UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-04550

THE MAINSTAY FUNDS

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna Avenue

Parsippany, New Jersey 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2015

FORM N-CSR

| Item 1. | Reports to Stockholders. |

MainStay Unconstrained Bond Fund

Message from the President and Annual Report

October 31, 2015

This Page Intentionally Left Blank

Message from the President

The 12-month period ended October 31, 2015, was marked by increased market volatility, particularly after the People’s Bank of China devalued the Chinese yuan on August 11, 2015. Following the devaluation, many stock markets around the world dropped substantially. Some took months to recover.

U.S. large-cap stocks were able to end the reporting period in positive territory. Concerns that the Federal Reserve might raise the federal funds target rate weighed on many investors during the reporting period. Successive developments in employment, inflation and the stock market, however, led the Federal Reserve to repeatedly postpone a tightening move. According to Russell data, U.S. growth stocks outperformed U.S. value stocks at all capitalization levels during the reporting period.

Not all market segments were as fortunate. Emerging-market stocks saw double-digit declines during the reporting period, as slowing growth in China, low oil and gas prices, and slack demand for metals led to fewer exports. International markets overall were somewhat better, but also slightly negative. Some European markets, however, delivered positive returns for the reporting period.

The U.S. bond market saw mixed results. Yields on most short-term U.S. Treasury securities rose, while yields on U.S. Treasury securities of five years and longer declined. High-yield corporate bonds and convertible securities generally declined during the reporting period, while leveraged loans showed positive overall performance. Additionally, municipal bonds generally advanced during the reporting period.

The stock and bond markets are constantly changing, often in unexpected ways. That’s why at MainStay, we encourage investors to view short-term performance in light of their long-term financial goals.

Rather than shifting investments every time the market moves or interest rates change, the portfolio managers of the MainStay Funds seek to pursue the investment objectives of their respective Funds. They may draw upon time-tested investment strategies, risk-management techniques and their own market experience as they seek to position their Funds for the long-term benefit of our shareholders.

The following pages provide more detailed information about the specific markets, securities and investment decisions that most affected your MainStay Fund during the 12 months ended October 31, 2015. We hope that you will carefully review this report and use it as you consider ways to pursue your personal financial goals and objectives.

Sincerely,

Stephen P. Fisher

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Annual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-MAINSTAY (624-6782), by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 169 Lackawanna Avenue, Parsippany, New Jersey 07054 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at mainstayinvestments.com/documents. Please read the Summary Prospectus and/or Prospectus carefully before investing.

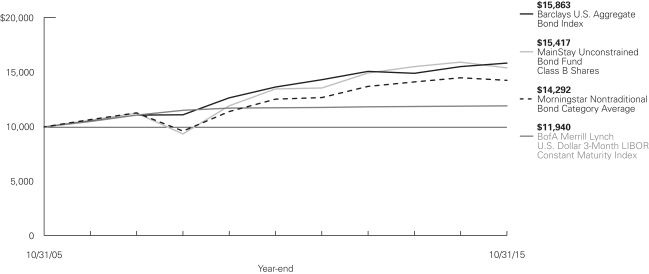

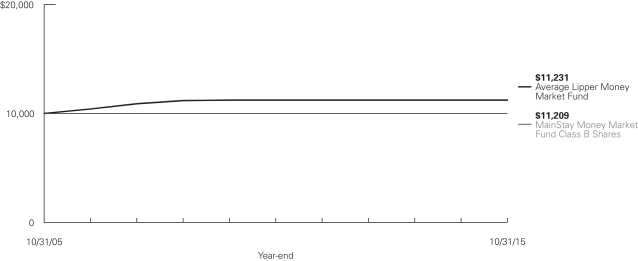

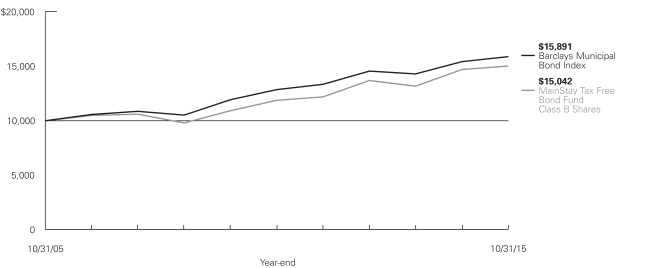

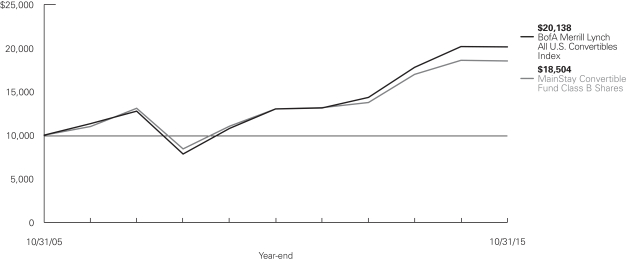

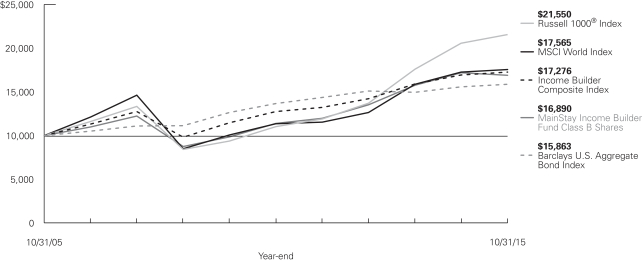

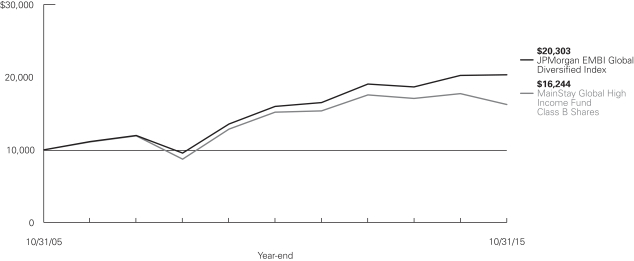

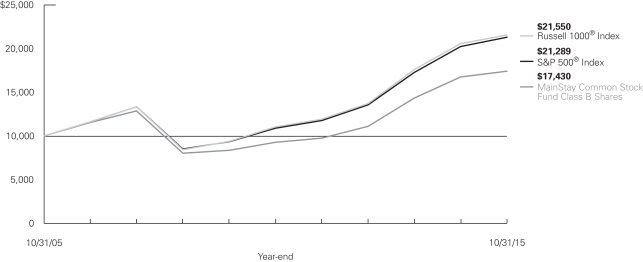

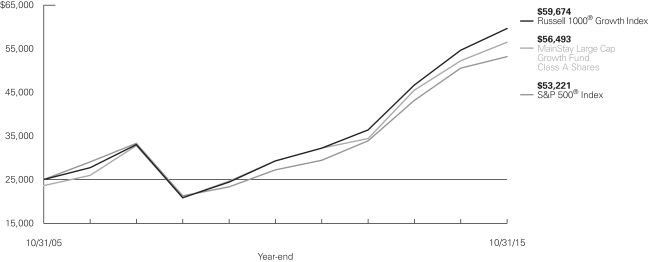

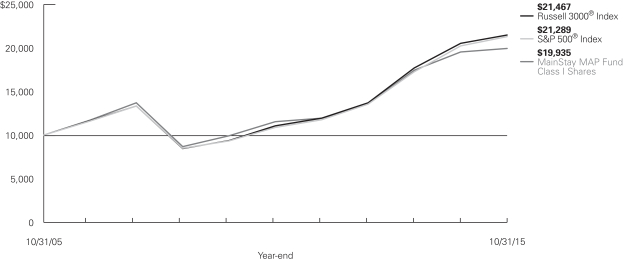

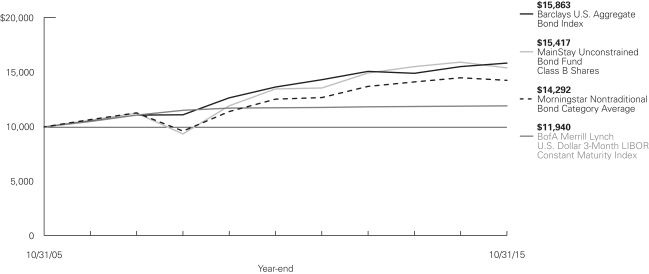

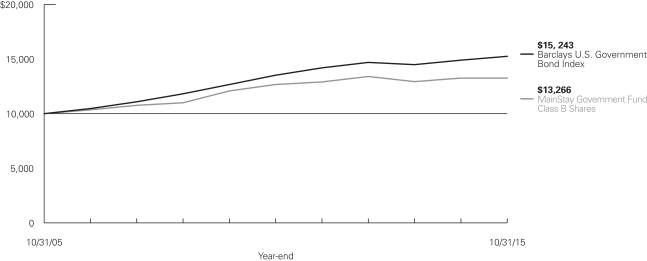

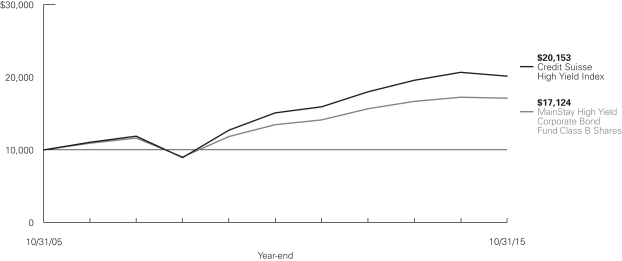

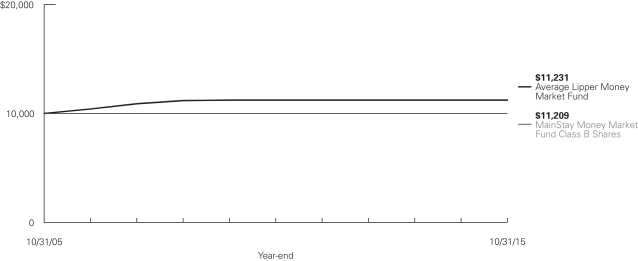

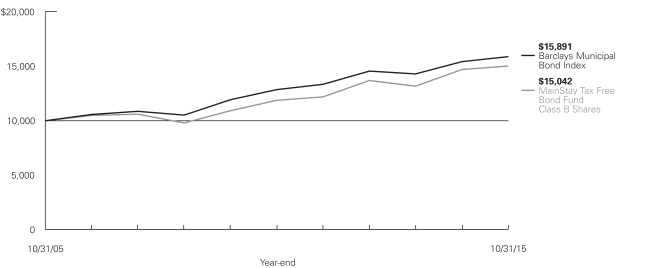

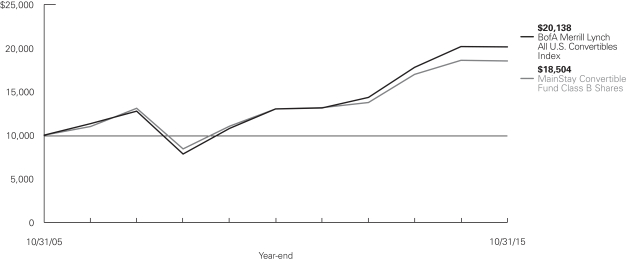

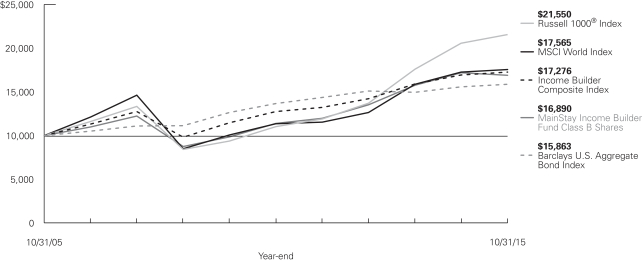

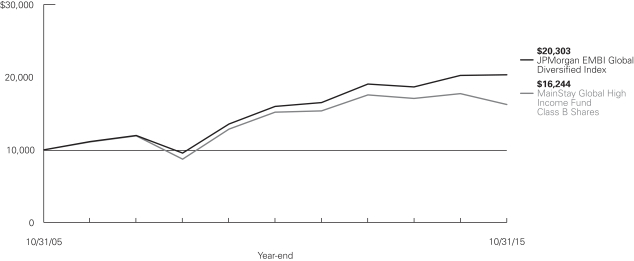

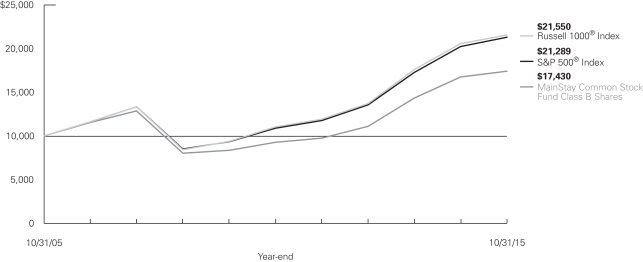

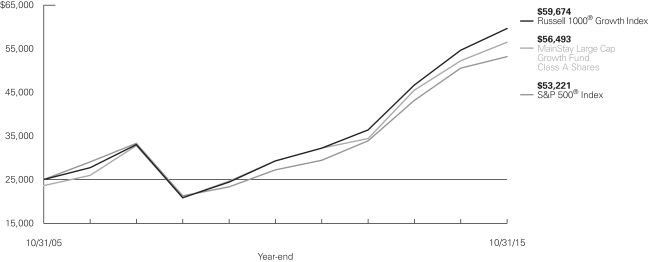

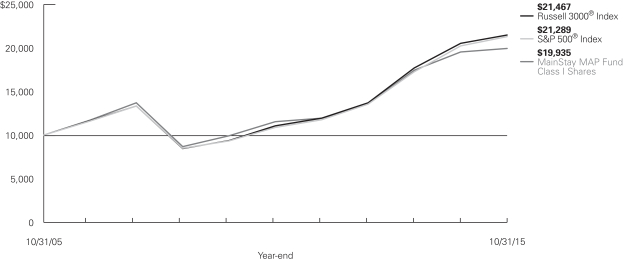

Investment and Performance Comparison1 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class B shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-MAINSTAY (624-6782) or visit mainstayinvestments.com.

(With sales charges)

Average Annual Total Returns for the Year Ended October 31, 2015

| | | | | | | | | | | | | | | | | | | | |

| Class | | Sales Charge | | | | One Year | | | Five Years | | | Ten Years | | | Gross

Expense

Ratio2 | |

| Class A Shares | | Maximum 4.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| –7.08

–2.70 | %

| |

| 2.66

3.61 | %

| |

| 4.82

5.31 | %

| |

| 1.04

1.04 | %

|

| Investor Class Shares3 | | Maximum 4.5% Initial Sales Charge | | With sales charges Excluding sales charges | |

| –7.07

–2.70 |

| |

| 2.51

3.46 |

| |

| 4.71

5.20 |

| |

| 1.06

1.06 |

|

| Class B Shares | | Maximum 5% CDSC

if Redeemed Within the First

Six Years of Purchase | | With sales charges Excluding sales charges | |

| –8.15

–3.45 |

| |

| 2.37

2.71 |

| |

| 4.42

4.42 |

| |

| 1.81

1.81 |

|

| Class C Shares | | Maximum 1% CDSC if Redeemed Within

One Year of Purchase | | With sales charges Excluding sales charges | |

| –4.40

–3.46 |

| |

| 2.69

2.69 |

| |

| 4.41

4.41 |

| |

| 1.81

1.81 |

|

| Class I Shares | | No Sales Charge | | | | | –2.56 | | | | 3.84 | | | | 5.61 | | | | 0.79 | |

| Class R2 Shares4 | | No Sales Charge | | | | | –2.81 | | | | 3.50 | | | | 5.20 | | | | 1.14 | |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations, please refer to the notes to the financial statements. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | Performance figures for Investor Class shares, first offered on February 28, 2008, include the historical performance of Class A shares through February 27, 2008, adjusted for differences in certain expenses and fees. Unadjusted, the performance shown for Investor Class shares would likely have been different. |

| 4. | Performance figures for Class R2 shares, first offered on February 28, 2014, include the historical performance of Class A shares through February 27, 2014, adjusted for differences in certain expenses and fees. Unadjusted, the performance shown for Class R2 shares would likely have been different. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | | | | | | | | | | | |

| Benchmark Performance | | One

Year | | | Five

Years | | | Ten

Years | |

Barclays U.S. Aggregate Bond Index5 | | | 1.96 | % | | | 3.03 | % | | | 4.72 | % |

BofA Merrill Lynch U.S. Dollar 3-Month LIBOR Constant Maturity Index6 | | | 0.26 | | | | 0.31 | | | | 1.79 | |

Morningstar Nontraditional Bond Category Average7 | | | –1.19 | | | | 2.07 | | | | 3.64 | |

| 5. | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasurys, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. The Barclays U.S. Aggregate Bond Index is the Fund’s primary broad-based securities market index for comparison purposes. Total returns assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 6. | The BofA Merrill Lynch U.S. Dollar 3-Month LIBOR Constant Maturity Index represents the London InterBank Offered Rate (“LIBOR”) with a constant 3-month average maturity and is the Fund’s secondary benchmark. LIBOR is |

| | a composite of interest rates at which banks borrow from one another in the London market, and it is a widely used benchmark for short-term interest rates. An investment cannot be made directly in an index. |

| 7. | The Morningstar Nontraditional Bond Category Average contains funds that pursue strategies divergent in one or more ways from conventional practice in the broader bond-fund universe. Morningstar category averages are equal-weighted returns based on constituents of the category at the end of the period. The Fund has selected the Morningstar nontraditional bond category average as an additional benchmark. Total returns assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | |

| 6 | | MainStay Unconstrained Bond Fund |

Cost in Dollars of a $1,000 Investment in MainStay Unconstrained Bond Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from May 1, 2015, to October 31, 2015, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from May 1, 2015, to October 31, 2015.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended October 31, 2015. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

5/1/15 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

10/31/15 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

10/31/15 | | | Expenses

Paid

During

Period1 | |

| | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 967.10 | | | $ | 5.06 | | | $ | 1,020.10 | | | $ | 5.19 | |

| | | | | |

| Investor Class Shares | | $ | 1,000.00 | | | $ | 966.20 | | | $ | 5.15 | | | $ | 1,020.00 | | | $ | 5.30 | |

| | | | | |

| Class B Shares | | $ | 1,000.00 | | | $ | 963.20 | | | $ | 8.86 | | | $ | 1,016.20 | | | $ | 9.10 | |

| | | | | |

| Class C Shares | | $ | 1,000.00 | | | $ | 963.20 | | | $ | 8.86 | | | $ | 1,016.20 | | | $ | 9.10 | |

| | | | | |

| Class I Shares | | $ | 1,000.00 | | | $ | 967.30 | | | $ | 3.82 | | | $ | 1,021.30 | | | $ | 3.92 | |

| | | | | |

| Class R2 Shares | | $ | 1,000.00 | | | $ | 966.50 | | | $ | 5.50 | | | $ | 1,019.60 | | | $ | 5.65 | |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of each class (1.02% for Class A, 1.04% for Investor Class, 1.79% for Class B and Class C, 0.77% for Class I and 1.11% for Class R2) multiplied by the average account value over the period, divided by 365 and multiplied by 184 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. |

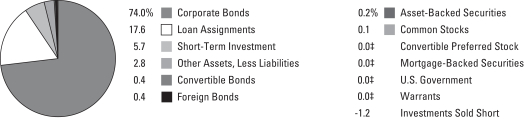

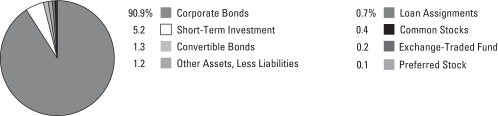

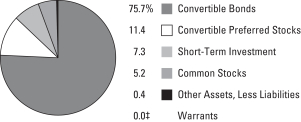

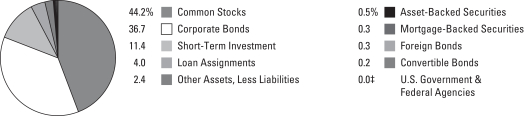

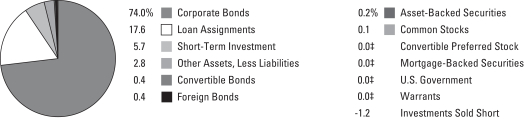

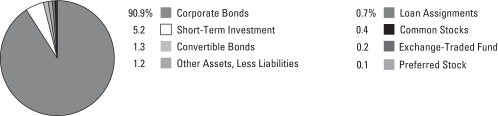

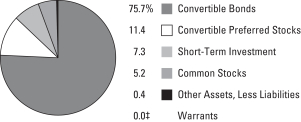

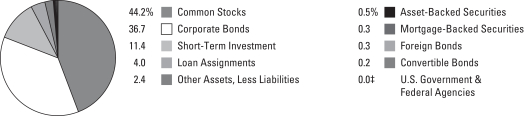

Portfolio Composition as of October 31, 2015 (Unaudited)

See Portfolio of Investments beginning on page 12 for specific holdings within these categories.

| ‡ | Less than one-tenth of a percent. |

Top Ten Holdings or Issuers Held as of October 31, 2015 (excluding short-term investment) (Unaudited)

| 1. | Bank of America Corp., 3.30%–8.57%, due 6/1/19–12/29/49 |

| 2. | CITGO Petroleum Corp., 4.50%–6.25%, due 7/29/21–8/15/22 |

| 3. | Tenet Healthcare Corp., 3.837%–8.125%, due 3/1/19–4/1/22 |

| 4. | Morgan Stanley, 4.875%–5.45%, due 11/1/22–7/29/49 |

| 5. | Realogy Corp., 3.75%–4.446%, due 10/10/16–3/5/20 |

| 6. | Energy Transfer Equity, L.P., 3.25%–5.875%, due 12/2/19–1/15/24 |

| 7. | USAGM HoldCo LLC, 4.75%–9.50%, due 7/28/22–7/28/23 |

| 8. | Signode Industrial Group U.S., Inc., 3.75%, due 5/1/21 |

| 9. | Ally Financial, Inc., 3.50%–8.00%, due 1/27/19–11/1/31 |

| 10. | Hilton Worldwide Finance LLC, 3.50%, due 10/26/20 |

| | |

| 8 | | MainStay Unconstrained Bond Fund |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by portfolio managers Dan Roberts, PhD, Michael Kimble, CFA, Louis N. Cohen, CFA, and Taylor Wagenseil of MacKay Shields LLC, the Fund’s Subadvisor.

How did MainStay Unconstrained Bond Fund perform relative to its benchmarks and peers during the 12 months ended October 31, 2015?

Excluding all sales charges, MainStay Unconstrained Bond Fund returned –2.70% for Class A shares and Investor Class shares, –3.45% for Class B shares and –3.46% for Class C shares for the 12 months ended October 31, 2015. Over the same period, the Fund returned –2.56% for Class I shares and –2.81% for Class R2 shares. For the 12 months ended October 31, 2015, all share classes underperformed the 1.96% return of the Barclays U.S. Aggregate Bond Index,1 which is the Fund’s primary benchmark. Over the same period, all share classes also underperformed the 0.26% return of the BofA Merrill Lynch U.S. Dollar 3-Month LIBOR Constant Maturity Index,1 which is the Fund’s secondary benchmark. For the 12 months ended October 31, 2015, all share classes also underperformed the –1.19% return of the Morningstar Nontraditional Bond Category Average,2 which is an additional benchmark for the Fund. See page 5 for Fund returns with applicable sales charges.

Were there any changes to the Fund during the reporting period?

During the reporting period, MacKay Shields announced that effective September 2016, Taylor Wagenseil will no longer serve as a portfolio manager of the Fund. Dan Roberts, Louis Cohen and Michael Kimble will continue to manage the Fund.

During the reporting period, how was the Fund’s performance materially affected by investments in derivatives?

In order to manage the Fund’s duration,3 the Fund held a sizeable short position in two year U.S. Treasury securities through the use of U.S. Treasury futures. This position made a negative contribution to the Fund’s performance. (Contributions take weightings and total returns into account.)

What factors affected the Fund’s relative performance during the reporting period?

Throughout the reporting period, our strategy was to maintain long positions in credit, including high-yield bonds and bank loans, combined with a short duration posture and yield-curve4 flattening bias. This positioning hurt relative performance during the second half of the reporting period. U.S. Treasury yields

generally declined during the reporting period; and because the Fund’s duration was shorter than that of the Barclays U.S. Aggregate Bond Index, the Fund was less sensitive to yield changes.

Corporate bonds trailed comparable-duration U.S. Treasury securities during the reporting period, with the performance gap more pronounced for below-investment-grade securities. Corporate-bond underperformance can be explained by dampened investor confidence in light of the sluggish economic recovery and lower commodity prices. The Fund held overweight positions relative to the Barclays U.S. Aggregate Bond Index in investment-grade and high-yield corporate bonds. Hard-asset segments such as energy and metals/mining were among the laggards in the Fund, while the Fund’s higher-quality financials and slightly longer duration bonds performed well. During the reporting period, the Fund slightly reduced its exposure to weaker credit profiles within the energy sector.

The senior loan market was not immune to the problems facing risky assets, including seasonal illiquidity, severe pressure in fixed-rate high-yield bonds and volatile commodity and asset prices globally. Even so, senior loans remained in positive territory as of October 31, 2015. We believed that senior loans were likely to better weather the energy and metals/mining storm that challenged their high-yield bond counterparts from a fundamental credit loss perspective.

We have not observed any meaningful earnings disappointments or economic developments that would force us to change our outlook. We believed that U.S. corporate credit fundamentals were sound and that credit-sensitive bonds continued to offer good relative value. We were constructive on both U.S. growth and valuations within U.S. credit markets. Since we did not believe that the domestic economic cycle had reached a turning point, we were not inclined to reduce the Fund’s overall risk. In fact, we believed that investor angst—reflected in declining prices and widening spreads5—may have reflected an overcompensation for fundamentals.

What was the Fund’s duration strategy during the reporting period?

The Fund’s duration was shorter than that of the Barclays U.S. Aggregate Bond Index throughout the reporting period. To reduce the Fund’s duration and minimize sensitivity to a move in

| 1. | See footnote on page 6 for more information on this index. |

| 2. | See footnote on page 6 for more information on the Morningstar Nontraditional Bond Category Average. |

| 3. | Duration is a measure of the price sensitivity of a fixed-income investment to changes in interest rates. Duration is expressed as a number of years and is considered a more accurate sensitivity gauge than average maturity. |

| 4. | The yield curve is a line that plots the yields of various securities of similar quality—typically U.S. Treasury issues—across a range of maturities. The U.S. Treasury yield curve serves as a benchmark for other debt and is used in economic forecasting. |

| 5. | The terms “spread” and “yield spread” may refer to the difference in yield between a security or type of security and comparable U.S. Treasury issues. The terms may also refer to the difference in yield between two specific securities or types of securities at a given time. The term “credit spread” typically refers to the difference in yield between corporate or municipal bonds (or a specific category of these bonds) and comparable U.S. Treasury issues. The term “spread product” refers to asset classes that typically trade at a spread to comparable U.S. Treasury securities. |

interest rates, we maintained a sizeable short position in two-year U.S. Treasury securities through U.S. Treasury futures and interest-rate swaps. At the end of the reporting period, the Fund’s duration was just above 1.0 year, compared to the 5.6 year duration of the Barclays U.S. Aggregate Bond Index.

What specific factors, risks or market forces prompted significant decisions for the Fund during the reporting period?

Throughout the reporting period, we considered a number of factors in positioning the Fund. These factors included inconsistent economic data, global central bank monetary policy, volatility in energy prices, China’s slowing economy and a flattening yield curve. We believed that corporate bonds—investment-grade and high-yield—warranted an overweight position relative to government-related securities because the low-interest-rate environment had sparked healthy demand for higher-yielding products. Additionally, improving profitability signaled that corporations were doing more with

less: less leverage, less short-term debt, and smaller funding gaps. In turn, we believed that strengthening credit fundamentals supported the narrowing of spreads, as did a favorable supply/demand balance for corporate debt. The positive momentum of the stock market could have also tended to strengthen the performance of corporate bonds across the credit-quality spectrum. For these reasons, we did not make any major shifts in the Fund’s positioning during the reporting period and we maintained the Fund’s credit bias. During the reporting period, however, we did reduce our position in emerging-markets because of idiosyncratic risks that bubbled up in that sector.

During the reporting period, which market segments were the strongest positive contributors to the Fund’s performance and which market segments were particularly weak?

The Fund’s position in bank loans held up well in a volatile market and posted positive returns during the reporting period. Our position in high-yield corporate bonds detracted from performance, as the yield advantage was more than offset by the effects of widening spreads. Within the Fund’s high-yield bond position, our allocation to the energy sector was the largest detractor. The outlook for companies involved in the exploration and production of gas and oil was clouded by an imbalance of supply and demand that led to price declines. Basic Energy Services, Chesapeake Energy and Samson Investment were among the energy positions that performed poorly. Some Fund positions in the basic industry sector were hurt by lower commodity prices.

Positive contributors within the high-yield bond market included homebuilders and related entities, such as KB Homes and

Building Materials Corp., which benefited from an upturn in housing. In the investment-grade bond portion of the Fund, lower interest rates enabled bank holdings to preserve margins and profitability. Among the Fund positions that benefited performance were Goldman Sachs, JPMorgan Chase, Bank of America and Morgan Stanley.

Did the Fund make any significant purchases or sales during the reporting period?

During the reporting period, we initiated Fund positions in power generation and utility company IPALCO Enterprises and oil and gas pipeline company Targa Resources Partners. IPALCO Enterprises, a subsidiary of AES Corp., is an Indiana-based utility that had a stable regulated business and strong cash flow. Targa Resources Partners’ bonds declined as energy prices fell. The pipeline operator, however, generally has minimal exposure to oil and gas prices. The company makes its money on the transfer of oil and gas through its network of pipelines.

We sold the Fund’s positions in pipeline company Energy Transfer Partners and insurance company Liberty Mutual. Energy Transfer’s partnership is being liquidated, so we sold the bonds on a relative-value trade and bought the bonds of Targa Resources Partners. We believed that the Fund’s Liberty Mutual bonds might not be called in 2017 as we had previously anticipated. We sold the position, expecting duration to widen and volatility to increase as the call became less likely.

How did the Fund’s sector weightings change during the reporting period?

During the reporting period, we reduced the Fund’s positon in emerging-market corporate bonds. Despite recent improvements, emerging markets still faced elevated idiosyncratic risk and were subject to weak commodity prices. We selectively increased the Fund’s position in domestic high-yield corporate bonds by paring back exposure to companies with weaker credit profiles and selectively participating in the new issue market. We also moderately increased the Fund’s exposure to investment-grade bonds.

How was the Fund positioned at the end of the reporting period?

In spite market volatility, we did not change our baseline view on Federal Reserve policy, economic fundamentals and valuations within the credit markets. At end of the reporting period, we believed that economic growth would continue to be moderate and that the Federal Reserve would remain highly accommodative. Even so, we believed that it was increasingly likely that the Federal Open Market Committee would raise the federal funds target rate in the coming months. Our central belief is that monetary policy plays a critical role in the creation

| | |

| 10 | | MainStay Unconstrained Bond Fund |

of credit and that the Federal Reserve has the ability to control monetary policy through its influence on short-term interest rates.

As of October 31, 2015, the Fund maintained an overweight position relative to the Barclays U.S. Aggregate Bond Index in

spread product, specifically in high-yield bonds. The increased volatility experienced in the third quarter of 2015 created a wider disparity between spreads and defaults, strengthening our resolve to maintain an overweight position in high-yield securities. As of the same date, the Fund held underweight positions relative to the Index in sectors that tend to be more interest-rate sensitive, such as U.S. Treasury securities and agency securities. As of October 31, 2015, the Fund’s duration remained well below that of the Barclays U.S. Aggregate Bond Index.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Portfolio of Investments October 31, 2015

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Long-Term Bonds 92.6%† Asset-Backed Securities 0.2% | | | | | |

Home Equity 0.1% | | | | | | | | |

Carrington Mortgage Loan Trust Series 2006-NC4, Class A5 0.254%, due 10/25/36 (a) | | $ | 296,665 | | | $ | 280,894 | |

Citigroup Mortgage Loan Trust Series 2007-AHL2, Class A3A 0.264%, due 5/25/37 (a) | | | 150,393 | | | | 106,322 | |

First NLC Trust

Series 2007-1, Class A1 0.264%, due 8/25/37 (a)(b) | | | 398,271 | | | | 219,417 | |

GSAA Home Equity Trust

Series 2006-14, Class A1 0.244%, due 9/25/36 (a) | | | 858,673 | | | | 450,603 | |

Home Equity Loan Trust

Series 2007-FRE1, Class 2AV1 0.324%, due 4/25/37 (a) | | | 112,993 | | | | 109,057 | |

HSI Asset Securitization Corp. Trust

Series 2007-NC1, Class A1 0.294%, due 4/25/37 (a) | | | 51,897 | | | | 51,379 | |

JPMorgan Mortgage Acquisition Trust

Series 2007-HE1, Class AF1 0.294%, due 3/25/47 (a) | | | 152,167 | | | | 93,277 | |

MASTR Asset Backed Securities Trust

Series 2006-HE4, Class A1 0.244%, due 11/25/36 (a) | | | 104,366 | | | | 47,964 | |

Morgan Stanley ABS Capital I, Inc.

Series 2006-HE6, Class A2B 0.294%, due 9/25/36 (a) | | | 364,032 | | | | 183,279 | |

Series 2006-HE8, Class A2B 0.294%, due 10/25/36 (a) | | | 189,844 | | | | 110,656 | |

Series 2007-HE4, Class A2A 0.304%, due 2/25/37 (a) | | | 97,878 | | | | 44,326 | |

Series 2007-NC2, Class A2FP 0.344%, due 2/25/37 (a) | | | 375,477 | | | | 226,127 | |

Renaissance Home Equity Loan Trust

Series 2007-2, Class AF1 5.893%, due 6/25/37 (c) | | | 898,334 | | | | 459,532 | |

Securitized Asset Backed Receivables LLC Trust

Series 2007-BR4, Class A2A 0.284%, due 5/25/37 (a) | | | 454,581 | | | | 278,290 | |

Soundview Home Equity Loan Trust

Series 2007-OPT1, Class 2A1 0.274%, due 6/25/37 (a) | | | 389,619 | | | | 234,524 | |

Series 2006-EQ2, Class A2 0.304%, due 1/25/37 (a) | | | 247,590 | | | | 166,231 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Home Equity (continued) | |

Specialty Underwriting & Residential Finance Trust

Series 2006-BC4, Class A2B 0.304%, due 9/25/37 (a) | | $ | 983,570 | | | $ | 460,456 | |

| | | | | | | | |

| | | | | | | 3,522,334 | |

| | | | | | | | |

Student Loans 0.1% | |

KeyCorp Student Loan Trust

Series 2000-A, Class A2 0.649%, due 5/25/29 (a) | | | 1,202,848 | | | | 1,163,768 | |

| | | | | | | | |

Total Asset-Backed Securities

(Cost $5,955,534) | | | | | | | 4,686,102 | |

| | | | | | | | |

| | |

| Convertible Bonds 0.4% | | | | | | | | |

Leisure Time 0.3% | | | | | | | | |

Jarden Corp.

1.125%, due 3/15/34 | | | 7,300,000 | | | | 8,084,750 | |

| | | | | | | | |

|

Transportation 0.1% | |

Hornbeck Offshore Services, Inc. 1.50%, due 9/1/19 | | | 1,900,000 | | | | 1,409,563 | |

| | | | | | | | |

Total Convertible Bonds

(Cost $9,379,837) | | | | | | | 9,494,313 | |

| | | | | | | | |

| | |

| Corporate Bonds 74.0% | | | | | | | | |

Advertising 0.2% | | | | | | | | |

Lamar Media Corp.

5.00%, due 5/1/23 | | | 830,000 | | | | 852,825 | |

5.375%, due 1/15/24 | | | 2,695,000 | | | | 2,796,063 | |

| | | | | | | | |

| | | | | | | 3,648,888 | |

| | | | | | | | |

Aerospace & Defense 1.5% | |

KLX, Inc.

5.875%, due 12/1/22 (b) | | | 8,935,000 | | | | 9,119,284 | |

Moog, Inc.

5.25%, due 12/1/22 (b) | | | 5,505,000 | | | | 5,615,100 | |

Orbital ATK, Inc.

5.25%, due 10/1/21 | | | 4,250,000 | | | | 4,345,625 | |

5.50%, due 10/1/23 (b) | | | 4,045,000 | | | | 4,227,025 | |

TransDigm, Inc.

6.00%, due 7/15/22 | | | 5,500,000 | | | | 5,555,000 | |

7.50%, due 7/15/21 | | | 4,440,000 | | | | 4,684,200 | |

| | | | | | | | |

| | | | | | | 33,546,234 | |

| | | | | | | | |

Airlines 1.0% | |

Continental Airlines, Inc.

Series 2007-1, Class A

5.983%, due 10/19/23 | | | 3,074,587 | | | | 3,412,792 | |

| † | Percentages indicated are based on Fund net assets. |

| ¨ | | Among the Fund’s 10 largest holdings or issuers held, as of October 31, 2015, excluding short-term investment. May be subject to change daily. |

| | | | |

| 12 | | MainStay Unconstrained Bond Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Airlines (continued) | |

Continental Airlines, Inc. (continued) | | | | | | | | |

Series 2003-ERJ1

7.875%, due 1/2/20 | | $ | 291,241 | | | $ | 303,153 | |

Series 2005-ERJ1

9.798%, due 10/1/22 | | | 490,811 | | | | 542,347 | |

Delta Air Lines, Inc.

Series 2011-1 Class A Pass Through Trust

5.30%, due 10/15/20 | | | 976,051 | | | | 1,035,005 | |

U.S. Airways Group, Inc.

Class A Series 2012-1 Pass Through Trust

5.90%, due 4/1/26 | | | 2,400,938 | | | | 2,653,036 | |

Class A Series 2010-1 Pass Through Trust

6.25%, due 10/22/24 | | | 7,272,221 | | | | 8,144,887 | |

United Airlines, Inc.

Series 2014-2, Class B Pass Through Trust

4.625%, due 3/3/24 | | | 6,185,000 | | | | 6,169,537 | |

| | | | | | | | |

| | | | | | | 22,260,757 | |

| | | | | | | | |

Auto Manufacturers 1.3% | |

Ford Holdings LLC

9.30%, due 3/1/30 (d) | | | 93,000 | | | | 130,078 | |

Ford Motor Co.

7.45%, due 7/16/31 | | | 39,000 | | | | 50,058 | |

8.90%, due 1/15/32 | | | 3,009,000 | | | | 3,859,337 | |

Ford Motor Credit Co. LLC

8.00%, due 12/15/16 (d) | | | 22,000 | | | | 23,536 | |

General Motors Co.

3.50%, due 10/2/18 | | | 3,000,000 | | | | 3,049,830 | |

General Motors Financial Co., Inc.

3.25%, due 5/15/18 | | | 670,000 | | | | 678,144 | |

3.45%, due 4/10/22 (d) | | | 12,950,000 | | | | 12,645,973 | |

Navistar International Corp.

8.25%, due 11/1/21 | | | 12,049,000 | | | | 9,398,220 | |

| | | | | | | | |

| | | | | | | 29,835,176 | |

| | | | | | | | |

Auto Parts & Equipment 2.5% | |

Dana Holding Corp.

5.375%, due 9/15/21 | | | 9,575,000 | | | | 9,766,500 | |

Goodyear Tire & Rubber Co. (The)

6.50%, due 3/1/21 (d) | | | 6,977,000 | | | | 7,413,062 | |

7.00%, due 5/15/22 | | | 1,000,000 | | | | 1,087,500 | |

8.25%, due 8/15/20 | | | 3,455,000 | | | | 3,613,930 | |

MPG Holdco I, Inc.

7.375%, due 10/15/22 | | | 12,480,000 | | | | 13,260,000 | |

Schaeffler Finance B.V.

4.75%, due 5/15/21 (b) | | | 3,475,000 | | | | 3,535,813 | |

4.75%, due 5/15/23 (b) | | | 6,490,000 | | | | 6,538,675 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Auto Parts & Equipment (continued) | |

ZF North America Capital, Inc.

4.50%, due 4/29/22 (b) | | $ | 10,440,000 | | | $ | 10,511,723 | |

| | | | | | | | |

| | | | | | | 55,727,203 | |

| | | | | | | | |

Banks 7.2% | |

¨Bank of America Corp.

3.30%, due 1/11/23 | | | 510,000 | | | | 508,524 | |

4.25%, due 10/22/26 | | | 7,260,000 | | | | 7,281,969 | |

5.125%, due 12/29/49 (a) | | | 8,395,000 | | | | 8,227,100 | |

5.625%, due 7/1/20 | | | 1,720,000 | | | | 1,937,470 | |

6.11%, due 1/29/37 | | | 2,807,000 | | | | 3,253,526 | |

7.625%, due 6/1/19 | | | 420,000 | | | | 494,779 | |

8.57%, due 11/15/24 | | | 1,645,000 | | | | 2,091,246 | |

Barclays Bank PLC

5.14%, due 10/14/20 (d) | | | 8,037,000 | | | | 8,810,047 | |

Capital One Financial Corp.

5.55%, due 12/29/49 (a) | | | 14,975,000 | | | | 15,003,078 | |

CIT Group, Inc.

3.875%, due 2/19/19 (d) | | | 2,037,000 | | | | 2,067,555 | |

5.00%, due 8/1/23 | | | 2,000,000 | | | | 2,095,000 | |

6.625%, due 4/1/18 (b) | | | 7,100,000 | | | | 7,650,250 | |

Citigroup, Inc.

6.30%, due 12/29/49 (a)(d) | | | 10,800,000 | | | | 10,681,740 | |

Citizens Financial Group, Inc.

4.15%, due 9/28/22 (b) | | | 2,270,000 | | | | 2,306,374 | |

Discover Bank

7.00%, due 4/15/20 | | | 3,895,000 | | | | 4,485,019 | |

Goldman Sachs Group, Inc. (The)

3.625%, due 1/22/23 | | | 7,257,000 | | | | 7,410,014 | |

HSBC Holdings PLC

6.375%, due 12/29/49 (a)(d) | | | 12,615,000 | | | | 12,495,284 | |

JPMorgan Chase & Co.

6.125%, due 12/29/49 (a) | | | 7,595,000 | | | | 7,756,773 | |

7.90%, due 4/29/49 (a) | | | 3,650,000 | | | | 3,792,350 | |

Mellon Capital III

6.369%, due 9/5/66 (a) | | | GBP 2,950,000 | | | | 4,597,743 | |

Mizuho Financial Group Cayman 3, Ltd.

4.60%, due 3/27/24 (b) | | $ | 9,300,000 | | | | 9,538,740 | |

¨Morgan Stanley

4.875%, due 11/1/22 | | | 4,287,000 | | | | 4,622,865 | |

5.00%, due 11/24/25 | | | 2,465,000 | | | | 2,637,587 | |

5.45%, due 7/29/49 (a) | | | 11,425,000 | | | | 11,239,344 | |

Royal Bank of Scotland Group PLC

5.125%, due 5/28/24 | | | 8,746,000 | | | | 8,967,326 | |

Wells Fargo & Co.

5.90%, due 12/29/49 (a) | | | 10,050,000 | | | | 10,301,250 | |

| | | | | | | | |

| | | | | | | 160,252,953 | |

| | | | | | | | |

Building Materials 1.3% | |

Associated Materials LLC / AMH New Finance, Inc.

9.125%, due 11/1/17 | | | 1,223,000 | | | | 975,343 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 13 | |

Portfolio of Investments October 31, 2015 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Building Materials (continued) | |

Building Materials Corporation of America

5.375%, due 11/15/24 (b) | | $ | 11,150,000 | | | $ | 11,470,562 | |

Masco Corp.

7.125%, due 3/15/20 | | | 2,250,000 | | | | 2,615,625 | |

USG Corp.

5.875%, due 11/1/21 (b) | | | 6,755,000 | | | | 7,118,081 | |

6.30%, due 11/15/16 | | | 1,245,000 | | | | 1,285,462 | |

7.875%, due 3/30/20 (b) | | | 4,258,000 | | | | 4,492,190 | |

9.75%, due 1/15/18 | | | 363,000 | | | | 407,468 | |

| | | | | | | | |

| | | | | | | 28,364,731 | |

| | | | | | | | |

Chemicals 1.3% | |

Ashland, Inc.

4.75%, due 8/15/22 | | | 2,970,000 | | | | 2,971,634 | |

Axalta Coating Systems U.S. Holdings, Inc. / Axalta Coating Systems Dutch Holding B.V.

7.375%, due 5/1/21 (b) | | | 6,356,000 | | | | 6,721,470 | |

Dow Chemical Co. (The)

8.55%, due 5/15/19 | | | 2,099,000 | | | | 2,524,381 | |

Hexion, Inc.

6.625%, due 4/15/20 | | | 2,385,000 | | | | 2,021,288 | |

8.875%, due 2/1/18 | | | 2,283,000 | | | | 1,746,495 | |

Huntsman International LLC

5.125%, due 4/15/21 | | | EUR 3,275,000 | | | | 3,488,812 | |

5.125%, due 11/15/22 (b) | | $ | 3,500,000 | | | | 3,255,000 | |

WR Grace & Co.

5.125%, due 10/1/21 (b) | | | 6,410,000 | | | | 6,666,400 | |

| | | | | | | | |

| | | | | | | 29,395,480 | |

| | | | | | | | |

Commercial Services 1.9% | |

Avis Budget Car Rental LLC / Avis Budget Finance, Inc.

5.125%, due 6/1/22 (b) | | | 5,000,000 | | | | 5,103,700 | |

5.50%, due 4/1/23 | | | 6,282,000 | | | | 6,509,722 | |

Hertz Corp. (The)

6.25%, due 10/15/22 | | | 8,500,000 | | | | 8,755,000 | |

7.375%, due 1/15/21 | | | 1,630,000 | | | | 1,696,211 | |

Iron Mountain Europe PLC 6.125%, due 9/15/22 (b) | | | GBP 4,475,000 | | | | 7,005,586 | |

Service Corporation International 5.375%, due 1/15/22 | | $ | 1,835,000 | | | | 1,935,925 | |

United Rentals North America, Inc.

4.625%, due 7/15/23 | | | 5,710,000 | | | | 5,734,953 | |

5.75%, due 11/15/24 | | | 1,750,000 | | | | 1,776,250 | |

6.125%, due 6/15/23 | | | 4,259,000 | | | | 4,444,266 | |

| | | | | | | | |

| | | | | | | 42,961,613 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Computers 0.5% | |

NCR Corp.

5.00%, due 7/15/22 | | $ | 7,215,000 | | | $ | 7,088,737 | |

6.375%, due 12/15/23 | | | 3,350,000 | | | | 3,450,500 | |

| | | | | | | | |

| | | | | | | 10,539,237 | |

| | | | | | | | |

Cosmetics & Personal Care 0.3% | |

Albea Beauty Holdings S.A. 8.375%, due 11/1/19 (b) | | | 5,470,000 | | | | 5,750,338 | |

| | | | | | | | |

|

Diversified Financial Services 0.3% | |

GE Capital Trust II

Series Reg S

5.50%, due 9/15/67 (a) | | | EUR 2,100,000 | | | | 2,413,404 | |

GE Capital Trust IV

Series Reg S

4.625%, due 9/15/66 (a) | | | 1,223,000 | | | | 1,357,280 | |

General Electric Capital Corp. Series Reg S 6.50%, due 9/15/67 (a) | | | GBP 815,000 | | | | 1,300,378 | |

Peachtree Corners Funding Trust

3.976%, due 2/15/25 (b) | | $ | 1,690,000 | | | | 1,700,863 | |

| | | | | | | | |

| | | | | | | 6,771,925 | |

| | | | | | | | |

Electric 1.9% | |

Calpine Corp.

5.75%, due 1/15/25 | | | 10,680,000 | | | | 10,119,300 | |

FirstEnergy Transmission LLC

5.45%, due 7/15/44 (b) | | | 10,815,000 | | | | 11,114,987 | |

Great Plains Energy, Inc.

4.85%, due 6/1/21 (d) | | | 5,200,000 | | | | 5,654,147 | |

5.292%, due 6/15/22 (c) | | | 663,000 | | | | 734,674 | |

IPALCO Enterprises, Inc.

3.45%, due 7/15/20 (b) | | | 8,560,000 | | | | 8,453,000 | |

WEC Energy Group, Inc.

6.25%, due 5/15/67 (a) | | | 7,793,280 | | | | 6,526,872 | |

| | | | | | | | |

| | | | | | | 42,602,980 | |

| | | | | | | | |

Engineering & Construction 0.4% | |

MasTec, Inc.

4.875%, due 3/15/23 | | | 1,704,000 | | | | 1,427,100 | |

SBA Communications Corp.

4.875%, due 7/15/22 | | | 6,561,000 | | | | 6,708,294 | |

| | | | | | | | |

| | | | | | | 8,135,394 | |

| | | | | | | | |

Entertainment 1.5% | |

Isle of Capri Casinos, Inc.

5.875%, due 3/15/21 | | | 485,000 | | | | 510,462 | |

8.875%, due 6/15/20 | | | 6,815,000 | | | | 7,326,125 | |

Mohegan Tribal Gaming Authority

9.75%, due 9/1/21 | | | 5,102,000 | | | | 5,255,060 | |

Pinnacle Entertainment, Inc.

7.75%, due 4/1/22 | | | 11,200,000 | | | | 12,404,000 | |

Scientific Games International, Inc.

7.00%, due 1/1/22 (b) | | | 1,010,000 | | | | 1,015,050 | |

| | | | |

| 14 | | MainStay Unconstrained Bond Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Entertainment (continued) | |

Scientific Games International, Inc. (continued) | | | | | |

10.00%, due 12/1/22 | | $ | 6,635,000 | | | $ | 5,871,975 | |

| | | | | | | | |

| | | | | | | 32,382,672 | |

| | | | | | | | |

Finance—Auto Loans 0.7% | |

¨Ally Financial, Inc.

3.50%, due 1/27/19 | | | 7,900,000 | | | | 7,949,375 | |

8.00%, due 3/15/20 | | | 565,000 | | | | 668,112 | |

8.00%, due 11/1/31 | | | 6,360,000 | | | | 7,711,500 | |

| | | | | | | | |

| | | | | | | 16,328,987 | |

| | | | | | | | |

Finance—Consumer Loans 1.8% | |

HSBC Finance Capital Trust IX 5.911%, due 11/30/35 (a)(d) | | | 4,575,000 | | | | 4,579,575 | |

Navient Corp.

5.00%, due 10/26/20 | | | 3,210,000 | | | | 3,005,363 | |

8.00%, due 3/25/20 | | | 6,316,000 | | | | 6,694,960 | |

OneMain Financial Holdings, Inc. 7.25%, due 12/15/21 (b) | | | 11,560,000 | | | | 12,080,200 | |

Springleaf Finance Corp.

5.25%, due 12/15/19 | | | 2,560,000 | | | | 2,547,200 | |

6.00%, due 6/1/20 | | | 5,100,000 | | | | 5,163,750 | |

7.75%, due 10/1/21 | | | 4,850,000 | | | | 5,219,812 | |

| | | | | | | | |

| | | | | | | 39,290,860 | |

| | | | | | | | |

Finance—Credit Card 0.4% | |

American Express Co.

6.80%, due 9/1/66 (a) | | | 5,901,000 | | | | 5,939,356 | |

Capital One Bank USA N.A. 3.375%, due 2/15/23 | | | 3,000,000 | | | | 2,935,581 | |

| | | | | | | | |

| | | | | | | 8,874,937 | |

| | | | | | | | |

Finance—Investment Banker/Broker 0.1% | |

Jefferies Group LLC

5.125%, due 1/20/23 | | | 813,000 | | | | 813,652 | |

6.45%, due 6/8/27 | | | 1,100,000 | | | | 1,147,123 | |

| | | | | | | | |

| | | | | | | 1,960,775 | |

| | | | | | | | |

Finance—Other Services 0.4% | |

Icahn Enterprises, L.P. / Icahn Enterprises Finance Corp.

5.875%, due 2/1/22 | | | 1,850,000 | | | | 1,905,500 | |

6.00%, due 8/1/20 | | | 6,880,000 | | | | 7,181,000 | |

| | | | | | | | |

| | | | | | | 9,086,500 | |

| | | | | | | | |

Food 1.1% | |

Cosan Luxembourg S.A.

5.00%, due 3/14/23 (b) | | | 1,100,000 | | | | 924,000 | |

Kerry Group Financial Services

3.20%, due 4/9/23 (b) | | | 4,595,000 | | | | 4,461,024 | |

Premier Foods Finance PLC

6.50%, due 3/15/21 (b) | | | GBP 4,500,000 | | | | 6,446,390 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Food (continued) | |

Smithfield Foods, Inc.

7.75%, due 7/1/17 | | $ | 1,361,000 | | | $ | 1,473,283 | |

TreeHouse Foods, Inc.

4.875%, due 3/15/22 | | | 6,125,000 | | | | 5,925,937 | |

Tyson Foods, Inc.

3.95%, due 8/15/24 | | | 5,450,000 | | | | 5,563,992 | |

| | | | | | | | |

| | | | | | | 24,794,626 | |

| | | | | | | | |

Food Services 0.3% | |

Aramark Services, Inc.

5.75%, due 3/15/20 | | | 5,475,000 | | | | 5,714,531 | |

| | | | | | | | |

|

Forest Products & Paper 0.2% | |

Domtar Corp.

10.75%, due 6/1/17 | | | 308,000 | | | | 347,811 | |

Georgia-Pacific LLC

8.00%, due 1/15/24 | | | 2,945,000 | | | | 3,774,286 | |

International Paper Co.

7.30%, due 11/15/39 | | | 693,000 | | | | 834,108 | |

| | | | | | | | |

| | | | | | | 4,956,205 | |

| | | | | | | | |

Gas 0.2% | |

AmeriGas Partners, L.P. / AmeriGas Finance Corp.

6.25%, due 8/20/19 (d) | | | 4,467,000 | | | | 4,567,508 | |

| | | | | | | | |

|

Health Care—Products 1.4% | |

Alere, Inc.

6.50%, due 6/15/20 | | | 475,000 | | | | 490,437 | |

Hologic, Inc.

5.25%, due 7/15/22 (b) | | | 11,380,000 | | | | 11,877,875 | |

Kinetic Concepts, Inc. / KCI USA, Inc.

10.50%, due 11/1/18 | | | 6,025,000 | | | | 6,361,797 | |

Mallinckrodt International Finance S.A.

4.75%, due 4/15/23 | | | 4,485,000 | | | | 3,901,950 | |

Mallinckrodt International Finance S.A. / Mallinckrodt CB LLC

4.875%, due 4/15/20 (b) | | | 1,900,000 | | | | 1,821,625 | |

5.75%, due 8/1/22 (b) | | | 4,485,000 | | | | 4,263,531 | |

Zimmer Biomet Holdings, Inc. 2.70%, due 4/1/20 | | | 1,895,000 | | | | 1,889,467 | |

| | | | | | | | |

| | | | | | | 30,606,682 | |

| | | | | | | | |

Health Care—Services 2.9% | |

CHS / Community Health Systems, Inc. 6.875%, due 2/1/22 | | | 11,735,000 | | | | 11,823,012 | |

DaVita HealthCare Partners, Inc.

5.125%, due 7/15/24 | | | 1,925,000 | | | | 1,953,875 | |

5.75%, due 8/15/22 | | | 6,825,000 | | | | 7,166,250 | |

Fresenius Medical Care U.S. Finance II, Inc.

6.50%, due 9/15/18 (b) | | | 2,500,000 | | | | 2,743,750 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 15 | |

Portfolio of Investments October 31, 2015 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Health Care—Services (continued) | |

HCA, Inc.

5.00%, due 3/15/24 | | $ | 9,645,000 | | | $ | 9,934,350 | |

5.875%, due 3/15/22 | | | 2,500,000 | | | | 2,750,000 | |

7.50%, due 2/15/22 | | | 2,000,000 | | | | 2,300,000 | |

MPH Acquisition Holdings LLC

6.625%, due 4/1/22 (b) | | | 6,780,000 | | | | 6,915,600 | |

¨Tenet Healthcare Corp.

3.837%, due 6/15/20 (a)(b) | | | 6,250,000 | | | | 6,203,125 | |

5.50%, due 3/1/19 | | | 3,500,000 | | | | 3,447,500 | |

6.00%, due 10/1/20 | | | 8,000,000 | | | | 8,640,000 | |

8.125%, due 4/1/22 | | | 1,000,000 | | | | 1,057,500 | |

| | | | | | | | |

| | | | | | | 64,934,962 | |

| | | | | | | | |

Holding Company—Diversified 0.3% | |

Stena AB

7.00%, due 2/1/24 (b) | | | 8,000,000 | | | | 7,300,000 | |

| | | | | | | | |

|

Home Builders 4.8% | |

Beazer Homes USA, Inc.

5.75%, due 6/15/19 | | | 4,206,000 | | | | 4,048,275 | |

7.25%, due 2/1/23 (d) | | | 1,000,000 | | | | 942,500 | |

CalAtlantic Group, Inc.

6.25%, due 12/15/21 | | | 2,875,000 | | | | 3,112,188 | |

8.375%, due 1/15/21 | | | 4,560,000 | | | | 5,409,528 | |

D.R. Horton, Inc.

3.75%, due 3/1/19 | | | 4,750,000 | | | | 4,880,625 | |

5.75%, due 8/15/23 | | | 4,250,000 | | | | 4,643,125 | |

K Hovnanian Enterprises, Inc.

7.00%, due 1/15/19 (b) | | | 3,100,000 | | | | 2,464,500 | |

7.25%, due 10/15/20 (b) | | | 8,110,000 | | | | 7,623,400 | |

KB Home

7.25%, due 6/15/18 | | | 3,300,000 | | | | 3,531,000 | |

8.00%, due 3/15/20 | | | 2,250,000 | | | | 2,446,875 | |

Lennar Corp.

4.50%, due 6/15/19 | | | 5,800,000 | | | | 6,017,500 | |

4.50%, due 11/15/19 | | | 7,400,000 | | | | 7,659,000 | |

MDC Holdings, Inc.

5.50%, due 1/15/24 | | | 7,025,000 | | | | 7,165,500 | |

5.625%, due 2/1/20 | | | 1,608,000 | | | | 1,680,360 | |

Meritage Homes Corp.

7.00%, due 4/1/22 | | | 8,800,000 | | | | 9,636,000 | |

Shea Homes, L.P. / Shea Homes Funding Corp.

5.875%, due 4/1/23 (b) | | | 11,150,000 | | | | 11,665,687 | |

Toll Brothers Finance Corp.

5.875%, due 2/15/22 | | | 5,750,000 | | | | 6,188,438 | |

6.75%, due 11/1/19 | | | 3,850,000 | | | | 4,350,500 | |

TRI Pointe Holdings, Inc.

4.375%, due 6/15/19 | | | 5,871,000 | | | | 5,834,306 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Home Builders (continued) | |

TRI Pointe Holdings, Inc. (continued) | | | | | |

5.875%, due 6/15/24 | | $ | 6,950,000 | | | $ | 6,950,000 | |

| | | | | | | | |

| | | | | | | 106,249,307 | |

| | | | | | | | |

Household Products & Wares 0.2% | |

Spectrum Brands, Inc.

5.75%, due 7/15/25 (b) | | | 5,085,000 | | | | 5,421,881 | |

| | | | | | | | |

|

Insurance 4.2% | |

Allstate Corp. (The)

6.50%, due 5/15/67 (a) | | | 8,525,000 | | | | 9,420,125 | |

Chubb Corp. (The)

6.375%, due 3/29/67 (a) | | | 9,873,000 | | | | 9,478,080 | |

Genworth Holdings, Inc.

4.90%, due 8/15/23 | | | 4,475,000 | | | | 3,389,813 | |

6.15%, due 11/15/66 (a) | | | 7,233,000 | | | | 3,218,685 | |

7.20%, due 2/15/21 | | | 1,145,000 | | | | 1,087,750 | |

Liberty Mutual Group, Inc.

4.25%, due 6/15/23 (b) | | | 390,000 | | | | 399,718 | |

6.50%, due 3/15/35 (b) | | | 870,000 | | | | 1,033,877 | |

7.80%, due 3/7/87 (b) | | | 7,453,000 | | | | 8,738,643 | |

10.75%, due 6/15/88 (a)(b) | | | 938,000 | | | | 1,407,000 | |

Lincoln National Corp.

7.00%, due 5/17/66 (a) | | | 3,537,000 | | | | 2,960,027 | |

Oil Insurance, Ltd.

3.309%, due 12/29/49 (a)(b) | | | 8,452,000 | | | | 7,437,760 | |

Pacific Life Insurance Co.

7.90%, due 12/30/23 (b) | | | 1,150,000 | | | | 1,437,314 | |

9.25%, due 6/15/39 (b) | | | 504,000 | | | | 743,902 | |

Progressive Corp. (The)

6.70%, due 6/15/67 (a) | | | 612,000 | | | | 615,060 | |

Protective Life Corp.

8.45%, due 10/15/39 | | | 5,546,000 | | | | 7,354,462 | |

Provident Cos., Inc.

7.25%, due 3/15/28 | | | 5,460,000 | | | | 6,700,201 | |

Prudential Financial, Inc.

5.625%, due 6/15/43 (a) | | | 3,120,000 | | | | 3,265,080 | |

Scottish Widows PLC

Series Reg S

5.50%, due 6/16/23 | | | GBP 6,500,000 | | | | 10,357,982 | |

Swiss Re Capital I, L.P.

6.854%, due 5/29/49 (a)(b) | | $ | 571,000 | | | | 579,137 | |

Validus Holdings, Ltd.

8.875%, due 1/26/40 | | | 5,383,000 | | | | 6,923,539 | |

Voya Financial, Inc.

5.50%, due 7/15/22 | | | 3,350,000 | | | | 3,793,007 | |

XLIT, Ltd.

6.50%, due 10/29/49 (a) | | | 4,116,000 | | | | 3,283,333 | |

| | | | | | | | |

| | | | | | | 93,624,495 | |

| | | | | | | | |

Iron & Steel 1.2% | |

AK Steel Corp.

7.625%, due 10/1/21 | | | 9,410,000 | | | | 4,493,275 | |

8.375%, due 4/1/22 | | | 2,200,000 | | | | 1,034,000 | |

| | | | |

| 16 | | MainStay Unconstrained Bond Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Iron & Steel (continued) | |

Allegheny Ludlum Corp.

6.95%, due 12/15/25 (d) | | $ | 693,000 | | | $ | 638,426 | |

ArcelorMittal

6.125%, due 6/1/18 (d) | | | 2,000,000 | | | | 2,005,000 | |

7.00%, due 2/25/22 | | | 6,175,000 | | | | 5,850,813 | |

Cliffs Natural Resources, Inc.

5.90%, due 3/15/20 | | | 1,140,000 | | | | 364,800 | |

5.95%, due 1/15/18 | | | 2,526,000 | | | | 1,300,890 | |

Steel Dynamics, Inc.

5.25%, due 4/15/23 | | | 7,666,000 | | | | 7,455,185 | |

United States Steel Corp.

7.375%, due 4/1/20 | | | 4,039,000 | | | | 3,009,055 | |

| | | | | | | | |

| | | | | | | 26,151,444 | |

| | | | | | | | |

Leisure Time 0.5% | |

NCL Corp., Ltd.

5.25%, due 11/15/19 (b) | | | 4,500,000 | | | | 4,668,750 | |

Royal Caribbean Cruises, Ltd.

7.25%, due 3/15/18 | | | 6,115,000 | | | | 6,695,925 | |

| | | | | | | | |

| | | | | | | 11,364,675 | |

| | | | | | | | |

Lodging 1.2% | |

MGM Resorts International

6.00%, due 3/15/23 | | | 7,600,000 | | | | 7,714,000 | |

6.75%, due 10/1/20 | | | 2,794,000 | | | | 2,975,610 | |

Starwood Hotels & Resorts Worldwide, Inc.

6.75%, due 5/15/18 | | | 946,000 | | | | 1,037,160 | |

7.15%, due 12/1/19 | | | 2,341,000 | | | | 2,700,702 | |

Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp.

5.375%, due 3/15/22 | | | 8,100,000 | | | | 8,019,000 | |

5.50%, due 3/1/25 (b) | | | 3,600,000 | | | | 3,378,780 | |

| | | | | | | | |

| | | | | | | 25,825,252 | |

| | | | | | | | |

Machinery—Construction & Mining 0.4% | |

Terex Corp.

6.00%, due 5/15/21 | | | 3,110,000 | | | | 3,079,522 | |

6.50%, due 4/1/20 | | | 5,000,000 | | | | 5,037,500 | |

| | | | | | | | |

| | | | | | | 8,117,022 | |

| | | | | | | | |

Machinery—Diversified 0.6% | |

Zebra Technologies Corp.

7.25%, due 10/15/22 | | | 11,860,000 | | | | 12,942,225 | |

| | | | | | | | |

|

Media 2.4% | |

CCO Holdings LLC / CCO Holdings Capital Corp.

5.25%, due 3/15/21 | | | 1,445,000 | | | | 1,491,963 | |

CCO Safari II LLC

4.464%, due 7/23/22 (b) | | | 13,655,000 | | | | 13,852,970 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Media (continued) | |

Clear Channel Worldwide Holdings, Inc.

Series B

6.50%, due 11/15/22 | | $ | 7,405,000 | | | $ | 7,719,712 | |

Series B

7.625%, due 3/15/20 | | | 4,270,000 | | | | 4,430,125 | |

Cox Communications, Inc.

6.95%, due 6/1/38 (b) | | | 2,241,000 | | | | 2,417,934 | |

DISH DBS Corp.

4.25%, due 4/1/18 | | | 7,500,000 | | | | 7,490,625 | |

6.75%, due 6/1/21 | | | 4,265,000 | | | | 4,403,613 | |

iHeartCommunications, Inc.

9.00%, due 12/15/19 | | | 2,600,000 | | | | 2,200,250 | |

9.00%, due 3/1/21 | | | 8,845,000 | | | | 7,275,012 | |

Time Warner Entertainment Co., L.P. 8.375%, due 3/15/23 | | | 1,087,000 | | | | 1,349,063 | |

| | | | | | | | |

| | | | | | | 52,631,267 | |

| | | | | | | | |

Mining 0.2% | |

Aleris International, Inc.

7.875%, due 11/1/20 | | | 2,057,000 | | | | 1,933,580 | |

Rio Tinto Finance USA, Ltd.

9.00%, due 5/1/19 | | | 1,500,000 | | | | 1,821,243 | |

| | | | | | | | |

| | | | | | | 3,754,823 | |

| | | | | | | | |

Miscellaneous—Manufacturing 1.3% | |

Amsted Industries, Inc.

5.00%, due 3/15/22 (b) | | | 10,610,000 | | | | 10,716,100 | |

Bombardier, Inc.

7.75%, due 3/15/20 (b) | | | 2,445,000 | | | | 2,133,263 | |

Gates Global LLC / Gates Global Co.

6.00%, due 7/15/22 (b) | | | 9,585,000 | | | | 7,691,962 | |

Textron Financial Corp.

6.00%, due 2/15/67 (a)(b) | | | 11,250,000 | | | | 8,325,000 | |

| | | | | | | | |

| | | | | | | 28,866,325 | |

| | | | | | | | |

Oil & Gas 5.7% | |

Anadarko Petroleum Corp.

(zero coupon), due 10/10/36 | | | 19,735,000 | | | | 7,652,049 | |

Berry Petroleum Co., LLC

6.75%, due 11/1/20 (d) | | | 3,523,000 | | | | 1,373,970 | |

California Resources Corp.

5.00%, due 1/15/20 | | | 3,435,000 | | | | 2,498,962 | |

CHC Helicopter S.A.

9.25%, due 10/15/20 | | | 9,714,600 | | | | 5,537,322 | |

Chesapeake Energy Corp.

4.875%, due 4/15/22 | | | 1,411,000 | | | | 874,820 | |

5.375%, due 6/15/21 | | | 1,500,000 | | | | 971,250 | |

6.625%, due 8/15/20 | | | 2,595,000 | | | | 1,758,113 | |

7.25%, due 12/15/18 | | | 2,000,000 | | | | 1,610,000 | |

¨CITGO Petroleum Corp.

6.25%, due 8/15/22 (b) | | | 10,000,000 | | | | 9,800,000 | |

Concho Resources, Inc.

5.50%, due 4/1/23 | | | 1,014,000 | | | | 1,019,070 | |

6.50%, due 1/15/22 | | | 1,550,000 | | | | 1,606,188 | |

7.00%, due 1/15/21 | | | 316,000 | | | | 326,270 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 17 | |

Portfolio of Investments October 31, 2015 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Oil & Gas (continued) | |

Denbury Resources, Inc.

4.625%, due 7/15/23 | | $ | 3,635,000 | | | $ | 2,426,362 | |

6.375%, due 8/15/21 | | | 6,630,000 | | | | 4,839,900 | |

Eni S.p.A.

4.15%, due 10/1/20 (b) | | | 2,000,000 | | | | 2,102,568 | |

EP Energy LLC / Everest Acquisition Finance, Inc.

9.375%, due 5/1/20 | | | 1,300,000 | | | | 1,131,000 | |

Hilcorp Energy I, L.P. / Hilcorp Finance Co.

5.00%, due 12/1/24 (b) | | | 10,000,000 | | | | 9,050,000 | |

7.625%, due 4/15/21 (b) | | | 1,823,000 | | | | 1,854,903 | |

LINN Energy LLC / LINN Energy Finance Corp.

6.50%, due 5/15/19 | | | 1,910,000 | | | | 496,600 | |

6.50%, due 9/15/21 | | | 7,250,000 | | | | 1,595,000 | |

8.625%, due 4/15/20 | | | 730,000 | | | | 189,800 | |

Murphy Oil USA, Inc.

6.00%, due 8/15/23 | | | 10,818,000 | | | | 11,412,990 | |

Precision Drilling Corp.

6.50%, due 12/15/21 | | | 1,127,000 | | | | 980,490 | |

6.625%, due 11/15/20 | | | 2,417,000 | | | | 2,154,151 | |

QEP Resources, Inc.

5.375%, due 10/1/22 | | | 3,350,000 | | | | 3,015,000 | |

Sanchez Energy Corp.

6.125%, due 1/15/23 | | | 9,620,000 | | | | 6,974,500 | |

SM Energy Co.

5.00%, due 1/15/24 | | | 1,970,000 | | | | 1,768,075 | |

6.125%, due 11/15/22 | | | 5,385,000 | | | | 5,223,450 | |

6.50%, due 1/1/23 | | | 4,665,000 | | | | 4,596,872 | |

Sunoco, L.P. / Sunoco Finance Corp.

5.50%, due 8/1/20 (b) | | | 5,635,000 | | | | 5,775,875 | |

6.375%, due 4/1/23 (b) | | | 6,850,000 | | | | 6,901,375 | |

Tesoro Corp.

5.125%, due 4/1/24 | | | 11,050,000 | | | | 11,160,500 | |

Whiting Petroleum Corp.

5.00%, due 3/15/19 | | | 2,350,000 | | | | 2,232,500 | |

5.75%, due 3/15/21 | | | 6,000,000 | | | | 5,572,500 | |

| | | | | | | | |

| | | | | | | 126,482,425 | |

| | | | | | | | |

Oil & Gas Services 1.1% | |

Basic Energy Services, Inc.

7.75%, due 2/15/19 | | | 8,717,000 | | | | 3,508,592 | |

7.75%, due 10/15/22 (d) | | | 3,770,000 | | | | 1,394,900 | |

Bristow Group, Inc.

6.25%, due 10/15/22 | | | 5,390,000 | | | | 4,689,300 | |

CGG S.A.

6.50%, due 6/1/21 | | | 6,150,000 | | | | 3,536,250 | |

PHI, Inc.

5.25%, due 3/15/19 | | | 11,885,000 | | | | 10,518,225 | |

| | | | | | | | |

| | | | | | | 23,647,267 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Packaging & Containers 2.4% | |

Ardagh Packaging Finance PLC

9.125%, due 10/15/20 (b) | | $ | 1,000,000 | | | $ | 1,048,760 | |

Ardagh Packaging Finance PLC / Ardagh Holdings USA, Inc.

6.75%, due 1/31/21 (b) | | | 6,775,000 | | | | 6,944,375 | |

7.00%, due 11/15/20 (b) | | | 652,941 | | | | 654,574 | |

Crown European Holdings S.A.

4.00%, due 7/15/22 (b) | | | EUR 7,700,000 | | | | 8,837,752 | |

Kloeckner Pentaplast of America, Inc.

7.125%, due 11/1/20 (b) | | | 3,175,000 | | | | 3,622,317 | |

MeadWestvaco Corp.

7.375%, due 9/1/19 | | $ | 1,800,000 | | | | 2,072,826 | |

Novelis, Inc.

8.75%, due 12/15/20 | | | 4,653,000 | | | | 4,664,632 | |

Owens-Brockway Glass Container, Inc.

5.00%, due 1/15/22 (b) | | | 5,555,000 | | | | 5,662,656 | |

Reynolds Group Issuer, Inc.

5.75%, due 10/15/20 | | | 925,000 | | | | 962,000 | |

7.875%, due 8/15/19 | | | 1,025,000 | | | | 1,062,156 | |

9.875%, due 8/15/19 | | | 5,714,000 | | | | 6,013,985 | |

Sealed Air Corp.

4.875%, due 12/1/22 (b) | | | 7,070,000 | | | | 7,264,425 | |

5.50%, due 9/15/25 (b) | | | 3,315,000 | | | | 3,497,325 | |

| | | | | | | | |

| | | | | | | 52,307,783 | |

| | | | | | | | |

Pharmaceuticals 0.7% | |

Endo Ltd. / Endo Finance LLC / Endo Finco, Inc.

6.00%, due 7/15/23 (b) | | | 5,560,000 | | | | 5,560,000 | |

6.00%, due 2/1/25 (b) | | | 2,375,000 | | | | 2,357,187 | |

Valeant Pharmaceuticals International, Inc.

5.375%, due 3/15/20 (b) | | | 4,600,000 | | | | 4,002,000 | |

6.375%, due 10/15/20 (b) | | | 4,800,000 | | | | 4,296,000 | |

| | | | | | | | |

| | | | | | | 16,215,187 | |

| | | | | | | | |

Pipelines 4.2% | |

Columbia Pipeline Group, Inc. 3.30%, due 6/1/20 (b) | | | 7,360,000 | | | | 7,341,526 | |

¨Energy Transfer Equity, L.P.

5.875%, due 1/15/24 | | | 1,960,000 | | | | 1,898,799 | |

Energy Transfer Partners, L.P.

5.20%, due 2/1/22 | | | 1,500,000 | | | | 1,492,440 | |

7.60%, due 2/1/24 | | | 662,000 | | | | 744,013 | |

EnLink Midstream Partners, L.P.

4.40%, due 4/1/24 | | | 10,000,000 | | | | 9,413,980 | |

Holly Energy Partners, L.P. / Holly Energy Finance Corp.

6.50%, due 3/1/20 | | | 3,875,000 | | | | 3,855,625 | |

Kinder Morgan, Inc.

5.625%, due 11/15/23 (b) | | | 2,449,000 | | | | 2,380,041 | |

7.75%, due 1/15/32 (d) | | | 11,700,000 | | | | 11,841,839 | |

| | | | |

| 18 | | MainStay Unconstrained Bond Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Pipelines (continued) | |

Panhandle Eastern Pipe Line Co., L.P.

8.125%, due 6/1/19 | | $ | 2,037,000 | | | $ | 2,351,655 | |

Plains All American Pipeline, L.P. / PAA Finance Corp.

4.70%, due 6/15/44 | | | 10,475,000 | | | | 9,021,740 | |

Regency Energy Partners, L.P. / Regency Energy Finance Corp.

5.00%, due 10/1/22 | | | 1,550,000 | | | | 1,506,361 | |

5.50%, due 4/15/23 | | | 3,525,000 | | | | 3,418,545 | |

5.875%, due 3/1/22 | | | 50,000 | | | | 51,348 | |

6.50%, due 7/15/21 | | | 2,825,000 | | | | 2,923,875 | |

Spectra Energy Partners, L.P. 4.75%, due 3/15/24 | | | 1,269,000 | | | | 1,305,264 | |

Targa Resources Partners, L.P. / Targa Resources Partners Finance Corp.

4.125%, due 11/15/19 | | | 2,500,000 | | | | 2,325,000 | |

4.25%, due 11/15/23 | | | 5,160,000 | | | | 4,515,000 | |

5.25%, due 5/1/23 | | | 3,725,000 | | | | 3,464,250 | |

6.375%, due 8/1/22 | | | 875,000 | | | | 848,750 | |

6.625%, due 10/1/20 (b) | | | 1,000 | | | | 993 | |

Tesoro Logistics, L.P. / Tesoro Logistics Finance Corp.

5.50%, due 10/15/19 (b) | | | 2,915,000 | | | | 3,017,025 | |

5.875%, due 10/1/20 | | | 3,810,000 | | | | 3,962,400 | |

6.125%, due 10/15/21 | | | 3,500,000 | | | | 3,640,000 | |

Williams Cos., Inc. (The)

3.70%, due 1/15/23 | | | 2,000,000 | | | | 1,632,480 | |

4.55%, due 6/24/24 | | | 8,500,000 | | | | 7,113,982 | |

Williams Partners, L.P. / ACMP Finance Corp.

4.875%, due 5/15/23 | | | 3,560,000 | | | | 3,213,253 | |

6.125%, due 7/15/22 | | | 29,000 | | | | 29,685 | |

| | | | | | | | |

| | | | | | | 93,309,869 | |

| | | | | | | | |

Real Estate Investment Trusts 0.9% | |

Crown Castle International Corp.

5.25%, due 1/15/23 | | | 2,625,000 | | | | 2,825,156 | |

GEO Group, Inc. (The)

6.625%, due 2/15/21 | | | 9,023,000 | | | | 9,338,805 | |

Host Hotels & Resorts, L.P.

3.75%, due 10/15/23 | | | 472,000 | | | | 456,189 | |

5.25%, due 3/15/22 | | | 75,000 | | | | 80,536 | |

Iron Mountain, Inc.

5.75%, due 8/15/24 | | | 4,125,000 | | | | 4,145,625 | |

6.00%, due 10/1/20 (b) | | | 744,000 | | | | 788,640 | |

6.00%, due 8/15/23 | | | 1,475,000 | | | | 1,546,906 | |

Ventas Realty, L.P. / Ventas Capital Corp.

2.70%, due 4/1/20 | | | 1,421,000 | | | | 1,409,264 | |

| | | | | | | | |

| | | | | | | 20,591,121 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Retail 2.1% | |

AmeriGas Finance LLC / AmeriGas Finance Corp.

7.00%, due 5/20/22 (d) | | $ | 5,200,000 | | | $ | 5,486,000 | |

Brinker International, Inc.

2.60%, due 5/15/18 (d) | | | 1,875,000 | | | | 1,877,582 | |

CVS Pass-Through Trust

5.789%, due 1/10/26 (b)(e) | | | 67,136 | | | | 74,038 | |

Dollar Tree, Inc.

5.75%, due 3/1/23 (b) | | | 11,670,000 | | | | 12,297,262 | |

Macy’s Retail Holdings, Inc.

3.875%, due 1/15/22 | | | 1,925,000 | | | | 1,959,194 | |

QVC, Inc.

4.85%, due 4/1/24 | | | 6,500,000 | | | | 6,354,582 | |

Signet UK Finance PLC

4.70%, due 6/15/24 | | | 10,160,000 | | | | 10,190,958 | |

Suburban Propane Partners, L.P. / Suburban Energy Finance Corp.

5.50%, due 6/1/24 | | | 8,550,000 | | | | 8,293,500 | |

| | | | | | | | |

| | | | | | | 46,533,116 | |

| | | | | | | | |

Semiconductors 1.7% | |

Freescale Semiconductor, Inc.

5.00%, due 5/15/21 (b) | | | 7,050,000 | | | | 7,279,125 | |

6.00%, due 1/15/22 (b) | | | 6,159,000 | | | | 6,559,335 | |

NXP B.V. / NXP Funding LLC

4.625%, due 6/15/22 (b) | | | 13,500,000 | | | | 13,770,000 | |

Sensata Technologies B.V.

5.00%, due 10/1/25 (b) | | | 9,700,000 | | | | 9,469,625 | |

| | | | | | | | |

| | | | | | | 37,078,085 | |

| | | | | | | | |

Software 0.3% | |

First Data Corp.

5.375%, due 8/15/23 (b) | | | 1,785,000 | | | | 1,816,238 | |

6.75%, due 11/1/20 (b) | | | 2,275,000 | | | | 2,397,281 | |

7.00%, due 12/1/23 (b) | | | 755,000 | | | | 768,213 | |

10.625%, due 6/15/21 | | | 1,137,000 | | | | 1,269,176 | |

| | | | | | | | |

| | | | | | | 6,250,908 | |

| | | | | | | | |

Telecommunications 4.1% | |

Bharti Airtel International Netherlands B.V.

Series Reg S

5.125%, due 3/11/23 | | | 6,500,000 | | | | 6,895,252 | |

CenturyLink, Inc.

5.80%, due 3/15/22 | | | 8,000,000 | | | | 7,780,000 | |

CommScope Holding Co., Inc.

6.625%, due 6/1/20 (b)(f) | | | 4,350,000 | | | | 4,524,000 | |

CommScope, Inc.

4.375%, due 6/15/20 (b) | | | 3,700,000 | | | | 3,774,000 | |

5.00%, due 6/15/21 (b) | | | 4,295,000 | | | | 4,321,844 | |

Hughes Satellite Systems Corp.

6.50%, due 6/15/19 | | | 2,250,000 | | | | 2,476,688 | |

7.625%, due 6/15/21 | | | 3,350,000 | | | | 3,651,500 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 19 | |

Portfolio of Investments October 31, 2015 (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Corporate Bonds (continued) | |

Telecommunications (continued) | |

Inmarsat Finance PLC

4.875%, due 5/15/22 (b) | | $ | 10,190,000 | | | $ | 10,113,575 | |

Intelsat Luxembourg S.A.

7.75%, due 6/1/21 | | | 5,885,000 | | | | 3,472,150 | |

8.125%, due 6/1/23 | | | 1,573,000 | | | | 932,003 | |

Sprint Capital Corp.

8.75%, due 3/15/32 | | | 2,060,000 | | | | 1,854,000 | |

Sprint Communications, Inc.

7.00%, due 8/15/20 | | | 1,800,000 | | | | 1,669,500 | |

Sprint Corp.

7.25%, due 9/15/21 | | | 4,000,000 | | | | 3,675,000 | |

7.875%, due 9/15/23 | | | 1,650,000 | | | | 1,526,250 | |

T-Mobile USA, Inc.

6.00%, due 3/1/23 | | | 3,000,000 | | | | 2,990,625 | |

6.125%, due 1/15/22 | | | 4,525,000 | | | | 4,604,187 | |

6.375%, due 3/1/25 | | | 3,500,000 | | | | 3,508,750 | |

6.542%, due 4/28/20 | | | 2,000,000 | | | | 2,050,000 | |

6.625%, due 11/15/20 | | | 1,000,000 | | | | 1,030,000 | |

Telecom Italia Capital S.A.

7.721%, due 6/4/38 | | | 1,085,000 | | | | 1,155,525 | |

Telefonica Emisiones SAU

4.57%, due 4/27/23 | | | 2,550,000 | | | | 2,681,205 | |

5.462%, due 2/16/21 | | | 396,000 | | | | 441,928 | |

Verizon Communications, Inc.

5.15%, due 9/15/23 | | | 3,573,000 | | | | 3,982,487 | |

ViaSat, Inc.

6.875%, due 6/15/20 | | | 7,340,000 | | | | 7,688,650 | |

Virgin Media Secured Finance PLC

5.50%, due 1/15/25 (b) | | | 5,000,000 | | | | 5,062,500 | |

| | | | | | | | |

| | | | | | | 91,861,619 | |

| | | | | | | | |

Transportation 0.9% | |

Hapag-Lloyd A.G.

9.75%, due 10/15/17 (b) | | | 2,000,000 | | | | 2,050,000 | |

Hornbeck Offshore Services, Inc.

5.00%, due 3/1/21 | | | 4,255,000 | | | | 3,255,075 | |

5.875%, due 4/1/20 | | | 3,748,000 | | | | 3,017,140 | |

XPO Logistics, Inc.

6.50%, due 6/15/22 (b) | | | 12,475,000 | | | | 11,133,937 | |

| | | | | | | | |

| | | | | | | 19,456,152 | |

| | | | | | | | |

Total Corporate Bonds

(Cost $1,726,433,229) | | | | | | | 1,639,274,402 | |

| | | | | | | | |

| | |

| Foreign Bonds 0.4% | | | | | | | | |

Belgium 0.1% | | | | | | | | |

Belfius Financing Co.

1.289%, due 2/9/17 (a) | | | GBP 2,000,000 | | | | 3,044,658 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Ireland 0.2% | |

UT2 Funding PLC

5.321%, due 6/30/16 | | | EUR 3,945,000 | | | $ | 4,385,389 | |

| | | | | | | | |

|

United Kingdom 0.1% | |

Barclays Bank PLC

Series Reg S

10.00%, due 5/21/21 | | | GBP 449,000 | | | | 887,890 | |

Rexam PLC

6.75%, due 6/29/67 (a) | | | EUR 978,000 | | | | 1,075,458 | |

| | | | | | | | |

| | | | | | | 1,963,348 | |

| | | | | | | | |

Total Foreign Bonds

(Cost $10,520,320) | | | | | | | 9,393,395 | |

| | | | | | | | |

| |

| Loan Assignments 17.6% (g) | | | | | |

Advertising 1.2% | | | | | | | | |

CBS Outdoor Americas Capital LLC

Term Loan B

3.00%, due 1/31/21 | | $ | 8,953,125 | | | | 8,900,901 | |

¨USAGM HoldCo LLC | | | | | | | | |

2015 Delayed Draw Term Loan

4.75%, due 7/28/22 | | | 576,347 | | | | 561,938 | |

2015 Term Loan

4.75%, due 7/28/22 | | | 8,173,653 | | | | 7,969,312 | |

2015 2nd Lien Delayed Draw Term Loan

9.50%, due 7/28/23 | | | 535,714 | | | | 518,750 | |

2015 2nd Lien Term Loan

9.50%, due 7/28/23 | | | 8,214,286 | | | | 7,954,164 | |

| | | | | | | | |

| | | | | | | 25,905,065 | |

| | | | | | | | |

Aerospace & Defense 0.2% | |

TransDigm, Inc.

Term Loan C

3.75%, due 2/28/20 | | | 1,747,168 | | | | 1,724,237 | |

Term Loan D

3.75%, due 6/4/21 | | | 1,975,000 | | | | 1,946,785 | |

| | | | | | | | |

| | | | | | | 3,671,022 | |

| | | | | | | | |

Auto Manufacturers 0.3% | |

Navistar International Corporation Term Loan B

6.50%, due 8/7/20 | | | 7,500,000 | | | | 7,250,003 | |

| | | | | | | | |

|

Auto Parts & Equipment 1.1% | |

Allison Transmission, Inc.

New Term Loan B3

3.50%, due 8/23/19 | | | 7,358,925 | | | | 7,360,765 | |

MPG Holdco I, Inc.

USD Term Loan B

3.75%, due 10/20/21 | | | 1,063,594 | | | | 1,056,567 | |

| | | | |

| 20 | | MainStay Unconstrained Bond Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Loan Assignments (continued) | |

Auto Parts & Equipment (continued) | |

TI Group Automotive Systems, LLC

2015 Term Loan

4.50%, due 6/30/22 | | $ | 11,075,000 | | | $ | 10,978,094 | |

Visteon Corp.

Delayed Draw Term Loan B 3.50%, due 4/9/21 | | | 4,068,677 | | | | 4,046,636 | |

| | | | | | | | |

| | | | | | | 23,442,062 | |

| | | | | | | | |

Building Materials 0.7% | |

Quikrete Holdings, Inc.

1st Lien Term Loan

4.00%, due 9/28/20 | | | 13,486,979 | | | | 13,442,027 | |

2nd Lien Term Loan

7.00%, due 3/26/21 | | | 1,193,684 | | | | 1,193,684 | |

| | | | | | | | |

| | | | | | | 14,635,711 | |

| | | | | | | | |

Chemicals 1.1% | |

Axalta Coating Systems U.S. Holdings, Inc.

USD Term Loan

3.75%, due 2/1/20 | | | 4,497,694 | | | | 4,481,633 | |

ECO Services Operations LLC

Initial Term Loan

4.75%, due 12/4/21 | | | 2,630,125 | | | | 2,600,536 | |

PQ Corp.

2014 Term Loan

4.00%, due 8/7/17 | | | 11,306,851 | | | | 11,267,990 | |

WR Grace & Co.

Delayed Draw Term Loan

2.75%, due 2/3/21 | | | 1,342,745 | | | | 1,317,568 | |

USD Exit Term Loan

2.75%, due 2/3/21 | | | 3,733,714 | | | | 3,663,707 | |

| | | | | | | | |

| | | | | | | 23,331,434 | |

| | | | | | | | |

Commercial Services 1.0% | |

Allied Security Holdings LLC

New 2nd Lien Term Loan

8.00%, due 8/13/21 | | | 5,808,219 | | | | 5,532,329 | |

KAR Auction Services, Inc.

Term Loan B2

3.50%, due 3/11/21 | | | 8,825,744 | | | | 8,814,712 | |

Neff Rental LLC

2nd Lien Term Loan 7.25%, due 6/9/21 | | | 8,872,957 | | | | 7,985,661 | |

| | | | | | | | |

| | | | | | | 22,332,702 | |

| | | | | | | | |

Containers, Packaging & Glass 0.3% | |

Milacron LLC

Term Loan B

4.50%, due 9/28/20 | | | 6,602,740 | | | | 6,610,993 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

Electric 0.1% | |

Calpine Corp.

Term Loan B5

3.50%, due 5/27/22 | | $ | 1,995,000 | | | $ | 1,970,063 | |

| | | | | | | | |

|

Entertainment 0.9% | |

Mohegan Tribal Gaming Authority

New Term Loan B

5.50%, due 6/15/18 | | | 2,947,500 | | | | 2,915,570 | |

Scientific Games International, Inc.

2014 Term Loan B1

6.00%, due 10/18/20 | | | 9,088,125 | | | | 8,875,126 | |