UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-04367

Columbia Funds Series Trust I

(Exact name of registrant as specified in charter)

225 Franklin Street

Boston, Massachusetts 02110

(Address of principal executive offices) (Zip code)

Christopher O. Petersen, Esq.

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, Massachusetts 02110

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800)345-6611

Date of fiscal year end: July 31

Date of reporting period: July 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

July 31, 2019

Columbia Large Cap Growth Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (columbiathreadneedleus.com/investor/), and each time a report is posted you will be notified by mail and provided with a website address to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, for Fund shares held directly with the Fund, by calling 800.345.6611 or by enrolling in “eDelivery” by logging into your account at columbiathreadneedleus.com/investor/.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue receiving paper copies of your shareholder reports. If you invest directly with the Fund, you can call 800.345.6611 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive paper reports will apply to all Columbia Funds held in your account if you invest through a financial intermediary or all Columbia Funds held with the fund complex if you invest directly with the Fund.

Not FDIC Insured • No bank guarantee • May lose value

Columbia Large Cap Growth Fund | Annual Report 2019

Investment objective

Columbia Large Cap Growth Fund (the Fund) seeks long-term capital appreciation.

Portfolio management

John Wilson, CFA

Lead Portfolio Manager

Managed Fund since 2005

Tchintcia Barros, CFA

Portfolio Manager

Managed Fund since 2015

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2019 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended July 31, 2019) |

| | | Inception | 1 Year | 5 Years | 10 Years |

| Class A | Excluding sales charges | 11/01/98 | 7.84 | 12.90 | 14.30 |

| | Including sales charges | | 1.63 | 11.57 | 13.63 |

| Advisor Class* | 11/08/12 | 8.11 | 13.18 | 14.59 |

| Class C | Excluding sales charges | 11/18/02 | 7.03 | 12.06 | 13.45 |

| | Including sales charges | | 6.06 | 12.06 | 13.45 |

| Class E | Excluding sales charges | 09/22/06 | 7.71 | 12.79 | 14.18 |

| | Including sales charges | | 2.86 | 11.75 | 13.66 |

| Institutional Class | 12/14/90 | 8.11 | 13.18 | 14.58 |

| Institutional 2 Class* | 03/07/11 | 8.17 | 13.28 | 14.70 |

| Institutional 3 Class | 07/15/09 | 8.24 | 13.34 | 14.78 |

| Class R* | 09/27/10 | 7.57 | 12.62 | 14.01 |

| Class V | Excluding sales charges | 12/14/90 | 7.84 | 12.90 | 14.27 |

| | Including sales charges | | 1.64 | 11.57 | 13.59 |

| Russell 1000 Growth Index | | 10.82 | 14.25 | 15.74 |

Returns for Class A and Class V shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the 1.00% contingent deferred sales charge for the first year only. Returns for Class E shares are shown with and without the maximum sales charge of 4.50%. The Fund’s other share classes are not subject to sales charges and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each share class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.345.6611.

| * | The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. Since the Fund launched more than one share class at its inception, Institutional Class shares were used. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information. |

The Russell 1000 Growth Index, an unmanaged index, measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Columbia Large Cap Growth Fund | Annual Report 2019

| 3 |

Fund at a Glance (continued)

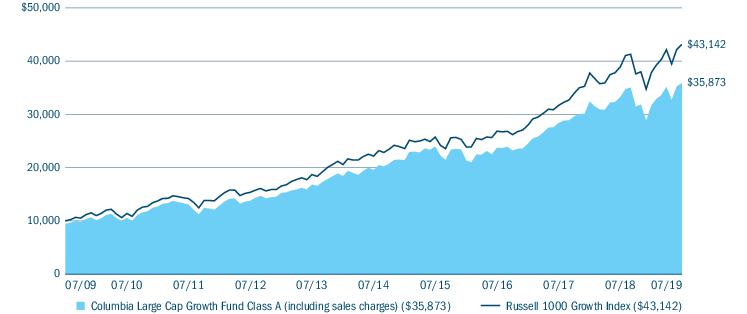

Performance of a hypothetical $10,000 investment (July 31, 2009 — July 31, 2019)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Large Cap Growth Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

| Top 10 holdings (%) (at July 31, 2019) |

| Microsoft Corp. | 6.6 |

| Amazon.com, Inc. | 5.9 |

| Apple, Inc. | 5.4 |

| Facebook, Inc., Class A | 4.0 |

| Visa, Inc., Class A | 3.6 |

| Alphabet, Inc., Class C | 3.1 |

| Adobe, Inc. | 3.0 |

| Alphabet, Inc., Class A | 2.9 |

| PayPal Holdings, Inc. | 2.4 |

| Nike, Inc., Class B | 2.2 |

Percentages indicated are based upon total investments excluding Money Market Funds and investments in derivatives, if any.

For further detail about these holdings, please refer to the section entitled “Portfolio of Investments.”

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Portfolio breakdown (%) (at July 31, 2019) |

| Common Stocks | 99.5 |

| Money Market Funds | 0.5 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at July 31, 2019) |

| Communication Services | 14.5 |

| Consumer Discretionary | 16.0 |

| Consumer Staples | 2.6 |

| Financials | 3.5 |

| Health Care | 15.9 |

| Industrials | 8.1 |

| Information Technology | 36.3 |

| Materials | 1.5 |

| Real Estate | 1.6 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| 4 | Columbia Large Cap Growth Fund | Annual Report 2019 |

Manager Discussion of Fund Performance

For the 12-month period that ended July 31, 2019, the Fund’s Class A shares returned 7.84% excluding sales charges. The Fund underperformed its benchmark, the Russell 1000 Growth Index, which returned 10.82% over the same period. Industrials, technology and consumer staples stocks were major contributors to the Fund’s gains. Disappointing results from consumer discretionary, communication services and materials holdings generally accounted for the Fund’s shortfall relative to the benchmark.

Trade concerns, interest rates drove financial markets

Optimism prevailed early in the 12-month period ended July 31, 2019 as positive global economic conditions, the impact of broad U.S. corporate tax cuts and moves to reduce regulation in a number of industries buoyed confidence. The labor markets added 164,000 jobs per month, on average, and manufacturing activity remained solid. Unemployment fell to a 50-year low of 3.7%.

However, the economic backdrop looked less rosy as the period wore on. U.S. growth slowed from above 3.0% to 2.3% (annualized). European economies transitioned to a slower pace of growth, struggling with rising interest rates, trade tensions and uncertainty surrounding the U.K.’s departure from the European Union (Brexit). At the same time, China’s economic conditions weakened and emerging markets came under pressure, driven by trade and tariff concerns and a rising U.S. dollar.

With global uncertainties on the rise, investors sold stocks and other risky assets late in 2018. Stock markets rebounded early in 2019, as the Federal Reserve (the Fed) backed away from additional rate hikes, then dipped again in the final months of the period as trade concerns amplified. On the last day of the period, the Fed lowered its key short-term borrowing rate by 25 basis points (a basis point is one hundredth of one percent).

Bonds generally outperformed equities for the 12-month period. The Bloomberg Barclays U.S. Aggregate Bond Index, a broad measure of investment-grade bonds, returned 8.08%. The S&P 500 Index, a broad measure of U.S. stock returns, gained 7.99%, led by growth stocks, which solidly outperformed value stocks for the period.

Contributors and detractors

Gains from industrials, technology and consumer staples stocks boosted relative results for the period. In the industrials sector, the Fund benefited from a position in L3Technologies, a leading defense communications systems company. It completed a merger with Harris Corporation, which we believe has the potential to strengthen the newly combined company’s long-term growth prospects. The transaction was viewed favorably by investors. A position in Ingersoll-Rand PLC, a leading manufacturer of heating and cooling equipment, did well on the announcement that it would sell its industrial division, a smaller and less profitable arm of the company. That left Ingersoll-Rand as a pure play on the heating, ventilation and air conditioning (HVAC) market, which investors seemed to favor. Finally, the Fund had no exposure to Boeing or 3M. Boeing slid on issues related to two crashes and subsequent worldwide grounding of the 737 Max airplane and questions about its certification process. Shares of 3M declined after a profit warning.

In the technology sector, Pay Pal Holdings, Inc., Visa, Inc. and Zebra Technologies Corp. were solid contributors to relative performance. The Fund was overweight in the payment services industry, where Pay Pal and Visa were standout performers. Both companies delivered strong revenue and earnings in a favorable industry environment, driven by strong global demand. Zebra Technologies is the leading provider of barcoding and hand-held scanning equipment, inventory management and tracking applications. Strong revenue and profit growth helped Zebra gain market share. We trimmed the Fund’s position as the stock moved closer to our price target.

The Fund’s returns from consumer discretionary, communications services and materials stocks lagged the benchmark. In the consumer discretionary sector, Alibaba Group Holdings Ltd., ADR, the leading China-based internet retailer, underperformed on concerns about China’s currency and sustainability of underlying e-commerce growth. We continue to hold the position, believing the company’s longer term business prospects remain strong, based partially on the shift to a more consumer driven Chinese economy. The Fund lost ground with a position in luxury brand retailer PVH Corp. Softness across Calvin Klein, which is one of PVH’s most lucrative brands, hurt overall results. We sold the stock. The Fund had no exposure

Columbia Large Cap Growth Fund | Annual Report 2019

| 5 |

Manager Discussion of Fund Performance (continued)

to either Starbucks or McDonalds, which enjoyed solid results for the period. A position in Canada Goose Holdings, Inc. also detracted from relative returns, as investors bid shares lower on a disappointing quarterly report. We continue to believe the brand is well positioned with solid long-term prospects in the specialty retailing market, and we continue to own the stock.

In the communication services sector, a position in Electronic Arts, Inc. weighed on relative performance. A long-term Fund holding, the company did not live up to expectations with several new game titles and faced increased competition. However, we remain confident in the company’s prospects and continue to hold the stock. Alphabet, Inc. (Google) underperformed as concerns mounted that the company might be facing increased regulation. The Fund has more exposure to Alphabet than the benchmark, which amplified the impact of its modest loss for the period. In the materials sector, which accounts for just 1.75% of the benchmark, the Fund lost ground with positions in Albemarle Corp. and Eastman Chemical Co., neither of which is in the benchmark. Albemarle is the leading provider of lithium for electric vehicle batteries. Concerns about the impact of weaker economic conditions on the roll-out of electric vehicles in China weighed on Albemarle shares. However, we believe the long-term outlook for the industry is strong and continue to own the stock. Eastman Chemical, a specialty chemical company, was hurt by broad economic concerns and a weaker profit outlook. We trimmed the Fund’s position but continue to own the stock.

At period’s end

At the close out the reporting period, our strategy remains unchanged. We continue to look for ideas where our internal research conviction is high and where we can find a differentiated research view combined with strong management and an attractive risk/return profile. We seek opportunities in companies that we believe have the potential to drive consistent organic revenue and earnings growth and where those growth prospects may be underestimated by the market.

Marketrisk may affect a single issuer, sector of the economy, industry or the market as a whole.Growthsecurities, at times, may not perform as well as value securities or the stock market in general and may be out of favor with investors.Foreigninvestments subject the Fund to risks, including political, economic, market, social and others within a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. The Fund may invest significantly in issuers within a particularsector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

| 6 | Columbia Large Cap Growth Fund | Annual Report 2019 |

Understanding Your Fund’s Expenses

(Unaudited)

As an investor, you incur two types of costs. There are shareholder transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing fund costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the “Actual” column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| February 1, 2019 — July 31, 2019 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Class A | 1,000.00 | 1,000.00 | 1,132.20 | 1,019.64 | 5.50 | 5.21 | 1.04 |

| Advisor Class | 1,000.00 | 1,000.00 | 1,133.50 | 1,020.88 | 4.18 | 3.96 | 0.79 |

| Class C | 1,000.00 | 1,000.00 | 1,128.00 | 1,015.92 | 9.44 | 8.95 | 1.79 |

| Class E | 1,000.00 | 1,000.00 | 1,131.70 | 1,019.14 | 6.03 | 5.71 | 1.14 |

| Institutional Class | 1,000.00 | 1,000.00 | 1,133.60 | 1,020.88 | 4.18 | 3.96 | 0.79 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 1,134.00 | 1,021.12 | 3.92 | 3.71 | 0.74 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 1,134.40 | 1,021.42 | 3.60 | 3.41 | 0.68 |

| Class R | 1,000.00 | 1,000.00 | 1,131.00 | 1,018.40 | 6.82 | 6.46 | 1.29 |

| Class V | 1,000.00 | 1,000.00 | 1,132.10 | 1,019.64 | 5.50 | 5.21 | 1.04 |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Columbia Large Cap Growth Fund | Annual Report 2019

| 7 |

Portfolio of Investments

July 31, 2019

(Percentages represent value of investments compared to net assets)

Investments in securities

| Common Stocks 99.5% |

| Issuer | Shares | Value ($) |

| Communication Services 14.4% |

| Entertainment 2.8% |

| Electronic Arts, Inc.(a) | 480,105 | 44,409,713 |

| Walt Disney Co. (The) | 398,400 | 56,975,184 |

| Total | | 101,384,897 |

| Interactive Media & Services 9.9% |

| Alphabet, Inc., Class A(a) | 86,419 | 105,275,626 |

| Alphabet, Inc., Class C(a) | 91,273 | 111,050,033 |

| Facebook, Inc., Class A(a) | 749,973 | 145,667,256 |

| Total | | 361,992,915 |

| Media 0.6% |

| DISH Network Corp., Class A(a) | 609,048 | 20,622,365 |

| Wireless Telecommunication Services 1.1% |

| T-Mobile U.S.A., Inc.(a) | 519,900 | 41,451,627 |

| Total Communication Services | 525,451,804 |

| Consumer Discretionary 15.9% |

| Hotels, Restaurants & Leisure 0.3% |

| Norwegian Cruise Line Holdings Ltd.(a) | 242,302 | 11,979,411 |

| Internet & Direct Marketing Retail 9.0% |

| Alibaba Group Holding Ltd., ADR(a) | 300,342 | 51,992,204 |

| Amazon.com, Inc.(a) | 113,705 | 212,262,220 |

| Booking Holdings, Inc.(a) | 31,594 | 59,605,556 |

| Chewy, Inc., Class A(a) | 59,622 | 2,000,914 |

| Total | | 325,860,894 |

| Multiline Retail 1.0% |

| Target Corp. | 424,000 | 36,633,600 |

| Specialty Retail 2.6% |

| Burlington Stores, Inc.(a) | 205,200 | 37,089,900 |

| Ulta Beauty, Inc.(a) | 164,800 | 57,556,400 |

| Total | | 94,646,300 |

| Textiles, Apparel & Luxury Goods 3.0% |

| Canada Goose Holdings, Inc.(a) | 326,324 | 15,268,700 |

| Nike, Inc., Class B | 916,000 | 78,803,480 |

| Tapestry, Inc. | 502,900 | 15,554,697 |

| Total | | 109,626,877 |

| Total Consumer Discretionary | 578,747,082 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Consumer Staples 2.6% |

| Food & Staples Retailing 1.5% |

| Costco Wholesale Corp. | 204,100 | 56,256,083 |

| Food Products 1.1% |

| Mondelez International, Inc., Class A | 731,800 | 39,143,982 |

| Total Consumer Staples | 95,400,065 |

| Financials 3.5% |

| Banks 1.1% |

| Citigroup, Inc. | 546,000 | 38,853,360 |

| Capital Markets 1.1% |

| BlackRock, Inc. | 84,739 | 39,630,736 |

| Insurance 1.3% |

| Allstate Corp. (The) | 439,400 | 47,191,560 |

| Total Financials | 125,675,656 |

| Health Care 15.8% |

| Biotechnology 3.2% |

| Alexion Pharmaceuticals, Inc.(a) | 318,134 | 36,041,401 |

| BioMarin Pharmaceutical, Inc.(a) | 305,800 | 24,256,056 |

| Exact Sciences Corp.(a) | 190,800 | 21,962,988 |

| Vertex Pharmaceuticals, Inc.(a) | 202,065 | 33,668,070 |

| Total | | 115,928,515 |

| Health Care Equipment & Supplies 6.4% |

| Abbott Laboratories | 765,200 | 66,648,920 |

| Baxter International, Inc. | 625,800 | 52,548,426 |

| Danaher Corp. | 195,143 | 27,417,591 |

| Edwards Lifesciences Corp.(a) | 231,767 | 49,331,606 |

| Medtronic PLC | 370,300 | 37,748,382 |

| Total | | 233,694,925 |

| Health Care Providers & Services 1.9% |

| Guardant Health, Inc.(a) | 216,300 | 20,330,037 |

| Humana, Inc. | 160,100 | 47,509,675 |

| Total | | 67,839,712 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 8 | Columbia Large Cap Growth Fund | Annual Report 2019 |

Portfolio of Investments (continued)

July 31, 2019

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Life Sciences Tools & Services 2.5% |

| Bio-Techne Corp. | 122,800 | 25,806,420 |

| Illumina, Inc.(a) | 97,400 | 29,159,612 |

| Thermo Fisher Scientific, Inc. | 129,748 | 36,028,425 |

| Total | | 90,994,457 |

| Pharmaceuticals 1.8% |

| Allergan PLC | 109,600 | 17,590,800 |

| Bristol-Myers Squibb Co. | 1,096,500 | 48,695,565 |

| Total | | 66,286,365 |

| Total Health Care | 574,743,974 |

| Industrials 8.0% |

| Aerospace & Defense 2.7% |

| L3 Harris Technologies, Inc. | 237,380 | 49,280,088 |

| Northrop Grumman Corp. | 142,600 | 49,278,282 |

| Total | | 98,558,370 |

| Electrical Equipment 1.0% |

| AMETEK, Inc. | 430,500 | 38,577,105 |

| Industrial Conglomerates 1.6% |

| Honeywell International, Inc. | 333,300 | 57,480,918 |

| Machinery 1.2% |

| Ingersoll-Rand PLC | 352,500 | 43,590,150 |

| Road & Rail 1.5% |

| Norfolk Southern Corp. | 278,200 | 53,169,584 |

| Total Industrials | 291,376,127 |

| Information Technology 36.2% |

| Electronic Equipment, Instruments & Components 1.6% |

| Corning, Inc. | 768,800 | 23,640,600 |

| Zebra Technologies Corp., Class A(a) | 156,101 | 32,920,140 |

| Total | | 56,560,740 |

| IT Services 8.5% |

| Fidelity National Information Services, Inc. | 208,100 | 27,729,325 |

| Fiserv, Inc.(a) | 269,100 | 28,371,213 |

| FleetCor Technologies, Inc.(a) | 32,006 | 9,095,145 |

| PayPal Holdings, Inc.(a) | 792,700 | 87,514,080 |

| Square, Inc., Class A(a) | 306,100 | 24,613,501 |

| Visa, Inc., Class A | 730,426 | 130,015,828 |

| Total | | 307,339,092 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Semiconductors & Semiconductor Equipment 5.9% |

| Broadcom, Inc. | 150,331 | 43,594,487 |

| Lam Research Corp. | 231,800 | 48,355,798 |

| NVIDIA Corp. | 320,760 | 54,118,627 |

| NXP Semiconductors NV | 436,700 | 45,150,413 |

| Teradyne, Inc. | 427,000 | 23,796,710 |

| Total | | 215,016,035 |

| Software 14.8% |

| Adobe, Inc.(a) | 360,600 | 107,768,916 |

| Microsoft Corp. | 1,745,338 | 237,837,209 |

| Palo Alto Networks, Inc.(a) | 211,700 | 47,958,518 |

| PTC, Inc.(a) | 192,763 | 13,065,476 |

| Salesforce.com, Inc.(a) | 361,105 | 55,790,723 |

| ServiceNow, Inc.(a) | 151,467 | 42,015,431 |

| VMware, Inc., Class A | 205,400 | 35,840,246 |

| Total | | 540,276,519 |

| Technology Hardware, Storage & Peripherals 5.4% |

| Apple, Inc. | 923,462 | 196,734,344 |

| Total Information Technology | 1,315,926,730 |

| Materials 1.5% |

| Chemicals 1.5% |

| Albemarle Corp. | 356,800 | 26,032,128 |

| Eastman Chemical Co. | 394,959 | 29,760,161 |

| Total | | 55,792,289 |

| Total Materials | 55,792,289 |

| Real Estate 1.6% |

| Equity Real Estate Investment Trusts (REITS) 1.6% |

| American Tower Corp. | 161,100 | 34,091,982 |

| Equinix, Inc. | 48,700 | 24,452,270 |

| Total | | 58,544,252 |

| Total Real Estate | 58,544,252 |

Total Common Stocks

(Cost $2,108,830,836) | 3,621,657,979 |

|

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Large Cap Growth Fund | Annual Report 2019

| 9 |

Portfolio of Investments (continued)

July 31, 2019

| Money Market Funds 0.4% |

| | Shares | Value ($) |

| Columbia Short-Term Cash Fund, 2.361%(b),(c) | 16,742,368 | 16,740,694 |

Total Money Market Funds

(Cost $16,742,664) | 16,740,694 |

Total Investments in Securities

(Cost: $2,125,573,500) | 3,638,398,673 |

| Other Assets & Liabilities, Net | | 2,482,075 |

| Net Assets | 3,640,880,748 |

Notes to Portfolio of Investments

| (a) | Non-income producing investment. |

| (b) | The rate shown is the seven-day current annualized yield at July 31, 2019. |

| (c) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended July 31, 2019 are as follows: |

| Issuer | Beginning

shares | Shares

purchased | Shares

sold | Ending

shares | Realized gain

(loss) —

affiliated

issuers ($) | Net change in

unrealized

appreciation

(depreciation) —

affiliated

issuers ($) | Dividends —

affiliated

issuers ($) | Value —

affiliated

issuers

at end of

period ($) |

| Columbia Short-Term Cash Fund, 2.361% |

| | 44,882,689 | 623,746,234 | (651,886,555) | 16,742,368 | (2,241) | 2,380 | 1,297,442 | 16,740,694 |

Abbreviation Legend

| ADR | American Depositary Receipt |

Fair value measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

| ■ | Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date. Valuation adjustments are not applied to Level 1 investments. |

| ■ | Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). |

| ■ | Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments). |

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund’s Board of Trustees (the Board), the Investment Manager’s Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The accompanying Notes to Financial Statements are an integral part of this statement.

| 10 | Columbia Large Cap Growth Fund | Annual Report 2019 |

Portfolio of Investments (continued)

July 31, 2019

Fair value measurements (continued)

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

The following table is a summary of the inputs used to value the Fund’s investments at July 31, 2019:

| | Level 1 ($) | Level 2 ($) | Level 3 ($) | Total ($) |

| Investments in Securities | | | | |

| Common Stocks | | | | |

| Communication Services | 525,451,804 | — | — | 525,451,804 |

| Consumer Discretionary | 578,747,082 | — | — | 578,747,082 |

| Consumer Staples | 95,400,065 | — | — | 95,400,065 |

| Financials | 125,675,656 | — | — | 125,675,656 |

| Health Care | 574,743,974 | — | — | 574,743,974 |

| Industrials | 291,376,127 | — | — | 291,376,127 |

| Information Technology | 1,315,926,730 | — | — | 1,315,926,730 |

| Materials | 55,792,289 | — | — | 55,792,289 |

| Real Estate | 58,544,252 | — | — | 58,544,252 |

| Total Common Stocks | 3,621,657,979 | — | — | 3,621,657,979 |

| Money Market Funds | 16,740,694 | — | — | 16,740,694 |

| Total Investments in Securities | 3,638,398,673 | — | — | 3,638,398,673 |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Large Cap Growth Fund | Annual Report 2019

| 11 |

Statement of Assets and Liabilities

July 31, 2019

| Assets | |

| Investments in securities, at value | |

| Unaffiliated issuers (cost $2,108,830,836) | $3,621,657,979 |

| Affiliated issuers (cost $16,742,664) | 16,740,694 |

| Cash | 87,208 |

| Receivable for: | |

| Investments sold | 31,864,328 |

| Capital shares sold | 526,489 |

| Dividends | 794,420 |

| Prepaid expenses | 25,035 |

| Trustees’ deferred compensation plan | 353,389 |

| Other assets | 43,170 |

| Total assets | 3,672,092,712 |

| Liabilities | |

| Payable for: | |

| Investments purchased | 28,365,191 |

| Capital shares purchased | 2,061,892 |

| Management services fees | 66,248 |

| Distribution and/or service fees | 17,309 |

| Transfer agent fees | 244,463 |

| Compensation of chief compliance officer | 113 |

| Other expenses | 103,359 |

| Trustees’ deferred compensation plan | 353,389 |

| Total liabilities | 31,211,964 |

| Net assets applicable to outstanding capital stock | $3,640,880,748 |

| Represented by | |

| Paid in capital | 1,926,794,537 |

| Total distributable earnings (loss) (Note 2) | 1,714,086,211 |

| Total - representing net assets applicable to outstanding capital stock | $3,640,880,748 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 12 | Columbia Large Cap Growth Fund | Annual Report 2019 |

Statement of Assets and Liabilities (continued)

July 31, 2019

| Class A | |

| Net assets | $1,932,367,182 |

| Shares outstanding | 44,495,792 |

| Net asset value per share | $43.43 |

| Maximum sales charge | 5.75% |

| Maximum offering price per share (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class A shares) | $46.08 |

| Advisor Class | |

| Net assets | $12,088,431 |

| Shares outstanding | 260,352 |

| Net asset value per share | $46.43 |

| Class C | |

| Net assets | $78,292,771 |

| Shares outstanding | 2,209,639 |

| Net asset value per share | $35.43 |

| Class E | |

| Net assets | $15,874,578 |

| Shares outstanding | 367,858 |

| Net asset value per share | $43.15 |

| Maximum sales charge | 4.50% |

| Maximum offering price per share (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class E shares) | $45.18 |

| Institutional Class | |

| Net assets | $975,663,517 |

| Shares outstanding | 21,501,613 |

| Net asset value per share | $45.38 |

| Institutional 2 Class | |

| Net assets | $13,783,265 |

| Shares outstanding | 303,353 |

| Net asset value per share | $45.44 |

| Institutional 3 Class | |

| Net assets | $394,049,397 |

| Shares outstanding | 8,643,937 |

| Net asset value per share | $45.59 |

| Class R | |

| Net assets | $13,233,310 |

| Shares outstanding | 308,352 |

| Net asset value per share | $42.92 |

| Class V | |

| Net assets | $205,528,297 |

| Shares outstanding | 4,778,409 |

| Net asset value per share | $43.01 |

| Maximum sales charge | 5.75% |

| Maximum offering price per share (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class V shares) | $45.63 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Large Cap Growth Fund | Annual Report 2019

| 13 |

Statement of Operations

Year Ended July 31, 2019

| Net investment income | |

| Income: | |

| Dividends — unaffiliated issuers | $31,984,439 |

| Dividends — affiliated issuers | 1,297,442 |

| Interest | 6,057 |

| Interfund lending | 326 |

| Foreign taxes withheld | (29,835) |

| Total income | 33,258,429 |

| Expenses: | |

| Management services fees | 23,352,733 |

| Distribution and/or service fees | |

| Class A | 4,690,124 |

| Class C | 762,133 |

| Class E | 55,149 |

| Class R | 71,018 |

| Class T | 691 |

| Class V | 494,681 |

| Transfer agent fees | |

| Class A | 2,157,948 |

| Advisor Class | 14,615 |

| Class C | 87,710 |

| Class E | 18,127 |

| Institutional Class | 1,082,500 |

| Institutional 2 Class | 7,753 |

| Institutional 3 Class | 29,060 |

| Class R | 16,351 |

| Class T | 315 |

| Class V | 227,569 |

| Compensation of board members | 62,734 |

| Custodian fees | 23,291 |

| Printing and postage fees | 207,424 |

| Registration fees | 148,104 |

| Audit fees | 32,936 |

| Legal fees | 75,257 |

| Compensation of chief compliance officer | 1,394 |

| Other | 121,005 |

| Total expenses | 33,740,622 |

| Net investment loss | (482,193) |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Investments — unaffiliated issuers | 286,205,699 |

| Investments — affiliated issuers | (2,241) |

| Foreign currency translations | (516) |

| Net realized gain | 286,202,942 |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments — unaffiliated issuers | (22,809,796) |

| Investments — affiliated issuers | 2,380 |

| Foreign currency translations | 364 |

| Net change in unrealized appreciation (depreciation) | (22,807,052) |

| Net realized and unrealized gain | 263,395,890 |

| Net increase in net assets resulting from operations | $262,913,697 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 14 | Columbia Large Cap Growth Fund | Annual Report 2019 |

Statement of Changes in Net Assets

| | Year Ended

July 31, 2019 | Year Ended

July 31, 2018 |

| Operations | | |

| Net investment loss | $(482,193) | $(1,616,179) |

| Net realized gain | 286,202,942 | 251,807,025 |

| Net change in unrealized appreciation (depreciation) | (22,807,052) | 333,931,469 |

| Net increase in net assets resulting from operations | 262,913,697 | 584,122,315 |

| Distributions to shareholders | | |

| Net investment income and net realized gains | | |

| Class A | (147,850,760) | |

| Advisor Class | (1,038,548) | |

| Class C | (7,122,236) | |

| Class E | (1,257,746) | |

| Institutional Class | (71,433,534) | |

| Institutional 2 Class | (946,487) | |

| Institutional 3 Class | (30,691,913) | |

| Class R | (1,153,898) | |

| Class T | (57,006) | |

| Class V | (15,653,992) | |

| Net investment income | | |

| Advisor Class | | (22,659) |

| Institutional Class | | (1,508,466) |

| Institutional 2 Class | | (62,104) |

| Institutional 3 Class | | (1,081,036) |

| Net realized gains | | |

| Class A | | (112,241,817) |

| Advisor Class | | (855,291) |

| Class C | | (7,326,924) |

| Class E | | (992,652) |

| Institutional Class | | (53,828,606) |

| Institutional 2 Class | | (1,668,444) |

| Institutional 3 Class | | (24,933,309) |

| Class K | | (4,285) |

| Class R | | (1,580,732) |

| Class T | | (52,395) |

| Class V | | (12,101,679) |

| Total distributions to shareholders (Note 2) | (277,206,120) | (218,260,399) |

| Decrease in net assets from capital stock activity | (91,690,891) | (152,557,783) |

| Total increase (decrease) in net assets | (105,983,314) | 213,304,133 |

| Net assets at beginning of year | 3,746,864,062 | 3,533,559,929 |

| Net assets at end of year | $3,640,880,748 | $3,746,864,062 |

| Excess of distributions over net investment income | $(2,363,876) | $(3,685,921) |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Large Cap Growth Fund | Annual Report 2019

| 15 |

Statement of Changes in Net Assets (continued)

| | Year Ended | Year Ended |

| | July 31, 2019 | July 31, 2018 |

| | Shares | Dollars ($) | Shares | Dollars ($) |

| Capital stock activity |

| Class A | | | | |

| Subscriptions | 1,426,450 | 57,174,126 | 2,102,312 | 89,098,132 |

| Distributions reinvested | 3,747,968 | 141,673,196 | 2,745,341 | 107,425,195 |

| Redemptions | (5,735,870) | (233,967,816) | (5,885,043) | (243,404,688) |

| Net decrease | (561,452) | (35,120,494) | (1,037,390) | (46,881,361) |

| Advisor Class | | | | |

| Subscriptions | 102,168 | 4,406,560 | 208,562 | 9,112,391 |

| Distributions reinvested | 22,737 | 917,219 | 19,245 | 797,718 |

| Redemptions | (178,940) | (7,737,359) | (188,110) | (8,398,940) |

| Net increase (decrease) | (54,035) | (2,413,580) | 39,697 | 1,511,169 |

| Class B | | | | |

| Redemptions | — | — | (74) | (2,385) |

| Net decrease | — | — | (74) | (2,385) |

| Class C | | | | |

| Subscriptions | 521,838 | 17,351,564 | 400,529 | 14,085,343 |

| Distributions reinvested | 213,974 | 6,631,057 | 209,315 | 6,886,462 |

| Redemptions | (593,560) | (19,909,665) | (1,535,106) | (55,326,412) |

| Net increase (decrease) | 142,252 | 4,072,956 | (925,262) | (34,354,607) |

| Class E | | | | |

| Subscriptions | 1,887 | 73,512 | 1,585 | 66,866 |

| Distributions reinvested | 33,469 | 1,257,746 | 25,479 | 992,652 |

| Redemptions | (54,195) | (2,208,191) | (55,739) | (2,298,436) |

| Net decrease | (18,839) | (876,933) | (28,675) | (1,238,918) |

| Class F | | | | |

| Redemptions | — | — | (76) | (2,621) |

| Net decrease | — | — | (76) | (2,621) |

| Institutional Class | | | | |

| Subscriptions | 1,438,810 | 61,794,580 | 1,902,143 | 81,613,462 |

| Distributions reinvested | 1,681,110 | 66,286,145 | 1,257,477 | 51,028,399 |

| Redemptions | (3,500,069) | (148,204,061) | (8,751,776) | (363,040,287) |

| Net decrease | (380,149) | (20,123,336) | (5,592,156) | (230,398,426) |

| Institutional 2 Class | | | | |

| Subscriptions | 112,453 | 4,784,662 | 212,123 | 9,197,173 |

| Distributions reinvested | 23,971 | 946,152 | 42,628 | 1,730,288 |

| Redemptions | (111,991) | (4,720,036) | (604,968) | (26,497,611) |

| Net increase (decrease) | 24,433 | 1,010,778 | (350,217) | (15,570,150) |

| Institutional 3 Class | | | | |

| Subscriptions | 510,725 | 21,835,021 | 6,212,215 | 254,221,819 |

| Distributions reinvested | 374,684 | 14,829,998 | 292,172 | 11,885,552 |

| Redemptions | (1,624,010) | (69,881,542) | (1,583,443) | (68,842,946) |

| Net increase (decrease) | (738,601) | (33,216,523) | 4,920,944 | 197,264,425 |

| Class K | | | | |

| Distributions reinvested | — | — | 101 | 4,118 |

| Redemptions | — | — | (1,805) | (80,309) |

| Net decrease | — | — | (1,704) | (76,191) |

| Class R | | | | |

| Subscriptions | 124,132 | 4,823,223 | 138,681 | 5,589,740 |

| Distributions reinvested | 10,431 | 390,237 | 5,896 | 229,133 |

| Redemptions | (192,102) | (7,708,150) | (530,901) | (21,760,491) |

| Net decrease | (57,539) | (2,494,690) | (386,324) | (15,941,618) |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 16 | Columbia Large Cap Growth Fund | Annual Report 2019 |

Statement of Changes in Net Assets (continued)

| | Year Ended | Year Ended |

| | July 31, 2019 | July 31, 2018 |

| | Shares | Dollars ($) | Shares | Dollars ($) |

| Class T | | | | |

| Distributions reinvested | 1,498 | 56,748 | 1,332 | 52,258 |

| Redemptions | (19,011) | (696,978) | (10,607) | (435,208) |

| Net decrease | (17,513) | (640,230) | (9,275) | (382,950) |

| Class V | | | | |

| Subscriptions | 103,032 | 3,910,111 | 88,665 | 3,488,181 |

| Distributions reinvested | 311,108 | 11,644,762 | 232,297 | 9,008,492 |

| Redemptions | (428,066) | (17,443,712) | (462,579) | (18,980,823) |

| Net decrease | (13,926) | (1,888,839) | (141,617) | (6,484,150) |

| Total net decrease | (1,675,369) | (91,690,891) | (3,512,129) | (152,557,783) |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Large Cap Growth Fund | Annual Report 2019

| 17 |

The following table is intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund’s portfolio turnover rate may be higher.

| | Net asset value,

beginning of

period | Net

investment

income

(loss) | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Distributions

from net

realized

gains | Total

distributions to

shareholders |

| Class A |

| Year Ended 7/31/2019 | $43.86 | (0.04) | 2.98 | 2.94 | — | (3.37) | (3.37) |

| Year Ended 7/31/2018 | $39.81 | (0.05) | 6.62 | 6.57 | — | (2.52) | (2.52) |

| Year Ended 7/31/2017 | $33.82 | 0.06 | 6.47 | 6.53 | (0.08) | (0.46) | (0.54) |

| Year Ended 7/31/2016 | $37.69 | 0.00(d) | (0.36) | (0.36) | — | (3.51) | (3.51) |

| Year Ended 7/31/2015 | $34.51 | 0.03 | 7.24 | 7.27 | (0.09) | (4.00) | (4.09) |

| Advisor Class |

| Year Ended 7/31/2019 | $46.53 | 0.07 | 3.20 | 3.27 | — | (3.37) | (3.37) |

| Year Ended 7/31/2018 | $42.06 | 0.05 | 7.00 | 7.05 | (0.06) | (2.52) | (2.58) |

| Year Ended 7/31/2017 | $35.69 | 0.15 | 6.84 | 6.99 | (0.16) | (0.46) | (0.62) |

| Year Ended 7/31/2016 | $39.49 | 0.07 | (0.36) | (0.29) | — | (3.51) | (3.51) |

| Year Ended 7/31/2015 | $35.98 | 0.06 | 7.63 | 7.69 | (0.18) | (4.00) | (4.18) |

| Class C |

| Year Ended 7/31/2019 | $36.70 | (0.29) | 2.39 | 2.10 | — | (3.37) | (3.37) |

| Year Ended 7/31/2018 | $33.95 | (0.30) | 5.57 | 5.27 | — | (2.52) | (2.52) |

| Year Ended 7/31/2017 | $29.06 | (0.18) | 5.53 | 5.35 | — | (0.46) | (0.46) |

| Year Ended 7/31/2016 | $33.11 | (0.21) | (0.33) | (0.54) | — | (3.51) | (3.51) |

| Year Ended 7/31/2015 | $30.90 | (0.21) | 6.42 | 6.21 | — | (4.00) | (4.00) |

| Class E |

| Year Ended 7/31/2019 | $43.65 | (0.08) | 2.95 | 2.87 | — | (3.37) | (3.37) |

| Year Ended 7/31/2018 | $39.67 | (0.10) | 6.60 | 6.50 | — | (2.52) | (2.52) |

| Year Ended 7/31/2017 | $33.70 | 0.02 | 6.45 | 6.47 | (0.04) | (0.46) | (0.50) |

| Year Ended 7/31/2016 | $37.60 | (0.03) | (0.36) | (0.39) | — | (3.51) | (3.51) |

| Year Ended 7/31/2015 | $34.44 | (0.00)(d) | 7.22 | 7.22 | (0.06) | (4.00) | (4.06) |

| Institutional Class |

| Year Ended 7/31/2019 | $45.56 | 0.06 | 3.13 | 3.19 | — | (3.37) | (3.37) |

| Year Ended 7/31/2018 | $41.23 | 0.06 | 6.86 | 6.92 | (0.07) | (2.52) | (2.59) |

| Year Ended 7/31/2017 | $35.00 | 0.15 | 6.70 | 6.85 | (0.16) | (0.46) | (0.62) |

| Year Ended 7/31/2016 | $38.79 | 0.09 | (0.37) | (0.28) | — | (3.51) | (3.51) |

| Year Ended 7/31/2015 | $35.41 | 0.13 | 7.43 | 7.56 | (0.18) | (4.00) | (4.18) |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 18 | Columbia Large Cap Growth Fund | Annual Report 2019 |

Financial Highlights (continued)

| | Net

asset

value,

end of

period | Total

return | Total gross

expense

ratio to

average

net assets(a) | Total net

expense

ratio to

average

net assets(a),(b) | Net investment

income (loss)

ratio to

average

net assets | Portfolio

turnover | Net

assets,

end of

period

(000’s) |

| Class A |

| Year Ended 7/31/2019 | $43.43 | 7.84% | 1.04% | 1.04% | (0.10%) | 35% | $1,932,367 |

| Year Ended 7/31/2018 | $43.86 | 17.26% | 1.05% | 1.05%(c) | (0.13%) | 32% | $1,976,097 |

| Year Ended 7/31/2017 | $39.81 | 19.61% | 1.09% | 1.09%(c) | 0.16% | 29% | $1,835,075 |

| Year Ended 7/31/2016 | $33.82 | (0.99%) | 1.10% | 1.10%(c) | 0.01% | 45% | $1,809,727 |

| Year Ended 7/31/2015 | $37.69 | 22.51% | 1.11% | 1.11%(c) | 0.09% | 59% | $1,870,452 |

| Advisor Class |

| Year Ended 7/31/2019 | $46.43 | 8.11% | 0.79% | 0.79% | 0.15% | 35% | $12,088 |

| Year Ended 7/31/2018 | $46.53 | 17.52% | 0.80% | 0.80%(c) | 0.12% | 32% | $14,629 |

| Year Ended 7/31/2017 | $42.06 | 19.92% | 0.84% | 0.84%(c) | 0.40% | 29% | $11,552 |

| Year Ended 7/31/2016 | $35.69 | (0.76%) | 0.85% | 0.85%(c) | 0.21% | 45% | $9,217 |

| Year Ended 7/31/2015 | $39.49 | 22.80% | 0.86% | 0.86%(c) | 0.17% | 59% | $6,506 |

| Class C |

| Year Ended 7/31/2019 | $35.43 | 7.03% | 1.79% | 1.79% | (0.86%) | 35% | $78,293 |

| Year Ended 7/31/2018 | $36.70 | 16.37% | 1.80% | 1.80%(c) | (0.87%) | 32% | $75,872 |

| Year Ended 7/31/2017 | $33.95 | 18.72% | 1.84% | 1.84%(c) | (0.58%) | 29% | $101,600 |

| Year Ended 7/31/2016 | $29.06 | (1.73%) | 1.86% | 1.86%(c) | (0.74%) | 45% | $109,092 |

| Year Ended 7/31/2015 | $33.11 | 21.59% | 1.86% | 1.86%(c) | (0.67%) | 59% | $85,724 |

| Class E |

| Year Ended 7/31/2019 | $43.15 | 7.71% | 1.14% | 1.14% | (0.20%) | 35% | $15,875 |

| Year Ended 7/31/2018 | $43.65 | 17.14% | 1.15% | 1.15%(c) | (0.23%) | 32% | $16,877 |

| Year Ended 7/31/2017 | $39.67 | 19.50% | 1.19% | 1.19%(c) | 0.06% | 29% | $16,478 |

| Year Ended 7/31/2016 | $33.70 | (1.08%) | 1.20% | 1.20%(c) | (0.09%) | 45% | $14,797 |

| Year Ended 7/31/2015 | $37.60 | 22.37% | 1.21% | 1.21%(c) | (0.00%)(d) | 59% | $16,539 |

| Institutional Class |

| Year Ended 7/31/2019 | $45.38 | 8.11% | 0.79% | 0.79% | 0.15% | 35% | $975,664 |

| Year Ended 7/31/2018 | $45.56 | 17.54% | 0.80% | 0.80%(c) | 0.13% | 32% | $996,845 |

| Year Ended 7/31/2017 | $41.23 | 19.92% | 0.84% | 0.84%(c) | 0.40% | 29% | $1,132,702 |

| Year Ended 7/31/2016 | $35.00 | (0.74%) | 0.85% | 0.85%(c) | 0.26% | 45% | $957,955 |

| Year Ended 7/31/2015 | $38.79 | 22.80% | 0.86% | 0.86%(c) | 0.34% | 59% | $1,049,380 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Large Cap Growth Fund | Annual Report 2019

| 19 |

Financial Highlights (continued)

| | Net asset value,

beginning of

period | Net

investment

income

(loss) | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Distributions

from net

realized

gains | Total

distributions to

shareholders |

| Institutional 2 Class |

| Year Ended 7/31/2019 | $45.59 | 0.09 | 3.13 | 3.22 | — | (3.37) | (3.37) |

| Year Ended 7/31/2018 | $41.25 | 0.08 | 6.87 | 6.95 | (0.09) | (2.52) | (2.61) |

| Year Ended 7/31/2017 | $35.02 | 0.18 | 6.70 | 6.88 | (0.19) | (0.46) | (0.65) |

| Year Ended 7/31/2016 | $38.77 | 0.09 | (0.33) | (0.24) | — | (3.51) | (3.51) |

| Year Ended 7/31/2015 | $35.39 | 0.09 | 7.51 | 7.60 | (0.22) | (4.00) | (4.22) |

| Institutional 3 Class |

| Year Ended 7/31/2019 | $45.70 | 0.11 | 3.15 | 3.26 | — | (3.37) | (3.37) |

| Year Ended 7/31/2018 | $41.35 | 0.09 | 6.88 | 6.97 | (0.10) | (2.52) | (2.62) |

| Year Ended 7/31/2017 | $35.10 | 0.16 | 6.76 | 6.92 | (0.21) | (0.46) | (0.67) |

| Year Ended 7/31/2016 | $38.83 | 0.13 | (0.35) | (0.22) | — | (3.51) | (3.51) |

| Year Ended 7/31/2015 | $35.44 | 0.07 | 7.57 | 7.64 | (0.25) | (4.00) | (4.25) |

| Class R |

| Year Ended 7/31/2019 | $43.49 | (0.14) | 2.94 | 2.80 | — | (3.37) | (3.37) |

| Year Ended 7/31/2018 | $39.59 | (0.14) | 6.56 | 6.42 | — | (2.52) | (2.52) |

| Year Ended 7/31/2017 | $33.65 | (0.04) | 6.44 | 6.40 | — | (0.46) | (0.46) |

| Year Ended 7/31/2016 | $37.60 | (0.07) | (0.37) | (0.44) | — | (3.51) | (3.51) |

| Year Ended 7/31/2015 | $34.44 | (0.07) | 7.24 | 7.17 | (0.01) | (4.00) | (4.01) |

| Class V |

| Year Ended 7/31/2019 | $43.47 | (0.04) | 2.95 | 2.91 | — | (3.37) | (3.37) |

| Year Ended 7/31/2018 | $39.48 | (0.05) | 6.56 | 6.51 | — | (2.52) | (2.52) |

| Year Ended 7/31/2017 | $33.55 | 0.06 | 6.41 | 6.47 | (0.08) | (0.46) | (0.54) |

| Year Ended 7/31/2016 | $37.41 | 0.00(d) | (0.35) | (0.35) | — | (3.51) | (3.51) |

| Year Ended 7/31/2015 | $34.27 | 0.03 | 7.19 | 7.22 | (0.08) | (4.00) | (4.08) |

| Notes to Financial Highlights |

| (a) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (b) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

| (c) | The benefits derived from expense reductions had an impact of less than 0.01%. |

| (d) | Rounds to zero. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 20 | Columbia Large Cap Growth Fund | Annual Report 2019 |

Financial Highlights (continued)

| | Net

asset

value,

end of

period | Total

return | Total gross

expense

ratio to

average

net assets(a) | Total net

expense

ratio to

average

net assets(a),(b) | Net investment

income (loss)

ratio to

average

net assets | Portfolio

turnover | Net

assets,

end of

period

(000’s) |

| Institutional 2 Class |

| Year Ended 7/31/2019 | $45.44 | 8.17% | 0.74% | 0.74% | 0.20% | 35% | $13,783 |

| Year Ended 7/31/2018 | $45.59 | 17.63% | 0.73% | 0.73% | 0.19% | 32% | $12,715 |

| Year Ended 7/31/2017 | $41.25 | 20.02% | 0.74% | 0.74% | 0.49% | 29% | $25,954 |

| Year Ended 7/31/2016 | $35.02 | (0.64%) | 0.76% | 0.76% | 0.28% | 45% | $21,789 |

| Year Ended 7/31/2015 | $38.77 | 22.95% | 0.75% | 0.75% | 0.25% | 59% | $3,879 |

| Institutional 3 Class |

| Year Ended 7/31/2019 | $45.59 | 8.24% | 0.69% | 0.69% | 0.26% | 35% | $394,049 |

| Year Ended 7/31/2018 | $45.70 | 17.65% | 0.69% | 0.69% | 0.20% | 32% | $428,819 |

| Year Ended 7/31/2017 | $41.35 | 20.09% | 0.69% | 0.69% | 0.41% | 29% | $184,471 |

| Year Ended 7/31/2016 | $35.10 | (0.58%) | 0.69% | 0.69% | 0.39% | 45% | $24,530 |

| Year Ended 7/31/2015 | $38.83 | 23.03% | 0.71% | 0.71% | 0.19% | 59% | $2,750 |

| Class R |

| Year Ended 7/31/2019 | $42.92 | 7.57% | 1.29% | 1.29% | (0.35%) | 35% | $13,233 |

| Year Ended 7/31/2018 | $43.49 | 16.96% | 1.30% | 1.30%(c) | (0.35%) | 32% | $15,911 |

| Year Ended 7/31/2017 | $39.59 | 19.29% | 1.34% | 1.34%(c) | (0.10%) | 29% | $29,781 |

| Year Ended 7/31/2016 | $33.65 | (1.22%) | 1.36% | 1.36%(c) | (0.22%) | 45% | $24,920 |

| Year Ended 7/31/2015 | $37.60 | 22.20% | 1.36% | 1.36%(c) | (0.20%) | 59% | $5,421 |

| Class V |

| Year Ended 7/31/2019 | $43.01 | 7.84% | 1.04% | 1.04% | (0.11%) | 35% | $205,528 |

| Year Ended 7/31/2018 | $43.47 | 17.25% | 1.05% | 1.05%(c) | (0.13%) | 32% | $208,329 |

| Year Ended 7/31/2017 | $39.48 | 19.59% | 1.09% | 1.09%(c) | 0.16% | 29% | $194,803 |

| Year Ended 7/31/2016 | $33.55 | (0.97%) | 1.11% | 1.11%(c) | 0.01% | 45% | $179,935 |

| Year Ended 7/31/2015 | $37.41 | 22.49% | 1.13% | 1.13%(c) | 0.08% | 59% | $197,026 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Large Cap Growth Fund | Annual Report 2019

| 21 |

Notes to Financial Statements

July 31, 2019

Note 1. Organization

Columbia Large Cap Growth Fund (the Fund), a series of Columbia Funds Series Trust I (the Trust), is a diversified fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

Fund shares

The Trust may issue an unlimited number of shares (without par value). The Fund offers each of the share classes listed in the Statement of Assets and Liabilities. Although all share classes generally have identical voting, dividend and liquidation rights, each share class votes separately when required by the Trust’s organizational documents or by law. Each share class has its own expense and sales charge structure. Different share classes may have different minimum initial investment amounts and pay different distribution amounts to the extent the expenses of distributing such share classes vary. Distributions to shareholders in a liquidation will be proportional to the net asset value of each share class.

As described in the Fund’s prospectus, Class A and Class C shares are offered to the general public for investment. Advisor Class, Institutional Class, Institutional 2 Class, Institutional 3 Class and Class R shares are available for purchase through authorized investment professionals to omnibus retirement plans or to institutional and to certain other investors as also described in the Fund’s prospectus. Class E shares are trust shares which are held in an irrevocable trust until the specified trust termination date and are closed to new investors and new accounts. Class C shares automatically convert to Class A shares after 10 years. Effective December 14, 2018, Class T shares merged, in a tax-free transaction, into Class A shares of the Fund and are no longer offered for sale. Class V shares are available only to investors who received (and who continuously held) Class V shares in connection with previous fund reorganizations.

Note 2. Summary of significant accounting policies

Basis of preparation

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946,Financial Services - Investment Companies (ASC 946). The financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security valuation

All equity securities are valued at the close of business of the New York Stock Exchange. Equity securities are valued at the official closing price on the principal exchange or market on which they trade. Unlisted securities or listed securities for which there were no sales during the day are valued at the mean of the latest quoted bid and ask prices on such exchanges or markets.

Foreign equity securities are valued based on the closing price on the foreign exchange in which such securities are primarily traded. If any foreign equity security closing prices are not readily available, the securities are valued at the mean of the latest quoted bid and ask prices on such exchanges or markets. Foreign currency exchange rates are determined at the scheduled closing time of the New York Stock Exchange. Many securities markets and exchanges outside the U.S. close prior to the close of the New York Stock Exchange; therefore, the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the New York Stock Exchange. In those situations, foreign securities will be fair valued pursuant to a policy adopted by the Board of Trustees, including, if available, utilizing a third party pricing service to determine these fair values. The third-party pricing service takes into account multiple factors, including, but not limited to, movements in the U.S. securities markets, certain depositary receipts, futures contracts and

| 22 | Columbia Large Cap Growth Fund | Annual Report 2019 |

Notes to Financial Statements (continued)

July 31, 2019

foreign exchange rates that have occurred subsequent to the close of the foreign exchange or market, to determine a good faith estimate that reasonably reflects the current market conditions as of the close of the New York Stock Exchange. The fair value of a security is likely to be different from the quoted or published price, if available.

Investments in open-end investment companies, including money market funds, are valued at their latest net asset value.

Investments for which market quotations are not readily available, or that have quotations which management believes are not reflective of market value or reliable, are valued at fair value as determined in good faith under procedures approved by and under the general supervision of the Board of Trustees. If a security or class of securities (such as foreign securities) is valued at fair value, such value is likely to be different from the quoted or published price for the security.

The determination of fair value often requires significant judgment. To determine fair value, management may use assumptions including but not limited to future cash flows and estimated risk premiums. Multiple inputs from various sources may be used to determine fair value.

GAAP requires disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category. This information is disclosed following the Fund’s Portfolio of Investments.

Foreign currency transactions and translations

The values of all assets and liabilities denominated in foreign currencies are generally translated into U.S. dollars at exchange rates determined at the close of regular trading on the New York Stock Exchange. Net realized and unrealized gains (losses) on foreign currency transactions and translations include gains (losses) arising from the fluctuation in exchange rates between trade and settlement dates on securities transactions, gains (losses) arising from the disposition of foreign currency and currency gains (losses) between the accrual and payment dates on dividends, interest income and foreign withholding taxes.

For financial statement purposes, the Fund does not distinguish that portion of gains (losses) on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices of the investments. Such fluctuations are included with the net realized and unrealized gains (losses) on investments in the Statement of Operations.

Security transactions

Security transactions are accounted for on the trade date. Cost is determined and gains (losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Income recognition

Corporate actions and dividend income are generally recorded net of any non-reclaimable tax withholdings, on the ex-dividend date or upon receipt of ex-dividend notification in the case of certain foreign securities.

The Fund may receive distributions from holdings in equity securities, business development companies (BDCs), exchange-traded funds (ETFs), limited partnerships (LPs), other regulated investment companies (RICs), and real estate investment trusts (REITs), which report information on the tax character of their distributions annually. These distributions are allocated to dividend income, capital gain and return of capital based on actual information reported. Return of capital is recorded as a reduction of the cost basis of securities held. If the Fund no longer owns the applicable securities, return of capital is recorded as a realized gain. With respect to REITs, to the extent actual information has not yet been reported, estimates for return of capital are made by the Fund’s management. Management’s estimates are subsequently adjusted when the actual character of the distributions is disclosed by the REITs, which could result in a proportionate change in return of capital to shareholders.

Awards from class action litigation are recorded as a reduction of cost basis if the Fund still owns the applicable securities on the payment date. If the Fund no longer owns the applicable securities, the proceeds are recorded as realized gains.

Columbia Large Cap Growth Fund | Annual Report 2019

| 23 |

Notes to Financial Statements (continued)

July 31, 2019

Expenses

General expenses of the Trust are allocated to the Fund and other funds of the Trust based upon relative net assets or other expense allocation methodologies determined by the nature of the expense. Expenses directly attributable to the Fund are charged to the Fund. Expenses directly attributable to a specific class of shares are charged to that share class.

Determination of class net asset value

All income, expenses (other than class-specific expenses, which are charged to that share class, as shown in the Statement of Operations) and realized and unrealized gains (losses) are allocated to each class of the Fund on a daily basis, based on the relative net assets of each class, for purposes of determining the net asset value of each class.

Federal income tax status

The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code, as amended, and will distribute substantially all of its investment company taxable income and net capital gain, if any, for its tax year, and as such will not be subject to federal income taxes. In addition, the Fund intends to distribute in each calendar year substantially all of its ordinary income, capital gain net income and certain other amounts, if any, such that the Fund should not be subject to federal excise tax. Therefore, no federal income or excise tax provision is recorded.

Foreign taxes

The Fund may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries, as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

Realized gains in certain countries may be subject to foreign taxes at the Fund level, based on statutory rates. The Fund accrues for such foreign taxes on realized and unrealized gains at the appropriate rate for each jurisdiction, as applicable. The amount, if any, is disclosed as a liability on the Statement of Assets and Liabilities.

Distributions to shareholders

Distributions from net investment income, if any, are declared and paid annually. Net realized capital gains, if any, are distributed at least annually. Income distributions and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

Guarantees and indemnifications

Under the Trust’s organizational documents and, in some cases, by contract, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust or its funds. In addition, certain of the Fund’s contracts with its service providers contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown since the amount of any future claims that may be made against the Fund cannot be determined, and the Fund has no historical basis for predicting the likelihood of any such claims.

Recent accounting pronouncements

Accounting Standards Update 2017-08 Premium Amortization on Purchased Callable Debt Securities

In March 2017, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2017-08 Premium Amortization on Purchased Callable Debt Securities. ASU No. 2017-08 updates the accounting standards to shorten the amortization period for certain purchased callable debt securities, held at a premium, to be amortized to the earliest call date. The update applies to securities with explicit, noncontingent call features that are callable at fixed prices and on preset dates. The standard is effective for annual periods beginning after December 15, 2018 and interim periods within those fiscal years. Management does not expect the implementation of this guidance to have a material impact on the financial statement amounts and footnote disclosures.

Accounting Standards Update 2018-13 Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement

| 24 | Columbia Large Cap Growth Fund | Annual Report 2019 |

Notes to Financial Statements (continued)

July 31, 2019

In August 2018, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2018-13 Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement. The standard is effective for annual periods beginning after December 15, 2019 and interim periods within those fiscal years, with early adoption permitted. After evaluation, Management determined to adopt the ASU effective for periods ending July 31, 2019 and all subsequent periods. As a result of the amendments, management implemented disclosure changes which include removal of the amount and reasons for transfers between level 1 and level 2 of the fair value hierarchy, removal of the policy for the timing of transfers between levels, removal of the description of the level 3 valuation processes, as well as modifications to the measurement uncertainty disclosure.

Disclosure Update and Simplification

In September 2018, the Securities and Exchange Commission (SEC) released Final Rule 33-10532, Disclosure Update and Simplification, which amends certain financial statement disclosure requirements that the SEC determined to be redundant, outdated, or superseded in light of other SEC disclosure requirements, GAAP, or changes in the information environment. As a result of the amendments, management implemented disclosure changes which included removing the components of distributable earnings presented on the Statement of Assets and Liabilities and combining income and gain distributions paid to shareholders as presented on the Statement of Changes in Net Assets. Any values presented to meet prior year requirements were left unchanged. The amendments had no effect on the Fund’s net assets or results of operation.

Note 3. Fees and other transactions with affiliates

Management services fees