UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-05084 |

|

Mutual of America Investment Corporation |

(Exact name of registrant as specified in charter) |

|

320 Park Avenue, New York, N.Y. | | 10022 |

(Address of principal executive offices) | | (Zip code) |

|

John R. Greed Senior Executive Vice President and Chief Financial Officer Mutual of America Life Insurance Company 320 Park Avenue New York, NY 10022 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 224-1600 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2008 | |

| | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

The Annual Report to Shareholders follows:

ANNUAL REPORTS OF

MUTUAL OF AMERICA INVESTMENT CORPORATION

AND

FIDELITY INVESTMENTS® VARIABLE INSURANCE

PRODUCT FUNDS

DECEMBER 31, 2008

This report is not to be construed as an offering for sale of any Variable Policy. No offering is made except in conjunction with a prospectus which must precede or accompany this report.

VOLUME I

CONTENTS

| Volume I | | Page | |

| Annual Report of Mutual of America Investment Corporation | |

|

| President's Message | | | 1 | | |

|

| Portfolio Management Discussions | | | 4 | | |

|

| Asset Allocations | | | 26 | | |

|

| Expense Example | | | 30 | | |

|

| Summary Portfolios of Investments in Securities: | |

|

| Equity Index Fund | | | 37 | | |

|

| All America Fund | | | 39 | | |

|

| Small Cap Value Fund | | | 43 | | |

|

| Small Cap Growth Fund | | | 45 | | |

|

| Mid Cap Value Fund | | | 47 | | |

|

| Mid-Cap Equity Index Fund | | | 49 | | |

|

| International Fund | | | 51 | | |

|

| Composite Fund | | | 52 | | |

|

| Retirement Income Fund | | | 55 | | |

|

| 2010 Retirement Fund | | | 55 | | |

|

| 2015 Retirement Fund | | | 56 | | |

|

| 2020 Retirement Fund | | | 56 | | |

|

| 2025 Retirement Fund | | | 57 | | |

|

| 2030 Retirement Fund | | | 57 | | |

|

| 2035 Retirement Fund | | | 58 | | |

|

| 2040 Retirement Fund | | | 58 | | |

|

| 2045 Retirement Fund | | | 59 | | |

|

| Conservative Allocation Fund | | | 59 | | |

|

| Moderate Allocation Fund | | | 60 | | |

|

| Aggressive Allocation Fund | | | 60 | | |

|

| Money Market Fund | | | 61 | | |

|

| Mid-Term Bond Fund | | | 63 | | |

|

| Bond Fund | | | 66 | | |

|

| Statements of Assets and Liabilities | | | 70 | | |

|

| Statements of Operations | | | 74 | | |

|

| Statements of Changes in Net Assets | | | 78 | | |

|

| Financial Highlights | | | 86 | | |

|

| Notes to Financial Statements | | | 96 | | |

|

| Additional Information | | | 111 | | |

|

Annual Report of Fidelity Investments® Variable Insurance Products Funds: Equity-Income Portfolio

Annual Report of Fidelity Investments® Variable Insurance Products Funds: Asset ManagerSM Portfolio

Annual Report of Fidelity Investments® Variable Insurance Products Funds: Contrafund Portfolio

Annual Report of Fidelity Investments® Variable Insurance Products Funds: Mid Cap Portfolio

Volume II

Annual Report of Vanguard Variable Insurance Fund: Diversified Value Portfolio

Annual Report of Vanguard Variable Insurance Fund: International Portfolio

Annual Report of DWS Variable Series I: Bond Portfolio

Annual Report of DWS Variable Series I: Capital Growth Portfolio

Annual Report of DWS Variable Series I: International Portfolio

Annual Report of Oppenheimer Main Street Fund®/VA

Annual Report of VP Capital Appreciation Fund of American Century Variable Portfolios, Inc.

Annual Report of Calvert Social Balanced Portfolio of Calvert Variable Series, Inc.

MUTUAL OF AMERICA INVESTMENT CORPORATION

We are pleased to present to you the Mutual of America Investment Corporation (the "Investment Company") Annual Report for the year ended December 31, 2008. This Annual Report includes important information regarding the performance and financial positions of the Investment Company's funds during 2008.

The year 2008 will go down in history as one of the worst ever for almost every conceivable type of asset. Except for a handful of small equity markets around the world and the U.S. government securities market, negative returns, and generally of large magnitude, were the norm.

For equities, the U.S. Large Cap S&P 500® Index was down 37.0% on a total return basis. Russell Small Cap and Mid-Cap Indexes were down 33.8% and 41.5%, respectively. Outside the United States, equity returns declined by similar amounts in the larger European markets, Canada, Japan, Korea, and Brazil, but among even the smaller Western markets, and especially among the markets of less developed economies, returns were much worse. In Europe, Italy was down 48.7%; Belgium, 53.8%; and Ireland, 66.2%. In Asia, the Philippines declined 48.3%, and Indonesia fell 50.6%. And the Chinese (Shanghai) and Russian markets were down an astounding 70.1% and 72.4% for the year, respectively!

Bonds also had a very difficult year. In the U.S. market, the only sectors that had positive returns were U.S. Treasuries and U.S. agency securities, up 12.4% and 4.4%, respectively. Investment Grade Corporate bonds declined 3.1%, while High Yield Corporate bonds declined 26.2%. Foreign bond markets generally fared worse, especially among emerging markets.

Housing, of course, is another asset class that performed poorly. For the year, residential housing prices were down about 19% and are now down 25% from their peak in mid-2006. Commercial real estate prices have also come under pressure as the financial and economic crisis has deepened over the past five months.

And then there are commodities, which essentially collapsed in mid-2008 after generating huge returns over the previous few years. In 2008, the CRB Index, which tracks a variety of industrial and agricultural goods, declined by 36%, paced by mid-50% declines in oil and copper, but mediated by less serious drops in food stuffs. Gold, generally a haven from market tumult, only managed to eke out a 4.3% gain in a year marked by fear, panic and risk aversion.

The causes of this market turmoil have been fairly exhaustively documented in our periodic Economic and Market Perspectives and in the press. In summary, a housing bubble turned into a housing recession; the housing recession caused an implosion of the global financial system; the financial meltdown caused a decline in overall economic activity; and the financial crisis and the economic contraction are now feeding on each other in what economists, borrowing a concept from medicine, call a "negative feedback loop," characterized by a reduction of output in one system in response to a reduction in output of the other, and so on.

As a result, the United States economy, and nearly every other economy in the world, is in recession, the length and depth of which is the central issue of concern and debate. It has already been officially determined that the U.S. entered a recession in December 2007, and it is fairly widely agreed that our recession began before those in other economies. Thus, even if the U.S. economy were to begin recovery within the next six months, global recovery would not be likely at least until early 2010.

Unfortunately, at the present time a U.S. recovery is probably unlikely to begin at least before the end of this year. Most key economic statistics continue to show deterioration, including consumer spending, employment, industrial production, capital spending and exports.

At the same time, the financial crisis persists, despite the unprecedented actions already taken by policy makers throughout the world. All central banks, led by our Federal Reserve, have lowered benchmark interest rates dramatically. In addition, the Fed has instituted a large number of programs to provide "liquidity," or funding for day-to-day operations of various key components of the financial system, in order to keep the system as a whole functioning. The Fed, along with the U.S. Treasury, has facilitated the acquisition of several failing financial institutions by healthier ones, as it did with Bear Stearns and Wachovia, for example. And it has effectively taken over control of the key federal mortgage lending agencies, Fannie Mae and Freddie Mac, as well as American International Group, formerly the largest insurance company in the world.

And then there's the infamous Troubled Asset Relief Program — or T.A.R.P. — legislation passed by Congress that authorized the U.S. Treasury to inject an initial $350 billion into the banking system to shore it up, and has recently authorized the use of an additional $350 billion for actions as yet to be determined. Notwithstanding these dramatic and expensive responses, the U.S. Treasury has within the last two months had to provide emergency bailouts for Citibank and Bank of America, two of the largest banks in the world.

1

Fortunately, even more firepower is on the way. The new Obama administration is on the verge of announcing a comprehensive, wide-ranging fiscal plan proposing a variety of federal spending programs totaling $850 billion over the next two years. Most commentators believe the final bill will end up being much higher, but that eventually such government spending will be successful in mitigating the downside of the recession and in laying the groundwork for a recovery.

However hopeful, or convinced, we are that the will and creativity of our leaders, the wealth generating capacity of the U.S. economy over time, and the strength and fortitude of the American people, will ultimately triumph over our current woes, it will take time, and it will be painful. U.S. Gross Domestic Product, the broadest measure of economic growth, was just reported to have contracted 3.8% in the 4th Quarter of 2008, following a 0.5% contraction in the 3rd Quarter. Further contractions are likely in at least each of the next two quarters of 2009. Given such dire growth prospects, unemployment will likely rise from its current 7.2% to probably more that 10%. Many smaller banks will close their doors and many companies, large and small, will go bankrupt. Moody's projects that the corporate default rate, currently at 4.4% in the U.S., will hit 15% by the end of 2009, well above the previous peaks of 10-11% in the 1991 and 2002 recessio ns.

Under such circumstances, stock markets are unlikely to show any sustained advance, and will almost surely continue to show the type of volatility witnessed last year. In general, bull markets require at least a good chance of sustainable positive economic growth, and that is just not a reasonable expectation on any near term horizon at this time.

And yet, markets tend to anticipate the future. We probably saw the lows in stocks last November, unless the financial crisis and recession deepen further, or prove totally unresponsive to stimulus. And we will probably have to endure a series of rallies and retrenchments before the fundamentals sort themselves out and stabilize. This bear market has already witnessed two 18-23% advances since late October, only to see most of those gains given back.

But stocks will at some point begin a sustainable advance well before the news becomes positive. Investors are already looking for signs of such an inflexion point by looking at economic data as it is reported for signs that deterioration is slowing. For markets, less bad sometimes is good, especially when enough of the data seem to confirm that the worst of the declines are past. That day will come, and we're hoping it will arrive before the end of this year. Right now, unfortunately, too much is unknown while the data is still moving in the wrong direction.

In the meantime, the Investment Company has positioned its portfolios for the current environment with the objective of outperforming our benchmarks and our peers, as they did in many cases last year.

The total return performance for each of the Investment Company Funds is reflected below:

Total Returns — Year Ended December 31, 2008

| Equity Index Fund | | | -37.08 | % | |

| All America Fund | | | -35.49 | % | |

| Small Cap Value Fund | | | -27.76 | % | |

| Small Cap Growth Fund | | | -34.37 | % | |

| Mid Cap Value Fund | | | -32.64 | % | |

| Mid-Cap Equity Index Fund | | | -36.31 | % | |

| International Fund | | | -40.06 | % | |

| Composite Fund | | | -22.51 | % | |

| Retirement Income Fund | | | - 9.61 | % | |

| 2010 Retirement Fund | | | -17.45 | % | |

| 2015 Retirement Fund | | | -21.01 | % | |

| 2020 Retirement Fund | | | -24.81 | % | |

| 2025 Retirement Fund | | | -28.32 | % | |

| 2030 Retirement Fund | | | -29.95 | % | |

| 2035 Retirement Fund | | | -32.53 | % | |

| 2040 Retirement Fund | | | -32.75 | % | |

| 2045 Retirement Fund | | | -32.90 | % | |

| Conservative Allocation Fund | | | -10.19 | % | |

| Moderate Allocation Fund | | | -19.85 | % | |

2

| Aggressive Allocation Fund | | | -28.20 | % | |

| Money Market Fund | | | + 2.34 | % | |

| Mid-Term Bond Fund | | | + 1.84 | % | |

| Bond Fund | | | - 1.75 | % | |

The above total return performance figures do not reflect the deduction of respective Separate Account fees and expenses imposed by Mutual of America Life Insurance Company. All Fund performances presented throughout this report are historical, reflect the full reinvestment of dividends paid, and should not be considered indicative of future results.

On the pages immediately following are brief presentations and graphs for each Fund (except the Money Market Fund), which illustrate each Fund's respective:

• Historical total return achieved over specified periods, expressed as an average annual rate and as a cumulative rate;

• Equivalent in dollars of a $10,000 hypothetical investment at the beginning of each specified period; and

• Historical performance compared to an appropriate index.

Following those are graphical representations of the asset allocations of each Fund and an illustration of each Fund's operating expenses. The summarized portfolios of each Fund and financial statements are presented in the pages which then follow.

Thank you for your continued investment in our Funds.

Sincerely,

Manfred Altstadt

Chairman of the Board, President

and Chief Executive Officer

Mutual of America Investment Corporation

The views expressed in this Annual Report are subject to change at any time based on market and other conditions and should not be construed as a recommendation. This Report contains forward-looking statements, which speak only as of the date they were made and involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed herein. Readers are cautioned not to place undue reliance on our forward-looking statements, as we assume no obligation to update these forward-looking statements. Readers assume any and all responsibility for any investment decision made as a result of the views expressed herein.

3

EQUITY INDEX FUND

The Equity Index Fund's objective is to replicate the performance of the S&P 500® Index (the "S&P 500"), which consists of 500 stocks chosen by Standard & Poor's for market size, liquidity and industry group representation. The S&P 500 is a market-weighted index of 500 stocks traded on the New York Stock Exchange, American Stock Exchange and Nasdaq, with each stock's weight in the index proportionate to its market value. The weightings make each company's influence on the S&P 500's performance directly proportional to that company's market value.

Overall, 2008 was an abysmal year for absolute returns. According to Standard & Poor's, the S&P 500 return of -37.00% marked the worst year for the index since 1937, when the market was down -38.59%. All ten sectors posted negative double digit returns with the Financial sector down 55.27%! Consumer Staples were the least hit with a negative 15.30% return. The fourth quarter of 2008 brought the most pain with a -22.56% return as the collapse of the financial industry leaders began in September.

The Equity Index Fund's performance for the year ended December 31, 2008, was -37.08%, in line with the benchmark return of -37.00%. Note that the Equity Index Fund's performance includes expenses, such as transaction costs and management fees, which are not applicable to the benchmark.

Equity Index Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,292 | | | | -37.08 | % | | | -37.08 | % | |

| 5 Years | | $ | 8,879 | | | | -11.21 | % | | | -2.35 | % | |

| 10 Years | | $ | 8,552 | | | | -14.48 | % | | | -1.55 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

| 5 Years | | $ | 8,950 | | | | -10.50 | % | | | -2.19 | % | |

| 10 Years | | $ | 8,699 | | | | -13.01 | % | | | -1.38 | % | |

The line representing the performance return of the Equity Index Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

4

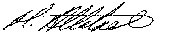

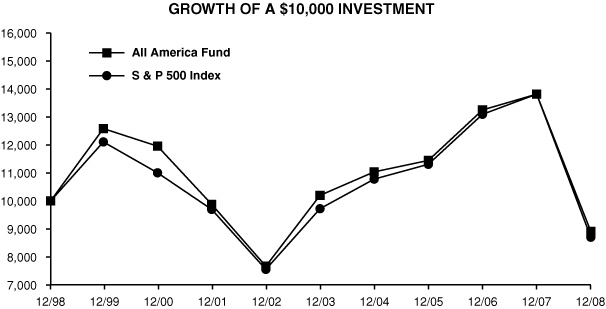

ALL AMERICA FUND

The investment objective of the All America Fund is to outperform the S&P 500® Index (the "S&P 500"). The All America Fund is approximately 60% invested in the 500 stocks that comprise the S&P 500, with the remaining 40% actively managed, using three different investment approaches. The actively managed portion of the All America Fund is approximately equally distributed between large cap stocks and small cap stocks, with the small cap stocks in turn equally distributed between small cap value and small cap growth stocks.

The year 2008 proved a difficult time for not only domestic equity markets, but global equity markets as well, as documented in the President's Letter. Only a handful of global equity indices had positive returns. In the U.S., the S&P 500® Index of large capitalization stocks declined by -37.00% , while the Russell 2000 (Small Cap) Growth® Index was down -38.54% and the Russell 2000 Value® Index was down -28.92% for the twelve month period ended December 31, 2008.

The All America Fund's return for the year ended December 31, 2008, was -35.49% versus the benchmark return of -37.00%. The indexed portion of the fund, representing 60% of the overall portfolio, performed in line with the S&P 500® index. The overperformance derived from results surpassing that of the S&P 500® Index by all three actively managed components of the Fund, specifically, Large Cap representing 20% of the Fund, and both Small Cap Value and Small Cap Growth, each representing 10% of the Fund.

All America Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,451 | | | | -35.49 | % | | | -35.49 | % | |

| 5 Years | | $ | 8,739 | | | | -12.61 | % | | | -2.66 | % | |

| 10 Years | | $ | 8,909 | | | | -10.91 | % | | | -1.15 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

| 5 Years | | $ | 8,950 | | | | -10.50 | % | | | -2.19 | % | |

| 10 Years | | $ | 8,699 | | | | -13.01 | % | | | -1.38 | % | |

The line representing the performance return of the All America Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

5

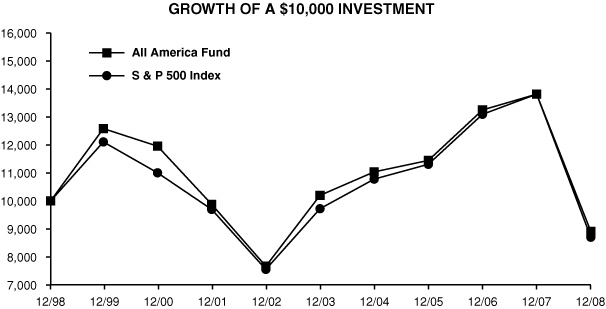

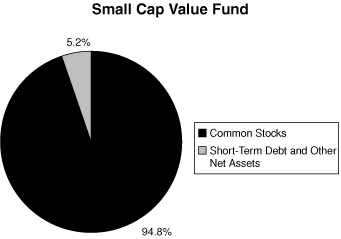

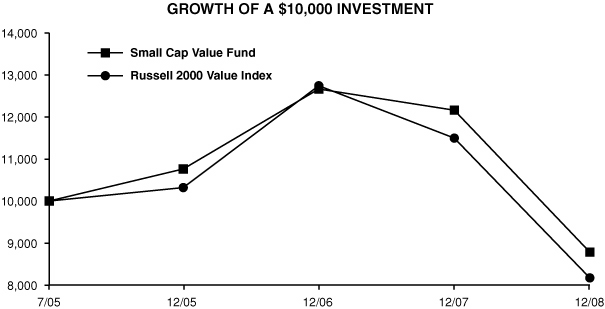

SMALL CAP VALUE FUND

The investment objective of the Small Cap Value Fund is to outperform the Russell 2000 Value® Index. The Small Cap Value Fund generally invests in companies that are below $3 billion in market capitalization and have lower price-to-book characteristics than the overall market.

For the year ended December 31, 2008, the Small Cap Value Fund returned -27.76% versus a -28.92% return for the Russell 2000 Value® Index. Stock selection was the primary driver of positive performance versus the benchmark. Sectors contributing to Fund performance included Finance, Consumer Cyclical and Consumer Staples, while sectors detracting from Fund performance included Basic Materials and Insurance.

Small Cap Value Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 7,224 | | | | -27.76 | % | | | -27.76 | % | |

Since 7/1/05

(Inception) | | $ | 8,784 | | | | -12.16 | % | | | -3.64 | % | |

Russell 2000 Value Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 7,108 | | | | -28.92 | % | | | -28.92 | % | |

Since 7/1/05

(Inception) | | $ | 8,171 | | | | -18.29 | % | | | -5.61 | % | |

The line representing the performance return of the Small Cap Value Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

6

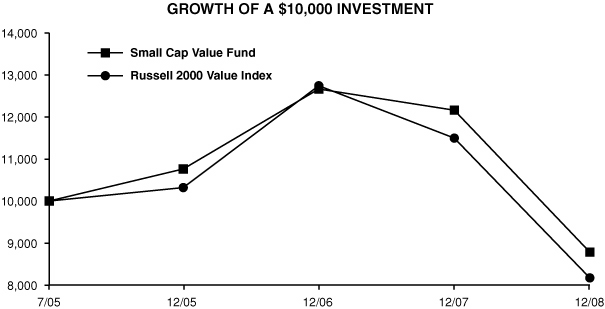

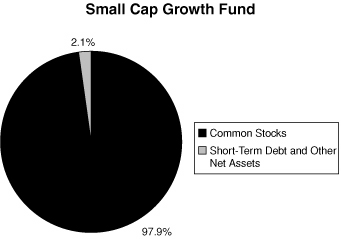

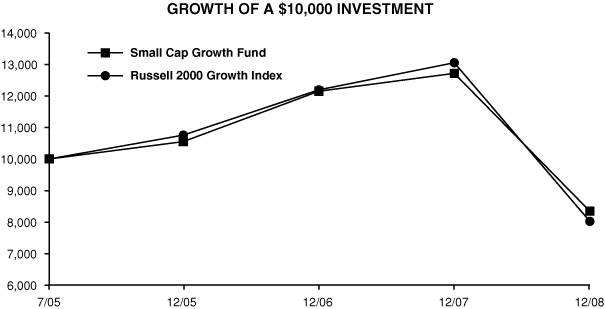

SMALL CAP GROWTH FUND

The investment objective of the Small Cap Growth Fund is capital appreciation. The Small Cap Growth Fund invests in growth stocks within the small capitalization marketplace. The Fund returned -34.37% during the year ended December 31, 2008. The Fund's benchmark, the Russell 2000 Growth® Index, returned -38.54% for the period.

The Small Cap Growth Fund's overperformance against its benchmark was due primarily to outperformance in the Financial, Consumer Discretionary and Industrial sectors. The Healthcare and Consumer Staples Sector underperformed the benchmark and detracted from the overall performance of the year. Also, we maintained a fairly defensive posture in our stock selection, which contributed to our overall outperformance for 2008. Stock selection, as opposed to sector allocation, continues to be the main factor in our returns.

Small Cap Growth Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,563 | | | | -34.37 | % | | | -34.37 | % | |

Since 7/1/05

(Inception) | | $ | 8,345 | | | | -16.55 | % | | | -5.04 | % | |

Russell 2000 Growth Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,146 | | | | -38.54 | % | | | -38.54 | % | |

Since 7/1/05

(Inception) | | $ | 8,022 | | | | -19.78 | % | | | -6.10 | % | |

The line representing the performance return of the Small Cap Growth Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

7

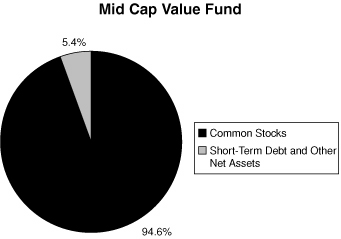

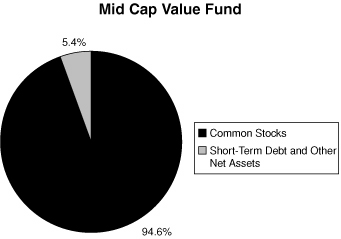

MID CAP VALUE FUND

The investment objective of the Mid Cap Value Fund is to outperform the Russell Mid Cap Value® Index. The Mid Cap Value Fund generally invests in companies that are between $1 billion and $20 billion in market capitalization and have lower price-to-book characteristics.

For the year ended December 31, 2008, the Mid Cap Value Fund returned -32.64% versus a -38.44% return for the Russell Mid Cap Value® Index. Stock selection was the primary driver of positive performance versus the benchmark. Sectors contributing to Mid Cap Value Fund performance included Finance and Retail, while sectors detracting from Mid Cap Value Fund performance included Consumer Staples and REITs.

Mid Cap Value Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,736 | | | | -32.64 | % | | | -32.64 | % | |

Since 7/1/05

(Inception) | | $ | 8,422 | | | | -15.78 | % | | | -4.78 | % | |

Russell Mid Cap Value Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,156 | | | | -38.44 | % | | | -38.44 | % | |

Since 7/1/05

(Inception) | | $ | 7,723 | | | | -22.77 | % | | | -7.12 | % | |

The line representing the performance return of the Mid Cap Value Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

8

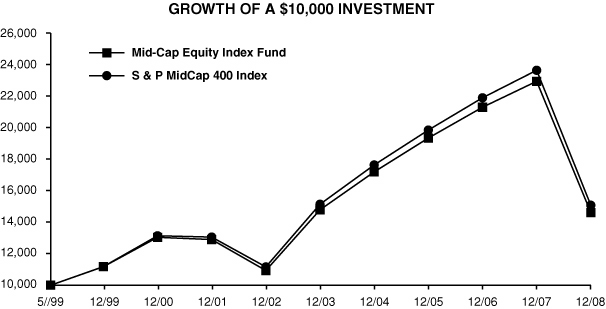

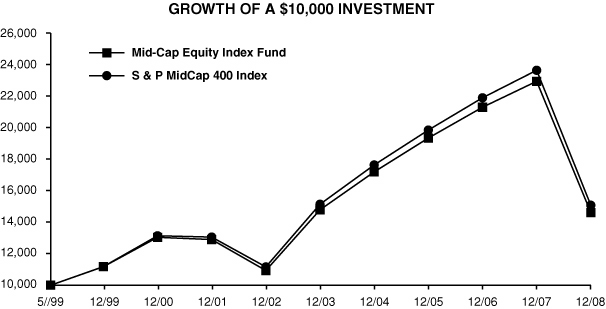

MID-CAP EQUITY INDEX FUND

The Mid-Cap Equity Index Fund invests in the 400 stocks that comprise the S&P MidCap 400® Index (the "S&P MidCap 400"). The S&P MidCap 400 is a market-weighted index of 400 stocks traded on the New York Stock Exchange, American Stock Exchange and Nasdaq. The weightings make each company's influence on the S&P MidCap 400's performance directly proportional to that company's market value. The companies included in the S&P MidCap 400 tend to be typical of this asset class, the medium-capitalized sector of the U.S. securities market.

The performance returns of 2008 were a disaster for all asset classes, with even the S&P MidCap 400 posting a -36.23% return, not far from its larger brethren, the S&P 500 at -37.00%. All ten sectors posted a negative double digit return with Energy leading the decline with -46.31%. Oil prices continued to drop from their peak of $145 a barrel in June 2008. Demand weakened as the global economy began to seize, leading to increases in inventory. The build out of global infrastructure slowed and consumers stopped spending. The mid-cap companies depend on these core sources to continue to grow and, as a result, the mid-cap index fell just as the large cap index was brutally hit by the capital market downturn. As 2009 begins, there is still uncertainty as to which direction the economy will head.

The Mid-Cap Equity Index Fund's performance for the year ended December 31, 2008, was -36.31%, in line with the -36.23% return of the S&P MidCap 400. Note that the performance of the Mid-Cap Equity Index Fund includes expenses, such as transaction costs and management fees, which are not applicable to the benchmark.

Mid-Cap Equity Index Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,369 | | | | -36.31 | % | | | -36.31 | % | |

| 5 Years | | $ | 9,883 | | | | -1.17 | % | | | -0.23 | % | |

Since 5/3/99

(Inception) | | $ | 14,614 | | | | 46.14 | % | | | 4.01 | % | |

S & P MidCap 400 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,377 | | | | -36.23 | % | | | -36.23 | % | |

| 5 Years | | $ | 9,959 | | | | -0.41 | % | | | -0.08 | % | |

Since 5/3/99

(Inception) | | $ | 15,079 | | | | 50.79 | % | | | 4.34 | % | |

The line representing the performance return of the Mid-Cap Equity Index Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

9

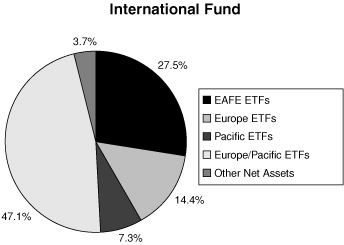

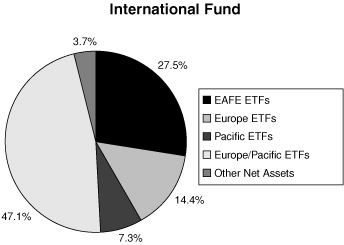

INTERNATIONAL FUND

The International Fund seeks capital appreciation by investing, directly or indirectly, in stocks of companies located outside of the United States that are reflected or contained in the Morgan Stanley Capital International, Inc. Europe, Australasia and Far East Index® (MSCI EAFE Index®). Currently the International Fund is invested exclusively in exchange traded funds that reflect or closely match the holdings in the MSCI EAFE Index®.

Performance for the International Fund is compared to the MSCI EAFE Index®. For the year ended December 31, 2008, the International Fund returned -40.06%, outperforming the -43.06% return of the benchmark. The Fund's outperformance against its benchmark was due to favorable management of cash inflows throughout the year.

International Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 5,994 | | | | -40.06 | % | | | -40.06 | % | |

Since 11/5/07

(Inception) | | $ | 5,819 | | | | -41.81 | % | | | -37.41 | % | |

MSCI EAFE Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 5,694 | | | | -43.06 | % | | | -43.06 | % | |

Since 11/5/07

(Inception) | | $ | 5,540 | | | | -44.60 | % | | | -40.02 | % | |

The line representing the performance return of the International Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

10

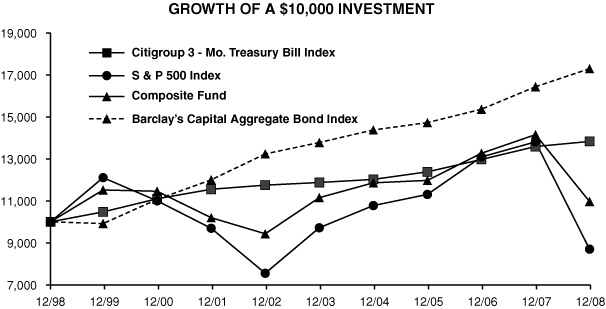

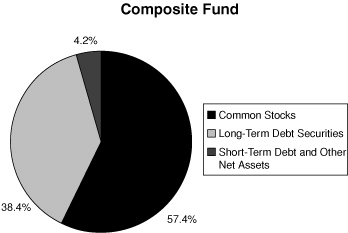

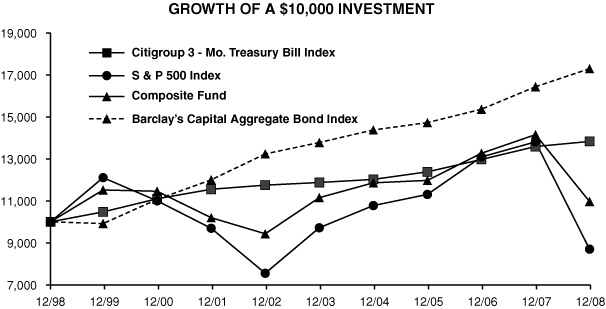

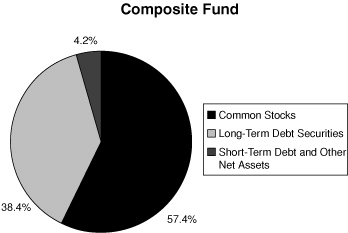

COMPOSITE FUND

The Composite Fund invests in a diversified portfolio of common stocks and fixed-income securities, seeking appreciation and current income. The equity portion of the Composite Fund invests in stocks within the S&P 500® Index.

The S&P 500 Index had a total return of -37.00% for the twelve months ended December 31, 2008. No sectors managed to generate positive total returns for the year as a whole. The worst performing sectors were Financials, Materials and Information Technology, which earned -55.27%, -45.68% and -43.01%, respectively. Only one sector, Consumer Staples, generated a return above -20%, coming in at -15.30%

The equity portion of the Composite Fund maintains sector weights within plus or minus 100 basis points of the S&P 500® Index and does not take positions in individual stocks with overweights of more than 200 basis points. This structural discipline produces a relatively low-risk portfolio that emphasizes stock selection based on strong fundamental analysis. For the twelve month period ending December 31, 2008, the equity portion of the Fund had a total return of -34.63% (before expenses), outperforming the S&P 500® Index by 237 basis points.

The Federal Reserve aggressively cut the federal funds rate throughout 2008. Starting the year at 4.25%, it was lowered to 2.00% by the end of the second quarter and then to a historic low range of 0.00%-0.25% by year's end. This seven-step process of reducing rates was part of the government's attempt to stimulate the economy and keep longer rates low.

The bond market became more focused on deflation as the government became increasingly involved in the credit markets in order to avoid instability and defaults. Nevertheless, credit spreads widened to unprecedented levels as traditional corporate bonds traded down to distress prices in a barely functioning market place.

The Fund emphasizes higher yielding corporate bonds and these were negatively affected, especially in the fourth quarter. The Fund ended the year with a shorter duration than the fixed-income component of its benchmark, which also hurt its performance.

The strategy of creating an extremely diversified credit portfolio with an intermediate maturity focus will be continued so long as inflation threatens to impair returns and economic concerns remain. The management focus will also continue to be on income, rather than capital gains, as compounded returns at favorable rates remains a primary objective.

For the year ended December 31, 2008, the Composite Fund returned -22.51% (after expenses) compared to the weighted benchmark return of -20.10%, 40% of which is based on the Barclay's Capital Aggregate Bond Index® and 60% of which is based on the S&P 500 Index®. This underperformance was the result of the significant underperformance of the fixed-income portion of the Fund offsetting the fairly strong overperformance of the equity portion of the Fund.

Composite Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 7,749 | | | | -22.51 | % | | | -22.51 | % | |

| 5 Years | | $ | 9,834 | | | | -1.66 | % | | | -0.33 | % | |

| 10 Years | | $ | 10,966 | | | | 9.66 | % | | | 0.93 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

| 5 Years | | $ | 8,950 | | | | -10.50 | % | | | -2.19 | % | |

| 10 Years | | $ | 8,699 | | | | -13.01 | % | | | -1.38 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

| 5 Years | | $ | 12,550 | | | | 25.50 | % | | | 4.65 | % | |

| 10 Years | | $ | 17,294 | | | | 72.94 | % | | | 5.63 | % | |

Citigroup 3 - Month T-Bill Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,180 | | | | 1.80 | % | | | 1.80 | % | |

| 5 Years | | $ | 11,647 | | | | 16.47 | % | | | 3.10 | % | |

| 10 Years | | $ | 13,830 | | | | 38.30 | % | | | 3.30 | % | |

The line representing the performance return of the Composite Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return lines of the Indices do not.

11

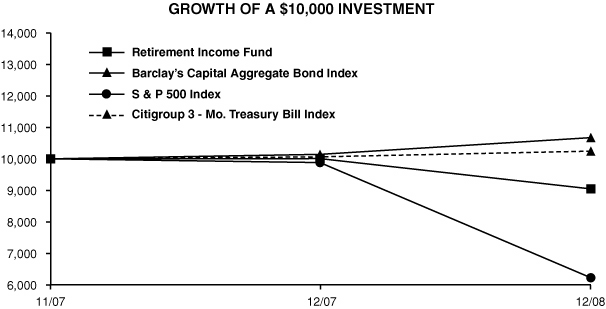

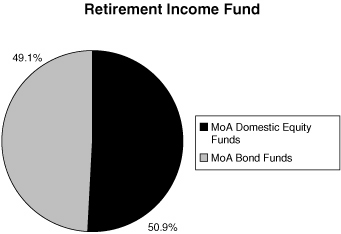

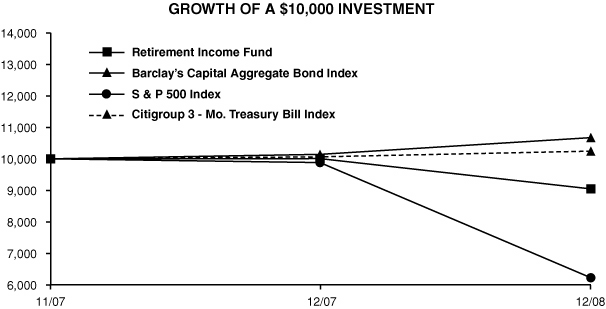

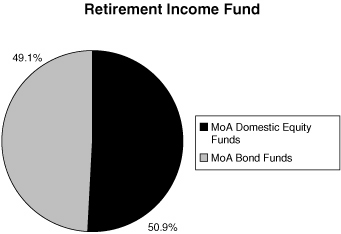

RETIREMENT INCOME FUND

The objective of the Retirement Income Fund is current income consistent with the preservation of capital and, to a lesser extent, capital appreciation. The Retirement Income Fund invests primarily in the fixed-income funds of the Investment Company and also invests in two equity funds of the Investment Company. The Fund's target allocation is approximately 75% of net assets in fixed-income funds (approximately 30% each in the Bond and Mid-Term Bond Funds and 15% in the Money Market Fund) and approximately 25% of net assets in equity funds (20% in the Equity Index Fund and 5% in the Mid-Cap Equity Index Fund).

Performance for the Retirement Income Fund is compared to the Barclay's Capital Aggregate Bond Index® (60% weighting), the Citigroup 3-Month Treasury Bill Index® (15% weighting) and the S&P 500® Index (25% weighting). For the year ended December 31, 2008, the Fund returned -9.61% versus a -5.84% return in the weighted benchmark. The underperformance of the Fund is mainly attributable to the Bond Fund and, to a lesser extent, the Mid-Term Bond Fund underperforming the Barclay's Capital Aggregate Bond Index®.

Retirement Income Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 9,039 | | | | -9.61 | % | | | -9.61 | % | |

Since 11/5/07

(Inception) | | $ | 9,046 | | | | -9.54 | % | | | -8.31 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

Since 11/5/07

(Inception) | | $ | 6,225 | | | | -37.75 | % | | | -33.65 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

Since 11/5/07

(Inception) | | $ | 10,673 | | | | 6.73 | % | | | 5.80 | % | |

Citigroup 3 - Month T-Bill Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,180 | | | | 1.80 | % | | | 1.80 | % | |

Since 11/5/07

(Inception) | | $ | 10,244 | | | | 2.44 | % | | | 2.11 | % | |

The line representing the performance return of the Retirement Income Fund includes expenses, such as transaction costs and management fees (including those incurred by the underlying funds) that reduce returns, while the performance return lines of the Indices do not.

12

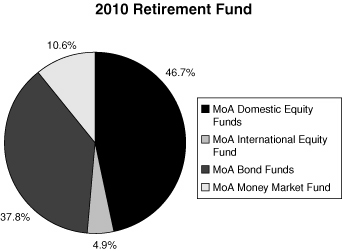

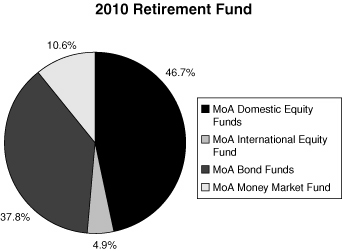

2010 RETIREMENT FUND

The objective of the 2010 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2010. The 2010 Retirement Fund invests in funds of the Investment Company. The Fund's target allocation is approximately 55% of net assets in fixed-income funds (approximately 25% in the Bond Fund, 20% in the Mid-Term Bond Fund and 10% in the Money Market Fund) and approximately 45% of net assets in equity funds (25% in the Equity Index Fund, 15% in the Mid-Cap Equity Index Fund and 5% in the International Fund).

Performance for the 2010 Retirement Fund is compared to the Barclay's Capital Aggregate Bond Index® (45% weighting), the Citigroup 3-Month Treasury Bill Index® (10% weighting) and the S&P 500® Index (45% weighting). For the year ended December 31, 2008, the Fund returned -17.45% versus a -14.11% return in the weighted benchmark. The underperformance of the Fund is mainly attributable to the Bond Fund and, to a lesser extent, the Mid-Term Bond Fund underperforming the Barclay's Capital Aggregate Bond Index®.

2010 Retirement Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 8,255 | | | | -17.45 | % | | | -17.45 | % | |

Since 11/5/07

(Inception) | | $ | 8,200 | | | | -18.00 | % | | | -15.78 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

Since 11/5/07

(Inception) | | $ | 6,225 | | | | -37.75 | % | | | -33.65 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

Since 11/5/07

(Inception) | | $ | 10,673 | | | | 6.73 | % | | | 5.80 | % | |

Citigroup 3 - Month T-Bill Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,180 | | | | 1.80 | % | | | 1.80 | % | |

Since 11/5/07

(Inception) | | $ | 10,244 | | | | 2.44 | % | | | 2.11 | % | |

The line representing the performance return of the 2010 Retirement Fund includes expenses, such as transaction costs and management fees (including those incurred by the underlying funds) that reduce returns, while the performance return lines of the Indices do not.

13

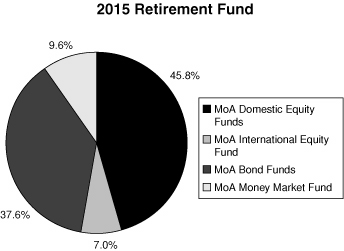

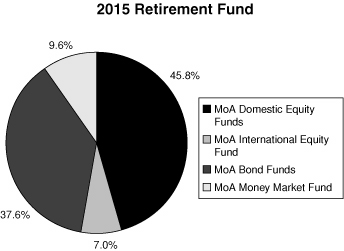

2015 RETIREMENT FUND

The objective of the 2015 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2015. The 2015 Retirement Fund invests in funds of the Investment Company. The Fund's target allocation is approximately 55% of net assets in equity funds (approximately 30% in the Equity Index Fund, 12% in the Mid-Cap Equity Index Fund, 7% in the International Fund and 3% each in the Small Cap Growth and Small Cap Value Funds) and approximately 45% of net assets in fixed-income funds (25% in the Bond Fund, 11% in the Mid-Term Bond Fund and 9% in the Money Market Fund).

Performance for the 2015 Retirement Fund is compared to the S&P 500® Index (55% weighting), the Barclay's Capital Aggregate Bond Index® (36% weighting) and the Citigroup 3-Month Treasury Bill Index® (9% weighting). For the year ended December 31, 2008, the Fund returned -21.01% versus a -18.30% return in the weighted benchmark. The underperformance of the Fund is mainly attributable to the Bond Fund and, to a lesser extent, the Mid-Term Bond Fund underperforming the Barclay's Capital Aggregate Bond Index®.

2015 Retirement Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 7,899 | | | | -21.01 | % | | | -21.01 | % | |

Since 11/5/07

(Inception) | | $ | 7,807 | | | | -21.93 | % | | | -19.28 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

Since 11/5/07

(Inception) | | $ | 6,225 | | | | -37.75 | % | | | -33.65 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

Since 11/5/07

(Inception) | | $ | 10,673 | | | | 6.73 | % | | | 5.80 | % | |

Citigroup 3 - Month T-Bill Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,180 | | | | 1.80 | % | | | 1.80 | % | |

Since 11/5/07

(Inception) | | $ | 10,244 | | | | 2.44 | % | | | 2.11 | % | |

The line representing the performance return of the 2015 Retirement Fund includes expenses, such as transaction costs and management fees (including those incurred by the underlying funds) that reduce returns, while the performance return lines of the Indices do not.

14

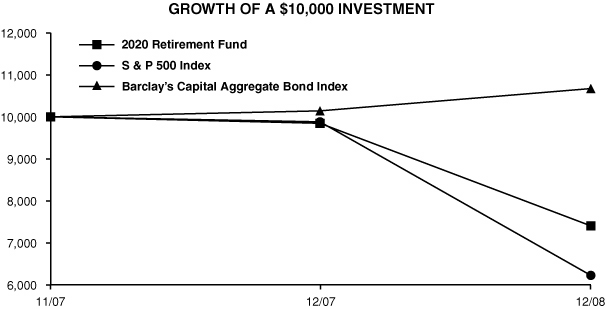

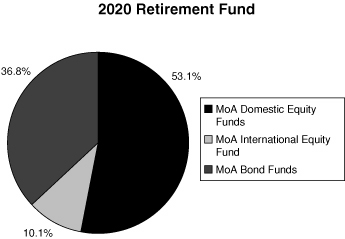

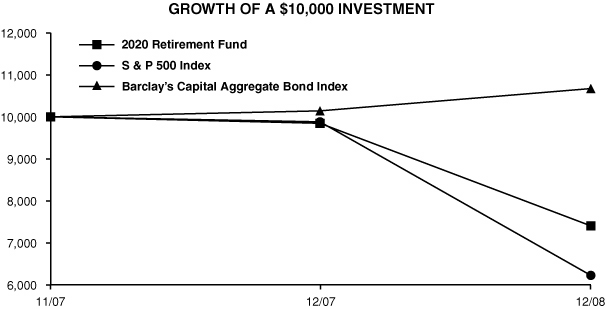

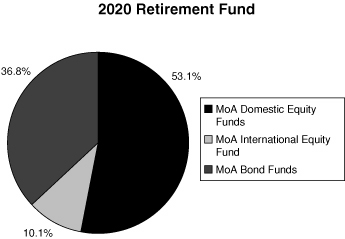

2020 RETIREMENT FUND

The objective of the 2020 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2020. The 2020 Retirement Fund invests in funds of the Investment Company. The Fund's target allocation is approximately 65% of net assets in equity funds (approximately 35% in the Equity Index Fund, 12% in the Mid-Cap Equity Index Fund, 10% in the International Fund and 4% each in the Small Cap Growth and Small Cap Value Funds) and approximately 35% of net assets in fixed-income funds (24% in the Bond Fund and 11% in the Mid-Term Bond Fund).

Performance for the 2020 Retirement Fund is compared to the S&P 500® Index (65% weighting) and the Barclay's Capital Aggregate Bond Index® (35% weighting). For the year ended December 31, 2008, the Fund returned -24.81% versus a -22.22% return in the weighted benchmark. The underperformance of the Fund is mainly attributable to the Bond Fund and, to a lesser extent, the Mid-Term Bond Fund underperforming the Barclay's Capital Aggregate Bond Index®.

2020 Retirement Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 7,519 | | | | -24.81 | % | | | -24.81 | % | |

Since 11/5/07

(Inception) | | $ | 7,404 | | | | -25.96 | % | | | -22.90 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

Since 11/5/07

(Inception) | | $ | 6,225 | | | | -37.75 | % | | | -33.65 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

Since 11/5/07

(Inception) | | $ | 10,673 | | | | 6.73 | % | | | 5.80 | % | |

The line representing the performance return of the 2020 Retirement Fund includes expenses, such as transaction costs and management fees (including those incurred by the underlying funds) that reduce returns, while the performance return lines of the Indices do not.

15

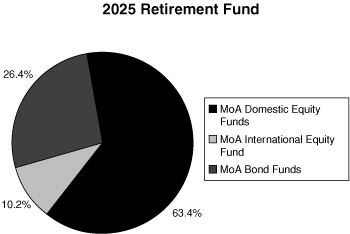

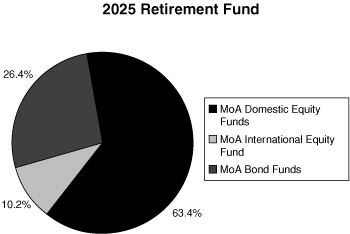

2025 RETIREMENT FUND

The objective of the 2025 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2025. The 2025 Retirement Fund invests in funds of the Investment Company. The Fund's target allocation is approximately 75% of net assets in equity funds (approximately 40% in the Equity Index Fund, 15% in the Mid-Cap Equity Index Fund, 10% in the International Fund and 5% each in the Small Cap Growth and Small Cap Value Funds) and approximately 25% of net assets in fixed-income funds (20% in the Bond Fund and 5% in the Mid-Term Bond Fund).

Performance for the 2025 Retirement Fund is compared to the S&P 500® Index (75% weighting) and the Barclay's Capital Aggregate Bond Index® (25% weighting). For the year ended December 31, 2008, the Fund returned -28.32% versus a -26.44% return in the weighted benchmark. The underperformance of the Fund is mainly attributable to the Bond Fund underperforming the Barclay's Capital Aggregate Bond Index® and, to a lesser extent, the International Fund underperforming the S&P 500® Index.

2025 Retirement Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 7,168 | | | | -28.32 | % | | | -28.32 | % | |

Since 11/5/07

(Inception) | | $ | 7,029 | | | | -29.71 | % | | | -26.30 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

Since 11/5/07

(Inception) | | $ | 6,225 | | | | -37.75 | % | | | -33.65 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

Since 11/5/07

(Inception) | | $ | 10,673 | | | | 6.73 | % | | | 5.80 | % | |

The line representing the performance return of the 2025 Retirement Fund includes expenses, such as transaction costs and management fees (including those incurred by the underlying funds) that reduce returns, while the performance return lines of the Indices do not.

16

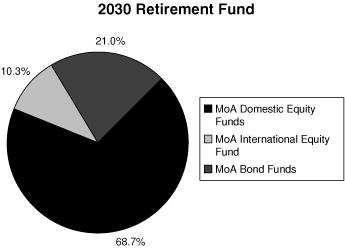

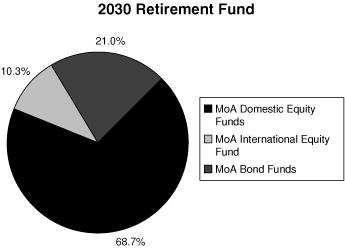

2030 RETIREMENT FUND

The objective of the 2030 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2030. The 2030 Retirement Fund invests in funds of the Investment Company. The Fund's target allocation is approximately 80% of net assets in equity funds (approximately 40% in the Equity Index Fund, 18% in the Mid-Cap Equity Index Fund, 10% in the International Fund and 6% each in the Small Cap Growth and Small Cap Value Funds) and approximately 20% of net assets in the Bond Fund.

Performance for the 2030 Retirement Fund is compared to the S&P 500® Index (80% weighting) and the Barclay's Capital Aggregate Bond Index® (20% weighting). For the year ended December 31, 2008, the Fund returned -29.95% versus a -28.55% return in the weighted benchmark. The underperformance of the Fund is mainly attributable to the Bond Fund underperforming the Barclay's Capital Aggregate Bond Index® and, to a lesser extent, the International Fund underperforming the S&P 500® Index.

2030 Retirement Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 7,005 | | | | -29.95 | % | | | -29.95 | % | |

Since 11/5/07

(Inception) | | $ | 6,850 | | | | -31.50 | % | | | -27.92 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

Since 11/5/07

(Inception) | | $ | 6,225 | | | | -37.75 | % | | | -33.65 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

Since 11/5/07

(Inception) | | $ | 10,673 | | | | 6.73 | % | | | 5.80 | % | |

The line representing the performance return of the 2030 Retirement Fund includes expenses, such as transaction costs and management fees (including those incurred by the underlying funds) that reduce returns, while the performance return lines of the Indices do not.

17

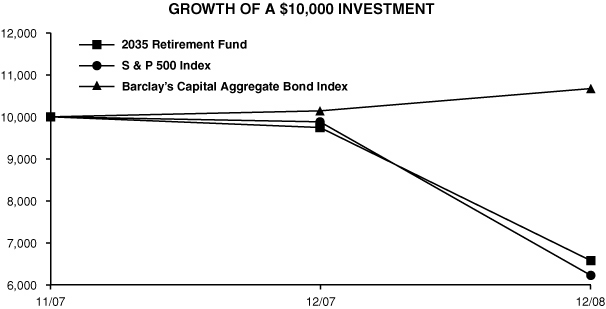

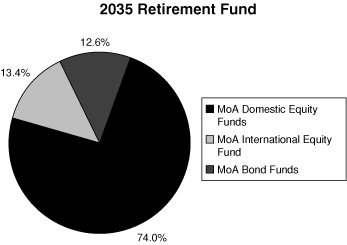

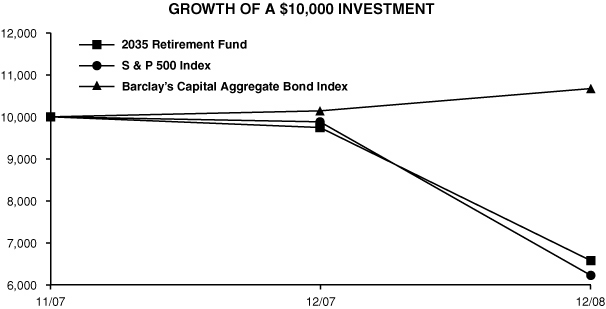

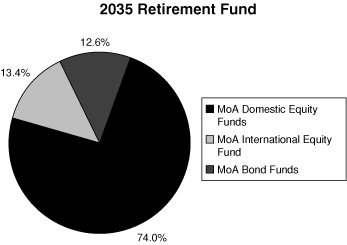

2035 RETIREMENT FUND

The objective of the 2035 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2035. The 2035 Retirement Fund invests in funds of the Investment Company. The Fund's target allocation is approximately 88% of net assets in equity funds (approximately 40% in the Equity Index Fund, 21% in the Mid-Cap Equity Index Fund, 13% in the International Fund and 7% each in the Small Cap Growth and Small Cap Value Funds) and approximately 12% of net assets in the Bond Fund.

Performance for the 2035 Retirement Fund is compared to the S&P 500® Index (88% weighting) and the Barclay's Capital Aggregate Bond Index® (12% weighting). For the year ended December 31, 2008, the Fund returned -32.53% versus a -31.93% return in the weighted benchmark. The underperformance of the Fund is mainly attributable to the Bond Fund underperforming the Barclay's Capital Aggregate Bond Index® and, to a lesser extent, the International Fund underperforming the S&P 500® Index.

2035 Retirement Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,747 | | | | -32.53 | % | | | -32.53 | % | |

Since 11/5/07

(Inception) | | $ | 6,576 | | | | -34.24 | % | | | -30.42 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

Since 11/5/07

(Inception) | | $ | 6,225 | | | | -37.75 | % | | | -33.65 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

Since 11/5/07

(Inception) | | $ | 10,673 | | | | 6.73 | % | | | 5.80 | % | |

The line representing the performance return of the 2035 Retirement Fund includes expenses, such as transaction costs and management fees (including those incurred by the underlying funds) that reduce returns, while the performance return lines of the Indices do not.

18

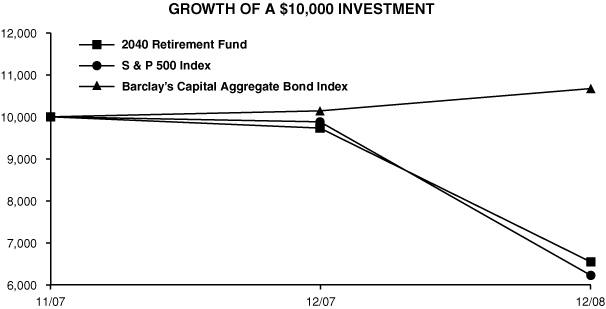

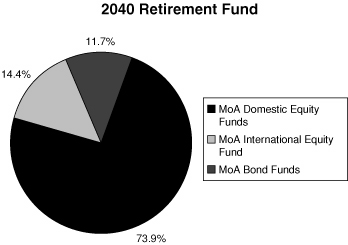

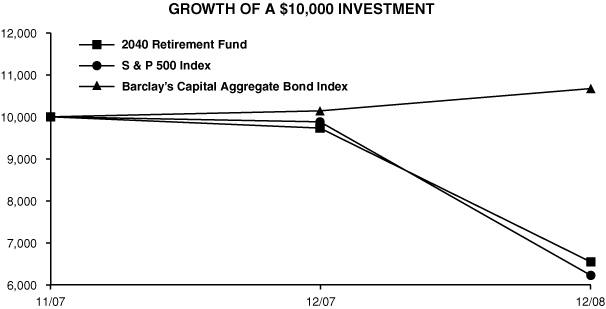

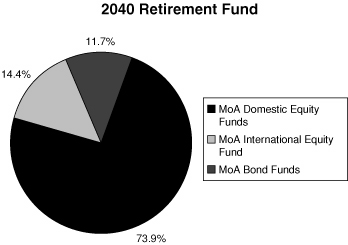

2040 RETIREMENT FUND

The objective of the 2040 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2040. The 2040 Retirement Fund invests in funds of the Investment Company. The Fund's target allocation is approximately 89% of net assets in equity funds (approximately 35% in the Equity Index Fund, 24% in the Mid-Cap Equity Index Fund, 14% in the International Fund and 8% each in the Small Cap Growth and Small Cap Value Funds) and approximately 11% of net assets in the Bond Fund.

Performance for the 2040 Retirement Fund is compared to the S&P 500® Index (89% weighting) and the Barclay's Capital Aggregate Bond Index® (11% weighting). For the year ended December 31, 2008, the Fund returned -32.75%, in line with the -32.35% return in the weighted benchmark. The slight underperformance of the Fund is mainly attributable to the Bond Fund underperforming the Barclay's Capital Aggregate Bond Index® and the International Fund underperforming the S&P 500® Index.

2040 Retirement Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,725 | | | | -32.75 | % | | | -32.75 | % | |

Since 11/5/07

(Inception) | | $ | 6,545 | | | | -34.55 | % | | | -30.71 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

Since 11/5/07

(Inception) | | $ | 6,225 | | | | -37.75 | % | | | -33.65 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

Since 11/5/07

(Inception) | | $ | 10,673 | | | | 6.73 | % | | | 5.80 | % | |

The line representing the performance return of the 2040 Retirement Fund includes expenses, such as transaction costs and management fees (including those incurred by the underlying funds) that reduce returns, while the performance return lines of the Indices do not.

19

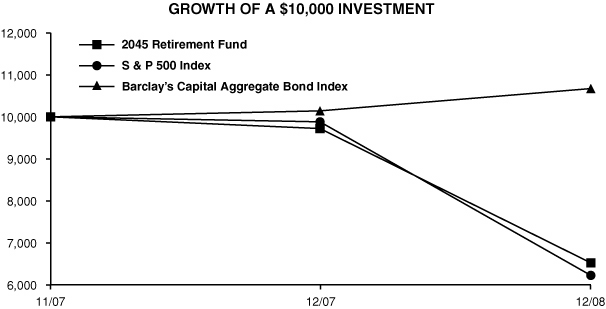

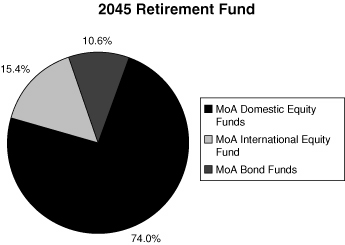

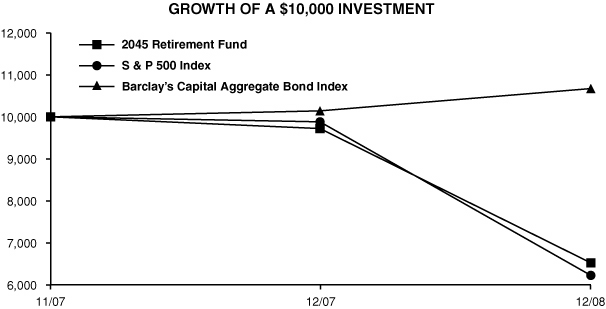

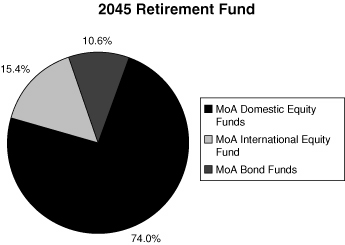

2045 RETIREMENT FUND

The objective of the 2045 Retirement Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2045. The 2045 Retirement Fund invests in funds of the Investment Company. The Fund's target allocation is approximately 90% of net assets in equity funds (approximately 35% in the Equity Index Fund, 20% in the Mid-Cap Equity Index Fund, 15% in the International Fund and 10% each in the Small Cap Growth and Small Cap Value Funds) and approximately 10% of net assets in the Bond Fund.

Performance for the 2045 Retirement Fund is compared to the S&P 500® Index (90% weighting) and the Barclay's Capital Aggregate Bond Index® (10% weighting). For the year ended December 31, 2008, the Fund returned -32.90%, in line with the -32.78% return in the weighted benchmark. The slight underperformance of the Fund is mainly attributable to the Bond Fund underperforming the Barclay's Capital Aggregate Bond Index® and the International Fund underperforming the S&P 500® Index.

2045 Retirement Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,710 | | | | -32.90 | % | | | -32.90 | % | |

Since 11/5/07

(Inception) | | $ | 6,523 | | | | -34.77 | % | | | -30.91 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

Since 11/5/07

(Inception) | | $ | 6,225 | | | | -37.75 | % | | | -33.65 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

Since 11/5/07

(Inception) | | $ | 10,673 | | | | 6.73 | % | | | 5.80 | % | |

The line representing the performance return of the 2045 Retirement Fund includes expenses, such as transaction costs and management fees (including those incurred by the underlying funds) that reduce returns, while the performance return lines of the Indices do not.

20

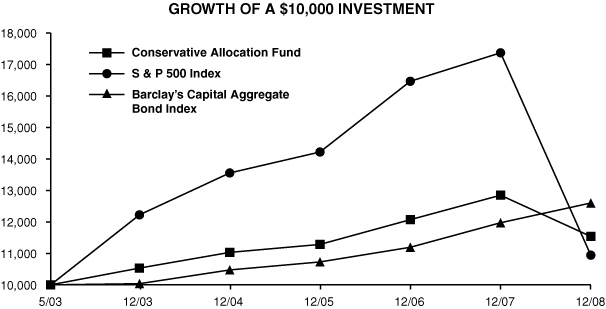

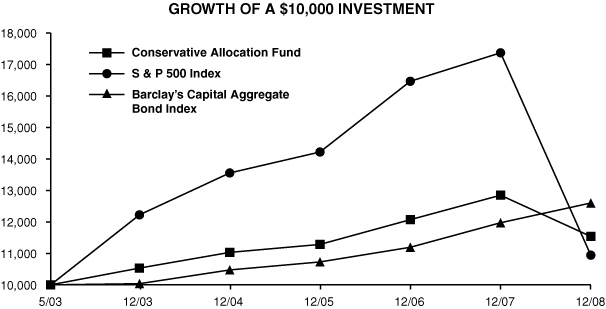

CONSERVATIVE ALLOCATION FUND

The objective of the Conservative Allocation Fund is current income and, to a lesser extent, capital appreciation. The Conservative Allocation Fund invests primarily in the fixed-income funds of the Investment Company and also invests in an equity fund of the Investment Company. The Conservative Allocation Fund's target allocation is approximately 75% of net assets in fixed-income funds (approximately 30% in the Bond Fund and approximately 45% in the Mid-Term Bond Fund) and approximately 25% of net assets in equity funds (the Equity Index Fund).

Performance for the Conservative Allocation Fund is compared to the Barclay's Capital Aggregate Bond Index® (75% weighting) and the S&P 500® Index (25% weighting). For the year ended December 31, 2008, the Conservative Allocation Fund returned -10.19% versus a -5.32% return in the weighted benchmark. The underperformance of the Fund is mainly attributable to the Bond Fund and, to a lesser extent, the Mid-Term Bond Fund underperforming the Barclay's Capital Aggregate Bond Index®.

Conservative Allocation Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 8,981 | | | | -10.19 | % | | | -10.19 | % | |

| 5 Years | | $ | 10,953 | | | | 9.53 | % | | | 1.84 | % | |

Since 5/20/03

(Inception) | | $ | 11,536 | | | | 15.36 | % | | | 2.58 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

| 5 Years | | $ | 8,950 | | | | -10.50 | % | | | -2.19 | % | |

Since 5/20/03

(Inception) | | $ | 10,941 | | | | 9.41 | % | | | 1.61 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

| 5 Years | | $ | 12,550 | | | | 25.50 | % | | | 4.65 | % | |

Since 5/20/03

(Inception) | | $ | 12,598 | | | | 25.98 | % | | | 4.20 | % | |

The line representing the performance return of the Conservative Allocation Fund includes expenses, such as transaction costs and management fees in the underlying funds that reduce returns, while the performance return lines of the Indices do not.

21

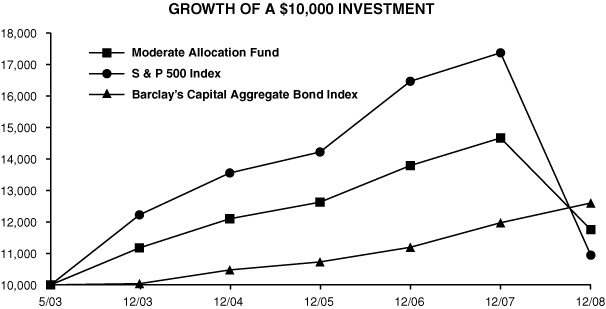

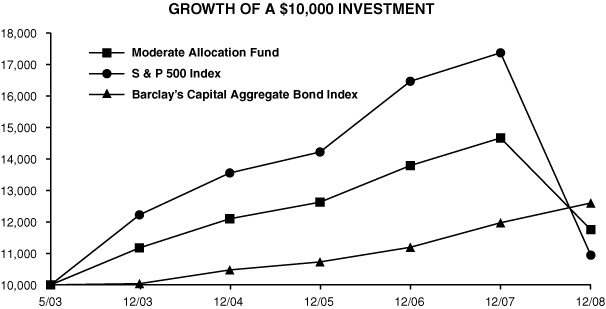

MODERATE ALLOCATION FUND

The objective of the Moderate Allocation Fund is capital appreciation and current income. The Moderate Allocation Fund invests in the equity and fixed-income funds of the Investment Company. The Moderate Allocation Fund's target allocation is approximately 50% of net assets in equity funds (approximately 35% of its net assets in the Equity Index Fund and approximately 15% of its net assets in the Mid-Cap Equity Index Fund) and approximately 50% of net assets in fixed-income funds (approximately 30% of its net assets in the Bond Fund and approximately 20% of its net assets in the Mid-Term Bond Fund).

Performance for the Moderate Allocation Fund is compared to the S&P 500® Index (50% weighting) and the Barclay's Capital Aggregate Bond Index® (50% weighting). For the year ended December 31, 2008, the Moderate Allocation Fund returned -19.85% versus a -15.88% return for the weighted benchmark. The underperformance of the Fund is mainly attributable to the Bond Fund and, to a lesser extent, the Mid-Term Bond Fund underperforming the Barclay's Capital Aggregate Bond Index®.

Moderate Allocation Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 8,015 | | | | -19.85 | % | | | -19.85 | % | |

| 5 Years | | $ | 10,517 | | | | 5.17 | % | | | 1.01 | % | |

Since 5/20/03

(Inception) | | $ | 11,751 | | | | 17.51 | % | | | 2.92 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

| 5 Years | | $ | 8,950 | | | | -10.50 | % | | | -2.19 | % | |

Since 5/20/03

(Inception) | | $ | 10,941 | | | | 9.41 | % | | | 1.61 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

| 5 Years | | $ | 12,550 | | | | 25.50 | % | | | 4.65 | % | |

Since 5/20/03

(Inception) | | $ | 12,598 | | | | 25.98 | % | | | 4.20 | % | |

The line representing the performance return of the Moderate Allocation Fund includes expenses, such as transaction costs and management fees in the underlying funds that reduce returns, while the performance return lines of the Indices do not.

22

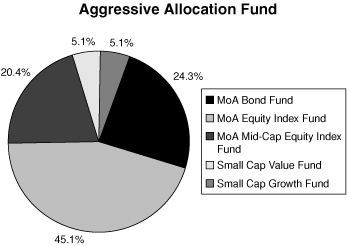

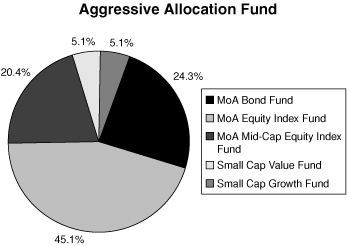

AGGRESSIVE ALLOCATION FUND

The objective of the Aggressive Allocation Fund is capital appreciation and, to a lesser extent, current income. The Aggressive Allocation Fund invests in the equity and fixed-income funds of the Investment Company. The Aggressive Allocation Fund's target allocation is approximately 75% of net assets in equity funds (approximately 45% of its net assets in the Equity Index Fund, approximately 20% of its net assets in the Mid-Cap Equity Index Fund, approximately 5% of its net assets in the Small Cap Value Fund and approximately 5% of its net assets in the Small Cap Growth Fund) and approximately 25% of net assets in the Bond Fund.

Performance for the Aggressive Allocation Fund is compared to the S&P 500 Index® (75% weighting) and the Barclay's Capital Aggregate Bond Index® (25% weighting). For the year ended December 31, 2008, the Aggressive Allocation Fund returned -28.20% versus a -26.44% return for the weighted benchmark. The underperformance of the Fund is mainly attributable to the Bond Fund and, to a lesser extent, the Mid-Term Bond Fund underperforming the Barclay's Capital Aggregate Bond Index®.

Aggressive Allocation Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 7,180 | | | | -28.20 | % | | | -28.20 | % | |

| 5 Years | | $ | 9,855 | | | | -1.45 | % | | | -0.29 | % | |

Since 5/20/03

(Inception) | | $ | 11,754 | | | | 17.54 | % | | | 2.92 | % | |

S & P 500 Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 6,300 | | | | -37.00 | % | | | -37.00 | % | |

| 5 Years | | $ | 8,950 | | | | -10.50 | % | | | -2.19 | % | |

Since 5/20/03

(Inception) | | $ | 10,941 | | | | 9.41 | % | | | 1.61 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

| 5 Years | | $ | 12,550 | | | | 25.50 | % | | | 4.65 | % | |

Since 5/20/03

(Inception) | | $ | 12,598 | | | | 25.98 | % | | | 4.20 | % | |

The line representing the performance return of the Aggressive Allocation Fund includes expenses, such as transaction costs and management fees in the underlying funds that reduce returns, while the performance return lines of the Indices do not.

23

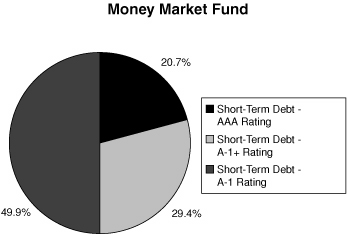

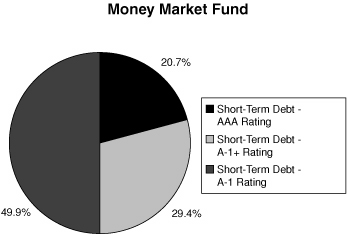

MONEY MARKET FUND

The Money Market Fund's investment objective is to realize current income while maintaining liquidity, investment quality and stability of capital through investing in high-quality commercial paper issued by U.S. corporations and securities issued by the U.S. government and its agencies. The Fund returned 2.34% for the year ended December 31, 2008, compared to a 1.80% return for the Citigroup 3 Month Treasury Bill Index. The Fund's overperformance compared to its benchmark is due to our efforts to extend the fund's weighted average maturity prior to the Fed's aggressive rate cuts.

The unprecedented events of 2008 have prompted the Federal Reserve and central banks around the world to take extraordinary measures to provide liquidity and restore confidence in the money markets. As a result, the Federal Reserve reduced the federal funds rate by 400 basis points during 2008, ending with a range of 0%-.25%. The seven-day effective yield as of February 17, 2009, was 0.02% As with all performance reporting, this yield is not necessarily indicative of future annual yields. Neither the Federal Deposit Insurance Corporation nor any other U.S. government agency insures or guarantees the Separate Account's investments in shares of the Money Market Fund.

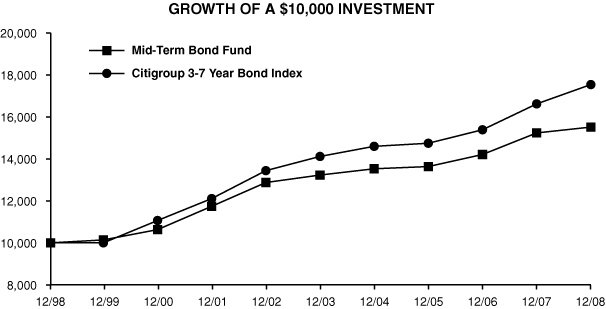

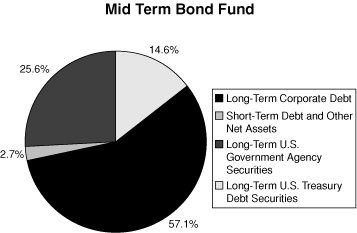

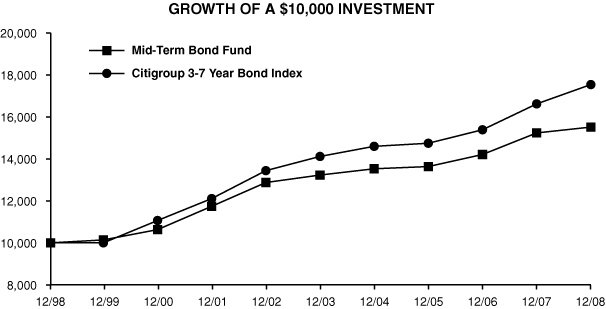

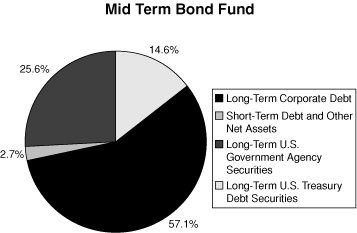

MID-TERM BOND FUND

The Mid-Term Bond Fund seeks a high level of return consistent with the preservation of capital through investment in publicly traded debt securities. The Mid-Term Bond Fund primarily invests in corporate and U.S. government agency securities, which normally yield more than U.S. Treasury issues.

Intermediate-term government rates declined substantially during the second half of 2008 in response to aggressive Federal Reserve easing. For example, five-year Treasury note yields declined from 3.33% on June 30th to 1.55% at year-end.

The Mid-Term Bond Fund maintained a shorter duration than its benchmark, the Citigroup Government/Corporate 3-7 Year Bond Index, due to concerns about inflation. This hurt performance since the Fund did not fully participate in the strong fourth quarter rally. The widening of corporate bonds' spreads also impeded returns since the Fund continues to emphasize higher yielding investment-grade securities in an extremely diversified portfolio. Credit diversification, along with shorter maturities, will continue to provide protection from event risk.

This portfolio strategy will be appropriate in an investment environment dominated by economic and inflationary concerns. Additionally, agency securities will become less dominant in the portfolio when fairly priced corporate securities become available.

For the year ended December 31, 2008, the Mid-Term Bond Fund returned 1.84% versus the 5.54% return for the Citigroup Government/Corporate 3-7 Year Bond Index. The Fund's underperformance compared to the benchmark was due to its shorter duration than the index and its underweighting of U.S. Treasuries.

Mid-Term Bond Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,184 | | | | 1.84 | % | | | 1.84 | % | |

| 5 Years | | $ | 11,727 | | | | 17.27 | % | | | 3.24 | % | |

| 10 Years | | $ | 15,512 | | | | 55.12 | % | | | 4.49 | % | |

Citigroup 3-7 Year Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,554 | | | | 5.54 | % | | | 5.54 | % | |

| 5 Years | | $ | 12,424 | | | | 24.24 | % | | | 4.44 | % | |

| 10 Years | | $ | 17,535 | | | | 75.35 | % | | | 5.77 | % | |

The line representing the performance return of the Mid-Term Bond Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

24

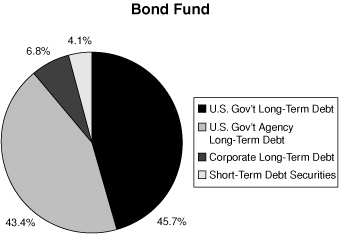

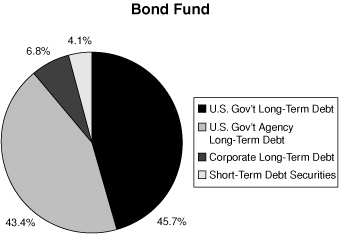

BOND FUND

The Bond Fund's primary investment objective is to provide as high a level of current income over time as is believed to be consistent with prudent investment risk by investing primarily in investment grade, publicly traded debt securities. A secondary objective is preservation of capital. The Bond Fund primarily invests in corporate, U.S. government agency and mortgage-backed securities, all of which normally yield more than U.S. Treasury issues.

The Federal Reserve aggressively cut the federal funds rate throughout 2008. Starting the year at 4.25%, it was lowered to 2.00% by the end of the second quarter and then to a historic low range of 0.00%-0.25% by year's end. This seven-step process of reducing rates was part of the government's attempt to stimulate the economy and keep longer rates low.

The bond market became more focused on deflation as the government became increasingly involved in the credit markets in order to avoid instability and defaults. Nevertheless, credit spreads widened to unprecedented levels as traditional corporate bonds traded down to distress prices in a barely functioning market place.

The Fund emphasizes higher yielding corporate bonds and these were negatively affected, especially in the fourth quarter. The Fund ended the year with a shorter duration than its benchmark, which also hurt its performance.

The strategy of creating an extremely diversified credit portfolio with an intermediate maturity focus will be continued so long as inflation threatens to impair returns and economic concerns remain. The management focus will also continue to be on income, rather than capital gains, as compounded returns at favorable rates remains a primary objective.

The Bond Fund's return for the year ended December 31, 2008, was -1.75%, compared to 5.24% for the Barclay's Capital Aggregate Bond Index®. The Fund's underperformance compared to the benchmark was due to its shorter duration than the index and its underweighting of U.S. Treasuries.

Bond Fund

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 9,825 | | | | -1.75 | % | | | -1.75 | % | |

| 5 Years | | $ | 11,610 | | | | 16.10 | % | | | 3.03 | % | |

| 10 Years | | $ | 15,360 | | | | 53.60 | % | | | 4.39 | % | |

Barclay's Capital Aggregate Bond Index

| Period | | Growth | | Total Return | |

Ended

12/31/08 | | of

$10,000 | | Cumu-

lative | | Average

Annual | |

| 1 Year | | $ | 10,524 | | | | 5.24 | % | | | 5.24 | % | |

| 5 Years | | $ | 12,550 | | | | 25.50 | % | | | 4.65 | % | |

| 10 Years | | $ | 17,294 | | | | 72.94 | % | | | 5.63 | % | |

The line representing the performance return of the Bond Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not.

25

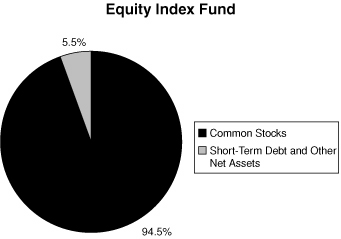

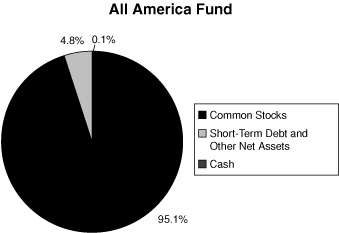

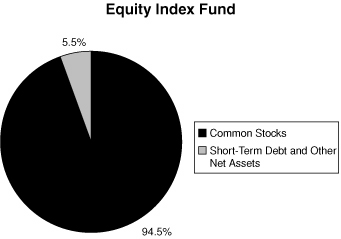

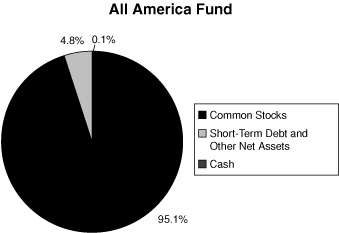

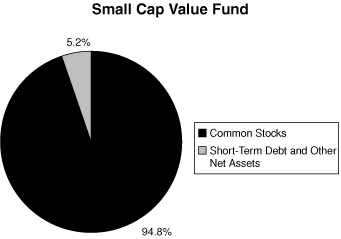

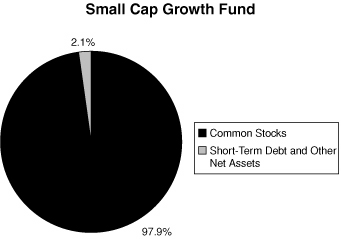

MUTUAL OF AMERICA INVESTMENT CORPORATION

ASSET ALLOCATIONS AS OF DECEMBER 31, 2008 (Unaudited)

26

MUTUAL OF AMERICA INVESTMENT CORPORATION

ASSET ALLOCATIONS AS OF DECEMBER 31, 2008 (Unaudited) (Continued)

27

MUTUAL OF AMERICA INVESTMENT CORPORATION

ASSET ALLOCATIONS AS OF DECEMBER 31, 2008 (Unaudited) (Continued)

28

MUTUAL OF AMERICA INVESTMENT CORPORATION

ASSET ALLOCATIONS AS OF DECEMBER 31, 2008 (Unaudited) (Continued)

29

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Unaudited)

EXAMPLE

As a shareholder of one of the Mutual of America Investment Corporation Funds, you incur ongoing costs, including management fees and other Fund expenses. You do not incur transactional costs, such as sales charges (loads), redemption fees or exchange fees.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at July 1, 2008 and held for the entire period ending December 31, 2008.

ACTUAL EXPENSES

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on each Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning other funds, which may also charge transactional costs, such as sales charges (loads), redemption fees or exchange fees.

Equity Index Fund

| | | Beginning

Account Value

July 1, 2008 | | Ending

Account Value

December 31, 2008 | | Expenses Paid

During Period*

July 1 –

December 31, 2008 | |

| Actual | | $ | 1,000.00 | | | $ | 715.06 | | | $ | 1.15 | | |

Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.44 | | | $ | 1.37 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.27%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

All America Fund

| | | Beginning

Account Value

July 1, 2008 | | Ending

Account Value

December 31, 2008 | | Expenses Paid

During Period*

July 1 –

December 31, 2008 | |

| Actual | | $ | 1,000.00 | | | $ | 726.21 | | | $ | 2.33 | | |

Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.05 | | | $ | 2.75 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.54%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

30

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Unaudited) (Continued)

Small Cap Value Fund

| | | Beginning

Account Value

July 1, 2008 | | Ending

Account Value

December 31, 2008 | | Expenses Paid

During Period*

July 1 –

December 31, 2008 | |

| Actual | | $ | 1,000.00 | | | $ | 794.45 | | | $ | 4.10 | | |

Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.14 | | | $ | 4.64 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.91%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Small Cap Growth Fund

| | | Beginning

Account Value

July 1, 2008 | | Ending

Account Value

December 31, 2008 | | Expenses Paid

During Period*

July 1 –

December 31, 2008 | |

| Actual | | $ | 1,000.00 | | | $ | 723.34 | | | $ | 3.93 | | |

Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.12 | | | $ | 4.65 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.92%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Mid Cap Value Fund

| | | Beginning

Account Value

July 1, 2008 | | Ending

Account Value

December 31, 2008 | | Expenses Paid

During Period*

July 1 –

December 31, 2008 | |

| Actual | | $ | 1,000.00 | | | $ | 712.74 | | | $ | 3.13 | | |

Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.05 | | | $ | 3.73 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.74%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Mid-Cap Equity Index Fund

| | | Beginning

Account Value

July 1, 2008 | | Ending

Account Value

December 31, 2008 | | Expenses Paid

During Period*

July 1 –

December 31, 2008 | |

| Actual | | $ | 1,000.00 | | | $ | 663.75 | | | $ | 1.03 | | |

Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.55 | | | $ | 1.27 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.25%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

31

MUTUAL OF AMERICA INVESTMENT CORPORATION

EXPENSE EXAMPLE (Unaudited) (Continued)

International Fund

| | | Beginning

Account Value

July 1, 2008 | | Ending

Account Value

December 31, 2008 | | Expenses Paid

During Period*

July 1 –

December 31, 2008 | |

| Actual | | $ | 1,000.00 | | | $ | 671.39 | | | $ | 1.57 | | |

Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.88 | | | $ | 1.93 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.38%, (reflecting direct expenses and the proportional expense ratios of the underlying Exchange Traded Funds in which the Fund invests) multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Composite Fund

| | | Beginning

Account Value

July 1, 2008 | | Ending

Account Value