UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04419 |

|

AEGON/TRANSAMERICA SERIES FUND, INC. |

(Exact name of registrant as specified in charter) |

|

570 Carillon Parkway, St. Petersburg, Florida | | 33716 |

(Address of principal executive offices) | | (Zip code) |

|

John K. Carter, Esq. P.O. Box 5068, Clearwater, Florida 33758-5068 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (727) 299-1800 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | January 1, 2004 - December 31, 2004 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1: Report(s) to Shareholders. The Annual Report is attached.

Investment Options Annual Report Winter 2004

Western Reserve Life Assurance Co. of Ohio

Home Office: Columbus, Ohio

Administrative Office Address: P.O. Box 5068

Clearwater, Florida 33758-5068

Distributor: AFSG Securities Corporation

www.westernreserve.com

Customer Service: 1-800-851-9777

WRL Investment Options Annual Report

The following pages contain the most recent annual reports for the investment options in which you are invested. In compliance with Securities and Exchange Commission regulations, we present these reports on a

semi-annual basis with the hope that they will foster greater understanding of the investment options' holdings, performance, financial data, accounting policies and other issues. Unlike our past reports, this streamlined version provides information only on the investment options in which you are invested.

If you have any questions about these reports, please do not hesitate to contact your financial professional. As always, we thank you for your trust and the opportunity to serve you.

Dear Fellow Shareholder,

On behalf of AEGON/Transamerica Series Funds, I would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial advisor in the future.

A financial professional can help you build a comprehensive picture of your current and future financial needs. In addition, financial advisors are familiar with the market's history, including long-term returns and volatility of various asset classes.

With your financial advisor, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

The Securities and Exchange Commission requires that an annual report be sent to all shareholders. The following pages provide a comprehensive review of the investments of each of your funds. This report also provides a discussion of accounting policies in addition to matters presented to shareholders that may have required their vote.

Please contact your financial advisor if you have any questions about the contents of this report.

Sincerely,

Brian C. Scott

President

AEGON/Transamerica Series Funds

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of AEGON/Transamerica Series Funds. These views are subject to change based upon market conditions. These views should not be relied on as investment advice and are not indicative of a trading intent on behalf of the AEGON/Transamerica Series Funds.

American Century Large Company Value

MARKET ENVIRONMENT

The stock market demonstrated resilience in 2004, overcoming numerous headwinds to post solid gains. As the year opened, economic expansion alongside record-low interest rates, tame inflation and flourishing profit growth encouraged investors. Their enthusiasm lifted the Dow Jones Industrial Average to its highest level in 22 months, the technology-heavy NASDAQ Composite Index to its highest point since July 2001 and the broader Standard and Poor's 500 Composite Stock Index ("S&P 500") to a 23-month high. However, challenges soon surfaced. Persistent labor-market weakness and rising interest rates generated speculation about the continued strength of corporate earnings, and numerous forecasts of more moderate profits in the months ahead only confirmed investors' concerns. Geopolitical turbulence also proved daunting. Oil prices soared to new highs, topping $55 a barrel amid continued conf lict in Iraq and the threat of supply disruption. However, as the period drew to a close, oil prices came off their highs, consumer confidence and spending rose, and the presidential election passed without incident. All helped stocks rally back to reach their highest level in more than three years. In that environment, American Century Large Company Value outperformed its benchmark, an outcome made possible both by effective security selection and variations in allocation across sectors and at the stock level.

PERFORMANCE

For the year ended December 31, 2004, American Century Large Company Value, Initial Class returned 13.91%. By comparison its benchmark, the S&P 500 returned 10.87%.

STRATEGY REVIEW

Investments in the utilities sector made the greatest contribution to relative performance during the year. We were well represented in this advancing area, a distinct advantage at a time when this group finished among the market's leaders. Overweight exposure combined with effective security selection in the electric utilities industry, which represented the bulk of our exposure in this sector, led the way. Our strategy steered us to some of the market's most rewarding performers. One noteworthy name was eXcelon Corporation, which announced a sizable shareholder dividend increase. The security's significant price gains made it among the portfolio's top contributors.

Our stake in the consumer staples sector provided considerable lift versus the heavier-weighted benchmark, and stock picking, especially among beverage companies again proved pivotal. We sidestepped some downtrodden names, while emphasizing others that performed well. Better selection among food and staples retailers, where we had relatively larger positions in advancing names, also added value.

The portfolio's interest in the materials sector also bolstered results, and overweight exposure was especially beneficial as this group ranked among the market's leaders. Increased worldwide demand and rising commodity prices benefited companies in the metals and mining industry, which yielded a top-contributor in Nucor Corporation, a leading steel manufacturer. Greater exposure to this well-performing company helped us outdistance our benchmark.

The portfolio's underweight stake in industrials companies was the only area of weakness versus the benchmark at the sector level. Though security selection was positive overall, it was not enough to overcome the drain from under representation in the air freight and logistics and the industrial conglomerates industries.

Elsewhere in the portfolio, we suffered some individual setbacks in this otherwise positive environment. On the last day of the third quarter, Merck & Co., Inc. pulled its blockbuster arthritis remedy Vioxx off the market, citing potentially fatal side effects. Later, several companies in the financials sector, including Marsh & McLennan Companies, Inc., came under regulatory and legal scrutiny amid allegations of fraud. Both holdings, which ranked among the portfolio's top detractors, fell sharply, and our overweights in each slowed relative performance.

During the year, the management of the American Century Large Company Value portfolio shifted from the Income & Growth team located in Mountain View, California, to the Large Company Value team located in Kansas City, Missouri. Going forward, we will remain committed to our strategy of searching for large, fundamentally sound businesses that, for temporary reasons, are selling at a discount to what we believe is fair market value.

Mark Mallon, CFA

Charles A. Ritter, CFA

Brendon Healy

Co-Portfolio Managers

American Century Investment Management, Inc.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

1

American Century Large Company Value

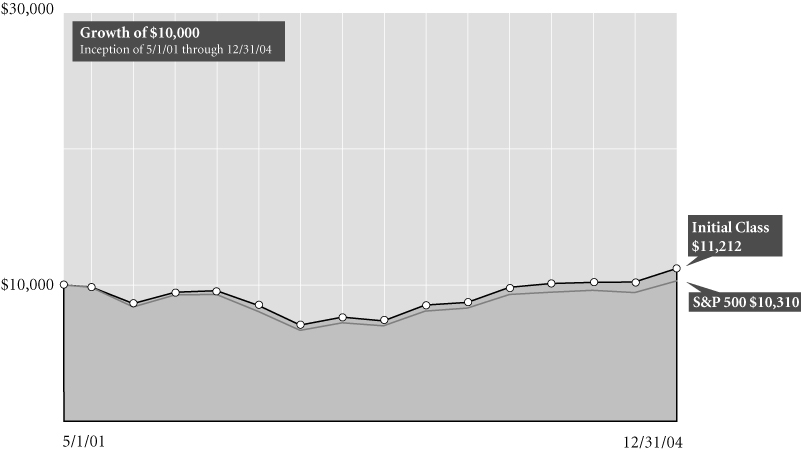

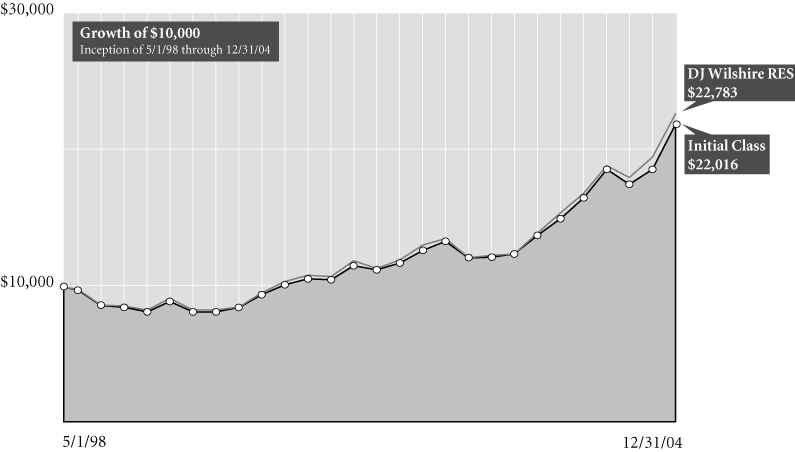

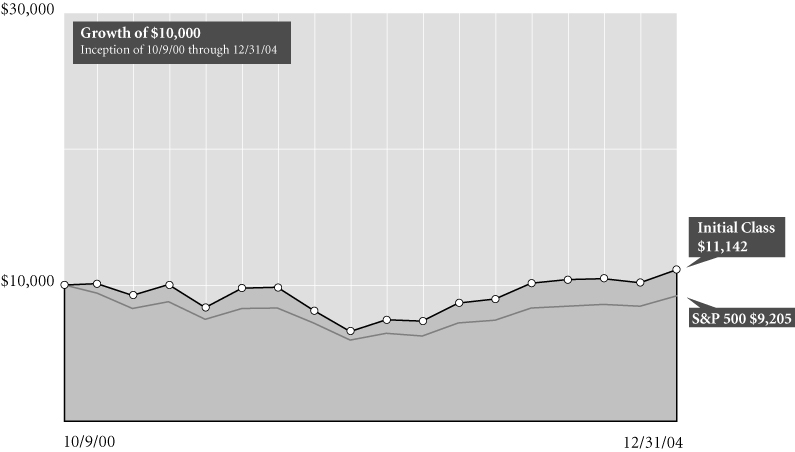

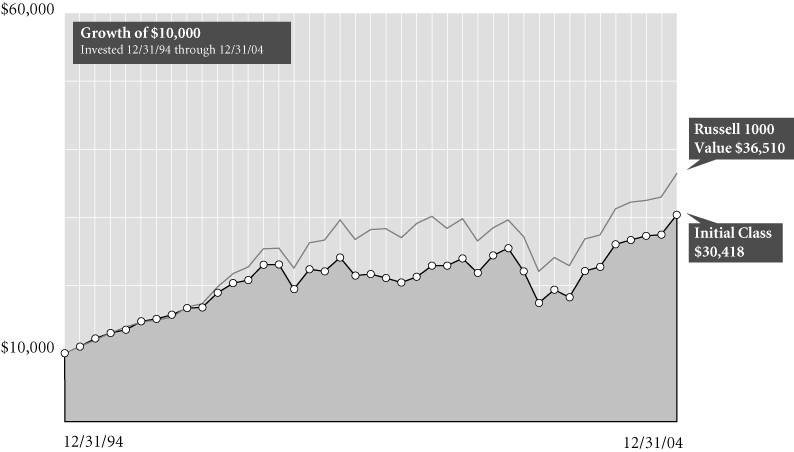

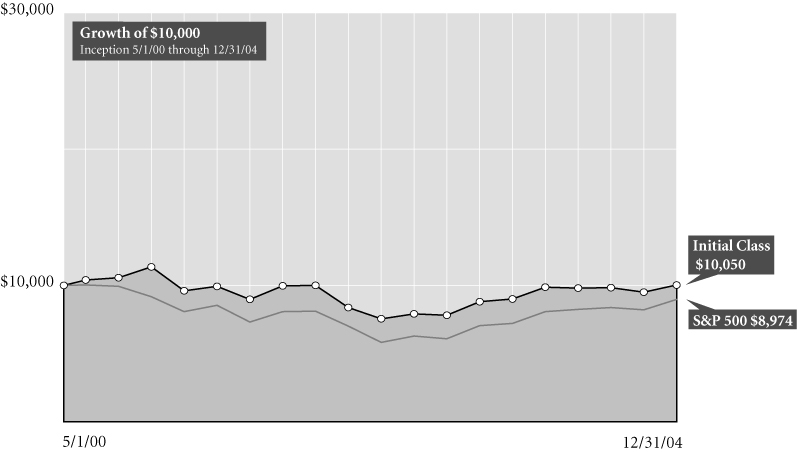

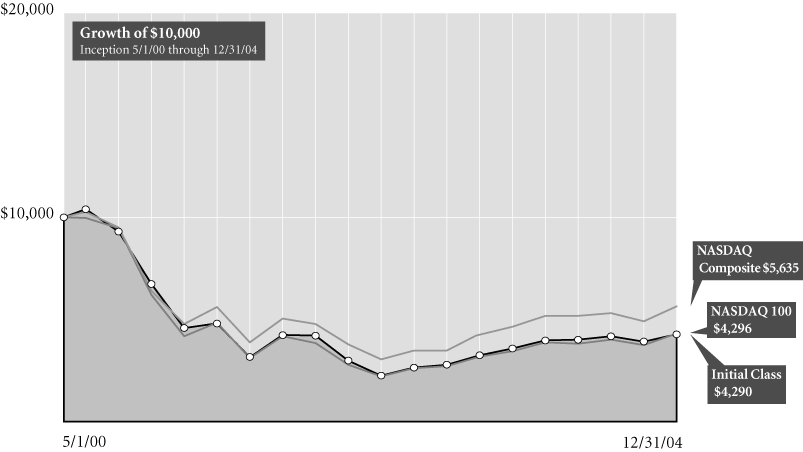

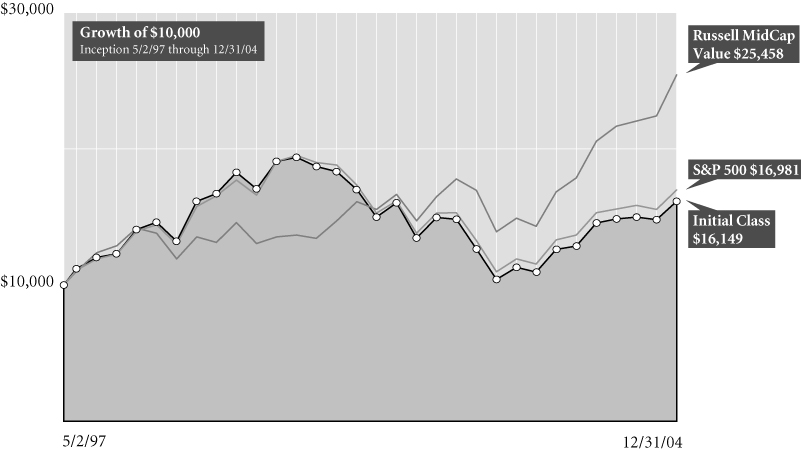

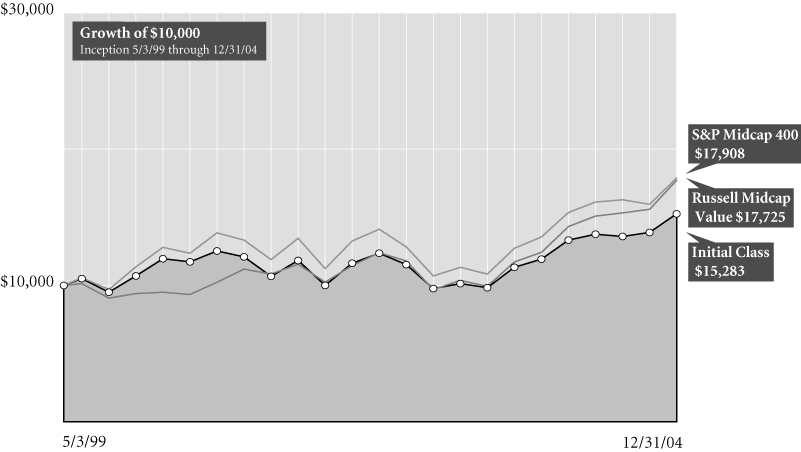

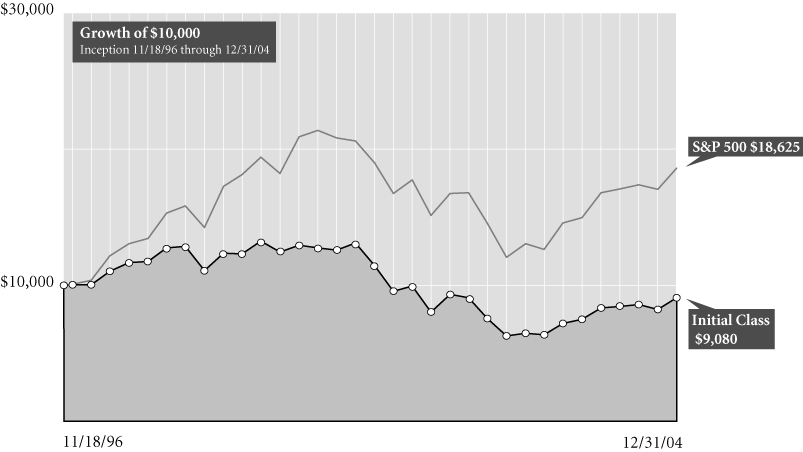

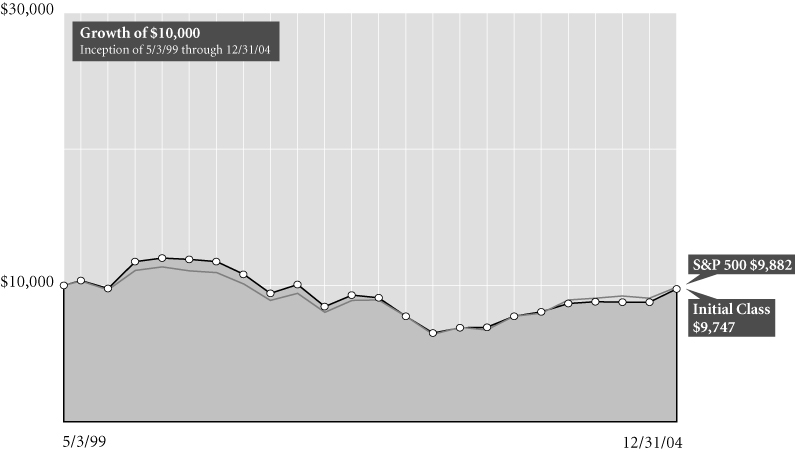

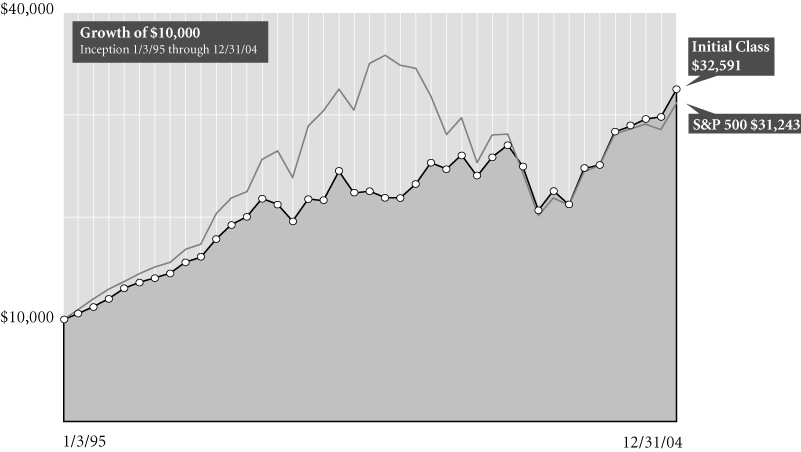

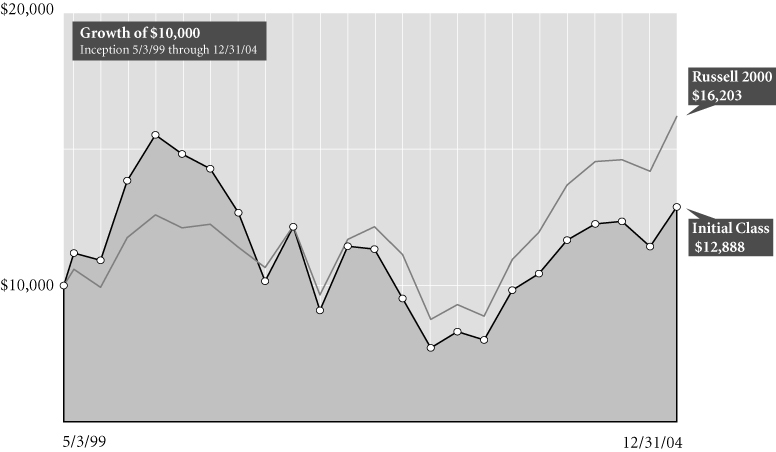

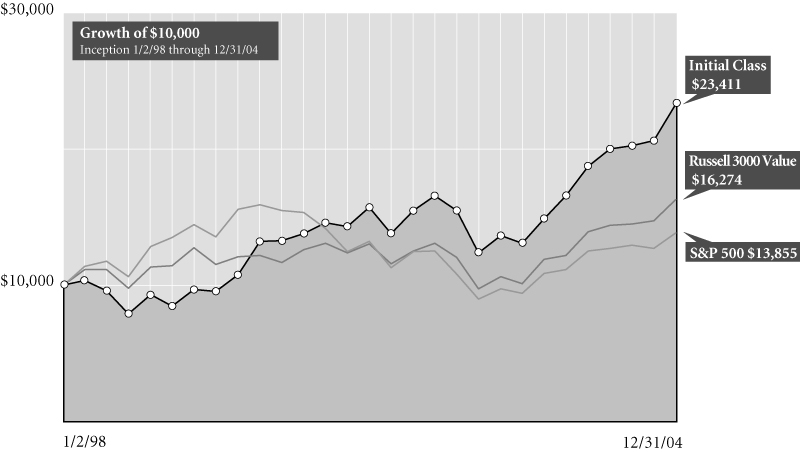

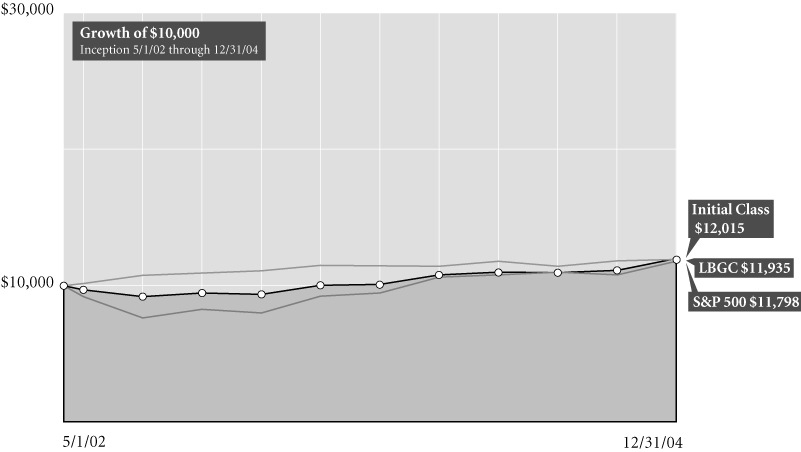

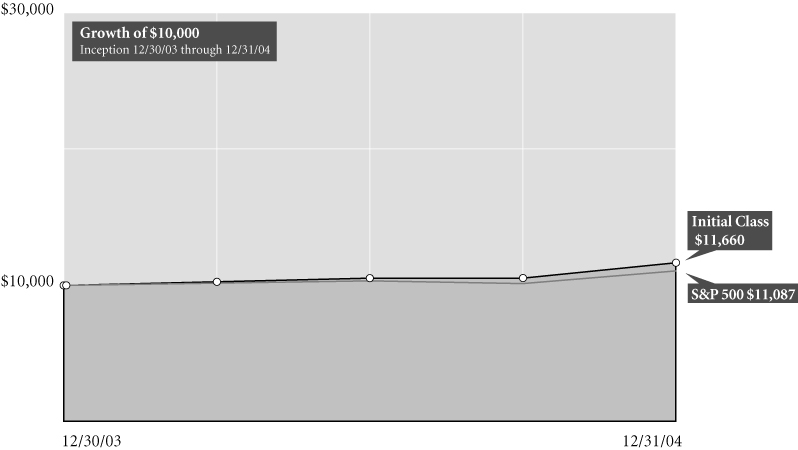

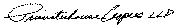

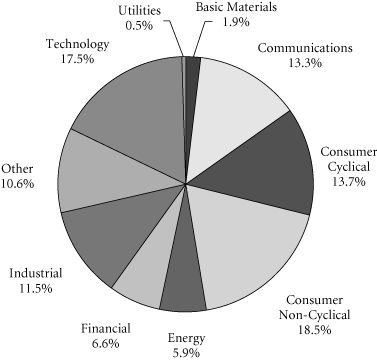

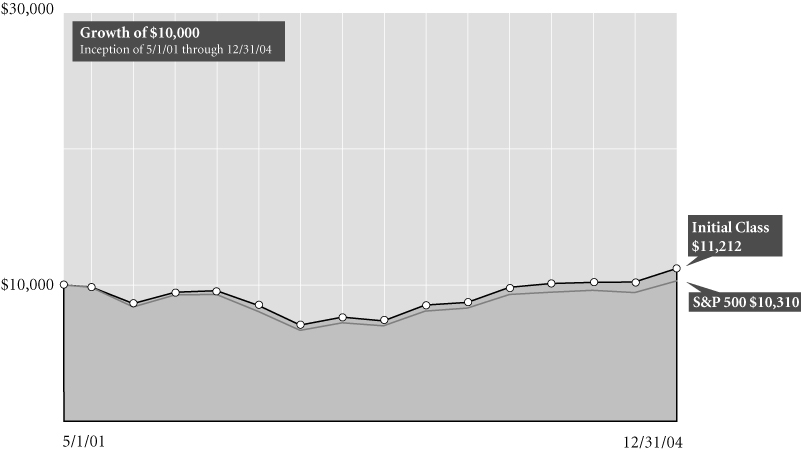

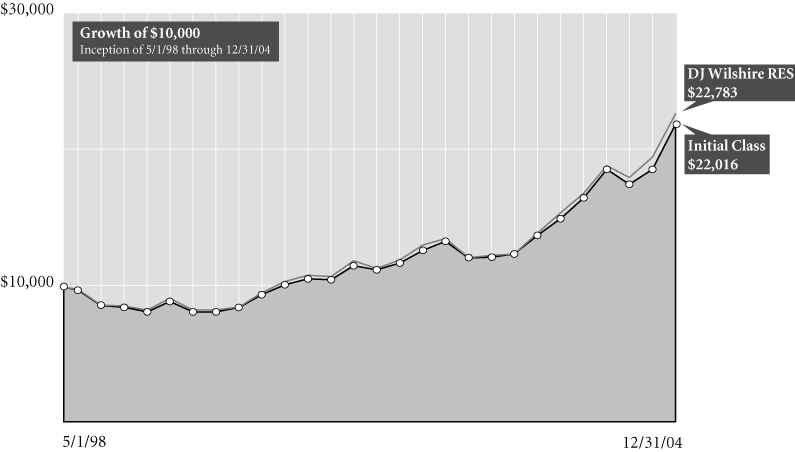

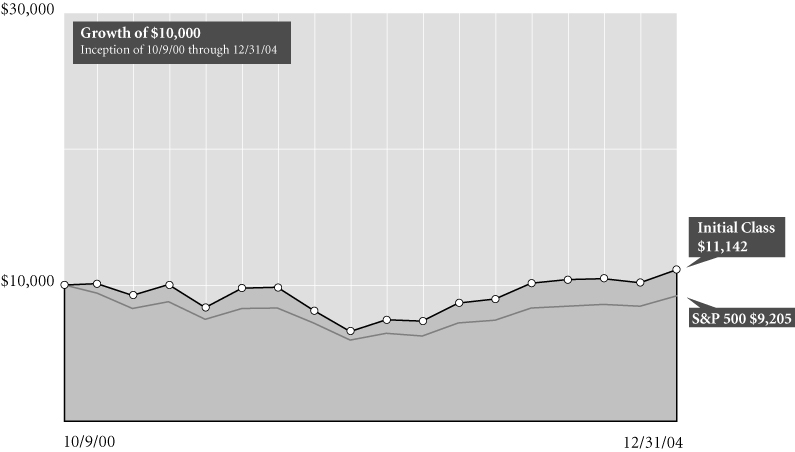

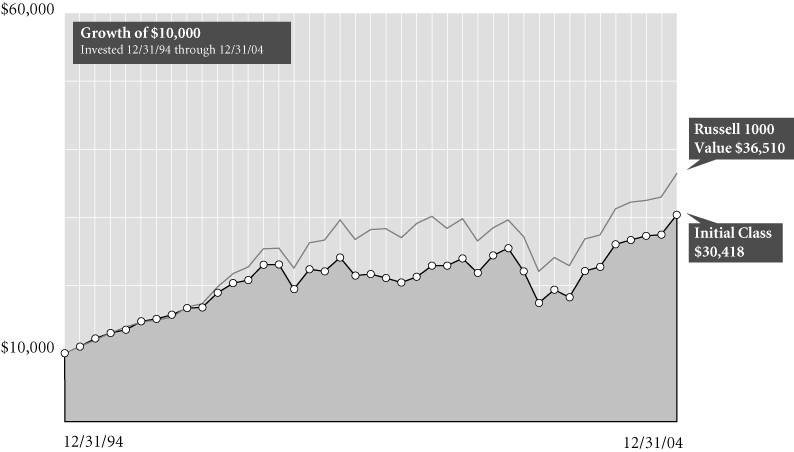

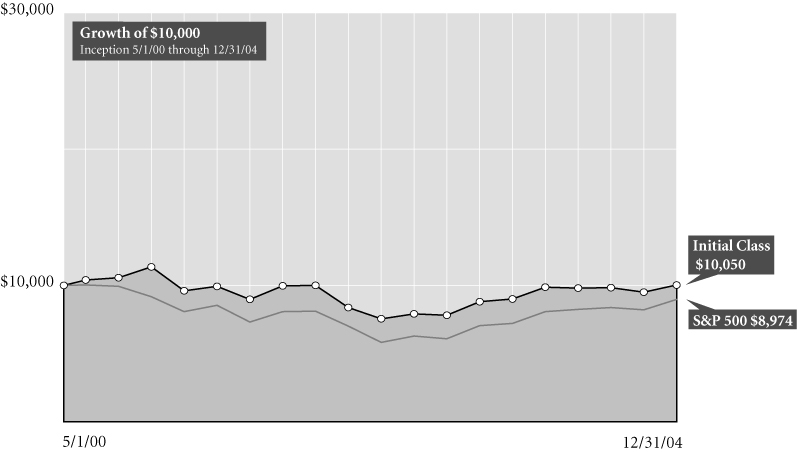

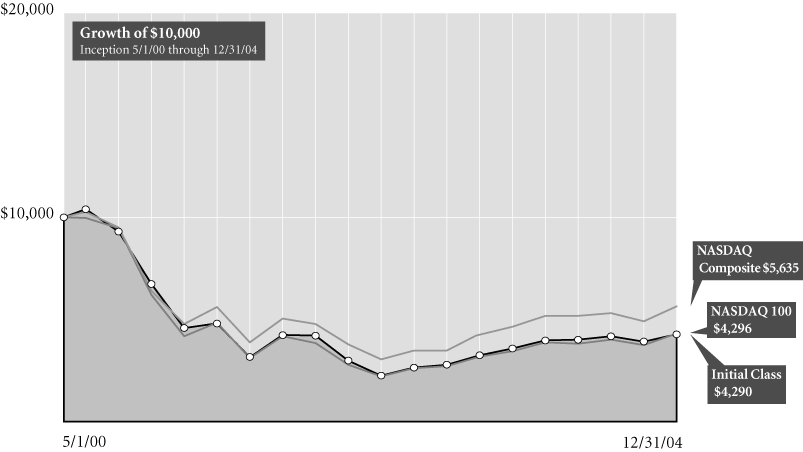

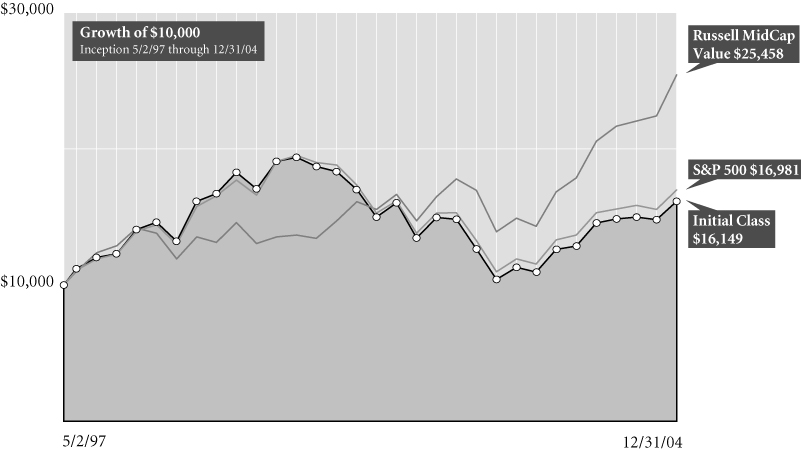

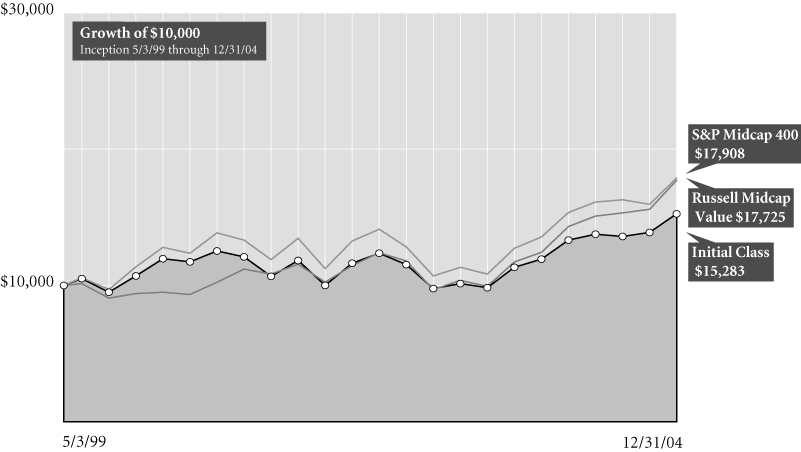

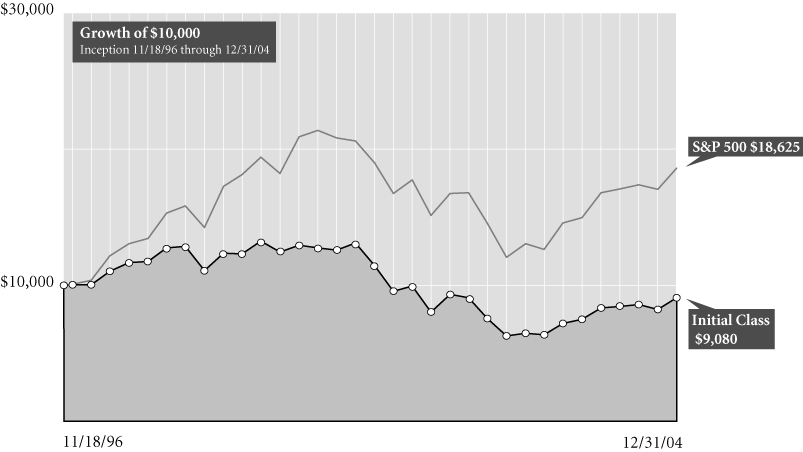

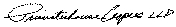

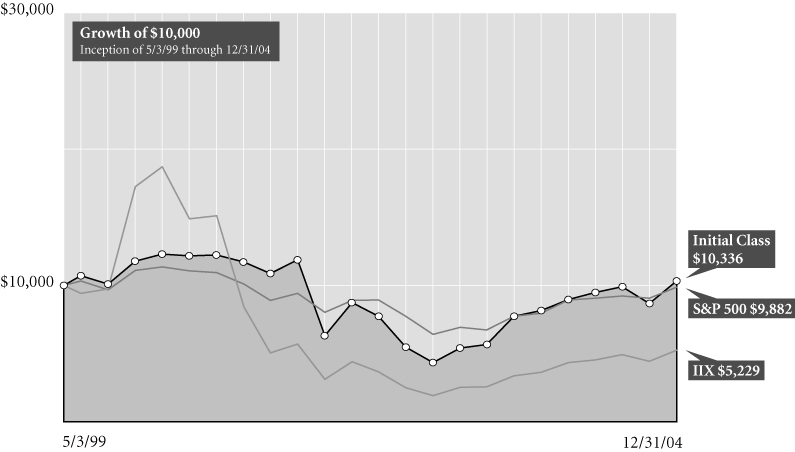

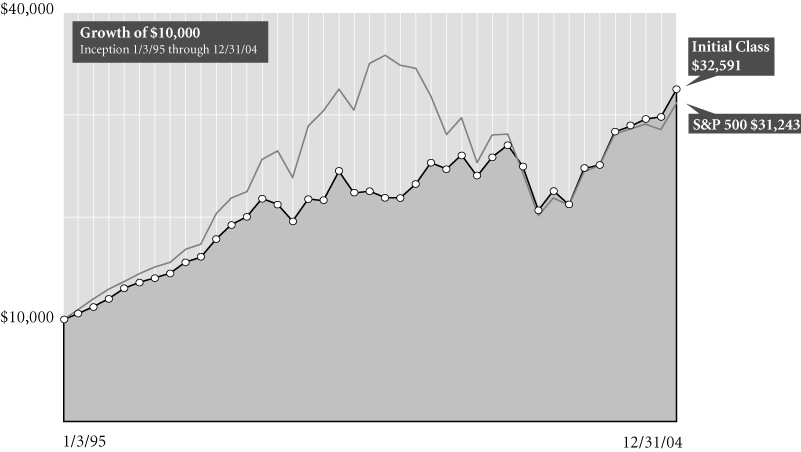

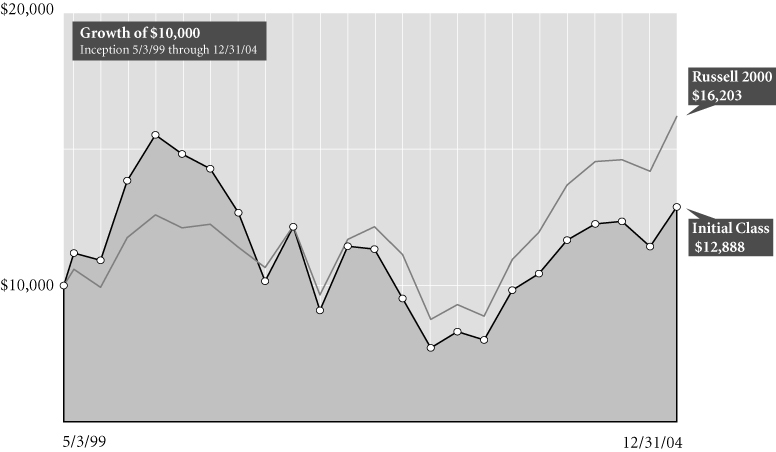

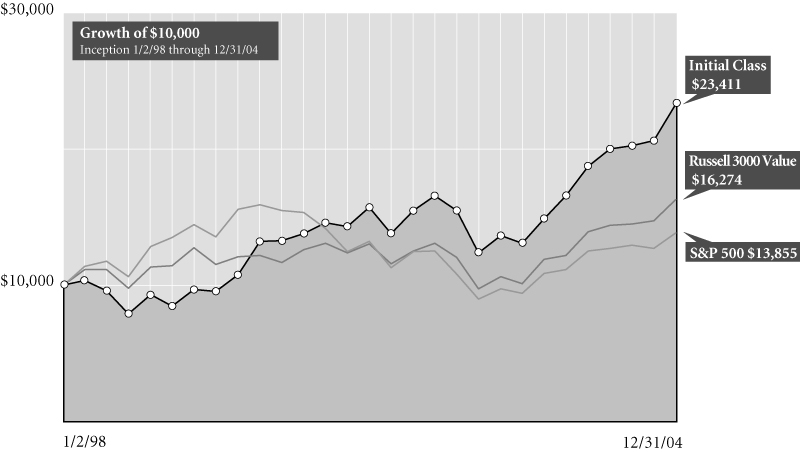

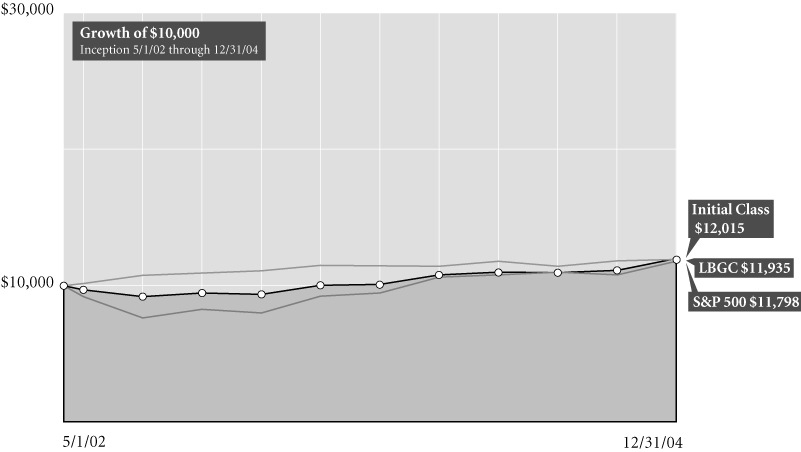

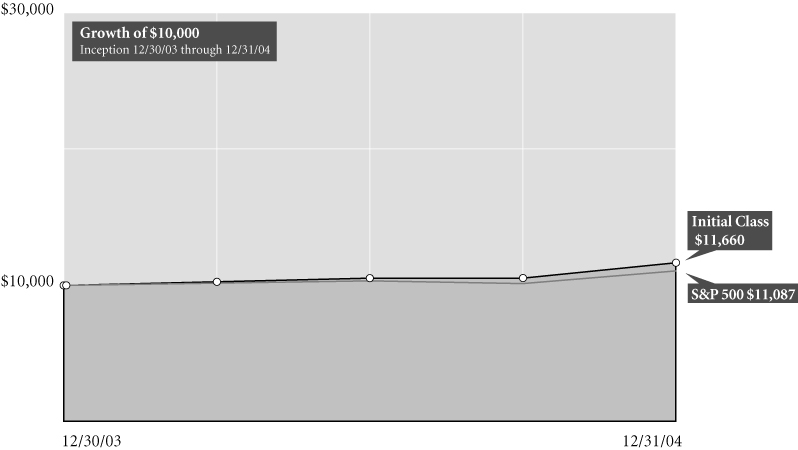

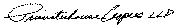

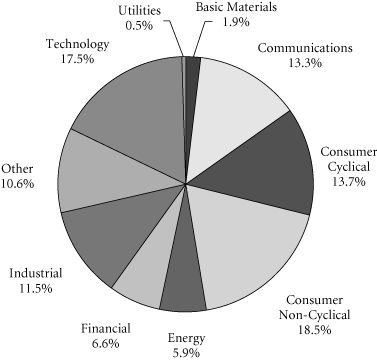

Comparison of change in value of $10,000 investment in Initial Class shares and its comparative index.

Average Annual Total Return for Periods Ended 12/31/04

| | | 1 year | | From

Inception | | Inception

Date | |

| Initial Class | | | 13.91 | % | | | 3.17 | % | | 5/1/01 | |

| S&P 5001 | | | 10.87 | % | | | 0.84 | % | | 5/1/01 | |

| Service Class | | | 13.61 | % | | | 23.00 | % | | 5/1/03 | |

NOTES

1 The Standard and Poor's 500 Composite Stock (S&P 500) Index is an unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception calculation is based on life of Initial Class shares. Source: Standard & Poor's Micropal®© Micropal, Inc. 2004 – 1-800-596-5323 – http://www.funds-sp.com.

The performance data presented represents past performance, future results may vary. The portfolio's investment return and net asset value will fluctuate. Past performance does not guarantee future results. Investor's units when redeemed, may be worth more or less than their original cost.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives, explanation of share classes and policies of this portfolio.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

2

American Century Large Company Value

UNDERSTANDING YOUR FUND'S EXPENSES (unaudited)

SHAREHOLDER EXPENSES

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at July 1, 2004 and held for the entire period until December 31, 2004.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, note that the expenses shown in the table are meant to highlight your ongoing costs and do not reflect any transaction costs.

| | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | Expenses Paid

During Period (a) | |

| Initial Class | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,098.80 | | | | 0.96 | % | | $ | 5.06 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,020.31 | | | | 0.96 | | | | 4.88 | | |

| Service Class | |

| Actual | | | 1,000.00 | | | | 1,098.10 | | | | 1.21 | | | | 6.38 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,019.05 | | | | 1.21 | | | | 6.14 | | |

(a) Expenses are calculated using each Fund's annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by number of days in the period (184 days), and divided by the number of days in the year (366 days).

(b) 5% return per year before expenses.

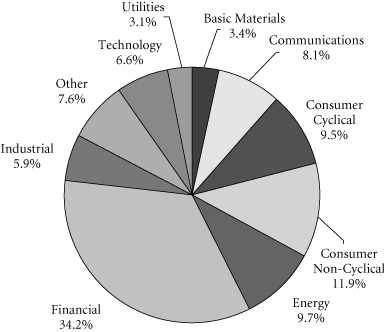

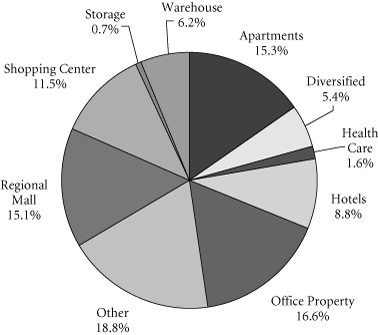

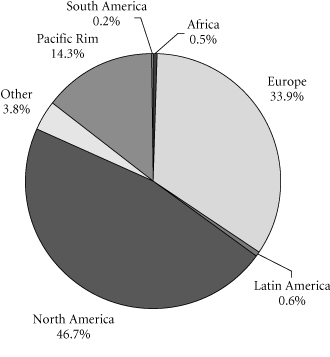

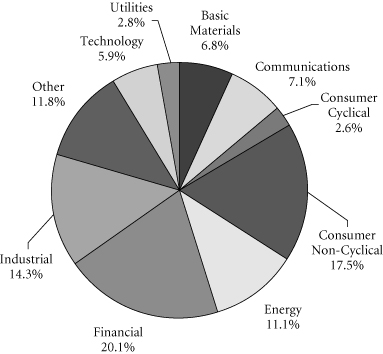

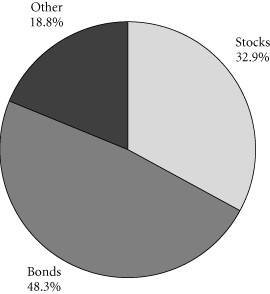

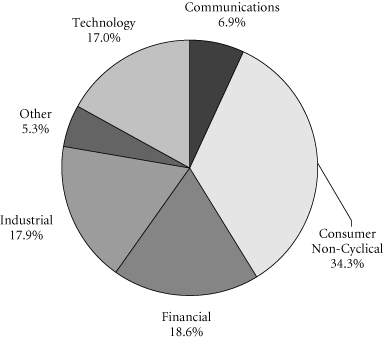

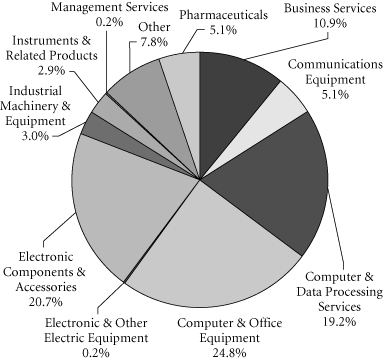

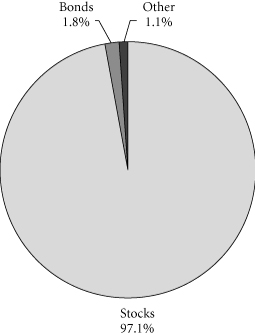

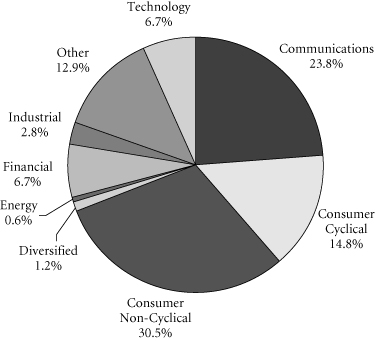

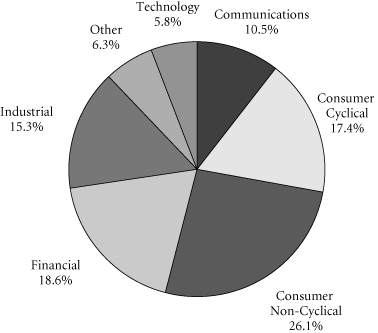

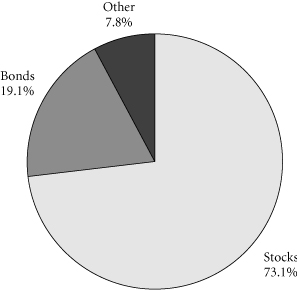

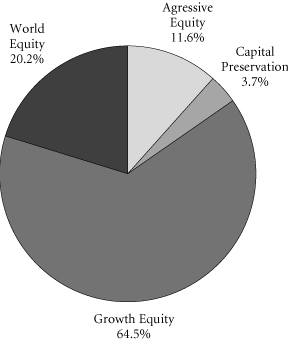

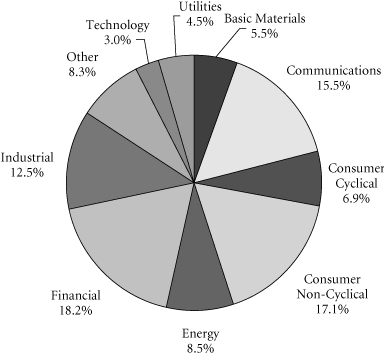

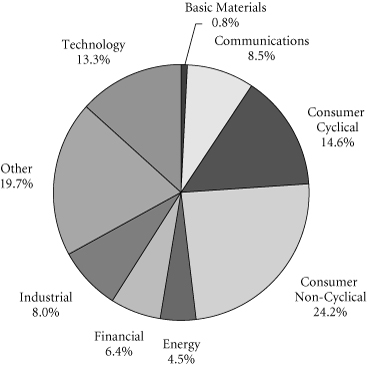

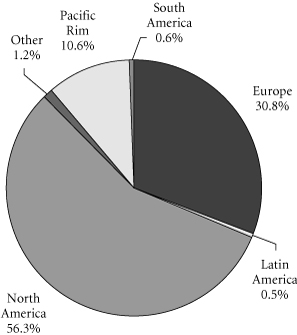

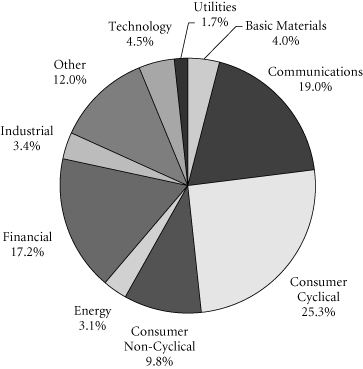

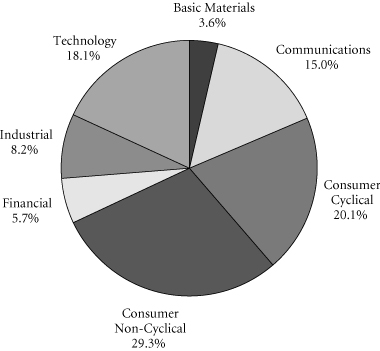

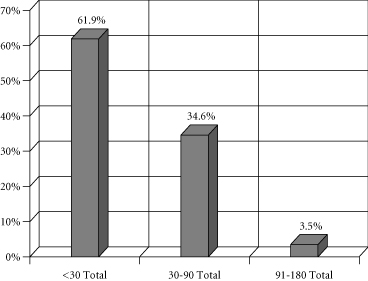

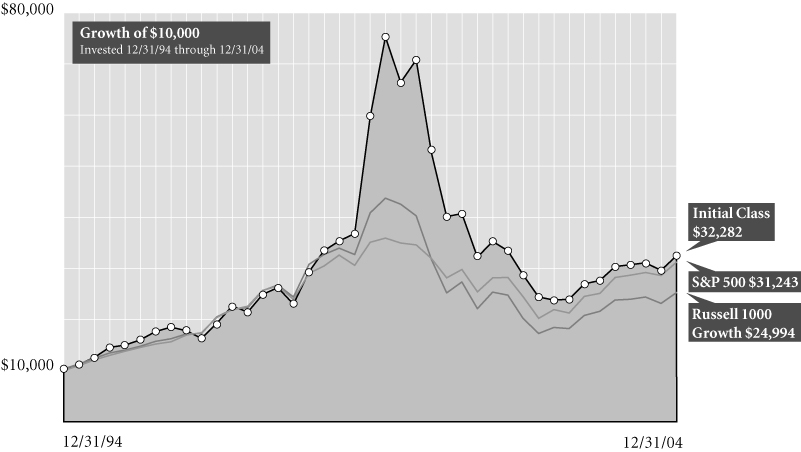

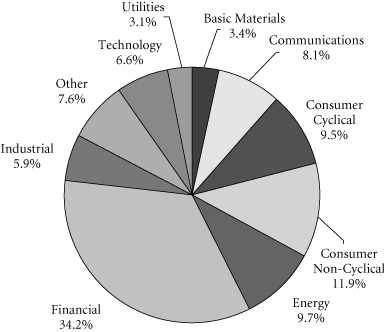

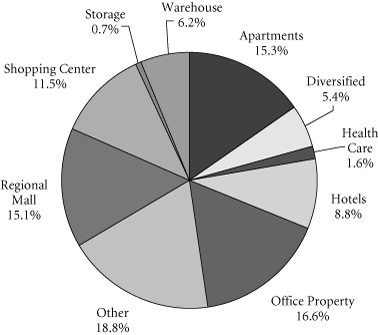

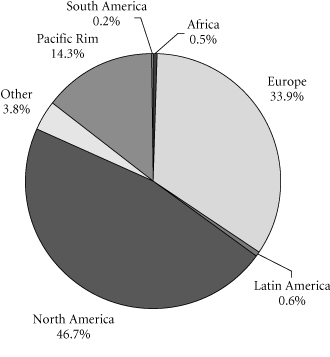

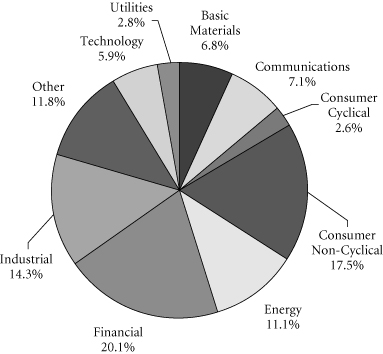

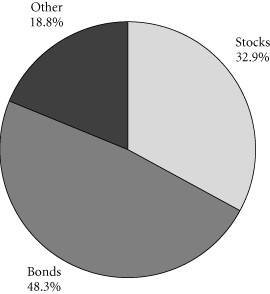

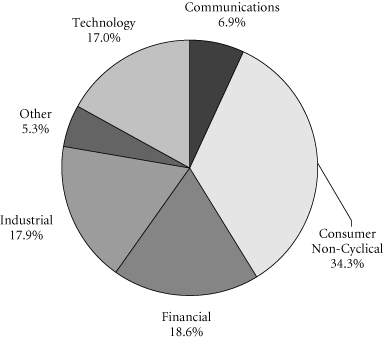

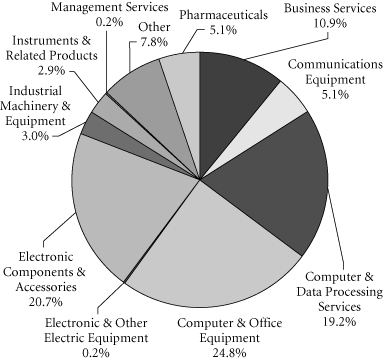

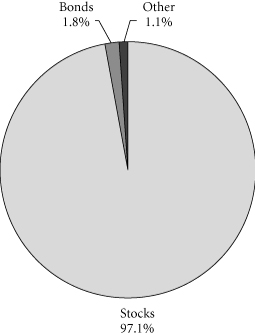

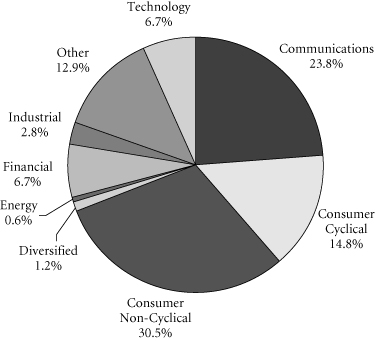

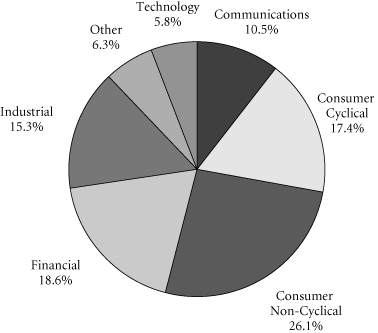

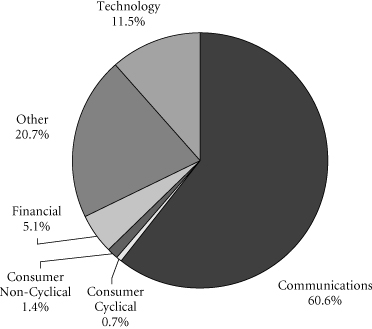

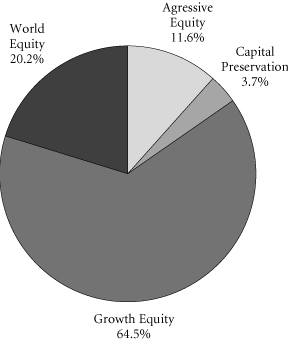

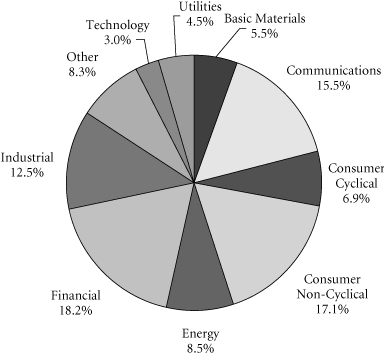

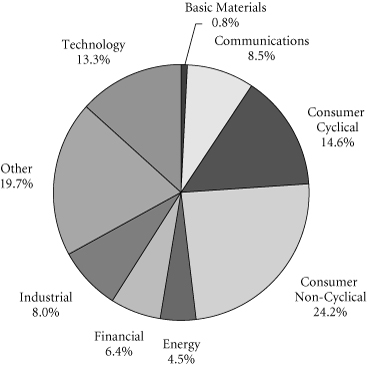

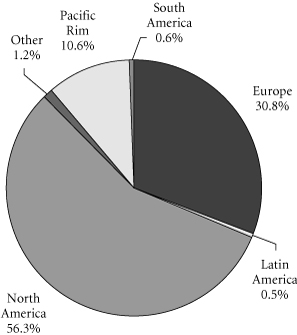

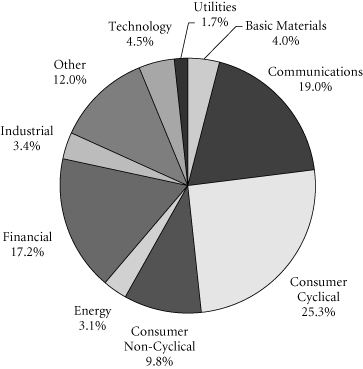

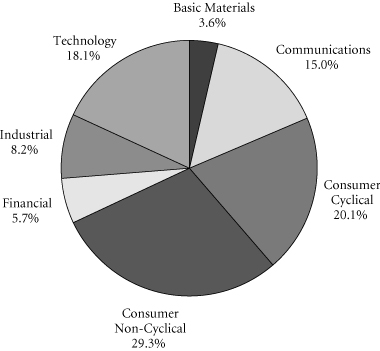

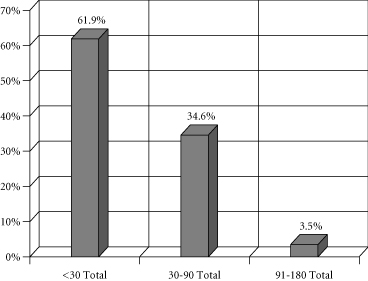

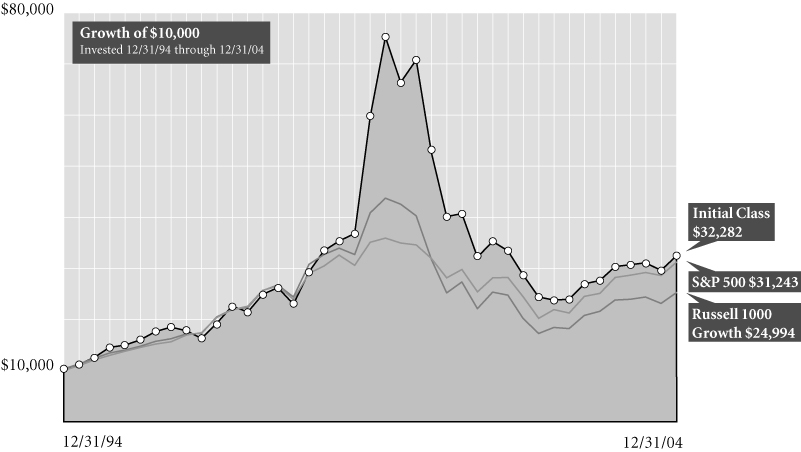

GRAPHICAL PRESENTATION OF SCHEDULE OF INVESTMENTS

By Sector

At December 31, 2004

This chart shows the percentage breakdown by Sector of the Fund's total investment securities.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

3

American Century Large Company Value

SCHEDULE OF INVESTMENTS

At December 31, 2004

(all amounts except share amounts in thousands)

| | | Shares | | Value | |

| COMMON STOCKS (95.2%) | |

| Aerospace (0.6%) | |

| Boeing Co. (The) | | | 22,500 | | | $ | 1,165 | | |

| Amusement & Recreation Services (0.6%) | |

| Harrah's Entertainment, Inc. (a) | | | 17,700 | | | | 1,184 | | |

| Apparel Products (1.3%) | |

| Liz Claiborne, Inc. | | | 28,000 | | | | 1,182 | | |

| VF Corp. | | | 21,300 | | | | 1,180 | | |

| Automotive (1.9%) | |

| General Motors Corp. (a) | | | 22,500 | | | | 901 | | |

| Lear Corp. | | | 19,200 | | | | 1,171 | | |

| Toyota Motor Corp.,–ADR | | | 19,000 | | | | 1,556 | | |

| Automotive Dealers & Service Stations (0.1%) | |

| Advance Auto Parts, Inc | | | 5,389 | | | | 235 | | |

| Beverages (1.9%) | |

| Adolph Coors Co.–Class B (a) | | | 12,700 | | | | 961 | | |

| Coca-Cola Co. (The) | | | 38,000 | | | | 1,582 | | |

| Pepsi Bottling Group, Inc. (a) | | | 40,100 | | | | 1,084 | | |

| Business Credit Institutions (3.7%) | |

| Freddie Mac | | | 94,600 | | | | 6,972 | | |

| Chemicals & Allied Products (1.2%) | |

| PPG Industries, Inc. | | | 31,700 | | | | 2,161 | | |

| Commercial Banks (17.6%) | |

| Bank of America Corp. | | | 131,200 | | | | 6,165 | | |

| Bank of New York Co., Inc. (The) | | | 27,800 | | | | 929 | | |

| Citigroup, Inc. | | | 181,300 | | | | 8,735 | | |

| JPMorgan Chase & Co. | | | 85,812 | | | | 3,348 | | |

| KeyCorp (a) | | | 33,100 | | | | 1,122 | | |

| National City Corp. (a) | | | 44,500 | | | | 1,671 | | |

| PNC Financial Services Group, Inc. | | | 35,100 | | | | 2,016 | | |

| US Bancorp | | | 82,800 | | | | 2,593 | | |

| Wachovia Corp. | | | 49,000 | | | | 2,577 | | |

| Wells Fargo & Co. | | | 62,900 | | | | 3,909 | | |

| Computer & Data Processing Services (3.5%) | |

| Computer Sciences Corp. (b) | | | 31,100 | | | | 1,753 | | |

| Electronic Data Systems Corp. | | | 28,500 | | | | 658 | | |

| Fiserv, Inc. (b) | | | 30,200 | | | | 1,214 | | |

| Microsoft Corp. | | | 106,900 | | | | 2,855 | | |

| Computer & Office Equipment (2.8%) | |

| Hewlett-Packard Co. | | | 174,100 | | | | 3,651 | | |

| International Business Machines Corp. | | | 16,800 | | | | 1,656 | | |

| Department Stores (1.2%) | |

| May Department Stores Co. (The) (a) | | | 74,000 | | | | 2,176 | | |

| | | Shares | | Value | |

| Drug Stores & Proprietary Stores (0.6%) | |

| CVS Corp. | | | 26,800 | | | $ | 1,208 | | |

| Electric Services (1.1%) | |

| PPL Corp. | | | 38,400 | | | | 2,046 | | |

| Electric, Gas & Sanitary Services (2.1%) | |

| Exelon Corp. (a) | | | 62,500 | | | | 2,754 | | |

| NiSource, Inc. | | | 48,900 | | | | 1,114 | | |

| Electronic & Other Electric Equipment (1.7%) | |

| General Electric Co. | | | 58,000 | | | | 2,117 | | |

| Whirlpool Corp. (a) | | | 14,800 | | | | 1,024 | | |

| Electronic Components & Accessories (1.5%) | |

| Intel Corp. | | | 45,400 | | | | 1,062 | | |

| Tyco International, Ltd. | | | 50,800 | | | | 1,816 | | |

| Environmental Services (0.7%) | |

| Waste Management, Inc. | | | 42,500 | | | | 1,273 | | |

| Fabricated Metal Products (0.7%) | |

| Parker Hannifin Corp. | | | 18,500 | | | | 1,401 | | |

| Finance (2.3%) | |

| SPDR Trust Series 1 (a) | | | 36,400 | | | | 4,401 | | |

| Food & Kindred Products (3.8%) | |

| Altria Group, Inc. | | | 45,500 | | | | 2,780 | | |

| HJ Heinz Co. | | | 39,600 | | | | 1,544 | | |

| Sara Lee Corp. | | | 51,900 | | | | 1,253 | | |

| Unilever NV–NY Shares | | | 23,300 | | | | 1,554 | | |

| Food Stores (0.8%) | |

| Kroger Co. (b) | | | 85,000 | | | | 1,491 | | |

| Health Services (0.6%) | |

| HCA, Inc. | | | 30,000 | | | | 1,199 | | |

| Industrial Machinery & Equipment (1.7%) | |

| Dover Corp. | | | 29,600 | | | | 1,241 | | |

| Ingersoll-Rand Co.–Class A | | | 23,200 | | | | 1,863 | | |

| Instruments & Related Products (0.3%) | |

| Snap-On, Inc. | | | 16,700 | | | | 574 | | |

| Insurance (4.9%) | |

| Allstate Corp. (The) | | | 49,300 | | | | 2,550 | | |

| American International Group, Inc. | | | 31,200 | | | | 2,049 | | |

| Cigna Corp. | | | 16,800 | | | | 1,370 | | |

| Loews Corp. | | | 30,000 | | | | 2,109 | | |

| MGIC Investment Corp. (a) | | | 15,100 | | | | 1,041 | | |

| Insurance Agents, Brokers & Service (1.7%) | |

| Hartford Financial Services Group, Inc. (a) | | | 31,400 | | | | 2,176 | | |

| Marsh & McLennan Cos., Inc. | | | 28,900 | | | | 951 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

4

American Century Large Company Value

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2004

(all amounts except share amounts in thousands)

| | | Shares | | Value | |

| Life Insurance (0.8%) | |

| Torchmark Corp. (a) | | | 25,100 | | | $ | 1,434 | | |

| Lumber & Wood Products (1.3%) | |

| Weyerhaeuser Co. | | | 35,000 | | | | 2,353 | | |

| Medical Instruments & Supplies (0.9%) | |

| Baxter International, Inc. | | | 46,400 | | | | 1,603 | | |

| Motion Pictures (1.9%) | |

| Blockbuster, Inc.–Class B | | | 45,112 | | | | 397 | | |

| Time Warner, Inc. (b) | | | 158,200 | | | | 3,075 | | |

| Petroleum Refining (10.0%) | |

| ChevronTexaco Corp. | | | 62,200 | | | | 3,266 | | |

| ConocoPhillips | | | 31,500 | | | | 2,735 | | |

| Exxon Mobil Corp. | | | 151,100 | | | | 7,745 | | |

| Royal Dutch Petroleum Co.–NY Shares | | | 86,400 | | | | 4,958 | | |

| Pharmaceuticals (3.5%) | |

| Abbott Laboratories | | | 48,200 | | | | 2,249 | | |

| Bristol-Myers Squibb Co. | | | 65,900 | | | | 1,688 | | |

| Johnson & Johnson | | | 33,900 | | | | 2,150 | | |

| Merck & Co., Inc. | | | 15,200 | | | | 489 | | |

| Primary Metal Industries (1.1%) | |

| Alcoa, Inc. | | | 46,100 | | | | 1,449 | | |

| Nucor Corp. (a) | | | 11,700 | | | | 612 | | |

| Printing & Publishing (1.8%) | |

| Donnelley (RR) & Sons Co. | | | 36,000 | | | | 1,271 | | |

| Gannett Co., Inc. | | | 25,900 | | | | 2,116 | | |

| Restaurants (1.4%) | |

| McDonald's Corp. | | | 84,500 | | | | 2,709 | | |

| Rubber & Misc. Plastic Products (1.3%) | |

| Newell Rubbermaid, Inc. (a) | | | 56,600 | | | | 1,369 | | |

| Reebok International, Ltd. (a) | | | 24,000 | | | | 1,056 | | |

| Savings Institutions (1.3%) | |

| Washington Mutual, Inc. | | | 59,500 | | | | 2,516 | | |

| Security & Commodity Brokers (2.9%) | |

| Merrill Lynch & Co., Inc. | | | 45,100 | | | | 2,696 | | |

| Morgan Stanley | | | 49,000 | | | | 2,721 | | |

| Telecommunications (5.6%) | |

| ALLTEL Corp. | | | 26,300 | | | | 1,545 | | |

| AT&T Corp. | | | 36,900 | | | | 703 | | |

| BellSouth Corp. | | | 65,900 | | | | 1,831 | | |

| SBC Communications, Inc. | | | 95,100 | | | | 2,451 | | |

| Sprint Corp. (FON Group) | | | 57,400 | | | | 1,426 | | |

| Verizon Communications, Inc. | | | 29,300 | | | | 1,187 | | |

| Vodafone Group PLC,–ADR | | | 47,600 | | | | 1,303 | | |

| | | Shares | | Value | |

| Variety Stores (0.5%) | |

| Dollar General Corp. | | | 46,700 | | | $ | 970 | | |

| Total Common Stocks (cost: $165,699) | | | | | | | 178,396 | | |

| | | Principal | | Value | |

| SECURITY LENDING COLLATERAL (7.9%) | |

| Debt (7.4%) | |

| Bank Notes (0.6%) | |

Bank of America

| |

| 2.27%, due 01/18/2005 (c) | | $ | 153 | | | $ | 153 | | |

| 2.26%, due 02/15/2005 (c) | | | 153 | | | | 153 | | |

| 2.27%, due 03/03/2005 (c) | | | 179 | | | | 179 | | |

| 2.30%, due 06/09/2005 (c) | | | 77 | | | | 77 | | |

Bear Stearns & Co.

2.45%, due 06/05/2005

2.45%, due 09/08/2005 | | | 230

153 | | | | 230

153 | | |

Canadian Imperial Bank of Commerce

2.02%, due 11/04/2005 | | | 77 | | | | 77 | | |

Credit Suisse First Boston Corp.

2.33%, due 09/09/2005 (c) | | | 77 | | | | 77 | | |

| Commercial Paper (1.5%) | |

Delaware Funding Corporation–144A

2.23%, due 01/04/2005

2.29%, due 01/14/2005 | | | 192

153 | | | | 192

153 | | |

Fairway Finance–144A

2.36%, due 01/25/2005 | | | 287 | | | | 287 | | |

Greyhawk Funding–144A

2.35%, due 02/08/2005 | | | 115 | | | | 115 | | |

Liberty Lighthouse Funding–144A

2.38%, due 01/27/2005 | | | 267 | | | | 267 | | |

Morgan Stanley Dean Witter & Co.

2.39%, due 03/16/2005 (c)

2.39%, due 06/10/2005 (c) | | | 483

498 | | | | 483

498 | | |

Preferred Receivables Funding–144A

2.23%, due 01/05/2005

2.35%, due 02/01/2005 | | | 382

267 | | | | 382

267 | | |

Ranger Funding–144A

2.27%, due 01/14/2005 | | | 115 | | | | 115 | | |

| Euro Dollar Overnight (0.3%) | |

Harris Trust & Savings Bank

2.23%, due 01/03/2005 | | | 77 | | | | 77 | | |

Royal Bank of Canada

2.25%, due 01/19/2005 | | | 387 | | | | 387 | | |

| Euro Dollar Terms (2.5%) | |

Bank of Montreal

2.26%, due 01/28/2005

2.13%, due 02/02/2005 | | | 90

192 | | | | 89

192 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

5

American Century Large Company Value

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2004

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Euro Dollar Terms (continued) | | | |

Bank of Nova Scotia

| |

| 2.33%, due 01/13/2005 | | $ | 448 | | | $ | 448 | | |

| 2.33%, due 01/24/2005 | | | 381 | | | | 381 | | |

| 2.32%, due 02/08/2005 | | | 365 | | | | 365 | | |

BNP Paribas

2.30%, due 01/03/2005

2.30%, due 02/01/2005 | | | 383

192 | | | | 383

192 | | |

Calyon

2.27%, due 01/20/2005

2.34%, due 02/02/2005 | | | 343

77 | | | | 343

77 | | |

Citigroup

2.06%, due 01/25/2005

2.31%, due 02/25/2005 | | | 268

333 | | | | 268

333 | | |

Den Danske Bank

2.26%, due 01/20/2005 | | | 192 | | | | 192 | | |

Dexia Group

2.04%, due 01/21/2005 | | | 79 | | | | 79 | | |

Fortis Bank

2.14%, due 01/12/2005 | | | 4 | | | | 4 | | |

Lloyds TSB Bank

2.28%, due 02/02/2005 | | | 77 | | | | 77 | | |

Royal Bank of Scotland

2.01%, due 01/20/2005

2.27%, due 02/02/2005 | | | 79

383 | | | | 79

383 | | |

Svenska Handlesbanken

2.25%, due 01/10/2005 | | | 115 | | | | 115 | | |

Wells Fargo & Co.

2.32%, due 01/14/2005

2.31%, due 01/28/2005 | | | 327

383 | | | | 327

383 | | |

| | | Principal | | Value | |

| Repurchase Agreements (2.5%) (d) | |

Credit Suisse First Boston (USA), Inc.

2.35%, Repurchase Agreement dated

12/31/2004 to be repurchased at $943 on

01/03/2005 | | $ | 943 | | | $ | 943 | | |

Merrill Lynch & Co., Inc. 2.35%,

Repurchase Agreement dated

12/31/2004 to be repurchased at $1,531 on

01/03/2005 | | | 1,531 | | | | 1,531 | | |

Morgan Stanley 2.42%,

Repurchase Agreement dated

12/31/2004 to be repurchased at $767

on 01/03/2005 | | | 766 | | | | 766 | | |

The Goldman Sachs Group, Inc. 2.35%,

Repurchase Agreement dated 12/31/2004

to be repurchased at $1,533 on 01/03/2005 | | | 1,533 | | | | 1,533 | | |

| | | Shares | | Value | |

| Investment Companies (0.5%) | |

| Money Market Funds (0.5%) | |

BGI Institutional Money Market Fund

1-day yield of 2.25% | | | 12,262 | | | $ | 12 | | |

Goldman Sachs Financial Square Prime

Obligations Fund

1-day yield of 2.05% | | | 199,255 | | | | 199 | | |

Merrill Lynch Premier Institutional Fund

1-day yield of 2.14% | | | 450,016 | | | | 450 | | |

Merrimac Cash Fund, Premium Class

1-day yield of 1.76% (e) | | | 325,920 | | | | 326 | | |

| Total Security Lending Collateral (cost: $14,792) | | | | | | | 14,792 | | |

| Total Investment Securities (cost: $180,491) | | | | | | $ | 193,188 | | |

| SUMMARY: | |

| Investments, at value | | | 103.1 | % | | | 193,188 | | |

| Liabilities in excess of other assets | | | (3.1 | )% | | | (5,796 | ) | |

| Net assets | | | 100.0 | % | | $ | 187,392 | | |

NOTES TO SCHEDULE OF INVESTMENTS:

(a) At December 31, 2004, all or a portion of this security is on loan (see Note 1). The value at December 31, 2004, of all securities on loan is $14,372.

(b) No dividends were paid during the preceding twelve months.

(c) Floating or variable rate note. Rate is listed as of December 31, 2004.

(d) Cash collateral for the Repurchase Agreements, valued at $4,868, that serve as collateral for securities lending are invested in corporate bonds with interest rates and maturity dates ranging from 0.00%–9.75% and 02/15/2005–12/31/2049, respectively.

(e) Regulated investment company advised by Investors Bank and Trust Co. ("IBT"). IBT is also the accounting, custody and lending agent for the Fund.

DEFINITIONS:

ADR American Depositary Receipt

144A 144A Securites are registered pursuant to Rule 144A of the Securites Act of 1933. These securities may be resold as transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2004, these securities aggregated $1,778 or .9% of the net assets of the Fund.

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

6

American Century Large Company Value

STATEMENT OF ASSETS AND LIABILITIES

At December 31, 2004

(all amounts except share amounts in thousands)

| Assets: | | | |

Investment securities, at value (cost: $180,491)

(including securities loaned of $14,372) | | $ | 193,188 | | |

| Cash | | | 8,647 | | |

| Receivables: | |

| Investment securities sold | | | 503 | | |

| Shares sold | | | 178 | | |

| Interest | | | 11 | | |

| Dividends | | | 276 | | |

| | | | 202,803 | | |

| Liabilities: | | | |

| Investment securities purchased | | | 455 | | |

| Accounts payable and accrued liabilities: | |

| Shares redeemed | | | 15 | | |

| Management and advisory fees | | | 136 | | |

| Payable for collateral for securities on loan | | | 14,792 | | |

| Other | | | 13 | | |

| | | | 15,411 | | |

| Net Assets | | $ | 187,392 | | |

| Net Assets Consist of: | | | |

Capital stock, 50,000 shares authorized

($.01 par value) | | $ | 169 | | |

| Additional paid-in capital | | | 166,330 | | |

| Undistributed net investment income (loss) | | | 1,287 | | |

Undistributed net realized gain (loss) from

investment securities | | | 6,909 | | |

Net unrealized appreciation (depreciation)

on investment securities | | | 12,697 | | |

| Net Assets | | $ | 187,392 | | |

| Net Assets by Class: | | | |

| Initial Class | | $ | 185,445 | | |

| Service Class | | | 1,947 | | |

| Shares Outstanding: | | | |

| Initial Class | | | 16,765 | | |

| Service Class | | | 176 | | |

| Net Asset Value and Offering Price Per Share: | | | |

| Initial Class | | $ | 11.06 | | |

| Service Class | | | 11.07 | | |

STATEMENT OF OPERATIONS

For the year ended December 31, 2004

(all amounts in thousands)

| Investment Income: | | | |

| Interest | | $ | 32 | | |

| Dividends | | | 2,012 | | |

| Income from loaned securities–net | | | 12 | | |

| Less withholding taxes on foreign dividends | | | (9 | ) | |

| | | | 2,047 | | |

| Expenses: | | | |

| Management and advisory fees | | | 691 | | |

| Printing and shareholder reports | | | 5 | | |

| Custody fees | | | 29 | | |

| Administration fees | | | 12 | | |

| Legal fees | | | 1 | | |

| Audit fees | | | 13 | | |

| Directors fees | | | 2 | | |

| Service fees: | |

| Service Class | | | 2 | | |

| Total expenses | | | 755 | | |

| Net Investment Income (Loss) | | | 1,292 | | |

| Net Realized and Unrealized Gain (Loss): | | | |

| Realized gain (loss) from investment securities | | | 8,353 | | |

Increase (decrease) in unrealized appreciation

(depreciation) on investment securities | | | 3,794 | | |

| Net Gain (Loss) on Investments | | | 12,147 | | |

Net Increase (Decrease) in Net Assets Resulting

from Operations | | $ | 13,439 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

7

American Century Large Company Value

STATEMENTS OF CHANGES IN NET ASSETS

For the periods ended

(all amounts in thousands)

| | | December 31,

2004 | | December 31,

2003 | |

| Increase (Decrease) in Net Assets From: | |

| Operations: | |

| Net investment income (loss) | | $ | 1,292 | | | $ | 655 | | |

Net realized gain (loss) from

investment securities | | | 8,353 | | | | 838 | | |

Net unrealized appreciation

(depreciation) on investment

securities | | | 3,794 | | | | 11,149 | | |

| | | | 13,439 | | | | 12,642 | | |

| Distributions to Shareholders: | |

| From net investment income: | |

| Initial Class | | | (623 | ) | | | (146 | ) | |

| Service Class | | | (6 | ) | | | – | | |

| | | | (629 | ) | | | (146 | ) | |

| Capital Share Transactions: | |

| Proceeds from shares sold: | |

| Initial Class | | | 125,897 | | | | 17,204 | | |

| Service Class | | | 1,856 | | | | 138 | | |

| | | | 127,753 | | | | 17,342 | | |

Dividends and distributions

reinvested: | |

| Initial Class | | | 623 | | | | 146 | | |

| Service Class | | | 6 | | | | – | | |

| | | | 629 | | | | 146 | | |

| Cost of shares redeemed: | |

| Initial Class | | | (13,722 | ) | | | (4,752 | ) | |

| Service Class | | | (205 | ) | | | (3 | ) | |

| | | | (13,927 | ) | | | (4,755 | ) | |

| | | | 114,455 | | | | 12,733 | | |

| Net increase (decrease) in net assets | | | 127,265 | | | | 25,229 | | |

| Net Assets: | |

| Beginning of year | | | 60,127 | | | | 34,898 | | |

| End of year | | $ | 187,392 | | | $ | 60,127 | | |

Undistributed Net Investment

Income (Loss) | | $ | 1,287 | | | $ | 655 | | |

| | | December 31,

2004 | | December 31,

2003 | |

| Share Activity: | | | |

| Shares issued: | |

| Initial Class | | | 11,948 | | | | 2,122 | | |

| Service Class | | | 180 | | | | 15 | | |

| | | | 12,128 | | | | 2,137 | | |

Shares issued–reinvested from

distributions: | |

| Initial Class | | | 64 | | | | 17 | | |

| Service Class | | | 1 | | | | – | | |

| | | | 65 | | | | 17 | | |

| Shares redeemed: | |

| Initial Class | | | (1,361 | ) | | | (593 | ) | |

| Service Class | | | (20 | ) | | | – | | |

| | | | (1,381 | ) | | | (593 | ) | |

Net increase (decrease) in shares

outstanding: | |

| Initial Class | | | 10,651 | | | | 1,546 | | |

| Service Class | | | 161 | | | | 15 | | |

| | | | 10,812 | | | | 1,561 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

8

American Century Large Company Value

FINANCIAL HIGHLIGHTS

| | | | | For a share outstanding throughout each period (a) | |

| | | | | Net Asset | | Investment Operations | | Distributions | | Net Asset | |

| | | For the

Period

Ended (b) | | Value,

Beginning

of Period | | Net

Investment

Income (Loss) | | Net Realized

and Unrealized

Gain (Loss) | | Total

Operations | | From Net

Investment

Income | | From Net

Realized

Gains | | Total

Distributions | | Value,

End

of Period | |

| Initial Class | | 12/31/2004 | | $ | 9.81 | | | $ | 0.17 | | | $ | 1.18 | | | $ | 1.35 | | | $ | (0.10 | ) | | $ | – | | | $ | (0.10 | ) | | $ | 11.06 | | |

| | | 12/31/2003 | | | 7.64 | | | | 0.12 | | | | 2.08 | | | | 2.20 | | | | (0.03 | ) | | | – | | | | (0.03 | ) | | | 9.81 | | |

| | | 12/31/2002 | | | 9.48 | | | | 0.06 | | | | (1.90 | ) | | | (1.84 | ) | | | – | | | | – | | | | – | | | | 7.64 | | |

| | | 12/31/2001 | | | 10.00 | | | | 0.03 | | | | (0.55 | ) | | | (0.52 | ) | | | – | | | | – | | | | – | | | | 9.48 | | |

| Service Class | | 12/31/2004 | | | 9.82 | | | | 0.17 | | | | 1.16 | | | | 1.33 | | | | (0.08 | ) | | | – | | | | (0.08 | ) | | | 11.07 | | |

| | | 12/31/2003 | | | 7.90 | | | | 0.08 | | | | 1.85 | | | | 1.93 | | | | (0.01 | ) | | | – | | | | (0.01 | ) | | | 9.82 | | |

| | | | | | | Ratios/Supplemental Data | |

| | | For the

Period | | Total | | Net Assets,

End of

Period | | Ratio of Expenses

to Average

Net Assets (f) | | Net Investment

Income (Loss)

to Average | | Portfolio

Turnover | |

| | | Ended (b) | | Return (c)(g) | | (000's) | | Net (d) | | Total (e) | | Net Assets (f) | | Rate (g) | |

| Initial Class | | 12/31/2004 | | | 13.91 | % | | $ | 185,445 | | | | 0.97 | % | | | 0.97 | % | | | 1.67 | % | | | 86 | % | |

| | | 12/31/2003 | | | 28.79 | | | | 59,978 | | | | 1.08 | | | | 1.08 | | | | 1.41 | | | | 62 | | |

| | | 12/31/2002 | | | (19.38 | ) | | | 34,898 | | | | 1.40 | | | | 1.54 | | | | 0.76 | | | | 94 | | |

| | | 12/31/2001 | | | (5.20 | ) | | | 6,785 | | | | 1.40 | | | | 5.95 | | | | 0.50 | | | | 47 | | |

| Service Class | | 12/31/2004 | | | 13.61 | | | | 1,947 | | | | 1.22 | | | | 1.22 | | | | 1.66 | | | | 86 | | |

| | | 12/31/2003 | | | 24.40 | | | | 149 | | | | 1.31 | | | | 1.31 | | | | 1.39 | | | | 62 | | |

NOTES TO FINANCIAL HIGHLIGHTS

(a) Per share information is calculated based on average number of shares outstanding.

(b) The inception dates of the Fund's share classes are as follows:

Initial Class – May 1, 2001

Service Class – May 1, 2003

(c) Total Return reflects all portfolio expenses and includes reinvestment of dividends and capital gains; it does not reflect the charges and deductions under the policies or annuity contracts.

(d) Ratio of Net Expenses to Average Net Assets is net of fee waivers and reimbursements by the investment adviser, if any (see note 2).

(e) Ratio of Total Expenses to Average Net Assets includes all expenses before fee waivers and reimbursements by the investment adviser.

(f) Annualized.

(g) Not annualized for periods of less than one year.

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

9

American Century Large Company Value

NOTES TO FINANCIAL STATEMENTS

At December 31, 2004

(all amounts in thousands)

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

The AEGON/Transamerica Series Fund, Inc. ("ATSF") is a Maryland corporation registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company. ATSF serves as a funding vehicle for variable life insurance, variable annuity and group annuity products. American Century Large Company Value ("the Fund"), part of ATSF, began operations on May 1, 2001.

On May 3, 2004, the Fund changed its name from American Century Income & Growth to American Century Large Company Value.

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties, which provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

See the Prospectus and Statement of Additional Information for a description of the Fund's investment objective.

In preparing the Fund's financial statements in accordance with accounting principles generally accepted in the United States of America ("GAAP"), estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures. The following policies were consistently followed by the Fund, in accordance with GAAP.

Multiple class operations and expenses: The Fund currently offers two classes of shares, an Initial Class and a Service Class. Income, non-class specific expenses and realized and unrealized gains and losses, are allocated daily to each class, based upon the value of shares outstanding method as permitted under Rule 18f-3 of the 1940 Act. Each class bears its own specific expenses as well as a portion of general, common expenses.

Pricing of shares: The Fund prices its shares on the basis of the net asset value of each class of shares of the Fund, which is determined as of the close of the New York Stock Exchange ("NYSE") (generally 4:00 p.m. Eastern Time) on each day on which the NYSE is open for trading.

Security valuations: Fund investments traded on an exchange are valued at the closing price on the day of valuation on the exchange where the security is principally traded.

Securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the last quoted bid price.

Debt securities are valued by independent pricing services at the last quoted bid price; however, those that mature in sixty days or less are valued at amortized cost, which approximates market.

Investment company securities are valued at net asset value of the underlying portfolio.

Other securities for which quotations are not readily available are valued at fair market value as determined in good faith using guidelines established by and under the supervision of the Board of Directors, and the Fund's Valuation Committee. These guidelines may include: the type of security; any restrictions on its resale; financial or business news of the issuer; similar or related securities that are actively trading; related corporate actions; and other significant events occurring after the close of trading in the security.

Cash: The Fund may leave cash overnight in its cash account with the custodian, Investors Bank & Trust Company ("IBT"). IBT has been contracted on behalf of the Fund to invest the excess cash into a savings account, which at December 31, 2004, was paying an interest rate of 2.01%.

Throughout the year, the Fund may have a cash overdraft balance. A fee is incurred on this overdraft, calculated by multiplying the overdraft by a rate based on the federal funds rate.

Repurchase agreements: The Fund is authorized to enter into repurchase agreements. The Fund, through IBT, receives delivery of the underlying securities, the value of which at the time of purchase is required to be an amount equal to at least 100% of the resale price. Repurchase agreements involve the risk that the seller will fail to repurchase the security, as agreed. In that case, the Fund will bear the risk of value fluctuations until the security can be sold and may encounter delays and incur costs in liquidating the security. In the event of bankruptcy or insolvency of the seller, delays and costs may be incurred.

Securities lending: The Fund may lend securities to enhance fund earnings from investing cash collateral in making such loans to qualified borrowers (typically broker/dealers). The Fund has engaged its custodian bank, IBT, as a lending agent to administer its securities lending program. IBT earned $5 of program income for its services. When the Fund makes a security loan, it receives cash collateral as protection against the risk that the borrower will default on the loan, and records an asset for the cash invested collateral and a liability for the return of the collateral.

Loans of securities are required to be secured by collateral at least equal to 102% of the value of the securities at inception of the loan, and not less then 100% thereafter. The Fund may invest cash collateral in short-term money market instruments including: U.S. Treasury Bills, U.S.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

10

American Century Large Company Value

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2004

(all amounts in thousands)

NOTE 1.–(continued)

agency obligations, commercial paper, money market mutual funds, repurchase agreements and other highly rated, liquid investments. During the life of securities loans, the collateral and securities loaned remain subject to fluctuation in value. IBT marks to market securities loaned and the collateral each business day. If additional collateral is due (at least $1), IBT collects additional cash collateral from the borrowers. Although securities loaned will be fully collateralized at all times, IBT may experience delays in, or may be prevented from, recovering the collateral on behalf of the Fund. The Fund may recall a loaned security position at any time from the borrower through IBT. In the event the borrower fails to timely return a recalled security, IBT may indemnify the Fund by purchasing replacement securities for the Fund at its own expense and claiming the collateral to fund such a purchase. IBT absorbs the loss if the collateral value is not sufficient to cover the cost of the replacement securities. If replacement securities are not available, IBT will credit the equivalent cash value to the Fund.

While a security is on loan, the Fund does not have the right to vote that security. However, if time permits, the Fund will attempt to recall a security on loan and vote the proxy.

Income from securities lending is included in the Statement of Operations. The amount of collateral and value of securities on loan are included in the Statement of Assets and Liabilities as well as in the Schedule of Investments.

Real Estate Investment Trusts ("REITs"): There are certain additional risks involved in investing in REITs. These include, but are not limited to, economic conditions, changes in zoning laws, real estate values, property taxes and interest rates.

Dividend income is recorded at management's estimate of the income included in distributions from the REIT investments. Distributions received in excess of the estimated amount are recorded as a reduction of the cost investments. The actual amounts of income, return of capital and capital gains are only determined by each REIT after the fiscal year end and may differ from the estimated amounts.

Security transactions and investment income: Security transactions are recorded on the trade date. Security gains and losses are calculated on the first-in, first-out basis. Dividend income is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is informed of the ex-dividend date. Interest Income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis commencing on the settlement date.

Dividend distributions: Dividends and capital gains distributions are typically declared and reinvested annually and are generally paid and reinvested on the business day following the ex-date.

NOTE 2. RELATED PARTY TRANSACTIONS

AEGON/Transamerica Fund Advisers, Inc. ("ATFA") is the Fund's investment adviser. AEGON/Transamerica Fund Services, Inc. ("ATFS") is the Fund's administrator and transfer agent. AFSG Securities Corp. ("AFSG") is the Fund's distributor. AFSG is 100% owned by AUSA Holding Company ("AUSA"). ATFA is a directly owned subsidiary of Western Reserve Life Assurance Co. of Ohio (78%) ("WRL") and AUSA (22%). ATFS is a wholly owned subsidiary of WRL. AUSA and WRL are wholly owned indirect subsidiaries of AEGON NV, a Netherlands corporation.

Certain officers and directors of the Fund are also officers and/or directors of ATFA, ATFS, AFSG and WRL. No affiliated officer or director receives any compensation directly from the Fund.

The following schedule reflects the percentage of fund assets owned by affiliated mutual funds (i.e. through the asset allocation funds):

| | | Net

Assets | | % of

Net Assets | |

| Asset Allocation–Conservative Portfolio | | $ | 24,049 | | | | 13 | % | |

| Asset Allocation–Moderate Portfolio | | | 91,882 | | | | 49 | % | |

| Total | | $ | 115,931 | | | | 62 | % | |

Investment advisory fee: The Fund pays management fees to ATFA based on average daily net assets ("ANA") at the following breakpoints:

0.90% of the first $100 million of ANA

0.85% of the next $150 million of ANA

0.80% of ANA over $250 million

ATFA has contractually agreed to waive its advisory fee and will reimburse the Fund to the extent that operating expenses, excluding 12b-1 fees, exceed the following stated annual limit:

1.40% Expense Limit

If total fund expenses fall below the annual expense limitation agreement agreed to by the adviser within the succeeding three years, the Fund may be required to pay that adviser a portion or all of the waived advisory fees.

There were no amounts available for recapture at December 31, 2004. There were no amounts recaptured for the year ended December 31, 2004.

Distribution and service fees: The Fund adopted a distribution plan ("Distribution Plan") pursuant to Rule 12b-1 under the Investment

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

11

American Century Large Company Value

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2004

(all amounts in thousands)

NOTE 2.–(continued)

Company Act of 1940, as amended. Pursuant to the Distribution Plan, ATSF entered into a Distribution Agreement with AFSG effective May 1, 1999.

Under the Distribution Plan and Distribution Agreement on the Initial Class shares, AFSG, on behalf of the Fund, is authorized to pay various service providers, as direct payment for expenses incurred in connection with distribution of the Fund's shares, amounts equal to actual expenses associated with distributing the shares.

The Distribution Plan on the Service Class shares requires ATSF to pay distribution fees to AFSG as compensation for its activities, not as reimbursement for specific expenses. The fee on the Service Class is paid to the insurance companies for providing services and account maintenance for their policyholders who invest in the variable insurance products which invest in the Service Class shares.

The Fund is authorized under the 12b-1 plan to pay fees on each class up to the following limits:

| Initial Class | | | 0.15 | % | |

| Service Class | | | 0.25 | % | |

AFSG has determined that it will not seek payment by the Fund of the distribution expenses incurred with respect to the Initial Class shares before April 30, 2005. Prior to AFSG seeking reimbursement of future expenses, policy and contract owners will be notified in advance. The Fund pays fees relating to Service Class shares.

Administrative services: The Fund has entered into an agreement with ATFS for financial and legal fund administration services, which includes such items as compliance, expenses, financial statements and other reporting, distributions, tax returns, prospectus preparation, board of directors meeting support, transfer agency and other legal matters. The Fund pays ATFS an annual fee of 0.015% of average net assets. The Legal fees on the Statement of Operations are for fees paid to external legal counsel.

Deferred compensation plan: Each eligible Fund Director may elect participation in the Deferred Compensation Plan for Directors of ATSF ("the Plan"). Under the Plan, such Directors may defer payment of a percentage of their total fees earned as a Fund Director. These deferred amounts may be invested in any portfolio of Transamerica IDEX Mutual Funds, an affiliate of the Fund. At December 31, 2004, the value of invested plan amounts was $8. Invested plan amounts and the total liability for deferred compensation to the Directors under the Plan at December 31, 2004, are included in Net Assets in the accompanying Statement of Assets and Liabilities.

NOTE 3. INVESTMENT TRANSACTIONS

The cost of securities purchased and proceeds from securities sold (excluding short-term securities) for the year ended December 31, 2004, were as follows:

| Purchases of securities: | | | |

| Long-Term excluding U.S. Government | | $ | 173,137 | | |

| U.S. Government | | | – | | |

| Proceeds from maturities and sales of securities: | | | |

| Long-Term excluding U.S. Government | | | 66,864 | | |

| U.S. Government | | | – | | |

NOTE 4. FEDERAL INCOME TAX MATTERS

The Fund has not made any provision for federal income taxes due to its policy to distribute all of its taxable income and capital gains to its shareholders and otherwise qualify as a regulated investment company under the Internal Revenue Code. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatments for items including, but not limited to, wash sales and REITs.

Reclassifications between Undistributed net investment income (loss), Accumulated net realized capital gains (loss) and Additional paid-in capital are made to reflect income and gains available for distribution under federal tax regulations. Results of operations and net assets are not effected by these reclassifications. These reclassifications are as follows:

| Additional paid-in capital | | $ | – | | |

| Undistributed net investment income (loss) | | | (31 | ) | |

Accumulated net realized gain (loss) from investment

securities | | | 31 | | |

The capital loss carryforward utilized during the year ended December 31, 2004 was $771.

The tax character of distributions paid may differ from the character of distributions shown in the Statement of Changes in Net Assets due to short-term gains being treated as ordinary income for tax purposes. The tax character of distributions paid during 2003 and 2004 was as follows:

| 2003 Distributions paid from: | |

| Ordinary Income | | $ | 146 | | |

| Long-term Capital Gain | | | – | | |

| 2004 Distributions paid from: | |

| Ordinary Income | | | 629 | | |

| Long-term Capital Gain | | | – | | |

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

12

American Century Large Company Value

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2004

(all amounts in thousands)

NOTE 4.–(continued)

The tax basis components of distributable earnings as of December 31, 2004, are as follows:

| Undistributed Ordinary Income | | $ | 5,059 | | |

| Undistributed Long-term Capital Gains | | $ | 3,516 | | |

| Capital Loss Carryforward | | $ | – | | |

| Net Unrealized Appreciation (Depreciation) | | $ | 12,318 | | |

The aggregate cost of investments and composition of unrealized appreciation (depreciation) for federal income tax purposes as of December 31, 2004, are as follows:

| Federal Tax Cost Basis | | $ | 180,870 | | |

| Unrealized Appreciation | | $ | 12,721 | | |

| Unrealized (Depreciation) | | | (403 | ) | |

| Net Unrealized Appreciation (Depreciation) | | $ | 12,318 | | |

NOTE 5. REGULATORY PROCEEDINGS

There continues to be significant federal and state regulatory activity relating to financial services companies, particularly mutual fund companies and their investment advisers. As part of an ongoing investigation regarding potential market timing, recordkeeping and trading compliance issues and matters affecting the Fund's investment adviser, Transamerica Fund Advisors, Inc. (the "Adviser"), and certain employees and affiliates of the Adviser, the SEC staff has indicated that it is likely to take some action against the Adviser and certain of its affiliates at the conclusion of the investigation. The potential timing and the scope of any such action is difficult to predict. Although the impact of any action brought against the Adviser and/or its affiliates is difficult to assess at the present time, the portfolios currently believe that the likelihood that it will have a material adverse impact on them is remote. It is important to note that the portfolios are not aware of any allegation of wrongdoing against them and their board at the time this annual report is printed. Although it is not anticipated that these developments will have an adverse impact on the portfolios, there can be no assurance at this time. The Adviser and its affiliates are actively working with the SEC in regard to this matter; however, the exact resolution cannot be determined at this time. The Adviser will take such actions that it deems necessary or appropriate to continue providing management services to the portfolios and to bring all matters to an appropriate conclusion.

The Adviser and/or its affiliates, and not the portfolios, will bear the costs regarding these regulatory matters.

NOTE 6. SUBSEQUENT EVENTS

Effective January 1, 2005, AEGON/Transamerica Investor Services, Inc. ("ATIS") and AEGON/Transamerica Fund Services, Inc. ("ATFS") merged into one entity and was renamed Transamerica Fund Services, Inc. ("TFS"). TFS is a wholly owned subsidiary of Western Reserve Life Assurance Co. of Ohio ("WRL") and AUSA Holding Company ("AUSA"). WRL and AUSA are indirect wholly owned subsidiaries of AEGON N.V.

Effective January 1, 2005 the administrative service fee paid to ATFS will be 0.02% of average net assets.

The Fund will pay management fees to ATFA based on the average daily net assets ("ANA") at the following rate:

From January 1, 2005 on:

0.85% of the first $250 million

0.80% over $250 million up to $500 million

0.775% over $500 million up to $750 million

0.70% in excess of $750 million

Effective January 1, 2005, the Fund has implemented new expense caps under which the Fund's Operating Expenses, excluding 12b-1 fees, will not exceed 1.35% for the Initial Class and 1.60% for the Service Class of average daily net assets on an annual basis, respectively. To the extent that the Total Fund Operating Expenses would exceed the expense cap for one of the Fund in any month if the maximum Adviser Fee was paid, the Adviser Fee automatically reduces to ensure compliance with the applicable expense cap. If the automatic reduction of the Adviser Fee is not sufficient to maintain an expense cap, the Investment Adviser and/or its affiliates will remit to the appropriate Fund an amount that is sufficient to pay the excess amount and maintain the expense cap.

Effective January 1, 2005, AEGON/Transamerica Fund Advisors, Inc. was renamed Transamerica Fund Advisors, Inc. ("TFAI").

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

13

Report of Independent Registered Certified Public Accounting Firm

To the Board of Directors and Shareholders of

American Century Large Company Value

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of American Century Large Company Value the "Fund") (one of the portfolios constituting the AEGON/Transamerica Series Fund, Inc.) at December 31, 2004, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinio n on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2004 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

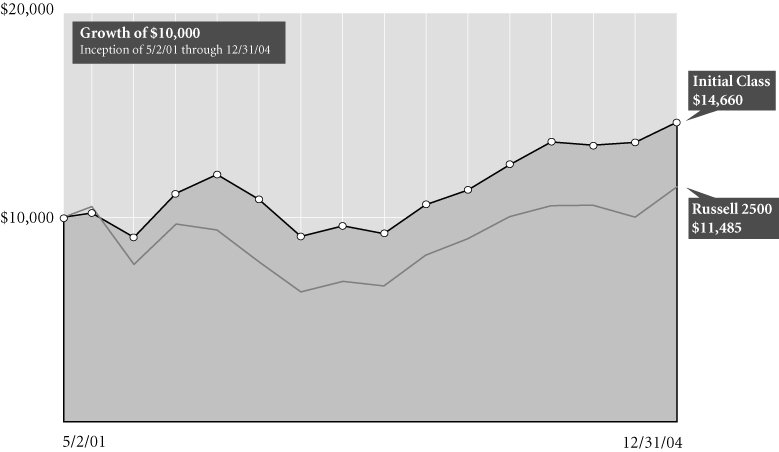

PricewaterhouseCoopers LLP

Tampa, Florida

February 18, 2005

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

14

AEGON Bond

MARKET ENVIRONMENT

Three key investment themes prevailed throughout the year: a flattening of the yield curve, as shorter-term rates increased and longer-term rates remained relatively stable; spread compression, as the differences in yield (spreads) between Treasury and non-Treasury sectors tightened; and the outperformance of lower-quality credit sectors.

As short-term interest rates slowly moved upward throughout the year, longer-term rates moved in a see-saw pattern from quarter to quarter. Although the year began with the economy growing at a healthy pace, driven primarily by consumer consumption and productivity growth, there were concerns that a slowdown was imminent. This caused interest rates to decline in the first quarter. But that sentiment was short lived, as employment and inflation figures showed unexpected increases during the second quarter. This led to significant upward movements in interest rates and a long-awaited change in the Federal Reserve Board's ("Fed") monetary policy.

In the third quarter, the economy remained on its growth track, and the Fed continued to raise the federal funds rate in a "measured" fashion. But, as oil prices began a rapid surge upward, inflation fears mounted, which led to renewed concerns of an economic slowdown and a decline in interest rates.

As we moved into the fourth quarter, an increase in business spending meant the still-growing U.S. economy was no longer supported solely by consumer consumption. Employment and inflation continued their modest moves upward. The Fed implemented two 25-basis-point rate hikes, and longer-term rate volatility subsided.

All of the spread sectors outperformed comparable duration Treasuries for both the quarter and the year. Corporate bonds were the best performers for the year, returning 163 basis points of excess return. Within the corporate sector, lower-rated securities fared the best in 2004, as investors sought yield. In the investment-grade universe, bonds in the BBB-rated segment were the top performers for the year. Mortgages and asset-backed securities ("ABS") also performed well with both returning 142 basis points of excess return for the year; although for ABS only 31 basis points occurred in the fourth quarter.

PERFORMANCE

For the year ended December 31, 2004, AEGON Bond, Initial Class returned 4.53%. By comparison its primary and secondary benchmarks, the Lehman Brothers Aggregate Bond Index and the Lehman Brothers U.S. Government/Credit Index returned 4.34% and 4.19%, respectively.

STRATEGY REVIEW

We continued to overweight mortgages and asset-backed securities during the year, which was a positive influence on performance in 2004. Security selection, particularly within the mortgage sector, was a strong driver of the portfolio's outperformance. We continued to favor collateralized mortgage obligations ("CMO"s) in the mortgage-backed sector.

We also continued to underweight corporate bonds, given our belief that the corporate sector was somewhat overvalued. Our approach was to add selectively to the portfolio's corporate allocation, purchasing higher-quality names that we believed provided acceptable risk/reward postures. Our high-quality bias continued to work against overall returns as investors continued to reach for yield. In particular, our underweight in BBB-rated bonds detracted from results.

The hallmark of our fixed income investment strategy is the selection of high-quality individual issues with an emphasis on identifying undervalued securities. Central to our philosophy is the construction of well-diversified portfolios within a highly disciplined investment process. AEGON Bond held 312 individual securities at year-end. Generally individual security concentrations are no more than 3% as measured by market value or less as dictated by individual portfolio guidelines. As a result of our highly diversified portfolio and disciplined investment process, any one holding should not have a significant effect on performance over a market cycle.

Consistent with our philosophy of de-emphasizing duration (sensitivity to interest rate changes), we kept the portfolio's duration within 10% of the benchmark's. At year-end, the portfolio's duration was 4.6 years, compared to 4.3 years for the benchmark. As such, the portfolio's duration strategy was neutral in terms of relative performance.

Investment Team

Banc One Investment Advisors Corporation

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

1

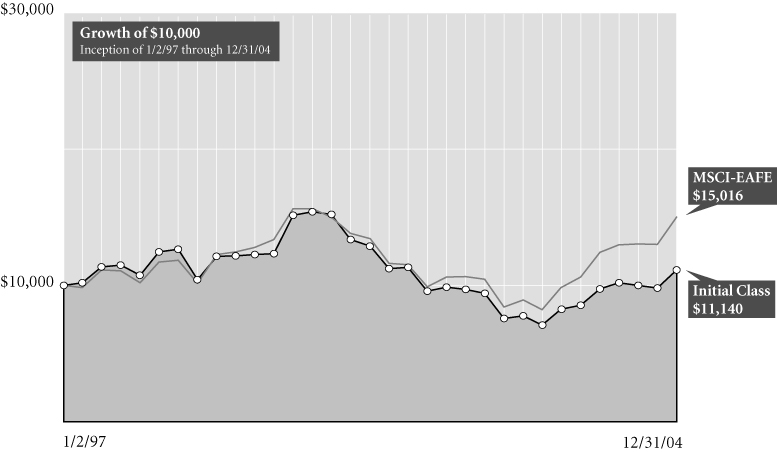

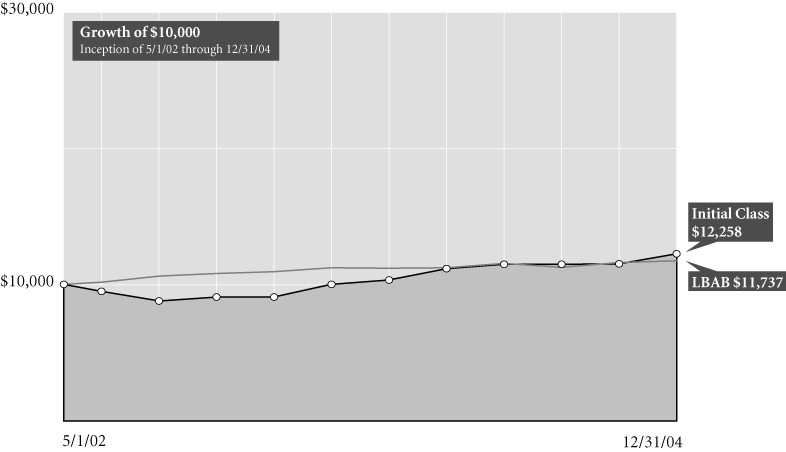

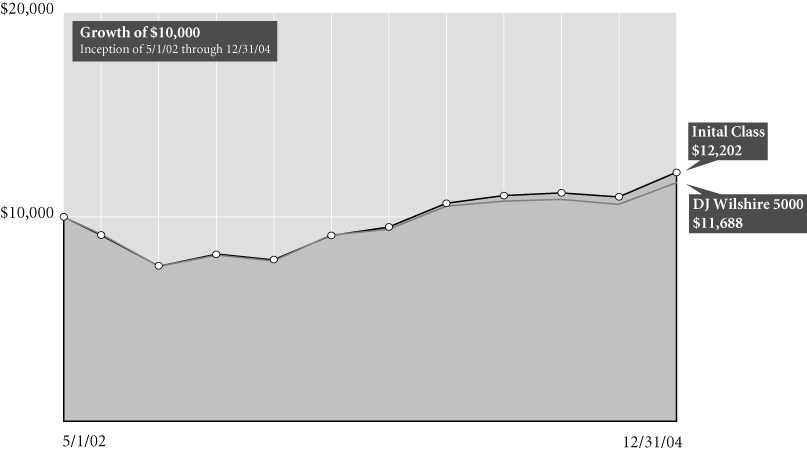

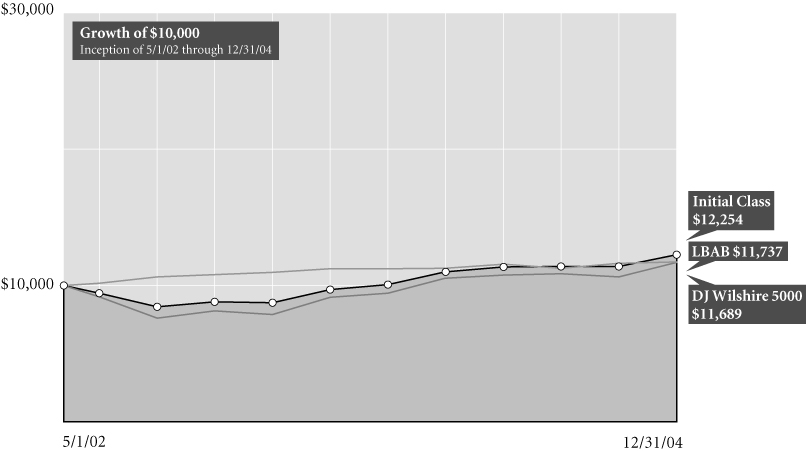

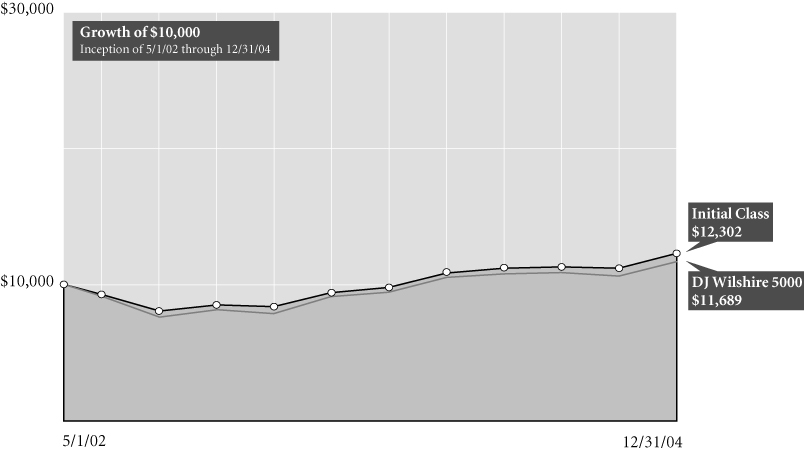

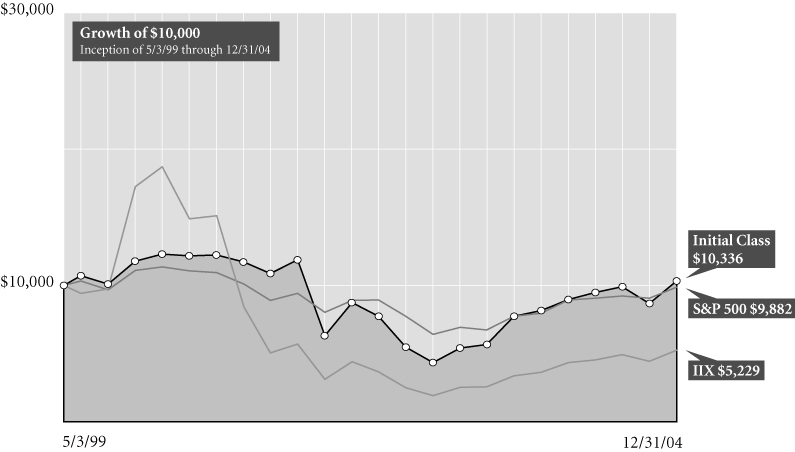

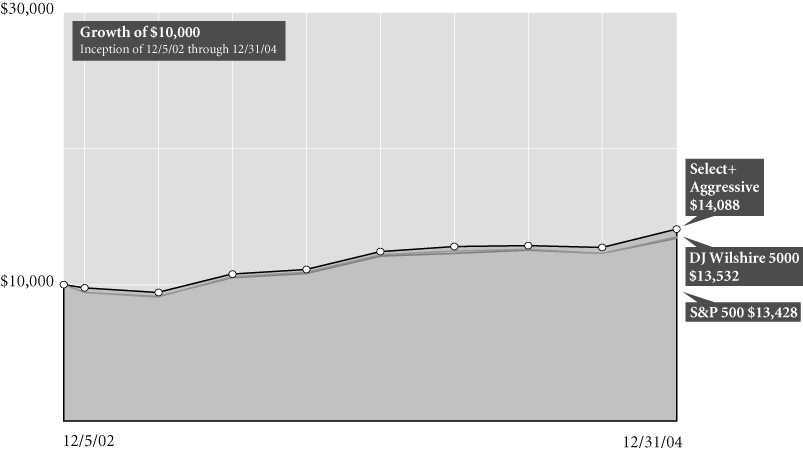

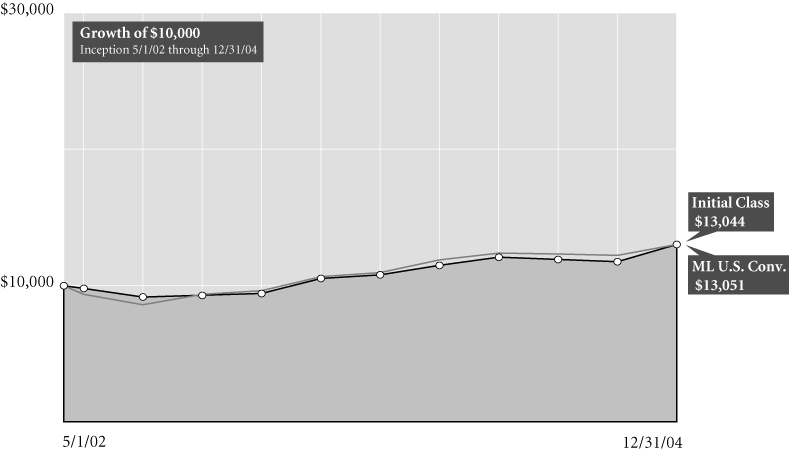

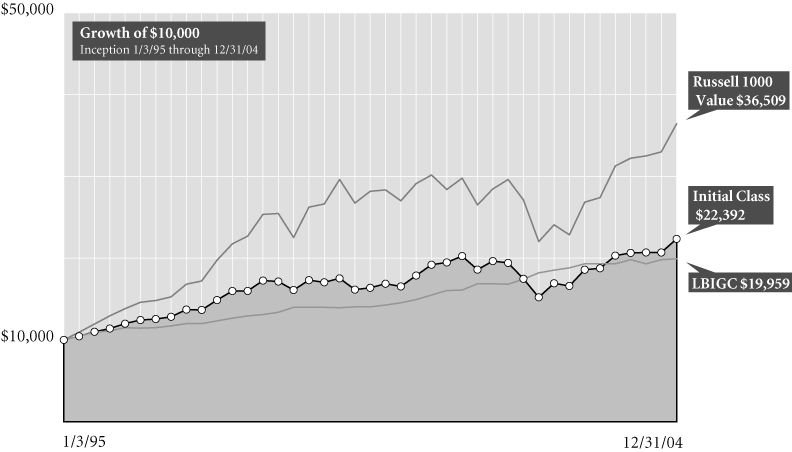

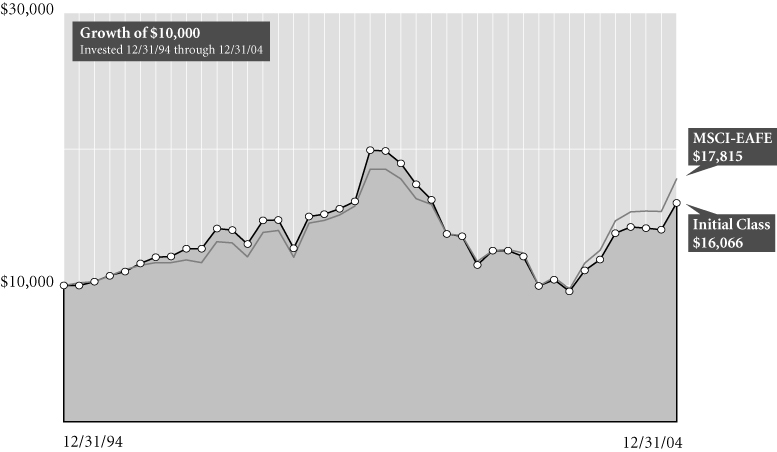

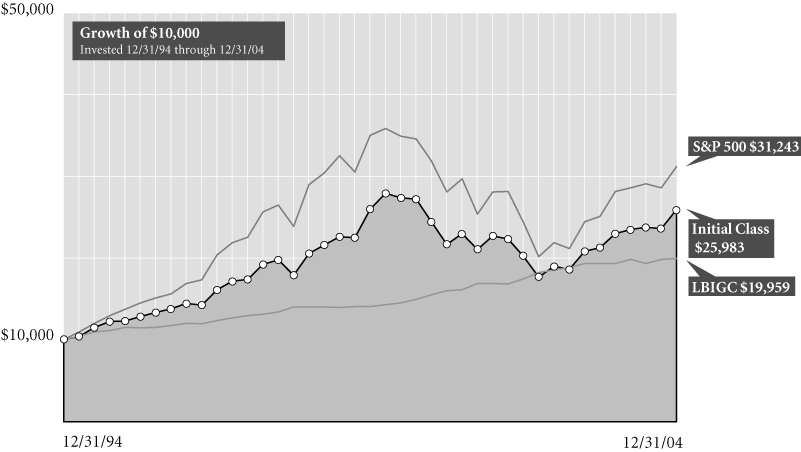

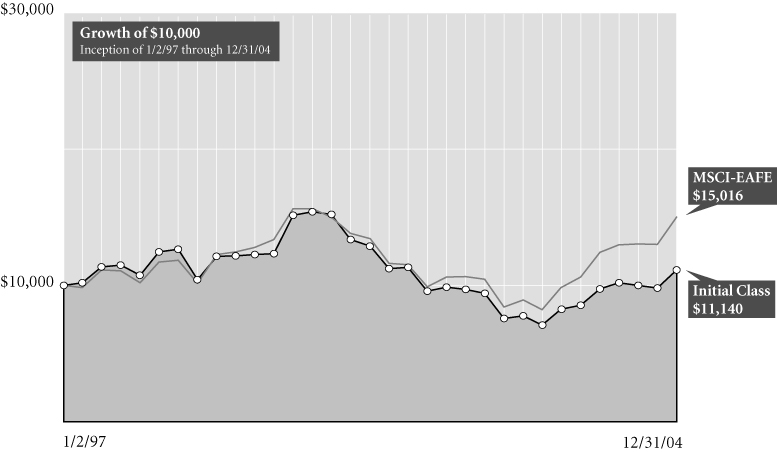

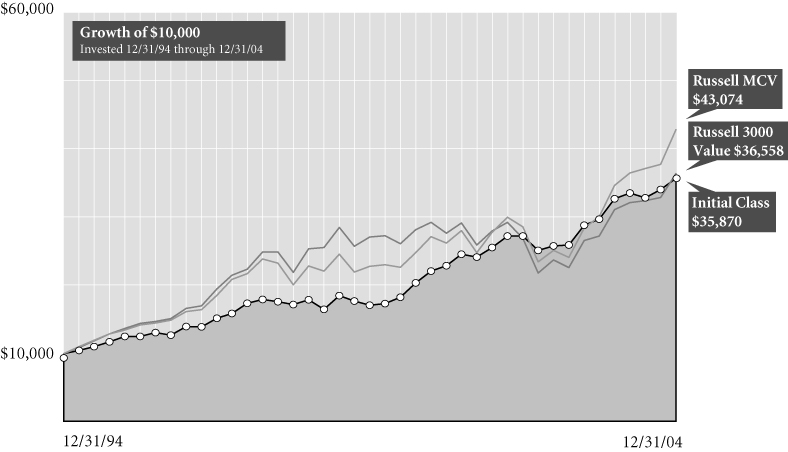

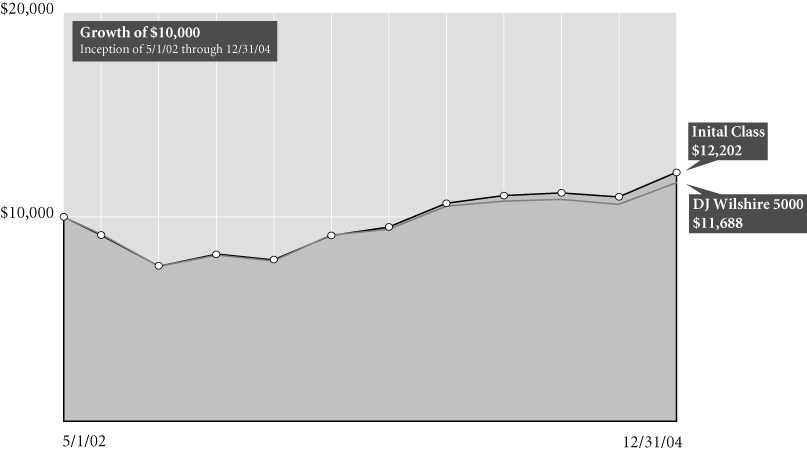

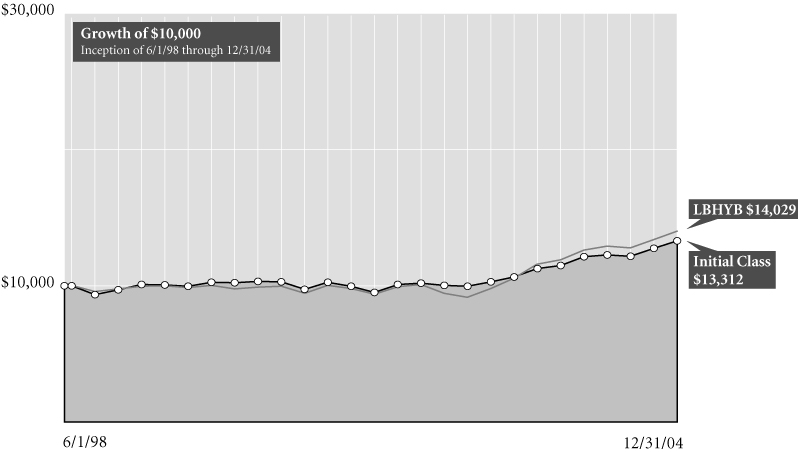

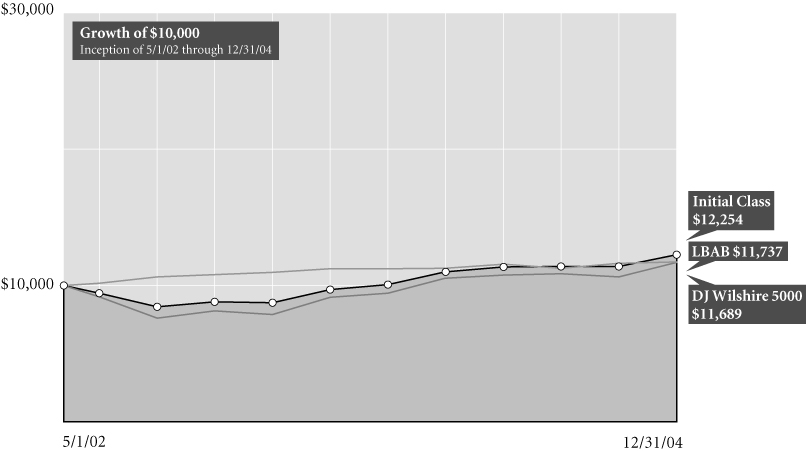

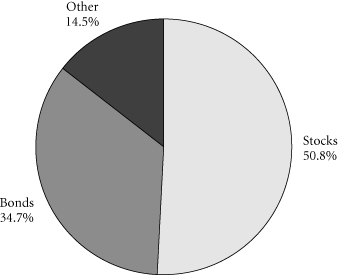

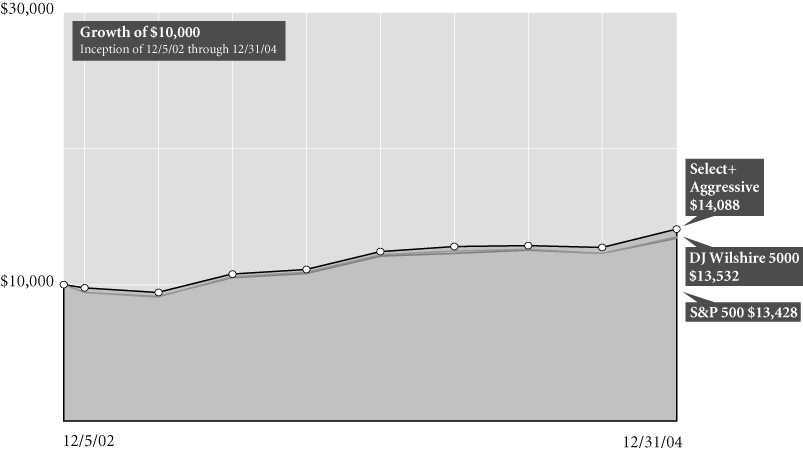

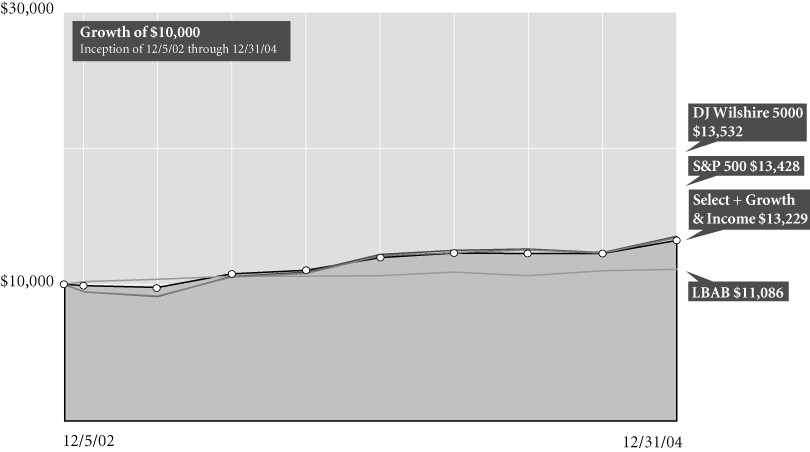

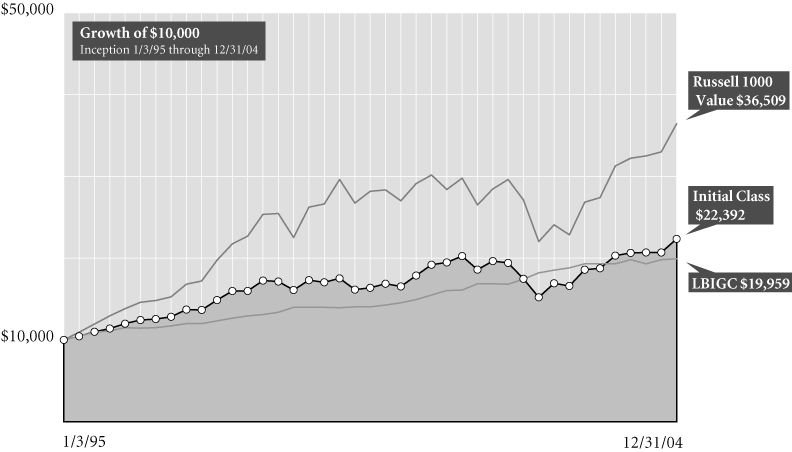

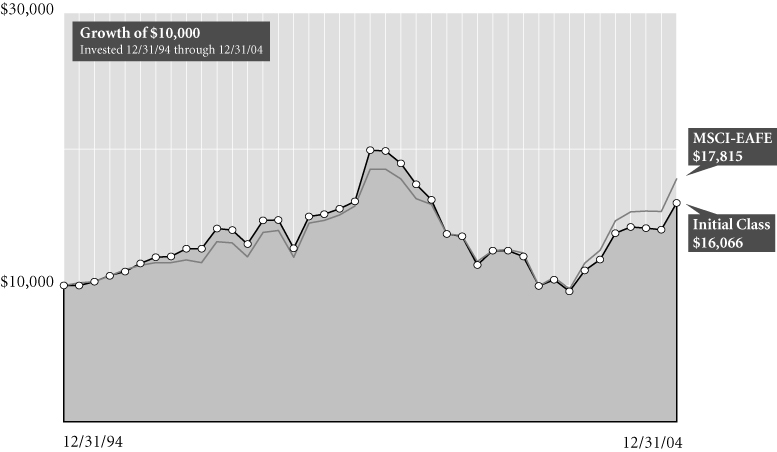

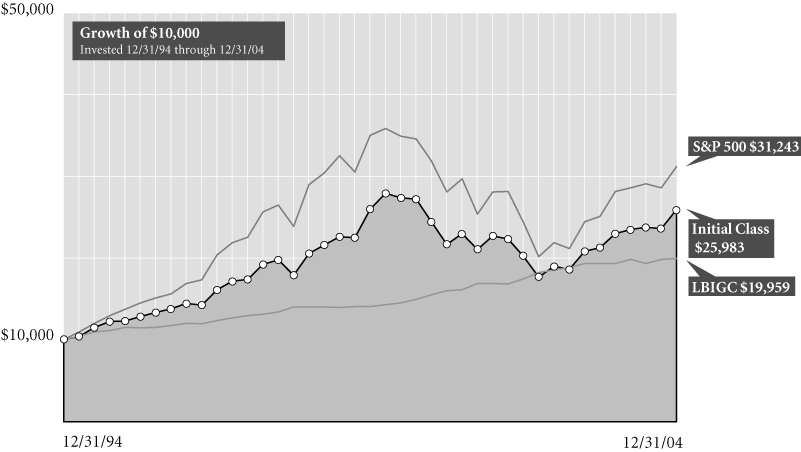

AEGON Bond

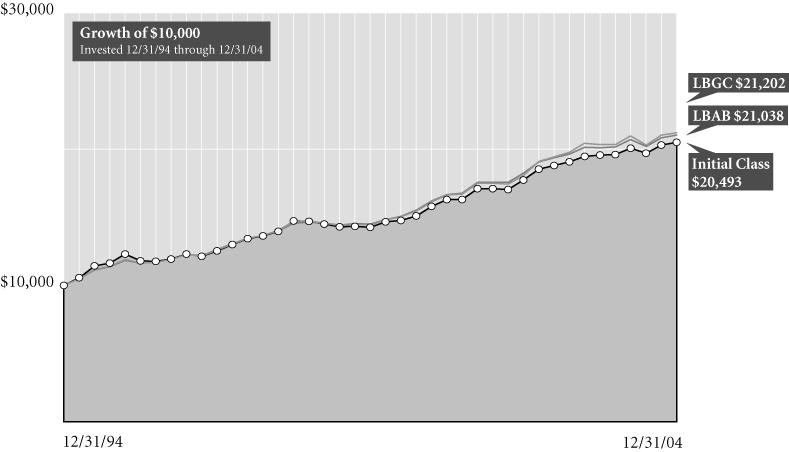

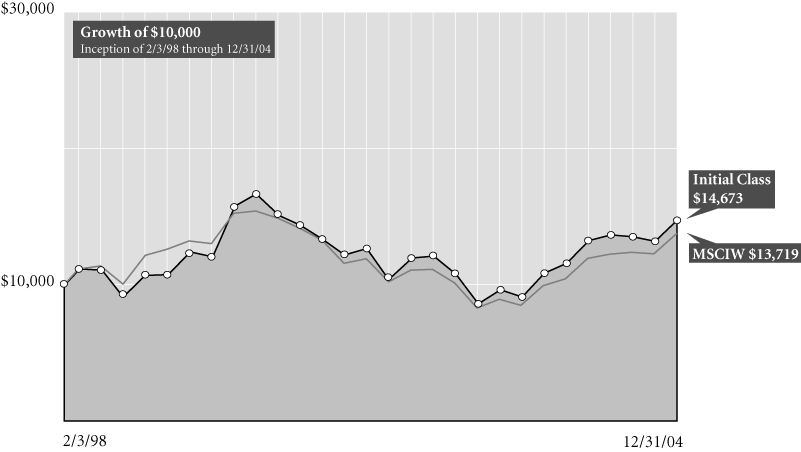

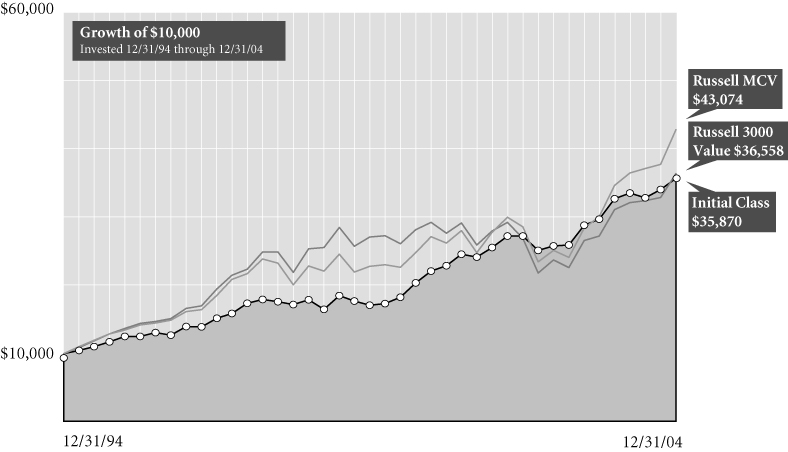

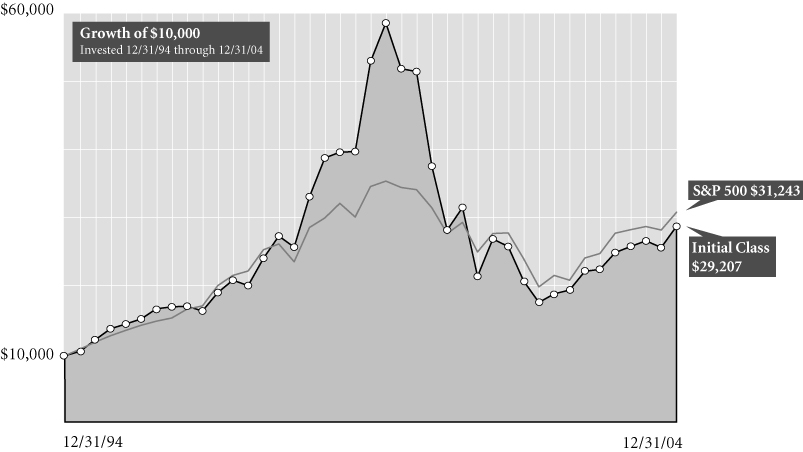

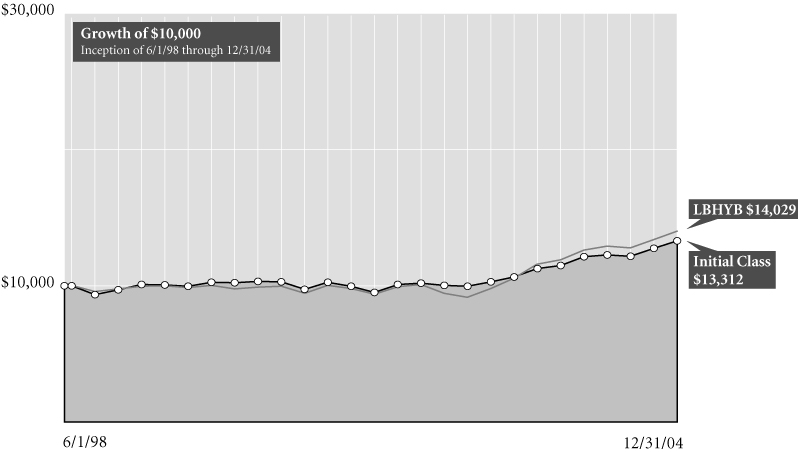

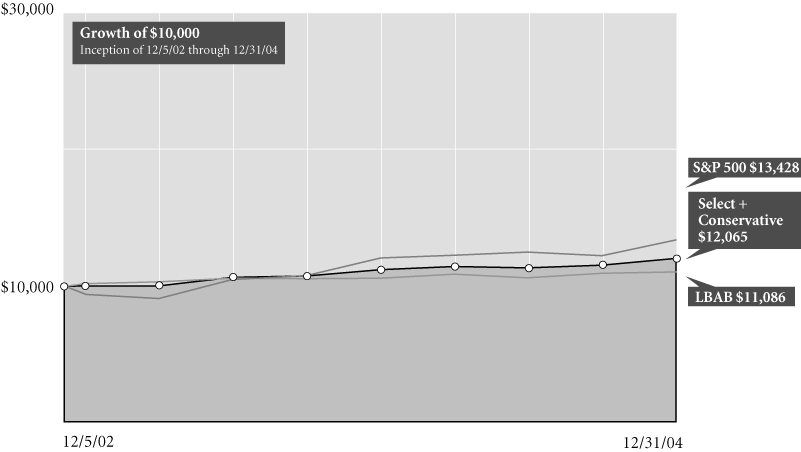

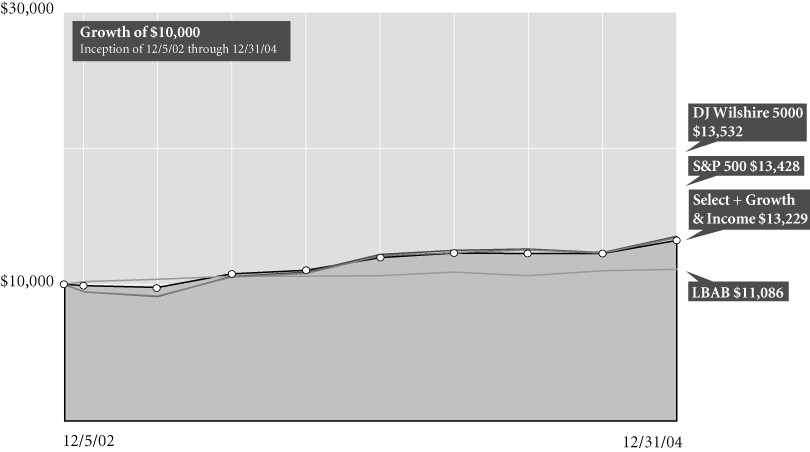

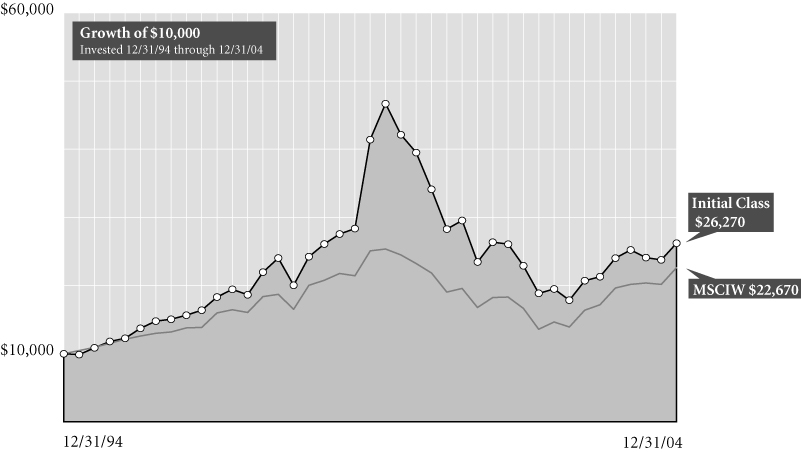

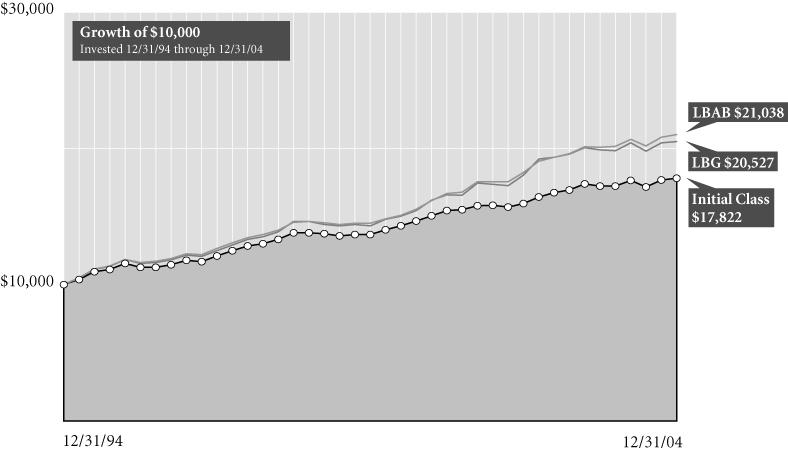

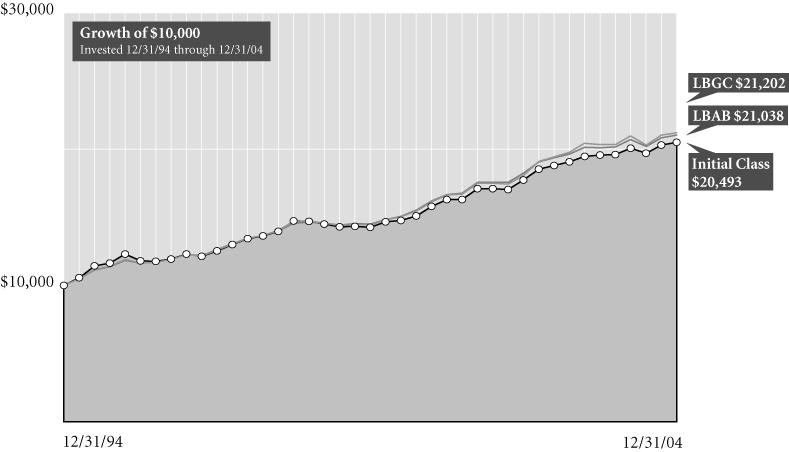

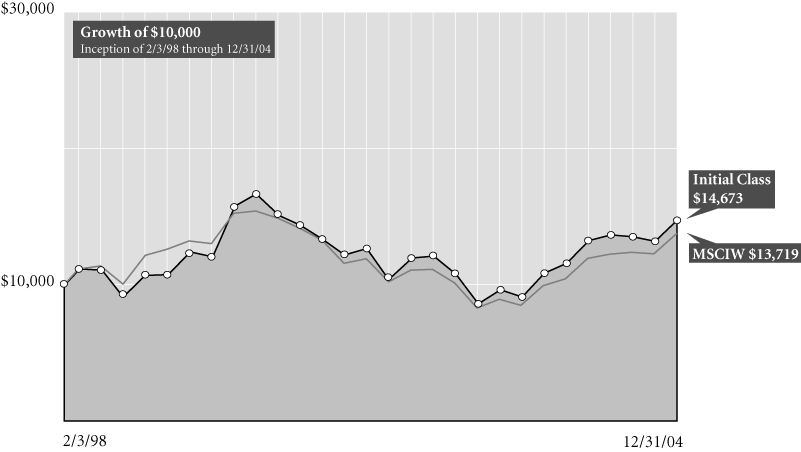

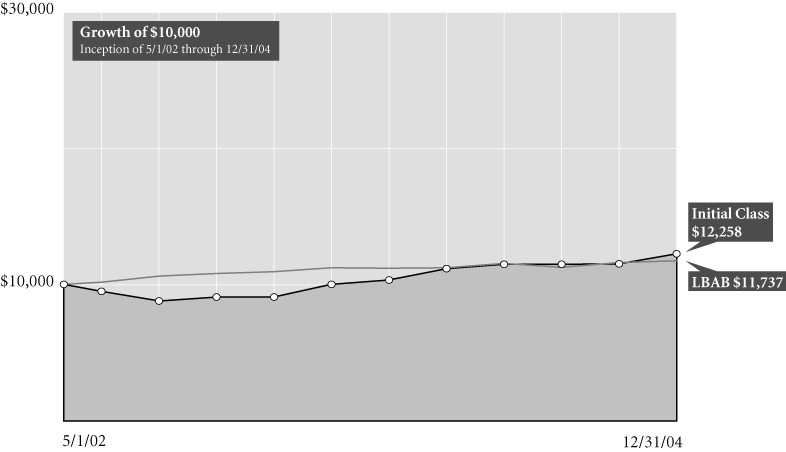

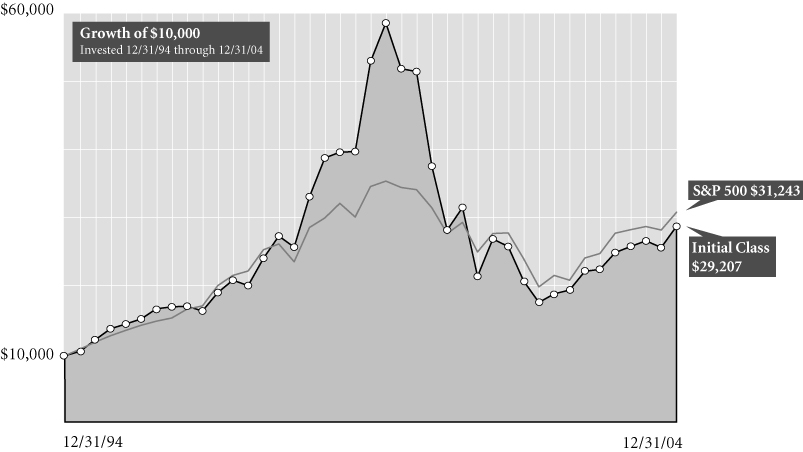

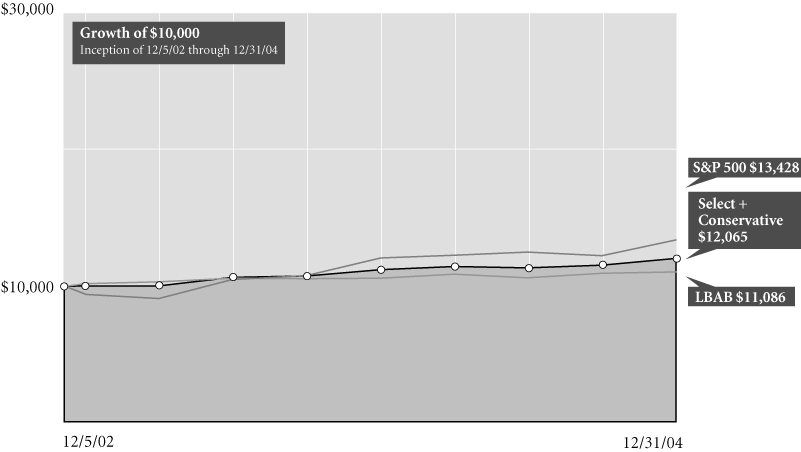

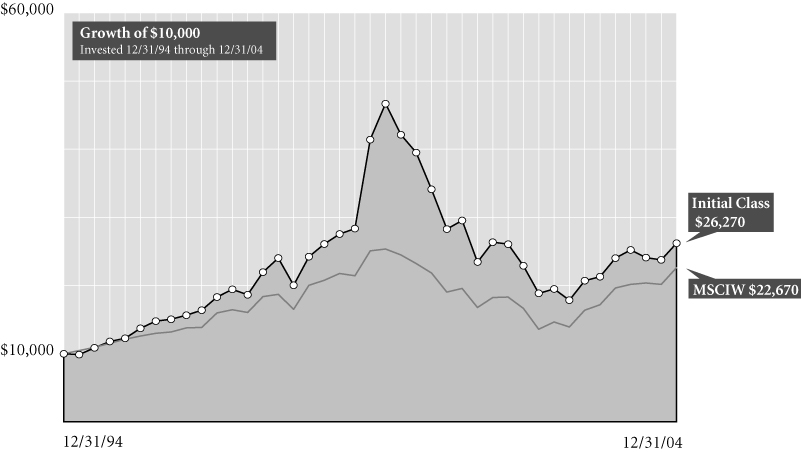

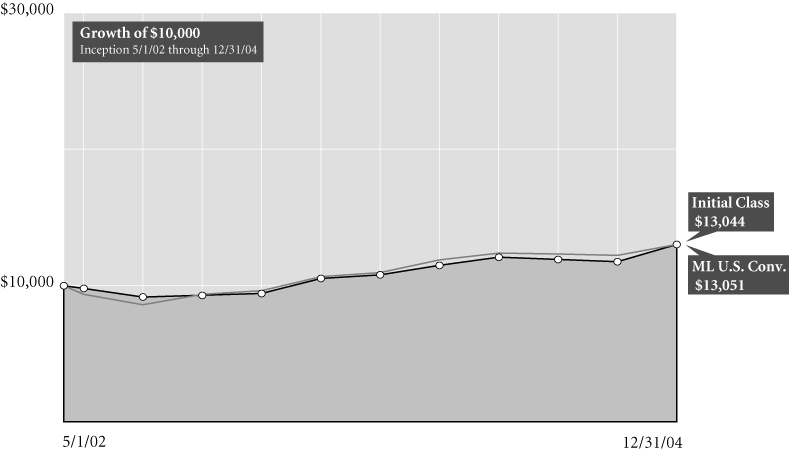

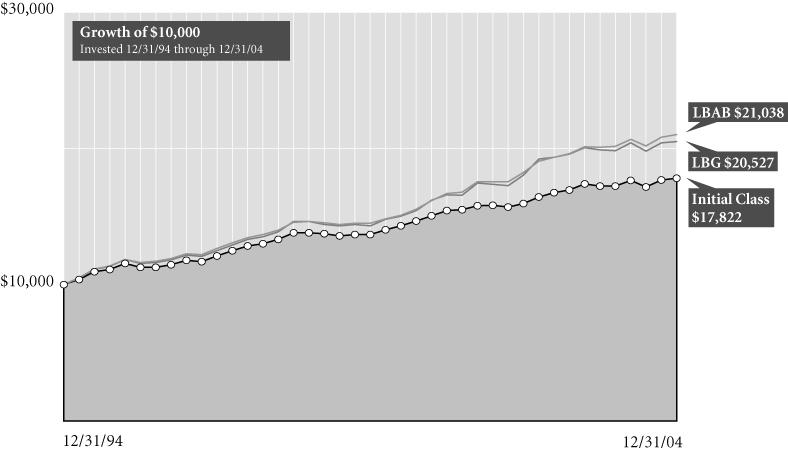

Comparison of change in value of $10,000 investment in Initial Class shares and its comparative indices.

Average Annual Total Return for Periods Ended 12/31/04

| | | 1 year | | 5 years | | 10 years | | From

Inception | | Inception

Date | |

| Initial Class | | | 4.53 | % | | | 7.51 | % | | | 7.44 | % | | | 7.17 | % | | 10/2/86 | |

| LBAB1 | | | 4.34 | % | | | 7.71 | % | | | 7.72 | % | | | 7.87 | % | | 10/2/86 | |

| LBGC1 | | | 4.19 | % | | | 8.00 | % | | | 7.80 | % | | | 7.86 | % | | 10/2/86 | |

| Service Class | | | 4.31 | % | | | – | | | | – | | | | 3.65 | % | | 5/1/03 | |

NOTES

1 The Lehman Brothers Aggregate Bond (LBAB) Index and Lehman Brothers U.S. Government/Credit (LBGC) Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception calculation is based on life of initial class shares. Source: Standard & Poor's Micropal®© Micropal, Inc. 2004 – 1-800-596-5323 – http://www.funds-sp.com.

The performance data presented represents past performance, future results may vary. The portfolio's investment return and net asset value will fluctuate. Past performance does not guarantee future results. Investor's units when redeemed, may be worth more or less than their original cost.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives, explanation of share classes and policies of this portfolio.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

2

AEGON Bond

UNDERSTANDING YOUR FUND'S EXPENSES (unaudited)

SHAREHOLDER EXPENSES

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at July 1, 2004 and held for the entire period until December 31, 2004.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, note that the expenses shown in the table are meant to highlight your ongoing costs and do not reflect any transaction costs.

| | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | Expenses Paid

During Period (a) | |

| Initial Class | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,040.30 | | | | 0.57 | % | | $ | 2.92 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,022.27 | | | | 0.57 | | | | 2.90 | | |

| Service Class | | | |

| Actual | | | 1,000.00 | | | | 1,039.20 | | | | 0.82 | | | | 4.20 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,021.01 | | | | 0.82 | | | | 4.17 | | |

(a) Expenses are calculated using each Fund's annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by number of days in the period (184 days), and divided by the number of days in the year (366 days).

(b) 5% return per year before expenses.

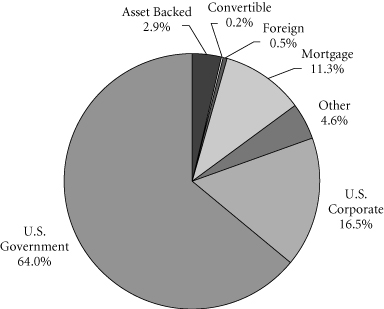

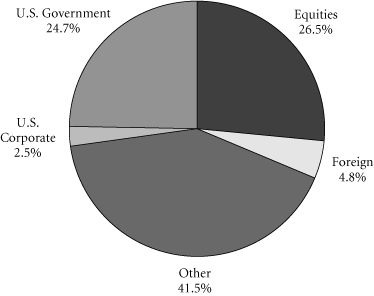

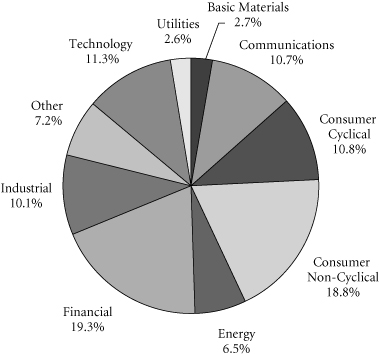

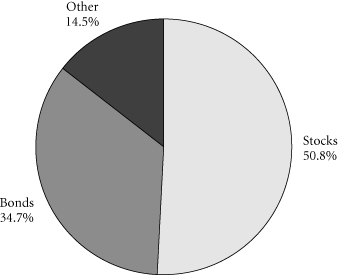

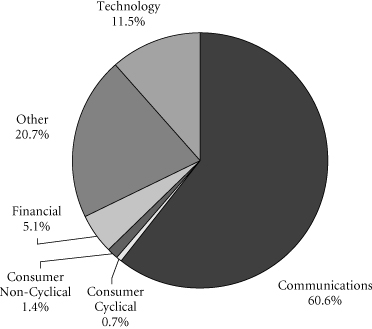

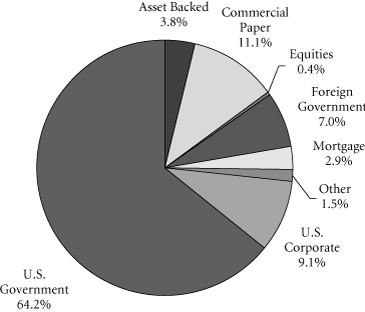

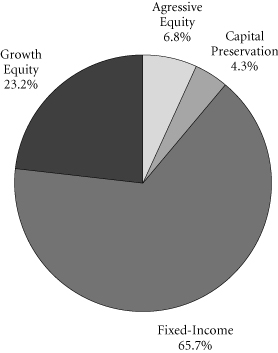

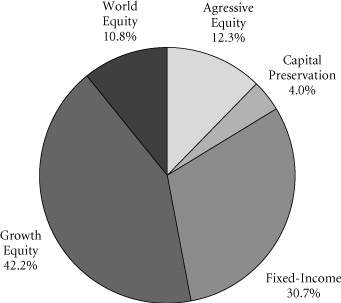

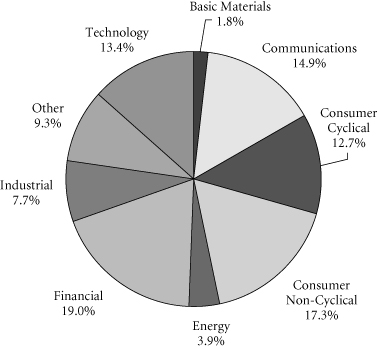

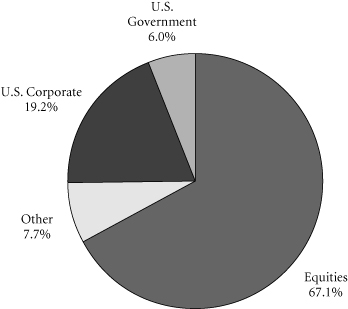

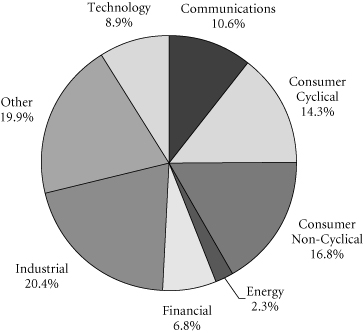

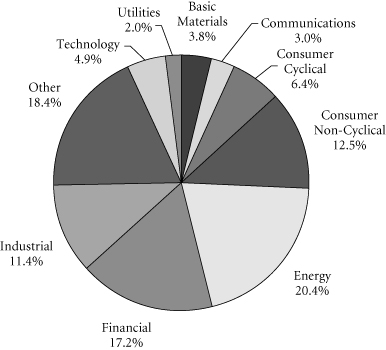

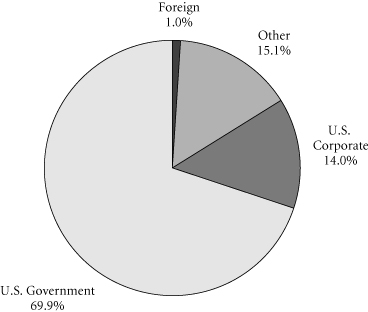

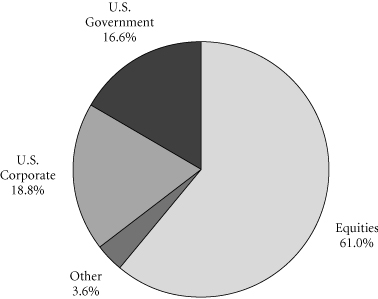

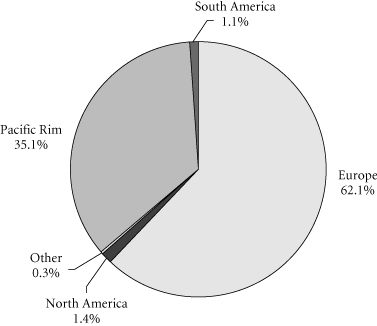

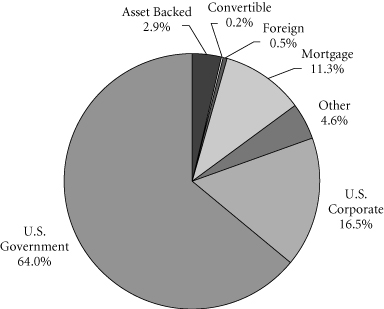

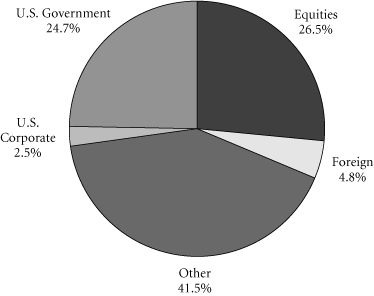

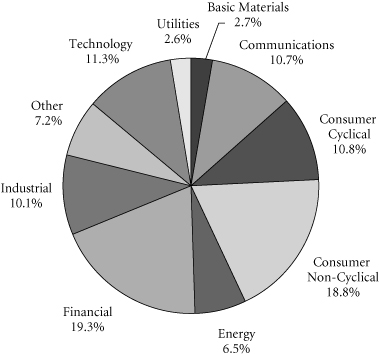

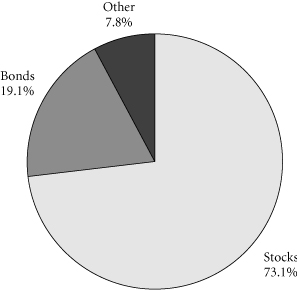

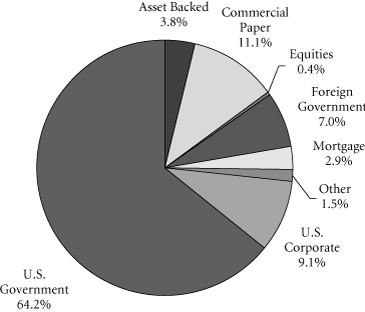

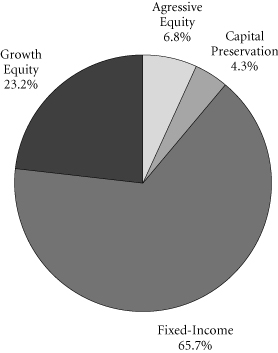

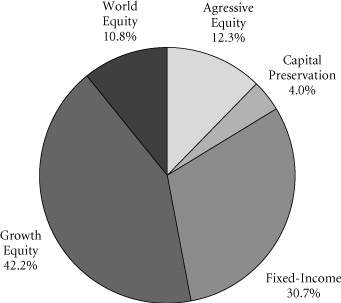

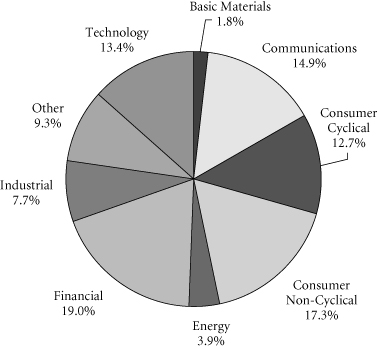

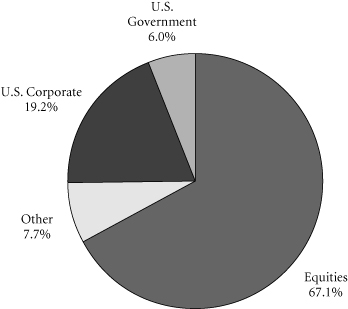

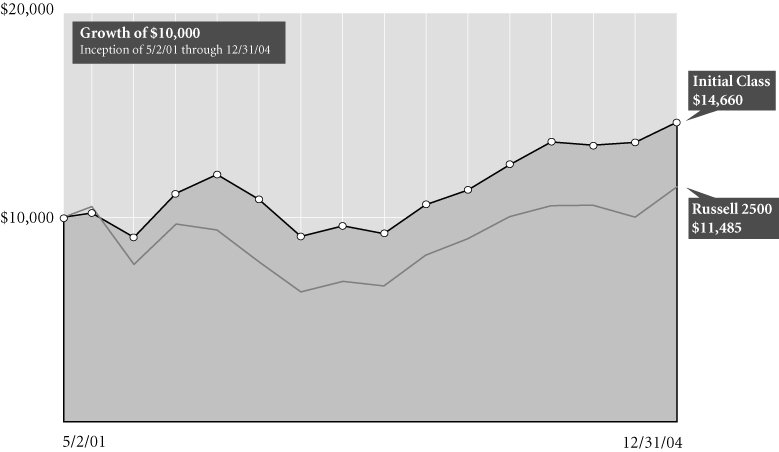

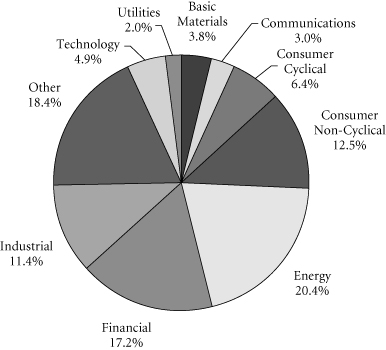

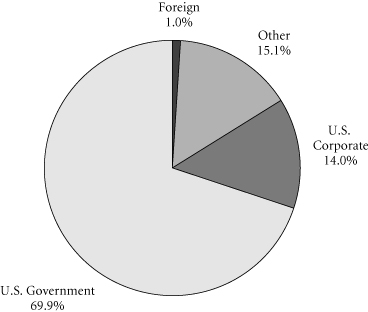

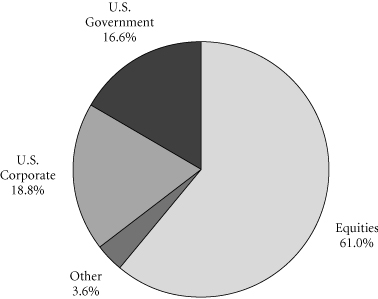

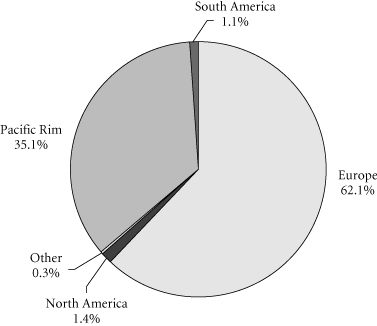

GRAPHICAL PRESENTATION OF SCHEDULE OF INVESTMENTS

By Bond Type

At December 31, 2004

This chart shows the percentage breakdown by Bond Type of the Fund's total investment securities.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

3

AEGON Bond

SCHEDULE OF INVESTMENTS

At December 31, 2004

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| U.S. GOVERNMENT OBLIGATIONS (15.4%) | |

U.S. Treasury Bond

| |

| 11.75%, due 11/15/2014 (a) | | $ | 2,500 | | | $ | 3,394 | | |

| 7.25%, due 05/15/2016 (a) | | | 2,000 | | | | 2,504 | | |

| 7.50%, due 11/15/2016 | | | 2,750 | | | | 3,514 | | |

| 7.25%, due 08/15/2022 | | | 300 | | | | 387 | | |

| 6.25%, due 08/15/2023 (a) | | | 5,000 | | | | 5,854 | | |

| 7.63%, due 02/15/2025 | | | 1,125 | | | | 1,524 | | |

| 6.50%, due 11/15/2026 | | | 1,500 | | | | 1,822 | | |

U.S. Treasury STRIPS

Zero Coupon, due 05/15/2008

Zero Coupon, due 02/15/2009

Zero Coupon, due 02/15/2010

Zero Coupon, due 02/15/2011

Zero Coupon, due 05/15/2012

Zero Coupon, due 08/15/2012

Zero Coupon, due 11/15/2012

Zero Coupon, due 02/15/2013

Zero Coupon, due 05/15/2013

Zero Coupon, due 11/15/2013 (a)

Zero Coupon, due 02/15/2014

Zero Coupon, due 02/15/2016

Zero Coupon, due 05/15/2016

Zero Coupon, due 02/15/2017

Zero Coupon, due 02/15/ 2019

Zero Coupon, due 02/15/2022

Zero Coupon, due 02/15/2023 | | | 1,000

200

1,800

700

1,200

250

1,200

200

200

3,000

750

1,650

2,200

8,400

300

150

750 | | | | 894

173

1,491

551

887

182

865

142

140

2,048

505

993

1,305

4,756

151

63

299 | | |

| Total U.S. Government Obligations (cost: $31,644) | | | | | | | 34,444 | | |

| U.S GOVERNMENT AGENCY OBLIGATIONS (50.5%) | |

FHLMC

6.50%, due 05/01/2009

6.88%, due 09/15/2010

5.75%, due 01/15/2012

6.50%, due 04/01/2016

6.50%, due 12/01/2017

4.00%, due 05/01/2019 | | | 334

500

200

209

636

1,152 | | | | 350

571

218

222

673

1,127 | | |

FHLMC–Series 2247

7.50%, due 08/15/2030 | | | 532 | | | | 546 | | |

FHLMC–Series 1466

7.50%, due 02/15/2023 | | | 1,225 | | | | 1,310 | | |

FHLMC–Series 1512

6.50%, due 02/15/2008 | | | 139 | | | | 140 | | |

FHLMC–Series 1695

7.00%, due 03/15/2024 | | | 1,000 | | | | 1,079 | | |

FHLMC–Series 1798

5.00%, due 05/15/2023 | | | 578 | | | | 584 | | |

| | | Principal | | Value | |

FHLMC–Series 1844

6.50%, due 10/15/2013 | | $ | 121 | | | $ | 123 | | |

FHLMC–Series 2102

6.00%, due 12/15/2013

6.00%, due 12/15/2013 | | | 1,500

3,042 | | | | 1,569

3,166 | | |

FHLMC–Series 2169

7.00%, due 06/15/2029 | | | 1,000 | | | | 1,107 | | |

FHLMC–Series 2210

8.00%, due 01/15/2030 | | | 1,675 | | | | 1,811 | | |

FHLMC–Series 2256

7.25%, due 09/15/2030 | | | 2,000 | | | | 2,099 | | |

FHLMC–Series 2259

7.00%, due 10/15/2030 | | | 1,338 | | | | 1,408 | | |

FHLMC–Series 2271

7.25%, due 12/15/2030 | | | 754 | | | | 799 | | |

FHLMC–Series 2317

6.50%, due 04/15/2031 | | | 862 | | | | 877 | | |

FHLMC–Series 2344

6.50%, due 08/15/2031 | | | 559 | | | | 590 | | |

FHLMC–Series 2357

6.50%, due 12/15/2017 | | | 1,000 | | | | 1,014 | | |

FHLMC–Series 2367

6.00%, due 01/15/2019 | | | 463 | | | | 467 | | |

FHLMC–Series 2371

6.00%, due 08/15/2015 | | | 2,000 | | | | 2,064 | | |

FHLMC–Series 2392

6.00%, due 12/15/2020 | | | 1,000 | | | | 1,035 | | |

FHLMC–Series 2410

5.50%, due 02/15/2009 | | | 950 | | | | 968 | | |

FHLMC–Series 2423

7.00%, due 03/15/2032 | | | 4,583 | | | | 4,800 | | |

FHLMC–Series 2424

6.38%, due 03/15/2032 | | | 1,000 | | | | 1,051 | | |

FHLMC–Series 2430B

6.50%, due 03/15/2032 | | | 729 | | | | 773 | | |

FHLMC–Series 2434

7.00%, due 04/15/2032 | | | 1,000 | | | | 1,065 | | |

FHLMC–Series 2435B

6.00%, due 02/15/2013 | | | 1,215 | | | | 1,274 | | |

FHLMC–Series 2444

6.50%, due 02/15/2013 | | | 529 | | | | 529 | | |

FHLMC–Series 2450

5.60%, due 03/15/2032 (b)(d)

7.00%, due 05/15/2032 | | | 696

1,328 | | | | 69

1,403 | | |

FHLMC–Series 2460

6.00%, due 11/15/2029 | | | 581 | | | | 606 | | |

FHLMC–Series 2462

6.50%, due 06/15/2032 | | | 600 | | | | 634 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Fund, Inc.

Annual Report 2004

4

AEGON Bond

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2004

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

FHLMC–Series 2474

5.30%, due 07/15/2017 (b)(d) | | $ | 2,376 | | | $ | 214 | | |

FHLMC–Series 2484

6.50%, due 07/15/2032 | | | 877 | | | | 934 | | |

FHLMC–Series 2496

8.50%, due 11/15/2015 | | | 64 | | | | 65 | | |

FHLMC–Series 2503

5.50%, due 11/15/2015 | | | 600 | | | | 615 | | |

FHLMC–Series 2515

4.00%, due 03/15/2032 | | | 1,000 | | | | 950 | | |

FHLMC–Series 2518

5.50%, due 09/15/2013 | | | 845 | | | | 877 | | |

FHLMC–Series 2527

5.50%, due 10/15/2013

6.00%, due 11/15/2032 | | | 852

500 | | | | 883

519 | | |

FHLMC–Series 2535

5.50%, due 12/15/2022 | | | 1,000 | | | | 1,029 | | |

FHLMC–Series 2541

5.50%, due 02/15/2017 | | | 1,000 | | | | 1,035 | | |

FHLMC–Series 2557

5.00%, due 07/15/2014 | | | 1,000 | | | | 1,023 | | |

FHLMC–Series 2565

6.00%, due 05/15/2030 | | | 500 | | | | 514 | | |

FHLMC–Series 2567

6.00%, due 02/15/2033 | | | 500 | | | | 513 | | |

FHLMC–Series 2597

5.15%, due 02/15/2033 (b)(d) | | | 1,754 | | | | 148 | | |

FHLMC–Series 2599

4.60%, due 02/15/2033 (b)(d) | | | 2,735 | | | | 242 | | |

FHLMC–Series 2610

4.70%, due 03/15/2033 (b)(d) | | | 2,818 | | | | 260 | | |

FHLMC–Series 2668

5.06%, due 10/15/2015 (b)(d) | | | 872 | | | | 842 | | |

FHLMC–Series 2684

Zero Coupon, due 10/15/2033 (e) | | | 250 | | | | 137 | | |

FHLMC–Series 2691

5.40%, due 10/15/2033 (b) | | | 226 | | | | 169 | | |

FHLMC–Series 2705

5.40%, due 11/15/2033 (b) | | | 130 | | | | 101 | | |

FHLMC–Series 2727

5.47%, due 01/15/2034 (b) | | | 700 | | | | 468 | | |

FHLMC–Series 2753

7.20%, due 02/15/2034 (b) | | | 150 | | | | 128 | | |

FHLMC–Series 2755

9.40%, due 05/15/2030 (b) | | | 449 | | | | 450 | | |

FHLMC–Series 2769

Zero Coupon, due 03/15/2034 | | | 147 | | | | 98 | | |

| | | Principal | | Value | |

FHLMC–Series 2776

5.47%, due 04/15/2034 (b) | | $ | 230 | | | $ | 173 | | |

FHLMC–Series 2846

Zero Coupon, due 08/15/2034 (e) | | | 250 | | | | 185 | | |

FHLMC–Series 77

8.50%, due 09/15/2020 | | | 424 | | | | 424 | | |

FHLMC–Series T-041

7.50%, due 07/25/2032 | | | 1,197 | | | | 1,276 | | |

FHLMC–Series T-051

7.50%, due 08/25/2042 (b) | | | 505 | | | | 535 | | |

FHLMC–Series T-054

6.50%, due 02/25/2043

7.00%, due 02/25/2043 | | | 1,100

354 | | | | 1,153

376 | | |

FNMA

7.50%, due 01/01/2008

6.50%, due 04/01/2008

6.50%, due 04/01/2009

8.00%, due 07/01/2009

5.50%, due 06/01/2012

5.00%, due 12/01/2016

5.50%, due 03/01/2017

6.50%, due 03/01/2017

5.50%, due 09/01/2017

4.00%, due 07/01/2018

4.50%, due 03/01/2019

9.00%, due 10/01/2019

9.00%, due 06/01/2025

6.00%, due 12/01/2032

6.00%, due 03/01/2033

6.00 %, due 03/01/2033

6.00%, due 03/01/2033 | | | 303

314

274

402

337

347

912

298

693

255

932

368

285

696

304

239

363 | | | | 314

326

289

427

349

353

942

316

715

249

930

409

318

721

314

248

376 | | |

FNMA–Series 1993-190

12.80%, due 10/25/2008 (b) | | | 247 | | | | 268 | | |

FNMA–Series 1994-G013

7.00%, due 06/17/2022 | | | 580 | | | | 594 | | |

FNMA–Series 2001-44

7.00%, due 09/25/2031

7.00%, due 09/25/2031 | | | 670

983 | | | | 702

1,030 | | |

FNMA–Series 2001-5

6.00%, due 03/25/2016 | | | 1,000 | | | | 1,044 | | |

FNMA–Series 2001-61

7.00%, due 12/25/2016

7.00%, due 11/25/2031 | | | 1,220

624 | | | | 1,304

667 | | |

FNMA–Series 2001-7

7.00%, due 03/25/2031 | | | 446 | | | | 467 | | |

FNMA–Series 2002-1

6.50%, due 02/25/2022