0000778365eatonvance:EATONVANCEIndexBloombergMarylandMunicipalBondIndex19126AdditionalIndexMember2018-07-310000778365eatonvance:EATONVANCEIndexBloombergMissouriMunicipalBondIndex19128AdditionalIndexMember2023-01-310000778365eatonvance:EATONVANCEIndexBloombergMunicipalBondIndex19214BroadBasedIndexMember2017-01-310000778365eatonvance:EATONVANCEIndexBloombergMunicipalBondIndex19218BroadBasedIndexMember2023-01-310000778365eatonvance:EATONVANCEIndexBloombergMunicipalBondIndex19339BroadBasedIndexMember2017-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04409

Eaton Vance Municipals Trust

(Exact Name of Registrant as Specified in Charter)

One Post Office Square, Boston, Massachusetts 02109

(Address of Principal Executive Offices)

Deidre E. Walsh

One Post Office Square, Boston, Massachusetts 02109

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

August 31

Date of Fiscal Year End

August 31, 2024

Date of Reporting Period

Item 1. Reports to Stockholders

(a)

Eaton Vance Georgia Municipal Income Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Georgia Municipal Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $73 | 0.71% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↓ Security selections and an underweight position in bonds with 22+ years remaining to maturity detracted from Index-relative returns as longer-maturity bonds generally outperformed shorter-maturity bonds during the period

↓ Security selections and an underweight position in the transportation sector, which outperformed the Index, also weighed on Index-relative returns

↓ An overweight position in AA-rated bonds detracted from relative returns as AA-rated bonds generally underperformed lower-rated bonds during the period

↑ An overweight position in the health care sector, which outperformed the Index during the period, contributed to Index-relative returns

↑ An overweight position in 4% coupon bonds, which typically have longer durations than higher-coupon bonds, contributed to Index-relative returns as interest rates generally declined during the period

↑ An out-of-Index allocation to nonrated bonds helped Index-relative returns as lower-rated bonds generally outperformed higher-rated bonds

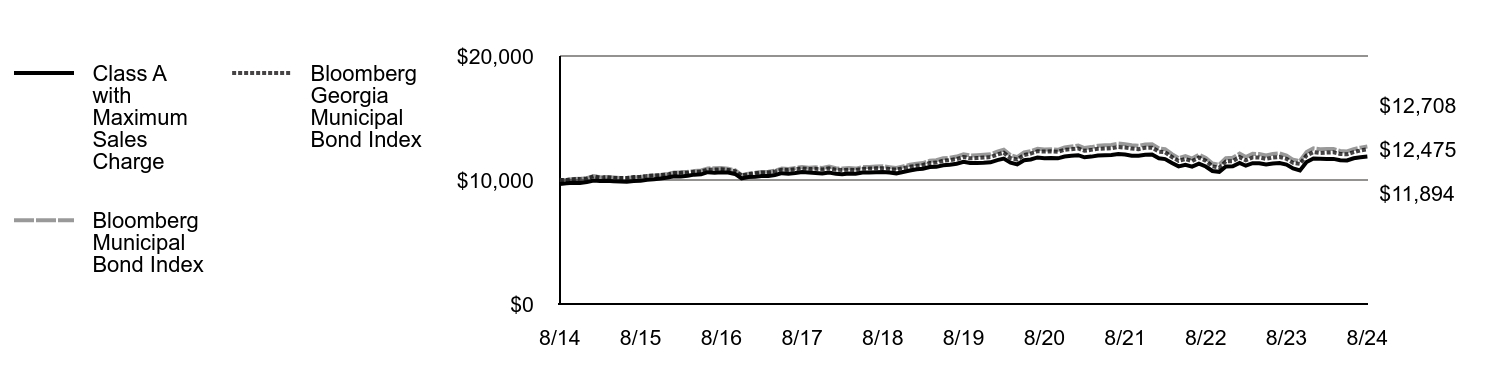

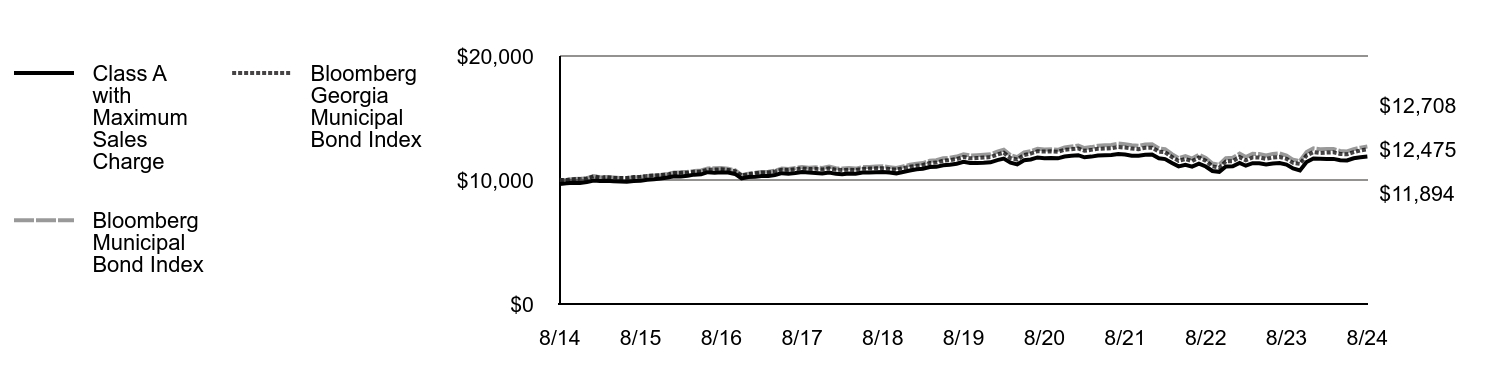

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | Bloomberg Municipal Bond Index | Bloomberg Georgia Municipal Bond Index |

|---|

| 8/14 | $9,675 | $10,000 | $10,000 |

| 9/14 | $9,729 | $10,010 | $10,002 |

| 10/14 | $9,782 | $10,079 | $10,065 |

| 11/14 | $9,756 | $10,096 | $10,082 |

| 12/14 | $9,832 | $10,147 | $10,128 |

| 1/15 | $9,964 | $10,327 | $10,294 |

| 2/15 | $9,914 | $10,220 | $10,196 |

| 3/15 | $9,931 | $10,250 | $10,230 |

| 4/15 | $9,891 | $10,196 | $10,181 |

| 5/15 | $9,885 | $10,168 | $10,161 |

| 6/15 | $9,854 | $10,159 | $10,158 |

| 7/15 | $9,916 | $10,232 | $10,233 |

| 8/15 | $9,942 | $10,252 | $10,260 |

| 9/15 | $10,027 | $10,327 | $10,330 |

| 10/15 | $10,053 | $10,368 | $10,360 |

| 11/15 | $10,115 | $10,409 | $10,392 |

| 12/15 | $10,200 | $10,482 | $10,447 |

| 1/16 | $10,309 | $10,607 | $10,562 |

| 2/16 | $10,286 | $10,624 | $10,579 |

| 3/16 | $10,347 | $10,658 | $10,602 |

| 4/16 | $10,433 | $10,736 | $10,669 |

| 5/16 | $10,459 | $10,765 | $10,685 |

| 6/16 | $10,628 | $10,936 | $10,835 |

| 7/16 | $10,594 | $10,943 | $10,845 |

| 8/16 | $10,632 | $10,958 | $10,865 |

| 9/16 | $10,598 | $10,903 | $10,811 |

| 10/16 | $10,490 | $10,789 | $10,722 |

| 11/16 | $10,130 | $10,386 | $10,364 |

| 12/16 | $10,240 | $10,508 | $10,474 |

| 1/17 | $10,252 | $10,577 | $10,538 |

| 2/17 | $10,314 | $10,651 | $10,603 |

| 3/17 | $10,327 | $10,674 | $10,616 |

| 4/17 | $10,401 | $10,751 | $10,683 |

| 5/17 | $10,549 | $10,922 | $10,835 |

| 6/17 | $10,514 | $10,883 | $10,797 |

| 7/17 | $10,563 | $10,971 | $10,868 |

| 8/17 | $10,652 | $11,054 | $10,939 |

| 9/17 | $10,604 | $10,998 | $10,879 |

| 10/17 | $10,568 | $11,025 | $10,903 |

| 11/17 | $10,520 | $10,966 | $10,844 |

| 12/17 | $10,608 | $11,081 | $10,940 |

| 1/18 | $10,496 | $10,950 | $10,825 |

| 2/18 | $10,471 | $10,918 | $10,807 |

| 3/18 | $10,521 | $10,958 | $10,833 |

| 4/18 | $10,497 | $10,919 | $10,798 |

| 5/18 | $10,599 | $11,044 | $10,904 |

| 6/18 | $10,601 | $11,053 | $10,920 |

| 7/18 | $10,626 | $11,080 | $10,939 |

| 8/18 | $10,650 | $11,108 | $10,957 |

| 9/18 | $10,600 | $11,037 | $10,891 |

| 10/18 | $10,536 | $10,969 | $10,836 |

| 11/18 | $10,651 | $11,090 | $10,955 |

| 12/18 | $10,766 | $11,223 | $11,072 |

| 1/19 | $10,869 | $11,308 | $11,154 |

| 2/19 | $10,907 | $11,368 | $11,209 |

| 3/19 | $11,048 | $11,548 | $11,363 |

| 4/19 | $11,059 | $11,591 | $11,402 |

| 5/19 | $11,186 | $11,751 | $11,554 |

| 6/19 | $11,234 | $11,794 | $11,602 |

| 7/19 | $11,309 | $11,889 | $11,689 |

| 8/19 | $11,461 | $12,077 | $11,859 |

| 9/19 | $11,367 | $11,980 | $11,747 |

| 10/19 | $11,377 | $12,002 | $11,774 |

| 11/19 | $11,387 | $12,032 | $11,806 |

| 12/19 | $11,422 | $12,068 | $11,845 |

| 1/20 | $11,602 | $12,285 | $12,049 |

| 2/20 | $11,729 | $12,444 | $12,206 |

| 3/20 | $11,394 | $11,992 | $11,763 |

| 4/20 | $11,256 | $11,842 | $11,651 |

| 5/20 | $11,595 | $12,219 | $12,014 |

| 6/20 | $11,656 | $12,319 | $12,134 |

| 7/20 | $11,822 | $12,527 | $12,322 |

| 8/20 | $11,762 | $12,468 | $12,290 |

| 9/20 | $11,781 | $12,470 | $12,309 |

| 10/20 | $11,746 | $12,433 | $12,280 |

| 11/20 | $11,899 | $12,621 | $12,439 |

| 12/20 | $11,957 | $12,697 | $12,483 |

| 1/21 | $12,002 | $12,778 | $12,545 |

| 2/21 | $11,830 | $12,575 | $12,356 |

| 3/21 | $11,887 | $12,653 | $12,430 |

| 4/21 | $11,972 | $12,759 | $12,513 |

| 5/21 | $12,001 | $12,797 | $12,535 |

| 6/21 | $12,016 | $12,832 | $12,557 |

| 7/21 | $12,098 | $12,939 | $12,655 |

| 8/21 | $12,059 | $12,891 | $12,615 |

| 9/21 | $11,965 | $12,798 | $12,532 |

| 10/21 | $11,952 | $12,761 | $12,487 |

| 11/21 | $12,035 | $12,869 | $12,594 |

| 12/21 | $12,050 | $12,890 | $12,608 |

| 1/22 | $11,751 | $12,537 | $12,285 |

| 2/22 | $11,686 | $12,492 | $12,243 |

| 3/22 | $11,372 | $12,087 | $11,852 |

| 4/22 | $11,101 | $11,753 | $11,549 |

| 5/22 | $11,228 | $11,928 | $11,695 |

| 6/22 | $11,081 | $11,732 | $11,526 |

| 7/22 | $11,320 | $12,042 | $11,809 |

| 8/22 | $11,090 | $11,778 | $11,553 |

| 9/22 | $10,724 | $11,326 | $11,103 |

| 10/22 | $10,661 | $11,232 | $10,995 |

| 11/22 | $11,086 | $11,757 | $11,501 |

| 12/22 | $11,107 | $11,791 | $11,516 |

| 1/23 | $11,380 | $12,130 | $11,845 |

| 2/23 | $11,153 | $11,856 | $11,582 |

| 3/23 | $11,359 | $12,119 | $11,817 |

| 4/23 | $11,356 | $12,091 | $11,818 |

| 5/23 | $11,254 | $11,986 | $11,704 |

| 6/23 | $11,336 | $12,106 | $11,812 |

| 7/23 | $11,362 | $12,154 | $11,856 |

| 8/23 | $11,246 | $11,979 | $11,711 |

| 9/23 | $10,933 | $11,628 | $11,378 |

| 10/23 | $10,776 | $11,529 | $11,298 |

| 11/23 | $11,446 | $12,261 | $11,981 |

| 12/23 | $11,731 | $12,546 | $12,255 |

| 1/24 | $11,716 | $12,482 | $12,184 |

| 2/24 | $11,702 | $12,498 | $12,209 |

| 3/24 | $11,702 | $12,497 | $12,231 |

| 4/24 | $11,588 | $12,343 | $12,099 |

| 5/24 | $11,574 | $12,307 | $12,073 |

| 6/24 | $11,748 | $12,495 | $12,246 |

| 7/24 | $11,836 | $12,609 | $12,385 |

| 8/24 | $11,894 | $12,708 | $12,475 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A | 5.77% | 0.74% | 2.09% |

| Class A with 3.25% Maximum Sales Charge | 2.28% | 0.09% | 1.75% |

| Bloomberg Municipal Bond Index | 6.09% | 1.02% | 2.42% |

| Bloomberg Georgia Municipal Bond Index | 6.52% | 1.02% | 2.23% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $122,460,706 |

| # of Portfolio Holdings | 96 |

| Portfolio Turnover Rate | 44% |

| Total Advisory Fees Paid | $390,911 |

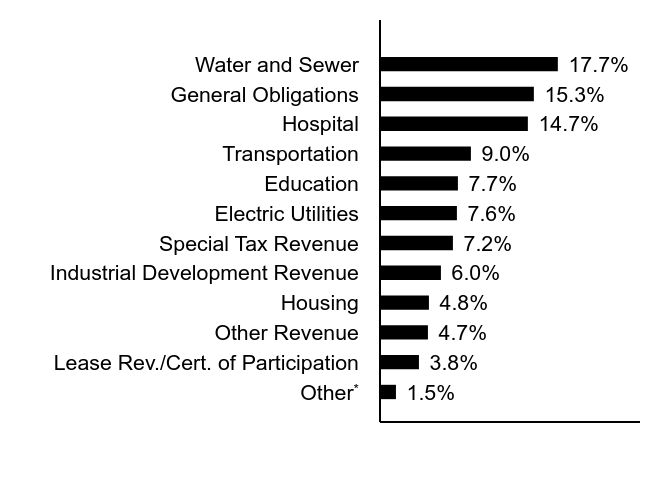

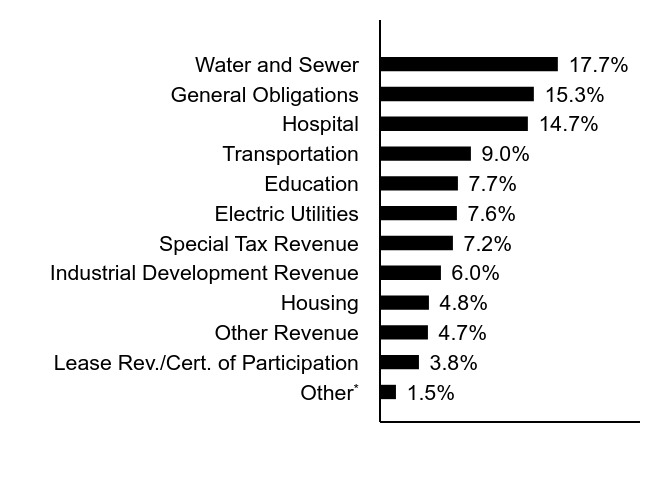

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

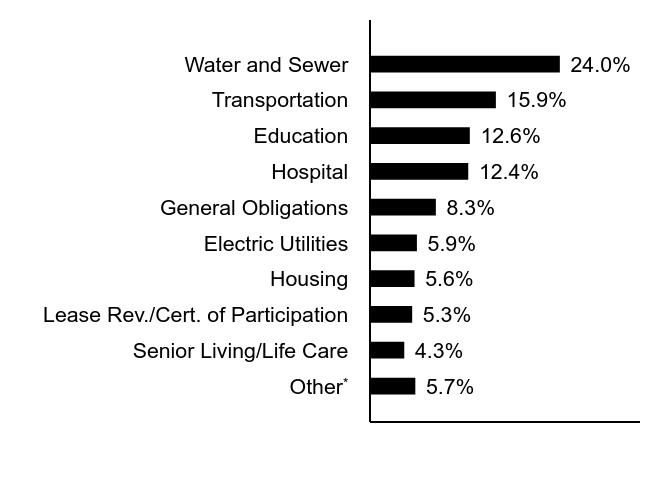

Sector Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference* | 1.5% |

| Lease Rev./Cert. of Participation | 3.8% |

| Other Revenue | 4.7% |

| Housing | 4.8% |

| Industrial Development Revenue | 6.0% |

| Special Tax Revenue | 7.2% |

| Electric Utilities | 7.6% |

| Education | 7.7% |

| Transportation | 9.0% |

| Hospital | 14.7% |

| General Obligations | 15.3% |

| Water and Sewer | 17.7% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

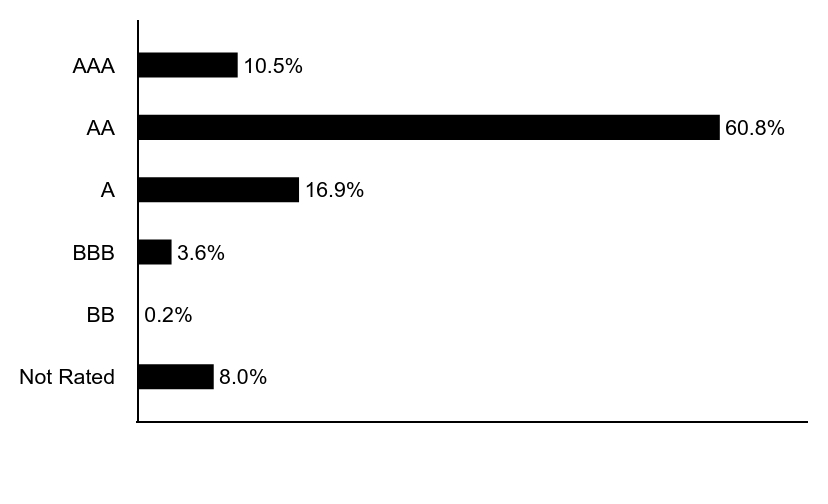

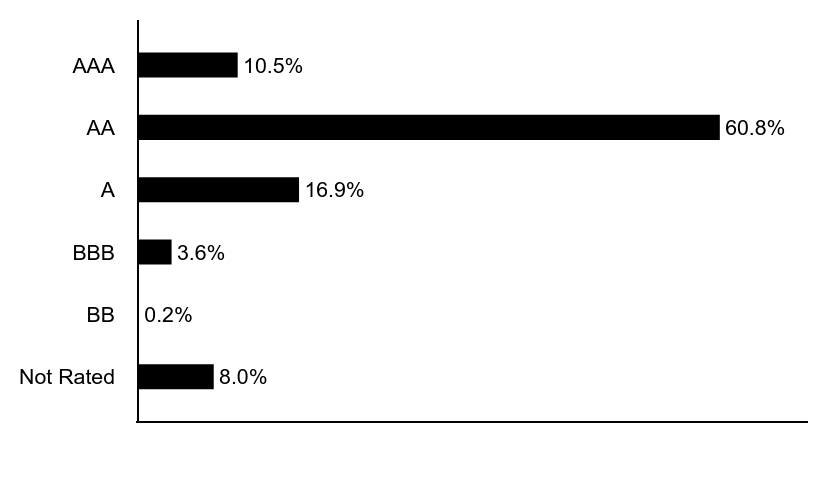

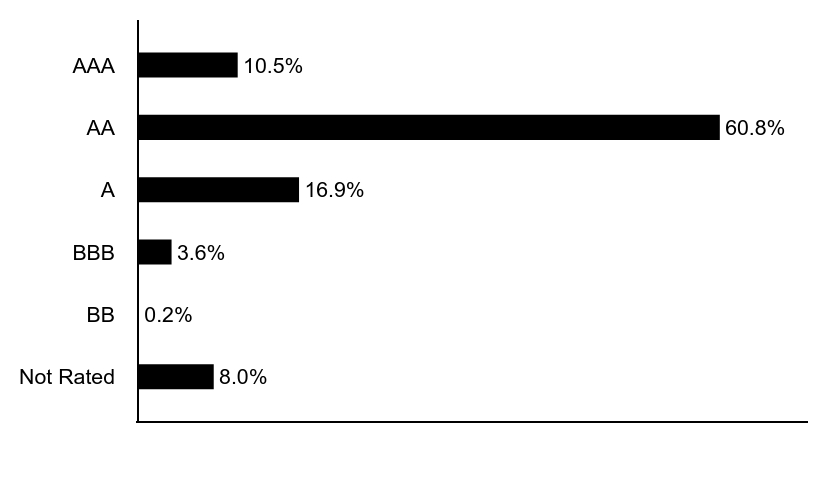

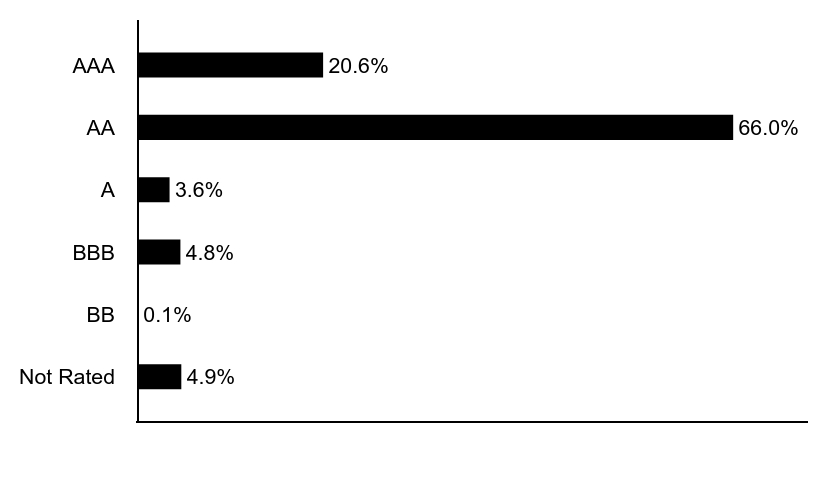

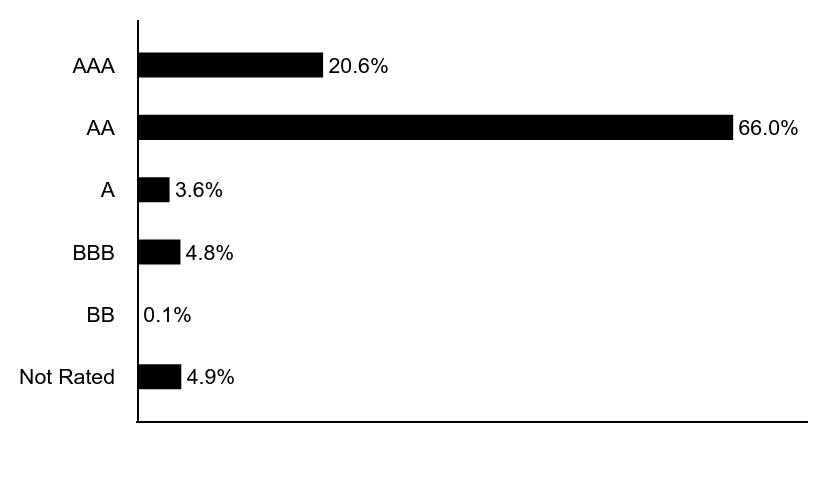

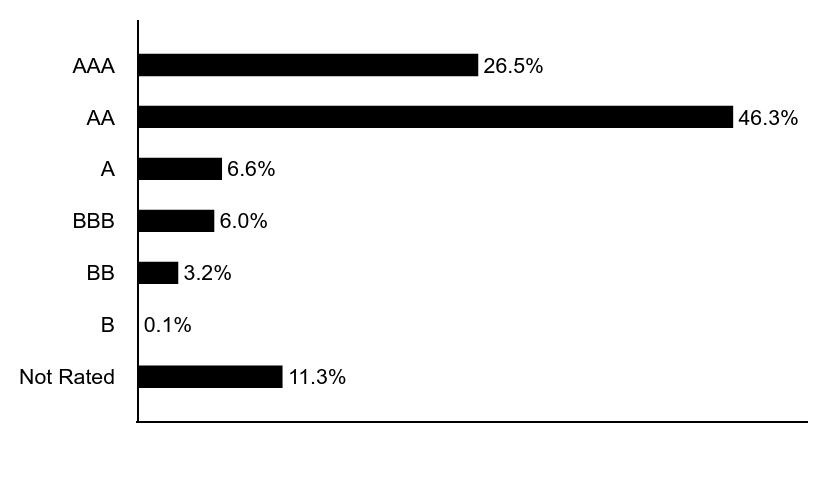

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 8.0% |

| BB | 0.2% |

| BBB | 3.6% |

| A | 16.9% |

| AA | 60.8% |

| AAA | 10.5% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

Eaton Vance Georgia Municipal Income Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Georgia Municipal Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $150 | 1.46% |

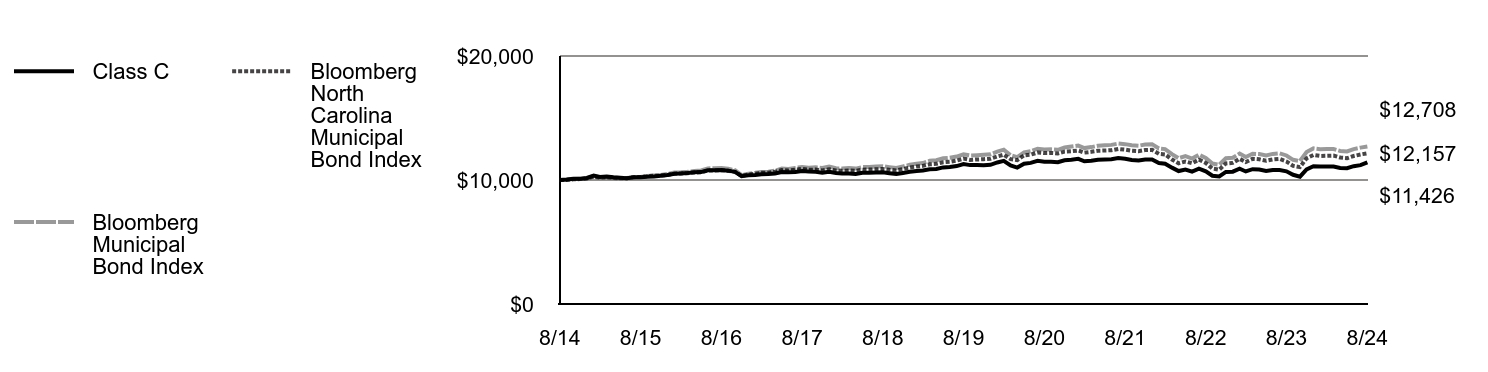

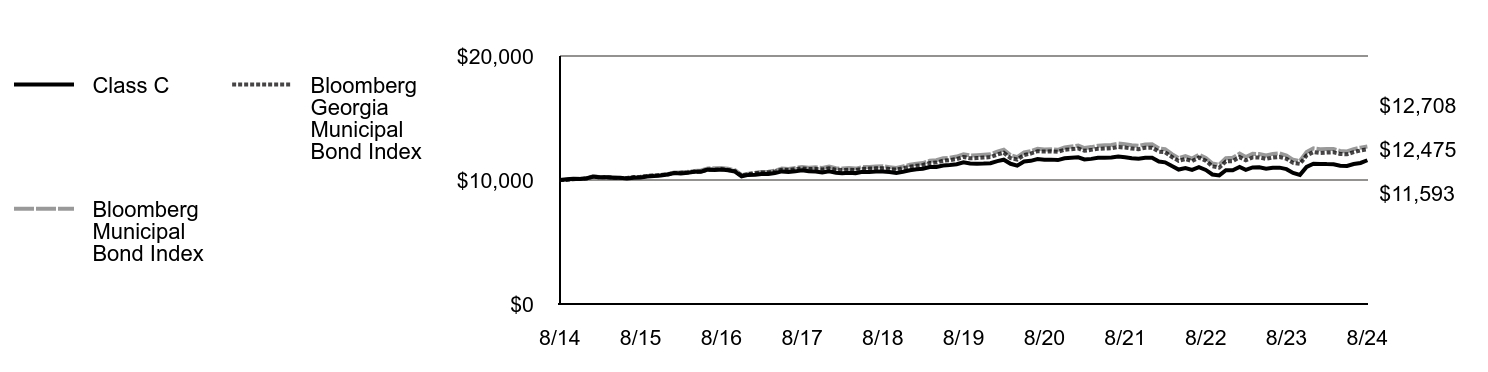

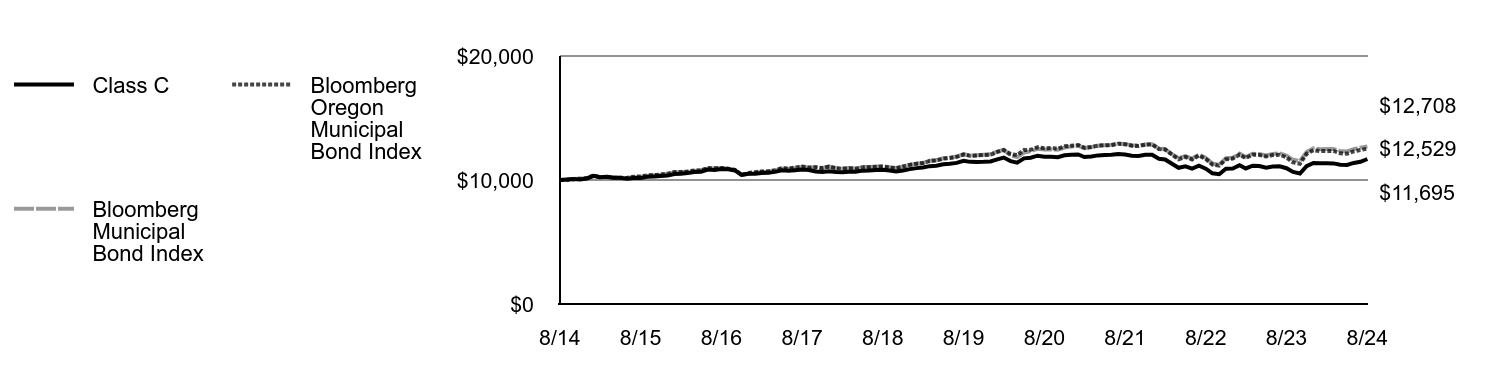

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↓ Security selections and an underweight position in bonds with 22+ years remaining to maturity detracted from Index-relative returns as longer-maturity bonds generally outperformed shorter-maturity bonds during the period

↓ Security selections and an underweight position in the transportation sector, which outperformed the Index, also weighed on Index-relative returns

↓ An overweight position in AA-rated bonds detracted from relative returns as AA-rated bonds generally underperformed lower-rated bonds during the period

↑ An overweight position in the health care sector, which outperformed the Index during the period, contributed to Index-relative returns

↑ An overweight position in 4% coupon bonds, which typically have longer durations than higher-coupon bonds, contributed to Index-relative returns as interest rates generally declined during the period

↑ An out-of-Index allocation to nonrated bonds helped Index-relative returns as lower-rated bonds generally outperformed higher-rated bonds

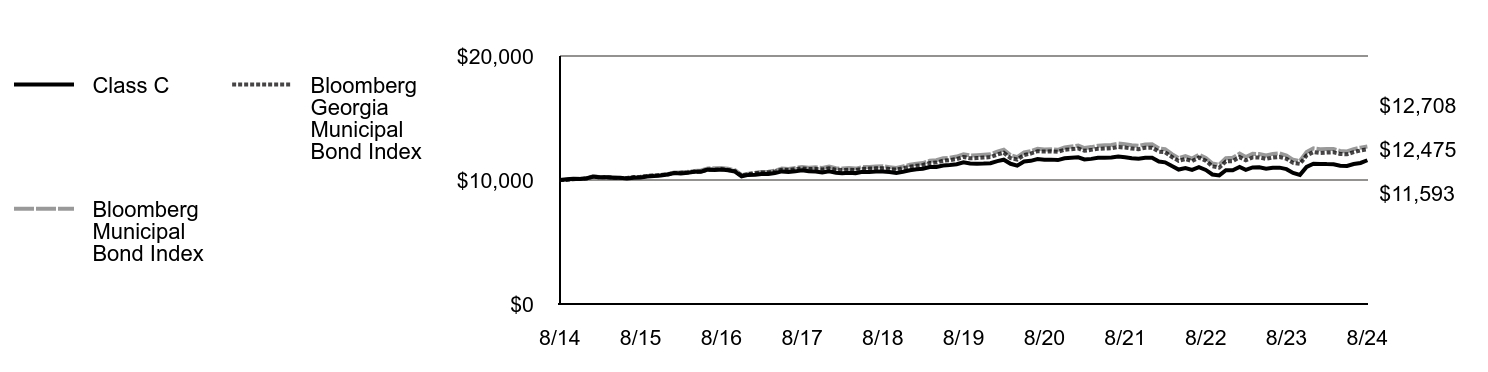

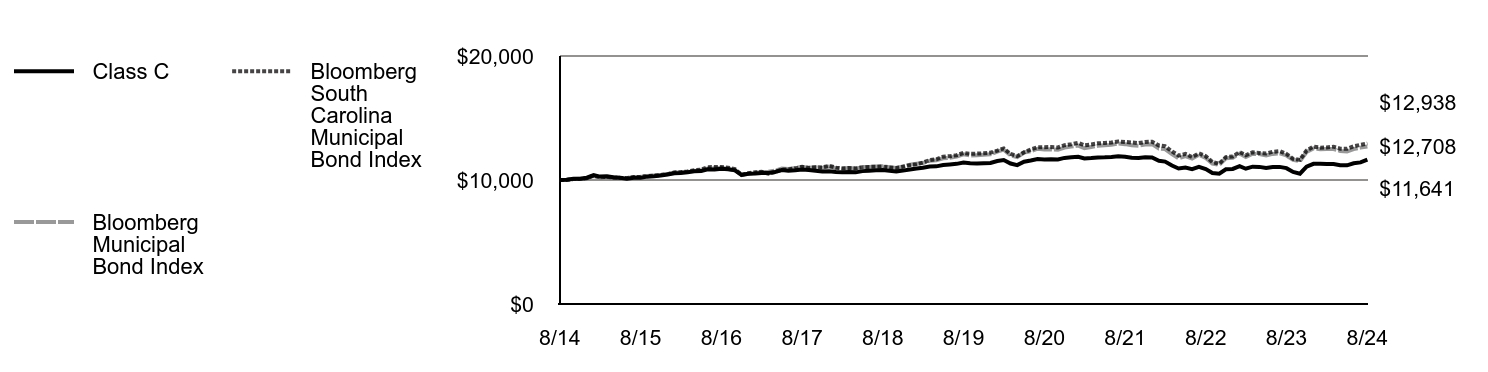

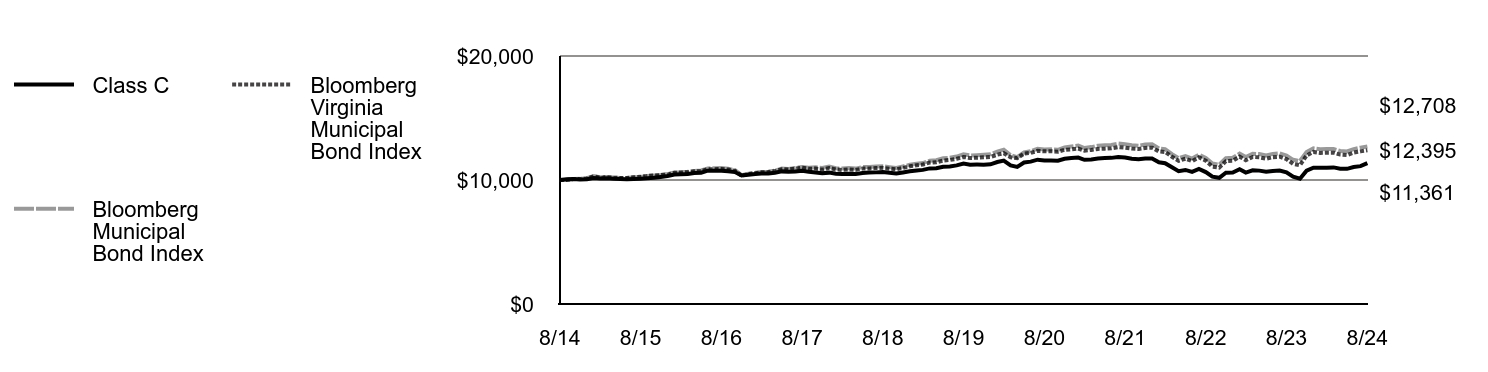

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | Bloomberg Municipal Bond Index | Bloomberg Georgia Municipal Bond Index |

|---|

| 8/14 | $10,000 | $10,000 | $10,000 |

| 9/14 | $10,059 | $10,010 | $10,002 |

| 10/14 | $10,106 | $10,079 | $10,065 |

| 11/14 | $10,077 | $10,096 | $10,082 |

| 12/14 | $10,146 | $10,147 | $10,128 |

| 1/15 | $10,269 | $10,327 | $10,294 |

| 2/15 | $10,216 | $10,220 | $10,196 |

| 3/15 | $10,228 | $10,250 | $10,230 |

| 4/15 | $10,185 | $10,196 | $10,181 |

| 5/15 | $10,175 | $10,168 | $10,161 |

| 6/15 | $10,129 | $10,159 | $10,158 |

| 7/15 | $10,185 | $10,232 | $10,233 |

| 8/15 | $10,205 | $10,252 | $10,260 |

| 9/15 | $10,282 | $10,327 | $10,330 |

| 10/15 | $10,313 | $10,368 | $10,360 |

| 11/15 | $10,357 | $10,409 | $10,392 |

| 12/15 | $10,445 | $10,482 | $10,447 |

| 1/16 | $10,555 | $10,607 | $10,562 |

| 2/16 | $10,529 | $10,624 | $10,579 |

| 3/16 | $10,583 | $10,658 | $10,602 |

| 4/16 | $10,659 | $10,736 | $10,669 |

| 5/16 | $10,668 | $10,765 | $10,685 |

| 6/16 | $10,836 | $10,936 | $10,835 |

| 7/16 | $10,810 | $10,943 | $10,845 |

| 8/16 | $10,841 | $10,958 | $10,865 |

| 9/16 | $10,792 | $10,903 | $10,811 |

| 10/16 | $10,684 | $10,789 | $10,722 |

| 11/16 | $10,302 | $10,386 | $10,364 |

| 12/16 | $10,413 | $10,508 | $10,474 |

| 1/17 | $10,419 | $10,577 | $10,538 |

| 2/17 | $10,474 | $10,651 | $10,603 |

| 3/17 | $10,481 | $10,674 | $10,616 |

| 4/17 | $10,559 | $10,751 | $10,683 |

| 5/17 | $10,694 | $10,922 | $10,835 |

| 6/17 | $10,655 | $10,883 | $10,797 |

| 7/17 | $10,697 | $10,971 | $10,868 |

| 8/17 | $10,776 | $11,054 | $10,939 |

| 9/17 | $10,714 | $10,998 | $10,879 |

| 10/17 | $10,686 | $11,025 | $10,903 |

| 11/17 | $10,612 | $10,966 | $10,844 |

| 12/17 | $10,702 | $11,081 | $10,940 |

| 1/18 | $10,591 | $10,950 | $10,825 |

| 2/18 | $10,552 | $10,918 | $10,807 |

| 3/18 | $10,594 | $10,958 | $10,833 |

| 4/18 | $10,555 | $10,919 | $10,798 |

| 5/18 | $10,658 | $11,044 | $10,904 |

| 6/18 | $10,654 | $11,053 | $10,920 |

| 7/18 | $10,684 | $11,080 | $10,939 |

| 8/18 | $10,691 | $11,108 | $10,957 |

| 9/18 | $10,638 | $11,037 | $10,891 |

| 10/18 | $10,561 | $10,969 | $10,836 |

| 11/18 | $10,665 | $11,090 | $10,955 |

| 12/18 | $10,791 | $11,223 | $11,072 |

| 1/19 | $10,870 | $11,308 | $11,154 |

| 2/19 | $10,913 | $11,368 | $11,209 |

| 3/19 | $11,039 | $11,548 | $11,363 |

| 4/19 | $11,057 | $11,591 | $11,402 |

| 5/19 | $11,170 | $11,751 | $11,554 |

| 6/19 | $11,210 | $11,794 | $11,602 |

| 7/19 | $11,274 | $11,889 | $11,689 |

| 8/19 | $11,422 | $12,077 | $11,859 |

| 9/19 | $11,328 | $11,980 | $11,747 |

| 10/19 | $11,320 | $12,002 | $11,774 |

| 11/19 | $11,324 | $12,032 | $11,806 |

| 12/19 | $11,351 | $12,068 | $11,845 |

| 1/20 | $11,524 | $12,285 | $12,049 |

| 2/20 | $11,637 | $12,444 | $12,206 |

| 3/20 | $11,308 | $11,992 | $11,763 |

| 4/20 | $11,162 | $11,842 | $11,651 |

| 5/20 | $11,495 | $12,219 | $12,014 |

| 6/20 | $11,545 | $12,319 | $12,134 |

| 7/20 | $11,693 | $12,527 | $12,322 |

| 8/20 | $11,631 | $12,468 | $12,290 |

| 9/20 | $11,643 | $12,470 | $12,309 |

| 10/20 | $11,605 | $12,433 | $12,280 |

| 11/20 | $11,753 | $12,621 | $12,439 |

| 12/20 | $11,800 | $12,697 | $12,483 |

| 1/21 | $11,834 | $12,778 | $12,545 |

| 2/21 | $11,658 | $12,575 | $12,356 |

| 3/21 | $11,704 | $12,653 | $12,430 |

| 4/21 | $11,788 | $12,759 | $12,513 |

| 5/21 | $11,797 | $12,797 | $12,535 |

| 6/21 | $11,816 | $12,832 | $12,557 |

| 7/21 | $11,885 | $12,939 | $12,655 |

| 8/21 | $11,842 | $12,891 | $12,615 |

| 9/21 | $11,750 | $12,798 | $12,532 |

| 10/21 | $11,719 | $12,761 | $12,487 |

| 11/21 | $11,801 | $12,869 | $12,594 |

| 12/21 | $11,796 | $12,890 | $12,608 |

| 1/22 | $11,491 | $12,537 | $12,285 |

| 2/22 | $11,425 | $12,492 | $12,243 |

| 3/22 | $11,120 | $12,087 | $11,852 |

| 4/22 | $10,841 | $11,753 | $11,549 |

| 5/22 | $10,964 | $11,928 | $11,695 |

| 6/22 | $10,812 | $11,732 | $11,526 |

| 7/22 | $11,037 | $12,042 | $11,809 |

| 8/22 | $10,809 | $11,778 | $11,553 |

| 9/22 | $10,444 | $11,326 | $11,103 |

| 10/22 | $10,369 | $11,232 | $10,995 |

| 11/22 | $10,789 | $11,757 | $11,501 |

| 12/22 | $10,790 | $11,791 | $11,516 |

| 1/23 | $11,057 | $12,130 | $11,845 |

| 2/23 | $10,821 | $11,856 | $11,582 |

| 3/23 | $11,016 | $12,119 | $11,817 |

| 4/23 | $11,020 | $12,091 | $11,818 |

| 5/23 | $10,910 | $11,986 | $11,704 |

| 6/23 | $10,979 | $12,106 | $11,812 |

| 7/23 | $10,997 | $12,154 | $11,856 |

| 8/23 | $10,874 | $11,979 | $11,711 |

| 9/23 | $10,573 | $11,628 | $11,378 |

| 10/23 | $10,413 | $11,529 | $11,298 |

| 11/23 | $11,052 | $12,261 | $11,981 |

| 12/23 | $11,317 | $12,546 | $12,255 |

| 1/24 | $11,298 | $12,482 | $12,184 |

| 2/24 | $11,281 | $12,498 | $12,209 |

| 3/24 | $11,276 | $12,497 | $12,231 |

| 4/24 | $11,154 | $12,343 | $12,099 |

| 5/24 | $11,136 | $12,307 | $12,073 |

| 6/24 | $11,289 | $12,495 | $12,246 |

| 7/24 | $11,375 | $12,609 | $12,385 |

| 8/24 | $11,593 | $12,708 | $12,475 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class C | 4.92% | (0.02)% | 1.49% |

| Class C with 1% Maximum Deferred Sales Charge | 3.92% | (0.02)% | 1.49% |

| Bloomberg Municipal Bond Index | 6.09% | 1.02% | 2.42% |

| Bloomberg Georgia Municipal Bond Index | 6.52% | 1.02% | 2.23% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $122,460,706 |

| # of Portfolio Holdings | 96 |

| Portfolio Turnover Rate | 44% |

| Total Advisory Fees Paid | $390,911 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference* | 1.5% |

| Lease Rev./Cert. of Participation | 3.8% |

| Other Revenue | 4.7% |

| Housing | 4.8% |

| Industrial Development Revenue | 6.0% |

| Special Tax Revenue | 7.2% |

| Electric Utilities | 7.6% |

| Education | 7.7% |

| Transportation | 9.0% |

| Hospital | 14.7% |

| General Obligations | 15.3% |

| Water and Sewer | 17.7% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 8.0% |

| BB | 0.2% |

| BBB | 3.6% |

| A | 16.9% |

| AA | 60.8% |

| AAA | 10.5% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

Eaton Vance Georgia Municipal Income Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Georgia Municipal Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $53 | 0.51% |

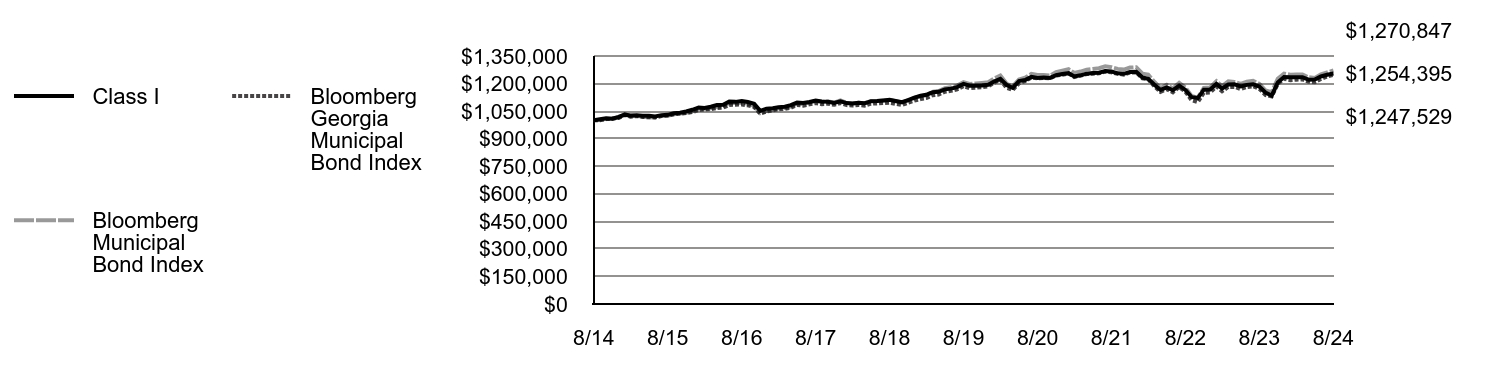

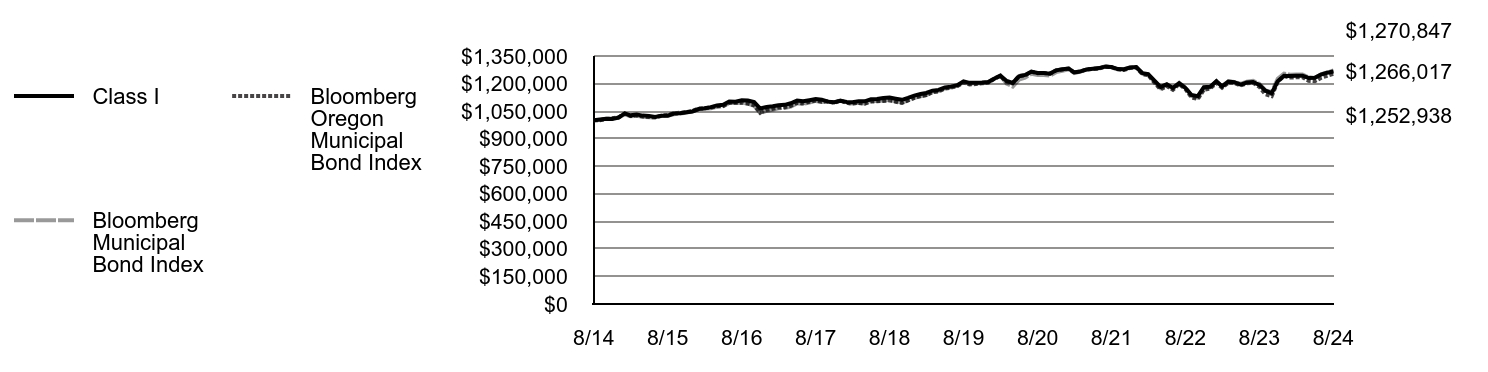

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↓ Security selections and an underweight position in bonds with 22+ years remaining to maturity detracted from Index-relative returns as longer-maturity bonds generally outperformed shorter-maturity bonds during the period

↓ Security selections and an underweight position in the transportation sector, which outperformed the Index, also weighed on Index-relative returns

↓ An overweight position in AA-rated bonds detracted from relative returns as AA-rated bonds generally underperformed lower-rated bonds during the period

↑ An overweight position in the health care sector, which outperformed the Index during the period, contributed to Index-relative returns

↑ An overweight position in 4% coupon bonds, which typically have longer durations than higher-coupon bonds, contributed to Index-relative returns as interest rates generally declined during the period

↑ An out-of-Index allocation to nonrated bonds helped Index-relative returns as lower-rated bonds generally outperformed higher-rated bonds

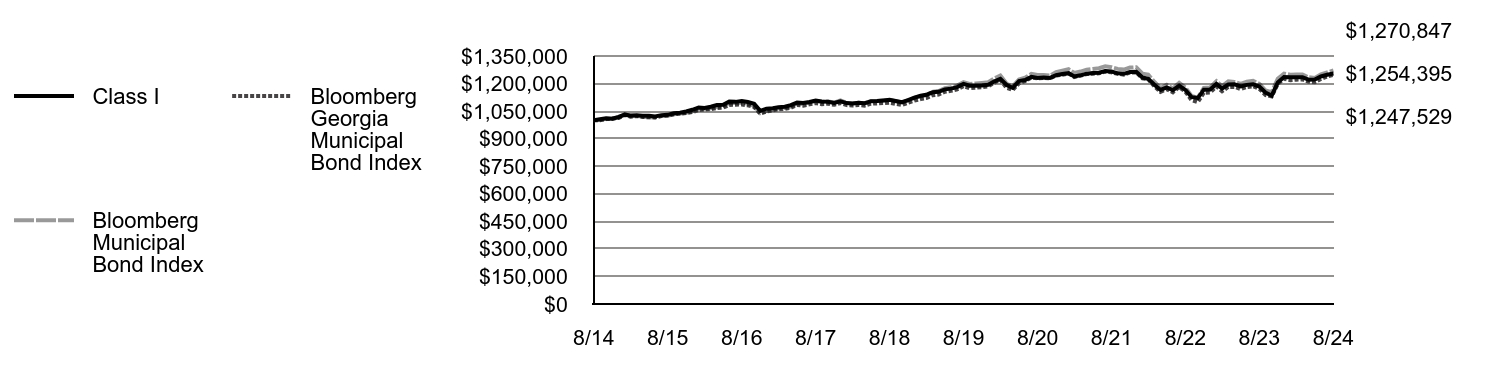

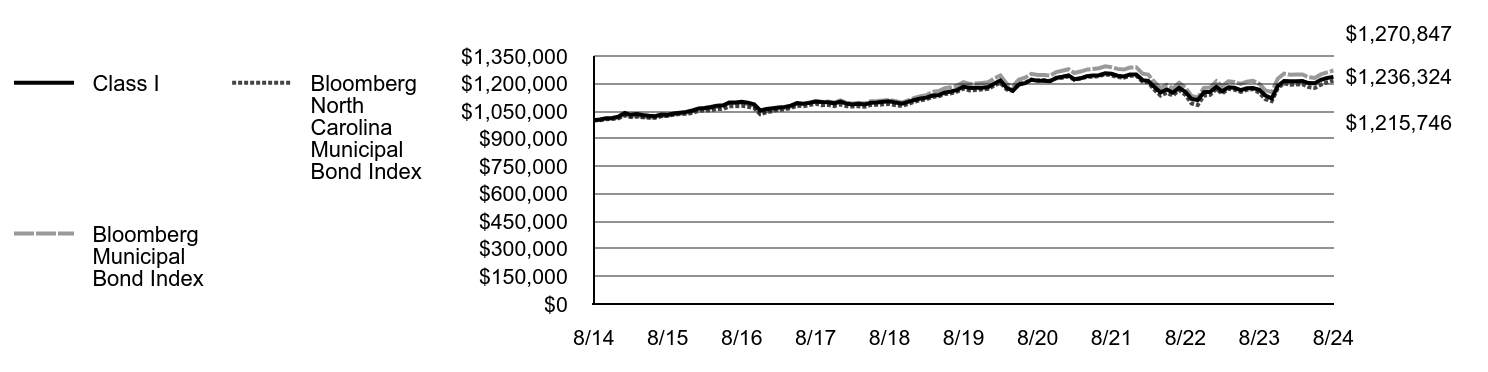

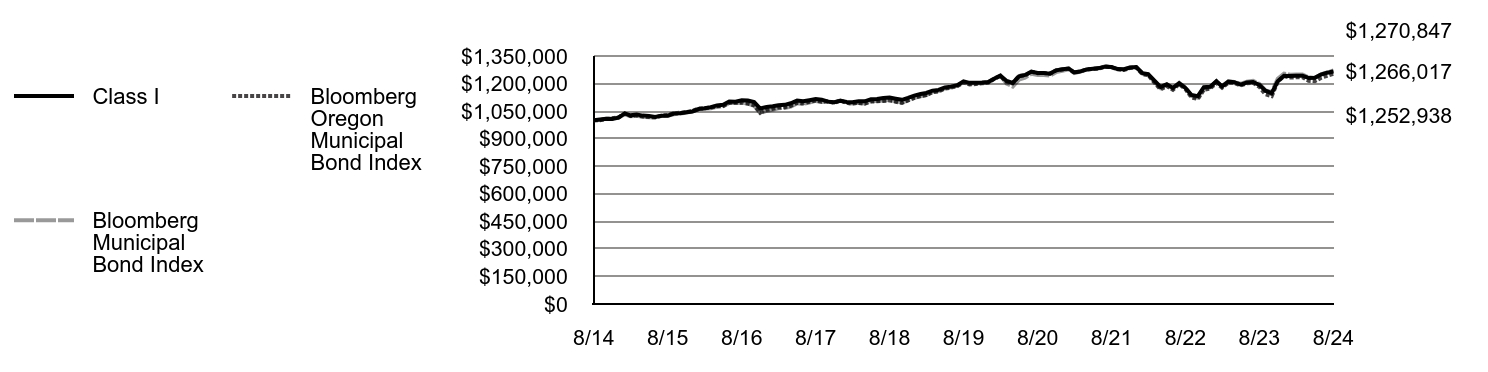

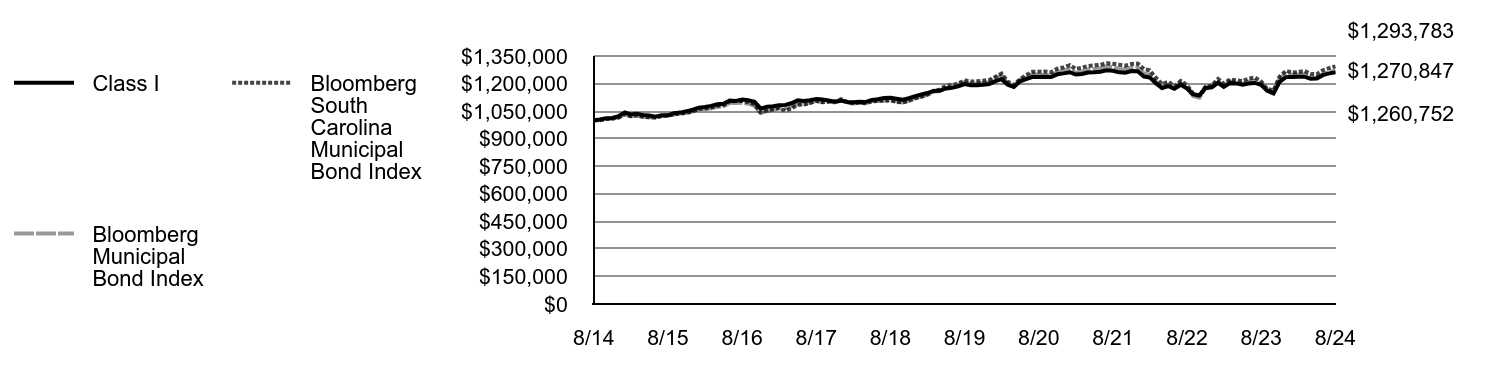

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | Bloomberg Municipal Bond Index | Bloomberg Georgia Municipal Bond Index |

|---|

| 8/14 | $1,000,000 | $1,000,000 | $1,000,000 |

| 9/14 | $1,005,692 | $1,001,017 | $1,000,177 |

| 10/14 | $1,011,392 | $1,007,880 | $1,006,476 |

| 11/14 | $1,008,914 | $1,009,624 | $1,008,180 |

| 12/14 | $1,018,088 | $1,014,718 | $1,012,821 |

| 1/15 | $1,030,731 | $1,032,703 | $1,029,380 |

| 2/15 | $1,025,718 | $1,022,050 | $1,019,560 |

| 3/15 | $1,027,690 | $1,025,002 | $1,022,954 |

| 4/15 | $1,024,870 | $1,019,624 | $1,018,125 |

| 5/15 | $1,024,417 | $1,016,807 | $1,016,104 |

| 6/15 | $1,021,390 | $1,015,880 | $1,015,754 |

| 7/15 | $1,028,033 | $1,023,239 | $1,023,334 |

| 8/15 | $1,029,666 | $1,025,248 | $1,025,974 |

| 9/15 | $1,038,611 | $1,032,675 | $1,033,024 |

| 10/15 | $1,041,517 | $1,036,780 | $1,036,034 |

| 11/15 | $1,048,115 | $1,040,903 | $1,039,160 |

| 12/15 | $1,057,098 | $1,048,216 | $1,044,731 |

| 1/16 | $1,069,724 | $1,060,723 | $1,056,217 |

| 2/16 | $1,067,571 | $1,062,391 | $1,057,874 |

| 3/16 | $1,074,096 | $1,065,756 | $1,060,207 |

| 4/16 | $1,083,111 | $1,073,593 | $1,066,918 |

| 5/16 | $1,084,766 | $1,076,497 | $1,068,544 |

| 6/16 | $1,102,448 | $1,093,622 | $1,083,519 |

| 7/16 | $1,100,356 | $1,094,290 | $1,084,499 |

| 8/16 | $1,104,514 | $1,095,766 | $1,086,470 |

| 9/16 | $1,099,889 | $1,090,297 | $1,081,102 |

| 10/16 | $1,090,195 | $1,078,859 | $1,072,225 |

| 11/16 | $1,051,828 | $1,038,623 | $1,036,430 |

| 12/16 | $1,063,394 | $1,050,816 | $1,047,389 |

| 1/17 | $1,066,107 | $1,057,744 | $1,053,766 |

| 2/17 | $1,071,397 | $1,065,088 | $1,060,317 |

| 3/17 | $1,074,229 | $1,067,401 | $1,061,555 |

| 4/17 | $1,082,143 | $1,075,146 | $1,068,266 |

| 5/17 | $1,096,403 | $1,092,209 | $1,083,533 |

| 6/17 | $1,094,163 | $1,088,292 | $1,079,725 |

| 7/17 | $1,099,489 | $1,097,097 | $1,086,796 |

| 8/17 | $1,107,651 | $1,105,446 | $1,093,852 |

| 9/17 | $1,102,851 | $1,099,825 | $1,087,902 |

| 10/17 | $1,100,571 | $1,102,510 | $1,090,260 |

| 11/17 | $1,094,459 | $1,096,607 | $1,084,404 |

| 12/17 | $1,103,812 | $1,108,068 | $1,093,958 |

| 1/18 | $1,093,683 | $1,095,023 | $1,082,518 |

| 2/18 | $1,091,257 | $1,091,751 | $1,080,702 |

| 3/18 | $1,095,418 | $1,095,781 | $1,083,254 |

| 4/18 | $1,093,118 | $1,091,870 | $1,079,757 |

| 5/18 | $1,103,864 | $1,104,374 | $1,090,436 |

| 6/18 | $1,105,536 | $1,105,316 | $1,092,020 |

| 7/18 | $1,108,326 | $1,107,998 | $1,093,866 |

| 8/18 | $1,111,113 | $1,110,844 | $1,095,687 |

| 9/18 | $1,104,699 | $1,103,652 | $1,089,146 |

| 10/18 | $1,098,253 | $1,096,856 | $1,083,624 |

| 11/18 | $1,110,466 | $1,108,996 | $1,095,471 |

| 12/18 | $1,123,914 | $1,122,274 | $1,107,194 |

| 1/19 | $1,133,438 | $1,130,758 | $1,115,441 |

| 2/19 | $1,138,960 | $1,136,812 | $1,120,918 |

| 3/19 | $1,152,429 | $1,154,783 | $1,136,285 |

| 4/19 | $1,155,158 | $1,159,123 | $1,140,217 |

| 5/19 | $1,168,554 | $1,175,103 | $1,155,365 |

| 6/19 | $1,172,477 | $1,179,442 | $1,160,154 |

| 7/19 | $1,180,477 | $1,188,947 | $1,168,890 |

| 8/19 | $1,197,853 | $1,207,701 | $1,185,940 |

| 9/19 | $1,188,227 | $1,198,020 | $1,174,713 |

| 10/19 | $1,188,126 | $1,200,167 | $1,177,447 |

| 11/19 | $1,189,391 | $1,203,169 | $1,180,612 |

| 12/19 | $1,193,279 | $1,206,842 | $1,184,520 |

| 1/20 | $1,212,240 | $1,228,525 | $1,204,853 |

| 2/20 | $1,225,680 | $1,244,367 | $1,220,579 |

| 3/20 | $1,192,298 | $1,199,230 | $1,176,257 |

| 4/20 | $1,176,711 | $1,184,180 | $1,165,066 |

| 5/20 | $1,213,677 | $1,221,850 | $1,201,434 |

| 6/20 | $1,218,807 | $1,231,906 | $1,213,391 |

| 7/20 | $1,236,366 | $1,252,655 | $1,232,219 |

| 8/20 | $1,230,295 | $1,246,777 | $1,228,969 |

| 9/20 | $1,232,545 | $1,247,042 | $1,230,853 |

| 10/20 | $1,230,523 | $1,243,296 | $1,227,983 |

| 11/20 | $1,245,333 | $1,262,058 | $1,243,852 |

| 12/20 | $1,251,608 | $1,269,746 | $1,248,279 |

| 1/21 | $1,256,458 | $1,277,837 | $1,254,512 |

| 2/21 | $1,238,747 | $1,257,534 | $1,235,590 |

| 3/21 | $1,244,858 | $1,265,290 | $1,242,971 |

| 4/21 | $1,253,928 | $1,275,903 | $1,251,337 |

| 5/21 | $1,257,273 | $1,279,709 | $1,253,505 |

| 6/21 | $1,258,997 | $1,283,223 | $1,255,692 |

| 7/21 | $1,267,821 | $1,293,866 | $1,265,514 |

| 8/21 | $1,265,306 | $1,289,118 | $1,261,453 |

| 9/21 | $1,255,712 | $1,279,814 | $1,253,173 |

| 10/21 | $1,253,173 | $1,276,072 | $1,248,734 |

| 11/21 | $1,263,517 | $1,286,935 | $1,259,428 |

| 12/21 | $1,263,878 | $1,289,012 | $1,260,803 |

| 1/22 | $1,232,769 | $1,253,728 | $1,228,455 |

| 2/22 | $1,226,119 | $1,249,236 | $1,224,324 |

| 3/22 | $1,193,506 | $1,208,739 | $1,185,221 |

| 4/22 | $1,165,329 | $1,175,306 | $1,154,927 |

| 5/22 | $1,178,838 | $1,192,765 | $1,169,501 |

| 6/22 | $1,163,682 | $1,173,230 | $1,152,554 |

| 7/22 | $1,188,899 | $1,204,229 | $1,180,860 |

| 8/22 | $1,165,005 | $1,177,836 | $1,155,278 |

| 9/22 | $1,126,795 | $1,132,630 | $1,110,341 |

| 10/22 | $1,120,432 | $1,123,211 | $1,099,504 |

| 11/22 | $1,166,584 | $1,175,747 | $1,150,050 |

| 12/22 | $1,167,547 | $1,179,113 | $1,151,615 |

| 1/23 | $1,197,843 | $1,212,983 | $1,184,520 |

| 2/23 | $1,172,787 | $1,185,555 | $1,158,207 |

| 3/23 | $1,194,597 | $1,211,860 | $1,181,722 |

| 4/23 | $1,195,916 | $1,209,092 | $1,181,848 |

| 5/23 | $1,183,968 | $1,198,614 | $1,170,427 |

| 6/23 | $1,192,803 | $1,210,621 | $1,181,196 |

| 7/23 | $1,195,712 | $1,215,410 | $1,185,601 |

| 8/23 | $1,183,796 | $1,197,913 | $1,171,129 |

| 9/23 | $1,151,106 | $1,162,804 | $1,137,786 |

| 10/23 | $1,134,798 | $1,152,908 | $1,129,814 |

| 11/23 | $1,205,357 | $1,226,096 | $1,198,080 |

| 12/23 | $1,235,559 | $1,254,593 | $1,225,505 |

| 1/24 | $1,234,207 | $1,248,186 | $1,218,391 |

| 2/24 | $1,234,446 | $1,249,789 | $1,220,927 |

| 3/24 | $1,234,673 | $1,249,749 | $1,223,117 |

| 4/24 | $1,221,311 | $1,234,271 | $1,209,935 |

| 5/24 | $1,221,560 | $1,230,651 | $1,207,314 |

| 6/24 | $1,238,638 | $1,249,514 | $1,224,586 |

| 7/24 | $1,248,090 | $1,260,903 | $1,238,469 |

| 8/24 | $1,254,395 | $1,270,847 | $1,247,529 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class I | 5.97% | 0.93% | 2.29% |

| Bloomberg Municipal Bond Index | 6.09% | 1.02% | 2.42% |

| Bloomberg Georgia Municipal Bond Index | 6.52% | 1.02% | 2.23% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $122,460,706 |

| # of Portfolio Holdings | 96 |

| Portfolio Turnover Rate | 44% |

| Total Advisory Fees Paid | $390,911 |

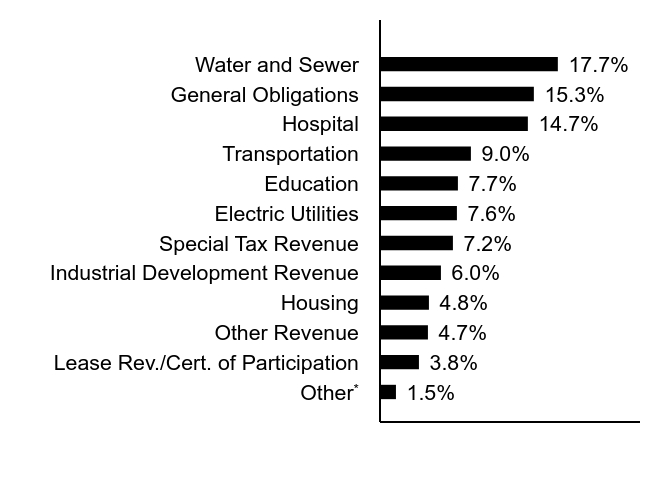

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference* | 1.5% |

| Lease Rev./Cert. of Participation | 3.8% |

| Other Revenue | 4.7% |

| Housing | 4.8% |

| Industrial Development Revenue | 6.0% |

| Special Tax Revenue | 7.2% |

| Electric Utilities | 7.6% |

| Education | 7.7% |

| Transportation | 9.0% |

| Hospital | 14.7% |

| General Obligations | 15.3% |

| Water and Sewer | 17.7% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 8.0% |

| BB | 0.2% |

| BBB | 3.6% |

| A | 16.9% |

| AA | 60.8% |

| AAA | 10.5% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

Eaton Vance Maryland Municipal Income Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Maryland Municipal Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $75 | 0.73% |

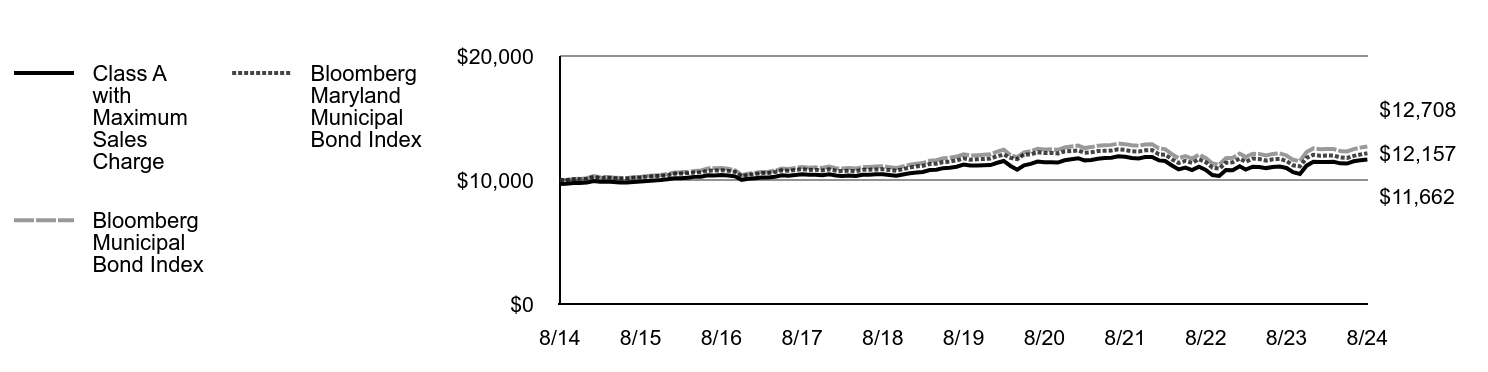

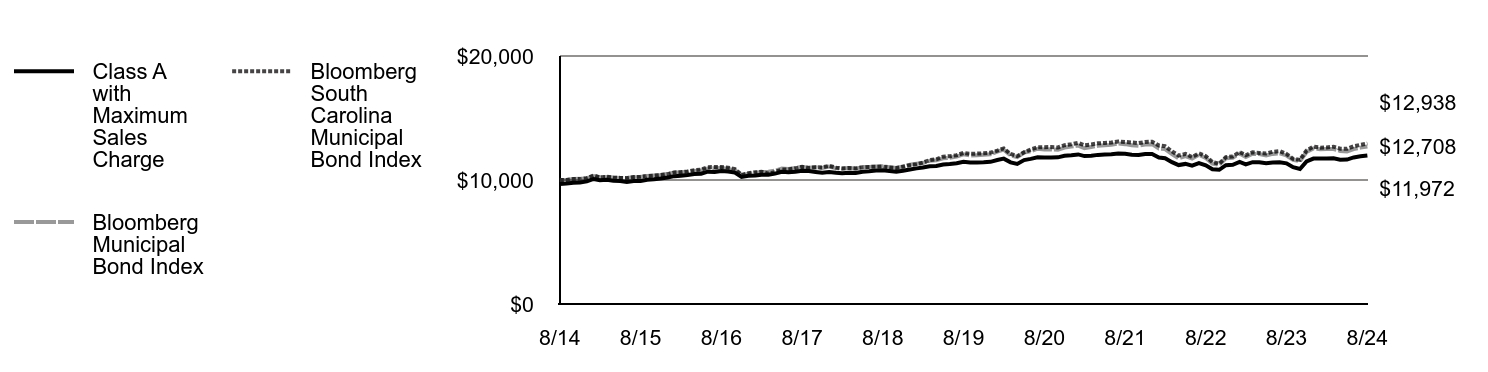

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↑ Security selections and an overweight position in the health care sector, which outperformed the Index during the period, contributed to Fund returns

↑ Security selections and an overweight position in 4% coupon bonds, which typically have longer durations than higher-coupon bonds, contributed to Index-relative returns as interest rates generally declined and bond prices rose during the period

↑ An overweight position in bonds with 17+ years remaining to maturity helped returns as longer-maturity bonds outperformed shorter-maturity bonds

↓ An out-of-Index position in variable-rate demand notes -- typically considered a defensive investment -- detracted from Index-relative returns as interest rates generally declined during the period

↓ An underweight position in the industrial development revenue sector -- the best-performing sector within the Index -- detracted from relative returns

↓ Security selections in BBB-rated bonds detracted from Fund performance versus the Index during the period

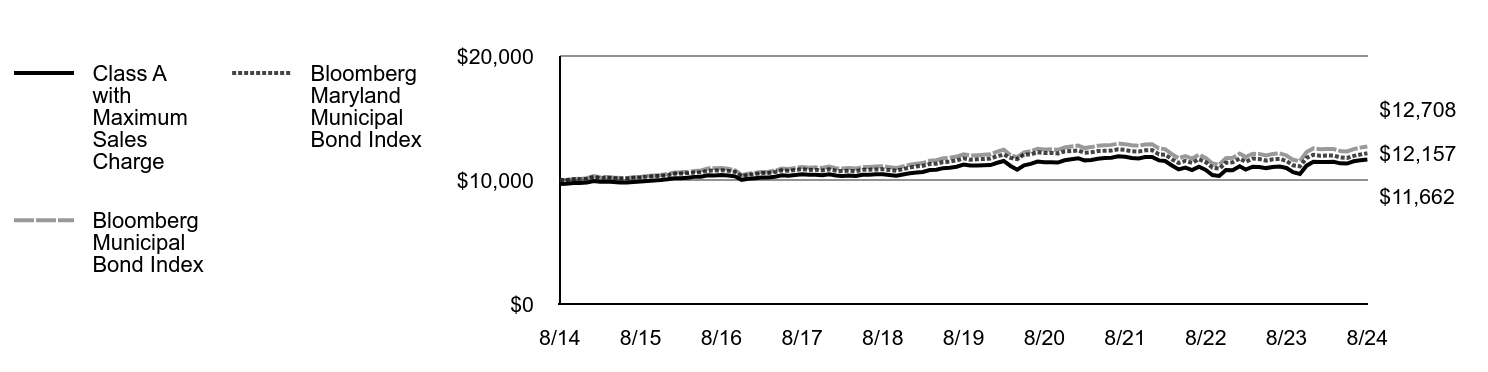

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | Bloomberg Municipal Bond Index | Bloomberg Maryland Municipal Bond Index |

|---|

| 8/14 | $9,675 | $10,000 | $10,000 |

| 9/14 | $9,692 | $10,010 | $9,997 |

| 10/14 | $9,752 | $10,079 | $10,052 |

| 11/14 | $9,749 | $10,096 | $10,071 |

| 12/14 | $9,788 | $10,147 | $10,101 |

| 1/15 | $9,923 | $10,327 | $10,256 |

| 2/15 | $9,855 | $10,220 | $10,164 |

| 3/15 | $9,872 | $10,250 | $10,191 |

| 4/15 | $9,835 | $10,196 | $10,143 |

| 5/15 | $9,808 | $10,168 | $10,123 |

| 6/15 | $9,804 | $10,159 | $10,119 |

| 7/15 | $9,842 | $10,232 | $10,184 |

| 8/15 | $9,880 | $10,252 | $10,207 |

| 9/15 | $9,919 | $10,327 | $10,278 |

| 10/15 | $9,957 | $10,368 | $10,312 |

| 11/15 | $9,996 | $10,409 | $10,331 |

| 12/15 | $10,066 | $10,482 | $10,383 |

| 1/16 | $10,149 | $10,607 | $10,505 |

| 2/16 | $10,142 | $10,624 | $10,528 |

| 3/16 | $10,182 | $10,658 | $10,542 |

| 4/16 | $10,252 | $10,736 | $10,602 |

| 5/16 | $10,264 | $10,765 | $10,611 |

| 6/16 | $10,377 | $10,936 | $10,753 |

| 7/16 | $10,368 | $10,943 | $10,765 |

| 8/16 | $10,394 | $10,958 | $10,781 |

| 9/16 | $10,362 | $10,903 | $10,736 |

| 10/16 | $10,296 | $10,789 | $10,653 |

| 11/16 | $10,013 | $10,386 | $10,326 |

| 12/16 | $10,097 | $10,508 | $10,423 |

| 1/17 | $10,145 | $10,577 | $10,488 |

| 2/17 | $10,195 | $10,651 | $10,557 |

| 3/17 | $10,210 | $10,674 | $10,570 |

| 4/17 | $10,260 | $10,751 | $10,645 |

| 5/17 | $10,382 | $10,922 | $10,779 |

| 6/17 | $10,351 | $10,883 | $10,744 |

| 7/17 | $10,410 | $10,971 | $10,816 |

| 8/17 | $10,469 | $11,054 | $10,880 |

| 9/17 | $10,423 | $10,998 | $10,814 |

| 10/17 | $10,423 | $11,025 | $10,832 |

| 11/17 | $10,378 | $10,966 | $10,762 |

| 12/17 | $10,462 | $11,081 | $10,863 |

| 1/18 | $10,356 | $10,950 | $10,744 |

| 2/18 | $10,332 | $10,918 | $10,718 |

| 3/18 | $10,368 | $10,958 | $10,746 |

| 4/18 | $10,333 | $10,919 | $10,705 |

| 5/18 | $10,429 | $11,044 | $10,819 |

| 6/18 | $10,431 | $11,053 | $10,827 |

| 7/18 | $10,466 | $11,080 | $10,851 |

| 8/18 | $10,467 | $11,108 | $10,867 |

| 9/18 | $10,407 | $11,037 | $10,805 |

| 10/18 | $10,346 | $10,969 | $10,743 |

| 11/18 | $10,443 | $11,090 | $10,872 |

| 12/18 | $10,539 | $11,223 | $11,007 |

| 1/19 | $10,600 | $11,308 | $11,095 |

| 2/19 | $10,649 | $11,368 | $11,144 |

| 3/19 | $10,808 | $11,548 | $11,286 |

| 4/19 | $10,832 | $11,591 | $11,313 |

| 5/19 | $10,954 | $11,751 | $11,449 |

| 6/19 | $10,990 | $11,794 | $11,483 |

| 7/19 | $11,074 | $11,889 | $11,581 |

| 8/19 | $11,244 | $12,077 | $11,741 |

| 9/19 | $11,169 | $11,980 | $11,636 |

| 10/19 | $11,165 | $12,002 | $11,672 |

| 11/19 | $11,185 | $12,032 | $11,697 |

| 12/19 | $11,206 | $12,068 | $11,733 |

| 1/20 | $11,389 | $12,285 | $11,925 |

| 2/20 | $11,535 | $12,444 | $12,049 |

| 3/20 | $11,131 | $11,992 | $11,782 |

| 4/20 | $10,826 | $11,842 | $11,680 |

| 5/20 | $11,188 | $12,219 | $12,055 |

| 6/20 | $11,299 | $12,319 | $12,067 |

| 7/20 | $11,485 | $12,527 | $12,245 |

| 8/20 | $11,430 | $12,468 | $12,174 |

| 9/20 | $11,438 | $12,470 | $12,184 |

| 10/20 | $11,406 | $12,433 | $12,139 |

| 11/20 | $11,592 | $12,621 | $12,299 |

| 12/20 | $11,674 | $12,697 | $12,335 |

| 1/21 | $11,757 | $12,778 | $12,377 |

| 2/21 | $11,583 | $12,575 | $12,191 |

| 3/21 | $11,613 | $12,653 | $12,233 |

| 4/21 | $11,706 | $12,759 | $12,331 |

| 5/21 | $11,772 | $12,797 | $12,357 |

| 6/21 | $11,800 | $12,832 | $12,371 |

| 7/21 | $11,905 | $12,939 | $12,473 |

| 8/21 | $11,869 | $12,891 | $12,426 |

| 9/21 | $11,768 | $12,798 | $12,319 |

| 10/21 | $11,744 | $12,761 | $12,296 |

| 11/21 | $11,850 | $12,869 | $12,395 |

| 12/21 | $11,852 | $12,890 | $12,411 |

| 1/22 | $11,581 | $12,537 | $12,069 |

| 2/22 | $11,533 | $12,492 | $12,044 |

| 3/22 | $11,171 | $12,087 | $11,671 |

| 4/22 | $10,849 | $11,753 | $11,373 |

| 5/22 | $10,997 | $11,928 | $11,538 |

| 6/22 | $10,795 | $11,732 | $11,385 |

| 7/22 | $11,075 | $12,042 | $11,674 |

| 8/22 | $10,817 | $11,778 | $11,427 |

| 9/22 | $10,403 | $11,326 | $10,991 |

| 10/22 | $10,330 | $11,232 | $10,918 |

| 11/22 | $10,799 | $11,757 | $11,387 |

| 12/22 | $10,780 | $11,791 | $11,428 |

| 1/23 | $11,107 | $12,130 | $11,729 |

| 2/23 | $10,838 | $11,856 | $11,466 |

| 3/23 | $11,073 | $12,119 | $11,724 |

| 4/23 | $11,056 | $12,091 | $11,690 |

| 5/23 | $10,960 | $11,986 | $11,563 |

| 6/23 | $11,052 | $12,106 | $11,665 |

| 7/23 | $11,090 | $12,154 | $11,706 |

| 8/23 | $10,972 | $11,979 | $11,539 |

| 9/23 | $10,639 | $11,628 | $11,182 |

| 10/23 | $10,492 | $11,529 | $11,101 |

| 11/23 | $11,158 | $12,261 | $11,781 |

| 12/23 | $11,472 | $12,546 | $12,036 |

| 1/24 | $11,459 | $12,482 | $11,955 |

| 2/24 | $11,461 | $12,498 | $11,972 |

| 3/24 | $11,462 | $12,497 | $11,973 |

| 4/24 | $11,341 | $12,343 | $11,819 |

| 5/24 | $11,329 | $12,307 | $11,773 |

| 6/24 | $11,510 | $12,495 | $11,943 |

| 7/24 | $11,595 | $12,609 | $12,051 |

| 8/24 | $11,662 | $12,708 | $12,157 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A | 6.34% | 0.74% | 1.89% |

| Class A with 3.25% Maximum Sales Charge | 2.92% | 0.09% | 1.55% |

| Bloomberg Municipal Bond Index | 6.09% | 1.02% | 2.42% |

| Bloomberg Maryland Municipal Bond Index | 5.36% | 0.70% | 1.97% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $84,537,545 |

| # of Portfolio Holdings | 87 |

| Portfolio Turnover Rate | 42% |

| Total Advisory Fees Paid | $244,106 |

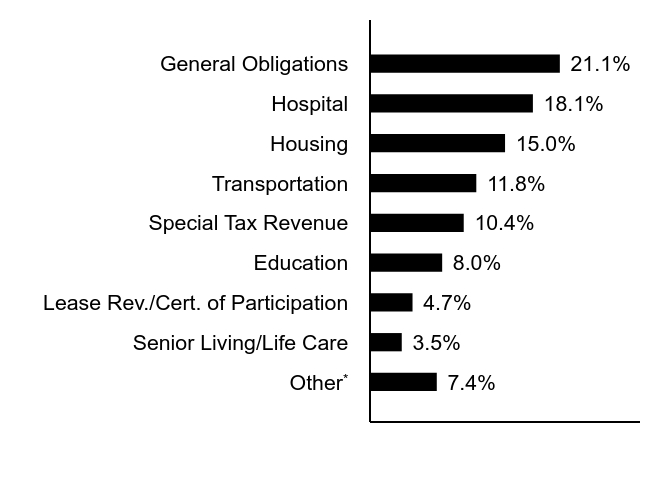

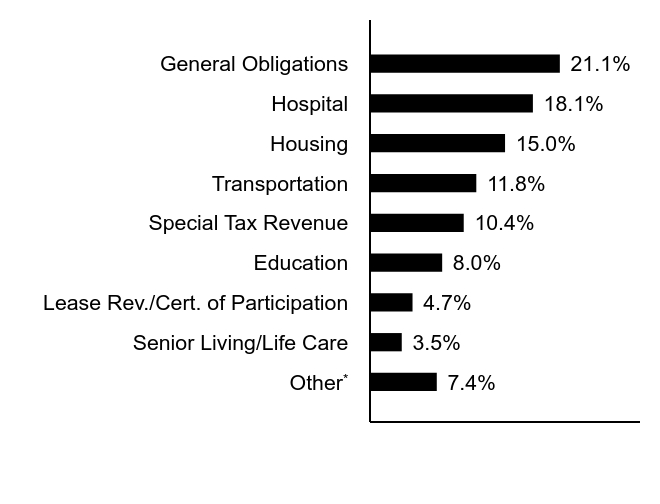

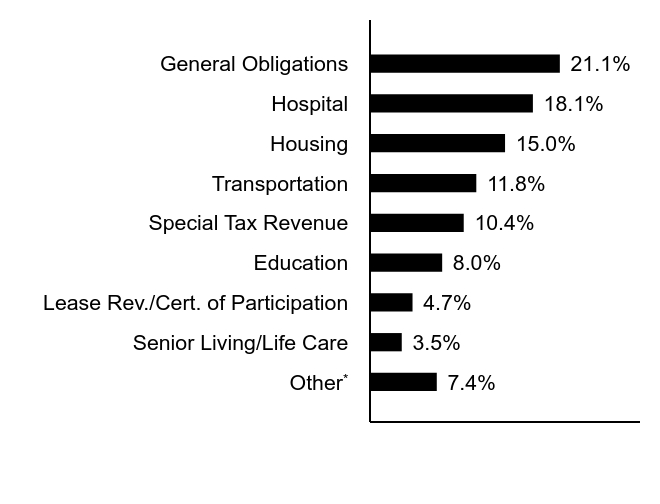

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference* | 7.4% |

| Senior Living/Life Care | 3.5% |

| Lease Rev./Cert. of Participation | 4.7% |

| Education | 8.0% |

| Special Tax Revenue | 10.4% |

| Transportation | 11.8% |

| Housing | 15.0% |

| Hospital | 18.1% |

| General Obligations | 21.1% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

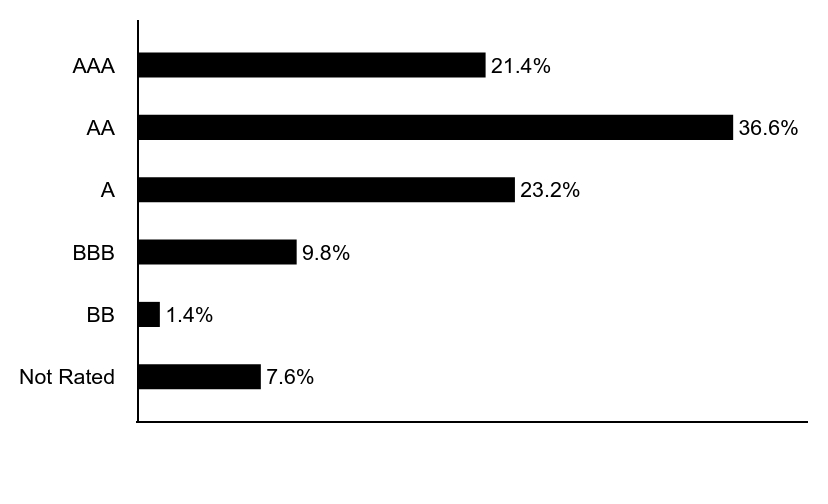

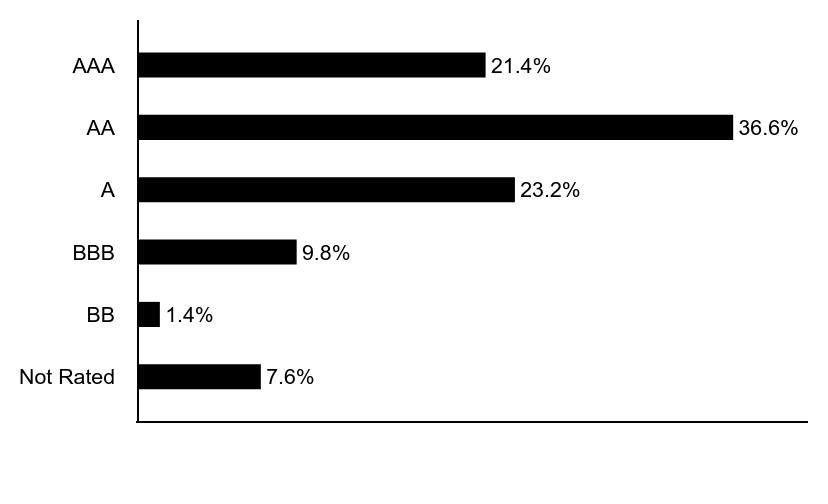

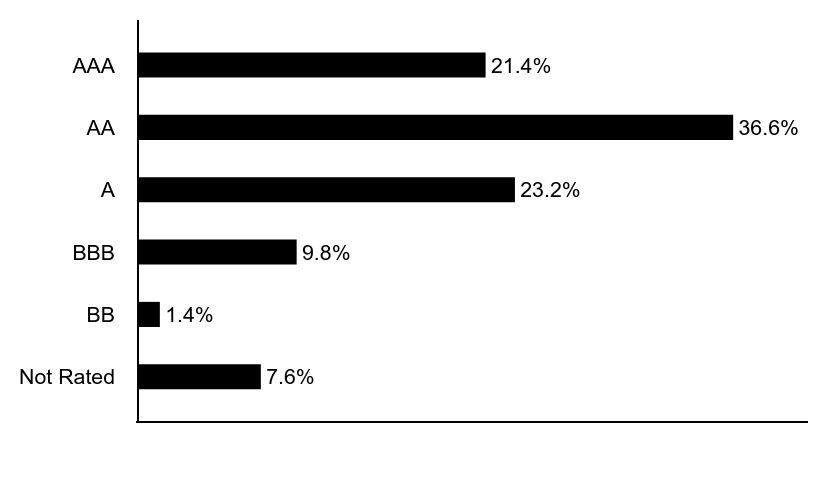

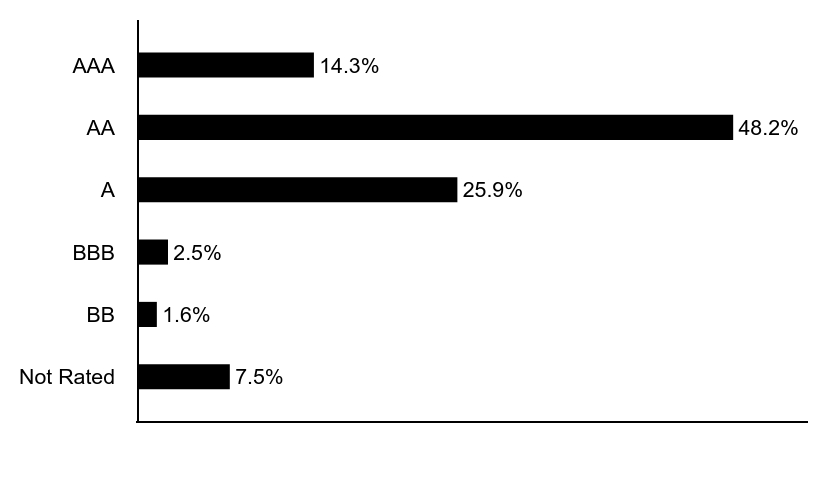

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 7.6% |

| BB | 1.4% |

| BBB | 9.8% |

| A | 23.2% |

| AA | 36.6% |

| AAA | 21.4% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

Eaton Vance Maryland Municipal Income Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Maryland Municipal Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $152 | 1.48% |

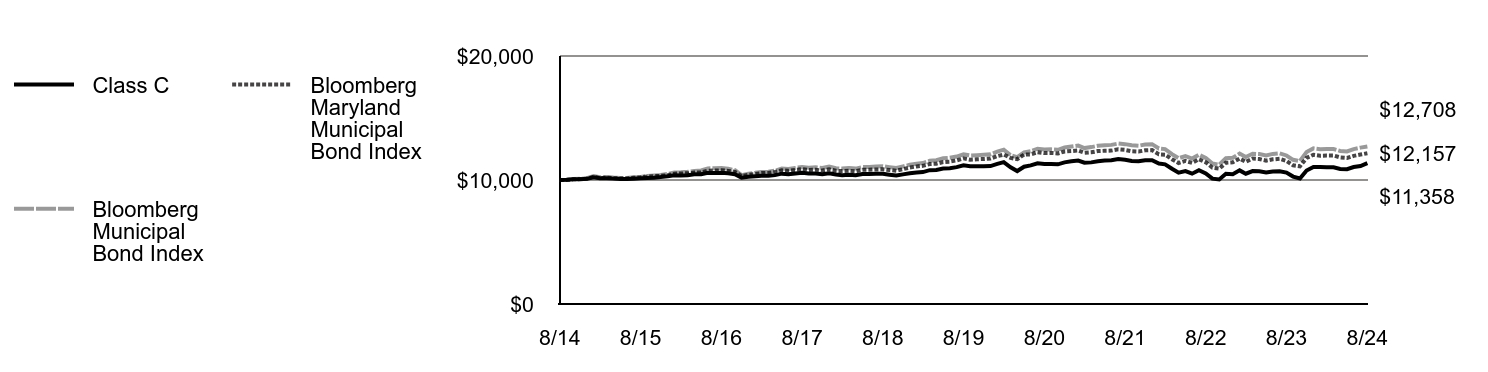

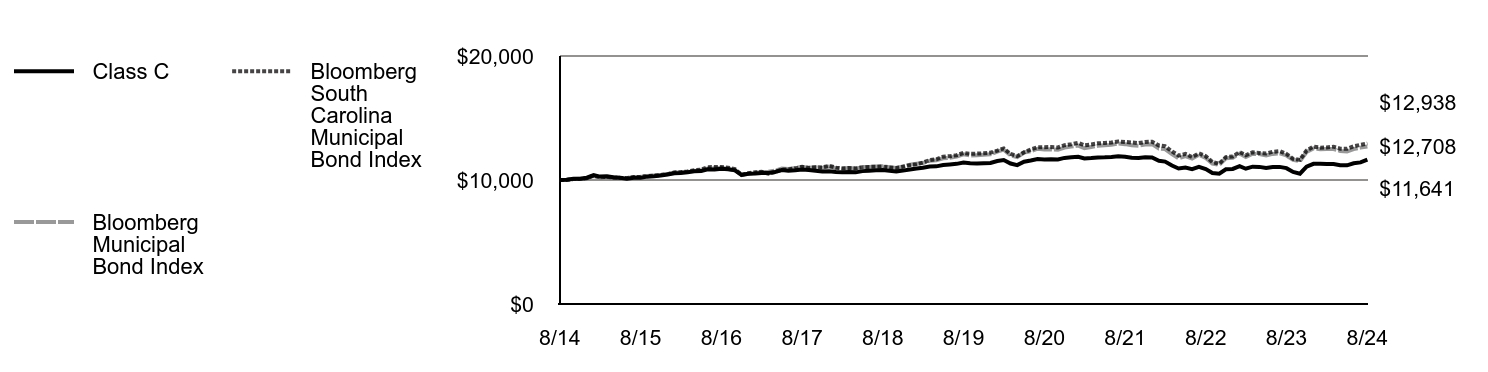

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↓ An out-of-Index position in variable-rate demand notes -- typically considered a defensive investment -- detracted from Index-relative returns as interest rates generally declined during the period

↓ An underweight position in the industrial development revenue sector -- the best-performing sector within the Index -- detracted from relative returns

↓ Security selections in BBB-rated bonds detracted from Fund performance versus the Index during the period

↑ Security selections and an overweight position in the health care sector, which outperformed the Index during the period, contributed to Fund returns

↑ Security selections and an overweight position in 4% coupon bonds, which typically have longer durations than higher-coupon bonds, contributed to Index-relative returns as interest rates generally declined and bond prices rose during the period

↑ An overweight position in bonds with 17+ years remaining to maturity helped returns as longer-maturity bonds outperformed shorter-maturity bonds

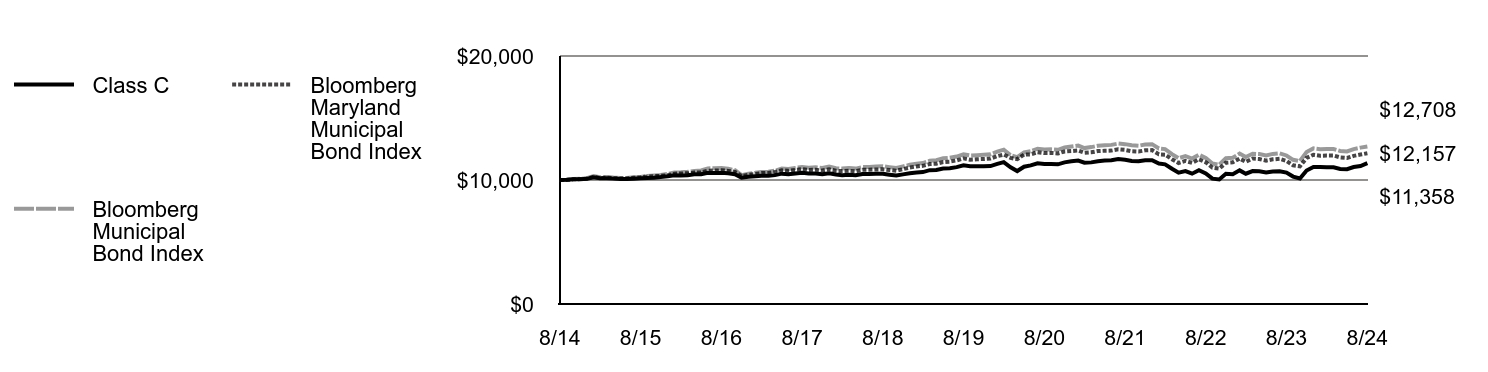

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | Bloomberg Municipal Bond Index | Bloomberg Maryland Municipal Bond Index |

|---|

| 8/14 | $10,000 | $10,000 | $10,000 |

| 9/14 | $10,013 | $10,010 | $9,997 |

| 10/14 | $10,066 | $10,079 | $10,052 |

| 11/14 | $10,059 | $10,096 | $10,071 |

| 12/14 | $10,092 | $10,147 | $10,101 |

| 1/15 | $10,226 | $10,327 | $10,256 |

| 2/15 | $10,137 | $10,220 | $10,164 |

| 3/15 | $10,149 | $10,250 | $10,191 |

| 4/15 | $10,111 | $10,196 | $10,143 |

| 5/15 | $10,071 | $10,168 | $10,123 |

| 6/15 | $10,073 | $10,159 | $10,119 |

| 7/15 | $10,105 | $10,232 | $10,184 |

| 8/15 | $10,137 | $10,252 | $10,207 |

| 9/15 | $10,159 | $10,327 | $10,278 |

| 10/15 | $10,191 | $10,368 | $10,312 |

| 11/15 | $10,234 | $10,409 | $10,331 |

| 12/15 | $10,296 | $10,482 | $10,383 |

| 1/16 | $10,380 | $10,607 | $10,505 |

| 2/16 | $10,359 | $10,624 | $10,528 |

| 3/16 | $10,392 | $10,658 | $10,542 |

| 4/16 | $10,465 | $10,736 | $10,602 |

| 5/16 | $10,463 | $10,765 | $10,611 |

| 6/16 | $10,586 | $10,936 | $10,753 |

| 7/16 | $10,563 | $10,943 | $10,765 |

| 8/16 | $10,583 | $10,958 | $10,781 |

| 9/16 | $10,538 | $10,903 | $10,736 |

| 10/16 | $10,472 | $10,789 | $10,653 |

| 11/16 | $10,183 | $10,386 | $10,326 |

| 12/16 | $10,256 | $10,508 | $10,423 |

| 1/17 | $10,297 | $10,577 | $10,488 |

| 2/17 | $10,339 | $10,651 | $10,557 |

| 3/17 | $10,349 | $10,674 | $10,570 |

| 4/17 | $10,392 | $10,751 | $10,645 |

| 5/17 | $10,511 | $10,922 | $10,779 |

| 6/17 | $10,467 | $10,883 | $10,744 |

| 7/17 | $10,528 | $10,971 | $10,816 |

| 8/17 | $10,579 | $11,054 | $10,880 |

| 9/17 | $10,531 | $10,998 | $10,814 |

| 10/17 | $10,516 | $11,025 | $10,832 |

| 11/17 | $10,458 | $10,966 | $10,762 |

| 12/17 | $10,543 | $11,081 | $10,863 |

| 1/18 | $10,440 | $10,950 | $10,744 |

| 2/18 | $10,392 | $10,918 | $10,718 |

| 3/18 | $10,432 | $10,958 | $10,746 |

| 4/18 | $10,384 | $10,919 | $10,705 |

| 5/18 | $10,479 | $11,044 | $10,819 |

| 6/18 | $10,476 | $11,053 | $10,827 |

| 7/18 | $10,504 | $11,080 | $10,851 |

| 8/18 | $10,501 | $11,108 | $10,867 |

| 9/18 | $10,430 | $11,037 | $10,805 |

| 10/18 | $10,358 | $10,969 | $10,743 |

| 11/18 | $10,454 | $11,090 | $10,872 |

| 12/18 | $10,548 | $11,223 | $11,007 |

| 1/19 | $10,599 | $11,308 | $11,095 |

| 2/19 | $10,640 | $11,368 | $11,144 |

| 3/19 | $10,792 | $11,548 | $11,286 |

| 4/19 | $10,810 | $11,591 | $11,313 |

| 5/19 | $10,928 | $11,751 | $11,449 |

| 6/19 | $10,956 | $11,794 | $11,483 |

| 7/19 | $11,038 | $11,889 | $11,581 |

| 8/19 | $11,189 | $12,077 | $11,741 |

| 9/19 | $11,115 | $11,980 | $11,636 |

| 10/19 | $11,106 | $12,002 | $11,672 |

| 11/19 | $11,108 | $12,032 | $11,697 |

| 12/19 | $11,121 | $12,068 | $11,733 |

| 1/20 | $11,294 | $12,285 | $11,925 |

| 2/20 | $11,444 | $12,444 | $12,049 |

| 3/20 | $11,026 | $11,992 | $11,782 |

| 4/20 | $10,722 | $11,842 | $11,680 |

| 5/20 | $11,068 | $12,219 | $12,055 |

| 6/20 | $11,176 | $12,319 | $12,067 |

| 7/20 | $11,350 | $12,527 | $12,245 |

| 8/20 | $11,294 | $12,468 | $12,174 |

| 9/20 | $11,296 | $12,470 | $12,184 |

| 10/20 | $11,262 | $12,433 | $12,139 |

| 11/20 | $11,424 | $12,621 | $12,299 |

| 12/20 | $11,505 | $12,697 | $12,335 |

| 1/21 | $11,573 | $12,778 | $12,377 |

| 2/21 | $11,400 | $12,575 | $12,191 |

| 3/21 | $11,421 | $12,653 | $12,233 |

| 4/21 | $11,511 | $12,759 | $12,331 |

| 5/21 | $11,564 | $12,797 | $12,357 |

| 6/21 | $11,595 | $12,832 | $12,371 |

| 7/21 | $11,684 | $12,939 | $12,473 |

| 8/21 | $11,633 | $12,891 | $12,426 |

| 9/21 | $11,537 | $12,798 | $12,319 |

| 10/21 | $11,509 | $12,761 | $12,296 |

| 11/21 | $11,599 | $12,869 | $12,395 |

| 12/21 | $11,594 | $12,890 | $12,411 |

| 1/22 | $11,322 | $12,537 | $12,069 |

| 2/22 | $11,262 | $12,492 | $12,044 |

| 3/22 | $10,909 | $12,087 | $11,671 |

| 4/22 | $10,592 | $11,753 | $11,373 |

| 5/22 | $10,719 | $11,928 | $11,538 |

| 6/22 | $10,510 | $11,732 | $11,385 |

| 7/22 | $10,790 | $12,042 | $11,674 |

| 8/22 | $10,531 | $11,778 | $11,427 |

| 9/22 | $10,110 | $11,326 | $10,991 |

| 10/22 | $10,040 | $11,232 | $10,918 |

| 11/22 | $10,501 | $11,757 | $11,387 |

| 12/22 | $10,467 | $11,791 | $11,428 |

| 1/23 | $10,776 | $12,130 | $11,729 |

| 2/23 | $10,509 | $11,856 | $11,466 |

| 3/23 | $10,724 | $12,119 | $11,724 |

| 4/23 | $10,705 | $12,091 | $11,690 |

| 5/23 | $10,614 | $11,986 | $11,563 |

| 6/23 | $10,692 | $12,106 | $11,665 |

| 7/23 | $10,708 | $12,154 | $11,706 |

| 8/23 | $10,599 | $11,979 | $11,539 |

| 9/23 | $10,277 | $11,628 | $11,182 |

| 10/23 | $10,119 | $11,529 | $11,101 |

| 11/23 | $10,763 | $12,261 | $11,781 |

| 12/23 | $11,048 | $12,546 | $12,036 |

| 1/24 | $11,045 | $12,482 | $11,955 |

| 2/24 | $11,030 | $12,498 | $11,972 |

| 3/24 | $11,026 | $12,497 | $11,973 |

| 4/24 | $10,890 | $12,343 | $11,819 |

| 5/24 | $10,875 | $12,307 | $11,773 |

| 6/24 | $11,043 | $12,495 | $11,943 |

| 7/24 | $11,125 | $12,609 | $12,051 |

| 8/24 | $11,358 | $12,708 | $12,157 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class C | 5.51% | (0.01)% | 1.28% |

| Class C with 1% Maximum Deferred Sales Charge | 4.51% | (0.01)% | 1.28% |

| Bloomberg Municipal Bond Index | 6.09% | 1.02% | 2.42% |

| Bloomberg Maryland Municipal Bond Index | 5.36% | 0.70% | 1.97% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $84,537,545 |

| # of Portfolio Holdings | 87 |

| Portfolio Turnover Rate | 42% |

| Total Advisory Fees Paid | $244,106 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference* | 7.4% |

| Senior Living/Life Care | 3.5% |

| Lease Rev./Cert. of Participation | 4.7% |

| Education | 8.0% |

| Special Tax Revenue | 10.4% |

| Transportation | 11.8% |

| Housing | 15.0% |

| Hospital | 18.1% |

| General Obligations | 21.1% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 7.6% |

| BB | 1.4% |

| BBB | 9.8% |

| A | 23.2% |

| AA | 36.6% |

| AAA | 21.4% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

Eaton Vance Maryland Municipal Income Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Maryland Municipal Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $55 | 0.53% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↑ Security selections and an overweight position in the health care sector, which outperformed the Index during the period, contributed to Fund returns

↑ Security selections and an overweight position in 4% coupon bonds, which typically have longer durations than higher-coupon bonds, contributed to Index-relative returns as interest rates generally declined and bond prices rose during the period

↑ An overweight position in bonds with 17+ years remaining to maturity helped returns as longer-maturity bonds outperformed shorter-maturity bonds

↓ An out-of-Index position in variable-rate demand notes -- typically considered a defensive investment -- detracted from Index-relative returns as interest rates generally declined during the period

↓ An underweight position in the industrial development revenue sector -- the best-performing sector within the Index -- detracted from relative returns

↓ Security selections in BBB-rated bonds detracted from Fund performance versus the Index during the period

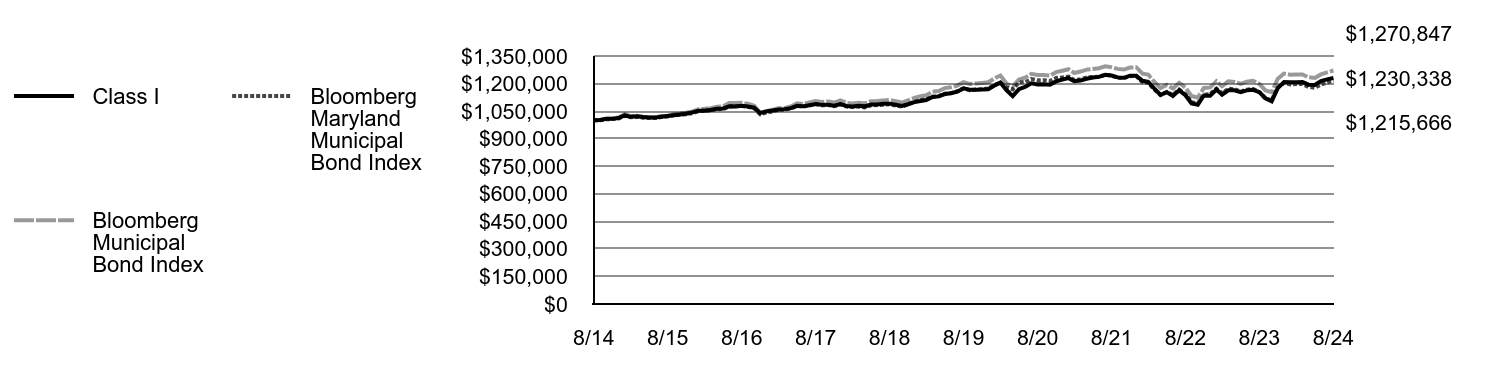

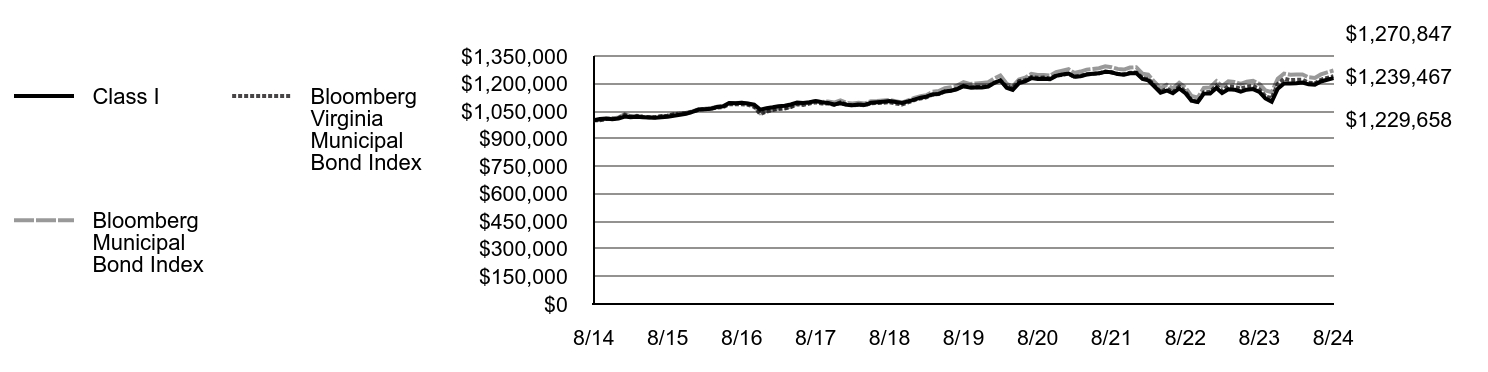

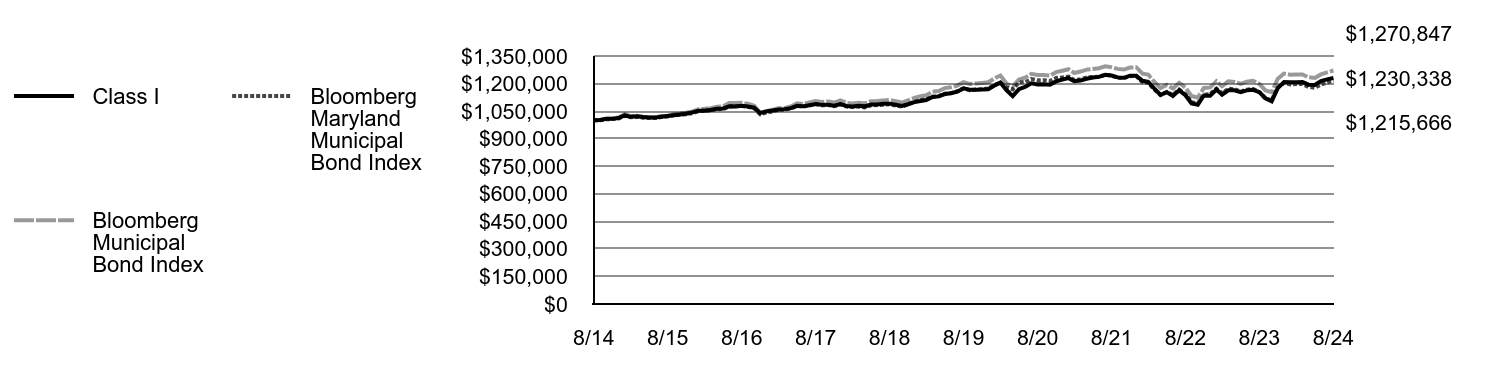

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | Bloomberg Municipal Bond Index | Bloomberg Maryland Municipal Bond Index |

|---|

| 8/14 | $1,000,000 | $1,000,000 | $1,000,000 |

| 9/14 | $1,001,960 | $1,001,017 | $999,750 |

| 10/14 | $1,008,317 | $1,007,880 | $1,005,167 |

| 11/14 | $1,008,132 | $1,009,624 | $1,007,082 |

| 12/14 | $1,012,356 | $1,014,718 | $1,010,089 |

| 1/15 | $1,026,509 | $1,032,703 | $1,025,621 |

| 2/15 | $1,019,574 | $1,022,050 | $1,016,394 |

| 3/15 | $1,021,537 | $1,025,002 | $1,019,060 |

| 4/15 | $1,017,928 | $1,019,624 | $1,014,310 |

| 5/15 | $1,015,332 | $1,016,807 | $1,012,322 |

| 6/15 | $1,015,015 | $1,015,880 | $1,011,910 |

| 7/15 | $1,019,152 | $1,023,239 | $1,018,363 |

| 8/15 | $1,023,240 | $1,025,248 | $1,020,687 |

| 9/15 | $1,027,442 | $1,032,675 | $1,027,782 |

| 10/15 | $1,031,580 | $1,036,780 | $1,031,223 |

| 11/15 | $1,035,754 | $1,040,903 | $1,033,129 |

| 12/15 | $1,043,191 | $1,048,216 | $1,038,261 |

| 1/16 | $1,051,934 | $1,060,723 | $1,050,504 |

| 2/16 | $1,051,436 | $1,062,391 | $1,052,819 |

| 3/16 | $1,055,665 | $1,065,756 | $1,054,153 |

| 4/16 | $1,063,141 | $1,073,593 | $1,060,163 |

| 5/16 | $1,064,521 | $1,076,497 | $1,061,077 |

| 6/16 | $1,076,409 | $1,093,622 | $1,075,323 |

| 7/16 | $1,075,694 | $1,094,290 | $1,076,508 |

| 8/16 | $1,078,552 | $1,095,766 | $1,078,096 |

| 9/16 | $1,075,430 | $1,090,297 | $1,073,649 |

| 10/16 | $1,068,768 | $1,078,859 | $1,065,334 |

| 11/16 | $1,039,697 | $1,038,623 | $1,032,639 |

| 12/16 | $1,048,486 | $1,050,816 | $1,042,299 |

| 1/17 | $1,053,732 | $1,057,744 | $1,048,775 |

| 2/17 | $1,059,059 | $1,065,088 | $1,055,701 |

| 3/17 | $1,060,814 | $1,067,401 | $1,056,978 |

| 4/17 | $1,066,200 | $1,075,146 | $1,064,538 |

| 5/17 | $1,078,948 | $1,092,209 | $1,077,906 |

| 6/17 | $1,075,953 | $1,088,292 | $1,074,437 |

| 7/17 | $1,082,275 | $1,097,097 | $1,081,562 |

| 8/17 | $1,088,576 | $1,105,446 | $1,088,039 |

| 9/17 | $1,083,988 | $1,099,825 | $1,081,398 |

| 10/17 | $1,084,220 | $1,102,510 | $1,083,185 |

| 11/17 | $1,079,656 | $1,096,607 | $1,076,192 |

| 12/17 | $1,088,577 | $1,108,068 | $1,086,315 |

| 1/18 | $1,077,793 | $1,095,023 | $1,074,422 |

| 2/18 | $1,075,444 | $1,091,751 | $1,071,768 |

| 3/18 | $1,079,373 | $1,095,781 | $1,074,591 |

| 4/18 | $1,075,920 | $1,091,870 | $1,070,503 |

| 5/18 | $1,086,100 | $1,104,374 | $1,081,899 |

| 6/18 | $1,086,454 | $1,105,316 | $1,082,712 |

| 7/18 | $1,090,366 | $1,107,998 | $1,085,099 |

| 8/18 | $1,090,653 | $1,110,844 | $1,086,705 |

| 9/18 | $1,084,586 | $1,103,652 | $1,080,530 |

| 10/18 | $1,078,419 | $1,096,856 | $1,074,273 |

| 11/18 | $1,087,433 | $1,108,996 | $1,087,181 |

| 12/18 | $1,098,876 | $1,122,274 | $1,100,672 |

| 1/19 | $1,105,362 | $1,130,758 | $1,109,532 |

| 2/19 | $1,110,645 | $1,136,812 | $1,114,359 |

| 3/19 | $1,127,403 | $1,154,783 | $1,128,613 |

| 4/19 | $1,130,148 | $1,159,123 | $1,131,266 |

| 5/19 | $1,143,032 | $1,175,103 | $1,144,868 |

| 6/19 | $1,146,961 | $1,179,442 | $1,148,275 |

| 7/19 | $1,155,864 | $1,188,947 | $1,158,116 |

| 8/19 | $1,173,862 | $1,207,701 | $1,174,130 |

| 9/19 | $1,166,196 | $1,198,020 | $1,163,610 |

| 10/19 | $1,166,000 | $1,200,167 | $1,167,200 |

| 11/19 | $1,166,999 | $1,203,169 | $1,169,719 |

| 12/19 | $1,169,341 | $1,206,842 | $1,173,275 |

| 1/20 | $1,189,890 | $1,228,525 | $1,192,461 |

| 2/20 | $1,205,327 | $1,244,367 | $1,204,944 |

| 3/20 | $1,163,385 | $1,199,230 | $1,178,216 |

| 4/20 | $1,131,843 | $1,184,180 | $1,168,039 |

| 5/20 | $1,169,777 | $1,221,850 | $1,205,505 |

| 6/20 | $1,181,567 | $1,231,906 | $1,206,749 |

| 7/20 | $1,201,104 | $1,252,655 | $1,224,500 |

| 8/20 | $1,195,562 | $1,246,777 | $1,217,368 |

| 9/20 | $1,196,589 | $1,247,042 | $1,218,437 |

| 10/20 | $1,193,531 | $1,243,296 | $1,213,863 |

| 11/20 | $1,211,744 | $1,262,058 | $1,229,946 |

| 12/20 | $1,221,919 | $1,269,746 | $1,233,513 |

| 1/21 | $1,229,399 | $1,277,837 | $1,237,742 |

| 2/21 | $1,212,844 | $1,257,534 | $1,219,058 |

| 3/21 | $1,216,149 | $1,265,290 | $1,223,275 |

| 4/21 | $1,226,075 | $1,275,903 | $1,233,055 |

| 5/21 | $1,233,223 | $1,279,709 | $1,235,650 |

| 6/21 | $1,236,376 | $1,283,223 | $1,237,068 |

| 7/21 | $1,247,560 | $1,293,866 | $1,247,288 |

| 8/21 | $1,243,933 | $1,289,118 | $1,242,580 |

| 9/21 | $1,233,603 | $1,279,814 | $1,231,942 |

| 10/21 | $1,231,340 | $1,276,072 | $1,229,603 |

| 11/21 | $1,242,652 | $1,286,935 | $1,239,475 |

| 12/21 | $1,243,033 | $1,289,012 | $1,241,122 |

| 1/22 | $1,214,909 | $1,253,728 | $1,206,941 |

| 2/22 | $1,208,712 | $1,249,236 | $1,204,434 |

| 3/22 | $1,172,371 | $1,208,739 | $1,167,085 |

| 4/22 | $1,138,859 | $1,175,306 | $1,137,281 |

| 5/22 | $1,153,222 | $1,192,765 | $1,153,847 |

| 6/22 | $1,132,191 | $1,173,230 | $1,138,515 |

| 7/22 | $1,163,075 | $1,204,229 | $1,167,404 |

| 8/22 | $1,136,266 | $1,177,836 | $1,142,702 |

| 9/22 | $1,091,682 | $1,132,630 | $1,099,110 |

| 10/22 | $1,084,280 | $1,123,211 | $1,091,769 |

| 11/22 | $1,135,026 | $1,175,747 | $1,138,677 |

| 12/22 | $1,133,232 | $1,179,113 | $1,142,846 |

| 1/23 | $1,167,625 | $1,212,983 | $1,172,857 |

| 2/23 | $1,139,605 | $1,185,555 | $1,146,559 |

| 3/23 | $1,163,065 | $1,211,860 | $1,172,428 |

| 4/23 | $1,162,941 | $1,209,092 | $1,168,959 |

| 5/23 | $1,153,001 | $1,198,614 | $1,156,274 |

| 6/23 | $1,162,866 | $1,210,621 | $1,166,516 |

| 7/23 | $1,165,640 | $1,215,410 | $1,170,627 |

| 8/23 | $1,153,441 | $1,197,913 | $1,153,868 |

| 9/23 | $1,120,106 | $1,162,804 | $1,118,249 |

| 10/23 | $1,103,457 | $1,152,908 | $1,110,086 |

| 11/23 | $1,175,000 | $1,226,096 | $1,178,064 |

| 12/23 | $1,208,198 | $1,254,593 | $1,203,596 |

| 1/24 | $1,207,098 | $1,248,186 | $1,195,461 |

| 2/24 | $1,207,452 | $1,249,789 | $1,197,192 |

| 3/24 | $1,207,816 | $1,249,749 | $1,197,292 |

| 4/24 | $1,193,796 | $1,234,271 | $1,181,854 |

| 5/24 | $1,192,747 | $1,230,651 | $1,177,313 |

| 6/24 | $1,213,501 | $1,249,514 | $1,194,331 |

| 7/24 | $1,222,643 | $1,260,903 | $1,205,085 |

| 8/24 | $1,230,338 | $1,270,847 | $1,215,666 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class I | 6.67% | 0.94% | 2.09% |

| Bloomberg Municipal Bond Index | 6.09% | 1.02% | 2.42% |

| Bloomberg Maryland Municipal Bond Index | 5.36% | 0.70% | 1.97% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $84,537,545 |

| # of Portfolio Holdings | 87 |

| Portfolio Turnover Rate | 42% |

| Total Advisory Fees Paid | $244,106 |

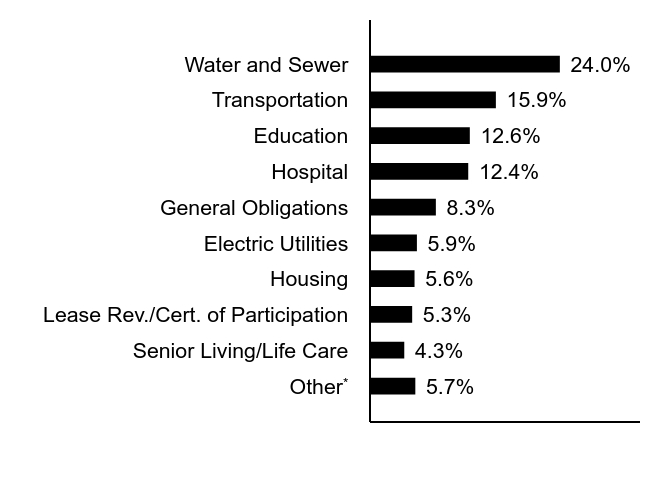

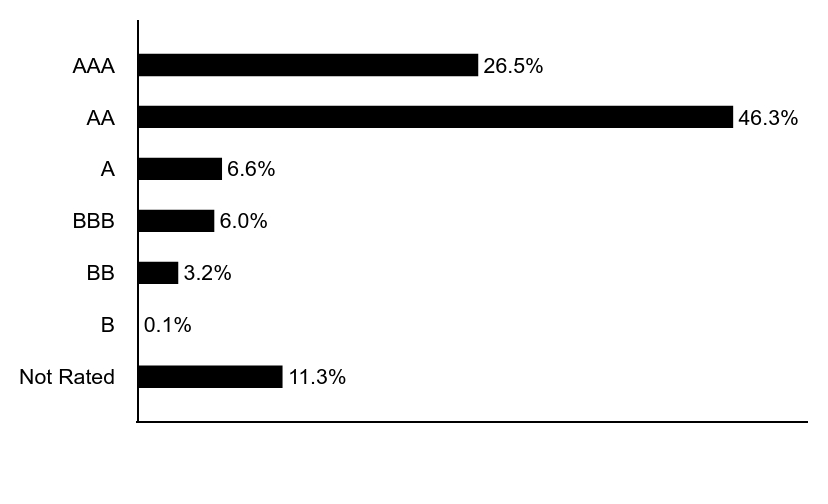

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference* | 7.4% |

| Senior Living/Life Care | 3.5% |

| Lease Rev./Cert. of Participation | 4.7% |

| Education | 8.0% |

| Special Tax Revenue | 10.4% |

| Transportation | 11.8% |

| Housing | 15.0% |

| Hospital | 18.1% |

| General Obligations | 21.1% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

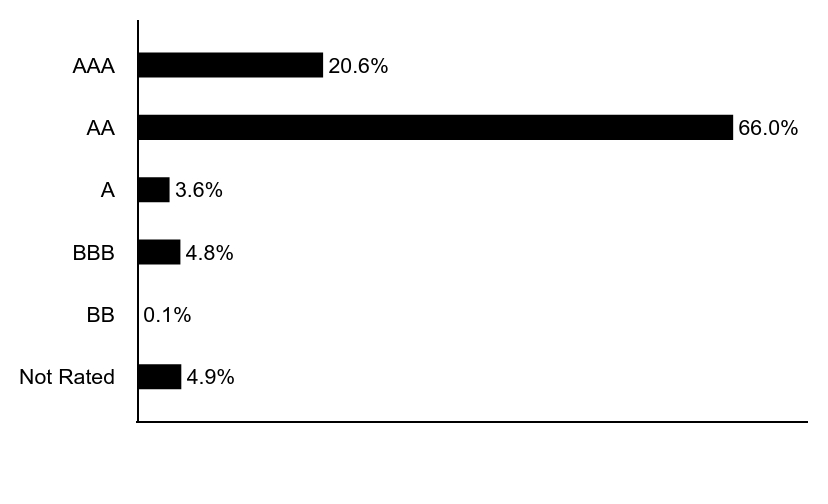

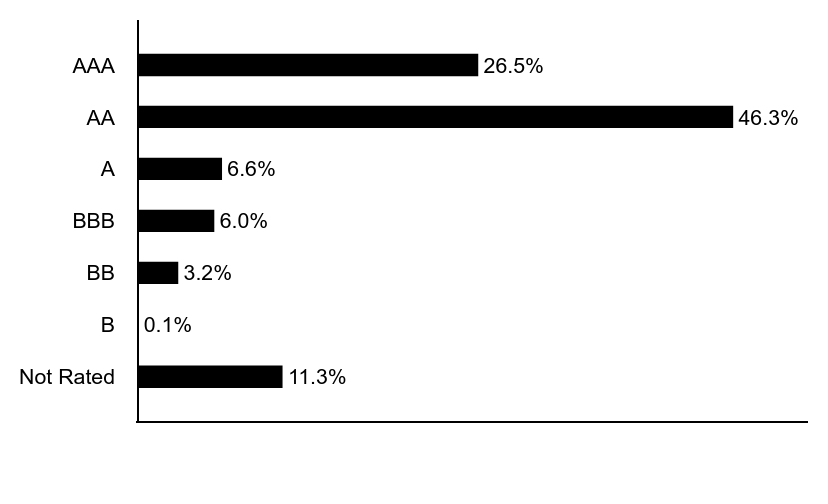

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 7.6% |

| BB | 1.4% |

| BBB | 9.8% |

| A | 23.2% |

| AA | 36.6% |

| AAA | 21.4% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

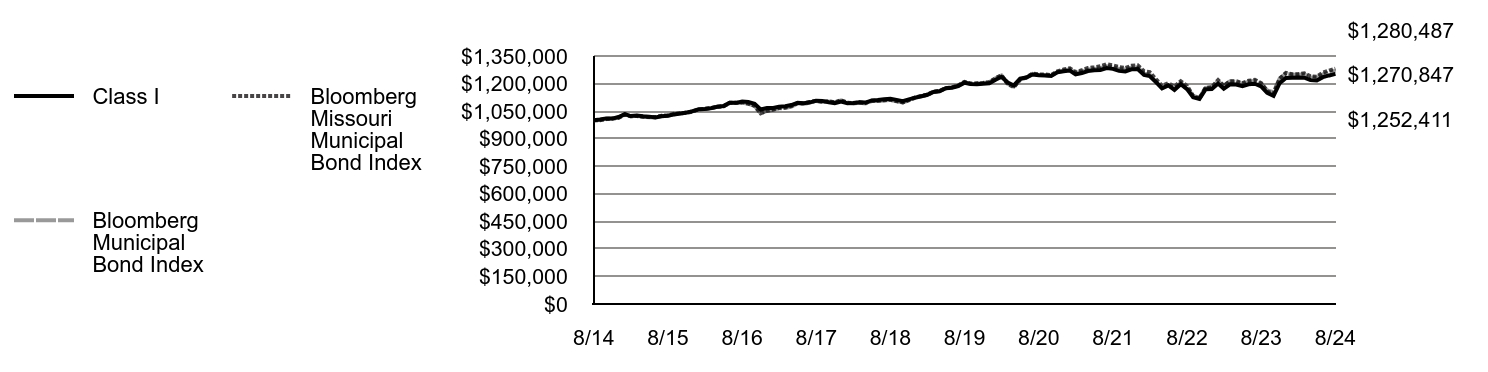

Eaton Vance Missouri Municipal Income Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Missouri Municipal Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $73 | 0.71% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↓ An underweight position in the industrial development revenue sector -- the best-performing sector within the Index -- detracted from relative returns

↓ An overweight position in AA-rated bonds detracted from relative returns as AA-rated bonds generally underperformed lower-rated bonds during the period

↓ Security selections in zero-coupon bonds detracted from Index-relative returns during the period

↑ Security selections and an overweight position in the health care sector, which outperformed the Index during the period, contributed to Fund returns

↑ An overweight position in 4% coupon bonds, which typically have longer durations than higher-coupon bonds, contributed to Index-relative returns as interest rates generally declined and bond prices rose during the period

↑ An out-of-Index allocation to taxable municipal bonds, which generally outperformed tax-exempt municipal bonds, contributed to Index-relative returns

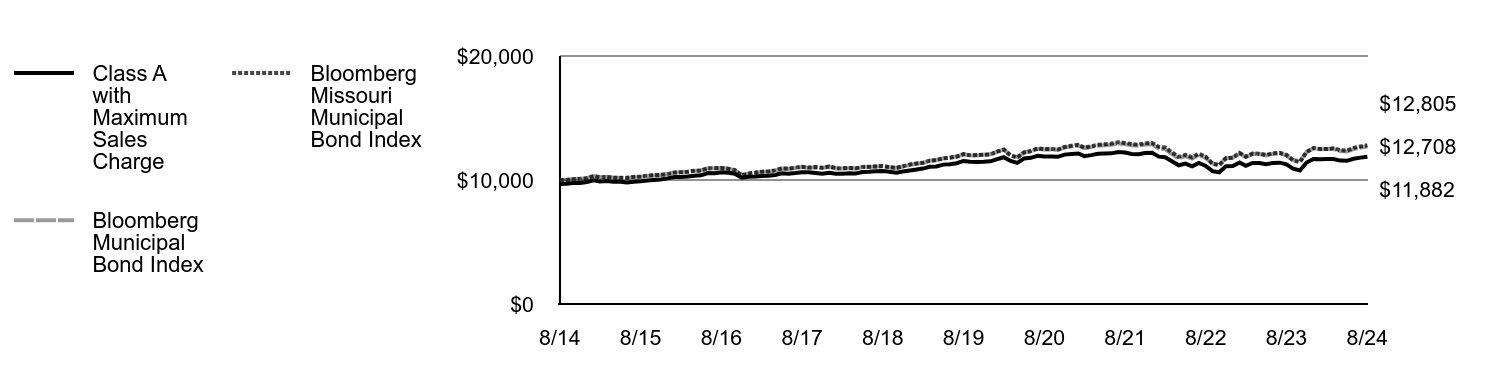

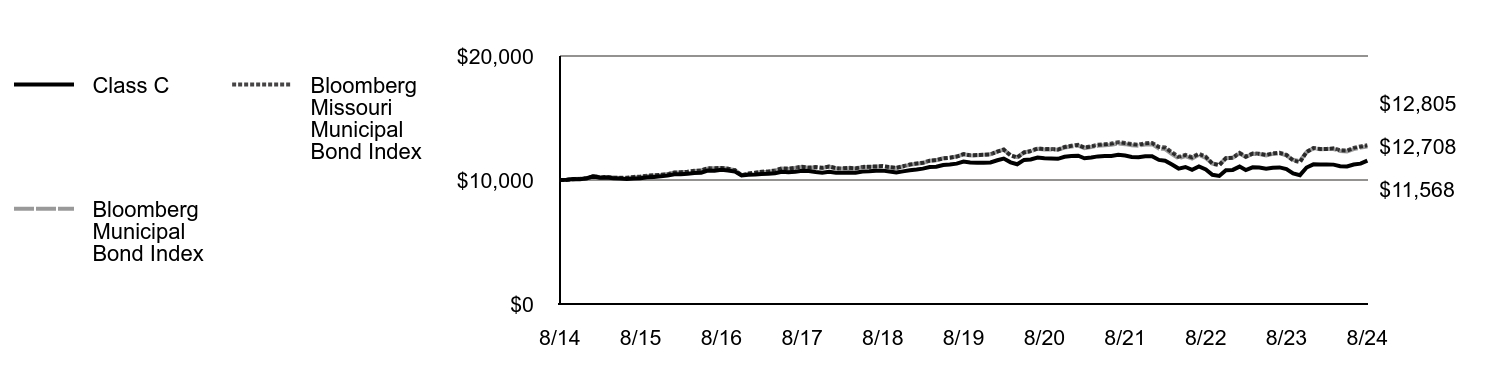

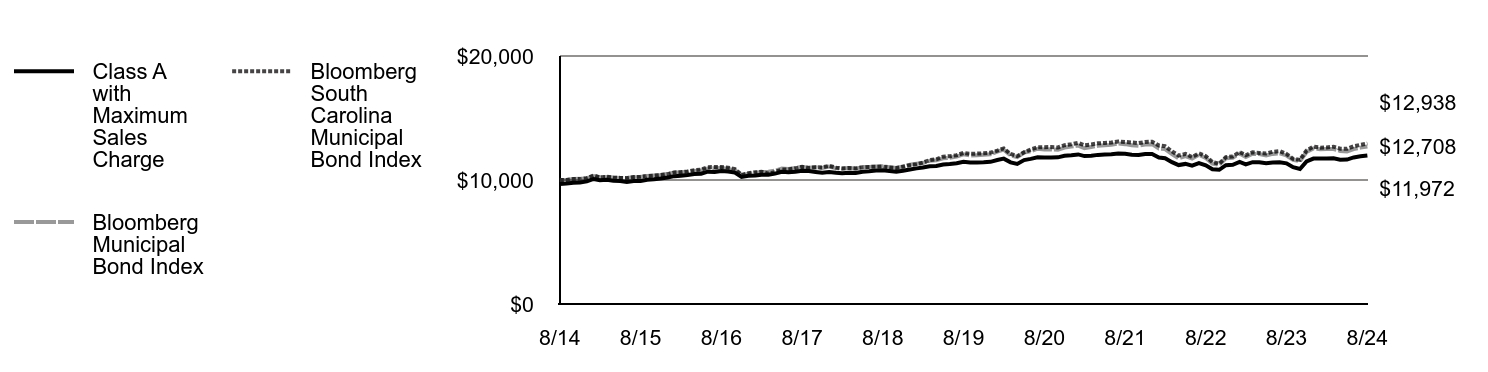

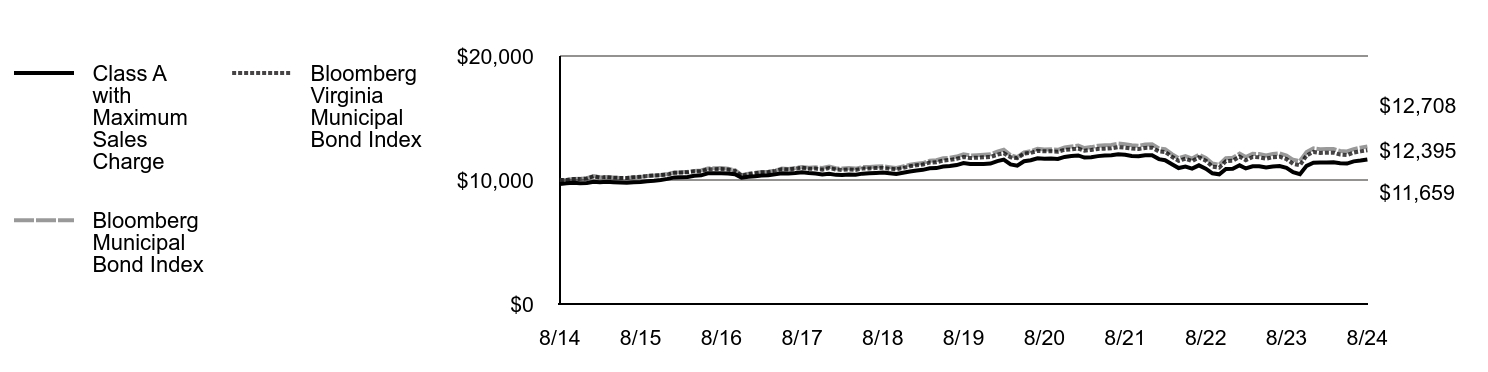

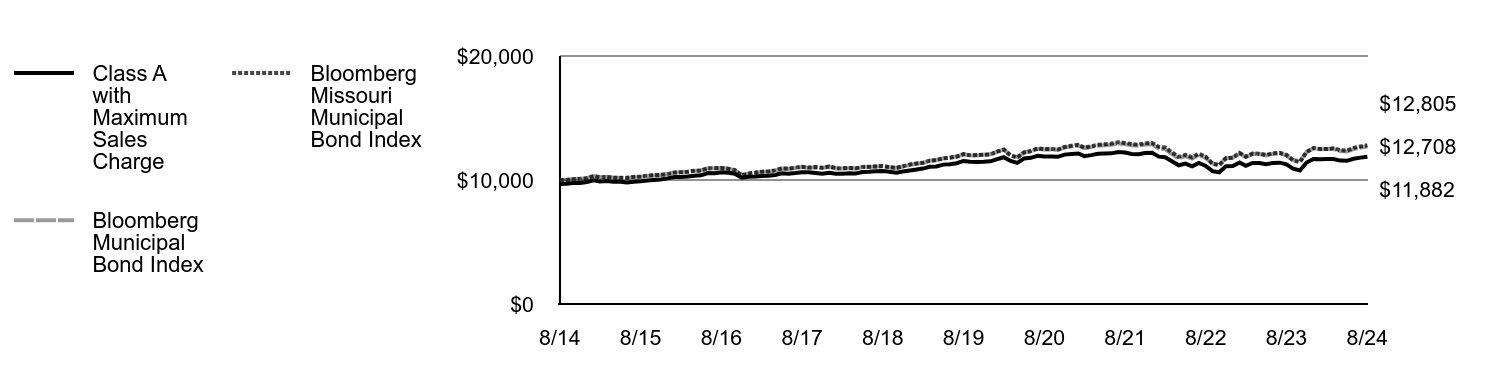

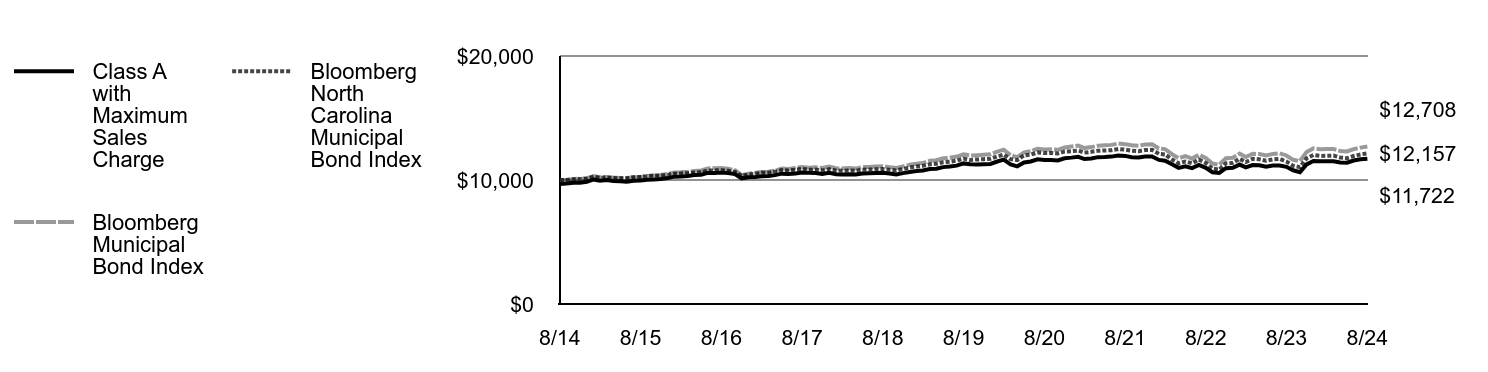

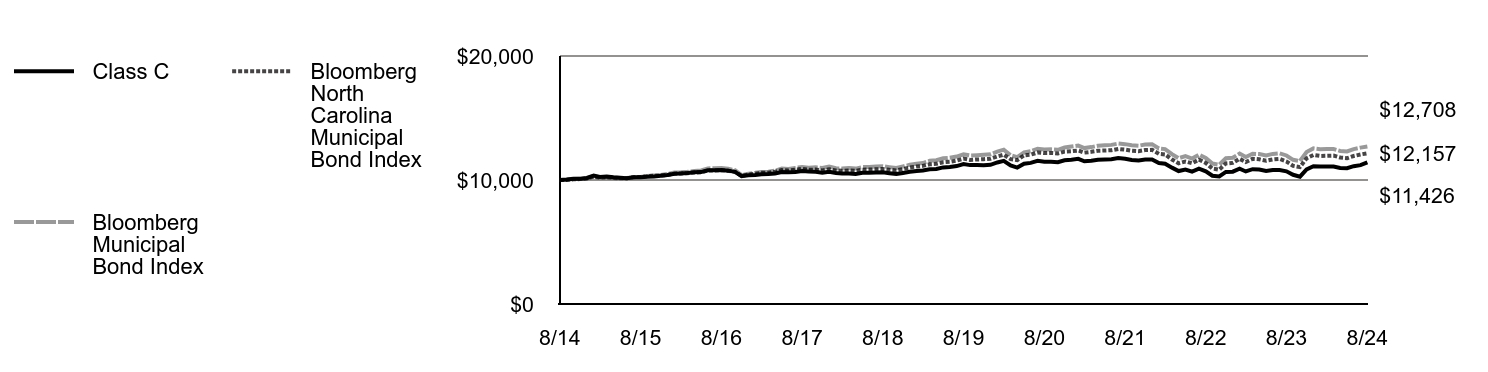

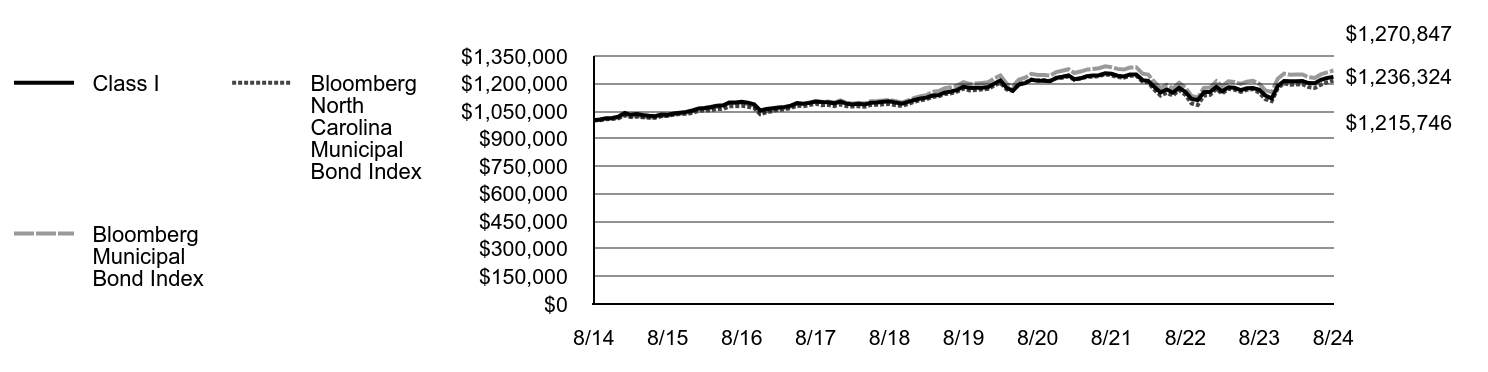

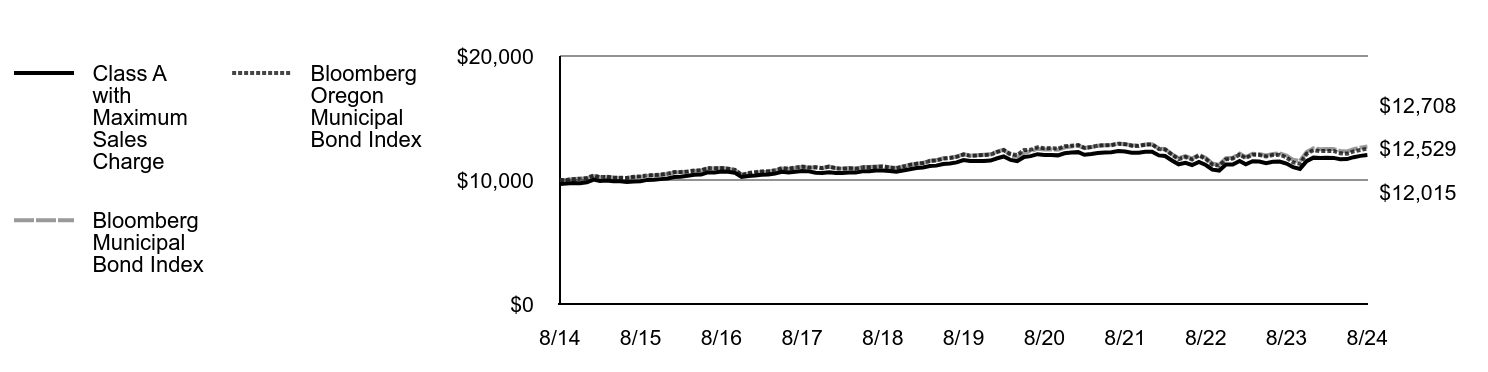

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | Bloomberg Municipal Bond Index | Bloomberg Missouri Municipal Bond Index |

|---|

| 8/14 | $9,675 | $10,000 | $10,000 |

| 9/14 | $9,703 | $10,010 | $10,001 |

| 10/14 | $9,762 | $10,079 | $10,065 |

| 11/14 | $9,761 | $10,096 | $10,092 |

| 12/14 | $9,830 | $10,147 | $10,133 |

| 1/15 | $9,982 | $10,327 | $10,314 |

| 2/15 | $9,888 | $10,220 | $10,216 |

| 3/15 | $9,918 | $10,250 | $10,239 |

| 4/15 | $9,865 | $10,196 | $10,188 |

| 5/15 | $9,853 | $10,168 | $10,185 |

| 6/15 | $9,800 | $10,159 | $10,175 |

| 7/15 | $9,861 | $10,232 | $10,252 |

| 8/15 | $9,891 | $10,252 | $10,277 |

| 9/15 | $9,963 | $10,327 | $10,352 |

| 10/15 | $10,004 | $10,368 | $10,379 |

| 11/15 | $10,045 | $10,409 | $10,413 |

| 12/15 | $10,129 | $10,482 | $10,474 |

| 1/16 | $10,233 | $10,607 | $10,601 |

| 2/16 | $10,242 | $10,624 | $10,623 |

| 3/16 | $10,283 | $10,658 | $10,664 |

| 4/16 | $10,345 | $10,736 | $10,739 |

| 5/16 | $10,375 | $10,765 | $10,765 |

| 6/16 | $10,555 | $10,936 | $10,953 |

| 7/16 | $10,553 | $10,943 | $10,950 |

| 8/16 | $10,615 | $10,958 | $10,968 |

| 9/16 | $10,580 | $10,903 | $10,907 |

| 10/16 | $10,501 | $10,789 | $10,788 |

| 11/16 | $10,184 | $10,386 | $10,376 |

| 12/16 | $10,257 | $10,508 | $10,522 |

| 1/17 | $10,276 | $10,577 | $10,590 |

| 2/17 | $10,329 | $10,651 | $10,671 |

| 3/17 | $10,348 | $10,674 | $10,695 |

| 4/17 | $10,411 | $10,751 | $10,773 |

| 5/17 | $10,541 | $10,922 | $10,938 |

| 6/17 | $10,505 | $10,883 | $10,919 |

| 7/17 | $10,558 | $10,971 | $10,995 |

| 8/17 | $10,633 | $11,054 | $11,066 |

| 9/17 | $10,619 | $10,998 | $10,999 |

| 10/17 | $10,561 | $11,025 | $11,043 |

| 11/17 | $10,500 | $10,966 | $10,982 |

| 12/17 | $10,575 | $11,081 | $11,086 |

| 1/18 | $10,503 | $10,950 | $10,957 |

| 2/18 | $10,509 | $10,918 | $10,931 |

| 3/18 | $10,549 | $10,958 | $10,980 |

| 4/18 | $10,521 | $10,919 | $10,943 |

| 5/18 | $10,641 | $11,044 | $11,058 |

| 6/18 | $10,658 | $11,053 | $11,069 |

| 7/18 | $10,698 | $11,080 | $11,091 |

| 8/18 | $10,726 | $11,108 | $11,119 |

| 9/18 | $10,663 | $11,037 | $11,046 |

| 10/18 | $10,587 | $10,969 | $10,975 |

| 11/18 | $10,686 | $11,090 | $11,108 |

| 12/18 | $10,772 | $11,223 | $11,246 |

| 1/19 | $10,847 | $11,308 | $11,335 |

| 2/19 | $10,922 | $11,368 | $11,387 |

| 3/19 | $11,067 | $11,548 | $11,560 |

| 4/19 | $11,094 | $11,591 | $11,606 |

| 5/19 | $11,240 | $11,751 | $11,746 |

| 6/19 | $11,278 | $11,794 | $11,797 |

| 7/19 | $11,355 | $11,889 | $11,892 |

| 8/19 | $11,538 | $12,077 | $12,094 |

| 9/19 | $11,470 | $11,980 | $11,998 |

| 10/19 | $11,460 | $12,002 | $12,012 |

| 11/19 | $11,475 | $12,032 | $12,032 |

| 12/19 | $11,503 | $12,068 | $12,073 |

| 1/20 | $11,687 | $12,285 | $12,291 |

| 2/20 | $11,835 | $12,444 | $12,456 |

| 3/20 | $11,537 | $11,992 | $11,974 |

| 4/20 | $11,382 | $11,842 | $11,804 |

| 5/20 | $11,738 | $12,219 | $12,223 |

| 6/20 | $11,790 | $12,319 | $12,333 |

| 7/20 | $11,950 | $12,527 | $12,547 |

| 8/20 | $11,889 | $12,468 | $12,496 |

| 9/20 | $11,897 | $12,470 | $12,498 |

| 10/20 | $11,868 | $12,433 | $12,460 |

| 11/20 | $12,049 | $12,621 | $12,662 |

| 12/20 | $12,106 | $12,697 | $12,764 |

| 1/21 | $12,138 | $12,778 | $12,831 |

| 2/21 | $11,924 | $12,575 | $12,623 |

| 3/21 | $12,005 | $12,653 | $12,723 |

| 4/21 | $12,112 | $12,759 | $12,843 |

| 5/21 | $12,131 | $12,797 | $12,887 |

| 6/21 | $12,149 | $12,832 | $12,939 |

| 7/21 | $12,256 | $12,939 | $13,050 |

| 8/21 | $12,213 | $12,891 | $12,988 |

| 9/21 | $12,096 | $12,798 | $12,899 |

| 10/21 | $12,078 | $12,761 | $12,843 |

| 11/21 | $12,173 | $12,869 | $12,969 |

| 12/21 | $12,192 | $12,890 | $12,988 |

| 1/22 | $11,885 | $12,537 | $12,670 |

| 2/22 | $11,830 | $12,492 | $12,628 |

| 3/22 | $11,509 | $12,087 | $12,235 |

| 4/22 | $11,189 | $11,753 | $11,867 |

| 5/22 | $11,324 | $11,928 | $12,027 |

| 6/22 | $11,105 | $11,732 | $11,835 |

| 7/22 | $11,383 | $12,042 | $12,122 |

| 8/22 | $11,136 | $11,778 | $11,879 |

| 9/22 | $10,713 | $11,326 | $11,320 |

| 10/22 | $10,622 | $11,232 | $11,190 |

| 11/22 | $11,110 | $11,757 | $11,765 |

| 12/22 | $11,135 | $11,791 | $11,797 |

| 1/23 | $11,418 | $12,130 | $12,189 |

| 2/23 | $11,149 | $11,856 | $11,884 |

| 3/23 | $11,372 | $12,119 | $12,130 |

| 4/23 | $11,362 | $12,091 | $12,127 |

| 5/23 | $11,274 | $11,986 | $12,026 |

| 6/23 | $11,369 | $12,106 | $12,152 |

| 7/23 | $11,399 | $12,154 | $12,199 |

| 8/23 | $11,257 | $11,979 | $12,028 |

| 9/23 | $10,919 | $11,628 | $11,577 |

| 10/23 | $10,764 | $11,529 | $11,439 |

| 11/23 | $11,404 | $12,261 | $12,264 |

| 12/23 | $11,689 | $12,546 | $12,582 |

| 1/24 | $11,681 | $12,482 | $12,504 |

| 2/24 | $11,687 | $12,498 | $12,507 |

| 3/24 | $11,693 | $12,497 | $12,557 |

| 4/24 | $11,565 | $12,343 | $12,399 |

| 5/24 | $11,545 | $12,307 | $12,375 |

| 6/24 | $11,714 | $12,495 | $12,593 |

| 7/24 | $11,803 | $12,609 | $12,707 |

| 8/24 | $11,882 | $12,708 | $12,805 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A | 5.52% | 0.58% | 2.07% |

| Class A with 3.25% Maximum Sales Charge | 2.06% | (0.07)% | 1.74% |

| Bloomberg Municipal Bond Index | 6.09% | 1.02% | 2.42% |

| Bloomberg Missouri Municipal Bond Index | 6.46% | 1.15% | 2.50% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $83,810,816 |

| # of Portfolio Holdings | 77 |

| Portfolio Turnover Rate | 68% |

| Total Advisory Fees Paid | $288,186 |

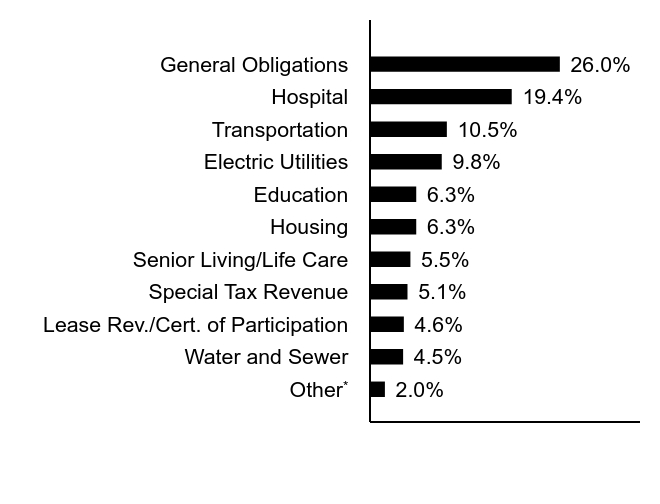

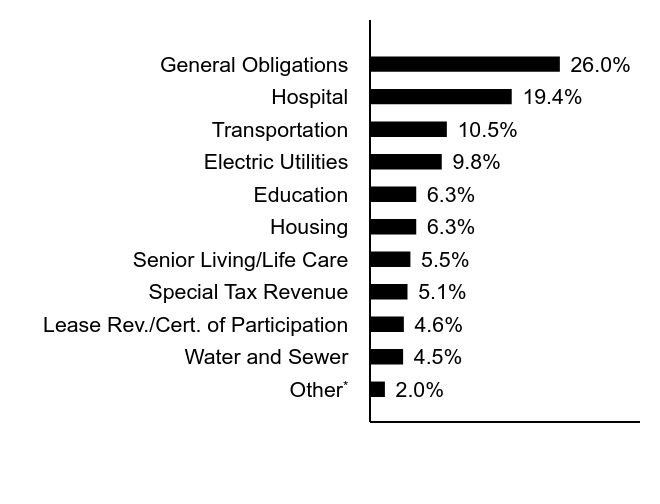

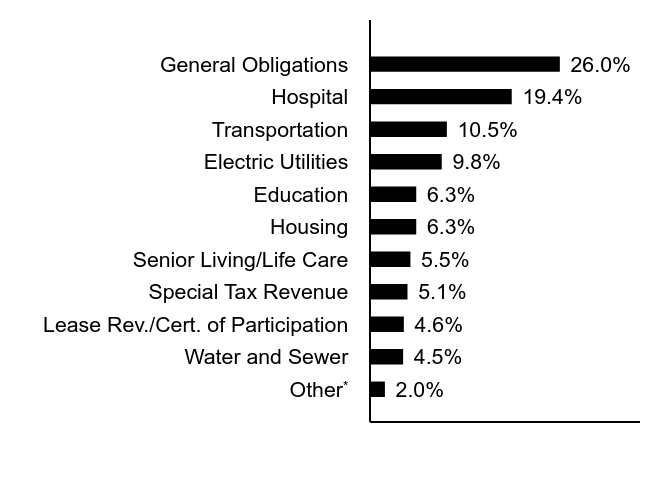

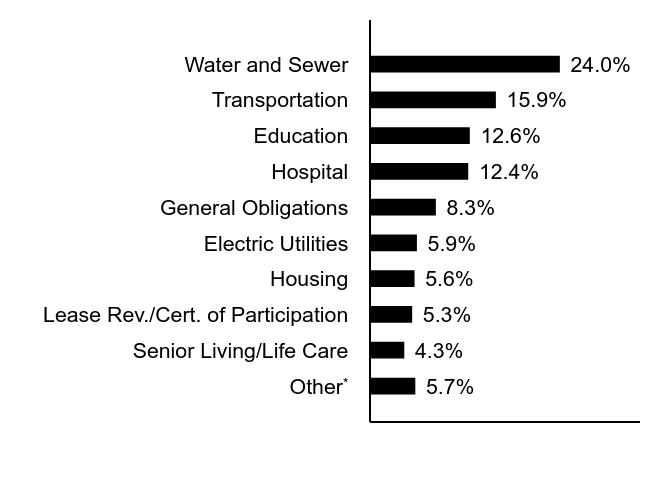

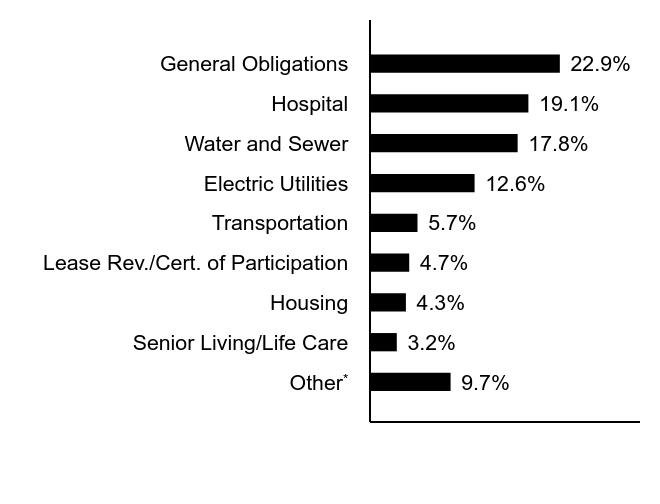

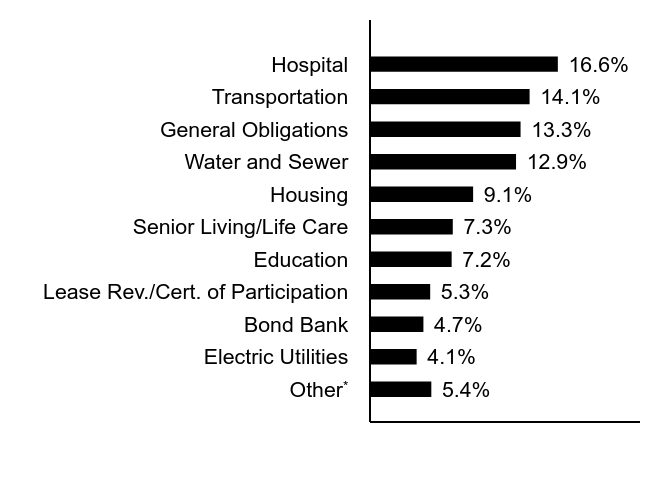

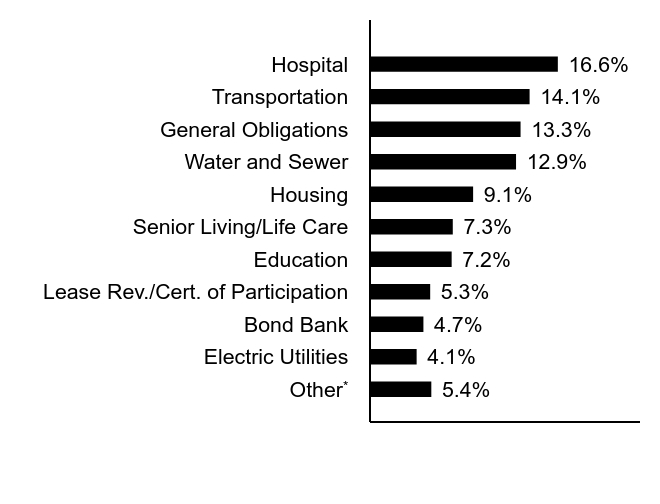

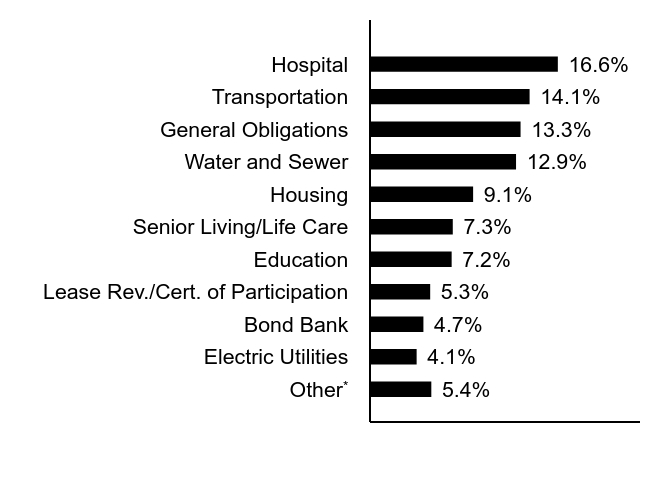

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

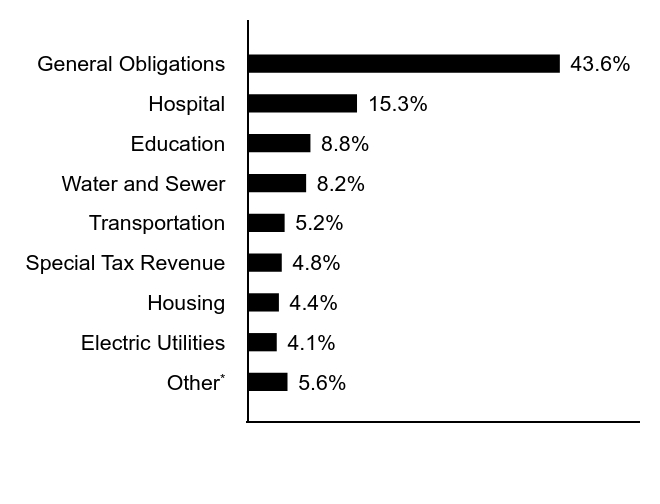

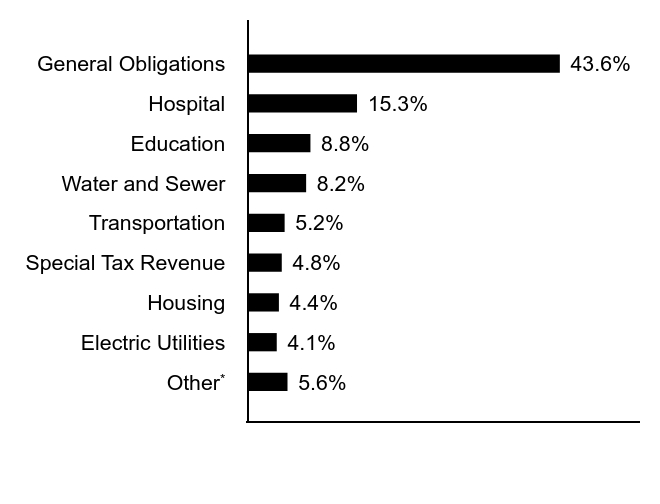

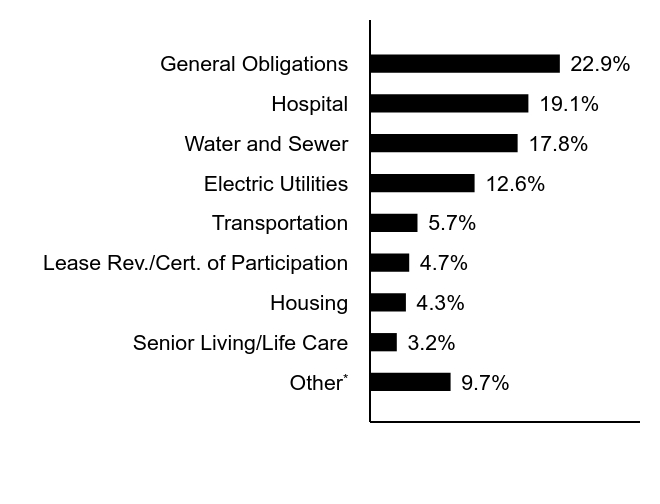

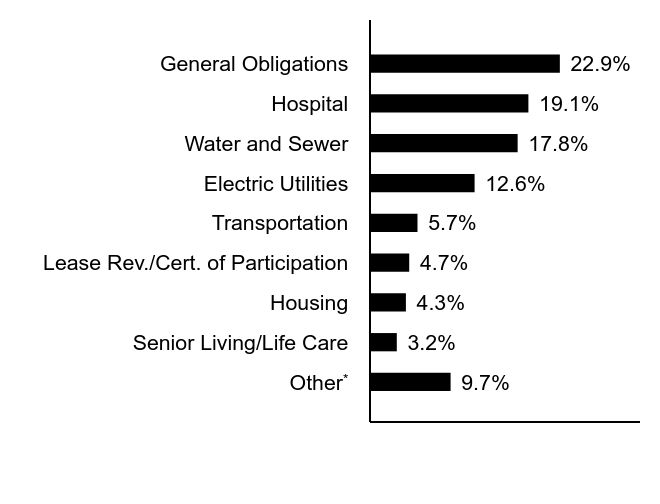

Sector Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference* | 2.0% |

| Water and Sewer | 4.5% |

| Lease Rev./Cert. of Participation | 4.6% |

| Special Tax Revenue | 5.1% |

| Senior Living/Life Care | 5.5% |

| Housing | 6.3% |

| Education | 6.3% |

| Electric Utilities | 9.8% |

| Transportation | 10.5% |

| Hospital | 19.4% |

| General Obligations | 26.0% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

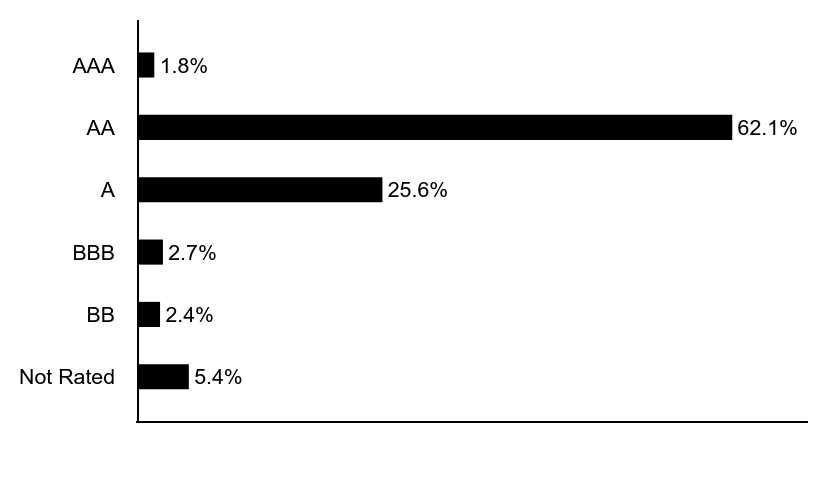

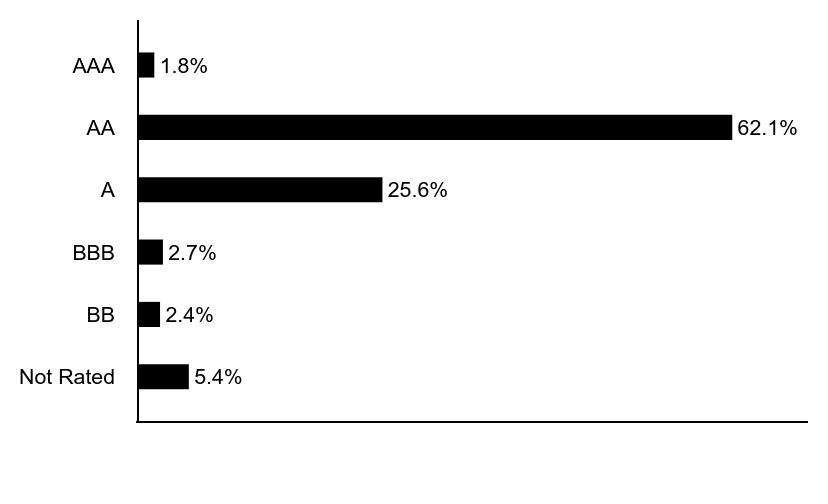

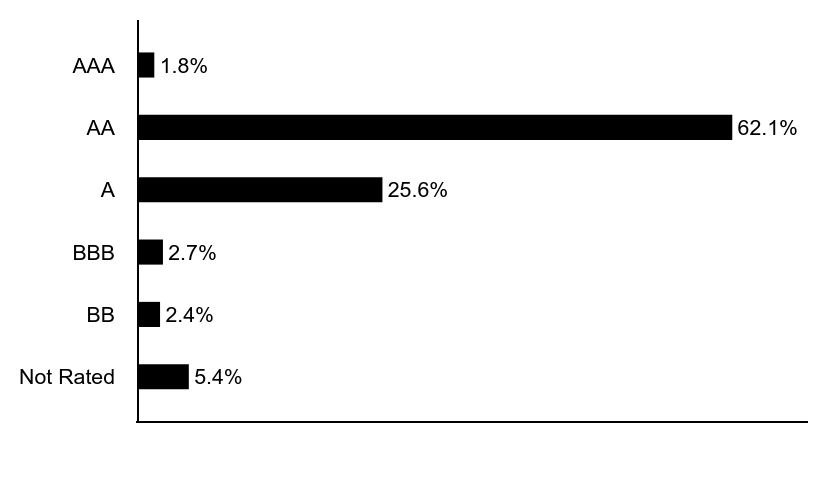

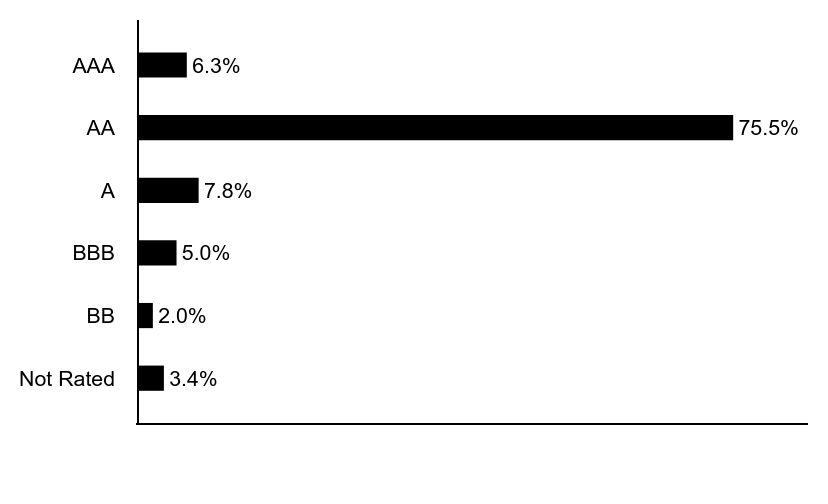

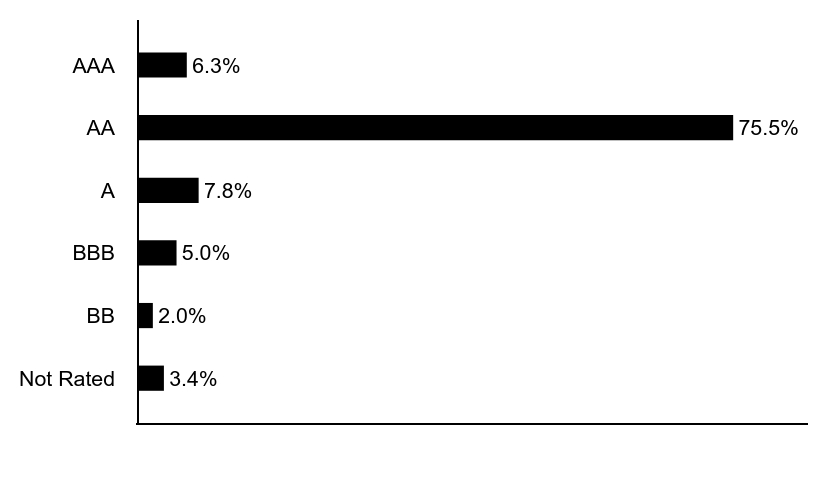

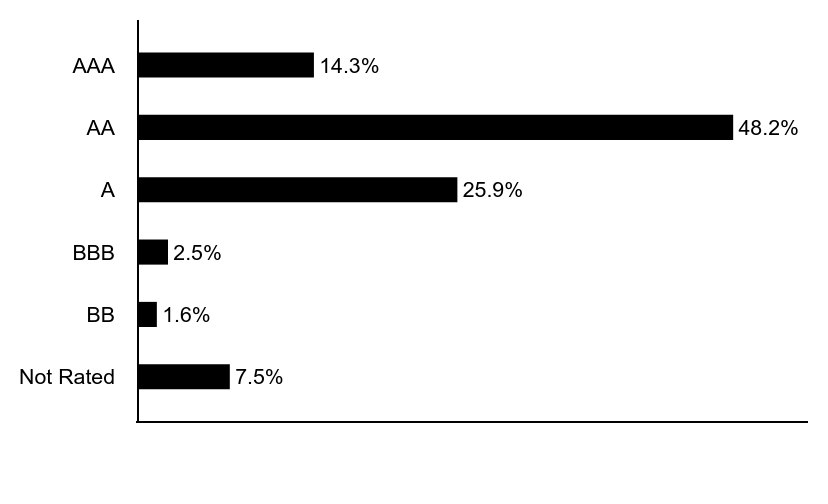

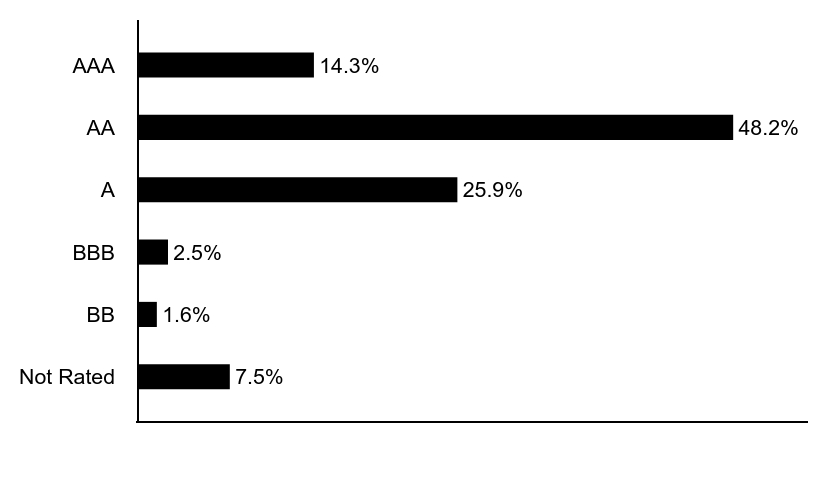

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 5.4% |

| BB | 2.4% |

| BBB | 2.7% |

| A | 25.6% |

| AA | 62.1% |

| AAA | 1.8% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

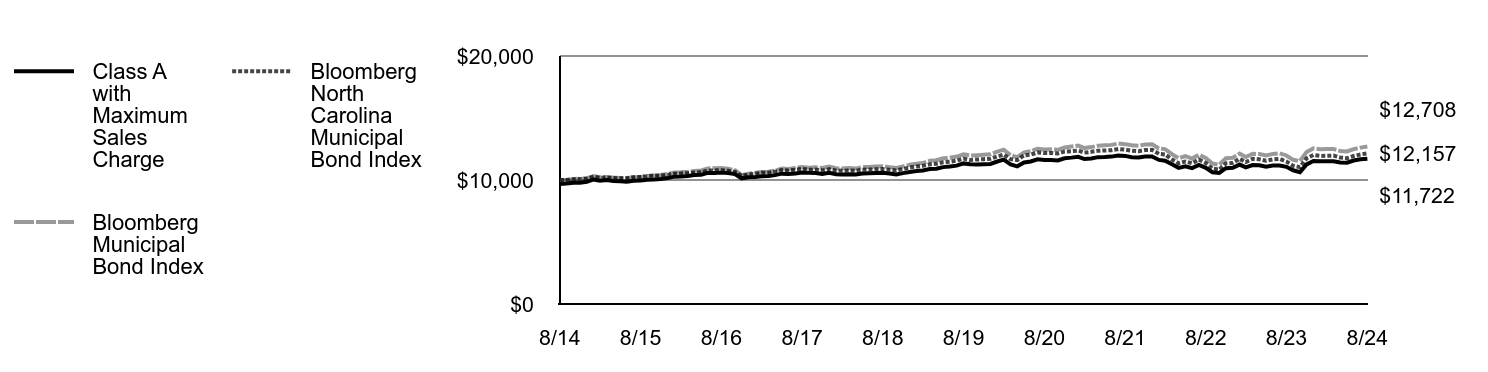

Eaton Vance Missouri Municipal Income Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Missouri Municipal Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

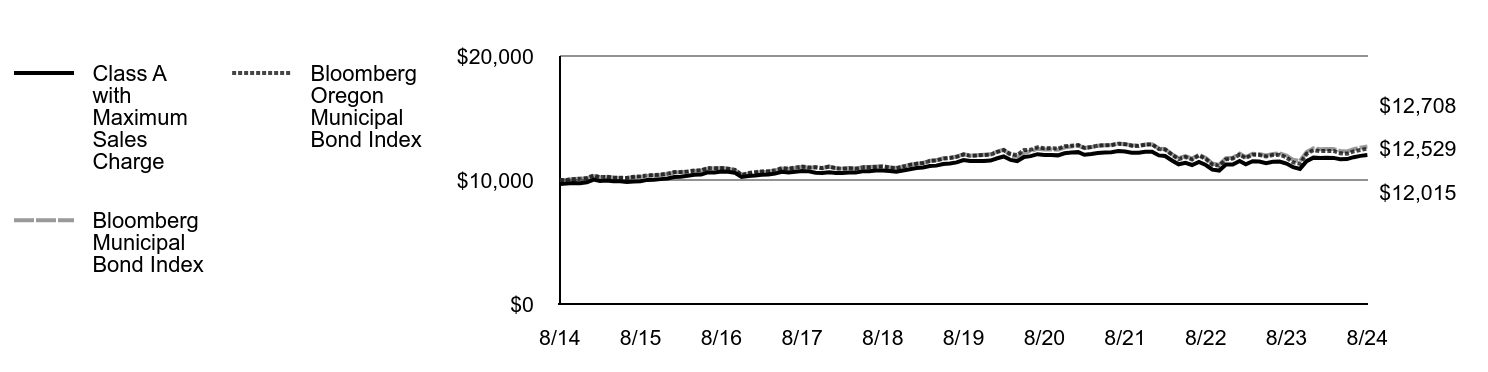

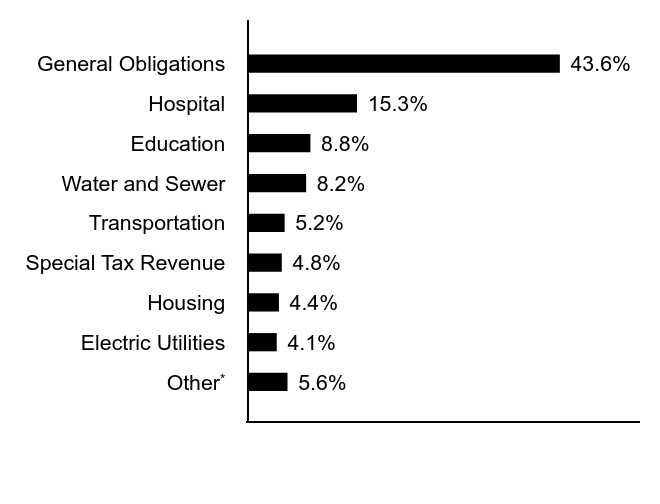

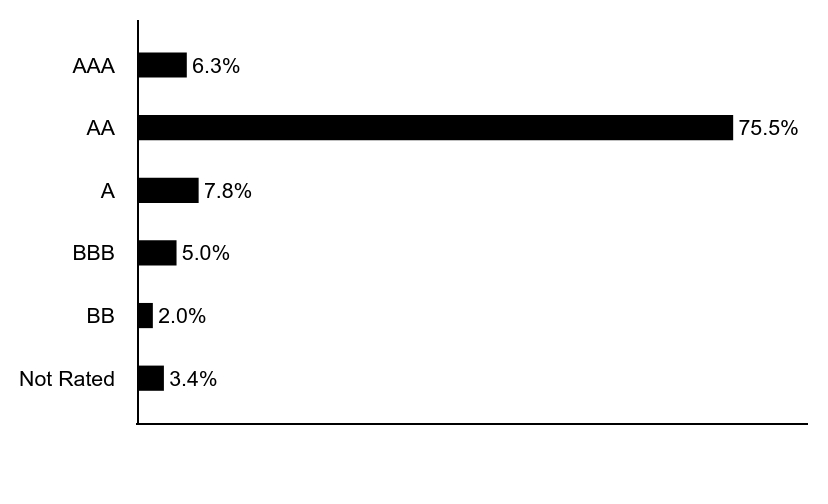

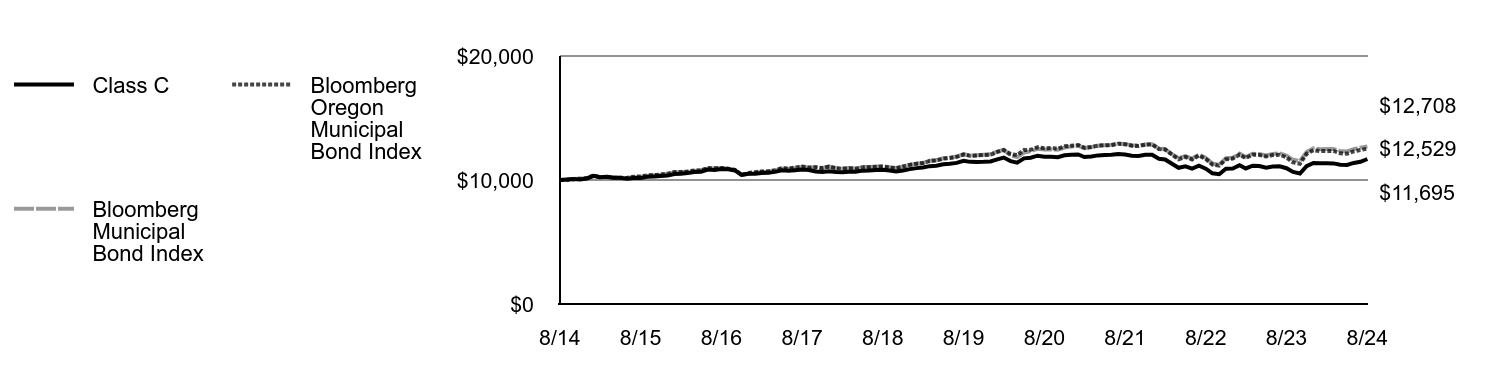

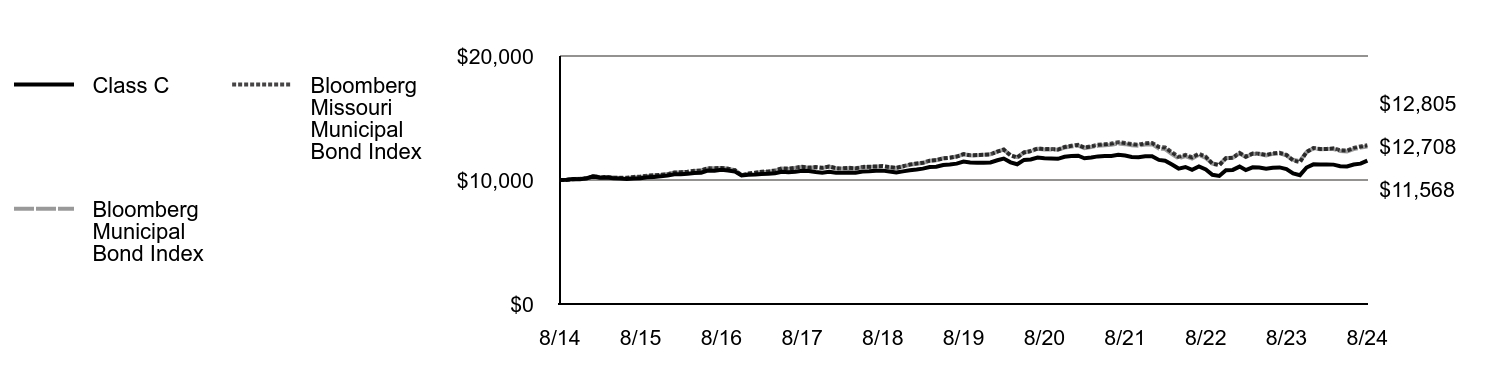

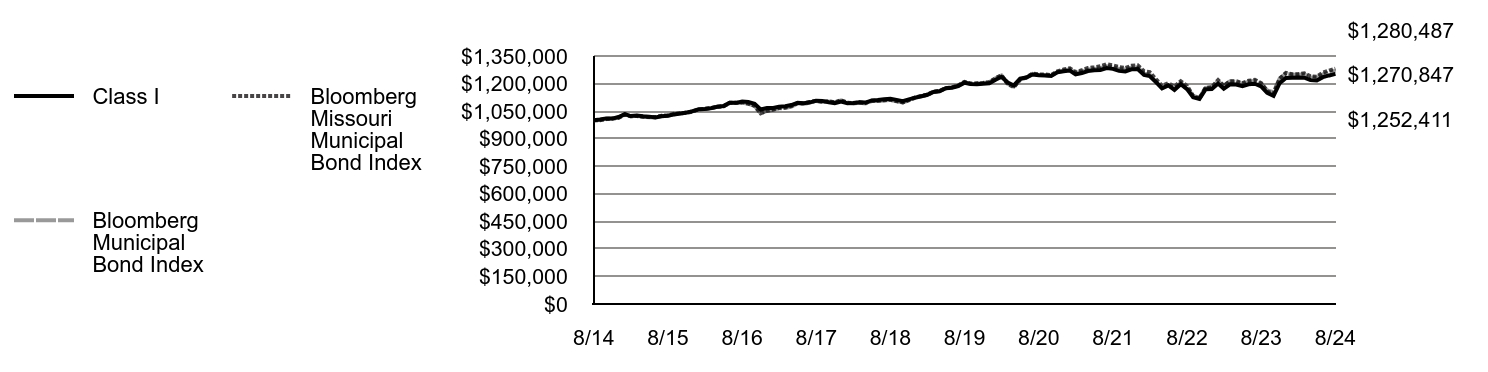

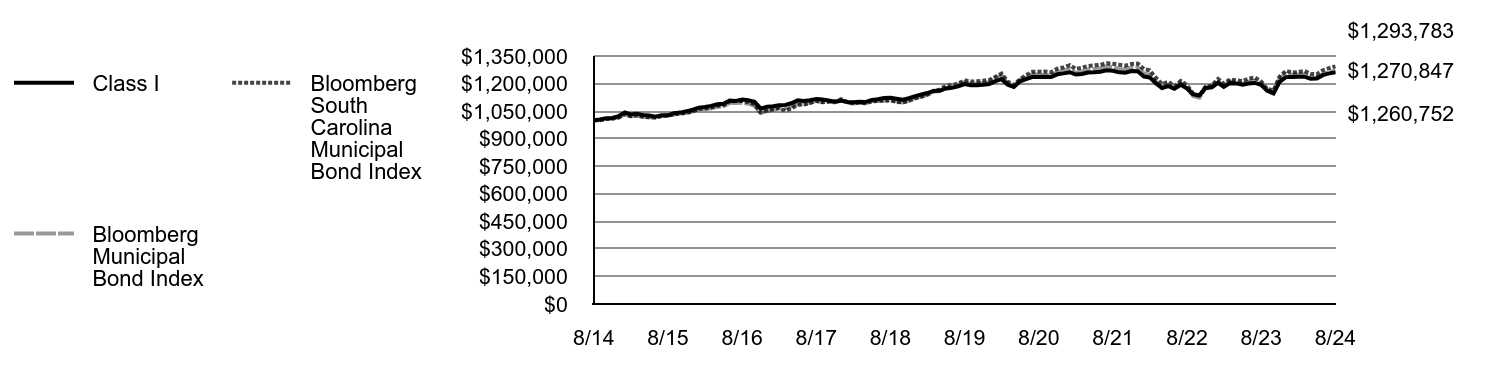

|---|