UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-4367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

One Financial Center, Boston, Massachusetts | | 02111 |

(Address of principal executive offices) | | (Zip code) |

|

James R. Bordewick, Jr., Esq.

Columbia Management Advisors, LLC

One Financial Center

Boston, MA 02111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-617-426-3750 | |

|

Date of fiscal year end: | September 30, 2006 | |

|

Date of reporting period: | September 30, 2006 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Management®

Columbia Equity Funds

Annual Report – September 30, 2006

g Columbia Asset Allocation Fund

g Columbia Large Cap Growth Fund

g Columbia Disciplined Value Fund

g Columbia Common Stock Fund

g Columbia Small Cap Core Fund

NOT FDIC INSURED

May Lose Value

No Bank Guarantee

President's Message

September 30, 2006

Table of contents

| Columbia Asset Allocation Fund | | | 2 | | |

|

| Columbia Large Cap Growth Fund | | | 7 | | |

|

| Columbia Disciplined Value Fund | | | 12 | | |

|

| Columbia Common Stock Fund | | | 16 | | |

|

| Columbia Small Cap Core Fund | | | 21 | | |

|

| Investment Portfolio | | | 26 | | |

|

Statements of Assets and

Liabilities | | | 60 | | |

|

| Statements of Operations | | | 64 | | |

|

Statements of Changes in

Net Assets | | | 68 | | |

|

| Financial Highlights | | | 74 | | |

|

| Notes to Financial Statements | | | 106 | | |

|

Report of Independent

Registered Public Accounting

Firm | | | 120 | | |

|

| Unaudited Information | | | 121 | | |

|

| Fund Governance | | | 122 | | |

|

| Columbia Funds | | | 126 | | |

|

Important Information About

This Report | | | 129 | | |

|

The views expressed in the President's Message and Portfolio Managers' reports reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific company securities should not be construed as a recommendation or investment advice.

Dear Shareholder,

Over the past few years, you've heard a lot about change here at Columbia Funds as we've streamlined our fund offerings, reduced our expenses and enhanced the different ways that you can do business with us. Our goal in all these matters has been to make investing easier and more convenient—and to ensure that you find the range of financial choices and services that you expect from one of the nation's leading financial companies.

As 78 million baby boomers move closer to retirement, we are also mindful that retirement is the single most important financial goal for many Americans. To that end we have committed considerable resources to ensure that you can find a wide range of choices at Columbia Funds, whether you are just beginning to invest for retirement or preparing to turn your retirement savings into income. If you haven't done so already, we suggest that you work closely with your financial adviser to draw up a personal investment plan that is based on what you'll require for your future. We continue to look for new ways to help meet the unique needs of all our investors—especially those who are approaching retirement.

As you read the following message from the manager or managers of your Columbia Funds, keep in mind that investing is often a long-term undertaking. While it's important to review the performance and market environment of the most recent period, it's essential to evaluate this information with your goal, time horizon and risk tolerance in mind.

Change is a constant in our lives, but one thing that does not change is our commitment to continue to improve your investment and service experiences. At Columbia Funds, we understand that you have a choice of financial providers and we want you to remain satisfied with your decision to invest with us—now and in the years to come.

Sincerely,

Christopher L. Wilson

President, Columbia Funds

Economic Update – Columbia Equity Funds

The U.S. economy grew at a solid but uneven pace during the 12-month period that began October 1, 2005 and ended September 30, 2006. Gross domestic product (GDP) expanded at an estimated annualized rate of approximately 3.5% as job growth provided support for consumer spending and rising profits freed up cash for business spending. Personal income also rose.

Yet these overall measures masked a host of challenges, which led to considerable volatility during the 12-month period. Early in the period, the economy reeled from the effects of hurricanes Katrina and Rita, which devastated the Gulf Coast late last summer. The twin storms disrupted the flow of energy products and left millions of Americans without homes or jobs. Consumer confidence plummeted in the wake of the storms. The impact on the labor market was actually less than anticipated. However, economic growth fell to a mere 1.8% in the fourth quarter of 2005.

The economy regained considerable momentum early in 2006. GDP growth rebounded to 5.6%, job growth resumed at a healthy pace and consumer confidence rebounded. Yet, the once strong housing market showed signs of serious slowing as the year wore on. Inflation edged higher as record-high energy prices took a bigger bite out of household budgets and the overall pace of economic growth slowed in the second half of the period. After 17 consecutive short-term interest rate hikes, the Federal Reserve Board Open Market Committee took no action in its August and September meetings,1 a potential indication that it may feel comfortable, at least for now, that inflation is under control. The federal funds rate, a key short-term lending rate, ended the period at 5.25%.

Stocks moved higher

Despite bouts of volatility, the S&P 500 Index—a broad measure of large company stock performance—returned 10.79% for this reporting period, gaining considerable ground in September. Large-, mid- and small-cap stocks generated similar returns as measured by their respective Russell indices. However, large-caps took the lead in the final months of the period and edged out both mid- and small-caps by a small margin. The Russell 1000 Index returned 10.25%, the Russell Midcap Index returned 9.57% and the Russell 2000 Index returned 9.92%.2 Foreign stock markets generally did better than the U.S. market. The MSCI EAFE Index, which tracks stock market performance in industrialized countries outside the United States, returned 19.16%. Japanese stocks, which accounted for a substantial percentage of the foreign index, contributed to the index's strong gains but gave back some returns as they reversed course in the final months of the period.

Bonds bounced back

The U.S. bond market delivered modest but positive returns, as interest rates spiked higher, then edged lower in the last three months of the period. The yield on the 10-year U.S. Treasury note, a bellwether for the bond market, ended the period at 4.64%—just slightly higher than where it started. In this environment, the Lehman Brothers U.S. Aggregate Bond Index returned 3.67% for the 12-month period. High-yield bonds led the fixed income markets, reflecting investor confidence about the overall resilience of the economy. The Merrill Lynch U.S. High Yield, Cash Pay Index returned 7.90%.

1The Fed took no action on the federal funds rate when it met in October, 2006.

2The Russell 1000 Index tracks the performance of 1000 of the largest U.S. companies, based on market capitalization. The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, as ranked by total market capitalization. The Russell 2000 Index tracks the performance of the 2,000 smallest of the 3,000 largest U.S. companies based on market capitalization. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index.

Summary

For the 12-month period ended September 30, 2006

g Despite bouts of volatility, the broad U.S. stock market, as measured by the S&P 500 Index, returned 10.79%. Foreign stocks did better than domestic stocks, as measured by the Morgan Stanley Capital International (MSCI) EAFE Index.

| S&P Index | | MSCI Index | |

|

| |  | |

|

g Investment-grade bonds rebounded in the final months of the period, lifting the Lehman Brothers U.S. Aggregate Bond Index to a positive return. High-yield bonds, as measured by the Merrill Lynch U.S. High Yield, Cash Pay Index, led the fixed-income markets.

| Lehman Index | | Merrill

Lynch Index | |

|

| |  | |

|

The S&P 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

The MSCI EAFE (Europe, Australasia, Far East) Index is a free-floated adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. and Canada.

The Lehman Brothers U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs, and total return performance of fixed-rate, publicly placed, dollar-denominated, and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

The Merrill Lynch U.S. High Yield, Cash Pay Index tracks the performance of non-investment-grade corporate bonds.

Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index.

1

Performance Information – Columbia Asset Allocation Fund

Net asset value per share

as of 09/30/06 ($)

| Class A | | | 16.06 | | |

| Class B | | | 16.06 | | |

| Class C | | | 16.06 | | |

| Class G | | | 16.06 | | |

| Class T | | | 16.08 | | |

| Class Z | | | 16.07 | | |

Distributions declared per share

10/01/05 – 09/30/06 ($)

| Class A | | | 1.55 | | |

| Class B | | | 1.43 | | |

| Class C | | | 1.43 | | |

| Class G | | | 1.44 | | |

| Class T | | | 1.55 | | |

| Class Z | | | 1.59 | | |

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

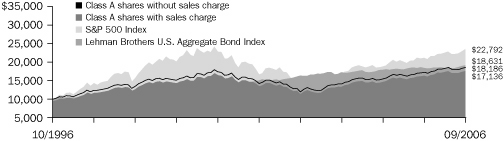

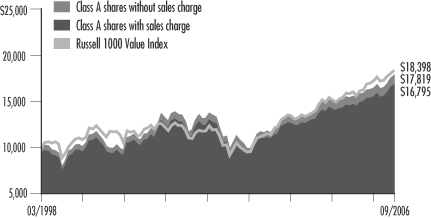

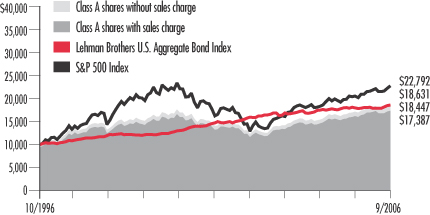

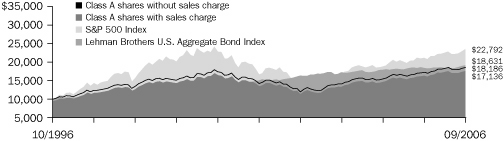

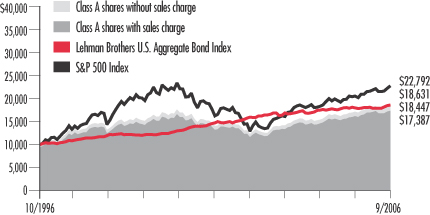

Growth of a $10,000 investment 10/01/96 – 09/30/06 ($)

| |

|

The chart above shows the growth in value of a hypothetical $10,000 investment in Class A shares of Columbia Asset Allocation Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. The Lehman Brothers U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs, and total return performance of fixed-rate, publicly placed, dollar-denominated, and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity. Indices are not investments, do not incur fees or expenses, and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may n ot match those in an index.

Growth of a $10,000 investment 10/01/96 – 09/30/06 ($)

| Sales charge: | | without | | with | |

| Class A | | | 18,186 | | | | 17,136 | | |

| Class B | | | 17,187 | | | | 17,187 | | |

| Class C | | | 17,180 | | | | 17,180 | | |

| Class G | | | 16,925 | | | | 16,925 | | |

| Class T | | | 18,108 | | | | 17,063 | | |

| Class Z | | | 18,542 | | | | n/a | | |

Average annual total return as of 09/30/06 (%)

| Share class | | A | | B | | C | | G | | T | | Z | |

| Inception | | 11/01/98 | | 11/01/98 | | 11/18/02 | | 03/04/96 | | 12/30/91 | | 12/30/91 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | 7.39 | | | | 1.24 | | | | 6.59 | | | | 1.71 | | | | 6.59 | | | | 5.61 | | | | 6.70 | | | | 1.83 | | | | 7.39 | | | | 1.19 | | | | 7.65 | | |

| 5-year | | | 5.31 | | | | 4.08 | | | | 4.57 | | | | 4.23 | | | | 4.56 | | | | 4.56 | | | | 4.59 | | | | 4.08 | | | | 5.30 | | | | 4.07 | | | | 5.61 | | |

| 10-year | | | 6.16 | | | | 5.53 | | | | 5.56 | | | | 5.56 | | | | 5.56 | | | | 5.56 | | | | 5.40 | | | | 5.40 | | | | 6.12 | | | | 5.49 | | | | 6.37 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A and T shares the applicable contingent deferred sales charge (5.00% in the first year, declining to 1.00% in the sixth year for Class B shares and 1.00% in the seventh year for Class G shares and eliminated thereafter) and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any voluntary waivers or reimbursement of fund expenses by the investment advisor and/or its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no Rule 12b-1 fees. Class Z shares have limited eligibility and the investment minimum requirement may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The returns for Class A and Class B shares include the returns of Prime A shares (for Class A shares) and Prime B shares (for Class B shares) of the Galaxy Asset Allocation Fund for periods prior to November 18, 2002, the date on which Class A and Class B shares were initially offered by the fund. The returns shown for Class A shares and Class B shares also include the returns of Retail A shares of the Galaxy Asset Allocation Fund (adjusted, as necessary, to reflect the sales charges applicable to Class A shares and Class B shares, respectively), for periods prior to the inception of Prime A shares and Prime B shares (November 1, 1998). Class A and Class B shares generally would have had substantially similar returns to Prime A shares, Prime B shares and Retail A shares because they would have been invested in the same portfolio of securities, although returns would have been lower to the extent that expenses for Class A and Cla ss B shares exceed expenses paid by Prime A shares and Retail A shares. The returns shown for Class C shares include the returns of Prime B shares of the Galaxy Asset Allocation Fund (adjusted to reflect the sales charge applicable to Class C shares) for periods prior to November 18, 2002, the date on which Class C shares were initially offered by the Fund. The returns shown for Class C shares also include the returns of Retail A Shares of the Galaxy Asset Allocation Fund (adjusted to reflect the sales charges applicable to Class C shares) for periods prior to the date of inception of Prime B shares (November 1, 1998). Class C shares generally would have had substantially similar returns because they would have been invested in the same portfolio of securities, although the returns would have been lower to the extent that expenses for Class C shares exceed expenses paid by Retail A or Prime B shares. Retail A shares of the Galaxy Asset Allocation Fund were initially offered on December 30, 1991. The returns for Class G and Class T shares include the returns of Retail A shares (for class T shares) and Retail B shares (for Class G shares) of the Galaxy Asset Allocation Fund for periods prior to November 18, 2002, the date on which Class T and Class G shares were initially offered by the fund. The returns for Class Z shares include returns of Trust Shares of the Galaxy Asset Allocation Fund for periods prior to November 18, 2002, the date on which Class Z shares were initially offered by the fund. Trust Shares of the Galaxy Asset Allocation Fund were initially offered on December 30, 1991.

2

Understanding Your Expenses – Columbia Asset Allocation Fund

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory, Rule 12b-1 fees and other fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this reporting period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other fund companies, it is important to note that hypothetical examples are meant to highlight the ongoing cost of investing in a fund and do not reflect any transaction costs, such as sales charges or redemption or exchange fees.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their brokerage firm, contact your brokerage firm to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

04/01/06 – 09/30/06

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,013.59 | | | | 1,018.45 | | | | 6.66 | | | | 6.68 | | | | 1.32 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,009.68 | | | | 1,014.69 | | | | 10.43 | | | | 10.45 | | | | 2.07 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,009.12 | | | | 1,014.69 | | | | 10.43 | | | | 10.45 | | | | 2.07 | | |

| Class G | | | 1,000.00 | | | | 1,000.00 | | | | 1,009.98 | | | | 1,014.94 | | | | 10.18 | | | | 10.20 | | | | 2.02 | | |

| Class T | | | 1,000.00 | | | | 1,000.00 | | | | 1,013.29 | | | | 1,018.20 | | | | 6.91 | | | | 6.93 | | | | 1.37 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,014.79 | | | | 1,019.70 | | | | 5.40 | | | | 5.42 | | | | 1.07 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the investment advisor and/or any of its affiliates not waived or reimbursed a portion of expenses, total return would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

3

Portfolio Managers' Report – Columbia Asset Allocation Fund

Top 5 equity sectors

as of 09/30/06 (%)

| Financials | | | 13.8 | | |

| Information technology | | | 9.3 | | |

| Consumer discretionary | | | 7.7 | | |

| Health care | | | 7.2 | | |

| Industrials | | | 7.1 | | |

Top 10 equity holdings

as of 09/30/06 (%)

| General Electric | | | 1.2 | | |

| Citigroup | | | 1.0 | | |

| Bank of New York | | | 0.8 | | |

| Merrill Lynch | | | 0.8 | | |

| JPMorgan Chase | | | 0.8 | | |

| United Technologies | | | 0.7 | | |

| Microsoft | | | 0.7 | | |

| American International Group | | | 0.6 | | |

| Altria Group | | | 0.6 | | |

| Pfizer | | | 0.6 | | |

Portfolio structure

as of 09/30/06 (%)

| Common stocks | | | 61.5 | % | |

Corporate fixed-income

bonds & notes | | | 12.1 | | |

| Mortgage-backed securities | | | 8.4 | | |

| Securities lending collateral | | | 7.4 | | |

Government & agency

obligations | | | 5.6 | | |

Collateralized mortgage

obligations | | | 3.8 | | |

Commercial mortgage-

backed securities | | | 2.1 | | |

| Asset-backed Securities | | | 0.5 | | |

| Convertible bonds | | | 0.3 | | |

| Investment companies | | | 0.1 | | |

Cash equivalent, net other

assets & liabilities | | | (1.8) | | |

This fund is actively managed and the composition of its portfolio will change over time. Information provided is calculated as a percentage of net assets.

For the 12-month period ended September 30, 2006, Class A shares of Columbia Asset Allocation Fund returned 7.39% without sales charge. The S&P 500 Index returned 10.79% and the Lehman Brothers U.S. Aggregate Bond Index returned 3.67%.1 The fund's return was slightly lower than the 7.58% average return of its peer group, the Morningstar Moderate Allocation Category.2

During the period we reduced the fund's equity exposure to 62% and added modestly to the fund's positions in investment grade bonds and cash equivalents. This slight underweight in equities detracted from performance, because equities outperformed fixed income for the period. However, we believe the fund is prudently allocated for the period ahead.

Emphasis on large cap stocks aided performance

Within the equity portion of the portfolio, the fund emphasized large cap stocks over small cap stocks. This turned out to be a good tactical decision since large-caps outperformed small-caps as economic growth slowed during the period. Historically, investors have leaned toward large caps when growth slows because they tend to be more resilient than smaller companies in a challenging environment. A position in international stocks also aided performance with double-digit gains for the period.

Both growth and value stocks made a positive contribution to the fund's return. However, the fund's allocation to value stocks underperformed its benchmark while the fund's allocation to growth stocks outperformed its benchmark.

Fixed income allocation produced mixed results

The fixed income markets trailed the equity markets during the reporting period as rising interest rates put a damper on returns. As a result, the fund's slight overweight in fixed income detracted from its return. Approximately 33% of the fund's assets were committed to fixed income compared to 62% of the fund's assets committed to equities, compared to a neutral allocation of 60%/40%. In addition, the fund's fixed income return was slightly lower than its benchmark.

Looking ahead

We expect the U.S. economy to expand at a relatively modest pace through the end of the year and into 2007. With energy costs and long-term interest rates edging lower, inflation is likely to remain benign, which should keep the Federal Reserve Board on the sidelines, holding short-term interest rates steady. The housing market is soft and personal consumption growth is likely to slow. However, these could be offset somewhat

1The S&P 500 Index tracks the performance of 500 widely held, large capitalization U.S. stocks. The Lehman Brothers U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily, price, coupon, pay-downs, and total return performance of fixed-rate, publicly placed, dollar-denominated, and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index.

2©2006 by Morningstar, Inc. All rights reserved. The information contained herein is the proprietary information of Morningstar, Inc., may not be copied or redistributed for any purpose and may only be used for noncommercial, personal purposes. The information contained herein is not represented or warranted to be accurate, correct, complete or timely. Morningstar, Inc. shall not be responsible for investment decisions, damages or other losses resulting from the use of this information. Past performance is no guarantee of future performance. Morningstar, Inc. has not granted consent for it to be considered or deemed an "expert" under the Securities Act of 1933. Morningstar Categories compare the performance of funds with similar investment objectives and strategies.

4

Portfolio Managers' Report (continued) – Columbia Asset Allocation Fund

by gains in capital spending. In this environment, we plan to keep the fund's slight tilt toward fixed income going forward. We believe the fund is appropriately positioned for an environment of slower economic growth and potentially steady to declining interest rates.

5

Fund Profile – Columbia Asset Allocation Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

| | | +7.39% | |

|

| | Class A shares

(without sales charge) | |

|

| | | +10.79% | |

|

| | S&P 500 Index | |

|

| | | +3.67% | |

|

| | Lehman Brothers

U.S. Aggregate Bond Index | |

|

Summary

g For the 12-month period ended September 30, 2006, the fund's Class A shares returned 7.39% without sales charge.

g The fund's return fell between the returns of its two benchmarks, the S&P 500 Index and the Lehman Brothers U.S. Aggregate Bond Index. It was somewhat lower than the average return of its peer group.

g A slight underweight in equities detracted from performance during the period, as equities outperformed fixed income. However, an emphasis on large cap stocks aided performance.

Portfolio Management

Vikram Kuriyan, PhD, is the lead manager for Columbia Asset Allocation Fund and has managed the fund since August 2005. He has been with the advisor or its predecessors or affiliate organizations since 2000.

Karen Wurdack has co-managed the fund since August 2005 and has been with the advisor or its predecessors or affiliate organizations since 1993.

Dr. Kuriyan and Ms. Wurdack are responsible for allocating the fund's assets among the various asset classes. The investment decisions for each asset class are made by professionals with expertise in that class.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this fund may differ from that presented for other Columbia Funds mutual funds and portfolios. Performance for different classes of shares will vary based on differences in sales charges and fees associated with each class. For standardized performance, please refer to the Performance Information page.

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

Investing in high-yield securities (commonly known as "junk" bonds) offers the potential for high current income and attractive total return, but involves certain risks. Changes in economic conditions or other circumstances may adversely affect a junk bond issuer's ability to make principal and interest payments. Rising interest rates tend to lower the value of all bonds. High-yield bonds issued by foreign entities have greater potential risks, including less regulation, currency fluctuations, economic instability and political developments.

The fund may be subject to the same types of risks associated with direct ownership of real estate including the decline of property value due to general, local and regional economic conditions.

International investing involves special risks, including currency risks, risks associated with possible differences in financial standards, and other monetary and political risks. Significant levels of foreign taxes, including potentially confiscatory levels of taxation and withholding taxes, may also apply to some foreign investments.

6

Performance Information – Columbia Large Cap Growth Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

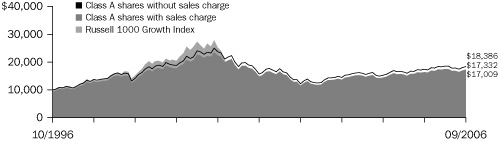

Growth of a $10,000 investment 10/01/96 – 09/30/06 ($)

The chart above shows the growth in value of a hypothetical $10,000 investment in Class A shares of Columbia Large Cap Growth Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

Growth of a $10,000 investment 10/01/96 – 09/30/06($)

| Sales charge | | without | | with | |

| Class A | | | 18,386 | | | | 17,332 | | |

| Class B | | | 17,332 | | | | 17,332 | | |

| Class C | | | 17,340 | | | | 17,340 | | |

| Class E | | | 18,386 | | | | 17,557 | | |

| Class F | | | 17,332 | | | | 17,332 | | |

| Class G | | | 16,956 | | | | 16,956 | | |

| Class T | | | 18,224 | | | | 17,179 | | |

| Class Z | | | 18,930 | | | | n/a | | |

Net asset value per share

as of 09/30/06 ($)

| Class A | | | 22.27 | | |

| Class B | | | 21.05 | | |

| Class C | | | 21.06 | | |

| Class E | | | 22.27 | | |

| Class F | | | 21.05 | | |

| Class G | | | 20.41 | | |

| Class T | | | 22.13 | | |

| Class Z | | | 22.68 | | |

Distributions declared per share

10/01/05 – 09/30/06 ($)

| Class A | | | 0.04 | | |

| Class B | | | 0.00 | | |

| Class C | | | 0.00 | | |

| Class E | | | 0.00 | | |

| Class F | | | 0.00 | | |

| Class G | | | 0.00 | | |

| Class T | | | 0.03 | | |

| Class Z | | | 0.09 | | |

The Fund's Class E and Class F are closed to new investors and new accounts.

Average annual total return as of 09/30/06 (%)

| Share class | | A | | B | | C | | E | | F | | G | | T | | Z | |

| Inception | | 11/01/98 | | 11/01/98 | | 11/18/02 | | 09/22/06 | | 09/22/06 | | 03/04/96 | | 12/14/90 | | 12/14/90 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 1- year | | | 5.69 | | | | -0.40 | | | | 4.88 | | | | -0.12 | | | | 4.78 | | | | 3.78 | | | | 5.69 | | | | 0.95 | | | | 4.88 | | | | -0.12 | | | | 4.94 | | | | -0.06 | | | | 5.63 | | | | -0.45 | | | | 5.92 | | |

| 5-year | | | 3.19 | | | | 1.97 | | | | 2.37 | | | | 2.01 | | | | 2.38 | | | | 2.38 | | | | 3.19 | | | | 2.25 | | | | 2.37 | | | | 2.01 | | | | 2.31 | | | | 1.75 | | | | 3.05 | | | | 1.84 | | | | 3.43 | | |

| 10-year | | | 6.28 | | | | 5.65 | | | | 5.65 | | | | 5.65 | | | | 5.66 | | | | 5.66 | | | | 6.28 | | | | 5.79 | | | | 5.65 | | | | 5.65 | | | | 5.42 | | | | 5.42 | | | | 6.19 | | | | 5.56 | | | | 6.59 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A and T shares and, 4.50% for Class E shares the applicable contingent deferred sales charge (5.00% in the first year, declining to 1.00% in the sixth year for Class B and Class F shares and 1.00% in the seventh year for Class G shares and eliminated thereafter) and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any voluntary waivers or reimbursement of fund expenses by the investment advisor and/or its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no Rule 12b-1 fees. Class Z shares have limited eligibility and the investment minimum requirement may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The returns for Class E and Class F shares include the returns of Class A shares (for Class E shares) and Class B shares (for Class F shares) of the fund for periods prior to September 22, 2006, the date on which Class E and F shares were initially offered by the fund. The returns for Class A and Class B shares include the returns of Prime A shares (for Class A shares) and Prime B shares (for Class B shares) of the Galaxy Equity Growth Fund for periods prior to November 18, 2002, the date on which Class A and Class B shares were initially offered by the fund. The returns shown for Class A shares and Class B shares also include the returns of Retail A shares of the Galaxy Equity Growth Fund (adjusted, as necessary, to reflect the sales charges applicable to Class A shares and Class B shares, respectively) for periods prior to the date of inception of Prime A shares and Prime B shares (November 1, 1998). Class E and Class F shares generally would have had substantially similar returns to Class A and Class B shares, respectively. Class A and Class B shares generally would have had substantially similar returns to Prime A shares, Prime B shares and Retail A shares because they would have been invested in the same portfolio of securities, although returns would have been lower to the extent that expenses for Class A and Class B shares exceed expenses paid by Prime A shares and Prime B shares, respectively or Retail A shares. The returns shown for Class C shares include the returns of Prime B shares of the Galaxy Equity Growth Fund (adjusted to reflect the sales charge applicable to Class C shares) for periods prior to November 18, 2002, the date on which Class C shares were initially offered by the fund. The returns shown for Class C shares also include the returns of Retail A shares of the Galaxy Equity Growth Fund (adjusted to reflect the sales charges applicable to Class C shares) for periods prior to the date of inception of Prime B shares (November 1, 1998). Class C shares generally would have had substantially similar returns because they would have been invested in the same portfolio of securities, although the returns would have been lower to the extent that expenses for Class C shares exceed expenses paid by Retail A or Prime B shares. The returns for Class G and Class T shares include the returns of Retail A shares (for Class T shares) and Retail B shares (for Class G shares) of the Galaxy Equity Growth Fund for periods prior to November 18, 2002, the date on which Class T and Class G shares were initially offered by the fund. Retail A shares were initially offered on December 14, 1990. The returns for Class Z shares include returns of Trust shares of the Galaxy Equity Growth Fund for periods prior to November 18, 2002, the date on which Class Z shares were initially offered by the fund. Trust shares of the Galaxy Equity Growth Fund were initially offered on December 14, 1990.

7

Understanding Your Expenses – Columbia Large Cap Growth Fund

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their brokerage firm, contact your brokerage firm to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory, Rule 12b-1 fees and other fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this reporting period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other fund companies, it is important to note that hypothetical examples are meant to highlight the ongoing cost of investing in a fund and do not reflect any transaction costs, such as sales charges or redemption or exchange fees.

04/01/06 – 09/30/06

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 990.22 | | | | 1,019.85 | | | | 5.19 | | | | 5.27 | | | | 1.04 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 986.91 | | | | 1,016.09 | | | | 8.92 | | | | 9.05 | | | | 1.79 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 986.01 | | | | 1,016.09 | | | | 8.91 | | | | 9.05 | | | | 1.79 | | |

| Class G | | | 1,000.00 | | | | 1,000.00 | | | | 986.91 | | | | 1,016.34 | | | | 8.67 | | | | 8.80 | | | | 1.74 | | |

| Class T | | | 1,000.00 | | | | 1,000.00 | | | | 990.22 | | | | 1,019.60 | | | | 5.44 | | | | 5.52 | | | | 1.09 | | |

| Class E | | | 1,000.00 | | | | 1,000.00 | | | | 1,017.80 | | | | 1,019.45 | | | | 0.30 | | | | 5.67 | | | | 1.12 | | |

| Class F | | | 1,000.00 | | | | 1,000.00 | | | | 1,017.40 | | | | 1,016.19 | | | | 0.49 | | | | 8.95 | | | | 1.77 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 991.28 | | | | 1,021.11 | | | | 3.94 | | | | 4.00 | | | | 0.79 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the investment advisor and/or any of its affiliates not waived or reimbursed a portion of expenses, total return would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

8

Portfolio Managers' Report – Columbia Large Cap Growth Fund

For the 12-month period ended September 30, 2006, Class A shares of Columbia Large Cap Growth Fund returned 5.69% without sales charge. The fund trailed the Russell 1000 Growth Index, which returned 6.04%,1 but beat the 4.59% average return of its peer group, the Morningstar Large Growth Category.2 Weak stock selection and underweights in consumer staples and health care dampened performance relative to the index. Strong stock selection in other sectors, driven by our focus on large-cap companies that we believe have strong or improving business prospects, as well as above-average growth, resulted in returns that were ahead of the peer group average.

Stock picking in consumer discretionary led the way

Consumer discretionary stocks gave the biggest boost to performance. We avoided retailers, which seemed vulnerable as consumer spending slowed, and focused instead on areas such as gaming and media. Las Vegas Sands, a casino company, produced especially sharp gains, as investors began to recognize the importance of its properties in Macau, a developing gaming center in the Far East. Office Depot, an office supply retailer, also rallied nicely, following a continued turnaround in its business. Stock selection in the telecommunications services, energy and financials sectors was also positive. Standouts included American Tower, a cell phone tower company that experienced strong demand from wireless service providers, and Kerr-McGee, an exploration and production company that was bought out at a premium. Our gains from Kerr-McGee more than offset losses from Halliburton, an energy service company that suffered as commodity prices d eclined. Our focus on capital markets companies in the financials services sector also benefited performance.

Disappointments came from consumer staples and health care

In the consumer staples sector, the fund lost ground by having a smaller investment than the index in Wal-Mart Stores, which did well even as consumer spending slowed. In health care, the fund avoided domestic pharmaceutical companies, which caused us to miss out on gains in certain major index stocks. Our focus on non-U.S. drug companies as well as biotechnology and medical device firms hampered returns as the market corrected over the summer. An exception was Thermo Electron, which makes laboratory instruments for drug companies. It rallied after reporting continued strong results and announcing the acquisition of Fisher Scientific International. Industrial conglomerates 3M and American Standard Companies, declined sharply, leading us to sell both stocks.

1The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index.

2©2006 by Morningstar, Inc. All rights reserved. The information contained herein is the proprietary information of Morningstar, Inc., may not be copied or redistributed for any purpose and may only be used for noncommercial, personal purposes. The information contained herein is not represented or warranted to be accurate, correct, complete or timely. Morningstar, Inc. shall not be responsible for investment decisions, damages or other losses resulting from the use of this information. Past performance is no guarantee of future performance. Morningstar, Inc. has not granted consent for it to be considered or deemed an "expert" under the Securities Act of 1933. Morningstar Categories compare the performance of funds with similar investment objectives and strategies.

Sectors

as of 09/30/06 (%)

| Information technology | | | 28.7 | | |

| Heath care | | | 16.5 | | |

| Consumer discretionary | | | 15.1 | | |

| Industrials | | | 12.4 | | |

| Consumer staples | | | 8.9 | | |

| Financials | | | 8.7 | | |

| Energy | | | 4.6 | | |

| Telecommunication services | | | 3.0 | | |

| Materials | | | 2.0 | | |

Sector breakdown is calculated as a percentage of total investments excluding short-term investments and securities lending collateral.

Top 10 holdings

as of 09/30/06 (%)

| Microsoft | | | 3.2 | | |

| Cisco Systems | | | 2.8 | | |

| General Electric | | | 2.7 | | |

| Google | | | 2.6 | | |

| Intel | | | 2.6 | | |

| Johnson & Johnson | | | 2.6 | | |

| Bank of New York | | | 2.1 | | |

| Thermo Electron | | | 1.9 | | |

| News | | | 1.8 | | |

| Waste Management | | | 1.7 | | |

Your fund is actively managed and the composition of its portfolio will change over time. Holdings are calculated as a percentage of net assets.

9

Portfolio Managers' Report (continued) – Columbia Large Cap Growth Fund

Holdings discussed in this report

as of 09/30/06 (%)

| Las Vegas Sands | | | 1.5 | | |

| Office Depot | | | 1.4 | | |

| American Tower | | | 1.0 | | |

| Halliburton | | | 0.7 | | |

| Wal-Mart Stores | | | 1.1 | | |

| Thermo Electron | | | 1.9 | | |

| Akamai Technologies | | | 1.0 | | |

| NVIDIA | | | 0.5 | | |

Your fund is actively managed and the composition of its portfolio will change over time. Holdings provided are calculated as a percentage of net assets.

Technology produced a mix of winners and losers

Gains in the technology sector overall were modest, as investors became concerned about a slowdown in tech spending and earnings growth. Akamai Technologies, a service provider for Internet websites, produced outsized gains as Internet traffic volume increased. However, NVIDIA and Corning were major disappointments as we missed the upswings in both holdings. NVIDIA is a leading manufacturer of chips for graphic applications such as video games, while Corning (no longer in the portfolio) makes glass for LCD displays.

Positive outlook for large-cap growth stocks

After years of trailing their small- and mid-cap peers, large-cap growth stocks appear to be poised for better times. Large-cap valuations appear attractive relative to other sectors. Plus, as the business cycle matures, companies with intrinsic growth rates may have an advantage over companies whose revenue gains have been primarily driven by their link to the current cycle. We also expect large-cap growth companies with multi-national operations to benefit if the U.S. dollar weakens further.

10

Fund Profile – Columbia Large Cap Growth Fund

Summary

g For the 12-month period ended September 30, 2006, the fund's Class A shares returned 5.69% without sales charge.

g The fund's return, after deducting fees and expenses, was modestly lower than the Russell 1000 Growth Index, but higher than the average return of the Morningstar Large Growth Category.

g Stock selection, especially in the consumer discretionary sector, contributed positively to performance relative to the fund's peer group.

Portfolio Management

Paul J. Berlinguet has managed or co-managed the fund since October 2003 and has been with the advisor or its predecessors or affiliate organizations since October 2003.

Edward P. Hickey has managed or co-managed the fund since June 2005 and has been with the advisor or its predecessors or affiliate organizations since November 1998.

Roger R. Sullivan has managed or co-managed the fund since June 2005 and has been with the advisor since January 2005.

Mary-Ann Ward has managed or co-managed the fund since June 2005 and has been with the advisor or its predecessors or affiliate organizations since July 1997.

John T. Wilson has managed or co-managed the fund since August 2005 and has been with the advisor since July 2005.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this fund may differ from that presented for other Columbia Funds mutual funds and portfolios. Performance for different classes of shares will vary based on differences in sales charges and fees associated with each class. For standardized performance, please refer to the Performance Information page.

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

International investing involves special risks, including currency risks, risks associated with possible differences in financial standards, and other monetary and political risks. Significant levels of foreign taxes, including potentially confiscatory levels of taxation and withholding taxes, may also apply to some foreign investments.

Investing in growth stocks incurs the possibility of losses because their prices are sensitive to changes in current or expected earnings.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

| | | +5.69% | |

|

| | Class A shares

(without sales charge) | |

|

| | | +6.04% | |

|

| | Russell 1000 Growth Index | |

|

Management Style

Management Style is determined by Columbia Management, and is based on the investment strategy and process as outlined in the fund's prospectus.

11

Performance Information – Columbia Disciplined Value Fund

Net asset value per share

as of 09/30/06 ($)

| Class A | | | 15.70 | | |

| Class B | | | 14.96 | | |

| Class C | | | 14.93 | | |

| Class G | | | 14.96 | | |

| Class T | | | 15.70 | | |

| Class Z | | | 16.02 | | |

Distributions declared per share

10/01/05 – 09/30/06 ($)

| Class A | | | 1.25 | | |

| Class B | | | 1.14 | | |

| Class C | | | 1.14 | | |

| Class G | | | 1.15 | | |

| Class T | | | 1.25 | | |

| Class Z | | | 1.29 | | |

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

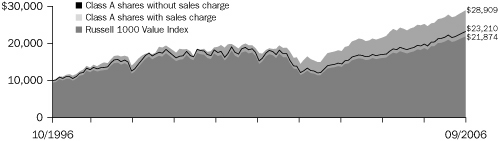

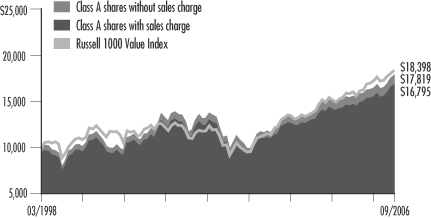

Growth of a $10,000 investment 10/01/96 – 09/30/06 ($)

The chart above shows the growth in value of a hypothetical $10,000 investment in Class A shares of Columbia Disciplined Value Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 1000 Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. Indices are not investments, do not incur fees or expenses, and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

Growth of a $10,000 investment 10/01/96 – 09/30/06 ($)

| Sales charge: | | without | | with | |

| Class A | | | 23,210 | | | | 21,874 | | |

| Class B | | | 21,522 | | | | 21,522 | | |

| Class C | | | 21,482 | | | | 21,482 | | |

| Class G | | | 21,552 | | | | 21,552 | | |

| Class T | | | 23,129 | | | | 21,798 | | |

| Class Z | | | 23,972 | | | | n/a | | |

Average annual total return as of 09/30/06 (%)

| Share class | | A | | B | | C | | G | | T | | Z | |

| Inception | | 11/25/02 | | 11/25/02 | | 11/25/02 | | 03/04/96 | | 09/01/88 | | 09/01/88 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | 17.19 | | | | 10.46 | | | | 16.35 | | | | 11.35 | | | | 16.30 | | | | 15.30 | | | | 16.32 | | | | 11.32 | | | | 17.13 | | | | 10.40 | | | | 17.50 | | |

| 5-year | | | 8.69 | | | | 7.41 | | | | 7.79 | | | | 7.50 | | | | 7.75 | | | | 7.75 | | | | 7.82 | | | | 7.38 | | | | 8.61 | | | | 7.33 | | | | 9.00 | | |

| 10-year | | | 8.78 | | | | 8.14 | | | | 7.97 | | | | 7.97 | | | | 7.95 | | | | 7.95 | | | | 7.98 | | | | 7.98 | | | | 8.75 | | | | 8.10 | | | | 9.14 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A and T shares, the applicable contingent deferred sales charge (5.00% in the first year, declining to 1.00% in the sixth year for Class B shares and 1.00% in the seventh year for Class G shares and eliminated thereafter) and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any voluntary waivers or reimbursement of fund expenses by the investment advisor and/or its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no Rule 12b-1 fees. Class Z shares have limited eligibility and the investment minimum requirement may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Class A, Class B and Class C are newer classes of shares. Their performance information includes returns of the Retail A shares (for Class A shares) and Retail B shares (for Class B and Class C shares) of the Galaxy Equity Value Fund for periods prior to November 25, 2002, the date on which Class A, B and C shares were initially offered by the Fund. The returns shown for Class B and Class C shares also include the performance of Retail A shares of the Galaxy Equity Value Fund for periods prior to the inception of Retail B shares (March 4, 1996). Class B and Class C shares generally would have had substantially similar returns to Retail A shares or Retail B shares because they would have been invested in the same portfolio of securities, although the returns would have been lower to the extent that expenses for Class B and Class C shares exceed expenses paid by Retail A shares. The returns have not been restated to reflect any di fferences in expenses (such as 12b-1 fees) between any of the predecessor shares and the newer Classes of shares. The returns for Class G and Class T shares include the returns of Retail A shares (for Class T shares) and Retail B shares (for Class G shares) of the Galaxy Equity Value Fund for periods prior to November 25, 2002, the date on which Class T and Class G shares were initially offered by the fund. Retail A shares were initially offered on September 1, 1988. The returns for Class Z shares include returns of Trust Shares of the Galaxy Equity Value Fund for periods prior to November 25, 2002, the date on which Class Z shares were initially offered by the fund. Trust shares of the Galaxy Equity Value Fund were initially offered on September 1, 1998.

12

Understanding Your Expenses – Columbia Disciplined Value Fund

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory, Rule 12b-1 fees and other fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this reporting period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other fund companies, it is important to note that hypothetical examples are meant to highlight the ongoing cost of investing in a fund and do not reflect any transaction costs, such as sales charges or redemption or exchange fees.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their brokerage firm, contact your brokerage firm to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

04/01/06 – 09/30/06

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,069.69 | | | | 1,019.00 | | | | 6.28 | | | | 6.12 | | | | 1.21 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,065.18 | | | | 1,015.24 | | | | 10.15 | | | | 9.90 | | | | 1.96 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,065.38 | | | | 1,015.24 | | | | 10.15 | | | | 9.90 | | | | 1.96 | | |

| Class G | | | 1,000.00 | | | | 1,000.00 | | | | 1,065.48 | | | | 1,015.49 | | | | 9.89 | | | | 9.65 | | | | 1.91 | | |

| Class T | | | 1,000.00 | | | | 1,000.00 | | | | 1,068.69 | | | | 1,018.75 | | | | 6.53 | | | | 6.38 | | | | 1.26 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,070.89 | | | | 1,020.26 | | | | 4.98 | | | | 4.86 | | | | 0.96 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the investment advisor and/or any of its affiliates not waived or reimbursed a portion of expenses, total return would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

13

Portfolio Managers' Report – Columbia Disciplined Value Fund

Sectors

as of 09/30/06 (%)

| Financials | | | 36.6 | | |

| Energy | | | 13.4 | | |

| Consumer discretionary | | | 8.4 | | |

| Consumer staples | | | 7.7 | | |

| Health care | | | 7.7 | | |

| Industrials | | | 6.7 | | |

| Utilities | | | 6.2 | | |

| Telecommunication services | | | 6.1 | | |

| Materials | | | 3.7 | | |

| Information technology | | | 3.6 | | |

Sector breakdown is calculated as a percentage of total investments excluding short-term investments and securities lending collateral.

Top 10 holdings

as of 09/30/06 (%)

| Exxon Mobil | | | 5.9 | | |

| Citigroup | | | 4.2 | | |

| Pfizer | | | 3.5 | | |

| Wachovia | | | 3.5 | | |

| ConocoPhillips | | | 3.0 | | |

| Allstate | | | 2.8 | | |

| Verizon Communications | | | 2.7 | | |

| Coca-Cola | | | 2.5 | | |

| CBS | | | 2.4 | | |

| Lehman Brothers Holdings | | | 2.4 | | |

Holdings discussed in this report

as of 09/30/06 (%)

| Goldman Sachs | | | 2.4 | | |

| JPMorgan Chase | | | 1.9 | | |

| Nucor | | | 1.4 | | |

| AT&T | | | 1.9 | | |

| Reynolds American | | | 2.3 | | |

| Avis Budget Group | | | 0.3 | | |

| USG | | | 1.2 | | |

Your fund is actively managed and the composition of its portfolio will change over time. Holdings are calculated as a percentage of net assets.

For the 12-month period ended September 30, 2006, Class A shares of Columbia Disciplined Value Fund returned 17.19% without sales charge. The fund outperformed its benchmark, the Russell 1000 Value Index, which returned 14.62% over the same period.1 Its return was also higher than the 11.14% average return of the Lipper Multi-Cap Value Classification average.2 Strong stock selection in the financials, materials, telecommunications and consumer staples sectors aided the fund's performance in an environment that was generally favorable to value stocks.

Stock selection drove positive performance—and a few disappointments

In the financials sector, Goldman Sachs and JPMorgan Chase were solid performers. JPMorgan Chase experienced strength in its capital markets and trading business while Goldman Sachs' investment banking and international operations produced solid results. In the materials sector, Nucor and Georgia-Pacific Group (no longer in the portfolio) were solid contributors to the fund's return as global demand for steel and paper—the primary products of the two companies—remained strong. AT&T made a solid contribution to the fund's return within the telecommunications sector. The company was buoyed by strong results in its Cingular wireless division. Tobacco maker Reynolds American also did well, as investors responded favorably to the company's strategy to drive future growth.

Stock selection in the industrials and health care sectors detracted from the fund's otherwise strong return. Avis Budget Group was the fund's biggest disappointment in the industrials sector—the only major sector to finish the period with a negative return. A soft real estate market hurt building supply company USG, also in the industrials sector, and Pulte Homes—an exception to otherwise strong performance in the consumer discretionary sector. Pulte was sold before the end of the period. In the health care sector, shares of CIGNA, the giant health care services provider, took a sharp dive in the spring as investors expressed concerns about the company's high cost structure. The decline was a drag on the fund's overall health care results and the stock was sold.

Looking ahead

Over the past several months, large, stable growth companies have led the charge to new highs for the equity markets. However, we believe the portfolio is positioned to weather any short-term shift in investor sentiment with solid value holdings that offer long-term growth potential.

1The Russell 1000 Value Index tracks the performance of those companies in the Russell 1000 Index with lower price-to-book ratios and lower forecasted growth values. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index.

2Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

14

Fund Profile – Columbia Disciplined Value Fund

Summary

g For the 12-month period ended September 30, 2006, the fund's Class A shares returned 17.19% without sales charge.

g In a period that was favorable to value stocks, the fund, its benchmark and peer group all delivered double-digit returns.1

g The fund outperformed its benchmark and Lipper peer group average, primarily because of strong stock selection in the financials, materials, telecommunications and consumer discretionary sectors.

Portfolio Management

Vikram Kuriyan has managed or co-managed the fund since June 2005 and has been with the advisor or its predecessors or affiliate organizations since 2000.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this fund may differ from that presented for other Columbia Funds mutual funds and portfolios. Performance for different classes of shares will vary based on differences in sales charges and fees associated with each class. For standardized performance, please refer to the Performance Information page.

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

Investments in small- and mid-cap stocks may present special risks. They tend to be more volatile and may be less liquid than the stocks of larger companies. Small-cap stocks often have narrower markets, limited financial resources and tend to be more thinly traded than stocks of larger companies.

Value stocks are securities of companies that may have experienced adverse business or industry developments or may be subject to special risks that have caused the stocks to be out of favor. If the advisor's assessment of a company's prospects is wrong, the price of its stock may not approach the value the advisor has placed on it.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

| | | +17.19% | |

|

| | Class A shares

(without sales charge) | |

|

| | | +14.62% | |

|

| | Russell 1000 Value Index | |

|

Management Style

Management Style is determined by Columbia Management, and is based on the investment strategy and process as outlined in the fund's prospectus.

15

Performance Information – Columbia Common Stock Fund

Net asset value per share

as of 09/30/06 ($)

| Class A | | | 14.03 | | |

| Class B | | | 13.42 | | |

| Class C | | | 13.43 | | |

| Class G | | | 13.30 | | |

| Class T | | | 13.95 | | |

| Class Z | | | 14.10 | | |

Distributions declared per share

10/01/05 – 09/30/06 ($)

| Class A | | | 0.77 | | |

| Class B | | | 0.76 | | |

| Class C | | | 0.76 | | |

| Class G | | | 0.76 | | |

| Class T | | | 0.77 | | |

| Class Z | | | 0.80 | | |

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

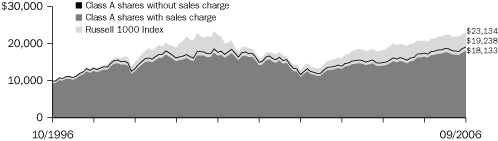

Growth of a $10,000 investment 10/01/96 – 09/30/06 ($)

The chart above shows the growth in value of a hypothetical $10,000 investment in Class A shares of Columbia Common Stock Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 1000 Index tracks the performance of 1000 of the largest U.S. companies, based on market capitalization. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

Growth of a $10,000 investment 10/01/96 – 09/30/06 ($)

| Sales charge | | without | | with | |

| Class A | | | 19,238 | | | | 18,133 | | |

| Class B | | | 18,115 | | | | 18,115 | | |

| Class C | | | 18,128 | | | | 18,128 | | |

| Class G | | | 17,741 | | | | 17,741 | | |

| Class T | | | 19,067 | | | | 17,973 | | |

| Class Z | | | 19,659 | | | | n/a | | |

Average annual total return as of 09/30/06 (%)

| Share class | | A | | B | | C | | G | | T | | Z | |

| Inception | | 11/01/98 | | 11/01/98 | | 12/09/02 | | 03/04/96 | | 02/12/93 | | 12/14/92 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 1- year | | | 9.24 | | | | 2.95 | | | | 8.40 | | | | 3.40 | | | | 8.40 | | | | 7.40 | | | | 8.49 | | | | 3.49 | | | | 9.16 | | | | 2.92 | | | | 9.45 | | |

| 5-year | | | 4.96 | | | | 3.73 | | | | 4.16 | | | | 3.82 | | | | 4.18 | | | | 4.18 | | | | 4.15 | | | | 3.64 | | | | 4.89 | | | | 3.66 | | | | 5.24 | | |

| 10-year | | | 6.76 | | | | 6.13 | | | | 6.12 | | | | 6.12 | | | | 6.13 | | | | 6.13 | | | | 5.90 | | | | 5.90 | | | | 6.67 | | | | 6.04 | | | | 6.99 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A and T shares, the applicable contingent deferred sales charge (5.00% in the first year, declining to 1.00% in the sixth year for Class B shares and 1.00% in the seventh year for Class G shares and eliminated thereafter) and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any voluntary waivers or reimbursement of fund expenses by the investment advisor and/or its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no Rule 12b-1 fees. Class Z shares have limited eligibility and the investment minimum requirement may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.