Table of Contents

As filed with the Securities and Exchange Commission on May 15, 2015

Securities Act File No. 333-

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

| REGISTRATION STATEMENT | ||||

| UNDER | ||||

| THE SECURITIES ACT OF 1933 | ||||

| ¨ | Pre-Effective Amendment No. | |||

| ¨ | Post-Effective Amendment No. | |||

| (Check appropriate box or boxes) |

THRIVENT SERIES FUND, INC.

(Exact Name of Registrant as Specified in Charter)

625 FOURTH AVENUE SOUTH

MINNEAPOLIS, MINNESOTA 55415

(Address of Principal Executive Offices)

(612) 844-4198

(Area Code and Telephone Number)

MICHAEL W. KREMENAK

SECRETARY AND CHIEF LEGAL OFFICER

THRIVENT SERIES FUNDS, INC.

625 FOURTH AVENUE SOUTH

MINNEAPOLIS, MINNESOTA 55415

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: As soon as practicable after this registration statement becomes effective. It is proposed that this filing will become effective on June 15, 2015 pursuant to Rule 488 under the Securities Act of 1933.

Title of Securities Being Registered: Shares of beneficial interest, par value $.01 per share. The Registrant has registered an indefinite number of shares of beneficial interest pursuant to Section 24(f) of the Investment Company Act of 1940, as amended, and is in a continuous offering of such shares under an effective registration statement (File Nos. 33-3677 and 811-4603). No filing fee is due herewith because of reliance on Section 24(f) of the Investment Company Act of 1940, as amended.

Table of Contents

LETTERS FOR MEMBERS

Dear Member:

The Board of Directors of Thrivent Series Fund, Inc. (the “Fund”) has scheduled special meetings of contractholders for August 14, 2015 to seek approval of six mergers. At the meetings, the contractholders for each of the series of the Fund listed in the first column below (each a “Target Portfolio”) will be asked to consider and approve an Agreement and Plan of Reorganization (an “Agreement”) providing for its reorganization into the Fund series listed in the second column below (each an “Acquiring Portfolio”).

TARGET PORTFOLIO | ACQUIRING PORTFOLIO | |

Thrivent Partner Small Cap Growth Portfolio | Thrivent Small Cap Stock Portfolio | |

Thrivent Partner Small Cap Value Portfolio | Thrivent Small Cap Stock Portfolio | |

Thrivent Mid Cap Growth Portfolio | Thrivent Mid Cap Stock Portfolio | |

Thrivent Partner Mid Cap Value Portfolio | Thrivent Mid Cap Stock Portfolio | |

Thrivent Natural Resources Portfolio | Thrivent Large Cap Stock Portfolio | |

Thrivent Partner Technology Portfolio | Thrivent Large Cap Growth Portfolio |

If you are not planning to attend the meeting in person, please vote before August 14th in one of the ways described below.

If a merger is approved, your investment in the Target Portfolio will automatically be transferred into the corresponding Acquiring Portfolio listed above. We will send you a written confirmation after this takes place. This transfer is not expected to be a taxable event.

Your vote counts! You may vote quickly and easily in any one of these ways:

| • | Via Internet: see the instructions on the enclosed proxy card. |

| • | Via Telephone: see the instructions on the enclosed proxy card. |

| • | Via Mail: use the enclosed proxy card and postage-paid envelope. |

| • | In person: attend the shareholder meetings on August 14 at the Thrivent Financial corporate office in Minneapolis. |

If you’d like more information about the Portfolios, you may order a statement of additional information to the Portfolios’ prospectuses, a shareholder report or the statement of additional information regarding the proposed Portfolio reorganizations (request the “Reorganization SAI”) by:

| • | Telephone: 1-800-THRIVENT (1-800-847-4836) and say “Variable Annuity” or “Variable Universal Life” |

| • | Mail: Thrivent Series Fund, Inc., 4321 North Ballard Road, Appleton, WI 54919 |

| • | Internet: |

| • | For a copy of a prospectus, a statement of additional information, or a shareholder report: www.thrivent.com |

| • | For a copy of this Prospectus/Proxy Statement or the Reorganization SAI: |

www.proxy-direct.com/thr-26705

Thank you for taking this matter seriously and participating in this important process.

Sincerely,

David S. Royal

President

Thrivent Series Fund, Inc.

Table of Contents

EXPLANATORY NOTE

| This Registration Statement is organized as follows: | ||||

| Page | ||||

Thrivent Partner Small Cap Growth Portfolio | 3 | |||

• Questions & Answers for Contractholders of Thrivent Partner Small Cap Growth Portfolio | ||||

• Notice of Special Meeting of Contractholders of Thrivent Partner Small Cap Growth Portfolio | ||||

• Prospectus/Proxy Statement Regarding Proposed Reorganization | ||||

Thrivent Partner Small Cap Value Portfolio | 29 | |||

• Questions & Answers for Contractholders of Thrivent Partner Small Cap Value Portfolio | ||||

• Notice of Special Meeting of Contractholders of Thrivent Partner Small Cap Value Portfolio | ||||

• Prospectus/Proxy Statement Regarding Proposed Reorganization | ||||

Thrivent Mid Cap Growth Portfolio | 55 | |||

• Questions & Answers for Contractholders of Thrivent Mid Cap Growth Portfolio | ||||

• Notice of Special Meeting of Contractholders of Thrivent Mid Cap Growth Portfolio | ||||

• Prospectus/Proxy Statement Regarding Proposed Reorganization | ||||

Thrivent Partner Mid Cap Value Portfolio | 81 | |||

• Questions & Answers for Contractholders of Thrivent Partner Mid Cap Value Portfolio | ||||

• Notice of Special Meeting of Contractholders of Thrivent Partner Mid Cap Value Portfolio | ||||

• Prospectus/Proxy Statement Regarding Proposed Reorganization | ||||

Thrivent Natural Resources Portfolio | 107 | |||

• Questions & Answers for Contractholders of Thrivent Natural Resources Portfolio | ||||

• Notice of Special Meeting of Contractholders of Thrivent Natural Resources Portfolio | ||||

• Prospectus/Proxy Statement Regarding Proposed Reorganization | ||||

Thrivent Partner Technology Portfolio | 133 | |||

• Questions & Answers for Contractholders of Thrivent Partner Technology Portfolio | ||||

• Notice of Special Meeting of Contractholders of Thrivent Partner Technology Portfolio | ||||

• Prospectus/Proxy Statement Regarding Proposed Reorganization | ||||

Statement of Additional Information Regarding the Proposed Reorganizations | ||||

Part C Information | ||||

Exhibits | ||||

- 2 -

Table of Contents

Questions & Answers

For Contractholders of Thrivent Partner Small Cap Growth Portfolio

Although we recommend that you read the complete Prospectus/Proxy Statement, we have provided the following questions and answers to clarify and summarize the issues to be voted on.

Q: Why is a contractholder meeting being held?

A: A special meeting of contractholders (the “Meeting”) of Thrivent Partner Small Cap Growth Portfolio (the “Target Portfolio”) is being held to seek contractholder approval of a reorganization (the “Reorganization”) of the Target Portfolio into Thrivent Small Cap Stock Portfolio (the “Acquiring Portfolio”). Please refer to the Prospectus/Proxy Statement for a detailed explanation of the proposed Reorganization and for a more complete description of the Acquiring Portfolio.

Q: Why is the Reorganization being recommended?

A: After careful consideration, the Board of Directors (the “Board”) of Thrivent Series Fund, Inc. (the “Fund”) has determined that the Reorganization is in the best interests of the contractholders of the Target Portfolio and recommends that you cast your vote “FOR” the proposed Reorganization. The Target Portfolio and the Acquiring Portfolio have substantially similar investment objectives, and each is a diversified series of the Company, an open-end investment company registered under the Investment Company Act of 1940. Thrivent Financial for Lutherans (“Thrivent Financial”) is the investment adviser for the Target Portfolio and the Acquiring Portfolio.

The Board believes that the Reorganization would be in the best interests of the contractholders of the Target Portfolio because: (i) contractholders will become contractholders of a larger combined portfolio with greater potential to increase asset size and achieve economies of scale (especially given the breakpoints in the advisory fee schedule for the Acquiring Portfolio), whereby certain administrative costs may be spread across the combined portfolio’s larger asset base and, therefore, may increase the combined portfolio’s overall efficiency in the long term; (ii) the Target Portfolio and the Acquiring Portfolio both invest in equities, although the Acquiring Portfolio invests in a more diversified portfolio of equities; (iii) the Acquiring Portfolio has better performance than the Target Portfolio for the one-year period ended December 31, 2014, which corresponds to when Matthew Finn assumed primary portfolio management responsibilities for the Acquiring Portfolio, though there is no guarantee of future performance; (iv) Thrivent Financial believes that it can most effectively manage the assets currently in the Target Portfolio by combining such assets with the Acquiring Portfolio into a single mandate and under the same portfolio manager; and (v) the Acquiring Portfolio has lower advisory fees than the Target Portfolio and the Target Portfolio contractholders will experience a lower expense ratio in the Acquiring Portfolio following the Reorganization.

Q: Who can vote?

A: Owners of the variable contracts funded by the Target Portfolio and shareholders of the Target Portfolio (e.g., mutual funds affiliated with Thrivent Financial) that invest in the Target Portfolio are entitled to vote. Thrivent Financial and Thrivent Life Insurance Company (“Thrivent Life”), the sponsors of your variable contracts, will cast your votes according to your voting instructions. If no timely voting instructions are received, any shares of the Target Portfolio attributable to a variable contract will be voted by Thrivent Financial or Thrivent Life in proportion to the voting instructions received for all variable contracts participating in the proxy solicitation. If a voting instruction form is returned with no voting instructions, the shares of the Target Portfolio to which the form relates will be voted FOR the Reorganization.

Any shares of the Target Portfolio held by Thrivent Financial, Thrivent Life or any of their affiliates (e.g., a Thrivent-sponsored mutual fund) for their own account will also be voted in proportion to the voting instructions received for all variable contracts participating in the proxy solicitation.

Table of Contents

Q: How will the Reorganization affect me?

A: Assuming contractholders approve the proposed Reorganization, the assets of the Target Portfolio will be combined with those of the Acquiring Portfolio. The shares of the Target Portfolio that fund your benefits under variable contracts automatically would be exchanged for an equal dollar value of shares of the Acquiring Portfolio. The Reorganization would affect only the investments underlying variable contracts and would not otherwise affect variable contracts. Following the Reorganization, the Target Portfolio will dissolve.

Q: Will I have to pay any commission or other similar fee as a result of the Reorganization?

A: No. You will not pay any commissions or other similar fees as a result of the Reorganization.

Q: Will the total annual operating expenses that my portfolio investment bears increase as a result of the Reorganization?

A: No, they will likely decrease, and the investment management fee, which comprises a portion of the annual operating expenses, will decrease. For more information about how fund expenses may change as a result of the Reorganization, please see the comparative and pro forma table and related disclosures in the COMPARISON OF THE PORTFOLIOS—Expenses section of the Prospectus/Proxy Statement.

Q: Will I have to pay any U.S. federal income taxes as a result of the Reorganization?

A: The Reorganization is expected to be tax-free for federal income tax purposes. The Target Portfolio will seek an opinion of counsel to this effect. Generally, neither shareholders nor contractholders will incur capital gains or losses on the exchange of Target Portfolio shares for Acquiring Portfolio shares as a result of the Reorganization. The cost basis on each investment will also remain the same. If you choose to make a total or partial surrender of your contract, you may be subject to taxes and other charges under your contract.

Q: Can I surrender or exchange my interests in the Target Portfolio for a different subaccount option of the Fund or surrender my contract before the Reorganization takes place?

A: Yes, but please refer to the most recent prospectus of your variable contract as certain charges and/or restrictions may apply to such exchanges and surrenders.

Q: If contractholders of the Target Portfolio do not approve the Reorganization, what will happen to the Target Portfolio?

A: Thrivent Financial will reassess what changes it would like to make to a Target Portfolio, including a possible repurposing of the Target Portfolio’s principal investment strategies or recommending a liquidation of the Target Portfolio to the Board. It may ultimately decide to make no changes.

Q: Who pays the costs of the Reorganization?

A: The expenses of the Reorganization, including the costs of the Meeting, will be paid by Thrivent Financial and will not be borne by shareholders of the Target Portfolio.

Q: How can I vote?

A: Contractholders are invited to attend the Meeting and to vote in person. You may also vote by executing a proxy using one of three methods:

| • | By Internet: Instructions for casting your vote via the Internet can be found in the enclosed proxy voting materials. The required control number is printed on your enclosed proxy card. If this feature is used, there is no need to mail the proxy card. |

| • | By Telephone: Instructions for casting your vote via telephone can be found in the enclosed proxy voting materials. The toll-free number and required control number are printed on your enclosed proxy card. If this feature is used, there is no need to mail the proxy card. |

- 2 -

Table of Contents

| • | By Mail: If you vote by mail, please indicate your voting instructions on the enclosed proxy card, date and sign the card, and return it in the envelope provided, which is addressed for your convenience and needs no postage if mailed in the United States. |

Contractholders who execute proxies by Internet, telephone or mail may revoke them at any time prior to the Meeting by filing with the Target Portfolio a written notice of revocation, by executing another proxy bearing a later date, by voting later by Internet or telephone or by attending the Meeting and voting in person. Merely attending the Meeting, however, will not revoke any previously submitted proxy.

Q: When should I vote?

A: Every vote is important and the Board encourages you to record your vote as soon as possible. Voting your proxy now will ensure that the necessary number of votes is obtained, without the time and expense required for additional proxy solicitation.

Q: Who should I call if I have questions about the proposal in the Prospectus/Proxy Statement?

A: Call 1-866-865-3843 with your questions.

Q: How can I get more information about the Target and Acquiring Portfolios or my variable contract?

A: You may obtain (1) a prospectus, statement of additional information or annual/semiannual report for the Portfolios, (2) a prospectus or statement of additional information for your variable contract or (3) the statement of additional information regarding the Reorganization (request the “Reorganization SAI”) by:

| • | Telephone: 1-800-THRIVENT (1-800-847-4836) and say “Variable Annuity” or “Variable Universal Life” |

| • | Mail: Thrivent Series Fund, Inc., 4321 North Ballard Road, Appleton, WI 54919 |

| • | Internet: |

| • | For a copy of a prospectus, a statement of additional information, or a shareholder report: www.thrivent.com |

| • | For a copy of this Prospectus/Proxy Statement or the Reorganization SAI: |

www.proxy-direct.com/thr-26705

- 3 -

Table of Contents

Thrivent Partner Small Cap Growth Portfolio

a series of

THRIVENT SERIES FUND, INC.

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(800) 847-4836

www.thrivent.com

NOTICE OF SPECIAL MEETING

OF CONTRACTHOLDERS

To be Held on August 14, 2015

NOTICE IS HEREBY GIVEN THAT a special meeting of contractholders (the “Meeting”) of Thrivent Partner Small Cap Growth Portfolio (the “Target Portfolio”), a series of Thrivent Series Fund, Inc. (the “Fund”), will be held at the offices of Thrivent Financial for Lutherans, 625 Fourth Avenue South, Minneapolis, Minnesota 55415 on August 14, 2015 at 9:30 a.m. Central time for the following purposes:

| 1. | To approve an Agreement and Plan of Reorganization pursuant to which the Target Portfolio would (i) transfer all of its assets to Thrivent Small Cap Stock Portfolio (the “Acquiring Portfolio”), a series of the Fund, in exchange for Shares of the Acquiring Portfolio, (ii) distribute such Shares of the Acquiring Portfolio to contractholders of the Target Portfolio, and (iii) dissolve. |

| 2. | To transact such other business as may properly be presented at the Meeting or any adjournment thereof. |

The Board of Directors of the Fund (the “Board”) has fixed the close of business on June 16, 2015 as the record date for the determination of contractholders entitled to notice of, and to vote at, the Meeting and all adjournments thereof.

Contractholders are invited to attend the meeting and vote in person. You may also vote by executing a proxy using one of three methods:

| • | By Internet—Instructions for casting your vote via the Internet can be found in the enclosed proxy voting materials. The required control number is printed on your enclosed proxy card. If this feature is used, there is no need to mail the proxy card. |

| • | By Telephone—Instructions for casting your vote via telephone can be found in the enclosed proxy voting materials. The toll-free number and required control number are printed on your enclosed proxy card. If this feature is used, there is no need to mail the proxy card. |

| • | By Mail—If you vote by mail, please indicate your voting instructions on the enclosed proxy card, date and sign the card, and return it in the envelope provided, which is addressed for your convenience and needs no postage if mailed in the United States. |

Contractholders who execute proxies by Internet, telephone, or mail may revoke them at any time prior to the Meeting by filing with the Target Portfolio a written notice of revocation, by executing another proxy bearing a later date, or by attending the Meeting and voting in person. Merely attending the Meeting, however, will not revoke any previously submitted proxy.

The Board recommends that you cast your vote FOR the proposed Reorganization as described in the Prospectus/Proxy Statement.

YOUR VOTE IS IMPORTANT

Please return your proxy card or record your voting instructions by telephone or via the Internet promptly no matter how many shares you own. In order to avoid the additional expense of further solicitation, we ask that you mail your proxy card or record your voting instructions by telephone or via the Internet promptly regardless of whether you plan to be present in person at the Meeting. |

Date: , 2015

Michael W. Kremenak

Secretary

Thrivent Series Fund, Inc.

Table of Contents

COMBINED PROSPECTUS/PROXY STATEMENT

THRIVENT PARTNER SMALL CAP GROWTH PORTFOLIO

a series of

THRIVENT SERIES FUND, INC.

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(800) 847-4836

, 2015

This Prospectus/Proxy Statement is furnished to you as a contractholder of Thrivent Partner Small Cap Growth Portfolio (the “Target Portfolio”), a series of Thrivent Series Fund, Inc. (the “Fund”). A special meeting of shareholders of the Target Portfolio will be held on August 14, 2015 (the “Meeting”) to consider the items that are described below and discussed in greater detail elsewhere in this Prospectus/Proxy Statement. The Board of Directors of the Fund (the “Board”) requests that you vote your shares by completing and returning the enclosed proxy card or by recording your voting instructions by telephone or via the Internet regardless of whether you plan to be present at the Meeting in order to avoid the additional expense of further solicitation.

The Acquiring Portfolio and the Target Portfolio are sometimes referred to herein individually as a “Portfolio” or collectively as the “Portfolios.” Each of the Acquiring Portfolio and the Target Portfolio is organized as a diversified series of the Fund, an open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

The reorganization proposed for the Target Portfolio (the “Reorganization”) is not contingent upon the approval or completion of any other reorganization or merger.

This Prospectus/Proxy Statement sets forth concisely the information shareholders of the Target Portfolio ought to know before voting on the Reorganization. Please read it carefully and retain it for future reference.

The following documents, each having been filed with the Securities and Exchange Commission (the “SEC”), are incorporated herein by reference:

| • | The Thrivent Series Fund, Inc. Prospectus, dated April 30, 2015 and as supplemented through the date hereof (the “Fund Prospectus”). |

| • | A Statement of Additional Information, dated , 2015, relating to this Combined Prospectus/Proxy Statement (the “Reorganization SAI”); |

| • | The Thrivent Series Fund, Inc. Statement of Additional Information, dated April 30, 2015 and as supplemented through the date hereof (the “Fund SAI”). |

Copies of the foregoing may be obtained without charge by calling or writing the Portfolio as set forth below. If you wish to request the Reorganization SAI, please ask for the “Reorganization SAI.”

In addition, each Portfolio will furnish, without charge, a copy of its most recent annual report and subsequent semi-annual report, if any, to a contractholder upon request.

Copies of each Portfolio’s most recent prospectus, statement of additional information, annual report and semi-annual report can be obtained at www.thrivent.com. Requests for documents can also be made by calling (800) 847-4836 or writing Thrivent Series Fund, Inc., 4321 North Ballard Road, Appleton, WI 54919.

The Portfolios file reports and other information with the SEC. Information filed by the Portfolios with the SEC can be reviewed and copied at the SEC’s Public Reference Room in Washington, DC or on the EDGAR database on the SEC’s internet site (http://www.sec.gov). Information on the operation of the SEC’s Public Reference Room may be obtained by calling the SEC at (202) 551-8090. You can also request copies of these materials, upon payment of a duplicating fee, by electronic request at the SEC’s e-mail address (publicinfo@sec.gov) or by writing the Public Reference Section of the SEC, Washington, DC 20549-1520.

The Board knows of no business other than that discussed above that will be presented for consideration at the Meeting. If any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment.

No person has been authorized to give any information or make any representation not contained in this Prospectus/Proxy Statement and, if so given or made, such information or representation must not be relied upon as having been authorized. This Prospectus/Proxy Statement does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

Table of Contents

Neither the Securities and Exchange Commission nor any state regulator has approved or disapproved of these shares or passed upon the adequacy of this Prospectus/Proxy Statement. A representation to the contrary is a crime.

The date of this Prospectus/Proxy Statement is , 2015. The Prospectus/Proxy Statement will be sent to contractholders on or around July 1, 2015.

- 2 -

Table of Contents

| Page | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

Investments in the Target Portfolio by Certain Affiliated Portfolios | 5 | |||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 12 | ||||

| 12 | ||||

Payments to Broker-Dealers and Other Financial Intermediaries | 12 | |||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

Material Federal Income Tax Consequences of the Reorganization | 14 | |||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

Table of Contents

The following is a summary of certain information contained elsewhere in this Prospectus/Proxy Statement and is qualified in its entirety by reference to the more complete information contained in this Prospectus/Proxy Statement. Contractholders should read the entire Prospectus/Proxy Statement carefully.

The Board, including the directors who are not “interested persons” (as defined in the 1940 Act) of each Portfolio, has unanimously approved an Agreement and Plan of Reorganization (the “Reorganization Agreement”) on behalf of each Portfolio, subject to Target Portfolio contractholder approval. The Reorganization Agreement provides for:

| • | the transfer of all of the assets of the Target Portfolio to the Acquiring Portfolio in exchange for shares of the Acquiring Portfolio; |

| • | the distribution by the Target Portfolio of such Acquiring Portfolio shares to Target Portfolio shareholders; and |

| • | the dissolution of the Target Portfolio. |

When the Reorganization is complete, Target Portfolio shareholders will hold Acquiring Portfolio shares. The aggregate value of the Acquiring Portfolio shares a Target Portfolio shareholder will receive in the Reorganization will equal the aggregate value of the Target Portfolio shares owned by such shareholder immediately prior to the Reorganization. After the Reorganization, the Acquiring Portfolio will continue to operate with the investment objective and investment policies set forth in this Prospectus/Proxy Statement. The Reorganization will not affect your variable contract.

As discussed in more detail elsewhere in this Prospectus/Proxy Statement, the Board believes that the Reorganization would be in the best interests of the Target Portfolio’s contractholders because: (i) contractholders will become contractholders of a larger combined fund with greater potential to increase asset size and achieve economies of scale (especially given the breakpoints in the advisory fee schedule for the Acquiring Portfolio), whereby certain administrative costs may be spread across the combined portfolio’s larger asset base and, therefore, may increase the combined portfolio’s overall efficiency in the long term; (ii) the Target Portfolio and the Acquiring Portfolio both invest in equities, although the Acquiring Portfolio invests in a more diversified portfolio of equities; (iii) the Acquiring Portfolio has better performance than the Target Portfolio for the one-year period ended December 31, 2014, which corresponds to when Matthew Finn assumed primary portfolio management responsibilities for the Acquiring Portfolio, though there is no guarantee of future performance; (iv) Thrivent Financial for Lutherans (“Thrivent Financial” or the “Adviser”) believes that it can most effectively manage the assets currently in the Target Portfolio by combining such assets with the Acquiring Portfolio into a single mandate with the Adviser and under the same portfolio manager; and (v) the Acquiring Portfolio has lower advisory fees than the Target Portfolio and the Target Portfolio contractholders will experience a lower expense ratio in the Acquiring Portfolio following the Reorganization.

In addition, the Board, when determining whether to approve the Reorganization, considered, among other things, the future growth prospects of each of the Target Portfolio and the Acquiring Portfolio, the fact that the Target Portfolio contractholders would not experience any diminution in contractholder services as a result of the Reorganization, and the fact that the Reorganization is expected to be a tax-free reorganization for federal income tax purposes.

Background and Reasons for the Reorganization

The Target Portfolio and the Acquiring Portfolio have substantially similar investment objectives. The investment objective of the Target Portfolio is to achieve long-term capital growth. The investment objective of the Acquiring Portfolio is to seek long-term capital growth.

The two Portfolios also have similar, although not identical, principal investment strategies, which are described in more detail in the COMPARISON OF PORTFOLIOS—Investment Objective and Principal Strategies section of the Prospectus/Proxy Statement. Under normal circumstances, both Portfolios invest at least 80% of their net assets (plus the amount of any borrowing for investment purposes) in securities of small companies. In the case

Table of Contents

of the Target Portfolio, the Adviser focuses mainly in the securities of smaller U.S. companies which have market capitalizations similar to those companies included in widely known indices such as the S&P SmallCap 600 Growth Index, the Russell 2000® Growth Index, or the small company market capitalization classifications published by Lipper, Inc. In the case of the Acquiring Portfolio, the Adviser focuses mainly in the securities of smaller companies which have market capitalizations similar to those companies included in widely known indices such as the S&P SmallCap 600 Index or the Russell 2000® Index.

In determining whether to recommend approval of the Reorganization Agreement to Target Portfolio contractholders, the Board considered a number of factors, including, but not limited to: (i) the expenses and advisory fees applicable to the Portfolios before the proposed Reorganization and the estimated expense ratios of the combined portfolio after the proposed Reorganization; (ii) the comparative investment performance of the Portfolios; (iii) the future growth prospects of each Portfolio; (iv) the terms and conditions of the Reorganization Agreement; (v) whether the Reorganization would result in the dilution of contractholder interests; (vi) the compatibility of the Portfolios’ investment objectives, policies, risks and restrictions; (vii) the anticipated tax consequences of the proposed Reorganization; (viii) the compatibility of the Portfolios’ service features available to contractholders, including exchange privileges; and (ix) the estimated costs of the Reorganization. The Board concluded that these factors supported a determination to approve the Reorganization Agreement.

The Board has determined that the Reorganization is in the best interests of the Target Portfolio and that the interests of the Target Portfolio’s contractholders will not be diluted as a result of the Reorganization. In addition, the Board has determined that the Reorganization is in the best interests of the Acquiring Portfolio and that the interests of the Acquiring Portfolio contractholders will not be diluted as a result of the Reorganization.

The Board is asking contractholders of the Target Portfolio to approve the Reorganization at the Meeting to be held on August 14, 2015. If contractholders of the Target Portfolio approve the proposed Reorganization, it is expected that the closing date of the transaction (the “Closing Date”) will be after the close of business on or about August 21, 2015, but it may be at a different time as described herein. If contractholders of the Target Portfolio do not approve the proposed Reorganization, the Board will consider alternatives, including repurposing the Target Portfolio’s principal strategies.

The Board recommends that you vote “FOR” the Reorganization.

- 2 -

Table of Contents

Investment Objective and Principal Strategies

Investment Objective. The Target Portfolio and the Acquiring Portfolio have substantially similar investment objectives. The investment objective of the Target Portfolio is to achieve long-term capital growth. The investment objective of the Acquiring Portfolio is to seek long-term capital growth.

Principal Strategies. Under normal circumstances, both Portfolios invest at least 80% of their net assets (plus the amount of any borrowing for investment purposes) in securities of small companies. In the case of the Target Portfolio, the Adviser focuses mainly in the securities of smaller U.S. companies which have market capitalizations similar to those companies included in widely known indices such as the S&P SmallCap 600 Growth Index, the Russell 2000® Growth Index, or the small company market capitalization classifications published by Lipper, Inc. In the case of the Acquiring Portfolio, the Adviser focuses mainly in the securities of smaller companies which have market capitalizations similar to those companies included in widely known indices such as the S&P SmallCap 600 Index or the Russell 2000® Index. Should the Adviser determine that a Portfolio would benefit from reducing the percentage of its assets invested in securities of small companies from 80% to a lesser amount, shareholders will be notified at least 60 days prior to such a change.

Each Portfolio seeks to achieve its investment objective by investing primarily in common stocks. The Adviser uses fundamental, quantitative, and technical investment research techniques to determine what securities to buy and sell. The Adviser looks for small companies that, in its opinion:

| • | have an improving fundamental outlook; |

| • | have capable management; and |

| • | are financially sound. |

The Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or reposition assets to more promising opportunities.

Portfolio Holdings. A description of the Portfolios’ policies and procedures with respect to the disclosure of the Portfolios’ portfolio securities is available on the Portfolios’ website.

The Portfolios are subject to similar principal risks. Both Portfolios are subject to Market Risk, Issuer Risk, Liquidity Risk, Small Cap Risk, and Investment Adviser Risk. Both Portfolios are also subject to Volatility Risk, though each may be subject to different types of risks. These risks are described below.

Principal risks to which both Portfolios are subject

Market Risk. Over time, securities markets generally tend to move in cycles with periods when security prices rise and periods when security prices decline. The value of the Portfolio’s investments may move with these cycles and, in some instances, increase or decrease more than the applicable market(s) as measured by the Portfolio’s benchmark index(es). The securities markets may also decline because of factors that affect a particular industry.

Issuer Risk. Issuer risk is the possibility that factors specific to a company to which the Portfolio’s portfolio is exposed will affect the market prices of the company’s securities and therefore the value of the Portfolio. Some factors affecting the performance of a company include demand for the company’s products or services, the quality of management of the company and brand recognition and loyalty. Common stock of a company is subordinate to other securities issued by the company. If a company becomes insolvent, interests of investors owning common stock will be subordinated to the interests of other investors in, and general creditors of, the company.

Small Cap Risk. Smaller, less seasoned companies often have greater price volatility, lower trading volume, and less liquidity than larger, more established companies. These companies tend to have small revenues, narrower product lines, less management depth and experience, small shares of their product or service markets, fewer financial resources, and less competitive strength than larger companies. Such companies seldom pay significant dividends that could cushion returns in a falling market.

- 3 -

Table of Contents

Investment Adviser Risk. The Portfolio is actively managed and the success of its investment strategy depends significantly on the skills of the adviser(s) in assessing the potential of the investments in which the Portfolio invests. This assessment of investments may prove incorrect, resulting in losses or poor performance, even in rising markets.

Volatility Risk. Volatility risk is the risk that certain types of securities shift in and out of favor depending on market and economic conditions as well as investor sentiment.

Liquidity Risk. Liquidity is the ability to sell a security relatively quickly for a price that most closely reflects the actual value of the security. As a result, the Portfolio may have difficulty selling or disposing of securities quickly in certain markets or may only be able to sell the holdings at prices substantially less than what the Portfolio believes they are worth.

Additional principal risks to which only the Target Portfolio is subject

Volatility Risk. Growth style investing includes the risk of investing in securities whose prices historically have been more volatile than other securities, especially over the short term. Growth stock prices reflect projection of future earnings or revenues and, if a company’s earnings or revenues fall short of expectation, its stock prices may fall dramatically.

The Board. The Board is responsible for the overall supervision of the operations of each Portfolio and performs the various duties imposed on the directors of investment companies by the 1940 Act and under applicable state law.

The Adviser. Thrivent Financial is the investment adviser for each Portfolio. Thrivent Financial and its investment advisory affiliate, Thrivent Asset Management, LLC, have been in the investment advisory business since 1986 and managed approximately $96 billion in assets as of December 31, 2014, including approximately $41 billion in mutual fund assets. These advisory entities are located at 625 Fourth Avenue South, Minneapolis, Minnesota 55415.

The Adviser and the Fund received an exemptive order from the SEC that permits the Adviser and the Portfolios, with the approval of the Board, to retain one or more subadvisers for the Portfolios, or subsequently change a subadviser, without submitting the respective investment subadvisory agreements, or material amendments to those agreements, to a vote of the contractholders of the applicable Portfolio. The Adviser will notify contractholders of a Portfolio if there is a new subadviser for that Portfolio.

The Portfolios’ annual report to contractholders discusses the basis for the Board approving the investment advisory agreement during the period covered by the report.

Portfolio Management. David J. Lettenberger, CFA has served as portfolio manager of the Target Portfolio since 2014. Mr. Lettenberger has been with Thrivent Financial since 2013 and previously served as an associate portfolio manager.

Matthew D. Finn, CFA has served as lead portfolio manager of the Acquiring Portfolio since 2013. James M. Tinucci, CFA has served as the associate portfolio manager of the Acquiring Portfolio since 2015. Mr. Finn has been a portfolio manager at Thrivent Financial since 2004, when he joined the firm. Mr. Tinucci has been with Thrivent Financial since 2014, and previously held various positions at Thrivent Financial from 2007 to 2012. Prior to joining Thrivent Financial, Mr. Tinucci was a manager at Deloitte Consulting.

The Fund SAI provides information about the portfolio managers’ compensation, other accounts managed by the portfolio managers, and the portfolio managers’ ownership of shares of the Portfolios.

- 4 -

Table of Contents

Advisory Fees. Each Portfolio pays an annual investment advisory fee to the Adviser. The advisory contract between the Adviser and the Fund provides for the following advisory fees for each class of shares of a Portfolio, expressed as an annual rate of average daily net assets:

Target Portfolio

1.000% of average daily net assets up to $500 million |

0.900% of average daily net assets over $500 million |

Acquiring Portfolio

0.700% of average daily net assets up to $200 million |

0.650% of average daily net assets greater than $200 million but not greater than $1 billion |

0.600% of average daily net assets greater than $1 billion but not greater than $2.5 billion |

0.550% of average daily net assets greater than $2.5 billion but not greater than $5 billion |

0.525% of average daily net assets over $5 billion |

During the twelve-months ended December 31, 2014, the contractual advisory fees for the Target Portfolio were 1.00% of the Target Portfolio’s average daily net assets.

During the twelve-months ended December 31, 2014, the contractual advisory fees for the Acquiring Portfolio were 0.68% of the Acquiring Portfolio’s average daily net assets.

For a complete description of each Portfolio’s advisory services, see the section of the Portfolio Prospectus entitled “Management” and the section of the Fund SAI entitled “Investment Adviser, Investment Subadvisers, and Portfolio Managers.”

Investments in the Target Portfolio by Certain Affiliated Portfolios

The Reorganization is not contingent upon the approval or completion of any other reorganization or merger. However, simultaneous with contractholders’ consideration of this Prospectus/Proxy Statement, contractholders of Thrivent Partner Small Cap Value Portfolio (the “Other Target Portfolio,” and collectively with the Target Portfolio, the “Target Portfolios”) are considering a reorganization of that portfolio into the Acquiring Portfolio. Therefore, pro forma financial and expense information presented in this Prospectus/Proxy Statement under the headings “COMPARISON OF THE PORTFOLIOS – Expenses” and “COMPARISON OF THE PORTFOLIOS – Capitalization”, and the pro forma information regarding the Acquiring and Target Portfolios in the Reorganization SAI (collectively, the “Pro Forma Information”), is presented on the basis of the alternate assumptions that the Reorganization involves solely the Target Portfolio or both of the Target Portfolios.

Other portfolios of the Fund for which Thrivent Financial is the investment adviser (the “Affiliated Portfolios”) currently invest in the Target Portfolios. The Affiliated Portfolios are asset allocation funds investing in a range of asset categories and permit Thrivent Financial to determine whether to invest directly in securities and other investments, in addition to, or instead of, investing in other portfolios of the Fund (including the Target Portfolios). Over time, Thrivent Financial has gradually invested a larger percentage of the Affiliated Portfolios’ assets in direct investments and has reduced the percentage of assets invested in other portfolios of the Fund. Thrivent Financial expects to continue decreasing the percentage of Affiliated Portfolios’ assets invested in other portfolios over time. This trend of relying more heavily on direct investments is expected to accelerate since Thrivent Financial has proposed changes that will simplify the investment advisory fee structure of the Affiliated Portfolios. These changes would encourage a more streamlined approach of direct investments, while accommodating investments in other portfolios of the Fund when Thrivent Financial deems it to be advisable. As a result, the Affiliated Portfolios are likely to redeem their holdings (if any) out of the Target Portfolios irrespective of whether the Reorganization is approved. These redemptions would most likely be processed as redemptions-in-kind, with the effect that the Affiliated Portfolios would receive a pro rata distribution of the Target Portfolios’ investments. These redemptions may be substantial, relative to the size of the Target Portfolio(s) prior to such redemption, and are likely to occur prior to the effective date of the Reorganization. The Pro Forma Information presented in this Prospectus/Proxy Statement and the Reorganization SAI does not include any effects of such redemptions.

- 5 -

Table of Contents

The table below sets forth the fees and expenses that investors may pay to buy and hold shares of each of the Target Portfolio and the Acquiring Portfolio, including (i) the fees and expenses paid by the Target Portfolio for the twelve-month period ended December 31, 2014, (ii) the fees and expenses paid by the Acquiring Portfolio for the twelve-month period ended December 31, 2014, (iii) pro forma fees and expenses for the Acquiring Portfolio for the twelve-month period ended December 31, 2014, assuming the Reorganization had been completed as of the beginning of such period, and (iv) pro forma fees and expenses for the Acquiring Portfolio for the twelve-month period ended December 31, 2014, assuming that the Target Portfolio and Thrivent Partner Small Cap Value Portfolio (collectively referred to as the “Target Portfolios”) all merged into the Acquiring Portfolio as of the beginning of such period. If you own a variable annuity contract or a variable life insurance contract, you will have additional expenses, including mortality and expense risk charges. These additional contract-level expenses are not reflected in the table below.

Shareholder Fees for Target and Acquiring Portfolios - Actual and Pro Forma

(fees directly paid from your investment)

Maximum Sales Charge (Load) | N/A | |||

Maximum Deferred Sales Charge (Load) | N/A |

| Actual | Pro Forma | |||||||||||||||

| Annual Fund Operating Expenses As a Percentage of Average Net Assets (expenses that you pay each year as a percentage of the value of your investment) | Target Portfolio | Acquiring Portfolio | Acquiring Portfolio (assuming merger with Target Portfolio) | Acquiring Portfolio (assuming merger with Target Portfolios) | ||||||||||||

Management Fees | 1.00 | % | 0.68 | % | 0.67 | % | 0.66 | % | ||||||||

Other Expenses | 0.08 | % | 0.07 | % | 0.05 | % | 0.04 | % | ||||||||

Acquired (Underlying) Portfolio Fees and Expenses | — | 0.01 | % | 0.01 | % | 0.01 | % | |||||||||

Total Annual Operating Expenses | 1.08 | % | 0.76 | % | 0.73 | % | 0.71 | % | ||||||||

Less Expense Reimbursement* | 0.13 | % | — | — | — | |||||||||||

Net Annual Portfolio Operating Expenses | 0.95 | % | 0.76 | % | 0.73 | % | 0.71 | % | ||||||||

| * | The Adviser has contractually agreed, through at least April 30, 2016, to waive certain fees and/or reimburse certain expenses associated with the shares of the Target Portfolio in order to limit the Net Annual Portfolio Operating Expenses (excluding Acquired (Underlying) Portfolio Fees and Expenses, if any) to an annual rate of 0.95% of the average daily net assets of the shares. This contractual provision, however, may be terminated before the indicated termination date upon the mutual agreement between the Independent Directors of the Fund and the Adviser. |

- 6 -

Table of Contents

Example

The following example, using the actual and pro forma operating expenses for the twelve-month period ended December 31, 2014, is intended to help you compare the costs of investing in the Acquiring Portfolio pro forma after the Reorganization with the costs of investing in each of the Target Portfolio and the Acquiring Portfolio without the Reorganization. The example assumes that you invest $10,000 in each Portfolio for the time period indicated and that you redeem all of your shares at the end of each period. The example also assumes that your investments have a 5% return each year and that each Portfolio’s operating expenses remain the same each year. Although your actual returns may be higher or lower, based on these assumptions your costs would be:

| Actual | Pro Forma | |||||||||||||||

| Target Portfolio | Acquiring Portfolio | Acquiring Portfolio (assuming merger with the Target Portfolio) | Acquiring Portfolio (assuming merger with the Target Portfolios) | |||||||||||||

Total operating expenses assuming redemption at the end of the period | ||||||||||||||||

One Year | $ | 97 | $ | 78 | $ | 75 | $ | 73 | ||||||||

Three Years | $ | 331 | $ | 243 | $ | 233 | $ | 227 | ||||||||

Five Years | $ | 583 | $ | 422 | $ | 406 | $ | 395 | ||||||||

Ten Years | $ | 1,305 | $ | 942 | $ | 906 | $ | 883 | ||||||||

Portfolio Turnover

Each Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Portfolio shares are held in a taxable account. These costs, which are not reflected in Total Annual Operating Expenses or in the Example, affect the Portfolios’ performance. During the fiscal year ended December 31, 2014, the Acquiring Portfolio’s and the Target Portfolio’s portfolio turnover rates were 56% and 88%, respectively, of the average value of their portfolios.

The Separate Accounts and the Retirement Plans

Shares in the Fund are currently sold, without sales charges, only to: (1) separate accounts of Thrivent Financial and Thrivent Life Insurance Company (“Thrivent Life”), a subsidiary of Thrivent Financial, which are used to fund benefits of variable life insurance and variable annuity contracts (each a “variable contract”) issued by Thrivent Financial and Thrivent Life; (2) other portfolios of the Fund; and (3) retirement plans sponsored by Thrivent Financial.

A Prospectus for the variable contract describes how the premiums and the assets relating to the variable contract may be allocated among one or more of the subaccounts that correspond to the portfolios of the Fund.

The Fund serves as the underlying investment vehicle for variable annuity contracts and variable life insurance policies that are funded through separate accounts established by Thrivent Financial and Thrivent Life. It is possible that in the future, it may not be advantageous for variable life insurance separate accounts and variable annuity separate accounts to invest in the portfolios at the same time. Although neither Thrivent Financial, Thrivent Life, nor the Fund currently foresees any such disadvantage, the Fund’s Board monitors events in order to identify any material conflicts between such policy owners and contract owners. Material conflict could result from, for example, (1) changes in state insurance laws, (2) changes in federal income tax law, (3) changes in the investment management of a portfolio, or (4) differences in voting instructions between those given by policy owners and those given by contract owners. Should it be necessary, the Board would determine what action if any, should be taken on response to any such conflicts.

As a result of differences in tax treatment and other considerations, a conflict could arise between the interests of the variable life insurance contract owners, variable annuity contract owners, and the retirement plans with respect to their investments in the Fund. The Fund’s Board will monitor events in order to identify the existence of any material irreconcilable conflicts and to determine what action if any, should be taken in response to any such conflicts.

- 7 -

Table of Contents

The price of a Portfolio’s shares is based on the Portfolio’s net asset value (“NAV”). The Portfolios determine their NAV once daily at the close of trading on the New York Stock Exchange (“NYSE”), which is normally 4:00 p.m. Eastern Time. The Portfolios do not determine NAV on holidays observed by the NYSE or on any other day when the NYSE is closed. The NYSE is regularly closed on Saturdays and Sundays, New Year’s Day, Martin Luther King, Jr. Day, Presidents Day, Good Friday, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day.

Each Portfolio determines its NAV by adding the value of Portfolio assets, subtracting the Portfolio’s liabilities, and dividing the result by the number of outstanding shares. To determine the NAV, the Portfolios generally value their securities at current market value using readily available market quotations. If market prices are not available or if the Adviser determines that they do not accurately reflect fair value for a security, the Board has authorized the Adviser to make fair valuation determinations pursuant to policies approved by the Board. Fair valuation of a particular security is an inherently subjective process, with no single standard to utilize when determining a security’s fair value. In each case where a security is fair valued, consideration is given to the facts and circumstances relevant to the particular situation. This consideration includes a review of various factors set forth in the pricing policies adopted by the Board.

Because many foreign markets close before the U.S. markets, significant events may occur between the close of the foreign market and the close of the U.S. markets, when the Portfolio’s assets are valued, that could have a material impact on the valuation of foreign securities (i.e., available price quotations for these securities may not necessarily reflect the occurrence of the significant event). The Fund, subject to oversight by the Board, evaluates the impact of these significant events and adjusts the valuation of foreign securities to reflect the fair value as of the close of the U.S. markets to the extent that the available price quotations do not, in the Adviser’s opinion, adequately reflect the occurrence of the significant events.

The separate accounts place an order to buy or sell shares of a respective Portfolio each business day. The amount of the order is based on the aggregate instructions from owners of the variable annuity contracts. Orders placed before the close of the NYSE on a given day by the separate accounts or the retirement plans result in share purchases and redemptions at the NAV calculated as of the close of the NYSE that day.

Please note that the Target Portfolio and the Acquiring Portfolio have identical valuation policies. As a result, there will be no material change to the value of the Target Portfolio’s assets because of the Reorganization.

Also, the Target Portfolio and the Acquiring Portfolio have identical policies with respect to frequent purchases and redemptions and standing allocation orders (for more information, please see Policy Regarding Frequent Purchases and Redemptions and Standing Allocation Order disclosures in the Acquiring Portfolio’s Prospectus - these disclosures are incorporate herein by reference). The Reorganization will not affect these policies.

The following table sets forth the capitalization of the Target Portfolio and the Acquiring Portfolio, as of December 31, 2014, and the pro forma capitalization of the Acquiring Portfolio as if the Reorganization occurred on that date. These numbers may differ as of the Closing Date.

| Actual | Pro Forma | |||||||||||||||

| Target Portfolio | Acquiring Portfolio | Acquiring Portfolio (assuming merger with the Target Portfolio) | Acquiring Portfolio (assuming merger with the Target Portfolios) | |||||||||||||

Net assets | ||||||||||||||||

Portfolio Net Assets | $ | 47,801,026 | $ | 306,338,035 | $ | 354,139,061 | $ | 742,771,667 | ||||||||

Net asset value per share | ||||||||||||||||

Net asset value | $ | 17.39 | $ | 18.37 | $ | 18.37 | $ | 18.37 | ||||||||

Shares outstanding | ||||||||||||||||

Portfolio Shares | 2,748,785 | 16,675,108 | 19,277,091 | 40,431,770 | ||||||||||||

- 8 -

Table of Contents

The pro forma shares outstanding reflect the issuance by the Acquiring Portfolio of: i) assuming a merger with the Target Portfolios, approximately 2,601,983 shares; and ii) assuming a merger with the Target Portfolios, approximately 23,756,662 shares. In each case, such issuance reflects the exchange of the assets of the Target Portfolio for newly issued shares of the Acquiring Portfolio, respectively, at the pro forma net asset value per share. The aggregate value of the Acquiring Portfolio shares that a Target Portfolio shareholder receives in the Reorganization will equal the aggregate value of the Target Portfolio shares owned immediately prior to the Reorganization.

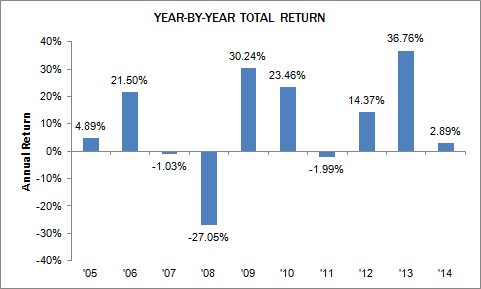

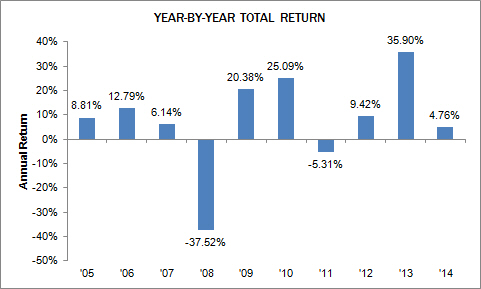

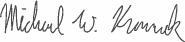

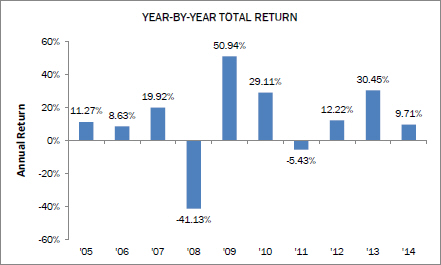

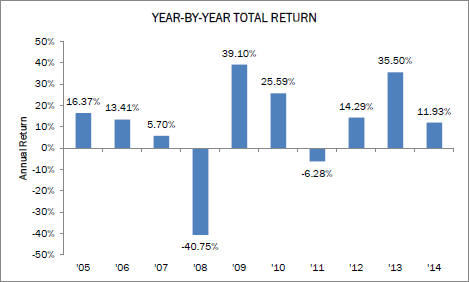

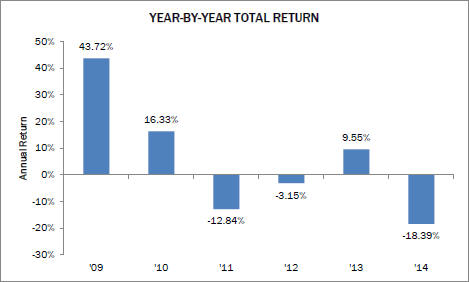

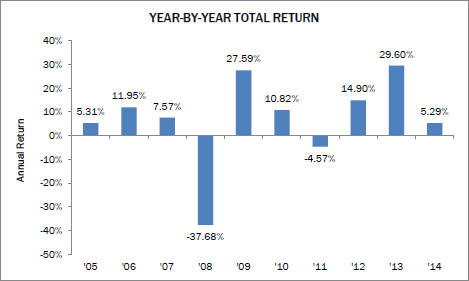

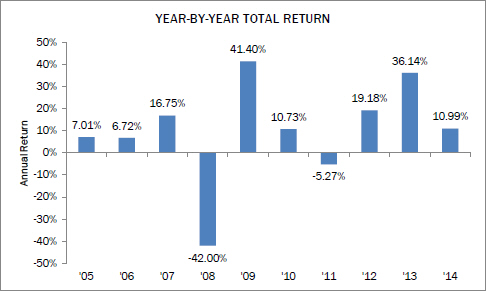

Annual Performance Information

The following chart shows the annual returns of the Target Portfolio and the Acquiring Portfolio for the past ten calendar years. The bar charts include the effects of each Portfolio’s expenses, but not charges or deductions against your variable contract. If these charges and deductions were included, returns would be lower than those shown.

Thrivent Partner Small Cap Growth Portfolio

- 9 -

Table of Contents

Thrivent Small Cap Stock Portfolio

As a result of market activity, current performance may vary from the figures shown.

The Target Portfolio’s total return for the three-month period from January 1, 2015 to March 31, 2015 was 7.78%. The Acquiring Portfolio’s total return for the three-month period from January 1, 2015 to March 31, 2015 was 3.53%. During the past 10 years, the Target Portfolio’s highest quarterly return was 22.98% (for the quarter ended June 30, 2009) and its lowest quarterly return was -27.38% (for the quarter ended December 31, 2008). During the past 10 years, the Acquiring Portfolio’s highest quarterly return was 19.09% (for the quarter ended September 30, 2009) and its lowest quarterly return was -24.43% (for the quarter ended December 31, 2008).

Comparative Performance Information

As a basis for evaluating each Portfolio’s performance and risks, the following table shows how each Portfolio’s performance compares with broad-based market indices that the Adviser believes are appropriate benchmarks for such Portfolio. The Target Portfolio’s benchmark is the Russell 2000® Growth Index, which is comprised of small-cap companies with a greater-than-average growth orientation. The Acquiring Portfolio’s benchmark is the Russell 2000® Index, which is comprised of 2000 of the smaller companies in the Russell 3000® Index. Further, the table includes the effects of each Portfolio’s expenses, but not charges or deductions against your variable contract. If these charges and deductions were included, returns would be lower than those shown.

Average annual total returns are shown below for each Portfolio for the periods ended December 31, 2014 (the most recently completed calendar year prior to the date of this Prospectus/Proxy Statement). Remember that past performance of a Portfolio is not indicative of its future performance.

Average Annual Total Returns for the Period ended December 31, 2014

| Target Portfolio | Acquiring Portfolio | |||||||||||||||||||||||

| Past 1 Year | Past 5 Years | Past 10 Years | Past 1 Year | Past 5 Years | Past 10 Years | |||||||||||||||||||

Applicable Portfolio | 2.31 | % | 14.93 | % | 6.90 | % | 4.76 | % | 13.03 | % | 6.10 | % | ||||||||||||

Russell 2000® Growth Index (reflects no deductions for fees, expenses or taxes) | 5.60 | % | 16.80 | % | 8.54 | % | — | — | — | |||||||||||||||

Russell 2000® Index (reflects no deductions for fees, expenses or taxes) | — | — | — | 4.89 | % | 15.55 | % | 7.77 | % | |||||||||||||||

- 10 -

Table of Contents

Financial Highlights of the Acquiring Portfolio

| Income from Investment Operations | Less Distributions From | Ratio to Average Net Assets** | Ratios to Average Net Assets Before Expenses Waived, Credited or Paid Indirectly** | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | Net Investment Income/ (Loss) | Net Realized and Unrealized Gain/(Loss) on Investments(a) | Total from Investment Operations | Net Investment Income | Net Realized Gain on Investments | Total Distributions | Net Asset Value, End of Period | Total Return(b) | Net Assets, End of Period (in millions) | Expenses | Net Investment Income/ (Loss) | Expenses | Net Investment Income/ (Loss) | Portfolio Turnover Rate | ||||||||||||||||||||||||||||||||||||||||||||||

Year Ended 12/31/2014 | $ | 17.77 | $ | 0.08 | $ | 0.75 | $ | 0.83 | $ | (0.04 | ) | $ | (0.19 | ) | $ | (0.23 | ) | $ | 18.37 | 4.76 | % | $ | 306.3 | 0.75 | % | 0.42 | % | 0.75 | % | 0.42 | % | 56 | % | |||||||||||||||||||||||||||

Year Ended 12/31/2013 | 13.12 | 0.04 | 4.67 | 4.71 | (0.06 | ) | — | (0.06 | ) | 17.77 | 35.90 | % | 354.6 | 0.75 | % | 0.25 | % | 0.75 | % | 0.25 | % | 62 | % | |||||||||||||||||||||||||||||||||||||

Year Ended 12/31/2012 | 11.99 | 0.06 | 1.07 | 1.13 | — | — | — | 13.12 | 9.42 | % | 269.5 | 0.76 | % | 0.49 | % | 0.76 | % | 0.49 | % | 96 | % | |||||||||||||||||||||||||||||||||||||||

Year Ended 12/31/2011 | 12.66 | (0.01 | ) | (0.66 | ) | (0.67 | ) | — | — | — | 11.99 | (5.31 | )% | 263.8 | 0.76 | % | (0.10 | )% | 0.76 | % | (0.10 | )% | 88 | % | ||||||||||||||||||||||||||||||||||||

Year Ended 12/31/2010 | 10.13 | (0.01 | ) | 2.54 | 2.53 | — | — | — | 12.66 | 25.09 | % | 303.2 | 0.77 | % | (0.11 | )% | 0.77 | % | (0.11 | )% | 208 | % | ||||||||||||||||||||||||||||||||||||||

| (a) | The amount shown may not correlate with the change in aggregate gains and losses of portfolio securities due to the timing of sales and redemptions of portfolio shares. |

| (b) | Total investment return assumes dividend reinvestment and does not reflect any deduction for applicable sales charges. Not annualized for periods less than one year. Total return shown does not reflect charges and expenses imposed on contractholders by the variable accounts. Those charges and expenses reduce the return received by contractholders as compared to the return presented. |

| * | All per share amounts have been rounded to the nearest cent. |

| ** | Computed on an annualized basis for periods less than one year |

The financial highlights for the Target Portfolio are available in the Thrivent Series Fund, Inc. Prospectus, dated April 30, 2015 and as supplemented through the date hereof and are incorporated herein by reference.

-11-

Table of Contents

Thrivent Financial, 625 Fourth Avenue South, Minneapolis, Minnesota 55415, provides administrative personnel and services necessary to operate the Portfolios and receives an administration fee from the Portfolios. The custodian for the Portfolios is State Street Bank and Trust Company, 225 Franklin Street, Boston, Massachusetts 02110. PricewaterhouseCoopers LLP, 225 South Sixth Street, Suite 1400, Minneapolis, MN 55402, serves as the Fund’s independent registered public accounting firm.

The Fund is an open-end management investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and was organized as a Minnesota corporation on February 24, 1986. The Fund is made up of 36 separate series or “Portfolios.” Each Portfolio of the Fund, other than the Thrivent Aggressive Allocation Portfolio, the Thrivent Moderately Aggressive Allocation Portfolio, the Thrivent Moderate Allocation Portfolio, the Thrivent Moderately Conservative Allocation Portfolio, the Thrivent Partner Healthcare Portfolio, and the Thrivent Natural Resources Portfolio, is diversified. Each Portfolio is in effect a separate investment fund, and a separate class of capital stock of the Fund is issued with respect to each Portfolio.

The Fund’s organizational documents are filed as part of the Fund’s registration statement with the SEC, and shareholders may obtain copies of such documents as described on the first page of this Prospectus/Proxy Statement and in the Questions and Answers preceding this Prospectus/Proxy Statement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase a Portfolio through a broker-dealer or other financial intermediary, the Portfolio and its related companies may pay the intermediary for the sale of Portfolio shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Portfolio over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

-12-

Table of Contents

INFORMATION ABOUT THE REORGANIZATION

Under the Reorganization Agreement, the Target Portfolio will transfer all of its assets to the Acquiring Portfolio in exchange for shares of the Acquiring Portfolio. The Acquiring Portfolio shares issued to the Target Portfolio will have an aggregate value equal to the aggregate value of the Target Portfolio’s net assets immediately prior to the Reorganization. Upon receipt by the Target Portfolio of Acquiring Portfolio shares, the Target Portfolio will distribute such shares of the Acquiring Portfolio to Target Portfolio shareholders. Then, as soon as practicable after the Closing Date of the Reorganization, the Target Portfolio will dissolve under applicable state law.

The Target Portfolio will distribute the Acquiring Portfolio shares received by it pro rata to Target Portfolio shareholders of record in exchange for their interest in shares of the Target Portfolio. Accordingly, as a result of the Reorganization, each Target Portfolio shareholder would own Acquiring Portfolio shares that would have an aggregate value immediately after the Reorganization equal to the aggregate value of that shareholder’s Target Portfolio shares immediately prior to the Reorganization. The interests of each of the Target Portfolio’s shareholders will not be diluted as a result of the Reorganization. However, as a result of the Reorganization, a shareholder of the Target Portfolio or the Acquiring Portfolio will hold a reduced percentage of ownership in the larger combined portfolio than the shareholder did in either of the separate Portfolios.

No sales charge or fee of any kind will be assessed to Target Portfolio shareholders in connection with their receipt of Acquiring Portfolio shares in the Reorganization.

Approval of the Reorganization will constitute approval of amendments to any of the fundamental investment restrictions of the Target Portfolio that might otherwise be interpreted as impeding the Reorganization, but solely for the purpose of and to the extent necessary for consummation of the Reorganization.

Terms of the Reorganization Agreement

The following is a summary of the material terms of the Reorganization Agreement. This summary is qualified in its entirety by reference to the form of Reorganization Agreement, a form of which is attached as Appendix A to the Reorganization SAI.

Pursuant to the Reorganization Agreement, the Acquiring Portfolio will acquire all of the assets of the Target Portfolio on the Closing Date in exchange for shares of the Acquiring Portfolio. Subject to the Target Portfolio’s contractholders approving the Reorganization, the Closing Date shall occur on August 21, 2015 or such other date as determined by an officer of the Fund.

On the Closing Date, the Target Portfolio will transfer to the Acquiring Portfolio all of its assets. The Acquiring Portfolio will in turn transfer to the Target Portfolio a number of its shares equal in value to the value of the net assets of the Target Portfolio transferred to the Acquiring Portfolio as of the Closing Date, as determined in accordance with the valuation method described in the Acquiring Portfolio’s then current prospectus. In order to minimize any potential for undesirable federal income and excise tax consequences in connection with the Reorganization, the Target Portfolio will distribute on or before the Closing Date all or substantially all of its undistributed net investment income (including net capital gains) as of such date.

The Target Portfolio expects to distribute shares of the Acquiring Portfolio received by the Target Portfolio to contractholders of the Target Portfolio promptly after the Closing Date and then dissolve.

The Acquiring Portfolio and the Target Portfolio have made certain standard representations and warranties to each other regarding their capitalization, status and conduct of business. Unless waived in accordance with the Reorganization Agreement, the obligations of the parties to the Reorganization Agreement are conditioned upon, among other things:

| • | the approval of the Reorganization by the Target Portfolio’s contractholders; |

| • | the absence of any rule, regulation, order, injunction or proceeding preventing or seeking to prevent the consummation of the transactions contemplated by the Reorganization Agreement; |

- 13 -

Table of Contents

| • | the receipt of all necessary approvals, registrations and exemptions under federal and state laws; |

| • | the truth in all material respects as of the Closing Date of the representations and warranties of the parties and performance and compliance in all material respects with the parties’ agreements, obligations and covenants required by the Reorganization Agreement; |

| • | the effectiveness under applicable law of the registration statement of the Acquiring Portfolio of which this Prospectus/Proxy Statement forms a part and the absence of any stop orders under the Securities Act of 1933, as amended, pertaining thereto; and |

| • | the receipt of an opinion of counsel relating to the characterization of the Reorganization as a tax-free reorganization for federal income tax purposes (as further described herein under the heading “Material Federal Income Tax Consequences of the Reorganization”). |

The Reorganization Agreement may be terminated or amended by the mutual consent of the parties either before or after approval thereof by the contractholders of the Target Portfolio, provided that no such amendment after such approval shall be made if it would have a material adverse effect on the interests of such Target Portfolio’s contractholders. The Reorganization Agreement also may be terminated by the non-breaching party if there has been a material misrepresentation, material breach of any representation or warranty, material breach of contract or failure of any condition to closing.

Reasons for the Proposed Reorganization

In determining whether to recommend approval of the Reorganization Agreement to Target Portfolio contractholders, the Board considered a number of factors, including, but not limited to: (i) the expenses and advisory fees applicable to the Portfolios before the proposed Reorganization and the estimated expense ratios of the combined portfolio after the proposed Reorganization; (ii) the comparative investment performance of the Portfolios; (iii) the future growth prospects of each Portfolio; (iv) the terms and conditions of the Reorganization Agreement; (v) whether the Reorganization would result in the dilution of contractholder interests; (vi) the compatibility of the Portfolios’ investment objectives, policies, risks and restrictions; (vii) the anticipated tax consequences of the proposed Reorganization; (viii) the compatibility of the Portfolios’ service features available to contractholders, including exchange privileges; and (ix) the estimated costs of the Reorganization. The Board concluded that these factors supported a determination to approve the Reorganization Agreement.

The Board believes that the Reorganization would be in the best interests of the Target Portfolio’s contractholders because: (i) contractholders will become contractholders of a larger combined portfolio with greater potential to increase asset size and achieve economies of scale (especially given the breakpoints in the advisory fee schedule for the Acquiring Portfolio), whereby certain administrative costs may be spread across the combined portfolio’s larger asset base and, therefore, may increase the combined portfolio’s overall efficiency in the long term; (ii) the Target Portfolio and the Acquiring Portfolio both invest in equities, although the Acquiring Portfolio invests in a more diversified portfolio of equities; (iii) the Acquiring Portfolio has better performance than the Target Portfolio for the one-year period ended December 31, 2014, which corresponds to when Matthew Finn assumed primary portfolio management responsibilities for the Acquiring Portfolio, though there is no guarantee of future performance; (iv) the Adviser believes that it can most effectively manage the assets currently in the Target Portfolio by combining such assets with the Acquiring Portfolio into a single mandate with the Adviser and under the same portfolio manager; and (v) the Acquiring Portfolio has lower advisory fees than the Target Portfolio and the Target Portfolio contractholders will experience a lower expense ratio in the Acquiring Portfolio following the Reorganization.

The Board has determined that the Reorganization is in the best interests of the Target Portfolio and that the interests of the Target Portfolio’s contractholders will not be diluted as a result of the Reorganization. In addition, the Board has determined that the Reorganization is in the best interests of the Acquiring Portfolio and that the interests of the Acquiring Portfolio contractholders will not be diluted as a result of the Reorganization.

Material Federal Income Tax Consequences of the Reorganization

The following is a general summary of the material anticipated U.S. federal income tax consequences of the Reorganization. This discussion is based upon the Internal Revenue Code of 1986, as amended (the “Code”), Treasury regulations, court decisions, published positions of the Internal Revenue Service (“IRS”) and other

- 14 -

Table of Contents

applicable authorities, all as in effect on the date hereof and all of which are subject to change or differing interpretations (possibly with retroactive effect). This discussion is limited to U.S. persons who hold shares of the Target Portfolio as capital assets for U.S. federal income tax purposes on the date of the exchange. For federal income tax purposes, the contractholders are not the shareholders of the Target Portfolio. Rather, Thrivent Financial and Thrivent Life and their separate accounts are the shareholders.

This summary does not address all of the U.S. federal income tax consequences that may be relevant to a particular contractholder or to contractholders who may be subject to special treatment under U.S. federal income tax laws. No assurance can be given that the IRS would not assert or that a court would not sustain a position contrary to any of the tax aspects described below. Contractholders should consult their own tax advisers as to the U.S. federal income tax consequences of the Reorganization to them, as well as the effects of state, local and non-U.S. tax laws.

The Reorganization is expected to be a tax-free reorganization for U.S. federal income tax purposes. It is a condition to closing the Reorganization that the Target Portfolio and the Acquiring Portfolio receive an opinion from Reed Smith LLP, special counsel to each Portfolio, dated as of the Closing Date, regarding the characterization of the Reorganization as a “reorganization” within the meaning of Section 368(a)(1) of the Code. As such a reorganization, the U.S. federal income tax consequences of the Reorganization can be summarized as follows: to the effect that on the basis of existing provisions of the Code, the Treasury regulations promulgated thereunder, current administrative rules and court decisions, generally for U.S. federal income tax purposes, except as noted below:

| • | the Reorganization will constitute a reorganization within the meaning of Section 368(a)(1) of the Code, and the Target Portfolio and the Acquiring Portfolio will each be a “party to a reorganization” within the meaning of Section 368(b) of the Code; |

| • | under Section 361 of the Code, no gain or loss will be recognized by the Target Portfolio upon the transfer of its assets to the Acquiring Portfolio in exchange for Acquiring Portfolio shares, or upon the distribution of Acquiring Portfolio shares by the Target Portfolio to its shareholders in liquidation; |

| • | under Section 1032 of the Code, no gain or loss will be recognized by the Acquiring Portfolio upon receipt of the assets transferred to the Acquiring Portfolio in exchange for Acquiring Portfolio shares; |

| • | under Section 362(b) of the Code, the Acquiring Portfolio’s tax basis in each asset that the Acquiring Portfolio receives from the Target Portfolio will be the same as the Target Portfolio’s tax basis in such asset immediately prior to such exchange; |

| • | under Section 1223(2) of the Code, the Acquiring Portfolio’s holding periods in each asset will include the Target Portfolio’s holding periods in such asset; |

| • | under Section 354 of the Code, no gain or loss will be recognized by shareholders of the Target Portfolio on the distribution of Acquiring Portfolio shares to them in exchange for their shares of the Target Portfolio; |

| • | under Section 358 of the Code, the aggregate tax basis of the Acquiring Portfolio shares that the Target Portfolio’s shareholders receive in exchange for their Target Portfolio shares will be the same as the aggregate tax basis of the Target Portfolio shares exchanged therefor; |