As filed with the SEC on March 8, 2007.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04419 |

|

AEGON/TRANSAMERICA SERIES TRUST |

(Exact name of registrant as specified in charter) |

|

570 Carillon Parkway, St. Petersburg, Florida | | 33716 |

(Address of principal executive offices) | | (Zip code) |

|

Dennis P. Gallagher, Esq. P.O. Box 9012, Clearwater, Florida 33758-9771 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (727) 299-1800 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | January 1, 2006 - December 31, 2006 | |

| | | | | | | | |

Item 1: Report(s) to Shareholders. The Annual Report is attached.

AEGON/Transamerica Series Trust Annual Report Winter 2006

AEGON/Transamerica Series Trust Annual Report

570 Carillon Parkway

St. Petersburg, FL 33716

Distributor: AFSG Securities Corporation

Customer Service: 1-800-851-9777

The following pages contain the most recent annual reports for the investment options in which you are invested. In compliance with Securities and Exchange Commission regulations, we present these reports on a semi-annual basis with the hope that they will foster greater understanding of the investment options' holdings, performance, financial data, accounting policies and other issues. Unlike our past reports, this streamlined version provides information only on the investment options in which you are invested.

If you have any questions about these reports, please do not hesitate to contact your financial professional. As always, we thank you for your trust and the opportunity to serve you.

Dear Shareholder,

On behalf of AEGON/Transamerica Series Trust, we would like to thank you for your continued support and confidence in our products and we look forward to continuing to serve you and your financial adviser in the future. We value the trust you have placed in us.

This annual report is provided to you with the intent of presenting a comprehensive review of the investments of each of your funds. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all shareholders, and we believe this report to be an important part of the investment process. In addition to providing a comprehensive review, this report also provides a discussion of accounting policies as well as matters presented to shareholders that may have required their vote.

We believe it is important to recognize and understand current market conditions in order to provide a context for reading this report. On August 8, 2006, the Federal Reserve decided to keep the federal funds rate at 5.25%, changing its course of consistent interest rate increases that began on June 30, 2004. This development, coupled with oil prices that receded from peaks reached in mid-summer 2006, provided some tailwind for the markets and some respite from downside volatility experienced in May and June. While concerns over a slowdown in the housing markets and lower Gross Domestic Product growth have weighed on investor sentiment, the markets have generally exhibited resilience for the annual period ended December 31, 2006. For the twelve months ended December 31, 2006, the Dow Jones Industrial Average returned 19.05%, while the Standard & Poor's 500 Index returned 15.78%. Please keep in mind it is important to maintai n a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial adviser is a key resource to help you build a comprehensive picture of your current and future financial needs. In addition, financial advisers are familiar with the market's history, including long-term returns and volatility of various asset classes. With your financial adviser, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance. Please contact your financial adviser if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

John K. Carter

President & Chief Executive Officer

AEGON/Transamerica Series Trust | | Christopher A. Staples

Senior Vice President – Investment Management

AEGON/Transamerica Series Trust | |

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of AEGON/Transamerica Series Trust. These views are subject to change based upon market conditions. These views should not be relied on as investment advice and are not indicative of a trading intent on behalf of the AEGON/Transamerica Series Trust.

AEGON Bond

MARKET ENVIRONMENT

The economy began the year on a strong note, with gross domestic product ("GDP") growth of 5.6% recorded for the first quarter. Concerned about the robust pace of economic growth and mounting inflationary pressures, the Federal Open Market Committee ("FOMC") raised the federal funds target rate twice during the first quarter and two more times in the second. Bond yields moved upward on concerns that stronger economic growth would lead to accelerating inflation and additional interest rate hikes from the Federal Reserve Board ("Fed").

By the third quarter, evidence emerged that the sharp slowdown in the housing market was having an impact on the pace of economic growth. The report on second-quarter GDP, released in the third quarter, showed that economic growth fell to 2.6%. In addition, oil prices moderated, lifting some inflationary concerns. The data were enough for the Fed to change course, holding the federal funds rate steady at 5.25% at its August meeting, and marking the first time in 18 consecutive meetings that the federal funds rate did not increase. After an initially muted response by market participants, a slight moderation in subsequent inflation readings and a relatively dovish set of minutes from the FOMC helped to persuade investors that the federal funds rate may have peaked for this cycle.

The yield on the benchmark 10-year Treasury note ended the year at 4.70%, compared to 4.39% at the end of 2005. The yield curve further inverted during the year, with the two-year Treasury note ending the year at 4.81%.

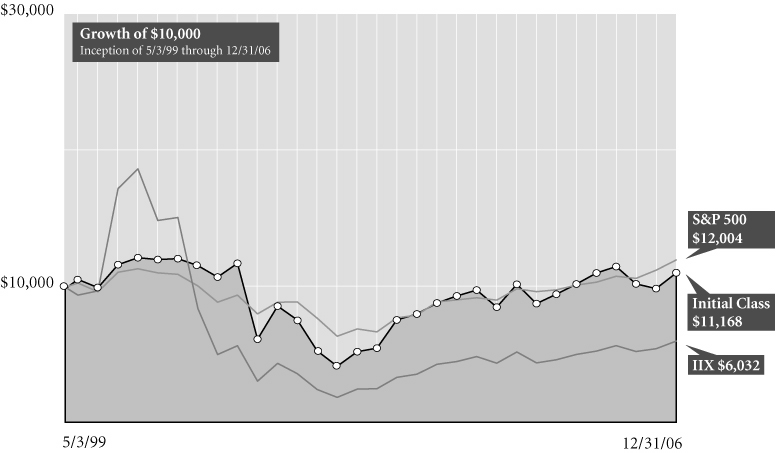

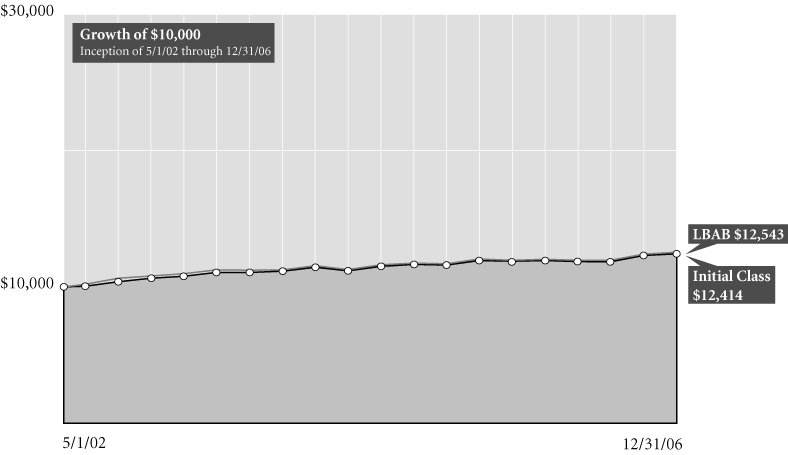

PERFORMANCE

For the year ended December 31, 2006, AEGON Bond, Initial Class returned 3.92%. By comparison its primary and secondary benchmarks, the Lehman Brothers Aggregate Bond Index and the Lehman Brothers U.S. Government/Credit Index, returned 4.33% and 3.78%, respectively.

STRATEGY REVIEW

We did not materially change our sector allocations throughout the year. Specifically, we remained overweight in mortgage securities, including commercial mortgage-backed securities ("CMBS"), and underweight in agency debentures and corporate bonds. Given the sector's positive excess returns, our corporate underweight had a modest negative effect on the portfolio's relative performance. On the positive side, our security selection in the corporate sector offset somewhat our underweight position.

In an environment of rising name-specific event risk and generally tight spreads, we maintained a defensive credit posture, overweighting the "Aaa" segment and underweighting the "Baa" area. In terms of maturity structure, we continued to overweight securities with maturities of one year and less and underweight securities with maturities of 20 years and longer. We continued to favor Treasury STRIPS in the 2014-2018 range for duration purposes. Throughout the year, our duration remained neutral relative to the benchmark, but ended the year slightly longer at 4.76 years versus 4.46 years for the benchmark.

Douglas S. Swanson

Portfolio Manager

JPMorgan Investment Advisors Inc.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 1

AEGON Bond

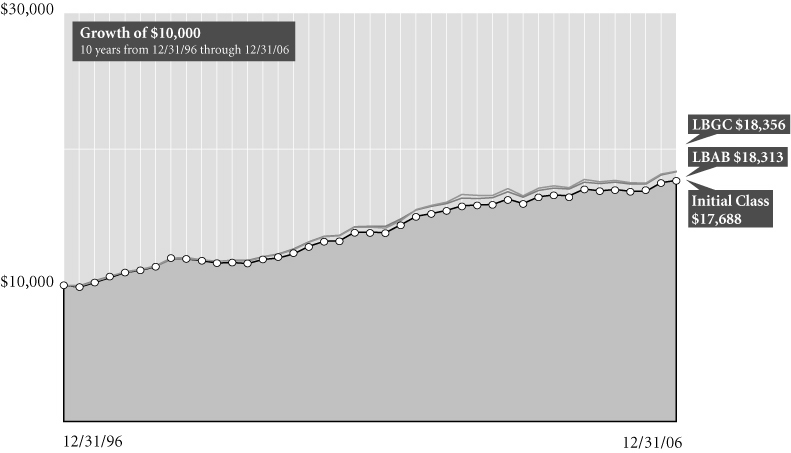

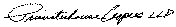

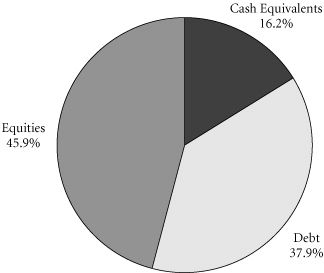

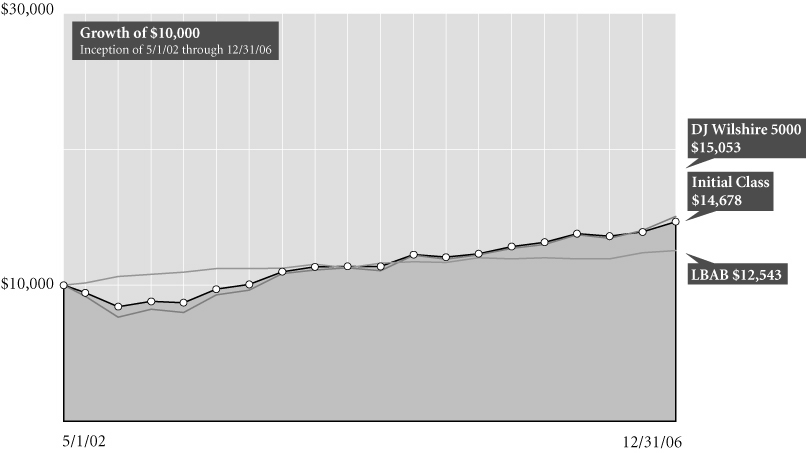

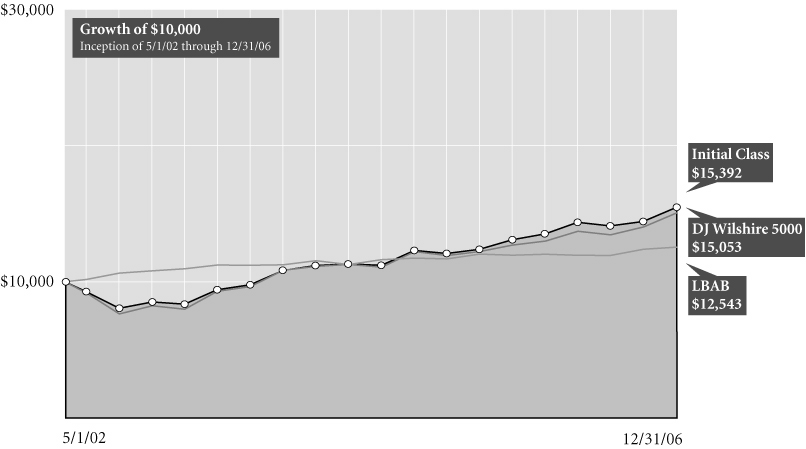

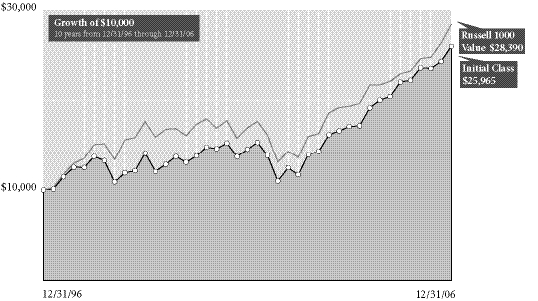

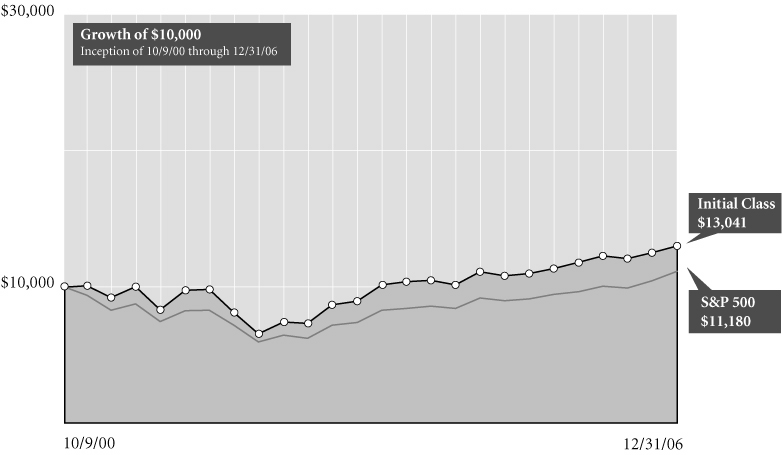

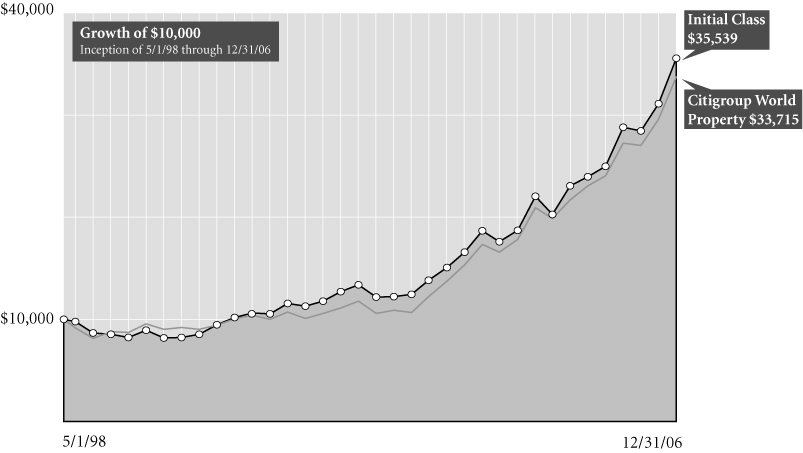

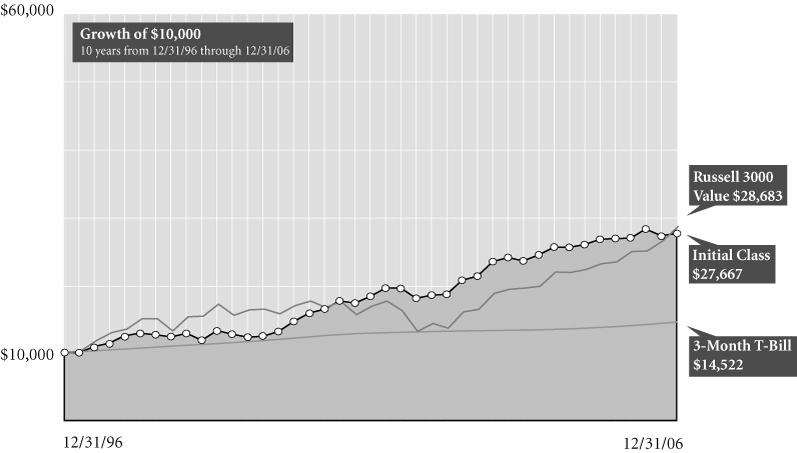

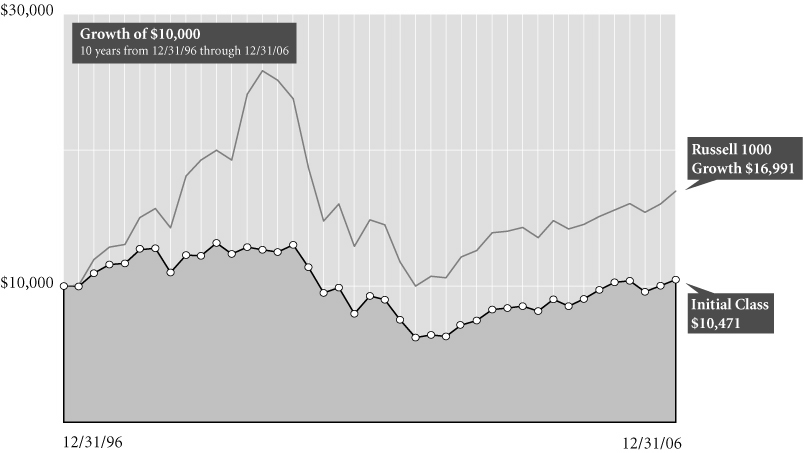

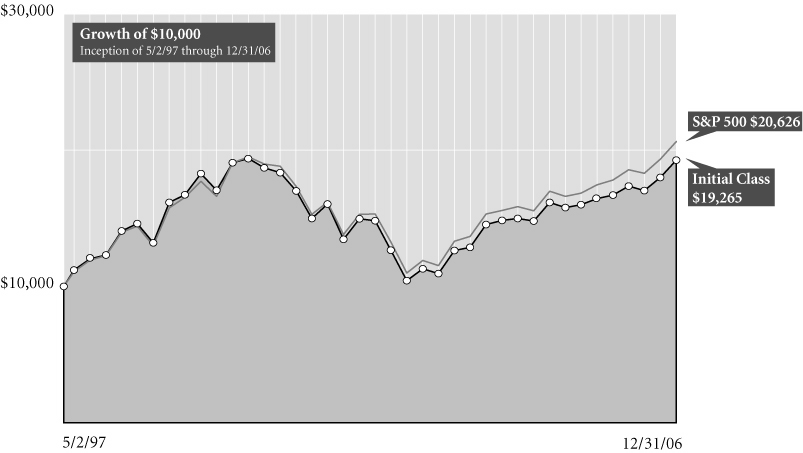

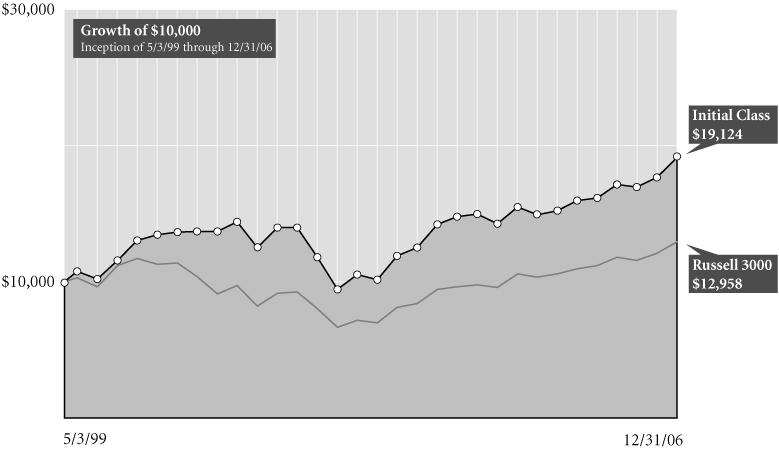

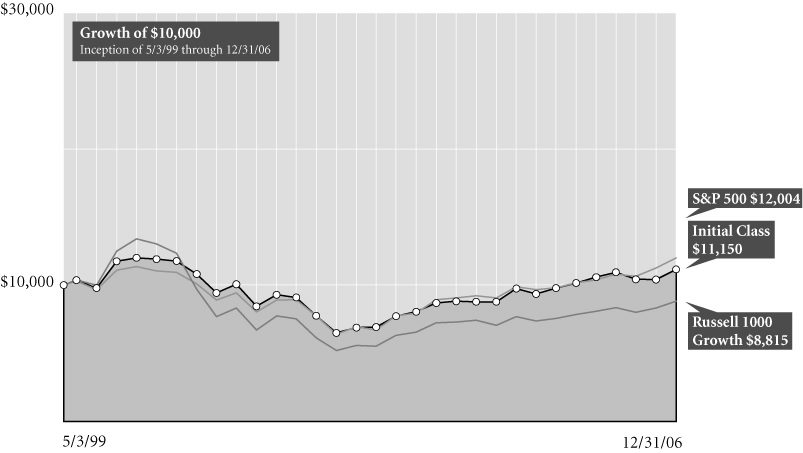

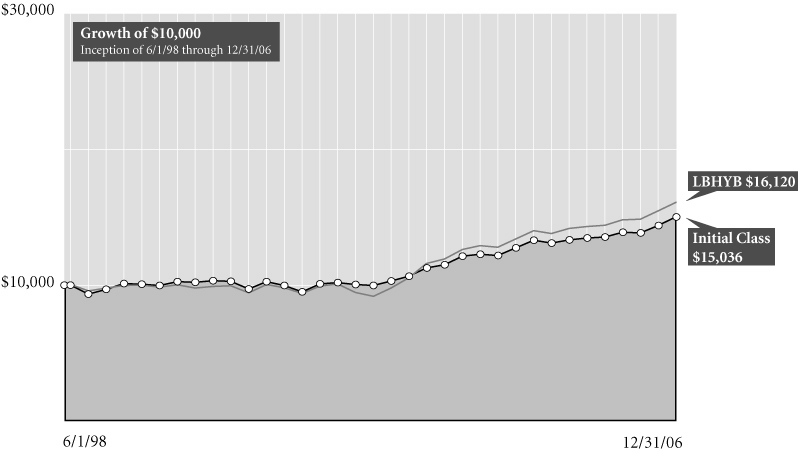

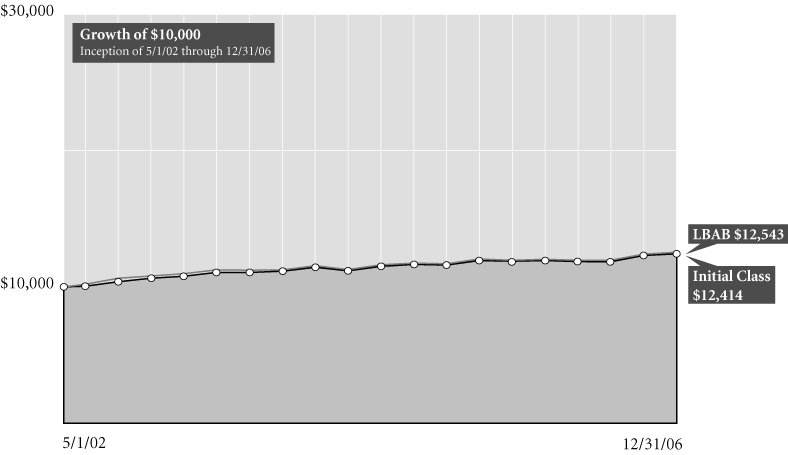

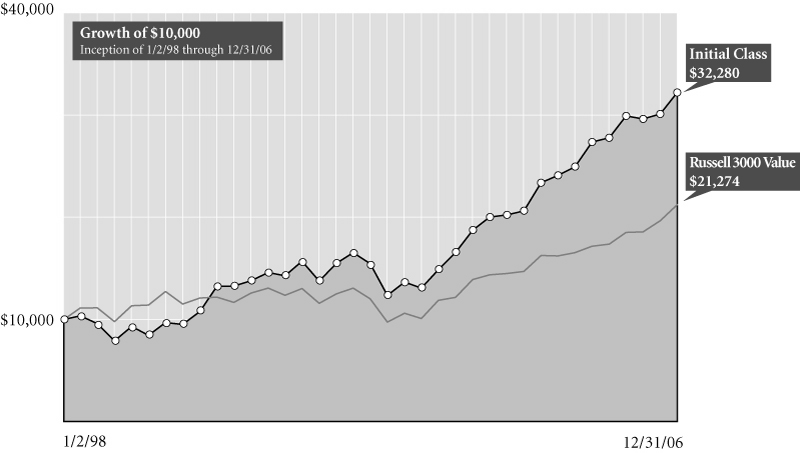

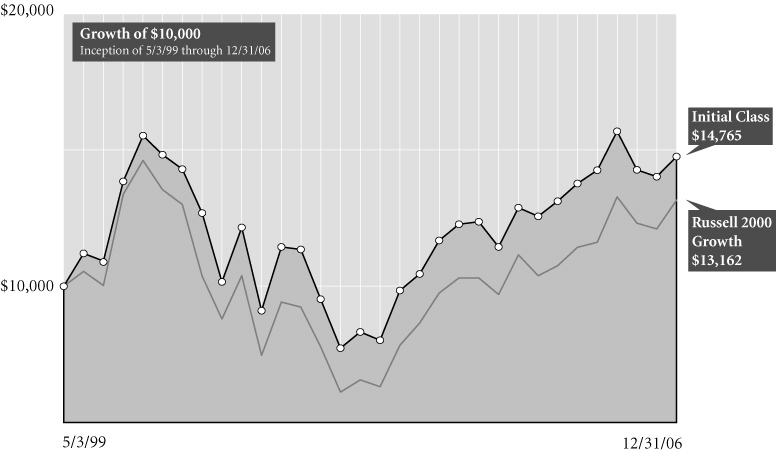

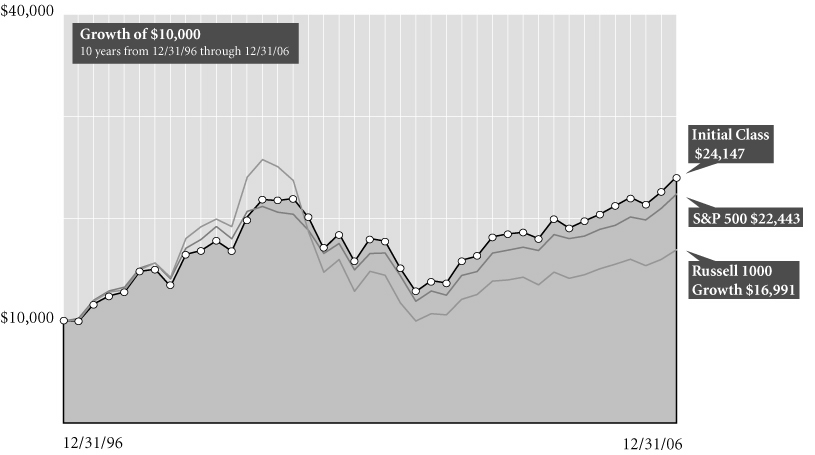

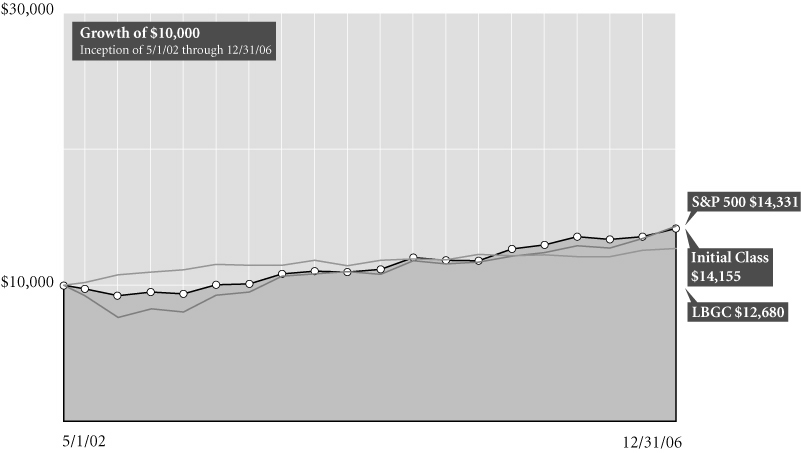

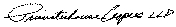

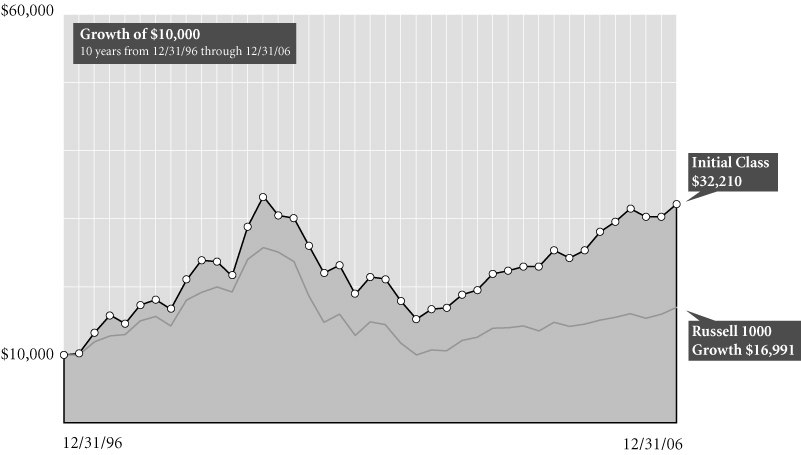

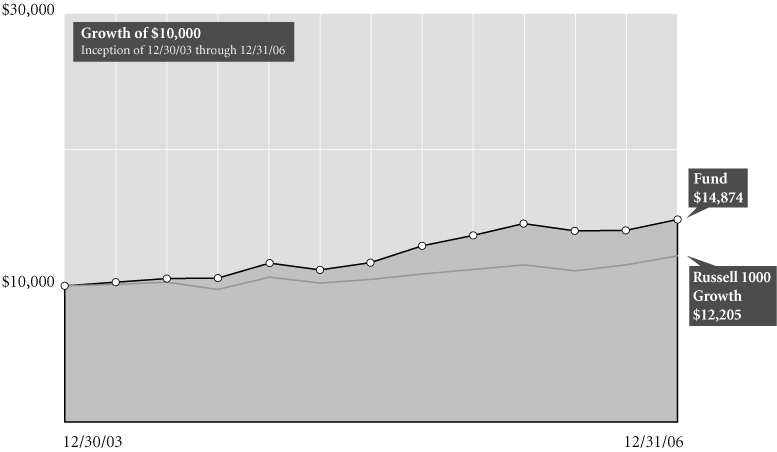

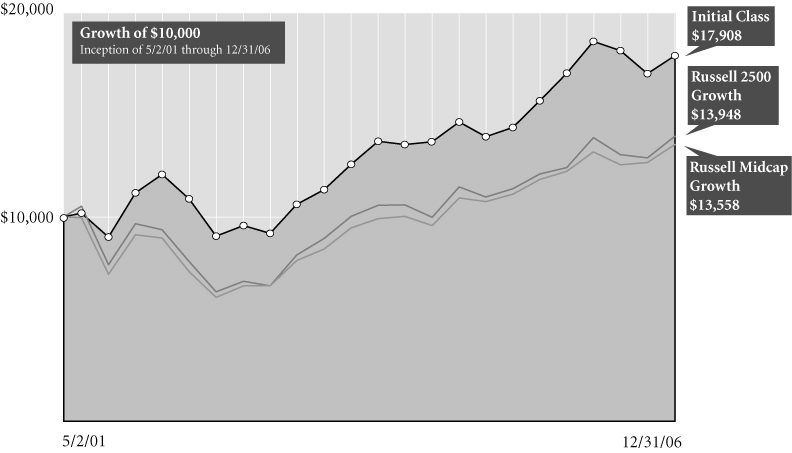

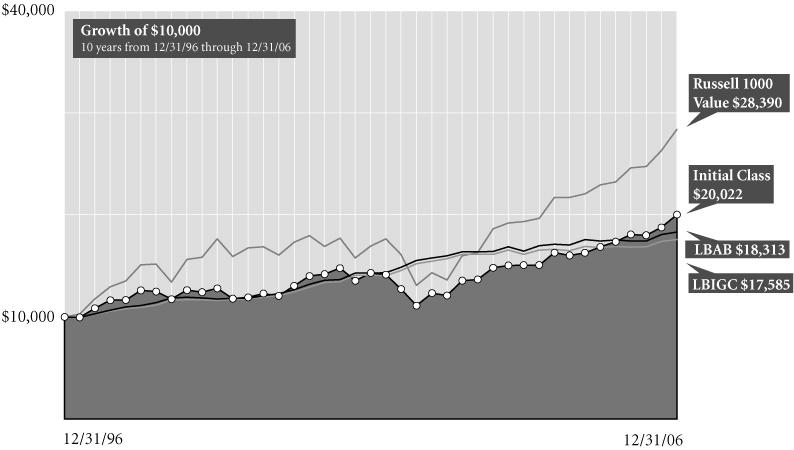

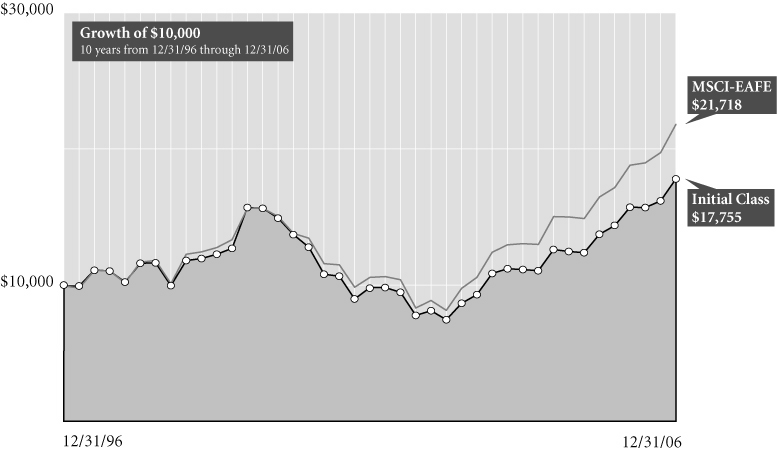

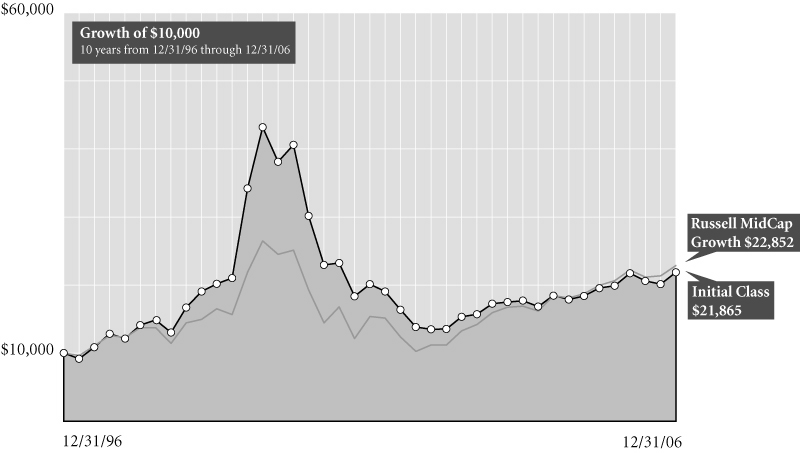

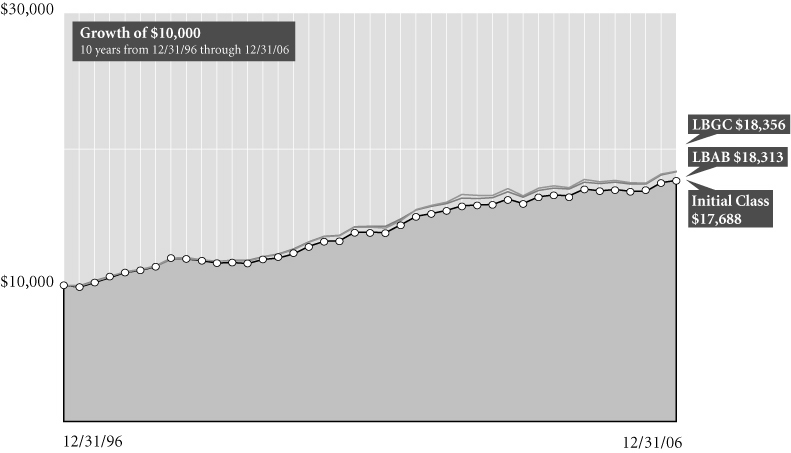

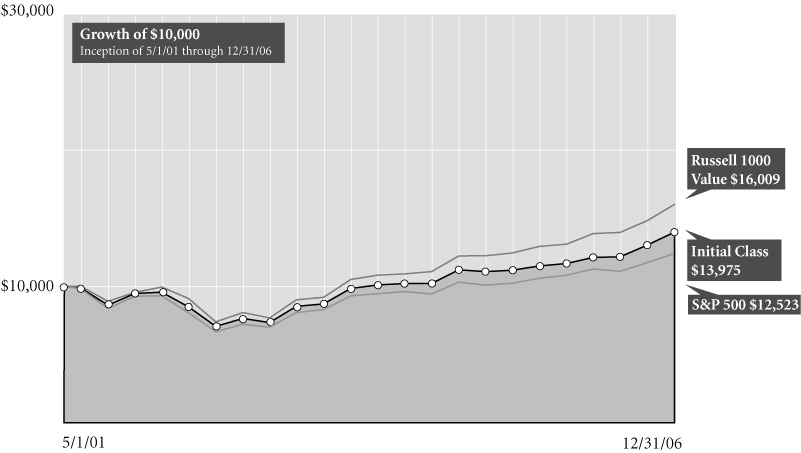

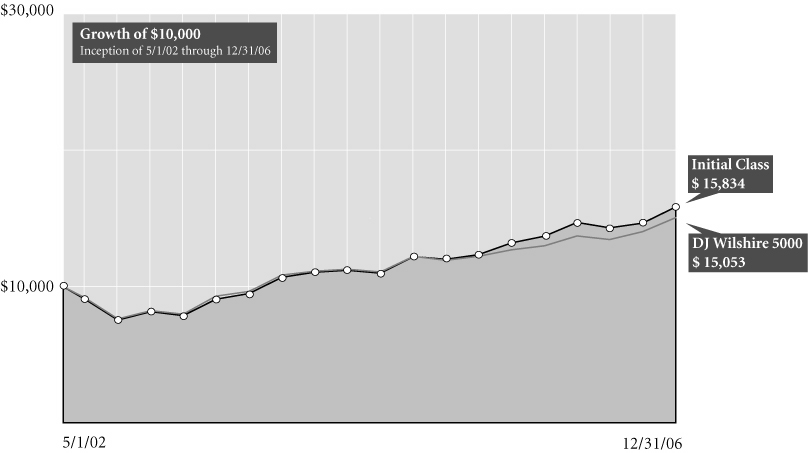

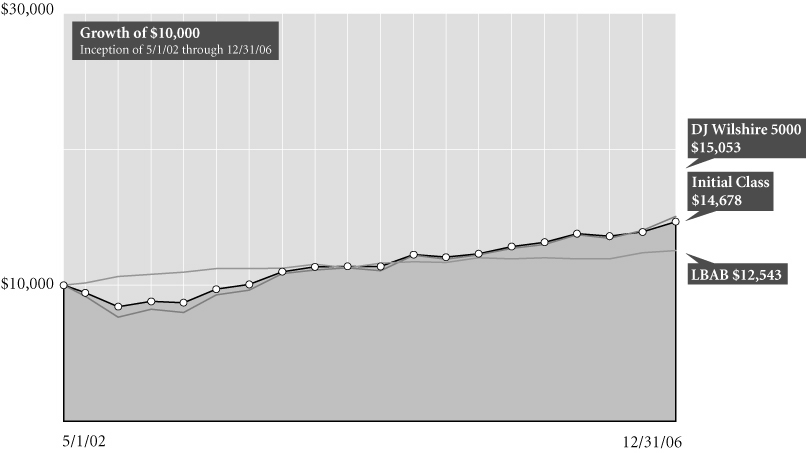

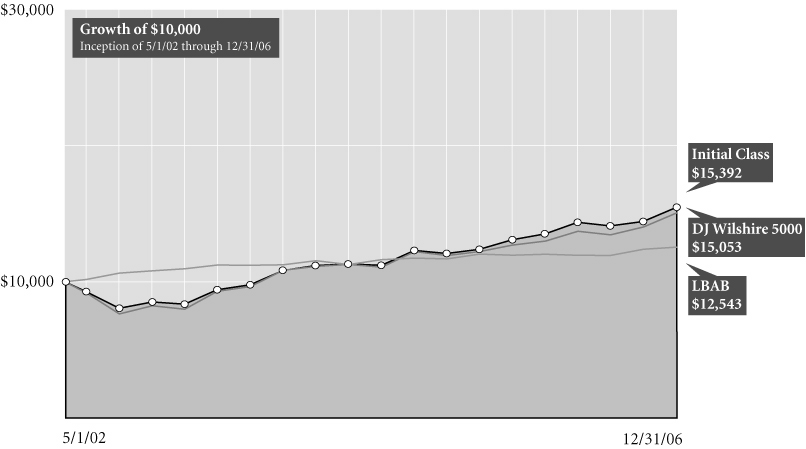

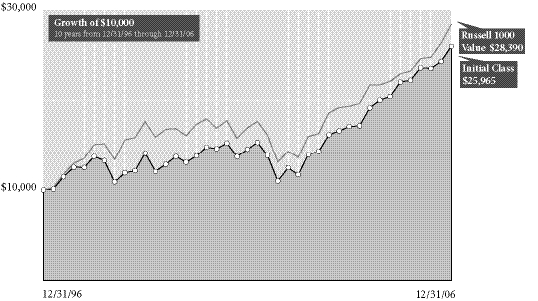

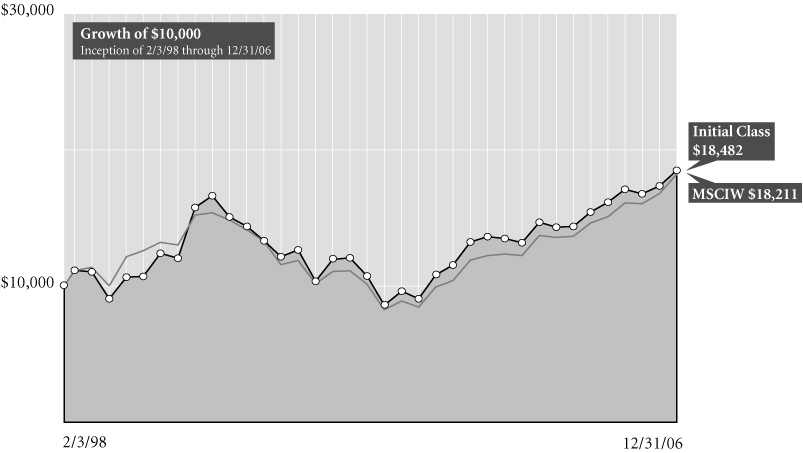

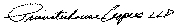

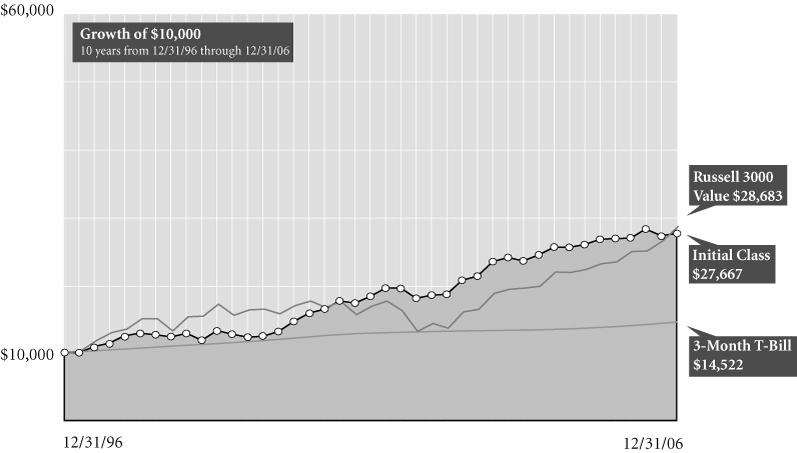

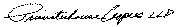

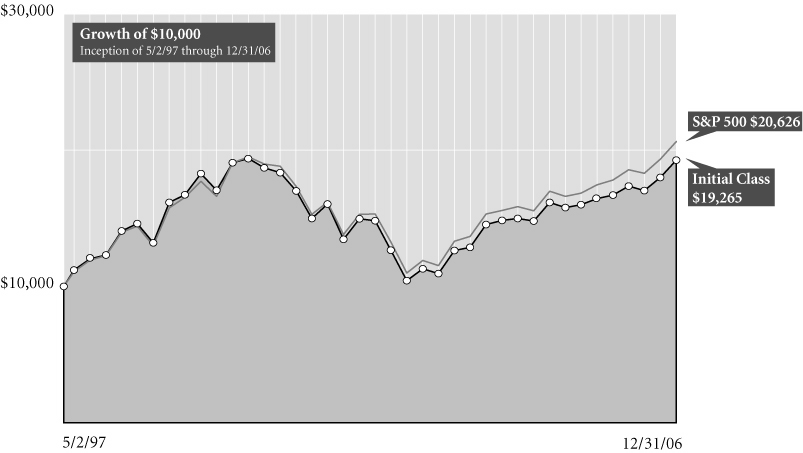

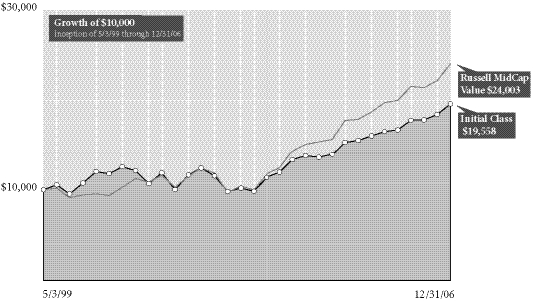

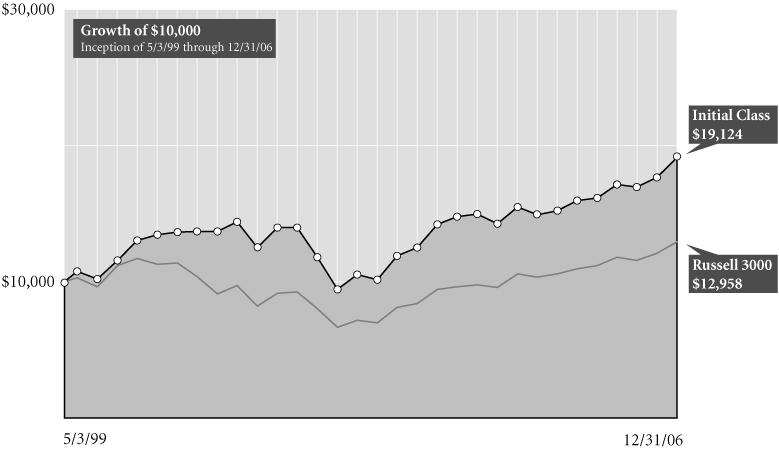

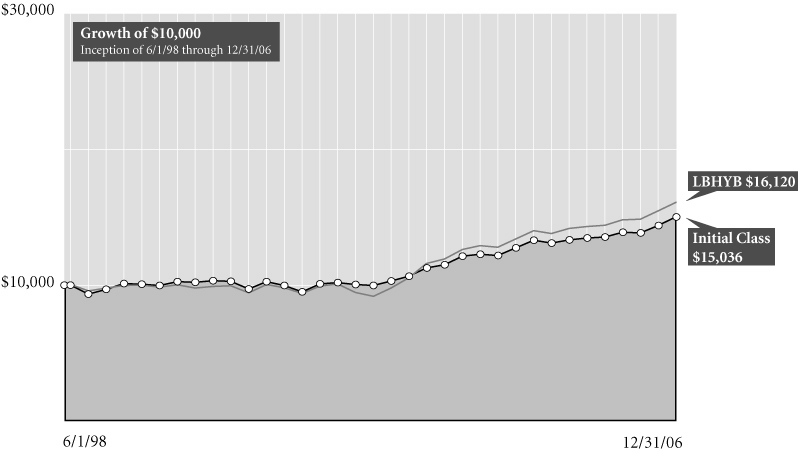

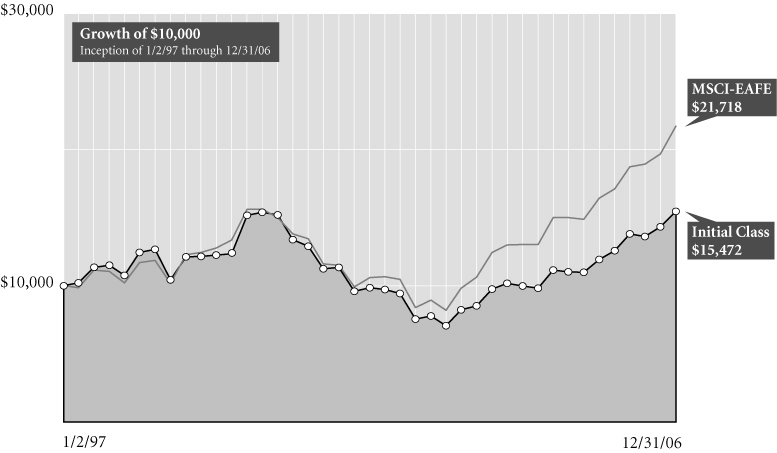

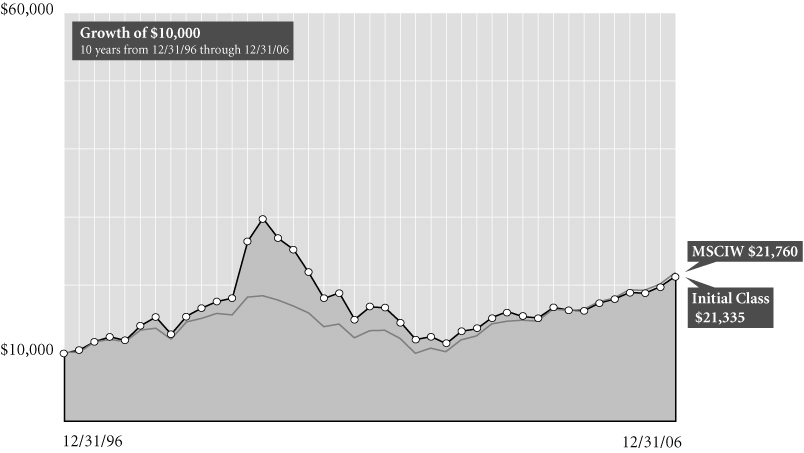

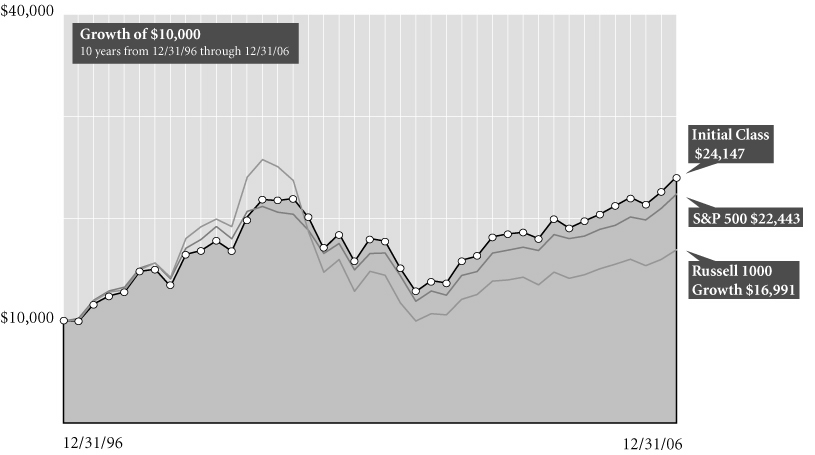

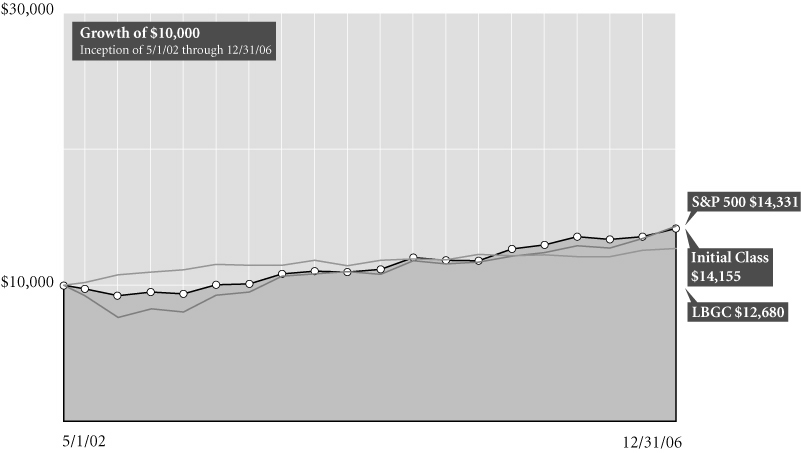

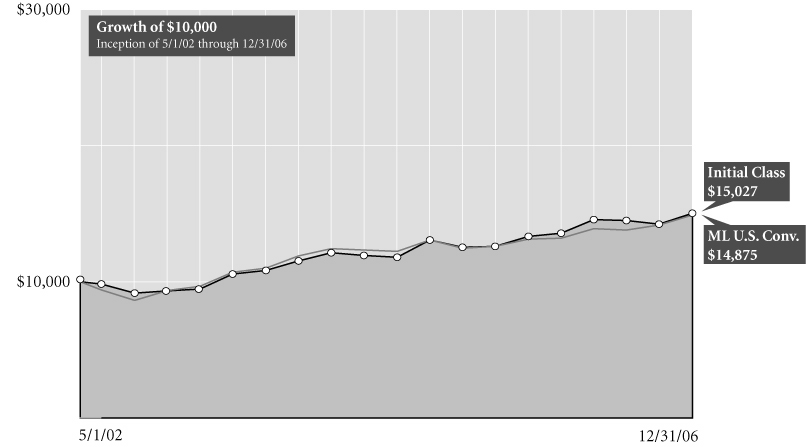

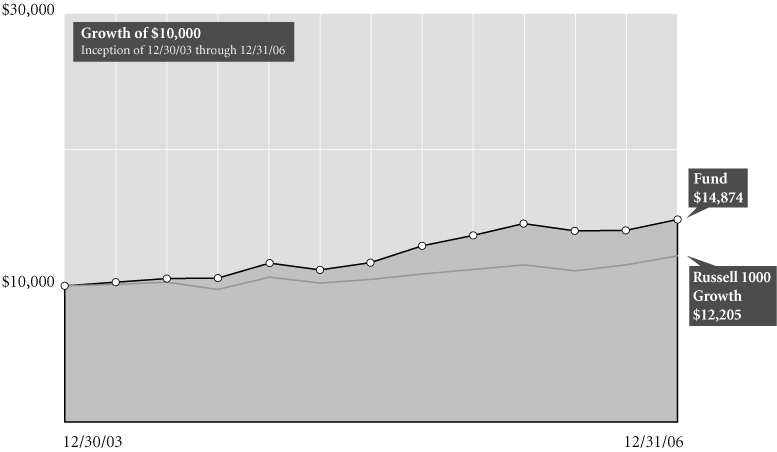

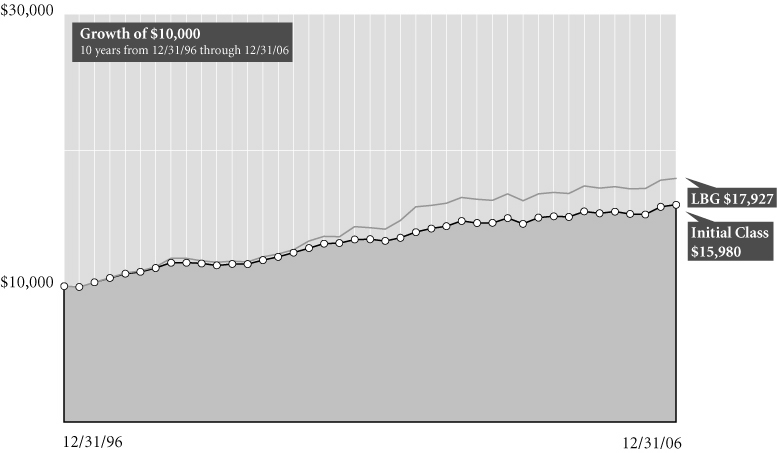

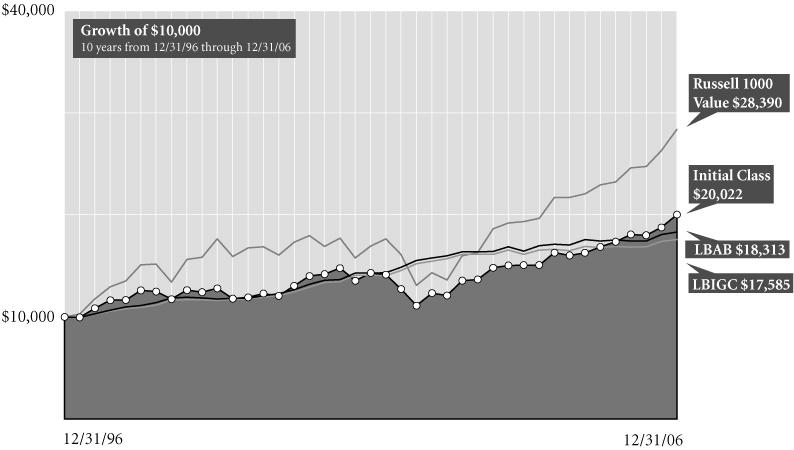

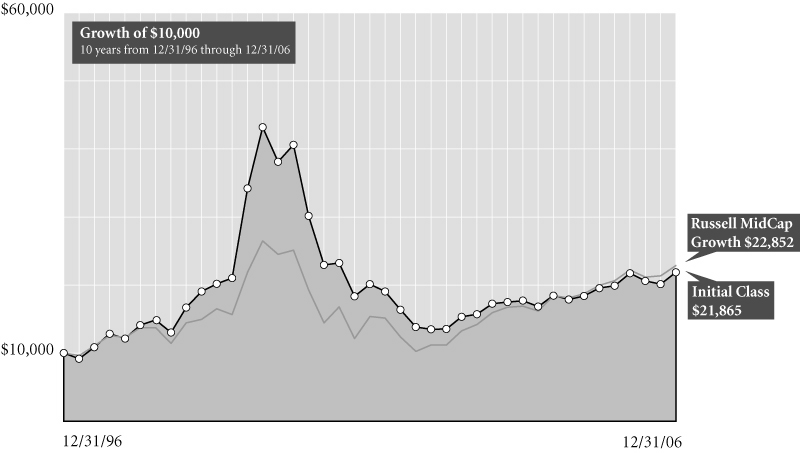

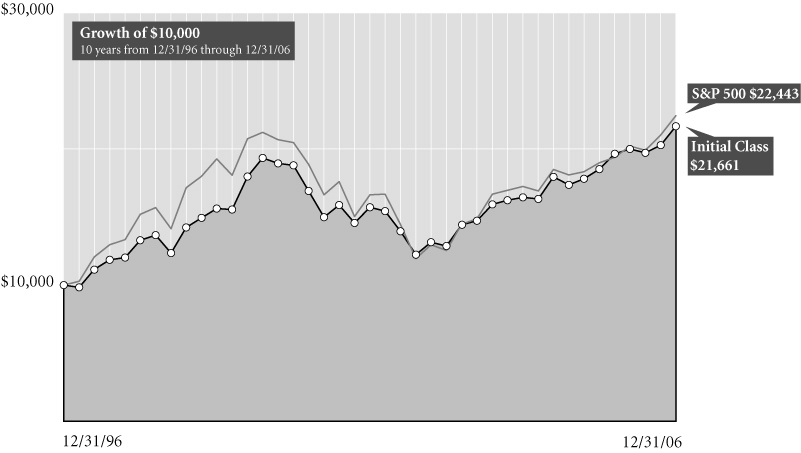

Comparison of change in value of $10,000 investment in Initial Class shares and its comparative indices.

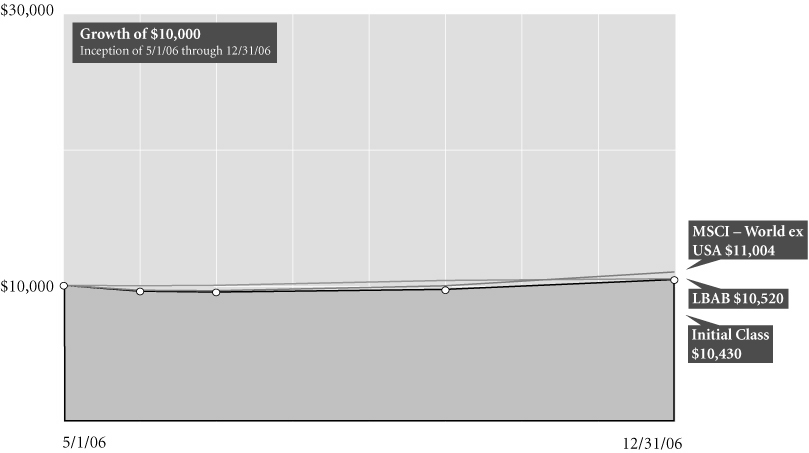

Average Annual Total Return for Periods Ended 12/31/06

| | | 1 year | | 5 years | | 10 years | | From

Inception | | Inception

Date | |

| Initial Class | | | 3.92 | % | | | 4.97 | % | | | 5.87 | % | | | 6.76 | % | | 10/2/86 | |

| LBAB1 | | | 4.33 | % | | | 5.06 | % | | | 6.24 | % | | | 7.42 | % | | 10/2/86 | |

| LBGC1 | | | 3.78 | % | | | 5.17 | % | | | 6.27 | % | | | 7.38 | % | | 10/2/86 | |

| Service Class | | | 3.63 | % | | | – | | | | – | | | | 3.21 | % | | 5/1/03 | |

NOTES

1 The Lehman Brothers Aggregate Bond (LBAB) Index and Lehman Brothers U.S. Government/Credit (LBGC) Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception calculation is based on life of Initial Class shares. Source: Standard & Poor's Micropal®© Micropal, Inc. 2006 – 1-800-596-5323 – http://www.funds-sp.com.

The performance data presented represents past performance, future results may vary. The portfolio's investment return and net asset value will fluctuate. Past performance does not guarantee future results. Investor's units when redeemed, may be worth more or less than their original cost.

Current performance may be higher or lower than the performance data quoted. Please visit your insurance company's website for contract or policy level standardized total returns current to the most recent month-end. Portfolio performance is net of investment fees and fund expenses, but not product charges, which, if included, would significantly lower the performance quoted.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives, explanation of share classes and policies of this portfolio.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 2

AEGON Bond

UNDERSTANDING YOUR FUND'S EXPENSES

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur ongoing costs, including management and advisory fees, distribution and service fees, and other fund expenses.

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at July 1, 2006 and held for the entire period until December 31, 2006.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

| | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | Expenses Paid

During Period (a) | |

| Initial Class | |

| Actual | | $ | 1,000.00 | | | $ | 1,046.30 | | | | 0.57 | % | | $ | 2.94 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,022.33 | | | | 0.57 | | | | 2.91 | | |

| Service Class | |

| Actual | | | 1,000.00 | | | | 1,044.70 | | | | 0.82 | | | | 4.23 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,021.07 | | | | 0.82 | | | | 4.18 | | |

(a) Expenses are calculated using the Fund's annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by number of days in the period (184 days), and divided by the number of days in the year (365 days).

(b) 5% return per year before expenses.

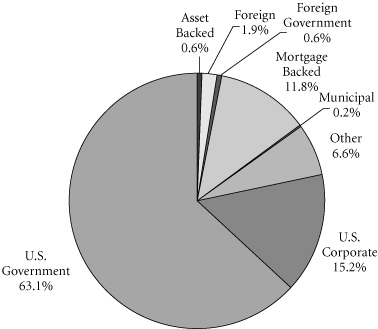

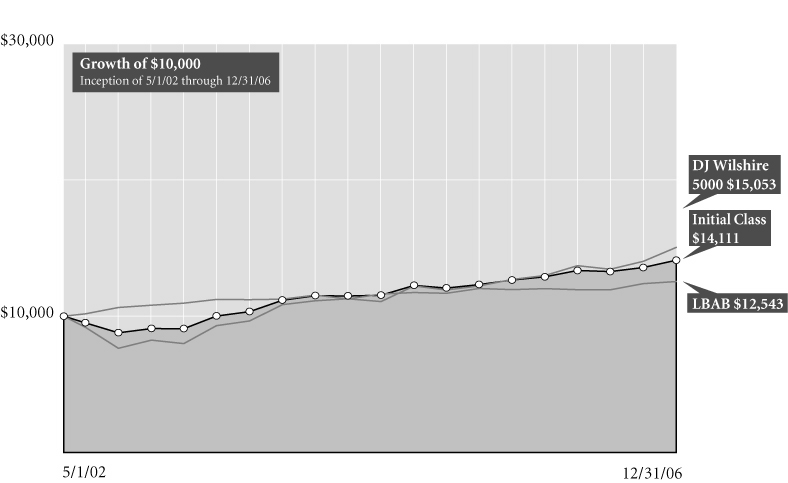

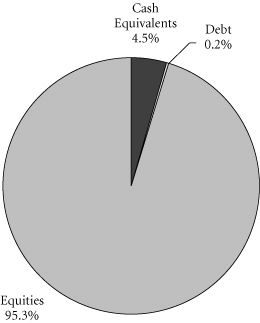

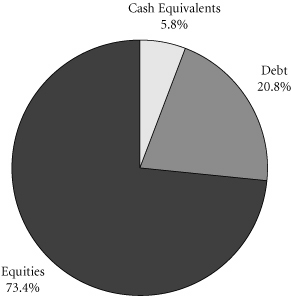

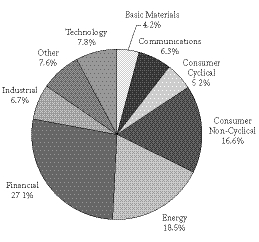

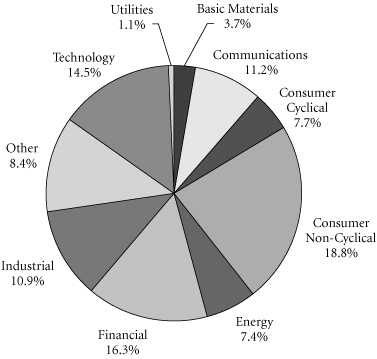

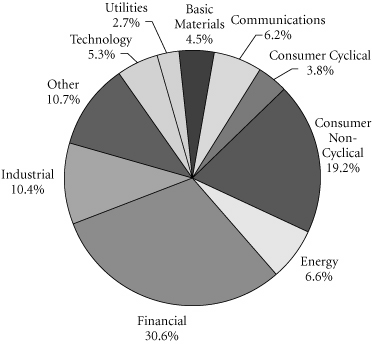

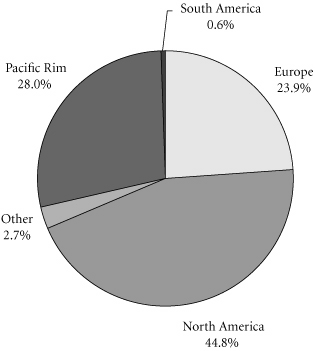

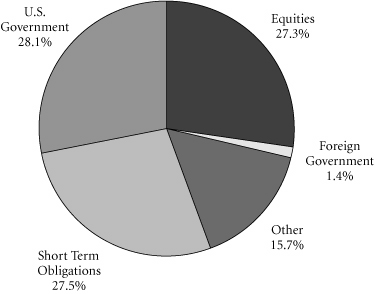

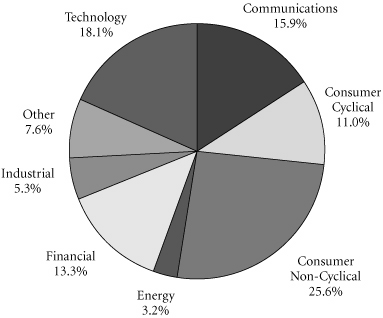

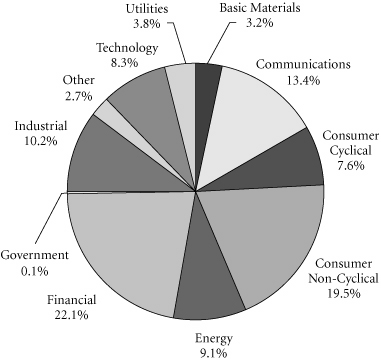

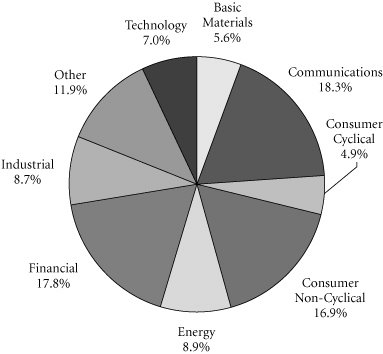

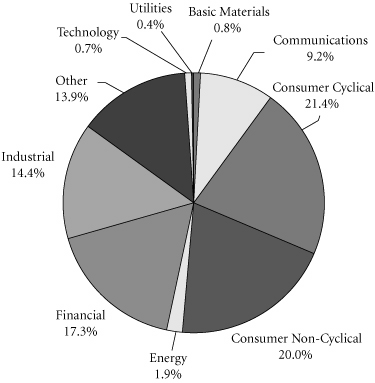

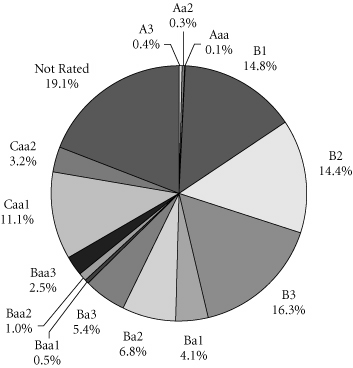

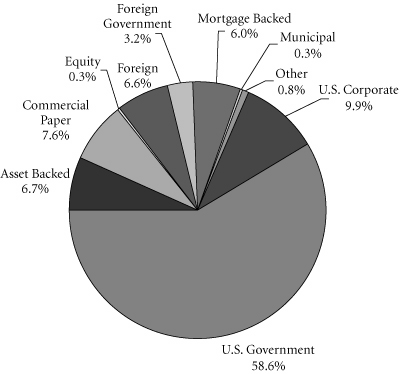

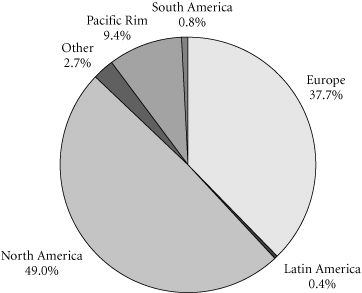

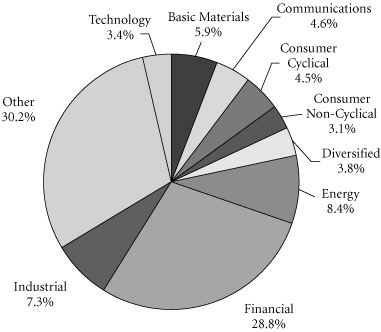

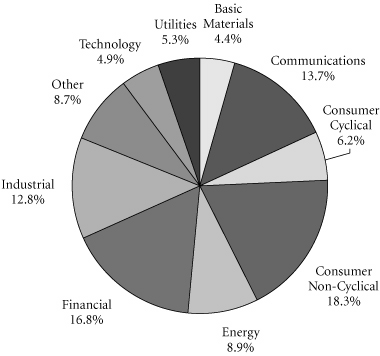

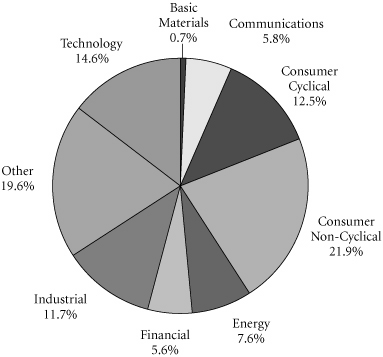

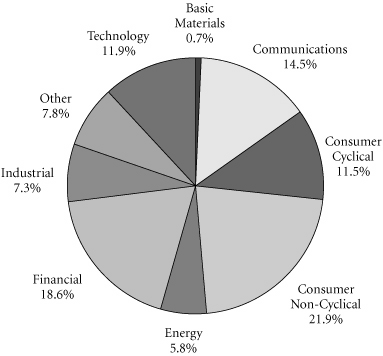

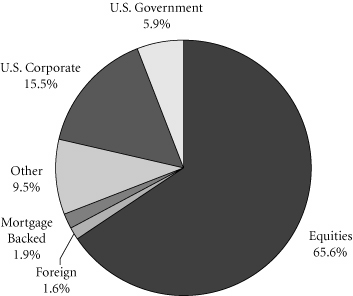

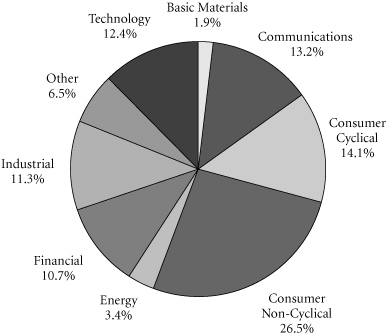

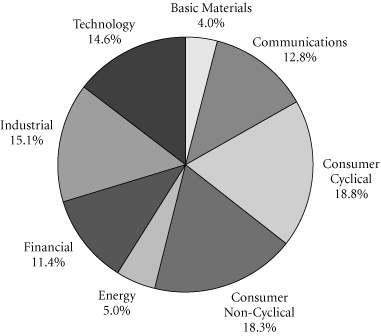

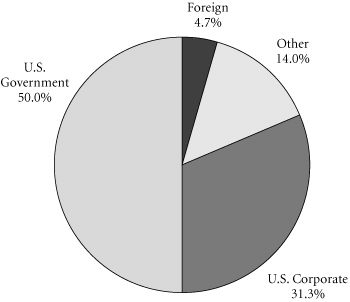

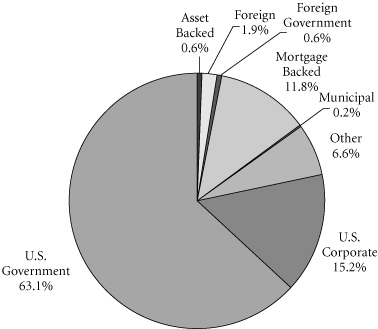

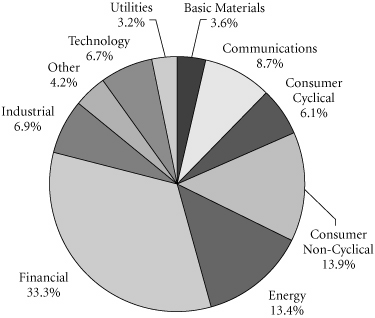

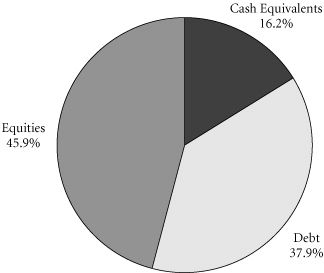

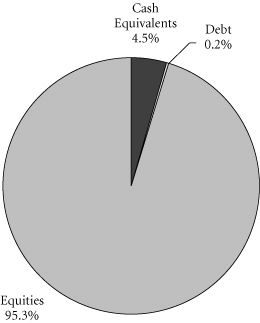

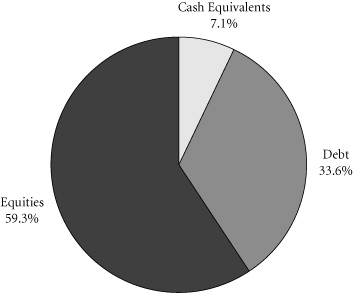

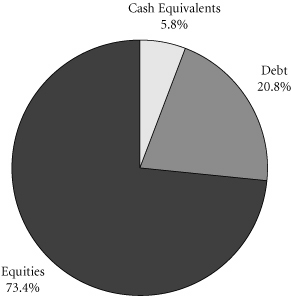

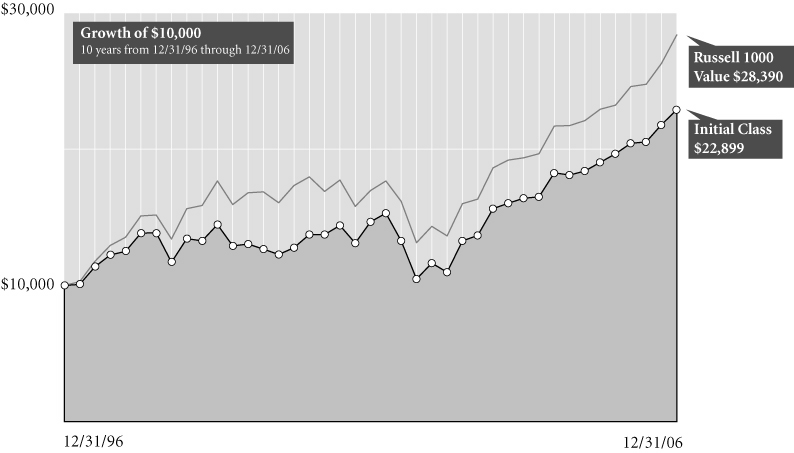

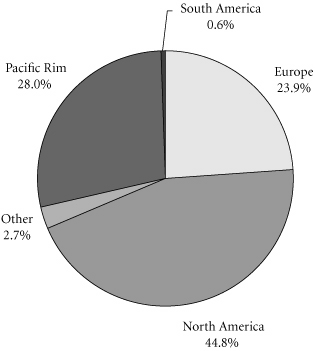

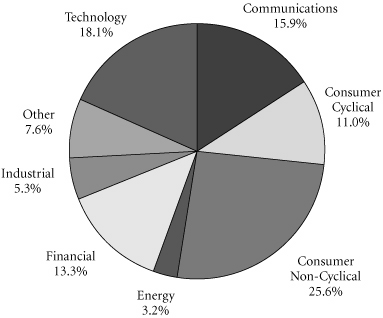

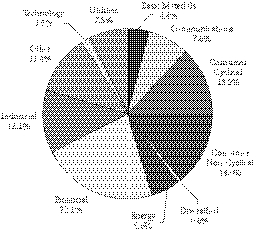

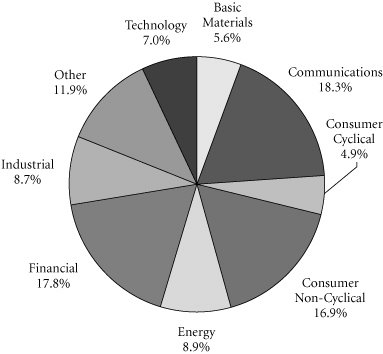

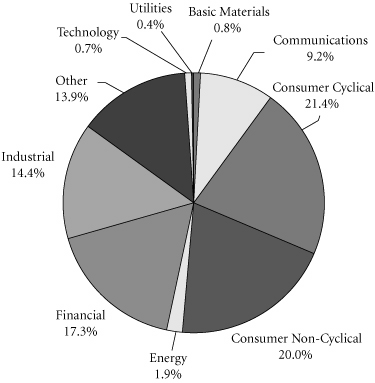

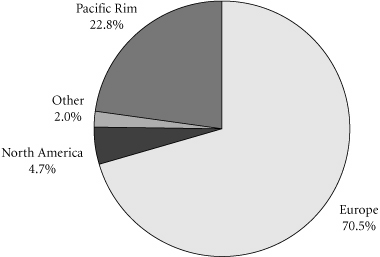

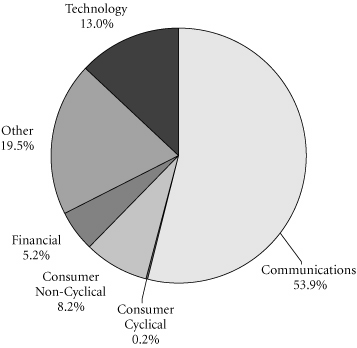

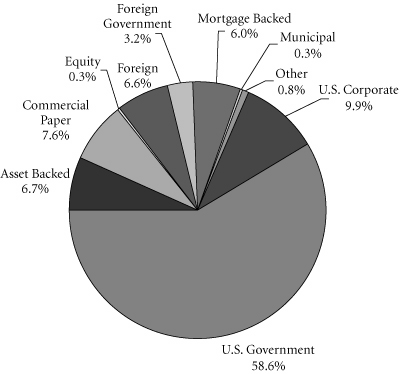

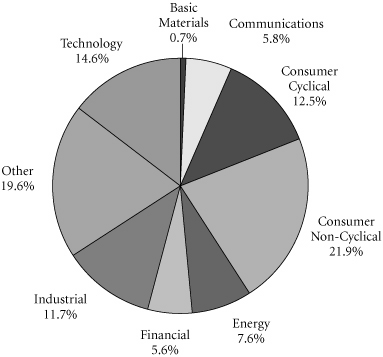

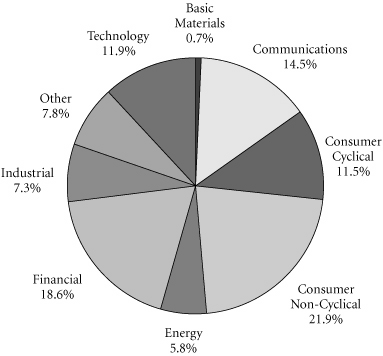

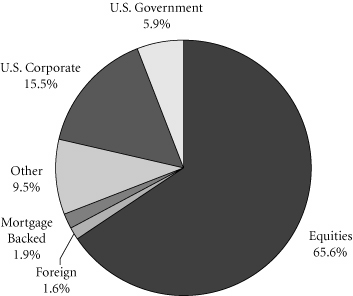

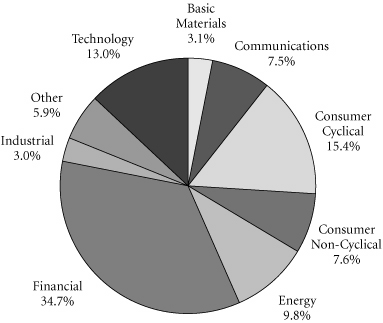

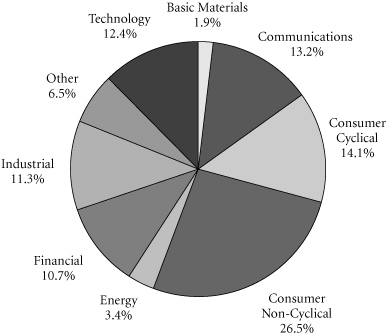

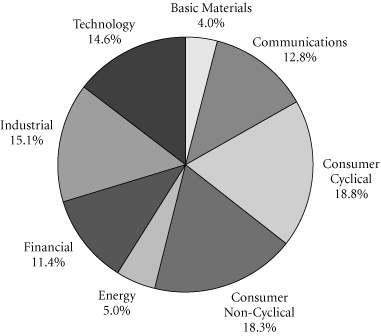

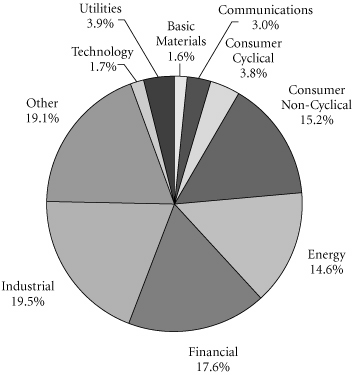

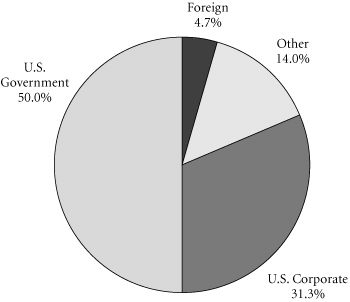

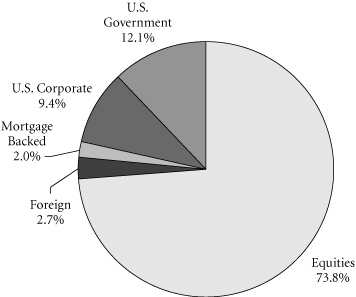

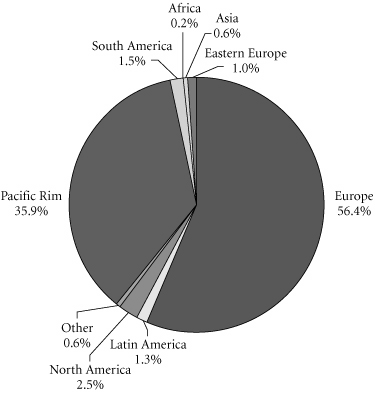

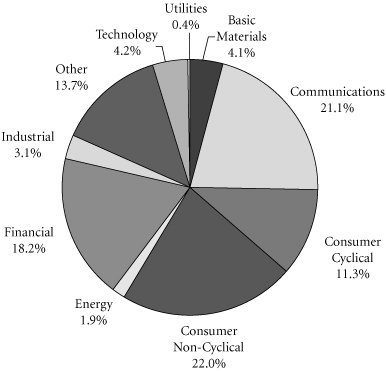

GRAPHICAL PRESENTATION OF SCHEDULE OF INVESTMENTS

By Bond Type

At December 31, 2006

This chart shows the percentage breakdown by bond type of the Fund's total investment securities.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 3

AEGON Bond

SCHEDULE OF INVESTMENTS

At December 31, 2006

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| U.S. GOVERNMENT OBLIGATIONS (20.9%) | |

| U.S. Treasury Bond | |

| 11.75%, due 11/15/2014 † | | $ | 2,500 | | | $ | 2,964 | | |

7.25%, due 05/15/2016 †

7.50%, due 11/15/2016 †

7.25%, due 08/15/2022

6.25%, due 08/15/2023 †

7.63%, due 02/15/2025

6.50%, due 11/15/2026 | | | 2,000

2,750

300

5,000

1,125

1,500 | | | | 2,377

3,342

376

5,755

1,489

1,802 | | |

U.S. Treasury STRIPS

Zero Coupon, due 05/15/2008

Zero Coupon, due 02/15/2009

Zero Coupon, due 02/15/2010

Zero Coupon, due 02/15/2011

Zero Coupon, due 05/15/2012

Zero Coupon, due 08/15/2012

Zero Coupon, due 11/15/2012

Zero Coupon, due 02/15/2013

Zero Coupon, due 05/15/2013

Zero Coupon, due 11/15/2013

Zero Coupon, due 02/15/2014

Zero Coupon, due 11/15/2014

Zero Coupon, due 02/15/2016

Zero Coupon, due 05/15/2016

Zero Coupon, due 02/15/2017

Zero Coupon, due 11/15/2017

Zero Coupon, due 02/15/2019

Zero Coupon, due 02/15/2022

Zero Coupon, due 02/15/2023 | | | 1,000

200

1,140

950

1,200

250

1,200

200

200

3,000

750

100

1,650

2,200

8,400

200

300

150

750 | | | | 936

181

987

787

944

193

915

151

149

2,182

539

69

1,072

1,413

5,197

119

166

71

338 | | |

U.S. Treasury Note

6.50%, due 02/15/2010 | | | 585 | | | | 615 | | |

| Total U.S. Government Obligations (cost: $33,297) | | | | | | | 35,129 | | |

| U.S. GOVERNMENT AGENCY OBLIGATIONS (45.8%) | |

Fannie Mae

7.50%, due 01/01/2008

7.00%, due 01/25/2008

6.50%, due 04/01/2008

6.73%, due 10/25/2008 *

8.00%, due 07/01/2009

5.50%, due 06/01/2012

6.50%, due 12/25/2012

5.00%, due 11/25/2015

6.00%, due 03/25/2016

5.00%, due 12/01/2016

7.00%, due 12/25/2016

5.50%, due 03/01/2017

6.50%, due 03/01/2017

5.50%, due 04/25/2017 | | | 52

150

57

75

161

186

634

1,500

624

198

1,220

542

165

1,000 | | | | 53

151

57

75

165

186

636

1,483

631

196

1,237

542

169

1,006 | | |

| | | Principal | | Value | |

| 5.50%, due 09/01/2017 | | $ | 449 | | | $ | 449 | | |

7.00%, due 09/01/2017

9.50%, due 06/25/2018

4.00%, due 07/01/2018

4.00%, due 12/01/2018

4.50%, due 03/01/2019

9.00%, due 10/01/2019

6.50%, due 08/01/2020

6.50%, due 02/25/2022

7.00%, due 06/17/2022

5.50%, due 05/25/2023

9.00%, due 06/01/2025

7.00%, due 03/25/2031

7.00%, due 09/25/2031

7.00%, due 09/25/2031

7.00%, due 11/25/2031

7.80%, due 02/25/2032 *

10.00%, due 03/25/2032 *

6.50%, due 04/25/2032

6.50%, due 11/25/2032

6.00%, due 12/01/2032

4.67%, due 12/25/2032 *

Zero Coupon, due 01/01/2033 (a)

6.00%, due 03/01/2033

6.00%, due 03/01/2033

6.00%, due 03/01/2033

5.50%, due 04/01/2033

4.00%, due 04/25/2033

5.75%, due 06/25/2033

0.38%, due 07/25/2033 *

0.33%, due 08/25/2033 *

Zero Coupon, due 09/01/2033 (a)

3.58%, due 09/25/2033 *

Zero Coupon, due 12/25/2033 (a)

5.50%, due 02/25/2034

1.05%, due 03/25/2034 *

Zero Coupon, due 04/25/2034 (a)

4.81%, due 04/25/2034 *

2.60%, due 05/25/2034 *

4.81%, due 05/25/2034 *

4.85%, due 01/01/2035 *

5.50%, due 12/25/2035

6.50%, due 01/01/2036

Zero Coupon, due 04/25/2036 (a)

Zero Coupon, due 06/25/2036 (a)

Zero Coupon, due 07/25/2036 (a)

Zero Coupon, due 11/25/2036 (a)

6.50%, due 10/25/2042

6.50%, due 12/25/2042

7.50%, due 12/25/2042 | | | 375

235

190

776

672

113

314

547

2

500

151

178

325

394

717

89

60

527

1,000

458

169

186

201

130

91

438

500

750

291

223

130

141

938

600

165

94

376

108

585

298

300

406

189

233

197

493

143

503

231 | | | | 386

255

179

733

649

121

322

559

2

486

163

184

337

408

747

96

67

527

1,038

462

162

141

202

131

92

433

413

743

190

144

95

124

692

594

111

57

370

97

569

296

291

415

138

184

150

348

145

511

240 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 4

AEGON Bond

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2006

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

Federal Home Loan Bank

4.72%, due 09/20/2012 * | | $ | 432 | | | $ | 421 | | |

Freddie Mac

5.50%, due 02/15/2009

4.13%, due 07/12/2010

5.75%, due 01/15/2012

6.00%, due 02/15/2013

5.50%, due 09/15/2013

5.50%, due 10/15/2013

6.50%, due 10/15/2013

6.00%, due 12/15/2013

6.00%, due 12/15/2013

5.00%, due 07/15/2014

6.00%, due 08/15/2015

2.44%, due 10/15/2015 *

5.50%, due 11/15/2015

6.50%, due 04/01/2016

5.50%, due 02/15/2017

2.35%, due 07/15/2017 *(b)

6.50%, due 12/01/2017

4.00%, due 05/01/2019

8.50%, due 09/15/2020

6.00%, due 12/15/2020

5.50%, due 12/15/2022

7.50%, due 02/15/2023

5.00%, due 05/15/2023

7.00%, due 03/15/2024

Zero Coupon, due 02/1 5/2029 (a)

7.00%, due 06/15/2029

6.00%, due 11/15/2029

8.00%, due 01/15/2030

3.50%, due 05/15/2030 *

6.00%, due 05/15/2030

7.50%, due 08/15/2030

7.25%, due 09/15/2030

7.00%, due 10/15/2030

7.25%, due 12/15/2030

6.50%, due 08/15/2031

2.65%, due 03/15/2032 *(b)

4.00%, due 03/15/2032

6.38%, due 03/15/2032

6.50%, due 03/15/2032

7.00%, due 03/15/2032

7.00%, due 04/15/2032

7.00%, due 05/15/2032

6.50%, due 06/15/2032

6.50%, due 07/15/2032

7.50%, due 07/25/2032

6.00%, due 11/15/2032 | | | 453

573

200

969

685

693

86

977

1,672

826

1,285

712

203

142

1,000

1,249

382

914

263

976

1,000

678

325

1,000

175

1,000

655

885

313

393

244

1,089

696

326

542

325

1,000

965

729

2,256

907

711

536

999

587

500 | | | | 451

558

207

982

689

695

86

988

1,692

821

1,285

644

203

145

1,001

76

391

861

279

978

999

697

317

1,044

151

1,056

659

920

295

396

254

1,120

715

332

556

25

936

982

751

2,328

937

731

552

1,039

608

506 | | |

| | | Principal | | Value | |

| Zero Coupon, due 12/15/2032 (a) | | $ | 136 | | | $ | 111 | | |

Zero Coupon, due 12/15/2032 (a)

Zero Coupon, due 01/15/2033 (a)

1.65%, due 02/15/2033 *(b)

2.20%, due 02/15/2033 *(b)

6.00%, due 02/15/2033

1.75%, due 03/15/2033 *(b)

Zero Coupon, due 10/15/2033 (a)

0.98%, due 10/15/2033 *

0.98%, due 11/15/2033 *

1.05%, due 01/15/2034 *

1.30%, due 02/15/2034 *

Zero Coupon, due 03/15/2034 (a)

1.05%, due 04/15/2034 *

Zero Coupon, due 08/15/2034 (a)

0.69%, due 11/15/2035 *

Zero Coupon, due 02/15/2036 (a)

Zero Coupon, due 02/15/2036 (a)

Zero Coupon, due 03/15/2036 (a)

Zero Coupon, due 04/15/2036 (a)

Zero Coupon, due 05/15/2036 *

Zero Coupon, due 07/15/2036 (a)

6.50%, due 11/01/2036

7.50%, due 08/25/2042 *

6.50%, due 02/25/2043

7.00%, due 02/25/2043 | | | 205

400

1,558

1,064

500

1,754

250

184

108

700

75

60

190

125

89

238

140

194

293

146

150

494

246

527

170 | | | | 167

252

83

68

505

103

131

126

73

396

45

33

131

87

85

181

105

148

216

119

112

504

255

537

175 | | |

Ginnie Mae

7.50%, due 09/15/2009

6.00%, due 03/20/2013

5.50%, due 12/20/2013

6.00%, due 12/20/2014

8.00%, due 01/15/2016

7.00%, due 07/15/2017

6.50%, due 03/15/2023

6.50%, due 10/16/2024

9.00%, due 05/16/2027

6.50%, due 04/20/2029

7.50%, due 11/20/2029

8.00%, due 12/20/2029

8.50%, due 02/16/2030

8.00%, due 06/20/2030

7.50%, due 09/20/2030

7.33%, due 11/20/2030

6.50%, due 03/20/2031

9.32%, due 04/20/2031 *

7.00%, due 10/20/2031

6.50%, due 12/20/2031

5.50%, due 01/20/2032 (b)

6.50%, due 01/20/2032 | | | 146

1,498

706

301

162

227

13

1,200

63

803

378

217

892

95

255

93

487

72

425

773

449

631 | | | | 148

1,495

709

301

171

234

13

1,243

66

821

394

226

960

100

259

95

497

79

441

791

68

646 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 5

AEGON Bond

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2006

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Ginnie Mae (continued) | |

| 2.60%, due 04/16/2032 *(b) | | $ | 520 | | | $ | 40 | | |

6.50%, due 06/20/2032

6.50%, due 06/20/2032

6.50%, due 07/16/2032

6.50%, due 07/20/2032

6.50%, due 08/20/2032

Zero Coupon, due 03/16/2033 (a)

Zero C oupon, due 06/16/2033 (a)

6.50%, due 06/20/2033

4.95%, due 04/16/2034 * | | | 1,400

473

1,000

860

382

69

207

850

103 | | | | 1,445

487

1,031

883

392

55

158

913

97 | | |

U.S. Department of Veteran Affairs

7.50%, due 02/15/2027 | | | 1,534 | | | | 1,614 | | |

| Total U.S. Government Agency Obligations (cost: $79,958) | | | | | | | 76,814 | | |

| FOREIGN GOVERNMENT OBLIGATIONS (0.6%) | |

United Mexican States

4.63%, due 10/08/2008

6.38%, due 01/16/2013

7.50%, due 04/08/2033 | | | 330

75

500 | | | | 326

79

590 | | |

| Total Foreign Government Obligations (cost: $896) | | | | | | | 995 | | |

| MORTGAGE-BACKED SECURITIES (12.5%) | |

Banc of America Commercial Mortgage, Inc.,

Series 2005-6, Class ASB

5.18%, due 09/10/2047 * | | | 150 | | | | 149 | | |

Banc of America Funding Corp.,

Series 2004-1

Zero Coupon, due 03/25/2034 (a) | | | 156 | | | | 118 | | |

Banc of America Funding Corp.,

Series 2005-7, Class 30PO

Zero Coupon, due 11/25/2035 (a) | | | 286 | | | | 204 | | |

Banc of America Funding Corp.,

Series 2005-8, Class 30PO

Zero Coupon, due 01/25/2036 (a) | | | 96 | | | | 68 | | |

Bank of America Mortgage

Securities–Series 2004-E, Class 2A5

4.11%, due 06/25/2034 * | | | 400 | | | | 390 | | |

Bear Stearns Adjustable Rate Mortgage

Trust–Series 2006-1, Class 1A1

4.63%, due 02/25/2036 * | | | 557 | | | | 547 | | |

Bear Stearns Commercial Mortgage

Securities–Series 2000-WF1

7.64%, due 02/15/2032 | | | 61 | | | | 63 | | |

Commercial Mortgage Asset

Trust–Series 1999-C1

6.59%, due 01/17/2032 | | | 139 | | | | 139 | | |

| | | Principal | | Value | |

Commercial Mortgage

Pass-Through–Series 2001-J2–144A

6.30%, due 07/16/2034 | | $ | 4,000 | | | $ | 4,166 | | |

Countrywide Alternative Loan Trust,

Series 2003-J1

Zero Coupon, due 10/25/2033 (a) | | | 201 | | | | 151 | | |

Countrywide Alternative Loan Trust,

Series 2004-2CB, Class 1A9

5.75%, due 03/25/2034 | | | 296 | | | | 289 | | |

Countrywide Alternative Loan Trust,

Series 2005-22T1, Class A2

Zero Coupon, due 06/25/2035 *(b) | | | 3,673 | | | | 25 | | |

Countrywide Alternative Loan Trust,

Series 2005-26CB, Class A10

3.35%, due 07/25/2035 * | | | 140 | | | | 134 | | |

Countrywide Alternative Loan Trust,

Series 2005-28CB, Class 1A4

5.50%, due 08/25/2035 | | | 500 | | | | 482 | | |

Countrywide Alternative Loan Trust,

Series 2005-54CB, Class 1A11

5.50%, due 11/25/2035 | | | 200 | | | | 197 | | |

Countrywide Alternative Loan Trust,

Series 2005-J1, Class 1A4

Zero Coupon, due 02/25/2035 *(b) | | | 1,973 | | | | 13 | | |

Countrywide Home Loan Mortgage

Pass Through Trust, Series 2004-7

4.07%, due 06/25/2034 * | | | 187 | | | | 183 | | |

Countrywide Home Loan Mortgage Pass

Through Trust, Series 2005-22, Class 2A1

5.28%, due 11/25/2035 * | | | 790 | | | | 785 | | |

Countrywide Home Loan Mortgage

Pass Through Trust–Series 2004-HYB1

4.25%, due 05/20/2034 * | | | 189 | | | | 187 | | |

First Horizon Asset Securities,

Inc.–Series 2004-AR7

4.92%, due 02/25/2035 * | | | 370 | | | | 367 | | |

GE Capital Commercial Mortgage Corp.–

Series 2001-2

6.44%, due 08/11/2033 | | | 3,000 | | | | 3,142 | | |

MASTR Adjustable Rate Mortgages

Trust–Series 2004-13

3.82%, due 04/21/2034 * | | | 366 | | | | 358 | | |

MASTR Alternative Loans

Trust–Series 2004-10

4.50%, due 09/25/2019 | | | 452 | | | | 433 | | |

MASTR Asset Securitization

Trust–Series 2003-4

5.00%, due 05/25/2018 | | | 181 | | | | 180 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 6

AEGON Bond

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2006

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

MASTR Resecuritization Trust–144A

Zero Coupon, due 05/28/2035 (a) | | $ | 858 | | | $ | 596 | | |

Merrill Lynch Mortgage Trust,

Series 2005-MCP1, Class ASB

4.67%, due 06/12/2043 * | | | 300 | | | | 290 | | |

Morgan Stanley Capital I–Series 1998-HF2

6.59%, due 11/15/2030 * | | | 2,000 | | | | 2,036 | | |

MortgageIT Trust, Series 2005-1

5.67%, due 02/25/2035 * | | | 208 | | | | 208 | | |

Nomura Asset Acceptance Corp.–

Series 2003-A1

7.00%, due 04/25/2033 28 28

6.00%, due 05/25/2033 | | | 113 | | | | 112 | | |

Prudential Securities Secured Financing

Corp.–Series 1998-C1

6.51%, due 07/15/2008 | | | 1,652 | | | | 1,664 | | |

Residential Accredit Loans, Inc.–

Series 2002-QS16

5.44%, due 10/25/2017 * | | | 117 | | | | 115 | | |

Residential Accredit Loans, Inc.–

Series 2003-QS3

4.73%, due 02/25/2018 * | | | 95 | | | | 90 | | |

Residential Funding Mortgage Security I,

Series 2004-S6, Class 2A6

Zero Coupon, due 06/25/2034 (a) | | | 154 | | | | 109 | | |

Washington Mutual Alternative

Mortgage Pass-Through Certificates,

Series 2005-2, Class 1A4

Zero Coupon, due 04/25/2035 *(b) | | | 2,577 | | | | 16 | | |

Washington Mutual Alternative Mortgage

Pass-Through Certificates, Series 2005-4,

Class CB7

5.50%, due 06/25/2035 | | | 500 | | | | 489 | | |

Washington Mutual MSC Mortgage

Pass-Through Certificates-Series 2003-MS7

Zero Coupon, due 03/25/2033 (a) | | | 222 | | | | 174 | | |

Washington Mutual–Series 2002-S7

Zero Coupon, due 11/25/2017 (a) | | | 292 | | | | 257 | | |

Washington Mutual–Series 2004-AR3

4.24%, due 06/25/2034 * | | | 157 | | | | 154 | | |

Wells Fargo Mortgage Backed Securities

Trust–Series 2004-7

5.00%, due 07/25/2019 | | | 370 | | | | 362 | | |

Wells Fargo Mortgage Backed Securities

Trust–Series 2004-BB

4.56%, due 01/25/2035 * | | | 652 | | | | 643 | | |

| | | Principal | | Value | |

Wells Fargo Mortgage Backed Securities

Trust–Series 2004-EE

3.99%, due 12/25/2034 * | | $ | 357 | | | $ | 352 | | |

Wells Fargo Mortgage Backed Securities

Trust–Series 2004-S

3.54%, due 09/25/2034 * | | | 500 | | | | 484 | | |

| Total Mortgage-Backed Securities (cost: $20,801) | | | | | | | 20,949 | | |

| ASSET-BACKED SECURITIES (0.7%) | |

Citibank Credit Card Issuance,

Series 2005-B1, Class B1

4.40%, due 09/15/2010 | | | 150 | | | | 148 | | |

Countrywide Asset-Backed Certificates–

Series 2004-AB2

5.62%, due 05/25/2036 * | | | 208 | | | | 208 | | |

Household Automotive Trust,

Series 2005-1, Class A4

4.35%, due 06/18/2012 | | | 110 | | | | 108 | | |

Household Credit Card Master Note Trust I,

Series 2006-1, Class A

5.10%, due 06/15/2012 | | | 150 | | | | 150 | | |

MBNA Credit Card Master Trust–

Series 2003-1C

7.05%, due 06/15/2012 * | | | 150 | | | | 156 | | |

MBNA Master Credit Card Trust USA–

Series 1999-J–144A

7.85%, due 02/15/2012 | | | 300 | | | | 321 | | |

Residential Asset Mortgage Products, Inc.–

Series 2001-RS3

6.79%, due 10/25/2031 | | | 9 | | | | 9 | | |

| Total Asset-Backed Securities (cost: $1,105) | | | | | | | 1,100 | | |

| CORPORATE DEBT SECURITIES (18.3%) | |

| Aerospace (0.1%) | |

Textron Financial Corp.

5.13%, due 02/03/2011 | | | 80 | | | | 79 | | |

| Automotive (0.1%) | |

Toyota Motor Credit Corp.

2.88%, due 08/01/2008 | | | 100 | | | | 96 | | |

| Business Credit Institutions (0.9%) | |

CIT Group, Inc.

7.75%, due 04/02/2012 | | | 150 | | | | 165 | | |

Systems 2001 AT LLC–Series 2001–144A

6.66%, due 09/15/2013 | | | 1,209 | | | | 1,266 | | |

| Business Services (0.0%) | |

International Lease Finance Corp.

5.88%, due 05/01/2013 | | | 75 | | | | 77 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 7

AEGON Bond

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2006

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Chemicals & Allied Products (1.4%) | |

Dow Chemical Co. (The)

6.13%, due 02/01/2011 | | $ | 260 | | | $ | 267 | | |

DSM NV–144A

6.75%, due 05/15/2009 | | | 2,000 | | | | 2,055 | | |

| Commercial Banks (2.4%) | |

Bank of America Corp.

7.40%, due 01/15/2011 | | | 1,600 | | | | 1,723 | | |

Citigroup, Inc.

4.25%, due 07/29/2009

5.63%, due 08/27/2012 | | | 200

400 | | | | 196

406 | | |

Corp Andina de Fomento

5.20%, due 05/21/2013 | | | 100 | | | | 98 | | |

Keycorp–Series G

4.70%, due 05/21/2009 | | | 100 | | | | 98 | | |

State Street Corp.

7.65%, due 06/15/2010 | | | 300 | | | | 320 | | |

Suntrust Banks, Inc.

6.38%, due 04/01/2011 | | | 250 | | | | 260 | | |

Wachovia Bank NA

7.80%, due 08/18/2010 | | | 250 | | | | 269 | | |

Wachovia Corp.

3.50%, due 08/15/2008 | | | 150 | | | | 146 | | |

Wells Fargo & Co.

3.13%, due 04/01/2009

4.20%, due 01/15/2010 | | | 260

300 | | | | 249

292 | | |

| Communication (1.5%) | |

Comcast Corp.

5.50%, due 03/15/2011 | | | 250 | | | | 251 | | |

COX Communications, Inc.

6.75%, due 03/15/2011 | | | 1,000 | | | | 1,045 | | |

Tele-Communications–TCI Group

9.80%, due 02/01/2012 | | | 500 | | | | 590 | | |

Verizon Pennsylvania, Inc.

8.35%, due 12/15/2030 | | | 500 | | | | 577 | | |

| Computer & Office Equipment (0.2%) | |

International Business Machines Corp.

6.22%, due 08/01/2027 | | | 250 | | | | 263 | | |

| Electric Services (0.9%) | |

CenterPoint Energy Houston Electric LLC

5.75%, due 01/15/2014 | | | 60 | | | | 60 | | |

Constellation Energy Group, Inc.

7.00%, due 04/01/2012 | | | 250 | | | | 268 | | |

Dominion Resources, Inc.

6.25%, due 06/30/2012 | | | 240 | | | | 249 | | |

DTE Energy Co.

6.65%, due 04/15/2009 | | | 200 | | | | 205 | | |

| | | Principal | | Value | |

| Electric Services (continued) | |

Duke Energy Corp.

4.20%, due 10/01/2008 $50��$49

5.63%, due 11/30/2012 | | | 200 | | | | 204 | | |

Exelon Generation Co. LLC

6.95%, due 06/15/2011 | | | 250 | | | | 263 | | |

PSEG Power LLC

7.75%, due 04/15/2011 | | | 115 | | | | 124 | | |

| Electronic Components & Accessories (0.0%) | |

Cisco Systems, Inc.

5.50%, due 02/22/2016 | | | 50 | | | | 50 | | |

| Food Stores (0.1%) | |

Kroger Co. (The)

8.05%, due 02/01/2010 | | | 200 | | | | 214 | | |

| Gas Production & Distribution (0.1%) | |

KeySpan Gas East Corp.

7.88%, due 02/01/2010 | | | 100 | | | | 107 | | |

Southern California Gas Co.

4.80%, due 10/01/2012 | | | 100 | | | | 97 | | |

| Holding & Other Investment Offices (0.6%) | |

EOP Operating, LP

6.75%, due 02/15/2012 | | | 300 | | | | 324 | | |

Illinois State

5.10%, due 06/01/2033 | | | 450 | | | | 431 | | |

Washington Mutual Bank FA

6.88%, due 06/15/2011 | | | 250 | | | | 264 | | |

| Insurance (0.2%) | |

American General Finance Corp.

5.38%, due 10/01/2012 | | | 100 | | | | 100 | | |

International Lease Finance Corp.

4.50%, due 05/01/2008 | | | 75 | | | | 74 | | |

MGIC Investment Corp.

6.00%, due 03/15/2007 | | | 150 | | | | 150 | | |

XL Capital, Ltd.

5.25%, due 09/15/2014 | | | 50 | | | | 49 | | |

| Life Insurance (0.7%) | |

ASIF Global Financing XIX–144A

4.90%, due 01/17/2013 | | | 500 | | | | 488 | | |

John Hancock Global Funding, Ltd.–144A

7.90%, due 07/02/2010 | | | 300 | | | | 324 | | |

New York Life Global Funding–144A

3.88%, due 01/15/2009 | | | 200 | | | | 195 | | |

Protective Life Secured Trust

4.00%, due 04/01/2011 | | | 250 | | | | 238 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 8

AEGON Bond

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2006

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Mortgage Bankers & Brokers (1.0%) | |

American General Finance Corp.

4.50%, due 11/15/2007 | | $ | 170 | | | $ | 169 | | |

Captiva Finance, Ltd.–Series A–144A

6.86%, due 11/30/2009 | | | 482 | | | | 482 | | |

ConocoPhillips Canada

Funding Co., Guaranteed Note

5.63%, due 10/15/2016 | | | 100 | | | | 100 | | |

Countrywide Home Loans

4.00%, due 03/22/2011 | | | 225 | | | | 214 | | |

Countrywide Home Loans, Inc.

3.25%, due 05/21/2008 | | | 250 | | | | 243 | | |

MassMutual Global Funding II–144A

3.50%, due 03/15/2010 | | | 150 | | | | 143 | | |

Principal Life Global Funding I–144A

2.80%, due 06/26/2008

6.25%, due 02/15/2012 | | | 140

250 | | | | 135

260 | | |

| Motion Pictures (0.6%) | |

Historic TW, Inc.

8.18%, due 08/15/2007

9.15%, due 02/01/2023 | | | 400

500 | | | | 407

619 | | |

| Paper & Allied Products (0.2%) | |

International Paper Co.

4.25%, due 01/15/2009

4.00%, due 04/01/2010 | | | 65

165 | | | | 64

158 | | |

Union Camp Corp.

6.50%, due 11/15/2007 | | | 50 | | | | 50 | | |

| Personal Credit Institutions (2.4%) | |

Ford Motor Credit Co.

7.38%, due 10/28/2009 | | | 160 | | | | 160 | | |

General Electric Capital Corp.

4.25%, due 01/15/2008

4.63%, due 09/15/2009

6.13%, due 02/22/2011

5.88%, due 02/15/2012

6.00%, due 06/15/2012 | | | 700

500

500

200

750 | | | | 694

494

517

206

776 | | |

Household Finance Corp.

6.40%, due 06/17/2008 100 101

6.75%, due 05/15/2011 | | | 760 | | | | 804 | | |

HSBC Finance Corp.

5.25%, due 01/15/2014 | | | 100 | | | | 99 | | |

SLM Corp.

4.00%, due 01/15/2010 | | | 175 | | | | 169 | | |

| Railroads (0.1%) | |

Burlington Northern Santa Fe Corp.

7.13%, due 12/15/2010 | | | 200 | | | | 213 | | |

| | | Principal | | Value | |

| Research & Testing Services (0.0%) | |

Monsanto Co., Senior Note

7.38%, due 08/15/2012 | | $ | 60 | | | $ | 65 | | |

| Savings Institutions (0.1%) | |

Popular North America, Inc.

4.25%, due 04/01/2008 | | | 150 | | | | 148 | | |

| Security & Commodity Brokers (3.0%) | |

Bear Stearns Cos. Inc. (The)

3.25%, due 03/25/2009 | | | 500 | | | | 480 | | |

Credit Suisse First Boston (USA), Inc.

4.70%, due 06/01/2009 125 124

4.88%, due 01/15/2015 | | | 300 | | | | 291 | | |

Goldman Sachs Group, Inc. (The)

6.88%, due 01/15/2011 | | | 1,250 | | | | 1,323 | | |

Lehman Brothers Holdings, Inc.

7.88%, due 08/15/2010 | | | 1,000 | | | | 1,080 | | |

Merrill Lynch & Co., Inc.

4.79%, due 08/04/2010 100 99

5.45%, due 07/15/2014 | | | 300 | | | | 302 | | |

Morgan Stanley

4.25%, due 05/15/2010 500 483

6.75%, due 04/15/2011 400 423

6.60%, due 04/01/2012 250 264

4.75%, due 04/01/2014 | | | 145 | | | | 139 | | |

| Telecommunications (1.7%) | |

AT&T Wireless Services, Inc.

7.50%, due 05/01/2007 225 226

7.88%, due 03/01/2011 | | | 100 | | | | 109 | | |

BellSouth Corp.

6.00%, due 10/15/2011 | | | 250 | | | | 256 | | |

British Telecommunications PLC

9.13%, due 12/15/2030 (c) | | | 150 | | | | 205 | | |

France Telecom SA

7.75%, due 03/01/2011 (c) | | | 200 | | | | 218 | | |

GTE Corp.

7.51%, due 04/01/2009 | | | 475 | | | | 495 | | |

Nynex Capital Funding Co.–Series B

8.23%, due 10/15/2009 | | | 400 | | | | 425 | | |

NYNEX Corp.

9.55%, due 05/01/2010 | | | 138 | | | | 143 | | |

Sprint Capital Corp.

6.88%, due 11/15/2028 | | | 801 | | | | 801 | | |

| Total Corporate Debt Securities (cost: $30,181) | | | | | | | 30,691 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 9

AEGON Bond

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2006

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| SECURITY LENDING COLLATERAL (7.0%) | |

| Debt (6.6%) | |

| Bank Notes (0.2%) | |

Bank of America

5.32%, due 02/16/2007 | | $ | 332 | | | $ | 332 | | |

| Commercial Paper (1.5%) | |

Barton Capital LLC–144A

5.32%, due 01/16/2007 133 133

5.30%, due 01/17/2007 66 66

5.30%, due 01/17/2007 | | | 64 | | | | 64 | | |

Charta LLC–144A

5.30%, due 01/31/2007 | | | 179 | | | | 179 | | |

CIESCO LLC

5.31%, due 01/04/2007 | | | 66 | | | | 66 | | |

Clipper Receivables Corp.

5.30%, due 01/31/2007 | | | 166 | | | | 166 | | |

Compass Securitization–144A

5.30%, due 01/09/2007 | | | 211 | | | | 211 | | |

CRC Funding LLC–144A

5.34%, due 01/23/2007 | | | 33 | | | | 33 | | |

Fairway Finance Corp.–144A

5.30%, due 01/09/2007 | | | 251 | | | | 251 | | |

Falcon Asset Securitization Corp.–144A

5.34%, due 01/22/2007 | | | 66 | | | | 66 | | |

General Electric Capital Corp.

5.30%, due 01/26/2007 | | | 94 | | | | 94 | | |

Greyhawk Funding–144A

5.31%, due 01/12/2007 | | | 66 | | | | 66 | | |

Kitty Hawk Funding Corp.–144A

5.34%, due 01/10/2007 | | | 99 | | | | 99 | | |

Liberty Street–144A

5.31%, due 01/17/2007 | | | 99 | | | | 99 | | |

Old Line Funding LLC–144A

5.35%, due 01/04/2007 | | | 66 | | | | 66 | | |

Park Avenue Receivables Corp.–144A

5.33%, due 01/18/2007 | | | 66 | | | | 66 | | |

Ranger Funding Co. LLC–144A

5.32%, due 01/04/2007 66 66

5.31%, due 01/08/2007 163 163

5.33%, due 02/08/2007 | | | 64 | | | | 64 | | |

Sheffield Receivables Corp.–144A

5.30%, due 01/12/2007 | | | 98 | | | | 98 | | |

Three Pillars Funding LLC–144A

5.38%, due 01/02/2007 | | | 133 | | | | 133 | | |

Variable Funding Capital Co. LLC–144A

5.29%, due 01/04/2007 33 33

5.31%, due 02/02/2007 | | | 66 | | | | 66 | | |

Yorktown Capital LLC

5.30%, due 01/10/2007 164 164

5.33%, due 01/16/2007 | | | 66 | | | | 66 | | |

| | | Principal | | Value | |

| Euro Dollar Overnight (0.9%) | |

Abbey National PLC

5.28%, due 01/05/2007 | | $ | 332 | | | $ | 332 | | |

BancoBilbao Vizcaya Argentaria SA

5.31%, due 01/03/2007 | | | 100 | | | | 100 | | |

Credit Suisse First Boston Corp.

5.30%, due 01/05/2007 | | | 66 | | | | 66 | | |

Fortis Bank

5.30%, due 01/02/2007 133 133

5.32%, due 01/03/2007 | | | 133 | | | | 133 | | |

Societe Generale

5.31%, due 01/02/2007 | | | 199 | | | | 199 | | |

Svenska Handlesbanken

5.25%, due 01/02/2007 | | | 117 | | | | 117 | | |

UBS AG

5.29%, due 01/02/2007 100 100

5.30%, due 01/04/2007 133 133

5.30%, due 01/05/2007 | | | 133 | | | | 133 | | |

| Euro Dollar Terms (3.0%) | |

Bank of Nova Scotia

5.29%, due 01/30/2007 199 199

5.29%, due 02/06/2007 100 100

5.30%, due 02/27/2007 | | | 100 | | | | 100 | | |

Barclays

5.31%, due 02/20/2007 | | | 332 | | | | 332 | | |

Calyon

5.31%, due 02/16/2007 166 166

5.31%, due 02/22/2007 332 332

5.29%, due 03/05/2007 | | | 166 | | | | 166 | | |

Canadian Imperial Bank of Commerce

5.31%, due 01/29/2007 | | | 332 | | | | 332 | | |

Citigroup

5.31%, due 03/05/2007 312 312

5.31%, due 03/16/2007 | | | 332 | | | | 332 | | |

Dexia Group

5.29%, due 01/16/2007 | | | 199 | | | | 199 | | |

Fortis Bank

5.30%, due 01/24/2007 199 199

5.30%, due 01/26/2007 | | | 199 | | | | 199 | | |

HBOS Halifax Bank of Scotland

5.30%, due 01/08/2007 332 332

5.31%, due 03/14/2007 | | | 199 | | | | 199 | | |

Lloyds TSB Bank

5.30%, due 02/26/2007 | | | 66 | | | | 66 | | |

Marshall & Ilsley Bank

5.30%, due 03/19/2007 | | | 100 | | | | 100 | | |

Rabobank Nederland

5.30%, due 03/05/2007 | | | 199 | | | | 199 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 10

AEGON Bond

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2006

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Euro Dollar Terms (continued) | |

Royal Bank of Canada

5.31%, due 02/14/2007 | | $ | 199 | | | $ | 199 | | |

Royal Bank of Scotland

5.28%, due 01/11/2007 199 199

5.29%, due 01/16/2007 100 100

5.29%, due 02/09/2007 | | | 100 | | | | 100 | | |

Societe Generale

5.27%, due 01/19/2007 133 133

5.29%, due 02/01/2007 | | | 332 | | | | 332 | | |

The Bank of the West

5.29%, due 01/17/2007 | | | 166 | | | | 166 | | |

| Repurchase Agreements (1.0%) †† | |

Credit Suisse First Boston Corp.

5.35%, dated 12/29/2006 to be

repurchased at $98 on 01/02/2007 | | | 98 | | | | 98 | | |

Merrill Lynch & Co.

5.30%, dated 12/29/2006 to be

repurchased at $1,210 on 01/02/2007 | | | 1,210 | | | | 1,210 | | |

| | | Principal | | Value | |

| Repurchase Agreements †† (continued) | |

Morgan Stanley Dean Witter & Co.

5.30%, dated 12/29/2006 to be

repurchased at $137 on 01/02/2007 | | $ | 137 | | | $ | 137 | | |

Morgan Stanley Dean Witter & Co.

5.36%, dated 12/29/2006 to be

repurchased at $207 on 01/02/2007 | | | 207 | | | | 207 | | |

| | | Shares | | Value | |

| Investment Companies (0.4%) | |

Merrimac Cash Fund, Premium Class

1-day yield of 5.11% @ | | | 660,533 | | | $ | 661 | | |

| Total Security Lending Collateral (cost: $11,762) | | | | | | | 11,762 | | |

| Total Investment Securities (cost: $178,000) # | | | | | | $ | 177,440 | | |

NOTES TO SCHEDULE OF INVESTMENTS:

† At December 31, 2006, all or a portion of this security is on loan (see Note 1). The value at December 31, 2006, of all securities on loan is $11,169.

* Floating or variable rate note. Rate is listed as of December 31, 2006.

(a) Principal only security. Holder is entitled to principal cash flows on the underlying pool.

(b) Interest only security. Holder is entitled to interest payments on the underlying pool.

(c) Coupon steps up or down by 25 BP for each rating upgrade or downgrade by Standard and Poor's or Moody's for each notch above or below A-/A3.

†† Cash collateral for the Repurchase Agreements, valued at $1,705, that serve as collateral for securities lending are invested in corporate bonds with interest rates and maturity dates ranging from 0.00%–9.12% and 01/16/2007–12/01/2096, respectively.

@ Regulated investment company advised by Investors Bank and Trust Co. ("IBT"). IBT is also the accounting, custody and lending agent for the Fund.

# Aggregate cost for federal income tax purposes is $178,000. Aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value were $3,867 and $4,427, respectively. Net unrealized depreciation for tax purposes is $560.

DEFINITIONS:

144A 144A Securities are registered pursuant to Rule 144A of the Securities Act of 1933. These securities are deemed to be liquid for purposes of compliance limitations on holdings of illiquid securities and may be resold as transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2006, these securities aggregated $12,453 or 7.4% of the net assets of the Fund.

MASTR Mortgage Asset Securitization Transactions, Inc.

STRIPS Separate Trading of Registered Interest and Principal of Securities

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 11

AEGON Bond

STATEMENT OF ASSETS AND LIABILITIES

At December 31, 2006

(all amounts except per share amounts in thousands)

| Assets: | |

Investment securities, at value (cost: $178,000)

(including securities loaned of $11,169) | | $ | 177,440 | | |

| Cash | | | 1,133 | | |

| Receivables: | |

| Shares sold | | | 58 | | |

| Interest | | | 1,263 | | |

| | | | 179,894 | | |

| Liabilities: | |

| Accounts payable and accrued liabilities: | |

| Shares redeemed | | | 235 | | |

| Management and advisory fees | | | 65 | | |

| Service fees | | | 2 | | |

| Administration fees | | | 3 | | |

| Payable for collateral for securities on loan | | | 11,762 | | |

| Other | | | 69 | | |

| | | | 12,136 | | |

| Net Assets | | $ | 167,758 | | |

| Net Assets Consist of: | |

| Capital stock ($.01 par value) | | $ | 143 | | |

| Additional paid-in capital | | | 160,254 | | |

Undistributed (accumulated) net investment

income (loss) | | | 8,098 | | |

Undistributed (accumulated) net realized

gain (loss) from investment securities | | | (177 | ) | |

Net unrealized appreciation (depreciation)

on investment securities | | | (560 | ) | |

| Net Assets | | $ | 167,758 | | |

| Net Assets by Class: | |

| Initial Class | | $ | 157,167 | | |

| Service Class | | | 10,591 | | |

| Shares Outstanding: | |

| Initial Class | | | 13,485 | | |

| Service Class | | | 865 | | |

| Net Asset Value and Offering Price Per Share: | |

| Initial Class | | $ | 11.66 | | |

| Service Class | | | 12.24 | | |

STATEMENT OF OPERATIONS

For the year ended December 31, 2006

(all amounts in thousands)

| Investment Income: | |

| Interest | | $ | 9,133 | | |

| Income from loaned securities-net | | | 15 | | |

| | | | 9,148 | | |

| Expenses: | |

| Management and advisory fees | | | 806 | | |

| Printing and shareholder reports | | | 74 | | |

| Custody fees | | | 74 | | |

| Administration fees | | | 36 | | |

| Legal fees | | | 3 | | |

| Audit fees | | | 17 | | |

| Trustees fees | | | 13 | | |

| Service fees: | |

| Service Class | | | 24 | | |

| Other | | | 3 | | |

| Total expenses | | | 1,050 | | |

| Net Investment Income (Loss) | | | 8,098 | | |

| Net Realized and Unrealized Gain (Loss) | |

| Realized gain (loss) from investment securities | | | (81 | ) | |

Increase (decrease) in unrealized appreciation

(depreciation) on investment securities | | | (1,348 | ) | |

Net Realized and Unrealized Gain (Loss)

on Investment Securities | | | (1,429 | ) | |

Net Increase (Decrease) in Net Assets Resulting

from Operations | | $ | 6,669 | | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 12

AEGON Bond

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended

(all amounts in thousands)

| | | December 31,

2006 | | December 31,

2005 | |

| Increase (Decrease) in Net Assets From: | |

| Operations: | |

| Net investment income (loss) | | $ | 8,098 | | | $ | 9,257 | | |

Net realized gain (loss) from

investment securities | | | (81 | ) | | | (62 | ) | |

Change in unrealized appreciation

(depreciation) on investment

securities | | | (1,348 | ) | | | (4,438 | ) | |

| | | | 6,669 | | | | 4,757 | | |

| Distributions to Shareholders: | |

| From net investment income: | |

| Initial Class | | | (8,764 | ) | | | (10,416 | ) | |

| Service Class | | | (493 | ) | | | (365 | ) | |

| | | | (9,257 | ) | | | (10,781 | ) | |

| From net realized gains: | |

| Initial Class | | | — | | | | (384 | ) | |

| Service Class | | | — | | | | (14 | ) | |

| | | | — | | | | (398 | ) | |

| Capital Share Transactions: | |

| Proceeds from shares sold: | |

| Initial Class | | | 18,113 | | | | 15,695 | | |

| Service Class | | | 3,798 | | | | 4,928 | | |

| | | | 21,911 | | | | 20,623 | | |

Dividends and distributions

reinvested: | |

| Initial Class | | | 8,764 | | | | 10,800 | | |

| Service Class | | | 493 | | | | 379 | | |

| | | | 9,257 | | | | 11,179 | | |

| Cost of shares redeemed: | |

| Initial Class | | | (53,060 | ) | | | (52,752 | ) | |

| Service Class | | | (1,875 | ) | | | (2,244 | ) | |

| | | | (54,935 | ) | | | (54,996 | ) | |

| | | | (23,767 | ) | | | (23,194 | ) | |

| Net increase (decrease) in net assets | | | (26,355 | ) | | | (29,616 | ) | |

| Net Assets: | |

| Beginning of year | | | 194,113 | | | | 223,729 | | |

| End of year | | $ | 167,758 | | | $ | 194,113 | | |

Undistributed (accumulated)

net investment income (loss) | | $ | 8,098 | | | $ | 9,257 | | |

| | | December 31,

2006 | | December 31,

2005 | |

| Shares issued: | |

| Initial Class | | | 1,546 | | | | 1,292 | | |

| Service Class | | | 308 | | | | 387 | | |

| | | | 1,854 | | | | 1,679 | | |

Shares issued—reinvested from

distributions: | |

| Initial Class | | | 769 | | | | 913 | | |

| Service Class | | | 42 | | | | 30 | | |

| | | | 811 | | | | 943 | | |

| Shares redeemed: | |

| Initial Class | | | (4,534 | ) | | | (4,346 | ) | |

| Service Class | | | (153 | ) | | | (176 | ) | |

| | | | (4,687 | ) | | | (4,522 | ) | |

Net increase (decrease) in shares

outstanding: | |

| Initial Class | | | (2,219 | ) | | | (2,141 | ) | |

| Service Class | | | 197 | | | | 241 | | |

| | | | (2,022 | ) | | | (1,900 | ) | |

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 13

AEGON Bond

FINANCIAL HIGHLIGHTS

| | | | | For a share outstanding throughout each period (a) | |

| | | | | Net Asset | | Investment Operations | | Distributions | | Net Asset | |

| | | For the

Period

Ended (b) | | Value,

Beginning

of Period | | Net

Investment

Income (Loss) | | Net Realized

and Unrealized

Gain (Loss) | | Total

Operations | | From Net

Investment

Income | | From Net

Realized

Gains | | Total

Distributions | | Value,

End

of Period | |

| Initial Class | | 12/31/2006 | | $ | 11.83 | | | $ | 0.53 | | | $ | (0.07 | ) | | $ | 0.46 | | | $ | (0.63 | ) | | $ | – | | | $ | (0.63 | ) | | $ | 11.66 | | |

| | | 12/31/2005 | | | 12.23 | | | | 0.54 | | | | (0.26 | ) | | | 0.28 | | | | (0.66 | ) | | | (0.02 | ) | | | (0.68 | ) | | | 11.83 | | |

| | | 12/31/2004 | | | 12.61 | | | | 0.56 | | | | (0.01 | ) | | | 0.55 | | | | (0.88 | ) | | | (0.05 | ) | | | (0.93 | ) | | | 12.23 | | |

| | | 12/31/2003 | | | 12.68 | | | | 0.62 | | | | (0.10 | ) | | | 0.52 | | | | (0.59 | ) | | | – | | | | (0.59 | ) | | | 12.61 | | |

| | | 12/31/2002 | | | 11.96 | | | | 0.64 | | | | 0.54 | | | | 1.18 | | | | (0.46 | ) | | | – | | | | (0.46 | ) | | | 12.68 | | |

| Service Class | | 12/31/2006 | | | 12.41 | | | | 0.53 | | | | (0.09 | ) | | | 0.44 | | | | (0.61 | ) | | | – | | | | (0.61 | ) | | | 12.24 | | |

| | | 12/31/2005 | | | 12.81 | | | | 0.53 | | | | (0.27 | ) | | | 0.26 | | | | (0.64 | ) | | | (0.02 | ) | | | (0.66 | ) | | | 12.41 | | |

| | | 12/31/2004 | | | 13.16 | | | | 0.55 | | | | – | | | | 0.55 | | | | (0.85 | ) | | | (0.05 | ) | | | (0.90 | ) | | | 12.81 | | |

| | | 12/31/2003 | | | 12.97 | | | | 0.40 | | | | (0.17 | ) | | | 0.23 | | | | (0.04 | ) | | | – | | | | (0.04 | ) | | | 13.16 | | |

| | | | | | | Ratios/Supplemental Data | |

| | | For the

Period

Ended (b) | | Total

Return (c)(e) | | Net Assets,

End of

Period

(000's) | | Ratio of Expenses

to Average

Net Assets (d) | | Net Investment

Income (Loss)

to Average

Net Assets (d) | | Portfolio

Turnover

Rate (e) | |

| Initial Class | | 12/31/2006 | | | 3.92 | % | | $ | 157,167 | | | | 0.57 | % | | | 4.54 | % | | | 5 | % | |

| | | 12/31/2005 | | | 2.30 | | | | 185,820 | | | | 0.59 | | | | 4.42 | | | | 6 | | |

| | | 12/31/2004 | | | 4.53 | | | | 218,258 | | | | 0.56 | | | | 4.52 | | | | 12 | | |

| | | 12/31/2003 | | | 4.28 | | | | 264,668 | | | | 0.52 | | | | 4.88 | | | | 27 | | |

| | | 12/31/2002 | | | 9.97 | | | | 331,734 | | | | 0.53 | | | | 5.21 | | | | 49 | | |

| Service Class | | 12/31/2006 | | | 3.63 | | | | 10,591 | | | | 0.82 | | | | 4.29 | | | | 5 | | |

| | | 12/31/2005 | | | 2.07 | | | | 8,293 | | | | 0.84 | | | | 4.16 | | | | 6 | | |

| | | 12/31/2004 | | | 4.31 | | | | 5,471 | | | | 0.81 | | | | 4.21 | | | | 12 | | |

| | | 12/31/2003 | | | 1.78 | | | | 1,315 | | | | 0.80 | | | | 4.57 | | | | 27 | | |

NOTES TO FINANCIAL HIGHLIGHTS

(a) Per share information is calculated based on average number of shares outstanding.

(b) AEGON Bond (the "Fund") share classes commenced operations as follows:

Initial Class – October 2, 1986

Service Class – May 1, 2003

(c) Total Return reflects all portfolio expenses and includes reinvestment of dividends and capital gains; it does not reflect the charges and deductions under the policies or annuity contracts.

(d) Annualized.

(e) Not annualized.

The notes to the financial statements are an integral part of this report.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 14

AEGON Bond

NOTES TO FINANCIAL STATEMENTS

At December 31, 2006

(all amounts in thousands)

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

AEGON/Transamerica Series Trust ("ATST") is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the "1940 Act"). ATST serves as a funding vehicle for variable life insurance, variable annuity and group annuity products. AEGON Bond (the "Fund") is part of ATST.

In the normal course of business, the Fund enters into contracts that contain a variety of representations that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

This report should be read in conjunction with the current Fund prospectus, which contains more complete information about the Fund.

In preparing the Fund's financial statements in accordance with accounting principles generally accepted in the United States of America ("GAAP"), estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures. The following is a summary of significant accounting policies followed by the Fund.

Multiple class operations, income and expenses: The Fund currently offers two classes of shares, an Initial Class and a Service Class. Income, non-class specific expenses and realized and unrealized gains and losses, are allocated daily to each class, based upon the value of shares outstanding method as permitted under Rule 18f-3 of the 1940 Act. Each class bears its own specific expenses as well as a portion of general, common expenses.

Security valuations: Debt securities are valued based on a price quotation or other equivalent indication of value supplied by an exchange, a pricing service or a major market maker; however, those that mature in sixty days or less are valued at amortized cost, which approximates market.

Investment company securities are valued at the net asset value of the underlying portfolio.

Securities for which quotations are not readily available are valued at fair market value as determined in good faith by the Fund's Administrative Valuation Committee, under the supervision of the Board's Valuation Committee, using guidelines adopted by the Board of Trustees.

Cash: The Fund may leave cash overnight in its cash account with the custodian, Investors Bank & Trust Company ("IBT"). IBT has been contracted on behalf of the Fund to invest the excess cash into a savings account, which at December 31, 2006 was paying an interest rate of 3.70%.

Interest only (IO) and principal only (PO) securities: The Fund may invest in interest only (IO) and principal only (PO) securities. Generally, the market prices of these securities are more volatile and are likely to respond to changes in interest rates to a greater degree than other types of debt securities having similar maturities and credit quality.

Repurchase agreements: The Fund is authorized to enter into repurchase agreements. The Fund, through its custodian, IBT, receives delivery of the underlying securities, the value of which at the time of purchase is required to be an amount equal to at least 100% of the resale price. The Fund will bear the risk of value fluctuations until the security can be sold and may encounter delays and incur costs in liquidating the security. In the event of bankruptcy or insolvency of the seller, delays and costs may be incurred.

Securities lending: The Fund may lend securities to qualified borrowers, with IBT acting as the Fund's lending agent. The Fund earns negotiated lenders' fees. The Fund receives cash and/or securities as collateral against the loaned securities. Cash collateral received is invested in short term, interest bearing securities. The Fund monitors the market value of securities loaned on a daily basis and requires collateral in an amount at least equal to the value of the securities loaned. Income from loaned securities on the Statement of Operations is net of fees, in the amount of $6, earned by IBT for its services.

Security transactions and investment income: Security transactions are recorded on the trade date. Security gains and losses are calculated on the first-in, first-out basis. Interest income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis commencing on the settlement date.

Dividend distributions: Dividends and capital gains distributions are typically declared and reinvested annually and are generally paid and reinvested on the business day following the ex-date.

NOTE 2. RELATED PARTY TRANSACTIONS

ATST serves as a funding vehicle for certain affiliated asset allocation portfolios and certain affiliated separate accounts of Western Reserve Life Assurance Co. of Ohio, Transamerica Life Insurance Company, Transamerica Financial Life Insurance Company, Inc., Peoples Benefit Life Insurance Company and Transamerica Occidental Life Insurance Company.

Transamerica Fund Advisors, Inc. ("TFAI") is the Fund's investment adviser. Transamerica Fund Services, Inc. ("TFS") is the Fund's administrator and transfer agent. AFSG Securities Corp. ("AFSG") is the Fund's distributor. TFAI, TFS and AFSG are affiliates of AEGON NV, a Netherlands corporation.

Certain officers and trustees of the Fund are also officers and/or directors of TFAI, TFS and AFSG.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 15

AEGON Bond

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2006

(all amounts in thousands)

NOTE 2.–(continued)

Investment advisory fee: The Fund pays management fees to TFAI based on average daily net assets ("ANA") at the following breakpoints:

0.45% of the first $750 million of ANA

0.40% of the next $250 million of ANA

0.375% of ANA over $1 billion

TFAI has contractually agreed to waive its advisory fee and will reimburse the Fund to the extent that operating expenses, excluding 12b-1 fees, exceed the following stated annual limit:

0.70% Expense Limit

If total Fund expenses fall below the annual expense limitation agreement agreed to by the adviser within the succeeding three years, the Fund may be required to pay the adviser a portion or all of the waived advisory fees.

There were no amounts recaptured during the year ended December 31, 2006. There are no amounts available for recapture at December 31, 2006.

Distribution and service fees: ATST entered into a Distribution Agreement with AFSG dated January 1, 1997, as amended. The Fund has also adopted a distribution plan ("Distribution Plan") pursuant to Rule 12b-1 under the 1940 Act.

Under the Distribution Plan for the Initial Class shares, AFSG, on behalf of the Fund, is authorized to pay various service providers, as direct payment for expenses incurred in connection with distribution of the Fund's shares, amounts equal to actual expenses associated with distributing the shares.

The Distribution Plan for the Service Class shares requires ATST to pay distribution fees to AFSG as compensation for its activities, not as reimbursement for specific expenses. The fee on the Service Class is paid to the insurance companies for providing services and account maintenance for their policyholders who invest in the variable insurance products which invest in the Service Class shares.

The Fund is authorized under the Distribution Plan to pay fees on each class up to the following limits:

| Initial Class | | | 0.15 | % | |

| Service Class | | | 0.25 | % | |

AFSG has determined that it will not seek payment by the Fund of the distribution expenses incurred with respect to the Initial Class shares before April 30, 2008. Prior to AFSG seeking reimbursement of future expenses, policy and contract owners will be notified in advance. The Fund will pay fees relating to Service Class shares.

Administrative services: The Fund has entered into an agreement with TFS for financial and legal fund administration services. The Fund pays TFS an annual fee of 0.02% of ANA. The Legal fees on the Statement of Operations are for fees paid to external legal counsel.

Deferred compensation plan: Each eligible independent Fund Trustee may elect participation in a non-qualified deferred compensation plan ("the Plan") maintained by Transamerica IDEX Mutual Funds, an affiliate of the Fund. Under the Plan, such Trustees may defer payment of all or a portion of their total fees earned as a Fund Trustee. Each Trustee who is a participant in the Plan may elect that the earnings, losses or gains credited to his or her deferred fee amounts be determined based on a deemed investment in any series of Transamerica IDEX Mutual Funds. The right of a participant to receive a distribution from the Plan of the deferred fees is an unsecured claim against the general assets of all series of Transamerica IDEX Mutual Funds. The pro rata liability to the Fund of all deferred fees in the Plan amounted, as of December 31, 2006, to $8. Amou nts deferred under the Deferred Compensation Plan are unfunded against the general assets of ATST.

Retirement plan: Under a retirement plan (the "Emeritus Plan") available to the Disinterested Trustees, each Disinterested Trustee is deemed to have elected to serve as Trustee Emeritus of ATST upon his or her termination of service, other than removal for cause, is entitled to 50% of the trustee's current retainer for a maximum period of five years determined by his or her years of service as a Trustee.

Such amounts shall be accrued by ATST on a pro rata basis allocable to each ATST fund based on the relative assets of the fund. If retainers increase in the future, past accruals (and credits) will be adjusted upward so that 50% of the Trustee's current retainer is accrued and credited at all times. Upon death, disability or termination of service, other than removal for cause, amounts deferred become payable to an Emeritus Trustee (or his/her beneficiary). Upon the commencement of service as Trustee Emeritus, compensation will be paid on a quarterly basis during the time period that the Trustee Emeritus is allowed to serve as such.

Amounts accrued under the Emeritus Plans are unsecured claims against the general assets of ATST. For the period ended December 31, 2006, the amount related to the Emeritus Plan was $8. As of December 31, 2006, the Fund has not made any payments related to the Emeritus Plan.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 16

AEGON Bond

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2006

(all amounts in thousands)

NOTE 3. INVESTMENT TRANSACTIONS

The cost of securities purchased and proceeds from securities sold (excluding short-term securities) for the year ended December 31, 2006 were as follows:

| Purchases of securities: | |

| Long-Term | | $ | 2,263 | | |

| U.S. Government | | | 5,602 | | |

| Proceeds from maturities and sales of securities: | |

| Long-Term | | | 10,085 | | |

| U.S. Government | | | 16,584 | | |

NOTE 4. FEDERAL INCOME TAX MATTERS

The Fund has not made any provision for federal income or excise taxes due to its policy to distribute all of its taxable income and capital gains to its shareholders and otherwise qualify as a regulated investment company under Subchapter M of the Internal Revenue Code. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatment for items including, but not limited to, capital loss carryforwards and post October loss deferrals.

The capital loss carryforwards are available to offset future realized capital gains through the periods listed:

Capital Loss

Carryforwards | | Available through | |

| $ | 96 | | | December 31, 2013 | |

| | 73 | | | December 31, 2014 | |

The tax character of distributions paid may differ from the character of distributions shown in the Statements of Changes in Net Assets due to short-term gains being treated as ordinary income for tax purposes.

The tax character of distributions paid during 2005 and 2006 was as follows:

| 2005 Distributions paid from: | |

| Ordinary Income | | $ | 10,789 | | |

| Long-term Capital Gain | | | 390 | | |

| 2006 Distributions paid from: | |

| Ordinary Income | | | 9,257 | | |

| Long-term Capital Gain | | | – | | |

The tax basis components of distributable earnings as of December 31, 2006 are as follows:

| Undistributed Ordinary Income | | $ | 8,098 | | |

| Undistributed Long-term Capital Gain | | $ | – | | |

| Post October Capital Loss Deferral | | $ | (8 | ) | |

| Capital Loss Carryforward | | $ | (169 | ) | |

| Net Unrealized Appreciation (Depreciation) | | $ | (560 | ) | |

NOTE 5. REGULATORY PROCEEDINGS

There continues to be significant federal and state regulatory activity relating to financial services companies, particularly mutual fund companies and their investment advisers. As part of an ongoing investigation regarding potential market timing, recordkeeping and trading compliance issues and matters affecting the Fund's investment adviser, TFAI, and certain affiliates and former employees of TFAI, the SEC staff has indicated that it is likely to take some action against TFAI and certain of its affiliates at the conclusion of the investigation. The potential timing and the scope of any such action is difficult to predict. Although the impact of any action brought against TFAI and/or its affiliates is difficult to assess at the present time, the Fund currently believes that the likelihood that any such action will have a material adverse impact on it is remote. It is important to note that the Fund is not aware of any allega tion of wrongdoing against it and its Board at the time this annual report is printed. Although it is not anticipated that these developments will have an adverse impact on the Fund, there can be no assurance at this time. TFAI and its affiliates are actively working with the SEC in regard to this matter; however, the exact resolution cannot be determined at this time. TFAI will take such actions that it deems necessary or appropriate to continue providing management services to the Fund and to bring all matters to an appropriate conclusion.

TFAI and/or its affiliates, and not the Fund, will bear the costs regarding these regulatory matters.

NOTE 6. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In July 2006, the Financial Accounting Standards Board ("FASB") released FASB Interpretation No. 48 "Accounting for Uncertainty in Income Taxes" ("FIN 48"), an interpretation of FASB Statement No. 109. FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the accounting and disclosure of tax positions taken or expected to be taken in the course of preparing the Fund's tax returns to determine whether the tax positions are "more-likely-than-not" of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is effective during the first required financial reporting period for fiscal years beginning after December 15, 2006. Management is evaluating the anticipated impact, if any, that FIN 48

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 17

AEGON Bond

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2006

(all amounts in thousands)

NOTE 6.–(continued)

will have on the Fund upon adoption, which, pursuant to a delay granted by the U.S. Securities and Exchange Commission, is expected to be on the last business day of the Fund's semi-annual period, June 29, 2007.

In September 2006, FASB issued its new Standard No. 157, "Fair Value Measurements" ("FAS 157"). FAS 157 is designed to unify guidance for the measurement of fair value of all types of assets, including financial instruments, and certain liabilities, throughout a number of accounting standards. FAS 157 also establishes a hierarchy for measuring fair value in generally accepted accounting principles and expands financial statement disclosures about fair value measurements that are relevant to mutual funds. FAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and earlier application is permitted. The Manager is evaluating the application of FAS 157 to the Fund, and is not in a position at this time to estimate the significance of its impact, if any, on the Fund's financial statements.

AEGON/Transamerica Series Trust

Annual Report 2006

AEGON Bond 18

Report of Independent Registered Certified Public Accounting Firm

To the Board of Trustees and Shareholders of

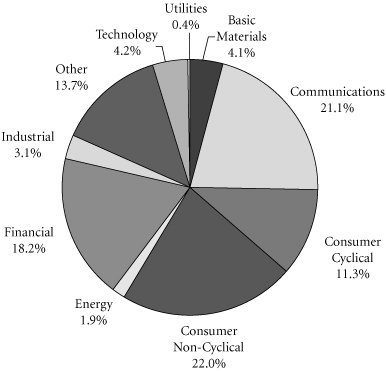

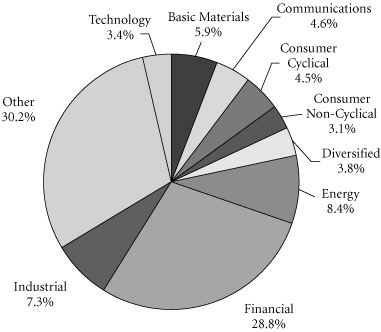

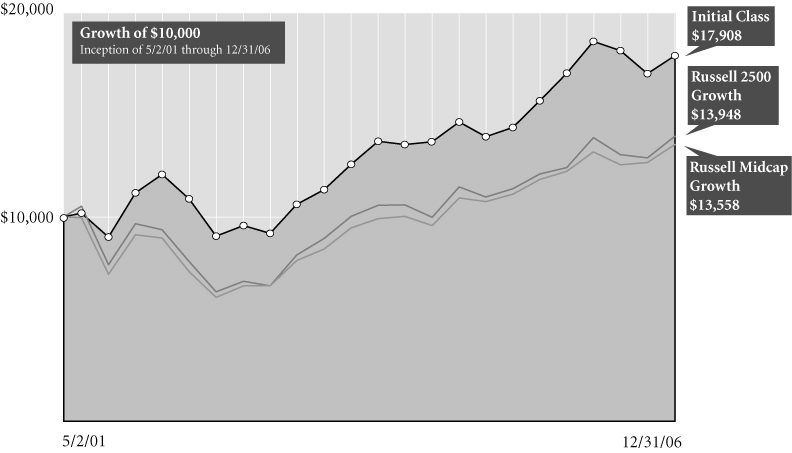

AEGON Bond