UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04665

Commonwealth International Series Trust

(Exact name of registrant as specified in charter)

791 Town & Country Blvd.

Houston, TX 77024-3925

(Address of principal executive offices) (Zip code)

CT Corporation System

155 Federal Street

Boston, MA 02110

(Name and address of agent for service)

Registrant's telephone number, including area code: (888) 345-1898

Date of fiscal year end: October 31

Date of reporting period: October 31, 2021

Item 1. Reports to Stockholders.

(a)

Commonwealth International

Series Trust 791 Town & Country Blvd., Suite 250

Houston, TX 77024-3925

888-345-1898

www.commonwealthfunds.com INVESTMENT ADVISOR

FCA Corp

791 Town & Country Blvd., Suite 250

Houston, TX 77024-3925 DISTRIBUTOR

Ultimus Fund Distributors, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 TRANSFER AGENT & ADMINISTRATOR

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 CUSTODIAN BANK

Fifth Third Bank N.A.

Fifth Third Center

38 Fountain Square Plaza

Cincinnati, OH 45263 INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

BBD, LLP

1835 Market Street, 3rd Floor

Philadelphia, PA 19103 LEGAL COUNSEL

Practus, LLP

11300 Tomahawk Creek Parkway, Suite 310

Leawood, KS 66211 This report is intended for the shareholders of the family of funds of the Commonwealth International Series Trust. It may not be distributed to prospective investors unless it is preceded or accompanied by the Funds’ current Prospectus. An additional Prospectus may be obtained at www.commonwealthfunds.com or from the principal underwriter of the Funds or your broker. Distributed by Ultimus Fund Distributors, LLC Distributed by Ultimus Fund Distributors, LLC

Member FINRA/SIPC | |

Commonwealth Australia/New Zealand Fund

Africa Fund Commonwealth Japan Fund Commonwealth Global Fund Commonwealth Real Estate Securities Fund ANNUAL REPORT October 31, 2021 |

Commonwealth-AR-21

Table of Contents

Shareholder Letter | 1 |

Performance Overview | |

Commonwealth Australia/New Zealand Fund | 5 |

Africa Fund | 7 |

Commonwealth Japan Fund | 10 |

Commonwealth Global Fund | 13 |

Commonwealth Real Estate Securities Fund | 15 |

Portfolio Composition | 17 |

Schedules of Investments | 19 |

Statements of Assets and Liabilities | 29 |

Statements of Operations | 30 |

Statements of Changes in Net Assets | 32 |

Financial Highlights | 34 |

Notes to Financial Statements | 39 |

Report of Independent Registered Public Accounting Firm | 52 |

Additional Information | 53 |

Liquidity Risk Management Program | 55 |

Notice of Privacy Policy & Practices | 59 |

Commonwealth Australia/New Zealand Fund (CNZLX)

Africa Fund (CAFRX)

Commonwealth Japan Fund (CNJFX)

Commonwealth Global Fund (CNGLX)

Commonwealth Real Estate Securities Fund (CNREX)

www.commonwealthfunds.com

Dear Fellow Shareholders:

We are pleased to present the enclosed annual report for the twelve-months ended October 31, 2021 of the Commonwealth International Series Trust on behalf of its separate series: Commonwealth Australia/New Zealand Fund, Commonwealth Japan Fund, Commonwealth Global Fund, Commonwealth Real Estate Securities Fund and Africa Fund (each a “Fund” and together the “Funds”).

The global economic recovery continues on the whole, albeit with variation across countries and regions. Vaccine access, early government and monetary support, are some of the principal drivers of the gaps. The United States and Europe, where vaccinations against COVID-19 moved ahead of other countries and regions, are seeing economic improvement as the resumption of economic activity continues to progress. The Chinese economy is still recovering, although the pace of improvement has decelerated, partly due to the resurgence of COVID-19 and power supply issues. In emerging and commodity-exporting economies other than China, domestic demand and production in many countries and regions were under downward pressure due to the continued spread of COVID-19 in the summer of 2021, but have improved on the whole as the effects of the spread wane.

The sharp contraction in demand in 2020 led many businesses to slash orders on intermediate inputs. As the recovery picked up steam in 2021, some producers found themselves flatfooted and unable to ramp up sufficient supply; for example, microchip production relative to demand remains hampered. Moreover, the world distribution of shipping containers became highly distorted during the pandemic, leaving many stranded off their usual routes. The aftershocks from the upheaval of 2020 and the prospects of renewed restrictions to slow virus transmission could translate into more persistent supply disruptions. Faced with continued rising demand, firms may continue to increase prices and workers may bid up wages more broadly. More generally, should households, businesses, and investors begin anticipating price pressures from pent-up demand, there is a risk that medium-term inflation expectations could drift upward and lead to a self-fulfilling further rise in prices (as prices and wages are reset in line with higher inflation expectations).

The International Monetary Fund (“IMF”), in its World Economic Outlook in October 2021, forecast the global economy is projected to grow 5.9 percent in 2021 and 4.9 percent in 2022. The downward revision to their 2021 forecast from the July estimate reflects a downgrade for developed economies – in part due to supply distributions – and for low-income developing countries, largely due to worsening pandemic dynamics. This is partly offset by strong near-term prospects among some commodity-exporting emerging market and developing economies. Beyond 2022 global growth is projected to moderate to about 3.3 percent over the medium term, according to the IMF’s October forecast.

Each of the Funds has exposure to international investments, with three of the Funds (Commonwealth Australia/New Zealand Fund, Commonwealth Japan Fund and Africa Fund) having a majority of their respective investments in international security markets, while the Commonwealth Global Fund has around one-half of its investments in international markets, and the Commonwealth Real Estate Securities Fund has around 15%.

1

| ANNUAL REPORT 2021 |

While we cannot forecast with precision how economic or geopolitical events will unfold, we have confidence that a long-term investment program remains essential. FCA Corp’s in-depth fundamental research, active investing and risk management strategies can serve investors well through challenging domestic and international markets.

Our investment theme includes that our shareholders may select the Funds for their individual attributes and the targeted markets they are designed to invest in. In many cases this could be an asset allocation decision by our shareholders. We continue to offer these differential characteristics among our Funds coupled with a fundamental based approach to investment selections.

We invite you to visit our website at www.commonwealthfunds.com. In addition to information on the funds, you will find under the Insight tab articles of interest on global topics. If you would like to receive these on a regular basis, you may join our mailing list by signing up under the Global Connections link at the bottom of the page.

As we begin on our 31st year as the investment advisor to the Funds, we would like to thank you as shareholders for your support and continued interest in the Commonwealth family of funds.

|

|

Robert W. Scharar | Wesley R. Yuhnke |

President and Portfolio Manager | Assistant Portfolio Manager |

Commonwealth International Series Trust | Commonwealth International Series Trust |

The views in the above discussion, along with discussion included under the “Performance Overview” for each Fund below, were those of the Funds’ investment advisor as of the date set forth above and may not reflect its views on the date this annual report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and the performance of the Funds during the period covered by this report and do not constitute investment advice.

THE PERFORMANCE INFORMATION QUOTED IN THIS ANNUAL REPORT REPRESENTS PAST PERFORMANCE AND PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE OF AN INVESTMENT WILL FLUCTUATE SO THAT AN INVESTOR’S SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. AN INVESTOR SHOULD CONSIDER THE FUND’S INVESTMENT OBJECTIVES, RISKS, AND CHARGES AND EXPENSES CAREFULLY BEFORE INVESTING. THE FUND’S PROSPECTUS CONTAINS THIS AND OTHER IMPORTANT INFORMATION. FOR INFORMATION ON THE FUND’S EXPENSE RATIO, PLEASE SEE THE FINANCIAL HIGHLIGHTS TABLE FOUND WITHIN THIS REPORT. TO OBTAIN A PROSPECTUS AND OTHER INFORMATION ABOUT THE FUNDS, PLEASE VISIT WWW.COMMONWEALTHFUNDS.COM OR CALL 888-345-1898. PLEASE READ THE PROSPECTUS CAREFULLY BEFORE INVESTING.

2

| ANNUAL REPORT 2021 |

Questions and Answers

To help shareholders better understand key attributes of the mutual funds (each a “Fund” and collectively the “Funds”) comprising the Commonwealth International Series Trust and their operations, the following Question and Answer section is provided.

Who is the Advisor?

The Funds’ investment advisor is FCA Corp (“FCA”). FCA is an investment advisor that is registered with the U.S. Securities and Exchange Commission and has its principal place of business located at 791 Town & Country Blvd., Suite 250, Houston, Texas 77024-3925. The firm was founded in 1975 and maintains a global perspective on the equity and fixed income marketplaces.

Why is investing outside the U.S. important?

The Funds invest in companies outside the United States because FCA believes there are significant investment opportunities in select foreign markets. In our view, U.S. investors benefit from the diversification that having investments outside the United States can provide. International investing offers exposure to more companies and other nations’ economies, currencies, and growth prospects. Nearly half of the value of equity markets is outside the United States. The growth experienced by many of these foreign economies appears to be attractive. FCA believes that, for a U.S. investor, allocation of a portion of the investor’s portfolio to international securities can provide the potential for less risk and can achieve a more consistent long-term performance in the investor’s overall portfolio.

How has international investing changed over the last decade?

International markets now comprise a significant portion of all equity value worldwide. As markets have blended through global commerce, capital has flowed from country to country following investment opportunities. Developed markets and emerging markets both require capital investments to provide the goods and services that their consumers need. During the last decade in particular, accounting and economic statistical information has become more uniform and thus more dependable. The trend appears to be in place for continued development of these distant countries and their markets. Their demand for investment capital outside the U.S. continues, which provides opportunities for diversification and growth. The Funds seek to be participants in these opportunities.

What are some of the factors influencing a Fund’s portfolio turnover?

Each Fund generally invests in equity securities with a long-term view. The Funds’ portfolio securities are evaluated on their long-term prospects. A particular Fund may experience higher or lower turnover ratios in certain years. Factors influencing portfolio turnover include, but are not limited to the following: rebalancing portfolio securities to take advantage of long-term opportunities and/or to reallocate between fixed income and equity securities; investing new subscriptions; or selling securities to cover redemptions. Higher levels of portfolio activity by a Fund will result in higher transaction costs and/or more realized gains or losses, the impact of which is borne by the Fund’s shareholders. The turnover of a portfolio is not predictable because managers do not know when the portfolio transactions will be dictated. Under most circumstances, it is desirable to limit transactions because of the costs associated with trading, currency conversions, and custody fees, although these are generally not the determining factors.

3

| ANNUAL REPORT 2021 |

How can the size of the Fund impact the Funds’ expense ratio?

Achieving each Fund’s objective with a portfolio comprised of international securities is historically more expensive than managing a portfolio comprised of domestic securities. Research of foreign markets, trading in different currencies, custody of assets, accurate evaluations of holdings, income tax, securities regulatory compliance, and generally overall communications are all known to be more expensive when managing these types of portfolios. Additionally, as with almost every mutual fund, size has an impact on the expense ratio of Funds. Typically, larger mutual funds can have lower expense ratios as there is an increased opportunity to spread out fixed and partially-fixed costs necessary to operate such mutual funds over a larger asset base. Generally, mutual fund expenses, including those of the Funds, are allocated on a daily basis among all shareholders. In addition, as portfolio assets increase, it is self-evident that fixed costs as a percentage of the assets managed generally decline. Whenever a new Fund is introduced or invests in highly specific objective portfolios, higher costs can be experienced during time periods of asset growth. The Financial Highlights section of the accompanying financial statements provides supplemental data that includes current and historic expense information, and where applicable, the advisor’s waiver of fees or voluntary expense reimbursements to help reduce these costs.

Coronavirus (COVID-19) Pandemic

The COVID-19 pandemic has caused financial markets to experience significant volatility and uncertainty exists as to its long-term impact. COVID-19 has resulted in closing borders, quarantines, disruptions to supply chains and customer activity, as well as general concern and economic uncertainty. The impact of the outbreak may be short term or may last for an extended period of time. The impact of epidemics and pandemics such as COVID-19 could affect the economies of many nations, individual companies and the market in general in ways that cannot necessarily be foreseen at the present time. As a result, a Fund’s performance and the ability to achieve its investment objective may be adversely impacted. Management is monitoring the development of the pandemic and evaluating its impact on the financial position and operating results of the Funds.

4

| ANNUAL REPORT 2021 |

Performance Overview – October 31, 2021 (Unaudited) |

Commonwealth Australia/New Zealand Fund |

The Commonwealth Australia/New Zealand Fund’s net asset value (NAV) as of October 31, 2021 was $17.17 per share compared to $13.00(a) per share on October 31, 2020. For the twelve-month period covered by this Annual Report, the Commonwealth Australia/New Zealand Fund returned 32.22%(b). This return figure includes the $0.016 per share distribution made in December 2020. In presenting comparative performance numbers on the Fund versus indexes, it is important to note that we do not make investment decisions with a view toward attempting to track any index. Rather, we invest based on fundamental research. We also invest a portion of the Fund’s assets in cash and cash equivalents and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. In an attempt to present various aspects of the marketplace return, we provide two indexes for consideration. During the twelve-month period, the NZX 50 Index returned 17.44% and the Australian All Ordinaries Index returned 39.51%. These indexes are unmanaged, expressed in terms of U.S. dollars and do not reflect the deduction of fees associated with ownership of a mutual fund, such as investment management and fund accounting fees, nor do they reflect the deduction of taxes associated with ownership of a mutual fund.

From our view, the long-term goal of owning the Australia/New Zealand Fund is to benefit from the ownership of companies domiciled and operating in both of these countries. Therefore, both countries are continuously represented in ownership. History shows that the returns of the respective marketplaces can vary significantly from one another. It is rare that both countries’ markets perform the same. Nonetheless, the overriding goal of long-term diversified ownership seeks to be maintained.

There are other considerations that impacted performance during the period covered by this year’s report:

- | The 8.4 percent increase of the New Zealand dollar versus the U.S. dollar had a predictably positive effect on the Fund’s returns. |

- | The 7.0 percent increase of the Australian dollar versus the U.S. dollar had a predictably positive effect on the Fund’s returns. |

- | The Fund’s holdings in the following securities had the largest positive impact on the Fund’s performance: South Port New Zealand Ltd., Mainfreight Ltd., Infratil Ltd., Pacific Edge Ltd., and Briscoe Group Ltd. |

- | The Fund’s holdings in the following securities had the largest negative impact on the Fund’s performance: Appen Ltd., Freedom Foods, APA Group, Lendlease Group, and AFT Pharmaceuticals Ltd. |

Investment Risks

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes.

The Fund’s expenses, as with any mutual fund, detract from the Fund’s performance. The Fund’s asset levels have a direct effect on the expense indirectly paid by shareholders. To the extent the Fund’s assets decline and the expenses of the Fund rise or do not decrease proportionately, performance will be negatively impacted.

International investing involves increased risk and volatility. An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Because the Fund invests primarily in the securities of, and depositary receipts represented by Australian and New Zealand issuers, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of those countries.

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments.

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in the Fund.

Portfolio holdings will change due to ongoing management of the Fund. References to specific securities or sectors should not be construed as recommendations by the Trust, the Fund, the Fund’s investment advisor or distributor.

(a) | Due to GAAP financial statement adjustments, the traded NAV differs from the NAV noted on the Financial Highlights as of October 31, 2020. |

(b) | Total return is calculated with the traded NAV on October 31, 2020. |

5

| ANNUAL REPORT 2021 |

PERFORMANCE OVERVIEW – October 31, 2021 (Unaudited) |

Commonwealth Australia/New Zealand Fund |

Comparison of Change in Value of a $10,000 investment in the Commonwealth Australia/New Zealand Fund (the “Fund”), the AAOI and the NZX 50 Index.

The above graph is a hypothetical $10,000 investment in the Fund from 10/31/11 to 10/31/21 and represents the reinvestment of dividends and distributions in the Fund.

| | Average Annual Total Returns

as of October 31, 2021 | Total Fund

Operating

Expense |

| 1 Year | 5 Year | 10 Year | Ratio(a) |

Commonwealth Australia/New Zealand Fund | 32.22% | 9.23% | 7.83% | 2.70% |

Australian All Ordinaries Index (“AAOI”) | 39.51% | 12.46% | 7.92% | — |

NZX 50 Index | 17.44% | 13.49% | 13.22% | — |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns which may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. The Fund’s performance reflects any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for 1 year are not annualized.

(a) | The above expense ratio is from the Fund’s Prospectus, dated February 28, 2021. Additional information pertaining to the Fund’s expense ratio as of October 31, 2021, can be found in the financial highlights. |

The Fund’s performance is measured against the Australian All Ordinaries Index (‘‘AAOI’’), an index made up of the largest 500 companies as measured by market capitalization that are listed on the Australian Stock Exchange; and the NZX 50 Index, a total return index consisting of the top 50 companies by free float adjusted market capitalization that are listed on the New Zealand Stock Exchange. These indices are unmanaged, are expressed in terms of U.S. dollars, and do not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index.

You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. This and other information can be found in the Fund’s Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contacting your investment representative. Please read it carefully before you invest or send money.

6

| ANNUAL REPORT 2021 |

PERFORMANCE OVERVIEW – October 31, 2021 (Unaudited) |

Africa Fund |

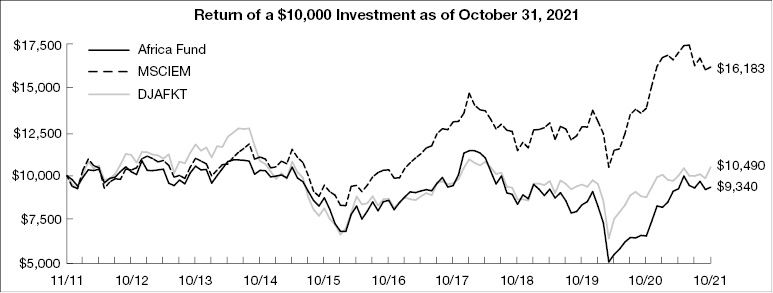

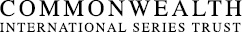

The Africa Fund’s net asset value (NAV) as of October 31, 2021 was $8.40 per share compared to $6.04 per share on October 31, 2020. For the period covered by this Annual Report, the Africa Fund returned 42.38% cumulative total return. This return figure includes the $0.18 per share distribution made in December 2020. Our investments do not attempt to track any indexes; rather, we make investment decisions on the basis of fundamental research. We also invest a portion of the Fund’s assets in cash and cash equivalents and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. The MSCI Emerging Markets Index and the Dow Jones Africa Titans 50 Index returned 16.96% and 19.60%, respectively for the same period. The indexes are unmanaged, expressed in terms of U.S. dollars and do not reflect the deduction of fees associated with ownership of a mutual fund such as investment management and fund accounting fees, nor do they reflect the deduction of taxes associated with ownership of a mutual fund. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index.

There are other considerations that impacted performance during the period covered by this year’s report:

- | For the period ended October 31, 2021, the Advisor limited the Fund operating expenses, which positively affected the Fund’s performance. Had the Advisor not capped the Fund’s operating expenses, performance would have been lower. Please see the accompanying notes to the financial statements for additional information. |

- | The 6.6 percent increase of the South African Rand versus the U.S. dollar had a predictably positive effect on the Fund’s performance. |

- | The Fund’s holdings in the following securities had the largest positive impact on the Fund’s performance: Capitec Bank Holdings Ltd., Impala Platinum Holdings Ltd., MTN Group Ltd., Anglo American Platinum Ltd., and Sasol Ltd. |

- | The Fund’s holdings in the following securities had the largest negative impact on the Fund’s performance: Gold Fields Ltd., Naspers Ltd., Jumia Technologies AG, AngloGold Ashanti Ltd., and Sibanye Stillwater Ltd. |

We believe that Africa represents a unique, complicated continent with the potential to be both economically rewarding and punitive. We feel equities listed on African stock exchanges offer investors a way to participate in what is expected to be sizeable growth in the consumer consumption of goods and services and the economies in general. It takes time for governments to change and for the people of an emerging country to adjust. With the vast number of countries within the African continent, it is an exciting yet daunting task. Our portfolio selection includes using information we gather firsthand through trips to the continent as we seek to monitor each investment and to make decisions we view as being in the best interests of the Fund. Because many U.S. investors share our vision for the African continent and have a desire to be informed beyond just financial aspects, we have constructed our web site’s Africa section to provide a variety of information in response to this, and we invite you to visit the website at commonwealthfunds.com.

Investment Risks

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes.

The Fund’s expenses, as with any mutual fund, detract from the Fund’s performance. The Fund’s asset levels have a direct effect on the expenses indirectly paid by shareholders. To the extent the Fund’s assets decline and the expenses of the Fund rise or do not decrease proportionately, performance will be negatively impacted.

International investing involves increased risk and volatility. An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Because the Fund invests primarily in the securities of, and depositary receipts represented by African issuers, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of those countries.

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments.

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in the Fund.

Portfolio holdings will change due to ongoing management of the Fund. References to specific securities or sectors should not be construed as recommendations by the Trust, the Advisor or the Distributor.

7

| ANNUAL REPORT 2021 |

PERFORMANCE OVERVIEW – October 31, 2021 (Unaudited) |

Africa Fund |

Comparison of Change in Value of a $10,000 investment in the Africa Fund (the “Fund”), the MSCIEM and the DJAFKT.

The above graph is a hypothetical $10,000 investment in the Fund from 11/7/11 (inception) to 10/31/21 and represents the reinvestment of dividends and distributions in the Fund.

| | Average Annual Total Returns

as of October 31, 2021 | Total Fund

Operating

Expense |

| 1 Year | 5 Year | Since

Inception

(11/7/11) | After Fee

Waiver

Ratio(a) |

Africa Fund | 42.38% | 1.69% | (0.68)% | 1.82% |

MSCI Emerging Markets Index (“MSCIEM”) | 16.96% | 9.39% | 4.94% | — |

Dow Jones Africa Titans 50 Index (“DJAFKT”) | 19.60% | 3.84% | 0.48% | — |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns which may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. The Fund’s performance reflects any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for 1 year are not annualized.

(a) | The above expense ratio is from the Fund’s Prospectus, dated February 28, 2021. FCA Corp has entered into a written expense limitation agreement under which it has agreed to limit the total expenses of the Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, extraordinary expenses and dividend expense on short sales) to an annual rate of 1.50% of the average daily net assets of the Fund. This expense limitation agreement may be terminated by FCA Corp or the Trust at any time after February 28, 2022. FCA Corp may recoup from the Fund any reduced fees and/or expenses reimbursed pursuant to this agreement if such recoupment does not cause the Fund to exceed the expense limitation in place at the time the fee was reduced and/or expenses were reimbursed and such recoupment is made within three years after the date in which FCA Corp incurred the expense. Excluding the indirect costs of investing in acquired funds, total fund operating expenses, before fee waiver, would be 5.04%. Additional information pertaining to the Fund’s expense ratio as of October 31, 2021, can be found in the financial highlights. |

8

| ANNUAL REPORT 2021 |

PERFORMANCE OVERVIEW – October 31, 2021 (Unaudited) |

Africa Fund |

The Fund’s performance is measured against the MSCI Emerging Markets Index (‘‘MSCIEM’’), a free float-adjusted market capitalization index that is designed to measure equity market performance within global emerging markets; and the Dow Jones Africa Titans 50 Index (‘‘DJAFKT’’), a float-adjusted market capitalization index that is designed to measure the stock performance of 50 leading companies that are headquartered or generate the majority of their revenues in Africa. The MSCIEM currently consists of the following 27 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Russia, Qatar, South Africa, Saudi Arabia, Taiwan, Thailand, Turkey and United Arab Emirates. These indices are unmanaged, are expressed in terms of U.S. dollars, and do not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index.

You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. This and other information can be found in the Fund’s Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contacting your investment representative. Please read it carefully before you invest or send money.

9

| ANNUAL REPORT 2021 |

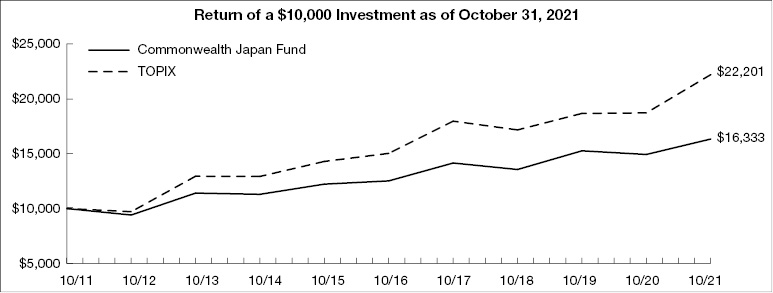

PERFORMANCE OVERVIEW – October 31, 2021 (Unaudited) |

Commonwealth Japan Fund |

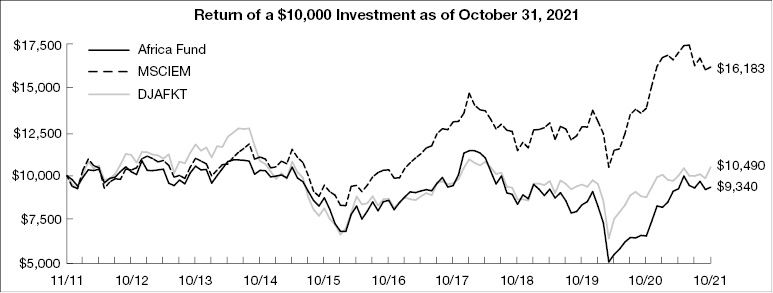

The Commonwealth Japan Fund’s net asset value (NAV) as of October 31, 2021 was $4.41 per share compared to $4.03 per share on October 31, 2020. For the twelve-month period covered by this Annual Report, the Commonwealth Japan Fund returned 9.43%. Our investments do not attempt to track any index, but rather we undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in cash and cash equivalents and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. The Tokyo Stock Price Index returned 18.64% for the same period. The index is unmanaged, expressed in terms of U.S. dollars and does not reflect the deduction of fees or taxes associated with ownership of a mutual fund such as investment management and fund accounting fees, nor does it reflect the deduction of taxes associated with ownership of a mutual fund. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index.

There are other considerations that impacted performance during the period covered by this year’s report:

- | For the period ended October 31, 2021, the Advisor limited the Fund operating expenses, which positively affected the Fund’s performance. Had the Advisor not capped the Fund’s operating expenses, performance would have been lower. Please see the accompanying notes to the financial statements for additional information. |

- | The 8.2 percent depreciation of the Japanese Yen versus the U.S. dollar during the year had a predictably negative effect on the Fund’s returns. |

- | The Fund’s holdings in the following securities had the largest positive impact on the Fund’s performance: Orix Corp., Hoya Corp., Hitachi Ltd., Dai-ichi Life Insurance Co. Ltd., and Terumo Corp. |

- | The Fund’s holdings in the following securities had the largest negative impact on the Fund’s performance: Asahi Intecc Co. Ltd., Cyberdyne, Inc., Softbank Group Corp., Unicharm Corp., and Nintendo Co. Ltd. |

Investment Risks

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes.

The Fund’s expenses, as with any mutual fund, detract from the Fund’s performance. The Fund’s asset levels have a direct effect on the expenses indirectly paid by shareholders. To the extent the Fund’s assets decline and the expenses of the Fund rise or do not decrease proportionately, performance will be negatively impacted.

International investing involves increased risk and volatility. An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Because the Fund invests primarily in the securities of, and depositary receipts represented by Japanese issuers, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of those countries.

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments.

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in the Fund.

Portfolio holdings will change due to ongoing management of the Fund. References to specific securities or sectors should not be construed as recommendations by the Trust, the Advisor or the Distributor.

10

| ANNUAL REPORT 2021 |

PERFORMANCE OVERVIEW – October 31, 2021 (Unaudited) |

Commonwealth Japan Fund |

Comparison of Change in Value of a $10,000 investment in the Commonwealth Japan Fund (the “Fund”) and the TOPIX.

The above graph is a hypothetical $10,000 investment in the Fund from 10/31/11 to 10/31/21 and represents the reinvestment of dividends and distributions in the Fund.

| | Average Annual Total Returns

as of October 31, 2021 | Total Fund

Operating

Expense

After Fee

Waiver |

| 1 Year | 5 Year | 10 Year | Ratio(a) |

Commonwealth Japan Fund | 9.43% | | 5.46% | | 5.03% | 1.75% |

Tokyo Stock Price Index (“TOPIX”) | 18.64% | | 8.12% | | 8.30% | — |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns which may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. The Fund’s performance reflects any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for 1 year are not annualized.

(a) | The above expense ratio is from the Fund’s Prospectus, dated February 28, 2021. FCA Corp has entered into a written expense limitation agreement under which it has agreed to limit the total expenses of the Fund (exclusive of interest, distribution fees pursuant to Rule 12b-1 Plans, taxes, acquired fund fees and expenses, brokerage commissions, extraordinary expenses and dividend expense on short sales) to an annual rate of 1.50% of the average daily net assets of the Fund. This expense limitation agreement may be terminated by FCA Corp or the Trust at any time after February 28, 2022. FCA Corp may recoup from the Fund any reduced fees and/or expenses reimbursed pursuant to this agreement if such recoupment does not cause the Fund to exceed the expense limitation in place at the time the fee was reduced and/or expenses were reimbursed and such recoupment is made within three years after the date in which FCA Corp incurred the expense. Excluding the indirect costs of investing in acquired funds, total fund operating expenses, before fee waiver, would be 3.29%. Additional information pertaining to the Fund’s expense ratio as of October 31, 2021, can be found in the financial highlights. |

11

| ANNUAL REPORT 2021 |

PERFORMANCE OVERVIEW – October 31, 2021 (Unaudited) |

Commonwealth Japan Fund |

The Fund’s performance is measured against the Tokyo Stock Price Index (“TOPIX”), an unmanaged capitalization-weighted index of all the companies stocks on the First Section of the Tokyo Stock Exchange. This index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index.

You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. This and other information can be found in the Fund’s Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contacting your investment representative. Please read it carefully before you invest or send money.

12

| ANNUAL REPORT 2021 |

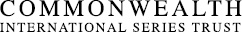

PERFORMANCE OVERVIEW – October 31, 2021 (Unaudited) |

Commonwealth Global Fund |

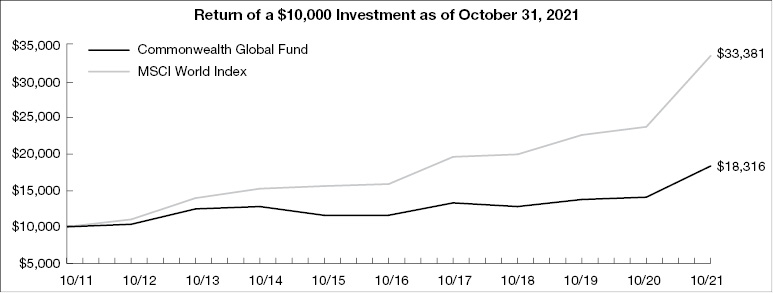

The Commonwealth Global Fund’s net asset value (NAV) as of October 31, 2021 was $21.12 per share compared to $16.20 per share on October 31, 2020. For the twelve-month period covered by this Annual Report, the Commonwealth Global Fund posted a 30.37% cumulative total return. Our investments do not attempt to track any index, but rather we undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in cash and cash equivalents and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. The MSCI World Index returned 41.05% for the same period. The index is unmanaged, expressed in terms of U.S. dollars and do not reflect the deduction of fees or taxes associated with ownership of a mutual fund such as investment management and fund accounting fees, nor do they reflect the deduction of taxes associated with ownership of a mutual fund. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index.

There are other considerations that impacted performance during the period covered by this year’s report:

- | The Fund’s holdings in the following securities had the largest positive impact on the Fund’s performance: NetApp, Inc., Apple, Inc., Group 1 Automotive, Inc., Thermo Fisher Scientific, Inc., and Norfolk Southern Corp. |

- | The Fund’s holdings in the following securities had the largest negative impact on the Fund’s performance: Unilever PLC, Fedex Corp., AT&T, Inc., Itochu Corp., and Boeing Co. call options. |

- | The Fund’s underperformance versus the Index was due in part to the Fund’s larger allocation to international equities relative to the Index as U.S. equities had the largest positive impact on the Index’s return. The Fund’s allocation to U.S. equities during the year was on average approximately 50% compared to 64% for the MSCI World Index. |

- | The Fund’s use of derivatives, which consisted of purchased call options, had a positive impact on the Fund’s performance due primarily to the purchased call options on Caterpillar, Inc. and Synchrony Financial. Please see the accompany notes to the financial statements for additional information. |

Investment Risks

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes.

The Fund’s expenses, as with any mutual fund, detract from the Fund’s performance. The Fund’s asset levels have a direct effect on the expenses indirectly paid by shareholders. To the extent the Fund’s assets decline and the expenses of the Fund rise or do not decrease proportionately, performance will be negatively impacted.

International investing involves increased risk and volatility. An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability.

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments.

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in the Fund.

Portfolio holdings will change due to ongoing management of the Fund. References to specific securities or sectors should not be construed as recommendations by the Trust, the Advisor or the Distributor.

13

| ANNUAL REPORT 2021 |

PERFORMANCE OVERVIEW – October 31, 2021 (Unaudited) |

Commonwealth Global Fund |

Comparison of Change in Value of a $10,000 investment in the Commonwealth Global Fund (the “Fund”) and the MSCI World Index.

The above graph is a hypothetical $10,000 investment in the Fund from 10/31/11 to 10/31/21 and represents the reinvestment of dividends and distributions in the Fund.

| | Average Annual Total Returns

as of October 31, 2021 | Total Fund

Operating

Expense |

| 1 Year | 5 Year | 10 Year | Ratio(a) |

Commonwealth Global Fund | 30.37% | 9.60% | 6.24% | 2.56% |

MSCI World Index | 41.05% | 16.06% | 12.81% | — |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns which may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. The Fund’s performance reflects any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for 1 year are not annualized.

(a) | The above expense ratio is from the Fund’s Prospectus, dated February 28, 2021. Additional information pertaining to the Fund’s expense ratio as of October 31, 2021, can be found in the financial highlights. |

The Fund’s performance is measured against the MSCI World Index, an unmanaged free float-adjusted market capitalization index that is designed to measure global developed market equity performance. Currently the MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The performance of the index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index.

You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. This and other information can be found in the Fund’s Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contacting your investment representative. Please read it carefully before you invest or send money.

14

| ANNUAL REPORT 2021 |

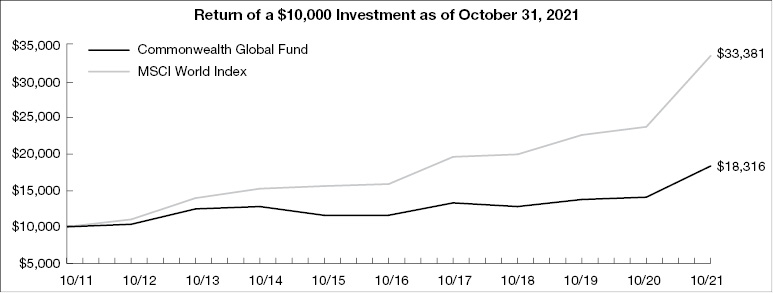

PERFORMANCE OVERVIEW – October 31, 2021 (Unaudited) |

Commonwealth Real Estate Securities Fund |

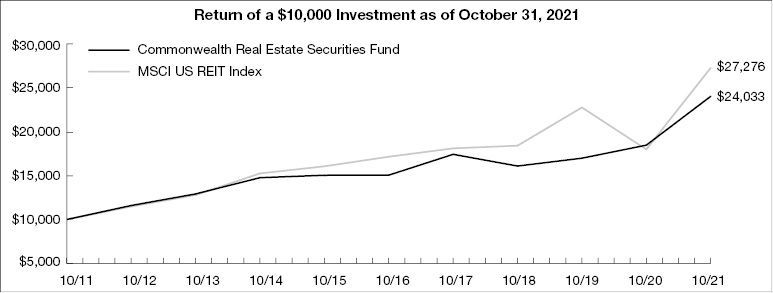

The Commonwealth Real Estate Securities Fund’s net asset value (NAV) as of October 31, 2021, was $22.57 per share compared to $15.95 per share on October 31, 2020. For the twelve-month period covered by this Annual Report, the Commonwealth Real Estate Securities Fund returned 41.50%. Our investments do not attempt to track any index, but rather we undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in cash and cash equivalents and acknowledge this process may mitigate some meaningful comparisons to indexes that do not have such investments represented within them. The MSCI US REIT Index returned 51.71% for the same period. The index is unmanaged, expressed in terms of U.S. dollars and does not reflect the deduction of fees or taxes associated with ownership of a mutual fund such as investment management and fund accounting fees, nor does it reflect the deduction of taxes associated with ownership of a mutual fund. The performance returns of the Fund do reflect the deduction of fees for these services.

There are other considerations that impacted performance during the period covered by this year’s report:

- | The Fund’s holdings in the following securities had the largest positive impact on the Fund’s performance: Tecnoglass, Inc., James Hardie Industries Plc, Extra Space Storage, Inc., Lowe’s Cos., Inc., and Hannon Armstrong Sustainable Infrastructure Capital, Inc. |

- | The Fund’s holdings in the following securities had the largest negative impact on the Fund’s performance: PotlachDeltic Corp. call options, Cemex S.A.B. de C.V., Cyrela Brazil Realty SA, and United States Lime & Minerals, Inc. |

- | The Fund’s use of derivatives, which was limited to purchased and written options, had a negative impact on the Fund’s performance due primarily to the purchased call options on PotlatchDeltic Corp. Please see the accompany notes to the financial statements for additional information. |

- | The Fund’s underperformance compared to the MSCI US REIT Index may be in part explained by our strategy of not investing solely in REITs but also investing in real estate and related industries as well as international companies. Real estate and related industries include companies and industries whose fortunes are impacted by the real estate market beyond just owning the underlying real estate. |

Investment Risks

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including high-grade fixed income securities. The net asset values per share of a Fund will fluctuate as the value of these securities in the portfolio changes.

The Fund’s expenses, as with any mutual fund, detract from the Fund’s performance. The Fund’s asset levels have a direct effect on the expenses indirectly paid by shareholders. To the extent the Fund’s assets decline and the expenses of the Fund rise or do not decrease proportionately, performance will be negatively impacted.

The Fund’s investments in real estate investment trusts (“REITs”) involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. Equity REITs may be affected by changes in the value of the underlying property owned by the REITs, while mortgage REITs may be affected by the quality of any credit extended.

Investments in the Fund are subject to the risks related to direct investment in real estate, such as real estate risk, regulatory risks, concentration risk, and diversification risk.

By itself the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather change in the value of their investments.

Investors should refer to the Fund’s Prospectus for a more complete description of risks associated with investing in the Fund.

Portfolio holdings will change due to ongoing management of the Fund. References to specific securities or sectors should not be construed as recommendations by the Trust, the Advisor or the Distributor.

15

| ANNUAL REPORT 2021 |

PERFORMANCE OVERVIEW – October 31, 2021 (Unaudited) |

Commonwealth Real Estate Securities Fund |

Comparison of Change in Value of a $10,000 investment in the Commonwealth Real Estate Securities Fund (the “Fund”) and the MSCI US REIT Index.

The above graph is a hypothetical $10,000 investment in the Fund from 10/31/11 to 10/31/21 and represents the reinvestment of dividends and distributions in the Fund.

| | Average Annual Total Returns

as of October 31, 2021 | Total Fund

Operating

Expense |

| 1 Year | 5 Year | 10 Year | Ratio(a) |

Commonwealth Real Estate Securities Fund | 41.50% | 9.81% | 9.16% | 2.73% |

MSCI US REIT Index | 51.71% | 9.72% | 10.55% | — |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns which may be lower or higher. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 888-345-1898. The Fund’s performance reflects any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for 1 year are not annualized.

(a) | The above expense ratio is from the Fund’s Prospectus, dated February 28, 2021. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 2.72%. Additional information pertaining to the Fund’s expense ratio as of October 31, 2021, can be found in the financial highlights. |

The Fund’s performance is measured against the MSCI US REIT Index which is an unmanaged free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI USA Investable Market Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 99% of the US REIT universe. This index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund, such as investment management and fund accounting fees. The performance of the Fund reflects the deduction of fees for these services. Investors cannot invest directly in an index.

You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. This and other information can be found in the Fund’s Prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contacting your investment representative. Please read it carefully before you invest or send money.

16

| ANNUAL REPORT 2021 |

Portfolio Composition – October 31, 2021* (Unaudited) |

COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND |

Industry or

Security Type | Percentage of Total

Investments |

Transport Operations & Services | 18.8% |

Logistics Services | 6.8% |

Power Generation | 6.4% |

Courier Services | 5.0% |

Home Products Stores | 4.8% |

Health Care Services | 4.5% |

Life Science & Diagnostics | 4.4% |

Flow Control Equipment | 3.5% |

Health Care Facilities | 3.3% |

Measurement Instruments | 3.2% |

Biotech | 3.0% |

Lodging | 2.6% |

Food & Drug Stores | 2.6% |

Real Estate Services | 2.2% |

Wireless Telecommunications | 2.1% |

Health Care Facilities | 2.1% |

Wireline Telecommunications | 2.1% |

Multi Asset Class Owners & Developers | 2.0% |

Gas Utilities | 1.9% |

Containers & Packaging | 1.8% |

Medical Devices | 1.7% |

Exploration & Production | 1.7% |

Internet Media & Services | 1.4% |

Logistics Services | 1.4% |

Agricultural Producers | 1.3% |

Retail REITs | 1.3% |

Environmental & Facilities Services | 1.3% |

Alcoholic Beverages | 1.2% |

Money Market Funds | 1.2% |

Building Construction | 1.1% |

Integrated Electric Utilities | 0.9% |

Food & Drug Stores | 0.9% |

P&C Insurance | 0.8% |

Health Care Supply Chain | 0.7% |

| | 100.0% |

AFRICA FUND |

Country or

Security Type | Percentage of Total

Investments |

South Africa | 87.0% |

Money Market Funds | 4.0% |

United Kingdom | 3.2% |

Egypt | 3.2% |

Exchange Traded Funds - Nigeria | 2.2% |

Germany | 0.4% |

| | 100.0% |

COMMONWEALTH JAPAN FUND |

Industry or

Security Type | Percentage of Total

Investments |

Medical Devices | 12.5% |

Transit Services | 6.8% |

Electronics Components | 5.9% |

Life Insurance | 5.6% |

Health Care Supplies | 5.5% |

Specialty Chemicals | 5.0% |

Commercial Finance | 4.8% |

Personal Care Products | 4.6% |

Multi Asset Class Owners & Developers | 4.2% |

Money Market Funds | 3.6% |

IT Services | 3.4% |

Commercial & Residential Building Equipment & Systems | 3.4% |

Logistics Services | 3.0% |

Food & Drug Stores | 2.8% |

Courier Services | 2.7% |

Electrical Power Equipment | 2.5% |

Building Construction | 2.5% |

Diversified Industrials | 2.2% |

Specialty Apparel Stores | 2.1% |

Food & Beverage Wholesalers | 2.1% |

Alcoholic Beverages | 1.9% |

Other Machinery & Equipment | 1.9% |

Factory Automation Equipment | 1.8% |

Auto Parts | 1.4% |

Automotive Wholesalers | 1.3% |

Consumer Electronics | 1.3% |

Advertising & Marketing | 1.3% |

Mass Merchants | 1.2% |

Home Products Stores | 1.1% |

Building Maintenance Services | 1.1% |

Infrastructure Construction | 0.5% |

| | 100.0% |

* | Portfolio composition is subject to change. |

17

| ANNUAL REPORT 2021 |

Portfolio Composition – October 31, 2021* (Unaudited) |

COMMONWEALTH GLOBAL FUND |

Country or

Security Type | Percentage of Total

Investments |

United States | 50.4% |

United Kingdom | 10.5% |

Japan | 6.5% |

Switzerland | 6.1% |

Israel | 4.3% |

Germany | 4.2% |

India | 2.9% |

France | 2.9% |

Norway | 2.6% |

Denmark | 1.8% |

South Africa | 1.5% |

Chile | 1.2% |

Taiwan Province of China | 1.2% |

Panama | 1.1% |

Mexico | 0.9% |

Call Options Purchased | 0.8% |

Brazil | 0.7% |

Austria | 0.3% |

Money Market Funds | 0.1% |

| | 100.0% |

COMMONWEALTH REAL ESTATE SECURITIES FUND |

Industry or

Security Type | Percentage of Total

Investments |

Infrastructure REITs | 11.8% |

Building Materials | 11.6% |

Industrial REITs | 8.4% |

Data Center REITs | 7.5% |

Homebuilding | 7.3% |

Specialized REITs | 6.5% |

Self-Storage REITs | 4.6% |

Retail REITs | 4.2% |

Home Products Stores | 4.1% |

Office REITs | 3.6% |

Banks | 3.5% |

Commercial & Residential Building Equipment & Systems | 3.4% |

Multi Asset Class REITs | 3.3% |

Cement & Aggregates | 2.9% |

Hotels Resorts & Cruise Lines | 2.9% |

Mortgage Finance | 2.1% |

Industrial Machinery | 2.1% |

Transport Operations & Services | 1.8% |

Hotel REITs | 1.7% |

Health Care REITs | 1.5% |

Building Construction | 1.4% |

Money Market Funds | 1.1% |

Mortgage REITs | 1.0% |

Residential Owners & Developers | 0.8% |

Agricultural Producers | 0.6% |

Retail Owners & Developers | 0.3% |

| | 100.0% |

* | Portfolio composition is subject to change. |

18

| ANNUAL REPORT 2021 |

Schedule of Investments – October 31, 2021 |

Commonwealth Australia/New Zealand Fund |

| | | Shares | | | Fair Value | |

| COMMON STOCKS (93.98%) | | | | | | | | |

| Australia (29.48%) | | | | | | | | |

| Biotech (2.83%) | | | | | | | | |

| CSL Ltd. | | | 2,500 | | | $ | 568,827 | |

| Building Construction (1.07%) | | | | | | | | |

| Lendlease Group | | | 27,267 | | | | 216,006 | |

| Containers & Packaging (1.67%) | | | | | | | | |

| Brambles Ltd. | | | 44,265 | | | | 335,811 | |

| Environmental & Facilities Services (1.24%) | | | | | | | | |

| Cleanaway Waste Management Ltd. | | | 122,255 | | | | 248,627 | |

| Exploration & Production (1.66%) | | | | | | | | |

| Senex Energy Ltd. | | | 100,000 | | | | 334,114 | |

| Food & Drug Stores (2.46%) | | | | | | | | |

| Coles Group Ltd. | | | 38,170 | | | | 494,624 | |

| Gas Utilities (1.85%) | | | | | | | | |

| APA Group | | | 60,000 | | | | 372,264 | |

| Health Care Facilities (1.99%) | | | | | | | | |

| Ramsay Health Care Ltd. | | | 7,500 | | | | 400,829 | |

| Health Care Services (4.27%) | | | | | | | | |

| Sonic Healthcare Ltd. | | | 28,382 | | | | 861,202 | |

| Integrated Electric Utilities (0.85%) | | | | | | | | |

| Origin Energy Ltd. | | | 44,398 | | | | 170,036 | |

| Internet Media & Services (1.36%) | | | | | | | | |

| Webjet Ltd.(a) | | | 57,000 | | | | 272,767 | |

| Logistics Services (1.36%) | | | | | | | | |

| Qube Holdings Ltd. | | | 113,645 | | | | 274,451 | |

| Medical Devices (1.66%) | | | | | | | | |

| Cochlear Ltd. | | | 2,000 | | | | 334,510 | |

| Retail REITs (1.25%) | | | | | | | | |

| Scentre Group Ltd. | | | 110,000 | | | | 250,887 | |

| Transport Operations & Services (1.95%) | | | | | | | | |

| Sydney Airport Ltd.(a) | | | 62,990 | | | | 390,613 | |

| Wireless Telecommunications (2.01%) | | | | | | | | |

| Telstra Corp. Ltd. | | | 140,000 | | | | 404,651 | |

| Total Australia | | | | | | | 5,930,219 | |

| | | | | | | | | |

| New Zealand (64.50%) | | | | | | | | |

| Agricultural Producers (1.25%) | | | | | | | | |

| New Zealand King Salmon Investments Ltd.(a) | | | 245,000 | | | | 251,118 | |

COMMON STOCKS (93.98%) – Continued | | | | | | | | |

New Zealand (64.50%) – Continued | | | | | | | | |

| Alcoholic Beverages (1.12%) | | | | | | | | |

| Delegat Group Ltd. | | | 21,456 | | | $ | 224,535 | |

| Courier Services (4.78%) | | | | | | | | |

| Freightways Ltd. | | | 103,540 | | | | 961,007 | |

| Flow Control Equipment (3.33%) | | | | | | | | |

| Skellerup Holdings Ltd. | | | 150,000 | | | | 669,475 | |

| Food & Drug Stores (0.84%) | | | | | | | | |

| Green Cross Health Ltd.(a) | | | 181,796 | | | | 169,260 | |

| Health Care Facilities (3.10%) | | | | | | | | |

| Ryman Healthcare Ltd. | | | 40,000 | | | | 413,815 | |

| Summerset Group Holdings Ltd. | | | 20,244 | | | | 210,532 | |

| | | | | | | | 624,347 | |

| Health Care Supply Chain (0.67%) | | | | | | | | |

| AFT Pharmaceuticals Ltd.(a) | | | 46,000 | | | | 135,009 | |

| Home Products Stores (4.52%) | | | | | | | | |

| Briscoe Group Ltd. | | | 183,520 | | | | 910,128 | |

| Life Science & Diagnostics (4.19%) | | | | | | | | |

| Pacific Edge Ltd.(a) | | | 800,000 | | | | 842,838 | |

| Lodging (2.49%) | | | | | | | | |

| Millennium & Copthorne Hotels New Zealand Ltd.(a) | | | 300,000 | | | | 499,924 | |

| Logistics Services (6.40%) | | | | | | | | |

| Mainfreight Ltd. | | | 20,000 | | | | 1,288,331 | |

| Measurement Instruments (3.04%) | | | | | | | | |

| ikeGPS Group Ltd.(a) | | | 831,366 | | | | 610,899 | |

| Multi Asset Class Owners & Developers (1.89%) |

| Marsden Maritime Holdings Ltd. | | | 81,425 | | | | 379,673 | |

| P&C Insurance (0.78%) | | | | | | | | |

| Turners Automotive Group Ltd. | | | 50,000 | | | | 156,115 | |

| Power Generation (6.10%) | | | | | | | | |

| Infratil Ltd. | | | 207,000 | | | | 1,227,772 | |

| Real Estate Services (2.13%) | | | | | | | | |

| Arvida Group Ltd. | | | 300,000 | | | | 428,855 | |

| Transport Operations & Services (15.92%) | | | | | | | | |

| Port of Tauranga Ltd. | | | 55,000 | | | | 271,997 | |

| South Port New Zealand Ltd. | | | 458,986 | | | | 2,931,174 | |

| | | | | | | | 3,203,171 | |

See accompanying notes to financial statements.

19

| ANNUAL REPORT 2021 |

SCHEDULE OF INVESTMENTS – October 31, 2021 |

Commonwealth Australia/New Zealand Fund |

| | | Shares | | | Fair Value | |

| COMMON STOCKS (93.98%) – Continued |

New Zealand (64.50%) – Continued | | | | | | | | |

| Wireline Telecommunications (1.95%) | | | | | | | | |

| Spark New Zealand Ltd. | | | 120,000 | | | $ | 392,694 | |

| Total New Zealand | | | | | | | 12,975,151 | |

| Total Common Stocks (Cost $8,761,200) | | | | | | | 18,905,370 | |

| | | | | | | | | |

| MONEY MARKET FUNDS (1.10%) | | | | | | | | |

| Federated Hermes Government Obligations Fund, Institutional Class, 0.03%(b) | | | 222,109 | | | | 222,109 | |

| Total Money Market Funds (Cost $222,109) | | | | | | | 222,109 | |

| Total Investments — 95.08% (Cost $8,983,309) | | | | | | | 19,127,479 | |

| Other Assets in Excess of Liabilities (4.92%) | | | | | | | 990,169 | |

| NET ASSETS — 100.00% | | | | | | $ | 20,117,648 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of October 31, 2021. |

REIT | — Real Estate Investment Trust |

See accompanying notes to financial statements.

20

| ANNUAL REPORT 2021 |

SCHEDULE OF INVESTMENTS – October 31, 2021 |

Africa Fund |

| | | Shares | | | Fair Value | |

| COMMON STOCKS (93.32%) | | | | | | | | |

| Egypt (3.17%) | | | | | | | | |

| Banks (1.71%) | | | | | | | | |

| Commercial International Bank Egypt SAE(a) | | | 16,333 | | | $ | 50,632 | |

| Other Commercial Support Services (1.46%) | | | | | | | | |

| Integrated Diagnostics Holdings PLC | | | 34,800 | | | | 43,065 | |

| Total Egypt | | | | | | | 93,697 | |

| Germany (0.43%) | | | | | | | | |

| Advertising & Marketing (0.43%) | | | | | | | | |

| Jumia Technologies AG - ADR(a) | | | 730 | | | | 12,753 | |

| South Africa (86.52%) | | | | | | | | |

| Agricultural Producers (3.50%) | | | | | | | | |

| Astral Foods Ltd. | | | 4,000 | | | | 46,363 | |

| Crookes Brothers Ltd. | | | 10,000 | | | | 27,432 | |

| Oceana Group Ltd. | | | 7,362 | | | | 29,534 | |

| | | | | | | | 103,329 | |

| Airlines (0.00%) | | | | | | | | |

| Comair Ltd.(a)(b) | | | 227,570 | | | | — | |

| Automotive Retailers (4.80%) | | | | | | | | |

| Barloworld Ltd. | | | 4,300 | | | | 36,125 | |

| Bidvest Group Ltd. | | | 4,167 | | | | 52,226 | |

| Motus Holdings Ltd. | | | 8,000 | | | | 53,399 | |

| | | | | | | | 141,750 | |

| Banks (17.80%) | | | | | | | | |

| Capitec Bank Holdings Ltd. | | | 3,000 | | | | 335,305 | |

| FirstRand Ltd. | | | 14,300 | | | | 54,323 | |

| Nedbank Group Ltd. | | | 4,000 | | | | 45,554 | |

| Standard Bank Group Ltd. - ADR | | | 10,200 | | | | 90,933 | |

| | | | | | | | 526,115 | |

| Basic & Diversified Chemicals (1.82%) | | | | | | | | |

| Sasol Ltd. - ADR(a) | | | 3,200 | | | | 53,632 | |

| Building Construction (0.95%) | | | | | | | | |

| Wilson Bayly Holmes-Ovcon Ltd. | | | 4,000 | | | | 27,994 | |

| Cable & Satellite (1.21%) | | | | | | | | |

| MultiChoice Group Ltd. | | | 4,500 | | | | 35,795 | |

| Coal Mining (1.11%) | | | | | | | | |

| Exxaro Resources Ltd. | | | 3,000 | | | | 32,857 | |

| Food & Beverage Wholesalers (2.30%) | | | | | | | | |

| Bid Corp. Ltd. | | | 3,167 | | | | 67,991 | |

| Food & Drug Stores (3.65%) | | | | | | | | |

| Shoprite Holdings Ltd. - ADR | | | 9,000 | | | | 107,820 | |

| | | | | | | | | |

| | | Shares | | | Fair Value | |

COMMON STOCKS (93.32%) – Continued | | | | | | |

| South Africa (86.52%) – Continued |

| Home & Office Product Wholesalers (1.68%) | | | | | | | | |

| Alviva Holdings Ltd. | | | 50,700 | | | $ | 49,569 | |

| Infrastructure Construction (1.39%) | | | | | | | | |

| Murray & Roberts Holdings Ltd.(a) | | | 45,000 | | | | 41,108 | |

| Institutional Brokerage (1.63%) | | | | | | | | |

| Coronation Fund Managers Ltd. | | | 14,500 | | | | 48,056 | |

| Internet Media & Services (4.02%) | | | | | | | | |

| Naspers Ltd., N Shares(a) | | | 700 | | | | 118,731 | |

| Investment Companies (1.77%) | | | | | | | | |

| PSG Group Ltd. | | | 10,400 | | | | 52,087 | |

| Life & Health Insurance (1.53%) | | | | | | | | |

| Momentum Metropolitan Holdings | | | 35,000 | | | | 45,060 | |

| Life Insurance (4.74%) | | | | | | | | |

| Clientele Ltd. | | | 90,000 | | | | 57,581 | |

| Discovery Ltd.(a) | | | 9,000 | | | | 82,470 | |

| | | | | | | | 140,051 | |

| Marine Shipping (1.59%) | | | | | | | | |

| Grindrod Ltd.(a) | | | 140,000 | | | | 47,031 | |

| Packaged Food (0.85%) | | | | | | | | |

| Tiger Brands Ltd. | | | 2,000 | | | | 25,234 | |

| Paper & Pulp Mills (1.65%) | | | | | | | | |

| Sappi Ltd.(a) | | | 16,000 | | | | 48,857 | |

| Precious Metals (15.17%) | | | | | | | | |

| Anglo American Platinum Ltd. | | | 1,000 | | | | 101,070 | |

| AngloGold Ashanti Ltd. - ADR | | | 3,000 | | | | 55,440 | |

| Gold Fields Ltd. - ADR | | | 8,700 | | | | 80,736 | |

| Impala Platinum Holdings Ltd. | | | 12,500 | | | | 162,067 | |

| Sibanye Stillwater Ltd. | | | 14,000 | | | | 48,902 | |

| | | | | | | | 448,215 | |

| Renewable Energy Project Developers (1.72%) |

| Renergen Ltd.(a) | | | 25,000 | | | | 50,833 | |

| Self-Storage Owners & Developers (1.86%) | | | | | | | | |

| Stor-Age Property REIT Ltd. | | | 60,000 | | | | 54,890 | |

| Specialty & Generic Pharmaceuticals (1.62%) |

| Aspen Pharmacare Holdings Ltd. | | | 3,000 | | | | 47,788 | |

| Specialty Apparel Stores (1.33%) | | | | | | | | |

| Mr. Price Group Ltd. | | | 3,000 | | | | 39,283 | |

| Wealth Management (1.26%) | | | | | | | | |

| Alexander Forbes Group Holdings Ltd. | | | 130,000 | | | | 37,372 | |

See accompanying notes to financial statements.

21

| ANNUAL REPORT 2021 |

SCHEDULE OF INVESTMENTS – October 31, 2021 |

Africa Fund |

| | | Shares | | | Fair Value | |

COMMON STOCKS (93.32%) – Continued | | | | | | |

| South Africa (86.52%) – Continued |

| Wireless Telecommunications (5.57%) | | | | | | | | |

| MTN Group Ltd. - ADR(a) | | | 12,500 | | | $ | 111,375 | |

| Vodacom Group Ltd. | | | 6,000 | | | | 53,271 | |

| | | | | | | | 164,646 | |

| Total South Africa | | | | | | | 2,556,094 | |

| United Kingdom (3.20%) | | | | | | | | |

| Health Care Facilities (1.48%) | | | | | | | | |

| Mediclinic International Ltd.(a) | | | 9,562 | | | | 43,706 | |

| Precious Metals (1.72%) | | | | | | | | |

| Endeavour Mining PLC | | | 2,000 | | | | 50,960 | |

| Total United Kingdom | | | | | | | 94,666 | |

| Total Common Stocks (Cost $2,641,347) | | | | | | | 2,757,210 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS (2.15%) | | | | | | | | |

| Global X MSCI Nigeria ETF | | | 5,550 | | | | 63,381 | |

| Total Exchange-Traded Funds (Cost $112,880) | | | | | | | 63,381 | |

| | | | | | | | | |

| | | Shares | | | Fair Value | |

| MONEY MARKET FUNDS (3.95%) | | | | | | | | |

| Federated Hermes Government Obligations Fund, Institutional Class, 0.03%(c) | | | 116,596 | | | $ | 116,596 | |

| Total Money Market Funds (Cost $116,596) | | | | | | | 116,596 | |

| Total Investments — 99.42% | | | | | | | | |

| (Cost $2,870,823) | | | | | | | 2,937,187 | |

| Other Assets in Excess of Liabilities (0.58%) | | | | | | | 17,227 | |

| NET ASSETS — 100.00% | | | | | | $ | 2,954,414 | |

(a) | Non-income producing security. |

(b) | Security is being fair valued in accordance with the Trust’s fair valuation policies and represents 0.00% of the Fund’s net assets. |

(c) | Rate disclosed is the seven day effective yield as of October 31, 2021. |

ADR | — American Depositary Receipt |

ETF | — Exchange-Traded Fund |

REIT | — Real Estate Investment Trust |

See accompanying notes to financial statements.

22

| ANNUAL REPORT 2021 |

SCHEDULE OF INVESTMENTS – October 31, 2021 |

Commonwealth Japan Fund |

| | | Shares | | | Fair Value | |

| COMMON STOCKS (92.10%) | | | | | | | | |

| Japan (92.10%) | | | | | | | | |

| Advertising & Marketing (1.20%) | | | | | | | | |

| Direct Marketing MiX, Inc. | | | 2,100 | | | $ | 80,548 | |

| Alcoholic Beverages (1.81%) | | | | | | | | |

| Kirin Holdings Co. Ltd. | | | 7,000 | | | | 121,840 | |

| Auto Parts (1.29%) | | | | | | | | |

| DENSO Corp. | | | 1,200 | | | | 86,993 | |

| Automotive Wholesalers (1.29%) | | | | | | | | |

| Toyota Tsusho Corp. | | | 2,000 | | | | 86,752 | |

| Building Construction (2.35%) | | | | | | | | |

| Kajima Corp. | | | 12,850 | | | | 158,217 | |

| Building Maintenance Services (1.05%) | | | | | | | | |

| Taihei Dengyo Kaisha Ltd. | | | 3,000 | | | | 70,864 | |

| Commercial & Residential Building Equipment & Systems (3.25%) |

| Daikin Industries Ltd. | | | 1,000 | | | | 219,013 | |

| Commercial Finance (4.57%) | | | | | | | | |

| Kyushu Leasing Service Co. Ltd. | | | 13,000 | | | | 69,061 | |

| ORIX Corp. | | | 12,000 | | | | 238,513 | |

| | | | | | | | 307,574 | |

| Consumer Electronics (1.21%) | | | | | | | | |

| Sony Group Corp. - ADR | | | 700 | | | | 81,053 | |

| Courier Services (2.56%) | | | | | | | | |

| Yamato Holdings Co. Ltd. | | | 7,000 | | | | 172,080 | |

| Diversified Industrials (2.14%) | | | | | | | | |

| Hitachi Ltd. | | | 2,500 | | | | 144,060 | |

| Electrical Power Equipment (2.38%) | | | | | | | | |

| Meidensha Corp. | | | 7,600 | | | | 159,973 | |

| Electronics Components (5.66%) | | | | | | | | |

| Murata Manufacturing Co. Ltd. | | | 1,000 | | | | 74,178 | |

| Nidec Corp. | | | 1,400 | | | | 155,060 | |

| Taiyo Yuden Co. Ltd. | | | 3,000 | | | | 152,058 | |

| | | | | | | | 381,296 | |

| Factory Automation Equipment (1.76%) | | | | | | | | |

| FANUC Corp. | | | 600 | | | | 118,572 | |

| Food & Beverage Wholesalers (1.96%) | | | | | | | | |

| ITOCHU Corp. - ADR | | | 1,400 | | | | 79,730 | |

| Yamae Group Holdings Co. Ltd. | | | 5,200 | | | | 52,189 | |

| | | | | | | | 131,919 | |

| Food & Drug Stores (2.66%) | | | | | | | | |

| Sugi Holdings Company Ltd. | | | 2,500 | | | | 179,002 | |

| | | Shares | | | Fair Value | |

COMMON STOCKS (92.10%) – Continued |

| Japan (92.10%) – Continued |

| Health Care Supplies (5.25%) | | | | | | | | |

| Hoya Corp. | | | 2,400 | | | $ | 353,297 | |

| Home Products Stores (1.09%) | | | | | | | | |

| Nitori Holdings Co. Ltd. | | | 400 | | | | 73,484 | |

| Infrastructure Construction (0.51%) | | | | | | | | |

| Takada Corp. | | | 6,000 | | | | 34,274 | |

| IT Services (3.28%) | | | | | | | | |

| INES Corp. | | | 5,000 | | | | 73,066 | |

| Otsuka Corp. | | | 3,000 | | | | 147,769 | |

| | | | | | | | 220,835 | |

| Life Insurance (5.34%) | | | | | | | | |

| Dai-ichi Life Insurance Co. Ltd. | | | 11,000 | | | | 231,423 | |

| T&D Holdings, Inc. | | | 10,000 | | | | 128,255 | |

| | | | | | | | 359,678 | |

| Logistics Services (2.82%) | | | | | | | | |

| Kintetsu World Express, Inc. | | | 4,000 | | | | 96,066 | |

| Nippon Express Co. Ltd. | | | 1,500 | | | | 93,891 | |

| | | | | | | | 189,957 | |

| Mass Merchants (1.18%) | | | | | | | | |

| Aeon Kyushu Co. Ltd. | | | 4,500 | | | | 79,523 | |

| Medical Devices (11.97%) | | | | | | | | |

| Asahi Intecc Co. Ltd. | | | 18,000 | | | | 474,463 | |

| Terumo Corp. | | | 7,500 | | | | 330,866 | |

| | | | | | | | 805,329 | |

| Multi Asset Class Owners & Developers (4.03%) |

| Mitsui Fudosan Company Ltd. | | | 3,000 | | | | 68,591 | |

| Sumitomo Realty & Development Co. Ltd. | | | 4,000 | | | | 144,558 | |

| Tokyu Fudosan Holdings Corp. | | | 10,000 | | | | 57,944 | |

| | | | | | | | 271,093 | |

| Other Machinery & Equipment (1.79%) | | | | | | | | |

| Makita Corp. | | | 2,600 | | | | 120,670 | |

| Personal Care Products (4.44%) | | | | | | | | |

| Kao Corp. | | | 1,000 | | | | 56,568 | |

| Unicharm Corp. | | | 6,000 | | | | 242,654 | |

| | | | | | | | 299,222 | |

| Specialty Apparel Stores (1.97%) | | | | | | | | |

| Fast Retailing Co. Ltd. | | | 200 | | | | 132,762 | |

See accompanying notes to financial statements.

23

| ANNUAL REPORT 2021 |

SCHEDULE OF INVESTMENTS – October 31, 2021 |

Commonwealth Japan Fund |

| | | Shares | | | Fair Value | |

COMMON STOCKS (92.10%) – Continued |

| Japan (92.10%) – Continued |

| Specialty Chemicals (4.79%) | | | | | | | | |

| JSR Corp. | | | 3,000 | | | $ | 108,808 | |

| Shin-Etsu Chemical Co. Ltd. | | | 1,200 | | | | 213,998 | |

| | | | | | | | 322,806 | |

| Transit Services (6.50%) | | | | | | | | |

| Daiichi Koutsu Sangyo Co. Ltd. | | | 7,200 | | | | 44,322 | |

| East Japan Railway Co. | | | 1,500 | | | | 93,429 | |

| Hankyu Hanshin Holdings, Inc. | | | 4,400 | | | | 136,423 | |

| Keikyu Corp. | | | 6,500 | | | | 73,361 | |

| Tobu Railway Co. Ltd. | | | 3,600 | | | | 89,631 | |

| | | | | | | | 437,166 | |

| Total Japan | | | | | | | 6,199,852 | |

| Total Common Stocks (Cost $3,470,552) | | | | | | | 6,199,852 | |

| | | Shares | | | Fair Value | |

| MONEY MARKET FUNDS (3.39%) | | | | | | | | |

| Federated Hermes Government Obligations Fund, Institutional Class, 0.03%(a) | | | 228,361 | | | $ | 228,361 | |

| Total Money Market Funds (Cost $228,361) | | | | | | | 228,361 | |

| Total Investments — 95.49% (Cost $3,698,913) | | | | | | | 6,428,213 | |

| Other Assets in Excess of Liabilities (4.51%) | | | | | | | 303,955 | |

| NET ASSETS — 100.00% | | | | | | $ | 6,732,168 | |

(a) | Rate disclosed is the seven day effective yield as of October 31, 2021. |

ADR | — American Depositary Receipt |

See accompanying notes to financial statements.

24

| ANNUAL REPORT 2021 |

SCHEDULE OF INVESTMENTS – October 31, 2021 |

Commonwealth Global Fund |

| | | Shares | | | Fair Value | |

| COMMON STOCKS (99.26%) | | | | | | | | |

| Austria (0.31%) | | | | | | | | |

| Integrated Oils (0.31%) | | | | | | | | |

| OMV AG - ADR | | | 1,000 | | | $ | 61,350 | |

| Brazil (0.74%) | | | | | | | | |

| Data & Transaction Processors (0.74%) | | | | | | | | |

| Pagseguro Digital Ltd., Class A(a) | | | 4,000 | | | | 144,800 | |

| Chile (1.24%) | | | | | | | | |