As filed with the SEC on March 9, 2009.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04419 |

|

TRANSAMERICA SERIES TRUST |

(Exact name of registrant as specified in charter) |

|

570 Carillon Parkway, St. Petersburg, Florida | | 33716 |

(Address of principal executive offices) | | (Zip code) |

|

Dennis P. Gallagher, Esq. P.O. Box 9012, Clearwater, Florida 33758-9771 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (727) 299-1800 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | January 1, 2008 - December 31, 2008 | |

| | | | | | | | | |

Item 1: Report(s) to Shareholders. The Annual Report is attached.

Transamerica Series Trust Annual Report

570 Carillon Parkway

St. Petersburg, FL 33716

Distributor: Transamerica Capital, Inc.

Customer Service: 1-800-851-9777

The following pages contain the most recent annual reports for the investment options in which you are invested. In compliance with Securities and Exchange Commission regulations, we present these reports on an annual and semi-annual basis with the hope that they will foster greater understanding of the investment options’ holdings, performance, financial data, accounting policies and other issues. This streamlined version provides information only on the investment options in which you are invested.

If you have any questions about these reports, please do not hesitate to contact your financial professional. As always, we thank you for your trust and the opportunity to serve you.

Dear Fellow Shareholder,

On behalf of Transamerica Series Trust, we would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial adviser in the future. We value the trust you have placed in us.

This annual report is provided to you with the intent of presenting a comprehensive review of the investments of each of your funds. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all shareholders, and we believe this report to be an important part of the investment process. In addition to providing a comprehensive review, this report also provides a discussion of accounting policies as well as matters presented to shareholders that may have required their vote.

We believe it is important to recognize and understand current market conditions in order to provide a context for reading this report. Both equity and fixed-income markets have experienced extreme volatility and accelerating downward pricing pressure over the past twelve months as a credit crisis has had profound effects on the financial markets and has spilled over into the global economy. Oil prices rose dramatically throughout the first seven months of 2008 and have fallen precipitously since then as the global economy has struggled and demand has declined. The Federal Reserve has lowered the federal funds rate during the past twelve months from 4.25% at the beginning of January 2008 to a range of 0% - 0.25% in December 2008 as it has sought to provide liquidity in a difficult market environment. The United States Department of Treasury has also been taking an active role in an effort to stabilize the markets, including the initiation of the Temporary Money Market Guarantee Program and the Troubled Assets Relief Program (“TARP”). The job market continues to struggle as non-farm payrolls have weakened and the unemployment rate has risen to 7.2%. In this environment, investors have flocked to money market instruments and Treasuries in a flight to quality. Many funds have struggled to produce positive returns. For the twelve months ending December 31, 2008, the Dow Jones Industrial Average returned (31.93)%, the Standard & Poor’s 500 Index returned (37.00)%, and the Barclays Capital Aggregate U.S. Bond Index (formerly known as the Lehman Brothers Aggregate Bond Index) returned 5.24%. Please keep in mind it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial adviser is a key resource to help you build a complete picture of your current and future financial needs. Financial advisors are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial adviser, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

Please contact your financial adviser if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

John K. Carter | Christopher A. Staples |

President & Chief Executive Officer | Vice President & Chief Investment Officer |

Transamerica Series Trust | Transamerica Series Trust |

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of Transamerica Series Trust. These views are subject to change based upon market conditions. These views should not be relied upon as investment advice and are not indicative of trading intent on behalf of Transamerica Series Trust.

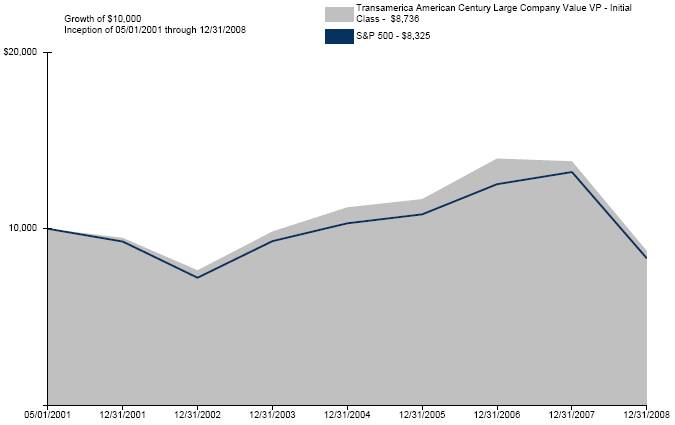

Transamerica American Century Large Company Value VP

(unaudited)

MARKET ENVIRONMENT

Extraordinary, if not unprecedented, market conditions characterized the period. Few investors anticipated the scope of the credit crunch, which grew into a full-blown financial crisis. The U.S. government and the Federal Reserve Board (“Fed”) took extraordinary steps to provide support for the flagging financial system, with other governments and central banks following suit. In the stock market, volatility was extreme on a day-to-day basis as investors lost confidence in the financial system and worried about the government’s ability to remedy the situation. U.S. equity indexes were universally down for the 12-month period, with value and growth stocks generally providing similar returns.

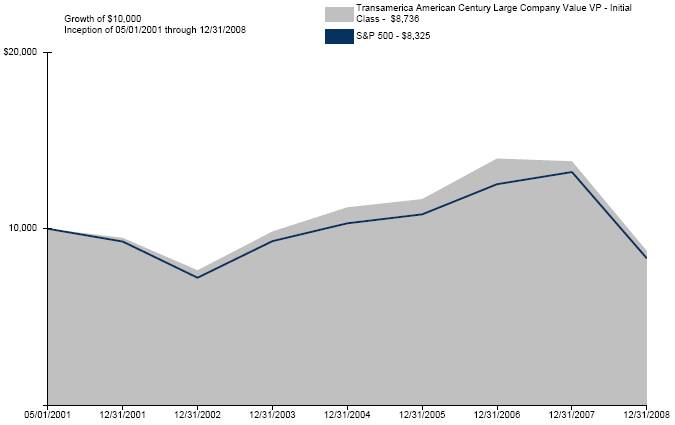

PERFORMANCE

For the year ended December 31, 2008, Transamerica American Century Large Company Value VP Initial Class returned (36.78)%. By comparison its primary and secondary benchmarks, the Standard and Poor’s 500 Composite Stock Index and the Russell 1000® Value Index, returned (37.00)% and (36.85)%, respectively.

STRATEGY REVIEW

Despite an underweight, the financials sector was the portfolio’s largest source of underperformance versus the benchmark. Although the portfolio management team continues to approach the sector with caution and selectivity, the best relative values were the most adversely affected by the financial crisis.

In particular, the portfolio was hampered by its mix of insurance, mortgage finance, and diversified financial services stocks. Three top detractors were financial giant Citigroup, Inc. (“Citigroup”); life, property and casualty insurer Hartford Financial Services Group, Inc. (“Hartford”); and American International Group, Inc. (“AIG”), the leading U.S.-based international insurer. Shares of Citigroup, which declined dramatically on worries that it had inadequate capital, stabilized only after the announcement of a U.S. government capital infusion. Hartford’s stock price fell on similar fears, while AIG’s shares lost significant value when the Fed had to rescue the company from bankruptcy. The portfolio’s positions in Hartford and AIG have been eliminated.

The portfolio’s holdings in the health care sector contributed to results. During difficult economic times or periods of stock market turbulence, investors often regard health care stocks as lower-risk, defensive investments. Moreover, our preference for large industry leaders proved advantageous. A significant holding was Abbott Laboratories (“Abbott”), which develops and manufactures laboratory diagnostics, medical devices and pharmaceutical therapies. Abbott reported strong sales across its entire product line, including Humira (a drug that treats autoimmune diseases).

The portfolio benefited from strong security selection in information technology, primarily from large leading software and technology companies. A notable contributor was Hewlett-Packard Co. (“HP”), a computer and peripheral maker. HP’s acquisition of outsourcing giant Electronic Data Systems appears to offer a competitive advantage and could add value through reorganization and cost-cutting efforts.

The portfolio’s position in the materials sector boosted relative performance. For some time, the share prices of metals and mining firms have been momentum-driven; many have not met the management team’s valuation criteria and thus have not merited sizeable exposure. This limited exposure was particularly beneficial when commodities prices fell during the final months of 2008.

The consumer discretionary sector provided a significant holding, H&R Block, Inc. The company closed its sub-prime mortgage unit, allowing it to focus on its core tax-preparation services business which is generally perceived as less economically sensitive.

The portfolio’s underweight in the utilities sector was another drag on results. The portfolio management team believes that because of their defensive nature, many utilities stocks have become overvalued. The portfolio was slowed by its lack of multi-utility names, and security selection among electric utilities also diminished relative performance.

Charles A. Ritter, CFA

Brendan Healy, CFA

Co-Portfolio Managers

American Century Investment Management, Inc.

Transamerica Series Trust | | Annual Report 2008 |

1

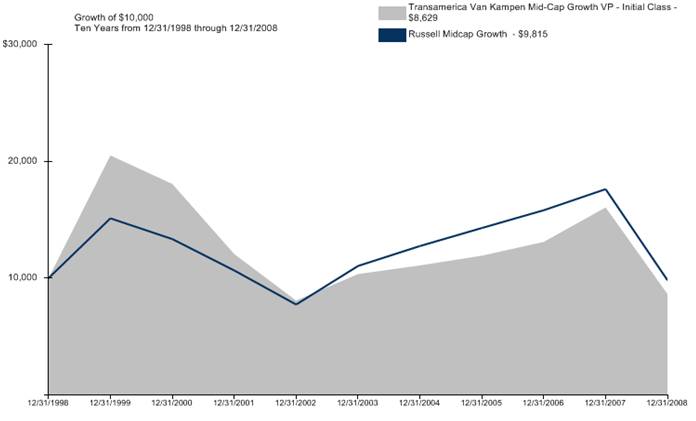

Average Annual Total Return for Periods Ended 12/31/2008

| | 1 Year | | 5 Years | | From

Inception | | Inception

Date | |

Initial Class | | (36.78 | )% | (2.36 | )% | (1.75 | )% | 05/01/2001 | |

S&P 500* | | (37.00 | )% | (2.19 | )% | (2.36 | )% | 05/01/2001 | |

Russell 1000 Value* | | (36.85 | )% | (0.79 | )% | 0.12 | % | 05/01/2001 | |

Service Class | | (37.05 | )% | (2.63 | )% | 1.51 | % | 05/01/2003 | |

NOTES

* The Standard and Poor’s 500 Composite Stock (S&P 500) Index and the Russell® 1000 Value Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception calculation is based on life of Initial Class shares. You cannot directly invest in an Index.

The performance data presented represents past performance, future results may vary. The portfolio’s investment return and net asset value will fluctuate. Past performance does not guarantee future results. Investor’s units when redeemed may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please visit your insurance company’s website for contract or policy level standardized total returns current to the most recent month end. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives, explanation of share classes and policies of this portfolio.

2

UNDERSTANDING YOUR FUND’S EXPENSES

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur ongoing costs, including management and advisory fees, distribution and service fees, and other fund expenses.

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at July 1, 2008 and held for the entire period until December 31, 2008.

ACTUAL EXPENSES

The first line in the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

| | Beginning Account

Value | | Ending Account

Value | | Annualized

Expense

Ratio | | Expenses

Paid During

Period (a) | |

| | | | | | | | | |

Initial Class | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 742.46 | | 0.87 | % | $ | 3.81 | |

Hypothetical (b) | | 1,000.00 | | 1,020.76 | | 0.87 | | 4.42 | |

| | | | | | | | | |

Service Class | | | | | | | | | |

Actual | | 1,000.00 | | 741.02 | | 1.12 | | 4.90 | |

Hypothetical (b) | | 1,000.00 | | 1,019.51 | | 1.12 | | 5.69 | |

| | | | | | | | | | | | |

(a) Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (366 days).

(b) 5% return per year before expenses.

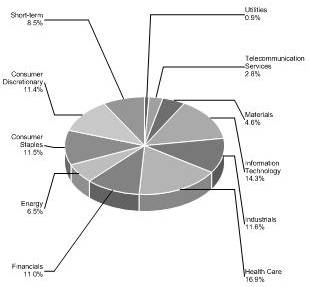

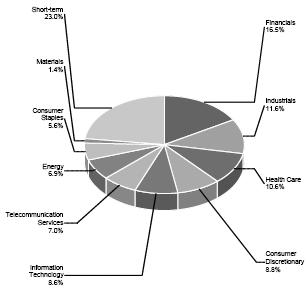

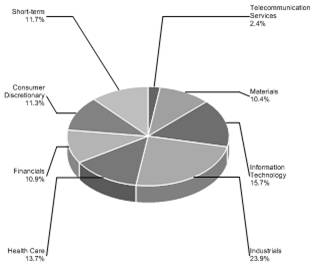

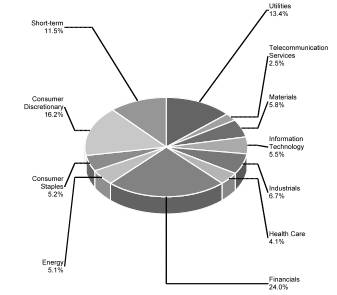

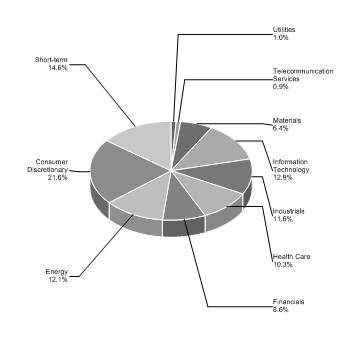

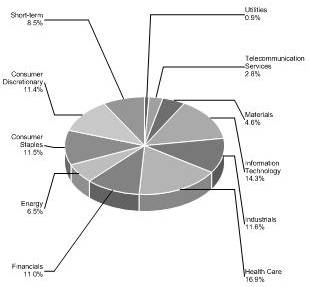

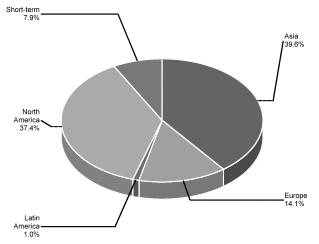

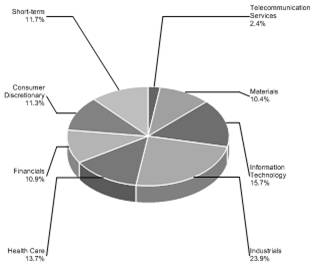

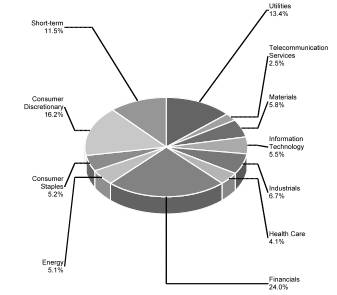

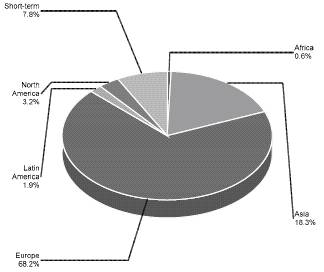

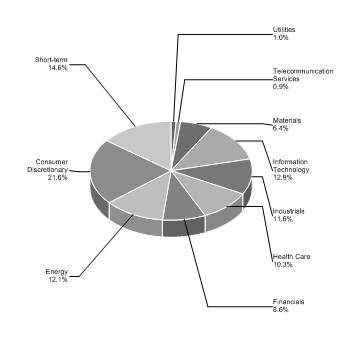

GRAPHICAL PRESENTATION OF SCHEDULE OF INVESTMENTS

By Sector

At December 31, 2008

(unaudited)

This chart shows the percentage breakdown by sector of the Fund’s total investment securities. The Short-term category includes Securities Lending Collateral.

3

SCHEDULE OF INVESTMENTS

At December 31, 2008

(all amounts except share amounts in thousands)

| | Shares | | Value | |

PREFERRED STOCK (0.1%) | | | | | |

Capital Markets (0.1%) | | | | | |

Legg Mason, Inc., 7.00% p | | 19,000 | | $ | 418 | |

Total Preferred Stock (cost $359) | | | | 418 | |

| | | | | |

COMMON STOCKS (93.8%) | | | | | |

Aerospace & Defense (1.1%) | | | | | |

Northrop Grumman Corp. | | 84,300 | | 3,797 | |

Beverages (2.3%) | | | | | |

Coca-Cola Co. | | 122,400 | | 5,541 | |

Pepsi Bottling Group, Inc. | | 124,500 | | 2,802 | |

Biotechnology (1.2%) | | | | | |

Amgen, Inc. ‡ | | 72,600 | | 4,193 | |

Capital Markets (3.2%) | | | | | |

Bank of New York Mellon Corp. | | 123,700 | | 3,504 | |

Goldman Sachs Group, Inc. ^ | | 37,200 | | 3,139 | |

Legg Mason, Inc. ^ | | 31,700 | | 695 | |

Merrill Lynch & Co., Inc. ^ | | 143,900 | | 1,675 | |

Morgan Stanley | | 123,200 | | 1,976 | |

Chemicals (1.8%) | | | | | |

E.I. duPont de Nemours & Co. | | 127,200 | | 3,218 | |

PPG Industries, Inc. | | 73,700 | | 3,127 | |

Commercial Banks (3.2%) | | | | | |

National City Corp. ^ | | 284,000 | | 514 | |

US Bancorp ^ | | 117,000 | | 2,926 | |

Wells Fargo & Co. ^ | | 274,900 | | 8,104 | |

Commercial Services & Supplies (2.0%) | | | | | |

Avery Dennison Corp. ^ | | 52,900 | | 1,731 | |

Pitney Bowes, Inc. | | 39,300 | | 1,001 | |

RR Donnelley & Sons Co. | | 126,500 | | 1,718 | |

Waste Management, Inc. ^ | | 74,800 | | 2,479 | |

Communications Equipment (0.6%) | | | | | |

Cisco Systems, Inc. ‡ | | 112,200 | | 1,829 | |

Motorola, Inc. ^ | | 96,400 | | 427 | |

Computers & Peripherals (1.9%) | | | | | |

Hewlett-Packard Co. | | 91,400 | | 3,317 | |

IBM Corp. | | 42,100 | | 3,543 | |

Consumer Finance (0.2%) | | | | | |

Discover Financial Services | | 92,400 | | 881 | |

Diversified Consumer Services (0.9%) | | | | | |

H&R Block, Inc. ^ | | 142,500 | | 3,238 | |

Diversified Financial Services (6.0%) | | | | | |

Bank of America Corp. £ | | 456,200 | | 6,423 | |

Citigroup, Inc. | | 627,100 | | 4,208 | |

JPMorgan Chase & Co. ^ | | 344,600 | | 10,865 | |

Diversified Telecommunication Services (7.4%) | | | | | |

AT&T, Inc. £ | | 550,200 | | 15,681 | |

Embarq Corp. | | 42,600 | | 1,532 | |

Verizon Communications, Inc. | | 279,300 | | 9,468 | |

Electric Utilities (2.9%) | | | | | |

Exelon Corp. | | 109,400 | | 6,084 | |

PPL Corp. | | 143,900 | | 4,416 | |

Energy Equipment & Services (0.5%) | | | | | |

National Oilwell Varco, Inc. ‡ | | 73,200 | | 1,789 | |

Food & Staples Retailing (3.0%) | | | | | |

Kroger Co. | | 112,400 | | 2,968 | |

Walgreen Co. | | 111,500 | | 2,751 | |

Wal-Mart Stores, Inc. | | 89,000 | | 4,989 | |

Food Products (0.8%) | | | | | |

Unilever NV ^ | | 123,200 | | 3,025 | |

Health Care Equipment & Supplies (0.6%) | | | | | |

Medtronic, Inc. ^ | | 66,400 | | 2,086 | |

Health Care Providers & Services (0.6%) | | | | | |

Quest Diagnostics, Inc. ^ | | 38,600 | | 2,004 | |

Hotels, Restaurants & Leisure (0.5%) | | | | | |

Darden Restaurants, Inc. ^ | | 37,300 | | 1,051 | |

Starbucks Corp. ‡ | | 94,500 | | 894 | |

Household Durables (0.5%) | | | | | |

Newell Rubbermaid, Inc. | | 181,300 | | 1,773 | |

Independent Power Producers & Energy Traders (0.4%) | | | | | |

NRG Energy, Inc. ‡ ^ | | 58,100 | | 1,355 | |

Industrial Conglomerates (4.6%) | | | | | |

General Electric Co. | | 940,800 | | 15,241 | |

Tyco International, Ltd. | | 63,000 | | 1,361 | |

Insurance (3.5%) | | | | | |

Allstate Corp. | | 133,300 | | 4,367 | |

Loews Corp. | | 47,000 | | 1,328 | |

Torchmark Corp. ^ | | 52,000 | | 2,324 | |

Travelers Cos., Inc. | | 102,500 | | 4,633 | |

IT Services (0.4%) | | | | | |

Fiserv, Inc. ‡ ^ | | 37,800 | | 1,375 | |

Machinery (2.5%) | | | | | |

Caterpillar, Inc. ^ | | 64,000 | | 2,859 | |

Dover Corp. ^ | | 71,800 | | 2,364 | |

Ingersoll-Rand Co., Ltd. -Class A ^ | | 105,500 | | 1,830 | |

Parker Hannifin Corp. | | 41,600 | | 1,770 | |

Media (2.9%) | | | | | |

CBS Corp. -Class B ^ | | 197,400 | | 1,617 | |

Gannett Co., Inc. ^ | | 128,000 | | 1,024 | |

Time Warner, Inc. ^ | | 496,700 | | 4,997 | |

Viacom, Inc. -Class B ‡ ^ | | 146,000 | | 2,783 | |

Metals & Mining (0.8%) | | | | | |

Nucor Corp. ^ | | 61,100 | | 2,823 | |

Multiline Retail (0.7%) | | | | | |

Kohl’s Corp. ‡ ^ | | 71,700 | | 2,596 | |

Office Electronics (0.5%) | | | | | |

Xerox Corp. ^ | | 224,200 | | 1,787 | |

Oil, Gas & Consumable Fuels (17.4%) | | | | | |

Apache Corp. | | 25,700 | | 1,915 | |

Chevron Corp. | | 249,200 | | 18,433 | |

ConocoPhillips ^ | | 203,100 | | 10,521 | |

Devon Energy Corp. ^ | | 26,000 | | 1,708 | |

Exxon Mobil Corp. | | 256,100 | | 20,444 | |

Occidental Petroleum Corp. | | 20,600 | | 1,236 | |

Royal Dutch Shell PLC -Class A ADR | | 159,700 | | 8,455 | |

Paper & Forest Products (0.7%) | | | | | |

International Paper Co. ^ | | 61,400 | | 725 | |

Weyerhaeuser Co. | | 61,500 | | 1,883 | |

Pharmaceuticals (11.3%) | | | | | |

Abbott Laboratories £ | | 65,000 | | 3,469 | |

Eli Lilly & Co. | | 88,500 | | 3,564 | |

Johnson & Johnson | | 184,100 | | 11,015 | |

Merck & Co., Inc. ^ | | 174,500 | | 5,305 | |

Pfizer, Inc. | | 671,300 | | 11,889 | |

Wyeth | | 136,400 | | 5,116 | |

Professional Services (0.1%) | | | | | |

Robert Half International, Inc. ^ | | 23,400 | | 487 | |

| | | | | | |

The notes to the financial statements are an integral part of this report.

4

| | Shares | | Value | |

Real Estate Investment Trusts (0.1%) | | | | | |

Developers Diversified Realty Corp. ^ | | 42,100 | | $ | 205 | |

Semiconductors & Semiconductor Equipment (0.9%) | | | | | |

Applied Materials, Inc. | | 105,400 | | 1,068 | |

Intel Corp. ^ | | 109,500 | | 1,605 | |

Texas Instruments, Inc. | | 42,700 | | 663 | |

Software (1.4%) | | | | | |

Microsoft Corp. | | 147,400 | | 2,865 | |

Oracle Corp. ‡ ^ | | 116,000 | | 2,057 | |

Specialty Retail (2.5%) | | | | | |

Best Buy Co., Inc. ^ | | 73,400 | | 2,063 | |

Gap, Inc. ^ | | 117,900 | | 1,579 | |

Home Depot, Inc. | | 124,500 | | 2,866 | |

Staples, Inc. ^ | | 136,300 | | 2,443 | |

Textiles, Apparel & Luxury Goods (0.6%) | | | | | |

V.F. Corp. ^ | | 42,200 | | 2,311 | |

Tobacco (1.1%) | | | | | |

Altria Group, Inc. | | 124,600 | | 1,876 | |

Lorillard, Inc. | | 40,000 | | 2,254 | |

Wireless Telecommunication Services (0.2%) | | | | | |

Sprint Nextel Corp. ‡ ^ | | 302,800 | | 554 | |

Total Common Stocks (cost $484,546) | | | | 336,390 | |

| | | | | |

| | Principal | | | |

REPURCHASE AGREEMENT (5.8%) | | | | | |

State Street Repurchase Agreement 0.01%, dated 12/31/2008, to be repurchased at $20,652 on 01/02/2009 à • | | $ | 20,652 | | 20,652 | |

Total Repurchase Agreement (cost $20,652) | | | | 20,652 | |

| | | | | |

| | Shares | | | |

SECURITIES LENDING COLLATERAL (5.8%) | | | | | |

State Street Navigator Securities Lending Trust - Prime Portfolio, 2.14% à p | | 20,934,442 | | 20,934 | |

| | | | | |

Total Securities Lending Collateral (cost $20,934) | | | | 20,934 | |

| | | | | |

Total Investment Securities (cost $526,491) # | | | | $ | 378,394 | |

| | | | | | | |

FUTURES CONTRACTS:

Description | | Contracts G | | Expiration Date | | Net Unrealized

Appreciation

(Depreciation) | |

S&P 500 E-Mini Index | | 371 | | 03/20/2009 | | | $ | (75 | ) |

| | | | | | | | | |

NOTES TO SCHEDULE OF INVESTMENTS:

p | Interest rate shown reflects the yield at 12/31/2008. |

‡ | Non-income producing security. |

^ | All or a portion of this security is on loan. The value of all securities on loan is $20,394. |

• | Repurchase agreement is collateralized by U.S. Government Agency Obligations with interest rates ranging from 4.12% to 4.79%, maturity dates ranging between 08/01/2033 to 09/01/2033, and with a market values plus accrued interests of $21,065. |

à | State Street Bank & Trust Company serves as the accounting, custody, and lending agent for the Fund and provides various services on behalf of the Fund. |

# | Aggregate cost for federal income tax purposes is $534,071. Aggregate gross unrealized appreciation/depreciation for all securities in which there is an excess of value over tax cost were $2,099 and $157,776, respectively. Net unrealized depreciation for tax purposes is $155,677. |

£ | All or a portion of this security is segregated with the custodian to cover margin requirements for open future contracts. The value of all securities segregated at 12/31/2008 is $4,594. |

G | Contract amounts are not in thousands. |

The notes to the financial statements are an integral part of this report.

5

At December 31, 2008

(all amounts in thousands)

DEFINITIONS:

ADR | American Depositary Receipt |

PLC | Public Limited Company |

|

The following is a summary of the fair valuations according to the inputs used as of December 31, 2008 in valuing the Fund’s assets and liabilities.

Investments in Securities | | | | Other Financial Instruments* | |

Level 1 | | Level 2 | | Level 3 | | Total Investments in Securities | | Level 1 | | Level 2 | | Level 3 | |

$ | 357,742 | | $ | 20,652 | | $ | — | | $ | 378,394 | | $ | — | | $ | (75 | ) | $ | — | |

| | | | | | | | | | | | | | | | | | | | |

*Other financial instruments are derivative instruments such as futures, forwards, and swap contracts, which are valued at the unrealized appreciation (depreciation) on the instrument.

The notes to the financial statements are an integral part of this report.

6

STATEMENT OF ASSETS AND LIABILITIES

At December 31, 2008

(all amounts except per share amounts in thousands)

Assets: | | | |

Investment securities, at value (cost: $526,491)

(including securities loaned of $20,394) | | $ | 378,394 | |

Receivables: | | | |

Investment securities sold | | 1,096 | |

Income from loaned securities | | 21 | |

Dividends | | 815 | |

Variation margin | | 221 | |

| | 380,547 | |

Liabilities: | | | |

Investment securities purchased | | 519 | |

Accounts payable and accrued liabilities: | | | |

Shares redeemed | | 10 | |

Management and advisory fees | | 260 | |

Transfer agent fees | | 1 | |

Administration fees | | 6 | |

Payable for collateral for securities on loan | | 20,934 | |

Other | | 34 | |

| | 21,764 | |

Net Assets | | $ | 358,783 | |

| | | |

Net Assets Consist of: | | | |

Capital Stock ($.01 par value) | | $ | 541 | |

Additional paid-in capital | | 555,180 | |

Undistributed net investment income | | 9,469 | |

Accumulated net realized loss from investment securities and futures | | (58,235 | ) |

Net unrealized depreciation on: | | | |

Investment securities | | (148,097 | ) |

Futures contracts | | (75 | ) |

Net Assets | | $ | 358,783 | |

Net Assets by Class: | | | |

Initial Class | | $ | 357,547 | |

Service Class | | 1,236 | |

Shares Outstanding: | | | |

Initial Class | | 53,885 | |

Service Class | | 186 | |

Net Asset Value and Offering Price Per Share: | | | |

Initial Class | | $ | 6.64 | |

Service Class | | 6.63 | |

STATEMENT OF OPERATIONS

For the year ended December 31, 2008

(all amounts in thousands)

Investment Income: | | | |

Dividends (net of withholding taxes on foreign dividends of $100) | | $ | 12,434 | |

Interest | | 221 | |

Income from loaned securities-net | | 294 | |

| | 12,949 | |

| | | |

Expenses: | | | |

Management and advisory fees | | 3,268 | |

Printing and shareholder reports | | 18 | |

Custody fees | | 48 | |

Administration fees | | 80 | |

Legal fees | | 16 | |

Audit fees | | 18 | |

Trustees fees | | 12 | |

Transfer agent fees | | 8 | |

Distribution and service fees: | | | |

Service Class | | 5 | |

Other | | 8 | |

Total expenses | | 3,481 | |

| | | |

Net Investment Income | | 9,468 | |

| | | |

Net Realized Loss from: | | | |

Investment securities | | (49,033 | ) |

Futures contracts | | (8,696 | ) |

| | (57,729 | ) |

| | | |

Net Decrease in Unrealized Depreciation on: | | | |

Investment securities | | (142,177 | ) |

Futures contracts | | 86 | |

| | (142,091 | ) |

Net Realized and Unrealized Loss | | (199,820 | ) |

| | | |

Net Decrease In Net Assets Resulting from Operations | | $ | (190,352 | ) |

The notes to the financial statements are an integral part of this report.

7

STATEMENT OF CHANGES IN NET ASSETS

For the years ended:

(all amounts in thousands)

| | December 31,

2008 | | December 31,

2007 | |

Increase (Decrease) in Net Assets From: | | | | | |

Operations: | | | | | |

Net investment income | | $ | 9,468 | | $ | 7,701 | |

Net realized gain (loss) from investment securities and futures contracts | | (57,729 | ) | 14,457 | |

Change in net unrealized depreciation on investment securities and futures contracts | | (142,091 | ) | (29,090 | ) |

Net decrease in net assets resulting from operations | | (190,352 | ) | (6,932 | ) |

| | | | | |

Distributions to Shareholders: | | | | | |

From net investment income: | | | | | |

Initial Class | | (7,673 | ) | (2,142 | ) |

Service Class | | (29 | ) | (6 | ) |

| | (7,702 | ) | (2,148 | ) |

From net realized gains: | | | | | |

Initial Class | | (14,753 | ) | (2,009 | ) |

Service Class | | (68 | ) | (11 | ) |

| | (14,821 | ) | (2,020 | ) |

Capital Share Transactions: | | | | | |

Proceeds from shares sold: | | | | | |

Initial Class | | 127,556 | | 322,804 | |

Service Class | | 331 | | 1,123 | |

| | 127,887 | | 323,927 | |

Dividends and distributions reinvested: | | | | | |

Initial Class | | 22,426 | | 4,151 | |

Service Class | | 97 | | 17 | |

| | 22,523 | | 4,168 | |

Cost of shares redeemed: | | | | | |

Initial Class | | (29,125 | ) | (40,470 | ) |

Service Class | | (680 | ) | (1,751 | ) |

| | (29,805 | ) | (42,221 | ) |

Net increase in net assets from capital shares transactions | | 120,605 | | 285,874 | |

Net increase (decrease) in net assets | | (92,270 | ) | 274,774 | |

| | | | | |

Net Assets: | | | | | |

Beginning of year | | 451,053 | | 176,279 | |

End of year | | $ | 358,783 | | $ | 451,053 | |

Undistributed Net Investment Income | | $ | 9,469 | | $ | 7,707 | |

| | | | | |

Share Activity: | | | | | |

Shares issued: | | | | | |

Initial Class | | 14,587 | | 28,236 | |

Service Class | | 38 | | 95 | |

| | 14,625 | | 28,331 | |

Shares issued-reinvested from distributions: | | | | | |

Initial Class | | 2,497 | | 361 | |

Service Class | | 11 | | 1 | |

| | 2,508 | | 362 | |

Shares redeemed: | | | | | |

Initial Class | | (3,566 | ) | (3,498 | ) |

Service Class | | (79 | ) | (151 | ) |

| | (3,645 | ) | (3,649 | ) |

Net increase in shares outstanding: | | | | | |

Initial Class | | 13,518 | | 25,099 | |

Service Class | | (30 | ) | (55 | ) |

| | 13,488 | | 25,044 | |

The notes to the financial statements are an integral part of this report.

8

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each period

| | Initial Class | |

| | Year Ended December 31, | |

| | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

Net Asset Value | | | | | | | | | | | |

Beginning of year | | $ | 11.11 | | $ | 11.34 | | $ | 11.01 | | $ | 11.06 | | $ | 9.81 | |

Investment Operations | | | | | | | | | | | |

Net investment income(a) | | 0.21 | | 0.21 | | 0.19 | | 0.18 | | 0.17 | |

Net realized and unrealized gain (loss) | | (4.16 | ) | (0.33 | ) | 1.80 | | 0.26 | | 1.18 | |

Total operations | | (3.95 | ) | (0.12 | ) | 1.99 | | 0.44 | | 1.35 | |

Distributions | | | | | | | | | | | |

From net investment income | | (0.18 | ) | (0.06 | ) | (0.30 | ) | (0.07 | ) | (0.10 | ) |

From net realized gains | | (0.34 | ) | (0.05 | ) | (1.36 | ) | (0.42 | ) | — | |

Total distributions | | (0.52 | ) | (0.11 | ) | (1.66 | ) | (0.49 | ) | (0.10 | ) |

Net Asset Value | | | | | | | | | | | |

End of year | | $ | 6.64 | | $ | 11.11 | | $ | 11.34 | | $ | 11.01 | | $ | 11.06 | |

Total Return(b) | | (36.78 | )% | (1.12 | )% | 19.68 | % | 4.15 | % | 13.91 | % |

Net Assets End of Year (000’s) | | $ | 357,547 | | $ | 448,651 | | $ | 173,206 | | $ | 120,738 | | $ | 185,445 | |

Ratio and Supplemental Data | | | | | | | | | | | |

Expenses to average net assets | | 0.87 | % | 0.86 | % | 0.92 | % | 0.91 | % | 0.97 | % |

Net investment income, to average net assets | | 2.38 | % | 1.79 | % | 1.72 | % | 1.62 | % | 1.67 | % |

Portfolio turnover rate | | 29 | % | 18 | % | 19 | % | 26 | % | 86 | % |

| | | | | | | | | | | |

For a share outstanding throughout each period | |

| |

| | Service Class | |

| | Year Ended December 31, | |

| | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

Net Asset Value | | | | | | | | | | | |

Beginning of year | | $ | 11.10 | | $ | 11.33 | | $ | 11.00 | | $ | 11.07 | | $ | 9.82 | |

Investment Operations | | | | | | | | | | | |

Net investment income(a) | | 0.19 | | 0.18 | | 0.17 | | 0.15 | | 0.17 | |

Net realized and unrealized gain (loss) | | (4.17 | ) | (0.33 | ) | 1.80 | | 0.26 | | 1.16 | |

Total operations | | (3.98 | ) | (0.15 | ) | 1.97 | | 0.41 | | 1.33 | |

Distributions | | | | | | | | | | | |

From net investment income | | (0.15 | ) | (0.03 | ) | (0.28 | ) | (0.06 | ) | (0.08 | ) |

From net realized gains | | (0.34 | ) | (0.05 | ) | (1.36 | ) | (0.42 | ) | — | |

Total distributions | | (0.49 | ) | (0.08 | ) | (1.64 | ) | (0.48 | ) | (0.08 | ) |

Net Asset Value | | | | | | | | | | | |

End of year | | $ | 6.63 | | $ | 11.10 | | $ | 11.33 | | $ | 11.00 | | $ | 11.07 | |

Total Return(b) | | (37.05 | )% | (1.33 | )% | 19.44 | % | 3.83 | % | 13.61 | % |

Net Assets End of Year (000’s) | | $ | 1,236 | | $ | 2,402 | | $ | 3,073 | | $ | 1,781 | | $ | 1,947 | |

Ratio and Supplemental Data | | | | | | | | | | | |

Expenses to average net assets | | 1.12 | % | 1.11 | % | 1.17 | % | 1.16 | % | 1.22 | % |

Net investment income, to average net assets | | 2.06 | % | 1.52 | % | 1.49 | % | 1.36 | % | 1.66 | % |

Portfolio turnover rate | | 29 | % | 18 | % | 19 | % | 26 | % | 86 | % |

(a) Calculation is based on average number of shares outstanding.

(b) Total Return reflects all portfolio expenses and includes reinvestment of dividends and capital gains; it does not reflect the charges and deductions under the policies or annuity contracts.

The notes to the financial statements are an integral part of this report.

9

NOTES TO FINANCIAL STATEMENTS

At December 31, 2008

(all amounts in thousands)

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Transamerica Series Trust (“TST”) is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Prior to May 1, 2008, TST was known as AEGON/Transamerica Series Trust. At the same time, American Century Large Company Value also changed its name to Transamerica American Century Large Company Value VP (the “Fund”). TST serves as a funding vehicle for variable life insurance, variable annuity, and group annuity products. The Fund is part of TST.

In the normal course of business, the Fund enters into contracts that contain a variety of representations that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

This report should be read in conjunction with the current Fund prospectus, which contains more complete information about the Fund.

In preparing the Fund’s financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”), estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures. The following is a summary of significant accounting policies followed by the Fund.

Multiple class operations, income, and expenses: The Fund currently offers two classes of shares; an Initial Class and a Service Class. Income, non-class specific expenses, and realized and unrealized gains and losses, are allocated daily to each class, based upon the value of shares outstanding method as permitted under Rule 18f-3 of the 1940 Act. Each class bears its own specific expenses as well as a portion of general, common expenses.

Security valuations: The Fund values its investments at the close of the New York Stock Exchange (“NYSE”), normally 4 p.m. ET, each day the NYSE is open for business. Fund investments are valued at the last sale price or closing price on the day of valuation taken from the primary exchange where the security is principally traded.

Securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the last quoted bid price.

Debt securities are valued based on a price quotation or other equivalent indication of value supplied by an exchange, a pricing service or a major market maker; however, those that mature in sixty days or less are valued at amortized cost, which approximates market.

Investment company securities are valued at the net asset value of the underlying portfolio.

Securities for which quotations are not readily available or whose values have been determined to be unreliable are valued at fair market value as determined in good faith by Transamerica Asset Management, Inc.’s (“TAM”) Valuation Committee under the supervision of the Board of Trustees.

The Financial Accounting Standards Board (“FASB”) Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”): FAS 157 defines fair value as the price that a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. It establishes and requires disclosure of a fair value hierarchy, separately for each major category of assets and liabilities,that segregates fair value measurements into levels (Levels 1, 2, and 3). Categorization of fair value measurements is determined by the nature of the inputs as follows: inputs using quoted prices in active markets for identical assets or liabilities (“Level 1”), significant other observable inputs (“Level 2”), and significant unobservable inputs (“Level 3”). Valuation levels are not necessarily an indication of the risk associated with investing in those securities. For fair valuations using significant unobservable inputs, FAS 157 requires a reconciliation of the beginning to ending balances for reported market values that presents changes attributable to total realized and unrealized gains or losses, purchases and sales, and transfers in/out of the Level 3 category during the period. In accordance with the requirements of FAS 157, a fair value hierarchy and Level 3 reconciliation have been included in the Notes to the Schedule of Investments.

Repurchase agreements: The Fund is authorized to enter into repurchase agreements. The Fund, through its custodian, State Street Bank & Trust Company (“State Street”), receives delivery of the underlying securities, the value of which at the time of purchase is required to be an amount equal to at least 102% of the resale price. The Fund will bear the risk of value fluctuations until the security can be sold and may encounter delays and incur costs in liquidating the security. In the event of bankruptcy or insolvency of the seller, delays and costs may be incurred.

Commission recapture: The sub-adviser, to the extent consistent with the best execution and usual commission rate policies and practices, may place security transactions of the Fund with broker/dealers with which TST has established a Commission Recapture Program. A Commission Recapture Program is any arrangement under which a broker/dealer applies a portion of the commissions received by such broker/dealer on the security transactions to the Fund. In no event will commissions paid by the Fund be used to pay expenses that would otherwise be borne by any other funds within TST, or by any other party.

There were no recaptured commissions during the year ended December 31, 2008.

10

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2008

(all amounts in thousands)

NOTE 1. (continued)

Securities lending: The Fund may lend securities to qualified borrowers, with State Street acting as the Fund’s lending agent. The Fund earns negotiated lenders’ fees. The Fund receives cash and/or securities as collateral against the loaned securities. Cash collateral received is invested in the State Street Navigator Securities Lending Trust-Prime Portfolio. The Fund monitors the market value of securities loaned on a daily basis and requires collateral in an amount at least equal to the value of the securities loaned. The value of loaned securities and related collateral outstanding at December 31, 2008 is shown in the Schedule of Investments and in the Statement of Assets and Liabilities.

Income from loaned securities on the Statement of Operations is net of fees earned by State Street for its services.

Futures contracts: The Fund may enter into futures contracts to manage exposure to market, interest rate or currency fluctuations. Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded. The primary risks associated with futures contracts are imperfect correlation between the change in market value of the securities held and the prices of futures contracts; the possibility of an illiquid market and inability of the counterparty to meet the contract terms.

The underlying face amounts of open futures contracts at December 31, 2008 are listed in the Schedule of Investments. The variation margin receivable or payable, as applicable, is included in the Statement of Assets and Liabilities. Variation margin represents the additional payment due or excess deposits made in order to maintain the equity account at the required margin level. In connection with these contracts, securities or cash may be held as collateral on deposit with broker counter parties in accordance with the terms of the respective futures contracts.

Real Estate Investment Trusts (“REITs”): There are certain additional risks involved in investing in REITs. These include, but are not limited to, economic conditions, changes in zoning laws, real estate values, property taxes and interest rates.

Dividend income is recorded at management’s estimate of the income included in distributions from the REIT investments. Distributions received in excess of the estimated amount are recorded as a reduction of the cost of investments. The actual amounts of income, return of capital and capital gains are only determined by each REIT after the fiscal year end and may differ from the estimated amounts.

Security transactions and investment income: Security transactions are recorded on the trade date. Security gains and losses are calculated on the first-in, first-out basis. Dividend income, if any, is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is informed of the ex-dividend date. Interest income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis commencing on the settlement date.

Dividend distributions: Dividends and capital gains distributions are typically declared and reinvested annually and are generally paid and reinvested on the business day following the ex-dividend date.

NOTE 2. RELATED PARTY TRANSACTIONS

TST serves as a funding vehicle for certain affiliated asset allocation portfolios and certain affiliated separate accounts of Western Reserve Life Assurance Co. of Ohio, Transamerica Life Insurance Company, Transamerica Financial Life Insurance Company, Monumental Life Insurance Company, Merrill Lynch Life Insurance Company, ML Life Insurance Company of New York, and Transamerica Occidental Life Insurance Company.

TAM is the Fund’s investment adviser. TAM is directly owned by Western Reserve Life Assurance Co. of Ohio (77%) and AUSA Holding Company (23%) (“AUSA”), both of which are indirect, wholly owned subsidiaries of AEGON NV. AUSA is wholly owned by AEGON USA, LLC (“AEGON USA”), a financial services holding company whose primary emphasis is on life and health insurance, and annuity and investment products. AEGON USA is owned by AEGON US Holding Corporation, which is owned by Transamerica Corporation (DE). Transamerica Corporation (DE) is owned by The AEGON Trust, which is owned by AEGON International B.V., which is owned by AEGON NV, a Netherlands corporation, and a publicly traded international insurance group.

Transamerica Fund Services, Inc. (“TFS”) is the Fund’s administrator and transfer agent. Transamerica Capital, Inc. (“TCI”) is the Fund’s distributor. TAM, TFS, and TCI are affiliates of AEGON NV, a Netherlands corporation.

Certain officers and trustees of the Fund are also officers and/or directors of TAM, TFS, and TCI.

The following schedule reflects the percentage of Fund assets owned by affiliated investment companies at December 31, 2008:

| | Net

Assets | | % of Net

Assets | |

| | | | | |

Transamerica Asset Allocation-Conservative VP | | $ | 22,966 | | 6.40 | % |

| | | | | |

Transamerica Asset Allocation-Growth VP | | 63,720 | | 17.76 | |

| | | | | |

Transamerica Asset Allocation-Moderate VP | | 74,021 | | 20.63 | |

| | | | | |

Transamerica Asset Allocation-Moderate Growth VP | | 172,200 | | 48.00 | |

| | | | | |

Total | | $ | 332,907 | | 92.79 | % |

11

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2008

(all amounts in thousands)

NOTE 2. (continued)

Investment advisory fee: The Fund pays management fees to TAM based on average daily net assets at the following breakpoints:

First $250 million | | 0.835 | % |

Over $250 million up to $400 million | | 0.80 | % |

Over $400 million up to $750 million | | 0.775 | % |

Over $750 million | | 0.70 | % |

TAM has contractually agreed to waive its advisory fee and will reimburse the Fund to the extent that operating expenses, excluding distribution and service fees, exceed the following stated annual limit:

1.35% Expense Limit

If total Fund expenses fall below the annual expense limitation agreement agreed to by the adviser within the succeeding three years, the Fund may be required to pay the adviser a portion or all of the waived advisory fees.

There were no amounts recaptured during the year ended December 31, 2008. There are no amounts available for recapture at December 31, 2008.

Distribution and service fees: TST has adopted a distribution plan (“Distribution Plan”) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Distribution Plan, TST entered into a Distribution Agreement with TCI as the Fund’s distributor.

Under the Distribution Plan and Distribution Agreement, TCI, on behalf of the Fund, is authorized to pay various service providers, as direct payment for expenses incurred in connection with distribution of the Fund’s Initial Class shares, amounts equal to actual expenses associated with distributing the shares.

The Distribution Plan requires TST to pay distribution fees to TCI as compensation for its activities, not as reimbursement for specific expenses. The fee on the Service Class shares is paid to the insurance companies for providing services and account maintenance for their policyholders who invest in the variable insurance products which invest in the Service Class shares.

The Fund is authorized under the Distribution Plan to pay fees on each class up to the following limits:

Initial Class | | 0.15 | % |

Service Class | | 0.25 | % |

TCI has determined that it will not seek payment by the Fund of the distribution expenses incurred with respect to the Initial Class shares before April 30, 2010. Prior to TCI seeking reimbursement of future expenses, policy and contract owners will be notified in advance. The Fund will pay fees relating to Service Class shares.

Administrative services: The Fund has entered into an agreement with TFS for financial and legal fund administration services. The Fund pays TFS an annual fee of 0.02% of average net assets. The Legal fees on the Statement of Operations are for fees paid to external legal counsel.

Brokerage commissions: Brokerage commissions incurred on security transactions placed with affiliates of the adviser for the year ended December 31, 2008 were $4.

Deferred compensation plan: Each eligible Trustee may defer a portion or all of total fees earned as a Fund Trustee under a non-qualified deferred compensation plan effective January 1, 1996, amended and restated April 3, 2008 (the “Deferred Compensation Plan”). Deferred compensation amounts will accumulate based on the value of Class A (or comparable) shares of a series of the Transamerica Funds (without imposition of sales charge), investment options under Transamerica Partners Funds Group II, or funds of Transamerica Investors, Inc. (“Premier”) as elected by the Trustee.

Amounts deferred and accrued under the Deferred Compensation Plan are unfunded and unsecured claims against the general assets of the Trust. The pro rata liability of the Fund for deferred fees in the Plan totaled $15 as of December 31, 2008.

Retirement plan: Under a prior retirement plan (the “Emeritus Plan”), effective September 1, 1990, amended and restated effective January 1, 2005, each Independent Trustee elected to serve as Trustee Emeritus of TST upon his or her termination of service, other than removal for cause, was entitled to 50% of the Trustee’s retainer at the time of election for a maximum period of five years, determined by his or her years of service as a Trustee.

These amounts were accrued by and allocated to each series of TST on a pro rata basis. Any increases in retainers during the existence of the plan were reflected in accruals, so that 50% of the Trustee’s current retainer was accrued and credited at all times. Upon death, disability or termination of service, other than removal for cause, amounts deferred would become payable to a Trustee Emeritus (or his/her beneficiary). Compensation would be paid on a quarterly basis during the time period that the Trustee Emeritus is allowed to serve as such.

The Emeritus Plan was terminated effective October 30, 2007. Upon termination, the Fund continues to pay any remaining benefits in accordance with the Plan, but no further compensation has been accrued. Amounts deferred and accrued under the Emeritus Plan are unfunded and unsecured claims against the general assets of TST.

At December 31, 2008, the Fund’s remaining liability related to the Emeritus Plan totaled less than $1.

12

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2008

(all amounts in thousands)

NOTE 3. INVESTMENT TRANSACTIONS

The cost of securities purchased and proceeds from securities sold (excluding short-term securities) for the year ended December 31, 2008 were as follows:

Purchases of securities: | | | |

Long-term | | $ | 204,590 | |

U.S. Government | | — | |

| | | |

Proceeds from maturities and sales of securities: | | | |

Long-term | | 109,127 | |

U.S. Government | | — | |

| | | | |

NOTE 4. FEDERAL INCOME TAX MATTERS

The Fund has not made any provision for federal income or excise taxes due to its policy to distribute all of its taxable income and capital gains to its shareholders and otherwise qualify as a regulated investment company under Subchapter M of the Internal Revenue Code. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatment for items including, but not limited to, such things as wash sales, return of capital, capital loss carryforwards, and post-October loss deferrals.

Therefore, distributions determined in accordance with tax regulations may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial records are not adjusted for temporary differences. These reclassifications are as follows:

Additional paid-in capital | | $ | — | |

Undistributed (accumulated) net investment income (loss) | | $ | (4 | ) |

Undistributed (accumulated) net realized gain (loss) from investment securities | | $ | 4 | |

The capital loss carryforward is available to offset future realized gains, subject to certain limitations under the Internal Revenue Code, through the period listed:

Capital Loss

Carryforward | | Available Through | |

| | | |

$ | 38,435 | | December 31, 2016 | |

| | | | |

The tax character of distributions paid may differ from the character of distributions shown in the Statements of Changes in Net Assets due to short-term gains being treated as ordinary income for tax purposes. The tax character of distributions paid during 2007 and 2008 was as follows:

2007 Distributions paid from: | | | |

Ordinary Income | | $ | 2,408 | |

Long-term Capital Gain | | 1,760 | |

| | | |

2008 Distributions paid from: | | | |

Ordinary Income | | 9,602 | |

Long-term Capital Gain | | 12,921 | |

| | | | |

The tax basis components of distributable earnings as of December 31, 2008 are as follows:

Undistributed Ordinary Income | | $ | 9,456 | |

Undistributed Long-term Capital Gain | | $ | — | |

Capital Loss Carryforward | | $ | (38,435 | ) |

Post October Capital Loss Deferral | | $ | (12,281 | ) |

Post October Currency Loss Deferral | | $ | — | |

Net Unrealized Appreciation (Depreciation) | | $ | (155,678 | ) |

NOTE 5. NEW ACCOUNTING PRONOUNCEMENT

In March 2008, the FASB issued its new Standard No. 161, “Disclosure About Derivative Instruments and Hedging Activities” (“FAS 161”). FAS 161 is effective for fiscal years and interim periods beginning after November 15, 2008. FAS 161 requires enhanced disclosures about a Fund’s derivative and hedging activities. Management is currently evaluating the impact the adoption of FAS 161 will have on the Fund’s financial statement disclosures.

13

Report of Independent Registered Certified Public Accounting Firm

To the Board of Trustees and Shareholders of

Transamerica American Century Large Company Value VP:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Transamerica American Century Large Company Value VP (the “Fund”) (one of the portfolios constituting Transamerica Series Trust) at December 31, 2008, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2008 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

Tampa, Florida

February 25, 2009

14

SUPPLEMENTAL TAX INFORMATION (unaudited)

(all amounts in thousands)

For tax purposes, the Fund has made a Long-Term Capital Gain Designation of $12,921 for the year ended December 31, 2008.

15

Transamerica Asset Allocation - Conservative VP

(unaudited)

MARKET ENVIRONMENT

2008 was one of the most difficult periods in history for financial markets. The housing-market decline and collapse in sub-prime mortgage bonds worsened as the year progressed. Financial institutions recorded massive write-downs of mortgage-related securities, requiring them to raise replacement capital to meet reserve requirements. The U.S. government took a number of steps intended to rescue the system. The Treasury Department persuaded Bear Stearns to sell itself to JPMorgan Chase. The Federal Reserve Board (“Fed”) opened up its short-term lending facilities to investment banks in an effort to alleviate the capital shortage. Federal regulators seized control of Fannie Mae and Freddie Mac and took a controlling stake in insurance giant American International Group, Inc. (“AIG”). Along with other market-greasing initiatives, the Treasury announced a $700 billion plan to buy troubled mortgage securities from financial institutions. Lehman Brothers filed for bankruptcy, Washington Mutual was acquired by JPMorgan Chase, and Merrill Lynch sold itself to Bank of America. Goldman Sachs and Morgan Stanley—by then the only remaining major stand-alone investment banks—petitioned the government to convert to chartered banks. The government also brokered Wachovia’s sale to Wells Fargo. On top of these activities, the Fed lowered its federal-funds rate seven times during the year, ultimately to a target range of between 0.00% and 0.25%. Other governments around the world also lowered rates and bailed out financial institutions in their own countries.

In the fixed-income markets, only the highest-quality bonds—Treasuries and other U.S. and foreign government issues—managed to post gains. With credit fears rampant, bonds with even a little credit exposure lost value. Even investment-grade corporate bonds lost 4.94% as measured by the Barclays Capital U.S. Corporate Investment Grade Index. High-yield bonds lost more than five times as much, and emerging-markets debt notched sizable losses. The only safe asset classes were government-sponsored bonds and cash. Yet not even all government bonds were safe: Treasury Inflation Protected Securities (“TIPS”) lost 2.35% as gauged by the Barclays Capital U.S. TIPS Index.

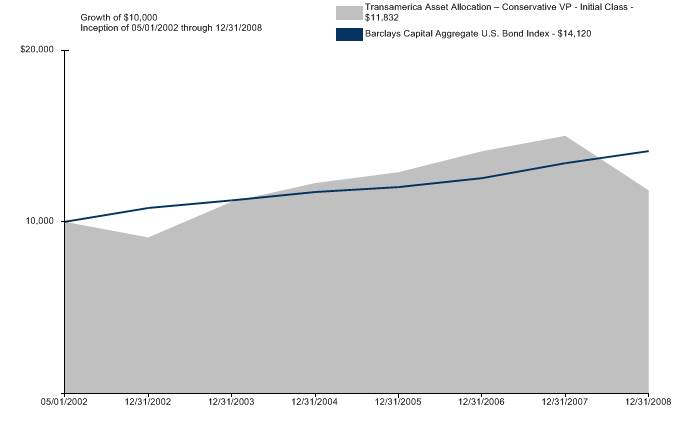

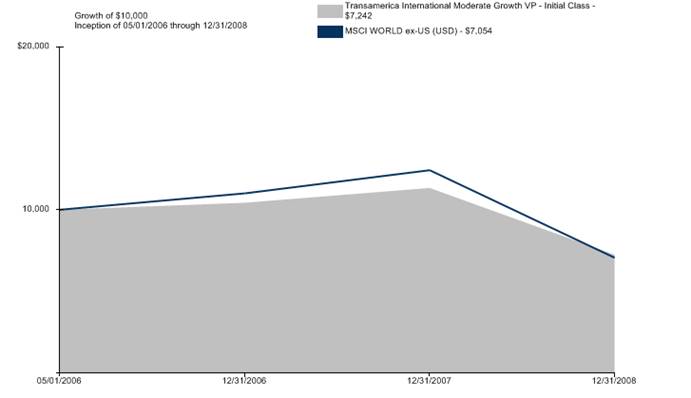

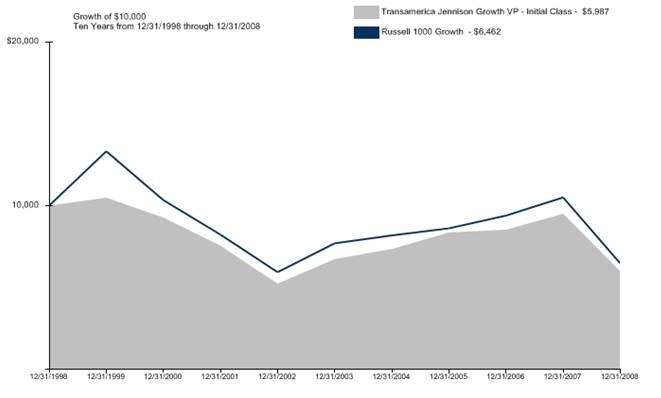

PERFORMANCE

For the year ended December 31, 2008, Transamerica Asset Allocation-Conservative VP Initial Class returned (21.18%). By comparison its primary and secondary benchmarks, the Barclays Capital (formerly Lehman Brothers) Aggregate U.S. Bond Index and the Dow Jones Wilshire 5000 Total Market Index, returned 5.24% and (37.33%), respectively.

STRATEGY REVIEW

This portfolio provides a mix of approximately 35% equity and 65% fixed-income securities (including cash). Its equity exposure is intended to provide broadly diversified coverage of domestic and international equity markets, across a range of market capitalizations and investment styles. The fixed-income portion covers investment-grade and credit-sensitive holdings, as well as international bonds. The portfolio also includes emerging markets, global real estate, and alternative strategies. The goal is to provide investors one-stop coverage of the financial markets, and the portfolio is more broadly diversified than most market indices or traditional balanced funds.

We consider the managers of our underlying funds to be top-notch within their specialties, but against the backdrop of largely indiscriminant market losses in 2008, most of our fund holdings ended well in the red. Still, we can point to some of the higher-beta asset classes as being the most negative contributors. For example, the international funds were among the biggest decliners, and several of the smaller-cap funds and the technology and real-estate sector funds were also hit hard.

The larger bond portfolio was hindered in its role of offsetting equity losses. The root cause of this past year’s market decline has been the credit crisis, and in that environment bonds with any credit sensitivity at all have suffered losses. Normally a predominantly investment-grade bond portfolio (such as ours) would tend to rise in value in times of stock-market volatility, but in this period only government bonds managed to avoid losses. Our portfolio owns government bonds, but also investment-grade corporate bonds, high-yield bonds, convertibles, and emerging-markets debt, all of which fell in the period. The convertible-bond and high-yield bond funds were the worst-hit bond holdings owing to their inherent equity sensitivity. Transamerica Loomis Sayles Bond simply had one of its rare bad years. The largest holding, Transamerica PIMCO Total Return VP, suffered only a 2.79% loss but still trailed its index. The only funds to finish 2008 in the black (other than Transamerica Money Market) were Transamerica U.S. Government Securities VP and Transamerica JPMorgan International Bond; both focus primarily on government issues.

During the period we added four new underlying funds in the international sleeve: Transamerica Thornburg International Value, Transamerica MFS International Equity, Transamerica Schroders International Small Cap and Transamerica WMC Emerging Markets. We eliminated Transamerica Small/Mid Cap Value after its longtime manager departed in the fall. We also eliminated a small position in Transamerica T. Rowe Price Small Cap VP because we didn’t need it to achieve our small-cap targets.

Michael Stout, CFA

Jon Hale, Ph.D., CFA

Jeff McConnell, CFA

Maciej Kowara, Ph.D., CFA

Co-Portfolio Managers

Morningstar Associates, LLC

1

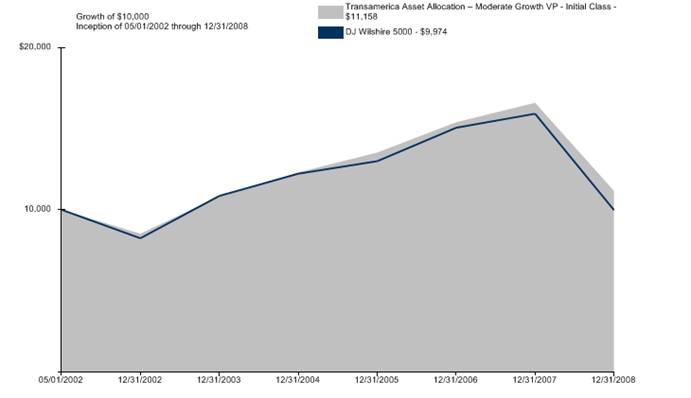

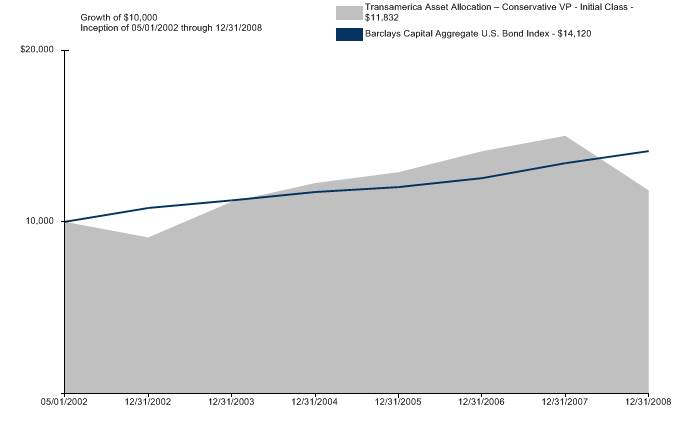

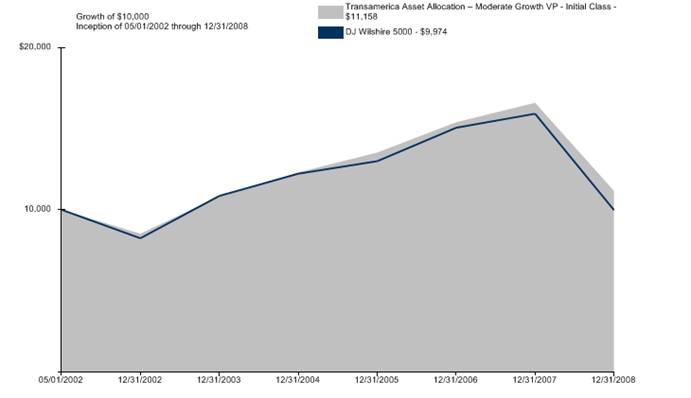

Average Annual Total Return for Periods Ended 12/31/2008

| | 1 Year | | 5 Years | | From Inception | | Inception Date | |

| | | | | | | | | |

Initial Class | | (21.18 | )% | 1.15 | % | 2.55 | % | 5/1/02 | |

Barclays Capital Aggregate U.S. Bond Index* | | 5.24 | % | 4.65 | % | 5.31 | % | 5/1/02 | |

DJ Wilshire 5000* | | (37.33 | )% | (1.67 | )% | (0.04 | )% | 5/1/02 | |

Service Class | | (21.40 | )% | 0.91 | % | 3.63 | % | 5/1/03 | |

NOTES

* The Barclays Capital Aggregate U.S. Bond Index and the Dow Jones Wilshire 5000 Total Market (DJ Wilshire 5000) Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From Inception calculation is based on life of Initial Class shares. You cannot invest directly in an Index.

The performance data presented represents past performance; future results may vary. The portfolio’s investment return and net asset value will fluctuate. Past performance does not guarantee future results. Investor’s units when redeemed may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please visit your insurance company’s website for contract or policy level standardized total returns current to the most recent month end. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives, explanation of share classes and policies of this portfolio.

2

UNDERSTANDING YOUR FUND’S EXPENSES

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur ongoing costs, including management and advisory fees, distribution and service fees, and other fund expenses.

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at July 1, 2008 and held for the entire period until December 31, 2008.

ACTUAL EXPENSES

The first line in the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

The expenses shown in the table do not reflect any expenses from the Fund’s investment in other affiliated investment companies.

| | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | Expenses

Paid During

Period (a) | |

| | | | | | | | | |

Initial Class | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 820.32 | | 0.13 | % | $ | 0.59 | |

Hypothetical (b) | | 1,000.00 | | 1,024.48 | | 0.13 | | 0.66 | |

| | | | | | | | | |

Service Class | | | | | | | | | |

Actual | | 1,000.00 | | 818.91 | | 0.38 | | 1.74 | |

Hypothetical (b) | | 1,000.00 | | 1,023.23 | | 0.38 | | 1.93 | |

| | | | | | | | | | | | |

(a) Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (366 days).

(b) 5% return per year before expenses.

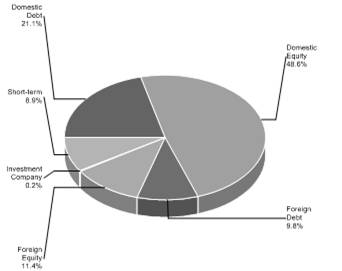

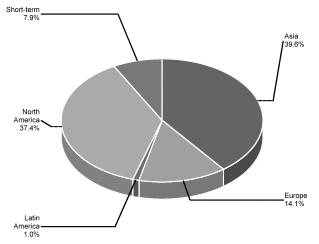

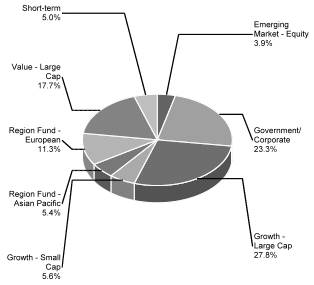

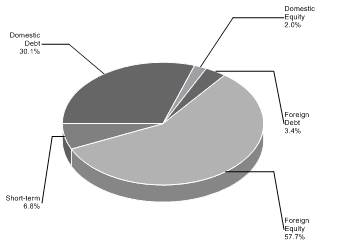

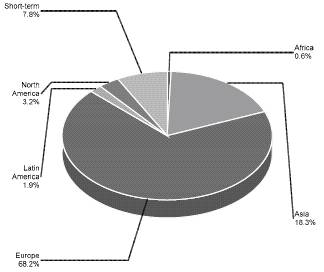

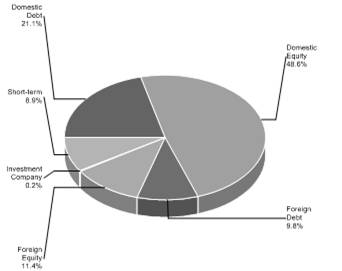

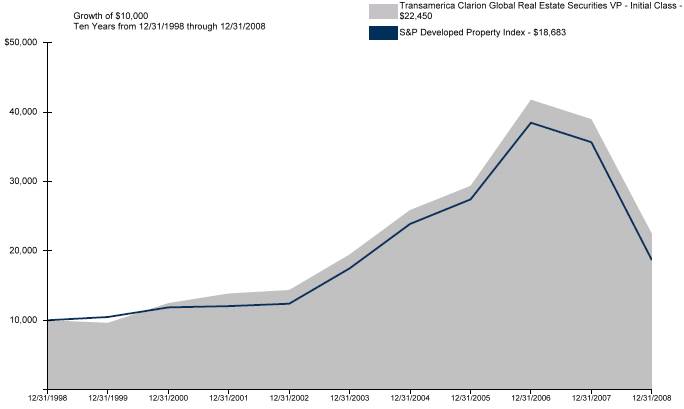

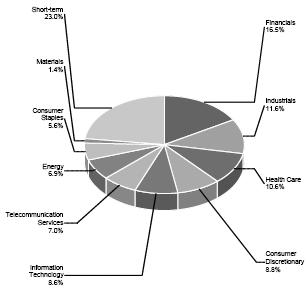

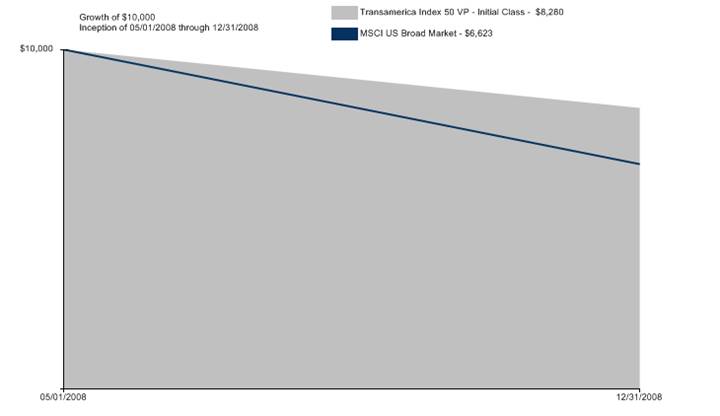

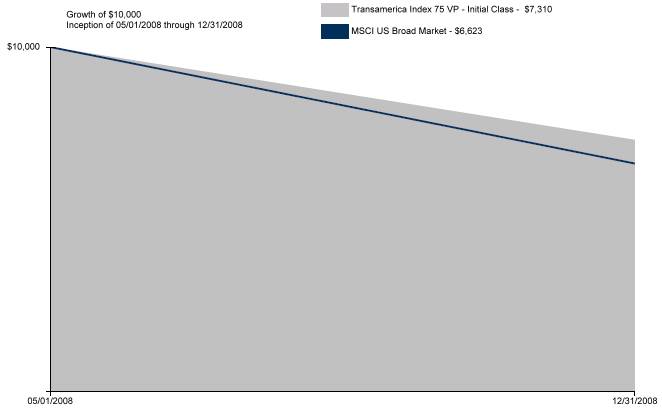

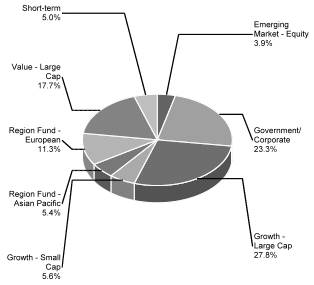

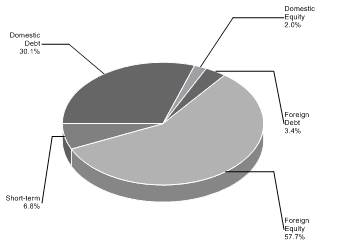

GRAPHICAL PRESENTATION OF SCHEDULE OF INVESTMENTS

By Asset Type

At December 31, 2008

(unaudited)

This chart shows the percentage breakdown by asset type of the aggregate portfolio holdings of the underlying affiliated investment companies in which the Fund invests. The security lending collateral in the underlying funds is excluded from this calculation.

3

SCHEDULE OF INVESTMENTS

At December 31, 2008

(all amounts except share amounts in thousands)

| | Shares | | Value | |

INVESTMENT COMPANIES (100.0%) | | | | | |

Bonds (48.6%) | | | | | |

Transamerica Convertible Securities VP ¹ | | 3,856,941 | | $ | 23,952 | |

Transamerica Flexible Income € | | 1,004,336 | | 6,950 | |

Transamerica High Yield Bond € | | 6,042,738 | | 36,800 | |

Transamerica JPMorgan International Bond € | | 8,144,641 | | 89,591 | |

Transamerica MFS High Yield VP ¹ | | 6,831,139 | | 40,099 | |

Transamerica PIMCO Total Return VP ¹ | | 15,562,237 | | 165,893 | |

Transamerica Short-Term Bond € | | 5,690,324 | | 52,465 | |

Transamerica U.S. Government Securities VP ¹ | | 571,149 | | 7,219 | |

Transamerica Van Kampen Emerging Markets Debt € | | 5,323,398 | | 44,557 | |

Capital Preservation (2.2%) | | | | | |

Transamerica Money Market VP ¹ | | 20,734,678 | | 20,735 | |

Global/International Stocks (5.7%) | | | | | |

Transamerica AllianceBernstein International Value € | | 1,090,553 | | 6,805 | |

Transamerica Evergreen International Small Cap € | | 732,257 | | 6,202 | |

Transamerica Marsico International Growth € | | 1,076,405 | | 7,072 | |

Transamerica MFS International Equity € | | 454,665 | | 3,005 | |

Transamerica Neuberger Berman International € | | 1,275,972 | | 7,554 | |

Transamerica Oppenheimer Developing Markets € | | 1,652,737 | | 10,082 | |

Transamerica Schroders International Small Cap € | | 1,763,728 | | 10,212 | |

Transamerica Thornburg International Value € | | 375,809 | | 2,920 | |

Transamerica WMC Emerging Markets € ‡ | | 197,125 | | 1,526 | |

Inflation-Protected Securities (8.6%) | | | | | |

Transamerica PIMCO Real Return TIPS € | | 8,658,849 | | 83,125 | |

Tactical and Specialty (13.1%) | | | | | |

Transamerica BlackRock Global Allocation € | | 2,044,198 | | 17,478 | |

Transamerica Clarion Global Real Estate Securities VP ¹ | | 1,648,469 | | 12,924 | |

Transamerica Evergreen Health Care € | | 466,098 | | 4,088 | |

Transamerica Federated Market Opportunity VP ¹ | | 920,249 | | 12,304 | |

Transamerica Loomis Sayles Bond € | | 10,247,966 | | 77,065 | |

Transamerica Science & Technology VP ¹ | | 1,193,381 | | 3,115 | |

U.S. Stocks (21.8%) | | | | | |

Transamerica American Century Large Company Value VP ¹ | | 3,461,061 | | 22,981 | |

Transamerica Bjurman, Barry Micro Emerging Growth € ‡ | | 233,739 | | 1,395 | |

Transamerica BlackRock Large Cap Value VP ¹ | | 3,256,890 | | 36,119 | |

Transamerica Capital Guardian Value VP ¹ | | 770,453 | | 7,288 | |

Transamerica Equity VP ¹ | | 1,735,649 | | 26,000 | |

Transamerica Growth Opportunity VP ¹ | | 354,204 | | 2,741 | |

Transamerica Jennison Growth VP ¹ | | 3,373,144 | | 16,866 | |

Transamerica JPMorgan Mid Cap Value VP ¹ | | 1,275,394 | | 11,797 | |

Transamerica Marsico Growth VP ¹ | | 3,599,508 | | 26,564 | |

Transamerica Munder Net50 VP ¹ | | 311,370 | | 1,557 | |

Transamerica Oppenheimer Small- & Mid-Cap Value € | | 1,205,169 | | 7,014 | |

Transamerica T. Rowe Price Equity Income VP ¹ | | 5,349 | | 45 | |

Transamerica T. Rowe Price Growth Stock VP ¹ | | 862,357 | | 11,900 | |

Transamerica Third Avenue Value € ‡ | | 799,850 | | 12,230 | |

Transamerica UBS Large Cap Value € | | 2,955,491 | | 21,664 | |

Transamerica Van Kampen Mid-Cap Growth € | | 379,499 | | 2,516 | |

Transamerica Van Kampen Small Company Growth € | | 112,797 | | 768 | |

Total Investment Securities (cost $1,250,498) # | | | | $ | 963,183 | |

NOTES TO SCHEDULE OF INVESTMENTS:

¹ | The Fund invests its assets in the Initial Class shares of Transamerica Series Trust. |

€ | The Fund invests its assets in the Class I shares of Transamerica Funds. |

‡ | Non-income producing security. |

# | Aggregate cost for federal income tax purposes is $1,253,932. Aggregate gross unrealized appreciation/depreciation for all securities in which there is an excess of value over tax cost were $2,388 and $293,137, respectively. Net unrealized depreciation for tax purposes is $290,749. |

The following is a summary of the fair valuations according to the inputs used as of December 31, 2008 in valuing the Fund’s assets and liabilities.

Investments in Securities | | | |

Level 1 | | Level 2 | | Level 3 | | Total Investments in Securities | |

$ | — | | $ | 963,183 | | $ | — | | $ | 963,183 | |

| | | | | | | | | | | |

The notes to the financial statements are an integral part of this report.

4

STATEMENT OF ASSETS AND LIABILITIES

At December 31, 2008

(all amounts except per share amounts in thousands)

Assets: | | | |

Investment in affiliated investment companies at value (cost: $1,250,498) | | $ | 963,183 | |

Receivables: | | | |

Shares sold | | 617 | |

Dividends | | 22 | |

| | 963,822 | |

Liabilities: | | | |

Investment securities purchased | | 114 | |

Accounts payable and accrued liabilities: | | | |

Shares redeemed | | 526 | |

Management and advisory fees | | 84 | |

Distribution and service fees | | 100 | |

Transfer agent fees | | 2 | |

Administration fees | | 10 | |

Other | | 55 | |

| | 891 | |

Net Assets | | $ | 962,931 | |

| | | |

Net Assets Consist of: | | | |

Capital Stock ($.01 par value) | | $ | 1,165 | |

Additional paid-in capital | | 1,217,596 | |

Undistributed net investment income | | 50,248 | |

Accumulated net realized loss from investment in affiliated investment companies | | (18,763 | ) |

Net unrealized depreciation on investment in affiliated investment companies | | (287,315 | ) |

Net Assets | | $ | 962,931 | |

| | | |

Net Assets by Class: | | | |

Initial Class | | $ | 497,129 | |

Service Class | | 465,802 | |

Shares Outstanding: | | | |

Initial Class | | 59,947 | |

Service Class | | 56,504 | |

Net Asset Value and Offering Price Per Share: | | | |

Initial Class | | $ | 8.29 | |

Service Class | | 8.24 | |

STATEMENT OF OPERATIONS

For the year ended December 31, 2008

(all amounts in thousands)

Investment Income: | | | |

Dividends from affiliated investment companies | | $ | 52,968 | |

| | | |

Expenses: | | | |

Management and advisory fees | | 1,100 | |

Printing and shareholder reports | | 66 | |

Custody fees | | 38 | |

Administration fees | | 137 | |

Legal fees | | 44 | |

Audit fees | | 21 | |

Trustees fees | | 31 | |

Transfer agent fees | | 21 | |

Registration fees | | 10 | |

Distribution and service fees: | | | |

Service Class | | 1,239 | |

Other | | 14 | |

Total expenses | | 2,721 | |

| | | |

Net Investment Income | | 50,247 | |

| | | |

Net Realized Gain from: | | | |

Investment in affiliated investment companies | | (26,704 | ) |

Distributions from investment in affiliated investment companies | | 29,339 | |

| | 2,635 | |

| | | |

Net Decrease in Unrealized Depreciation on: | | | |

Investment in affiliated investment companies | | (311,396 | ) |

Net Realized and Unrealized Loss on Investment in Affiliated Investment Companies | | (308,761 | ) |

| | | |

Net Decrease In Net Assets Resulting from Operations | | $ | (258,514 | ) |

The notes to the financial statements are an integral part of this report.

5

STATEMENT OF CHANGES IN NET ASSETS

For the years ended

(all amounts in thousands)

| | December 31,

2008 | | December 31,

2007 | |

Increase (Decrease) in Net Assets From: | | | | | |

Operations: | | | | | |

Net investment income | | $ | 50,247 | | $ | 32,254 | |

Net realized gain from investment in affiliated investment companies | | 2,635 | | 43,940 | |

Change in net unrealized depreciation on investment in affiliated investment companies | | (311,396 | ) | (18,517 | ) |

Net increase (decrease) in net assets resulting from operations | | (258,514 | ) | 57,677 | |

| | | | | |

Distributions to Shareholders: | | | | | |

From net investment income: | | | | | |

Initial Class | | (17,312 | ) | (17,032 | ) |

Service Class | | (14,942 | ) | (9,906 | ) |

| | (32,254 | ) | (26,938 | ) |

From net realized gains: | | | | | |

Initial Class | | (34,012 | ) | (20,994 | ) |

Service Class | | (31,044 | ) | (12,917 | ) |

| | (65,056 | ) | (33,911 | ) |

Capital Share Transactions: | | | | | |

Proceeds from shares sold: | | | | | |

Initial Class | | 330,310 | | 234,966 | |

Service Class | | 340,313 | | 151,376 | |

| | 670,623 | | 386,342 | |

Dividends and distributions reinvested: | | | | | |

Initial Class | | 51,324 | | 38,026 | |

Service Class | | 45,986 | | 22,824 | |

| | 97,310 | | 60,850 | |

Cost of shares redeemed: | | | | | |

Initial Class | | (249,866 | ) | (244,742 | ) |

Service Class | | (147,258 | ) | (69,222 | ) |

| | (397,124 | ) | (313,964 | ) |

Net increase in net assets resulting from capital shares transactions | | 370,809 | | 133,228 | |

| | | | | |

Net increase in net assets | | 14,985 | | 130,056 | |

| | | | | |

Net Assets: | | | | | |

Beginning of year | | 947,946 | | 817,890 | |

End of year | | $ | 962,931 | | $ | 947,946 | |

Undistributed Net Investment Income | | $ | 50,248 | | $ | 32,255 | |

| | | | | |

Share Activity: | | | | | |

Shares issued: | | | | | |

Initial Class | | 31,370 | | 20,148 | |

Service Class | | 32,660 | | 13,024 | |

| | 64,030 | | 33,172 | |

Shares issued-reinvested from distributions: | | | | | |

Initial Class | | 5,232 | | 3,435 | |