UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-04665

Commonwealth International Series Trust

(Exact name of registrant as specified in charter)

791 Town & Country Blvd

Houston, TX 77024-3925

(Address of principal executive offices) (Zip code)

CT Corporation System

155 Federal Street

Boston, MA 02110

(Name and address of agent for service)

Copies to:

John H. Lively

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law Group

2041 West 141st Terrace, Suite 119

Leawood, KS 66224

Registrant’s telephone number, including area code: (888) 345-1898

Date of fiscal year end: October 31

Date of reporting period: October 31, 2010

| Item 1. Reports to Stockholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

Commonwealth International

Series Trust

791 Town & Country Blvd, Suite 250

Houston, TX 77024-3925

888-345-1898

www.commonwealthfunds.com

INVESTMENT ADVISOR

FCA Corp

791 Town & Country Blvd, Suite 250

Houston, TX 77024-3925

713-781-2856

DISTRIBUTOR

UMB Distribution Services, LLC

803 West Michigan Street

Milwaukee, WI 53233

TRANSFER AGENT & ADMINISTRATOR

UMB Fund Services, Inc.

803 West Michigan Street

Milwaukee, WI 53233

CUSTODIAN BANK

Fifth Third Bank

Fifth Third Center

38 Fountain Square Plaza

Cincinnati, OH 45263

INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

BBD, LLP

1835 Market Street, 26th Floor

Philadelphia, PA 19103

LEGAL COUNSEL

The Law Offices of John H. Lively & Associates, Inc.

A Member Firm of the 1940 Act Law Group

2041 W. 141st Terrance, Suite 119

Leawood, KS 66224 | |

Commonwealth Australia/New Zealand Fund

Commonwealth Japan Fund

Commonwealth Global Fund

Commonwealth Real Estate Securities Fund

ANNUAL REPORT

October 31, 2010 |

| | | |

| | | |

| This report is intended for the shareholders of the family of funds of the Commonwealth International Series Trust. It may not be distributed to prospective investors unless it is preceded or accompanied by the Funds’ current Prospectus. An additional Prospectus may be obtained at www.commonwealthfunds.com or from the principal underwriter of the Funds or your broker. | | |

| Table of Contents | | |

| | | |

| Shareholder Letter | | 2 |

| | | |

| Performance Overview | | |

Commonwealth Australia/New Zealand Fund | | 6 |

Commonwealth Japan Fund | | 8 |

Commonwealth Global Fund | | 10 |

Commonwealth Real Estate Securities Fund | | 12 |

| | | |

| Glossary of Terms | | 14 |

| Portfolio Composition | | 15 |

| Schedules of Investments | | 16 |

| Statements of Assets and Liabilities | | 24 |

| Statements of Operations | | 25 |

| Statements of Changes in Net Assets | | 26 |

| Financial Highlights | | 28 |

| | | |

| Notes to Financial Statements | | 32 |

| | | |

| Report of Independent Registered Public Accounting Firm | | 41 |

| | | |

| Additional Information | | 42 |

| | | |

| Trustees and Officers | | 44 |

| | | |

|

791 Town & Country Blvd, Suite 250, Houston, TX 77024-3925

888.345.1898

Commonwealth Australia/New Zealand Fund (CNZLX)

Commonwealth Japan Fund (CNJFX)

Commonwealth Global Fund (CNGLX)

Commonwealth Real Estate Securities Fund (CNREX)

www.commonwealthfunds.com

October 31, 2010

Dear Fellow Shareholders:

Historians have a lot of work to do. Years from now, commentaries of market historians will be interesting indeed to read. We believe they will tell of the 2008 – 2010 eras when marketplaces of the world were collectively brought to their financial knees. The research provided might reveal how the nations of the world likely believed themselves to be independent; yet did find that perhaps they were truly dependent on each other more than they ever realized.

New alliances among developing countries and governments stood strong tests and for the most part survived. Developed countries found themselves with significant debt and modest growth if any growth at all. These circumstances resulted in various attempts to shift the value of each country’s currency against other nations’ currencies in a manner that would hopefully stimulate export growth.

Generations will read of these events and likely marvel at how investors could have possibly followed the worldwide events of the period. How were decisions made? How were investments consummated with a reasonable assurance that accuracy of financials and reporting procedures were proper and dependable? How did investment committees receive, analyze and dispatch decisions based on such voluminous activity?

Welcome to the current world of FCA Corp, the investment advisor to the Commonwealth International Series Trust comprised of four separate series: the Commonwealth Australia/New Zealand Fund, the Commonwealth Japan Fund, the Commonwealth Global Fund and the Commonwealth Real Estate Securities Fund (each being a “Fund” and together the “Funds.”)

When investments are contemplated to be made within a country, intense efforts are expended to “understand” the country from several points of view. An analysis is made of the government platforms upon which businesses operate and a review of the tax policies and incentives provided by the government is considered. Essential sources of investment capital for expansion are identified and a strong sense of the culture of the country is sought to be understood.

By knowing the nation, learning the people, sensing their needs and discovering companies who produce products and services to meet those needs, we believe that investments can be made that keep the interests of the Funds in the pathway of progress. The selection of companies with innovative, flexible managements is essential to our process.

Our investment themes remain relatively unchanged yet the landscape of the world markets is ever changing. In our opinion, it is a time in the marketplaces to be applying the years of investment experience and a time to potentially benefit from the associations of so many well developed relationships.

2

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| |

|

The following individual reports on each of the Funds are very important and we ask you to review them thoroughly.

In closing, as we reflect on our nineteenth year as the investment advisor to the Trust, we would like to take this opportunity to thank you for your support and continued interest in our family of Funds. We truly value our shareholders. If you have any questions, please feel free to contact us.

| |  |

| Robert W. Scharar | | Wesley R. Yuhnke |

| President and Portfolio Manager | | Assistant Portfolio Manager |

| Commonwealth International Series Trust | | Commonwealth International Series Trust |

| | | |

| |  |

| | | |

| Carlos Rubio | | Ronald Manning |

| Assistant Portfolio Manager | | Assistant Portfolio Manager |

| Commonwealth International Series Trust | | Commonwealth International Series Trust |

The views in the above discussion, along with discussion included under the “Performance Overview” for each Fund below, were those of the Funds’ investment advisor as of the date set forth above and may not reflect its views on the date this annual report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and the performance of the Funds during the period covered by this report and do not constitute investment advice.

THE PERFORMANCE INFORMATION QUOTED IN THIS ANNUAL REPORT REPRESENTS PAST PERFORMANCE AND PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE OF AN INVESTMENT WILL FLUCTUATE SO THAT AN INVESTOR’S SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. AN INVESTOR SHOULD CONSIDER THE FUND’S INVESTMENT OBJECTIVES, RISKS, AND CHARGES AND EXPENSES CAREFULLY BEFORE INVESTING. THE FUND’S PROSPECTUS CONTAINS THIS AND OTHER IMPORTANT INFORMATION. FOR INFORMATION ON THE FUND’S EXPENSE RATIO, PLEASE SEE THE FINANCIAL HIGHLIGHTS TABLE FOUND WITHIN THIS REPORT. TO OBTAIN A PROSPECTUS AND OTHER INFORMATION ABOUT THE FUNDS, PLEASE VISIT WWW.COMMONWEALTHFUNDS.COM OR CALL 888-345-1898. PLEASE READ THE PROSPECTUS CAREFULLY BEFORE INVESTING.

3

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| |

|

Questions and Answers

To help shareholders better understand key attributes of the Funds and their operations, the following Question and Answer section is provided.

Who is the advisor?

The Funds’ investment advisor is FCA Corp (“FCA”). FCA is an investment advisor that is registered with the U.S. Securities and Exchange Commission and is located at 791 Town & Country Blvd., Suite 250, Houston, Texas 77024-3925. The firm was founded 35 years ago and maintains a global perspective on the equity and fixed income marketplaces.

Why do our Funds include shares of foreign companies?

We invest in companies outside the United States because we believe there are significant investment opportunities in select foreign markets. We also believe U.S. investors benefit from the diversification that having investments outside the United States can provide. International investing offers exposure to more companies and other nations’ economies. In 2010, over 50% of the value of equity markets was outside the United States, and the growth experienced by many of these foreign economies appeared to be attractive. We believe that for a U.S. investor, allocation of a portion of the investor’s portfolio to international securities can provide the potential for less risk and can achieve a more consistent long-term performance in the investor’s overall portfolio.1

How has international investing changed over the last decade?

International markets now comprise a significant portion of all equity value worldwide. As markets have blended through global commerce, capital has flowed from country to country following investment opportunities. Developed markets and emerging markets both require capital investments to provide the goods and services of their respective needs. During the last two decades in particular, statistical information has become more uniform thus more dependable. The trend appears to be in place for continued development of these distant countries and their markets long term. Their demand for investment capital continues as they provide opportunities for diversification and growth. The Funds seek to be participants in these developments. The challenge continues to be one of positioning portfolios for growth while seeking to protect against negative trends that might develop.

What are some of the factors influencing a Fund’s portfolio turnover?

Each Fund generally invests in equity securities with a long-term view and in debt securities to be held to maturity. The portfolio’s securities are evaluated on their long-term prospects. A particular Fund may experience higher or lower turnover ratios in certain years. Factors influencing portfolio turnover include, but are not limited to the following: rebalancing portfolio securities to take advantage of long-term opportunities and/or to reallocate between fixed income and equity securities; investing new Fund subscriptions; or selling securities to cover Fund redemptions. Higher levels of portfolio activity by a Fund may result in higher transaction costs and/or more realized gains or losses, the impact of which is borne by the Fund’s shareholders. The turnover of a portfolio is not predictable because managers do not know when the portfolio transactions will be dictated. Under most circumstances, it is desirable to limit transactions because of the costs associated with trading although these are generally not the determining factor.

| 1 | Investing in international markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. |

We advise you to consider each Fund’s objectives, risks, charges and expenses carefully before investing in that Fund. The Prospectus contains information about those and other important matters relating to the Funds. Please read the Prospectus carefully before you invest.

4

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| |

|

How can the size of the Fund impact the Funds’ expense ratio?

The primary objective of investment management is to seek a reasonable return in keeping with the risks assumed. Obtaining this objective in global portfolios is historically more expensive than the costs associated with managing a portfolio comprised of domestic securities. Research of foreign markets, trading in different currencies, custody of assets, accurate evaluations of holdings and generally overall communications are all known to be more expensive when managing foreign portfolios. As with almost every mutual fund, size has an impact on the expense ratio of Funds. Typically, larger mutual funds can have lower expense ratios as there is an increased opportunity to spread out fixed and partially-fixed costs necessary to operate such mutual funds over a larger asset base. Generally, mutual fund expenses, including those of the Funds, are allocated on a daily basis among all shareholders. In addition, as a portfolio grows, it is self-evident that fixed costs as a percentage of the assets managed generally decline. In youthful portfolios or in highly specific investment objective portfolios, higher costs can be experienced during these growth of assets time periods. The Financial Highlights section of the accompanying financial statements provides supplemental data that includes current and historic expense information.

5

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| PERFORMANCE OVERVIEW – October 31, 2010 (Unaudited) |

| COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND |

The Commonwealth Australia/New Zealand Fund’s net asset value (NAV) as of October 31, 2010 was $10.74 per share compared to $9.84 per share on October 31, 2009. For the twelve month period covered by this Annual Report, the Commonwealth Australia/New Zealand Fund returned 9.15%. Our investments do not attempt to track any index, but rather we undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in fixed income investments and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. During the twelve-month period, the Fund outperformed the New Zealand SmallCap Index1, while underperforming the Australian All Ordinaries Index1 and the NZX 50 Index,1 which returned 5.74%, 17.08% and 9.34%, respectively. These indexes do not include any fixed income instruments. Additionally, the indexes are unmanaged, they are expressed in terms of U.S. dollars and they do not reflect the deduction of fees or taxes associated with a mutual fund such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| |

| The appreciation of the Australian and New Zealand dollar versus the U.S. dollar positively impacted the Fund’s returns during the year. When measured in the respective local currency, Australian equities outperformed New Zealand equities. New Zealand small cap equities generally underperformed relative to large-cap equities. Due to the allocation of the fund’s assets to the small-cap area, the fund’s performance was correspondingly negatively impacted. The Fund’s investments in fixed income and other debt securities including U.S. dollar denominated securities therefore did not benefit from the appreciation of the Australian and New Zealand dollars. |

| |

| Compared to many other developed countries, both Australia and New Zealand were less affected during the recent global financial crisis. In fact, Australia was one of the few major developed economies to avoid a recession. New Zealand’s economy has now emerged from recession and has experienced some quarters of meaningful growth. New Zealand’s exports, which make up approximately 30% of the economy, made a strong contribution to the economic recovery. The overall increased economic activity in New Zealand was particularly beneficial for transportation companies, a group in which the Fund has a significant allocation, including the Fund’s largest holding, South Port New Zealand Ltd.* Both countries’ continued economic development have recently been helped by growth in the Asia Pacific region. Australia’s economy continues to benefit from the natural resource boom, which is expected to continue if not intensify over the medium term, in our opinion. However, the pace of Australia’s economic growth may slow in the near-term due to higher borrowing costs and less government stimulus for the housing market, while a stronger currency may hurt exports. |

| The strength of the commodity mineral boom has contributed to Australia’s economic recovery and an appreciation of the Australian dollar. The Fund’s investments in commodity producing companies had a positive impact on the Fund’s returns. Both of these outcomes, strong economic activity and the appreciation of the Australian dollar, are driving strong demand for food and manufacturing exports from a more competitive New Zealand. Strong growth in the East Asia and Australian markets have been beneficial for New Zealand’s economy. These markets were less affected by the Global Financial Crisis, and have enjoyed strong export prices as well as increasing domestic demand. China and India are two economies continuing to display strong export demands. They each have significant infrastructure needs and each is experiencing evolving domestic demand. Australia and New Zealand are well positioned to help meet these needs. |

| | |

| Investment Risks |

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes. |

| | |

The Fund’s investments in debt and/or fixed income securities also contain risk factors. The value of these securities tends to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each. |

| | |

International investing involves increased risk and volatility. An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Because the Fund invests primarily in the securities of, and depositary receipts represented by Australian and New Zealand issuers, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of those countries. |

| | |

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments. |

| | |

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in and of the Fund. |

| | |

| * | Portfolio holdings will change due to ongoing management of the funds. References to specific securities or sectors should not be construed as recommendations by the Funds, the Advisor or the Distributor. |

| 1 | For additional information, please refer to the Glossary of Terms following the Performance Overview section. |

6

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| PERFORMANCE OVERVIEW – October 31, 2010 (Unaudited) |

| COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND |

Comparison of Change in Value of a $10,000 Investment in the Commonwealth Australia/New Zealand Fund, the NZSCI, AAOI, and NZX 50 Index.

The above graph is a hypothetical $10,000 investment in the Commonwealth Australia/New Zealand Fund from 10/31/00 to 10/31/10, and represents the reinvestment of dividends and distributions in the Fund.

| | | Average Annual Total Return | | Average Annual Total Return | | Gross |

| | | as of September 30, 2010 | | as of October 31, 2010 | | Expense |

| | | 1 Year | | 5 Year | | 10 Year | | 1 Year | | 5 Year | | 10 Year | | Ratio1 |

| Commonwealth Australia/New Zealand Fund | | 1.40 | % | | 3.26 | % | | 11.49 | % | | 9.15 | % | | 5.05 | % | | 12.80 | % | | 3.63 | % |

| New Zealand SmallCap Index (“NZSCI”) | | 0.24 | % | | 1.08 | % | | 16.44 | % | | 5.74 | % | | 3.52 | % | | 17.90 | % | | — | |

| Australian All Ordinaries Index (“AAOI”) | | 12.51 | % | | 10.78 | % | | 15.60 | % | | 17.08 | % | | 13.00 | % | | 16.67 | % | | — | |

| NZX 50 Index | | 1.90 | % | | -0.51 | % | | — | | | 9.34 | % | | 1.83 | % | | — | | | — | |

| |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. |

| | |

| 1 | The above expense ratio is from the Funds’ Prospectus dated March 1, 2010. Additional information pertaining to the Funds’ expense ratios as of October 31, 2010 can be found in the financial highlights. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 3.59%. |

| | |

| The Fund’s performance is measured against the New Zealand SmallCap Index (“NZSCI”), a capitalization-weighted index of all New Zealand equities, excluding those in the NZX 50 Index, is considered to be reflective of the performance of the New Zealand small-cap equity market; the Australian All Ordinaries Index (“AAOI”), an index made up of the largest 500 companies as measured by market capitalization that are listed on the Australian Stock Exchange; and the NZX 50 Index, a total return index consisting of the top 50 companies by free float adjusted market capitalization that are listed on the New Zealand Stock Exchange. These indices are unmanaged, are expressed in terms of U.S. dollars, and do not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| | |

You should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. This and other information can be found in the Funds’ Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contracting your investment representative. Please read it carefully before you invest or send money. |

| | |

| The Commonwealth Australia/New Zealand Fund was formerly known as Capstone New Zealand (2000) and subsequently the Commonwealth New Zealand Fund (2001). |

7

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| PERFORMANCE OVERVIEW – October 31, 2010 (Unaudited) |

| COMMONWEALTH JAPAN FUND |

The Commonwealth Japan Fund’s NAV as of October 31, 2010 was $2.80 per share compared to $2.69 per share on October 31, 2009. For the twelve month period covered by this Annual Report, the Commonwealth Japan Fund posted a 4.09% cumulative total return. Our investments do not attempt to track any index, but rather we undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in fixed income investments and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. The Fund outperformed the Tokyo Stock Price Index1 which posted a return of 3.09% for the same period. The index does not include any fixed income instruments. Additionally, the index is unmanaged, it is expressed in terms of U.S. dollars and it does not reflect the deduction of fees or taxes associated with a mutual fund such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| |

Japan’s equity market was among the world’s worst performing developed equity markets during the year. The 3.09% return on the Tokyo Stock Price Index was significantly lower than the 13.32% return for the MSCI World Index.1 Although the Tokyo Stock Price Index returned 3.09%, when measured in U.S. dollar terms, the index returned -7.80% when measured in the local currency, the Japanese Yen. The appreciation of the Yen versus the U.S. dollar during the period had a significant impact on the benchmark’s and the Fund’s returns. The impact on returns from a strengthening Yen were twofold: (1) a majority of the securities held by the Fund are denominated in Japanese Yen and thus a higher exchange rate resulted in a higher value when converted to U.S. dollars and (2) companies with a greater proportion of overseas revenues and earnings may be positively or negatively impacted from the higher exchange rate. The effect on foreign investment returns from a higher exchange rate has the same impact on all foreign currency denominated shares. The second effect, the impact on a company’s revenue and earnings from changes in exchange rates, is generally company specific. |

| |

| The Fund’s overweight position in utility companies whose revenues are generally less sensitive to changes in the exchange rate, had a positive contribution to the Fund’s relative outperformance. The energy and financial sectors were two of the worst performing sectors for the index, however, the Fund’s underweight position in these two sectors relative to the index, along with a positive contribution from stock selection within the financial sector, contributed to the Fund’s outperformance relative to the index. Stock selection within the information technology and consumer discretionary sectors additionally contributed to the Fund’s relative outperformance during the year.* |

| Japan’s economy has been showing signs of recovery recently. This summer, sales of air conditioners and beverages were buoyant due to the extremely hot weather and a last-minute increase in demand ahead of the expiration of the government subsidies for purchasing energy efficient cars turned out to be significant. These both elevated the economy. However, amid increased uncertainty due mainly to fiscal problems in European peripheral countries and the outlook for the U.S. economy, global investors have become increasingly risk averse. The increased demand for the yen (considered a relatively safe currency) resulted in the yen’s appreciation. In addition, some overseas economies have slowed and the pace of growth in exports has recently been moderating. Taking into account that exports, which have been leading the economic activity have been showing weak signs, it is appropriate to conclude that Japan’s economy still shows signs of moderate recovery but the pace of recovery is slowing. When looking from a somewhat longer perspective, as emerging market economies with high growth potential continue to complete their current mild adjustment phase Japan’s economy is expected to return to its own moderate recovery path. |

| | |

| Investment Risks |

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes. |

| | |

The Fund’s investments in debt and/or fixed income securities also contain risk factors. The value of these securities tends to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each. |

| | |

International investing involves increased risk and volatility. An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Because the Fund invests primarily in the securities of, and depositary receipts represented by Japan issuers, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of that country. |

| | |

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments. |

| | |

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in and of the Fund. |

| | |

| * | Portfolio holdings will change due to ongoing management of the funds. References to specific securities or sectors should not be construed as recommendations by the Funds, the Advisor or the Distributor. |

| 1 | For additional information, please refer to the Glossary of Terms following the Performance Overview section. |

8

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| PERFORMANCE OVERVIEW – October 31, 2010 (Unaudited) |

| COMMONWEALTH JAPAN FUND |

Comparison of Change in Value of a $10,000 Investment in the Commonwealth Japan Fund and the TOPIX Index.

The above graph is a hypothetical $10,000 investment in the Commonwealth Japan Fund from 10/31/00 to 10/31/10, and represents the reinvestment of dividends and distributions in the Fund.

| | | Average Annual Total Return | | Average Annual Total Return | | | |

| | | as of September 30, 2010 | | as of October 31, 2010 | | Gross |

| | | | | | | | | | | | | | | | | | | | | Expense |

| | | 1 Year | | 5 Year | | 10 Year | | 1 Year | | 5 Year | | 10 Year | | Ratio1 |

| Commonwealth Japan Fund | | -2.48 | % | | -4.96 | % | | -6.16 | % | | 4.09 | % | | -4.80 | % | | -5.38 | % | | 4.63 | % |

| Tokyo Stock Price Index (“TOPIX”) | | -0.34 | % | | -2.95 | % | | -1.91 | % | | 3.09 | % | | -2.65 | % | | -1.05 | % | | — | |

| |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. |

| | |

| 1 | The above expense ratio is from the Funds’ Prospectus dated March 1, 2010. Additional information pertaining to the Funds’ expense ratios as of October 31, 2010 can be found in the financial highlights. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 4.56%. |

| | |

| The Fund’s performance is measured against the Tokyo Stock Price Index an unmanaged capitalization-weighted index of all the common stocks on the First Selection of the Tokyo Stock Exchange. This index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| | |

You should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. This and other information can be found in the Funds’Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contracting your investment representative. Please read it carefully before you invest or send money. |

| | |

| The Commonwealth Japan Fund was formerly known as the Capstone Japan Fund (2000), established as a series of the Trust on July 10, 1989 under the name of the Capstone Nikko Japan Tilt Fund. |

9

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| PERFORMANCE OVERVIEW – October 31, 2010 (Unaudited) |

| COMMONWEALTH GLOBAL FUND |

The Commonwealth Global Fund’s NAV as of October 31, 2010 was $15.44 per share compared to $13.40 per share on October 31, 2009. For the twelve month period covered by this Annual Report, the Commonwealth Global Fund posted a 15.22% cumulative total return. Our investments do not attempt to track any index, but rather we undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in fixed income investments and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them.* The Fund outperformed the Morgan Stanley Capital International (MSCI) World Index,1 which returned 13.32% for the same period. The index does not include any fixed income instruments. Additionally, the index is unmanaged, it is expressed in terms of U.S. dollars and it does not reflect the deduction of fees or taxes associated with a mutual fund such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| |

| World economic growth continued to recover moderately during the year, underpinned by the effects of both stimulus measures adopted around the world and inventory restocking. Recently the pace of growth has slowed somewhat. The U.S. economy has been recovering at a moderate pace supported by massive government stimulus packages. European economies overall are also picking up – although there are some differences across countries – led by increases in exports and production partly due to a decline in their respective currencies. Recovery in the Euro area, however, has been weaker than in other regions likely because stimulus measures adopted in the region were relatively small in scale, their individual economic structures lack flexibility and credit uncertainty triggered by the fiscal problems in Greece remains. In the Asia Pacific region, the Chinese economy has continued to manifest high growth supported by the surge in fixed asset investment spurred in part by a large stimulus package. |

| |

| Against this back-drop of improving economic growth, emerging market equities outperformed developed market equities although this was accompanied by higher volatility in the emerging markets. The Fund’s returns during the year were primarily driven by the energy, material and industrial sectors. These sectors’performances set the basis for the emerging market’s growth that continues to outpace the rest of the global markets. The Fund’s investments in emerging markets at year-end was 10.9% of net assets versus 11.5% a year earlier, while debt and fixed income securities including preferred stock was 6.6%. The Fund’s investments in debt and fixed income securities generally lagged the broader equity market. |

| Investment Risks |

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes. |

| | |

The Fund’s investments in debt and/or fixed income securities also contain risk factors. The value of these securities tends to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each. |

| | |

International investing involves increased risk and volatility. An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. |

| | |

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments. |

| | |

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in and of the Fund. |

| | |

| * | Portfolio holdings will change due to ongoing management of the funds. References to specific securities or sectors should not be construed as recommendations by the Funds, the Advisor or the Distributor. |

| | |

| 1 | For additional information, please refer to the Glossary of Terms following the Performance Overview section. |

10

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| PERFORMANCE OVERVIEW – October 31, 2010 (Unaudited) |

| COMMONWEALTH GLOBAL FUND |

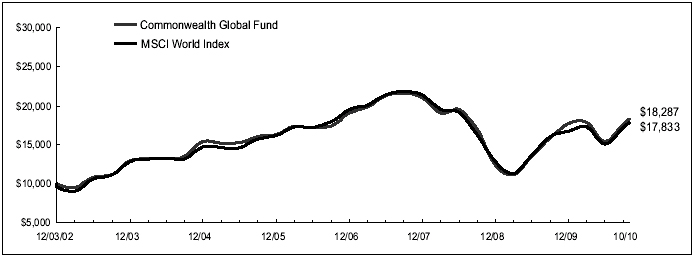

Comparison of Change in Value of a $10,000 Investment in the Commonwealth Global Fund and the MSCI World Index.

The above graph is a hypothetical $10,000 investment in the Commonwealth Global Fund from 12/3/02 (inception) to 10/31/10, and represents the reinvestment of dividends and distributions in the Fund.

| | | Average Annual Total Return | | Average Annual Total Return | | | |

| | | as of September 30, 2010 | | as of October 31, 2010 | | | |

| | | | | | | | | | | | | | | | | | | | | Gross |

| | | | | | | | | Inception | | | | | | | | Inception | | Expense |

| | | 1 Year | | 5 Year | | (12/03/02) | | 1 Year | | 5 Year | | (12/03/02) | | Ratio1 |

| Commonwealth Global Fund | | 10.78 | % | | 1.96 | % | | 7.53 | % | | 15.22 | % | | 3.35 | % | | 7.93 | % | | 3.42 | % |

| MSCI World Index | | 7.31 | % | | 1.85 | % | | 7.36 | % | | 13.32 | % | | 3.11 | % | | 7.78 | % | | — | |

| |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. |

| | |

| 1 | The above expense ratio is from the Funds’ Prospectus dated March 1, 2010. Additional information pertaining to the Funds’ expense ratios as of October 31, 2010 can be found in the financial highlights. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 3.40%. |

| | |

| The Fund’s performance is measured against the MSCI World Index, an unmanaged free float-adjusted market capitalization index that is designed to measure global developed market equity performance. Currently the MSCI World Index consists of the following 24 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. This performance of the index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| | |

You should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. This and other information can be found in the Funds’Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contracting your investment representative. Please read it carefully before you invest or send money. |

11

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| PERFORMANCE OVERVIEW – October 31, 2010 (Unaudited) |

| COMMONWEALTH REAL ESTATE SECURITIES FUND |

The Commonwealth Real Estate Securities Fund’s NAV as of October 31, 2010, was $10.09 per share compared to $8.42 per share on October 31, 2009. For the twelve month period covered by this Annual Report, the Commonwealth Real Estate Securities Fund posted a 19.83% cumulative total return. Our investments do not attempt to track any index, but rather we undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in fixed income investments and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. The Fund underperformed the Morgan Stanley Capital International (MSCI) US REIT Index,1 which posted a 43.39% total return for the same period. The index does not include any fixed income instruments. Additionally, the index is unmanaged, it is expressed in terms of U.S. dollars and it does not reflect the deduction of fees or taxes associated with a mutual fund such as investment management and fund accounting fees. The performance of the Fund, however, reflects the deduction of fees for these various services. Investors cannot invest directly in an index. |

| |

| More specifically, due to uncertainties within the marketplace as viewed by the management of the Fund, it was determined a lower risk profile should be assumed and therefore the cash positions were allowed to be larger than in retrospect would have been desired. This larger cash position and, thus the comfort of lower risks, resulted in the Fund experiencing an apparent lower return than might have been potentially possible when comparisons to certain indexes are made. |

| |

| In addition, the Fund’s diversified investments in international real estate underperformed U.S. real estate indexes for this time period. Therefore, the combination of greater cash positions and greater allocations to international markets primarily explain the differing return numbers when index returns are reviewed keeping in mind that the two are dissimilar in many ways as described above. |

| |

| Considering the market place for the last time period, as represented by the MSCI US REIT Index, REITs (Real Estate Investment Trusts) rallied sharply for the reporting period, advancing by more than 40% and outpacing the gains of approximately 17% for the broader U.S. equity indexes. One factor favoring REITs was a nascent economic recovery that began to take shape at the beginning of the year and gradually gained momentum. REITs had fallen substantially in late 2008 and early 2009 as a severe economic downturn led to declining occupancy rates for commercial properties. |

| |

| REITs benefited from improving credit conditions and from many investors’ desires to hold higher dividend paying instruments. These factors enabled them to more easily raise capital in both the equity and debt markets. The financings helped ease concerns about near-term debt maturities and deteriorating balance sheets. In addition, as commercial property values generally declined during the year, many REITs, with the financial strength to do so, took advantage of bargain prices in the commercial property markets. |

| The Fund’s investments in REITs made a positive contribution to the Fund’s returns during the year. In fact, a majority of the Fund’s REIT holdings delivered double-digit returns. Hotel REITs, which tend to have the greatest economic sensitivity, and apartment REITs benefited as mortgage delinquencies increased and continuing foreclosures fueled demand for rental housing. These two groups were among the best performing REIT sectors in the Fund. Their performance helped offset the Fund’s investments in the building materials and home builders as they experienced negative returns or underperformed the broader MSCI US REIT Index during the year. |

| | |

| Even though improving vacancy rates and better rent levels have led to slightly higher demand for Commercial Real Estate (CRE), a continuing weak macro-economic picture and an increasing economic recovery time may continue to pressure leveraged and/or restructuring companies. The removal of the government stimulus program from the residential market in April led to disappointing performances in housing related stocks. The residential market has been negatively impacted by the bank foreclosure hiatus and is expected to extend the recovery time even longer than expected. The creation of jobs remains of great focus due to the direct effect on residential and commercial demand. |

| | |

| Investment Risks |

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes. |

| | |

The Fund’s investments in debt and/or fixed income securities also contain risk factors. The value of these securities tends to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each. |

| | |

The Fund’s investments in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. Equity REITs may be affected by changes in the value of the underlying property owned by the REITs, while mortgage REITs may be affected by the quality of any credit extended. |

| | |

Investments in the Fund are subject to the risks related to direct investment in real estate, such as real estate risk, regulatory risks, concentration risk, and diversification risk. |

| | |

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments. |

| | |

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in and of the Fund. |

| | |

| * | Portfolio holdings will change due to ongoing management of the funds. References to specific securities or sectors should not be construed as recommendations by the Funds, the Advisor or the Distributor. |

| | |

| 1 | For additional information, please refer to the Glossary of Terms following the Performance Overview section. |

12

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| PERFORMANCE OVERVIEW – October 31, 2010 (Unaudited) |

| COMMONWEALTH REAL ESTATE SECURITIES FUND |

Comparison of Change in Value of a $10,000 Investment in the Commonwealth Real Estate Securities Fund and the MSCI US REIT Index.

The above graph is a hypothetical $10,000 investment in the Commonwealth Real Estate Securities Fund from 1/5/04 (inception) to 10/31/10, and represents the reinvestment of dividends and distributions in the Fund.

| | | Average Annual Total Return | | Average Annual Total Return | | | |

| | | as of September 30, 2010 | | as of October 31, 2010 | | | |

| | | | | | | | | | | | | | | | | | | | | Gross |

| | | | | | | | | Inception | | | | | | | | Inception | | Expense |

| | | 1 Year | | 5 Year | | (1/5/04) | | 1 Year | | 5 Year | | (1/5/04) | | Ratio1 |

| Commonwealth Real Estate Securities Fund | | 11.64 | % | | -1.89 | % | | 1.55 | % | | 19.83 | % | | -1.02 | % | | 1.85 | % | | 3.79 | % |

| MSCI US REIT Index | | 30.54 | % | | 1.88 | % | | 7.15 | % | | 43.39 | % | | 3.33 | % | | 7.79 | % | | — | |

| |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. |

| | |

| 1 | The above expense ratio is from the Funds’ Prospectus dated March 1, 2010. Additional information pertaining to the Funds’ expense ratios as of October 31, 2010 can be found in the financial highlights. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 3.71%. |

| | |

| The Fund’s performance is measured against the MSCI US REIT Index which is an unmanaged free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. MSCI started calculating and maintaining the MSCI US REIT Index on June 20, 2005. Prior to this date the MSCI US REIT Index (then known as the Morgan Stanley REIT Index) was calculated and maintained by the AMEX. This index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| | |

You should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. This and other information can be found in the Funds’Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contracting your investment representative. Please read it carefully before you invest or send money. |

13

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| |

|

Glossary of Terms

The Australian All Ordinaries Index (“AAOI”) — is a capitalization-weighted index. The index is made up of the largest 500 companies as measured by market cap that are listed on the Australian Stock Exchange.

Gross Domestic Product (GDP) — is a measure of the market value of the goods and services produced by labor and property within the United States and/or other foreign countries.

MSCI World Index — is an unmanaged free float-adjusted market capitalization index that is designed to measure global developed market equity performance. Currently the MSCI World Index consists of the following 24 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States.

MSCI US REIT Index — is an unmanaged free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. MSCI started calculating and maintaining the MSCI US REIT Index on June 20, 2005. Prior to this date the MSCI US REIT Index (then known as the Morgan Stanley REIT Index) was calculated and maintained by the AMEX.

The NZX 50 Index — is a modified market capitalization weighted index. This index consists of the top 50 companies by free float adjusted market capitalization that are listed on the New Zealand Stock Exchange.

The New Zealand SmallCap Index (“NZSCI”) — is a capitalization-weighted index of all New Zealand equities, excluding those in the NZX 50 Index, is considered to be reflective of the performance of the New Zealand small-cap equity market.

Tokyo Stock Price Index (“TOPIX”) — is an unmanaged capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange.

14

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

| | |

| PORTFOLIO COMPOSITION – October 31, 2010* (Unaudited) |

| COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND |

| Industry or | | Percent of Total |

| Security Type | | Investments |

| Commercial Services | | 19.8 | % |

| REITS | | 9.0 | % |

| Mining | | 6.7 | % |

| Electric | | 5.8 | % |

| Oil & Gas | | 4.8 | % |

| Transportation | | 4.7 | % |

| Retail | | 4.1 | % |

| Coal | | 4.0 | % |

| Bonds – Australia | | 3.8 | % |

| Media | | 3.7 | % |

| Metal Fabricate/Hardware | | 3.4 | % |

| Telecommunications | | 2.9 | % |

| Insurance | | 2.9 | % |

| Diversified Financial Services | �� | 2.8 | % |

| Food | | 2.6 | % |

| Healthcare – Services | | 2.6 | % |

| Preferred Stocks | | 2.2 | % |

| Agriculture | | 1.9 | % |

| Leisure Time | | 1.6 | % |

| Home Furnishings | | 1.5 | % |

| Bonds – New Zealand | | 1.4 | % |

| Apparel | | 1.2 | % |

| Healthcare – Products | | 1.2 | % |

| Short Term Investments | | 1.0 | % |

| Building Materials | | 1.0 | % |

| Internet | | 0.8 | % |

| Chemicals | | 0.8 | % |

| Biotechnology | | 0.7 | % |

| Computers | | 0.4 | % |

| Pharmaceuticals | | 0.3 | % |

| Banks | | 0.3 | % |

| Call Options | | 0.1 | % |

| | | 100.0 | % |

| COMMONWEALTH JAPAN FUND |

| Industry or | | Percent of Total |

| Security Type | | Investments |

| Transportation | | 16.5 | % |

| Electronics | | 9.2 | % |

| Retail | | 8.2 | % |

| Electric | | 7.1 | % |

| Healthcare – Products | | 4.9 | % |

| Auto Parts & Equipment | | 4.8 | % |

| Real Estate | | 4.8 | % |

| Machinery – Diversified | | 4.7 | % |

| Gas | | 4.6 | % |

| Toys/Games/Hobbies | | 3.9 | % |

| Computers | | 3.7 | % |

| Insurance | | 3.7 | % |

| Distribution/Wholesale | | 3.1 | % |

| Banks | | 2.8 | % |

| Pharmaceuticals | | 2.8 | % |

| Entertainment | | 2.7 | % |

| Cosmetics/Personal Care | | 2.6 | % |

| Beverages | | 1.7 | % |

| Hand/Machine Tools | | 1.6 | % |

| Engineering & Construction | | 1.6 | % |

| Internet | | 1.3 | % |

| Telecommunications | | 1.1 | % |

| Electrical Components & Equip. | | 1.1 | % |

| Metal Fabricate/Hardware | | 1.0 | % |

| Short Term Investments | | 0.5 | % |

| | | 100.0 | % |

| | | | |

| COMMONWEALTH GLOBAL FUND |

| Country or | | Percent of Total |

| Security Type | | Investments |

| United States | | 42.3 | % |

| United Kingdom | | 10.4 | % |

| France | | 7.0 | % |

| Spain | | 5.0 | % |

| Switzerland | | 4.4 | % |

| Israel | | 3.9 | % |

| Germany | | 3.6 | % |

| Brazil | | 3.3 | % |

| Canada | | 3.2 | % |

| Short Term Investments | | 3.1 | % |

| Bermuda | | 2.4 | % |

| Mexico | | 2.0 | % |

| Korea (Republic of-South) | | 1.8 | % |

| Portugal | | 1.8 | % |

| Netherlands | | 1.6 | % |

| Guernsey | | 1.5 | % |

| South Africa | | 1.4 | % |

| Japan | | 1.3 | % |

| | | 100.0 | % |

| | | | |

| COMMONWEALTH REAL ESTATE SECURITIES FUND |

| Industry or | | Percent of Total |

| Security Type | | Investments |

| Short Term Investments | | 17.2 | % |

| REITS – Office Property | | 10.8 | % |

| REITS – Apartments | | 10.8 | % |

| Lodging | | 7.6 | % |

| Home Builders | | 7.4 | % |

| Building Materials | | 6.7 | % |

| REITS – Hotels | | 6.7 | % |

| Real Estate | | 5.4 | % |

| REITS – Diversified | | 4.9 | % |

| REITS – Warehouse/Industries | | 3.1 | % |

| Exchange Traded Funds | | 2.9 | % |

| REITS – Shopping Centers | | 2.9 | % |

| Bonds | | 2.7 | % |

| Telecommunications | | 2.6 | % |

| REITS – Storage | | 2.6 | % |

| Retail | | 1.6 | % |

| REITS – Health Care | | 1.4 | % |

| REITS – Single Tenant | | 1.2 | % |

| Call Options | | 0.8 | % |

| Insurance | | 0.7 | % |

| | | 100.0 | % |

| * Portfolio composition is subject to change. |

15

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

SCHEDULE OF INVESTMENTS – October 31, 2010

| COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND |

| | | Shares | | | Value |

| AUSTRALIA (26.4%) | | | | | | | | | |

| COMMON STOCKS (22.8%) | | | | | | | | |

| APPAREL (1.1%) | | | | | | | | |

| Billabong International, Ltd. | | | 35,565 | | | $ | 283,230 | |

| BANKS (0.3%) | | | | | | | | |

| Suncorp-Metway, Ltd. | | | 7,791 | | | 70,211 | |

| BIOTECHNOLOGY (0.6%) | | | | | | | | |

| CSL, Ltd. | | | 5,000 | | | 160,793 | |

| BUILDING MATERIALS (0.6%) | | | | | | | | |

| James Hardie Industries NV – ADR(1) | | | 5,200 | | | 138,216 | |

| CHEMICALS (0.7%) | | | | | | | | |

| Nufarm, Ltd. (1) | | | 39,562 | | | 176,326 | |

| COMPUTERS (0.4%) | | | | | | | | |

| Computershare, Ltd. | | | 10,000 | | | 99,130 | |

| ELECTRIC (1.9%) | | | | | | | | |

| AGL Energy, Ltd. | | | 30,046 | | | 473,552 | |

| FOOD (2.5%) | | | | | | | | |

| Woolworths, Ltd. | | | 22,184 | | | 616,053 | |

| HEALTHCARE-PRODUCTS (1.1%) | | | | | | | | |

| Cochlear, Ltd. | | | 4,000 | | | 278,270 | |

| HEALTHCARE-SERVICES (1.1%) | | | | | | | | |

| Sonic Healthcare Ltd. | | | 25,628 | | | 273,381 | |

| INSURANCE (2.7%) | | | | | | | | |

| AMP, Ltd. | | | 21,149 | | | | 110,626 | |

| QBE Insurance Group, Ltd. | | | 33,321 | | | 560,746 | |

| | | | | | | 671,372 | |

| INTERNET (0.7%) | | | | | | | | |

| Webjet, Ltd. | | | 71,081 | | | 180,334 | |

| MINING (6.3%) | | | | | | | | |

| Orica Ltd. | | | 7,273 | | | | 179,388 | |

| OZ Minerals, Ltd. | | | 308,661 | | | | 473,175 | |

| PanAust, Ltd. (1) | | | 1,250,000 | | | 912,203 | |

| | | | | | | 1,564,766 | |

| OIL & GAS (1.0%) | | | | | | | | |

| Eastern Star Gas, Ltd. (1) | | | 200,000 | | | | 165,543 | |

| Woodside Petroleum, Ltd. | | | 2,246 | | | 95,703 | |

| | | | | | | 261,246 | |

| RETAIL (0.7%) | | | | | | | | |

| Wesfarmers, Ltd. | | | 5,311 | | | 172,407 | |

| TRANSPORTATION (1.1%) | | | | | | | | |

| Asciano Group (1) | | | 180,000 | | | 275,938 | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $3,794,022) | | | | | | 5,695,225 | |

| | | | | | | | | |

| | | Principal | | | | | |

| CORPORATE BONDS (3.6%) | | | | | | | | |

| CBA Capital Australia, Ltd., 3.82%, | | | | | | | | |

4/15/15 (2) (3) (4) | | $ | 300,000 | | | | 212,696 | |

| Hanson Australia Funding, Ltd., | | | | | | | | |

5.25%, 3/15/13 (4) | | | 250,000 | | | | 253,750 | |

| Telstra Corp., Ltd., 6.38%, 4/1/12 (4) | | | 400,000 | | | 427,773 | |

TOTAL CORPORATE BONDS (Cost $859,752) | | | | | | 894,219 | |

TOTAL AUSTRALIA (Cost $4,653,774) | | | | | | 6,589,444 | |

| | | | | | | | | |

| | | Shares | | | | | |

| NEW ZEALAND (66.7%) | | | | | | | | | |

| COMMON STOCKS (63.1%) | | | | | | | | |

| AGRICULTURE (1.8%) | | | | | | | | |

| PGG Wrightson, Ltd. (1) | | | 1,088,676 | | | 448,175 | |

| BUILDING MATERIALS (0.4%) | | | | | | | | |

| Fletcher Building Ltd. | | | 15,000 | | | 93,884 | |

| COAL (3.8%) | | | | | | | | |

| Pike River Coal, Ltd. (1) | | | 1,192,295 | | | 945,306 | |

| COMMERCIAL SERVICES (18.6%) | | | | | | | | |

| Allied Work Force Group, Ltd. | | | 65,400 | | | | 47,365 | |

| Cavotec MSL Holdings, Ltd. | | | 190,000 | | | | 492,479 | |

| Guinness Peat Group PLC | | | 666,750 | | | | 365,975 | |

| Mowbray Collectables, Ltd. (5) | | | 821,593 | | | | 469,757 | |

| Northland Port Corp. (NZ), Ltd. | | | 81,425 | | | | 105,527 | |

| Port of Tauranga, Ltd. | | | 175,000 | | | | 993,916 | |

| South Port New Zealand, Ltd. | | | 1,027,930 | | | 2,162,859 | |

| | | | | | | | 4,637,878 | |

| See accompanying notes to financial statements. |

|

| 16 |

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

SCHEDULE OF INVESTMENTS – October 31, 2010

| COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND |

| | | Shares | | | Value |

| NEW ZEALAND (66.7%) – (Continued) | | | | | | | | | |

| COMMON STOCKS (63.1%) – Continued | | | | | | | | |

| DIVERSIFIED FINANCIAL SERVICES (2.6%) | | | | | | | | |

| Canterbury Building Society | | | 316,655 | | | $ | 663,857 | |

| ELECTRIC (3.5%) | | | | | | | | |

| Infratil, Ltd. | | | 633,424 | | | 883,693 | |

| HEALTHCARE-SERVICES (1.3%) | | | | | | | | |

| Ryman Healthcare, Ltd. | | | 205,000 | | | 337,570 | |

| HOME FURNISHINGS (1.4%) | | | | | | | | |

| Scott Technology, Ltd. | | | 324,770 | | | 341,673 | |

| LEISURE TIME (1.5%) | | | | | | | | |

| Tourism Holdings, Ltd. | | | 637,569 | | | 374,260 | |

| MEDIA (3.5%) | | | | | | | | |

| Sky Network Television, Ltd. | | | 209,745 | | | 868,254 | |

| METAL FABRICATE/HARDWARE (3.2%) | | | | | | | | |

| Methven, Ltd. | | | 606,250 | | | 804,186 | |

| OIL & GAS (3.5%) | | | | | | | | |

| New Zealand Oil & Gas, Ltd. | | | 893,571 | | | 865,144 | |

| PHARMACEUTICALS (0.3%) | | | | | | | | |

| Pharmacybrands, Ltd. (1) | | | 281,673 | | | 73,010 | |

| REITS (8.5%) | | | | | | | | |

| Argosy Property Trust | | | 1,053,723 | | | | 626,580 | |

| Goodman Property Trust | | | 515,851 | | | | 385,395 | |

| Kermadec Property Fund | | | 1,212,929 | | | | 490,080 | |

| Kiwi Income Property Trust | | | 227,642 | | | | 182,220 | |

| Vital Healthcare Property Trust | | | 423,819 | | | 436,184 | |

| | | | | | | 2,120,459 | |

| RETAIL (3.1%) | | | | | | | | |

| Briscoe Group, Ltd. | | | 405,000 | | | | 404,466 | |

| Colonial Motor Co., Ltd. | | | 199,565 | | | 374,261 | |

| | | | | | | 778,727 | |

| TELECOMMUNICATIONS (2.7%) | | | | | | | | |

| TeamTalk, Ltd. | | | 403,590 | | | 683,044 | |

| TRANSPORTATION (3.4%) | | | | | | | | |

| Freightways, Ltd. | | | 113,540 | | | | 263,135 | |

| Mainfreight, Ltd. | | | 105,000 | | | 576,338 | |

| | | | | | | 839,473 | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $13,074,407) | | | | | | | 15,758,593 | |

| PREFERRED STOCKS (2.1%) | | | | | | | | |

| INVESTMENT COMPANIES (2.1%) | | | | | | | | |

| ASB Capital, Ltd., 3.86% | | | 954,218 | | | 520,127 | |

TOTAL PREFERRED STOCKS | | | | | | | | |

(Cost $686,799) | | | | | | 520,127 | |

| CALL OPTIONS (0.1%) | | | | | | | | |

| Pike River Coal, Ltd., Strike Price: | | | | | | | | |

$1.25, Expiration 4/24/2011 (1) | | | 350,000 | | | 30,685 | |

TOTAL CALL OPTIONS | | | | | | | | |

(Cost $0) | | | | | | 30,685 | |

| | | Principal | | | | | |

| CORPORATE BONDS (1.4%) | | | | | | | | |

| Sky Network Television, Ltd., 4.01%, | | | | | | | | |

10/16/16 (2) (3) (4) | | $ | 500,000 | | | 336,388 | |

TOTAL CORPORATE BONDS (Cost $313,561) | | | | | | 336,388 | |

TOTAL NEW ZEALAND | | | | | | | | |

(Cost $14,074,767) | | | | | | 16,645,793 | |

| | | Shares | | | | | |

| SHORT-TERM INVESTMENTS (0.9%) | | | | | | | | |

| Fifth Third Bank Institutional Govt. | | | | | | | | |

Money Market Fund, 0.04% (6) | | | 235,376 | | | 235,376 | |

TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

(Cost $235,376) | | | | | | 235,376 | |

| TOTAL INVESTMENTS (94.0%) | | | | | | | | |

| (Cost $18,963,917) | | | | | | | 23,470,613 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (6.0%) | | | | | | 1,503,954 | |

| NET ASSETS (100.0%) | | | | | | $ | 24,974,567 | |

| (1) | Non-income producing. |

| (2) | Variable, Floating, or Step Rate Security. The rate reflected in the Schedule of Investments is the rate in effect at 10/31/2010. |

| (3) | Principal amount shown is in New Zealand Dollars; value shown in U.S. Dollars. |

| (4) | Callable. |

| (5) | Affiliated Investment. See Note 5 of the Notes to Financial Statements. |

| (6) | Rate disclosed is the seven day yield as of 10/31/2010. |

| ADR — American Depositary Receipt |

| PLC — Public Limited Company |

| See accompanying notes to financial statements. |

|

| 17 |

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

SCHEDULE OF INVESTMENTS – October 31, 2010

| | | Shares | | | Value |

| COMMON STOCKS (99.1%) | | | | | | | | |

| AUTO PARTS & EQUIPMENT (4.8%) | | | | | | | | |

| NGK Spark Plug Co., Ltd. | | | 6,000 | | | $ | 83,658 | |

| Sumitomo Rubber Industries, Ltd. | | | 10,000 | | | 107,742 | |

| | | | | | | 191,400 | |

| BANKS (2.8%) | | | | | | | | |

Sumitomo Mitsui Financial Group, Inc. | | | 3,800 | | | 113,901 | |

| BEVERAGES (1.7%) | | | | | | | | |

| Kirin Holdings Co., Ltd. | | | 5,000 | | | 68,597 | |

| COMPUTERS (3.7%) | | | | | | | | |

| Fujitsu, Ltd. | | | 10,000 | | | | 68,349 | |

| Melco Holdings, Inc. | | | 2,500 | | | 81,210 | |

| | | | | | | 149,559 | |

| COSMETICS/PERSONAL CARE (2.6%) | | | | | | | | |

| Unicharm Corp. | | | 2,700 | | | 103,175 | |

| DISTRIBUTION/WHOLESALE (3.1%) | | | | | | | | |

| Marubeni Corp. | | | 20,000 | | | 125,761 | |

| ELECTRIC (7.1%) | | | | | | | | |

| Hokkaido Electric Power Co., Inc. | | | 6,000 | | | | 126,233 | |

| Tohoku Electric Power Co., Inc. | | | 7,000 | | | 157,189 | |

| | | | | | | 283,422 | |

| ELECTRICAL COMPONENTS & EQUIPMENT (1.1%) | | | | | | | | |

| Nippon Signal Co., Ltd. | | | 6,000 | | | 42,053 | |

| ELECTRONICS (9.1%) | | | | | | | | |

| Hamamatsu Photonics K.K. | | | 1,500 | | | | 48,503 | |

| Hoya Corp. | | | 4,000 | | | | 93,550 | |

| Star Micronics Co., Ltd. | | | 5,000 | | | | 47,720 | |

| Taiyo Yuden Co., Ltd. | | | 8,000 | | | | 102,796 | |

| Toyo Corp. | | | 8,000 | | | 74,462 | |

| | | | | | | 367,031 | |

| ENGINEERING & CONSTRUCTION (1.6%) | | | | | | | | |

| Kajima Corp. | | | 18,000 | | | | 42,276 | |

| Taihei Dengyo Kaisha, Ltd. | | | 3,000 | | | 20,952 | |

| | | | | | | 63,228 | |

| ENTERTAINMENT (2.7%) | | | | | | | | |

| Sankyo Co., Ltd. | | | 2,000 | | | 106,624 | |

| GAS (4.6%) | | | | | | | | |

| Toho Gas Co., Ltd. | | | 35,000 | | | 184,851 | |

| HAND/MACHINE TOOLS (1.6%) | | | | | | | | |

| Meidensha Corp. | | | 18,000 | | | 64,198 | |

| HEALTHCARE-PRODUCTS (4.8%) | | | | | | | | |

| Asahi Intecc Co., Ltd. | | | 4,000 | | | | 67,006 | |

| Terumo Corp. | | | 2,500 | | | 126,911 | |

| | | | | | | 193,917 | |

| INSURANCE (3.6%) | | | | | | | | |

| T & D Holdings, Inc. | | | 2,000 | | | | 40,984 | |

| Tokio Marine Holdings, Inc. – ADR | | | 3,750 | | | 105,338 | |

| | | | | | | 146,322 | |

| INTERNET (1.3%) | | | | | | | | |

| DeNA Co., Ltd. | | | 2,000 | | | 51,746 | |

| MACHINERY-DIVERSIFIED (4.6%) | | | | | | | | |

| Fanuc, Ltd. | | | 1,000 | | | | 144,774 | |

| Torishima Pump Manufacturing Co., Ltd. | | | 2,500 | | | 41,227 | |

| | | | | | | 186,001 | |

| METAL FABRICATE/HARDWARE (1.0%) | | | | | | | | |

| Okano Valve Manufacturing Co. | | | 5,000 | | | 40,388 | |

| PHARMACEUTICALS (2.8%) | | | | | | | | |

| Chugai Pharmaceutical Co., Ltd. | | | 6,500 | | | 113,813 | |

| REAL ESTATE (4.8%) | | | | | | | | |

| Sumitomo Realty & Development Co., Ltd. | | | 6,000 | | | | 130,782 | |

| Tokyo Tatemono Co., Ltd. | | | 15,000 | | | 60,581 | |

| | | | | | | 191,363 | |

| RETAIL (8.2%) | | | | | | | | |

| ABC-Mart, Inc. | | | 2,000 | | | | 68,025 | |

| Nitori Co., Ltd. | | | 600 | | | | 52,790 | |

| Sundrug Co., Ltd. | | | 4,000 | | | | 111,346 | |

| Yamada Denki Co., Ltd. | | | 1,500 | | | 97,490 | |

| | | | | | | 329,651 | |

| TELECOMMUNICATIONS (1.1%) | | | | | | | | |

| Hitachi Kokusai Electric, Inc. | | | 5,000 | | | 45,421 | |

| TOYS/GAMES/HOBBIES (3.9%) | | | | | | | | |

| Nintendo Co., Ltd. | | | 600 | | | 155,462 | |

| TRANSPORTATION (16.5%) | | | | | | | | |

| East Japan Railway Co. | | | 1,500 | | | | 92,736 | |

| Hankyu Hanshin Holdings, Inc. | | | 22,000 | | | | 105,530 | |

| See accompanying notes to financial statements. |

|

| 18 |

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

SCHEDULE OF INVESTMENTS – October 31, 2010

| | | Shares | | | Value |

| COMMON STOCKS (99.1%) – Continued | | | | | | | | | |

| Keihin Electric Express Railway Co., Ltd. | | | 13,000 | | | $ | 122,940 | |

| Keio Corp. | | | 18,000 | | | | 125,935 | |

| Tobu Railway Co., Ltd. | | | 18,000 | | | | 101,106 | |

| Yamato Holdings Co., Ltd. | | | 9,000 | | | 113,409 | |

| | | | | | | 661,656 | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $3,116,911) | | | | | | | 3,979,540 | |

| SHORT-TERM INVESTMENTS (0.5%) | | | | | | | | |

| Fifth Third Bank Institutional Govt. | | | | | | | | |

Money Market Fund, 0.04% (1) | | | 20,387 | | | | 20,387 | |

TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

(Cost $20,387) | | | | | | 20,387 | |

| TOTAL INVESTMENTS (99.6%) | | | | | | | | |

| (Cost $3,137,298) | | | | | | | 3,999,927 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (0.4%) | | | | | | 17,249 | |

| NET ASSETS (100.0%) | | | | | | $ | 4,017,176 | |

| (1) | Rate disclosed is the seven day yield as of 10/31/2010. |

| ADR — American Depositary Receipt |

| See accompanying notes to financial statements. |

|

| 19 |

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

SCHEDULE OF INVESTMENTS – October 31, 2010

| | | Shares | | | Value |

| COMMON STOCKS (90.5%) | | | | | | | | |

| BERMUDA (2.4%) | | | | | | | | |

| Bunge, Ltd. | | | 6,500 | | | $ | 390,455 | |

| BRAZIL (3.3%) | | | | | | | | |

| Cia de Saneamento Basico do Estado de Sao Paulo ADR | | | 5,000 | | | | 229,800 | |

| Vale SA ADR | | | 10,000 | | | 321,400 | |

| | | | | | | 551,200 | |

| CANADA (3.2%) | | | | | | | | |

| InterOil Corp. (1) | | | 5,000 | | | | 355,900 | |

| Vitran Corp., Inc. (1) | | | 16,000 | | | 179,040 | |

| | | | | | | 534,940 | |

| FRANCE (7.0%) | | | | | | | | |

| Arkema SA ADR | | | 6,130 | | | | 397,530 | |

| BNP Paribas ADR | | | 6,000 | | | | 219,600 | |

| France Telecom SA ADR | | | 11,000 | | | | 262,790 | |

| Total SA ADR | | | 5,200 | | | 283,296 | |

| | | | | | | 1,163,216 | |

| GERMANY (3.6%) | | | | | | | | |

| E.ON AG ADR | | | 8,000 | | | | 249,920 | |

| Siemens AG ADR | | | 3,000 | | | 342,930 | |

| | | | | | | 592,850 | |

| GUERNSEY (1.5%) | | | | | | | | |

| Amdocs, Ltd. (1) | | | 8,000 | | | 245,440 | |

| ISRAEL (3.9%) | | | | | | | | |

| NICE Systems, Ltd. ADR (1) | | | 10,000 | | | | 334,900 | |

| Teva Pharmaceutical Industries, Ltd. ADR | | | 6,000 | | | 311,400 | |

| | | | | | | 646,300 | |

| JAPAN (1.3%) | | | | | | | | |

| Nidec Corp. ADR | | | 9,000 | | | 219,690 | |

| KOREA (REPUBLIC OF-SOUTH) (1.8%) | | | | | | | | |

| Korea Electric Power Corp. ADR (1) | | | 8,000 | | | | 105,680 | |

| KT Corp. ADR | | | 9,500 | | | 196,555 | |

| | | | | | | 302,235 | |

| MEXICO (2.0%) | | | | | | | | |

| Grupo Televisa SA ADR | | | 15,000 | | | 336,750 | |

| NETHERLANDS (1.6%) | | | | | | | | |

| Unilever NV | | | 9,000 | | | 267,210 | |

| PORTUGAL (1.8%) | | | | | | | | |

| Portugal Telecom SGPS SA ADR | | | 20,300 | | | 292,320 | |

| SOUTH AFRICA (1.4%) | | | | | | | | |

| Sanlam, Ltd. ADR | | | 5,000 | | | | 95,450 | |

| Shoprite Holdings, Ltd. ADR | | | 5,000 | | | 142,800 | |

| | | | | | | 238,250 | |

| SPAIN (5.0%) | | | | | | | | |

| Banco Bilbao Vizcaya Argentaria SA ADR | | | 17,497 | | | | 230,085 | |

| Banco Santander SA ADR | | | 17,186 | | | | 220,153 | |

| Repsol YPF SA ADR | | | 8,000 | | | | 221,520 | |

| Telefonica SA ADR | | | 2,000 | | | 162,280 | |

| | | | | | | 834,038 | |

| SWITZERLAND (4.4%) | | | | | | | | |

| Nestle SA ADR | | | 7,750 | | | | 425,088 | |

| Roche Holding AG ADR | | | 8,000 | | | 294,000 | |

| | | | | | | 719,088 | |

| UNITED KINGDOM (10.4%) | | | | | | | | |

| Anglo American PLC ADR | | | 11,830 | | | | 275,048 | |

| BG Group PLC ADR | | | 2,000 | | | | 194,700 | |

| Centrica PLC ADR | | | 3,000 | | | | 63,540 | |

| Diageo PLC ADR | | | 2,000 | | | | 148,000 | |

| GlaxoSmithKline PLC ADR | | | 2,000 | | | | 78,080 | |

| Old Mutual PLC ADR | | | 15,000 | | | | 247,800 | |

| Prudential PLC ADR | | | 18,000 | | | | 363,600 | |

| Tate & Lyle PLC ADR | | | 4,136 | | | | 133,014 | |

| Vodafone Group PLC ADR | | | 7,875 | | | 216,641 | |

| | | | | | | 1,720,423 | |

| UNITED STATES (35.9%) | | | | | | | | |

| AGCO Corp. (1) | | | 12,000 | | | | 509,640 | |

| American National Insurance Co. | | | 4,498 | | | | 352,823 | |

| BJ’s Wholesale Club, Inc. (1) | | | 5,075 | | | | 211,780 | |

| Chemed Corp. | | | 5,200 | | | | 306,488 | |

| Conmed Corp. (1) | | | 15,720 | | | | 345,997 | |

| DENTSPLY International, Inc. | | | 6,700 | | | | 210,313 | |

| DST Systems, Inc. | | | 5,000 | | | | 216,350 | |

| Electronic Arts, Inc. (1) | | | 10,000 | | | | 158,500 | |

| KVH Industries, Inc. (1) | | | 30,000 | | | | 421,200 | |

| LifePoint Hospitals, Inc. (1) | | | 6,500 | | | | 220,480 | |

| Lubrizol Corp. | | | 5,055 | | | | 518,087 | |

| Lufkin Industries, Inc. | | | 12,000 | | | | 586,200 | |

| Norfolk Southern Corp. | | | 9,000 | | | | 553,410 | |

| Northwest Natural Gas Co. | | | 5,000 | | | | 246,450 | |

| Pentair, Inc. | | | 12,760 | | | | 417,635 | |

| Valero Energy Corp. | | | 10,000 | | | | 179,500 | |

| See accompanying notes to financial statements. |

|

| 20 |

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2010 |

SCHEDULE OF INVESTMENTS – October 31, 2010

| | | Shares | | | Value |

| COMMON STOCKS (90.5%) – Continued | | | | | | | | |

| Varian Semiconductor Equipment Associates, Inc. (1) | | | 15,000 | | | $ | 490,050 | |

| | | | | | | 5,944,903 | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $11,377,726) | | | | | | 14,999,308 | |

| PREFERRED STOCKS (4.3%) | | | | | | | | |

| UNITED STATES (4.3%) | | | | | | | | |

| Chesapeake Energy Corp., 1.13% (2) | | | 1,000 | | | | 91,210 | |

| HSBC USA, Inc., Series F, 0.22%, | | | | | | | | |

Callable 12/1/10 (3) (4) | | | 18,000 | | | | 379,080 | |

| HSBC USA, Inc., Series G, 0.25%, | | | | | | | | |

Callable 1/1/11 (3) (4) | | | 10,000 | | | 231,200 | |

TOTAL PREFERRED STOCKS | | | | | | | | |

(Cost $561,255) | | | | | | 701,490 | |

| | | | | | | | | |

| | | Principal | | | | | |

| CORPORATE BONDS (2.3%) | | | | | | | | |

| UNITED STATES (2.3%) | | | | | | | | |

| JPMorgan Chase & Co., 0.00%, | | | | | | | | |

2/10/11 (5) | | $ | 150,000 | | | | 182,175 | |

| Toyota Motor Credit Corp., 4.75%, | | | | | | | | |

2/4/25 (3) (4) | | | 200,000 | | | 200,907 | |

| | | | | | | 383,082 | |