/30/85, the date nearest the Investor Class’s inception for which data are available. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

3

Ginnie Mae

| | | | | | | | | | |

| | | | | | | | | | |

| One-Year Returns Over 10 Years | | | | | | | |

| Periods ended March 31 | | | | | | | | | |

| | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| Investor Class | 2.01% | 11.70% | 5.43% | 8.03% | 2.43% | 2.11% | 2.47% | 5.69% | 7.39%* | 7.22%* |

| Citigroup | | | | | | | | | | |

| GNMA Index | 2.95% | 11.93% | 6.57% | 8.42% | 3.79% | 2.96% | 3.11% | 6.24% | 8.09% | 7.41% |

| *Returns would have been lower, along with the ending value, if a portion of the class’s management fee had not been waived during the period. |

| | | |

| | | |

| Total Annual Fund Operating Expenses | | |

| Investor Class | Institutional Class | Advisor Class | R Class |

| 0.57% | 0.37% | 0.82% | 1.07% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

4

Ginnie Mae

Portfolio Managers: Bob Gahagan, Hando Aguilar, and Dan Shiffman

Performance Summary

Ginnie Mae returned 7.22%* for the 12 months ended March 31, 2009. By comparison, the Citigroup GNMA Index returned 7.41%. See page 3 for additional performance comparisons. Portfolio returns reflect operating expenses, while Citigroup index returns do not.

Ginnie Mae enjoyed positive returns despite the extreme volatility in the market for mortgage-backed securities (MBS), helped by the high credit quality of the bonds in which the portfolio invests. The portfolio trailed its benchmark modestly for the period, as our sector allocation decisions had a mixed effect.

Government-Backed Mortgages Did Best

Returns for MBS in the last 12 months were colored by the dramatic events surrounding the subprime credit crisis. To prop up the housing market, the government took over mortgage market giants Fannie Mae and Freddie Mac and bought their securities on the open market. These moves helped agency MBS perform best of the segments of the broad taxable bond market for the period.

However, the government’s moves to lower home borrowing costs meant a spike in mortgage prepayment expectations. Mortgage refinancing is undesirable for MBS investors, who get their money returned to them before the bond’s stated maturity date to reinvest at a new, lower interest rate. As a result, higher-coupon bonds, which are most subject to prepayments, performed worst among MBS during the quarter.

Performance Drivers

Given the sharp interest rate volatility and market conditions in the last 12 months, we held a stake in GNMA collateralized mortgage obligations (CMOs). We preferred their more predictable cash flows than passthrough MBS at a time when mortgage prepayments surged. However, these bonds underperformed in the extreme market conditions of late 2008 because they’re less liquid than traditional passthrough MBS.

At the other end of the spectrum, it helped to hold an overweight position in the GNMA II sector versus GNMA Is. GNMA II securities are multi-issuer pools of mortgages, making them more diversified geographically and by issuer than GNMA I (single-issuer) securities. We viewed this greater diversification as another way to protect against prepayments. This positioning contributed to performance, as GNMA IIs outperformed GNMA Is for the fiscal year. In terms of the portfolio’s coupon structure, it helped to favor current coupon GNMAs over higher-coupon bonds, which underperformed.

*All fund returns referenced in this commentary are for Investor Class shares. Class returns would have been lower had a portion of its management fees not been waived

5

Ginnie Mae

We also helped performance by eliminating our long-running yield curve steepening trade near where the curve hit its steepest slope in November. Since late 2008, we kept the portfolio’s duration (price sensitivity to interest rate changes) and curve exposure neutral relative to its index. In part, that’s because we base our duration and curve allocation decisions on macroeconomic factors, which are not currently the best guideposts—the Fed has essentially been manipulating rates and the curve to meet its own economic and political objectives.

Outlook

“Despite extraordinary intervention and stimulus provided by the government and central bank, we expect the credit crisis will continue and overall economic conditions will remain weak for some time,“ said Portfolio Manager Bob Gahagan. “That’s because we think this consumer-led recession will require housing and employment market stability before any meaningful, sustained recovery can take place.”

“Though the macroeconomic backdrop remains challenging, we see some positive signs emerging in the market for MBS. The array of policies pursued by the Federal Reserve appears to be helping securitized markets begin to return to some semblance of normal functioning,” said Portfolio Manager Hando Aguilar. “It’s not clear if this improvement is sustainable, but regardless of market conditions, we will continue to focus on sector management and security selection as the largest performance drivers of our investment process.”

6

| | |

| Ginnie Mae | | |

| |

| Portfolio at a Glance | | |

| | As of 3/31/09 | As of 3/31/08 |

| Average Duration (effective) | 2.3 years | 3.2 years |

| Weighted Average Life | 4.3 years | 5.4 years |

| |

| Yields as of March 31, 2009 | | |

| 30-Day SEC Yield(1) | | |

| Investor Class | | 3.83% |

| Institutional Class | | 4.03% |

| Advisor Class | | 3.59% |

| R Class | | 3.33% |

| (1) The yields presented reflect the waiver of a portion of the fund’s management fee. Without such waiver, the 30-day yields would have been lower. |

| | |

| Types of Investments in Portfolio | | |

| | % of | % of |

| | fund investments | fund investments |

| | as of 3/31/09 | as of 9/30/08 |

| Fixed-Rate U.S. Government Agency | | |

| Mortgage-Backed Securities (all GNMAs) | 84.1% | 74.5% |

| U.S. Government Agency Collateralized | | |

| Mortgage Obligations (all GNMAs) | 10.3% | 16.3% |

| U.S. Government Agency Securities | — | 2.3% |

| Adjustable-Rate U.S. Government Agency | | |

| Mortgage-Backed Securities (all GNMAs) | 1.5% | 1.7% |

| Temporary Cash Investments | 4.1% | 5.2% |

7

| | | | | |

| Government Bond | | | | | |

| |

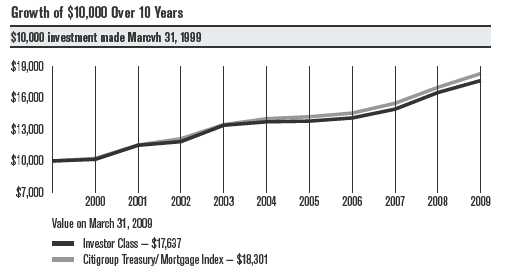

| Total Returns as of March 31, 2009 | | | | |

| | | Average Annual Returns | |

| | | | | Since | Inception |

| | 1 year | 5 years | 10 years | Inception | Date |

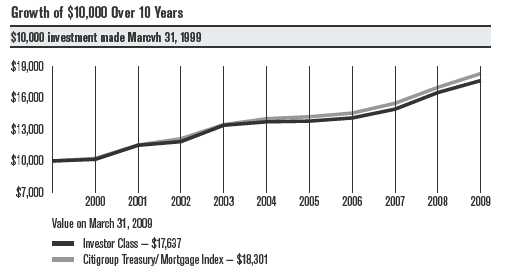

| Investor Class | 6.90% | 5.16% | 5.83% | 7.67% | 5/16/80 |

| Citigroup Treasury/Mortgage Index | 7.68% | 5.48% | 6.23% | —(1) | — |

| Advisor Class | 6.64% | 4.90% | 5.57% | 5.71% | 10/9/97 |

Performance information prior to September 3, 2002, is that of the American Century Treasury Fund, all of the net assets of which were acquired by Government Bond pursuant to a plan of reorganization approved by Treasury shareholders on August 2, 2002.

(1) Index data not available prior to 1982.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

8

Government Bond

| | | | | | | | | | |

| | | | | | | | | | |

| One-Year Returns Over 10 Years | | | | | | | |

| Periods ended March 31 | | | | | | | | | |

| | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| Investor Class | 1.51% | 13.17% | 3.01% | 13.17% | 2.42% | 0.50% | 2.17% | 5.95% | 10.58% | 6.90% |

| Citigroup Treasury/ | | | | | | | | | | |

| Mortgage Index | 2.31% | 12.53% | 5.17% | 11.06% | 4.21% | 1.33% | 2.44% | 6.44% | 9.78% | 7.68% |

| |

| |

| Total Annual Fund Operating Expenses | |

| Investor Class | Advisor Class |

| 0.49% | 0.74% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

9

Government Bond

Portfolio Managers: Bob Gahagan, Hando Aguilar, Brian Howell, Dan Shiffman, and Jim Platz

Performance Summary

Government Bond returned 6.90%* for the 12 months ended March 31, 2009. By comparison, the Citigroup Treasury/Mortgage Index returned 7.68%. See page 8 for additional performance comparisons. Portfolio returns reflect operating expenses, while Citigroup index returns do not.

The portfolio’s solid absolute returns reflected the performance of government-backed bonds in a difficult period for the economy and financial markets (see page 2). Relative to its benchmark, Government Bond lagged as a result of some of our sector allocation decisions.

Sector Selection Detracted

In managing the portfolio, we attempt to capitalize on inefficiencies and mean-reversion tendencies in the market by taking active positions in the areas of duration (price sensitivity to interest rate changes), yield curve, sector allocation, and security selection.

In regard to sector and security selection, we viewed Treasuries as the least attractive segment of the market given record low yields at a time of massive government borrowing, as well as policies that are likely to prove inflationary down the road. Instead, we added government-backed securities (“government agency equivalents” issued by financial institutions and guaranteed by the Federal Deposit Insurance Corporation, or FDIC) that offer yields above Treasury securities. These are good examples of the sorts of trades we look for in an attempt to add value over time—adding yield with little or no additional risk. While these positions should contribute to relative return over the long run, they can underperform over short periods, as they did during the fiscal year.

What’s more, within our Treasury allocation we held inflation-protected securities (TIPS), which trailed plain-vanilla Treasury bonds. The difference in yield between nominal and inflation-adjusted 10-year Treasuries narrowed so sharply in late 2008 as to suggest inflation would run at less than 1% a year over the life of the bonds. We think that is much too low given the unprecedented, and ultimately inflationary, policies the government is pursuing to support the economy and financial system. Here again, we believe this is likely to be an effective long-term trade—buying future inflation protection at very cheap levels—though it detracted from results during the period.

*All fund returns referenced in this commentary are for Investor Class shares.

10

Government Bond

On a positive note, it helped that the portfolio held an overweight position in high-quality agency mortgage-backed securities (MBS). Government agency MBS were the best-performing segment of the market in the last 12 months because of explicit government steps aimed at supporting the issuers of these bonds and driving down mortgage rates. However, those policies meant an increase in home loan refinancing expectations, which are undesirable for MBS investors. To combat the effects of mortgage prepayments, we held a stake in types of collateralized mortgage obligations (CMOs) that offer more dependable cash flows. Unfortunately, these bonds underperformed in the extreme market conditions of late 2008 because they’re less liquid than traditional passthrough MBS.

Curve Positioning Contributed

In terms of the portfolio’s duration and yield curve positions, we have been neutral relative to the index since late 2008. In part, that’s because we base our duration and curve allocation decisions on macroeconomic factors, which are not currently the best guideposts—the Fed has essentially been manipulating rates and the curve to meet its own economic and political objectives. It helped performance that we eliminated our long-running yield curve steepening trade near where the curve hit its steepest slope in November.

Outlook

“Despite extraordinary intervention and stimulus provided by the government and central bank, we expect the credit crisis will continue and overall economic conditions will remain weak for some time,“ said Portfolio Manager Bob Gahagan. “In that environment, we believe we’re finding opportunities to add long-term value by starting to build positions in TIPS and higher-yielding paper that carries government backing. In the MBS slice, we’re likely to continue to focus on seasoned securities or those structured with protection from prepayments in an attempt to support the portfolio’s yield and total return characteristics in an environment of rising mortgage refinancings.”

11

| | |

| Government Bond | | |

| |

| Portfolio at a Glance | | |

| | As of 3/31/09 | As of 3/31/08 |

| Average Duration (effective) | 3.2 years | 4.1 years |

| Weighted Average Life | 3.9 years | 6.3 years |

| |

| Yields as of March 31, 2009 | | |

| 30-Day SEC Yield | | |

| Investor Class | | 3.02% |

| Advisor Class | | 2.78% |

| |

| Types of Investments in Portfolio | | |

| | % of | % of |

| | fund investments | fund investments |

| | as of 3/31/09 | as of 9/30/08 |

| U.S. Government Agency Mortgage-Backed Securities | 51.3% | 50.0% |

| U.S. Treasury Securities | 25.8% | 27.2% |

| Collateralized Mortgage Obligations | 9.3% | 15.1% |

| U.S. Government Agency Securities and Equivalents | 9.0% | 3.0% |

| Asset-Backed Securities | 0.6% | 0.9% |

| Temporary Cash Investments | 4.0% | 3.8% |

12

| | | | | |

| Inflation-Adjusted Bond | | | | |

| |

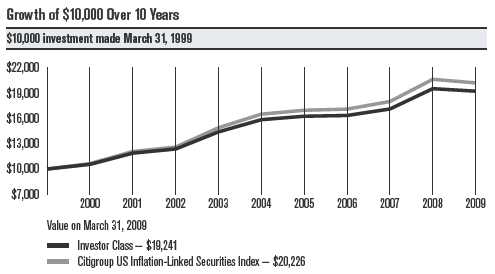

| Total Returns as of March 31, 2009 | | | | |

| | | Average Annual Returns | |

| | | | | Since | Inception |

| | 1 year | 5 years | 10 years | Inception | Date |

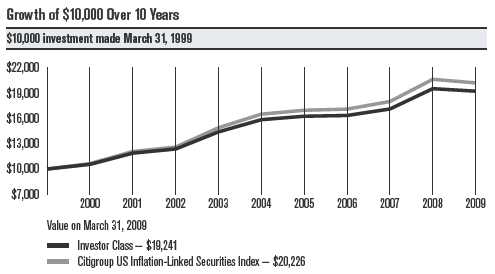

| Investor Class | -1.51% | 3.94% | 6.76% | 5.95% | 2/10/97 |

| Citigroup US Inflation-Linked | | | | | |

| Securities Index | -2.05% | 4.14% | 7.30% | 6.57%(1) | — |

| Institutional Class | -1.32% | 4.15% | — | 5.30% | 10/1/02 |

| Advisor Class | -1.73% | 3.70% | 6.50% | 6.20% | 6/15/98 |

| (1) Since 2/28/97, the date nearest the Investor Class’s inception for which data are available. | | |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

13

Inflation-Adjusted Bond

| | | | | | | | | | |

| | | | | | | | | | |

| One-Year Returns Over 10 Years | | | | | | | |

| Periods ended March 31 | | | | | | | | | |

| | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| Investor Class | 5.52% | 12.62% | 4.16% | 16.42% | 10.04% | 2.57% | 0.56% | 4.71% | 14.08% | -1.51% |

| Citigroup US | | | | | | | | | | |

| Inflation-Linked | | | | | | | | | | |

| Securities Index | 6.39% | 13.54% | 4.37% | 18.20% | 10.83% | 2.78% | 0.81% | 5.27% | 14.64% | -2.05% |

| | |

| | |

| Total Annual Fund Operating Expenses | |

| Investor Class | Institutional Class | Advisor Class |

| 0.49% | 0.29% | 0.74% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

14

Inflation-Adjusted Bond

Portfolio Managers: Brian Howell, Jim Platz, and Bob Gahagan

Performance Summary

Inflation-Adjusted Bond declined 1.51%* for the 12 months ended March 31, 2009. By comparison, the fund’s benchmark, the Citigroup US Inflation-Linked Securities Index, declined 2.05%. Portfolio returns reflect operating expenses, while the index returns do not.

TIPS Underperformed, Even as Quality Reigned

As the mounting credit crisis morphed into a full-blown financial crisis, and the U.S. economy faced its most severe recession in decades, investors fled to the safety and stability of Treasury securities. Yet, even though the Treasury sector was the top performer for the 12-month period, TIPS (Treasury inflation-protected securities) lagged nominal Treasuries. This underperformance was due to the weakening economy, which led to declining inflation expectations that rendered the inflation-protection element of TIPS unattractive to investors on a near-term basis.

Our strategy incorporates sector allocation (TIPS and investment-grade non-Treasury sectors), security selection, and yield-curve positioning, while maintaining full inflation-protection exposure. These factors generally accounted for the portfolio’s outperformance relative to the benchmark. Most non-Treasury (spread) sectors outperformed TIPS for the period, but our position in investment-grade corporate securities detracted from results. High-quality corporate bonds struggled during most of the period, as spreads (the difference between corporate and Treasury yields) widened on default concerns and risk aversion.

Inflation Rose Sharply Then Tumbled Quickly

Early in the 12-month period, the lingering threat of stagflation (stalled economic growth and rising inflation) worried investors and kept TIPS in favor. This scenario changed dramatically in the summer of 2008, as the financial crisis and correspondingly weaker global economy sent commodity prices—and inflation expectations—tumbling.

For example, oil prices soared to a record-high $147 a barrel in July, primarily due to heightened demand from emerging markets. This helped push headline inflation, as measured by the 12-month change in the Consumer Price Index (CPI), to a reporting-period high of 5.6% in July. But, oil prices dropped sharply during the next several months, finishing the period at $50 a barrel. Furthermore, 12-month headline inflation turned negative by the end of March 2009, reflecting the impact of generally sagging commodity prices combined with dismal global economic growth prospects and a stronger U.S. dollar.

*All fund returns referenced in this commentary are for Investor Class shares.

15

Inflation-Adjusted Bond

Portfolio Strategy

We continued to invest most of the portfolio in TIPS (approximately 87% as of March 31, 2009). We invested the remainder of the portfolio in high-quality corporate, municipal, agency, and mortgage securities—spread sectors we believe offer attractive long-term value. In addition, we complemented our spread-sector investments with strategies that maintain full inflation-protection exposure. These strategies contributed positively to the fund’s 12-month performance. Furthermore, over time, we believe these efforts may enhance the portfolio’s yield and outperform Treasury securities.

Additionally, our bias toward a steeper yield curve during most of 2008 contributed positively to the portfolio’s performance. Investors swarmed to shorter-term, lower-risk Treasuries as the financial crisis worsened, causing the Treasury yield curve to steepen. We removed this strategy late in 2008, when the steepening trend started to subside.

Outlook

After peaking at 2.6 percentage points in July 2008, the yield difference (breakeven) between 10-year TIPS and nominal 10-year Treasuries fell to 0.09 percentage point at the end of December before rising to 1.31 percentage points as of March 31. The breakeven rate represents investors’ expectations for inflation for the next decade—expectations we believe are unreasonably low.

We believe inflationary pressures are likely to build in the months ahead, given historical CPI patterns and the extraordinary amount of economic stimulus from the government and the Federal Reserve. Therefore, our longer-term inflation outlook, along with the relatively low breakeven rate, suggests TIPS currently offer attractive long-term value.

Due to the unexpected death of portfolio manager Seth Plunkett on November 9, 2008, co-portfolio managers Brian Howell, Jim Platz, and Bob Gahagan assumed his responsibilities. Our team structure means the management process and objectives for this portfolio remain the same, despite the loss of a cherished colleague.

16

| | |

| Inflation-Adjusted Bond | | |

| |

| Portfolio at a Glance | | |

| | As of 3/31/09 | As of 3/31/08 |

| Weighted Average Maturity | 9.2 years | 6.7 years |

| Average Duration (effective) | 5.8 years | 6.1 years |

| |

| Yields as of March 31, 2009 | | |

| 30-Day SEC Yield | | |

| Investor Class | | 6.03% |

| Institutional Class | | 6.23% |

| Advisor Class | | 5.78% |

| |

| Portfolio Composition by Weighted Average Life | | |

| | % of | % of |

| | fund investments | fund investments |

| | as of 3/31/09 | as of 9/30/08 |

| 0 – 5-Year Notes(1) | 37.1% | 31.8% |

| 5 – 10-Year Notes | 29.0% | 40.7% |

| 10 – 35-Year Bonds | 33.9% | 27.5% |

| (1) Includes temporary cash investments. | | |

17

| | | | | |

| Short-Term Government | | | | |

| |

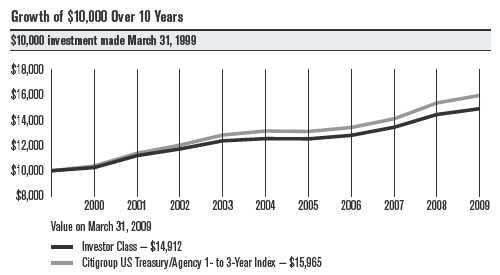

| Total Returns as of March 31, 2009 | | | | |

| | | Average Annual Returns | |

| | | | | Since | Inception |

| | 1 year | 5 years | 10 years | Inception | Date |

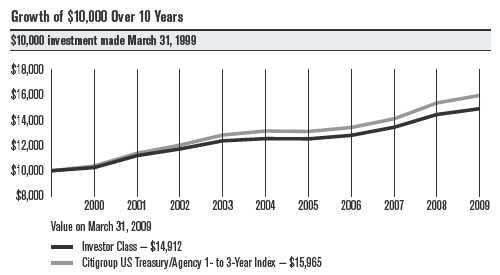

| Investor Class | 3.17% | 3.52% | 4.07% | 5.92% | 12/15/82 |

| Citigroup US Treasury/Agency | | | | | |

| 1- to 3-Year Index | 3.88% | 3.96% | 4.79% | 6.89%(1) | — |

| Advisor Class | 2.91% | 3.26% | 3.81% | 3.87% | 7/8/98 |

| (1) Since 12/31/82, the date nearest the Investor Class’s inception for which data are available. | | |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

18

Short-Term Government

| | | | | | | | | | |

| | | | | | | | | | |

| One-Year Returns Over 10 Years | | | | | | | |

| Periods ended March 31 | | | | | | | | | |

| | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| Investor Class | 2.51% | 9.25% | 4.68% | 5.52% | 1.40% | -0.16% | 2.22% | 5.02% | 7.50% | 3.17% |

| Citigroup US | | | | | | | | | | |

| Treasury/Agency | | | | | | | | | | |

| 1- to 3-Year Index | 3.72% | 9.77% | 5.61% | 6.71% | 2.45% | -0.27% | 2.41% | 5.11% | 8.91% | 3.88% |

| |

| |

| Total Annual Fund Operating Expenses | |

| Investor Class | Advisor Class |

| 0.57% | 0.82% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. As interest rates rise, bond values will decline.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

19

Portfolio Commentary

Short-Term Government

Portfolio Managers: Bob Gahagan, Hando Aguilar, Brian Howell, Dan Shiffman, and Jim Platz

Performance Summary

Short-Term Government returned 3.17%* for the 12 months ended March 31, 2009. By comparison, the Citigroup US Treasury/Agency 1- to 3-Year Index returned 3.88%. See page 18 for additional performance comparisons. Portfolio returns reflect operating expenses, while Citigroup index returns do not.

The portfolio’s positive absolute returns reflected the performance of short-term government bonds in a difficult period for the economy and financial markets (see page 2). Relative to its benchmark, Short-Term Government lagged as a result of some of our sector allocation decisions.

Underweight Treasuries Detracted

Our sector allocation decisions were key drivers of Short-Term Government’s relative results. The main reason the portfolio lagged its benchmark was its underweight position in Treasury bonds. We viewed Treasuries as the least attractive segment of the market given record low yields at a time of massive government borrowing, as well as policies that are likely to prove inflationary down the road. Unfortunately, safe-haven buying made Treasuries one of the best-performing segments of the market in the 12 months.

In addition, within our Treasury allocation we held inflation-protected securities (TIPS), which trailed plain-vanilla Treasury bonds. We added these securities when the yield difference between nominal and inflation-adjusted 10-year Treasuries was so narrow as to suggest inflation would run at less than 1% a year for the life of the bonds. We think that is much too low given the unprecedented, and ultimately inflationary, policies the government is pursuing to support the economy and financial system. We believe this is likely to be an effective long-term trade—buying future inflation protection at very cheap levels—though it detracted from results during the period.

Mortgages Had Mixed Effect

On a positive note, it helped that the portfolio held an overweight position in high-quality agency mortgage-backed securities (MBS). Government agency MBS were the best-performing segment of the market in the last 12 months because of explicit government steps aimed at supporting the issuers of these bonds and driving down mortgage rates. However, those policies meant a big increase in expectations for home loan refinancing, which is undesirable for MBS investors. To combat the effects of mortgage prepayments, we held a sizable stake in commercial MBS (CMBS) and types of collateralized mortgage obligations (CMOs) that offer more dependable cash flows. Unfortunately, these bonds underperformed in the extreme market conditions of late 2008 because they’re less liquid than traditional passthrough MBS.

*All fund returns referenced in this commentary are for Investor Class shares.

20

Short-Term Government

Other Notable Trades

We made a number of other notable sector trades in the 12 months, building positions in high-quality segments of the market that we believed were significantly oversold as a result of the dislocations in the market. For example, we added pre-refunded municipal bonds (refinanced municipal bonds backed by Treasury bonds) and government-backed securities (“government agency equivalents” issued by financial institutions and guaranteed by the Federal Deposit Insurance Corporation, or FDIC) that offer yields above Treasury securities. These are the sorts of trades we look for in an attempt to add value over time—adding yield with little or no additional risk.

And we helped performance by eliminating our long-running yield curve steepening trade near where the curve hit its steepest slope in November. The curve subsequently flattened significantly as long-term Treasuries rallied on worries about deflation.

Outlook

“Despite extraordinary intervention and stimulus provided by the government and central bank, we expect the credit crisis will continue and overall economic conditions will remain weak for some time,“ said Portfolio Manager Bob Gahagan. “In that environment, we believe we’re finding opportunities to add long-term value by starting to build positions in investment-grade municipals, TIPS, and higher-yielding paper that carries government backing. In the MBS slice, we’re likely to continue to focus on seasoned securities or those structured with protection from prepayments in an attempt to support the portfolio’s yield and total return characteristics in an environment of rising mortgage refinancings.”

21

| | |

| Short-Term Government | | |

| |

| Portfolio at a Glance | | |

| | As of 3/31/09 | As of 3/31/08 |

| Average Duration (effective) | 1.7 years | 1.6 years |

| Weighted Average Life | 1.9 years | 2.6 years |

| |

| Yields as of March 31, 2009 | | |

| 30-Day SEC Yield | | |

| Investor Class | | 1.92% |

| Advisor Class | | 1.67% |

| |

| Types of Investments in Portfolio | | |

| | % of | % of |

| | fund investments | fund investments |

| | as of 3/31/09 | as of 9/30/08 |

| U.S. Treasury Securities | 37.9% | 46.7% |

| Collateralized Mortgage Obligations & | | |

| Commercial Mortgage-Backed Securities | 28.9% | 31.4% |

| U.S. Government Agency Securities and Equivalents | 22.4% | 10.1% |

| U.S. Government Agency Mortgage-Backed Securities | 5.1% | 8.3% |

| Municipal Securities | 2.9% | 1.4% |

| Asset-Backed Securities | —(1) | —(1) |

| Temporary Cash Investments | 2.8% | 2.1% |

| (1) Category is less than 0.05% of total investments. | | |

22

|

| Shareholder Fee Examples (Unaudited) |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/ exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2008 to March 31, 2009.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

23

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | |

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period(1) | Annualized |

| | 10/1/08 | 3/31/09 | 10/1/08 – 3/31/09 | Expense Ratio(1) |

| Ginnie Mae | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,062.10 | $2.83 | 0.55% |

| (after waiver)(2) | | | | |

| Investor Class | $1,000 | $1,062.10(3) | $2.93 | 0.57% |

| (before waiver) | | | | |

| Institutional Class | $1,000 | $1,063.10 | $1.80 | 0.35% |

| (after waiver)(2) | | | | |

| Institutional Class | $1,000 | $1,063.10(3) | $1.90 | 0.37% |

| (before waiver) | | | | |

| Advisor Class | $1,000 | $1,060.80 | $4.11 | 0.80% |

| (after waiver)(2) | | | | |

| Advisor Class | $1,000 | $1,060.80(3) | $4.21 | 0.82% |

| (before waiver) | | | | |

| R Class (after waiver)(2) | $1,000 | $1,059.40 | $5.39 | 1.05% |

| R Class (before waiver) | $1,000 | $1,059.40(3) | $5.49 | 1.07% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,022.19 | $2.77 | 0.55% |

| (after waiver)(2) | | | | |

| Investor Class | $1,000 | $1,022.09 | $2.87 | 0.57% |

| (before waiver) | | | | |

| Institutional Class | $1,000 | $1,023.19 | $1.77 | 0.35% |

| (after waiver)(2) | | | | |

| Institutional Class | $1,000 | $1,023.09 | $1.87 | 0.37% |

| (before waiver) | | | | |

| Advisor Class | $1,000 | $1,020.94 | $4.03 | 0.80% |

| (after waiver)(2) | | | | |

| Advisor Class | $1,000 | $1,020.84 | $4.13 | 0.82% |

| (before waiver) | | | | |

| R Class (after waiver)(2) | $1,000 | $1,019.70 | $5.29 | 1.05% |

| R Class (before waiver) | $1,000 | $1,019.60 | $5.39 | 1.07% |

| (1) | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

| (2) | During the six months ended March 31, 2009, the investment advisor waived a portion of the class’s management fee. |

| (3) | Ending account value assumes the return earned after waiver. The return would have been lower had fees not been waived and would have resulted in a lower ending account value. |

24

| | | | | |

| | Beginning | Ending | Expenses Paid | |

| Account Value | Account Value | During Period(1) | Annualized |

| | 10/1/08 | 3/31/09 | 10/1/08 – 3/31/09 | Expense Ratio(1) |

| Government Bond | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,067.30 | $2.53 | 0.49% |

| Advisor Class | $1,000 | $1,065.90 | $3.81 | 0.74% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,022.49 | $2.47 | 0.49% |

| Advisor Class | $1,000 | $1,021.24 | $3.73 | 0.74% |

| Inflation-Adjusted Bond | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,024.10 | $2.47 | 0.49% |

| Institutional Class | $1,000 | $1,025.00 | $1.46 | 0.29% |

| Advisor Class | $1,000 | $1,023.20 | $3.73 | 0.74% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,022.49 | $2.47 | 0.49% |

| Institutional Class | $1,000 | $1,023.49 | $1.46 | 0.29% |

| Advisor Class | $1,000 | $1,021.24 | $3.73 | 0.74% |

| Short-Term Government | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,025.60 | $2.88 | 0.57% |

| Advisor Class | $1,000 | $1,024.40 | $4.14 | 0.82% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,022.09 | $2.87 | 0.57% |

| Advisor Class | $1,000 | $1,020.84 | $4.13 | 0.82% |

| (1) | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

25

|

| Schedule of Investments |

| Ginnie Mae |

| | | | | | |

| MARCH 31, 2009 | | | | | | |

| | | | | | | |

| | Principal | | | | Principal | |

| | Amount | Value | | | Amount | Value |

| U.S. Government Agency | | | GNMA, 8.15%, 1/15/20 | | |

| Mortgage-Backed Securities(1) — 99.2% | | | to 2/15/21(3) | $ 148,453 | $ 159,496 |

| | | | | GNMA, 8.25%, 10/20/16 | | |

| ADJUSTABLE-RATE U.S. GOVERNMENT AGENCY | | to 5/15/27(3) | 584,047 | 626,781 |

| MORTGAGE-BACKED SECURITIES — 1.7% | | | GNMA, 8.35%, 11/15/20(3) | 48,039 | 51,848 |

| GNMA, VRN, 3.00%, | | | | GNMA, 8.50%, 1/20/13 | | |

| 1/1/10 | $ 2,897,036 | $ 2,846,456 | | to 12/15/30(3) | 2,299,836 | 2,492,840 |

| GNMA, VRN, 4.50%, | | | | GNMA, 8.75%, 1/15/17 | | |

| 1/1/10 | 6,520,695 | 6,523,133 | | to 7/15/27(3) | 223,781 | 241,674 |

| GNMA, VRN, 5.00%, | | | | GNMA, 9.00%, 4/15/09 | | |

| 10/1/09 | 16,086,119 | 16,185,092 | | to 1/15/25(3) | 1,412,281 | 1,526,921 |

| | | 25,554,681 | | GNMA, 9.25%, 9/15/16 | | |

| FIXED-RATE U.S. GOVERNMENT AGENCY | | | to 3/15/25(3) | 264,224 | 288,307 |

| MORTGAGE-BACKED SECURITIES — 97.5% | | | GNMA, 9.50%, 7/15/09 | | |

| GNMA, 5.00%, settlement | | | | to 7/20/25(3) | 504,840 | 554,290 |

| date 4/21/09(2) | 38,000,000 | 39,353,826 | | GNMA, 9.75%, 8/15/17 | | |

| GNMA, 5.50%, settlement | | | | to 11/20/21(3) | 142,786 | 154,893 |

| date 4/21/09(2) | 76,000,000 | 78,992,652 | | GNMA, 10.00%, 11/15/09 | | |

| GNMA, 6.00%, settlement | | | | to 1/15/22(3) | 146,541 | 161,108 |

| date 4/21/09(2) | 57,500,000 | 60,015,625 | | GNMA, 10.25%, 5/15/12 | | |

| GNMA, 4.50%, 7/15/33 | | | | to 2/15/19(3) | 52,959 | 58,219 |

| to 3/20/38 | 9,669,972 | 9,898,380 | | GNMA, 10.50%, 3/15/14 | | |

| GNMA, 5.00%, 6/15/33 | | | | to 4/20/19(3) | 85,188 | 95,442 |

| to 3/20/39(3) | 134,600,962 | 140,100,001 | | GNMA, 11.00%, 12/15/09 | | |

| GNMA, 5.50%, 4/15/33 | | | | to 6/15/20(3) | 89,398 | 97,880 |

| to 3/20/39(3) | 514,550,573 | 536,556,968 | | GNMA, 11.25%, 2/20/16(3) | 2,263 | 2,554 |

| GNMA, 6.00%, 7/20/16 | | | | GNMA, 11.50%, 2/15/13 | | |

| to 2/20/39(3) | 445,993,253 | 466,538,273 | | to 10/20/18(3) | 7,404 | 8,388 |

| GNMA, 6.50%, 6/15/23 | | | | GNMA, 12.00%, 3/15/11 | | |

| to 11/15/38(3) | 84,770,849 | 89,557,799 | | to 12/15/12(3) | 10,237 | 11,177 |

| GNMA, 7.00%, 5/15/17 | | | | GNMA, 12.25%, 2/15/14(3) | 4,537 | 5,234 |

| to 12/20/29(3) | 11,879,289 | 12,734,404 | | GNMA, 12.50%, 6/15/10 | | |

| GNMA, 7.25%, 4/15/23 | | | | to 12/15/13(3) | 29,653 | 32,225 |

| to 6/15/23(3) | 64,492 | 68,899 | | GNMA, 13.00%, 1/15/11 | | |

| GNMA, 7.50%, 6/15/13 | | | | to 8/15/15(3) | 71,681 | 82,293 |

| to 11/15/31(3) | 9,226,489 | 9,940,553 | | GNMA, 13.50%, 5/15/10 | | |

| GNMA, 7.65%, 6/15/16 | | | | to 8/15/14(3) | 29,835 | 34,831 |

| to 12/15/16(3) | 96,706 | 102,982 | | GNMA, 13.75%, 8/15/14(3) | 5,944 | 7,144 |

| GNMA, 7.75%, 11/15/22 | | | | GNMA, 14.00%, 6/15/11 | | |

| to 6/20/23(3) | 69,781 | 74,458 | | to 7/15/11(3) | 2,042 | 2,310 |

| GNMA, 7.77%, 4/15/20 | | | | GNMA, 14.50%, 10/15/12 | | |

| to 6/15/20(3) | 247,289 | 265,888 | | to 12/15/12(3) | 14,730 | 17,244 |

| GNMA, 7.85%, 9/20/22(3) | 34,575 | 36,932 | | GNMA, 15.00%, 7/15/11 | | |

| GNMA, 7.89%, 9/20/22(3) | 15,011 | 16,050 | | to 10/15/12(3) | 20,566 | 23,866 |

| GNMA, 7.98%, 6/15/19(3) | 97,460 | 105,135 | | | | 1,454,120,954 |

| GNMA, 8.00%, 2/20/17 | | | | TOTAL U.S. GOVERNMENT AGENCY | |

| to 7/20/30(3) | 2,800,031 | 3,025,164 | | MORTGAGE-BACKED SECURITIES | |

| | | | | (Cost $1,447,704,483) | | 1,479,675,635 |

26

| | | | | | |

| Ginnie Mae |

| |

| |

| | Principal | | | | Principal | |

| | Amount | Value | | | Amount | Value |

| U.S. Government Agency Collateralized | | GNMA, Series 2002-50, | | |

| Mortgage Obligations(1) — 12.0% | | | Class PD, 6.00%, | | |

| | | | 5/20/31(3) | $ 4,967,969 | $ 4,985,621 |

| GNMA, Series 1998-6, | | | | GNMA, Series 2002-57, | | |

| Class FA, VRN, 1.07%, | | | | Class PD, 6.00%, | | |

| 4/16/09, resets monthly | | | | 6/20/31(3) | 1,052,479 | 1,053,039 |

| off the 1-month LIBOR | | | | GNMA, Series 2002-60, | | |

| plus 0.51% with a cap | | | | Class PE, 6.00%, 7/20/31(3) | 436,882 | 439,992 |

| of 9.00%(3) | $ 4,158,827 | $ 4,131,621 | | GNMA, Series 2003-10, | | |

| GNMA, Series 1998-17, | | | | Class JC, 6.00%, | | |

| Class F, VRN, 1.06%, | | | | 4/20/30(3) | 171,480 | 172,052 |

| 4/16/09, resets monthly | | | | GNMA, Series 2003-14, | | |

| off the 1-month LIBOR | | | | Class F, VRN, 0.90%, | | |

| plus 0.50% with a cap | | | | 4/20/09, resets monthly | | |

| of 9.00%(3) | 506,268 | 502,690 | | off the 1-month LIBOR | | |

| GNMA, Series 2000-22, | | | | plus 0.35% with a cap | | |

| Class FG, VRN, 0.76%, | | | | of 7.50%(3) | 504,131 | 502,670 |

| 4/16/09, resets monthly | | | | GNMA, Series 2003-42, | | |

| off the 1-month LIBOR | | | | Class FW, VRN, 0.90%, | | |

| plus 0.20% with a cap | | | | 4/20/09, resets monthly | | |

| of 10.00%(3) | 251,705 | 248,253 | | off the 1-month LIBOR | | |

| GNMA, Series 2001-59, | | | | plus 0.35% with a cap | | |

| Class FD, VRN, 1.06%, | | | | of 7.00%(3) | 2,460,877 | 2,465,112 |

| 4/16/09, resets monthly | | | | GNMA, Series 2003-46, | | |

| off the 1-month LIBOR | | | | Class PA, 5.00%, | | |

| plus 0.50% with a cap | | | | 5/20/29(3) | 12,554,049 | 12,725,909 |

| of 8.50%(3) | 2,434,785 | 2,416,684 | | GNMA, Series 2003-55, | | |

| GNMA, Series 2001-62, | | | | Class PG, 5.00%, | | |

| Class FB, VRN, 1.06%, | | | | 6/20/29(3) | 14,477,929 | 14,696,390 |

| 4/16/09, resets monthly | | | | GNMA, Series 2003-66, | | |

| off the 1-month LIBOR | | | | Class EH, 5.00%, | | |

| plus 0.50% with a cap | | | | 5/20/32(3) | 17,650,000 | 18,432,252 |

| of 8.50%(3) | 5,024,951 | 4,987,585 | | GNMA, Series 2003-66, | | |

| GNMA, Series 2002-13, | | | | Class HF, VRN, 1.00%, | | |

| Class FA, VRN, 1.06%, | | | | 4/20/09, resets monthly | | |

| 4/16/09, resets monthly | | | | off the 1-month LIBOR | | |

| off the 1-month LIBOR | | | | plus 0.45% with a cap | | |

| plus 0.50% with a cap | | | | of 7.50% | 4,964,139 | 4,849,651 |

| of 8.50%(3) | 2,825,446 | 2,803,760 | | GNMA, Series 2003-85, | | |

| GNMA, Series 2002-24, | | | | Class A SEQ, 4.50%, | | |

| Class FA, VRN, 1.06%, | | | | 9/20/27 | 4,413,104 | 4,485,412 |

| 4/16/09, resets monthly | | | | GNMA, Series 2003-85, | | |

| off the 1-month LIBOR | | | | Class BM SEQ, 5.00%, | | |

| plus 0.50% with a cap | | | | 2/20/24 | 1,349,299 | 1,363,302 |

| of 8.50%(3) | 4,985,530 | 4,951,275 | | GNMA, Series 2003-85, | | |

| GNMA, Series 2002-29, | | | | Class BX SEQ, 5.50%, | | |

| Class FA SEQ, VRN, 0.90%, | | | | 2/20/24 | 1,349,299 | 1,363,050 |

| 4/20/09, resets monthly | | | | GNMA, Series 2003-86, | | |

| off the 1-month LIBOR | | | | Class BD SEQ, 5.50%, | | |

| plus 0.35% with a cap | | | | 4/20/30 | 20,459,711 | 20,746,840 |

| of 9.00%(3) | 1,414,255 | 1,395,104 | | GNMA, Series 2003-110, | | |

| GNMA, Series 2002-31, | | | | Class HA SEQ, 5.00%, | | |

| Class FW, VRN, 0.96%, | | | | 5/20/29(3) | 2,832,398 | 2,864,680 |

| 4/16/09, resets monthly | | | | | | |

| off the 1-month LIBOR | | | | | | |

| plus 0.40% with a cap | | | | | | |

| of 8.50%(3) | 1,465,292 | 1,436,002 | | | | |

27

| | | | | | |

| Ginnie Mae |

| |

| |

| | Principal | | | | Principal | |

| | Amount | Value | | | Amount/ | |

| GNMA, Series 2004-30, | | | | | Shares | Value |

| Class PD, 5.00%, | | | | Temporary Cash Investments — 4.7% |

| 2/20/33(3) | $22,223,224 | $ 23,212,735 | | FHLB Discount Notes, | | |

| GNMA, Series 2004-39, | | | | 0.01%, 4/1/09(3)(4) | $ 11,304,000 | $ 11,304,000 |

| Class XF SEQ, VRN, 0.81%, | | | | JPMorgan U.S. Treasury | | |

| 4/16/09, resets monthly | | | | Plus Money Market Fund | | |

| off the 1-month LIBOR | | | | Agency Shares(3) | 3,306,967 | 3,306,967 |

| plus 0.25% with a cap | | | | Repurchase Agreement, Goldman Sachs | |

| of 7.50%(3) | 3,357,568 | 3,365,977 | | Group, Inc. (The), (collateralized by various | |

| GNMA, Series 2004-46, | | | | U.S. Treasury obligations, 6.25%, 5/15/30, | |

| Class BG SEQ, 5.00%, | | | | valued at $57,046,110), in a joint trading | |

| 5/20/25 | 4,792,267 | 4,857,844 | | account at 0.02%, dated 3/31/09, due | |

| GNMA, Series 2004-82, | | | | 4/1/09 (Delivery value $55,969,031)(3) | 55,969,000 |

| Class DM, 5.00%, | | | | | | |

| 10/20/27(3) | 3,050,835 | 3,060,344 | | TOTAL TEMPORARY | | |

| GNMA, Series 2004-87, | | | | CASH INVESTMENTS | | |

| Class LA, 3.625%, | | | | (Cost $70,579,967) | | 70,579,967 |

| 12/20/28(3) | 9,463,449 | 9,496,288 | | TOTAL INVESTMENT | | |

| GNMA, Series 2007-6, | | | | SECURITIES — 115.9% | | |

| Class LA, 5.50%, | | | | (Cost $1,693,243,145) | | 1,728,728,206 |

| 10/20/30 | 7,215,985 | 7,316,203 | | OTHER ASSETS AND | | |

| GNMA, Series 2007-33, | | | | LIABILITIES — (15.9)% | | (236,791,691) |

| Class LA, 5.50%, | | | | TOTAL NET ASSETS — 100.0% | $1,491,936,515 |

| 4/20/31 | 12,915,571 | 13,144,267 | | | | |

| TOTAL U.S. GOVERNMENT | | | | | | |

| AGENCY COLLATERALIZED | | | | | | |

| MORTGAGE OBLIGATIONS | | | | | | |

| (Cost $174,958,695) | | 178,472,604 | | | | |

|

| Notes to Schedule of Investments |

FHLB = Federal Home Loan Bank

GNMA = Government National Mortgage Association

LIBOR = London Interbank Offered Rate

resets = The frequency with which a security’s coupon changes, based on current market conditions or an underlying index. The more frequently a

security resets, the less risk the investor is taking that the coupon will vary significantly from current market rates.

SEQ = Sequential Payer

VRN = Variable Rate Note. Interest reset date is indicated. Rate shown is effective at the period end.

| (1) | Final maturity indicated, unless otherwise noted. |

| (2) | Forward commitment. |

| (3) | Security, or a portion thereof, has been segregated for forward commitments. At the period end, the aggregate value of securities pledged was $178,363,000. |

| (4) | The rate indicated is the yield to maturity at purchase. |

See Notes to Financial Statements.

28

| | | | | | |

| Government Bond | | | | | |

| |

| MARCH 31, 2009 |

| |

| | Principal | | | | Principal | |

| | Amount | Value | | | Amount | Value |

| U.S. Government Agency | | | FNMA, 6.50%, 9/1/47(2) | $ 1,203,506 | $ 1,264,279 |

| Mortgage-Backed Securities(1) — 59.1% | | FNMA, 6.50%, 9/1/47(2) | 1,785,508 | 1,875,670 |

| ADJUSTABLE-RATE U.S. GOVERNMENT AGENCY | | FNMA, 6.00%, 4/1/48(2) | 9,671,136 | 10,075,317 |

| MORTGAGE-BACKED SECURITIES — 0.5% | | | GNMA, 5.50%, settlement | | |

| FNMA, VRN, 5.71%, | | | | date 4/21/09(3) | 30,000,000 | 31,181,310 |

| 12/1/12(2) | $ 5,472,292 | $ 5,667,816 | | GNMA, 5.50%, 12/20/38 | 32,244,365 | 33,562,351 |

| FIXED-RATE U.S. GOVERNMENT AGENCY | | | GNMA, 6.00%, 1/20/39 | 7,818,414 | 8,172,316 |

| MORTGAGE-BACKED SECURITIES — 58.6% | | | GNMA, 5.00%, 3/20/39 | 25,000,000 | 25,942,771 |

| FHLMC, 4.50%, 1/1/19(2) | 4,084,355 | 4,231,476 | | GNMA, 5.50%, 3/20/39 | 10,000,000 | 10,408,927 |

| FHLMC, 5.00%, 5/1/23(2) | 27,370,223 | 28,414,454 | | | | 635,875,144 |

| FHLMC, 5.50%, 10/1/34(2) | 5,716,333 | 5,950,625 | | TOTAL U.S. GOVERNMENT AGENCY | |

| FHLMC, 5.50%, 4/1/38(2) | 70,011,790 | 72,735,166 | | MORTGAGE-BACKED SECURITIES | |

| FHLMC, 6.50%, 7/1/47(2) | 486,458 | 511,417 | | (Cost $620,754,038) | | 641,542,960 |

| FNMA, 6.00%, settlement | | | | U.S. Treasury Securities — 29.7% | |

| date 4/14/09(3) | 69,784,384 | 72,891,952 | | U.S. Treasury Bonds, | | |

| FNMA, 6.50%, settlement | | | | 11.25%, 2/15/15(2) | 13,500,000 | 20,385,000 |

| date 4/14/09(3) | 15,170,000 | 15,978,288 | | U.S. Treasury Bonds, | | |

| FNMA, 4.50%, 5/1/19(2) | 14,921,599 | 15,459,087 | | 10.625%, 8/15/15(2) | 4,500,000 | 6,765,120 |

| FNMA, 5.00%, 9/1/20(2) | 1,203,490 | 1,252,670 | | U.S. Treasury Bonds, | | |

| FNMA, 6.50%, 3/1/32(2) | 632,045 | 670,949 | | 8.125%, 8/15/19(2) | 7,600,000 | 11,024,750 |

| FNMA, 7.00%, 6/1/32(2) | 556,492 | 599,509 | | U.S. Treasury Bonds, | | |

| FNMA, 6.50%, 8/1/32(2) | 823,016 | 874,704 | | 8.125%, 8/15/21(2) | 14,720,000 | 21,891,407 |

| FNMA, 5.50%, 7/1/33(2) | 9,986,683 | 10,410,337 | | U.S. Treasury Bonds, | | |

| FNMA, 5.00%, 11/1/33(2) | 44,511,042 | 46,086,315 | | 7.125%, 2/15/23(2) | 10,700,000 | 15,053,563 |

| FNMA, 5.50%, 8/1/34 | 35,899,720 | 37,377,778 | | U.S. Treasury Bonds, | | |

| FNMA, 5.50%, 9/1/34(2) | 2,670,107 | 2,780,040 | | 6.625%, 2/15/27(2) | 4,500,000 | 6,337,971 |

| FNMA, 5.50%, 10/1/34(2) | 15,672,115 | 16,317,365 | | U.S. Treasury Bonds, | | |

| FNMA, 5.00%, 8/1/35(2) | 9,420,855 | 9,743,961 | | 5.50%, 8/15/28(2) | 5,000,000 | 6,317,190 |

| FNMA, 5.50%, 1/1/36(2) | 35,960,139 | 37,406,972 | | U.S. Treasury Bonds, | | |

| FNMA, 5.00%, 2/1/36(2) | 4,196,817 | 4,340,754 | | 3.50%, 2/15/39(2) | 12,000,000 | 11,895,036 |

| FNMA, 5.50%, 4/1/36(2) | 12,454,230 | 12,955,318 | | U.S. Treasury Inflation | | |

| FNMA, 5.00%, 5/1/36(2) | 19,700,039 | 20,375,689 | | Indexed Bonds, 2.50%, | | |

| FNMA, 5.50%, 12/1/36(2) | 11,850,427 | 12,316,112 | | 1/15/29(2) | 2,889,317 | 3,140,327 |

| FNMA, 5.50%, 2/1/37(2) | 42,282,071 | 43,943,624 | | U.S. Treasury Inflation | | |

| FNMA, 6.50%, 8/1/37(2) | 7,384,066 | 7,761,643 | | Indexed Notes, 3.00%, | | |

| FNMA, 6.00%, 9/1/38 | 5,188,216 | 5,400,051 | | 7/15/12(2) | 13,449,487 | 14,344,712 |

| FNMA, 6.00%, 11/1/38 | 6,822,721 | 7,101,293 | | U.S. Treasury Inflation | | |

| FNMA, 4.50%, 2/1/39 | 14,865,703 | 15,214,007 | | Indexed Notes, 1.375%, | | |

| FNMA, 6.50%, 6/1/47(2) | 283,496 | 297,812 | | 7/15/18(2) | 10,868,565 | 10,814,222 |

| FNMA, 6.50%, 8/1/47(2) | 760,249 | 798,639 | | U.S. Treasury Notes, | | |

| FNMA, 6.50%, 8/1/47(2) | 1,011,917 | 1,063,016 | | 2.625%, 5/31/10(2) | 20,000,000 | 20,474,220 |

| FNMA, 6.50%, 9/1/47(2) | 123,732 | 129,980 | | U.S. Treasury Notes, | | |

| FNMA, 6.50%, 9/1/47(2) | 874,661 | 918,828 | | 0.875%, 3/31/11(2) | 40,000,000 | 40,068,760 |

| FNMA, 6.50%, 9/1/47(2) | 1,030,343 | 1,082,372 | | U.S. Treasury Notes, | | |

| | | | | 4.125%, 8/31/12(2) | 19,750,000 | 21,643,235 |

| | | | | U.S. Treasury Notes, | | |

| | | | 1.875%, 2/28/14(2) | 47,810,000 | 48,366,652 |

| | | | | U.S. Treasury Notes, | | |

| | | | | 4.875%, 8/15/16(2) | 14,538,000 | 17,117,361 |

29

| | | | | | |

| Government Bond |

| |

| |

| | Principal | | | | Principal | |

| | Amount | Value | | | Amount | Value |

| U.S. Treasury Notes, | | | | FHLMC, Series 2892, | | |

| 4.75%, 8/15/17(2) | $ 28,950,000 | $ 33,880,561 | | Class A SEQ, 5.00%, | | |

| U.S. Treasury Notes, | | | | 5/15/21(2) | $ 3,508,268 | $ 3,582,003 |

| 4.00%, 8/15/18(2) | 12,085,000 | 13,437,021 | | FHLMC, Series 2900, | | |

| TOTAL U.S. TREASURY SECURITIES | | | Class PA, 4.50%, 3/15/14(2) | 385,415 | 385,762 |

| (Cost $307,424,725) | | 322,957,108 | | FHLMC, Series 3203, | | |

| | | | | Class VN SEQ, 5.00%, | | |

| Collateralized Mortgage | | | 6/15/22(2) | 10,000,000 | 10,430,820 |

| Obligations(1) — 10.7% | | | FHLMC, Series 3316, | | |

| FHLMC, Series 2560, | | | | Class EA, 5.50%, | | |

| Class FG SEQ, VRN, 1.06%, | | | | 10/15/29(2) | 12,493,913 | 12,775,460 |

| 4/15/09, resets monthly | | | | FHLMC, Series R005, | | |

| off the 1-month LIBOR | | | | Class AB SEQ, 5.50%, | | |

| plus 0.50% with a cap | | | | 12/15/18(2) | 3,082,970 | 3,144,925 |

| of 8.50%(2) | 879,474 | 877,373 | | FNMA, Series 2002-5, | | |

| FHLMC, Series 2625, | | | | Class PJ, 6.00%, | | |

| Class FJ SEQ, VRN, 0.86%, | | | | 10/25/21(2) | 2,870,497 | 3,006,725 |

| 4/15/09, resets monthly | | | | FNMA, Series 2002-89, | | |

| off the 1-month LIBOR | | | | Class CA SEQ, 5.00%, | | |

| plus 0.30% with a cap | | | | 4/25/16(2) | 450,530 | 454,595 |

| of 7.50%(2) | 2,893,201 | 2,879,441 | | FNMA, Series 2003-10, | | |

| FHLMC, Series 2706, | | | | Class HW SEQ, 5.00%, | | |

| Class EB, 5.00%, | | | | 11/25/16(2) | 3,069,446 | 3,124,461 |

| 9/15/20(2) | 6,165,490 | 6,353,771 | | FNMA, Series 2003-14, | | |

| FHLMC, Series 2779, | | | | Class LA SEQ, 5.00%, | | |

| Class FM SEQ, VRN, 0.91%, | | | | 8/25/16(2) | 1,179,634 | 1,196,125 |

| 4/15/09, resets monthly | | | | FNMA, Series 2003-42, | | |

| off the 1-month LIBOR | | | | Class FK, VRN, 0.92%, | | |

| plus 0.35% with a cap | | | | 4/25/09, resets monthly | | |

| of 7.50%(2) | 3,157,775 | 3,119,801 | | off the 1-month LIBOR | | |

| FHLMC, Series 2780, | | | | plus 0.40% with a cap | | |

| Class BD SEQ, 4.50%, | | | | of 7.50%(2) | 3,141,663 | 3,105,254 |

| 10/15/17(2) | 4,607,269 | 4,652,503 | | FNMA, Series 2003-43, | | |

| FHLMC, Series 2812, | | | | Class LF, VRN, 0.87%, | | |

| Class EF SEQ, VRN, 0.96%, | | | | 4/25/09, resets monthly | | |

| 4/15/09, resets monthly | | | | off the 1-month LIBOR | | |

| off the 1-month LIBOR | | | | plus 0.35% with a cap | | |

| plus 0.40% with a cap | | | | of 8.00%(2) | 5,492,225 | 5,437,025 |

| of 7.50%(2) | 6,119,278 | 6,068,353 | | FNMA, Series 2003-52, | | |

| FHLMC, Series 2831, | | | | Class KF SEQ, VRN, 0.92%, | | |

| Class AF, VRN, 0.86%, | | | | 4/25/09, resets monthly | | |

| 4/15/09, resets monthly | | | | off the 1-month LIBOR | | |

| off the 1-month LIBOR | | | | plus 0.40% with a cap | | |

| plus 0.30% with a cap | | | | of 7.50%(2) | 4,746,114 | 4,697,253 |

| of 7.50%(2) | 4,771,626 | 4,698,243 | | FNMA, Series 2004 W5, | | |

| FHLMC, Series 2836, | | | | Class F1, VRN, 0.97%, | | |

| Class ND, 4.00%, | | | | 4/25/09, resets monthly | | |

| 7/15/13(2) | 556,035 | 556,069 | | off the 1-month LIBOR | | |

| FHLMC, Series 2855, | | | | plus 0.45% with a cap | | |

| Class FK SEQ, VRN, 0.91%, | | | | of 7.50%(2) | 4,947,758 | 4,818,801 |

| 4/15/09, resets monthly | | | | FNMA, Series 2005-47, | | |

| off the 1-month LIBOR | | | | Class AN SEQ, 5.00%, | | |

| plus 0.35% with a cap | | | | 12/25/16(2) | 1,080,179 | 1,101,594 |

| of 7.50%(2) | 8,634,464 | 8,537,882 | | | | |

30

| | | | | | |

| Government Bond |

| |

| |

| | Principal | | | | Principal | |

| | Amount | Value | | | Amount | Value |

| FNMA, Series 2006-44, | | | | Asset-Backed Securities(1) — 0.7% |

| Class OA, 5.50%, | | | | FHLMC, Series T20, | | |

| 12/25/26(2) | $ 8,072,010 | $ 8,268,705 | | Class A7, VRN, 0.82%, | | |

| GNMA, Series 2004-30, | | | | 4/27/09, resets monthly off | | |

| Class PD, 5.00%, | | | | the 1-month LIBOR plus | | |

| 2/20/33(2) | 12,000,000 | 12,534,312 | | 0.15% with no caps(2) | $ 2,416,436 | $ 2,138,108 |

| TOTAL COLLATERALIZED | | | | FHLMC, Series T21, | | |

| MORTGAGE OBLIGATIONS | | | | Class A, VRN, 0.88%, | | |

| (Cost $113,826,211) | | 115,807,256 | | 4/27/09, resets monthly off | | |

| U.S. Government Agency Securities | | the 1-month LIBOR plus | | |

| and Equivalents — 10.4% | | | 0.18% with no caps(2) | 4,754,135 | 4,351,269 |

| | | | FHLMC, Series T34, | | |

| FIXED-RATE U.S. GOVERNMENT | | | Class A1V, VRN, 0.76%, | | |

| AGENCY SECURITIES — 4.6% | | | 4/27/09, resets monthly off | | |

| FHLMC, 5.00%, 6/11/09(2) | 8,800,000 | 8,876,182 | | the 1-month LIBOR plus | | |

| FHLMC, 5.00%, 1/30/14(2) | 16,490,000 | 18,324,842 | | 0.12% with no caps(2) | 718,178 | 649,340 |

| FNMA, 1.75%, 3/23/11(2) | 9,650,000 | 9,718,698 | | FHLMC, Series T35, | | |

| FNMA, 2.75%, 3/13/14(2) | 5,000,000 | 5,067,850 | | Class A, VRN, 0.80%, | | |

| FNMA, 5.00%, 2/13/17(2) | 7,250,000 | 7,947,610 | | 4/27/09, resets monthly off | | |

| | | 49,935,182 | | the 1-month LIBOR plus | | |

| | | | | 0.14% with no caps(2) | 586,305 | 535,202 |

| GOVERNMENT-BACKED CORPORATE BONDS — 5.8% | | TOTAL ASSET-BACKED SECURITIES | |

| Bank of America Corp., | | | | (Cost $8,481,163) | | 7,673,919 |

| 3.125%, 6/15/12(2)(4) | 20,000,000 | 20,709,320 | | | Shares | |

| General Electric Capital | | | | | | |

| Corp., 1.80%, 3/11/11(2)(4) | 5,000,000 | 5,016,530 | | Temporary Cash Investments — 4.6% |

| General Electric Capital | | | | JPMorgan U.S. Treasury | | |

| Corp., 2.20%, 6/8/12(2)(4) | 9,150,000 | 9,217,198 | | Plus Money Market Fund | | |

| Goldman Sachs Group LP, | | | | Agency Shares | 1,075 | 1,075 |

| 3.25%, 6/15/12(2)(4) | 5,000,000 | 5,223,545 | | Repurchase Agreement, Bank of America | |

| Goldman Sachs Group, Inc. | | | | Securities, LLC, (collateralized by various | |

| (The), 1.625%, 7/15/11(2)(4) | 3,500,000 | 3,505,295 | | U.S. Treasury obligations, 0.875%, 2/28/11, | |

| Morgan Stanley, 2.00%, | | | | valued at $50,897,147), in a joint trading | |

| 9/22/11(2)(4) | 6,700,000 | 6,744,990 | | account at 0.07%, dated 3/31/09, due | |

| State Street Corp., 2.15%, | | | | 4/1/09 (Delivery value $49,862,097)(2) | 49,862,000 |

| 4/30/12(2)(4) | 7,500,000 | 7,536,803 | | TOTAL TEMPORARY | | |

| Wells Fargo & Co., 3.00%, | | | | CASH INVESTMENTS | | |

| 12/9/11(2)(4) | 4,500,000 | 4,656,272 | | (Cost $49,863,075) | | 49,863,075 |

| | | 62,609,953 | | TOTAL INVESTMENT | | |

| | | | | SECURITIES — 115.2% | | |

| TOTAL U.S. GOVERNMENT AGENCY | | | (Cost $1,210,106,228) | | 1,250,389,453 |

| SECURITIES AND EQUIVALENTS | | | OTHER ASSETS AND | | |

| (Cost $109,757,016) | | 112,545,135 | | LIABILITIES — (15.2)% | | (164,600,496) |

| | | | | TOTAL NET ASSETS — 100.0% | $1,085,788,957 |

31

| | | | |

| Government Bond | | | |

| |

| Futures Contracts | | | |

| | | | Underlying Face | |

| | Contracts Sold | Expiration Date | Amount at Value | Unrealized Gain (Loss) |

| 113 | U.S. Treasury 10-Year Notes | June 2009 | $14,020,828 | $(378,097) |

| 100 | U.S. Treasury 5-Year Notes | June 2009 | 11,876,563 | (90,069) |

| | | | $25,897,391 | $(468,166) |

| |

| Notes to Schedule of Investments | | |

Equivalent = Security whose principal payments are backed by the full faith and credit of the United States

FHLMC = Federal Home Loan Mortgage Corporation

FNMA = Federal National Mortgage Association

GNMA = Government National Mortgage Association

LIBOR = London Interbank Offered Rate

resets = The frequency with which a security’s coupon changes, based on current market conditions or an underlying index. The more frequently a

security resets, the less risk the investor is taking that the coupon will vary significantly from current market rates.

SEQ = Sequential Payer

VRN = Variable Rate Note. Interest reset date is indicated. Rate shown is effective at the period end.

| (1) | Final maturity indicated, unless otherwise noted. |

| (2) | Security, or a portion thereof, has been segregated for forward commitments and/or futures contracts. At the period end, the aggregate value of securities pledged was $145,949,000. |

| (3) | Forward commitment. |