Management’s Discussion of

Fund Performance

MARKET REVIEW

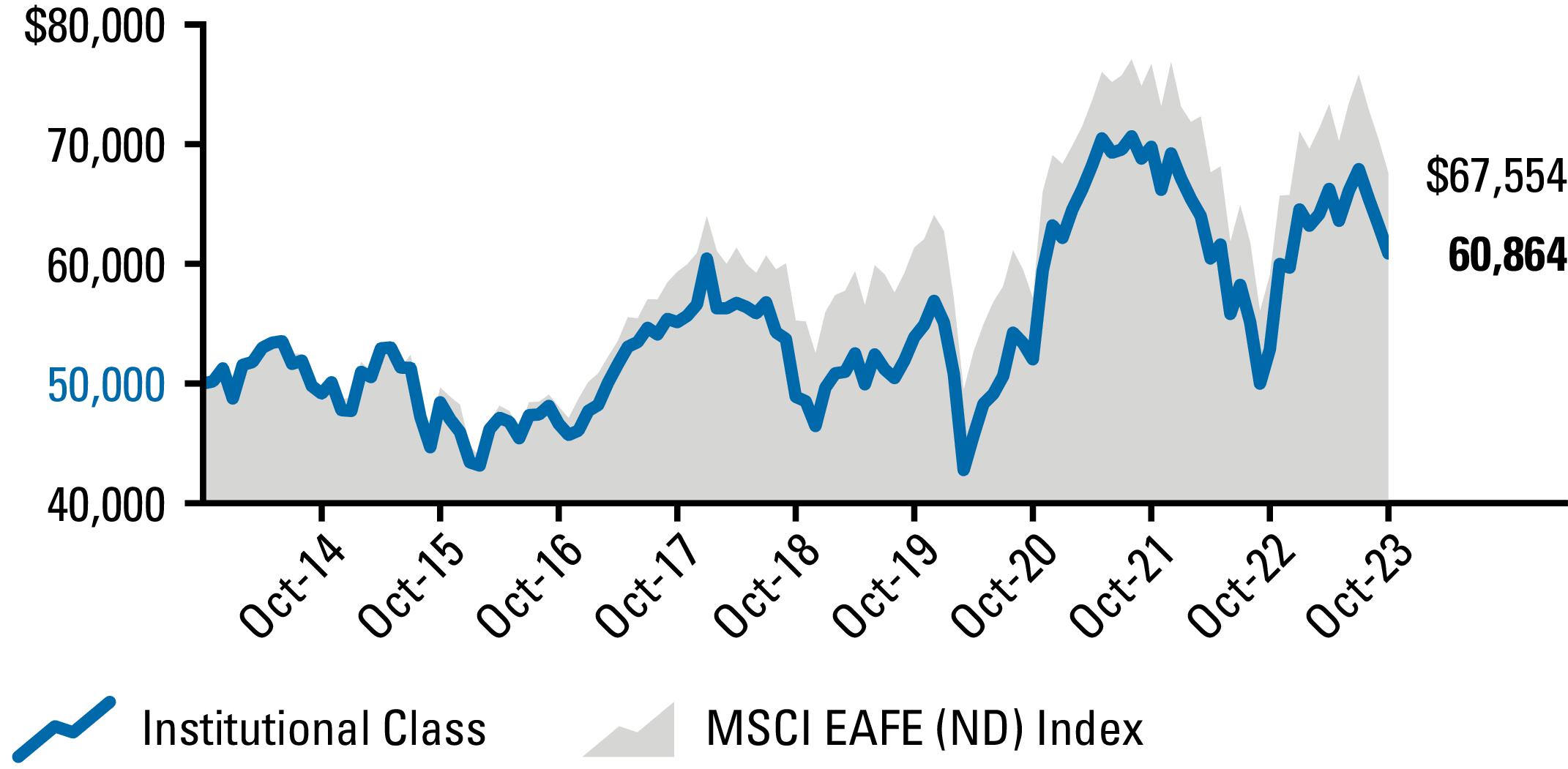

During the fiscal year ended October 31, 2023, financial markets once again experienced significant volatility. Government bond yields in the U.S. and many developed countries rose to their highest levels in over a decade. In addition, non-U.S. developed market equities broadly outperformed U.S. equities as the MSCI EAFE Index’s 11.3% gain outperformed the S&P 500 Index’s 8.3% return. Similarly, the MSCI EAFE Small Cap Index’s 3.7% gain handily outperformed the Russell 2000 Index’s decline of -10%. Given persistent commentary in the financial press about the “Magnificent Seven” (the seven dominant tech platform stocks: Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, Tesla) as a “safe” haven and the U.S. economy’s persistent growth relative to weaker Europe and Japan, U.S. equity market underperformance during the period is likely surprising to many, in our view.

It is often difficult to pinpoint precise causes for equity market performance, but we believe the U.S. dollar’s (“USD”) 4% decline during the period likely contributed to non-U.S. equity outperformance. We would also point out that non-U.S. equities are trading at a significant discount to U.S. equities. The MSCI EAFE Index trades at 11.8x P/E and 1.56x P/B multiples with a 3.45% dividend yield. The S&P 500 Index trades at 19.1x P/E and 4.0x P/B multiples with a 1.65% dividend yield. Valuation on its own is often not enough to drive investment behavior, in our view, but when valuation is considered in the context of opportunity cost, we believe it can impact investor behavior.

With 10-year U.S. Treasury bonds yielding 4.93% on October 31, 2023, investors are able to buy a risk-free asset with a more compelling yield, in our view, than the 1.65% offered by the S&P 500. In theory, an asset with relatively higher risk, such as the securities comprising the S&P 500, should have to offer investors a higher rate of return to compensate for the greater risk. Historically, the majority of the S&P 500’s returns have been generated by dividends, not capital appreciation. In the aftermath of the pandemic, when 10-year Treasury yields were around 0.5%, investors likely viewed investing in U.S. equities as their best option. Today, in uncertain times, we believe there appear to be plenty of alternatives that offer better yields and greater margins of safety than U.S. equities.

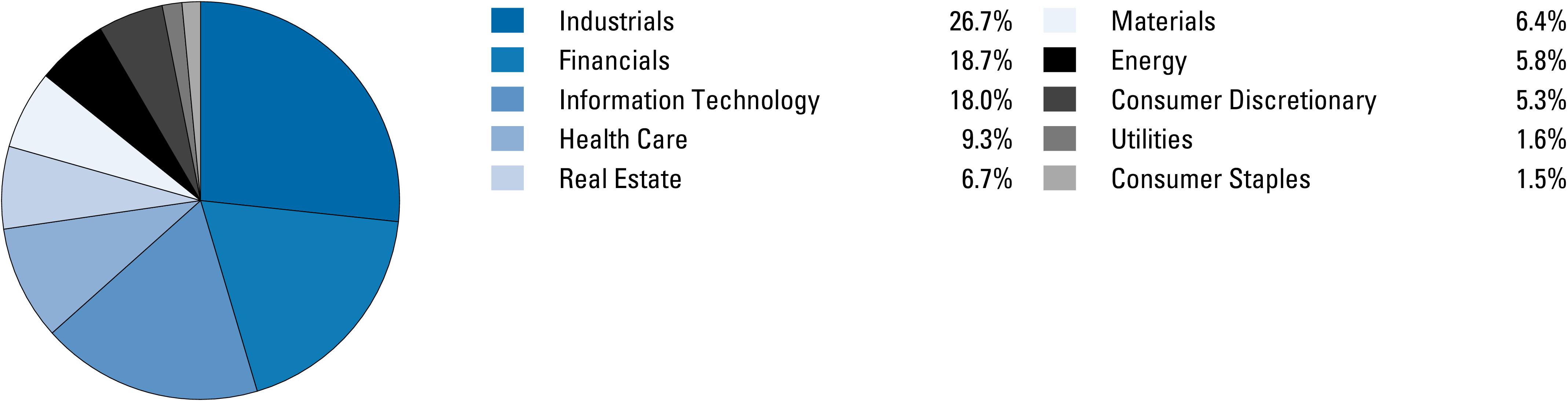

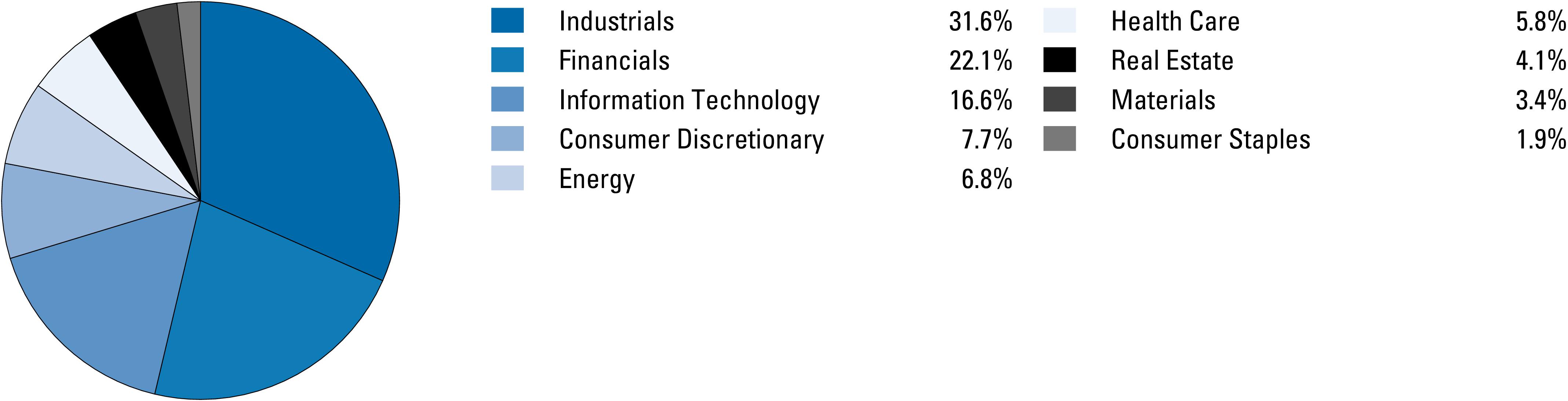

Non-U.S. developed market small caps were also impacted by elevated bond yields. At the sector level, the top performing sectors, Financials and Consumer Staples, are often favored during a rising rate environment. Financials tend to benefit, at least in theory, from improved spreads as rates rise. Consumer Staples, meanwhile, are often highly sought after during inflationary periods because their products typically have inelastic demand and prices are easily passed on to customers. Meanwhile, Real Estate was the worst performing sector as rising rates will likely have a significant impact on affordability, in our view.

One unexpected dynamic during the period was the significant outperformance of the larger cap segment (companies with market capitalization of greater than $5 billion) of the MSCI EAFE Small Cap Index. Although this segment makes up only approximately 10% of the index, it contributed more than half of the index’s return for the year. Meanwhile, the segment of companies with less than $2 billion market cap generated a loss for the index. Consistent with the rising interest rate environment, we believe larger cap companies within the small cap universe, benefitted from liquidity and size factor dynamics during the year.

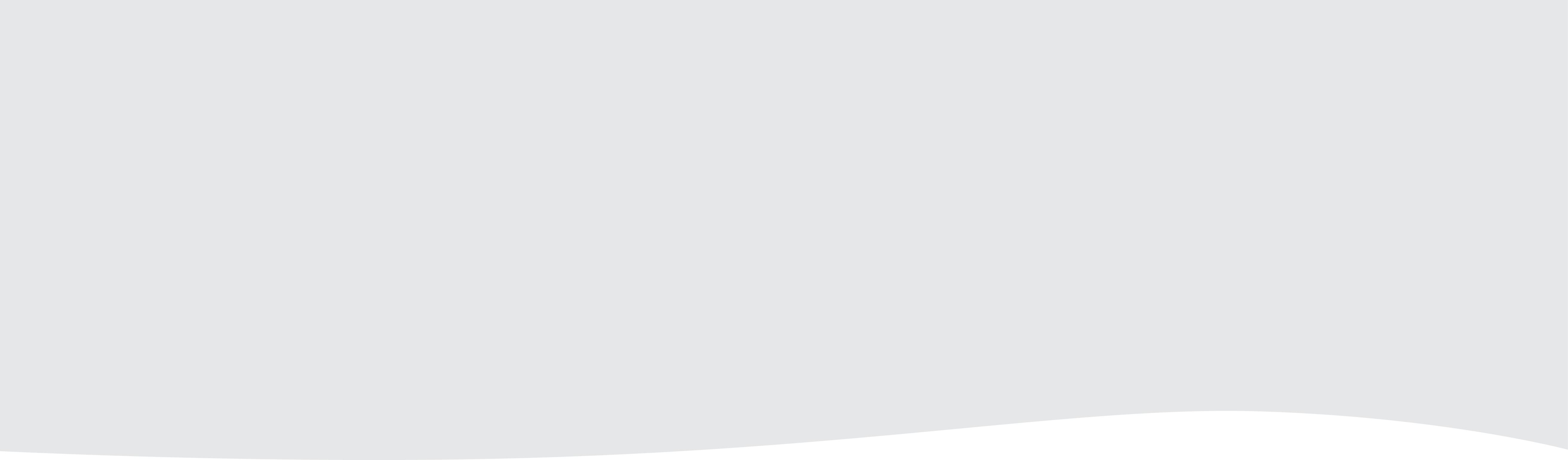

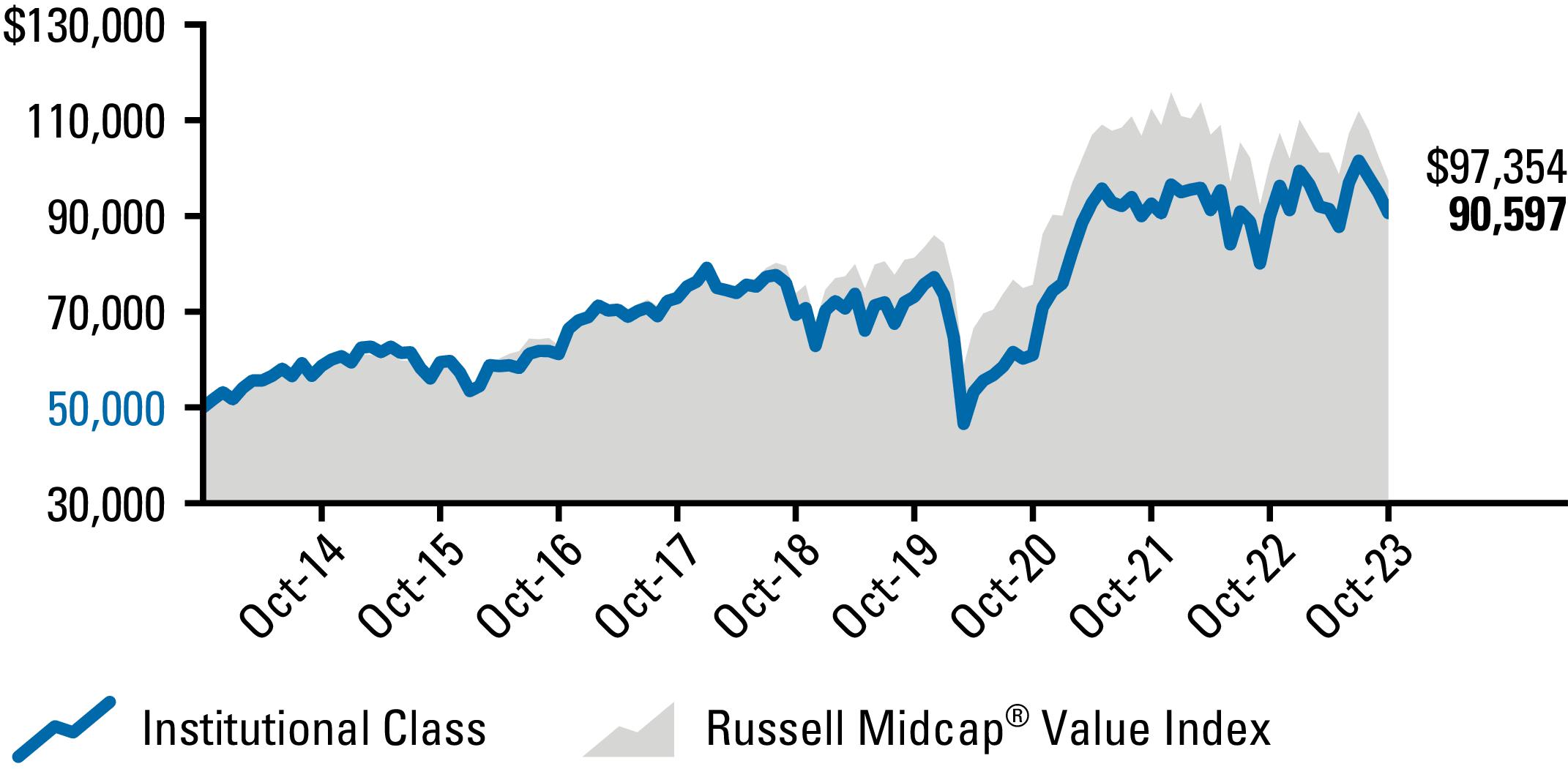

PERFORMANCE

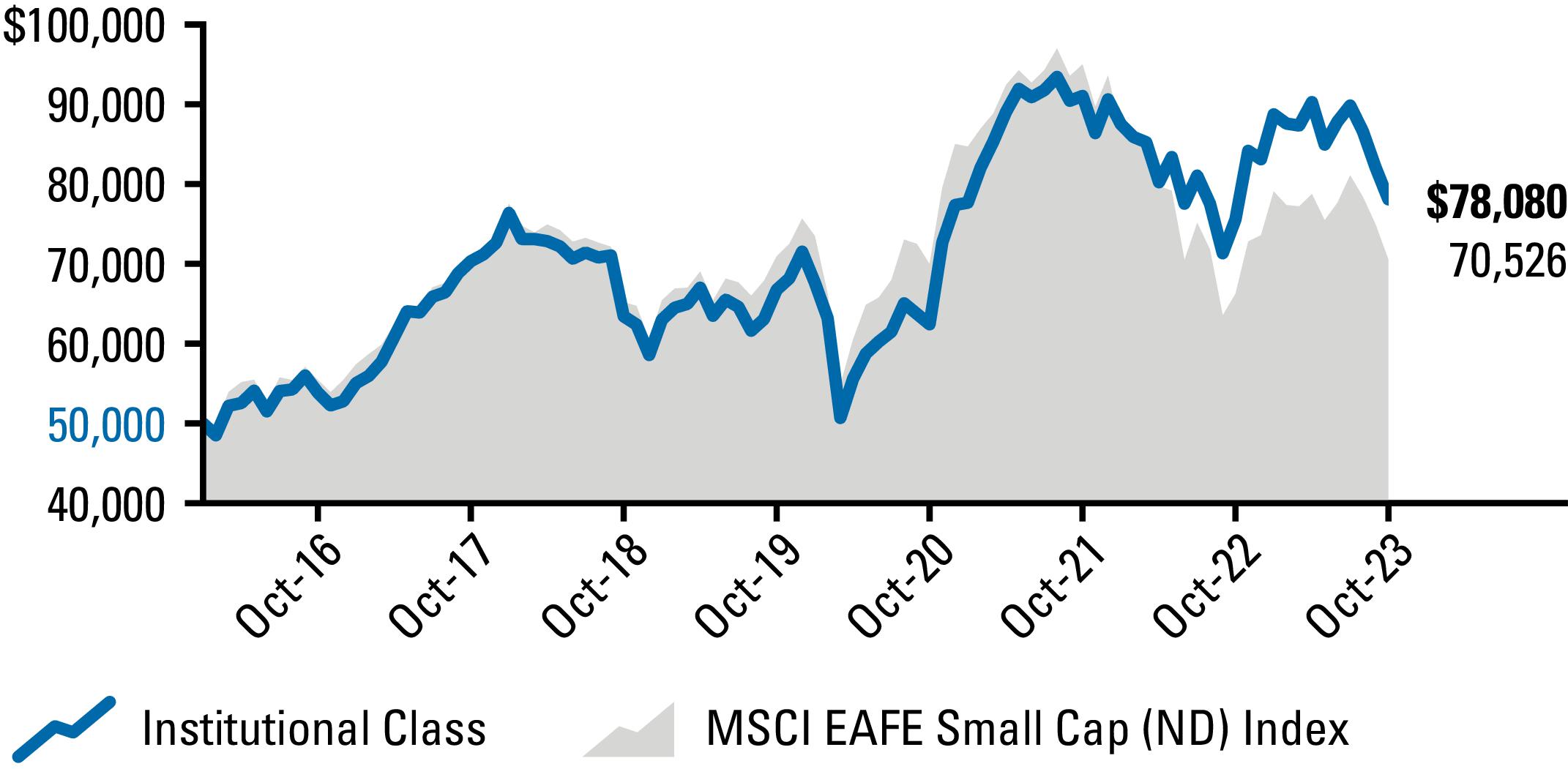

Harbor International Small Cap Fund returned 3.47% (Retirement Class), 3.33% (Institutional Class), 3.21% (Administrative Class), and 2.98% (Investor Class), while the MSCI EAFE Small Cap (ND) Index returned 6.47% during the same period.

The negative relative performance was primarily driven by the macroeconomic environment described above that favored factor exposure to deep value, high dividend, high leverage, and larger market capitalization companies. Although the Fund maintains a strong valuation discipline, it also tends to maintain higher quality attributes and a smaller market capitalization focus. Our analysis indicates that more than half of the benchmark’s return during the period was driven by the 10% of companies with market capitalization greater than $5 billion.

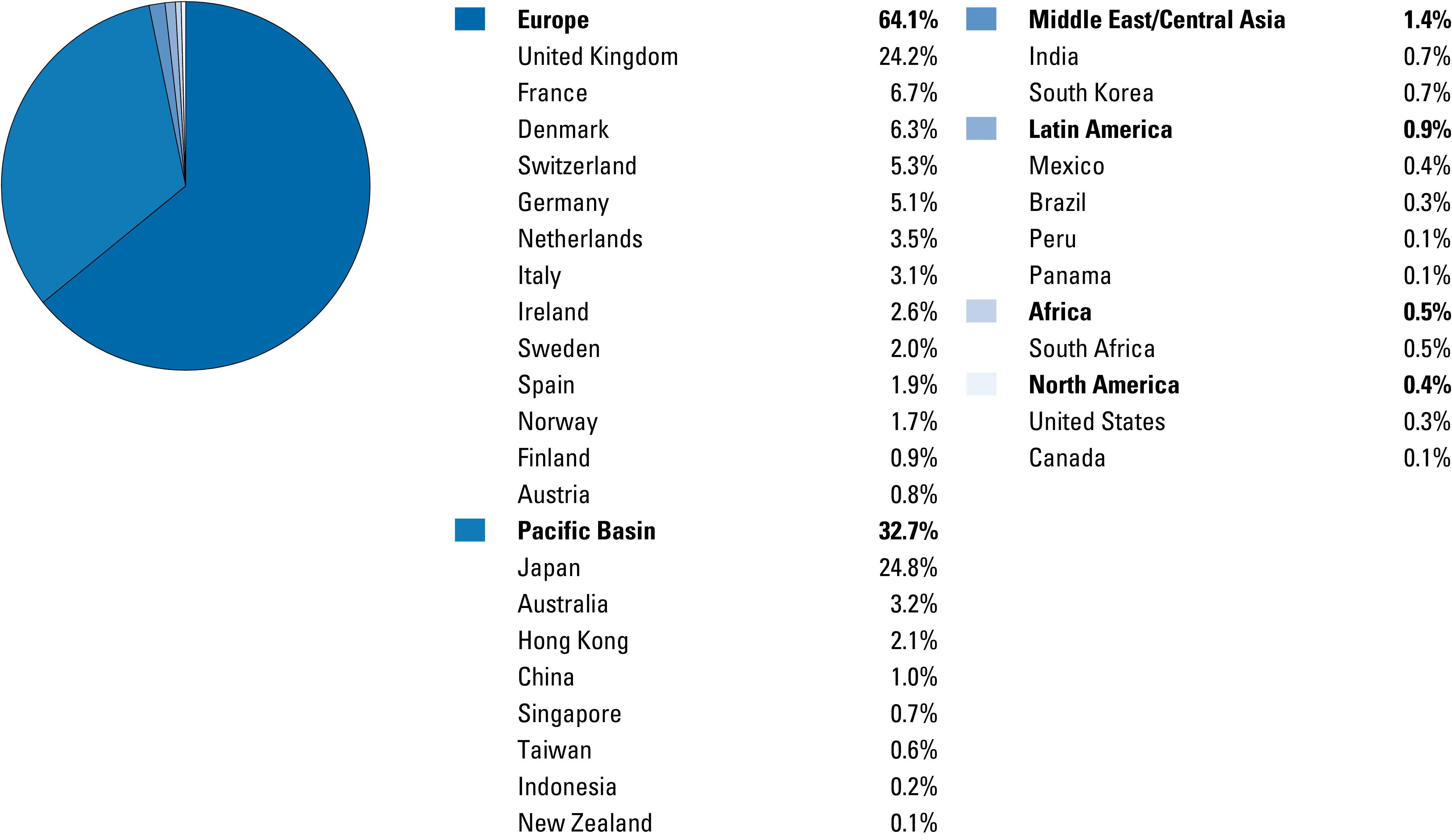

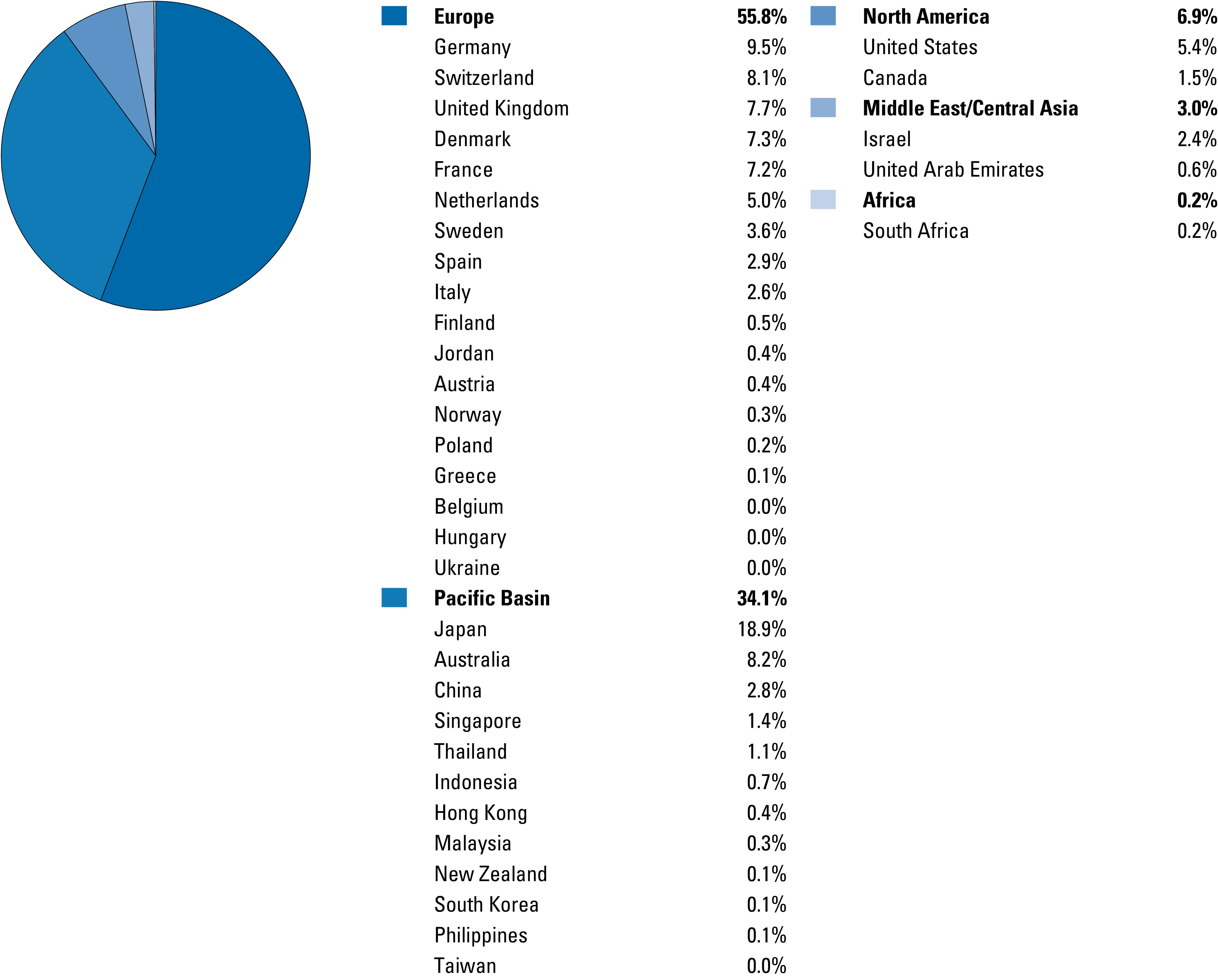

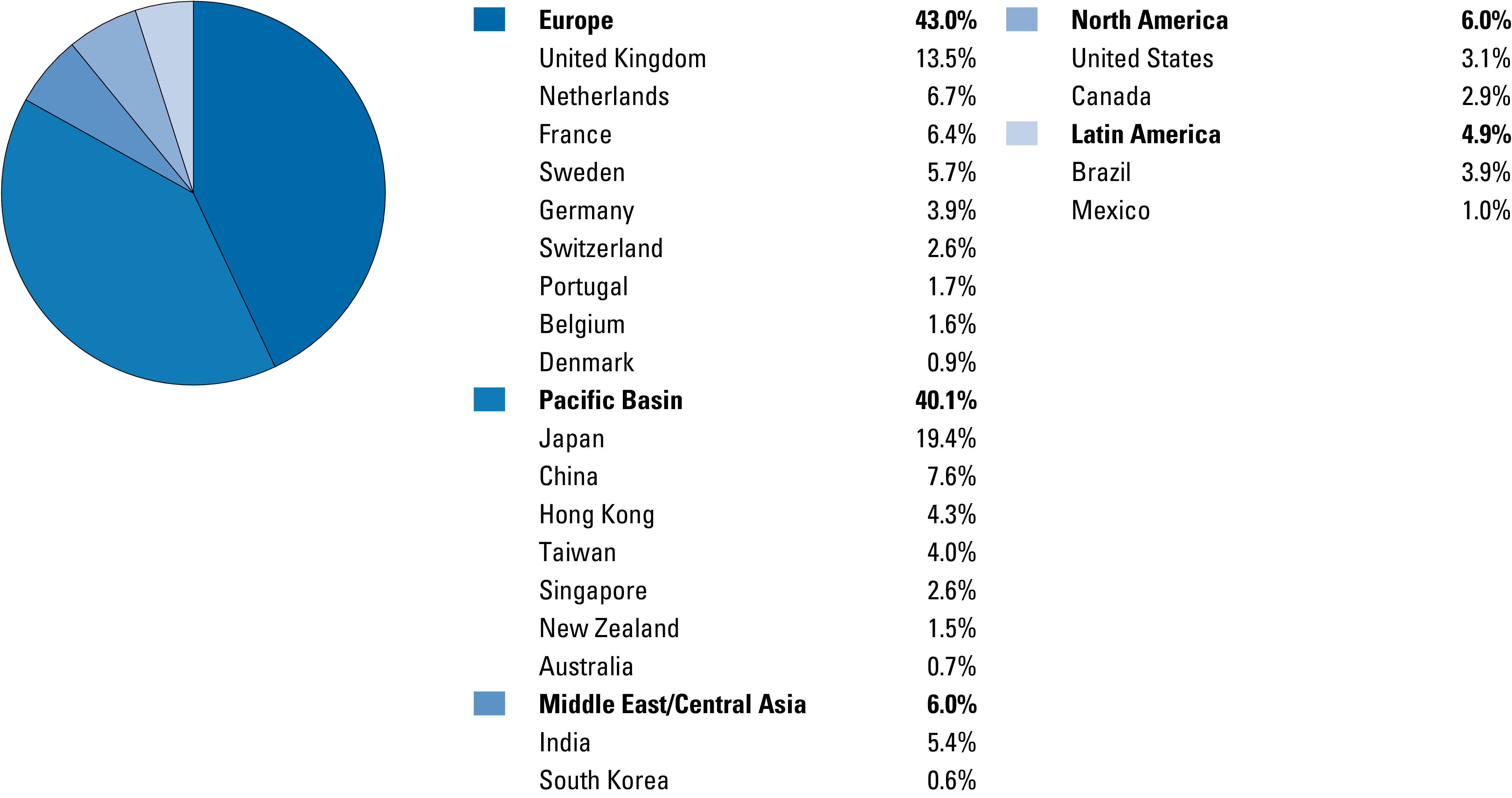

On a relative basis, poor stock selection in Japan (where the size and quality factor dynamics described above manifested themselves, in our view) was the predominant detractor to Fund performance. However, good stock selection in Belgium and France somewhat offset negative effects in Japan.

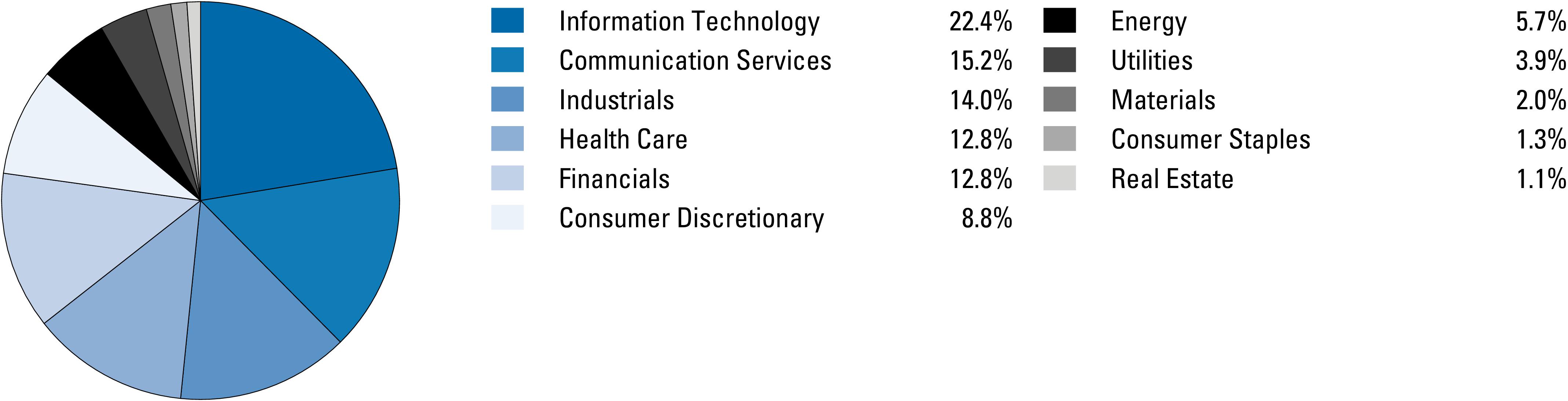

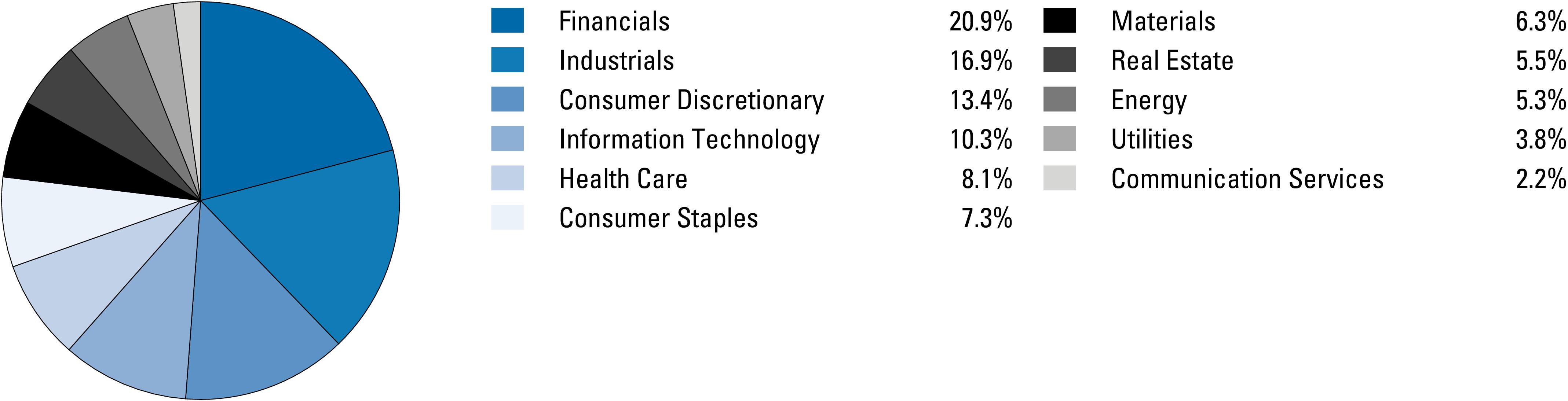

During the period under review, from a sector perspective, the main detractors to Fund performance were stock selection in Financials and Technology sectors, offset somewhat by positive stock selection in Energy and allocation effects in Real Estate. The Fund has not allocated to Real Estate for some time now due to our continued belief that the sector will face challenges in a rising interest rate environment, combined with our inability to identify favorable risk-reward opportunities that suit the Fund.

The Fund’s top contributors are broadly diversified across countries and sectors, including Energy, Consumer