UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04612

Name of Fund: BlackRock EuroFund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock EuroFund, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 06/30/2016

Date of reporting period: 12/31/2015

Item 1 – Report to Stockholders

DECEMBER 31, 2015

| | | | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | | |  |

BlackRock EuroFund

BlackRock Global SmallCap Fund, Inc.

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| | | | | | |

| | | | | | | |

| 2 | | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | |

Dear Shareholder,

Diverging monetary policies and shifting economic outlooks across regions have been the overarching themes driving financial markets over the past couple of years. With U.S. growth outpacing the global economic recovery in 2015 while inflationary pressures remained low, investors spent most of the year anticipating a short-term rate hike from the Federal Reserve (the “Fed”), which ultimately came to fruition in December. In contrast, the European Central Bank (“ECB”) and the Bank of Japan moved to a more accommodative stance during the year. In this environment, the U.S. dollar strengthened considerably, causing profit challenges for U.S. exporters and high levels of volatility in emerging market currencies and commodities. Oil prices were particularly volatile and below the historical norm due to an ongoing imbalance in global supply and demand.

Market volatility broadly increased in the middle of 2015, beginning with a sharp, but temporary, selloff in June as Greece’s long-brewing debt troubles came to an impasse. Just as these concerns abated, Chinese equities tumbled amid weakness in the country’s economy. This, combined with a depreciation of the yuan and declining confidence in China’s policymakers, stoked worries about the potential impact to the broader world economy, causing heightened volatility to spread throughout markets globally. Given a dearth of meaningful growth across most of the world, financial markets became more reliant on central bank policies to drive performance. In that vein, risk assets (such as equities and high yield bonds) rallied in October when China’s central bank provided more stimulus, the ECB hinted at further easing, and soft U.S. data pushed back expectations for a Fed rate hike. As the period came to a close, however, the ECB disappointed investors with its subdued policy changes. The Fed’s December rate hike had a positive impact on the markets as it removed a source of uncertainty, but this was counteracted by the dampening effect of a stronger U.S. dollar, falling oil prices and tighter credit conditions.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of December 31, 2015 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities

(S&P 500® Index) | | | 0.15 | % | | | 1.38 | % |

U.S. small cap equities

(Russell 2000® Index) | | | (8.75 | ) | | | (4.41 | ) |

International equities

(MSCI Europe, Australasia,

Far East Index) | | | (6.01 | ) | | | (0.81 | ) |

Emerging market equities

(MSCI Emerging

Markets Index) | | | (17.35 | ) | | | (14.92 | ) |

3-month Treasury bills

(BofA Merrill Lynch 3-Month

U.S. Treasury Bill Index) | | | 0.04 | | | | 0.05 | |

U.S. Treasury securities

(BofA Merrill Lynch 10-Year

U.S. Treasury Index) | | | 1.43 | | | | 0.91 | |

U.S. investment-grade

bonds (Barclays

U.S. Aggregate Bond Index) | | | 0.65 | | | | 0.55 | |

Tax-exempt municipal

bonds (S&P Municipal

Bond Index) | | | 3.31 | | | | 3.32 | |

U.S. high yield bonds

(Barclays U.S.

Corporate High Yield 2%

Issuer Capped Index) | | | (6.79 | ) | | | (4.43 | ) |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | | | | | |

| | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | |

| Fund Summary as of December 31, 2015 | | BlackRock EuroFund |

BlackRock EuroFund’s (the “Fund”) investment objective is to seek capital appreciation primarily through investment in equities of corporations domiciled in European countries.

| | |

| Portfolio Management Commentary | | |

How did the Fund perform?

| • | | For the six-month period ended December 31, 2015, the Fund underperformed its benchmark, the Morgan Stanley Capital International (“MSCI”) Europe Index. |

What factors influenced performance?

| • | | The Fund’s performance was driven by stock selection; the positive contribution was slightly offset by the adverse impact of its sector allocations. The Fund was underweight in consumer staples, which was the best-performing sector in the market. In particular, the Fund’s lack of a position in defensive stocks such as Nestle SA (Switzerland) detracted from performance. An overweight exposure in the energy sector, which underperformed due to the continued decline in oil prices, also hindered returns. The Fund’s position in Royal Dutch Shell PLC (United Kingdom) delivered the largest individual negative performance in energy. Among individual stocks, the mining company BHP Billiton PLC (United Kingdom) — which lost ground due to falling commodity prices and a dam burst in Brazil — was the largest detractor in the period. |

| • | | The Fund’s positioning in the industrials sector made the largest contribution to performance. The low-cost airline Ryanair Holdings PLC (Ireland) and the toll road operator Alantia SpA (Italy) were the Fund’s leading contributors in the group. Ryanair benefited from a new high in passenger traffic, while Atlantia delivered solid second quarter results behind improved motorway traffic volumes. Stock selection in the financials sector also proved successful, with positions in Hargreaves |

| | Lansdown PLC (United Kingdom), AXA SA (France) and London Stock Exchange Group PLC finishing among the top contributors. The investment advisor’s decision to avoid the Spanish banks Banco Santander SA and Banco Bilbao Vizcaya Argentaria SA also helped returns. The Fund further benefited from an overweight position in information technology (“IT”) and an underweight position in the lagging materials sector. |

Describe recent portfolio activity.

| • | | Throughout the period, the investment advisor increased the Fund’s weighting in the IT sector by participating in two initial public offerings. The Fund added the technology payments operator Worldpay Group PLC (United Kingdom), which is one of the few payment companies that operates globally across different platforms (online, offline mobile) and across the value chain. It also added the German online real estate marketplace leader Scout24 AG (Germany). The Fund increased its exposure to the consumer staples sector by buying Anheuser-Busch InBev SA (Belgium) and British American Tobacco PLC. The Fund exited its position in SABMiller PLC (United Kingdom) after the strong performance that accompanied its acquisition by Anheuser-Busch InBev. |

Describe portfolio positioning at period end.

| • | | Relative to the MSCI Europe Index, the Fund ended the period with overweight positions in the IT, telecommunications services, consumer discretionary, financials and energy sectors, and it was underweight in consumer staples, materials, healthcare, utilities and industrials. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Ten Largest Holdings | | Percent of

Net Assets |

| | | | |

Royal Dutch Shell PLC, Class B | | | 4 | % |

Novo Nordisk A/S, Class B | | | 3 | |

BT Group PLC | | | 3 | |

Prudential PLC | | | 3 | |

Lloyds Banking Group | | | 3 | |

Anheuser-Busch InBev SA | | | 3 | |

ING Groep NV CVA | | | 3 | |

AXA SA | | | 3 | |

British American Tobacco PLC. | | | 3 | |

SAP SE | | | 3 | |

| | |

| Geographic Allocation | | Percent of

Net Assets |

| | | | |

United Kingdom | | | 32 | % |

Germany | | | 13 | |

France | | | 13 | |

Netherlands | | | 13 | |

Sweden | | | 6 | |

Ireland | | | 5 | |

Switzerland | | | 5 | |

Belgium | | | 5 | |

Italy | | | 4 | |

Denmark | | | 4 | |

| | | | | | |

| | | | | | | |

| 4 | | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | |

| | |

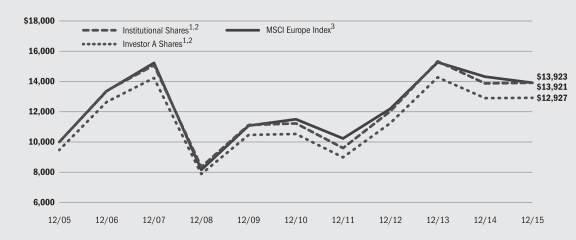

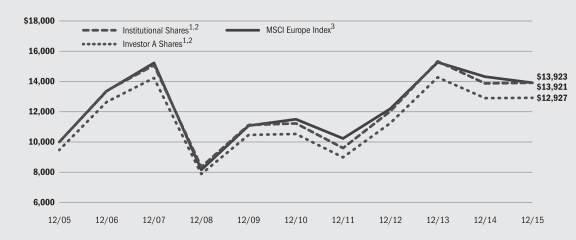

| Total Return Based on a $10,000 Investment | | |

| | 1 | | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| | 2 | | Under normal circumstances, the Fund will invest at least 80% of its net assets in equity securities, including common stock and convertible securities, of companies located in Europe. The Fund currently expects that a majority of the Fund’s assets will be invested in equity securities of companies in Western European countries, but may also invest in emerging markets in Eastern European countries. |

| | 3 | | A free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. |

| | |

| Performance Summary for the Period Ended December 31, 2015 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns4 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | | (6.53 | )% | | | 0.39 | % | | | N/A | | | | 4.38 | % | | | N/A | | | | 3.36 | % | | | N/A | |

Investor A | | | (6.67 | ) | | | 0.17 | | | | (5.09 | )% | | | 4.17 | | | | 3.05 | % | | | 3.16 | | | | 2.60 | % |

Investor C | | | (7.05 | ) | | | (0.62 | ) | | | (1.60 | ) | | | 3.28 | | | | 3.28 | | | | 2.29 | | | | 2.29 | |

Class R | | | (6.85 | ) | | | (0.17 | ) | | | N/A | | | | 3.61 | | | | N/A | | | | 2.60 | | | | N/A | |

MSCI Europe Index | | | (6.42 | ) | | | (2.84 | ) | | | N/A | | | | 3.88 | | | | N/A | | | | 3.36 | | | | N/A | |

| | 4 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| | | | N/A — Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Hypothetical6 | | | | |

| | | Beginning

Account Value

July 1, 2015 | | | Ending

Account Value

December 31, 2015 | | | Expenses Paid

During the

Period5 | | | Beginning

Account Value

July 1, 2015 | | | Ending

Account Value

December 31, 2015 | | | Expenses Paid

During the

Period5 | | | Annualized

Expense Ratio | |

Institutional | | $ | 1,000.00 | | | $ | 934.70 | | | $ | 5.11 | | | $ | 1,000.00 | | | $ | 1,019.86 | | | $ | 5.33 | | | | 1.05 | % |

Investor A | | $ | 1,000.00 | | | $ | 933.30 | | | $ | 5.98 | | | $ | 1,000.00 | | | $ | 1,018.95 | | | $ | 6.24 | | | | 1.23 | % |

Investor C | | $ | 1,000.00 | | | $ | 929.50 | | | $ | 9.99 | | | $ | 1,000.00 | | | $ | 1,014.78 | | | $ | 10.43 | | | | 2.06 | % |

Class R | | $ | 1,000.00 | | | $ | 931.50 | | | $ | 8.21 | | | $ | 1,000.00 | | | $ | 1,016.64 | | | $ | 8.57 | | | | 1.69 | % |

| | 5 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period shown). |

| | 6 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 366. |

| | | | See “Disclosure of Expenses” on page 9 for further information on how expenses were calculated. |

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | 5 |

| | |

| Fund Summary as of December 31, 2015 | | BlackRock Global SmallCap Fund, Inc. |

BlackRock Global SmallCap Fund, Inc.’s (the “Fund”) investment objective is to seek long-term growth of capital by investing primarily in a portfolio of equity securities of small cap issuers located in various foreign countries and in the United States.

| | |

| Portfolio Management Commentary | | |

How did the Fund perform?

| • | | For the six-month period ended December 31, 2015, the Fund underperformed its benchmark, the MSCI All Country World Small Cap Index, as well as the broad-market MSCI World Index. The following discussion of relative performance pertains to the MSCI All Country World Small Cap Index. |

What factors influenced performance?

| • | | Stock selection in the consumer discretionary sector, particularly within the specialty retail and hotels, restaurants & leisure industries, was the most significant detractor from performance during the period. Stock selection in the materials and consumer staples sectors hindered performance as well. The combination of stock selection and a small overweight in the underperforming energy sector also weighed on returns, as did stock selection in industrials and an underweight position in utilities. |

| • | | The largest contributor to relative performance was the combination of an overweight position and stock selection within the health care sector. An overweight position in the health care equipment & supplies industry, as well as selection in both the life sciences & tools and providers & services industries, were the most notable sources of outperformance. The Fund’s overweight position in the information technology sector, together with positive stock selection in the group, also aided performance. Stock selection in both the utilities and telecommunications sectors further contributed to the Fund’s six-month results. |

Describe recent portfolio activity.

| • | | The Fund added to new and existing positions in the financials, consumer staples, health care, technology and utilities sectors, while it |

| | | exited positions in the materials, consumer discretionary, telecommunications, energy and industrials sectors. Regionally, this activity resulted in small increases to the Fund’s weightings in the United States, United Kingdom and emerging markets, along with marginal decreases in both Europe and Japan. |

Describe portfolio positioning at period end.

| • | | The Fund continued to emphasize high-quality, reasonably valued companies with strong balance sheets, effective management teams and the potential for rising market share and sustainable growth. The investment advisor took a more defensive approach, emphasizing individual companies whose earnings are not wholly dependent on broader economic growth trends. Relative to the MSCI All Country World Small Cap Index, the Fund ended the period with overweights in the health care and information technology sectors and underweight positions in the consumer discretionary, utilities, materials, industrials and consumer staples sectors. |

| • | | The Fund remained well-balanced between the growth and value styles, and it was substantially diversified across sectors and regions. The investment advisor became increasingly selective in the U.S. and European markets at a time in which divergent central bank policies, elevated profit margins and above-average valuations needed to be weighed against fundamentals and the prospect of sustainable, longer-term growth. Despite Japan’s strong performance during 2015, the Fund remains underweight in the country given the better representation of higher-quality companies available elsewhere in the global markets. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Ten Largest Holdings | | Percent of

Net Assets |

| | | | |

NuVasive, Inc. | | | 2 | % |

Insulet Corp. | | | 1 | |

Teleflex, Inc. | | | 1 | |

CyrusOne, Inc | | | 1 | |

Owens & Minor, Inc | | | 1 | |

Quotient Ltd. | | | 1 | |

Tanger Factory Outlet Centers, Inc. | | | 1 | |

Cable One, Inc. | | | 1 | |

Supervalu, Inc. | | | 1 | |

Yelp, Inc. | | | 1 | |

| | |

| Geographic Allocation | | Percent of

Net Assets |

| | | | |

United States | | | 64 | % |

United Kingdom | | | 7 | |

Japan | | | 6 | |

Canada | | | 5 | |

India | | | 3 | |

Switzerland | | | 3 | |

France | | | 2 | |

Italy | | | 2 | |

China | | | 2 | |

Other1 | | | 13 | |

Liabilities in Excess of Other Assets | | | (7 | ) |

| | 1 | | Includes holdings within countries that are 1% or less of net assets. Please refer to the Schedule of Investments for such countries. |

| | | | | | |

| | | | | | | |

| 6 | | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | |

| | |

| | | BlackRock Global SmallCap Fund, Inc. |

| | |

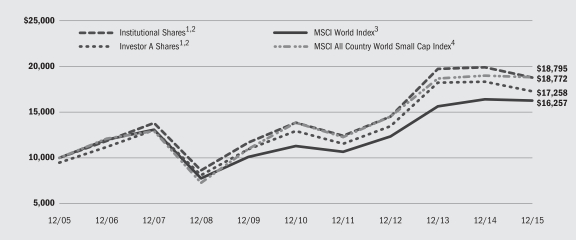

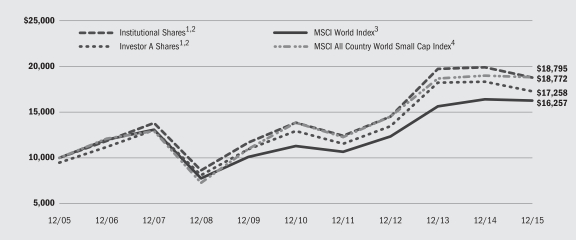

| Total Return Based on a $10,000 Investment | | |

| | 1 | | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| | 2 | | The Fund invests in a diversified portfolio primarily consisting of equity securities of small cap issuers located in various foreign countries and in the United States. |

| | 3 | | A free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 23 developed market country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. |

| | 4 | | A free float-adjusted market capitalization weighted index that is designed to measure equity market results of smaller capitalization companies in both developed and emerging markets. |

| | |

| Performance Summary for the Period Ended December 31, 2015 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | | (10.05 | )% | | | (5.58 | )% | | | N/A | | | | 6.27 | % | | | N/A | | | | 6.50 | % | | | N/A | |

Investor A | | | (10.16 | ) | | | (5.85 | ) | | | (10.79 | )% | | | 5.94 | | | | 4.81 | % | | | 6.18 | | | | 5.61 | % |

Investor B | | | (10.64 | ) | | | (6.77 | ) | | | (10.74 | ) | | | 4.96 | | | | 4.66 | | | | 5.42 | | | | 5.42 | |

Investor C | | | (10.52 | ) | | | (6.59 | ) | | | (7.47 | ) | | | 5.08 | | | | 5.08 | | | | 5.31 | | | | 5.31 | |

Class R | | | (10.36 | ) | | | (6.20 | ) | | | N/A | | | | 5.53 | | | | N/A | | | | 5.76 | | | | N/A | |

MSCI World Index | | | (3.41 | ) | | | (0.87 | ) | | | N/A | | | | 7.59 | | | | N/A | | | | 4.98 | | | | N/A | |

MSCI All Country World Small Cap Index | | | (6.79 | ) | | | (1.04 | ) | | | N/A | | | | 6.30 | | | | N/A | | | | 6.51 | | | | N/A | |

| | 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 8 for a detailed description of share classes, including any related sales charges and fees. |

| | | | N/A — Not applicable as share class and index do not have a sales charge. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Hypothetical7 | | | | |

| | | Beginning

Account Value

July 1, 2015 | | | Ending

Account Value

December 31, 2015 | | | Expenses Paid

During the Period6 | | | Beginning

Account Value

July 1, 2015 | | | Ending

Account Value

December 31, 2015 | | | Expenses Paid

During the Period6 | | | Annualized

Expense Ratio | |

Institutional | | $ | 1,000.00 | | | $ | 899.50 | | | $ | 5.11 | | | $ | 1,000.00 | | | $ | 1,019.76 | | | $ | 5.43 | | | | 1.07 | % |

Investor A | | $ | 1,000.00 | | | $ | 898.40 | | | $ | 6.68 | | | $ | 1,000.00 | | | $ | 1,018.10 | | | $ | 7.10 | | | | 1.40 | % |

Investor B | | $ | 1,000.00 | | | $ | 893.60 | | | $ | 11.57 | | | $ | 1,000.00 | | | $ | 1,012.92 | | | $ | 12.30 | | | | 2.43 | % |

Investor C | | $ | 1,000.00 | | | $ | 894.80 | | | $ | 10.48 | | | $ | 1,000.00 | | | $ | 1,014.08 | | | $ | 11.14 | | | | 2.20 | % |

Class R | | $ | 1,000.00 | | | $ | 896.40 | | | $ | 8.39 | | | $ | 1,000.00 | | | $ | 1,016.29 | | | $ | 8.92 | | | | 1.76 | % |

| | 6 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period shown). |

| | 7 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 366. |

| | | | See “Disclosure of Expenses” on page 9 for further information on how expenses were calculated. |

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | 7 |

| • | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| • | | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. |

| • | | Investor B Shares (available only in BlackRock Global SmallCap, Inc.) are subject to a maximum CDSC of 4.50% declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares automatically convert to Investor A Shares after approximately eight years. (There is no initial sales charge for automatic share conversions.) These shares are only available through exchanges and dividend reinvestments by existing shareholders and for purchase by certain employer-sponsored retirement plans. |

| • | | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. |

| • | | Class R Shares are not subject to any sales charge. These shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. These shares are available only to certain employer-sponsored retirement plans. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Funds’ investment advisor, has voluntarily waived a portion of the Funds’ expenses. Without such waiver, the Funds’ performance would have been lower. The Manager is under no obligation to waive or to continue waiving its fees and such voluntary waiver may be reduced or discontinued at any time. See Note 5 of the Notes to Financial Statements for additional information on waivers.

| | | | | | |

| | | | | | | |

| 8 | | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | |

Shareholders of these Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other Fund expenses. The expense examples shown on previous pages (which are based on a hypothetical investment of $1,000 invested on July 1, 2015 and held through December 31, 2015) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | |

| Derivative Financial Instruments | | |

The Funds may invest in various derivative financial instruments. Derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage. Derivative financial instruments also involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to

the transaction or illiquidity of the derivative financial instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | 9 |

| | |

Schedule of Investments December 31, 2015 (Unaudited) | | BlackRock EuroFund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Belgium — 4.7% | | | | | | | | |

Anheuser-Busch InBev SA | | | 101,507 | | | $ | 12,632,255 | |

KBC Groep NV | | | 111,268 | | | | 6,957,159 | |

| | | | | | | | |

| | | | | | | | 19,589,414 | |

Denmark — 3.7% | | | | | | | | |

Carlsberg A/S, Class B | | | 10,542 | | | | 933,933 | |

Novo Nordisk A/S, Class B | | | 251,833 | | | | 14,580,680 | |

| | | | | | | | |

| | | | | | | | 15,514,613 | |

Finland — 0.5% | | | | | | | | |

Wartsila OYJ | | | 47,117 | | | | 2,151,263 | |

France — 12.9% | | | | | | | | |

AXA SA | | | 414,337 | | | | 11,321,159 | |

Bouygues SA | | | 70,037 | | | | 2,777,010 | |

Cap Gemini SA | | | 57,637 | | | | 5,347,883 | |

LVMH Moet Hennessy Louis Vuitton SA | | | 62,494 | | | | 9,815,947 | |

Pernod Ricard SA | | | 45,135 | | | | 5,147,393 | |

Renault SA | | | 91,666 | | | | 9,175,351 | |

Safran SA | | | 30,231 | | | | 2,076,953 | |

Unibail-Rodamco SE | | | 33,825 | | | | 8,589,215 | |

| | | | | | | | |

| | | | | | | | 54,250,911 | |

Germany — 13.1% | | | | | | | | |

adidas AG | | | 43,236 | | | | 4,196,444 | |

Bayer AG, Registered Shares | | | 60,894 | | | | 7,605,072 | |

Continental AG | | | 26,832 | | | | 6,490,923 | |

Covestro AG (a)(b) | | | 26,696 | | | | 975,814 | |

Daimler AG, Registered Shares | | | 85,455 | | | | 7,140,104 | |

Deutsche Telekom AG, Registered Shares | | | 450,626 | | | | 8,093,534 | |

Fresenius SE & Co. KGaA | | | 42,756 | | | | 3,045,603 | |

SAP SE | | | 133,917 | | | | 10,626,731 | |

Scout24 AG (a)(b) | | | 52,570 | | | | 1,863,675 | |

TUI AG | | | 280,396 | | | | 5,006,493 | |

| | | | | | | | |

| | | | | | | | 55,044,393 | |

Ireland — 4.9% | | | | | | | | |

Bank of Ireland (b) | | | 21,396,701 | | | | 7,834,493 | |

CRH PLC (c) | | | 221,419 | | | | 6,410,457 | |

Ryanair Holdings PLC — ADR | | | 76,373 | | | | 6,603,210 | |

| | | | | | | | |

| | | | | | | | 20,848,160 | |

Italy — 4.2% | | | | | | | | |

Atlantia SpA | | | 270,006 | | | | 7,143,927 | |

Intesa Sanpaolo SpA | | | 3,177,115 | | | | 10,551,195 | |

| | | | | | | | |

| | | | | | | | 17,695,122 | |

Netherlands — 12.7% | | | | | | | | |

ASML Holding NV | | | 72,738 | | | | 6,462,880 | |

Heineken NV | | | 55,223 | | | | 4,705,931 | |

ING Groep NV CVA | | | 836,965 | | | | 11,324,166 | |

Koninklijke KPN NV | | | 2,564,527 | | | | 9,699,967 | |

RELX NV | | | 229,005 | | | | 3,856,969 | |

Royal Dutch Shell PLC, Class B | | | 767,514 | | | | 17,492,351 | |

| | | | | | | | |

| | | | | | | | 53,542,264 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Sweden — 6.6% | | | | | | | | |

Assa Abloy AB | | | 415,306 | | | $ | 8,693,478 | |

Electrolux AB, Class B | | | 218,132 | | | | 5,262,958 | |

Hexagon AB, Class B | | | 154,936 | | | | 5,731,520 | |

Lundin Petroleum AB (b) | | | 324,842 | | | | 4,687,266 | |

Nordea Bank AB | | | 331,908 | | | | 3,641,613 | |

| | | | | | | | |

| | | | | | | | 28,016,835 | |

Switzerland — 4.9% | | | | | | | | |

Cie Financiere Richemont SA, Registered Shares | | | 44,736 | | | | 3,201,886 | |

Novartis AG, Registered Shares | | | 105,960 | | | | 9,114,602 | |

Zurich Insurance Group AG (b) | | | 31,850 | | | | 8,182,259 | |

| | | | | | | | |

| | | | | | | | 20,498,747 | |

United Kingdom — 31.8% | | | | | | | | |

Associated British Foods PLC | | | 132,720 | | | | 6,530,768 | |

AstraZeneca PLC | | | 130,429 | | | | 8,810,128 | |

Barclays PLC | | | 435,832 | | | | 1,402,842 | |

BG Group PLC | | | 244,072 | | | | 3,538,028 | |

BHP Billiton PLC | | | 379,185 | | | | 4,228,599 | |

BP PLC | | | 818,305 | | | | 4,252,470 | |

British American Tobacco PLC | | | 200,720 | | | | 11,146,782 | |

BT Group PLC | | | 1,991,896 | | | | 13,830,873 | |

Carnival PLC | | | 102,577 | | | | 5,843,409 | |

Hargreaves Lansdown PLC | | | 274,211 | | | | 6,087,651 | |

Imperial Tobacco Group PLC | | | 198,781 | | | | 10,499,139 | |

Lloyds Banking Group PLC | | | 11,940,345 | | | | 12,847,734 | |

London Stock Exchange Group PLC | | | 207,812 | | | | 8,407,674 | |

Merlin Entertainments PLC (a) | | | 890,279 | | | | 5,969,370 | |

Prudential PLC | | | 603,996 | | | | 13,607,721 | |

Tesco PLC (b) | | | 1,546,321 | | | | 3,397,692 | |

Vodafone Group PLC | | | 2,411,195 | | | | 7,818,943 | |

Worldpay Group PLC (a)(b) | | | 1,291,736 | | | | 5,851,844 | |

| | | | | | | | |

| | | | | | | | 134,071,667 | |

Total Long-Term Investments (Cost — $407,087,962) — 100.0% | | | | | | | 421,223,389 | |

| | | | | | | | |

| | | | | | | | | |

Short-Term Securities | | | | | | | | |

BlackRock Liquidity Funds, TempFund,

Institutional Class, 0.23% (d)(e) | | | 336,491 | | | | 336,491 | |

| | | | | | | | |

| | |

| Short-Term Securities | | Beneficial

Interest

(000) | | | | |

BlackRock Liquidity Series, LLC, Money Market Series, 0.39% (d)(e)(f) | | | 1,034 | | | $ | 1,034,491 | |

Total Short-Term Securities

(Cost — $1,370,982) — 0.3% | | | | | | | 1,370,982 | |

| Total Investments (Cost — $408,458,944) — 100.3% | | | | 422,594,371 | |

| Liabilities in Excess of Other Assets — (0.3)% | | | | | | | (1,144,651 | ) |

| | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 421,449,720 | |

| | | | | | | | |

| | |

| ADR | | American Depositary Receipts |

| CVA | | Certificaten Van Aandelen (Dutch Certificate) |

| GDR | | Global Depositary Receipt |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 10 | | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | |

| | |

Schedule of Investments (continued) | | BlackRock Euro Fund |

| | | | |

| Notes to Schedule of Investments | | | | |

| (a) | | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (b) | | Non-income producing security. |

| (c) | | Security, or a portion of security, is on loan. |

| (d) | | During the period ended December 31, 2015, investments in issuers considered to be affiliates of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | |

| Affiliate | | Shares/Beneficial

Interest Held at

June 30,

2015 | | | Net

Activity | | | Shares/Beneficial

Interest Held at

December 31,

2015 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 2,077,341 | | | | (1,740,850 | ) | | | 336,491 | | | $ | 483 | |

BlackRock Liquidity Series, LLC, Money Market Series | | | — | | | $ | 1,034,491 | | | $ | 1,034,491 | | | $ | 438 | 1 |

1 Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees, and other payments to and from borrowers of securities, and less the collateral investment expenses. | |

| (e) | | Current yield as of period end. |

| (f) | | Security was purchased with the cash collateral from loaned securities. The Fund may withdraw up to 25% of its investment daily, although the manager of the BlackRock Liquidity Series, LLC, Money Market Series, in its sole discretion, may permit an investor to withdraw more than 25% on any one day. |

| | |

| Fair Value Hierarchy as of Period End | | |

Various inputs are used in determining the fair value of investments. For information about the Fund’s policy regarding valuation of investments, refer to the Notes to Financial Statements.

The following tables summarize the Fund’s investments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | Total | |

Assets: | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | |

Belgium | | | — | | | $ | 19,589,414 | | | — | | $ | 19,589,414 | |

Denmark | | | — | | | | 15,514,613 | | | — | | | 15,514,613 | |

Finland | | | — | | | | 2,151,263 | | | — | | | 2,151,263 | |

France | | | — | | | | 54,250,911 | | | — | | | 54,250,911 | |

Germany | | $ | 975,814 | | | | 54,068,579 | | | — | | | 55,044,393 | |

Ireland | | | 6,603,210 | | | | 14,244,950 | | | — | | | 20,848,160 | |

Italy | | | — | | | | 17,695,122 | | | — | | | 17,695,122 | |

Netherlands | | | 11,324,166 | | | | 42,218,098 | | | — | | | 53,542,264 | |

Sweden | | | — | | | | 28,016,835 | | | — | | | 28,016,835 | |

Switzerland | | | — | | | | 20,498,747 | | | — | | | 20,498,747 | |

United Kingdom | | | 5,851,844 | | | | 128,219,823 | | | — | | | 134,071,667 | |

Short-Term Securities | | | 336,491 | | | | 1,034,491 | | | — | | | 1,370,982 | |

| | | | | | | | | | | | | | |

Total | | $ | 25,091,525 | | | $ | 397,502,846 | | | — | | $ | 422,594,371 | |

| | | | | | | | | | | | | | |

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of period end, such assets and/or liabilities are categorized within the disclosure hierarchy as follows: | |

| | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | Total | |

Liabilities: | | | | | | | | | | | | | | |

Collateral on securities loaned at value | | | — | | | $ | (1,034,491 | ) | | — | | $ | (1,034,491 | ) |

Foreign currency overdraft | | | — | | | | (413 | ) | | — | | | (413 | ) |

| | | | | | | | | | | | | | |

Total | | | — | | | $ | (1,034,904 | ) | | — | | $ | (1,034,904 | ) |

| | | | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | 11 |

| | |

Schedule of Investments (concluded) | | BlackRock Euro Fund |

Transfers between Level 1 and Level 2 were as follows:

| | | | | | | | | | | | | | | | |

| | | Transfers Into

Level 11 | | | Transfers Out

of Level 12 | | | Transfers Into

Level 22 | | | Transfers Out

of Level 21 | |

Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

France | | | — | | | $ | (5,912,261 | ) | | $ | 5,912,261 | | | | — | |

Netherlands | | $ | 13,758,591 | | | | — | | | | — | | | $ | (13,758,591 | ) |

| | | | | | | | | | | | | | | | |

Total | | $ | 13,758,591 | | | $ | (5,912,261 | ) | | $ | 5,912,261 | | | $ | (13,758,591 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

1 Systematic Fair Value Prices were not utilized at period end for these investments. | |

2 External pricing service used to reflect any significant market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 12 | | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | |

| | |

Schedule of Investments December 31, 2015 (Unaudited) | | BlackRock Global SmallCap Fund, Inc. (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Argentina — 0.3% | |

Arcos Dorados Holdings, Inc., Class A (a)(b) | | | 992,552 | | | $ | 3,086,837 | |

Australia — 0.8% | |

Orocobre Ltd. (a)(b) | | | 3,359,540 | | | | 5,630,622 | |

Pancontinental Oil & Gas NL (a) | | | 17,119,600 | | | | 37,425 | |

Parnell Pharmaceuticals Holdings Ltd. (a) | | | 560,849 | | | | 2,170,486 | |

| | | | | | | | |

| | | | | | | | 7,838,533 | |

Austria — 0.8% | |

Schoeller-Bleckmann Oilfield Equipment AG (b) | | | 129,100 | | | | 7,081,199 | |

Belgium — 0.5% | |

Ontex Group NV | | | 123,280 | | | | 4,383,238 | |

Brazil — 0.5% | |

Companhia Hering SA | | | 1,129,731 | | | | 4,343,307 | |

Canada — 5.1% | |

Africa Oil Corp. (a)(b) | | | 4,092,100 | | | | 5,944,295 | |

Continental Gold, Inc. (a)(b) | | | 4,218,883 | | | | 4,786,909 | |

Diagnocure, Inc. (a)(c) | | | 4,675,280 | | | | 422,353 | |

Dollarama, Inc. | | | 83,700 | | | | 4,835,570 | |

Element Financial Corp. | | | 562,100 | | | | 6,784,036 | |

Entertainment One Ltd. | | | 1,341,000 | | | | 3,302,826 | |

Lundin Mining Corp. (a) | | | 1,596,100 | | | | 4,383,306 | |

Methanex Corp. | | | 165,100 | | | | 5,449,951 | |

Mogo Finance Technology, Inc. (a) | | | 513,496 | | | | 1,458,437 | |

Painted Pony Petroleum Ltd. (a) | | | 1,059,625 | | | | 2,664,953 | |

Torex Gold Resources, Inc. (a)(b) | | | 5,747,900 | | | | 5,234,049 | |

Trevali Mining Corp. (a)(b) | | | 1,236,123 | | | | 455,606 | |

Trevali Mining Corp. | | | 4,848,800 | | | | 1,787,156 | |

| | | | | | | | |

| | | | | | | | 47,509,447 | |

Chile — 0.4% | |

Embotelladora Andina SA — ADR | | | 193,600 | | | | 3,370,576 | |

China — 1.6% | |

Colour Life Services Group Co. Ltd. (b) | | | 2,246,000 | | | | 1,912,758 | |

Daphne International Holdings Ltd. (a)(b) | | | 5,166,300 | | | | 862,638 | |

Far East Horizon Ltd. | | | 8,361,000 | | | | 7,746,283 | |

Huaneng Renewables Corp. Ltd., Class H | | | 15,336,000 | | | | 4,551,315 | |

| | | | | | | | |

| | | | | | | | 15,072,994 | |

Denmark — 0.4% | |

ALK-Abello A/S | | | 25,890 | | | | 3,294,486 | |

Finland — 0.2% | |

Ferratum OYJ (a) | | | 62,390 | | | | 2,024,894 | |

France — 2.0% | |

Elior SCA (d) | | | 293,220 | | | | 6,143,138 | |

Elis SA | | | 426,877 | | | | 7,063,872 | |

GameLoft SE (a)(b) | | | 328,083 | | | | 2,156,855 | |

Saft Groupe SA | | | 18,000 | | | | 548,616 | |

UbiSoft Entertainment SA (a) | | | 79,700 | | | | 2,306,606 | |

| | | | | | | | |

| | | | | | | | 18,219,087 | |

Georgia — 0.6% | |

BGEO Group PLC | | | 190,582 | | | | 5,342,870 | |

Germany — 1.0% | |

Rheinmetall AG | | | 83,400 | | | | 5,543,750 | |

Vossloh AG (a)(b) | | | 51,087 | | | | 3,295,847 | |

| | | | | | | | |

| | | | | | | | 8,839,597 | |

Hong Kong — 1.3% | |

Chow Sang Sang Holdings International Ltd. (b) | | | 1,265,000 | | | | 2,078,828 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Hong Kong (continued) | |

Clear Media Ltd. | | | 2,015,000 | | | $ | 2,076,713 | |

EVA Precision Industrial Holdings Ltd. | | | 18,236,000 | | | | 3,227,436 | |

Melco International Development Ltd. (b) | | | 3,131,000 | | | | 4,677,521 | |

| | | | | | | | |

| | | | | | | | 12,060,498 | |

India — 2.8% | |

Container Corp. of India | | | 154,650 | | | | 3,065,166 | |

Indiabulls Real Estate Ltd. (a) | | | 4,212,500 | | | | 4,047,455 | |

MakeMyTrip Ltd. (a)(b) | | | 271,100 | | | | 4,652,076 | |

Oberoi Realty Ltd. | | | 1,380,700 | | | | 5,588,415 | |

Yes Bank Ltd. | | | 476,300 | | | | 5,196,798 | |

Zee Entertainment Enterprises Ltd. | | | 578,000 | | | | 3,810,166 | |

| | | | | | | | |

| | | | | | | | 26,360,076 | |

Indonesia — 1.2% | |

Bank Tabungan Negara Persero Tbk PT | | | 88,551,700 | | | | 8,252,775 | |

Tower Bersama Infrastructure Tbk PT (a) | | | 7,402,076 | | | | 3,131,208 | |

| | | | | | | | |

| | | | | | | | 11,383,983 | |

Ireland — 0.9% | |

Ryanair Holdings PLC — ADR | | | 100,981 | | | | 8,730,817 | |

Italy — 1.8% | |

Banca Mediolanum SpA | | | 669,300 | | | | 5,317,014 | |

Banca Popolare di Milano Scarl | | | 2,574,510 | | | | 2,549,950 | |

Beni Stabili SpA SIIQ | | | 4,423,800 | | | | 3,334,300 | |

Credito Valtellinese (a) | | | 3,195,100 | | | | 3,762,463 | |

Massimo Zanetti Beverage Group SpA (a)(b)(d) | | | 186,940 | | | | 1,928,375 | |

| | | | | | | | |

| | | | | | | | 16,892,102 | |

Japan — 5.9% | |

Asics Corp. | | | 152,050 | | | | 3,154,656 | |

Bank of Yokohama Ltd. | | | 705,000 | | | | 4,321,366 | |

Credit Saison Co. Ltd. | | | 168,600 | | | | 3,321,791 | |

Don Quijote Holdings Co. Ltd. | | | 130,700 | | | | 4,590,019 | |

JGC Corp. | | | 408,000 | | | | 6,244,938 | |

Mitsui Chemicals, Inc. | | | 2,110,000 | | | | 9,357,865 | |

NGK Insulators Ltd. | | | 240,400 | | | | 5,418,660 | |

Nomura Real Estate Holdings, Inc. | | | 186,600 | | | | 3,461,844 | |

Pioneer Corp. (a)(b) | | | 552,300 | | | | 1,520,433 | |

Rohm Co. Ltd. | | | 107,500 | | | | 5,444,967 | |

Tokyo Broadcasting System Holdings, Inc. | | | 521,300 | | | | 8,253,718 | |

| | | | | | | | |

| | | | | | | | 55,090,257 | |

Luxembourg — 0.9% | |

B&M European Value Retail SA | | | 311,725 | | | | 1,308,325 | |

Eurofins Scientific SE | | | 7,875 | | | | 2,746,958 | |

Stabilus SA (a) | | | 110,686 | | | | 4,626,930 | |

| | | | | | | | |

| | | | | | | | 8,682,213 | |

Netherlands — 0.4% | |

Intertrust NV (a)(d) | | | 173,900 | | | | 3,828,852 | |

Norway — 0.3% | |

Hoegh Liquified Natural Gas Holdings Ltd. (b) | | | 243,100 | | | | 2,580,147 | |

Panama — 0.1% | |

Copa Holdings SA, Class A | | | 25,200 | | | | 1,216,152 | |

Poland — 0.6% | |

Alior Bank SA (a) | | | 301,000 | | | | 5,102,800 | |

Russia — 0.4% | |

Globaltrans Investment PLC — GDR (a) | | | 852,397 | | | | 3,878,406 | |

South Korea — 0.4% | |

GS Holdings Corp. (a) | | | 76,600 | | | | 3,282,213 | |

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | 13 |

See Notes to Financial Statements.

| | |

Schedule of Investments (continued) | | BlackRock Global SmallCap Fund, Inc. |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Sweden — 1.3% | |

Hoist Finance AB (a)(b)(d) | | | 806,300 | | | $ | 8,399,928 | |

SSAB AB, A Shares (a)(b) | | | 1,223,900 | | | | 3,251,664 | |

| | | | | | | | |

| | | | | | | | 11,651,592 | |

Switzerland — 2.8% | |

Aryzta AG (a) | | | 74,322 | | | | 3,759,859 | |

EFG International AG (a) | | | 604,800 | | | | 6,370,447 | |

Leonteq AG (a)(b) | | | 50,700 | | | | 7,323,615 | |

OC Oerlikon Corp. AG, Registered Shares (a) | | | 180,400 | | | | 1,605,819 | |

Straumann Holding AG, Registered Shares | | | 16,300 | | | | 4,947,169 | |

Valiant Holding AG | | | 18,336 | | | | 2,153,584 | |

| | | | | | | | |

| | | | | | | | 26,160,493 | |

Taiwan — 0.5% | |

Mercuries Life Insurance Co. Ltd. | | | 8,881,000 | | | | 4,844,369 | |

United Kingdom — 6.6% | | | | | | | | |

Arrow Global Group PLC | | | 1,931,600 | | | | 7,510,452 | |

Atlas Mara Co-Nvest Ltd. (a) | | | 702,525 | | | | 3,699,922 | |

Aveva Group PLC | | | 118,800 | | | | 2,823,695 | |

Babcock International Group PLC | | | 220,300 | | | | 3,296,821 | |

Balfour Beatty PLC (a) | | | 1,353,400 | | | | 5,390,556 | |

Crest Nicholson Holdings PLC | | | 416,900 | | | | 3,415,908 | |

De La Rue PLC | | | 489,900 | | | | 3,194,354 | |

Exova Group PLC | | | 1,902,419 | | | | 4,044,590 | |

IMI PLC | | | 180,500 | | | | 2,290,414 | |

Intertek Group PLC | | | 159,600 | | | | 6,528,687 | |

Michael Page International PLC | | | 543,300 | | | | 3,881,520 | |

Nomad Foods Ltd. (a) | | | 236,246 | | | | 2,787,703 | |

Poundland Group PLC | | | 751,200 | | | | 2,300,109 | |

Rentokil Initial PLC | | | 1,166,500 | | | | 2,736,888 | |

Virgin Money Holdings UK PLC | | | 1,272,887 | | | | 7,134,402 | |

| | | | | | | | |

| | | | | | | | 61,036,021 | |

United States — 57.4% | |

Albemarle Corp. | | | 114,300 | | | | 6,401,943 | |

AMC Entertainment Holdings, Inc., Class A | | | 95,058 | | | | 2,281,392 | |

ARRIS Group, Inc. (a) | | | 301,047 | | | | 9,203,007 | |

Axiall Corp. | | | 66,564 | | | | 1,025,086 | |

Blackhawk Network Holdings, Inc. (a) | | | 106,176 | | | | 4,694,041 | |

Bottomline Technologies, Inc. (a) | | | 260,082 | | | | 7,732,238 | |

Burlington Stores, Inc. (a) | | | 87,273 | | | | 3,744,012 | |

Cable One, Inc. | | | 24,088 | | | | 10,446,002 | |

CARBO Ceramics, Inc. (b) | | | 69,600 | | | | 1,197,120 | |

Chart Industries, Inc. (a) | | | 245,489 | | | | 4,408,982 | |

Cypress Semiconductor Corp. (a) | | | 715,000 | | | | 7,014,150 | |

CyrusOne, Inc. | | | 353,339 | | | | 13,232,546 | |

Deckers Outdoor Corp. (a) | | | 14,707 | | | | 694,170 | |

DSP Group, Inc. (a) | | | 331,849 | | | | 3,132,655 | |

DSW, Inc., Class A | | | 149,897 | | | | 3,576,542 | |

DXP Enterprises, Inc. (a) | | | 132,200 | | | | 3,014,160 | |

E*Trade Financial Corp. (a) | | | 100,100 | | | | 2,966,964 | |

Endologix, Inc. (a)(b) | | | 565,324 | | | | 5,596,708 | |

Essent Group Ltd. (a) | | | 297,200 | | | | 6,505,708 | |

First Solar, Inc. (a) | | | 89,000 | | | | 5,873,110 | |

Five Below, Inc. (a) | | | 197,200 | | | | 6,330,120 | |

Flowers Foods, Inc. | | | 263,560 | | | | 5,663,904 | |

GNC Holdings, Inc., Class A | | | 123,000 | | | | 3,815,460 | |

Halyard Health, Inc. (a) | | | 269,375 | | | | 8,999,819 | |

Haynes International, Inc. | | | 100,300 | | | | 3,680,007 | |

Heritage Insurance Holdings, Inc. | | | 63,600 | | | | 1,387,752 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

United States (continued) | |

IDEX Corp. | | | 98,350 | | | $ | 7,534,593 | |

Insulet Corp. (a) | | | 362,921 | | | | 13,722,043 | |

Insys Therapeutics, Inc. (a) | | | 265,403 | | | | 7,598,488 | |

Invacare Corp. | | | 487,527 | | | | 8,478,095 | |

Itron, Inc. (a) | | | 199,500 | | | | 7,217,910 | |

j2 Global, Inc. | | | 73,300 | | | | 6,034,056 | |

Jack Henry & Associates, Inc. | | | 72,500 | | | | 5,659,350 | |

KBR, Inc. | | | 430,800 | | | | 7,289,136 | |

KLX, Inc. (a) | | | 245,300 | | | | 7,552,787 | |

Kraton Performance Polymers, Inc. (a) | | | 210,300 | | | | 3,493,083 | |

La Quinta Holdings, Inc. (a) | | | 80,589 | | | | 1,096,816 | |

Live Nation Entertainment, Inc. (a) | | | 188,700 | | | | 4,636,359 | |

LKQ Corp. (a) | | | 260,985 | | | | 7,732,986 | |

ManpowerGroup, Inc. | | | 55,500 | | | | 4,678,095 | |

Marcus & Millichap, Inc. (a) | | | 296,543 | | | | 8,641,263 | |

Match Group, Inc. (a)(b) | | | 588,900 | | | | 7,979,595 | |

Mentor Graphics Corp. | | | 265,000 | | | | 4,881,300 | |

Merit Medical Systems, Inc. (a) | | | 377,073 | | | | 7,009,787 | |

MRC Global, Inc. (a) | | | 256,600 | | | | 3,310,140 | |

MSC Industrial Direct Co., Inc., Class A | | | 80,000 | | | | 4,501,600 | |

Murphy USA, Inc. (a) | | | 49,800 | | | | 3,024,852 | |

Netscout Systems, Inc. (a) | | | 147,400 | | | | 4,525,180 | |

New Relic, Inc. (a)(b) | | | 93,800 | | | | 3,417,134 | |

Nordson Corp. | | | 77,400 | | | | 4,965,210 | |

NuVasive, Inc. (a) | | | 293,922 | | | | 15,904,119 | |

Oasis Petroleum, Inc. (a)(b) | | | 68,800 | | | | 507,056 | |

Opus Bank | | | 168,800 | | | | 6,240,536 | |

OSI Systems, Inc. (a) | | | 90,100 | | | | 7,988,266 | |

Owens & Minor, Inc. | | | 325,570 | | | | 11,714,009 | |

Pacific Biosciences of California, Inc. (a)(b) | | | 696,932 | | | | 9,150,717 | |

Party City Holdco, Inc. (a)(b) | | | 235,815 | | | | 3,044,372 | |

Pebblebrook Hotel Trust | | | 286,166 | | | | 8,018,371 | |

People’s United Financial, Inc. | | | 373,200 | | | | 6,027,180 | |

Performance Sports Group Ltd. (a) | | | 541,941 | | | | 5,218,892 | |

Pfenex, Inc. (a) | | | 685,025 | | | | 8,480,609 | |

Pinnacle Foods, Inc. | | | 96,309 | | | | 4,089,280 | |

Pitney Bowes, Inc. | | | 284,411 | | | | 5,873,087 | |

Prestige Brands Holdings, Inc. (a) | | | 150,021 | | | | 7,723,081 | |

PrivateBancorp, Inc. | | | 120,000 | | | | 4,922,400 | |

PTC, Inc. (a) | | | 230,500 | | | | 7,982,215 | |

QLIK Technologies, Inc. (a) | | | 245,200 | | | | 7,763,032 | |

Quotient Ltd. (a) | | | 715,768 | | | | 11,452,288 | |

Rouse Properties, Inc. (b) | | | 531,792 | | | | 7,742,892 | |

Semtech Corp. (a) | | | 251,401 | | | | 4,756,507 | |

Silver Bay Realty Trust Corp. | | | 613,598 | | | | 9,608,945 | |

SM Energy Co. | | | 303,600 | | | | 5,968,776 | |

Smart & Final Stores, Inc. (a) | | | 299,300 | | | | 5,450,253 | |

South Jersey Industries, Inc. | | | 155,500 | | | | 3,657,360 | |

Stratasys Ltd. (a)(b) | | | 45,600 | | | | 1,070,688 | |

Supervalu, Inc. (a) | | | 1,446,181 | | | | 9,805,107 | |

Synovus Financial Corp. | | | 145,700 | | | | 4,717,766 | |

Tanger Factory Outlet Centers, Inc. | | | 322,737 | | | | 10,553,500 | |

Teleflex, Inc. | | | 103,654 | | | | 13,625,318 | |

TimkenSteel Corp. | | | 126,889 | | | | 1,063,330 | |

Triumph Group, Inc. | | | 159,800 | | | | 6,352,050 | |

Ultimate Software Group, Inc. (a) | | | 23,900 | | | | 4,672,689 | |

Urban Outfitters, Inc. (a)(b) | | | 74,239 | | | | 1,688,937 | |

Verint Systems, Inc. (a) | | | 184,464 | | | | 7,481,860 | |

VWR Corp. (a)(b) | | | 313,772 | | | | 8,882,885 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 14 | | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | |

| | |

Schedule of Investments (continued) | | BlackRock Global SmallCap Fund, Inc. |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

United States (continued) | |

Yelp, Inc. (a) | | | 336,039 | | | $ | 9,677,923 | |

Zynga, Inc., Class A (a) | | | 1,809,100 | | | | 4,848,388 | |

| | | | | | | | |

| | | | | | | | 531,322,140 | |

| Total Common Stocks — 99.8% | | | | | | | 924,510,196 | |

| | | | | | | | |

| | | | | | | | | |

| | |

| Warrants — 0.0% | | | | | | |

United Kingdom — 0.0% | | | | | | | | |

Atlas Mara Co-Nvest Ltd. | | | 549,800 | | | | 68,725 | |

Total Long-Term Investments

(Cost — $881,065,164) — 99.8% | | | | | | | 924,578,921 | |

| | | | | | | | |

| Short-Term Securities | | Shares | | | Value | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.23% (e)(f) | | | 2,138,415 | | | $ | 2,138,415 | |

| | |

| | | Beneficial

Interest

(000) | | | | |

BlackRock Liquidity Series, LLC, Money Market Series, 0.39% (e)(f)(g) | | $ | 60,583 | | | | 60,582,770 | |

Total Short-Term Securities

(Cost — $62,721,185) — 6.8% | | | | | | | 62,721,185 | |

| Total Investments (Cost — $943,786,349) — 106.6% | | | | 987,300,106 | |

| Liabilities in Excess of Other Assets — (6.6)% | | | | (61,052,254 | ) |

| | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 926,247,852 | |

| | | | | | | | |

| | |

| Notes to Schedule of Investments | | |

| (a) | | Non-income producing security. |

| (b) | | Security, or a portion of security, is on loan. |

| (c) | | During the period ended December 31, 2015, investments in issuers (whereby the Fund held 5% or more of the companies’ outstanding securities) that were considered to be an affiliate, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Affiliate | | Shares Held

at June 30,

2015 | | | Shares

Purchased | | | Shares

Sold | | | Shares Held

at December 31,

2015 | | | Value at

December 31,

2015 | | | Income | | | Realized

Loss | |

Diagnocure, Inc. | | | 4,745,180 | | | | — | | | | (69,900 | ) | | | 4,675,280 | | | $ | 422,353 | | | | — | | | $ | (308,957 | ) |

| (d) | | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (e) | | During the period ended December 31, 2015, investments in issuers considered to be affiliates of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | |

| Affiliate | | Shares/Beneficial

Interest Held at

June 30,

2015 | | | Net

Activity | | | Shares/Beneficial

Interest Held at

December 31,

2015 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 122,722 | | | | 2,015,693 | | | | 2,138,415 | | | $ | 1,763 | |

BlackRock Liquidity Series, LLC, Money Market Series | | $ | 33,012,761 | | | $ | 27,570,009 | | | $ | 60,582,770 | | | $ | 325,595 | 1 |

1 Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees, and other payments to and from borrowers of securities, and less the collateral investment expenses. | |

| (f) | | Current yield as of period end. |

| (g) | | Security was purchased with the cash collateral from loaned securities. The Fund may withdraw up to 25% of its investment daily, although the manager of the BlackRock Liquidity Series, LLC, Money Market Series, in its sole discretion, may permit an investor to withdraw more than 25% on any one day. |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | 15 |

| | |

Schedule of Investments (continued) | | BlackRock Global SmallCap Fund, Inc. |

| | |

| Fair Value Hierarchy as of Period End | | |

Various inputs are used in determining the fair value of investments. For information about the Fund’s policy regarding valuation of investments, refer to the Notes to Financial Statements.

The following tables summarize the Fund’s investments categorized in the disclosure hierarchy:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Argentina | | $ | 3,086,837 | | | | — | | | | — | | | $ | 3,086,837 | |

Australia | | | 7,838,533 | | | | — | | | | — | | | | 7,838,533 | |

Austria | | | — | | | $ | 7,081,199 | | | | — | | | | 7,081,199 | |

Belgium | | | — | | | | 4,383,238 | | | | — | | | | 4,383,238 | |

Brazil | | | 4,343,307 | | | | — | | | | — | | | | 4,343,307 | |

Canada | | | 42,419,465 | | | | 5,089,982 | | | | — | | | | 47,509,447 | |

Chile | | | 3,370,576 | | | | — | | | | — | | | | 3,370,576 | |

China | | | — | | | | 15,072,994 | | | | — | | | | 15,072,994 | |

Cyprus | | | 3,878,406 | | | | — | | | | — | | | | 3,878,406 | |

Denmark | | | — | | | | 3,294,486 | | | | — | | | | 3,294,486 | |

Finland | | | — | | | | 2,024,894 | | | | — | | | | 2,024,894 | |

France | | | — | | | | 18,219,087 | | | | — | | | | 18,219,087 | |

Georgia | | | — | | | | 5,342,870 | | | | — | | | | 5,342,870 | |

Germany | | | — | | | | 8,839,597 | | | | — | | | | 8,839,597 | |

Hong Kong | | | — | | | | 12,060,498 | | | | — | | | | 12,060,498 | |

India | | | 4,652,076 | | | | 21,708,000 | | | | — | | | | 26,360,076 | |

Indonesia | | | — | | | | 11,383,983 | | | | — | | | | 11,383,983 | |

Ireland | | | 8,730,817 | | | | — | | | | — | | | | 8,730,817 | |

Italy | | | 5,317,014 | | | | 11,575,088 | | | | — | | | | 16,892,102 | |

Japan | | | — | | | | 55,090,257 | | | | — | | | | 55,090,257 | |

Luxembourg | | | 1,308,325 | | | | 7,373,888 | | | | — | | | | 8,682,213 | |

Netherlands | | | 3,828,852 | | | | — | | | | — | | | | 3,828,852 | |

Norway | | | — | | | | 2,580,147 | | | | — | | | | 2,580,147 | |

Panama | | | 1,216,152 | | | | — | | | | — | | | | 1,216,152 | |

Poland | | | 5,102,800 | | | | — | | | | — | | | | 5,102,800 | |

South Korea | | | — | | | | 3,282,213 | | | | — | | | | 3,282,213 | |

Sweden | | | — | | | | 11,651,592 | | | | — | | | | 11,651,592 | |

Switzerland | | | 6,370,447 | | | | 19,790,046 | | | | — | | | | 26,160,493 | |

Taiwan | | | — | | | | 4,844,369 | | | | — | | | | 4,844,369 | |

United Kingdom | | | 12,598,264 | | | | 48,437,757 | | | | — | | | | 61,036,021 | |

United States | | | 531,322,140 | | | | — | | | | — | | | | 531,322,140 | |

Warrants | | | — | | | | 68,725 | | | | — | | | | 68,725 | |

Short-Term Securities | | | 2,138,415 | | | | 60,582,770 | | | | — | | | | 62,721,185 | |

| | | | |

Total | | $ | 647,522,426 | | | $ | 339,777,680 | | | | — | | | $ | 987,300,106 | |

| | | | |

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of period end, such assets and/or liabilities are categorized within the disclosure hierarchy as follows:

| | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | Total | |

Assets: | | | | | | | | | | | | | | |

Foreign currency at value | | $ | 90 | | | | — | | | — | | $ | 90 | |

Liabilities: | | | | | | | | | | | | | | |

Collateral on securities loaned at value | | | — | | | $ | (60,582,770 | ) | | — | | | (60,582,770 | ) |

| | | | |

Total | | $ | 90 | | | $ | (60,582,770 | ) | | — | | $ | (60,582,680 | ) |

| | | | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 16 | | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | |

| | |

Schedule of Investments (concluded) | | BlackRock Global SmallCap Fund, Inc. |

Transfers between Level 1 and Level 2 were as follows:

| | | | | | | | | | | | | | | | |

| | | Transfers Into

Level 11 | | | Transfers Out

of Level 12 | | | Transfers Into

Level 22 | | | Transfers Out

of Level 21 | |

Assets: | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

China | | | — | | | $ | (1,861,102 | ) | | $ | 1,861,102 | | | | — | |

Cyprus | | $ | 2,871,361 | | | | — | | | | — | | | $ | (2,871,361 | ) |

Denmark | | | — | | | | (3,010,948 | ) | | | 3,010,948 | | | | — | |

France | | | — | | | | (9,646,544 | ) | | | 9,646,544 | | | | — | |

Indonesia | | | — | | | | (5,180,030 | ) | | | 5,180,030 | | | | — | |

Italy | | | — | | | | (3,187,775 | ) | | | 3,187,775 | | | | — | |

Poland | | | 5,304,528 | | | | — | | | | — | | | | (5,304,528 | ) |

Switzerland | | | — | | | | (1,643,954 | ) | | | 1,643,954 | | | | — | |

United Kingdom | | | — | | | | (19,866,675 | ) | | | 19,866,675 | | | | — | |

| | | | |

Total | | $ | 8,175,889 | | | $ | (44,397,028 | ) | | $ | 44,397,028 | | | $ | (8,175,889 | ) |

| | | | |

1 Systematic Fair Value Prices were not utilized at period end for these investments. | |

2 External pricing service used to reflect any significant market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | 17 |

| | |

| Statements of Assets and Liabilities | | |

| | | | | | | | |

| December 31, 2015 (Unaudited) | | BlackRock

EuroFund | | | BlackRock

Global SmallCap

Fund, Inc. | |

| | | | | | | | |

| Assets | | | | | | | | |

Investments at value — unaffiliated1,2 | | $ | 421,223,389 | | | $ | 924,156,568 | |

Investments at value — affiliated3 | | | 1,370,982 | | | | 63,143,538 | |

Foreign currency at value4 | | | — | | | | 90 | |

| Receivables: | | | | | | | | |

Investments sold | | | 1,251,982 | | | | 6,410,153 | |

Dividends | | | 769,607 | | | | 904,295 | |

Capital shares sold | | | 725,983 | | | | 2,658,216 | |

Securities lending income — affiliated | | | 29 | | | | 99,475 | |

Prepaid expenses | | | 53,045 | | | | 64,619 | |

| | | | |

Total assets | | | 425,395,017 | | | | 997,436,954 | |

| | | | |

| | | | | | | | |

| Liabilities | | | | | | | | |

Collateral on securities loaned at value | | | 1,034,491 | | | | 60,582,770 | |

Foreign bank overdraft4 | | | 413 | | | | — | |

| Payables: | | | | | | | | |

Capital shares redeemed | | | 2,324,679 | | | | 5,784,141 | |

Investment advisory fees | | | 271,947 | | | | 677,636 | |

Investments purchased | | | 66,875 | | | | 3,265,242 | |

Service and distribution fees | | | 62,661 | | | | 331,836 | |

Officer’s and Directors’ fees | | | 5,226 | | | | 7,817 | |

Other affiliates | | | 631 | | | | 3,045 | |

Other accrued expenses | | | 178,374 | | | | 536,615 | |

| | | | |

Total liabilities | | | 3,945,297 | | | | 71,189,102 | |

| | | | |

Net Assets | | $ | 421,449,720 | | | $ | 926,247,852 | |

| | | | |

| | | | | | | | |

| Net Assets Consist of | | | | | | | | |

Paid-in capital | | $ | 528,823,020 | | | $ | 911,341,513 | |

Undistributed (distributions in excess of) net investment income | | | 984,560 | | | | (13,330,815 | ) |

Accumulated net realized loss | | | (122,439,964 | ) | | | (15,254,870 | ) |

Net unrealized appreciation (depreciation) | | | 14,082,104 | | | | 43,492,024 | |

| | | | |

Net Assets | | $ | 421,449,720 | | | $ | 926,247,852 | |

| | | | |

1 Investments at cost — unaffiliated | | $ | 407,087,962 | | | $ | 867,928,540 | |

2 Securities loaned at value | | $ | 973,993 | | | $ | 57,624,077 | |

3 Investments at cost — affiliated | | $ | 1,370,982 | | | $ | 75,857,809 | |

4 Foreign currency at cost | | $ | (413 | ) | | $ | 91 | |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| 18 | | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | |

| | |

| Statements of Assets and Liabilities (concluded) | | |

| | | | | | | | |

| December 31, 2015 (Unaudited) | | BlackRock

EuroFund | | | BlackRock

Global SmallCap

Fund, Inc. | |

| | | | | | | | |

| Net Asset Value | | | | | | | | |

| Institutional | | | | | | | | |

Net assets | | $ | 181,504,832 | | | $ | 214,589,268 | |

| | | | |

Shares outstanding | | | 12,729,629 | | | | 9,721,084 | |

| | | | |

Net asset value | | $ | 14.26 | | | $ | 22.07 | |

| | | | |

Par value | | $ | 0.10 | | | $ | 0.10 | |

| | | | |

Shares authorized | | | Unlimited | | | | 100 million | |

| | | | |

| Investor A | | | | | | | | |

Net assets | | $ | 222,144,715 | | | $ | 417,876,071 | |

| | | | |

Shares outstanding | | | 15,875,245 | | | | 19,667,776 | |

| | | | |

Net asset value | | $ | 13.99 | | | $ | 21.25 | |

| | | | |

Par value | | $ | 0.10 | | | $ | 0.10 | |

| | | | |

Shares authorized | | | Unlimited | | | | 100 million | |

| | | | |

| Investor B | | | | | | | | |

Net assets | | | — | | | $ | 1,246,748 | |

| | | | |

Shares outstanding | | | — | | | | 63,807 | |

| | | | |

Net asset value | | | — | | | $ | 19.54 | |

| | | | |

Par value | | | — | | | $ | 0.10 | |

| | | | |

Shares authorized | | | — | | | | 100 million | |

| | | | |

| Investor C | | | | | | | | |

Net assets | | $ | 16,659,005 | | | $ | 271,060,344 | |

| | | | |

Shares outstanding | | | 1,679,135 | | | | 14,700,947 | |

| | | | |

Net asset value | | $ | 9.92 | | | $ | 18.44 | |

| | | | |

Par value | | $ | 0.10 | | | $ | 0.10 | |

| | | | |

Shares authorized | | | Unlimited | | | | 100 million | |

| | | | |

| Class R | | | | | | | | |

Net assets | | $ | 1,141,168 | | | $ | 21,475,421 | |

| | | | |

Shares outstanding | | | 106,791 | | | | 1,087,701 | |

| | | | |

Net asset value | | $ | 10.69 | | | $ | 19.74 | |

| | | | |

Par value per share | | $ | 0.10 | | | $ | 0.10 | |

| | | | |

Shares authorized | | | Unlimited | | | | 100 million | |

| | | | |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | 19 |

| | | | | | | | |

| | | | | | | |

| Six Months Ended December 31, 2015 (Unaudited) | | BlackRock

EuroFund | | | BlackRock

Global SmallCap

Fund, Inc. | |

| | | | | | | | |

| Investment Income | | | | | | | | |

Dividends — unaffiliated | | $ | 3,845,448 | | | $ | 4,800,643 | |

Securities lending — affiliated — net | | | 438 | | | | 325,595 | |

Dividends — affiliated | | | 483 | | | | 1,763 | |

Foreign taxes withheld | | | (124,749 | ) | | | (30,264 | ) |

| | | | |

Total income | | | 3,721,620 | | | | 5,097,737 | |

| | | | |

| | | | | | | | |

| Expenses | | | | | | | | |

Investment advisory | | | 1,735,556 | | | | 4,296,648 | |

Service — Investor A | | | 303,271 | | | | 560,206 | |

Service and distribution — Investor B | | | — | | | | 7,706 | |

Service and distribution — Investor C | | | 88,701 | | | | 1,475,331 | |

Service and distribution — Class R | | | 2,888 | | | | 60,396 | |

Transfer agent — Institutional | | | 174,697 | | | | 154,599 | |

Transfer agent — Investor A | | | 126,346 | | | | 464,039 | |

Transfer agent — Investor B | | | — | | | | 3,749 | |

Transfer agent — Investor C | | | 16,217 | | | | 378,248 | |

Transfer agent — Class R | | | 1,815 | | | | 37,956 | |

Accounting services | | | 73,876 | | | | 144,164 | |

Custodian | | | 64,492 | | | | 120,612 | |

Professional | | | 55,844 | | | | 73,692 | |

Registration | | | 42,354 | | | | 55,722 | |

Printing | | | 20,056 | | | | 31,740 | |

Officer and Directors | | | 15,364 | | | | 19,504 | |

Miscellaneous | | | 15,178 | | | | 20,152 | |

| | | | |

Total expenses | | | 2,736,655 | | | | 7,904,464 | |

Less fees waived by the Manager | | | (282 | ) | | | (1,096 | ) |

| | | | |

Total expenses after fees waived | | | 2,736,373 | | | | 7,903,368 | |

| | | | |

Net investment income (loss) | | | 985,247 | | | | (2,805,631 | ) |

| | | | |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) | | | | | | | | |

Net realized gain (loss) from: | | | | | | | | |

Investments — unaffiliated | | | (16,780,527 | ) | | | 3,837,030 | |

Investments — affiliated | | | — | | | | (308,957 | ) |

Foreign currency transactions | | | (322,399 | ) | | | (119,470 | ) |

| | | | |

| | | (17,102,926 | ) | | | 3,408,603 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments — unaffiliated | | | (16,096,681 | ) | | | (111,887,418 | ) |

Investments — affiliated | | | — | | | | 298,914 | |

Foreign currency translations | | | (39,918 | ) | | | (10,735 | ) |

| | | | |

| | | (16,136,599 | ) | | | (111,599,239 | ) |

| | | | |

Net realized and unrealized loss | | | (33,239,525 | ) | | | (108,190,636 | ) |

| | | | |

Net Decrease in Net Assets Resulting from Operations | | $ | (32,254,278 | ) | | $ | (110,996,267 | ) |

| | | | |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| 20 | | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | |

| | |

| Statements of Changes in Net Assets | | |

| | | | | | | | |

| | | BlackRock EuroFund | |

| Increase (Decrease) in Net Assets: | | Six Months Ended

December 31,

2015

(Unaudited) | | | Year Ended

June 30, 2015 | |

| | | | | | | | |

| Operations | | | | | | | | |

Net investment income | | $ | 985,247 | | | $ | 8,228,877 | |

Net realized loss | | | (17,102,926 | ) | | | (14,384,504 | ) |

Net change in unrealized appreciation (depreciation) | | | (16,136,599 | ) | | | (17,741,375 | ) |

| | | | |

Net decrease in net assets resulting from operations | | | (32,254,278 | ) | | | (23,897,002 | ) |

| | | | |

| | | | | | | | |

| Distributions to Shareholders1 | | | | | | | | |

From net investment income: | | | | | | | | |

Institutional | | | (2,952,513 | ) | | | (7,567,115 | ) |

Investor A | | | (3,544,726 | ) | | | (4,208,952 | ) |

Investor C | | | (227,669 | ) | | | (487,187 | ) |

Class R | | | (17,596 | ) | | | (29,498 | ) |

| | | | |

Decrease in net assets resulting from distributions to shareholders | | | (6,742,504 | ) | | | (12,292,752 | ) |

| | | | |

| | | | | | | | |

| Capital Share Transactions | | | | | | | | |

Net increase (decrease) in net assets derived from capital transactions | | | (38,834,943 | ) | | | 128,896,263 | |

| | | | |

| | | | | | | | |

| Net Assets | | | | | | | | |

Total increase (decrease) in net assets | | | (77,831,725 | ) | | | 92,706,509 | |

Beginning of period | | | 499,281,445 | | | | 406,574,936 | |

| | | | |

End of period | | $ | 421,449,720 | | | $ | 499,281,445 | |

| | | | |

Undistributed net investment income, end of period | | $ | 984,560 | | | $ | 6,741,817 | |

| | | | |

| | 1 | | Distributions for annual periods determined in accordance with federal income tax regulations. |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | DECEMBER 31, 2015 | | 21 |

| | |

| Statements of Changes in Net Assets | | |

| | | | | | | | |

| | | BlackRock Global SmallCap Fund, Inc. | |

| Increase (Decrease) in Net Assets: | | Six Months Ended

December 31, 2015

(Unaudited) | | | Year Ended June 30,

2015 | |

| | | | | | | | |

| Operations | | | | | | | | |

Net investment loss | | $ | (2,805,631 | ) | | $ | (2,017,274 | ) |

Net realized gain | | | 3,408,603 | | | | 116,689,720 | |

Net change in unrealized appreciation (depreciation) | | | (111,599,239 | ) | | | (157,259,253 | ) |

| | | | |

Net decrease in net assets resulting from operations | | | (110,996,267 | ) | | | (42,586,807 | ) |

| | | | |

| | | | | | | | |

| Distributions to Shareholders1 | | | | | | | | |

From net investment income: | | | | | | | | |

Institutional | | | — | | | | (1,114,270 | ) |

Investor A | | | — | | | | (1,069,605 | ) |

Class R | | | — | | | | (4,597 | ) |

From net realized gain: | | | | | | | | |

Institutional | | | (10,362,846 | ) | | | (39,378,923 | ) |

Investor A | | | (20,728,610 | ) | | | (65,151,603 | ) |

Investor B | | | (69,998 | ) | | | (458,909 | ) |

Investor C | | | (15,477,586 | ) | | | (48,850,849 | ) |

Class R | | | (1,196,436 | ) | | | (4,023,638 | ) |

| | | | |

Decrease in net assets resulting from distributions to shareholders | | | (47,835,476 | ) | | | (160,052,394 | ) |

| | | | |

| | | | | | | | |

| Capital Share Transactions | | | | | | | | |

Net increase (decrease) in net assets derived from capital transactions | | | (1,328,462 | ) | | | 60,558,897 | |

| | | | |

| | | | | | | | |

| Net Assets | | | | | | | | |

Total decrease in net assets | | | (160,160,205 | ) | | | (142,080,304 | ) |

Beginning of period | | | 1,086,408,057 | | | | 1,228,488,361 | |

| | | | |

End of period | | $ | 926,247,852 | | | $ | 1,086,408,057 | |

| | | | |