UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04642

Virtus Variable Insurance Trust

(Exact name of registrant as specified in charter)

100 Pearl Street

Hartford, CT 06103-4506

(Address of principal executive offices) (Zip code)

Kevin J. Carr, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

100 Pearl Street

Hartford, CT 06103-4506

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 248-7971

Date of fiscal year end: December 31

Date of reporting period: December 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

VIRTUS VARIABLE INSURANCE TRUST

ANNUAL REPORT

Virtus Capital Growth Series*

Virtus Growth & Income Series*

Virtus International Series

Virtus Multi-Sector Fixed Income Series

Virtus Premium AlphaSectorTM Series*

Virtus Real Estate Securities Series

Virtus Small-Cap Growth Series

Virtus Small-Cap Value Series

Virtus Strategic Allocation Series*

| | | | | | |

| * Prospectus supplements applicable to these Series appear at the back of this annual report. | | | | | December 31, 2011 | |

| The Annual Report describes one or more Series available for underlying investment through your variable contract. For information about your variable contract, including information about insurance-related expenses, see the prospectus for your variable contract. | | | | | Not FDIC Insured No Bank Guarantee May Lose Value | |

Table of Contents

* Prospectus supplements applicable to these Series appear at the back of this annual report

Proxy Voting Procedures and Voting Record (Form N-PX)

The adviser and subadvisers vote proxies relating to portfolio securities in accordance with procedures that have been approved by the Trustees of the Trust (“Trustees,” or the “Board”). You may obtain a description of these procedures, along with information regarding how the Series voted proxies during the most recent 12-month period ended June 30, free of charge, by calling toll-free 800-367-5877. This information is also available through the Securities and Exchange Commission’s (the “SEC”) website at http://www.sec.gov.

Form N-Q Information

The Fund files a complete schedule of portfolio holdings for each Series with the SEC for the first and third quarters of each fiscal year on Form N-Q. Form N-Q is available on the SEC’s website at http://www.sec.gov. Form N-Q may be reviewed and copied at the SEC’s Public Reference Room. Information on the operation of the SEC’s Public Reference Room can be obtained by calling toll-free 1-800-SEC-0330.

MESSAGE TO SHAREHOLDERS

Dear Virtus Variable Product Investors:

| Investors will likely recall 2011 as a highly volatile year for the global financial markets, which were tested by a number of geopolitical and economic events, including social unrest in the Middle East, the European sovereign debt crisis, the impact of Japan’s earthquake, and persistent U.S. political gridlock. |

| | Global equity markets suffered heavy losses, with developed markets, as measured by the MSCI EAFE Index, declining 11.7%, and emerging markets, as measured by the MSCI Emerging Markets Index, falling even further, 18.2%. By comparison, U.S. stocks managed to pull ahead of other markets. Dividend-paying blue-chip stocks were rewarded the most, as indicated by the Dow Jones Industrial Average’s 8.4% return for the year. By comparison, the S&P 500® Total Return Index, a broad benchmark of U.S. stocks, gained 2.1%. |

Fixed-income markets were among the strongest performers in 2011. The Barclays Capital U.S. Aggregate Bond Index, a metric of taxable bond returns, rose 7.8%. Investor skittishness fueled demand for the relative safety of U.S. government bonds, pushing the yield on the 10-year Treasury below 2% for the first time ever.

As we turn the corner into 2012, the U.S. economy is starting to show encouraging signs of growth. The manufacturing sector is recovering, consumer spending is rising and the labor market is moving in the right direction, with unemployment dropping four straight months, to 8.5% in December.

Last year’s volatility is an important reminder of the importance of diversification. While diversification cannot guarantee a profit or prevent loss, owning a variety of asset classes may cushion your portfolio against market fluctuations. In fact, this is an excellent time of year to check with your advisor to make sure your variable product portfolio is adequately diversified.

Thank you for entrusting Virtus with your assets. We appreciate your business and remain committed to your long-term financial success.

Sincerely,

George R. Aylward

President, Virtus Variable Insurance Trust

February 2012

Variable insurance products are sold by prospectus. You should carefully consider investment objectives, charges, expenses and risks before you invest. The contract prospectuses and underlying Series prospectuses contain this and other important information about the variable insurance product. You may obtain contract prospectuses from your registered representative. You may obtain Series prospectuses by contacting us at 1-800-367-5877 or Virtus.com. Please read the prospectuses carefully before you invest.

1

KEY INVESTMENT TERMS

ADR (American Depositary Receipt)

Represents shares of foreign companies traded in U.S. dollars on U.S. exchanges that are held by a U.S. bank or trust. Foreign companies use ADRs in order to make it easier for Americans to buy their shares. An ADR is likely to be traded over the counter.

Barclays Capital U.S. Aggregate Bond Index

The Barclays Capital U.S. Aggregate Bond Index measures the U.S. investment grade fixed rate bond market. The index is calculated on a total return basis.

Composite Index for Strategic Allocation Series

A composite index made up of 60% of the S&P 500® Index, which measures stock market total return performance, and 40% of the Barclays Capital U.S. Aggregate Bond Index, which measures bond market total return performance.

ETF (Exchange-Traded Fund)

A Fund that tracks an index, but can be traded like a stock.

Federal Reserve (the “Fed”)

The central bank of the United States, responsible for controlling the money supply, interest rates and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 branches and all national and state banks that are part of the system.

FTSE NAREIT Equity REITs Index

The FTSE NAREIT Equity REITs Index is a free-float market capitalization-weighted index measuring equity tax-qualified real estate investment trusts, which meet minimum size and liquidity criteria, that are listed on the New York Stock Exchange, the American Stock Exchange and the NASDAQ National Market System. The index is calculated on a total return basis with dividends reinvested.

MSCI EAFE® Index

The MSCI EAFE® Index is a free float-adjusted market capitalization index that measures developed foreign market equity performance, excluding the U.S. and Canada. The index is calculated on a total return basis with gross dividends reinvested.

PIK (Payment-in-Kind)

A bond which pays interest in the form of additional bonds, or preferred stock which pays dividends in the form of additional preferred stock.

REIT (Real Estate Investment Trust)

A publicly traded company that owns, develops and operates income-producing real estate such as apartments, office buildings, hotels, shopping centers and other commercial properties.

Russell 1000® Growth Index

The Russell 1000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Russell 2000® Growth Index

The Russell 2000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the 2,000 smallest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Russell 2000® Value Index

The Russell 2000® Value Index is a market capitalization-weighted index of value-oriented stocks of the 2,000 smallest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

S&P 500® Index

The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested.

Sponsored ADR (American Depositary Receipt)

An ADR which is issued with the cooperation of the company whose stock will underlie the ADR. Sponsored ADRs generally carry the same rights normally given to stockholders, such as voting rights. ADRs must be sponsored to be able to trade on a major U.S. exchange such as the NYSE.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

2

VIRTUS VARIABLE INSURANCE TRUST

Disclosure of Fund Expenses (Unaudited)

For the six-month period of July 1, 2011 to December 31, 2011

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of Virtus Variable Insurance Trust Series (each a “Series”), you incur ongoing costs including investment advisory fees and other expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in a Series and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period. The following Expense Table illustrates your Series’ costs in two ways.

Actual Expenses

This section of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. The expense estimate does not include the fees or expenses associated with the separate insurance accounts, and if such charges were included, your costs would have been higher.

Hypothetical Example for Comparison Purposes

This section of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not your Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Series and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the accompanying table are meant to highlight your ongoing costs only and do not reflect additional fees and expenses associated with the annuity or life insurance policy through which you invest. Therefore, this section of the accompanying table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if the annuity or life insurance policy costs were included, your costs would have been higher. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| | | | | | | | | | | | | | | | |

| Expense Table | |

| | | Beginning

Account Value

July 1, 2011 | | | Ending

Account Value

December 31, 2011 | | | Annualized

Expense

Ratio | | | Expenses Paid

During

Period* | |

Capital Growth Series | | | | | |

Actual | | $ | 1,000.00 | | | $ | 899.60 | | | | 0.95 | % | | $ | 4.55 | |

|

Hypothetical (5% return before expenses) | |

| | | | 1,000.00 | | | | 1,020.36 | | | | 0.95 | | | | 4.85 | |

Growth & Income Series | |

Actual | | $ | 1,000.00 | | | $ | 923.00 | | | | 0.90 | % | | $ | 4.36 | |

|

Hypothetical (5% return before expenses) | |

| | | | 1,000.00 | | | | 1,020.61 | | | | 0.90 | | | | 4.59 | |

International Series | |

Actual | | $ | 1,000.00 | | | $ | 910.90 | | | | 1.03 | % | | $ | 4.96 | |

|

Hypothetical (5% return before expenses) | |

| | | | 1,000.00 | | | | 1,019.95 | | | | 1.03 | | | | 5.26 | |

Multi-Sector Fixed Income Series | |

Actual | | $ | 1,000.00 | | | $ | 983.50 | | | | 0.75 | % | | $ | 3.75 | |

|

Hypothetical (5% return before expenses) | |

| | | | 1,000.00 | | | | 1,021.38 | | | | 0.75 | | | | 3.83 | |

Premium AlphaSector Series | |

Actual | | $ | 1,000.00 | | | $ | 949.60 | | | | 1.70 | % | | $ | 8.35 | |

|

Hypothetical (5% return before expenses) | |

| | | | 1,000.00 | | | | 1,016.53 | | | | 1.70 | | | | 8.68 | |

Real Estate Securities Series | |

Actual | | $ | 1,000.00 | | | $ | 987.50 | | | | 1.10 | % | | $ | 5.56 | |

|

Hypothetical (5% return before expenses) | |

| | | | 1,000.00 | | | | 1,019.54 | | | | 1.10 | | | | 5.67 | |

Small-Cap Growth Series | |

Actual | | $ | 1,000.00 | | | $ | 984.50 | | | | 1.05 | % | | $ | 5.25 | |

|

Hypothetical (5% return before expenses) | |

| | | | 1,000.00 | | | | 1,019.85 | | | | 1.05 | | | | 5.36 | |

Small-Cap Value Series | |

Actual | | $ | 1,000.00 | | | $ | 929.90 | | | | 1.30 | % | | $ | 6.32 | |

|

Hypothetical (5% return before expenses) | |

| | | | 1,000.00 | | | | 1,018.57 | | | | 1.30 | | | | 6.64 | |

Strategic Allocation Series | |

Actual | | $ | 1,000.00 | | | $ | 964.40 | | | | 0.85 | % | | $ | 4.21 | |

|

Hypothetical (5% return before expenses) | |

| | | | 1,000.00 | | | | 1,020.87 | | | | 0.85 | | | | 4.34 | |

| * | Expenses are equal to the relevant Series’ annualized expense ratio which includes waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (184) expenses were accrued in the most recent fiscal half-year, then divided by 365 days to reflect the one-half year period. Exceptions noted below. |

| | The Series may invest in other funds, and the annualized expense ratios noted above do not reflect fees and expenses associated with the underlying funds. If such fees and expenses had been included, the expenses would have been higher. |

| | You can find more information about the Series’ expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs, including contractual charges associated with the separate account, refer to the Series prospectus and the contract prospectus. |

3

Portfolio Manager Commentary

| ¢ | | Virtus Capital Growth Series (the “Series”) is diversified and has an investment objective of long-term growth of capital. There is no guarantee that the Series will meet its objective. |

| ¢ | | For the fiscal year ended December 31, 2011, the Series returned -4.60%. For the same period, the S&P 500® Index, a broad-based equity index, returned 2.11% and the Russell 1000® Growth Index, the Series’ style-specific benchmark, returned 2.64%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above.

How did the market in which the Series invests perform during the Series’ fiscal year?

| ¢ | | U.S. markets ended the year mixed after a tumultuous global geo-political and macro-economic environment. Strong first and fourth quarters were offset by weak second and third quarters which were influenced by Euro-zone collapse fears, the U.S. credit rating downgrade, and inklings of a double-dip recession within our borders. The fourth quarter alone was equally volatile, as initial hopes of a resolution in Europe led to a solid October after four straight down quarters, only to be met by a flat November and December as talks among European countries seemed to be going nowhere. |

| ¢ | | The top performing sectors for the reporting period were the more defensive sectors of utilities, consumer staples, and health care while the materials, telecommunications-services, and industrials sectors did not perform as strongly. |

| ¢ | | High-quality stocks, as measured by S&P Quality Rankings, outperformed low-quality stocks for the year. Additionally, less risky stocks, as measured by beta, had superior returns relative to more risky stocks. |

What factors affected the Series’ performance during its fiscal year?

| ¢ | | The Series underperformed the Russell 1000® Growth Index for the reporting period. Performance of the Series was helped by stock selection in the health care sector. However, performance was hurt by negative stock selection and an underweight in financials, negative stock selection in information technology, and negative stock selection and an overweight in energy. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice.

Because the Series is heavily weighted in the technology sector, it will be impacted by that Sector’s performance more than a series with broader sector diversification.

| | | | |

| |

| Asset Allocation | |

| |

The following table presents asset allocations within certain sectors and as a percentage of total investments as of December 31, 2011. | |

Information Technology | | | 25 | % |

Industrials | | | 16 | |

Consumer Discretionary | | | 16 | |

Consumer Staples | | | 14 | |

Energy | | | 11 | |

Health Care | | | 8 | |

Materials | | | 6 | |

Other (includes short-term investments) | | | 4 | |

| | | | | |

Total | | | 100 | % |

| | | | | |

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

4

| | |

| Capital Growth Series (Continued) | | |

| | | | | | | | | | | | |

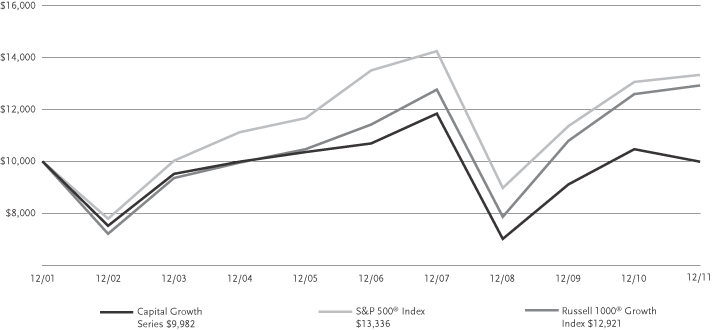

| Average Annual Total Return1 for periods ended 12/31/11 | | | | | | | | | |

| | | |

| | | 1 year | | | 5 years | | | 10 years | |

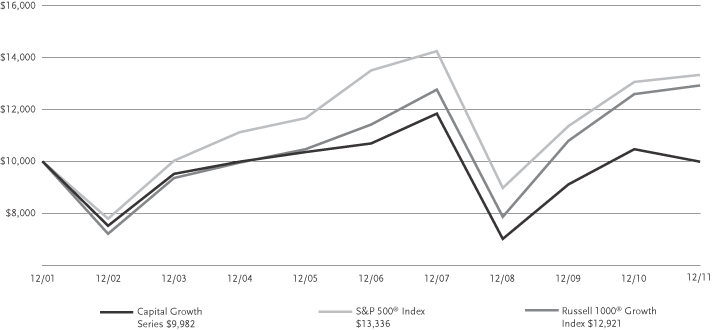

| Capital Growth Series | | | –4.60 | % | | | –1.36 | % | | | –0.02 | % |

| S&P 500® Index | | | 2.11 | | | | –0.25 | | | | 2.92 | |

| Russell 1000® Growth Index | | | 2.64 | | | | 2.50 | | | | 2.60 | |

| Series expense ratios2: Gross: 1.18%; Net: 0.95%. | | | | | | | | | | | | |

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | The expense ratios of the Series are set forth according to the prospectus for the Series effective May 1, 2011, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. Net Expenses: Expenses reduced by a contractual waiver in effect through November 5, 2012. Gross Expenses: Does not reflect the effect of a contractual waiver. See the financial highlights for more current information. |

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2001. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

5

Portfolio Manager Commentary

| ¢ | | Virtus Growth & Income Series (the “Series”) is diversified and has an investment objective of capital appreciation and current income. There is no guarantee that the Series will meet its objective. |

| ¢ | | For the fiscal year ended December 31, 2011, the Series returned -1.66%. For the same period, the S&P 500® Index, a broad-based equity index, returned 2.11%. |

All performance figures assume the reinvest- ment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above.

How did the market in which the Series invests perform during the Series’ fiscal year?

| ¢ | | The S&P 500® Index ended the year with a slight gain of 2.11%, although that hides the extreme volatility experienced by the market. The year 2011 can be divided almost in half with the first two quarters being highlighted by higher stock prices, investors willing to buy cyclically sensitive stocks, and a general rise in asset prices. Beginning in mid-July things got much more difficult as the market started a massive correction over concerns about the European debt crisis. While in the first six months stocks that had economically sensitive earnings did well, the second half of the year was marked by the much better performance of late-cycle equities such as utilities, consumer staple names, and other high dividend paying stocks. Volatility was also extreme, with so-called “headline risk” associated with both global economic growth data and news regarding Greece, and the European debt crisis, dominating price action, even in our own markets. In the end, the market managed a marginal gain, but it was a difficult market for most investors. |

What factors affected the Series’ performance during its fiscal year?

| ¢ | | For most of the year, the Series had a greater weighting in more economically sensitive stocks such as energy stocks, material and mining names and industrial stocks, which generally did very well in the first half of the year. While the Series managers did reduce holdings of many of these names early in the summer, it was not enough to offset the negative effects of the sell-off. Furthermore, the under-weighting in utilities and staple stocks created a head-wind for the Series as much of the back half of the year was dominated by a move to yield-oriented stocks. While on balance the Series did keep up with peers, the stretch between late July and early October was difficult and the Series slightly under-performed the S&P 500® Index on the year. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice, and there is no guarantee that market forecasts will be realized.

Investing internationally involves risks not associated with investing solely in the U.S., such as currency fluctuation, political risk, differences in accounting and the limited availability of information.

| | | | |

| |

| Asset Allocation | |

| |

The following table presents asset allocations within certain sectors and as a percentage of total investments as of December 31, 2011. | |

Energy | | | 17 | % |

Information Technology | | | 15 | |

Industrials | | | 14 | |

Materials | | | 14 | |

Consumer Discretionary | | | 13 | |

Health Care | | | 10 | |

Financials | | | 7 | |

Other (includes short-term investments) | | | 10 | |

| | | | | |

Total | | | 100 | % |

| | | | | |

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

6

| | |

| Growth & Income Series (Continued) | | |

| | | | | | | | | | | | |

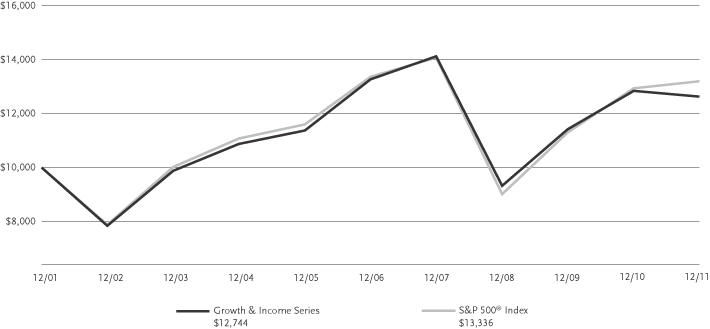

| Average Annual Total Return1 for periods ended 12/31/11 | | | | | | | | | |

| | | |

| | | 1 year | | | 5 years | | | 10 years | |

| Growth & Income Series | | | –1.66 | % | | | –1.00 | % | | | 2.45 | % |

| S&P 500® Index | | | 2.11 | | | | –0.25 | | | | 2.92 | |

| Series expense ratios2: Gross: 1.19%; Net: 0.90%. | | | | | | | | | | | | |

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | The expense ratios of the Series, both net and gross are set forth according to the prospectus for the Series effective May 1, 2011, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. Net Expenses: Expenses reduced by a contractual waiver in effect through November 5, 2012. Gross Expenses: Does not reflect the effect of the contractual waiver. See the financial highlights for more current information. |

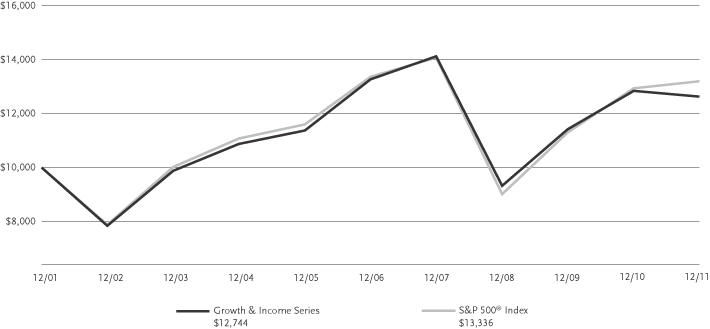

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2001. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

7

Portfolio Manager Commentary

| ¢ | | Virtus International Series (the “Series”) is diversified and has an investment objective of high total return consistent with reasonable risk. There is no guarantee that the Series will meet its objective. |

| ¢ | | For the fiscal year ended December 31, 2011, the Series returned -4.57%. For the same period, the S&P 500® Index, a broad-based equity index, returned 2.11% and the MSCI EAFE® Index, the Series’ style-specific benchmark, returned -11.73%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above.

How did the market in which the Series invests perform during the Series’ fiscal year?

| ¢ | | It was a volatile twelve months in global equity markets. Initially, in January there was renewed optimism over global growth prospects on the back of improving economic data. However, by June we saw global equities fall on the back of worries over the Greek debt crisis and the Federal Reserve’s downgrade of the nation’s growth outlook. Euro-zone worries together with worries over a general slowdown in global growth continued through 2011, which resulted in equity stock markets being down significantly, and the MSCI EAFE® Index in particular fell 11.73% over the year. |

What factors affected the Series’ performance during its fiscal year?

| ¢ | | In 2011, the Series outperformed the MSCI EAFE® Index benchmark as a result of both asset allocation and stock selection. We invest in what we believe are quality stocks with strong balance sheets, experienced management and sustainable business models as these are the types of stocks that can survive these challenging times and come out the other side in a strong position. It was these types of stocks that held up relatively well in 2011 and resulted in our relative outperformance. With regards to stock selection, the main contributors to our relative outperformance came from our holdings in Switzerland, Japan, the United Kingdom and Italy as well as our non-benchmark holdings in China, Korea, Taiwan, Mexico and Canada. |

| ¢ | | At the sector level, the largest contribution to relative outperformance came from financials where not holding any diversified financials benefited the Series. In addition, stock selection within our banks, insurance and real estate holdings was relatively strong. We also gained from stock selection in the information technology and telecommunication sectors and benefited from being underweight in materials and industrials as these sectors had struggled last year on the back of worries over a general slowdown in global growth. We also gained from our overweight to consumer staples and pharmaceuticals, with the more defensive stocks such as tobacco and healthcare stocks holding up relatively well over the year. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice.

Investing internationally involves risks not associated with investing solely in the U.S., such as currency fluctuation, political risk, differences in accounting and the limited availability of information. The economies of developing countries may be adversely affected by trade barriers, exchange controls, managed adjustments in relative currency values and other protagonist measures imposed or negotiated by the countries with which they trade.

Because the Series is heavily weighted in the financial sector, it will be impacted by that Sector’s performance more than a series with broader sector diversification.

| | | | |

| |

| Asset Allocation | |

| |

The following table presents asset allocations within certain sectors and as a percentage of total investments as of December 31, 2011. | |

Financials | | | 26 | % |

Energy | | | 13 | |

Consumer Staples | | | 12 | |

Information Technology | | | 12 | |

Telecommunication Services | | | 11 | |

Health Care | | | 10 | |

Industrials | | | 8 | |

Other (includes short-term investments) | | | 8 | |

| | | | | |

Total | | | 100 | % |

| | | | | |

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

8

| | |

| International Series (Continued) | | |

| | | | | | | | | | | | |

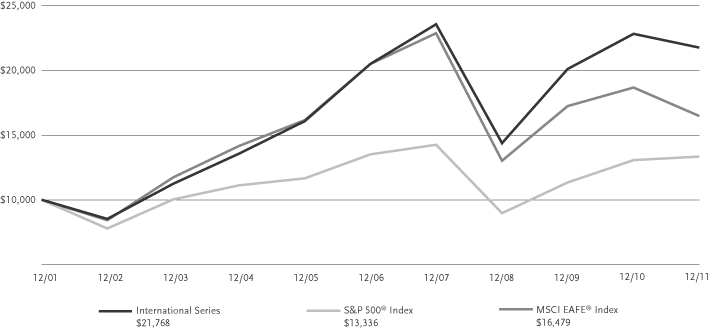

| Average Annual Total Return1 for periods ended 12/31/11 | | | | | | | | | |

| | | |

| | | 1 year | | | 5 years | | | 10 years | |

| International Series | | | –4.57 | % | | | 1.21 | % | | | 8.09 | % |

| S&P 500® Index | | | 2.11 | | | | –0.25 | | | | 2.92 | |

| MSCI EAFE® Index | | | –11.73 | | | | –4.26 | | | | 5.12 | |

| Series expense ratios2: Gross: 1.21%; Net: 1.03%. | |

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | The expense ratios of the Series, both net and gross are set forth according to the prospectus for the Series effective May 1, 2011, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. Net Expenses: Expenses reduced by a contractual waiver in effect through November 5, 2012. Gross Expenses: Does not reflect the effect of the contractual waiver. See the financial highlights for more current information. |

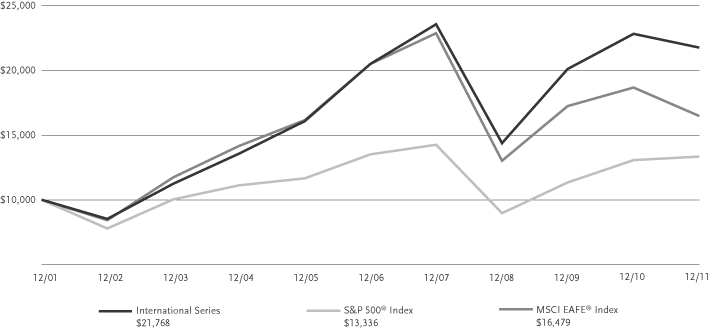

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2001. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

9

| | |

| Multi-Sector Fixed Income Series | | |

Portfolio Manager Commentary

| ¢ | | Virtus Multi-Sector Fixed Income Series (the “Series”) is diversified and has an investment objective of long-term total return. There is no guarantee that the Series will meet its objective. |

| ¢ | | For the fiscal year ended December 31, 2011, the Series returned 2.99%. For the same period, the Barclays Capital U.S. Aggregate Bond Index, a broad-based fixed income index, returned 7.84%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above.

How did the fixed income market perform during the Series’ fiscal year?

| ¢ | | During the last 12 months the economy showed signs of improvement and the likelihood of the U.S. entering another recession diminished. This has been positive for spread sectors. However, during the year there have been periods of volatility and subsequent spread widening stemming from growing concerns over the sovereign debt crisis in Europe, the U.S. debt ceiling debate and subsequent loss of its AAA long-term rating by Standard & Poor’s, and global growth concerns. Overall U.S. Treasuries outperformed most spread sectors during the Series’ fiscal year. |

| ¢ | | Over the last 12 months yields declined across the U.S. Treasury curve and the curve flattened. |

What factors affected the Series’ performance during its fiscal year?

| ¢ | | The underperformance of most spread sectors relative to U.S. Treasuries was a key factor that detracted from Series’ performance for the year. |

| ¢ | | Among fixed income sectors, the Series’ overweight to emerging markets, non-U.S. Dollar securities, and corporate high yield securities detracted from the Series’ performance. |

| ¢ | | Strong issue selection within the commercial mortgage backed security sector benefited performance. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice.

Investing internationally involves risks not associated with investing solely in the U.S., such as currency fluctuation, political risk, differences in accounting and the limited availability of information.

Portfolios that invest in high-yield securities are subject to greater credit risk and price fluctuation than portfolios that invest in higher quality securities.

The value of mortgage-backed and other asset-backed securities, including pass-through type securities and collateralized mortgage obligations (CMOs) may fluctuate to a greater degree than other debt securities in response to interest rate changes.

��

| | | | | | | | |

| |

| Asset Allocation | |

| |

The following table presents asset allocations within certain sectors and as a percentage of total investments as of December 31, 2011. | |

Corporate Bonds | | | | | | | 52 | % |

Financials | | | 21 | % | | | | |

Energy | | | 9 | | | | | |

Consumer Discretionary | | | 7 | | | | | |

Total of all others | | | 15 | | | | | |

Mortgage-Backed Securities | | | | | | | 15 | |

Loan Agreements | | | | | | | 15 | |

Foreign Government Securities | | | | | | | 12 | |

Asset-Backed Securities | | | | | | | 3 | |

Other (includes short-term investments) | | | | | | | 3 | |

| | | | | | | | | |

Total | | | | | | | 100 | % |

| | | | | | | | | |

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

10

| | |

| Multi-Sector Fixed Income Series (Continued) | | |

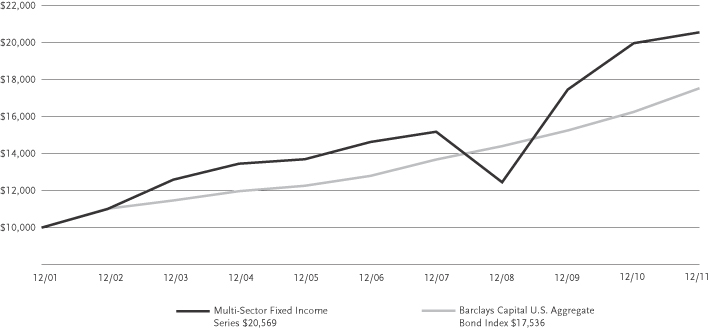

| | | | | | | | | | | | |

| Average Annual Total Return1 for periods ended 12/31/11 | | | | | | | | | |

| | | |

| | | 1 year | | | 5 years | | | 10 years | |

| Multi-Sector Fixed Income Series | | | 2.99 | % | | | 7.03 | % | | | 7.48 | % |

| Barclays Capital U.S. Aggregate Bond Index | | | 7.84 | | | | 6.50 | | | | 5.78 | |

| Series expense ratios2: Gross: 0.99%; Net: 0.75%. | | | | | | | | | | | | |

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | The expense ratios of the Series is set forth according to the prospectus for the Series effective May 1, 2011, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. Net Expenses: Expenses reduced by a contractual waiver in effect through November 5, 2012. Gross Expenses: Does not reflect the effect of the contractual waiver. See the financial highlights for more current information. |

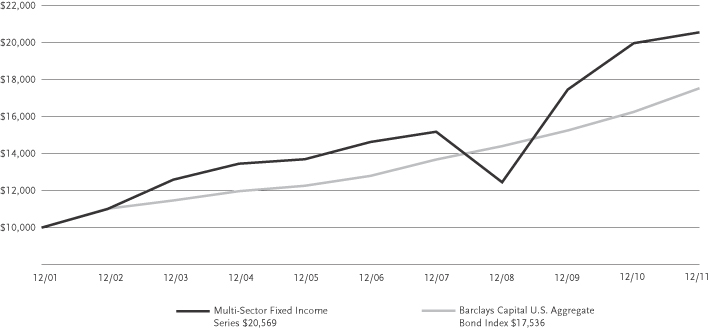

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2001. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

11

| | |

| Premium AlphaSector™ Series | | |

Portfolio Manager Commentary

| ¢ | | Premium AlphaSectorTM Series (the “Series”) is diversified and has an investment objective of long-term capital appreciation. There is no guarantee that the Series will achieve its objective. |

| ¢ | | For the fiscal period ended December 31, 2011, the Series returned -4.47%*. For the same period, the S&P 500® Index, a broad-based equity index, returned -3.83%*. |

| * | Returns less than 1 year are not annualized |

All performance figures assume reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above.

How did the market perform during the Series’ fiscal period?

| ¢ | | Sustained market volatility was the major challenge in 2011. The series invests in the U.S. equity market. On a full-year 2011 basis, the S&P 500® Index returned a modest 2.1%. But to reach that destination, investors experienced a turbulent up-and-down ride. Volatility rattled the markets, especially in the second half of the year. |

| ¢ | | Three examples of the market volatility are as follows: (1) The first quarter of 2011 was the best Q1 since 1998 for the S&P 500® Total Return Index, but the third quarter was the worst Q3 since 2008. (2) The Chicago Board Options Exchange Market Volatility Index (a common measure of volatility) reached a high of 30 or more during twenty weeks in 2011, a level of volatility exceeded in only two periods since 1989 — the 2002 and 2008-2009 market crashes. (3) Between August 1 and December 1, the S&P 500® Index saw eight declines of 5% or more and eight advances of 5% or more; the total of sixteen such movements means that, on average, big swings were a weekly occurrence. |

| ¢ | | The headlines echoed the market swings and added to investor uncertainty. Stories on the sluggish economy at home and abroad, U.S. government deficits, and the Euro credit crisis added to investor uncertainty. Altogether, the period was an unsettled time in the US equity markets. |

What factors affected the Series’ performance during its fiscal period?

| ¢ | | The Series is designed to “de-risk the portfolio” in volatile and negative markets. In an extended bear market, as in 2008-2009, the goal is to reduce capital loss. In periods of up-and-down swings such as 2011, the dual objectives are to 1) position the portfolio defensively to move quickly to cash if the markets deteriorate significantly, and 2) to reduce volatility and its negative impact on clients. |

| ¢ | | When volatility spiked in late July and August, the Series reduced exposure to the most volatile sectors and assumed a defensive part-cash position. Cash remained in the portfolio, at 25% or 50% weighting, into early December. The result was meaningful lowering of day-to-day volatility. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio of securities. Sector ETFs are subject to sector risks and non-diversification risks, which may result in greater price fluctuations than the overall market. Because the Fund invests in ETFs, it indirectly bears its proportionate share of the operating expenses of the underlying funds. Indirectly, the Fund is subject to all risks associated with the underlying ETFs.

The guarantee on U.S. government securities applies only to the underlying securities of the portfolio, and not to the value of the portfolio’s shares.

A portfolio that holds a limited number of securities will be impacted by each security’s performance more than a portfolio with a larger number of holdings.

| | | | |

| |

| Asset Allocation | |

| |

The following table presents asset allocations within certain sectors and as a percentage of total investments as of December 31, 2011. | |

Exchange-Traded Funds | | | 99 | % |

Other (includes short-term investments) | | | 1 | |

| | | | | |

Total | | | 100 | % |

| | | | | |

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

12

| | |

| Premium AlphaSector™ Series (Continued) | | |

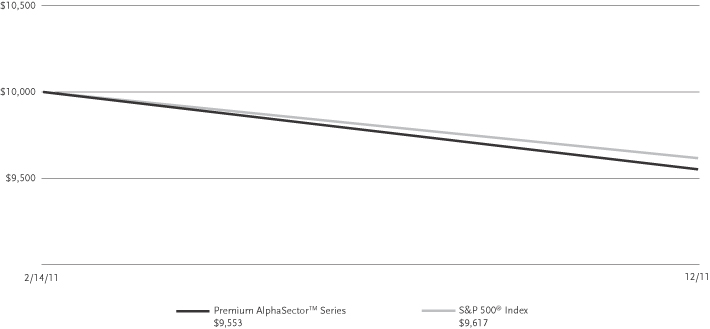

| | | | | | | | |

| Average Annual Total Return1 for periods ended 12/31/11 | | | | | | |

| | |

| | | Since

Inception | | | Inception

Date | |

| Premium AlphaSector™ Series | | | –4.47 | % | | | 2/14/11 | |

| S&P 500® Index | | | –3.83 | | | | —3 | |

| Series expense ratios2: Gross: 4.78%; Net: 1.70%. | |

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | The expense ratio of the Series is set forth according to the prospectus for the Series effective May 1, 2011, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. Net Expenses: Expenses reduced by a contractual waiver in effect through April 30, 2012. Gross Expenses: Does not reflect the effect of the contractual waiver. See the financial highlights for more current information. |

| 3 | The since inception index returns are from the Series’ inception date. |

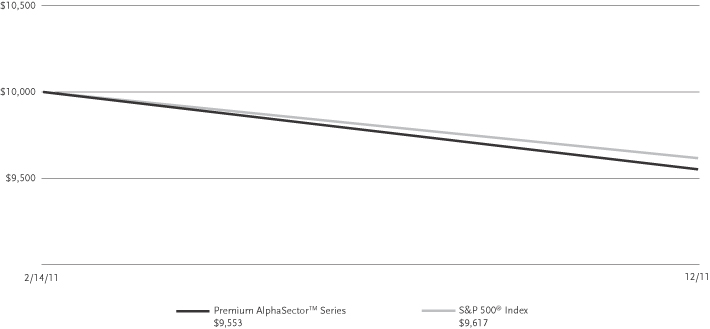

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on February 14, 2011 (inception date of the Series). Returns shown include the reinvestment of all distributions at net asset value and the change in share price for the stated period.

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

13

| | |

| Real Estate Securities Series | | |

Portfolio Manager Commentary

| ¢ | | Virtus Real Estate Securities Series (the “Series”) is non-diversified and has an investment objective of capital appreciation and income with approximately equal emphasis. There is no guarantee that the Series will meet its objective. |

| ¢ | | For the fiscal year ended December 31, 2011, the Series returned 9.87%. For the same period, the S&P 500® Index, a broad-based equity index, returned 2.11% and the FTSE NAREIT Equity REITs Index, the Series’ style-specific benchmark, returned 8.29%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above.

How did the market in which the Series invests perform during the Series’ fiscal year?

| ¢ | | Total returns in 2011 were driven by a more meaningful increase in cash flow growth as a result of better than expected internal and external growth across a number of the large property sectors (i.e. regional malls, apartments and health care) and a couple of the niche property sectors (i.e. self storage and manufactured homes). |

| ¢ | | The market was influenced in both directions by macro forces and events throughout the year while supported by an accelerating U.S. economy, limited new supply, and low interest rates, ultimately ending on another positive note. |

| ¢ | | De-leveraging and debt refinancing via competitive advantages of access to and cost of capital over private real estate players were visible through 2011. |

| ¢ | | More than $30.9 billion in secondary equity, $2.3 billion in IPOs and $12.5 billion in unsecured debt was raised in 2011 by U.S. REITs (NAREIT). |

What factors affected the Series’ performance during its fiscal year?

| ¢ | | The Series performed well in 2011 as did its Benchmark vs. the S&P 500® Index. |

| ¢ | | Attribution results highlight positive contributions from both property sector allocation and stock selection in the year. |

| ¢ | | Results were broad based with the majority of the sectors contributing to positive results. The largest contributions came from the Office, Self Storage and Regional Mall sectors. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Investing in REITs involves certain risks such as refinancing, changes in the value of properties REITs own, dependency on management skills, economic impact on the industry and risks similar to those linked to small-company investing.

Investing in sector funds or non-diversified funds may be more volatile than investing in broadly diversified funds, and may be more susceptible to adverse economic, political or regulatory developments affecting a single issuer than would be the case if the Series were more broadly diversified.

| | | | |

| |

| Asset Allocation | |

| |

The following table presents asset allocations within certain sectors and as a percentage of total investments as of December 31, 2011. | |

Apartments | | | 21 | % |

Regional Malls | | | 18 | |

Office | | | 12 | |

Health Care | | | 12 | |

Self Storage | | | 10 | |

Shopping Centers | | | 7 | |

Lodging/Resorts | | | 6 | |

Other (includes short-term investments) | | | 14 | |

| | | | | |

Total | | | 100 | % |

| | | | | |

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

14

| | |

| Real Estate Securities Series (Continued) | | |

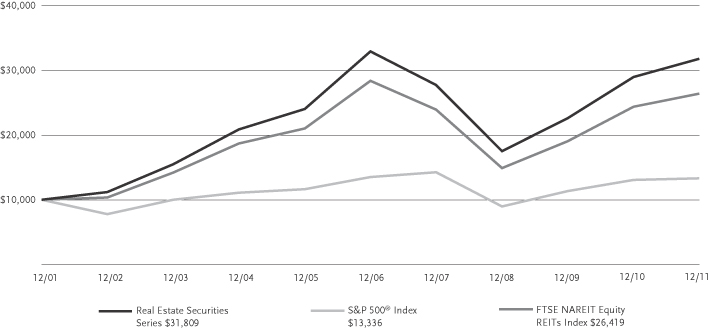

| | | | | | | | | | | | |

| Average Annual Total Return1 for periods ended 12/31/11 | | | | | | | | | |

| | | |

| | | 1 year | | | 5 years | | | 10 years | |

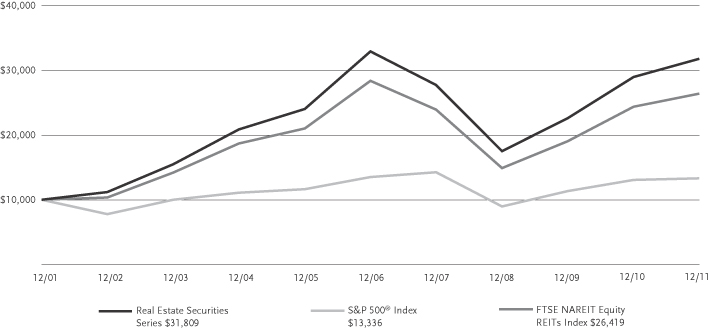

| Real Estate Securities Series | | | 9.87 | % | | | –0.69 | % | | | 12.27 | % |

| S&P 500® Index | | | 2.11 | | | | –0.25 | | | | 2.92 | |

| FTSE NAREIT Equity REITs Index | | | 8.29 | | | | –1.42 | | | | 10.20 | |

| Series expense ratios2: Gross: 1.25%; Net: 1.10%. | |

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | The expense ratio of the Series is set forth according to the prospectus for the Series effective May 1, 2011, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. Net Expenses: Expenses reduced by a contractual waiver in effect through November 5, 2012. Gross Expenses: Does not reflect the effect of the contractual waiver. See the financial highlights for more current information. |

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2001. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

15

Portfolio Manager Commentary

| ¢ | | Virtus Small-Cap Growth Series (the “Series”) is diversified and has an investment objective of long-term capital growth. There is no guarantee that the Series will meet its objective. |

| ¢ | | For the fiscal year ended December 31, 2011, the Series returned 16.59%. For the same period, the S&P 500® Index, a broad-based equity index, returned 2.11% and the Russell 2000® Growth Index, the Series’ style-specific benchmark, returned –2.91%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above.

How did the market in which the Series invests perform during the Series’ fiscal year?

| ¢ | | U.S. markets ended the year mixed after a tumultuous global geo-political and macro-economic environment. Strong first and fourth quarters were offset by weak second and third quarters, which were influenced by Euro-zone collapse fears, the U.S. credit rating downgrade, and inklings of a double-dip recession within our borders. The fourth quarter alone was equally volatile, as initial hopes of a resolution in Europe led to a solid October after four straight down quarters, only to be met by a flat November and December as talks among European countries seemed to be going nowhere. |

| ¢ | | The top performing sectors for the reporting period were consumer staples, financial services, and health care while the materials and processing, technology, and consumer-discretionary sectors did not perform as strongly. |

| ¢ | | High-quality stocks, as measured by S&P Quality Rankings, outperformed low-quality stocks for the year. Additionally, less risky stocks, as measured by beta, had superior returns relative to more risky stocks. |

What factors affected the Series’ performance during its fiscal year?

| ¢ | | Given the high-quality tailwind, the Series outperformed the Russell 2000® Growth Index for the reporting period. |

| ¢ | | Performance of the Series was helped by strong stock selection and an underweight in the consumer-discretionary and consumer-staples sectors, as well as strong stock selection in the producer-durables sector. An underweight in utilities was the lowest contributor to performance during the period. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice.

Investing in the securities of small companies involves risks, such as relatively low trading volumes, more price volatility and less liquidity than securities from larger, more established companies.

Because the Series is heavily weighted in the information technology sector, it will be impacted by that Sector’s performance more than a series with a broader sector diversification.

| | | | |

| |

| Asset Allocation | |

| |

The following table presents asset allocations within certain sectors and as a percentage of total investments as of December 31, 2011. | |

Information Technology | | | 35 | % |

Health Care | | | 20 | |

Consumer Discretionary | | | 15 | |

Industrials | | | 15 | |

Financials | | | 10 | |

Consumer Staples | | | 3 | |

Other (includes short-term investments) | | | 2 | |

| | | | | |

Total | | | 100 | % |

| | | | | |

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

16

| | |

| Small-Cap Growth Series (Continued) | | |

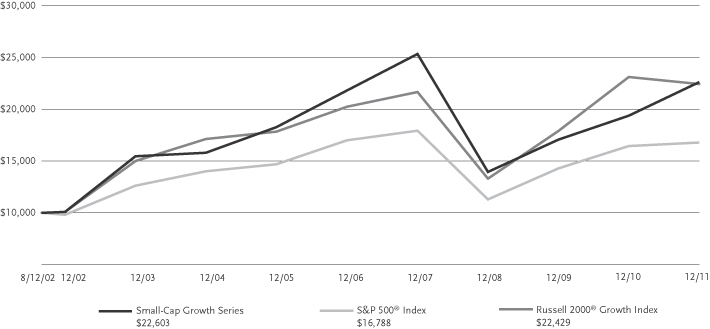

| | | | | | | | | | | | | | | | |

| Average Annual Total Return1 for periods ended 12/31/11 | | | | | | | | | | |

| | | | |

| | | 1 year | | | 5 years | | | Inception

to 12/31/11 | | | Inception

Date | |

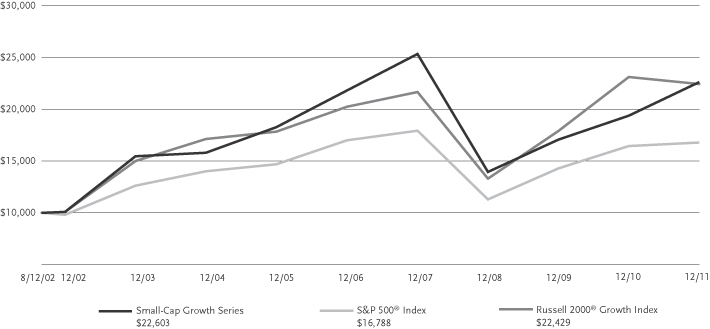

| Small-Cap Growth Series | | | 16.59 | % | | | 0.71 | % | | | 9.07 | % | | | 8/12/02 | |

| S&P 500® Index | | | 2.11 | | | | –0.25 | | | | 5.67 | | | | —3 | |

| Russell 2000® Growth Index | | | –2.91 | | | | 2.09 | | | | 8.98 | | | | —3 | |

| Series expense ratios2: Gross: 1.44%; Net: 1.05%. | | | | | | | | | | | | | | | | |

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | The expense ratios of the Series, both net and gross are set forth according to the prospectus for the Series effective May 1, 2011, as supplemented and revised, may differ from the expense ratios disclosed in the Financial Highlights tables in this report. Net Expenses: Expenses reduced by a contractual waiver in effect through November 5, 2012. Gross Expenses: Does not reflect the effect of the contractual waiver. See the financial highlights for more current information. |

| 3 | The since inception index returns are from the Series inception date. |

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on August 12, 2002 (inception of the Series). Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

17

Portfolio Manager Commentary

| ¢ | | Virtus Small-Cap Value Series (the “Series”) is diversified and has an investment objective of long-term capital appreciation. There is no guarantee that the Series will meet its objective. |

| ¢ | | For the fiscal year ended December 31, 2011, the Series returned 4.54%. For the same period, the S&P 500® Index, a broad-based equity index, returned 2.11% and the Russell 2000® Value Index, the Series’ style-specific benchmark, returned -5.50%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above.

How did the market in which the Series invests perform during the Series’ fiscal year?

| ¢ | | U.S. markets ended the year mixed after a tumultuous global geo-political and macro-economic environment. Strong first and fourth quarters were offset by weak second and third quarters, which were influenced by Euro-zone collapse fears, the U.S. credit rating downgrade, and inklings of a double-dip recession within our borders. The fourth quarter alone was equally volatile, as initial hopes of a resolution in Europe led to a solid October after four straight down quarters, only to be met by a flat November and December as talks among European countries seemed to be going nowhere. |

| ¢ | | The top performing sectors for the reporting period were the more defensive sectors of utilities, health care, and consumer staples while the technology, producer-durables, and consumer-discretionary sectors did not perform as strongly. |

| ¢ | | High-quality stocks, as measured by S&P Quality Rankings, outperformed low-quality stocks for the year. Additionally, less risky stocks, as measured by beta, had superior returns relative to more risky stocks. |

What factors affected the Series’ performance during its fiscal year?

| ¢ | | Given the high-quality tailwind, the Series outperformed the Russell 2000® Value Index for the reporting period. |

| ¢ | | Performance of the Series was helped by strong stock selection in the consumer-discretionary, producer-durables, and energy sectors. An underweight in utilities was the largest detractor from performance, given that the Series had a zero percent weight and this was the strongest performing sector for the period. Also, negative stock selection in health care detracted from performance. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice.

Investing in the securities of small companies involves risks, such as relatively low trading volumes, more price volatility and less liquidity than securities from larger, more established companies.

| | | | |

| |

| Asset Allocation | |

| |

The following table presents asset allocations within certain sectors and as a percentage of total investments as of December 31, 2011. | |

Industrials | | | 23 | % |

Financials | | | 19 | |

Information Technology | | | 19 | |

Consumer Discretionary | | | 14 | |

Energy | | | 9 | |

Health Care | | | 7 | |

Consumer Staples | | | 6 | |

Other (includes short-term investments) | | | 3 | |

| | | | | |

Total | | | 100 | % |

| | | | | |

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

18

| | |

| Small-Cap Value Series (Continued) | | |

| | | | | | | | | | | | |

| Average Annual Total Return1 for periods ended 12/31/11 | | | | | | | | | |

| | | |

| | | 1 year | | | 5 years | | | 10 years | |

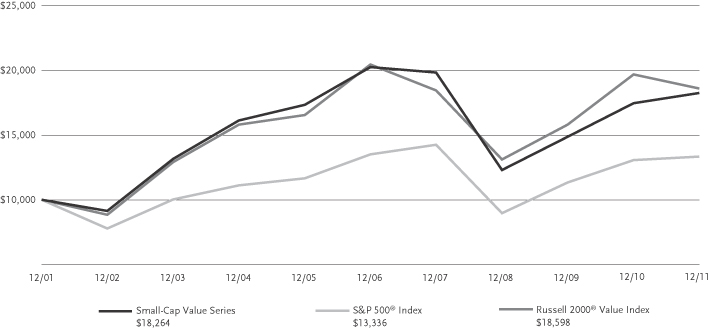

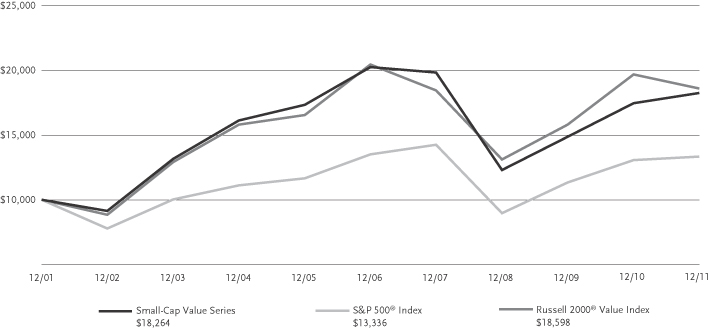

| Small-Cap Value Series | | | 4.54 | % | | | –2.04 | % | | | 6.21 | % |

| S&P 500® Index | | | 2.11 | | | | –0.25 | | | | 2.92 | |

| Russell 2000® Value Index | | | –5.50 | | | | –1.87 | | | | 6.40 | |

| Series expense ratios2: Gross: 1.41%; Net: 1.30%. | | | | | | | | | | | | |

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | The expense ratios of the Series, both net and gross are set forth according to the prospectus for the Series effective May 1, 2011, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. Net Expenses: Expenses reduced by a contractual waiver in effect through November 5, 2012. Gross Expenses: Does not reflect the effect of the contractual waiver. See the financial highlights for more current information. |

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2001. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

19

| | |

| Strategic Allocation Series | | |

Portfolio Manager Commentary

| ¢ | | Virtus Strategic Allocation Series (the “Series”) is diversified and has an investment objective of high total return over an extended period of time consistent with prudent investment risk. There is no guarantee that the Series will meet its objective. |

| ¢ | | For the fiscal year ended December 31, 2011, the Series returned 1.91%. For the same period, the S&P 500® Index, a broad-based equity index, returned 2.11% and the Barclays Capital U.S. Aggregate Bond Index, a broad-based fixed income index, returned 7.84%. The Composite Index for the Series, the Series’ style-specific benchmark, returned 4.69%. |

All performance figures assume the reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above.

How did the markets perform during the Series’ fiscal year?

Equities:

| ¢ | | The S&P 500® Index ended the year with a slight gain of 2.11%, although that hides the extreme volatility experienced by the market. The year 2011 can be divided almost in half, with the first two quarters being highlighted by higher stock prices, investors willing to buy cyclically sensitive stocks, and a general rise in asset prices. Beginning in mid-July things got much more difficult, as the market started a massive correction over concerns about the European debt crisis. While in the first six months stocks that had economically sensitive earnings did well, the second half of the year was marked by the much better performance of late-cycle equities such as utilities, consumer staple names, and other high dividend paying stocks. Volatility was also extreme, with so-called “headline risk” associated with both global economic growth data and news regarding Greece, and the European debt crisis, dominating price action, even in our own markets. In the end, the market managed a marginal gain, but it was a difficult market for most investors. |

Fixed Income:

| ¢ | | During the last 12 months the economy showed signs of improvement and the likelihood of the U.S. entering another recession diminished. This has been positive for spread sectors. However, during the year there have been periods of volatility and subsequent spread widening stemming from growing concerns over the sovereign debt crisis in Europe, the U.S. debt ceiling debate and subsequent loss of its AAA long-term rating by Standard & Poor’s, and global growth concerns. Overall U.S. Treasuries outperformed most spread sectors during the Series’ fiscal year. |

| ¢ | | Over the last 12 months yields declined across the U.S. Treasury curve and the curve flattened. |

What factors affected the Series’ performance during its fiscal year?

Equities:

| ¢ | | For most of the year the Series had a greater weighting in more economically sensitive stocks such as energy stocks, material and mining names and industrial stocks, which generally did very well in the first half of the year. While the Series managers did reduce holdings of many of these names early in the summer, it was not enough to offset the negative effects of the sell-off. Furthermore, the under-weighting in utilities and staple stocks created a head-wind for the Series as much of the back half of the year was dominated by a move to yield-oriented stocks. While on balance the Series did keep up with peers, the stretch between late July and early October was difficult and the Series slightly under-performed the S&P 500® Index on the year. |

Fixed Income:

| ¢ | | The underperformance of most spread sectors relative to U.S. Treasuries was a key factor that detracted from Series’ performance for the year. |

| ¢ | | Among fixed income sectors, the Series’ overweight to emerging markets, non-U.S. Dollar securities, corporate high yield, and corporate high quality securities detracted from the Series’ performance. |

| ¢ | | Strong issue selection within the commercial mortgage backed security sector benefited performance. |

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice, and there is no guarantee that market forecasts will be realized.

Portfolios that invest in high yield securities are subject to greater credit risk and price fluctuation than portfolios that invest in higher quality securities.

Investing internationally involves risks not associated with investing solely in the U.S., such as currency fluctuation, political risk, differences in accounting and the limited availability of information.

The value of mortgage-backed and other asset-backed securities, including pass-through type securities and collateralized mortgage obligations (CMOs) may fluctuate to a greater degree than other debt securities in response to interest rate changes.

| | | | | | | | |

| |

| Asset Allocation | |

| |

The following table presents asset allocations within certain sectors and as a percentage of total investments as of December 31, 2011. | |

Equities | | | | | | | | |

Common Stocks | | | | | | | 58 | % |

Energy | | | 11 | % | | | | |

Information Technology | | | 9 | % | | | | |

Industrials | | | 8 | % | | | | |

Total of all other common stock sectors | | | 30 | % | | | | |

Corporate Bonds | | | | | | | 20 | % |

Financials | | | 10 | % | | | | |

Industrials | | | 3 | % | | | | |

Energy | | | 2 | % | | | | |

Total of all other corporate bond sectors | | | 5 | % | | | | |

Mortgage-Backed Securities | | | | | | | 11 | % |

Municipal Bonds | | | | | | | 3 | % |

Exchange-Traded Funds | | | | | | | 3 | % |

Asset-Backed Securities | | | | | | | 2 | % |

Foreign Government Securities | | | | | | | 1 | % |

Loan Agreements | | | | | | | 1 | % |

Other | | | | | | | 1 | % |

| | | | | | | | | |

Total | | | | | | | 100 | % |

| | | | | | | | | |

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

20

| | |

| Strategic Allocation Series (Continued) | | |

| | | | | | | | | | | | |

| Average Annual Total Return1 for periods ended 12/31/11 | | | | | | | | | |

| | | |

| | | 1 year | | | 5 years | | | 10 years | |

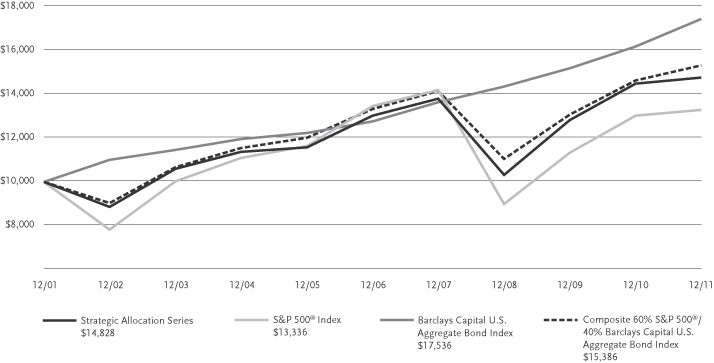

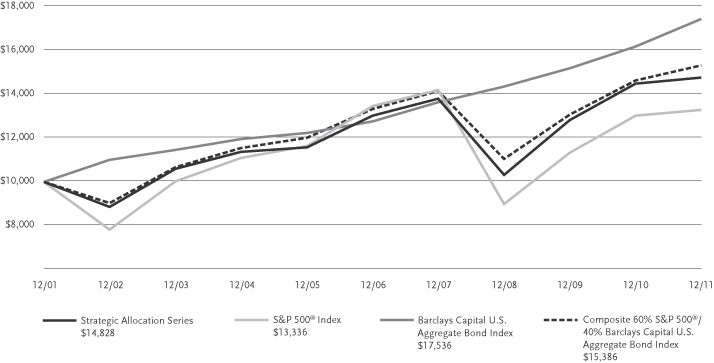

| Strategic Allocation Series | | | 1.91 | % | | | 2.56 | % | | | 4.02 | % |

| S&P 500® Index | | | 2.11 | | | | –0.25 | | | | 2.92 | |

| Barclays Capital U.S. Aggregate Bond Index | | | 7.84 | | | | 6.50 | | | | 5.70 | |

| Composite Index for Strategic Allocation Series | | | 4.69 | | | | 2.84 | | | | 4.40 | |

| Series expense ratios2: Gross: 1.09%; Net: 0.85%. | | | | | | | | | | | | |

Returns represent past performance, which is no guarantee of future results. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Total return does not reflect expenses associated with the separate account such as the administrative fees, account charges and surrender charges, which if reflected, would reduce total return. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Please visit Virtus.com for performance data current to the most recent month-end.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gains distributions. |

| 2 | The expense ratios of the Series are set forth according to the prospectus for the Series effective May 1, 2011, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. Net Expenses: Expenses reduced by a contractual waiver in effect through November 5, 2012. Gross Expenses: Does not reflect the effect of the contractual waiver. See the financial highlights for more current information. |

Growth of $10,000 For periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2001. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and key investment terms, see the Key Investment Terms starting on page 2.

21

VIRTUS CAPITAL GROWTH SERIES

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2011

($ reported in thousands)

| | | | | | | | |

| | | SHARES | | | VALUE | |

| COMMON STOCKS—98.9% | |

|

| Consumer Discretionary—15.8% | |

Bed Bath & Beyond, Inc.(2) | | | 61,300 | | | $ | 3,554 | |

Coach, Inc. | | | 88,100 | | | | 5,378 | |

McDonald’s Corp. | | | 58,400 | | | | 5,859 | |

NIKE, Inc. Class B | | | 57,700 | | | | 5,561 | |

priceline.com, Inc.(2) | | | 7,700 | | | | 3,601 | |

Ross Stores, Inc. | | | 125,000 | | | | 5,941 | |

| | | | | | | | |

| | | | | | | 29,894 | |

| | | | | | | | |

|

| Consumer Staples—13.6% | |

Coca-Cola Co. (The) | | | 84,000 | | | | 5,877 | |

Colgate-Palmolive Co. | | | 62,000 | | | | 5,728 | |