UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 25, 2006 (12 weeks)

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-1183

PepsiCo, Inc.

(Exact name of registrant as specified in its charter)

| | |

| North Carolina | | 13-1584302 |

| (State or Other Jurisdiction | | (I.R.S. Employer |

| of Incorporation or Organization) | | Identification No.) |

| 700 Anderson Hill Road, Purchase, New York | | 10577 |

| (Address of Principal Executive Offices) | | (Zip Code) |

914-253-2000

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YESx NO¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

Large accelerated filerx | | Accelerated filer¨ | | Non-accelerated filer¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Nox

Number of shares of Common Stock outstanding as of April 21, 2006: 1,652,489,595

PEPSICO, INC. AND SUBSIDIARIES

INDEX

2

PART I - FINANCIAL INFORMATION

ITEM 1. | Condensed Consolidated Financial Statements |

PEPSICO, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF INCOME

(in millions except per share amounts, unaudited)

| | | | | | |

| | | 12 Weeks Ended

| |

| | | 3/25/06

| | | 3/19/05

| |

Net Revenue | | $7,205 | | | $6,585 | |

| | |

Cost of sales | | 3,179 | | | 2,870 | |

Selling, general and administrative expenses | | 2,647 | | | 2,439 | |

Amortization of intangible assets | | 31 | | | 29 | |

| | |

|

| |

|

|

| | |

Operating Profit | | 1,348 | | | 1,247 | |

| | |

Bottling equity income | | 84 | | | 65 | |

Interest expense | | (62 | ) | | (50 | ) |

Interest income | | 45 | | | 23 | |

| | |

|

| |

|

|

| | |

Income before income taxes | | 1,415 | | | 1,285 | |

| | |

Provision for income taxes | | 396 | | | 373 | |

| | |

|

| |

|

|

Net Income | | $1,019 | | | $ 912 | |

| | |

|

| |

|

|

| | |

Net Income Per Common Share | | | | | | |

Basic | | $ 0.61 | | | $ 0.54 | |

Diluted | | $ 0.60 | | | $ 0.53 | |

| | |

Cash Dividends Declared Per Common Share | | $ 0.26 | | | $ 0.23 | |

See accompanyingNotes to the Condensed Consolidated Financial Statements.

3

PEPSICO, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions, unaudited)

| | | | | | | | |

| | | 12 Weeks Ended

| |

| | | 3/25/06

| | | 3/19/05

| |

Operating Activities | | | | | | | | |

Net income | | $ | 1,019 | | | $ | 912 | |

Depreciation and amortization | | | 286 | | | | 282 | |

Stock-based compensation expense | | | 67 | | | | 77 | |

Excess tax benefits from share-based payment arrangements | | | (34 | ) | | | — | |

Cash payments for merger-related costs and restructuring charges | | | — | | | | (14 | ) |

Pension and retiree medical plan contributions | | | (28 | ) | | | (48 | ) |

Pension and retiree medical plan expenses | | | 123 | | | | 102 | |

Bottling equity income, net of dividends | | | (70 | ) | | | (51 | ) |

Deferred income taxes and other tax charges and credits | | | 20 | | | | 51 | |

Change in accounts and notes receivable | | | (347 | ) | | | (237 | ) |

Change in inventories | | | (179 | ) | | | (93 | ) |

Change in prepaid expenses and other current assets | | | (39 | ) | | | 3 | |

Change in accounts payable and other current liabilities | | | (441 | ) | | | (522 | ) |

Change in income taxes payable | | | (140 | ) | | | 233 | |

Other, net | | | 9 | | | | 54 | |

| | |

|

|

| |

|

|

|

Net Cash Provided by Operating Activities | | | 246 | | | | 749 | |

| | |

|

|

| |

|

|

|

Investing Activities | | | | | | | | |

Snack Ventures Europe (SVE) minority interest acquisition | | | — | | | | (750 | ) |

Capital spending | | | (289 | ) | | | (181 | ) |

Sales of property, plant and equipment | | | 6 | | | | 25 | |

Other acquisitions and investments in noncontrolled affiliates | | | (275 | ) | | | (41 | ) |

Cash proceeds from sale of The Pepsi Bottling Group (PBG) stock | | | 85 | | | | 47 | |

Short-term investments, by original maturity | | | | | | | | |

More than three months—purchases | | | — | | | | (17 | ) |

More than three months—maturities | | | 20 | | | | 17 | |

Three months or less, net | | | 780 | | | | (528 | ) |

| | |

|

|

| |

|

|

|

Net Cash Provided by/(Used for) Investing Activities | | | 327 | | | | (1,428 | ) |

| | |

|

|

| |

|

|

|

Financing Activities | | | | | | | | |

Proceeds from issuances of long-term debt | | | — | | | | 13 | |

Payments of long-term debt | | | (22 | ) | | | (3 | ) |

Short-term borrowings, by original maturity | | | | | | | | |

More than three months—proceeds | | | 10 | | | | 37 | |

More than three months—payments | | | (204 | ) | | | (2 | ) |

Three months or less, net | | | (497 | ) | | | 698 | |

Cash dividends paid | | | (432 | ) | | | (387 | ) |

Share repurchases—common | | | (660 | ) | | | (494 | ) |

Share repurchases—preferred | | | (2 | ) | | | (6 | ) |

Proceeds from exercises of stock options | | | 436 | | | | 233 | |

Excess tax benefits from share-based payment arrangements | | | 34 | | | | — | |

| | |

|

|

| |

|

|

|

Net Cash (Used for)/Provided by Financing Activities | | | (1,337 | ) | | | 89 | |

Effect of Exchange Rate Changes on Cash and Cash Equivalents | | | 4 | | | | (9 | ) |

| | |

|

|

| |

|

|

|

Net Decrease in Cash and Cash Equivalents | | | (760 | ) | | | (599 | ) |

Cash and Cash Equivalents—Beginning of year | | | 1,716 | | | | 1,280 | |

| | |

|

|

| |

|

|

|

Cash and Cash Equivalents—End of period | | $ | 956 | | | $ | 681 | |

| | |

|

|

| |

|

|

|

See accompanyingNotes to the Condensed Consolidated Financial Statements.

4

PEPSICO, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET

(in millions)

| | | | | | |

| | | (Unaudited) | | | | |

| | | 3/25/06

| | | 12/31/05

| |

Assets | | | | | | |

Current Assets | | | | | | |

Cash and cash equivalents | | $ 956 | | | $ 1,716 | |

Short-term investments | | 2,373 | | | 3,166 | |

| | |

Accounts and notes receivable, less allowance: 3/06—$72, 12/05—$75 | | 3,634 | | | 3,261 | |

| | |

Inventories | | | | | | |

Raw materials | | 764 | | | 738 | |

Work-in-process | | 159 | | | 112 | |

Finished goods | | 958 | | | 843 | |

| | |

|

| |

|

|

| | | 1,881 | | | 1,693 | |

Prepaid expenses and other current assets | | 658 | | | 618 | |

| | |

|

| |

|

|

Total Current Assets | | 9,502 | | | 10,454 | |

| | |

Property, Plant and Equipment | | 17,386 | | | 17,145 | |

Accumulated Depreciation | | (8,632 | ) | | (8,464 | ) |

| | |

|

| |

|

|

| | | 8,754 | | | 8,681 | |

| | |

Amortizable Intangible Assets, net | | 503 | | | 530 | |

| | |

Goodwill | | 4,100 | | | 4,088 | |

Other Nonamortizable Intangible Assets | | 1,098 | | | 1,086 | |

| | |

|

| |

|

|

Nonamortizable Intangible Assets | | 5,198 | | | 5,174 | |

| | |

Investments in Noncontrolled Affiliates | | 3,506 | | | 3,485 | |

Other Assets | | 3,531 | | | 3,403 | |

| | |

|

| |

|

|

Total Assets | | $30,994 | | | $31,727 | |

| | |

|

| |

|

|

Continued on next page.

5

PEPSICO, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET (continued)

(in millions except per share amounts)

| | | | | | |

| | | (Unaudited) | | | | |

| | | 3/25/06

| | | 12/31/05

| |

Liabilities and Shareholders’ Equity | | | | | | |

Current Liabilities | | | | | | |

Short-term obligations | | $ 2,214 | | | $ 2,889 | |

Accounts payable and other current liabilities | | 5,587 | | | 5,971 | |

Income taxes payable | | 359 | | | 546 | |

| | |

|

| |

|

|

Total Current Liabilities | | 8,160 | | | 9,406 | |

| | |

Long-term Debt Obligations | | 2,288 | | | 2,313 | |

| | |

Other Liabilities | | 4,427 | | | 4,323 | |

| | |

Deferred Income Taxes | | 1,378 | | | 1,434 | |

| | |

|

| |

|

|

Total Liabilities | | 16,253 | | | 17,476 | |

| | |

Commitments and Contingencies | | | | | | |

| | |

Preferred Stock, no par value | | 41 | | | 41 | |

Repurchased Preferred Stock | | (112 | ) | | (110 | ) |

| | |

Common Shareholders’ Equity | | | | | | |

Common stock, par value 1 2/3 cents per share: Authorized 3,600 shares, issued 3/06 and 12/05—1,782 shares | | 30 | | | 30 | |

Capital in excess of par value | | 567 | | | 614 | |

Retained earnings | | 21,702 | | | 21,116 | |

Accumulated other comprehensive loss | | (989 | ) | | (1,053 | ) |

| | |

|

| |

|

|

| | | 21,310 | | | 20,707 | |

Less: repurchased common stock, at cost: 3/06 and 12/05—126 shares | | (6,498 | ) | | (6,387 | ) |

| | |

|

| |

|

|

Total Common Shareholders’ Equity | | 14,812 | | | 14,320 | |

| | |

|

| |

|

|

Total Liabilities and Shareholders’ Equity | | $30,994 | | | $31,727 | |

| | |

|

| |

|

|

See accompanyingNotes to the Condensed Consolidated Financial Statements.

6

PEPSICO, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

(in millions, unaudited)

| | | | | | |

| | | 12 Weeks Ended

| |

| | | 3/25/06

| | | 3/19/05

| |

Net Income | | $1,019 | | | $912 | |

| | |

Other Comprehensive Income | | | | | | |

Currency translation adjustment | | 65 | | | 14 | |

Cash flow hedges, net of tax: | | | | | | |

Net derivative gains(a) | | 4 | | | 12 | |

Reclassification of (gains)/losses to net income | | (6 | ) | | 8 | |

Unrealized loss on securities, net of tax | | (3 | ) | | (2 | ) |

Other | | 4 | | | 1 | |

| | |

|

| |

|

|

| | |

| | | 64 | | | 33 | |

| | |

|

| |

|

|

Comprehensive Income | | $1,083 | | | $945 | |

| | |

|

| |

|

|

(a) | Net derivative gains for the 12 weeks ended March 25, 2006 include $4 million of net losses on commodity derivatives. |

See accompanyingNotes to the Condensed Consolidated Financial Statements.

7

PEPSICO, INC. AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Basis of Presentation and Our Divisions

Basis of Presentation

Our Condensed Consolidated Balance Sheet as of March 25, 2006 and the Condensed Consolidated Statements of Income, Cash Flows and Comprehensive Income for the 12 weeks ended March 25, 2006 and March 19, 2005 have not been audited. These statements have been prepared on a basis that is substantially consistent with the accounting principles applied in our Annual Report on Form 10-K for the year ended December 31, 2005. In our opinion, these financial statements include all normal and recurring adjustments necessary for a fair presentation. The results for the 12 weeks are not necessarily indicative of the results expected for the year.

Our significant interim accounting policies include the recognition of a pro rata share of certain estimated annual sales incentives, and certain advertising and marketing costs, generally in proportion to revenue, and the recognition of income taxes using an estimated annual effective tax rate. Raw materials, direct labor and plant overhead, as well as purchasing and receiving costs, costs directly related to production planning, inspection costs and raw material handling facilities, are included in cost of sales. The costs of moving, storing and delivering finished product are included in selling, general and administrative expenses.

Bottling equity income includes our share of the net income or loss of our noncontrolled bottling affiliates and any changes in our ownership interests of these affiliates. Bottling equity income includes pre-tax gains on our sale of PBG stock of $50 million and $28 million in the first quarter of 2006 and 2005, respectively.

The following information is unaudited. Tabular dollars are in millions, except per share amounts. All per share amounts reflect common per share amounts, assume dilution unless noted and are based on unrounded amounts. Certain reclassifications were made to prior year amounts to conform to the 2006 presentation. This report should be read in conjunction with our Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

8

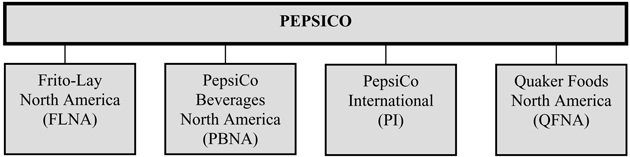

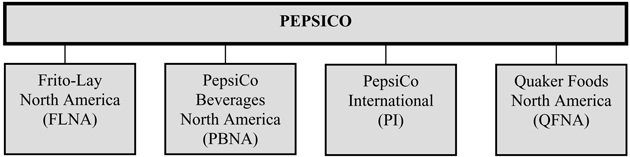

Our Divisions

| | | | | | | | | | |

| | | Net Revenue | | Operating Profit | |

| | | 12 Weeks Ended

| | 12 Weeks Ended

| |

| | | 3/25/06

| | 3/19/05

| | 3/25/06

| | | 3/19/05

| |

FLNA | | $2,393 | | $2,263 | | $ 569 | | | $ 539 | |

PBNA | | 1,991 | | 1,784 | | 428 | | | 415 | |

PI | | 2,378 | | 2,121 | | 371 | | | 307 | |

QFNA | | 443 | | 417 | | 151 | | | 145 | |

| | |

| |

| |

|

| |

|

|

Total division | | 7,205 | | 6,585 | | 1,519 | | | 1,406 | |

Corporate | | — | | — | | (171 | ) | | (159 | ) |

| | |

| |

| |

|

| |

|

|

| | | $7,205 | | $6,585 | | $1,348 | | | $1,247 | |

| | |

| |

| |

|

| |

|

|

| | | |

| | | | | | | Total Assets

| |

| | | | | | | 3/25/06

| | | 12/31/05

| |

FLNA | | | | | | $ 6,146 | | | $ 5,948 | |

PBNA | | | | | | 6,676 | | | 6,316 | |

PI | | | | | | 10,200 | | | 9,983 | |

QFNA | | | | | | 994 | | | 989 | |

| | | | | | |

|

| |

|

|

Total division | | | | | | 24,016 | | | 23,236 | |

Corporate | | | | | | 3,817 | | | 5,331 | |

Investments in bottling affiliates | | | | | | 3,161 | | | 3,160 | |

| | | | | | |

|

| |

|

|

| | | | | | | $30,994 | | | $31,727 | |

| | | | | | |

|

| |

|

|

Intangible Assets

| | | | | | |

| | | 3/25/06

| | | 12/31/05

| |

Amortizable intangible assets, net | | | | | | |

Brands | | $1,058 | | | $1,054 | |

Other identifiable intangibles | | 260 | | | 257 | |

| | |

|

| |

|

|

| | | 1,318 | | | 1,311 | |

Accumulated amortization | | (815 | ) | | (781 | ) |

| | |

|

| |

|

|

| | | $ 503 | | | $ 530 | |

| | |

|

| |

|

|

9

The change in the book value of nonamortizable intangible assets is as follows:

| | | | | | |

| | | Balance 12/31/05

| | Translation and Other

| | Balance 3/25/06

|

Frito-Lay North America | | | | | | |

Goodwill | | $ 145 | | $— | | $ 145 |

| | |

| |

| |

|

PepsiCo Beverages North America | | | | | | |

Goodwill | | 2,164 | | — | | 2,164 |

Brands | | 59 | | — | | 59 |

| | |

| |

| |

|

| | | 2,223 | | — | | 2,223 |

| | |

| |

| |

|

PepsiCo International | | | | | | |

Goodwill | | 1,604 | | 12 | | 1,616 |

Brands | | 1,026 | | 12 | | 1,038 |

| | |

| |

| |

|

| | | 2,630 | | 24 | | 2,654 |

| | |

| |

| |

|

Quaker Foods North America | | | | | | |

Goodwill | | 175 | | — | | 175 |

| | |

| |

| |

|

Corporate | | | | | | |

Pension intangible | | 1 | | — | | 1 |

| | |

| |

| |

|

| | | |

Total goodwill | | 4,088 | | 12 | | 4,100 |

Total brands | | 1,085 | | 12 | | 1,097 |

Total pension intangible | | 1 | | — | | 1 |

| | |

| |

| |

|

| | | $5,174 | | $ 24 | | $5,198 |

| | |

| |

| |

|

Stock-Based Compensation

On January 1, 2006, we adopted Statement of Financial Accounting Standards (SFAS) 123R,Share-Based Payment, under the modified prospective method. Since we had previously accounted for our stock-based compensation plans under the fair value provisions of SFAS 123, our adoption did not significantly impact our financial position or our results of operations. Under SFAS 123R, actual tax benefits recognized in excess of tax benefits previously established upon grant are reported as a financing cash inflow. Prior to adoption, such excess tax benefits were reported as an increase to operating cash flows.

We account for our employee stock options, which include grants under our executive program and broad-based SharePower program, under the fair value method of accounting using a Black-Scholes valuation model to measure stock option expense at the date of grant. All stock option grants have an exercise price equal to the fair market value of our common stock on the date of grant and generally have a 10-year term. The fair value of stock option grants is amortized to expense over the vesting period, generally three years. Executives who are awarded long-term incentives based on their performance are offered the choice of stock options or restricted stock units (RSUs). Executives who elect RSUs receive one RSU for every four stock options that would have otherwise been granted. Senior officers do not have a choice and are granted 50% stock options and 50% RSUs. RSU expense is based on the fair value of PepsiCo stock on the date of grant and is amortized over the vesting period, generally three years. Each RSU is settled

10

in a share of our stock after the vesting period. Vesting of RSU awards for senior officers is contingent upon the achievement of pre-established performance targets. As of March 25, 2006, 37 million shares were available for future stock-based compensation grants.

For the 12 weeks, we recognized stock-based compensation expense of $67 million in 2006 and $77 million in 2005, as well as related income tax benefits recognized in earnings of $19 million and $21 million, respectively. For the 12 weeks, stock-based compensation cost of $1 million in 2006 and $1 million in 2005 was capitalized in connection with our BPT initiative.

Our weighted average Black-Scholes fair value assumptions are as follows:

| | | | | | |

| | | 3/25/06

| | | 3/19/05

| |

Expected life | | 6 yrs. | | | 6 yrs. | |

Risk free interest rate | | 4.5 | % | | 3.8 | % |

Expected volatility(a) | | 18 | % | | 24 | % |

Expected dividend yield | | 1.9 | % | | 1.8 | % |

(a) | Reflects movements in our stock price over the most recent historical period equivalent to the expected life. |

A summary of option activity during the 12 weeks ended 3/25/06 is presented below:

Our Stock Option Activity(a)

| | | | | | | | |

| | | | | | Average | | Average |

| | | Options

| | | Price(b)

| | Life(c)

|

Outstanding at beginning of year | | 150,149 | | | $ | 42.03 | | |

Granted | | 11,786 | | | | 57.50 | | |

Exercised | | (11,438 | ) | | | 38.18 | | |

Forfeited/expired | | (845 | ) | | | 47.40 | | |

| | |

|

| | | | | |

Outstanding at end of quarter | | 149,652 | | | | 43.48 | | 5.56 |

| | |

|

| | | | | |

Exercisable at end of quarter | | 109,702 | | | | 40.53 | | 4.92 |

| | |

|

| | | | | |

(a) | Options are in thousands and include options previously granted under Quaker plans. No additional options or shares may be granted under the Quaker plans. |

(b) | Weighted-average exercise price. |

(c) | Weighted-average contractual life remaining. |

11

A summary of RSU activity during the 12 weeks ended 3/25/06 is presented below:

Our RSU Activity(a)

| | | | | | | | |

| | | RSUs

| | | Average

Intrinsic

Value(b)

| | Average

Life(c)

|

Outstanding at beginning of year | | 5,669 | | | $ | 50.70 | | |

Granted | | 2,576 | | | | 57.54 | | |

Converted | | (62 | ) | | | 49.70 | | |

Forfeited/expired | | (159 | ) | | | 50.30 | | |

| | |

|

| | | | | |

Outstanding at end of quarter | | 8,024 | | | | 52.88 | | 2.04 yrs. |

| | |

|

| | | | | |

(a) | RSUs are in thousands. |

(b) | Weighted-average intrinsic value at grant date. |

(c) | Weighted-average contractual life remaining. |

Other stock-based compensation data

| | | | | | | | |

| | | Stock Options

| | RSUs

|

| | | 12 Weeks Ended

| | 12 Weeks Ended

|

| | | 3/25/06

| | 3/19/05

| | 3/25/06

| | 3/19/05

|

Weighted-average fair value of options granted | | $ 12.76 | | $ 13.48 | | | | |

Total intrinsic value of options/RSUs exercised/converted(a) | | $ 236,070 | | $ 139,536 | | $ 3,679 | | $ 1,230 |

Total intrinsic value of options/RSUs outstanding(a) | | $2,362,734 | | $2,028,080 | | $476,137 | | $290,654 |

Total intrinsic value of options exercisable(a) | | $2,060,825 | | $1,463,197 | | | | |

As of March 25, 2006, there was $485 million of total unrecognized compensation cost related to nonvested share-based compensation grants. This unrecognized compensation is expected to be recognized over a weighted-average period of 1.7 years.

12

Pension and Retiree Medical Benefits

The components of net periodic benefit cost for pension and retiree medical plans are as follows:

| | | | | | | | | | | | | | | | | | |

| | | 12 Weeks Ended

| |

| | | Pension

| | | Retiree Medical

| |

| | | 3/25/06

| | | 3/19/05

| | | 3/25/06

| | | 3/19/05

| | | 3/25/06

| | | 3/19/05

| |

| | | U.S.

| | | International

| | | | | | | |

Service cost | | $56 | | | $49 | | | $12 | | | $8 | | | $11 | | | $9 | |

Interest cost | | 73 | | | 68 | | | 15 | | | 14 | | | 17 | | | 18 | |

Expected return on plan assets | | (90 | ) | | (80 | ) | | (18 | ) | | (17 | ) | | — | | | — | |

Amortization of prior service cost/(benefit) | | 1 | | | 1 | | | — | | | — | | | (3 | ) | | (2 | ) |

Amortization of experience loss | | 38 | | | 24 | | | 6 | | | 4 | | | 5 | | | 6 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total expense | | $78 | | | $62 | | | $15 | | | $9 | | | $30 | | | $31 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Net Income Per Common Share

The computations of basic and diluted net income per common share are as follows:

| | | | | | | | | | |

| | | 12 Weeks Ended

|

| | | 3/25/06

| | 3/19/05

|

| | | Income

| | | Shares(a)

| | Income

| | | Shares(a)

|

Net income | | $1,019 | | | | | $ 912 | | | |

Preferred shares: | | | | | | | | | | |

Dividends | | — | | | | | (1 | ) | | |

Redemption premium | | (2 | ) | | | | (4 | ) | | |

| | |

|

| | | |

|

| | |

Net income available for common shareholders | | $1,017 | | | 1,656 | | $ 907 | | | 1,678 |

| | |

|

| | | |

|

| | |

Basic net income per common share | | $ 0.61 | | | | | $0.54 | | | |

| | |

|

| | | |

|

| | |

Net income available for common shareholders | | $1,017 | | | 1,656 | | $ 907 | | | 1,678 |

Dilutive securities: | | | | | | | | | | |

Stock options and RSUs(b) | | — | | | 37 | | — | | | 33 |

ESOP convertible preferred stock | | 2 | | | 2 | | 5 | | | 2 |

| | |

|

| |

| |

|

| |

|

Diluted | | $1,019 | | | 1,695 | | $ 912 | | | 1,713 |

| | |

|

| |

| |

|

| |

|

Diluted net income per common share | | $ 0.60 | | | | | $0.53 | | | |

| | |

|

| | | |

|

| | |

(a) | Weighted average common shares outstanding. |

(b) | There were no out-of-the-money options in 2006. Options to purchase 12 million shares in 2005 were not included in the calculation of earnings per share because these options were out-of-the-money. Out-of-the-money options had an average exercise price of $53.77 in 2005. |

13

Supplemental Cash Flow Information

| | | | | | |

| | | 12 Weeks Ended

| |

| | | 3/25/06

| | | 3/19/05

| |

Interest paid | | $ 54 | | | $ 44 | |

Income taxes paid, net of refunds | | $ 517 | | | $ 86 | |

| | |

Acquisitions(a): | | | | | | |

Fair value of assets acquired | | $ 287 | | | $ 602 | |

Less: Cash paid and debt assumed | | (275 | ) | | (791 | ) |

Add: Minority interest eliminated | | — | | | 221 | |

| | |

|

| |

|

|

Liabilities assumed | | $ 12 | | | $ 32 | |

| | |

|

| |

|

|

(a) | In 2005, these amounts include the impact of our first quarter acquisition of General Mills, Inc.’s 40.5% ownership interest in SVE for $750 million. |

14

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

FINANCIAL REVIEW

Our discussion and analysis is an integral part of understanding our financial results. Also refer toBasis of Presentation and Our Divisions in the Notes to the Condensed Consolidated Financial Statements. Tabular dollars are presented in millions, except per share amounts. All per share amounts reflect common per share amounts, assume dilution unless noted, and are based on unrounded amounts. Percentage changes are based on unrounded amounts.

Our Critical Accounting Policies

Sales Incentives and Advertising and Marketing Costs

We offer sales incentives through various programs to our customers and to consumers. These incentives are recorded as a reduction of the sales price of our products. Certain sales incentives are recognized at the time of sale while other incentives, such as bottler funding and customer volume rebates, are recognized during the year incurred, generally in proportion to revenue, based on annual targets. Anticipated payments are estimated based on historical experience with similar programs and require management judgment with respect to estimating customer participation and performance levels. Differences between estimated expenses and actual incentive costs are normally insignificant and are recognized in earnings in the period such differences are determined. In addition, certain advertising and marketing costs are also recognized during the year incurred, generally in proportion to revenue.

Income Taxes

In determining our quarterly provision for income taxes, we use an estimated annual effective tax rate which is based on our expected annual income, statutory tax rates and tax planning opportunities available to us in the various jurisdictions in which we operate. Our estimated annual effective tax rate also reflects our best estimate of the ultimate outcome of tax audits. The IRS audits of our tax returns for the years 1998 through 2002 may be concluded in 2006. Significant or unusual items are separately recognized in the quarter in which they occur.

Stock-Based Compensation

On January 1, 2006, we adopted Statement of Financial Accounting Standards (SFAS) 123R,Share-Based Payment, under the modified prospective method. Since we had previously accounted for our stock-based compensation plans under the fair value provisions of SFAS 123, our adoption did not significantly impact our financial position or our results of operations. Under SFAS 123R, actual tax benefits recognized in excess of tax benefits previously established upon grant are reported as a financing cash inflow. Prior to adoption, such excess tax benefits were reported as an increase to operating cash flows.

We account for our employee stock options under the fair value method of accounting using a Black-Scholes valuation model to measure stock option expense at the date of grant. All stock option grants have an exercise price equal to the fair market value of our common stock on the date of grant and generally have a 10-year term. The fair value of stock option grants is

15

amortized to expense over the vesting period, generally three years. RSU expense is based on the fair value of PepsiCo stock on the date of grant and is amortized over the vesting period, generally three years. Expected volatility reflects movements in our stock price over the most recent historical period equivalent to the expected life.

For our 2006 Black-Scholes assumptions and other stock-based compensation required disclosures, seeStock-Based Compensationin the Notes to the Condensed Consolidated Financial Statements.

Our Business Risks

We discuss expectations regarding our future performance, such as our business outlook, in our annual and quarterly reports, press releases, and other written and oral statements. These “forward-looking statements” are based on currently available competitive, financial and economic data and our operating plans. They are inherently uncertain, and investors must recognize that events could turn out to be significantly different from our expectations. We undertake no obligations to update any forward-looking statement.

Our operations outside of the United States generate over a third of our net revenue. As a result, we are exposed to foreign currency risks, including unforeseen economic changes and political unrest. During the quarter, net favorable foreign currency contributed slightly to net revenue growth, primarily due to increases in the Mexican peso, Brazilian real and Canadian dollar, which were mostly offset by declines in the British pound and the euro. Currency declines which are not offset could adversely impact our future results.

While there is continued pricing pressure on our raw materials and energy costs, we expect to be able to mitigate the impact of these increased costs through our hedging strategies and ongoing productivity initiatives.

Cautionary statements included in Management’s Discussion and Analysis and in Item 1A. in our Annual Report on Form 10-K for the fiscal year ended December 31, 2005 should be considered when evaluating our trends and future results.

Results of Operations—Consolidated Review

In the discussions of net revenue and operating profit below, “effective net pricing” reflects the year-over-year impact of discrete pricing actions, sales incentive activities and mix resulting from selling varying products in different package sizes and in different countries.

Volume

Since our divisions each use different measures of physical unit volume, a common servings metric is necessary to reflect our consolidated physical unit volume. In 2006, total servings increased 7% for the 12 weeks, with worldwide beverages growing 9% and worldwide snacks growing 4%.

We discuss volume for our beverage businesses on a bottler case sales (BCS) basis in which all beverage volume is converted to an 8 ounce case metric. A portion of our volume is sold by our bottlers, and that portion is based on our bottlers’ sales to retailers and independent distributors.

16

The remainder of our volume is based on our shipments to customers. BCS is reported to us by our bottlers on a monthly basis. Our first quarter beverage volume includes PBNA bottler sales for January, February and March and PI bottler sales for January and February.

Consolidated Results

Total Net Revenue and Operating Profit

| | | | | | | | | |

| | | 12 Weeks Ended

| | | | |

| | | 3/25/06

| | | 3/19/05

| | | Change

| |

Total net revenue | | $ 7,205 | | | $ 6,585 | | | 9 | % |

| | |

|

| |

|

| | | |

Division operating profit | | $ 1,519 | | | $ 1,406 | | | 8 | % |

Corporate unallocated | | (171 | ) | | (159 | ) | | 7 | % |

| | |

|

| |

|

| | | |

Total operating profit | | $ 1,348 | | | $ 1,247 | | | 8 | % |

| | |

|

| |

|

| | | |

Division operating profit margin | | 21.1 | % | | 21.4 | % | | (0.3 | ) |

Impact of Corporate unallocated on total operating profit margin | | (2.4 | ) | | (2.4 | ) | | | |

| | |

|

| |

|

| | | |

Total operating profit margin | | 18.7 | % | | 18.9 | %* | | (0.2 | ) |

| | |

|

| |

|

| | | |

* | Amounts do not sum due to rounding. |

Net revenue increased 9% primarily reflecting higher volume and positive effective net pricing across all divisions. The volume gains contributed almost 6 percentage points to net revenue growth and the effective net pricing contributed 3 percentage points. The impact of acquisitions contributed almost 1 percentage point to net revenue growth.

Total operating profit increased 8%, while margin decreased 0.2 percentage points. The operating profit performance reflects leverage from the revenue growth, as well as the impact of higher raw material and energy costs, and increased selling, general and administrative expenses.

Corporate unallocated expenses increased 7%. This increase primarily reflects higher employee-related costs which contributed 9 percentage points to the increase, net losses from certain mark-to-market derivatives which contributed 6 percentage points, and higher costs associated with our BPT initiative which contributed 4 percentage points. These increases were partially offset by the absence of foundation contributions made in the prior year which reduced corporate unallocated expenses by 6 percentage points. In 2006, corporate unallocated expenses also reflect a gain of $11 million related to the revaluation of an asset held for sale. Corporate departmental expenses were flat.

Division operating profit and division operating profit margin are not measures defined by generally accepted accounting principles (GAAP). However, we believe investors should consider these measures as they are consistent with how management evaluates our operational results and trends.

17

Other Consolidated Results

| | | | | | | | | |

| | | 12 Weeks Ended

| | | | |

| | | 3/25/06

| | | 3/19/05

| | | Change

| |

Bottling equity income | | $ 84 | | | $ 65 | | | 30 | % |

| | | |

Interest expense, net | | $ (17 | ) | | $ (27 | ) | | (38 | )% |

| | | |

Tax rate | | 28.0 | % | | 29.0 | % | | | |

| | | |

Net income | | $1,019 | | | $ 912 | | | 12 | % |

| | | |

Net income per common share—diluted | | $ 0.60 | | | $ 0.53 | | | 13 | % |

Bottling equity income increased 30% primarily reflecting a $50 million pre-tax gain on our sale of PBG stock in the quarter, which compared favorably to a $28 million pre-tax gain in the prior year.

Net interest expense decreased 38% reflecting the impact of higher interest rates on investments and gains in the market value of investments used to economically hedge a portion of our deferred compensation liability. This decrease was partially offset by the impact of higher interest rates on debt.

The tax rate decreased 1.0 percentage point compared to prior year primarily reflecting changes in our concentrate sourcing around the world, which is taxed at lower rates.

Net income increased 12% and the related net income per share increased 13%. These increases primarily reflect our solid operating profit growth, the increased gains on our sale of PBG stock and the decrease in our effective tax rate. Net income per share was also favorably impacted by our share repurchases.

18

Results of Operations—Division Review

The results and discussions below are based on how our Chief Executive Officer monitors the performance of our divisions. For additional information on our divisions, seeOur Divisionsin the Notes to the Condensed Consolidated Financial Statements.

Net Revenue

| | | | | | | | | | | | | | | | | | | | |

| | | FLNA

| | | PBNA

| | | PI

| | | QFNA

| | | Total

| |

Q1, 2006 | | $ | 2,393 | | | $ | 1,991 | | | $ | 2,378 | | | $ | 443 | | | $ | 7,205 | |

Q1, 2005 | | $ | 2,263 | | | $ | 1,784 | | | $ | 2,121 | | | $ | 417 | | | $ | 6,585 | |

| | | | | |

% Impact of: | | | | | | | | | | | | | | | | | | | | |

Volume | | | 2 | % | | | 8 | %(a) | | | 8 | %(a) | | | 2 | % | | | 6 | % |

Effective net pricing | | | 3 | | | | 3 | | | | 2 | | | | 4 | | | | 3 | |

Foreign exchange | | | 0.5 | | | | — | | | | — | | | | 1 | | | | — | |

Acquisitions/divestitures | | | — | | | | — | | | | 2 | | | | — | | | | 1 | |

% Change(b) | | | 6 | % | | | 12 | % | | | 12 | % | | | 6 | % | | | 9 | % |

(a) | For beverages sold to our bottlers, net revenue volume growth is based on our concentrate shipments and equivalents (CSE). |

(b) | Amounts may not sum due to rounding. |

Frito-Lay North America

| | | | | | |

| | | 12 Weeks Ended

| | % Change

|

| | | 3/25/06

| | 3/19/05

| |

Net revenue | | $2,393 | | $2,263 | | 6 |

| | | |

Operating profit | | $ 569 | | $ 539 | | 6 |

Net revenue grew 6% reflecting volume growth of 2% and positive effective net pricing due to salty snack pricing actions and favorable mix. Pound volume grew primarily due to double-digit growth in Chewy granola bars, Sun Chips and Quakes rice cakes, mid single-digit growth in Dips and double-digit growth in Multipack. These volume gains were partially offset by a high single-digit decline in trademark Doritos and a low single-digit decline in trademark Lay’s potato chips. Overall, salty snacks revenue grew 5% with volume growth of 1%, and convenience foods products revenue grew 13% with volume growth of 11%. The shift in the New Year’s and Easter holidays negatively impacted FLNA volume by approximately 1 percentage point.

Operating profit grew 6% reflecting the revenue growth, partially offset by higher selling and distribution costs, reflecting increased labor and benefit charges, and higher commodity costs, primarily cooking oil.

Smart Spot eligible products represented approximately 15% of net revenue. These products experienced double-digit revenue growth, while the balance of the portfolio had mid single-digit revenue growth.

19

PepsiCo Beverages North America

| | | | | | |

| | | 12 Weeks Ended

| | % Change

|

| | | 3/25/06

| | 3/19/05

| |

Net revenue | | $1,991 | | $1,784 | | 12 |

| | | |

Operating profit | | $ 428 | | $ 415 | | 3 |

Net revenue grew 12% and BCS volume grew 5%. The volume increase was driven by an 18% increase in non-carbonated beverages, partially offset by a 1% decline in CSDs. The non-carbonated portfolio performance was driven by double-digit growth in Gatorade, trademark Aquafina, Lipton ready-to-drink teas and Propel. Tropicana Pure Premium experienced a low single-digit decline. The decline in CSDs reflects a low single-digit decline in trademark Pepsi, partially offset by a low single-digit increase in Mountain Dew and a slight increase in trademark Sierra Mist. Across the brands, both regular and diet CSDs experienced low single-digit declines. BCS lagged CSE volume growth due to the timing of shipments. Additionally, BCS was negatively impacted by the timing of the Easter holiday which reduced BCS growth by 0.5 percentage points.

Net revenue also benefited from favorable mix, reflecting the strength of non-carbonated beverages, which contributed 3 percentage points to growth, and price increases in 2006, primarily on concentrate and fountain, which contributed 2 percentage points. These gains were partially offset by increased trade spending in the current year.

Operating profit increased 3%, primarily reflecting net revenue growth. This increase was partially offset by higher raw material and energy costs, primarily for Tropicana and Gatorade, as well as higher selling, general and administrative expenses. Operating profit growth was also negatively impacted by the favorable resolution in 2005 of estimated marketing accruals which reduced operating profit growth in the current year by 4 percentage points.

Smart Spot eligible products represented approximately 70% of net revenue. These products experienced double-digit revenue growth, while the balance of the portfolio grew in the mid single-digit range.

PepsiCo International

| | | | | | |

| | | 12 Weeks Ended

| | % Change

|

| | | 3/25/06

| | 3/19/05

| |

Net revenue | | $2,378 | | $2,121 | | 12 |

| | | |

Operating profit | | $ 371 | | $307 | | 21 |

International snacks volume grew 7%, reflecting growth of 15% in the Europe, Middle East & Africa region, 18% in the Asia Pacific region and 1% in the Latin America region. The acquisition of a business in Australia increased Asia region volume by 2 percentage points. The acquisition of a business in Poland in early 2006, increased the Europe, Middle East & Africa region volume growth by 3 percentage points. Cumulatively, acquisitions contributed 1

20

percentage point to the reported total PepsiCo International snack volume growth rate. The overall gains reflected high single-digit growth at Walkers in the United Kingdom, double-digit growth in Turkey, Russia, and Australia, and low single-digit growth at Sabritas in Mexico, partially offset by a low single-digit decline at Gamesa in Mexico. The decline at Gamesa is due principally to marketplace pressures and a mix shift to higher-end products.

Beverage volume grew 16%, reflecting growth of 22% in the Asia Pacific region, 14% in the Europe, Middle East & Africa region and 12% in the Latin America region. Acquisitions contributed 2 percentage points to the Europe, Middle East & Africa region volume growth rate and 1 percentage point to the reported total PepsiCo International beverage volume growth rate. Broad-based increases were led by double-digit growth in China, the Middle East, Argentina, India and Venezuela, and mid single-digit growth in Mexico. Carbonated soft drinks and non-carbonated beverages both grew at a double-digit rate.

Net revenue grew 12%, primarily as a result of the broad-based volume growth and favorable effective net pricing. Foreign currency had no significant impact on the growth rate. Acquisitions contributed 2 percentage points of growth.

Operating profit grew 21% driven largely by the broad-based volume growth and favorable effective net pricing, slightly offset by increased raw material costs. Foreign currency contributed 2 percentage points of growth based on the favorable Mexican peso and Brazilian real, partially offset by the unfavorable British pound and euro. Acquisitions had a slightly favorable impact on the growth rate.

Quaker Foods North America

| | | | | | |

| | | 12 Weeks Ended

| | % Change

|

| | | 3/25/06

| | 3/19/05

| |

Net revenue | | $443 | | $417 | | 6 |

| | | |

Operating profit | | $151 | | $145 | | 4 |

Net revenue increased 6% and volume increased 2%. The volume increase reflects double-digit growth in Life cereal, low single-digit growth in Oatmeal and high single-digit growth in Rice-A-Roni. This increase was partially offset by a low single-digit decline in Cap’n Crunch cereal. Higher effective net pricing contributed almost 4 percentage points of net revenue growth reflecting favorable product mix and lower trade spending accruals driven by timing. Favorable Canadian exchange rates contributed almost 1 percentage point to net revenue growth.

Operating profit increased 4% primarily reflecting the net revenue growth. This growth was partially offset by increased cost of sales and higher general and administrative costs.

Smart Spot eligible products represented approximately half of net revenue and had low single-digit revenue growth. The balance of the portfolio experienced high single-digit revenue growth.

21

OUR LIQUIDITY AND CAPITAL RESOURCES

Operating Activities

In the first quarter of 2006 and 2005, our operations provided $246 million and $749 million in cash, respectively, primarily reflecting our solid business results in both periods. In 2006, our operating cash flow reflects a tax payment of $420 million related to our repatriation of international cash in 2005 in connection with the American Jobs Creation Act. In addition, seasonality contributed to the use of cash in operating working capital accounts in both periods.

Investing Activities

During the quarter, our investing activities provided $327 million reflecting sales of short-term investments of $800 million and proceeds from our sale of PBG stock of $85 million, partially offset by acquisitions of $275 million, primarily the Stacy’s Pita Chip Company acquisition, as well as capital spending of $289 million. Capital spending reflects our North American Gatorade business and increased investment in support of our ongoing BPT initiative, as well as increased investments in manufacturing capacity to support growth in our China snack and beverage operations.

We anticipate net capital spending of approximately $2.2 billion in 2006, which is above our long-term target of approximately 5% of net revenue.

Financing Activities

During the quarter, we used $1.3 billion, reflecting net repayments of short-term borrowings of $691 million, common share repurchases of $660 million and dividend payments of $432 million, partially offset by stock option proceeds of $436 million.

Management Operating Cash Flow

We focus on management operating cash flow as a key element in achieving maximum shareholder value, and it is the primary measure we use to monitor cash flow performance. However, it is not a measure provided by accounting principles generally accepted in the U.S. Since net capital spending is essential to our product innovation initiatives and maintaining our operational capabilities, we believe that it is a recurring and necessary use of cash. As such, we believe investors should also consider net capital spending when evaluating our cash from operating activities. The table below reconciles net cash provided by operating activities as reflected in our Condensed Consolidated Statement of Cash Flows to our management operating cash flow.

| | | | | | |

| | | 12 Weeks Ended

| |

| | | 3/25/06

| | | 3/19/05

| |

Net cash provided by operating activities | | $246 | | | $749 | |

Capital spending | | (289 | ) | | (181 | ) |

Sales of property, plant and equipment | | 6 | | | 25 | |

| | |

|

| |

|

|

Management operating cash flow | | $(37 | ) | | $593 | |

| | |

|

| |

|

|

22

In the first quarter of 2006, management operating cash flow reflects our tax payment of $420 million related to our repatriation of international cash in 2005 in connection with the AJCA. During 2006, we expect to return approximately all of our management operating cash flow to our shareholders through dividends and share repurchases. However, see “Risk Factors” in Item 1A. and “Our Business Risks” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2005 for certain factors that may impact our operating cash flows.

23

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders

PepsiCo, Inc.

We have reviewed the accompanying Condensed Consolidated Balance Sheet of PepsiCo, Inc. and Subsidiaries as of March 25, 2006, and the related Condensed Consolidated Statements of Income, Comprehensive Income and Cash Flows for the twelve weeks ended March 25, 2006 and March 19, 2005. These interim condensed consolidated financial statements are the responsibility of PepsiCo, Inc.’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the accompanying interim condensed consolidated financial statements referred to above for them to be in conformity with U.S. generally accepted accounting principles.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Consolidated Balance Sheet of PepsiCo, Inc. and Subsidiaries as of December 31, 2005, and the related Consolidated Statements of Income, Common Shareholders’ Equity and Cash Flows for the year then ended not presented herein; and in our report dated February 24, 2006, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying Condensed Consolidated Balance Sheet as of December 31, 2005, is fairly stated, in all material respects, in relation to the Consolidated Balance Sheet from which it has been derived.

/s/ KPMG LLP

New York, New York

April 26, 2006

24

ITEM 4. | Controls and Procedures |

As of the end of the period covered by this report, we carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures, as such term is defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that as of the end of the period covered by this report our disclosure controls and procedures were effective to ensure that information required to be disclosed by us in reports we file or submit under the Exchange Act is (1) recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms, and (2) accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

In addition, there were no changes in our internal control over financial reporting during our first fiscal quarter of 2006 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

25

PART II OTHER INFORMATION

We are party to a variety of legal proceedings arising in the normal course of business, including the matters discussed below. While the results of proceedings cannot be predicted with certainty, management believes that the final outcome of these proceedings will not have a material adverse effect on our consolidated financial statements, results of operations or cash flows.

On April 30, 2004, we announced that Frito-Lay and Pepsi-Cola Company received notification from the Securities and Exchange Commission (the “SEC”) indicating that the SEC staff was proposing to recommend that the SEC bring a civil action alleging that a non-executive employee at Pepsi-Cola and another at Frito-Lay signed documents in early 2001 prepared by Kmart acknowledging payments in the amount of $3 million from Pepsi-Cola and $2.8 million from Frito-Lay. Kmart allegedly used these documents to prematurely recognize the $3 million and $2.8 million in revenue. Frito-Lay and Pepsi-Cola have cooperated fully with this investigation and provided written responses to the SEC staff notices setting forth the factual and legal bases for their belief that no enforcement actions should be brought against Frito-Lay or Pepsi-Cola.

Based on an internal review of the Kmart matters, no officers of PepsiCo, Pepsi-Cola or Frito-Lay are involved. Neither of these matters involves any allegations regarding PepsiCo’s accounting for its transactions with Kmart or PepsiCo’s financial statements.

There have been no material changes with respect to the risk factors disclosed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

26

ITEM 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

A summary of our common stock repurchases (in millions, except average price per share) during the first quarter under the $7 billion repurchase program authorized by our Board of Directors and publicly announced on March 29, 2004, and expiring on March 31, 2007, is set forth in the following table. All such shares of common stock were repurchased pursuant to open market transactions.

Issuer Purchases of Common Stock

| | | | | | | | | |

Period

| | (a) Total

Number of

Shares

Repurchased

| | (b) Average

Price Paid

Per Share

| | (c) Total

Number of

Shares

Purchased as

Part of Publicly

Announced

Plans or

Programs

| | (d) Maximum

Number of

Shares that may

Yet Be

Purchased

Under the Plans

or Programs

| |

12/31/05 | | | | | | | | $1,875 | |

1/1/06—1/28/06 | | 3.7 | | $58.52 | | 3.7 | | (217 | ) |

| | | | | | | | |

|

|

| | | | | | | | | 1,658 | |

1/29/06—2/25/06 | | 3.1 | | 58.08 | | 3.1 | | (177 | ) |

| | | | | | | | |

|

|

| | | | | | | | | 1,481 | |

2/26/06—3/25/06 | | 5.1 | | 59.68 | | 5.1 | | (306 | ) |

| | |

| | | |

| |

|

|

| | | 11.9 | | $58.91 | | 11.9 | | $1,175 | |

| | |

| |

| |

| |

|

|

In addition, PepsiCo repurchases shares of its convertible preferred stock from an employee stock ownership plan (ESOP) fund established by Quaker in connection with share redemptions by ESOP participants. The following table summarizes our convertible preferred share repurchases during the first quarter:

Issuer Purchases of Convertible Preferred Stock

| | | | | | | | |

Period

| | (a) Total

Number of

Shares

Repurchased

| | (b) Average

Price Paid Per

Share

| | (c) Total

Number of

Shares

Purchased as

Part of Publicly

Announced

Plans or

Programs

| | (d) Maximum

Number of

Shares that may

Yet Be

Purchased

Under the Plans

or Programs

|

12/31/05 | | | | | | | | |

1/1/06—1/28/06 | | 1,000 | | $284.46 | | N/A | | N/A |

1/29/06—2/25/06 | | 3,900 | | 292.94 | | N/A | | N/A |

2/26/06—3/25/06 | | 2,600 | | 298.06 | | N/A | | N/A |

| | |

| | | |

| |

|

| | | 7,500 | | $293.58 | | N/A | | N/A |

| | |

| |

| |

| |

|

27

SeeIndex to Exhibits on page 30.

28

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned.

| | | | | | |

| | | | | | | PepsiCo, Inc. |

| | | | | | | (Registrant) |

| | | |

Date: | | April 26, 2006 | | | | /S/ PETER A. BRIDGMAN |

| | | | | | | Peter A. Bridgman |

| | | | | | | Senior Vice President and |

| | | | | | | Controller |

| | | |

Date: | | April 26, 2006 | | | | /S/ ROBERT E. COX |

| | | | | | | Robert E. Cox |

| | | | | | | Vice President, Deputy General |

| | | | | | | Counsel and Assistant Secretary |

| | | | | | | (Duly Authorized Officer) |

29

INDEX TO EXHIBITS

ITEM 6 (a)

| | |

EXHIBITS | | |

| |

Exhibit 3.2 | | By-laws of PepsiCo, Inc. as amended to March 17, 2006 |

| |

Exhibit 12 | | Computation of Ratio of Earnings to Fixed Charges |

| |

Exhibit 15 | | Letter re: Unaudited Interim Financial Information |

| |

Exhibit 31 | | Certifications of Chief Executive Officer and Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

Exhibit 32 | | Certifications of Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, 18 U.S.C. Section 1350 |

30