UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-04665

Commonwealth International Series Trust

(Exact name of registrant as specified in charter)

791 Town & Country Blvd

Houston, TX 77024-3925

(Address of principal executive offices) (Zip code)

CT Corporation System

155 Federal Street

Boston, MA 02110

(Name and address of agent for service)

Copies to:

John H. Lively

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Parkway, Suite 310

Leawood, KS 66211

Registrant’s telephone number, including area code: (888) 345-1898

Date of fiscal year end: October 31

Date of reporting period: October 31, 2013

| Item 1. Reports to Stockholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

Commonwealth International

Series Trust

791 Town & Country Blvd, Suite 250

Houston, TX 77024-3925

888-345-1898

www.commonwealthfunds.com

INVESTMENT ADVISOR

FCA Corp

791 Town & Country Blvd, Suite 250

Houston, TX 77024-3925

713-781-2856

DISTRIBUTOR

UMB Distribution Services, LLC

803 West Michigan Street

Milwaukee, WI 53233

TRANSFER AGENT & ADMINISTRATOR

UMB Fund Services, Inc.

803 West Michigan Street

Milwaukee, WI 53233

CUSTODIAN BANK

Fifth Third Bank

Fifth Third Center

38 Fountain Square Plaza

Cincinnati, OH 45263

INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

BBD, LLP

1835 Market Street, 26th Floor

Philadelphia, PA 19103

LEGAL COUNSEL

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Creek Parkway, Ste. 310

Leawood, KS 66211 | |

Commonwealth Australia/New Zealand Fund

Africa Fund

Commonwealth Japan Fund

Commonwealth Global Fund

Commonwealth Real Estate Securities Fund

ANNUAL REPORT

October 31, 2013 |

| | | |

| This report is intended for the shareholders of the family of funds of the Commonwealth International Series Trust. It may not be distributed to prospective investors unless it is preceded or accompanied by a current prospectus. An additional prospectus may be obtained at www.commonwealthfunds.com or from the principal underwriter of the Commonwealth International Series Trust or your broker. | | |

| Table of Contents | | |

| | | |

| | | |

| Shareholder Letter | | 2 |

| | | |

| Performance Overview | | |

Commonwealth Australia/New Zealand Fund | | 6 |

Africa Fund | | 8 |

Commonwealth Japan Fund | | 10 |

Commonwealth Global Fund | | 12 |

Commonwealth Real Estate Securities Fund | | 14 |

| | | |

| Glossary of Terms | | 16 |

| Portfolio Composition | | 17 |

| Schedules of Investments | | 19 |

| Statements of Assets and Liabilities | | 28 |

| Statements of Operations | | 29 |

| Statements of Changes in Net Assets | | 30 |

| Financial Highlights | | 32 |

| | | |

| Notes to Financial Statements | | 37 |

| | | |

| Report of Independent Registered Public Accounting Firm | | 50 |

| | | |

| Additional Information | | 51 |

| | | |

| Trustees and Officers | | 53 |

| | | |

|

791 Town & Country Blvd, Suite 250, Houston, TX 77024-3925

Commonwealth Australia/New Zealand Fund (CNZLX)

Africa Fund (CAFRX)

Commonwealth Japan Fund (CNJFX)

Commonwealth Global Fund (CNGLX)

Commonwealth Real Estate Securities Fund (CNREX)

www.commonwealthfunds.com

October 31, 2013

Dear Fellow Shareholders:

Many quotations have been attributed to the venerableWinston Churchill. The following seems so appropriate for today:

“Politics is the ability to foretell what is going to happen tomorrow, next week, next month and next year.... and to have the ability afterwards to explain why it didn’t happen.”

Substitute “economics” for politics and you have what investors have been grappling with in interpreting where the markets are headed. In this light, investors have been digesting a wide array of economic and geopolitical developments in recent months. While economic growth has modestly continued despite the negative impact of the federal budget sequester, the Federal Reserve’s expected tapering of its bond buying program has prompted greater market volatility and bond yields have risen substantially. Emerging markets in particular have experienced movements as investors began to extract capital in anticipation of higher rates only to begin reinvestment anew when it became evident the tapering was not to be immediate.

There is concern that the ultimate reduction of Federal Reserve bond purchases will allow long-term interest rates to move higher, running the risk of curtailing any recovery. Already, mortgage rates have jumped and housing market data appear less robust than earlier in the year. Overseas, instability in Egypt and Syria has contributed to volatile oil prices, which if they remain at lofty prices, could undermine the reasonably positive trends in consumer spending. Fortunately, the Eurozone posted positive GDP growth in the second quarter after many months of contraction though the 17-nation currency-block continues to grapple with significant economic challenges.

While we at FCA Corp., the investment adviser to the Funds comprising the Commonwealth International Series Trust, cannot forecast with precision how economic or geopolitical events will unfold, we have confidence that a long-term investment program remains essential. FCACorp’s in-depth fundamental research, active investing and risk management strategies can serve investors well through challenging domestic and international markets.

2

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| |

|

As we reflect on our twenty-second year as the investment advisor to the Funds, we would like to thank you as shareholders for your support and continued interest in the Commonwealth family of funds.

| |  |

Robert W. Scharar | | Wesley R. Yuhnke |

President and Portfolio Manager | | Assistant Portfolio Manager |

Commonwealth International Series Trust | | Commonwealth International Series Trust |

| | | |

| | |  |

| | | |

| | | Ronald Manning |

| | | Assistant Portfolio Manager |

| | | Commonwealth International Series Trust |

The views in the above discussion, along with discussion included under the “Performance Overview” for each Fund below, were those of the Funds’ investment advisor as of the date set forth above and may not reflect its views on the date this annual report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and the performance of the Funds during the period covered by this report and do not constitute investment advice.

THE PERFORMANCE INFORMATION QUOTED IN THIS ANNUAL REPORT REPRESENTS PAST PERFORMANCE AND PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE OF AN INVESTMENT WILL FLUCTUATE SO THAT AN INVESTOR’S SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. AN INVESTOR SHOULD CONSIDER THE FUND’S INVESTMENT OBJECTIVES, RISKS, AND CHARGES AND EXPENSES CAREFULLY BEFORE INVESTING. THE FUNDS’PROSPECTUS CONTAINS THIS AND OTHER IMPORTANT INFORMATION. FOR INFORMATION ON EACH FUND’S EXPENSE RATIO, PLEASE SEE THE FINANCIAL HIGHLIGHTS TABLE FOUND WITHIN THIS REPORT. TO OBTAIN A PROSPECTUS AND OTHER INFORMATION ABOUT THE FUNDS, PLEASE VISIT WWW.COMMONWEALTHFUNDS.COM OR CALL 888-345-1898. PLEASE READ THE PROSPECTUS CAREFULLY BEFORE INVESTING.

3

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| |

|

Questions and Answers

To help shareholders better understand key attributes of the mutual funds (each a “Fund” and collectively the “Funds”) comprising the Commonwealth International Series Trust and their operations, the following Question and Answer section is provided.

Who is the Funds’ investment advisor?

The Funds’investment advisor is FCA Corp (“FCA”). FCA is an investment advisor that is registered with the U.S. Securities and Exchange Commission and has its principle place of business located at 791 Town & Country Blvd., Suite 250, Houston, Texas 77024-3925. The firm was founded 39 years ago and maintains a global perspective on the equity and fixed income marketplaces.

Why is investing outside the U.S. important?

The Funds invest in companies outside the United States because FCA believes there are significant investment opportunities in select foreign markets. FCA also believe U.S. investors benefit from the diversification that having investments outside the United States can provide. International investing offers exposure to more companies and other nations’ economies. In 2013, over 50% of the value of equity markets was outside the United States, and the growth experienced by many of these foreign economies appeared to be attractive. FCA believes that for a U.S. investor, allocation of a portion of the investor’s portfolio to international securities can provide the potential for less risk and can achieve a more consistent long-term performance in the investor’s overall portfolio.1

How has international investing changed over the last decade?

International markets now comprise a significant portion of all equity value worldwide. As markets have blended through global commerce, capital has flowed from country to country following investment opportunities. Developed markets and emerging markets both require capital investments to provide the goods and services of their respective needs. During the last two decades in particular, statistical information has become more uniform thus more dependable. The trend appears to be in place for continued development of these distant countries and their markets long term. Their demand for investment capital continues as they provide opportunities for diversification and growth. The Funds seek to be participants in these developments.

What are some of the factors influencing a Fund’s portfolio turnover?

Each Fund generally invests in equity securities with a long-term view and in debt securities to be held to maturity. The Funds’ portfolio securities are evaluated on their long-term prospects. A particular Fund may experience higher or lower turnover ratios in certain years. Factors influencing portfolio turnover include, but are not limited to the following: rebalancing portfolio securities to take advantage of long-term opportunities and/or to reallocate between fixed income and equity securities; investing new subscriptions; or selling securities to cover redemptions. Higher levels of portfolio activity by a Fund will result in higher transaction costs and/or more realized gains or losses, the impact of which is borne by the Fund’s shareholders. The turnover of a portfolio is not predictable because managers do not know when the portfolio transactions will be dictated. Under most circumstances, it is desirable to limit transactions because of the costs associated with trading although these are generally not the determining factor.

| 1 | Investing in international markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. |

You should consider each Fund’s objectives, risks, charges and expenses carefully before investing. The Prospectus contains information about those and other important matters relating to the Funds. Please read the Prospectus carefully before you invest.

4

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| |

|

How can the asset size of a Fund impact the Fund’s expense ratio?

Achieving each Fund’s objective with a portfolio comprised of international securities is historically more expensive than the costs associated with managing a portfolio comprised of domestic securities. Research of foreign markets, trading in different currencies, custody of assets, accurate evaluations of holdings and generally overall communications are all known to be more expensive when managing these types of portfolios. Additionally, as with almost every mutual fund, size has an impact on the expense ratio of Funds. Typically, larger mutual funds can have lower expense ratios as there is an increased opportunity to spread out fixed and partially-fixed costs necessary to operate such mutual funds over a larger asset base. Generally, mutual fund expenses, including those of the Funds, are allocated on a daily basis among all shareholders. In addition, as a portfolio grows, it is self-evident that fixed costs as a percentage of the assets managed generally decline. Whenever a new Fund is introduced or in highly specific investment objective portfolios, higher costs can be experienced during time periods of asset growth. The Financial Highlights section of the accompanying financial statements provides supplemental data that includes current and historic expense information, and where applicable, the advisor’s waiver of fees or voluntary contributions of expenses.

5

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| PERFORMANCE OVERVIEW – October 31, 2013 (Unaudited) |

| COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND |

The Commonwealth Australia/New Zealand Fund’s net asset value (NAV) as of October 31, 2013 was $13.25 per share compared to $12.05 per share on October 31, 2012. For the twelve month period covered by this Annual Report, the Commonwealth Australia/New Zealand Fund returned 11.40%. This return figure includes the $0.16 per share dividend distribution made in December 2012.

In presenting comparative performance numbers on the Fund versus indexes, it is important to note that we do not make investment decisions with a view toward attempting to track any index. Rather, we invest based on fundamental research. Comparisons to indexes, which are not fundamentally based, may not appear as reasonable as we would prefer. We also invest a portion of the Fund’s assets in fixed income investments and, as a result, we would note that a comparison of the performance of the Fund to indexes may be less meaningful than a comparison of funds that do not incorporate such fixed income investments. In an attempt to present various aspects of the marketplace return, we provide three indexes for consideration. During the twelve-month period, the New Zealand SmallCap Index returned 20.01%, the NZX 50 Index returned 24.71% and the Australian All Ordinaries Index returned 15.33%. These indexes do not include any fixed income instruments. Additionally, you should note that the indexes are unmanaged, they are expressed in terms of U.S. dollars and they do not reflect the deduction of fees or taxes associated with a mutual fund such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. In addition, investors cannot directly invest in an index.

From our view, the long term goal of owning the Australia/New Zealand Fund is to benefit from the ownership of companies domiciled and operating in both of these fine countries. Therefore, both countries are continuously represented in ownership. History shows that the returns of the respective marketplaces can vary significantly from one another. It is rare that both countries perform similarly. Nonetheless, the overriding goal of long term diversified ownership seeks to be maintained.

There are other considerations as well: |

| |

| – | The 0.5 percent appreciation of the New Zealand dollar versus the U.S. dollar positively impacted the Fund’s returns during the year while the 8.9 percent decline of the Australian dollar had a predictably negative effect. |

| |

| | When measured in the respective local currency, New Zealand equities outperformed Australian equities. New Zealand small-cap equities generally underperformed relative to large-cap equities. Due to the allocation of the Fund’s assets to the small-cap area, the Fund’s performance was negatively impacted. |

| |

| – | The Fund’s New Zealand holdings within the commercial services and transportation industries (particularly in the shipping and handling of goods through the port facilities) positively impacted the Fund’s performance, although South Port NZ, the Fund’s largest position returned less than the broader market. |

| – | Driven by the market appreciation of Ryman Healthcare, healthcare-services related investments in both Australia and New Zealand were solid contributors to the Fund’s overall performance and represented the second largest industry exposure in the portfolio. |

| |

| – | The Fund’s Australian mining and chemicals holdings had negative returns for the year with commensurate effects on total returns. |

| |

| – | The Fund’s commitment to fixed income investments (5.8% of total investments) is designed to provide a degree of stability to the portfolio while providing a modest income. During the period, these fixed income instruments outperformed the broader fixed income markets. |

| | |

| Investment Risks |

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes.

The Fund’s investments in debt and/or fixed income securities also contain risk factors. The value of these securities tends to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each.

The Fund’s expenses, as with any mutual fund, detract from the Fund’s performance. The Fund’s asset levels have a direct effect on the expense indirectly paid by shareholders. To the extent the Fund’s assets decline and the expenses of the Fund rise or do not decrease proportionately, performance will be negatively impacted.

International investing involves increased risk and volatility. An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Because the Fund invests primarily in the securities of, and depositary receipts represented by Australian and New Zealand issuers, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of those countries.

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments.

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in the Fund. |

| | |

| * | Portfolio holdings will change due to ongoing management of the Fund. References to specific securities or sectors should not be construed as recommendations by the Trust, the Advisor or the Distributor. |

| | |

| 1 | For additional information, please refer to the Glossary of Terms following the Performance Overview section. |

6

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| PERFORMANCE OVERVIEW – October 31, 2013 (Unaudited) |

| COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND |

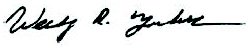

Comparison of Change in Value of a $10,000 Investment in the Commonwealth Australia/New Zealand Fund, the NZSCI, AAOI, and NZX 50 Index.

The above graph is a hypothetical $10,000 investment in the Commonwealth Australia/New Zealand Fund from 10/31/03 to 10/31/13, and represents the reinvestment of dividends and distributions in the Fund.

| | | Average Annual Total Return | | Average Annual Total Return | | Total Fund

Operating |

| | | as of September 30, 2013 | | as of October 31, 2013 | | Expense |

| | | 1 Year | | 5 Year | | 10 Year | | 1 Year | | 5 Year | | 10 Year | | Ratio1 |

| Commonwealth Australia/New Zealand Fund | | 11.16 | % | | 8.00 | % | | 8.44 | % | | 11.40 | % | | 12.62 | % | | 7.86 | % | | 3.32 | % |

| New Zealand SmallCap Index (“NZSCI”) | | 12.05 | % | | 14.00 | % | | 13.36 | % | | 20.01 | % | | 21.29 | % | | 13.51 | % | | — | |

| Australian All Ordinaries Index (“AAOI”) | | 12.68 | % | | 12.17 | % | | 14.51 | % | | 15.33 | % | | 20.89 | % | | 14.28 | % | | — | |

| NZX 50 Index | | 23.83 | % | | 13.76 | % | | 11.25 | % | | 24.71 | % | | 19.77 | % | | 11.13 | % | | — | |

| |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. |

| | |

| 1 | The above expense ratio is from the Fund’s Prospectus dated February 28, 2013. Additional information pertaining to the Fund’s expense ratios as of October 31, 2013 can be found in the financial highlights. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 3.32%. |

| | |

| The Fund’s performance is measured against the New Zealand SmallCap Index (“NZSCI”), a capitalization-weighted index of all New Zealand equities, excluding those in the NZX 50 Index, is considered to be reflective of the performance of the New Zealand small-cap equity market; the Australian All Ordinaries Index (“AAOI”), an index made up of the largest 500 companies as measured by market capitalization that are listed on the Australian Stock Exchange; and the NZX 50 Index, a total return index consisting of the top 50 companies by free float adjusted market capitalization that are listed on the New Zealand Stock Exchange. These indices are unmanaged, are expressed in terms of U.S. dollars, and do not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| | |

You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. This and other information can be found in the Fund’s Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contracting your investment representative. Please read it carefully before you invest or send money. |

| | |

| The Commonwealth Australia/New Zealand Fund was formerly known as Capstone New Zealand (2000) and subsequently the Commonwealth New Zealand Fund (2001). |

7

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| PERFORMANCE OVERVIEW – October 31, 2013 (Unaudited) |

| AFRICA FUND |

The Africa Fund’s net asset value (NAV) as of October 31, 2013 was $10.38 per share compared to $10.23 per share on October 31, 2012. For the period covered by this Annual Report, the Africa Fund posted a 3.02% cumulative total return. This return figure includes the $0.16 per share dividend distribution made in December 2012. Our investments do not attempt to track any indexes; rather, we make investment decisions on the basis of fundamental research. We also invest a portion of the Fund’s assets in fixed income investments and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. The MSCI Emerging Markets Index and the Dow Jones Africa Titans 50 Index, returned 6.53% and 5.34%, respectively for the same period. These indexes do not include any fixed income instruments. Additionally, indexes are unmanaged, expressed in terms of U.S. dollars and do not reflect the deduction of fees or taxes associated with a mutual fund such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index.

For the period ended October 31, 2013, the Advisor contractually waived its advisory fee in the amount of $22,542 and voluntarily reimbursed Fund operating expenses in the amount of $88,266. The waived advisory fees are subject to recoupment. Please see accompanying notes to the financial statements for additional information.

We believe that Africa represents a unique, complicated continent with the potential to be both economically rewarding and punitive. We feel equities listed on African stock exchanges offer investors a way to participate in what is expected to be sizeable growth in the consumer consumption of goods and services and the economies in general. It takes time for governments to change and for the people of an emerging country to adjust. With the vast number of countries within the African continent, it is an exciting yet daunting task. Our portfolio selection includes using information we gather first hand through trips to the continent as we seek to monitor each investment and to make decisions we view as being in the best interests of the Fund. Because many U.S. investors share our vision for the African continent and have a desire to be informed beyond just financial aspects, we have constructed our website’s Africa section to provide a variety of information in response to this, and we invite you to visit the website at commonwealthfunds.com. |

| Investment Risks |

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes.

The Fund’s investments in debt and/or fixed income securities also contain risk factors. The value of these securities tends to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each.

The Fund’s expenses, as with any mutual fund, detract from the Fund’s performance. The Fund’s asset levels have a direct effect on the expense indirectly paid by shareholders. To the extent the Fund’s assets decline and the expenses of the Fund rise or do not decrease proportionately, performance will be negatively impacted.

International investing involves increased risk and volatility. An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Because the Fund invests primarily in the securities of, and depositary receipts represented by African issuers, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of those countries.

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments.

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in the Fund. |

| | |

| * | Portfolio holdings will change due to ongoing management of the Funds. References to specific securities or sectors should not be construed as recommendations by the Trust, the Advisor or the Distributor. |

| | |

| 1 | For additional information, please refer to the Glossary of Terms following the Performance Overview section. |

8

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| PERFORMANCE OVERVIEW – October 31, 2013 (Unaudited) |

| AFRICA FUND |

Comparison of Change in Value of a $10,000 Investment in the Africa Fund, the MSCIEM and DJAFKT.

The above graph is a hypothetical $10,000 investment in the Africa Fund from 11/07/11 (inception) to 10/31/13, and represents the reinvestment of dividends and distributions in the Fund.

| | | | | | | | | | | | | | | | | | | | Total Fund |

| | | Average Annual Total Return | | Average Annual Total Return | | | Total Fund | | | Operating |

| | | as of September 30, 2013 | | as of October 31, 2013 | | | Operating | | | Expense |

| | | | | | Inception | | | | | Inception | | | Expense | | | After Fee |

| | | 1 Year | | (11/07/11) | | 1 Year | | (11/07/11) | | | Ratio1 | | | Waiver Ratio1 |

| |

| Africa Fund | | -3.31 | % | | 0.80 | % | | 3.02 | % | | 2.68 | % | | | 8.36 | % | | | 7.11 | % |

| MSCI Emerging Markets Index (“MSCIEM”) | | 0.98 | % | | 2.51 | % | | 6.53 | % | | 4.88 | % | | | — | | | | — | |

| Dow Jones Africa Titans 50 Index (“DJAFKT”) | | 0.55 | % | | 6.63 | % | | 5.34 | % | | 8.59 | % | | | — | | | | — | |

| |

| | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. |

| | |

| 1 | The above expense ratios are from the Fund’s Prospectus dated February 28, 2013. FCA Corp has contractually agreed to waive the Management Fee of 1.25% through February 28, 2014. Please see Note 4 of the Notes to Financial Statements relating to additional voluntary expense reimbursements by FCA Corp. Additional information pertaining to the Fund’s expense ratios as of October 31, 2013 can be found in the financial highlights. |

| | |

| The Fund’s performance is measured against the MSCI Emerging Markets Index (“MSCIEM”), a free float-adjusted market capitalization index that is designed to measure equity market performance within global emerging markets; the Dow Jones Africa Titans 50 Index (“DJAFKT”), a float-adjusted market capitalization index that is designed to measure the stock performance of 50 leading companies that are headquartered or generate the majority of their revenues in Africa. The MSCI Emerging Markets Index currently consists of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. These indices are unmanaged, are expressed in terms of U.S. dollars, and do not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| | |

You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. This and other information can be found in the Fund’s Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contracting your investment representative. Please read it carefully before you invest or send money. |

9

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| PERFORMANCE OVERVIEW – October 31, 2013 (Unaudited) |

| COMMONWEALTH JAPAN FUND |

The Commonwealth Japan Fund’s net asset value (NAV) as of October 31, 2013 was $3.08 per share compared to $2.54 per share on October 31, 2012. For the twelve month period covered by this Annual Report, the Commonwealth Japan Fund returned 21.26%. Our investments do not attempt to track any index, but rather we undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in fixed income investments and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. The Tokyo Stock Price Index returned 33.19% for the same period. The index does not include any fixed income instruments. Additionally, the index is unmanaged, it is expressed in terms of U.S. dollars and it does not reflect the deduction of fees or taxes associated with a mutual fund such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Japan’s economy registered growth of around 4% on an annualized basis in the first half of 2013. This growth was led by strong domestic demand; for example, (1) public investment continued to increase as positive effects of various economic measures came to take hold fully and (2) private consumption remained resilient, reflecting an improvement in consumer sentiment supported by the depreciation of the Yen and a rise in stock prices.

The Bank of Japan introduced the quantitative and qualitative monetary easing (or “QQE”) in April 2013, with a two year view for seeking to achieve the price stability target of +2% growth in the Consumer Price Index. The Bank of Japan announced its’ goal of doubling the monetary base within two years. In accomplish this, the Bank plan to purchase massive amounts of Japanese government bonds. In addition, in aiming to achieve the price stability target of +2%, the Bank made a commitment to continue with QQE as long as necessary to maintain the target in a stable manner. So far, QQE appears to have exerted positive influences on Japan’s economy as evidenced by the improving expectations of the financial markets and of individual firms and households.

The Tokyo Stock Price Index returned 60.88% in local currency terms over the last year. The decline in the exchange rate, a period in which the Yen depreciated almost 19% versus the dollar, reduced the return to US investors. While exports have been picking up at a somewhat slower pace, domestic demand, notably private consumption, has been firm, and positively impacted the Fund’s investments in the following industries: (1) auto parts & equipment; (2) leisure time; and (3) retail.

Business fixed investments overall grew for the third consecutive quarter. This reflected the improvements in corporate profits yet the recovery in the manufacturing sector was somewhat disappointing. Therefore, exports — which largely affect investments by these manufacturing firms — lacked resilience and decreased for the first time in three quarters. In this environment, the Fund’s investments in capital goods and transportation companies underperformed the broader market. |

| Investment Risks |

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes.

The Fund’s investments in debt and/or fixed income securities also contain risk factors. The value of these securities tends to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each.

The Fund’s expenses, as with any mutual fund, detract from the Fund’s performance. The Fund’s asset levels have a direct effect on the expense indirectly paid by shareholders. To the extent the Fund’s assets decline and the expenses of the Fund rise or do not decrease proportionately, performance will be negatively impacted.

International investing involves increased risk and volatility. An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Because the Fund invests primarily in the securities of, and depositary receipts represented by Japanese issuers, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of those countries.

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments.

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in the Fund. |

| | |

| * | Portfolio holdings will change due to ongoing management of the Fund. References to specific securities or sectors should not be construed as recommendations by the Trust, the Advisor or the Distributor. |

| | |

| 1 | For additional information, please refer to the Glossary of Terms following the Performance Overview section. |

10

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| PERFORMANCE OVERVIEW – October 31, 2013 (Unaudited) |

| COMMONWEALTH JAPAN FUND |

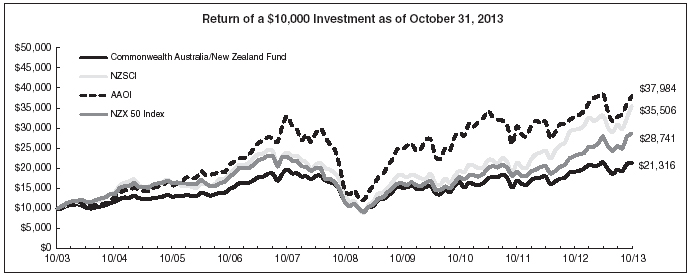

Comparison of Change in Value of a $10,000 Investment in the Commonwealth Japan Fund and the TOPIX Index.

The above graph is a hypothetical $10,000 investment in the Commonwealth Japan Fund from 10/31/03 to 10/31/13, and represents the reinvestment of dividends and distributions in the Fund.

| | | Average Annual Total Return | | Average Annual Total Return | | Total Fund

Operating |

| | | as of September 30, 2013 | | as of October 31, 2013 | | Expense |

| | | 1 Year | | 5 Year | | 10 Year | | 1 Year | | 5 Year | | 10 Year | | Ratio1 |

| Commonwealth Japan Fund | | 19.46 | % | | 1.57 | % | | -0.63 | % | | 21.26 | % | | 4.51 | % | | -1.08 | % | | 4.85 | % |

| Tokyo Stock Price Index (“TOPIX”) | | 30.48 | % | | 5.62 | % | | 4.66 | % | | 33.19 | % | | 8.87 | % | | 4.29 | % | | — | |

| |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. |

| | |

| 1 | The above expense ratio is from the Fund’s Prospectus dated February 28, 2013. Additional information pertaining to the Fund’s expense ratios as of October 31, 2013 can be found in the financial highlights. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 4.84%. |

| | |

| The Fund’s performance is measured against the Tokyo Stock Price Index an unmanaged capitalization-weighted index of all the common stocks on the First Selection of the Tokyo Stock Exchange. This index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| | |

You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. This and other information can be found in the Fund’s Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contracting your investment representative. Please read it carefully before you invest or send money. |

| | |

| The Commonwealth Japan Fund was formerly known as the Capstone Japan Fund (2000), established as a series of the Trust on July 10, 1989 under the name of the Capstone Nikko Japan Tilt Fund. |

11

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| PERFORMANCE OVERVIEW – October 31, 2013 (Unaudited) |

| COMMONWEALTH GLOBAL FUND |

| The Commonwealth Global Fund’s net asset value (NAV) as of October 31, 2013 was $17.00 per share compared to $14.13 per share on October 31, 2012. For the twelve month period covered by this Annual Report, the Commonwealth Global Fund posted a 20.31% cumulative total return. Our investments do not attempt to track any index, but rather we undertake investments on the basis of fundamental research.We also invest a portion of the Fund’s assets in fixed income investments and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. The MSCI World Index returned 26.48% for the same period. The index does not include any fixed income instruments. Additionally, the index is unmanaged, it is expressed in terms of U.S. dollars and it does not reflect the deduction of fees or taxes associated with a mutual fund such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| |

In review of the year, it is fair to conclude that “uncertainty” has been the underlying concern of all markets domestic or international. Governments and their respective peoples have had to deal with the events of the year which included, but were not limited to: “The Arab Spring”, the endless turmoil of the Euro-zone countries, threats of nuclear development (Iran) and changes in various degrees within the political leadership of the United States, France, Japan and China. As each country strives to adjust, economic policies can become very fluid, varied in application and undependable. Indeed, risk is everywhere and very hard to quantify. However, to address these concerns, our approach is to intensely analyze and determine the most appropriate risk-adjusted investments to be held in the portfolio. During this most recent time period, in light of these unpredictable circumstances, the Commonwealth Global Fund’s management maintained the portfolio in a more reserved, protected position which in retrospect was not the most beneficial for the greatest total return relative growth. Nonetheless, the risks assumed were less and the investments more secure, from our view. We believe progress has been made.

The ownership of the financial sector was beneficial and was the best performing sector of the Fund. Other areas of promise such as transportation experienced disappointing returns as rail road companies carried less coal due to the switch of coal powered electric-generation plants to natural gas as the primary source to be used to create electricity. This produced the obvious effect of significantly lower transportation tonnage of coal nationwide and this trend is continuing at present. This does not diminish our belief in the rails and their excellent competitive long range economies of scale fundamentals. It simply means that some of the dynamics are changing in this very important industry. |

| |

| During the last year, the United States continued to deserve an increased flow of capital into its markets as earnings improved for the international yet domestically domiciled companies. Corporate America showed a resiliency that will be continuously challenged. As we look at the year and beyond, diversification across markets remains a guiding key to continued portfolio management. |

| Investment Risks |

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes.

The Fund’s investments in debt and/or fixed income securities also contain risk factors. The value of these securities tends to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each. |

| | |

The Fund’s expenses, as with any mutual fund, detract from the Fund’s performance. The Fund’s asset levels have a direct effect on the expense indirectly paid by shareholders. To the extent the Fund’s assets decline and the expenses of the Fund rise or do not decrease proportionately, performance will be negatively impacted. |

| | |

International investing involves increased risk and volatility. An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. |

| | |

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments. |

| | |

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in the Fund. |

| | |

| * | Portfolio holdings will change due to ongoing management of the Fund. References to specific securities or sectors should not be construed as recommendations by the Trust, the Advisor or the Distributor. |

| | |

| 1 | For additional information, please refer to the Glossary of Terms following the Performance Overview section. |

12

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| PERFORMANCE OVERVIEW – October 31, 2013 (Unaudited) |

| COMMONWEALTH GLOBAL FUND |

Comparison of Change in Value of a $10,000 Investment in the Commonwealth Global Fund and the MSCI World Index.

The above graph is a hypothetical $10,000 investment in the Commonwealth Global Fund from 10/31/03 to 10/31/13, and represents the reinvestment of dividends and distributions in the Fund.

| | | Average Annual Total Return | | Average Annual Total Return | | Total Fund

Operating |

| | | as of September 30, 2013 | | as of October 31, 2013 | | Expense |

| | | 1 Year | | 5 Year | | 10 Year | | 1 Year | | 5 Year | | 10 Year | | Ratio1 |

| Commonwealth Global Fund | | 14.30 | % | | 5.11 | % | | 6.89 | % | | 20.31 | % | | 11.20 | % | | 6.48 | % | | 3.33 | % |

| MSCI World Index | | 20.90 | % | | 8.46 | % | | 8.16 | % | | 26.48 | % | | 13.99 | % | | 7.95 | % | | — | |

| |

| | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. |

| | |

| 1 | The above expense ratio is from the Fund’s Prospectus dated February 28, 2013. Additional information pertaining to the Fund’s expense ratios as of October 31, 2013 can be found in the financial highlights. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 3.31%. |

| | |

| The Fund’s performance is measured against the MSCI World Index, an unmanaged free float-adjusted market capitalization index that is designed to measure global developed market equity performance. Currently the MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. This performance of the index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| | |

You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. This and other information can be found in the Fund’s Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contracting your investment representative. Please read it carefully before you invest or send money. |

13

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| PERFORMANCE OVERVIEW – October 31, 2013 (Unaudited) |

| COMMONWEALTH REAL ESTATE SECURITIES FUND |

| The Commonwealth Real Estate Securities Fund’s net asset value (NAV) as of October 31, 2013, was $12.55 per share compared to $11.27 per share on October 31, 2012. For the twelve month period covered by this Annual Report, the Commonwealth Real Estate Securities Fund posted 11.36% cumulative total return. The MSCI US REIT Index returned 11.42% for the same period. Our investments do not attempt to track any index, but rather we undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in fixed income investments and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. Additionally, the index is unmanaged, it is expressed in terms of U.S. dollars and it does not reflect the deduction of fees or taxes associated with a mutual fund such as investment management and fund accounting fees. The performance returns of the Fund do reflect the deduction of fees for these services. |

| |

| Information on the various Real Estate interests throughout the Global/Domestic universe seems to remain at best confusingly constructive. As always, investors are generally optimistic and in the case of the international and domestic companies, they have expressed their optimism, even if unfounded, through new ownership of companies. |

| |

Internationally and domestically, the price movements of equities are from a very low base and large appreciation numbers can be seen with even the hint of modest improvements in fundamentals. The Commonwealth Real Estate Fund has stayed the course of ownership allowing time to heal many markets as the invisible hand of capitalism works its magic providing modest improvements in basic markets which have led to some appreciation of assets.

The Fund’s investments in hotels, lodging and building materials industries had a positive impact on the performance, whereas home builders trailed the broader market.

The commercial real estate market seems to have fundamentally improved during the last year. Prices and property values in many areas have held up and the commercial sector has been aided by some increased building activity. Low interest rates certainly encourage activity across the country, yet many corporate entities continue to deleverage their balance sheets by paying off debt and building cash positions. This process often restricts hiring and job creation which we continue to view as vital to future growth of the real estate sector. At present, we do not see reasons to be making material changes and believe the practice of holding the course longer term is the best process to follow.

The U.S. economy is on a recovery path, albeit at a moderate pace, against the background of progress in households’ balance-sheet adjustments and an improvement in the housing market. Speculation among investors about an earlier-than-expected reduction by the Federal Reserve in the pace of its asset purchases became heightened in late May 2013. This triggered instability within many global financial markets, as evidenced by the simultaneous declines in stock prices, bond prices, and in the value of currencies in many emerging economies. |

| The Fund’s investments in Real Estate Investment Trusts (REITs), in particular hotels, had a positive impact on the fund’s performance. Apartment REITs and building materials companies, having outperformed the prior year, mostly underperformed the MSCI US REIT Index in the current reporting period. |

| | |

| | |

| Investment Risks |

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes.

The Fund’s investments in debt and/or fixed income securities also contain risk factors. The value of these securities tends to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each. |

| | |

The Fund’s expenses, as with any mutual fund, detract from the Fund’s performance. The Fund’s asset levels have a direct effect on the expense indirectly paid by shareholders. To the extent the Fund’s assets decline and the expenses of the Fund rise or do not decrease proportionately, performance will be negatively impacted. |

| | |

The Fund’s investments in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. Equity REITs may be affected by changes in the value of the underlying property owned by the REITs, while mortgage REITs may be affected by the quality of any credit extended. |

| | |

Investments in the Fund are subject to the risks related to direct investment in real estate, such as real estate risk, regulatory risks, concentration risk, and diversification risk. |

| | |

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments. |

| | |

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in the Fund. |

| | |

| * | Portfolio holdings will change due to ongoing management of the Fund. References to specific securities or sectors should not be construed as recommendations by the Trust, the Advisor or the Distributor. |

| | |

| 1 | For additional information, please refer to the Glossary of Terms following the Performance Overview section. |

14

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| PERFORMANCE OVERVIEW – October 31, 2013 (Unaudited) |

| COMMONWEALTH REAL ESTATE SECURITIES FUND |

Comparison of Change in Value of a $10,000 Investment in the Commonwealth Real Estate Securities Fund and the MSCI US REIT Index.

The above graph is a hypothetical $10,000 investment in the Commonwealth Real Estate Securities Fund from 1/5/04 (inception) to 10/31/13, and represents the reinvestment of dividends and distributions in the Fund.

| | | Average Annual Total Return | | Average Annual Total Return | | Total Fund |

| | | as of September 30, 2013 | | as of October 31, 2013 | | Operating |

| | | | | | | | | Inception | | | | | | | | Inception | | Expense |

| | | 1 Year | | 5 Year | | (1/5/04) | | 1 Year | | 5 Year | | (1/5/04) | | Ratio1 |

| Commonwealth Real Estate Securities Fund | | 8.03 | % | | 3.45 | % | | 3.21 | % | | 11.36 | % | | 10.67 | % | | 3.55 | % | | 3.53 | % |

| MSCI US REIT Index | | 5.75 | % | | 5.87 | % | | 8.73 | % | | 11.42 | % | | 15.30 | % | | 9.13 | % | | — | |

| |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. |

| | |

| 1 | The above expense ratio is from the Fund’s Prospectus dated February 28, 2013. Additional information pertaining to the Fund’s expense ratios as of October 31, 2013 can be found in the financial highlights. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 3.53%. |

| | |

| The Fund’s performance is measured against the MSCI US REIT Index which is an unmanaged free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. MSCI started calculating and maintaining the MSCI US REIT Index on June 20, 2005. Prior to this date the MSCI US REIT Index (then known as the Morgan Stanley REIT Index) was calculated and maintained by the AMEX. This index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index. |

| | |

You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. This and other information can be found in the Fund’s Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contracting your investment representative. Please read it carefully before you invest or send money. |

15

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| |

|

Glossary of Terms

Australian All Ordinaries Index (“AAOI”) — is a capitalization-weighted index. The index is made up of the largest 500 companies as measured by market cap that are listed on the Australian Stock Exchange.

Consumer Price Index (“CPI”) — is a measure of changes in the price level of a market basket of consumer goods and services purchased by households.

Dow Jones Africa Titans 50 Index (“DJAFKT”) — a float-adjusted market capitalization index that is designed to measure the stock performance of 50 leading companies that are headquartered or generate the majority of their revenues in Africa.

Gross Domestic Product (GDP) — is a measure of the market value of the goods and services produced by labor and property within the United States and/or other foreign countries.

MSCI Emerging Markets Index (“MSCIEM”) — is a float-adjusted market capitalization index that is designed to measure equity market performance within global emerging markets. The Emerging Markets Index currently consists of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

MSCI US REIT Index — is an unmanaged free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. MSCI started calculating and maintaining the MSCI US REIT Index on June 20, 2005. Prior to this date the MSCI US REIT Index (then known as the Morgan Stanley REIT Index) was calculated and maintained by the AMEX.

MSCI World Index — is an unmanaged free float-adjusted market capitalization index that is designed to measure global developed market equity performance. Currently the MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States.

New Zealand SmallCap Index (“NZSCI”) — is a capitalization-weighted index of all New Zealand equities, excluding those in the NZX 50 Index, considered to be reflective of the performance of the New Zealand small-cap equity market.

NZX 50 Index — is a modified market capitalization weighted index. This index consists of the top 50 companies by free float adjusted market capitalization that are listed on the New Zealand Stock Exchange.

Tokyo Stock Price Index (“TOPIX”) — is an unmanaged capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange.

16

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| | |

| PORTFOLIO COMPOSITION – October 31, 2013* (Unaudited) |

| COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND |

| Industry or | | Percent of Total |

| Security Type | | Investments |

| |

| Commercial Services | | 18.2 | % |

| Healthcare – Services | | 13.6 | % |

| Electric | | 7.7 | % |

| Oil & Gas | | 7.6 | % |

| Retail | | 7.1 | % |

| Transportation | | 6.6 | % |

| Telecommunications | | 5.7 | % |

| Diversified Financial Services | | 4.0 | % |

| REITs | | 4.0 | % |

| Home Furnishings | | 3.9 | % |

| Media | | 3.5 | % |

| Mining | | 3.4 | % |

| Electrical Components & Equipment | | 2.9 | % |

| Preferred Stocks | | 2.8 | % |

| Insurance | | 2.3 | % |

| Bonds – New Zealand | | 2.2 | % |

| Healthcare – Products | | 2.1 | % |

| Chemicals | | 1.1 | % |

| Bonds – Australia | | 1.0 | % |

| Food | | 0.3 | % |

| Short-Term Investments | | 0.0 | % |

| |

| | | 100.0 | % |

| AFRICA FUND |

| Country or | | Percent of Total |

| Security Type | | Investments |

| |

| South Africa | | 55.5 | % |

| Exchange Traded Funds – Africa Region | | 12.6 | % |

| Exchange Traded Funds – South Africa | | 11.7 | % |

| Short-Term Investments | | 10.5 | % |

| Egypt | | 3.2 | % |

| Exchange Traded Funds – Nigeria | | 2.6 | % |

| United Kingdom | | 2.5 | % |

| Sovereign Bonds – South Africa | | 1.0 | % |

| Guernsey | | 0.4 | % |

| |

| | | 100.0 | % |

| COMMONWEALTH JAPAN FUND |

| Industry or | | Percent of Total |

| Security Type | | Investments |

| |

| Transportation | | 24.7 | % |

| Healthcare – Products | | 7.2 | % |

| Short-Term Investments | | 7.2 | % |

| Real Estate | | 6.5 | % |

| Auto Parts & Equipment | | 6.2 | % |

| Insurance | | 5.1 | % |

| Engineering & Construction | | 4.5 | % |

| Retail | | 4.3 | % |

| Distribution/Wholesale | | 3.7 | % |

| Machinery – Diversified | | 3.5 | % |

| Beverages | | 3.5 | % |

| Electronics | | 3.4 | % |

| Cosmetics/Personal Care | | 2.9 | % |

| Hand/Machine Tools | | 2.3 | % |

| Banks | | 2.3 | % |

| Computers | | 2.2 | % |

| Entertainment | | 2.1 | % |

| Electric | | 1.9 | % |

| REITs | | 1.9 | % |

| Leisure Time | | 1.6 | % |

| Chemicals | | 1.3 | % |

| Food | | 1.0 | % |

| Diversified Financial Services | | 0.7 | % |

| |

| | | 100.0 | % |

| COMMONWEALTH GLOBAL FUND |

| Country or | | Percent of Total |

| Security Type | | Investments |

| |

| United States | | 34.8 | % |

| Switzerland | | 11.5 | % |

| United Kingdom | | 9.5 | % |

| Short-Term Investments | | 8.0 | % |

| France | | 4.9 | % |

| Israel | | 3.8 | % |

| Preferred Stocks | | 3.5 | % |

| Bermuda | | 3.3 | % |

| Canada | | 3.1 | % |

| Mexico | | 2.9 | % |

| Guernsey | | 2.4 | % |

| Germany | | 2.4 | % |

| Netherlands | | 2.2 | % |

| Japan | | 2.1 | % |

| Spain | | 1.8 | % |

| Brazil | | 1.2 | % |

| South Africa | | 1.1 | % |

| Singapore | | 0.7 | % |

| South Korea | | 0.6 | % |

| Call Options | | 0.2 | % |

| |

| | | 100.0 | % |

17

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

| | |

| PORTFOLIO COMPOSITION – October 31, 2013* (Unaudited) |

| COMMONWEALTH REAL ESTATE SECURITIES FUND |

| Industry or | | Percent of Total |

| Security Type | | Investments |

| |

| REITS-Office Property | | 12.4 | % |

| Building Materials | | 10.9 | % |

| Lodging | | 10.9 | % |

| REITS-Hotels | | 9.2 | % |

| REITS-Apartments | | 8.6 | % |

| Real Estate | | 8.3 | % |

| Telecommunications | | 5.5 | % |

| REITS-Storage | | 5.1 | % |

| Home Builders | | 5.0 | % |

| REITS-Diversified | | 4.3 | % |

| REITS-Shopping Centers | | 3.9 | % |

| Retail | | 2.9 | % |

| Engineering & Construction | | 2.8 | % |

| REITS-Warehouse/Industries | | 2.3 | % |

| Exchange Traded Funds | | 2.2 | % |

| REITS-Health Care | | 1.9 | % |

| Savings & Loans | | 1.9 | % |

| REITS-Single Tenant | | 1.6 | % |

| Short-Term Investments | | 0.4 | % |

| |

| | | 100.0 | % |

| * Portfolio composition is subject to change. | | | |

18

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

SCHEDULES OF INVESTMENTS – October 31, 2013

| COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND |

| | | Shares | | | Value |

| | | | | | |

| AUSTRALIA (20.4%) | | | | | | | | |

| COMMON STOCKS (19.4%) | | | | | | | | |

| CHEMICALS (1.1%) | | | | | | | | |

| Nufarm, Ltd. | | | 55,308 | | | $ | 255,630 | |

| | | | | | | | |

| COMMERCIAL SERVICES (0.4%) | | | | | | | | |

| Silver Chef, Ltd. | | | 2,146 | | | | 16,612 | |

| Slater & Gordon, Ltd. | | | 20,208 | | | | 73,918 | |

| | | | | | | | |

| | | | | | | | 90,530 | |

| | | | | | | | |

| DIVERSIFIED FINANCIAL SERVICES (0.3%) | | | | | | | | |

| FlexiGroup, Ltd. | | | 15,000 | | | | 66,635 | |

| | | | | | | | |

| ELECTRIC (2.5%) | | | | | | | | |

| AGL Energy, Ltd. | | | 34,025 | | | | 502,978 | |

| ERM Power, Ltd. | | | 30,634 | | | | 82,521 | |

| | | | | | | | |

| | | | | | | | 585,499 | |

| | | | | | | | |

| HEALTHCARE-PRODUCTS (0.9%) | | | | | | | | |

| Cochlear, Ltd. | | | 4,000 | | | | 222,684 | |

| | | | | | | | |

| HEALTHCARE-SERVICES (1.7%) | | | | | | | | |

| Sonic Healthcare, Ltd. | | | 26,324 | | | | 401,578 | |

| | | | | | | | |

| INSURANCE (2.3%) | | | | | | | | |

| QBE Insurance Group, Ltd. | | | 38,954 | | | | 544,914 | |

| | | | | | | | |

| MINING (3.3%) | | | | | | | | |

| Orica, Ltd. | | | 13,622 | | | | 271,281 | |

| OZ Minerals, Ltd. | | | 30,866 | | | | 105,609 | |

| PanAust, Ltd. | | | 216,232 | | | | 412,844 | |

| | | | | | | | |

| | | | | | | | 789,734 | |

| | | | | | | | |

| OIL & GAS (2.7%) | | | | | | | | |

| Santos, Ltd. | | | 28,828 | | | | 413,347 | |

| Woodside Petroleum, Ltd. | | | 6,518 | | | | 239,157 | |

| | | | | | | | |

| | | | | | | | 652,504 | |

| | | | | | | | |

| RETAIL (2.0%) | | | | | | | | |

| Wesfarmers, Ltd. | | | 11,874 | | | | 482,255 | |

| | | | | | | | |

| TRANSPORTATION (2.2%) | | | | | | | | |

| Asciano Group | | | 93,333 | | | | 513,420 | |

| | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $3,862,001) | | | | | | | 4,605,383 | |

| | | | | | | | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | | | | | | |

| CORPORATE BONDS (1.0%) | | | | | | | | |

| CBA Capital Australia, Ltd., 3.43%, | | | | | | | | |

4/15/15 (1) (2) (3) | | | NZ$300,000 | | | | 242,215 | |

| | | | | | | | |

TOTAL CORPORATE BONDS | | | | | | | | |

(Cost $201,986) | | | | | | | 242,215 | |

| | | | | | | | |

TOTAL AUSTRALIA | | | | | | | | |

(Cost $4,063,987) | | | | | | | 4,847,598 | |

| | | | | | | | |

|

| | | | | | | | | |

| | Shares | | | | | | | | | | | | | | |

| NEW ZEALAND (77.5%) | | | | | | | | |

| COMMON STOCKS (72.7%) | | | | | | | | |

| COAL (0.0%) | | | | | | | | |

| Pike River Coal, Ltd. (4) (5) | | | 1,145,295 | | | | — | |

| | | | | | | | |

| COMMERCIAL SERVICES (17.4%) | | | | | | | | |

| Guinness Peat Group PLC (5) | | | 495,906 | | | | 241,666 | |

| Mowbray Collectables, Ltd. (4) (6) | | | 821,593 | | | | 339,305 | |

| Northland Port Corp. (NZ), Ltd. | | | 81,425 | | | | 191,675 | |

| Port of Tauranga, Ltd. | | | 50,000 | | | | 569,918 | |

| South Port New Zealand, Ltd. | | | 1,027,930 | | | | 2,801,825 | |

| | | | | | | | |

| | | | | | | | 4,144,389 | |

| | | | | | | | |

| DIVERSIFIED FINANCIAL SERVICES (3.7%) | | | | | | | | |

| Heartland New Zealand, Ltd. | | | 1,252,765 | | | | 869,185 | |

| | | | | | | | |

| ELECTRIC (5.1%) | | | | | | | | |

| Contact Energy, Ltd. | | | 90,000 | | | | 390,270 | |

| Infratil, Ltd. | | | 216,613 | | | | 447,289 | |

| TrustPower, Ltd. | | | 65,000 | | | | 370,447 | |

| | | | | | | | |

| | | | | | | | 1,208,006 | |

| | | | | | | | |

| ELECTRICAL COMPONENTS & EQUIPMENT (2.8%) | | | | | | | | |

| Cavotec SA | | | 130,250 | | | | 669,330 | |

| | | | | | | | |

| FOOD (0.3%) | | | | | | | | |

| Sanford, Ltd. | | | 20,000 | | | | 75,493 | |

| | | | | | | | |

| HEALTHCARE-PRODUCTS (1.1%) | | | | | | | | |

| Ebos Group, Ltd. | | | 33,389 | | | | 267,509 | |

| | | | | | | | |

| HEALTHCARE-SERVICES (11.6%) | | | | | | | | |

| Metlifecare, Ltd. | | | 171,484 | | | | 577,893 | |

| Ryman Healthcare, Ltd. | | | 350,000 | | | | 2,182,621 | |

| | | | | | | | |

| | | | | | | | 2,760,514 | |

| | | | | | | | |

| HOME FURNISHINGS (3.8%) | | | | | | | | |

| Scott Technology, Ltd. (4) | | | 497,396 | | | | 903,833 | |

| | | | | | | | |

| MEDIA (3.4%) | | | | | | | | |

| Sky Network Television, Ltd. | | | 159,745 | | | | 818,055 | |

| | | | | | | | |

| OIL & GAS (4.7%) | | | | | | | | |

| New Zealand Oil & Gas, Ltd. | | | 962,531 | | | | 667,817 | |

| New Zealand Refining Co., Ltd./The | | | 235,157 | | | | 437,023 | |

| | | | | | | | |

| | | | | | | | 1,104,840 | |

| | | | | | | | |

| REITS (3.9%) | | | | | | | | |

| Goodman Property Trust | | | 376,216 | | | | 320,065 | |

| Vital Healthcare Property Trust | | | 572,941 | | | | 610,468 | |

| | | | | | | | |

| | | | | | | | 930,533 | |

| | | | | | | | |

| RETAIL (5.0%) | | | | | | | | |

| Briscoe Group, Ltd. | | | 183,520 | | | | 360,765 | |

| Colonial Motor Co., Ltd. (4) | | | 199,565 | | | | 815,930 | |

| | | | | | | | |

| | | | | | | | 1,176,695 | |

| | | | | | | | |

| See accompanying notes to financial statements. |

|

| 19 |

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

SCHEDULES OF INVESTMENTS – October 31, 2013

| COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND |

| | | Shares | | | Value |

| | | | | | |

| NEW ZEALAND (77.5%) - Continued | | | | | | | | |

| COMMON STOCKS (72.7%) - Continued | | | | | | | | |

| TELECOMMUNICATIONS (5.6%) | | | | | | | | |

| Chorus, Ltd. | | | 226,311 | | | $ | 495,353 | |

| TeamTalk, Ltd. | | | 415,473 | | | | 830,466 | |

| | | | | | | | |

| | | | | | | | 1,325,819 | |

| | | | | | | | |

| TRANSPORTATION (4.3%) | | | | | | | | |

| Freightways, Ltd. | | | 173,540 | | | | 626,390 | |

| Mainfreight, Ltd. | | | 40,000 | | | | 383,249 | |

| | | | | | | | |

| | | | | | | | 1,009,639 | |

| | | | | | | | |

TOTAL COMMON STOCKS (Cost $11,660,666) | | | | | | | 17,263,840 | |

| | | | | | | | |

| PREFERRED STOCKS (2.7%) | | | | | | | | |

| INVESTMENT COMPANIES (2.7%) | | | | | | | | |

| ASB Capital, Ltd., 3.68% (1) (2) | | | 954,218 | | | | 639,981 | |

| | | | | | | | |

TOTAL PREFERRED STOCKS (Cost $686,799) | | | | | | | 639,981 | |

| | | | | | | | |

| | |

Principal | | | | | |

| | | | | | | | |

| CORPORATE BONDS (2.1%) | | | | | | | | |

| Credit Agricole SA, 5.04%, 12/29/49 (1) (2) (3) | | | NZ$890,000 | | | | 507,228 | |

| | | | | | | | |

TOTAL CORPORATE BONDS (Cost $463,084) | | | | | | | 507,228 | |

| | | | | | | | |

TOTAL NEW ZEALAND (Cost $12,810,549) | | | | | | | 18,411,049 | |

| | | | | | | | |

| | |

Shares | | | | | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS (0.0%) | | | | | | | | |

| Federated Government Obligations Fund, 0.01% (7) | | | 6,088 | | | | 6,088 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $6,088) | | | | | | | 6,088 | |

| | | | | | | | |

| TOTAL INVESTMENTS (97.9%) (Cost $16,880,624) | | | | | | | 23,264,735 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (2.1%) | | | | | | | 501,620 | |

| | | | | | | | |

| NET ASSETS (100.0%) | | | | | | $ | 23,766,355 | |

| | | | | | | | |

| (1) | | Variable, Floating, or Step Rate Security. The rate reflected in the Schedule of Investments is the rate in effect at October 31, 2013. |

| (2) | | Callable. |

| (3) | | Principal amount shown is in New Zealand Dollars (NZ$); value shown in U.S. Dollars. |

| (4) | | Security is being fair valued in accordance with the Trust’s fair valuation policies. |

| (5) | | Non-income producing. |

| (6) | | Affiliated Issuer. See Note 5 of the Notes to Financial Statements. |

| (7) | | Rate disclosed is the seven day yield as of October 31, 2013. |

| PLC — Public Limited Company |

| See accompanying notes to financial statements. |

|

| 20 |

C O M M O N W E A L T H

INTERNATIONAL SERIES TRUST | ANNUAL REPORT 2013 |

SCHEDULES OF INVESTMENTS – October 31, 2013

| | | Shares | | | Value |

| | | | | | |

| COMMON STOCKS (61.1%) | | | | | | | | |

| EGYPT (3.2%) | | | | | | | | |

| Global Telecom Holding GDR (1) | | | 20,000 | | | $ | 67,600 | |

| | | | | | | | |

| GUERNSEY (0.4%) | | | | | | | | |

| Agriterra, Ltd. (1) | | | 210,000 | | | | 7,811 | |

| | | | | | | | |

| SOUTH AFRICA (55.0%) | | | | | | | | |

| African Bank Investments, Ltd. | | | 10,145 | | | | 17,180 | |

| Anglo American Platinum, Ltd. (1) | | | 800 | | | | 32,365 | |

| AngloGold Ashanti, Ltd. ADR | | | 1,000 | | | | 15,100 | |

| Astral Foods, Ltd. | | | 4,000 | | | | 40,244 | |

| Barloworld, Ltd. | | | 3,300 | | | | 29,585 | |

| Bidvest Group, Ltd. | | | 1,400 | | | | 37,335 | |

| Capitec Bank Holdings, Ltd. | | | 2,850 | | | | 60,754 | |

| Clientele, Ltd. | | | 25,000 | | | | 32,624 | |

| Coronation Fund Managers, Ltd. | | | 6,500 | | | | 53,029 | |

| Discovery Holdings, Ltd. | | | 9,000 | | | | 76,204 | |

| FirstRand, Ltd. | | | 9,800 | | | | 35,144 | |

| Gold Fields, Ltd. ADR | | | 5,000 | | | | 23,000 | |

| Grindrod, Ltd. | | | 35,000 | | | | 84,198 | |

| Howden Africa Holdings, Ltd. | | | 11,000 | | | | 44,926 | |

| Imperial Holdings, Ltd. ADR | | | 1,200 | | | | 25,716 | |

| Invicta Holdings, Ltd. | | | 3,000 | | | | 29,854 | |

| JD Group, Ltd. | | | 9,200 | | | | 28,318 | |

| Kagiso Media, Ltd. | | | 16,000 | | | | 44,228 | |

| MTN Group, Ltd. ADR | | | 2,600 | | | | 51,636 | |

| Nedbank Group, Ltd. | | | 2,000 | | | | 43,432 | |

| Pinnacle Technology Holdings, Ltd. | | | 15,000 | | | | 36,698 | |

| PSG Group, Ltd. | | | 5,200 | | | | 42,734 | |

| RCL Foods, Ltd. (1) | | | 18,000 | | | | 30,661 | |

| Sasol, Ltd. ADR | | | 1,600 | | | | 81,632 | |

| Shoprite Holdings, Ltd. ADR | | | 900 | | | | 33,147 | |

| Standard Bank Group, Ltd. ADR | | | 2,800 | | | | 35,784 | |

| Steinhoff International Holdings, Ltd. | | | 13,222 | | | | 51,116 | |