UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| | |

| Investment Company Act file number: | | 811- 04661 |

| |

| Exact name of registrant as specified in charter: | | Prudential Global Total Return Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2023 |

| |

| Date of reporting period: | | 10/31/2023 |

Item 1 – Reports to Stockholders

PGIM GLOBAL TOTAL RETURN FUND

ANNUAL REPORT

OCTOBER 31, 2023

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2023 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

Letter from the President

| | |

| | Dear Shareholder: We hope you find the annual report for the PGIM Global Total Return Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2023. Although central banks raised interest rates aggressively to tame surging inflation during the period, the global economy and financial markets demonstrated resilience. Employers continued hiring, consumers continued spending, home prices rose, and recession fears receded. |

Early in the period, stocks began a rally that eventually ended a bear market and continued to rise globally for much of 2023 as inflation cooled and the Federal Reserve (the Fed) slowed the pace of its rate hikes. However, stocks declined late in the period when the Fed signaled that rates may remain elevated longer than investors had expected. For the entire period, large-cap US stocks and equities in international markets posted gains, while small-cap US stocks declined.

Bond markets benefited during the period as the Fed moderated its rate-hiking cycle, and the higher level of interest rates offered investors an additional cushion from fixed income volatility. US and global investment-grade bonds, along with US high yield corporate bonds and emerging market debt, all posted gains.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is the world’s 14th-largest investment manager with more than $1.3 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

|

|

| Stuart S. Parker, President |

|

| PGIM Global Total Return Fund |

| December 15, 2023 |

PGIM Global Total Return Fund 3

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | |

| |

| | | Average Annual Total Returns as of 10/31/23 |

| | | | |

| | | One Year (%) | | Five Years (%) | | Ten Years (%) | | Since Inception (%) |

| | | | |

Class A | | | | | | | | |

| | | | |

(with sales charges) | | 2.76 | | -2.33 | | -0.24 | | — |

| | | | |

(without sales charges) | | 6.22 | | -1.68 | | 0.09 | | — |

| | | | |

Class C | | | | | | | | |

| | | | |

(with sales charges) | | 4.43 | | -2.42 | | -0.66 | | — |

| | | | |

(without sales charges) | | 5.43 | | -2.42 | | -0.66 | | — |

| | | | |

Class Z | | | | | | | | |

| | | | |

(without sales charges) | | 6.47 | | -1.48 | | 0.33 | | — |

| | | | |

Class R2 | | | | | | | | |

| | | | |

(without sales charges) | | 6.20 | | -1.88 | | N/A | | -2.34 (12/27/2017) |

| | | | |

Class R4 | | | | | | | | |

| | | | |

(without sales charges) | | 6.24 | | -1.67 | | N/A | | -2.10 (12/27/2017) |

| | | | |

Class R6 | | | | | | | | |

| | | | |

(without sales charges) | | 6.56 | | -1.39 | | 0.48 | | — |

| | | | |

Bloomberg Global Aggregate Index | | | | | | | | |

| | | | |

| | | 1.72 | | -1.64 | | -0.66 | | — |

| | |

|

| Average Annual Total Returns as of 10/31/23 Since Inception (%) |

| |

| | | Class R2, Class R4 |

| |

| | | (12/27/2017) |

| |

Bloomberg Global Aggregate Index | | -2.00 |

Since Inception returns are provided for any share class that has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’s inception date.

4 Visit our website at pgim.com/investments

Growth of a $10,000 Investment (unaudited)

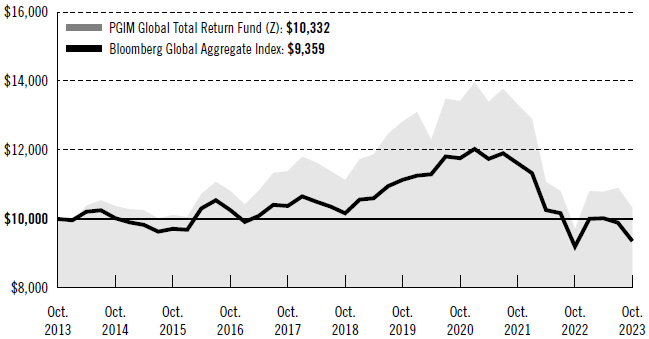

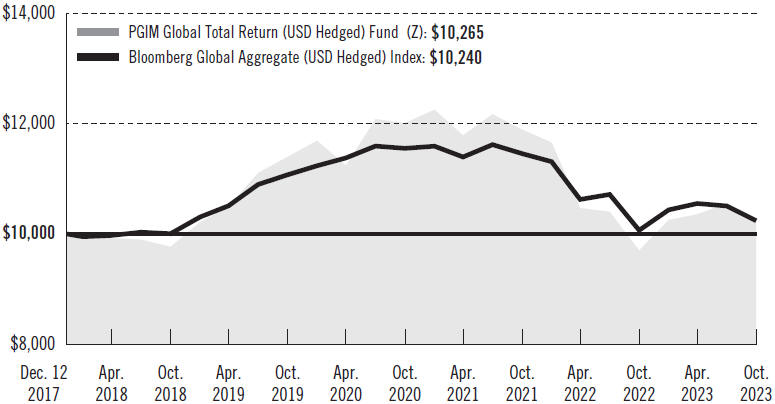

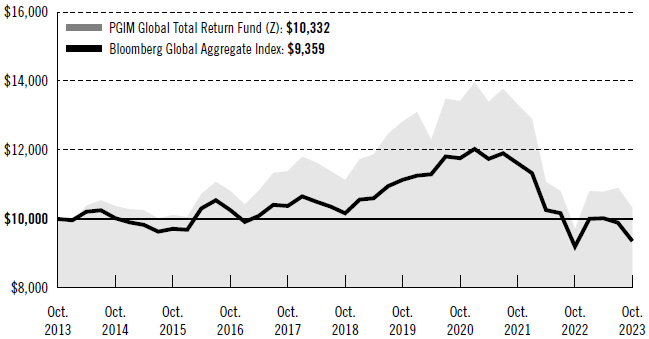

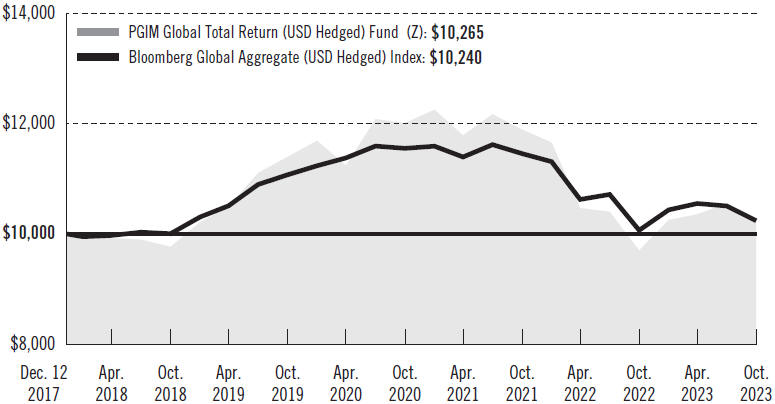

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the Bloomberg Global Aggregate Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (October 31, 2013) and the account values at the end of the current fiscal year (October 31, 2023) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

PGIM Global Total Return Fund 5

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | | | | | |

| | | | | | |

| | | Class A | | Class C | | Class Z | | Class R2 | | Class R4 | | Class R6 |

| Maximum initial sales charge | | 3.25% of the public offering price | | None | | None | | None | | None | | None |

| | | | | | | |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | 1.00% on sales of $500,000 or more made within 12 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | | None | | None | | None |

| | | | | | | |

| Annual distribution or distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.25% | | 1.00% | | None | | 0.25% | | None | | None |

| | | | | | | |

| Shareholder service fees | | None | | None | | None | | 0.10%* | | 0.10%* | | None |

*Shareholder service fee reflects maximum allowable fees under a shareholder services plan.

Benchmark Definition

Bloomberg Global Aggregate Index—The Bloomberg Global Aggregate Index is an unmanaged index of global investment-grade fixed income markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The Index also includes Eurodollar and Euro-Yen corporate bonds, and Canadian government, agency, and corporate securities.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

6 Visit our website at pgim.com/investments

| | | | |

| |

| Credit Quality expressed as a percentage of total investments as of 10/31/23 (%) | | | |

| |

AAA | | | 14.5 | |

| |

AA | | | 9.0 | |

| |

A | | | 13.9 | |

| |

BBB | | | 35.1 | |

| |

BB | | | 15.2 | |

| |

B | | | 4.7 | |

| |

CCC | | | 2.0 | |

| |

Not Rated | | | 2.2 | |

| |

Cash/Cash Equivalents | | | 3.4 | |

| | |

Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | | | | | |

|

| Distributions and Yields as of 10/31/23 |

| | | |

| | | Total Distributions | | SEC 30-Day | | SEC 30-Day |

| | | Paid for | | Subsidized | | Unsubsidized |

| | | One Year ($) | | Yield* (%) | | Yield** (%) |

| | | |

Class A | | 0.20 | | 5.86 | | 5.94 |

| | | |

Class C | | 0.16 | | 5.30 | | 5.48 |

| | | |

Class Z | | 0.21 | | 6.32 | | 6.48 |

| | | |

Class R2 | | 0.19 | | 5.86 | | 5.96 |

| | | |

Class R4 | | 0.20 | | 6.11 | | 6.22 |

| | | |

Class R6 | | 0.22 | | 6.52 | | 6.52 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

PGIM Global Total Return Fund 7

Strategy and Performance Overview* (unaudited)

How did the Fund perform?

The PGIM Global Total Return Fund’s Class Z shares returned 6.47% in the 12-month reporting period that ended October 31, 2023, outperforming the 1.72% return of the Bloomberg Global Aggregate Bond Index (the Index).

What were the market conditions?

| ● | | In the US, interest rate volatility increased as markets sought to price in both the aggressive Federal Open Market Committee (FOMC) policy tightening and the potential for a hard economic landing. Toward the end of the reporting period, macroeconomic and market conditions raised hopes of a soft landing as the FOMC held interest rates steady, and Federal Reserve (Fed) Chairman Jerome Powell acknowledged that higher yields on US Treasuries have aided in the tightening of financial conditions. (When central banks raise interest rates enough to cause a significant economic slowdown or a recession, it is known as a hard landing. When they raise rates just enough to slow the economy and lower inflation without causing a recession, it is known as a soft landing.) The 10-year/2-year US Treasury spread narrowed from –0.41% as of October 31, 2022 to –0.19% as of October 31, 2023, while the 10-year US Treasury yield rose by 79 basis points (bps) to end the reporting period at 4.88%. (One basis point equals 0.01%.) |

| ● | | Despite the debt ceiling debate and threats of a government shutdown, inflation that remained above the Fed’s 2% target, and geopolitical risks abroad, the economy proved resilient, posting strong growth for the third quarter of 2023 (i.e., annualized gross domestic product (GDP) of 4.9%) that was driven by consumer spending. With that stated, the durability of the third quarter’s economic momentum doesn’t appear to be repeatable. While September’s payrolls report of 336,000 jobs added came in much stronger than expected, October’s payrolls report of 150,000 jobs added surprised to the downside and provided further evidence of labor market rebalancing. |

| ● | | In Europe, German 10-year bond yields rose to end the reporting period at 2.83%. While the decision of the European Central Bank (ECB) to keep monetary policy unchanged appeared prudent and justified, headwinds from higher global interest rates, high energy prices, and persistent inflation continued to paint a challenging picture for the euro economy. Similarly, United Kingdom 10-year bond yields rose over the reporting period, ending it at 4.54%. The Bank of England also remained on hold in October 2023. This was the second meeting at which the Bank of England kept its key rate at 5.25%, reflecting the fact that the real economy and inflation both came in slightly weaker than what was expected at the time of its August 2023 report. |

| ● | | Euro-area inflation fell off a bit more than expected to 2.9% year-over-year in October 2023, down from 4.3% the previous month. The decline was led mostly by energy, while core inflation dropped a bit as well to 4.2% year-over-year from 4.5% in September. With inflation now within striking distance of the ECB’s 2% target and core inflation starting to show some signs of a downward trend, barring any major changes, the ECB increasingly appears to have hit peak rates. |

8 Visit our website at pgim.com/investments

| ● | | In the elevated volatility environment, US investment-grade corporate spreads tightened as expectations for a hard landing dissipated, and fundamentals remained solid. US high yield bonds posted gains over the reporting period amid limited new issuance, resilient economic data, and an ongoing supply deficit. Securitized credit spreads were mixed, with high-quality collateralized loan obligation (CLO) spreads tightening over the reporting period and commercial mortgage-backed securities (CMBS) spreads widening slightly as the commercial real estate sector remained challenged. The emerging-markets sector posted positive total returns, and spreads tightened through October 2023. Meanwhile, agency mortgage-backed securities (MBS) posted negative returns over the reporting period, as elevated interest-rate volatility weighed on the sector over the first half of the reporting period. |

What worked?

| ● | | The Fund’s duration and yield curve positioning in both developed-markets and emerging-markets rates contributed to performance during the reporting period. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) |

| ● | | Overall security selection contributed to performance, with selection in developed high yield, emerging sovereigns, and emerging agencies contributing most. |

| ● | | Overall sector allocation also contributed, with overweights to emerging-markets sovereigns, developed-markets investment-grade corporates, and emerging-markets Treasuries contributing most. |

| ● | | Within credit, positioning in foreign non-corporates, retailers & restaurants, and telecom contributed. |

| ● | | In individual security selection, the Fund benefited from selection in the Republic of Greece, the Republic of Ukraine, and Colombia. |

What didn’t work?

| ● | | Within security selection, positions in developed-markets futures and emerging-markets Treasuries detracted the most from performance during the reporting period. |

| ● | | Within sector allocation, an overweight to developed-markets high yields, along with underweights to developed-markets local authorities and developed-markets agencies, detracted most from performance. |

| ● | | Within credit, positioning in transportation & environmental services, banking, and media & entertainment detracted from performance. |

| ● | | In individual security selection, positioning in the Republic of Panama (emerging sovereigns), the Republic of Panama, and US Bancorp (banking) detracted from performance. |

PGIM Global Total Return Fund 9

Strategy and Performance Overview* (continued)

Did the Fund use derivatives?

The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used interest rate futures, options, and swaps to help manage duration positioning and yield curve exposure, which detracted from performance. Credit default swaps and credit default swap index positions were used to either add risk exposure to certain issuers or to hedge credit risk imposed by certain issuers. Overall, credit derivative exposure detracted from performance during the reporting period.

Current outlook

| ● | | The main forces pushing the yield curve higher are the central banks and a heavy supply of government bond issuance. In PGIM Fixed Income’s view, upward momentum in long-dated yields could easily continue through year-end—pushing US Treasuries toward 5% and German Bunds to 3%—and yields could go beyond those levels if fundamentals heat up again. |

| ● | | PGIM Fixed Income believes that the Fed is at or nearing the end of its aggressive tightening cycle. With inflation in the US receding, the real question is where it troughs and whether it is within an acceptable tolerance band for the Fed. After a series of hikes, the Fed once again held rates steady at the November 2023 FOMC meeting. While there were no surprises in the “higher-for-longer” interest rate messaging, it was reiterated that monetary policy works with an uncertain lag. Fed officials are increasingly expressing a desire to “wait and watch” the incoming data for signs that the effects of prior hikes transmit to the real economy and whether the October surge in market-determined rates provided the last dose of tightening in financial conditions. |

| ● | | As the economic backdrop slows and revenue growth begins to run slower than wage growth, PGIM Fixed Income expects companies will first cut hours, then wages, and then head count. If revenue growth continues to run slower than wage growth, the risk of further cuts to head count would grow—a scenario consistent with PGIM Fixed Income’s baseline US economic view whereby tight monetary, fiscal, and credit conditions slow momentum to a below-trend pace of real GDP. Under this “weakflation” scenario, PGIM Fixed Income still expects real GDP growth of between 1.0%-1.5%, inflation descending to 2.5%-3.0%, and the Fed “fine-tuning” its policy rates, with 50 bps of easing next year. |

| ● | | PGIM Fixed Income maintains its positive view of the spread sectors over the medium to long term, and the Fund is overweight investment-grade corporates, high yield, securitized products (CLOs and CMBS), and emerging markets. The Fund holds a significant underweight relative to the Index to MBS and US Treasuries in favor of more attractive opportunities across spread sectors. |

| ● | | From a long-term perspective, exposure to developed-markets duration is becoming more compelling after the broad repricing and with the looming moderation in global growth. While acknowledging the immediate trajectory of inflation is going to dictate market volatility and the path of the US Treasury 10-year yield, PGIM Fixed Income’s |

10 Visit our website at pgim.com/investments

| | base case is that implied volatility will ultimately decline, and the 10-year yield will stay below the terminal rate of this hiking cycle when it is eventually reached. In the meantime, the best course will be to focus on the micro-alpha opportunities within and across sectors. (Alpha is a measure of an investment’s active return compared to a market or index.) |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

PGIM Global Total Return Fund 11

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2023. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

12 Visit our website at pgim.com/investments

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | | | |

| PGIM Global Total Return Fund | | Beginning

Account Value May 1, 2023 | | Ending Account Value

October 31, 2023 | | Annualized Expense Ratio Based on the Six-Month Period | | Expenses Paid During the Six-Month Period* |

| | | | | |

Class A | | Actual | | $1,000.00 | | $ 958.00 | | 0.88% | | $4.34 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,020.77 | | 0.88% | | $4.48 |

| | | | | |

Class C | | Actual | | $1,000.00 | | $ 954.30 | | 1.63% | | $8.03 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,016.99 | | 1.63% | | $8.29 |

| | | | | |

Class Z | | Actual | | $1,000.00 | | $ 957.60 | | 0.63% | | $3.11 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,022.03 | | 0.63% | | $3.21 |

| | | | | |

Class R2 | | Actual | | $1,000.00 | | $ 957.80 | | 1.08% | | $5.33 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,019.76 | | 1.08% | | $5.50 |

| | | | | |

Class R4 | | Actual | | $1,000.00 | | $ 957.10 | | 0.83% | | $4.09 |

| | | | | |

| | Hypothetical | | $1,000.00 | | $1,021.02 | | 0.83% | | $4.23 |

| | | | | |

Class R6 | | Actual | | $1,000.00 | | $ 958.50 | | 0.53% | | $2.62 |

| | | | | |

| | | Hypothetical | | $1,000.00 | | $1,022.53 | | 0.53% | | $2.70 |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2023, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2023 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

PGIM Global Total Return Fund 13

Schedule of Investments

as of October 31, 2023

| | | | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest

Rate | | Maturity Date | | | Principal Amount (000)# | | | Value | |

| | | | | |

LONG-TERM INVESTMENTS 97.2% | | | | | | | | | | | | | | | | | | |

| | | | | |

ASSET-BACKED SECURITIES 12.6% | | | | | | | | | | | | | | | | | | |

| | | | | |

Canada 0.1% | | | | | | | | | | | | | | | | | | |

Fairstone Financial Issuance Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-01A, Class A, 144A | | 2.509% | | | 10/20/39 | | | | CAD | | | | 1,500 | | | $ | 1,047,171 | |

Ford Auto Securitization Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-AA, Class B, 144A | | 1.872 | | | 06/15/26 | | | | CAD | | | | 400 | | | | 273,806 | |

Series 2020-AA, Class C, 144A | | 2.763 | | | 04/15/28 | | | | CAD | | | | 500 | | | | 345,329 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 1,666,306 | |

| | | | | |

Cayman Islands 3.9% | | | | | | | | | | | | | | | | | | |

Battalion CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2015-08A, Class A1R2, 144A, 3 Month SOFR + 1.332% (Cap N/A, Floor 1.070%) | | 6.727(c) | | | 07/18/30 | | | | | | | | 4,731 | | | | 4,707,874 | |

Carlyle CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series C17A, Class A1AR, 144A, 3 Month SOFR + 1.292% (Cap N/A, Floor 0.000%) | | 6.682(c) | | | 04/30/31 | | | | | | | | 14,620 | | | | 14,545,856 | |

Carlyle US CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2018-01A, Class A1, 144A, 3 Month SOFR + 1.282% (Cap N/A, Floor 0.000%) | | 6.697(c) | | | 04/20/31 | | | | | | | | 11,639 | | | | 11,602,235 | |

Elevation CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2017-06A, Class A1, 144A, 3 Month SOFR + 1.542% (Cap N/A, Floor 1.542%) | | 6.935(c) | | | 07/15/29 | | | | | | | | 170 | | | | 168,666 | |

MidOcean Credit CLO, | | | | | | | | | | | | | | | | | | |

Series 2018-08A, Class B, 144A, 3 Month SOFR + 1.912% (Cap N/A, Floor 0.000%) | | 7.291(c) | | | 02/20/31 | | | | | | | | 2,000 | | | | 1,956,673 | |

Series 2018-09A, Class A1, 144A, 3 Month SOFR + 1.412% (Cap N/A, Floor 1.150%) | | 6.827(c) | | | 07/20/31 | | | | | | | | 1,788 | | | | 1,780,323 | |

Mountain View CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2015-09A, Class A2R, 144A, 3 Month SOFR + 2.042% (Cap N/A, Floor 0.000%) | | 7.435(c) | | | 07/15/31 | | | | | | | | 5,750 | | | | 5,599,411 | |

Series 2019-01A, Class A1R, 144A, 3 Month SOFR + 1.512% (Cap N/A, Floor 1.250%) | | 6.905(c) | | | 10/15/34 | | | | | | | | 15,000 | | | | 14,853,464 | |

OZLM Ltd., | | | | | | | | | | | | | | | | | | |

Series 2014-06A, Class A2AS, 144A, 3 Month SOFR + 2.012% (Cap N/A, Floor 0.000%) | | 7.414(c) | | | 04/17/31 | | | | | | | | 2,000 | | | | 1,974,087 | |

Series 2018-20A, Class A1, 144A, 3 Month SOFR + 1.312% (Cap N/A, Floor 1.050%) | | 6.727(c) | | | 04/20/31 | | | | | | | | 4,758 | | | | 4,739,889 | |

Race Point CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2013-08A, Class AR2, 144A, 3 Month SOFR + 1.302% (Cap N/A, Floor 1.040%) | | 6.681(c) | | | 02/20/30 | | | | | | | | 6,713 | | | | 6,683,274 | |

See Notes to Financial Statements.

PGIM Global Total Return Fund 15

Schedule of Investments (continued)

as of October 31, 2023

| | | | | | | | | | | | | | | | |

| | | | | |

Description | | Interest

Rate | | Maturity

Date | | | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Cayman Islands (cont’d.) | | | | | | | | | | | | | | | | |

Shackleton CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2014-05RA, Class A, 144A, 3 Month SOFR + 1.362% (Cap N/A, Floor 0.262%) | | 6.731%(c) | | 05/07/31 | | | | | | | 4,967 | | | $ | 4,931,375 | |

Series 2014-05RA, Class B, 144A, 3 Month SOFR + 1.962% (Cap N/A, Floor 0.262%) | | 7.331(c) | | 05/07/31 | | | | | | | 6,500 | | | | 6,363,722 | |

Series 2017-10A, Class BR, 144A, 3 Month SOFR + 1.812% (Cap N/A, Floor 0.000%) | | 7.227(c) | | 04/20/29 | | | | | | | 10,000 | | | | 9,822,871 | |

Voya CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2013-02A, Class A1R, 144A, 3 Month SOFR + 1.232% (Cap N/A, Floor 0.970%) | | 6.610(c) | | 04/25/31 | | | | | | | 3,959 | | | | 3,945,099 | |

Zais CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2015-03A, Class A2R, 144A, 3 Month SOFR + 2.452% (Cap N/A, Floor 0.000%) | | 7.845(c) | | 07/15/31 | | | | | | | 8,500 | | | | 8,312,819 | |

Series 2017-02A, Class A, 144A, 3 Month SOFR + 1.552% (Cap N/A, Floor 0.000%) | | 6.945(c) | | 04/15/30 | | | | | | | 392 | | | | 390,532 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 102,378,170 | |

| | | | | |

Ireland 7.1% | | | | | | | | | | | | | | | | |

Anchorage Capital Europe CLO DAC, | | | | | | | | | | | | | | | | |

Series 04A, Class A, 144A, 3 Month EURIBOR + 0.870% (Cap N/A, Floor 0.870%) | | 4.826(c) | | 04/25/34 | | | EUR | | | | 4,000 | | | | 4,118,400 | |

Ares European CLO DAC, | | | | | | | | | | | | | | | | |

Series 2013-06A, Class B1RR, 144A, 3 Month EURIBOR + 1.250% (Cap N/A, Floor 1.250%) | | 5.215(c) | | 04/15/30 | | | EUR | | | | 8,000 | | | | 8,198,782 | |

Armada Euro CLO DAC, | | | | | | | | | | | | | | | | |

Series 02A, Class A3, 144A | | 1.500 | | 11/15/31 | | | EUR | | | | 1,369 | | | | 1,373,751 | |

BNPP AM Euro CLO DAC, | | | | | | | | | | | | | | | | |

Series 2018-01A, Class AR, 144A, 3 Month EURIBOR + 0.600% (Cap N/A, Floor 0.600%) | | 4.565(c) | | 04/15/31 | | | EUR | | | | 10,000 | | | | 10,363,050 | |

Bosphorus CLO DAC, | | | | | | | | | | | | | | | | |

Series 06A, Class A, 144A, 3 Month EURIBOR + 0.850% (Cap N/A, Floor 0.850%) | | 4.676(c) | | 05/25/34 | | | EUR | | | | 20,000 | | | | 20,616,217 | |

Capital Four CLO DAC, | | | | | | | | | | | | | | | | |

Series 02A, Class A, 144A, 3 Month EURIBOR + 1.050% (Cap N/A, Floor 1.050%) | | 5.015(c) | | 01/15/34 | | | EUR | | | | 23,000 | | | | 23,811,714 | |

Carlyle Euro CLO DAC, | | | | | | | | | | | | | | | | |

Series 2017-02A, Class AA2R, 144A, 3 Month EURIBOR + 1.300% (Cap N/A, Floor 1.300%) | | 5.081(c) | | 08/15/30 | | | EUR | | | | 9,500 | | | | 9,695,754 | |

Series 2019-01A, Class A1R, 144A, 3 Month EURIBOR + 0.750% (Cap N/A, Floor 0.750%) | | 4.595(c) | | 03/15/32 | | | EUR | | | | 20,000 | | | | 20,787,716 | |

See Notes to Financial Statements.

16

| | | | | | | | | | | | | | | | |

| | | | | |

Description | | Interest

Rate | | Maturity

Date | | | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Ireland (cont’d.) | | | | | | | | | | | | | | | | |

CIFC European Funding CLO DAC, | | | | | | | | | | | | | | | | |

Series 03A, Class A, 144A, 3 Month EURIBOR + 1.050% (Cap N/A, Floor 1.050%) | | 5.015%(c) | | 01/15/34 | | | EUR | | | | 15,000 | | | $ | 15,543,844 | |

Series 03A, Class B2, 144A | | 2.000 | | 01/15/34 | | | EUR | | | | 11,500 | | | | 10,416,452 | |

Hayfin Emerald CLO DAC, | | | | | | | | | | | | | | | | |

Series 05A, Class A, 144A, 3 Month EURIBOR + 1.100% (Cap N/A, Floor 1.100%) | | 4.887(c) | | 11/17/32 | | | EUR | | | | 18,500 | | | | 19,312,477 | |

Henley CLO DAC, | | | | | | | | | | | | | | | | |

Series 04A, Class A, 144A, 3 Month EURIBOR + 0.900% (Cap N/A, Floor 0.900%) | | 4.856(c) | | 04/25/34 | | | EUR | | | | 5,000 | | | | 5,151,852 | |

Invesco Euro CLO DAC, | | | | | | | | | | | | | | | | |

Series 01A, Class A2R, 144A | | 0.800 | | 07/15/31 | | | EUR | | | | 30,000 | | | | 29,629,929 | |

OAK Hill European Credit Partners DAC, | | | | | | | | | | | | | | | | |

Series 2017-06A, Class A2, 144A | | 1.150 | | 01/20/32 | | | EUR | | | | 2,292 | | | | 2,320,666 | |

Providus CLO DAC, | | | | | | | | | | | | | | | | |

Series 02A, Class B1R, 144A, 3 Month EURIBOR + 1.650% (Cap N/A, Floor 1.650%) | | 5.615(c) | | 07/15/31 | | | EUR | | | | 7,500 | | | | 7,695,612 | |

Rathlin Residential DAC, | | | | | | | | | | | | | | | | |

Series 2021-01A, Class A, 144A, 1 Month EURIBOR + 2.000% (Cap N/A, Floor 0.000%) | | 5.845(c) | | 09/27/75 | | | EUR | | | | 894 | | | | 921,219 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 189,957,435 | |

| | | | | |

Spain 0.1% | | | | | | | | | | | | | | | | |

LSF11 Boson Investments Sarl Compartment 2, | | | | | | | | | | | | | | | | |

Series 2021-NPLA, Class A1, 144A, 3 Month EURIBOR + 2.000% (Cap 3.000%, Floor 0.000%) | | 5.826(c) | | 11/25/60 | | | EUR | | | | 1,083 | | | | 1,093,580 | |

TFS, | | | | | | | | | | | | | | | | |

Series 2018-03, Class A1^ | | 0.000(s) | | 04/16/40 | | | EUR | | | | —(r) | | | | 1 | |

Series 2018-03, Class A1, 1 Month EURIBOR + 3.000%^ | | 7.122(c) | | 03/15/26 | | | EUR | | | | 2,965 | | | | 2,667,064 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 3,760,645 | |

| | | | | |

United Kingdom 0.1% | | | | | | | | | | | | | | | | |

Newday Funding Master Issuer PLC, | | | | | | | | | | | | | | | | |

Series 2021-01A, Class A2, 144A, SOFR + 1.100% (Cap N/A, Floor 0.000%) | | 6.418(c) | | 03/15/29 | | | | | | | 3,500 | | | | 3,491,876 | |

See Notes to Financial Statements.

PGIM Global Total Return Fund 17

Schedule of Investments (continued)

as of October 31, 2023

| | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

United States 1.3% | | | | | | | | | | | | | | | | |

Ameriquest Mortgage Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | | | | | |

Series 2002-02, Class M3, 1 Month SOFR + 2.769% (Cap N/A, Floor 2.655%) | | 4.870%(c) | | 08/25/32 | | | | | | | 150 | | | $ | 146,198 | |

Series 2002-03, Class M3, 1 Month SOFR + 2.964% (Cap N/A, Floor 2.850%) | | 8.289(c) | | 08/25/32 | | | | | | | 101 | | | | 99,311 | |

Chase Funding Trust, | | | | | | | | | | | | | | | | |

Series 2003-04, Class 2A2, 1 Month SOFR + 0.714% (Cap N/A, Floor 0.600%) | | 6.039(c) | | 05/25/33 | | | | | | | 423 | | | | 409,600 | |

Commonbond Student Loan Trust, | | | | | | | | | | | | | | | | |

Series 2020-AGS, Class A, 144A | | 1.980 | | 08/25/50 | | | | | | | 1,764 | | | | 1,476,494 | |

EquiFirst Mortgage Loan Trust, | | | | | | | | | | | | | | | | |

Series 2004-01, Class 1A1, 1 Month SOFR + 0.594% (Cap N/A, Floor 0.480%) | | 5.919(c) | | 01/25/34 | | | | | | | 394 | | | | 369,144 | |

Ford Credit Auto Owner Trust, | | | | | | | | | | | | | | | | |

Series 2020-02, Class C, 144A | | 1.740 | | 04/15/33 | | | | | | | 1,300 | | | | 1,180,251 | |

JPMorgan Chase Bank, NA, | | | | | | | | | | | | | | | | |

Series 2020-01, Class R, 144A | | 33.784 | | 01/25/28 | | | | | | | 1,175 | | | | 1,343,488 | |

Series 2020-02, Class E, 144A | | 3.072 | | 02/25/28 | | | | | | | 146 | | | | 145,275 | |

Series 2020-02, Class R, 144A | | 31.355 | | 02/25/28 | | | | | | | 553 | | | | 653,124 | |

Series 2021-01, Class E, 144A | | 2.365 | | 09/25/28 | | | | | | | 89 | | | | 86,704 | |

Series 2021-01, Class F, 144A | | 4.280 | | 09/25/28 | | | | | | | 600 | | | | 571,362 | |

Series 2021-01, Class R, 144A | | 28.348 | | 09/25/28 | | | | | | | 1,855 | | | | 2,168,412 | |

Series 2021-02, Class F, 144A | | 4.393 | | 12/26/28 | | | | | | | 600 | | | | 562,523 | |

Series 2021-03, Class F, 144A | | 3.694 | | 02/26/29 | | | | | | | 600 | | | | 534,627 | |

Laurel Road Prime Student Loan Trust, | | | | | | | | | | | | | | | | |

Series 2018-A, Class A, 144A | | 0.000(cc) | | 02/25/43 | | | | | | | 3,430 | | | | 689,814 | |

Series 2018-C, Class A, 144A | | 0.000(cc) | | 08/25/43 | | | | | | | 696 | | | | 638,489 | |

Series 2019-A, Class R, 144A | | 0.000 | | 10/25/48 | | | | | | | 1,772 | | | | 340,722 | |

Lending Funding Trust, | | | | | | | | | | | | | | | | |

Series 2020-02A, Class A, 144A | | 2.320 | | 04/21/31 | | | | | | | 1,100 | | | | 977,688 | |

Lendmark Funding Trust, | | | | | | | | | | | | | | | | |

Series 2021-01A, Class D, 144A | | 5.050 | | 11/20/31 | | | | | | | 1,900 | | | | 1,492,796 | |

Long Beach Mortgage Loan Trust, | | | | | | | | | | | | | | | | |

Series 2004-03, Class M1, 1 Month SOFR + 0.969% (Cap N/A, Floor 0.855%) | | 6.294(c) | | 07/25/34 | | | | | | | 101 | | | | 96,049 | |

Mariner Finance Issuance Trust, | | | | | | | | | | | | | | | | |

Series 2020-AA, Class A, 144A | | 2.190 | | 08/21/34 | | | | | | | 1,433 | | | | 1,393,238 | |

MASTR Asset-Backed Securities Trust, | | | | | | | | | | | | | | | | |

Series 2004-WMC02, Class M1, 1 Month SOFR + 1.014% (Cap N/A, Floor 0.900%) | | 6.339(c) | | 04/25/34 | | | | | | | 790 | | | | 760,964 | |

See Notes to Financial Statements.

18

| | | | | | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | | | | | |

Merrill Lynch Mortgage Investors Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2004-HE02, Class M1, 1 Month SOFR + 1.314% (Cap N/A, Floor 1.200%) | | | 6.639%(c) | | | | 08/25/35 | | | | | | | | 14 | | | $ | 13,155 | |

Morgan Stanley ABS Capital I, Inc. Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2003-NC08, Class M1, 1 Month SOFR + 1.164% (Cap N/A, Floor 1.050%) | | | 6.489(c) | | | | 09/25/33 | | | | | | | | 61 | | | | 59,867 | |

Morgan Stanley Dean Witter Capital I, Inc. Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2002-AM03, Class A3, 1 Month SOFR + 1.094% (Cap N/A, Floor 0.980%) | | | 6.419(c) | | | | 02/25/33 | | | | | | | | 78 | | | | 76,882 | |

OneMain Direct Auto Receivables Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2019-01A, Class B, 144A | | | 3.950 | | | | 11/14/28 | | | | | | | | 1,300 | | | | 1,228,782 | |

OneMain Financial Issuance Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2023-02A, Class C, 144A | | | 6.740 | | | | 09/15/36 | | | | | | | | 1,300 | | | | 1,266,647 | |

Series 2023-02A, Class D, 144A | | | 7.520 | | | | 09/15/36 | | | | | | | | 3,700 | | | | 3,607,219 | |

Santander Bank Auto Credit-Linked Notes, | | | | | | | | | | | | | | | | | | | | |

Series 2022-A, Class C, 144A | | | 7.375 | | | | 05/15/32 | | | | | | | | 1,059 | | | | 1,051,952 | |

Santander Bank, NA, | | | | | | | | | | | | | | | | | | | | |

Series 2021-01A, Class D, 144A | | | 5.004 | | | | 12/15/31 | | | | | | | | 1,300 | | | | 1,242,372 | |

Santander Consumer Auto Receivables Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2021-AA, Class D, 144A | | | 1.570 | | | | 01/15/27 | | | | | | | | 850 | | | | 781,727 | |

Series 2021-AA, Class R, 144A | | | 0.000 | | | | 08/15/28 | | | | | | | | 6 | | | | 294,246 | |

Silver Creek CLO Ltd., | | | | | | | | | | | | | | | | | | | | |

Series 2014-01A, Class AR, 144A, 3 Month SOFR + 1.502% (Cap N/A, Floor 0.000%) | | | 6.917(c) | | | | 07/20/30 | | | | | | | | 198 | | | | 198,130 | |

SoFi RR Funding III Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2020-01, Class A, 144A, 1 Month SOFR + 2.364% (Cap N/A, Floor 1.250%) | | | 7.689(c) | | | | 11/29/24 | | | | | | | | 2,132 | | | | 2,131,378 | |

TH MSR Issuer Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2019-FT01, Class A, 144A, 1 Month SOFR + 2.914% (Cap N/A, Floor 2.800%) | | | 8.239(c) | | | | 06/25/24 | | | | | | | | 4,730 | | | | 4,610,479 | |

Wellfleet CLO Ltd., | | | | | | | | | | | | | | | | | | | | |

Series 2017-03A, Class A1, 144A, 3 Month SOFR + 1.412% (Cap N/A, Floor 1.150%) | | | 6.814(c) | | | | 01/17/31 | | | | | | | | 2,205 | | | | 2,192,719 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 34,891,828 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

TOTAL ASSET-BACKED SECURITIES (cost $374,656,732) | | | | | | | | | | | | | | | | | | | 336,146,260 | |

| | | | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

PGIM Global Total Return Fund 19

Schedule of Investments (continued)

as of October 31, 2023

| | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES 8.2% | | | | | | | | | | | | | | | | |

| | | | | |

Canada 0.0% | | | | | | | | | | | | | | | | |

Real Estate Asset Liquidity Trust, | | | | | | | | | | | | | | | | |

Series 2020-01A, Class A1, 144A | | 2.381%(cc) | | 02/12/55 | | | CAD | | | | 1,635 | | | $ | 1,081,160 | |

| | | | | | | | | | | | | | | | |

| | | | | |

United Kingdom 0.9% | | | | | | | | | | | | | | | | |

Taurus DAC, | | | | | | | | | | | | | | | | |

Series 2021-UK1A, Class D, 144A, SONIA + 2.600% (Cap N/A, Floor 2.600%) | | 7.819(c) | | 05/17/31 | | | GBP | | | | 546 | | | | 628,038 | |

Series 2021-UK4A, Class B, 144A, SONIA + 1.500% (Cap N/A, Floor 1.500%) | | 6.719(c) | | 08/17/31 | | | GBP | | | | 4,973 | | | | 5,821,068 | |

Series 2021-UK4A, Class C, 144A, SONIA + 1.750% (Cap N/A, Floor 1.750%) | | 6.969(c) | | 08/17/31 | | | GBP | | | | 8,164 | | | | 9,437,602 | |

Series 2021-UK4A, Class D, 144A, SONIA + 2.100% (Cap N/A, Floor 2.100%) | | 7.319(c) | | 08/17/31 | | | GBP | | | | 6,790 | | | | 7,715,591 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 23,602,299 | |

| | | | | |

United States 7.3% | | | | | | | | | | | | | | | | |

20 Times Square Trust, | | | | | | | | | | | | | | | | |

Series 2018-20TS, Class G, 144A (original cost $909,111; purchased 05/09/18)(f) | | 3.100(cc) | | 05/15/35 | | | | | | | 1,000 | | | | 680,000 | |

Series 2018-20TS, Class H, 144A (original cost $885,052; purchased 05/09/18)(f) | | 3.100(cc) | | 05/15/35 | | | | | | | 1,000 | | | | 660,000 | |

BANK, | | | | | | | | | | | | | | | | |

Series 2017-BNK05, Class A3 | | 3.020 | | 06/15/60 | | | | | | | 3,156 | | | | 3,054,366 | |

Benchmark Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2020-B17, Class A4 | | 2.042 | | 03/15/53 | | | | | | | 6,200 | | | | 4,759,134 | |

BX Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2019-XL, Class F, 144A, 1 Month SOFR + 2.114% (Cap N/A, Floor 2.000%) | | 7.449(c) | | 10/15/36 | | | | | | | 2,805 | | | | 2,762,576 | |

Series 2019-XL, Class G, 144A, 1 Month SOFR + 2.414% (Cap N/A, Floor 2.300%) | | 7.749(c) | | 10/15/36 | | | | | | | 7,416 | | | | 7,263,027 | |

Series 2019-XL, Class J, 144A, 1 Month SOFR + 2.764% (Cap N/A, Floor 2.650%) | | 8.099(c) | | 10/15/36 | | | | | | | 22,142 | | | | 21,604,110 | |

Cantor Commercial Real Estate Lending, | | | | | | | | | | | | | | | | |

Series 2019-CF02, Class A3 | | 2.647 | | 11/15/52 | | | | | | | 16,531 | | | | 15,409,997 | |

CF Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2020-P01, Class A1, 144A | | 2.840(cc) | | 04/15/25 | | | | | | | 9,272 | | | | 8,711,586 | |

Citigroup Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2014-GC21, Class XB, IO | | 0.434(cc) | | 05/10/47 | | | | | | | 27,500 | | | | 24,758 | |

Series 2016-GC37, Class XB, IO | | 0.681(cc) | | 04/10/49 | | | | | | | 33,868 | | | | 467,734 | |

Series 2016-P04, Class XB, IO | | 1.313(cc) | | 07/10/49 | | | | | | | 9,100 | | | | 277,959 | |

Series 2017-P08, Class A2 | | 3.109 | | 09/15/50 | | | | | | | 1,767 | | | | 1,582,478 | |

See Notes to Financial Statements.

20

| | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest

Rate | | Maturity

Date | | Principal Amount (000)# | | | Value | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | |

Cold Storage Trust, | | | | | | | | | | | | | | | | |

Series 2020-ICE05, Class E, 144A, 1 Month SOFR + 2.880% (Cap N/A, Floor 2.766%) | | 8.216%(c) | | 11/15/37 | | | | | | | 4,399 | | | $ | 4,343,692 | |

Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2014-UBS04, Class XB, IO, 144A | | 0.216(cc) | | 08/10/47 | | | | | | | 50,000 | | | | 50,165 | |

Credit Suisse Mortgage Capital Certificates, | | | | | | | | | | | | | | | | |

Series 2019-ICE04, Class E, 144A, 1 Month SOFR + 2.197% (Cap N/A, Floor 2.150%) | | 7.532(c) | | 05/15/36 | | | | | | | 14,090 | | | | 13,866,475 | |

CSAIL Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2018-CX11, Class A3 | | 4.095 | | 04/15/51 | | | | | | | 1,037 | | | | 983,234 | |

DBWF Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2016-85T, Class E, 144A | | 3.808(cc) | | 12/10/36 | | | | | | | 3,000 | | | | 1,804,875 | |

Eleven Madison Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2015-11MD, Class C, 144A | | 3.555(cc) | | 09/10/35 | | | | | | | 500 | | | | 384,955 | |

ELP Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2021-ELP, Class F, 144A, 1 Month SOFR + 2.781% (Cap N/A, Floor 2.667%) | | 8.116(c) | | 11/15/38 | | | | | | | 13,600 | | | | 12,918,436 | |

FHLMC Multifamily Structured Pass-Through Certificates, | | | | | | | | | | | | | | | | |

Series K037, Class X1, IO | | 0.947(cc) | | 01/25/24 | | | | | | | 7,093 | | | | 3,689 | |

Series K043, Class X1, IO | | 0.501(cc) | | 12/25/24 | | | | | | | 11,269 | | | | 50,233 | |

Series K049, Class X1, IO | | 0.549(cc) | | 07/25/25 | | | | | | | 36,782 | | | | 281,707 | |

Series K052, Class X1, IO | | 0.628(cc) | | 11/25/25 | | | | | | | 11,309 | | | | 116,651 | |

Series K053, Class X1, IO | | 0.871(cc) | | 12/25/25 | | | | | | | 43,321 | | | | 653,990 | |

Series K054, Class X1, IO | | 1.149(cc) | | 01/25/26 | | | | | | | 29,044 | | | | 595,679 | |

Series K058, Class X1, IO | | 0.910(cc) | | 08/25/26 | | | | | | | 39,000 | | | | 801,797 | |

Series K090, Class X1, IO | | 0.708(cc) | | 02/25/29 | | | | | | | 22,821 | | | | 727,329 | |

Series K111, Class X1, IO | | 1.571(cc) | | 05/25/30 | | | | | | | 29,235 | | | | 2,267,219 | |

Series K113, Class X1, IO | | 1.380(cc) | | 06/25/30 | | | | | | | 118,391 | | | | 8,193,239 | |

Series K114, Class X1, IO | | 1.116(cc) | | 06/25/30 | | | | | | | 75,146 | | | | 4,305,594 | |

Series K116, Class X1, IO | | 1.424(cc) | | 07/25/30 | | | | | | | 48,918 | | | | 3,472,028 | |

Series K121, Class X1, IO | | 1.022(cc) | | 10/25/30 | | | | | | | 126,215 | | | | 6,645,971 | |

Series KG03, Class X1, IO | | 1.377(cc) | | 06/25/30 | | | | | | | 101,085 | | | | 6,673,871 | |

Series Q001, Class XA, IO | | 2.109(cc) | | 02/25/32 | | | | | | | 5,486 | | | | 410,993 | |

Greystone Commercial Capital Trust, | | | | | | | | | | | | | | | | |

Series 2021-03, Class A, 144A, 1 Month SOFR + 2.344% (Cap N/A, Floor 2.230%) | | 7.680(c) | | 08/01/24 | | | | | | | 17,250 | | | | 17,072,485 | |

GS Mortgage Securities Corp. Trust, | | | | | | | | | | | | | | | | |

Series 2021-RENT, Class C, 144A, 1 Month SOFR + 1.664% (Cap N/A, Floor 1.550%) | | 6.999(c) | | 11/21/35 | | | | | | | 7,700 | | | | 7,378,712 | |

Series 2021-RENT, Class D, 144A, 1 Month SOFR + 1.964% (Cap N/A, Floor 1.850%) | | 7.299(c) | | 11/21/35 | | | | | | | 4,454 | | | | 4,189,950 | |

See Notes to Financial Statements.

PGIM Global Total Return Fund 21

Schedule of Investments (continued)

as of October 31, 2023

| | | | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | | | |

GS Mortgage Securities Trust, | | | | | | | | | | | | | | | | | | |

Series 2014-GC20, Class XB, IO | | 0.472%(cc) | | | 04/10/47 | | | | | | | | 30,000 | | | $ | 10,602 | |

Series 2014-GC22, Class XB, IO | | 0.294(cc) | | | 06/10/47 | | | | | | | | 35,000 | | | | 43,911 | |

Series 2014-GC24, Class XB, IO | | 0.021(cc) | | | 09/10/47 | | | | | | | | 83,262 | | | | 11,490 | |

Series 2014-GC26, Class XB, IO | | 0.295(cc) | | | 11/10/47 | | | | | | | | 56,483 | | | | 146,884 | |

JPMCC Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | | | |

Series 2017-JP06, Class A3 | | 3.109 | | | 07/15/50 | | | | | | | | 2,240 | | | | 2,068,808 | |

JPMDB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-COR07, Class A4 | | 1.915 | | | 05/13/53 | | | | | | | | 5,000 | | | | 3,668,211 | |

JPMorgan Chase Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | | | |

Series 2018-AON, Class E, 144A | | 4.613(cc) | | | 07/05/31 | | | | | | | | 5,564 | | | | 1,892,449 | |

Morgan Stanley Capital I Trust, | | | | | | | | | | | | | | | | | | |

Series 2019-MEAD, Class E, 144A | | 3.177(cc) | | | 11/10/36 | | | | | | | | 1,700 | | | | 1,336,361 | |

Series 2020-HR08, Class XB, IO | | 0.876(cc) | | | 07/15/53 | | | | | | | | 54,413 | | | | 2,630,700 | |

One New York Plaza Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-01NYP, Class C, 144A, 1 Month SOFR + 2.314% (Cap N/A, Floor 2.200%) | | 7.649(c) | | | 01/15/36 | | | | | | | | 8,475 | | | | 7,246,125 | |

Series 2020-01NYP, Class D, 144A, 1 Month SOFR + 2.864% (Cap N/A, Floor 2.750%) | | 8.199(c) | | | 01/15/36 | | | | | | | | 2,975 | | | | 2,290,750 | |

UBS-Barclays Commercial Mortgage Trust, | | | | | | | | | | | | | | | | | | |

Series 2012-C02, Class XA, IO, 144A | | 0.775(cc) | | | 05/10/63 | | | | | | | | 349 | | | | 4 | |

Wells Fargo Commercial Mortgage Trust, | | | | | | | | | | | | | | | | | | |

Series 2016-C35, Class XB, IO | | 0.929(cc) | | | 07/15/48 | | | | | | | | 24,000 | | | | 504,214 | |

Series 2016-LC24, Class XB, IO | | 0.975(cc) | | | 10/15/49 | | | | | | | | 20,910 | | | | 497,154 | |

Series 2021-FCMT, Class B, 144A, 1 Month SOFR + 1.964% (Cap N/A, Floor 1.850%) | | 7.299(c) | | | 05/15/31 | | | | | | | | 1,800 | | | | 1,690,315 | |

Series 2021-FCMT, Class C, 144A, 1 Month SOFR + 2.514% (Cap N/A, Floor 2.400%) | | 7.849(c) | | | 05/15/31 | | | | | | | | 1,700 | | | | 1,565,629 | |

Series 2021-FCMT, Class D, 144A, 1 Month SOFR + 3.614% (Cap N/A, Floor 3.500%) | | 8.949(c) | | | 05/15/31 | | | | | | | | 2,200 | | | | 1,996,176 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 193,050,477 | |

| | | | | | | | | | | | | | | | | | |

| | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $242,210,557) | | | | | | | | | | | | | | | 217,733,936 | |

| | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

22

| | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest

Rate | | Maturity Date | | Principal

Amount (000)# | | | Value | |

| | | | |

CONVERTIBLE BOND 0.0% | | | | | | | | | | | | | | |

| | | | | |

Jamaica | | | | | | | | | | | | | | | | |

Digicel Group Holdings Ltd., | | | | | | | | | | | | | | | | |

Sub. Notes, 144A, Cash coupon 7.000% (original cost $36,600; purchased

03/21/23 - 04/03/23)(f) (cost $36,600) | | 7.000% | | 11/16/23(d)(oo) | | | | | | | 248 | | | $ | 12,420 | |

| | | | | | | | | | | | | | | | |

| | | | | |

CORPORATE BONDS 44.2% | | | | | | | | | | | | | | | | |

| | | | | |

Australia 0.0% | | | | | | | | | | | | | | | | |

Australia & New Zealand Banking Group Ltd., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, EMTN | | 3.700 | | 03/18/24 | | | CNH | | | | 2,000 | | | | 272,257 | |

| | | | | |

Brazil 0.7% | | | | | | | | | | | | | | | | |

Petrobras Global Finance BV, | | | | | | | | | | | | | | | | |

Gtd. Notes | | 5.375 | | 10/01/29 | | | GBP | | | | 9,184 | | | | 9,740,789 | |

Gtd. Notes(a) | | 6.625 | | 01/16/34 | | | GBP | | | | 7,100 | | | | 7,585,157 | |

Gtd. Notes, EMTN | | 6.250 | | 12/14/26 | | | GBP | | | | 2,000 | | | | 2,343,971 | |

Suzano Austria GmbH, | | | | | | | | | | | | | | | | |

Gtd. Notes | | 6.000 | | 01/15/29 | | | | | | | 200 | | | | 192,660 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 19,862,577 | |

| | | | | |

Bulgaria 0.5% | | | | | | | | | | | | | | | | |

Bulgarian Energy Holding EAD, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.450 | | 07/22/28 | | | EUR | | | | 14,580 | | | | 12,650,220 | |

| | | | | |

Canada 0.8% | | | | | | | | | | | | | | | | |

Barrick North America Finance LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes | | 5.700 | | 05/30/41 | | | | | | | 45 | | | | 41,273 | |

Barrick PD Australia Finance Pty Ltd., | | | | | | | | | | | | | | | | |

Gtd. Notes | | 5.950 | | 10/15/39 | | | | | | | 50 | | | | 46,579 | |

Bombardier, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 7.125 | | 06/15/26 | | | | | | | 3,900 | | | | 3,741,184 | |

Sr. Unsec’d. Notes, 144A(a) | | 7.500 | | 02/01/29 | | | | | | | 375 | | | | 347,344 | |

Sr. Unsec’d. Notes, 144A | | 7.875 | | 04/15/27 | | | | | | | 2,535 | | | | 2,439,937 | |

Brookfield Residential Properties, Inc./Brookfield Residential US LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | 4.875 | | 02/15/30 | | | | | | | 2,320 | | | | 1,763,200 | |

Gtd. Notes, 144A | | 6.250 | | 09/15/27 | | | | | | | 2,175 | | | | 1,889,531 | |

Sr. Unsec’d. Notes, 144A | | 5.000 | | 06/15/29 | | | | | | | 1,675 | | | | 1,306,500 | |

Cenovus Energy, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes(a) | | 2.650 | | 01/15/32 | | | | | | | 1,340 | | | | 1,013,961 | |

See Notes to Financial Statements.

PGIM Global Total Return Fund 23

Schedule of Investments (continued)

as of October 31, 2023

| | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest

Rate | | Maturity

Date | | Principal Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Canada (cont’d.) | | | | | | | | | | | | | | | | |

Cenovus Energy, Inc., (cont’d.) | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 3.750% | | 02/15/52 | | | | | | | 955 | | | $ | 595,476 | |

MEG Energy Corp., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | 7.125 | | 02/01/27 | | | | | | | 605 | | | | 609,538 | |

Methanex Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 4.250 | | 12/01/24 | | | | | | | 1,500 | | | | 1,458,750 | |

Ontario Teachers’ Cadillac Fairview Properties Trust, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 2.500 | | 10/15/31 | | | | | | | 1,775 | | | | 1,306,884 | |

Rogers Communications, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | 3.250 | | 05/01/29 | | | CAD | | | | 700 | | | | 442,942 | |

Teck Resources Ltd., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 5.400 | | 02/01/43 | | | | | | | 1,403 | | | | 1,124,363 | |

Sr. Unsec’d. Notes | | 6.000 | | 08/15/40 | | | | | | | 4,142 | | | | 3,581,691 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 21,709,153 | |

| | | | | |

China 0.6% | | | | | | | | | | | | | | | | |

Agricultural Development Bank of China, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 3.800 | | 10/27/30 | | | CNH | | | | 55,000 | | | | 7,824,826 | |

Aircraft Finance Co. Ltd., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, Series B | | 4.100 | | 03/29/26 | | | | | | | 1,099 | | | | 1,049,691 | |

China Development Bank, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 4.300 | | 08/02/32 | | | CNH | | | | 25,000 | | | | 3,688,780 | |

Unsec’d. Notes | | 4.200 | | 01/19/27 | | | CNH | | | | 16,000 | | | | 2,262,279 | |

NXP BV/NXP Funding LLC/NXP USA, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes | | 3.150 | | 05/01/27 | | | | | | | 575 | | | | 519,863 | |

Gtd. Notes | | 3.400 | | 05/01/30 | | | | | | | 725 | | | | 606,267 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 15,951,706 | |

| | | | | |

Denmark 0.2% | | | | | | | | | | | | | | | | |

Danske Bank A/S, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 1.621(ff) | | 09/11/26 | | | | | | | 4,645 | | | | 4,230,503 | |

Sr. Unsec’d. Notes, 144A | | 3.244(ff) | | 12/20/25 | | | | | | | 1,095 | | | | 1,048,219 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 5,278,722 | |

| | | | | |

France 2.2% | | | | | | | | | | | | | | | | |

Altice France SA, | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | 3.375 | | 01/15/28 | | | EUR | | | | 8,475 | | | | 6,454,239 | |

Banque Federative du Credit Mutuel SA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, Series 19 | | 0.999 | | 10/15/25 | | | JPY | | | | 200,000 | | | | 1,322,751 | |

See Notes to Financial Statements.

24

| | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

France (cont’d.) | | | | | | | | | | | | | | | | |

BNP Paribas SA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 2.159%(ff) | | 09/15/29 | | | | | | | 23,127 | | | $ | 18,802,374 | |

Sr. Unsec’d. Notes, 144A | | 2.871(ff) | | 04/19/32 | | | | | | | 5,220 | | | | 3,968,113 | |

Sr. Unsec’d. Notes, 144A | | 5.335(ff) | | 06/12/29 | | | | | | | 2,450 | | | | 2,352,461 | |

Sub. Notes, EMTN | | 4.625 | | 03/09/27 | | | AUD | | | | 370 | | | | 216,319 | |

BPCE SA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, Series 03 | | 0.989 | | 07/12/28 | | | JPY | | | | 300,000 | | | | 1,903,951 | |

Credit Agricole Assurances SA, | | | | | | | | | | | | | | | | |

Sub. Notes | | 4.250(ff) | | 01/13/25(oo) | | | EUR | | | | 2,000 | | | | 2,075,357 | |

Credit Agricole Corporate & Investment Bank SA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, EMTN | | 2.670 | | 02/20/24 | | | NZD | | | | 1,400 | | | | 806,660 | |

Credit Agricole SA, | | | | | | | | | | | | | | | | |

Sub. Notes, EMTN | | 4.200(ff) | | 05/29/34 | | | AUD | | | | 400 | | | | 214,536 | |

Iliad Holding SASU, | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 5.125 | | 10/15/26 | | | EUR | | | | 6,850 | | | | 7,009,726 | |

Loxam SAS, | | | | | | | | | | | | | | | | |

Sr. Sub. Notes | | 4.500 | | 04/15/27 | | | EUR | | | | 1,900 | | | | 1,764,720 | |

SNCF Reseau, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, Series MPLE | | 4.700 | | 06/01/35 | | | CAD | | | | 6,400 | | | | 4,443,425 | |

Societe Generale SA, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A(a) | | 3.337(ff) | | 01/21/33 | | | | | | | 4,915 | | | | 3,684,254 | |

Sr. Unsec’d. Notes, 144A | | 2.889(ff) | | 06/09/32 | | | | | | | 1,685 | | | | 1,237,884 | |

Sr. Unsec’d. Notes, 144A, MTN(a) | | 6.446(ff) | | 01/10/29 | | | | | | | 1,500 | | | | 1,463,467 | |

Sub. Notes, EMTN | | 5.000 | | 05/19/27 | | | AUD | | | | 220 | | | | 129,867 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 57,850,104 | |

| | | | | |

Germany 0.4% | | | | | | | | | | | | | | | | |

Deutsche Bahn Finance GMBH, | | | | | | | | | | | | | | | | |

Gtd. Notes, MTN | | 1.987 | | 07/08/30 | | | AUD | | | | 1,000 | | | | 486,864 | |

Deutsche Bank AG, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.129(ff) | | 11/24/26 | | | | | | | 3,760 | | | | 3,383,306 | |

Sub. Notes, EMTN | | 3.662(ff) | | 04/10/25 | | | CNH | | | | 53,000 | | | | 7,133,388 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 11,003,558 | |

| | | | | |

Hong Kong 0.4% | | | | | | | | | | | | | | | | |

HKT Capital No. 3 Ltd., | | | | | | | | | | | | | | | | |

Gtd. Notes | | 1.650 | | 04/10/27 | | | EUR | | | | 9,300 | | | | 8,698,163 | |

See Notes to Financial Statements.

PGIM Global Total Return Fund 25

Schedule of Investments (continued)

as of October 31, 2023

| | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest

Rate | | Maturity

Date | | Principal Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Hong Kong (cont’d.) | | | | | | | | | | | | | | | | |

Sun Hung Kai Properties Capital Market Ltd., | | | | | | | | | | | | | | | | |

Gtd. Notes, EMTN | | 3.160% | | 01/25/28 | | | CNH | | | | 4,000 | | | $ | 532,268 | |

Gtd. Notes, EMTN | | 3.200 | | 08/14/27 | | | CNH | | | | 3,000 | | | | 401,754 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 9,632,185 | |

| | | | | |

Hungary 0.1% | | | | | | | | | | | | | | | | |

MFB Magyar Fejlesztesi Bank Zrt, | | | | | | | | | | | | | | | | |

Gov’t. Gtd. Notes | | 1.375 | | 06/24/25 | | | EUR | | | | 3,470 | | | | 3,444,518 | |

| | | | | |

Iceland 0.2% | | | | | | | | | | | | | | | | |

Landsvirkjun, | | | | | | | | | | | | | | | | |

Gov’t. Gtd. Notes, EMTN, 3 Month EURIBOR + 0.090% | | 4.059(c) | | 07/24/26 | | | EUR | | | | 5,100 | | | | 5,296,194 | |

| | | | | |

India 0.6% | | | | | | | | | | | | | | | | |

NTPC Ltd., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, EMTN | | 2.750 | | 02/01/27 | | | EUR | | | | 11,600 | | | | 11,417,851 | |

Power Finance Corp. Ltd., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, GMTN | | 1.841 | | 09/21/28 | | | EUR | | | | 5,000 | | | | 4,449,734 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 15,867,585 | |

| | | | | |

Indonesia 0.4% | | | | | | | | | | | | | | | | |

Freeport Indonesia PT, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A, MTN | | 5.315 | | 04/14/32 | | | | | | | 1,890 | | | | 1,678,811 | |

Sr. Unsec’d. Notes, EMTN | | 5.315 | | 04/14/32 | | | | | | | 600 | | | | 532,956 | |

Perusahaan Perseroan Persero PT Perusahaan Listrik Negara, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.875 | | 10/25/25 | | | EUR | | | | 2,636 | | | | 2,682,355 | |

Sr. Unsec’d. Notes, 144A | | 1.875 | | 11/05/31 | | | EUR | | | | 6,900 | | | | 5,561,891 | |

Sr. Unsec’d. Notes, 144A | | 2.875 | | 10/25/25 | | | EUR | | | | 900 | | | | 915,827 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 11,371,840 | |

| | | | | |

Israel 0.6% | | | | | | | | | | | | | | | | |

Israel Electric Corp. Ltd., | | | | | | | | | | | | | | | | |

Sec’d. Notes, 144A, GMTN | | 3.750 | | 02/22/32 | | | | | | | 600 | | | | 456,000 | |

Sr. Sec’d. Notes | | 7.875 | | 12/15/26 | | | | | | | 5,889 | | | | 5,898,246 | |

Sr. Sec’d. Notes, EMTN | | 3.700 | | 05/23/30 | | | JPY | | | | 200,000 | | | | 1,411,896 | |

Sr. Sec’d. Notes, EMTN | | 7.750 | | 12/15/27 | | | | | | | 8,650 | | | | 8,722,487 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 16,488,629 | |

See Notes to Financial Statements.

26

| | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest

Rate | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Italy 0.4% | | | | | | | | | | | | | | | | |

Intesa Sanpaolo SpA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 7.778%(ff) | | 06/20/54 | | | | | | | 1,985 | | | $ | 1,714,287 | |

Sub. Notes, 144A | | 4.198(ff) | | 06/01/32 | | | | | | | 1,430 | | | | 1,018,317 | |

UniCredit SpA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 1.982(ff) | | 06/03/27 | | | | | | | 8,485 | | | | 7,487,525 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 10,220,129 | |

| | | | | |

Jamaica 0.3% | | | | | | | | | | | | | | | | |

Digicel Group Holdings Ltd., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A, Cash coupon 5.000% and PIK 3.000% (original cost $205,016; purchased 03/21/23 - 03/22/23)(f) | | 8.000 | | 04/01/25(d) | | | | | | | 522 | | | | 104,467 | |

Digicel International Finance Ltd./Digicel International Holdings Ltd., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A (original cost $1,071,125; purchased 04/16/21)(f) | | 8.000 | | 12/31/26(d) | | | | | | | 1,100 | | | | 22,000 | |

Gtd. Notes, 144A, Cash coupon 13.000% (original cost $803,828; purchased 10/19/23)(f) | | 13.000 | | 12/31/25(d) | | | | | | | 1,148 | | | | 792,370 | |

Sr. Sec’d. Notes, 144A (original cost $678,023; purchased 10/19/23)(f) | | 8.750 | | 05/25/24 | | | | | | | 750 | | | | 686,949 | |

Sr. Sec’d. Notes, 144A (original cost $6,852,555; purchased 10/19/23)(f) | | 8.750 | | 05/25/24 | | | | | | | 7,250 | | | | 6,640,523 | |

Digicel Ltd., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | 6.750 | | 03/01/23(d) | | | | | | | 700 | | | | 17,500 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 8,263,809 | |

| | | | | |

Japan 0.3% | | | | | | | | | | | | | | | | |

Nomura Holdings, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.608 | | 07/14/31 | | | | | | | 2,070 | | | | 1,541,885 | |

Sr. Unsec’d. Notes(a) | | 2.999 | | 01/22/32 | | | | | | | 7,475 | | | | 5,635,214 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 7,177,099 | |

| | | | | |

Kazakhstan 0.4% | | | | | | | | | | | | | | | | |

Kazakhstan Temir Zholy National Co. JSC, | | | | | | | | | | | | | | | | |

Gtd. Notes | | 3.250 | | 12/05/23 | | | CHF | | | | 9,300 | | | | 9,921,704 | |

See Notes to Financial Statements.

PGIM Global Total Return Fund 27

Schedule of Investments (continued)

as of October 31, 2023

| | | | | | | | | | | | | | |

| | | | |

Description | | Interest

Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | |

| | | | | |

Luxembourg 0.4% | | | | | | | | | | | | | | |

Blackstone Property Partners Europe Holdings Sarl, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, EMTN | | 1.000% | | 05/04/28 | | EUR | | | 9,850 | | | $ | 8,180,868 | |

Sr. Unsec’d. Notes, EMTN | | 1.625 | | 04/20/30 | | EUR | | | 2,400 | | | | 1,853,563 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 10,034,431 | |

| | | | | |

Malta 0.1% | | | | | | | | | | | | | | |

Freeport Terminal Malta PLC, | | | | | | | | | | | | | | |

Gov’t. Gtd. Notes, 144A | | 7.250 | | 05/15/28 | | | | | 3,000 | | | | 3,150,940 | |

| | | | | |

Mexico 1.4% | | | | | | | | | | | | | | |

Comision Federal de Electricidad, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 5.000 | | 09/29/36 | | | | | 10,590 | | | | 8,630,850 | |

Mexico City Airport Trust, | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | 3.875 | | 04/30/28 | | | | | 389 | | | | 343,363 | |

Sr. Sec’d. Notes | | 5.500 | | 07/31/47 | | | | | 3,137 | | | | 2,232,007 | |

Petroleos Mexicanos, | | | | | | | | | | | | | | |

Gtd. Notes | | 9.500 | | 09/15/27 | | | | | 2,000 | | | | 1,881,840 | |

Gtd. Notes, EMTN | | 2.750 | | 04/21/27 | | EUR | | | 4,500 | | | | 3,685,219 | |

Gtd. Notes, EMTN | | 4.875 | | 02/21/28 | | EUR | | | 23,000 | | | | 19,488,509 | |

U.S. Gov’t. Gtd. Notes, 3 Month SOFR + 0.692% | | 6.056(c) | | 02/15/24 | | | | | 375 | | | | 375,104 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 36,636,892 | |

| | | | | |

Netherlands 0.9% | | | | | | | | | | | | | | |

ABN AMRO Bank NV, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A, MTN | | 6.575(ff) | | 10/13/26 | | | | | 5,800 | | | | 5,789,004 | |

Sub. Notes, 144A, MTN | | 4.750 | | 07/28/25 | | | | | 500 | | | | 481,363 | |

Cooperatieve Rabobank UA, | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, EMTN | | 2.750 | | 03/04/24 | | NZD | | | 376 | | | | 216,651 | |

Sr. Unsec’d. Notes, GMTN | | 3.500 | | 12/14/26 | | AUD | | | 2,882 | | | | 1,703,459 | |

Sr. Unsec’d. Notes, GMTN | | 9.298(s) | | 03/11/39 | | MXN | | | 22,000 | | | | 219,646 | |

OCI NV, | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 3.625 | | 10/15/25 | | EUR | | | 8,370 | | | | 8,656,499 | |

TMNL Holding BV, | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 3.750 | | 01/15/29 | | EUR | | | 2,300 | | | | 2,095,769 | |

Ziggo Bond Co. BV, | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | 3.375 | | 02/28/30 | | EUR | | | 6,000 | | | | 4,647,048 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 23,809,439 | |

See Notes to Financial Statements.

28

| | | | | | | | | | | | | | | | |

| | | | |

Description | | Interest

Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Norway 0.1% | | | | | | | | | | | | | | | | |

Equinor ASA, | | | | | | | | | | | | | | | | |

Gtd. Notes | | 6.800% | | 01/15/28 | | | | | | | 2,140 | | | $ | 2,205,311 | |

| | | | | |

Peru 0.0% | | | | | | | | | | | | | | | | |

Lima Metro Line 2 Finance Ltd., | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | 5.875 | | 07/05/34 | | | | | | | 89 | | | | 84,330 | |

Peru Enhanced Pass-Through Finance Ltd., | | | | | | | | | | | | | | | | |

Pass-Through Certificates | | 3.002(s) | | 06/02/25 | | | | | | | 836 | | | | 790,601 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 874,931 | |

| | | | | |

Philippines 0.2% | | | | | | | | | | | | | | | | |

Bangko Sentral ng Pilipinas International Bond, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, Series A | | 8.600 | | 06/15/27 | | | | | | | 3,560 | | | | 4,091,544 | |

| | | | | |

Poland 0.3% | | | | | | | | | | | | | | | | |

Bank Gospodarstwa Krajowego, | | | | | | | | | | | | | | | | |

Gov’t. Gtd. Notes | | 1.625 | | 04/30/28 | | | EUR | | | | 600 | | | | 560,264 | |

Gov’t. Gtd. Notes, 144A, MTN | | 5.375 | | 05/22/33 | | | | | | | 1,215 | | | | 1,129,950 | |

Gov’t. Gtd. Notes, EMTN | | 0.500 | | 07/08/31 | | | EUR | | | | 500 | | | | 384,223 | |

Gov’t. Gtd. Notes, EMTN(a) | | 1.750 | | 05/06/26 | | | EUR | | | | 4,700 | | | | 4,649,820 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 6,724,257 | |

| | | | | |

Qatar 0.0% | | | | | | | | | | | | | | | | |

QNB Finance Ltd., | | | | | | | | | | | | | | | | |

Gtd. Notes, EMTN | | 3.500 | | 03/09/26 | | | CNH | | | | 7,400 | | | | 995,247 | |

Gtd. Notes, MTN | | 4.900 | | 02/01/28 | | | AUD | | | | 250 | | | | 151,462 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 1,146,709 | |

| | | | | |

Russia 0.7% | | | | | | | | | | | | | | | | |

Gazprom PJSC Via Gaz Capital SA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.500 | | 03/21/26(d) | | | EUR | | | | 3,500 | | | | 2,407,178 | |

Sr. Unsec’d. Notes | | 4.250 | | 04/06/24 | | | GBP | | | | 7,927 | | | | 7,611,549 | |

Sr. Unsec’d. Notes, EMTN | | 4.364 | | 03/21/25(d) | | | EUR | | | | 4,000 | | | | 2,962,680 | |

Gazprom PJSC via Gaz Finance PLC, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 3.000 | | 06/29/27(d) | | | | | | | 1,410 | | | | 930,600 | |

Sr. Unsec’d. Notes, EMTN | | 1.540 | | 06/30/27 | | | CHF | | | | 6,000 | | | | 4,056,505 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 17,968,512 | |

See Notes to Financial Statements.

PGIM Global Total Return Fund 29

Schedule of Investments (continued)

as of October 31, 2023

| | | | | | | | | | | | | | |

| | | | |