UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-04661 |

| |

| Exact name of registrant as specified in charter: | | Prudential Global Total Return Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 6 th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | | 655 Broad Street, 6 th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | |

| |

| Date of fiscal year end: | | 10/31/2024 |

| |

| Date of reporting period: | | 10/31/2024 |

Item 1 – Reports to Stockholders

(a) Report transmitted to stockholders pursuant to Rule

30e-1

under the Act (17 CFR

270.30e-1).

PGIM Global Total Return Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class A shares of PGIM Global Total Return Fund (the “Fund”) for the

period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Global Total Return Fund—Class A | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Global fixed income markets posted strong returns during the reporting period as spreads across investment grade corporates, high yield,

securitized credit, and emerging markets tightened. Moderating inflation data and a cooling of the labor market set the table for the first interest

rate cut by the US Federal Reserve (Fed) of this rate-cutting cycle, with US Treasury yields declining across the curve leading up to the Fed’s

0.50% rate cut in September.

■

Overall security selection and sector allocation both contributed to performance. Within sector allocation, overweights to emerging-markets high

yield, non-agency commercial mortgage-backed securities (CMBS) AA-and-below, and AAA collateralized loan obligations (CLOs) contributed

positively. For credit, security selection in banking, health care & pharmaceuticals, and consumer non-cyclicals contributed to performance.

■

Duration and yield curve positioning both detracted from performance, with positioning in developed-market rates detracting the most. Within

sector allocation, positioning in sovereigns and an underweight in mortgage-backed securities (MBS) detracted from performance. Within credit,

security selection in electric utilities and media & entertainment detracted.

■

The Fund used interest rate futures, options, and swaps as well as credit default swaps and foreign exchange forwards to help manage duration

positioning and yield curve exposure, manage currency exposure, and/or to hedge credit risk imposed by certain issuers. Overall, the use of

derivatives contributed to Fund performance.

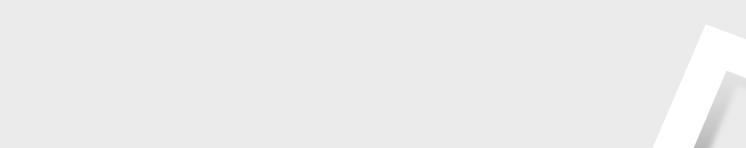

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class A shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: October 31, 2014 to October 31, 2024 Initial Investment of $10,000 |

The line graph reflects the return on the Fund's Class A shares with sales charges.

Average Annual Total Returns as of 10/31/2024 |

| | | |

Class A with sales charges | | | |

Class A without sales charges | | | |

Broad-Based Securities Market Index: Bloomberg Global Aggregate | | | |

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

Credit Quality expressed as a percentage of total investments as of 10/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Global Total Return Fund

PGIM Global Total Return Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class C shares of PGIM Global Total Return Fund (the “Fund”) for the

period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Global Total Return Fund—Class C | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Global fixed income markets posted strong returns during the reporting period as spreads across investment grade corporates, high yield,

securitized credit, and emerging markets tightened. Moderating inflation data and a cooling of the labor market set the table for the first interest

rate cut by the US Federal Reserve (Fed) of this rate-cutting cycle, with US Treasury yields declining across the curve leading up to the Fed’s

0.50% rate cut in September.

■

Overall security selection and sector allocation both contributed to performance. Within sector allocation, overweights to emerging-markets high

yield, non-agency commercial mortgage-backed securities (CMBS) AA-and-below, and AAA collateralized loan obligations (CLOs) contributed

positively. For credit, security selection in banking, health care & pharmaceuticals, and consumer non-cyclicals contributed to performance.

■

Duration and yield curve positioning both detracted from performance, with positioning in developed-market rates detracting the most. Within

sector allocation, positioning in sovereigns and an underweight in mortgage-backed securities (MBS) detracted from performance. Within credit,

security selection in electric utilities and media & entertainment detracted.

■

The Fund used interest rate futures, options, and swaps as well as credit default swaps and foreign exchange forwards to help manage duration

positioning and yield curve exposure, manage currency exposure, and/or to hedge credit risk imposed by certain issuers. Overall, the use of

derivatives contributed to Fund performance.

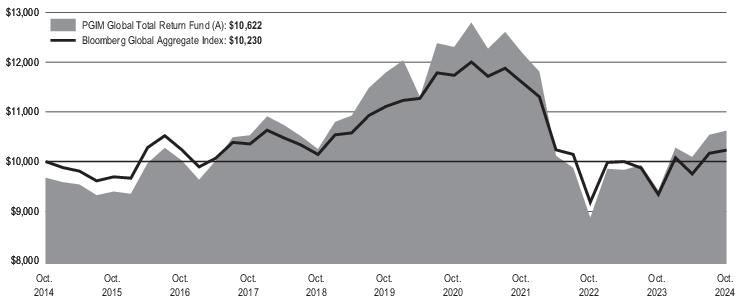

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class C shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver

of

fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: October 31, 2014 to October 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 10/31/2024 |

| | | |

Class C with sales charges | | | |

Class C without sales charges | | | |

Broad-Based Securities Market Index: Bloomberg Global Aggregate | | | |

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

Credit Quality expressed as a percentage of total investments as of 10/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Global Total Return Fund

PGIM Global Total Return Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class Z shares of PGIM Global Total Return Fund (the “Fund”) for the

period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Global Total Return Fund—Class Z | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Global fixed income markets posted strong returns during the reporting period as spreads across investment grade corporates, high yield,

securitized credit, and emerging markets tightened. Moderating inflation data and a cooling of the labor market set the table for the first interest

rate cut by the US Federal Reserve (Fed) of this rate-cutting cycle, with US Treasury yields declining across the curve leading up to the Fed’s

0.50% rate cut in September.

■

Overall security selection and sector allocation both contributed to performance. Within sector allocation, overweights to emerging-markets high

yield, non-agency commercial mortgage-backed securities (CMBS) AA-and-below, and AAA collateralized loan obligations (CLOs) contributed

positively. For credit, security selection in banking, health care & pharmaceuticals, and consumer non-cyclicals contributed to performance.

■

Duration and yield curve positioning both detracted from performance, with positioning in developed-market rates detracting the most. Within

sector allocation, positioning in sovereigns and an underweight in mortgage-backed securities (MBS) detracted from performance. Within credit,

security selection in electric utilities and media & entertainment detracted.

■

The Fund used interest rate futures, options, and swaps as well as credit default swaps and foreign exchange forwards to help manage duration

positioning and yield curve exposure, manage currency exposure, and/or to hedge credit risk imposed by certain issuers. Overall, the use of

derivatives contributed to Fund performance.

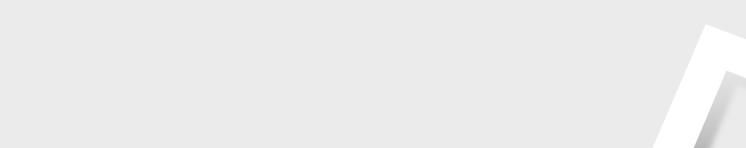

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class Z shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: October 31, 2014 to October 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 10/31/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: Bloomberg Global Aggregate | | | |

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

Credit Quality expressed as a percentage of total investments as of 10/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Global Total Return Fund

PGIM Global Total Return Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class R2 shares of PGIM Global Total Return Fund (the “Fund”) for the

period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Global Total Return Fund—Class R2 | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Global fixed income markets posted strong returns during the reporting period as spreads across investment grade corporates, high yield,

securitized credit, and emerging markets tightened. Moderating inflation data and a cooling of the labor market set the table for the first interest

rate cut by the US Federal Reserve (Fed) of this rate-cutting cycle, with US Treasury yields declining across the curve leading up to the Fed’s

0.50% rate cut in September.

■

Overall security selection and sector allocation both contributed to performance. Within sector allocation, overweights to emerging-markets high

yield, non-agency commercial mortgage-backed securities (CMBS) AA-and-below, and AAA collateralized loan obligations (CLOs) contributed

positively. For credit, security selection in banking, health care & pharmaceuticals, and consumer non-cyclicals contributed to performance.

■

Duration and yield curve positioning both detracted from performance, with positioning in developed-market rates detracting the most. Within

sector allocation, positioning in sovereigns and an underweight in mortgage-backed securities (MBS) detracted from performance. Within credit,

security selection in electric utilities and media & entertainment detracted.

■

The Fund used interest rate futures, options, and swaps as well as credit default swaps and foreign exchange forwards to help manage duration

positioning and yield curve exposure, manage currency exposure, and/or to hedge credit risk imposed by certain issuers. Overall, the use of

derivatives contributed to Fund performance.

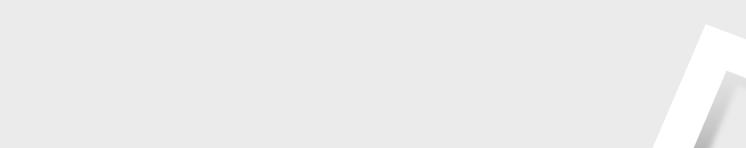

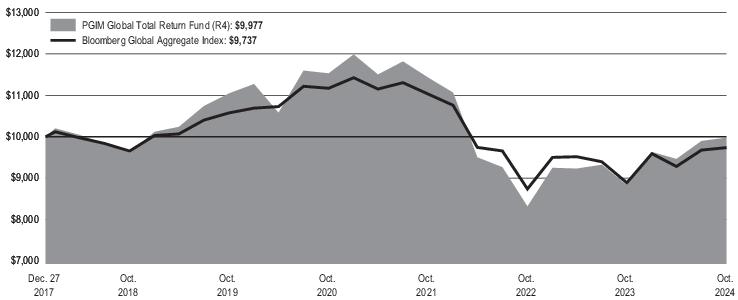

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R2 shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 27, 2017 to October 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 10/31/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: Bloomberg Global | | | |

Since Inception returns are provided for the share class since it has less than 10

fiscal

years of returns. Since Inception returns for the Index are measured from the

closest month-end to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

Credit Quality expressed as a percentage of total investments as of 10/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Global Total Return Fund

PGIM Global Total Return Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class R4 shares of PGIM Global Total Return Fund (the “Fund”) for the

period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Global Total Return Fund—Class R4 | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Global fixed income markets posted strong returns during the reporting period as spreads across investment grade corporates, high yield,

securitized credit, and emerging markets tightened. Moderating inflation data and a cooling of the labor market set the table for the first interest

rate cut by the US Federal Reserve (Fed) of this rate-cutting cycle, with US Treasury yields declining across the curve leading up to the Fed’s

0.50% rate cut in September.

■

Overall security selection and sector allocation both contributed to performance. Within sector allocation, overweights to emerging-markets high

yield, non-agency commercial mortgage-backed securities (CMBS) AA-and-below, and AAA collateralized loan obligations (CLOs) contributed

positively. For credit, security selection in banking, health care & pharmaceuticals, and consumer non-cyclicals contributed to performance.

■

Duration and yield curve positioning both detracted from performance, with positioning in developed-market rates detracting the most. Within

sector allocation, positioning in sovereigns and an underweight in mortgage-backed securities (MBS) detracted from performance. Within credit,

security selection in electric utilities and media & entertainment detracted.

■

The Fund used interest rate futures, options, and swaps as well as credit default swaps and foreign exchange forwards to help manage duration

positioning and yield curve exposure, manage currency exposure, and/or to hedge credit risk imposed by certain issuers. Overall, the use of

derivatives contributed to Fund performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R4 shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 27, 2017 to October 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 10/31/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: Bloomberg Global | | | |

Since Inception returns are provided for the share class since it has less than 10

fiscal

years of returns. Since Inception returns for the Index are measured from the

closest month-end to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

Credit Quality expressed as a percentage of total investments as of 10/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Global Total Return Fund

PGIM Global Total Return Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class R6 shares of PGIM Global Total Return Fund (the “Fund”) for the

period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Global Total Return Fund—Class R6 | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Global fixed income markets posted strong returns during the reporting period as spreads across investment grade corporates, high yield,

securitized credit, and emerging markets tightened. Moderating inflation data and a cooling of the labor market set the table for the first interest

rate cut by the US Federal Reserve (Fed) of this rate-cutting cycle, with US Treasury yields declining across the curve leading up to the Fed’s

0.50% rate cut in September.

■

Overall security selection and sector allocation both contributed to performance. Within sector allocation, overweights to emerging-markets high

yield, non-agency commercial mortgage-backed securities (CMBS) AA-and-below, and AAA collateralized loan obligations (CLOs) contributed

positively. For credit, security selection in banking, health care & pharmaceuticals, and consumer non-cyclicals contributed to performance.

■

Duration and yield curve positioning both detracted from performance, with positioning in developed-market rates detracting the most. Within

sector allocation, positioning in sovereigns and an underweight in mortgage-backed securities (MBS) detracted from performance. Within credit,

security selection in electric utilities and media & entertainment detracted.

■

The Fund used interest rate futures, options, and swaps as well as credit default swaps and foreign exchange forwards to help manage duration

positioning and yield curve exposure, manage currency exposure, and/or to hedge credit risk imposed by certain issuers. Overall, the use of

derivatives contributed to Fund performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R6 shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: October 31, 2014 to October 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 10/31/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: Bloomberg Global Aggregate | | | |

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

Credit Quality expressed as a percentage of total investments as of 10/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Global Total Return Fund

PGIM Global Total Return (USD Hedged) Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class A shares of PGIM Global Total Return (USD Hedged) Fund (the

“Fund”) for the period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Global Total Return (USD Hedged) Fund— | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Global fixed income markets posted strong returns during the reporting period as spreads across investment grade corporates, high yield,

securitized credit, and emerging markets tightened. Moderating inflation data and a cooling of the labor market set the table for the first interest

rate cut by the US Federal Reserve (Fed) of this rate-cutting cycle, with US Treasury yields declining across the curve leading up to the Fed’s

0.50% rate cut in September.

■

Overall, security selection and sector allocation both contributed to the Fund’s performance. Within security allocation, overweights to emerging

markets high yield, US investment grade corporates, and AAA collateralized loan obligations (CLOs) relative to the Bloomberg Global

Aggregate (USD Hedged) Index contributed the most. Within credit security selection, health care & pharmaceuticals, retailers & restaurants,

and consumer non-cyclicals contributed to performance.

■

Duration and yield curve positioning detracted from performance, with positioning in developed-market rates detracting the most. On a sector

level, an underweight to mortgage-backed securities (MBS) and positioning in sovereigns detracted from performance. Within credit, security

selection in telecommunications, electric utilities, and media & entertainment detracted.

■

The Fund used interest rate futures, options, swaps, credit default swaps, and foreign exchange forwards to help manage duration positioning

and yield curve exposure and/or hedge credit risk imposed by certain issuers, and to managed foreign currency exposure, which collectively

contributed to performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

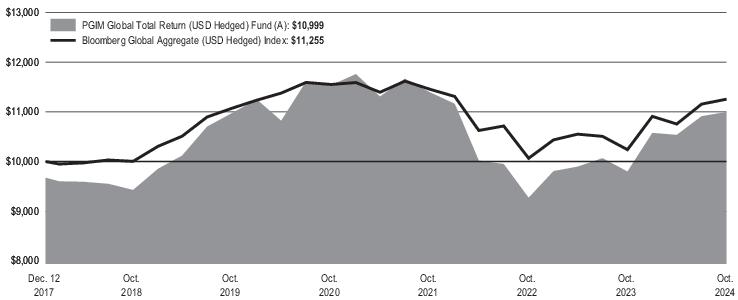

The line graph reflects a hypothetical $10,000 investment in Class A shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 12, 2017 to October 31, 2024 Initial Investment of $10,000 |

The line graph reflects the return on the Fund's Class A shares with sales charges.

Average Annual Total Returns as of 10/31/2024 |

| | | |

Class A with sales charges | | | |

Class A without sales charges | | | |

Broad-Based Securities Market Index: Bloomberg Global Aggregate (USD Hedged) Index | | | |

Since Inception returns are provided for the share class since it has less than 10 fiscal

years

of returns. Since Inception returns for the Index are measured from the

closest month-end to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

Credit Quality expressed as a percentage of total investments as of 10/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Global Total Return (USD Hedged) Fund

PGIM Global Total Return (USD Hedged) Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class C shares of PGIM Global Total Return (USD Hedged) Fund (the

“Fund”) for the period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Global Total Return USD Hedged Fund— | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Global fixed income markets posted strong returns during the reporting period as spreads across investment grade corporates, high yield,

securitized credit, and emerging markets tightened. Moderating inflation data and a cooling of the labor market set the table for the first interest

rate cut by the US Federal Reserve (Fed) of this rate-cutting cycle, with US Treasury yields declining across the curve leading up to the Fed’s

0.50% rate cut in September.

■

Overall, security selection and sector allocation both contributed to the Fund’s performance. Within security allocation, overweights to emerging

markets high yield, US investment grade corporates, and AAA collateralized loan obligations (CLOs) relative to the Bloomberg Global

Aggregate (USD Hedged) Index contributed the most. Within credit security selection, health care & pharmaceuticals, retailers & restaurants,

and consumer non-cyclicals contributed to performance.

■

Duration and yield curve positioning detracted from performance, with positioning in developed-market rates detracting the most. On a sector

level, an underweight to mortgage-backed securities (MBS) and positioning in sovereigns detracted from performance. Within credit, security

selection in telecommunications, electric utilities, and media & entertainment detracted.

■

The Fund used interest rate futures, options, swaps, credit default swaps, and foreign exchange forwards to help manage duration positioning

and yield curve exposure and/or hedge credit risk imposed by certain issuers, and to managed foreign currency exposure, which collectively

contributed to performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

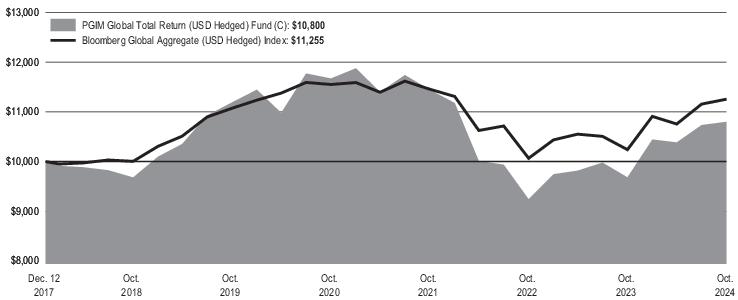

The line graph reflects a hypothetical $10,000 investment in Class C shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 12, 2017 to October 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 10/31/2024 |

| | | |

Class C with sales charges | | | |

Class C without sales charges | | | |

Broad-Based Securities Market Index: Bloomberg Global Aggregate (USD Hedged) Index | | | |

Since Inception returns are provided for the share class since it has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the

closest month-end to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

Credit Quality expressed as a percentage of total investments as of 10/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Global Total Return (USD Hedged) Fund

PGIM Global Total Return (USD Hedged) Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class Z shares of PGIM Global Total Return (USD Hedged) Fund (the

“Fund”) for the period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Global Total Return USD Hedged Fund— | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Global fixed income markets posted strong returns during the reporting period as spreads across investment grade corporates, high yield,

securitized credit, and emerging markets tightened. Moderating inflation data and a cooling of the labor market set the table for the first interest

rate cut by the US Federal Reserve (Fed) of this rate-cutting cycle, with US Treasury yields declining across the curve leading up to the Fed’s

0.50% rate cut in September.

■

Overall, security selection and sector allocation both contributed to the Fund’s performance. Within security allocation, overweights to emerging

markets high yield, US investment grade corporates, and AAA collateralized loan obligations (CLOs) relative to the Bloomberg Global

Aggregate (USD Hedged) Index contributed the most. Within credit security selection, health care & pharmaceuticals, retailers & restaurants,

and consumer non-cyclicals contributed to performance.

■

Duration and yield curve positioning detracted from performance, with positioning in developed-market rates detracting the most. On a sector

level, an underweight to mortgage-backed securities (MBS) and positioning in sovereigns detracted from performance. Within credit, security

selection in telecommunications, electric utilities, and media & entertainment detracted.

■

The Fund used interest rate futures, options, swaps, credit default swaps, and foreign exchange forwards to help manage duration positioning

and yield curve exposure and/or hedge credit risk imposed by certain issuers, and to managed foreign currency exposure, which collectively

contributed to performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class Z shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 12, 2017 to October 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 10/31/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: Bloomberg Global Aggregate (USD Hedged) Index | | | |

Since Inception returns are provided for the share class since it has less than 10 fiscal years of returns. Since Inception

returns

for the Index are measured from the

closest month-end to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

Credit Quality expressed as a percentage of total investments as of 10/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Global Total Return (USD Hedged) Fund

PGIM Global Total Return (USD Hedged) Fund

ANNUAL SHAREHOLDER REPORT – October 31, 2024

This annual shareholder report contains important information about the Class R6 shares of PGIM Global Total Return (USD Hedged) Fund (the

“Fund”) for the period of November 1, 2023 to October 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM Global Total Return USD Hedged Fund— | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

Global fixed income markets posted strong returns during the reporting period as spreads across investment grade corporates, high yield,

securitized credit, and emerging markets tightened. Moderating inflation data and a cooling of the labor market set the table for the first interest

rate cut by the US Federal Reserve (Fed) of this rate-cutting cycle, with US Treasury yields declining across the curve leading up to the Fed’s

0.50% rate cut in September.

■

Overall, security selection and sector allocation both contributed to the Fund’s performance. Within security allocation, overweights to emerging

markets high yield, US investment grade corporates, and AAA collateralized loan obligations (CLOs) relative to the Bloomberg Global

Aggregate (USD Hedged) Index contributed the most. Within credit security selection, health care & pharmaceuticals, retailers & restaurants,

and consumer non-cyclicals contributed to performance.

■

Duration and yield curve positioning detracted from performance, with positioning in developed-market rates detracting the most. On a sector

level, an underweight to mortgage-backed securities (MBS) and positioning in sovereigns detracted from performance. Within credit, security

selection in telecommunications, electric utilities, and media & entertainment detracted.

■

The Fund used interest rate futures, options, swaps, credit default swaps, and foreign exchange forwards to help manage duration positioning

and yield curve exposure and/or hedge credit risk imposed by certain issuers, and to managed foreign currency exposure, which collectively

contributed to performance.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

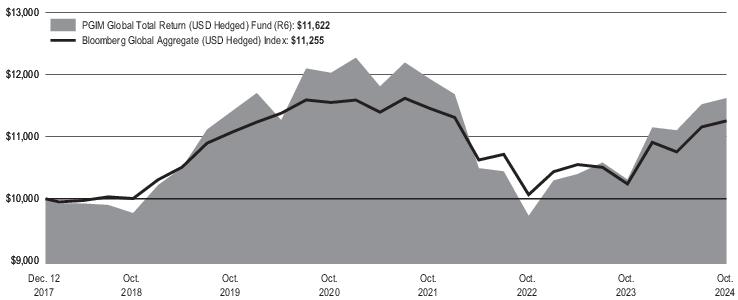

The line graph reflects a hypothetical $10,000 investment in Class R6 shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: December 12, 2017 to October 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 10/31/2024 |

| | | |

| | | |

Broad-Based Securities Market Index: Bloomberg Global Aggregate (USD Hedged) Index | | | |

Since Inception returns are provided for the share class since it has less

than

10 fiscal years of returns. Since Inception returns for the Index are measured from the

closest month-end to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 10/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 10/31/2024?

Credit Quality expressed as a percentage of total investments as of 10/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM Global Total Return (USD Hedged) Fund

| | (b) | Copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule – Not applicable. |

Item 2 – Code of Ethics – See Exhibit (a)

As of the end of the period covered by this report, the registrant has adopted a code of ethics (the “Section 406 Standards for Investment Companies – Ethical Standards for Principal Executive and Financial Officers”) that applies to the registrant’s Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer.

The registrant hereby undertakes to provide any person, without charge, upon request, a copy of the code of ethics. To request a copy of the code of ethics, contact the registrant 800-225-1852, and ask for a copy of the Section 406 Standards for Investment Companies - Ethical Standards for Principal Executive and Financial Officers.

Item 3 – Audit Committee Financial Expert –

The registrant’s Board has determined that Ms. Grace C. Torres, member of the Board’s Audit Committee is an “audit committee financial expert,” and that she is “independent,” for purposes of this item.

Item 4 – Principal Accountant Fees and Services –

For the fiscal years ended October 31, 2024 and October 31, 2023, PricewaterhouseCoopers LLP (“PwC”), the Registrant’s principal accountant, billed the Registrant $119,785 and $112,890, respectively, for professional services rendered for the audit of the Registrant’s annual financial statements or services that are normally provided in connection with statutory and regulatory filings.

For the fiscal years ended October 31, 2024 and October 31, 2023: none.

For the fiscal years ended October 31, 2024 and October 31, 2023: none.

For the fiscal years ended October 31, 2024 and October 31, 2023: none.

| | (e) | (1) Audit Committee Pre-Approval Policies and Procedures |

THE PGIM MUTUAL FUNDS

AUDIT COMMITTEE POLICY

on

Pre-Approval of Services Provided by the Independent Accountants

The Audit Committee of each PGIM Mutual Fund is charged with the responsibility to monitor the independence of the Fund’s independent accountants. As part of this responsibility, the Audit Committee must pre-approve the independent accounting firm’s engagement to render audit and/or permissible non-audit services, as required by law. In evaluating a proposed engagement of the independent accountants, the Audit Committee will assess the effect that the engagement might reasonably be expected to have on the accountant’s independence. The Committee’s evaluation will be based on:

| | • | | a review of the nature of the professional services expected to be provided, |

| | • | | a review of the safeguards put into place by the accounting firm to safeguard independence, and |

| | • | | periodic meetings with the accounting firm. |

Policy for Audit and Non-Audit Services Provided to the Funds

On an annual basis, the scope of audits for each Fund, audit fees and expenses, and audit-related and non-audit services (and fees proposed in respect thereof) proposed to be performed by the Fund’s independent accountants will be presented by the Treasurer and the independent accountants to the Audit Committee for review and, as appropriate, approval prior to the initiation of such services.

Such presentation shall be accompanied by confirmation by both the Treasurer and the independent accountants that the proposed non-audit services will not adversely affect the independence of the independent accountants. Such proposed non-audit services shall be described in sufficient detail to enable the Audit Committee to assess the appropriateness of such services and fees, and the compatibility of the provision of such services with the auditor’s independence. The Committee shall receive periodic reports on the progress of the audit and other services which are approved by the Committee or by the Committee Chair pursuant to authority delegated in this Policy.

The categories of services enumerated under “Audit Services”, “Audit-related Services”, and “Tax Services” are intended to provide guidance to the Treasurer and the independent accountants as to those categories of services which the Committee believes are generally consistent with the independence of the independent accountants and which the Committee (or the Committee Chair) would expect upon the presentation of specific proposals to pre-approve. The enumerated categories are not intended as an exclusive list of audit, audit-related or tax services, which the Committee (or the Committee Chair) would consider for pre-approval.

Audit Services

The following categories of audit services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Annual Fund financial statement audits |

| | • | | Seed audits (related to new product filings, as required) |

| | • | | SEC and regulatory filings and consents |

Audit-related Services

The following categories of audit-related services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Accounting consultations |

| | • | | Fund merger support services |

| | • | | Agreed Upon Procedure Reports |

| | • | | Other Internal Control Reports |

Individual audit-related services that fall within one of these categories (except for fund merger support services) and are not presented to the Audit Committee as part of the annual pre-approval process are subject to an authorized pre-approval by the Audit Committee so long as the estimated fee for those services does not exceed $30,000. Any services provided under such pre-approval will be reported to the Audit Committee at its next regular meeting. Should the amount of such services exceed $30,000 any additional fees will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated). Fees related to fund merger support services are subject to a separate authorized pre-approval by the Audit Committee with fees determined on a per occurrence and merger complexity basis.

Tax Services

The following categories of tax services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Tax compliance services related to the filing or amendment of the following: |

| | • | | Federal, state and local income tax compliance; and, |

| | • | | Sales and use tax compliance |

| | • | | Timely RIC qualification reviews |

| | • | | Tax distribution analysis and planning |

| | • | | Tax authority examination services |

| | • | | Tax appeals support services |

| | • | | Accounting methods studies |

| | • | | Fund merger support services |

| | • | | Tax consulting services and related projects |

Individual tax services that fall within one of these categories and are not presented to the Audit Committee as part of the annual pre-approval process are subject to an authorized pre-approval by the Audit Committee so long as the estimated fee for those services does not exceed $30,000. Any services provided under such pre-approval will be reported to the Audit Committee at its next regular meeting. Should the amount of such services exceed $30,000 any additional fees will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated).

Other Non-Audit Services

Certain non-audit services that the independent accountants are legally permitted to render will be subject to pre-approval by the Committee or by one or more Committee members to whom the Committee has delegated this authority and who will report to the full Committee any pre-approval decisions made pursuant to this Policy. Non-audit services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Proscribed Services

The Fund’s independent accountants will not render services in the following categories of non-audit services:

| | • | | Bookkeeping or other services related to the accounting records or financial statements of the Fund |

| | • | | Financial information systems design and implementation |

| | • | | Appraisal or valuation services, fairness opinions, or contribution-in-kind reports |

| | • | | Internal audit outsourcing services |

| | • | | Management functions or human resources |

| | • | | Broker or dealer, investment adviser, or investment banking services |

| | • | | Legal services and expert services unrelated to the audit |

| | • | | Any other service that the Public Company Accounting Oversight Board determines, by regulation, is impermissible. |

Pre-approval of Non-Audit Services Provided to Other Entities Within the PGIM Fund Complex

Certain non-audit services provided to PGIM Investments LLC or any of its affiliates that also provide ongoing services to the PGIM Mutual Funds will be subject to pre-approval by the Audit Committee. The only non-audit services provided to these entities that will require pre-approval are those related directly to the operations and financial reporting of the Funds. Individual projects that are not presented to the Audit Committee as part of the annual pre-approval process will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated) so long as the estimated fee for those services does not exceed $30,000. Services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Although the Audit Committee will not pre-approve all services provided to PGIM Investments LLC and its affiliates, the Committee will receive an annual report from the Fund’s independent accounting firm showing the aggregate fees for all services provided to PGIM Investments and its affiliates.

| | |

| (e) (2) | | Percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X – |

| | |

| | | | | | | | |

| | | | | Fiscal Year Ended October 31,

2024 | | Fiscal Year Ended October 31,

2023 | | |

| | 4(b) | | Not applicable. | | Not applicable. | | |

| | 4(c) | | Not applicable. | | Not applicable. | | |

| | 4(d) | | Not applicable. | | Not applicable. | | |

| (f) | Percentage of hours expended attributable to work performed by other than full time employees of principal accountant if greater than 50%. |

The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was 0%.

The aggregate non-audit fees billed by the Registrant’s principal accountant for services rendered to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant for the fiscal years ended October 31, 2024 and October 31, 2023 was $0 and $0, respectively.

| (h) | Principal Accountant’s Independence |

Not applicable as the Registrant’s principal accountant has not provided non-audit services to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X.

Item 5 – Audit Committee of Listed Registrants – Not applicable.

| | |

| Item 6 – | | Investments – The registrant’s Schedule of Investments is included in the financial statements filed under Item 7 of this Form. |

| Items 7 | – 11 (Refer to Report below) |

PRUDENTIAL GLOBAL TOTAL RETURN FUND, INC.

PGIM Global Total Return Fund

PGIM Global Total Return (USD Hedged) Fund

FINANCIAL STATEMENTS AND OTHER INFORMATION

OCTOBER 31, 2024

| | | | |

Table of Contents | | Financial Statements and Other Information | | October 31, 2024 |

Form N-CSR Item 7 - Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Other Information - Form N-CSR Items 8-11

Glossary

The following abbreviations are used in the Funds’ descriptions:

AUD—Australian Dollar

BRL—Brazilian Real

CAD—Canadian Dollar

CHF—Swiss Franc

CLP—Chilean Peso

CNH—Chinese Renminbi

CNY—China Yuan

COP—Colombian Peso

CZK—Czech Koruna

DKK—Danish Krone

EUR—Euro

GBP—British Pound

HKD—Hong Kong Dollar

HUF—Hungarian Forint

IDR—Indonesian Rupiah

ILS—Israeli Shekel

ITL—Italian Lira

JPY—Japanese Yen

KRW—South Korean Won

MXN—Mexican Peso

MYR—Malaysian Ringgit

NOK—Norwegian Krone

NZD—New Zealand Dollar

PEN—Peruvian Nuevo Sol

PLN—Polish Zloty

RON—Romanian Leu

SAR—Saudi Arabian Riyal

SEK—Swedish Krona

SGD—Singapore Dollar

THB—Thai Baht

TWD—New Taiwanese Dollar

USD—US Dollar

USD—US Dollar

ZAR—South African Rand

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

1

A—Annual payment frequency for swaps

AID—Agency for International Development

BARC—Barclays Bank PLC

BBR—New Zealand Bank Bill Rate

BBSW—Australian Bank Bill Swap Reference Rate

BNP—BNP Paribas S.A.

BNYM—Bank of New York Mellon

BOA—Bank of America, N.A.

BROIS—Brazil Overnight Index Swap

BTP—Buoni del Tesoro Poliennali

BUBOR—Budapest Interbank Offered Rate

CAC—French Stock Market Index

CDX—Credit Derivative Index

CF—CF Secured, LLC

CIBOR—Copenhagen Interbank Offered Rate

CITI—Citibank, N.A.

CLO—Collateralized Loan Obligation

CLOIS—Sinacofi Chile Interbank Rate Average

CME—Chicago Mercantile Exchange

CMS—Constant Maturity Swap

CORRA—Canadian Overnight Repo Rate Average

DAC—Designated Activity Company

DB—Deutsche Bank AG

EMTN—Euro Medium Term Note

ETF—Exchange-Traded Fund

EURIBOR—Euro Interbank Offered Rate

EuroSTR—Euro Short-Term Rate

FHLMC—Federal Home Loan Mortgage Corporation

GMTN—Global Medium Term Note

GS—Goldman Sachs & Co. LLC

GSI—Goldman Sachs International

HSBC—HSBC Bank PLC

ICE—Intercontinental Exchange

IG—Investment Grade

IO—Interest Only (Principal amount represents notional)

JIBAR—Johannesburg Interbank Agreed Rate

JPM—JPMorgan Chase Bank N.A.

JPS—J.P. Morgan Securities LLC

KLIBOR—Kuala Lumpur Interbank Offered Rate

2

KWCDC—Korean Won Certificate of Deposit

LIBOR—London Interbank Offered Rate

LP—Limited Partnership

M—Monthly payment frequency for swaps

MASTR—Morgan Stanley Structured Asset Security

MPLE—Maple Bonds

MSI—Morgan Stanley & Co International PLC

MTN—Medium Term Note

MUNIPSA—Municipal Swap Weekly Yield Index

N/A—Not Applicable

NIBOR—Norwegian Interbank Offered Rate

OAT—Obligations Assimilables du Tresor

OTC—Over-the-counter

PIK—Payment-in-Kind

PJSC—Public Joint-Stock Company

PRIBOR—Prague Interbank Offered Rate

Q—Quarterly payment frequency for swaps

REMIC—Real Estate Mortgage Investment Conduit

S—Semiannual payment frequency for swaps

SAIBOR—Saudi Arabian Interbank Offered Rate

SARON—Swiss Average Rate Overnight

SCB—Standard Chartered Bank

SOFR—Secured Overnight Financing Rate

SONIA—Sterling Overnight Index Average

SORA—Singapore Overnight Rate Average

SSB—State Street Bank & Trust Company

STIBOR—Stockholm Interbank Offered Rate

T—Swap payment upon termination

TAIBOR—Taiwan Interbank Offered Rate

TELBOR—Tel Aviv Interbank Offered Rate

THOR—Thai Overnight Repurchase Rate

TONAR—Tokyo Overnight Average Rate

UBS—UBS Securities LLC

USOIS—United States Overnight Index Swap

WIBOR—Warsaw Interbank Offered Rate

3

PGIM Global Total Return Fund

Schedule of Investments

as of October 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | | |

LONG-TERM INVESTMENTS 98.8% | | | | | | | | | | | | | | | | |

| | | | | |

ASSET-BACKED SECURITIES 11.5% | | | | | | | | | | | | | | | | |

| | | | | |

Canada 0.2% | | | | | | | | | | | | | | | | |

| | | | | |

Evergreen Credit Card Trust, | | | | | | | | | | | | | | | | |

Series 2024-CRT04, Class C, 144A | | 5.640% | | 10/16/28 | | | | | | | 5,600 | | | $ | 5,585,218 | |

Fairstone Financial Issuance Trust, | | | | | | | | | | | | | | | | |

Series 2020-01A, Class A, 144A | | 2.509 | | 10/20/39 | | | CAD | | | | 360 | | | | 256,578 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 5,841,796 | |

| | | | | |

Cayman Islands 2.0% | | | | | | | | | | | | | | | | |

| | | | | |

Battalion CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2015-08A, Class A1R2, 144A, 3 Month SOFR + 1.332% (Cap N/A,

Floor 1.070%) | | 5.964(c) | | 07/18/30 | | | | | | | 2,302 | | | | 2,308,846 | |

Carlyle CLO Ltd., | | | | | | | | | | | | | | | | |

Series C17A, Class A1AR, 144A, 3 Month SOFR + 1.292% (Cap N/A, Floor 0.000%) | | 5.881(c) | | 04/30/31 | | | | | | | 7,292 | | | | 7,296,965 | |

MidOcean Credit CLO, | | | | | | | | | | | | | | | | |

Series 2018-08A, Class B, 144A, 3 Month SOFR + 1.912% (Cap N/A, Floor 0.000%) | | 7.040(c) | | 02/20/31 | | | | | | | 2,000 | | | | 2,000,000 | |

Series 2018-09A, Class A1, 144A, 3 Month SOFR + 1.412% (Cap N/A, Floor 1.150%) | | 6.029(c) | | 07/20/31 | | | | | | | 769 | | | | 769,663 | |

Mountain View CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2015-09A, Class A2R, 144A, 3 Month SOFR + 2.042% (Cap N/A, Floor 0.000%) | | 6.698(c) | | 07/15/31 | | | | | | | 5,750 | | | | 5,751,545 | |

Series 2019-01A, Class A1R, 144A, 3 Month SOFR + 1.512% (Cap N/A, Floor 1.250%) | | 6.168(c) | | 10/15/34 | | | | | | | 15,000 | | | | 15,012,345 | |

OZLM Ltd., | | | | | | | | | | | | | | | | |

Series 2018-20A, Class A1, 144A, 3 Month SOFR + 1.312% (Cap N/A, Floor 1.050%) | | 5.929(c) | | 04/20/31 | | | | | | | 1,604 | | | | 1,607,985 | |

Shackleton CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2014-05RA, Class A, 144A, 3 Month SOFR + 1.362% (Cap N/A, Floor 0.262%) | | 6.494(c) | | 05/07/31 | | | | | | | 2,783 | | | | 2,783,558 | |

Series 2014-05RA, Class B, 144A, 3 Month SOFR + 1.962% (Cap N/A, Floor 0.262%) | | 7.094(c) | | 05/07/31 | | | | | | | 6,500 | | | | 6,512,621 | |

Voya CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2013-02A, Class A1R, 144A, 3 Month SOFR + 1.232% (Cap N/A, Floor 0.970%) | | 5.857(c) | | 04/25/31 | | | | | | | 1,737 | | | | 1,737,482 | |

See Notes to Financial Statements.

4

PGIM Global Total Return Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Cayman Islands (cont’d.) | | | | | | | | | | | | | | | | |

| | | | | |

Zais CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2015-03A, Class A2R, 144A, 3 Month SOFR + 2.452% (Cap N/A, Floor 0.000%) | | 7.108%(c) | | 07/15/31 | | | | | | | 8,500 | | | $ | 8,515,137 | |

Series 2017-02A, Class A, 144A, 3 Month SOFR + 1.552% (Cap N/A, Floor 0.000%) | | 6.208(c) | | 04/15/30 | | | | | | | 82 | | | | 81,544 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 54,377,691 | |

| | | | | |

Ireland 6.4% | | | | | | | | | | | | | | | | |

| | | | | |

Anchorage Capital Europe CLO DAC, | | | | | | | | | | | | | | | | |

Series 04A, Class A, 144A, 3 Month EURIBOR + 0.870% (Cap N/A, Floor 0.870%) | | 3.956(c) | | 04/25/34 | | | EUR | | | | 4,000 | | | | 4,339,811 | |

Ares European CLO DAC, | | | | | | | | | | | | | | | | |

Series 2013-06A, Class B1RR, 144A, 3 Month EURIBOR + 1.250% (Cap N/A, Floor 1.250%) | | 4.434(c) | | 04/15/30 | | | EUR | | | | 8,000 | | | | 8,698,283 | |

BNPP AM Euro CLO DAC, | | | | | | | | | | | | | | | | |

Series 2018-01A, Class AR, 144A, 3 Month EURIBOR + 0.600% (Cap N/A, Floor 0.600%) | | 3.779(c) | | 04/15/31 | | | EUR | | | | 9,990 | | | | 10,792,957 | |

Bosphorus CLO DAC, | | | | | | | | | | | | | | | | |

Series 06A, Class A, 144A, 3 Month EURIBOR + 0.850% (Cap N/A, Floor 0.850%) | | 4.391(c) | | 05/25/34 | | | EUR | | | | 20,000 | | | | 21,643,516 | |

Capital Four CLO DAC, | | | | | | | | | | | | | | | | |

Series 02A, Class A, 144A, 3 Month EURIBOR + 1.050% (Cap N/A, Floor 1.050%) | | 4.234(c) | | 01/15/34 | | | EUR | | | | 23,000 | | | | 25,023,264 | |

Carlyle Euro CLO DAC, | | | | | | | | | | | | | | | | |

Series 2019-01A, Class A1R, 144A, 3 Month EURIBOR + 0.750% (Cap N/A, Floor 0.750%) | | 4.231(c) | | 03/15/32 | | | EUR | | | | 19,044 | | | | 20,640,590 | |

CIFC European Funding CLO DAC, | | | | | | | | | | | | | | | | |

Series 03A, Class A, 144A, 3 Month EURIBOR + 1.050% (Cap N/A, Floor 1.050%) | | 4.234(c) | | 01/15/34 | | | EUR | | | | 15,000 | | | | 16,319,725 | |

Series 03A, Class B2, 144A | | 2.000 | | 01/15/34 | | | EUR | | | | 11,500 | | | | 11,585,272 | |

Hayfin Emerald CLO DAC, | | | | | | | | | | | | | | | | |

Series 05A, Class A, 144A, 3 Month EURIBOR + 1.100% (Cap N/A, Floor 1.100%) | | 4.649(c) | | 11/17/32 | | | EUR | | | | 18,390 | | | | 20,003,785 | |

See Notes to Financial Statements.

PGIM Global Total Return Fund 5

PGIM Global Total Return Fund

Schedule of Investments (continued)

as of October 31, 2024

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Ireland (cont’d.) | | | | | | | | | | | | | | | | |

| | | | | |

Henley CLO DAC, | | | | | | | | | | | | | | | | |

Series 04A, Class A, 144A, 3 Month EURIBOR + 0.900% (Cap N/A, Floor 0.900%) | | 3.986%(c) | | 04/25/34 | | | EUR | | | | 5,000 | | | $ | 5,425,205 | |

Invesco Euro CLO DAC, | | | | | | | | | | | | | | | | |

Series 01A, Class A2R, 144A | | 0.800 | | 07/15/31 | | | EUR | | | | 30,000 | | | | 31,381,422 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 175,853,830 | |

| | | | | |

Spain 0.1% | | | | | | | | | | | | | | | | |

| | | | | |

LSF11 Boson Investments Sarl Compartment 2, | | | | | | | | | | | | | | | | |

Series 2021-NPLA, Class A1, 144A, 3 Month EURIBOR + 2.000% (Cap N/A, Floor 0.000%) | | 5.541(c) | | 11/25/60 | | | EUR | | | | 309 | | | | 323,957 | |

TFS, | | | | | | | | | | | | | | | | |

Series 2018-03, Class A1^ | | 0.000(s) | | 04/16/40 | | | EUR | | | | —(r | ) | | | 1 | |

Series 2018-03, Class A1, 1 Month EURIBOR + 3.250%^ | | 6.856(c) | | 03/15/26 | | | EUR | | | | 2,505 | | | | 2,095,014 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 2,418,972 | |

| | | | | |

United Kingdom 1.0% | | | | | | | | | | | | | | | | |

| | | | | |

Apidos CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2023-44A, Class A1R, 144A, 3 Month SOFR + 1.360% (Cap N/A, Floor 1.360%) | | 5.977(c) | | 10/26/37 | | | | | | | 25,000 | | | | 25,004,400 | |

NewDay Funding, | | | | | | | | | | | | | | | | |

Series 2024-01A, Class B, 144A, SONIA + 1.650% (Cap N/A, Floor 0.000%) | | 6.610(c) | | 03/15/32 | | | GBP | | | | 2,600 | | | | 3,382,827 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 28,387,227 | |

| | | | | |

United States 1.8% | | | | | | | | | | | | | | | | |

| | | | | |

Ally Bank Auto Credit-Linked Notes, | | | | | | | | | | | | | | | | |

Series 2024-B, Class E, 144A | | 6.678 | | 09/15/32 | | | | | | | 4,000 | | | | 3,998,116 | |