UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04409 |

|

Eaton Vance Municipals Trust |

(Exact name of registrant as specified in charter) |

|

The Eaton Vance Building, 255 State Street, Boston, Massachusetts | | 02109 |

(Address of principal executive offices) | | (Zip code) |

|

Maureen A. Gemma The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (617) 482-8260 | |

|

Date of fiscal year end: | July 31 | |

|

Date of reporting period: | January 31, 2008 | |

| | | | | | | |

Item 1. Reports to Stockholders

Semiannual Report January 31, 2008

EATON VANCE

MUNICIPALS

TRUST

Arizona

Colorado

Connecticut

Michigan

Minnesota

New Jersey

Pennsylvania

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS, AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy ("Privacy Policy") with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer's account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer's account (i.e., fund shares) is held in the name of a third-party financial adviser/broker-dealer, it is likely that only such adviser's privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance's Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission (the "SEC") permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called "householding" and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and its underlying Portfolio (if applicable) will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC's website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC's public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds' and Portfolios' Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC's website at www.sec.gov.

Eaton Vance Municipals Funds as of January 31, 2008

FUND EXPENSES

Example: As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2007 – January 31, 2008).

Actual Expenses: The first section of each table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of each table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in each table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Eaton Vance Arizona Municipals Fund

| | | Beginning Account Value

(8/1/07) | | Ending Account Value

(1/31/08) | | Expenses Paid During Period*

(8/1/07 – 1/31/08) | |

| Actual | |

| Class A | | $ | 1,000.00 | | | $ | 1,011.30 | | | $ | 4.55 | | |

| Class B | | $ | 1,000.00 | | | $ | 1,007.70 | | | $ | 8.33 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,007.70 | | | $ | 8.33 | | |

| Hypothetical | |

| (5% return per year before expenses) | |

| Class A | | $ | 1,000.00 | | | $ | 1,020.60 | | | $ | 4.57 | | |

| Class B | | $ | 1,000.00 | | | $ | 1,016.80 | | | $ | 8.36 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,016.80 | | | $ | 8.36 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.90% for Class A shares, 1.65% for Class B shares and 1.65% for Class C shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2007.

11

Eaton Vance Municipals Funds as of January 31, 2008

FUND EXPENSES CONT'D

Eaton Vance Colorado Municipals Fund

| | | Beginning Account Value

(8/1/07) | | Ending Account Value

(1/31/08) | | Expenses Paid During Period

(8/1/07 – 1/31/08) | |

| Actual* | |

| Class A | | $ | 1,000.00 | | | $ | 997.70 | | | $ | 3.72 | | |

| Class B | | $ | 1,000.00 | | | $ | 994.70 | | | $ | 7.47 | | |

| Class C | | $ | 1,000.00 | | | $ | 990.90 | | | $ | 4.48 | | |

* Class C had not commenced operations on August, 1 2007. Actual expenses are equal to the Fund's annualized expense ratio of 0.74% for Class A shares, 1.49% for Class B shares and 1.49% for Class C Shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period) and by 116/366 for Class C (to reflect the period from commencement of operations on October 8, 2007 to January 31, 2008). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2007 (October 5, 2007 for Class C).

Hypothetical**

| (5% return per year before expenses) | |

| Class A | | $ | 1,000.00 | | | $ | 1,021.40 | | | $ | 3.76 | | |

| Class B | | $ | 1,000.00 | | | $ | 1,017.60 | | | $ | 7.56 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,018.00 | | | $ | 7.20 | | |

** Hypothetical expenses are equal to the Fund's annualized expense ratio of 0.74% for Class A shares, 1.49% for Class B shares and 1.49% for Class C shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half-year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2007.

Eaton Vance Connecticut Municipals Fund

| | | Beginning Account Value

(8/1/07) | | Ending Account Value

(1/31/08) | | Expenses Paid During Period*

(8/1/07 – 1/31/08) | |

| Actual | |

| Class A | | $ | 1,000.00 | | | $ | 1,019.20 | | | $ | 5.43 | | |

| Class B | | $ | 1,000.00 | | | $ | 1,015.30 | | | $ | 9.22 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,016.30 | | | $ | 9.22 | | |

| Hypothetical | |

| (5% return per year before expenses) | |

| Class A | | $ | 1,000.00 | | | $ | 1,019.80 | | | $ | 5.43 | | |

| Class B | | $ | 1,000.00 | | | $ | 1,016.00 | | | $ | 9.22 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,016.00 | | | $ | 9.22 | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.07% for Class A shares, 1.82% for Class B shares and 1.82% for Class C shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2007.

12

Eaton Vance Municipals Funds as of January 31, 2008

FUND EXPENSES CONT'D

Eaton Vance Michigan Municipals Fund

| | | Beginning Account Value

(8/1/07) | | Ending Account Value

(1/31/08) | | Expenses Paid During Period*

(8/1/07 – 1/31/08) | |

| Actual | |

| Class A | | $ | 1,000.00 | | | $ | 1,011.50 | | | $ | 4.40 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,008.60 | | | $ | 8.18 | | |

| Hypothetical | |

| (5% return per year before expenses) | |

| Class A | | $ | 1,000.00 | | | $ | 1,020.80 | | | $ | 4.42 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,017.00 | | | $ | 8.21 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.87% for Class A shares and 1.62% for Class C shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2007.

Eaton Vance Minnesota Municipals Fund

| | | Beginning Account Value

(8/1/07) | | Ending Account Value

(1/31/08) | | Expenses Paid During Period*

(8/1/07 – 1/31/08) | |

| Actual | |

| Class A | | $ | 1,000.00 | | | $ | 1,018.70 | | | $ | 4.31 | | |

| Class B | | $ | 1,000.00 | | | $ | 1,014.10 | | | $ | 8.10 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,015.10 | | | $ | 8.10 | | |

| Hypothetical | |

| (5% return per year before expenses) | |

| Class A | | $ | 1,000.00 | | | $ | 1,020.90 | | | $ | 4.32 | | |

| Class B | | $ | 1,000.00 | | | $ | 1,017.10 | | | $ | 8.11 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,017.10 | | | $ | 8.11 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.85% for Class A shares, 1.60% for Class B shares and 1.60% for Class C shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2007.

13

Eaton Vance Municipals Funds as of January 31, 2008

FUND EXPENSES CONT'D

Eaton Vance New Jersey Municipals Fund

| | | Beginning Account Value

(8/1/07) | | Ending Account Value

(1/31/08) | | Expenses Paid During Period*

(8/1/07 – 1/31/08) | |

| Actual | |

| Class A | | $ | 1,000.00 | | | $ | 980.90 | | | $ | 5.28 | | |

| Class B | | $ | 1,000.00 | | | $ | 979.50 | | | $ | 7.86 | | |

| Class C | | $ | 1,000.00 | | | $ | 977.80 | | | $ | 9.00 | | |

| Hypothetical | |

| (5% return per year before expenses) | |

| Class A | | $ | 1,000.00 | | | $ | 1,019.80 | | | $ | 5.38 | | |

| Class B | | $ | 1,000.00 | | | $ | 1,017.20 | | | $ | 8.01 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,016.00 | | | $ | 9.17 | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.06% for Class A shares, 1.58% for Class B shares and 1.81% for Class C shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2007.

Eaton Vance Pennsylvania Municipals Fund

| | | Beginning Account Value

(8/1/07) | | Ending Account Value

(1/31/08) | | Expenses Paid During Period*

(8/1/07 – 1/31/08) | |

| Actual | |

| Class A | | $ | 1,000.00 | | | $ | 992.50 | | | $ | 6.51 | | |

| Class B | | $ | 1,000.00 | | | $ | 988.70 | | | $ | 10.25 | | |

| Class C | | $ | 1,000.00 | | | $ | 988.80 | | | $ | 10.25 | | |

| Hypothetical | |

| (5% return per year before expenses) | |

| Class A | | $ | 1,000.00 | | | $ | 1,018.60 | | | $ | 6.60 | | |

| Class B | | $ | 1,000.00 | | | $ | 1,014.80 | | | $ | 10.38 | | |

| Class C | | $ | 1,000.00 | | | $ | 1,014.80 | | | $ | 10.38 | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.30% for Class A shares, 2.05% for Class B shares and 2.05% for Class C shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2007.

14

Eaton Vance Municipals Funds as of January 31, 2008

TABLE OF CONTENTS

Investment Update | | 2 |

| | |

Morningstar RatingsTM | | 3 |

| | |

Fund Investment Updates | | |

Arizona | | 4 |

Colorado | | 5 |

Connecticut | | 6 |

Michigan | | 7 |

Minnesota | | 8 |

New Jersey | | 9 |

Pennsylvania | | 10 |

| | |

Fund Expenses | | 11 |

| | |

Financial Statements | | 15 |

| | |

Board of Trustees’ Annual Approval of the Investment Advisory Agreements | | 79 |

| | |

Investment Management | | 82 |

1

Eaton Vance Municipals Funds as of January 31, 2008

INVESTMENT UPDATE

The investment objective of each Eaton Vance Municipals Fund (the “Funds”) is to provide current income exempt from regular federal income tax and from particular state or local income or other taxes. The Funds primarily invest in investment-grade municipal obligations but may also invest in lower-rated obligations.

Economic and Market Conditions

Economic growth in the fourth quarter of 2007 measured 0.6%, following the 4.9% growth rate achieved in the third quarter, according to preliminary Commerce Department data reported in January 2008. At January 31, 2008, the housing sector continued to struggle due to market concerns related to subprime mortgages. While the weaker dollar was having a beneficial effect on export-related industries, tourism, and U.S.-based multinational companies, there were signs that consumers were starting to curtail spending by January 31, 2008.

The Federal Reserve (the Fed) lowered its target for the Federal Funds Rate by 0.75% to 3.50% in an unscheduled meeting on January 22, 2008. In its statement, the Fed pointed to a weakening economic outlook, continued deterioration in broader financial market conditions and tighter credit for some businesses and households. They further lowered the Federal Funds Rate to 3.00% in a scheduled meeting on January 31, 2008 noting considerable financial market stress and continued credit tightening. The Fed has now lowered its benchmark Federal Funds Rate by 2.25% (from 5.25%) since September 18, 2007. It has also cut the Discount Rate – the rate charged to banks borrowing directly from the Fed – by 2.75% from 6.25% to 3.50% since August 17, 2007. Management believes these moves were aimed at providing liquidity during this period of increased uncertainty and tighter credit conditions that first surfaced in August 2007.

Management Discussion

The Funds invest primarily in bonds with stated maturities of 10 years or longer, as longer-maturity bonds historically have provided greater tax-exempt income for investors than shorter-maturity bonds.

The Funds underperformed their benchmark, the Lehman Brothers Municipal Bond Index, during the six months ended January 31, 2008.(1) Management believes that much of the underperformance can be attributed to the broader-based credit scare that has shaken the fixed-income markets since August 2007, and led to a flight-to-quality bid in the Treasury market, particularly in shorter-maturity bonds. This move was originally driven by uncertainty surrounding financial companies’ exposure to mortgage-backed collateralized debt obligations (CDOs). More recently, the municipal bond market has been impacted by the downgrade of major municipal bond insurers due to their exposure to mortgage-related CDO debt. As a result of an active management style that focuses on income and longer call protection, the Funds generally hold longer-duration bonds. Accordingly, management believes that investor flight to shorter-maturity uninsured bonds from longer-maturity insured bonds resulted in the Funds’ relative underperformance for the period.

The ratio of yields on current coupon AAA-rated insured bonds to the yield on 30-year Treasury bonds was 105% as of January 31, 2008, with many individual bonds trading higher than 105%.(2) Management believes that this was the result of dislocation in the fixed-income marketplace caused by the subprime contagion fears, insurance companies’ mark-to-market risks and the decentralized nature of the municipal marketplace. Historically, this is a rare occurrence in the municipal bond market and is generally considered a signal that municipal bonds are significantly undervalued compared to Treasuries.

With this backdrop, Eaton Vance continues to manage all of its municipal funds with the same relative value approach that it has traditionally employed – maintaining a long-term perspective when markets exhibit extreme short-term volatility. We believe this approach has provided excellent long-term benefits to our investors over time.

(1) It is not possible to invest directly in an Index or a Lipper Classification. The Index’s total return does not reflect expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

(2) Source: Bloomberg L.P. Yields are a compilation of a representative variety of general obligations and are not necessarily representative of a Fund’s yield.

Past performance is no guarantee of future results.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

The views expressed in this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund. In addition, portfolio information provided in the report may not be representative of a Fund’s current or future investments and may change due to active management.

2

Eaton Vance Municipals Funds as of January 31, 2008

MORNINGSTAR RATINGSTM

As of January 31, 2008

FUND | | OVERALL | | 3-YEAR | | 5-YEAR | | 10-YEAR |

| | | | | | | | |

ARIZONA MUNICIPALS FUND – CLASS A | | *** | | *** | | *** | | *** |

Load waived | | ***** | | ***** | | ***** | | **** |

MUNI SINGLE STATE LONG CATEGORY | | 339 FUNDS | | 339 FUNDS | | 339 FUNDS | | 297 FUNDS |

| | | | | | | | |

COLORADO MUNICIPALS FUND – CLASS A | | ** | | ** | | ** | | ** |

Load waived | | **** | | **** | | **** | | *** |

MUNI SINGLE STATE LONG CATEGORY | | 339 FUNDS | | 339 FUNDS | | 339 FUNDS | | 297 FUNDS |

| | | | | | | | |

CONNECTICUT MUNICIPALS FUND – CLASS A | | *** | | ** | | ** | | *** |

Load waived | | **** | | **** | | **** | | **** |

MUNI SINGLE STATE LONG CATEGORY | | 339 FUNDS | | 339 FUNDS | | 339 FUNDS | | 297 FUNDS |

| | | | | | | | |

MICHIGAN MUNICIPALS FUND – CLASS A | | *** | | ** | | *** | | *** |

Load waived | | **** | | **** | | **** | | **** |

MUNI SINGLE STATE LONG CATEGORY | | 339 FUNDS | | 339 FUNDS | | 339 FUNDS | | 297 FUNDS |

| | | | | | | | |

MINNESOTA MUNICIPALS FUND – CLASS A | | *** | | *** | | *** | | *** |

Load waived | | ***** | | ***** | | ***** | | **** |

MUNI MINNESOTA CATEGORY | | 60 FUNDS | | 60 FUNDS | | 60 FUNDS | | 52 FUNDS |

| | | | | | | | |

NEW JERSEY MUNICIPALS FUND – CLASS A | | *** | | ** | | *** | | *** |

Load waived | | **** | | *** | | **** | | **** |

MUNI NEW JERSEY CATEGORY | | 66 FUNDS | | 66 FUNDS | | 66 FUNDS | | 53 FUNDS |

| | | | | | | | |

PENNSYLVANIA MUNICIPALS FUND – CLASS A | | *** | | *** | | **** | | *** |

Load waived | | ***** | | ***** | | ***** | | **** |

MUNI PENNSYLVANIA CATEGORY | | 85 FUNDS | | 85 FUNDS | | 85 FUNDS | | 78 FUNDS |

Based on risk-adjusted returns. Eaton Vance offers other mutual funds that are not listed here and that do not have similar performance records.

The Overall Morningstar Rating™ for a fund is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-year (if applicable) Morningstar Rating™ metrics.

©2008 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers is responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on how a fund ranks on a Morningstar Risk-Adjusted Return measure against other funds in the same category. This measure takes into account variations in a fund’s monthly performance after adjusting for sales loads (except for load-waived A shares), redemption fees, and the risk-free rate, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars; the next 22.5% receive 4 stars; the next 35% receive 3 stars; the next 22.5% receive 2 stars, and the bottom 10% receive 1 star.

Load-waived A share star ratings do not include any front-end sales load and are intended for those investors who have access to such purchase terms (e.g., plan participants of a defined contribution plan). Not all A share mutual funds for which Morningstar calculates a load-waived A share star rating may actually waive their front-end load. Therefore, Morningstar strongly encourages investors to contact their investment professional to determine whether they are eligible to purchase the A share without paying the front-end load. The Morningstar Rating may differ among share classes of a mutual fund as a result of different sales loads and/or expense structure.

As interest rates rise, the value of fixed-income securities is likely to decrease. Fluctuations in the value of securities may not affect interest income on existing securities, but will be reflected in the Funds’ net asset values. For state municipal funds, a portion of income may be subject to federal, state and local tax; a portion may be subject to federal alternative minimum tax. Please see the Funds’ prospectus for more information. Consult your tax/legal advisor before making any tax-related investment decisions.

For information regarding each Fund’s performance, please refer to pages titled “Performance Information and Portfolio Composition” contained in this report.

3

Eaton Vance Arizona Municipals Fund as of January 31, 2008

PERFORMANCE INFORMATION AND PORTFOLIO COMPOSITION

Performance(1) | | Class A | | Class B | | Class C | |

Share Class Symbol | | ETAZX | | EVAZX | | ECAZX | |

| | | | | | | |

Average Annual Total Returns (at net asset value) | | | | | | | |

Six Months | | 1.13 | % | 0.77 | % | 0.77 | % |

One Year | | 2.36 | | 1.61 | | 1.61 | |

Five Years | | 4.54 | | 3.80 | | N.A. | |

Ten Years | | 4.27 | | 3.51 | | N.A. | |

Life of Fund† | | 4.76 | | 5.25 | | 3.50 | |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | |

Six Months | | -3.71 | % | -4.18 | % | -0.22 | % |

One Year | | -2.50 | | -3.29 | | 0.63 | |

Five Years | | 3.52 | | 3.46 | | N.A. | |

Ten Years | | 3.77 | | 3.51 | | N.A. | |

Life of Fund† | | 4.39 | | 5.25 | | 3.50 | |

† Inception date: Class A: 12/13/93; Class B: 7/25/91; Class C: 12/16/05

Total Annual | | | | | | | |

Operating Expenses(2)* | | Class A | | Class B | | Class C | |

| | | | | | | |

Expense Ratio | | 0.98 | % | 1.73 | % | 1.73 | % |

*From the Fund’s prospectus dated 10/5/07.

Distribution Rates/Yields | | Class A | | Class B | | Class C | |

| | | | | | | |

Distribution Rate(3) | | 4.27 | % | 3.53 | % | 3.53 | % |

Taxable-Equivalent Distribution Rate(3),(4) | | 6.88 | | 5.69 | | 5.69 | |

SEC 30-day Yield(5) | | 3.48 | | 2.90 | | 2.89 | |

Taxable-Equivalent SEC 30-day Yield(4),(5) | | 5.61 | | 4.67 | | 4.66 | |

Index Performance(6)

Lehman Brothers Municipal Bond Index (Average Annual Total Returns) | | | |

Six Months | | 3.71 | % |

One Year | | 4.93 | |

Five Years | | 4.61 | |

Ten Years | | 5.20 | |

Lipper Averages(7)

Lipper Arizona Municipal Debt Funds Classification (Average Annual Total Returns) | | | |

Six Months | | 1.49 | % |

One Year | | 2.39 | |

Five Years | | 3.83 | |

Ten Years | | 4.09 | |

Portfolio Manager: Craig R. Brandon, CFA

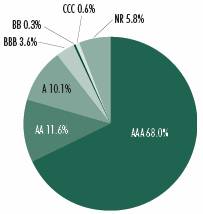

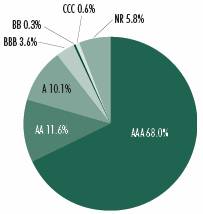

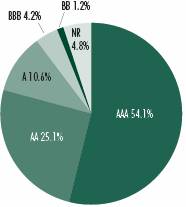

Rating Distribution**(8)

By total investments

** | The rating distribution presented above includes the ratings of securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1I to the Fund’s financial statements. Absent such securities, the Fund’s rating distribution at January 31, 2008, is as follows, and the average rating is AA+: |

AAA | | 66.4% |

AA | | 12.2% |

A | | 10.6% |

BBB | | 3.8% |

BB | | 0.4% |

CCC | | 0.6% |

Not Rated | | 6.0% |

Fund Statistics(9)

· Number of Issues: | | 85 | |

· Average Maturity: | | 19.8 years | |

· Average Effective Maturity: | | 12.5 years | |

· Average Call Protection: | | 8.3 years | |

· Average Dollar Price: | | $ | 99.35 | |

| | | | |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

(1) Average Annual Total Returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC Average Annual Total Returns for Class A reflect the maximum 4.75% sales charge. SEC Average Annual Total Returns for Class B reflect the applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC Average Annual Total Returns for Class C reflect a 1% CDSC for the first year.

(2) Includes interest expense of 0.22% relating to the Fund’s liability with respect to floating rate notes held by third parties in conjunction with inverse floater securities transactions by the Fund. The Fund also records offsetting interest income relating to the municipal obligation underlying such transactions, and as a result net asset value and performance have not been affected by this expense.

(3) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value.

(4) Taxable-equivalent figures assume a maximum 37.95% combined federal and state income tax rate. A lower tax rate would result in lower tax-equivalent figures.

(5) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

(6) It is not possible to invest directly in an Index. The Index’s total return does not reflect the expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. Index performance is available as of month end only.

(7) The Lipper Averages are the average annual total returns, at net asset value, of the funds that are in the same Lipper Classification as the Fund. It is not possible to invest in a Lipper Classification. Lipper Classifications may include insured and uninsured funds, as well as leveraged and unleveraged funds. The Lipper Arizona Municipal Debt Funds Classification contained 33, 33, 28 and 23 funds for the 6-month, 1-year, 5-year and 10-year time periods, respectively. Lipper Averages are available as of month end only.

(8) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(9) Portfolio holdings information excludes securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1I to the Fund’s financial statements.

4

Eaton Vance Colorado Municipals Fund as of January 31, 2008

PERFORMANCE INFORMATION AND PORTFOLIO COMPOSITION

Performance(1) | | Class A | | Class B | | Class C | |

Share Class Symbol | | ETCOX | | EVCLX | | ECCOX | |

| | | | | | | |

Average Annual Total Returns (at net asset value) | | | | | | | |

Six Months | | -0.23 | % | -0.53 | % | N.A. | |

One Year | | -0.43 | | -1.10 | | N.A. | |

Five Years | | 4.16 | | 3.41 | | N.A. | |

Ten Years | | 4.28 | | 3.53 | | N.A. | |

Life of Fund† | | 4.64 | | 4.72 | | -0.91 | % |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | |

Six Months | | -4.95 | % | -5.41 | % | N.A. | |

One Year | | -5.13 | | -5.87 | | N.A. | |

Five Years | | 3.15 | | 3.07 | | N.A. | |

Ten Years | | 3.77 | | 3.53 | | N.A. | |

Life of Fund† | | 4.28 | | 4.72 | | -1.89 | % |

† Inception date: Class A: 12/10/93; Class B: 8/25/92; Class C: 10/8/07

Total Annual | | | | | | | |

Operating Expenses(2)* | | Class A | | Class B | | Class C | |

| | | | | | | |

Expense Ratio | | 0.78 | % | 1.53 | % | 1.53 | % |

* From the Fund’s prospectus dated 10/5/07.

Distribution Rates/Yields | | Class A | | Class B | | Class C | |

| | | | | | | |

Distribution Rate(3) | | 4.31 | % | 3.55 | % | 3.61 | % |

Taxable-Equivalent Distribution Rate(3),(4) | | 6.95 | | 5.73 | | 5.82 | |

SEC 30-day Yield(5) | | 3.87 | | 3.31 | | 3.34 | |

Taxable-Equivalent SEC 30-day Yield(4),(5) | | 6.24 | | 5.34 | | 5.39 | |

Index Performance(6)

Lehman Brothers Municipal Bond Index (Average Annual Total Returns) | | | |

Six Months | | 3.71 | % |

One Year | | 4.93 | |

Five Years | | 4.61 | |

Ten Years | | 5.20 | |

Lipper Averages(7)

Lipper Colorado Municipal Debt Funds Classification (Average Annual Total Returns) | | | |

Six Months | | 2.21 | % |

One Year | | 2.89 | |

Five Years | | 3.93 | |

Ten Years | | 4.19 | |

Portfolio Manager: William H. Ahern, CFA

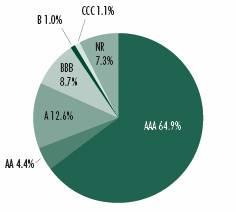

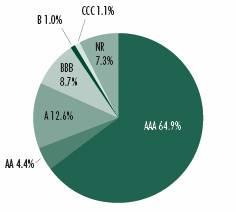

Rating Distribution**(8)

By total investments

** | The rating distribution presented above includes the ratings of securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1I to the Fund’s financial statements. Absent such securities, the Fund’s rating distribution at January 31, 2008, is as follows, and the average rating is AA: |

AAA | | 64.7% |

AA | | 4.4% |

A | | 12.7% |

BBB | | 8.8% |

BB | | 1.0% |

CCC | | 1.2% |

Not Rated | | 7.2% |

Fund Statistics(9)

· Number of Issues: | | 58 | |

· Average Maturity: | | 20.2 years | |

· Average Effective Maturity: | | 13.6 years | |

· Average Call Protection: | | 9.0 years | |

· Average Dollar Price: | | $ | 96.69 | |

| | | | |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

(1) Average Annual Total Returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC Average Annual Total Returns for Class A reflect the maximum 4.75% sales charge. SEC Average Annual Total Returns for Class B reflect the applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC Average Annual Total Returns for Class C reflect a 1% CDSC for the first year.

(2) Includes interest expense of 0.08% relating to the Fund’s liability with respect to floating rate notes held by third parties in conjunction with inverse floater securities transactions by the Fund. The Fund also records offsetting interest income relating to the municipal obligation underlying such transactions, and as a result net asset value and performance have not been affected by this expense.

(3) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value.

(4) Taxable-equivalent figures assume a maximum 38.01% combined federal and state income tax rate. A lower tax rate would result in lower tax-equivalent figures.

(5) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

(6) It is not possible to invest directly in an Index. The Index’s total return does not reflect the expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. Index performance is available as of month end only.

(7) The Lipper Averages are the average annual total returns, at net asset value, of the funds that are in the same Lipper Classification as the Fund. It is not possible to invest in a Lipper Classification. Lipper Classifications may include insured and uninsured funds, as well as leveraged and unleveraged funds. The Lipper Colorado Municipal Debt Funds Classification contained 23, 23, 23 and 19 funds for the 6-month, 1-year, 5-year and 10-year time periods, respectively. Lipper Averages are available as of month end only.

(8) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(9) Portfolio holdings information excludes securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1I to the Fund’s financial statements.

5

Eaton Vance Connecticut Municipals Fund as of January 31, 2008

PERFORMANCE INFORMATION AND PORTFOLIO COMPOSITION

Performance(1) | | Class A | | Class B | | Class C | |

Share Class Symbol | | ETCTX | | EVCTX | | ECCTX | |

| | | | | | | |

Average Annual Total Returns (at net asset value) | | | | | | | |

Six Months | | 1.92 | % | 1.53 | % | 1.63 | % |

One Year | | 2.65 | | 1.87 | | 1.97 | |

Five Years | | 3.95 | | 3.20 | | N.A. | |

Ten Years | | 4.46 | | 3.69 | | N.A. | |

Life of Fund† | | 5.37 | | 4.67 | | 3.00 | |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | |

Six Months | | -2.96 | % | -3.46 | % | 0.63 | % |

One Year | | -2.20 | | -3.05 | | 0.98 | |

Five Years | | 2.93 | | 2.85 | | N.A. | |

Ten Years | | 3.96 | | 3.69 | | N.A. | |

Life of Fund† | | 5.00 | | 4.67 | | 3.00 | |

† Inception date: Class A: 4/19/94; Class B: 5/1/92; Class C: 2/9/06

Total Annual | | | | | | | |

Operating Expenses(2)* | | Class A | | Class B | | Class C | |

| | | | | | | |

Expense Ratio | | 1.05 | % | 1.80 | % | 1.80 | % |

* From the Fund’s prospectus dated 10/5/07.

Distribution Rates/Yields | | Class A | | Class B | | Class C | |

| | | | | | | |

Distribution Rate(3) | | 4.16 | % | 3.39 | % | 3.39 | % |

Taxable-Equivalent Distribution Rate(3),(4) | | 5.85 | | 6.74 | | 5.49 | |

SEC 30-day Yield(5) | | 3.59 | | 3.01 | | 2.98 | |

Taxable-Equivalent SEC 30-day Yield(4),(5) | | 5.81 | | 4.87 | | 4.83 | |

Index Performance(6)

Lehman Brothers Municipal Bond Index (Average Annual Total Returns) | | | |

Six Months | | 3.71 | % |

One Year | | 4.93 | |

Five Years | | 4.61 | |

Ten Years | | 5.20 | |

Lipper Averages(7)

Lipper Connecticut Municipal Debt Funds Classification (Average Annual Total Returns) | | | |

Six Months | | 2.64 | % |

One Year | | 3.30 | |

Five Years | | 3.55 | |

Ten Years | | 4.16 | |

Portfolio Manager: William H. Ahern, CFA

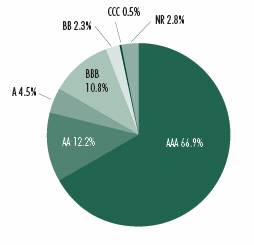

Rating Distribution**(8)

By total investments

** | The rating distribution presented above includes the ratings of securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1I to the Fund’s financial statements. Absent such securities, the Fund’s rating distribution at January 31, 2008, is as follows, and the average rating is AA+: |

AAA | | 64.1% |

AA | | 13.2% |

A | | 4.8% |

BBB | | 11.7% |

BB | | 2.5% |

CCC | | 0.5% |

Not Rated | | 3.2% |

Fund Statistics(9)

· Number of Issues: | | 77 | |

· Average Maturity: | | 18.2 years | |

· Average Effective Maturity: | | 10.2 years | |

· Average Call Protection: | | 8.3 years | |

· Average Dollar Price: | | $ | 106.09 | |

| | | | |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

(1) Average Annual Total Returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC Average Annual Total Returns for Class A reflect the maximum 4.75% sales charge. SEC Average Annual Total Returns for Class B reflect the applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC Average Annual Total Returns for Class C reflect a 1% CDSC for the first year.

(2) Includes interest expense of 0.27% relating to the Fund’s liability with respect to floating rate notes held by third parties in conjunction with inverse floater securities transactions by the Fund. The Fund also records offsetting interest income relating to the municipal obligation underlying such transactions, and as a result net asset value and performance have not been affected by this expense.

(3) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value.

(4) Taxable-equivalent figures assume a maximum 38.25% combined federal and state income tax rate. A lower tax rate would result in lower tax-equivalent figures.

(5) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

(6) It is not possible to invest directly in an Index. The Index’s total return does not reflect the expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. Index performance is available as of month end only.

(7) The Lipper Averages are the average annual total returns, at net asset value, of the funds that are in the same Lipper Classification as the Fund. It is not possible to invest in a Lipper Classification. Lipper Classifications may include insured and uninsured funds, as well as leveraged and unleveraged funds. The Lipper Connecticut Municipal Debt Funds Classification contained 24, 23, 22 and 21 funds for the 6-month, 1-year, 5-year and 10-year time periods, respectively. Lipper Averages are available as of month end only.

(8) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(9) Portfolio holdings information excludes securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1I to the Fund’s financial statements.

6

Eaton Vance Michigan Municipals Fund as of January 31, 2008

PERFORMANCE INFORMATION AND PORTFOLIO COMPOSITION

Performance(1) | | Class A | | Class C | |

Share Class Symbol | | ETMIX | | ECMIX | |

| | | | | |

Average Annual Total Returns (at net asset value) | | | | | |

Six Months | | 1.15 | % | 0.86 | % |

One Year | | 1.33 | | 0.57 | |

Five Years | | 4.11 | | N.A. | |

Ten Years | | 4.37 | | N.A. | |

Life of Fund† | | 4.51 | | 2.99 | |

| | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | |

Six Months | | -3.63 | % | -0.12 | % |

One Year | | -3.46 | | -0.40 | |

Five Years | | 3.10 | | N.A. | |

Ten Years | | 3.87 | | N.A. | |

Life of Fund† | | 4.15 | | 2.99 | |

†Inception date: Class A: 12/7/93; Class C: 5/2/06

Total Annual | | | | | |

Operating Expenses(2)* | | Class A | | Class C | |

| | | | | |

Expense Ratio | | 1.02 | % | 1.77 | % |

*From the Fund’s prospectus dated 10/5/07.

Distribution Rates/Yields | | Class A | | Class C | |

| | | | | |

Distribution Rate(3) | | 4.30 | % | 3.53 | % |

Taxable-Equivalent Distribution rate(3),(4) | | 6.92 | | 5.68 | |

SEC 30-day Yield(5) | | 3.70 | | 3.13 | |

Taxable-Equivalent SEC 30-day Yield(4),(5) | | 5.95 | | 5.03 | |

Index Performance(6)

Lehman Brothers Municipal Bond Index (Average Annual Total Returns) | | | |

Six Months | | 3.71 | % |

One Year | | 4.93 | |

Five Years | | 4.61 | |

Ten Years | | 5.20 | |

Lipper Averages(7)

Lipper Michigan Municipal Debt Funds Classification (Average Annual Total Returns) | | | |

One Year | | 2.14 | % |

One Year | | 2.94 | |

Five Years | | 3.68 | |

Ten Years | | 4.17 | |

Portfolio Manager: William H. Ahern, CFA

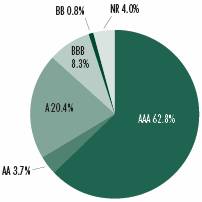

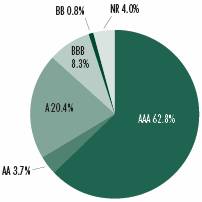

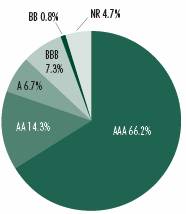

Rating Distribution**(8)

By total investments

** | The rating distribution presented above includes the ratings of securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1I to the Fund’s financial statements. Absent such securities, the Fund’s rating distribution at January 31, 2008, is as follows, and the average rating is AA: |

AAA | | 61.1% |

AA | | 3.9% |

A | | 21.3% |

BBB | | 8.7% |

BB | | 0.8% |

Not Rated | | 4.2% |

Fund Statistics(9)

· Number of Issues: | | 54 | |

· Average Maturity: | | 21.9 years | |

· Average Effective Maturity: | | 13.3 years | |

· Average Call Protection: | | 8.7 years | |

· Average Dollar Price: | | $ | 99.73 | |

| | | | |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

(1) Average Annual Total Returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class C shares. If sales charges were deducted, returns would be lower. SEC Average Annual Total Returns for Class A reflect the maximum 4.75% sales charge. SEC Average Annual Total Returns for Class C reflect a 1% CDSC for the first year.

(2) Includes interest expense of 0.24% relating to the Fund’s liability with respect to floating rate notes held by third parties in conjunction with inverse floater securities transactions by the Fund. The Fund also records offsetting interest income relating to the municipal obligation underlying such transactions, and as a result net asset value and performance have not been affected by this expense.

(3) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value.

(4) Taxable-equivalent figures assume a maximum 37.83% combined federal and state income tax rate. A lower tax rate would result in lower tax-equivalent figures.

(5) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

(6) It is not possible to invest directly in an Index. The Index’s total return does not reflect the expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. Index performance is available as of month end only.

(7) The Lipper Averages are the average annual total returns, at net asset value, of the funds that are in the same Lipper Classification as the Fund. It is not possible to invest in a Lipper Classification. Lipper Classifications may include insured and uninsured funds, as well as leveraged and unleveraged funds. The Lipper Michigan Municipal Debt Funds Classification contained 31, 31, 26 and 23 funds for the 6-month, 1-year, 5-year and 10-year time periods, respectively. Lipper Averages are available as of month end only.

(8) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(9) Portfolio holdings information excludes securities held by special purpose vehicles in which the Fund holds a residual interest.

See Note 1I to the Fund’s financial statements.

7

Eaton Vance Minnesota Municipals Fund as of January 31, 2008

PERFORMANCE INFORMATION AND PORTFOLIO COMPOSITION

Performance(1) | | Class A | | Class B | | Class C | |

Share Class Symbol | | ETMNX | | EVMNX | | ECMNX | |

| | | | | | | |

Average Annual Total Returns (at net asset value) | | | | | | | |

Six Months | | 1.87 | % | 1.41 | % | 1.51 | % |

One Year | | 2.77 | | 2.02 | | 2.02 | |

Five Years | | 4.71 | | 3.96 | | N.A. | |

Ten Years | | 4.31 | | 3.54 | | N.A. | |

Life of Fund† | | 4.52 | | 4.63 | | 3.78 | |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | |

Six Months | | -2.94 | % | -3.57 | % | 0.51 | % |

One Year | | -2.12 | | -2.90 | | 1.04 | |

Five Years | | 3.69 | | 3.62 | | N.A. | |

Ten Years | | 3.81 | | 3.54 | | N.A. | |

Life of Fund† | | 4.16 | | 4.63 | | 3.78 | |

†Inception date: Class A: 12/9/93; Class B: 7/29/91; Class C: 12/21/05

Total Annual | | | | | | | |

Operating Expenses(2)* | | Class A | | Class B | | Class C | |

| | | | | | | |

Expense Ratio | | 0.98 | % | 1.73 | % | 1.73 | % |

*From the Fund’s prospectus dated 10/5/07.

Distribution Rates/Yields | | Class A | | Class B | | Class C | |

| | | | | | | |

Distribution Rate(3) | | 4.27 | % | 3.52 | % | 3.51 | % |

Taxable-Equivalent Distribution Rate(3),(4) | | 7.13 | | 5.88 | | 5.86 | |

SEC 30-day Yield(5) | | 3.48 | | 2.91 | | 2.90 | |

Taxable-Equivalent SEC 30-day Yield(4),(5) | | 5.81 | | 4.86 | | 4.84 | |

Index Performance(6)

Lehman Brothers Municipal Bond Index (Average Annual Total Returns) | | | |

Six Months | | 3.71 | % |

One Year | | 4.93 | |

Five Years | | 4.61 | |

Ten Years | | 5.20 | |

Lipper Averages(7)

Lipper Minnesota Municipal Debt Funds Classification (Average Annual Total Returns) | | | |

Six Months | | 1.96 | % |

One Year | | 2.58 | |

Five Years | | 3.80 | |

Ten Years | | 4.17 | |

Portfolio Manager: Craig R. Brandon, CFA

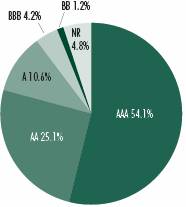

Rating Distribution**(8)

By total Investments

** | The rating distribution presented above includes the ratings of securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1I to the Fund’s financial statements. Absent such securities, the Fund’s rating distribution at January 31, 2008, is as follows, and the average rating is AA+: |

AAA | | 57.4% |

AA | | 21.2% |

A | | 10.9% |

BBB | | 4.4% |

BB | | 1.2% |

Not Rated | | 4.9% |

Fund Statistics(9)

· Number of Issues: | | 72 | |

· Average Maturity: | | 21.1 years | |

· Average Effective Maturity: | | 11.0 years | |

· Average Call Protection: | | 7.3 years | |

· Average Dollar Price: | | $ | 98.55 | |

| | | | |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

(1) Average Annual Total Returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC Average Annual Total Returns for Class A reflect the maximum 4.75% sales charge. SEC Average Annual Total Returns for Class B reflect the applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC Average Annual Total Returns for Class C reflect a 1% CDSC for the first year.

(2) Includes interest expense of 0.20% relating to the Fund’s liability with respect to floating rate notes held by third parties in conjunction with inverse floater securities transactions by the Fund. The Fund also records offsetting interest income relating to the municipal obligation underlying such transactions, and as a result net asset value and performance have not been affected by this expense.

(3) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value.

(4) Taxable-equivalent figures assume a maximum 40.10% combined federal and state income tax rate. A lower tax rate would result in lower tax-equivalent figures.

(5) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

(6) It is not possible to invest directly in an Index. The Index’s total return does not reflect the expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. Index performance is available as of month end only.

(7) The Lipper Averages are the average annual total returns, at net asset value, of the funds that are in the same Lipper Classification as the Fund. It is not possible to invest in a Lipper Classification. Lipper Classifications may include insured and uninsured funds, as well as leveraged and unleveraged funds. The Lipper Minnesota Municipal Debt Funds Classification contained 47, 47, 40 and 33 funds for the 6-month, 1-year, 5-year and 10-year time periods, respectively. Lipper Averages are available as of month end only.

(8) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(9) Portfolio holdings information excludes securities held by special purpose vehicles in which the Fund holds a residual interest.

See Note 1I to the Fund’s financial statements.

8

Eaton Vance New Jersey Municipals Fund as of January 31, 2008

PERFORMANCE INFORMATION AND PORTFOLIO COMPOSITION

Performance(1) | | Class A | | Class B | | Class C | |

Share Class Symbol | | ETNJX | | EVNJX | | ECNJX | |

| | | | | | | |

Average Annual Total Returns (at net asset value) | | | | | | | |

Six Months | | -1.91 | % | -2.05 | % | -2.22 | % |

One Year | | -1.76 | | -2.28 | | -2.45 | |

Five Years | | 4.31 | | 3.58 | | N.A. | |

Ten Years | | 4.49 | | 3.75 | | N.A. | |

Life of Fund† | | 5.40 | | 5.19 | | 2.63 | |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | |

Six Months | | -6.54 | % | -6.84 | % | -3.18 | % |

One Year | | -6.39 | | -6.98 | | -3.39 | |

Five Years | | 3.30 | | 3.24 | | N.A. | |

Ten Years | | 3.99 | | 3.75 | | N.A. | |

Life of Fund† | | 5.03 | | 5.19 | | 2.63 | |

†Inception date: Class A: 4/13/94; Class B: 1/8/91; Class C: 12/14/05

Total Annual | | | | | | | |

Operating Expenses(2)* | | Class A | | Class B | | Class C | |

| | | | | | | |

Expense Ratio | | 1.21 | % | 1.96 | % | 1.96 | % |

*From the Fund’s prospectus dated 10/5/07.

Distribution Rates/Yields | | Class A | | Class B | | Class C | |

| | | | | | | |

Distribution Rate(3) | | 4.59 | % | 4.42 | % | 3.80 | % |

Taxable-Equivalent Distribution Rate(3),(4) | | 7.76 | | 7.47 | | 6.42 | |

SEC 30-day Yield(5) | | 4.13 | | 4.15 | | 3.53 | |

Taxable-Equivalent SEC 30-day Yield(4),(5) | | 6.98 | | 7.01 | | 5.97 | |

Index Performance(6)

Lehman Brothers Municipal Bond Index (Average Annual Total Returns) | | | |

Six Months | | 3.71 | % |

One Year | | 4.93 | |

Five Years | | 4.61 | |

Ten Years | | 5.20 | |

Lipper Averages(7)

Lipper New Jersey Municipal Debt Funds Classification (Average Annual Total Returns) | | | |

Six Months | | 1.94 | % |

One Year | | 2.62 | |

Five Years | | 3.99 | |

Ten Years | | 4.16 | |

Portfolio Manager: Robert B. MacIntosh, CFA

Rating Distribution**(8)

By total investments

** | The rating distribution presented above includes the ratings of securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1I to the Fund’s financial statements. Absent such securities, the Fund’s rating distribution at January 31, 2008, is as follows, and the average rating is AA-: |

AAA | | 43.1% |

AA | | 15.8% |

A | | 17.9% |

BBB | | 13.8% |

BB | | 0.4% |

B | | 1.3% |

Not Rated | | 7.7% |

Fund Statistics(9)

· Number of Issues: | | 107 | |

· Average Maturity: | | 27.3 years | |

· Average Effective Maturity: | | 16.1 years | |

· Average Call Protection: | | 9.8 years | |

· Average Dollar Price: | | $ | 93.06 | |

| | | | |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

(1) Average Annual Total Returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC Average Annual Total Returns for Class A reflect the maximum 4.75% sales charge. SEC Average Annual Total Returns for Class B reflect the applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC Average Annual Total Returns for Class C reflect a 1% CDSC for the first year.

(2) Includes interest expense of 0.42% relating to the Fund’s liability with respect to floating rate notes held by third parties in conjunction with inverse floater securities transactions by the Fund. The Fund also records offsetting interest income relating to the municipal obligation underlying such transactions, and as a result net asset value and performance have not been affected by this expense.

(3) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value.

(4) Taxable-equivalent figures assume a maximum 40.83% combined federal and state income tax rate. A lower tax rate would result in lower tax-equivalent figures.

(5) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

(6) It is not possible to invest directly in an Index. The Index’s total return does not reflect the expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. Index performance is available as of month end only.

(7) The Lipper Averages are the average annual total returns, at net assest value, of the funds that are in the same Lipper Classification as the Fund. It is not possible to invest in a Lipper Classification. Lipper Classifications may include insured and uninsured funds, as well as leveraged and unleveraged funds. The Lipper New Jersey Municipal Debt Funds Classification contained 51, 50, 44 and 37 funds for the 6-month, 1-year, 5-year and 10-year time periods, respectively. Lipper Averages are available as of month end only.

(8) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(9) Portfolio holdings information excludes securities held by special purpose vehicles in which the Fund holds a residual interest.

See Note 1I to the Fund’s financial statements.

9

Eaton Vance Pennsylvania Municipals Fund as of January 31, 2008

PERFORMANCE INFORMATION AND PORTFOLIO COMPOSITION

Performance(1) | | Class A | | Class B | | Class C | |

Share Class Symbol | | EXPNX | | ELPNX | | EZPNX | |

| | | | | | | |

Average Annual Total Returns (at net asset value) | | | | | | | |

Six Months | | -0.75 | % | -1.13 | % | -1.12 | % |

One Year | | -0.28 | | -1.07 | | -1.07 | |

Five Years | | 4.59 | | 3.84 | | N.A. | |

Ten Years | | 4.29 | | 3.51 | | N.A. | |

Life of Fund† | | 5.23 | | 5.02 | | 2.55 | |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | |

Six Months | | -5.49 | % | -5.98 | % | -2.09 | % |

One Year | | -5.06 | | -5.85 | | -2.02 | |

Five Years | | 3.58 | | 3.50 | | N.A. | |

Ten Years | | 3.78 | | 3.51 | | N.A. | |

Life of Fund† | | 4.86 | | 5.02 | | 2.55 | |

†Inception date: Class A: 6/1/94; Class B: 1/8/91; Class C: 1/13/06

Total Annual | | | | | | | |

Operating Expenses(2)* | | Class A | | Class B | | Class C | |

| | | | | | | |

Expense Ratio | | 1.34 | % | 2.09 | % | 2.09 | % |

*From the Fund’s prospectus dated 10/5/07.

Distribution Rates/Yields | | Class A | | Class B | | Class C | |

| | | | | | | |

Distribution Rate(3) | | 4.51 | % | 3.75 | % | 3.75 | % |

Taxable-Equivalent Distribution Rate(3),(4) | | 7.16 | | 5.95 | | 5.95 | |

SEC 30-day Yield(5) | | 3.80 | | 3.24 | | 3.24 | |

Taxable-Equivalent SEC 30-day Yield(4),(5) | | 6.03 | | 5.14 | | 5.14 | |

Index Performance(6)

Lehman Brothers Municipal Bond Index (Average Annual Total Returns) | | | |

Six Months | | 3.71 | % |

One Year | | 4.93 | |

Five Years | | 4.61 | |

Ten Years | | 5.20 | |

Lipper Averages(7)

Lipper Pennsylvania Municipal Debt Funds Classification (Average Annual Total Returns) | | | |

Six Months | | 1.84 | % |

One Year | | 2.54 | |

Five Years | | 3.87 | |

Ten Years | | 4.10 | |

Portfolio Manager: Adam A. Weigold, CFA

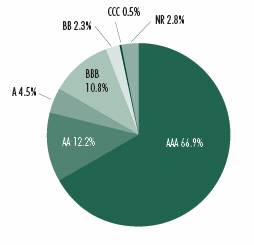

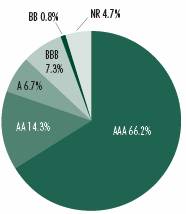

Rating Distribution**(8)

By total Investments

** | The rating distribution presented above includes the ratings of securities held by special purpose vehicles in which the Fund holds a residual interest. See Note 1I to the Fund’s financial statements. Absent such securities, the Fund’s rating distribution at January 31, 2008, is as follows, and the average rating is AA: |

AAA | | 60.7% |

AA | | 16.1% |

A | | 7.6% |

BBB | | 8.3% |

BB | | 0.8% |

Not Rated | | 6.5% |

Fund Statistics(9)

· Number of Issues: | | 120 | |

· Average Maturity: | | 22.8 years | |

· Average Effective Maturity: | | 14.4 years | |

· Average Call Protection: | | 8.8 years | |

· Average Dollar Price: | | $ | 98.10 | |

| | | | |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

(1) Average Annual Total Returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC Average Annual Total Returns for Class A reflect the maximum 4.75% sales charge. SEC Average Annual Total Returns for Class B reflect the applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC Average Annual Total Returns for Class C reflect a 1% CDSC for the first year.

(2) Includes interest expense of 0.54% relating to the Fund’s liability with respect to floating rate notes held by third parties in conjunction with inverse floater securities transactions by the Fund. The Fund also records offsetting interest income relating to the municipal obligation underlying such transactions, and as a result net asset value and performance have not been affected by this expense.

(3) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value.

(4) Taxable-equivalent figures assume a maximum 37.00% combined federal and state income tax rate. A lower tax rate would result in lower tax-equivalent figures.

(5) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

(6) It is not possible to invest directly in an Index. The Index’s total return does not reflect the expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. Index performance is available as of month end only.

(7) The Lipper Averages are the average annual total returns, at net asset value, of the funds that are in the same Lipper Classification as the Fund. It is not possible to invest in a Lipper Classification. Lipper Classifications may include insured and uninsured funds, as well as leveraged and unleveraged funds. The Lipper Pennsylvania Municipal Debt Funds Classification contained 57, 57, 51 and 48 funds for the 6-month, 1-year, 5-year and 10-year time periods, respectively. Lipper Averages are available as of month end only.

(8) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(9) Portfolio holdings information excludes securities held by special purpose vehicles in which the Fund holds a residual interest.

See Note 1I to the Fund’s financial statements.

10

Eaton Vance Arizona Municipals Fund as of January 31, 2008

PORTFOLIO OF INVESTMENTS (Unaudited)

Tax-Exempt Investments — 102.2%

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Education — 2.8% | | | |

| $ | 1,500 | | | Arizona Board of Regents, University System Revenue,

5.00%, 6/1/33 | | $ | 1,561,980 | | |

| | 1,500 | | | Glendale Industrial Development Authority,

(Midwestern University), 5.00%, 5/15/25 | | | 1,570,245 | | |

| | | $ | 3,132,225 | | |

| Electric Utilities — 6.4% | | | |

| $ | 250 | | | Puerto Rico Electric Power Authority, DRIVERS,

Variable Rate, 10.08%, 7/1/25(1)(2) | | $ | 257,545 | | |

| | 750 | | | Puerto Rico Electric Power Authority, DRIVERS,

Variable Rate, 10.08%, 7/1/37(1)(2) | | | 737,895 | | |

| | 4,000 | | | Salt River Agriculture Improvements and Power District,

4.75%, 1/1/35 | | | 4,061,840 | | |

| | 1,000 | | | Salt River Agriculture Improvements and Power District,

5.00%, 1/1/31 | | | 1,034,140 | | |

| | 1,000 | | | Salt River Agriculture Improvements and Power District,

5.00%, 1/1/37 | | | 1,040,050 | | |

| | | $ | 7,131,470 | | |

| Escrowed / Prerefunded — 13.2% | | | |

| $ | 650 | | | Arizona Health Facilities Authority, (John C. Lincoln

Health Network), Prerefunded to 12/1/12,

5.75%, 12/1/32 | | $ | 741,994 | | |

| | 500 | | | Glendale Industrial Development Authority,

(Midwestern University), Prerefunded to 5/15/11,

5.75%, 5/15/21 | | | 555,335 | | |

| | 1,250 | | | Maricopa County Industrial Development Authority,

(Place Five and The Greenery), Escrowed to Maturity,

8.625%, 1/1/27 | | | 1,251,450 | | |

| | 7,500 | | | Maricopa County, Single Family, Escrowed to Maturity,

0.00%, 2/1/16 | | | 5,654,925 | | |

| | 6,500 | | | Phoenix Industrial Development Authority, Single Family,

Escrowed to Maturity, 0.00%, 12/1/14 | | | 5,225,350 | | |

| | 1,000 | | | Scottsdale Industrial Development Authority,

(Scottsdale Healthcare), Prerefunded to 12/01/11,

5.70%, 12/1/21 | | | 1,122,400 | | |

| | | $ | 14,551,454 | | |

| General Obligations — 3.6% | | | |

| $ | 1,125 | | | Puerto Rico, 0.00%, 7/1/18 | | $ | 731,149 | | |

| | 1,485 | | | Tempe, 3.75%, 7/1/24 | | | 1,419,021 | | |

| | 1,600 | | | Tucson, 5.375%, 7/1/21 | | | 1,847,392 | | |

| | | $ | 3,997,562 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Health Care-Miscellaneous — 0.8% | | | |

| $ | 500 | | | Yavapai County Industrial Development Authority,

Health Care Institution Revenue Bonds, (West Yavapai

Guidance Clinic Project), 6.25%, 12/1/36 | | $ | 453,735 | | |

| | 500 | | | Yavapai County Industrial Development Authority,

Health Care Institution Revenue Bonds, (West Yavapai

Guidance Clinic Project), 6.625%, 8/15/24 | | | 484,865 | | |

| | | $ | 938,600 | | |

| Hospital — 8.2% | | | |

| $ | 1,275 | | | Glendale Industrial Development Authority,

(John C. Lincoln Health Network), 5.00%, 12/1/28 | | $ | 1,229,342 | | |

| | 750 | | | Glendale Industrial Development Authority,

(John C. Lincoln Health Network), 5.00%, 12/1/32 | | | 706,740 | | |

| | 500 | | | Glendale Industrial Development Authority,

(John C. Lincoln Health Network), 5.00%, 12/1/37 | | | 465,935 | | |

| | 1,750 | | | Maricopa County Industrial Development Authority,

(Catholic Healthcare), 5.25%, 7/1/32 | | | 1,777,212 | | |

| | 1,350 | | | Maricopa County Industrial Development Authority,

(Catholic Healthcare), 5.50%, 7/1/26 | | | 1,405,377 | | |

| | 2,500 | | | Maricopa County Industrial Development Authority,

(Mayo Clinic), 5.00%, 11/15/36 | | | 2,514,150 | | |

| | 1,000 | | | Winslow Industrial Development Authority,

(Winslow Memorial Hospital), 5.50%, 6/1/22 | | | 923,340 | | |

| | | $ | 9,022,096 | | |

| Industrial Development Revenue — 0.6% | | | |

| $ | 650 | | | Phoenix Industrial Development Authority,

(America West Airlines, Inc.), (AMT), 6.25%, 6/1/19 | | $ | 624,715 | | |

| | | $ | 624,715 | | |

| Insured-Education — 2.6% | | | |

| $ | 1,000 | | | North Campus Facilities LLC, (Northern Arizona University),

(AMBAC), 5.00%, 6/1/25 | | $ | 1,050,320 | | |

| | 1,800 | | | Northern Arizona University, (Research Projects), (AMBAC),

5.00%, 9/1/30 | | | 1,834,794 | | |

| | | $ | 2,885,114 | | |

| Insured-Electric Utilities — 4.2% | | | |

| $ | 750 | | | Maricopa County Pollution Control Corp.,

(El Paso Electric Co.), (FGIC), 4.80%, 8/1/40 | | $ | 720,675 | | |

| | 1,000 | | | Mesa Utility System, (FGIC), 5.00%, 7/1/23 | | | 1,091,870 | | |

| | 1,120 | | | Mesa Utility System, (FSA), 4.25%, 7/1/29 | | | 1,092,112 | | |

| | 380 | | | Pima County Industrial Development Authority,

(Tucson Electric Power Co.), (FSA), 7.25%, 7/15/10 | | | 392,354 | | |

See notes to financial statements

15

Eaton Vance Arizona Municipals Fund as of January 31, 2008

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Insured-Electric Utilities (continued) | | | |

| $ | 1,200 | | | Puerto Rico Electric Power Authority, (MBIA),

5.50%, 7/1/16(3) | | $ | 1,349,876 | | |

| | | $ | 4,646,887 | | |

| Insured-Escrowed / Prerefunded — 7.0% | | | |

| $ | 1,000 | | | Maricopa County Industrial Development Authority,

(Samaritan Health Services), (MBIA), Escrowed to Maturity,

7.00%, 12/1/16 | | $ | 1,240,780 | | |

| | 1,000 | | | Mesa Industrial Development Authority, (Discovery Health

System), (MBIA), Prerefunded to 1/1/10,

5.625%, 1/1/29 | | | 1,068,130 | | |

| | 1,000 | | | Pima County Industrial Development Authority, (Carondolet

Health Care Corp.), (MBIA), Escrowed to Maturity,

5.25%, 7/1/11 | | | 1,090,010 | | |

| | 2,000 | | | Puerto Rico Electric Power Authority, (FSA),

Prerefunded to 7/1/10, 5.25%, 7/1/29(3) | | | 2,157,845 | | |

| | 500 | | | Puerto Rico Electric Power Authority, (MBIA),

Prerefunded to 7/1/13, 5.00%, 7/1/32 | | | 559,315 | | |

| | 500 | | | Tucson Street and Highway Revenue, (FGIC),

Prerefunded to 7/1/10, 5.00%, 7/1/18 | | | 531,365 | | |

| | 1,000 | | | Yuma Industrial Development Authority, (Yuma Regional

Medical Center), (FSA), Prerefunded to 8/1/11,

5.00%, 8/1/31 | | | 1,093,440 | | |

| | | $ | 7,740,885 | | |

| Insured-General Obligations — 9.6% | | | |

| $ | 400 | | | Flagstaff, (AMBAC), 3.25%, 7/1/23 | | $ | 350,736 | | |

| | 1,300 | | | Goodyear, (MBIA), 3.00%, 7/1/26 | | | 1,055,444 | | |

| | 2,920 | | | Maricopa County Elementry School District No. 3,

(FSA), 5.00%, 7/1/25 | | | 3,250,544 | | |

| | 1,425 | | | Maricopa County Unified High School District No. 2, (MBIA),

5.00%, 7/1/20 | | | 1,532,673 | | |

| | 1,200 | | | Maricopa County Unified School District No. 11, (MBIA),

5.00%, 7/1/25 | | | 1,266,996 | | |

| | 2,350 | | | Pinal County Unified School District No. 43, Apache Junction,

(FSA), 5.00%, 7/1/24 | | | 2,605,280 | | |

| | 500 | | | Puerto Rico, (FSA), Variable Rate, 8.682%, 7/1/27(1)(2) | | | 612,130 | | |

| | | $ | 10,673,803 | | |

| Insured-Hospital — 3.9% | | | |

| $ | 1,195 | | | Arizona Health Facilities Authority, (Arizona Healthcare

Systems), (FGIC), 5.50%, 6/1/15 | | $ | 1,341,937 | | |

| | 1,000 | | | Arizona Health Facilities Authority, (Northern Arizona

Healthcare System), (AMBAC), 4.75%, 10/1/30 | | | 961,670 | | |

| | 2,000 | | | Maricopa County Industrial Development Authority, (Mayo

Clinic Hospital), (AMBAC), 5.25%, 11/15/37(4) | | | 2,028,420 | | |

| | | $ | 4,332,027 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Insured-Housing — 0.9% | | | |

| $ | 1,000 | | | Phoenix Industrial Development Authority,

Student Housing Revenue, (Downtown Phoenix Student,

LLC), (AMBAC), 4.50%, 7/1/42 | | $ | 961,890 | | |

| | | $ | 961,890 | | |

Insured-Lease Revenue / Certificates of

Participation — 3.2% | | | |

| $ | 1,000 | | | Arizona State University, (Research Infrastructure Projects),

(AMBAC), 5.00%, 9/1/30 | | $ | 1,019,330 | | |

| | 550 | | | Marana Municipal Facilities, (Municipal Property Corp.),

(AMBAC), 5.00%, 7/1/28 | | | 564,267 | | |

| | 500 | | | Nogales Municipal Development Authority, Inc., (MBIA),