UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-4367 |

Columbia Funds Series Trust I

|

| (Exact name of registrant as specified in charter) |

| | |

| One Financial Center, Boston, Massachusetts | | 02111 |

| (Address of principal executive offices) | | (Zip code) |

James R. Bordewick, Jr., Esq.

Columbia Management Advisors, LLC

One Financial Center

Boston, MA 02111

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 1-617-426-3750

Date of fiscal year end: June 30, 2007

Date of reporting period: June 30, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Columbia High Yield Municipal Fund

Annual Report – June 30, 2007

| | |

| NOT FDIC INSURED | | May Lose Value |

| NOT BANK ISSUED | | No Bank Guarantee |

Table of Contents

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific company securities should not be construed as a recommendation or investment advice.

President’s Message

Dear Shareholder:

Investing is a long-term process and we are pleased that you have chosen to include the Columbia family of funds in your overall financial plan.

Your financial advisor can help you establish an appropriate investment portfolio and periodically review that portfolio. A well balanced portfolio is one of the keys to successful long-term investing. Your portfolio should be diversified across different asset classes and market segments and your chosen asset allocation should be appropriate for your investment goals, risk tolerance and time horizons.

However, creating an investment strategy is not a one-step process. From time to time, you’ll need to re-evaluate your strategy to determine whether your investment needs have changed. Most experts recommend giving your portfolio a “check-up” every year.

As you begin your portfolio check-up, consider whether you have experienced any major life events since the last time you assessed your portfolio. You may need to tweak your strategy if you have:

| n | | Gotten married or divorced |

| n | | Added a child to your family |

| n | | Made a significant change in employment |

| n | | Entered or moved significantly closer to retirement |

| n | | Experienced a serious illness or death in the family |

| n | | Taken on or paid off substantial debt |

It’s important to remember that over time, performance in different market segments will fluctuate. These shifts can cause your portfolio balance to drift away from your chosen asset allocation. A periodic portfolio check-up can help make sure your portfolio stays on track. Remember that asset allocation does not ensure a profit or guarantee against loss.

You’ll also want to analyze the individual investments in your portfolio. Of course, performance should be a key factor in your analysis, but it’s not the only factor to consider. Make sure the investments in your portfolio line up with your overall objectives and risk tolerance. Be aware of changes in portfolio management and pay special attention to any funds that have made significant shifts in their investment strategy.

We hope this information will help you, in working with your financial advisor, to stay on track to reach your investment goals. Thank you for your business and for your continued confidence in Columbia Funds.

Sincerely,

Christopher L. Wilson

President, Columbia Funds

Fund Profile – Columbia High Yield Municipal Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Summary

1-year return as of 06/30/07

| | |

| |

| | +5.23% Class A shares (without sales charge) |

| |

| | +4.69% Lehman Brothers Municipal Bond Index |

Management Style

Fixed Income Maturity

Management style is determined by Columbia Management and is based on the investment strategy and process as outlined in the fund’s prospectus.

Summary

| n | | For the 12-month period that ended June 30, 2007, the fund’s Class A shares returned 5.23% without sales charge. |

| n | | The fund outperformed its benchmark, the Lehman Brothers Municipal Bond Index, and came in just behind the average return of its peer group, the Lipper High Yield Municipal Debt Funds Classification. |

| n | | Exposure to lower quality, higher-yielding bonds helped the fund outperform its benchmark. However, we believe the fund had less exposure to lower quality bonds than competing funds, which accounted for a portion of its slight shortfall against its peer group. |

1

Economic Update – Columbia High Yield Municipal Fund

Summary

For the 12-month period that ended June 30, 2007

| | n | | Despite a weak second half, the Lehman Brothers U.S. Aggregate Bond Index delivered a respectable return. High-yield bonds, as measured by the Merrill Lynch U.S. High Yield, Cash Pay Index, led the US fixed-income markets. | |

| | |

Lehman

Index | | Merrill Lynch

Index |

| |

| |

|

6.12% | | 11.63% |

| | n | | The broad US stock market, as measured by the S&P 500 Index, returned 20.59%. Stock markets outside the United States were even stronger, as measured by the MSCI EAFE Index. | |

| | |

| S&P Index | | MSCI Index |

| |

| |

|

20.59% | | 27.00% |

The Lehman Brothers U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs, and total return performance of fixed-rate, publicly placed, dollar denominated, and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

The Morgan Stanley Capital International (MSCI) Europe, Australasia, Far East (EAFE) Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the US and Canada.

The S&P 500 Index tracks the performance of 500 widely held, large-capitalization US stocks.

The Merrill Lynch U.S. High Yield, Cash Pay Index tracks the performance of non-investment-grade corporate bonds.

Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index.

A sharp fall-off in the pace of US economic growth, volatility in China’s stock market, and dashed hopes about a short-term rate increase created moments of discomfort for US investors during an otherwise favorable 12-month period. Housing sales, construction and home prices moved lower, with no near-term relief in sight. Rising energy prices pinched household budgets and higher industrial metals prices drove up manufacturing costs, raising concerns about both consumer spending and inflation.

In fact, inflation concerns, coupled with a sense that growth was poised to pick up in the second half of 2007, kept the Federal Reserve Board (the Fed) on hold during the period. Although investors anticipated a rate cut some time this year, the Fed has so far held the federal funds rate, a key short-term lending rate, at 5.25% and raised the possibility of a rate increase instead. Indeed, there were signs of economic momentum as job growth remained healthy. An average of 167,000 new jobs were added to the labor markets each month during the period and unemployment remained low at approximately 4.5%. A solid job market and rising personal income also helped sustain consumer spending. In addition, manufacturing activity was livelier than expected in the final months of the period.

After a solid start, bonds falter

The US bond market enjoyed solid returns in the first half of the 12-month period. As investors anticipated a Fed rate cut, bond prices rose and yields declined across the maturity spectrum. However, when it became apparent that a rate cut was unlikely — and that the Fed remained concerned about inflation, the bond market’s perennial enemy — bond prices slid in the second half of the period and yields rose. The benchmark 10-year US Treasury yield moved above 5.0% in the last month of the period. In this environment, the Lehman Brothers U.S. Aggregate Bond Index returned a respectable 6.12%, thanks to a strong start to the period. High-yield bonds continued to lead the fixed-income markets, reflecting investor confidence about the overall resilience of the economy despite its slower pace of growth. The Merrill Lynch U.S. High Yield, Cash Pay Index returned 11.63%.

Stocks stage a broad rally

Against a relatively positive economic backdrop and better-than-expected corporate profits, the US stock market staged a broad rally that took all major market averages significantly higher for the 12-month period. The S&P 500 Index returned 20.59%. Large- and mid-cap stocks outperformed small-cap stocks, as measured by their respective Russell indices. Value stocks generally outperformed growth stocks, except among small-cap stocks where growth edged out value by a small margin. Stock markets outside the US did even better, as measured by the MSCI EAFE Index, which gained 27.00% for the period.

Past performance is no guarantee of future results.

2

Performance Information – Columbia High Yield Municipal Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

| | |

| Operating expense ratio (%)* |

| |

Class A | | 0.85 |

Class B | | 1.60 |

Class C | | 1.60 |

Class Z | | 0.65 |

| * | The annual operating expense ratio is as stated in the fund’s prospectus that is current as of the date of this report. Differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and reimbursements as well as different time periods used in calculating the ratios. |

| | |

Net asset value per share |

| |

as of 06/30/07 ($) | | |

Class A | | 11.33 |

Class B | | 11.33 |

Class C | | 11.33 |

Class Z | | 11.33 |

| | |

| Distributions declared per share |

| |

07/01/06 – 06/30/07 ($) | | |

Class A | | 0.51 |

Class B | | 0.42 |

Class C | | 0.44 |

Class Z | | 0.53 |

A portion of the fund’s income may be subject to the alternative minimum tax. The fund may at times purchase tax-exempt securities at a discount. Some or all of this discount may be included in the fund’s ordinary income, and is taxable when distributed.

|

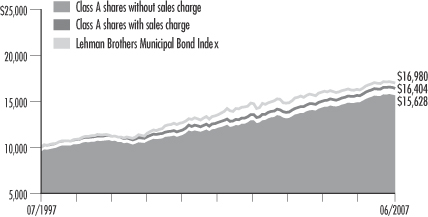

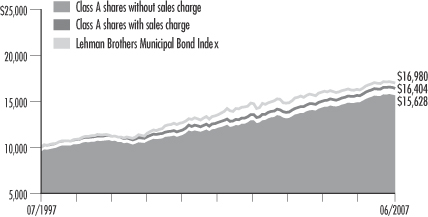

| Growth of a $10,000 investment 07/01/97 – 06/30/07 |

The chart above shows the growth in value of a hypothetical $10,000 investment in Class A shares of Columbia High Yield Municipal Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. The Lehman Brothers Municipal Bond Index is considered representative of the broad market for investment-grade, tax exempt bonds with a maturity of at least one year. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. Securities in the fund may not match those in an index.

| | | | |

| Performance of a $10,000 investment 07/01/97– 06/30/07 ($) |

| | |

| Sales charge | | without | | with |

Class A | | 16,404 | | 15,628 |

Class B | | 15,803 | | 15,803 |

Class C | | 15,920 | | 15,920 |

Class Z | | 16,674 | | n/a |

| | | | | | | | | | | | | | |

| Average annual total return as of 06/30/07 (%) |

| | | | |

| Share class | | A | | B | | C | | Z |

| Inception | | 07/31/00 | | 07/15/02 | | 07/15/02 | | 03/05/84 |

| Sales charge | | without | | with | | without | | with | | without | | with | | without |

1- year | | 5.23 | | 0.24 | | 4.45 | | –0.55 | | 4.61 | | 3.61 | | 5.44 |

5- year | | 5.23 | | 4.21 | | 4.45 | | 4.11 | | 4.60 | | 4.60 | | 5.46 |

10- year | | 5.07 | | 4.57 | | 4.68 | | 4.68 | | 4.76 | | 4.76 | | 5.25 |

The “with sales charge” returns include the maximum initial sales charge of 4.75% for Class A shares, the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The “without sales charge” returns do not include the effect of sales charges. If they had, returns would be lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no Rule 12b-1 fees. Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

Performance results reflect any waivers or reimbursement of fund expenses by the investment advisor and/or any of its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower.

The table does not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares.

Class A is a newer class of shares. Its performance information includes returns of the fund’s Class Z shares (the oldest existing fund class) for periods prior to its inception. These returns have not been restated to reflect any differences in expenses (such as Rule 12b-1 fees) between Class Z shares and Class A shares. If differences in expenses had been reflected, the returns shown for periods prior to the inception of Class A shares would have been lower. Class Z shares were initially offered on March 5, 1984, and Class A shares were initially offered on July 31, 2000.

Class B and Class C are newer classes of shares. Their performance information includes returns of the fund’s Class A shares from July 31, 2000 (Class A’s inception date) to July 15, 2002 (inception date of Class B and Class C shares). Class B and Class C shares performance information prior to July 31, 2000 includes returns of the fund’s Class Z shares (the oldest existing fund class). These returns have not been restated to reflect any differences in expenses (such as Rule 12b-1 fees) between Class A or Class Z shares and Class B and Class C shares. If differences in expenses had been reflected, the returns shown for periods prior to the inception of Class B and Class C shares would have been lower. Class Z shares were initially offered on March 5, 1984, Class A shares were initially offered on July 31, 2000, and Class B and Class C shares were initially offered on July 15, 2002.

3

Understanding Your Expenses – Columbia High Yield Municipal Fund

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

| | n | | For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiamanagement.com or by calling Shareholder Services at 800.345.6611. | |

| | n | | For shareholders who receive their account statements from their brokerage firm, contact your brokerage firm to obtain your account balance. | |

| | 1. | Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6. | |

| | 2. | In the section of the table below titled “Expenses paid during the period,” locate the amount for your share class. You will find this number in the column labeled “actual.” Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period. | |

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory fees, Rule 12b-1 fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund’s expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “actual” column is calculated using the fund’s actual operating expenses and total return for the period. The amount listed in the “hypothetical” column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund’s actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this reporting period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. A minimum account balance fee of $20 that is charged once per year may be assessed if the value of your account falls below the minimum initial investment applicable to you. This fee is not included in the table below. If it was, the estimate of expenses paid during the period would be higher, and account value during the period lower, by this amount.

| | | | | | | | | | | | | | |

| 01/01/07 – 06/30/07 |

| | | | |

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund’s annualized

expense ratio (%) |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual |

Class A | | 1,000.00 | | 1,000.00 | | 1,004.41 | | 1,020.03 | | 4.77 | | 4.81 | | 0.96 |

Class B | | 1,000.00 | | 1,000.00 | | 1,000.69 | | 1,016.31 | | 8.48 | | 8.55 | | 1.71 |

Class C | | 1,000.00 | | 1,000.00 | | 1,001.39 | | 1,017.06 | | 7.74 | | 7.80 | | 1.56 |

Class Z | | 1,000.00 | | 1,000.00 | | 1,005.41 | | 1,021.03 | | 3.78 | | 3.81 | | 0.76 |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund’s most recent fiscal half-year and divided by 365.

Had the investment advisor and/or any of its affiliates not waived or reimbursed a portion of expenses for class C shares, account values at end of period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

4

Portfolio Manager’s Report – Columbia High Yield Municipal Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

| | |

30-day SEC yields |

| |

as of 06/30/07 (%) | | |

Class A | | 4.26 |

Class B | | 3.75 |

Class C | | 3.89 |

Class Z | | 4.67 |

The 30-day SEC yields reflect the portfolio’s earning power, net of expenses, expressed as an annualized percentage of the public offering price at the end of the period.

| | |

| Taxable-equivalent SEC yields |

| |

as of 06/30/07 (%) | | |

Class A | | 6.55 |

Class B | | 5.76 |

Class C | | 5.99 |

Class Z | | 7.18 |

| | Taxable-equivalent SEC yields are based on the maximum effective 35.0% federal income tax rate. This tax rate does not reflect the phase out of exemptions or the reduction of otherwise allowable deductions that occur when adjusted gross income exceeds certain levels. |

For the 12-month period that ended June 30, 2007, the fund’s Class A shares returned 5.23% without sales charge. The fund outperformed its benchmark, the Lehman Brothers Municipal Bond Index, which returned 4.69% for the same period.1 The fund’s return was slightly lower than the 5.40% average return of its peer group, the Lipper High Yield Municipal Debt Funds Classification.2 Exposure to lower quality, higher-yielding bonds helped the fund outperform its benchmark. However, we believe the fund had less exposure to lower quality bonds than competing funds, which accounted for a slight shortfall against its peer group.

Security selection aided performance

Several of the fund’s holdings did particularly well during the period, relative to the market. Bonds issued by Northwest Parkway, a toll road that connects key segments of suburban Denver, performed well as the toll road’s board voted to sell the road to a third party. Economic development bonds issued for the construction of the Heldrich Hotel, located in Brunswick, New Jersey, performed well on the completion of construction. Holt Hauling, a food shipping and distribution company, also performed well for the fund as the result of general credit improvement.

Lower coupon bonds, higher quality focus detracted from performance

An overweight in lower coupon bonds, especially those in the 4.0% to 5.0% range, slightly detracted from the fund’s performance during the period. Nevertheless, we have maintained these positions because they provide tactical flexibility in managing the fund through periods of changing interest rates. A portion of the underperformance relative to the peer group came from the fund’s average credit quality, which was slightly higher than competing funds’ during the period.

1 | The Lehman Brothers Municipal Bond Index considered representative of the broad market for investment-grade, tax-exempt bonds with maturity of at least one year. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. |

2 | Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads. |

1 | The Lehman Brothers Municipal Bond Index considered representative of the broad market for investment-grade, tax-exempt bonds with maturity of at least one year. Indices are not investments, do not incur fees or expenses and are not professionally managed. It is not possible to invest directly in an index. |

2 | Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads. |

5

Portfolio Manager’s Report (continued) – Columbia High Yield Municipal Fund

Looking ahead

Turmoil in the subprime mortgage market has generally elevated the level of concern about credit risk in the fixed income markets. The difference in yield between US Treasury bonds and bonds of similar maturities in other sectors has widened, reflecting concerns that defaults in the subprime market could result in lower risk tolerance among investors and tighter standards among lenders. Against this backdrop, we believe that we have maintained a slightly higher credit quality than some competing funds. If the difference in yields widens even further, we believe the fund could experience higher volatility than it has in the past.

Portfolio Management

Maureen G. Newman has managed the fund since November 1998 and has been associated with the advisor or its predecessors or affiliate organizations since 1996.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for the fund may differ from that presented for other Columbia Funds.

Tax-exempt investing offers current tax-exempt income, but it also involves special risks. The value of the fund will be affected by interest rate changes and the creditworthiness of issues held in the fund. When interest rates go up, bond prices generally drop and vice versa. Interest income from certain tax-exempt bonds may be subject to certain state and local taxes and, if applicable, the alternative minimum tax. Capital gains are not exempt from income taxes.

Investments in high-yield or “junk” bonds offer the potential for higher income than investments in investment-grade bonds, but they also have a higher degree of risk. Changes in economic conditions or other circumstances may adversely affect a high-yield bond issuer’s ability to make timely principal and interest payments.

| | |

Top 10 holdings |

| |

as of 06/30/07 (%) | | |

PR Commonwealth of Puerto Rico Infrastructure Financing Authority | | 1.5 |

NV Clark County Industrial Development Authority | | 1.2 |

FL Tampa Bay Water Utility Systems | | 1.0 |

NC Charlotte/Douglas International Airport | | 1.0 |

WA Port of Seattle | | 1.0 |

NH Business Finance Authority | | 0.9 |

TX Matagorda County Navigation District No. 1 | | 0.9 |

MA Bay Transportation Authority | | 0.8 |

CO Department of Transportation | | 0.8 |

FL Highlands County Health Facilities Authority | | 0.7 |

| | |

Quality breakdown |

| |

as of 06/30/07 (%) | | |

AAA | | 22.7 |

AA | | 5.0 |

A | | 13.7 |

BBB | | 21.4 |

BB | | 2.5 |

B | | 1.3 |

CCC | | 0.3 |

Non-rated | | 32.1 |

Cash and equivalent | | 1.0 |

| | |

Maturity breakdown |

| |

as of 06/30/07 (%) | | |

0-1 years | | 0.8 |

1-3 years | | 4.1 |

3-5 years | | 4.8 |

5-7 years | | 3.2 |

7-10 years | | 4.4 |

10-15 years | | 16.7 |

15-20 years | | 18.0 |

20 - 25 years | | 14.2 |

25 years and over | | 32.8 |

Cash and equivalent | | 1.0 |

The fund is actively managed and the composition of its portfolio will change over time. Top 10 Holdings, quality and maturity breakdowns are calculated as a percentage of net assets. Ratings shown in the quality breakdown represent the rating assigned to a particular bond by one of the following nationally-recognized rating agencies: Standard & Poor’s, a division of the McGraw-Hill Companies, Inc., Moody’s Investors Service, Inc. or Fitch Ratings Ltd. Ratings are relative and subjective and are not absolute standards of quality. The Fund’s credit quality does not remove the market risk.

6

Financial Statements – Columbia High Yield Municipal Fund, June 30, 2007

| | |

| | A guide to understanding your fund’s financial statements |

| | |

| Investment Portfolio | | The investment portfolio details all of the fund’s holdings and their market value as of the last day of the reporting period. Portfolio holdings are organized by type of asset, industry, country or geographic region (if applicable) to demonstrate areas of concentration and diversification. |

| | |

| Statement of Assets and Liabilities | | This statement details the fund’s assets, liabilities, net assets and share price for each share class as of the last day of the reporting period. Net assets are calculated by subtracting all the fund’s liabilities (including any unpaid expenses) from the total of the fund’s investment and non-investment assets. The share price for each class is calculated by dividing net assets for that class by the number of shares outstanding in that class as of the last day of the reporting period. |

| | |

| Statement of Operations | | This statement details income earned by the fund and the expenses accrued by the fund during the reporting period. This statement also shows any net gain or loss the fund realized on the sales of its holdings during the period, as well as any unrealized gains or losses recognized over the period. The total of these results represents the fund’s net increase or decrease in net assets from operations. |

| | |

| Statement of Changes in Net Assets | | This statement demonstrates how the fund’s net assets were affected by its operating results, distributions to shareholders and shareholder transactions (e.g., subscriptions, redemptions and dividend reinvestments) during the reporting period. This statement also details changes in the number of shares outstanding. |

| | |

| Financial Highlights | | The financial highlights demonstrate how the fund’s net asset value per share was affected by the fund’s operating results. The financial highlights table also discloses the classes’ performance and certain key ratios (e.g., class expenses and net investment income as a percentage of average net assets). |

| | |

| Notes to Financial Statements | | These notes disclose the organizational background of the fund, its significant accounting policies (including those surrounding security valuation, income recognition and distributions to shareholders), federal tax information, fees and compensation paid to affiliates and significant risks and contingencies. |

7

Investment Portfolio – Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds – 99.5%

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Education – 3.0% |

| Education – 1.0% | | | | | | |

| CA Statewide Communities Development Authority | | San Francisco Art Institute, Series 2002,

7.375% 04/01/32 | | 750,000 | | 766,808 |

| | | |

| FL Broward County Educational Facilities Authority | | Nova Southeastern University, Series 2004,

5.625% 04/01/34 | | 925,000 | | 963,637 |

| | | |

| OH University of Cincinnati | | Series 2003 C, Insured: FGIC,

5.000% 06/01/21 | | 1,000,000 | | 1,036,750 |

| | | |

| OR Forest Grove Student Housing | | Series 2007,

5.500% 03/01/37 | | 1,750,000 | | 1,751,155 |

| | | |

| PA Higher Education Facilities Authority | | Philadelphia University, Series 2004 A,

5.125% 06/01/25 | | 1,100,000 | | 1,114,982 |

| | | |

| VT Education & Health Buildings Agency | | Vermont Law School Project, Series 2003 A,

5.500% 01/01/33 | | 500,000 | | 511,230 |

| | | |

| WV University | | Series 2000 A, Insured: AMBAC:

(a) 04/01/19 | | 1,250,000 | | 737,425 |

| | (a) 04/01/25 | | 2,750,000 | | 1,194,902 |

| | | | | | |

| | Education Total | | | | 8,076,889 |

| | | |

| Prep School – 1.1% | | | | | | |

| CA Statewide Communities Development Authority | | Crossroads School for Arts & Sciences, Series 1998,

6.000% 08/01/28 (b) | | 965,000 | | 994,211 |

| | | |

| IL Finance Authority | | Chicago Charter School Foundation, Series 2007,

5.000% 12/01/36 | | 1,750,000 | | 1,757,770 |

| | | |

| KY Louisville & Jefferson County Metropolitan Government | | Assumption High School, Inc., Series 2006,

5.000% 10/01/35 | | 1,500,000 | | 1,503,195 |

| | | |

| MA Health & Educational Facilities Authority | | Learning Center for Deaf Children, Series 1999 C,

6.100% 07/01/19 | | 1,000,000 | | 1,016,220 |

| | | |

| MI Conner Creek Academy | | Series 2007,

5.000% 11/01/26 | | 2,540,000 | | 2,439,467 |

| | | |

| MI Summit Academy North | | Series 2005,

5.500% 11/01/35 | | 750,000 | | 746,737 |

| | | |

| NH Business Finance Authority | | Proctor Academy, Series 1998 A,

5.400% 06/01/17 | | 775,000 | | 786,586 |

| | | | | | |

| | Prep School Total | | | | 9,244,186 |

| | | |

| Student Loan – 0.9% | | | | | | |

| CT Higher Education Supplemental Loan Authority | | Family Education Loan Program, Series 2005 A, AMT, Insured: MBIA

4.375% 11/15/21 | | 1,215,000 | | 1,190,177 |

| | | |

| NE Nebhelp, Inc. | | Series 1993 A-6, AMT, Insured: MBIA

6.450% 06/01/18 | | 4,000,000 | | 4,156,160 |

See Accompanying Notes to Financial Statements.

8

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Education (continued) |

| Student Loan (continued) | | | | |

| NM Educational Assistance Foundation | | Series 1996 A-2, AMT,

6.650% 11/01/25 | | 1,915,000 | | 1,948,149 |

| | | | | | |

| | Student Loan Total | | | | 7,294,486 |

| | | | | | |

| Education Total | | | | | | 24,615,561 |

| | | | | | |

| Health Care – 30.4% | | | | | | |

| Continuing Care Retirement – 12.7% | | | | | | |

| AZ Health Facilities Authority | | Beatitudes Campus Project, Series 2007,

5.200% 10/01/37 | | 1,750,000 | | 1,718,447 |

| | | |

| CA La Verne | | Brethren Hillcrest Homes, Series 2003 B,

6.625% 02/15/25 | | 685,000 | | 738,916 |

| | | |

| CO Health Facilities Authority | | Christian Living Communities Project, Series 2006 A:

5.750% 01/01/26 | | 500,000 | | 517,925 |

| | 5.750% 01/01/37 | | 1,500,000 | | 1,543,620 |

| | Covenant Retirement Communities, Inc., Series 2005,

5.000% 12/01/35 | | 2,900,000 | | 2,878,134 |

| | | |

| CT Development Authority | | Elim Park Baptist Home, Inc., Series 2003,

5.850% 12/01/33 | | 660,000 | | 695,501 |

| | | |

| FL Lee County Industrial Development Authority | | Shell Point Village, Series 2007,

5.000% 11/15/29 | | 2,100,000 | | 2,058,315 |

| | | |

| FL Orange County Health Facilities Authority | | Orlando Lutheran:

Series 2005,

5.700% 07/01/26 | | 1,000,000 | | 1,012,140 |

| | Series 2007: 5.500% 07/01/32 | | 350,000 | | 345,783 |

| | 5.500% 07/01/38 | | 1,750,000 | | 1,716,802 |

| | | |

| FL Palm Beach County Health Facilities Authority | | Abbey Delray South, Series 2003,

5.350% 10/01/14 | | 1,250,000 | | 1,293,500 |

| | | |

| FL Sarasota County Health Facility Authority | | Series 2007,

5.500% 01/01/32(c) | | 3,000,000 | | 3,043,020 |

| | | |

| FL St. John’s County Industrial Development Authority | | Glenmoor at St. John’s, Inc., Series 2006 A,

5.375% 01/01/40 | | 2,000,000 | | 2,013,580 |

| | Ponte Vedra, Inc., Series 2007,

5.000% 02/15/27 | | 2,000,000 | | 1,992,460 |

| | | |

| GA Fulton County | | Canterbury Court Project, Series 2004 A,

6.125% 02/15/34 | | 1,000,000 | | 1,039,630 |

| | Lenbrook Project, Series 2006 A:

5.000% 07/01/29 | | 3,000,000 | | 2,929,590 |

| | 5.125% 07/01/42 | | 1,000,000 | | 975,380 |

See Accompanying Notes to Financial Statements.

9

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Health Care (continued) | | | | | | |

| Continuing Care Retirement (continued) | | | | |

| GA Savannah Economic Development Authority | | Marshes of Skidaway, Series 2003 A: 7.400% 01/01/24 | | 500,000 | | 525,015 |

| | 7.400% 01/01/34 | | 1,000,000 | | 1,046,330 |

| | | |

| IA Finance Authority | | Deerfield Retirement Community, Inc., Series 2007 A, 5.500% 11/15/27 | | 1,135,000 | | 1,145,624 |

| | | |

| IL Finance Authority | | Lutheran Senior Services, Series 2006,

5.125% 02/01/26 | | 2,000,000 | | 2,021,800 |

| | Tabor Hills Supportive Living, Series 2006, 5.250% 11/15/36 | | 2,000,000 | | 1,996,900 |

| | Washington & Jane Smith Community:

Series 2003 A, 7.000% 11/15/32 | | 1,000,000 | | 1,076,180 |

| | Series 2005 A,

6.250% 11/15/35 | | 2,750,000 | | 2,875,290 |

| | | |

| IN Health & Educational Facilities Financing Authority | | Baptist Homes of Indiana, Inc., Series 2005,

5.250% 11/15/35 | | 2,750,000 | | 2,803,955 |

| | | |

| KS Lenexa Health Care Facility Revenue | | Series 2007,

5.500% 05/15/39 | | 2,250,000 | | 2,289,307 |

| | | |

| KS Manhattan Health Care Facility | | Manhattan Retirement Foundation, Series 2007,

5.125% 05/15/37 | | 1,000,000 | | 973,840 |

| | | |

| MA Boston Industrial Development Financing Authority | | Springhouse, Inc., Series 1998,

5.875% 07/01/20 | | 385,000 | | 390,725 |

| | | |

| MA Development Finance Agency | | Berkshire Retirement Community, Inc., Series 1999,

5.625% 07/01/29 | | 1,250,000 | | 1,279,400 |

| | Loomis House, Inc.:

Series 1999 A, 5.625% 07/01/15 | | 650,000 | | 658,704 |

| | Series 2002 A,

6.900% 03/01/32 | | 220,000 | | 238,682 |

| | | |

| MD Howard County | | Columbia Vantage House Corp., Series 2007 A,

5.250% 04/01/33 | | 750,000 | | 754,770 |

| | | |

| MD Westminster Economic Development Authority | | Carroll Lutheran Village, Inc., Series 2004 A,

6.250% 05/01/34 | | 1,750,000 | | 1,826,282 |

| | | |

| MI Kentwood Economic Development Corp. | | Holland Home, Series 2006 A,

5.375% 11/15/36 | | 2,500,000 | | 2,517,225 |

| | | |

| MI Meridian Economic Development Corp. | | Burcham Hills Retirement Center II, Series 2007 A-1,

5.250% 07/01/26 | | 1,050,000 | | 1,036,833 |

| | | |

| MO Health & Educational Facilities Authority | | Lutheran Senior Services, Series 2007 A,

4.875% 02/01/27 | | 3,000,000 | | 2,942,370 |

| | | |

| MT Facility Finance Authority | | St. John’s Lutheran Ministries, Inc., Series 2006 A,

6.125% 05/15/36 | | 1,000,000 | | 1,030,770 |

See Accompanying Notes to Financial Statements.

10

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Health Care (continued) | | | | | | |

| Continuing Care Retirement (continued) | | | | |

| NC Medical Care Commission | | United Methodist Retirement Homes, Inc., Series 2005 C,

5.500% 10/01/32 | | 1,000,000 | | 1,015,790 |

| | | |

| NH Higher Educational & Health Facilities Authority | | Rivermead at Peterborough, Series 1998:

5.625% 07/01/18 | | 500,000 | | 506,360 |

| | 5.750% 07/01/28 | | 1,665,000 | | 1,678,586 |

| | | |

| NJ Economic Development Authority | | Cranes Mill Project A, Series 2005 A,

5.000% 06/01/20 | | 2,120,000 | | 2,100,030 |

| | Lions Gate, Series 2005 A:

5.750% 01/01/25 | | 400,000 | | 410,756 |

| | 5.875% 01/01/37 | | 1,330,000 | | 1,364,128 |

| | Seabrook Village, Inc., Series 2006,

5.250% 11/15/36 | | 2,700,000 | | 2,696,193 |

| | Seashore Gardens Project, Series 2006,

5.300% 11/01/26 | | 500,000 | | 503,590 |

| | | |

| NY East Rochester Housing Authority | | Woodland Village Project, Series 2006,

5.500% 08/01/33 | | 1,700,000 | | 1,705,525 |

| | | |

| OR Multnomah County Hospital Facilities Authority | | Terwilliger Plaza Project, Series 2006 A,

5.250% 12/01/36 | | 650,000 | | 637,559 |

| | | |

| PA Bucks County Industrial Development Authority | | Ann’s Choice, Inc., Series 2005 A,

6.250% 01/01/35 | | 1,750,000 | | 1,832,460 |

| | | |

| PA Chartiers Valley Industrial & Commercial Development Authority | | Asbury Health Center, Series 1999,

6.375% 12/01/24 | | 750,000 | | 780,930 |

| | Friendship Village of South Hills, Series 2003 A,

5.750% 08/15/20 | | 1,000,000 | | 1,012,740 |

| | | |

| PA Delaware County Authority | | Dunwoody Village, Series 2003 A,

5.375% 04/01/17 | | 750,000 | | 775,898 |

| | | |

| PA Montgomery County Industrial Development Authority | | Whitemarsh Continuing Care Retirement Community,

Series 2005: 6.125% 02/01/28 | | 1,400,000 | | 1,466,766 |

| | 6.250% 02/01/35 | | 1,350,000 | | 1,412,802 |

| | | |

| SC Jobs Economic Development Authority | | Lutheran Homes, Series 2007,

5.500% 05/01/28(c) | | 1,100,000 | | 1,090,485 |

| | Wesley Commons, Series 2006,

5.300% 10/01/36 | | 2,500,000 | | 2,503,400 |

| | | |

| TN Johnson City Health & Educational Facilities Authority | | Appalachian Christian Village, Series 2004 A,

6.250% 02/15/32 | | 250,000 | | 259,698 |

| | | |

| TN Metropolitan Government Nashville & Davidson County | | Blakeford at Green Hills, Series 1998,

5.650% 07/01/24 | | 1,825,000 | | 1,831,442 |

See Accompanying Notes to Financial Statements.

11

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Health Care (continued) | | | | | | |

| Continuing Care Retirement (continued) | | | | |

| TN Shelby County Health Educational & Housing Facilities Board | | Germantown Village:

Series 2003 A, 7.250% 12/01/34 | | 675,000 | | 690,147 |

| | Series 2006, 6.250% 12/01/34 | | 500,000 | | 460,770 |

| | Trezevant Manor, Series 2006 A,

5.750% 09/01/37 | | 3,950,000 | | 3,997,281 |

| | | |

| TX Abilene Health Facilities Development Corp. | | Sears Methodist Retirement Center:

Series 1998 A, 5.900% 11/15/25 | | 1,350,000 | | 1,359,274 |

| | Series 2003 A, 7.000% 11/15/33 | | 800,000 | | 857,712 |

| | | |

| TX Bexar County Health Facilities Development Corp. | | Army Retirement Residence, Series 2007,

5.000% 07/01/27 | | 1,000,000 | | 986,310 |

| | | |

| TX HFDC of Central Texas, Inc. | | Legacy at Willow Bend, Series 2006 A,

5.750% 11/01/36 | | 2,100,000 | | 2,148,468 |

| | Village at Gleannloch Farms, Series 2006 A,

5.500% 02/15/37 | | 1,850,000 | | 1,867,205 |

| | | |

| TX Houston Health Facilities Development Corp. | | Buckingham Senior Living Community, Inc., Series 2004 A,

7.125% 02/15/34 | | 1,000,000 | | 1,094,790 |

| | | |

| TX Tarrant County Cultural Education Facilities | | Northwest Senior Housing-Edgemere, Series 2006 A,

6.000% 11/15/36 | | 1,000,000 | | 1,050,300 |

| | | |

| VA James City County Economic Development Authority | | Williamsburg Landing, Inc., Series 2005 A,

5.500% 09/01/34 | | 750,000 | | 768,248 |

| | | |

| VA Suffolk Industrial Development Authority | | Lake Prince Center, Series 2006,

5.150% 09/01/24 | | 750,000 | | 754,298 |

| | | |

| VA Virginia Beach Development Authority | | Westminster-Canterbury of Hampton, Series 2005,

5.375% 11/01/32 | | 700,000 | | 711,872 |

| | | |

| WI Health & Educational Facilities Authority | | Clement Manor, Series 1998,

5.750% 08/15/24 | | 2,200,000 | | 2,221,626 |

| | Eastcastle Place, Inc., Series 2004,

6.125% 12/01/34 | | 500,000 | | 506,785 |

| | Milwaukee Catholic Home, Series 2006,

5.000% 07/01/26 | | 750,000 | | 752,693 |

| | Three Pillars Senior Living Communities:

Series 2003, 5.600% 08/15/23 | | 790,000 | | 812,855 |

| | Series 2004 A,

5.500% 08/15/34 | | 870,000 | | 881,701 |

| | United Lutheran Program for the Aging, Series 1998,

5.700% 03/01/28 | | 750,000 | | 754,515 |

| | | | | | |

| | Continuing Care Retirement Total | | | | 104,204,733 |

See Accompanying Notes to Financial Statements.

12

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Health Care (continued) |

| Health Services – 0.6% | | | | | | |

| CO Health Facilities Authority | | National Jewish Medical & Research Center, Series 1998, 5.375% 01/01/23 | | 1,080,000 | | 1,082,754 |

| | | |

| MA Development Finance Agency | | Boston Biomedical Research Institute, Series 1999: 5.650% 02/01/19 | | 370,000 | | 382,480 |

| | 5.750% 02/01/29 | | 550,000 | | 564,460 |

| | | |

| MA Health & Educational Facilities Authority | | Civic Investments, Inc., Series 2002 A, 9.000% 12/15/15 | | 1,500,000 | | 1,779,585 |

| | | |

| MN Minneapolis & St. Paul Housing & Redevelopment Authority | | HealthPartners:

Series 2003, 5.875% 12/01/29 | | 400,000 | | 424,412 |

| | Series 2006,

5.250% 05/15/23 | | 1,000,000 | | 1,019,220 |

| | | | | | |

| | Health Services Total | | | | 5,252,911 |

| | | |

| Hospitals – 13.1% | | | | | | |

| AR Baxter County | | Baxter County Regional Hospital, Series 2007, 5.000% 09/01/26 | | 1,500,000 | | 1,488,930 |

| | | |

| AR Washington County | | Washington Regional Medical Center:

Series 2005 A, 5.000% 02/01/35 | | 1,000,000 | | 998,470 |

| | Series 2005 B, 5.000% 02/01/30 | | 250,000 | | 250,615 |

| | | |

| AZ Health Facilities Authority | | Phoenix Memorial Hospital, Series 1991, 8.125% 06/01/12 (d) | | 1,849,099 | | 6,472 |

| | | |

| CA ABAG Finance Authority for Nonprofit Corps. | | San Diego Hospital Association, Series 2003 C, 5.375% 03/01/21 | | 500,000 | | 515,780 |

| | | |

| CA Health Facilities Financing Authority | | Catholic Health Care West, Series 2004 G, 5.250% 07/01/23 | | 500,000 | | 513,250 |

| | Stanford Hospital & Clinics Projects, Series 2003 A, 5.000% 11/15/23 | | 1,500,000 | | 1,513,770 |

| | | |

| CA Statewide Communities Development Authority | | Huntington Memorial Hospital, Series 2005, 5.000% 07/01/35 | | 3,500,000 | | 3,525,235 |

| | Kaiser Permanente:

Series 2004 I, 3.450% 04/01/35 | | 1,000,000 | | 965,020 |

| | Series 2007 A,

4.750% 04/01/33 | | 3,250,000 | | 3,151,135 |

| | | |

| CA Turlock | | Emanuel Medical Center, Inc., Series 2004, 5.375% 10/15/34 | | 2,000,000 | | 2,043,380 |

| | | |

| CA Whittier | | Presbyterian Intercommunity Hospital, Series 2002, 5.750% 06/01/31 | | 1,000,000 | | 1,088,960 |

See Accompanying Notes to Financial Statements.

13

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Health Care (continued) |

| Hospitals (continued) | | | | |

| CO Health Facilities Authority | | Vail Valley Medical Center, Series 2004, 5.000% 01/15/20 | | 1,000,000 | | 1,009,360 |

| | | |

| CT Health & Educational Facilities Authority | | Hospital for Special Care, Series 1997 B, 5.500% 07/01/27 | | 730,000 | | 745,513 |

| | | |

| FL Highlands County Health Facilities Authority | | Adventist Health Care, Series 2005 B, 5.000% 11/15/30 | | 5,500,000 | | 5,529,590 |

| | | |

| FL Hillsborough County Industrial Development Authority | | Tampa General Hospital Project, Series 2003 B, 5.250% 10/01/34 | | 1,000,000 | | 1,014,280 |

| | | |

| FL Jacksonville Health Facilities Authority | | Baptist Medical Center Project, Series 2007 A, 5.000% 08/15/37 | | 5,000,000 | | 5,003,650 |

| | | |

| FL Miami Health Facilities Authority | | Catholic Health East, Series 2003 B, 5.125% 11/15/24 | | 1,000,000 | | 1,015,420 |

| | | |

| FL Orange County Health Facilities Authority | | Orlando Regional Healthcare System, Series 1999 E, 6.000% 10/01/26 | | 855,000 | | 888,576 |

| | | |

| FL South Lake County Hospital District | | South Lake Hospital, Inc., Series 2003: 6.375% 10/01/28 | | 750,000 | | 816,067 |

| | 6.375% 10/01/34 | | 500,000 | | 542,355 |

| | | |

| FL West Orange Health Care District | | Series 2001 A,

5.650% 02/01/22 | | 1,450,000 | | 1,501,475 |

| | | |

| IL Health Facilities Authority | | Thorek Hospital & Medical Center, Series 1998, 5.375% 08/15/28 | | 500,000 | | 506,420 |

| | | |

| IL Southwestern Development Authority | | Anderson Hospital:

Series 1999: 5.500% 08/15/20 | | 500,000 | | 510,370 |

| | 5.625% 08/15/29 | | 250,000 | | 255,655 |

| | Series 2006,

5.125% 08/15/26 | | 1,245,000 | | 1,250,092 |

| | | |

| IN Health & Educational Facility Financing Authority | | Clarian Health Partners, Series 2006 A, 5.000% 02/15/39 | | 1,875,000 | | 1,851,394 |

| | Jackson County Schneck Memorial, Series 2006 A, 5.250% 02/15/30 | | 1,000,000 | | 1,022,910 |

| | | |

| IN Health Facility Financing Authority | | Community Foundation of Northwest Indiana, Inc.,

Series 2004 A, 6.000% 03/01/34 | | 850,000 | | 898,807 |

| | | |

| KS University Hospital Authority | | Series 2006:

4.500% 09/01/32 | | 1,000,000 | | 912,760 |

| | 5.000% 09/01/36 | | 2,200,000 | | 2,193,136 |

| | | |

| LA Public Facilities Authority | | Touro Infirmary, Series 1999 A:

5.500% 08/15/19 | | 510,000 | �� | 518,150 |

| | 5.625% 08/15/29 | | 240,000 | | 244,486 |

See Accompanying Notes to Financial Statements.

14

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Health Care (continued) |

| Hospitals (continued) | | | | | | |

| MA Health & Educational Facilities Authority | | Jordan Hospital:

Series 1998 D, 5.250% 10/01/18 | | 600,000 | | 601,548 |

| | Series 2003 E,

6.750% 10/01/33 | | 750,000 | | 814,237 |

| | Milford-Whitinsville Regional Hospital:

Series 1998 C, 5.750% 07/15/13 | | 610,000 | | 628,758 |

| | Series 2007,

5.000% 07/15/32 | | 1,250,000 | | 1,227,200 |

| | | |

| MD Health & Higher Educational Facilities Authority | | Adventist Health Care, Series 2003 A: 5.000% 01/01/16 | | 400,000 | | 403,756 |

| | 5.750% 01/01/25 | | 600,000 | | 627,774 |

| | | |

| MI Dickinson County | | Dickinson County Health Care System, Series 1999, 5.800% 11/01/24 | | 1,000,000 | | 1,022,020 |

| | | |

| MI Hospital Finance Authority | | Garden City Hospital, Series 2007, 5.000% 08/15/38 | | 2,250,000 | | 2,102,152 |

| | Henry Ford Health, Series 2006 A, 5.000% 11/15/21 | | 1,000,000 | | 1,013,400 |

| | McLaren Health Care Corp., Series 2005 C, 5.000% 08/01/35 | | 2,500,000 | | 2,524,075 |

| | Oakwood Obligated Group, Series 2003, 5.500% 11/01/18 | | 1,600,000 | | 1,672,032 |

| | | |

| MN St. Paul Housing & Redevelopment Authority | | HealthEast, Inc., Series 2005, 5.150% 11/15/20 | | 750,000 | | 778,320 |

| | | |

| MN Washington County Housing & Redevelopment Authority | | HealthEast, Inc., Series 1998, 5.250% 11/15/12 | | 1,100,000 | | 1,122,231 |

| | | |

| MO Cape Girardeau County | | Southeast Missouri Hospital Association, Series 2003, 5.000% 06/01/27 | | 3,750,000 | | 3,755,662 |

| | | |

| MO Health & Educational Facilities Authority | | Lake Regional Health Systems Project, Series 2003, 5.700% 02/15/34 | | 1,000,000 | | 1,047,340 |

| | | |

| MO Saline County Industrial Development Authority | | John Fitzgibbon Memorial Hospital, Series 2005, 5.625% 12/01/35 | | 2,750,000 | | 2,755,665 |

| | | |

| MT Facilities Finance Authority | | Montana’s Children’s Home and Hospital, Series 2005 B, 4.750% 01/01/24 | | 750,000 | | 746,602 |

| | | |

| NC Medical Care Commission | | Stanly Memorial Hospital, Series 1999, 6.375% 10/01/29 | | 1,000,000 | | 1,047,430 |

See Accompanying Notes to Financial Statements.

15

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Health Care (continued) |

| Hospitals (continued) | | | | | | |

| NH Higher Educational & Health Facilities Authority | | Catholic Medical Center, Series 2002 A, 6.125% 07/01/32 | | 50,000 | | 53,288 |

| | Littleton Hospital Association, Inc.:

Series 1998 A: 5.900% 05/01/18 | | 500,000 | | 509,955 |

| | 6.000% 05/01/28 | | 1,000,000 | | 1,020,920 |

| | Series 1998 B,

5.900% 05/01/28 | | 675,000 | | 687,373 |

| | The Memorial Hospital at North Conway, Series 2006, 5.250% 06/01/21 | | 1,000,000 | | 1,022,110 |

| | | |

| NJ Health Care Facilities Financing Authority | | Children’s Specialized Hospital, Series 2005 A, 5.000% 07/01/24 | | 745,000 | | 745,484 |

| | | |

| NM Farmington | | San Juan Medical Center, Series 2004 A, 5.000% 06/01/23 | | 500,000 | | 502,885 |

| | | |

| NV Henderson | | St. Rose Dominican Hospital, Series 1998, 5.125% 07/01/28 | | 540,000 | | 552,193 |

| | | |

| NY Dormitory Authority | | Mount Sinai Hospital, NYU Medical Center, Series 2000 C, 5.500% 07/01/26 | | 2,275,000 | | 2,298,000 |

| | Mount Sinai Hospital, Series 2000, 5.500% 07/01/26 | | 225,000 | | 227,851 |

| | | |

| NY Monroe County Industrial Development Agency | | Highland Hospital, Series 2005, 5.000% 08/01/25 | | 1,115,000 | | 1,117,888 |

| | | |

| OH Higher Educational Facility Commission | | University Hospitals Health Systems, Inc., Series 2007 A, 4.500% 01/15/31 | | 5,000,000 | | 4,591,350 |

| | | |

| OH Highland County Joint Township | | Series 1999, 6.750% 12/01/29 | | 1,815,000 | | 1,947,441 |

| | | |

| OH Lakewood Hospital Improvement District | | Lakewood Hospital Association, Series 2003, 5.500% 02/15/15 | | 1,250,000 | | 1,309,575 |

| | | |

| OH Miami County Hospital Facilities Authority | | Upper Valley Medical Center, Inc., 5.250% 05/15/17 | | 1,000,000 | | 1,041,700 |

| | | |

| OH Sandusky County | | Memorial Hospital, Series 1998, 5.150% 01/01/10 | | 250,000 | | 250,348 |

| | | |

| OK Development Finance Authority | | Duncan Regional Hospital, Series 2003 A, 5.125% 12/01/23 | | 2,000,000 | | 2,030,660 |

| | | |

| OK Norman Regional Hospital Authority | | Series 2007, 5.000% 09/01/27 | | 2,000,000 | | 1,982,300 |

| | | |

| OK Stillwater Medical Center Authority | | Series 2003, 5.625% 05/15/23 | | 1,000,000 | | 1,074,720 |

| | Series 2005, 5.000% 05/15/17 | | 1,155,000 | | 1,171,031 |

See Accompanying Notes to Financial Statements.

16

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Health Care (continued) |

| Hospitals (continued) | | | | | | |

| SC Jobs Economic Development Authority | | Bon Secours-St. Francis Medical Center, Series 2002, 5.500% 11/15/23 | | 2,250,000 | | 2,318,377 |

| | | |

| SD Health & Educational Facilities Authority | | Sioux Valley Hospital & Health System, Series 2004 A, 5.250% 11/01/34 | | 1,100,000 | | 1,132,296 |

| | | |

| TN Johnson City Health & Educational Facilities Board | | Mountain States Health Alliance, Series 2006 A, 5.500% 07/01/36 | | 750,000 | | 775,275 |

| | | |

| TN Knox County Health, Educational & Housing Facilities Authority | | East Tennessee Hospital, Series 2003 B, 5.750% 07/01/33 | | 150,000 | | 157,838 |

| | | |

| TN Sullivan County Health Educational & Housing Facilities Board | | Wellmont Health System, Series 2006 C, 5.250% 09/01/26 | | 4,000,000 | | 4,087,320 |

| | | |

| VA Augusta County Industrial Development Authority | | Augusta Health Care, Inc., Series 2003, 5.250% 09/01/19 | | 2,000,000 | | 2,127,680 |

| | | |

| VT Educational & Health Buildings Financing Agency | | Fletcher Allen Health Care, Series 2007 A, 4.750% 12/01/36 | | 800,000 | | 757,544 |

| | | |

| WA Skagit County Public Hospital District No. 1 | | Series 2003, 6.000% 12/01/23 | | 1,000,000 | | 1,059,940 |

| | | |

| WI Health & Educational Facilities Authority | | Aurora Health Care, Inc., Series 2003, 6.400% 04/15/33 | | 700,000 | | 763,917 |

| | Fort Health Care, Inc., Series 2004, 6.100% 05/01/34 | | 1,965,000 | | 2,138,293 |

| | | | | | |

| | Hospitals Total | | | | 107,637,237 |

| | | |

| Intermediate Care Facilities – 0.6% | | | | | | |

| IL Development Finance Authority | | Hoosier Care, Inc., Series 1999 A, 7.125% 06/01/34 | | 1,410,000 | | 1,443,248 |

| | | |

| IN Health Facilities Financing Authority | | Hoosier Care, Inc., Series 1999 A, 7.125% 06/01/34 | | 1,165,000 | | 1,192,471 |

| | | |

| LA Public Facilities Authority | | Progressive Health Care Providers, Inc., Series 1998, 6.375% 10/01/28 | | 2,000,000 | | 2,028,020 |

| | | | | | |

| | Intermediate Care Facilities Total | | | | 4,663,739 |

| | | |

| Nursing Homes – 3.4% | | | | | | |

| AK Juneau | | St. Ann’s Care Center, Inc., Series 1999, 6.875% 12/01/25 | | 1,660,000 | | 1,640,246 |

| | | |

| CO Health Facilities Authority | | Evangelical Lutheran Good Samaritan Foundation:

Series 2005, 5.000% 06/01/35 | | 750,000 | | 749,970 |

| | Series 2006, 5.250% 06/01/24 | | 2,000,000 | | 2,051,480 |

| | Volunteers of America Care Facilities, Series 1999 A, 5.750% 07/01/10 | | 550,000 | | 563,953 |

See Accompanying Notes to Financial Statements.

17

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Health Care (continued) |

| Nursing Homes (continued) | | | | | | |

| DE Economic Development Authority | | Churchman Village Project, Series 1991 A, 10.000% 03/01/21 | | 615,000 | | 608,235 |

| | | |

| Greystone Midwest Junior Lien | | 7.148% 08/01/36 (e) | | 3,581,328 | | 3,220,653 |

| | | |

| IA Finance Authority | | Care Initiatives, Series 1998 B: 5.500% 07/01/08 | | 210,000 | | 212,331 |

| | 5.750% 07/01/18 | | 600,000 | | 616,194 |

| | 5.750% 07/01/28 | | 1,475,000 | | 1,503,718 |

| | | |

| IA Marion Health Care Facilities | | Series 2003,

6.500% 01/01/29 (f)

(8.000% 01/01/09) | | 300,000 | | 335,361 |

| | | |

| KY Economic Development Finance Authority | | Series 2003,

6.500% 01/01/29 (f)

(8.000% 01/01/09) | | 920,000 | | 1,028,440 |

| | | |

| MA Development Finance Agency | | Alliance Health Care Facilities, Series 1999 A, 7.100% 07/01/32 | | 2,170,000 | | 2,205,219 |

| | | |

| MA Industrial Finance Agency | | GF/Massachusetts, Inc., Series 1994, 8.300% 07/01/23 | | 835,000 | | 807,821 |

| | | |

| MN Eveleth | | Arrowhead Senior Living Community, Series 2007, 5.200% 10/01/27 | | 1,375,000 | | 1,344,585 |

| | | |

| MN Sartell | | Foundation for Health Care:

Series 1999 A, 6.625% 09/01/29 | | 2,000,000 | | 2,048,040 |

| | Series 2001 A,

8.000% 09/01/30 | | 1,000,000 | | 1,088,700 |

| | | |

| MN St. Paul Housing & Redevelopment Authority | | Sholom Home East Inc., Series 2007 A, 5.050% 10/01/27 | | 1,000,000 | | 972,260 |

| | | |

| MO St. Louis County Industrial Development Authority | | Ranken Jordan Project, Series 2007, 5.000% 11/15/35 | | 1,300,000 | | 1,267,032 |

| | | |

| NY Dutchess County Industrial Development Agency | | Elant Fishkill, Inc., Series 2007 A, 5.250% 01/01/37 | | 1,400,000 | | 1,374,044 |

| | | |

| PA Chester County Industrial Development Authority | | Pennsylvania Nursing Home, Series 2002, 8.500% 05/01/32 | | 380,000 | | 394,615 |

| | | |

| PA Delaware County Industrial Development Authority | | Care Institute-Main Line LLC, Series 2005, 9.000% 08/01/31 | | 50,000 | | 37,563 |

| | | |

| WI Health & Educational Facilities Authority | | Series 2003 A,

8.500% 11/01/33 | | 3,535,000 | | 3,558,508 |

| | | | | | |

| | Nursing Homes Total | | | | 27,628,968 |

| | | | | | |

| Health Care Total | | | | | | 249,387,588 |

See Accompanying Notes to Financial Statements.

18

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Housing – 12.7% |

| Assisted Living/Senior – 2.6% | | | | | | |

| DE Kent County | | Heritage at Dover, Series 1999, AMT, 7.625% 01/01/30 | | 2,550,000 | | 2,456,032 |

| | | |

| FL St. Johns County Industrial Development Authority | | St. John’s County Welfare, Series 2007 A: 5.200% 10/01/27 | | 1,130,000 | | 1,124,305 |

| | 5.250% 10/01/41 | | 1,400,000 | | 1,380,162 |

| | | |

| GA Columbus Housing Authority | | The Gardens at Calvary Project, Series 1999, 7.000% 11/15/29 | | 2,000,000 | | 1,930,040 |

| | | |

| GA Jefferson Development Authority | | Sumner Smith Facility, Series 2007 A, AMT, 5.875% 08/01/38 | | 2,360,000 | | 2,312,021 |

| | | |

| MA Development Finance Agency | | VOA Concord Assisted Living Inc, Series 2007, 5.200% 11/01/41 | | 1,000,000 | | 965,810 |

| | | |

| MN Rochester | | Madonna Meadows, Series 2007 A, 5.200% 10/01/23 | | 830,000 | | 816,529 |

| | | |

| MN Roseville | | Care Institute, Inc., Series 1993, 7.750% 11/01/23 | | 1,270,000 | | 1,114,730 |

| | | |

| MN St. Paul Housing & Redevelopment Authority | | Marian Center Project, Series 2007 A, 5.300% 11/01/30 | | 1,000,000 | | 972,530 |

| | | |

| NC Medical Care Commission | | DePaul Community Facilities, Inc.:

Series 1998, 6.125% 01/01/28 | | 750,000 | | 723,983 |

| | Series 1999,

7.625% 11/01/29 | | 2,190,000 | | 2,278,323 |

| | | |

| NY Huntington Housing Authority | | Gurwin Jewish Senior Center, Series 1999 A: 5.875% 05/01/19 | | 1,900,000 | | 1,947,082 |

| | 6.000% 05/01/29 | | 625,000 | | 641,425 |

| | | |

| NY Mount Vernon Industrial Development Agency | | Wartburg Senior Housing, Inc., Series 1999, 6.200% 06/01/29 | | 1,000,000 | | 1,009,570 |

| | | |

| NY Suffolk County Industrial Development Agency | | Gurwin Jewish Phase II, Series 2004, 6.700% 05/01/39 | | 500,000 | | 541,200 |

| | | |

| OR Clackamas County Hospital Facility Authority | | Robison Jewish Home, Series 2005, 5.250% 10/01/27 | | 700,000 | | 697,347 |

| | | | | | |

| | Assisted Living/Senior Total | | | | 20,911,089 |

| | | |

| Multi-Family – 4.8% | | | | | | |

| CA Statewide Communities Development Authority | | Series 2005, AMT, Guarantor: GNMA, 5.050% 01/20/41 | | 5,000,000 | | 4,947,950 |

| | | |

| DC Housing Finance Agency | | FDS Residential II LP, Series 2004, AMT, Insured: FHA 4.850% 06/01/35 | | 1,460,000 | | 1,414,360 |

| | | |

| DE Wilmington | | Electra Arms Senior Association, Series 1998, AMT, 6.250% 06/01/28 | | 875,000 | | 853,038 |

See Accompanying Notes to Financial Statements.

19

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Housing – 12.7% |

| Multi-Family (continued) | | | | | | |

| FL Broward County Housing Finance Authority | | Chaves Lake Apartments Ltd., Series 2000 A, AMT,

7.500% 07/01/40 | | 1,500,000 | | 1,578,705 |

| | | |

| FL Capital Trust Agency | | Atlantic Housing Foundation, Inc., Series 2005 C,

5.875% 01/01/28 | | 1,500,000 | | 1,556,010 |

| | | |

| FL Clay County Housing Finance Authority | | Breckenridge Commons Ltd., Series 2000 A, AMT,

7.450% 07/01/40 | | 1,360,000 | | 1,424,206 |

| | | |

| MA Housing Finance Agency | | Series 2005 E, AMT,

5.000% 12/01/28 | | 750,000 | | 755,055 |

| | | |

| ME Housing Authority | | Series 2005 A-2, AMT,

4.950% 11/15/27 | | 2,500,000 | | 2,484,000 |

| | | |

| MN Minneapolis Student Housing | | Riverton Community Housing, Inc., Series 2006 A,

5.700% 08/01/40 | | 1,600,000 | | 1,597,552 |

| | | |

| MN Washington County Housing & Redevelopment Authority | | Cottages of Aspen, Series 1992, AMT,

9.250% 06/01/22 | | 425,000 | | 425,332 |

| | | |

| MN White Bear Lake | | Birch Lake Townhomes, Series 1989 A,

9.750% 07/15/19 | | 750,000 | | 711,375 |

| | | |

| NC Durham Housing Authority | | Magnolia Pointe Apartments, Series 2005, AMT,

5.650% 02/01/38 | | 3,500,000 | | 3,434,830 |

| | | |

| NC Medical Care Commission | | ARC Project, Series 2004 A,

5.800% 10/01/34 | | 1,550,000 | | 1,622,230 |

| | | |

| NM Mortgage Finance Authority | | Series 2005 E, AMT, Insured: FHA

4.800% 09/01/40 | | 1,200,000 | | 1,135,284 |

| | | |

| NY New York City Housing Development Corp. | | Series 2005 F-1,

4.650% 11/01/25 | | 2,750,000 | | 2,749,835 |

| | | |

| OH Montgomery County | | Heartland of Centerville LLC, Series 2005, AMT,

Insured: FHLMC 4.950% 11/01/35 | | 750,000 | | 743,895 |

| | | |

| OK County Finance Authority | | Sail Associates Project, Series 2007, AMT,

5.250% 05/15/41 | | 1,475,000 | | 1,479,336 |

| | | |

| OR Housing & Community Services Department | | Series 2005 A, AMT, Insured: FHA

4.850% 07/01/35 | | 1,755,000 | | 1,700,121 |

| | | |

| Resolution Trust Corp. | | Pass-Through Certificates, Series 1993 A,

8.500% 12/01/16 (g) | | 455,481 | | 450,794 |

| | | |

| TX El Paso County Housing Finance Corp. | | American Village Communities:

Series 2000 C, 8.000% 12/01/32 | | 570,000 | | 583,976 |

| | Series 2000 D,

10.000% 12/01/32 | | 675,000 | | 702,992 |

See Accompanying Notes to Financial Statements.

20

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Housing (continued) |

| Multi-Family (continued) | | | | | | |

| VA Fairfax County Redevelopment & Housing Authority | | Cedar Ridge Project, Series 2007, AMT,

Insured: FHA

4.700% 04/01/27 | | 3,000,000 | | 2,882,550 |

| | | |

| WA Seattle Housing Authority | | High Rise Rehabilitation Phase I LP, Series 2005, AMT,

Insured: FSA

5.000% 11/01/25 | | 1,000,000 | | 1,000,610 |

| | | |

| WA Tacoma Housing Authority | | Redwood, Series 2005, AMT,

Guarantor: GNMA

5.050% 11/20/37 | | 3,000,000 | | 2,979,090 |

| | | | | | |

| | Multi-Family Total | | | | 39,213,126 |

|

| Single-Family – 5.3% |

| AR Development Finance Authority | | Series 2005 D, AMT, Guarantor: GNMA,

4.750% 07/01/35 | | 240,000 | | 228,924 |

| | Series 2007 B, AMT, Guarantor: GNMA,

4.624% 07/01/22 | | 2,795,000 | | 2,696,728 |

| | | |

| CO Housing & Finance Authority | | Series 1995 D-1, AMT,

7.375% 06/01/26 | | 25,000 | | 25,683 |

| | Series 1997 A-2, AMT,

7.250% 05/01/27 | | 30,000 | | 30,797 |

| | | |

| FL Housing Finance Corp. | | Series 2006 1, AMT, Guarantor: GNMA,

4.850% 07/01/37 | | 2,000,000 | | 1,931,920 |

| | | |

| MA Housing Finance Agency | | Series 2005 A, AMT,

5.200% 06/01/36 | | 1,500,000 | | 1,510,335 |

| | Series 2006 122, AMT,

4.875% 12/01/37 | | 3,970,000 | | 3,850,424 |

| | | |

| MN Housing Finance Agency | | Series 2006I, AMT,

5.000% 07/01/21 | | 1,350,000 | | 1,354,631 |

| | | |

| MN Minneapolis St. Paul Housing Finance Board | | Series 2006, AMT, Guarantor: GNMA,

5.000% 12/01/38 | | 2,733,963 | | 2,699,706 |

| | | |

| MT Board of Housing | | Series 2005 A, AMT,

5.000% 06/01/36 | | 940,000 | | 932,856 |

| | | |

| NC Housing Finance Agency | | Series 2006 23-A, AMT,

4.800% 01/01/37 | | 2,500,000 | | 2,406,125 |

| | | |

| NJ Housing & Mortgage Finance Agency | | Series 2005 M, AMT,

5.000% 10/01/36 | | 1,735,000 | | 1,732,224 |

| | | |

| OK Housing Finance Agency | | Series 2006 C, AMT, Guarantor: GNMA,

5.000% 09/01/26 | | 2,000,000 | | 1,990,100 |

| | Series 2006, AMT, Guarantor: GNMA,

4.850% 09/01/37 | | 2,410,000 | | 2,327,626 |

| | | |

| PA Housing Finance Agency | | Series 2005 90-A, AMT,

4.700% 10/01/25 | | 1,440,000 | | 1,389,571 |

See Accompanying Notes to Financial Statements.

21

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Housing (continued) |

| Single-Family (continued) | | | | | | |

| | | |

| PA Pittsburgh Urban Redevelopment Authority | | Series 2006 A, AMT, Guarantor: GNMA,

5.000% 10/01/36 | | 1,750,000 | | 1,736,560 |

| | | |

| RI Housing & Mortgage Finance Corp. | | Series 2005, AMT,

4.750% 10/01/30 | | 4,000,000 | | 3,847,160 |

| | | |

| TN Housing Development Agency | | Series 2006,

5.000% 07/01/21 | | 1,425,000 | | 1,429,888 |

| | Series 2007-1, AMT,

4.650% 07/01/27 | | 2,000,000 | | 1,910,180 |

| | | |

| TX Affordable Housing Corp. | | Series 2005 A, AMT, Guarantor: GNMA,

5.100% 09/01/39 | | 3,300,000 | | 3,279,111 |

| | | |

| UT Utah Housing Corp. | | Series 2006, AMT:

4.850% 07/01/26 | | 1,000,000 | | 982,940 |

| | 4.950% 07/01/37 | | 2,000,000 | | 1,963,200 |

| | | |

| VA Housing Development Authority | | Series 2005 A, AMT,

5.000% 01/01/31 | | 1,500,000 | | 1,500,000 |

| | | |

| WA Housing Finance Commission | | Single Family Program, Series 2006 5A,

Guarantor: GNMA

4.900% 06/01/37 | | 2,000,000 | | 1,947,840 |

| | | | | | |

| | Single-Family Total | | | | 43,704,529 |

| | | | | | |

| Housing Total | | | | | | 103,828,744 |

| | | | | | |

| Industrials – 5.7% | | | | | | |

| Food Products – 0.4% | | | | | | |

| MI Strategic Fund | | Imperial Sugar Co.:

Series 1998 A, 6.250% 11/01/15 | | 1,000,000 | | 1,023,920 |

| | Series 1998 C, AMT,

6.550% 11/01/25 | | 1,500,000 | | 1,527,510 |

| | | |

| OH Toledo Lucas County Port Authority | | Cargill, Inc. Project, Series 2004 A,

4.800% 03/01/22 | | 500,000 | | 501,945 |

| | | | | | |

| | Food Products Total | | | | 3,053,375 |

| | | |

| Forest Products & Paper – 1.3% | | | | | | |

| AL Camden Industrial Development Board | | Weyerhaeuser Co.,

Series 2003 B, AMT, 6.375% 12/01/24 | | 275,000 | | 298,760 |

| | | |

| AL Courtland Industrial Development Board | | International Paper Co.:

Series 2003 B, AMT, 6.250% 08/01/25 | | 2,000,000 | | 2,147,080 |

| | Series 2005 A,

5.200% 06/01/25 | | 1,000,000 | | 1,010,170 |

See Accompanying Notes to Financial Statements.

22

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Industrials (continued) |

| Forest Products & Paper (continued) | | | | | | |

| AL Phenix City Industrial Development Board | | Meadwestvaco Corp., Series 2002 A, AMT,

6.350% 05/15/35 | | 1,000,000 | | 1,061,140 |

| | | |

| AR Camden Environmental Improvement Authority | | International Paper Co., Series 2004 A, AMT,

5.000% 11/01/18 | | 250,000 | | 252,738 |

| | | |

| GA Rockdale County Development Authority | | Visy Paper, Inc., Series 1993, AMT,

7.500% 01/01/26 | | 2,800,000 | | 2,813,524 |

| | | |

| MS Lowndes County | | Weyerhaeuser Co.:

Series 1992 A, 6.800% 04/01/22 | | 1,995,000 | | 2,354,918 |

| | Series 1992 B, 6.700% 04/01/22 | | 230,000 | | 269,123 |

| | | |

| VA Bedford County Industrial Development Authority | | Nekoosa Packaging Corp., Series 1998, AMT,

5.600% 12/01/25 | | 400,000 | | 402,736 |

| | | | | | |

| | Forest Products & Paper Total | | | | 10,610,189 |

| | | |

| Manufacturing – 0.5% | | | | | | |

| IL Will-Kankakee Regional Development Authority | | Flanders Corp., Series 1997, AMT,

6.500% 12/15/17 | | 700,000 | | 708,113 |

| | | |

| KS Wichita Airport Authority | | Cessna Citation Service Center, Series 2002 A, AMT,

6.250% 06/15/32 | | 1,875,000 | | 1,988,775 |

| | | |

| MS Business Finance Corp. | | Northrop Grumman Ship Systems, Inc., Series 2006,

4.550% 12/01/28 | | 1,500,000 | | 1,429,635 |

| | | | | | |

| | Manufacturing Total | | | | 4,126,523 |

| | | |

| Metals & Mining – 0.3% | | | | | | |

| NV Department of Business & Industry | | Wheeling-Pittsburgh Steel Corp., Series 1999 A, AMT,

8.000% 09/01/14 (g) | | 380,000 | | 392,065 |

| | | |

| VA Greensville County Industrial Development Authority | | Wheeling-Pittsburgh Steel Corp., Series 1999 A, AMT,

7.000% 04/01/14 | | 1,895,000 | | 1,879,707 |

| | | | | | |

| | Metals & Mining Total | | | | 2,271,772 |

| | | |

| Oil & Gas – 2.7% | | | | | | |

| LA St. John Baptist Parish | | Marathon Oil Corp., Series 2007 A,

5.125% 06/01/37 | | 3,050,000 | | 3,070,862 |

| | | |

| NJ Middlesex County Pollution Control Authority | | Amerada Hess Corp., Series 2004,

6.050% 09/15/34 | | 285,000 | | 305,577 |

| | | |

| NV Clark County Industrial Development Authority | | Southwest Gas Corp.:

Series 2003 E, AMT, 5.800% 03/01/38 | | 1,750,000 | | 1,824,410 |

| | Series 2005 A, AMT, Insured: AMBAC

4.850% 10/01/35 | | 10,000,000 | | 9,773,600 |

See Accompanying Notes to Financial Statements.

23

Columbia High Yield Municipal Fund

June 30, 2007

Municipal Bonds (continued)

| | | | | | |

| | | | | Par ($) | | Value ($) |

| Industrials (continued) |

| Oil & Gas (continued) | | | | | | |

| TX Gulf Coast Industrial Development Authority | | Citgo Petroleum, Series 1998, AMT,

8.000% 04/01/28 | | 875,000 | | 988,408 |

| | | |

| TX Texas City Industrial Development Corp. | | Arco Pipeline Co., Inc., Series 1990,

7.375% 10/01/20 | | 2,000,000 | | 2,497,860 |

| | | |

| VI Virgin Islands Public Finance Authority | | Hovensa LLC:

Series 2003, AMT, 6.125% 07/01/22 | | 875,000 | | 948,264 |

| | Series 2004, AMT,

5.875% 07/01/22 | | 1,000,000 | | 1,066,990 |

| | Series 2007, AMT,

4.700% 07/01/22 | | 2,000,000 | | 1,964,920 |

| | | |

| VI Virgin Islands | | Hovensa LLC, Series 2002, AMT,

6.500% 07/01/21 | | 125,000 | | 139,294 |

| | | | | | |

| | Oil & Gas Total | | | | 22,580,185 |

| | |

| Other Industrial Development Bonds – 0.5% | | | | |

| NJ Economic Development Authority | | GMT Realty LLC, Series 2006 B, AMT,

6.875% 01/01/37 | | 4,000,000 | | 4,307,240 |