| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-04524) |

| | |

| Exact name of registrant as specified in charter: | Putnam Global Income Trust |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant's telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | October 31, 2017 |

| | |

| Date of reporting period: | November 1, 2016 — April 30, 2017 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

Global Income

Trust

Semiannual report

4 | 30 | 17

Consider these risks before investing: International investing involves currency, economic, and political risks. Emerging-market securities carry illiquidity and volatility risks. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed investments carry the risk that they may increase in value when interest rates decline and decline in value when interest rates rise. The fund invests in fewer issuers or concentrates its investments by region or sector, and involves more risk than a more broadly invested fund. The fund’s policy of concentrating on a limited group of industries and the fund’s non-diversified status, which means the fund may invest in fewer issuers, can increase the fund’s vulnerability to common economic forces and may result in greater losses and volatility. Bond investments are subject to interest-rate risk (the risk of bond prices falling if interest rates rise) and credit risk (the risk of an issuer defaulting on interest or principal payments). Interest-rate risk is greater for longer-term bonds, and credit risk is greater for below-investment-grade bonds. Risks associated with derivatives include increased investment exposure (which may be considered leverage) and, in the case of over-the-counter instruments, the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Unlike bonds, funds that invest in bonds have fees and expenses. Bond prices may fall or fail to rise over extended periods of time for a variety of reasons, including general financial market conditions, changing market perceptions (including perceptions about the risk of default and expectations about monetary policy or interest rates), changes in government intervention in the financial markets, and factors related to a specific issuer or industry. These and other factors may also lead to periods of high volatility and reduced liquidity in the bond markets. You can lose money by investing in the fund.

Message from the Trustees

June 8, 2017

Dear Fellow Shareholder:

An impressive level of investor optimism has helped to fuel financial markets through most of 2017’s first half. Global stock and bond markets have generally fared well, with many stock market indexes achieving new record highs with relatively low volatility. At the same time, however, investors worldwide are monitoring a number of macroeconomic and political risks that could disrupt the positive momentum.

While calm markets are generally welcome, we believe investors should continue to remember time-tested strategies: maintain a well-diversified portfolio, keep a long-term view, and do not overreact to short-term market fluctuations. We also believe it is a good idea to speak regularly with your financial advisor to help ensure that your portfolio is aligned with your goals. In the following pages, you will find an overview of your fund’s performance for the reporting period as well as an outlook for the coming months.

We would also like to take this opportunity to announce the arrival of Catharine Bond Hill and Manoj P. Singh to your fund’s Board of Trustees. Dr. Hill and Mr. Singh bring extensive professional and directorship experience to their role as Trustees, and we are pleased to welcome them.

Thank you for investing with Putnam.

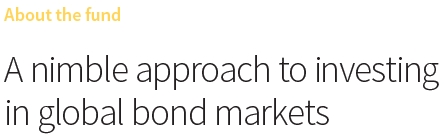

Investing in today’s bond markets requires a broad-based approach, the flexibility to exploit a range of sectors and opportunities, and a keen understanding of the complex global interrelationships that drive the markets. With support from more than 90 fixed-income professionals, the fund’s managers actively position the portfolio in securities from a broad range of sectors.

The fund’s management team has an average of more than 25 years of experience.

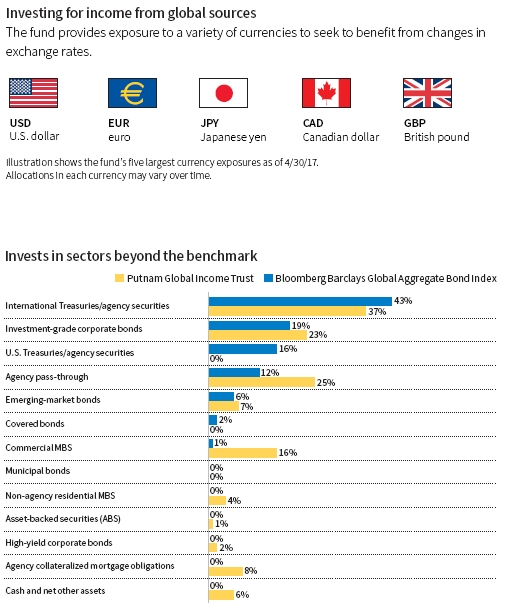

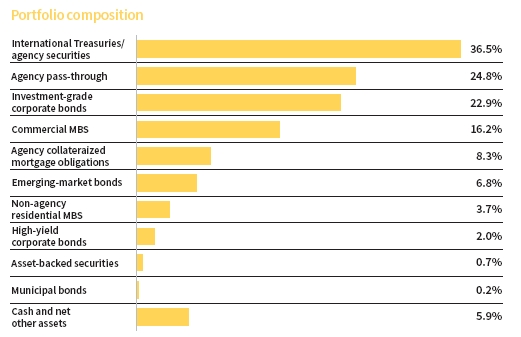

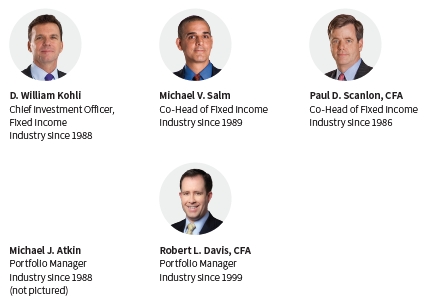

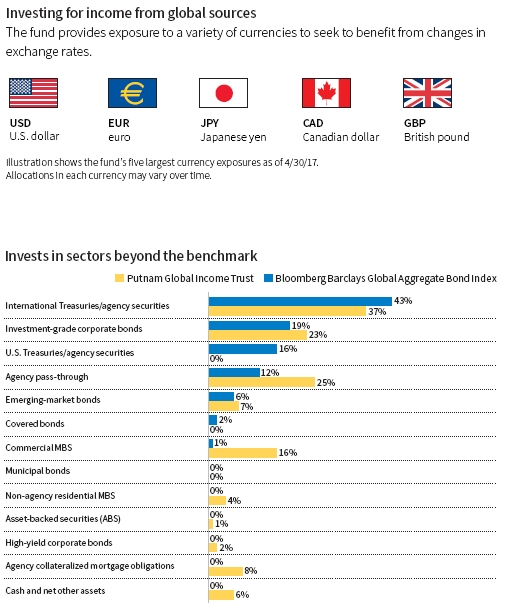

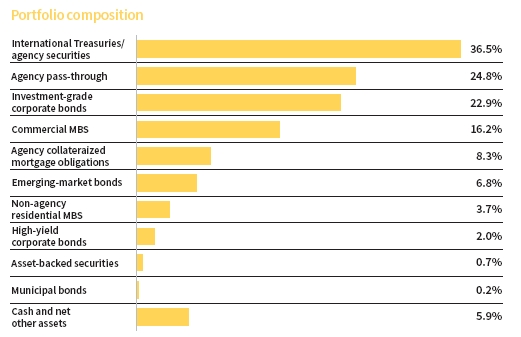

Putnam Global Income Trust invests in a number of sectors, from international sovereign debt and investment-grade corporate bonds to a wide range of mortgage-backed securities.

Allocations are shown as a percentage of the fund’s and/or benchmark’s net assets as of 4/30/17. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the use of different classifications of securities for presentation purposes, and rounding. Allocations may not total 100% because the table includes the notional value of certain derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time. For more information on current fund holdings, see pages 19–57.

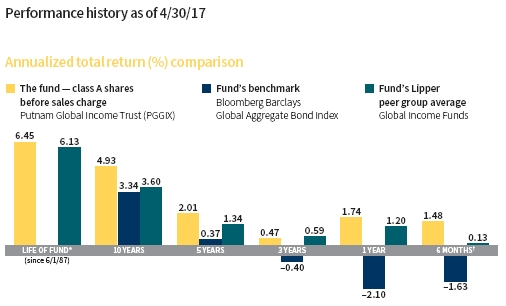

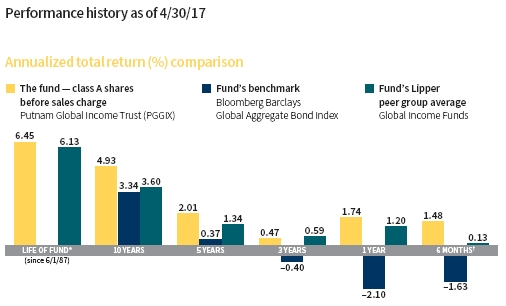

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower. See below and pages 11–13 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the Bloomberg Barclays Global Aggregate Bond Index, was introduced on 12/31/89, which post-dates the inception of the fund’s class A shares.

† Returns for the six-month period are not annualized, but cumulative.

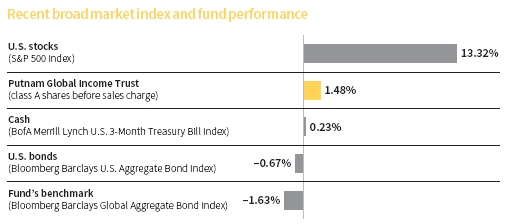

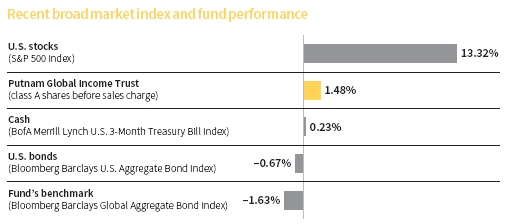

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 4/30/17. See above and pages 11–13 for additional fund performance information. Index descriptions can be found on page 16.

Bill is Chief Investment Officer, Fixed Income, at Putnam. He has an M.B.A. from the Haas School of Business, University of California, Berkeley, and a B.A. from the University of California, San Diego. Bill joined Putnam in 1994 and has been in the investment industry since 1988.

In addition to Bill, your fund’s portfolio managers are Michael J. Atkin; Robert L. Davis, CFA; Michael V. Salm; and Paul D. Scanlon, CFA.

Bill, what was the fund’s investment environment like during the six-month reporting period ended April 30, 2017?

In the months immediately after the U.S. presidential election, investors were optimistic about the potential for tax cuts and increases in infrastructure and defense spending under the incoming Trump administration. Treasury yields rose sharply during this time, with the yield on the 10-year note reaching 2.60% in mid-December, reflecting investor expectations for higher inflation and potentially expansionary fiscal policy under the new administration.

In March, however, a failed effort to repeal the Affordable Care Act [ACA] triggered uncertainty about the administration’s ability to get its tax-reform and fiscal-stimulus plans passed by Congress. A second attempt at an ACA repeal-and-replace bill was approved by the U.S. House of Representatives in April, but faces an uncertain outcome when it is taken up by the U.S. Senate.

After posting solid growth in the second half of 2016, the U.S. economy registered disappointing results in 2017’s first quarter, repeating a pattern that we’ve seen over the past two years. U.S. gross domestic product [GDP] grew

Allocations are shown as a percentage of the fund’s net assets as of 4/30/17. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the use of different classifications of securities for presentation purposes, and rounding. Allocations may not total 100% because the table includes the notional value of certain derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time.

at a 0.7% annual rate in January through March, the slowest pace of expansion in three years, according to the Commerce Department. Consumers sharply reduced spending on big-ticket items, such as automobiles. At the same time, there were signs of underlying strength in the data. For example, final sales to domestic purchasers — a key measure of the health of domestic demand — rose at a 2.2% annual rate. In our view, transitory factors likely suppressed consumer spending in the first quarter, and we believe GDP may pick up in the second quarter.

The Federal Reserve increased its target for short-term interest rates by a quarter percentage point twice during the period, raising the federal funds rate to a range of 0.75% to 1%. The Fed issued a fairly upbeat statement at its early May policy meeting, saying that it expected economic growth to rebound after a soft first quarter. The central bank signaled that it is likely to continue gradually raising short-term rates this year if its growth forecast appears to be on track.

Overseas, the 19-country eurozone economy grew at a steady pace in the first three months of 2017, and its jobless rate declined to 9.5%, the lowest level since 2009. In early May, the European Union raised its 2017 economic growth forecast to a 1.7% annual rate, saying the bloc’s revival is strengthening despite geopolitical risks that could undermine its fifth year of recovery.

Within this environment, credit spreads continued to grind tighter, reflecting persistent investor demand for credit risk, as market volatility remained low and corporate earnings growth was positive overall.

The fund outpaced its benchmark and the average return of its Lipper peer group. Which holdings and strategies fueled its relative performance?

Our interest-rate and yield-curve positioning in the United States and overseas was the biggest contributor to performance. We continued our efforts to de-emphasize interest-rate risk by keeping the portfolio’s duration — a key measure of interest-rate sensitivity — meaningfully shorter than that of the benchmark for much of the period. This strategy was particularly helpful in November when Treasury yields rose sharply across the yield curve in response to the U.S. presidential election outcome. Internationally, rates also rose in Europe, particularly in the United Kingdom, so our lower-than-benchmark duration positioning aided performance there as well.

Our mortgage-credit strategies also notably contributed versus the benchmark, led by holdings of mezzanine commercial mortgage-backed securities [CMBS]. Early in the period, our positions in CMBS that were issued before the 2008 financial crisis performed particularly well. However, gains from the sector were pared in February when headlines concerning retail store closures prompted some investors to express a bearish view on certain parts of the CMBS market due to the sector’s exposure to retail properties. Although we agree that retailers face challenges amid evolving shopper preferences and a shift from traditional brick-and-mortar to online commerce, we believe the CMBS held by the fund have enough credit protection to withstand the changes that are occurring in retail.

Elsewhere within mortgage credit, non-agency residential mortgage-backed securities [RMBS] also aided the fund’s relative performance. Our investments in agency credit risk-transfer securities [CRTS] performed well, as a combination of relatively high yields and high-quality collateral continued to attract investors to this

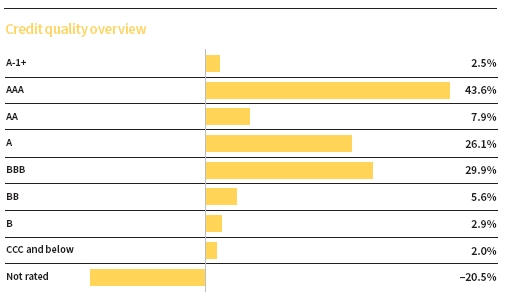

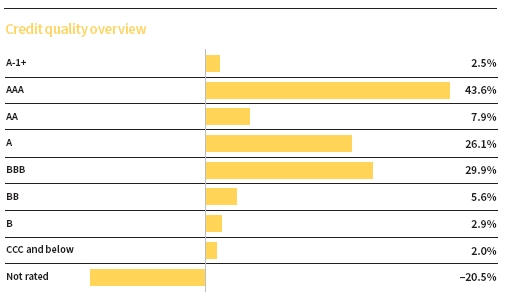

Credit qualities are shown as a percentage of the fund’s net assets as of 4/30/17. A bond rated BBB or higher (A-3 or higher, for short-term debt) is considered investment grade. This chart reflects the highest security rating provided by one or more of Standard & Poor’s, Moody’s, and Fitch. To-be-announced (TBA) mortgage commitments, if any, are included based on their issuer ratings. Ratings may vary over time.

Cash, derivative instruments, and net other assets are shown in the not-rated category. Payables and receivables for TBA mortgage commitments are included in the not-rated category and may result in negative weights. The fund itself has not been rated by an independent rating agency.

growing market. Furthermore, an increasing number of institutional investment managers are embracing CRTS as an easier way to access the mortgage market.

How did corporate credit influence performance?

An overweight allocation to investment-grade corporate credit, and a modest out-of-benchmark position in high-yield bonds, also aided relative results. Positive sentiment toward both sectors was fueled by investor expectations that economic growth could potentially accelerate if the Trump administration is successful at implementing tax cuts and more-robust fiscal policy. Relatively stable global oil prices also provided a tailwind.

Were there other parts of the portfolio that contributed versus the benchmark?

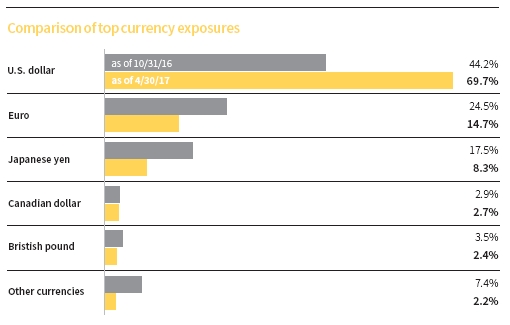

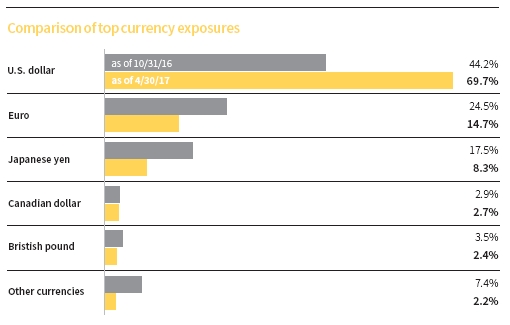

Our active currency strategy and our holdings of emerging-market [EM] bonds contributed about equally. Within active currency, underweight exposure to the Japanese yen and the euro bolstered results, as both of these currencies weakened significantly versus the U.S. dollar during the final two months of 2016.

In EM debt, positions in Argentina, Brazil, and Mexico added the most, partly helped by stable oil prices and persistent investor demand for high-yielding securities. Our EM exposure also benefited from reduced fears that the Trump administration might take a more protectionist approach to foreign trade.

What detracted on a relative basis?

There were no notable relative detractors, as our prepayment strategies had a net neutral impact on results. On the positive side of our prepayment strategies, our holdings of interest-only collateralized mortgage obligations [IO CMOs] performed well amid consistent investor demand for the higher return potential offered by securities with greater risk. Additionally, after spiking early in the period, the yield on the 10-year Treasury stayed in a fairly narrow range for the remainder of the period, keeping mortgage refinancing activity subdued and prepayment speeds slow. Conversely, adverse results from a strategy that sought to

This chart shows how the fund’s top currency holdings have changed over the past six months. Allocations are shown as a percentage of the fund’s net assets. Holdings and allocations may vary over time.

exploit the yield differential between current mortgage rates and longer-term Treasury yields detracted from relative performance and negated the benefit of our IO CMO positions.

How did you use derivatives during the period?

We used bond futures and interest-rate swaps to take tactical positions at various points along the yield curve, and to hedge the risk associated with the fund’s curve positioning. We also employed interest-rate swaps to gain exposure to interest rates in various countries. Additionally, we utilized options to isolate the prepayment risks associated with our CMO holdings and to help manage the downside risk of these positions. We used total return swaps to help manage the fund’s sector and inflation exposure. Lastly, we employed currency forward contracts to hedge the foreign exchange risk associated with non-U.S. bonds and to efficiently gain exposure to foreign currencies.

What is your outlook for the coming months?

As we look at the world today, we see economic activity picking up and inflation levels beginning to rise. Higher commodity prices appear to be working their way into final prices, which is leading to fairly persistent pricing pressures in the United States and elsewhere. In our view, global economies appear to be normalizing, and we think this is particularly true in the United States. Given this normalization, we think the level of interest rates remains too low.

The declining U.S. unemployment rate suggests wage pressures could start to build as businesses compete for scarcer workers, though so far wage increases have been

ABOUT DERIVATIVES

Derivatives are an increasingly common type of investment instrument, the performance of which is derived from an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the fund’s managers generally serve one of two main purposes: to implement a strategy that may be difficult or more expensive to invest in through traditional securities, or to hedge unwanted risk associated with a particular position.

For example, the fund’s managers might use currency forward contracts to capitalize on an anticipated change in exchange rates between two currencies. This approach would require a significantly smaller outlay of capital than purchasing traditional bonds denominated in the underlying currencies. In another example, the managers may identify a bond that they believe is undervalued relative to its risk of default, but may seek to reduce the interest-rate risk of that bond by using interest-rate swaps, a derivative through which two parties “swap” payments based on the movement of certain rates.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable or unwilling to pay. Putnam monitors the counterparty risks we assume. For example, Putnam often enters into collateral agreements that require the counterparties to post collateral on a regular basis to cover their obligations to the fund. Counterparty risk for exchange-traded futures and centrally cleared swaps is mitigated by the daily exchange of margin and other safeguards against default through their respective clearinghouses.

modest. It also means, in our view, that the Fed is likely to raise interest rates for the second time this year at its next policy meeting in June, and then likely again in September.

Later this year, we also think the central bank is likely to communicate a plan for beginning the process of winding down its $4.5 trillion portfolio of U.S. Treasuries and mortgage-backed securities. The Fed has stated that its objective is to gently pull back the stimulus it pumped into the economy during and after the financial crisis now that it appears to be on more stable footing.

In Europe, the European Central Bank [ECB] left its monetary policy unchanged at its April meeting. In light of recent upside surprises in growth and inflation data, we think the ECB may soon be in a position to begin gradually reducing its highly accommodative policy. In the United Kingdom, Prime Minister Theresa May surprised the markets by calling for a June election, in an effort to garner greater support as the country transitions out of the European Union.

What implications does your outlook have for fund positioning?

We plan to continue seeking opportunities outside the benchmark, particularly in mortgage credit and prepayment-sensitive areas of the market that we believe offer relative value.

As of period-end, the fund’s duration was modestly shorter than that of the benchmark, reflecting diverse positioning across various countries. The fund had lower-than-benchmark duration in some of the largest developed-market economies, including the United States, Japan, the United Kingdom, Germany, and France. At the same time, we had above-benchmark duration in several other markets, including Canada, New Zealand, and Mexico.

Thanks for your time and for bringing us up to date, Bill.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended April 30, 2017, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, R5, R6, and Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 4/30/17

| | | | | | | | | |

| | Annual | | | | | | | | |

| | average | | Annual | | Annual | | Annual | | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | 6 months |

|

| Class A (6/1/87) | | | | | | | | | |

| Before sales charge | 6.45% | 61.79% | 4.93% | 10.49% | 2.01% | 1.42% | 0.47% | 1.74% | 1.48% |

|

| After sales charge | 6.30 | 55.32 | 4.50 | 6.07 | 1.18 | –2.64 | –0.89 | –2.33 | –2.58 |

|

| Class B (2/1/94) | | | | | | | | | |

| Before CDSC | 6.21 | 52.33 | 4.30 | 6.45 | 1.26 | –0.84 | –0.28 | 0.98 | 1.10 |

|

| After CDSC | 6.21 | 52.33 | 4.30 | 4.56 | 0.90 | –3.61 | –1.22 | –3.94 | –3.89 |

|

| Class C (7/26/99) | | | | | | | | | |

| Before CDSC | 5.65 | 50.10 | 4.15 | 6.46 | 1.26 | –0.82 | –0.27 | 0.98 | 1.10 |

|

| After CDSC | 5.65 | 50.10 | 4.15 | 6.46 | 1.26 | –0.82 | –0.27 | 0.00 | 0.10 |

|

| Class M (3/17/95) | | | | | | | | | |

| Before sales charge | 6.15 | 57.70 | 4.66 | 9.14 | 1.76 | 0.68 | 0.23 | 1.43 | 1.38 |

|

| After sales charge | 6.04 | 52.58 | 4.32 | 5.59 | 1.09 | –2.59 | –0.87 | –1.87 | –1.92 |

|

| Class R (12/1/03) | | | | | | | | | |

| Net asset value | 6.18 | 57.78 | 4.67 | 9.16 | 1.77 | 0.68 | 0.23 | 1.49 | 1.34 |

|

| Class R5 (7/2/12) | | | | | | | | | |

| Net asset value | 6.56 | 66.19 | 5.21 | 12.12 | 2.31 | 2.44 | 0.81 | 2.16 | 1.67 |

|

| Class R6 (7/2/12) | | | | | | | | | |

| Net asset value | 6.57 | 66.72 | 5.24 | 12.48 | 2.38 | 2.63 | 0.87 | 2.14 | 1.77 |

|

| Class Y (10/4/05) | | | | | | | | | |

| Net asset value | 6.55 | 65.89 | 5.19 | 11.92 | 2.28 | 2.28 | 0.75 | 2.08 | 1.69 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 4.00% and 3.25% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R, R5, R6, and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable. Performance for class R5 and R6 shares prior to their inception is derived from the historical performance of class Y shares and has not been adjusted for the lower investor servicing fees applicable to class R5 and R6 shares; had it, returns would have been higher.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance reflects conversion to class A shares after eight years.

Comparative index returns For periods ended 4/30/17

| | | | | | | | | |

| | Annual | | | | | | | | |

| | average | | Annual | | Annual | | Annual | | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | 6 months |

|

| Bloomberg Barclays | | | | | | | | | |

| Global Aggregate | —† | 38.84% | 3.34% | 1.88% | 0.37% | –1.18% | –0.40% | –2.10% | –1.63% |

| Bond Index | | | | | | | | | |

|

| Lipper Global Income | | | | | | | | | |

| Funds category | 6.13% | 43.38 | 3.60 | 7.18 | 1.34 | 1.90 | 0.59 | 1.20 | 0.13 |

| average* | | | | | | | | | |

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 4/30/17, there were 219, 214, 198, 157, 86, and 2 funds, respectively, in this Lipper category.

† The fund’s benchmark, the Bloomberg Barclays Global Aggregate Bond Index, was introduced on 12/31/89, which post-dates the inception of the fund’s class A shares.

Fund price and distribution information For the six-month period ended 4/30/17

| | | | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Number | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

|

| Income | $0.192 | $0.148 | $0.148 | $0.179 | $0.157 | $0.214 | $0.216 | $0.207 |

|

| Capital gains | — | — | — | — | — | — | — | — |

|

| Total | $0.192 | $0.148 | $0.148 | $0.179 | $0.157 | $0.214 | $0.216 | $0.207 |

|

| | Before | After | Net | Net | Before | After | Net | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value | value |

|

| 10/31/16 | $11.93 | $12.43 | $11.87 | $11.87 | $11.80 | $12.20 | $11.90 | $11.93 | $11.92 | $11.92 |

|

| 4/30/17 | 11.91 | 12.41 | 11.85 | 11.85 | 11.78 | 12.18 | 11.90 | 11.91 | 11.91 | 11.91 |

|

| Current rate | Before | After | Net | Net | Before | After | Net | Net | Net | Net |

| (end of | sales | sales | asset | asset | sales | sales | asset | asset | asset | asset |

| period) | charge | charge | value | value | charge | charge | value | value | value | value |

|

| Current | | | | | | | | | | |

| dividend rate1 | 3.22% | 3.09% | 2.53% | 2.53% | 3.06% | 2.96% | 3.03% | 3.53% | 3.63% | 3.43% |

|

| Current | | | | | | | | | | |

| 30-day | | | | | | | | | | |

| SEC yield2 | N/A | 1.89 | 1.23 | 1.23 | N/A | 1.67 | 1.72 | 2.33 | 2.39 | 2.22 |

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (4.00% for class A shares and 3.25% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, including any return of capital and excluding capital gains, annualized and divided by share price before or after sales charge at period-end.

2 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

Fund performance as of most recent calendar quarter Total return for periods ended 3/31/17

| | | | | | | | | |

| | Annual | | | | | | | | |

| | average | | Annual | | Annual | | Annual | | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | 6 months |

|

| Class A (6/1/87) | | | | | | | | | |

| Before sales charge | 6.43% | 62.37% | 4.97% | 10.28% | 1.98% | 1.27% | 0.42% | 3.10% | –1.68% |

|

| After sales charge | 6.29 | 55.88 | 4.54 | 5.87 | 1.15 | –2.78 | –0.94 | –1.03 | –5.61 |

|

| Class B (2/1/94) | | | | | | | | | |

| Before CDSC | 6.20 | 52.89 | 4.34 | 6.25 | 1.22 | –1.00 | –0.33 | 2.33 | –2.05 |

|

| After CDSC | 6.20 | 52.89 | 4.34 | 4.37 | 0.86 | –3.76 | –1.27 | –2.66 | –6.89 |

|

| Class C (7/26/99) | | | | | | | | | |

| Before CDSC | 5.64 | 50.77 | 4.19 | 6.26 | 1.22 | –0.97 | –0.32 | 2.43 | –1.97 |

|

| After CDSC | 5.64 | 50.77 | 4.19 | 6.26 | 1.22 | –0.97 | –0.32 | 1.43 | –2.94 |

|

| Class M (3/17/95) | | | | | | | | | |

| Before sales charge | 6.14 | 58.40 | 4.71 | 9.02 | 1.74 | 0.54 | 0.18 | 2.89 | –1.72 |

|

| After sales charge | 6.03 | 53.25 | 4.36 | 5.48 | 1.07 | –2.73 | –0.92 | –0.46 | –4.92 |

|

| Class R (12/1/03) | | | | | | | | | |

| Net asset value | 6.17 | 58.21 | 4.69 | 8.95 | 1.73 | 0.45 | 0.15 | 2.86 | –1.81 |

|

| Class R5 (7/2/12) | | | | | | | | | |

| Net asset value | 6.55 | 66.76 | 5.25 | 11.91 | 2.28 | 2.21 | 0.73 | 3.53 | –1.41 |

|

| Class R6 (7/2/12) | | | | | | | | | |

| Net asset value | 6.56 | 67.29 | 5.28 | 12.27 | 2.34 | 2.40 | 0.79 | 3.59 | –1.48 |

|

| Class Y (10/4/05) | | | | | | | | | |

| Net asset value | 6.54 | 66.48 | 5.23 | 11.72 | 2.24 | 2.06 | 0.68 | 3.45 | –1.47 |

See the discussion following the fund performance table on page 11 for information about the calculation of fund performance.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Total annual operating | | | | | | | | |

| expenses for the fiscal year | | | | | | | | |

| ended 10/31/16 | 1.21%* | 1.96%* | 1.96%* | 1.46%* | 1.46%* | 0.86% | 0.79% | 0.96%* |

|

| Annualized expense ratio | | | | | | | | |

| for the six-month period | | | | | | | | |

| ended 4/30/17 | 1.22% | 1.97% | 1.97% | 1.47% | 1.47% | 0.86% | 0.79% | 0.97% |

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Expenses are shown as a percentage of average net assets.

* Restated to reflect current fees resulting from a change to the fund’s investor servicing arrangements effective 9/1/16.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in each class of the fund from 11/1/16 to 4/30/17. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Expenses paid per $1,000*† | $6.09 | $9.82 | $9.82 | $7.34 | $7.34 | $4.30 | $3.95 | $4.85 |

|

| Ending value (after expenses) | $1,014.80 | $1,011.00 | $1,011.00 | $1,013.80 | $1,013.40 | $1,016.70 | $1,017.70 | $1,016.90 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/17. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

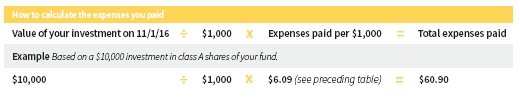

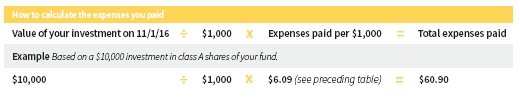

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended 4/30/17, use the following calculation method. To find the value of your investment on 11/1/16, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Expenses paid per $1,000*† | $6.11 | $9.84 | $9.84 | $7.35 | $7.35 | $4.31 | $3.96 | $4.86 |

|

| Ending value (after expenses) | $1,018.74 | $1,015.03 | $1,015.03 | $1,017.50 | $1,017.50 | $1,020.53 | $1,020.88 | $1,019.98 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/17. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are closed to new investments and are only available by exchange from another Putnam fund or through dividend and/or capital gains reinvestment. They are not subject to an initial sales charge and may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC.

Class R shares are not subject to an initial sales charge or CDSC and are only available to employer-sponsored retirement plans.

Class R5 and R6 shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are only available to employer-sponsored retirement plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Fixed-income terms

Current rate is the annual rate of return earned from dividends or interest of an investment. Current rate is expressed as a percentage of the price of a security, fund share, or principal investment.

Mortgage-backed security (MBS), also known as a mortgage “pass-through,” is a type of asset-backed security that is secured by a mortgage or collection of mortgages. The following are types of MBSs:

• Agency “pass-through” has its principal and interest backed by a U.S. government agency, such as the Federal National Mortgage Association (Fannie Mae), Government National Mortgage Association (Ginnie Mae), and Federal Home Loan Mortgage Corporation (Freddie Mac).

• Collateralized mortgage obligation (CMO) represents claims to specific cash flows from pools of home mortgages. The streams of principal and interest payments on the mortgages are distributed to the different classes of CMO interests in “tranches.” Each tranche may have different principal balances, coupon rates, prepayment risks, and maturity dates.

A CMO is highly sensitive to changes in interest rates and any resulting change in the rate at which homeowners sell their properties, refinance, or otherwise prepay loans. CMOs are subject to prepayment, market, and liquidity risks.

• Interest-only (IO) security is a type of CMO in which the underlying asset is the interest portion of mortgage, Treasury, or bond payments.

• Non-agency residential mortgage-backed security (RMBS) is an MBS not backed by Fannie Mae, Ginnie Mae, or Freddie Mac. One type of RMBS is an Alt-A mortgage-backed security.

• Commercial mortgage-backed security (CMBS) is secured by the loan on a commercial property.

• Agency credit risk transfer security (CRTS) is backed by a reference pool of agency mortgages. Unlike regular agency pass-throughs, the principal invested in a CRTS is not backed by Fannie Mae or Freddie Mac. To compensate investors for this risk, CRTS offer a higher yield than conventional pass-through securities. Similar to CMBS, CRTS are structured into various tranches offering different levels of risk and yield based on the underlying reference pool.

Yield curve is a graph that plots the yields of bonds with equal credit quality against their differing maturity dates, ranging from shortest to longest. It is used as a benchmark for other debt, such as mortgage or bank lending rates.

Comparative indexes

Bloomberg Barclays Global Aggregate Bond Index is an unmanaged index of global investment-grade fixed-income securities.

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2016, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Form N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of April 30, 2017, Putnam employees had approximately $494,000,000 and the Trustees had approximately $139,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

Financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

The fund’s portfolio 4/30/17 (Unaudited)

| | | |

| U.S. GOVERNMENT AND AGENCY | | Principal | |

| MORTGAGE OBLIGATIONS (44.5%)* | | amount | Value |

|

| U.S. Government Guaranteed Mortgage Obligations (2.1%) | | | |

|

| Government National Mortgage Association Pass-Through Certificates | | |

|

| 3.50%, TBA, 5/1/47 | | $3,000,000 | $3,117,188 |

|

| 3.00%, TBA, 5/1/47 | | 2,000,000 | 2,026,875 |

|

| | | | 5,144,063 |

|

| U.S. Government Agency Mortgage Obligations (42.4%) | | | |

|

| Federal Home Loan Mortgage Corporation Ser. 2775, | | | |

| Class OE 4.50%, 4/15/19 i | | 123,139 | 126,515 |

|

| Federal National Mortgage Association Pass-Through Certificates | | | |

|

| 4.50%, TBA, 5/1/47 | | 1,000,000 | 1,076,094 |

|

| 4.00%, TBA, 5/1/47 | | 6,000,000 | 6,319,687 |

|

| 3.50%, TBA, 6/1/47 | | 38,000,000 | 38,997,500 |

|

| 3.50%, TBA, 5/1/47 | | 38,000,000 | 39,077,657 |

|

| 3.00%, TBA, 6/1/47 | | 2,000,000 | 1,994,531 |

|

| 3.00%, TBA, 5/1/47 | | 8,000,000 | 7,993,125 |

|

| 2.50%, TBA, 5/1/47 | | 9,000,000 | 8,666,719 |

|

| | | | 104,251,828 |

|

| Total U.S. government and agency mortgage obligations (cost $108,770,578) | $109,395,891 |

|

| |

| FOREIGN GOVERNMENT AND AGENCY | | Principal | |

| BONDS AND NOTES (37.8%)* | | amount | Value |

|

| Argentina (Republic of) sr. unsec. unsub. bonds 7.125%, | | | |

| 7/6/36 (Argentina) | | $275,000 | $278,300 |

|

| Argentina (Republic of) sr. unsec. unsub. notes 6.875%, | | | |

| 1/26/27 (Argentina) | | 780,000 | 824,070 |

|

| Australia (Government of) sr. unsec. bonds Ser. 133, 5.50%, | | | |

| 4/21/23 (Australia) | AUD | 690,000 | 610,675 |

|

| Australia (Government of) sr. unsec. bonds Ser. 144, 3.75%, | | | |

| 4/21/37 (Australia) | AUD | 200,000 | 161,347 |

|

| Australia (Government of) sr. unsec. bonds Ser. 149, 2.25%, | | | |

| 5/21/28 (Australia) | AUD | 670,000 | 480,449 |

|

| Australia (Government of) sr. unsec. notes Ser. 122, 5.25%, | | | |

| 3/15/19 (Australia) | AUD | 1,010,000 | 806,120 |

|

| Belgium (Kingdom of) sr. unsec. bonds Ser. 77, 1.00%, | | | |

| 6/22/26 (Belgium) | EUR | 620,000 | 698,396 |

|

| Belgium (Kingdom of) sr. unsec. unsub. notes Ser. 65, 4.25%, | | | |

| 9/28/22 (Belgium) | EUR | 530,000 | 715,957 |

|

| Belgium (Kingdom of) unsec. bonds Ser. 60, 4.25%, | | | |

| 3/28/41 (Belgium) | EUR | 330,000 | 555,523 |

|

| Brazil (Federal Republic of) sr. unsec. unsub. bonds 4.875%, | | | |

| 1/22/21 (Brazil) | | $490,000 | 518,175 |

|

| Brazil (Federal Republic of) sr. unsec. unsub. notes 5.875%, | | | |

| 1/15/19 (Brazil) | | 100,000 | 106,865 |

|

| Brazil (Federal Republic of) unsec. notes 10.00%, 1/1/21 | | | |

| (Brazil) (units) | BRL | 790 | 257,592 |

|

| Buenos Aires (Province of) 144A sr. unsec. unsub. notes 9.125%, | | | |

| 3/16/24 (Argentina) | | $848,000 | 962,449 |

|

| Canada (Government of) bonds 1.25%, 9/1/18 (Canada) | CAD | 960,000 | 708,686 |

|

| Canada (Government of) sr. unsec. bonds 3.50%, 12/1/45 (Canada) | CAD | 180,000 | 168,347 |

|

| Denmark (Kingdom of) unsec. bonds 4.50%, 11/15/39 (Denmark) | DKK | 740,000 | 183,221 |

|

| | | |

| FOREIGN GOVERNMENT AND AGENCY | | Principal | |

| BONDS AND NOTES (37.8%)* cont. | | amount | Value |

|

| Denmark (Kingdom of) unsec. bonds 1.75%, 11/15/25 (Denmark) | DKK | 2,550,000 | $419,196 |

|

| France (Government of) unsec. bonds 4.50%, 4/25/41 (France) | EUR | 830,000 | 1,416,203 |

|

| France (Government of) unsec. bonds 4.00%, 4/25/55 (France) | EUR | 150,000 | 252,641 |

|

| France (Government of) unsec. bonds 3.25%, 10/25/21 (France) | EUR | 3,410,000 | 4,298,099 |

|

| France (Government of) unsec. bonds 2.75%, 10/25/27 (France) | EUR | 250,000 | 323,114 |

|

| France (Government of) unsec. bonds 0.50%, 5/25/25 (France) | EUR | 1,490,000 | 1,623,706 |

|

| Germany (Federal Republic of) unsec. bonds 2.50%, | | | |

| 7/4/44 (Germany) | EUR | 1,460,000 | 2,124,331 |

|

| Germany (Federal Republic of) unsec. bonds 1.00%, | | | |

| 8/15/25 (Germany) | EUR | 1,000,000 | 1,173,198 |

|

| Germany (Federal Republic of) unsec. bonds 0.50%, | | | |

| 2/15/25 (Germany) | EUR | 420,000 | 475,179 |

|

| Hellenic (Republic of) sr. unsec. unsub. bonds Ser. PSI, | | | |

| stepped-coupon 3.00% (3.65%, 2/24/20), 2/24/33 (Greece) †† | EUR | 36,000 | 28,189 |

|

| Hellenic (Republic of) sr. unsec. unsub. bonds Ser. PSI, | | | |

| stepped-coupon 3.00% (3.65%, 2/24/20), 2/24/32 (Greece) †† | EUR | 286,000 | 227,349 |

|

| Hellenic (Republic of) sr. unsec. unsub. bonds Ser. PSI, | | | |

| stepped-coupon 3.00% (3.65%, 2/24/20), 2/24/30 (Greece) †† | EUR | 502,541 | 411,133 |

|

| Hellenic (Republic of) sr. unsec. unsub. bonds Ser. PSI, | | | |

| stepped-coupon 3.00% (3.65%, 2/24/20), 2/24/29 (Greece) †† | EUR | 987,903 | 821,856 |

|

| Hellenic (Republic of) sr. unsec. unsub. bonds Ser. PSI, | | | |

| stepped-coupon 3.00% (3.65%, 2/24/20), 2/24/28 (Greece) †† | EUR | 103,000 | 88,235 |

|

| Hellenic (Republic of) sr. unsec. unsub. bonds Ser. PSI, | | | |

| stepped-coupon 3.00% (3.65%, 2/24/20), 2/24/26 (Greece) †† | EUR | 137,000 | 122,767 |

|

| Hellenic (Republic of) sr. unsec. unsub. bonds Ser. PSI, | | | |

| stepped-coupon 3.00% (3.65%, 2/24/20), 2/24/25 (Greece) †† | EUR | 49,312 | 44,681 |

|

| Hellenic (Republic of) sr. unsec. unsub. bonds Ser. PSI, | | | |

| stepped-coupon 3.00% (3.65%, 2/24/20), 2/24/24 (Greece) †† | EUR | 209,000 | 192,301 |

|

| Hellenic (Republic of) sr. unsec. unsub. bonds Ser. PSI, | | | |

| stepped-coupon 3.00% (3.65%, 2/24/20), 2/24/23 (Greece) †† | EUR | 694,884 | 649,989 |

|

| Indonesia (Republic of) 144A sr. unsec. unsub. notes 3.375%, | | | |

| 4/15/23 (Indonesia) | | $1,235,000 | 1,238,088 |

|

| Ireland (Republic of) unsec. bonds 5.00%, 10/18/20 (Ireland) | EUR | 380,000 | 490,454 |

|

| Ireland (Republic of) unsec. notes 5.40%, 3/13/25 (Ireland) | EUR | 250,000 | 371,506 |

|

| Italy (Republic of) sr. unsec. bonds 6.50%, 11/1/27 (Italy) | EUR | 670,000 | 1,014,868 |

|

| Italy (Republic of) sr. unsec. bonds 4.75%, 9/1/44 (Italy) | EUR | 820,000 | 1,117,380 |

|

| Italy (Republic of) sr. unsec. bonds 2.50%, 12/1/24 (Italy) | EUR | 1,060,000 | 1,210,727 |

|

| Italy (Republic of) sr. unsec. unsub. bonds 4.75%, 8/1/23 (Italy) | EUR | 1,950,000 | 2,551,547 |

|

| Italy (Republic of) unsec. notes 0.30%, 10/15/18 (Italy) | EUR | 2,590,000 | 2,837,348 |

|

| Japan (Government of) 10 yr sr. unsec. unsub. notes Ser. 330, | | | |

| 0.80%, 9/20/23 (Japan) | JPY | 650,000,000 | 6,179,009 |

|

| Japan (Government of) 20 yr sr. unsec. bonds Ser. 95, 2.30%, | | | |

| 6/20/27 (Japan) | JPY | 500,000,000 | 5,517,874 |

|

| Japan (Government of) 20 yr sr. unsec. unsub. bonds Ser. 125, | | | |

| 2.20%, 3/20/31 (Japan) | JPY | 308,000,000 | 3,510,357 |

|

| Japan (Government of) 20 yr sr. unsec. unsub. bonds Ser. 156, | | | |

| 0.40%, 3/20/36 (Japan) | JPY | 120,000,000 | 1,054,805 |

|

| Japan (Government of) 20 yr sr. unsec. unsub. notes Ser. 318, | | | |

| 1.00%, 9/20/21 (Japan) | JPY | 1,377,000,000 | 12,984,255 |

|

| Japan (Government of) 20 yr sr. unsec. unsub. notes Ser. 41, 1.50%, | | | |

| 3/20/19 (Japan) | JPY | 370,000,000 | 3,425,939 |

|

| | | |

| FOREIGN GOVERNMENT AND AGENCY | | Principal | |

| BONDS AND NOTES (37.8%)* cont. | | amount | Value |

|

| Japan (Government of) 30 yr sr. unsec. unsub. bonds Ser. 32, | | | |

| 2.30%, 3/20/40 (Japan) | JPY | 407,000,000 | $4,932,887 |

|

| Japan (Government of) 40 yr sr. unsec. unsub. bonds Ser. 4, 2.20%, | | | |

| 3/20/51 (Japan) | JPY | 230,000,000 | 2,890,067 |

|

| Netherlands (Government of) unsec. bonds 3.75%, | | | |

| 1/15/42 (Netherlands) | EUR | 290,000 | 501,234 |

|

| Netherlands (Government of) unsec. bonds 2.25%, | | | |

| 7/15/22 (Netherlands) | EUR | 1,290,000 | 1,591,947 |

|

| New Zealand (Government of) sr. unsec. bonds Ser. 423, 5.50%, | | | |

| 4/15/23 (New Zealand) | NZD | 360,000 | 284,616 |

|

| Norway (Government of) unsec. bonds Ser. 476, 3.00%, | | | |

| 3/14/24 (Norway) | NOK | 1,760,000 | 227,287 |

|

| Ontario (Province of) unsec. bonds 4.00%, 6/2/21 (Canada) | CAD | 1,690,000 | 1,365,280 |

|

| Poland (Republic of) unsec. notes Ser. 0721, 1.75%, | | | |

| 7/25/21 (Poland) | PLN | 2,400,000 | 595,236 |

|

| Russia (Federation of) 144A sr. unsec. unsub. bonds 5.625%, | | | |

| 4/4/42 (Russia) | | $600,000 | $667,500 |

|

| South Africa (Republic of) unsec. bonds Ser. 2023, 7.75%, 2/28/23 | | | |

| (South Africa) | ZAR | 11,140,000 | 818,662 |

|

| Spain (Kingdom of) sr. unsec. bonds 5.15%, 10/31/44 (Spain) | EUR | 350,000 | 543,179 |

|

| Spain (Kingdom of) sr. unsec. bonds 5.15%, 10/31/28 (Spain) | EUR | 590,000 | 863,371 |

|

| Spain (Kingdom of) sr. unsec. bonds 4.40%, 10/31/23 (Spain) | EUR | 890,000 | 1,186,969 |

|

| Spain (Kingdom of) sr. unsec. unsub. bonds 4.65%, 7/30/25 (Spain) | EUR | 440,000 | 602,614 |

|

| Spain (Kingdom of) sr. unsec. unsub. bonds 4.00%, 4/30/20 (Spain) | EUR | 590,000 | 721,312 |

|

| Spain (Kingdom of) sr. unsec. unsub. bonds 2.90%, | | | |

| 10/31/46 (Spain) | EUR | 20,000 | 21,549 |

|

| Spain (Kingdom of) sr. unsec. unsub. notes 4.10%, 7/30/18 (Spain) | EUR | 630,000 | 723,580 |

|

| Sri Lanka (Republic of) 144A sr. unsec. unsub. bonds 6.85%, | | | |

| 11/3/25 (Sri Lanka) | | $200,000 | 210,523 |

|

| Sweden (Government of) unsec. bonds Ser. 1053, 3.50%, | | | |

| 3/30/39 (Sweden) | SEK | 270,000 | 41,379 |

|

| Sweden (Government of) unsec. bonds Ser. 1054, 3.50%, | | | |

| 6/1/22 (Sweden) | SEK | 6,120,000 | 817,345 |

|

| Switzerland (Government of) unsec. bonds 2.00%, | | | |

| 4/28/21 (Switzerland) | CHF | 600,000 | 668,322 |

|

| Turkey (Republic of) unsec. notes 11.00%, 3/2/22 (Turkey) | TRY | 576,000 | 164,759 |

|

| United Kingdom Treasury unsec. bonds 4.00%, 1/22/60 | | | |

| (United Kingdom) | GBP | 1,320,000 | 2,999,262 |

|

| United Kingdom Treasury unsec. bonds 3.75%, 9/7/19 | | | |

| (United Kingdom) | GBP | 920,000 | 1,294,941 |

|

| United Kingdom Treasury unsec. bonds 2.75%, 9/7/24 | | | |

| (United Kingdom) | GBP | 70,000 | 103,638 |

|

| United Kingdom Treasury unsec. notes 1.25%, 7/22/18 | | | |

| (United Kingdom) | GBP | 500,000 | 657,184 |

|

| United Mexican States sr. unsec. notes Ser. M 20, 10.00%, | | | |

| 12/5/24 (Mexico) | MXN | 12,310,000 | 789,230 |

|

| United Mexican States sr. unsec. unsub. notes Ser. MTN, 4.75%, | | | |

| 3/8/44 (Mexico) | | $440,000 | 435,539 |

|

| Total foreign government and agency bonds and notes (cost $98,250,433) | | $92,951,908 |

|

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (31.3%)* | amount | Value |

|

| Basic materials (1.6%) | | |

|

| Celanese US Holdings, LLC company guaranty sr. unsec. notes | | |

| 5.875%, 6/15/21 (Germany) | $160,000 | $179,333 |

|

| Celanese US Holdings, LLC company guaranty sr. unsec. unsub. | | |

| notes 4.625%, 11/15/22 (Germany) | 153,000 | 164,475 |

|

| Cemex Finance, LLC 144A company guaranty sr. notes 9.375%, | | |

| 10/12/22 (Mexico) | 200,000 | 215,250 |

|

| Eastman Chemical Co. sr. unsec. notes 3.80%, 3/15/25 | 229,000 | 235,875 |

|

| Georgia-Pacific, LLC sr. unsec. unsub. notes 7.75%, 11/15/29 | 120,000 | 167,157 |

|

| Georgia-Pacific, LLC 144A company guaranty sr. unsec. notes | | |

| 5.40%, 11/1/20 | 13,000 | 14,270 |

|

| Glencore Finance Canada, Ltd. 144A company guaranty sr. unsec. | | |

| unsub. notes 6.00%, 11/15/41 (Canada) | 234,000 | 259,494 |

|

| Glencore Funding, LLC 144A company guaranty sr. unsec. unsub. | | |

| notes 4.625%, 4/29/24 | 510,000 | 533,197 |

|

| Glencore Funding, LLC 144A company guaranty sr. unsec. unsub. | | |

| notes 4.00%, 4/16/25 | 187,000 | 187,370 |

|

| International Paper Co. sr. unsec. notes 8.70%, 6/15/38 | 6,000 | 8,657 |

|

| INVISTA Finance, LLC 144A company guaranty sr. notes | | |

| 4.25%, 10/15/19 | 262,000 | 269,205 |

|

| Westlake Chemical Corp. company guaranty sr. unsec. unsub. | | |

| notes 3.60%, 8/15/26 | 755,000 | 747,375 |

|

| WestRock MWV, LLC company guaranty sr. unsec. unsub. notes | | |

| 8.20%, 1/15/30 | 286,000 | 394,390 |

|

| WestRock MWV, LLC company guaranty sr. unsec. unsub. notes | | |

| 7.95%, 2/15/31 | 73,000 | 99,715 |

|

| WestRock RKT Co. company guaranty sr. unsec. unsub. notes | | |

| 4.45%, 3/1/19 | 105,000 | 109,268 |

|

| Weyerhaeuser Co. sr. unsec. unsub. notes 7.375%, 3/15/32 R | 195,000 | 261,888 |

|

| | | 3,846,919 |

|

| Capital goods (0.9%) | | |

|

| Crown Americas, LLC/Crown Americas Capital Corp. IV company | | |

| guaranty sr. unsec. notes 4.50%, 1/15/23 | 105,000 | 108,413 |

|

| Johnson Controls International PLC sr. unsec. unsub. bonds | | |

| 4.50%, 2/15/47 | 545,000 | 557,447 |

|

| L3 Technologies, Inc. company guaranty sr. unsec. bonds | | |

| 3.85%, 12/15/26 | 117,000 | 120,122 |

|

| Legrand France SA sr. unsec. unsub. notes 8.50%, 2/15/25 (France) | 253,000 | 330,813 |

|

| Rockwell Collins, Inc. sr. unsec. bonds 4.35%, 4/15/47 | 971,000 | 983,527 |

|

| | | 2,100,322 |

|

| Communication services (2.1%) | | |

|

| America Movil SAB de CV company guaranty sr. unsec. unsub. | | |

| notes 6.125%, 3/30/40 (Mexico) | 100,000 | 118,874 |

|

| American Tower Corp. sr. unsec. notes 4.00%, 6/1/25 R | 235,000 | 241,504 |

|

| American Tower Corp. sr. unsec. unsub. bonds 3.375%, 10/15/26 R | 322,000 | 313,623 |

|

| Charter Communications Operating, LLC/Charter | | |

| Communications Operating Capital Corp. company guaranty sr. | | |

| sub. bonds 6.484%, 10/23/45 | 622,000 | 730,460 |

|

| Charter Communications Operating, LLC/Charter | | |

| Communications Operating Capital Corp. company guaranty sr. | | |

| sub. notes 4.908%, 7/23/25 | 148,000 | 158,618 |

|

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (31.3%)* cont. | amount | Value |

|

| Communication services cont. | | |

|

| Charter Communications Operating, LLC/Charter | | |

| Communications Operating Capital 144A company guaranty | | |

| sr. bonds 5.375%, 5/1/47 | $240,000 | $245,557 |

|

| Comcast Cable Communications Holdings, Inc. company | | |

| guaranty sr. unsec. notes 9.455%, 11/15/22 | 70,000 | 94,315 |

|

| Comcast Corp. company guaranty sr. unsec. unsub. notes | | |

| 6.50%, 11/15/35 | 75,000 | 96,029 |

|

| Crown Castle International Corp. sr. unsec. notes 5.25%, 1/15/23 R | 192,000 | 212,455 |

|

| Crown Castle International Corp. sr. unsec. notes 4.75%, 5/15/47 R | 420,000 | 418,557 |

|

| Crown Castle Towers, LLC 144A company guaranty sr. notes | | |

| 4.883%, 8/15/20 | 190,000 | 202,606 |

|

| Koninklijke KPN NV sr. unsec. unsub. bonds 8.375%, | | |

| 10/1/30 (Netherlands) | 42,000 | 57,290 |

|

| NBCUniversal Media, LLC company guaranty sr. unsec. unsub. | | |

| notes 6.40%, 4/30/40 | 125,000 | 160,877 |

|

| Rogers Communications, Inc. company guaranty sr. unsec. unsub. | | |

| notes 4.50%, 3/15/43 (Canada) | 188,000 | 190,809 |

|

| Sprint Spectrum Co., LLC/Sprint Spectrum Co. II, LLC/ | | |

| Sprint Spectrum Co. III, LL 144A company guaranty sr. notes | | |

| 3.36%, 9/20/21 | 585,000 | 590,119 |

|

| Telecom Italia SpA 144A sr. unsec. notes 5.303%, 5/30/24 (Italy) | 600,000 | 621,000 |

|

| Verizon Communications, Inc. sr. unsec. unsub. notes 5.90%, | | |

| 2/15/54 (units) | 9,074 | 241,550 |

|

| Verizon Communications, Inc. sr. unsec. unsub. notes | | |

| 4.522%, 9/15/48 | 68,000 | 62,552 |

|

| Videotron Ltd./Videotron Ltee. 144A sr. unsec. bonds 5.125%, | | |

| 4/15/27 (Canada) | 390,000 | 397,683 |

|

| | | 5,154,478 |

|

| Conglomerates (0.1%) | | |

|

| General Electric Co. jr. unsec. sub. FRB Ser. D, 5.00%, | | |

| perpetual maturity | 346,000 | 367,556 |

|

| | | 367,556 |

|

| Consumer cyclicals (3.3%) | | |

|

| 21st Century Fox America, Inc. company guaranty sr. unsec. notes | | |

| 7.85%, 3/1/39 | 115,000 | 159,890 |

|

| Autonation, Inc. company guaranty sr. unsec. unsub. notes | | |

| 5.50%, 2/1/20 | 194,000 | 208,397 |

|

| CBS Corp. company guaranty sr. unsec. unsub. bonds | | |

| 2.90%, 1/15/27 | 567,000 | 534,665 |

|

| D.R. Horton, Inc. company guaranty sr. unsec. sub. notes | | |

| 5.75%, 8/15/23 | 425,000 | 481,313 |

|

| Expedia, Inc. company guaranty sr. unsec. unsub. notes | | |

| 5.00%, 2/15/26 | 115,000 | 123,598 |

|

| Ford Motor Co. sr. unsec. unsub. notes 9.98%, 2/15/47 | 630,000 | 969,428 |

|

| Ford Motor Co. sr. unsec. unsub. notes 7.45%, 7/16/31 | 122,000 | 153,892 |

|

| Ford Motor Co. sr. unsec. unsub. notes 7.40%, 11/1/46 | 15,000 | 19,051 |

|

| General Motors Co. sr. unsec. notes 6.25%, 10/2/43 | 265,000 | 289,507 |

|

| General Motors Financial Co., Inc. company guaranty sr. unsec. | | |

| notes 4.00%, 10/6/26 | 630,000 | 626,241 |

|

| General Motors Financial Co., Inc. company guaranty sr. unsec. | | |

| unsub. notes 4.30%, 7/13/25 | 222,000 | 225,998 |

|

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (31.3%)* cont. | amount | Value |

|

| Consumer cyclicals cont. | | |

|

| General Motors Financial Co., Inc. company guaranty sr. unsec. | | |

| unsub. notes 3.45%, 4/10/22 | $301,000 | $304,092 |

|

| Grupo Televisa SAB sr. unsec. unsub. bonds 6.625%, | | |

| 1/15/40 (Mexico) | 215,000 | 241,240 |

|

| Grupo Televisa SAB sr. unsec. unsub. notes 5.00%, 5/13/45 (Mexico) | 250,000 | 235,525 |

|

| Hilton Domestic Operating Co., Inc. 144A sr. unsec. sub. notes | | |

| 4.25%, 9/1/24 | 125,000 | 125,938 |

|

| Hilton Worldwide Finance, LLC/Hilton Worldwide Finance Corp. | | |

| 144A sr. unsec. bonds 4.875%, 4/1/27 | 655,000 | 671,375 |

|

| Host Hotels & Resorts LP sr. unsec. unsub. notes 6.00%, 10/1/21 R | 61,000 | 68,267 |

|

| Host Hotels & Resorts LP sr. unsec. unsub. notes 5.25%, 3/15/22 R | 29,000 | 31,545 |

|

| Hyatt Hotels Corp. sr. unsec. unsub. notes 3.375%, 7/15/23 | 160,000 | 162,688 |

|

| IHS Markit Ltd. 144A company guaranty notes 4.75%, 2/15/25 | | |

| (United Kingdom) | 120,000 | 125,400 |

|

| L Brands, Inc. company guaranty sr. unsec. sub. notes | | |

| 5.625%, 2/15/22 | 220,000 | 232,375 |

|

| Lear Corp. company guaranty sr. unsec. unsub. notes | | |

| 5.375%, 3/15/24 | 225,000 | 237,848 |

|

| O’Reilly Automotive, Inc. company guaranty sr. unsec. sub. notes | | |

| 3.55%, 3/15/26 | 220,000 | 221,038 |

|

| Omnicom Group, Inc. company guaranty sr. unsec. unsub. notes | | |

| 3.60%, 4/15/26 | 182,000 | 183,397 |

|

| Owens Corning company guaranty sr. unsec. sub. notes | | |

| 9.00%, 6/15/19 | 15,000 | 16,885 |

|

| Priceline Group, Inc. (The) sr. unsec. notes 3.65%, 3/15/25 | 116,000 | 118,302 |

|

| QVC, Inc. company guaranty sr. notes 4.85%, 4/1/24 | 238,000 | 242,562 |

|

| S&P Global, Inc. company guaranty sr. unsec. unsub. notes | | |

| 4.40%, 2/15/26 | 195,000 | 208,804 |

|

| Standard Industries, Inc. 144A sr. unsec. notes 5.00%, 2/15/27 | 335,000 | 338,350 |

|

| Time Warner, Inc. company guaranty sr. unsec. unsub. bonds | | |

| 3.80%, 2/15/27 | 95,000 | 94,583 |

|

| Time Warner, Inc. company guaranty sr. unsec. unsub. bonds | | |

| 2.95%, 7/15/26 | 160,000 | 150,114 |

|

| Vulcan Materials Co. sr. unsec. unsub. notes 4.50%, 4/1/25 | 125,000 | 132,399 |

|

| Wyndham Worldwide Corp. sr. unsec. unsub. bonds 4.50%, 4/1/27 | 275,000 | 280,561 |

|

| | | 8,215,268 |

|

| Consumer staples (2.1%) | | |

|

| Anheuser-Busch InBev Finance, Inc. company guaranty sr. unsec. | | |

| unsub. bonds 4.90%, 2/1/46 | 440,000 | 480,679 |

|

| Anheuser-Busch InBev Finance, Inc. company guaranty sr. unsec. | | |

| unsub. bonds 3.65%, 2/1/26 | 200,000 | 203,806 |

|

| Anheuser-Busch InBev Worldwide, Inc. company guaranty sr. | | |

| unsec. unsub. notes 8.20%, 1/15/39 | 154,000 | 235,680 |

|

| Bacardi, Ltd. 144A unsec. notes 4.50%, 1/15/21 (Bermuda) | 230,000 | 242,809 |

|

| Constellation Brands, Inc. company guaranty sr. unsec. unsub. | | |

| bonds 3.70%, 12/6/26 | 185,000 | 187,258 |

|

| CVS Pass-Through Trust sr. notes 6.036%, 12/10/28 | 54,768 | 62,195 |

|

| CVS Pass-Through Trust 144A sr. mtge. notes 7.507%, 1/10/32 | 289,026 | 360,491 |

|

| ERAC USA Finance, LLC 144A company guaranty sr. unsec. bonds | | |

| 4.50%, 2/15/45 | 15,000 | 14,307 |

|

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (31.3%)* cont. | amount | Value |

|

| Consumer staples cont. | | |

|

| ERAC USA Finance, LLC 144A company guaranty sr. unsec. notes | | |

| 7.00%, 10/15/37 | $85,000 | $106,837 |

|

| ERAC USA Finance, LLC 144A company guaranty sr. unsec. notes | | |

| 5.625%, 3/15/42 | 472,000 | 519,243 |

|

| ERAC USA Finance, LLC 144A company guaranty sr. unsec. notes | | |

| 3.85%, 11/15/24 | 277,000 | 284,028 |

|

| Grupo Bimbo SAB de CV 144A company guaranty sr. unsec. notes | | |

| 3.875%, 6/27/24 (Mexico) | 550,000 | 557,621 |

|

| Grupo Bimbo SAB de CV 144A company guaranty sr. unsec. unsub. | | |

| notes 4.875%, 6/27/44 (Mexico) | 500,000 | 480,207 |

|

| Kraft Heinz Co. (The) company guaranty sr. unsec. bonds | | |

| 4.375%, 6/1/46 | 231,000 | 219,782 |

|

| Kraft Heinz Co. (The) company guaranty sr. unsec. unsub. notes | | |

| 6.50%, 2/9/40 | 371,000 | 451,224 |

|

| Lamb Weston Holdings, Inc. 144A company guaranty sr. unsec. | | |

| unsub. notes 4.875%, 11/1/26 | 481,000 | 496,031 |

|

| Walgreens Boots Alliance, Inc. sr. unsec. bonds 3.45%, 6/1/26 | 231,000 | 227,216 |

|

| | | 5,129,414 |

|

| Energy (5.1%) | | |

|

| Anadarko Petroleum Corp. sr. unsec. notes 6.45%, 9/15/36 | 165,000 | 195,540 |

|

| Anadarko Petroleum Corp. sr. unsec. unsub. notes 5.55%, 3/15/26 | 10,000 | 11,161 |

|

| BP Capital Markets PLC company guaranty sr. unsec. bonds | | |

| 3.119%, 5/4/26 (United Kingdom) | 99,000 | 98,055 |

|

| Cenovus Energy, Inc. sr. unsec. bonds 6.75%, 11/15/39 (Canada) | 811,000 | 912,375 |

|

| Cenovus Energy, Inc. 144A sr. unsec. notes 4.25%, | | |

| 4/15/27 (Canada) | 345,000 | 342,206 |

|

| Concho Resources, Inc. company guaranty sr. unsec. notes | | |

| 4.375%, 1/15/25 | 560,000 | 567,000 |

|

| DCP Midstream Operating LP company guaranty sr. unsec. notes | | |

| 3.875%, 3/15/23 | 193,000 | 188,175 |

|

| Devon Energy Corp. sr. unsec. unsub. notes 3.25%, 5/15/22 | 132,000 | 132,475 |

|

| EQT Midstream Partners LP company guaranty sr. unsec. sub. | | |

| notes 4.00%, 8/1/24 | 405,000 | 411,321 |

|

| Kerr-McGee Corp. company guaranty sr. unsec. unsub. notes | | |

| 7.875%, 9/15/31 | 185,000 | 240,983 |

|

| Lukoil International Finance BV 144A company guaranty sr. unsec. | | |

| notes 4.563%, 4/24/23 (Russia) | 310,000 | 318,525 |

|

| Marathon Petroleum Corp. sr. unsec. unsub. notes 6.50%, 3/1/41 | 45,000 | 50,852 |

|

| MPLX LP sr. unsec. unsub. notes 4.125%, 3/1/27 | 315,000 | 319,071 |

|

| Nabors Industries, Inc. company guaranty sr. unsec. unsub. notes | | |

| 4.625%, 9/15/21 | 305,000 | 308,050 |

|

| Noble Holding International, Ltd. company guaranty sr. unsec. | | |

| unsub. notes 6.05%, 3/1/41 | 160,000 | 113,200 |

|

| Pertamina Persero PT 144A sr. unsec. unsub. notes 4.30%, | | |

| 5/20/23 (Indonesia) | 200,000 | 205,768 |

|

| Petrobras Global Finance BV company guaranty sr. unsec. unsub. | | |

| bonds 7.25%, 3/17/44 (Brazil) | 1,177,000 | 1,170,723 |

|

| Petrobras Global Finance BV company guaranty sr. unsec. unsub. | | |

| notes 6.85%, 6/5/15 (Brazil) | 361,000 | 321,471 |

|

| Petrobras Global Finance BV company guaranty sr. unsec. unsub. | | |

| notes 6.25%, 3/17/24 (Brazil) | 651,000 | 674,599 |

|

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (31.3%)* cont. | amount | Value |

|

| Energy cont. | | |

|

| Petrobras Global Finance BV company guaranty sr. unsec. unsub. | | |

| notes 5.375%, 1/27/21 (Brazil) | $225,000 | $231,154 |

|

| Petroleos de Venezuela SA company guaranty sr. unsec. unsub. | | |

| notes 5.375%, 4/12/27 (Venezuela) | 23,000 | 8,735 |

|

| Petroleos de Venezuela SA 144A company guaranty sr. unsec. | | |

| notes 6.00%, 11/15/26 (Venezuela) | 155,000 | 59,133 |

|

| Petroleos Mexicanos company guaranty sr. unsec. unsub. bonds | | |

| 5.625%, 1/23/46 (Mexico) | 315,000 | 280,429 |

|

| Petroleos Mexicanos company guaranty sr. unsec. unsub. notes | | |

| 5.50%, 1/21/21 (Mexico) | 625,000 | 665,126 |

|

| Petroleos Mexicanos company guaranty sr. unsec. unsub. notes | | |

| 4.50%, 1/23/26 (Mexico) | 1,281,000 | 1,242,570 |

|

| Pride International, LLC company guaranty sr. unsec. unsub. notes | | |

| 7.875%, 8/15/40 | 425,000 | 388,875 |

|

| Sabine Pass Liquefaction, LLC sr. notes 5.625%, 4/15/23 | 213,000 | 234,575 |

|

| Sabine Pass Liquefaction, LLC 144A sr. bonds 5.00%, 3/15/27 | 800,000 | 844,337 |

|

| Sabine Pass Liquefaction, LLC 144A sr. bonds 4.20%, 3/15/28 | 25,000 | 25,033 |

|

| Spectra Energy Capital, LLC company guaranty sr. unsec. notes | | |

| 5.65%, 3/1/20 | 20,000 | 21,541 |

|

| Spectra Energy Partners LP sr. unsec. notes 3.375%, 10/15/26 | 180,000 | 175,040 |

|

| Statoil ASA company guaranty sr. unsec. notes 5.10%, | | |

| 8/17/40 (Norway) | 165,000 | 187,340 |

|

| Transcanada Trust company guaranty jr. unsec. sub. FRB 5.30%, | | |

| 3/15/77 (Canada) | 595,000 | 600,206 |

|

| Valero Energy Partners LP sr. unsec. unsub. notes | | |

| 4.375%, 12/15/26 | 175,000 | 179,910 |

|

| Williams Partners LP sr. unsec. sub. notes 4.30%, 3/4/24 | 505,000 | 524,307 |

|

| Williams Partners LP sr. unsec. sub. notes 3.60%, 3/15/22 | 155,000 | 158,618 |

|

| Williams Partners LP/ACMP Finance Corp. sr. unsec. sub. notes | | |

| 4.875%, 3/15/24 | 208,000 | 215,800 |

|

| | | 12,624,279 |

|

| Financials (9.9%) | | |

|

| Aflac, Inc. sr. unsec. notes 6.45%, 8/15/40 | 29,000 | 38,365 |

|

| Air Lease Corp. sr. unsec. notes 3.75%, 2/1/22 | 125,000 | 129,411 |

|

| Ally Financial, Inc. sub. unsec. notes 5.75%, 11/20/25 | 425,000 | 435,094 |

|

| American Express Co. jr. unsec. sub. FRN Ser. C, 4.90%, | | |

| perpetual maturity | 215,000 | 217,688 |

|

| American International Group, Inc. jr. unsec. sub. FRB | | |

| 8.175%, 5/15/58 | 414,000 | 534,060 |

|

| Aon PLC company guaranty sr. unsec. unsub. notes | | |

| 4.25%, 12/12/42 | 545,000 | 507,012 |

|

| AXA SA 144A jr. unsec. sub. FRN 6.463%, perpetual | | |

| maturity (France) | 485,000 | 488,031 |

|

| Bank of America Corp. jr. unsec. sub. FRN Ser. Z, 6.50%, | | |

| perpetual maturity | 460,000 | 511,175 |

|

| BGC Partners, Inc. sr. unsec. notes 5.125%, 5/27/21 | 405,000 | 422,239 |

|

| BPCE SA 144A unsec. sub. notes 5.70%, 10/22/23 (France) | 210,000 | 227,307 |

|

| BPCE SA 144A unsec. sub. notes 5.15%, 7/21/24 (France) | 215,000 | 224,431 |

|

| Cantor Fitzgerald LP 144A unsec. notes 6.50%, 6/17/22 | 320,000 | 353,289 |

|

| Capital One Financial Corp. unsec. sub. notes 4.20%, 10/29/25 | 150,000 | 151,051 |

|

| | |

| | Principal | |

| CORPORATE BONDS AND NOTES (31.3%)* cont. | amount | Value |

|

| Financials cont. | | |

|

| CBRE Services, Inc. company guaranty sr. unsec. notes | | |

| 5.25%, 3/15/25 | $156,000 | $168,022 |

|

| CBRE Services, Inc. company guaranty sr. unsec. unsub. notes | | |

| 4.875%, 3/1/26 | 230,000 | 242,106 |

|

| Citigroup, Inc. jr. unsec. sub. FRB Ser. B, 5.90%, perpetual maturity | 152,000 | 159,600 |

|

| Citigroup, Inc. jr. unsec. sub. FRB Ser. P, 5.95%, perpetual maturity | 148,000 | 155,493 |

|

| Citigroup, Inc. jr. unsec. sub. FRN 5.875%, perpetual maturity | 59,000 | 61,286 |

|

| CNO Financial Group, Inc. sr. unsec. unsub. notes 5.25%, 5/30/25 | 220,000 | 227,150 |

|

| Commerzbank AG 144A unsec. sub. notes 8.125%, | | |

| 9/19/23 (Germany) | 320,000 | 378,231 |

|

| Cooperatieve Rabobank UA 144A jr. unsec. sub. FRN 11.00%, | | |

| perpetual maturity (Netherlands) | 790,000 | 922,325 |

|

| Credit Suisse Group AG 144A jr. unsec. sub. FRN 6.25%, perpetual | | |

| maturity (Switzerland) | 200,000 | 208,500 |

|

| Credit Suisse Group AG 144A sr. unsec. bonds 4.282%, | | |

| 1/9/28 (Switzerland) | 1,100,000 | 1,117,333 |

|

| Dresdner Funding Trust I 144A jr. unsec. sub. notes 8.151%, 6/30/31 | 1,000,000 | 1,187,500 |

|

| EPR Properties company guaranty sr. unsec. sub. notes | | |

| 5.25%, 7/15/23 R | 162,000 | 171,963 |

|

| Fifth Third Bancorp jr. unsec. sub. FRB 5.10%, perpetual maturity | 83,000 | 82,585 |

|

| GE Capital International Funding Co. Unlimited Co. company | | |