Use these links to rapidly review the document

TABLE OF CONTENTS

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

CH2M Hill Companies, Ltd. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

TABLE OF CONTENTS

CH2M HILL COMPANIES, LTD.

6060 South Willow Drive

Greenwood Village, CO 80111

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of CH2M HILL Companies, Ltd. will be held on Tuesday, May 7, 2002 at 10:00 a.m. Mountain Daylight Time, at CH2M HILL's headquarters, 6060 South Willow Drive, Greenwood Village, Colorado 80111 for the following purposes:

- 1.

- To elect six Directors to serve for various terms until their successors are elected and qualified.

- 2.

- To adopt the proposal to amend the Payroll Deduction Stock Purchase Plan to increase the number of shares reserved under the Plan from 1,000,000 to 3,000,000 shares.

- 3.

- To transact any other business that may properly come before the meeting at the time and place scheduled or, should the meeting be adjourned, at such time and place as it may be resumed.

Only shareholders of record of shares of CH2M HILL's common stock at the close of business on March 29, 2002 will be entitled to vote at this meeting or at any postponements or adjournments thereof.

Your proxy is very important. You may vote your shares via the Internet, by telephone or by proxy card. Please see the accompanying instructions for more details on electronic and telephonic voting. Your proxy is revocable at any time prior to its use and the giving of your proxy will not affect your right to vote the shares you hold in your name if you decide to attend and vote at the meeting.

| | | BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

|

|

Samuel H. Iapalucci

Executive Vice President, Chief Financial Officer and Corporate Secretary

Greenwood Village, Colorado |

|

|

March 29, 2002

|

CH2M HILL COMPANIES, LTD.

6060 South Willow Drive

Greenwood Village, Colorado 80111

PROXY STATEMENT

General Information

This proxy statement is being furnished to shareholders of CH2M HILL Companies, Ltd. in connection with the solicitation of proxies for use at the 2002 Annual Meeting of Shareholders of CH2M HILL to be held on May 7, 2002, at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. The record date for determining shareholders entitled to vote at the 2002 Annual Meeting was March 29, 2002.

Your proxy is being solicited by the Board of Directors of CH2M HILL. This proxy statement and the accompanying materials are being delivered electronically or mailed to shareholders on or about April 8, 2002.

What is the Purpose of the Annual Meeting?

At our annual meeting, shareholders will have the opportunity to act on the matters discussed in the accompanying Notice of Annual Meeting of Shareholders. In addition to customary items such as the election of directors, shareholders are being requested to approve an amendment to the Payroll Deduction Stock Purchase Plan. CH2M HILL's management also will report on CH2M HILL's financial results and respond to questions from shareholders.

What Information Will I Receive?

We have included in this mailing a copy of the 2001 Annual Report to Shareholders on Form 10-K. The Annual Report includes audited financial statements for the fiscal year ending December 31, 2001 and other information about CH2M HILL. The Annual Report is not a part of the Proxy materials and it is not subject to Federal Securities Regulations 14A or 14C under the Securities Exchange Act of 1934, as amended.

Who Can Attend the Meeting?

All shareholders of record as of March 29, 2002, or their duly appointed proxies, may attend the meeting.

Who is Entitled to Vote?

Only shareholders of record of shares of CH2M HILL common stock at the close of business on the record date, which was March 29, 2002, are entitled to vote at the meeting. Such shareholders will be able to vote only CH2M HILL shares of common stock that they held on the record date. Each outstanding share entitles its holder to cast one vote on each matter to be voted upon.

What Constitutes a Quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum, permitting the meeting to conduct its business. As of the record date, 31,015,285 shares of CH2M HILL's common stock were outstanding. Proxies received but marked as abstentions will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining a quorum.

How Do I Vote?

If you are a record holder of CH2M HILL shares of common stock as of March 29, 2002 you can vote in one of four ways:

- 1.

- Vote by internet – follow the instructions on the internet at

http://www.proxyvoting.com/ch2m

- 2.

- Vote by phone – call toll-free 1(800) 676-5925

- 3.

- Vote by proxy card – mark, sign, and date your proxy card and return it promptly

- 4.

- Vote in person – if you attend the meeting, you may deliver your completed proxy card in person

Can I Change My Vote After I Return My Proxy Card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with the Corporate Secretary of CH2M HILL at 6060 South Willow Drive, Greenwood Village, CO 80111 either a notice of revocation or a duly executed proxy bearing a later date as long as it is received by May 7, 2002 at 10:00 a.m. Mountain Daylight Time. Your proxy also will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

How Do I Vote My Plan Shares?

If you participate in the CH2M HILL Retirement and Tax-Deferred Savings Plan, you have the right, if you choose, to instruct the trustee of the Plan how to vote the shares of common stock credited to your Plan account as well as a pro-rata portion of common stock credited to the accounts of other Plan participants and beneficiaries for which no instructions are received. Your instructions to the trustee of the Plan should be made by voting as discussed in "How Do I Vote?" above. The trustee of the Plan will vote your shares in accordance with your duly executed instructionswhich must be received by the trustee no later than 5:00 p.m. Mountain Daylight Time on May 3, 2002. If you do not send instructions regarding the voting of common stock credited to your Plan account, such shares shall be voted pro rata according to the voting instruction of other Plan participants. You may also revoke previously given instructions by filing with the trustee of the Plan no later than 5:00 p.m. Mountain Daylight Time on May 3, 2002 either written notice of revocation or a properly completed and signed voting instruction bearing a date later than the date of the prior instructions.

How will my proxy be voted?

Unless you give other instructions on your proxy card, the person named as proxy holder on the proxy card will vote in accordance with the recommendations of the Board of Directors as discussed in this proxy statement. With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes and abstentions.

How many votes are required for each proposal?

With respect to Proposal 1, a nominee for Director must receive the number of votes equal to a majority of the shares entitled to vote and represented at the meeting to be elected. All other proposals may be approved and adopted if the votes cast in favor of the proposal exceed the votes cast opposing the proposal.

How are abstentions treated?

A properly executed proxy marked "ABSTAIN" with respect to any matter will not be voted on that matter, although they will be counted for purposes of determining whether there is a quorum. Accordingly, in the election of Directors, an abstention or "Withhold Authority" vote will have the effect of a negative vote. With respect to each other proposal, an abstention will have no effect on the outcome of the vote because each proposal will be approved by a majority of the votes cast.

How will proxies be solicited?

Proxies will be solicited through electronic delivery or by mail, for those who do not have access to email. The cost of solicitation of the proxies will be paid by CH2M HILL. Officers, directors and regular employees of CH2M HILL, without additional compensation, also may solicit proxies by further mailing, by telephone or personal conversations. CH2M HILL has no plans to retain any firms or otherwise incur any extraordinary expense in connection with the solicitation.

Proposal 1. Election of Directors

The existing articles of incorporation and bylaws provide that the Board of Directors shall consist of at least nine and no more than thirteen Directors, subject to increase or decrease pursuant to resolutions of the Board of Directors. The current number of Directors is eleven. If all of the Director nominees are elected, the number of Directors will be twelve. The bylaws provide that the Directors shall be elected to three-year staggered terms by dividing the Directors into three classes as equal in number as possible. Each Director shall serve until his respective successor is elected and qualified. A decrease in the number of Directors shall not shorten the term of any incumbent Director.

Pursuant to CH2M HILL's bylaws, the Nominating Committee proposes Gregory T. Mc Intyre for election as a director for a one-year term expiring in 2003 and James J. Ferris, Michael D. Kennedy and Nancy R. Tuor for election as directors for three-year terms expiring in 2005 and until their successors are elected and qualified or their earlier retirement, death, resignation or removal. The Board of Directors has nominated Barry L. Williams to continue his service as an outside Director for a one-year term. In addition, the Board of Directors has nominated David B. Price to serve as an outside Director for a three-year term. To the best knowledge of the Board of Directors, all of the nominees are, and will be, able and willing to serve. In the event that any of the six nominees listed below should become unavailable to stand for election at the Annual Meeting, the proxy holders intend to vote for such other person, if any, as may be designated by the Board of Directors, in the place and stead of any nominee unable to serve.

Nominees for Election as Directors

James J. Ferris, 58, served as a Director of CH2M HILL from May 1998 to April 2001 and as a Senior Vice President since 1995. Dr. Ferris has served as President of the Energy, Environment and Systems business since 1995 and President of CH2M HILL Constructors, Inc. since 1994. Dr. Ferris also serves as a Director of Kaiser-Hill Company, LLC and CH2M HILL Hanford Group, Inc.

Michael D. Kennedy, 52, served as a Director of CH2M HILL from May 1998 to April 2001 and as a Senior Vice President since 1995. Mr. Kennedy served as the Northwest Regional Manager of CH2M HILL, Inc. from 1993 to 1998.

Gregory T. Mc Intyre, 43, has served as a Director since August 2001. Mr. Mc Intyre has been an employee of CH2M HILL since 1981. He has served as the Senior Vice President and Director of the CH2M HILL Communications Group since 1997. He has previously served as Senior Vice President for the Environmental business, U.S. Operations Director and Vice President and Regional Manager for the Southeast Region.

David B. Price, 56, served as President of Noveon, Inc., formerly BF Goodrich Performance Materials segment, from February to April 2001. Prior to joining Noveon, Inc., Mr. Price served as President and Chief Operating Officer of BF Goodrich Performance Materials and Executive Vice President of the BF Goodrich Company from 1997 to 2001. Mr. Price also spent 25 years with Monsanto Company, a global chemical company from 1972 to 1997. He currently serves as a Director of Tenneco Automotive.

Nancy R. Tuor, 54, served as a Director of CH2M HILL from May 1994 to April 1996. Ms. Tuor has been an employee of CH2M HILL since 1980 and has served in numerous capacities, including Regional Manager of the South Atlantic Region and currently as Chief Operating Officer of Kaiser-Hill Company, LLC.

Barry L. Williams, 57, has served as a Director of CH2M HILL since 1995. He has been President of Williams Pacific Ventures, Inc., a consulting firm, since 1987 and President and CEO of American Management Association from 2000 until mid-2001. Mr. Williams has served as Senior Mediator for JAMS/Endispute since 1993 and a visiting lecturer for the Haas Graduate School of Business, University of California since 1993. Mr. Williams has acted as a general partner of WDG, a California limited partnership, since 1987 and a general partner of Oakland Alameda Coliseum Joint Venture since 1998. He also serves as a Director of PG&E Corp., Northwestern Mutual Life Insurance Company, Synavant Inc., Newhall Land & Farming Company, Simpson Manufacturing Company, USA Group, Inc., R.H. Donnelley Corporation and several not-for-profit organizations.

The Board of Directors recommends a vote FOR the above nominees for election as directors.

Continuing Directors

Kenneth F. Durant, 64, has served as a Director of CH2M HILL since May 2001, and from May 1994 to April 2000 and as a Senior Vice President since 1997. Mr. Durant has served as the President of CH2M HILL Industrial Design and Construction, Inc., a subsidiary of CH2M HILL, since its formation in 1985. Mr. Durant's term expires in 2004.

Donald S. Evans, 51, has served as a Director of CH2M HILL since May 2001, and from May 1990 to April 1996, and from May 1997 to April 2000 and as a Senior Vice President since 1997. Mr. Evans has served as the President of the Water business since 1995 and the Operations and Maintenance business since 1985. Mr. Evans' term expires in 2004.

Jerry D. Geist, 67, has served as a Director of CH2M HILL since May 1989. Mr. Geist has been Chairman of Santa Fe Center Enterprises, Inc. since 1990 and Chief Executive Officer of Howard International Utilities from 1990 through 2000. Mr. Geist is currently Chairman and CEO of Energy & Technology Company, Ltd., a privately held energy development and investment firm in oil, gas and LNG and Chairman of DMLP GP, DMLP LP and PEMI, privately held oil and gas exploration and development firms. Mr. Geist serves as a Director of the Davis Family of Mutual Funds. Mr. Geist's term expires in 2004.

Steven D. Guttenplan, 53, has served as a Director of CH2M HILL since May 2001. Mr. Guttenplan has been an employee of CH2M HILL since 1978 and has served in various capacities, including as a Regional Manager of the North Atlantic Region, the Rocky Mountain Region and currently in the Northeast Region for CH2M HILL, Inc. Mr. Guttenplan's term expires in 2004.

Susan D. King, 45, has served as a Director of CH2M HILL since 1997. Ms. King has served as the Chief Financial Officer of CH2M HILL Industrial Design and Construction, Inc. since 1993, and as its Secretary and Treasurer since 1995. Ms. King's term expires in 2003.

Ralph R. Peterson, 57, has served as a Director and Chairman of CH2M HILL since May 2000 and as a Director for three previous terms from May 1981 to April 1984 and from May 1986 to April 1991. He has served as President and Chief Executive Officer of CH2M HILL since 1991. Mr. Peterson also serves as a Director of Kaiser-Hill Company, LLC and of StanCorp Financial Group. Mr. Peterson's term expires in 2003.

Other Executive Officers

Joseph A. Ahearn, 65, has served as a Director from May 2000 to April 2002. He served as a Director of CH2M HILL for one previous term from May 1996 to April 1999, as a Senior Vice President of CH2M HILL since 1995, and as Vice Chairman of the Board of Directors since February 2001. Mr. Ahearn has served as President of the Transportation business of CH2M HILL, Inc. since 1996 and as the Eastern Regional Manager of CH2M HILL, Inc. from 1994 until 1996.

Samuel H. Iapalucci, 49, has served as Executive Vice President of CH2M HILL since February 2001, and as Chief Financial Officer and Corporate Secretary of CH2M HILL since 1994. Mr. Iapalucci served as Senior Vice President of CH2M HILL from 1994 until February 2001.

E. Kent Robinson, 62, has served as a Senior Vice President of CH2M HILL since February 2000 and as a Senior Vice President of CH2M HILL, Inc. since 1995.

CH2M HILL's executive officers are Joseph A. Ahearn, Kenneth F. Durant, Donald S. Evans, James J. Ferris, Samuel H. Iapalucci, Michael D. Kennedy, Ralph R. Peterson and E. Kent Robinson.

There are no family relationships among any of the Directors, executive officers or nominees for Director of CH2M HILL.

Corporate Governance

Board of Directors

During the year ended December 31, 2001, the Board of Directors held five meetings. Average attendance by each director at meetings of the Board of Directors and committees of the Board of Directors was 100%, except for Philip G. Hall, who, in 2001, attended fewer than 75% of the aggregate of the total number of meetings of the Board of Directors and committees of the Board of Directors due to family illness.

Committees of the Board

The Board of Directors has various standing committees, which are discussed below.

Audit and Finance Committee

The Audit and Finance Committee held four meetings during fiscal 2001. The current director members are Jerry D. Geist, Steven D. Guttenplan, Susan D. King, Gregory T. Mc Intyre, Ralph R. Peterson, Jill T. Sideman and Barry L. Williams (Chairman). The current non-director members are Ralph F. Cox, Thomas A. Dames, Thomas G. Searle and Robert B. Sheh. Ralph F. Cox and Robert B. Sheh serve as consultants to the committee and actively participate in committee meetings on a regular basis.

The Audit and Finance Committee is responsible for CH2M HILL's financial processes and internal control environment. Its responsibilities include:

- •

- Appointing CH2M HILL's independent certified public accountants,

- •

- Reviewing and evaluating the work and performance of CH2M HILL's internal auditors and its independent certified public accountants,

- •

- Conferring with CH2M HILL's independent certified public accountants and its internal auditors and financial officers to monitor CH2M HILL's internal accounting methods and procedures and evaluating any recommended changes therefrom,

- •

- Reviewing legislative or other business environment change conditions that could have a noticeable impact on CH2M HILL's financial controls and future operations,

- •

- Reviewing all acquisitions and/or investments that are valued in excess of $1.0 million,

- •

- Reviewing all capital expenditures with unit costs of $1.0 million or more and monitoring capital expenditures relative to annual capital plans, and

- •

- Monitoring various financial measurements for the Company relative to established financial policies.

Audit Subcommittee

The Audit and Finance Committee has established an Audit Subcommittee whose current director members include Jerry D. Geist and Barry L. Williams (Chairman). Ralph F. Cox and Robert B. Sheh serve as consultants to the committee and actively participate in committee meetings on a regular basis. The Audit Subcommittee meets in conjunction with the regular Audit and Finance Committee meetings. Each member of the Audit Subcommittee is independent in accordance with the definition provided in the National Association of Securities Dealers Rule 4200(a)(15). The Audit Subcommittee operates under a written charter approved by the Board of Directors.

For the year 2001, the Company incurred fees for services from its independent certified accountants, Arthur Andersen LLP, as discussed below.

Audit Fees. The Company incurred fees of $421,000 for services from its independent certified accountants for the annual audit and for the review of the financial statements included in the Company's Form 10-Qs and Form 10-K for the fiscal year ended December 31, 2001.

All Other Fees. The Company incurred fees of $1,803,000 including audit-related fees of $658,000 and other fees of $1,145,000 for the fiscal year ended December 31, 2001. Audit-related fees include statutory audits of subsidiaries, benefit plan audits, acquisition due diligence, accounting consultation, various attest services under professional standards, assistance with registration statements and consents. Other fees were primarily for tax services.

There were no financial information systems design and implementation fees incurred in 2001.

Report of the Audit Subcommittee

February, 2002

To the Board of Directors of CH2M HILL Companies, Ltd.

We have reviewed and discussed with management the Company's financial reporting process. Management has the primary responsibility for the financial statements and the reporting process. The Company's independent auditors are responsible for expressing an opinion on the conformity of our audited financial statements to generally accepted accounting principles.

We have reviewed and discussed with management and the independent auditors the audited financial statements for the fiscal year ended December 31, 2001. We have discussed with the independent auditors the matters required to be discussed by Statement of Auditing Standards No. 61,Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

We have received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1,Independence Discussions with Audit Committees, as amended by the Independence Standards Board, and have discussed with the auditors the auditors' independence from the Company and its management. We also have considered whether the independent auditors provision of other non-audit services to the Company is compatible with the auditors' independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the audited financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2001, for filing with the U.S. Securities and Exchange Commission.

Submitted by the CH2M HILL Companies, Ltd. Audit Subcommittee:

Barry L. Williams, Chairman

Jerry D. Geist

Ralph F. Cox

Robert B. Sheh

Compensation and Work Force Committee

The Compensation and Work Force Committee held four meetings during fiscal 2001. The current director members are Joseph A. Ahearn, Kenneth F. Durant, Donald S. Evans, Jerry D. Geist (Chairman), Ralph R. Peterson (non-voting member) and Barry L. Williams. The current non-director members are Ralph F. Cox, James J. Ferris and Robert B. Sheh. Ralph F. Cox and Robert B. Sheh serve as consultants to the committee and actively participate in committee meetings on a regular basis.

The Committee, in addition to other responsibilities, is responsible for determining the executive compensation programs, including the Chief Executive Officer and Chairman of the Board and the executive officers of CH2M HILL, and recommending to the Board of Directors the amount of awards to be made to the Chief Executive Officer and Chairman of the Board, and the executive officers. The Committee engages outside compensation consultants from time to time to advise it and CH2M HILL management on executive compensation matters.

Total compensation for CH2M HILL executive officers consists of salary, annual cash and stock bonuses and long-term incentives, which include stock options and a long-term incentive bonus of cash and stock. The annual bonus and long-term incentives introduce risk to the total executive compensation programs. The compensation levels determined by the Committee are variable, may fluctuate significantly from year to year, and are directly tied to company and individual performance.

The Committee annually reviews the competitiveness of CH2M HILL's executive compensation programs within the industries in which it competes – Water, Environmental, Microelectronics, Transportation, Operations and Maintenance and Construction. CH2M HILL targets a level of total compensation of its competitor group for like positions and like performance.

The Committee reviews executive compensation in light of Section 162(m) of the Internal Revenue Code which establishes a limit on the deductibility of annual compensation for certain executive officers that exceeds $1,000,000. It is the general intention of the Committee to meet the requirements for deductibility under Section 162(m); however, the Committee reserves the right, where merited by changing business conditions or an executive's individual performance, to authorize compensation payments which may not be fully deductible by CH2M HILL. The Committee reviews this policy on an ongoing basis.

The Committee is also responsible for issuing reports required by the U.S. Securities and Exchange Commission regarding CH2M HILL's compensation policies applicable to the Chief Executive Officer and the four other most highly compensated executive officers.

Report of the Compensation and Work Force Committee on Executive Compensation

February, 2002

To the Board of Directors of CH2M HILL Companies, Ltd.

CH2M HILL's compensation policies are based on a philosophy of market based compensation for its employees, including its Chief Executive Officer (CEO), and other Executive Officers. The company's compensation practices are aligned to this philosophy and are designed to reward performance and facilitate attraction, retention and motivation of executive staff in a manner which furthers the financial interest of our shareholders. Our compensation policy dictates that a substantial portion of Executive Officers' total compensation be at risk. By making Executive Officers' compensation contingent on individual performance, the performance of business units under their management, and the performance of CH2M HILL as a whole, CH2M HILL seeks to encourage continued executive focus on increasing CH2M HILL's revenue, profitability and shareholder value. In addition, this approach serves to motivate our Executive Officers to perform to the fullest extent of their abilities.

As is customary at other companies similar to CH2M HILL, the subcommittee of the Compensation and Work Force Committee consisting entirely of outside Directors (Executive Compensation Subcommittee) is responsible for reviewing and approving all salary incentive compensation and stock option grant recommendations for the CEO. The Subcommittee is also responsible for reviewing all incentive compensation and stock option grant recommendations made by the CEO for other Executive Officers. These determinations are made after considering individual, corporate and business unit performance, the performance of our competitors and other similar businesses, and relevant market compensation data. The Subcommittee retained the services of a well regarded and reputable executive compensation consulting firm ("Independent Compensation Consultant") to assist it in carrying out its responsibilities by providing a comprehensive assessment of the various components of our executive compensation programs and relevant compensation data for market comparison purposes. The Subcommittee with assistance of the Independent Compensation Consultant also utilized a variety of credible third party sources for executive compensation information and best practices to augment their own assessments.

The CEO's and other Executive Officers' compensation is comprised of three major components: base salary, short-term incentive compensation, and long-term incentive compensation, including stock options. By setting the annual salaries of our Executive Officers at or below competitive market levels, a significant portion of compensation is reserved for incentive compensation. With 50% or more of total compensation represented by "at risk" short- and long-term variable components, Executive Officers' compensation is heavily dependent on their individual performance, performance of the business unit they are responsible for, and the company's performance as a whole during the prior fiscal year, in the case of short-term incentive compensation and over a longer period in the case of long-term incentives compensation.

The CEO's and other Executive Officers' incentive compensation may consist of cash, vested stock and stock options or a combination of these components. Generally, annual incentives are awarded when results of the prior fiscal year have been identified and reviewed against that individual's business unit performance and objective company-wide performance results. By awarding part of the incentive pay in CH2M HILL stock, CH2M HILL seeks to encourage individuals to remain with the company and continue to focus on the long-term performance of CH2M HILL and our shareholder value. Annual stock options are granted in concert with incentives to also focus on growing shareholder value. Further, the exercise price of all stock options granted is equal to the price of the common stock on the date of grant. Therefore, such stock options only have value to the extent that the price of CH2M HILL's stock increases during the term of the stock option.

In determining the CEO's and other Executive Officers' compensation for 2001, the Subcommittee took into account CH2M HILL's performance relative to plan, performance relative to market benchmarks, how well the CEO and Executive Officers performed on their personal goals and objectives, and their compensation in relationship to peers in the market place. The short-term incentive compensation awards granted to these executives were determined in major part by the company's financial performance during the fiscal year ended December 31, 2001.

During the past year, Mr. Peterson was paid an annual base salary of $600,000. After deliberation, the Subcommittee set Mr. Peterson's annual base salary at $640,000 for fiscal year 2002, which represents a 6.7% increase over his base salary for the prior year. Our Independent Compensation Consultant believes this increase will bring Mr. Peterson's base salary marginally within the market competitive range when compared to base salaries of chief executive officers of engineering and construction companies of similar size. The Subcommittee believes that base salary increase is warranted given CH2M HILL's performance during the prior year and goals and challenges for the company in the coming year.

Mr. Peterson was paid a short-term incentive compensation award of $530,000 for fiscal year ended 2001. The Subcommittee believes that this award was more than warranted by CH2M HILL's performance against its market metrics – during 2001, CH2M HILL's gross revenues grew by 13.7%, profit after tax grew by 13.8% and CH2M HILL stock price appreciated by 15.0%.

Our long-term incentive compensation program was instituted in 1999. The program is built around the concept of incentive compensation based on the company's aggregate performance over a three-year period. Therefore, the first long-term incentive bonus payment will be made this year based on awards, goals and objectives set three years ago in 1999. Just as with every other Executive Officer at CH2M HILL, Mr. Peterson's long-term incentive compensation objectives were set based on targeted profit before taxes and before incentive compensation payments (PBBP) over a three-year period and share price growth over the same period. During the relevant period of 1999 through 2001, CH2M HILL exceeded the PBBP target by approximately 54%. During the same period, CH2M HILL share price grew by 252.9%.

After deliberations, the Subcommittee determined that Mr. Peterson's 1999 long-term incentive compensation award to be payable in 2002 should be $1,084,896. The Subcommittee believes that the award is in line with the objectives of CH2M HILL's long-term incentive compensation program, is in strict compliance with the program's objective performance measures, and is warranted given the company's outstanding performance during the last three years. The Subcommittee awarded Mr. Peterson 10,500 stock options, in accordance with the CH2M HILL Companies, Ltd. Amended and Restated 1999 Stock Option Plan.

Our Independent Compensation Consultant has reviewed the aforementioned 2002 compensation determinations for Mr. Peterson and is of the opinion that Mr. Peterson's total compensation (base salary and incentive compensation) falls below market by 18.4% when compared to the median total compensation of chief executive officers of engineering and construction companies of similar size and performance. The Subcommittee would like to emphasize that Mr. Peterson's below market compensation is not a reflection of the Subcommittee's opinion of Mr. Peterson's performance but a reaction to Mr. Peterson's desire not to accelerate his compensation to market levels at this time.

The Subcommittee also reviewed the compensation for each of CH2M HILL's Executive Officers in 2001. Based on the review of relevant survey data and advice received from an Independent Compensation Consultant, the Subcommittee determined that the compensation of these Executive Officers is within or slightly below the comparable market level in 2001 for executives with comparable duties and responsibilities in engineering and construction companies of CH2M HILL's size. The Executive Officers' compensation for 2002 has been set to correspond to the market level for these positions.

The Subcommittee believes that the compensation policies, plans and programs implemented at CH2M HILL have encouraged management to focus on the long-term financial performance of the company and have contributed to achieving CH2M HILL's technical and financial success.

| Compensation and Work Force Committee: |

Jerry D. Geist, Chairman |

|

Donald S. Evans |

| Joseph A. Ahearn | | James J. Ferris |

| Ralph F. Cox | | Robert B. Sheh |

| Kenneth F. Durant | | Barry L. Williams |

Executive Compensation Subcommittee: |

Jerry D. Geist, Chairman |

Barry L. Williams

|

Executive Committee

The Executive Committee held two meetings during fiscal 2001. The current director members are Donald S. Evans, Jerry D. Geist, Susan D. King, Ralph R. Peterson (Chairman) and Barry L. Williams. Ralph F. Cox and Robert B. Sheh are non-voting participants and consultants to the committee, and actively participate in committee meetings on a regular basis. The Executive Committee, except as limited by Oregon law, may exercise any of the powers and perform any of the duties of the Board of Directors if delegated by the Board of Directors.

Nominating Committee

The Nominating Committee held two meetings during fiscal 2001. The current director members are Philip G. Hall, Ralph R. Peterson (Chairman, non-voting) and Jill T. Sideman. The current non-director members are Richard A. Hirsekorn and Patrick L. Klampe. The Nominating Committee's responsibilities include:

- •

- Establishing a procedure for identifying employee nominees for election as directors to the Board of Directors,

- •

- Reviewing and recommending to the Board of Directors criteria for membership on the Board, and

- •

- Proposing employee nominees to fill vacancies on the Board of Directors as they occur.

CH2M HILL's bylaws provide that shareholders may nominate directors outside of the Nominating Committee process by petition signed by shareholders representing at least 10% of the outstanding shares of common stock and by complying with the appropriate U.S. Securities and Exchange Commission Proxy Rules.

Ownership and Incentive Compensation Committee

The Ownership and Incentive Compensation Committee held eight meetings during fiscal 2001. The current director members are Joseph A. Ahearn (Chairman), Kenneth F. Durant, Donald S. Evans, Steven D. Guttenplan, Philip G. Hall, Susan D. King, Gregory T. Mc Intyre, Ralph R. Peterson and Jill T. Sideman. The current non-director members are Michael D. Kennedy, Katherine M. Lombardo and Edward M. Stanley.

The Ownership and Incentive Compensation Committee's responsibilities include:

- •

- Developing policies and procedures for the Board of Directors approval governing the ownership and incentive compensation programs for CH2M HILL,

- •

- Monitoring the stock ownership program,

- •

- Allocating funds for employee incentive plans,

- •

- Monitoring the long-term incentive program,

- •

- Monitoring the activities of, and acting on recommendations from, the Stock Option Management Committee,

- •

- Acting in synergy with the Compensation and Work Force Committee to support their approvals of executive compensation,

- •

- Acting in synergy with the Audit and Finance Committee, and as an extension of the Board of Directors, to oversee the application of the policies and procedures, and

- •

- Recommending Board of Director action as appropriate to achieve CH2M HILL's mission and goals.

Strategic Planning Group

The Strategic Planning Group held four meetings during fiscal 2001. The current director members are Joseph A. Ahearn, Kenneth F. Durant, Donald S. Evans, Jerry D. Geist, Steven D. Guttenplan, Philip G. Hall, Susan D. King, Gregory T. Mc Intyre, Ralph R. Peterson (Chairman), Jill T. Sideman and Barry L. Williams. The current non-director members are Robert C. Allen, Ralph F. Cox, James J. Ferris, Samuel H. Iapalucci, Michael D. Kennedy, E. Kent Robinson and Robert B. Sheh. Ralph F. Cox and Robert B. Sheh serve as consultants to the committee and actively participate in committee meetings on a regular basis. The Strategic Planning Group's responsibilities include reviewing the long-range plans of CH2M HILL.

Outside Director Search/Review Committee

The Outside Director Search/Review Committee held five meetings during fiscal 2001. The current director members are Donald S. Evans, Jerry D. Geist, Philip G. Hall (Chairman), Susan D. King, Ralph R. Peterson and Barry L. Williams. The current non-director members are Ralph F. Cox, James J. Ferris and Robert B. Sheh. Ralph F. Cox and Robert B. Sheh serve as consultants to the committee and actively participate in committee meetings on a regular basis. The Outside Director Search/Review Committee's responsibilities include seeking qualified candidates for director who are not employees of CH2M HILL and whose backgrounds and expertise will add valuable skills and perspectives to the Board of Directors.

Directors' Compensation

Non-employee directors of CH2M HILL receive an annual retainer of $21,000 and an additional $4,000 for each committee on which they serve as the chairman. CH2M HILL also pays non-employee directors a meeting fee of $1,000 for attendance at each Board of Directors meeting and $1,000 per day for attendance at committee meetings. Directors are reimbursed for expenses incurred in connection with attendance at meetings and other CH2M HILL functions. In 2001, each non-employee director received a $20,000 discretionary cash bonus and 2,000 stock options.

Security Ownership of Certain Shareholders and Management

The following tables set forth information regarding the ownership of all classes of CH2M HILL's voting securities as of March 29, 2002, by (a) any person or group known to have ownership of more than five percent of the common stock and (b) beneficial ownership by Directors, Director nominees, and executive officers individually and as a group.

Security Ownership of Certain Shareholders

The following table presents information as of March 29, 2002, concerning the only known shareholder who owns five percent or more of CH2M HILL's common stock.

Name and Address of Shareholder

| | Title of

Class

| | Number of

Shares Held

| | Percent

of Class

| |

|---|

Trustees of the CH2M HILL Retirement and Tax-Deferred Savings Plan

6060 South Willow Drive

Greenwood Village, CO 80111 | | Common | | 12,986,295(1 | ) | 41.9 | % |

(1) Common shares are held of record by the Trustees for the accounts of participants in the Retirement and Tax-Deferred Savings Plan and will be voted in accordance with instructions received from participants. Shares as to which no instructions are received will be voted pro rata in accordance with the voting instructions submitted by all other plan participants.

Security Ownership of Directors, Director Nominees and Executive Officers

The following table sets forth information as of March 29, 2002 as to the beneficial ownership of CH2M HILL's equity securities by each Director, Director nominee, executive officer and by all Directors, Director nominees, and executive officers as a group. None of the individuals listed below owns directly more than one percent of the outstanding shares of CH2M HILL. As a group, all Directors, Director nominees, and executive officers own 6.6% of the outstanding shares of CH2M HILL.

Name of Beneficial Owner

| | Common

Stock Held

Directly

| | Common

Stock Held

Indirectly(1)

| | Stock Options

Exercisable

Within 60 Days

| | Total

Beneficial

Ownership

|

|---|

| Joseph A. Ahearn | | 62,762 | | 35,831 | | 31,500 | | 130,093 |

| Kenneth F. Durant | | 228,372 | | 110,480 | | - | | 338,852 |

| Donald S. Evans | | 201,511 | | 39,210 | | 31,500 | | 272,221 |

| James J. Ferris | | 86,079 | | 43,955 | | 31,500 | | 161,534 |

| Jerry D. Geist | | - | | - | | 1,500 | | 1,500 |

| Steven D. Guttenplan | | 72,692 | | 30,938 | | 15,755 | | 119,385 |

| Samuel H. Iapalucci | | 83,396 | | 43,331 | | 31,500 | | 158,227 |

| Michael D. Kennedy | | 77,157 | | 48,104 | | 31,500 | | 156,761 |

| Susan D. King | | 66,668 | | 21,421 | | 12,500 | | 100,589 |

| Gregory T. Mc Intyre | | 46,807 | | 22,666 | | 7,000 | | 76,473 |

| Ralph R. Peterson | | 285,665 | | 79,689 | | 36,225 | | 401,579 |

| David B. Price | | - | | - | | - | | - |

| E. Kent Robinson | | 61,701 | | 37,408 | | 19,130 | | 118,239 |

| Nancy R. Tuor | | 10,454 | | 7,882 | | 5,000 | | 23,336 |

| Barry L. Williams | | - | | - | | 1,500 | | 1,500 |

| All directors, director nominees and executive officers as a group (15 people) | | 1,283,264 | | 520,915 | | 256,110 | | 2,060,289 |

(1) Includes common stock held through the Retirement and Tax-Deferred Savings Plan and the deferred compensation plan trusts.

Compensation Committee Interlocks and Insider Participation

The current director members of CH2M HILL's Compensation and Work Force Committee of the Board of Directors are Joseph A. Ahearn, Kenneth F. Durant, Donald S. Evans, Jerry D. Geist (Chairman), Ralph R. Peterson (non-voting member) and Barry L. Williams. The current non-director members are Ralph F. Cox, James J. Ferris and Robert B. Sheh. Ralph F. Cox and Robert B. Sheh serve as consultants to the committee and actively participate in committee meetings on a regular basis. All members of the Compensation and Work Force Committee except Ralph F. Cox, Jerry D. Geist, Robert B. Sheh and Barry L. Williams are officers of CH2M HILL.

Change of Control Agreements. The Board of Directors authorized CH2M HILL to enter into Change of Control Agreements with Joseph A. Ahearn, Kenneth F. Durant, Donald S. Evans, James J. Ferris, Steven D. Guttenplan, Philip G. Hall, Samuel H. Iapalucci, Michael D. Kennedy, Susan D. King, Gregory T. Mc Intyre, Ralph R. Peterson, E. Kent Robinson and Jill T. Sideman (each hereafter a "COC Executive"). Jill T. Sideman's COC Agreement was terminated in March 2002 but will remain in effect, under the terms of that agreement, for six months following the date of such termination, thus providing her with coverage through the end of her term on the Board and a few months therafter. The provisions of these agreements will become effective if and when there is a Change of Control (as that term is defined below) of CH2M HILL and, with respect to most benefits, only if the COC Executive is terminated within twenty-four months of such Change of Control. All of the Change of Control Agreements were automatically renewed for an additional one year period on March 31, 2002. The Agreements automatically renew for successive one-year terms on March 31 of each year unless CH2M HILL gives notice to the COC Executives that it does not intend to extend the Agreement or intends to change its terms (such notice cannot be given during the pendency of a potential Change of Control). If a Change of Control occurs, the expiration date of the Agreements will automatically extend for twenty-four months beyond the month in which the Change of Control occurs.

Under the Change of Control Agreements, CH2M HILL will provide each COC Executive with the following benefits at the time the Change of Control event occurs:

- •

- Immediate vesting in all retirement plans and of all outstanding options;

- •

- Pro-rata payout of amounts payable under the Short-Term Incentive Plan for the year of termination; and

- •

- Pro-rata payout of amounts payable under the Long-Term Incentive Plan.

CH2M HILL will provide each COC Executive with the following additional benefits in the event of termination of their employment (actual or constructive and other than for cause) by CH2M HILL or its successor in interest within twenty-four months of a Change of Control:

- •

- For the CEO and direct reports, lump-sum payments in the amount equal to 2.99 times the sum of (a) annual base salary in effect at the time the Change of Control occurs and (b) target annual incentive bonus payable under the Short-Term Incentive Plan;

- •

- For the other Executives, lump-sum payments in the amount equal to 1.5 times the sum of (a) annual base salary in effect at the time the Change of Control occurs and (b) target annual incentive bonus payable under the Short-Term Incentive Plan;

- •

- Continuation of health benefits for 36 months for CEO and direct reports and continuation for 18 months for other COC Executives.

For purposes of the Change of Control Agreements, a "Change of Control" is defined generally to include:

- •

- Acquisition of 25% (or more) of the voting securities of CH2M HILL;

- •

- A significant merger or consolidation where CH2M HILL shareholders hold less than 75% of all shares outstanding of the surviving company;

- •

- A change in the majority of the Board of Directors, not otherwise recommended by the Board of Directors, during the course of one fiscal year; and

- •

- Liquidation or dissolution of CH2M HILL, or direct or indirect sale or other disposition of all or substantially all of the assets of CH2M HILL.

Executive Compensation

The following table sets forth information regarding annual incentive compensation for the chief executive officer and the other four most highly compensated executive officers of CH2M HILL.

Summary Compensation Table(1)

| | Annual Compensation

| | Long-Term Compensation

| |

|

|---|

(a)

| | (b)

| | (c)

| | (d)

| | (e)

| | (g)

| | (h)

| | (i)

|

|---|

| |

| |

| |

| |

| | Awards

| | Payouts

| |

|

|---|

Name and principal position

| | Year

| | Salary(2)

| | Bonus(2)

| | Other Annual

Compensation(3)

| | Securities

Underlying

Options (#)

| | LTIP

Payouts(4)

| | All Other

Compensation(5)

|

|---|

Ralph R. Peterson

President &

Chief Executive Officer |

|

2001

2000

1999 |

|

$

|

597,862

509,819

471,435 |

|

$

|

530,000

480,000

290,000 |

|

$

|

898,697

- -

- - |

|

10,500

10,500

28,350 |

|

$

|

249,526

- -

- - |

|

$

|

54,649

113,276

9,381 |

Kenneth F. Durant

Senior Vice President |

|

2001 2000 1999 |

|

|

342,838

310,000

273,000 |

|

|

315,000

280,000

- - |

|

|

202,320

- -

- - |

|

- -

- -

- - |

|

|

134,880

- -

- - |

|

|

71,430

4,792

14,970 |

James J. Ferris

Senior Vice President |

|

2001

2000

1999 |

|

|

349,274

309,640

302,519 |

|

|

290,000

270,000

185,000 |

|

|

308,060

- -

- - |

|

9,000

9,000

24,750 |

|

|

69,610

- -

- - |

|

|

29,814

65,553

7,893 |

Samuel H. Iapalucci

Executive Vice President,

Chief Financial Officer &

Secretary |

|

2001

2000

1999 |

|

|

356,009

334,179

299,645 |

|

|

275,000

270,000

165,000 |

|

|

238,431

- -

- - |

|

9,000

9,000

24,750 |

|

|

139,219

- -

- - |

|

|

27,993

56,716

7,013 |

Donald S. Evans

Senior Vice President |

|

2001

2000

1999 |

|

|

353,763

456,116

305,219 |

|

|

250,000

260,000

185,000 |

|

|

270,189

- -

- - |

|

9,000

9,000

24,750 |

|

|

109,832

- -

- - |

|

|

28,014

58,571

6,998 |

- (1)

- Certain columns have been omitted because they are not applicable to CH2M HILL.

- (2)

- Amounts shown include compensation earned by executive officers, whether paid during or after such year, or deferred at the election of those officers.

- (3)

- Amounts shown for 2001 include:

| | Deferred Paid

Time Off

| | Deferred Portion of LTIP Payout

| |

| |

|

|---|

| Ralph R. Peterson | | $ | 63,327 | | $ | 835,370 | | | | |

| Kenneth F. Durant | | | - | | | 202,320 | | | | |

| James J. Ferris | | | 29,622 | | | 278,438 | | | | |

| Samuel H. Iapalucci | | | 29,602 | | | 208,829 | | | | |

| Donald S. Evans | | | 36,797 | | | 233,392 | | | | |

- (4)

- Amounts shown represent the portion of the 1999 award of the long-term incentive plan which will be paid in 2002. The deferred portion of the LTIP Payout is included in Other Annual Compensation.

- (5)

- Amounts shown for 2001 include:

| | Retirement and Tax-

Deferred Savings Plan

| | Group Term Life Insurance Premiums

| | Executive Deferred Compensation Plan

| | Deferred Compensation Retirement Plan

| |

|---|

| Ralph R. Peterson | | $ | 8,908 | | $ | 3,326 | | $ | 40,850 | | $ | 1,565 | |

| Kenneth F. Durant | | | 13,600 | | | 792 | | | 7,838 | | | 49,200 | (a) |

| James J. Ferris | | | 8,908 | | | 2,332 | | | 17,104 | | | 1,470 | |

| Samuel H. Iapalucci | | | 8,952 | | | 1,403 | | | 17,081 | | | 557 | |

| Donald S. Evans | | | 8,908 | | | 978 | | | 17,503 | | | 625 | |

- (a)

- Amount represents contribution made to named executive officer in lieu of funding to a corporate owned life insurance policy for which he is not eligible.

CH2M HILL has not entered into employment agreements with its executive officers, who serve at the pleasure of CH2M HILL's Board of Directors. Therefore, since compensation for executive officers is comprised of salary, bonus and other incentive compensation, some of which are based on year-end performance results, CH2M HILL does not know the aggregate amount of compensation that will be paid to its executive officers in the current fiscal year.

Option Grants in the Last Fiscal Year

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

|---|

| | Number of

Securities

Underlying

Options

Granted (#)

| | Percent of

Total Options

Granted to

Employees in

Fiscal Year

| |

| |

|

|---|

| | Exercise

or Base Price

($/sh)

| | Expiration

Date

|

|---|

Name

| | 5%

| | 10%

|

|---|

| | Ralph R. Peterson | | 10,500 | | * | | $ | 9.75 | | 02/16/2006 | | $ | 28,284 | | $ | 62,501 |

| | Kenneth F. Durant | | - | | * | | | - | | - | | | - | | | - |

| | James J. Ferris | | 9,000 | | * | | | 9.75 | | 02/16/2006 | | | 24,244 | | | 53,572 |

| | Samuel H. Iapalucci | | 9,000 | | * | | | 9.75 | | 02/16/2006 | | | 24,244 | | | 53,572 |

| | Donald S. Evans | | 9,000 | | * | | | 9.75 | | 02/16/2006 | | | 24,244 | | | 53,572 |

| |

* Less than 1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year-End Option Values

No options were exercised by the Chief Executive Officer and the other four most highly compensated executive officers of CH2M HILL during the fiscal year ended December 31, 2001.

| | Number of Securities Underlying

Unexercised Options at FY-End (#)

| | Value of Unexercised In-the Money Options at FY-End

|

|---|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| | Ralph R. Peterson | | 16,800 | | 32,550 | | $ | 105,383 | | $ | 141,398 |

| | Kenneth F. Durant | | - | | - | | | - | | | - |

| | James J. Ferris | | 14,625 | | 28,125 | | | 91,811 | | | 122,681 |

| | Samuel H. Iapalucci | | 14,625 | | 28,125 | | | 91,811 | | | 122,681 |

| | Donald S. Evans | | 14,625 | | 28,125 | | | 91,811 | | | 122,681 |

2001 Long-Term Incentives

The following table sets forth information regarding long-term incentive plan opportunities that were granted to the chief executive officer and the other four most highly compensated executive officers of CH2M HILL. This long-term incentive plan was established effective January 1, 1999 and consists of a new 3-year program each year. The 2001 program will be paid out on or after the 3-year award period ending December 31, 2003. Generally, the payment of the awards will be 60 percent in common stock, valued at the date of payment, and 40 percent cash. The criteria for payout is based on specific long-term goals of earnings growth and strategic imperatives for CH2M HILL as well as individual goals.

Long-Term Incentive Awards in 2001(1)

| |

| | Estimated Future Payouts Under

Non-Stock Price-Based Plans

|

|---|

(a)

Name

| | (c)

Period Until Payout

| | (d)

Threshold

| | (e)

Target

| | (f)

Maximum

|

|---|

| | Ralph R. Peterson | | 3 years | | $ | 0 | | $ | 480,000 | | $ | 960,000 |

| | Kenneth F. Durant | | 3 years | | | 0 | | | 134,000 | | | 268,000 |

| | James J. Ferris | | 3 years | | | 0 | | | 140,016 | | | 280,032 |

| | Samuel H. Iapalucci | | 3 years | | | 0 | | | 138,000 | | | 276,000 |

| | Donald S. Evans | | 3 years | | | 0 | | | 134,016 | | | 268,032 |

- (1)

- Certain columns have been omitted because they are not applicable.

Deferred Compensation Plans

Messrs. Peterson, Durant, Ferris, Iapalucci and Evans are participants in the Deferred Compensation Plan (DCP). The plan provides for participants to defer up to 50 percent of base pay and 100 percent of incentive pay. Participants are vested 100 percent at all times. The plan is funded by corporate owned life insurance (COLI) inside a rabbi trust. Participants can choose to start distribution upon: (a) termination of employment, (b) retirement, or (c) date elected by the participant. Participants can choose payment in either a lump sum or through annual installments over 5, 10, or 15 years.

Messrs. Peterson, Durant, Ferris, Iapalucci and Evans are participants in the Executive Deferred Compensation Plan (EDCP). CH2M HILL will contribute 4.75 percent times base pay in excess of the IRS limitation on compensation for qualified plans, which during 2001 was $170,000 and currently is $200,000. Participants may defer up to an additional 4.75 percent of base pay in excess of the IRS limitation and CH2M HILL will match the contribution. Certain participants may also defer up to 100 percent of compensation in lieu of paid time off. They may also receive additional discretionary CH2M HILL contributions keyed to base pay. Participants are 100 percent vested at all times on deferrals and earnings on deferrals. CH2M HILL contributions vest over a six-year period. Both the DCP and the EDCP utilize a rabbi trust arrangement. Participants can choose to start distributions upon (a) termination of employment, (b) retirement, or (c) date elected by the participant. Participants can choose payment in either a lump sum or through an annual distribution over 5, 10 or 15 years.

Messrs. Peterson, Durant, Ferris, Iapalucci and Evans are participants in the Deferred Compensation Retirement Plan (DCRP). This plan provides for CH2M HILL to pay the "Account Value" to a participant, if the participant retires from CH2M HILL on or after age 65. The Account Value is equal to (a) the present value of the "Calculated Benefit" at age 65 minus (b) the cash surrender value of the split dollar life insurance policies used to fund this plan (after return of premiums paid by CH2M HILL). The DCRP is funded for eligible participants by COLI inside a rabbi trust. For those DCRP participants for which insurance is not available, CH2M HILL establishes a deferred compensation account on their behalf.

Participants are vested 100 percent of Account Values on reaching age 65. The benefits of the DCRP are funded by the offsetting benefit plans and the cash surrender value of the split dollar policies. To the extent that the offsetting benefit plans and the split dollar policies do not cover the cost of the benefit, the Account Values will be paid from CH2M HILL general assets. The same distribution criterion apply as the DCP and the EDCP.

Retirement Plans

Mr. Peterson is a participant in the CH2M HILL Pension Plan. Benefits under the CH2M HILL Pension Plan are equal to one percent of average base compensation (up to $150,000) for 1987 through 1991, multiplied by years of credited benefit service prior to 1992, plus one percent of each year's base compensation (up to $150,000) for each year of credited benefit service from January 1, 1992 through December 31, 1993. CH2M HILL Pension Plan benefits were frozen as of December 31, 1993. Mr. Peterson's estimated annual benefit payable at the earliest age when a participant may retire with an unreduced benefit (age 65) is $37,849.

Mr. Durant is a participant in the CH2M HILL Pension Plan with respect to credited benefit service prior to February 25, 1985, and he is a participant in the CH2M HILL Industrial Design Corporation Pension Plan with respect to credited benefit service from February 25, 1985 through January 31, 1994. The benefits under the CH2M HILL Industrial Design Corporation Pension Plan are equal to 1.3 percent of each year's base compensation (up to the applicable IRS compensation limit for each year) for each year of credited benefit service from February 25, 1985 through January 31, 1994. Benefits under the CH2M HILL Industrial Design Corporation Pension Plan were frozen as of January 31, 1994. The estimated annual benefits payable to Mr. Durant at the earliest age when a participant may retire with an unreduced benefit (age 65) are $15,718 from the CH2M HILL Pension Plan and $13,101 from the CH2M HILL Industrial Design Corporation Pension Plan, or a total of $28,819.

Mr. Evans is a participant in the CH2M HILL Pension Plan with respect to his credited benefit service prior to May 1, 1986, and he is a participant in the OMI Retirement Plan with respect to his credited benefit service from May 1, 1986 through December 31, 1995. Benefits under the OMI Retirement Plan are equal to 1.5 percent of average compensation (up to the applicable IRS compensation limit for each year) multiplied by the first 20 years of credited benefit service, plus 0.5 percent of average compensation (up to the applicable IRS compensation limit for each year) multiplied by credited benefit service in excess of 20 years. Mr. Evans' benefit under the OMI Retirement Plan was frozen as of December 31, 1995 upon his transfer from employment covered by the Plan. Mr. Evans' estimated annual benefit payable at the earliest age when a participant may retire with an unreduced benefit (age 65) is $23,521 under the OMI Retirement Plan and $12,771 under the CH2M HILL Pension Plan, or a total of $36,292.

Messrs. Iapalucci and Ferris are not participants in a company-sponsored pension plan.

Change of Control Agreements

The Board of Directors authorized CH2M HILL to enter into Change of Control Agreements with Messrs. Peterson, Durant, Ferris, Iapalucci and Evans as well as other certain Directors and Officers of CH2M HILL. The provisions of these agreements are described in the Compensation Committee Interlocks and Insider Participation section of this Proxy Statement.

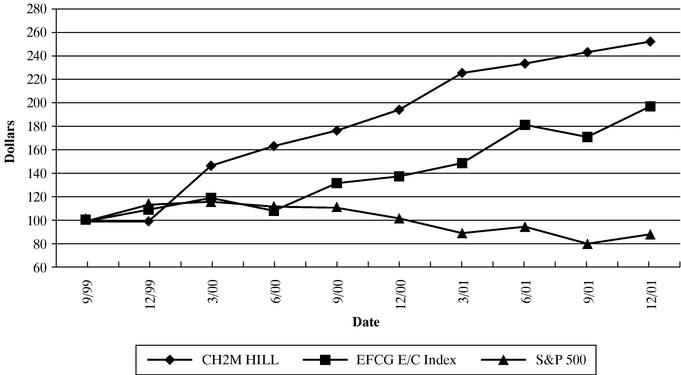

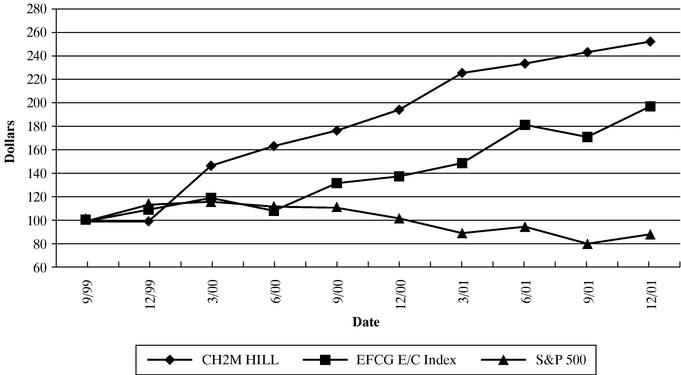

Stock Performance Graph

The following graph shows the total shareholder return on CH2M HILL's common stock from September 7, 1999 (the date CH2M HILL's registration with the U.S. Securities and Exchange Commission became effective) until December 31, 2001, for (i) CH2M HILL's common stock, (ii) the Standard & Poor's Composite – 500 Stock Index and (iii) the companies in the Environmental Financial Consulting Group's engineering/consulting industry index.

The graph assumes the investment of $100 in CH2M HILL common stock and in each of the indexes on September 7, 1999 and reinvestment of all dividends, if any. CH2M HILL does not currently anticipate paying any cash dividends on the common stock.

Proposal 2.Approval of Amendment of Payroll Deduction Stock Purchase Plan to increase the number of shares reserved under the Plan from 1,000,000 to 3,000,000 shares

On November 12, 1999, the Board of Directors of CH2M HILL adopted the CH2M HILL Companies, Ltd. Payroll Deduction Stock Purchase Plan. The stock purchase plan was subsequently approved by the shareholders of CH2M HILL. Under the stock purchase plan, employees of CH2M HILL and employees of certain affiliates of CH2M HILL may purchase common stock of CH2M HILL through payroll deductions, subject to certain limits. The Company may contribute a percentage of the purchase price of the common stock purchased by participants under the plan. Since the establishment of the stock purchase plan, CH2M HILL has contributed 10% of the purchase price of the common stock purchased by participants under the stock purchase plan.

The stock purchase plan as originally adopted reserved 1,000,000 shares of common stock for issuance under the stock purchase plan. As of December 31, 2001, a total of 1,461,731 shares of common stock had been issued by CH2M HILL under the stock purchase plan. The Board of Directors of CH2M HILL determined that the number of shares of common stock reserved for issuance under the stock purchase plan should be increased in order to continue selling shares of common stock directly to employees under the plan. Any amendment to increase the number of shares reserved under the plan requires shareholder approval within twelve months after the effective date of the amendment. The Board of Directors believes that stock ownership by competent, loyal, contributing employees and directors of, and consultants to, CH2M HILL and its affiliates will be of continuing benefit to CH2M HILL.

On August 10, 2001, the Board of Directors of CH2M HILL approved an increase in the number of shares of common stock reserved for issuance under the stock purchase plan from 1,000,000 shares to 3,000,000 shares. This increase in the number of shares of common stock reserved for issuance under the stock purchase plan was incorporated into an amended and restated stock purchase plan document that was approved by the Board of Directors of CH2M HILL on November 9, 2001. The amended and restated stock purchase plan document also made certain minor conforming changes in the provisions of the plan, relating in large part to the date of adopting the amendments. On February 15, 2002, the Board of Directors further amended the stock purchase plan so that each participant may elect payroll deductions of up to 15% (an increase from 10%) of the participant's compensation for the purchase of shares under the plan. These changes, other than the increase in reserved shares, do not require shareholder approval and are in effect.

During the year ended December 31, 2001, shares of common stock were purchased under the stock purchase plan at the weighted average price of $10.30 per share in the following amounts:

Named Executive Officers:

| | Number of Shares

|

|---|

| | Ralph R. Peterson | | 2,514 |

| | Kenneth F. Durant | | - |

| | James J. Ferris | | 2,466 |

| | Samuel H. Iapalucci | | 2,439 |

| | Donald S. Evans | | 2,285 |

Current executive officers as a group |

|

12,142 |

Current directors, who are not executive officers, as a group |

|

3,934 |

All employees, excluding executive officers and directors, as a group |

|

806,088 |

At December 31, 2001, approximately 10,332 employees were eligible to participate in the stock purchase plan.

The stock purchase plan and the Internal Revenue Code's provisions relevant to the Code section 423 component of the plan require shareholder approval of the increase in reserved shares. As a result, the shareholders are asked to vote on and approve the following resolution:

RESOLVED, that the shareholders approve the CH2M HILL Companies, Ltd. Payroll Deduction Stock Purchase Plan as amended and restated through February 15, 2002, which includes an increase in the number of shares of common stock of CH2M HILL reserved for issuance under the plan from 1,000,000 shares to 3,000,000 shares.

The required vote for approval under the stock purchase plan is a majority of the voting power of the common stock of CH2M HILL present or represented at the meeting of the shareholders. Abstentions will not be counted.

CH2M HILL's Board of Directors unanimously recommends that the shareholders vote "for" approval of the amended and restated stock purchase plan.

What are material features of the stock purchase plan?

The stock purchase plan provides for the purchase of common stock through payroll deductions by participating employees. The stock purchase plan has one component intended to qualify under Section 423 of the Internal Revenue Code. Shares purchased under that component will qualify for favorable tax treatment under the Code (the "423 component"). The second component provides for the purchase of shares which do not qualify for the favorable tax treatment (the "non-423 component"). To date, no purchases of shares have been made under the non-423 component. The stock purchase plan is not subject to ERISA. Other material terms are described below.

Who administers the stock purchase plan?

The stock purchase plan is currently administered by the Ownership and Incentive Compensation Committee ("O&IC Committee"). The O&IC Committee is appointed by the Board of Directors and has been selected by the President of CH2M HILL as the administrative committee. The O&IC consists of two or more members of the Board of Directors and other individuals appointed by the Board of Directors. Under the terms of the stock purchase plan, the administrative committee can be a committee with members determined by the President of CH2M HILL, with a minimum of two members.

The administrative committee decides which subsidiaries or other affiliates of CH2M HILL will be eligible to participate in the stock purchase plan. The administrative committee may adopt rules for the administration of the stock purchase plan. The administrative committee interprets the stock purchase plan.

Who is eligible?

Generally, all employees of CH2M HILL and any participating affiliate may participate in the stock purchase plan. Only subsidiary corporations in which CH2M HILL owns at least 50% of the total voting power may participate in the 423 component of the stock purchase plan.

The administrative committee has excluded employees whose customary employment is less than 20 hours per week or is less than five months in a year from participating in the stock purchase plan. Also, any employee who owns five percent or more of CH2M HILL or of any subsidiary of CH2M HILL is excluded from participating in the stock purchase plan. By the terms of the plan, these employees are ineligible to participate in the 423 component of the stock purchase plan. The administrative committee may also decide whether employees must meet other eligibility requirements.

An employee who terminates employment with CH2M HILL and all participating affiliates is no longer eligible to participate in the stock purchase plan. For this purpose, termination of employment includes death, disability, retirement, transfer to an affiliate that is not eligible to participate in the stock purchase plan, or any other termination of employment. If an employee becomes ineligible to continue participating in the stock purchase plan, any amount held in the employee's stock purchase account will be distributed to the employee.

How does an employee participate?

In order to participate in the stock purchase plan, an employee must complete a payroll deduction authorization form. The payroll deduction authorization form will tell the eligible employee's employer to withhold a specific percentage of the eligible employee's pay to be used to buy common stock under the stock purchase plan. The payroll deduction authorization form must provide for the deduction of at least one percent of the employee's pay, but no more than 15 percent of the employee's pay, in a whole number percentage.

Is there any limitation on shares purchased under the stock purchase plan?

An employee cannot purchase more than $25,000 of common stock under the stock purchase plan in any calendar year.

How is common stock acquired under the stock purchase plan?

CH2M HILL uses the amount in the employee's stock purchase account to buy common stock for the employee on each trade date. CH2M HILL will either buy the common stock on each trade date in the internal market, if available, or CH2M HILL will issue new shares of common stock to make common stock available for stock purchase plan buys. These stock purchases may be made on predetermined purchase dates established by the administrative committee, which coincide with dates that trades are conducted in the internal market. The purchase price for each share of common stock under the plan is the fair market value in effect at the date of purchase.

Does CH2M HILL contribute any amount of the purchase price for the common stock?

Each year, the Board of Directors will decide what percentage of the purchase price of common stock CH2M HILL will contribute toward the purchase of common stock under the stock purchase plan during that year. CH2M HILL's percentage may be as low as zero percent or as high as 15 percent. It is intended that CH2M HILL's percentage will be 10% for the 2002 year, which has been the percentage in past years. CH2M HILL will add the contribution percentage to the amount in the employee's stock purchase account and use the combined amount to purchase common stock on each trade date.

How many shares of common stock are reserved for purchase under the stock purchase plan?

CH2M HILL has reserved 3,000,000 shares of common stock to be sold under the stock purchase plan (subject to approval of the amended and restated plan by the shareholders). This is in addition to any shares of common stock bought in the internal market under the stock purchase plan. The number of shares of common stock reserved for sale under the stock purchase plan can be changed by the administrative committee to reflect any stock split, stock dividend, recapitalization, or similar transaction that CH2M HILL may experience.

Are the bylaw restrictions applicable to common stock bought through the stock purchase plan?

Yes. All shares of common stock bought through the stock purchase plan will be subject to the restrictions on common stock contained in CH2M HILL's Restated Bylaws.

An employee is not permitted to purchase common stock under the stock purchase plan if doing so would cause the employee to own more shares of common stock than the employee is permitted to own under CH2M HILL's Restated Bylaws.

Can CH2M HILL amend or terminate the stock purchase plan?

The Board of Directors of CH2M HILL may amend or terminate the stock purchase plan at any time. However, the Board of Directors may not increase the number of shares of common stock reserved for sale under the stock purchase plan unless the shareholders of CH2M HILL also approve that change.

Unless previously terminated by CH2M HILL, the stock purchase plan will terminate on December 31, 2007.

What are the federal income tax aspects of the stock purchase plan?

The federal income tax consequences of purchasing common stock under the stock purchase plan are described below. Sometimes the sale of shares of common stock bought through the stock purchase plan may produce compensation income to an employee. In that case, the employee's employer may be required to withhold federal, state, and local income taxes with respect to the amount of compensation income recognized by the employee.

This summary is intended to be general and is not intended to address every federal income tax issue that may arise from participation in the stock purchase plan. This summary does not address foreign, state or local tax issues, which may be significant.

Federal Income Tax Consequences for the Participant. With respect to most of the participating affiliates, the stock purchase plan is intended to qualify as an employee stock purchase plan under Section 423 of the Internal Revenue Code. This means that, with respect to purchases of common stock under the stock purchase plan by employees of those affiliates:

- •

- The participant will not recognize income for federal income tax purposes when the participant buys shares of common stock under the stock purchase plan.

- •

- The participant will recognize ordinary income when the participant disposes of the common stock bought under the stock purchase plan.

- •

- The amount of ordinary income recognized by the participant when the participant disposes of shares of common stock bought under the stock purchase plan depends on whether the participant held the shares for at least two years before disposing of them. If the participant held the shares for at least two years after the date on which the shares were bought for the participant's account under the stock purchase plan, the amount of the ordinary income is equal to the smaller of:

- i.

- the amount by which the fair market value on the purchase date exceeded the amount paid for the shares, or

- ii.

- the amount by which the fair market value on the date of disposition exceeds the amount paid for the shares.

- •

- If the participant dies while owning shares of common stock bought under the stock purchase plan, ordinary income is recognized in the year of death in the amount described in the previous sentence.