UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-04704

The Primary Trend Fund, Inc.

3960 Hillside Drive, Suite 204

Delafield, WI 53018

(Address of principal executive offices)

Arnold Investment Counsel Incorporated

3960 Hillside Drive, Suite 204

Delafield, WI 53018

(Name and address of agent for service)

Registrant's telephone number, including area code: (262) 303-4850

Date of fiscal year end: June 30

Date of reporting period: June 30, 2014

Item 1. Reports to Stockholders

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1)

ANNUAL REPORT

The Primary

Trend Fund

DELAFIELD, WISCONSIN

JUNE 30, 2014

MESSAGE TO SHAREHOLDERS…

| “This bull keeps snorting. And the internal strength, especially during the most recent pullback [early 2014], gives even more support to our case that this is an ‘extended bull market.’ The primary driving force during this phase of a bull market is not fundamentals, but momentum… The good news is that a momentum phase is very conducive to achieving outsized gains… While this is still a bull market, this is not the time or the place for the unbridled, wholesale buying of stocks.” |

| The Primary Trend Fund | |

| December 31, 2013 – Semiannual Report |

The high-octane stock market of 2013 was quickly greeted in January of this year with profit-taking. But this year’s low made in the first few days of February is a distant memory as this extended bull market continues to march ahead. New all-time highs are being recorded by the major blue-chip averages as we close out the end of June.

In so doing, the past year’s performance in all baskets of stocks has been quite extraordinary. For the full year ended 6/30/14, the Nasdaq Composite led the hit parade with a total return of +31.27%. The S&P 500 Composite continued to excel with a total return of +24.61%. Of the major indices, the Dow Jones Industrial Average posted a less-generous +15.56% total return. For the same 12-month period ending 6/30/14, The Primary Trend Fund posted a total return of +18.36%, beating the Dow Jones Industrial Average but lagging the S&P 500.

Strapped Consumer

We’ve been harping about the lackluster economic recovery for the past couple of years. Despite the magnitude of the pain inflicted by the Great Recession (2007-09), our snapback in the U.S. has been disappointing – by some measures, the worst post-recession recovery since World War II. In fact, the first quarter gross domestic product (GDP) registered a –2.9%. Most pundits blamed it on the harsh winter. Our suspicion is that the consumer is still in rough shape and those consumer-driven sectors will be hard pressed to move the needle for the U.S. economy going forward. All of the above is a long-winded rationale for why the Fund has absolutely zero exposure to the Consumer Discretionary sector (S&P 500 weight = 11.9%). We sold our remaining retail holdings (Kohl’s, Wal-Mart) and have no interest in housing and related durable goods at this point in the cycle either.

Oil is the New Black

Our investment thesis for loading up on energy stocks over the past two years is threefold: 1) both oil and gas stocks were on the chopping block and traded at cheap valuations; 2) we believe that oil and natural gas exploration, especially due to fracking, is the new growth sector despite the disdain for and roadblocks to this industry coming from Congress and the Obama Administration; and 3) energy stocks are historically late-cycle outperformers in a bull market, and we believe we are in the late innings/extra innings of this bull’s game. The Primary Trend Fund currently has 20.1% of the portfolio invested in the stocks of oil and gas production and oilfield services companies. This is double the weight of the S&P 500’s 10.9%. We have trimmed our Schlumberger position strictly due to price appreciation, but consider this sector one of the leaders in this aging bull.

The Fed Play

Janet Yellen took over as Chair of the Federal Reserve in February and continues the easy money policy that former Chairman Ben Bernanke had implemented since the financial fallout in 2008. The good news is that short-term interest rates are at nearly 0%, and the tapering program will continue (although winding down) at least through the end of 2014. The bad news is that this easy money is not reigniting the economy but it will, in our estimation, ignite monetary inflation in the future.

We continue to underweight financials in the portfolio (5.0% vs. 16.1% for the S&P 500) as we anticipate a ratcheting up in the yield curve (as such, bonds would be a bad bet as well). On the other hand, the Fund’s 8.7% investment in the materials sector (gold and silver mining stocks) is more than twice that of the S&P 500’s exposure to

MESSAGE TO SHAREHOLDERS…(continued)

this sector (3.5%). We believe that the specter of inflation due to the Fed’s open spigot to the tune of trillions of dollars, coupled with the geopolitical tinderbox creating a “black swan” event, makes the precious metals sector an attractive alternative in this late-stage bull market.

A Jesse Livermore Market

Famed investor Jesse Livermore once said, “You never grow poor taking profits.” We concur and have done that repeatedly over the past year. We have trimmed a number of positions as they’ve marched higher, but we have also sold entire positions (for various reasons) in Campbell Soup, Microsoft, Kohl’s Corp., Wal-Mart and DreamWorks Animation. The Fund currently has 24.8% invested in cash and short-term equivalents. In the long term, we intend to redeploy that cash into value-oriented equities. In the short term, it does act as a defensive cushion during this late-stage momentum phase of this bull market. Cash is never our objective…merely a by-product of our philosophy of selling dear and awaiting a low-risk, undervalued investment opportunity.

One for the Record Books

This bull market in stocks turned 5-years old this past March. Since World War II, the average bull market has lasted 4½ years and produced price gains of 141% (as measured by the S&P 500). The current cyclical bull so far has climbed 198% – nearly a three-bagger off the bear market lows. Therefore, based on historical precedence, this bull is not only long in the tooth in terms of time, but price as well.

This market has made a few notable “record-breakers” along the way:

| 1. | Thus far in 2014, the S&P 500 Index has registered 27 new all-time highs (ATHs), with the latest occurring on 7/25/14, when it closed at 1,987.98. The Dow Jones Transportation Average has also made 27 new ATHs this year; the Nasdaq Composite posted 19 new recovery highs; the Dow Jones Industrial Average hit 15 new ATHs; and the Russell 2000 Index has lagged with only 8 new ATHs (a warning crack in our minds). | |

| 2. | At 1,023 days and counting, the S&P 500’s rally since 10/3/11 is the 5th-longest on record (since 1928) without an intervening 10% correction. This is the longest “pain-free” rally since the 1984-87 bull run. | |

| 3. | According to Walter Murphy of Walter Murphy’s Insights, the second quarter of 2014 was the 10th consecutive quarter in which the S&P 500 has recorded a higher low than the previous quarter. “This 10-quarter run ties the streak that ended in the second quarter of 1946 as the second-longest such string,” says Walter Murphy. The longest streak was the 12-quarter run from Q3-1984 to Q3-1987. This sounds impressive, and it is; but the 1946 streak ended with a 3-year bear market that erased 25% of the stock market’s value and shareholders are well aware of the financial damage from the Crash of 1987. |

Pulling in Our Horns on This Bull

With all of these record-breaking moments in this 5½-year-old bull, it must be smooth sailing going forward, right? Not necessarily. We reiterate: while we anticipate the stock market has more upside fireworks in store for investors as 2014 unfolds, this is an “extended bull market” that is in the late innings and, therefore, risks are heightened and prudence is warranted.

For one, stock valuations are fully valued with a market price-to-earnings (P/E) ratio approximating 18-20x. Unfortunately, we believe that this pathetic economic recovery will not help corporate top line (revenues) growth counter the fact that corporate bottom line (net profits) margins are “as good as it gets.” Net profit margins for the S&P 500 companies, on average, are at an all-time high of 9.8%, while the 20-year average is 7.5%. Any deterioration in these metrics will surely make overall P/E multiples contract even if earnings remain stable.

Secondly, and sadly, the U.S. as the “shining light on the hill” has hit the dim-switch. Domestically, the lack of a federal budget, the $17.6 trillion debt level and climbing, the costs and confusion surrounding Obamacare and the ever-

2

MESSAGE TO SHAREHOLDERS…(continued)

increasing entitlement society are all long-term systemic negatives. Internationally, our foreign policy is now being mocked by despots and nations that once feared our resolute role on the world stage. The escalation in conflicts and potential war in Syria, Iraq, Ukraine and southeast Asia is real and may spawn “black swan” events that blindside global financial markets, at least in the short term.

Lastly, investor sentiment has certainly joined the bullish bandwagon. While not ebullient yet, it is quite obvious that the majority are increasingly ignoring the equity risks and becoming intoxicated by the gains of the recent past. Money managers are very exposed to stocks at 90% invested; quite the contrast to their underexposed levels of 0-10% during the bear market lows in 2009. Also, Investors Intelligence continues to register high bullish opinion in the 55-60% area – levels that are generally greeted to corrections, at a minimum.

We believe that the stock market has the potential to show a burst of enthusiasm in the remaining months of 2014, with the S&P 500 Index slicing through the 2000-2100 level and the Dow Jones Industrial Average breaking up through 18,000. We would expect cracks to appear as this fanfare gains momentum.

Our somewhat defensive posture in The Primary Trend Fund now would become even more risk-averse as Wall Street celebrates. As long-time friend and professional student of the market, Steve Leuthold, always says: “Successful investing is a combination of making money AND keeping it.”

As this year turns the page into the next, we intend to do just that for our shareholders in The Primary Trend Fund.

Our best regards,

|  | |

| Lilli Gust | Barry S. Arnold | |

| President | Vice President | |

| Chief Investment Officer |

Summary of Investments by Sector (Unaudited)

| Percent of | ||||

| Sector | Investment Securities | |||

| Short-Term Investments | 24.7 | % | ||

| Consumer, Non-Cyclical | 22.9 | % | ||

| Energy | 20.1 | % | ||

| Basic Materials | 8.7 | % | ||

| Communications | 6.7 | % | ||

| Technology | 6.0 | % | ||

| Financials | 5.0 | % | ||

| Industrials | 3.7 | % | ||

| Utilities | 2.2 | % | ||

| Total Investments | 100.0 | % | ||

Top Ten Equity Holdings (Unaudited)

| Percent of | ||||

| Security | Investment Securities | |||

| Intel Corp. | 6.0 | % | ||

| Royal Dutch Shell | ||||

| PLC ADR, Class A | 5.5 | % | ||

| Encana Corp. | 5.3 | % | ||

| Schlumberger Ltd. | 4.6 | % | ||

| Pfizer, Inc. | 4.1 | % | ||

| Molson Coors | ||||

| Brewing Co., Class B | 4.1 | % | ||

| Apache Corp. | 3.9 | % | ||

| Cisco Systems, Inc. | 3.7 | % | ||

| General Electric Co. | 3.7 | % | ||

| Eli Lilly & Co. | 3.5 | % | ||

| Total | 44.4 | % | ||

3

EXPENSE EXAMPLE (Unaudited)

For the Six Months Ended June 30, 2014

As a shareholder of the Primary Trend Fund, you incur ongoing costs, including management fees and other Fund expenses. If you invest through a financial intermediary, you may also incur additional costs such as a transaction fee charged on the purchase or sale of the Fund or an asset-based management fee. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2014 to June 30, 2014.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any costs that may be associated with investing in the Fund through a financial intermediary. Therefore, the second line of the table is useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if any costs associated with investing through a financial intermediary were included, your costs would have been higher.

| Beginning | Ending | Expenses paid | |

| account value | account value | during period | |

| 1/1/14 | 6/30/14 | 1/1/14-6/30/141 | |

| Actual | $1,000.00 | $1,086.50 | $10.19 |

| Hypothetical (5% return before expenses) | 1,000.00 | 1,015.20 | 9.84 |

| 1 | Expenses are equal to the Fund’s annualized expense ratio of 1.97% for the period from January 1, 2014 through June 30, 2014, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The Fund is contractually obligated to limit annual expenses to 2.00% of its average daily net assets for the fiscal year. |

4

PORTFOLIO OF INVESTMENTS

As of June 30, 2014

The Primary Trend Fund

| Shares | Value | ||||||

| COMMON STOCKS (75.3%) | |||||||

| BASIC MATERIALS (8.7%) | |||||||

| Mining (8.7%) | |||||||

| 23,000 | Barrick Gold Corp. | $ | 420,900 | ||||

| 25,000 | Kinross Gold Corp.* | 103,500 | |||||

| 20,000 | Newmont Mining Corp. | 508,800 | |||||

| 20,000 | Silver Wheaton Corp. | 525,400 | |||||

| Total Basic Materials | 1,558,600 | ||||||

| COMMUNICATIONS (6.6%) | |||||||

| Internet (1.2%) | |||||||

| 15,000 | magicJack VocalTec Ltd.* | 226,800 | |||||

| Telecommunications (5.4%) | |||||||

| 27,000 | Cisco Systems, Inc. | 670,950 | |||||

| 6,000 | Verizon Communications, Inc. | 293,580 | |||||

| 964,530 | |||||||

| Total Communications | 1,191,330 | ||||||

| CONSUMER, NON-CYCLICAL (23.0%) | |||||||

| Beverages (4.2%) | |||||||

| 10,000 | Molson Coors Brewing Co., Class B | 741,600 | |||||

| Food (4.5%) | |||||||

| 3,333 | Kraft Foods Group, Inc. | 199,813 | |||||

| 16,000 | Mondelez International, Inc. | 601,760 | |||||

| 801,573 | |||||||

| Pharmaceuticals (14.3%) | |||||||

| 7,000 | Abbott Laboratories | 286,300 | |||||

| 7,000 | AbbVie, Inc. | 395,080 | |||||

| 10,000 | Eli Lilly & Co. | 621,700 | |||||

| 5,000 | Johnson & Johnson | 523,100 | |||||

| 25,000 | Pfizer, Inc. | 742,000 | |||||

| 2,568,180 | |||||||

| Total Consumer, Non-Cyclical | 4,111,353 | ||||||

| ENERGY (20.1%) | |||||||

| Oil & Gas (14.7%) | |||||||

| 7,000 | Apache Corp. | 704,340 | |||||

| 40,000 | Encana Corp. | 948,400 | |||||

See notes to financial statements.

5

PORTFOLIO OF INVESTMENTS (continued)

As of June 30, 2014

The Primary Trend Fund (continued)

| Shares | Value | ||||||

| COMMON STOCKS (75.3%) (continued) | |||||||

| ENERGY (20.1%) (continued) | |||||||

| Oil & Gas (14.7%) (continued) | |||||||

| 12,000 | Royal Dutch Shell PLC ADR, Class A | $ | 988,440 | ||||

| 2,641,180 | |||||||

| Oil & Gas Services (5.4%) | |||||||

| 15,000 | Key Energy Services, Inc.* | 137,100 | |||||

| 7,000 | Schlumberger Ltd. | 825,650 | |||||

| 962,750 | |||||||

| Total Energy | 3,603,930 | ||||||

| FINANCIALS (5.0%) | |||||||

| Banks (5.0%) | |||||||

| 8,000 | JPMorgan Chase & Co. | 460,960 | |||||

| 10,000 | U.S. Bancorp | 433,200 | |||||

| Total Financials | 894,160 | ||||||

| INDUSTRIALS (3.7%) | |||||||

| Miscellaneous Manufacturing (3.7%) | |||||||

| 25,000 | General Electric Co. | 657,000 | |||||

| TECHNOLOGY (6.0%) | |||||||

| Semiconductors (6.0%) | |||||||

| 35,000 | Intel Corp. | 1,081,500 | |||||

| UTILITIES (2.2%) | |||||||

| Water (2.2%) | |||||||

| 15,000 | Aqua America, Inc. | 393,300 | |||||

| Total Common Stocks | |||||||

| (Cost $9,781,846) | 13,491,173 | ||||||

See notes to financial statements.

6

PORTFOLIO OF INVESTMENTS (continued)

As of June 30, 2014

The Primary Trend Fund (continued)

| Principal | |||||||

| Amount | Value | ||||||

| SHORT-TERM INVESTMENTS (24.8%) | |||||||

| Commercial Paper (20.9%) | |||||||

| $ | 3,435,000 | Abbey National, 0.04%, 07/01/2014(a) | $ | 3,435,000 | |||

| 300,000 | U.S. Bank, 0.14%, 8/29/2014(a) | 299,931 | |||||

| 3,734,931 | |||||||

| U.S. Treasury Bills (3.9%) | |||||||

| 700,000 | 0.05%, 9/4/2014(a) | 699,983 | |||||

| Total Short-Term Investments | |||||||

| (Cost $4,434,868) | 4,434,914 | ||||||

| TOTAL INVESTMENTS (100.1%) | |||||||

| (Cost $14,216,714) | 17,926,087 | ||||||

| Other Liabilities less Assets (-0.1%) | (16,791 | ) | |||||

| NET ASSETS (100.0%) | $ | 17,909,296 | |||||

| * | Non-income producing. | |

| (a) | Each issue shows the rate of the discount at the time of purchase. |

ADR – American Depository Receipt

PLC – Public Limited Company

See notes to financial statements.

7

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2014

| The Primary | ||||

| Trend Fund | ||||

| Assets: | ||||

| Investments, at Value (Note 2a): | ||||

| Common Stocks | $ | 13,491,173 | ||

| Short-Term Investments | 4,434,914 | |||

| Total Investments (Cost $14,216,714) | 17,926,087 | |||

| Cash | 2,787 | |||

| Receivable for Capital Shares Sold | 8,840 | |||

| Dividends Receivable | 13,550 | |||

| Prepaid Expenses and Other Assets | 21,295 | |||

| Total Assets | 17,972,559 | |||

| Liabilities: | ||||

| Payable for Capital Stock Redeemed | 12,143 | |||

| Accrued Investment Advisory Fees (Note 3) | 13,555 | |||

| Professional Fees | 16,180 | |||

| Transfer Agent Fees | 8,550 | |||

| Administration and Accounting Fees | 5,424 | |||

| Other Fees | 7,411 | |||

| Total Liabilities | 63,263 | |||

| Net Assets | $ | 17,909,296 | ||

| Shares Outstanding | 1,250,377 | |||

| Net Asset Value, Offering and Redemption Price Per Share | $ | 14.32 | ||

| Net Assets Consist of: | ||||

| Capital Stock ($0.01 par value, 30,000,000 shares authorized) | $ | 13,552,800 | ||

| Distributions in Excess of Net Investment Income | (4,028 | ) | ||

| Accumulated Undistributed Net Realized Gain on Investments | 651,151 | |||

| Net Unrealized Appreciation on Investments | 3,709,373 | |||

| Net Assets | $ | 17,909,296 | ||

See notes to financial statements.

8

STATEMENT OF OPERATIONS

For the Year Ended June 30, 2014

| The Primary | ||||

| Trend Fund | ||||

| Investment Income: | ||||

| Dividends* | $ | 349,087 | ||

| Interest | 1,685 | |||

| Total Investment Income | 350,772 | |||

| Expenses: | ||||

| Investment Advisory Fees (Note 3) | 124,053 | |||

| Administration and Accounting Fees | 64,191 | |||

| Shareholder Servicing Costs | 51,095 | |||

| Professional Fees | 23,750 | |||

| Registration Fees | 22,834 | |||

| Printing & Postage | 12,893 | |||

| Directors | 8,000 | |||

| Custodial Fees | 7,355 | |||

| Pricing | 3,960 | |||

| Insurance | 2,409 | |||

| Other | 1,562 | |||

| Total Expenses Before Recoupment | 322,102 | |||

| Recoupment of Advisory Fees Previously Waived (Note 3) | 10,779 | |||

| Total Expenses | 332,881 | |||

| Net Investment Income | 17,891 | |||

| Net Realized Gain on Investments | 1,173,883 | |||

| Change in Net Unrealized Appreciation on Investments | 1,652,960 | |||

| Net Realized and Unrealized Gain on Investments | 2,826,843 | |||

| Net Increase in Net Assets from Operations | $ | 2,844,734 | ||

* Net of foreign tax withholding of $10,320.

See notes to financial statements.

9

STATEMENTS OF CHANGES IN NET ASSETS

| The Primary | ||||||||

| Trend Fund | ||||||||

| Year Ended | Year Ended | |||||||

| June 30, 2014 | June 30, 2013 | |||||||

| Operations: | ||||||||

| Net Investment Income | $ | 17,891 | $ | 47,774 | ||||

| Net Realized Gain on Investments | 1,173,883 | 140,342 | ||||||

| Change in Net Unrealized Appreciation on Investments | 1,652,960 | 1,555,267 | ||||||

| Net Increase in Net Assets from Operations | 2,844,734 | 1,743,383 | ||||||

| Distributions to Shareholders: | ||||||||

| From Net Investment Income | (71,205 | ) | (67,183 | ) | ||||

| From Net Realized Gains | (467,824 | ) | — | |||||

| Decrease in Net Assets from Distributions | (539,029 | ) | (67,183 | ) | ||||

| Fund Share Transactions: | ||||||||

| Proceeds from Shares Sold | 249,328 | 292,315 | ||||||

| Reinvested Distributions | 506,868 | 63,146 | ||||||

| Cost of Shares Redeemed | (1,107,180 | ) | (1,216,070 | ) | ||||

| Net Decrease in Net Assets from Fund Share Transactions | (350,984 | ) | (860,609 | ) | ||||

| Total Increase in Net Assets | 1,954,721 | 815,591 | ||||||

| Net Assets: | ||||||||

| Beginning of Year | 15,954,575 | 15,138,984 | ||||||

| End of Year | $ | 17,909,296 | $ | 15,954,575 | ||||

| Accumulated Undistributed Net Investment Income (Distributions in | ||||||||

| Excess of Net Investment Income) at End of Year | $ | (4,028 | ) | $ | 34,059 | |||

| Transactions in Shares: | ||||||||

| Sales | 18,782 | 24,295 | ||||||

| Reinvested Distributions | 38,636 | 5,501 | ||||||

| Redemptions | (83,152 | ) | (102,066 | ) | ||||

| Net Decrease | (25,734 | ) | (72,270 | ) | ||||

See notes to financial statements.

10

FINANCIAL HIGHLIGHTS

The following table shows per share operation performance data, total investment return, ratios and supplemental data for each of the years ended June 30:

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| The Primary Trend Fund | ||||||||||||||||||||

| Per Share Operating Performance | ||||||||||||||||||||

| Net Asset Value, Beginning of Year | $ | 12.50 | $ | 11.23 | $ | 10.94 | $ | 9.15 | $ | 8.11 | ||||||||||

| Net Investment Income | 0.01 | 0.04 | 0.05 | 0.03 | 0.02 | |||||||||||||||

| Net Realized and Unrealized Gain on Investments | 2.24 | 1.28 | 0.28 | 1.78 | 1.06 | |||||||||||||||

| Total from Investment Operations | 2.25 | 1.32 | 0.33 | 1.81 | 1.08 | |||||||||||||||

| Less Distributions: | ||||||||||||||||||||

| From Net Investment Income | (0.06 | ) | (0.05 | ) | (0.04 | ) | (0.02 | ) | (0.04 | ) | ||||||||||

| From Net Realized Gains | (0.37 | ) | — | — | — | — | ||||||||||||||

| Total Distributions | (0.43 | ) | (0.05 | ) | (0.04 | ) | (0.02 | ) | (0.04 | ) | ||||||||||

| Net Increase | 1.82 | 1.27 | 0.29 | 1.79 | 1.04 | |||||||||||||||

| Net Asset Value, End of Year | $ | 14.32 | $ | 12.50 | $ | 11.23 | $ | 10.94 | $ | 9.15 | ||||||||||

| Total Investment Return | 18.36 | % | 11.80 | % | 3.08 | % | 19.81 | % | 13.39 | % | ||||||||||

| Ratios and Supplemental Data | ||||||||||||||||||||

| Net Assets, End of Year (in thousands) | $ | 17,909 | $ | 15,955 | $ | 15,139 | $ | 15,128 | $ | 14,164 | ||||||||||

| Ratio of Expenses to Average Net Assets: | ||||||||||||||||||||

| Net of Waivers, Reimbursements and Recoupments | 1.98 | % | 2.00 | % | 2.00 | % | 2.00 | % | 2.00 | % | ||||||||||

| Before Waivers, Reimbursements and Recoupments | 1.92 | % | 1.99 | % | 2.06 | % | 2.03 | % | 1.97 | % | ||||||||||

| Ratio of Net Investment Income to Average Net Assets: | ||||||||||||||||||||

| Net of Waivers, Reimbursements and Recoupments | 0.11 | % | 0.31 | % | 0.51 | % | 0.26 | % | 0.20 | % | ||||||||||

| Before Waivers, Reimbursements and Recoupments | 0.17 | % | 0.32 | % | 0.45 | % | 0.23 | % | 0.23 | % | ||||||||||

| Portfolio Turnover | 14.0 | % | 38.0 | % | 57.1 | % | 92.4 | % | 52.2 | % | ||||||||||

See notes to financial statements.

11

NOTES TO FINANCIAL STATEMENTS

June 30, 2014

| 1. | Organization |

The Primary Trend Fund, Inc. (The “Fund”), a Wisconsin Corporation, began operations on September 15, 1986. The Fund is registered under the Investment Company Act of 1940, as amended, as an open-end diversified investment management company. The Fund seeks capital growth and income. | |

| 2. | Significant Accounting Policies |

| The following is a summary of significant accounting policies followed by the Fund. |

| a. | Securities listed on a national securities exchange are valued at the last sale price. Securities that are traded on the NASDAQ National Market or the NASDAQ Small-Cap Market are valued at the NASDAQ Official Closing Price. If no sale is reported, the average of the last bid and asked prices is used. Other securities for which market quotations are readily available are valued at the average of the latest bid and asked prices. Debt securities (other than short-term instruments) are valued at prices furnished by a national pricing service, subject to review by the Adviser and determination of the appropriate price whenever a furnished price is significantly different from the previous day’s furnished price. Other assets and securities for which no quotations are readily available are valued at fair value as determined in good faith by the Board of Directors. Securities with maturities of 60 days or less are valued at amortized cost. | |

Generally accepted accounting principles (“GAAP”) defines fair value, establishes a framework for measuring fair value and expands disclosure about fair value measurements. It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or liability, when a transaction is not orderly and how that information must be incorporated into a fair value measurement. | ||

| Under GAAP, various inputs are used in determining the value of the Fund’s investments. These inputs are summarized into three broad levels and described below: |

| Level 1 – | quoted prices for active markets for identical securities. An active market for the security is a market in which transactions occur with sufficient frequency and volume to provide pricing information on an ongoing basis. | |

| Level 2 – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). | |

| Level 3 – | significant unobservable inputs, including the Fund’s own assumptions in determining the fair value of investments. |

Common Stocks. Securities traded on a national exchange (or reported on the NASDAQ national market) are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. | ||

Short-Term Investments. Short-term investments may be valued using amortized cost, which approximates fair value. To the extent the inputs are observable and timely, the values would be categorized in Level 2 of the fair value hierarchy. |

12

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2014

| The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s investments as of June 30, 2014: |

| Level 1 | Level 2 | Level 3 | Total | ||||||||||||||

| Common Stocks* | $ | 13,491,173 | $ | — | $ | — | $ | 13,491,173 | |||||||||

| Short-Term Investments | — | 4,434,914 | — | 4,434,914 | |||||||||||||

| Total | $ | 13,491,173 | $ | 4,434,914 | $ | — | $ | 17,926,087 | |||||||||

| * | All sub-categories within common stocks as detailed in the Portfolio of Investments represent Level 1 evaluation status. |

The Fund adopted the Financial Accounting Standards Board (“FASB”) amendments to authoritative guidance which require the Fund to disclose details of transfers in and out of Level 1 and Level 2 measurements and Level 2 and Level 3 measurements and the reasons for the transfers. For the year ended June 30, 2014, there were no transfers in and out of Level 1, Level 2 and Level 3. The Fund did not hold any Level 3 securities during the year ended June 30, 2014. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period. | ||

| b. | Security transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recorded as earned, and includes amortization of premiums and discounts. Securities gains and losses are determined on the basis of identified cost, which is the same basis used for federal income tax purposes. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the country’s tax codes and regulations. | |

| c. | The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized gains to its shareholders. Therefore, no provision is made for federal income or excise taxes. | |

Accounting for Uncertainty in Income Taxes (the “Income Tax Statement”) requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing a Fund’s tax returns to determine whether these positions meet a “more likely than not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more likely than not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. | ||

| The Income Tax Statement requires management of the Fund to analyze all open tax years 2010-2013, as defined by IRS statute of limitations for all major jurisdictions, including federal tax authorities and certain state tax authorities. As of and during the year ended June 30, 2014, the Fund does not have a liability for any unrecognized tax benefits. The Fund has no examination in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. |

13

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2014

| d. | Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The character of distributions made during the year from net investment income or net realized gain may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain/(loss) items for financial statement and tax purposes. Where appropriate, reclassifications between net asset accounts are made for such differences that are permanent in nature. The following reclassifications made by the Fund during the fiscal year ended June 30, 2014 are primarily the result of permanent book/tax differences in the tax treatment of certain items of net investment income. |

| Distributions in excess of net investment income | $ | 15,227 | ||||

| Accumulated undistributed net realized gain on investments | (15,227 | ) |

| The tax character of distributions paid during the fiscal years ended June 30, 2014, and 2013 were as follows: |

| 2014 | 2013 | ||||||||

| Distributions paid from: | |||||||||

| Ordinary income | $ | 71,205 | $ | 67,183 | |||||

| Net long term capital gains | 467,824 | — | |||||||

| Total distributions paid | $ | 539,029 | $ | 67,183 | |||||

| e. | The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| 3. | Investment Advisory Fees and Management Agreements |

The Fund has an agreement with Arnold Investment Counsel, Inc. (the “Adviser”), with whom certain officers and directors of the Fund are affiliated, to serve as investment adviser. Under the terms of the agreement, the Adviser receives from the Fund a monthly fee at an annual rate of 0.74% of its average daily net assets. The agreement further stipulates that the Adviser will reimburse the Fund for annual expenses exceeding 2.0% of the Fund’s average daily net asset value. There were no such reimbursements necessary for the year ended June 30, 2014. | |

| As part of the Expense Reimbursement Recoupment Agreement, the Fund has agreed to repay the Adviser for amounts previously waived or reimbursed by the Adviser pursuant to the Investment Advisory Agreement provided that such repayment does not cause the Fund’s expenses, exclusive of taxes, interest, fees incurred in acquiring or disposing of portfolio securities, and extraordinary expenses, to exceed 2.0% and the repayment is made within three years after the year in which the Adviser incurred the expense. For the twelve month fiscal period ended June 30, 2014, the Fund paid the Adviser $10,779 in repayment for fees previously waived. As of June 30, 2014, there are no additional recoupment fees that the Fund owes the Adviser. |

14

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2014

| 4. | Purchases and Sales of Securities |

| Total purchases and sales of securities, other than short-term investments, for the Fund for the year ended June 30, 2014 were as follows: |

| Purchases | $ | 1,905,937 | |||

| Sales | 5,403,127 |

| 5. | Tax Information |

| At June 30, 2014, gross unrealized appreciation and depreciation of investments, based on cost for federal income tax purposes was as follows: |

| Cost of investments | $ | 14,216,714 | |||

| Gross unrealized appreciation | 4,041,287 | ||||

| Gross unrealized depreciation | (331,914 | ) | |||

| Net unrealized appreciation on investments | $ | 3,709,373 |

| As of June 30, 2014, the components of accumulated earnings/(deficit) on a tax basis were as follows: |

| Undistributed ordinary income | $ | 5,588 | |||

| Undistributed long-term capital gains | 645,563 | ||||

| Accumulated earnings | 651,151 | ||||

| Accumulated capital and other losses | (4,028 | ) | |||

| Net unrealized appreciation | 3,709,373 | ||||

| Total accumulated earnings/(deficit) | $ | 4,356,496 |

During the year ended June 30, 2014, the Fund utilized $39,681 of its capital loss carryforwards. | |

As of June 30, 2014, the Fund had $4,028 of qualified late-year ordinary losses, which are deferred until fiscal year 2015 for tax purposes. Net late-year ordinary losses incurred after December 31, and within the taxable year are deemed to arise on the first day of the Fund’s next taxable year. | |

| 6. | Beneficial Ownership |

| The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of the Fund creates a presumption of control under Section 2(a)(9) of the 1940 Act. As of June 30, 2014, Ruth L. Leef owned 26.5% of the Fund. |

15

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of

The Primary Trend Fund, Inc.

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of The Primary Trend Fund, Inc. (the “Fund”) as of June 30, 2014, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2014, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Primary Trend Fund, Inc. as of June 30, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

August 22, 2014

16

Proxy Voting Policies and Procedures (Unaudited)

For a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, please call 1-800-443-6544 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the website of the Securities and Exchange Commission at http://www.sec.gov. Information on how the Fund voted proxies relating to portfolio securities during the twelve-month period ended June 30, 2014, will be available without charge, upon request, by calling 1-800-443-6544 or by accessing the website of the Securities and Exchange Commission.

Disclosure of Portfolio Holdings (Unaudited)

The Fund will file its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Form N-Q will be available on the website of the Securities and Exchange Commission at http://www.sec.gov.

Tax Designation (Unaudited)

For the year ended June 30, 2014, 100.00% of the dividends paid from net investment income, including short-term capital gains (if any), for the Fund, is designated as qualified dividend income.

For the year ended June 30, 2014, 100.00% of the dividends paid from net investment income, including short-term capital gains (if any), for the Fund, qualifies for the dividends received deduction available to corporate shareholders.

For federal income tax purposes, the Fund designates long-term capital gain dividends of $467,824 or the amounts determined to be necessary, for the year ended June 30, 2014.

17

DIRECTORS AND OFFICERS (Unaudited)

| Number of | |||||

| Term of | Principal | Funds | Other | ||

| Position(s) | Office and | Occupation(s) | in Complex | Directorships | |

| Name, Address | Held with | Length of | During Past | Overseen | Held |

| and Age | the Fund | Time Served | 5 Years | by Director | by Director |

| Independent Directors: | |||||

| Clark Hillery | Director | Indefinite, until | Director of Team Services | 1 | None |

| 3960 Hillside Drive | successor elected | for the Milwaukee Bucks | |||

| Suite 204 | since December, 2000. | ||||

| Delafield, WI 53018 | 16 years | ||||

| Age: 64 | |||||

| William J. Rack | Director | Indefinite, until | Managing member of Lakeland | 1 | None |

| 3960 Hillside Drive | successor elected | Business Properties LLC, | |||

| Suite 204 | which engages in | ||||

| Delafield, WI 53018 | 12 years | commercial real estate | |||

| Age: 68 | development and leasing. | ||||

| Interested Director: | |||||

| Barry S. Arnold | Director | As Director, | Portfolio Manager, Chief | 1 | None |

| 3960 Hillside Drive | indefinite, until | Investment Officer and | |||

| Suite 204 | successor elected | Secretary of the Adviser. | |||

| Delafield, WI 53018 | As Director, | ||||

| Age: 49 | served 17 years | ||||

| Vice | One year term, | ||||

| President | elected annually | ||||

| and | As Vice President | ||||

| Secretary | and Secretary, | ||||

| served 11 years | |||||

| Officer: | |||||

| Lilli Gust | President, | One year term, | Portfolio Manager, | N/A | N/A |

| 3960 Hillside Drive | Treasurer | elected annually | President and Treasurer | ||

| Suite 204 | and Chief | As President, | of the Adviser. | ||

| Delafield, WI 53018 | Compliance | served 25 years | |||

| Age: 68 | Officer | ||||

| As Treasurer, | |||||

| served 11 years | |||||

| As Chief | |||||

| Compliance | |||||

| Officer, | |||||

| served 10 years |

Certain officer and directors of the Fund are affiliated with the Adviser. None of these individuals receives a fee from the Fund for serving as an officer or director. The independent directors’ remuneration for the Fund totaled $8,000 for the year ended June 30, 2014.

Additional information about the Fund’s Directors is available in the Statement of Additional Information and is available, without charge, upon request, by calling 1-800-443-6544.

18

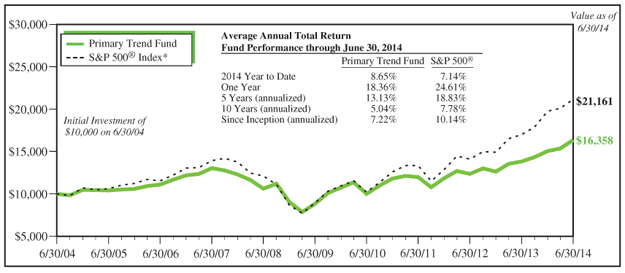

FUND PERFORMANCE COMPARISON (Unaudited)

The performance data quoted is past performance and past performance is no guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. To obtain performance current to the most recent month-end, please call 1-800-443-6544.

The performance included in the table and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. Total returns are based on net change in NAV assuming reinvestment of distributions. As of October 31, 2013, the effective date of the most recent prospectus, the gross and net expense ratios for the Fund were 1.99% and 2.00%, respectively.

| * | The S&P 500® Index is an unmanaged but commonly used measure of common stock total return performance. The Fund’s total returns include operating expenses such as transaction costs and advisory fees which reduce total returns while the total returns of the Index do not include such costs. |

19

www.primarytrendfunds.com

INVESTMENT ADVISER

Arnold Investment Counsel Incorporated

3960 Hillside Drive, Suite 204

Delafield, Wisconsin 53018

1-800-443-6544

OFFICERS

Lilli Gust, President and Treasurer

Barry S. Arnold, Vice President and Secretary

DIRECTORS

Barry S. Arnold

Clark J. Hillery

William J. Rack

ADMINISTRATOR

UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, Wisconsin 53212

CUSTODIAN

U.S. Bank, N.A.

1555 North RiverCenter Drive

Milwaukee, Wisconsin 53212

TRANSFER AGENT AND

DIVIDEND DISBURSING AGENT

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, Wisconsin 53202

1-800-968-2122

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, Ohio 44115

LEGAL COUNSEL

Foley & Lardner LLP

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Founding member of

| 100% | NO-LOAD TM | |

| MUTUAL FUND | ||

| COUNCIL | ||

Item 2. Code of Ethics

The Registrant has a code of ethics (the “Code”) that applies to the Registrant’s principal executive officer and principal financial officer. A copy of the Code is filed as an exhibit to this Form N-CSR. During the period covered by this report, there were no amendments to the provisions of the Code, nor were there any implicit or explicit waivers to the provisions of the Code.

Item 3. Audit Committee Financial Expert

While The Primary Trend Fund, Inc. believes that each of the members of its audit committee has sufficient knowledge of accounting principles and financial statements to serve on the audit committee, none has the requisite experience to qualify as an “audit committee financial expert” as such term is defined by the Securities and Exchange Commission.

Item 4. Principal Accountant Fees and Services

The aggregate fees billed for professional services by the Registrant’s principal accountant for each of the last two fiscal years were as follows:

(a) Audit Fees for Registrant.

The aggregate fees billed for professional services rendered by the principal accountant to the Registrant for the audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements.

Fiscal year ended June 30, 2014 $14,000

Fiscal year ended June 30, 2013 $14,000

(b) Audit-Related Fees for Registrant.

The aggregate fees billed for assurance and related services by the principal accountant to the Registrant that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not required under “Audit Fees” above.

Fiscal year ended June 30, 2014 $0

Fiscal year ended June 30, 2013 $0

(c) Tax Fees for Registrant.

The aggregate fees billed for professional services rendered by the principal accountant to the Registrant for review of Federal and excise tax returns, tax compliance, tax advice and tax planning. The fees paid were comprised of a review of the tax returns, tax notes and other documentation for the filing and returns, along with their underlying schedules, that were prepared by the Registrant’s administrator.

Fiscal year ended June 30, 2014 $1,000

Fiscal year ended June 30, 2013 $1,000

(d) All Other Fees.

The aggregate fees billed for products and services provided by the principal accountant to the Registrant, other than services reported under “Audit Fees,” “Audit-Related Fees,” and “Tax Fees” above.

Fiscal year ended June 30, 2014 $0

Fiscal year ended June 30, 2013 $0

(e) Audit Committee’s pre-approval policies and procedures.

(1) Pursuant to the registrant’s Audit Committee Charter (“Charter”), the Audit Committee shall pre-approve all auditing services and permissible non-audit services to be provided. In addition, the Charter provides that the Audit Committee may delegate to one or more of its members the authority to grant such pre-approvals.

(2) During the fiscal year ended June 30, 2014, all of the non-audit services provided by the Registrant’s principal accountant were pre-approved by the audit committee.

(f) Less than 50% of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) During the last two fiscal years there were no other non-audit services rendered by the Registrant’s principal accountant to the Registrant, its investment adviser or any entity controlling, controlled by or under the common control with the investment adviser that provides ongoing services to the Registrant.

(h) Not applicable.

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Schedule of Investments

Included as part of the report to shareholders filed under Item I of this Form N-CSR.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9. Purchase of Equity Securities of Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders

Not applicable.

Item 11. Controls and Procedures

| (a) | The Principal Executive and Financial Officers concluded that the Registrant’s Disclosure Controls and Procedures are effective based on their evaluation of the Disclosure Controls and Procedures as of a date within 90 days of the filing date of this report. |

| (b) | There were no changes in Registrant’s internal control over financial reporting that occurred during the Registrant’s second fiscal quarter of the period covered by this report that materially affected or were reasonably likely to materially affect Registrant’s internal control over financial reporting. |

Item 12. Exhibits

| (a) | (1) Code of Ethics. Filed as an attachment to this filing. |

| (2) | Certifications required pursuant to Sections 302 of the Sarbanes-Oxley Act of 2002. Filed herewith. |

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or

given during the period covered by the report by or on behalf of the registrant to 10 or

more persons. Not applicable to open-end management investment companies.

| (b) | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

The Primary Trend Fund, Inc.

| /s/ Lilli Gust |

Lilli Gust

Principal Executive Officer

August 28, 2014

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| /s/ Lilli Gust |

Lilli Gust

Principal Executive Officer

August 28, 2014

| /s/ Lilli Gust |

Lilli Gust

Principal Financial Officer

August 28, 2014