UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4603

Thrivent Series Fund, Inc.

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

Michael W. Kremenak, Assistant Secretary

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-4198

Date of fiscal year end: December 31

Date of reporting period: December 31, 2013

| Item 1. | Report to Stockholders |

Make variable annuity changes online, quickly and easily

You have more options to manage your variable annuity—in fewer steps

You’ve invested in an annuity-now you have another way to manage it with our online annuity service center. With 24/7 access, it’s there when you want it. Plus, you can make changes any time in seconds.

The online annuity service center offers you more options, including:

• Complete reallocation • Partial reallocation • New money allocation • Partial withdrawals • Transaction status and history

|  |

Just log in* to Thrivent.com and select your variable annuity contract by clicking on Manage Contract to make changes. It’s the easiest and most convenient way to update your annuity. Save time by making changes with just a few easy clicks!

As always, your Thrivent Financial representative is available to answer any questions you may have.

| * | In order to access your variable annuity contract on Thrivent.com, you must be a registered user. If you are not already registered, you can register immediately by clicking on Register Now next to the login area. |

This page is not part of the annual report.

Table of Contents

| 2 | ||||

Portfolio Perspectives | ||||

| 4 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

| 16 | ||||

| 18 | ||||

| 20 | ||||

| 22 | ||||

| 24 | ||||

| 26 | ||||

| 28 | ||||

| 30 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| 38 | ||||

| 40 | ||||

| 42 | ||||

| 44 | ||||

| 46 | ||||

| 48 | ||||

| 50 | ||||

| 52 | ||||

| 54 | ||||

| 56 | ||||

| 58 | ||||

| 60 | ||||

| 62 | ||||

| 64 | ||||

| 66 | ||||

| 68 | ||||

| 70 | ||||

| 73 | ||||

| 74 | ||||

| 85 | ||||

| 109 | ||||

| 134 | ||||

| 155 | ||||

| 167 | ||||

| 181 | ||||

| 196 | ||||

| 207 | ||||

| 209 | ||||

| 211 | ||||

| 213 | ||||

| 217 | ||||

| 220 | ||||

| 223 | ||||

| 227 | ||||

| 231 | ||||

| 239 | ||||

| 242 | ||||

| 245 | ||||

| 247 | ||||

| 254 | ||||

| 274 | ||||

| 276 | ||||

| 279 | ||||

| 282 | ||||

| 284 | ||||

| 287 | ||||

| 294 | ||||

| 302 | ||||

| 316 | ||||

| 322 | ||||

| 334 | ||||

| 338 | ||||

| 344 | ||||

| 350 | ||||

| 362 | ||||

| 381 | ||||

| 393 | ||||

| 397 | ||||

| 399 | ||||

The stock market surged to record highs in 2013 as the U.S. economy accelerated and Europe showed signs of emerging from a recession. Fixed-income markets mostly fell as investors worried that the improving economic picture might prompt the Federal Reserve to temper its accommodative monetary policy. The investment outlook was generally positive heading into 2014.

Economic Review

After nearly stalling in the fourth quarter of 2012, the U.S. economy accelerated steadily through the first nine months of 2013. The housing and auto markets were particularly strong, with housing starts rising to a seasonally adjusted annual rate of 1,091,000 units by November, up nearly 30% from a year earlier and the highest rate in nearly six years. Auto sales rose 8% to 15.6 million units, nearly matching the number of cars and light trucks sold in 2007 just before the start of the last recession.

Gross domestic product (GDP), the sum of all goods and services produced, rose at a 1.1% annual rate in the first quarter, a 2.5% rate in the second, and a 4.1% rate in the third. The latest performance marked only the fourth time in the past 10 years that GDP growth surpassed the 4% level. Rising business inventories accounted for nearly 41% of third-quarter GDP growth, but the economy showed renewed vigor on a broad front. Investment in factories and other nonresidential structures grew at a 13.4% annual rate. Exports rose 3.9%, reflecting improving economic conditions abroad, and hit a record high in November. On the consumer front, personal consumption expenditures grew 2.0% in the third quarter, while spending on durable goods, such as appliances and automobiles, increased 7.9%. All those gains were offset in part by continued reductions in federal spending and investment, which fell 1.5%. We expect fourth-quarter GDP results to show continued economic growth, albeit not at the heady rate exhibited in the third.

Despite the economy’s strong showing in 2013, the recovery from the 2008–2009 recession remains sluggish by historical standards, and that has translated into sluggish gains in the job market, too. The U.S. created an average of 182,000 jobs per month in 2013, about the same as in 2012, leaving the country with 1.2 million fewer jobs than it had prior to the 2008–2009 recession. The unemployment rate, which peaked at 10% in 2009, fell dramatically in 2013, to 6.7% in December from 7.9% a year earlier. But a large part of that improvement was attributable not to job creation but simply to people giving up looking for work.

Economic conditions improved in Europe and China, which are important to the American economy and its financial markets. After a year and a half of economic contraction, GDP for the 17-country eurozone grew 0.3% in the second quarter of 2013 and another 0.1% in the third. China, after watching its economic growth slow for much of the past three years, saw its GDP rise 7.5% year-over-year in the second quarter, then jump 7.8% in the third.

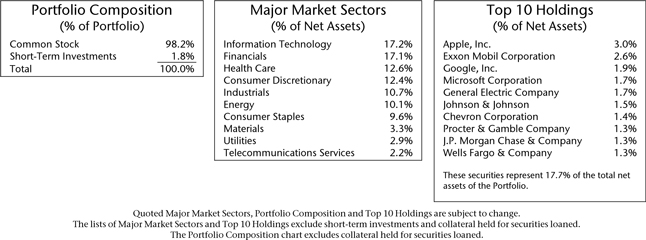

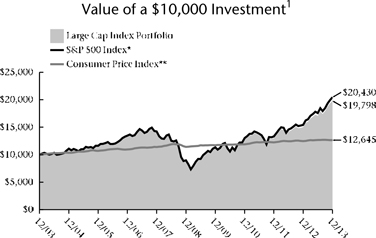

Market Review

Equity investors were generally cheered by the improving global economic outlook, sending several major U.S. stock market indexes to their first record highs since 2007. After posting a total return of 16% in 2012, the S&P 500 Index of large-company stocks earned 32.4% in 2013, its biggest gain since 1997. Small-company stocks did even better, with the Russell 2000 Index earning 38.8%. Growth stocks generally outperformed value stocks. On a price basis alone, the S&P 500 finished the year up 173% from its March 2009 low.

Stocks in developed markets overseas also turned in strong results in 2013 amid improving economic conditions in Europe and a shift in Japan to growth-oriented fiscal and monetary policies. The MSCI EAFE Index, which tracks developed markets in Europe, Asia and Australia, posted a total return of 23.3%.

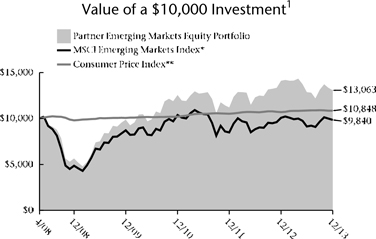

Emerging market stocks were mostly lower, with the MSCI Emerging Markets index posting a total return of -2.3%. The index slumped during the second quarter as investors worried about slowing economic growth in China, India and Brazil, and about lower commodities prices, which adversely impact the many natural resources companies located in emerging economies. While stock prices rebounded in October when China’s economy began showing new signs of strength, they drifted lower again as the year wound to a close.

While equity markets were clearly helped by the improving economic climate, they also benefited from a dearth of opportunities in the fixed-income markets, where the accommodative monetary policies of the Federal Reserve were helping to keep bond yields near historic lows as the year got under way. New worries swept through the fixed-income markets in May, though, after Federal Reserve Chairman Ben Bernanke said the improving economy might prompt the Fed to pare back its quantitative easing program, which involved the Fed buying $85 billion of bonds each month to help keep long-term interest rates low. In December, the Fed announced that it would reduce its monthly purchases by $10 billion beginning in January 2014, and might schedule further cuts if the economy continued to improve.

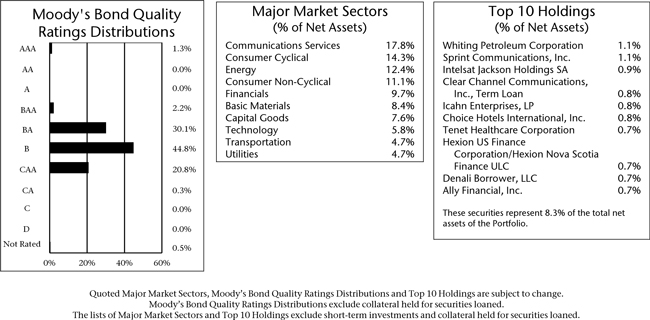

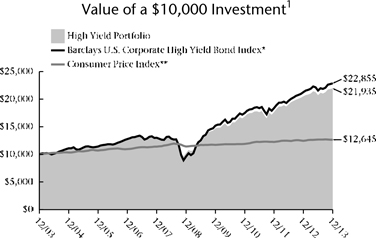

Anticipating a shift in Fed policy, bond yields began to rise mid-year, which resulted in falling bond prices. By year-end, the yield on the 10-year Treasury note had jumped to just over 3% from 1.8% a year earlier. With most sectors of the bond market following the lead of the Treasury market, the broad-based Barclays U.S. Aggregate Bond Index finished the year with a loss of 2%. High-yield corporate bonds, which tend to rally when the economy grows, were the standout exception in the fixed-income markets, with the Barclays U.S. Corporate High Yield Bond Index posting a positive return of 7.4%.

2

Our Outlook

The generally tepid pace of the economic recovery over the past four and a half years has an opportunity to accelerate slightly in 2014, barring an unexpected crisis, and that should create a favorable environment for the investment markets. Our economic models suggest GDP growth in 2014 has the potential to meet or exceed the 2.2% rate averaged over the past three years. We also expect further improvement in GDP growth in the U.K. and Europe to about 2%, in China to about 8%, and in Japan to between 1% and 2%.

Continued economic progress will be important to the equity markets, where valuations are now relatively high and reflect a general expectation of stronger corporate profits in the year ahead. We believe profits will improve slightly, a consequence of both organic growth and corporate share repurchases. Stock prices could advance under that scenario, but we expect performance to be modest, especially compared to the extraordinary performance of 2013.

Activity in the fixed-income markets will depend to a large degree on U.S. monetary policy. The Fed is expected to keep short-term interest rates low through 2014, but longer-term rates are likely to ratchet somewhat higher, particularly if the Fed continues to pare back its quantitative easing program. We would not be surprised to see modest losses in the Treasury sector. High-yield bonds could post modest gains as fixed-income investors searching for yield continue buying in that sector.

To ensure that your portfolio is positioned to negotiate the shifting investment environment, we encourage you to meet with your Thrivent Financial representative. He or she can make sure your portfolio remains aligned with your financial goals and tolerance for risk.

As always, thank you for the trust you have placed in our entire team of professionals at Thrivent Financial.

Sincerely,

Russell W. Swansen

President

Thrivent Series Fund, Inc.

3

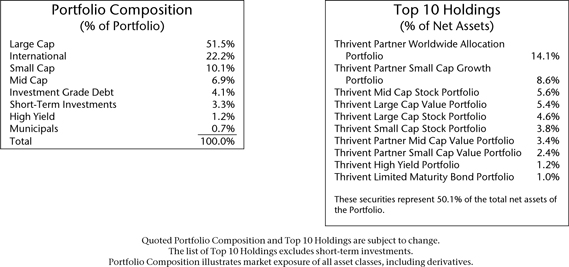

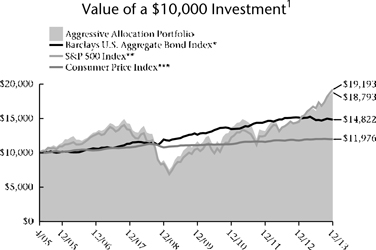

Thrivent Aggressive Allocation Portfolio

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

Thrivent Aggressive Allocation Portfolio seeks long-term capital growth.

The Portfolio invests in other Thrivent mutual funds and in directly held equity and debt instruments. The Portfolio is subject to its own operating expenses and the operating expenses of the other funds in which it invests, and is subject to all of the risks of the other funds in which it invests. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment adviser. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. The use of equity index futures involves transaction costs and the loss from investing in them can exceed the initial investment.

How did the Portfolio perform during the 12-month period ended December 31, 2013?

Thrivent Aggressive Allocation Portfolio earned a return of 27.05%, compared with the median return of its peer group, the Lipper Multi-Cap Core category, of 29.51%. The Portfolio’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 32.39% and -2.02%, respectively.

What factors affected the Portfolio’s performance?

Most major equity markets meaningfully outperformed fixed-income markets in the period. Across equity markets, small- and mid-cap domestic stocks outperformed large caps in both domestic and foreign developed markets. Emerging market equities, while positive, provided dramatically lower returns versus most other stock groups.

In fixed income, Treasury and agency securities underperformed both investment-grade corporate and high-yield bonds. The Portfolio’s return in its fixed-income segment bested the bond index because the Portfolio had limited exposure to the underperforming sectors.

The Portfolio’s return was aided by its significant exposure to equities across most major market segments. We were overweighted in large-cap stocks within our equity portfolio, which partially limited our advance because large-cap stocks did not keep pace with small and mid caps, although returns to all categories were quite attractive on an absolute basis.

Over the period, the Portfolio had an average exposure to fixed-income securities of 6%. Our holdings performed well versus the fixed-income benchmark, but even the best segment of bonds did not keep pace with the strong advance in U.S. stocks. Performance was mixed across the actively managed equity segments of the Portfolio.

The large-cap growth and value segments outperformed, while the mid-cap growth and small-cap core portfolios underperformed, each measured versus their respective benchmarks. However, absolute returns for all of the domestic equity segments of the Portfolio were quite good.

Within our international section, we had exposure to emerging markets debt and equity, and both of those segments—while performing well against their respective indexes—did not keep pace with the broader market advance. In total, results were close to management expectations given the asset mix of the Portfolio.

What is your outlook?

As the period drew to a close, we became modestly more conservative in our portfolio positioning. Within fixed income, in the absence of an unexpected decline in the economy, we believe U.S. Treasury and agency securities are overvalued due to an aggressive purchase program that the Federal Reserve Bank has undertaken. As a result, we are overweighted in corporate bonds, and underweighted in Treasury and agency securities.

In equities, we have taken steps to modestly reduce our equity exposure. With the significant advance in global stock markets, it is difficult to represent that stocks are undervalued. At best, we would suggest equities are fairly valued. That does not mean any decline is imminent; in our process, however, it suggests it is appropriate to modestly adjust allocations.

While the rally certainly could continue to advance, we believe it will likely be at a more moderate pace. We do think that within equities, small- and mid-cap domestic stocks are richly priced versus large caps, and that within large caps, non-U.S. stocks provide better opportunities. Thus, we have tilted the Portfolio’s positions to take advantage of those opportunities.

4

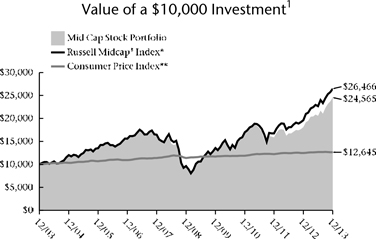

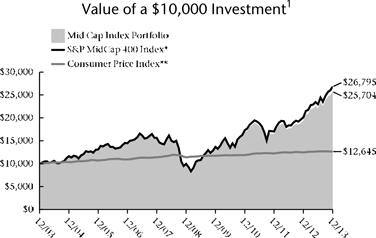

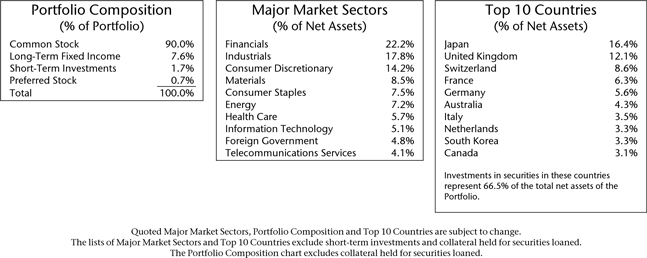

Average Annual Total Returns1

As of December 31, 2013

1-Year | 5-Year | From Inception 4/29/2005 | ||

| 27.05% | 16.03% | 7.54% |

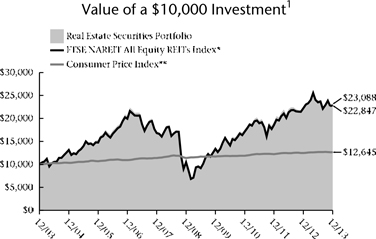

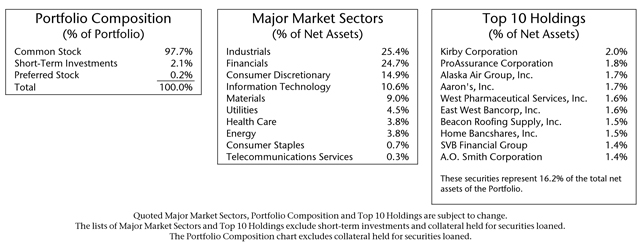

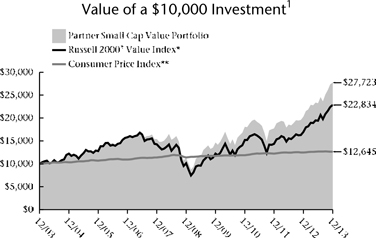

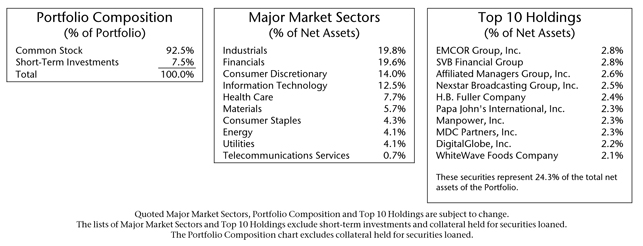

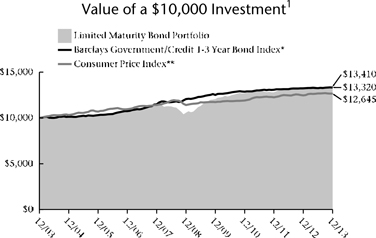

| * | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

| *** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

5

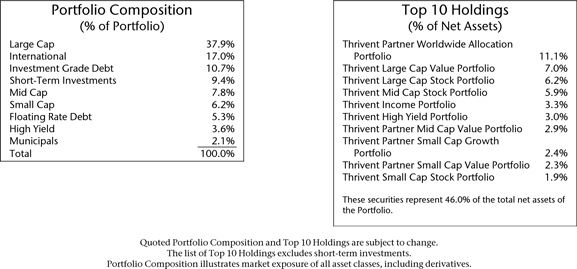

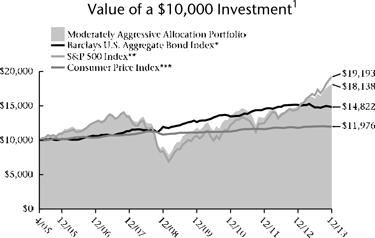

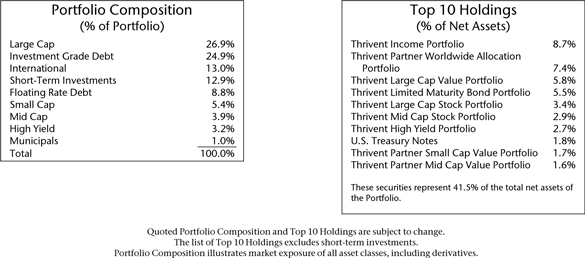

Thrivent Moderately Aggressive Allocation Portfolio

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

Thrivent Moderately Aggressive Allocation Portfolio seeks long-term capital growth.

The Portfolio invests in other Thrivent mutual funds and in directly held equity and debt instruments. The Portfolio is subject to its own operating expenses and the operating expenses of the other funds in which it invests, and is subject to all of the risks of the other funds in which it invests. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment adviser. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. The use of equity index futures involves transaction costs and the loss from investing in them can exceed the initial investment.

How did the Portfolio perform during the 12-month period ended December 31, 2013?

Thrivent Moderately Aggressive Allocation Portfolio earned a return of 21.30%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Growth category, of 19.15%. The Portfolio’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 32.39% and -2.02%, respectively.

What factors affected the Portfolio’s performance?

Most major equity markets meaningfully outperformed fixed-income markets in the period. Across equity markets, small- and mid-cap domestic stocks outperformed large caps—both domestic as well as foreign. Emerging market equities, while positive, provided dramatically lower returns versus most other stock groups.

In fixed income, Treasury and agency securities underperformed both investment-grade corporate and high-yield bonds. The Portfolio’s return in its fixed-income segment bested the bond index because the Portfolio had limited exposure to the underperforming sectors.

The Portfolio’s return was aided by its significant exposure to equities across most major market segments. We were overweighted in large-cap stocks within our equity portfolio, which partially limited our advance because large-cap stocks did not keep pace with small and mid caps, but returns to all categories were quite attractive on an absolute basis.

Over the period, the Portfolio had an average exposure to fixed-income securities of 23%. Our holdings performed well versus the fixed-income benchmark, but even the best segment of bonds did not keep pace with the strong advance in U.S. stocks. Performance was mixed across the actively managed equity segments of the Portfolio.

The large-cap growth and value segments outperformed, while the mid-cap growth and small-cap core portfolios underperformed, each measured versus their respective benchmarks. However, absolute returns for all of the domestic equity segments of the Portfolio were quite good.

Within our international section, we had exposure to emerging markets debt and equity, and both of those segments—while performing well against their respective indexes—did not keep pace with the broader market advance. In total, results were close to management expectations given the asset mix of the Portfolio.

What is your outlook?

As the period drew to a close, we became modestly more conservative in our portfolio positioning. Within fixed income, in the absence of an unexpected decline in the economy, we believe U.S. Treasury and agency securities are overvalued due to an aggressive purchase program that the Federal Reserve Bank has undertaken. As a result, we are overweighted in corporate bonds, and underweighted in Treasury and agency securities.

In equities, we have taken steps to modestly reduce our equity exposure. With the significant advance in global stock markets, it is difficult to represent that stocks are undervalued. At best, we would suggest equities are fairly valued. That does not mean any decline is imminent; in our process, however, it suggests it is appropriate to modestly adjust allocations.

While the rally certainly could continue to advance, we believe it will likely be at a more moderate pace. We do think that within equities, small- and mid-cap domestic stocks are richly priced versus large caps, and that within large caps, non-U.S. stocks provide better opportunities. Thus, we have tilted the Portfolio’s positions to take advantage of those opportunities.

6

Average Annual Total Returns1

As of December 31, 2013

1-Year | 5-Year | From Inception 4/29/2005 | ||

| 21.30% | 14.78% | 7.10% |

| * | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

| *** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

7

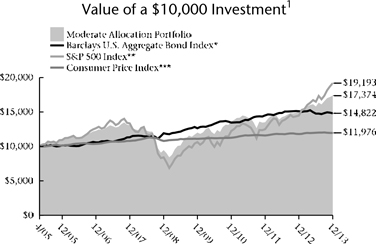

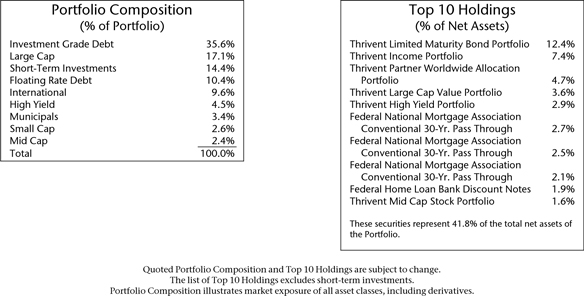

Thrivent Moderate Allocation Portfolio

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

Thrivent Moderate Allocation Portfolio seeks long-term capital growth while providing reasonable stability of principal.

The Portfolio invests in other Thrivent mutual funds and in directly held equity and debt instruments. The Portfolio is subject to its own operating expenses and the operating expenses of the other funds in which it invests, and is subject to all of the risks of the other funds in which it invests. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment adviser. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. The use of equity index futures involves transaction costs and the loss from investing in them can exceed the initial investment.

How did the Portfolio perform during the 12-month period ended December 31, 2013?

Thrivent Moderate Allocation Portfolio earned a return of 15.12%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Moderate category, of 14.15%. The Portfolio’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 32.39% and -2.02%, respectively.

What factors affected the Portfolio’s performance?

Most major equity markets meaningfully outperformed fixed-income markets in the period. Across equity markets, small- and mid-cap domestic stocks outperformed large caps—both domestic as well as foreign. Emerging market equities, while positive, provided dramatically lower returns versus most other stock groups.

In fixed income, Treasury and agency securities underperformed both investment-grade corporate and high-yield bonds. The Portfolio’s return in its fixed-income segment bested the bond index because the Portfolio had limited exposure to the underperforming sectors.

The Portfolio’s return was aided by its significant exposure to equities across most major market segments. We were overweighted in large-cap stocks within our equity portfolio, which partially limited our advance because large-cap stocks did not keep pace with small and mid caps, but returns to all categories were quite attractive on an absolute basis.

Over the period, the Portfolio had an average exposure to fixed-income securities of 42%. Our holdings performed well versus the fixed-income benchmark, but even the best segment of bonds did not keep pace with the strong advance in U.S. stocks. Performance was mixed across the actively managed equity segments of the Portfolio.

The large-cap growth and value segments outperformed, while the mid-cap growth and small-cap core portfolios underperformed, each measured versus their respective benchmarks. However, absolute returns for all of the domestic equity segments of the Portfolio were quite good.

Within our international section, we had exposure to emerging markets debt and equity, and both of those segments—while performing well against their respective indexes—did not keep pace with the broader market advance. In total, results were close to management expectations given the asset mix of the Portfolio.

What is your outlook?

As the period drew to a close, we became modestly more conservative in our portfolio positioning. Within fixed income, in the absence of an unexpected decline in the economy, we believe U.S. Treasury and agency securities are overvalued due to an aggressive purchase program that the Federal Reserve Bank has undertaken. As a result, we are overweighted in corporate bonds, and underweighted in Treasury and agency securities.

In equities, we have taken steps to modestly reduce our equity exposure. With the significant advance in global stock markets, it is difficult to represent that stocks are undervalued. At best, we would suggest equities are fairly valued. That does not mean any decline is imminent; in our process, however, it suggests it is appropriate to modestly adjust allocations.

While the rally certainly could continue to advance, we believe it will likely be at a more moderate pace. We do think that within equities, small- and mid-cap domestic stocks are richly priced versus large caps, and that within large caps, non-U.S. stocks provide better opportunities. Thus, we have tilted the Portfolio’s positions to take advantage of those opportunities.

8

Average Annual Total Returns1

As of December 31, 2013

1-Year | 5-Year | From Inception 4/29/2005 | ||

| 15.12% | 12.92% | 6.57% |

| * | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

| *** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

9

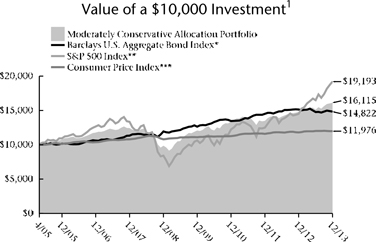

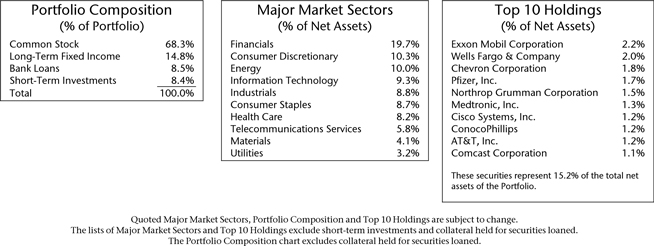

Thrivent Moderately Conservative Allocation Portfolio

Russell W. Swansen, David C. Francis, CFA and Mark L. Simenstad, CFA, Portfolio Co-Managers

Thrivent Moderately Conservative Allocation Portfolio seeks long-term capital growth while providing reasonable stability of principal.

The Portfolio invests in other Thrivent mutual funds and in directly held equity and debt instruments. The Portfolio is subject to its own operating expenses and the operating expenses of the other funds in which it invests, and is subject to all of the risks of the other funds in which it invests. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment adviser. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. The use of equity index futures involves transaction costs and the loss from investing in them can exceed the initial investment.

How did the Portfolio perform during the 12-month period ended December 31, 2013?

Thrivent Moderately Conservative Allocation Portfolio earned a return of 9.02%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Conservative category, of 7.56%. The Portfolio’s market benchmarks, the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, earned returns of 32.39% and -2.02%, respectively.

What factors affected the Portfolio’s performance?

Most major equity markets meaningfully outperformed fixed-income markets in the period. Across equity markets, small- and mid-cap domestic stocks outperformed large caps—both domestic as well as foreign. Emerging market equities, while positive, provided dramatically lower returns versus most other stock groups.

In fixed income, Treasury and agency securities underperformed both investment-grade corporate and high-yield bonds. The Portfolio’s return in its fixed-income segment bested the bond index because the Portfolio had limited exposure to the underperforming sectors.

The Portfolio’s return was aided by its significant exposure to equities across most major market segments. We were overweighted in large-cap stocks within our equity portfolio, which partially limited our advance because large-cap stocks did not keep pace with small and mid caps, but returns to all categories were quite attractive on an absolute basis.

Over the period, the Portfolio had an average exposure to fixed-income securities of 62%. Our holdings performed well versus the fixed-income benchmark, but even the best segment of bonds did not keep pace with the strong advance in U.S. stocks. Performance was mixed across the actively managed equity segments of the Portfolio.

The large-cap growth and value segments outperformed, while the mid-cap growth and small-cap core portfolios underperformed, each measured versus their respective benchmarks. However, absolute returns for all of the domestic equity segments of the Portfolio were quite good.

Within our international section, we had exposure to emerging markets debt and equity, and both of those segments—while performing well against their respective indexes—did not keep pace with the broader market advance. In total, results were close to management expectations given the asset mix of the Portfolio.

What is your outlook?

As the period drew to a close, we became modestly more conservative in our portfolio positioning. Within fixed income, in the absence of an unexpected decline in the economy, we believe U.S. Treasury and agency securities are overvalued due to an aggressive purchase program that the Federal Reserve Bank has undertaken. As a result, we are overweighted in corporate bonds, and underweighted in Treasury and agency securities.

In equities, we have taken steps to modestly reduce our equity exposure. With the significant advance in global stock markets, it is difficult to represent that stocks are undervalued. At best, we would suggest equities are fairly valued. That does not mean any decline is imminent; in our process, however, it suggests it is appropriate to modestly adjust allocations.

While the rally certainly could continue to advance, we believe it will likely be at a more moderate pace. We do think that within equities, small- and mid-cap domestic stocks are richly priced versus large caps, and that within large caps, non-U.S. stocks provide better opportunities. Thus, we have tilted the Portfolio’s positions to take advantage of those opportunities.

10

Average Annual Total Returns1

As of December 31, 2013

1-Year | 5-Year | From Inception 4/29/2005 | ||

| 9.02% | 10.32% | 5.65% |

| * | The Barclays U.S. Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

| *** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

11

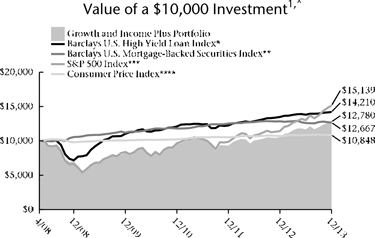

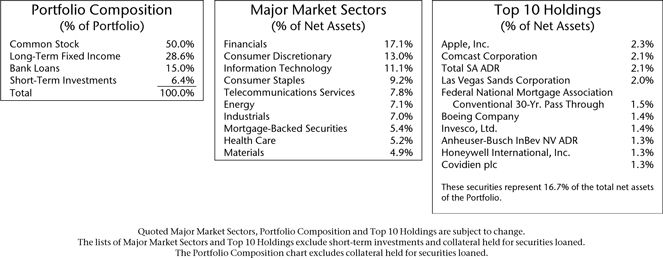

Thrivent Growth and Income Plus Portfolio

David R. Spangler, CFA and Stephen D. Lowe, CFA, Portfolio Co-Managers*

Thrivent Growth and Income Plus Portfolio seeks income plus long-term capital growth.

The Portfolio invests in equity securities and debt securities. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment adviser. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. Leveraged loans, preferred securities, sovereign debt, and mortgage-related and other asset-backed securities are subject to additional risks. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards; these risks are magnified for investments in emerging markets. Writing options is a highly specialized activity that can lead to losses and transaction costs.

As of August 16, 2013, the Portfolio changed its name from Thrivent Equity Income Plus Portfolio to its current name.

| * | Effective August 16, 2013, Stephen D. Lowe became a Portfolio Co-Manager. |

How did the Portfolio perform during the 12-month period ended December 31, 2013?

Thrivent Growth and Income Plus Portfolio earned a return of 21.24%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Growth category, of 19.15%. The Portfolio’s market benchmarks, the S&P 500 Index, the Barclays U.S. High Yield Loan Index and the Barclays U.S. Mortgage-Backed Securities Index, earned returns of 32.39%, 5.39%, and -1.41%, respectively.

What factors affected the Portfolio’s performance?

The former Thrivent Equity Income Plus Portfolio was restructured on August 16, 2013, and renamed Thrivent Growth and Income Plus Portfolio. While the Portfolio continues to be managed as a multi-asset class product with strategic target weights to various asset classes, a fixed-income component was added to its asset mix as a result of this change. Approximately 70% of the Portfolio’s holdings are now composed of domestic dividend equity, international dividend equity, preferred stocks and real estate investment trusts (REITs). The remaining 30% of the Portfolio is invested in fixed-income securities.

For 2013, strong positive contribution came from domestic dividend-paying stocks which performed in line with the S&P 500 Index. Good security selection allowed the dividend equity portion of the Portfolio to keep pace with the broader market, particularly in the technology, industrials and consumer staples sectors. However, stock selection hurt returns in the energy and consumer discretionary sectors, which underperformed the S&P 500 Index. Relative to the S&P 500 Index, underperforming asset classes included international dividend equity in the form of ADRs, preferreds and REITs.

Within fixed-income markets, the improving economy made investors more comfortable with higher-risk sectors, despite a mid-year uptick in interest rates. All fixed-income sectors in the Portfolio generated positive results, particularly high-yield bonds and mortgage-backed securities.

What is your outlook?

Continued economic growth in 2014, at or slightly above the pace in 2013, should create a favorable investment environment for the asset classes in which the Portfolio invests. Stock valuations were much higher heading into 2014 than they were in 2013, suggesting that stock returns are unlikely to match last year’s heady results. We anticipate tilting the Portfolio’s equity holdings slightly away from utilities, telecommunications and consumer staples stocks and into cyclical sectors that typically do well in a growing economy, such as technology, industrials and consumer discretionary.

Interest rates could creep higher in 2014, especially if the Federal Reserve, as expected, announces further cuts in the bond-buying program it has been using to support the economy. That could also moderate or negatively impact returns in the fixed-income markets. We may become slightly more defensive on interest rates by adding to our holdings of floating-rate leveraged loans and keeping the duration of the Portfolio’s bond holdings low.

12

Average Annual Total Returns1

As of December 31, 2013

1-Year | 5-Year | From Inception 4/30/2008 | ||

| 21.24% | 12.66% | 4.42% |

| ^ | Effective August 2013, the Portfolio’s benchmark indices changed to include the Barclays U.S. High Yield Loan Index and the Barclays U.S. Mortgage-Backed Securities Index. The Adviser made these benchmark changes because of changes to the Portfolio’s principal investment strategies. It is not possible to invest directly in the Indices shown. The performance of the Indices does not reflect deductions for fees, expenses or taxes. |

| * | The Barclays U.S. High Yield Loan Index measures U.S. Dollar denominated syndicated term loans. |

| ** | The Barclays U.S. Mortgage-Backed Securities Index (MBS) is formed by grouping the universe of over 600,000 individual fixed-rate U.S. government agency MBS pools into approximately 3,500 generic types of securities. |

| *** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| **** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

13

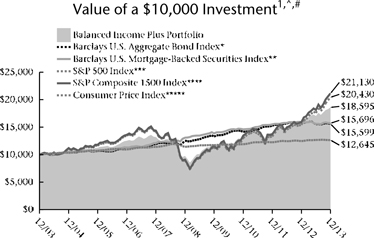

Thrivent Balanced Income Plus Portfolio

Darren M. Bagwell, CFA, Michael G. Landreville, CFA and CPA (inactive), and Stephen D. Lowe, CFA, Portfolio Co-Managers*

Thrivent Balanced Income Plus Portfolio seeks long-term total return through a balance between income and the potential for long-term capital growth.

The Portfolio invests in equity securities and debt securities. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment adviser. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. Leveraged loans, preferred securities, sovereign debt, and mortgage-related and other asset-backed securities are subject to additional risks. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards; these risks are magnified for investments in emerging markets.

As of August 16, 2013, the Portfolio changed its name from Thrivent Balanced Portfolio to its current name.

| * | Effective August 16, 2013, Darren M. Bagwell and Stephen D. Lowe became Portfolio Co-Managers. |

How did the Portfolio perform during the 12-month period ended December 31, 2013?

Thrivent Balanced Income Plus Portfolio earned a return of 17.95%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Moderate category, of 14.15%. The Portfolio’s market benchmarks, the S&P Composite 1500 Index, the Barclays U.S. High Yield Loan Index and the Barclays U.S. Mortgage-Backed Securities Index, returned 32.79%, 5.39% and -1.41%, respectively.

What factors affected the Portfolio’s performance?

The former Thrivent Balanced Portfolio was restructured on August 16, 2013, and renamed Thrivent Balanced Income Plus Portfolio. While still investing in equities and fixed income, the Portfolio reduced the duration of its fixed-income portfolio to make it less sensitive to interest rates, and increased its allocation to noninvestment-grade assets, which are higher risk but also offer the potential for higher yields. After starting the year with two-thirds of its assets in equities, it ended with equal weightings in equities and fixed income.

Equities performed well as the U.S. economy expanded at an increasingly fast pace, with gross domestic product (GDP) growing at a 4.1% annual rate by the third quarter. The Portfolio’s stock holdings earned 37.5%, outperforming their equity benchmark largely due to security selection. Industrials, media and entertainment stocks, and energy shares all performed well, offset in part by real estate investment trusts (REITs) that underperformed when interest rates moved higher mid-year. The absence of any holdings in gold-related stocks also helped the Portfolio, as gold shares lagged.

The duration of the fixed-income portion of the Portfolio was reduced to 2.6 years from 5.6 as a result of the August makeover. The timing of that change was set by a shareholder vote. Unfortunately, the duration change occurred after the mid-year spike in interest rates relating to concerns the Federal Reserve might throttle back its accommodative monetary policy.

More helpfully, the percentage of the Portfolio allocated to noninvestment-grade securities rose to 60% from 15% in the makeover, and noninvestment-grade debt subsequently outperformed investment-grade debt. Overall, fixed-income generated a modest 0.5% loss.

What is your outlook?

We believe that equity markets have an opportunity to generate returns in a range of 5% to 10% next year, propelled by continued economic growth, expanding corporate profit margins, corporate stock buybacks and dividend increases. We also see an opportunity for a modest expansion of stock price-to-earnings multiples.

We expect an upward but modest bias to interest rates over the course of 2014, especially if the Federal Reserve, as expected, announces further cuts in the bond-buying program it has been using to support the economy. That could moderate or negatively impact returns in the fixed-income market. With its shorter duration and higher yield, we believe the fixed-income portion of the Portfolio should come close to earning its coupon yield.

14

Average Annual Total Returns1

As of December 31, 2013

1-Year | 5-Year | 10-Year | ||

| 17.95% | 13.76% | 6.40% |

| ^ | Effective August 2013, the Portfolio’s benchmark indices changed from the Barclays U.S. Aggregate Bond Index and the S&P 500 Index to the Barclays U.S. High Yield Loan Index, the Barclays U.S. Mortgage-Backed Securities Index and the S&P Composite 1500 Index. The Adviser made these benchmark changes because of changes to the Portfolio’s principal investment strategies. It is not possible to invest directly in the Indices shown. The performance of the Indices does not reflect deductions for fees, expenses or taxes. |

| * | The Barclays U.S. Aggregate Bond Index measures the performance of U.S. investment grade bonds. |

| ** | The Barclays U.S. Mortgage-Backed Securities Index (MBS) is formed by grouping the universe of over 600,000 individual fixed-rate U.S. government agency MBS pools into approximately 3,500 generic types of securities. |

| *** | The S&P 500 Index is an index that represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

| **** | The S&P Composite 1500 Index measures the performance of a group of 1500 publicly traded stocks. “S&P Composite 1500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

| ***** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. |

| # | The Barclays U.S. High Yield Loan Index incepted in January 2006. This index is not shown in the chart because it does not have 10 years of history and thus an accurate comparison of a $10,000 investment over 10 years cannot be shown. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

15

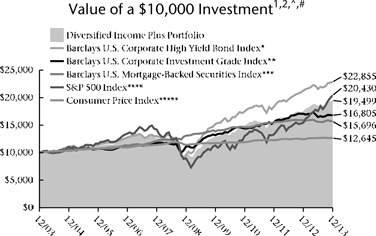

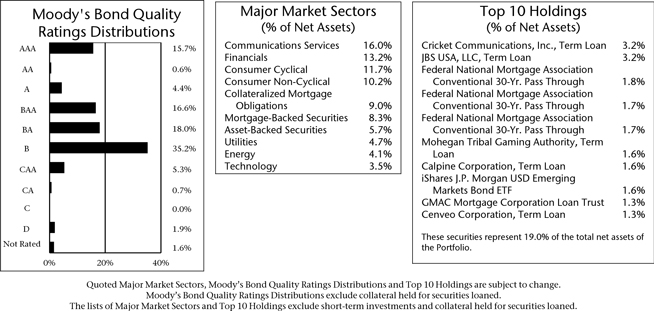

Thrivent Diversified Income Plus Portfolio

Mark L. Simenstad, CFA, David R. Spangler, CFA and Paul J. Ocenasek, CFA, Portfolio Co-Managers

Thrivent Diversified Income Plus Portfolio seeks to maximize income while maintaining prospects for capital appreciation.

The Portfolio invests in debt securities and equity securities. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment adviser. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. Leveraged loans and mortgage-related and other asset-backed securities are subject to additional risks.

How did the Portfolio perform during the 12-month period ended December 31, 2013?

Thrivent Diversified Income Plus Portfolio earned a return of 11.17%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Conservative category, of 7.56%. The Portfolio’s market benchmarks, the S&P 500 Index, the Barclays U.S. High Yield Loan Index and the Barclays U.S. Mortgage-Backed Securities Index, returned 32.39%, 5.39% and -1.41%, respectively.

What factors affected the Portfolio’s performance?

A strengthening economy drove the stock market to record highs and also helped spur solid gains in the high-yield sector of the bond market.

Stocks accounted for just 30% of the Portfolio’s holdings, but played an outsized role in its results by generating a total return in line with the S&P 500 Index. Approximately 90% of the Portfolio’s equity holdings consisted of dividend-paying stocks, which typically underperform the broader market when stock prices are climbing sharply. Good security selection allowed the equity portion of the Portfolio to keep pace with the broader market, particularly in the technology, industrials and consumer staples sectors. Stock selection hurt returns in the energy and consumer discretionary sectors, which underperformed the S&P 500 Index.

The improving economy made investors more comfortable with higher-risk sectors of the fixed-income markets, despite a mid-year uptick in interest rates. Within the Portfolio, fixed-income holdings performed relatively well. All sectors had positive results, with nonagency mortgage-backed securities contributing exceptional results once again. The high-yield bond segment was modestly lower than the Barclays U.S. High Yield Bond Index due to our more conservative orientation in this sector. Finally, high-grade corporate bonds and preferred stocks generated positive but low-single-digit returns.

What is your outlook?

Continued economic growth in 2014, at or slightly above the pace in 2013, should create a favorable investment environment for the asset classes in which the Portfolio invests. Stock valuations were much higher heading into 2014 than they were in 2013, however, suggesting that stock returns are unlikely to match last year’s heady results. We anticipate tilting equity holdings slightly away from utilities, telecommunications and consumer staples stocks and into cyclical sectors that typically do well in a growing economy, such as technology, industrials and consumer discretionary stocks.

Interest rates could creep higher in 2014, especially if the Federal Reserve, as expected, announces further cuts in the bond-buying program it has been using to support the economy. We believe this could moderate or negatively impact returns in the fixed-income markets, too. We may consider becoming slightly more defensive on interest rates by adding to our holdings of floating-rate leveraged loans and keeping the duration of the Portfolio’s bond holdings low.

16

Average Annual Total Returns1,2

As of December 31, 2013

1-Year | 5-Year | 10-Year | ||

| 11.17% | 14.96% | 6.91% |

| ^ | Effective August 2013, the Portfolio’s benchmark indices changed from the Barclays U.S. Corporate High Yield Bond Index and the Barclays U.S. Corporate Investment Grade Index to the Barclays U.S. High Yield Loan Index and the Barclays U.S. Mortgage-Backed Securities Index. The Adviser made these benchmark changes because of changes to the Portfolio’s principal investment strategies. It is not possible to invest directly in the Indices shown. The performance of the Indices does not reflect deductions for fees, expenses or taxes. |

| * | The Barclays U.S. Corporate High Yield Bond Index measures the performance of fixed-rate non-investment grade bonds. |

| ** | The Barclays U.S. Corporate Investment Grade Index measures the performance of investment grade corporate bonds. |

| *** | The Barclays U.S. Mortgage-Backed Securities Index (MBS) is formed by grouping the universe of over 600,000 individual fixed-rate U.S. government agency MBS pools into approximately 3,500 generic types of securities. |

| **** | The S&P 500 Index represents the average performance of a group of 500 widely held, publicly traded stocks. “S&P 500” is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Thrivent Financial for Lutherans. The product is not sponsored, endorsed or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product. |

| ***** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. |

| # | The Barclays U.S. High Yield Loan Index incepted in January 2006. This index is not shown in the chart because it does not have 10 years of history and thus an accurate comparison of a $10,000 investment over 10 years cannot be shown. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower.The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

| 2 | Prior to July 3, 2006, the Portfolio, as a high yield fund, invested primarily in “junk bonds”. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

17

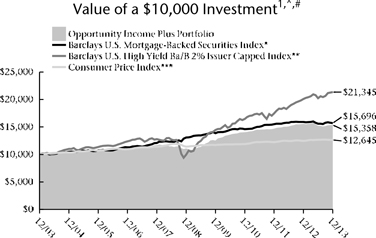

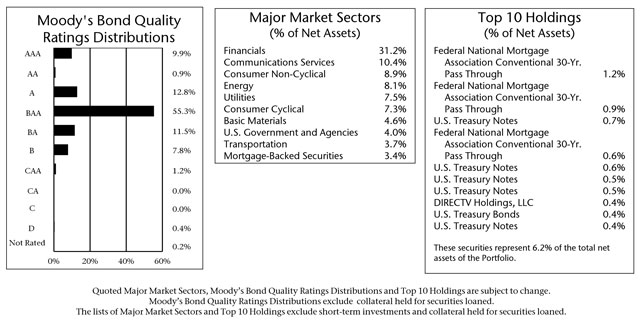

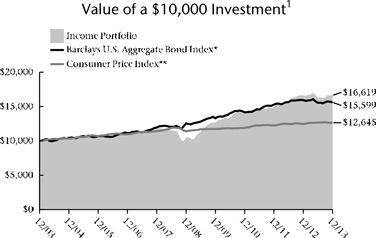

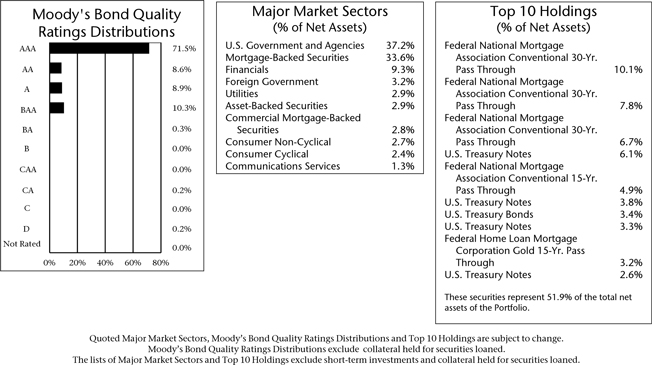

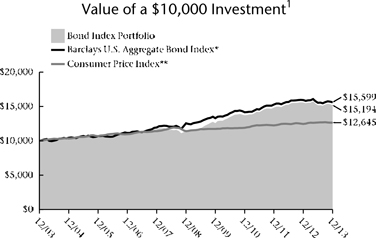

Thrivent Opportunity Income Plus Portfolio

Gregory R. Anderson, CFA, Michael G. Landreville, CFA and CPA (inactive) and Conrad Smith, CFA, Portfolio Co-Managers*

Thrivent Opportunity Income Plus Portfolio seeks a combination of current income and long-term capital appreciation.

The Portfolio primarily invests in a broad range of debt securities. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment adviser. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. Leveraged loans, sovereign debt, and mortgage-related and other asset-backed securities are subject to additional risks. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards; these risks are magnified for investments in emerging markets. The prices of futures contracts can be highly volatile and the loss from investing in them can exceed the initial investment.

As of August 16, 2013, the Portfolio changed its name from Thrivent Mortgage Securities Portfolio to its current name.

| * | Effective August 16, 2013, Michael G. Landreville and Conrad Smith became Portfolio Co-Managers. |

How did the Portfolio perform during the 12-month period ended December 31, 2013?

Thrivent Opportunity Income Plus Portfolio generated a return of -1.39%, compared with the median return of its peer group, the Lipper General Bond category, of -0.97%. The Portfolio’s market benchmarks, the Barclays U.S. Mortgage-Backed Securities Index, the Barclays U.S. High Yield Loan Index and the Barclays U.S. High Yield Ba/B 2% Issuer Capped Index, posted returns of -1.41%, 5.39% and 6.23%, respectively.

What factors affected the Portfolio’s performance?

The former Thrivent Mortgage Securities Portfolio changed its name and underwent a significant restructuring on August 16, 2013, to make it less sensitive to interest rate fluctuations while still generating a competitive yield.

Leading up to the restructuring, the Portfolio had approximately 80% of its assets in government agency mortgage-backed securities and 20% in nonagency mortgage-backed securities. The agency securities were under pressure due to rising interest rates and expectations that the Federal Reserve would soon begin paring back its purchases of these securities. It had been buying agency and Treasury securities as part of its quantitative easing program aimed at keeping interest rates low and stimulating the economy.

Upon its restructuring, the Portfolio reduced its allocation to agency mortgage-backed securities to about 20% and added new holdings in the high-yield bond, high-yield bank loan, and investment-grade corporate bond sectors. By year-end, agency mortgage-backed securities and nonagency mortgage-backed securities each accounted for about 10% of the Portfolio.

After posting negative returns prior to the restructuring, the Portfolio generated a positive return of approximately 2.7% after August 16, with high-yield bonds and loans, and corporate bonds all posting gains.

What is your outlook?

The U.S. economy grew at an increasingly fast rate for much of 2013, with gross domestic product (GDP) expanding at a 1.1% annual rate in the first quarter and a 4.1% rate in the third. We anticipate that the economy will continue to improve in 2014, but not dramatically, and that inflation will remain low. An improving economy would likely prompt the Fed to further ratchet down its bond purchases, which it reduced from $85 billion a month to $75 billion in January, creating a headwind for the bond market.

We believe the Portfolio is positioned well for this changing environment. Corporate credit fundamentals remain sound, providing an opportunity for gains in corporate bonds, especially in the high-yield sector. Bank loans also should do well in a rising interest-rate environment, as their yields float with market rates. Barring unforeseen developments in the U.S. or global economies, we feel it would be reasonable to expect Portfolio returns in the low single digits.

18

Average Annual Total Returns1

As of December 31, 2013

1-Year | 5-Year | 10-Year | ||

| -1.39% | 6.72% | 4.38% |

| ^ | Effective August 2013, the Portfolio’s benchmark indices changed to include the Barclays U.S. High Yield Ba/B 2% Issuer Capped Index and the Barclays U.S. High Yield Loan Index. The Adviser made these benchmark changes because of changes to the Portfolio’s principal investment strategies. It is not possible to invest directly in the Indices shown. The performance of the Indices does not reflect deductions for fees, expenses or taxes. |

| * | The Barclays U.S. Mortgage-Backed Securities Index (MBS) is formed by grouping the universe of over 600,000 individual fixed-rate U.S. government agency MBS pools into approximately 3,500 generic types of securities. |

| ** | The Barclays U.S. High Yield Ba/B 2% Issuer Capped Index covers the USD denominated, non-investment grade, Ba or B rated, fixed-rate, taxable corporate bond market. The Index limits issuer exposures to a maximum 2%, redistributing excess market value index-wide on a pro-rata basis. |

| *** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. |

| # | The Barclays U.S. High Yield Loan Index incepted in January 2006. This index is not shown in the chart because it does not have 10 years of history and thus an accurate comparison of a $10,000 investment over 10 years cannot be shown. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

19

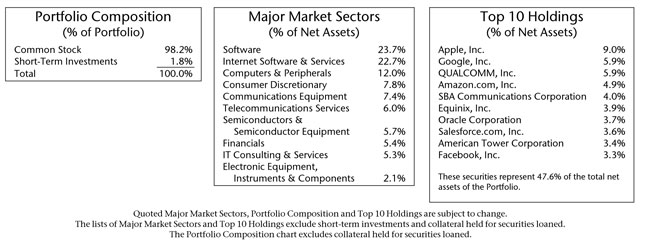

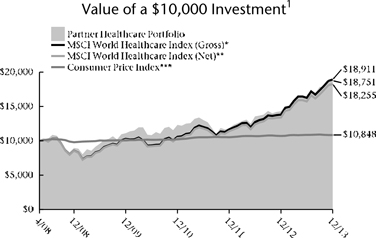

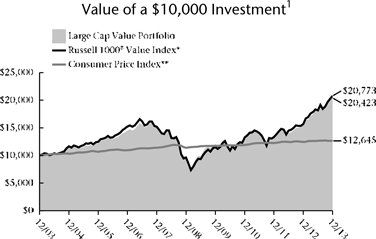

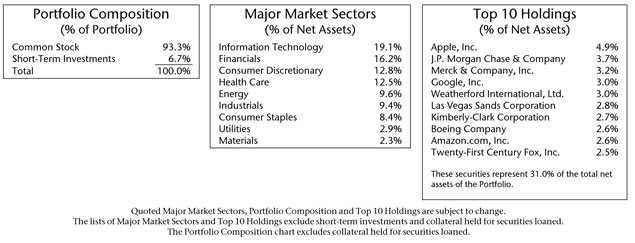

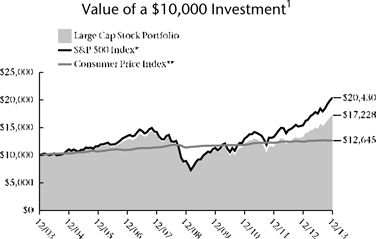

How did the Portfolio perform during the 12-month period ended December 31, 2013?

Thrivent Partner Technology Portfolio earned a return of 29.01%, compared with the median return of its peer group, the Lipper Science & Technology category, of 27.81%. The Portfolio’s market benchmark, the NASDAQ Composite Index, earned a return of 40.17%.

What factors affected the Portfolio’s performance?

Neither the Lipper category nor the Portfolio kept pace with the unusually strong return for the NASDAQ Composite Index. This was primarily due to the exceptionally strong returns for select companies that held more significant representation in the index than that of the managed portfolios. Google and Microsoft are two examples of companies with strong returns that were under-represented in the Portfolio and its peer group.

Pandora Media, a leading Internet radio service provider, contributed to performance during the year. The outperformance was driven by strong growth in key audience metrics. Listener hours, share of total U.S. radio listening and number of active listeners have all increased from a year ago. The stock was also bolstered by the announcement of a new CEO. In our view, Pandora Media is uniquely positioned to monetize mobile and gain market share within the terrestrial radio market as it grows its active user base. The company’s differentiated business model, first-mover advantage and strong brand recognition, along with a continued shift in ad spend online, should also support sustainable growth.

Rackspace Hosting, a leading provider of managed hosting and cloud computing services, detracted from performance as it reported disappointing results during the year. The slowdown in sales growth highlights the challenges the company is experiencing in gaining traction with its new cloud offering and, more specifically, transitioning large enterprise customers to the new offering. We sold out of our position in Rackspace Hosting during the fourth quarter of 2013 as we realized there are many new entrants into this space, some of which are large, established competitors that we believe could lead to price degradation.

What is your outlook?

Despite strong 2013 performance, we believe U.S. equities have further upside as the U.S. economy accelerates and as real earnings growth serves as a fundamental driver of performance going forward. We believe that U.S. corporate fundamentals remain solid, evidenced by both healthy balance sheets and earnings resilience, and should provide companies with a number of options to increase shareholder value.

20

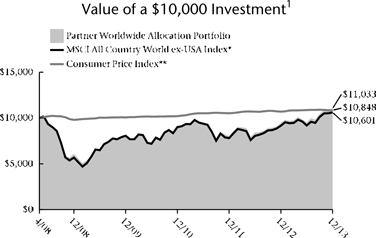

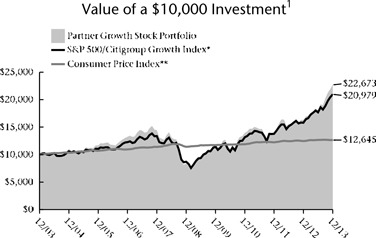

Average Annual Total Returns1

As of December 31, 2013

| 1-Year | 5-Year | 10-Year | ||

| 29.01% | 21.66% | 5.56% |

| * | The NASDAQ Composite Index is a market capitalization-weighted index of all domestic and foreign securities listed on the NASDAQ Stock Exchange. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. |

| ** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

Past performance is not an indication of future results. Total investment return and principal value of your investment will fluctuate and units, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT or visit Thrivent.com for performance results current to the most recent month-end.

| 1 | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. At various times, the Portfolio’s adviser may have waived its management fee and/or reimbursed Portfolio expenses. If this were the case, the Portfolio’s total returns would have been lower. The returns shown do not reflect charges and expenses imposed on contract holders by the variable accounts. Those charges and expenses reduce the returns received by contract holders as compared to the returns presented. |

The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit Thrivent.com.

21

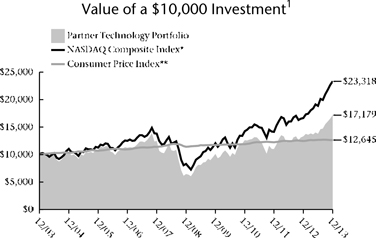

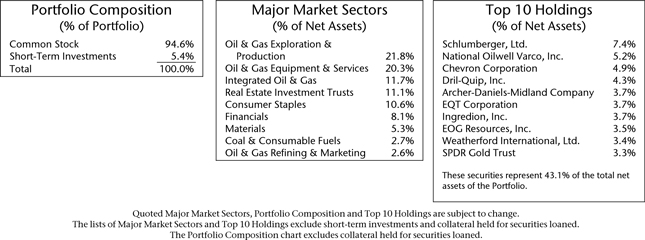

| Thrivent Partner Healthcare Portfolio |

Subadvised by Sectoral Asset Management, Inc.

Thrivent Partner Healthcare Portfolio seeks long-term capital growth.

The Portfolio primarily invests in healthcare companies, which are subject to numerous risks including legislative or regulatory changes and adverse market conditions. The value of the Portfolio is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Portfolio may incur losses due to incorrect assessments of investments by its investment advisers. Small and medium-sized companies often have greater price volatility and less liquidity than larger companies. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards; these risks are magnified for investments in emerging markets. The Portfolio is non-diversified, which means that it may invest a greater percentage of its assets in the securities of any single issuer compared with diversified funds.

How did the Portfolio perform during the 12-month period ended December 31, 2013?

Thrivent Partner Healthcare Portfolio earned a return of 31.09%, compared with the median return of its peer group, the Lipper Health/Biotechnology category, of 47.62%. The Portfolio’s market benchmark, the Morgan Stanley Capital International (MSCI) World Healthcare Net Index, earned a return of 36.27%.

What factors affected the Portfolio’s performance?

The key performance factor limiting returns relative to the benchmark and Lipper peers over the past 12 months was stock selection, with an additional negative contribution from holding a modest cash position for liquidity purposes in such a strongly advancing market.

On the stock selection side, performance was negatively impacted by our holdings in two biotechnology companies. Both companies had a product that experienced unexpected safety concerns after the drugs had previously been approved by the FDA. That new information caused significant declines in their stock prices.