UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-04550

THE MAINSTAY FUNDS

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna Avenue

Parsippany, New Jersey 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2012

FORM N-CSR

| Item 1. | Reports to Stockholders. |

MainStay Flexible Bond Opportunities Fund

Message from the President and Annual Report

October 31, 2012

This Page Intentionally Left Blank

Message from the President

Most major equity markets delivered positive results for the 12 months ended October 31, 2012. In the United States, stocks provided solid double-digit returns. With a few notable exceptions, international stock markets generally ended the reporting period in positive territory.

The stock market’s advance, however, was far from uniform. After rising to an early peak at the end of March 2012, domestic and international stocks lost ground until the beginning of June. After that, stocks generally rose, reaching their high point for the reporting period in mid-September. Although stocks remained relatively buoyant through mid-October, they drifted lower as the reporting period came to a close.

A variety of forces converged to help fuel these market movements. Investors kept a close eye on developments in the European sovereign debt crisis. The European Central Bank’s Long Term Refinancing Operations helped stabilize European credit markets and provide needed liquidity. Although private holders of Greek sovereign debt had to accept a reduction in their recovery value, the anticipated voluntary exchange provided a positive spark to the markets. Rising unemployment and new austerity measures may impede economic growth as the European Union seeks to strike a delicate balance between fiscal and monetary policies.

In the United States, the Federal Reserve announced an open-ended agency mortgage-backed security purchase program, which helped calm market concerns. The Federal Reserve also continued its maturity extension program (referred to by some as “operation twist”), which seeks to put downward pressure on longer-term interest rates. At the short end of the yield curve, the Federal Reserve maintained the federal funds rate in a near-zero range. In September 2012, the Federal Open Market Committee anticipated that “exceptionally low levels for the federal funds rate” were “likely to be warranted at least through mid-2015.”

With markets stabilizing and short-term interest rates at very low levels, yield-hungry investors had incentives to lengthen maturities and accept higher risk. Domestic high-yield bonds provided double-digit returns for the reporting period, municipal bonds and convertible securities provided high single-digit returns, and domestic corporate bonds provided positive overall returns.

While most investors are pleased when markets rise, MainStay portfolio managers know that long-term results depend on more than short-term market movements. They also depend on the consistent application of well-defined investment strategies and risk-management techniques over longer periods. Our long-term perspective gives our portfolio managers the ability to look past the daily ups and downs of the market as they pursue the specific investment objectives of their individual Funds.

At MainStay, we believe that a long-term perspective can help investors as well. Instead of trying to capitalize on short-term market movements, you may prefer to focus on the long-term potential that can come from getting invested, staying invested and adding to your investments over time. Of course, past performance is no guarantee of future results.

The following pages contain more specific information on the securities, market events and investment decisions that affected your MainStay Fund(s) during the 12 months ended October 31, 2012. We invite you to read the information carefully and use it as part of your ongoing portfolio evaluation and investment review.

Sincerely,

Stephen P. Fisher

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Not part of the Annual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-MAINSTAY (624-6782), by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 169 Lackawanna Avenue, Parsippany, New Jersey 07054 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at mainstayinvestments.com/documents. Please read the Summary Prospectus and/or Prospectus carefully before investing.

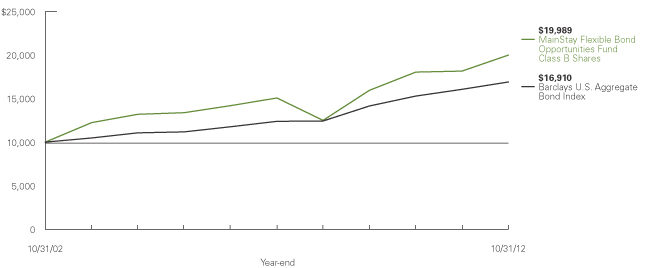

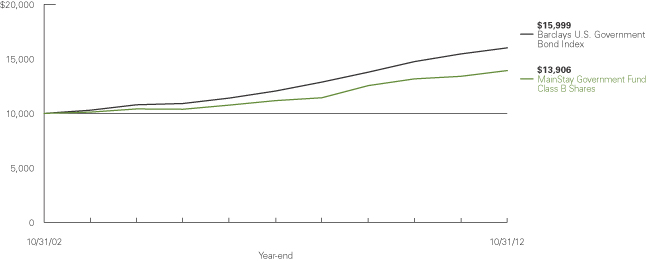

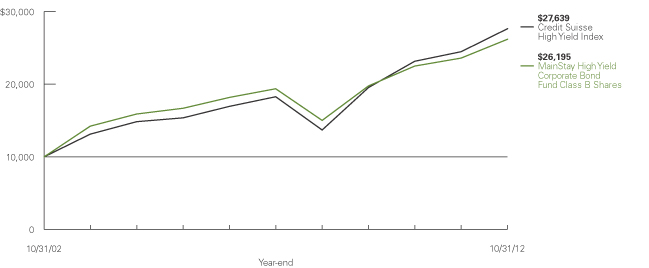

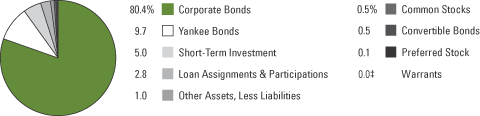

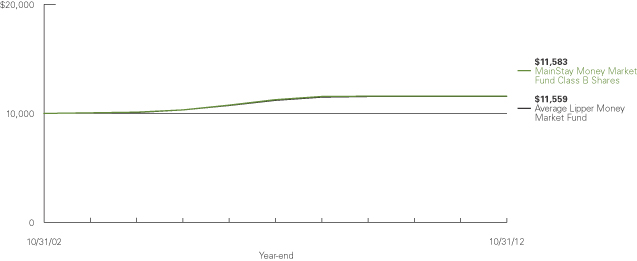

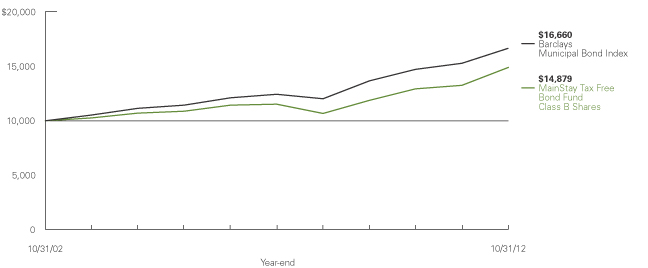

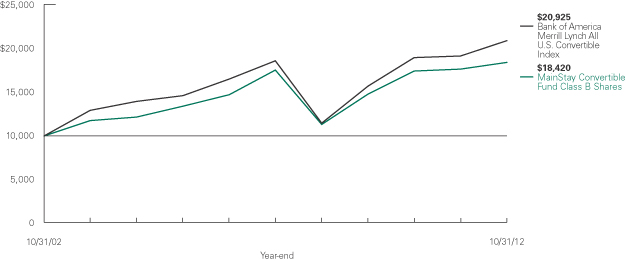

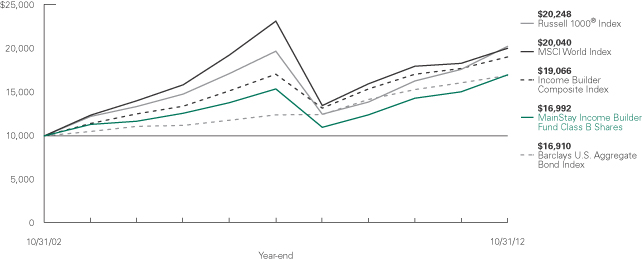

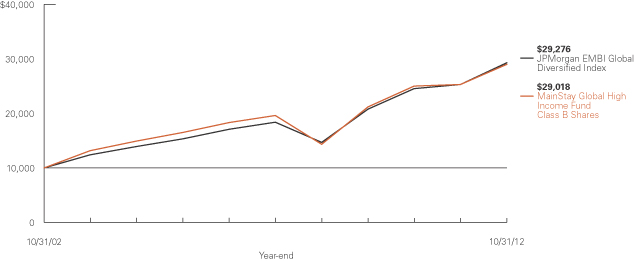

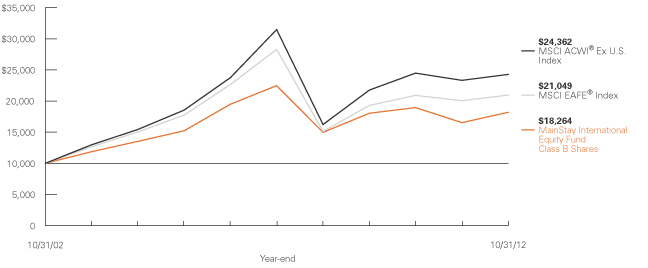

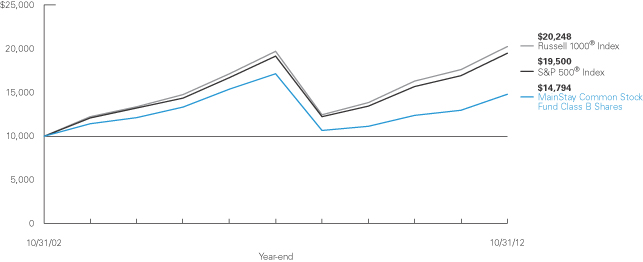

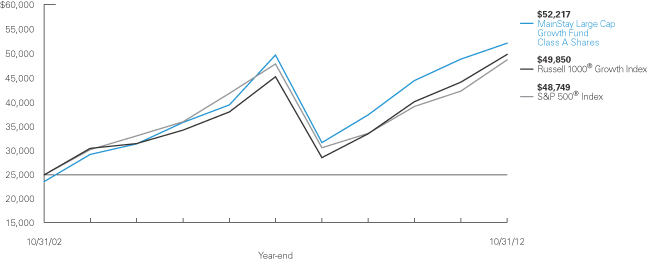

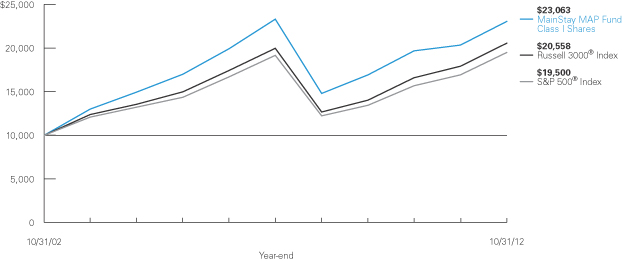

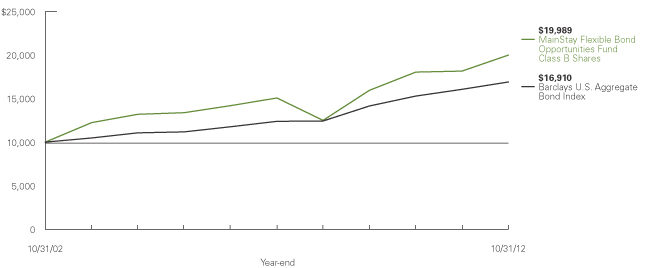

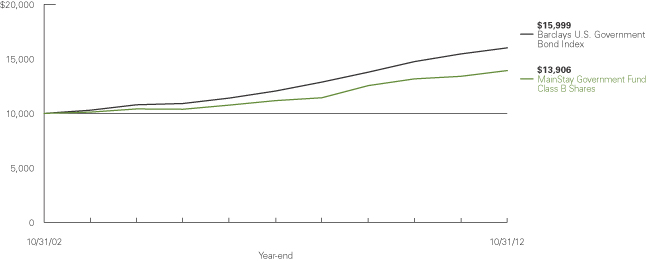

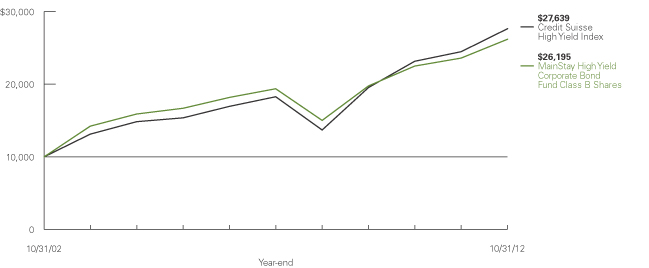

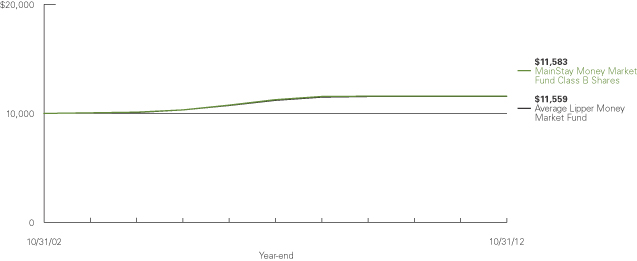

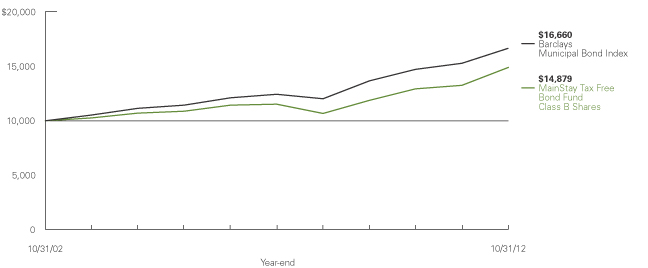

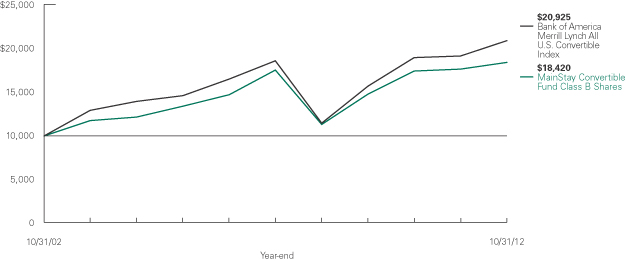

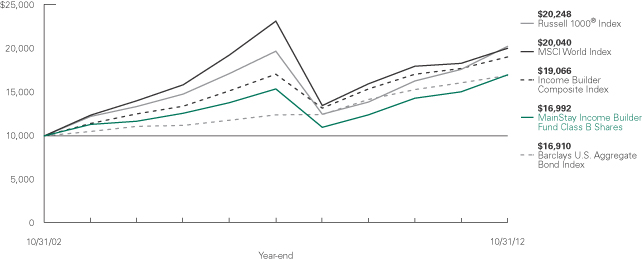

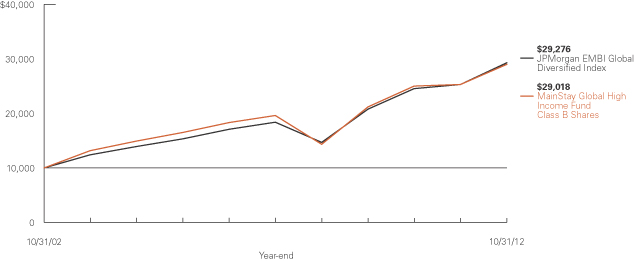

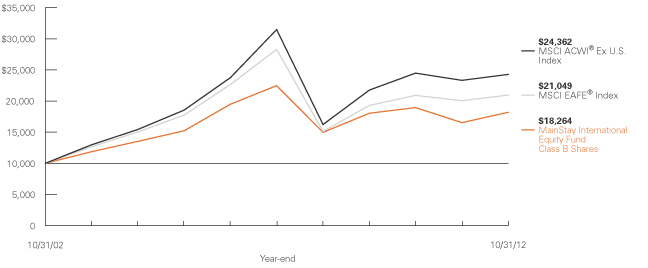

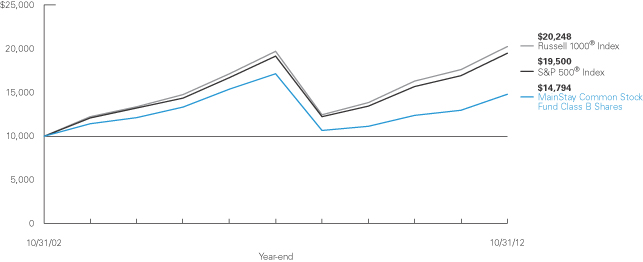

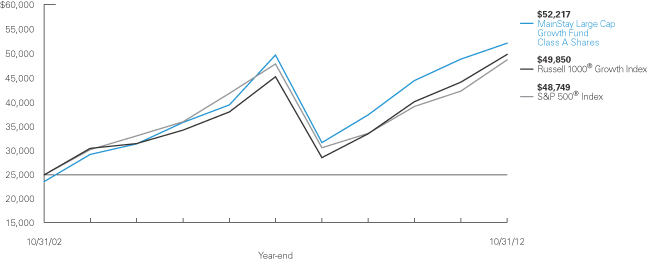

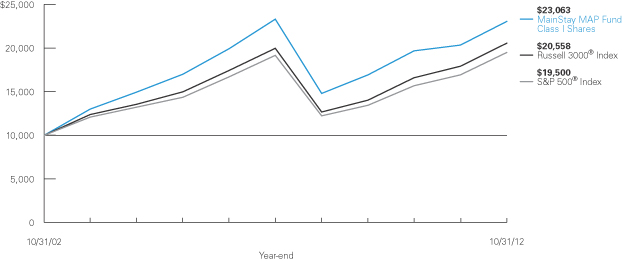

Investment and Performance Comparison1 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class B shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-MAINSTAY (624-6782) or visit mainstayinvestments.com.

(With sales charges)

Average Annual Total Returns for the Year Ended October 31, 2012

| | | | | | | | | | | | | | | | | | | | |

| Class | | Sales Charge | | | | One Year | | | Five Years | | | Ten Years | | | Gross

Expense

Ratio2 | |

| Investor Class Shares3 | | Maximum 4.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| 5.98

10.98 | %

| |

| 5.64

6.62 | %

| |

| 7.48

7.97 | %

| |

| 1.42

1.42 | %

|

| Class A Shares | | Maximum 4.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| 6.26

11.26 |

| |

| 5.81

6.79 |

| |

| 7.57

8.06 |

| |

| 1.22

1.22 |

|

| Class B Shares | | Maximum 5% CDSC

if Redeemed Within the First Six Years of Purchase | | With sales charges Excluding sales charges | |

| 5.15

10.15 |

| |

| 5.50

5.82 |

| |

| 7.17

7.17 |

| |

| 2.16

2.16 |

|

| Class C Shares | | Maximum 1% CDSC if Redeemed Within One Year of Purchase | | With sales charges Excluding sales charges | |

| 9.16

10.16 |

| |

| 5.80

5.80 |

| |

| 7.16

7.16 |

| |

| 2.19

2.19 |

|

| Class I Shares4 | | No Sales Charge | | | | | 11.41 | | | | 7.08 | | | | 8.38 | | | | 1.02 | |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund-share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations, please refer to the notes to the financial statements. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | Performance figures for Investor Class shares, first offered on February 28, 2008, include the historical performance of Class A shares through February 27, 2008, adjusted for differences in certain expenses and fees. Unadjusted, the performance shown for Investor Class shares might have been different. |

| 4. | Performance figures for Class I shares, first offered on January 2, 2004, include the historical performance of Class A shares through January 1, 2004, adjusted for differences in certain expenses and fees. Unadjusted, the performance shown for Class I shares might have been different. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | | | |

| mainstayinvestments.com | | | 5 | |

| | | | | | | | | | | | |

| Benchmark Performance | | One

Year | | | Five

Years | | | Ten

Years | |

Barclays U.S. Aggregate Bond Index5 | | | 5.25 | % | | | 6.38 | % | | | 5.39 | % |

Average Lipper Multi-Sector Income Fund6 | | | 9.75 | | | | 6.47 | | | | 7.63 | |

| 5. | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasurys, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. The Barclays U.S. Aggregate Bond Index is the Fund’s broad-based securities market index for comparison purposes. Total returns assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 6. | The average Lipper multi-sector income fund is representative of funds that seek current income by allocating assets among several different fixed income securities sectors (with no more than 65% in any one sector except for defensive purposes), including U.S. government and foreign governments, with a significant portion of assets in securities rated below investment-grade. This benchmark is a product of Lipper Inc. Lipper Inc. is an independent monitor of fund performance. Results are based on average total returns of similar funds with all dividend and capital gain distributions reinvested. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | |

| 6 | | MainStay Flexible Bond Opportunities Fund |

Cost in Dollars of a $1,000 Investment in MainStay Flexible Bond Opportunities Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from May 1, 2012, to October 31, 2012, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from May 1, 2012, to October 31, 2012.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended October 31, 2012. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

5/1/12 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

10/31/12 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

10/31/12 | | | Expenses

Paid

During

Period1 | |

| | | | | |

| Investor Class Shares | | $ | 1,000.00 | | | $ | 1,054.00 | | | $ | 7.90 | | | $ | 1,017.40 | | | $ | 7.76 | |

| | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 1,054.10 | | | $ | 6.97 | | | $ | 1,018.30 | | | $ | 6.85 | |

| | | | | |

| Class B Shares | | $ | 1,000.00 | | | $ | 1,049.50 | | | $ | 11.75 | | | $ | 1,013.70 | | | $ | 11.54 | |

| | | | | |

| Class C Shares | | $ | 1,000.00 | | | $ | 1,048.40 | | | $ | 11.74 | | | $ | 1,013.70 | | | $ | 11.54 | |

| | | | | |

| Class I Shares | | $ | 1,000.00 | | | $ | 1,055.40 | | | $ | 5.63 | | | $ | 1,019.70 | | | $ | 5.53 | |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of each class (1.53% for Investor Class, 1.35% for Class A, 2.28% for Class B and Class C and 1.09% for Class I) multiplied by the average account value over the period, divided by 366 and multiplied by 184 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. |

| | | | |

| mainstayinvestments.com | | | 7 | |

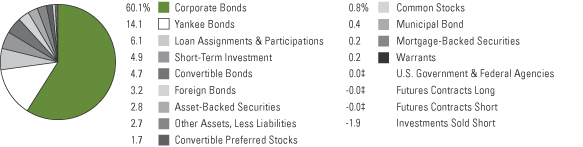

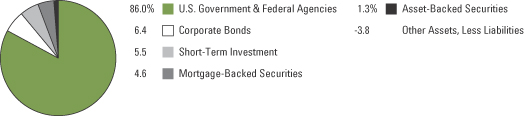

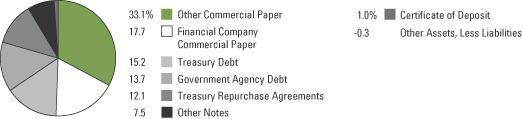

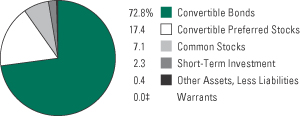

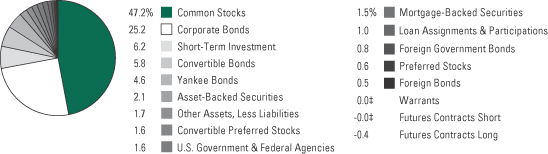

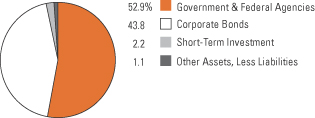

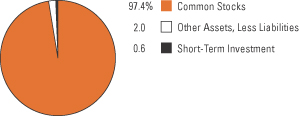

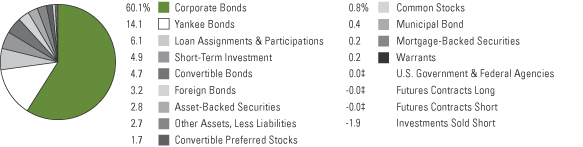

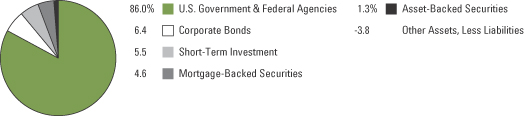

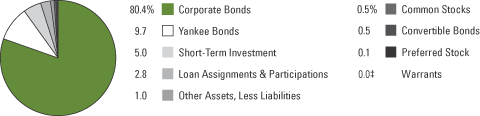

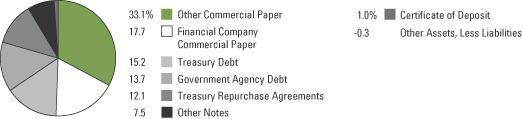

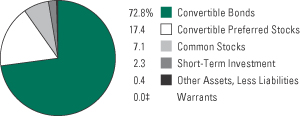

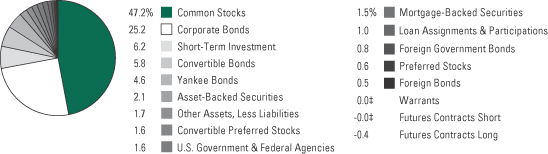

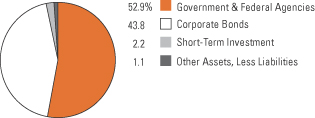

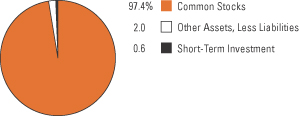

Portfolio Composition as of October 31, 2012 (Unaudited)

See Portfolio of Investments beginning on page 11 for specific holdings within these categories.

| ‡ | Less than one-tenth of a percent. |

Top Ten Holdings or Issuers Held as of October 31, 2012 (excluding short-term investment)

| 1. | Bank of America Corp., 5.625%–7.625%, due 6/1/19–7/1/20 |

| 2. | Caesars Entertainment Operating Co., Inc., 4.461%–10.00%, due 1/26/18–12/15/18 |

| 3. | Ford Motor Credit Co. LLC, 8.00%–8.125%, due 12/15/16–1/15/20 |

| 4. | First Data Corp., 7.375%–8.875%, due 6/15/19–8/15/20 |

| 5. | Avis Budget Car Rental LLC / Avis Budget Finance, Inc., 8.25%–9.625%, due 3/15/18–1/15/19 |

| 6. | Canada Square Operations PLC, 7.50%, due 5/29/49 |

| 7. | Novelis, Inc., 4.00%–8.75%, due 3/10/17–12/15/20 |

| 8. | Lincoln National Corp., 7.00%, due 5/17/66 |

| 9. | Reynolds Group Issuer, Inc., 7.875%–9.875%, due 8/15/19 |

| 10. | MGM Resorts International, 4.25%–8.625%, due 4/15/15–10/1/20 |

| | |

| 8 | | MainStay Flexible Bond Opportunities Fund |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by portfolio managers Dan Roberts, PhD, Michael Kimble, Louis N. Cohen and Taylor Wagenseil of MacKay Shields LLC, the Fund’s Subadvisor.

How did MainStay Flexible Bond Opportunities Fund perform relative to its peers and its benchmark during the 12 months ended October 31, 2012?

Excluding all sales charges, MainStay Flexible Bond Opportunities Fund returned 10.98% for Investor Class shares, 11.26% for Class A shares, 10.15% for Class B shares and 10.16% for Class C shares for the 12 months ended October 31, 2012. Over the same period, the Fund’s Class I shares returned 11.41%. All share classes outperformed the 9.75% return of the average Lipper1 multi-sector income fund and the 5.25% return of the Barclays U.S. Aggregate Bond Index2 for the 12 months ended October 31, 2012. The Barclays U.S. Aggregate Bond Index is the Fund’s broad-based securities-market index. See page 5 for Fund returns with applicable sales charges.

What factors affected the Fund’s relative performance during the reporting period?

The Fund’s outperformance of the Barclays U.S. Aggregate Bond Index was primarily driven by an overweight position in spread3 products, specifically high-yield corporate bonds. Assets with higher risk profiles provided strong results during the reporting period, largely in response to accommodative monetary policies among the world’s central banks. In particular, the European Central Bank’s Long Term Refinancing Operation offered in late December 2011 and February 2012 helped recapitalize the European banking system. In the last quarter of the reporting period, the European Central Bank president’s proclamation to “preserve the euro”—along with the U.S. Federal Reserve’s announcement that it would engage in an open-ended mortgage purchase program—calmed market fears and kept the “risk rally” alive as investors continued to search for yield. A stronger appetite for risk benefited the Fund’s overweight positions in high-yield corporate bonds and convertible bonds.

High-yield corporate bonds made up the Fund’s largest overweight position in relation to the Barclays U.S. Aggregate Bond Index. (The Index consists entirely of investment-grade bonds.) Within high-yield corporate bonds, holdings in sectors that are more cyclical—such as financials, gaming and housing—were among the Fund’s strongest performers.

Lower-risk assets, such as U.S. Treasury securities and agency mortgages, underperformed the Barclays U.S. Aggregate Bond Index. Fortunately, the Fund’s underweight positions in these asset classes helped the Fund’s performance relative to the Index.

What was the Fund’s duration4 strategy during the reporting period?

The Fund’s duration was shorter than that of the Barclays U.S. Aggregate Bond Index, in large part because of the Fund’s overweight position in high-yield corporate bonds. These bonds tend to have shorter durations than investment-grade corporate bonds. They also tend to have a low correlation to U.S. Treasury securities, so they have a lower sensitivity to interest rates. To further insulate the Fund from a potential rise in interest rates, we maintained a short position in U.S. Treasury futures to keep the Fund’s duration shorter than that of the Index.

What specific factors, risks or market forces prompted significant decisions for the Fund during the reporting period?

There were many macro factors to consider, and the Fund experienced some periods of volatility. Nevertheless, we did not make any material changes to the Fund’s positioning. Prior to the reporting period, we had judged the Federal Reserve’s accommodative monetary policy, along with improving economic data, to be a positive for spread products such as high-yield corporate bonds. For this reason, we maintained a risk profile that was higher than that of the Barclays U.S. Aggregate Bond Index.

During the reporting period, we saw several reasons to believe that the market would continue to favor spread products. The low interest-rate environment sparked healthy demand for higher-yielding securities. Improving profitability signaled that many corporations were doing more with less: less leverage, less short-term debt and smaller funding gaps. In our opinion, improving credit fundamentals would support narrower spreads—or less compensation for assuming credit risk—alongside a favorable balance of supply and demand for corporate debt.

During the reporting period, which market segments were the strongest positive contributors to the Fund’s performance and which market segments were particularly weak?

An overweight position in high-yield corporate bonds was the driving force behind the Fund’s outperformance of the Barclays U.S. Aggregate Bond Index. The Barclays U.S. Aggregate Bond Index was up 5.25%, while high-yield corporate bonds, as measured by the Bank of America Merrill Lynch High Yield

| 1. | See footnote on page 6 for more information on Lipper Inc. |

| 2. | See footnote on page 6 for more information on the Barclays U.S. Aggregate Bond Index. |

| 3. | The terms “spread” and “yield spread” may refer to the difference in yield between a security or type of security and comparable U.S. Treasury issues. The terms may also refer to the difference in yield between two specific securities or types of securities at a given time. |

| 4. | Duration is a measure of the price sensitivity of a fixed-income investment to changes in interest rates. Duration is expressed as a number of years and is considered a more accurate sensitivity gauge than average maturity. |

| | | | |

| mainstayinvestments.com | | | 9 | |

Master II Constrained Index,5 were up 13.15%. Within high-yield corporate bonds, the Fund’s financials and real estate securities were the best performers. Of course, not all of the Fund’s high-yield securities were strong performers. Within the high-yield asset class, energy and utilities holdings were among the Fund’s weakest performers.

The Fund’s position in convertible bonds had a positive impact on its performance during the reporting period.

With an overweight position in high-yield corporate bonds came underweight positions in U.S. Treasury securities and agency mortgages. These underweight sector positions contributed positively to the Fund’s relative performance as investors continued their search for higher-yielding assets and were willing to assume higher levels of risk to pursue their yield objectives.

Did the Fund make any significant purchases or sales during the reporting period?

Through October 31, the year 2012 brought robust new issuance in the high-yield corporate bond market. Year-to-date volume exceeded the previous record set in 2010. The majority of new issuance (61% year-to-date) was for refinancing. As a result, several companies in which the Fund held positions, including privatized correctional and detention facilities operator Corrections Corporation of America and residential home builder Meritage Homes, redeemed their bonds from the Fund during the reporting period.

During the reporting period, some companies whose bonds the Fund had previously owned issued new securities that fit our process, and we bought them for the Fund. Among these companies were oil and gas producer Chesapeake Energy, gaming facilities operator Mohegan Tribal Gaming Authority and residential home builder KB Home.

How did the Fund’s sector weightings change during the reporting period?

During the reporting period, we slightly increased the Fund’s exposure to high-yield corporate bonds and bank loans. Over the same period, we decreased the Fund’s exposure to U.S.

Treasury securities.

How was the Fund positioned at the end of the reporting period?

As of October 31, 2012, the Fund’s most substantially overweight sector relative to the Barclays U.S. Aggregate Bond Index was high-yield corporate bonds. The Fund also held overweight positions in bank loans and convertible securities.

As of the same date, the Fund held underweight positions relative to the Index in U.S. Treasury securities, agency debentures and agency mortgage-backed securities. As of October 31, 2012, the Fund had a shorter duration than the Barclays U.S. Aggregate Bond Index.

| 5. | The Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index is a market value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issuers included in the Index have maturities of one year or more and have a credit rating lower than BBB–/Baa3, but are not in default. No single issuer may constitute greater than 2% of the Index. Total returns assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

| | |

| 10 | | MainStay Flexible Bond Opportunities Fund |

Portfolio of Investments††† October 31, 2012

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Long-Term Bonds 91.6%† Asset-Backed Securities 2.8% | | | | | | | | |

Airlines 0.5% | | | | | | | | |

American Airlines Pass-Through Trust

Series 2001-1, Class A1

6.977%, due 5/23/21 (a) | | $ | 673,668 | | | $ | 666,931 | |

Continental Airlines, Inc.

Series 2004-ERJ1, Class A

9.558%, due 9/1/19 | | | 105,116 | | | | 111,423 | |

Northwest Airlines, Inc.

Series 2007-1, Class A

7.027%, due 11/1/19 | | | 363,466 | | | | 401,630 | |

United Air Lines, Inc.

Series 2009-2, Class A

9.75%, due 1/15/17 | | | 649,826 | | | | 752,174 | |

| | | | | | | | |

| | | | 1,932,158 | |

| | | | | | | | |

Home Equity 1.7% | |

Carrington Mortgage Loan Trust

Series 2006-NC4, Class A5

0.271%, due 10/25/36 (b)(c) | | | 654,138 | | | | 464,123 | |

Citicorp Residential Mortgage Securities, Inc.

Series 2006-1, Class A3

5.706%, due 7/25/36 (c) | | | 2,349 | | | | 2,345 | |

Citigroup Mortgage Loan Trust, Inc.

Series 2007-AHL2, Class A3A

0.281%, due 5/25/37 (b)(c) | | | 410,970 | | | | 308,390 | |

Equifirst Loan Securitization Trust

Series 2007-1, Class A2A

0.271%, due 4/25/37 (b)(c) | | | 174,369 | | | | 163,187 | |

First NLC Trust

Series 2007-1, Class A1

0.281%, due 8/25/37 (b)(c)(d) | | | 482,208 | | | | 201,131 | |

GSAA Home Equity Trust

Series 2006-14, Class A1

0.261%, due 9/25/36 (b) | | | 1,023,817 | | | | 509,923 | |

Home Equity Loan Trust

Series 2007-FRE1, Class 2AV1

0.341%, due 4/25/37 (b)(c) | | | 293,169 | | | | 242,669 | |

HSI Asset Securitization Corp. Trust

Series 2007-NC1, Class A1

0.311%, due 4/25/37 (b)(c) | | | 555,089 | | | | 470,266 | |

JP Morgan Mortgage Acquisition Corp.

Series 2007-HE1, Class AF1

0.311%, due 3/25/47 (b)(c) | | | 362,149 | | | | 250,915 | |

Master Asset Backed Securities Trust

Series 2006-HE4, Class A1

0.261%, due 11/25/36 (b)(c) | | | 128,605 | | | | 51,096 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Home Equity (continued) | | | | | | | | |

Merrill Lynch Mortgage Investors Trust

Series 2007-MLN1, Class A2A

0.321%, due 3/25/37 (b)(c) | | $ | 872,975 | | | $ | 614,932 | |

Morgan Stanley ABS Capital I, Inc. | |

Series 2006-HE6, Class A2B 0.311%, due 9/25/36 (b)(c) | | | 591,165 | | | | 375,600 | |

Series 2006-HE8, Class A2B 0.311%, due 10/25/36 (b)(c) | | | 247,241 | | | | 130,924 | |

Series 2007-HE4, Class A2A 0.321%, due 2/25/37 (b)(c) | | | 111,922 | | | | 43,332 | |

Series 2007-NC2, Class A2FP 0.361%, due 2/25/37 (b)(c) | | | 475,573 | | | | 241,656 | |

Renaissance Home Equity Loan Trust

Series 2007-2, Class AF1

5.893%, due 6/25/37 (c) | | | 917,007 | | | | 450,482 | |

Securitized Asset Backed Receivables LLC Trust

Series 2007-BR4, Class A2A

0.301%, due 5/25/37 (b)(c) | | | 566,727 | | | | 270,507 | |

Soundview Home Equity Loan Trust | | | | | | | | |

Series 2007-OPT1, Class 2A1 0.291%, due 6/25/37 (b)(c) | | | 759,679 | | | | 703,220 | |

Series 2006-EQ2, Class A2 0.321%, due 1/25/37 (b)(c) | | | 371,299 | | | | 212,590 | |

Specialty Underwriting & Residential Finance

Series 2006-BC4, Class A2B

0.321%, due 9/25/37 (b)(c) | | | 1,550,558 | | | | 1,238,209 | |

| | | | | | | | |

| | | | | | | 6,945,497 | |

| | | | | | | | |

Student Loans 0.6% | | | | | | | | |

Keycorp Student Loan Trust

Series 2000-A, Class A2

0.747%, due 5/25/29 (b) | | | 2,498,724 | | | | 2,288,631 | |

| | | | | | | | |

Total Asset-Backed Securities

(Cost $12,107,724) | | | | 11,166,286 | |

| | | | | | | | |

| | |

| Convertible Bonds 4.7% | | | | | | | | |

Apparel 0.1% | | | | | | | | |

Iconix Brand Group, Inc.

2.50%, due 6/1/16 (d) | | | 323,000 | | | | 323,202 | |

| | | | | | | | |

| | |

Auto Manufacturers 0.1% | | | | | | | | |

Ford Motor Co.

4.25%, due 11/15/16 | | | 266,000 | | | | 392,849 | |

| | | | | | | | |

| | |

Auto Parts & Equipment 0.2% | | | | | | | | |

Meritor, Inc.

4.00%, due 2/15/27 (e) | | | 855,000 | | | | 635,906 | |

| | | | | | | | |

| † | Percentages indicated are based on Fund net assets. |

| ¨ | | Among the Fund’s 10 largest holdings or issuers held as of October 31, 2012, excluding short-term investments. May be subject to change daily. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | 11 | |

Portfolio of Investments††† October 31, 2012 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Convertible Bonds (continued) | |

Biotechnology 0.2% | | | | | | | | |

Amgen, Inc.

0.375%, due 2/1/13 | | $ | 182,000 | | | $ | 206,343 | |

Gilead Sciences, Inc.

1.00%, due 5/1/14 | | | 488,000 | | | | 742,675 | |

| | | | | | | | |

| | | | | | | 949,018 | |

| | | | | | | | |

Coal 0.2% | | | | | | | | |

Alpha Natural Resources, Inc.

2.375%, due 4/15/15 | | | 246,000 | | | | 224,475 | |

Peabody Energy Corp.

4.75%, due 12/15/66 | | | 565,000 | | | | 514,856 | |

| | | | | | | | |

| | | | | | | 739,331 | |

| | | | | | | | |

Commercial Services 0.0%‡ | | | | | | | | |

Hertz Global Holdings, Inc.

5.25%, due 6/1/14 | | | 93,000 | | | | 160,716 | |

| | | | | | | | |

| | |

Computers 0.3% | | | | | | | | |

EMC Corp.

1.75%, due 12/1/13 | | | 411,000 | | | | 638,079 | |

Mentor Graphics Corp.

4.00%, due 4/1/31 | | | 331,000 | | | | 376,306 | |

SanDisk Corp.

1.50%, due 8/15/17 | | | 245,000 | | | | 273,328 | |

| | | | | | | | |

| | | | | | | 1,287,713 | |

| | | | | | | | |

Distribution & Wholesale 0.2% | | | | | | | | |

WESCO International, Inc.

6.00%, due 9/15/29 | | | 355,000 | | | | 847,563 | |

| | | | | | | | |

| | |

Electronics 0.1% | | | | | | | | |

TTM Technologies, Inc.

3.25%, due 5/15/15 | | | 541,000 | | | | 547,424 | |

| | | | | | | | |

| | |

Entertainment 0.1% | | | | | | | | |

International Game Technology

3.25%, due 5/1/14 | | | 470,000 | | | | 490,563 | |

| | | | | | | | |

| | |

Environmental Controls 0.3% | | | | | | | | |

Covanta Holding Corp.

3.25%, due 6/1/14 | | | 1,080,000 | | | | 1,313,550 | |

| | | | | | | | |

| | |

Health Care—Products 0.3% | | | | | | | | |

Teleflex, Inc.

3.875%, due 8/1/17 | | | 788,000 | | | | 973,672 | |

| | | | | | | | |

| | |

Health Care—Services 0.1% | | | | | | | | |

WellPoint, Inc.

2.75%, due 10/15/42 (d) | | | 276,000 | | | | 289,110 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Household Products & Wares 0.1% | | | | | | | | |

Jarden Corp.

1.875%, due 9/15/18 (d) | | $ | 389,000 | | | $ | 390,945 | |

| | | | | | | | |

| | |

Internet 0.1% | | | | | | | | |

At Home Corp.

4.75%, due 12/31/49 (a)(f)(g)(h) | | | 504,238 | | | | 50 | |

DealerTrack Holdings, Inc.

1.50%, due 3/15/17 | | | 39,000 | | | | 40,731 | |

Symantec Corp.

Series B

1.00%, due 6/15/13 | | | 270,000 | | | | 293,625 | |

VeriSign, Inc.

3.25%, due 8/15/37 | | | 186,000 | | | | 231,221 | |

| | | | | | | | |

| | | | | | | 565,627 | |

| | | | | | | | |

Iron & Steel 0.4% | | | | | | | | |

Allegheny Technologies, Inc.

4.25%, due 6/1/14 | | | 730,000 | | | | 802,544 | |

ArcelorMittal

5.00%, due 5/15/14 | | | 398,000 | | | | 405,711 | |

Steel Dynamics, Inc.

5.125%, due 6/15/14 | | | 36,000 | | | | 38,452 | |

United States Steel Corp.

4.00%, due 5/15/14 | | | 190,000 | | | | 194,869 | |

| | | | | | | | |

| | | | | | | 1,441,576 | |

| | | | | | | | |

Lodging 0.1% | | | | | | | | |

¨MGM Resorts International

4.25%, due 4/15/15 | | | 317,000 | | | | 325,718 | |

| | | | | | | | |

| | |

Machinery—Diversified 0.1% | | | | | | | | |

Chart Industries, Inc.

2.00%, due 8/1/18 | | | 224,000 | | | | 286,440 | |

| | | | | | | | |

| | |

Media 0.0%‡ | | | | | | | | |

Central European Media Enterprises, Ltd.

5.00%, due 11/15/15 | | | 149,000 | | | | 135,590 | |

| | | | | | | | |

| | |

Mining 0.0%‡ | | | | | | | | |

Alcoa, Inc.

5.25%, due 3/15/14 | | | 76,000 | | | | 109,773 | |

| | | | | | | | |

| | |

Miscellaneous—Manufacturing 0.2% | | | | | | | | |

Danaher Corp.

(zero coupon), due 1/22/21 | | | 484,000 | | | | 730,235 | |

| | | | | | | | |

| | |

Oil & Gas 0.0%‡ | | | | | | | | |

Transocean, Inc.

Series C

1.50%, due 12/15/37 | | | 126,000 | | | | 126,236 | |

| | | | | | | | |

| | | | |

| 12 | | MainStay Flexible Bond Opportunities Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Convertible Bonds (continued) | |

Oil & Gas Services 0.1% | | | | | | | | |

JPMorgan Chase & Co.

(Convertible into Schlumberger, Ltd.)

1.50%, due 6/25/15 (d) | | $ | 129,375 | | | $ | 165,134 | |

Subsea 7 S.A.

3.50%, due 10/13/14 | | | 200,000 | | | | 289,120 | |

| | | | | | | | |

| | | | | | | 454,254 | |

| | | | | | | | |

Pharmaceuticals 0.3% | | | | | | | | |

BioMarin Pharmaceutical, Inc.

1.875%, due 4/23/17 | | | 187,000 | | | | 361,377 | |

Salix Pharmaceuticals, Ltd.

1.50%, due 3/15/19 (d) | | | 143,000 | | | | 136,744 | |

2.75%, due 5/15/15 | | | 238,000 | | | | 271,171 | |

Teva Pharmaceutical Finance Co. LLC

0.25%, due 2/1/26 | | | 456,000 | | | | 485,925 | |

| | | | | | | | |

| | | | | | | 1,255,217 | |

| | | | | | | | |

Real Estate Investment Trusts 0.1% | | | | | | | | |

SL Green Operating Partnership, L.P.

3.00%, due 10/15/17 (d) | | | 454,000 | | | | 504,791 | |

| | | | | | | | |

| | |

Semiconductors 0.3% | | | | | | | | |

Microchip Technology, Inc.

2.125%, due 12/15/37 | | | 277,000 | | | | 336,382 | |

ON Semiconductor Corp.

Series B

2.625%, due 12/15/26 | | | 473,000 | | | | 488,077 | |

Xilinx, Inc.

2.625%, due 6/15/17 | | | 309,000 | | | | 401,700 | |

| | | | | | | | |

| | | | | | | 1,226,159 | |

| | | | | | | | |

Software 0.1% | | | | | | | | |

Microsoft Corp.

(zero coupon), due 6/15/13 (d) | | | 131,000 | | | | 134,439 | |

Nuance Communications, Inc.

2.75%, due 8/15/27 | | | 46,000 | | | | 61,237 | |

| | | | | | | | |

| | | | | | | 195,676 | |

| | | | | | | | |

Telecommunications 0.6% | | | | | | | | |

Anixter International, Inc.

1.00%, due 2/15/13 | | | 509,000 | | | | 549,084 | |

Ciena Corp.

4.00%, due 3/15/15 (d) | | | 243,000 | | | | 256,669 | |

InterDigital, Inc.

2.50%, due 3/15/16 | | | 159,000 | | | | 166,851 | |

SBA Communications Corp.

1.875%, due 5/1/13 | | | 419,000 | | | | 676,423 | |

4.00%, due 10/1/14 | | | 318,000 | | | | 712,916 | |

| | | | | | | | |

| | | | | | | 2,361,943 | |

| | | | | | | | |

Total Convertible Bonds

(Cost $19,989,455) | | | | | | | 19,060,797 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds 60.1% | |

Aerospace & Defense 1.4% | | | | | | | | |

B/E Aerospace, Inc.

5.25%, due 4/1/22 | | $ | 1,850,000 | | | $ | 1,928,625 | |

Ducommun, Inc.

9.75%, due 7/15/18 | | | 1,190,000 | | | | 1,258,425 | |

TransDigm, Inc.

7.75%, due 12/15/18 | | | 815,000 | | | | 898,538 | |

Triumph Group, Inc.

8.625%, due 7/15/18 | | | 1,305,000 | | | | 1,464,862 | |

| | | | | | | | |

| | | | | | | 5,550,450 | |

| | | | | | | | |

Airlines 1.9% | | | | | | | | |

Continental Airlines, Inc.

7.875%, due 1/2/20 | | | 537,981 | | | | 555,465 | |

9.798%, due 10/1/22 | | | 700,981 | | | | 764,069 | |

Delta Air Lines, Inc.

Series 2011-1 Class A Pass Through Trust

5.30%, due 10/15/20 | | | 1,410,347 | | | | 1,544,330 | |

Series 2010-1 Class A Pass Through Trust

6.20%, due 1/2/20 | | | 382,571 | | | | 424,654 | |

Series 2010-2 Class B Pass Through Trust

6.75%, due 5/23/17 | | | 612,000 | | | | 636,480 | |

U.S. Airways, Inc. Class A

Class A Series 2012-1, Pass-Through Trust 5.90%, due 4/1/26 | | | 2,891,000 | | | | 3,151,190 | |

United Air Lines, Inc.

9.875%, due 8/1/13 (d) | | | 667,000 | | | | 680,340 | |

| | | | | | | | |

| | | | | | | 7,756,528 | |

| | | | | | | | |

Auto Manufacturers 1.1% | | | | | | | | |

Chrysler Group LLC / CG Co-Issuer, Inc.

8.25%, due 6/15/21 | | | 2,190,000 | | | | 2,340,562 | |

Ford Motor Co.

6.625%, due 10/1/28 | | | 229,000 | | | | 260,417 | |

General Motors Corp. (Escrow Shares)

8.375%, due 7/15/33 (f)(g)(i) | | | 11,365,000 | | | | 1,137 | |

Navistar International Corp.

8.25%, due 11/1/21 | | | 2,156,000 | | | | 2,018,555 | |

| | | | | | | | |

| | | | | | | 4,620,671 | |

| | | | | | | | |

Auto Parts & Equipment 0.4% | | | | | | | | |

Commercial Vehicle Group, Inc.

7.875%, due 4/15/19 | | | 1,000,000 | | | | 983,750 | |

Tomkins LLC / Tomkins, Inc.

9.00%, due 10/1/18 | | | 594,000 | | | | 665,280 | |

| | | | | | | | |

| | | | | | | 1,649,030 | |

| | | | | | | | |

Banks 3.6% | | | | | | | | |

AgriBank FCB

9.125%, due 7/15/19 | | | 500,000 | | | | 661,769 | |

¨Bank of America Corp.

5.625%, due 7/1/20 | | | 3,590,000 | | | | 4,188,478 | |

7.625%, due 6/1/19 | | | 420,000 | | | | 532,606 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | 13 | |

Portfolio of Investments††† October 31, 2012 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Banks (continued) | |

CIT Group, Inc.

4.25%, due 8/15/17 | | $ | 330,000 | | | $ | 338,516 | |

5.00%, due 5/15/17 | | | 2,003,000 | | | | 2,110,762 | |

Discover Bank

7.00%, due 4/15/20 | | | 2,445,000 | | | | 2,996,829 | |

JPMorgan Chase & Co.

7.90%, due 4/29/49 (b) | | | 2,200,000 | | | | 2,533,806 | |

Morgan Stanley

4.875%, due 11/1/22 | | | 1,287,000 | | | | 1,301,068 | |

| | | | | | | | |

| | | | | | | 14,663,834 | |

| | | | | | | | |

Biotechnology 0.6% | | | | | | | | |

Life Technologies Corp.

5.00%, due 1/15/21 | | | 2,050,000 | | | | 2,340,061 | |

| | | | | | | | |

| | |

Building Materials 1.6% | | | | | | | | |

Associated Materials LLC /AMH New Finance, Inc.

9.125%, due 11/1/17 | | | 1,223,000 | | | | 1,210,770 | |

Boise Cascade LLC

7.125%, due 10/15/14 | | | 859,000 | | | | 860,632 | |

Masco Corp.

7.125%, due 3/15/20 | | | 2,250,000 | | | | 2,609,415 | |

Texas Industries, Inc.

9.25%, due 8/15/20 | | | 840,000 | | | | 896,700 | |

USG Corp. | | | | | | | | |

6.30%, due 11/15/16 | | | 615,000 | | | | 625,762 | |

9.75%, due 1/15/18 | | | 363,000 | | | | 396,578 | |

| | | | | | | | |

| | | | | | | 6,599,857 | |

| | | | | | | | |

Chemicals 1.8% | | | | | | | | |

Dow Chemical Co. (The)

8.55%, due 5/15/19 | | | 1,084,000 | | | | 1,470,020 | |

Hexion U.S. Finance Corp. / Hexion Nova Scotia Finance ULC

8.875%, due 2/1/18 | | | 1,223,000 | | | | 1,235,230 | |

Huntsman International LLC

8.625%, due 3/15/21 | | | 2,000,000 | | | | 2,275,000 | |

Momentive Performance Materials, Inc.

9.00%, due 1/15/21 | | | 815,000 | | | | 562,350 | |

Rockwood Specialties Group, Inc.

4.625%, due 10/15/20 | | | 1,753,000 | | | | 1,805,590 | |

Vertellus Specialties, Inc.

9.375%, due 10/1/15 (d) | | | 102,000 | | | | 81,600 | |

| | | | | | | | |

| | | | | | | 7,429,790 | |

| | | | | | | | |

Coal 1.6% | | | | | | | | |

Alpha Natural Resources, Inc.

6.00%, due 6/1/19 | | | 1,560,000 | | | | 1,368,900 | |

Arch Coal, Inc.

7.25%, due 10/1/20 | | | 1,630,000 | | | | 1,442,550 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Coal (continued) | | | | | | | | |

Cloud Peak Energy Resources LLC / Cloud Peak Energy Finance Corp.

8.25%, due 12/15/17 (j) | | $ | 2,162,000 | | | $ | 2,340,365 | |

Peabody Energy Corp.

7.375%, due 11/1/16 | | | 1,025,000 | | | | 1,173,625 | |

| | | | | | | | |

| | | | | | | 6,325,440 | |

| | | | | | | | |

Commercial Services 2.7% | | | | | | | | |

¨Avis Budget Car Rental LLC / Avis Budget Finance, Inc.

8.25%, due 1/15/19 | | | 1,223,000 | | | | 1,334,599 | |

9.625%, due 3/15/18 | | | 2,375,000 | | | | 2,645,156 | |

Geo Group, Inc. (The)

6.625%, due 2/15/21 | | | 1,223,000 | | | | 1,317,782 | |

Hertz Corp. (The)

7.375%, due 1/15/21 | | | 1,630,000 | | | | 1,754,287 | |

Iron Mountain, Inc. | | | | | | | | |

7.75%, due 10/1/19 | | | 431,000 | | | | 485,953 | |

8.375%, due 8/15/21 | | | 1,293,000 | | | | 1,428,765 | |

Quebecor World, Inc.

(Litigation Recovery Trust - Escrow Shares) | | | | | | | | |

6.50%, due 8/1/49 (f)(g)(i) | | | 5,000 | | | | 80 | |

9.75%, due 1/15/49 (f)(g)(i) | | | 160,000 | | | | 2,560 | |

UR Merger Sub Corp.

8.375%, due 9/15/20 | | | 1,849,000 | | | | 2,024,655 | |

| | | | | | | | |

| | | | | | | 10,993,837 | |

| | | | | | | | |

Computers 0.8% | | | | | | | | |

NCR Corp.

5.00%, due 7/15/22 (d) | | | 1,565,000 | | | | 1,598,256 | |

SunGard Data Systems, Inc.

6.625%, due 11/1/19 (d) | | | 1,050,000 | | | | 1,059,188 | |

10.25%, due 8/15/15 | | | 572,000 | | | | 585,156 | |

| | | | | | | | |

| | | | 3,242,600 | |

| | | | | | | | |

Diversified Financial Services 0.8% | |

Ford Holdings LLC

9.30%, due 3/1/30 | | | 127,000 | | | | 178,276 | |

GE Capital Trust IV

Series Reg S

4.625%, due 9/15/66 (b) | | € | 1,223,000 | | | | 1,515,943 | |

General Electric Capital Corp.

6.50%, due 9/15/67 (b) | | £ | 815,000 | | | | 1,331,317 | |

| | | | | | | | |

| | | | 3,025,536 | |

| | | | | | | | |

Electric 1.6% | |

CMS Energy Corp. | |

6.25%, due 2/1/20 | | $ | 98,000 | | | | 116,920 | |

8.75%, due 6/15/19 | | | 533,000 | | | | 702,906 | |

Energy Future Intermediate Holding Co. LLC / EFIH Finance, Inc.

10.00%, due 12/1/20 | | | 1,724,000 | | | | 1,883,470 | |

| | | | |

| 14 | | MainStay Flexible Bond Opportunities Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Electric (continued) | |

Great Plains Energy, Inc.

4.85%, due 6/1/21 | | $ | 750,000 | | | $ | 851,991 | |

NRG Energy, Inc.

8.50%, due 6/15/19 | | | 1,970,000 | | | | 2,132,525 | |

Wisconsin Energy Corp.

6.25%, due 5/15/67 (b) | | | 833,280 | | | | 893,693 | |

| | | | | | | | |

| | | | 6,581,505 | |

| | | | | | | | |

Entertainment 0.2% | |

Mohegan Tribal Gaming Authority

10.50%, due 12/15/16 (d) | | | 815,000 | | | | 768,138 | |

United Artists Theatre Circuit, Inc.

Series BA7

9.30%, due 7/1/15 (f)(g) | | | 35,016 | | | | 24,511 | |

| | | | | | | | |

| | | | 792,649 | |

| | | | | | | | |

Environmental Controls 0.1% | |

EnergySolutions, Inc. / EnergySolutions LLC

10.75%, due 8/15/18 (j) | | | 550,000 | | | | 510,125 | |

| | | | | | | | |

|

Finance—Auto Loans 1.1% | |

¨Ford Motor Credit Co. LLC | |

8.00%, due 12/15/16 | | | 22,000 | | | | 26,643 | |

8.125%, due 1/15/20 | | | 3,361,000 | | | | 4,271,656 | |

| | | | | | | | |

| | | | 4,298,299 | |

| | | | | | | | |

Finance—Commercial 0.4% | |

Textron Financial Corp.

6.00%, due 2/15/67 (b)(d) | | | 1,860,000 | | | | 1,599,600 | |

| | | | | | | | |

|

Finance—Consumer Loans 1.1% | |

HSBC Finance Capital Trust IX

5.911%, due 11/30/35 (b)(j) | | | 2,425,000 | | | | 2,417,022 | |

SLM Corp. | |

4.75%, due 3/17/14 | | € | 815,000 | | | | 1,070,923 | |

6.25%, due 1/25/16 | | $ | 408,000 | | | | 440,660 | |

8.00%, due 3/25/20 | | | 408,000 | | | | 472,513 | |

| | | | | | | | |

| | | | 4,401,118 | |

| | | | | | | | |

Finance—Credit Card 1.4% | |

American Express Co.

6.80%, due 9/1/66 (b)(j) | | | 2,139,000 | | | | 2,323,489 | |

Capital One Capital III

7.686%, due 8/1/66 | | | 3,097,000 | | | | 3,141,597 | |

| | | | | | | | |

| | | | | | | 5,465,086 | |

| | | | | | | | |

Finance—Other Services 0.6% | | | | | | | | |

Icahn Enterprises, L.P. / Icahn Enterprises Finance Corp.

7.75%, due 1/15/16 (j) | | | 2,180,000 | | | | 2,278,100 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Food 0.8% | | | | | | | | |

JBS USA LLC / JBS USA Finance, Inc.

8.25%, due 2/1/20 (d) | | $ | 672,000 | | | $ | 693,840 | |

Smithfield Foods, Inc.

7.75%, due 7/1/17 | | | 2,206,000 | | | | 2,492,780 | |

| | | | | | | | |

| | | | | | | 3,186,620 | |

| | | | | | | | |

Forest Products & Paper 1.0% | | | | | | | | |

Domtar Corp.

10.75%, due 6/1/17 | | | 734,000 | | | | 950,335 | |

International Paper Co.

7.30%, due 11/15/39 | | | 693,000 | | | | 962,554 | |

MeadWestvaco Corp.

7.375%, due 9/1/19 | | | 1,800,000 | | | | 2,284,252 | |

| | | | | | | | |

| | | | | | | 4,197,141 | |

| | | | | | | | |

Gas 0.2% | | | | | | | | |

Southern Union Co.

7.60%, due 2/1/24 | | | 662,000 | | | | 851,186 | |

| | | | | | | | |

| | |

Hand & Machine Tools 0.4% | | | | | | | | |

Mcron Finance Sub LLC / Mcron Finance Corp.

8.375%, due 5/15/19 (d) | | | 1,635,000 | | | | 1,679,962 | |

| | | | | | | | |

| | |

Health Care—Products 1.1% | | | | | | | | |

Alere, Inc.

8.625%, due 10/1/18 | | | 1,323,000 | | | | 1,389,150 | |

Kinetic Concepts, Inc. / KCI U.S.A., Inc.

10.50%, due 11/1/18 (d) | | | 2,825,000 | | | | 3,008,625 | |

| | | | | | | | |

| | | | | | | 4,397,775 | |

| | | | | | | | |

Health Care—Services 1.2% | | | | | | | | |

Fresenius Medical Care U.S. Finance, Inc.

6.50%, due 9/15/18 (d) | | | 2,500,000 | | | | 2,800,000 | |

HCA, Inc.

6.50%, due 2/15/16 | | | 2,000,000 | | | | 2,187,500 | |

| | | | | | | | |

| | | | | | | 4,987,500 | |

| | | | | | | | |

Home Builders 2.7% | | | | | | | | |

Beazer Homes USA, Inc. | | | | | | | | |

8.125%, due 6/15/16 (j) | | | 819,000 | | | | 864,045 | |

9.125%, due 6/15/18 | | | 1,700,000 | | | | 1,782,875 | |

K Hovnanian Enterprises, Inc.

7.25%, due 10/15/20 (d) | | | 1,460,000 | | | | 1,540,300 | |

KB Home

8.00%, due 3/15/20 | | | 2,250,000 | | | | 2,514,375 | |

Lennar Corp.

6.95%, due 6/1/18 | | | 204,000 | | | | 229,245 | |

MDC Holdings, Inc.

5.625%, due 2/1/20 | | | 693,000 | | | | 772,526 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | 15 | |

Portfolio of Investments††† October 31, 2012 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Home Builders (continued) | |

Shea Homes, L.P. / Shea Homes Funding Corp.

8.625%, due 5/15/19 | | $ | 2,000,000 | | | $ | 2,225,000 | |

Standard Pacific Corp.

8.375%, due 5/15/18 | | | 815,000 | | | | 949,475 | |

| | | | | | | | |

| | | | 10,877,841 | |

| | | | | | | | |

Household Products & Wares 1.8% | | | | | | | | |

Jarden Corp. | | | | | | | | |

7.50%, due 5/1/17 | | | 500,000 | | | | 567,500 | |

7.50%, due 1/15/20 | | | 1,223,000 | | | | 1,339,185 | |

Mead Products LLC / ACCO Brands Corp.

6.75%, due 4/30/20 (d) | | | 2,002,000 | | | | 2,044,543 | |

¨Reynolds Group Issuer, Inc. | |

7.875%, due 8/15/19 | | | 1,025,000 | | | | 1,112,125 | |

9.875%, due 8/15/19 | | | 2,089,000 | | | | 2,188,227 | |

| | | | | | | | |

| | | | 7,251,580 | |

| | | | | | | | |

Insurance 3.3% | | | | | | | | |

Allstate Corp. (The)

6.50%, due 5/15/67 (b) | | | 713,000 | | | | 766,475 | |

American International Group, Inc. | | | | | | | | |

4.875%, due 3/15/67 (b) | | € | 1,250,000 | | | | 1,400,651 | |

Series A2

5.75%, due 3/15/67 (b) | | £ | 450,000 | | | | 663,009 | |

Chubb Corp. (The)

6.375%, due 3/29/67 (b) | | $ | 1,955,000 | | | | 2,121,175 | |

Farmers Exchange Capital

7.20%, due 7/15/48 (d) | | | 603,000 | | | | 742,078 | |

Liberty Mutual Group, Inc. | | | | | | | | |

7.80%, due 3/7/87 (d) | | | 453,000 | | | | 508,493 | |

10.75%, due 6/15/88 (b)(d) | | | 938,000 | | | | 1,397,620 | |

¨Lincoln National Corp.

7.00%, due 5/17/66 (b) | | | 3,443,000 | | | | 3,529,075 | |

Pacific Life Insurance Co. | | | | | | | | |

7.90%, due 12/30/23 (d) | | | 1,150,000 | | | | 1,405,120 | |

9.25%, due 6/15/39 (d) | | | 204,000 | | | | 288,590 | |

Progressive Corp. (The)

6.70%, due 6/15/67 (b) | | | 612,000 | | | | 666,315 | |

| | | | | | | | |

| | | | 13,488,601 | |

| | | | | | | | |

Iron & Steel 0.2% | | | | | | | | |

Allegheny Ludlum Corp.

6.95%, due 12/15/25 | | | 693,000 | | | | 830,234 | |

| | | | | | | | |

| | |

Leisure Time 0.1% | | | | | | | | |

Harley-Davidson Funding Corp.

6.80%, due 6/15/18 (d) | | | 408,000 | | | | 506,182 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Lodging 1.6% | | | | | | | | |

¨Caesars Entertainment Operating Co., Inc. 10.00%, due 12/15/18 | | $ | 2,250,000 | | | $ | 1,406,250 | |

¨MGM Resorts International | |

6.75%, due 10/1/20 (d) | | | 1,994,000 | | | | 1,979,045 | |

8.625%, due 2/1/19 (d) | | | 825,000 | | | | 892,031 | |

Starwood Hotels & Resorts Worldwide, Inc.

7.15%, due 12/1/19 | | | 1,700,000 | | | | 2,090,973 | |

| | | | | | | | |

| | | | | | | 6,368,299 | |

| | | | | | | | |

Machinery—Construction & Mining 0.3% | |

Terex Corp.

8.00%, due 11/15/17 | | | 1,182,000 | | | | 1,233,712 | |

| | | | | | | | |

| | |

Media 2.0% | | | | | | | | |

CCO Holdings LLC / CCO Holdings Capital Corp.

7.00%, due 1/15/19 (j) | | | 978,000 | | | | 1,051,350 | |

Cequel Communications Holdings I LLC / Cequel Capital Corp.

8.625%, due 11/15/17 (d) | | | 938,000 | | | | 1,003,660 | |

Clear Channel Communications, Inc.

9.00%, due 3/1/21 | | | 1,405,000 | | | | 1,225,862 | |

COX Communications, Inc.

6.95%, due 6/1/38 (d) | | | 2,241,000 | | | | 3,055,601 | |

DISH DBS Corp. | | | | | | | | |

6.75%, due 6/1/21 | | | 765,000 | | | | 852,019 | |

7.125%, due 2/1/16 (j) | | | 815,000 | | | | 910,763 | |

| | | | | | | | |

| | | | | | | 8,099,255 | |

| | | | | | | | |

Metal Fabricate & Hardware 0.2% | | | | | | | | |

Mueller Water Products, Inc.

8.75%, due 9/1/20 | | | 627,000 | | | | 719,483 | |

| | | | | | | | |

| | |

Mining 0.9% | | | | | | | | |

Alcoa, Inc.

6.15%, due 8/15/20 (j) | | | 1,426,000 | | | | 1,560,644 | |

Old AII, Inc. | | | | | | | | |

7.625%, due 2/15/18 | | | 1,426,000 | | | | 1,447,390 | |

7.875%, due 11/1/20 (d) | | | 475,000 | | | | 472,625 | |

| | | | | | | | |

| | | | | | | 3,480,659 | |

| | | | | | | | |

Miscellaneous—Manufacturing 0.4% | | | | | | | | |

American Railcar Industries, Inc.

7.50%, due 3/1/14 | | | 729,000 | | | | 736,290 | |

Polypore International, Inc.

7.50%, due 11/15/17 | | | 815,000 | | | | 880,200 | |

| | | | | | | | |

| | | | | | | 1,616,490 | |

| | | | | | | | |

Office Furnishings 0.4% | | | | | | | | |

Interface, Inc.

7.625%, due 12/1/18 | | | 1,674,000 | | | | 1,810,012 | |

| | | | | | | | |

| | | | |

| 16 | | MainStay Flexible Bond Opportunities Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Oil & Gas 5.2% | | | | | | | | |

Berry Petroleum Co.

6.75%, due 11/1/20 (j) | | $ | 1,223,000 | | | $ | 1,296,380 | |

Chesapeake Energy Corp.

6.625%, due 8/15/20 | | | 2,445,000 | | | | 2,567,250 | |

Concho Resources, Inc. | | | | | | | | |

6.50%, due 1/15/22 | | | 750,000 | | | | 823,125 | |

7.00%, due 1/15/21 | | | 2,002,000 | | | | 2,222,220 | |

Denbury Resources, Inc.

6.375%, due 8/15/21 (j) | | | 815,000 | | | | 892,425 | |

Frontier Oil Corp.

6.875%, due 11/15/18 | | | 571,000 | | | | 608,115 | |

Hilcorp Energy I, L.P. / Hilcorp Finance Co.

7.625%, due 4/15/21 (d) | | | 1,223,000 | | | | 1,333,070 | |

8.00%, due 2/15/20 (d) | | | 1,000,000 | | | | 1,095,000 | |

Linn Energy LLC / Linn Energy Finance Corp.

6.50%, due 5/15/19 | | | 2,250,000 | | | | 2,266,875 | |

7.75%, due 2/1/21 | | | 815,000 | | | | 870,013 | |

Nabors Industries, Inc.

5.00%, due 9/15/20 (j) | | | 2,853,000 | | | | 3,178,784 | |

Plains Exploration & Production Co.

6.125%, due 6/15/19 | | | 2,250,000 | | | | 2,244,375 | |

Swift Energy Co.

7.125%, due 6/1/17 | | | 750,000 | | | | 770,625 | |

8.875%, due 1/15/20 | | | 658,000 | | | | 710,640 | |

| | | | | | | | |

| | | | | | | 20,878,897 | |

| | | | | | | | |

Oil & Gas Services 1.3% | | | | | | | | |

Basic Energy Services, Inc.

7.75%, due 2/15/19 | | | 1,600,000 | | | | 1,592,000 | |

Dresser-Rand Group, Inc.

6.50%, due 5/1/21 | | | 1,292,000 | | | | 1,356,600 | |

Helix Energy Solutions Group, Inc.

9.50%, due 1/15/16 (d)(j) | | | 625,000 | | | | 646,094 | |

Hornbeck Offshore Services, Inc.

5.875%, due 4/1/20 | | | 848,000 | | | | 862,840 | |

8.00%, due 9/1/17 | | | 815,000 | | | | 872,050 | |

| | | | | | | | |

| | | | | | | 5,329,584 | |

| | | | | | | | |

Packaging & Containers 0.7% | | | | | | | | |

Ball Corp.

6.75%, due 9/15/20 (j) | | | 2,648,000 | | | | 2,906,180 | |

| | | | | | | | |

| | |

Pipelines 2.1% | | | | | | | | |

Energy Transfer Partners, L.P.

4.65%, due 6/1/21 | | | 1,490,000 | | | | 1,654,836 | |

MarkWest Energy Partners, L.P. / MarkWest Energy Finance Corp.

6.75%, due 11/1/20 | | | 1,223,000 | | | | 1,333,070 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Pipelines (continued) | | | | | | | | |

Panhandle Eastern Pipe Line Co., L.P.

8.125%, due 6/1/19 | | $ | 2,037,000 | | | $ | 2,526,831 | |

Regency Energy Partners, L.P. / Regency Energy Finance Corp.

6.875%, due 12/1/18 | | | 1,750,000 | | | | 1,881,250 | |

Targa Resources Partners, L.P. / Targa Resources Partners Finance Corp.

7.875%, due 10/15/18 | | | 1,170,000 | | | | 1,281,150 | |

| | | | | | | | |

| | | | | | | 8,677,137 | |

| | | | | | | | |

Real Estate Investment Trusts 0.3% | | | | | | | | |

Host Hotels & Resorts, L.P.

5.875%, due 6/15/19 | | | 1,000,000 | | | | 1,100,000 | |

| | | | | | | | |

| | |

Retail 1.6% | | | | | | | | |

AmeriGas Partners, L.P. / AmeriGas Finance Corp.

6.25%, due 8/20/19 | | | 1,460,000 | | | | 1,533,000 | |

6.50%, due 5/20/21 | | | 741,000 | | | | 785,460 | |

CVS Caremark Corp.

4.75%, due 5/18/20 | | | 2,445,000 | | | | 2,880,237 | |

5.789%, due 1/10/26 (d)(f) | | | 80,983 | | | | 90,612 | |

Suburban Propane Partners L.P. / Suburban Energy Finance Corp.

7.50%, due 10/1/18 (d) | | | 934,000 | | | | 1,004,050 | |

| | | | | | | | |

| | | | | | | 6,293,359 | |

| | | | | | | | |

Semiconductors 0.5% | | | | | | | | |

Freescale Semiconductor, Inc.

9.25%, due 4/15/18 (d) | | | 1,934,000 | | | | 2,069,380 | |

| | | | | | | | |

| | |

Software 1.6% | | | | | | | | |

Fidelity National Information Services, Inc.

7.625%, due 7/15/17 (j) | | | 1,549,000 | | | | 1,690,346 | |

7.875%, due 7/15/20 | | | 489,000 | | | | 546,458 | |

¨First Data Corp.

7.375%, due 6/15/19 (d) | | | 3,502,000 | | | | 3,624,570 | |

8.875%, due 8/15/20 (d) | | | 550,000 | | | | 599,500 | |

| | | | | | | | |

| | | | | | | 6,460,874 | |

| | | | | | | | |

Telecommunications 3.2% | | | | | | | | |

CommScope, Inc.

8.25%, due 1/15/19 (d) | | | 2,930,000 | | | | 3,157,075 | |

Frontier Communications Corp.

8.50%, due 4/15/20 (j) | | | 1,489,000 | | | | 1,719,795 | |

Hughes Satellite Systems Corp.

7.625%, due 6/15/21 | | | 1,695,000 | | | | 1,885,687 | |

MetroPCS Wireless, Inc.

7.875%, due 9/1/18 | | | 1,386,000 | | | | 1,517,670 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | 17 | |

Portfolio of Investments††† October 31, 2012 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Telecommunications (continued) | |

Nextel Communications, Inc.

5.95%, due 3/15/14 (j) | | $ | 1,630,000 | | | $ | 1,632,038 | |

Sprint Capital Corp.

6.90%, due 5/1/19 | | | 612,000 | | | | 665,550 | |

8.75%, due 3/15/32 | | | 2,060,000 | | | | 2,430,800 | |

| | | | | | | | |

| | | | | | | 13,008,615 | |

| | | | | | | | |

Transportation 0.2% | | | | | | | | |

PHI, Inc.

8.625%, due 10/15/18 | | | 669,000 | | | | 705,795 | |

| | | | | | | | |

Total Corporate Bonds

(Cost $230,521,309) | | | | | | | 243,136,469 | |

| | | | | | | | |

|

| Foreign Bonds 3.2% | |

Cayman Islands 0.1% | | | | | | | | |

Government of the Cayman Islands

5.95%, due 11/24/19 (d) | | | 200,000 | | | | 233,000 | |

| | | | | | | | |

| | |

Colombia 0.1% | | | | | | | | |

Republic of Colombia

7.375%, due 3/18/19 | | | 200,000 | | | | 264,000 | |

| | | | | | | | |

| | |

El Salvador 0.1% | | | | | | | | |

Republic of El Salvador

7.65%, due 6/15/35 | | | 163,000 | | | | 189,487 | |

8.25%, due 4/10/32 (d) | | | 163,000 | | | | 199,675 | |

| | | | | | | | |

| | | | | | | 389,162 | |

| | | | | | | | |

Germany 0.2% | | | | | | | | |

IKB Deutsche Industriebank A.G.

4.50%, due 7/9/13 | | € | 734,000 | | | | 913,319 | |

| | | | | | | | |

| | |

Indonesia 0.1% | | | | | | | | |

Republic of Indonesia

5.875%, due 3/13/20 (d) | | $ | 300,000 | | | | 360,375 | |

| | | | | | | | |

| | |

Liberia 0.1% | | | | | | | | |

Royal Caribbean Cruises, Ltd.

Series Reg S

5.625%, due 1/27/14 | | € | 525,000 | | | | 708,909 | |

| | | | | | | | |

| | |

Philippines 0.1% | | | | | | | | |

Republic of Philippines

6.50%, due 1/20/20 | | $ | 300,000 | | | | 383,625 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Portugal 0.8% | | | | | | | | |

Portugal Obrigacoes do Tesouro OT

Series Reg S

4.95%, due 10/25/23 | | € | 3,190,000 | | | $ | 3,194,064 | |

| | | | | | | | |

| | |

Turkey 0.1% | | | | | | | | |

Republic of Turkey

5.125%, due 3/25/22 | | $ | 200,000 | | | | 224,500 | |

| | | | | | | | |

| | |

United Kingdom 1.5% | | | | | | | | |

Barclays Bank PLC

Series Reg S

10.00%, due 5/21/21 | | £ | 449,000 | | | | 908,022 | |

¨Canada Square Operations PLC

7.50%, due 5/29/49 (b) | | | 2,450,000 | | | | 3,948,941 | |

Rexam PLC

6.75%, due 6/29/67 (b) | | € | 978,000 | | | | 1,305,169 | |

| | | | | | | | |

| | | | | | | 6,162,132 | |

| | | | | | | | |

Total Foreign Bonds

(Cost $11,193,608) | | | | | | | 12,833,086 | |

| | | | | | | | |

|

| Loan Assignments & Participations 6.1% (k) | |

Airlines 0.5% | | | | | | | | |

U.S. Airways Group, Inc.

Term Loan

2.711%, due 3/21/14 | | $ | 1,944,444 | | | | 1,896,238 | |

| | | | | | | | |

| | |

Auto Manufacturers 0.4% | | | | | | | | |

Federal-Mogul Corp. | | | | | | | | |

Term Loan B

2.148%, due 12/29/14 | | | 1,032,363 | | | | 968,486 | |

Term Loan C

2.148%, due 12/28/15 | | | 526,716 | | | | 494,125 | |

| | | | | | | | �� |

| | | | | | | 1,462,611 | |

| | | | | | | | |

Beverage, Food & Tobacco 0.4% | | | | | | | | |

Del Monte Corp.

Term Loan

4.50%, due 3/8/18 | | | 1,725,767 | | | | 1,720,589 | |

| | | | | | | | |

| | |

Buildings & Real Estate 0.2% | | | | | | | | |

Realogy Corp. | | | | | | | | |

Extended Term Loan 4.464%, due 10/10/16 | | | 852,913 | | | | 850,070 | |

Extended Letter of Credit 4.465%, due 10/10/16 | | | 120,093 | | | | 119,693 | |

| | | | | | | | |

| | | | | | | 969,763 | |

| | | | | | | | |

| | | | |

| 18 | | MainStay Flexible Bond Opportunities Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Loan Assignments & Participations (continued) | |

Chemicals 0.2% | | | | | | | | |

PQ Corp.

Term Loan B

3.962%, due 7/30/14 | | $ | 768,808 | | | $ | 766,337 | |

| | | | | | | | |

| | |

Electric 0.3% | | | | | | | | |

Calpine Corp.

New Term Loan

4.50%, due 4/2/18 | | | 1,083,500 | | | | 1,084,731 | |

| | | | | | | | |

| | |

Finance—Consumer Loans 0.5% | | | | | | | | |

Springleaf Finance Corp.

Term Loan

5.50%, due 5/10/17 | | | 2,000,000 | | | | 1,967,500 | |

| | | | | | | | |

| | |

Healthcare, Education & Childcare 0.3% | | | | | | | | |

Community Health Systems, Inc. Extended Term Loan

3.921%, due 1/25/17 | | | 172,741 | | | | 173,268 | |

Warner Chilcott Co., LLC

New Term Loan B2

4.25%, due 3/15/18 | | | 191,840 | | | | 192,319 | |

Warner Chilcott Corp. | | | | | | | | |

Incremental Term Loan B1

4.25%, due 3/15/18 | | | 145,706 | | | | 146,070 | |

New Term Loan B1

4.25%, due 3/15/18 | | | 383,679 | | | | 384,639 | |

WC Luxco S.A.R.L.

New Term Loan B3

4.25%, due 3/15/18 | | | 263,780 | | | | 264,439 | |

| | | | | | | | |

| | | | | | | 1,160,735 | |

| | | | | | | | |

Lodging 0.7% | | | | | | | | |

¨Caesars Entertainment Operating Co., Inc. Extended Term Loan B5

4.461%, due 1/26/18 | | | 3,500,000 | | | | 3,028,750 | |

| | | | | | | | |

| | |

Machinery 0.2% | | | | | | | | |

Edwards (Cayman Islands II), Ltd.

Term Loan B

5.50%, due 5/31/16 | | | 857,311 | | | | 858,919 | |

| | | | | | | | |

|

Media 0.4% | |

Charter Communications Operating LLC

Extended Term Loan C

3.47%, due 9/6/16 | | | 66,466 | | | | 66,653 | |

Clear Channel Communications, Inc.

Term Loan B

3.862%, due 1/29/16 | | | 2,862,028 | | | | 1,578,664 | |

| | | | | | | | |

| | | | 1,645,317 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Metals & Mining 0.7% | |

FMG America Finance, Inc.

Term Loan

5.25%, due 10/18/17 | | $ | 1,850,000 | | | $ | 1,840,461 | |

Walter Energy, Inc.

Term Loan B

4.00%, due 4/2/18 | | | 909,519 | | | | 895,119 | |

| | | | | | | | |

| | | | 2,735,580 | |

| | | | | | | | |

Mining 0.4% | |

¨Novelis, Inc.

Term Loan

4.00%, due 3/10/17 | | | 1,572,000 | | | | 1,568,397 | |

| | | | | | | | |

|

Oil & Gas 0.7% | |

MEG Energy Corp.

New Term Loan B

4.00%, due 3/16/18 | | | 2,970,000 | | | | 2,976,032 | |

| | | | | | | | |

|

Telecommunications 0.2% | |

MetroPCS Wireless, Inc.

Incremental Term Loan B3

4.00%, due 3/16/18 | | | 982,525 | | | | 982,729 | |

| | | | | | | | |

Total Loan Assignments & Participations

(Cost $25,021,655) | | | | 24,824,228 | |

| | | | | | | | |

|

| Mortgage-Backed Securities 0.2% | |

Commercial Mortgage Loans

(Collateralized Mortgage Obligations) 0.2% | |

Banc of America Commercial Mortgage, Inc. Series 2005-J, Class 1A1

2.905%, due 11/25/35 (l) | | | 459,396 | | | | 389,160 | |

Bayview Commercial Asset Trust

Series 2006-4A, Class A1

0.441%, due 12/25/36 (b)(d)(g) | | | 61,490 | | | | 47,558 | |

Deutsche ALT-A Securities, Inc.

Alternate Loan Trust

Series 2005-5, Class 1A3

5.50%, due 11/25/35 (b) | | | 180,874 | | | | 161,066 | |

WaMu Mortgage Pass-Through Certificates

Series 2006-AR14, Class 1A1

2.298%, due 11/25/36 (l) | | | 226,197 | | | | 179,569 | |

Wells Fargo Mortgage Backed Securities Trust

Series 2006-AR10, Class 5A2

2.614%, due 7/25/36 (l) | | | 282,257 | | | | 241,947 | |

| | | | | | | | |

Total Mortgage-Backed Securities

(Cost $1,067,394) | | | | 1,019,300 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | mainstayinvestments.com | | | 19 | |

Portfolio of Investments††† October 31, 2012 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Municipal Bond 0.4% | |

New York 0.4% | |

New York City Industrial Development Agency, JFK International Airport, Revenue Bonds

Series A

8.00%, due 8/1/12 (a)(m) | | $ | 1,430,000 | | | $ | 1,428,198 | |

| | | | | | | | |

Total Municipal Bond

(Cost $1,454,084) | | | | 1,428,198 | |

| | | | | | | | |

|

| U.S. Government & Federal Agencies 0.0%‡ | |

Government National Mortgage Association

(Mortgage Pass-Through Securities) 0.0%‡ | |

6.00%, due 8/15/32 | | | 1 | | | | 1 | |

| | | | | | | | |

United States Treasury Note 0.0%‡ | | | | | | | | |

2.125%, due 8/15/21 | | | 70,000 | | | | 73,659 | |

| | | | | | | | |

Total U.S. Government & Federal Agencies

(Cost $71,957) | | | | 73,660 | |

| | | | | | | | |

|

| Yankee Bonds 14.1% (n) | |

Banks 1.6% | |

Bangkok Bank PCL

4.80%, due 10/18/20 (d) | | | 250,000 | | | | 274,462 | |

Barclays Bank PLC

5.14%, due 10/14/20 | | | 2,037,000 | | | | 2,130,665 | |

BBVA Bancomer S.A.

6.75%, due 9/30/22 (d) | | | 1,685,000 | | | | 1,908,262 | |

Mizuho Capital Investment, Ltd.

14.95%, due 12/31/49 (b)(d) | | | 1,092,000 | | | | 1,312,650 | |

Royal Bank of Scotland Group PLC

6.40%, due 10/21/19 | | | 856,000 | | | | 995,357 | |

| | | | | | | | |

| | | | | | | 6,621,396 | |

| | | | | | | | |

Building Materials 1.4% | | | | | | | | |

Cemex Espana Luxembourg

9.25%, due 5/12/20 (d) | | | 1,560,000 | | | | 1,622,400 | |

Desarrolladora Homex S.A.B. de C.V.

9.50%, due 12/11/19 (d) | | | 2,000,000 | | | | 1,997,600 | |

Urbi Desarrollos Urbanos S.A.B. de C.V.

9.50%, due 1/21/20 (d) | | | 2,250,000 | | | | 2,070,000 | |

| | | | | | | | |

| | | | | | | 5,690,000 | |

| | | | | | | | |

Cosmetics & Personal Care 0.5% | | | | | | | | |

Albea Beauty Holdings S.A.

8.375%, due 11/1/19 (d) | | | 1,985,000 | | | | 2,014,775 | |

| | | | | | | | |

Electric 0.2% | | | | | | | | |

InterGen N.V.

9.00%, due 6/30/17 (d) | | | 685,000 | | | | 649,038 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Finance—Leasing Companies 0.4% | | | | | | | | |

Banque PSA Finance S.A.

5.75%, due 4/4/21 (d) | | $ | 1,900,000 | | | $ | 1,828,121 | |

| | | | | | | | |

| | |

Food 1.8% | | | | | | | | |

Grupo Bimbo S.A.B. de C.V.

4.50%, due 1/25/22 (d) | | | 2,504,000 | | | | 2,754,515 | |

JBS Finance II, Ltd.

8.25%, due 1/29/18 (d) | | | 650,000 | | | | 677,625 | |

Minerva Luxembourg S.A.

12.25%, due 2/10/22 (d) | | | 1,240,000 | | | | 1,475,600 | |

Virgolino de Oliveira Finance, Ltd.

11.75%, due 2/9/22 (d) | | | 2,250,000 | | | | 2,193,750 | |

| | | | | | | | |

| | | | | | | 7,101,490 | |

| | | | | | | | |

Forest Products & Paper 0.1% | | | | | | | | |

Norske Skogindustrier A.S.A.

7.125%, due 10/15/33 (d) | | | 815,000 | | | | 489,000 | |

| | | | | | | | |

| | |

Insurance 0.3% | | | | | | | | |

Oil Insurance, Ltd.

3.342%, due 12/29/49 (b)(d) | | | 652,000 | | | | 582,255 | |

Swiss Re Capital I, L.P.

6.854%, due 5/29/49 (b)(d) | | | 571,000 | | | | 595,683 | |

| | | | | | | | |

| | | | | | | 1,177,938 | |

| | | | | | | | |

Iron & Steel 0.4% | | | | | | | | |

APERAM

7.375%, due 4/1/16 (d) | | | 2,075,000 | | | | 1,805,250 | |

| | | | | | | | |

| | |

Leisure Time 0.2% | | | | | | | | |

Royal Caribbean Cruises, Ltd.

7.25%, due 3/15/18 | | | 675,000 | | | | 751,781 | |

| | | | | | | | |

| |

Machinery—Construction & Mining 0.4% | | | | | |

Boart Longyear Management Pty, Ltd.

7.00%, due 4/1/21 (d) | | | 1,606,000 | | | | 1,626,075 | |

| | | | | | | | |

| | |

Mining 2.2% | | | | | | | | |

¨Novelis, Inc.

8.375%, due 12/15/17 | | | 734,000 | | | | 798,225 | |

8.75%, due 12/15/20 | | | 1,223,000 | | | | 1,348,358 | |

Teck Resources, Ltd.

2.50%, due 2/1/18 | | | 1,421,000 | | | | 1,437,388 | |

10.75%, due 5/15/19 | | | 500,000 | | | | 602,072 | |

Vedanta Resources PLC

8.25%, due 6/7/21 (d) | | | 2,565,000 | | | | 2,635,537 | |

Xstrata Finance Canada, Ltd.

5.80%, due 11/15/16 (d) | | | 1,877,000 | | | | 2,127,165 | |

| | | | | | | | |

| | | | | | | 8,948,745 | |

| | | | | | | | |

| | | | |

| 20 | | MainStay Flexible Bond Opportunities Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Yankee Bonds (continued) | |

Oil & Gas 2.3% | | | | | | | | |

CITIC Resources Finance, Ltd.

6.75%, due 5/15/14 (d) | | $ | 200,000 | | | $ | 209,450 | |

ENI S.p.A.

4.15%, due 10/1/20 (d) | | | 1,630,000 | | | | 1,669,739 | |

MEG Energy Corp.

6.50%, due 3/15/21 (d) | | | 1,862,000 | | | | 1,996,995 | |

OGX Austria GmbH

8.50%, due 6/1/18 (d) | | | 2,740,000 | | | | 2,390,650 | |

Precision Drilling Corp.

6.50%, due 12/15/21 | | | 643,000 | | | | 679,973 | |

6.625%, due 11/15/20 (j) | | | 1,630,000 | | | | 1,744,100 | |

TNK-BP Finance S.A.

7.875%, due 3/13/18 (d) | | | 400,000 | | | | 474,972 | |

| | | | | | | | |

| | | | | | | 9,165,879 | |

| | | | | | | | |

Oil & Gas Services 0.6% | | | | | | | | |

Cie Generale de Geophysique—Veritas

6.50%, due 6/1/21 | | | 600,000 | | | | 633,000 | |

9.50%, due 5/15/16 | | | 1,675,000 | | | | 1,809,000 | |

| | | | | | | | |

| | | | | | | 2,442,000 | |

| | | | | | | | |

Packaging & Containers 0.3% | | | | | | | | |

Ardagh Packaging Finance PLC

9.125%, due 10/15/20 (d) | | | 1,000,000 | | | | 1,045,000 | |

| | | | | | | | |

| | |

Savings & Loans 0.6% | | | | | | | | |

RBS Citizens Financial Group, Inc.

4.15%, due 9/28/22 (d) | | | 2,270,000 | | | | 2,281,652 | |

| | | | | | | | |

| | |

Telecommunications 0.2% | | | | | | | | |

Intelsat Luxembourg S.A.

11.25%, due 2/4/17 | | | 815,000 | | | | 855,750 | |

| | | | | | | | |

| | |

Transportation 0.6% | | | | | | | | |

CHC Helicopter S.A.

9.25%, due 10/15/20 | | | 2,109,000 | | | | 2,140,635 | |

Hapag-Lloyd A.G.

9.75%, due 10/15/17 (d) | | | 500,000 | | | | 487,500 | |

| | | | | | | | |

| | | | | | | 2,628,135 | |

| | | | | | | | |

Total Yankee Bonds

(Cost $56,247,462) | | | | | | | 57,122,025 | |

| | | | | | | | |

Total Long-Term Bonds

(Cost $357,674,648) | | | | | | | 370,664,049 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

| | | | | | | | |

| Common Stocks 0.8% | |

Auto Manufacturers 0.4% | | | | | | | | |

General Motors Co. (i) | | | 45,730 | | | $ | 1,166,115 | |

Motors Liquidation Co. GUC Trust (i) | | | 11,598 | | | | 231,380 | |

| | | | | | | | |

| | | | | | | 1,397,495 | |

| | | | | | | | |

Banks 0.4% | | | | | | | | |

CIT Group, Inc. (i) | | | 6,479 | | | | 241,149 | |

Citigroup, Inc. | | | 41,400 | | | | 1,547,946 | |

| | | | | | | | |

| | | | | | | 1,789,095 | |

| | | | | | | | |

Building Materials 0.0%‡ | | | | | | | | |

U.S. Concrete, Inc. (g)(i) | | | 19,613 | | | | 150,824 | |

| | | | | | | | |

| | |

Media 0.0%‡ | | | | | | | | |

Adelphia Contingent Value Vehicle (f)(g)(h)(i) | | | 100,330 | | | | 1,003 | |

| | | | | | | | |

Total Common Stocks