UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04537

Liberty All-Star Growth Fund, Inc.

(exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Tane T. Tyler, General Counsel

ALPS Fund Services, Inc.

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: December 31

Date of reporting period: January 1 - December 31, 2012

Item 1. Reports to Stockholders.

Contents

1 | ||

4 | ||

6 | ||

7 | ||

10 | ||

11 | ||

12 | ||

13 | ||

14 | ||

20 | ||

21 | ||

22 | ||

23 | ||

24 | ||

28 | ||

29 | ||

30 | ||

31 | ||

34 | ||

35 | ||

36 | ||

Inside Back Cover: Fund Information | ||

| A SINGLE INVESTMENT... | ||||||

| A DIVERSIFIED GROWTH PORTFOLIO | ||||||

| A single fund that offers: | ||||||

• A diversified, multi-managed portfolio of small, mid- and large cap growth stocks | ||||||

• Exposure to many of the industries that make the U.S. economy one of the world’s most dynamic | ||||||

• Access to institutional quality investment managers | ||||||

• Objective and ongoing manager evaluation | ||||||

• Active portfolio rebalancing | ||||||

• A quarterly fixed distribution policy | ||||||

• Actively managed, exchange traded fund listed on the New York Stock Exchange (ticker symbol: ASG) | ||||||

LIBERTY ALL-STAR® GROWTH FUND, INC. | ||||||

| ||||||

The views expressed in the President’s Letter, Unique Fund Attributes and Manager Roundtable reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions, and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for the Fund are based on numerous factors, may not be relied on as an indication of trading intent. References to specific company securities should not be construed as a recommendation or investment advice.

LIBERTY ALL-STAR® GROWTH FUND | 1 | |||

|

Fellow Shareholders: | February 2013 |

Overcoming a wide range of potential obstacles, U.S. stocks turned in a solid 2012, as the S&P 500® Index gained 16.00 percent for the year. The first and third quarters—with returns of 12.59 percent and 6.35 percent, respectively—propelled the index to its best year since 2009, when it was in rebound mode after the 2007-08 financial crisis. Moderate losses of 2.75 percent and 0.38 percent in the second and fourth quarters, respectively, kept the index from an even stronger year.

Other major indices also advanced, with the widely followed Dow Jones Industrial Average returning 10.24 percent. Among key growth benchmarks, the broad market Russell 3000® Growth Index returned 15.21 percent for the year, while the NASDAQ Composite Index advanced 17.45 percent. Among market capitalization indices, the Russell 1000® Growth Index (large cap), the Russell Midcap® Growth Index and the Russell 2000® Growth Index (small cap) all moderately trailed their Russell value index counterparts for the year.

The gains came despite a global macro environment with ample reasons for investors to be wary. Among the worries were the ongoing financial crisis in Europe, fears of a hard economic landing in China, continuing high unemployment and lower consumer spending in the U.S., the uncertainty of a presidential election year, and the fiscal cliff debates in Washington. But, coming off a good fourth quarter of 2011, the S&P 500® Index started the year with its strongest first quarter return since 1998. The index continued to advance until hitting a waterfall sell-off in May, sparked by J.P Morgan’s announcement of a multi-billion dollar trading loss in London, anemic readings on the U.S. economy, and continued struggles with massive sovereign debt and weak financial institutions in the Euro Zone. While some of these same issues simmered beneath the surface in the third quarter, investors appeared willing to accept the risks, as they were heartened by central banks around the world stimulating their respective economies and, in the U.S., a stronger housing sector, higher consumer confidence and corporate earnings reports that exceeded expectations. Gradual but ongoing improvements in the U.S. economy were not enough to overcome worries over

the outcome of the fiscal cliff debate in Washington, and stocks ended the fourth quarter with moderate declines. Although not as severe as it was in 2011, volatility continued to roil stock markets in 2012, as an upwardly trending market was hit with sharp sell-offs in May and October-November.

For the year, Liberty All-Star Growth Fund advanced 14.33 percent with shares valued at net asset value (NAV) with dividends reinvested and 13.78 percent with shares valued at market price with dividends reinvested. The Fund’s NAV reinvested return moderately lagged the Fund’s primary benchmark, the Lipper Multi-Cap Growth Mutual Fund Average, which returned 15.25 percent for the year. The Fund outperformed the S&P 500® and the Russell 3000® Growth Index for three quarters during 2012. Only in the second quarter, when the Fund’s -8.01 percent NAV reinvested return lagged key benchmarks, did the Fund underperform. The Fund closed the year with a modest fourth quarter gain compared with slightly negative returns for the S&P 500® and the Russell 3000® Growth Index. The discount at which Fund shares traded relative to their underlying NAV during 2012 was generally unchanged compared to 2011, ranging from as narrow as 6.2 percent to as wide as 12.3 percent.

Owing to the disappointing second quarter, the Fund ranked in the 63rd percentile of peer funds in the Lipper Multi-Cap Growth Mutual Fund Average for the year—although its better fourth quarter performance ranked it in the 31st percentile for that period. For three- and five-year periods, the Fund ranks above median (28th and 35th percentiles, respectively). For other long-term periods, the Fund is slightly below median (56th percentile) for the trailing 10 years but above median (48th percentile) since inception. We are pleased that since inception Fund shares valued at market price with dividends reinvested have outperformed the S&P 500® Index, the NASDAQ Composite and the Russell 3000®Growth Index. We note that the Fund’s return over this period is net of fees, while benchmark returns include no fees (and would further point out that an investment in any of these three indices would incur fees).

www.all-starfunds.com |

ASG |

| 2 | LIBERTY ALL-STAR® GROWTH FUND | |||

PRESIDENT’S LETTER (UNAUDITED) |

Fund distributions totaled $0.27 per share in 2012. The Fund’s distribution policy has been in place since 1997 and is a major component of the Fund's total return. Since 1997, the Fund has paid distributions totaling $11.24 per share and we would emphasize that shareholders must include these distributions when determining the return on their investment in the Fund.

Once again, in this annual report we offer a question and answer session with the Fund’s three growth style investment managers. We believe you will find the comments of these leading investors to be both interesting and insightful. As we have also done in recent annual reports, we once again offer a brief summary of the Fund’s attributes (on pages 4 and 5). I urge you to revisit these attributes, as they help to make the Fund a unique and attractive vehicle for investment in quality growth stocks.

We are pleased that the Fund provided a return of 14 percent in 2012—a year in which concerns over issues both at home and abroad could have given pause to investors. But, continued strong company fundamentals and gradual improvements in the economy were sources of optimism and they ultimately carried the day. Volatility, albeit somewhat muted in 2012 compared with 2011, is often a challenge for actively managed funds, such as Liberty All-Star Growth Fund; but the professionalism of the Fund’s investment managers and its multi-cap, multi-manager structure led to a rewarding year for investors. We are optimistic about prospects for 2013, but whatever the market holds, please be assured that we will remain diligent and disciplined, and place our shareholders’ best interests first and foremost.

Sincerely,

William R. Parmentier, Jr.

President and Chief Executive Officer

Liberty All-Star® Growth Fund, Inc.

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 3 | |||

PRESIDENT’S LETTER (UNAUDITED) |

FUND STATISTICS AND SHORT-TERM PERFORMANCE PERIODS ENDING DECEMBER 31, 2012 | ||||||||||||||

FUND STATISTICS: | ||||||||||||||

Net Asset Value (NAV) | $4.54 | |||||||||||||

Market Price | $4.06 | |||||||||||||

Discount | 10.6% | |||||||||||||

| Quarter | 2012 | |||||||||||||

Distributions | $0.07 | $0.27 | ||||||||||||

Market Price Trading Range | $3.65 to $4.24 | $3.65 to $4.43 | ||||||||||||

Discount Range | 7.8% to 12.3% | 6.2% to 12.3% | ||||||||||||

PERFORMANCE: | ||||||||||||||

Shares Valued at NAV with Dividends Reinvested | 0.87% | 14.33% | ||||||||||||

Shares Valued at Market Price with Dividends Reinvested | (2.34% | ) | 13.78% | |||||||||||

NASDAQ Composite Index | (2.65% | ) | 17.45% | |||||||||||

Russell 3000® Growth Index | (1.19% | ) | 15.21% | |||||||||||

S&P 500® Index | (0.38% | ) | 16.00% | |||||||||||

Lipper Multi-Cap Growth Mutual Fund Average* | (0.22% | ) | 15.25% | |||||||||||

NAV Reinvested Percentile Rank (1 = best; 100 = worst) | 31st | 63rd | ||||||||||||

Number of Funds in Category | 551 | 531 | ||||||||||||

LONG-TERM PERFORMANCE SUMMARY AND DISTRIBUTIONS | ANNUALIZED RATES OF RETURN | |||||||||||||

PERIODS ENDING DECEMBER 31, 2012 | 3 YEARS | 5 YEARS | 10 YEARS | INCEPTION | ** | |||||||||

LIBERTY ALL-STAR® GROWTH FUND, INC.

| ||||||||||||||

Distributions | $0.79 | $1.50 | $4.49 | $6.45 | ||||||||||

Shares Valued at NAV with Dividends Reinvested | 11.28% | 2.14% | 7.61% | 0.78% | ||||||||||

Shares Valued at Market Price with Dividends Reinvested | 13.63% | 0.11% | 7.21% | 1.95% | ||||||||||

NASDAQ Composite Index | 11.19% | 3.70% | 9.42% | (1.19% | ) | |||||||||

Russell 3000® Growth Index | 11.46% | 3.15% | 7.69% | (0.61% | ) | |||||||||

S&P 500® Index | 10.87% | 1.66% | 6.88% | 1.77% | ||||||||||

Lipper Multi-Cap Growth Mutual Fund Average* | 9.83% | 0.94% | 8.07% | 0.34% | ||||||||||

NAV Reinvested Percentile Rank (1 = best; 100 = worst) | 28th | 35th | 56th | 48th | ||||||||||

Number of Funds in Category | 466 | 387 | 255 | 177 | ||||||||||

| * | Percentile ranks calculated using the Fund’s NAV Reinvested results within the Lipper Multi-Cap Growth Mutual Fund Universe. |

| ** | Since restructuring to a multi-cap growth fund on May 1, 2000. |

Figures shown for the Fund and the Lipper Multi-Cap Growth Mutual Fund Average are total returns, which include dividends, after deducting Fund expenses. The Fund’s performance is calculated assuming that a shareholder exercised all primary rights in the Fund’s rights offerings. Figures shown for the unmanaged NASDAQ Composite Index, the Russell 3000® Growth Index and the S&P 500® Index are total returns, including dividends. A description of the Lipper benchmark and the market indices can be found on page 36.

Past performance cannot predict future results. Performance will fluctuate with market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

Shares of closed-end funds frequently trade at a discount to net asset value. The price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below or above net asset value.

www.all-starfunds.com |

ASG |

| 4 | LIBERTY ALL-STAR® GROWTH FUND | |||

| Unique Attributes of Liberty All-Star® Growth Fund

Several attributes help to make the Fund a core equity holding for investors seeking a diversified growth portfolio, income and the potential for long-term appreciation.

|

| ||

| Multi-management for Individual Investors

| |

Large institutional investors have traditionally employed multiple investment managers. With three investment managers investing across the full capitalization range of growth stocks, the Fund brings multi-management to individual investors. | ||

| Real-time Trading and Liquidity

| |

The Fund has a fixed number of shares that trade on the New York Stock Exchange and other exchanges. Share pricing is continuous—not just end-of-day, as it is with open-end mutual funds. In addition, Fund shares offer immediate liquidity and there are no annual sales fees. | ||

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 5 | |||

UNIQUE FUND ATTRIBUTES (UNAUDITED) |

| Access to Institutional Managers

| |

The Fund’s investment managers invest primarily for pension funds, endowments, foundations and other institutions. Because institutional managers are closely monitored by their clients, they tend to be more disciplined and consistent in their investment process. | ||

| Monitoring and Rebalancing

| |

| ALPS Advisors continuously monitors these investment managers to ensure that they are performing as expected and adhering to their style and strategy, and will replace the managers when warranted. Periodic rebalancing maintains the Fund’s structural integrity and is a well-recognized investment discipline. | |

Alignment and Objectivity

| ||

| Alignment with shareholders’ best interests and objective decision-making help to ensure that the Fund is managed openly and equitably. In addition, the Fund is governed by a Board of Directors that is elected by and responsible to shareholders. | |

Distribution Policy

| ||

Since 1997, the Fund has followed a policy of paying annual distributions on its shares at a rate that approximates historical equity market returns. The current annual distribution rate is 6 percent of the Fund’s net asset value (paid quarterly at 1.5 percent per quarter), providing a systematic mechanism for distributing funds to shareholders. | ||

www.all-starfunds.com |

ASG |

| 6 | LIBERTY ALL-STAR® GROWTH FUND | |||

|

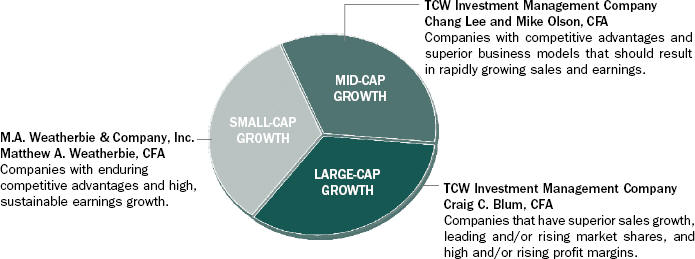

THE FUND’S THREE GROWTH INVESTMENT MANAGERS AND THE MARKET CAPITALIZATION ON WHICH EACH FOCUSES:

MANAGERS’ DIFFERING INVESTMENT STRATEGIES ARE REFLECTED IN PORTFOLIO CHARACTERISTICS

The portfolio characteristics table below is a regular feature of the Fund’s shareholder reports. It serves as a useful tool for understanding the value of the Fund’s multi-managed portfolio. The characteristics are different for each of the Fund’s three investment managers. These differences are a reflection of the fact that each has a different capitalization focus and investment strategy. The shaded column highlights the characteristics of the Fund as a whole, while the first three columns show portfolio characteristics for the Russell Smallcap, Midcap and Largecap Growth indices. See page 36 for a description of these indices.

| MARKET CAPITALIZATION SPECTRUM | ||||||

PORTFOLIO CHARACTERISTICS | SMALL | LARGE | ||||

AS OF DECEMBER 31, 2012 |  | |||||

| RUSSELL GROWTH: | ||||||||||||||

| Smallcap Index | Midcap Index | Largecap Index | M.A. Weatherbie | TCW (Mid-Cap) | TCW (Large-Cap) | Total Fund | ||||||||

Number of Holdings | 1120 | 457 | 571 | 59 | 56 | 31 | 128* | |||||||

Weighted Average Market Capitalization (billions) | $1.5 | $9.1 | $99.8 | $2.7 | $8.9 | $81.7 | $32.5 | |||||||

Average Five-Year Earnings Per Share Growth | 16% | 16% | 18% | 20% | 20% | 23% | 21% | |||||||

Average Five-Year Sales Per Share Growth | 8% | 9% | 12% | 13% | 12% | 16% | 14% | |||||||

Price/Earnings Ratio** | 21x | 20x | 18x | 21x | 24x | 23x | 23x | |||||||

Price/Book Value Ratio | 4.6x | 4.9x | 5.6x | 4.9x | 6.4x | 5.4x | 5.6x | |||||||

| * | Certain holdings are held by more than one manager. |

| ** | Excludes negative earnings. |

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 7 | |||

|

Investment Manager Roundtable

A look back at 2012 and a look ahead over the next 12-18 months from the Fund’s three growth style investment managers. Plus thoughts on market volatility and professional insights about when to sell a stock.

Liberty All-Star Growth Fund’s investment managers bring long experience, deep knowledge, a proven track record and a firm commitment to growth style investing. Once again, therefore, we are grateful to be able to call upon this resource to provide Fund shareholders with commentary and insight. The Fund’s Investment Advisor, ALPS Advisors, Inc., serves as moderator of the roundtable. Participating investment management firms, the portfolio manager for each and their respective capitalization ranges are:

M. A. WEATHERBIE & CO., INC.

Portfolio Manager/Matthew A. Weatherbie, CFA President and Founder

Capitalization Focus/Small-Cap Growth – M.A. Weatherbie practices a small capitalization growth investment style focusing on high quality companies that demonstrate superior earnings growth prospects, yet are reasonably priced relative to their intrinsic value. The firm seeks to provide superior returns relative to small capitalization growth indices over a full market cycle.

TCW INVESTMENT MANAGEMENT COMPANY

Co-Portfolio Managers/Chang Lee and Mike Olson, CFA

Managing Directors

Capitalization Focus/Mid-Cap Growth – TCW seeks capital appreciation through investment in the securities of rapidly growing companies whose business prospects, in TCW’s view, are not properly perceived by consensus research.

TCW INVESTMENT MANAGEMENT COMPANY

Portfolio Manager/Craig C. Blum, CFA

Group Managing Director

Capitalization Focus/Large-Cap Growth – TCW seeks large-cap companies that have superior sales growth, leading and/or rising market shares, and high and/or rising profit margins. TCW’s concentrated growth equity strategy seeks companies with distinct advantages in their business model.

Please summarize what produced the best results for you in 2012 and what, in retrospect, didn’t play out the way you thought. As an active manager, did you find volatility and changes in market direction to be especially challenging in 2012? Let’s start with Matt Weatherbie and his perspective as a small cap growth manager.

Weatherbie (M.A. Weatherbie – Small-Cap Growth):

As bottom-up, fundamentally driven investors, both our outperformers and our few underperformers reflect the company-specific nature of our research. Portfolio companies that delivered strong earnings growth resulting in superior stock price appreciation in 2012 included IPG Photonics, which is engaged in laser and communication systems; Portfolio Recovery Associates, an outsourced receivables management company; and Francesca’s Holdings, which is engaged in women’s apparel, accessories and gifts. Earnings shortfalls resulting in stock price declines included Servicesource International, an IT maintenance and support company, and BJ’s Restaurants, a casual dining chain. We found market volatility and changes in market direction especially challenging in the first half of 2012, but less so in the second half.

Thank you. Let’s continue up the capitalization range by hearing from TCW’s mid-cap and large-cap managers.

Lee (TCW – Mid-Cap Growth): Our best stock selection was in technology, where Salesforce.com, ARM Holdings, Rackspace Hosting and LinkedIn notably helped. Healthcare also was a bright spot for us, as Human Genome Sciences was acquired by GlaxoSmithKline and athenahealth posted good returns. Companies with significant emerging markets and European exposure hurt us—i.e., Arcos Dorados in Brazil and Ctrip.com in China. Materials names Cliffs Natural Resources and Allegheny Technologies were negatively impacted by the slowdown in the global economy, especially China. In financials, GreenDot did not contribute as we underestimated competitive pressures.

While investing in times of volatility can be challenging, we like to use it to our advantage. For example, we added to ARM Holdings and bought Rackspace Hosting when it pulled back.

Blum (TCW – Large-Cap Growth): As a group, our information technology holdings produced our best results in 2012. Although we recognized the slack in the economy, we were surprised by the margin compression in two long-held transportation stocks C.H. Robinson Worldwide and Expeditors International of Washington. We thought volume growth would be tepid but the magnitude of the continued margin compression was disappointing.

The key difficulty in today’s market is not the existence of volatility, but rather the fact that policy response is often

www.all-starfunds.com |

ASG |

| 8 | LIBERTY ALL-STAR® GROWTH FUND | |||

MANAGER ROUNDTABLE (UNAUDITED) |

a bigger driver of that volatility than true fundamentals. We have assumed this type of environment would persist leading to our balance between offense and defense in the portfolio over the last few years. | ||

Something that investors frequently overlook is a manager’s sell discipline. They may understand the manager’s style and strategy, and the factors that lead to purchasing a stock; but the sell decision is often forgotten. Give us some insights into your sell discipline, please. Let’s reverse the order and hear how Craig Blum approaches his sell discipline. | ||

Blum (TCW – Large-Cap Growth): We evaluate every holding on an ongoing basis and have both intermediate, 12-18 months, and long-term price targets for every stock in the portfolio. It is much easier to sell a stock that we have owned for several years and that has fulfilled our long-term price target. | ||

The much harder decision is to sell a stock where an unexpected negative development has occurred and the stock is getting hit. In this latter case, we place the stock on review and ask ourselves two primary questions: | “As we think about the next 12-18 months, we see a bevy of irreversible trends, including higher inflation, cloud computing and high data-rate wireless.”

Craig Blum (TCW – Large-Cap Growth)

| |

First, is the business model impaired? Second, is the revenue opportunity impaired? If either is true, we will sell the position. | ||

Weatherbie (M.A. Weatherbie – Small-Cap Growth): We will sell for one of three reasons. First, if we can anticipate or are confronted with a significant deterioration in a company’s fundamental outlook, we will sell the stock. Second, if a company becomes overvalued based on several of our internally developed stock valuation criteria, we will eliminate the position. Third, since we will never own more than 60 stocks, and are always close to that number, we will eliminate what we believe is our least good idea if we have a better alternative.

Olson (TCW – Mid-Cap Growth): Our sell discipline is driven by our three price targets—base case, best case and worst case. Once a stock hits our base case price target, we tend to trim. Once the stock hits our best case, we sell all. When a stock hits our worst case price target, our process forces us to either buy more or sell all. If we determine that the stock is down due to market volatility without any changes to fundamentals, then we buy more. If the stock is down because the thesis is broken, then we sell. We can also sell a name to fund a more compelling investment idea.

In the current market environment, volatility seems to have widened the performance differential between winner and loser stocks, even when the fundamentals do not justify |

such wide differentials. Does this phenomenon affect your sell decisions? Do you consider such harsh treatment of stocks unreasonable when the fundamentals are still strong? Chang Lee, what are your thoughts?

Lee (TCW – Mid-Cap Growth): Over the past 24 months, market volatility has not only picked up but the valuation gap between sectors has widened. While it is counterintuitive to think that volatility is a good thing, it is the best environment for investors who can accurately estimate intrinsic value because securities are more likely to be mispriced. These are the periods when it is crucial to stick to your discipline because it is the means by which excess returns can be achieved.

Good. Matt and Craig, share your thoughts, please.

Weatherbie (M.A. Weatherbie – Small-Cap Growth): This current market volatility has caused us to be slightly more aggressive at the margin in trimming recent strong performers and adding to laggards, assuming no change in fundamentals. Harsh treatment of stocks with strong fundamentals is both unjustified and unreasonable. It is our business to know our companies well and take advantage of this naïve, computer-driven trading. | ||

Blum (TCW – Large-Cap Growth): Our view on the current market volatility is that we welcome it. We believe it provides a real opportunity for true stock pickers to generate alpha, which we generally define as excess return over a benchmark. | ||

As you look out over the next 12 to 18 months, what are the key trends that you will be focusing on, and what is a stock in the portion of the Fund’s portfolio that you manage that represents each? Matt Weatherbie, please lead off.

Weatherbie (M.A. Weatherbie – Small-Cap Growth): Over the next 12-18 months we see the U.S. economy continuing to grow, but at a rate that remains quite weak by historical standards, with real GDP growing at around a 2 percent annual rate. Within this slow growth context, we see strong demand for software as a service, referred to as “SaaS.” These companies offer | ||

“Harsh treatment of stocks with strong fundamentals is both unjustified and unreasonable. it is our business to know our companies well and take advantage of this naïve, computer-driven trading.”

Matt Weatherbie (M.A. Weatherbie - Small-Cap Growth)

| productivity-enhancing software to businesses using a cloud-based delivery model. Portfolio companies that should continue to benefit from this trend are SPS Commerce, the leader in software sold as an on-demand service connecting retailers and their suppliers to achieve | |

supply chain efficiencies, and Ultimate Software, which designs, markets and supports web-based and | ||

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 9 | |||

MANAGER ROUNDTABLE (UNAUDITED) |

cross-industry human resource management and payroll software solutions. | ||

One other major trend that we see is the continued development of U.S. oil and gas reserves using hydraulic fracturing leading to the coming re-industrialization of America that should result from factories having access to cheap natural gas. Two portfolio holdings that should benefit from this trend are Forum Energy Technologies, a leading supplier of industrial tools used in energy exploration and development, and Mistras Group, which is a leading provider of acoustic, ultrasonic, thermographic and other non-destructive testing platforms used to evaluate the structural and mechanical integrity of critical infrastructure. | ||

Each of these four portfolio companies has a strong, differentiated business model, a leadership position in a growth market, innovative products and services, and high caliber management. | ||

Lee (TCW – Mid-Cap Growth): Pricing power, pricing power and pricing power! As always, we are focused on investing in rapidly growing companies with sustainable long-term competitive advantages. When we look at the current global macro picture, two counterbalancing factors stand out to us. First, there is still excess capacity around the world, which is deflationary in nature. Second, there are the aggressive fiscal and monetary policies in numerous countries as they fight against deflation as well as attempt to avoid recession. A simple measure of excess capacity can be measured in terms of unemployment rates, which remain elevated in the U.S. and in Europe. In businesses that are undifferentiated, it is difficult to raise prices in an environment of excess capacity. We believe capacity. | ||

We believe that it is critical to find companies that exhibit sustainable long-term competitive advantages with pricing power now more than ever. If the inflationary policies of the central banks of developed nations win the battle, the |

“While it is counterintuitive to think that volatility is a good thing, it is the best environment for investors who can accurately estimate intrinsic value because securities are more likely to be mispriced.”

—Chang Lee (TCW – Mid-Cap Growth) | |

ability to adjust prices rapidly is essential in an inflationary environment. The Federal Reserve in the U.S. and the central banks in Europe and Japan are committed to inflating the economy. Inflation seems to be a “when” and not an “if” question at this point given the magnitude of monetary and fiscal stimulus that has been deployed globally. | ||

An example of a company that has pricing power is Salesforce.com, which is a long-term holding in the fund. Salesforce.com provides sales force automation software-as-a-service (SaaS) and generally charges its customers a subscription fee on a monthly basis per user. Salesforce.com has a high degree of pricing power given | ||

the high utility/cost ratio that the service provides. This means that the usefulness of the software is high relative to its cost, which is collected as a monthly subscription. Furthermore, as sales personnel rely more heavily on the software, switching costs become prohibitive given the required ancillary investments to switch such as: training, data migration, systems integration, lower sales force productivity etc. The ongoing cost of the software, $65 per month, is not prohibitive and can be booked as an operating expense by customers, but the value provided by the service is high and thus it is fairly easy to pass incremental price increases along to the customer.

Blum (TCW – Large-Cap Growth): As we think about the next 12-18 months, we see a bevy of irreversible trends, including but not limited to the following: higher inflation, cloud computing and high data-rate wireless. With regard to inflation, we believe monetary inflation has already occurred due to the many rounds of quantitative easing by the Fed but that we are just starting to see inflation in goods. Although many investors think inflation is terrible for equities, we believe inflation can help stocks as companies with pricing power—a key characteristic that we look for—can adjust to higher inflation and pass along higher prices. While this theme is broadly represented in our portfolio, one name we’d highlight that you won’t find in many growth portfolios, is Silver Wheaton (SLW), a silver streaming company. Streaming is basically a form of alternative financing for miners and the business model is characterized by high margins, high cash flow, limited ongoing capital intensity and more limited operational risks. The model works particularly well in silver because the majority of silver is produced as a by-product and not as the focus ore for the miner. Given SLW’s leverage to silver prices that comes without the exposure to higher production costs, SLW benefits from higher inflation. Yet, the company also benefits from periods of lower silver prices as financing options for miners become more scarce and streaming deals become more accretive to SLW. Cloud computing is another trend that we have invested in for years and that we see only getting bigger. Amazon is a good example of this trend. A third trend is high data-rate wireless. It is no secret that with the ubiquity of smartphones, tablets and mobile devices, data growth is exploding. In fact, we think wireless network demand could increase 25 times over the next five years. American Tower, a wireless tower company, is a key beneficiary of this trend. The business model is also very attractive with very strong revenue and cash flow visibility resulting from long-term contracts of five to 10 years, with annual price escalators. Unique economics and incremental margins from tenant additions are robust and there are high switching costs for American Tower’s customers. | ||

Great insights from experienced investment managers and we thank you all. It should be an interesting year ahead. We’ll check in again next year. | ||

www.all-starfunds.com |

ASG |

| 10 | LIBERTY ALL-STAR® GROWTH FUND | |||

|

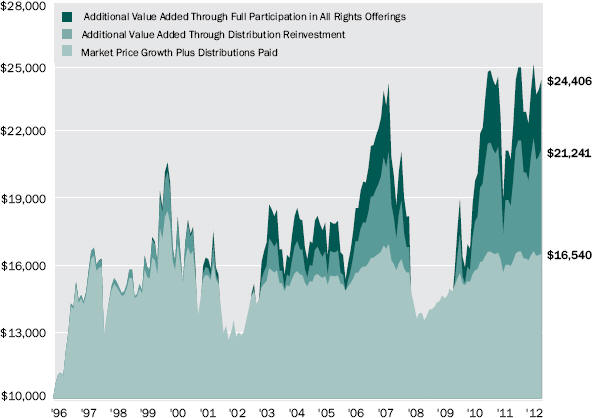

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

The graph below illustrates the growth of a hypothetical $10,000 investment assuming the purchase of shares of common stock at the closing market price (NYSE: ASG) of $9.25 on December 31, 1996, and tracking its progress through December 31, 2012. For certain information, it also assumes that a shareholder exercised all primary rights in the Fund’s rights offerings (see below). This graph covers the period since the Fund commenced its 10 percent distribution policy in 1997. Effective with the 2009 second quarter distribution, the annual distribution rate was changed from 10 percent to 6 percent.

| The growth of the investment assuming all distributions were received in cash and not reinvested back into the Fund. The value of the investment under this scenario grew to $16,540 (including the December 31, 2012 value of the original investment of $4,389, plus distributions during the period of $12,151). | |

| The additional value realized through reinvestment of all distributions. The value of the investment under this scenario grew to $21,241. | |

| The additional value realized by exercising all primary rights in the Fund’s rights offerings. The value of the investment under this scenario grew to $24,406 excluding the cost to exercise all primary rights in the rights offerings which was $5,299. | |

Past performance cannot predict future results. Performance will fluctuate with changes in market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 11 | |||

|

| RIGHTS OFFERINGS | ||||||||||

| YEAR | PER SHARE DISTRIBUTIONS | MONTH COMPLETED | SHARES NEEDED TO PURCHASE ONE ADDITIONAL SHARE | SUBSCRIPTION PRICE | ||||||

1997 | $1.24 | |||||||||

1998 | 1.35 | July | 10 | $12.41 | ||||||

1999 | 1.23 | |||||||||

2000 | 1.34 | |||||||||

2001 | 0.92 | September | 8 | 6.64 | ||||||

2002 | 0.67 | |||||||||

2003 | 0.58 | September | 8* | 5.72 | ||||||

2004 | 0.63 | |||||||||

2005 | 0.58 | |||||||||

2006 | 0.59 | |||||||||

2007 | 0.61 | |||||||||

2008 | 0.47 | |||||||||

2009** | 0.24 | |||||||||

2010 | 0.25 | |||||||||

2011 | 0.27 | |||||||||

2012 | 0.27 | |||||||||

Total | $11.24 | |||||||||

| * | The number of shares offered was increased by an additional 25% to cover a portion of the over-subscription requests. |

| ** | Effective with the second quarter distribution, the annual distribution rate was changed from 10 percent to 6 percent. |

DISTRIBUTION POLICY

Liberty All-Star® Growth Fund, Inc.’s current policy is to pay distributions on its shares totaling approximately 6 percent of its net asset value per year, payable in four quarterly installments of 1.5 percent of the Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. The fixed distributions are not related to the amount of the Fund’s net investment income or net realized capital gains or losses and may be taxed as ordinary income up to the amount of the Fund’s current and accumulated earnings and profits. If, for any calendar year, the total distributions made under the distribution policy exceed the Fund’s net investment income and net realized capital gains, the excess will generally be treated as a non-taxable return of capital, reducing the shareholder’s adjusted basis in his or her shares. If the Fund’s net investment income and net realized capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain and not distribute net realized capital gains and pay income tax thereon to the extent of such excess.

www.all-starfunds.com |

ASG |

| 12 | LIBERTY ALL-STAR® GROWTH FUND | |||

| ||||

December 31, 2012 |

| TOP 20 HOLDINGS* | PERCENT OF NET ASSETS | |||||

Apple, Inc. | 2.61% | |||||

Salesforce.com, Inc. | 2.37 | |||||

ACE Ltd. | 2.24 | |||||

ARM Holdings PLC | 2.00 | |||||

Oceaneering International, Inc. | 1.95 | |||||

QUALCOMM, Inc. | 1.91 | |||||

Fastenal Co. | 1.85 | |||||

American Tower Corp., Class A | 1.75 | |||||

BioMarin Pharmaceutical, Inc. | 1.71 | |||||

Core Laboratories N.V. | 1.65 | |||||

Cerner Corp. | 1.63 | |||||

Intuitive Surgical, Inc. | 1.62 | |||||

Precision Castparts Corp. | 1.57 | |||||

Signature Bank | 1.48 | |||||

Google, Inc., Class A | 1.37 | |||||

LKQ Corp. | 1.23 | |||||

Allergan, Inc. | 1.21 | |||||

Visa, Inc., Class A | 1.20 | |||||

Starbucks Corp. | 1.19 | |||||

Amazon.com, Inc. | 1.12 | |||||

| 33.66% | ||||||

| ECONOMIC SECTORS* | PERCENT OF NET ASSETS | |||||

Information Technology | 30.10% | |||||

Industrials | 16.10 | |||||

Consumer Discretionary | 13.35 | |||||

Health Care | 11.41 | |||||

Financials | 10.01 | |||||

Energy | 7.98 | |||||

Consumer Staples | 4.17 | |||||

Materials | 2.61 | |||||

Telecommunication Services | 1.75 | |||||

Other Net Assets | 2.52 | |||||

| 100.00% | ||||||

| * | Because the Fund is actively managed, there can be no guarantee that the Fund will continue to hold securities of the indicated issuers and sectors in the future. |

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 13 | |||

| ||||

December 31, 2012 |

The following are the major ($400,000) stock changes—both purchases and sales—that were made in the Fund’s portfolio during the fourth quarter of 2012.

| SHARES | ||||||||

| SECURITY NAME | PURCHASES (SALES) | HELD AS OF 12/31/12 | ||||||

| PURCHASES | ||||||||

B/E Aerospace, Inc. | 10,050 | 10,050 | ||||||

Cerner Corp. | 6,100 | 21,850 | ||||||

Cummins, Inc. | 4,550 | 4,550 | ||||||

Forum Energy Technologies, Inc. | 20,585 | 20,585 | ||||||

The Hain Celestial Group, Inc. | 10,550 | 10,550 | ||||||

LinkedIn Corp., Class A | 5,300 | 8,400 | ||||||

Ultimate Software Group, Inc. | 4,798 | 11,508 | ||||||

Under Armour, Inc., Class A | 9,455 | 22,840 | ||||||

| SALES | ||||||||

Baidu, Inc. | (9,225) | 0 | ||||||

FMC Technologies, Inc. | (17,300) | 0 | ||||||

IHS, Inc., Class A | (6,117) | 9,472 | ||||||

ITC Holdings Corp. | (7,494) | 0 | ||||||

Mylan, Inc. | (16,150) | 17,250 | ||||||

PSS World Medical, Inc. | (14,622) | 0 | ||||||

QLIK Technologies, Inc. | (27,077) | 0 | ||||||

Teavana Holdings, Inc. | (46,897) | 0 | ||||||

www.all-starfunds.com |

ASG |

| 14 | LIBERTY ALL-STAR® GROWTH FUND | |||

| ||||

as of December 31, 2012 |

| COMMON STOCKS (97.48%) | SHARES | MARKET VALUE | ||||||||||||

| u CONSUMER DISCRETIONARY (13.35%) | ||||||||||||||

Auto Components (0.67%) | ||||||||||||||

BorgWarner, Inc.(a) | 9,700 | $ | 694,714 | |||||||||||

Automobiles (0.37%) | ||||||||||||||

Thor Industries, Inc. | 10,179 | 381,000 | ||||||||||||

Distributors (1.23%) | ||||||||||||||

LKQ Corp.(a) | 60,981 | 1,286,699 | ||||||||||||

Hotels, Restaurants & Leisure (2.26%) | ||||||||||||||

Arcos Dorados Holdings, Inc., Class A | 50,300 | 601,588 | ||||||||||||

BJ's Restaurants, Inc.(a) | 15,797 | 519,721 | ||||||||||||

Starbucks Corp. | 23,100 | 1,238,622 | ||||||||||||

| 2,359,931 | ||||||||||||||

Household Durables (0.66%) | ||||||||||||||

Harman International Industries, Inc. | 15,467 | 690,447 | ||||||||||||

Internet & Catalog Retail (2.54%) | ||||||||||||||

Amazon.com, Inc.(a) | 4,665 | 1,171,568 | ||||||||||||

priceline.com, Inc.(a) | 1,625 | 1,009,450 | ||||||||||||

Shutterfly, Inc.(a) | 15,758 | 470,691 | ||||||||||||

| 2,651,709 | ||||||||||||||

Specialty Retail (3.06%) | ||||||||||||||

CarMax, Inc.(a) | 23,700 | 889,698 | ||||||||||||

Dick's Sporting Goods, Inc. | 15,100 | 686,899 | ||||||||||||

DSW, Inc., Class A | 4,800 | 315,312 | ||||||||||||

Francesca's Holdings Corp.(a) | 20,088 | 521,485 | ||||||||||||

Restoration Hardware Holdings, Inc.(a) | 1,500 | 50,595 | ||||||||||||

rue21, Inc.(a) | 25,360 | 719,970 | ||||||||||||

| 3,183,959 | ||||||||||||||

Textiles, Apparel & Luxury Goods (2.56%) | ||||||||||||||

Deckers Outdoor Corp.(a) | 11,000 | 442,970 | ||||||||||||

Gildan Activewear, Inc. | 17,500 | 640,150 | ||||||||||||

Michael Kors Holdings Ltd.(a) | 9,350 | 477,131 | ||||||||||||

Under Armour, Inc., Class A(a) | 22,840 | 1,108,425 | ||||||||||||

| 2,668,676 | ||||||||||||||

| u CONSUMER STAPLES (4.17%) | ||||||||||||||

Beverages (0.60%) | ||||||||||||||

Monster Beverage Corp.(a) | 11,800 | 623,984 | ||||||||||||

Food & Staples Retailing (2.20%) | ||||||||||||||

Costco Wholesale Corp. | 8,700 | 859,299 | ||||||||||||

The Fresh Market, Inc.(a) | 15,973 | 768,142 | ||||||||||||

PriceSmart, Inc. | 8,604 | 662,938 | ||||||||||||

| 2,290,379 | ||||||||||||||

See Notes to Schedule of Investments and Financial Statements

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 15 | |||

SCHEDULE OF INVESTMENTS | ||||

as of December 31, 2012 |

| COMMON STOCKS (continued) | SHARES | MARKET VALUE | ||||||||||||

Food Products (1.37%) | ||||||||||||||

The Hain Celestial Group, Inc.(a) | 10,550 | $ | 572,021 | |||||||||||

Mead Johnson Nutrition Co. | 13,100 | 863,159 | ||||||||||||

| 1,435,180 | ||||||||||||||

| u ENERGY (7.98%) | ||||||||||||||

Energy Equipment & Services (7.08%) | ||||||||||||||

Core Laboratories N.V. | 15,688 | 1,714,855 | ||||||||||||

Dril-Quip, Inc.(a) | 8,153 | 595,577 | ||||||||||||

Forum Energy Technologies, Inc.(a) | 20,585 | 509,479 | ||||||||||||

Lufkin Industries, Inc. | 12,732 | 740,111 | ||||||||||||

National-Oilwell Varco, Inc. | 9,100 | 621,985 | ||||||||||||

Oceaneering International, Inc. | 37,800 | 2,033,262 | ||||||||||||

Schlumberger Ltd. | 16,745 | 1,160,261 | ||||||||||||

| 7,375,530 | ||||||||||||||

Oil, Gas & Consumable Fuels (0.90%) | ||||||||||||||

Occidental Petroleum Corp. | 12,250 | 938,472 | ||||||||||||

u FINANCIALS (10.01%) | ||||||||||||||

Capital Markets (4.03%) | ||||||||||||||

Affiliated Managers Group, Inc.(a) | 6,069 | 789,880 | ||||||||||||

The Charles Schwab Corp. | 45,650 | 655,534 | ||||||||||||

Financial Engines, Inc.(a) | 19,079 | 529,442 | ||||||||||||

FXCM, Inc., Class A | 38,943 | 392,156 | ||||||||||||

T. Rowe Price Group, Inc. | 12,400 | 807,612 | ||||||||||||

Virtus Investment Partners, Inc.(a) | 8,509 | 1,029,079 | ||||||||||||

| 4,203,703 | ||||||||||||||

Commercial Banks (1.48%) | ||||||||||||||

Signature Bank(a) | 21,689 | 1,547,293 | ||||||||||||

Diversified Financial Services (0.60%) | ||||||||||||||

Portfolio Recovery Associates, Inc.(a) | 5,843 | 624,383 | ||||||||||||

Insurance (2.86%) | ||||||||||||||

ACE Ltd. | 29,250 | 2,334,150 | ||||||||||||

Greenlight Capital Re Ltd., Class A(a) | 27,804 | 641,717 | ||||||||||||

| 2,975,867 | ||||||||||||||

Real Estate Management & Development (1.04%) | ||||||||||||||

FirstService Corp.(a) | 28,442 | 803,771 | ||||||||||||

Zillow, Inc., Class A(a) | 10,044 | 278,721 | ||||||||||||

| 1,082,492 | ||||||||||||||

| u HEALTH CARE (11.41%) | ||||||||||||||

Biotechnology (2.90%) | ||||||||||||||

Ariad Pharmaceuticals, Inc.(a) | 13,650 | 261,807 | ||||||||||||

BioMarin Pharmaceutical, Inc.(a) | 36,226 | 1,784,131 | ||||||||||||

Cepheid, Inc.(a) | 9,300 | 314,433 | ||||||||||||

Ironwood Pharmaceuticals, Inc.(a) | 14,300 | 158,587 | ||||||||||||

Vertex Pharmaceuticals, Inc.(a) | 12,000 | 503,280 | ||||||||||||

| 3,022,238 | ||||||||||||||

See Notes to Schedule of Investments and Financial Statements

www.all-starfunds.com |

ASG |

| 16 | LIBERTY ALL-STAR® GROWTH FUND | |||

SCHEDULE OF INVESTMENTS | ||||

as of December 31, 2012 |

| COMMON STOCKS (continued) | SHARES | MARKET VALUE | ||||||||||||

Health Care Equipment & Supplies (2.64%) | ||||||||||||||

Accuray, Inc.(a) | 52,338 | $ | 336,533 | |||||||||||

Intuitive Surgical, Inc.(a) | 3,450 | 1,691,777 | ||||||||||||

Masimo Corp. | 23,112 | 485,583 | ||||||||||||

Neogen Corp.(a) | 5,371 | 243,414 | ||||||||||||

| 2,757,307 | ||||||||||||||

Health Care Technology (2.44%) | ||||||||||||||

athenahealth, Inc.(a) | 11,583 | 850,771 | ||||||||||||

Cerner Corp.(a) | 21,850 | 1,696,434 | ||||||||||||

| 2,547,205 | ||||||||||||||

Life Sciences Tools & Services (1.76%) | ||||||||||||||

Illumina, Inc.(a) | 14,600 | 811,614 | ||||||||||||

Life Technologies Corp.(a) | 20,800 | 1,020,864 | ||||||||||||

| 1,832,478 | ||||||||||||||

Pharmaceuticals (1.67%) | ||||||||||||||

Allergan, Inc. | 13,800 | 1,265,874 | ||||||||||||

Mylan, Inc.(a) | 17,250 | 474,030 | ||||||||||||

| 1,739,904 | ||||||||||||||

| u INDUSTRIALS (16.10%) | ||||||||||||||

Aerospace & Defense (3.71%) | ||||||||||||||

B/E Aerospace, Inc.(a) | 10,050 | 496,470 | ||||||||||||

HEICO Corp. | 16,939 | 758,190 | ||||||||||||

Precision Castparts Corp. | 8,650 | 1,638,483 | ||||||||||||

TransDigm Group, Inc. | 7,157 | 975,928 | ||||||||||||

| 3,869,071 | ||||||||||||||

Air Freight & Logistics (0.61%) | ||||||||||||||

Echo Global Logistics, Inc.(a) | 16,904 | 303,765 | ||||||||||||

Expeditors International of Washington, Inc. | 8,500 | 336,175 | ||||||||||||

| 639,940 | ||||||||||||||

Commercial Services & Supplies (1.31%) | ||||||||||||||

American Reprographics Co.(a) | 36,870 | 94,387 | ||||||||||||

InnerWorkings, Inc.(a) | 19,075 | 262,854 | ||||||||||||

Waste Connections, Inc. | 29,779 | 1,006,232 | ||||||||||||

| 1,363,473 | ||||||||||||||

Electrical Equipment (2.01%) | ||||||||||||||

AMETEK, Inc. | 9,500 | 356,915 | ||||||||||||

II-VI, Inc.(a) | 20,067 | 366,624 | ||||||||||||

Rockwell Automation, Inc. | 8,500 | 713,915 | ||||||||||||

Roper Industries, Inc. | 5,900 | 657,732 | ||||||||||||

| 2,095,186 | ||||||||||||||

See Notes to Schedule of Investments and Financial Statements

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 17 | |||

SCHEDULE OF INVESTMENTS | ||||

as of December 31, 2012 |

| COMMON STOCKS (continued) | SHARES | MARKET VALUE | ||||||||||||

Machinery (1.90%) | ||||||||||||||

Cummins, Inc. | 4,550 | $ | 492,993 | |||||||||||

Graco, Inc. | 11,545 | 594,452 | ||||||||||||

Middleby Corp.(a) | 5,045 | 646,819 | ||||||||||||

Rexnord Corp.(a) | 11,861 | 252,639 | ||||||||||||

| 1,986,903 | ||||||||||||||

Professional Services (3.46%) | ||||||||||||||

Huron Consulting Group, Inc.(a) | 15,092 | 508,450 | ||||||||||||

IHS, Inc., Class A(a) | 9,472 | 909,312 | ||||||||||||

Mistras Group, Inc.(a) | 6,676 | 164,830 | ||||||||||||

Robert Half International, Inc. | 16,100 | 512,302 | ||||||||||||

Stantec, Inc. | 16,475 | 660,648 | ||||||||||||

Verisk Analytics, Inc., Class A(a) | 16,650 | 849,150 | ||||||||||||

| 3,604,692 | ||||||||||||||

Road & Rail (0.59%) | ||||||||||||||

Landstar System, Inc. | 11,691 | 613,310 | ||||||||||||

Trading Companies & Distributors (2.51%) | ||||||||||||||

Fastenal Co. | 41,300 | 1,928,297 | ||||||||||||

MSC Industrial Direct Co., Inc., Class A | 9,100 | 685,958 | ||||||||||||

| 2,614,255 | ||||||||||||||

| u INFORMATION TECHNOLOGY (30.10%) | ||||||||||||||

Communications Equipment (3.48%) | ||||||||||||||

InterDigital, Inc. | 11,626 | 477,829 | ||||||||||||

Palo Alto Networks, Inc.(a) | 6,500 | 347,880 | ||||||||||||

Polycom, Inc.(a) | 69,384 | 725,757 | ||||||||||||

QUALCOMM, Inc. | 32,115 | 1,991,772 | ||||||||||||

Ruckus Wireless, Inc.(a) | 3,781 | 85,186 | ||||||||||||

| 3,628,424 | ||||||||||||||

Computers & Peripherals (3.37%) | ||||||||||||||

Apple, Inc. | 5,100 | 2,718,452 | ||||||||||||

Fusion-io, Inc.(a) | 34,472 | 790,443 | ||||||||||||

| 3,508,895 | ||||||||||||||

Electronic Equipment & Instruments (1.64%) | ||||||||||||||

FARO Technologies, Inc.(a) | 13,972 | 498,521 | ||||||||||||

IPG Photonics Corp. | 10,980 | 731,817 | ||||||||||||

National Instruments Corp. | 18,674 | 481,976 | ||||||||||||

| 1,712,314 | ||||||||||||||

Internet Software & Services (6.86%) | ||||||||||||||

Equinix, Inc.(a) | 5,300 | 1,092,860 | ||||||||||||

Google, Inc., Class A(a) | 2,010 | 1,425,834 | ||||||||||||

LinkedIn Corp., Class A(a) | 8,400 | 964,488 | ||||||||||||

Liquidity Services, Inc.(a) | 26,923 | 1,100,074 | ||||||||||||

NIC, Inc. | 18,978 | 310,100 | ||||||||||||

Rackspace Hosting, Inc.(a) | 12,800 | 950,656 | ||||||||||||

SPS Commerce, Inc.(a) | 9,970 | 371,582 | ||||||||||||

Stamps.com, Inc.(a) | 19,678 | 495,886 | ||||||||||||

VistaPrint Ltd.(a) | 13,418 | 440,915 | ||||||||||||

| 7,152,395 | ||||||||||||||

See Notes to Schedule of Investments and Financial Statements

www.all-starfunds.com |

ASG |

| 18 | LIBERTY ALL-STAR® GROWTH FUND | |||

SCHEDULE OF INVESTMENTS | ||||

as of December 31, 2012 |

| COMMON STOCKS (continued) | SHARES | MARKET VALUE | ||||||||||||

IT Services (3.29%) | ||||||||||||||

Cognizant Technology Solutions Corp., Class A(a) | 13,900 | $ | 1,029,295 | |||||||||||

ServiceSource International, Inc.(a) | 37,854 | 221,446 | ||||||||||||

VeriFone Systems, Inc.(a) | 31,103 | 923,137 | ||||||||||||

Visa, Inc., Class A | 8,265 | 1,252,809 | ||||||||||||

| 3,426,687 | ||||||||||||||

Semiconductors & Semiconductor Equipment (3.53%) | ||||||||||||||

ARM Holdings PLC(b) | 55,017 | 2,081,293 | ||||||||||||

Avago Technologies Ltd. | 15,500 | 490,730 | ||||||||||||

Cavium, Inc.(a) | 13,638 | 425,642 | ||||||||||||

Hittite Microwave Corp.(a) | 10,963 | 680,802 | ||||||||||||

| 3,678,467 | ||||||||||||||

Software (7.93%) | ||||||||||||||

ANSYS, Inc.(a) | 12,331 | 830,370 | ||||||||||||

Concur Technologies, Inc.(a) | 8,551 | 577,363 | ||||||||||||

RealPage, Inc.(a) | 25,691 | 554,155 | ||||||||||||

Salesforce.com, Inc.(a) | 14,700 | 2,471,070 | ||||||||||||

ServiceNow, Inc.(a) | 1,600 | 48,048 | ||||||||||||

Solera Holdings, Inc. | 19,675 | 1,052,022 | ||||||||||||

Splunk, Inc.(a) | 21,500 | 623,930 | ||||||||||||

Ultimate Software Group, Inc.(a) | 11,508 | 1,086,470 | ||||||||||||

VMware, Inc., Class A(a) | 9,800 | 922,572 | ||||||||||||

Workday, Inc., Class A(a) | 1,800 | 98,100 | ||||||||||||

| 8,264,100 | ||||||||||||||

| u MATERIALS (2.61%) | ||||||||||||||

Chemicals (1.06%) | ||||||||||||||

Praxair, Inc. | 10,125 | 1,108,181 | ||||||||||||

Metals & Mining (1.55%) | ||||||||||||||

Allegheny Technologies, Inc. | 21,200 | 643,632 | ||||||||||||

Silver Wheaton Corp. | 26,950 | 972,356 | ||||||||||||

| 1,615,988 | ||||||||||||||

| u TELECOMMUNICATION SERVICES (1.75%) | ||||||||||||||

Wireless Telecommunication Services (1.75%) | ||||||||||||||

American Tower Corp., Class A | 23,550 | 1,819,708 | ||||||||||||

| TOTAL COMMON STOCKS | ||||||||||||||

(COST OF $77,227,184) | 101,615,539 | |||||||||||||

See Notes to Schedule of Investments and Financial Statements

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 19 | |||

SCHEDULE OF INVESTMENTS | ||||

| as of December 31, 2012 |

| SHORT TERM INVESTMENT (2.99%) | PAR VALUE | MARKET VALUE | ||||||||||

| u REPURCHASE AGREEMENT (2.99%) | ||||||||||||

Repurchase agreement with State Street Bank & Trust Co., dated 12/31/12, due 01/02/13 at 0.01%, collateralized by various Federal National Mortgage Association Securities 3.05% - 3.26%, 05/01/41 - 05/25/41, market value of $3,180,565 (Repurchase proceeds of $3,113,002) (COST OF $3,113,000) | $ | 3,113,000 | $ | 3,113,000 | ||||||||

|

| |||||||||||

TOTAL INVESTMENTS (100.47%) | ||||||||||||

(COST OF $80,340,184)(c) | 104,728,539 | |||||||||||

LIABILITIES IN EXCESS OF OTHER ASSETS (-0.47%) |

| (493,642 | ) | |||||||||

|

| |||||||||||

NET ASSETS (100.00%) | $ | 104,234,897 | ||||||||||

|

| |||||||||||

NET ASSET VALUE PER SHARE | ||||||||||||

(22,974,458 SHARES OUTSTANDING) | $ | 4.54 | ||||||||||

|

| |||||||||||

Notes to Schedule of Investments:

| (a) | Non-income producing security. |

| (b) | American Depositary Receipt. |

| (c) | Cost of investments for federal income tax purposes is $81,185,561. |

Gross unrealized appreciation and depreciation at December 31, 2012 based on cost of investments for federal income tax purposes is as follows:

Gross unrealized appreciation | $ | 27,106,656 | ||||

Gross unrealized depreciation | (3,563,678 | ) | ||||

| ||||||

Net unrealized appreciation | $ | 23,542,978 | ||||

| ||||||

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are unaudited.

See Notes to Financial Statements

www.all-starfunds.com |

ASG |

| 20 | LIBERTY ALL-STAR® GROWTH FUND | |||

| ||||

| December 31, 2012 |

| ||||||

ASSETS: | ||||||

Investments at market value (Cost $80,340,184) | $ | 104,728,539 | ||||

Cash | 1,956 | |||||

Receivable for investment securities sold | 446,950 | |||||

Dividends and interest receivable | 48,649 | |||||

Due from Portfolio Manager | 44,910 | |||||

Prepaid and other assets | 181 | |||||

| ||||||

TOTAL ASSETS | 105,271,185 | |||||

| ||||||

LIABILITIES: | ||||||

Payable for investments purchased | 164,713 | |||||

Distributions payable to shareholders | 634,286 | |||||

Investment advisory fee payable | 102,022 | |||||

Payable for administration, pricing and bookkeeping fees | 23,978 | |||||

Accrued expenses | 111,289 | |||||

| ||||||

TOTAL LIABILITIES | 1,036,288 | |||||

| ||||||

NET ASSETS | $ | 104,234,897 | ||||

| ||||||

NET ASSETS REPRESENTED BY: | ||||||

Paid-in capital | $ | 81,381,626 | ||||

Overdistributed net investment income | (634,286 | ) | ||||

Accumulated net realized loss on investments | (900,798 | ) | ||||

Net unrealized appreciation on investments | 24,388,355 | |||||

| ||||||

NET ASSETS | $ | 104,234,897 | ||||

| ||||||

Shares of common stock outstanding | 22,974,458 | |||||

| ||||||

NET ASSET VALUE PER SHARE | $ | 4.54 | ||||

| ||||||

See Notes to Financial Statements

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 21 | |||

| ||||

| For the Year Ended December 31, 2012 |

| ||||||

INVESTMENT INCOME: | ||||||

Dividends (Net of foreign taxes withheld at source which amounted to $7,487) | $ | 1,031,662 | ||||

Interest | 333 | |||||

| ||||||

TOTAL INVESTMENT INCOME | 1,031,995 | |||||

| ||||||

EXPENSES: | ||||||

Investment advisory fee | 967,873 | |||||

Administration fee | 241,968 | |||||

Pricing and bookkeeping fees | 72,443 | |||||

Audit fee | 25,249 | |||||

Custodian fee | 43,177 | |||||

Directors’ fees and expenses | 69,538 | |||||

Insurance expense | 8,361 | |||||

Legal fees | 190,059 | |||||

NYSE fee | 27,975 | |||||

Shareholder communication expenses | 71,557 | |||||

Transfer agent fees | 62,906 | |||||

Miscellaneous expenses | 46,149 | |||||

| ||||||

Total Expenses Before Waiver/Reimbursement | 1,827,255 | |||||

Less fees waived by investment advisor | (16,821 | ) | ||||

Less expenses reimbursed by Portfolio Manager | (44,910 | ) | ||||

| ||||||

TOTAL NET EXPENSES | 1,765,524 | |||||

| ||||||

NET INVESTMENT LOSS | (733,529 | ) | ||||

REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | ||||||

Net realized gain on investment transactions | 5,103,936 | |||||

Net change in unrealized appreciation on investments | 7,662,738 | |||||

| ||||||

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 12,766,674 | |||||

| ||||||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 12,033,145 | ||||

| ||||||

See Notes to Financial Statements

www.all-starfunds.com |

ASG |

| 22 | LIBERTY ALL-STAR® GROWTH FUND | |||

|

| Year Ended December 31, |

| |||||||||||

| 2012 | 2011 | |||||||||||

FROM OPERATIONS: | ||||||||||||

Net investment loss | $ | (733,529 | ) | $ | (1,423,102 | ) | ||||||

Net realized gain on investment transactions | 5,103,936 | 9,291,538 | ||||||||||

Net change in unrealized appreciation/(depreciation) on investments | 7,662,738 | (9,617,091 | ) | |||||||||

| ||||||||||||

Net Increase/(Decrease) in Net Assets From Operations | 12,033,145 | (1,748,655 | ) | |||||||||

| ||||||||||||

DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||||||

From net investment income | – | (1,994,479 | ) | |||||||||

From net realized gains on investments | (5,715,134 | ) | (6,127,216 | ) | ||||||||

From tax return of capital | (1,441,154 | ) | – | |||||||||

| ||||||||||||

Total Distributions | (7,156,288 | ) | (8,121,695 | ) | ||||||||

| ||||||||||||

CAPITAL SHARE TRANSACTIONS: | ||||||||||||

Dividend reinvestments | 1,666,589 | – | ||||||||||

Shares repurchased through tender offer, net of costs | (29,910,946 | ) | – | |||||||||

| ||||||||||||

Net Decrease Resulting From Capital Share Transactions | (28,244,357 | ) | – | |||||||||

| ||||||||||||

Net Decrease in Net Assets | (23,367,500 | ) | (9,870,350 | ) | ||||||||

NET ASSETS: | ||||||||||||

Beginning of year | 127,602,397 | 137,472,747 | ||||||||||

| ||||||||||||

End of year (Includes overdistributed net investment income of $(634,286) and $(26,710), respectively) | $ | 104,234,897 | $ | 127,602,397 | ||||||||

| ||||||||||||

See Notes to Financial Statements

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 23 | |||

|

| Year Ended December 31, | ||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||||

PER SHARE OPERATING PERFORMANCE: | ||||||||||||||||||||||

Net asset value at beginning of year | $ | 4.24 | $ | 4.57 | $ | 4.00 | $ | 3.24 | $ | 6.03 | ||||||||||||

|

| |||||||||||||||||||||

INCOME FROM INVESTMENT OPERATIONS: | ||||||||||||||||||||||

Net investment loss(a) | (0.03 | ) | (0.05 | ) | (0.04 | ) | (0.02 | ) | (0.03 | ) | ||||||||||||

Net realized and unrealized gain/(loss) on investments | 0.54 | (0.01 | ) | 0.86 | 1.02 | (2.29 | ) | |||||||||||||||

|

| |||||||||||||||||||||

Total from Investment Operations | 0.51 | (0.06 | ) | 0.82 | 1.00 | (2.32 | ) | |||||||||||||||

|

| |||||||||||||||||||||

LESS DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||||||||||||||||

Net investment income | – | (0.07 | ) | (0.19 | ) | – | – | |||||||||||||||

Net realized gain on investments | (0.22 | ) | (0.20 | ) | – | – | (0.02 | ) | ||||||||||||||

Tax return of capital | (0.05 | ) | – | (0.06 | ) | (0.24 | ) | (0.45 | ) | |||||||||||||

|

| |||||||||||||||||||||

Total Distributions | (0.27 | ) | (0.27 | ) | (0.25 | ) | (0.24 | ) | (0.47 | ) | ||||||||||||

|

| |||||||||||||||||||||

Change due to tender offer(b) | 0.06 | – | – | – | – | |||||||||||||||||

|

| |||||||||||||||||||||

Net asset value at end of year | $ | 4.54 | $ | 4.24 | $ | 4.57 | $ | 4.00 | $ | 3.24 | ||||||||||||

|

| |||||||||||||||||||||

Market price at end of year | $ | 4.06 | $ | 3.81 | $ | 4.25 | $ | 3.36 | $ | 2.60 | ||||||||||||

|

| |||||||||||||||||||||

| TOTAL INVESTMENT RETURN FOR SHAREHOLDERS:(c) | ||||||||||||||||||||||

Based on net asset value | 14.3 | % | (1.0 | %) | 21.8 | % | 34.6 | % | (40.0 | %) | ||||||||||||

Based on market price | 13.8 | % | (4.4 | %) | 34.8 | % | 40.8 | % | (51.3 | %) | ||||||||||||

RATIOS AND SUPPLEMENTAL DATA: | ||||||||||||||||||||||

Net assets at end of year (millions) | $ | 104 | $ | 128 | $ | 137 | $ | 120 | $ | 96 | ||||||||||||

Ratio of expenses to average net assets after waiver/reimbursement | 1.46 | % | – | – | – | – | ||||||||||||||||

Ratio of expenses to average net assets before waiver/reimbursement | 1.51 | % | 1.52 | % | 1.79 | % | 1.44 | % | 1.46 | % | ||||||||||||

Ratio of net investment loss to average net assets | (0.61 | %) | (1.04 | %) | (0.95 | %) | (0.58 | %) | (0.74 | %) | ||||||||||||

Portfolio turnover rate | 35 | % | 32 | % | 80 | % | 135 | % | 97 | % | ||||||||||||

| (a) | Calculated using average shares outstanding during the period. |

| (b) | Effect of Fund’s tender offer for shares at a price below net asset value, net of costs. |

| (c) | Calculated assuming all distributions are reinvested at actual reinvestment prices. The net asset value and market price returns will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares traded during the period. Past performance is not a guarantee of future results. |

See Notes to Financial Statements

www.all-starfunds.com |

ASG |

| 24 | LIBERTY ALL-STAR® GROWTH FUND | |||

|

December 31, 2012

NOTE 1. ORGANIZATION

Liberty All-Star® Growth Fund, Inc. (the “Fund”) is a Maryland corporation registered under the Investment Company Act of 1940 (the “Act”), as amended, as a diversified, closed-end management investment company.

Investment Goal

The Fund seeks long-term capital appreciation.

Fund Shares

The Fund may issue 60,000,000 shares of common stock at $0.10 par.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

Security Valuation

Equity securities including common stocks and exchange traded funds are valued at the last sale price at the close of the principal exchange on which they trade, except for securities listed on the National Association of Securities Dealers Automated Quotations (“NASDAQ”) exchange, which are valued at the NASDAQ official closing price. Unlisted securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges or over-the-counter markets.

Short-term debt obligations maturing in more than 60 days for which market quotations are readily available are valued at current market value. Short-term debt obligations maturing within 60 days are valued at amortized cost, which approximates market value.

Investments for which market quotations are not readily available are valued at fair value as determined in good faith under consistently applied procedures approved by and under the general supervision of the Fund’s Board of Directors.

Foreign Securities

The Fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible reevaluation of currencies, the inability to repatriate foreign currency, less complete financial information about companies and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than those of securities of comparable

U.S. issuers. For the year ended December 31, 2012, the Fund only held American Depositary Receipts and did not hold any securities denominated in foreign currencies.

Security Transactions

Security transactions are recorded on trade date. Cost is determined and gains/(losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Repurchase Agreements

The Fund engages in repurchase agreement transactions with institutions that the Fund’s investment advisor has determined are creditworthy. The Fund, through its custodian, receives delivery of underlying securities collateralizing a repurchase agreement. Collateral is at least equal, at all times, to the value of the repurchase obligation including interest. A repurchase agreement transaction involves certain risks in the event of default or insolvency of the counterparty. These risks include possible delays or restrictions upon a Fund’s ability to dispose of the underlying securities and a possible decline in the value of the underlying securities during the period while the Fund seeks to assert its rights.

Income Recognition

Interest income is recorded on the accrual basis. Corporate actions and dividend income are recorded on the ex-date.

Fair Value Measurements

The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

Level 1 – Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date;

ANNUAL REPORT |

|

DECEMBER 31, 2012 |

LIBERTY ALL-STAR® GROWTH FUND | 25 | |||

NOTES TO FINANCIAL STATEMENTS |

December 31, 2012

Level 2 – Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and

Level 3 – Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date.

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2012. The Fund recognizes transfers between the levels as of the beginning of the annual period in which the transfer occurred.

| Valuation Inputs | ||||||||||||||||

| Investments in Securities at Value* | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stocks | $ | 101,615,539 | $ | – | $ | – | $ | 101,615,539 | ||||||||

Short-Term Investment | – | 3,113,000 | – | 3,113,000 | ||||||||||||

TOTAL | $ | 101,615,539 | $ | 3,113,000 | $ | – | $ | 104,728,539 | ||||||||

| * | See Schedule of Investments for industry classifications. |

For the year ended December 31, 2012, the Fund did not have any transfers between Level 1 and Level 2 securities. The Fund did not have any securities which used significant unobservable inputs (Level 3) in determining fair value during the year.

Distributions to Shareholders

The Fund currently has a policy of paying distributions on its common shares totaling approximately 6% of its net asset value per year. The distributions are payable in four quarterly distributions of 1.5% of the Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. Distributions to shareholders are recorded on ex-date.

NOTE 3. FEDERAL TAX INFORMATION

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. Reclassifications are made to the Fund’s capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under income tax regulations. If, for any calendar year, the total distributions made under the distribution policy exceed the Fund’s net investment income and net realized capital gains, the excess will generally be treated as a non- taxable return of capital, reducing the shareholder’s adjusted basis in his or her shares. If the Fund’s net investment income and net realized capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain and not distribute net realized

capital gains and pay income tax thereon to the extent of such excess.

For the year ended December 31, 2012, permanent book and tax basis differences resulting primarily from a net operating loss and excess distributions were identified and reclassified among the components of the Fund’s net assets as follows:

Accumulated Net Investment Income | Accumulated Net Realized Loss | Paid-In Capital | ||

$125,953 | $(26,710) | $(99,243) |

Included in the amounts reclassified was a net operating loss of $733,529. Net investment loss and net realized gain, as disclosed on the Statement of Operations, and net assets were not affected by this reclassification.

Classification of Distributions to Shareholders

Net investment income/(loss) and net realized gain/(loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year-end. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

The tax character of distributions paid during the years ended December 31, 2012 and December 31, 2011, were as follows:

| 12/31/12 | 12/31/11 | |||||||

Distributions paid from: | ||||||||

Ordinary income | $ | – | $ | 1,994,479 | ||||

Long-term capital gain | 5,715,134 | 6,127,216 | ||||||

Return of Capital | 1,441,154 | – | ||||||

Total | $ | 7,156,288 | $ | 8,121,695 | ||||

Future realized gains offset by the loss carryforwards are not required to be distributed to shareholders. However, under the Fund’s distribution policy, such gains may be distributed to shareholders in the year the gains are realized. Any such gains distributed may be taxable to shareholders as ordinary income.

As of December 31, 2012, the components of distributable earnings on a tax basis were as follows:

Accumulated Capital Losses | Net Unrealized Appreciation | Other Cumulative Effect of Timing Differences | Total | |||||||||

$(55,421) | $ | 23,542,978 | $ | (634,286 | ) | $ | 22,853,271 | |||||

www.all-starfunds.com |

ASG |

| 26 | LIBERTY ALL-STAR® GROWTH FUND | |||

NOTES TO FINANCIAL STATEMENTS | ||||

December 31, 2012 |

The differences between book-basis and tax-basis are primarily due to deferral of losses from wash sales and the differing treatment of certain other investments.

As of December 31, 2012, the costs of investments for federal income tax purposes and accumulated net unrealized appreciation/(depreciation) on investments were as follows:

Cost of Investments | Gross Unrealized Appreciation (excess of value over tax cost) | Gross Unrealized Depreciation (excess of tax cost over value) | Net Unrealized Appreciation | |||||||||

$81,185,561 | $ | 27,106,656 | $ | (3,563,678 | ) | $ | 23,542,978 | |||||

The fund elects to defer to the fiscal year ending December 31, 2013, capital losses recognized during the period from November 1, 2012 to December 31, 2012 in the amount of $55,421.

Federal Income Tax Status

For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified, as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, by distributing substantially all of its investment company taxable net income including realized gain, not offset by capital loss carryforwards, if any, to its shareholders. Accordingly, no provision for federal income or excise taxes has been made.

Management of the Fund analyzes all open tax years, as defined by the Statute of Limitations, for all major jurisdictions, including federal tax authorities and certain state tax authorities. As of and during the fiscal year ended December 31, 2012, the Fund did not have a liability for any unrecognized tax benefits. The Fund will file income tax returns in the U.S. federal jurisdiction and Colorado. For the years ended December 31, 2009 through December 31, 2012 for the federal jurisdiction and for the years ended December 31, 2008 through December 31, 2012 for Colorado, the Fund’s returns are still open to examination by the appropriate taxing authority.

NOTE 4. FEES AND COMPENSATION PAID TO AFFILIATES

Investment Advisory Fee

ALPS Advisors, Inc. (“AAI”) serves as the investment advisor to the Fund. AAI receives a monthly investment advisory fee based on the Fund’s average daily net assets at the following annual rates:

Average Daily Net Assets | Annual Fee Rate | |||

First $ 300 million | 0.80% | |||

Over $300 million | 0.72% |

AAI retains multiple Portfolio Managers to manage the Fund’s investments in various asset classes. AAI pays each Portfolio Manager a portfolio management fee based on the assets of the investment portfolio that they manage. The portfolio management fee is paid from the investment advisory fees collected by AAI and is based on the Fund’s average daily net assets at the following annual rates:

Average Daily Net Assets | Annual Fee Rate | |||

First $ 300 million | 0.40% | |||

Over $300 million | 0.36% |

Administration, Bookkeeping and Pricing

Services Agreement

ALPS Fund Services, Inc. (“ALPS”) provides administrative and other services to the Fund for a monthly administration fee based on the Fund’s average daily net assets at the following annual rates:

Average Daily Net Assets | Annual Fee Rate | |||