UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-04661 |

| |

| Exact name of registrant as specified in charter: | | Prudential Global Total Return Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | | 655 Broad Street, 17th Floor |

| | | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2021 |

| |

| Date of reporting period: | | 10/31/2021 |

Item 1 – Reports to Stockholders

PGIM GLOBAL TOTAL RETURN FUND

ANNUAL REPORT

OCTOBER 31, 2021

|

|

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery |

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2021 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgim.com/investments |

Letter from the President

| | |

| | Dear Shareholder: We hope you find the annual report for the PGIM Global Total Return Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2021. The global economy and markets continued to recover throughout the period from the ongoing impact of the COVID-19 pandemic. The Federal Reserve slashed interest rates and kept them near zero to encourage borrowing. Congress passed stimulus bills worth several trillion dollars to help consumers and businesses. And several |

| | |

| effective COVID-19 vaccines received regulatory approval. Those measures were enough to offset the fear of rising inflation and supply chain challenges that threatened to disrupt growth. |

At the start of the period, stocks had recovered most of the steep losses they had suffered at the onset of the pandemic. Equities rallied as states reopened their economies but became more volatile as investors worried that a surge in COVID-19 infections would stall the recovery. However, rising corporate profits and economic growth, the resolution of the US presidential election, and the global rollout of approved vaccines lifted equity markets to record levels, helping stocks around the globe post gains for the full period.

Throughout this volatile period, investors sought safety in fixed income. Investment-grade bonds in the US and the overall global bond market declined slightly during the period as the economy recovered, but emerging market debt rose. While the 10-year US Treasury yield hovered near record lows early in the period after a significant rally in interest rates, rates moved higher later on as investors began to focus on stronger economic growth and the prospects of higher inflation. The Fed also took several aggressive actions to keep the bond markets running smoothly, implementing many of the relief programs that proved to be successful in helping end the global financial crisis in 2008-09.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1.5 trillion in assets under management. This scale and investment expertise allow us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Global Total Return Fund

December 15, 2021

| | | | |

PGIM Global Total Return Fund | | | 3 | |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | Average Annual Total Returns as of 10/31/21 |

| | | | | | | | | One Year (%) | | Five Years (%) | | Ten Years (%) | | Since Inception (%) |

| | | | | | | |

| Class A | | | | | | | | | | | | | | |

| | | | | | | |

| (with sales charges) | | | | | | | | -4.19 | | 3.31 | | 3.15 | | — |

| | | | | | | |

| (without sales charges) | | | | | | | | -0.97 | | 4.00 | | 3.49 | | — |

| | | | | | | |

| Class C | | | | | | | | | | | | | | |

| | | | | | | |

| (with sales charges) | | | | | | | | -2.68 | | 3.23 | | 2.74 | | — |

| | | | | | | |

| (without sales charges) | | | | | | | | -1.72 | | 3.23 | | 2.74 | | — |

| | | | | | | |

| Class Z | | | | | | | | | | | | | | |

| | | | | | | |

| (without sales charges) | | | | | | | | -0.70 | | 4.27 | | 3.76 | | — |

| | | | | | | |

| Class R2 | | | | | | | | | | | | | | |

| | | | | | | |

| (without sales charges) | | | | | | | | -1.12 | | N/A | | N/A | | 3.28 (12/27/2017) |

| | | | | | | |

| Class R4 | | | | | | | | | | | | | | |

| | | | | | | |

| (without sales charges) | | | | | | | | -0.87 | | N/A | | N/A | | 3.54 (12/27/2017) |

| | | | | | | |

| Class R6 | | | | | | | | | | | | | | |

| | | | | | | |

| (without sales charges) | | | | | | | | -0.58 | | 4.30 | | N/A | | 3.87 (02/03/2012) |

| | | | | | | |

| Bloomberg Global Aggregate Index | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | -1.24 | | 2.52 | | 1.70 | | — |

| | | | | | | | | | | | | | |

|

| Average Annual Total Returns as of 10/31/21 Since Inception (%) |

| | | | | | | | | | | | | Class R2, Class R4

(12/27/2017) | | Class R6 (02/03/2012) |

| | | | | | | |

| Bloomberg Global Aggregate Index | | | | | | | | | | | | 2.59 | | 1.69 |

Since Inception returns are provided for any share class that has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’ inception date.

| | |

| 4 | | Visit our website at pgim.com/investments |

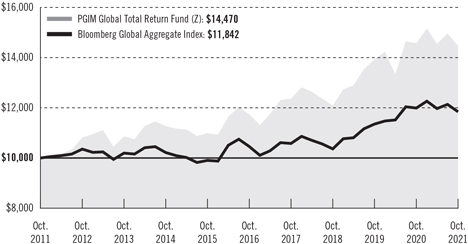

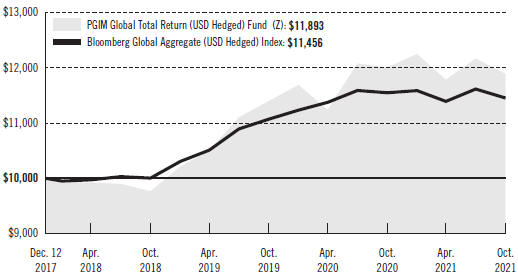

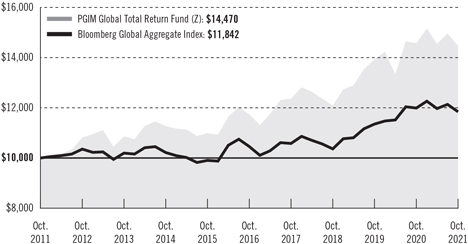

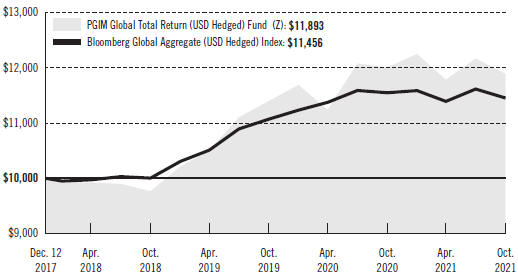

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the Bloomberg Global Aggregate Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (October 31, 2011) and the account values at the end of the current fiscal year (October 31, 2021), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

| | | | |

PGIM Global Total Return Fund | | | 5 | |

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | | | | | |

| | | | | | | |

| | | Class A | | Class C | | Class Z | | Class R2 | | Class R4 | | Class R6 |

| Maximum initial sales charge | | 3.25% of the public offering price | | None | | None | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | 1.00% on sales of $500,000 or more made within 12 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | | None | | None | | None |

| Annual distribution or distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.25% | | 1.00% | | None | | 0.25% | | None | | None |

| Shareholder service fees | | None | | None | | None | | 0.10%* | | 0.10%* | | None |

*Shareholder service fee reflects maximum allowable fees under a shareholder services plan.

Benchmark Definitions

Bloomberg Global Aggregate Index—The Bloomberg Global Aggregate Index is an unmanaged index of global investment-grade fixed income markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The Index also includes Eurodollar and Euro-Yen corporate bonds, and Canadian government, agency, and corporate securities.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

| | |

| 6 | | Visit our website at pgim.com/investments |

| | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Distributions and Yields as of 10/31/21 | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Total Distributions

Paid for

12 Months ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized

Yield** (%) |

| Class A | | | | | | | | | | | | | | | | | | 0.23 | | 1.37 | | 1.38 |

| Class C | | | | | | | | | | | | | | | | | | 0.18 | | 0.67 | | 0.64 |

| Class Z | | | | | | | | | | | | | | | | | | 0.25 | | 1.66 | | 1.61 |

| Class R2 | | | | | | | | | | | | | | | | | | 0.22 | | 1.21 | | 1.81 |

| Class R4 | | | | | | | | | | | | | | | | | | 0.23 | | 1.46 | | 1.41 |

| Class R6 | | | | | | | | | | | | | | | | | | 0.26 | | 1.79 | | 1.79 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| | | | |

| |

| Credit Quality expressed as a percentage of total investments as of 10/31/21 (%) | |

| | |

| AAA | | | 15.5 | |

| | |

| AA | | | 9.3 | |

| | |

| A | | | 17.4 | |

| | |

| BBB | | | 31.7 | |

| | |

| BB | | | 12.4 | |

| | |

| B | | | 5.3 | |

| | |

| CCC | | | 1.3 | |

| | |

| Not Rated | | | 6.0 | |

| | |

| Cash/Cash Equivalents | | | 1.1 | |

| | |

| Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | | | |

PGIM Global Total Return Fund | | | 7 | |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM Global Total Return Fund’s Class Z shares returned -0.70% in the 12-month reporting period that ended October 31, 2021, outperforming the -1.24% return of the Bloomberg Global Aggregate Index (the Index).

What were the market conditions?

| • | | The strong global rebound from the depths of the COVID-19 pandemic continued throughout the reporting period, as economies continued to respond to the unprecedented monetary and fiscal stimulus programs. The effective rollout of COVID-19 vaccines, along with clear messaging from both President Biden and the Federal Reserve (the Fed) on the potential for further stimulus, shifted the prospects for growth and inflation, kicking off a robust “reflation trade” in bond markets, which caused the US Treasury yield curve to steepen over the period. (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) |

| • | | Although yields for short-term Treasuries remained well anchored during the first quarter of 2021 by the Fed’s commitment to maintain its low-rate policy, longer-term Treasuries sold off sharply, with the yield on the benchmark US 10-year Treasury note rising from 0.92% on December 31, 2020 to 1.74% by March 31, 2021. Similarly, the yield on the 30-year Treasury bond rose from 1.65% to 2.41% over the same period. |

| • | | Market volatility for rates then eased in the second and third quarters of 2021, with long-term US Treasury yields declining gradually before rising again in late September after the Fed signaled it could begin tapering its monthly bond purchases shortly after its November meeting. The US 10-year and 30-year Treasury yields ended the period at 1.55% and 1.93%, respectively. Meanwhile, the yield on the 2-year Treasury note rose sharply the last month of the period as markets began pricing in two rate hikes in 2022, ending October 31, 2021 at 0.45%—a rise of 28 basis points (bps) over the period. (One basis point equals 0.01%.) Despite flattening over the last six months of the period as the market pulled forward its expectation for rate hikes, the US Treasury yield curve steepened during the period, with the 10-year and 2-year Treasury spread rising from 0.74% to 1.07% as of October 31, 2021. |

| • | | In Europe, German 10-year bond yields rose to end the period at -0.10%, as rate hike expectations were brought forward amid concerns about prolonged inflation even as the European Central Bank continued to signal rate hikes in 2022 were unlikely. Similarly, United Kingdom (UK) 10-year bond yields rose over the period to end October 31, 2021 at 1.03% amid inflation concerns driven by demand and supply-chain bottlenecks. |

| • | | Spread markets continued to tighten, supported by the Fed’s monetary responses, fiscal stimulus, the rollout of COVID-19 vaccines, better-than-expected corporate earnings, and surging growth in the US, Europe, and some emerging market economies. (Spread markets are non-government-related sectors of the fixed income market, such as investment grade corporate bonds, high yield bonds, or asset-backed |

| | |

| 8 | | Visit our website at pgim.com/investments |

| | securities.) Strengthening economic fundamentals coupled with aggressive central bank measures (e.g., zero interest rate policies and asset purchases) drove corporate and securitized asset spreads tighter, with many sectors rallying to, or through, their pre-COVID-19 levels. |

| • | | The US investment grade corporate market performed well, with spreads tightening to near-historic levels by the end of the period, supported by better-than-expected corporate earnings, positive vaccination progress, and a favorable technical backdrop. Strengthening fundamentals generally kept securitized credit on a tightening trajectory as well, with commercial mortgage-backed securities (CMBS) spreads trading well below their pre-pandemic tights by the end of the period. US high yield bond spreads tightened as fundamentals remained supportive. Meanwhile, emerging market spreads tightened, boosting returns as investor appetite remained strong amid a global search for yield. |

What worked?

| • | | Security selection and sector allocation both contributed to the Fund’s performance over the reporting period. |

| • | | Within security selection, positions in developed high yield, emerging sovereigns, developed sovereigns, developed asset-backed securities (ABS), emerging agencies, developed Treasuries, and developed investment grade corporates were the largest contributors for the period. |

| • | | Within sector allocation, overweights to emerging sovereigns, developed CMBS, developed high yield, and developed ABS relative to the Index were the largest contributors to performance. |

| • | | Within credit, positioning in foreign non-corporates, upstream and midstream energy, retailers & restaurants, and gaming, lodging & leisure contributed. |

| • | | In individual security selection, the Fund benefited from overweights to Ukraine, Italy, and Greece sovereign bonds relative to the Index, along with positioning in Chesapeake Energy Corp. (upstream energy) and Petroleos Mexicanos SA de CV (foreign non-corporate). |

What didn’t work?

| • | | During the reporting period, the Fund’s long duration bias, principally in emerging market rates, detracted from returns. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) The Fund’s yield curve flattener positioning in US rates also detracted, as the curve steepened over the period. (A yield curve flattener is an interest rate environment in which long-term rates are decreasing more quickly than short-term rates.) |

| • | | Although overall security selection contributed to performance, positioning in emerging LIBOR (London Interbank Offered Rate) derivatives, emerging Treasuries, and developed LIBOR derivatives detracted from performance. Within sector |

| | | | |

PGIM Global Total Return Fund | | | 9 | |

Strategy and Performance Overview (continued)

| | allocation, an underweight to developed investment grade corporates and developed local authorities, along with an overweight to emerging Treasuries, relative to the Index detracted. |

| • | | Within credit, positioning in life insurance, finance companies, and property & casualty detracted from performance. |

| • | | In individual security selection, overweights to Prologis Inc. (REIT) and Medtronic PLC (healthcare) relative to the Index, along with positioning in UK and China sovereign bonds, detracted from performance. |

Did the Fund use derivatives?

The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used interest rate futures, options, and swaps to help manage duration positioning and yield curve exposure. Over the period, options contributed to performance while futures and swaps detracted. Credit default swaps and credit default swap index (CDX) positions were used to either add risk exposure to certain issuers or to hedge credit risk imposed by certain issuers. Overall, credit derivative exposure contributed during the period. In addition, the Fund traded foreign-exchange derivatives, which had a negative impact on performance over the period.

Current outlook

| • | | As the Fed’s tapering approached, PGIM Fixed Income believed the Fed would likely draw a clear distinction between the removal of accommodation via reduction in asset purchases and tightening of policy through rate hikes in the federal funds rate target. |

| • | | Looking beyond the next year or two, PGIM Fixed Income believes the secular fundamental drivers—such as aging demographics and high debt levels—that pushed rates lower for decades are likely to reassert themselves with even more downward force on rates in a post-COVID world of older populations and markedly higher debt levels. As a result, many central bankers may end up leaving administered rates near, or at, their effective lower bounds, and rate hike cycles will likely continue cresting at progressively lower levels. From that perspective, the third quarter 2021 increase in longer-term rates—which lifted them back up to levels that reflect a substantial and permanent rise in administered rates over the coming years—has probably already overshot fundamentals, in PGIM Fixed Income’s view. |

| • | | As for spread sectors, PGIM Fixed Income continues to expect the ongoing economic expansion to support credit fundamentals and, in turn, to allow credit products to continue outperforming. Given the relatively narrow level of spreads, however, excess returns are likely to be more modest, deriving primarily from incremental yield and rolling down the spread curve, rather than from the kinds of wholesale spread compression seen since March 2020. (Roll-down return is a strategy for selling a bond as it approaches its maturity date. In general, as a bond’s maturity date grows |

| | |

| 10 | | Visit our website at pgim.com/investments |

| | closer, its interest rate moves closer to zero. Since there is an inverse relationship between bond yields and prices, bond prices increase as their interest rates decrease.) |

| • | | PGIM Fixed Income maintains its positive view of the spread sectors over the medium to long term, and the Fund holds allocations to an array of credit sectors, including investment-grade and high yield corporates, high-quality structured products, and emerging markets. While valuations are now a bit full, with spreads in many sectors tighter than historical norms, PGIM Fixed Income generally expects ongoing spread sector outperformance. However, this outlook is not without caveats. First, the relatively narrow level of spreads diminishes the pace and magnitude of further outperformance. Additionally, narrower spreads leave little room for error, and the uncertain course of the long-term economic recovery warrants a discerning approach to credit selection. |

| • | | Within structured products, PGIM Fixed Income is biased to own the top of the capital structure, as near-zero policy rates and ongoing Fed purchases support a spread tightening environment. In investment grade corporates, PGIM Fixed Income is looking to take advantage of spread compression in select higher-yielding BBB-rated bonds, solid credits in stressed industries, and cyclicals. PGIM Fixed Income remains constructive on high yield over the medium term as improving fundamentals and a decline in defaults is expected to drive spread compression going forward, and it believes the prospects for emerging market debt performance are encouraging given the supportive backdrop, attractive valuations, and global search for yield. |

| | | | |

PGIM Global Total Return Fund | | | 11 | |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2021. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

| | |

| 12 | | Visit our website at pgim.com/investments |

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | | |

| PGIM Global Total Return Fund | | Beginning Account Value May 1, 2021 | | Ending Account Value October 31, 2021 | | | Annualized Expense Ratio Based on the Six-Month Period | | Expenses Paid During the Six-Month Period* |

| | | | | |

| Class A | | Actual | | $1,000.00 | | | $ 993.20 | | | 0.88% | | $4.42 |

| | Hypothetical | | $1,000.00 | | | $1,020.77 | | | 0.88% | | $4.48 |

| Class C | | Actual | | $1,000.00 | | | $ 989.40 | | | 1.63% | | $8.17 |

| | Hypothetical | | $1,000.00 | | | $1,016.99 | | | 1.63% | | $8.29 |

| Class Z | | Actual | | $1,000.00 | | | $ 994.50 | | | 0.64% | | $3.22 |

| | Hypothetical | | $1,000.00 | | | $1,021.98 | | | 0.64% | | $3.26 |

| Class R2 | | Actual | | $1,000.00 | | | $ 993.90 | | | 1.08% | | $5.43 |

| | Hypothetical | | $1,000.00 | | | $1,019.76 | | | 1.08% | | $5.50 |

| Class R4 | | Actual | | $1,000.00 | | | $ 993.70 | | | 0.83% | | $4.17 |

| | Hypothetical | | $1,000.00 | | | $1,021.02 | | | 0.83% | | $4.23 |

| Class R6 | | Actual | | $1,000.00 | | | $ 995.20 | | | 0.52% | | $2.62 |

| | | Hypothetical | | $1,000.00 | | | $1,022.58 | | | 0.52% | | $2.65 |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2021, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2021 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | | | |

PGIM Global Total Return Fund | | | 13 | |

Schedule of Investments

as of October 31, 2021

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

LONG-TERM INVESTMENTS 98.7% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

ASSET-BACKED SECURITIES 11.0% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Canada 0.1% | | | | | | | | | | | | | | | | | | | | |

Fairstone Financial Issuance Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2020-01A, Class A, 144A | | | 2.509 | % | | | 10/20/39 | | | | CAD | | | | 1,500 | | | $ | 1,206,327 | |

Ford Auto Securitization Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2020-AA, Class B, 144A | | | 1.872 | | | | 06/15/26 | | | | CAD | | | | 400 | | | | 320,275 | |

Series 2020-AA, Class C, 144A | | | 2.763 | | | | 04/15/28 | | | | CAD | | | | 500 | | | | 406,496 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 1,933,098 | |

| | | | | |

Cayman Islands 3.2% | | | | | | | | | | | | | | | | | | | | |

Battalion CLO Ltd., | | | | | | | | | | | | | | | | | | | | |

Series 2015-08A, Class A1R2, 144A, 3 Month LIBOR + 1.070% (Cap N/A, Floor 1.070%) | | | 1.192 | (c) | | | 07/18/30 | | | | | | | | 5,500 | | | | 5,498,837 | |

Brookside Mill CLO Ltd., | | | | | | | | | | | | | | | | | | | | |

Series 2013-01A, Class BR, 144A, 3 Month LIBOR + 1.350% (Cap N/A, Floor 0.000%) | | | 1.472 | (c) | | | 01/17/28 | | | | | | | | 4,000 | | | | 4,002,573 | |

Carlyle CLO Ltd., | | | | | | | | | | | | | | | | | | | | |

Series C17A, Class A1AR, 144A, 3 Month LIBOR + 1.030% (Cap N/A, Floor 0.000%) | | | 1.159 | (c) | | | 04/30/31 | | | | | | | | 15,000 | | | | 15,007,489 | |

Carlyle US CLO Ltd., | | | | | | | | | | | | | | | | | | | | |

Series 2018-01A, Class A1, 144A, 3 Month LIBOR + 1.020% (Cap N/A, Floor 0.000%) | | | 1.152 | (c) | | | 04/20/31 | | | | | | | | 12,500 | | | | 12,500,002 | |

CBAM Ltd., | | | | | | | | | | | | | | | | | | | | |

Series 2019-11A, Class A1, 144A, 3 Month LIBOR + 1.360% (Cap N/A, Floor 1.360%) | | | 1.492 | (c) | | | 10/20/32 | | | | | | | | 25,000 | | | | 25,010,295 | |

Elevation CLO Ltd., | | | | | | | | | | | | | | | | | | | | |

Series 2017-06A, Class A1, 144A, 3 Month LIBOR + 1.280% (Cap N/A, Floor 0.000%) | | | 1.404 | (c) | | | 07/15/29 | | | | | | | | 500 | | | | 500,376 | |

Generate CLO Ltd., | | | | | | | | | | | | | | | | | | | | |

Series 02A, Class AR, 144A, 3 Month LIBOR + 1.150% (Cap N/A, Floor 0.000%) | | | 1.278 | (c) | | | 01/22/31 | | | | | | | | 5,000 | | | | 4,999,995 | |

Greywolf CLO Ltd., | | | | | | | | | | | | | | | | | | | | |

Series 2020-03RA, Class A1R, 144A, 3 Month LIBOR + 1.290% (Cap N/A, Floor 1.290%) | | | 1.418 | (c) | | | 04/15/33 | | | | | | | | 14,000 | | | | 14,024,233 | |

MidOcean Credit CLO, | | | | | | | | | | | | | | | | | | | | |

Series 2016-05A, Class AR, 144A, 3 Month LIBOR + 1.120% (Cap N/A, Floor 0.000%) | | | 1.244 | (c) | | | 07/19/28 | | | | | | | | 3,563 | | | | 3,562,683 | |

Series 2018-08A, Class B, 144A, 3 Month LIBOR + 1.650% (Cap N/A, Floor 0.000%) | | | 1.781 | (c) | | | 02/20/31 | | | | | | | | 2,000 | | | | 2,000,400 | |

Series 2018-09A, Class A1, 144A, 3 Month LIBOR + 1.150% (Cap N/A, Floor 1.150%) | | | 1.282 | (c) | | | 07/20/31 | | | | | | | | 2,000 | | | | 1,999,952 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 15 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Cayman Islands (cont’d.) | | | | | | | | | | | | | | | | |

Mountain View CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2015-09A, Class A2R, 144A, 3 Month LIBOR + 1.780% (Cap N/A, Floor 0.000%) | | | 1.904 | %(c) | | | 07/15/31 | | | | 5,750 | | | $ | 5,748,540 | |

Series 2019-01A, Class A1R, 144A, 3 Month LIBOR + 1.250% (Cap N/A, Floor 1.250%) | | | 1.374 | (c) | | | 10/15/34 | | | | 15,000 | | | | 15,002,895 | |

OZLM Ltd., | | | | | | | | | | | | | | | | |

Series 2014-06A, Class A2AS, 144A, 3 Month LIBOR + 1.750% (Cap N/A, Floor 0.000%) | | | 1.872 | (c) | | | 04/17/31 | | | | 2,000 | | | | 2,000,090 | |

Series 2018-20A, Class A1, 144A, 3 Month LIBOR + 1.050% (Cap N/A, Floor 0.000%) | | | 1.182 | (c) | | | 04/20/31 | | | | 5,000 | | | | 4,998,509 | |

Race Point CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2013-08A, Class AR2, 144A, 3 Month LIBOR + 1.040% (Cap N/A, Floor 1.040%) | | | 1.171 | (c) | | | 02/20/30 | | | | 8,540 | | | | 8,542,578 | |

Shackleton CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2014-05RA, Class A, 144A, 3 Month LIBOR + 1.100% (Cap N/A, Floor 0.000%) | | | 1.225 | (c) | | | 05/07/31 | | | | 5,000 | | | | 4,996,991 | |

Series 2014-05RA, Class B, 144A, 3 Month LIBOR + 1.700% (Cap N/A, Floor 0.000%) | | | 1.825 | (c) | | | 05/07/31 | | | | 6,500 | | | | 6,496,813 | |

Series 2017-10A, Class BR, 144A, 3 Month LIBOR + 1.550% (Cap N/A, Floor 0.000%) | | | 1.682 | (c) | | | 04/20/29 | | | | 10,000 | | | | 9,980,764 | |

Signal Peak CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2018-05A, Class A, 144A, 3 Month LIBOR + 1.110% (Cap N/A, Floor 1.110%) | | | 1.234 | (c) | | | 04/25/31 | | | | 6,250 | | | | 6,248,226 | |

Silver Creek CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2014-01A, Class AR, 144A, 3 Month LIBOR + 1.240% (Cap N/A, Floor 0.000%) | | | 1.372 | (c) | | | 07/20/30 | | | | 493 | | | | 492,694 | |

TCW CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2018-01A, Class A1A, 144A, 3 Month LIBOR + 1.050% (Cap N/A, Floor 0.000%) | | | 1.174 | (c) | | | 04/25/31 | | | | 15,000 | | | | 14,997,841 | |

TIAA CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2016-01A, Class AR, 144A, 3 Month LIBOR + 1.200% (Cap N/A, Floor 0.000%) | | | 1.332 | (c) | | | 07/20/31 | | | | 2,000 | | | | 2,000,136 | |

Tryon Park CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2013-01A, Class A2R, 144A, 3 Month LIBOR + 1.500% (Cap N/A, Floor 0.000%) | | | 1.624 | (c) | | | 04/15/29 | | | | 3,700 | | | | 3,699,913 | |

Voya CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2013-02A, Class A1R, 144A, 3 Month LIBOR + 0.970% (Cap N/A, Floor 0.970%) | | | 1.094 | (c) | | | 04/25/31 | | | | 4,500 | | | | 4,502,226 | |

Wellfleet CLO Ltd., | | | | | | | | | | | | | | | | |

Series 2017-03A, Class A1, 144A, 3 Month LIBOR + 1.150% (Cap N/A, Floor 1.150%) | | | 1.272 | (c) | | | 01/17/31 | | | | 2,500 | | | | 2,500,677 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Cayman Islands (cont’d.) | | | | | | | | | | | | | | | | | | | | |

Zais CLO Ltd., | | | | | | | | | | | | | | | | | | | | |

Series 2015-03A, Class A2R, 144A, 3 Month LIBOR + 2.190% (Cap N/A, Floor 0.000%) | | | 2.314 | %(c) | | | 07/15/31 | | | | | | | | 8,500 | | | $ | 8,503,947 | |

Series 2017-02A, Class A, 144A, 3 Month LIBOR + 1.290% (Cap N/A, Floor 0.000%) | | | 1.414 | (c) | | | 04/15/30 | | | | | | | | 733 | | | | 732,276 | |

Series 2018-01A, Class A, 144A, 3 Month LIBOR + 0.950% (Cap N/A, Floor 0.000%) | | | 1.074 | (c) | | | 04/15/29 | | | | | | | | 5,745 | | | | 5,740,844 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 196,292,795 | |

| | | | | |

Ireland 4.8% | | | | | | | | | | | | | | | | | | | | |

Anchorage Capital Europe CLO Ltd., | | | | | | | | | | | | | | | | | | | | |

Series 04A, Class A, 144A, 3 Month EURIBOR + 0.870% (Cap N/A, Floor 0.870%) | | | 0.870 | (c) | | | 04/25/34 | | | | EUR | | | | 4,000 | | | | 4,593,500 | |

Ares European CLO DAC, | | | | | | | | | | | | | | | | | | | | |

Series 2013-06A, Class B1RR, 144A, 3 Month EURIBOR + 1.250% (Cap N/A, Floor 1.250%) | | | 1.250 | (c) | | | 04/15/30 | | | | EUR | | | | 8,000 | | | | 9,239,580 | |

Armada Euro CLO DAC, | | | | | | | | | | | | | | | | | | | | |

Series 02A, Class A3, 144A | | | 1.500 | | | | 11/15/31 | | | | EUR | | | | 1,500 | | | | 1,736,018 | |

Bosphorus CLO DAC, | | | | | | | | | | | | | | | | | | | | |

Series 06A, Class A, 144A, 3 Month EURIBOR + 0.850% (Cap N/A, Floor 0.850%) | | | 0.850 | (c) | | | 05/25/34 | | | | EUR | | | | 20,000 | | | | 22,981,846 | |

Capital Four CLO DAC, | | | | | | | | | | | | | | | | | | | | |

Series 02A, Class A, 144A, 3 Month EURIBOR + 1.050% (Cap N/A, Floor 1.050%) | | | 1.050 | (c) | | | 01/15/34 | | | | EUR | | | | 23,000 | | | | 26,636,922 | |

Carlyle Euro CLO DAC, | | | | | | | | | | | | | | | | | | | | |

Series 2017-02A, Class A1R, 144A, 3 Month EURIBOR + 0.630% (Cap N/A, Floor 0.630%) | | | 0.630 | (c) | | | 08/15/30 | | | | EUR | | | | 55,950 | | | | 64,436,717 | |

Series 2017-02A, Class AA2R, 144A, 3 Month EURIBOR + 1.300% (Cap N/A, Floor 1.300%) | | | 1.300 | (c) | | | 08/15/30 | | | | EUR | | | | 9,500 | | | | 10,999,017 | |

Series 2019-01A, Class A1R, 144A, 3 Month EURIBOR + 0.750% (Cap N/A, Floor 0.750%) | | | 0.750 | (c) | | | 03/15/32 | | | | EUR | | | | 20,000 | | | | 23,031,293 | |

CIFC European Funding CLO DAC, | | | | | | | | | | | | | | | | | | | | |

Series 03A, Class A, 144A, 3 Month EURIBOR + 1.050% (Cap N/A, Floor 1.050%) | | | 1.050 | (c) | | | 01/15/34 | | | | EUR | | | | 15,000 | | | | 17,376,116 | |

Series 03A, Class B2, 144A | | | 2.000 | | | | 01/15/34 | | | | EUR | | | | 11,500 | | | | 13,330,372 | |

Hayfin Emerald CLO, | | | | | | | | | | | | | | | | | | | | |

Series 05A, Class A, 144A, 3 Month EURIBOR + 1.100% (Cap N/A, Floor 1.100%) | | | 1.100 | (c) | | | 11/17/32 | | | | EUR | | | | 18,500 | | | | 21,391,024 | |

Henley CLO DAC, | | | | | | | | | | | | | | | | | | | | |

Series 04A, Class A, 144A, 3 Month EURIBOR + 0.900% (Cap N/A, Floor 0.900%) | | | 0.900 | (c) | | | 04/25/34 | | | | EUR | | | | 5,000 | | | | 5,770,698 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 17 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Ireland (cont’d.) | | | | | | | | | | | | | | | | | | | | |

Invesco Euro CLO DAC, | | | | | | | | | | | | | | | | | | | | |

Series 01A, Class A2R, 144A | | | 0.800 | % | | | 07/15/31 | | | | EUR | | | | 30,000 | | | $ | 34,652,037 | |

OAK Hill European Credit Partners DAC, | | | | | | | | | | | | | | | | | | | | |

Series 2017-06A, Class A2, 144A | | | 1.150 | | | | 01/20/32 | | | | EUR | | | | 3,000 | | | | 3,475,431 | |

Providus CLO DAC, | | | | | | | | | | | | | | | | | | | | |

Series 02A, Class B1R, 144A, 3 Month EURIBOR + 1.650% (Cap N/A, Floor 1.650%) | | | 1.650 | (c) | | | 07/15/31 | | | | EUR | | | | 7,500 | | | | 8,681,701 | |

Rathlin Residential DAC, | | | | | | | | | | | | | | | | | | | | |

Series 2021-01A, Class A, 144A, 1 Month EURIBOR + 2.000% | | | 1.443 | (c) | | | 09/27/75 | | | | EUR | | | | 1,600 | | | | 1,813,594 | |

RRE Loan Management DAC, | | | | | | | | | | | | | | | | | | | | |

Series 05A, Class A1, 144A, 3 Month EURIBOR + 1.100% (Cap N/A, Floor 1.100%) | | | 1.100 | (c) | | | 10/15/33 | | | | EUR | | | | 8,500 | | | | 9,827,655 | |

St. Paul’s CLO DAC, | | | | | | | | | | | | | | | | | | | | |

Series 02A, Class ARRR, 144A, 3 Month EURIBOR + 0.750% (Cap N/A, Floor 0.750%) | | | 0.750 | (c) | | | 10/15/30 | | | | EUR | | | | 11,000 | | | | 12,710,455 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 292,683,976 | |

| | | | | |

Netherlands 0.2% | | | | | | | | | | | | | | | | | | | | |

BNPP AM Euro CLO BV, | | | | | | | | | | | | | | | | | | | | |

Series 2018-01A, Class AR, 144A, 3 Month EURIBOR + 0.600% (Cap N/A, Floor 0.600%) | | | 0.600 | (c) | | | 04/15/31 | | | | EUR | | | | 10,000 | | | | 11,517,200 | |

| | | | | |

Spain 0.1% | | | | | | | | | | | | | | | | | | | | |

TFS, | | | | | | | | | | | | | | | | | | | | |

Series 2018-03, Class A1, 1 Month EURIBOR + 3.000% | | | 3.000 | (c) | | | 04/16/23 | | | | EUR | | | | 6,132 | | | | 6,202,664 | |

| | | | | |

United Kingdom 0.3% | | | | | | | | | | | | | | | | | | | | |

Newday Funding Master Issuer PLC, | | | | | | | | | | | | | | | | | | | | |

Series 2021-01A, Class A1, 144A, SONIA + 0.970% (Cap N/A, Floor 0.000%) | | | 1.020 | (c) | | | 03/15/29 | | | | GBP | | | | 3,700 | | | | 5,088,614 | |

Series 2021-01A, Class A2, 144A, SOFR + 1.100% (Cap N/A, Floor 0.000%) | | | 1.150 | (c) | | | 03/15/29 | | | | | | | | 3,500 | | | | 3,527,405 | |

Newday Partnership Funding PLC, | | | | | | | | | | | | | | | | | | | | |

Series 2020-01A, Class A3, 144A, SONIA + 1.400% (Cap N/A, Floor 0.000%) | | | 1.450 | (c) | | | 11/15/28 | | | | GBP | | | | 6,205 | | | | 8,613,663 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 17,229,682 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | | | |

| | | | | |

United States 2.3% | | | | | | | | | | | | | | | | | | |

AmeriCredit Automobile Receivables Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-03, Class D | | | 1.490 | % | | 09/18/26 | | | | | | | 1,900 | | | $ | 1,909,988 | |

Ameriquest Mortgage Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | | | | | | | |

Series 2002-02, Class M3, 1 Month LIBOR + 2.655% (Cap N/A, Floor 2.655%) | | | 2.744 | (c) | | 08/25/32 | | | | | | | 312 | | | | 315,913 | |

Series 2002-03, Class M3, 1 Month LIBOR + 2.850% (Cap N/A, Floor 2.850%) | | | 2.939 | (c) | | 08/25/32 | | | | | | | 167 | | | | 167,922 | |

Battalion CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2018-12A, Class A1, 144A, 3 Month LIBOR + 1.070% (Cap N/A, Floor 1.070%) | | | 1.194 | (c) | | 05/17/31 | | | | | | | 15,000 | | | | 14,995,840 | |

Chase Funding Trust, | | | | | | | | | | | | | | | | | | |

Series 2003-04, Class 2A2, 1 Month LIBOR + 0.600% (Cap N/A, Floor 0.600%) | | | 0.689 | (c) | | 05/25/33 | | | | | | | 496 | | | | 491,008 | |

CHEC Loan Trust, | | | | | | | | | | | | | | | | | | |

Series 2004-01, Class A3, 144A, 1 Month LIBOR + 1.000% (Cap N/A, Floor 1.000%) | | | 1.089 | (c) | | 07/25/34 | | | | | | | 496 | | | | 493,622 | |

Commonbond Student Loan Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-AGS, Class A, 144A | | | 1.980 | | | 08/25/50 | | | | | | | 2,882 | | | | 2,904,554 | |

Countrywide Asset-Backed Certificates, | | | | | | | | | | | | | | | | | | |

Series 2002-05, Class MV1, 1 Month LIBOR + 1.500% (Cap N/A, Floor 1.500%) | | | 1.589 | (c) | | 03/25/33 | | | | | | | 74 | | | | 74,135 | |

Credit Suisse Mortgage Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-11R, Class 1A1, 144A, 1 Month LIBOR + 2.150% | | | 2.230 | (c) | | 04/25/38 | | | | | | | 2,126 | | | | 2,141,564 | |

EquiFirst Mortgage Loan Trust, | | | | | | | | | | | | | | | | | | |

Series 2004-01, Class 1A1, 1 Month LIBOR + 0.480% (Cap N/A, Floor 0.480%) | | | 0.569 | (c) | | 01/25/34 | | | | | | | 547 | | | | 531,347 | |

Exeter Automobile Receivables Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-03A, Class D | | | 1.730 | | | 07/15/26 | | | | | | | 700 | | | | 707,528 | |

Ford Credit Auto Owner Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-02, Class C, 144A | | | 1.740 | | | 04/15/33 | | | | | | | 1,300 | | | | 1,291,755 | |

Ford Credit Floorplan Master Owner Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-02, Class C | | | 1.870 | | | 09/15/27 | | | | | | | 2,100 | | | | 2,080,381 | |

JPMorgan Chase Bank, NA, | | | | | | | | | | | | | | | | | | |

Series 2020-01, Class R, 144A | | | 33.784 | | | 01/25/28 | | | | | | | 1,237 | | | | 1,341,389 | |

Series 2020-02, Class E, 144A | | | 3.072 | | | 02/25/28 | | | | | | | 2,315 | | | | 2,332,597 | |

Series 2020-02, Class R, 144A | | | 31.355 | | | 02/25/28 | | | | | | | 582 | | | | 634,808 | |

Series 2021-01, Class E, 144A | | | 2.365 | | | 09/25/28 | | | | | | | 489 | | | | 488,709 | |

Series 2021-01, Class F, 144A | | | 4.280 | | | 09/25/28 | | | | | | | 600 | | | | 594,144 | |

Series 2021-01, Class R, 144A | | | 28.348 | | | 09/25/28 | | | | | | | 1,977 | | | | 2,121,268 | |

Series 2021-02, Class F, 144A | | | 4.393 | | | 12/26/28 | | | | | | | 600 | | | | 594,126 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 19 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | | | |

| | | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | | | |

JPMorgan Chase Bank, NA, (cont’d.) | | | | | | | | | | | | | | | | | | |

Series 2021-03, Class F, 144A | | | 3.694 | % | | 02/26/29 | | | | | | | 600 | | | $ | 592,441 | |

Laurel Road Prime Student Loan Trust, | | | | | | | | | | | | | | | | | | |

Series 2018-A, Class A, 144A | | | 0.000 | | | 02/25/43 | | | | | | | 3,430 | | | | 1,308,676 | |

Series 2018-C, Class A, 144A | | | 0.000 | (cc) | | 08/25/43 | | | | | | | 1,266 | | | | 1,301,698 | |

Series 2019-A, Class R, 144A | | | 0.000 | | | 10/25/48 | | | | | | | 3,087 | | | | 522,420 | |

Legacy Mortgage Asset Trust, | | | | | | | | | | | | | | | | | | |

Series 2019-GS02, Class A1, 144A | | | 3.750 | | | 01/25/59 | | | | | | | 1,220 | | | | 1,221,808 | |

Series 2019-GS04, Class A1, 144A | | | 3.438 | | | 05/25/59 | | | | | | | 2,286 | | | | 2,287,865 | |

Lending Funding Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-02A, Class A, 144A | | | 2.320 | | | 04/21/31 | | | | | | | 1,100 | | | | 1,113,949 | |

Lendmark Funding Trust, | | | | | | | | | | | | | | | | | | |

Series 2019-02A, Class A, 144A | | | 2.780 | | | 04/20/28 | | | | | | | 2,300 | | | | 2,340,796 | |

Series 2021-01A, Class D, 144A | | | 5.050 | | | 11/20/31 | | | | | | | 1,900 | | | | 1,982,753 | |

Long Beach Mortgage Loan Trust, | | | | | | | | | | | | | | | | | | |

Series 2004-03, Class M1, 1 Month LIBOR + 0.855% (Cap N/A, Floor 0.855%) | | | 0.944 | (c) | | 07/25/34 | | | | | | | 115 | | | | 114,283 | |

Mariner Finance Issuance Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-AA, Class A, 144A | | | 2.190 | | | 08/21/34 | | | | | | | 1,800 | | | | 1,827,127 | |

MASTR Asset-Backed Securities Trust, | | | | | | | | | | | | | | | | | | |

Series 2004-WMC02, Class M1, 1 Month LIBOR + 0.900% (Cap N/A, Floor 0.900%) | | | 0.989 | (c) | | 04/25/34 | | | | | | | 1,113 | | | | 1,094,624 | |

Merrill Lynch Mortgage Investors Trust, | | | | | | | | | | | | | | | | | | |

Series 2004-HE02, Class M1, 1 Month LIBOR + 1.200% (Cap N/A, Floor 1.200%) | | | 1.289 | (c) | | 08/25/35 | | | | | | | 32 | | | | 31,731 | |

Morgan Stanley ABS Capital I, Inc. Trust, | | | | | | | | | | | | | | | | | | |

Series 2003-NC08, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 1.050%) | | | 1.139 | (c) | | 09/25/33 | | | | | | | 93 | | | | 92,654 | |

Morgan Stanley Dean Witter Capital I, Inc. Trust, | | | | | | | | | | | | | | | | | | |

Series 2002-AM03, Class A3, 1 Month LIBOR + 0.980% (Cap N/A, Floor 0.980%) | | | 1.069 | (c) | | 02/25/33 | | | | | | | 153 | | | | 152,488 | |

Navient Private Education Refi Loan Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-GA, Class B, 144A | | | 2.500 | | | 09/16/69 | | | | | | | 2,000 | | | | 2,012,642 | |

Series 2021-A, Class B, 144A | | | 2.240 | | | 05/15/69 | | | | | | | 1,850 | | | | 1,840,321 | |

OneMain Direct Auto Receivables Trust, | | | | | | | | | | | | | | | | | | |

Series 2019-01A, Class B, 144A | | | 3.950 | | | 11/14/28 | | | | | | | 1,300 | | | | 1,402,569 | |

Oportun Funding LLC, | | | | | | | | | | | | | | | | | | |

Series 2020-01, Class A, 144A | | | 2.200 | | | 05/15/24 | | | | | | | 912 | | | | 915,025 | |

Oportun Funding XIII LLC, | | | | | | | | | | | | | | | | | | |

Series 2019-A, Class B, 144A | | | 3.870 | | | 08/08/25 | | | | | | | 4,158 | | | | 4,220,158 | |

Series 2019-A, Class D, 144A | | | 6.220 | | | 08/08/25 | | | | | | | 3,400 | | | | 3,470,337 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | | | |

| | | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | | | |

Oportun Funding XIV LLC, | | | | | | | | | | | | | | | | | | |

Series 2021-A, Class C, 144A | | | 3.440 | % | | 03/08/28 | | | | | | | 1,200 | | | $ | 1,212,969 | |

Series 2021-A, Class D, 144A | | | 5.400 | | | 03/08/28 | | | | | | | 500 | | | | 505,002 | |

PNMAC FMSR Issuer Trust, | | | | | | | | | | | | | | | | | | |

Series 2018-FT01, Class A, 144A, 1 Month LIBOR + 2.350% (Cap N/A, Floor 0.000%) | | | 2.439 | (c) | | 04/25/23 | | | | | | | 4,290 | | | | 4,294,283 | |

PNMAC GMSR Issuer Trust, | | | | | | | | | | | | | | | | | | |

Series 2018-GT01, Class A, 144A, 1 Month LIBOR + 2.850% (Cap N/A, Floor 2.850%) | | | 2.939 | (c) | | 02/25/23 | | | | | | | 1,020 | | | | 1,022,373 | |

Series 2018-GT02, Class A, 144A, 1 Month LIBOR + 2.650% (Cap N/A, Floor 0.000%) | | | 2.739 | (c) | | 08/25/25 | | | | | | | 2,300 | | | | 2,299,312 | |

Santander Consumer Auto Receivables Trust, | | | | | | | | | | | | | | | | | | |

Series 2021-AA, Class D, 144A | | | 1.570 | | | 01/15/27 | | | | | | | 850 | | | | 845,841 | |

Series 2021-AA, Class R, 144A | | | 0.000 | | | 08/15/28 | | | | | | | 6 | | | | 999,450 | |

Santander Drive Auto Receivables Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-03, Class D | | | 1.640 | | | 11/16/26 | | | | | | | 4,800 | | | | 4,847,974 | |

Series 2020-04, Class D | | | 1.480 | | | 01/15/27 | | | | | | | 3,200 | | | | 3,225,502 | |

Series 2021-01, Class D | | | 1.130 | | | 11/16/26 | | | | | | | 12,700 | | | | 12,664,821 | |

SoFi Alternative Trust, | | | | | | | | | | | | | | | | | | |

Series 2019-B, Class PT, 144A | | | 0.000 | (cc) | | 12/15/45 | | | | | | | 5,007 | | | | 5,169,215 | |

Series 2019-D, Class 1PT, 144A | | | 2.847 | (cc) | | 01/16/46 | | | | | | | 5,198 | | | | 5,356,556 | |

Series 2019-F, Class PT1, 144A | | | 3.932 | (cc) | | 02/15/45 | | | | | | | 6,743 | | | | 6,878,890 | |

SoFi Professional Loan Program LLC, | | | | | | | | | | | | | | | | | | |

Series 2019-C, Class BFX, 144A | | | 3.050 | | | 11/16/48 | | | | | | | 2,100 | | | | 2,125,371 | |

SoFi RR Funding II Trust, | | | | | | | | | | | | | | | | | | |

Series 2019-01, Class A, 144A, 1 Month LIBOR + 1.250% (Cap N/A, Floor 1.250%) | | | 1.336 | (c) | | 11/29/24 | | | | | | | 4,695 | | | | 4,689,134 | |

SoFi RR Funding III Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-01, Class A, 144A, 1 Month LIBOR + 3.750% (Cap N/A, Floor 3.750%) | | | 3.836 | (c) | | 11/29/24 | | | | | | | 2,700 | | | | 2,702,818 | |

Springleaf Funding Trust, | | | | | | | | | | | | | | | | | | |

Series 2017-AA, Class C, 144A | | | 3.860 | | | 07/15/30 | | | | | | | 800 | | | | 800,948 | |

TH MSR Issuer Trust, | | | | | | | | | | | | | | | | | | |

Series 2019-FT01, Class A, 144A, 1 Month LIBOR + 2.800% (Cap N/A, Floor 2.800%) | | | 2.889 | (c) | | 06/25/24 | | | | | | | 9,330 | | | | 9,307,194 | |

World Omni Select Auto Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-A, Class D | | | 1.700 | | | 10/15/26 | | | | | | | 5,900 | | | | 5,917,742 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 140,924,358 | |

| | | | | | | | | | | | | | | | | | |

TOTAL ASSET-BACKED SECURITIES

(cost $677,352,799) | | | | | | | | | | | | | | | | | 666,783,773 | |

| | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 21 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

BANK LOANS 1.0% | | | | | | | | | | | | | | | | | | |

| | | | | |

Germany 0.1% | | | | | | | | | | | | | | | | | | |

Speedster Bidco GmbH, | | | | | | | | | | | | | | | | | | |

Second Lien Term Loan, 6 Month EURIBOR + 6.000% (Cap N/A, Floor 0.000%) | | | 6.000 | %(c) | | 03/31/28 | | | EUR | | | | 3,265 | | | $ | 3,793,212 | |

| | | | | |

United Kingdom 0.9% | | | | | | | | | | | | | | | | | | |

CD&R Firefly Bidco Ltd., | | | | | | | | | | | | | | | | | | |

Initial Term Loan, 3 Month GBP LIBOR + 8.356%^ | | | 8.412 | (c) | | 06/21/26 | | | GBP | | | | 16,075 | | | | 21,999,441 | |

Constellation Automotive Group Ltd., | | | | | | | | | | | | | | | | | | |

Facility B-2 Loan, 5 Day SONIA + 4.750% | | | 4.800 | (c) | | 07/16/28 | | | GBP | | | | 8,850 | | | | 12,075,333 | |

EG Group Ltd., | | | | | | | | | | | | | | | | | | |

Additional Second Lien Loan Facility, 1 - 6 Month EURIBOR + 7.000% (Cap N/A, Floor 0.000%) | | | 7.000 | (c) | | 04/30/27 | | | EUR | | | | 18,800 | | | | 21,814,298 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 55,889,072 | |

| | | | | |

United States 0.0% | | | | | | | | | | | | | | | | | | |

Ascent Resources Utica Holdings LLC, | | | | | | | | | | | | | | | | | | |

Second Lien Term Loan, 3 Month LIBOR + 9.000% | | | 10.000 | (c) | | 11/01/25 | | | | | | | 1,199 | | | | 1,311,706 | |

Diamond Sports Group LLC, | | | | | | | | | | | | | | | | | | |

Term Loan, 1 Month LIBOR + 3.250% | | | 3.340 | (c) | | 08/24/26 | | | | | | | 2,308 | | | | 1,201,430 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 2,513,136 | |

| | | | | | | | | | | | | | | | | | |

TOTAL BANK LOANS

(cost $63,211,261) | | | | | | | | | | | | | | | | | 62,195,420 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES 6.6% | | | | | | | | | | | | | | | | | | |

| | | | | |

Canada 0.0% | | | | | | | | | | | | | | | | | | |

Real Estate Asset Liquidity Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-01A, Class A1, 144A | | | 2.381 | (cc) | | 02/12/55 | | | CAD | | | | 2,159 | | | | 1,755,942 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

Ireland 0.5% | | | | | | | | | | | | | | | | | | |

Taurus DAC, | | | | | | | | | | | | | | | | | | |

Series 2021-UK1A, Class D, 144A, SONIA + 2.600% (Cap N/A, Floor 2.600%) | | | 2.649 | (c) | | 05/17/31 | | | GBP | | | | 550 | | | | 754,246 | |

Series 2021-UK4A, Class B, 144A, SONIA + 1.500% | | | 1.550 | (c) | | 08/17/31 | | | GBP | | | | 5,300 | | | | 7,239,487 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | |

| | | | | |

Ireland (cont’d.) | | | | | | | | | | | | | | | | |

Taurus DAC, (cont’d.) | | | | | | | | | | | | | | | | |

Series 2021-UK4A, Class C, 144A, SONIA + 1.750% | | | 1.800 | %(c) | | 08/17/31 | | GBP | | | 8,700 | | | $ | 11,881,232 | |

Series 2021-UK4A, Class D, 144A, SONIA + 2.100% | | | 2.150 | (c) | | 08/17/31 | | GBP | | | 7,250 | | | | 9,904,093 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 29,779,058 | |

| | | | | |

United Kingdom 0.0% | | | | | | | | | | | | | | | | |

Salus European Loan Conduit DAC, | | | | | | | | | | | | | | | | |

Series 33A, Class A, 144A, 3 Month GBP LIBOR + 1.500% (Cap 6.500%, Floor 1.500%) | | | 1.704 | (c) | | 01/23/29 | | GBP | | | 500 | | | | 685,986 | |

| | | | | | | | | | | | | | | | |

| | | | | |

United States 6.1% | | | | | | | | | | | | | | | | |

20 Times Square Trust, | | | | | | | | | | | | | | | | |

Series 2018-20TS, Class G, 144A | | | 3.100 | (cc) | | 05/15/35 | | | | | 1,000 | | | | 926,714 | |

Series 2018-20TS, Class H, 144A | | | 3.100 | (cc) | | 05/15/35 | | | | | 1,000 | | | | 910,775 | |

BANK, | | | | | | | | | | | | | | | | |

Series 2017-BNK05, Class A3 | | | 3.020 | | | 06/15/60 | | | | | 3,600 | | | | 3,714,005 | |

Series 2017-BNK06, Class A3 | | | 3.125 | | | 07/15/60 | | | | | 4,400 | | | | 4,553,864 | |

Series 2017-BNK09, Class A3 | | | 3.279 | | | 11/15/54 | | | | | 3,000 | | | | 3,183,862 | |

Series 2019-BN21, Class A3 | | | 2.458 | | | 10/17/52 | | | | | 6,293 | | | | 6,473,787 | |

Benchmark Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2018-B02, Class A3 | | | 3.544 | | | 02/15/51 | | | | | 5,000 | | | | 5,298,526 | |

Series 2018-B03, Class A3 | | | 3.746 | | | 04/10/51 | | | | | 7,200 | | | | 7,629,260 | |

Series 2020-B17, Class A4 | | | 2.042 | | | 03/15/53 | | | | | 6,200 | | | | 6,166,000 | |

Series 2020-B20, Class A3 | | | 1.945 | | | 10/15/53 | | | | | 11,000 | | | | 11,008,504 | |

BX Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2019-XL, Class F, 144A, 1 Month LIBOR + 2.000% (Cap N/A, Floor 2.000%) | | | 2.090 | (c) | | 10/15/36 | | | | | 2,805 | | | | 2,799,721 | |

Series 2019-XL, Class G, 144A, 1 Month LIBOR + 2.300% (Cap N/A, Floor 2.300%) | | | 2.390 | (c) | | 10/15/36 | | | | | 7,416 | | | | 7,397,631 | |

Series 2019-XL, Class J, 144A, 1 Month LIBOR + 2.650% (Cap N/A, Floor 2.650%) | | | 2.740 | (c) | | 10/15/36 | | | | | 21,488 | | | | 21,434,141 | |

Series 2020-BXLP, Class F, 144A, 1 Month LIBOR + 2.000% (Cap N/A, Floor 2.000%) | | | 2.090 | (c) | | 12/15/36 | | | | | 3,244 | | | | 3,233,569 | |

Series 2020-BXLP, Class G, 144A, 1 Month LIBOR + 2.500% (Cap N/A, Floor 2.500%) | | | 2.590 | (c) | | 12/15/36 | | | | | 11,267 | | | | 11,210,960 | |

Cantor Commercial Real Estate Lending, | | | | | | | | | | | | | | | | |

Series 2019-CF02, Class A3 | | | 2.647 | | | 11/15/52 | | | | | 16,531 | | | | 16,956,539 | |

CF Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2020-P01, Class A1, 144A | | | 2.840 | (cc) | | 04/15/25 | | | | | 9,412 | | | | 9,759,457 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 23 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | |

| | | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | |

Citigroup Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2014-GC21, Class XB, IO | | | 0.437 | %(cc) | | 05/10/47 | | | | | 27,500 | | | $ | 298,535 | |

Series 2016-GC37, Class XB, IO | | | 0.693 | (cc) | | 04/10/49 | | | | | 33,868 | | | | 965,668 | |

Series 2016-P04, Class XB, IO | | | 1.317 | (cc) | | 07/10/49 | | | | | 9,100 | | | | 537,293 | |

Series 2017-P08, Class A2 | | | 3.109 | | | 09/15/50 | | | | | 2,000 | | | | 2,055,220 | |

Cold Storage Trust, | | | | | | | | | | | | | | | | |

Series 2020-ICE05, Class E, 144A, 1 Month LIBOR + 2.766% (Cap N/A, Floor 2.833%) | | | 2.856 | (c) | | 11/15/37 | | | | | 4,399 | | | | 4,396,241 | |

Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2012-CR01, Class XA, IO | | | 1.874 | (cc) | | 05/15/45 | | | | | 2,581 | | | | 6,540 | |

Series 2014-UBS04, Class XB, IO, 144A | | | 0.216 | (cc) | | 08/10/47 | | | | | 50,000 | | | | 292,375 | |

Series 2015-CR24, Class A4 | | | 3.432 | | | 08/10/48 | | | | | 3,831 | | | | 4,017,627 | |

Credit Suisse Mortgage Capital Certificates, | | | | | | | | | | | | | | | | |

Series 2019-ICE04, Class E, 144A, 1 Month LIBOR + 2.150% (Cap N/A, Floor 2.150%) | | | 2.240 | (c) | | 05/15/36 | | | | | 14,125 | | | | 14,133,765 | |

CSAIL Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2018-CX11, Class A3 | | | 4.095 | | | 04/15/51 | | | | | 2,250 | | | | 2,385,898 | |

Series 2019-C17, Class A3 | | | 2.769 | | | 09/15/52 | | | | | 12,444 | | | | 12,963,643 | |

DBWF Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2016-85T, Class E, 144A | | | 3.808 | (cc) | | 12/10/36 | | | | | 3,000 | | | | 2,895,393 | |

Deutsche Bank Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2016-C03, Class A3 | | | 2.362 | | | 08/10/49 | | | | | 1,500 | | | | 1,520,398 | |

Series 2017-C06, Class A3 | | | 3.269 | | | 06/10/50 | | | | | 4,400 | | | | 4,557,565 | |

Series 2020-C09, Class A3 | | | 1.882 | | | 08/15/53 | | | | | 20,000 | | | | 19,988,508 | |

Eleven Madison Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2015-11MD, Class C, 144A | | | 3.555 | (cc) | | 09/10/35 | | | | | 500 | | | | 516,283 | |

FHLMC Multifamily Structured Pass-Through Certificates, | | | | | | | | | | | | | | | | |

Series K019, Class X1, IO | | | 1.580 | (cc) | | 03/25/22 | | | | | 7,887 | | | | 860 | |

Series K020, Class X1, IO | | | 1.337 | (cc) | | 05/25/22 | | | | | 9,496 | | | | 39,995 | |

Series K025, Class X1, IO | | | 0.781 | (cc) | | 10/25/22 | | | | | 17,400 | | | | 106,830 | |

Series K037, Class X1, IO | | | 0.938 | (cc) | | 01/25/24 | | | | | 10,022 | | | | 176,978 | |

Series K043, Class X1, IO | | | 0.520 | (cc) | | 12/25/24 | | | | | 11,831 | | | | 181,230 | |

Series K049, Class X1, IO | | | 0.586 | (cc) | | 07/25/25 | | | | | 39,574 | | | | 761,042 | |

Series K052, Class X1, IO | | | 0.646 | (cc) | | 11/25/25 | | | | | 11,837 | | | | 272,932 | |

Series K053, Class X1, IO | | | 0.881 | (cc) | | 12/25/25 | | | | | 44,670 | | | | 1,420,249 | |

Series K054, Class X1, IO | | | 1.164 | (cc) | | 01/25/26 | | | | | 30,173 | | | | 1,297,797 | |

Series K058, Class X1, IO | | | 0.922 | (cc) | | 08/25/26 | | | | | 40,658 | | | | 1,586,070 | |

Series K090, Class X1, IO | | | 0.705 | (cc) | | 02/25/29 | | | | | 22,957 | | | | 1,106,515 | |

Series K111, Class X1, IO | | | 1.572 | (cc) | | 05/25/30 | | | | | 29,376 | | | | 3,418,080 | |

Series K113, Class X1, IO | | | 1.387 | (cc) | | 06/25/30 | | | | | 119,112 | | | | 12,355,463 | |

Series K114, Class X1, IO | | | 1.118 | (cc) | | 06/25/30 | | | | | 75,459 | | | | 6,383,802 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

|

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | |

| | | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | |

FHLMC Multifamily Structured Pass-Through Certificates, (cont’d.) | | | | | | | | | | |

Series K116, Class X1, IO | | | 1.427 | %(cc) | | 07/25/30 | | | | | 49,175 | | | $ | 5,166,638 | |

Series K121, Class X1, IO | | | 1.028 | (cc) | | 10/25/30 | | | | | 127,749 | | | | 9,966,408 | |

Series KG03, Class X1, IO | | | 1.381 | (cc) | | 06/25/30 | | | | | 101,850 | | | | 10,290,354 | |

Series Q001, Class XA, IO | | | 2.142 | (cc) | | 02/25/32 | | | | | 6,126 | | | | 637,019 | |

Greystone Commercial Capital Trust, | | | | | | | | | | | | | | | | |

Series 2021-03, Class A, 144A^ | | | 0.000 | (cc) | | 08/17/23 | | | | | 17,250 | | | | 17,250,000 | |

GS Mortgage Securities Corp. Trust, | | | | | | | | | | | | | | | | |

Series 2021-RENT, Class C, 144A, 1 Month LIBOR + 1.550% (Cap N/A, Floor 1.550%) | | | 1.636 | (c) | | 11/21/35 | | | | | 7,780 | | | | 7,760,429 | |

Series 2021-RENT, Class D, 144A, 1 Month LIBOR + 1.850% (Cap N/A, Floor 1.850%) | | | 1.936 | (c) | | 11/21/35 | | | | | 4,500 | | | | 4,490,090 | |

GS Mortgage Securities Trust, | | | | | | | | | | | | | | | | |

Series 2014-GC20, Class XB, IO | | | 0.427 | (cc) | | 04/10/47 | | | | | 30,000 | | | | 300,768 | |

Series 2014-GC22, Class XB, IO | | | 0.298 | (cc) | | 06/10/47 | | | | | 35,000 | | | | 310,331 | |

Series 2014-GC24, Class XB, IO | | | 0.021 | (cc) | | 09/10/47 | | | | | 83,262 | | | | 43,105 | |

Series 2014-GC26, Class XB, IO | | | 0.294 | (cc) | | 11/10/47 | | | | | 56,483 | | | | 558,888 | |

Series 2018-GS09, Class A3 | | | 3.727 | | | 03/10/51 | | | | | 7,000 | | | | 7,629,821 | |

JPMBB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | |

Series 2016-C01, Class A3 | | | 3.515 | | | 03/15/49 | | | | | 966 | | | | 966,026 | |

JPMCC Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | |

Series 2017-JP05, Class A3 | | | 3.342 | | | 03/15/50 | | | | | 1,600 | | | | 1,623,822 | |

Series 2017-JP06, Class A3 | | | 3.109 | | | 07/15/50 | | | | | 4,600 | | | | 4,731,748 | |

Series 2017-JP07, Class A3 | | | 3.379 | | | 09/15/50 | | | | | 5,100 | | | | 5,295,315 | |

JPMDB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | |

Series 2020-COR07, Class A4 | | | 1.915 | | | 05/13/53 | | | | | 10,000 | | | | 9,872,503 | |

JPMorgan Chase Commercial Mortgage Securities Corp., | | | | | | | | | | | | | | | | |

Series 2018-AON, Class E, 144A | | | 4.613 | (cc) | | 07/05/31 | | | | | 5,564 | | | | 5,696,025 | |

MKT Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2020-525M, Class F, 144A | | | 2.941 | (cc) | | 02/12/40 | | | | | 3,775 | | | | 3,498,479 | |

Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | | | | | | | | | |

Series 2016-C31, Class A3 | | | 2.731 | | | 11/15/49 | | | | | 2,211 | | | | 2,219,210 | |

Morgan Stanley Capital I Trust, | | | | | | | | | | | | | | | | |

Series 2016-UBS09, Class A2 | | | 2.982 | | | 03/15/49 | | | | | 286 | | | | 291,889 | |

Series 2017-H01, Class A3 | | | 3.153 | | | 06/15/50 | | | | | 4,500 | | | | 4,671,196 | |

Series 2019-MEAD, Class E, 144A | | | 3.177 | (cc) | | 11/10/36 | | | | | 1,700 | | | | 1,626,580 | |

Series 2020-HR08, Class XB, IO | | | 0.878 | (cc) | | 07/15/53 | | | | | 54,413 | | | | 3,891,917 | |

One New York Plaza Trust, | | | | | | | | | | | | | | | | |

Series 2020-01NYP, Class C, 144A, 1 Month LIBOR + 2.200% (Cap N/A, Floor 2.200%) | | | 2.290 | (c) | | 01/15/26 | | | | | 8,475 | | | | 8,507,270 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 25 | |

Schedule of Investments (continued)

as of October 31, 2021

| | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | |

| | | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | | | |

One New York Plaza Trust, (cont’d.) | | | | | | | | | | | | | | | | | | |

Series 2020-01NYP, Class D, 144A, 1 Month LIBOR + 2.750% (Cap N/A, Floor 2.750%) | | | 2.840 | %(c) | | 01/15/26 | | | | | | | 2,975 | | | $ | 2,989,902 | |

UBS Commercial Mortgage Trust, | | | | | | | | | | | | | | | | | | |

Series 2017-C04, Class A3 | | | 3.301 | | | 10/15/50 | | | | | | | 6,500 | | | | 6,851,735 | |

Series 2017-C06, Class A3 | | | 3.581 | | | 12/15/50 | | | | | | | 5,000 | | | | 5,241,242 | |

Series 2017-C07, Class A3 | | | 3.418 | | | 12/15/50 | | | | | | | 4,400 | | | | 4,699,012 | |

UBS-Barclays Commercial Mortgage Trust, | | | | | | | | | | | | | | | | | | |

Series 2012-C02, Class XA, IO, 144A | | | 1.271 | (cc) | | 05/10/63 | | | | | | | 4,090 | | | | 19,145 | |

Wells Fargo Commercial Mortgage Trust, | | | | | | | | | | | | | | | | | | |

Series 2016-C35, Class XB, IO | | | 0.933 | (cc) | | 07/15/48 | | | | | | | 24,000 | | | | 966,775 | |

Series 2016-LC24, Class XB, IO | | | 0.979 | (cc) | | 10/15/49 | | | | | | | 20,910 | | | | 927,605 | |

Series 2017-C40, Class A3 | | | 3.317 | | | 10/15/50 | | | | | | | 2,600 | | | | 2,766,831 | |

Series 2021-FCMT, Class B, 144A, 1 Month LIBOR + 1.850% (Cap N/A, Floor 1.850%) | | | 1.940 | (c) | | 05/15/31 | | | | | | | 1,800 | | | | 1,800,560 | |

Series 2021-FCMT, Class C, 144A, 1 Month LIBOR + 2.400% (Cap N/A, Floor 2.400%) | | | 2.490 | (c) | | 05/15/31 | | | | | | | 1,700 | | | | 1,700,529 | |

Series 2021-FCMT, Class D, 144A, 1 Month LIBOR + 3.500% (Cap N/A, Floor 3.500%) | | | 3.590 | (c) | | 05/15/31 | | | | | | | 2,200 | | | | 2,200,693 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 370,755,970 | |

| | | | | | | | | | | | | | | | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $397,533,045) | | | | | | | | | | | | | | 402,976,956 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

CORPORATE BONDS 41.4% | | | | | | | | | | | | | | | | | | |

| | | | | |

Australia 0.1% | | | | | | | | | | | | | | | | | | |

Australia & New Zealand Banking Group Ltd., | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, EMTN | | | 3.700 | | | 03/18/24 | | | CNH | | | | 2,000 | | | | 315,248 | |

Westpac Banking Corp., | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, EMTN | | | 4.420 | | | 08/14/23 | | | CNH | | | | 21,000 | | | | 3,349,207 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 3,664,455 | |

| | | | | |

Belgium 0.2% | | | | | | | | | | | | | | | | | | |

Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide, Inc., | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 4.900 | | | 02/01/46 | | | | | | | 7,380 | | | | 9,412,612 | |

Anheuser-Busch InBev Worldwide, Inc., | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.550 | | | 01/23/49 | | | | | | | 3,800 | | | | 5,326,355 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 14,738,967 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Brazil 0.7% | | | | | | | | | | | | | | | | | | | | |

Petrobras Global Finance BV, | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.375 | % | | | 10/01/29 | | | | GBP | | | | 9,621 | | | $ | 14,079,192 | |

Gtd. Notes | | | 6.625 | | | | 01/16/34 | | | | GBP | | | | 8,080 | | | | 12,423,269 | |

Gtd. Notes, EMTN | | | 6.250 | | | | 12/14/26 | | | | GBP | | | | 8,644 | | | | 13,131,466 | |

Suzano Austria GmbH, | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 6.000 | | | | 01/15/29 | | | | | | | | 200 | | | | 229,875 | |

Swiss Insured Brazil Power Finance Sarl, | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | | 9.850 | | | | 07/16/32 | | | | BRL | | | | 20,174 | | | | 3,308,510 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | 43,172,312 | |

| | | | | |

Bulgaria 0.3% | | | | | | | | | | | | | | | | | | | | |

Bulgarian Energy Holding EAD, | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 2.450 | | | | 07/22/28 | | | | EUR | | | | 13,680 | | | | 15,714,160 | |

| | | | | |

Canada 0.9% | | | | | | | | | | | | | | | | | | | | |

Barrick Gold Corp., | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.250 | | | | 04/01/42 | | | | | | | | 35 | | | | 45,794 | |

Barrick North America Finance LLC, | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.700 | | | | 05/30/41 | | | | | | | | 45 | | | | 61,626 | |

Barrick PD Australia Finance Pty Ltd., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.950 | | | | 10/15/39 | | | | | | | | 50 | | | | 68,736 | |

Bombardier, Inc., | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 7.125 | | | | 06/15/26 | | | | | | | | 3,900 | | | | 4,093,825 | |

Sr. Unsec’d. Notes, 144A | | | 7.500 | | | | 12/01/24 | | | | | | | | 4,050 | | | | 4,215,903 | |

Sr. Unsec’d. Notes, 144A | | | 7.875 | | | | 04/15/27 | | | | | | | | 2,535 | | | | 2,636,321 | |

Brookfield Residential Properties, Inc./Brookfield | | | | | | | | | | | | | | | | | | | | |

Residential US LLC, | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 4.875 | | | | 02/15/30 | | | | | | | | 2,320 | | | | 2,326,888 | |

Gtd. Notes, 144A | | | 6.250 | | | | 09/15/27 | | | | | | | | 2,175 | | | | 2,270,129 | |

Sr. Unsec’d. Notes, 144A | | | 5.000 | | | | 06/15/29 | | | | | | | | 1,675 | | | | 1,686,404 | |

Cenovus Energy, Inc., | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 2.650 | | | | 01/15/32 | | | | | | | | 1,340 | | | | 1,308,116 | |

Sr. Unsec’d. Notes | | | 3.750 | | | | 02/15/52 | | | | | | | | 955 | | | | 963,791 | |

Sr. Unsec’d. Notes | | | 4.250 | | | | 04/15/27 | | | | | | | | 3,500 | | | | 3,844,222 | |

Hydro-Quebec, | | | | | | | | | | | | | | | | | | | | |

Local Gov’t. Gtd. Notes, MTN | | | 6.000 | | | | 02/15/40 | | | | CAD | | | | 1,000 | | | | 1,189,206 | |

Local Gov’t. Gtd. Notes, Series B, MTN | | | 8.400 | | | | 03/28/25 | | | | | | | | 654 | | | | 800,997 | |

Local Gov’t. Gtd. Notes, Series HE | | | 8.625 | | | | 06/15/29 | | | | | | | | 600 | | | | 865,397 | |

Local Gov’t. Gtd. Notes, Series HK | | | 9.375 | | | | 04/15/30 | | | | | | | | 1,000 | | | | 1,547,512 | |

Local Gov’t. Gtd. Notes, Series HQ | | | 9.500 | | | | 11/15/30 | | | | | | | | 800 | | | | 1,279,949 | |