Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-4603

Thrivent Series Fund, Inc.

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

Rebecca A. Paulzine

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-5168

Date of fiscal year end: December 31

Date of reporting period: December 31, 2010

Table of Contents

| Item 1. | Report to Stockholders |

Table of Contents

Table of Contents

Why should you consider eDelivery?

| • | It provides you with easy access to prospectuses and financial reports, allowing you to view your information anytime, anywhere, without having to dig through files of paper. |

| • | It’s simple and safe. Your personal information will always be protected by a password, making it much more secure than an envelope in your mailbox. |

| • | It’s less expensive than mailing your documents, and because you’re part of a membership organization, the cost savings will benefit you. |

| • | It’s good for the environment. Each year, Thrivent Financial uses nearly 50 million sheets of paper to communicate with our members. That’s as many as 26 acres of trees that could be saved by choosing eDelivery. |

Act by April 1 and receive the April 30 prospectus via eDelivery.

Table of Contents

| 2 | ||||

Portfolio Perspectives | ||||

| 4 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

| 16 | ||||

| 18 | ||||

| 20 | ||||

| 22 | ||||

| 24 | ||||

| 26 | ||||

| 28 | ||||

| 30 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| 38 | ||||

| 40 | ||||

| 42 | ||||

| 44 | ||||

| 46 | ||||

| 48 | ||||

| 50 | ||||

| 52 | ||||

| 54 | ||||

| 56 | ||||

| 58 | ||||

| 60 | ||||

| 62 | ||||

| 64 | ||||

| 66 | ||||

| 68 | ||||

| 70 | ||||

| 72 | ||||

| 74 | ||||

| 76 | ||||

| 78 | ||||

| 80 | ||||

| 82 | ||||

| 84 | ||||

| 86 | ||||

| 90 | ||||

| Schedules of Investments | ||||

| 91 | ||||

| 100 | ||||

| 109 | ||||

| 118 | ||||

| 127 | ||||

| 129 | ||||

| 131 | ||||

| 134 | ||||

| 137 | ||||

| 140 | ||||

| 143 | ||||

| 147 | ||||

| 151 | ||||

| 155 | ||||

| 163 | ||||

| 166 | ||||

| 169 | ||||

| 172 | ||||

| 174 | ||||

| 180 | ||||

| 192 | ||||

| 197 | ||||

| 199 | ||||

| 202 | ||||

| 204 | ||||

| 207 | ||||

| 210 | ||||

| 214 | ||||

| 218 | ||||

| 220 | ||||

| 225 | ||||

| 232 | ||||

| 238 | ||||

| 250 | ||||

| 257 | ||||

| 267 | ||||

| 272 | ||||

| 286 | ||||

| 292 | ||||

| 302 | ||||

| 306 | ||||

| 310 | ||||

| 318 | ||||

| 326 | ||||

| 340 | ||||

| 358 | ||||

| 374 | ||||

| 377 | ||||

Table of Contents

Dear Member: Dear Member: | ||

A brief review of the economy

The 12-month period ended December 31, 2010, was productive for investors as the nation’s financial markets and economy continued to recover from a deep recession and ensuing investment sell off in 2008 and 2009.

The U.S. economy grew slowly during the year but posted positive growth nonetheless. Gross domestic product (GDP) growth was measured at a 3.7% annual rate during the first quarter of 2010, then fell to a 1.7% rate for the second quarter, strengthening to a 2.6% annual rate for the third quarter.1 The pace of GDP growth in the fourth quarter fell to a 2.2% annual rate, according to a board of 43 professional forecasters surveyed by the Federal Reserve Bank of Philadelphia.

While this level of growth is far from the robust economic recovery required to generate the myriad of new jobs needed, it shows strong improvement since mid-2009.

The U.S. employment picture continues to be the major area of concern and the slowest part of the economy to recover. The monthly U.S. nonfarm payrolls report, which indicates the health of the nation’s employment, has been mixed in recent months. In 2009, nearly all of the monthly reports showed a net decrease in jobs, while 2010 saw slight improvement. Through the end of 2010, the economy added 1.124 million jobs—certainly an improvement over 2009, but still many fewer than the 200,000 or 300,000 jobs per month required to loosen a national unemployment rate stuck above 9.5% for most of the year.

Inflation continued to be muted, with the December 2010 Consumer Price Index registering a 1.5% year-over-year increase.1 With inflation largely in check, the Federal Reserve Open Market Committee may feel more comfortable leaving the benchmark federal funds target interest rate unchanged at its current 0.25%. The consensus appears to be that we have enough inflation to provide evidence that the overall economy is growing, albeit weakly, but not so little that we risk deflation.

That said, low inflation and a low interest rate environment can be viewed as a double-edged sword. Low interest rates make borrowing money, funding business plans and servicing debt less costly and can lead to greater economic growth. The flip side, unfortunately, is that conservative investors and savers get little in exchange for placing assets in bank accounts, money markets and fixed-rate products.

A brief review of the markets

Stock prices posted strong returns to close out 2009, and opened 2010 in much the same way before falling back in May and June due to concerns over faltering U.S. economic data and debt worries in the European Union. The rally resumed toward late summer, as another round of strong corporate profit reports, teamed with improved economic news, generally propelled stocks forward through the end of the year.

As is typical of a strong market, the most aggressive investment types generally performed best. Small-company stocks, as measured by the Russell 2000® Index, recorded a 26.85% total return. Their large-company cousins, as measured by the S&P 500 Index, posted a 15.06% total return. Large-company stocks typically trail the more nimble small-cap stocks in sharp market rallies and tend to outperform in more modest market conditions later in economic recoveries. The value and growth styles of investing varied somewhat over the period, as investor interest in growth sectors—such as information technology and consumer discretionary—led to larger gains as measured by the Russell 1000® Growth Index, which returned 16.71%. Weighed down in part by uncertainty over the prospects for banks and other financial companies, the value style underperformed as illustrated by the Russell 1000® Value Index’s total return of 15.51%.

Overseas equities posted weaker returns than their domestic counterparts over concerns about the financial health and ongoing debt issues of several European Union countries and weaker economic conditions in Europe. The Morgan Stanley Capital International Europe, Australasia and Far East (MSCI EAFE) Index, a common benchmark for large, higher-quality international company stocks, posted an 8.21% total return. Holding true to higher-risk financial assets performing better, the MSCI Emerging Markets Index recorded a robust 19.20% total return. Emerging Markets Index stocks benefited from strong retail demand for the securities. Also, many of these emerging market countries are simply growing faster than our more mature economy, and may offer greater prospects along with greater potential risks.

Most sectors of the U.S. bond market posted solid results during 2010, with the riskiest sectors—such as

2

Table of Contents

commercial- and nonagency-backed mortgage securities and high-yield bonds—generating the best returns. The recovery extended through most of the year, but in May, Europe’s debt crisis and high U.S. unemployment renewed concerns about growth and pushed Treasury yields to historic lows.

Outlook

We think that much of the rally in stocks and higher-risk bonds is behind us, and that returns going forward will be more muted.

We see economic conditions continuing to improve, but at a relatively slow pace. With economic growth in the 2% to 3% range, it may be difficult to see major improvements in the employment picture. That said, we think the current fundamental underpinnings are stronger than they were a year ago, and that’s one thing for which to be thankful.

Though improvement in the economy has been slow, economic data has shown recent signs of strengthening. In October, the Institute for Supply Management reported that its Manufacturing Index improved at a level above expectations. Additionally, some leading indicators data showed marked improvement in new orders, while existing inventories dropped. The service industry, which accounts for close to 70% of the U.S. economy, also has shown signs of improvement. In our opinion, this kind of evidence supports a pickup in both the manufacturing and service sides of our economy and could spell new jobs if the improvements take a more lasting hold.

The Federal Reserve appears to be willing to actively foster more economic growth. Its second round of quantitative easing, or QE2, was designed to improve consumer and business confidence. While I am not entirely sure of the necessity of such a program, the Fed’s commitment to growth could prove a positive for many asset classes and investment types, at least for the near term.

Despite the Fed’s easing programs, we expect interest rates to stay in their current range or move modestly higher through the first half of 2011. Longer term, we are concerned about the risk of rising interest rates, which would negatively impact bond portfolios with longer average durations more than those with shorter durations.

In conclusion

Moving into a new year is a great time to get your financial house in order. As you do this, it’s important to remember that stock investments should be viewed with a longer time frame. They can provide growth prospects for the long haul while adding a hedge against inflation versus bonds and other fixed-rate investments. Most investors need a meaningful allocation to stocks in their portfolio to generate the growth that retirees require in order to not outlive their savings. But you have to be comfortable with the amount of risk in your portfolio.

If fear of the stock market or fear of not having enough growth in your retirement portfolio keeps you up at night, it’s time to sit down with your Thrivent Financial representative. He or she can help you build a personal strategy that seeks to balance your appetite for risk with the goals you have for your money. Thrivent Financial has many tools and product solutions that can help. Let us know if we can help in any way, and thank you for continuing to put your trust with us.

Sincerely,

Russell W. Swansen

President

Thrivent Series Fund, Inc.

| 1 | U.S. Department of Commerce, Bureau of Economic Analysis |

3

Table of Contents

| Thrivent Aggressive Allocation Portfolio

Russell W. Swansen (left), David C. Francis, CFA (right) and Mark L. Simenstad, CFA (far right), Portfolio Co-Managers |  |

The Portfolio seeks long-term capital growth.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return, given its allocation to equity securities. Another risk of investing in the Portfolio is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Portfolio’s prospectus. Views expressed in this discussion of portfolio performance are the views of this particular portfolio’s management team.

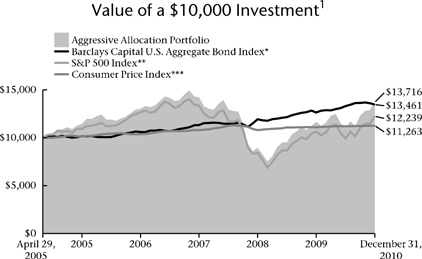

How did the Portfolio perform during the 12-month period ended December 31, 2010?

Thrivent Aggressive Allocation Portfolio earned a return of 17.53%, compared with the median return of its peer group, the Lipper Multi-Cap Core category, of 15.11%. The Portfolio’s market benchmarks, the S&P 500 Index and the Barclays Capital U.S. Aggregate Bond Index, earned a return of 15.06% and 6.54%, respectively.

What factors affected the Portfolio’s performance?

Allocations to equity segments providing higher returns than the S&P 500, good relative returns on the part of many of the managers in their respective asset classes, and exposure to better-performing sectors of the fixed-income markets were all factors in achieving the good results over the last fiscal year. The Portfolio benefited from exposure to mid- and small-capitalization companies, as those segments of the market outperformed the S&P 500. International mid- and small-cap stocks as well as emerging market equity and debt exposure provided higher returns than large-cap domestic equity. Exposure to large-cap international stocks offset some of those results, as this group did not keep pace with the advance in domestic stocks.

Additionally, because of underweighting, our investments in large-cap stocks did not perform as well as the S&P 500. Over the course of the year, there were a few tactical adjustments versus our long-term strategic targets that added value. In particular, in April, we increased fixed- income exposure as equity prices appeared full, and following the equity market sell off over the summer, repositioned back to equities. We also implemented some unique investment positions in mortgage-backed securities in the fixed-income segment of the Portfolio, and that strategy proved to be quite rewarding.

What is your outlook?

We believe the economic cycle is likely to be sustained. While there is some risk of a “double dip” recession, we believe that should one occur it would be a function of policy decisions rather than the underlying economic fundamentals. A sustained recovery, albeit subpar versus historic experience after prior severe recessions, would be sufficient to support continued profit growth and moderate advances in stock prices. We feel that fixed-income securities are fully priced, and returns to this sector will be modest relative to the last few years. Based on current expectations, stocks appear to be the

4

Table of Contents

undervalued asset, and we are positioned to reflect that stance. Our outlook would be at risk in a deflationary environment, but we believe the probability of sustained deflation is low. We acknowledge the risks of accelerating inflation beyond the level the Federal Reserve is attempting to bring about could truncate the economic outlook. That risk will likely be a more significant factor in 2012.

Portfolio Facts

As of December 31, 2010

Net Assets | $587,105,042 | |

NAV | $12.22 | |

NAV - High† | 12/29/2010 - $12.25 | |

NAV - Low† | 7/2/2010 - $9.74 | |

Number of Holdings: 332 | ||

† For the year ended December 31, 2010 |

Average Annual Total Returns1

As of December 31, 2010

1-Year | 5-Year | From Inception 4/29/2005 | ||

17.53% | 3.69% | 5.72% |

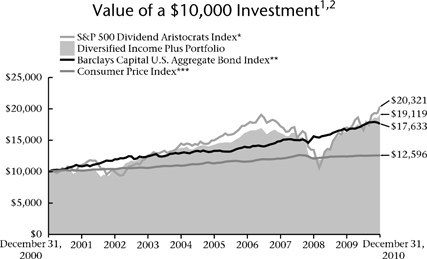

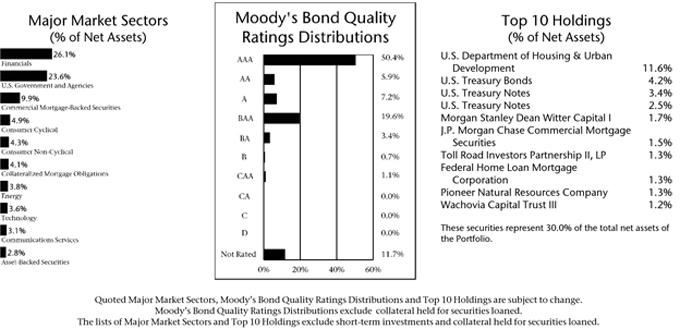

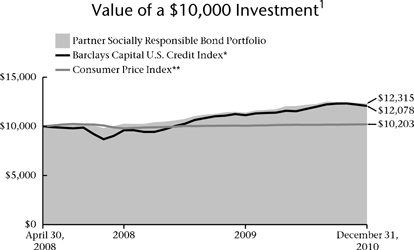

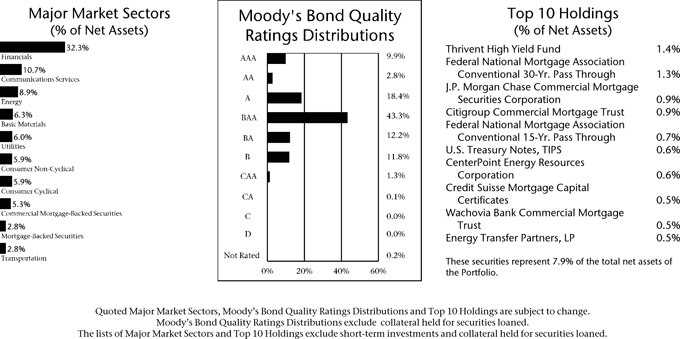

| * | The Barclays Capital U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

| *** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

5

Table of Contents

| Thrivent Moderately Aggressive Allocation Portfolio

Russell W. Swansen (left), David C. Francis, CFA (right) and Mark L. Simenstad, CFA (far right), Portfolio Co-Managers |  |

The Portfolio seeks long-term capital growth.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return, given its allocation to equity securities. Another risk of investing in the Portfolio is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Portfolio’s prospectus. Views expressed in this discussion of portfolio performance are the views of this particular portfolio’s management team.

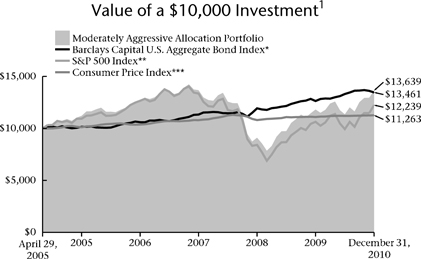

How did the Portfolio perform during the 12-month period ended December 31, 2010?

Thrivent Moderately Aggressive Allocation Portfolio earned a return of 15.43%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Growth category, of 13.18%. The Portfolio’s market benchmarks, the S&P 500 Index and the Barclays Capital U.S. Aggregate Bond Index, returned 15.06% and 6.54%, respectively.

What factors affected the Portfolio’s performance?

Allocations to equity segments providing higher returns than the S&P 500, good relative returns on the part of many of the managers in their respective asset classes, and exposure to better-performing sectors of the fixed-income markets were all factors in achieving the good results over the last fiscal year. The Portfolio benefited from exposure to mid- and small-capitalization companies, as those segments of the market outperformed the S&P 500. International mid- and small-cap stocks as well as emerging market equity and debt exposure provided higher returns than large-cap domestic equity. Exposure to large-cap international stocks offset some of those results as this group did not keep pace with the advance in domestic stocks.

Additionally, because of underweighting, our investments in large-cap stocks did not perform as well as the S&P 500. Over the course of the year, there were a few tactical adjustments versus our long-term strategic targets that added value. In particular, in April, we increased fixed- income exposure as equity prices appeared full, and following the equity market sell off over the summer, repositioned back to equities. We also implemented some unique investment positions in mortgage-backed securities in the fixed-income segment of the Portfolio, and that strategy proved to be quite rewarding.

What is your outlook?

We believe the economic cycle is likely to be sustained. While there is some risk of a “double dip” recession, we believe that should one occur it would be a function of policy decisions rather than the underlying economic fundamentals. A sustained recovery, albeit subpar versus historic experience after prior severe recessions, would be sufficient to support continued profit growth and moderate advances in stock prices. We feel that fixed-

6

Table of Contents

income securities are fully priced, and returns to this sector will be modest relative to the last few years. Based on current expectations, stocks appear to be the undervalued asset, and we are positioned to reflect that stance. Our outlook would be at risk in a deflationary environment, but we believe the probability of sustained deflation is low. We acknowledge the risks of accelerating inflation beyond the level the Federal Reserve is attempting to bring about could truncate the economic outlook. That risk will likely be a more significant factor in 2012.

Portfolio Facts

As of December 31, 2010

Net Assets | $2,505,554,313 | |

NAV | $11.89 | |

NAV - High† | 12/29/2010 - $11.90 | |

NAV - Low† | 7/2/2010 - $9.84 | |

Number of Holdings: 367 | ||

† For the year ended December 31, 2010 |

Average Annual Total Returns1

As of December 31, 2010

1-Year | 5-Year | From Inception 4/29/2005 | ||

15.43% | 4.00% | 5.62% |

| * | The Barclays Capital U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

| *** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

7

Table of Contents

| Thrivent Moderate Allocation Portfolio

Russell W. Swansen (left), David C. Francis, CFA (right) and Mark L. Simenstad, CFA (far right), Portfolio Co-Managers |  |

The Portfolio seeks long-term capital growth while providing reasonable stability of principal.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return, given its allocation to equity securities. Another risk of investing in the Portfolio is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Portfolio’s prospectus. Views expressed in this discussion of portfolio performance are the views of this particular portfolio’s management team.

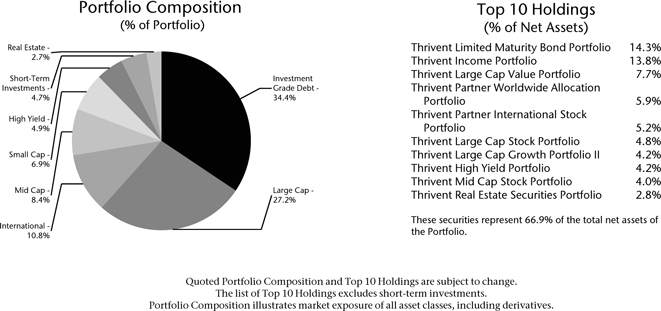

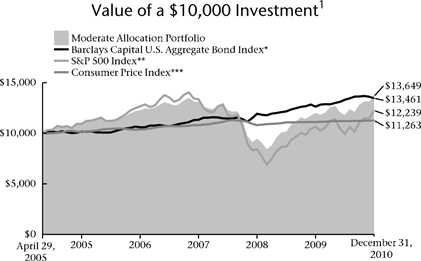

How did the Portfolio perform during the 12-month period ended December 31, 2010?

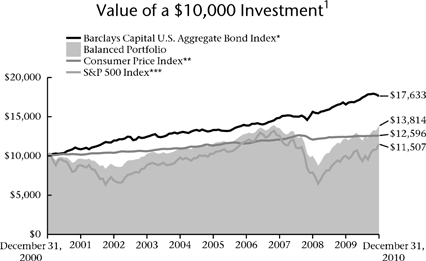

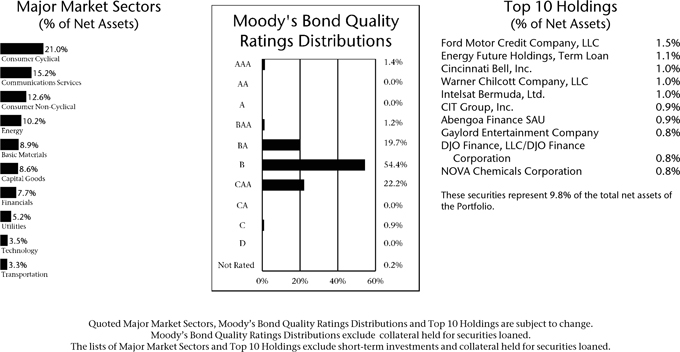

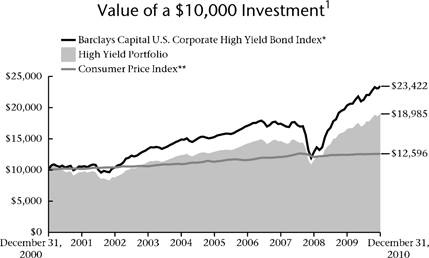

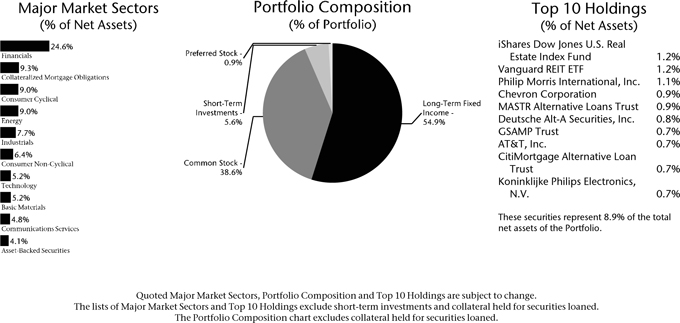

Thrivent Moderate Allocation Portfolio earned a return of 13.68%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Moderate category, of 11.40%. The Portfolio’s market benchmarks, the S&P 500 Index and the Barclays Capital U.S. Aggregate Bond Index, returned 15.06% and 6.54%, respectively.

What factors affected the Portfolio’s performance?

Allocations to equity segments providing higher returns than the S&P 500, good relative returns on the part of many of the managers in their respective asset classes, and exposure to better-performing sectors of the fixed-income markets were all factors in achieving the good results over the last fiscal year. The Portfolio benefited from exposure to mid- and small-capitalization companies as those segments of the market outperformed the S&P 500. International mid- and small-cap stocks as well as emerging market equity and debt exposure provided higher returns than large-cap domestic equity. Exposure to large-cap international stocks offset some of those results as this group did not keep pace with the advance in domestic stocks.

Additionally, because of underweighting, our investments in large-cap stocks did not perform as well as the S&P 500. Over the course of the year, there were a few tactical adjustments versus our long-term strategic targets that added value. In particular, in April, we increased fixed- income exposure as equity prices appeared full, and following the equity market sell off over the summer, repositioned back to equities. We also implemented some unique investment positions in mortgage-backed securities in the fixed-income segment of the Portfolio, and that strategy proved to be quite rewarding.

What is your outlook?

We believe the economic cycle is likely to be sustained. While there is some risk of a “double dip” recession, we believe that should one occur, it would be a function of policy decisions rather than the underlying economic fundamentals. A sustained recovery, albeit subpar versus historic experience after prior severe recessions, would be sufficient to support continued profit growth and moderate advances in stock prices. We feel that fixed-income securities are fully priced, and returns to this sector will be modest relative to the last few years. Based on current expectations, stocks appear to be the

s

s

8

Table of Contents

undervalued asset, and we are positioned to reflect that stance. Our outlook would be at risk in a deflationary environment, but we believe the probability of sustained deflation is low. We acknowledge the risks of accelerating inflation beyond the level the Federal Reserve is attempting to bring about could truncate the economic outlook. That risk will likely be a more significant factor in 2012.

Portfolio Facts

As of December 31, 2010

Net Assets | $3,569,369,286 | |

NAV | $11.79 | |

NAV - High† | 12/29/2010 - $11.80 | |

NAV - Low† | 7/2/2010 - $10.15 | |

Number of Holdings: 370 | ||

† For the year ended December 31, 2010 |

Average Annual Total Returns1

As of December 31, 2010

1-Year | 5-Year | From Inception 4/29/2005 | ||

13.68% | 4.42% | 5.63% |

| * | The Barclays Capital U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

| *** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

9

Table of Contents

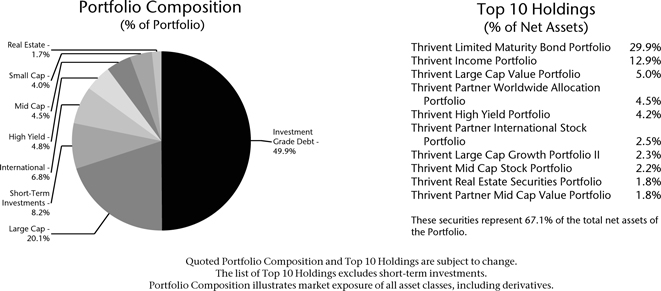

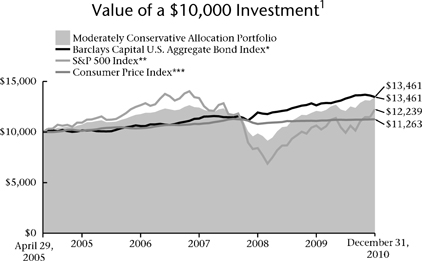

| Thrivent Moderately Conservative Allocation Portfolio

Russell W. Swansen (left), David C. Francis, CFA (right) and Mark L. Simenstad, CFA (far right), Portfolio Co-Managers |  |

The Portfolio seeks long-term capital growth while providing reasonable stability of principal.

The Portfolio’s performance depends upon how its assets are allocated across broad asset categories and applicable sub-classes within such categories. Some broad asset categories and sub-classes may perform below expectations or below the securities markets generally over short or extended periods. In particular, underperformance in the equity markets would have material adverse effect on the Portfolio’s total return, given its allocation to equity securities. Another risk of investing in the Portfolio is that its performance is dependent upon the performance of the underlying asset classes in which it invests. As a result, the Portfolio is subject to the same risks as those faced by the underlying asset classes. These and other risks are described in the Portfolio’s prospectus. Views expressed in this discussion of portfolio performance are the views of this particular portfolio’s management team.

How did the Portfolio perform during the 12-month period ended December 31, 2010?

Thrivent Moderately Conservative Allocation Portfolio earned a return of 11.41%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Conservative category, of 9.42%. The Portfolio’s market benchmarks, the S&P 500 Index and the Barclays Capital U.S. Aggregate Bond Index, earned a return of 15.06% and 6.54%, respectively.

What factors affected the Portfolio’s performance?

Allocations to equity segments providing higher returns than the S&P 500, good relative returns on the part of many of the managers in their respective asset classes, and exposure to better-performing sectors of the fixed-income markets were all factors in achieving good results over the last fiscal year. The Portfolio benefited from exposure to mid- and small-capitalization companies, as those segments of the market outperformed the S&P 500. International mid- and small-cap stocks, as well as emerging market equity and debt exposure, provided higher returns than large-cap domestic equity. Exposure to large-cap international stocks offset some of those results, as this group did not keep pace with the advance in domestic stocks.

Additionally, our investments in large-cap stocks did not perform as well as the S&P 500. Over the course of the year, there were a few tactical adjustments versus our long-term strategic targets that added value. In particular, in April, we increased fixed-income exposure as equity prices appeared full, and following the equity market sell off over the summer, repositioned back to equities. We also implemented some unique investment positions in mortgage-backed securities in the fixed-income segment of the Portfolio, and that strategy proved to be quite rewarding.

What is your outlook?

We believe the economic cycle is likely to be sustained. While there is some risk of a “double dip” recession, we believe that should one occur it would be a function of policy decisions rather than the underlying economic fundamentals. A sustained recovery, albeit subpar versus historic experience after prior severe recessions, would be sufficient to support continued profit growth and moderate advances in stock prices. We feel that fixed-

10

Table of Contents

income securities are fully priced, and returns to this sector will be modest relative to the last few years. Based on current expectations, stocks appear to be the undervalued asset, and we are positioned to reflect that stance. Our outlook would be at risk in a deflationary environment, but we believe the probability of sustained deflation is low. We acknowledge the risks of accelerating inflation beyond the level the Federal Reserve is attempting to bring about could truncate the economic outlook. That risk will likely be a more significant factor in 2012.

Portfolio Facts

As of December 31, 2010

Net Assets | $1,591,317,482 | |

NAV | $11.66 | |

NAV - High† | 12/31/2010 - $11.66 | |

NAV - Low† | 7/2/2010 - $10.43 | |

Number of Holdings: 360 | ||

† For the year ended December 31, 2010 | ||

Average Annual Total Returns1

As of December 31, 2010

1-Year | 5-Year | From Inception 4/29/2005 | ||

| 11.41% | 4.62% | 5.38% |

| * | The Barclays Capital U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

| *** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

11

Table of Contents

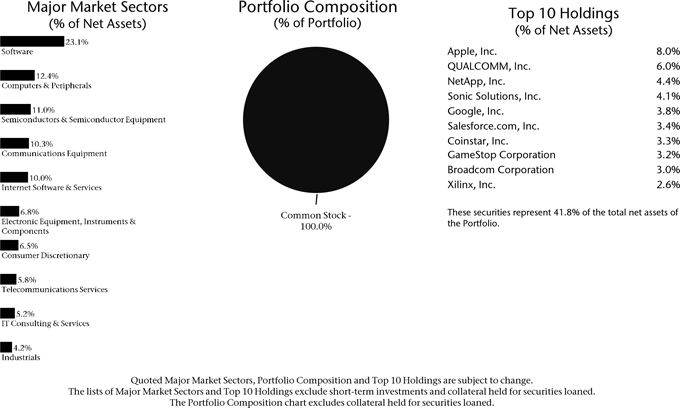

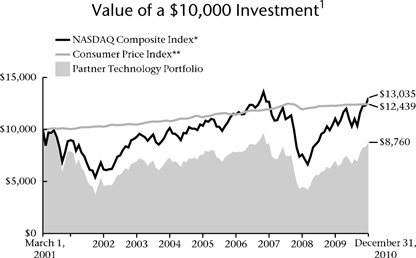

How did the Portfolio perform during the 12-month period ended December 31, 2010?

Thrivent Partner Technology Portfolio earned a return of 25.00%, compared with the median return of its peer group, the Lipper Science & Technology category, of 20.12%. The Portfolio’s market benchmark, the NASDAQ Composite Index, returned 18.15%.

What factors affected the Portfolio’s performance?

The Portfolio’s outperformance was a direct result of our bottom-up stock selection. Netflix, Inc. and NetApp, Inc. were the top positive contributors to relative performance, while FormFactor, Inc. and Equinix, Inc. detracted from performance.

Netflix rapidly added subscribers during the period, driven predominantly by its “watch instantly” service that can stream movies and TV shows from the Internet directly to subscribers’ computers.

NetApp develops data storage hardware and software for enterprise clients. Within this space, we believe the company’s storage devices are easier to buy, install and manage than competing products.

FormFactor designs and manufactures wafer probe cards that are used for testing semiconductor chips. We decided to exit the position in favor of higher conviction names.

In October, Equinix pre-announced third-quarter and full-year 2010 revenue that fell short of expectations as the company is believed to have made pricing concessions to retain key customers.

What is your outlook?

Equity returns were strong in 2010 despite continued concerns over the impact that new government regulations may have on the economy and the generally uneven nature of the U.S. recovery. Additionally, it appears that stock price momentum became a growing trend and investors’ appetite for equities increased, as noted in retail mutual fund flows. We are encouraged that

12

Table of Contents

the global economy appears to have entered its next chapter of recovery, moving from government-subsidized stimulus to what we expect to be a more sustainable stage led by healthy corporate spending and consumer participation. We expect recent tax policies out of Washington may also be helpful in increasing confidence and helping create some needed visibility into the future so that longer-term investment plans can be put in place.

We remain optimistic on corporate profits, predominantly driven by top-line rather than margin expansion, particularly in the information technology sector. We have seen and expect to continue to see more in the way of strategic mergers and acquisitions, private equity transactions and corporate buybacks. Collectively, we believe this provides a good backdrop for demand for equities. However, we feel that the need to pick the right stocks in the coming year will increase as not all companies will be beneficiaries of these trends. In our view, greater differentiation between stocks will continue as correlations decline from their 2010 highs.

Portfolio Facts

As of December 31, 2010

Net Assets | $36,305,028 | |

NAV | $7.11 | |

NAV - High† | 12/27/2010 - $7.16 | |

NAV - Low† | 2/4/2010 - $5.18 | |

Number of Holdings: 40 | ||

† For the year ended December 31, 2010 | ||

Average Annual Total Returns1

As of December 31, 2010

| 1-Year | 5-Year | From Inception 3/1/2001 | ||

| 25.00% | 3.01% | -1.34% |

| * | The NASDAQ Composite Index is a market capitalization-weighted index of all domestic and foreign securities listed on the NASDAQ Stock Exchange. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

13

Table of Contents

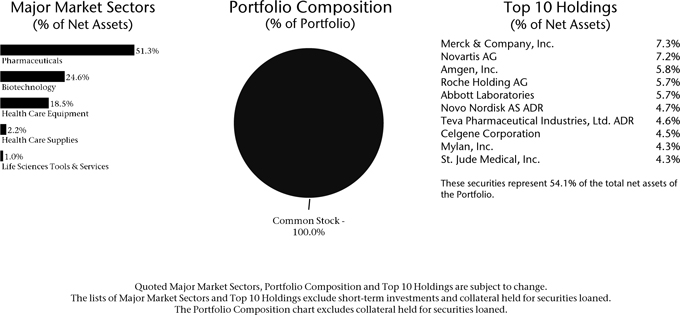

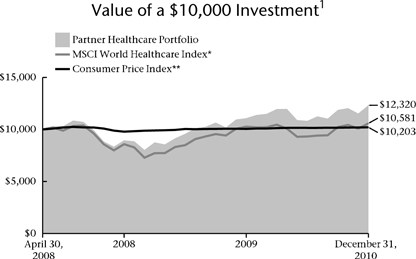

| Thrivent Partner Healthcare Portfolio |

Subadvised by Sectoral Asset Management, Inc.

Thrivent Partner Healthcare Portfolio seeks long-term capital growth.

The Portfolio’s investments are concentrated in issuers in the health care industry; therefore, the Portfolio is more vulnerable to price changes in the securities of issuers in this industry and factors specific to this industry than a more broadly diversified portfolio. In addition, as a non-diversified portfolio, the Portfolio is susceptible to the risk that events affecting a particular issuer will significantly affect the Portfolio’s performance. These and other risks are described in the Portfolio’s prospectus. Views expressed in this discussion of portfolio performance are the views of this particular portfolio’s management team.

How did the Portfolio perform during the 12-month period ended December 31, 2010?

Thrivent Partner Healthcare Portfolio earned a return of 11.13%, compared with the median return of its peer group, the Lipper Health/Biotechnology category of 7.10%. The Portfolio’s market benchmark, the Morgan Stanley Capital International (MSCI) World Healthcare Index, earned a return of 3.03%.

What factors affected the Portfolio’s performance?

Over the last 12 months, stock selection accounted for the outperformance of the Thrivent Partner Healthcare Portfolio relative to the benchmark (the MSCI World Healthcare Index), with both industry selection and cash positions detracting from outperformance slightly. In biotechnology, InterMune, Inc. and Genzyme Corporation were additive to results. Illumina, Inc., in life sciences, was also a positive contributor to results. In pharmaceuticals, Novo Nordisk favorably impacted returns. Pfizer, Inc. and Roche Holding detracted from returns as these stocks underperformed both the group and the overall markets.

What is your outlook?

All industries appear to offer good value at the current levels. The biotech focus is on companies entering new product cycles, primarily mid- and large-cap stocks. Earnings are expected to grow at 20%, while the industry pipeline should continue to advance. Recent approvals and pipeline progress on new vaccinations, medications and treatments, position the industry for continued growth despite a deteriorating pricing and reimbursement environment. We expect biotechnology companies to significantly outgrow the pharmaceuticals market.

For medtech companies, the emphasis is on novel technologies. Medtechs are expected to continue to grow, led by companies developing products offering significant innovations with marked improvements over current treatment practice.

For generics, we expect companies based in emerging pharmaceutical markets to continue performing well, benefiting from strong domestic growth mainly driven by branded generics. Japan, a potentially huge market for generics that is currently not well-penetrated, is showing

14

Table of Contents

some signs of progress, but more political support is still needed. We believe the generics industry remains attractively valued with good sales and earnings growth projected over the next five years. We think pharmaceuticals, through restructuring via mergers and acquisitions, spinouts and cost-cutting, are in the process of reinvigorating business models. Companies with manageable generic exposures, a significant presence in emerging markets, and developing pipelines are the most attractive investment opportunities, offering attractive price/earnings ratios and dividend yields.

Portfolio Facts

As of December 31, 2010

Net Assets | $17,868,183 | |

NAV | $12.08 | |

NAV - High† | 12/23/2010 - $12.16 | |

NAV - Low† | 7/1/2010 - $10.54 | |

Number of Holdings: 34 | ||

† For the year ended December 31, 2010 | ||

Average Annual Total Returns1

As of December 31, 2010

| 1-Year | From Inception 4/30/2008 | |

| 11.13% | 8.12% |

| * | The MSCI World Healthcare Index is a capitalization-weighted index of selected health care stocks from around the world. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

15

Table of Contents

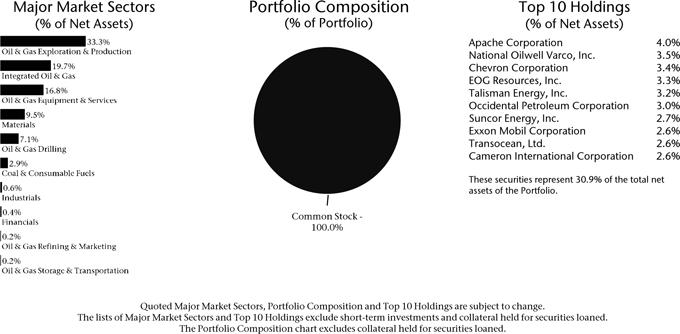

| Thrivent Partner Natural Resources Portfolio |

Subadvised by BlackRock Investment Management, LLC

Thrivent Partner Natural Resources Portfolio seeks long-term capital growth.

The Portfolio’s investments are concentrated in issuers in the natural resources industry; therefore, the Portfolio is more vulnerable to price changes in the securities of issuers in this industry and factors specific to this industry than a more broadly diversified portfolio. In addition, as a non-diversified portfolio, the Portfolio is susceptible to the risk that events affecting a particular issuer will significantly affect the Portfolio’s performance. These and other risks are described in the Portfolio’s prospectus. Views expressed in this discussion of portfolio performance are the views of this particular portfolio’s management team.

How did the Portfolio perform during the 12-month period ended December 31, 2010?

Thrivent Partner Natural Resources Portfolio earned a return of 16.33%, compared with the median return of its peer group, the Lipper Natural Resources category, of 19.34%. The Portfolio’s market benchmark, the S&P North American Natural Resources Sector Index, earned a return of 23.88%.

What factors affected the Portfolio’s performance?

Energy and resources stocks were particularly strong in the fourth quarter, in conjunction with the broad market, as stronger-than-anticipated global growth combined with continued monetary and fiscal stimulus contributed to improved investor sentiment, benefiting “risk” assets broadly.

Stock selection among oil and gas drilling names detracted from performance. Our allocation to Transocean, Ltd. was the major factor here, as the stock fell sharply following the Gulf oil spill. Our allocation to cash created a drag on performance, as 2010 was a relatively strong year for energy and resources stocks and equities in general.

The Portfolio’s overweighting to the oil and gas equipment and services segment, one of the higher-beta and better-performing groups in the energy sector, contributed strongly to returns. Stock selection among exploration and production names, particularly Whiting Petroleum Corporation and CNOOC, Ltd., also aided relative returns. Our overweighting to metals and mining within the materials sector also contributed, as returns in this group were particularly strong in the fourth quarter.

What is your outlook?

With supply for many natural resources relatively constrained, global demand and economic activity levels are likely to remain the key drivers of prices. To the extent that the worldwide economy continues to generate solid growth, oil prices will likely be supported above the $90 per barrel mark as demand remains robust. All groups look

16

Table of Contents

attractively valued, and we believe the sector will continue to outperform broad equity markets.

At the end of 2010, we had a large focus on oil-related names, and subsequently the Portfolio’s largest weightings were in the exploration and production, integrated oil and gas, and equipment and services segments of the energy sector. At this time, we continue to prefer oil to gas-related names and also carry an allocation to both precious and diversified metals names.

Portfolio Facts

As of December 31, 2010

Net Assets | $28,699,411 | |

NAV | $9.56 | |

NAV - High† | 12/31/2010 - $9.56 | |

NAV - Low† | 7/2/2010 - $7.19 | |

Number of Holdings: 94 | ||

† For the year ended December 31, 2010 | ||

Average Annual Total Returns1

As of December 31, 2010

| 1-Year | From Inception 4/30/2008 | |

| 16.33% | -1.58% |

| * | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

| ** | The S&P North American Natural Resources Sector Index is an index of selected U.S. traded natural resource related stocks. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

17

Table of Contents

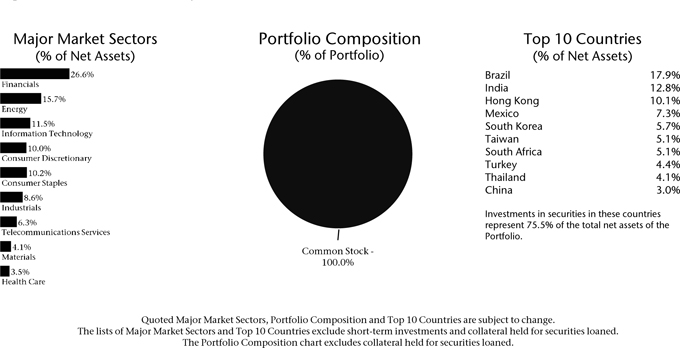

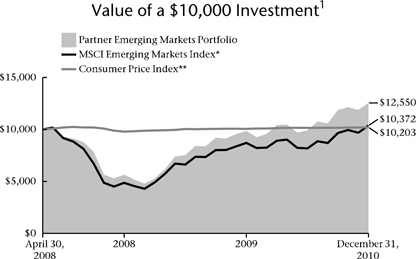

| Thrivent Partner Emerging Markets Portfolio |

Subadvised by Aberdeen Asset Management Investment Services Limited

Thrivent Partner Emerging Markets Portfolio seeks long-term capital growth.

Foreign investments, as compared to domestic ones, involve additional risks, including currency fluctuations, different accounting standards, and greater political, economic and market instability. These risks are magnified when the Portfolio invests in emerging markets, which may be of relatively small size and less liquid than domestic markets. These and other risks are described in the Portfolio’s prospectus. Views expressed in this discussion of portfolio performance are the views of this particular portfolio’s management team.

How did the Portfolio perform during the 12-month period ended December 31, 2010?

Thrivent Partner Emerging Markets Portfolio earned a return of 27.33%, compared with the median return of its peer group, the Lipper Emerging Markets category, of 18.21%. The Portfolio’s market benchmark, the MSCI Emerging Markets Index, earned a return of 19.20%.

What factors affected the Portfolio’s performance?

Emerging stock markets had a good 2010, in spite of a still uncertain environment. What were initially buoyant stock markets lost their footing in April and May because of recurrent fears over Europe’s sovereign debt problems and China’s monetary tightening. But equities bounced back after the summer, encouraged by the European Central Bank and International Monetary Fund bailout of Greece, continued growth in key emerging economies and improved corporate results. Capital inflows and expectations that the Fed would unleash another bout of quantitative easing lent further support. The momentum remained largely uninterrupted for the rest of the year, though November saw markets stumble briefly following the artillery attack on South Korea by the North.

The Portfolio’s significant outperformance was largely due to positive stock selection, notably in Brazil and South Africa. In Brazil, our holding in tobacco company Souza Cruz was buoyed by healthy third-quarter results, while retailer Lojas Renner gained from robust like-for-like sales growth across its network of apparel stores. South African retailers Massmart and Truworths rose on the back of improved consumer spending; Massmart was further bolstered by Walmart’s bid.

Stock selection in India was also beneficial. Our financial holdings, such as Housing Development Finance Corp. and ICICI Bank, aided performance as they experienced buoyant earnings growth and remained relatively unaffected by news of alleged corruption among senior officials at Indian state-owned banks, which hurt sentiment in the domestic banking sector. Meanwhile, Infosys Technologies was bolstered by robust sales and new clients.

At the regional level, our overweightings to several smaller markets, such as the Philippines, Thailand and Turkey, contributed to relative return, as these markets rallied on better-than-expected economic growth. The significant underweighting to China also helped, as the China domestic market lagged the benchmark on concerns over inflationary risks.

18

Table of Contents

What is your outlook?

Looking ahead, robust growth in the developing world, and a further influx of liquidity fueled by the Fed’s latest bout of quantitative easing, may well continue to drive emerging equities. But we expect volatility to persist, as structural imbalances, rising inflation, international currency disputes and Europe’s debt problems continue to dominate market attention in 2011. Also, gains of the last year have left some markets looking vulnerable to a correction, so a degree of caution is merited.

Portfolio Facts

As of December 31, 2010

Net Assets | $40,943,672 | |

NAV | $12.38 | |

NAV - High† | 11/4/2010 - $12.56 | |

NAV - Low† | 2/8/2010 - $8.91 | |

Number of Holdings: 53 | ||

† For the year ended December 31, 2010 | ||

Average Annual Total Returns1

As of December 31, 2010

| 1-Year | From Inception 4/30/2008 | |

| 27.33% | 8.87% |

| * | The MSCI Emerging Markets Index is a modified capitalization-weighted index of selected emerging economies from around the world. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

19

Table of Contents

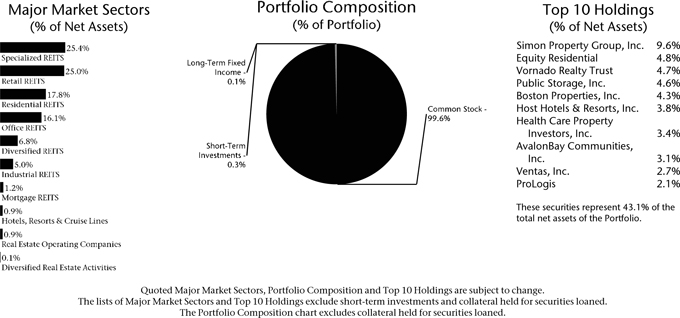

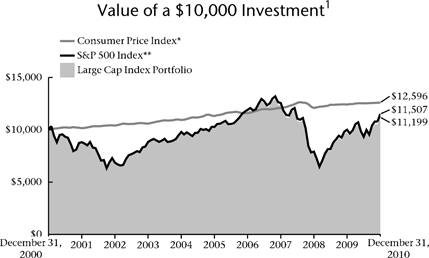

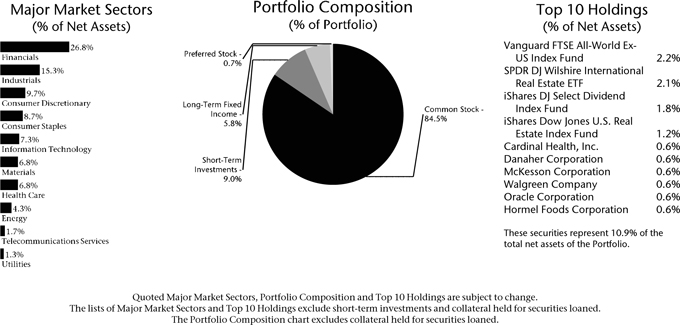

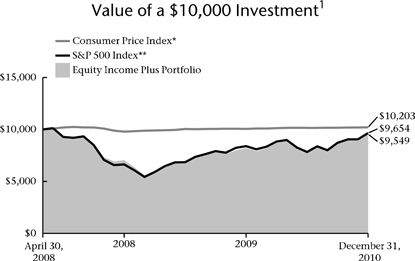

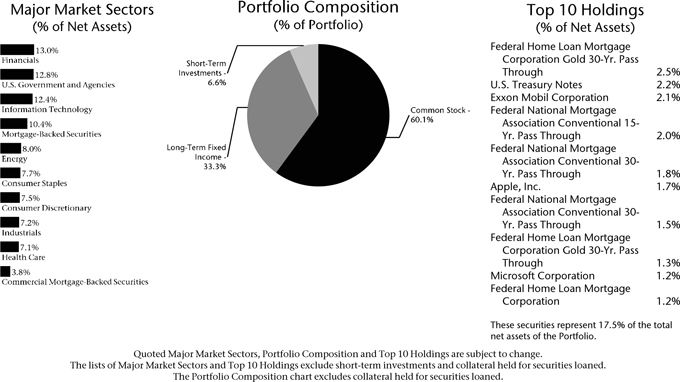

How did the Portfolio perform during the 12-month period ended December 31, 2010?

Thrivent Real Estate Securities Portfolio earned a return of 27.56%, compared with the median return of its peer group, the Lipper U.S. Real Estate category, of 25.29%. The Portfolio’s market benchmark, the FTSE NAREIT All Equity REITs Index, earned a return of 27.95%.

What factors affected the Portfolio’s performance?

While the Portfolio slightly outperformed its peer group and slightly underperformed its index, real estate investment trust (REIT) stocks performed well during 2010, benefiting from the demand for equities with attractive current dividend yields as a result of historically low interest rates. Another factor that helped performance was an improvement in capital markets, which allowed REITs to refinance their debt maturities at favorably low interest rates. Most importantly, occupancy rates improved for certain property types, specifically lodging properties and apartments, which allowed owners to increase rental rates as a result of improving demand. Investment demand for high-quality institutional real estate was strong in 2010, which supported an increase in transaction activity at higher valuation levels than expected when the year began. The significant deterioration in commercial real estate and widespread mortgage defaults that were expected in 2010 did not materialize, primarily because of lenders’ willingness to restructure or extend loan maturities.

The best-performing sectors in the Portfolio were apartments, lodging and regional malls. The Portfolio’s largest positive contributors to performance were: Equity Residential, which acquires, develops and manages apartment complexes throughout the United States; Simon Property Group, which develops, owns and manages regional malls, outlet centers and community shopping centers (domestically and abroad); and Host Hotels & Resorts, which owns upscale and luxury full-service hotels throughout the United States, Europe and Asia.

What is your outlook?

The U.S. economy appears to have stabilized and should continue to expand in 2011, though the pace of economic recovery is likely to be slower than historical recoveries. As a result, the commercial real estate market is likely to experience a gradual recovery. Occupancy rates are low by historical standards, particularly for office and industrial properties. The apartment sector is an exception, with healthy occupancy rates in the mid-90% range in most U.S. metropolitan markets. New construction within commercial real estate has been exceptionally low for several years. We believe this is a result of the weak

20

Table of Contents

economy, and it represents a necessary condition for an eventual improvement in occupancy and rental rates. The Portfolio has exposure to companies within each property sector, as well as mid- and small-capitalization REITs that offer attractive relative value and long-term growth characteristics. We believe 2010’s improvement in commercial real estate will continue, and we have positioned the Portfolio to benefit from improving trends.

Portfolio Facts

As of December 31, 2010

Net Assets | $329,450,651 | |

NAV | $14.49 | |

NAV - High† | 11/5/2010 - $15.23 | |

NAV - Low† | 2/9/2010 - $10.73 | |

Number of Holdings: 120 | ||

† For the year ended December 31, 2010 |

Average Annual Total Returns1

As of December 31, 2010

1-Year | 5-Year | From Inception 4/30/2003 | ||

27.56% | 2.90% | 11.44% |

| * | The FTSE NAREIT All Equity REITs Index is an unmanaged capitalization-weighted index of all equity real estate investment trusts. It is not possible to invest directly in this Index. The performance of this Index does not reflect deductions for fees, expenses or taxes. |

| ** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

21

Table of Contents

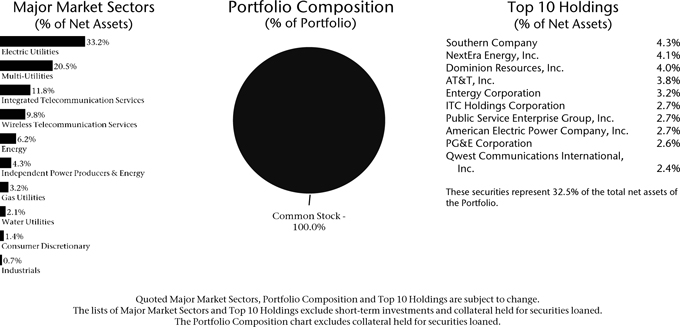

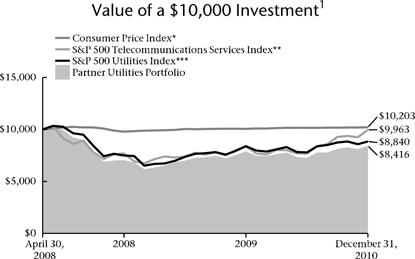

| Thrivent Partner Utilities Portfolio |

Subadvised by BlackRock Investment Management, LLC

Thrivent Partner Utilities Portfolio seeks capital appreciation and current income.

The Portfolio’s investments are concentrated in issuers in the utilities industry; therefore the Portfolio is more vulnerable to price changes in the securities of issuers in this industry and factors specific to this industry than a more broadly diversified portfolio. The Portfolio is also subject to the risks of investing in foreign (including emerging markets) stocks. These and other risks are described in the Portfolio’s prospectus. Views expressed in this discussion of portfolio performance are the views of this particular portfolio’s management team.

How did the Portfolio perform during the 12-month period ended December 31, 2010?

Thrivent Partner Utilities Portfolio earned a return of 6.69%, compared with the median return of its peer group, the Lipper Utility category, of 13.31%. The Portfolio’s market benchmarks, the S&P 500 Utilities Index and the S&P 500 Telecommunications Services Index, earned returns of 5.46% and 18.97%, respectively.

What factors affected the Portfolio’s performance?

The biggest impact on relative returns for the fourth quarter were stock selection within the electric utilities, integrated utilities and independent power-producing industries. Separately, an overweighted position in the oil, gas and consumable fuels industry within the energy sector also contributed significantly to relative performance during the quarter.

The biggest detractor from performance for the fourth quarter was an underweighting in the diversified telecommunications industry, followed by an underweighting in the wireless telecommunications industry. Finally, a small Portfolio weighting in the Internet and software services industry within the information technology sector detracted from relative performance.

The largest contributors to performance for the year were overweightings in the gas utilities and electric utilities industries, followed by stock selection within the independent power-producing industries. Additionally, an overweighting in the wireless telecommunications industry added meaningfully to relative returns for the year.

The biggest detriments to overall performance for the year were an underweighting in the diversified telecommunications industry, a marginal overweighting in the energy sector, and an overweighting in the commercial services and supplies segment within the industrials sector.

What is your outlook?

With respect to the U.S. electric utility sector, we are positive and believe that general profitability at the company level will move in-line with a recovering economy in 2011. We expect some overdue multiple expansions and look for stronger earnings from the sector. Additionally, increased usage of modern electronics and appliances should continue to provide a robust base for volume growth into the next few years.

In terms of industry trends, we will be keeping a watchful eye on management succession, the general move toward

22

Table of Contents

a more regulated approach and away from merchant generation at the company level, and public utilities seeking to increase their scale to help offset new environmental rules. Within the telecom sector, we are currently favoring the wireless companies, and believe that a lowering unemployment figure and gradually improving economy will directly impact the proliferation of data-heavy smart phones and tablets, helping to support earnings within the sector.

Portfolio Facts

As of December 31, 2010

Net Assets | $7,906,814 | |

NAV | $8.10 | |

NAV - High† | 12/29/2010 - $8.10 | |

NAV - Low† | 7/2/2010 - $6.97 | |

Number of Holdings: 86 | ||

† For the year ended December 31, 2010 |

Average Annual Total Returns1

As of December 31, 2010

1-Year | From Inception | |

| 6.69% | -6.25% |

| * | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

| ** | The S&P 500 Telecommunications Services Index is a capitalization-weighted index of telecommunications sector securities. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in this Index. The performance of this Index does not reflect deductions for fees, expenses or taxes. |

| *** | The S&P 500 Utilities Index is a capitalization-weighted index of utilities sector securities. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in this Index. The performance of this Index does not reflect deductions for fees, expenses or taxes. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

23

Table of Contents

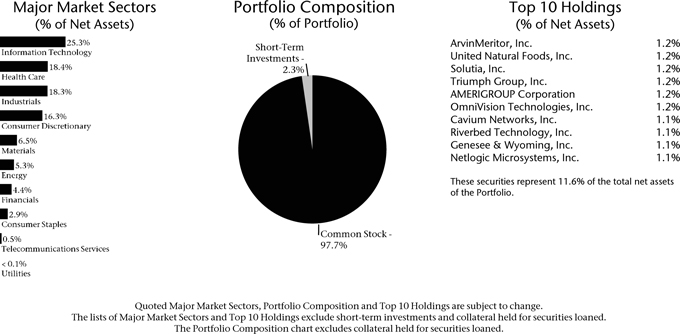

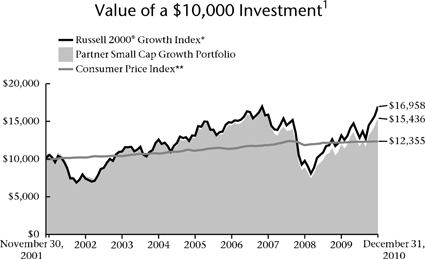

| Thrivent Partner Small Cap Growth Portfolio |

Subadvised by Turner Investment Partners, Inc.

Thrivent Partner Small Cap Growth Portfolio seeks long-term capital growth.

The Portfolio is exposed to the risks of investing in equity securities of smaller companies, which may include, but are not limited to, lower trading volume and less liquidity than larger, more established companies. Small company stock prices are generally more volatile than large company stock prices. These and other risks are described in the Portfolio’s prospectus. Views expressed in this discussion of portfolio performance are the views of this particular portfolio’s management team.

How did the Portfolio perform during the 12-month period ended December 31, 2010?

Thrivent Partner Small Cap Growth Portfolio earned a return of 28.86%, compared with the median return of its peer group, the Lipper Small-Cap Growth category, of 26.49%. The Portfolio’s market benchmark, the Russell 2000® Growth Index, earned a return of 29.09%.

What factors affected the Portfolio’s performance?

Strong earnings, cash-rich companies and fair valuations, along with signs of life from the battered U.S. economy, combined to push the market up in the second half of the year. With improving economic conditions and what we feel is a favorable backdrop for companies to grow their earnings, the Thrivent Partner Small Cap Growth Portfolio provided a healthy return and performed in-line with the Russell 2000® Growth Index. With the exception of the utilities sector, every Portfolio sector generated positive returns led by energy and technology. On a relative basis, the health care sector was the best-returning sector, by far. Meanwhile, the technology sector, despite posting a solid absolute return, detracted from results.

The technology sector was an area of weakness for the Portfolio. Specifically, semiconductor and Internet software services holdings contributed to a large amount of the underperformance. Vocus, Inc., which offers on-demand software for public relations management, continues to be a low priority for enterprises in the initial stages of an IT spending recovery. While there is nothing fundamentally flawed with the company, we sold the position as we believe it will take longer for the company to see a rebound in its bookings. Volterra Semiconductor Corp., the maker of low voltage power supply chips used in servers, PCs and notebooks, reported a lackluster quarter during the period as the company’s new chip for notebooks was moving along slower than anticipated. We exited the position because we feel the server market refresh cycle has passed

What is your outlook?

Although the equity markets posted solid gains over the past year, we believe that the market can continue to march higher for several reasons. First, the market still appears cheap from a valuation standpoint. Second,

24

Table of Contents

earnings continue to exceed Wall Street’s expectations, with the S&P 500 Index reporting seven straight quarters of positive earnings surprises. We expect this trend to continue through 2011. Third, the equity market should benefit from a continuation of corporate-related mergers as companies seek ways to generate returns from their stockpiles of cash.

Portfolio Facts

As of December 31, 2010

Net Assets | $208,524,665 | |

NAV | $12.92 | |

NAV - High† | 12/21/2010 - $13.18 | |

NAV - Low† | 2/8/2010 - $9.33 | |

Number of Holdings: 210 | ||

† For the year ended December 31, 2010 |

Average Annual Total Returns1

As of December 31, 2010

1-Year | 5-Year | From Inception 11/30/2001 | ||

28.86% | 3.79% | 4.89% |

| * | The Russell 2000® Growth Index is an index comprised of small capitalization companies with a greater than average growth orientation. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

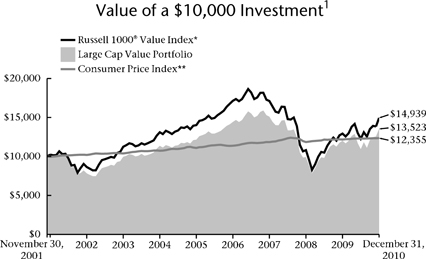

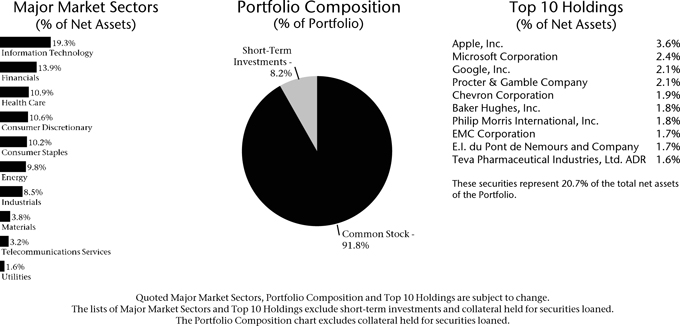

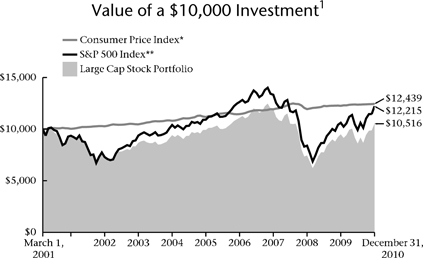

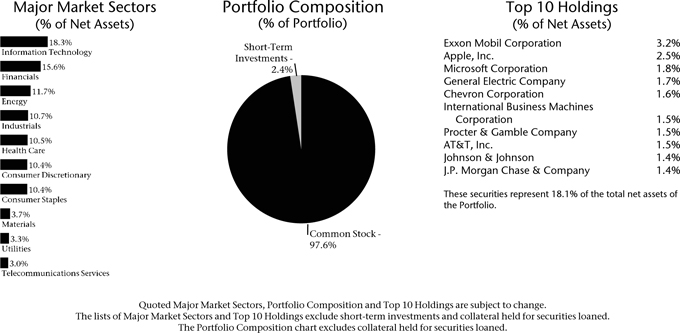

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.