As filed with the SEC on March 7, 2008.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04419 |

|

AEGON/TRANSAMERICA SERIES TRUST |

(Exact name of registrant as specified in charter) |

|

570 Carillon Parkway, St. Petersburg, Florida | | 33716 |

(Address of principal executive offices) | | (Zip code) |

|

Dennis P. Gallagher, Esq. P.O. Box 9012, Clearwater, Florida 33758-9771 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (727) 299-1800 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | January 1, 2007 - December 31, 2007 | |

| | | | | | | | |

Item 1: Report(s) to Shareholders.

2

AEGON/Transamerica Series Trust Annual Report Winter 2007

AEGON/Transamerica Series Trust Annual Report

570 Carillon Parkway

St. Petersburg, FL 33716

Distributor: Transamerica Capital, Inc.

Customer Service: 1-800-851-9777

The following pages contain the most recent annual reports for the investment options in which you are invested. In compliance with Securities and Exchange Commission regulations, we present these reports on a semi-annual basis with the hope that they will foster greater understanding of the investment options’ holdings, performance, financial data, accounting policies and other issues. Unlike our past reports, this streamlined version provides information only on the investment options in which you are invested.

If you have any questions about these reports, please do not hesitate to contact your financial professional. As always, we thank you for your trust and the opportunity to serve you.

Dear Shareholder,

On behalf of AEGON/Transamerica Series Trust, we would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial advisor in the future. We value the trust you have placed in us.

This annual report is provided to you with the intent of presenting a comprehensive review of the investments of each of your funds. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all shareholders, and we believe this report to be an important part of the investment process. In addition to providing a comprehensive review, this report also provides a discussion of accounting policies as well as matters presented to shareholders that may have required their vote.

We believe it is important to recognize and understand current market conditions in order to provide a context for reading the contents of this report. The mildly positive returns experienced in the equity markets for the trailing 12 months ending December 31, 2007, were marked by volatility experienced along the way, with significant pullbacks occurring in February-March, July-August and November. The Federal Reserve was on hold until September when a series of cuts lowered interest rates from 5.25% to 4.25%. The rate reductions by the Federal Reserve signaled an effort to inject liquidity and stability to the markets which have been adversely affected by subprime mortgage debt writedowns and general weakness in the housing market. Concerns over the extent to which subprime debt and housing market weakness may affect consumer spending and persistently high oil prices have weighed on market returns. For the twelve months ending December 31, 2007, the Dow Jones Industrial Average returned 8.88%, the Standard & Poor’s 500 Index returned 5.49%, and the Lehman Aggregate Bond Index returned 6.97%. Please keep in mind it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial advisor is a key resource to help you build a comprehensive picture of your current and future financial needs. In addition, financial advisors are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial advisor, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance. Please contact your financial advisor if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

John K. Carter | | Christopher A. Staples |

President & Chief Executive Officer | | Vice President & Chief Investment Officer |

AEGON/Transamerica Series Trust | | AEGON/Transamerica Series Trust |

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of AEGON/Transamerica Series Trust. These views are subject to change based upon market conditions. These views should not be relied on as investment advice and are not indicative of a trading intent on behalf of the AEGON/Transamerica Series Trust.

American Century Large Company Value

MARKET ENVIRONMENT

Stocks struggled for most of the one-year reporting period, providing a challenging market environment for the portfolio. The slowing U.S. economy, the sub-prime meltdown, and subsequent credit crisis weighed on investors, who gravitated toward companies that were already strong performers. This momentum bias did not fit well with the portfolio’s investment approach, which seeks stocks that are undervalued by the market. In addition, growth stocks outperformed value across the capitalization spectrum.

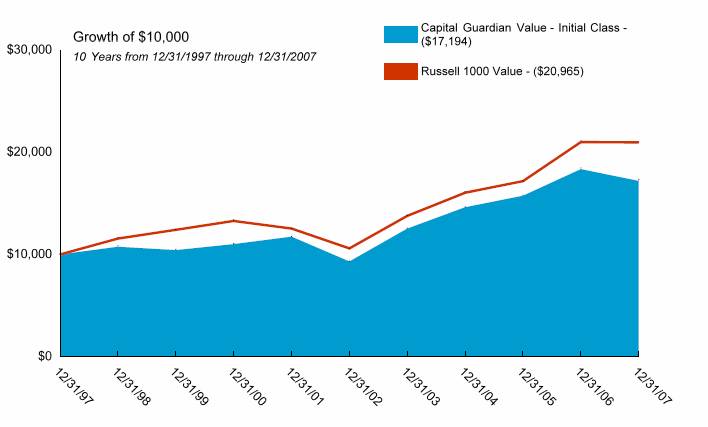

PERFORMANCE

For the year ended December 31, 2007, American Century Large Company Value, Initial Class returned (1.12)%. By comparison its primary and secondary benchmarks, the Standard and Poor’s 500 Composite Stock Index and the Russell 1000 Value Index (“Russell 1000 Value”), returned 5.49% and (0.17)%, respectively.

STRATEGY REVIEW

The portfolio benefited from strong security selection in the information technology (“IT”) sector, with most of the gains coming from large leading software and technology companies. A significant holding was software giant Microsoft Corporation, which benefited from strong sales of its new Vista operating system and Office 2007. Hewlett Packard Company continued to gain ground in the personal computer (“PC”) market and moved into high-end enterprise printing equipment.

Our position in consumer staples benefited performance as the U.S. economy slowed and investors sought out companies that provide everyday goods and services. During difficult economic times, consumer staples stocks are regarded as sound, defensive investments. Moreover, our preference for large industry leaders proved advantageous as many of these names outperformed the benchmark. The Pepsi Bottling Group, Inc. (“Pepsi”) and The Coca-Cola Company (“Coca-Cola”), for example, gained about 30% during the period. Despite higher commodity costs, Pepsi announced a healthy increase in profit. Meanwhile, Coca-Cola reported growing revenues and bought back a large number of its shares.

Financial stocks, the portfolio’s largest single position, but a relative underweight nonetheless, represented our largest sources of underperformance versus the benchmark. Many financial firms came under pressure amid the fallout in the sub-prime lending category. Three of our top detractors were the Federal Home Loan Mortgage Corporation (“Freddie Mac”), a stockholder-owned corporation chartered by Congress to keep money flowing to mortgage lenders in support of home ownership; Washington Mutual, Inc., a major thrift involved in mortgage finance; and Citigroup Inc., a diversified global financial services company. All three stocks declined on news of wider-than-expected losses, resulting from housing weakness and the deterioration of mortgage credit.

Although the portfolio’s position in the energy sector contributed on an absolute basis, it underperformed in relative terms. Energy stocks, specifically oil and gas companies, provided the strongest results for the Russell 1000 Value. Because of valuations, we held a smaller-than-the-benchmark allocation, which was a drag on results.

As bottom-up investment managers, we evaluate each company individually and build the portfolio one stock at a time. As of December 31, 2007, the portfolio was broadly diversified, with continued overweight positions in the IT and health care sectors. Our valuation work contributed to our smaller relative weightings in utilities stocks. We have also continued to find greater value opportunities among mega-cap stocks and have maintained our bias toward these firms.

Charles A. Ritter, CFA

Brendan Healy, CFA

Co-Portfolio Managers

American Century Investment Management, Inc.

AEGON/Transamerica Series Trust | Annual Report 2007 |

1

American Century Large Company Value

(unaudited)

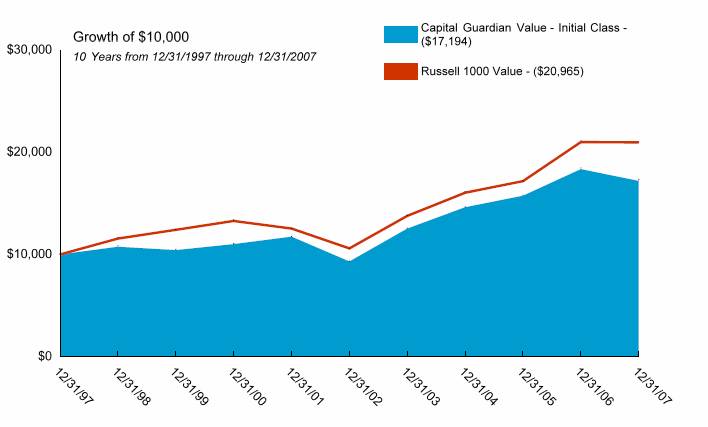

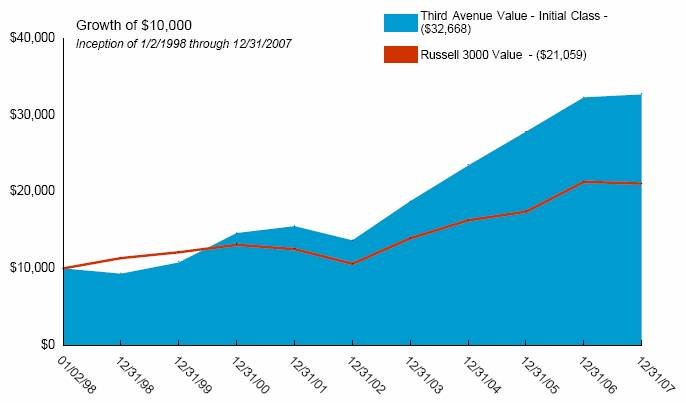

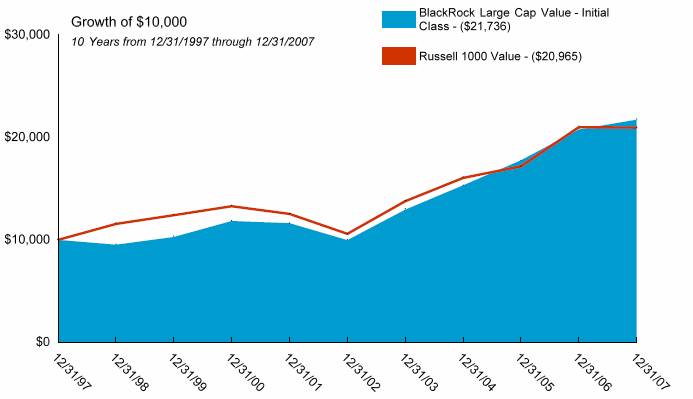

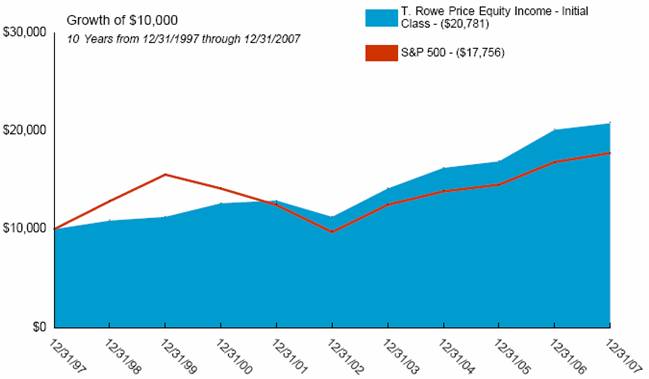

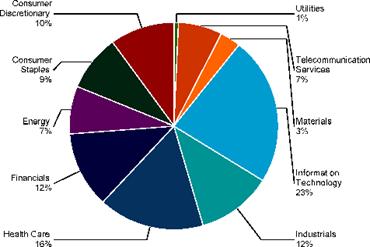

Average Annual Total Return for Periods Ended 12/31/2007

| | | | | | From | | Inception | |

| | 1 Year | | 5 Years | | Inception | | Date | |

| | | | | | | | | |

Initial Class | | (1.12 | )% | 12.58 | % | 4.97 | % | 5/1/01 | |

S&P 500(1) | | 5.49 | % | 12.83 | % | 4.27 | % | 5/1/01 | |

Russell 1000 Value(1) | | (0.17 | )% | 14.63 | % | 7.28 | % | 5/1/01 | |

| | | | | | | | | |

Service Class | | (1.33 | )% | — | % | 12.44 | % | 5/1/03 | |

NOTES

(1) The Standard and Poor’s 500 Composite Stock (S&P 500) Index and the Russell 1000 Value (Russell 1000 Value) Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception, calculation is based on life of Initial Class shares.

The performance data presented represents past performance; future results may vary. The portfolio’s investment return and net asset value will fluctuate. Past performance does not guarantee future results. Investor’s units when redeemed may be worth more or less than their original cost.

Current performance may be lower or higher than performance quoted. Please visit your insurance company’s website for contract or policy level standardized total returns current to the most recent month end. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives, explanation of share classes and policies of this portfolio.

2

American Century Large Company Value

UNDERSTANDING YOUR FUND’S EXPENSES

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur ongoing costs, including management and advisory fees, distribution and service fees, and other fund expenses.

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at July 1, 2007 and held for the entire period until December 31, 2007.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

| | Beginning | | Ending | | Annualized | | Expenses | |

| | Account | | Account | | Expense | | Paid During | |

| | Value | | Value | | Ratio | | Period (a) | |

| | | | | | | | | |

Initial Class | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 932.91 | | 0.86 | % | $ | 4.19 | |

Hypothetical (b) | | 1,000.00 | | 1,020.87 | | 0.86 | | 4.38 | |

| | | | | | | | | |

Service Class | | | | | | | | | |

Actual | | 1,000.00 | | 932.36 | | 1.11 | | 5.41 | |

Hypothetical (b) | | 1,000.00 | | 1,019.61 | | 1.11 | | 5.65 | |

| | | | | | | | | | | | |

(a) | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (365 days). |

| |

(b) | 5% return per year before expenses. |

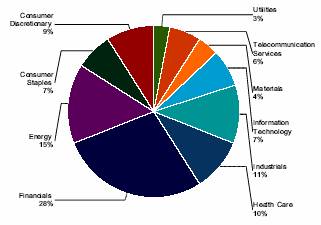

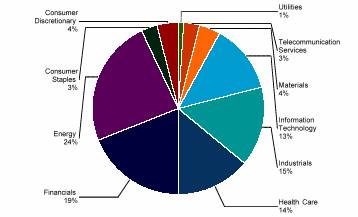

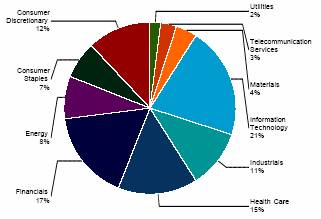

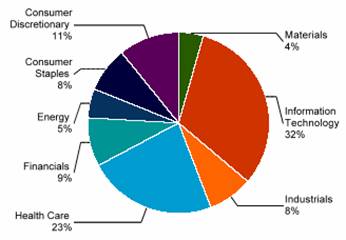

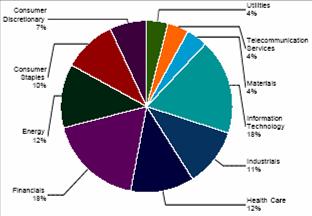

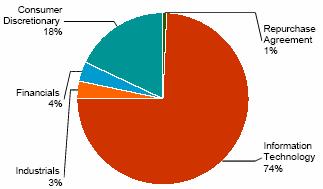

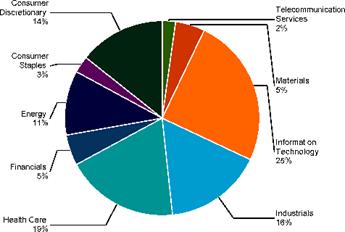

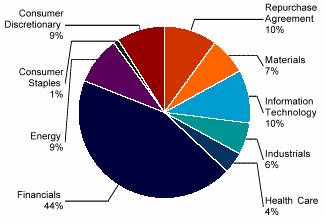

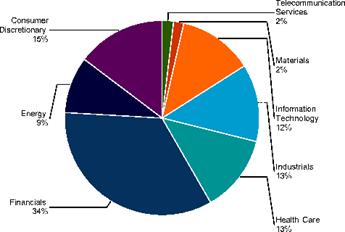

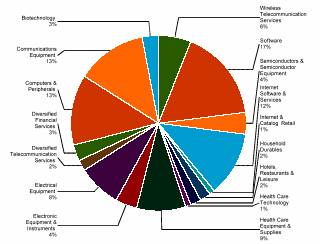

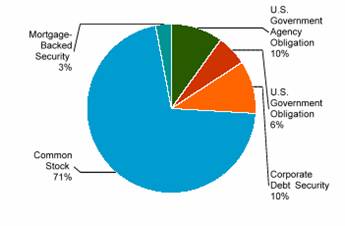

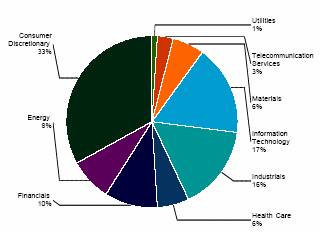

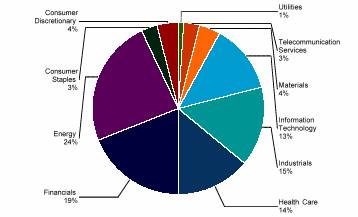

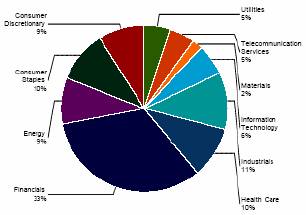

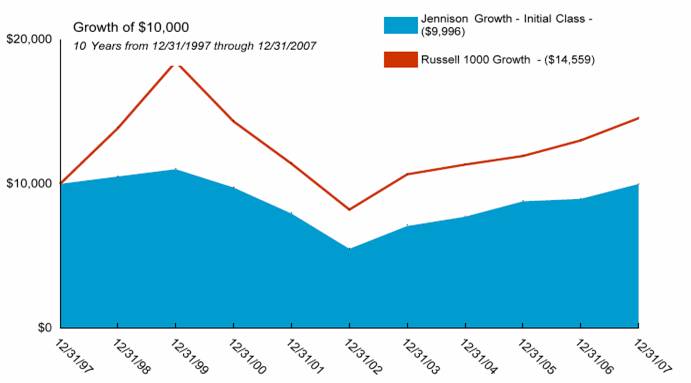

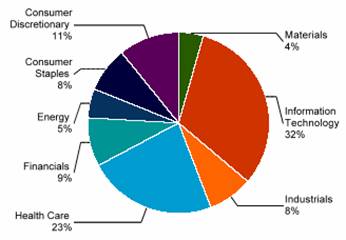

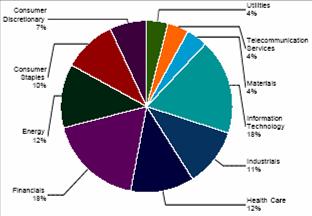

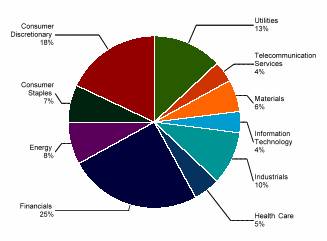

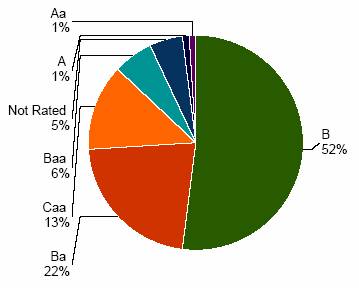

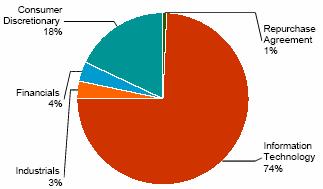

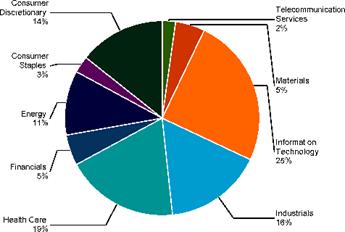

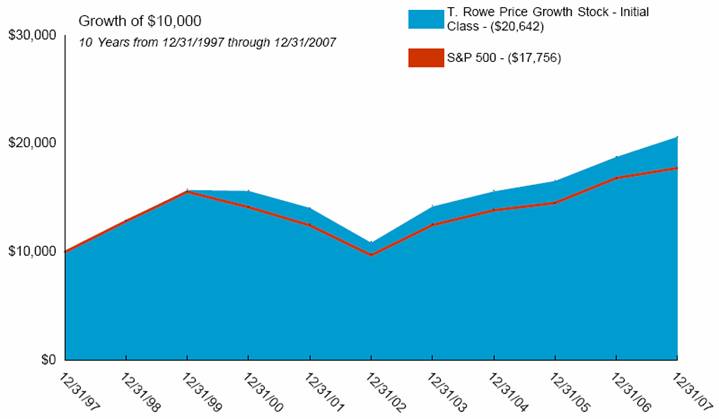

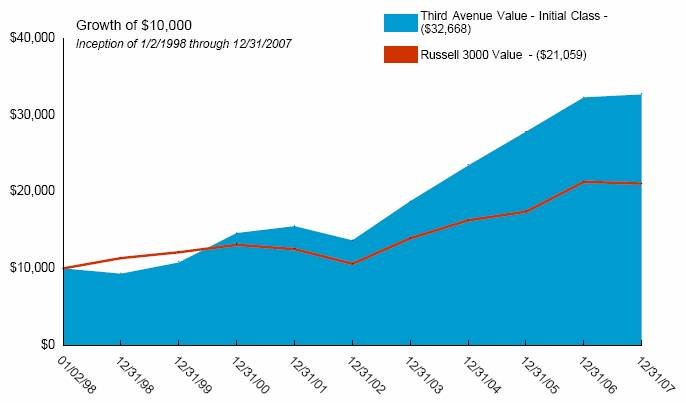

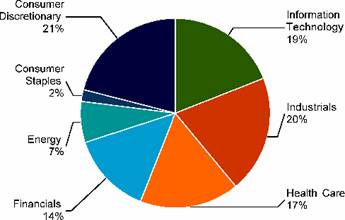

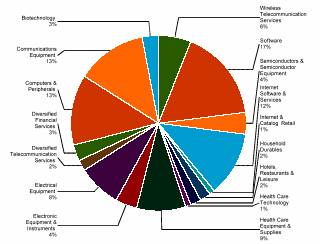

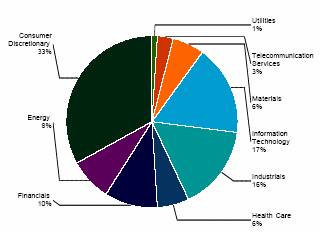

GRAPHICAL PRESENTATION OF SCHEDULE OF INVESTMENTS

By Sector

At December 31, 2007

This chart shows the percentage breakdown by sector of the Fund’s total investment securities.

3

American Century Large Company Value

SCHEDULE OF INVESTMENTS

At December 31, 2007

(all amounts except share amounts in thousands)

| | Shares | | Value | |

COMMON STOCKS (95.0%) | | | | | |

Aerospace & Defense (1.0%) | | | | | |

Northrop Grumman Corp. | | 58,800 | | $ | 4,624 | |

Beverages (2.0%) | | | | | |

Coca-Cola Co. (The) | | 90,900 | | 5,579 | |

Pepsi Bottling Group, Inc. | | 83,200 | | 3,283 | |

Biotechnology (0.5%) | | | | | |

Amgen, Inc. ‡ | | 48,800 | | 2,266 | |

Capital Markets (2.6%) | | | | | |

Bear Stearns Cos., Inc. (The) ^ | | 10,600 | | 935 | |

Merrill Lynch & Co., Inc. | | 96,800 | | 5,196 | |

Morgan Stanley ^ | | 100,900 | | 5,359 | |

Chemicals (2.1%) | | | | | |

Ei DU Pont de Nemours & Co. | | 112,300 | | 4,951 | |

PPG Industries, Inc. | | 67,000 | | 4,706 | |

Commercial Banks (6.0%) | | | | | |

Bank of New York Mellon Corp. | | 46,500 | | 2,268 | |

National City Corp. ^ | | 83,400 | | 1,373 | |

PNC Financial Services Group, Inc. | | 43,500 | | 2,856 | |

US Bancorp | | 192,700 | | 6,116 | |

Wachovia Corp. | | 149,600 | | 5,689 | |

Wells Fargo & Co. | | 296,500 | | 8,951 | |

Commercial Services & Supplies (1.5%) | | | | | |

Avery Dennison Corp. | | 22,000 | | 1,169 | |

RR Donnelley & Sons Co. | | 79,300 | | 2,993 | |

Waste Management, Inc. | | 81,500 | | 2,662 | |

Communications Equipment (0.2%) | | | | | |

Motorola, Inc. | | 63,200 | | 1,014 | |

Computers & Peripherals (2.4%) | | | | | |

Hewlett-Packard Co. | | 108,800 | | 5,492 | |

International Business Machines Corp. | | 49,800 | | 5,384 | |

Consumer Finance (0.2%) | | | | | |

Discover Financial Services | | 55,600 | | 838 | |

Diversified Consumer Services (0.5%) | | | | | |

H&R Block, Inc. | | 128,700 | | 2,390 | |

Diversified Financial Services (8.8%) | | | | | |

Bank of America Corp. (1) | | 328,100 | | 13,537 | |

Citigroup, Inc. | | 490,100 | | 14,429 | |

JPMorgan Chase & Co. | | 262,800 | | 11,471 | |

Diversified Telecommunication Services (4.9%) | | | | | |

AT&T, Inc. (1) | | 356,200 | | 14,804 | |

Verizon Communications, Inc. | | 168,400 | | 7,357 | |

Electric Utilities (2.7%) | | | | | |

Exelon Corp. | | 83,700 | | 6,833 | |

PPL Corp. | | 106,000 | | 5,522 | |

Electronic Equipment & Instruments (0.5%) | | | | | |

Tyco International, Ltd. | | 50,900 | | 2,018 | |

Energy Equipment & Services (0.5%) | | | | | |

National Oilwell Varco, Inc. ‡ | | 31,200 | | 2,292 | |

Food & Staples Retailing (2.3%) | | | | | |

Kroger Co. (The) | | 105,500 | | 2,818 | |

Walgreen Co. | | 64,100 | | 2,441 | |

Wal-Mart Stores, Inc. | | 110,900 | | 5,271 | |

Food Products (1.1%) | | | | | |

Unilever NV | | 138,000 | | $ | 5,031 | |

Health Care Equipment & Supplies (0.5%) | | | | | |

Medtronic, Inc. | | 46,800 | | 2,353 | |

Health Care Providers & Services (0.3%) | | | | | |

Quest Diagnostics, Inc. | | 25,600 | | 1,354 | |

Hotels, Restaurants & Leisure (0.4%) | | | | | |

McDonald’s Corp. | | 30,300 | | 1,785 | |

Household Durables (0.7%) | | | | | |

Newell Rubbermaid, Inc. | | 117,100 | | 3,031 | |

Independent Power Producers & Energy Traders (0.5%) | | | | | |

NRG Energy, Inc. ‡ | | 54,500 | | 2,362 | |

Industrial Conglomerates (4.3%) | | | | | |

General Electric Co. | | 522,300 | | 19,362 | |

Insurance (6.3%) | | | | | |

Allstate Corp. (The) | | 97,000 | | 5,066 | |

American International Group, Inc. | | 181,200 | | 10,564 | |

Hartford Financial Services Group, Inc. | | 58,700 | | 5,118 | |

Loews Corp. | | 71,300 | | 3,589 | |

Marsh & McLennan Cos., Inc. | | 43,400 | | 1,149 | |

Torchmark Corp. | | 45,300 | | 2,742 | |

IT Services (0.5%) | | | | | |

Fiserv, Inc. ‡ | | 38,000 | | 2,109 | |

Machinery (3.4%) | | | | | |

Caterpillar, Inc. | | 47,300 | | 3,432 | |

Deere & Co. | | 20,000 | | 1,862 | |

Dover Corp. | | 68,100 | | 3,139 | |

Ingersoll-Rand Co., Ltd. Class A | | 80,800 | | 3,755 | |

Parker Hannifin Corp. | | 42,700 | | 3,216 | |

Media (3.1%) | | | | | |

Gannett Co., Inc. | | 111,300 | | 4,341 | |

Time Warner, Inc. | | 337,400 | | 5,571 | |

Viacom, Inc. Class B ‡ | | 96,800 | | 4,251 | |

Metals & Mining (0.6%) | | | | | |

Nucor Corp. | | 45,500 | | 2,694 | |

Multiline Retail (0.5%) | | | | | |

Kohl’s Corp. ‡ | | 51,900 | | 2,377 | |

Office Electronics (0.6%) | | | | | |

Xerox Corp. ^ | | 164,600 | | 2,665 | |

Oil, Gas & Consumable Fuels (13.9%) | | | | | |

Chevron Corp. | | 168,700 | | 15,745 | |

ConocoPhillips | | 122,900 | | 10,852 | |

Devon Energy Corp. | | 12,300 | | 1,093 | |

Exxon Mobil Corp. | | 242,500 | | 22,720 | |

Royal Dutch Shell PLC Class A | | 147,400 | | 12,411 | |

Paper & Forest Products (1.2%) | | | | | |

Weyerhaeuser Co. | | 70,600 | | 5,206 | |

Pharmaceuticals (8.4%) | | | | | |

Abbott Laboratories (1) | | 97,000 | | 5,447 | |

Eli Lilly & Co. | | 57,800 | | 3,086 | |

Johnson & Johnson | | 160,800 | | 10,725 | |

Merck & Co., Inc. | | 67,700 | | 3,934 | |

Pfizer, Inc. | | 416,600 | | 9,469 | |

The notes to the financial statements are an integral part of this report.

4

| | Shares | | Value | |

Pharmaceuticals (continued) | | | | | |

Wyeth | | 120,000 | | $ | 5,303 | |

Semiconductors & Semiconductor Equipment (0.9%) | | | | | |

Applied Materials, Inc. | | 87,500 | | 1,554 | |

Intel Corp. | | 85,800 | | 2,287 | |

Software (2.3%) | | | | | |

Microsoft Corp. | | 195,000 | | 6,942 | |

Oracle Corp. ‡ | | 144,400 | | 3,261 | |

Specialty Retail (2.3%) | | | | | |

Best Buy Co., Inc. | | 64,100 | | 3,375 | |

Gap, Inc. (The) | | 95,100 | | 2,024 | |

Home Depot, Inc. | | 85,700 | | 2,309 | |

Staples, Inc. | | 122,300 | | 2,821 | |

Textiles, Apparel & Luxury Goods (0.5%) | | | | | |

V.F. Corp. | | 33,300 | | 2,286 | |

Thrifts & Mortgage Finance (2.1%) | | | | | |

Countrywide Financial Corp. ^ | | 42,600 | | 381 | |

Freddie Mac | | 168,900 | | 5,754 | |

MGIC Investment Corp. ^ | | 67,800 | | 1,521 | |

Washington Mutual, Inc. ^ | | 132,800 | | 1,807 | |

Tobacco (1.2%) | | | | | |

Altria Group, Inc. | | 72,700 | | $ | 5,495 | |

Wireless Telecommunication Services (0.7%) | | | | | |

Sprint Nextel Corp. | | 230,900 | | 3,032 | |

Total Common Stocks (cost $434,829) | | | | 428,645 | |

| | | | | |

INVESTMENT COMPANIES (0.9%) | | | | | |

Capital Markets (0.9%) | | | | | |

SPDR Trust Series 1 Series T, Class T ^ | | 26,700 | | 3,905 | |

Total Investment Companies (cost $3,641) | | | | 3,905 | |

| | | | | |

Total Securities Lending Collateral (cost $18,370) (2) | | | | 18,370 | |

| | | | | |

Total Investment Securities (cost $456,840) # | | | | $ | 450,920 | |

FUTURES CONTRACTS:

| | Contracts (·) | | Settlement

Date | | Amount | | Net Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | | |

S&P 500 E-MINI Index | | 189 | | 03/20/2008 | | $ | 13,960 | | $ | (161 | ) |

| | | | | | | | | | | |

NOTES TO SCHEDULE OF INVESTMENTS:

^ | At December 31, 2007, all or a portion of this security is on loan (see Note 1). The value at December 31, 2007, of all securities on loan is $17,712. |

‡ | Non-Income Producing. |

(1) | At December 31, 2007, all or a portion of this security is segregated with the custodian to cover margin requirements for open futures contracts. The value of all securities segregated at December 31, 2007 is $7,342. |

(2) | Cash collateral for the Repurchase Agreements, valued at $6,659, that serves as collateral for securities lending, is invested in corporate bonds with interest rates and maturity dates ranging from 3.00% - 10.18% and 04/28/2008 - 12/01/2096, respectively. |

· | Contract amounts are not in thousands. |

# | Aggregate cost for federal income tax purposes is $457,505. Aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value were $41,011 and $47,596, respectively. Net unrealized depreciation for tax purposes is $6,585. |

The notes to the financial statements are an integral part of this report.

5

American Century Large Company Value

STATEMENT OF ASSETS AND LIABILITIES

At December 31, 2007

(all amounts except per share amounts in thousands)

Assets: | | | |

Investment securities, at value (cost: $456,840) (including securities loaned of $17,712) | | $ | 450,920 | |

Cash | | 18,576 | |

Receivables: | | | |

Investment securities sold | | 3,403 | |

Shares sold | | 200 | |

Interest | | 44 | |

Income from loaned securities | | 5 | |

Dividends | | 668 | |

| | 473,816 | |

Liabilities: | | | |

Investment securities purchased | | 3,870 | |

Accounts payable and accrued liabilities: | | | |

Shares redeemed | | 101 | |

Management and advisory fees | | 315 | |

Distribution and service fees | | — | |

Administration fees | | 8 | |

Payable for collateral for securities on loan | | 18,370 | |

Variation margin | | 61 | |

Other | | 38 | |

| | 22,763 | |

Net Assets | | $ | 451,053 | |

| | | |

Net Assets Consist of: | | | |

Capital Stock ($.01 par value) | | $ | 406 | |

Additional paid-in capital | | 434,710 | |

Undistributed (accumulated) net investment income | | 7,707 | |

Undistributed (accumulated) net realized gain from investment securities and futures | | 14,311 | |

Net unrealized (depreciation) on investment securities | | (5,920 | ) |

Futures contracts | | (161 | ) |

Net Assets | | $ | 451,053 | |

Net Assets by Class: | | | |

Initial Class | | $ | 448,651 | |

Service Class | | 2,402 | |

Shares Outstanding: | | | |

Initial Class | | 40,367 | |

Service Class | | 216 | |

Net Asset Value and Offering Price Per Share: | | | |

Initial Class | | $ | 11.11 | |

Service Class | | 11.10 | |

STATEMENT OF OPERATIONS

For the period ended December 31, 2007

(all amounts in thousands)

Investment Income: | | | |

Dividends (net of withholding taxes on foreign dividends of $95) | | $ | 10,637 | |

Interest | | 707 | |

Income from loaned securities-net | | 78 | |

| | 11,422 | |

Expenses: | | | |

Management and advisory fees | | 3,519 | |

Printing and shareholder reports | | 9 | |

Custody fees | | 53 | |

Administration fees | | 86 | |

Legal fees | | 9 | |

Audit fees | | 20 | |

Trustees fees | | 14 | |

Distribution and service fees: | | | |

Service Class | | 7 | |

Other | | 4 | |

Total expenses | | 3,721 | |

| | | |

Net Investment Income | | 7,701 | |

| | | |

Net Realized Gain (Loss) from: | | | |

Investment securities | | 14,622 | |

Futures contracts | | (165 | ) |

| | 14,457 | |

Net Increase (Decrease) in Unrealized Appreciation (Depreciation) on: | | | |

Investment securities | | (28,929 | ) |

Futures contracts | | (161 | ) |

| | (29,090 | ) |

Net Realized and Unrealized (Loss): | | (14,633 | ) |

Net (Decrease) In Net Assets Resulting from Operations | | $ | (6,932 | ) |

The notes to the financial statements are an integral part of this report.

6

American Century Large Company Value

STATEMENT OF CHANGES IN NET ASSETS

For the years ended

(all amounts in thousands)

| | December 31, | | December 31, | |

| | 2007 | | 2006 | |

Increase (Decrease) in Net Assets From: | | | | | |

Operations: | | | | | |

Net investment income | | $ | 7,701 | | $ | 2,166 | |

Net realized gain from investment securities, futures contracts | | 14,457 | | 1,976 | |

Change in unrealized appreciation (depreciation) on investment securities, futures contracts | | (29,090 | ) | 19,119 | |

| | (6,932 | ) | 23,261 | |

Distributions to Shareholders: | | | | | |

From net investment income: | | | | | |

Initial Class | | (2,142 | ) | (2,975 | ) |

Service Class | | (6 | ) | (45 | ) |

| | (2,148 | ) | (3,020 | ) |

From net realized gains: | | | | | |

Initial Class | | (2,009 | ) | (13,551 | ) |

Service Class | | (11 | ) | (225 | ) |

| | (2,020 | ) | (13,776 | ) |

Capital Share Transactions: | | | | | |

Proceeds from shares sold: | | | | | |

Initial Class | | 322,804 | | 55,163 | |

Service Class | | 1,123 | | 1,515 | |

| | 323,927 | | 56,678 | |

Dividends and distributions reinvested: | | | | | |

Initial Class | | 4,151 | | 16,526 | |

Service Class | | 17 | | 270 | |

| | 4,168 | | 16,796 | |

Cost of shares redeemed: | | | | | |

Initial Class | | (40,470 | ) | (25,548 | ) |

Service Class | | (1,751 | ) | (631 | ) |

| | (42,221 | ) | (26,179 | ) |

| | 285,874 | | 47,295 | |

Net increase (decrease) in net assets | | 274,774 | | 53,760 | |

| | | | | |

Net Assets: | | | | | |

Beginning of year | | 176,279 | | 122,519 | |

End of year | | $ | 451,053 | | $ | 176,279 | |

Undistributed (Accumulated) Net Investment Income (Loss) | | $ | 7,707 | | $ | 2,166 | |

Share Activity: | | | | | |

Shares issued: | | | | | |

Initial Class | | 28,236 | | 4,952 | |

Service Class | | 95 | | 139 | |

| | 28,331 | | 5,091 | |

Shares issued-reinvested from distributions: | | | | | |

Initial Class | | 361 | | 1,611 | |

Service Class | | 1 | | 26 | |

| | 362 | | 1,637 | |

Shares redeemed: | | | | | |

Initial Class | | (3,498 | ) | (2,265 | ) |

Service Class | | (151 | ) | (56 | ) |

| | (3,649 | ) | (2,321 | ) |

Net increase (decrease) in shares outstanding: | | | | | |

Initial Class | | 25,099 | | 4,298 | |

Service Class | | (55 | ) | 109 | |

| | 25,044 | | 4,407 | |

The notes to the financial statements are an integral part of this report.

7

American Century Large Company Value

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each period(a)

| | Initial Class | |

| | Year Ended December 31, | |

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

Net Asset Value | | | | | | | | | | | |

Beginning of period | | $ | 11.34 | | $ | 11.01 | | $ | 11.06 | | $ | 9.81 | | $ | 7.64 | |

Investment Operations | | | | | | | | | | | |

Net investment income (loss) | | 0.21 | | 0.19 | | 0.18 | | 0.17 | | 0.12 | |

Net realized and unrealized gain (loss) | | (0.33 | ) | 1.80 | | 0.26 | | 1.18 | | 2.08 | |

Total operations | | (0.12 | ) | 1.99 | | 0.44 | | 1.35 | | 2.20 | |

Distributions | | | | | | | | | | | |

From net investment income | | (0.06 | ) | (0.30 | ) | (0.07 | ) | (0.10 | ) | (0.03 | ) |

From net realized gains | | (0.05 | ) | (1.36 | ) | (0.42 | ) | — | | — | |

Total distributions | | (0.11 | ) | (1.66 | ) | (0.49 | ) | (0.10 | ) | (0.03 | ) |

Net Asset Value | | | | | | | | | | | |

End of period(b) | | $ | 11.11 | | $ | 11.34 | | $ | 11.01 | | $ | 11.06 | | $ | 9.81 | |

Total Return(c),(d) | | (1.12 | )% | 19.68 | % | 4.15 | % | 13.91 | % | 28.79 | % |

Net Assets End of Period (000’s) | | $ | 448,651 | | $ | 173,206 | | $ | 120,738 | | $ | 185,445 | | $ | 59,978 | |

Ratio and Supplemental Data | | | | | | | | | | | |

Expenses to average net assets(e) | | 0.86 | % | 0.92 | % | 0.91 | % | 0.97 | % | 1.08 | % |

Net investment income (loss), to average net assets(e) | | 1.79 | % | 1.72 | % | 1.62 | % | 1.67 | % | 1.41 | % |

Portfolio turnover rate(d) | | 18 | % | 19 | % | 26 | % | 86 | % | 62 | % |

For a share outstanding throughout each period(a)

| | Service Class | |

| | Year Ended December 31, | | May 1 to Dec | |

| | 2007 | | 2006 | | 2005 | | 2004 | | 31, 2003 | |

Net Asset Value | | | | | | | | | | | |

Beginning of period | | $ | 11.33 | | $ | 11.00 | | $ | 11.07 | | $ | 9.82 | | $ | 7.90 | |

Investment Operations | | | | | | | | | | | |

Net investment income (loss) | | 0.18 | | 0.17 | | 0.15 | | 0.17 | | 0.08 | |

Net realized and unrealized gain (loss) | | (0.33 | ) | 1.80 | | 0.26 | | 1.16 | | 1.85 | |

Total operations | | (0.15 | ) | 1.97 | | 0.41 | | 1.33 | | 1.93 | |

Distributions | | | | | | | | | | | |

From net investment income | | (0.03 | ) | (0.28 | ) | (0.06 | ) | (0.08 | ) | (0.01 | ) |

From net realized gains | | (0.05 | ) | (1.36 | ) | (0.42 | ) | — | | — | |

Total distributions | | (0.08 | ) | (1.64 | ) | (0.48 | ) | (0.08 | ) | (0.01 | ) |

Net Asset Value | | | | | | | | | | | |

End of period(b) | | $ | 11.10 | | $ | 11.33 | | $ | 11.00 | | $ | 11.07 | | $ | 9.82 | |

Total Return(c),(d) | | (1.33 | )% | 19.44 | % | 3.83 | % | 13.61 | % | 24.40 | % |

Net Assets End of Period (000’s) | | $ | 2,402 | | $ | 3,073 | | $ | 1,781 | | $ | 1,947 | | $ | 149 | |

Ratio and Supplemental Data | | | | | | | | | | | |

Expenses to average net assets(e) | | 1.11 | % | 1.17 | % | 1.16 | % | 1.22 | % | 1.31 | % |

Net investment income (loss), to average net assets(e) | | 1.52 | % | 1.49 | % | 1.36 | % | 1.66 | % | 1.39 | % |

Portfolio turnover rate(d) | | 18 | % | 19 | % | 26 | % | 86 | % | 62 | % |

(a) | Per share information is calculated based on average number of shares outstanding. |

(b) | American Century Large Company Value (the “Fund”) share class commenced operations as follows: |

| Initial Class - May 1, 2001 |

| Service Class - May 1, 2003 |

(c) | Total Return reflects all portfolio expenses and includes reinvestment of dividends and capital gains; it does not reflect the charges and deductions under the policies or annuity contracts. |

(d) | Not annualized. |

(e) | Annualized. |

The notes to the financial statements are an integral part of this report.

8

American Century Large Company Value

NOTES TO FINANCIAL STATEMENTS

At December 31, 2007

(all amounts in thousands)

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

AEGON/Transamerica Series Trust (“ATST”) is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). ATST serves as a funding vehicle for variable life insurance, variable annuity and group annuity products. American Century Large Company Value (the “Fund”) is part of ATST.

In the normal course of business, the Fund enters into contracts that contain a variety of representations that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

This report should be read in conjunction with the current Fund prospectus, which contains more complete information about the Fund.

In preparing the Fund’s financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”), estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures. The following is a summary of significant accounting policies followed by the Fund.

Multiple class operations, income and expenses: The Fund currently offers two classes of shares, an Initial Class and a Service Class. Income, non-class specific expenses and realized and unrealized gains and losses, are allocated daily to each class, based upon the value of shares outstanding method as permitted under Rule 18f-3 of the 1940 Act. Each class bears its own specific expenses as well as a portion of general, common expenses.

Security valuations: The Fund values its investments at the close of the New York Stock Exchange (“NYSE”), normally 4 p.m. ET, each day the NYSE is open for business. Fund investments are valued at the last sale price or closing price on the day of valuation taken from the primary exchange where the security is principally traded.

Securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the last quoted bid price.

Debt securities are valued based on a price quotation or other equivalent indication of value supplied by an exchange, a pricing service or a major market maker; however, those that mature in sixty days or less are valued at amortized cost, which approximates market.

Investment company securities are valued at the net asset value of the underlying portfolio.

Securities for which quotations are not readily available are valued at fair market value as determined in good faith by the Fund’s Administrative Valuation Committee, using guidelines adopted by the Board of Trustees.

Cash: The Fund may leave cash overnight in its cash account with the custodian, State Street Bank & Trust Company (“State Street”). On July 2, 2007, State Street acquired the parent company of Investors Bank & Trust Company. State Street has been contracted on behalf of the Fund to invest the excess cash into a savings account, which at December 31, 2007 was paying an interest rate of 2.60%.

Repurchase agreements: The Fund is authorized to enter into repurchase agreements. The Fund, through its custodian, State Street, receives delivery of the underlying securities, the value of which at the time of purchase is required to be an amount equal to at least 100% of the resale price. The Fund will bear the risk of value fluctuations until the security can be sold and may encounter delays and incur costs in liquidating the security. In the event of bankruptcy or insolvency of the seller, delays and costs may be incurred.

Securities lending: The Fund may lend securities to qualified borrowers, with State Street acting as the Fund’s lending agent. The Fund earns negotiated lenders’ fees. The Fund receives cash and/or securities as collateral against the loaned securities. Cash collateral received is invested in short-term, interest-bearing securities. The Fund monitors the market value of securities loaned on a daily basis and requires collateral in an amount at least equal to the value of the securities loaned. Income from loaned securities earned by State Street for its services, shown in the Statement of Operations is net of fees, in the amount of $34.

The Fund has invested the cash collateral received from securities loaned in the following short-term, interest-bearing securities:

Abbey National PLC, Eurodollar Term, 5.00%, 1/7/2008 | | $ | 793 | |

ABN AMRO Bank NV, Eurodollar Term, 5.18%, 1/4/2008 | | 634 | |

Bank of Nova Scotia, Eurodollar Term, 4.96%, 1/22/2008 | | 555 | |

Barclays, Eurodollar Term, 5.00%, 2/12/2008 | | 1,110 | |

BNP Paribas, Eurodollar Term, 5.01%, 1/11/2008 | | 1,031 | |

Calyon, Eurodollar Term, 5.12%, 3/3/2008 | | 238 | |

Credit Suisse First Boston Corp., Repurchase Agreement, 4.60%, 1/2/2008 | | 2,062 | |

Dexia Group, Eurodollar Term, 4.82%, 1/3/2008 | | 793 | |

HBOS Halifax Bank of Scotland, Eurodollar Term, 5.15%, 1/2/2008 | | 396 | |

JPMorgan Chase & Co., Eurodollar Term, 5.15%, 2/12/2008 | | 396 | |

Lloyds TSB Bank, Eurodollar Term, 5.15%, 1/24/2008 | | 793 | |

Merrill Lynch & Co. (RPG), Repurchase Agreement, 4.60%, 1/2/2008 | | 1,189 | |

Morgan Stanley & Co. (Corp. Repo), Repurchase Agreement, 4.60%, 1/2/2008 | | 3,251 | |

Rabobank Nederland, Eurodollar Term, 5.08%, 1/10/2008 | | 952 | |

Reserve Primary Money Market Fund 4.95% | | 846 | |

Royal Bank of Scotland, Eurodollar Term, 5.00%, 2/25/2008 | | 952 | |

Societe Generale, Eurodollar Term, 5.15%, 3/3/2008 | | 476 | |

Toronto Dominion Bank, Eurodollar Term, 5.05%, 1/10/2008 | | 952 | |

UBS AG, Eurodollar Term, 4.92%, 1/11/2008 | | 555 | |

Wells Fargo, Bank Note, 4.75%, 1/8/2008 | | 396 | |

| | | |

| | $ | 18,370 | |

9

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2007

(all amounts in thousands)

NOTE 1.–(continued)

Futures contracts: The Fund may enter into futures contracts to manage exposure to market, interest rate or currency fluctuations. Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded. The primary risks associated with futures contracts are: imperfect correlation between the change in market value of the securities held and the prices of futures contracts; the possibility of an illiquid market; and inability of the counterparty to meet the contract terms.

The underlying face amounts of open futures contracts at December 31, 2007 are listed in the Schedule of Investments. The variation margin receivable or payable, as applicable, is included in the Statement of Assets and Liabilities. Variation margin represents the additional payment due or excess deposits made in order to maintain the equity account at the required margin level.

Security transactions and investment income: Security transactions are recorded on the trade date. Security gains and losses are calculated on the first-in, first-out basis. Dividend income, if any, is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is informed of the ex-dividend date. Interest income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis commencing on the settlement date.

Dividend distributions: Dividends and capital gains distributions are typically declared and reinvested annually and are generally paid and reinvested on the business day following the ex-date.

NOTE 2. RELATED PARTY TRANSACTIONS

ATST serves as a funding vehicle for certain affiliated asset allocation portfolios and certain affiliated separate accounts of Western Reserve Life Assurance Co. of Ohio, Transamerica Life Insurance Company, Transamerica Financial Life Insurance Company, Inc., Monumental Life Insurance Company and Transamerica Occidental Life Insurance Company.

Transamerica Fund Advisors, Inc. (“TFAI”) is the Fund’s investment adviser. Transamerica Fund Services, Inc. (“TFS”) is the Fund’s administrator and transfer agent. Prior to May 1, 2007, AFSG Securities Corp. (“AFSG”), was the Fund’s distributor. Transamerica Capital Inc. (“TCI”) is now the Fund’s distributor. TFAI, TFS, and TCI are affiliates of AEGON NV, a Netherlands corporation.

Certain officers and trustees of the Fund are also officers and/or directors of TFAI, TFS and TCI.

The following schedule reflects the percentage of Fund assets owned by affiliated investment companies at December 31, 2007:

| | Net | | % of Net | |

| | Assets | | Assets | |

| | | | | |

Asset Allocation-Conservative Portfolio | | $ | 17,640 | | 3.91 | % |

Asset Allocation-Growth Portfolio | | 86,386 | | 19.15 | |

Asset Allocation-Moderate Growth Portfolio | | 209,167 | | 46.37 | |

Asset Allocation-Moderate Portfolio | | 84,726 | | 18.79 | |

Total | | $ | 397,919 | | 88.22 | % |

Investment advisory fee: The Fund pays management fees to TFAI based on average daily net assets (“ANA”) at the following breakpoints:

| 0.835% of the first $250 million of ANA |

| 0.80% of the next $150 million of ANA |

| 0.775% of the next $350 million of ANA |

| 0.70% of ANA over $750 million |

TFAI has contractually agreed to waive its advisory fee and will reimburse the Fund to the extent that operating expenses, excluding 12b-1 fees, exceed the following stated annual limit:

If total Fund expenses fall below the annual expense limitation agreement agreed to by the adviser within the succeeding three years, the Fund may be required to pay the adviser a portion or all of the waived advisory fees.

There were no amounts recaptured during the year ended December 31, 2007. There are no amounts available for recapture at December 31, 2007.

Distribution and service fees: ATST entered into a Distribution Agreement with AFSG dated January 1, 1997, as amended. On May 1, 2007, the Distribution Agreement was amended to replace AFSG with TCI as the Fund’s distributor. The Fund has also adopted a distribution plan (“Distribution Plan”) pursuant to Rule 12b-1 under the 1940 Act.

Under the Distribution Plan for the Initial Class shares, TCI, on behalf of the Fund, is authorized to pay various service providers, as direct payment for expenses incurred in connection with distribution of the Fund’s shares, amounts equal to actual expenses associated with distributing the shares.

The Distribution Plan for the Service Class shares requires ATST to pay distribution fees to TCI as compensation for its activities, not as reimbursement for specific expenses. The fee on the Service Class is paid to the insurance companies for providing services and account maintenance for their policyholders who invest in the variable insurance products which invest in the Service Class shares.

The Fund is authorized under the Distribution Plan to pay fees on each class up to the following limits:

Initial Class | | 0.15 | % |

Service Class | | 0.25 | % |

TCI has determined that it will not seek payment by the Fund of the distribution expenses incurred with respect to the Initial

10

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2007

(all amounts in thousands)

NOTE 2.–(continued)

Class shares before April 30, 2009. Prior to TCI seeking reimbursement of future expenses, policy and contract owners will be notified in advance. The Fund will pay fees relating to Service Class shares.

Administrative services: The Fund has entered into an agreement with TFS for financial and legal fund administration services. The Fund pays TFS an annual fee of 0.02% of ANA. The Legal fees on the Statement of Operations are for fees paid to external legal counsel.

Deferred compensation plan: Each eligible independent Fund Trustee may elect participation in a non-qualified deferred compensation plan (“the Plan”). Under the Plan, such Trustees may defer payment of all or a portion of their total fees earned as a Fund Trustee. Each Trustee who is a participant in the Plan may elect that the earnings, losses or gains credited to his or her deferred fee amounts be determined based on a deemed investment in any series of Transamerica IDEX Mutual Funds. The right of a participant to receive a distribution from the Plan of the deferred fees is an unsecured claim against the general assets of all series of Transamerica IDEX Mutual Funds. The pro rata liability to the Fund of all deferred fees in the Plan amounted, as of December 31, 2007, to $22. Amounts deferred under the Plan are unfunded against the general assets of ATST.

Retirement plan: Under a retirement plan (the “Emeritus Plan”) available to the Independent Trustees, each Independent Trustee is deemed to have elected to serve as Trustee Emeritus of ATST upon his or her termination of service, other than removal for cause, and is entitled to 50% of the trustee’s current retainer for a maximum period of five years determined by his or her years of service as a Trustee.

Such amounts shall be accrued by ATST on a pro rata basis allocable to each series of ATST fund based on the relative assets of the series. If retainers increase in the future, past accruals (and credits) will be adjusted upward so that 50% of the Trustee’s current retainer is accrued and credited at all times. Upon death, disability or termination of service, other than removal for cause, amounts deferred become payable to a Trustee Emeritus (or his/her beneficiary). Upon the commencement of service as Trustee Emeritus, compensation will be paid on a quarterly basis during the time period that the Trustee Emeritus is allowed to serve as such.

Amounts accrued under the Emeritus Plan are unsecured claims against the general assets of ATST. For the year ended December 31, 2007, the amount related to the Emeritus Plan was $5. As of December 31, 2007, the Fund has not made any payments related to the Emeritus Plan.

The Emeritus Plan was terminated effective October 30, 2007. Upon the termination, the Fund shall continue to pay any remaining benefits in accordance with the Plan, but no further compensation shall accrue under the Plan.

NOTE 3. INVESTMENT TRANSACTIONS

The cost of securities purchased and proceeds from securities sold (excluding short-term securities) for the year ended December 31, 2007 were as follows:

Purchases of securities: | | | |

Long-term | | $ | 348,588 | |

U.S. Government | | — | |

Proceeds from maturities and sales of securities: | | | |

Long-term | | 70,701 | |

U.S. Government | | — | |

| | | | |

NOTE 4. FEDERAL INCOME TAX MATTERS

The Fund has not made any provision for federal income or excise taxes due to its policy to distribute all of its taxable income and capital gains to its shareholders and otherwise qualify as a regulated investment company under Subchapter M of the Internal Revenue Code. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatment for items including, but not limited to, wash sales.

Therefore, distributions determined in accordance with tax regulations may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial records are not adjusted for temporary differences. These reclassifications are as follows:

Additional paid-in capital | | $ | — | |

Undistributed (accumulated) net investment income (loss) | | $ | (12 | ) |

Undistributed (accumulated) net realized gain (loss) from investment securities | | $ | 12 | |

The tax character of distributions paid may differ from the character of distributions shown in the Statements of Changes in Net Assets due to short-term gains being treated as ordinary income for tax purposes. The tax character of distributions paid during 2006 and 2007 was as follows:

2006 Distributions paid from: | | | |

Ordinary Income | | $ | 7,004 | |

Long-term Capital Gain | | 9,792 | |

| | | |

2007 Distributions paid from: | | | |

Ordinary Income | | 2,408 | |

Long-term Capital Gain | | 1,760 | |

| | | |

| | | | |

The tax basis components of distributable earnings as of December 31, 2007 are as follows:

Undistributed Ordinary Income | | $ | 9,600 | |

Undistributed Long-term Capital Gain | | $ | 12,922 | |

Capital Loss Carryforward | | $ | — | |

Net Unrealized Appreciation (Depreciation) | | $ | (6,585 | ) |

11

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2007

(all amounts in thousands)

NOTE 5. REGULATORY PROCEEDINGS

There continues to be significant federal and state regulatory activity relating to financial services companies, particularly mutual fund companies and their investment advisers. As part of an ongoing investigation regarding potential market timing, recordkeeping and trading compliance issues and matters affecting the Fund’s investment adviser, TFAI, and certain affiliates and former employees of TFAI, the SEC staff has indicated that it is likely to take some action against TFAI and certain of its affiliates at the conclusion of the investigation. The potential timing and the scope of any such action is difficult to predict. Although the impact of any action brought against TFAI and/or its affiliates is difficult to assess at the present time, the Fund currently believes that the likelihood that any such action will have a material adverse impact is remote. It is important to note that the Fund is not aware of any allegation of wrongdoing against it and its Board at the time this annual report is printed. Although it is not anticipated that these developments will have an adverse impact on the Fund, there can be no assurance at this time. TFAI and its affiliates are actively working with the SEC in regard to this matter; however, the exact resolution cannot be determined at this time. TFAI will take such actions that it deems necessary or appropriate to continue providing management services to the Fund and to bring all matters to an appropriate conclusion.

TFAI and/or its affiliates, and not the Fund, will bear the costs regarding these regulatory matters.

NOTE 6. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In July 2006, the Financial Accounting Standards Board (“FASB”) released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”), an interpretation of FASB Statement No. 109. FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the accounting and disclosure of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely- than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year.

Adoption of FIN 48 is effective during the first required financial reporting period for fiscal years beginning after December 15, 2006. Management adopted FIN 48 on June 29, 2007.

Implementation of FIN 48 requires Management of the Fund to analyze all open tax years, as defined by the Statute of Limitations, for all major jurisdictions, which includes federal and certain states. Open tax years are those that are open for exam by taxing authorities (i.e., the last 4 tax year ends and the interim tax period since then). The Fund has no examinations in progress and none are expected at this time.

Management of the Fund has reviewed all open tax years and major jurisdictions and concluded the adoption of FIN 48 resulted in no impact to the Fund’s net assets or results of operations. There is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next 12 months.

In September 2006, FASB issued its new Standard No. 157, “Fair Value Measurements” (“FAS 157”). FAS 157 is designed to unify guidance for the measurement of fair value of all types of assets, including financial instruments, and certain liabilities, throughout a number of accounting standards. FAS 157 also establishes a hierarchy for measuring fair value in generally accepted accounting principles and expands financial statement disclosures about fair value measurements that are relevant to mutual funds. FAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and earlier application is permitted.

As of December 31, 2007, Management does not expect the adoption of FAS 157 to impact the amounts reported in the financial statements, however, additional disclosures will be required about the inputs used to develop the measurements of fair value and the effect of certain of the measurements reported in the statement of operations for a fiscal period.

NOTE 7. SUBSEQUENT EVENT

Effective January 1, 2008, TFAI changed its name to Transamerica Asset Management, Inc.

Effective May 1, 2008, AEGON/Transamerica Series Trust will change its name to Transamerica Series Trust. At that time, the Fund will also change its name to Transamerica American Century Large Company Value VP.

12

Report of Independent Registered Certified Public Accounting Firm

To the Board of Trustees and Shareholders of

American Century Large Company Value:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of American Century Large Company Value (the “Fund”) (one of the portfolios constituting AEGON/Transamerica Series Trust) at December 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2007 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

Tampa, Florida

February 29, 2008

13

American Century Large Company Value

SUPPLEMENTAL TAX INFORMATION (unaudited)

(all amounts in thousands)

For tax purposes, the Fund has made a Long-Term Capital Gain Designation of $1,760 for the year ended December 31, 2007.

RESULTS OF SHAREHOLDER PROXY (unaudited)

At a special meeting of shareholders held on October 30, 2007, the results of the Proposals were as follows:

Proposal 1: To elect a new Board:

Proposed | | | | | | Abstentions/Broker Non- | |

Trustee | | For | | Against | | Votes | |

John K. Carter | | 2,274,998,840.817 | | 57,804,698.755 | | 35,433.883 | |

| | | | | | | |

Leo J. Hill | | 2,277,212,702.754 | | 55,590,836.819 | | 35,433.883 | |

| | | | | | | |

Neal M. Jewell | | 2,266,793,295.663 | | 66,010,243.909 | | 35,433.883 | |

| | | | | | | |

Russell A. Kimball, Jr. | | 2,274,825,235.835 | | 57,978,303.737 | | 35,433.883 | |

| | | | | | | |

Eugene M. Mannella | | 2,274,623,165.033 | | 58,180,374.539 | | 35,433.883 | |

| | | | | | | |

Norm R. Nielsen | | 2,275,050,055.885 | | 57,753,483.687 | | 35,433.883 | |

| | | | | | | |

Joyce Galpern Norden | | 2,270,278,122.250 | | 62,525,417.323 | | 35,433.883 | |

| | | | | | | |

Patricia L. Sawyer | | 2,275,737,737.456 | | 57,065,802.116 | | 35,433.883 | |

| | | | | | | |

John W. Waechter | | 2,276,615,120.140 | | 56,188,419.433 | | 35,433.883 | |

Proposal 2: To approve an amendment to the Agreement and Declaration of Trust:

| | | | Abstentions/Broker Non- | |

For | | Against | | Votes | |

2,182,022,669.110 | | 77,590,048.544 | | 73,226,255.801 | |

14

American Century Large Company Value

INVESTMENT ADVISORY AND SUB-ADVISORY AGREEMENTS-REVIEW AND RENEWAL (unaudited)

At a meeting of the Board of Trustees of AEGON/Transamerica Series Trust (“ATST”) held on December 4th, 2007, the Board reviewed and considered the renewal of the investment advisory agreement (the “Investment Advisory Agreement”) between American Century Large Company Value (the “Fund”) and Transamerica Fund Advisors, Inc. (“TFAI”), as well as the renewal of the investment sub-advisory agreement (the “Sub-Advisory Agreement”) of the Fund between TFAI and American Century Investment Management, Inc. (the “Sub-Adviser”), to determine whether the agreements should be renewed for a six-month period. It was noted that this review was interim in nature to align all the Funds on the same calendar, and that the Funds’ advisory arrangements would be reviewed again in the first half of 2008.

Following their review and consideration, the Trustees determined that the renewal of the Investment Advisory Agreement and the Sub-Advisory Agreement would enable shareholders of the Fund to obtain high quality services at a cost that is appropriate, fair, and in the best interests of its shareholders. The Board, including the independent members of the Board, unanimously approved the renewal of the Investment Advisory Agreement and Sub-Advisory Agreement. In reaching their decision, the Trustees requested and obtained from TFAI and the Sub-Adviser such information as they deemed reasonably necessary to evaluate the agreements, including information about fees and performance of comparable funds managed by the Sub-Adviser. The Trustees also carefully considered information they had previously received from TFAI and the Sub-Adviser throughout the year as part of their regular oversight of the Fund, as well as comparative fee, expense, and performance information prepared by Lipper Inc. (“Lipper”), an independent provider of mutual fund performance, fee and expense information and profitability data prepared by management. In considering the proposed continuation of the Investment Advisory and Sub-Advisory Agreements, the Trustees evaluated a number of considerations that they believed, in light of the legal advice furnished to them by independent legal counsel and their own business judgment, to be relevant. They based their decisions on a variety of factors, including the following considerations, among others, although they did not identify any consideration or particular information that was controlling of their decisions:

The nature, extent and quality of the advisory services to be provided. The Board considered the nature and quality of the services provided by TFAI and the Sub-Adviser to the Fund in the past, as well as the services anticipated to be provided in the future. The Board concluded that TFAI and the Sub-Adviser are capable of providing high quality services to the Fund, as indicated by the nature and quality of services provided in the past by TFAI and the Sub-Adviser for this series and the experience, capability and integrity of TFAI’s senior management, the financial resources of TFAI and the Sub-Adviser, TFAI’s management oversight process and the professional qualifications of the portfolio management team of the Sub-Adviser. The Trustees determined that TFAI and the Sub-Adviser can provide investment and related services that are appropriate in scope and extent in light of the Fund’s operations, the competitive landscape of the investment company business and investor needs.

The investment performance of the Fund. The Board examined the short and longer-term performance of the Fund, including relative performance against a peer universe of comparable mutual funds as prepared by Lipper for various trailing periods ended June 30, 2007. The Board noted that performance was around median for comparable funds for 1-, 3- and 5-year periods, but the Board also noted that part of the Fund’s longer-term record was generated under a different investment team. On the basis of the Board’s assessment of the nature, extent and quality of advisory services to be provided or procured by TFAI and the Sub-Adviser, the Board concluded that TFAI and the Sub-Adviser are capable of providing a level of investment performance that is appropriate in light of the Fund’s proposed investment objectives, policies and strategies and competitive with other similarly situated investment companies.

The cost of advisory services provided and the level of profitability. The Board reviewed profitability information of TFAI’s cost of procuring fund management services, as well as the costs of provision of administration, fund accounting and other services, to the Fund and to ATST as a whole by TFAI and its affiliates. The Board reviewed the management and sub-advisory fees for the Fund. Although fees were higher relative to the peer group and universe of comparable mutual funds, the Board noted that fees were renegotiated for 2008. Based on their review, the Trustees determined that the management fees of the Fund generally are appropriate in light of the services expected to be provided or procured, the management fees and the anticipated profitability of the relationship between the Fund, TFAI and its affiliates, and the Sub-Adviser. In making these observations and determinations, the Board reviewed among other things, comparative information provided by Lipper.

Whether fee levels reflect economies of scale and the extent to which economies of scale would be realized as the Fund grows. In evaluating the extent to which the management fees payable under the Investment Advisory and Sub-Advisory Agreements reflect economies of scale or will permit economies of scale to be realized in the future, the Board noted that TFAI and the Sub-Adviser offer breakpoints which appropriately benefit investors by passing on economies of scale in the form of lower management fees as the level of assets grows. The Board also noted that an additional advisory breakpoint occurs above the sub-advisory breakpoints offered. The Trustees also concluded that they will have the opportunity to periodically reexamine whether the Fund has achieved economies of scale, and the appropriateness of management fees payable to TFAI and fees paid to the Sub-Adviser, in the future.

Benefits (such as soft dollars) to TFAI, its affiliates, or the Sub-Adviser from their relationship with the Fund. The Board concluded that other benefits anticipated to be derived by TFAI, its affiliates, and the Sub-Adviser from their relationships with the Fund are expected to be reasonable and fair, and consistent with industry practice and the best interests of the Fund and its shareholders. The Trustees noted that TFAI would not realize soft dollar benefits from its relationship with the Fund, and that the Sub-Adviser’s soft dollar trading is consistent with applicable law, including best execution requirements in particular.

Other considerations. The Board determined that TFAI has made a substantial commitment to the recruitment and retention of high quality personnel, and maintains the financial, compliance and operational resources reasonably necessary to manage the Fund in a professional manner that is consistent with the best interests of the Fund and its shareholders. In this regard, the Trustees favorably considered the procedures and policies in place by TFAI to enforce compliance with applicable laws and regulations and oversee the

15

portfolio management activities of the Sub-Adviser. The Trustees also determined that TFAI has made a significant entrepreneurial commitment to the management and success of the Fund, reflected by TFAI’s expense limitation and fee waiver arrangements with the Fund which may result in TFAI waiving a substantial amount of management fees for the benefit of shareholders.

16

Asset Allocation - Conservative Portfolio

MARKET ENVIRONMENT

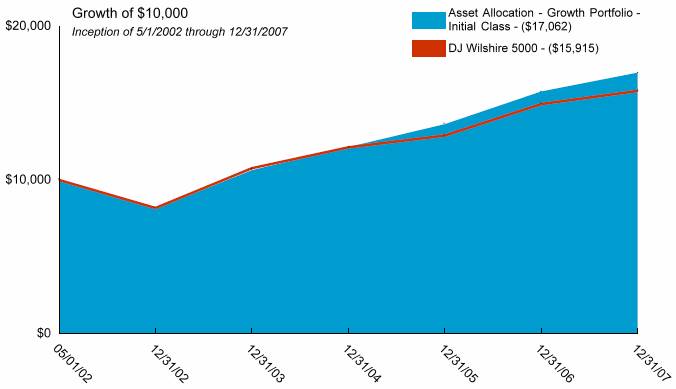

The stock and bond markets rose for the twelve-month period through December 31, 2007, but suffered plenty of volatility along the way. The Standard and Poor’s 500 Composite Stock Index returned 5.49%, while the broad Dow Jones Wilshire 5000 Total Market Index (“DJ Wilshire 5000”) gained 5.74%. These modest gains were punctuated by setbacks, however. In the summer, gathering concern about the U.S. mortgage and housing markets reached alarming levels. The mortgage industry’s loose lending standards of recent years came back to haunt lenders, investors, and borrowers alike. Lenders responded by tightening credit standards, many borrowers could no longer qualify for loans, and home sales and refinancings slowed. These problems worsened in the year’s last two months as financial institutions announced write-downs of mortgage-related holdings. After tumbling in the summer, stocks of financial companies again pulled the broad indices down in November and December.

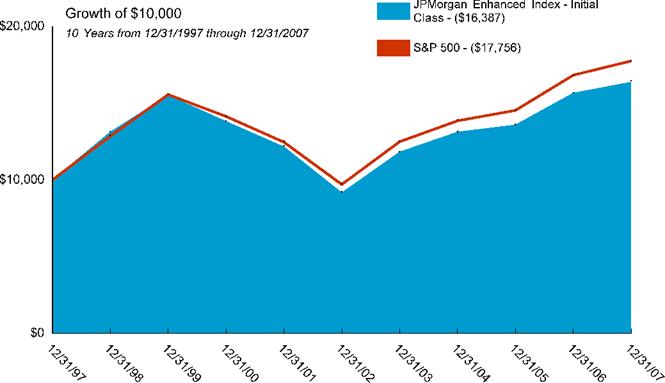

By midyear investors were favoring the relative safety of larger stocks. As they migrated toward large caps while also steering away from financials and other value stocks, they boosted large-cap growth stocks in sectors such as technology. Large growth companies were also rewarded for being big exporters, an advantage with the weak U.S. dollar. For the year, large caps outpaced small caps, and growth stocks significantly outperformed value stocks across all market-cap ranges.

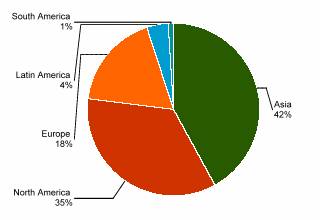

Foreign equity returns surpassed the U.S. indices. The Morgan Stanley Capital International EAFE Index rose 11.63% (gross) for the period, mainly because major foreign currencies strengthened against the dollar (the index gained only 3.54% (net) in local-currency terms). Emerging markets were especially strong as high commodity prices bolstered the developing nations that export them. The Morgan Stanley Capital International Emerging Markets Index soared 39.78% (gross) for the year.

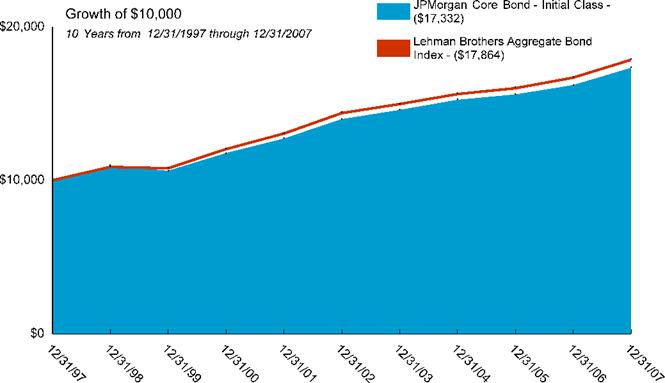

Bond returns improved throughout the year as nervous investors sought safety from the shaky stock market. The Federal Reserve Board’s three rate cuts from September through December also helped bond prices. The Lehman Brothers Aggregate Bond Index (“LBAB”) finished the year with a 6.97% return, with U.S. government bonds leading the gains. High-yield bonds weakened as credit conditions worsened, but posted modestly positive returns thanks to strength earlier in the year.

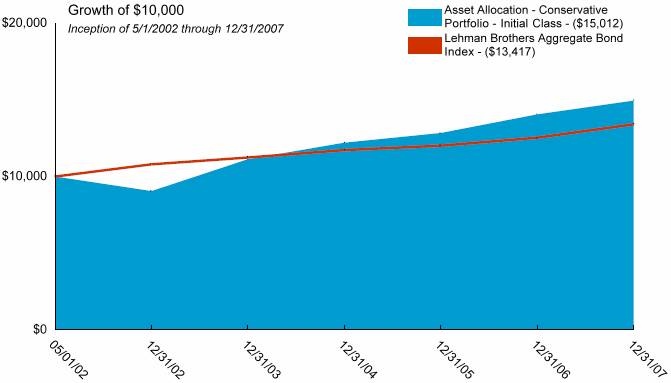

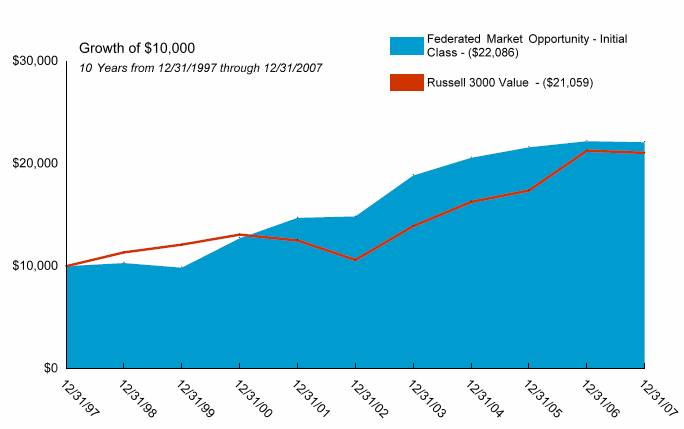

PERFORMANCE

For the year ended December 31, 2007, Asset Allocation - Conservative Portfolio, Initial Class returned 6.38%. By comparison its primary and secondary benchmarks, the LBAB and the DJ Wilshire 5000, returned 6.97% and 5.74%, respectively.

STRATEGY REVIEW

This fund-of-funds portfolio is structured to provide an approximately 35%/55%/10% mix of stocks, bonds, and cash. The fixed-income portion of the portfolio is well diversified, covering investment-grade and credit-sensitive holdings, as well as international bonds. Its equity exposure is intended to provide broad coverage of domestic and international equity markets, across market capitalizations and investment styles. It also includes emerging markets, global real estate, and absolute-return strategies.

The largest position, PIMCO Total Return, finished the year strongly; it beat the LBAB by two percentage points after lagging earlier in the year. Transamerica Convertible Securities was the best performer among the bond funds. MFS High Yield and TA IDEX Transamerica Flexible Income were laggards, but the remaining bond funds performed decently relative to their asset classes. Transamerica Science & Technology was the portfolio’s top gainer thanks to surging tech stocks, and TA IDEX Oppenheimer Developing Markets performed almost as well, as many emerging markets soared. The portfolio’s growth funds within the mid- and large-cap tiers clearly benefited from the strength of growth stocks. A couple of the value funds were weighed down by the financials sector, but in the small-cap area Transamerica Small/Mid Cap Value posted a significant gain and the other small-cap focused value fund, TA IDEX Oppenheimer Small- & Mid-Cap Value, also impressed with a positive return. The international position’s emerging-markets exposure (mostly via the aforementioned Oppenheimer fund) was certainly a boost to returns, but TA IDEX Marsico International Growth also posted strong results, and TA IDEX International Small Cap beat the Morgan Stanley Capital International EAFE Index even though the year favored large caps.

In early 2007 we conducted a broad rebalancing, mainly to further diversify the bond position and better balance the portfolio’s equity exposure. We believe the portfolio’s good 2007 return, demonstrate the effectiveness of maintaining disciplined and balanced market coverage while emphasizing strong managers in each style.

In January 2007, TA IDEX Loomis Sayles Bond was added to the menu of underlying funds available for use in this portfolio, and it was added to the portfolio’s holdings that same month.

Michael Stout, CFA

Jon Hale, Ph.D., CFA

Jeff McConnell, CFA

Maciej Kowara, Ph.D., CFA

Co-Portfolio Managers

Morningstar Associates, LLC

AEGON/Transamerica Series Trust | | | | Annual Report 2007 |

1

Asset Allocation - Conservative Portfolio

(unaudited)

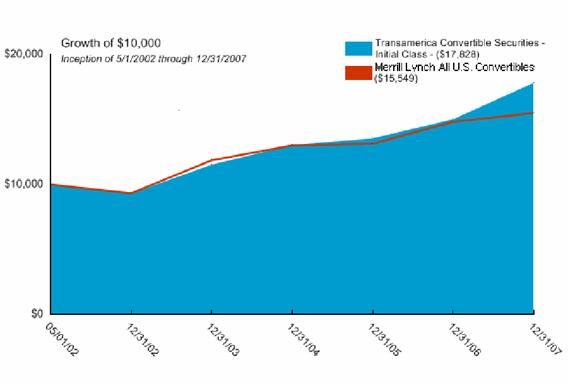

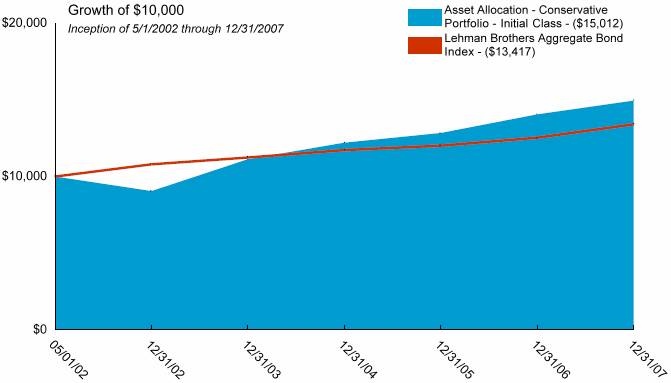

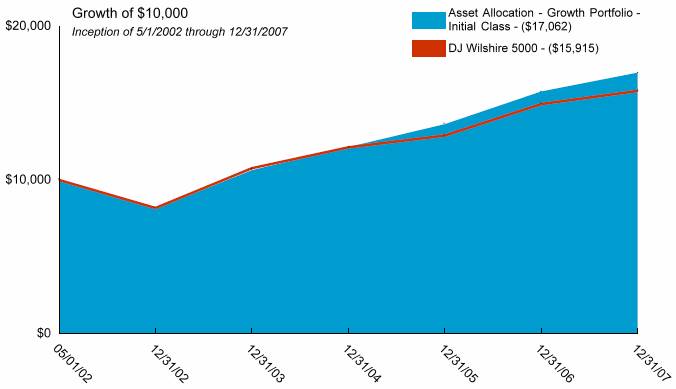

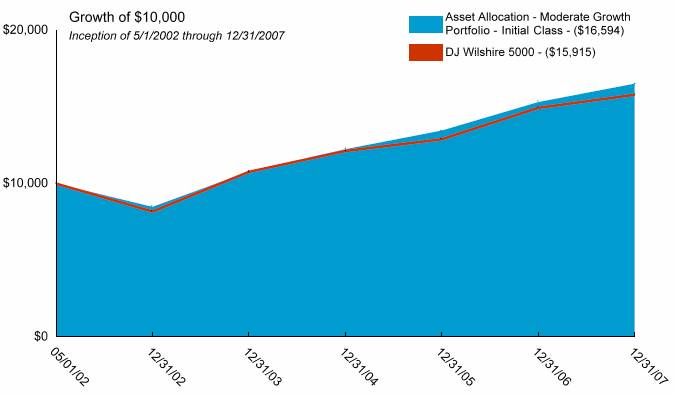

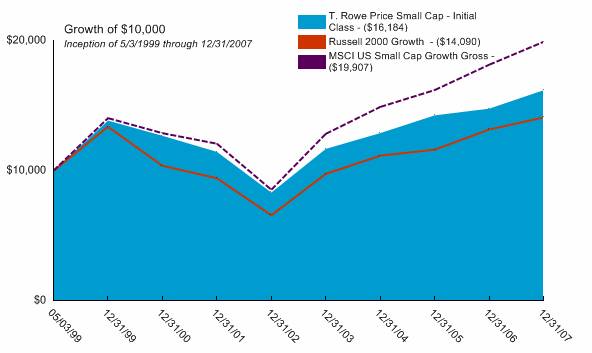

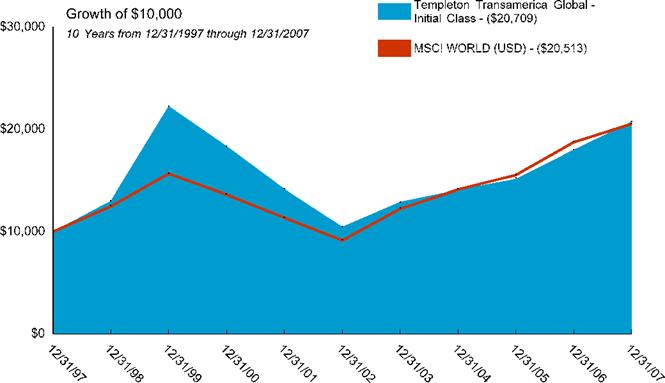

Average Annual Total Return for Periods Ended 12/31/2007

| | | | | | From | | Inception | |

| | 1 Year | | 5 Years | | Inception | | Date | |

| | | | | | | | | |

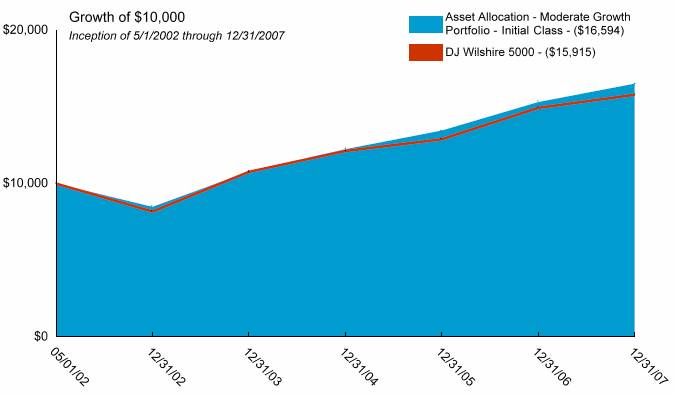

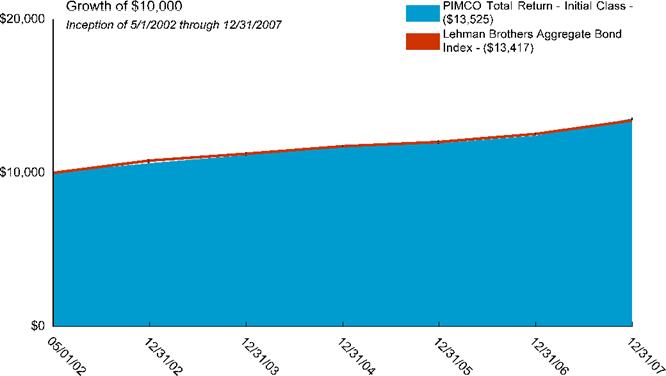

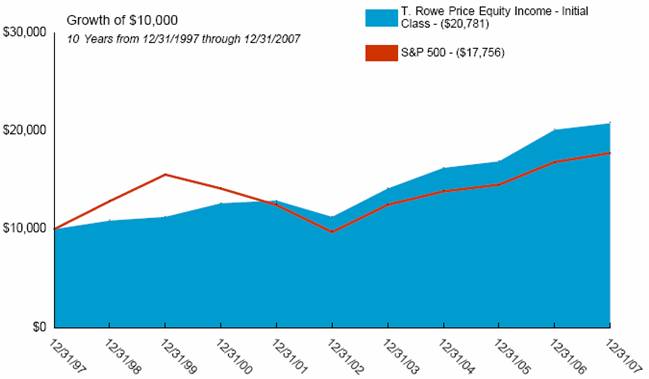

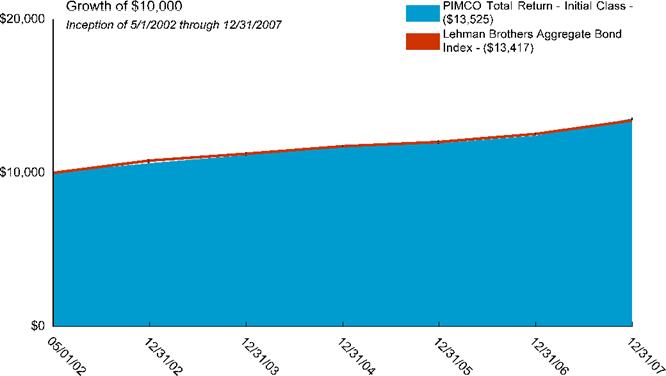

Initial Class | | 6.38 | % | 10.55 | % | 7.43 | % | 5/1/02 | |

Lehman Brothers Aggregate Bond Index(1) | | 6.97 | % | 4.42 | % | 5.32 | % | 5/1/02 | |

DJ Wilshire 5000(1) | | 5.74 | % | 14.07 | % | 8.54 | % | 5/1/02 | |

| | | | | | | | | |

Service Class | | 6.15 | % | — | % | 9.95 | % | 5/1/03 | |

NOTES

(1) The Lehman Brothers Aggregate Bond (LBAB) Index and the Dow Jones Wilshire 5000 Total Market (DJ Wilshire 5000) Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception, calculation is based on life of Initial Class shares.

The performance data presented represents past performance; future results may vary. The portfolio’s investment return and net asset value will fluctuate. Past performance does not guarantee future results. Investor’s units when redeemed may be worth more or less than their original cost.

Current performance may be lower or higher than performance quoted. Please visit your insurance company’s website for contract or policy level standardized total returns current to the most recent month end. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives, explanation of share classes and policies of this portfolio.

2

Asset Allocation - Conservative Portfolio

UNDERSTANDING YOUR FUND’S EXPENSES

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur ongoing costs, including management and advisory fees, distribution and service fees, and other fund expenses.

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at July 1, 2007 and held for the entire period until December 31, 2007.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

The expenses shown in the table do not reflect any expenses from the Funds investment in other affiliated investment companies. The average weighted annualized expense ratio of the underlying investment companies at December 31, 2007, was 0.77%.

| | Beginning | | Ending | | Annualized | | Expenses | |

| | Account | | Account | | Expense | | Paid During | |

| | Value | | Value | | Ratio | | Period (a) | |

| | | | | | | | | |

Initial Class | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,030.79 | | 0.13 | % | $ | 0.67 | |

Hypothetical(b) | | 1,000.00 | | 1,024.55 | | 0.13 | | 0.66 | |

| | | | | | | | | |

Service Class | | | | | | | | | |

Actual | | 1,000.00 | | 1,029.25 | | 0.38 | | 1.99 | |

Hypothetical(b) | | 1,000.00 | | 1,023.24 | | 0.38 | | 1.99 | |

| | | | | | | | | | | | |

(a) | | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (365 days). |

| | |

(b) | | 5% return per year before expenses. |

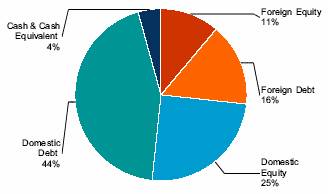

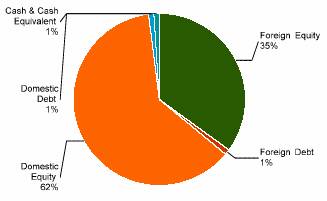

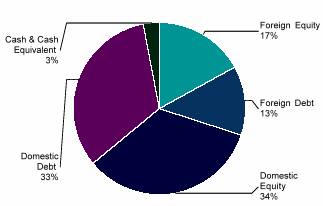

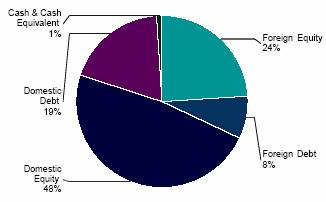

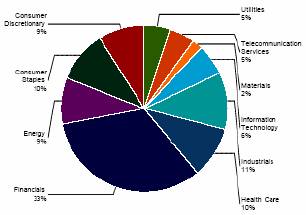

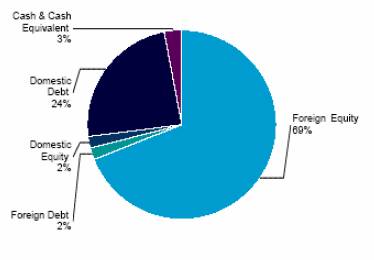

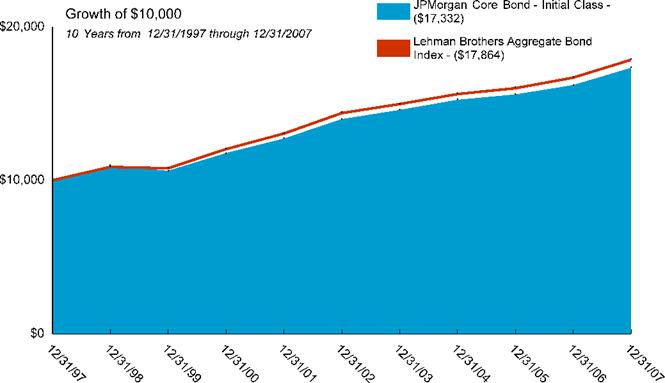

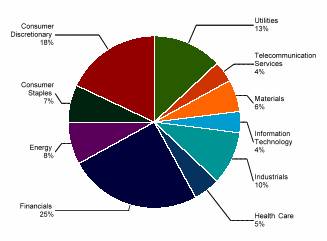

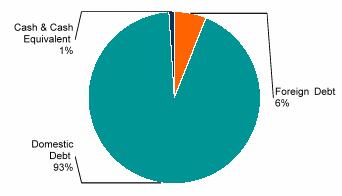

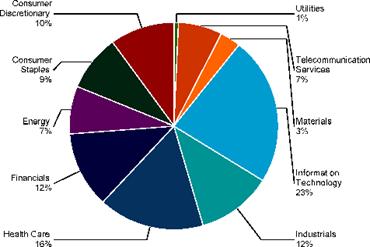

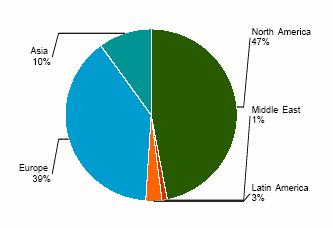

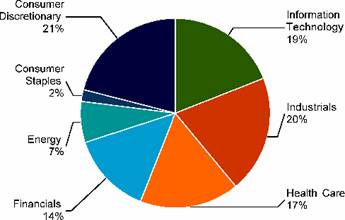

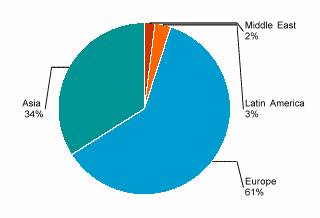

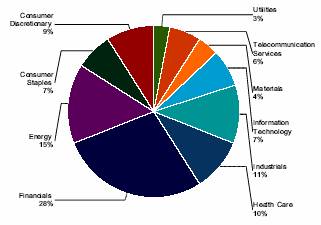

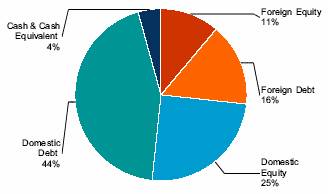

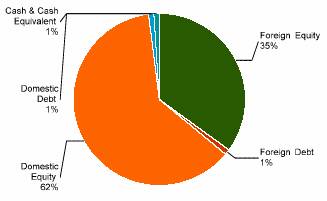

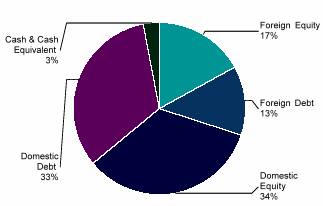

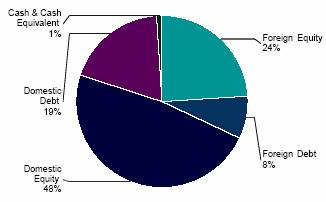

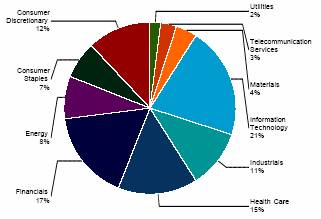

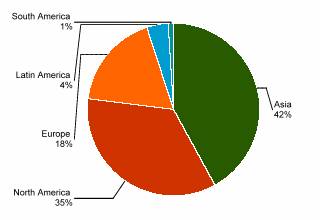

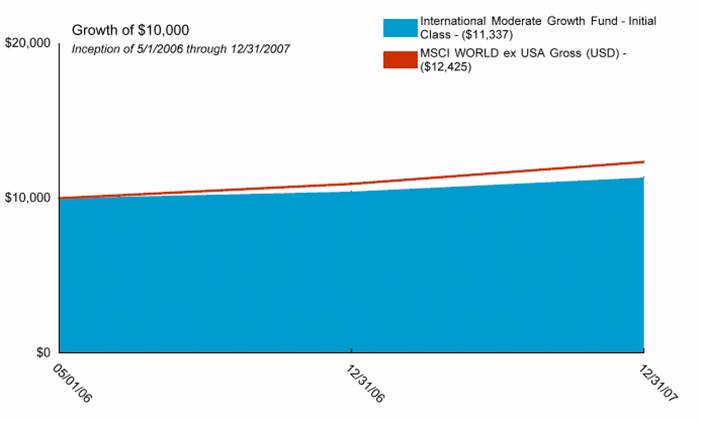

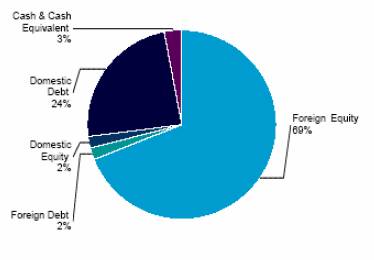

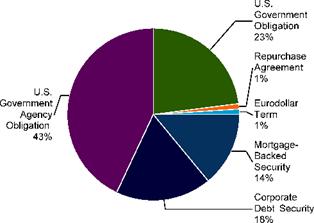

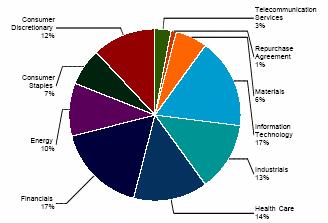

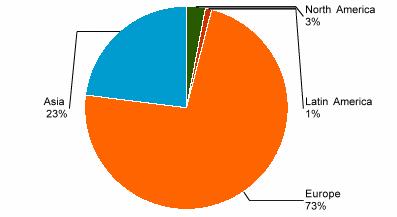

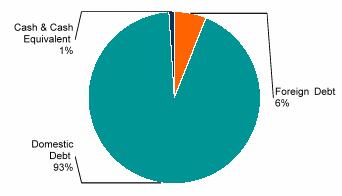

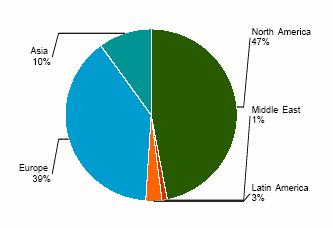

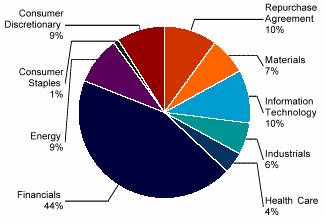

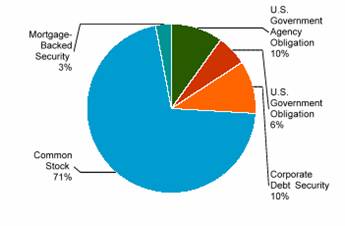

GRAPHICAL PRESENTATION OF SCHEDULE OF INVESTMENTS

By Asset Type

At December 31, 2007

This chart shows the percentage breakdown by asset type of the aggregate portfolio holdings of the underlying affiliated investment companies in which the Fund invests. The security lending collateral in the underlying funds is excluded from this calculation.

3

Asset Allocation - Conservative Portfolio

SCHEDULE OF INVESTMENTS

At December 31, 2007

(all amounts except share amounts in thousands)

| | Shares | | Value | |

INVESTMENT COMPANIES (100.0%) | | | | | |

Bond (44.3%) | | | | | |

MFS High Yield (1) | | 2,369,350 | | $ | 20,708 | |

PIMCO Total Return (1) | | 11,428,285 | | 133,140 | |

TA IDEX JPMorgan International Bond (2) | | 6,167,925 | | 67,662 | |

TA IDEX Transamerica Flexible Income (2) | | 5,855,797 | | 52,878 | |

TA IDEX Transamerica High-Yield Bond (2) | | 2,029,774 | | 18,065 | |

TA IDEX Transamerica Short-Term Bond (2) | | 6,743,847 | | 65,887 | |

TA IDEX Van Kampen Emerging Markets Debt (2) | | 2,787,789 | | 29,300 | |

Transamerica Convertible Securities (1) | | 2,556,188 | | 31,901 | |

Transamerica U.S. Government Securities (1) | | 53,601 | | 643 | |

Capital Preservation (1.9%) | | | | | |