UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04367

Columbia Funds Series Trust I

(Exact name of registrant as specified in charter)

290 Congress Street

Boston, MA 02210

(Address of principal executive offices) (Zip code)

Daniel J. Beckman

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 345-6611

Date of fiscal year end: April 30

Date of reporting period: April 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Bond Fund

Annual Report

April 30, 2024

In October 2022, the Securities and Exchange Commission (SEC) adopted a final rule, "Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds; Fee Information in Investment Company Advertisements." The rule and form amendments will, among other things, require the Fund to transmit concise and visually engaging shareholder reports that highlight key information. The amendments will require that funds tag information in a structured data format and that certain more in-depth information be made available online and available for delivery free of charge to investors on request. The amendments became effective January 24, 2023. There is an 18-month transition period after the effective date of the amendments.

Each Tailored Shareholder Report will be share-class specific and will highlight key fund information the SEC believes is most relevant to investors in assessing their investment in the Fund. Much of the information, including a Fund’s financial statements, that is currently disclosed in a Fund’s shareholder reports will instead be made available on the Fund’s website and filed on Form N-CSR on an annual and semiannual basis. This information will be delivered to investors free of charge upon request. Columbia Fund reports will follow the Tailored Shareholder Report approach beginning with reports covering the period ending May 31, 2024.

The new rule also requires the Fund to mail a printed version of the Tailored Shareholder Report to all shareholders who have not elected to receive shareholder reports electronically. Rather than receiving a postcard notifying investors that the shareholder report for Funds in which they invest is available online, investors will begin receiving the Tailored Shareholder Report in the mail unless they have elected to receive their Fund documents electronically.

| No Financial Institution Guarantee | |

If you elect to receive the shareholder report for Columbia Bond Fund (the Fund) in paper, mailed to you, the Fund mails one shareholder report to each shareholder address, unless such shareholder elects to receive shareholder reports from the Fund electronically via e-mail or by having a paper notice mailed to you (Postcard Notice) that your Fund’s shareholder report is available at the Columbia funds’ website (columbiathreadneedleus.com/investor/). If you would like more than one report in paper to be mailed to you, or would like to elect to receive reports via e-mail or access them through Postcard Notice, please call shareholder services at 800.345.6611 and additional reports will be sent to you.

Proxy voting policies and procedures

The policy of the Board of Trustees is to vote the proxies of the companies in which the Fund holds investments consistent with the procedures as stated in the Statement of Additional Information (SAI). You may obtain a copy of the SAI without charge by calling 800.345.6611; contacting your financial intermediary; visiting columbiathreadneedleus.com/investor/; or searching the website of the Securities and Exchange Commission (SEC) at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities is filed with the SEC by August 31st for the most recent 12-month period ending June 30th of that year, and is available without charge by visiting columbiathreadneedleus.com/investor/, or searching the website of the SEC at sec.gov.

Quarterly schedule of investments

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT filings are available on the SEC’s website at sec.gov. The Fund’s complete schedule of portfolio holdings, as filed on Form N-PORT, is available on columbiathreadneedleus.com/investor/ or can also be obtained without charge, upon request, by calling 800.345.6611.

Additional Fund information

For more information about the Fund, please visit columbiathreadneedleus.com/investor/ or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

Fund investment manager

Columbia Management Investment Advisers, LLC (the Investment Manager)

290 Congress Street

Boston, MA 02210

Fund distributor

Columbia Management Investment Distributors, Inc.

290 Congress Street

Boston, MA 02210

Fund transfer agent

Columbia Management Investment Services Corp.

P.O. Box 219104

Kansas City, MO 64121-9104

Columbia Bond Fund | Annual Report 2024

Fund at a Glance(Unaudited) Investment objective

The Fund seeks current income, consistent with minimal fluctuation of principal.

Portfolio management

Jason Callan

Lead Portfolio Manager

Managed Fund since 2016

Gene Tannuzzo, CFA

Portfolio Manager

Managed Fund since 2017

Alex Christensen, CFA

Portfolio Manager

Managed Fund since 2021

Average annual total returns (%) (for the period ended April 30, 2024) |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Bloomberg U.S. Aggregate Bond Index | | | | |

Returns for Class A shares are shown with and without the maximum initial sales charge of 4.75%. The Fund’s other share classes are not subject to sales charges and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each share class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.345.6611.

The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage passthroughs), asset-backed securities, and commercial mortgage-backed securities.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Columbia Bond Fund | Annual Report 2024

3

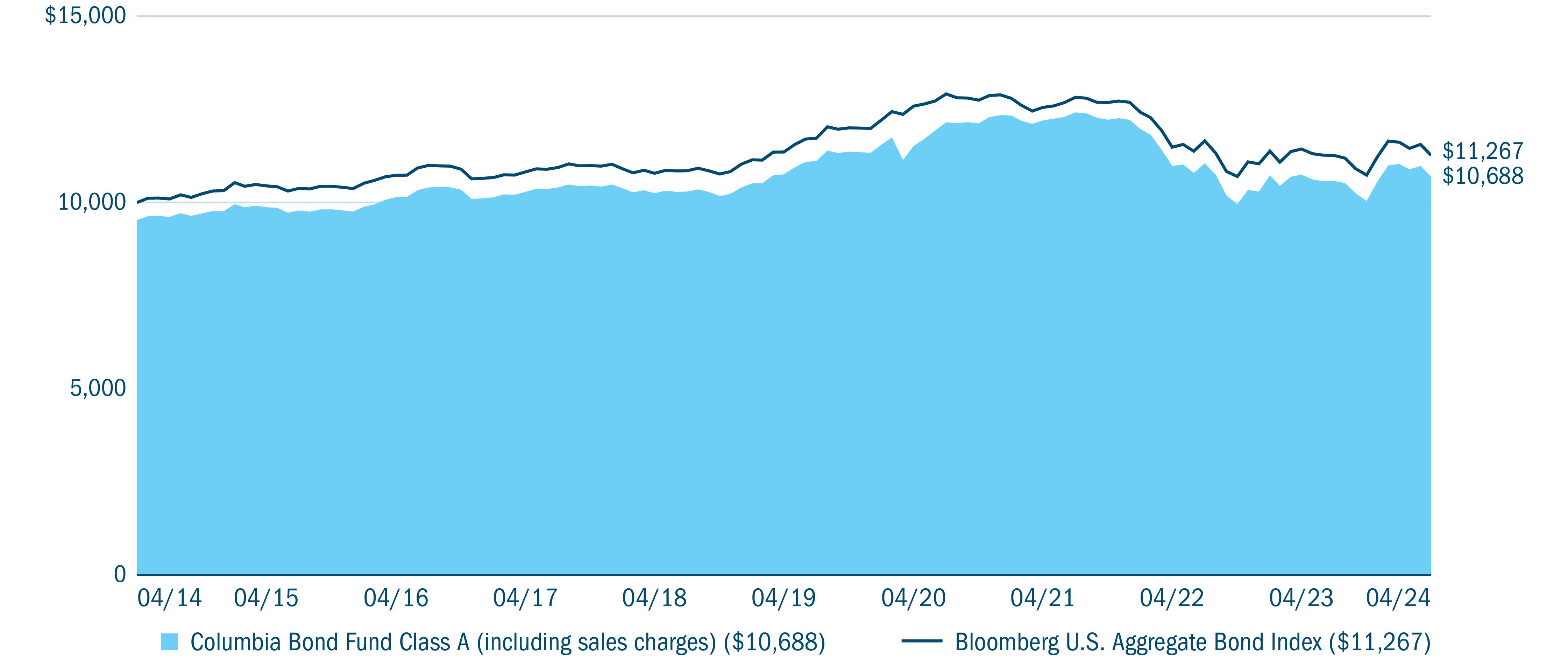

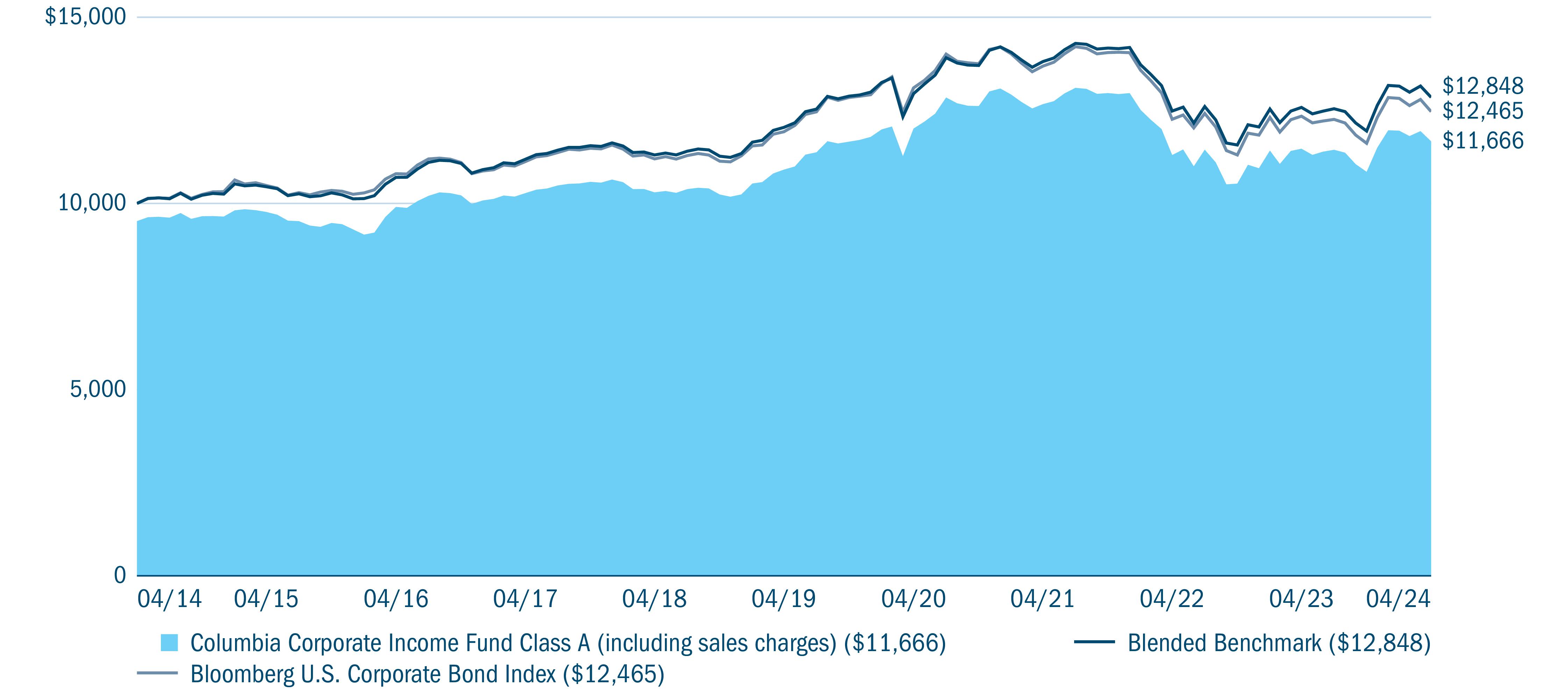

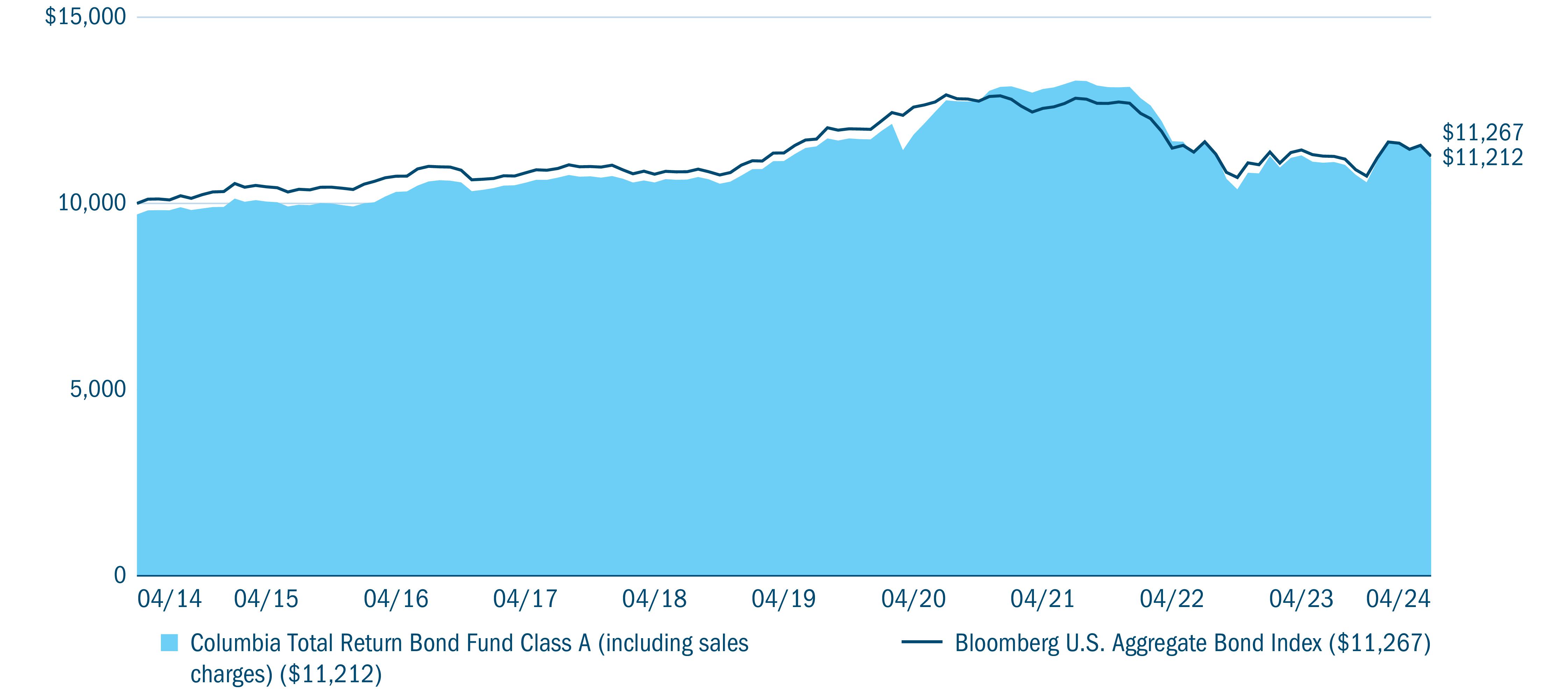

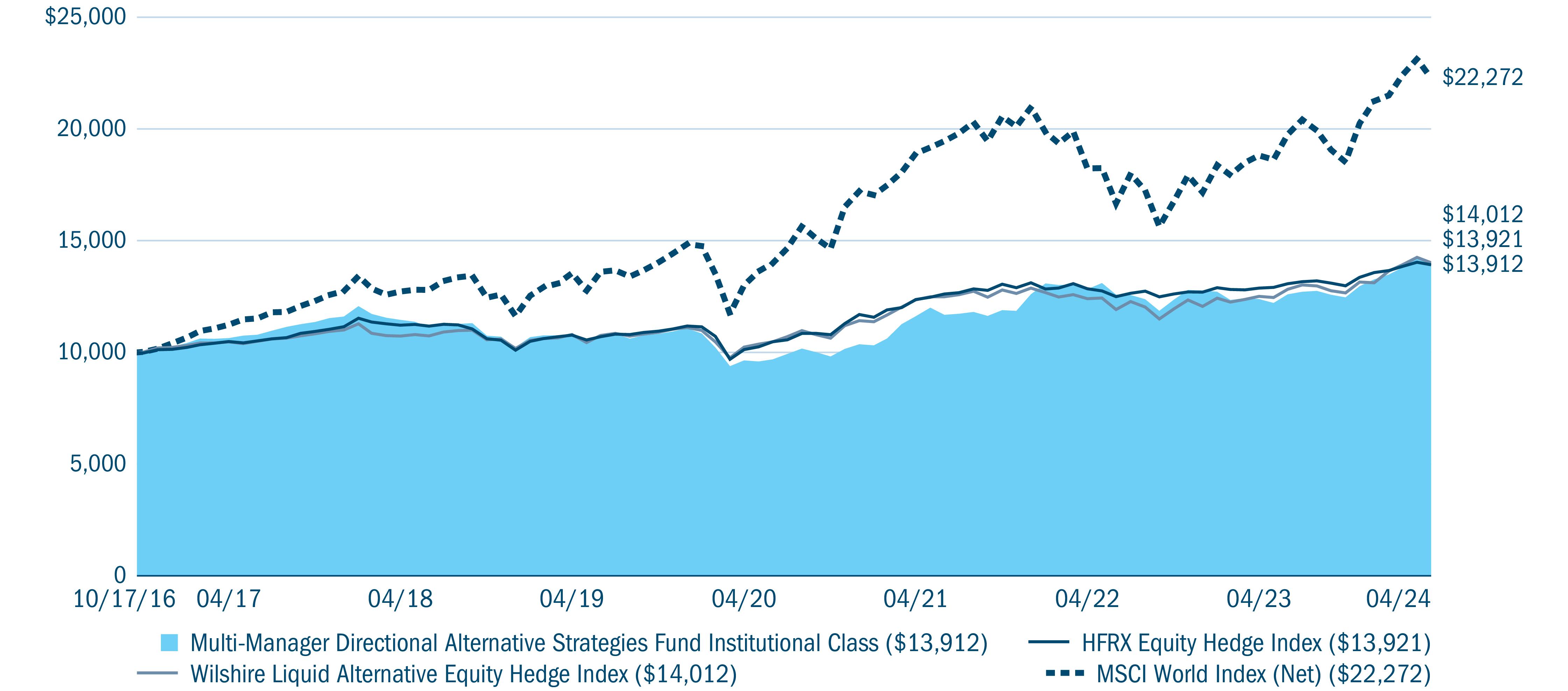

Fund at a Glance (continued)(Unaudited) Performance of a hypothetical $10,000 investment (April 30, 2014 — April 30, 2024)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Bond Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Portfolio breakdown (%) (at April 30, 2024) |

Asset-Backed Securities - Non-Agency | |

Call Option Contracts Purchased | |

Commercial Mortgage-Backed Securities - Agency | |

Commercial Mortgage-Backed Securities - Non-Agency | |

| |

| |

| |

| |

Put Option Contracts Purchased | |

Residential Mortgage-Backed Securities - Agency | |

Residential Mortgage-Backed Securities - Non-Agency | |

| |

Percentages indicated are based upon total investments including option contracts purchased and excluding all other investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

Quality breakdown (%) (at April 30, 2024) |

| |

| |

| |

| |

| |

| |

Percentages indicated are based upon total fixed income investments.

Bond ratings apply to the underlying holdings of the Fund and not the Fund itself and are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. If a security is not rated but has a rating by Kroll and/or DBRS, the same methodology is applied to those bonds that would otherwise be not rated. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. The ratings assigned by credit rating agencies are but one of the considerations that the Investment Manager and/or Fund’s subadviser incorporates into its credit analysis process, along with such other issuer-specific factors as cash flows, capital structure and leverage ratios, ability to de-leverage (repay) through free cash flow, quality of management, market positioning and access to capital, as well as such security-specific factors as the terms of the security (e.g., interest rate and time to maturity) and the amount and type of any collateral.

4

Columbia Bond Fund | Annual Report 2024

Manager Discussion of Fund Performance(Unaudited) At April 30, 2024, approximately 40.22% of the Fund’s shares were owned in the aggregate by affiliated funds-of-funds managed by Columbia Management Investment Advisers, LLC (the Investment Manager). As a result of asset allocation decisions by the Investment Manager, it is possible that the Fund may experience relatively large purchases or redemptions from affiliated funds-of-funds. The Investment Manager seeks to minimize the impact of these transactions by structuring them over a reasonable period of time. The Fund may experience increased expenses as it buys and sells securities as a result of purchases or redemptions by affiliated funds-of-funds.

For the 12-month period that ended April 30, 2024, Class A shares of Columbia Bond Fund returned -0.53% excluding sales charges. The Fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index, returned -1.47% for the same period.

Market overview

For the 12 months that ended April 30, 2024, returns for the broader bond market were constrained as U.S. Treasury yields finished the period notably higher. At the same time, performance for credit-sensitive sectors of the market was supported by a resilient economic backdrop.

Inflation continued to ease as 2023 progressed, with June U.S. consumer price inflation coming in at 3.0%. With the economic and employment backdrop remaining strong despite the past policy tightening of the U.S. Federal Reserve (Fed), the central bank would implement additional 25 basis point increases at its May and July meetings, leaving the target range for the federal funds rate at 5.25% to 5.50%. (A basis point is 1/100 of a percent.) The Fed held rates steady at its last three meetings of 2023, citing the improving inflation outlook.

Entering 2024, with inflation seemingly headed towards the Fed’s 2% target, investors were anticipating as many as six or seven rate cuts in 2024, beginning as soon as March 2024. However, these hopes were dampened as U.S. economic and employment data remained robust, largely dispelling any lingering recession concerns. In addition, the pace of progress in taming inflation remained highly incremental. Against this backdrop, the consensus outlook shifted by the end of the first quarter of 2024 to encompass three Fed rate cuts before year end, with the first occurring in June. Inflation data for March reported in April actually reflected an uptick, leading investors to further push back expectations for the first rate cut to the fall. As of April 30, 2024, the yield on the 10-year U.S. Treasury note closed at 4.69% versus 3.44% 12 months earlier.

The Fund’s notable contributors during the period

•

In broad terms, positive contributions to the Fund’s performance relative to the benchmark were driven by overweight exposure to credit-based sectors, along with an underweight to U.S. Treasuries as the yield curve moved higher over the period.

•

Most notably, exposure to consumer-based credit proved beneficial, led by holdings of non-agency mortgage-backed securities as housing fundamentals remained strong and borrower delinquencies remained low.

•

Positioning in asset-backed securities was also additive, highlighted by holdings of unsecured consumer loans and collateralized loan obligations with floating interest rates.

•

Within corporate bonds, the Fund took advantage of shifting expectations around growth and inflation to add value by tactically increasing or decreasing its overall credit risk exposure.

•

In addition, a focus on the financials sector at the expense of industrials contributed positively. Within financials, the Fund favored the largest, global systemically important banks subject to the most rigorous capital requirements while avoiding the regional and second-tier banks viewed as most vulnerable to any downturn in conditions.

The Fund’s notable detractors during the period

•

The Fund’s positioning with respect to interest rates weighed most heavily on relative performance. Specifically, the Fund had an above-benchmark stance with respect to duration and corresponding interest rate sensitivity as U.S. Treasury yields moved higher over the period.

•

In addition, performance for the Fund’s agency mortgage-backed security holdings suffered against a backdrop of elevated interest rate volatility which at various junctures raised concerns around either a pick-up in prepayments or duration extension.

Columbia Bond Fund | Annual Report 2024

5

Manager Discussion of Fund Performance (continued)(Unaudited) Derivative usage

We invested in highly-liquid, widely traded Treasury futures and interest rate swaption contracts to help manage portfolio duration. These enabled us to efficiently implement our yield curve opinions and offset unintended yield curve impacts from other investments in the portfolio. We also used indexed exposure to credit default swaps to manage the Fund’s overall level of credit risk. On a standalone basis, the Fund’s use of derivatives had a negative impact on performance.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Mortgage- and asset-backed securities are affected by interest rates, financial health of issuers/originators, creditworthiness of entities providing credit enhancements and the value of underlying assets. Fixed-income securities present issuer default risk. A rise in interest rates may result in a price decline of fixed-income instruments held by the Fund, negatively impacting its performance and NAV. Falling rates may result in the Fund investing in lower yielding debt instruments, lowering the Fund’s income and yield. These risks may be heightened for longer maturity and duration securities. Non-investment-grade (high-yield or junk) securities present greater price volatility and more risk to principal and income than higher rated securities. Prepayment and extension risk exists because the timing of payments on a loan, bond or other investment may accelerate when interest rates fall or decelerate when interest rates rise which may reduce investment opportunities and potential returns. Investing in derivatives is a specialized activity that involves special risks that subject the Fund to significant loss potential, including when used as leverage, and may result in greater fluctuation in Fund value. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties who have contributed to this report. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

6

Columbia Bond Fund | Annual Report 2024

Understanding Your Fund’s Expenses(Unaudited) As an investor, you incur two types of costs. There are shareholder transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing fund costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the “Actual” column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

November 1, 2023 — April 30, 2024 |

| Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 366.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Columbia Bond Fund | Annual Report 2024

7

Portfolio of InvestmentsApril 30, 2024(Percentages represent value of investments compared to net assets)

Investments in securities

Asset-Backed Securities - Non-Agency 21.0% |

| | | | |

|

|

| | | | |

Subordinated Series 2023-1PL Class B |

| | | | |

Subordinated Series 2023-3PL Class C |

| | | | |

|

|

| | | | |

Affirm Asset Securitization Trust(a) |

|

| | | | |

|

| | | | |

|

| | | | |

American Credit Acceptance Receivables Trust(a) |

Subordinated Series 2022-2 Class C |

| | | | |

Avant Loans Funding Trust(a) |

Subordinated Series 2021-REV1 Class B |

| | | | |

Bain Capital Credit CLO Ltd.(a),(b) |

|

3-month Term SOFR + 1.662%

04/23/2031 | | | | |

Carlyle Global Market Strategies CLO Ltd.(a),(b) |

Series 2016-1A Class A1R2 |

3-month Term SOFR + 1.402%

Floor 1.140%

04/20/2034 | | | | |

|

|

3-month Term SOFR + 1.662%

01/20/2030 | | | | |

Carvana Auto Receivables Trust(a) |

|

| | | | |

|

Series 2018-C17A Class A2R |

3-month Term SOFR + 1.862%

Floor 1.600%

04/30/2031 | | | | |

Dell Equipment Finance Trust(a) |

|

| | | | |

Asset-Backed Securities - Non-Agency (continued) |

| | | | |

Dryden 83 CLO Ltd.(a),(b) |

|

3-month Term SOFR + 2.412%

Floor 2.150%

01/18/2032 | | | | |

|

|

3-month Term SOFR + 1.612%

Floor 1.350%

05/15/2031 | | | | |

|

|

| | | | |

Subordinated Series 2021-3A Class C |

| | | | |

Subordinated Series 2022-1A Class C |

| | | | |

Subordinated Series 2023-3A Class B |

| | | | |

Exeter Automobile Receivables Trust |

|

| | | | |

Subordinated Series 2023-3A Class B |

| | | | |

GLS Auto Receivables Issuer Trust(a) |

Subordinated Series 2022-1A-B Class B |

| | | | |

GLS Auto Select Receivables Trust(a) |

|

| | | | |

LendingPoint Asset Securitization Trust(a) |

Subordinated Series 2022-A Class C |

| | | | |

|

|

| | | | |

Madison Park Funding XXIV Ltd.(a),(b) |

|

3-month Term SOFR + 2.012%

10/20/2029 | | | | |

Madison Park Funding XXVII Ltd.(a),(b) |

|

3-month Term SOFR + 1.612%

04/20/2030 | | | | |

Marlette Funding Trust(a) |

|

| | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

8

Columbia Bond Fund | Annual Report 2024

Portfolio of Investments (continued)April 30, 2024 Asset-Backed Securities - Non-Agency (continued) |

| | | | |

|

| | | | |

Octagon Investment Partners 35 Ltd.(a),(b) |

|

3-month Term SOFR + 1.662%

Floor 1.400%

01/20/2031 | | | | |

Octagon Investment Partners XXII Ltd.(a),(b) |

|

3-month Term SOFR + 1.712%

Floor 1.450%

01/22/2030 | | | | |

Oportun Issuance Trust(a) |

|

| | | | |

|

| | | | |

|

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

Subordinated Series 2022-1 Class B |

| | | | |

Subordinated Series 2022-2 Class B |

| | | | |

Subordinated Series 2023-7 Class B |

| | | | |

Subordinated Series 2024-3 Class B |

| | | | |

Pagaya AI Debt Trust(a),(c) |

Subordinated Series 2023-7 Class AB |

| | | | |

Palmer Square Loan Funding Ltd.(a),(b) |

Series 2022-3A Class A1BR |

3-month Term SOFR + 1.400%

Floor 1.400%

04/15/2031 | | | | |

Prosper Marketplace Issuance Trust(a) |

Subordinated Series 2023-1A Class B |

| | | | |

Asset-Backed Securities - Non-Agency (continued) |

| | | | |

|

Subordinated Series 2023-1A Class B |

| | | | |

Research-Driven Pagaya Motor Asset Trust(a) |

|

| | | | |

Research-Driven Pagaya Motor Asset Trust IV(a) |

|

| | | | |

Research-Driven Pagaya Motor Trust(a) |

|

| | | | |

|

|

3-month Term SOFR + 1.862%

Floor 1.600%

07/15/2035 | | | | |

|

Series 2014-14A Class A1R2 |

3-month Term SOFR + 1.352%

Floor 1.090%

01/15/2030 | | | | |

Santander Drive Auto Receivables Trust |

|

| | | | |

Santander Revolving Auto Loan Trust(a) |

|

| | | | |

|

|

| | | | |

|

| | | | |

|

| | | | |

Upstart Pass-Through Trust(a) |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

Upstart Securitization Trust(a) |

|

| | | | |

|

| | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2024

9

Portfolio of Investments (continued)April 30, 2024 Asset-Backed Securities - Non-Agency (continued) |

| | | | |

Subordinated Series 2021-5 Class B |

| | | | |

Upstart Structured Pass-Through Trust(a) |

|

| | | | |

Westlake Automobile Receivables Trust(a) |

|

| | | | |

Total Asset-Backed Securities — Non-Agency

(Cost $177,815,819) | |

|

Commercial Mortgage-Backed Securities - Agency 0.1% |

| | | | |

Federal Home Loan Mortgage Corp. Multifamily Structured Pass-Through Certificates(c) |

Series 2017-K070 Class A2 |

| | | | |

Total Commercial Mortgage-Backed Securities - Agency

(Cost $1,011,771) | |

|

Commercial Mortgage-Backed Securities - Non-Agency 8.0% |

| | | | |

BAMLL Commercial Mortgage Securities Trust(a),(c) |

|

| | | | |

Braemar Hotels & Resorts Trust(a),(b) |

|

1-month Term SOFR + 0.867%

Floor 0.820%

06/15/2035 | | | | |

COMM Mortgage Trust(a),(c) |

Subordinated Series 2020-CBM Class D |

| | | | |

Corevest American Finance Trust(a) |

|

| | | | |

Credit Suisse Mortgage Capital Certificates OA LLC(a) |

|

| | | | |

|

Subordinated Series 2016-SFP Class D |

| | | | |

Invitation Homes Trust(a),(b) |

Subordinated Series 2018-SFR4 Class C |

1-month Term SOFR + 1.514%

Floor 1.400%

01/17/2038 | | | | |

JPMorgan Chase Commercial Mortgage Securities Trust(a),(c) |

Subordinated Series 2021-2NU Class C |

| | | | |

Morgan Stanley Capital I Trust(a),(c) |

|

| | | | |

Commercial Mortgage-Backed Securities - Non-Agency (continued) |

| | | | |

New Residential Mortgage Loan Trust(a) |

|

| | | | |

One New York Plaza Trust(a),(b) |

Subordinated Series 2020-1NYP Class B |

1-month Term SOFR + 1.614%

Floor 1.500%

01/15/2036 | | | | |

Subordinated Series 2020-1NYP Class C |

1-month Term SOFR + 2.314%

Floor 2.200%

01/15/2036 | | | | |

Progress Residential Trust(a) |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

Subordinated Series 2022-SFR4 Class B |

| | | | |

SFO Commercial Mortgage Trust(a),(b) |

|

1-month Term SOFR + 1.264%

Floor 1.150%

05/15/2038 | | | | |

|

|

| | | | |

UBS Commercial Mortgage Trust(a),(b) |

|

1-month Term SOFR + 1.297%

Floor 1.250%

02/15/2032 | | | | |

Wells Fargo Commercial Mortgage Trust(a),(b) |

Subordinated Series 2017-SMP Class C |

1-month Term SOFR + 1.372%

Floor 1.200%

12/15/2034 | | | | |

Total Commercial Mortgage-Backed Securities - Non-Agency

(Cost $73,899,907) | |

The accompanying Notes to Financial Statements are an integral part of this statement.

10

Columbia Bond Fund | Annual Report 2024

Portfolio of Investments (continued)April 30, 2024

|

| | |

|

|

Crimson Wine Group Ltd.(d) | | |

| |

|

Oil, Gas & Consumable Fuels 0.0% |

| | |

| |

|

|

Jefferies Financial Group, Inc. | | |

| |

Total Common Stocks

(Cost $—) | |

Corporate Bonds & Notes 18.6% |

| | | | |

|

|

| | | | |

|

| | | | |

|

| | | | |

L3Harris Technologies, Inc. |

| | | | |

| | | | |

|

| | | | |

|

| | | | |

Raytheon Technologies Corp. |

| | | | |

| |

|

|

| | | | |

| | | | |

| | | | |

|

| | | | |

|

| | | | |

Corporate Bonds & Notes (continued) |

| | | | |

Goldman Sachs Group, Inc. (The)(f) |

| | | | |

| | | | |

|

| | | | |

|

| | | | |

| | | | |

| | | | |

|

| | | | |

| | | | |

| | | | |

|

| | | | |

PNC Financial Services Group, Inc. (The)(f) |

| | | | |

|

| | | | |

|

| | | | |

| | | | |

| |

|

Charter Communications Operating LLC/Capital |

| | | | |

| | | | |

| | | | |

| |

Construction Machinery 0.2% |

|

| | | | |

|

|

| | | | |

|

| | | | |

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2024

11

Portfolio of Investments (continued)April 30, 2024 Corporate Bonds & Notes (continued) |

| | | | |

Pacific Gas and Electric Co. |

| | | | |

| |

|

|

| | | | |

Bacardi Ltd./Bacardi-Martini BV(a) |

| | | | |

Constellation Brands, Inc. |

| | | | |

|

| | | | |

Pepsico Singapore Financing I Pte Ltd. |

| | | | |

| |

|

|

| | | | |

| | | | |

GE HealthCare Technologies, Inc. |

| | | | |

|

| | | | |

| |

Healthcare Insurance 1.8% |

|

| | | | |

| | | | |

|

| | | | |

| | | | |

|

| | | | |

| | | | |

| |

|

Peachtree Corners Funding Trust(a) |

| | | | |

Media and Entertainment 0.6% |

Warnermedia Holdings, Inc. |

| | | | |

|

|

| | | | |

Corporate Bonds & Notes (continued) |

| | | | |

Kinder Morgan Energy Partners LP |

| | | | |

|

| | | | |

Plains All American Pipeline LP/Finance Corp. |

| | | | |

Western Midstream Operating LP |

| | | | |

| |

|

|

| | | | |

|

|

| | | | |

|

| | | | |

|

| | | | |

Pfizer Investment Enterprises Pte., Ltd. |

| | | | |

| |

|

|

| | | | |

| | | | |

| |

|

|

| | | | |

NXP BV/Funding LLC/USA, Inc. |

| | | | |

| | | | |

| |

Transportation Services 0.4% |

|

| | | | |

|

|

| | | | |

Total Corporate Bonds & Notes

(Cost $167,721,212) | |

|

The accompanying Notes to Financial Statements are an integral part of this statement.

12

Columbia Bond Fund | Annual Report 2024

Portfolio of Investments (continued)April 30, 2024 Inflation-Indexed Bonds 1.5% |

| | | | |

|

U.S. Treasury Inflation-Indexed Bond |

| | | | |

| | | | |

| | | | |

| |

Total Inflation-Indexed Bonds

(Cost $13,340,809) | |

|

Residential Mortgage-Backed Securities - Agency 40.6% |

| | | | |

|

CMO Series 2023-46 Class SC |

30-day Average SOFR + 5.886%

Cap 6.000%

06/25/2050 | | | | |

Federal Home Loan Mortgage Corp.(h) |

| | | | |

| | | | |

Federal Home Loan Mortgage Corp. |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Federal Home Loan Mortgage Corp.(b),(g) |

|

-1.0 x 30-day Average SOFR + 5.936%

Cap 6.050%

08/25/2049 | | | | |

Federal Home Loan Mortgage Corp.(g) |

|

| | | | |

Federal Home Loan Mortgage Corp. REMICS(b),(g) |

|

-1.0 x 30-day Average SOFR + 5.886%

Cap 6.000%

01/15/2048 | | | | |

Federal National Mortgage Association |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Residential Mortgage-Backed Securities - Agency (continued) |

| | | | |

Federal National Mortgage Association(h) |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Federal National Mortgage Association(b),(g) |

CMO Series 2016-53 Class KS |

-1.0 x 30-day Average SOFR + 5.886%

Cap 6.000%

08/25/2046 | | | | |

CMO Series 2016-57 Class SA |

-1.0 x 30-day Average SOFR + 5.886%

Cap 6.000%

08/25/2046 | | | | |

CMO Series 2016-93 Class SL |

-1.0 x 30-day Average SOFR + 6.536%

Cap 6.650%

12/25/2046 | | | | |

CMO Series 2017-109 Class SA |

-1.0 x 30-day Average SOFR + 6.036%

Cap 6.150%

01/25/2048 | | | | |

CMO Series 2017-20 Class SA |

-1.0 x 30-day Average SOFR + 5.986%

Cap 6.100%

04/25/2047 | | | | |

CMO Series 2017-54 Class SN |

-1.0 x 30-day Average SOFR + 6.036%

Cap 6.150%

07/25/2047 | | | | |

CMO Series 2018-66 Class SM |

-1.0 x 30-day Average SOFR + 6.086%

Cap 6.200%

09/25/2048 | | | | |

CMO Series 2018-74 Class SA |

-1.0 x 30-day Average SOFR + 6.036%

Cap 6.150%

10/25/2048 | | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2024

13

Portfolio of Investments (continued)April 30, 2024 Residential Mortgage-Backed Securities - Agency (continued) |

| | | | |

CMO Series 2019-33 Class SB |

-1.0 x 30-day Average SOFR + 5.936%

Cap 6.050%

07/25/2049 | | | | |

CMO Series 2019-60 Class SH |

-1.0 x 30-day Average SOFR + 5.936%

Cap 6.050%

10/25/2049 | | | | |

CMO Series 2019-67 Class SE |

-1.0 x 30-day Average SOFR + 5.936%

Cap 6.050%

11/25/2049 | | | | |

Federal National Mortgage Association(g) |

CMO Series 2021-3 Class TI |

| | | | |

Federal National Mortgage Association REMICS(b),(g) |

CMO Series 2017-108 Class SA |

-1.0 x 30-day Average SOFR + 6.036%

Cap 6.150%

01/25/2048 | | | | |

CMO Series 2019-73 Class SC |

-1.0 x 30-day Average SOFR + 5.936%

Cap 6.050%

12/25/2049 | | | | |

CMO Series 2020-39 Class MS |

-1.0 x 30-day Average SOFR + 5.966%

Cap 6.080%

06/25/2050 | | | | |

|

|

| | | | |

|

| | | | |

Government National Mortgage Association(b) |

1-year CMT + 1.500%

Cap 10.000%

04/20/2028 | | | | |

Government National Mortgage Association(h) |

| | | | |

Government National Mortgage Association(b),(g) |

CMO Series 2017-112 Class SJ |

-1.0 x 1-month Term SOFR + 5.546%

Cap 5.660%

07/20/2047 | | | | |

Residential Mortgage-Backed Securities - Agency (continued) |

| | | | |

CMO Series 2017-130 Class HS |

-1.0 x 1-month Term SOFR + 6.086%

Cap 6.200%

08/20/2047 | | | | |

CMO Series 2017-149 Class BS |

-1.0 x 1-month Term SOFR + 6.086%

Cap 6.200%

10/20/2047 | | | | |

CMO Series 2017-163 Class SA |

-1.0 x 1-month Term SOFR + 6.086%

Cap 6.200%

11/20/2047 | | | | |

CMO Series 2017-37 Class SB |

-1.0 x 1-month Term SOFR + 6.036%

Cap 6.150%

03/20/2047 | | | | |

CMO Series 2018-103 Class SA |

-1.0 x 1-month Term SOFR + 6.086%

Cap 6.200%

08/20/2048 | | | | |

CMO Series 2018-112 Class LS |

-1.0 x 1-month Term SOFR + 6.086%

Cap 6.200%

08/20/2048 | | | | |

CMO Series 2018-125 Class SK |

-1.0 x 1-month Term SOFR + 6.136%

Cap 6.250%

09/20/2048 | | | | |

CMO Series 2018-134 Class KS |

-1.0 x 1-month Term SOFR + 6.086%

Cap 6.200%

10/20/2048 | | | | |

CMO Series 2018-148 Class SB |

-1.0 x 1-month Term SOFR + 6.086%

Cap 6.200%

01/20/2048 | | | | |

CMO Series 2018-151 Class SA |

-1.0 x 1-month Term SOFR + 6.036%

Cap 6.150%

11/20/2048 | | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

14

Columbia Bond Fund | Annual Report 2024

Portfolio of Investments (continued)April 30, 2024 Residential Mortgage-Backed Securities - Agency (continued) |

| | | | |

CMO Series 2018-89 Class MS |

-1.0 x 1-month Term SOFR + 6.086%

Cap 6.200%

06/20/2048 | | | | |

CMO Series 2018-91 Class DS |

-1.0 x 1-month Term SOFR + 6.086%

Cap 6.200%

07/20/2048 | | | | |

CMO Series 2019-20 Class JS |

-1.0 x 1-month Term SOFR + 5.886%

Cap 6.000%

02/20/2049 | | | | |

CMO Series 2019-5 Class SH |

-1.0 x 1-month Term SOFR + 6.036%

Cap 6.150%

01/20/2049 | | | | |

CMO Series 2019-56 Class SG |

-1.0 x 1-month Term SOFR + 6.036%

Cap 6.150%

05/20/2049 | | | | |

CMO Series 2019-59 Class KS |

-1.0 x 1-month Term SOFR + 5.936%

Cap 6.050%

05/20/2049 | | | | |

CMO Series 2019-74 Class PS |

-1.0 x 1-month Term SOFR + 5.936%

Cap 6.050%

06/20/2049 | | | | |

CMO Series 2019-85 Class SC |

-1.0 x 1-month Term SOFR + 6.036%

Cap 6.150%

07/20/2049 | | | | |

CMO Series 2019-90 Class SD |

-1.0 x 1-month Term SOFR + 6.036%

Cap 6.150%

07/20/2049 | | | | |

CMO Series 2019-92 Class SD |

-1.0 x 1-month Term SOFR + 5.986%

Cap 6.100%

07/20/2049 | | | | |

Residential Mortgage-Backed Securities - Agency (continued) |

| | | | |

CMO Series 2020-11 Class LS |

-1.0 x 1-month Term SOFR + 6.164%

Cap 6.050%

01/20/2050 | | | | |

CMO Series 2020-188 Class SA |

-1.0 x 1-month Term SOFR + 6.186%

Cap 6.300%

12/20/2050 | | | | |

CMO Series 2020-21 Class VS |

-1.0 x 1-month Term SOFR + 6.164%

Cap 6.050%

02/20/2050 | | | | |

CMO Series 2020-61 Class SW |

-1.0 x 1-month Term SOFR + 5.936%

Cap 6.050%

08/20/2049 | | | | |

CMO Series 2020-62 Class SG |

-1.0 x 1-month Term SOFR + 6.036%

Cap 6.150%

05/20/2050 | | | | |

CMO Series 2022-207 Class SA |

-1.0 x 1-month Term SOFR + 5.886%

Cap 6.000%

09/20/2049 | | | | |

CMO Series 2022-207 Class SC |

-1.0 x 1-month Term SOFR + 5.986%

Cap 6.100%

01/20/2050 | | | | |

CMO Series 2023-141 Class SN |

-1.0 x 1-month Term SOFR + 5.936%

Cap 6.050%

04/20/2049 | | | | |

CMO Series 2023-17 Class SY |

-1.0 x 1-month Term SOFR + 5.936%

Cap 6.050%

05/20/2050 | | | | |

CMO Series 2023-47 Class DS |

-1.0 x 1-month Term SOFR + 5.936%

Cap 6.050%

09/20/2049 | | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2024

15

Portfolio of Investments (continued)April 30, 2024 Residential Mortgage-Backed Securities - Agency (continued) |

| | | | |

CMO Series 2024-30 Class XH |

-1.0 x 30-day Average SOFR + 5.850%

Cap 5.850%

02/20/2054 | | | | |

Government National Mortgage Association(g) |

CMO Series 2020-164 Class CI |

| | | | |

CMO Series 2020-175 Class KI |

| | | | |

CMO Series 2020-191 Class UG |

| | | | |

CMO Series 2021-119 Class QI |

| | | | |

CMO Series 2021-139 Class IC |

| | | | |

CMO Series 2021-16 Class KI |

| | | | |

Government National Mortgage Association TBA(e) |

| | | | |

| | | | |

Uniform Mortgage-Backed Security TBA(e) |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Total Residential Mortgage-Backed Securities - Agency

(Cost $366,266,435) | |

|

Residential Mortgage-Backed Securities - Non-Agency 24.1% |

| | | | |

510 Asset Backed Trust(a),(c) |

CMO Series 2021-NPL2 Class A1 |

| | | | |

Angel Oak Mortgage Trust(a),(c) |

CMO Series 2020-1 Class M1 |

| | | | |

CMO Series 2020-3 Class A1 |

| | | | |

CMO Series 2021-5 Class A2 |

| | | | |

Angel Oak Mortgage Trust I LLC(a),(c) |

CMO Series 2018-3 Class M1 |

| | | | |

Residential Mortgage-Backed Securities - Non-Agency (continued) |

| | | | |

Arroyo Mortgage Trust(a),(c) |

CMO Series 2019-2 Class A3 |

| | | | |

|

CMO Series 2020-1 Class M1 |

| | | | |

Bellemeade Re Ltd.(a),(b) |

CMO Series 2019-3A Class M1C |

1-month Term SOFR + 2.064%

Floor 1.950%

07/25/2029 | | | | |

CMO Series 2022-1 Class M1A |

30-day Average SOFR + 1.750%

Floor 1.750%

01/26/2032 | | | | |

BRAVO Residential Funding Trust(a),(c) |

CMO Series 2020-NQM1 Class M1 |

| | | | |

CMO Series 2020-RPL2 Class A1 |

| | | | |

CMO Series 2021-A Class A1 |

| | | | |

Bunker Hill Loan Depositary Trust(a),(c) |

CMO Series 2019-3 Class A2 |

| | | | |

CMO Series 2019-3 Class A3 |

| | | | |

CMO Series 2020-1 Class A1 |

| | | | |

BVRT Financing Trust(a),(b),(i) |

CMO Series 2021-3F Class M2 |

30-day Average SOFR + 2.900%

Floor 2.900%

07/12/2033 | | | | |

CHNGE Mortgage Trust(a),(c) |

CMO Series 2022-1 Class A1 |

| | | | |

CMO Series 2022-2 Class A1 |

| | | | |

CMO Series 2022-3 Class A1 |

| | | | |

CMO Series 2023-3 Class A1 |

| | | | |

COLT Mortgage Loan Trust(a),(c) |

CMO Series 2020-2 Class A2 |

| | | | |

CMO Series 2021-3 Class A1 |

| | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

16

Columbia Bond Fund | Annual Report 2024

Portfolio of Investments (continued)April 30, 2024 Residential Mortgage-Backed Securities - Non-Agency (continued) |

| | | | |

CMO Series 2021-5 Class A2 |

| | | | |

Connecticut Avenue Securities Trust(a),(b) |

CMO Series 2022-R01 Class 1M2 |

30-day Average SOFR + 1.900%

12/25/2041 | | | | |

CMO Series 2022-R04 Class 1M2 |

30-day Average SOFR + 3.100%

03/25/2042 | | | | |

Credit Suisse Mortgage Trust(a),(c) |

CMO Series 2021-NQM2 Class A2 |

| | | | |

CMO Series 2021-RPL2 Class A1A |

| | | | |

|

CMO Series 2020-RPL2 Class A12 |

| | | | |

CMO Series 2020-RPL6 Class A1 |

| | | | |

CMO Series 2021-NQM8 Class A1 |

| | | | |

CMO Series 2022-NQM1 Class A3 |

| | | | |

CMO Series 2022-RPL3 Class A1 |

| | | | |

Subordinated CMO Series 2020-RPL3 Class A1 |

| | | | |

Deephaven Residential Mortgage Trust(a),(c) |

CMO Series 2021-1 Class A2 |

| | | | |

Ellington Financial Mortgage Trust(a),(c) |

CMO Series 2020-1 Class A3 |

| | | | |

Freddie Mac STACR REMIC Trust(a),(b) |

CMO Series 2021-DNA3 Class M1 |

30-day Average SOFR + 0.750%

10/25/2033 | | | | |

CMO Series 2022-DNA1 Class M1B |

30-day Average SOFR + 1.850%

01/25/2042 | | | | |

Subordinated CMO Series 2022-DNA6 Class M1A |

30-day Average SOFR + 2.150%

09/25/2042 | | | | |

Freddie Mac Structured Agency Credit Risk Debt Notes(a),(b) |

CMO Series 2022-DNA2 Class M1B |

30-day Average SOFR + 2.400%

02/25/2042 | | | | |

Residential Mortgage-Backed Securities - Non-Agency (continued) |

| | | | |

FWD Securitization Trust(a),(c) |

CMO Series 2020-INV1 Class M1 |

| | | | |

|

CMO Series 2021-CM1 Class A1 |

| | | | |

|

CMO Series 2021-CM2 Class A1 |

| | | | |

CMO Series 2022-NQM2 Class A3 |

| | | | |

GS Mortgage-Backed Securities Corp. Trust(a),(c) |

CMO Series 2021-NQM1 Class A1 |

| | | | |

|

Subordinated CMO Series 2022-1 Class M1A |

30-day Average SOFR + 2.850%

10/25/2034 | | | | |

Imperial Fund Mortgage Trust(a),(c) |

CMO Series 2021-NQM4 Class A2 |

| | | | |

Legacy Mortgage Asset Trust(a),(c) |

CMO Series 2021-GS2 Class A1 |

| | | | |

CMO Series 2021-SL2 Class A |

| | | | |

Mello Mortgage Capital Acceptance(a),(c) |

CMO Series 2024-SD1 Class A3 |

| | | | |

|

CMO Series 2020-NQM2 Class M1 |

| | | | |

CMO Series 2020-NQM3 Class A1 |

| | | | |

CMO Series 2020-NQM3 Class A2 |

| | | | |

CMO Series 2020-NQM3 Class A3 |

| | | | |

CMO Series 2021-INV2 Class A3 |

| | | | |

|

CMO Series 2021-INV1 Class A2 |

| | | | |

CMO Series 2021-INV1 Class A3 |

| | | | |

New Residential Mortgage Loan Trust(a),(c) |

CMO Series 2018-1A Class A1A |

| | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2024

17

Portfolio of Investments (continued)April 30, 2024 Residential Mortgage-Backed Securities - Non-Agency (continued) |

| | | | |

NRZ Excess Spread-Collateralized Notes(a) |

|

| | | | |

Oaktown Re III Ltd.(a),(b) |

CMO Series 2019-1A Class M1B |

30-day Average SOFR + 2.064%

Floor 1.950%

07/25/2029 | | | | |

PMT Credit Risk Transfer Trust(a),(b) |

|

1-month Term SOFR + 3.864%

Floor 3.750%

05/30/2025 | | | | |

Preston Ridge Partners Mortgage Trust(a),(c) |

CMO Series 2020-6 Class A1 |

| | | | |

CMO Series 2021-2 Class A1 |

| | | | |

CMO Series 2021-3 Class A1 |

| | | | |

CMO Series 2021-8 Class A1 |

| | | | |

Pretium Mortgage Credit Partners(a),(c) |

CMO Series 2022-NPL1 Class A1 |

| | | | |

|

CMO Series 2021-AFC1 Class A3 |

| | | | |

CMO Series 2021-AFC1 Class M1 |

| | | | |

|

CMO Series 2021-RPL1 Class A1 |

| | | | |

CMO Series 2023-RCF2 Class A2 |

| | | | |

Residential Mortgage Loan Trust(a),(c) |

CMO Series 2019-3 Class A3 |

| | | | |

Stanwich Mortgage Loan Co. LLC(a),(c) |

CMO Series 2021-NPB1 Class A1 |

| | | | |

Starwood Mortgage Residential Trust(a),(c) |

CMO Series 2019-INV1 Class A3 |

| | | | |

CMO Series 2020-2 Class A3 |

| | | | |

CMO Series 2020-3 Class A3 |

| | | | |

Residential Mortgage-Backed Securities - Non-Agency (continued) |

| | | | |

CMO Series 2020-3 Class M1 |

| | | | |

CMO Series 2020-INV1 Class A2 |

| | | | |

CMO Series 2020-INV1 Class A3 |

| | | | |

CMO Series 2021-3 Class A1 |

| | | | |

Towd Point Mortgage Trust(a),(c) |

CMO Series 2019-4 Class M1B |

| | | | |

|

CMO Series 2021-INV2 Class A1 |

| | | | |

Vendee Mortgage Trust(c),(g) |

CMO Series 1998-1 Class 2IO |

| | | | |

CMO Series 1998-3 Class IO |

| | | | |

Verus Securitization Trust(a),(c) |

CMO Series 2019-INV3 Class A3 |

| | | | |

CMO Series 2020-1 Class A3 |

| | | | |

CMO Series 2020-4 Class A3 |

| | | | |

CMO Series 2021-4 Class A2 |

| | | | |

Verus Securitization Trust(a) |

CMO Series 2020-INV1 Class A2 |

| | | | |

CMO Series 2020-INV1 Class A3 |

| | | | |

|

CMO Series 2020-1R Class A3 |

| | | | |

CMO Series 2021-1R Class A1 |

| | | | |

Total Residential Mortgage-Backed Securities - Non-Agency

(Cost $221,983,783) | |

Call Option Contracts Purchased 0.1% |

| | | | |

| |

|

Put Option Contracts Purchased 0.1% |

| | | | |

| |

The accompanying Notes to Financial Statements are an integral part of this statement.

18

Columbia Bond Fund | Annual Report 2024

Portfolio of Investments (continued)April 30, 2024

|

| | |

Columbia Short-Term Cash Fund, 5.485%(j),(k) | | |

Total Money Market Funds

(Cost $40,617,125) | |

Total Investments in Securities

(Cost: $1,064,138,261) | |

Other Assets & Liabilities, Net | | |

| |

At April 30, 2024, securities and/or cash totaling $10,355,482 were pledged as collateral.

Investments in derivatives

|

| | | | | Value/Unrealized

appreciation ($) | Value/Unrealized

depreciation ($) |

U.S. Treasury 2-Year Note | | | | | | |

U.S. Treasury 5-Year Note | | | | | | |

| | | | | | |

| | | | | | |

|

| | | | | Value/Unrealized

appreciation ($) | Value/Unrealized

depreciation ($) |

| | | | | | |

U.S. Treasury 10-Year Note | | | | | | |

| | | | | | |

Call option contracts purchased |

| | | | | | | | |

10-Year OTC interest rate swap with Citi to receive exercise rate and pay SOFR | | | | | | | | |

10-Year OTC interest rate swap with Morgan Stanley to receive exercise rate and pay SOFR | | | | | | | | |

| | | | | | | | |

Put option contracts purchased |

| | | | | | | | |

10-Year OTC interest rate swap with Citi to receive SOFR and pay exercise rate | | | | | | | | |

5-Year OTC interest rate swap with Citi to receive SOFR and pay exercise rate | | | | | | | | |

| | | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2024

19

Portfolio of Investments (continued)April 30, 2024 Notes to Portfolio of Investments

| Represents privately placed and other securities and instruments exempt from Securities and Exchange Commission registration (collectively, private placements), such as Section 4(a)(2) and Rule 144A eligible securities, which are often sold only to qualified institutional buyers. At April 30, 2024, the total value of these securities amounted to $454,763,902, which represents 53.76% of total net assets. |

| Variable rate security. The interest rate shown was the current rate as of April 30, 2024. |

| Variable or floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. The interest rate shown was the current rate as of April 30, 2024. |

| Non-income producing investment. |

| Represents a security purchased on a when-issued basis. |

| Represents a variable rate security with a step coupon where the rate adjusts according to a schedule for a series of periods, typically lower for an initial period and then increasing to a higher coupon rate thereafter. The interest rate shown was the current rate as of April 30, 2024. |

| Represents interest only securities which have the right to receive the monthly interest payments on an underlying pool of mortgage loans. |

| This security or a portion of this security has been pledged as collateral in connection with derivative contracts. |

| Valuation based on significant unobservable inputs. |

| The rate shown is the seven-day current annualized yield at April 30, 2024. |

| As defined in the Investment Company Act of 1940, as amended, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. The value of the holdings and transactions in these affiliated companies during the year ended April 30, 2024 are as follows: |

| | | | Net change in

unrealized

appreciation

(depreciation)($) | | | | |

Columbia Short-Term Cash Fund, 5.485% |

| | | | | | | | |

Abbreviation Legend

| Collateralized Mortgage Obligation |

| Constant Maturity Treasury |

| Secured Overnight Financing Rate |

| |

Currency Legend

Fair value measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

■

Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date. Valuation adjustments are not applied to Level 1 investments.

■

Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

■

Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

The accompanying Notes to Financial Statements are an integral part of this statement.

20

Columbia Bond Fund | Annual Report 2024

Portfolio of Investments (continued)April 30, 2024 Fair value measurements (continued)

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

The Fund’s Board of Trustees (the Board) has designated the Investment Manager, through its Valuation Committee (the Committee), as valuation designee, responsible for determining the fair value of the assets of the Fund for which market quotations are not readily available using valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. Representatives of Columbia Management Investment Advisers, LLC report to the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

The following table is a summary of the inputs used to value the Fund’s investments at April 30, 2024:

| | | | |

Investments in Securities | | | | |

Asset-Backed Securities - Non-Agency | | | | |

Commercial Mortgage-Backed Securities - Agency | | | | |

Commercial Mortgage-Backed Securities - Non-Agency | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Residential Mortgage-Backed Securities - Agency | | | | |

Residential Mortgage-Backed Securities - Non-Agency | | | | |

Call Option Contracts Purchased | | | | |

Put Option Contracts Purchased | | | | |

| | | | |

Total Investments in Securities | | | | |

Investments in Derivatives | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund’s assets assigned to the Level 2 input category are generally valued using the market approach, in which a security’s value is determined through reference to prices and information from market transactions for similar or identical assets.

Futures contracts are valued at unrealized appreciation (depreciation).

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2024

21

Portfolio of Investments (continued)April 30, 2024 Fair value measurements (continued)

The following table is a reconciliation of Level 3 assets for which significant observable and unobservable inputs were used to determine fair value:

| Balance

as of

04/30/2023

($) | Increase

(decrease)

in accrued

discounts/

premiums

($) | | Change

in unrealized

appreciation

(depreciation)

($) | | | | Transfers

out of

Level 3

($) | Balance

as of

04/30/2024

($) |

Asset-Backed Securities — Non-Agency | | | | | | | | | |

Residential Mortgage-Backed Securities — Non-Agency | | | | | | | | | |

| | | | | | | | | |

Financial assets were transferred from Level 3 to Level 2 as observable market inputs were utilized and management determined that there was sufficient, reliable and observable market data to value these assets as of period end.

The Fund’s assets assigned to the Level 3 category are valued utilizing the valuation technique deemed the most appropriate in the circumstances. The following table is a summary of valuation technique(s) used to value the Fund’s investments at April 30, 2024:

| | |

Residential Mortgage-Backed Securities - Non-Agency | Single Market Quotes from Broker | |

The appropriateness of fair values for these securities is monitored on an ongoing basis which may include results of back testing, manual price reviews and other control procedures. Significant increases (decreases) to any of these inputs would have resulted in a significantly higher (lower) fair value measurement.

The accompanying Notes to Financial Statements are an integral part of this statement.

22

Columbia Bond Fund | Annual Report 2024

Statement of Assets and LiabilitiesApril 30, 2024

| |

Investments in securities, at value | |

Unaffiliated issuers (cost $1,022,039,736) | |

Affiliated issuers (cost $40,617,125) | |

Option contracts purchased (cost $1,481,400) | |

| |

Cash collateral held at broker for: | |

| |

| |

| |

| |

| |

Variation margin for futures contracts | |

Expense reimbursement due from Investment Manager | |

| |

Deferred compensation of board members | |

| |

| |

| |

| |

Investments purchased on a delayed delivery basis | |

| |

Distributions to shareholders | |

Variation margin for futures contracts | |

| |

Distribution and/or service fees | |

| |

Compensation of board members | |

| |

Deferred compensation of board members | |

| |

Net assets applicable to outstanding capital stock | |

| |

| |

Total distributable earnings (loss) | |

Total - representing net assets applicable to outstanding capital stock | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2024

23

Statement of Assets and Liabilities (continued)April 30, 2024 | |

| |

| |

Net asset value per share | |

| |

Maximum offering price per share (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class A shares) | |

| |

| |

| |

Net asset value per share | |

| |

| |

| |

Net asset value per share | |

| |

| |

| |

Net asset value per share | |

| |

| |

| |

Net asset value per share | |

The accompanying Notes to Financial Statements are an integral part of this statement.

24

Columbia Bond Fund | Annual Report 2024

Statement of OperationsYear Ended April 30, 2024

| |

| |

Dividends — unaffiliated issuers | |

Dividends — affiliated issuers | |

| |

| |

| |

| |

| |

| |

Distribution and/or service fees | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Printing and postage fees | |

| |

| |

| |

| |

Compensation of chief compliance officer | |

Compensation of board members | |

Deferred compensation of board members | |

| |

| |

Fees waived or expenses reimbursed by Investment Manager and its affiliates | |

Fees waived by transfer agent | |

| |

| |

| |

| |

| |

Realized and unrealized gain (loss) — net | |

Net realized gain (loss) on: | |

Investments — unaffiliated issuers | |

Investments — affiliated issuers | |

| |

Option contracts purchased | |

| |

| |

Net change in unrealized appreciation (depreciation) on: | |

Investments — unaffiliated issuers | |

Investments — affiliated issuers | |

| |

Option contracts purchased | |

Net change in unrealized appreciation (depreciation) | |

Net realized and unrealized loss | |

Net decrease in net assets resulting from operations | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2024

25

Statement of Changes in Net Assets

| | |

| | |

| | |

| | |

Net change in unrealized appreciation (depreciation) | | |

Net decrease in net assets resulting from operations | | |

Distributions to shareholders | | |

Net investment income and net realized gains | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Total distributions to shareholders | | |

Decrease in net assets from capital stock activity | | |

Total decrease in net assets | | |

Net assets at beginning of year | | |

Net assets at end of year | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

26

Columbia Bond Fund | Annual Report 2024

Statement of Changes in Net Assets (continued)

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2024

27

The following table is intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The ratios of expenses and net investment income are annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund’s portfolio turnover rate may be higher.

| Net asset value,

beginning of

period | | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Distributions

from net

realized

gains | Total

distributions to

shareholders |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Notes to Financial Highlights |

| In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

| Ratios include interest on collateral expense which is less than 0.01%. |

| The benefits derived from expense reductions had an impact of less than 0.01%. |

| Per share amounts have been adjusted on a retroactive basis to reflect a 4 to 1 reverse stock split completed after the close of business on September 11, 2020. |

The accompanying Notes to Financial Statements are an integral part of this statement.

28

Columbia Bond Fund | Annual Report 2024

Financial Highlights (continued)

| Net

asset

value,

end of

period | | Total gross

expense

ratio to

average

| Total net

expense

ratio to

average

| Net investment

income

ratio to

average

net assets | | Net

assets,

end of

period

(000’s) |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Bond Fund | Annual Report 2024

29

Notes to Financial StatementsApril 30, 2024 Note 1. Organization

Columbia Bond Fund (the Fund), a series of Columbia Funds Series Trust I (the Trust), is a diversified fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

Fund shares

The Trust may issue an unlimited number of shares (without par value). The Fund offers each of the share classes listed in the Statement of Assets and Liabilities. Although all share classes generally have identical voting, dividend and liquidation rights, each share class votes separately when required by the Trust’s organizational documents or by law. Each share class has its own expense and sales charge structure. Different share classes may have different minimum initial investment amounts and pay different net investment income distribution amounts to the extent the expenses of distributing such share classes vary. Distributions to shareholders in a liquidation will be proportional to the net asset value of each share class.

As described in the Fund’s prospectus, Class A shares are offered to the general public for investment. Advisor Class, Institutional Class, Institutional 2 Class and Institutional 3 Class shares are available for purchase through authorized investment professionals to omnibus retirement plans or to institutional investors and to certain other investors as also described in the Fund’s prospectus.

In September 2023, the Fund’s Board of Trustees approved the liquidation of Class V shares of the Fund on December 8, 2023. Effective at the open of business on October 25, 2023, any applicable contingent deferred sales charges were waived on redemptions and exchanges out of Class V shares, and effective at the open of business on November 27, 2023, Class V shares of the Fund were closed to all investors. For federal tax purposes, this liquidation was treated as a redemption of fund shares.

The Fund’s Board of Trustees also approved a proposal to accelerate the conversion of Class C shares into Class A shares of the Fund and a proposal to liquidate Class R shares of the Fund. Effective on February 12, 2024, Class C shares of the Fund were closed to new and existing investors and effective on April 15, 2024, shares held by Class C shareholders were converted into Class A shares in a tax-free transaction. Effective on March 11, 2024, Class R shares of the Fund were closed to new and existing investors and effective on April 19, 2024, Class R shares of the Fund were liquidated. For federal tax purposes, this liquidation was treated as a redemption of fund shares.

Note 2. Summary of significant accounting policies

Basis of preparation

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services - Investment Companies (ASC 946). The financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security valuation

Equity securities listed on an exchange are valued at the closing price or last trade price on their primary exchange at the close of business of the New York Stock Exchange. Securities with a closing price not readily available or not listed on any exchange are valued at the mean between the closing bid and ask prices. Listed preferred stocks convertible into common stocks are valued using an evaluated price from a pricing service.

30

Columbia Bond Fund | Annual Report 2024

Notes to Financial Statements (continued)April 30, 2024 Debt securities generally are valued based on prices obtained from pricing services, which are intended to reflect market transactions for normal, institutional-size trading units of similar securities. The services may use various pricing techniques that take into account, as applicable, factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as approved independent broker-dealer quotes. Debt securities for which quotations are not readily available or not believed to be reflective of market value may also be valued based upon a bid quote from an approved independent broker-dealer. Debt securities maturing in 60 days or less are valued primarily at amortized market value, unless this method results in a valuation that management believes does not approximate fair value.