UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

| Investment Company Act file number | 811-04363 |

| | |

| AMERICAN CENTURY GOVERNMENT INCOME TRUST |

| (Exact name of registrant as specified in charter) |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 03-31 |

| | |

| Date of reporting period: | 3-31-2018 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

| | |

| | Annual Report |

| | |

| | March 31, 2018 |

| | |

| | Capital Preservation Fund |

| | Investor Class (CPFXX) |

|

| |

| President’s Letter | 2 |

| Performance | 3 |

| Fund Characteristics | |

| Shareholder Fee Example | |

| Schedule of Investments | |

| Statement of Assets and Liabilities | |

| Statement of Operations | |

| Statement of Changes in Net Assets | |

| Notes to Financial Statements | |

| Financial Highlights | |

| Report of Independent Registered Public Accounting Firm | |

| Management | |

| Additional Information | |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended March 31, 2018. Annual reports help convey important information about fund returns, including market factors that affected performance during the reporting period. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

Rally Rolled On, Until Volatility Resurfaced

For most of the 12-month period, broad U.S. stock and bond indices generated positive returns. Stocks generally rallied against a backdrop of robust corporate earnings results, steady economic growth, relatively low interest rates, and U.S. tax reform. For bonds, modest economic gains, relatively muted inflation, and gradual—and well telegraphed—tightening from the Federal Reserve (the Fed) continued to support positive performance.

Then, in early February, a force that was largely dormant during 2017—volatility—re-emerged. Robust U.S. wage growth triggered expectations for rising inflation, higher interest rates, and a more-hawkish Fed. Treasury yields climbed to their highest levels in several years, and stock prices plunged into correction territory. Economic data released in March helped calm the unrest, while the Fed's March rate hike, which investors had expected, had little impact. Markets recovered much of the previous weeks’ losses, until a fresh round of worries emerged. President Trump announced the U.S. would implement tariffs on certain imports from China, sparking fears of a global trade war and triggering a flight to quality in the financial markets.

Despite the resurgence of volatility late in the period, U.S. stocks (S&P 500 Index) delivered a total return of 13.99% for the 12 months. Continuing a long-standing trend, growth stocks significantly outperformed their value counterparts across the capitalization spectrum. Meanwhile, the March flight to quality helped bonds hang onto the modest gains generated ahead of the market turbulence, and investment-grade bonds (Bloomberg Barclays U.S. Aggregate Bond Index) returned 1.20% for the 12-month period.

With inflationary pressures mounting, Treasury yields rising, volatility resurfacing, and the implications of tax reform still unfolding, investors likely will face new opportunities and challenges in the months ahead. We believe this scenario warrants a disciplined, diversified, and risk-aware approach, using professionally managed portfolios in pursuit of investment goals. We appreciate your continued trust and confidence in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | | |

| Total Returns as of March 31, 2018 | | |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | 5 years | 10 years | Inception Date |

| Investor Class | CPFXX | 0.63% | 0.14% | 0.16% | 10/13/72 |

Fund returns would have been lower if a portion of the fees had not been waived.

|

| | |

| Total Annual Fund Operating Expenses |

| Investor Class | 0.48% | |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

The 7-day current yield more closely reflects the current earnings of the fund than the total return.

|

| |

| MARCH 31, 2018 | |

| Yields | |

| 7-Day Current Yield | 1.08% |

| 7-Day Effective Yield | 1.09% |

| | |

| Portfolio at a Glance | |

| Weighted Average Maturity | 39 days |

| Weighted Average Life | 51 days |

| | |

| Portfolio Composition by Maturity | % of fund investments |

| 1-30 days | 49% |

| 31-90 days | 40% |

| 91-180 days | 11% |

| More than 180 days | 0% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2017 to March 31, 2018.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| | Beginning

Account Value

10/1/17 | Ending

Account Value

3/31/18 | Expenses Paid

During Period(1)

10/1/17 - 3/31/18 | Annualized

Expense Ratio(1) |

| Actual | | | | |

| Investor Class | $1,000 | $1,004.00 | $2.40 | 0.48% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,022.54 | $2.42 | 0.48% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses. |

MARCH 31, 2018

|

| | | | | | |

| | Principal Amount | Value |

U.S. TREASURY NOTES(1) — 12.3% | | |

| U.S. Treasury Notes, 2.375%, 6/30/18 | $ | 8,000,000 |

| $ | 8,011,984 |

|

U.S. Treasury Notes, VRN, 1.77%, 4/2/18, resets daily off the 3-month USBMMY | 10,000,000 |

| 9,994,300 |

|

U.S. Treasury Notes, VRN, 1.82%, 4/2/18, resets daily off the 3-month USBMMY plus 0.05% | 5,000,000 |

| 4,999,842 |

|

U.S. Treasury Notes, VRN, 1.83%, 4/2/18, resets daily off the 3-month USBMMY plus 0.06% | 7,182,000 |

| 7,181,992 |

|

U.S. Treasury Notes, VRN, 1.94%, 4/2/18, resets daily off the 3-month USBMMY plus 0.17% | 15,000,000 |

| 15,000,350 |

|

U.S. Treasury Notes, VRN, 1.94%, 4/2/18, resets daily off the 3-month USBMMY plus 0.17% | 50,000,000 |

| 50,002,758 |

|

U.S. Treasury Notes, VRN, 1.96%, 4/2/18, resets daily off the 3-month USBMMY plus 0.19% | 90,000,000 |

| 90,000,240 |

|

| U.S. Treasury STRIPS - COUPON, 1.22%, 5/15/18 | 60,000,000 |

| 59,910,906 |

|

| U.S. Treasury STRIPS - COUPON, 1.31%, 8/15/18 | 10,000,000 |

| 9,951,930 |

|

| TOTAL U.S. TREASURY NOTES | | 255,054,302 |

|

U.S. TREASURY BILLS(1) — 76.2% | | |

| U.S. Treasury Bills, 1.64%, 4/5/18 | 112,000,000 |

| 111,982,380 |

|

| U.S. Treasury Bills, 1.65%, 4/12/18 | 235,000,000 |

| 234,893,804 |

|

| U.S. Treasury Bills, 1.65%, 4/19/18 | 150,000,000 |

| 149,890,750 |

|

| U.S. Treasury Bills, 1.61%, 4/26/18 | 100,000,000 |

| 99,901,042 |

|

| U.S. Treasury Bills, 1.65%, 5/3/18 | 150,000,000 |

| 149,810,000 |

|

| U.S. Treasury Bills, 1.65%, 5/10/18 | 100,000,000 |

| 99,837,500 |

|

| U.S. Treasury Bills, 1.66%, 5/17/18 | 100,000,000 |

| 99,796,194 |

|

| U.S. Treasury Bills, 1.67%, 5/24/18 | 150,000,000 |

| 149,640,042 |

|

| U.S. Treasury Bills, 1.69%, 5/31/18 | 25,000,000 |

| 24,941,042 |

|

| U.S. Treasury Bills, 1.68%, 6/7/18 | 125,000,000 |

| 124,662,674 |

|

| U.S. Treasury Bills, 1.68%, 6/14/18 | 130,891,500 |

| 130,442,178 |

|

| U.S. Treasury Bills, 1.71%, 6/28/18 | 200,000,000 |

| 199,139,555 |

|

| TOTAL U.S. TREASURY BILLS | | 1,574,937,161 |

|

| TOTAL INVESTMENT SECURITIES — 88.5% | | 1,829,991,463 |

|

OTHER ASSETS AND LIABILITIES(2) — 11.5% | | 237,482,033 |

|

| TOTAL NET ASSETS — 100.0% | | $ | 2,067,473,496 |

|

|

| | |

| NOTES TO SCHEDULE OF INVESTMENTS |

| resets | - | The frequency with which a security's coupon changes, based on current market conditions or an underlying index. |

| STRIPS | - | Separate Trading of Registered Interest and Principal of Securities |

| USBMMY | - | United States Treasury Bill Money Market Yield |

| VRN | - | Variable Rate Note. Interest reset date is indicated. Rate shown is effective at the period end. |

| |

| (1) | The rates for U.S. Treasury Bills are the yield to maturity at purchase. The rates for U.S. Treasury Notes are the stated coupon rates. |

| |

| (2) | Amount relates primarily to receivable for investments sold, but not settled, at period end. |

See Notes to Financial Statements.

|

|

| Statement of Assets and Liabilities |

|

| | | |

| MARCH 31, 2018 | |

| Assets | |

| Investment securities, at value (amortized cost and cost for federal income tax purposes) | $ | 1,829,991,463 |

|

| Cash | 83,467,793 |

|

| Receivable for investments sold | 159,040,934 |

|

| Receivable for capital shares sold | 4,401,823 |

|

| Interest receivable | 1,418,730 |

|

| | 2,078,320,743 |

|

| | |

| Liabilities | |

| Payable for investments purchased | 10,021,931 |

|

| Accrued management fees | 825,316 |

|

| | 10,847,247 |

|

| | |

| Net Assets | $ | 2,067,473,496 |

|

| | |

| Investor Class Capital Shares | |

| Shares outstanding (unlimited number of shares authorized) | 2,067,530,020 |

|

| | |

| Net Asset Value Per Share | $ | 1.00 |

|

| | |

| Net Assets Consist of: | |

| Capital paid in | $ | 2,067,532,910 |

|

| Undistributed net investment income | 1,596 |

|

| Accumulated net realized loss | (61,010 | ) |

| | $ | 2,067,473,496 |

|

See Notes to Financial Statements.

|

| | | |

| YEAR ENDED MARCH 31, 2018 | |

| Investment Income (Loss) | |

| Income: | |

| Interest | $ | 23,167,442 |

|

| | |

| Expenses: | |

| Management fees | 9,913,806 |

|

| Trustees' fees and expenses | 127,683 |

|

| Other expenses | 1,786 |

|

| | 10,043,275 |

|

| | |

| Net investment income (loss) | 13,124,167 |

|

| | |

| Net realized gain (loss) on investment transactions | (61,010 | ) |

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 13,063,157 |

|

See Notes to Financial Statements.

|

|

| Statement of Changes in Net Assets |

|

| | | | | | |

| YEARS ENDED MARCH 31, 2018 AND MARCH 31, 2017 |

| Increase (Decrease) in Net Assets | March 31, 2018 | March 31, 2017 |

| Operations | | |

| Net investment income (loss) | $ | 13,124,167 |

| $ | 646,797 |

|

| Net realized gain (loss) | (61,010 | ) | 5,802 |

|

| Net increase (decrease) in net assets resulting from operations | 13,063,157 |

| 652,599 |

|

| | | |

| Distributions to Shareholders | | |

| From net investment income | (13,124,167 | ) | (646,797 | ) |

| From net realized gains | — |

| (38,100 | ) |

| Decrease in net assets from distributions | (13,124,167 | ) | (684,897 | ) |

| | | |

| Capital Share Transactions | | |

| Proceeds from shares sold | 630,496,615 |

| 756,945,561 |

|

| Proceeds from reinvestment of distributions | 12,971,694 |

| 684,897 |

|

| Payments for shares redeemed | (790,984,388 | ) | (786,310,115 | ) |

| Net increase (decrease) in net assets from capital share transactions | (147,516,079 | ) | (28,679,657 | ) |

| | | |

| Net increase (decrease) in net assets | (147,577,089 | ) | (28,711,955 | ) |

| | | |

| Net Assets | | |

| Beginning of period | 2,215,050,585 |

| 2,243,762,540 |

|

| End of period | $ | 2,067,473,496 |

| $ | 2,215,050,585 |

|

| | | |

| Undistributed net investment income | $ | 1,596 |

| $ | 1,596 |

|

| | | |

| Transactions in Shares of the Fund | | |

| Sold | 630,496,615 |

| 756,945,561 |

|

| Issued in reinvestment of distributions | 12,971,694 |

| 684,897 |

|

| Redeemed | (790,984,388 | ) | (786,310,115 | ) |

| Net increase (decrease) in shares of the fund | (147,516,079 | ) | (28,679,657 | ) |

See Notes to Financial Statements.

|

|

| Notes to Financial Statements |

MARCH 31, 2018

1. Organization

American Century Government Income Trust (the trust) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Massachusetts business trust. Capital Preservation Fund (the fund) is one fund in a series issued by the trust. The fund is a money market fund and its investment objective is to seek maximum safety and liquidity. Its secondary objective is to seek to pay shareholders the highest rate of return consistent with safety and liquidity.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value (NAV) per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. Investments are generally valued at amortized cost, which approximates fair value. Open-end management investment companies are valued at the reported NAV per share. If the fund determines that the valuation methods do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Trustees or its delegate, in accordance with policies and procedures adopted by the Board of Trustees.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Treasury Roll Transactions — The fund purchases a security and at the same time makes a commitment to sell the same security at a future settlement date at a specified price. These types of transactions are known as treasury roll transactions. The difference between the purchase price and the sale price represents interest income reflective of an agreed upon rate between the fund and the counterparty.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Distributions to Shareholders — Distributions from net investment income, if any, are declared daily and paid monthly. The fund may make capital gains distributions to comply with the distribution requirements of the Internal Revenue Code.

Indemnifications — Under the trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Certain officers and trustees of the trust are also officers and/or directors of American Century Companies, Inc. (ACC). The trust's investment advisor, American Century Investment Management, Inc. (ACIM), the trust's distributor, American Century Investment Services, Inc., and the trust's transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

Management Fees — The trust has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee). The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, brokerage expenses, taxes, interest, fees and expenses of the independent trustees (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on the daily net assets of the fund and paid monthly in arrears. The fee consists of (1) an Investment Category Fee based on the daily net assets of the fund and certain other accounts managed by the investment advisor that are in the same broad investment category as the fund and (2) a Complex Fee based on the assets of all the funds in the American Century Investments family of funds. The rates for the Investment Category Fee range from 0.1370% to 0.2500%. The rates for the Complex Fee range from 0.2500% to 0.3100%. The effective annual management fee for the period ended March 31, 2018 was 0.47%.

Trustees’ Fees and Expenses — The Board of Trustees is responsible for overseeing the investment advisor’s management and operations of the fund. The trustees receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

Interfund Transactions — The fund may enter into security transactions with other American Century Investments funds and other client accounts of the investment advisor, in accordance with the 1940 Act rules and procedures adopted by the Board of Trustees. The rules and procedures require, among other things, that these transactions be effected at the independent current market price of the security. There were no interfund transactions during the period.

4. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

| |

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments. |

| |

| • | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars. |

| |

| • | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments. There were no significant transfers between levels during the period.

As of period end, the fund’s investment securities were classified as Level 2. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

5. Federal Tax Information

The tax character of distributions paid during the years ended March 31, 2018 and March 31, 2017 were as follows:

|

| | | | | | |

| | 2018 | 2017 |

| Distributions Paid From | | |

| Ordinary income | $ | 13,124,167 |

| $ | 684,897 |

|

| Long-term capital gains | — |

| — |

|

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of March 31, 2018, the fund had undistributed ordinary income for federal income tax purposes of $1,596.

As of March 31, 2018, the fund had accumulated short-term capital losses of $(61,010), which represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. The capital loss carryovers may be carried forward for an unlimited period. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations.

6. Recently Issued Accounting Standards

In March 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No.2017-08, “Receivables - Nonrefundable Fees and Other Costs (Subtopic 310-20), Premium Amortization on Purchased Callable Debt Securities” (ASU 2017-08). ASU 2017-08 amends the amortization period for certain purchased callable debt securities held at a premium, shortening such period to the earliest call date. The amendments are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. Management is currently evaluating the impact that adopting ASU 2017-08 will have on the financial statements.

|

| | | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | | | |

| Per-Share Data | | | | Ratios and Supplemental Data |

| | | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | |

| | Net Asset

Value,

Beginning

of Period | Net Investment Income (Loss) | Net Realized and Unrealized Gain (Loss) | Total From Investment Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total

Return(1) | Operating

Expenses | Operating

Expenses

(before

expense

waiver) | Net

Investment

Income

(Loss) | Net Investment Income (Loss) (before expense waiver) | Net

Assets,

End of

Period

(in thousands) |

| Investor Class | | | | | | | | | | | | | |

| 2018 | $1.00 | 0.01 | —(2) | 0.01 | (0.01) | — | (0.01) | $1.00 | 0.63% | 0.48% | 0.48% | 0.62% | 0.62% |

| $2,067,473 |

|

| 2017 | $1.00 | —(2) | —(2) | —(2) | —(2) | —(2) | —(2) | $1.00 | 0.03% | 0.39% | 0.48% | 0.03% | (0.06)% |

| $2,215,051 |

|

| 2016 | $1.00 | —(2) | —(2) | —(2) | —(2) | —(2) | —(2) | $1.00 | 0.01% | 0.13% | 0.48% | 0.01% | (0.34)% |

| $2,243,763 |

|

| 2015 | $1.00 | —(2) | —(2) | —(2) | —(2) | — | —(2) | $1.00 | 0.01% | 0.04% | 0.48% | 0.01% | (0.43)% |

| $2,355,574 |

|

| 2014 | $1.00 | —(2) | —(2) | —(2) | —(2) | —(2) | —(2) | $1.00 | 0.01% | 0.06% | 0.48% | 0.01% | (0.41)% |

| $2,536,874 |

|

|

|

| Notes to Financial Highlights |

| |

| (1) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

| |

| (2) | Per-share amount was less than $0.005. |

See Notes to Financial Statements.

|

|

| Report of Independent Registered Public Accounting Firm |

To the Board of Trustees of American Century Government Income Trust and Shareholders of Capital Preservation Fund:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Capital Preservation Fund (one of the five funds constituting American Century Government Income Trust, referred to hereafter as the “Fund”) as of March 31, 2018, the related statement of operations for the year ended March 31, 2018, the statement of changes in net assets for each of the two years in the period ended March 31, 2018, including the related notes, and the financial highlights for each of the five years in the period ended March 31, 2018 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended March 31, 2018 and the financial highlights for each of the five years in the period ended March 31, 2018 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of March 31, 2018 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Kansas City, Missouri

May 17, 2018

We have served as the auditor of one or more investment companies in American Century Investments since 1997.

Board of Trustees

The individuals listed below serve as trustees of the funds. Each trustee will continue to serve in this capacity until death, retirement, resignation or removal from office. The board has adopted a mandatory retirement age for trustees who are not “interested persons,” as that term is defined in the Investment Company Act (independent trustees). Independent trustees shall retire on December 31 of the year in which they reach their 75th birthday; provided, however, that on or after January 1, 2022, independent trustees shall retire on December 31 of the year in which they reach their 76th birthday.

Mr. Thomas is an “interested person” because he currently serves as President and Chief Executive Officer of American Century Companies, Inc. (ACC), the parent company of American Century Investment Management, Inc. (ACIM or the advisor). The other trustees (more than three-fourths of the total number) are independent. They are not employees, directors or officers of, and have no financial interest in, ACC or any of its wholly owned, direct or indirect, subsidiaries, including ACIM, American Century Investment Services, Inc. (ACIS) and American Century Services, LLC (ACS), and they do not have any other affiliations, positions or relationships that would cause them to be considered “interested persons” under the Investment Company Act. The trustees serve in this capacity for eight (in the case of Jonathan S. Thomas, 16; and Ronald J. Gilson, 9) registered investment companies in the American Century Investments family of funds.

The following table presents additional information about the trustees. The mailing address for each trustee other than Mr. Thomas is 1665 Charleston Road, Mountain View, California 94043. The mailing address for Mr. Thomas is 4500 Main Street, Kansas City, Missouri 64111.

|

| | | | | |

Name

(Year of Birth) | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Trustee | Other Directorships Held During Past 5 Years |

| Independent Trustees |

|

|

Tanya S. Beder

(1955) | Trustee | Since 2011 | Chairman and CEO, SBCC Group Inc. (independent advisory services) (2006 to present) | 45 | CYS Investments, Inc.; Nabors Industries Ltd. |

Jeremy I. Bulow

(1954) | Trustee | Since 2011 | Professor of Economics, Stanford University, Graduate School of Business (1979 to present) | 45 | None |

Anne Casscells

(1958) | Trustee | Since 2016 | Co-Chief Executive Officer and Chief Investment Officer, Aetos Alternatives Management (investment advisory firm) (2001 to present); Lecturer in Accounting, Stanford University, Graduate School of Business (2009 to present) | 45 | None |

Ronald J. Gilson

(1946) | Trustee and Chairman of the Board | Since 1995

(Chairman since 2005) | Charles J. Meyers Professor of Law and Business, Emeritus, Stanford Law School (1979 to 2016); Marc and Eva Stern Professor of Law and Business, Columbia University School of Law (1992 to present) | 47 | None |

|

| | | | | |

Name

(Year of Birth) | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Trustee | Other Directorships Held During Past 5 Years |

| Independent Trustees |

|

|

Frederick L. A. Grauer

(1946) | Trustee | Since 2008 | Senior Advisor, iShares by BlackRock, Inc. (investment management firm) (2010 to 2011, 2013 to 2015); Senior Advisor, Course Hero (an educational technology company) (2015 to present) | 45 | None |

Jonathan D. Levin

(1972) | Trustee | Since 2016 | Philip H. Knight Professor and Dean, Graduate School of Business, Stanford University (2016 to present); Professor, Stanford University, (2000 to present); Chair, Department of Economics, Stanford University (2011 to 2014) | 45 | None |

Peter F. Pervere

(1947) | Trustee | Since 2007 | Retired | 45 | None |

John B. Shoven

(1947) | Trustee | Since 2002 | Charles R. Schwab Professor of Economics, Stanford University (1973 to present) | 45 | Cadence Design Systems; Exponent; Financial Engines |

| Interested Trustee |

|

|

Jonathan S. Thomas

(1963) | Trustee and President | Since 2007 | President and Chief Executive Officer, ACC (2007 to present). Also serves as Chief Executive Officer, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and other ACC subsidiaries | 115 | BioMed Valley Discoveries, Inc. |

The Statement of Additional Information has additional information about the fund's trustees and is available without charge, upon request, by calling 1-800-345-2021.

Officers

The following table presents certain information about the executive officers of the funds. Each officer serves as an officer for 16 (in the case of Robert J. Leach, 15) investment companies in the American Century family of funds, unless otherwise noted. No officer is compensated for his or her service as an officer of the funds. The listed officers are interested persons of the funds and are appointed or re-appointed on an annual basis. The mailing address for each of the officers listed below is 4500 Main Street, Kansas City, Missouri 64111.

|

| | |

Name

(Year of Birth) | Offices with the Funds | Principal Occupation(s) During the Past Five Years |

Jonathan S. Thomas

(1963) | Trustee and President since 2007 | President and Chief Executive Officer, ACC (2007 to present). Also serves as Chief Executive Officer, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and other ACC subsidiaries |

Amy D. Shelton

(1964) | Chief Compliance Officer and Vice President since 2014 | Chief Compliance Officer, American Century funds, (2014 to present); Chief Compliance Officer, ACIM (2014 to present); Chief Compliance Officer, ACIS (2009 to present); Vice President, Client Interactions and Marketing, ACIS (2013 to 2014). Also serves as Vice President, ACIS |

Charles A. Etherington

(1957) | General Counsel since 2007 and Senior Vice President since 2006 | Attorney, ACC (1994 to present); Vice President, ACC (2005 to present); General Counsel, ACC (2007 to present). Also serves as General Counsel, ACIM, ACS, ACIS and other ACC subsidiaries; and Senior Vice President, ACIM and ACS |

C. Jean Wade

(1964) | Vice President, Treasurer and Chief Financial Officer since 2012 | Vice President, ACS (2000 to present) |

Robert J. Leach

(1966) | Vice President since 2006 and Assistant Treasurer since 2012 | Vice President, ACS (2000 to present) |

David H. Reinmiller

(1963) | Vice President since 2000 | Attorney, ACC (1994 to present); Associate General Counsel, ACC (2001 to present). Also serves as Vice President, ACIM and ACS |

Ward D. Stauffer

(1960) | Secretary since 2005 | Attorney, ACC (2003 to present) |

Retirement Account Information

As required by law, distributions you receive from certain retirement accounts are subject to federal income tax withholding, unless you elect not to have withholding apply*. Tax will be withheld on the total amount withdrawn even though you may be receiving amounts that are not subject to withholding, such as nondeductible contributions. In such case, excess amounts of withholding could occur. You may adjust your withholding election so that a greater or lesser amount will be withheld.

If you don’t want us to withhold on this amount, you must notify us to not withhold the federal income tax. You may notify us in writing or in certain situations by telephone or through other electronic means. For systematic withdrawals, your withholding election will remain in effect until revoked or changed by filing a new election. You have the right to revoke your election at any time and change your withholding percentage for future distributions.

Remember, even if you elect not to have income tax withheld, you are liable for paying income tax on the taxable portion of your withdrawal. If you elect not to have income tax withheld or you don’t have enough income tax withheld, you may be responsible for payment of estimated tax. You may incur penalties under the estimated tax rules if your withholding and estimated tax payments are not sufficient. You can reduce or defer the income tax on a distribution by directly or indirectly rolling such distribution over to another IRA or eligible plan. You should consult your tax advisor for additional information.

State tax will be withheld if, at the time of your distribution, your address is within one of the mandatory withholding states and you have federal income tax withheld (or as otherwise required by state law). State taxes will be withheld from your distribution in accordance with the respective state rules.

*Some 403(b), 457 and qualified retirement plan distributions may be subject to 20% mandatory withholding, as they are subject to special tax and withholding rules. Your plan administrator or plan sponsor is required to provide you with a special tax notice explaining those rules at the time you request a distribution. If applicable, federal and/or state taxes may be withheld from your distribution amount.

Proxy Voting Policies

Descriptions of the principles and policies that the fund's investment advisor uses in exercising the voting rights associated with the securities purchased and/or held by the fund are available without charge, upon request, by calling 1-800-345-2021 or visiting the "About Us" page of American Century Investments’ website at americancentury.com. A description of the policies is also available on the Securities and Exchange Commission’s website at sec.gov. Information regarding how the investment advisor voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the "About Us" page at americancentury.com. It is also available at sec.gov.

Quarterly Portfolio Disclosure

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at sec.gov, and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The fund also makes its complete schedule of portfolio holdings for the most recent quarter of its fiscal year available on its website at americancentury.com and, upon request, by calling 1-800-345-2021.

|

| | |

| |

| | | |

| Contact Us | americancentury.com | |

| Automated Information Line | 1-800-345-8765 | |

| Investor Services Representative | 1-800-345-2021 or 816-531-5575 | |

| Investors Using Advisors | 1-800-378-9878 | |

| Business, Not-For-Profit, Employer-Sponsored Retirement Plans | 1-800-345-3533 | |

| Banks and Trust Companies, Broker-Dealers, Financial Professionals, Insurance Companies | 1-800-345-6488 | |

| Telecommunications Relay Service for the Deaf | 711 | |

| | | |

| American Century Government Income Trust | |

| | | |

Investment Advisor: American Century Investment Management, Inc. Kansas City, Missouri | |

| | | |

| This report and the statements it contains are submitted for the general information of our shareholders. The report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. | |

| | | |

©2018 American Century Proprietary Holdings, Inc. All rights reserved.

CL-ANN-92274 1805 | |

|

| |

| | |

| | Annual Report |

| | |

| | March 31, 2018 |

| | |

| | Ginnie Mae Fund |

| | Investor Class (BGNMX) |

| | I Class (AGMHX) |

| | A Class (BGNAX) |

| | C Class (BGNCX) |

| | R Class (AGMWX) |

| | R5 Class (AGMNX) |

|

| | |

| President’s Letter | 2 |

|

| Performance | 3 |

|

| Portfolio Commentary | |

|

| Fund Characteristics | |

|

| Shareholder Fee Example | |

|

| Schedule of Investments | |

|

| Statement of Assets and Liabilities | |

|

| Statement of Operations | |

|

| Statement of Changes in Net Assets | |

|

| Notes to Financial Statements | |

|

| Financial Highlights | |

|

| Report of Independent Registered Public Accounting Firm | |

|

| Management | |

|

| Additional Information | |

|

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended March 31, 2018. Annual reports help convey important information about fund returns, including market factors that affected performance during the reporting period. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

Rally Rolled On, Until Volatility Resurfaced

For most of the 12-month period, broad U.S. stock and bond indices generated positive returns. Stocks generally rallied against a backdrop of robust corporate earnings results, steady economic growth, relatively low interest rates, and U.S. tax reform. For bonds, modest economic gains, relatively muted inflation, and gradual—and well telegraphed—tightening from the Federal Reserve (the Fed) continued to support positive performance.

Then, in early February, a force that was largely dormant during 2017—volatility—re-emerged. Robust U.S. wage growth triggered expectations for rising inflation, higher interest rates, and a more-hawkish Fed. Treasury yields climbed to their highest levels in several years, and stock prices plunged into correction territory. Economic data released in March helped calm the unrest, while the Fed's March rate hike, which investors had expected, had little impact. Markets recovered much of the previous weeks’ losses, until a fresh round of worries emerged. President Trump announced the U.S. would implement tariffs on certain imports from China, sparking fears of a global trade war and triggering a flight to quality in the financial markets.

Despite the resurgence of volatility late in the period, U.S. stocks (S&P 500 Index) delivered a total return of 13.99% for the 12 months. Continuing a long-standing trend, growth stocks significantly outperformed their value counterparts across the capitalization spectrum. Meanwhile, the March flight to quality helped bonds hang onto the modest gains generated ahead of the market turbulence, and investment-grade bonds (Bloomberg Barclays U.S. Aggregate Bond Index) returned 1.20% for the 12-month period.

With inflationary pressures mounting, Treasury yields rising, volatility resurfacing, and the implications of tax reform still unfolding, investors likely will face new opportunities and challenges in the months ahead. We believe this scenario warrants a disciplined, diversified, and risk-aware approach, using professionally managed portfolios in pursuit of investment goals. We appreciate your continued trust and confidence in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | | | |

| Total Returns as of March 31, 2018 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date |

| Investor Class | BGNMX | -0.24% | 0.82% | 3.03% | — | 9/23/85 |

| Bloomberg Barclays U.S. GNMA Index | — | 0.28% | 1.48% | 3.45% | — | — |

| I Class | AGMHX | — | — | — | -0.21% | 4/10/17 |

| A Class | BGNAX | | | | | 10/9/97 |

| No sales charge | | -0.49% | 0.57% | 2.78% | — | |

| With sales charge | | -5.01% | -0.35% | 2.30% | — | |

| C Class | BGNCX | -1.24% | -0.18% | — | 1.25% | 3/1/10 |

| R Class | AGMWX | -0.74% | 0.34% | 2.52% | — | 9/28/07 |

| R5 Class | AGMNX | -0.04% | 1.02% | 3.24% | — | 9/28/07 |

Average annual returns since inception are presented when ten years of performance history is not available.

Fund returns would have been lower if a portion of the fees had not been waived. Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been adjusted to reflect this charge. Prior to April 10, 2017, the R5 Class was referred to as the Institutional Class.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 4.50% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

|

|

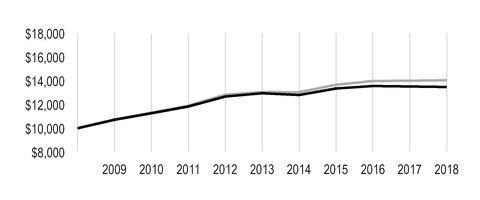

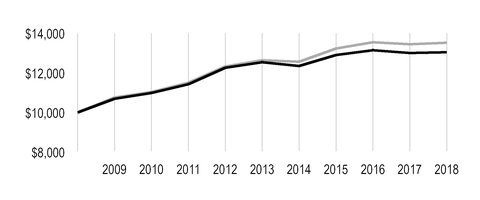

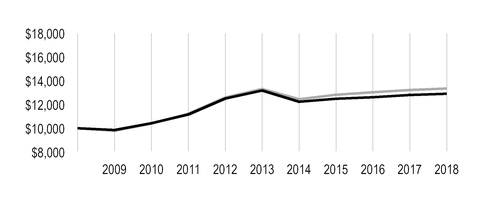

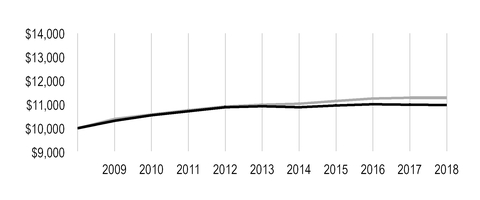

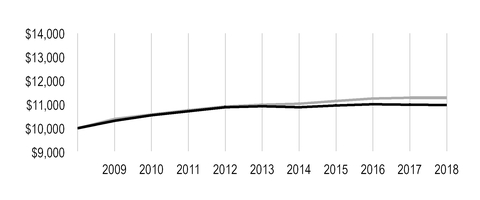

| Growth of $10,000 Over 10 Years |

| $10,000 investment made March 31, 2008 |

Performance for other share classes will vary due to differences in fee structure.

|

|

| |

| Value on March 31, 2018 |

| | Investor Class — $13,483 |

| |

| | Bloomberg Barclays U.S. GNMA Index — $14,045 |

| |

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

|

| | | | | |

| Total Annual Fund Operating Expenses |

| Investor Class | I Class | A Class | C Class | R Class | R5 Class |

| 0.55% | 0.45% | 0.80% | 1.55% | 1.05% | 0.35% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Hando Aguilar, Dan Shiffman, Bob Gahagan, and Jesse Singh

Performance Summary

Ginnie Mae declined -0.24%* for the 12 months ended March 31, 2018. By comparison, the Bloomberg Barclays U.S. GNMA Index gained 0.28%. Fund returns reflect operating expenses, while index returns do not.

The absolute returns of the fund and the index reflect the increasingly challenging backdrop for U.S. government agency mortgage-backed securities (MBS) during the 12-month period. The broad agency MBS market generated positive performance for the first several months of the period, as longer-maturity U.S. Treasury yields generally declined amid a backdrop of muted inflation and modest economic growth. A “risk-on” sentiment prevailed, and higher-risk securities generally outperformed government agency securities. But broad performance results shifted dramatically in the second half of the reporting period. Expectations for stronger growth and higher inflation drove longer-maturity Treasury yields sharply higher and credit spreads (the difference in yield between Treasury and non-Treasury securities of similar maturity) wider, triggering higher volatility throughout global financial markets. Meanwhile, the Federal Reserve (the Fed) continued to normalize monetary policy by reducing its balance sheet (exiting its positions in U.S. Treasury and mortgage securities), hiking its target interest rate three times, and reiterating its commitment to raising rates.

Within the fund, security selection accounted for the underperformance relative to the index during the 12-month period.

Security Selection Delivered Mixed Results

Security selection within the GNMA sector generally delivered mixed results, modestly weighing on relative performance during the first several months of the reporting period before contributing to performance in the final few months. For example, we continued to favor higher-coupon securities over lower-coupon mortgages. This strategy detracted modestly during the first several months of the period, as yield-curve flattening (which occurs when yields on shorter-maturity Treasuries increase while yields on longer-maturity securities either increase at a slower pace or decline) pressured our higher-coupon securities. But the magnitude of yield-curve flattening subsided in the final few months of the period, and our higher-coupon mortgage-backed securities (MBS) rebounded.

We also continued to invest in out-of-index securities, including agency collateralized mortgage obligations (CMOs) and agency adjustable-rate mortgages (ARMs). These positions had a relatively neutral effect on performance until the final few months of the reporting period, when they contributed to relative returns. ARMs and CMOs typically perform better in more volatile rate environments, as was the case beginning in January 2018.

Portfolio Positioning

Amid an environment of consistently solid growth data and potential added stimulus from fiscal expansion, we expect U.S. economic growth to improve modestly. We believe gross domestic

* All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the index, other share classes may not. See page 3 for returns for all share classes.

product will move toward the higher end of our anticipated 2%-3% range. Following the March 2018 rate hike, we expect the Fed will continue to normalize monetary policy and stick to its stated goal of raising short-term rates two more times in 2018. We believe solid growth data and a gradual increase in inflation support the Fed’s rate-tightening strategy. We also expect this backdrop to push longer-maturity Treasury yields slightly higher. Our expected trading range for the 10-year Treasury is 2.75%-3.25%, but we believe rates will generally settle at or near the midpoint of that range in the near term.

The housing market appears relatively stable, with consistent price appreciation and an uptick in demand from younger buyers, while housing supply remains near 20-year lows. However, higher interest rates and property taxes are making home ownership relatively more expensive than in recent years. Meanwhile, investor demand for MBS is slowing, particularly from international buyers and banks. Softening demand combined with the Fed’s balance sheet cuts are creating some excess supply in the market, which we believe is reflected in the recent widening in MBS spreads.

Given this outlook, we plan to maintain a neutral duration while continuing to focus on higher-coupon securities and positions in out-of-index ARMs and CMOs. We will remain selective in our purchases, favoring mortgage securities we believe are undervalued and provide favorable prepayment terms.

|

| |

| MARCH 31, 2018 | |

| Portfolio at a Glance | |

| Average Duration (effective) | 5.1 years |

| Weighted Average Life | 8.7 years |

| | |

| Types of Investments in Portfolio | % of net assets |

| U.S. Government Agency Mortgage-Backed Securities (all GNMAs) | 101.3% |

| U.S. Government Agency Collateralized Mortgage Obligations (all GNMAs) | 9.6% |

| Temporary Cash Investments | 17.5% |

| Other Assets and Liabilities | (28.4)%* |

*Amount relates primarily to payable for investments purchased, but not settled, at period end.

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2017 to March 31, 2018.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| | Beginning

Account Value

10/1/17 | Ending

Account Value

3/31/18 | Expenses Paid

During Period(1)

10/1/17 - 3/31/18 |

Annualized

Expense Ratio(1) |

| Actual | | | | |

| Investor Class | $1,000 | $985.90 | $2.72 | 0.55% |

| I Class | $1,000 | $987.40 | $2.23 | 0.45% |

| A Class | $1,000 | $984.70 | $3.96 | 0.80% |

| C Class | $1,000 | $981.00 | $7.66 | 1.55% |

| R Class | $1,000 | $983.50 | $5.19 | 1.05% |

| R5 Class | $1,000 | $986.90 | $1.73 | 0.35% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,022.19 | $2.77 | 0.55% |

| I Class | $1,000 | $1,022.69 | $2.27 | 0.45% |

| A Class | $1,000 | $1,020.94 | $4.03 | 0.80% |

| C Class | $1,000 | $1,017.20 | $7.80 | 1.55% |

| R Class | $1,000 | $1,019.70 | $5.29 | 1.05% |

| R5 Class | $1,000 | $1,023.19 | $1.77 | 0.35% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses. |

MARCH 31, 2018

|

| | | | | | |

| | Principal Amount | Value |

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES(1) — 101.3% | |

Adjustable-Rate U.S. Government Agency Mortgage-Backed Securities(2) — 5.3% | |

| GNMA, VRN, 2.00%, 4/20/18 | $ | 21,186,505 |

| $ | 20,951,646 |

|

| GNMA, VRN, 2.375%, 4/20/18 | 5,544,802 |

| 5,772,033 |

|

| GNMA, VRN, 2.50%, 4/20/18 | 7,987,765 |

| 7,977,566 |

|

| GNMA, VRN, 2.625%, 4/20/18 | 7,071,501 |

| 7,365,509 |

|

| GNMA, VRN, 2.75%, 4/20/18 | 3,319,727 |

| 3,448,498 |

|

| GNMA, VRN, 3.125%, 4/20/18 | 4,466,094 |

| 4,641,576 |

|

| | | 50,156,828 |

|

| Fixed-Rate U.S. Government Agency Mortgage-Backed Securities — 96.0% | |

| GNMA, 2.50%, 6/20/46 to 7/20/46 | 39,627,299 |

| 37,746,114 |

|

GNMA, 3.00%, 4/19/18(3) | 150,000,000 |

| 147,475,188 |

|

| GNMA, 3.00%, 2/20/43 to 7/20/45 | 34,818,415 |

| 34,402,632 |

|

GNMA, 3.50%, 4/19/18(3) | 52,500,000 |

| 52,984,204 |

|

| GNMA, 3.50%, 12/20/41 to 4/20/46 | 275,035,705 |

| 278,894,517 |

|

GNMA, 4.00%, 4/19/18(3) | 50,000,000 |

| 51,380,506 |

|

| GNMA, 4.00%, 12/20/39 to 5/15/42 | 96,805,998 |

| 100,834,887 |

|

| GNMA, 4.50%, 7/15/33 to 3/20/42 | 62,034,491 |

| 65,437,242 |

|

| GNMA, 5.00%, 6/15/33 to 5/20/41 | 51,250,456 |

| 54,977,654 |

|

| GNMA, 5.50%, 4/15/33 to 8/15/39 | 52,812,239 |

| 57,949,903 |

|

| GNMA, 6.00%, 2/20/26 to 2/20/39 | 22,070,959 |

| 24,853,938 |

|

| GNMA, 6.50%, 9/20/23 to 11/15/38 | 3,027,871 |

| 3,421,436 |

|

| GNMA, 7.00%, 12/20/25 to 12/20/29 | 563,471 |

| 643,259 |

|

| GNMA, 7.25%, 4/15/23 to 6/15/23 | 26,314 |

| 26,587 |

|

| GNMA, 7.50%, 12/20/23 to 2/20/31 | 120,991 |

| 142,680 |

|

| GNMA, 7.75%, 11/15/22 | 5,282 |

| 5,295 |

|

| GNMA, 7.77%, 4/15/20 to 6/15/20 | 44,820 |

| 45,180 |

|

| GNMA, 7.89%, 9/20/22 | 5,466 |

| 5,478 |

|

| GNMA, 8.00%, 11/15/21 to 7/20/30 | 458,348 |

| 474,125 |

|

| GNMA, 8.25%, 4/20/21 to 2/15/22 | 96,009 |

| 96,832 |

|

| GNMA, 8.50%, 11/15/19 to 12/15/30 | 324,802 |

| 348,738 |

|

| GNMA, 8.75%, 6/20/21 to 7/15/27 | 50,300 |

| 50,803 |

|

| GNMA, 9.00%, 6/15/18 to 12/15/24 | 94,258 |

| 96,378 |

|

| GNMA, 9.25%, 9/15/21 to 3/15/25 | 34,004 |

| 34,387 |

|

| GNMA, 9.50%, 8/20/18 to 7/20/25 | 100,318 |

| 101,550 |

|

| GNMA, 9.75%, 12/15/18 to 11/20/21 | 27,682 |

| 28,082 |

|

| GNMA, 10.00%, 1/15/21 to 8/15/21 | 534 |

| 539 |

|

| GNMA, 10.25%, 2/15/19 | 1,118 |

| 1,122 |

|

| GNMA, 10.50%, 4/20/19 | 2 |

| 2 |

|

| GNMA, 11.00%, 9/15/18 to 6/15/20 | 8,938 |

| 8,977 |

|

| | | 912,468,235 |

|

TOTAL U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES

(Cost $970,031,073) | 962,625,063 |

|

|

| | | | | | |

| | Principal Amount | Value |

U.S. GOVERNMENT AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS(1) — 9.6% | |

| GNMA, Series 2000-22, Class FG, VRN, 1.99%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.20% | $ | 2,047 |

| $ | 2,047 |

|

| GNMA, Series 2001-59, Class FD, VRN, 2.29%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.50% | 365,851 |

| 368,686 |

|

| GNMA, Series 2001-62, Class FB, VRN, 2.29%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.50% | 774,018 |

| 780,053 |

|

| GNMA, Series 2002-13, Class FA, VRN, 2.29%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.50% | 505,194 |

| 505,256 |

|

| GNMA, Series 2002-24, Class FA, VRN, 2.29%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.50% | 1,095,644 |

| 1,104,451 |

|

| GNMA, Series 2002-29, Class FA SEQ, VRN, 2.17%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.35% | 416,131 |

| 417,570 |

|

| GNMA, Series 2002-31, Class FW, VRN, 2.19%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.40% | 310,351 |

| 312,162 |

|

| GNMA, Series 2003-110, Class F, VRN, 2.22%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.40% | 1,435,080 |

| 1,438,774 |

|

| GNMA, Series 2003-42, Class FW, VRN, 2.17%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.35% | 577,896 |

| 578,165 |

|

| GNMA, Series 2003-66, Class HF, VRN, 2.27%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.45% | 827,425 |

| 833,469 |

|

| GNMA, Series 2004-39, Class XF SEQ, VRN, 2.04%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.25% | 464,835 |

| 465,189 |

|

| GNMA, Series 2004-76, Class F, VRN, 2.22%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.40% | 1,262,858 |

| 1,266,076 |

|

| GNMA, Series 2005-13, Class FA, VRN, 2.02%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.20% | 3,102,287 |

| 3,067,845 |

|

| GNMA, Series 2007-5, Class FA, VRN, 1.96%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.14% | 2,942,445 |

| 2,937,966 |

|

| GNMA, Series 2007-58, Class FC, VRN, 2.32%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.50% | 1,888,805 |

| 1,897,560 |

|

| GNMA, Series 2007-74, Class FL, VRN, 2.25%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.46% | 4,418,703 |

| 4,437,157 |

|

| GNMA, Series 2008-18, Class FH, VRN, 2.42%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.60% | 2,579,841 |

| 2,589,410 |

|

| GNMA, Series 2008-2, Class LF, VRN, 2.28%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.46% | 2,010,857 |

| 2,018,548 |

|

| GNMA, Series 2008-27, Class FB, VRN, 2.37%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.55% | 4,420,744 |

| 4,459,383 |

|

| GNMA, Series 2008-61, Class KF, VRN, 2.49%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.67% | 2,204,018 |

| 2,229,022 |

|

| GNMA, Series 2008-73, Class FK, VRN, 2.58%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.76% | 3,039,423 |

| 3,081,836 |

|

| GNMA, Series 2008-75, Class F, VRN, 2.35%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.53% | 3,526,105 |

| 3,559,184 |

|

| GNMA, Series 2008-88, Class UF, VRN, 2.82%, 4/20/18, resets monthly off the 1-month LIBOR plus 1.00% | 1,988,814 |

| 2,034,534 |

|

| GNMA, Series 2009-109, Class FA, VRN, 2.19%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.40% | 79,331 |

| 79,347 |

|

| GNMA, Series 2009-127, Class FA, VRN, 2.37%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.55% | 2,844,943 |

| 2,858,480 |

|

| GNMA, Series 2009-76, Class FB, VRN, 2.39%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.60% | 1,967,902 |

| 1,984,116 |

|

| GNMA, Series 2009-92, Class FJ, VRN, 2.47%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.68% | 1,241,617 |

| 1,255,710 |

|

| GNMA, Series 2010-14, Class QF, VRN, 2.24%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.45% | 9,227,400 |

| 9,261,901 |

|

|

| | | | | | |

| | Principal Amount/Shares | Value |

| GNMA, Series 2010-25, Class FB, VRN, 2.34%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.55% | $ | 7,116,675 |

| $ | 7,163,716 |

|

| GNMA, Series 2012-105, Class FE, VRN, 2.12%, 4/20/18, resets monthly off the 1-month LIBOR plus 0.30% | 6,069,203 |

| 6,078,833 |

|

| GNMA, Series 2015-111, Class FK, VRN, 1.86%, 4/1/18, resets monthly off the 1-month LIBOR plus 0.20% | 7,577,296 |

| 7,556,726 |

|

| GNMA, Series 2015-80, Class YF, VRN, 2.22%, 4/16/18, resets monthly off the 1-month LIBOR plus 0.43% | 10,698,749 |

| 10,732,995 |

|

| GNMA, Series 2016-68, Class MF, VRN, 1.96%, 4/1/18, resets monthly off the 1-month LIBOR plus 0.30% | 3,790,171 |

| 3,792,375 |

|

TOTAL U.S. GOVERNMENT AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $91,129,205) | 91,148,542 |

|

TEMPORARY CASH INVESTMENTS(4) — 17.5% | | |

Federal Home Loan Bank Discount Notes, 1.43%, 4/2/18(5) | 50,000,000 |

| 50,000,000 |

|

| Repurchase Agreement, BMO Capital Markets Corp., (collateralized by various U.S. Treasury obligations, 1.375% - 3.625%, 2/15/23 - 5/15/47, valued at $64,690,990), in a joint trading account at 1.45%, dated 3/29/18, due 4/2/18 (Delivery value $63,289,020) | | 63,278,825 |

|

| Repurchase Agreement, Fixed Income Clearing Corp., (collateralized by various U.S. Treasury obligations, 1.625%- 2.250%, 11/15/24 -5/15/26, valued at $53,814,844), at 0.74%, dated 3/29/18, due 4/2/18 (Delivery value $52,758,338) | | 52,754,000 |

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 477,121 |

| 477,121 |

|

TOTAL TEMPORARY CASH INVESTMENTS

(Cost $166,508,002) | | 166,509,946 |

|

TOTAL INVESTMENT SECURITIES — 128.4%

(Cost $1,227,668,280) | | 1,220,283,551 |

|

OTHER ASSETS AND LIABILITIES(6) — (28.4)% | | (269,944,525 | ) |

| TOTAL NET ASSETS — 100.0% | | $ | 950,339,026 |

|

|

| | |

| NOTES TO SCHEDULE OF INVESTMENTS |

| GNMA | - | Government National Mortgage Association |

| LIBOR | - | London Interbank Offered Rate |

| resets | - | The frequency with which a security’s coupon changes, based on current market conditions or an underlying index. |

| SEQ | - | Sequential Payer |

| VRN | - | Variable Rate Note. Interest reset date is indicated. Rate shown is effective at the period end. |

| |

| (1) | Final maturity date indicated, unless otherwise noted. |

| |

| (2) | The interest rate resets periodically based on the weighted average coupons of the underlying mortgage-related or asset-backed obligations. |

| |

| (3) | Forward commitment. Settlement date is indicated. |

| |

| (4) | Category includes collateral received at the custodian bank for collateral requirements on forward commitments. At the period end, the aggregate value of cash deposits received was $490,000. |

| |

| (5) | The rate indicated is the yield to maturity at purchase. |

| |

| (6) | Amount relates primarily to payable for investments purchased, but not settled, at period end. |

See Notes to Financial Statements.

|

|

| Statement of Assets and Liabilities |

|

| | | |

| MARCH 31, 2018 | |

| Assets | |

| Investment securities, at value (cost of $1,227,668,280) | $ | 1,220,283,551 |

|

| Receivable for capital shares sold | 1,650,891 |

|

| Interest receivable | 2,726,482 |

|

| | 1,224,660,924 |

|

| | |

| Liabilities | |

| Payable for collateral received for forward commitments | 490,000 |

|

| Payable for investments purchased | 271,901,933 |

|

| Payable for capital shares redeemed | 1,395,233 |

|

| Accrued management fees | 418,579 |

|

| Distribution and service fees payable | 16,557 |

|

| Dividends payable | 99,596 |

|

| | 274,321,898 |

|

| | |

| Net Assets | $ | 950,339,026 |

|

| | |

| Net Assets Consist of: | |

| Capital paid in | $ | 1,015,813,478 |

|

| Undistributed net investment income | 1,037 |

|

| Accumulated net realized loss | (58,090,760) |

|

| Net unrealized depreciation | (7,384,729) |

|

| | $ | 950,339,026 |

|

|

| | | | | |

| | Net Assets | Shares Outstanding | Net Asset Value Per Share |

| Investor Class |

| $782,697,655 |

| 76,423,535 | $10.24 |

| I Class |

| $25,599,039 |

| 2,498,399 | $10.25 |

| A Class |

| $30,653,825 |

| 2,992,963 | $10.24* |

| C Class |

| $7,438,903 |

| 726,237 | $10.24 |

| R Class |

| $8,618,882 |

| 841,941 | $10.24 |

| R5 Class |

| $95,330,722 |

| 9,308,999 | $10.24 |

*Maximum offering price $10.72 (net asset value divided by 0.955).

See Notes to Financial Statements.

|

| | | |

| YEAR ENDED MARCH 31, 2018 | |

| Investment Income (Loss) | |

| Income: | |

| Interest | $ | 22,513,016 |

|

| | |

| Expenses: | |

| Management fees | 5,374,193 |

|