0000793769 harbor:HarborIndexSP500Index23794BroadBasedIndexMember 2022-01-31 0000793769 harbor:C000099979Member 2018-09-30 0000793769 harbor:HarborIndexBloombergUSAggregateBondIndex23800BroadBasedIndexMember 2018-06-30 0000793769 harbor:C000001977Member 2021-11-30 0000793769 harbor:C000001983Member 2019-06-30 0000793769 harbor:HarborIndexMSCIAllCountryWorldexUSNDIndex23811BroadBasedIndexMember 2022-11-30 0000793769 harbor:C000001997Member 2022-05-31 0000793769 harbor:C000210022Member harbor:AfricaCTIMember 2024-10-31 0000793769 harbor:HarborIndexMSCIEAFESmallCapNDIndex23827AdditionalIndexMember 2019-08-31 0000793769 harbor:C000001990Member 2024-05-31 0000793769 harbor:HarborIndexSP500Index23837BroadBasedIndexMember 2023-11-01 2024-10-31 0000793769 harbor:HarborIndexSP500Index23839BroadBasedIndexMember 2022-04-30 0000793769 harbor:HarborIndexRussell2000GrowthIndex23842AdditionalIndexMember 2019-05-31 0000793769 harbor:HarborIndexRussell2000ValueIndex23845AdditionalIndexMember 2016-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4676

Harbor Funds

(Exact name of Registrant as specified in charter)

111 South Wacker Drive, 34th Floor

Chicago, Illinois 60606-4302

(Address of principal executive offices) (Zip code)

Charles F. McCain, Esq.

HARBOR FUNDS

111 South Wacker Drive, 34th Floor

Chicago, Illinois 60606-4302 | Christopher P. Harvey, Esq.

DECHERT LLP

One International Place – 40th Floor

100 Oliver Street

Boston, MA 02110-2605 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 443-4400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

ITEM 1 – REPORTS TO STOCKHOLDERS

The following are copies of reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1):

Harbor Capital Appreciation Fund

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Capital Appreciation Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retirement Class | $72 | 0.59% |

Management's Discussion of Fund Performance

Subadvisor: Jennison Associates LLC

Performance Summary

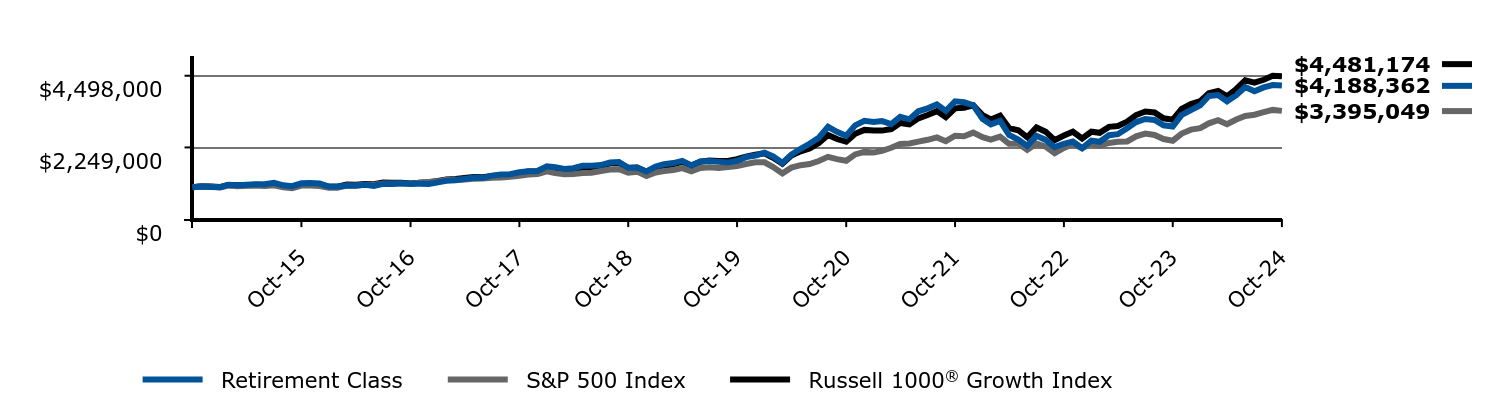

The Retirement Class returned 44.21% for the year ended October 31, 2024, while the Russell 1000® Growth Index returned 43.77% and the S&P 500 Index returned 38.02% during the same period.

Top contributors to relative performance included:

• Positions in technology. Accelerated spending on Artificial Intelligence (AI) applications fueled significant gains for several of the Fund’s holdings including NVIDIA Corp., Broadcom, Inc., and Advanced Micro Devices, Inc.

• Positions in communication services. The top performers were Meta Platforms, Inc. and Netflix, Inc. Both companies benefited from demand growth and advertising revenue. Costco Wholesale Corp. also added to performance. The company benefited from higher demand through their pricing strategy.

Top detractors from relative performance included:

• Shares in Boeing Co. which lost value over the period. Production issues, coupled with the recent labor strike, weighed on the company’s share price.

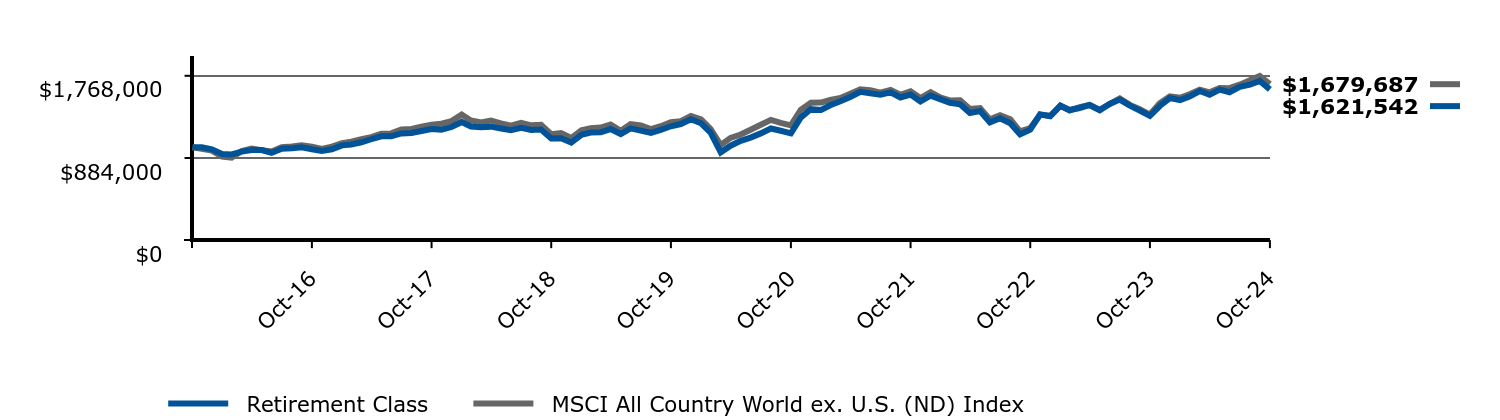

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

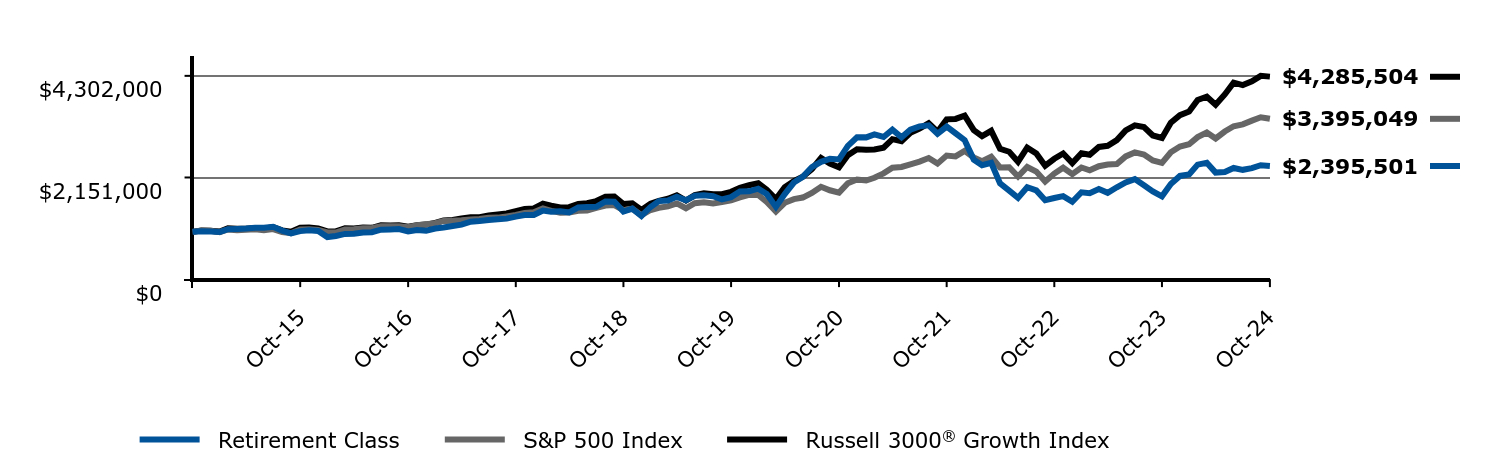

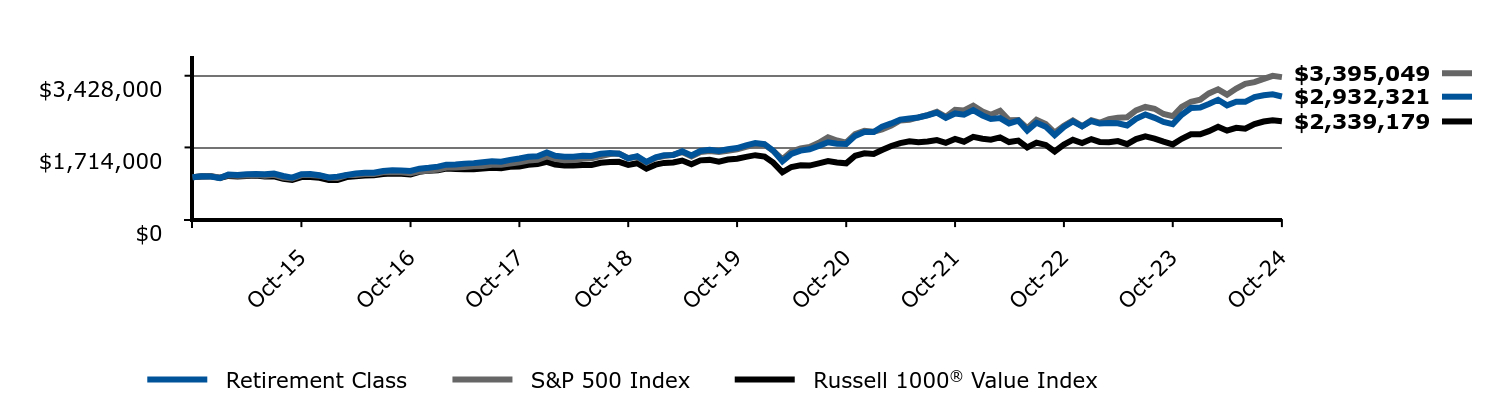

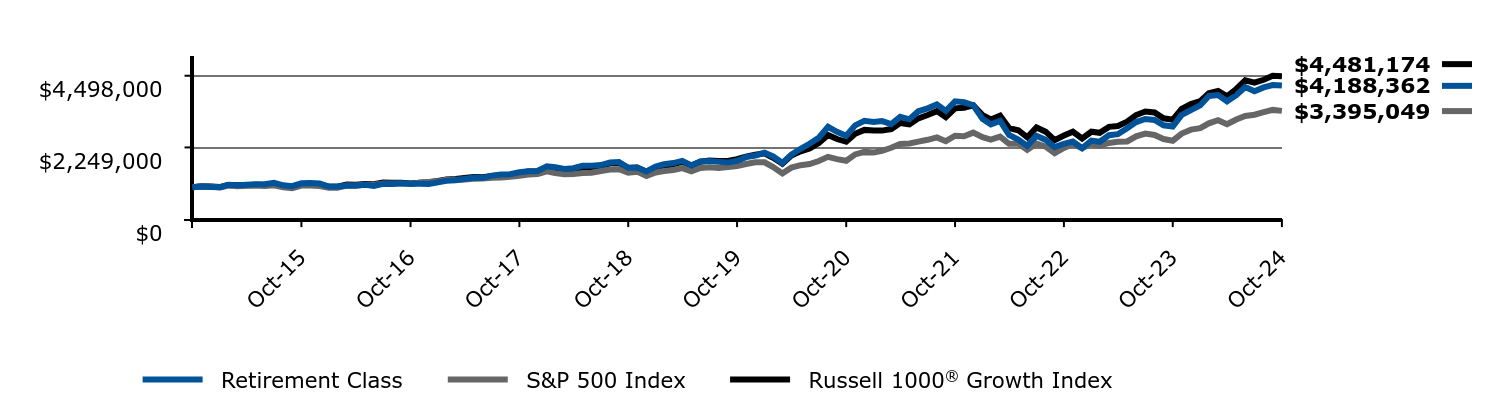

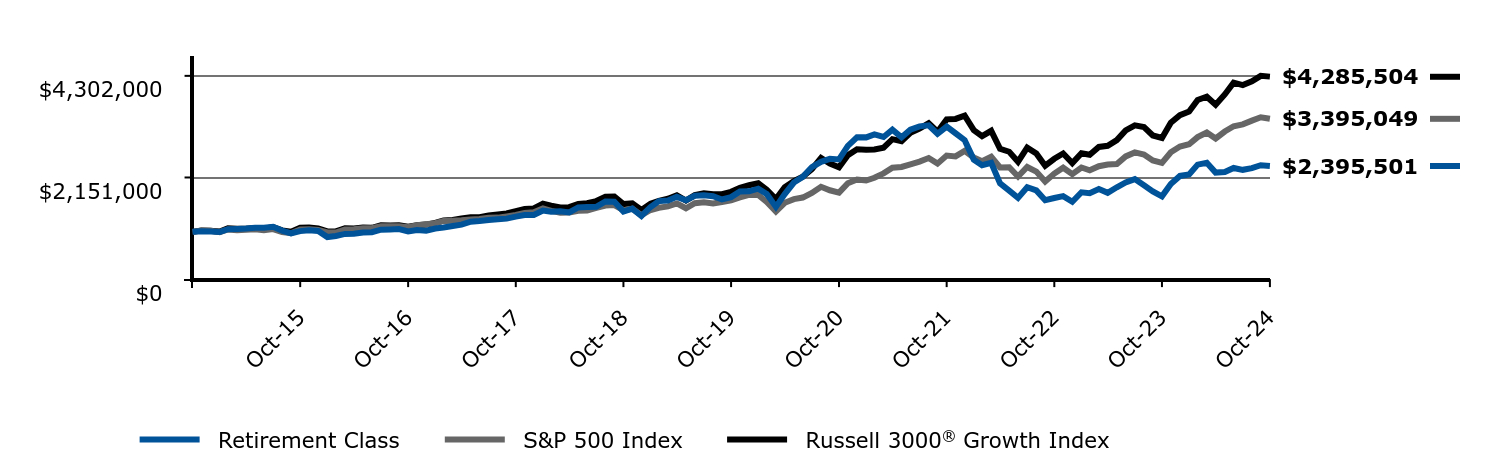

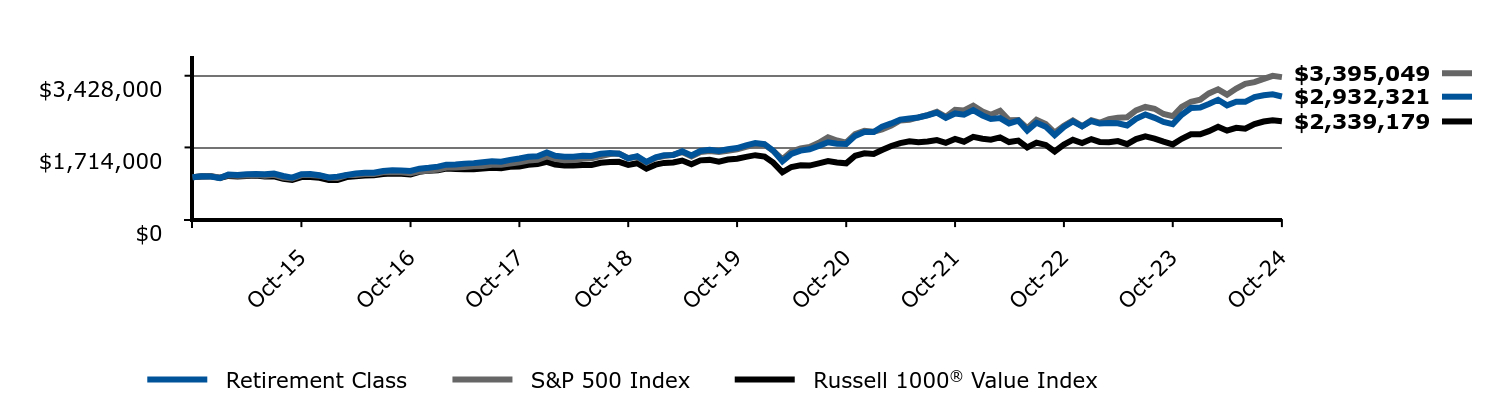

Change in a $1,000,000 Investment

For the period 11/01/2014 through 10/31/2024

| Retirement Class | S&P 500 Index | Russell 1000® Growth Index |

|---|

| Oct-14 | $1,000,000 | $1,000,000 | $1,000,000 |

| Nov-14 | $1,021,462 | $1,026,895 | $1,031,682 |

| Dec-14 | $1,005,647 | $1,024,308 | $1,020,937 |

| Jan-15 | $1,002,210 | $993,559 | $1,005,300 |

| Feb-15 | $1,074,214 | $1,050,660 | $1,072,313 |

| Mar-15 | $1,061,497 | $1,034,044 | $1,060,117 |

| Apr-15 | $1,074,730 | $1,043,964 | $1,065,427 |

| May-15 | $1,090,711 | $1,057,389 | $1,080,418 |

| Jun-15 | $1,092,086 | $1,036,920 | $1,061,390 |

| Jul-15 | $1,138,828 | $1,058,645 | $1,097,383 |

| Aug-15 | $1,059,435 | $994,773 | $1,030,740 |

| Sep-15 | $1,032,627 | $970,158 | $1,005,242 |

| Oct-15 | $1,121,644 | $1,051,995 | $1,091,799 |

| Nov-15 | $1,133,501 | $1,055,124 | $1,094,864 |

| Dec-15 | $1,116,157 | $1,038,482 | $1,078,797 |

| Jan-16 | $1,021,079 | $986,949 | $1,018,570 |

| Feb-16 | $1,024,015 | $985,617 | $1,018,136 |

| Mar-16 | $1,054,852 | $1,052,480 | $1,086,800 |

| Apr-16 | $1,047,693 | $1,056,560 | $1,076,876 |

| May-16 | $1,075,225 | $1,075,533 | $1,097,788 |

| Jun-16 | $1,041,269 | $1,078,320 | $1,093,477 |

| Jul-16 | $1,108,264 | $1,118,076 | $1,145,091 |

| Aug-16 | $1,104,960 | $1,119,646 | $1,139,402 |

| Sep-16 | $1,126,252 | $1,119,858 | $1,143,570 |

| Oct-16 | $1,108,081 | $1,099,430 | $1,116,715 |

| Nov-16 | $1,105,327 | $1,140,148 | $1,141,013 |

| Dec-16 | $1,104,589 | $1,162,684 | $1,155,138 |

| Jan-17 | $1,153,547 | $1,184,736 | $1,194,064 |

| Feb-17 | $1,199,970 | $1,231,777 | $1,243,660 |

| Mar-17 | $1,222,401 | $1,233,214 | $1,258,045 |

| Apr-17 | $1,257,706 | $1,245,879 | $1,286,817 |

| May-17 | $1,304,129 | $1,263,412 | $1,320,277 |

| Jun-17 | $1,295,937 | $1,271,298 | $1,316,798 |

| Jul-17 | $1,364,400 | $1,297,439 | $1,351,799 |

| Aug-17 | $1,397,559 | $1,301,411 | $1,376,579 |

| Sep-17 | $1,407,897 | $1,328,256 | $1,394,476 |

| Oct-17 | $1,469,534 | $1,359,252 | $1,448,509 |

| Nov-17 | $1,499,963 | $1,400,940 | $1,492,515 |

| Dec-17 | $1,509,774 | $1,416,516 | $1,504,133 |

| Jan-18 | $1,657,467 | $1,497,617 | $1,610,666 |

| Feb-18 | $1,628,537 | $1,442,420 | $1,568,433 |

| Mar-18 | $1,575,464 | $1,405,763 | $1,525,421 |

| Apr-18 | $1,595,692 | $1,411,157 | $1,530,750 |

| May-18 | $1,673,563 | $1,445,141 | $1,597,846 |

| Jun-18 | $1,675,738 | $1,454,035 | $1,613,231 |

| Jul-18 | $1,694,009 | $1,508,145 | $1,660,589 |

| Aug-18 | $1,775,795 | $1,557,289 | $1,751,384 |

| Sep-18 | $1,788,411 | $1,566,152 | $1,761,172 |

| Oct-18 | $1,609,178 | $1,459,106 | $1,603,676 |

| Nov-18 | $1,619,837 | $1,488,840 | $1,620,710 |

| Dec-18 | $1,495,258 | $1,354,411 | $1,481,365 |

| Jan-19 | $1,647,150 | $1,462,948 | $1,614,519 |

| Feb-19 | $1,719,112 | $1,509,921 | $1,672,286 |

| Mar-19 | $1,758,232 | $1,539,261 | $1,719,885 |

| Apr-19 | $1,826,330 | $1,601,585 | $1,797,589 |

| May-19 | $1,681,199 | $1,499,807 | $1,684,030 |

| Jun-19 | $1,811,841 | $1,605,508 | $1,799,682 |

| Jul-19 | $1,822,708 | $1,628,583 | $1,840,321 |

| Aug-19 | $1,795,662 | $1,602,786 | $1,826,227 |

| Sep-19 | $1,773,687 | $1,632,774 | $1,826,453 |

| Oct-19 | $1,830,193 | $1,668,140 | $1,877,944 |

| Nov-19 | $1,944,415 | $1,728,692 | $1,961,255 |

| Dec-19 | $1,994,492 | $1,780,867 | $2,020,428 |

| Jan-20 | $2,081,702 | $1,780,169 | $2,065,595 |

| Feb-20 | $1,964,720 | $1,633,627 | $1,924,924 |

| Mar-20 | $1,759,211 | $1,431,853 | $1,735,559 |

| Apr-20 | $2,023,738 | $1,615,407 | $1,992,373 |

| May-20 | $2,206,851 | $1,692,346 | $2,126,129 |

| Jun-20 | $2,362,564 | $1,726,002 | $2,218,710 |

| Jul-20 | $2,555,427 | $1,823,323 | $2,389,416 |

| Aug-20 | $2,896,888 | $1,954,384 | $2,635,985 |

| Sep-20 | $2,737,223 | $1,880,124 | $2,511,962 |

| Oct-20 | $2,613,391 | $1,830,124 | $2,426,652 |

| Nov-20 | $2,941,415 | $2,030,457 | $2,675,121 |

| Dec-20 | $3,082,730 | $2,108,525 | $2,798,153 |

| Jan-21 | $3,046,651 | $2,087,238 | $2,777,449 |

| Feb-21 | $3,075,633 | $2,144,793 | $2,776,806 |

| Mar-21 | $2,978,928 | $2,238,726 | $2,824,512 |

| Apr-21 | $3,206,939 | $2,358,203 | $3,016,689 |

| May-21 | $3,131,822 | $2,374,674 | $2,974,964 |

| Jun-21 | $3,382,605 | $2,430,110 | $3,161,606 |

| Jul-21 | $3,474,282 | $2,487,837 | $3,265,801 |

| Aug-21 | $3,598,786 | $2,563,482 | $3,387,906 |

| Sep-21 | $3,397,095 | $2,444,255 | $3,198,163 |

| Oct-21 | $3,693,421 | $2,615,504 | $3,475,174 |

| Nov-21 | $3,664,439 | $2,597,381 | $3,496,422 |

| Dec-21 | $3,567,798 | $2,713,785 | $3,570,345 |

| Jan-22 | $3,146,310 | $2,573,355 | $3,263,921 |

| Feb-22 | $2,972,340 | $2,496,305 | $3,125,290 |

| Mar-22 | $3,083,016 | $2,588,992 | $3,247,544 |

| Apr-22 | $2,643,495 | $2,363,227 | $2,855,365 |

| May-22 | $2,496,045 | $2,367,563 | $2,788,985 |

| Jun-22 | $2,298,030 | $2,172,135 | $2,568,066 |

| Jul-22 | $2,611,317 | $2,372,416 | $2,876,288 |

| Aug-22 | $2,484,022 | $2,275,664 | $2,742,299 |

| Sep-22 | $2,256,659 | $2,066,078 | $2,475,704 |

| Oct-22 | $2,362,738 | $2,233,351 | $2,620,405 |

| Nov-22 | $2,434,872 | $2,358,160 | $2,739,809 |

| Dec-22 | $2,223,774 | $2,222,296 | $2,530,059 |

| Jan-23 | $2,464,928 | $2,361,931 | $2,740,932 |

| Feb-23 | $2,427,093 | $2,304,302 | $2,708,380 |

| Mar-23 | $2,631,119 | $2,388,903 | $2,893,515 |

| Apr-23 | $2,663,296 | $2,426,190 | $2,922,062 |

| May-23 | $2,850,349 | $2,436,736 | $3,055,245 |

| Jun-23 | $3,045,181 | $2,597,744 | $3,264,180 |

| Jul-23 | $3,142,774 | $2,681,196 | $3,374,148 |

| Aug-23 | $3,112,365 | $2,638,508 | $3,343,853 |

| Sep-23 | $2,941,577 | $2,512,709 | $3,162,001 |

| Oct-23 | $2,904,450 | $2,459,875 | $3,116,982 |

| Nov-23 | $3,267,241 | $2,684,525 | $3,456,767 |

| Dec-23 | $3,421,409 | $2,806,485 | $3,609,840 |

| Jan-24 | $3,566,384 | $2,853,645 | $3,699,875 |

| Feb-24 | $3,865,174 | $3,006,018 | $3,952,307 |

| Mar-24 | $3,891,694 | $3,102,736 | $4,021,884 |

| Apr-24 | $3,695,094 | $2,976,004 | $3,851,292 |

| May-24 | $3,886,036 | $3,123,570 | $4,081,851 |

| Jun-24 | $4,145,577 | $3,235,649 | $4,357,096 |

| Jul-24 | $4,010,149 | $3,275,035 | $4,282,981 |

| Aug-24 | $4,132,494 | $3,354,476 | $4,372,186 |

| Sep-24 | $4,204,981 | $3,426,117 | $4,496,052 |

| Oct-24 | $4,188,362 | $3,395,049 | $4,481,174 |

The graph compares a $1,000,000 initial investment minimum in the Retirement Class with the performance of the S&P 500 Index and Russell 1000® Growth Index. The Retirement Class performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Retirement Class | 44.21% | 18.01% | 15.40% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

Russell 1000® Growth Index | 43.77% | 19.00% | 16.18% |

The Retirement Class shares commenced operations on March 1, 2016. The performance attributed to the Retirement Class shares prior to that date is that of the Institutional Class shares. Performance prior to March 1, 2016 has not been adjusted to reflect the lower expenses of Retirement Class shares. During this period, Retirement Class shares would have had returns similar to, but potentially higher than, Institutional Class shares due to the fact that Retirement Class shares represent interests in the same portfolio as Institutional Class shares but are subject to lower expenses. Please refer to the Fund’s prospectus for further details.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $28,246,465 |

| Number of Investments | 51 |

| Total Net Advisory Fees Paid (in thousands) | $153,947 |

| Portfolio Turnover Rate | 28% |

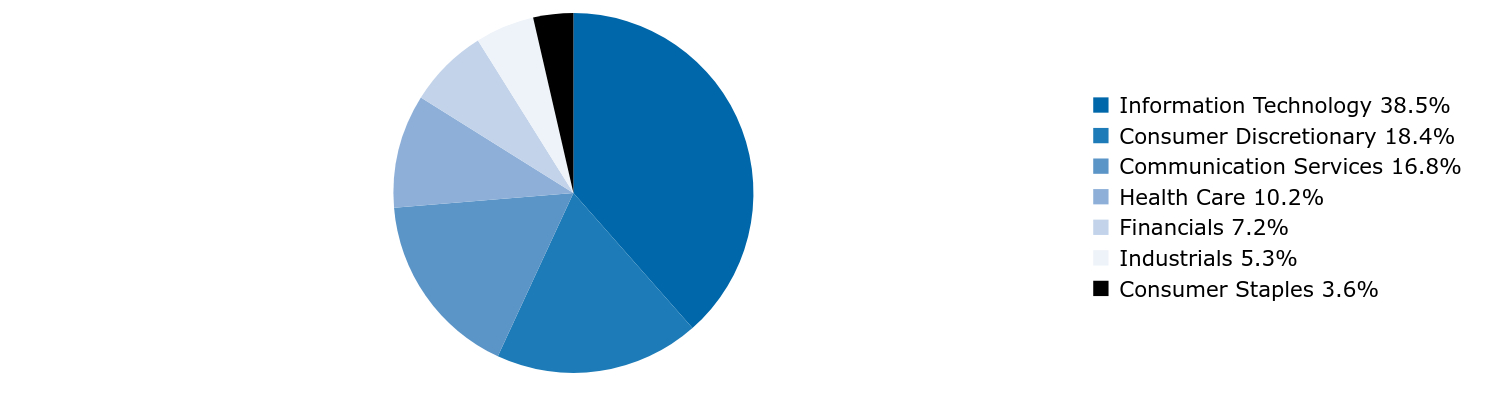

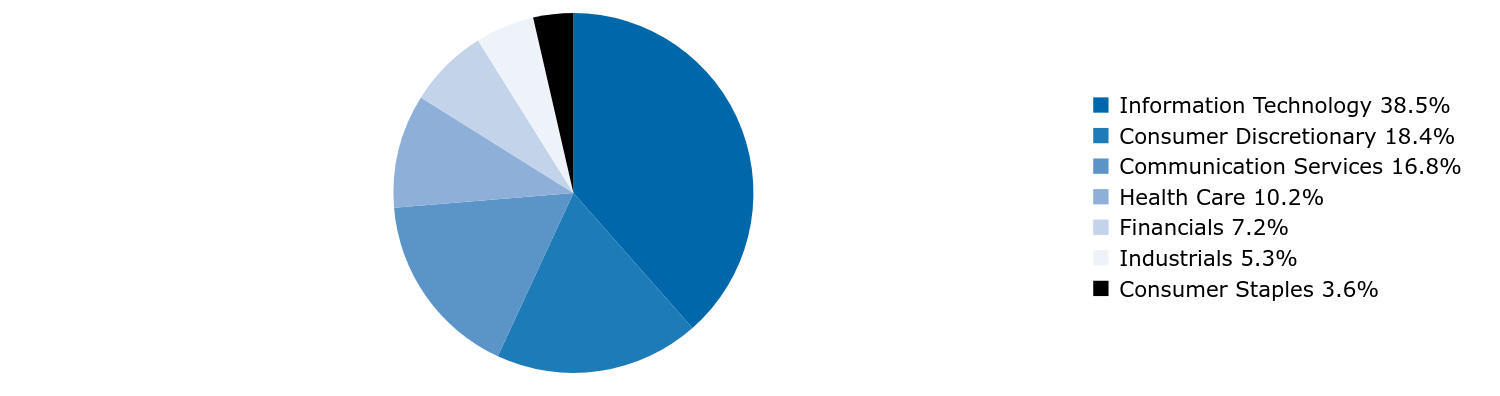

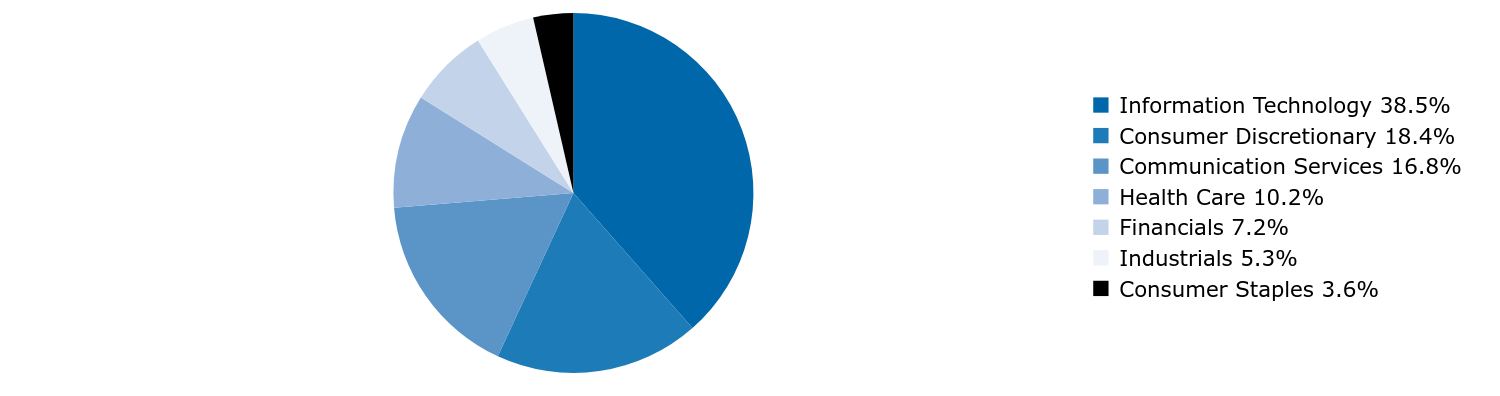

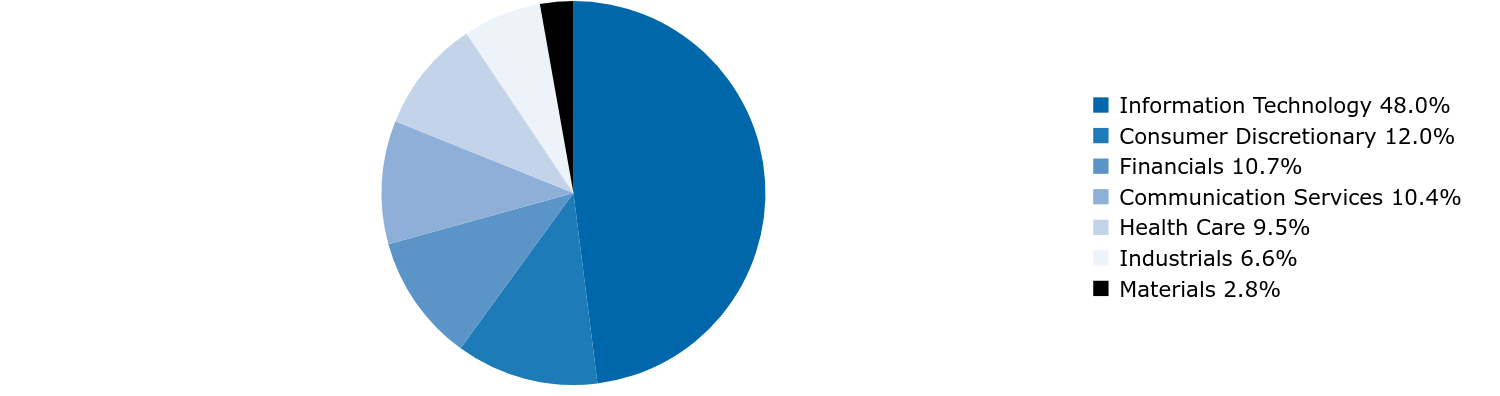

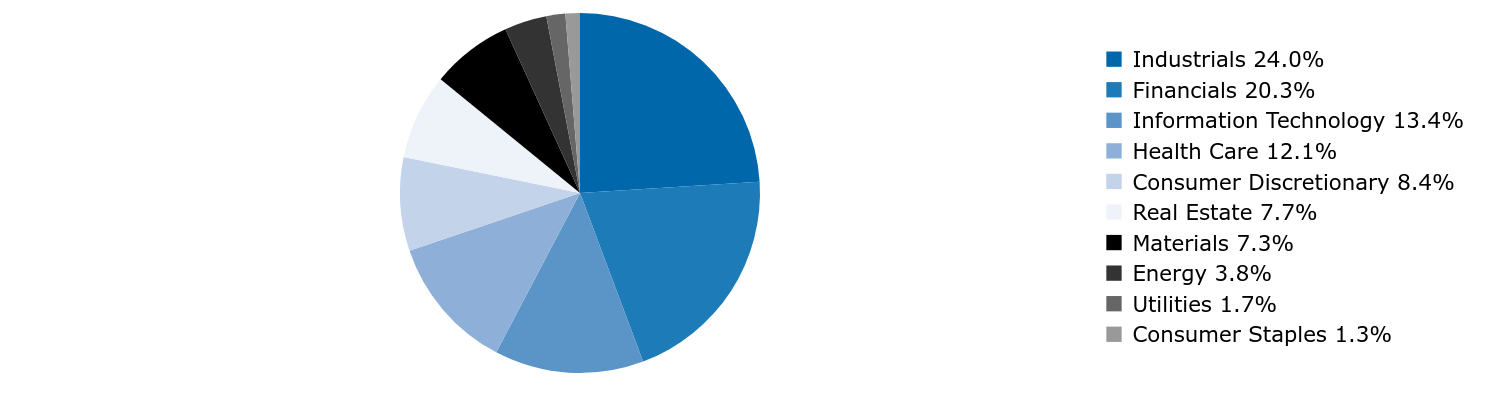

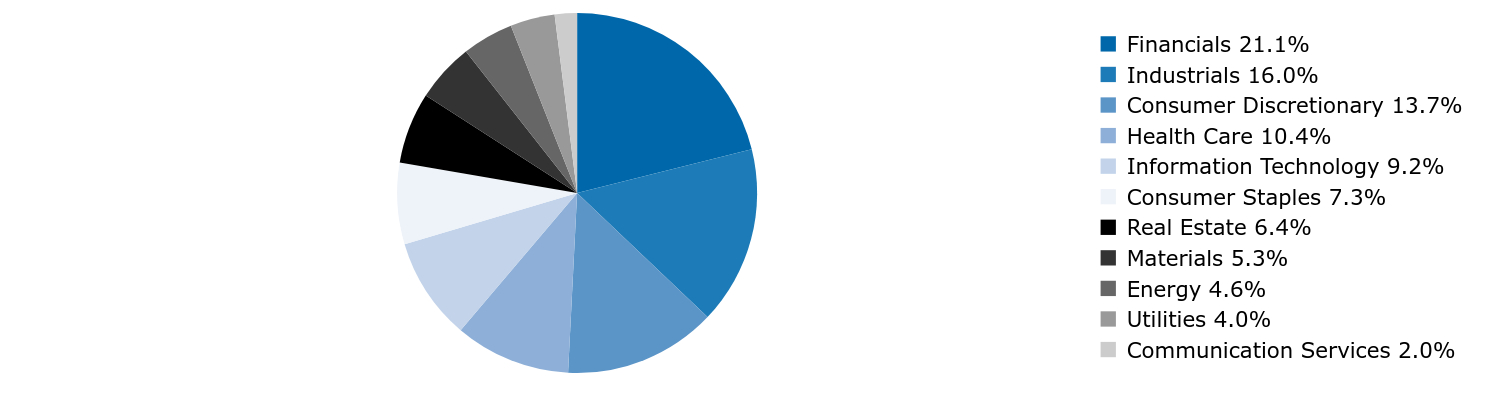

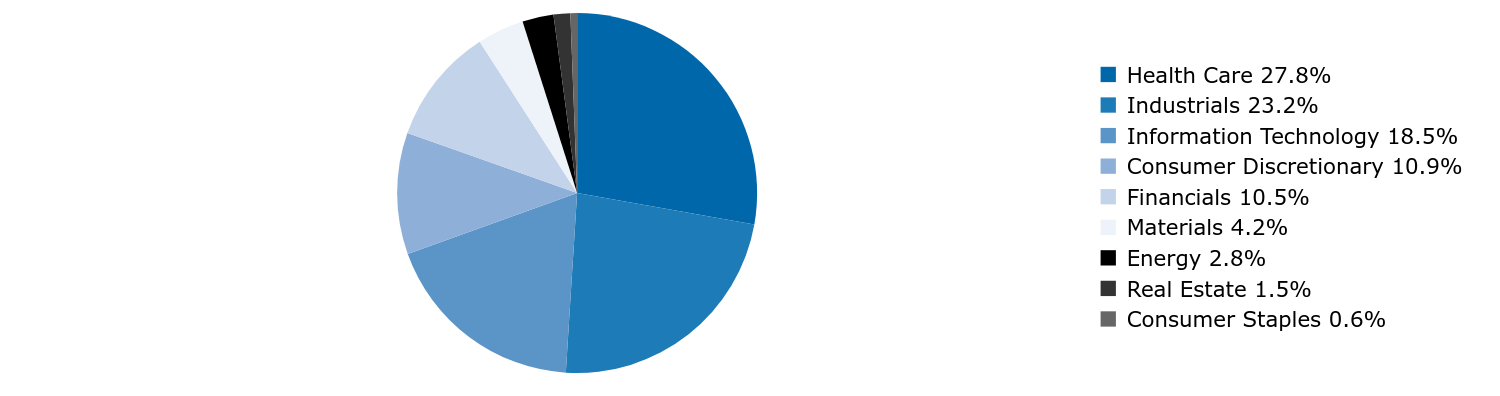

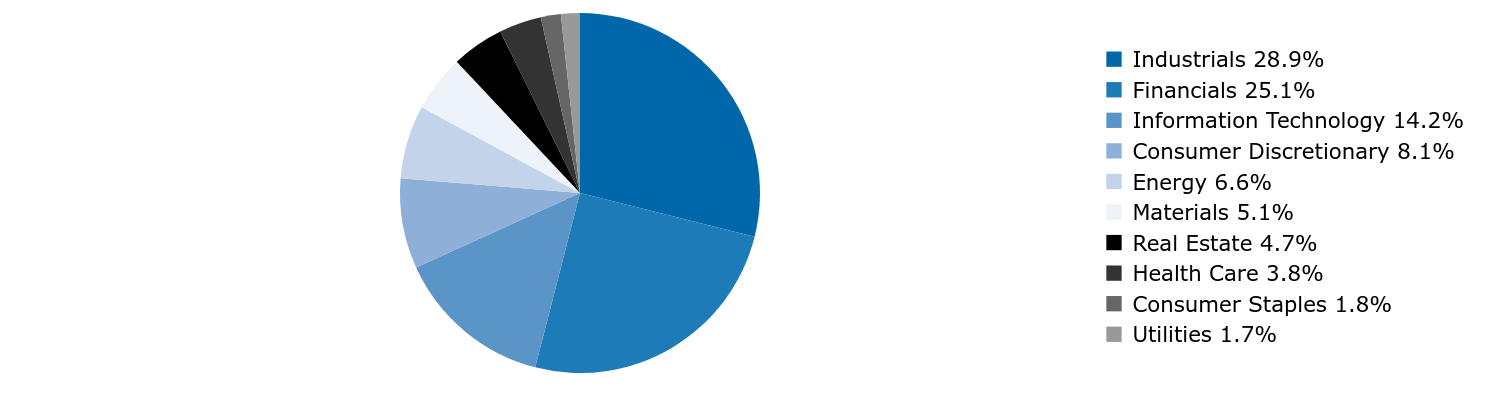

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Information Technology | 38.5% |

| Consumer Discretionary | 18.4% |

| Communication Services | 16.8% |

| Health Care | 10.2% |

| Financials | 7.2% |

| Industrials | 5.3% |

| Consumer Staples | 3.6% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

The Fund has adopted a policy that allows it to send only one copy of a Fund’s prospectus, proxy materials, annual report and semi-annual report to certain shareholders residing at the same household. This reduces Fund expenses, which benefits you and other shareholders. If you need additional copies or do not want your mailings to be “householded,” please call the Shareholder Servicing Agent at 800-422-1050. Individual copies will be sent within thirty (30) days after the Shareholder Servicing Agent receives your instructions. Your consent to householding is considered valid until revoked.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Capital Appreciation Fund

Institutional Class: HACAX

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Capital Appreciation Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $82 | 0.67% |

Management's Discussion of Fund Performance

Subadvisor: Jennison Associates LLC

Performance Summary

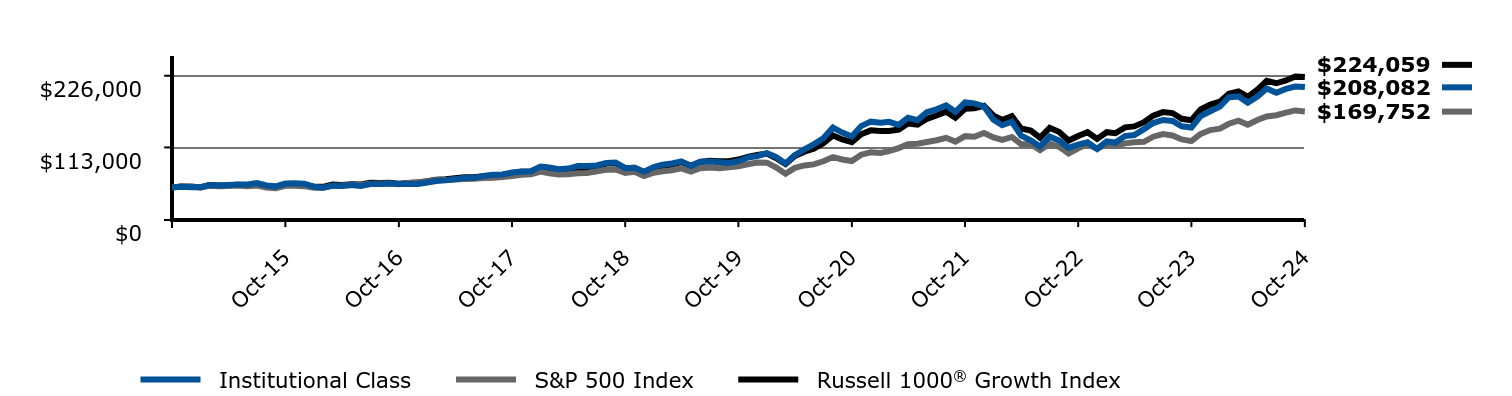

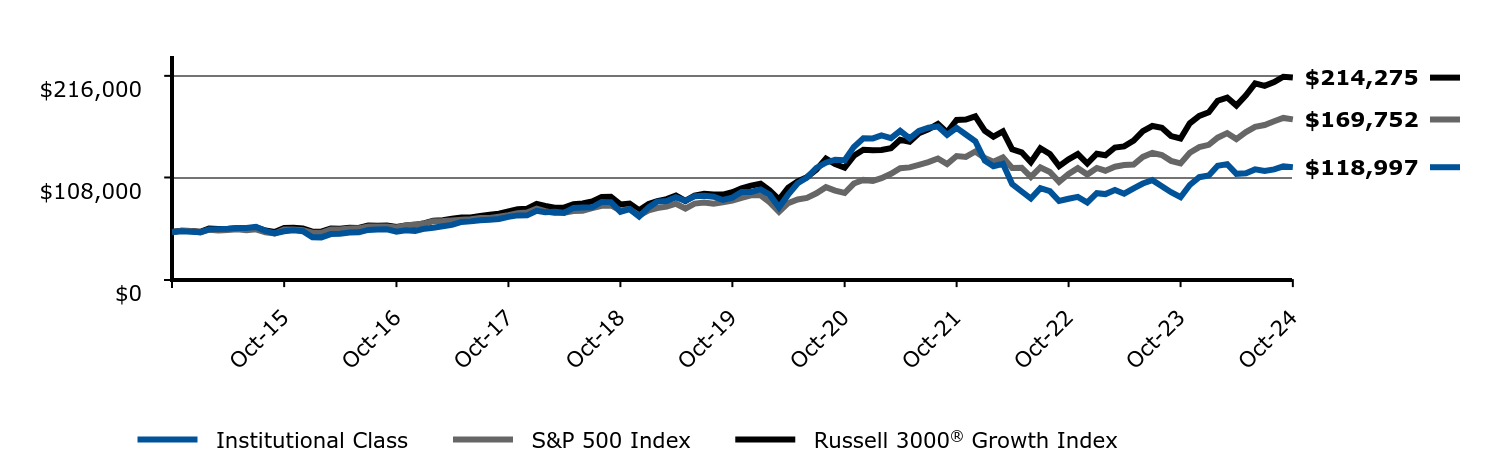

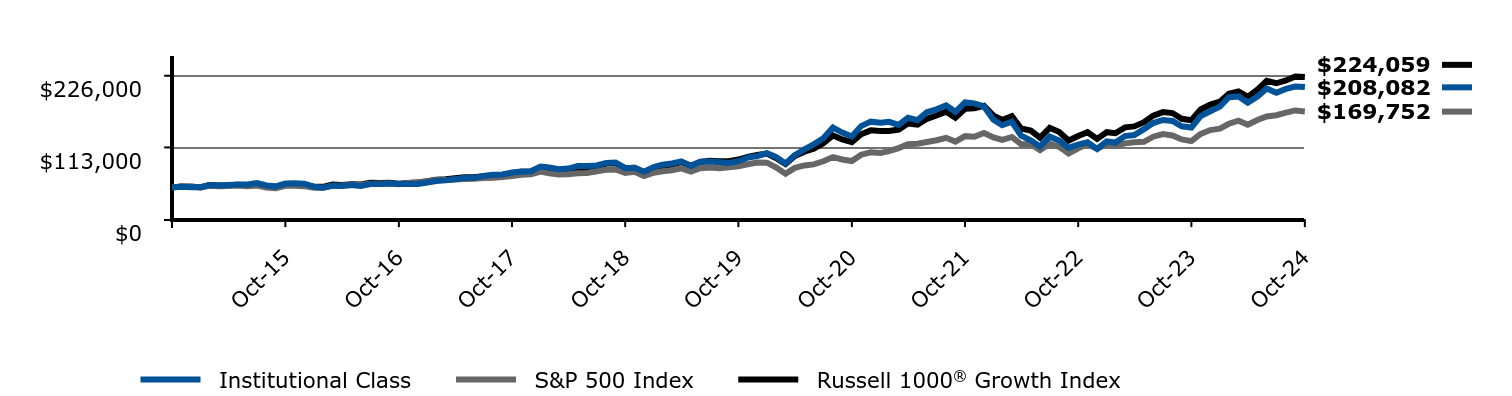

The Institutional Class returned 44.09% for the year ended October 31, 2024, while the Russell 1000® Growth Index returned 43.77% and the S&P 500 Index returned 38.02% during the same period.

Top contributors to relative performance included:

• Positions in technology. Accelerated spending on Artificial Intelligence (AI) applications fueled significant gains for several of the Fund’s holdings including NVIDIA Corp., Broadcom, Inc., and Advanced Micro Devices, Inc.

• Positions in communication services. The top performers were Meta Platforms, Inc. and Netflix, Inc. Both companies benefited from demand growth and advertising revenue. Costco Wholesale Corp. also added to performance. The company benefited from higher demand through their pricing strategy.

Top detractors from relative performance included:

• Shares in Boeing Co. which lost value over the period. Production issues, coupled with the recent labor strike, weighed on the company’s share price.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

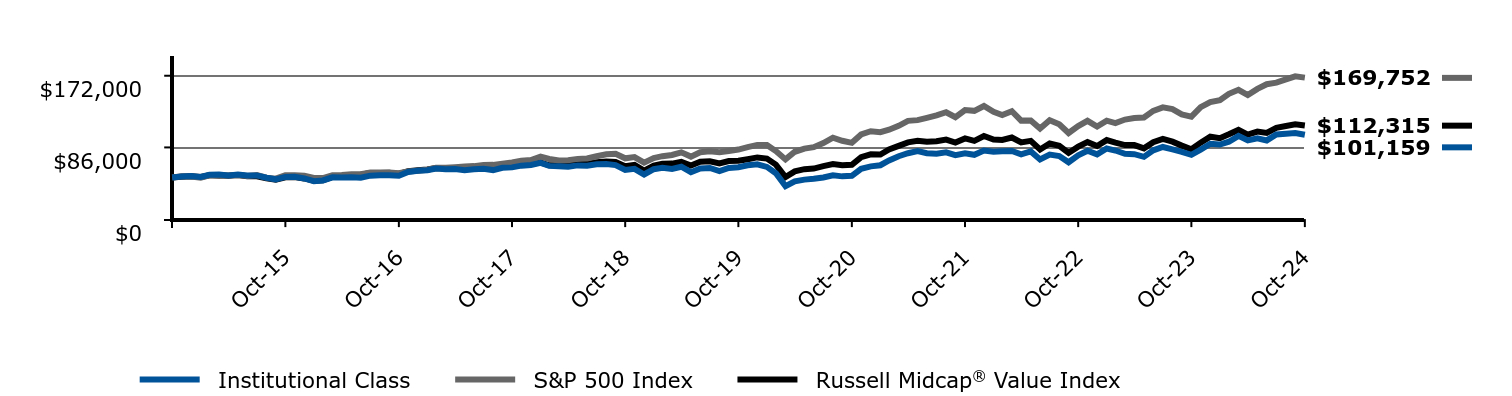

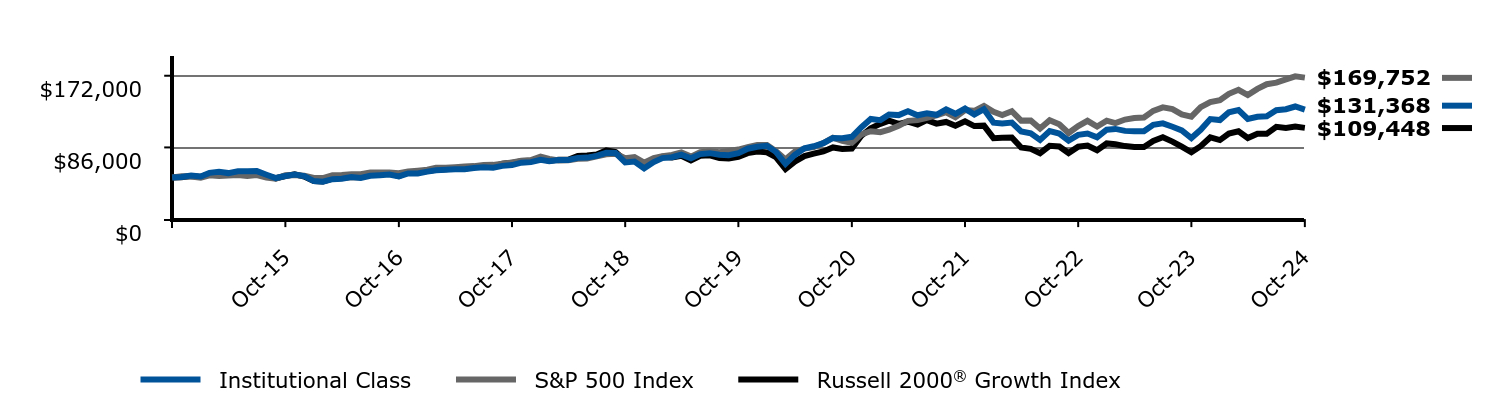

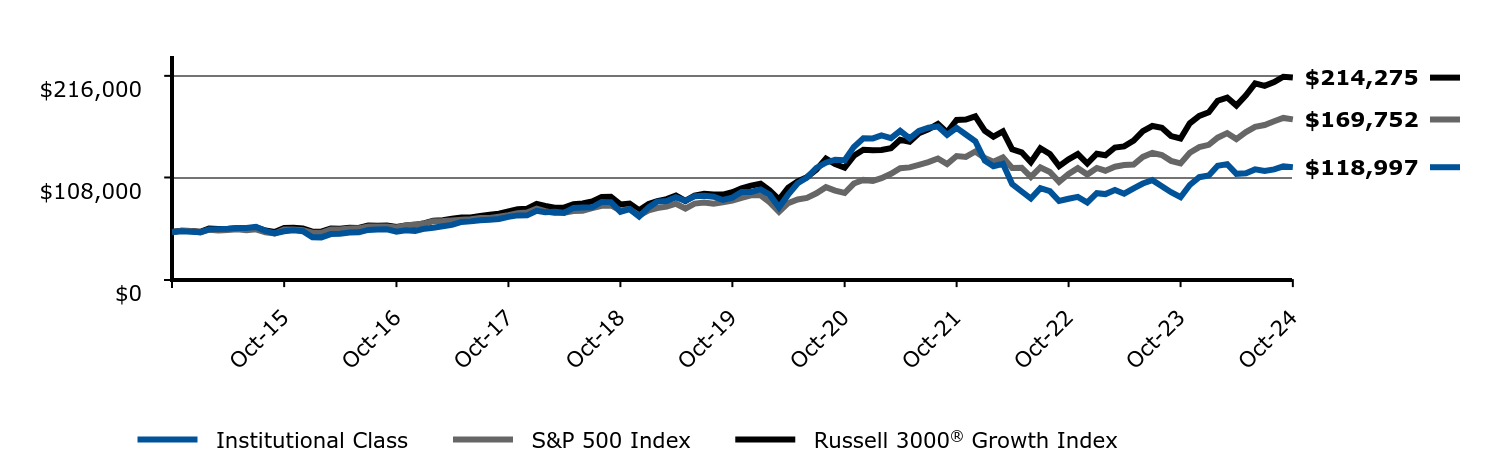

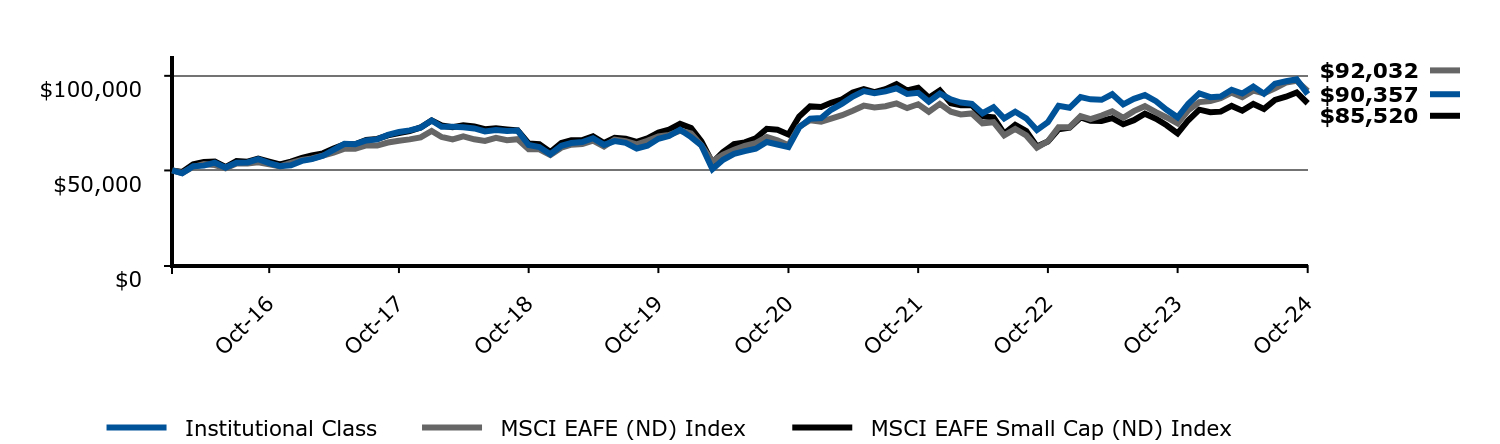

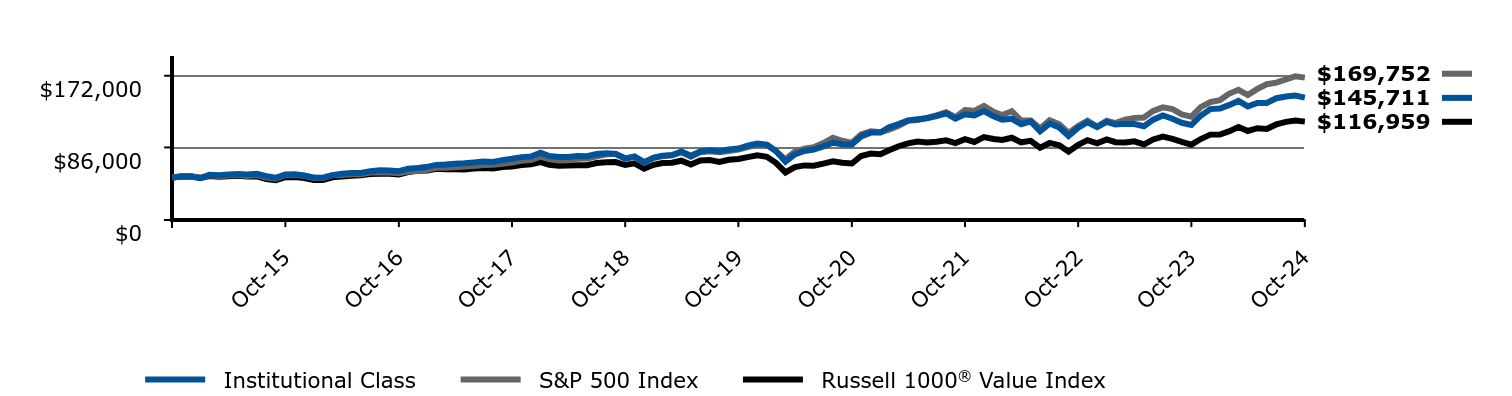

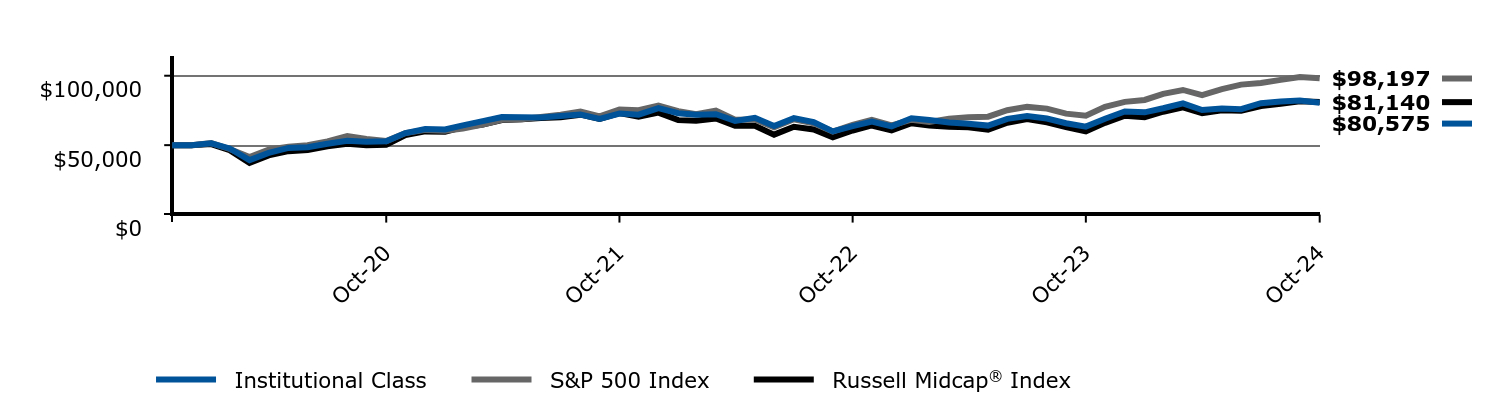

Change in a $50,000 Investment

For the period 11/01/2014 through 10/31/2024

| Institutional Class | S&P 500 Index | Russell 1000® Growth Index |

|---|

| Oct-14 | $50,000 | $50,000 | $50,000 |

| Nov-14 | $51,073 | $51,345 | $51,584 |

| Dec-14 | $50,282 | $51,215 | $51,047 |

| Jan-15 | $50,111 | $49,678 | $50,265 |

| Feb-15 | $53,711 | $52,533 | $53,616 |

| Mar-15 | $53,075 | $51,702 | $53,006 |

| Apr-15 | $53,736 | $52,198 | $53,271 |

| May-15 | $54,536 | $52,869 | $54,021 |

| Jun-15 | $54,604 | $51,846 | $53,070 |

| Jul-15 | $56,941 | $52,932 | $54,869 |

| Aug-15 | $52,972 | $49,739 | $51,537 |

| Sep-15 | $51,631 | $48,508 | $50,262 |

| Oct-15 | $56,082 | $52,600 | $54,590 |

| Nov-15 | $56,675 | $52,756 | $54,743 |

| Dec-15 | $55,808 | $51,924 | $53,940 |

| Jan-16 | $51,054 | $49,347 | $50,929 |

| Feb-16 | $49,567 | $49,281 | $50,907 |

| Mar-16 | $52,743 | $52,624 | $54,340 |

| Apr-16 | $52,385 | $52,828 | $53,844 |

| May-16 | $53,761 | $53,777 | $54,889 |

| Jun-16 | $52,054 | $53,916 | $54,674 |

| Jul-16 | $55,413 | $55,904 | $57,255 |

| Aug-16 | $55,239 | $55,982 | $56,970 |

| Sep-16 | $56,303 | $55,993 | $57,178 |

| Oct-16 | $55,395 | $54,972 | $55,836 |

| Nov-16 | $55,257 | $57,007 | $57,051 |

| Dec-16 | $55,213 | $58,134 | $57,757 |

| Jan-17 | $57,649 | $59,237 | $59,703 |

| Feb-17 | $59,969 | $61,589 | $62,183 |

| Mar-17 | $61,090 | $61,661 | $62,902 |

| Apr-17 | $62,844 | $62,294 | $64,341 |

| May-17 | $65,173 | $63,171 | $66,014 |

| Jun-17 | $64,754 | $63,565 | $65,840 |

| Jul-17 | $68,175 | $64,872 | $67,590 |

| Aug-17 | $69,822 | $65,071 | $68,829 |

| Sep-17 | $70,339 | $66,413 | $69,724 |

| Oct-17 | $73,409 | $67,963 | $72,425 |

| Nov-17 | $74,929 | $70,047 | $74,626 |

| Dec-17 | $75,417 | $70,826 | $75,207 |

| Jan-18 | $82,781 | $74,881 | $80,533 |

| Feb-18 | $81,336 | $72,121 | $78,422 |

| Mar-18 | $78,675 | $70,288 | $76,271 |

| Apr-18 | $79,686 | $70,558 | $76,538 |

| May-18 | $83,574 | $72,257 | $79,892 |

| Jun-18 | $83,671 | $72,702 | $80,662 |

| Jul-18 | $84,573 | $75,407 | $83,029 |

| Aug-18 | $88,657 | $77,864 | $87,569 |

| Sep-18 | $89,286 | $78,308 | $88,059 |

| Oct-18 | $80,337 | $72,955 | $80,184 |

| Nov-18 | $80,859 | $74,442 | $81,036 |

| Dec-18 | $74,641 | $67,721 | $74,068 |

| Jan-19 | $82,206 | $73,147 | $80,726 |

| Feb-19 | $85,796 | $75,496 | $83,614 |

| Mar-19 | $87,735 | $76,963 | $85,994 |

| Apr-19 | $91,132 | $80,079 | $89,879 |

| May-19 | $83,892 | $74,990 | $84,201 |

| Jun-19 | $90,398 | $80,275 | $89,984 |

| Jul-19 | $90,940 | $81,429 | $92,016 |

| Aug-19 | $89,578 | $80,139 | $91,311 |

| Sep-19 | $88,482 | $81,639 | $91,323 |

| Oct-19 | $91,289 | $83,407 | $93,897 |

| Nov-19 | $96,975 | $86,435 | $98,063 |

| Dec-19 | $99,478 | $89,043 | $101,021 |

| Jan-20 | $103,824 | $89,008 | $103,280 |

| Feb-20 | $97,981 | $81,681 | $96,246 |

| Mar-20 | $87,711 | $71,593 | $86,778 |

| Apr-20 | $100,909 | $80,770 | $99,619 |

| May-20 | $110,023 | $84,617 | $106,306 |

| Jun-20 | $117,784 | $86,300 | $110,936 |

| Jul-20 | $127,384 | $91,166 | $119,471 |

| Aug-20 | $144,390 | $97,719 | $131,799 |

| Sep-20 | $136,432 | $94,006 | $125,598 |

| Oct-20 | $130,247 | $91,506 | $121,333 |

| Nov-20 | $146,583 | $101,523 | $133,756 |

| Dec-20 | $153,627 | $105,426 | $139,908 |

| Jan-21 | $151,814 | $104,362 | $138,872 |

| Feb-21 | $153,244 | $107,240 | $138,840 |

| Mar-21 | $148,424 | $111,936 | $141,226 |

| Apr-21 | $159,774 | $117,910 | $150,834 |

| May-21 | $156,015 | $118,734 | $148,748 |

| Jun-21 | $168,500 | $121,506 | $158,080 |

| Jul-21 | $173,055 | $124,392 | $163,290 |

| Aug-21 | $179,232 | $128,174 | $169,395 |

| Sep-21 | $169,178 | $122,213 | $159,908 |

| Oct-21 | $183,934 | $130,775 | $173,759 |

| Nov-21 | $182,475 | $129,869 | $174,821 |

| Dec-21 | $177,639 | $135,689 | $178,517 |

| Jan-22 | $156,661 | $128,668 | $163,196 |

| Feb-22 | $147,988 | $124,815 | $156,265 |

| Mar-22 | $153,488 | $129,450 | $162,377 |

| Apr-22 | $131,594 | $118,161 | $142,768 |

| May-22 | $124,243 | $118,378 | $139,449 |

| Jun-22 | $114,371 | $108,607 | $128,403 |

| Jul-22 | $129,955 | $118,621 | $143,814 |

| Aug-22 | $123,626 | $113,783 | $137,115 |

| Sep-22 | $112,309 | $103,304 | $123,785 |

| Oct-22 | $117,562 | $111,668 | $131,020 |

| Nov-22 | $121,141 | $117,908 | $136,990 |

| Dec-22 | $110,634 | $111,115 | $126,503 |

| Jan-23 | $122,639 | $118,097 | $137,047 |

| Feb-23 | $120,735 | $115,215 | $135,419 |

| Mar-23 | $130,889 | $119,445 | $144,676 |

| Apr-23 | $132,475 | $121,309 | $146,103 |

| May-23 | $141,765 | $121,837 | $152,762 |

| Jun-23 | $151,443 | $129,887 | $163,209 |

| Jul-23 | $156,291 | $134,060 | $168,707 |

| Aug-23 | $154,775 | $131,925 | $167,193 |

| Sep-23 | $146,261 | $125,635 | $158,100 |

| Oct-23 | $144,410 | $122,994 | $155,849 |

| Nov-23 | $162,443 | $134,226 | $172,838 |

| Dec-23 | $170,094 | $140,324 | $180,492 |

| Jan-24 | $177,286 | $142,682 | $184,994 |

| Feb-24 | $192,129 | $150,301 | $197,615 |

| Mar-24 | $193,433 | $155,137 | $201,094 |

| Apr-24 | $183,650 | $148,800 | $192,565 |

| May-24 | $193,116 | $156,178 | $204,093 |

| Jun-24 | $206,002 | $161,782 | $217,855 |

| Jul-24 | $199,268 | $163,752 | $214,149 |

| Aug-24 | $205,332 | $167,724 | $218,609 |

| Sep-24 | $208,911 | $171,306 | $224,803 |

| Oct-24 | $208,082 | $169,752 | $224,059 |

The graph compares a $50,000 initial investment minimum in the Institutional Class with the performance of the S&P 500 Index and Russell 1000® Growth Index. The Institutional Class performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Class | 44.09% | 17.91% | 15.33% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

Russell 1000® Growth Index | 43.77% | 19.00% | 16.18% |

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $28,246,465 |

| Number of Investments | 51 |

| Total Net Advisory Fees Paid (in thousands) | $153,947 |

| Portfolio Turnover Rate | 28% |

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Information Technology | 38.5% |

| Consumer Discretionary | 18.4% |

| Communication Services | 16.8% |

| Health Care | 10.2% |

| Financials | 7.2% |

| Industrials | 5.3% |

| Consumer Staples | 3.6% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

The Fund has adopted a policy that allows it to send only one copy of a Fund’s prospectus, proxy materials, annual report and semi-annual report to certain shareholders residing at the same household. This reduces Fund expenses, which benefits you and other shareholders. If you need additional copies or do not want your mailings to be “householded,” please call the Shareholder Servicing Agent at 800-422-1050. Individual copies will be sent within thirty (30) days after the Shareholder Servicing Agent receives your instructions. Your consent to householding is considered valid until revoked.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Capital Appreciation Fund

Administrative Class: HRCAX

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Capital Appreciation Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Administrative Class | $112 | 0.92% |

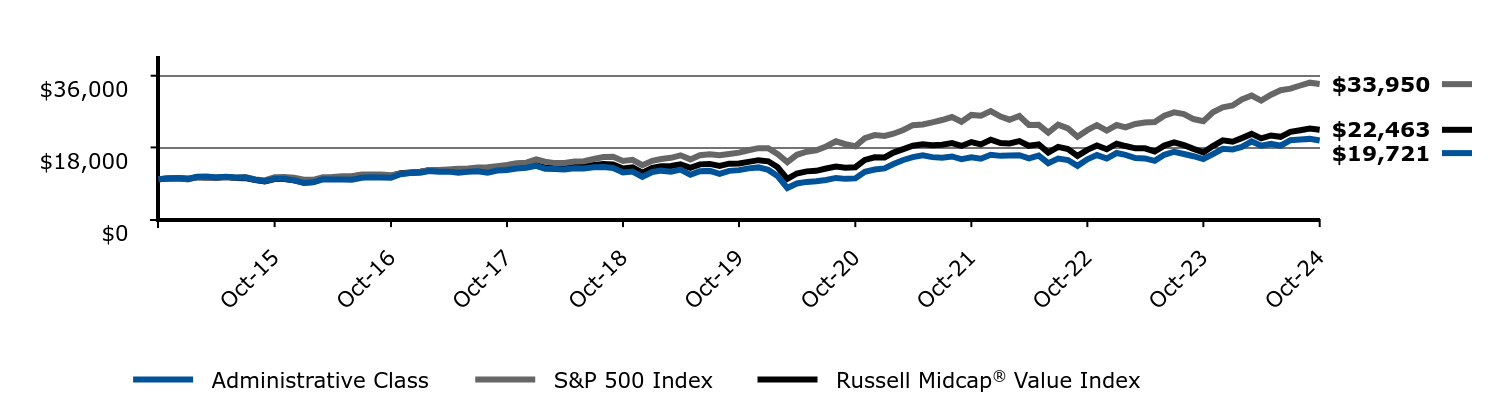

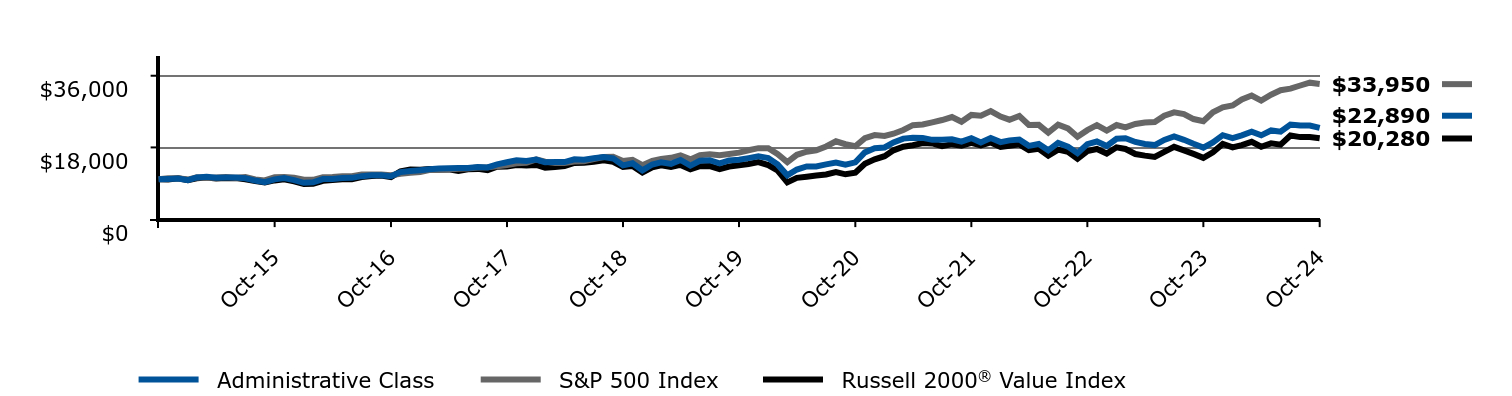

Management's Discussion of Fund Performance

Subadvisor: Jennison Associates LLC

Performance Summary

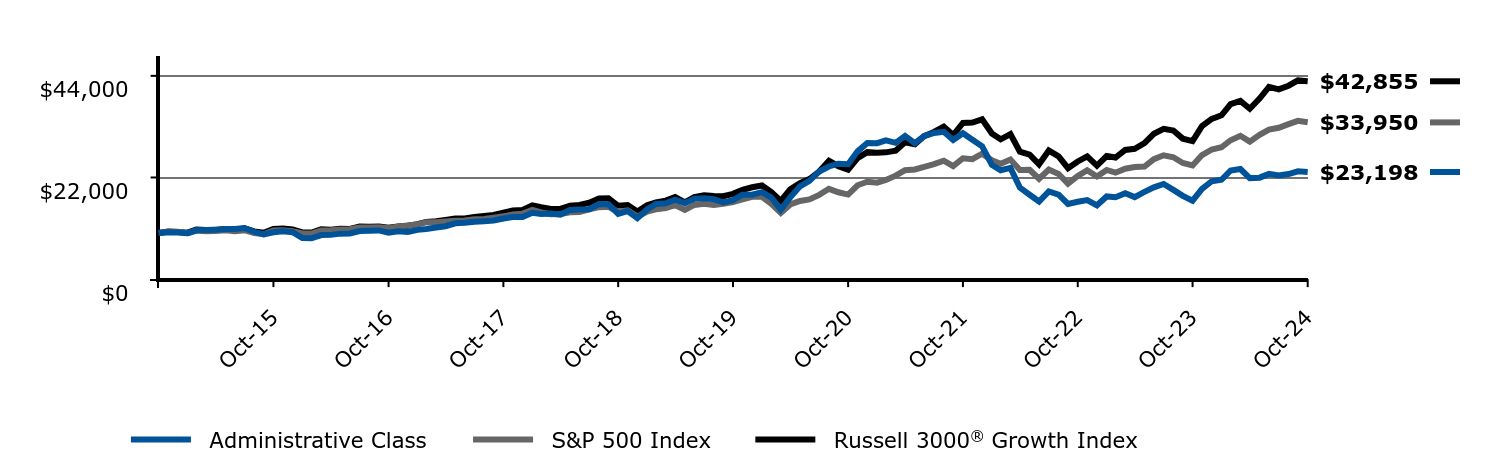

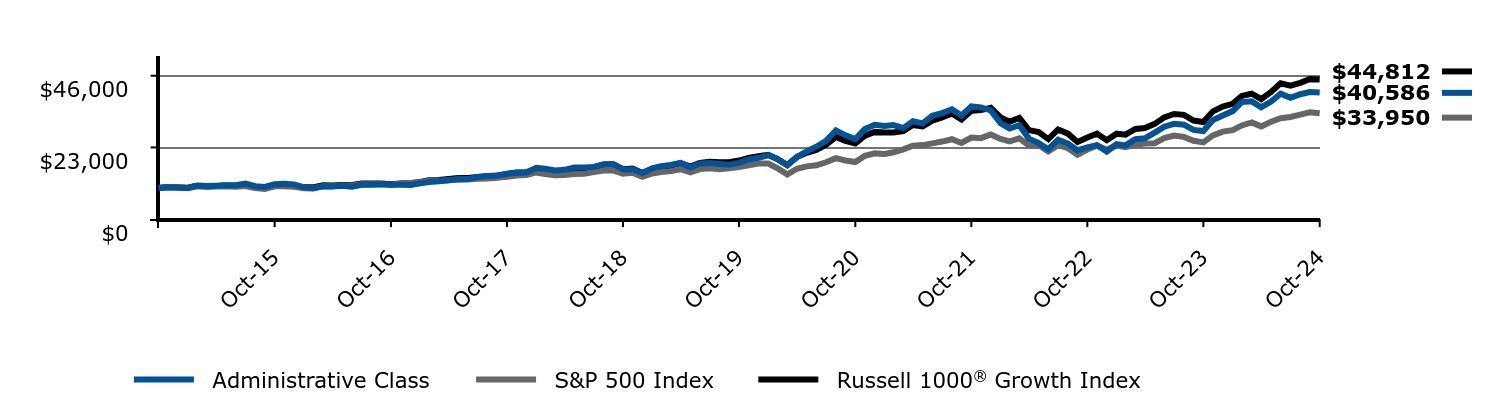

The Administrative Class returned 43.73% for the year ended October 31, 2024, while the Russell 1000® Growth Index returned 43.77% and the S&P 500 Index returned 38.02% during the same period.

Top contributors to relative performance included:

• Positions in technology. Accelerated spending on Artificial Intelligence (AI) applications fueled significant gains for several of the Fund’s holdings including NVIDIA Corp., Broadcom, Inc., and Advanced Micro Devices, Inc.

• Positions in communication services. The top performers were Meta Platforms, Inc. and Netflix, Inc. Both companies benefited from demand growth and advertising revenue. Costco Wholesale Corp. also added to performance. The company benefited from higher demand through their pricing strategy.

Top detractors from relative performance included:

• Shares in Boeing Co. which lost value over the period. Production issues, coupled with the recent labor strike, weighed on the company’s share price.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

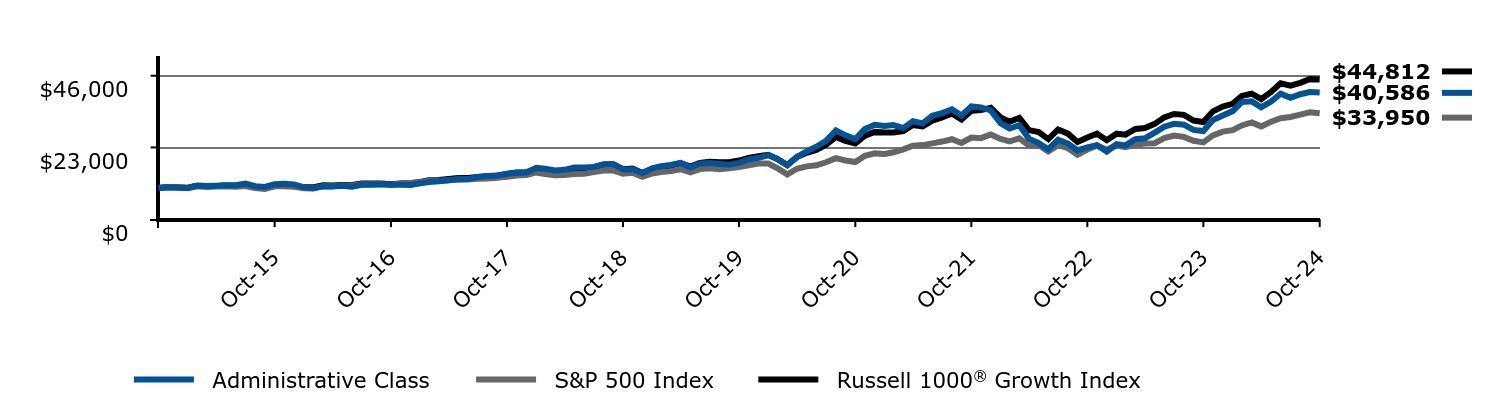

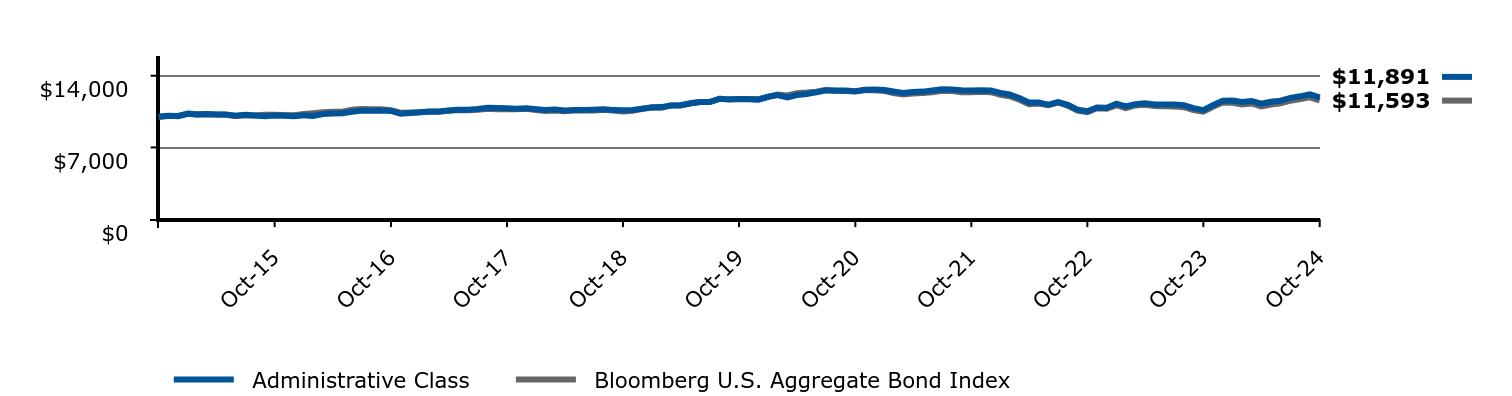

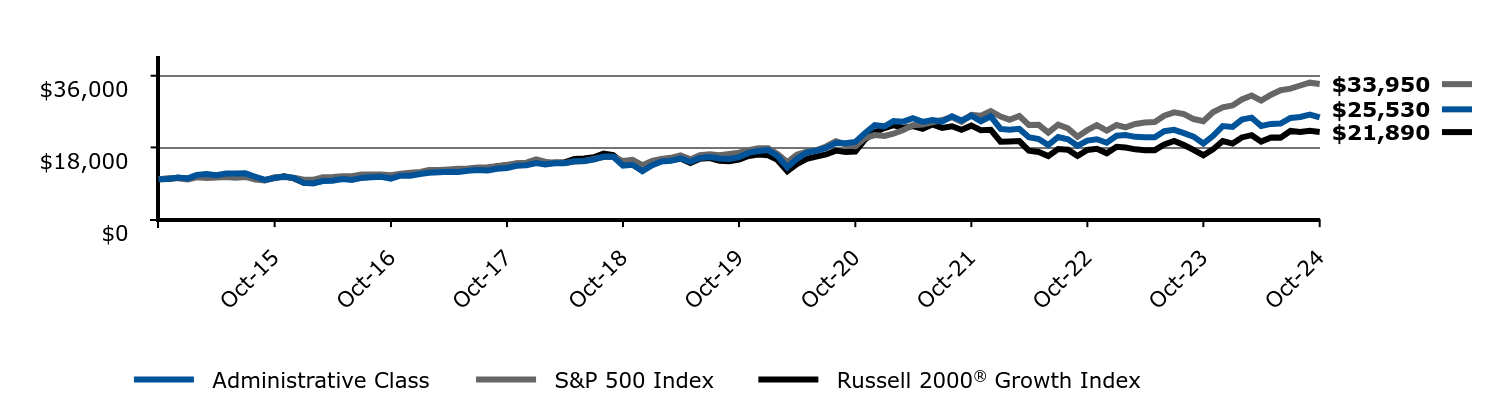

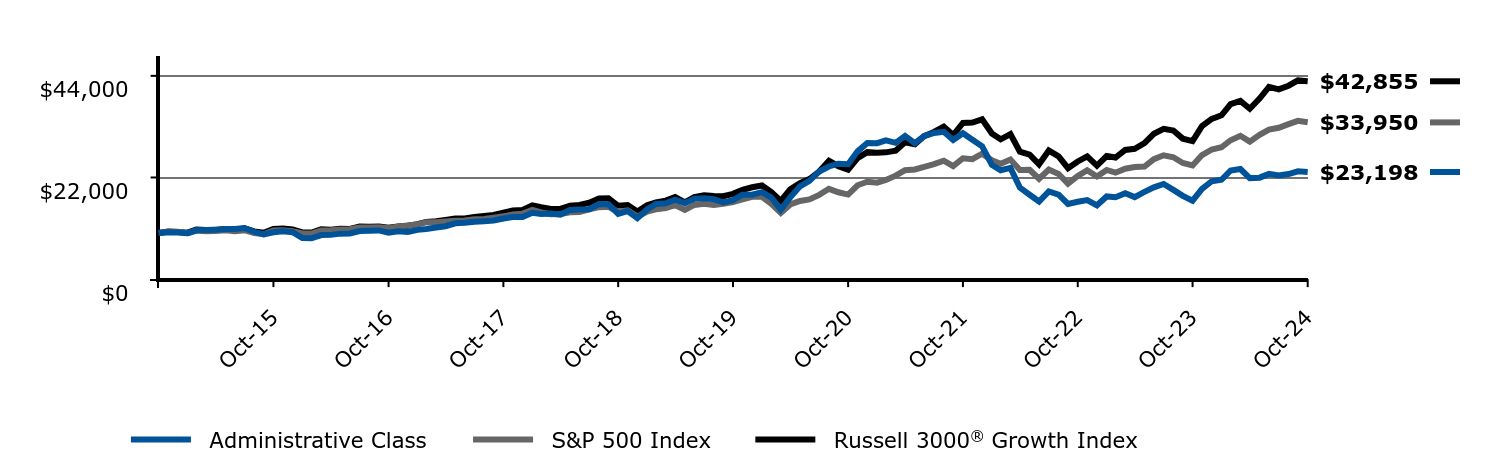

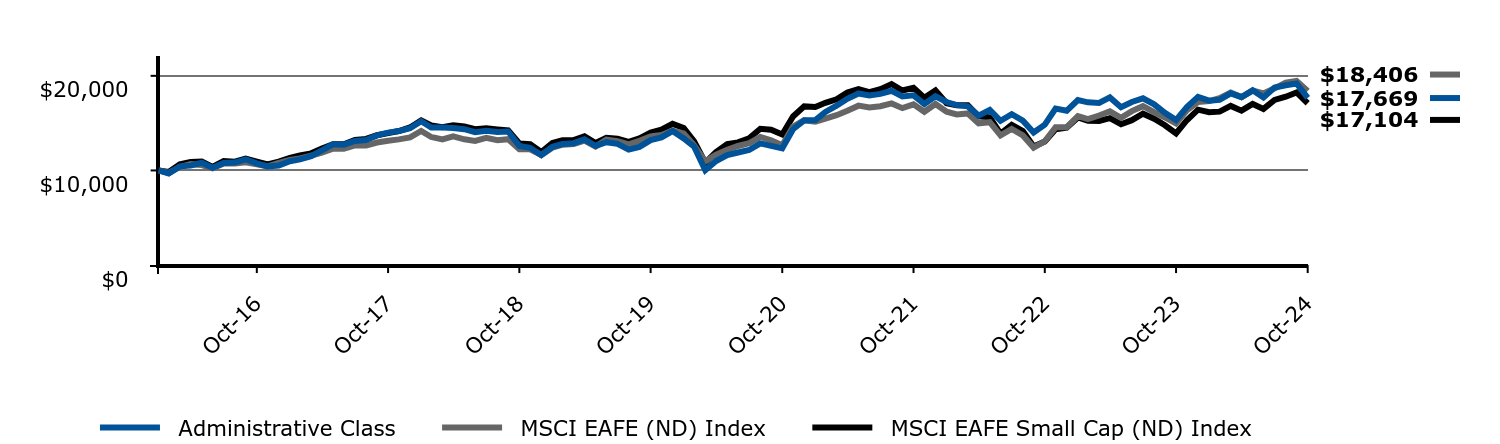

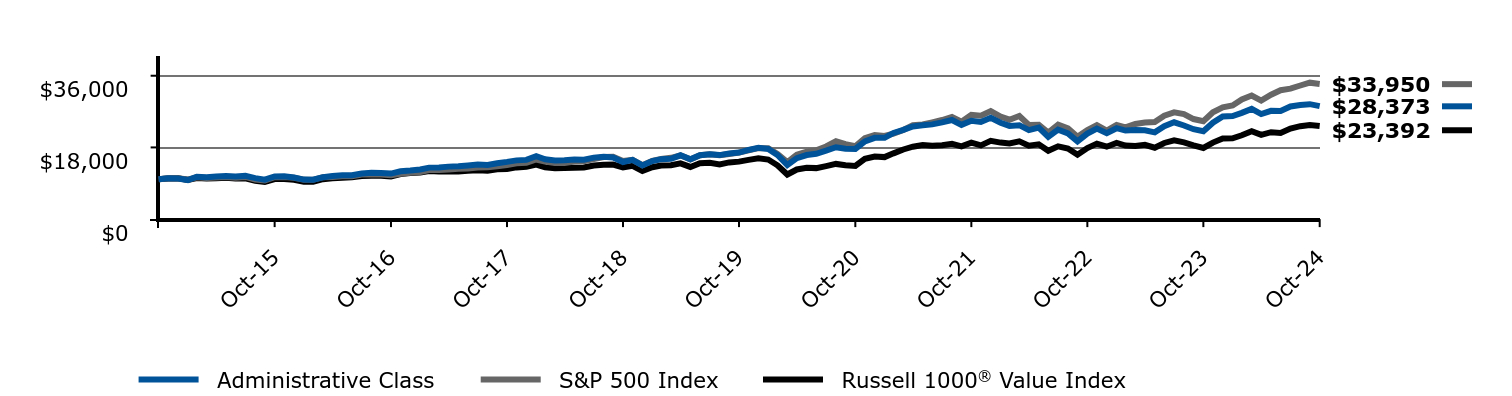

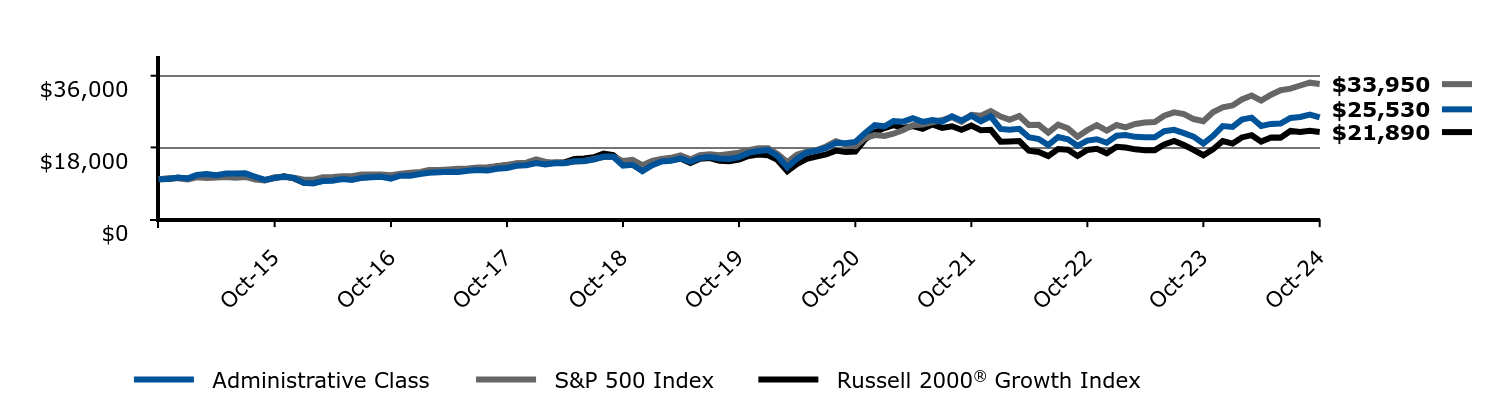

Change in a $10,000 Investment

For the period 11/01/2014 through 10/31/2024

| Administrative Class | S&P 500 Index | Russell 1000® Growth Index |

|---|

| Oct-14 | $10,000 | $10,000 | $10,000 |

| Nov-14 | $10,212 | $10,269 | $10,317 |

| Dec-14 | $10,051 | $10,243 | $10,209 |

| Jan-15 | $10,016 | $9,936 | $10,053 |

| Feb-15 | $10,732 | $10,507 | $10,723 |

| Mar-15 | $10,602 | $10,340 | $10,601 |

| Apr-15 | $10,732 | $10,440 | $10,654 |

| May-15 | $10,892 | $10,574 | $10,804 |

| Jun-15 | $10,902 | $10,369 | $10,614 |

| Jul-15 | $11,367 | $10,586 | $10,974 |

| Aug-15 | $10,571 | $9,948 | $10,307 |

| Sep-15 | $10,302 | $9,702 | $10,052 |

| Oct-15 | $11,188 | $10,520 | $10,918 |

| Nov-15 | $11,303 | $10,551 | $10,949 |

| Dec-15 | $11,128 | $10,385 | $10,788 |

| Jan-16 | $10,178 | $9,869 | $10,186 |

| Feb-16 | $9,879 | $9,856 | $10,181 |

| Mar-16 | $10,511 | $10,525 | $10,868 |

| Apr-16 | $10,437 | $10,566 | $10,769 |

| May-16 | $10,709 | $10,755 | $10,978 |

| Jun-16 | $10,367 | $10,783 | $10,935 |

| Jul-16 | $11,033 | $11,181 | $11,451 |

| Aug-16 | $10,996 | $11,196 | $11,394 |

| Sep-16 | $11,206 | $11,199 | $11,436 |

| Oct-16 | $11,022 | $10,994 | $11,167 |

| Nov-16 | $10,993 | $11,401 | $11,410 |

| Dec-16 | $10,982 | $11,627 | $11,551 |

| Jan-17 | $11,464 | $11,847 | $11,941 |

| Feb-17 | $11,924 | $12,318 | $12,437 |

| Mar-17 | $12,144 | $12,332 | $12,580 |

| Apr-17 | $12,491 | $12,459 | $12,868 |

| May-17 | $12,949 | $12,634 | $13,203 |

| Jun-17 | $12,864 | $12,713 | $13,168 |

| Jul-17 | $13,539 | $12,974 | $13,518 |

| Aug-17 | $13,866 | $13,014 | $13,766 |

| Sep-17 | $13,964 | $13,283 | $13,945 |

| Oct-17 | $14,572 | $13,593 | $14,485 |

| Nov-17 | $14,871 | $14,009 | $14,925 |

| Dec-17 | $14,963 | $14,165 | $15,041 |

| Jan-18 | $16,421 | $14,976 | $16,107 |

| Feb-18 | $16,132 | $14,424 | $15,684 |

| Mar-18 | $15,601 | $14,058 | $15,254 |

| Apr-18 | $15,798 | $14,112 | $15,308 |

| May-18 | $16,564 | $14,451 | $15,978 |

| Jun-18 | $16,581 | $14,540 | $16,132 |

| Jul-18 | $16,757 | $15,081 | $16,606 |

| Aug-18 | $17,561 | $15,573 | $17,514 |

| Sep-18 | $17,682 | $15,662 | $17,612 |

| Oct-18 | $15,906 | $14,591 | $16,037 |

| Nov-18 | $16,007 | $14,888 | $16,207 |

| Dec-18 | $14,771 | $13,544 | $14,814 |

| Jan-19 | $16,267 | $14,629 | $16,145 |

| Feb-19 | $16,974 | $15,099 | $16,723 |

| Mar-19 | $17,353 | $15,393 | $17,199 |

| Apr-19 | $18,022 | $16,016 | $17,976 |

| May-19 | $16,585 | $14,998 | $16,840 |

| Jun-19 | $17,869 | $16,055 | $17,997 |

| Jul-19 | $17,971 | $16,286 | $18,403 |

| Aug-19 | $17,699 | $16,028 | $18,262 |

| Sep-19 | $17,480 | $16,328 | $18,265 |

| Oct-19 | $18,029 | $16,681 | $18,779 |

| Nov-19 | $19,148 | $17,287 | $19,613 |

| Dec-19 | $19,638 | $17,809 | $20,204 |

| Jan-20 | $20,492 | $17,802 | $20,656 |

| Feb-20 | $19,335 | $16,336 | $19,249 |

| Mar-20 | $17,305 | $14,319 | $17,356 |

| Apr-20 | $19,906 | $16,154 | $19,924 |

| May-20 | $21,697 | $16,923 | $21,261 |

| Jun-20 | $23,226 | $17,260 | $22,187 |

| Jul-20 | $25,113 | $18,233 | $23,894 |

| Aug-20 | $28,460 | $19,544 | $26,360 |

| Sep-20 | $26,884 | $18,801 | $25,120 |

| Oct-20 | $25,660 | $18,301 | $24,267 |

| Nov-20 | $28,874 | $20,305 | $26,751 |

| Dec-20 | $30,252 | $21,085 | $27,982 |

| Jan-21 | $29,890 | $20,872 | $27,774 |

| Feb-21 | $30,165 | $21,448 | $27,768 |

| Mar-21 | $29,212 | $22,387 | $28,245 |

| Apr-21 | $31,438 | $23,582 | $30,167 |

| May-21 | $30,694 | $23,747 | $29,750 |

| Jun-21 | $33,142 | $24,301 | $31,616 |

| Jul-21 | $34,030 | $24,878 | $32,658 |

| Aug-21 | $35,237 | $25,635 | $33,879 |

| Sep-21 | $33,256 | $24,443 | $31,982 |

| Oct-21 | $36,146 | $26,155 | $34,752 |

| Nov-21 | $35,853 | $25,974 | $34,964 |

| Dec-21 | $34,896 | $27,138 | $35,703 |

| Jan-22 | $30,767 | $25,734 | $32,639 |

| Feb-22 | $29,059 | $24,963 | $31,253 |

| Mar-22 | $30,130 | $25,890 | $32,475 |

| Apr-22 | $25,829 | $23,632 | $28,554 |

| May-22 | $24,383 | $23,676 | $27,890 |

| Jun-22 | $22,440 | $21,721 | $25,681 |

| Jul-22 | $25,491 | $23,724 | $28,763 |

| Aug-22 | $24,242 | $22,757 | $27,423 |

| Sep-22 | $22,020 | $20,661 | $24,757 |

| Oct-22 | $23,048 | $22,334 | $26,204 |

| Nov-22 | $23,743 | $23,582 | $27,398 |

| Dec-22 | $21,682 | $22,223 | $25,301 |

| Jan-23 | $24,027 | $23,619 | $27,409 |

| Feb-23 | $23,649 | $23,043 | $27,084 |

| Mar-23 | $25,631 | $23,889 | $28,935 |

| Apr-23 | $25,937 | $24,262 | $29,221 |

| May-23 | $27,753 | $24,367 | $30,552 |

| Jun-23 | $29,638 | $25,977 | $32,642 |

| Jul-23 | $30,580 | $26,812 | $33,741 |

| Aug-23 | $30,278 | $26,385 | $33,439 |

| Sep-23 | $28,605 | $25,127 | $31,620 |

| Oct-23 | $28,239 | $24,599 | $31,170 |

| Nov-23 | $31,756 | $26,845 | $34,568 |

| Dec-23 | $33,245 | $28,065 | $36,098 |

| Jan-24 | $34,648 | $28,536 | $36,999 |

| Feb-24 | $37,540 | $30,060 | $39,523 |

| Mar-24 | $37,784 | $31,027 | $40,219 |

| Apr-24 | $35,867 | $29,760 | $38,513 |

| May-24 | $37,709 | $31,236 | $40,819 |

| Jun-24 | $40,216 | $32,356 | $43,571 |

| Jul-24 | $38,892 | $32,750 | $42,830 |

| Aug-24 | $40,068 | $33,545 | $43,722 |

| Sep-24 | $40,759 | $34,261 | $44,961 |

| Oct-24 | $40,586 | $33,950 | $44,812 |

The graph compares a $10,000 initial investment in the Administrative Class with the performance of the S&P 500 Index and Russell 1000® Growth Index. The Administrative Class performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Administrative Class | 43.73% | 17.62% | 15.04% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

Russell 1000® Growth Index | 43.77% | 19.00% | 16.18% |

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $28,246,465 |

| Number of Investments | 51 |

| Total Net Advisory Fees Paid (in thousands) | $153,947 |

| Portfolio Turnover Rate | 28% |

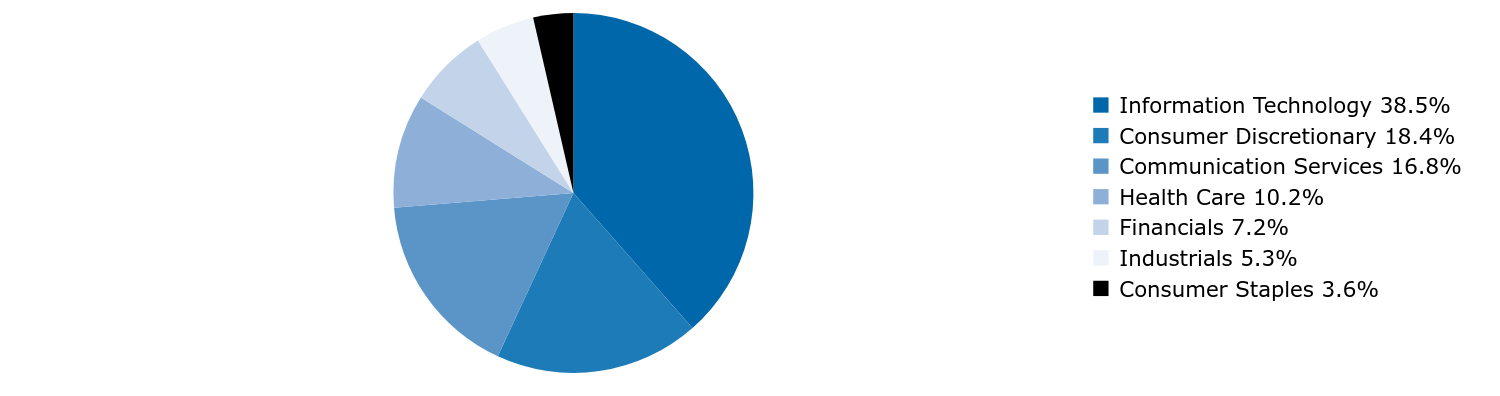

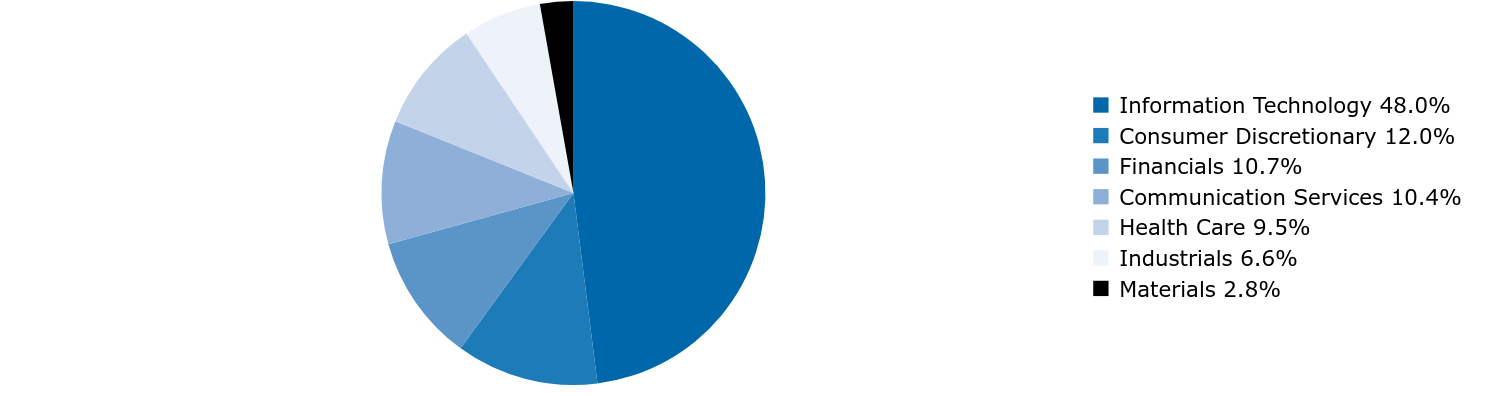

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Information Technology | 38.5% |

| Consumer Discretionary | 18.4% |

| Communication Services | 16.8% |

| Health Care | 10.2% |

| Financials | 7.2% |

| Industrials | 5.3% |

| Consumer Staples | 3.6% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

The Fund has adopted a policy that allows it to send only one copy of a Fund’s prospectus, proxy materials, annual report and semi-annual report to certain shareholders residing at the same household. This reduces Fund expenses, which benefits you and other shareholders. If you need additional copies or do not want your mailings to be “householded,” please call the Shareholder Servicing Agent at 800-422-1050. Individual copies will be sent within thirty (30) days after the Shareholder Servicing Agent receives your instructions. Your consent to householding is considered valid until revoked.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Capital Appreciation Fund

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Capital Appreciation Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $125 | 1.03% |

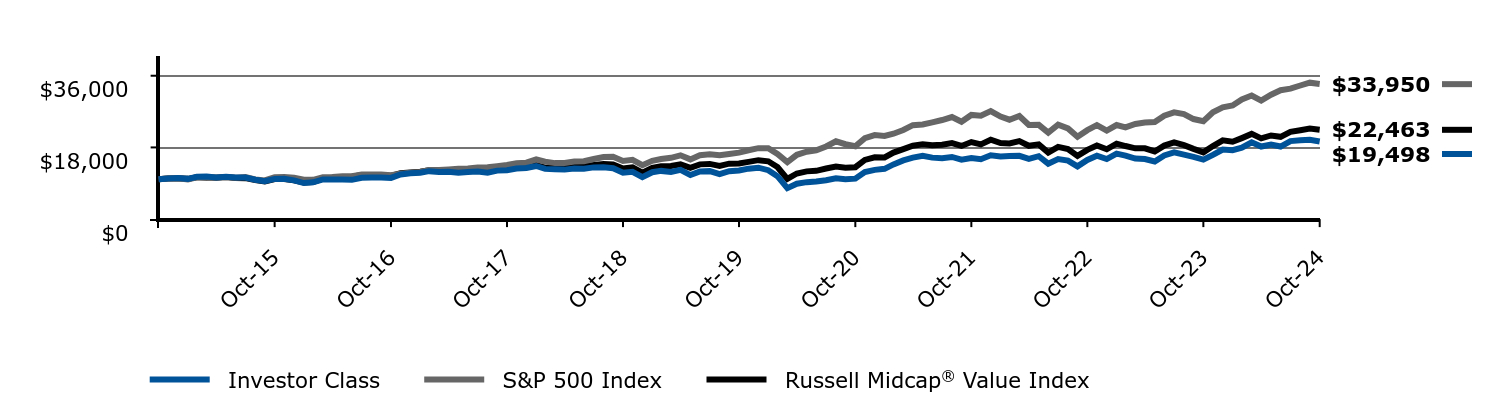

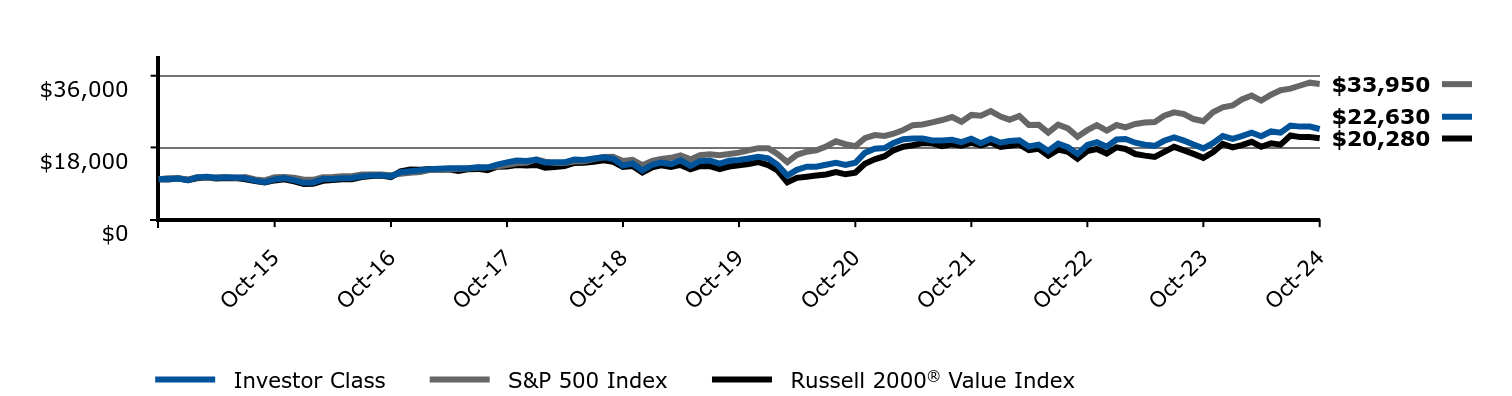

Management's Discussion of Fund Performance

Subadvisor: Jennison Associates LLC

Performance Summary

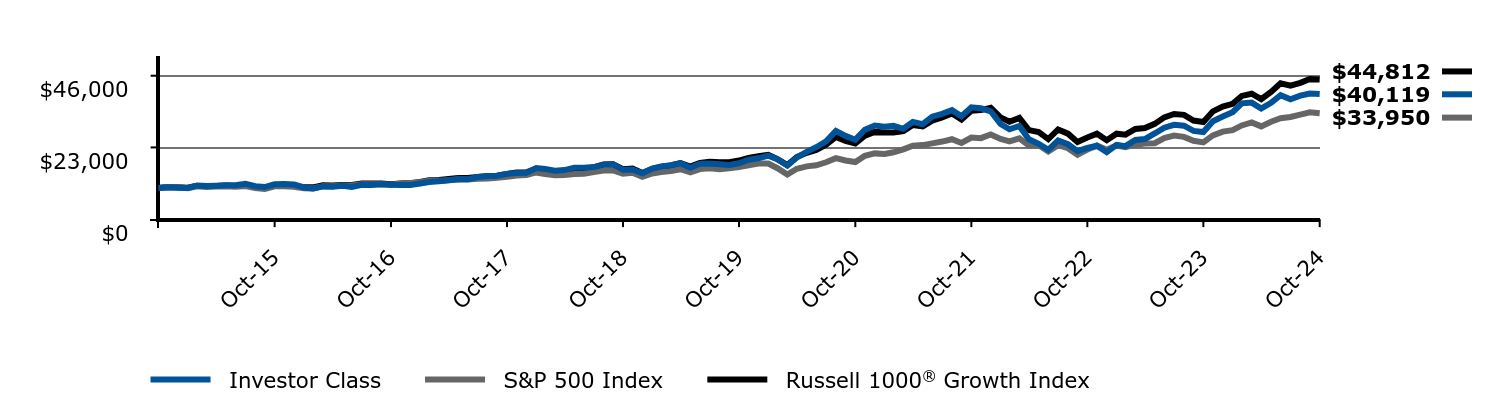

The Investor Class returned 43.58% for the year ended October 31, 2024, while the Russell 1000® Growth Index returned 43.77% and the S&P 500 Index returned 38.02% during the same period.

Top contributors to relative performance included:

• Positions in technology. Accelerated spending on Artificial Intelligence (AI) applications fueled significant gains for several of the Fund’s holdings including NVIDIA Corp., Broadcom, Inc., and Advanced Micro Devices, Inc.

• Positions in communication services. The top performers were Meta Platforms, Inc. and Netflix, Inc. Both companies benefited from demand growth and advertising revenue. Costco Wholesale Corp. also added to performance. The company benefited from higher demand through their pricing strategy.

Top detractors from relative performance included:

• Shares in Boeing Co. which lost value over the period. Production issues, coupled with the recent labor strike, weighed on the company’s share price.

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

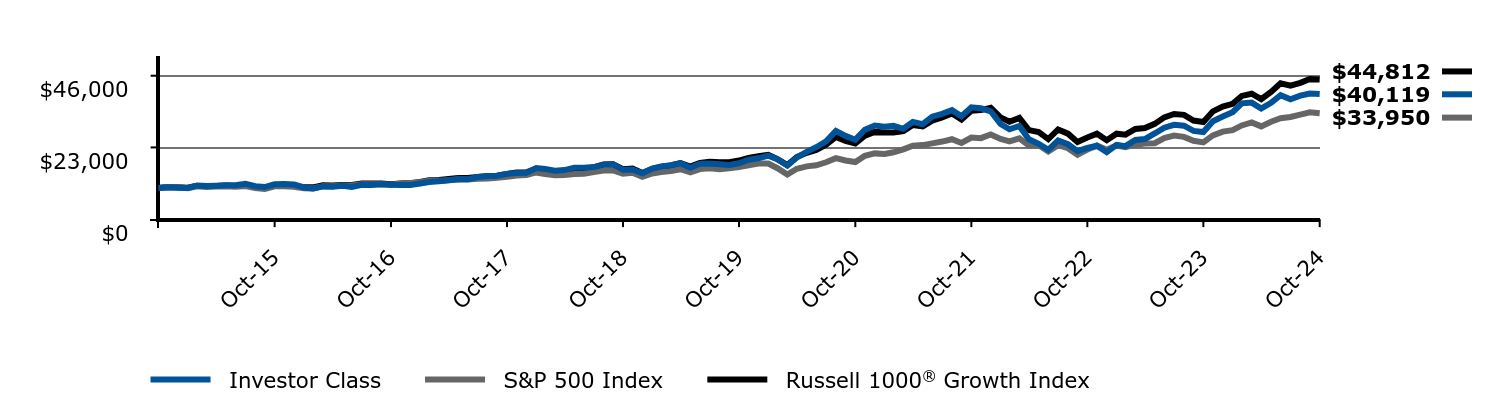

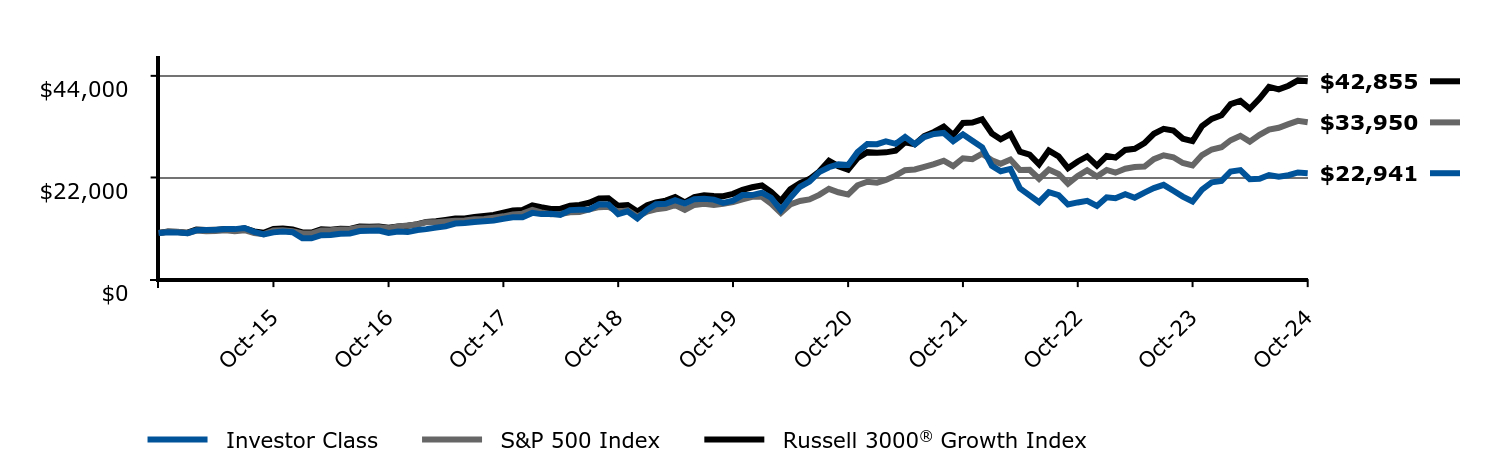

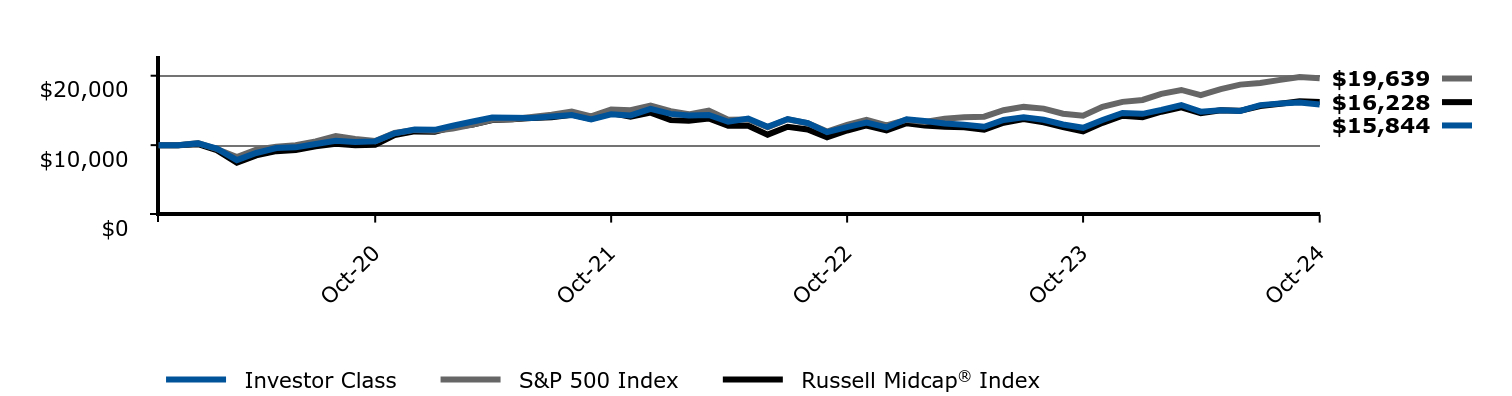

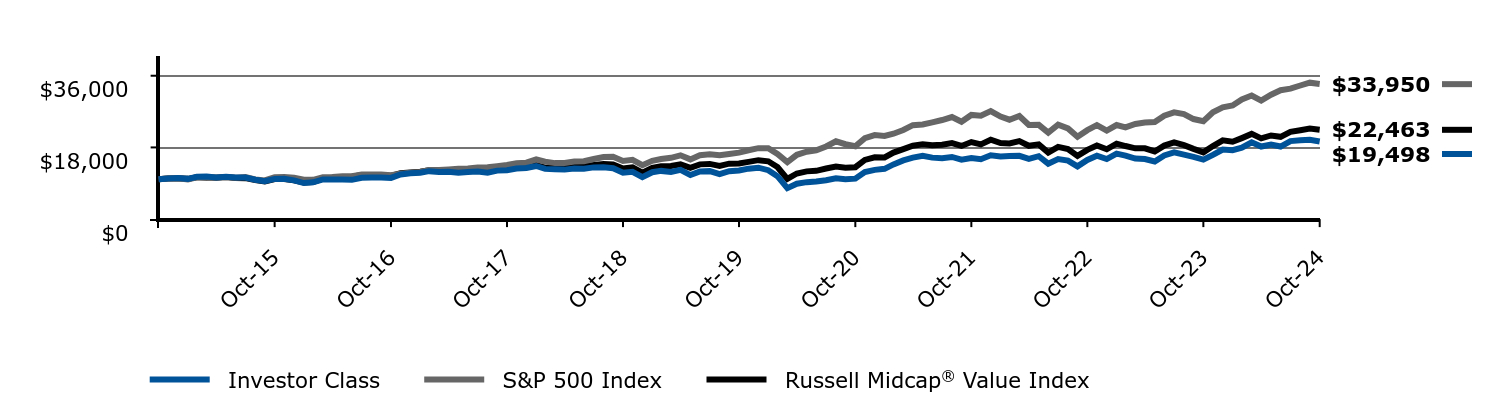

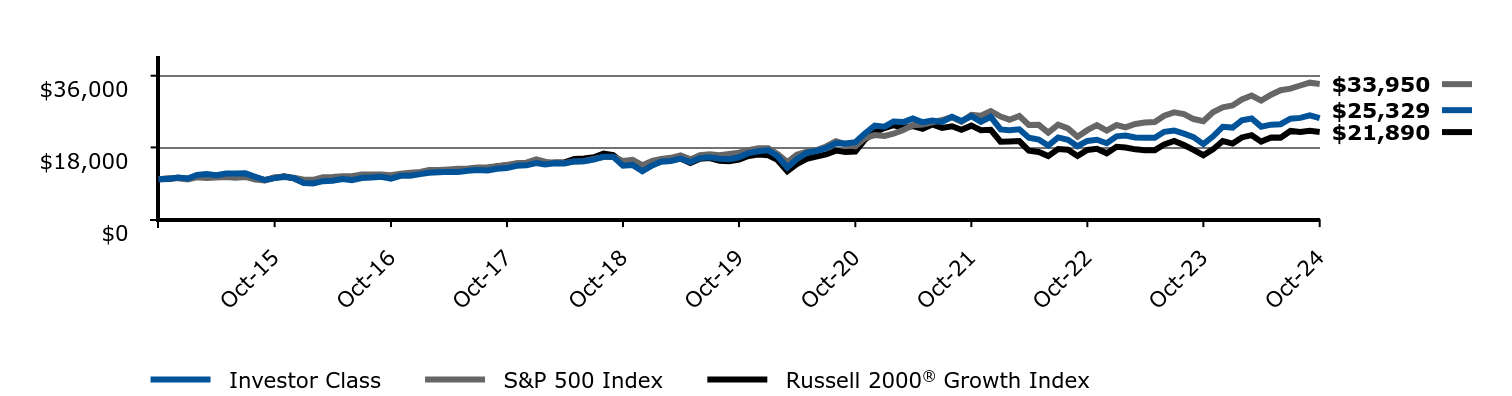

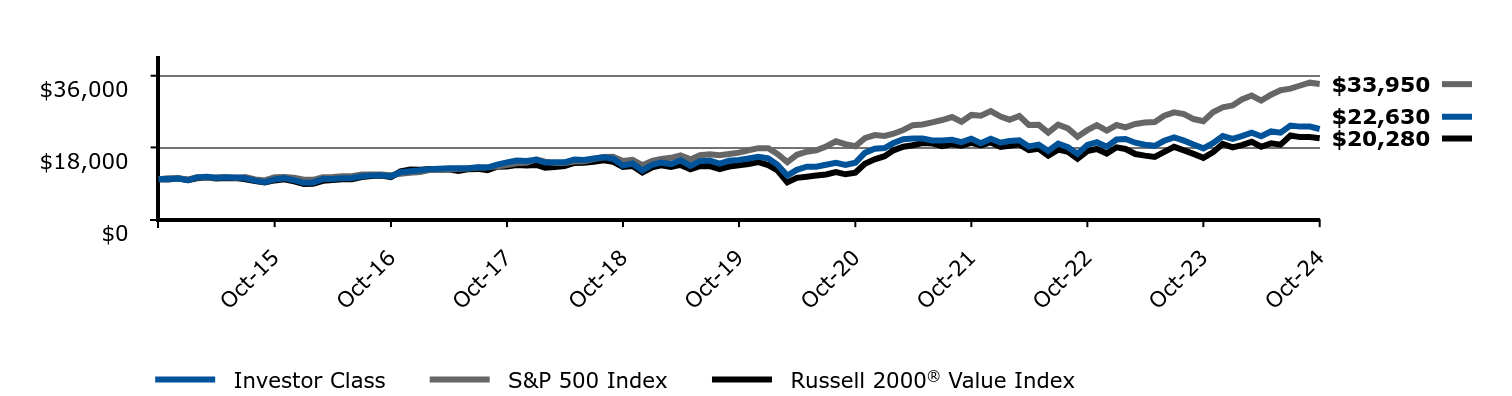

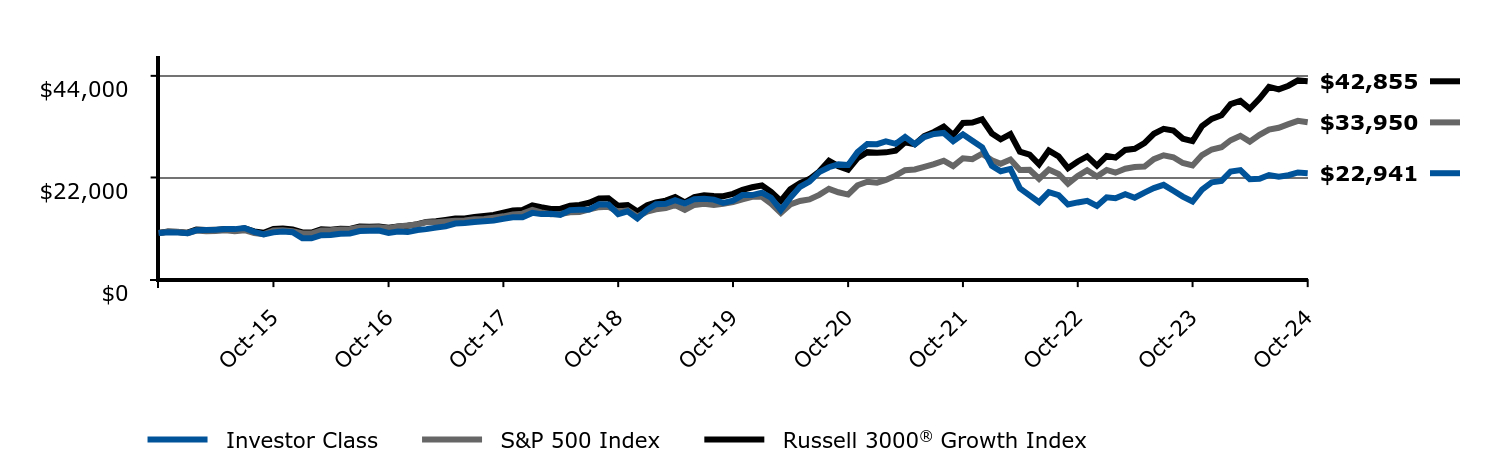

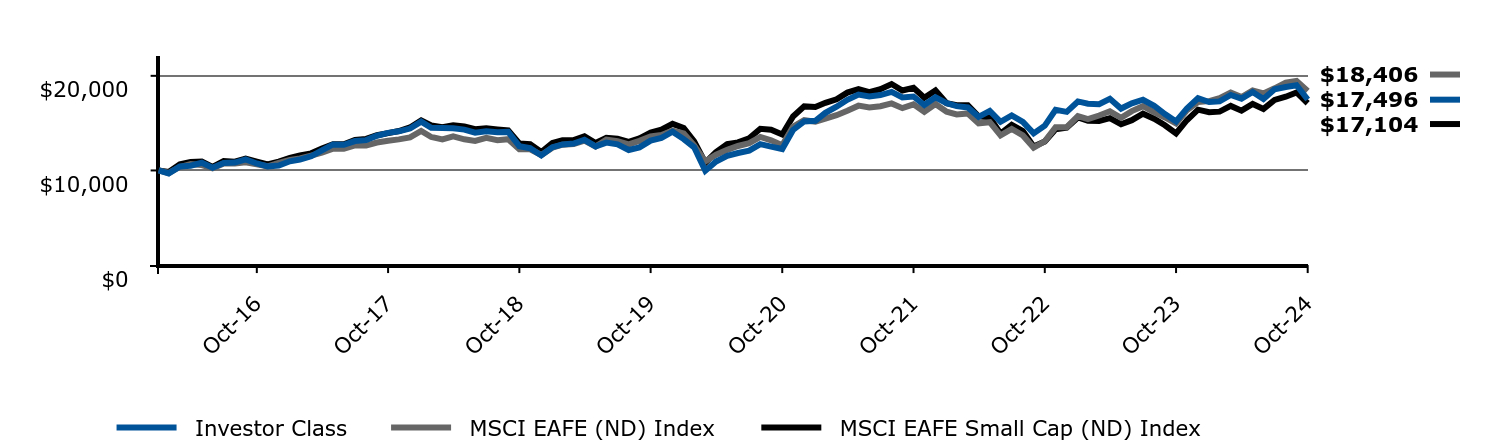

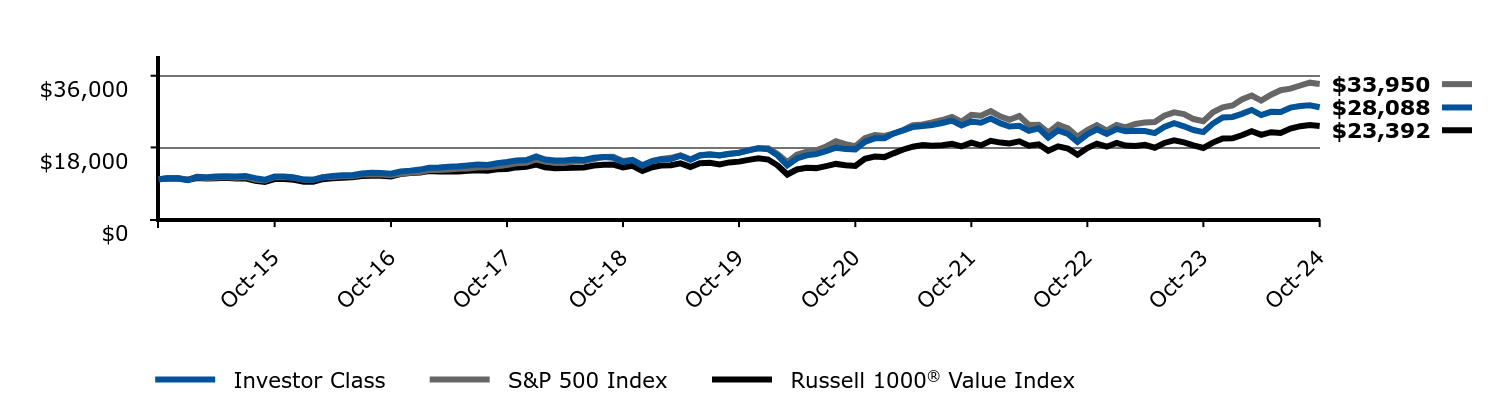

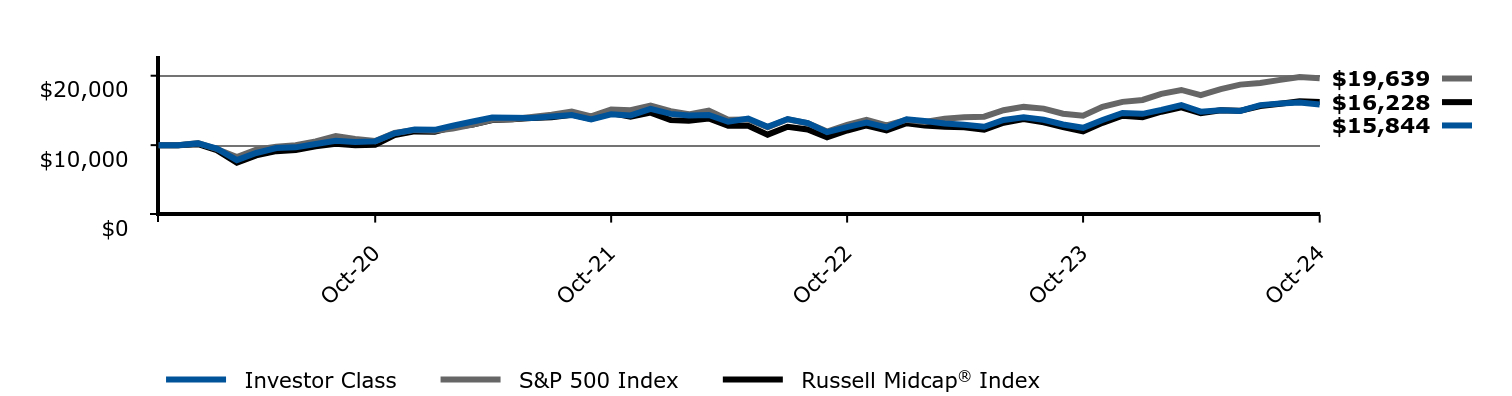

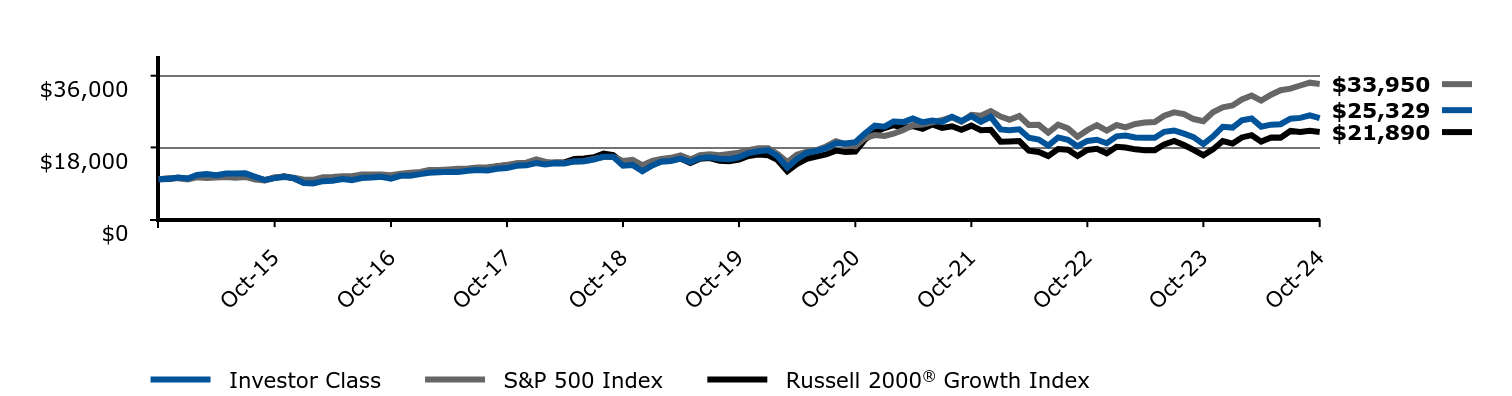

Change in a $10,000 Investment

For the period 11/01/2014 through 10/31/2024

| Investor Class | S&P 500 Index | Russell 1000® Growth Index |

|---|

| Oct-14 | $10,000 | $10,000 | $10,000 |

| Nov-14 | $10,212 | $10,269 | $10,317 |

| Dec-14 | $10,050 | $10,243 | $10,209 |

| Jan-15 | $10,013 | $9,936 | $10,053 |

| Feb-15 | $10,728 | $10,507 | $10,723 |

| Mar-15 | $10,599 | $10,340 | $10,601 |

| Apr-15 | $10,727 | $10,440 | $10,654 |

| May-15 | $10,884 | $10,574 | $10,804 |

| Jun-15 | $10,893 | $10,369 | $10,614 |

| Jul-15 | $11,358 | $10,586 | $10,974 |

| Aug-15 | $10,562 | $9,948 | $10,307 |

| Sep-15 | $10,292 | $9,702 | $10,052 |

| Oct-15 | $11,175 | $10,520 | $10,918 |

| Nov-15 | $11,289 | $10,551 | $10,949 |

| Dec-15 | $11,113 | $10,385 | $10,788 |

| Jan-16 | $10,162 | $9,869 | $10,186 |

| Feb-16 | $9,864 | $9,856 | $10,181 |

| Mar-16 | $10,492 | $10,525 | $10,868 |

| Apr-16 | $10,419 | $10,566 | $10,769 |

| May-16 | $10,689 | $10,755 | $10,978 |

| Jun-16 | $10,346 | $10,783 | $10,935 |

| Jul-16 | $11,009 | $11,181 | $11,451 |

| Aug-16 | $10,972 | $11,196 | $11,394 |

| Sep-16 | $11,180 | $11,199 | $11,436 |

| Oct-16 | $10,996 | $10,994 | $11,167 |

| Nov-16 | $10,964 | $11,401 | $11,410 |

| Dec-16 | $10,953 | $11,627 | $11,551 |

| Jan-17 | $11,433 | $11,847 | $11,941 |

| Feb-17 | $11,892 | $12,318 | $12,437 |

| Mar-17 | $12,109 | $12,332 | $12,580 |

| Apr-17 | $12,453 | $12,459 | $12,868 |

| May-17 | $12,910 | $12,634 | $13,203 |

| Jun-17 | $12,824 | $12,713 | $13,168 |

| Jul-17 | $13,495 | $12,974 | $13,518 |

| Aug-17 | $13,818 | $13,014 | $13,766 |

| Sep-17 | $13,916 | $13,283 | $13,945 |

| Oct-17 | $14,519 | $13,593 | $14,485 |

| Nov-17 | $14,816 | $14,009 | $14,925 |

| Dec-17 | $14,905 | $14,165 | $15,041 |

| Jan-18 | $16,358 | $14,976 | $16,107 |

| Feb-18 | $16,067 | $14,424 | $15,684 |

| Mar-18 | $15,537 | $14,058 | $15,254 |

| Apr-18 | $15,731 | $14,112 | $15,308 |

| May-18 | $16,494 | $14,451 | $15,978 |

| Jun-18 | $16,507 | $14,540 | $16,132 |

| Jul-18 | $16,681 | $15,081 | $16,606 |

| Aug-18 | $17,482 | $15,573 | $17,514 |

| Sep-18 | $17,598 | $15,662 | $17,612 |

| Oct-18 | $15,831 | $14,591 | $16,037 |

| Nov-18 | $15,929 | $14,888 | $16,207 |

| Dec-18 | $14,698 | $13,544 | $14,814 |

| Jan-19 | $16,186 | $14,629 | $16,145 |

| Feb-19 | $16,886 | $15,099 | $16,723 |

| Mar-19 | $17,264 | $15,393 | $17,199 |

| Apr-19 | $17,927 | $16,016 | $17,976 |

| May-19 | $16,495 | $14,998 | $16,840 |

| Jun-19 | $17,769 | $16,055 | $17,997 |

| Jul-19 | $17,870 | $16,286 | $18,403 |

| Aug-19 | $17,598 | $16,028 | $18,262 |

| Sep-19 | $17,378 | $16,328 | $18,265 |

| Oct-19 | $17,922 | $16,681 | $18,779 |

| Nov-19 | $19,032 | $17,287 | $19,613 |

| Dec-19 | $19,518 | $17,809 | $20,204 |

| Jan-20 | $20,365 | $17,802 | $20,656 |

| Feb-20 | $19,212 | $16,336 | $19,249 |

| Mar-20 | $17,195 | $14,319 | $17,356 |

| Apr-20 | $19,775 | $16,154 | $19,924 |

| May-20 | $21,555 | $16,923 | $21,261 |

| Jun-20 | $23,067 | $17,260 | $22,187 |

| Jul-20 | $24,941 | $18,233 | $23,894 |

| Aug-20 | $28,260 | $19,544 | $26,360 |

| Sep-20 | $26,694 | $18,801 | $25,120 |

| Oct-20 | $25,477 | $18,301 | $24,267 |

| Nov-20 | $28,663 | $20,305 | $26,751 |

| Dec-20 | $30,032 | $21,085 | $27,982 |

| Jan-21 | $29,669 | $20,872 | $27,774 |

| Feb-21 | $29,938 | $21,448 | $27,768 |

| Mar-21 | $28,987 | $22,387 | $28,245 |

| Apr-21 | $31,194 | $23,582 | $30,167 |

| May-21 | $30,454 | $23,747 | $29,750 |

| Jun-21 | $32,881 | $24,301 | $31,616 |

| Jul-21 | $33,758 | $24,878 | $32,658 |

| Aug-21 | $34,953 | $25,635 | $33,879 |

| Sep-21 | $32,981 | $24,443 | $31,982 |

| Oct-21 | $35,848 | $26,155 | $34,752 |

| Nov-21 | $35,552 | $25,974 | $34,964 |

| Dec-21 | $34,600 | $27,138 | $35,703 |

| Jan-22 | $30,503 | $25,734 | $32,639 |

| Feb-22 | $28,808 | $24,963 | $31,253 |

| Mar-22 | $29,866 | $25,890 | $32,475 |

| Apr-22 | $25,602 | $23,632 | $28,554 |

| May-22 | $24,166 | $23,676 | $27,890 |

| Jun-22 | $22,238 | $21,721 | $25,681 |

| Jul-22 | $25,262 | $23,724 | $28,763 |

| Aug-22 | $24,022 | $22,757 | $27,423 |

| Sep-22 | $21,816 | $20,661 | $24,757 |

| Oct-22 | $22,830 | $22,334 | $26,204 |

| Nov-22 | $23,518 | $23,582 | $27,398 |

| Dec-22 | $21,472 | $22,223 | $25,301 |

| Jan-23 | $23,792 | $23,619 | $27,409 |

| Feb-23 | $23,419 | $23,043 | $27,084 |

| Mar-23 | $25,380 | $23,889 | $28,935 |

| Apr-23 | $25,680 | $24,262 | $29,221 |

| May-23 | $27,475 | $24,367 | $30,552 |

| Jun-23 | $29,341 | $25,977 | $32,642 |

| Jul-23 | $30,270 | $26,812 | $33,741 |

| Aug-23 | $29,966 | $26,385 | $33,439 |

| Sep-23 | $28,312 | $25,127 | $31,620 |

| Oct-23 | $27,942 | $24,599 | $31,170 |

| Nov-23 | $31,421 | $26,845 | $34,568 |

| Dec-23 | $32,894 | $28,065 | $36,098 |

| Jan-24 | $34,275 | $28,536 | $36,999 |

| Feb-24 | $37,132 | $30,060 | $39,523 |

| Mar-24 | $37,373 | $31,027 | $40,219 |

| Apr-24 | $35,474 | $29,760 | $38,513 |

| May-24 | $37,291 | $31,236 | $40,819 |

| Jun-24 | $39,764 | $32,356 | $43,571 |

| Jul-24 | $38,454 | $32,750 | $42,830 |

| Aug-24 | $39,612 | $33,545 | $43,722 |

| Sep-24 | $40,289 | $34,261 | $44,961 |

| Oct-24 | $40,119 | $33,950 | $44,812 |

The graph compares a $10,000 initial investment in the Investor Class with the performance of the S&P 500 Index and Russell 1000® Growth Index. The Investor Class performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Investor Class | 43.58% | 17.49% | 14.90% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

Russell 1000® Growth Index | 43.77% | 19.00% | 16.18% |

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $28,246,465 |

| Number of Investments | 51 |

| Total Net Advisory Fees Paid (in thousands) | $153,947 |

| Portfolio Turnover Rate | 28% |

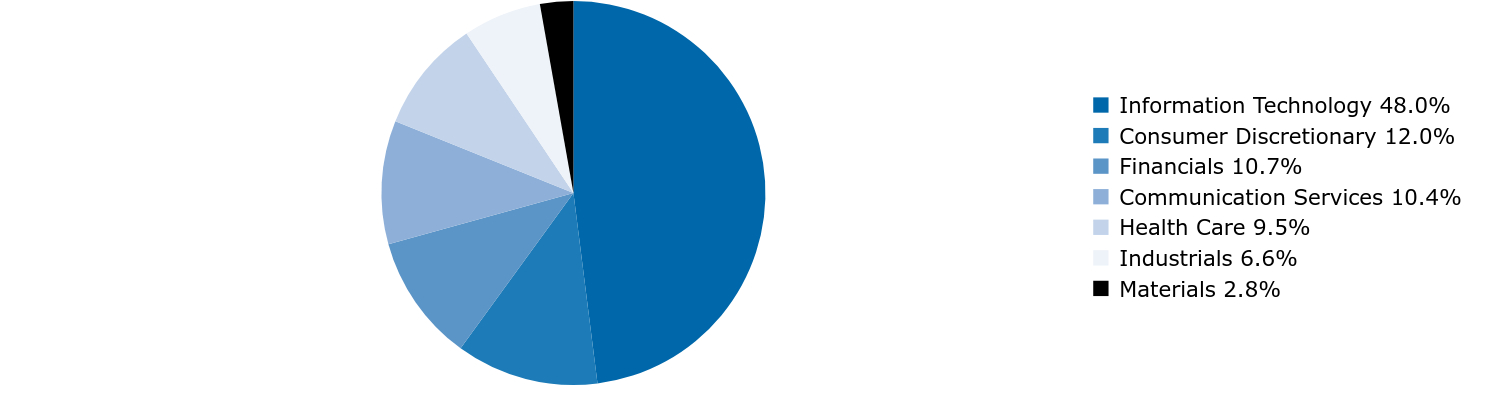

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Information Technology | 38.5% |

| Consumer Discretionary | 18.4% |

| Communication Services | 16.8% |

| Health Care | 10.2% |

| Financials | 7.2% |

| Industrials | 5.3% |

| Consumer Staples | 3.6% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

The Fund has adopted a policy that allows it to send only one copy of a Fund’s prospectus, proxy materials, annual report and semi-annual report to certain shareholders residing at the same household. This reduces Fund expenses, which benefits you and other shareholders. If you need additional copies or do not want your mailings to be “householded,” please call the Shareholder Servicing Agent at 800-422-1050. Individual copies will be sent within thirty (30) days after the Shareholder Servicing Agent receives your instructions. Your consent to householding is considered valid until revoked.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Convertible Securities Fund

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Convertible Securities Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retirement Class | $70 | 0.63% |

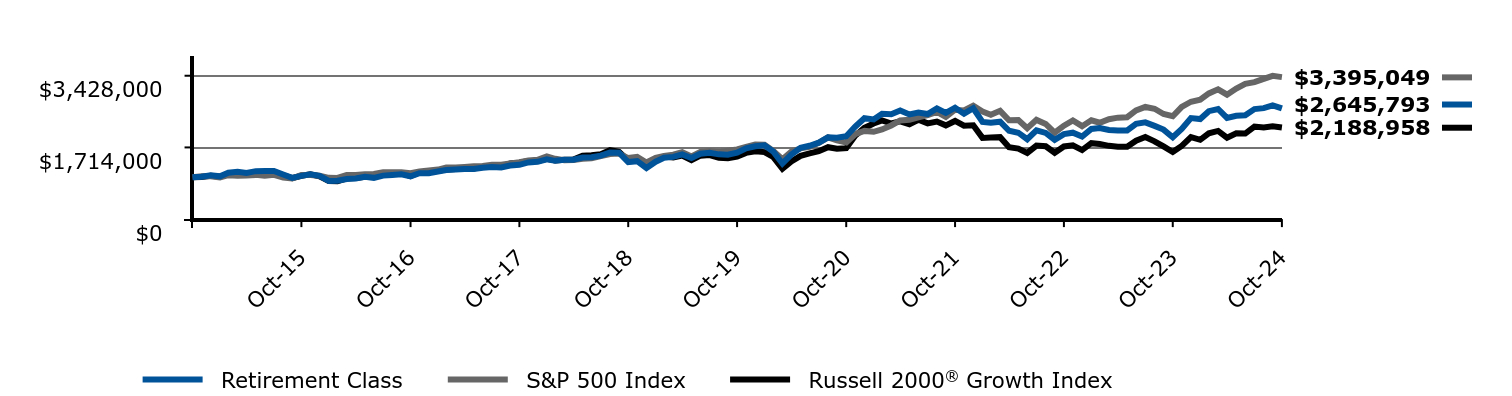

Management's Discussion of Fund Performance

Subadvisor: BlueCove Limited

Performance Summary

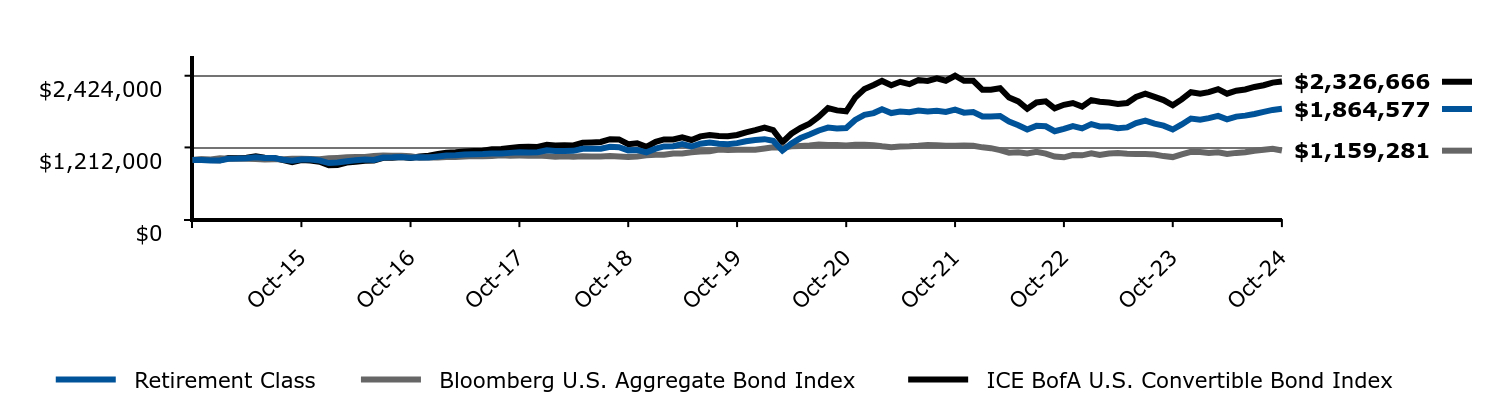

The Retirement Class returned 23.08% for the year ended October 31, 2024, while the ICE BofA U.S. Convertible Bond Index returned 20.97% during the same period.

Top contributors to relative performance included:

• Security selection within Technology, Basic Industry, and Consumer Cyclicals.

Top detractors from relative performance included:

• Security selection within Consumer Non-Cyclicals and Financials.

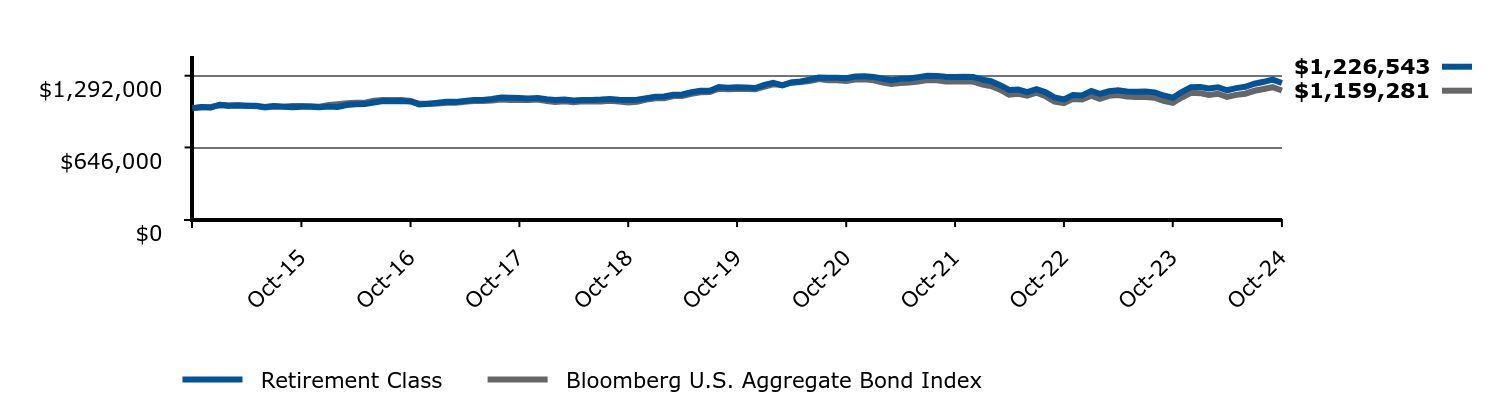

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

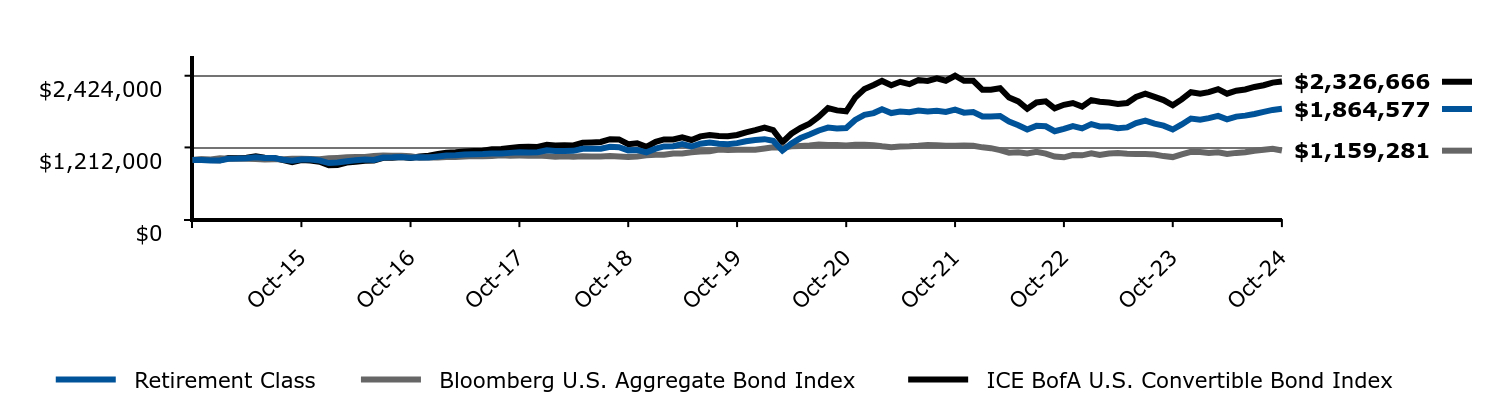

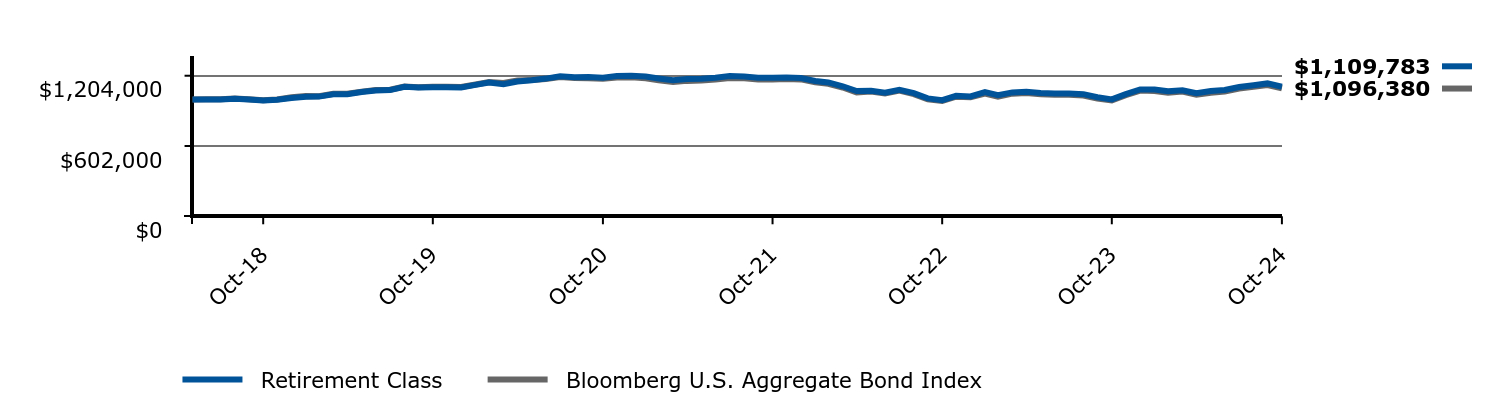

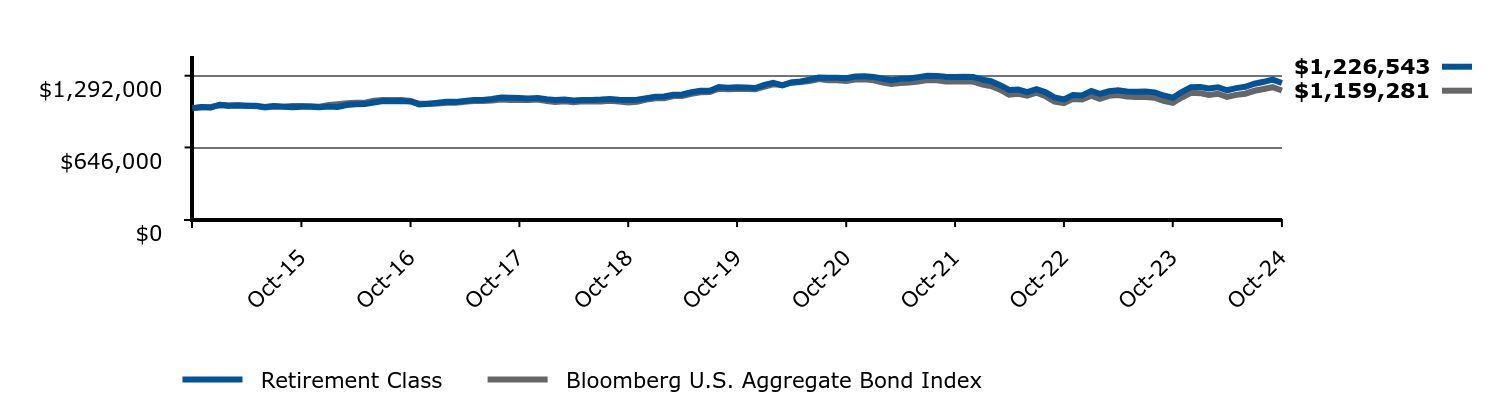

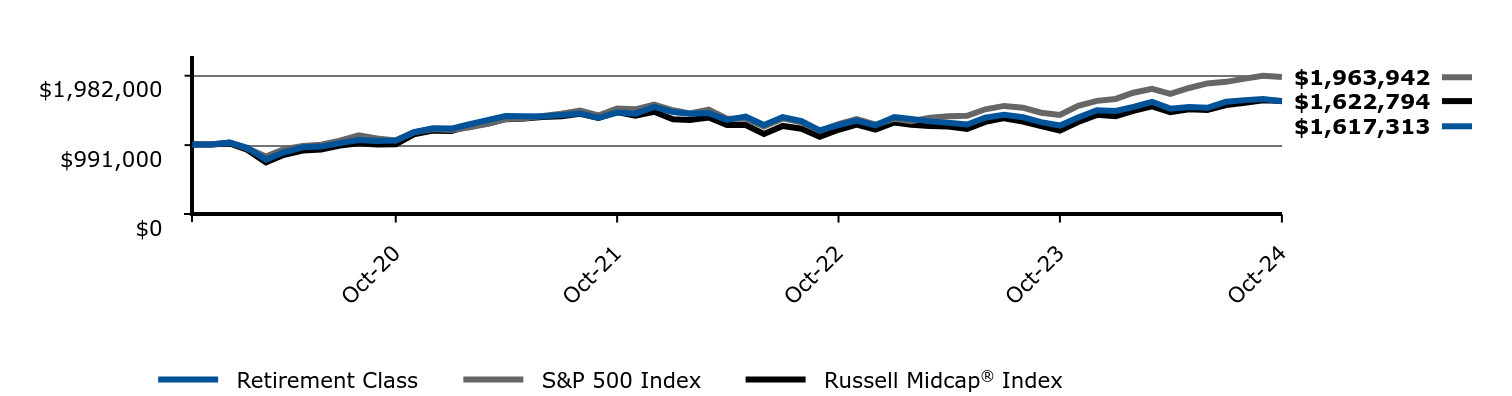

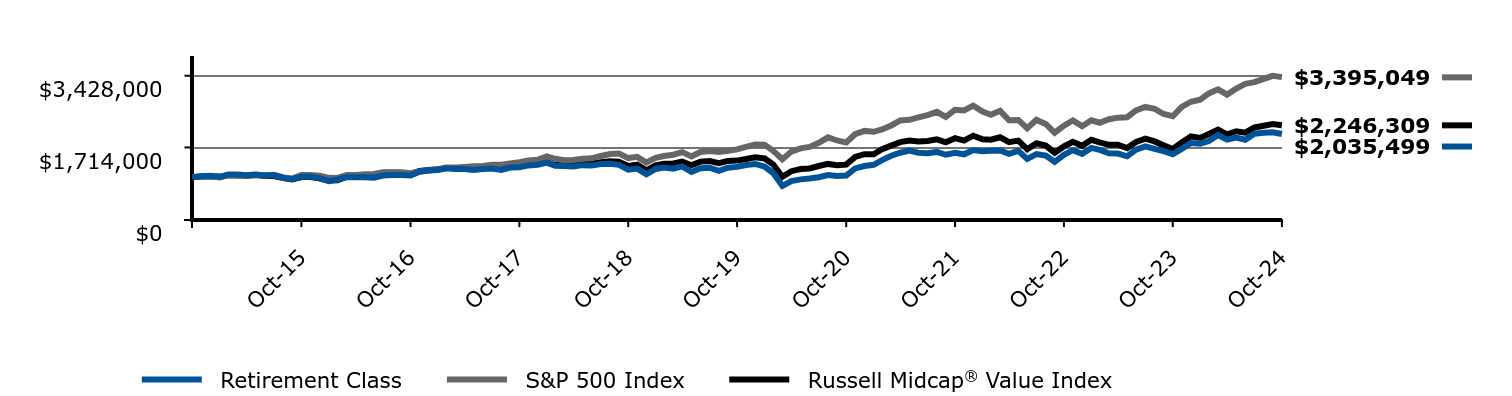

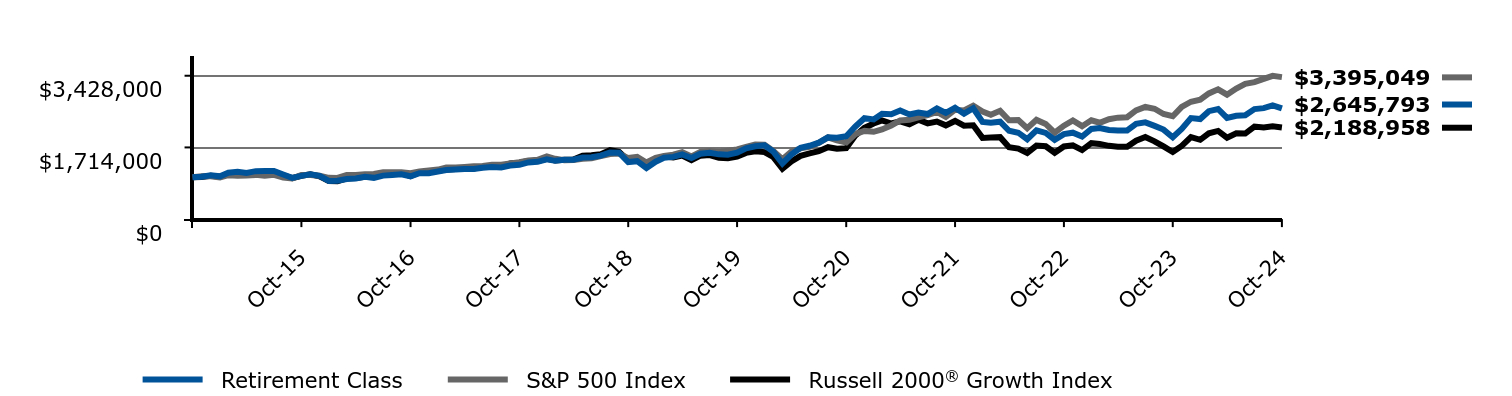

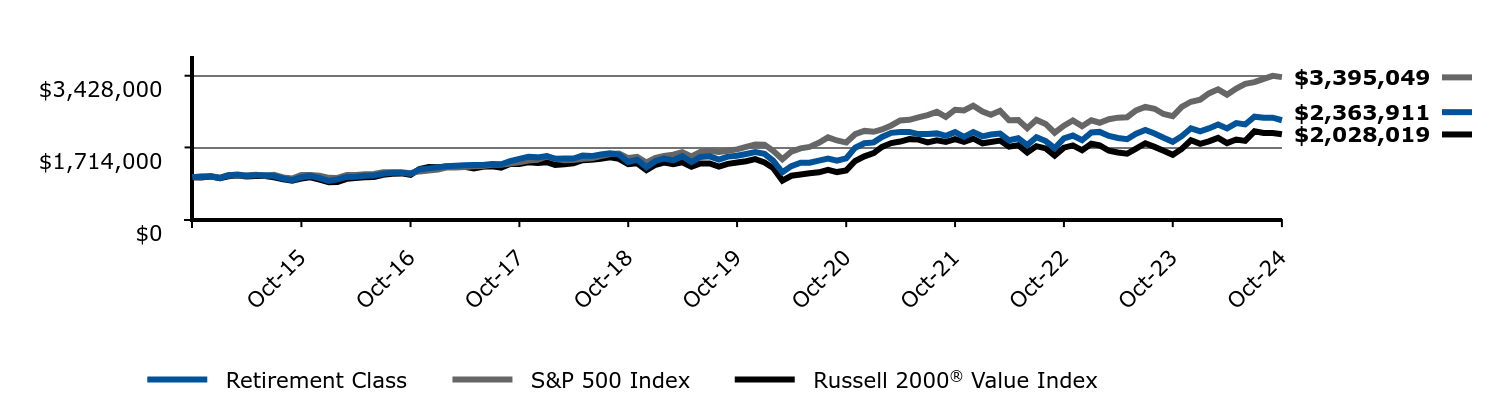

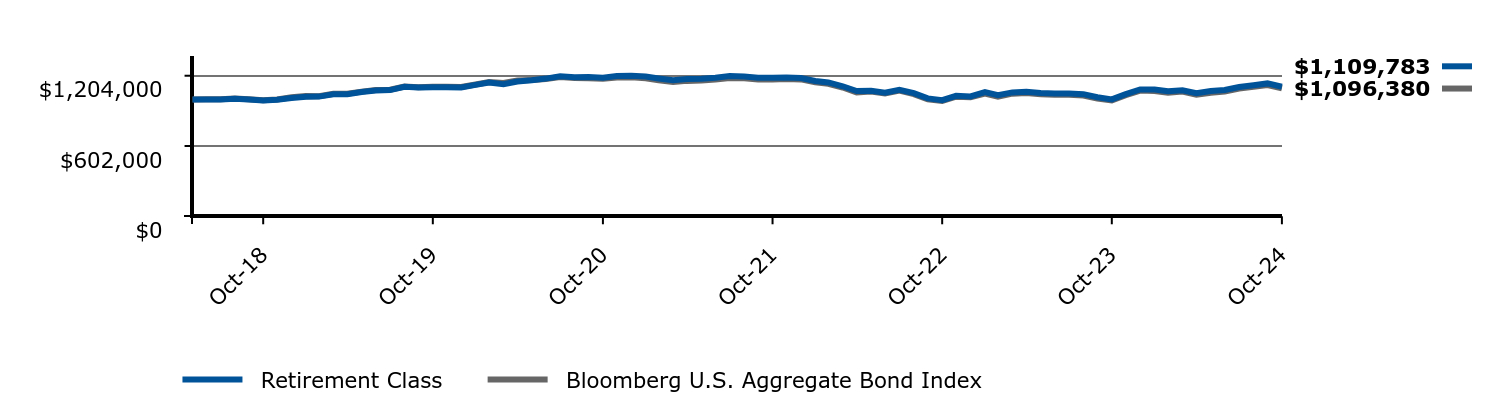

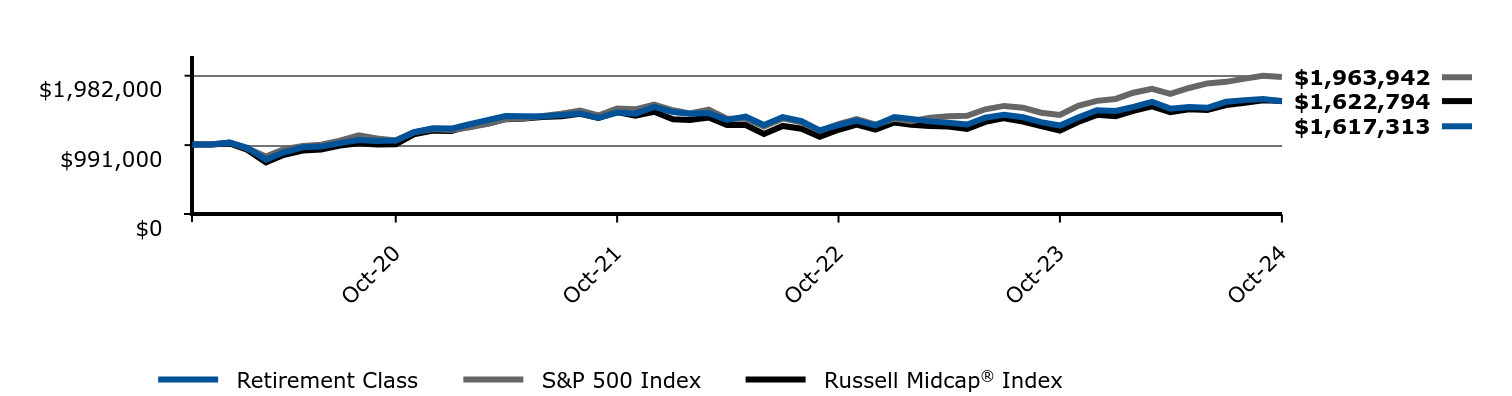

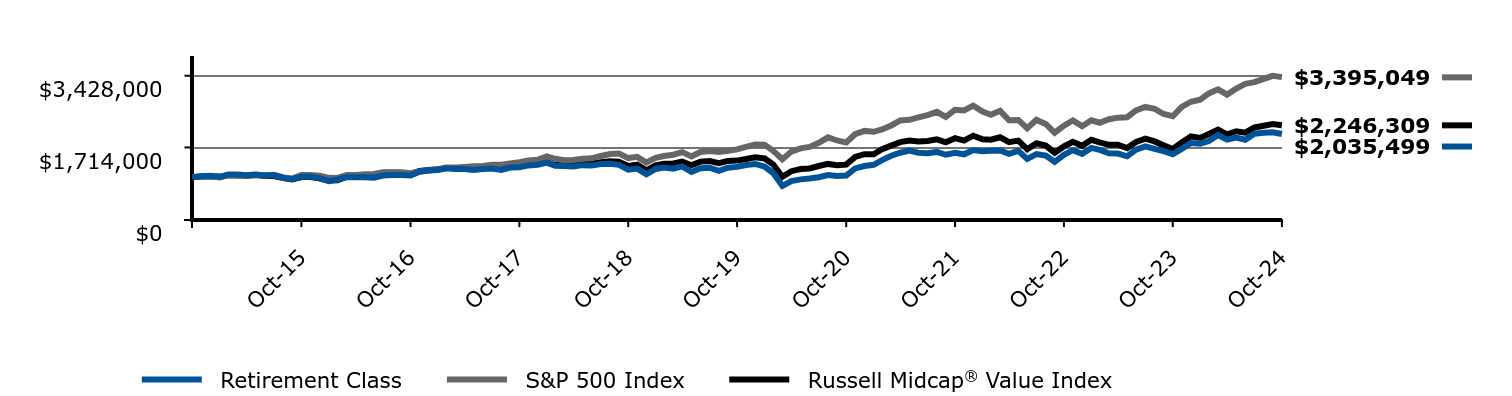

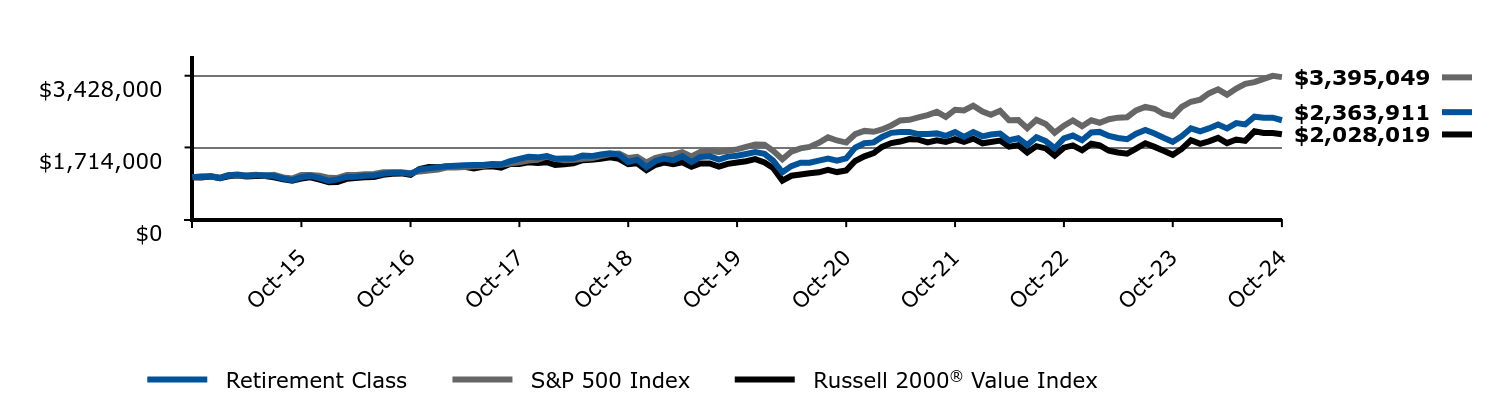

Change in a $1,000,000 Investment

For the period 11/01/2014 through 10/31/2024

| Retirement Class | Bloomberg U.S. Aggregate Bond Index | ICE BofA U.S. Convertible Bond Index |

|---|

| Oct-14 | $1,000,000 | $1,000,000 | $1,000,000 |

| Nov-14 | $1,000,893 | $1,007,094 | $1,009,505 |

| Dec-14 | $990,420 | $1,008,036 | $1,001,299 |

| Jan-15 | $990,420 | $1,029,174 | $993,561 |

| Feb-15 | $1,019,523 | $1,019,497 | $1,034,838 |

| Mar-15 | $1,022,786 | $1,024,231 | $1,031,491 |

| Apr-15 | $1,030,321 | $1,020,556 | $1,039,129 |

| May-15 | $1,045,390 | $1,018,098 | $1,062,824 |

| Jun-15 | $1,032,505 | $1,006,997 | $1,037,222 |

| Jul-15 | $1,031,560 | $1,013,997 | $1,033,604 |

| Aug-15 | $1,004,165 | $1,012,541 | $996,370 |

| Sep-15 | $988,225 | $1,019,390 | $963,183 |

| Oct-15 | $1,007,175 | $1,019,559 | $998,955 |

| Nov-15 | $1,007,175 | $1,016,866 | $991,287 |

| Dec-15 | $989,953 | $1,013,580 | $971,384 |

| Jan-16 | $947,849 | $1,027,528 | $911,513 |

| Feb-16 | $957,640 | $1,034,817 | $913,813 |

| Mar-16 | $979,792 | $1,044,311 | $956,199 |

| Apr-16 | $993,537 | $1,048,320 | $970,162 |

| May-16 | $1,006,300 | $1,048,589 | $986,690 |

| Jun-16 | $1,001,260 | $1,067,430 | $990,955 |

| Jul-16 | $1,040,641 | $1,074,178 | $1,036,007 |

| Aug-16 | $1,044,579 | $1,072,950 | $1,038,940 |

| Sep-16 | $1,051,932 | $1,072,321 | $1,050,619 |

| Oct-16 | $1,039,103 | $1,064,119 | $1,033,217 |

| Nov-16 | $1,046,011 | $1,038,949 | $1,056,843 |

| Dec-16 | $1,042,699 | $1,040,414 | $1,072,691 |

| Jan-17 | $1,059,580 | $1,042,455 | $1,101,330 |

| Feb-17 | $1,073,483 | $1,049,462 | $1,122,318 |

| Mar-17 | $1,079,391 | $1,048,911 | $1,129,508 |

| Apr-17 | $1,090,354 | $1,057,006 | $1,142,001 |

| May-17 | $1,098,327 | $1,065,142 | $1,149,982 |

| Jun-17 | $1,101,619 | $1,064,070 | $1,157,293 |

| Jul-17 | $1,110,616 | $1,068,649 | $1,180,690 |

| Aug-17 | $1,107,617 | $1,078,234 | $1,185,006 |

| Sep-17 | $1,119,658 | $1,073,099 | $1,200,934 |

| Oct-17 | $1,130,694 | $1,073,720 | $1,220,572 |

| Nov-17 | $1,127,684 | $1,072,342 | $1,222,073 |

| Dec-17 | $1,129,587 | $1,077,264 | $1,219,654 |

| Jan-18 | $1,163,784 | $1,064,857 | $1,257,448 |

| Feb-18 | $1,151,650 | $1,054,763 | $1,242,843 |

| Mar-18 | $1,151,928 | $1,061,527 | $1,248,925 |

| Apr-18 | $1,154,139 | $1,053,632 | $1,246,366 |

| May-18 | $1,188,409 | $1,061,151 | $1,290,548 |

| Jun-18 | $1,190,942 | $1,059,846 | $1,295,974 |

| Jul-18 | $1,188,727 | $1,060,098 | $1,304,342 |

| Aug-18 | $1,223,070 | $1,066,919 | $1,350,241 |

| Sep-18 | $1,216,767 | $1,060,049 | $1,346,902 |

| Oct-18 | $1,162,367 | $1,051,674 | $1,265,405 |

| Nov-18 | $1,167,918 | $1,057,949 | $1,281,526 |

| Dec-18 | $1,128,139 | $1,077,384 | $1,221,499 |

| Jan-19 | $1,191,796 | $1,088,829 | $1,307,581 |

| Feb-19 | $1,229,518 | $1,088,197 | $1,346,814 |

| Mar-19 | $1,233,571 | $1,109,091 | $1,346,790 |

| Apr-19 | $1,266,656 | $1,109,375 | $1,382,961 |

| May-19 | $1,227,663 | $1,129,069 | $1,337,662 |

| Jun-19 | $1,274,327 | $1,143,246 | $1,398,701 |

| Jul-19 | $1,295,645 | $1,145,762 | $1,422,521 |

| Aug-19 | $1,275,512 | $1,175,452 | $1,404,965 |

| Sep-19 | $1,264,050 | $1,169,193 | $1,400,852 |

| Oct-19 | $1,284,227 | $1,172,715 | $1,422,987 |

| Nov-19 | $1,315,087 | $1,172,115 | $1,467,822 |

| Dec-19 | $1,336,744 | $1,171,299 | $1,504,278 |

| Jan-20 | $1,351,474 | $1,193,840 | $1,546,586 |

| Feb-20 | $1,323,242 | $1,215,329 | $1,502,967 |

| Mar-20 | $1,159,858 | $1,208,175 | $1,299,401 |

| Apr-20 | $1,276,705 | $1,229,653 | $1,443,529 |

| May-20 | $1,370,182 | $1,235,377 | $1,541,005 |

| Jun-20 | $1,428,767 | $1,243,161 | $1,613,269 |

| Jul-20 | $1,497,742 | $1,261,728 | $1,730,328 |

| Aug-20 | $1,548,242 | $1,251,544 | $1,878,516 |

| Sep-20 | $1,532,786 | $1,250,858 | $1,837,973 |

| Oct-20 | $1,540,184 | $1,245,272 | $1,822,918 |

| Nov-20 | $1,677,062 | $1,257,491 | $2,054,752 |

| Dec-20 | $1,764,122 | $1,259,224 | $2,199,576 |

| Jan-21 | $1,792,510 | $1,250,195 | $2,266,331 |

| Feb-21 | $1,858,749 | $1,232,143 | $2,336,089 |

| Mar-21 | $1,793,256 | $1,216,756 | $2,262,589 |

| Apr-21 | $1,818,951 | $1,226,369 | $2,321,042 |

| May-21 | $1,806,779 | $1,230,375 | $2,281,883 |

| Jun-21 | $1,834,208 | $1,239,020 | $2,351,307 |

| Jul-21 | $1,817,976 | $1,252,874 | $2,336,287 |

| Aug-21 | $1,831,502 | $1,250,489 | $2,379,620 |

| Sep-21 | $1,811,212 | $1,239,662 | $2,339,794 |

| Oct-21 | $1,851,792 | $1,239,320 | $2,423,625 |

| Nov-21 | $1,799,038 | $1,242,988 | $2,337,583 |

| Dec-21 | $1,810,156 | $1,239,808 | $2,339,106 |

| Jan-22 | $1,735,766 | $1,213,097 | $2,185,826 |

| Feb-22 | $1,734,217 | $1,199,563 | $2,186,450 |

| Mar-22 | $1,742,933 | $1,166,235 | $2,212,631 |

| Apr-22 | $1,649,894 | $1,121,978 | $2,055,592 |

| May-22 | $1,587,868 | $1,129,211 | $1,989,229 |

| Jun-22 | $1,514,396 | $1,111,497 | $1,866,330 |

| Jul-22 | $1,576,461 | $1,138,655 | $1,972,604 |

| Aug-22 | $1,568,703 | $1,106,485 | $1,990,626 |

| Sep-22 | $1,485,637 | $1,058,675 | $1,871,694 |

| Oct-22 | $1,526,041 | $1,044,962 | $1,932,622 |

| Nov-22 | $1,572,662 | $1,083,391 | $1,963,165 |

| Dec-22 | $1,534,220 | $1,078,506 | $1,901,483 |

| Jan-23 | $1,606,161 | $1,111,686 | $2,011,753 |

| Feb-23 | $1,567,063 | $1,082,943 | $1,985,795 |

| Mar-23 | $1,565,641 | $1,110,449 | $1,972,714 |

| Apr-23 | $1,535,714 | $1,117,182 | $1,945,273 |

| May-23 | $1,549,890 | $1,105,016 | $1,962,402 |

| Jun-23 | $1,623,162 | $1,101,074 | $2,064,133 |

| Jul-23 | $1,666,128 | $1,100,310 | $2,120,532 |

| Aug-23 | $1,613,614 | $1,093,277 | $2,065,610 |

| Sep-23 | $1,579,300 | $1,065,498 | $2,011,922 |

| Oct-23 | $1,514,970 | $1,048,684 | $1,923,371 |

| Nov-23 | $1,600,207 | $1,096,173 | $2,023,558 |

| Dec-23 | $1,700,531 | $1,138,134 | $2,146,218 |

| Jan-24 | $1,679,477 | $1,135,007 | $2,121,249 |

| Feb-24 | $1,707,010 | $1,118,972 | $2,146,683 |

| Mar-24 | $1,745,715 | $1,129,306 | $2,196,497 |

| Apr-24 | $1,686,926 | $1,100,779 | $2,120,003 |

| May-24 | $1,732,651 | $1,119,441 | $2,171,695 |

| Jun-24 | $1,749,471 | $1,130,043 | $2,191,838 |

| Jul-24 | $1,777,476 | $1,156,433 | $2,234,045 |

| Aug-24 | $1,812,070 | $1,173,052 | $2,263,329 |

| Sep-24 | $1,846,313 | $1,188,760 | $2,307,268 |

| Oct-24 | $1,864,577 | $1,159,281 | $2,326,666 |

The graph compares a $1,000,000 initial investment minimum in the Retirement Class with the performance of the Bloomberg U.S. Aggregate Bond Index and ICE BofA U.S. Convertible Bond Index. The Retirement Class performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Retirement Class | 23.08% | 7.74% | 6.43% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| ICE BofA U.S. Convertible Bond Index | 20.97% | 10.33% | 8.81% |

The Retirement Class shares commenced operations on March 1, 2016. The performance attributed to the Retirement Class shares prior to that date is that of the Institutional Class shares. Performance prior to March 1, 2016 has not been adjusted to reflect the lower expenses of Retirement Class shares. During this period, Retirement Class shares would have had returns similar to, but potentially higher than, Institutional Class shares due to the fact that Retirement Class shares represent interests in the same portfolio as Institutional Class shares but are subject to lower expenses. Please refer to the Fund’s prospectus for further details.

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $24,812 |

| Number of Investments | 127 |

| Total Net Advisory Fees Paid (in thousands) | $126 |

| Portfolio Turnover Rate | 100% |

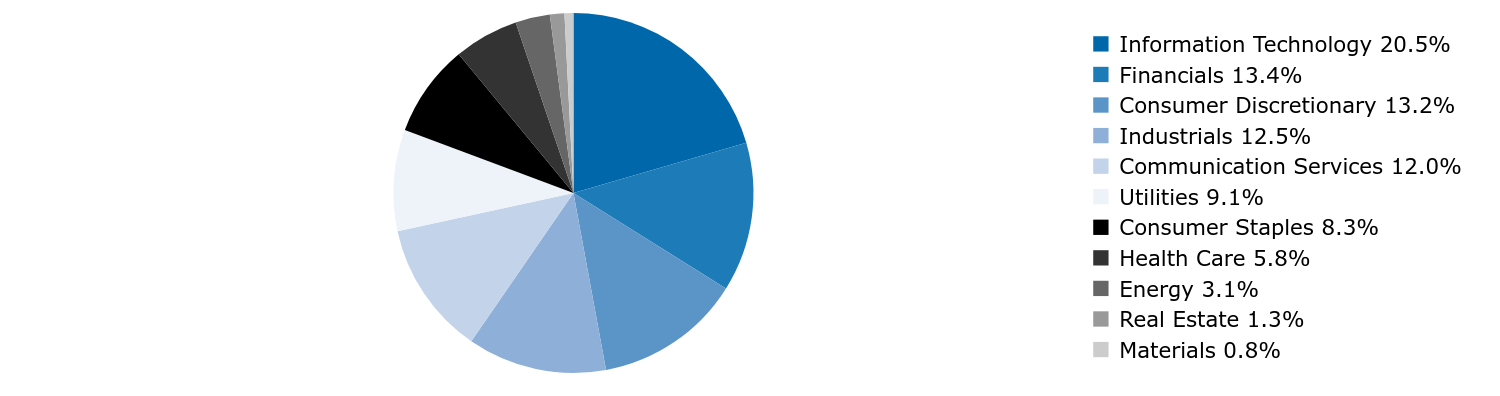

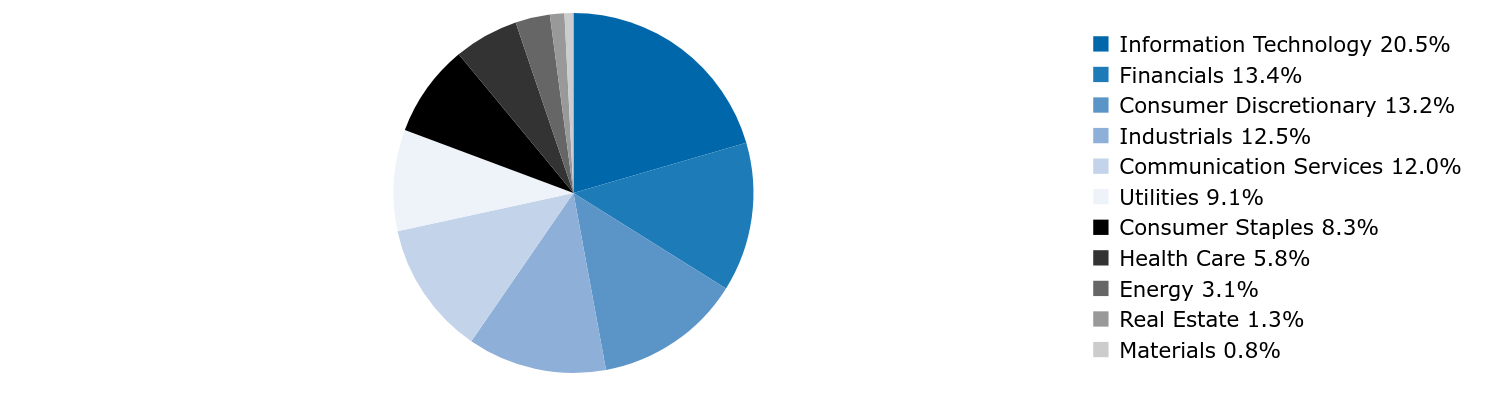

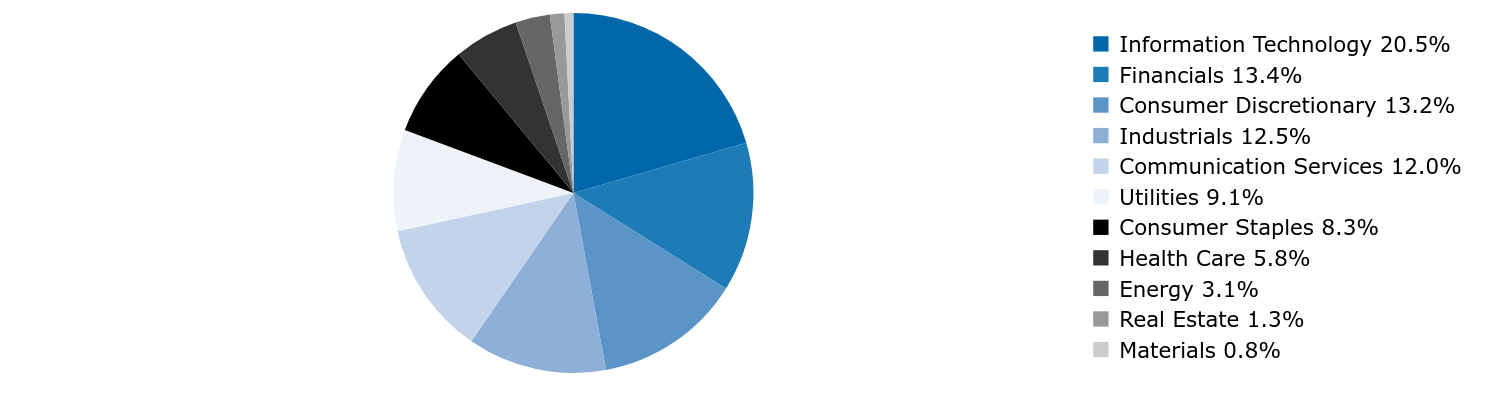

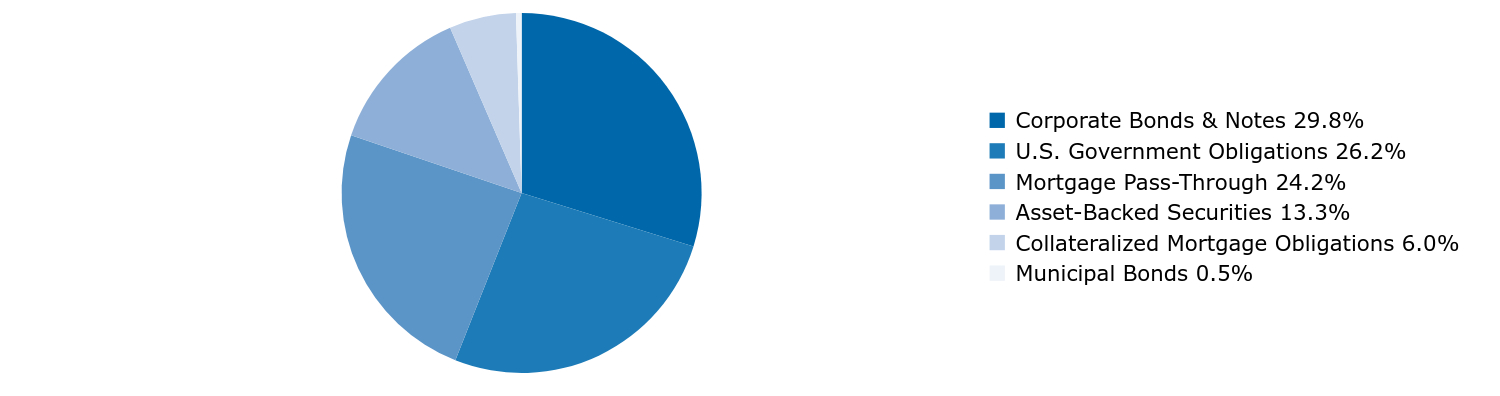

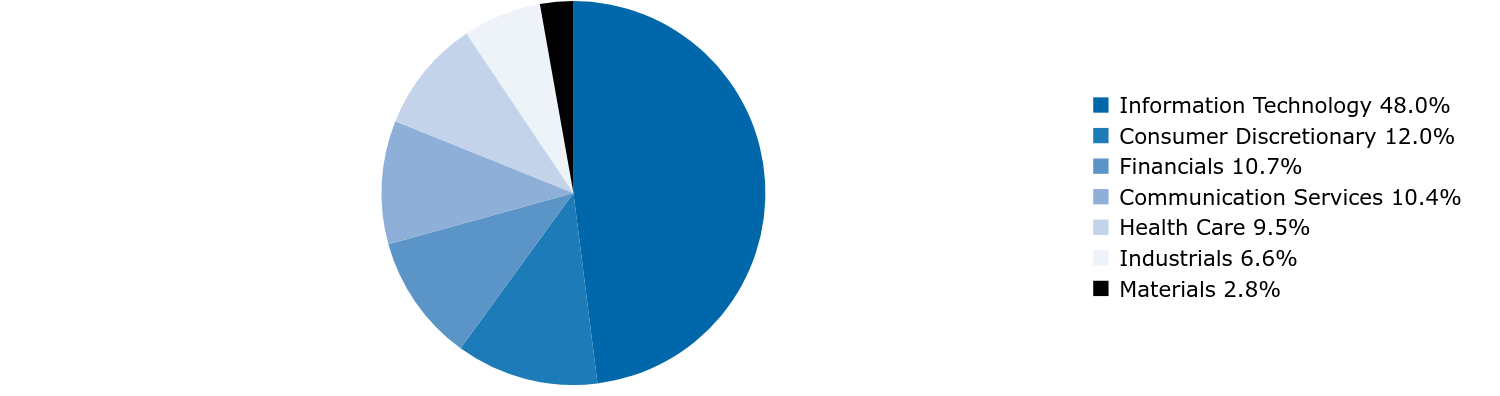

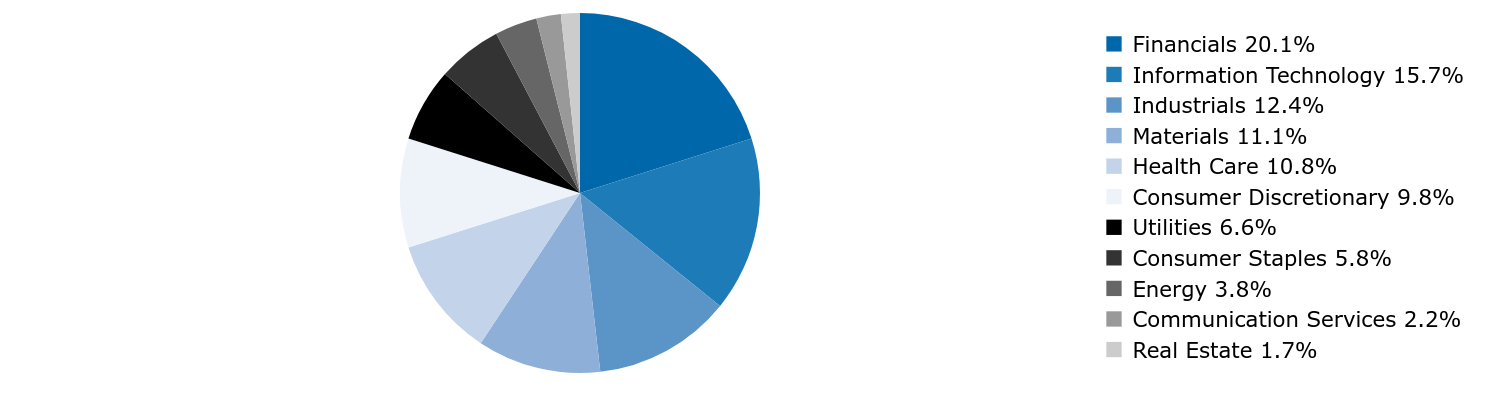

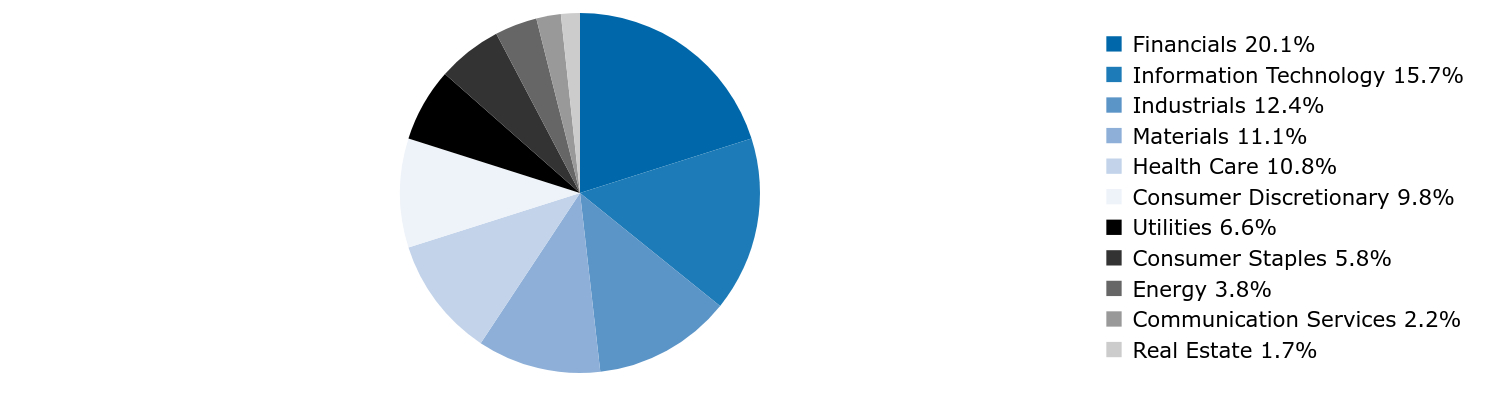

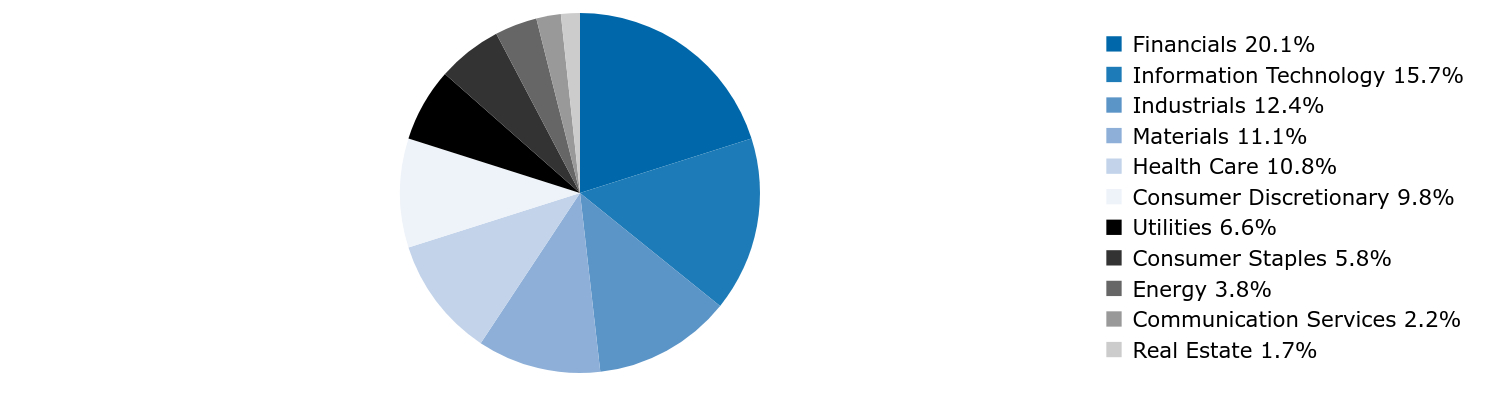

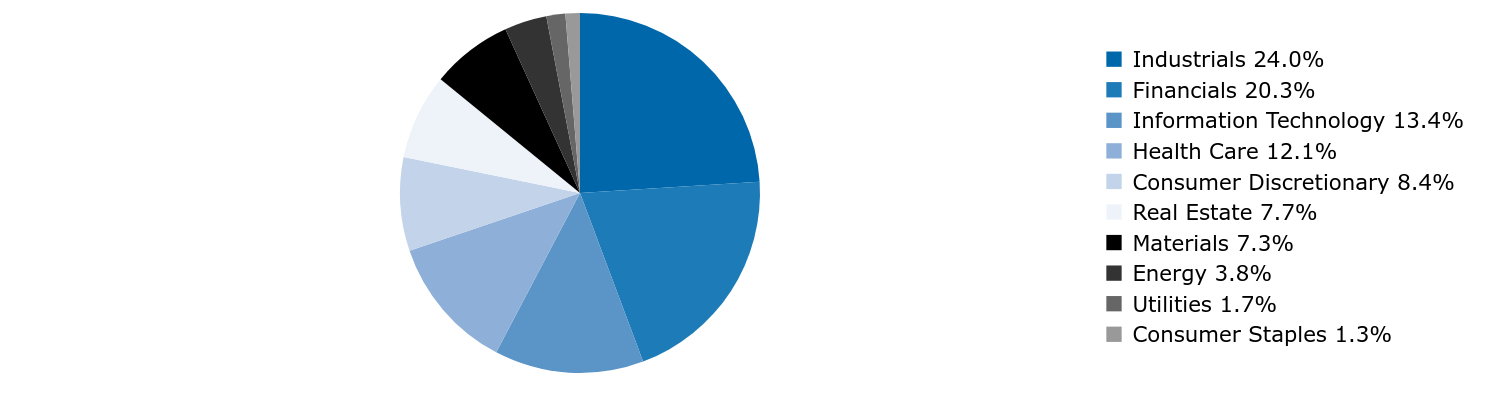

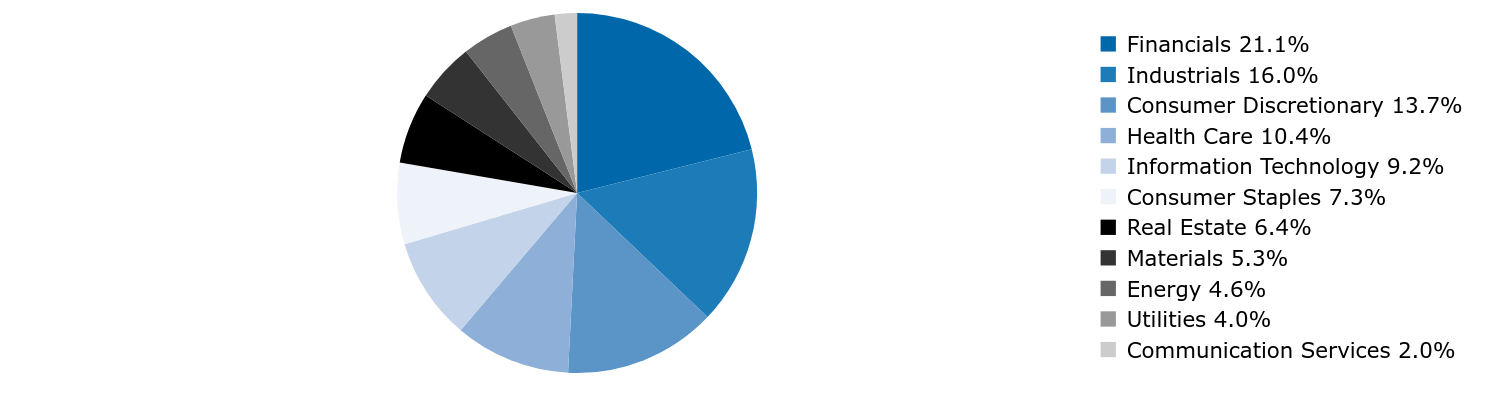

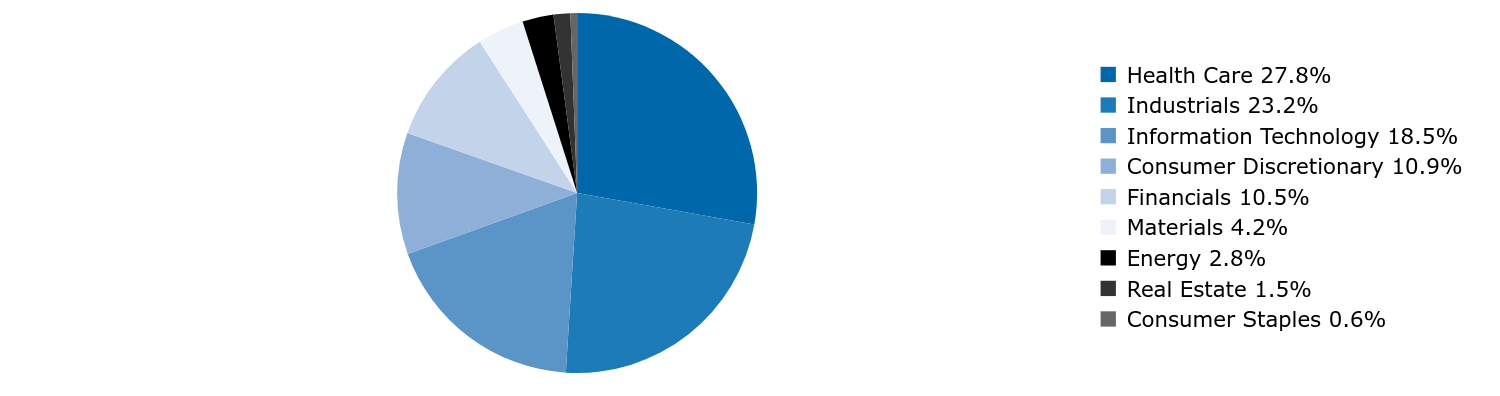

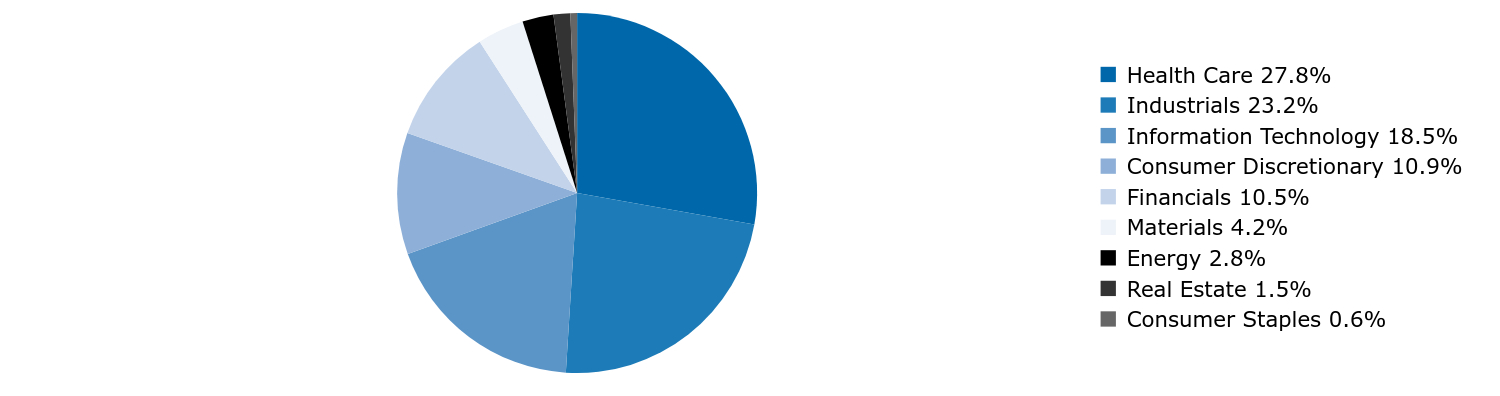

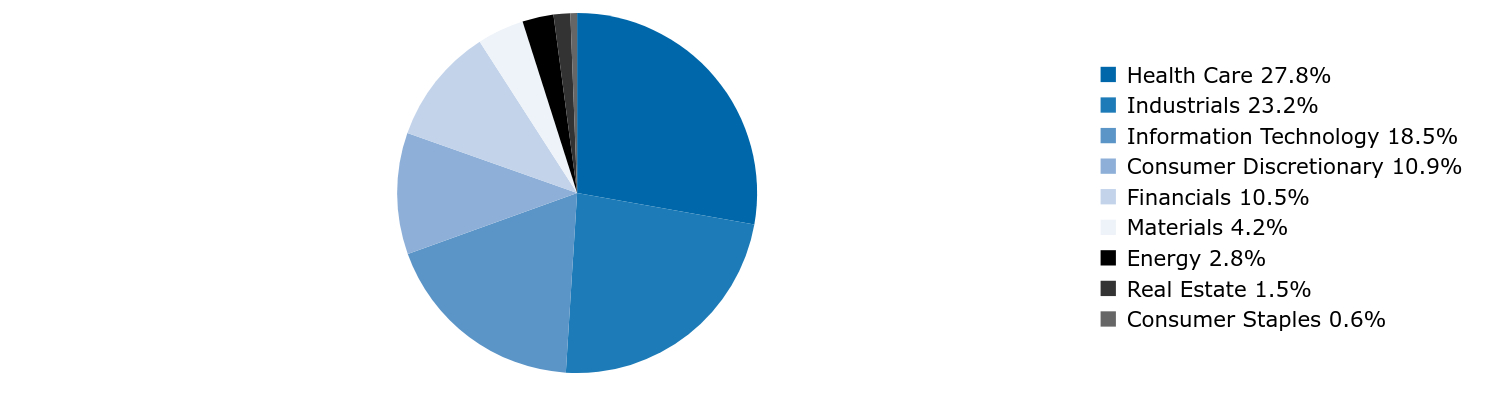

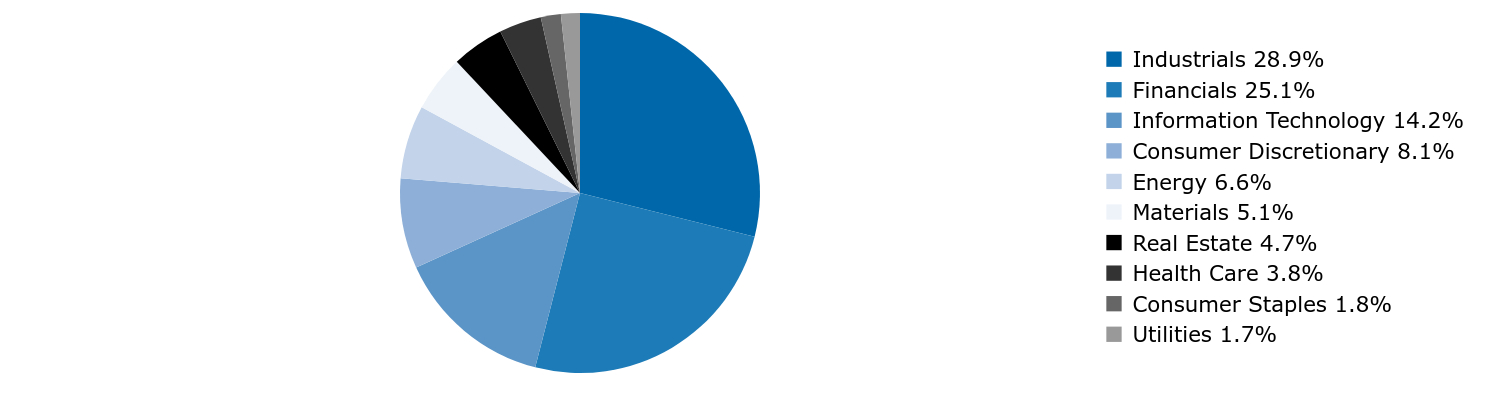

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Information Technology | 20.5% |

| Financials | 13.4% |

| Consumer Discretionary | 13.2% |

| Industrials | 12.5% |

| Communication Services | 12.0% |

| Utilities | 9.1% |

| Consumer Staples | 8.3% |

| Health Care | 5.8% |

| Energy | 3.1% |

| Real Estate | 1.3% |

| Materials | 0.8% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

The Fund has adopted a policy that allows it to send only one copy of a Fund’s prospectus, proxy materials, annual report and semi-annual report to certain shareholders residing at the same household. This reduces Fund expenses, which benefits you and other shareholders. If you need additional copies or do not want your mailings to be “householded,” please call the Shareholder Servicing Agent at 800-422-1050. Individual copies will be sent within thirty (30) days after the Shareholder Servicing Agent receives your instructions. Your consent to householding is considered valid until revoked.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

Harbor Convertible Securities Fund

Institutional Class: HACSX

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Convertible Securities Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $79 | 0.71% |

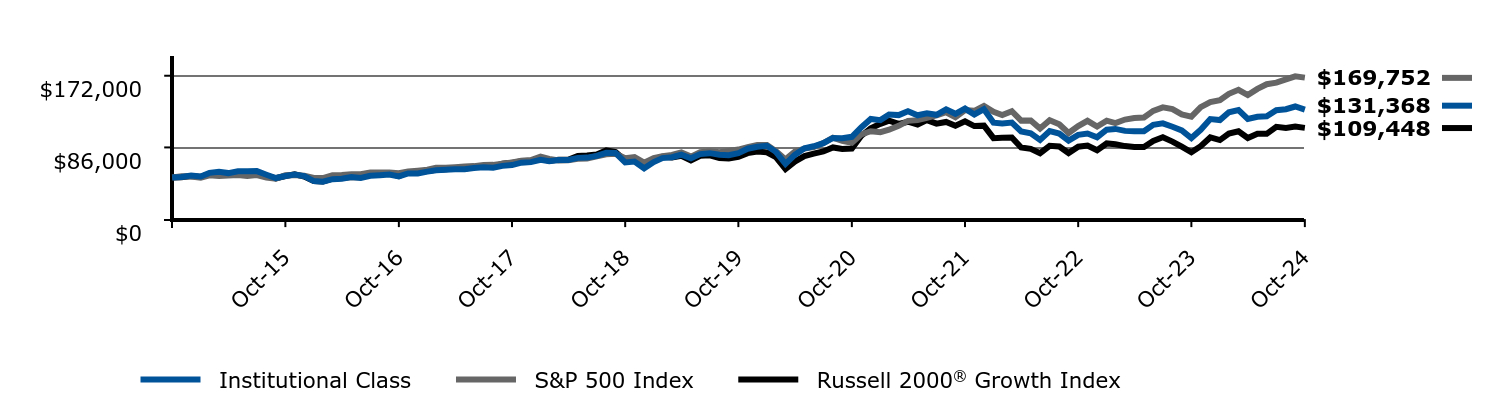

Management's Discussion of Fund Performance

Subadvisor: BlueCove Limited

Performance Summary

The Institutional Class returned 22.98% for the year ended October 31, 2024, while the ICE BofA U.S. Convertible Bond Index returned 20.97% during the same period.

Top contributors to relative performance included:

• Security selection within Technology, Basic Industry, and Consumer Cyclicals.

Top detractors from relative performance included:

• Security selection within Consumer Non-Cyclicals and Financials.

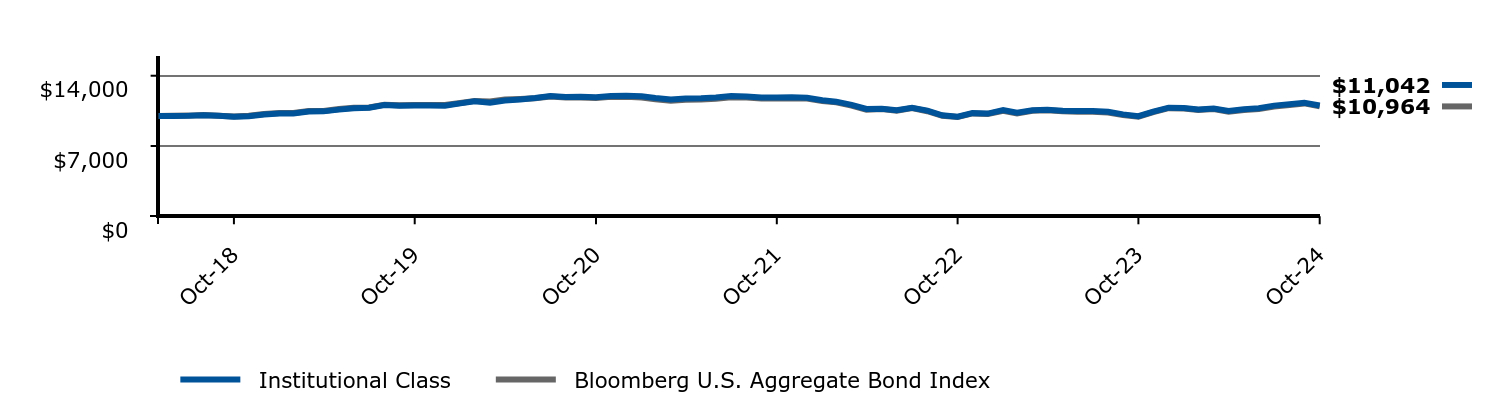

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

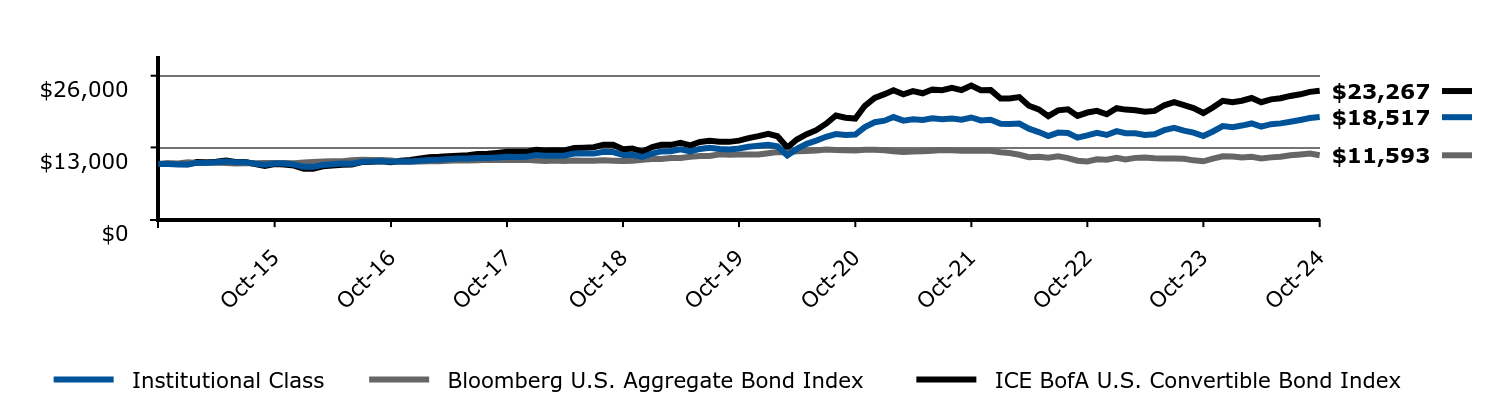

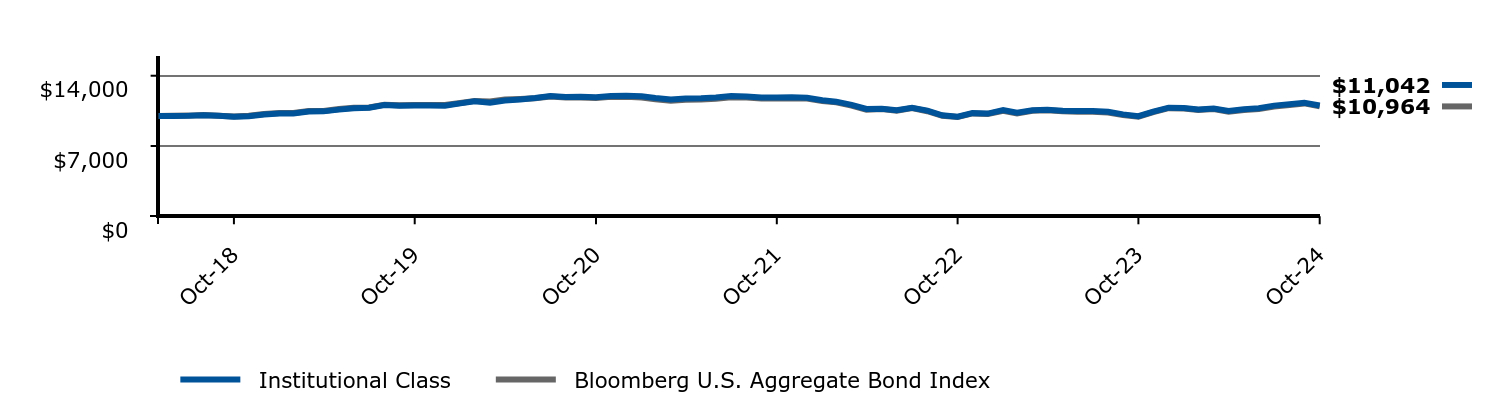

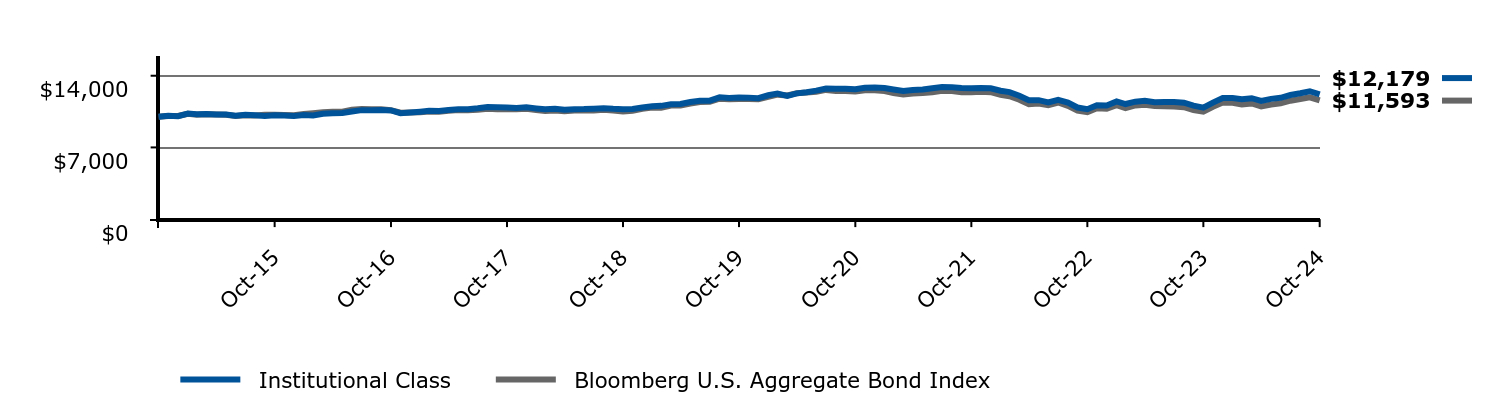

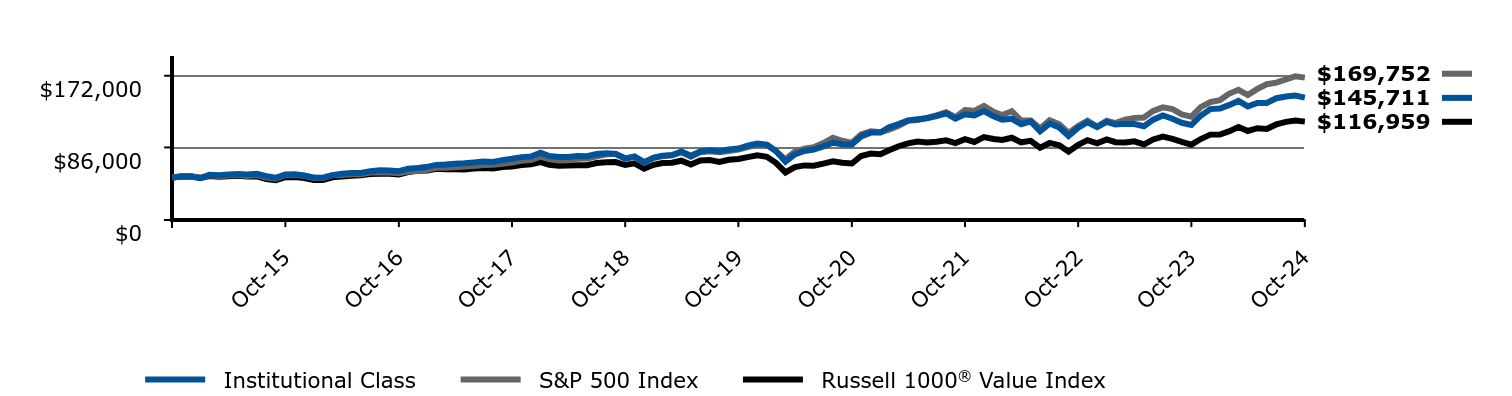

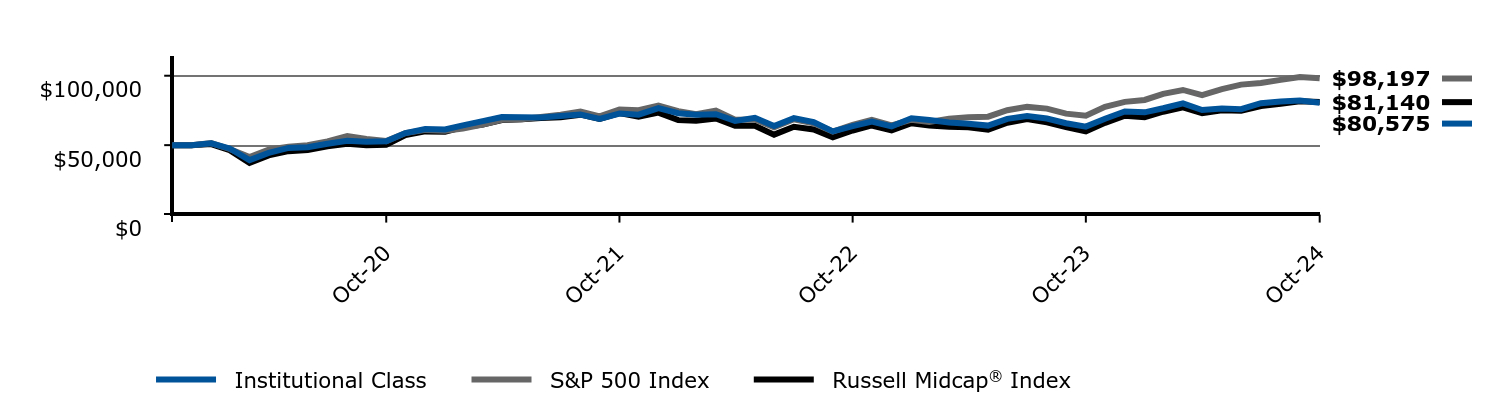

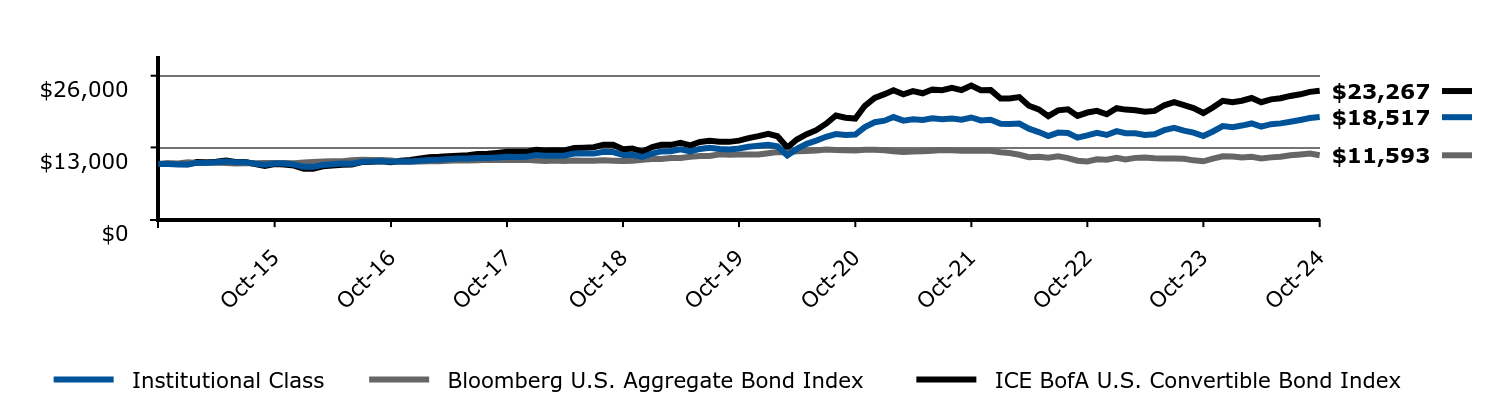

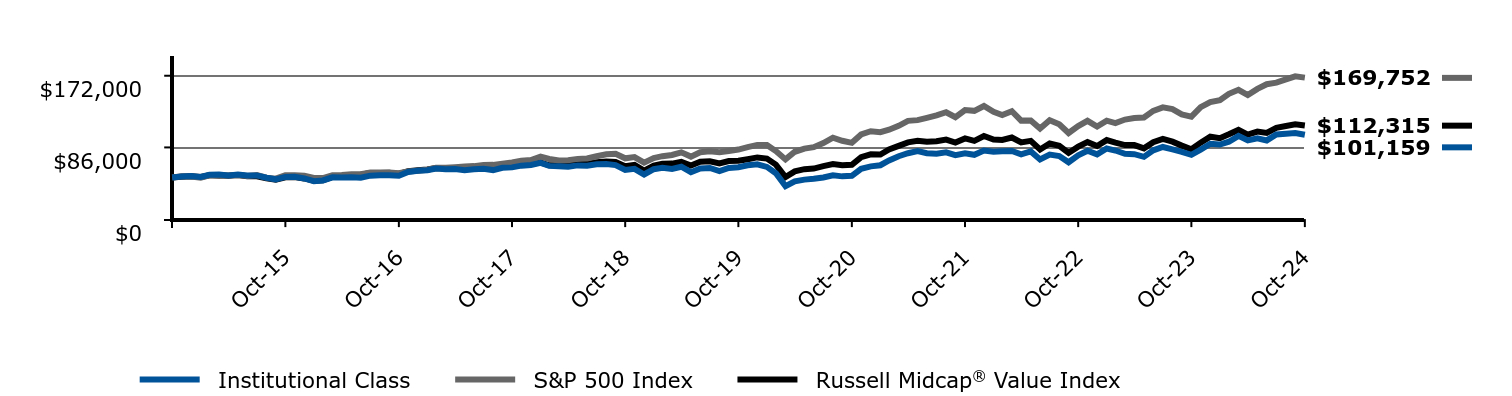

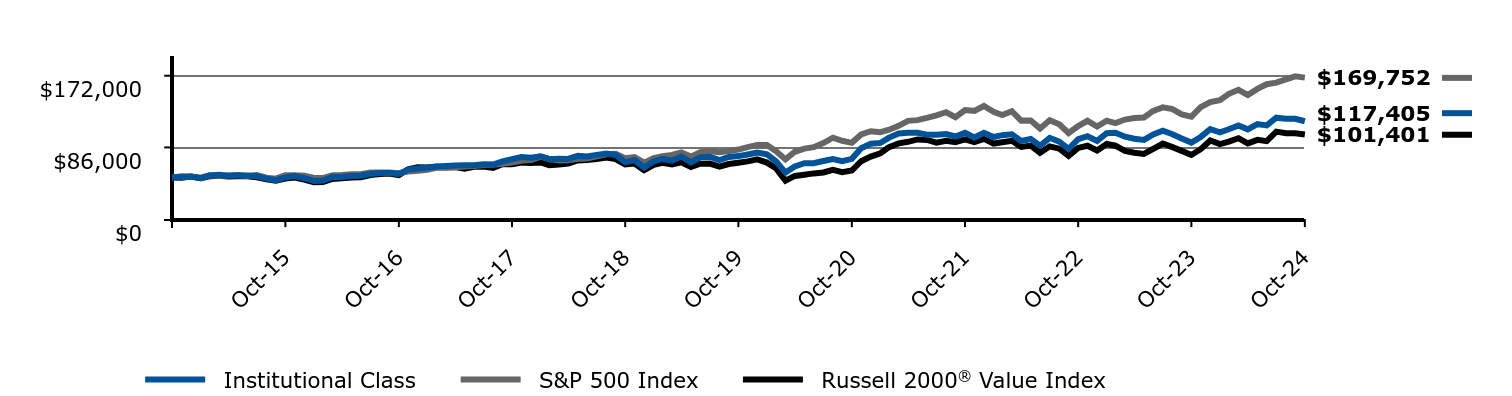

Change in a $10,000 Investment

For the period 11/01/2014 through 10/31/2024

| Institutional Class | Bloomberg U.S. Aggregate Bond Index | ICE BofA U.S. Convertible Bond Index |

|---|

| Oct-14 | $10,000 | $10,000 | $10,000 |

| Nov-14 | $10,009 | $10,071 | $10,095 |

| Dec-14 | $9,904 | $10,080 | $10,013 |

| Jan-15 | $9,904 | $10,292 | $9,936 |

| Feb-15 | $10,195 | $10,195 | $10,348 |

| Mar-15 | $10,228 | $10,242 | $10,315 |

| Apr-15 | $10,303 | $10,206 | $10,391 |

| May-15 | $10,454 | $10,181 | $10,628 |

| Jun-15 | $10,325 | $10,070 | $10,372 |

| Jul-15 | $10,316 | $10,140 | $10,336 |

| Aug-15 | $10,042 | $10,125 | $9,964 |

| Sep-15 | $9,882 | $10,194 | $9,632 |

| Oct-15 | $10,072 | $10,196 | $9,990 |

| Nov-15 | $10,072 | $10,169 | $9,913 |

| Dec-15 | $9,900 | $10,136 | $9,714 |

| Jan-16 | $9,478 | $10,275 | $9,115 |

| Feb-16 | $9,478 | $10,348 | $9,138 |

| Mar-16 | $9,797 | $10,443 | $9,562 |

| Apr-16 | $9,934 | $10,483 | $9,702 |

| May-16 | $10,062 | $10,486 | $9,867 |

| Jun-16 | $10,019 | $10,674 | $9,910 |

| Jul-16 | $10,403 | $10,742 | $10,360 |

| Aug-16 | $10,442 | $10,729 | $10,389 |

| Sep-16 | $10,515 | $10,723 | $10,506 |

| Oct-16 | $10,386 | $10,641 | $10,332 |

| Nov-16 | $10,455 | $10,389 | $10,568 |

| Dec-16 | $10,431 | $10,404 | $10,727 |

| Jan-17 | $10,600 | $10,425 | $11,013 |

| Feb-17 | $10,729 | $10,495 | $11,223 |

| Mar-17 | $10,786 | $10,489 | $11,295 |

| Apr-17 | $10,896 | $10,570 | $11,420 |

| May-17 | $10,985 | $10,651 | $11,500 |

| Jun-17 | $11,006 | $10,641 | $11,573 |

| Jul-17 | $11,096 | $10,686 | $11,807 |

| Aug-17 | $11,066 | $10,782 | $11,850 |

| Sep-17 | $11,184 | $10,731 | $12,009 |

| Oct-17 | $11,294 | $10,737 | $12,206 |

| Nov-17 | $11,274 | $10,723 | $12,221 |

| Dec-17 | $11,291 | $10,773 | $12,197 |

| Jan-18 | $11,622 | $10,649 | $12,574 |

| Feb-18 | $11,512 | $10,548 | $12,428 |

| Mar-18 | $11,512 | $10,615 | $12,489 |

| Apr-18 | $11,524 | $10,536 | $12,464 |

| May-18 | $11,877 | $10,612 | $12,905 |

| Jun-18 | $11,889 | $10,598 | $12,960 |

| Jul-18 | $11,878 | $10,601 | $13,043 |

| Aug-18 | $12,210 | $10,669 | $13,502 |

| Sep-18 | $12,156 | $10,600 | $13,469 |

| Oct-18 | $11,613 | $10,517 | $12,654 |

| Nov-18 | $11,657 | $10,579 | $12,815 |

| Dec-18 | $11,269 | $10,774 | $12,215 |

| Jan-19 | $11,892 | $10,888 | $13,076 |

| Feb-19 | $12,280 | $10,882 | $13,468 |

| Mar-19 | $12,319 | $11,091 | $13,468 |

| Apr-19 | $12,660 | $11,094 | $13,830 |

| May-19 | $12,260 | $11,291 | $13,377 |

| Jun-19 | $12,723 | $11,432 | $13,987 |

| Jul-19 | $12,935 | $11,458 | $14,225 |

| Aug-19 | $12,723 | $11,755 | $14,050 |

| Sep-19 | $12,618 | $11,692 | $14,009 |

| Oct-19 | $12,819 | $11,727 | $14,230 |

| Nov-19 | $13,115 | $11,721 | $14,678 |

| Dec-19 | $13,316 | $11,713 | $15,043 |

| Jan-20 | $13,475 | $11,938 | $15,466 |

| Feb-20 | $13,181 | $12,153 | $15,030 |

| Mar-20 | $11,562 | $12,082 | $12,994 |

| Apr-20 | $12,727 | $12,297 | $14,435 |

| May-20 | $13,646 | $12,354 | $15,410 |

| Jun-20 | $14,227 | $12,432 | $16,133 |

| Jul-20 | $14,927 | $12,617 | $17,303 |

| Aug-20 | $15,418 | $12,515 | $18,785 |

| Sep-20 | $15,273 | $12,509 | $18,380 |

| Oct-20 | $15,335 | $12,453 | $18,229 |

| Nov-20 | $16,699 | $12,575 | $20,548 |

| Dec-20 | $17,563 | $12,592 | $21,996 |

| Jan-21 | $17,846 | $12,502 | $22,663 |

| Feb-21 | $18,506 | $12,321 | $23,361 |

| Mar-21 | $17,850 | $12,168 | $22,626 |

| Apr-21 | $18,106 | $12,264 | $23,210 |

| May-21 | $17,985 | $12,304 | $22,819 |

| Jun-21 | $18,268 | $12,390 | $23,513 |

| Jul-21 | $18,093 | $12,529 | $23,363 |

| Aug-21 | $18,227 | $12,505 | $23,796 |

| Sep-21 | $18,025 | $12,397 | $23,398 |

| Oct-21 | $18,429 | $12,393 | $24,236 |

| Nov-21 | $17,904 | $12,430 | $23,376 |

| Dec-21 | $18,005 | $12,398 | $23,391 |

| Jan-22 | $17,280 | $12,131 | $21,858 |

| Feb-22 | $17,265 | $11,996 | $21,864 |

| Mar-22 | $17,333 | $11,662 | $22,126 |

| Apr-22 | $16,407 | $11,220 | $20,556 |

| May-22 | $15,789 | $11,292 | $19,892 |

| Jun-22 | $15,055 | $11,115 | $18,663 |

| Jul-22 | $15,688 | $11,387 | $19,726 |

| Aug-22 | $15,611 | $11,065 | $19,906 |

| Sep-22 | $14,781 | $10,587 | $18,717 |

| Oct-22 | $15,183 | $10,450 | $19,326 |

| Nov-22 | $15,647 | $10,834 | $19,632 |

| Dec-22 | $15,257 | $10,785 | $19,015 |

| Jan-23 | $15,957 | $11,117 | $20,118 |

| Feb-23 | $15,584 | $10,829 | $19,858 |

| Mar-23 | $15,552 | $11,104 | $19,727 |

| Apr-23 | $15,270 | $11,172 | $19,453 |

| May-23 | $15,395 | $11,050 | $19,624 |

| Jun-23 | $16,136 | $11,011 | $20,641 |

| Jul-23 | $16,547 | $11,003 | $21,205 |

| Aug-23 | $16,041 | $10,933 | $20,656 |

| Sep-23 | $15,696 | $10,655 | $20,119 |

| Oct-23 | $15,057 | $10,487 | $19,234 |

| Nov-23 | $15,888 | $10,962 | $20,236 |

| Dec-23 | $16,882 | $11,381 | $21,462 |

| Jan-24 | $16,672 | $11,350 | $21,212 |

| Feb-24 | $16,962 | $11,190 | $21,467 |

| Mar-24 | $17,343 | $11,293 | $21,965 |

| Apr-24 | $16,759 | $11,008 | $21,200 |

| May-24 | $17,214 | $11,194 | $21,717 |

| Jun-24 | $17,361 | $11,300 | $21,918 |

| Jul-24 | $17,655 | $11,564 | $22,340 |

| Aug-24 | $17,983 | $11,731 | $22,633 |

| Sep-24 | $18,336 | $11,888 | $23,073 |

| Oct-24 | $18,517 | $11,593 | $23,267 |

The graph compares a $10,000 initial investment in the Institutional Class with the performance of the Bloomberg U.S. Aggregate Bond Index and ICE BofA U.S. Convertible Bond Index. The Institutional Class performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Class | 22.98% | 7.63% | 6.35% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| ICE BofA U.S. Convertible Bond Index | 20.97% | 10.33% | 8.81% |

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $24,812 |

| Number of Investments | 127 |

| Total Net Advisory Fees Paid (in thousands) | $126 |

| Portfolio Turnover Rate | 100% |

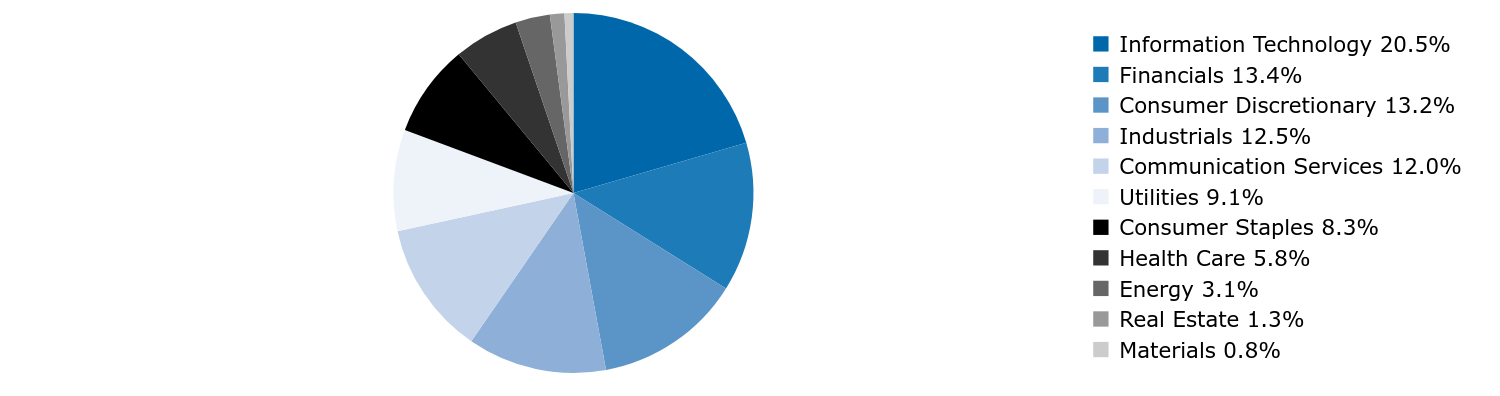

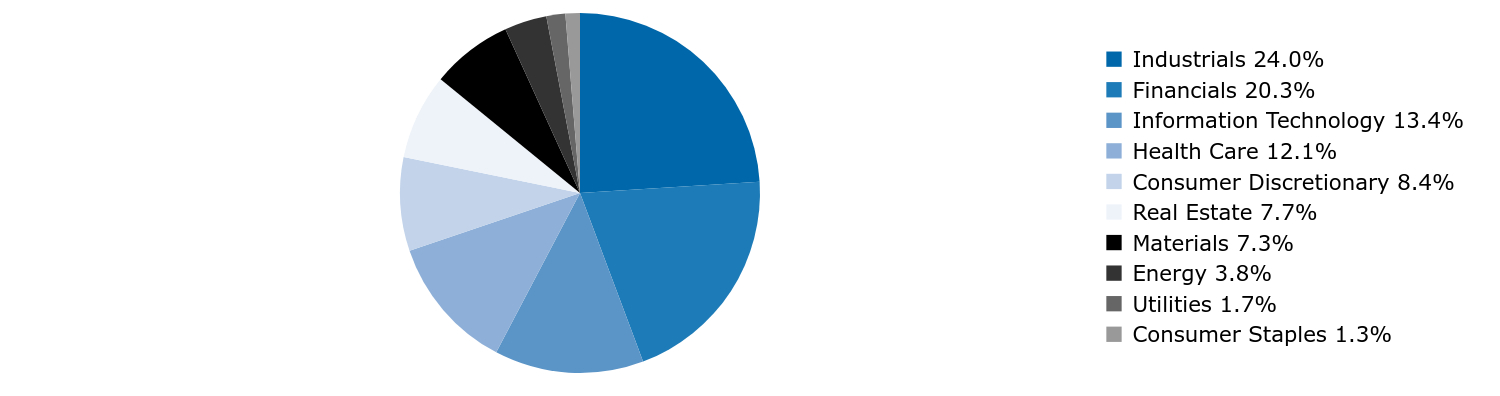

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Information Technology | 20.5% |

| Financials | 13.4% |

| Consumer Discretionary | 13.2% |

| Industrials | 12.5% |

| Communication Services | 12.0% |

| Utilities | 9.1% |

| Consumer Staples | 8.3% |

| Health Care | 5.8% |

| Energy | 3.1% |

| Real Estate | 1.3% |

| Materials | 0.8% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

The Fund has adopted a policy that allows it to send only one copy of a Fund’s prospectus, proxy materials, annual report and semi-annual report to certain shareholders residing at the same household. This reduces Fund expenses, which benefits you and other shareholders. If you need additional copies or do not want your mailings to be “householded,” please call the Shareholder Servicing Agent at 800-422-1050. Individual copies will be sent within thirty (30) days after the Shareholder Servicing Agent receives your instructions. Your consent to householding is considered valid until revoked.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

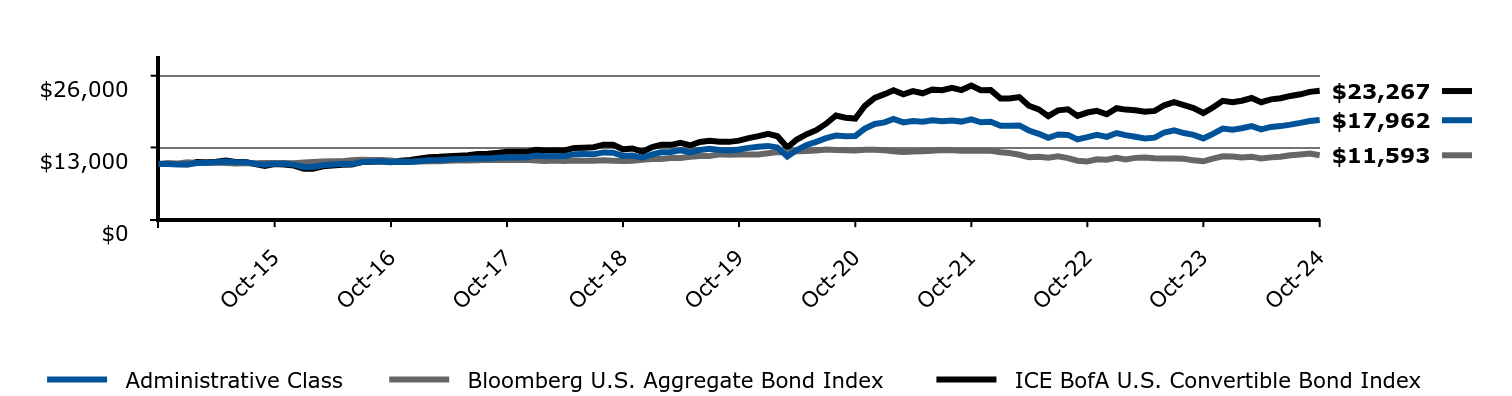

Harbor Convertible Securities Fund

Administrative Class: HRCSX

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Convertible Securities Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Administrative Class | $107 | 0.96% |

Management's Discussion of Fund Performance

Subadvisor: BlueCove Limited

Performance Summary

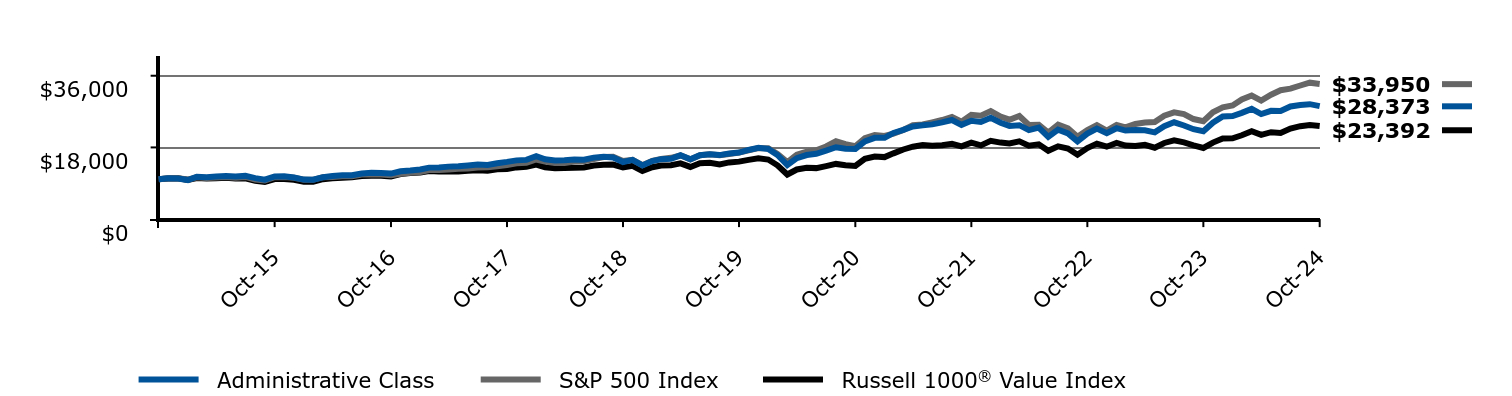

The Administrative Class returned 22.73% for the year ended October 31, 2024, while the ICE BofA U.S. Convertible Bond Index returned 20.97% during the same period.

Top contributors to relative performance included:

• Security selection within Technology, Basic Industry, and Consumer Cyclicals.

Top detractors from relative performance included:

• Security selection within Consumer Non-Cyclicals and Financials.

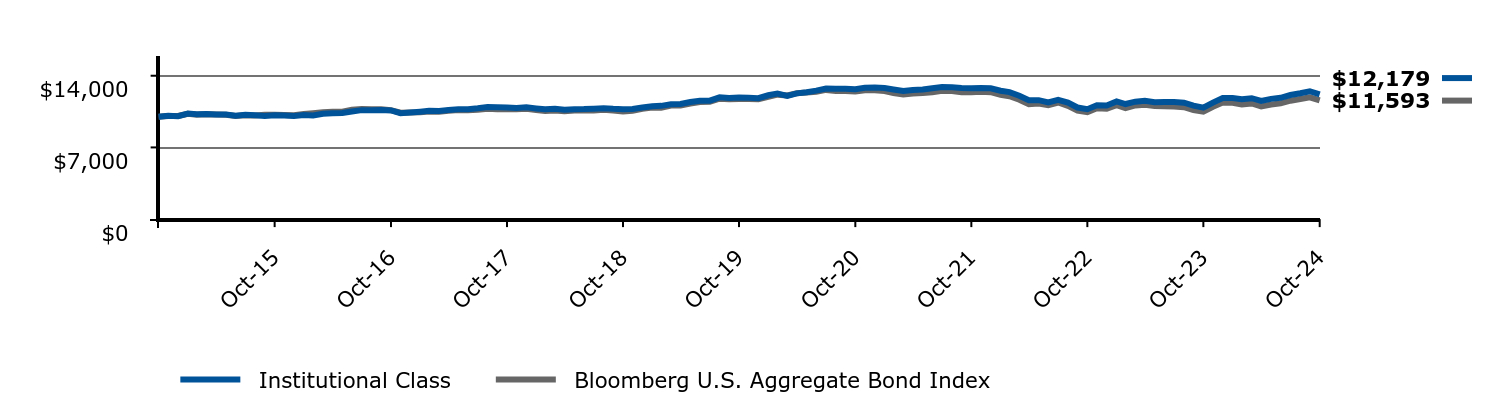

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

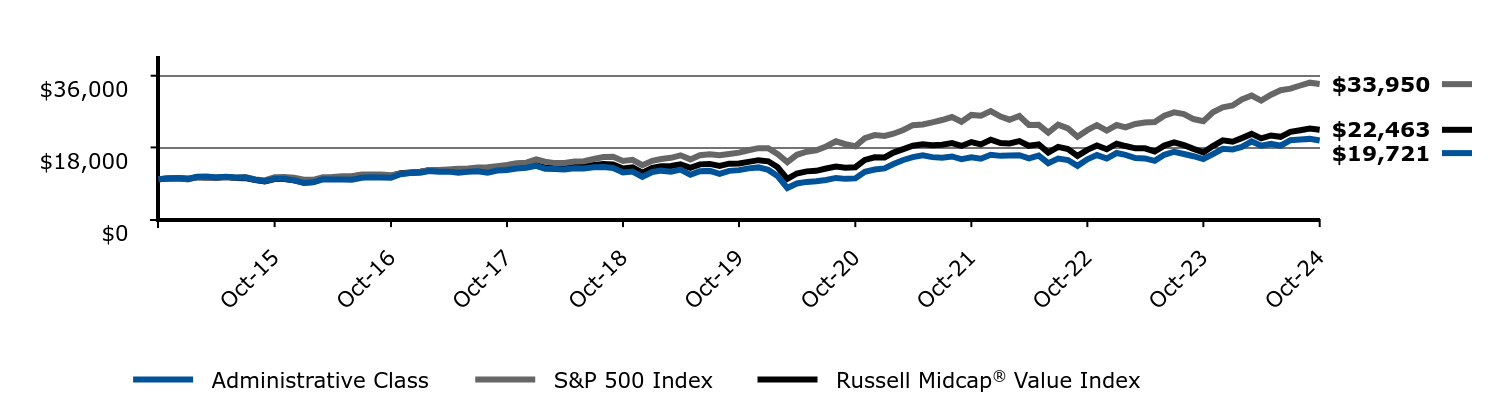

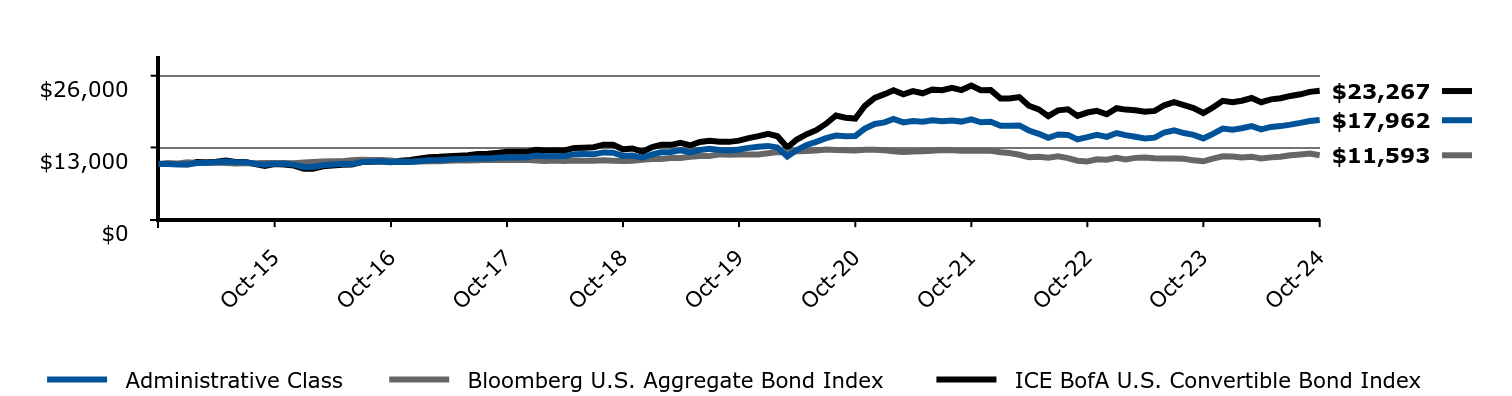

Change in a $10,000 Investment

For the period 11/01/2014 through 10/31/2024

| Administrative Class | Bloomberg U.S. Aggregate Bond Index | ICE BofA U.S. Convertible Bond Index |

|---|

| Oct-14 | $10,000 | $10,000 | $10,000 |

| Nov-14 | $10,009 | $10,071 | $10,095 |

| Dec-14 | $9,897 | $10,080 | $10,013 |

| Jan-15 | $9,897 | $10,292 | $9,936 |

| Feb-15 | $10,188 | $10,195 | $10,348 |

| Mar-15 | $10,225 | $10,242 | $10,315 |

| Apr-15 | $10,291 | $10,206 | $10,391 |

| May-15 | $10,442 | $10,181 | $10,628 |

| Jun-15 | $10,307 | $10,070 | $10,372 |

| Jul-15 | $10,297 | $10,140 | $10,336 |

| Aug-15 | $10,023 | $10,125 | $9,964 |

| Sep-15 | $9,858 | $10,194 | $9,632 |

| Oct-15 | $10,047 | $10,196 | $9,990 |

| Nov-15 | $10,047 | $10,169 | $9,913 |

| Dec-15 | $9,878 | $10,136 | $9,714 |

| Jan-16 | $9,448 | $10,275 | $9,115 |

| Feb-16 | $9,448 | $10,348 | $9,138 |

| Mar-16 | $9,770 | $10,443 | $9,562 |

| Apr-16 | $9,907 | $10,483 | $9,702 |

| May-16 | $10,024 | $10,486 | $9,867 |

| Jun-16 | $9,976 | $10,674 | $9,910 |

| Jul-16 | $10,358 | $10,742 | $10,360 |

| Aug-16 | $10,398 | $10,729 | $10,389 |

| Sep-16 | $10,473 | $10,723 | $10,506 |

| Oct-16 | $10,345 | $10,641 | $10,332 |

| Nov-16 | $10,404 | $10,389 | $10,568 |

| Dec-16 | $10,373 | $10,404 | $10,727 |

| Jan-17 | $10,541 | $10,425 | $11,013 |

| Feb-17 | $10,669 | $10,495 | $11,223 |

| Mar-17 | $10,730 | $10,489 | $11,295 |

| Apr-17 | $10,829 | $10,570 | $11,420 |

| May-17 | $10,918 | $10,651 | $11,500 |

| Jun-17 | $10,941 | $10,641 | $11,573 |

| Jul-17 | $11,020 | $10,686 | $11,807 |

| Aug-17 | $11,000 | $10,782 | $11,850 |

| Sep-17 | $11,111 | $10,731 | $12,009 |

| Oct-17 | $11,211 | $10,737 | $12,206 |

| Nov-17 | $11,191 | $10,723 | $12,221 |

| Dec-17 | $11,200 | $10,773 | $12,197 |

| Jan-18 | $11,539 | $10,649 | $12,574 |

| Feb-18 | $11,419 | $10,548 | $12,428 |

| Mar-18 | $11,413 | $10,615 | $12,489 |

| Apr-18 | $11,424 | $10,536 | $12,464 |

| May-18 | $11,775 | $10,612 | $12,905 |

| Jun-18 | $11,790 | $10,598 | $12,960 |

| Jul-18 | $11,768 | $10,601 | $13,043 |

| Aug-18 | $12,097 | $10,669 | $13,502 |

| Sep-18 | $12,036 | $10,600 | $13,469 |

| Oct-18 | $11,465 | $10,517 | $12,654 |

| Nov-18 | $11,520 | $10,579 | $12,815 |

| Dec-18 | $11,125 | $10,774 | $12,215 |

| Jan-19 | $11,742 | $10,888 | $13,076 |

| Feb-19 | $12,126 | $10,882 | $13,468 |

| Mar-19 | $12,157 | $11,091 | $13,468 |

| Apr-19 | $12,483 | $11,094 | $13,830 |

| May-19 | $12,098 | $11,291 | $13,377 |

| Jun-19 | $12,549 | $11,432 | $13,987 |

| Jul-19 | $12,747 | $11,458 | $14,225 |

| Aug-19 | $12,549 | $11,755 | $14,050 |

| Sep-19 | $12,437 | $11,692 | $14,009 |

| Oct-19 | $12,624 | $11,727 | $14,230 |

| Nov-19 | $12,916 | $11,721 | $14,678 |

| Dec-19 | $13,130 | $11,713 | $15,043 |

| Jan-20 | $13,275 | $11,938 | $15,466 |

| Feb-20 | $12,985 | $12,153 | $15,030 |

| Mar-20 | $11,379 | $12,082 | $12,994 |

| Apr-20 | $12,528 | $12,297 | $14,435 |

| May-20 | $13,435 | $12,354 | $15,410 |

| Jun-20 | $14,000 | $12,432 | $16,133 |

| Jul-20 | $14,678 | $12,617 | $17,303 |

| Aug-20 | $15,162 | $12,515 | $18,785 |

| Sep-20 | $15,022 | $12,509 | $18,380 |

| Oct-20 | $15,083 | $12,453 | $18,229 |

| Nov-20 | $16,414 | $12,575 | $20,548 |

| Dec-20 | $17,258 | $12,592 | $21,996 |

| Jan-21 | $17,536 | $12,502 | $22,663 |

| Feb-21 | $18,173 | $12,321 | $23,361 |

| Mar-21 | $17,536 | $12,168 | $22,626 |

| Apr-21 | $17,775 | $12,264 | $23,210 |

| May-21 | $17,656 | $12,304 | $22,819 |

| Jun-21 | $17,921 | $12,390 | $23,513 |

| Jul-21 | $17,762 | $12,529 | $23,363 |

| Aug-21 | $17,881 | $12,505 | $23,796 |

| Sep-21 | $17,682 | $12,397 | $23,398 |

| Oct-21 | $18,080 | $12,393 | $24,236 |

| Nov-21 | $17,549 | $12,430 | $23,376 |

| Dec-21 | $17,653 | $12,398 | $23,391 |

| Jan-22 | $16,939 | $12,131 | $21,858 |

| Feb-22 | $16,909 | $11,996 | $21,864 |

| Mar-22 | $16,985 | $11,662 | $22,126 |

| Apr-22 | $16,074 | $11,220 | $20,556 |

| May-22 | $15,467 | $11,292 | $19,892 |

| Jun-22 | $14,754 | $11,115 | $18,663 |

| Jul-22 | $15,346 | $11,387 | $19,726 |

| Aug-22 | $15,270 | $11,065 | $19,906 |

| Sep-22 | $14,459 | $10,587 | $18,717 |

| Oct-22 | $14,854 | $10,450 | $19,326 |

| Nov-22 | $15,294 | $10,834 | $19,632 |

| Dec-22 | $14,921 | $10,785 | $19,015 |

| Jan-23 | $15,608 | $11,117 | $20,118 |

| Feb-23 | $15,226 | $10,829 | $19,858 |

| Mar-23 | $14,936 | $11,104 | $19,727 |

| Apr-23 | $14,631 | $11,172 | $19,453 |

| May-23 | $14,768 | $11,050 | $19,624 |

| Jun-23 | $15,711 | $11,011 | $20,641 |

| Jul-23 | $16,112 | $11,003 | $21,205 |

| Aug-23 | $15,603 | $10,933 | $20,656 |

| Sep-23 | $15,273 | $10,655 | $20,119 |

| Oct-23 | $14,635 | $10,487 | $19,234 |

| Nov-23 | $15,460 | $10,962 | $20,236 |

| Dec-23 | $16,418 | $11,381 | $21,462 |

| Jan-24 | $16,214 | $11,350 | $21,212 |

| Feb-24 | $16,481 | $11,190 | $21,467 |

| Mar-24 | $16,858 | $11,293 | $21,965 |

| Apr-24 | $16,274 | $11,008 | $21,200 |

| May-24 | $16,716 | $11,194 | $21,717 |

| Jun-24 | $16,865 | $11,300 | $21,918 |

| Jul-24 | $17,135 | $11,564 | $22,340 |

| Aug-24 | $17,453 | $11,731 | $22,633 |

| Sep-24 | $17,801 | $11,888 | $23,073 |

| Oct-24 | $17,962 | $11,593 | $23,267 |

The graph compares a $10,000 initial investment in the Administrative Class with the performance of the Bloomberg U.S. Aggregate Bond Index and ICE BofA U.S. Convertible Bond Index. The Administrative Class performance assumes the reinvestment of all dividend and capital gain distributions.

Average Annual Total Returns

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Administrative Class | 22.73% | 7.31% | 6.03% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| ICE BofA U.S. Convertible Bond Index | 20.97% | 10.33% | 8.81% |

Current performance may differ from returns shown. The most recent month end performance is available under products at www.harborcapital.com or by calling 800-422-1050.

| Total Net Assets (in thousands) | $24,812 |

| Number of Investments | 127 |

| Total Net Advisory Fees Paid (in thousands) | $126 |

| Portfolio Turnover Rate | 100% |

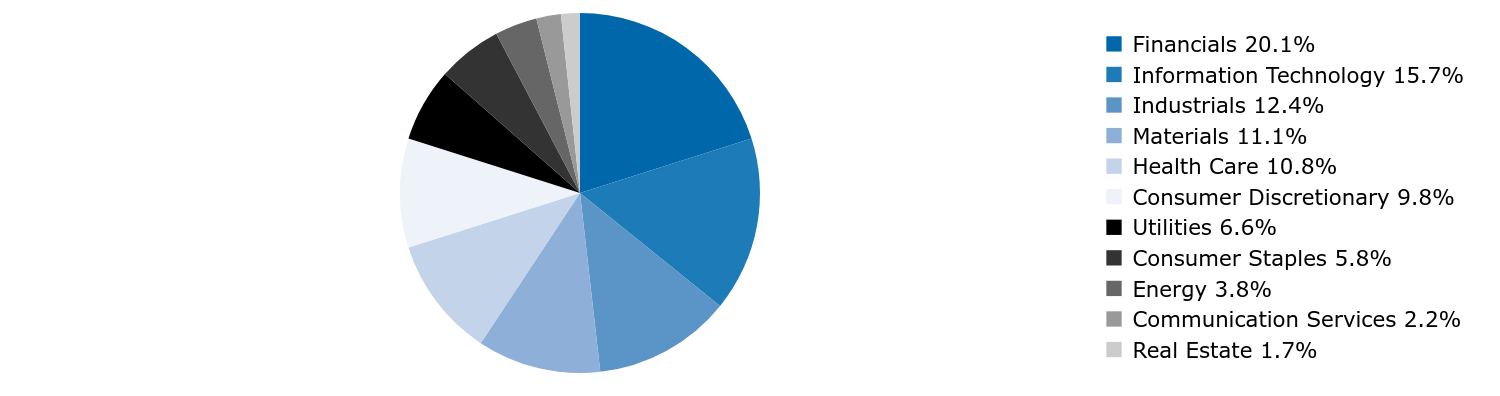

Sector Allocation (% of Investments)

| Value | Value |

|---|

| Information Technology | 20.5% |

| Financials | 13.4% |

| Consumer Discretionary | 13.2% |

| Industrials | 12.5% |

| Communication Services | 12.0% |

| Utilities | 9.1% |

| Consumer Staples | 8.3% |

| Health Care | 5.8% |

| Energy | 3.1% |

| Real Estate | 1.3% |

| Materials | 0.8% |

Availability of Additional Information

Additional information about the Fund, including but not limited to the Fund’s financial statements, prospectus, schedule of holdings or proxy voting information can be accessed by visiting www.harborcapital.com/documents/fund, by scanning the QR code, or by contacting us at 800-422-1050. For proxy voting information, visit www.harborcapital.com/proxy-voting.

The Fund has adopted a policy that allows it to send only one copy of a Fund’s prospectus, proxy materials, annual report and semi-annual report to certain shareholders residing at the same household. This reduces Fund expenses, which benefits you and other shareholders. If you need additional copies or do not want your mailings to be “householded,” please call the Shareholder Servicing Agent at 800-422-1050. Individual copies will be sent within thirty (30) days after the Shareholder Servicing Agent receives your instructions. Your consent to householding is considered valid until revoked.

All trademarks or product names mentioned herein are the property of their respective owners. Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

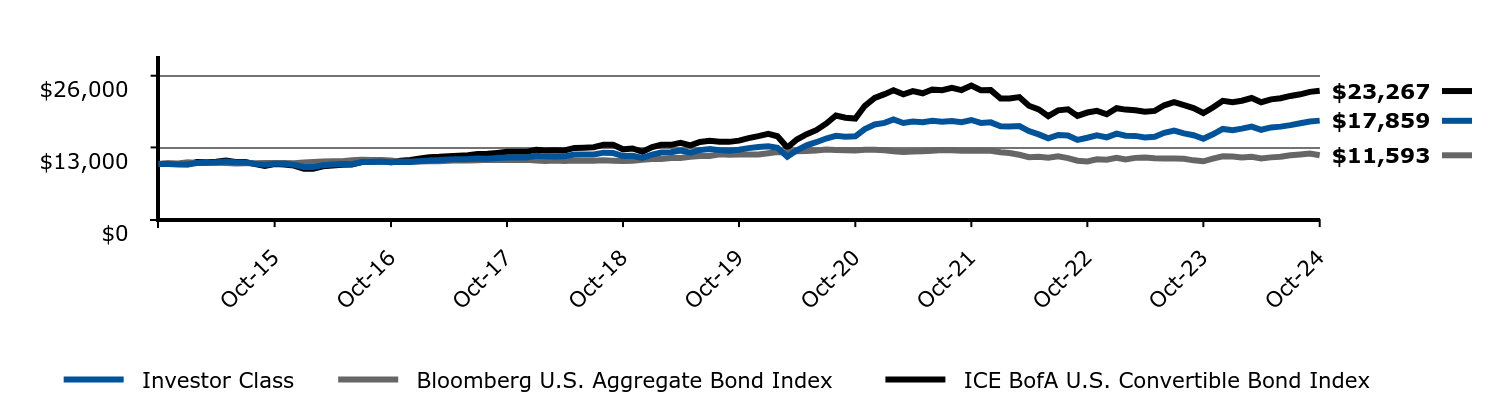

Harbor Convertible Securities Fund

Annual Shareholder Report

This annual shareholder report contains important information about Harbor Convertible Securities Fund ("Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.harborcapital.com/documents/fund. You can also request this information by contacting us at 800-422-1050.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $119 | 1.07% |

Management's Discussion of Fund Performance

Subadvisor: BlueCove Limited

Performance Summary

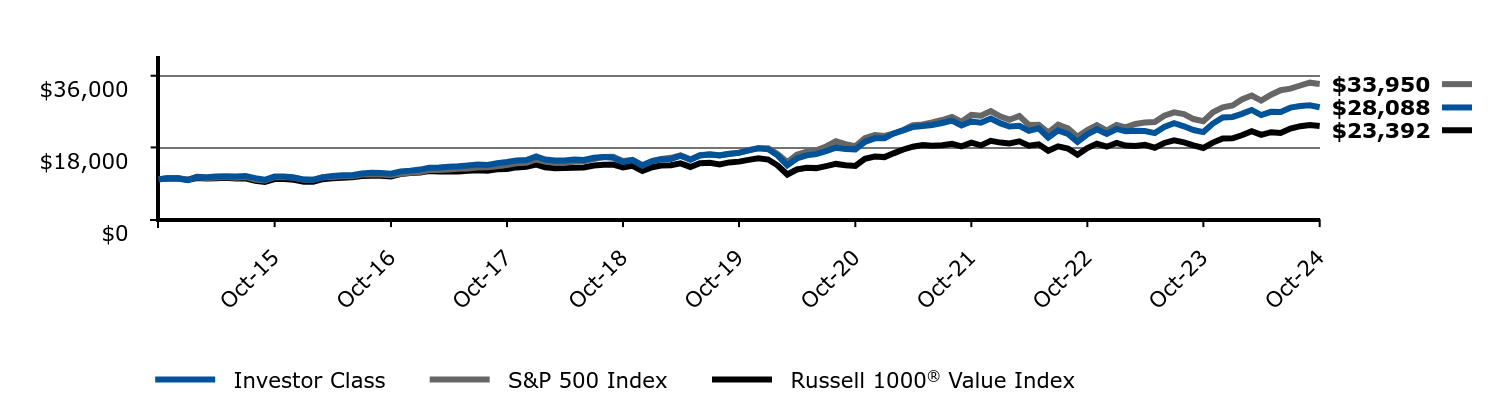

The Investor Class returned 22.55% for the year ended October 31, 2024, while the ICE BofA U.S. Convertible Bond Index returned 20.97% during the same period.

Top contributors to relative performance included:

• Security selection within Technology, Basic Industry, and Consumer Cyclicals.

Top detractors from relative performance included:

• Security selection within Consumer Non-Cyclicals and Financials.

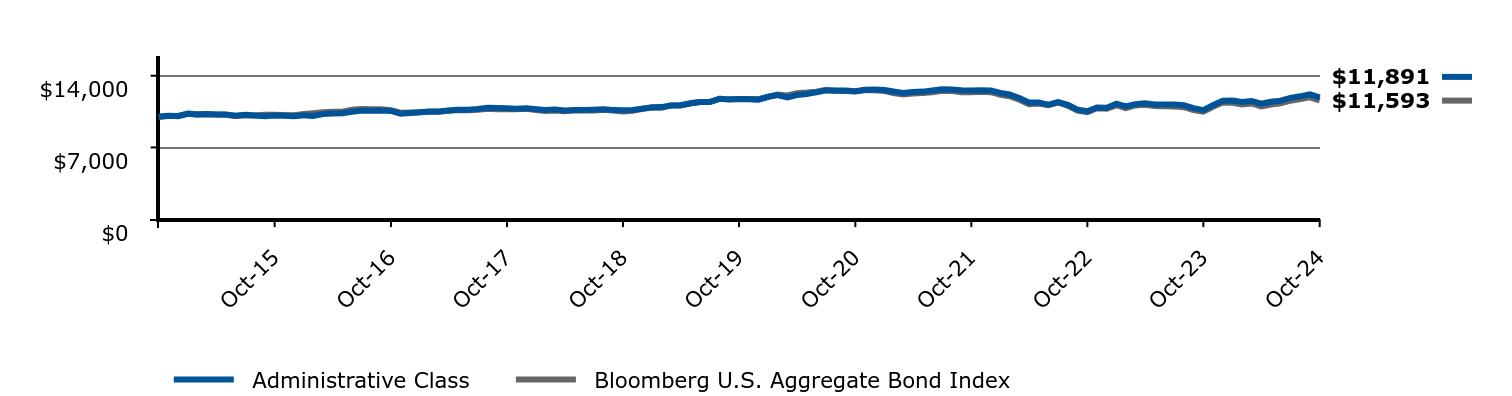

Keep in mind that the Fund's past performance shown is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

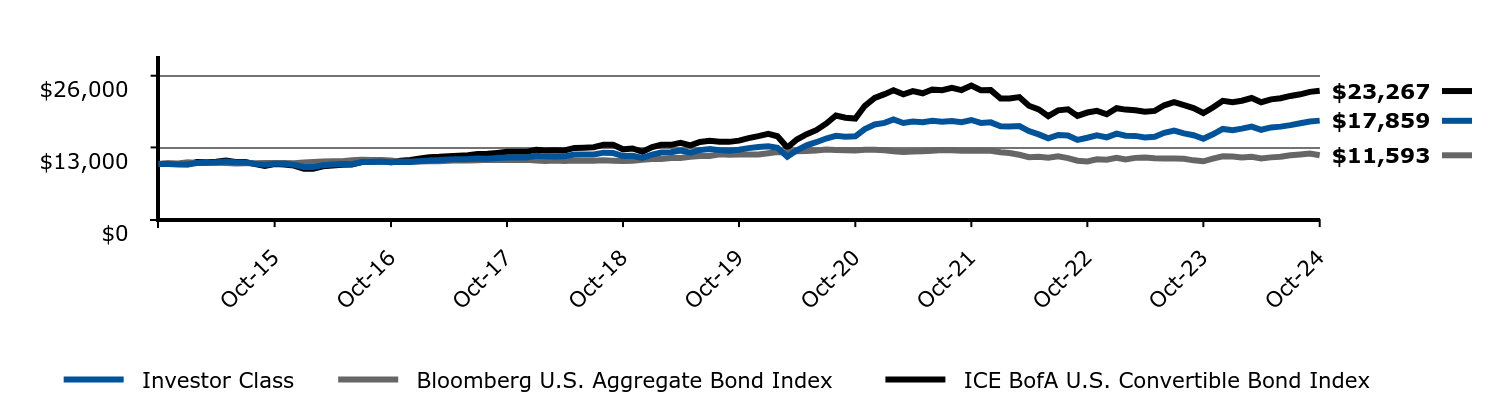

Change in a $10,000 Investment

For the period 11/01/2014 through 10/31/2024

| Investor Class | Bloomberg U.S. Aggregate Bond Index | ICE BofA U.S. Convertible Bond Index |

|---|

| Oct-14 | $10,000 | $10,000 | $10,000 |

| Nov-14 | $10,009 | $10,071 | $10,095 |

| Dec-14 | $9,903 | $10,080 | $10,013 |

| Jan-15 | $9,903 | $10,292 | $9,936 |

| Feb-15 | $10,184 | $10,195 | $10,348 |

| Mar-15 | $10,218 | $10,242 | $10,315 |

| Apr-15 | $10,284 | $10,206 | $10,391 |

| May-15 | $10,435 | $10,181 | $10,628 |

| Jun-15 | $10,297 | $10,070 | $10,372 |

| Jul-15 | $10,288 | $10,140 | $10,336 |

| Aug-15 | $10,014 | $10,125 | $9,964 |

| Sep-15 | $9,855 | $10,194 | $9,632 |

| Oct-15 | $10,035 | $10,196 | $9,990 |

| Nov-15 | $10,035 | $10,169 | $9,913 |

| Dec-15 | $9,862 | $10,136 | $9,714 |

| Jan-16 | $9,442 | $10,275 | $9,115 |

| Feb-16 | $9,433 | $10,348 | $9,138 |

| Mar-16 | $9,751 | $10,443 | $9,562 |

| Apr-16 | $9,888 | $10,483 | $9,702 |

| May-16 | $10,005 | $10,486 | $9,867 |

| Jun-16 | $9,956 | $10,674 | $9,910 |

| Jul-16 | $10,338 | $10,742 | $10,360 |

| Aug-16 | $10,378 | $10,729 | $10,389 |

| Sep-16 | $10,449 | $10,723 | $10,506 |