| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number: (811- 04616) |

| |

| Exact name of registrant as specified in charter: Putnam High Yield Advantage Fund |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: November 30, 2007 | |

| |

| Date of reporting period: December 1, 2006 — November 30, 2007 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

What makes Putnam different?

A time-honored tradition in

money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their financial representatives can build diversified portfolios.

A commitment to doing what’s right

for investors

With a focus on investment performance, below-average expenses, and in-depth information about our funds, we put the interests of investors first and seek to set the standard for integrity and service.

Industry-leading service

We help investors, along with their financial representatives, make informed investment decisions with confidence.

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

Putnam

High Yield

Advantage Fund

11| 30| 07

Annual Report

| |

| Message from the Trustees | 1 |

| About the fund | 2 |

| Performance and portfolio snapshots | 4 |

| Report from the fund managers | 5 |

| Performance in depth | 9 |

| Expenses | 12 |

| Portfolio turnover | 14 |

| Risk | 14 |

| Your fund’s management | 15 |

| Terms and definitions | 16 |

| Trustee approval of management contract | 17 |

| Other information for shareholders | 21 |

| Financial statements | 22 |

| Shareholder meeting results | 50 |

| Federal tax information | 51 |

| About the Trustees | 52 |

| Officers | 56 |

Cover photograph: © Richard H. Johnson

Message from the Trustees

Dear Fellow Shareholder:

As we look toward the new year, we note that 2007 was marked by heightened market turbulence. Stock market indexes in the United States reached new highs in July and again in October, but volatility was the norm rather than the exception. Business losses related to the subprime mortgage sector were farther-reaching and more acute than many observers had predicted, and the market’s daily fluctuations were understandably unsettling. Putnam’s bond funds generally provided sources of stability and income to investors’ portfolios in spite of these difficulties, while international funds posted continued strong gains. Importantly, the U.S. economy registered some of the strongest growth of this business expansion in the spring and summer months, creating a cushion that, along with timely action by the Federal Reserve, should help to support moderate economic growth in 2008. Although the events of the past year have tested the mettle of long-term investors, they also help us to understand the importance of certain time-tested principles: the wisdom of a long-term perspective, the power of stocks to achieve capital growth over long periods, and the benefits of diversification across asset classes.

We are pleased to announce that a new independent Trustee, Robert J. Darretta, has joined your fund’s Board of Trustees. Mr. Darretta brings extensive leadership experience in corporate finance and accounting. He is a former Vice Chairman of the Board of Directors of Johnson & Johnson, one of the leading U.S. health-care and consumer products companies, where he also served as Chief Financial Officer, Executive Vice President, and Treasurer.

Putnam Investments celebrated its 70th anniversary in November. From modest beginnings in Boston, Massachusetts, the firm has grown into a global asset manager that serves millions of investors worldwide. Although the mutual fund industry has undergone many changes since George Putnam introduced his innovative balanced fund in 1937, Putnam’s guiding principles have not. As we celebrate this 70-year milestone, we look forward to Putnam continuing its long tradition of prudent money management. Thank you for your support of the Putnam funds.

Putnam High Yield Advantage Fund:

Seeking high current income and capital growth

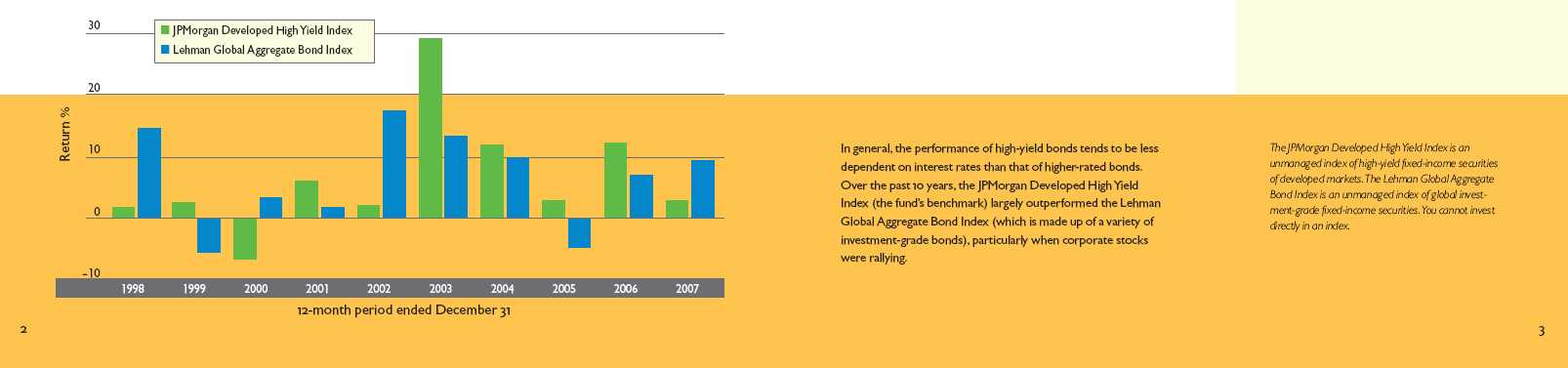

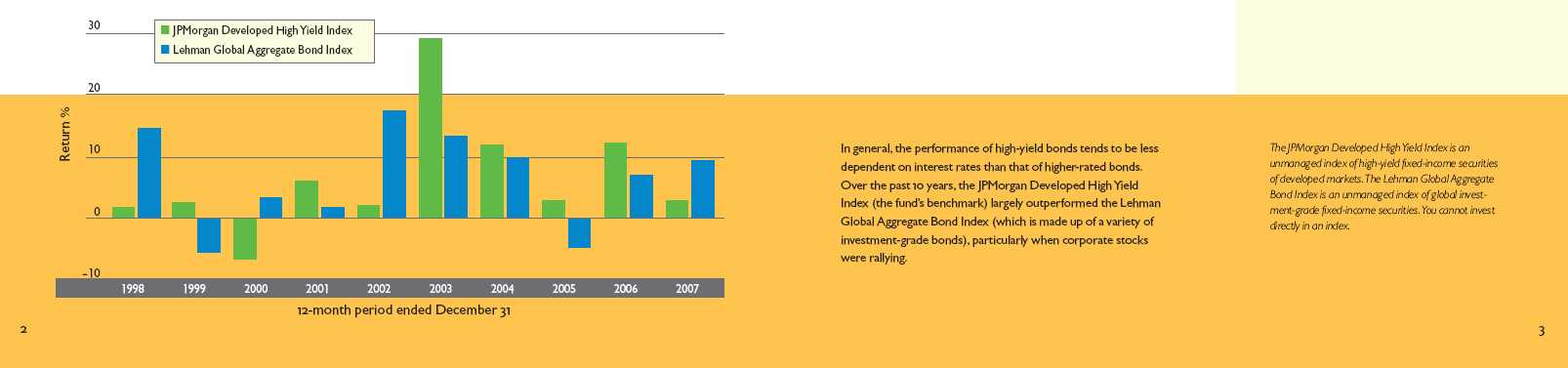

Unlike most types of fixed-income investments, high-yield bond performance is more dependent on the performance of the companies that issue the bonds than on interest rates. For this reason, distinguishing between opportunities and potential pitfalls requires a rigorous investment process. With Putnam High Yield Advantage Fund, this process is highlighted by intensive research, investment diversification, and carefully timed portfolio adjustments.

Because of the risks of high-yield bond investing, in-depth credit research is essential. The fund’s research team — more than 20 professionals, including analysts who specialize by industry — visits with the management of issuing companies and analyzes each company’s prospects. The team then compares this information to the bond’s potential upside or downside before deciding whether it is an appropriate investment for the fund.

The fund’s portfolio typically consists of bonds from a broad range of industries and companies. Holdings are diversified across industry sectors and among bonds with differing credit ratings. While the fund invests primarily in the bonds of U.S. companies, its diversified approach allows it to include foreign bonds as well. Among these securities, investments in emerging-market bonds may be used to enhance the fund’s appreciation potential. Although diversification does not ensure a profit or protect against a loss and it is possible to lose money in a diversified portfolio, the fund’s diversification can help reduce the volatility that typically comes with higher-risk investments.

As the bond markets shift over time, the fund’s management looks for ways to capitalize on developments that affect fixed-income securities in general and high-yield bonds in particular. For example, when credit spreads are wide and expected to tighten, the fund may pursue the higher income potential offered by lower-quality issues. On the other hand, when credit spreads are narrow — that is, when the difference in yield between higher- and lower-rated bonds of comparable maturities is small — the fund may shift its emphasis to higher-quality high-yield bonds.

Lower-rated bonds may offer higher yields in return for more risk. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

What makes a bond

“high yield”?

High-yield bonds are fixed-income investments typically issued by companies that lack an established earnings track record or a solid credit history. In general, high-yield bonds offer higher interest rates than investment-grade bonds to compensate for their increased risk. Because of this added risk, these bonds are rated below investment grade by an independent rating agency (for example, the lowest Moody’s Investors Service rating of investment-grade bonds is Baa). The lower the rating, the greater the possibility that a bond’s issuer will be unable to make interest payments or repay the principal.

| |

| BOND RATINGS | |

|

| Moody’s | Grade |

|

| Aaa | Investment |

|

| Aa | Investment |

|

| Baa | Investment |

|

| Ba, B | High yield |

|

| Caa/Ca | High yield |

|

| C | High yield |

|

High-yield bonds historically have offered greater return

potential than investment-grade bonds.

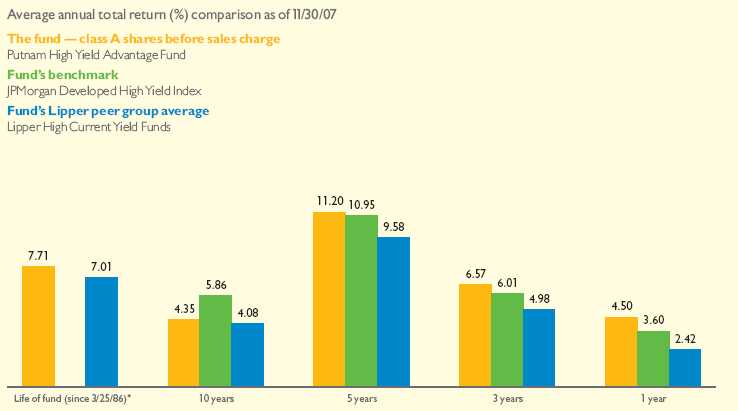

Performance and portfolio snapshots

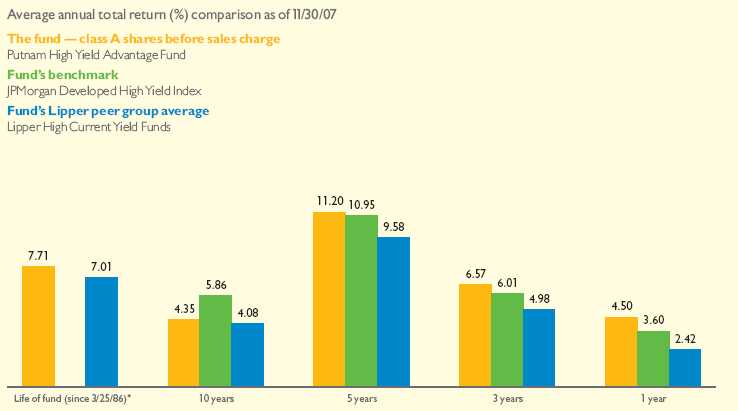

Putnam High Yield Advantage Fund

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge; had they, returns would have been lower. See pages 9–11 for additional performance information. For a portion of the periods, this fund may have limited expenses, without which returns would have been lower. A 1% short-term trading fee may apply. To obtain the most recent month-end performance, visit www.putnam.com.

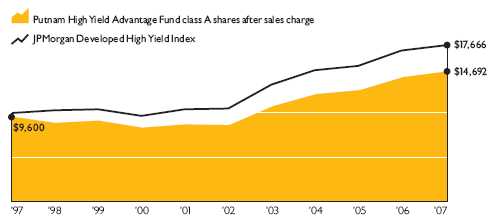

* The inception date of the fund’s benchmark, the JPMorgan Developed High Yield Index, was 12/31/94, which post-dates the 3/25/86 inception date of the fund’s class A shares.

“During the period we continued to emphasize

relatively high-quality issues and maintained

our rigorous fundamental credit research,

which benefited the fund during the second

half of the year, in particular.”

Paul Scanlon, Portfolio Leader, Putnam High Yield Advantage Fund

Credit qualities shown as a percentage of portfolio value as of 11/30/07. A bond rated Baa or higher (MIG3/VMIG3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds not rated by Moody’s but considered by Putnam Management to be of comparable quality. Ratings will vary over time.

4

Report from the fund managers

The year in review

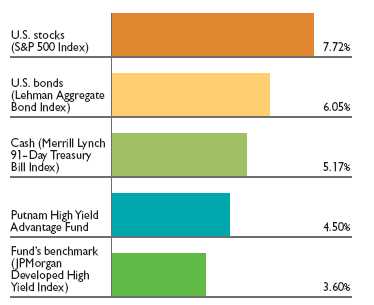

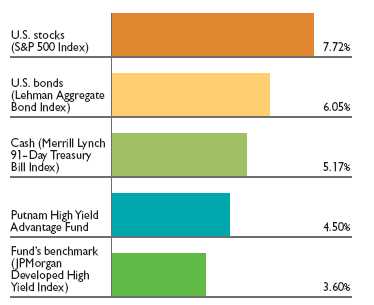

We are pleased to report that your fund’s class A shares posted a 4.50% total return during the fiscal year that ended November 30, 2007, based on results before sales charges. The year was marked by a sharp change in the tone of the market, as robust growth in the high-yield market was replaced in the summer by significant volatility related to the burgeoning mortgage crisis.

Favorable security selection was the main driver of your fund’s outperformance of its benchmark and Lipper peer group. While our decision not to emphasize the lower-quality segments of the market may have been a drag on performance earlier in the year, that decision proved sound in the face of market turmoil from the summer through the end of the fiscal year.

Market overview

Solid corporate business fundamentals coupled with sustained demand helped high-yield bonds post positive performance during the first half of your fund’s fiscal year. However, that backdrop changed dramatically as problems in the subprime mortgage and associated structured credit markets dampened investor sentiment and stunted market activity. This shift occurred just when the debt markets faced an unprecedented backlog of new issuance, much of which had been generated by firms seeking to raise capital for leveraged buyouts. In some cases, this new bond issuance was of lower quality, coming primarily from companies with significant debt leverage. This merger of too much supply and shrinking demand caused prices of high-yield bonds to decline dramatically during the summer, even though default rates remained at historically low levels.

The market staged a bit of a rebound in September, as some large deals successfully came to market. Nevertheless, access to credit continued to contract through the end of the fiscal year. In the face of uncertainty about the extent of their subprime and associated losses, financial institutions tightened their lending practices and sought to preserve assets to ensure liquidity. The Federal Reserve attempted to

Market sector and fund performance

This comparison shows your fund’s performance in the context of different market sectors for the 12 months ended 11/30/07. See the previous page and pages 9–11 for additional fund performance information. Index descriptions can be found on page 16.

5

alleviate this credit crunch by lowering short-term interest rates on three separate occasions, but evidence of widening losses were already afoot. In the final months of the fiscal year, corporate earnings in the financial, homebuilding, and consumer-related industries showed signs of deterioration.

Strategy overview

Our basic investment approach of maintaining a broadly diversified portfolio of bonds from a variety of sectors and industries remained the same during the year.

In terms of credit quality, we continued to emphasize the higher-quality segment of the market. As mentioned, this strategy may have held back the fund’s relative performance during the first half of its fiscal year — when lower-quality bonds outperformed — but was of benefit during the downturn in the second half. As the market fell into turmoil, we maintained our rigorous fundamental credit research, carefully reviewing each holding to make sure its balance of risk and reward had not changed.

Additionally, as the market regained some stability in the latter stages of the period, we were able to find opportunities to make new investments at very attractive yields. Given that defaults remained very low, some of these bonds appeared to have a fair amount of bad news already reflected in their yields, which should ultimately accrue more income to the fund.

Further, we continued to add to the fund’s investments in floating-rate bank loans. These loans are issued by banks to companies with below-investment-grade ratings, and are subsequently traded on the open market. This asset class suffered sharp declines in the summer, as investor demand for structured credit programs, including collateralized loan obligations (CLOs), plunged. As a result, the loans began to offer yields that became attractive when compared with some high-yield bonds. An added benefit is that floating-rate loans generally are senior to high-yield bonds in many corporate capital structures, meaning that holders of a company’s bank loans generally would be paid before investors who hold the firm’s unsecured bonds, should the company default on its debt obligations.

Your fund’s holdings

The fund’s overweight exposure to the energy sector provided an important boost to performance during the year. Business fundamentals for energy companies remained robust because global demand for energy continued to outpace supply. Among bond holdings that helped your fund during the fiscal year were natural gas companies El Paso and Williams, both of which benefited as natural gas prices rose. El Paso is one of North America’s largest independent

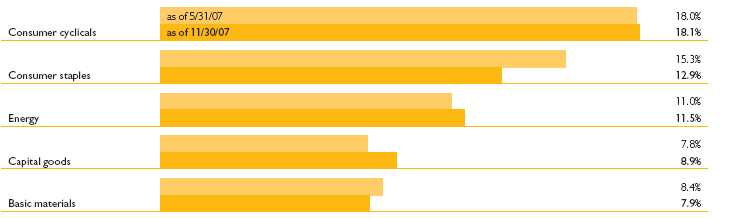

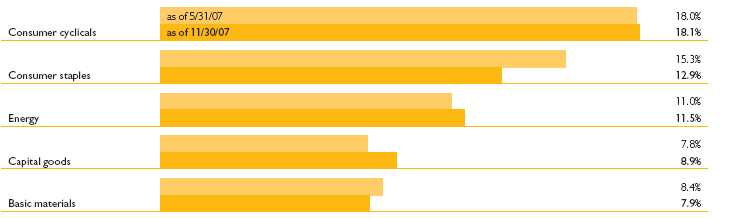

Comparison of top sector weightings

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Holdings will vary over time.

6

natural gas producers. Its bond prices rose when the company sold a pipeline subsidiary to pay down debt. Williams also used to engage in electricity and power generation, but sold this portion of its business to Bear Stearns’ energy-trading subsidiary. By doing so, the company looked to refocus on its core business of producing, processing, and transporting natural gas. Another energy company, XCL, a Louisiana-based oil and natural gas company, was acquired during the year, which bolstered the value of its securities, which we held in the fund.

Other holdings that helped performance came from a diverse set of industries. Bonds issued by Chaparral Steel rose when that company was purchased, and metals and mining firm Freeport-McMoRan offered very strong returns. Our holdings in this company’s convertible securities appreciated in concert with the underlying equity price in an environment of heightened global demand for copper, and after Freeport announced its acquisition of competitor Phelps Dodge.

When measuring the fund’s performance against its benchmarks, relative performance is sometimes aided by what we do not own or what we chose to sell. For example, the fund’s relative performance benefited from our decision not to own auto parts manufacturer Delphi, an index component whose valuation declined as the company worked its way through bankruptcy. Additionally, our decision to underweight the homebuilder and forest products sectors bolstered relative performance. For example, selling homebuilder Technical Olympic before its bond prices collapsed proved helpful.

Within a difficult investing environment, however, the fund was not immune to declines due to problems encountered by some of its holdings. The main detractor during the year was casino operator Tropicana. Its bond prices declined due to poor execution by management, as well as concerns about licensing renewals. Elsewhere, diversified media company Vertis called off a proposed acquisition of one of its chief competitors, causing its bonds to sell off; and Buffets, a restaurant chain, suffered from weak operating results.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

Of special interest

Fund’s dividend increased

We are pleased to announce an increase in the fund’s dividend from $0.0340 per share to $0.0350 per share, which occurred in October 2007. This dividend increase was possible because of the fund’s overall increase in net asset value and the amount of income flowing from the portfolio holdings.

Top holdings

This table shows the fund’s top holdings, and the percentage of the fund’s net assets that each represented, as of 11/30/07. The fund’s holdings will change over time.

| | | | |

| Holding (percent of fund’s net assets) | Coupon (%) and maturity date | | Sector/Industry |

|

| CCH I, LLC/Capital Corp. (1.0%) | | 11%, 2015 | | Consumer staples/Cable television |

|

| General Motors Corp. (0.9%) | | 7.2%, 2011 | | Consumer cyclicals/Automotive |

|

| Ford Motor Credit Corp. (0.8%) | | 9.875%, 2011 | | Consumer cyclicals/Automotive |

|

| General Motors Acceptance Corp. (GMAC LLC) (0.7%) | | 7.75%, 2010 | | Financial/Financial |

|

| General Motors Acceptance Corp. (GMAC LLC) (0.7%) | | 6.875%, 2012 | | Financial/Financial |

|

| NRG Energy, Inc. (0.7%) | | 7.375%, 2016 | | Utilities & power/Power producers |

|

| SunGard Data Systems, Inc. (0.7%) | | 9.125%, 2013 | | Technology/Computers |

|

| Echostar DBS Corp. (0.7%) | | 6.375%, 2011 | | Consumer staples/Broadcasting |

|

| Legrand SA (0.6%) | | 8.5%, 2025 | | Capital goods/Manufacturing |

|

| Freeport-McMoRan Copper & Gold, Inc. (0.6%) | | 8.375%, 2017 | | Basic materials/Metals |

|

7

The outlook for your fund

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

By the close of the fiscal year, many high-yield bond prices had declined from their highs in keeping with the turn in investor sentiment. Corporate business fundamentals are not as strong as they appeared at the start of the year, and it is unclear whether the economy is entering a period of slower growth or outright recession. Against this backdrop, it is widely expected that default rates on high-yield bonds will start rising from their historically low levels. Although there is currently a lack of liquidity in the markets, we believe valuations are becoming attractive.

For our part, we are neither overly bullish nor bearish. Going forward, we will aim to avoid being too aggressive or defensive, instead maintaining a consistent investment approach, selecting securities one at a time with a focus on diversification, as well as taking care to choose investments for the fund that offer an attractive balance of risk and potential reward.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Lower-rated bonds may offer higher yields in return for more risk. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

8

Your fund’s performance

This section shows your fund’s performance, price, and distribution information periods ended November 30, 2007, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit www.putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients and clients in other approved programs. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 11/30/07

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | Class A | | | Class B | | | Class C | | | Class M | | | Class R | | Class Y |

| (inception dates) | | | (3/25/86) | | | (5/16/94) | | | (3/30/07) | | | (12/1/94) | | | (3/30/07) | | (12/31/98) |

| | | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | | |

| (life of fund) | | 7.71% | 7.51% | 6.79% | 6.79% | 6.89% | 6.89% | 7.41% | 7.25% | 7.44% | 7.88% |

|

| 10 years | | 53.12 | 46.92 | 41.33 | 41.33 | 41.70 | 41.70 | 49.87 | 45.06 | 49.38 | 58.23 |

| Annual average | | 4.35 | 3.92 | 3.52 | 3.52 | 3.55 | 3.55 | 4.13 | 3.79 | 4.09 | 4.70 |

|

| 5 years | | 70.04 | 63.10 | 63.47 | 61.47 | 63.32 | 63.32 | 67.87 | 62.53 | 68.07 | 72.58 |

| Annual average | | 11.20 | 10.28 | 10.33 | 10.06 | 10.31 | 10.31 | 10.92 | 10.20 | 10.94 | 11.53 |

|

| 3 years | | 21.03 | 16.13 | 18.29 | 15.35 | 18.01 | 18.01 | 20.06 | 16.11 | 20.23 | 21.87 |

| Annual average | | 6.57 | 5.11 | 5.76 | 4.88 | 5.68 | 5.68 | 6.28 | 5.10 | 6.33 | 6.82 |

|

| 1 year | | 4.50 | 0.31 | 3.58 | –1.27 | 3.46 | 2.50 | 4.11 | 0.71 | 4.35 | 4.78 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After sales charge returns (public offering price, or POP) for class A and M shares reflect a maximum 4.00% and 3.25% load, respectively as of 1/2/08. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year and is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and, except for class Y shares, the higher operating expenses for such shares.

For a portion of the periods, this fund limited expenses, without which returns would have been lower.

A 1% short-term trading fee may be applied to shares exchanged or sold within 7 days of purchase.

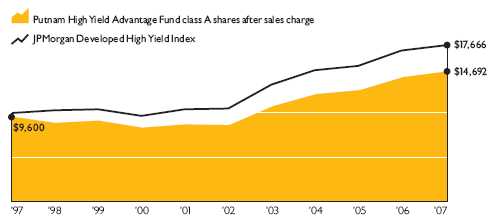

Change in the value of a $10,000 investment ($9,600 after sales charge)

Cumulative total return from 11/30/97 to 11/30/07

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B and class C shares would have been valued at $14,133 and $14,170, respectively, and no contingent deferred sales charges would apply. A $10,000 investment in the fund’s class M shares ($9,675 after sales charge) would have been valued at $14,506 at public offering price. A $10,000 investment in the fund’s class R and class Y shares would have been valued at $14,938 and $15,823, respectively.

9

Comparative index returns For periods ended 11/30/07

| | | |

| | | | Lipper High |

| | JPMorgan Developed | | Current Yield Funds |

| | High Yield Index | | category average* |

|

| Annual average | | | |

| (life of fund) | —† | | 7.01% |

|

| 10 years | 76.66% | | 51.61 |

| Annual average | 5.86 | | 4.08 |

|

| 5 years | 68.14 | | 58.75 |

| Annual average | 10.95 | | 9.58 |

|

| 3 years | 19.12 | | 15.88 |

| Annual average | 6.01 | | 4.98 |

|

| 1 year | 3.60 | | 2.42 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 1-, 3-, 5-, 10-year, and life of fund periods ended 11/30/07, there were 447, 381, 326, 148, and 28 funds, respectively, in this Lipper category.

† This index began operations on 12/31/94.

Fund price and distribution information For the 12-month period ended 11/30/07

| | | | | | | | |

| Distributions | Class A | | Class B | Class C | Class M | | Class R | Class Y |

|

| Number | 12 | 12 | 8 | 12 | 8 | 12 |

|

| Income | $0.447 | $0.399 | $0.252 | $0.434 | $0.265 | $0.460 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.447 | $0.399 | $0.252 | $0.434 | $0.265 | $0.460 |

|

| Share value: | NAV | POP† | NAV | NAV | NAV | POP | NAV | NAV |

|

| 11/30/06 | $6.22 | $6.48 | $6.14 | — | $6.23 | $6.44 | — | $6.35 |

|

| 3/30/07* | — | — | — | $6.27 | — | — | $6.35 | — |

|

| 11/30/07 | 6.05 | 6.30 | 5.96 | 5.95 | 6.05 | 6.25 | 6.05 | 6.19 |

|

| Current yield (end of period) | | | | | | | | |

|

| Current dividend rate1 | 6.94% | 6.67% | 6.24% | 6.25% | 6.74% | 6.53% | 6.74% | 6.98% |

|

| Current 30-day SEC yield2,3 | | | | | | | | |

| (with expense limitation) | N/A | 7.37 | 6.91 | 6.90 | N/A | 7.18 | 7.48 | 7.86 |

|

| Current 30-day SEC yield3 | | | | | | | | |

| (without expense limitation) | N/A | 7.37 | 6.90 | 6.90 | N/A | 7.18 | 7.48 | 7.86 |

|

* Inception date of class C and class R shares.

† Reflects an increase in sales charges that took effect on 1/2/08.

1 Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period.

2 For a portion of the period, this fund may have limited expenses, without which yields would have been lower.

3 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

10

Fund performance as of most recent calendar quarter Total return for periods ended 12/31/07

| | | | | | | | | | | |

| | | Class A | | Class B | | Class C | | Class M | | Class R | Class Y |

| (inception dates) | | (3/25/86) | | (5/16/94) | | (3/30/07) | | (12/1/94) | | (3/30/07) | (12/31/98) |

| | | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | | |

| (life of fund) | | 7.69% | 7.48% | 6.76% | 6.76% | 6.87% | 6.87% | 7.39% | 7.22% | 7.43% | 7.85% |

|

| 10 years | | 51.43 | 45.32 | 39.75 | 39.75 | 40.09 | 40.09 | 48.23 | 43.35 | 47.97 | 56.51 |

| Annual average | | 4.24 | 3.81 | 3.40 | 3.40 | 3.43 | 3.43 | 4.01 | 3.67 | 4.00 | 4.58 |

|

| 5 years | | 69.48 | 62.84 | 62.92 | 60.92 | 62.98 | 62.98 | 67.32 | 61.98 | 67.76 | 72.01 |

| Annual average | | 11.13 | 10.24 | 10.25 | 9.98 | 10.26 | 10.26 | 10.84 | 10.13 | 10.90 | 11.46 |

|

| 3 years | | 19.73 | 14.91 | 17.01 | 14.11 | 16.86 | 16.86 | 18.77 | 14.89 | 19.12 | 20.59 |

| Annual average | | 6.19 | 4.74 | 5.38 | 4.50 | 5.33 | 5.33 | 5.90 | 4.74 | 6.01 | 6.44 |

|

| 1 year | | 3.44 | –0.71 | 2.68 | –2.14 | 2.51 | 1.55 | 3.05 | –0.31 | 3.44 | 3.74 |

|

Fund’s annual operating expenses For the fiscal year ended 11/30/06

| | | | | | | |

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual fund operating expenses | | 1.05% | 1.80% | 1.80% | 1.30% | 1.30% | 0.80% |

|

Expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown in the next section and in the financial highlights of this report. Expenses are shown as a percentage of average net assets. Please refer to the fund’s prospectus for more detail.

11

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Putnam High Yield Advantage Fund from June 1, 2007, to November 30, 2007. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | | $ 5.30 | $ 9.00 | $ 9.00 | $ 6.54 | $ 6.54 | $ 4.07 |

|

| Ending value (after expenses) | | $977.60 | $973.30 | $972.70 | $976.40 | $976.40 | $979.10 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 11/30/07. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended November 30, 2007, use the calculation method below. To find the value of your investment on June 1, 2007, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | | $ 5.42 | $ 9.20 | $ 9.20 | $ 6.68 | $ 6.68 | $ 4.15 |

|

| Ending value (after expenses) | | $1,019.70 | $1,015.94 | $1,015.94 | $1,018.45 | $1,018.45 | $1,020.96 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 11/30/07. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

12

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown below indicates how much of your fund’s average net assets have been used to pay ongoing expenses during the period.

| | | | | | | |

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Your fund’s annualized expense ratio* | | 1.07% | 1.82% | 1.82% | 1.32% | 1.32% | 0.82% |

|

| Average annualized expense ratio for Lipper peer group† | | 1.13% | 1.88% | 1.88% | 1.38% | 1.38% | 0.88% |

|

* For the fund’s most recent fiscal half year; may differ from expense ratios based on one-year data in the financial highlights.

† Putnam is committed to keeping fund expenses below the Lipper peer group average expense ratio and will limit fund expenses if they exceed the Lipper average. The Lipper average is a simple average of front-end load funds in the peer group that excludes 12b-1 fees as well as any expense offset and brokerage service arrangements that may reduce fund expenses. To facilitate the comparison in this presentation, Putnam has adjusted the Lipper average to reflect the 12b-1 fees carried by each class of shares other than class Y shares, which do not incur 12b-1 fees. Investors should note that the other funds in the peer group may be significantly smaller or larger than the fund, and that an asset-weighted average would likely be lower than the simple average. Also, the fund and Lipper report expense data at different times and for different periods. The fund’s expense ratio shown here is annualized data for the most recent six-month period, while the quarte rly updated Lipper average is based on the most recent fiscal year-end data available for the peer group funds as of 9/30/07.

13

Your fund’s portfolio turnover

and Morningstar® Risk

Putnam funds are actively managed by teams of experts who buy and sell securities based on intensive analysis of companies, industries, economies, and markets. Portfolio turnover is a measure of how often a fund’s managers buy and sell securities for your fund. A portfolio turnover of 100%, for example, means that the managers sold and replaced securities valued at 100% of a fund’s average portfolio value within a given period. Funds with high turnover may be more likely to generate capital gains that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance.

Funds that invest in bonds or other fixed-income instruments may have higher turnover than funds that invest only in stocks. Short-term bond funds tend to have higher turnover than longer-term bond funds, because shorter-term bonds will mature or be sold more frequently than longer-term bonds. You can use the table below to compare your fund’s turnover with the average turnover for funds in its Lipper category.

Turnover comparisons

Percentage of holdings that change every year

| | | | | | |

| | | 2007 | 2006 | 2005 | 2004 | 2003 |

|

| Putnam High Yield Advantage Fund | | 48% | 46% | 33% | 53% | 79% |

|

| Lipper High Current Yield Funds category average | | 83% | 83% | 73% | 95% | 98% |

|

Turnover data for the fund is calculated based on the fund’s fiscal-year period, which ends on November 30. Turnover data for the fund’s Lipper category is calculated based on the average of the turnover of each fund in the category for its fiscal year ended during the indicated year. Fiscal years vary across funds in the Lipper category, which may limit the comparability of the fund’s portfolio turnover rate to the Lipper average. Comparative data for 2007 is based on information available as of 11/30/07.

Your fund’s Morningstar® Risk

This risk comparison is designed to help you understand how your fund compares with other funds. The comparison utilizes a risk measure developed by Morningstar, an independent fund-rating agency. This risk measure is referred to as the fund’s Morningstar Risk.

Your fund’s Morningstar Risk is shown alongside that of the average fund in its Morningstar category. The risk bar broadens the comparison by translating the fund’s Morningstar Risk into a percentile, which is based on the fund’s ranking among all funds rated by Morningstar as of December 31, 2007. A higher Morningstar Risk generally indicates that a fund’s monthly returns have varied more widely.

Morningstar determines a fund’s Morningstar Risk by assessing variations in the fund’s monthly returns — with an emphasis on downside variations — over a 3-year period, if available. Those measures are weighted and averaged to produce the fund’s Morningstar Risk. The information shown is provided for the fund’s class A shares only; information for other classes may vary. Morningstar Risk is based on historical data and does not indicate future results. Morningstar does not purport to measure the risk associated with a current investment in a fund, either on an absolute basis or on a relative basis. Low Morningstar Risk does not mean that you cannot lose money on an investment in a fund. Copyright 2007 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Nei ther Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

14

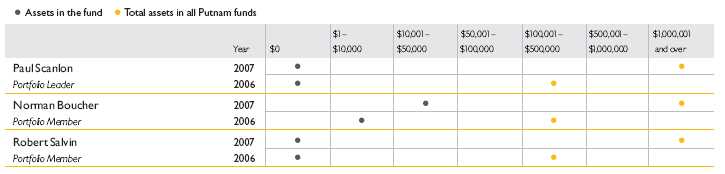

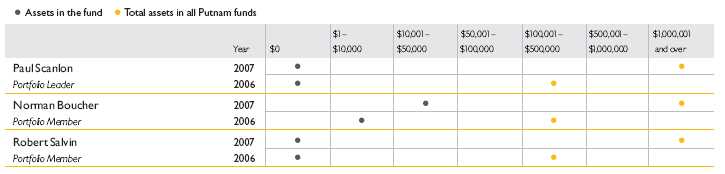

Your fund’s management

Your fund is managed by the members of the Putnam Core Fixed-Income High-Yield Team. Paul Scanlon is the Portfolio Leader. Norman Boucher and Robert Salvin are Portfolio Members of your fund. The Portfolio Leader and Portfolio Members coordinate the team’s management of the fund.

For a complete listing of the members of the Putnam Core Fixed-Income High-Yield Team, including those who are not Portfolio Leaders or Portfolio Members of your fund, visit Putnam’s Individual Investor Web site at www.putnam.com.

Investment team fund ownership

The table below shows how much the fund’s current Portfolio Leader and Portfolio Members have invested in the fund and in all Putnam mutual funds (in dollar ranges). Information shown is as of November 30, 2007, and November 30, 2006.

Trustee and Putnam employee fund ownership

As of November 30, 2007, all of the Trustees of the Putnam funds owned fund shares. The table below shows the approximate value of investments in the fund and all Putnam funds as of that date by the Trustees and Putnam employees. These amounts include investments by the Trustees’ and employees’ immediate family members and investments through retirement and deferred compensation plans.

| | |

| | | Total assets in |

| | Assets in the fund | all Putnam funds |

|

| Trustees | $ 233,000 | $ 92,000,000 |

|

| Putnam employees | $2,071,000 | $770,000,000 |

|

Other Putnam funds managed by the Portfolio Leader and Portfolio Members

Paul Scanlon is also a Portfolio Leader of Putnam Floating Rate Income Fund and Putnam High Yield Trust. He is also a Portfolio Member of Putnam Diversified Income Trust, Putnam Master Intermediate Income Trust, and Putnam Premier Income Trust.

Norman Boucher is also a Portfolio Member of Putnam High Yield Trust.

Robert Salvin is also a Portfolio Leader of Putnam High Income Securities Fund and a Portfolio Member of Putnam Convertible Income-Growth Trust and Putnam High Yield Trust.

Paul Scanlon, Norman Boucher, and Robert Salvin may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Members

Your fund’s Portfolio Leader and Portfolio Members did not change during the year ended November 30, 2007.

15

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class. Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC.

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

JPMorgan Developed High Yield Index is an unmanaged index of high-yield fixed-income securities issued in developed countries.

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Merrill Lynch 91-Day Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

16

Trustee approval

of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract between Putnam Management’s affiliate, Putnam Investments Limited (“PIL”), and Putnam Management. In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2007, the Contract Committee met several times to consider the information provided by Putnam Management and other information develo ped with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. The Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management contract and sub-management contract, effective July 1, 2007. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

In addition, in anticipation of the sale of Putnam Investments to Great-West Lifeco, at a series of meetings ending in March 2007, the Trustees reviewed and approved new management and distribution arrangements to take effect upon the change of control. Shareholders of all funds approved the management contracts in May 2007, and the change of control transaction was completed on August 3, 2007. Upon the change of control, the management contracts that were approved by the Trustees in June 2007 automatically terminated and were replaced by new contracts that had been approved by shareholders. In connection with their review for the June 2007 continuance of the Putnam funds’ management contracts, the Trustees did not identify any facts or circumstances that would alter the substance of the conclusions and recommendations they made in their review of the contracts to take effect upon the change of control.

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That this fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and the assignment of funds to particular fee categories. In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example, changes in a fund’s size or investment style, changes in Putnam Management’s operating costs or responsibilities, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund, which had been carefully developed over the years, re-examined on many occasions and adjusted where appropriate. The Trustees focused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that,

17

in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 69th percentile in management fees and in the 34th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2006 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense information may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distribution (12b-1) fees and other expenses, had been increasing recently as a result of declining net assets and the natural operation of fee breakpoints.

The Trustees noted that the expense ratio increases described above were currently being controlled by expense limitations implemented in January 2004 and which Putnam Management had committed to maintain at least through 2007. In anticipation of the change of control of Putnam Investments, the Trustees requested, and received a commitment from Putnam Management and Great-West Lifeco, to extend this program through at least June 30, 2009. These expense limitations give effect to a commitment by Putnam Management that the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception.

In order to ensure that the expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to extend for the twelve months beginning July 1, 2007, an additional expense limitation for certain funds at an amount equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper to correspond to the size of the fund. This additional expense limitation will be applied to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the custom peer group data for the period ended December 31, 2006. This additional expense limitation will not be applied to your fund because it had a below-average expense ratio relative to its custom peer group.

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of a fund (as a percentage of fund assets) declines as a fund grows in size and crosses specified asset thresholds. Conversely, as a fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedules in effect for the funds represented an appropriate sharing of economies of scale at current asset levels. In reaching this conclusion, the Trustees considered the Contract Committee’s stated intent to con tinue to work with Putnam Management to plan for an eventual resumption in the growth of assets, and to consider the potential economies that might be produced under various growth assumptions.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

Investment performance during the Trustees’ review period

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Process Committee of the Trustees and the Investment Oversight Committees of the Trustees, which had met on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and

18

retain high-quality personnel — but also recognized that this does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and discussed with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. In particular, they noted the important contributions of Putnam Management’s leadership in attracting, retaining and supporting high-quality investment professionals and in systematically implementing an investment process that seeks to merge the best features of fundamental and quantitative analysis. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper High Current Yield Funds) for the one-, three- and five-year periods ended March 31, 2007 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| | |

| One-year period | Three-year period | Five-year period |

|

| 4th | 13th | 19th |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report. Over the one-, three- and five-year periods ended March 31, 2007, there were 445, 382, and 315 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future returns.)

As a general matter, the Trustees concluded that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage to ensure that the principle of seeking “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company (“PFTC”), each of which provides benefits to affiliates of Putnam Management. In the case of the custodian agreement, the Trustees considered that, effective January 1, 2007, the Putnam funds had engaged State Street Bank and Trust Company as custodian and began to transition the responsibility for providing custody services away from PFTC.

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper High Current Yield Funds category for the one-, five- and ten-year periods ended December 31, 2007 were 11%, 15%, and 53%, respectively. Over the one-, five- and ten-year periods ended December 31, 2007, the fund ranked 50 out of 455, 47 out of 334, and 80 out of 151 funds, respectively. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

19

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

20

Other information for shareholders

Putnam’s policy on confidentiality

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ addresses, telephone numbers, Social Security numbers, and the names of their financial representatives. We use this information to assign an account number and to help us maintain accurate records of transactions and account balances. It is our policy to protect the confidentiality of your information, whether or not you currently own shares of our funds, and, in particular, not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use. Under certain circumstances, we share this information with outside vendors who provide services to us, such as mailing and proxy solicitation. In those cases, the service providers enter into confi dentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. We may also share this information with our Putnam affiliates to service your account or provide you with information about other Putnam products or services. It is also our policy to share account information with your financial representative, if you’ve listed one on your Putnam account. If you would like clarification about our confidentiality policies or have any questions or concerns, please don’t hesitate to contact us at 1-800-225-1581, Monday through Friday, 8:30 a.m. to 7:00 p.m., or Saturdays from 9:00 a.m. to 5:00 p.m. Eastern Time.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2007, are available on the Putnam Individual Investor Web site, www.putnam.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

21

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

22

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders of

Putnam High Yield Advantage Fund:

We have audited the accompanying statement of assets and liabilities of Putnam High Yield Advantage Fund, including the fund’s portfolio, as of November 30, 2007, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years or periods in the period then ended. These financial statements and financial highlights are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform our audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2007 by correspondence with the custodian and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Putnam High Yield Advantage Fund as of November 30, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years or periods in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

January 15, 2008

23

The fund’s portfolio 11/30/07

| | | | |

| CORPORATE BONDS AND NOTES (81.5%)* | | |

|

| | | Principal amount | | Value |

|

| Advertising and Marketing | | | | |

| Services (0.3%) | | | | |

| Lamar Media Corp. company | | | | |

| guaranty 7 1/4s, 2013 | $ | 1,450,000 | $ | 1,431,875 |

| Lamar Media Corp. 144A | | | | |

| sr. sub. notes 6 5/8s, 2015 | | 565,000 | | 536,750 |

| | | | | 1,968,625 |

|

| |

| Automotive (4.0%) | | | | |

| Allison Transmission 144A | | | | |

| company guaranty 11s, 2015 | | 405,000 | | 389,813 |

| ArvinMeritor, Inc. sr. unsec. | | | | |

| notes 8 1/8s, 2015 | | 380,000 | | 332,500 |

| Dana Corp. notes 5.85s, 2015 | | 2,135,000 | | 1,601,250 |

| Ford Motor Co. notes | | | | |

| 7.45s, 2031 | | 1,445,000 | | 1,090,975 |

| Ford Motor Credit Corp. | | | | |

| notes 7 7/8s, 2010 | | 3,200,000 | | 2,970,224 |

| Ford Motor Credit Corp. | | | | |

| notes 7.8s, 2012 | | 405,000 | | 360,946 |

| Ford Motor Credit Corp. | | | | |

| notes 7 3/8s, 2009 | | 1,345,000 | | 1,273,445 |

| Ford Motor Credit Corp. | | | | |

| sr. notes 9 7/8s, 2011 | | 5,600,000 | | 5,418,616 |

| Ford Motor Credit Corp. sr. | | | | |

| unsec. 9 3/4s, 2010 | | 1,970,000 | | 1,915,840 |

| Ford Motor Credit Corp. sr. | | | | |

| unsec. FRN 7.993s, 2012 | | 625,000 | | 549,966 |

| General Motors Corp. debs. | | | | |

| 9.4s, 2021 | | 425,000 | | 378,250 |

| General Motors Corp. notes | | | | |

| 7.2s, 2011 | | 7,195,000 | | 6,691,350 |

| Lear Corp. company | | | | |

| guaranty 8 3/4s, 2016 | | 860,000 | | 791,200 |

| Lear Corp. company | | | | |

| guaranty 8 1/2s, 2013 | | 265,000 | | 250,425 |

| Meritor Automotive, Inc. | | | | |

| notes 6.8s, 2009 | | 282,000 | | 277,770 |

| Tenneco Automotive, Inc. | | | | |

| company guaranty 8 5/8s, | | | | |

| 2014 (S) | | 1,810,000 | | 1,803,213 |

| Tenneco Automotive, Inc. sec. | | | | |

| notes Ser. B, 10 1/4s, 2013 | | 205,000 | | 220,888 |

| Tenneco, Inc. 144A sr. unsec. | | | | |

| 8 1/8s, 2015 | | 170,000 | | 169,575 |

| UCI Holdco, Inc. 144A | | | | |

| sr. notes FRN 12.694s, 2013 ‡‡ | | 2,098,001 | | 2,045,551 |

| United Components, Inc. | | | | |

| sr. sub. notes 9 3/8s, 2013 | | 45,000 | | 44,325 |

| | | | | 28,576,122 |

|

| |

| Basic Materials (7.3%) | | | | |

| AK Steel Corp. company | | | | |

| guaranty 7 3/4s, 2012 | | 3,295,000 | | 3,286,763 |

| Aleris International, Inc. | | | | |

| company guaranty 10s, 2016 | | 1,660,000 | | 1,394,400 |

| Aleris International, Inc. | | | | |

| company guaranty 9s, 2014 ‡‡ | | 1,620,000 | | 1,393,200 |

| | | | |

| CORPORATE BONDS AND NOTES (81.5%)* continued | | |

|

| | Principal amount | | Value |

|

| Basic Materials continued | | | | |

| Algoma Acquisition Corp. 144A | | | | |

| unsec. notes 9 7/8s, | | | | |

| 2015 (Canada) | $ | 675,000 | $ | 540,000 |

| Builders FirstSource, Inc. company | | | | |

| guaranty FRN 9.119s, 2012 | | 1,675,000 | | 1,474,000 |

| Century Aluminum Co. company | | | | |

| guaranty 7 1/2s, 2014 | | 1,135,000 | | 1,113,719 |

| Clondalkin Acquisition BV 144A | | | | |

| sec. FRN 7.694s, | | | | |

| 2013 (Netherlands) | | 1,165,000 | | 1,121,313 |

| Domtar Corp. company | | | | |

| guaranty 7 7/8s, 2011 (Canada) | | 580,000 | | 590,150 |

| Freeport-McMoRan Copper & | | | | |

| Gold, Inc. sr. unsec. | | | | |

| bonds 8 3/8s, 2017 | | 4,070,000 | | 4,405,775 |

| Freeport-McMoRan Copper & | | | | |

| Gold, Inc. sr. unsec. FRN | | | | |

| 8.394s, 2015 | | 715,000 | | 729,300 |

| Freeport-McMoRan Copper & | | | | |

| Gold, Inc. sr. unsec. | | | | |

| notes 8 1/4s, 2015 | | 2,030,000 | | 2,169,563 |

| Georgia-Pacific Corp. | | | | |

| debs. 9 1/2s, 2011 | | 1,435,000 | | 1,485,225 |

| Georgia-Pacific Corp. | | | | |

| 144A company | | | | |

| guaranty 7 1/8s, 2017 | | 140,000 | | 134,050 |

| Gerdau Ameristeel Corp. | | | | |

| sr. notes 10 3/8s, 2011 (Canada) | | 1,922,000 | | 2,008,490 |

| Hercules, Inc. company | | | | |

| guaranty 6 3/4s, 2029 | | 1,630,000 | | 1,568,875 |

| Hexion U.S. Finance | | | | |

| Corp./Hexion | | | | |

| Nova Scotia Finance, | | | | |

| ULC company guaranty | | | | |

| 9 3/4s, 2014 | | 2,270,000 | | 2,440,250 |

| Huntsman, LLC company | | | | |

| guaranty 11 5/8s, 2010 | | 3,000 | | 3,180 |

| Jefferson Smurfit Corp. company | | | | |

| guaranty 8 1/4s, 2012 | | 540,000 | | 534,600 |

| Lyondell Chemical Co. company | | | | |

| guaranty 8 1/4s, 2016 | | 3,575,000 | | 4,191,688 |

| Lyondell Chemical Co. company | | | | |

| guaranty 8s, 2014 | | 1,505,000 | | 1,704,413 |

| Lyondell Chemical Co. company | | | | |

| guaranty 6 7/8s, 2017 | | 60,000 | | 68,100 |

| MacDermid, Inc. 144A | | | | |

| sr. sub. notes 9 1/2s, 2017 | | 870,000 | | 789,525 |

| Metals USA, Inc. sec. | | | | |

| notes 11 1/8s, 2015 | | 1,085,000 | | 1,122,975 |

| Momentive Performance | | | | |

| Materials, Inc. 144A | | | | |

| sr. notes 9 3/4s, 2014 | | 3,805,000 | | 3,529,138 |

| Mosaic Co. (The) 144A | | | | |

| sr. notes 7 5/8s, 2016 | | 1,115,000 | | 1,193,050 |

| Mosaic Co. (The) 144A | | | | |

| sr. notes 7 3/8s, 2014 | | 670,000 | | 706,850 |

24

| | | | | |

| CORPORATE BONDS AND NOTES (81.5%)* continued | | |

| |

| | | Principal amount | | Value |

|

| Basic Materials continued | | | | | |

| NewPage Corp. company | | | | | |

| guaranty 10s, 2012 | | $ | 840,000 | $ | 856,800 |

| NewPage Holding Corp. | | | | | |

| sr. notes FRN 11.818s, 2013 ‡‡ | | 534,266 | | 512,895 |

| Norske Skog Canada, Ltd. | | | | | |

| company guaranty Ser. D, 8 5/8s, | | | | |

| 2011 (Canada) | | | 735,000 | | 610,050 |

| Novelis, Inc. company | | | | | |

| guaranty 7 1/4s, 2015 | | | 2,520,000 | | 2,349,900 |

| Rockwood Specialties | | | | | |

| Group, Inc. company | | | | | |

| guaranty 7 5/8s, 2014 | EUR | | 965,000 | | 1,386,857 |

| Smurfit-Stone Container | | | | | |

| Enterprises, Inc. sr. unsec. | | | | | |

| 8s, 2017 | | $ | 1,240,000 | | 1,190,400 |

| Steel Dynamics, Inc. 144A | | | | | |

| sr. notes 7 3/8s, 2012 | | | 50,000 | | 49,625 |

| Steel Dynamics, Inc. 144A | | | | | |

| sr. notes 6 3/4s, 2015 | | | 2,900,000 | | 2,769,500 |

| Stone Container Finance | | | | | |

| company guaranty 7 3/8s, | | | | | |

| 2014 (Canada) | | | 415,000 | | 385,950 |

| Tube City IMS Corp. company | | | | |

| guaranty 9 3/4s, 2015 | | | 1,530,000 | | 1,453,500 |

| Ucar Finance, Inc. company | | | | | |

| guaranty 10 1/4s, 2012 | | | 102,000 | | 105,060 |

| Verso Paper Holdings, | | | | | |

| LLC/ Verso Paper, Inc. company | | | | |

| guaranty 11 3/8s, 2016 | | | 685,000 | | 695,275 |

| | | | | | 52,064,404 |

|

| |

| Broadcasting (2.3%) | | | | | |

| DirecTV Holdings, LLC company | | | | |

| guaranty 6 3/8s, 2015 | | | 3,180,000 | | 3,076,650 |

| Echostar DBS Corp. company | | | | |

| guaranty 7 1/8s, 2016 | | | 125,000 | | 130,156 |

| Echostar DBS Corp. company | | | | |

| guaranty 7s, 2013 | | | 1,495,000 | | 1,547,325 |

| Echostar DBS Corp. company | | | | |

| guaranty 6 5/8s, 2014 | | | 270,000 | | 273,375 |

| Echostar DBS Corp. | | | | | |

| sr. notes 6 3/8s, 2011 | | | 4,585,000 | | 4,653,775 |

| Ion Media Networks, Inc. 144A | | | | |

| sr. sec. notes 11.493s, 2013 | | | 995,000 | | 987,538 |

| Ion Media Networks, Inc. 144A | | | | |

| sr. sec. notes 8.493s, 2012 | | | 1,175,000 | | 1,154,438 |

| Sinclair Broadcast Group, Inc. | | | | |

| company guaranty 8s, 2012 | | | 60,000 | | 61,200 |

| Sirius Satellite Radio, Inc. | | | | | |

| sr. unsec. notes 9 5/8s, 2013 | | 2,060,000 | | 1,993,050 |

| Univision Communications, Inc. | | | | |

| 144A sr. notes 9 3/4s, 2015 ‡‡ | | 1,080,000 | | 1,004,400 |

| Young Broadcasting, Inc. | | | | | |

| company guaranty 10s, 2011 | | 1,142,000 | | 913,600 |

| Young Broadcasting, Inc. | | | | | |

| sr. sub. notes 8 3/4s, 2014 | | | 395,000 | | 290,325 |

| | | | | | 16,085,832 |

|

| | | | |