UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| | |

| |

| Investment Company Act file number: | | 811-04661 |

| |

| Exact name of registrant as specified in charter: | | Prudential Global Total Return Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2020 |

| |

| Date of reporting period: | | 10/31/2020 |

Item 1 – Reports to Stockholders

PGIM GLOBAL TOTAL RETURN FUND

ANNUAL REPORT

OCTOBER 31, 2020

COMING SOON: PAPERLESS SHAREHOLDER REPORTS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (pgim.com/investments), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-225-1852 or by sending an email request to PGIM Investments at shareholderreports@pgim.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-225-1852 or send an email request to shareholderreports@pgim.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2020 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

Effective June 26, 2020, all of the issued and outstanding Class B shares of the Fund converted into Class A shares.

| | |

| 2 | | Visit our website at pgim.com/investments |

Letter from the President

Dear Shareholder:

We hope you find the annual report for the PGIM Global Total Return Fund informative and useful. The report covers performance for the 12-month period that ended October 31, 2020.

During the first four months of the period, the global economy remained healthy—particularly in the US—fueled by rising corporate profits and strong job growth. The outlook changed dramatically in March as the coronavirus outbreak quickly and substantially shut down economic activity worldwide, leading to significant job losses and a steep decline in global growth and earnings. Responding to this disruption, the Federal Reserve (the Fed) cut the federal funds rate target to near zero and flooded capital markets with liquidity; and Congress passed stimulus bills worth approximately $3 trillion that offered an economic lifeline to consumers and businesses.

While stocks climbed throughout the first four months of the period, they fell significantly in March amid a spike in volatility, ending the 11-year-long equity bull market. With stores and factories closing and consumers staying at home to limit the spread of the virus, investors sold stocks on fears that corporate earnings would take a serious hit. Equities rallied around the globe throughout the spring and summer as states reopened their economies, but became more volatile during the last two months of the period as investors worried that a surge in coronavirus infections would stall the economic recovery. For the period overall, large-cap US and emerging market stocks rose, small-cap US stocks were virtually unchanged, and stocks in developed foreign markets declined.

The bond market overall—including US and global bonds as well as emerging market debt—rose during the period as investors sought safety in fixed income. A significant rally in interest rates pushed the 10-year US Treasury yield down to a record low. In March, the Fed took several aggressive actions to keep the bond markets running smoothly, restarting many of the relief programs that proved to be successful in helping end the global financial crisis in 2008-09.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This scale and investment expertise allow us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Global Total Return Fund

December 15, 2020

| | | | |

PGIM Global Total Return Fund | | | 3 | |

Your Fund’s Performance (unaudited)

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | |

| |

| | | Average Annual Total Returns as of 10/31/20 |

| | | One Year (%) | | Five Years (%) | | Ten Years (%) | | Since Inception (%) |

| Class A | | | | | | | | |

| (with sales charges) | | 0.96 | | 4.85 | | 3.71 | | — |

| (without sales charges) | | 4.35 | | 5.54 | | 4.06 | | — |

| Class C | | | | | | | | |

| (with sales charges) | | 2.59 | | 4.77 | | 3.34 | | — |

| (without sales charges) | | 3.57 | | 4.77 | | 3.34 | | — |

| Class Z | | | | | | | | |

| (without sales charges) | | 4.61 | | 5.81 | | 4.33 | | — |

| Class R2 | | | | | | | | |

| (without sales charges) | | 4.13 | | N/A | | N/A | | 4.87 (12/27/17) |

| Class R4 | | | | | | | | |

| (without sales charges) | | 4.39 | | N/A | | N/A | | 5.13 (12/27/17) |

| Class R6 | | | | | | | | |

| (without sales charges) | | 4.69 | | 5.83 | | N/A | | 4.39 (2/3/12) |

| Bloomberg Barclays Global Aggregate Index |

| | | 5.63 | | 3.90 | | 2.24 | | — |

| | | | |

|

| Average Annual Total Returns as of 10/31/20 Since Inception (%) |

| | | Class R2, R4 (12/27/17) | | Class R6 (2/3/12) |

| Bloomberg Barclays Global Aggregate Index | | 3.98 | | 2.03 |

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the class’ inception date.

| | |

| 4 | | Visit our website at pgim.com/investments |

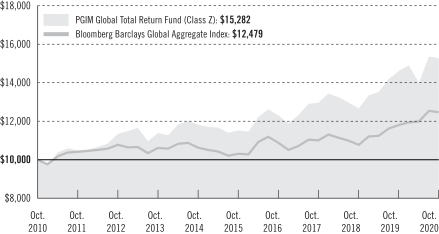

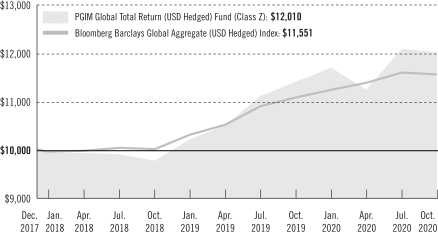

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the Bloomberg Barclays Global Aggregate Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (October 31, 2010) and the account values at the end of the current fiscal year (October 31, 2020) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the Fund’s returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

| | | | |

PGIM Global Total Return Fund | | | 5 | |

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | | | | | |

| | | | | | | |

| | | Class A | | Class C | | Class Z | | Class R2 | | Class R4 | | Class R6 |

| Maximum initial sales charge | | 3.25% of the public offering price | | None | | None | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | 1.00% on sales of $500,000 or more made within 12 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | | None | | None | | None |

| Annual distribution or distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.25% | | 1.00% | | None | | 0.25% | | None | | None |

| Shareholder service fee | | None | | None | | None | | 0.10%* | | 0.10%* | | None |

*Shareholder service fee reflects maximum allowable fees under a shareholder services plan.

| | |

| 6 | | Visit our website at pgim.com/investments |

Benchmark Definitions

Bloomberg Barclays Global Aggregate Index—The Bloomberg Barclays Global Aggregate Index is an unmanaged index of global investment-grade fixed income markets. The three major components of this index are the US Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The Index also includes euro dollar and euro-yen corporate bonds, and Canadian government, agency, and corporate securities.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

| | | | | | |

|

| Distributions and Yields as of 10/31/20 |

| | Total Distributions

Paid for

One Year ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized

Yield** (%) |

| Class A | | 0.40 | | 1.54 | | 1.48 |

| Class C | | 0.35 | | 0.85 | | 0.79 |

| Class Z | | 0.42 | | 1.85 | | 1.68 |

| Class R2 | | 0.39 | | 1.40 | | 0.84 |

| Class R4 | | 0.41 | | 1.65 | | 1.22 |

| Class R6 | | 0.43 | | 1.91 | | 1.91 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| | | | |

PGIM Global Total Return Fund | | | 7 | |

Your Fund’s Performance (continued)

| | | | |

|

| Credit Quality expressed as a percentage of total investments as of 10/31/20 (%) | |

| AAA | | | 18.5 | |

| AA | | | 8.4 | |

| A | | | 18.8 | |

| BBB | | | 29.3 | |

| BB | | | 10.5 | |

| B | | | 5.6 | |

| CCC | | | 0.9 | |

| Not Rated | | | 8.1 | |

| Cash/Cash Equivalents | | | –0.1 | |

| Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by a NRSRO. Credit ratings are subject to change.

| | |

| 8 | | Visit our website at pgim.com/investments |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM Global Total Return Fund’s Class Z shares returned 4.61% in the 12-month reporting period that ended October 31, 2020, underperforming the 5.63% return of the Bloomberg Barclays Global Aggregate Index (the Index).

What were the market conditions?

| | • | | Following several stable months, the second half of the reporting period was dominated by the global outbreak of COVID-19, its economic impact, and the resulting decline in risk sentiment around the globe. After generating sizable returns throughout the latter part of 2019, credit spreads widened sharply during the first quarter of 2020 as COVID-19 and an oil price shock led to acute declines across most fixed income spread sectors. In response to unprecedented monetary and fiscal stimulus programs aimed at stabilizing the global economy and financial markets, spreads subsequently tightened sharply, but most spread sectors remained wider than their pre-COVID-19 levels at the end of the period. |

| | • | | At the beginning of the period, spread sectors benefited from accommodative central banks, low and range-bound interest rates, and an extended (albeit slow) economic expansion. The signing of a phase one US-China trade deal, declining Brexit (i.e., the United Kingdom’s decision to leave the European Union) uncertainty, and stable monetary policy further boosted sentiment toward the end of 2019. At the start of 2020, the global economy appeared poised to stabilize and perhaps even improve, with manufacturing bottoming out across a number of countries and a pipeline of monetary stimulus in place following a global round of central bank easing in the second half of 2019. The optimism generated by the US-China trade deal, a positive turn in the global technology cycle, and central banks’ bias to ease further, if needed, shifted perceived economic risks from being skewed to the downside to being more balanced, as possible upside risks came into view. But then COVID-19 hit headlines, with person-to-person transmission reported in January 2020 marking a turning point. Financial markets then witnessed a dramatic turn of events, perhaps best exemplified by the sharp drop in US Treasury yields and, to a lesser extent, the decline in other developed market rates. |

| | • | | After generating gains throughout the latter part of 2019, spread sectors declined sharply during the first quarter of 2020. US and European investment-grade corporate bond spreads widened dramatically before narrowing into quarter-end following aggressive actions from the Federal Reserve (the Fed) and European Central Bank. Collateralized loan obligation (CLO) spreads widened across the board, with US CLO AAA-rated tranches widening 117 basis points (bps) to 250 bps and US CLO AA-rated tranches widening 195 bps during the first quarter. (One basis point equals 0.01%.) Commercial mortgage-backed securities (CMBS) markets also widened across the capital stack, with spreads on high-quality tranches of US conduit CMBS widening by 98 bps during the quarter and by as much as 250 bps during March 2020 before the Fed intervened to stabilize markets. High yield bond spreads rose to their widest levels |

| | | | |

PGIM Global Total Return Fund | | | 9 | |

Strategy and Performance Overview (continued)

| | since the 2008-09 financial crisis, with US high yield spreads widening to 1,087 bps the last week of March, up from a trough of 338 bps in January, and European high yield spreads widening by 437 bps to end the first quarter at 745 bps. |

| | • | | Following a difficult first quarter, spread markets rebounded sharply in the second and third quarters of 2020 as the unprecedented fiscal and monetary policy responses, including a near-zero US federal funds rate and the European Union’s €750 billion recovery fund, significantly improved market liquidity. Risk-on sentiment amid improving economic data and a gradual re-opening of the economy helped spreads decline sharply over the last seven months of the period. However, as of the end of the period, most assets remained wider than where they began in 2020. Investment-grade spreads and high yield spreads continued to tighten in the third quarter but remained well wider than where they began the year. Spreads on high-quality tranches of conduit CMBS continued to tighten but also remained wide of where they began in 2020. Meanwhile, US CLO AAA-rated tranches were one of the few assets that revisited pre-COVID-19 levels, ending the period only slightly wider than where they began the year. |

| | • | | US Treasury rates sold off and steepened for the entire period, with the 10-year/2-year Treasury spread rising from 0.17% to 0.74%. US Treasury yields fell sharply, with the yield on the 2-year Treasury note declining from 1.63% to 0.18% and the yield on the 10-year Treasury note declining from 1.78% to 0.88%. In early August 2020, the US 10-year Treasury dropped to its year-to-date lows as COVID-19 cases flared up across the country, with the yield dropping to 50 bps and the curve flattening amid uncertainty over the economic re-opening. The Treasury curve then bear-steepened the last three months of the period, as the US 5-year yield rose by 17 bps and the 30-year yield rose by 46 bps after the Fed adjusted its inflation targeting framework to allow for overshoots of its 2% target. (Bear steepening is a change in the yield curve wherein longer-term yields rise faster than short-term yields.) Meanwhile, other major market rates remained significantly below US rates, with the 10-year German bund yield declining to -0.62% by the end of the period and the 10-year Japanese government bond yield resting just above 0%. Despite more favorable growth fundamentals than the US, even the Australian 10-year yield was sitting comfortably below 1% by the end of the period. |

What worked?

| | • | | During the reporting period, the Fund’s duration positioning was a significant contributor to performance. Duration is a measure of the interest rate sensitivity of a bond portfolio or debt securities that is expressed as a number of years. |

| | • | | Underweights to developed-markets investment-grade corporates (from a spread-duration perspective) and developed-markets agency mortgage-backed securities, along with overweights to developed-markets sovereigns and emerging-markets Treasuries relative to the Index, boosted returns over the period. |

| | |

| 10 | | Visit our website at pgim.com/investments |

| | • | | Security selection in LIBOR (London Interbank Offered Rate) derivatives, developed-markets Treasuries, developed-markets sovereigns, emerging-markets high yield corporates, and emerging-markets Treasuries contributed to performance. |

| | • | | Within credit, positions in the cable & satellite, banking, telecom, and healthcare & pharmaceutical industries were the largest contributors to performance. |

| | • | | Positioning within Greece and United Group (telecom) were among the largest single-name contributors to performance. |

| | • | | Although overall currency positioning hurt performance, underweights to the Brazilian real and Turkish lira, along with overweights to the Chinese yuan and the euro relative to the Index, helped offset some of the losses. |

What didn’t work?

| | • | | The Fund’s yield curve-flattener positioning, primarily in US rates, detracted from performance as the curve steepened over the period. |

| | • | | Security selection in developed-markets high yield and investment-grade corporates detracted from the Fund’s performance. |

| | • | | Positions within AMC Entertainment Holdings Inc. (gaming, lodging & leisure) and the sovereign debt of Argentina were among the largest detractors from performance. |

| | • | | Currency positioning hurt performance. Overweights to the Czech koruna, Japanese yen, and Polish zloty, along with an underweight to the Australian dollar relative to the Index, were among the largest detractors from performance. |

Did the Fund use derivatives?

The Fund used interest rate futures and swaps to implement its investment strategy, as well as to help manage duration and yield curve exposure. Credit derivatives, primarily in the form of credit default swap index (CDX) positions, were used to either add risk exposure to certain issuers or to hedge credit risk imposed by certain issuers. In addition, to implement most currency strategies, the Fund employed foreign exchange derivatives.

Current outlook

| | • | | COVID-19 and the lockdowns implemented to fight it have taken a heavy toll on the economy, with global growth absorbing the most severe hit in many decades. The severity of the contraction triggered a torrent of monetary and fiscal stimulus, including cutting policy rates, initiating asset purchases, and expanding liquidity facilities. In response to unprecedented monetary and fiscal stimulus programs aimed at stabilizing the economy and financial markets, spread sectors rebounded sharply during the last seven months of the reporting period. |

| | | | |

PGIM Global Total Return Fund | | | 11 | |

Strategy and Performance Overview (continued)

| | • | | Developed market interest rates remained range-bound in the third quarter of 2020, and PGIM Fixed Income generally expects the trend to continue in the fourth quarter of 2020 with periodic bouts of volatility in risk assets. With central banks re-examining how to achieve the inflation targets that they have been missing and with plenty of slack in the global economy, PGIM Fixed Income has every reason to expect the quantitative easing flood to continue, given its key role in underpinning the markets and the recovery. With the heightened probability for increased, short-term volatility, PGIM Fixed Income continues to believe that the US 10-year yield may trade near the bottom of the current 50-100 bp range through the end of the year. PGIM Fixed Income has less conviction on its views in Europe amid flatter yield curves and lower yields relative to the US. |

| | • | | Although spread sectors have continued to rebound from their March wides, spreads largely remain wide of their pre-COVID-19 levels. PGIM Fixed Income remains cautious on certain sectors that are most exposed to negative, longer-term impacts associated with the pandemic. However, PGIM Fixed Income maintains a positive view of the credit sectors over the medium to long term and is currently overweight an array of credit sectors, including both investment-grade and high yield corporates, high-quality structured products, and emerging markets. In PGIM Fixed Income’s view, these allocations represent attractive value in relation to Treasuries and agency mortgage-backed securities. |

| | • | | The US election process, the policy aftermath, and COVID-19 are just a few of the risks investors face in the fourth quarter of 2020 and beyond. But the configuration of value, fundamentals, and fiscal and monetary policies leaves PGIM Fixed Income relatively optimistic about the bond market outlook. Unless the market’s worst fears materialize, PGIM Fixed Income expects credit sectors to perform better than feared, finding that the combination of moderate growth and high levels of quantitative easing keeps government yields low and encourages a search for yield that further compresses credit spreads. |

| | |

| 12 | | Visit our website at pgim.com/investments |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2020. The example is for illustrative purposes only; you should consult the Fund’s Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period

| | | | |

PGIM Global Total Return Fund | | | 13 | |

Fees and Expenses (continued)

and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | |

| PGIM Global Total Return Fund | | Beginning Account

Value May 1, 2020 | | | Ending Account

Value October 31, 2020 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,088.90 | | | | 0.88 | % | | $ | 4.62 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.71 | | | | 0.88 | % | | $ | 4.47 | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 1,085.00 | | | | 1.63 | % | | $ | 8.54 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,016.94 | | | | 1.63 | % | | $ | 8.26 | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 1,091.50 | | | | 0.63 | % | | $ | 3.31 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.97 | | | | 0.63 | % | | $ | 3.20 | |

| Class R2 | | Actual | | $ | 1,000.00 | | | $ | 1,088.50 | | | | 1.08 | % | | $ | 5.67 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,019.71 | | | | 1.08 | % | | $ | 5.48 | |

| Class R4 | | Actual | | $ | 1,000.00 | | | $ | 1,089.90 | | | | 0.83 | % | | $ | 4.36 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.96 | | | | 0.83 | % | | $ | 4.22 | |

| Class R6 | | Actual | | $ | 1,000.00 | | | $ | 1,089.90 | | | | 0.55 | % | | $ | 2.89 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.37 | | | | 0.55 | % | | $ | 2.80 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2020, and divided by the 366 days in the Fund’s fiscal year ended October 31, 2020 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| 14 | | Visit our website at pgim.com/investments |

Schedule of Investments

as of October 31, 2020

| | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount (000)# | | | Value | |

| | | | | |

LONG-TERM INVESTMENTS 96.9% | | | | | | | | | | | | | | | | | | |

| | | | | |

ASSET-BACKED SECURITIES 14.4% | | | | | | | | | | | | | | | | | | |

| | | | | |

Canada 0.0% | | | | | | | | | | | | | | | | | | |

Fairstone Financial Issuance Trust,

Series 2020-01A, Class A, 144A | | | 2.509 | % | | 10/20/39 | | | CAD | | | | 1,500 | | | $ | 1,127,151 | |

Ford Auto Securitization Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-AA, Class B, 144A^ | | | 1.872 | | | 06/15/26 | | | CAD | | | | 400 | | | | 300,385 | |

Series 2020-AA, Class C, 144A | | | 2.763 | | | 04/15/28 | | | CAD | | | | 500 | | | | 368,241 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 1,795,777 | |

| | | | | |

Cayman Islands 7.9% | | | | | | | | | | | | | | | | | | |

Anchorage Capital CLO LLC,

Series 2019-13A, Class A, 144A, 3 Month LIBOR + 1.470% (Cap N/A, Floor 1.470%) | | | 1.707 | (c) | | 04/15/32 | | | | | | | 10,000 | | | | 9,942,830 | |

Anchorage Capital CLO Ltd.,

Series 2019-11A, Class A, 144A, 3 Month LIBOR + 1.390% (Cap N/A, Floor 1.390%) | | | 1.606 | (c) | | 07/22/32 | | | | | | | 20,000 | | | | 19,824,184 | |

ArrowMark Colorado Holdings,

Series 2017-06A, Class A1, 144A, 3 Month LIBOR + 1.280% (Cap N/A, Floor 0.000%) | | | 1.517 | (c) | | 07/15/29 | | | | | | | 500 | | | | 494,962 | |

Battalion CLO Ltd.,

Series 2015-08A, Class A1R2, 144A, 3 Month LIBOR + 1.070% (Cap N/A, Floor 1.070%) | | | 1.288 | (c) | | 07/18/30 | | | | | | | 5,500 | | | | 5,431,765 | |

Benefit Street Partners CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2013-IIA, Class A1R, 144A, 3 Month LIBOR + 1.250% (Cap N/A, Floor 0.000%) | | | 1.487 | (c) | | 07/15/29 | | | | | | | 1,249 | | | | 1,241,141 | |

Series 2017-12A, Class A1, 144A, 3 Month LIBOR + 1.250% (Cap N/A, Floor 0.000%) | | | 1.487 | (c) | | 10/15/30 | | | | | | | 750 | | | | 743,141 | |

BlueMountain CLO Ltd.,

Series 2016-02A, Class A1R, 144A, 3 Month LIBOR + 1.310% (Cap N/A, Floor 1.310%) | | | 1.563 | (c) | | 08/20/32 | | | | | | | 11,000 | | | | 10,874,059 | |

Brookside Mill CLO Ltd.,

Series 2013-01A, Class BR, 144A, 3 Month LIBOR + 1.350% (Cap N/A, Floor 0.000%) | | | 1.568 | (c) | | 01/17/28 | | | | | | | 4,000 | | | | 3,933,008 | |

Canyon Capital CLO Ltd.,

Series 2015-01A, Class AS, 144A, 3 Month LIBOR + 1.250% (Cap N/A, Floor 0.000%) | | | 1.487 | (c) | | 04/15/29 | | | | | | | 3,750 | | | | 3,726,207 | |

Carlyle CLO Ltd.,

Series C17A, Class A1AR, 144A, 3 Month LIBOR + 1.030% (Cap N/A, Floor 0.000%) | | | 1.244 | (c) | | 04/30/31 | | | | | | | 15,000 | | | | 14,734,488 | |

Carlyle Global Market Strategies CLO Ltd.,

Series 2016-03A, Class A1R, 144A, 3 Month LIBOR + 1.020% (Cap N/A, Floor 1.020%) | | | 1.238 | (c) | | 10/20/29 | | | | | | | 5,468 | | | | 5,393,818 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 15 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | |

Cayman Islands (cont’d.) | | | | | | | | | | | | | | |

| | | | |

Carlyle US CLO Ltd.,

Series 2018-01A, Class A1, 144A, 3 Month LIBOR + 1.020% (Cap N/A, Floor 0.000%) | | | 1.238 | %(c) | | 04/20/31 | | | 12,500 | | | $ | 12,312,657 | |

CBAM Ltd., | | | | | | | | | | | | | | |

Series 2019-11A, Class A1, 144A, 3 Month LIBOR + 1.360% (Cap N/A, Floor 1.360%) | | | 1.578 | (c) | | 10/20/32 | | | 25,000 | | | | 24,781,132 | |

Elevation CLO Ltd., | | | | | | | | | | | | | | |

Series 2015-04A, Class BR, 144A, 3 Month LIBOR + 1.670% (Cap N/A, Floor 0.000%) | | | 1.888 | (c) | | 04/18/27 | | | 10,000 | | | | 9,980,008 | |

Greywolf CLO Ltd., | | | | | | | | | | | | | | |

Series 2020-03RA, Class A1R, 144A, 3 Month LIBOR + 1.290% (Cap N/A, Floor 1.290%) | | | 1.506 | (c) | | 04/15/33 | | | 14,000 | | | | 13,713,847 | |

KVK CLO Ltd., | | | | | | | | | | | | | | |

Series 2018-01A, Class B, 144A, 3 Month LIBOR + 1.650% (Cap N/A, Floor 0.000%) | | | 1.903 | (c) | | 05/20/29 | | | 5,000 | | | | 4,922,738 | |

Madison Park Funding Ltd., | | | | | | | | | | | | | | |

Series 2016-21A, Class A1AR, 144A, 3 Month LIBOR + 1.350% (Cap N/A, Floor 1.350%) | | | 1.587 | (c) | | 10/15/32 | | | 10,000 | | | | 9,934,545 | |

Mariner CLO Ltd., | | | | | | | | | | | | | | |

Series 2018-05A, Class A, 144A, 3 Month LIBOR + 1.110% (Cap N/A, Floor 1.110%) | | | 1.325 | (c) | | 04/25/31 | | | 6,250 | | | | 6,177,260 | |

MidOcean Credit CLO, | | | | | | | | | | | | | | |

Series 2016-05A, Class AR, 144A, 3 Month LIBOR + 1.120% (Cap N/A, Floor 0.000%) | | | 1.338 | (c) | | 07/19/28 | | | 7,620 | | | | 7,566,952 | |

Series 2018-08A, Class B, 144A, 3 Month LIBOR + 1.650% (Cap N/A, Floor 0.000%) | | | 1.903 | (c) | | 02/20/31 | | | 2,000 | | | | 1,945,292 | |

Series 2018-09A, Class A1, 144A, 3 Month LIBOR + 1.150% (Cap N/A, Floor 1.150%) | | | 1.368 | (c) | | 07/20/31 | | | 2,000 | | | | 1,953,993 | |

Mountain View CLO Ltd., | | | | | | | | | | | | | | |

Series 2015-09A, Class A2R, 144A, 3 Month LIBOR + 1.780% (Cap N/A, Floor 0.000%) | | | 2.017 | (c) | | 07/15/31 | | | 5,750 | | | | 5,584,292 | |

OCP CLO Ltd., | | | | | | | | | | | | | | |

Series 2019-17A, Class A1, 144A, 3 Month LIBOR + 1.330% (Cap N/A, Floor 1.330%) | | | 1.548 | (c) | | 07/20/32 | | | 5,000 | | | | 4,956,582 | |

OZLM Ltd., | | | | | | | | | | | | | | |

Series 2014-06A, Class A2AS, 144A, 3 Month LIBOR + 1.750% (Cap N/A, Floor 0.000%) | | | 1.968 | (c) | | 04/17/31 | | | 2,000 | | | | 1,976,137 | |

Series 2018-20A, Class A1, 144A, 3 Month LIBOR + 1.050% (Cap N/A, Floor 0.000%) | | | 1.268 | (c) | | 04/20/31 | | | 5,000 | | | | 4,866,379 | |

Series 2019-24A, Class A1A, 144A, 3 Month LIBOR + 1.390% (Cap N/A, Floor 0.000%) | | | 1.608 | (c) | | 07/20/32 | | | 8,000 | | | | 7,936,914 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | |

Cayman Islands (cont’d.) | | | | | | | | | | | | | | |

Pikes Peak CLO, | | | | | | | | | | | | | | |

Series 2019-04A, Class A, 144A, 3 Month LIBOR + 1.370% (Cap N/A, Floor 1.370%) | | | 1.607 | %(c) | | 07/15/32 | | | 18,000 | | | $ | 17,886,470 | |

Race Point CLO Ltd., | | | | | | | | | | | | | | |

Series 2013-08A, Class AR2, 144A, 3 Month LIBOR + 1.040% (Cap N/A, Floor 1.040%) | | | 1.293 | (c) | | 02/20/30 | | | 8,540 | | | | 8,482,322 | |

Shackleton CLO Ltd., | | | | | | | | | | | | | | |

Series 2014-05RA, Class A, 144A, 3 Month LIBOR + 1.100% (Cap N/A, Floor 0.000%) | | | 1.342 | (c) | | 05/07/31 | | | 5,000 | | | | 4,912,351 | |

Series 2014-05RA, Class B, 144A, 3 Month LIBOR + 1.700% (Cap N/A, Floor 0.000%) | | | 1.942 | (c) | | 05/07/31 | | | 6,500 | | | | 6,351,795 | |

Series 2017-10A, Class BR, 144A, 3 Month LIBOR + 1.550% (Cap N/A, Floor 0.000%) | | | 1.768 | (c) | | 04/20/29 | | | 10,000 | | | | 9,844,956 | |

Silver Creek CLO Ltd., | | | | | | | | | | | | | | |

Series 2014-01A, Class AR, 144A, 3 Month LIBOR + 1.240% (Cap N/A, Floor 0.000%) | | | 1.458 | (c) | | 07/20/30 | | | 500 | | | | 497,256 | |

Sound Point CLO Ltd., | | | | | | | | | | | | | | |

Series 2016-02A, Class BR, 144A, 3 Month LIBOR + 1.800% (Cap N/A, Floor 1.800%) | | | 2.018 | (c) | | 10/20/28 | | | 3,000 | | | | 2,945,395 | |

Series 2016-03A, Class AR, 144A, 3 Month LIBOR + 1.150% (Cap N/A, Floor 0.000%) | | | 1.359 | (c) | | 01/23/29 | | | 8,000 | | | | 7,939,848 | |

Series 2017-03A, Class A1B, 144A, 3 Month LIBOR + 1.220% (Cap N/A, Floor 0.000%) | | | 1.438 | (c) | | 10/20/30 | | | 500 | | | | 495,246 | |

TCW CLO Ltd., | | | | | | | | | | | | | | |

Series 2017-01A, Class AR, 144A, 3 Month LIBOR + 1.030% (Cap N/A, Floor 0.000%) | | | 1.243 | (c) | | 07/29/29 | | | 20,000 | | | | 19,806,584 | |

Series 2018-01A, Class A1A, 144A, 3 Month LIBOR + 1.050% (Cap N/A, Floor 0.000%) | | | 1.265 | (c) | | 04/25/31 | | | 15,000 | | | | 14,733,174 | |

Series 2020-01A, Class B, 144A, 3 Month LIBOR + 3.600% (Cap N/A, Floor 0.000%) | | | 3.818 | (c) | | 04/20/28 | | | 17,250 | | | | 17,249,784 | |

Telos CLO Ltd., | | | | | | | | | | | | | | |

Series 2013-03A, Class AR, 144A, 3 Month LIBOR + 1.300% (Cap N/A, Floor 1.300%) | | | 1.518 | (c) | | 07/17/26 | | | 277 | | | | 276,077 | |

TIAA CLO Ltd., | | | | | | | | | | | | | | |

Series 2016-01A, Class AR, 144A, 3 Month LIBOR + 1.200% (Cap N/A, Floor 0.000%) | | | 1.418 | (c) | | 07/20/31 | | | 2,000 | | | | 1,973,131 | |

TICP CLO Ltd., | | | | | | | | | | | | | | |

Series 2015-01A, Class BR, 144A, 3 Month LIBOR + 1.300% (Cap N/A, Floor 0.000%) | | | 1.518 | (c) | | 07/20/27 | | | 5,188 | | | | 5,101,505 | |

Trinitas CLO Ltd., | | | | | | | | | | | | | | |

Series 2015-03A, Class BR, 144A, 3 Month LIBOR + 1.400% (Cap N/A, Floor 0.000%) | | | 1.637 | (c) | | 07/15/27 | | | 5,000 | | | | 4,896,168 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 17 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | | | |

| | | | | |

Cayman Islands (cont’d.) | | | | | | | | | | | | | | | | | | |

Tryon Park CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2013-01A, Class A2R, 144A, 3 Month LIBOR + 1.500% (Cap N/A, Floor 0.000%) | | | 1.737 | %(c) | | 04/15/29 | | | | | | | 3,700 | | | $ | 3,659,286 | |

Voya CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2013-02A, Class A1R, 144A, 3 Month LIBOR + 0.970% (Cap N/A, Floor 0.970%) | | | 1.185 | (c) | | 04/25/31 | | | | | | | 4,500 | | | | 4,438,103 | |

Wellfleet CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2017-03A, Class A1, 144A, 3 Month LIBOR + 1.150% (Cap N/A, Floor 1.150%) | | | 1.368 | (c) | | 01/17/31 | | | | | | | 2,500 | | | | 2,440,831 | |

York CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2015-01A, Class AR, 144A, 3 Month LIBOR + 1.150% (Cap N/A, Floor 0.000%) | | | 1.366 | (c) | | 01/22/31 | | | | | | | 5,000 | | | | 4,933,755 | |

Zais CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2015-03A, Class A2R, 144A, 3 Month LIBOR + 2.190% (Cap N/A, Floor 0.000%) | | | 2.427 | (c) | | 07/15/31 | | | | | | | 8,500 | | | | 8,123,470 | |

Series 2017-01A, Class A1, 144A, 3 Month LIBOR + 1.370% (Cap N/A, Floor 0.000%) | | | 1.607 | (c) | | 07/15/29 | | | | | | | 4,129 | | | | 4,082,455 | |

Series 2017-02A, Class A, 144A, 3 Month LIBOR + 1.290% (Cap N/A, Floor 0.000%) | | | 1.527 | (c) | | 04/15/30 | | | | | | | 733 | | | | 720,946 | |

Series 2018-01A, Class A, 144A, 3 Month LIBOR + 0.950% (Cap N/A, Floor 0.000%) | | | 1.187 | (c) | | 04/15/29 | | | | | | | 7,011 | | | | 6,801,104 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 353,540,343 | |

| | | | | |

Ireland 1.8% | | | | | | | | | | | | | | | | | | |

Anchorage Capital Europe CLO, | | | | | | | | | | | | | | | | | | |

Series 01X, Class A2 | | | 1.500 | | | 01/15/31 | | | EUR | | | | 8,250 | | | | 9,591,623 | |

Arbour CLO DAC, | | | | | | | | | | | | | | | | | | |

Series 03A, Class B1R, 144A | | | 1.920 | | | 03/15/29 | | | EUR | | | | 4,000 | | | | 4,620,211 | |

Armada Euro CLO DAC, | | | | | | | | | | | | | | | | | | |

Series 02A, Class A3, 144A | | | 1.500 | | | 11/15/31 | | | EUR | | | | 1,500 | | | | 1,744,527 | |

Carlyle Euro CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2019-02A, Class A1B, 144A, 3 Month EURIBOR + 1.400% (Cap N/A, Floor 1.400%) | | | 1.400 | (c) | | 08/15/32 | | | EUR | | | | 8,000 | | | | 9,150,562 | |

Hayfin Emerald CLO, | | | | | | | | | | | | | | | | | | |

Series 5A, Class A, 144A, 3 Month EURIBOR + 1.100% (Cap N/A, Floor 1.100%) | | | 1.100 | (c) | | 11/17/32 | | | EUR | | | | 18,500 | | | | 21,546,025 | |

Hayfin Emerald CLO DAC, | | | | | | | | | | | | | | | | | | |

Series 02A, Class B2, 144A | | | 2.650 | | | 05/27/32 | | | EUR | | | | 4,000 | | | | 4,649,358 | |

OAK Hill European Credit Partners DAC, | | | | | | | | | | | | | | | | | | |

Series 2017-06A, Class A2, 144A | | | 1.150 | | | 01/20/32 | | | EUR | | | | 3,000 | | | | 3,455,820 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal Amount (000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | | | |

| | | | | |

Ireland (cont’d.) | | | | | | | | | | | | | | | | | | |

RRE Loan Management DAC, | | | | | | | | | | | | | | | | | | |

Series 5A, Class A1, 144A, 3 Month EURIBOR + 1.100% (Cap N/A, Floor 1.100%)^ | | | 1.100 | %(c) | | 10/15/33 | | | EUR | | | | 8,500 | | | $ | 9,904,475 | |

St Paul’s CLO DAC, | | | | | | | | | | | | | | | | | | |

Series 02A, Class ARRR, 144A, 3 Month EURIBOR + 0.750% (Cap N/A, Floor 0.750%) | | | 0.750 | (c) | | 10/15/30 | | | EUR | | | | 11,000 | | | | 12,720,495 | |

Series 07A, Class B2R, 144A | | | 2.400 | | | 04/30/30 | | | EUR | | | | 1,000 | | | | 1,163,038 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 78,546,134 | |

| | | | | |

Spain 0.2% | | | | | | | | | | | | | | | | | | |

TFS, | | | | | | | | | | | | | | | | | | |

Series 2018-03, Class A1, 1 Month EURIBOR + 2.900% | | | 2.900 | (c) | | 04/16/23 | | | EUR | | | | 6,926 | | | | 7,384,279 | |

| | | | | |

United Kingdom 0.2% | | | | | | | | | | | | | | | | | | |

Newday Partnership Funding PLC, | | | | | | | | | | | | | | | | | | |

Series 2020-01A, Class A3, 144A, 1 Month Sterling Overnight Index Average + 1.400% (Cap N/A, Floor 0.000%) | | | 1.454 | (c) | | 11/15/28 | | | GBP | | | | 6,205 | | | | 8,036,166 | |

| | | | | |

United States 4.3% | | | | | | | | | | | | | | | | | | |

ACE Securities Corp. Home Equity Loan Trust, | | | | | | | | | | | | | | | | | | |

Series 2005-HE2, Class M4, 1 Month LIBOR + 0.960% (Cap N/A, Floor 0.640%) | | | 1.109 | (c) | | 04/25/35 | | | | | | | 52 | | | | 52,880 | |

Ameriquest Mortgage Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | | | | | | | |

Series 2002-02, Class M3, 1 Month LIBOR + 2.655% (Cap N/A, Floor 1.770%) | | | 2.804 | (c) | | 08/25/32 | | | | | | | 413 | | | | 412,454 | |

Series 2002-03, Class M3, 1 Month LIBOR + 2.850% (Cap N/A, Floor 1.900%) | | | 2.999 | (c) | | 08/25/32 | | | | | | | 217 | | | | 216,358 | |

Argent Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | | | | | | | |

Series 2005-W02, Class A2C, 1 Month LIBOR + 0.360% (Cap N/A, Floor 0.360%) | | | 0.509 | (c) | | 10/25/35 | | | | | | | 138 | | | | 137,935 | |

Asset-Backed Funding Certificates Trust, | | | | | | | | | | | | | | | | | | |

Series 2004-OPT05, Class A1, 1 Month LIBOR + 0.700% (Cap N/A, Floor 0.350%) | | | 0.849 | (c) | | 06/25/34 | | | | | | | 639 | | | | 620,468 | |

Battalion CLO Ltd., | | | | | | | | | | | | | | | | | | |

Series 2018-12A, Class A1, 144A, 3 Month LIBOR + 1.070% (Cap N/A, Floor 1.070%) | | | 1.350 | (c) | | 05/17/31 | | | | | | | 15,000 | | | | 14,713,593 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 19 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | |

United States (cont’d.) | | | | | | | | | | | | | | |

Chase Auto Credit Linked Notes, | | | | | | | | | | | | | | |

Series 2020-01, Class R, 144A^ | | | 33.784 | % | | 01/25/28 | | | 1,300 | | | $ | 1,277,058 | |

Chase Funding Loan Acquisition Trust, | | | | | | | | | | | | | | |

Series 2004-AQ1, Class A2, 1 Month LIBOR + 0.800% (Cap N/A, Floor 0.400%) | | | 0.949 | (c) | | 05/25/34 | | | 142 | | | | 141,643 | |

Chase Funding Trust, | | | | | | | | | | | | | | |

Series 2003-04, Class 2A2, 1 Month LIBOR + 0.600% (Cap N/A, Floor 0.300%) | | | 0.749 | (c) | | 05/25/33 | | | 753 | | | | 730,376 | |

CHEC Loan Trust, | | | | | | | | | | | | | | |

Series 2004-01, Class A3, 144A, 1 Month LIBOR + 1.000% (Cap N/A, Floor 0.500%) | | | 1.149 | (c) | | 07/25/34 | | | 611 | | | | 604,055 | |

CIT Mortgage Loan Trust, | | | | | | | | | | | | | | |

Series 2007-01, Class 1A, 144A, 1 Month LIBOR + 1.350% (Cap N/A, Floor 1.350%) | | | 1.499 | (c) | | 10/25/37 | | | 886 | | | | 888,963 | |

Commonbond Student Loan Trust, | | | | | | | | | | | | | | |

Series 2020-AGS, Class A, 144A | | | 1.980 | | | 08/25/50 | | | 4,966 | | | | 5,059,521 | |

Countrywide Asset-Backed Certificates, | | | | | | | | | | | | | | |

Series 2002-05, Class MV1, 1 Month LIBOR + 1.500% (Cap N/A, Floor 1.000%) | | | 1.649 | (c) | | 03/25/33 | | | 91 | | | | 90,349 | |

Credit Suisse Mortgage Trust, | | | | | | | | | | | | | | |

Series 2018-RPL08, Class A1, 144A | | | 4.125 | (cc) | | 07/25/58 | | | 2,538 | | | | 2,548,402 | |

ELFI Graduate Loan Program LLC, | | | | | | | | | | | | | | |

Series 2020-A, Class A, 144A | | | 1.730 | | | 08/25/45 | | | 8,401 | | | | 8,480,379 | |

EquiFirst Mortgage Loan Trust, | | | | | | | | | | | | | | |

Series 2004-01, Class 1A1, 1 Month LIBOR + 0.480% (Cap N/A, Floor 0.240%) | | | 0.629 | (c) | | 01/25/34 | | | 616 | | | | 584,631 | |

Exeter Automobile Receivables Trust, | | | | | | | | | | | | | | |

Series 2020-03A, Class D | | | 1.730 | | | 07/15/26 | | | 700 | | | | 699,797 | |

Ford Credit Auto Owner Trust, | | | | | | | | | | | | | | |

Series 2020-02, Class C, 144A | | | 1.740 | | | 04/15/33 | | | 1,300 | | | | 1,299,930 | |

Ford Credit Floorplan Master Owner Trust, | | | | | | | | | | | | | | |

Series 2018-04, Class A | | | 4.060 | | | 11/15/30 | | | 5,000 | | | | 5,686,015 | |

Series 2020-02, Class C | | | 1.870 | | | 09/15/27 | | | 2,100 | | | | 2,091,053 | |

Laurel Road Prime Student Loan Trust, | | | | | | | | | | | | | | |

Series 2018-A, Class A, 144A | | | 0.000 | | | 02/25/43 | | | 3,430 | | | | 2,436,309 | |

Series 2018-C, Class A, 144A | | | 0.000 | (cc) | | 08/25/43 | | | 2,067 | | | | 2,120,759 | |

Series 2019-A, Class R, IO, 144A | | | 0.000 | | | 10/25/48 | | | 5,258 | | | | 368,031 | |

Legacy Mortgage Asset Trust, | | | | | | | | | | | | | | |

Series 2019-GS01, Class A1, 144A | | | 4.000 | | | 01/25/59 | | | 1,385 | | | | 1,408,159 | |

Series 2019-GS02, Class A1, 144A | | | 3.750 | | | 01/25/59 | | | 1,709 | | | | 1,715,271 | |

Series 2019-GS04, Class A1, 144A | | | 3.438 | | | 05/25/59 | | | 2,809 | | | | 2,817,516 | |

Series 2019-SL01, Class A, 144A | | | 4.000 | (cc) | | 12/28/54 | | | 814 | | | | 821,752 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | |

Lending Funding Trust, | | | | | | | | | | | | | | | | |

Series 2020-02A, Class A, 144A | | | 2.320 | % | | | 04/21/31 | | | | 1,100 | | | $ | 1,098,946 | |

Lendmark Funding Trust, | | | | | | | | | | | | | | | | |

Series 2018-02A, Class A, 144A | | | 4.230 | | | | 04/20/27 | | | | 1,800 | | | | 1,840,736 | |

Series 2019-02A, Class A, 144A | | | 2.780 | | | | 04/20/28 | | | | 2,300 | | | | 2,322,628 | |

Long Beach Mortgage Loan Trust, | | | | | | | | | | | | | | | | |

Series 2003-04, Class AV1, 1 Month LIBOR + 0.620% (Cap N/A, Floor 0.310%) | | | 0.769 | (c) | | | 08/25/33 | | | | 689 | | | | 669,979 | |

Series 2004-03, Class M1, 1 Month LIBOR + 0.855% (Cap N/A, Floor 0.570%) | | | 1.004 | (c) | | | 07/25/34 | | | | 131 | | | | 128,684 | |

Mariner Finance Issuance Trust, | | | | | | | | | | | | | | | | |

Series 2020-AA, Class A, 144A | | | 2.190 | | | | 08/21/34 | | | | 1,800 | | | | 1,802,913 | |

MASTR Asset-Backed Securities Trust, | | | | | | | | | | | | | | | | |

Series 2004-WMC02, Class M1, 1 Month LIBOR + 0.900% (Cap N/A, Floor 0.600%) | | | 1.049 | (c) | | | 04/25/34 | | | | 1,246 | | | | 1,236,318 | |

Merrill Lynch Mortgage Investors Trust, | | | | | | | | | | | | | | | | |

Series 2004-HE02, Class M1, 1 Month LIBOR + 1.200% (Cap N/A, Floor 0.800%) | | | 1.349 | (c) | | | 08/25/35 | | | | 44 | | | | 43,818 | |

Morgan Stanley ABS Capital I, Inc. Trust, | | | | | | | | | | | | | | | | |

Series 2003-NC08, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 0.700%) | | | 1.199 | (c) | | | 09/25/33 | | | | 121 | | | | 119,823 | |

Morgan Stanley Dean Witter Capital I, Inc. Trust, | | | | | | | | | | | | | | | | |

Series 2002-AM3, Class A3, 1 Month LIBOR + 0.980% (Cap N/A, Floor 0.490%) | | | 1.129 | (c) | | | 02/25/33 | | | | 183 | | | | 181,454 | |

Navient Private Education Refi Loan Trust, | | | | | | | | | | | | | | | | |

Series 2020-DA, Class A, 144A | | | 1.690 | | | | 05/15/69 | | | | 6,704 | | | | 6,804,857 | |

Series 2020-GA, Class B, 144A | | | 2.500 | | | | 09/16/69 | | | | 2,000 | | | | 1,991,391 | |

OneMain Direct Auto Receivables Trust, | | | | | | | | | | | | | | | | |

Series 2019-01A, Class A, 144A | | | 3.630 | | | | 09/14/27 | | | | 5,900 | | | | 6,429,841 | |

Series 2019-01A, Class B, 144A | | | 3.950 | | | | 11/14/28 | | | | 1,300 | | | | 1,413,085 | |

OneMain Financial Issuance Trust, | | | | | | | | | | | | | | | | |

Series 2017-01A, Class C, 144A | | | 3.350 | | | | 09/14/32 | | | | 400 | | | | 400,556 | |

Series 2020-02A, Class B, 144A | | | 2.210 | | | | 09/14/35 | | | | 6,300 | | | | 6,336,769 | |

Series 2020-02A, Class C, 144A | | | 2.760 | | | | 09/14/35 | | | | 4,500 | | | | 4,515,440 | |

Oportun Funding IX LLC, | | | | | | | | | | | | | | | | |

Series 2018-B, Class D, 144A (original cost $2,612,250; purchased 10/29/20)(f) | | | 5.770 | | | | 07/08/24 | | | | 2,700 | | | | 2,612,250 | |

Oportun Funding LLC, | | | | | | | | | | | | | | | | |

Series 2020-01, Class A, 144A (original cost $4,299,769; purchased 10/30/20)(f) | | | 2.200 | | | | 05/15/24 | | | | 4,300 | | | | 4,299,769 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 21 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | |

United States (cont’d.) | | | | | | | | | | | | | | |

Oportun Funding VIII LLC, | | | | | | | | | | | | | | |

Series 2018-A, Class A, 144A (original cost $1,329,623; purchased 2/22/18)(f) | | | 3.610 | % | | 03/08/24 | | | 1,330 | | | $ | 1,331,957 | |

Oportun Funding X LLC, | | | | | | | | | | | | | | |

Series 2018-C, Class A, 144A (original cost $2,458,611; purchased 10/12/18-6/28/19)(f) | | | 4.100 | | | 10/08/24 | | | 2,450 | | | | 2,489,559 | |

Oportun Funding XII LLC, | | | | | | | | | | | | | | |

Series 2018-D, Class A, 144A (original cost $1,499,918; purchased 11/30/18)(f) | | | 4.150 | | | 12/09/24 | | | 1,500 | | | | 1,526,723 | |

Oportun Funding XIII LLC, | | | | | | | | | | | | | | |

Series 2019-A, Class B, 144A (original cost $4,157,334; purchased 7/25/19)(f) | | | 3.870 | | | 08/08/25 | | | 4,158 | | | | 4,181,208 | |

Series 2019-A, Class D, 144A (original cost $3,289,500; purchased 10/29/20)(f) | | | 6.220 | | | 08/08/25 | | | 3,400 | | | | 3,253,589 | |

Option One Mortgage Acceptance Corp.,

Asset-Backed Certificates, | | | | | | | | | | | | | | |

Series 2003-06, Class A2, 1 Month LIBOR + 0.660% (Cap N/A, Floor 0.330%) | | | 0.809 | (c) | | 11/25/33 | | | 692 | | | | 661,087 | |

PNMAC FMSR Issuer Trust, | | | | | | | | | | | | | | |

Series 2018-FT01, Class A, 144A, 1 Month LIBOR + 2.350% (Cap N/A, Floor 0.000%) | | | 2.498 | (c) | | 04/25/23 | | | 4,290 | | | | 4,126,661 | |

PNMAC GMSR Issuer Trust, | | | | | | | | | | | | | | |

Series 2018-GT01, Class A, 144A, 1 Month LIBOR + 2.850% (Cap N/A, Floor 2.850%) | | | 2.999 | (c) | | 02/25/23 | | | 1,020 | | | | 996,799 | |

Series 2018-GT02, Class A, 144A, 1 Month LIBOR + 2.650% (Cap N/A, Floor 0.000%) | | | 2.799 | (c) | | 08/25/25 | | | 2,300 | | | | 2,221,302 | |

Santander Drive Auto Receivables Trust, | | | | | | | | | | | | | | |

Series 2020-03, Class D | | | 1.640 | | | 11/16/26 | | | 4,800 | | | | 4,806,588 | |

SoFi Alternative Trust, | | | | | | | | | | | | | | |

Series 2019-B, Class PT, 144A | | | 0.000 | | | 12/15/45 | | | 8,194 | | | | 8,448,313 | |

Series 2019-D, Class 1PT, 144A | | | 2.616 | (cc) | | 01/16/46 | | | 8,985 | | | | 9,255,979 | |

Series 2019-F, Class PT1, 144A | | | 3.932 | (cc) | | 02/15/45 | | | 11,063 | | | | 11,351,385 | |

SoFi Professional Loan Program LLC, | | | | | | | | | | | | | | |

Series 2019-C, Class BFX, 144A | | | 3.050 | | | 11/16/48 | | | 2,100 | | | | 2,164,282 | |

SoFi Professional Loan Program Trust, | | | | | | | | | | | | | | |

Series 2020-C, Class AFX, 144A | | | 1.950 | | | 02/15/46 | | | 4,087 | | | | 4,159,472 | |

SoFi RR Funding II Trust, | | | | | | | | | | | | | | |

Series 2019-01, Class A, 144A, 1 Month LIBOR + 1.250% (Cap N/A, Floor 1.250%) | | | 1.398 | (c) | | 11/29/24 | | | 7,702 | | | | 7,596,137 | |

SoFi RR Funding III Trust, | | | | | | | | | | | | | | |

Series 2020-01, Class A, 144A, 1 Month LIBOR + 3.750% (Cap N/A, Floor 3.750%) | | | 3.898 | (c) | | 11/29/24 | | | 4,248 | | | | 4,298,235 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | | | |

| | | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | | | |

Springleaf Funding Trust, | | | | | | | | | | | | | | | | | | |

Series 2017-AA, Class C, 144A | | | 3.860 | % | | 07/15/30 | | | | | | | 800 | | | $ | 800,808 | |

TH MSR Issuer Trust, | | | | | | | | | | | | | | | | | | |

Series 2019-FT01, Class A, 144A, 1 Month LIBOR + 2.800% (Cap N/A, Floor 2.800%) | | | 2.949 | (c) | | 06/25/24 | | | | | | | 9,330 | | | | 8,810,136 | |

World Omni Select Auto Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-A, Class D | | | 1.700 | | | 10/15/26 | | | | | | | 5,900 | | | | 5,867,749 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 190,620,883 | |

| | | | | | | | | | | | | | | | | | |

TOTAL ASSET-BACKED SECURITIES

(cost $642,726,069) | | | | | | | | | | | | | | | | | 639,923,582 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

BANK LOANS 0.7% | | | | | | | | | | | | | | | | | | |

| | | | | |

France 0.1% | | | | | | | | | | | | | | | | | | |

Ceva Sante Animale SA, | | | | | | | | | | | | | | | | | | |

Term Loan B, 6 Month EURIBOR + 4.750% (Cap N/A, Floor 0.000%) | | | 4.750 | (c) | | 04/13/26 | | | EUR | | | | 1,575 | | | | 1,819,191 | |

| | | | | |

Germany 0.1% | | | | | | | | | | | | | | | | | | |

Speedster Bidco GmbH,

Second Lien Term Loan, 6 Month EURIBOR + 6.250% (Cap N/A, Floor 0.000%) | | | 6.250 | (c) | | 03/31/28 | | | EUR | | | | 3,265 | | | | 3,593,440 | |

| | | | | |

United Kingdom 0.2% | | | | | | | | | | | | | | | | | | |

BBD Bidco Ltd., | | | | | | | | | | | | | | | | | | |

Facility B-1 Loan, 6 Month GBP LIBOR + 4.750% | | | 4.839 | (c) | | 11/13/26 | | | GBP | | | | 2,125 | | | | 2,611,849 | |

Froneri Finco SARL,

Second Lien Facility (EUR) Loan, 1 Month EURIBOR + 5.750% (Cap N/A, Floor 0.000%) | | | 5.750 | (c) | | 01/31/28 | | | EUR | | | | 6,400 | | | | 7,458,419 | |

Richmond UK Bidco Ltd., | | | | | | | | | | | | | | | | | | |

Facility B, 6 Month GBP LIBOR + 4.250% | | | 4.338 | (c) | | 03/03/24 | | | GBP | | | | 72 | | | | 83,612 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 10,153,880 | |

| | | | | |

United States 0.3% | | | | | | | | | | | | | | | | | | |

Ascent Resources Utica Holdings LLC,

Second Lien Term Loan, 3 Month LIBOR + 9.000% | | | 10.000 | | | 11/03/25 | | | | | | | 1,199 | | | | 1,258,950 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 23 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

BANK LOANS (Continued) | | | | | | | | | | | | | | | | | | |

| | | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | | | |

Chesapeake Energy Corp.,

Class A Loan, 3 Month LIBOR + 8.000% (Cap N/A, Floor 1.000%) | | | 9.000 | %(c) | | 06/24/24(d) | | | | | | | 3,575 | | | $ | 2,627,625 | |

CRH Europe Investments B.V., | | | | | | | | | | | | | | | | | | |

Term Loan | | | — | (p) | | 10/30/26 | | | EUR | | | | 9,000 | | | | 10,311,521 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 14,198,096 | |

| | | | | | | | | | | | | | | | | | |

TOTAL BANK LOANS

(cost $30,206,030) | | | | | | | | | | | | | | | | | 29,764,607 | |

| | | | | | | | | | | | | | | | | | |

|

COMMERCIAL MORTGAGE-BACKED SECURITIES 7.2% | |

| | | | | |

Canada 0.1% | | | | | | | | | | | | | | | | | | |

Real Estate Asset Liquidity Trust, | | | | | | | | | | | | | | | | | | |

Series 2020-01A, Class A1, 144A | | | 2.381 | (cc) | | 02/12/55 | | | CAD | | | | 2,261 | | | | 1,707,710 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

United Kingdom 0.0% | | | | | | | | | | | | | | | | | | |

Salus European Loan Conduit DAC,

Series 33A, Class A, 144A, 3 Month GBP LIBOR + 1.500% (Cap 6.500%, Floor 1.500%) | | | 1.545 | (c) | | 01/23/29 | | | GBP | | | | 500 | | | | 637,743 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

United States 7.1% | | | | | | | | | | | | | | | | | | |

20 Times Square Trust, | | | | | | | | | | | | | | | | | | |

Series 2018-20TS, Class G, 144A | | | 3.100 | (cc) | | 05/15/35 | | | | | | | 1,000 | | | | 888,724 | |

Series 2018-20TS, Class H, 144A | | | 3.100 | (cc) | | 05/15/35 | | | | | | | 1,000 | | | | 824,845 | |

BANK, | | | | | | | | | | | | | | | | | | |

Series 2017-BNK05, Class A3 | | | 3.020 | | | 06/15/60 | | | | | | | 3,600 | | | | 3,817,467 | |

Series 2017-BNK06, Class A3 | | | 3.125 | | | 07/15/60 | | | | | | | 4,400 | | | | 4,664,744 | |

Series 2017-BNK07, Class A4 | | | 3.175 | | | 09/15/60 | | | | | | | 5,000 | | | | 5,449,580 | |

Series 2017-BNK09, Class A3 | | | 3.279 | | | 11/15/54 | | | | | | | 3,000 | | | | 3,284,066 | |

Series 2019-BN21, Class A3 | | | 2.458 | | | 10/17/52 | | | | | | | 6,293 | | | | 6,631,578 | |

Benchmark Mortgage Trust, | | | | | | | | | | | | | | | | | | |

Series 2018-B02, Class A3 | | | 3.544 | | | 02/15/51 | | | | | | | 5,000 | | | | 5,411,244 | |

Series 2018-B03, Class A3 | | | 3.746 | | | 04/10/51 | | | | | | | 7,200 | | | | 7,825,566 | |

Series 2020-B17, Class A4 | | | 2.042 | | | 03/15/53 | | | | | | | 6,200 | | | | 6,338,776 | |

Series 2020-B20, Class A3 | | | 1.945 | | | 10/15/53 | | | | | | | 11,000 | | | | 11,255,423 | |

BX Commercial Mortgage Trust, | | | | | | | | | | | | | | | | | | |

Series 2019-XL, Class F, 144A, 1 Month LIBOR + 2.000% (Cap N/A, Floor 2.000%) | | | 2.148 | (c) | | 10/15/36 | | | | | | | 3,133 | | | | 3,066,302 | |

Series 2019-XL, Class G, 144A, 1 Month LIBOR + 2.300% (Cap N/A, Floor 2.300%) | | | 2.448 | (c) | | 10/15/36 | | | | | | | 3,228 | | | | 3,130,623 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

| | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | |

| | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | |

BX Commercial Mortgage Trust, (cont’d.) | | | | | | | | | | | | | | | | |

Series 2019-XL, Class J, 144A, 1 Month LIBOR + 2.650% (Cap N/A, Floor 2.650%) | | | 2.798 | %(c) | | | 10/15/36 | | | | 14,676 | | | $ | 14,161,647 | |

Series 2020-BXLP, Class F, 144A, 1 Month LIBOR + 2.000% (Cap N/A, Floor 2.000%) | | | 2.148 | (c) | | | 12/15/36 | | | | 3,796 | | | | 3,668,390 | |

Cantor Commercial Real Estate Lending, | | | | | | | | | | | | | | | | |

Series 2019-CF02, Class A3 | | | 2.647 | | | | 11/15/52 | | | | 16,531 | | | | 17,041,479 | |

CF Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2020-P01, Class A1, 144A | | | 2.840 | (cc) | | | 04/15/25 | | | | 9,471 | | | | 9,941,768 | |

Citigroup Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2014-GC21, Class XB, IO | | | 0.439 | (cc) | | | 05/10/47 | | | | 27,500 | | | | 415,156 | |

Series 2016-GC37, Class XB, IO | | | 0.687 | (cc) | | | 04/10/49 | | | | 33,868 | | | | 1,163,515 | |

Series 2016-P04, Class XB, IO | | | 1.345 | (cc) | | | 07/10/49 | | | | 9,100 | | | | 620,608 | |

Series 2017-P08, Class A2 | | | 3.109 | | | | 09/15/50 | | | | 2,000 | | | | 2,088,409 | |

Series 2018-B02, Class A3 | | | 3.744 | | | | 03/10/51 | | | | 7,500 | | | | 8,511,589 | |

Cold Storage Trust, | | | | | | | | | | | | | | | | |

Series 2020-ICE05, Class E, 144A, 1 Month LIBOR + 2.766% (Cap N/A, Floor 2.833%) | | | 2.989 | (c) | | | 11/15/23 | | | | 4,475 | | | | 4,429,692 | |

Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2012-CR01, Class XA, IO | | | 1.845 | (cc) | | | 05/15/45 | | | | 3,344 | | | | 67,573 | |

Series 2014-UBS04, Class XB, IO, 144A | | | 0.214 | (cc) | | | 08/10/47 | | | | 50,000 | | | | 398,290 | |

Series 2015-CR24, Class A4 | | | 3.432 | | | | 08/10/48 | | | | 3,962 | | | | 4,321,041 | |

Credit Suisse Mortgage Capital Certificates, | | | | | | | | | | | | | | | | |

Series 2019-ICE04, Class E, 144A, 1 Month LIBOR + 2.150% (Cap N/A, Floor 2.150%) | | | 2.298 | (c) | | | 05/15/36 | | | | 14,125 | | | | 13,877,307 | |

CSAIL Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2018-CX11, Class A3 | | | 4.095 | | | | 04/15/51 | | | | 2,250 | | | | 2,474,145 | |

Series 2019-C17, Class A3 | | | 2.769 | | | | 09/15/52 | | | | 12,444 | | | | 13,184,372 | |

DBJPM Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2016-C03, Class A3 | | | 2.362 | | | | 08/10/49 | | | | 1,500 | | | | 1,530,376 | |

Series 2017-C06, Class A3 | | | 3.269 | | | | 06/10/50 | | | | 4,400 | | | | 4,683,426 | |

Series 2020-C09, Class A3 | | | 1.882 | | | | 09/15/53 | | | | 20,000 | | | | 20,552,648 | |

DBWF Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2016-85T, Class E, 144A | | | 3.808 | (cc) | | | 12/10/36 | | | | 3,000 | | | | 2,853,620 | |

Eleven Madison Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2015-11MD, Class C, 144A | | | 3.555 | (cc) | | | 09/10/35 | | | | 500 | | | | 513,465 | |

FHLMC Multifamily Structured Pass-Through Certificates, | | | | | | | | | | | | | | | | |

Series K019, Class X1, IO | | | 1.591 | (cc) | | | 03/25/22 | | | | 8,667 | | | | 152,752 | |

Series K020, Class X1, IO | | | 1.355 | (cc) | | | 05/25/22 | | | | 10,068 | | | | 169,430 | |

Series K025, Class X1, IO | | | 0.803 | (cc) | | | 10/25/22 | | | | 17,912 | | | | 227,953 | |

Series K037, Class X1, IO | | | 0.959 | (cc) | | | 01/25/24 | | | | 10,284 | | | | 261,643 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 25 | |

Schedule of Investments (continued)

ss of October 31, 2020

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal Amount (000)# | | | Value | |

| | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | |

| | | | |

United States (cont’d.) | | | | | | | | | | | | | | |

FHLMC Multifamily Structured Pass-Through Certificates, (cont’d.) | | | | | | | | | | | | | | |

Series K043, Class X1, IO | | | 0.530 | %(cc) | | 12/25/24 | | | 12,027 | | | $ | 233,567 | |

Series K049, Class X1, IO | | | 0.595 | (cc) | | 07/25/25 | | | 40,368 | | | | 986,892 | |

Series K052, Class X1, IO | | | 0.655 | (cc) | | 11/25/25 | | | 12,083 | | | | 345,999 | |

Series K053, Class X1, IO | | | 0.886 | (cc) | | 12/25/25 | | | 45,271 | | | | 1,817,393 | |

Series K054, Class X1, IO | | | 1.170 | (cc) | | 01/25/26 | | | 30,656 | | | | 1,631,921 | |

Series K058, Class X1, IO | | | 0.925 | (cc) | | 08/25/26 | | | 41,117 | | | | 1,937,583 | |

Series K090, Class X1, IO | | | 0.705 | (cc) | | 02/25/29 | | | 22,976 | | | | 1,241,865 | |

Series K111, Class X1, IO | | | 1.573 | (cc) | | 05/25/30 | | | 29,435 | | | | 3,728,756 | |

Series K113, Class X1, IO | | | 1.490 | (cc) | | 06/25/30 | | | 92,319 | | | | 10,383,063 | |

Series K114, Class X1, IO | | | 1.119 | (cc) | | 06/25/30 | | | 75,582 | | | | 6,951,146 | |

Series K116, Class X1, IO | | | 1.428 | (cc) | | 07/25/30 | | | 49,254 | | | | 5,665,408 | |

Series K717, Class X1, IO | | | 0.469 | (cc) | | 09/25/21 | | | 10,740 | | | | 20,213 | |

Series KG03, Class X1, IO | | | 1.381 | (cc) | | 06/25/30 | | | 101,850 | | | | 10,971,842 | |

Series Q001, Class XA, IO | | | 2.190 | (cc) | | 02/25/32 | | | 6,355 | | | | 699,710 | |

GS Mortgage Securities Trust, | | | | | | | | | | | | | | |

Series 2014-GC20, Class XB, IO | | | 0.436 | (cc) | | 04/10/47 | | | 30,000 | | | | 431,064 | |

Series 2014-GC22, Class XB, IO | | | 0.301 | (cc) | | 06/10/47 | | | 35,000 | | | | 428,841 | |

Series 2014-GC24, Class XB, IO | | | 0.021 | (cc) | | 09/10/47 | | | 83,262 | | | | 57,800 | |

Series 2014-GC26, Class XB, IO | | | 0.296 | (cc) | | 11/10/47 | | | 56,483 | | | | 735,431 | |

Series 2018-GS09, Class A3 | | | 3.727 | | | 03/10/51 | | | 7,000 | | | | 7,831,296 | |

JPMBB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | |

Series 2016-C01, Class A3 | | | 3.515 | | | 03/15/49 | | | 1,500 | | | | 1,571,881 | |

JPMCC Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | |

Series 2017-JP05, Class A3 | | | 3.342 | | | 03/15/50 | | | 1,600 | | | | 1,671,124 | |

Series 2017-JP06, Class A3 | | | 3.109 | | | 07/15/50 | | | 4,600 | | | | 4,822,374 | |

Series 2017-JP07, Class A3 | | | 3.379 | | | 09/15/50 | | | 5,100 | | | | 5,402,230 | |

JPMDB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | |

Series 2020-COR07, Class A4 | | | 1.915 | | | 05/13/53 | | | 10,000 | | | | 10,132,462 | |

MKT Mortgage Trust, | | | | | | | | | | | | | | |

Series 2020-525M, Class F, 144A | | | 2.941 | (cc) | | 02/12/40 | | | 3,775 | | | | 3,246,750 | |

Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | | | | | | | |

Series 2016-C31, Class A3 | | | 2.731 | | | 11/15/49 | | | 2,211 | | | | 2,301,038 | |

Morgan Stanley Capital I Trust, | | | | | | | | | | | | | | |

Series 2016-UBS09, Class A2 | | | 2.982 | | | 03/15/49 | | | 344 | | | | 354,670 | |

Series 2017-H01, Class A3 | | | 3.153 | | | 06/15/50 | | | 4,500 | | | | 4,750,535 | |

Series 2019-MEAD, Class E, 144A | | | 3.177 | (cc) | | 11/10/36 | | | 1,700 | | | | 1,305,750 | |

Series 2020-HR08, Class XB, IO | | | 0.878 | (cc) | | 07/15/53 | | | 54,413 | | | | 4,226,399 | |

UBS Commercial Mortgage Trust, | | | | | | | | | | | | | | |

Series 2017-C04, Class A3 | | | 3.301 | | | 10/15/50 | | | 6,500 | | | | 7,109,179 | |

Series 2017-C06, Class A3 | | | 3.581 | | | 12/15/50 | | | 5,000 | | | | 5,370,539 | |

Series 2017-C07, Class A3 | | | 3.418 | | | 12/15/50 | | | 4,400 | | | | 4,883,747 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal Amount (000)# | | | Value | |

| | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | | | | |

| | | | | |

United States (cont’d.) | | | | | | | | | | | | | | | | | | |

UBS-Barclays Commercial Mortgage Trust, | | | | | | | | | | | | | | | | | | |

Series 2012-C02, Class XA, IO, 144A | | | 1.293 | %(cc) | | 05/10/63 | | | | | | | 4,235 | | | $ | 73,053 | |

Wells Fargo Commercial Mortgage Trust, | | | | | | | | | | | | | | | | | | |

Series 2016-C35, Class XB, IO | | | 0.935 | (cc) | | 07/15/48 | | | | | | | 24,000 | | | | 1,161,096 | |

Series 2016-LC24, Class XB, IO | | | 1.011 | (cc) | | 10/15/49 | | | | | | | 20,910 | | | | 1,092,890 | |

Series 2017-C40, Class A3 | | | 3.317 | | | 10/15/50 | | | | | | | 2,600 | | | | 2,799,475 | |

Series 2018-C43, Class A3 | | | 3.746 | | | 03/15/51 | | | | | | | 8,350 | | | | 9,269,813 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 317,544,027 | |

| | | | | | | | | | | | | | | | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $310,466,583) | | | | | | | | | | | | | | | | | 319,889,480 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

CORPORATE BONDS 33.9% | | | | | | | | | | | | | | | | | | |

| | | | | |

Australia 0.1% | | | | | | | | | | | | | | | | | | |

Australia & New Zealand Banking Group Ltd., | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, EMTN | | | 3.700 | | | 03/18/24 | | | CNH | | | | 2,000 | | | | 300,756 | |

Westpac Banking Corp., | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, EMTN | | | 4.350 | | | 01/19/21 | | | CNH | | | | 8,770 | | | | 1,313,316 | |

Sr. Unsec’d. Notes, EMTN | | | 4.420 | | | 08/14/23 | | | CNH | | | | 21,000 | | | | 3,236,342 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 4,850,414 | |

| | | | | |

Belgium 0.1% | | | | | | | | | | | | | | | | | | |

Anheuser-Busch InBev Worldwide, Inc., | | | | | | | | | | | | | | | | | | |

Gtd. Notes (a) | | | 5.550 | | | 01/23/49 | | | | | | | 3,800 | | | | 5,086,112 | |

| | | | | |

Brazil 0.6% | | | | | | | | | | | | | | | | | | |

Petrobras Global Finance BV, | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.375 | | | 10/01/29 | | | GBP | | | | 9,000 | | | | 12,508,528 | |

Gtd. Notes | | | 6.625 | | | 01/16/34 | | | GBP | | | | 2,200 | | | | 3,158,867 | |

Gtd. Notes, EMTN | | | 6.250 | | | 12/14/26 | | | GBP | | | | 5,743 | | | | 8,297,706 | |

Suzano Austria GmbH, | | | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 6.000 | | | 01/15/29 | | | | | | | 200 | | | | 232,173 | |

Swiss Insured Brazil Power Finance Sarl, | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | | 9.850 | | | 07/16/32 | | | BRL | | | | 21,407 | | | | 4,230,279 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | 28,427,553 | |

| | | | | |

Canada 0.6% | | | | | | | | | | | | | | | | | | |

Barrick Gold Corp., | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 5.250 | | | 04/01/42 | | | | | | | 35 | | | | 47,239 | |

See Notes to Financial Statements.

| | | | |

| PGIM Global Total Return Fund | | | 27 | |

Schedule of Investments (continued)

as of October 31, 2020

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | Principal Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | | |

Canada (cont’d.) | | | | | | | | | | | | | | | | |

Barrick North America Finance LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.700 | % | | 05/30/41 | | | | | 45 | | | $ | 62,732 | |

Barrick PD Australia Finance Pty Ltd., | | | | | | | | | | | | | | | | |

Gtd. Notes | | | 5.950 | | | 10/15/39 | | | | | 50 | | | | 70,535 | |

Bombardier, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 7.500 | | | 12/01/24 | | | | | 4,050 | | | | 3,046,855 | |