Use these links to rapidly review the document

TABLE OF CONTENTS

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

CH2M HILL COMPANIES, LTD. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

NOTICE OF 2003 ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

TABLE OF CONTENTS

CH2M HILL COMPANIES, LTD.

9191 South Jamaica Street

Englewood, CO 80112

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of CH2M HILL Companies, Ltd. will be held on Tuesday, May 6, 2003 at 10:00 a.m. Mountain Daylight Time, at CH2M HILL's headquarters, 9191 South Jamaica Street, Englewood, Colorado 80112 for the following purposes:

- 1.

- To elect five Directors to serve for three year terms.

- 2.

- To approve the Executive Officers Long Term Incentive Plan.

- 3.

- To ratify the appointment of KPMG LLP as the independent auditors of CH2M HILL for the fiscal year ending December 31, 2003.

- 4.

- To transact any other business that may properly come before the meeting at the time and place scheduled or, should the meeting be adjourned, at such time and place as it may be resumed.

Only shareholders of record owning shares of CH2M HILL's common stock at the close of business on March 28, 2003 will be entitled to vote at this meeting or at any postponements or adjournments thereof.

Your proxy is very important. You may vote your shares via the Internet, by telephone or by proxy card. Please see the accompanying instructions for more details on electronic and telephonic voting. Your proxy is revocable at any time prior to its use and the giving of your proxy will not affect your right to vote the shares you hold in your name if you decide to attend and vote at the meeting.

|

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

| | | Samuel H. Iapalucci

Executive Vice President, Chief Financial Officer

and Corporate Secretary |

Englewood, Colorado

March 28, 2003

CH2M HILL COMPANIES, LTD.

9191 South Jamaica Street

Englewood, CO 80112

PROXY STATEMENT

General Information

This proxy statement is being furnished to shareholders of CH2M HILL Companies, Ltd. in connection with the solicitation of proxies for use at the 2003 Annual Meeting of Shareholders of CH2M HILL to be held on May 6, 2003, at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. The record date for determining shareholders entitled to vote at the 2003 Annual Meeting was established by the Board of Directors to be March 28, 2003.

Your proxy is being solicited by the Board of Directors of CH2M HILL. This proxy statement and the accompanying materials are being delivered electronically or mailed to shareholders on or about April 7, 2003.

What is the Purpose of the Annual Meeting?

At our annual meeting, shareholders will have the opportunity to act on the matters discussed in the accompanying Notice of Annual Meeting of Shareholders. In addition to customary items such as the election of directors, shareholders are being requested to approve the Executive Officers Long Term Incentive Plan. CH2M HILL's management also will report on CH2M HILL's financial results and respond to questions from shareholders.

What Information Will I Receive?

We have included in this mailing a copy of the 2002 Annual Report to Shareholders on Form 10-K. The Annual Report includes audited financial statements for the fiscal year ending December 31, 2002 and other information about CH2M HILL. The Annual Report is not a part of the Proxy materials and it is not subject to Federal Securities Regulations 14A or 14C under the Securities Exchange Act of 1934, as amended.

Who Can Attend the Meeting?

All shareholders of record as of March 28, 2003 or their duly appointed proxies, may attend the meeting.

Who is Entitled to Vote?

Only shareholders of record owning shares of CH2M HILL common stock at the close of business on the record date, March 28, 2003, are entitled to vote at the meeting. Such shareholders will be able to vote only CH2M HILL shares of common stock that they held on the record date. Each outstanding share entitles its holder to cast one vote on each matter to be voted upon.

What Constitutes a Quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum, permitting the meeting to conduct its business. As of the record date, 31,393,775 shares of CH2M HILL's common stock were outstanding. Proxies received but marked as abstentions will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining a quorum.

1

How Do I Vote?

If you are a record holder of CH2M HILL shares of common stock as of March 28, 2003 you can vote in one of four ways:

- 1.

- Vote by internet—follow the instructions on the internet atwww.computershare.com/us/proxy

- 2.

- Vote by phone—call toll-free 1(877) 438-8312

- 3.

- Vote by proxy card—mark, sign, and date your proxy card and return it promptly

- 4.

- Vote in person—if you attend the meeting, you may deliver your completed proxy card in person

Can I Change My Vote After I Return My Proxy Card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with the Corporate Secretary of CH2M HILL at 9191 South Jamaica Street, Englewood, CO 80112 either a notice of revocation or a duly executed proxy bearing a later date as long as it is received by May 6, 2003 at 10:00 a.m. Mountain Daylight Time. Your proxy also will be revoked if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

How Do I Vote My Plan Shares?

If you participate in the CH2M HILL Retirement and Tax-Deferred Savings Plan, you have the right, if you choose, to instruct the trustee of the Plan how to vote the shares of common stock credited to your Plan account as well as a pro-rata portion of common stock credited to the accounts of other Plan participants and beneficiaries for which no instructions are received. Your instructions to the trustee of the Plan should be made by voting as discussed in "How Do I Vote?" above. The trustee of the Plan will vote your shares in accordance with your duly executed instructionswhich must be received by the trustee no later than 5:00 p.m. Mountain Daylight Time on May 2, 2003. If you do not send instructions regarding the voting of common stock credited to your Plan account, such shares shall be voted pro rata according to the voting instruction of other Plan participants. You may also revoke previously given instructions by filing with the trustee of the Plan no later than 5:00 p.m. Mountain Daylight Time on May 2, 2003 either written notice of revocation or a properly completed and signed voting instruction bearing a date later than the date of the prior instructions.

How will my proxy be voted?

Unless you give other instructions on your proxy card, the person named as proxy holder on the proxy card will vote in accordance with the recommendations of the Board of Directors as discussed in this proxy statement. With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes and abstentions.

How many votes are required for each proposal?

With respect to Proposal 1, a nominee for Director must receive the number of votes equal to a majority of the shares present or represented at the meeting and entitled to vote to be elected. Cumulative voting is not permitted in the election of Directors.

With respect to Proposal 2, the affirmative vote of a majority of the shares present or represented at the meeting and entitled to vote is required for approval.

2

Proposal 3 will be approved and adopted if the votes cast in favor of the proposal exceed the votes cast opposing the proposal.

How are abstentions treated?

A properly executed proxy marked "ABSTAIN" with respect to any matter will not be voted on that matter, although they will be counted for purposes of determining whether there is a quorum. Accordingly, in the election of Directors and with respect to Proposal 2, an abstention or "Withhold Authority" vote will have the effect of a negative vote. With respect to Proposal 3, an abstention will have no effect on the outcome of the vote because that proposal will be approved by a majority of the votes cast.

How will proxies be solicited?

Proxies will be solicited through electronic delivery or by mail, for those who do not have access to email. The cost of solicitation of the proxies will be paid by CH2M HILL. Officers, directors and regular employees of CH2M HILL, without additional compensation, also may solicit proxies by further mailing, by telephone or personal conversations. CH2M HILL has no plans to retain any firms or otherwise incur any extraordinary expense in connection with the solicitation.

Proposal 1.Election of Directors

The existing articles of incorporation and bylaws provide that the Board of Directors shall consist of at least nine and no more than thirteen Directors, subject to increase or decrease pursuant to resolutions of the Board of Directors. The current number of Directors is twelve. If all of the Director nominees are elected, the number of Directors will be thirteen. The bylaws provide that the Directors shall be elected to three-year staggered terms by dividing the Directors into three classes as equal in number as possible. Each Director shall serve until his/her respective successor is elected and qualified. A decrease in the number of Directors shall not shorten the term of any incumbent Director.

Pursuant to CH2M HILL's bylaws, the Nominating Committee proposes Ralph R. Peterson, M. Catherine Santee and Thomas G. Searle for election as directors for three-year terms expiring in 2006 and until their successors are elected and qualified or their earlier retirement, death, resignation or removal. The Board of Directors has nominated Barry L. Williams to continue his service as an outside Director for a three-year term expiring in 2006. In addition, the Board of Directors has nominated Carolyn Chin to serve as an outside Director for a three-year term expiring in 2006. To the best knowledge of the Board of Directors, all of the nominees are, and will be, able and willing to serve. In the event that any of the five nominees listed below should become unavailable to stand for election at the Annual Meeting, the proxy holders intend to vote for such other person, if any, as may be designated by the Board of Directors, in the place and stead of any nominee unable to serve.

Nominees for Election as Directors

Carolyn Chin, 55, has served as Chief Executive Officer of Cebiz since February 1999. She also has served as Chairman of C3 Partners, LLC, a consulting firm, since March 2002 and Chairman of the Board of Commtouch Software Ltd., a leader in email and messaging solutions, since August 2000. From April 2001 to January 2002, she served as Chairman and interim CEO for KindMark. Ms. Chin's prior experience includes Executive Vice President of Marketing, Sales and Business Development at MarketXT, Inc. from August 1999 to August 2000 and Executive Vice President and Chief Marketing Officer and Executive Board Member for Reuters America Inc. from February 1998 to February 1999. Prior to Reuters, Ms. Chin held a number of senior positions at IBM Corporation from March 1994 to February 1998.

3

Ralph R. Peterson, 58, has served as a Director and Chairman of CH2M HILL since May 2000 and as a Director for three previous terms from May 1981 to April 1984, from May 1986 to April 1989 and from May 1989 to April 1991. He has served as President and Chief Executive Officer of CH2M HILL since 1991. Mr. Peterson also serves as a Director of Kaiser-Hill Company, LLC and of StanCorp Financial Group.

M. Catherine Santee, 41, has served as Senior Vice President and Chief Financial Officer of the Infrastructure and Environmental business since 2000. Ms. Santee has been an employee of CH2M HILL since 1995 and has served in a wide range of financial roles, including Vice President and Chief Financial Officer for the Energy, Environment and Systems business from 1995 to 2000. Ms. Santee serves as a Director of CH2M HILL Hanford Group, Inc., CH2M HILL Mound, Inc. and Junior Achievement of Rocky Mountain, Inc.

Thomas G. Searle, 49, has served as Water Business Group Global Operations Director since 2000 and Water Business Group North American Operations Director from 1997 to 2000. Mr. Searle has been an employee of CH2M HILL since 1977 and has served in a wide range of project management and business management roles. Mr. Searle has been a Director of CH2M HILL Canada Limited since 2001 and serves on several committees of the CH2M HILL Board of Directors.

Barry L. Williams, 58, has served as a Director of CH2M HILL since 1995. He has been President of Williams Pacific Ventures, Inc., a consulting firm, since 1987 and President and CEO of American Management Association from 2000 until mid-2001. Mr. Williams has served as Senior Mediator for JAMS/Endispute since 1993 and a visiting lecturer for the Haas Graduate School of Business, University of California since 1993. Mr. Williams has acted as a general partner of WDG, a California limited partnership, from 1987 to 2002 and a general partner of Oakland Alameda Coliseum Joint Venture since 1998. He also serves as a Director of PG&E Corp., Northwestern Mutual Life Insurance Company, Synavant Inc., Newhall Land & Farming Company, Simpson Manufacturing Company, SLM Corporation, R.H. Donnelley Corporation and several private and not-for-profit organizations.

The Board of Directors recommends a vote FOR all of the above nominees for election as directors.

Continuing Directors

Kenneth F. Durant, 65, has served as a Director of CH2M HILL since May 2001, and from May 1994 to April 2000, and as a Senior Vice President since 1997. Mr. Durant has served as the President of CH2M HILL Industrial Design and Construction, Inc., a subsidiary of CH2M HILL, since its formation in 1985. Mr. Durant's term expires in 2004.

Donald S. Evans, 52, has served as a Director of CH2M HILL since May 2001, and from May 1990 to April 1996 and from May 1997 to April 2000, and as a Senior Vice President since 1997. Mr. Evans has served as the President of the Water business since 1995 and the Operations and Maintenance business since 1985. Mr. Evans' term expires in 2004.

James J. Ferris, 59, has served as a Director of CH2M HILL since May 2002 and from May 1998 to April 2001. Dr. Ferris has served as a Senior Vice President since 1995 and as President of the Energy, Environment and Systems business since 1995 and President of CH2M HILL Constructors, Inc. since 1994. Dr. Ferris also serves as a Director of Kaiser-Hill Company, LLC, CH2M HILL Hanford Group, Inc. and CH2M HILL Mound, Inc. Dr. Ferris' term expires in 2005.

Jerry D. Geist, 68, has served as a Director of CH2M HILL since May 1989. Mr. Geist has been Chairman of Santa Fe Center Enterprises, Inc. since 1990 and Chief Executive Officer of Howard International Utilities from 1990 through 2000. Mr. Geist was Chairman and CEO of Energy & Technology Company, Ltd. until June 2002. Mr. Geist serves as a Director of the Davis Family of Mutual Funds. Mr. Geist's term expires in 2004.

4

Steven D. Guttenplan, 54, has served as a Director of CH2M HILL since May 2001. Mr. Guttenplan has been an employee of CH2M HILL since 1978 and has served in various capacities, including as a Regional Manager of the North Atlantic Region, the Rocky Mountain Region and currently in the Northeast Region for CH2M HILL, Inc. Mr. Guttenplan's term expires in 2004.

Michael D. Kennedy, 53, has served as a Director of CH2M HILL since May 2002 and from May 1998 to April 2001. He also served as the President of CH2M HILL's Regional Operations between 1998 and March 2003. He currently serves as President of CH2M HILL's Transportation business. Mr. Kennedy served as a Senior Vice President since 1995 and as the Northwest Regional Manager of CH2M HILL, Inc. from 1993 to 1998. Mr. Kennedy's term expires in 2005.

David B. Price, 57, has served as a Director of CH2M HILL since May 2002. He served as President of Noveon, Inc., formerly BF Goodrich Performance Materials, from February 2001 to April 2001. Prior to joining Noveon, Inc., Mr. Price served as President and Chief Operating Officer of BF Goodrich Performance Materials and Executive Vice President of the BF Goodrich Company from 1997 to 2001. Mr. Price also spent 25 years with Monsanto Company, a global chemical company from 1972 to 1997. He currently serves as a Director of Tenneco Automotive. Mr. Price's term expires in 2005.

Nancy R. Tuor, 55, has served as a Director of CH2M HILL since May 2002 and from May 1994 to April 1996. Ms. Tuor has been an employee of CH2M HILL since 1980 and has served in numerous capacities, including Regional Manager of the South Atlantic Region. She is currently the Chief Operating Officer of Kaiser-Hill Company, LLC. Ms. Tuor's term expires in 2005.

Other Executive Officers

Joseph A. Ahearn, 66, has served as a Senior Vice President of CH2M HILL since 1995 and as Vice Chairman of the Board of Directors since February 2001. Mr. Ahearn served as President of CH2M HILL's Transportation business between 1996 and 2003 and as the Eastern Regional Manager of CH2M HILL, Inc. from 1994 until 1996. Mr. Ahearn also served as a Director of CH2M HILL from May 1996 to April 1999 and from May 2000 to April 2002.

Samuel H. Iapalucci, 50, has served as Executive Vice President of CH2M HILL since February 2001, and as Chief Financial Officer and Corporate Secretary of CH2M HILL since 1994. Mr. Iapalucci served as Senior Vice President of CH2M HILL from 1994 until February 2001.

Robert B. Sheh, 63, has served as Senior Vice President of CH2M HILL and CH2M HILL, Inc. and President of CH2M HILL's International business since June 2002. He served as Executive Vice President—Construction & Operations at Global Crossing Ltd. from February 1999 to 2001. Prior to joining Global Crossing, Mr. Sheh served as chief executive officer of Air and Water Technology from 1996 to 1997. Mr. Sheh also spent over 20 years with the Ralph M. Parsons Corporation, a worldwide engineering and construction firm from 1971 to 1992. He currently serves as a Director of Consolidated Contractors International Company and L. A. Sports Council.

CH2M HILL's executive officers are Joseph A. Ahearn, Kenneth F. Durant, Donald S. Evans, James J. Ferris, Samuel H. Iapalucci, Michael D. Kennedy, Ralph R. Peterson and Robert B Sheh.

There are no family relationships among any of the Directors, executive officers or nominees for Director of CH2M HILL.

5

Corporate Governance

Board of Directors

During the year ended December 31, 2002, the Board of Directors held five meetings. Each director attended all meetings of the Board of Directors and each of the committees of the Board of Directors on which such director served during 2002.

Committees of the Board

The Board of Directors has various standing committees, which are discussed below.

Audit and Finance Committee

The Audit and Finance Committee held four meetings during fiscal 2002. The current director members are James J. Ferris, Jerry D. Geist, Susan D. King, Gregory T. McIntyre, Ralph R. Peterson, David B. Price and Barry L. Williams (Chairman). The current non-director members are Ralph F. Cox, Thomas A. Dames and Thomas G. Searle. Ralph F. Cox serves as a consultant to the committee and actively participates in committee meetings on a regular basis.

The Audit and Finance Committee is responsible for CH2M HILL's financial processes and internal control environment. Its responsibilities include:

- •

- Appointing CH2M HILL's independent auditors,

- •

- Reviewing and evaluating the work and performance of CH2M HILL's internal auditors and its independent auditors,

- •

- Establishing procedures for (a) the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters and (b) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters,

- •

- Conferring with CH2M HILL's independent auditors and its internal auditors and financial officers to monitor CH2M HILL's internal accounting methods and procedures and evaluating any recommended changes therefrom,

- •

- Reviewing legislative or other business environment change conditions that could have a noticeable impact on CH2M HILL's financial controls and future operations,

- •

- Reviewing all acquisitions and/or investments that are valued in excess of $1.0 million,

- •

- Reviewing all individual capital expenditure items in excess of $5.0 million or more and monitoring capital expenditures relative to annual capital plans, and

- •

- Monitoring various financial measurements for the Company relative to established financial policies.

Audit Subcommittee

The Audit and Finance Committee has established an Audit Subcommittee consisting entirely of outside directors, which currently includes Jerry D. Geist, David B. Price and Barry L. Williams (Chairman). Ralph F. Cox serves as an independent consultant to the subcommittee and actively participates in committee meetings on a regular basis. The Audit Subcommittee meets independently of the regular Audit and Finance Committee. Each member of the Audit Subcommittee is independent in accordance with the definition provided in the National Association of Securities Dealers Rule 4200(a)(14) and complies in all material respects with the requirements of the Accounting and

6

Corporate Responsibilities (Sarbanes-Oxley) Act of 2002. The Audit Subcommittee operates under a written charter approved by the Board of Directors.

The following table presents fees for services rendered by our independent auditors, KPMG LLP for 2002 and Arthur Andersen LLP for 2001:

| | 2002

| | 2001

|

|---|

| | (in thousands)

|

|---|

| Audit fees | | $ | 446 | | $ | 421 |

| Audit-related fees (1) | | | 198 | | | 658 |

| | |

| |

|

| | Audit and audit-related fees | | | 644 | | | 1,079 |

| Tax fees (2) | | | 803 | | | 1,145 |

| | |

| |

|

| | Total fees | | $ | 1,447 | | $ | 2,224 |

| | |

| |

|

- (1)

- Audit-related fees include statutory audits of subsidiaries, benefit plan audits, acquisition due diligence, accounting consultation, various attest services under professional standards, assistance with registration statements and consents.

- (2)

- Tax fees consist of fees for tax consultation and tax compliance services.

There were no financial information systems design and implementation fees incurred in 2002 or 2001.

Report of the Audit Subcommittee

February, 2003

To the Board of Directors of CH2M HILL Companies, Ltd.

We have reviewed and discussed with management the Company's financial reporting process. Management has the primary responsibility for the financial statements and the reporting process. The Company's independent auditors are responsible for expressing an opinion on the conformity of our audited financial statements to generally accepted accounting principles.

We have reviewed and discussed with management and the independent auditors the audited financial statements for the fiscal year ended December 31, 2002. We have discussed with the independent auditors the matters required to be discussed by Statement of Auditing Standards No. 61,Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

We have received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1,Independence Discussions with Audit Committees, as amended by the Independence Standards Board, and have discussed with the auditors the auditors' independence from the Company and its management. We also have considered whether the independent auditors provision of other non-audit services to the Company is compatible with the auditors' independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the audited financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2002, for filing with the U.S. Securities and Exchange Commission.

Submitted by the CH2M HILL Companies, Ltd. Audit Subcommittee:

Barry L. Williams, Chairman

Ralph F. Cox

Jerry D. Geist

David B. Price

7

Compensation and Work Force Committee

The Compensation and Work Force Committee held four meetings during fiscal 2002. The current director members are Kenneth F. Durant, Donald S. Evans, James J. Ferris, Jerry D. Geist (Chairman), Ralph R. Peterson (non-voting member), David B. Price and Barry L. Williams. The current non-director members are Joseph A. Ahearn and Ralph F. Cox. Ralph F. Cox serves as a consultant to the committee and actively participates in committee meetings on a regular basis.

The Compensation and Workforce Committee has established an Executive Compensation Subcommittee consisting entirely of outside independent directors, which members currently include Jerry D. Geist (Chairman), David B. Price and Barry L. Williams. Ralph F. Cox serves as an independent consultant to the Subcommittee and actively participates in committee meetings on a regular basis. The Subcommittee is responsible for determining the senior executive compensation programs, including that of the Chief Executive Officer and Chairman of the Board and the other senior executive officers of CH2M HILL. The Subcommittee engages outside compensation consultants from time to time to advise it and CH2M HILL management on executive compensation matters.

Total compensation for CH2M HILL senior executive officers consists of salary, annual cash and stock bonuses and long-term incentives, which include stock options and an objective performance based long-term incentive bonus of cash and stock. The annual bonus and long-term incentives introduce risk to the total senior executive compensation programs. The compensation levels determined by the Subcommittee are variable, may fluctuate significantly from year to year, and are directly tied to company and individual performance.

The Subcommittee annually reviews the competitiveness of CH2M HILL's executive compensation programs within the industries in which it competes—Water, Environmental, Microelectronics, Transportation, Operations and Maintenance and Construction. CH2M HILL targets a level of total compensation of its competitor group for like positions and like performance.

The Subcommittee reviews executive compensation in light of Section 162(m) of the Internal Revenue Code which establishes a limit on the deductibility of annual compensation for certain executive officers that exceeds $1,000,000. It is the general intention of the Subcommittee to meet the requirements for deductibility under Section 162(m); however, the Subcommittee reserves the right, where merited by changing business conditions or an executive's individual performance, to authorize compensation payments which may not be fully deductible by CH2M HILL. The Subcommittee reviews this policy on an ongoing basis.

The Subcommittee is also responsible for issuing reports required by the U.S. Securities and Exchange Commission regarding CH2M HILL's compensation policies applicable to the Chief Executive Officer and the four other most highly compensated executive officers.

Report of the Compensation and Work Force Committee on Executive Compensation

February, 2003

To the Board of Directors of CH2M HILL Companies, Ltd.

CH2M HILL's compensation policies are based on a philosophy of market based compensation for its employees, including its Chief Executive Officer (CEO), and other executive officers. The company's compensation practices are aligned to this philosophy and are designed to reward performance and facilitate attraction, retention and motivation of executive staff in a manner which furthers the financial interest of our shareholders. Our compensation policy dictates that a substantial portion of executive officers' total compensation be at risk. By making executive officers' compensation contingent on individual performance, the performance of business units under their management, and the performance of CH2M HILL as a whole, CH2M HILL seeks to encourage continued executive focus on increasing CH2M HILL's revenue, profitability and shareholder value.

8

As is customary at other companies similar to CH2M HILL, a subcommittee of the Compensation and Work Force Committee consisting entirely of outside Directors (Executive Compensation Subcommittee) is responsible for establishing all compensation for the CEO, including base salary, incentive compensation, and stock option grants. The Subcommittee is also responsible for reviewing and approving all incentive compensation and stock option grant recommendations made by the CEO for other executive officers. These determinations are made after considering individual, corporate and business unit performance, the performance of our competitors and other similar businesses, and other relevant market compensation data. The Subcommittee retained the services of a well regarded executive compensation consulting firm (Independent Compensation Consultant) to assist it in carrying out its responsibilities through a comprehensive assessment of the various components of our executive compensation programs against relevant compensation data for our market. The Subcommittee with assistance of the Independent Compensation Consultant also utilized a variety of credible third party sources for executive compensation information and best practices to augment their own assessments.

The CEO's and other executive officers' compensation is comprised of three major components: base salary, short-term incentive compensation, and long-term incentive compensation, including stock options. By setting the annual salaries of our executive officers at or below competitive market levels, a significant portion of compensation is reserved for incentive at risk compensation. With 50% or more of total compensation represented by "at risk" short- and long-term variable components, executive officers' compensation is heavily dependent on their individual performance, performance of the business unit they are responsible for, and the company's performance as a whole during the prior fiscal year, in the case of short-term incentive compensation and over a longer period in the case of long-term incentives compensation.

The CEO's and other executive officers' incentive compensation may consist of cash, stock and stock options. Generally, annual incentives are awarded when prior fiscal year's results have been identified and reviewed against that individual's business unit performance and objective company-wide performance goals. By awarding part of the incentive pay in CH2M HILL stock, CH2M HILL seeks to encourage individuals to remain with the company, and focus on the long-term performance of CH2M HILL and maximize our shareholder value. Annual stock option grants are made to further encourage the focus on growing shareholder value over time. Further, the exercise price of all stock options granted is equal to the price of the common stock on the date of grant. Therefore, such stock options only have value to the extent that the price of CH2M HILL's stock increases during the term of the stock option.

In determining the CEO's and other executive officers' compensation paid in 2002, the Subcommittee took into account CH2M HILL's performance relative to plan, performance relative to market benchmarks, how well the CEO and executive officers performed on their personal goals and objectives, and their compensation as compared to peers in the market place. The short-term incentive compensation awards granted to these executives were determined in major part by the company's financial performance during the fiscal year ended December 31, 2001.

During the past year, Mr. Peterson was paid an annual base salary of $640,000. After deliberation, the Subcommittee set Mr. Peterson's annual base salary at $700,000 for fiscal year 2003, which represents a 9.4% increase over his base salary for the prior year. Our Independent Compensation Consultant believes this increase will bring Mr. Peterson's base salary marginally within the market competitive range when compared to base salaries of chief executive officers of engineering and construction companies of similar size. The Subcommittee believes that base salary increase is warranted given CH2M HILL's performance during the prior year and goals and challenges for the company and the industry in the coming year.

In 2003, Mr. Peterson was paid a short-term incentive compensation award of $525,000 for fiscal year 2002. The Subcommittee believes that this award was warranted by CH2M HILL's performance

9

against its market metrics during 2002—CH2M HILL's gross revenues grew by 3.0%, profit after tax grew by 6.2% and CH2M HILL stock price appreciated by 6.1%.

Our long-term incentive compensation program was instituted in 1999. The program is built around the concept of incentive compensation based on the company's aggregate performance over a three-year period. The long-term incentive bonus payment for the 2000 LTI Program was made this year based on awards, goals and objectives set three years ago in 2000. Just as with every other executive officer at CH2M HILL, Mr. Peterson's long-term incentive compensation objectives were set based on targeted profit before taxes and incentive compensation accruals over a three-year period and share price growth over the same period. During the relevant period of 2000 through 2002, CH2M HILL exceeded the target for profit before taxes and incentive compensation accruals by approximately 54%. During the same period, CH2M HILL share price grew by more than 88%.

After deliberations, the Subcommittee determined that Mr. Peterson's 2000 long-term incentive compensation award to be payable in 2003 should be $1,171,152. The Subcommittee believes that the award is in line with the objectives of CH2M HILL's long-term incentive compensation program, is in strict compliance with the program's objective performance measures, and is warranted given the company's outstanding performance during the last three years. The Subcommittee awarded Mr. Peterson 10,500 stock options, in accordance with the CH2M HILL Companies, Ltd. Amended and Restated 1999 Stock Option Plan.

Our Independent Compensation Consultant has reviewed the aforementioned 2003 compensation determinations for Mr. Peterson and advised us that Mr. Peterson's total compensation (base salary and incentive compensation) for 2003 will fall below market by 19.4% when compared to the median total compensation of chief executive officers of engineering and construction companies of similar size and performance. The Subcommittee would like to emphasize that Mr. Peterson's below market compensation is not a reflection of the Subcommittee's opinion of Mr. Peterson's performance but rather the outcome of Mr. Peterson's desire not to accelerate his compensation to market levels in prior years. Although the Subcommittee supports a philosophy of conservative and measured adjustments which allow closing the gap over time, it may consider adjustments at a later point, once a clearer market picture emerges in terms of executive compensation components.

The Subcommittee also reviewed the compensation for each of CH2M HILL's executive officers in 2002. Based on the review of relevant survey data and advice received from an Independent Compensation Consultant, the Subcommittee determined that the compensation of these executive officers was within or slightly below the comparable market level in 2002 for executives with comparable duties and responsibilities in engineering and construction companies of CH2M HILL's size. The executive officers' compensation for 2003 has been set to correspond to the market level for these positions.

While the Subcommittee believes that all of CH2M HILL's long-term incentive programs are based on objective performance goals, it recommends that CH2M HILL implement a special executive long-term compensation program that would be compliant with the requirements of the IRS section 162(m) to assure full deductibility for senior executive compensation.

The Subcommittee believes that the compensation policies, plans and programs implemented at CH2M HILL have encouraged management to focus on the long-term financial performance of the company and have contributed to achieving CH2M HILL's technical and financial success.

Executive Compensation Subcommittee:

Jerry D. Geist, Chairman

David B. Price

Barry L. Williams

10

Executive Committee

The Executive Committee held one meeting during fiscal 2002. The current director members are Kenneth F. Durant, Donald S. Evans, Jerry D. Geist, Ralph R. Peterson (Chairman), David B. Price and Barry L. Williams. Ralph F. Cox is a non-voting participant and consultant to the committee, and actively participates in committee meetings on a regular basis. The Executive Committee, except as limited by Oregon law, may exercise any of the powers and perform any of the duties of the Board of Directors if delegated by the Board of Directors.

Nominating Committee

The Nominating Committee held one meeting during fiscal 2002. The current director members are Michael D. Kennedy, Gregory T. McIntyre and Ralph R. Peterson (Chairman, non-voting). The current non-director members are Robert C. Allen and Richard A. Hirsekorn. The Nominating Committee's responsibilities include:

- •

- Establishing a procedure for identifying employee nominees for election as directors to the Board of Directors,

- •

- Reviewing and recommending to the Board of Directors criteria for membership on the Board, and

- •

- Proposing employee nominees to fill vacancies on the Board of Directors as they occur.

CH2M HILL's bylaws provide that shareholders may nominate directors outside of the Nominating Committee process by petition signed by shareholders representing at least 10% of the outstanding shares of common stock and by complying with the appropriate U.S. Securities and Exchange Commission Proxy Rules, regarding among other things, the deadlines for submitting nominee candidates.

Ownership and Incentive Compensation Committee

The Ownership and Incentive Compensation Committee held eight meetings during fiscal 2002. The current director members are Kenneth F. Durant, Donald S. Evans, James J. Ferris, Steven D. Guttenplan, Michael D. Kennedy (Chairman), Susan D. King, Gregory T. McIntyre, Ralph R. Peterson and Nancy R. Tuor. The current non-director members are Joseph A. Ahearn, Bevin A. Beaudet, Eugene A. Lupia and Edward M. Stanley.

The Ownership and Incentive Compensation Committee's responsibilities include:

- •

- Developing policies and procedures for the Board of Directors approval governing the ownership and incentive compensation programs for CH2M HILL,

- •

- Monitoring the stock ownership program,

- •

- Allocating funds for employee incentive plans,

- •

- Monitoring the long-term incentive program,

- •

- Monitoring the activities of, and acting on recommendations from, the Stock Option Management Committee,

- •

- Acting in synergy with the Compensation and Work Force Committee to support their approvals of executive compensation,

- •

- Acting in synergy with the Audit and Finance Committee, and as an extension of the Board of Directors, to oversee the application of the policies and procedures, and

- •

- Recommending Board of Director action as appropriate to achieve CH2M HILL's mission and goals.

11

Strategic Planning Group

The Strategic Planning Group held three meetings during fiscal 2002. The current director members are Kenneth F. Durant, Donald S. Evans, James J. Ferris, Jerry D. Geist, Steven D. Guttenplan, Susan D. King, Gregory T. McIntyre, Ralph R. Peterson (Chairman), David B. Price, Nancy R. Tuor and Barry L. Williams. The current non-director members are Joseph A. Ahearn, Robert C. Allen, Ralph F. Cox, Samuel H. Iapalucci, David W. Miller (non-voting participant) and Robert B. Sheh. Ralph F. Cox serves as a consultant to the committee and actively participates in committee meetings on a regular basis. The Strategic Planning Group's responsibilities include reviewing the long-range plans of CH2M HILL.

Outside Director Search/Review Committee

The Outside Director Search/Review Committee held four meetings during fiscal 2002. The current director members are Jerry D. Geist, Susan D. King (Chairman), Ralph R. Peterson, David B. Price, Nancy R. Tuor and Barry L. Williams. The current non-director members are Ralph F. Cox and David W. Miller (non-voting participant). Ralph F. Cox serves as a consultant to the committee and actively participates in committee meetings on a regular basis. The Outside Director Search/Review Committee's responsibilities include seeking qualified candidates for director who are not employees of CH2M HILL and whose backgrounds and expertise will add valuable skills and perspectives to the Board of Directors.

Directors' Compensation

Non-employee directors of CH2M HILL receive an annual retainer of $25,000 and an additional $4,000 for each committee on which they serve as the chairman. CH2M HILL also pays non-employee directors a meeting fee of $1,000 for attendance at each Board of Directors meeting and $1,000 for attendance at each committee meeting up to $2,000 per day. Directors are reimbursed for expenses incurred in connection with attendance at meetings and other CH2M HILL functions. In 2002, Messrs. Geist and Williams each received a discretionary bonus of $18,000 and 2,000 stock options in recognition of their service in the prior year as a non-employee director.

Security Ownership of Certain Shareholders and Management

The following tables set forth information regarding the ownership of all classes of CH2M HILL's voting securities as of March 28, 2003, by (a) any person or group known to have ownership of more than five percent of the common stock and (b) beneficial ownership by Directors, Director nominees, and executive officers individually and as a group.

Security Ownership of Certain Shareholders

The following table presents information as of March 28, 2003, concerning the only known shareholder who owns five percent or more of CH2M HILL's common stock.

Name and Address of Shareholder

| | Title of

Class

| | Number of

Shares Held

| | Percent

of Class

| |

|---|

| Trustees of the CH2M HILL Retirement and Tax-Deferred Savings Plan | | Common | | 13,471,738(1 | ) | 42.9 | % |

| | 9191 South Jamaica Street | | | | | | | |

| | Englewood, CO 80112 | | | | | | | |

- (1)

- Common shares are held of record by the Trustees for the accounts of participants in the Retirement and Tax-Deferred Savings Plan and will be voted in accordance with instructions received from participants. Shares as to which no instructions are received will be voted pro rata in accordance with the voting instructions submitted by all other plan participants.

12

Security Ownership of Directors, Director Nominees and Executive Officers

The following table sets forth information as of March 28, 2003 as to the beneficial ownership of CH2M HILL's equity securities by each Director, Director nominee, executive officer and by all Directors, Director nominees, and executive officers as a group. None of the individuals listed below owns directly more than one percent of the outstanding shares of CH2M HILL. As a group, all Directors, Director nominees, and executive officers own 6.7% of the outstanding shares of CH2M HILL.

Name of Beneficial Owner

| | Common

Stock Held

Directly

| | Common

Stock Held

Indirectly(1)

| | Stock Options

Exercisable

Within 60 Days

| | Total

Beneficial

Ownership

|

|---|

| Joseph A. Ahearn | | 64,957 | | 57,463 | | 40,500 | | 162,920 |

| Carolyn Chin | | — | | — | | — | | — |

| Kenneth F. Durant | | 193,372 | | 129,555 | | — | | 322,927 |

| Donald S. Evans | | 203,663 | | 67,033 | | 40,500 | | 311,196 |

| James J. Ferris | | 88,301 | | 72,619 | | 40,500 | | 201,420 |

| Jerry D. Geist | | 2,000 | | — | | 3,500 | | 5,500 |

| Steven D. Guttenplan | | 73,946 | | 43,713 | | 20,255 | | 137,914 |

| Samuel H. Iapalucci | | 85,602 | | 71,456 | | 40,500 | | 197,558 |

| Michael D. Kennedy | | 77,157 | | 70,948 | | 40,500 | | 188,605 |

| Ralph R. Peterson | | 287,928 | | 79,992 | | 46,725 | | 414,645 |

| David B. Price | | 2,000 | | — | | — | | 2,000 |

| M. Catherine Santee | | 19,868 | | 23,365 | | 9,625 | | 52,858 |

| Thomas G. Searle | | 46,853 | | 39,974 | | 20,255 | | 107,082 |

| Robert B. Sheh | | 1,997 | | 4,487 | | 500 | | 6,984 |

| Nancy R. Tuor | | 3,956 | | 7,882 | | 5,000 | | 16,838 |

| Barry L. Williams | | 2,000 | | — | | 3,500 | | 5,500 |

| All directors, director nominees and executive officers as a group (16 people) | | 1,153,600 | | 668,487 | | 311,860 | | 2,133,947 |

- (1)

- Includes common stock held through the Retirement and Tax-Deferred Savings Plan and the deferred compensation plan trusts.

Compensation Committee Interlocks and Insider Participation

CH2M HILL's Executive Compensation Subcommittee was formed to establish all compensation for the CEO and for reviewing and approving all compensation recommendations made by the CEO for other executive officers. The Subcommittee members currently include Jerry D. Geist (Chairman), David B. Price and Barry L. Williams. No interlocking relationship exists between any member of the Board of Directors or the Executive Compensation Subcommittee and the board of directors or compensation committee of any other company.

Change of Control Agreements

The Board of Directors authorized CH2M HILL to enter into Change of Control Agreements (COC Agreements) with Joseph A. Ahearn, Kenneth F. Durant, Donald S. Evans, James J. Ferris, Steven D. Guttenplan, Samuel H. Iapalucci, Michael D. Kennedy, Susan D. King, Gregory T. McIntyre, Ralph R. Peterson, Robert B. Sheh and Nancy R. Tuor; and subject to their election to the Board of Directors, M. Catherine Santee and Thomas G. Searle (each hereafter a COC Executive). Mr. McIntyre's and Ms. King's COC Agreements will be terminated in 2003 once they complete their service on the Board of Directors, but will remain in effect for six months following the date of such termination. The provisions of these agreements will become effective if and when there is a Change of Control (as that term is defined below) of CH2M HILL and, with respect to most benefits, only if the COC Executive is terminated within twenty-four months of such Change of Control. All of the COC Agreements, in effect at that time, were automatically renewed for an additional one year period on

13

March 31, 2003. The Agreements automatically renew for successive one-year terms on the anniversary date of the COC Agreement unless CH2M HILL gives notice to the COC Executives that it does not intend to extend the Agreement or intends to change its terms (such notice cannot be given during the pendency of a potential Change of Control). If a Change of Control occurs, the expiration date of the Agreements will automatically extend for twenty-four months beyond the month in which the Change of Control occurs.

Under the Change of Control Agreements, CH2M HILL will provide each COC Executive with the following benefits at the time the Change of Control event occurs:

- •

- Immediate vesting in all retirement plans and of all outstanding options;

- •

- Pro-rata payout of amounts payable under the Short-Term Incentive Plan for the year of termination; and

- •

- Pro-rata payout of amounts payable under the Long-Term Incentive Plan.

CH2M HILL will provide each COC Executive with the following additional benefits in the event of termination of their employment (actual or constructive and other than for cause) by CH2M HILL or its successor in interest within twenty-four months of a Change of Control:

- •

- For the CEO and direct reports, lump-sum payments in the amount equal to 2.99 times the sum of (a) annual base salary in effect at the time the Change of Control occurs and (b) target annual incentive bonus payable under the Short-Term Incentive Plan;

- •

- For the other COC Executives, lump-sum payments in the amount equal to 1.5 times the sum of (a) annual base salary in effect at the time the Change of Control occurs and (b) target annual incentive bonus payable under the Short-Term Incentive Plan;

- •

- Continuation of health benefits for 36 months for CEO and direct reports and continuation for 18 months for other COC Executives.

- •

- Immediate vesting of all option, restricted stock and other inecentive grants and long-term incentive pay.

For purposes of the Change of Control Agreements, a "Change of Control" is defined generally to include:

- •

- Acquisition of 25% (or more) of the voting securities of CH2M HILL;

- •

- A significant merger or consolidation where CH2M HILL shareholders hold less than 75% of all shares outstanding of the surviving company;

- •

- A change in the majority of the Board of Directors, not otherwise recommended by the Board of Directors, during the course of one fiscal year; and

- •

- Liquidation or dissolution of CH2M HILL, or direct or indirect sale or other disposition of all or substantially all of the assets of CH2M HILL.

14

Executive Compensation

The following table sets forth information regarding annual incentive compensation for the chief executive officer and the other four most highly compensated executive officers of CH2M HILL.

Summary Compensation Table(1)

| | Annual Compensation

| | Long-Term Compensation

| |

|

|---|

(a)

| | (b)

| | (c)

| | (d)

| | (e)

| | (g)

| | (h)

| | (i)

|

|---|

| |

| |

| |

| |

| | Awards

| | Payouts

| |

|

|---|

Name and principal position

| | Year

| | Salary(2)($)

| | Bonus(2)($)

| | Other Annual

Compensation(3)($)

| | Securities

Underlying

Options(#)

| | LTIP

Payouts(4)($)

| | All Other

Compensation(5)($)

|

|---|

Ralph R. Peterson

President & Chief Executive Officer | | 2002

2001

2000 | | 639,267

597,862

509,819 | | 525,000

530,000

480,000 | | 1,009,261

898,697

— | | 10,500

10,500

10,500 | | 228,375

249,526

— | | 59,237

54,649

113,276 |

James J. Ferris

Senior Vice President |

|

2002

2001

2000 |

|

369,646

349,274

309,640 |

|

285,000

290,000

270,000 |

|

328,933

308,060

— |

|

9,000

9,000

9,000 |

|

74,405

69,610

— |

|

31,944

29,814

65,553 |

Donald S. Evans

Senior Vice President |

|

2002

2001

2002 |

|

368,954

353,763

456,116 |

|

260,000

250,000

260,000 |

|

269,009

270,189

— |

|

9,000

9,000

9,000 |

|

141,369

109,832

— |

|

27,909

28,014

58,571 |

Samuel H. Iapalucci

Executive Vice President, Chief Financial Officer & Corporate Secretary |

|

2002

2001

2000 |

|

367,066

356,009

334,179 |

|

260,000

275,000

270,000 |

|

257,896

238,431

— |

|

9,000

9,000

9,000 |

|

151,200

139,219

— |

|

28,228

27,993

56,716 |

Michael D. Kennedy

Senior Vice President |

|

2002

2001

2000 |

|

309,642

289,287

253,073 |

|

220,000

220,000

210,000 |

|

202,116

151,776

— |

|

9,000

9,000

9,000 |

|

114,009

93,024

— |

|

22,629

28,109

47,787 |

- (1)

- Certain columns have been omitted because they are not applicable to CH2M HILL.

- (2)

- Amounts shown include compensation earned by executive officers, whether paid during or after such year, or deferred at the election of those officers.

- (3)

- Amounts shown for 2002 include:

| | Deferred Paid

Time Off

| | Deferred Portion of

LTIP Payout

|

|---|

| Ralph R. Peterson | | $ | 66,484 | | $ | 942,777 |

| James J. Ferris | | | 31,314 | | | 297,619 |

| Donald S. Evans | | | 38,355 | | | 230,654 |

| Samuel H. Iapalucci | | | 31,096 | | | 226,800 |

| Michael D. Kennedy | | | 16,102 | | | 186,014 |

- (4)

- Amounts shown for 2002 represent the portion of the 2000 award of the long-term incentive plan which will be paid in 2003. The deferred portion of the LTIP Payout is included in Other Annual Compensation.

- (5)

- Amounts shown for 2002 include:

| | Retirement and Tax-

Deferred Savings Plan

| | Group Term Life

Insurance Premiums

| | Executive Deferred

Compensation Plan

| | Deferred

Compensation

Retirement Plan

|

|---|

| Ralph R. Peterson | | $ | 9,880 | | $ | 5,726 | | $ | 41,802 | | $ | 1,829 |

| James J. Ferris | | | 9,880 | | | 4,194 | | | 16,152 | | | 1,718 |

| Donald S. Evans | | | 9,880 | | | 1,257 | | | 16,078 | | | 694 |

| Samuel H. Iapalucci | | | 9,880 | | | 1,828 | | | 15,907 | | | 613 |

| Michael D. Kennedy | | | 9,880 | | | 1,679 | | | 10,452 | | | 618 |

15

CH2M HILL has not entered into employment agreements with its executive officers, who serve at the pleasure of CH2M HILL's Board of Directors. Therefore, since compensation for executive officers is comprised of salary, bonus and other incentive compensation, some of which are based on year-end performance results, CH2M HILL does not know the aggregate amount of compensation that will be paid to its executive officers in the current fiscal year.

Option Grants in the Last Fiscal Year

| |

| |

| |

| |

| | Potential Realizable

Value at Assumed

Annual Rates of

Stock Price

Appreciation for

Option Term

|

|---|

| | Number of

Securities

Underlying

Options

Granted(#)

| |

| |

| |

|

|---|

| | Percent of Total Options

Granted to

Employees in

Fiscal Year

| | Exercise

or Base

Price

($/sh)

| |

|

|---|

Name

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Ralph R. Peterson | | 10,500 | | * | | 11.21 | | 02/15/2007 | | 32,520 | | 71,860 |

| James J. Ferris | | 9,000 | | * | | 11.21 | | 02/15/2007 | | 27,874 | | 61,594 |

| Donald S. Evans | | 9,000 | | * | | 11.21 | | 02/15/2007 | | 27,874 | | 61,594 |

| Samuel H. Iapalucci | | 9,000 | | * | | 11.21 | | 02/15/2007 | | 27,874 | | 61,594 |

| Michael D. Kennedy | | 9,000 | | * | | 11.21 | | 02/15/2007 | | 27,874 | | 61,594 |

- *

- Less than 1%

Fiscal Year-End Option Values

No options were exercised by the Chief Executive Officer and the other four most highly compensated executive officers of CH2M HILL during the fiscal year ended December 31, 2002.

| | Number of Securities Underlying

Unexercised Options

at FY-End(#)

| | Value of Unexercised In-the Money Options

at FY-End($)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Ralph R. Peterson | | 36,225 | | 23,625 | | 238,418 | | 45,806 |

| James J. Ferris | | 31,500 | | 20,250 | | 207,630 | | 39,263 |

| Donald S. Evans | | 31,500 | | 20,250 | | 207,630 | | 39,263 |

| Samuel H. Iapalucci | | 31,500 | | 20,250 | | 207,630 | | 39,263 |

| Michael D. Kennedy | | 31,500 | | 20,250 | | 207,630 | | 39,263 |

2002 Long-Term Incentives

The following table sets forth information regarding long-term incentive plan opportunities that were granted to the chief executive officer and the other four most highly compensated executive officers of CH2M HILL. This long-term incentive plan was established effective January 1, 1999 and consists of a new 3-year program each year. The 2002 program will be paid out on or after the 3-year award period ending December 31, 2004. Generally, the payment of the awards will be 60 percent in common stock, valued at the date of payment, and 40 percent cash. The criteria for payout is based on specific long-term goals of earnings growth and strategic imperatives for CH2M HILL as well as individual goals.

16

Long-Term Incentive Awards in 2002(1)

| |

| | Estimated Future Payouts Under

Non-Stock Price-Based Plans

|

|---|

(a)

Name

| | (c)

Period Until Payout

| | (d)

Threshold($)

| | (e)

Target($)

| | (f)

Maximum($)

|

|---|

| Ralph R. Peterson | | 3 years | | 0 | | 576,018 | | 1,152,036 |

| James J. Ferris | | 3 years | | 0 | | 185,010 | | 370,020 |

| Donald S. Evans | | 3 years | | 0 | | 175,020 | | 350,040 |

| Samuel H. Iapalucci | | 3 years | | 0 | | 182,520 | | 365,040 |

| Michael D. Kennedy | | 3 years | | 0 | | 155,010 | | 310,020 |

- (1)

- Certain columns have been omitted because they are not applicable.

Equity Compensation Plan Information

The following information is provided as of December 31, 2002 with respect to compensation plans pursuant to which CH2M HILL may grant equity awards to eligible persons. The table does not include information about the proposed ELTI Plan. See Note 15 to the Consolidated Financial Statements, contained in CH2M HILL's Annual Report on Form 10-K for the year ended December 31, 2002, for descriptions of the equity compensation plans.

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding

options, warrants

and rights

| | Number of securities

remaining available for future

issuance under equity

compensation plans

(excluding securities

reflected in column(a))

| |

|---|

| | (a)

| | (b)

| | (c)

| |

|---|

| Equity compensation plans approved by security holders(1) | | 4,583,566 | | $ | 7.38 | | 3,501,288(2 | ) |

| Equity compensation plans not approved by security holders(3) | | 1,597,218(4 | ) | $ | — | (5) | — (6 | ) |

| | |

| |

| |

| |

| Total | | 6,180,784 | | $ | 7.38 | | 3,501,288 | |

| | |

| |

| |

| |

- (1)

- The equity compensation plans approved by security holders include the 1999 Stock Option Plan and the Payroll Deduction Stock Purchase Plan (PDSPP).

- (2)

- Includes 2,833,551 shares reserved for future issuance under the Stock Option Plan and 667,737 shares available for purchase under PDSPP.

- (3)

- The equity compensation plans not approved by security holders include the Short Term Incentive Plan (STIP) and Long Term Incentive Plan (LTIP).

- (4)

- Includes 955,282 shares to be issued under the STIP and 641,937 shares to be issued under the LTIP during the first quarter of 2003.

- (5)

- The STIP and LTIP shares will be issued at a price of $11.89 during the first quarter of 2003.

- (6)

- Shares available for future issuance under the STIP and LTIP (excluding shares reflected in column (a)) are not determinable until the end of each fiscal year.

17

Deferred Compensation Plans

Messrs. Peterson, Ferris, Evans, Iapalucci and Kennedy are participants in the Deferred Compensation Plan (DCP). The plan provides for participants to defer up to 50 percent of base pay and 100 percent of incentive pay. Participants are vested 100 percent at all times. The plan is funded by corporate owned life insurance (COLI) inside a rabbi trust. Participants can choose to start distribution upon: (a) termination of employment, (b) retirement, or (c) date elected by the participant. Participants can choose payment in either a lump sum or through annual installments over 5, 10, or 15 years.

Messrs. Peterson, Ferris, Evans, Iapalucci and Kennedy are participants in the Executive Deferred Compensation Plan (EDCP). CH2M HILL will contribute 4.75 percent times base pay in excess of the IRS limitation on compensation for qualified plans, which during 2002 was $200,000. Participants may defer up to an additional 4.75 percent of base pay in excess of the IRS limitation and CH2M HILL will match the contribution. Certain participants may also defer up to 100 percent of compensation in lieu of paid time off. They may also receive additional discretionary CH2M HILL contributions keyed to base pay. Participants are 100 percent vested at all times on deferrals and earnings on deferrals. CH2M HILL contributions vest over a six-year period. Both the DCP and the EDCP utilize a rabbi trust arrangement. Participants can choose to start distributions upon (a) termination of employment, (b) retirement, or (c) date elected by the participant. Participants can choose payment in either a lump sum or through an annual distribution over 5, 10 or 15 years.

Messrs. Peterson, Ferris, Evans, Iapalucci and Kennedy are participants in the Deferred Compensation Retirement Plan (DCRP). This plan provides for CH2M HILL to pay the "Account Value" to a participant, if the participant retires from CH2M HILL on or after age 65. The Account Value is equal to (a) the present value of the "Calculated Benefit" at age 65 minus (b) the cash surrender value of the split dollar life insurance policies used to fund this plan (after return of premiums paid by CH2M HILL). The DCRP is funded for eligible participants by COLI inside a rabbi trust. For those DCRP participants for whom insurance is not available, CH2M HILL establishes a deferred compensation account on their behalf.

"Calculated Benefit" means:

- (i)

- 50% of the participant's projected base pay at age 65 (assuming a 5% increase in base pay each year) payable each year from the first of the month following the date the participant retires until the first of the month following the date the participant dies, minus

- (ii)

- benefits provided (or deemed provided) by CH2M HILL to the participant.

Participants are vested 100 percent of Account Values on reaching age 65. The benefits of the DCRP are funded by the offsetting benefit plans and the cash surrender value of the split dollar policies. To the extent that the offsetting benefit plans and the split dollar policies do not cover the cost of the benefit, the Account Values will be paid from CH2M HILL general assets. The same distribution criterion apply as the DCP and the EDCP. The Accounting and Corporate Responsibilities (Sarbanes-Oxley) Act of 2002 established certain prohibitions against companies, like CH2M HILL, providing loans and loan arrangements to its executive officers. While the Act and related regulations are vague on this issue, most commentators believe that the payment of premiums for split dollar insurance funding vehicle constitutes a possible violation of the Act. Pending further guidance from the regulators, CH2M HILL elected not to continue paying premiums for the DCRP related split dollar insurance. If guidance does not become available during 2003, CH2M HILL may restructure how the DCRP is funded going forward.

18

Retirement Plans

Mr. Peterson is a participant in the CH2M HILL Pension Plan. Benefits under the CH2M HILL Pension Plan are equal to one percent of average base compensation (up to $150,000) for 1987 through 1991, multiplied by years of credited benefit service prior to 1992, plus one percent of each year's base compensation (up to $150,000) for each year of credited benefit service from January 1, 1992 through December 31, 1993. CH2M HILL Pension Plan benefits were frozen as of December 31, 1993. Mr. Peterson's estimated annual benefit payable at the earliest age when a participant may retire with an unreduced benefit (age 65) is $37,849.

Mr. Evans is a participant in the CH2M HILL Pension Plan with respect to his credited benefit service prior to May 1, 1986, and he is a participant in the OMI Retirement Plan with respect to his credited benefit service from May 1, 1986 through December 31, 1995. Benefits under the OMI Retirement Plan are equal to 1.5 percent of average compensation (up to the applicable IRS compensation limit for each year) multiplied by the first 20 years of credited benefit service, plus 0.5 percent of average compensation (up to the applicable IRS compensation limit for each year) multiplied by credited benefit service in excess of 20 years. Mr. Evans' benefit under the OMI Retirement Plan was frozen as of December 31, 1995 upon his transfer from employment covered by the Plan. Mr. Evans' estimated annual benefit payable at the earliest age when a participant may retire with an unreduced benefit (age 65) is $23,521 under the OMI Retirement Plan and $12,771 under the CH2M HILL Pension Plan, or a total of $36,292.

Mr. Kennedy is a participant in the CH2M HILL Pension Plan. Benefits under the CH2M HILL Pension Plan are equal to 1 percent of average base compensation (up to $150,000) for 1987 through 1991, multiplied by years of credited benefit service prior to 1992, plus 1 percent of each year's base compensation (up to $150,000) for each year of credited benefit service from January 1, 1992 through December 31, 1993. CH2M HILL Pension Plan benefits were frozen as of December 31, 1993. Mr. Kennedy's estimated annual benefit payable at the earliest age when a participant may retire with an unreduced benefit (age 65) is $14,683.

Messrs. Ferris and Iapalucci are not participants in a company-sponsored pension plan.

Change of Control Agreements

The Board of Directors authorized CH2M HILL to enter into Change of Control Agreements with Messrs. Peterson, Ferris, Evans, Iapalucci and Kennedy as well as other certain Directors and Officers of CH2M HILL. The provisions of these agreements are described in the Compensation Committee Interlocks and Insider Participation section of this Proxy Statement.

19

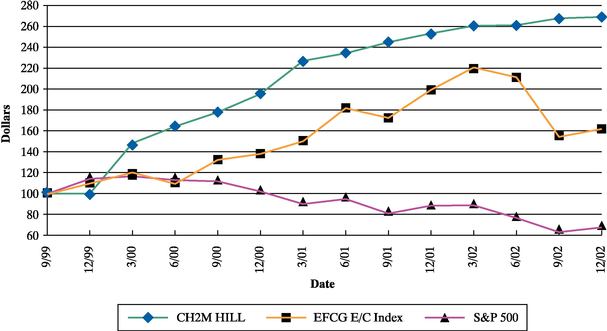

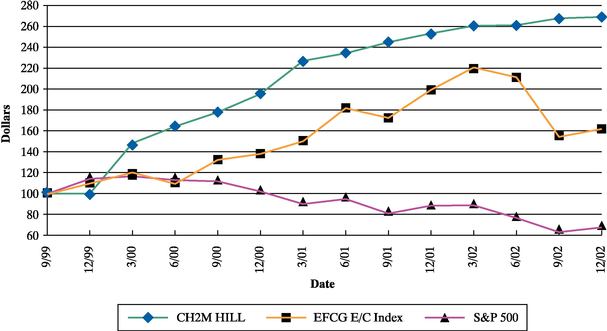

Stock Performance Graph

The following graph shows the total shareholder return on CH2M HILL's common stock from September 7, 1999 (the date CH2M HILL's registration with the U.S. Securities and Exchange Commission became effective) until December 31, 2002, for (i) CH2M HILL's common stock, (ii) the Standard & Poor's Composite—500 Stock Index and (iii) the companies in the Environmental Financial Consulting Group's engineering/consulting industry index.

The graph assumes the investment of $100 in CH2M HILL common stock and in each of the indexes on September 7, 1999 and reinvestment of all dividends, if any. CH2M HILL does not currently anticipate paying any cash dividends on the common stock.

Proposal 2.Approval of Executive Officers Long Term Incentive Plan

On February 14, 2003, the Board of Directors of CH2M HILL adopted, subject to shareholder approval, the CH2M HILL Companies, Ltd. Executive Officers Long Term Incentive Plan (the ELTI). The purposes of ELTI are to reward a limited group of senior executive officers for the creation of value within CH2M HILL and to provide financial incentives to such officers related to their contribution to the annual and long-term financial performance of CH2M HILL.

ELTI is designed to satisfy the requirements for performance-based compensation within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (Section 162(m)) so that CH2M HILL may fully deduct for federal tax purposes the compensation paid under ELTI to certain top paid executives. Under Section 162(m), CH2M HILL generally may not take a federal tax deduction for certain compensation paid in any fiscal year to its CEO and any of its four highest compensated executive officers, if such compensation is in excess of $1,000,000. Performance-based compensation that satisfies the requirements of Section 162(m) is fully deductible. One of these requirements is that material terms of the benefit plan and related performance goals, under which the compensation is to be paid, must be disclosed to and approved by CH2M HILL's shareholders.

ELTI is similar to the CH2M HILL Companies, Ltd. Long Term Incentive Plan (LTI), under which CH2M HILL currently provides incentive compensation to certain of its senior executives, project managers, and technologists. Only the members of the CH2M HILL Executive Leadership Team (ELT), which includes the CEO and the four highest compensated executive officers, are eligible to

20

participate in ELTI, because only the deductibility of their compensation may be affected by the Section 162(m) limitations. The executive officers eligible for awards under ELTI will not be eligible for awards under the LTI for the same program period.

If approved by the shareholders, ELTI will be effective as of January 1, 2003.

Shareholders are asked to vote on and approve the following resolution:

The required vote for approval under Section 162(m) is a majority of the voting power of the common stock of CH2M HILL present or represented at the meeting of the shareholders. Abstentions will have the effect of votes cast against ELTI.

CH2M HILL's Board of Directors unanimously recommends that the shareholders vote "for" approval of ELTI.

Some members of the Board of Directors are also members of the ELT and hence eligible to participate in ELTI. A summary of ELTI is set forth below. The full text of ELTI is attached as Appendix A to this Proxy Statement.

Why are we asking the shareholders to approve ELTI?

Approving ELTI will allow CH2M HILL to get the full tax deduction for payments under this benefit plan for federal income tax purposes.

What are the material features of ELTI?

ELTI allows CH2M HILL to award performance-based incentive compensation to a limited number of senior executive officers in a manner that makes such compensation fully deductible to CH2M HILL for federal income tax purposes. Awards under ELTI must be basedsolely on the attainment by the executives of pre-established, objective performance goals during certain specified program periods. Under ELTI, awards may be granted for one-year, two-year or three-year program periods beginning on January 1 of each calendar year. It is contemplated that ELTI will usually use three-year program periods once it is fully phased-in.

Who administers the plan?

ELTI is administered by a committee appointed by the Board of Directors (the Committee) consisting solely of outside directors of CH2M HILL, as required by the Internal Revenue Code. The Committee must consist of at least two members at all times. Currently, the plan is to be administered by the Executive Compensation Subcommittee, the members of which are Barry L. Williams, Jerry D. Geist, and David B. Price.

ELTI plan documents give the Committee broad authority to determine the terms and conditions of the incentive compensation awards and the amounts paid out pursuant to such awards, subject to the limitations contained in ELTI and in Section 162(m).

Who is eligible to participate in ELTI?

Generally, all members of the ELT are eligible to participate in ELTI. Although the tax deductibility limitations of Section 162(m) pertain only to the compensation of the CEO and the four highest compensated officers, other senior executive officers and ELT members may in the future become one of the four highest compensated officers. The Committee has the authority to determine from time to time which executive officers are eligible to participate in ELTI for any program period.

21

The number of eligible executive officers selected by the Committee will vary from year to year at the discretion of the Committee. There are eight executive officers initially eligible for participation in ELTI for program periods beginning in 2003.

How are awards established under ELTI?

The Committee must establish any awards under ELTI in writing within 90 days of the beginning of each program period. Each award must specify (i) the length of the program period, and (ii) the participant's target bonus for such program period, which must be between 20% to 150% of the participant's base salary as of the beginning of such program period. The target bonus for any participant in any program period may not exceed $1.75 million, and the target bonuses for all participants in any program period may not exceed $7.5 million.

The award must also specify one or more of the following objective performance goals, which must be met as a condition to receiving compensation under the award and specific performance against which would impact potential payout available under ELTI:

a. "Available Funds" target to be achieved during the program period. "Available Funds" means CH2M HILL's consolidated funds remaining from gross revenue after all normally accrued operating expenses are deducted, but prior to accruals for incentive compensation programs, retained earnings and income taxes.

b. "Full Service Revenue" target to be achieved during the program period. "Full Service Revenue" means revenue generated by CH2M HILL from work outside of CH2M HILL's traditional consulting and engineering business. "Full Service" includes primarily integrated project delivery (design-build), operations and maintenance (O&M), remediation, and construction work.

c. "Global Revenue" target to be achieved during the program period. "Global Revenue" means revenue generated by CH2M HILL from clients located and work performed outside the North America continent.

d. "Stock Price Appreciation" target to be achieved during the program period.

e. "Return on Equity" target to be achieved during the program period.

f. "Backlog" target to be achieved during the program period.

How will the amounts paid pursuant to awards be determined?

After the end of each program period, the Committee shall determine whether and to what extent the participant achieved his/her performance goals for such program period. If the Committee determines that the participant has achieved his/her performance goals, the Committee shall then determine the amount of compensation payable pursuant to the award. Any award paid for any program period may not exceed two times the amount of the specified target bonus and may be decreased in the discretion of the Committee. As a condition to any payment of an award under ELTI, the Committee must certify in writing that the participant has met his/her specific performance goals.

What is the maximum amount payable under ELTI?