UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM N-CSR |

INVESTMENT COMPANIES

Investment Company Act file number: 811-4603

Thrivent Series Fund, Inc.

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

| James M. Odland, Secretary 625 Fourth Avenue South Minneapolis, Minnesota 55415 (Name and address of agent for service) |

Registrant's telephone number, including area code: (612) 340-7215

Date of fiscal year end: December 31

Date of reporting period: December 31, 2005

| Item 1. Report to Stockholders |

Table of Contents

| President’s Letter | 1 |

| Economic and Market Overview | 2 |

| Portfolio Perspectives | |

| Thrivent Aggressive Allocation Portfolio | 4 |

| Thrivent Moderately Aggressive Allocation Portfolio | 6 |

| Thrivent Moderate Allocation Portfolio | 8 |

| Thrivent Moderately Conservative Allocation Portfolio | 10 |

| Thrivent Technology Portfolio | 12 |

| Thrivent Partner Small Cap Growth Portfolio | 14 |

| Thrivent Partner Small Cap Value Portfolio | 16 |

| Thrivent Small Cap Stock Portfolio | 18 |

| Thrivent Small Cap Index Portfolio | 20 |

| Thrivent Mid Cap Growth Portfolio | 22 |

| Thrivent Mid Cap Growth Portfolio II | 24 |

| Thrivent Partner Mid Cap Value Portfolio | 26 |

| Thrivent Mid Cap Stock Portfolio | 28 |

| Thrivent Mid Cap Index Portfolio | 30 |

| Thrivent Partner International Stock Portfolio | 32 |

| Thrivent Partner All Cap Portfolio | 34 |

| Thrivent Large Cap Growth Portfolio | 36 |

| Thrivent Large Cap Growth Portfolio II | 38 |

| Thrivent Partner Growth Stock Portfolio | 40 |

| Thrivent Large Cap Value Portfolio | 42 |

| Thrivent Large Cap Stock Portfolio | 44 |

| Thrivent Large Cap Index Portfolio | 46 |

| Thrivent Real Estate Securities Portfolio | 48 |

| Thrivent Balanced Portfolio | 50 |

| Thrivent High Yield Portfolio | 52 |

| Thrivent High Yield Portfolio II | 54 |

| Thrivent Income Portfolio | 56 |

| Thrivent Bond Index Portfolio | 58 |

| Thrivent Limited Maturity Bond Portfolio | 60 |

| Thrivent Mortgage Securities Portfolio | 62 |

| Thrivent Money Market Portfolio | 64 |

| Shareholder Expense Example | 66 |

| Report of Independent Registered Public | |

| Accounting Firm | 69 |

| Schedules of Investments | |

| Thrivent Aggressive Allocation Portfolio | 70 |

| Thrivent Moderately Aggressive Allocation Portfolio | 71 |

| Thrivent Moderate Allocation Portfolio | 72 |

| Thrivent Moderately Conservative Allocation Portfolio | 73 |

| Thrivent Technology Portfolio | 74 |

| Thrivent Partner Small Cap Growth Portfolio | 77 |

| Thrivent Partner Small Cap Value Portfolio | 82 |

| Thrivent Small Cap Stock Portfolio | 84 |

| Thrivent Small Cap Index Portfolio | 88 |

| Thrivent Mid Cap Growth Portfolio | 97 |

| Thrivent Mid Cap Growth Portfolio II | 103 |

| Thrivent Partner Mid Cap Value Portfolio | 108 |

| Thrivent Mid Cap Stock Portfolio | 110 |

| Thrivent Mid Cap Index Portfolio | 114 |

| Thrivent Partner International Stock Portfolio | 120 |

| Thrivent Partner All Cap Portfolio | 124 |

| Thrivent Large Cap Growth Portfolio | 127 |

| Thrivent Large Cap Growth Portfolio II | 131 |

| Thrivent Partner Growth Stock Portfolio | 135 |

| Thrivent Large Cap Value Portfolio | 138 |

| Thrivent Large Cap Stock Portfolio | 141 |

| Thrivent Large Cap Index Portfolio | 145 |

| Thrivent Real Estate Securities Portfolio | 152 |

| Thrivent Balanced Portfolio | 155 |

| Thrivent High Yield Portfolio | 175 |

| Thrivent High Yield Portfolio II | 183 |

| Thrivent Income Portfolio | 191 |

| Thrivent Bond Index Portfolio | 198 |

| Thrivent Limited Maturity Bond Portfolio | 210 |

| Thrivent Mortgage Securities Portfolio | 217 |

| Thrivent Money Market Portfolio | 220 |

| Statement of Assets and Liabilities | 226 |

| Statement of Operations | 232 |

| Statement of Changes in Net Assets | 238 |

| Notes to Financial Statements | 244 |

| Financial Highlights | |

| Thrivent Aggressive Allocation Portfolio | 264 |

| Thrivent Moderately Aggressive Allocation Portfolio | 264 |

| Thrivent Moderate Allocation Portfolio | 264 |

| Thrivent Moderately Conservative Allocation Portfolio | 264 |

| Thrivent Technology Portfolio | 264 |

| Thrivent Partner Small Cap Growth Portfolio | 264 |

| Thrivent Partner Small Cap Value Portfolio | 264 |

| Thrivent Small Cap Stock Portfolio | 264 |

| Thrivent Small Cap Index Portfolio | 264 |

| Thrivent Mid Cap Growth Portfolio | 266 |

| Thrivent Mid Cap Growth Portfolio II | 266 |

| Thrivent Partner Mid Cap Value Portfolio | 266 |

| Thrivent Mid Cap Stock Portfolio | 266 |

| Thrivent Mid Cap Index Portfolio | 266 |

| Thrivent Partner International Stock Portfolio | 266 |

| Thrivent Partner All Cap Portfolio | 266 |

| Thrivent Large Cap Growth Portfolio | 268 |

| Thrivent Large Cap Growth Portfolio II | 268 |

| Thrivent Partner Growth Stock Portfolio | 268 |

| Thrivent Large Cap Value Portfolio | 268 |

| Thrivent Large Cap Stock Portfolio | 268 |

| Thrivent Large Cap Index Portfolio | 268 |

| Thrivent Real Estate Securities Portfolio | 268 |

| Thrivent Balanced Portfolio | 268 |

| Thrivent High Yield Portfolio | 270 |

| Thrivent High Yield Portfolio II | 270 |

| Thrivent Income Portfolio | 270 |

| Thrivent Bond Index Portfolio | 270 |

| Thrivent Limited Maturity Bond Portfolio | 270 |

| Thrivent Mortgage Securities Portfolio | 270 |

| Thrivent Money Market Portfolio | 270 |

| Additional Information | 272 |

| Board of Directors and Officers | 275 |

| Supplements to the Prospectus | 279 |

Dear Member:

We are pleased to provide you with the Thrivent Series Fund, Inc. annual report for the 12-month period ended Dec. 31, 2005. In this report, you will find detailed information about each investment portfolio in the Thrivent Series Fund, including summaries prepared by each portfolio manager on his or her performance and management strategies for the applicable portfolio and period. In addition, Russell Swansen, Thrivent Financial’s chief investment officer, summarizes the overall market and economic environment over the past year.

In previous letters, I have often highlighted integrity and commitment to you, our member, as a common thread running through our organization--from our customer service areas to our portfolio managers. On the investment management side, we seek to align our investment discipline with our investors’ best interests by striving for consistent, long-term performance, taking risk management seriously in our pursuit of potential market rewards and adhering to a consistent approach that supports sound asset allocation. These various facets of investing are signatures of a more sophisticated, institutional-quality asset management philosophy, and I am delighted to say that since we implemented these strategies and new approach, our investment performance results have shown marked improvement.

Strong Investment Performance

Follows New Approach

Just over two years ago, Thrivent Financial for Lutherans welcomed our new chief investment officer, Russ Swansen, to the organization. Russ and his team implemented an institutional money management approach throughout 2004 and 2005 which has provided our members with strong results. For example, 80% of our internally-managed portfolios bettered their respective Lipper, Inc. peer group medians for the one-year period ended Dec. 31, 2005. That is a high outperformance percentage when one takes into account that many firms consider anything above 60% to be strong results. Even more importantly, our products’ three-year track records have greatly improved, with more than 60% of our internally-managed products outpacing their respective Lipper, Inc. medians. Given 15% of our internally-managed products outperformed over the five-year period and 33% outperformed over the 10-year period, the improvement is even more impressive.

A Smart and Simple Strategy

If you like the idea of strong investment performance, built on a foundation of trust, with your interests placed first, but find investing time consuming and complex, you should consider our new suite of four asset allocation portfolios designed to provide a simple one-step investment solution. An attractive combination of professional, institutional-quality money management, lower-than-average fees and guidance from a financial professional who lives in your community have made these products very popular with investors after less than one year. We’re excited to offer what we call A Simple Choice for Smart Investing! Talk with your Thrivent registered representative for more information.

Our Ongoing Commitment to You

As a member-owned organization, Thrivent Financial for Lutherans is uniquely designed and positioned to serve the financial and fraternal needs of one entity--you, our valued member. Many of you have one thing foremost on your minds at this point in your life--retirement. Our investment management philosophy is squarely focused on sound asset allocation strategies, striving for strong investment performance and meaningful advice that can provide a clear roadmap to the retirement of your dreams. Whether saving for that retirement, sharing your success with your church or community, or leaving a legacy to the next generation, we stand ready to assist you each step of the way.

I want to personally wish you the best in 2006. Thank you for continuing to turn to us for your financial solutions. We very much value your business.

| Sincerely, |

| Pamela J. Moret Director and President Thrivent Series Fund, Inc. |

1

| Russell W. Swansen | December 31, 2005 |

| Senior Vice President and | |

| Chief Investment Officer |

Economic and Market Review

Stocks and bonds generally provided positive returns during the one-year period ended Dec. 31, 2005, despite skyrocketing energy prices, devastating hurricanes, and rising interest rates. U.S. and foreign stocks benefited from solid economic growth and rising corporate profits. Despite repeated interest rate hikes by the Federal Reserve (the Fed), bonds generally managed modest positive returns.

U.S. Economy

Gross domestic product growth slowed from a 3.8% annual pace in the first quarter to 3.3% in the second quarter, then accelerated to 4.1% in the third quarter--surprising many economists who expected a slowdown due to the Gulf Coast storms. Preliminary data for the fourth quarter indicate a growth rate of 1.1% in the period, a marked deceleration from prior quarters and perhaps reflecting some of the lagging effects of storms and rising energy prices of the third quarter.

The labor market improved as the unemployment rate declined to 4.9% over the period, and the housing market generally enjoyed robust sales activity and rising prices. Sales of new and existing homes began moderating during the fourth quarter, however.

Inflation & Monetary Policy

Inflation accelerated slightly during the period, due mainly to rising energy prices. The Consumer Price Index rose at a 3.4% annual rate during 2005, compared with an increase of 3.3% in 2004. “Core” inflation--which excludes prices of food and energy--rose at a more modest 2.2% during 2005, the same as the previous year.

While core inflation remained relatively tame during the period, the Federal Reserve continued its program of increasing short-term interest rates, indicating that prior levels of interest rates were too low given the robust growth in the economy. On Dec. 13, the Fed raised its target for the federal funds rate by a quarter point to 4.25%, the 13th consecutive increase since June 2004.

With its December rate increase the Fed omitted the word “accommodative” used previously in describing its monetary policy, which may mean that it now sees rates at a neutral level--neither accommodative nor restrictive. But it also indicated that “some further measured policy firming is likely to be needed.”

In another change at the Fed, President Bush nominated former Princeton University economist Ben Bernanke to succeed Alan Greenspan as chairman of the Federal Reserve Board. The financial markets’ reaction to the choice of Bernanke, who is widely respected by economists and investors, was positive.

Equity Performance

Stocks were buffeted by the mixed circumstances of a period of fundamentally sound economic and profit growth counterbalanced by a surge in commodity prices and the stirring of inflation risks. A resurgence in oil prices early in the new year turned stock prices downward until the end of April. Strong corporate profits and confidence that the Fed would succeed against inflation inspired a summer-long rally that, surprisingly, continued even after Hurricane Katrina. As fall began, investors refocused on worries about higher infla-tion and interest rates and a slowdown in corporate profits. But a surge in November--fueled by higher consumer spending, incomes, and corporate profits--lifted several indexes to their highs for the year.

Large-cap stocks modestly outperformed small-cap issues during the period. The S&P 500 Index of large-cap stocks posted a 4.92% total return, while the Russell 2000 Index of small-cap stocks recorded a 4.64% return. Investors generally also favored value stocks over growth stocks during the period, with the Russell 1000 Value Index returning 7.05% while the Russell 1000 Growth Index registered a 5.26% total return.

Sectors that performed best during the period included energy, utilities, and health care, while telecommunications services, consumer discretionary, and industrials did worst. Although energy and utilities stocks lost ground in the fourth quarter, they still were the top performers by far for the entire year.

Foreign stocks generally outperformed domestic issues, measured in both local currency and dollar returns. The Morgan Stanley Capital International Europe, Australasia, and the Far East (EAFE) Index posted a 14.02% total return during the period.

2

Fixed Income Performance

With the headwind of ongoing hikes in short-term benchmark rates by the Fed, most bond sectors offered modest total returns during the period. Yields on short-term securities rose more than yields on intermediate- and longer-term bonds, continuing the “flattening” of the yield curve that began in early 2004.

In late December, the yield curve “inverted” slightly, with some intermediate-term Treasury securities yielding less than shorter-term Treasuries. This rarely occurs, since investors usually require higher yields for assuming the risk of higher inflation in future years.

The Lehman Brothers Aggregate Bond Index of the broad U.S. bond market posted a 2.43% total return for the 12 months ended Dec. 31, 2005. During the period, the credit ratings of General Motors and Ford, which are two of the largest corporate bond issuers, were downgraded to below investment grade. Municipal bonds fared better than other types of securities in this environment, with the Lehman Brothers Municipal Bond Index posting a total return of 3.51% during the period.

Although high yield bonds were hurt by an investor flight to quality earlier in the period, the sector modestly outperformed many other bonds sectors for the entire 12 months. The Lehman U.S. High Yield Bond Index registered a 2.74% total return.

Outlook

We believe the U.S. economy will grow at a somewhat slower pace over the next year. In 2005, a combination of relatively low interest rates and strong housing prices prompted aggressive borrowing by consumers as they were able to leverage housing capital to supplement current incomes and spending. This is unlikely to be repeated in 2006.

We think oil prices have likely peaked in the near term and will stabilize or even decline somewhat during 2006. Inflation will likely moderate with prices rising around 2% to 3% on a core basis, excluding volatile food and energy prices. Nevertheless, this will encourage the Fed to continue its policy of measured interest rate hikes.

Our outlook for U.S. stocks is moderately positive. We are mindful, however, that equity valuations remain higher than historical averages, and we expect that price volatility will continue as investors sort through positive and negative economic news. Bond returns will feel the drag of rising interest rates until the Fed has completed its tightening campaign. Investors will remain sensitive to signs of rising inflation or a slowing economy.

As always, your best strategy is to work with your Thrivent Investment Management registered representative to create an investment plan based on your goals, diversify your portfolio, and remain focused on the long term.

3

Thrivent Aggressive

Allocation Portfolio

Russell W. Swansen (left), David C. Francis (right) and Mark L. Simenstad (far right), Portfolio Co-Managers

Thrivent Aggressive Allocation Portfolio seeks long-term capital growth by implementing an asset allocation strategy.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return given its significant allocation to equity securities. Therefore a principal risk of investing in the Portfolio is that the allocation strategies used, and the allocation decisions made will not produce the desired results. In addition, the performance of the Portfolio is heavily dependent upon the performance of the underlying portfolios in which the Portfolio invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying portfolios. Those risks include, but are not limited to, market risk, issuer risk, volatility risk, liquidity risk, investment advisor risk, loss of principal risk, as well as credit risk and interest rate risk. These and other risks are described in the Portfolio’s prospectus.

How did the Portfolio perform for the period from April 29 through Dec. 31, 2005?

Thrivent Aggressive Allocation Portfolio produced a 14.45% return from its inception date, April 29, 2005, through Dec. 31, 2005. For the same period, the Portfolio’s market benchmarks, the S&P 500 Index and the Lehman Brothers Aggregate Bond Index, returned 9.29% and 1.55%, respectively.

What market conditions were present during the period?

During the period, all major equity markets provided robust returns, while fixed-income markets generally achieved more modest, but positive total returns.

Stocks

Generally speaking, investment style was not a significant factor during the period, with value and growth stocks achieving similar returns. Company size, however, did make a meaningful difference in returns. Stocks of small- and mid-capitalization companies posted percentage returns in the mid- to high-teens, while large-capitalization companies centered more around high-single-digit results.

Foreign stocks, as measured by the MSCI EAFE Index, also provided returns in the high teens on a U.S. dollar basis and significantly higher on a local currency basis. Dollar returns were reduced by a strengthening of the U.S. dollar against both the euro and the yen in 2005. Emerging markets companies provided returns in the mid- to high-20s and higher, driven especially by rising commodities prices.

Bonds

Fixed-income returns for the period depended on maturity length and sector selection. For the overall market, as measured by the Lehman Brothers Aggregate Bond Index, modest price declines caused by rising interest rates were offset by modest coupon income, providing total returns of about 1.5% . However, longer-maturity bonds (10 years and greater) had much better returns than shorter-maturity bonds -- as yields on long Treasury bonds moved up only 0.15%, while yields on two-year notes moved up almost 0.70% . High yield, corporate and asset-backed securities provided modestly better returns due to their higher yields.

What factors affected the Portfolio’s performance?

Our investment strategy during the period was to overweight equities, resulting in above-target allocations to foreign and domestic asset classes or categories within the Portfolio. We believed the equity bull market that had begun in the latter half of 2002 was still under way and that economic growth remained strong enough to support an overexposure to equities.

| Top 10 Holdings | |

| (% of Portfolio) | |

| Thrivent Partner International | |

| Stock Portfolio | 25.9% |

| Thrivent Large Cap Growth Portfolio | 15.8% |

| Thrivent Large Cap Value Portfolio | 11.9% |

| Thrivent Large Cap Stock Portfolio | 11.8% |

| Thrivent Mid Cap Stock Portfolio | 6.0% |

| Thrivent Small Cap Stock Portfolio | 4.9% |

| Thrivent Mid Cap Growth Portfolio | 4.0% |

| Thrivent Real Estate Securities Portfolio | 4.0% |

| Thrivent Partner Small Cap Growth Portfolio | 4.0% |

| Thrivent Partner Mid Cap Value Portfolio | 3.9% |

| These common stocks represent 92.2% of the total | |

| investment portfolio. | |

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

4

In particular, we had a meaningful overweight in foreign equities and reasonable exposure to small- and mid-capitalization stocks, categories that provided significantly higher returns than large-cap stocks as measured by the S&P 500 Index. Consequently, we generally underweighted fixed-income investments. Fixed-income asset categories did not achieve returns as high as equity asset classes, and thus our results were better than if we had stayed with the target allocations for the Portfolio.

What is your outlook?

At the end of 2005 we began reducing our exposure to the more risky equity asset classes and repositioning funds to select fixed-income categories. We expect total returns in these fixed-income categories -- particularly high-yield bonds -- to be reasonably competitive with returns from equities.

With the Federal Reserve now in the final stages of its campaign to raise short-term interest rates, it appears that bonds now seem more reasonably valued, especially in short- to intermediate maturities. Thus we have reduced our exposure to equities. We have not made this adjustment because we expect a significant decline in equity prices, but rather a less robust outlook on equities advances versus other asset choices.

| Portfolio Facts | |||

| as of December 31, 2005 | |||

| Net Assets | $71,803,919 | NAV | $11.44 |

| NAV -- High† | 12/23/2005 -- $11.58 | ||

| NAV -- Low† | 4/29/2005 -- $10.00 | ||

| Number of Holdings: 13 | † For the period ended December 31, 2005 | ||

Average Annual Total Returns1

as of December 31, 2005

From

Inception

4/29/2005

--------------------------------------------------------------------------------------------------

14.45%

* The S&P 500 Index is an index that represents the average performance of a group of 500 large-capitalization stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

** The Lehman Brothers Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

*** The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index.

Past performance is not an indication of future results. Total investment return and principal value will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Market volatility can significantly affect short-term performance, and more recent returns may be different from those shown. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end.

1 Annualized total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser reimbursed and/or paid non-advisory Portfolio expenses. Had the adviser not done so, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented.

Investing in a variable product involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. Please read your prospectus carefully.

5

Thrivent Moderately

Aggressive Allocation

Portfolio

Russell W. Swansen (left), David C. Francis (right) and Mark L. Simenstad (far right), Portfolio Co-Managers

Thrivent Aggressive Allocation Portfolio seeks long-term capital growth by implementing an asset allocation strategy.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return given its significant allocation to equity securities. Therefore a principal risk of investing in the Portfolio is that the allocation strategies used, and the allocation decisions made will not produce the desired results. In addition, the performance of the Portfolio is heavily dependent upon the performance of the underlying portfolios in which the Portfolio invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying portfolios. Those risks include, but are not limited to, market risk, issuer risk, volatility risk, liquidity risk, investment advisor risk, loss of principal risk, as well as credit risk and interest rate risk. These and other risks are described in the Portfolio’s prospectus.

How did the Portfolio perform for the period from April 29 through Dec. 31, 2005?

Thrivent Moderately Aggressive Allocation Portfolio produced a 12.12% return from its inception date, April 29, 2005, through Dec. 31, 2005. For the same period, the Portfolio’s market benchmarks, the S&P 500 Index and the Lehman Brothers Aggregate Bond Index, returned 9.29% and 1.55%, respectively.

What market conditions were present during the period?

During the period, all major equity markets provided robust returns, while fixed-income markets generally achieved more modest, but positive total returns.

Stocks

Generally speaking, investment style was not a significant factor during the period, with value and growth stocks achieving similar returns. Company size, however, did make a meaningful difference in returns. Stocks of small- and mid-capitalization companies posted percentage returns in the mid- to high-teens, while large-capitalization companies centered more around high-single-digit results.

Foreign stocks, as measured by the MSCI EAFE Index, also provided returns in the high teens on a U.S. dollar basis and significantly higher on a local currency basis. Dollar returns were reduced by a strengthening of the U.S. dollar against both the euro and the yen in 2005. Emerging markets companies provided returns in the mid- to high-20s and higher, driven especially by rising commodities prices.

Bonds

Fixed-income returns for the period depended on maturity length and sector selection. For the overall market, as measured by the Lehman Brothers Aggregate Bond Index, modest price declines caused by rising interest rates were offset by modest coupon income, providing total returns of about 1.5% . However, longer-maturity bonds (10 years and greater) had much better returns than shorter-maturity bonds -- as yields on long Treasury bonds moved up only 0.15%, while yields on two-year notes moved up almost 0.70% . High yield, corporate and asset-backed securities provided modestly better returns due to their higher yields.

What factors affected the Portfolio’s performance?

Our investment strategy during the period was to overweight equities, resulting in above-target allocations to foreign and domestic asset classes or categories within the Portfolio. We believed the equity bull market that had begun in the latter half of 2002 was still under way and that economic growth remained strong enough to support an overexposure to equities.

| Top 10 Holdings | |

| (% of Portfolio) | |

| Thrivent Partner International | |

| Stock Portfolio | 23.9% |

| Thrivent Large Cap Growth Portfolio | 13.9% |

| Thrivent Large Cap Value Portfolio | 10.9% |

| Thrivent Large Cap Stock Portfolio | 10.9% |

| Thrivent Limited Maturity Bond Portfolio | 9.7% |

| Thrivent Income Portfolio | 4.9% |

| Thrivent Mid Cap Stock Portfolio | 4.0% |

| Thrivent Real Estate Securities Portfolio | 4.0% |

| Thrivent Mid Cap Growth Portfolio | 3.0% |

| Thrivent Partner Small Cap Growth Portfolio | 3.0% |

| These common stocks represent 88.2% of the total | |

| investment portfolio. | |

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

6

In particular, we had a meaningful overweight in foreign equities and reasonable exposure to small- and mid-capitalization stocks, categories that provided significantly higher returns than large-cap stocks as measured by the S&P 500 Index. Consequently, we generally underweighted fixed-income investments. Fixed-income asset categories did not achieve returns as high as equity asset classes, and thus our results were better than if we had stayed with the target allocations for the Portfolio.

What is your outlook?

At the end of 2005 we began reducing our exposure to the more risky equity asset classes and repositioning funds to select fixed-income categories. We expect total returns in these fixed-income categories -- particularly high-yield bonds -- to be reasonably competitive with returns from equities.

With the Federal Reserve now in the final stages of its campaign to raise short-term interest rates, it appears that bonds now seem more reasonably valued, especially in short- to intermediate maturities. Thus we have reduced our exposure to equities. We have not made this adjustment because we expect a significant decline in equity prices, but rather a less robust outlook on equities advances versus other asset choices.

| Portfolio Facts | |||

| as of December 31, 2005 | |||

| Net Assets | $238,095,482 | NAV | $11.19 |

| NAV -- High† | 12/23/2005 -- $11.32 | ||

| NAV -- Low† | 4/29/2005 -- $10.00 | ||

| Number of Holdings: 14 | † For the period ended December 31, 2005 | ||

| Average Annual Total Returns1 as of December 31, 2005 From Inception 4/29/2005 -------------------------------------------------------------------------------------------------- 12.12% |

* The S&P 500 Index is an index that represents the average performance of a group of 500 large-capitalization stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

** The Lehman Brothers Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

*** The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index.

Past performance is not an indication of future results. Total investment return and principal value will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Market volatility can significantly affect short-term performance, and more recent returns may be different from those shown. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end.

1 Annualized total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser reimbursed and/or paid non-advisory Portfolio expenses. Had the adviser not done so, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented.

Investing in a variable product involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. Please read your prospectus carefully.

7

| Thrivent Moderate Allocation Portfolio |

Russell W. Swansen (left), David C. Francis (right) and Mark L. Simenstad (far right), Portfolio Co-Managers

Thrivent Aggressive Allocation Portfolio seeks long-term capital growth by implementing an asset allocation strategy.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return given its significant allocation to equity securities. Therefore a principal risk of investing in the Portfolio is that the allocation strategies used, and the allocation decisions made will not produce the desired results. In addition, the performance of the Portfolio is heavily dependent upon the performance of the underlying portfolios in which the Portfolio invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying portfolios. Those risks include, but are not limited to, market risk, issuer risk, volatility risk, liquidity risk, investment advisor risk, loss of principal risk, as well as credit risk and interest rate risk. These and other risks are described in the Portfolio’s prospectus.

How did the Portfolio perform for the period from April 29 through Dec. 31, 2005?

Thrivent Moderate Allocation Portfolio produced a 9.98% return from its inception date, April 29, 2005, through Dec. 31, 2005. For the same period, the Portfolio’s market benchmarks, the S&P 500 Index and the Lehman Brothers Aggregate Bond Index, returned 9.29% and 1.55%, respectively.

What market conditions were present during the period?

During the period, all major equity markets provided robust returns, while fixed-income markets generally achieved more modest, but positive total returns.

Stocks

Generally speaking, investment style was not a significant factor during the period, with value and growth stocks achieving similar returns. Company size, however, did make a meaningful difference in returns. Stocks of small- and mid-capitalization companies posted percentage returns in the mid- to high-teens, while large-capitalization companies centered more around high-single-digit results.

Foreign stocks, as measured by the MSCI EAFE Index, also provided returns in the high teens on a U.S. dollar basis and significantly higher on a local currency basis. Dollar returns were reduced by a strengthening of the U.S. dollar against both the euro and the yen in 2005. Emerging markets companies provided returns in the mid- to high-20s and higher, driven especially by rising commodities prices.

Bonds

Fixed-income returns for the period depended on maturity length and sector selection. For the overall market, as measured by the Lehman Brothers Aggregate Bond Index, modest price declines caused by rising interest rates were offset by modest coupon income, providing total returns of about 1.5% . However, longer-maturity bonds (10 years and greater) had much better returns than shorter-maturity bonds -- as yields on long Treasury bonds moved up only 0.15%, while yields on two-year notes moved up almost 0.70% . High yield, corporate and asset-backed securities provided modestly better returns due to their higher yields.

What factors affected the Portfolio’s performance?

Our investment strategy during the period was to overweight equities, resulting in above-target allocations to foreign and domestic asset classes or categories within the Portfolio. We believed the equity bull market that had begun in the latter half of 2002 was still under way and that economic growth remained strong enough to support an overexposure to equities.

| Top 10 Holdings | |

| (% of Portfolio) | |

| Thrivent Partner International | |

| Stock Portfolio | 18.8% |

| Thrivent Limited Maturity Bond Portfolio | 14.6% |

| Thrivent Large Cap Growth Portfolio | 13.0% |

| Thrivent Large Cap Stock Portfolio | 10.9% |

| Thrivent Large Cap Value Portfolio | 10.0% |

| Thrivent Mid Cap Stock Portfolio | 7.1% |

| Thrivent Small Cap Stock Portfolio | 5.9% |

| Thrivent Income Portfolio | 5.9% |

| Thrivent Real Estate Securities Portfolio | 5.0% |

| Thrivent Money Market Portfolio | 4.9% |

| These common stocks represent 96.1% of the total | |

| investment portfolio. | |

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

8

In particular, we had a meaningful overweight in foreign equities and reasonable exposure to small- and mid-capitalization stocks, categories that provided significantly higher returns than large-cap stocks as measured by the S&P 500 Index. Consequently, we generally underweighted fixed-income investments. Fixed-income asset categories did not achieve returns as high as equity asset classes, and thus our results were better than if we had stayed with the target allocations for the Portfolio.

What is your outlook?

At the end of 2005 we began reducing our exposure to the more risky equity asset classes and repositioning funds to select fixed-income categories. We expect total returns in these fixed-income categories -- particularly high-yield bonds -- to be reasonably competitive with returns from equities.

With the Federal Reserve now in the final stages of its campaign to raise short-term interest rates, it appears that bonds now seem more reasonably valued, especially in short- to intermediate maturities. Thus we have reduced our exposure to equities. We have not made this adjustment because we expect a significant decline in equity prices, but rather a less robust outlook on equities advances versus other asset choices.

| Portfolio Facts | |||

| as of December 31, 2005 | |||

| Net Assets | $331,158,862 | NAV | $10.96 |

| NAV -- High† | 12/23/2005 -- $11.09 | ||

| NAV -- Low† | 4/29/2005 -- $10.00 | ||

| Number of Holdings: 11 | † For the period ended December 31, 2005 | ||

| Average Annual Total Returns1 as of December 31, 2005 From Inception 4/29/2005 -------------------------------------------------------------------------------------------------- 9.98% |

* The S&P 500 Index is an index that represents the average performance of a group of 500 large-capitalization stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

** The Lehman Brothers Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

*** The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index.

Past performance is not an indication of future results. Total investment return and principal value will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Market volatility can significantly affect short-term performance, and more recent returns may be different from those shown. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end.

1 Annualized total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser reimbursed and/or paid non-advisory Portfolio expenses. Had the adviser not done so, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented.

Investing in a variable product involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. Please read your prospectus carefully.

9

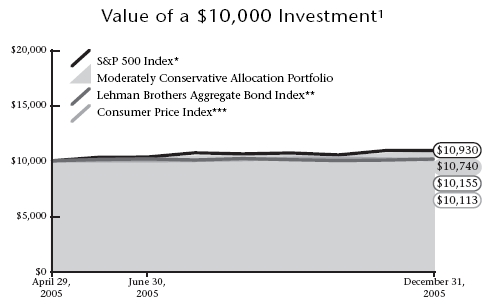

Thrivent Moderately

Conservative Allocation

Portfolio

Russell W. Swansen (left), David C. Francis (right) and Mark L. Simenstad (far right), Portfolio Co-Managers

Thrivent Aggressive Allocation Portfolio seeks long-term capital growth by implementing an asset allocation strategy.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return given its significant allocation to equity securities. Therefore a principal risk of investing in the Portfolio is that the allocation strategies used, and the allocation decisions made will not produce the desired results. In addition, the performance of the Portfolio is heavily dependent upon the performance of the underlying portfolios in which the Portfolio invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying portfolios. Those risks include, but are not limited to, market risk, issuer risk, volatility risk, liquidity risk, investment advisor risk, loss of principal risk, as well as credit risk and interest rate risk. These and other risks are described in the Portfolio’s prospectus.

How did the Portfolio perform for the period from April 29 through Dec. 31, 2005

Thrivent Moderately Conservative Allocation Portfolio produced a 7.40% return from its inception date, April 29, through Dec. 31, 2005. For the same period, the Portfolio’s market benchmarks, the S&P 500 Index and the Lehman Brothers Aggregate Bond Index, returned 9.29% and 1.55%, respectively.

What market conditions were present during the period?

During the period, all major equity markets provided robust returns, while fixed-income markets generally achieved more modest, but positive total returns.

Stocks

Generally speaking, investment style was not a significant factor during the period, with value and growth stocks achieving similar returns. Company size, however, did make a meaningful difference in returns. Stocks of small- and mid-capitalization companies posted percentage returns in the mid- to high-teens, while large-capitalization companies centered more around high-single-digit results.

Foreign stocks, as measured by the MSCI EAFE Index, also provided returns in the high teens on a U.S. dollar basis and significantly higher on a local currency basis. Dollar returns were reduced by a strengthening of the U.S. dollar against both the euro and the yen in 2005. Emerging markets companies provided returns in the mid- to high-20s and higher, driven especially by rising commodities prices.

Bonds

Fixed-income returns for the period depended on maturity length and sector selection. For the overall market, as measured by the Lehman Brothers Aggregate Bond Index, modest price declines caused by rising interest rates were offset by modest coupon income, providing total returns of about 1.5% . However, longer-maturity bonds (10 years and greater) had much better returns than shorter-maturity bonds -- as yields on long Treasury bonds moved up only 0.15%, while yields on two-year notes moved up almost 0.70% . High yield, corporate and asset-backed securities provided modestly better returns due to their higher yields.

What factors affected the Portfolio’s performance?

Our investment strategy during the period was to overweight equities, resulting in above-target allocations to foreign and domestic asset classes or categories within the Portfolio. We believed the equity bull market that had begun in the latter half of 2002 was still under way and that economic growth remained strong enough to support an overexposure to equities.

| Top 10 Holdings | |

| (% of Portfolio) | |

| Thrivent Limited Maturity Bond Portfolio | 26.5% |

| Thrivent Partner International | |

| Stock Portfolio | 12.6% |

| Thrivent Income Portfolio | 10.8% |

| Thrivent Large Cap Growth Portfolio | 10.1% |

| Thrivent Money Market Portfolio | 9.9% |

| Thrivent Large Cap Stock Portfolio | 8.0% |

| Thrivent Large Cap Value Portfolio | 7.0% |

| Thrivent Mid Cap Stock Portfolio | 4.1% |

| Thrivent Small Cap Stock Portfolio | 4.0% |

| Thrivent High Yield Portfolio | 4.0% |

| These common stocks represent 97.0% of the total | |

| investment portfolio. | |

Quoted Portfolio Composition and Top 10 Holdings are subject to change.

10

In particular, we had a meaningful overweight in foreign equities and reasonable exposure to small- and mid-capitalization stocks, categories that provided significantly higher returns than large-cap stocks as measured by the S&P 500 Index. Consequently, we generally underweighted fixed-income investments. Fixed-income asset categories did not achieve returns as high as equity asset classes, and thus our results were better than if we had stayed with the target allocations for the Portfolio.

What is your outlook?

At the end of 2005 we began reducing our exposure to the more risky equity asset classes and repositioning funds to select fixed-income categories. We expect total returns in these fixed-income categories -- particularly high-yield bonds -- to be reasonably competitive with returns from equities.

With the Federal Reserve now in the final stages of its campaign to raise short-term interest rates, it appears that bonds now seem more reasonably valued, especially in short- to intermediate maturities. Thus we have reduced our exposure to equities. We have not made this adjustment because we expect a significant decline in equity prices, but rather a less robust outlook on equities advances versus other asset choices.

| Portfolio Facts | ||||

| as of December 31, 2005 | ||||

| Net Assets | $146,733,200 | NAV | $10.68 | |

| NAV -- High† | 12/23/2005 -- $10.80 | |||

| NAV -- Low† | 4/29/2005 -- $10.00 | |||

| Number of Holdings: 11 | † For the period ended December 31, 2005 | |||

| Average Annual Total Returns1 as of December 31, 2005 From Inception 4/29/2005 -------------------------------------------------------------------------------------------------- 7.40% |

* The S&P 500 Index is an index that represents the average performance of a group of 500 large-capitalization stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

** The Lehman Brothers Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

*** The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index.

Past performance is not an indication of future results. Total investment return and principal value will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Market volatility can significantly affect short-term performance, and more recent returns may be different from those shown. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end.

1 Annualized total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser reimbursed and/or paid non-advisory Portfolio expenses. Had the adviser not done so, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented.

Investing in a variable product involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. Please read your prospectus carefully.

11

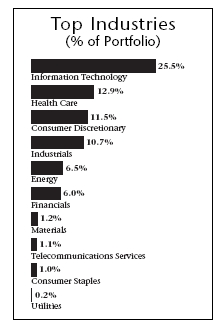

Thrivent Technology Portfolio

James A. Grossman and Michael C. Marzolf, Portfolio Co-Managers

The Thrivent Technology Portfolio seeks long-term capital appreciation by investing primarily in a diversified portfolio of common stocks and securities convertible into common stocks.

The Portfolio primarily invests in technology-related industries. As a consequence, the Portfolio may be subject to greater price volatility than a Portfolio investing in a broad range of industries. These and other risks are described in the Portfolio’s prospectus.

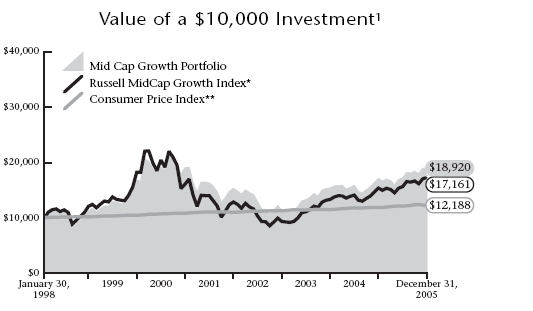

How did the Portfolio perform during the 12-month period ended Dec. 31, 2005?

Thrivent Technology Portfolio provided a 3.72% total return, while its Lipper Inc. Science & Technology Funds peer group posted a 4.97% median return. The Portfolio’s market benchmark, the Goldman Sachs Technology Industry Composite Index, returned 2.03% during the period.

What market conditions were present during the period?

Stocks advanced during the period, although returns varied across market segments. The technology segment did not participate as fully as other segments in market advances, and it was particularly weak early in the period. However, the segment rallied enough in the second half of the period to achieve a reasonable return for the year. Energy stocks provided the market’s best returns, especially those of companies focused on domestic production as well as exploration and development.

A number of cross-currents, including rising energy prices, steady increases in short-term interest rates, and fears of heightened inflation diminished the constructive impact of continued solid economic growth and positive earnings advances over the period. Also, there were unusual increases in energy prices and distorted economic activity caused by the Gulf Coast hurricanes. These events contributed to investors’ increasing aversion to the more volatile segments of the market.

What factors affected the Portfolio’s performance?

The Portfolio maintained a bias over the period to larger-capitalization companies with strong business models. This had a negative impact on our performance versus our peer group, as small- and mid-capitalization companies provided higher levels of returns than larger ones.

The Portfolio earned strong returns throughout the period from its technology hardware equipment holdings in Apple Computer, but this advantage was more than offset by below-average returns from our position in other large companies such as Dell Computer and IBM.

An underweighted stance in Google was a meaningful factor in the Portfolio’s underperformance versus its peer group. Also, the Portfolio’s below-average performance in the consumer, health care and telecommunications services segments -- other areas of the market that provide opportunity for participation in new technologies -- also were detrimental relative to our peers.

What is your outlook?

Many of 2005’s economic concerns -- such as rising interest rates, higher commodity prices, and political instability --will carry over to 2006, albeit with less intensity. Easing concerns that these factors will limit growth in technology spending should support better earnings visibility and thus valuation expansion. We expect technology spending to increase by the mid-single digits during the year.

| Top 10 Holdings | |

| (% of Portfolio) | |

| Intel Corporation | 3.0% |

| Apple Computer, Inc. | 3.0% |

| Google, Inc. | 2.8% |

| Microsoft Corporation | 2.7% |

| Cisco Systems, Inc. | 2.7% |

| International Business Machines Corporation | 2.3% |

| EMC Corporation | 2.2% |

| Yahoo!, Inc. | 2.2% |

| QUALCOMM, Inc. | 2.0% |

| Marvell Technology Group, Ltd. | 1.8% |

| These common stocks represent 24.7% of the total | |

| investment portfolio. | |

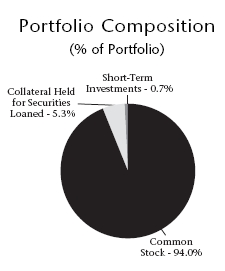

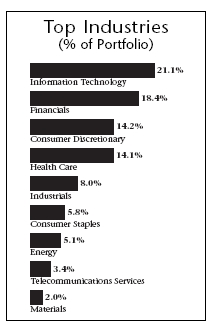

Quoted Top Industries, Portfolio Composition and Top 10 Holdings are subject to change.

The lists of Top Industries and Top 10 Holdings exclude short-term investments and collateral held for securities loaned.

12

A more favorable economic environment, combined with an explosion in consumer devices and elevated demand for network services, make us optimistic about technology stocks in 2006. Our focus will continue to include the device side of the technology market, but we will increasingly emphasize providers of infrastructure and services to capture the inevitable network build out and replacement cycle.

We expect business investment will be a more significant component of technology spending growth than the consumer in the coming year and have positioned the Portfolio to benefit from that trend. The technology market continues to evolve, and we continue to cast a broad net to identify not only successful investments within the traditional technology segment, but also new and emerging technologies in other fields such as medicine and energy.

| Portfolio Facts | ||||

| as of December 31, 2005 | ||||

| Net Assets | $59,827,688 | NAV | $7.53 | |

| NAV -- High† | 12/2/2005 -- $7.71 | |||

| NAV -- Low† | 4/15/2005 -- $6.23 | |||

| Number of Holdings: 148 | † For the year ended December 31, 2005 | |||

| Average Annual Total Returns1 | |

| as of December 31, 2005 | |

| From | |

| Inception | |

| 1 Year | 3/1/2001 |

| ---------------------------------------------------------------------------------------------------------------------------------------------------------- | |

| 3.72% | –5.64% |

* The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index.

** The Goldman Sachs Technology Industry Composite Index is a modified capitalization-weighted index of selected technology stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

Past performance is not an indication of future results. Total investment return and principal value will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Market volatility can significantly affect short-term performance, and more recent returns may be different from those shown. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end.

1 Annualized total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. At various times, the Portfolio’s adviser reimbursed and/or paid non-advisory Portfolio expenses. Had the adviser not done so, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented.

Investing in a variable product involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. Please read your prospectus carefully.

13

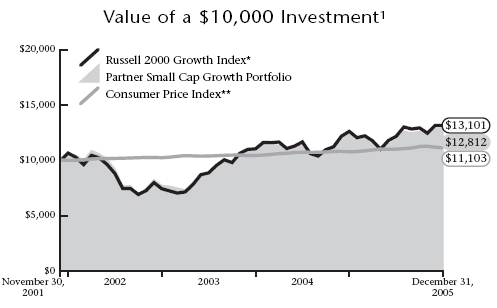

| Thrivent Partner Small Cap Growth Portfolio |

Subadvised by Turner Investment Partners, Inc. and Transamerica Investment Management LLC

The Thrivent Partner Small Cap Growth Portfolio seeks long-term capital growth by investing primarily in a diversified portfolio of common stocks of U.S. small-capitalization companies.

The Portfolio is exposed to the risks of investing in equity securities of smaller companies, which may include, but are not limited to, higher credit risks such as defaulted debt, bankruptcy, mergers,

reorganizations and liquidations. Small company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Portfolio’s prospectus.

How did the Portfolio perform during the one-year period ended Dec. 31, 2005?

The Thrivent Partner Small Cap Growth Portfolio gained 3.96% for the annual reporting period. It underperformed the median return of 7.07% for its peer group, as represented by the Lipper Small Cap Growth Funds Category. The Portfolio performed in line with the benchmark Russell 2000 Growth Index, which advanced 4.15% over the same time frame.

What market conditions were present during the period?

For the most part U.S. stock market returns were somewhat subdued during the period, as investors tried to determine how U.S. economic growth would be affected by higher energy prices and interest rate increases by the Federal Reserve Board. The stock market rallied late in 2005, resulting in positive one-year returns for all the major equity indices. After six consecutive years of outperforming, small-capitalization stocks -- as measured by Russell indices --underperformed large-caps by a narrow margin. However, neither segment could keep pace with mid-cap indices, which fared well primarily because of strong returns from energy-related stocks. The energy sector, mainly energy equipment and services companies, and energy-related industries within the utility sector, led the market. Stocks in the consumer discretionary sector were the worst performers during the reporting period. For the first time in recent years, growth-oriented stocks gained a slight performance advantage versus value-oriented stocks in the latter part of the year. However, a bias toward value or growth did not substantially impact performance in 2005, a reversal from recent years.

What factors affected the Portfolio’s performance?

The Portfolio underperformed its peer group mainly because of poor stock selection in the health care and consumer discretionary sectors. In health care, two holdings in the biotechnology industry -- Nabi Biopharmaceuticals and Eyetech Pharmaceuticals -- turned in disappointing returns. These were partially offset by good results achieved by our positions in United Therapeutics and Amylin Pharmaceuticals. The Portfolio’s holdings in internet and catalog retail companies such as Overstock.com, Provide Commerce and ValueVision Media provided sub-par returns during the period as well. Coldwater Creek, a specialty retailer, was an outstanding performer but only sufficient to mitigate the weakness in the other holdings. Elsewhere in retail, our holding in PETCO Animal Supplies proved to be disappointing, as the stock came under significant pressure during the period.

On the other hand, stocks in the industrial and financial services sectors of the Portfolio aided returns and helped it keep pace with the Russell benchmark. We achieved strong results from commercial services companies like FTI Consulting and construction and engineering companies like Jacobs Engineering. Stericycle, in the medical waste management industry, also proved beneficial to the Portfolio. Exposure to the investment securities and asset management industries

| Top 10 Holdings | |

| (% of Portfolio) | |

| ValueClick, Inc. | 1.5% |

| Digital Insight Corporation | 1.2% |

| Jacobs Engineering Group, Inc. | 1.2% |

| Macrovision Corporation | 1.0% |

| FTI Consulting, Inc. | 1.0% |

| Forward Air Corporation | 0.9% |

| Affiliated Managers Group, Inc. | 0.8% |

| Wintrust Financial Corporation | 0.8% |

| Zebra Technologies Corporation | 0.8% |

| Tractor Supply Company | 0.8% |

| These common stocks represent 10.0% of the total | |

| investment portfolio. | |

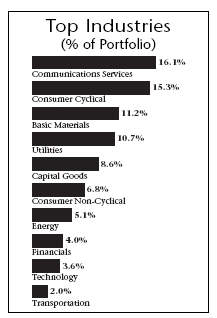

Quoted Top Industries, Portfolio Composition and Top 10 Holdings are subject to change.

The lists of Top Industries and Top 10 Holdings exclude short-term investments and collateral held for securities loaned.

14

added to the Portfolio’s results. We obtained particularly good returns from Investment Technology Group, a full service trade execution firm, and Affiliated Managers Group, an asset management company.

What is your outlook?

Economic growth will likely slow during the first half of 2006 as a result of a decline in consumer spending. However, business spending is likely to increase, due to high productivity, low interest expense and a healthy economy, which have combined to produce increased profitability and cash-flow for U.S. corporations. Our outlook for equities remains positive for 2006, as earnings growth remains positive, albeit at a slower pace. In addition, corporate management has ample motivation to focus on providing improved returns for their shareholders, given that there are a number of well capitalized acquirers looking to take advantage of underperforming businesses. Other positive factors for stocks include stable energy prices and indications that the Federal Reserve is nearing the end of its tightening cycle. Because of these factors, we believe growth-oriented stocks will outperform value in 2006. Therefore, we are very optimistic about the outlook for growth stocks, as well as the Portfolio, in the coming year.

| Portfolio Facts | ||||

| as of December 31, 2005 | ||||

| Net Assets | $64,746,550 | NAV | $12.11 | |

| NAV -- High† | 12/9/2005 -- $12.4 | |||

| NAV -- Low† | 4/28/2005 -- $10.08 | |||

| Number of Holdings: 190 | † For the year ended December 31, 2005 | |||

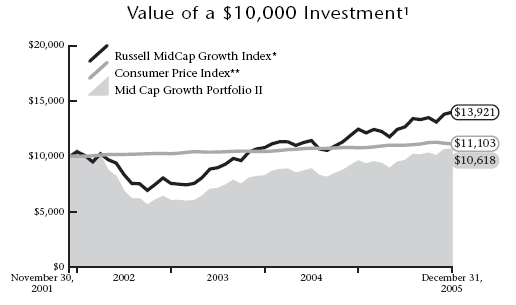

| Average Annual Total Returns1 | |

| as of December 31, 2005 | |

| From | |

| Inception | |

| 1 Year | 11/30/2001 |

| -------------------------------------------------------------------------------------------------------------------------------------------------- | |

| 3.96% | 6.26% |

* The Russell 2000 Growth Index is an index comprised of companies with a greater than average growth orientation within the Russell 2000 Index. The Russell 2000 Index is comprised of the 2,000 smaller companies in the Russell 3000 Index, which represents the 3,000 largest companies based on market capitalization and is designed to represent the performance of about 98% of the U.S. equity market. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

** The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index.

Past performance is not an indication of future results. Total investment return and principal value will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Market volatility can significantly affect short-term performance, and more recent returns may be different from those shown. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end.

1 Annualized total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. At various times, the Portfolio’s adviser reimbursed and/or paid non-advisory Portfolio expenses. Had the adviser not done so, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented.

Investing in a variable product involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. Please read your prospectus carefully.

15

| Thrivent Partner Small Cap Value Portfolio |

Subadvised by T. Rowe Price Associates, Inc.

The Thrivent Partner Small Cap Value Portfolio seeks long-term growth of capital by investing primarily in a diversified portfolio of smaller capitalization common stocks.

The Portfolio is exposed to the risks of investing in equity securities of smaller companies, which may include, but are not limited to, higher credit risks such as defaulted debt, bankruptcy, mergers, reorganizations and liquidations. Small company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Portfolio’s prospectus.

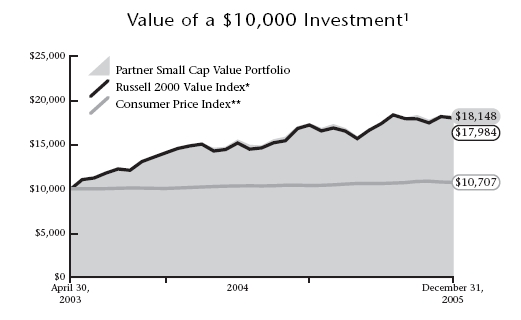

How did the Portfolio perform during the one-year period ended Dec. 31, 2005?

The Thrivent Partner Small Cap Value Portfolio advanced 4.89%, underperforming its peer group during the year. The peer group, as represented by the Lipper Small Cap Value Funds Category, posted a median return of 7.38% . However, the Portfolio performed in line with the benchmark Russell 2000 Value Index, which gained 4.71% over the same 12-month period.

What market conditions were present during the period?

For the most part U.S. stock market returns were somewhat subdued during the period, as investors tried to determine how U.S. economic growth would be affected by higher energy prices and interest rate increases by the Federal Reserve Board. The stock market rallied late in 2005, resulting in positive one-year returns for all the major equity indices. After six consecutive years of outperforming, small-capitalization stocks -- as measured by Russell indices --underperformed large-caps by a narrow margin. However, neither segment could keep pace with mid-cap indices, which fared well primarily because of strong returns from energy-related stocks. The energy sector, mainly energy equipment and services companies, and energy-related industries within the utility sector led the market. Stocks in the consumer discretionary sector were the worst performers during the reporting period. For the first time in recent years, growth-oriented stocks gained a slight performance advantage versus value-oriented stocks in the latter part of the year. However, a bias toward value or growth did not substantially impact performance in 2005, a reversal from recent years.

What factors affected the Portfolio’s performance?

Solid stock selection in the energy and health care sectors helped the Portfolio slightly outpace the Russell benchmark during the year. Our energy holdings provided the highest levels of absolute and relative returns for the period. The energy sector benefited from unusually high oil and natural gas prices, as demand exceeded normal supplies and shortages were exacerbated by Hurricane Katrina’s devastation along the Gulf coast. An above-average weighting in the energy equipment and services industries relative to our peers and the benchmark contributed favorably to the Portfolio’s results as well.

In health care facilities, our positions in Odyssey Healthcare, a provider of hospice care, and Capital Senior Living, a U.S. operator of senior living communities, achieved excellent returns. Also, the biopharmaceutical company Myogen, which focuses on treatments for cardiovascular disorders, provided extraordinary results in the period.

| Top 10 Holdings | |

| (% of Portfolio) | |

| Texas Regional Bancshares, Inc. | 1.4% |

| First Republic Bank | 1.3% |

| Genesee & Wyoming, Inc. | 1.2% |

| Forest Oil Corporation | 1.2% |

| Strategic Hotel Capital, Inc. | 1.1% |

| ProAssurance Corporation | 1.1% |

| Kirby Corporation | 1.1% |

| Whiting Petroleum Corporation | 1.0% |

| Owens & Minor, Inc. | 1.0% |

| East West Bancorp, Inc. | 1.0% |

| These common stocks represent 11.4% of the total | |

| investment portfolio. | |

Quoted Top Industries, Portfolio Composition and Top 10 Holdings are subject to change.

The lists of Top Industries and Top 10 Holdings exclude short-term investments and collateral held for securities loaned.

16

On the other hand, the Portfolio’s results fell short of its peer group primarily because of sub-par stock selection in the information technology and consumer discretionary sectors. In particular, computer storage company SBS Technologies achieved poor results. Additionally, we realized disappointing returns from our holdings in application software companies Catapult Communications and Agile Software and electronics manufacturer Merix Corp. In consumer discretionary, Haverty Furniture and Aaron Rents contributed to below-average results, as housing-related stocks came under pressure with higher interest rates.

What is your outlook?

As we anticipated, performance leadership shifted from small-cap stocks to large-caps in 2005 after six years of small-cap outperformance. As the economy slows to a more moderate growth rate in 2006, we expect large-cap stocks to again lead the market in the coming year. If this trend continues, it may create more investment opportunities in the small-cap segment of the market. This would be a welcome change, given the current difficulty in finding attractively valued, small-cap stocks for the Portfolio.

| Portfolio Facts | |||

| as of December 31, 2005 | |||

| Net Assets | $106,240,429 | NAV | $16.82 |

| NAV -- High† | 12/14/2005 -- $17.25 | ||

| NAV -- Low† | 5/13/2005 -- $14.56 | ||

| Number of Holdings: 135 | † For the year ended December 31, 2005 | ||

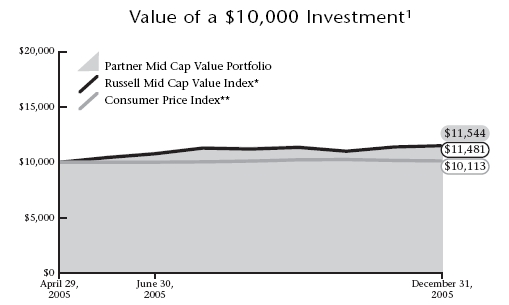

| Average Annual Total Returns1 | |

| as of December 31, 2005 | |

| From | |

| Inception | |

| 1 Year | 4/30/2003 |

| -------------------------------------------------------------------------------------------------------------------------------------------------------- | |

| 4.89% | 24.98% |

* The Russell 2000 Value Index is an index comprised of companies with a greater than average value orientation within the Russell 2000 Index. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

** The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index.

Past performance is not an indication of future results. Total investment return and principal value will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Market volatility can significantly affect short-term performance, and more recent returns may be different from those shown. Call 800-THRIVENT or visit www.thrivent.com for performance results current to the most recent month-end.

1 Annualized total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. At various times, the Portfolio’s adviser reimbursed and/or paid non-advisory Portfolio expenses. Had the adviser not done so, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented.

Investing in a variable product involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. Please read your prospectus carefully.

17

Thrivent Small Cap Stock Portfolio

Christopher J. Serra, Portfolio Manager

The Thrivent Small Cap Stock Portfolio seeks long-term capital growth by investing primarily in small company common stocks and securities convertible into small company common stocks.

The Portfolio is exposed to the risks of investing in equity securities of smaller companies, which may include, but are not limited to, higher credit risks such as defaulted debt, bankruptcy, mergers, reorganizations and liquidations. Small company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Portfolio’s prospectus.

How did the Portfolio perform during the 12-month period ended Dec. 31, 2005?

Thrivent Small Cap Stock Portfolio produced a 8.81% return, while its Lipper Inc. Small Cap Core Funds peer group posted a 4.94% median return. The Portfolio’s market benchmark, the Russell 2000 Index, returned 4.55% during the period.

What market conditions were present during the period?

The economy produced generally solid numbers. With gross domestic product growth at more then 3% and with stable inflation figures, the environment was generally constructive for investing in small-capitalization stocks. This was welcome news to many investors who sought growth in small-caps after struggling to identify similar opportunities in the large-cap segment of the market.

Leading the strong small-cap performance during the period were higher-quality companies with visible earnings growth and good returns on capital. Also, the energy sector was a substantial driver of the market. Although there were pockets of performance in lower-quality, emerging-growth companies, they generally underperformed their higher-quality counterparts during the period.

What factors affected the Portfolio’s performance?