UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-05084 |

|

Mutual of America Investment Corporation |

(Exact name of registrant as specified in charter) |

|

320 Park Avenue, New York, N.Y. | | 10022 |

(Address of principal executive offices) | | (Zip code) |

|

John R. Greed Executive Vice President and Treasurer Mutual of America Life Insurance Company 320 Park Avenue New York, NY 10022 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 224-1600 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2005 | |

| | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

The Annual Report to Shareholders follows:

ANNUAL REPORTS OF

MUTUAL OF AMERICA INVESTMENT CORPORATION

AND

FIDELITY INVESTMENTS® VARIABLE INSURANCE

PRODUCT FUNDS

DECEMBER 31, 2005

This report is not to be construed as an offering for sale of any Variable Policy. No offering is made except in conjunction with a prospectus which must precede or accompany this report.

VOLUME I

CONTENTS

| Volume I | | Page | |

| Annual Report of Mutual of America Investment Corporation | |

|

| President's Message | | | 1 | | |

|

| Portfolio Management Discussions | | | 4 | | |

|

| Asset Allocations | | | 16 | | |

|

| Expense Example | | | 19 | | |

|

| Summary Portfolios of Investments in Securities: | |

|

| Equity Index Fund | | | 27 | | |

|

| All America Fund | | | 29 | | |

|

| Small Cap Value Fund | | | 32 | | |

|

| Small Cap Growth Fund | | | 33 | | |

|

| Mid Cap Value Fund | | | 34 | | |

|

| Mid-Cap Equity Index Fund | | | 35 | | |

|

| Aggressive Equity Fund | | | 37 | | |

|

| Composite Fund | | | 39 | | |

|

| Conservative Allocation Fund | | | 42 | | |

|

| Moderate Allocation Fund | | | 42 | | |

|

| Aggressive Allocation Fund | | | 42 | | |

|

| Short-Term Bond Fund | | | 43 | | |

|

| Mid-Term Bond Fund | | | 46 | | |

|

| Bond Fund | | | 48 | | |

|

| Statements of Assets and Liabilities | | | 51 | | |

|

| Statements of Operations | | | 56 | | |

|

| Statements of Changes in Net Assets | | | 59 | | |

|

| Financial Highlights | | | 62 | | |

|

| Notes to Financial Statements | | | 68 | | |

|

| Additional Information | | | 78 | | |

|

Annual Report of Fidelity Investments® Variable Insurance Products Funds: Equity-Income Portfolio

Annual Report of Fidelity Investments® Variable Insurance Products Funds: Asset ManagerSM Portfolio

Annual Report of Fidelity Investments® Variable Insurance Products Funds: Contrafund Portfolio

Annual Report of Fidelity Investments® Variable Insurance Products Funds: Mid Cap Portfolio

Annual Report of Vanguard Variable Insurance Fund: Diversified Value Portfolio

Annual Report of Vanguard Variable Insurance Fund: International Portfolio

Annual Report of DWS (formerly Scudder) Variable Series I: Bond Portfolio

Annual Report of DWS (formerly Scudder) Variable Series I: Capital Growth Portfolio

Annual Report of DWS (formerly Scudder) Variable Series I: International Portfolio

Annual Report of Oppenheimer Main Street Fund®/VA

Annual Report of VP Capital Appreciation Fund of American Century Variable Portfolios, Inc.

Annual Report of Calvert Social Balanced Portfolio of Calvert Variable Series, Inc.

MUTUAL OF AMERICA INVESTMENT CORPORATION

We are pleased to present to you the Mutual of America Investment Corporation ("the Investment Company") Annual Report for the year ended December 31, 2005. The report includes important information regarding the performance and financial position of the Investment Company's Funds during 2005.

Although 2005 was a very eventful year, those events did not have a large impact on the economy or the markets. While the Gulf Coast and Florida suffered severely with a spate of hurricanes, the net result for the economy is likely to be neutral to positive given the flow of money unleashed for the relief efforts. It is also true that energy prices went higher and have stayed higher than expected, and that the consumer will be somewhat hampered as a result going forward. The Federal Reserve has continued to raise short-term interest rates, although that has not discernibly slowed the economy or corporate profits. Likewise, the Iraq war remains a source of emotional, psychological, and financial concern for America.

However, the remarkable thing about the U.S. domestic equity and longer term fixed income markets during 2005 is that despite some ups and downs in prices, there was very little change. For instance, the yield on the 10-Year Treasury Note finished the year at 4.39%, only 17 basis points higher than its 4.22% close on the last day of 2004 a year earlier. Also note that this 2004 close was only 3 basis points lower than the year-end 2003 close. Similarly, the equity markets, as represented by the S&P 500 showed little change over the full year 2005, advancing only 3.0% on a price basis and generating a modest total return of 4.9%. And the difference between the year's low and high price was only 12%, providing limited opportunity to generate outsized returns without taking on a high degree of timin g and trading risk.

However, the one dramatic change that did occur in 2005 was a 133 basis point increase in the 2-Year Treasury note following a similar 125 basis point advance during 2004. This increase was driven by the steady, consistent 25 basis point hikes, from 1.00% to 4.25%, in the Fed Funds rate at each of the thirteen Federal Reserve Open Market Committee Meetings between June 2004 and December 2005. The Federal Reserve has added an additional increase early in 2006, so the Feds Fund Rate currently stands at 4.50%, resulting in the 2-Year Treasury note yielding more than the 10-Year Treasury note. This situation, referred to as an "inverted yield curve," has historic ally had a very high degree of correlation with subsequent economic slowdowns and recessions.

While it is not the intent of the Federal Reserve to create a recession, its rationale for engineering the rise in short rates over the past twenty months, besides moving back to "normal" from an unprecedented low Fed Funds rate, was to preclude the economy from overheating and, as a result, generating an acceleration in generalized inflation. The escalation in the price of oil and its derivatives put special emphasis on the potential for rising inflation. It is likely that the Federal Reserve did not expect longer term rates to remained essentially fixed as short rates rose, but rather to also increase, albeit at a slower pace. That didn't happen, at least to the degree that history would have suggested, and thus we have an inverted yield curve. The primary explanation for why long-term rates have not advanced is that a glut of global savings, especially in Asia, has prompted huge investments in U.S. bonds, the safest securities in the worl d, which also happened to offer the highest government yields in the developed markets, other than Australia and New Zealand.

With regards to the U.S. equity markets'muted advance, a variety of explanations have been offered, all of them reasonable and most of them representing a manifestation of "risk aversion." For instance, while corporate profits have continued to grow at double-digit rates for the past ten quarters, the price to earnings ratio of the equity market has continued to shrink, suggesting limited confidence in the sustainability of growth and the expectation that the cycle will end sooner rather than later, and perhaps abruptly and dramatically. The tendency of the market to focus on the problems rather than the strengths in the economy intimates fear as a greater motivator than greed. Some commentators have suggested this is the lingering effect of the bubble bursting in 2000. Thus, the constant expression of worry over high energy prices, the potential for a burst "housing bubble," the growing federal budget and trade deficits, and the persistent flow of bad news out of the Middle East. One can actually watch the markets respond to news as it is announced on an intra-day basis. While that is what markets always do to some extent, typical adjustments have tended to be incremental and generally moved in one direction or another for sustained periods. What we have been observing in this market cycle is a generalized lack of conviction in the sustainability of economic growth.

And yet, all the statistics make it evident that we are in the midst of a powerful economic expansion. The economy continues to grow at a very firm pace and corporate profits continue to advance at a double-digit rate and above expectations. Cash flow is up, balance sheets are very healthy, margins are at peak historical levels, employment continues to grow, incomes are rising, and consumers and businesses are spending. While short-term interest rates have continued to be raised by the Federal Reserve, markets have been very well prepared for the measured increases, and the economy has so far accommodated them well. Likewise, the dramatic increase in the nominal cost of energy has so far been well accommodated by consumers and businesses, the former by cutting back a bit and the latter by passing on the cost increases where they can.

1

Despite a generally healthy tone to the economy, equity and fixed income markets have remained within narrow trading ranges, as noted previously. One possible reason is that both economic and profit growth are much more likely to slow than to accelerate over the next 6-12 months; frankly, it's difficult to imagine things getting much better than they are. Another is the heightened concern about the potential for inflation as the result of higher energy costs. Markets always oscillate around the questions of growth on the one hand and inflation on the other. The last 3-4 months have been a period of increased uncertainty regarding both. And with Chairman Greenspan's retirement, there is an added uncertainty regarding the course that will be taken by his successor, Ben Bernanke. Thus, markets mark time until the outlook clarifies.

The question is: Will the Fed be successful in curbing any potential for secular inflation without throwing the economy into recession?

In our opinion, there is a good probability that it will be successful. Over the next few months, the types of evidence that would support that conclusion include: Continued growth of employment; continued moderate "core" inflation; continued subdued wage growth and on-going productivity growth; continued consumer spending advances; and continued growth in capital expenditures. If we get these types of results, confidence will increase that interest rate increases are near an end. As a result, markets should respond positively.

For the stock market, valuation has become fairly attractive, especially relative to cash, bonds and housing prices. A "soft landing" with prospects for a longer period of growth, albeit moderate, could yield some multiple expansion along with further profit growth. For fixed income markets, yields will probably not decline much but should hold at higher levels. It is even possible that longer-term bonds would stage a modest rally, exacerbating the yield curve inversion, but one that would not necessarily derail the recovery. Note that the banking system has very successfully navigated a significant flattening of the yield curve with only limited damage to net interest margins, and lower long-term rates would alleviate some of the recent pressure on mortgage rates.

The risk is that the Fed chokes off the recovery by continuing to raise short-term rates to too high a level. It will continue to raise rates until it is convinced inflation is not a problem. It is very likely that the Fed would risk tipping the economy into recession if it believed inflation was spreading much beyond commodities and early players in the intermediate supply chains, and especially if there was evidence suggesting that wages and salaries were beginning to accelerate. So far, wages and salaries have only moved up modestly in line with typical cyclical advances, benefits have actually moderated, productivity remains positive, and union labor remains limited in power. If the economic expansion can persist, even at a reduced pace, financial markets can continue to generate positive returns, although they may remain in single digit territory.

The total return performance for each of the Investment Company Funds is reflected below:

Total Returns — Year Ended December 31, 2005

| Equity Index Fund | | | + 4.81 | % | |

| All America Fund | | | + 3.71 | % | |

| Small Cap Value Fund* | | | + 7.61 | % | |

| Small Cap Growth Fund* | | | + 5.49 | % | |

| Mid Cap Value* | | | + 6.91 | % | |

| Mid-Cap Equity Index Fund | | | +12.50 | % | |

| Aggressive Equity Fund | | | + 5.73 | % | |

| Composite Fund | | | + 0.96 | % | |

| Conservative Allocation Fund | | | + 2.30 | % | |

| Moderate Allocation Fund Fund | | | + 4.35 | % | |

| Aggressive Allocation Fund | | | + 5.78 | % | |

| Money Market Fund | | | + 2.97 | % | |

| Short-Term Bond Fund | | | + 1.58 | % | |

| Mid-Term Bond Fund | | | + 0.77 | % | |

| Bond Fund | | | + 1.79 | % | |

* For the period July 1, 2005 (commencement of operations) to December 31, 2005.

The above total return performance figures do not reflect the deduction of respective Separate Account fees and expenses imposed by Mutual of America Life Insurance Company. All Fund performances presented throughout this report are historical, reflect the full reinvestment of dividends paid, and should not be considered indicative of future results.

2

On the pages immediately following are brief presentations and graphs for each Fund (except the Money Market Fund) which illustrate each Fund's respective:

• Historical total return achieved over specified periods, expressed as an average annual rate and as a cumulative rate;

• Equivalent in dollars of a $10,000 hypothetical investment at the beginning of each specified period; and

• Historical performance compared with an appropriate index.

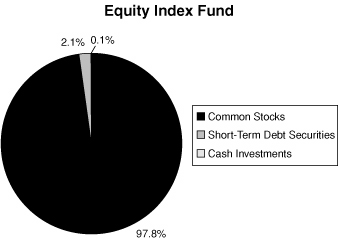

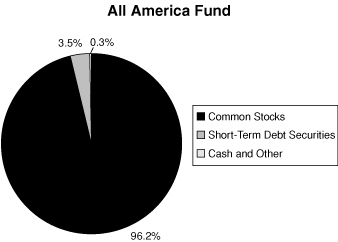

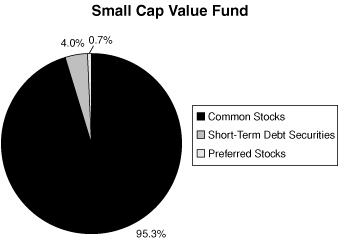

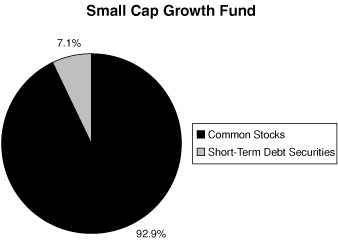

Following that are graphical representations of the asset allocations of each Fund and an illustration of each Fund's operating expenses. The summarized portfolios of each Fund (other than the Money Market Fund) and financial statements are presented in the pages which then follow.

Thank you for your continued investment in our Funds.

Sincerely,

Manfred Altstadt

Chairman of the Board, President and Chief Executive Officer

Mutual of America Investment Corporation

3

EQUITY INDEX FUND

The Equity Index Fund's objective is to replicate the performance of the S&P 500 Index®, which consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market-weighted index of 500 stocks that are traded on the New York Stock Exchange, American Stock Exchange and NASDAQ, with each stock's weight in the Index proportionate to its market value. The weightings make each company's influence on the Index's performance directly proportional to that company's market value.

The S&P 500 had a total return of 4.91% for 2005. The Energy sector was the stellar performer with a positive return of over 29% during 2005 with oil rising to a new all-time high of $70 a barrel in the wake of Hurricane Katrina and coming back down to $60 by year's end. Telecom was the worst performing sector with a return of -9% due to competitive pressures from the cable and satellite industry for market share. As the year came to a close, there were still concerns as to whether consumer spending would slow down considerably and whether rising interest rates could hold off the threat of higher inflation.

The Fund's performance for the twelve months ended December 31, 2005 was 4.81%, in line with the benchmark return of 4.91%. Note that the Fund's performance includes expenses, such as transaction costs and management fees, which are not applicable to the benchmark.

| Equity Index Fund | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,481 | | | | 4.81 | % | | | 4.81 | % | |

| 5 Years | | $ | 10,181 | | | | 1.81 | % | | | 0.36 | % | |

| 10 Years | | $ | 23,472 | | | | 134.72 | % | | | 8.91 | % | |

| S & P 500 Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,491 | | | | 4.91 | % | | | 4.91 | % | |

| 5 Years | | $ | 10,275 | | | | 2.75 | % | | | 0.54 | % | |

| 10 Years | | $ | 23,841 | | | | 138.41 | % | | | 9.07 | % | |

The line representing the performance return of the Equity Index Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

4

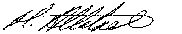

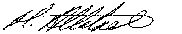

ALL AMERICA FUND

The investment objective of the All America Fund is to outperform the S&P 500 Index®. The Fund is approximately 60% invested in the 500 stocks that comprise the S&P 500 Index® with the remaining 40% actively managed using four different investment approaches. The actively managed portion of the fund is approximately equally distributed among large-cap growth, small-cap growth, large-cap value and small-cap value.

The U. S. equity markets performed better in the second half of 2005 than in the first six months of the year, and produced modest returns for the full year. For 2005, large-cap value stocks performed best while small-cap value, large-cap growth and small-cap growth stocks under-performed the S&P 500 for the period. Concerns relating to rising interest rates, higher energy prices, and possible inflation have kept the equity markets in a narrow trading range for most of 2005.

The Fund's return for the twelve months ending December 31, 2005 was 3.71% versus the benchmark return of 4.91%. Most of the Fund's modest underperformance came from the large-cap and small-cap growth component of the Fund as well as the recognition of the Fund's expenses. The large-cap component of the Fund was managed for the first seven months of the year by an independent sub-advisor, whose philosophy of highly volatile portfolios proved unsuitable in the low volatility market that existed in 2005. Mutual of America Capital Management Corporation assumed management of this component of the Fund on July 29, 2005. Stock selection, specifically in the Technology and Healthcare sectors, was the primary driver of the underperformance of the small-cap growth component of the Fund.

| All America Fund | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,371 | | | | 3.71 | % | | | 3.71 | % | |

| 5 Years | | $ | 9,574 | | | | -4.26 | % | | | -0.87 | % | |

| 10 Years | | $ | 21,239 | | | | 112.39 | % | | | 7.82 | % | |

| S & P 500 INDEX | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,491 | | | | 4.91 | % | | | 4.91 | % | |

| 5 Years | | $ | 10,275 | | | | 2.75 | % | | | 0.54 | % | |

| 10 Years | | $ | 23,841 | | | | 138.41 | % | | | 9.07 | % | |

The line representing the performance return of the All America Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

5

SMALL CAP VALUE FUND

The investment objective of the Small Cap Value Fund is to outperform the Russell 2000 Value® Index. The Fund generally invests in companies that are below $3 billion in market capitalization and have lower price to book characteristics. The inception date of the Fund was July 1, 2005.

For the inception period ending December 31, 2005 the best performing sectors within the benchmark were energy, technology, and materials and the worst performing sectors were consumer staples, utilities, and consumer discretionary.

For the inception period ending December 31, 2005 the Fund returned 7.61% versus a 3.14% return for the Russell 2000 Value® Index. Stock selection was the primary driver of better performance than the benchmark. Sectors contributing to stock selection included energy, materials, and producer durables, while sectors detracting from stock selection included healthcare, technology, and consumer staples.

Since the Fund has been in operation for less than a year, no graphical depiction of performance is being presented at this time.

SMALL CAP GROWTH FUND

The investment objective of the Small Cap Growth Fund is capital appreciation. The Fund invests in growth stocks within the small capitalization marketplace. The inception date of the Fund was July 1, 2005. The Fund returned 5.49% during the period ended December 31, 2005.

The Fund underperformed its benchmark, the Russell 2000 Growth® Index, due to stock selection in the Technology and Healthcare sectors. The benchmark increased 7.55% from July 1, 2005 through the end of the year. The energy sector of the Index was the best performing sector for the period, returning approximately 51%. However, the sector had a difficult 4th quarter, declining 7%. Most equity returns in 2005 were quite dependent on energy and related sectors.

Since the Fund has been in operation for less than a year, no graphical depiction of performance is being presented at this time.

MID-CAP VALUE FUND

The investment objective of the Mid Cap Value Fund is to outperform the Russell Mid Cap Value® Index. The Fund generally invests in companies that are between $1 billion and $20 billion in market capitalization and have lower price to book characteristics. The inception date of the Fund was July 1, 2005.

During the inception period ending December 31, 2005, the best performing sectors within the benchmark were energy, technology, and materials and the worst performing sectors were consumer staples, transportation, and utilities.

For the inception period ending December 31, 2005, the Fund returned 6.91% versus a 6.17% return for the Russell Mid Cap Value Index. Stock selection was the primary driver of better performance than the benchmark. Sectors contributing to stock selection included consumer discretionary, transportation, consumer staples, while sectors detracting from stock selection included utilities, technology, and material processing.

Since the Fund has been in operation for less than a year, no graphical depiction of performance is being presented at this time.

6

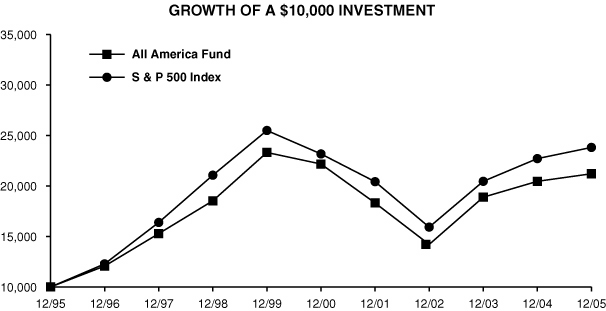

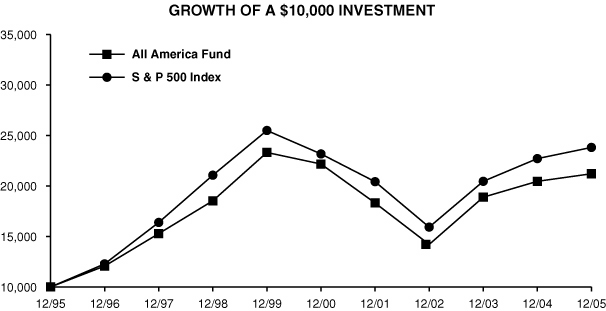

MID-CAP EQUITY INDEX FUND

The Mid-Cap Equity Index Fund invests in the 400 stocks that comprise the S&P 400 MidCap Index®. The index is a market-weighted index of 400 stocks traded on the New York Stock Exchange, American Stock Exchange and NASDAQ. The weightings make each company's influence on the index's performance directly proportional to that company's market value. The companies included in the index tend to be typical of this asset class, the medium-capitalized sector of the U.S. securities market.

The S&P MidCap 400 Index® continued to significantly outperform the S&P 500 Index® during 2005 with a return of 12.56% versus the S&P 500 return of 4.91%. For the fourth year in a row, the S&P 400 returned double-digit growth. Energy was the big story in 2005 with oil rising to an all-time high of $70 a barrel in the wake of Hurricane Katrina. It was also the top performing sector, with a 52% return for the year. Telecom was the only sector ending in negative territory, with a return of -10% due to competitive pressures from the cable and satellite industry for market share. As the year came to a close, there were still concerns as to whether consumer spending would slow down considerably and whether rising interest rates could hold off the threat of higher inflation.

The Fund's performance for the twelve month period ending December 31, 2005 was 12.50%, in line with the 12.56% return of the S&P MidCap 400 Index®. Note that the performance of the Fund includes expenses, such as transaction costs and management fees, which are not applicable to the benchmark.

| Mid-Cap Equity Index Fund | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 11,250 | | | | 12.50 | % | | | 12.50 | % | |

| 5 Years | | $ | 14,835 | | | | 48.35 | % | | | 8.21 | % | |

Since 5/3/99

(Inception) | | $ | 19,343 | | | | 93.43 | % | | | 10.41 | % | |

| S & P MidCap 400 Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 11,256 | | | | 12.56 | % | | | 12.56 | % | |

| 5 Years | | $ | 15,108 | | | | 51.08 | % | | | 8.60 | % | |

Since 5/3/99

(Inception) | | $ | 19,850 | | | | 98.50 | % | | | 10.84 | % | |

The line representing the performance return of the Mid-Cap Equity Index Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

7

AGGRESSIVE EQUITY FUND

The objective of the Aggressive Equity Fund is to generate capital appreciation by investing in a combination of small-cap growth and value stocks, with the respective weightings to be determined by market conditions.

For the twelve months ended December 31, 2005, the small-cap Russell 2000® Index underperformed larger caps as measured by either the S&P 400 Index® or the S&P 500 Index®. For the year 2005, the best performing sectors for small-cap stocks were Energy and Utilities; the worst performer was Technology. All sectors, with the exception of Technology, contributed positively for the year, and overall value stocks outperformed growth stocks by a small margin in this segment of the m arket.

Over the twelve-month period ended December 31, 2005, the Fund returned 5.73% versus a 4.55% return for the Russell 2000 Index®. Stock selection was the primary driver of outperformance relative to the benchmark. Sectors contributing to the outperformance included Energy, Materials & Processing and Utilities. Sectors detracting from performance included Technology and Healthcare.

| Aggressive Equity Fund | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,573 | | | | 5.73 | % | | | 5.73 | % | |

| 5 Years | | $ | 11,043 | | | | 10.43 | % | | | 2.00 | % | |

| 10 Years | | $ | 22,856 | | | | 128.56 | % | | | 8.62 | % | |

| Russell 2000 Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,455 | | | | 4.55 | % | | | 4.55 | % | |

| 5 Years | | $ | 14,846 | | | | 48.46 | % | | | 8.22 | % | |

| 10 Years | | $ | 24,248 | | | | 142.48 | % | | | 9.26 | % | |

The line representing the performance return of the Aggressive Equity Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

8

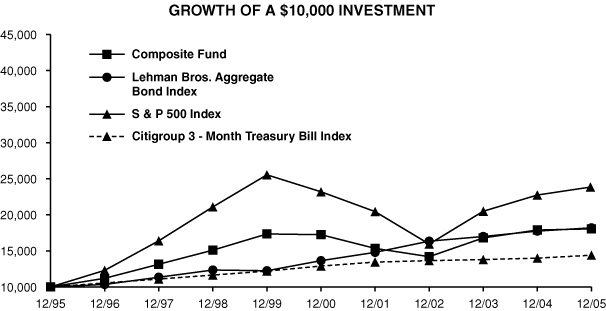

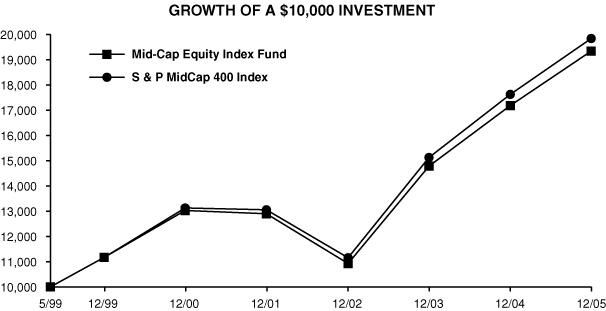

COMPOSITE FUND

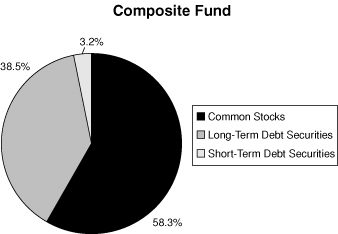

The Composite Fund invests in a diversified portfolio of common stocks and fixed-income securities seeking appreciation and current income. The equity portion of the Fund invests in stocks within the S&P 500 Index®.

The S&P 500 showed little change over the full year 2005, advancing only 3.0% on a price basis and generating a modest total return of 4.9%. The largest contributor to performance was the energy sector, followed by materials and utilities, all benefiting from commodities inflation. Offsetting the risks that these inflationary forces would stimulate a more serious and sustained increase in the general price level was the Federal Reserve's steadfast campaign to raise short term interest rates, as well as the secular forces of globalization and productivity growth. Both economic and profit growth remained robust throughout the year, underscoring the meager returns generated in the aggregate by domestic stocks.

The shape of the yield curve flattened dramatically in 2005 as the Federal Reserve continued to raise short-term rates in an attempt to get back to a more "normal" relationship between short and long-term rates, as well as to head off any acceleration in the general price level in the face of dramatically increased energy prices, a strengthening domestic economic recovery, and signs of a global economic boom. Three-month Treasury Bill yields rose from 2.21% on December 31, 2004 to 4.07% on December 31, 2005 (an increase of 186 basis points), while the yield on the two-year notes rose from 3.07% to 4.40%(an increase of 133 basis points). At the same time, 10-Y ear Treasury bonds advanced only 17 basis points from 4.22% to 4.39%, essentially flat with the 2-Year Treasury.

For the twelve months ended December 31, 2005, the Composite Fund returned 0.96%, compared to the benchmark return of 3.92%, 40% of which is based on the Lehman Brothers Aggregate Bond Index® and 60% of which is based on the S&P 500 Index®. The Fund maintained a shorter duration in fixed-income investments than the Lehman Index during 2005, expecting long rates to rise along with short rates. This caused the Fund to return less than the Index. However, inflationary expectations might cause long rates to rise during 2006. Thus, a defensive interest rate posture will be maintained and the majority of corporate bond positions wi ll have maturities of less than five years.

| Composite Fund | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,096 | | | | 0.96 | % | | | 0.96 | % | |

| 5 Years | | $ | 10,451 | | | | 4.51 | % | | | 0.89 | % | |

| 10 Years | | $ | 18,049 | | | | 80.49 | % | | | 6.08 | % | |

| S & P 500 Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,491 | | | | 4.91 | % | | | 4.91 | % | |

| 5 Years | | $ | 10,275 | | | | 2.75 | % | | | 0.54 | % | |

| 10 Years | | $ | 23,841 | | | | 138.41 | % | | | 9.07 | % | |

| Lehman Bros. Aggregate Bond Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,243 | | | | 2.43 | % | | | 2.43 | % | |

| 5 Years | | $ | 13,302 | | | | 33.02 | % | | | 5.87 | % | |

| 10 Years | | $ | 18,185 | | | | 81.85 | % | | | 6.16 | % | |

| Citigroup 3-Month T-Bill Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,300 | | | | 3.00 | % | | | 3.00 | % | |

| 5 Years | | $ | 11,156 | | | | 11.56 | % | | | 2.21 | % | |

| 10 Years | | $ | 14,408 | | | | 44.08 | % | | | 3.72 | % | |

The line representing the performance return of the Composite Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return lines of the Indices do not.

9

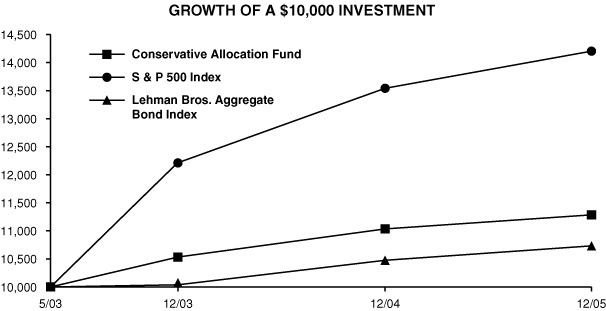

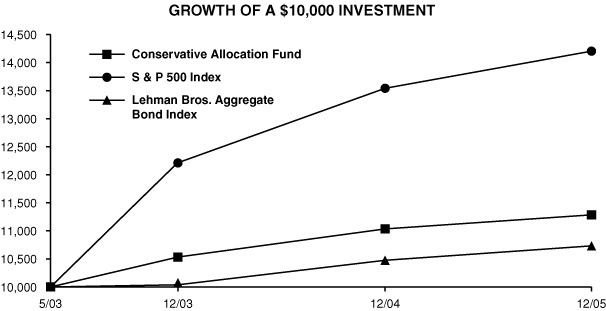

CONSERVATIVE ALLOCATION FUND

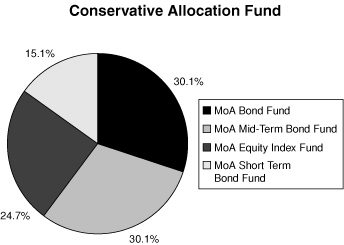

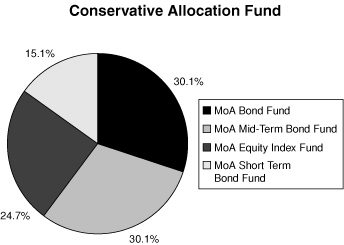

The objective of the Conservative Allocation Fund is current income and, to a lesser extent, capital appreciation. The Conservative Allocation Fund invests primarily in the fixed-income Funds of the Investment Company and also invests in an equity Fund of the Investment Company. The Fund's target allocation is approximately 75% of net assets in fixed-income Funds and approximately 25% of net assets in equity Funds. The Fund seeks to maintain approximately 30% of its net assets in the Bond Fund, approximately 30% in the Mid-Term Bond Fund, approximately 15% in the Short-Term Bond Fund and approximately 25% in the Equity Index Fund.

Performance for the Fund is compared to the Lehman Brothers Aggregate Bond Index® (75% weighting) and the S&P 500 Index® (25% weighting). For the twelve months ended December 31, 2005, the Fund returned 2.30% versus a 3.05% return in the benchmark. The underperformance of the Fund is attributable to the fact that the Short-Term Bond Fund and Mid-Term Bond Fund underperformed the benchmark's longer duration bond component as well as the recognition of the Fund's expenses.

| Conservative Allocation Fund | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,230 | | | | 2.30 | % | | | 2.30 | % | |

Since 5/20/03

(Inception) | | $ | 11,283 | | | | 12.83 | % | | | 4.73 | % | |

| S & P 500 Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,491 | | | | 4.91 | % | | | 4.91 | % | |

Since 5/20/03

(Inception) | | $ | 14,201 | | | | 42.01 | % | | | 14.36 | % | |

| Lehman Bros. Aggregate Bond Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,243 | | | | 2.43 | % | | | 2.43 | % | |

Since 5/20/03

(Inception) | | $ | 10,727 | | | | 7.27 | % | | | 2.72 | % | |

The line representing the performance return of the Conservative Allocation Fund includes expenses, such as transaction costs and management fees in the underlying funds that reduce returns, while the performance return line of the Indices do not.

10

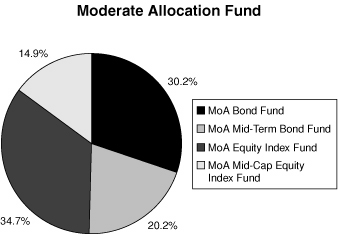

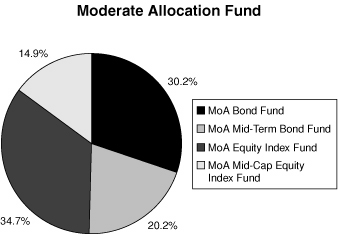

MODERATE ALLOCATION FUND

The objective of the Moderate Allocation Fund is capital appreciation and current income. The Moderate Allocation Fund invests in the equity and fixed-income Funds of the Investment Company. The Fund's target allocation is approximately 50% of net assets in equity Funds and approximately 50% of net assets in fixed-income Funds. The Fund seeks to maintain approximately 35% of its net assets in the Equity Index Fund, approximately 15% in the Mid-Cap Equity Index Fund, approximately 30% in the Bond Fund and approximately 20% in the Mid-Term Bond Fund.

Performance for the Fund is compared to the S&P 500 Index® (50% weighting) and the Lehman Brothers Aggregate Bond Index® (50% weighting). For the twelve months ending December 31, 2005, the Fund returned 4.35% versus a 3.67% return for the benchmark. The outperformance of the Fund was due largely to the Mid-Cap Equity Index Fund significantly outperforming the stock component of the benchmark, which focuses on large-cap stocks.

| Moderate Allocation Fund | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,435 | | | | 4.35 | % | | | 4.35 | % | |

Since 5/20/03

(Inception) | | $ | 12,624 | | | | 26.24 | % | | | 9.32 | % | |

| S & P 500 Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,491 | | | | 4.91 | % | | | 4.91 | % | |

Since 5/20/03

(Inception) | | $ | 14,201 | | | | 42.01 | % | | | 14.36 | % | |

| Lehman Bros. Aggregate Bond Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,243 | | | | 2.43 | % | | | 2.43 | % | |

Since 5/20/03

(Inception) | | $ | 10,727 | | | | 7.27 | % | | | 2.72 | % | |

The line representing the performance return of the Moderate Allocation Fund includes expenses, such as transaction costs and management fees in the underlying funds that reduce returns, while the performance return line of the Indices do not.

11

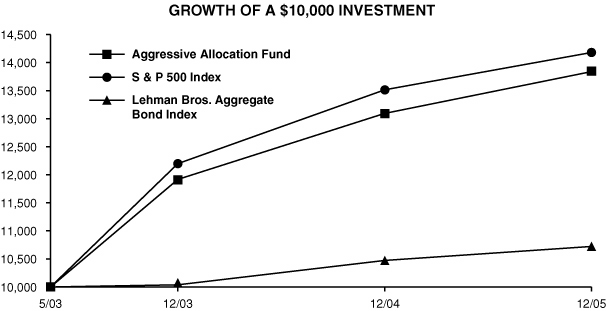

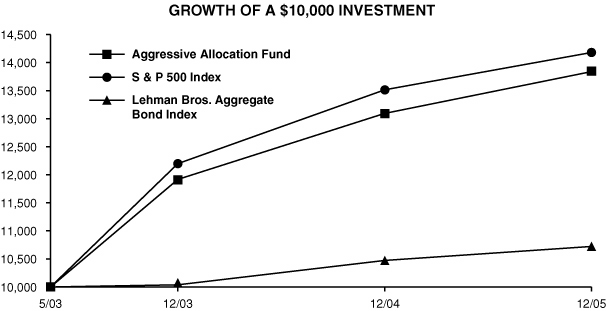

AGGRESSIVE ALLOCATION FUND

The objective of the Aggressive Allocation Fund is capital appreciation and, to a lesser extent, current income. The Aggressive Allocation Fund invests in the equity and fixed income Funds of the Investment Company. The Fund's target allocation is approximately 75% of net assets in equity Funds and approximately 25% of net assets in fixed-income Funds. The Fund seeks to maintain approximately 45% of its net assets in the Equity Index Fund, approximately 20% in the Mid-Cap Equity Index Fund, approximately 10% in the Aggressive Equity Fund and approximately 25% in the Bond Fund.

Performance for the Fund is compared to the S&P 500 Index® (75% weighting) and the Lehman Brothers Aggregate Bond Index® (25% weighting). For the twelve months ending December 31, 2005, the Fund returned 5.78% versus a 4.29% return for the benchmark. The outperformance was mainly due to the Mid-Cap Index Fund and to a lesser extent the Aggressive Equity Fund outperforming the benchmark's stock component, which has a large-cap focus.

| Aggressive Allocation Fund | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,578 | | | | 5.78 | % | | | 5.78 | % | |

Since 5/20/03

(Inception) | | $ | 13,867 | | | | 38.67 | % | | | 13.32 | % | |

| S & P 500 Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,491 | | | | 4.91 | % | | | 4.91 | % | |

Since 5/20/03

(Inception) | | $ | 14,201 | | | | 42.01 | % | | | 14.36 | % | |

| Lehman Bros. Aggregate Bond Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,243 | | | | 2.43 | % | | | 2.43 | % | |

Since 5/20/03

(Inception) | | $ | 10,727 | | | | 7.27 | % | | | 2.72 | % | |

The line representing the performance return of the Aggressive Allocation Fund includes expenses, such as transaction costs and management fees in the underlying funds that reduce returns, while the performance return line of the Indices do not.

12

MONEY MARKET FUND

The Money Market Fund's investment objective is to realize current income while maintaining liquidity, investment quality and stability of capital. Through investing in high-quality commercial paper issued by U.S. corporations and securities issued by the U.S. government and its agencies, the Fund returned 2.97% for the twelve months ended December 31, 2005. Short-term rates continued to move higher during 2005 as the Federal Open Market Committee raised the Federal funds rate eight times, bringing it to 4.25% from 2.25% at the beginning of the year. The seven-day effective yield as of February 14, 2006 was 4.36%. As with all performance reporting, this yield is not necessarily indicative of future annual yields. Neither the Federal Deposit Insurance Corporation nor any other U.S. Government agency insures or guarantees the Separate Account's investments in shares of the Money Market Fund.

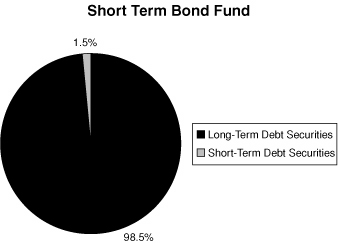

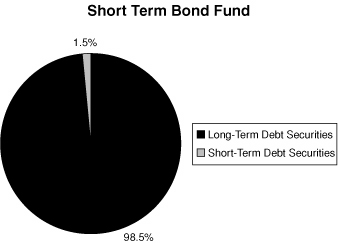

SHORT-TERM BOND FUND

The Short-Term Bond Fund seeks a high level of return consistent with the preservation of capital through investment in publicly traded debt securities. The Fund primarily invests in corporate, U.S. Government agency and mortgage-backed securities, all of which normally yield more than U.S. Treasury issues. The Fund's strategy focuses on overweighting corporate and agency bonds, which yield more than competing index sectors.

Over the 12 month period ended December 31, 2005, the yield on two-year Treasury issues increased from 3.07% to 4.40%. Mortgage-backed securities, which make up 11% of the Fund, outperformed other securities with a similar duration. However, as these bonds mature, generally they will be replaced by corporate bonds.

The Fund's return was 1.58% for the twelve months ended December 31, 2005, compared to the Citigroup Government/Corporate 1-3 Year Bond Index return of 1.81% for the same period. The Fund modestly outperformed the benchmark on a pre-expense basis because it benefited from a shorter duration than that of the index as the Federal Reserve was raising short-term interest rates. The slight underperformance as reported here was entirely a result of expenses, such as transaction costs and management fees, which are not carried by the benchmark.

| Short-Term Bond Fund | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,158 | | | | 1.58 | % | | | 1.58 | % | |

| 5 Years | | $ | 11,848 | | | | 18.48 | % | | | 3.45 | % | |

| 10 Years | | $ | 15,652 | | | | 56.52 | % | | | 4.58 | % | |

| Citigroup 1-3 Year Bond Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,181 | | | | 1.81 | % | | | 1.81 | % | |

| 5 Years | | $ | 12,263 | | | | 22.63 | % | | | 4.17 | % | |

| 10 Years | | $ | 16,437 | | | | 64.37 | % | | | 5.10 | % | |

The line representing the performance return of the Short-Term Bond Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

13

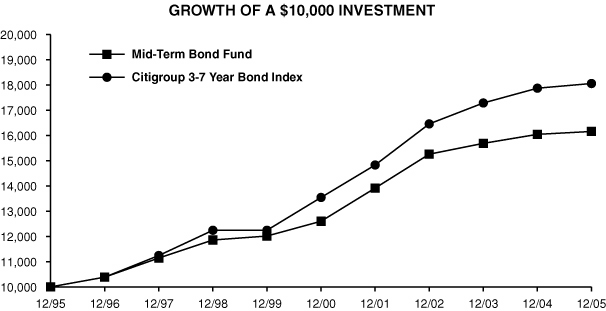

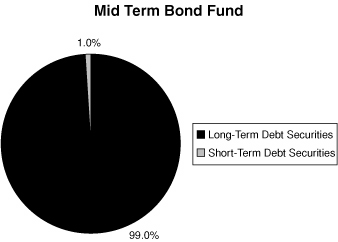

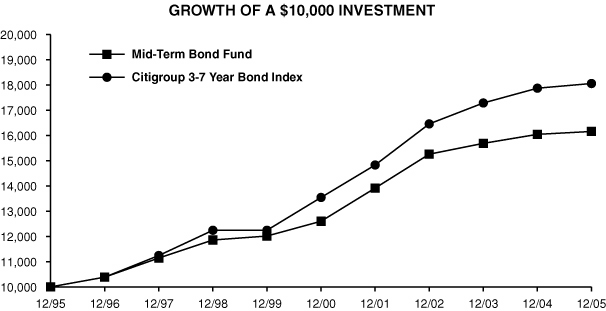

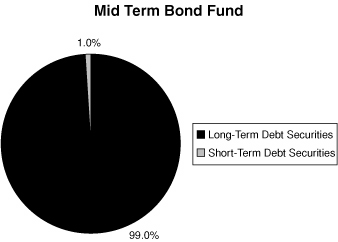

MID-TERM BOND FUND

The Mid-Term Bond Fund seeks a high level of return consistent with the preservation of capital through investment in publicly traded debt securities. The Fund primarily invests in corporate and U.S. Government agency securities, which normally yield more than U.S. Treasury issues.

The Fund continued to emphasize Agency issues and underweight Treasury and corporate bonds during 2005. So long as Agency yields remain similar to corporates, this position will be maintained. For the twelve months ended December 31, 2005, the Fund returned 0.77% compared to the Citigroup Government/Corporate 3-7 Year Bond Index, which returned 1.00%. The Fund modestly outperformed the benchmark on a pre-expense basis because its duration was shorter than that of the index when the Federal Reserve was raising short-term interest rates. The slight underperformance as reported above was entirely the result of expenses, such as transaction costs and management fees, which are not carried by the benchmark.

| Mid-Term Bond Fund | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,077 | | | | 0.77 | % | | | 0.77 | % | |

| 5 Years | | $ | 12,825 | | | | 28.25 | % | | | 5.10 | % | |

| 10 Years | | $ | 16,167 | | | | 61.67 | % | | | 4.92 | % | |

| Citigroup 3-7 Year Bond Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,100 | | | | 1.00 | % | | | 1.00 | % | |

| 5 Years | | $ | 13,325 | | | | 33.25 | % | | | 5.91 | % | |

| 10 Years | | $ | 18,056 | | | | 80.56 | % | | | 6.09 | % | |

The line representing the performance return of the Mid-Term Bond Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

14

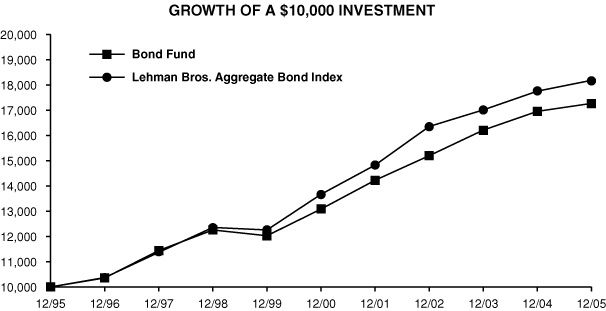

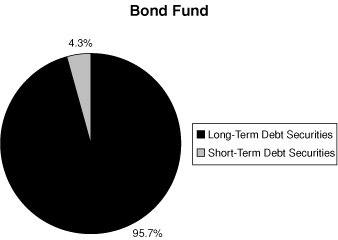

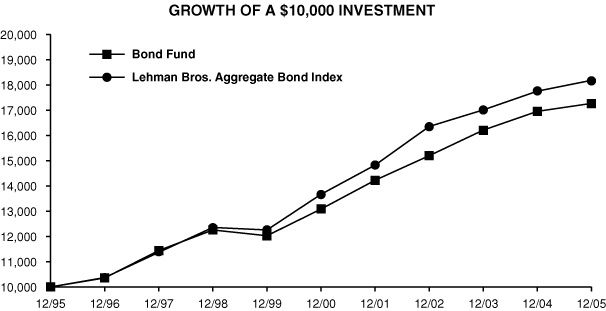

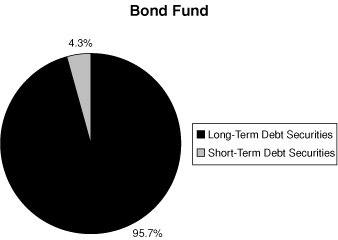

BOND FUND

The Bond Fund's primary investment objective is to provide as high a level of current income over time as is believed to be consistent with prudent investment risk by investing primarily in investment grade, publicly traded debt securities. A secondary objective is preservation of capital. The Fund primarily invests in corporate, U.S. Government agency and mortgage-backed securities, all of which normally yield more than U.S. Treasury issues.

The shape of the yield curve changed dramatically during 2005. Even though the Federal Reserve continued to raise short-term rates while energy prices escalated and signs of inflation became more apparent, long-term rates actually declined. Three-month Treasury Bill yields rose from 2.21% on December 31, 2004 to 4.07% at year end, while the yield on the two-year notes rose from 3.07% to 4.40%. At the same time, long Treasury rates declined from 4.83% to 4.54%.

The Bond Fund's return for the twelve months ended December 31, 2005 was 1.79%, compared to 2.43% for the Lehman Brothers Aggregate Bond Index. The Fund maintained a shorter duration than the Index throughout the year, anticipating long rates to rise along with short rates. However, as noted above, while short-term rates increased by over 100 basis points, long-term rates actually came down, causing the Fund to return less than the Index. However, inflationary expectations might cause long rates to rise during 2006. As such, a defensive interest rate posture will be maintained and the majority of corporate bond positions will have maturities of less than five years.

| Bond Fund | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,179 | | | | 1.79 | % | | | 1.79 | % | |

| 5 Years | | $ | 13,192 | | | | 31.92 | % | | | 5.70 | % | |

| 10 Years | | $ | 17,261 | | | | 72.61 | % | | | 5.61 | % | |

| Lehman Bros. Aggregate Bond Index | |

| Period | | Growth | | Total Return | |

Ended

12/31/05 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,243 | | | | 2.43 | % | | | 2.43 | % | |

| 5 Years | | $ | 13,302 | | | | 33.02 | % | | | 5.87 | % | |

| 10 Years | | $ | 18,185 | | | | 81.85 | % | | | 6.16 | % | |

The line representing the performance return of the Bond Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return lines of the Indices do not.

15

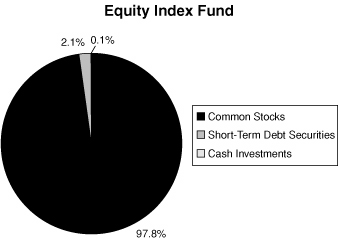

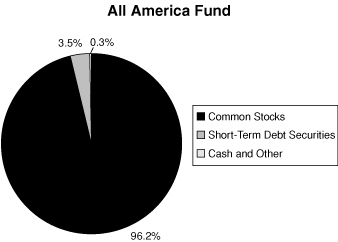

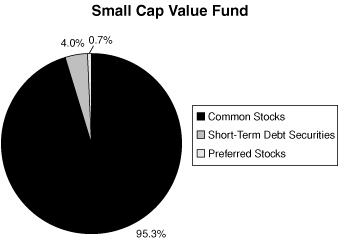

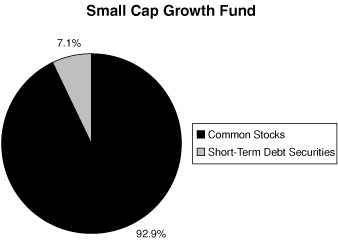

MUTUAL OF AMERICA INVESTMENT CORPORATION

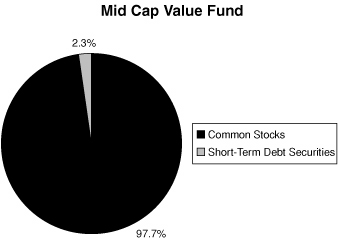

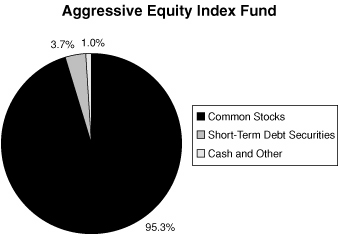

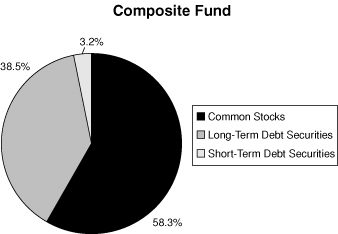

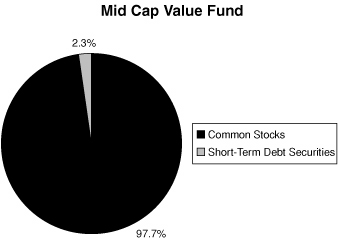

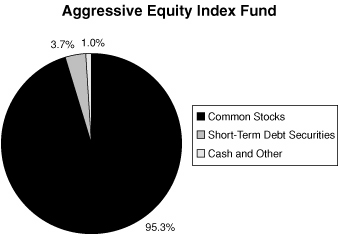

ASSET ALLOCATIONS AS OF DECEMBER 31, 2005

16

MUTUAL OF AMERICA INVESTMENT CORPORATION

ASSET ALLOCATIONS AS OF DECEMBER 31, 2005 (Continued)

17

MUTUAL OF AMERICA INVESTMENT CORPORATION

ASSET ALLOCATIONS AS OF DECEMBER 31, 2005 (Continued)

18

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE

EXAMPLE

As a shareholder of one of the Mutual of America Investment Corporation Funds, you incur ongoing costs, including management fees and other Fund expenses. You do not incur transactional costs, such as sales charges (loads), redemption fees or exchange fees. Additionally, Mutual of America Capital Management Corporation, the Funds' Advisor, has contractually agreed to limit each Fund's total operating expenses to its investment management fees. This contractual obligation was in effect for 2005 and will continue through April 30, 2006. In addition, effective May 1, 2006, the Funds' Advisor will reduce the investment management fee it charges the Funds. Details about the Advisor's investment management fees are in footnotes 2 and 6 of the accompanying financial statements.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at July 1, 2005 and held for the entire period ending December 31, 2005. See Footnote (1) on Page 23 for comparable amounts as if the contractual expense limitation described above was not in effect, and the reduced investment management fees were in effect, during the six months ended December 31, 2005.

ACTUAL EXPENSES

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on each Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning other funds, which may also charge transactional costs, such as sales charges (loads), redemption fees or exchange fees.

Equity Index Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,057.13 | | | $ | 0.65 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,024.26 | | | $ | 0.63 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.125%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

19

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Continued)

All America Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,059.14 | | | $ | 2.59 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,022.33 | | | $ | 2.54 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.50%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Small Cap Value Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,076.16 | | | $ | 4.38 | | |

Hypothetical

(5% Return before expenses) | | $ | 1,000.00 | | | $ | 1,020.52 | | | $ | 4.33 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.85%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Small Cap Growth Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,055.03 | | | $ | 4.32 | | |

Hypothetical

(5% Return before expenses) | | $ | 1,000.00 | | | $ | 1,020.52 | | | $ | 4.33 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.85%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Mid-Cap Value Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,069.12 | | | $ | 3.23 | | |

Hypothetical

(5% Return before expenses) | | $ | 1,000.00 | | | $ | 1,021.71 | | | $ | 3.15 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.65%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

20

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Continued)

Mid-Cap Equity Index Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,083.58 | | | $ | 0.65 | | |

Hypothetical

(5% Return before expenses) | | $ | 1,000.00 | | | $ | 1,024.26 | | | $ | 0.63 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.125%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Aggressive Equity Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,067.31 | | | $ | 4.42 | | |

Hypothetical

(5% Return before expenses) | | $ | 1,000.00 | | | $ | 1,020.52 | | | $ | 4.33 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.85%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Composite Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,029.75 | | | $ | 2.55 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,022.33 | | | $ | 2.54 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.50%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Conservative Allocation Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,014.66 | | | $ | 2.07 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,022.80 | | | $ | 2.08 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.41% (reflecting the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

21

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Continued)

Moderate Allocation Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,032.15 | | | $ | 1.60 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,023.28 | | | $ | 1.60 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.31% (reflecting the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Aggressive Allocation Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,049.47 | | | $ | 1.51 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,023.39 | | | $ | 1.49 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.29% (reflecting the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Money Market Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,017.22 | | | $ | 1.27 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,023.62 | | | $ | 1.27 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.25%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Short-Term Bond Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,007.83 | | | $ | 2.52 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,022.33 | | | $ | 2.54 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.50%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

22

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Continued)

Mid-Term Bond Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 996.38 | | | $ | 2.50 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,022.33 | | | $ | 2.54 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.50%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Bond Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,000.23 | | | $ | 2.51 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1.022.33 | | | $ | 2.54 | | |

* Expenses are equal to the Fund's annual expense ratio of 0.50%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

1. Effective, May 1, 2006, the Advisor will no longer limit the Funds' expenses to its investment management fees. Also effective on the same date, the Advisor will be lowering the investment management fees it charges the funds. Details about the Advisor's investment management fees are in footnotes 2 and 6 of the accompanying financial statements. The expense example tables below are based on an investment of $1,000 invested at July 1, 2005 and held for the entire period ending December 31, 2005 assuming the contractual expense limitation was not in effect, and the reduced investment management fees were in effect, during the six months ended December 31, 2005.

Equity Index Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,056.74 | | | $ | 1.02 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,023.87 | | | $ | 1.02 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.20%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

All America Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,059.14 | | | $ | 2.82 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,022.33 | | | $ | 2.77 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.54%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

23

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Continued)

Small Cap Value Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,076.04 | | | $ | 4.58 | | |

Hypothetical

(5% Return before expenses) | | $ | 1,000.00 | | | $ | 1,020.39 | | | $ | 4.46 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.88%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Small Cap Growth Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,054.91 | | | $ | 4.53 | | |

Hypothetical

(5% Return before expenses) | | $ | 1,000.00 | | | $ | 1,020.39 | | | $ | 4.46 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.88%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Mid-Cap Value Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,068.55 | | | $ | 3.59 | | |

Hypothetical

(5% Return before expenses) | | $ | 1,000.00 | | | $ | 1,021.35 | | | $ | 3.51 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.69%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Mid-Cap Equity Index Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,083.15 | | | $ | 1.07 | | |

Hypothetical

(5% Return before expenses) | | $ | 1,000.00 | | | $ | 1,023.87 | | | $ | 1.02 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.20%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Aggressive Equity Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,067.24 | | | $ | 4.51 | | |

Hypothetical

(5% Return before expenses) | | $ | 1,000.00 | | | $ | 1,020.44 | | | $ | 4.41 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.87%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

24

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Continued)

Composite Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,029.54 | | | $ | 2.77 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,022.11 | | | $ | 2.76 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.54%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Conservative Allocation Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,014.24 | | | $ | 2.49 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,022.37 | | | $ | 2.50 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.49% (reflecting the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Moderate Allocation Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,031.96 | | | $ | 1.90 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,022.99 | | | $ | 1.89 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.37% (reflecting the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Aggressive Allocation Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,049.28 | | | $ | 1.81 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,023.09 | | | $ | 1.78 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.35% (reflecting the proportional expense ratios of the underlying funds in which the Fund invests), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Money Market Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,017.12 | | | $ | 1.37 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,023.51 | | | $ | 1.38 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.27%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

25

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Continued)

Short-Term Bond Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,006.54 | | | $ | 3.82 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,021.00 | | | $ | 3.85 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.76%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Mid-Term Bond Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 996.10 | | | $ | 2.80 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,022.03 | | | $ | 2.83 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.56%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Bond Fund

| | | Beginning

Account Value

July 1, 2005 | | Ending

Account Value

December 31, 2005 | | Expenses Paid

During Period*

July 1 –

December 31, 2005 | |

| Actual | | $ | 1,000.00 | | | $ | 1,000.13 | | | $ | 2.62 | | |

Hypothetical

(5% Return before Expenses) | | $ | 1,000.00 | | | $ | 1,022.22 | | | $ | 2.65 | | |

* Expenses are equal to the Fund's annual expense ratio (before reimbursement) of 0.52%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

26

MUTUAL OF AMERICA INVESTMENT CORPORATION (EQUITY INDEX FUND)

SUMMARY PORTFOLIO OF INVESTMENTS IN SECURITIES

December 31, 2005

| | | Shares | | Value | |

| COMMON STOCKS: | |

| BASIC MATERIALS (2.9%) | |

| Other Securities | | | 458,316 | | | $ | 20,907,187 | | |

| CONSUMER, CYCLICAL (10.4%) | |

| Comcast Corp. Cl A* | | | 136,686 | | | | 3,548,369 | | |

| Home Depot, Inc. | | | 133,714 | | | | 5,412,743 | | |

| Time Warner, Inc. | | | 293,489 | | | | 5,118,448 | | |

| Other Securities | | | 1,814,683 | | | | 61,430,757 | | |

| | | | 75,510,317 | | |

| CONSUMER, NON-CYCLICAL (9.3%) | |

| Altria Group, Inc. | | | 131,075 | | | | 9,793,924 | | |

| Coca-Cola Co. | | | 130,289 | | | | 5,251,950 | | |

| PepsiCo, Inc. | | | 104,438 | | | | 6,170,197 | | |

| Proctor & Gamble Co. | | | 210,978 | | | | 12,211,407 | | |

| Wal-Mart Stores, Inc. | | | 157,243 | | | | 7,358,972 | | |

| Other Securities | | | 756,527 | | | | 26,883,601 | | |

| | | | 67,670,051 | | |

| ENERGY (9.1%) | |

| ChevronTexaco Corp. | | | 141,311 | | | | 8,022,225 | | |

| ConocoPhillips | | | 87,341 | | | | 5,081,499 | | |

| Exxon Mobil Corp. | | | 391,670 | | | | 22,000,104 | | |

| Schlumberger, Ltd. | | | 37,080 | | | | 3,602,322 | | |

| Other Securities | | | 485,628 | | | | 27,506,971 | | |

| | | | 66,213,121 | | |

| FINANCIAL (20.8%) | |

| American Express Co. | | | 78,158 | | | | 4,022,011 | | |

| American Int'l. Group, Inc. | | | 163,381 | | | | 11,147,486 | | |

| Bank of America Corp. | | | 252,793 | | | | 11,666,397 | | |

| Citigroup, Inc. | | | 318,439 | | | | 15,453,845 | | |

| Goldman Sachs Group, Inc. | | | 28,376 | | | | 3,623,899 | | |

| J.P. Morgan Chase & Co. | | | 220,250 | | | | 8,741,722 | | |

| Merrill Lynch & Co., Inc. | | | 57,844 | | | | 3,917,774 | | |

| Morgan Stanley | | | 67,850 | | | | 3,849,809 | | |

| Wachovia Corp. | | | 97,784 | | | | 5,168,862 | | |

| Wells Fargo & Company | | | 105,260 | | | | 6,613,486 | | |

| Other Securities | | | 1,692,643 | | | | 76,643,930 | | |

| | | | 150,849,221 | | |

| HEALTHCARE (13.0%) | |

| Abbott Laboratories | | | 97,642 | | | | 3,850,024 | | |

| Amgen, Inc.* | | | 77,695 | | | | 6,127,028 | | |

| Johnson & Johnson | | | 187,258 | | | | 11,254,206 | | |

| Lilly (Eli) & Co. | | | 71,545 | | | | 4,048,732 | | |

| Medtronic, Inc. | | | 76,138 | | | | 4,383,265 | | |

| Merck & Co., Inc. | | | 137,638 | | | | 4,378,265 | | |

| Pfizer, Inc. | | | 463,995 | | | | 10,820,363 | | |

| UnitedHealth Group, Inc. | | | 85,782 | | | | 5,330,493 | | |

| Wyeth | | | 84,489 | | | | 3,892,408 | | |

| Other Securities | | | 939,422 | | | | 39,937,730 | | |

| | | | 94,022,514 | | |

* Non-income producing security.

| | | Shares | | Value | |

| COMMON STOCKS (CONTINUED): | |

| INDUSTRIAL (11.3%) | |

| 3M Company | | | 47,834 | | | $ | 3,707,135 | | |

| Boeing Co. | | | 50,814 | | | | 3,569,175 | | |

| General Electric Co. | | | 665,090 | | | | 23,311,405 | | |

| Tyco International, Ltd. | | | 126,712 | | | | 3,656,908 | | |

| United Parcel Service Cl B | | | 69,463 | | | | 5,220,144 | | |

| United Technologies Corp. | | | 64,119 | | | | 3,584,893 | | |

| Other Securities | | | 809,987 | | | | 38,895,617 | | |

| | | | 81,945,277 | | |

| TECHNOLOGY (14.8%) | |

| Apple Computer, Inc.* | | | 53,048 | | | | 3,813,621 | | |

| Cisco Systems, Inc.* | | | 386,644 | | | | 6,619,345 | | |

| Dell, Inc.* | | | 148,143 | | | | 4,442,809 | | |

| Hewlett-Packard Co. | | | 180,338 | | | | 5,163,077 | | |

| IBM Corp. | | | 99,423 | | | | 8,172,571 | | |

| Intel Corp. | | | 379,497 | | | | 9,472,245 | | |

| Microsoft Corp. | | | 576,228 | | | | 15,068,362 | | |

| Motorola, Inc. | | | 156,784 | | | | 3,541,751 | | |

| Qualcomm, Inc. | | | 103,494 | | | | 4,458,522 | | |

| Other Securities | | | 2,631,112 | | | | 46,229,130 | | |

| | | | 106,981,433 | | |

| TELECOMMUNICATIONS (2.9%) | |

| AT & T, Inc. | | | 245,889 | | | | 6,021,822 | | |

| Sprint Nextel Corp. | | | 185,970 | | | | 4,344,259 | | |

| Verizon Communications | | | 174,042 | | | | 5,242,145 | | |

| Other Securities | | | 265,643 | | | | 5,719,671 | | |

| | | | 21,327,897 | | |

| UTILITIES (3.3%) | |

| Other Securities | | | 641,567 | | | | 23,820,496 | | |

TOTAL COMMON STOCKS

(Cost: $615,527,933) 97.8% | | | | | | $ | 709,247,514 | | |

The accompanying notes are an integral part of these financial statements.

27

MUTUAL OF AMERICA INVESTMENT CORPORATION (EQUITY INDEX FUND)

SUMMARY PORTFOLIO OF INVESTMENTS IN SECURITIES (Continued)

December 31, 2005

| | | Rate | | Maturity | | Face

Amount | | Value | |

| SHORT-TERM DEBT SECURITIES: | |

| U.S. GOVERNMENT (0.1%) | |

| U.S. Treasury Bill (a) | | | 3.85 | % | | 02/09/06 | | $ | 800,000 | | | $ | 796,561 | | |

| U.S. Treasury Bill (a) | | | 3.87 | | | 03/30/06 | | | 200,000 | | | | 198,038 | | |

| | | | 994,599 | | |

| U.S. GOVERNMENT AGENCIES (2.0%) | |

| Federal Home Loan Bank | | | 3.35 | | | 01/03/06 | | | 14,500,000 | | | | 14,495,952 | | |

TOTAL SHORT-TERM DEBT SECURITIES

(Cost: $15,490,598) 2.1% | | | | | | | | | | | | | 15,490,551 | | |

TEMPORARY CASH INVESTMENTS**

(Cost $750,000) 0.1% | | | | | | | | | | | | | 750,000 | | |

TOTAL INVESTMENTS

(Cost: $631,768,531) 100.0% | | | | | | | | | | | | | 725,488,065 | | |

| OTHER NET ASSETS 0.0% (b) | | | | | | | | | | | | | 286,093 | | |

| NET ASSETS 100.0% | | | | | | | | | | | | $ | 725,774,158 | | |

(a) This security, or a portion thereof, has been segregated to cover initial margin requirements on open futures contracts.

(b) Less than 0.05%.

** The fund has an arrangement with its custodian bank, JPMorgan Chase Bank, whereby uninvested cash, subject to parameters set by the fund, is automatically invested in the fund's name by the bank in overnight commercial paper issued by J.P. Morgan Chase & Co. On the next business day, these funds (and earned interest) are automatically returned to the fund. The annual rate of interest earned on this temporary cash investment at December 31, 2005 was 3.79%.

The total value of non-income producing investments was $101,136,858, or 13.9%, of the Fund's total investments as of December 31, 2005.

FUTURES CONTRACTS OUTSTANDING AS OF DECEMBER 31, 2005:

| | | Expiration

Date | | Underlying Face

Amount at Value | | Unrealized

Gain (Loss) | |

| PURCHASED | |

| 50 S & P Stock Index Futures Contracts | | March 2005 | | $ | 15,685,000 | | | $ | (336,975 | ) | |

Face value of futures purchased and outstanding as a percentage of total investments in securities: 2.2%

The accompanying notes are an integral part of these financial statements.

28

MUTUAL OF AMERICA INVESTMENT CORPORATION (ALL AMERICA FUND)

SUMMARY PORTFOLIO OF INVESTMENTS IN SECURITIES

December 31, 2005

| | | Shares | | Value | |

| INDEXED ASSETS: | |

| COMMON STOCKS | |

| BASIC MATERIALS (1.6%) | |

| Other Securities | | | 139,503 | | | $ | 6,364,205 | | |

| CONSUMER, CYCLICAL (5.7%) | |

| Home Depot, Inc. | | | 40,702 | | | | 1,647,617 | | |

| Time Warner, Inc. | | | 89,337 | | | | 1,558,037 | | |

| Other Securities | | | 593,936 | | | | 19,778,646 | | |

| | | | 22,984,300 | | |

| CONSUMER, NON-CYCLICAL (5.1%) | |

| Altria Group, Inc. | | | 39,899 | | | | 2,981,253 | | |

| Coca-Cola Co. | | | 39,669 | | | | 1,599,057 | | |

| PepsiCo, Inc. | | | 31,791 | | | | 1,878,212 | | |

| Proctor & Gamble Co. | | | 64,221 | | | | 3,717,111 | | |

| Wal-Mart Stores, Inc. | | | 47,865 | | | | 2,240,082 | | |

| Other Securities | | | 230,257 | | | | 8,181,613 | | |

| | | | 20,597,328 | | |

| ENERGY (5.0%) | |

| ChevronTexaco Corp. | | | 43,023 | | | | 2,442,416 | | |

| ConocoPhillips | | | 26,594 | | | | 1,547,239 | | |

| Exxon Mobil Corp. | | | 119,224 | | | | 6,696,812 | | |

| Other Securities | | | 159,094 | | | | 9,467,922 | | |

| | | | 20,154,389 | | |

| FINANCIAL (11.3%) | |

| American Int'l. Group, Inc. | | | 49,733 | | | | 3,393,283 | | |