Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, N.W., Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

(a) Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

THOMPSON IM FUNDS, INC.

ANNUAL REPORT TO SHAREHOLDERS

NOTE ON FORWARD-LOOKING STATEMENTS

The matters discussed in this report may constitute forward-looking statements. These include any Advisor or portfolio manager predictions, assessments, analyses or outlooks for individual securities, industries, investment styles, market sectors, interest rates, economic trends and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each Fund in its current Prospectus, other factors bearing on these reports include the accuracy of the Advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the Advisor or portfolio manager and the ability of the Advisor or portfolio manager to implement its strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any Fund to differ materially as compared to its benchmarks.

THOMPSON IM FUNDS, INC.

ANNUAL REPORT TO SHAREHOLDERS

November 30, 2020

CONTENTS

| | Page(s) |

| LargeCap Fund | | |

| Investment review | | 2-4 |

| Schedule of investments | | 5-8 |

| |

| MidCap Fund | | |

| Investment review | | 9-11 |

| Schedule of investments | | 12-16 |

| |

| Bond Fund | | |

| Investment review | | 17-19 |

| Schedule of investments | | 20-32 |

| |

| Fund Expense Examples | | 33 |

| |

| Financial Statements | | |

| Statements of assets and liabilities | | 34 |

| Statements of operations | | 35 |

| Statements of changes in net assets | | 36 |

| Notes to financial statements | | 37-43 |

| Financial highlights | | 44-46 |

| |

| Report of Independent Registered Public Accounting Firm | | 47 |

| |

| Directors and Officers | | 48-49 |

| |

| Additional Information | | 50 |

This report contains information for existing shareholders of Thompson IM Funds, Inc. It

does not constitute an offer to sell. This Annual Report is authorized for distribution to prospective investors

only when preceded or accompanied by a Fund Prospectus, which contains information about

the Funds’ objectives and policies, risks, management, expenses and other information.

A Prospectus can be obtained by calling 1-800-999-0887.

Please read your Prospectus carefully.

1

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) |

| November 30, 2020 |

| Portfolio Managers |

| James T. Evans, CFA |

| Jason L. Stephens, CFA |

Performance

The LargeCap Fund produced a total return of 15.08% for the fiscal year ended November 30, 2020, as compared to its benchmark, the S&P 500 Index, which returned 17.46%.

| Comparison of Change in Value of a Hypothetical $10,000 Investment |

| Average Annual Total Returns |

| Through 11/30/20 |

| | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Thompson LargeCap Fund | | 15.08% | | 10.08% | | 11.92% | | 12.00% |

| S&P 500 Index | | 17.46% | | 13.17% | | 13.99% | | 14.19% |

Gross Expense Ratio as of 03/31/20 was 1.23%.

Net Expense Ratio after reimbursement as of 03/31/20 was 0.99%*

| * | The Advisor has contractually agreed to waive management fees and/or reimburse expenses incurred by the LargeCap Fund through March 31, 2021, so that the annual operating expenses of the Fund do not exceed 0.99% of its average daily net assets. Net expense ratios are current as of the most recent Prospectus and are applicable to investors. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot directly invest in an index.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and has been licensed for use by Thompson Investment Management, Inc. S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”). The Thompson IM Funds are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P or their respective affiliates, and none of S&P Dow Jones Indices LLC, Dow Jones, S&P nor their respective affiliates make any representation regarding the advisability of investing in such products.

See Notes to Financial Statements.

2

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2020 |

Management Commentary

Despite a relatively benign start to the fiscal year, by the end of March there were brutal losses for both the overall equity markets and the LargeCap Fund. Thanks to the various stay-in-place orders instituted across the United States and elsewhere to fight COVID-19, economic activity went from robust to recession in a matter of 6 weeks or less. The market reacted accordingly, as the longest bull market in history came to a sudden end.

While the rest of the fiscal year was one of recovery from this low point, the initial months of recovery favored many of the same stocks that had performed well headed into the March decline. The 5 largest members of the S&P 500 Index (the “Index”), the Fund’s benchmark (Apple, Microsoft, Amazon, Alphabet and Facebook), finished the fiscal year averaging a 56.04% return on a weighted basis, and accounted for 11.16% of the Index’s total 17.46% return. The Fund’s underweight in Amazon and Apple alone accounted for roughly a 3.5% lag versus the S&P 500 during the fiscal year that we had to make up elsewhere.

The situation changed in early November once word that Pfizer and Moderna’s vaccine candidates for COVID-19 were 95% effective. We believe that effectively, this creates a ticking clock counting down towards a return to normal. Due to the enormous logistical challenges of vaccinating the entire country investors can debate whether that timeframe is the spring, the summer or even the fall of 2021. Regardless, we think the end is in sight. This has profound implications for the stock market going forward.

We have written before about how the overall S&P 500 seems overvalued to us, with that overvaluation concentrated in the growth side of the index. As a result, we expect sub-par returns for the overall index over the next 5 years as this valuation excess is worked off. We see things as more attractive on the value side of the index, and we have tilted portfolios to try and take advantage of this dichotomy.

This ties into the vaccine news because many of the areas that we think will see the greatest improvement in a return to normal happen to coincide with the value side of the Index. Thus the “recovery trade” and the “value trade” have a high degree of overlap. While the entire market was strong during November, the value portion of the index clearly outperformed the growth side. We believe this is just the beginning of this trade. While the vaccine may end up being the catalyst that ignited this shift in market leadership, the gap between the growth companies and everyone else has grown so large that it will take quite some time to fully reverse. So to the extent value stocks are attractive because they are a) cheaper, b) a play on a recovery and c) the area of recent price momentum, hopefully they will perform strongly over the next fiscal year as all three types of investors find reasons to buy them.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in American Depositary Receipts (“ADRs”) are subject to some extent to the risks associated with directly investing in securities of foreign issuers, including the risk of changes in currency exchange rates, expropriation or nationalization of assets, and the impact of political, diplomatic, or social events. Investments in real estate securities may involve greater risk and volatility including greater exposure to economic downturns and changes in real estate values, rents, property taxes, and tax and other laws. A real estate investment trust’s (REIT’s) share price may decline because of adverse developments affecting the real estate industry.

Please refer to the Schedule of Investments on page 5 of this report for holdings information. The management commentary above as well as Fund holdings and asset/sector allocations should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings and asset/sector allocations are subject to change.

The S&P 500 Growth Index is a market capitalization weighted index. It consists of stocks within the S&P 500 Index that exhibit strong growth characteristics -sales growth, the ratio of earnings change to price, and momentum.

The S&P 500 Value Index is a market capitalization weighted index. It consists of stocks within the S&P 500 Index that exhibit strong value characteristics - the ratios of book value, earnings, and sales to price.

Earnings Growth is a measure of growth in a company’s net income over a specific period, often one year. It is not a prediction of the Fund’s future returns.

See Notes to Financial Statements.

3

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2020 |

| Sector Weightings at 11/30/20 |

| % of Total Investments |

| Top 10 Equity Holdings at 11/30/20 |

| | % of Fund’s |

| Company | Industry | Net Assets |

| Alphabet Inc. Class A | Interactive Media & Services | 3.76% |

| Microsoft Corp. | Software | 3.11% |

| Qualcomm Inc. | Semiconductors & Semiconductor Equipment | 2.85% |

| General Electric Co. | Industrial Conglomerates | 2.73% |

| Alliance Data Systems Corp. | IT Services | 2.51% |

| Bank of America Corp. | Banks | 2.32% |

| Exact Sciences Corp. | Biotechnology | 2.32% |

| Citigroup Inc. | Banks | 2.29% |

| Facebook, Inc. Class A | Interactive Media & Services | 2.22% |

| Apple Inc. | Technology Hardware, Storage & Peripherals | 2.19% |

As of November 30, 2020, 99.9% of the Fund’s net assets were in equity and short-term investments.

See Notes to Financial Statements.

4

| LARGECAP FUND SCHEDULE OF INVESTMENTS |

| November 30, 2020 |

| | Shares | | Value |

| COMMON STOCKS - 99.8% | | | | $140,786,949 |

| (COST $114,312,988) | | | | |

| |

| Communication Services - 9.3% | | | | 13,150,129 |

| Interactive Media & Services - 6.0% | | | | |

| Alphabet Inc. Class A (a) | | 3,020 | | 5,298,288 |

| Facebook, Inc. Class A (a) | | 11,325 | | 3,136,685 |

| Media - 3.3% | | | | |

| Discovery, Inc. Class A (a) | | 60,450 | | 1,626,710 |

| ViacomCBS Inc. Class B | | 87,541 | | 3,088,446 |

| |

| Consumer Discretionary - 8.6% | | | | 12,152,513 |

| Distributors - 1.7% | | | | |

| LKQ Corp. (a) | | 66,900 | | 2,356,218 |

| Hotels, Restaurants & Leisure - 3.1% | | | | |

| Darden Restaurants, Inc. | | 12,900 | | 1,392,942 |

| Las Vegas Sands Corp. (a) | | 32,275 | | 1,798,040 |

| Starbucks Corp. | | 11,625 | | 1,139,482 |

| Household Durables - 0.8% | | | | |

| TopBuild Corp. (a) | | 6,825 | | 1,189,120 |

| Internet & Direct Marketing Retail - 1.0% | | | | |

| eBay Inc. | | 28,995 | | 1,462,218 |

| Multiline Retail - 1.0% | | | | |

| Target Corp. | | 8,135 | | 1,460,477 |

| Specialty Retail - 1.0% | | | | |

| Bed Bath & Beyond Inc. | | 64,600 | | 1,354,016 |

| |

| Consumer Staples - 6.1% | | | | 8,596,259 |

| Beverages - 0.6% | | | | |

| MGP Ingredients, Inc. | | 17,900 | | 780,619 |

| Food & Staples Retailing - 3.0% | | | | |

| Sysco Corp. | | 21,200 | | 1,511,348 |

| Walgreens Boots Alliance, Inc. | | 69,750 | | 2,651,197 |

| Food Products - 1.6% | | | | |

| The Kraft Heinz Co. | | 70,225 | | 2,313,211 |

| Household Products - 0.9% | | | | |

| Kimberly-Clark Corp. | | 9,618 | | 1,339,884 |

| |

| Energy - 3.1% | | | | 4,361,609 |

| Energy Equipment & Services - 0.4% | | | | |

| Schlumberger Ltd. | | 24,244 | | 504,033 |

| Oil, Gas & Consumable Fuels - 2.7% | | | | |

| Chevron Corp. | | 10,820 | | 943,288 |

| Devon Energy Corp. | | 25,425 | | 355,696 |

| EOG Resources, Inc. | | 9,475 | | 444,188 |

| Exxon Mobil Corp. | | 29,470 | | 1,123,691 |

| Pioneer Natural Resources Co. | | 9,850 | | 990,713 |

See Notes to Financial Statements.

5

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2020 |

| | Shares | | Value |

| COMMON STOCKS (continued) | | | | |

| |

| Financials - 17.6% | | | | $24,742,309 |

| Banks - 10.2% | | | | |

| Bank of America Corp. | | 116,325 | | 3,275,712 |

| Citigroup Inc. | | 58,640 | | 3,229,305 |

| Citizens Financial Group, Inc. | | 26,625 | | 869,572 |

| JPMorgan Chase & Co. | | 24,820 | | 2,925,782 |

| PNC Financial Services Group, Inc. | | 7,695 | | 1,062,449 |

| Truist Financial Corp. | | 15,432 | | 716,353 |

| Wells Fargo & Co. | | 56,275 | | 1,539,121 |

| Zions Bancorporation, N.A. | | 19,550 | | 754,435 |

| Capital Markets - 5.6% | | | | |

| Northern Trust Corp. | | 20,985 | | 1,954,123 |

| State Street Corp. | | 36,800 | | 2,593,664 |

| The Charles Schwab Corp. | | 40,200 | | 1,960,956 |

| The Goldman Sachs Group, Inc. | | 5,900 | | 1,360,422 |

| Consumer Finance - 0.8% | | | | |

| Discover Financial Services | | 15,120 | | 1,151,690 |

| Insurance - 1.0% | | | | |

| Fidelity National Financial, Inc. | | 37,475 | | 1,348,725 |

| |

| Health Care - 19.1% | | | | 27,011,760 |

| Biotechnology - 5.1% | | | | |

| AbbVie Inc. | | 22,225 | | 2,324,291 |

| Amgen Inc. | | 5,475 | | 1,215,669 |

| Exact Sciences Corp. (a) | | 27,050 | | 3,274,673 |

| MiMedx Group Inc. (a) | | 57,600 | | 386,496 |

| Health Care Equipment & Supplies - 0.6% | | | | |

| Abbott Laboratories | | 7,875 | | 852,233 |

| Health Care Providers & Services - 8.1% | | | | |

| Cigna Corp. | | 8,975 | | 1,877,031 |

| CVS Health Corp. | | 36,975 | | 2,506,535 |

| HCA Healthcare, Inc. | | 10,075 | | 1,512,358 |

| McKesson Corp. | | 16,385 | | 2,947,825 |

| UnitedHealth Group Inc. | | 7,700 | | 2,589,818 |

| Pharmaceuticals - 5.3% | | | | |

| Bristol-Myers Squibb Co. | | 42,125 | | 2,628,600 |

| Johnson & Johnson | | 6,725 | | 972,973 |

| Merck & Co., Inc. | | 15,725 | | 1,264,133 |

| Pfizer Inc. | | 65,825 | | 2,521,756 |

| Viatris Inc. (a) | | 8,167 | | 137,369 |

| |

| Industrials - 7.7% | | | | 10,873,021 |

| Aerospace & Defense - 0.8% | | | | |

| General Dynamics Corp. | | 8,175 | | 1,220,936 |

| Air Freight & Logistics - 1.4% | | | | |

| FedEx Corp. | | 6,750 | | 1,934,415 |

| Industrial Conglomerates - 3.4% | | | | |

| General Electric Co. | | 378,000 | | 3,848,040 |

| 3M Co. | | 5,400 | | 932,742 |

See Notes to Financial Statements.

6

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2020 |

| | Shares | | Value |

| COMMON STOCKS (continued) | | | | |

| |

| Industrials (continued) | | | | |

| Machinery - 1.0% | | | | |

| Westinghouse Air Brake Technologies Corp. | | 18,626 | | $1,365,286 |

| Trading Companies & Distributors - 1.1% | | | | |

| HD Supply Holdings, Inc. (a) | | 28,175 | | 1,571,602 |

| |

| Information Technology - 25.0% | | | | 35,142,104 |

| Communications Equipment - 3.3% | | | | |

| Cisco Systems, Inc. | | 69,810 | | 3,003,226 |

| Lumentum Holdings Inc. (a) | | 10,125 | | 874,597 |

| Viavi Solutions Inc. (a) | | 58,735 | | 795,566 |

| Electronic Equipment, Instruments & Components - 3.6% | | | | |

| Corning Inc. | | 46,850 | | 1,753,127 |

| II-VI Inc. (a) | | 37,600 | | 2,543,640 |

| Keysight Technologies, Inc. (a) | | 6,450 | | 774,258 |

| IT Services - 5.3% | | | | |

| Alliance Data Systems Corp. | | 48,400 | | 3,539,976 |

| Fiserv, Inc. (a) | | 19,149 | | 2,205,582 |

| PayPal Holdings, Inc. (a) | | 4,635 | | 992,446 |

| Visa Inc. Class A | | 3,250 | | 683,637 |

| Semiconductors & Semiconductor Equipment - 5.9% | | | | |

| Infineon Technologies A.G. ADR | | 72,275 | | 2,563,233 |

| NXP Semiconductors N.V. | | 11,000 | | 1,742,620 |

| Qualcomm Inc. | | 27,280 | | 4,014,798 |

| Software - 4.7% | | | | |

| Microsoft Corp. | | 20,476 | | 4,383,297 |

| Oracle Corp. | | 37,775 | | 2,180,373 |

| Technology Hardware, Storage & Peripherals - 2.2% | | | | |

| Apple Inc. | | 25,970 | | 3,091,728 |

| |

| Materials - 1.6% | | | | 2,305,085 |

| Metals & Mining - 1.6% | | | | |

| Freeport-McMoRan Inc. | | 98,550 | | 2,305,085 |

| |

| Real Estate - 1.7% | | | | 2,452,160 |

| Equity Real Estate Investment - 1.0% | | | | |

| Simon Property Group, Inc. | | 17,600 | | 1,453,232 |

| Real Estate Management & Development - 0.7% | | | | |

| Colliers Int’l. Group Inc. | | 11,200 | | 998,928 |

| |

| RIGHTS - 0.0%^ | | | | 32,303 |

| (COST $58,309) | | | | |

| |

| Health Care - 0.0%^ | | | | 32,303 |

| Pharmaceuticals - 0.0%^ | | | | |

| Bristol-Myers Squibb Co. CVR (a) | | 27,375 | | 32,303 |

See Notes to Financial Statements.

7

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2020 |

| | Shares | | Value |

| SHORT-TERM INVESTMENTS - 0.1% | | | | $100,000 |

| (COST $100,000) | | | | |

| | | | | |

| Money Market Funds - 0.1% | | | | 100,000 |

| First American Gov’t. Obligations Fund Class X, 0.046% (b) | | 100,000 | | 100,000 |

| | | | | |

| TOTAL INVESTMENTS - 99.9% (COST $114,471,297) | | | | 140,919,252 |

| | | | | |

| NET OTHER ASSETS AND LIABILITIES - 0.1% | | | | 168,054 |

| | | | | |

| NET ASSETS - 100.0% | | | | $141,087,306 |

| (a) | Non-income producing security. |

| (b) | Represents the 7-day yield at November 30, 2020. |

| ^ | Rounds to 0.0%. |

| Abbreviations: |

| ADR | American Depositary Receipt |

| A.G. | Aktiengesellschaft is the German term for a public limited liability corporation. |

| CVR | Contingent Value Right |

| N.V. | Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”) and is licensed for use by Thompson Investment Management, Inc. Neither MSCI, S&P, nor any other party involved in making or compiling the GICS or any GICS classifications makes any warranties with respect thereto or the results to be obtained by the use thereof, and no such party shall have any liability whatsoever with respect thereto.

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2020:

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Common stocks | | | | | | | | |

| Communication services | | $13,150,129 | | $– | | $– | | $13,150,129 |

| Consumer discretionary | | 12,152,513 | | – | | – | | 12,152,513 |

| Consumer staples | | 8,596,259 | | – | | – | | 8,596,259 |

| Energy | | 4,361,609 | | – | | – | | 4,361,609 |

| Financials | | 24,742,309 | | – | | – | | 24,742,309 |

| Health care | | 27,011,760 | | – | | – | | 27,011,760 |

| Industrials | | 10,873,021 | | – | | – | | 10,873,021 |

| Information technology | | 35,142,104 | | – | | – | | 35,142,104 |

| Materials | | 2,305,085 | | – | | – | | 2,305,085 |

| Real estate | | 2,452,160 | | – | | – | | 2,452,160 |

| Total common stocks | | 140,786,949 | | – | | – | | 140,786,949 |

| Rights | | | | | | | | |

| Health care | | 32,303 | | – | | – | | 32,303 |

| Total rights | | 32,303 | | – | | – | | 32,303 |

| Short-term investments | | | | | | | | |

| Money market funds | | 100,000 | | – | | – | | 100,000 |

| Total short-term investments | | 100,000 | | – | | – | | 100,000 |

| Total investments | | $140,919,252 | | $– | | $– | | $140,919,252 |

The Fund did not invest in any level-3 investments as of and during the fiscal year ended November 30, 2020.

For more information on valuation inputs, see financial statement Note 2 - Significant Accounting Policies.

See Notes to Financial Statements.

8

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) |

| November 30, 2020 |

| Portfolio Managers |

| James T. Evans, CFA |

| Jason L. Stephens, CFA |

Performance

The MidCap Fund produced a total return of 10.56% for the fiscal year ended November 30, 2020, as compared to its benchmark, the Russell Midcap Index, which returned 14.43%.

| Comparison of Change in Value of a Hypothetical $10,000 Investment |

| Average Annual Total Returns |

| Through 11/30/20 |

| | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Thompson MidCap Fund | | 10.56% | | 4.55% | | 8.34% | | 9.81% |

| Russell Midcap Index | | 14.43% | | 10.26% | | 11.75% | | 12.65% |

Gross Expense Ratio as of 03/31/20 was 1.53%.

Net Expense Ratio after reimbursement as of 03/31/20 was 1.15%.*

| * | The Advisor has contractually agreed to waive management fees and/or reimburse expenses incurred by the MidCap Fund through March 31, 2021, so that the annual operating expenses of the Fund do not exceed 1.15% of its average daily net assets. Net expense ratios are current as of the most recent Prospectus and are applicable to investors. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index based on total market capitalization. You cannot directly invest in an index.

FTSE Russell is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. “FTSE®” and “Russell®” are trademarks of the London Stock Exchange Group.

See Notes to Financial Statements.

9

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2020 |

Management Commentary

What a rollercoaster ride this fiscal year has been! At the beginning we were concerned about excessive stock valuations, until the outbreak of a global pandemic cratered asset values and accelerated by years myriad technologically driven trends in a number of industries. In the end, after an unprecedented amount of fiscal and monetary stimulus, many markets actually reached new all-time highs. We did not predict most of these events. Nor would we have guessed investors’ subsequent reaction thereto – to inflate asset prices to even more expensive levels than prior to the recession.

While we are pleased with the Fund’s ultimate absolute return over this unusual period, it did not keep up with its benchmark. The biggest reason for the lag was its underexposure to a number of Health Care stocks in the benchmark that performed exceptionally well. The Fund’s return in that sector was positive, but not nearly positive enough to match the Russell Midcap Index’s appreciation in that sector. To a large degree we view this divergence as an anomaly, and believe we could see a reversal of this phenomenon in the future.

But what about those valuation levels? US markets are currently the second most expensive they’ve been in history when comparing aggregate stock prices to underlying earnings (both for trailing and estimated future earnings). While we can’t be certain of the cause, we suspect that a new historic low in prevailing interest rates is one of the primary culprits. The amount of cash in the system has increased substantially, and needs somewhere to go. While policy-makers would undoubtedly prefer that it circulate throughout the economy, much of it is being diverted to investment markets. As expensive as stocks appear to have become, on a relative basis they still might seem more attractive to many investors than alternatives.

This environment does remind us of the Technology Bubble, and we’re hearing some of the same “this time is different” arguments we heard then. That bubble was popped when earnings growth started to slow and in some cases never materialized. We don’t know what catalyst might pop any bubble this time. It could be an increase in inflation and interest rates. It could be an increase in taxes. The bubble might not even pop at all. Instead, we could be subjected to an extended period of time where the air gets let out slowly. Regardless, we are bracing for below-average returns once current momentum stalls.

As is always the case, we believe that sticking to our strategy of focusing on both valuation and earnings growth potential is the way to react to this current environment. When the Technology Bubble popped, not everything dropped to the same degree. In aggregate, stocks without astronomical valuations outperformed. We have positioned the Fund to try to take advantage of this possibility.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Midcap companies tend to have more limited liquidity and greater volatility than large-capitalization companies. Investments in American Depositary Receipts (“ADRs”) are subject to some extent to the risks associated with directly investing in securities of foreign issuers, including the risk of changes in currency exchange rates, expropriation or nationalization of assets, and the impact of political, diplomatic, or social events. Investments in real estate securities may involve greater risk and volatility including greater exposure to economic downturns and changes in real estate values, rents, property taxes, and tax and other laws. A real estate investment trust’s (REIT’s) share price may decline because of adverse developments affecting the real estate industry.

Please refer to the Schedule of Investments on page 12 of this report for holdings information. The management commentary above as well as Fund holdings and asset/sector allocations should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings and asset/sector allocations are subject to change.

Earnings Growth is a measure of growth in a company’s net income over a specific period, often one year. It is not a prediction of the Fund’s future returns.

See Notes to Financial Statements

10

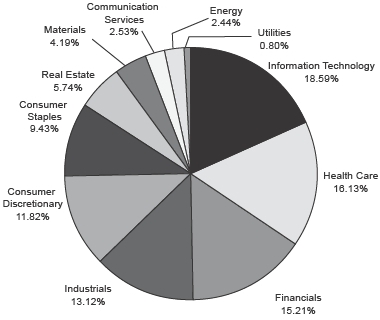

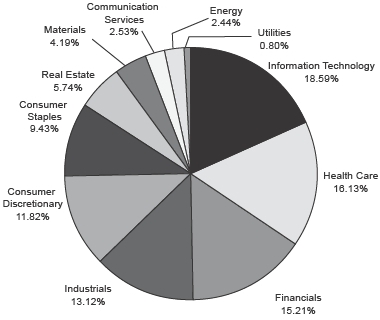

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2020 |

| Sector Weightings at 11/30/20 |

| % of Total Investments |

| Top 10 Equity Holdings at 11/30/20 |

| | % of Fund’s |

| Company | Industry | Net Assets |

| Alliance Data Systems Corp. | IT Services | 2.72% |

| Exact Sciences Corp. | Biotechnology | 2.33% |

| First Horizon National Corp. | Banks | 2.16% |

| II-VI Inc. | Electronic Equipment, Instruments & Components | 2.05% |

| LKQ Corp. | Distributors | 2.02% |

| Newell Brands, Inc. | Household Durables | 1.95% |

| Walgreens Boots Alliance, Inc. | Food & Staples Retailing | 1.83% |

| HD Supply Holdings, Inc. | Trading Companies & Distributors | 1.83% |

| NXP Semiconductors N.V. | Semiconductors & Semiconductor Equipment | 1.80% |

| Discover Financial Services | Consumer Finance | 1.77% |

As of November 30, 2020, 99.9% of the Fund’s net assets were in equity and short-term investments.

See Notes to Financial Statements.

11

| MIDCAP FUND SCHEDULE OF INVESTMENTS |

| November 30, 2020 |

| | Shares | | Value |

| COMMON STOCKS - 99.7% | | | | $50,461,517 |

| (COST $38,733,896) | | | | |

| |

| Communication Services - 2.5% | | | | 1,277,741 |

| Entertainment - 0.8% | | | | |

| Take-Two Interactive Software, Inc. (a) | | 2,150 | | 388,096 |

| Media - 1.7% | | | | |

| Discovery, Inc. Class A (a) | | 33,060 | | 889,645 |

| |

| Consumer Discretionary - 11.8% | | | | 5,977,727 |

| Distributors - 2.0% | | | | |

| LKQ Corp. (a) | | 28,950 | | 1,019,619 |

| Hotels, Restaurants & Leisure - 1.1% | | | | |

| Darden Restaurants, Inc. | | 5,200 | | 561,496 |

| Household Durables - 2.8% | | | | |

| Newell Brands, Inc. | | 46,426 | | 987,017 |

| TopBuild Corp. (a) | | 2,590 | | 451,256 |

| Internet & Direct Marketing Retail - 1.5% | | | | |

| Duluth Holdings Inc. Class B (a) | | 50,325 | | 739,777 |

| Specialty Retail - 2.2% | | | | |

| Bed Bath & Beyond Inc. | | 26,800 | | 561,728 |

| Urban Outfitters, Inc. (a) | | 19,620 | | 537,196 |

| Textiles, Apparel & Luxury Goods - 2.2% | | | | |

| Hanesbrands, Inc. | | 25,555 | | 362,881 |

| Skechers U.S.A., Inc. Class A (a) | | 22,610 | | 756,757 |

| |

| Consumer Staples - 9.4% | | | | 4,767,157 |

| Beverages - 2.3% | | | | |

| MGP Ingredients, Inc. | | 10,794 | | 470,726 |

| Molson Coors Brewing Co. Class B | | 14,805 | | 681,030 |

| Food & Staples Retailing - 3.9% | | | | |

| Performance Food Group Co. (a) | | 11,900 | | 516,222 |

| Sysco Corp. | | 7,550 | | 538,239 |

| Walgreens Boots Alliance, Inc. | | 24,395 | | 927,254 |

| Food Products - 2.3% | | | | |

| Lamb Weston Holdings, Inc. | | 6,660 | | 482,051 |

| The Kraft Heinz Co. | | 21,100 | | 695,034 |

| Household Products - 0.9% | | | | |

| Energizer Holdings, Inc. | | 10,900 | | 456,601 |

| |

| Energy - 2.5% | | | | 1,235,826 |

| Energy Equipment & Services - 0.2% | | | | |

| Helmerich & Payne, Inc. | | 3,510 | | 79,923 |

| Oil, Gas & Consumable Fuels - 2.3% | | | | |

| Cameco Corp. | | 15,200 | | 152,304 |

| Cheniere Energy, Inc. (a) | | 7,145 | | 405,050 |

| Devon Energy Corp. | | 10,345 | | 144,727 |

| Parsley Energy, Inc. Class A | | 12,900 | | 161,637 |

| Pioneer Natural Resources Co. | | 2,905 | | 292,185 |

See Notes to Financial Statements.

12

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2020 |

| | Shares | | Value |

| COMMON STOCKS (continued) | | | | |

| |

| Financials - 15.0% | | | | $7,590,159 |

| Banks - 7.7% | | | | |

| Associated Banc-Corp | | 46,758 | | 716,333 |

| Citizens Financial Group, Inc. | | 16,625 | | 542,972 |

| First Horizon National Corp. | | 89,605 | | 1,094,973 |

| Regions Financial Corp. | | 17,585 | | 268,523 |

| Truist Financial Corp. | | 10,091 | | 468,424 |

| Zions Bancorporation, N.A. | | 21,345 | | 823,704 |

| Capital Markets - 3.5% | | | | |

| Northern Trust Corp. | | 9,580 | | 892,090 |

| State Street Corp. | | 8,625 | | 607,890 |

| The Charles Schwab Corp. | | 5,750 | | 280,485 |

| Consumer Finance - 1.8% | | | | |

| Discover Financial Services | | 11,779 | | 897,206 |

| Insurance - 0.9% | | | | |

| Fidelity National Financial, Inc. | | 12,140 | | 436,919 |

| Thrifts & Mortgage Finance - 1.1% | | | | |

| Flagstar Bancorp, Inc. | | 16,000 | | 560,640 |

| |

| Health Care - 16.1% | | | | 8,156,758 |

| Biotechnology - 4.7% | | | | |

| Alexion Pharmaceuticals, Inc. (a) | | 4,100 | | 500,651 |

| Exact Sciences Corp. (a) | | 9,735 | | 1,178,519 |

| MiMedx Group Inc. (a) | | 20,015 | | 134,301 |

| Neurocrine Biosciences, Inc. (a) | | 4,430 | | 420,584 |

| Xencor, Inc. (a) | | 3,600 | | 152,352 |

| Health Care Equipment & Supplies - 0.9% | | | | |

| Accelerate Diagnostics, Inc. (a) | | 60,900 | | 476,847 |

| Health Care Providers & Services - 7.0% | | | | |

| Acadia Healthcare Co., Inc. (a) | | 16,660 | | 707,217 |

| AMN Healthcare Services, Inc. (a) | | 8,150 | | 531,054 |

| Hanger, Inc. (a) | | 24,200 | | 549,098 |

| Henry Schein, Inc. (a) | | 2,730 | | 175,566 |

| McKesson Corp. | | 1,945 | | 349,925 |

| Premier, Inc. Class A | | 19,830 | | 702,379 |

| Universal Health Services, Inc., Class B (a) | | 3,900 | | 509,262 |

| Pharmaceuticals - 3.5% | | | | |

| Aerie Pharmaceuticals, Inc. (a) | | 32,405 | | 402,146 |

| Bausch Health Cos., Inc. (a) | | 26,475 | | 491,641 |

| Jazz Pharmaceuticals PLC (a) | | 6,220 | | 875,216 |

| |

| Industrials - 13.1% | | | | 6,630,924 |

| Building Products - 1.9% | | | | |

| A.O. Smith Corp. | | 9,880 | | 556,343 |

| Trane Technologies PLC | | 2,650 | | 387,536 |

| Commercial Services & Supplies - 0.6% | | | | |

| Hudson Technologies, Inc. (a) | | 225,325 | | 301,935 |

See Notes to Financial Statements.

13

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2020 |

| | Shares | | Value |

| COMMON STOCKS (continued) | | | | |

| |

| Industrials (continued) | | | | |

| Construction & Engineering - 2.3% | | | | |

| MasTec, Inc. (a) | | 9,740 | | $552,355 |

| Willscot Mobile Mini Holdings Corp. (a) | | 29,041 | | 624,672 |

| Electrical Equipment - 0.8% | | | | |

| Regal Beloit Corp. | | 3,405 | | 405,331 |

| Machinery - 5.7% | | | | |

| Hillenbrand, Inc. | | 14,750 | | 552,682 |

| Ingersoll-Rand Inc. (a) | | 2,272 | | 100,581 |

| Kornit Digital Ltd. (a) | | 3,415 | | 288,124 |

| Mueller Water Products, Inc. Class A | | 30,225 | | 358,771 |

| REV Group, Inc. | | 39,995 | | 369,554 |

| SPX Corp. (a) | | 4,495 | | 230,279 |

| SPX Flow, Inc. (a) | | 13,845 | | 741,815 |

| Westinghouse Air Brake Technologies Corp. | | 3,225 | | 236,392 |

| Trading Companies & Distributors - 1.8% | | | | |

| HD Supply Holdings, Inc. (a) | | 16,575 | | 924,554 |

| |

| Information Technology - 18.6% | | | | 9,399,585 |

| Communications Equipment - 2.0% | | | | |

| Lumentum Holdings Inc. (a) | | 7,275 | | 628,415 |

| Viavi Solutions Inc. (a) | | 28,771 | | 389,703 |

| Electronic Equipment, Instruments & Components - 4.0% | | | | |

| Corning Inc. | | 13,200 | | 493,944 |

| II-VI Inc. (a) | | 15,340 | | 1,037,751 |

| Keysight Technologies, Inc. (a) | | 4,150 | | 498,166 |

| IT Services - 4.4% | | | | |

| Alliance Data Systems Corp. | | 18,835 | | 1,377,592 |

| Black Knight, Inc. (a) | | 5,890 | | 539,642 |

| Fiserv, Inc. (a) | | 2,813 | | 324,001 |

| Semiconductors & Semiconductor Equipment - 4.8% | | | | |

| Infineon Technologies A.G. ADR | | 22,225 | | 788,210 |

| Marvell Technology Group Ltd. | | 15,450 | | 715,180 |

| NXP Semiconductors N.V. | | 5,750 | | 910,915 |

| Software - 1.4% | | | | |

| SS&C Technologies Holdings, Inc. | | 10,300 | | 709,567 |

| Technology Hardware, Storage & Peripherals - 2.0% | | | | |

| CPI Card Group Inc. (a) | | 148,397 | | 618,815 |

| Pure Storage, Inc. Class A (a) | | 20,125 | | 367,684 |

| |

| Materials - 4.2% | | | | 2,116,638 |

| Containers & Packaging - 2.2% | | | | |

| Berry Global Group, Inc. (a) | | 10,000 | | 530,000 |

| Crown Holdings, Inc. (a) | | 6,230 | | 587,177 |

| Metals & Mining - 2.0% | | | | |

| Freeport-McMoRan Inc. | | 37,150 | | 868,939 |

| Lundin Mining Corp. | | 16,350 | | 130,522 |

See Notes to Financial Statements.

14

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2020 |

| | Shares | | Value |

| COMMON STOCKS (continued) | | | | |

| |

| Real Estate - 5.7% | | | | $2,904,529 |

| Equity Real Estate Investment - 3.8% | | | | |

| DiamondRock Hospitality Co. | | 52,225 | | 392,732 |

| Host Hotels & Resorts Inc. | | 24,225 | | 339,877 |

| Kimco Realty Corp. | | 27,310 | | 394,356 |

| Service Properties Trust | | 28,505 | | 338,069 |

| Simon Property Group, Inc. | | 5,710 | | 471,475 |

| Real Estate Management & Development - 1.9% | | | | |

| Colliers Int’l. Group Inc. | | 7,100 | | 633,249 |

| FirstService Corp. | | 2,425 | | 334,771 |

| |

| Utilities - 0.8% | | | | 404,473 |

| Electric Utilities - 0.3% | | | | |

| Xcel Energy, Inc. | | 2,080 | | 140,109 |

| Multi-Utilities - 0.5% | | | | |

| MDU Resources Group, Inc. | | 10,600 | | 264,364 |

| |

| SHORT-TERM INVESTMENTS - 0.2% | | | | 100,000 |

| (COST $100,000) | | | | |

| |

| Money Market Funds - 0.2% | | | | 100,000 |

| First American Gov’t. Obligations Fund Class X, 0.046% (b) | | 100,000 | | 100,000 |

| |

| TOTAL INVESTMENTS - 99.9% (COST $38,833,896) | | | | 50,561,517 |

| |

| NET OTHER ASSETS AND LIABILITIES - 0.1% | | | | 30,646 |

| |

| NET ASSETS - 100.0% | | | | $50,592,163 |

| (a) | Non-income producing security. |

| (b) | Represents the 7-day yield at November 30, 2020. |

| Abbreviations: |

| ADR | American Depositary Receipt |

| A.G. | Aktiengesellschaft is the German term for a public limited liability corporation. |

| N.V. | Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

| PLC | Public Limited Company |

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”) and is licensed for use by Thompson Investment Management, Inc. Neither MSCI, S&P, nor any other party involved in making or compiling the GICS or any GICS classifications makes any warranties with respect thereto or the results to be obtained by the use thereof, and no such party shall have any liability whatsoever with respect thereto.

See Notes to Financial Statements.

15

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2020 |

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2020.

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Common stocks | | | | | | | | |

| Communication services | | $1,277,741 | | $– | | $– | | $1,277,741 |

| Consumer discretionary | | 5,977,727 | | – | | – | | 5,977,727 |

| Consumer staples | | 4,767,157 | | – | | – | | 4,767,157 |

| Energy | | 1,235,826 | | – | | – | | 1,235,826 |

| Financials | | 7,590,159 | | – | | – | | 7,590,159 |

| Health care | | 8,156,758 | | – | | – | | 8,156,758 |

| Industrials | | 6,630,924 | | – | | – | | 6,630,924 |

| Information technology | | 9,399,585 | | – | | – | | 9,399,585 |

| Materials | | 2,116,638 | | – | | – | | 2,116,638 |

| Real estate | | 2,904,529 | | – | | – | | 2,904,529 |

| Utilities | | 404,473 | | – | | – | | 404,473 |

| Total common stocks | | 50,461,517 | | – | | – | | 50,461,517 |

| Short-term investments | | | | | | | | |

| Money market funds | | 100,000 | | – | | – | | 100,000 |

| Total short-term investments | | 100,000 | | – | | – | | 100,000 |

| Total investments | | $50,561,517 | | $– | | $– | | $50,561,517 |

The Fund did not invest in any level-3 investments as of and during the fiscal year ended November 30, 2020.

For more information on valuation inputs, see financial statement Note 2 - Significant Accounting Policies.

See Notes to Financial Statements.

16

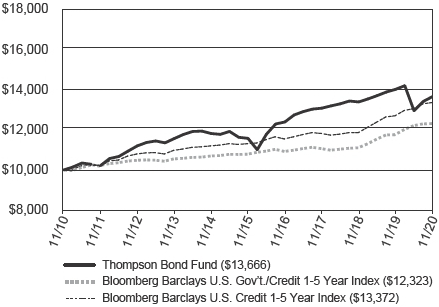

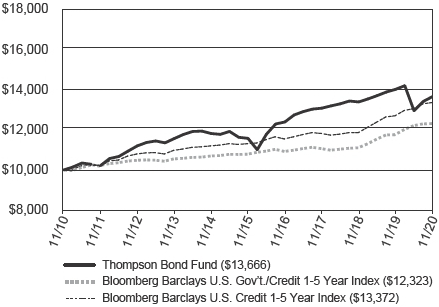

| BOND FUND INVESTMENT REVIEW (Unaudited) |

| November 30, 2020 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

Performance

The Bond Fund produced a total return of -2.60% for the fiscal year ended November 30, 2020, as compared to its benchmark, the Bloomberg Barclays U.S. Government/Credit 1-5 Year Index, which returned 4.75%, and as compared to the Bloomberg Barclays U.S. Credit 1-5 Year Index, which returned 5.20%.

| Comparison of Change in Value of a Hypothetical $10,000 Investment |

| Average Annual Total Returns |

| Through 11/30/20 |

| | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Thompson Bond Fund | | -2.60% | | 1.45% | | 3.37% | | 3.17% |

| Bloomberg Barclays U.S. Gov’t./Credit 1-5 Year Index | | 4.75% | | 3.64% | | 2.69% | | 2.11% |

| Bloomberg Barclays U.S. Credit 1-5 Year Index | | 5.20% | | 4.18% | | 3.39% | | 2.95% |

| Gross Expense Ratio as of 03/31/20 was 0.71%. | 30-Day SEC Yield as of 11/30/20 was 4.61%. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may have been in effect. In the absence of such waivers, total return would have been reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The Bloomberg Barclays U.S. Government/Credit 1-5 Year Index is a market-value-weighted index of all investment-grade bonds with maturities of more than one year and less than 5 years. The Bloomberg Barclays U.S. Credit 1-5 Year Index is a market-value-weighted index which includes virtually every major investment-grade rated corporate bond with 1-5 years remaining until maturity that serves as a supplementary benchmark. You cannot directly invest in an index.

Bloomberg® is a trademark and service mark of Bloomberg Finance L.P. Barclays® is a trademark and service mark of Barclays Bank PLC.

See Notes to Financial Statements.

17

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2020 |

Management Commentary

The fiscal year was a disappointing one for shareholders, as the Fund’s positioning as a higher credit risk/lower interest-rate risk strategy was not the correct one for the COVID-19 pandemic. Many of the Fund’s asset-backed or commercial mortgage-backed securities were disproportionately hit in price relative to other types of bonds, as investors feared the impact of a recession on various industries. Generally bonds exposed to the travel, lodging, or retail industries were hit the hardest. As a result, the Fund was down significantly as of April 3, 2020, which proved to be the bottom during the year.

The rest of the fiscal year was spent recovering from this low point. The efforts of the Federal Reserve and the federal government’s CARES Act were both quite helpful in this regard. However, markets recovered from the top of the credit quality stack first, as AAA- and AA-rated bonds saw a return to more historically normal spreads long before the recovery broadened out to include the BBB-rated issuers that comprise the majority of the Fund’s holdings. In addition, the drop in yields for the Treasury curve created a larger benefit for both our benchmark and for strategies with a higher allocation to Treasury bonds than it did for our Fund. This was due to the very short duration of the Fund, which had been intentionally crafted to reduce interest-rate risk. So less interest-rate risk translated to less reward when rates dropped.

Still, by the by the end of the fiscal year the majority of the Fund’s losses had been recovered, especially as the recession grew to be perceived as less severe than initially feared and hopeful signs began to appear that a series of vaccines would bring the pandemic under control. While we would have preferred a complete recovery, we are happy with the progress made thus far and are hopeful it will continue into the next fiscal year.

Going forward, we believe the Fund is likely to continue to benefit from the passage of time. With a 30-day SEC yield of 4.61% as of the end of the fiscal year, we are simply clipping coupons faster than our benchmark, which has a large exposure to Treasury bonds. Given how low Treasury yields are, we are at a loss as to how alternative strategies with a large Treasury exposure expect to earn a meaningfully positive return going forward unless interest rates continue to decline. With an effective duration of 1.62 at fiscal year end, the Fund is less sensitive than its primary and supplementary benchmarks to changes in overall interest rates. Going forward, this may turn into an advantage. Between the combination of potentially greater fiscal stimulus from the Biden administration and a potential cure for COVID-19 in the form of vaccines, we believe the intermediate-to-longer end of the Treasury curve could see increasing yields. If this happens, we believe our combination of higher credit risk/lower interest-rate risk than our benchmarks will be favorable. A better economy could lower credit spreads, while higher rates are expected to disproportionately hurt longer-duration strategies. Thus we are bullish on the prospects for shareholders in 2021, and are optimistic the next fiscal year will prove more rewarding for shareholders than the last one has been.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities. Investments in bonds of foreign issuers involve greater volatility, political and economic risks, and differences in accounting methods. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities.

Please refer to the Schedule of Investments on page 20 of this report for holdings information. The management commentary above as well as Fund holdings should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings are subject to change.

The federal government guarantees interest payments from government securities while dividend payments carry no such guarantee. Government securities, if held to maturity, guarantee the timely payment of principal and interest.

Coupon is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

SEC Yield is a standardized yield computed by dividing the net investment income per share earned during the 30-day period prior to quarter-end and was created to allow for fairer comparisons among bond funds.

Spread is the percentage point difference between yields of various classes of bonds compared to treasury bonds.

Yield is the income earned from a bond, which takes into account the sum of the interest payment, the redemption value at the bond’s maturity, and the initial purchase price of the bond.

See Notes to Financial Statements.

18

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2020 |

Although the makeup of the Bond Fund’s portfolio is constantly changing, as of November 30, 2020, 65.75% of the Fund’s portfolio was invested in corporate bonds. Due to prevailing market conditions, the percentage of corporate bonds held in the Fund’s portfolio over the past 5 years has generally equaled or exceeded the percentage of corporate bonds held in the Fund’s portfolio as of that date. In addition, as of that date 31.09% of the Fund’s portfolio was invested in securities rated BBB by Standard & Poor’s, while an additional 9.34% of the Fund’s portfolio was rated below investment-grade and 44.24% of the Fund’s portfolio was not rated by Standard & Poor’s. Additional information regarding the ratings of securities held in the Fund’s portfolio, including information pertaining to securities that have not been rated by Standard & Poor’s but have been rated by another Nationally Recognized Statistical Credit Rating Organization, is reflected in the quality composition table below. For portfolio information current as of the most recent quarter-end, please call 1-800-999-0887 or visit our website at www.thompsonim.com. Compared to a portfolio that is more evenly allocated between government and corporate bonds, a portfolio that is heavily allocated to corporate bonds may provide higher returns but is also subject to greater levels of credit and liquidity risk and to greater price fluctuations. A portfolio that is significantly allocated to bonds having lower and below-investment-grade ratings may also be subject to greater levels of credit and liquidity risk and experience greater price fluctuations than a portfolio comprised of higher-rated investment-grade bonds.

| Asset Allocation at 11/30/20 |

| (Includes cash equivalents) |

| % of Total Investments |

| Corporate Bonds | | 65.75% |

| Asset-Backed Securities | | 14.18% |

| U.S. Government Agency Mortgage-Backed Securities | | 7.03% |

| U.S. Government & Agency Securities | | 6.51% |

| Commercial Mortgage-Backed Securities | | 3.47% |

| Convertible Bonds | | 1.87% |

| Sovereign Bonds | | 0.48% |

| Taxable Municipal Bonds | | 0.46% |

| Residential Mortgage-Backed Securities | | 0.25% |

| | 100.00% |

| Quality Composition at 11/30/20^ |

| (Includes cash equivalents) |

| % of Total Investments |

| U.S. Government & Agency Issues | | 13.54% |

| AAA | | 0.49% |

| AA | | 1.58% |

| A | | 10.71% |

| BBB | | 57.38% |

| BB and Below | | 14.14% |

| Not Rated | | 2.16% |

| | 100.00% |

| ^ | The Bond Fund’s quality composition is calculated using ratings from Standard & Poor’s. If Standard & Poor’s does not rate a holding then Moody’s is used. If Standard & Poor’s and Moody’s do not rate a holding then Fitch is used. For certain securities that are not rated by any of these three agencies, credit ratings from other Nationally Recognized Statistical Credit Rating Organization (NRSRO) agencies may be used. Not rated category includes holdings that are not rated by any NRSRO. All ratings are as of 11/30/20. |

| Top 10 Bond Holdings by Issuer at 11/30/20 |

| % of Fund’s Net Assets |

| U.S. Treasury Bills | | 6.40% |

| Ginnie Mae REMIC Trust | | 4.43% |

| General Electric Co. | | 2.05% |

| Flagstar Bancorp, Inc. | | 1.83% |

| Lincoln National Corp. | | 1.81% |

| AmTrust Financial Services, Inc. | | 1.66% |

| Marathon Petroleum Corp. | | 1.65% |

| Arbor Realty Trust, Inc. | | 1.64% |

| MBIA Inc. | | 1.42% |

| Reinsurance Group of America, Inc. | | 1.32% |

See Notes to Financial Statements.

19

| BOND FUND SCHEDULE OF INVESTMENTS |

| November 30, 2020 |

| | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS - 93.1% | | | | | | | | $ 2,110,084,297 |

| (COST $2,300,408,296) | | | | | | | | |

| |

| Asset-Backed Securities - 14.1% | | | | | | | | 319,675,604 |

| AASET Trust, Series 2018-1A B (g) | | 5.437 | | 01/16/38 | | 7,546,459 | | 5,299,791 |

| Air Canada, Series 2013-1B (g) | | 5.375 | | 11/15/22 | | 353,600 | | 338,699 |

| Air Canada, Series 2015-1B (g) | | 3.875 | | 09/15/24 | | 1,560,383 | | 1,384,485 |

| America West Airlines, Series 2001-1 | | 7.100 | | 10/02/22 | | 842,690 | | 830,021 |

| American Airlines, Series 2013-2 A | | 4.950 | | 07/15/24 | | 289,668 | | 262,828 |

| American Airlines, Series 2014-1 B | | 4.375 | | 04/01/24 | | 94,890 | | 69,387 |

| American Airlines, Series 2015-1 B | | 3.700 | | 11/01/24 | | 2,482,137 | | 1,829,776 |

| American Airlines, Series 2015-2 B | | 4.400 | | 03/22/25 | | 4,023,161 | | 2,869,697 |

| American Airlines, Series 2016-1 B | | 5.250 | | 07/15/25 | | 1,277,620 | | 960,835 |

| Aqua Finance Trust, Series 2017-A C (g) | | 8.350 | | 11/15/35 | | 1,750,000 | | 1,839,907 |

| Blackbird Capital Aircraft Lease Securitization Ltd., Series 2016-1A A (g) | | 4.213 | | 12/16/41 | | 604,531 | | 574,627 |

| Burlington Northern and Santa Fe Railway Co. Trust, Series 2002-1 | | 5.943 | | 01/15/23 | | 2,043 | | 2,075 |

| Business Jet Securities, LLC, Series 2019-1 B (g) | | 5.193 | | 07/15/34 | | 1,594,514 | | 1,603,426 |

| Cajun Global LLC, Series 2017-1A A2 (g) | | 6.500 | | 08/20/47 | | 20,585,000 | | 20,976,321 |

| Cibolo Canyons Special Improvement District (g) | | 4.250 | | 08/20/34 | | 2,520,000 | | 2,242,800 |

| Coinstar Funding, LLC, Series 2017-1A A2 (g) | | 5.216 | | 04/25/47 | | 27,304,675 | | 26,214,230 |

| DCAL Aviation Finance Ltd., Series 2015-1A A1 (g) | | 4.213 | | 02/15/40 | | 1,350,605 | | 1,032,805 |

| Delta Air Lines, Series 2007-1 B | | 8.021 | | 02/10/24 | | 1,092,598 | | 1,048,439 |

| ECAF I Ltd., Series 2015-1A A2 (g) | | 4.947 | | 06/15/40 | | 10,044,018 | | 8,913,836 |

| ECAF I Ltd., Series 2015-1A B1 (g) | | 5.802 | | 06/15/40 | | 21,086,196 | | 14,388,651 |

| GAIA Aviation Ltd. ( TAILWIND), Series 2019-1 B (g) | | 5.193 | | 12/15/44 | | 3,787,003 | | 2,978,343 |

| Global Container Assets Ltd., Series 2015-1A A2 (g) | | 3.450 | | 02/05/30 | | 2,844,707 | | 2,843,216 |

| Global SC Finance II SRL (SEACO), Series 2014-1A A1 (g) | | 3.190 | | 07/17/29 | | 2,992,000 | | 2,992,000 |

| Harley Marine Financing LLC, Series 2018-1A A2 (g)(i) | | 5.682 | | 05/15/43 | | 13,792,091 | | 12,252,895 |

| HOA Funding LLC, Series 2014-1A A2 (g) | | 4.846 | | 08/20/44 | | 14,875,000 | | 13,504,864 |

| Horizon Aircraft Finance I Ltd., Series 2018-1 B (g) | | 5.270 | | 12/15/38 | | 2,702,399 | | 2,048,583 |

| HP Communities LLC (g) | | 5.320 | | 03/15/23 | | 157,793 | | 165,250 |

| Icon Brand Holdings LLC, Series 2012-1A A (g)(i) | | 4.229 | | 01/25/43 | | 7,140,614 | | 4,796,484 |

| JOL Air Limited, Series 2019-1 B (g) | | 4.948 | | 04/15/44 | | 907,397 | | 664,784 |

| KDAC Aviation Finance Ltd., Series 2017-1A B (g) | | 5.926 | | 12/15/42 | | 17,132,629 | | 11,405,972 |

| Kestrel Aircraft Funding Ltd., Series 2018-1A B (g) | | 5.500 | | 12/15/38 | | 2,691,017 | | 1,777,527 |

| Korth Direct Mortgage Inc., Series 19-N008Q (g) | | 5.500 | | 01/25/25 | | 3,300,000 | | 3,270,672 |

| Labrador Aviation Finance Ltd., Series 2016-1A B1 (g) | | 5.682 | | 01/15/42 | | 33,166,314 | | 23,109,807 |

| Latam Airlines Group, Series 2015-1 B (h) | | 4.500 | | 08/15/25 | | 3,664,131 | | 1,996,951 |

| MAPS Ltd., Series 2018-1A B (g) | | 5.193 | | 05/15/43 | | 2,128,193 | | 1,357,010 |

| ME Funding, LLC, Series 2019-1 A2 (g) | | 6.448 | | 07/30/49 | | 22,770,000 | | 21,063,161 |

| Merlin Aviation Holdings D.A.C., Series 2016-1 A (g) | | 4.500 | | 12/15/32 | | 7,501,461 | | 6,714,303 |

| Merlin Aviation Holdings D.A.C., Series 2016-1 B (g) | | 6.500 | | 12/15/32 | | 1,554,779 | | 1,053,372 |

| METAL LLC, Series 2017-1 A (g) | | 4.581 | | 10/15/42 | | 16,411,490 | | 12,456,646 |

| METAL LLC, Series 2017-1 B (g) | | 6.500 | | 10/15/42 | | 26,657,035 | | 14,997,405 |

| Mosaic Solar Loans, LLC, Series 2017-2A C (g) | | 2.000 | | 06/22/43 | | 1,218,118 | | 1,210,293 |

| Northwest Airlines, Series 2002-1 G-2 | | 6.264 | | 05/20/23 | | 382,287 | | 378,367 |

| Norwegian Air Shuttle ASA, Series 2016-1 A (g)(h) | | 4.875 | | 11/10/29 | | 5,709,458 | | 4,453,377 |

| Oportun Funding, LLC, Series 2018-A B (g) | | 4.450 | | 03/08/24 | | 5,000,000 | | 5,003,005 |

| Pioneer Aircraft Finance Ltd., Series 2019-1 B (g) | | 4.948 | | 06/15/44 | | 1,419,643 | | 1,036,997 |

| PNMAC GMSR Issuer Trust, Series 2018-GT1 A | | | | | | | | |

| (1 month LIBOR + 2.850%, floor 2.850%) (d)(g) | | 3.000 | | 02/25/23 | | 4,000,000 | | 3,918,206 |

See Notes to Financial Statements.

20

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2020 |

| | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS (continued) | | | | | | | | |

| |

| Asset-Backed Securities (continued) | | | | | | | | |

| PROP Limited, Series 2017-1 B (g)(i) | | 6.900 | | 03/15/42 | | 4,296,552 | | $1,718,621 |

| Sapphire Aviation Finance I Ltd., Series 2018-1A B (g) | | 5.926 | | 03/15/40 | | 9,598,908 | | 6,557,341 |

| S-Jets Limited, Series 2017-1 B (g) | | 5.682 | | 08/15/42 | | 12,342,901 | | 8,872,461 |

| SMB Private Education Loan Trust, Series 2014-A C (g) | | 4.500 | | 09/15/45 | | 7,000,000 | | 6,454,989 |

| Solarcity Lmc Series VI LLC, Series 2016-A B (g) | | 6.850 | | 09/20/48 | | 4,858,823 | | 5,027,640 |

| Sprite Limited, Series 2017-1 B (g) | | 5.750 | | 12/15/37 | | 14,177,604 | | 9,877,611 |

| Taco Bell Funding, LLC, Series 2016-1A A2II (g) | | 4.377 | | 05/25/46 | | 1,158,000 | | 1,158,093 |

| TGIF Funding LLC, Series 2017-1A A2 (g) | | 6.202 | | 04/30/47 | | 27,900,000 | | 21,012,048 |

| Thunderbolt Aircraft Lease Ltd., Series 2017-A B (g) | | 5.750 | | 05/17/32 | | 3,899,920 | | 3,106,226 |

| Thunderbolt Aircraft Lease Ltd., Series 2019-1 B (g) | | 4.750 | | 11/15/39 | | 1,718,081 | | 1,364,044 |

| United Air Lines, Series 2013-1 B | | 5.375 | | 02/15/23 | | 1,240,507 | | 1,243,546 |

| US Airways, Series 2001-1 G | | 7.076 | | 09/20/22 | | 153,205 | | 147,953 |

| US Airways, Series 2012-2B | | 6.750 | | 12/03/22 | | 2,066,424 | | 1,986,489 |

| US Airways, Series 2013-1B | | 5.375 | | 05/15/23 | | 1,162,559 | | 1,016,416 |

| |

| Commercial Mortgage-Backed Securities - 3.4% | | | | | | | | 78,183,495 |

| BBCMS Mortgage Trust, Series 2015-VFM A2 (g) | | 3.375 | | 03/12/36 | | 6,000,000 | | 5,580,722 |

| CG-CCRE Commercial Mortgage Trust, Series 2014-FL1 D | | | | | | | | |

| (1 month LIBOR + 2.750%, floor 2.750%) (d)(g)(i) | | 2.891 | | 06/15/31 | | 12,000,000 | | 5,006,484 |

| COMM Mortgage Trust, Series 2012-CR3 E (d)(g) | | 4.750 | | 10/15/45 | | 5,000,000 | | 2,784,866 |

| COMM Mortgage Trust, Series 2013-CR9 D (d)(g) | | 4.243 | | 07/10/45 | | 4,898,000 | | 2,827,430 |

| COMM Mortgage Trust, Series 2013-CR11 D (d)(g) | | 5.120 | | 08/10/50 | | 5,000,000 | | 4,338,457 |

| COMM Mortgage Trust, Series 2014-CC17 D (d)(g) | | 4.847 | | 05/10/47 | | 5,210,000 | | 3,760,602 |

| COMM Mortgage Trust, Series 2014-UBS4 D (d)(g) | | 4.707 | | 08/10/47 | | 9,740,000 | | 7,623,937 |

| COMM Mortgage Trust, Series 2014-UBS5 | | 4.514 | | 09/10/47 | | 2,270,000 | | 2,336,508 |

| Credit Suisse Commercial Mortgage Securities Corp., | | | | | | | | |

| Series 2019-SKLZ C (1 month LIBOR + 2.750%, floor 2.750%) (d)(g) | | 2.891 | | 01/15/34 | | 2,500,000 | | 2,378,498 |

| CSAIL Commercial Mortgage Trust, Series 2015-C3 D (d) | | 3.376 | | 08/15/48 | | 5,795,000 | | 2,499,069 |

| GS Mortgage Securities Trust, Series 2010-C1 E (e)(g)(h)(i) | | 4.000 | | 08/10/43 | | 17,741,000 | | 177,410 |

| GS Mortgage Securities Trust, Series 2014-GC24 B (d) | | 4.511 | | 09/10/47 | | 4,340,000 | | 4,134,066 |

| GS Mortgage Securities Trust, Series 2014-GC24 D (d)(g) | | 4.532 | | 09/10/47 | | 2,955,000 | | 1,288,897 |

| J.P. Morgan Chase Commercial Mortgage Securities Trust, | | | | | | | | |

| Series 2014-C20 D (d)(g) | | 4.598 | | 07/15/47 | | 5,000,000 | | 3,528,469 |

| JPMBB Commercial Mortgage Securities Trust, Series 2014-C22 D (d)(g) | | 4.554 | | 09/15/47 | | 4,966,000 | | 3,298,181 |

| Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | |

| Series 2014-C18 D (g) | | 3.389 | | 10/15/47 | | 5,000,000 | | 3,519,131 |

| Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | |

| Series 2015-C22 D (d)(g) | | 4.215 | | 04/15/48 | | 5,000,000 | | 3,949,744 |

| Morgan Stanley Capital I Trust, Series 2011-C2 B (g) | | 5.200 | | 06/15/44 | | 1,570,000 | | 1,563,855 |

| Morgan Stanley Capital I Trust, Series 2011-C2 D (d)(g) | | 5.477 | | 06/15/44 | | 1,000,000 | | 779,662 |

| MSCG Trust (Morgan Stanley/Citigroup Global), Series 2016-SNR D (g) | | 6.550 | | 11/15/34 | | 262,859 | | 260,142 |

| Palisades Center Trust, Series 2016-PLSD B (g)(i) | | 3.357 | | 04/13/33 | | 4,500,000 | | 1,890,000 |

| Tharaldson Hotel Portfolio Trust, Series 2018-THL D | | | | | | | | |

| (1 month LIBOR + 2.000%, floor 2.100%) (d)(g) | | 2.277 | | 11/11/34 | | 4,900,986 | | 4,434,462 |

| Wells Fargo Commercial Mortgage Trust, Series 2014-LC16 D (g)(i) | | 3.938 | | 08/15/50 | | 8,072,000 | | 3,987,131 |

| Wells Fargo Commercial Mortgage Trust, Series 2015-LC22 B (d) | | 4.537 | | 09/15/58 | | 800,000 | | 862,047 |

| Wells Fargo Commercial Mortgage Trust, Series 2017-SMP A | | | | | | | | |

| (1 month LIBOR + 0.750%, floor 0.750%) (d)(g) | | 0.891 | | 12/15/34 | | 1,625,000 | | 1,588,582 |

| WFRBS Commercial Mortgage Trust, Series 2014-C21 D (g) | | 3.497 | | 08/15/47 | | 5,000,000 | | 3,785,143 |

See Notes to Financial Statements.

21

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2020 |

| | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS (continued) | | | | | | | | |

| |

| Convertible Bonds - 1.9% | | | | | | | | $42,105,048 |

| Colony Capital, Inc. | | 5.000 | | 04/15/23 | | 19,225,000 | | 18,839,705 |

| Hope Bancorp Inc. | | 2.000 | | 05/15/38 | | 25,750,000 | | 23,265,343 |

| |

| Corporate Bonds - 65.4% | | | | | | | | 1,482,646,436 |

| Adani Abbot Point Terminal Pty. Ltd. (g) | | 4.450 | | 12/15/22 | | 15,670,000 | | 14,817,638 |

| Air Lease Corp. | | 3.875 | | 04/01/21 | | 500,000 | | 503,860 |

| Air Lease Corp. | | 3.375 | | 06/01/21 | | 1,312,000 | | 1,327,305 |

| Aircastle Ltd. | | 5.125 | | 03/15/21 | | 9,562,000 | | 9,673,352 |

| Aircastle Ltd. | | 5.500 | | 02/15/22 | | 1,590,000 | | 1,639,618 |

| Albemarle Corp. (3 month LIBOR + 1.050%) (d) | | 1.271 | | 11/15/22 | | 1,590,000 | | 1,590,106 |

| Ally Financial Inc. | | 4.250 | | 04/15/21 | | 3,600,000 | | 3,647,616 |

| Amerant Bancorp Inc. | | 5.750 | | 06/30/25 | | 10,000,000 | | 10,254,085 |

| Ameris Bancorp (5.750% to 03/15/22, then 3 month LIBOR + 3.616%) (d) | | 5.750 | | 03/15/27 | | 5,000,000 | | 5,088,916 |

| AmTrust Financial Services, Inc. | | 6.125 | | 08/15/23 | | 39,078,000 | | 37,578,363 |

| Andeavor LLC | | 5.125 | | 04/01/24 | | 3,380,000 | | 3,456,731 |

| Arbor Realty Trust, Inc. | | 5.625 | | 05/01/23 | | 16,495,000 | | 16,489,904 |

| Arbor Realty Trust, Inc. (g) | | 5.750 | | 04/01/24 | | 10,000,000 | | 9,982,211 |

| Arbor Realty Trust, Inc. (g) | | 4.750 | | 10/15/24 | | 10,000,000 | | 9,697,747 |

| Arbor Realty Trust, Inc. | | 4.750 | | 10/15/24 | | 1,000,000 | | 969,775 |

| Arena Finance II LLC (g) | | 6.750 | | 09/30/25 | | 2,000,000 | | 2,000,000 |

| Aspen Insurance Holdings Ltd. | | 4.650 | | 11/15/23 | | 2,377,000 | | 2,579,566 |

| Assured Guaranty US Holdings Inc. (3 month LIBOR + 2.380%) (d) | | 2.630 | | 12/15/66 | | 31,751,000 | | 21,273,170 |

| AutoNation, Inc. | | 3.350 | | 01/15/21 | | 19,105,000 | | 19,143,246 |

| Avana Bonhon, LLC (g) | | 6.125 | | 09/15/24 | | 5,000,000 | | 5,159,397 |

| Axos Financial, Inc. (4.875% to 10/15/25, then SOFRRATE + 4.760%) (d) | | 4.875 | | 10/01/30 | | 3,500,000 | | 3,585,466 |

| BAC Capital Trust XIII (Greater of 4.000% or | | | | | | | | |

| 3 month LIBOR + 0.400%, floor 4.000%) (d)(f) | | 4.000 | | 12/16/20 | | 2,600,000 | | 2,535,000 |

| BAC Capital Trust XIV (3 month LIBOR + 0.400%, floor 4.000%) (d)(f) | | 4.000 | | 12/16/20 | | 4,000,000 | | 3,950,800 |

| Banc of California, Inc. | | 5.250 | | 04/15/25 | | 5,400,000 | | 5,692,469 |

| Banc of California, Inc. (4.375% to 10/30/25, | | | | | | | | |

| then SOFRRATE + 4.195%) (d) | | 4.375 | | 10/30/30 | | 8,000,000 | | 8,087,352 |

| Bank of America Corp. (5.200% to 06/01/23, | | | | | | | | |

| then 3 month LIBOR + 3.135%) (d)(f) | | 5.200 | | 06/01/23 | | 2,500,000 | | 2,575,000 |

| Bank of America Corp. (4.0 times (USISDA10 - USISDA02 - 0.250%), | | | | | | | | |

| floor 0.000%, cap 10.000%) (d) | | 1.464 | | 11/19/30 | | 671,000 | | 577,972 |

| Bank of Montreal (4.800% to 08/25/24, then H15T5Y + 2.979%) (d)(f) | | 4.800 | | 08/25/24 | | 6,977,000 | | 7,272,127 |

| Bank of New York Mellon Corp. (3 month LIBOR + 3.420%) (d)(f) | | 3.647 | | 03/20/21 | | 9,989,000 | | 10,033,051 |

| Bank of the Ozarks, Inc. (5.500% to 07/01/21, | | | | | | | | |

| then 3 month LIBOR + 4.425%) (d) | | 5.500 | | 07/01/26 | | 20,370,000 | | 20,710,184 |

| Barclays Bank PLC (8.0 times (USISDA30 - USISDA05 - 0.250%), | | | | | | | | |

| floor 0.000%, cap 8.000%) (d) | | 4.680 | | 08/28/29 | | 3,618,000 | | 3,398,521 |

| Bay Banks of Virginia, Inc. (5.625% to 10/15/24, | | | | | | | | |

| then SOFRRATE + 4.335%) (d)(g) | | 5.625 | | 10/15/29 | | 3,000,000 | | 3,124,268 |

| BayCom Corp. (5.250% to 09/15/25, then SOFRRATE + 5.210%) (d) | | 5.250 | | 09/15/30 | | 8,455,000 | | 8,632,862 |

| BCB Bancorp, Inc. (5.625% to 08/01/23, | | | | | | | | |

| then 3 month LIBOR + 2.720%) (d)(g) | | 5.625 | | 08/01/28 | | 9,000,000 | | 9,423,058 |

| Becton Dickinson and Co. (3 month LIBOR + 1.030%) (d) | | 1.280 | | 06/06/22 | | 25,355,000 | | 25,572,019 |

| Block Financial LLC | | 5.500 | | 11/01/22 | | 1,432,000 | | 1,526,766 |

| Byline Bancorp, Inc. (6.000% to 07/01/25, then SOFRRATE + 5.880%) (d) | | 6.000 | | 07/01/30 | | 12,000,000 | | 12,271,889 |

See Notes to Financial Statements.

22

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2020 |

| | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS (continued) | | | | | | | | |

| |

| Corporate Bonds (continued) | | | | | | | | |

| Capital Funding Bancorp, Inc. (g) | | 6.000 | | 12/01/23 | | 20,000,000 | | $21,123,184 |

| CenterState Bank Corp. (5.750% to 06/01/25, | | | | | | | | |

| then SOFRRATE + 5.617%) (d) | | 5.750 | | 06/01/30 | | 680,000 | | 716,059 |

| Charles Schwab Corp. (4.625% to 03/01/22, | | | | | | | | |

| then 3 month LIBOR + 3.315%) (d)(f) | | 4.625 | | 03/01/22 | | 21,618,000 | | 22,076,302 |

| Citigroup Global Markets Holdings Inc. (6.400% to 01/29/21, | | | | | | | | |

| then (15 x (USISDA30 - USISDA02) subject to index barriers, | | | | | | | | |

| floor 0.000%, cap 6.400%) (d) | | 6.400 | | 01/29/35 | | 4,500,000 | | 4,430,142 |

| Citigroup, Inc. (4.0 times (USISDA30 - USISDA05), floor 0.000%, | | | | | | | | |

| cap 10.000%) (d) | | 3.224 | | 07/09/28 | | 740,000 | | 691,020 |

| Citigroup, Inc. (4.0 times (USISDA30 - USISDA05), floor 0.000%, | | | | | | | | |

| cap 10.000%) (d) | | 3.516 | | 11/15/28 | | 245,000 | | 225,583 |

| Citigroup, Inc. (4.0 times (USISDA30 - USISDA02), floor 0.000%, | | | | | | | | |

| cap 8.150%) (d) | | 3.336 | | 03/26/29 | | 1,303,000 | | 1,256,668 |

| Citigroup, Inc. (5.0 times (USISDA30 - USISDA05), floor 0.000%, | | | | | | | | |

| cap 10.000%) (d) | | 3.620 | | 03/28/29 | | 936,000 | | 829,143 |

| Citigroup, Inc. (5.5 times (USISDA30 - USISDA05), floor 0.000%, | | | | | | | | |

| cap 10.000%) (d) | | 4.538 | | 04/29/29 | | 269,000 | | 252,082 |

| Citigroup, Inc. (4.0 times (USISDA30 - USISDA02), floor 0.000%, | | | | | | | | |

| cap 10.000%) (d) | | 3.324 | | 12/23/29 | | 1,152,000 | | 1,100,699 |

| Citigroup, Inc. (4.0 times (USISDA10 - USISDA02 - 0.250%), | | | | | | | | |

| floor 0.000%, cap 10.000%) (d) | | 1.464 | | 11/19/30 | | 727,000 | | 628,193 |

| Citigroup, Inc. (4.35 times (USISDA30 - USISDA05), floor 0.000%, | | | | | | | | |

| cap 10.000%) (d) | | 3.506 | | 07/09/33 | | 1,394,000 | | 1,269,860 |

| Citigroup, Inc. (5.0 times (USISDA30 - USISDA05), floor 0.000%, | | | | | | | | |

| cap 10.000%) (d) | | 3.640 | | 12/20/33 | | 2,863,000 | | 2,640,430 |

| Clear Blue Financial Holdings, LLC (g) | | 7.000 | | 04/15/25 | | 5,000,000 | | 5,057,342 |

| CNH Industrial Capital LLC | | 3.875 | | 10/15/21 | | 436,000 | | 446,827 |

| Congressional Bancshares, Inc. (5.750% to 12/01/24, | | | | | | | | |

| then SOFRRATE + 4.390%) (d)(g) | | 5.750 | | 12/01/29 | | 5,000,000 | | 5,161,943 |

| ConnectOne Bancorp, Inc. (5.200% to 02/01/23, | | | | | | | | |

| then 3 month LIBOR + 2.840%) (d) | | 5.200 | | 02/01/28 | | 6,375,000 | | 6,339,448 |

| ConnectOne Bancorp, Inc. (5.750% to 06/15/25, | | | | | | | | |

| then SOFRRATE + 5.605%) (d) | | 5.750 | | 06/15/30 | | 7,780,000 | | 8,374,652 |

| County Bancorp, Inc. (5.875% to 06/01/23, | | | | | | | | |

| then 3 month LIBOR + 2.884%) (d) | | 5.875 | | 06/01/28 | | 8,250,000 | | 8,613,223 |

| Cowen Inc. (g) | | 7.250 | | 05/06/24 | | 20,000,000 | | 21,042,039 |

| CRB Group, Inc. (g) | | 6.250 | | 06/15/23 | | 5,000,000 | | 5,033,413 |

| D.R. Horton, Inc. | | 2.550 | | 12/01/20 | | 250,000 | | 250,000 |

| Depository Trust & Clearing Corp. (3 month LIBOR + 3.167%) (d)(f)(g) | | 3.417 | | 03/15/21 | | 1,850,000 | | 1,757,500 |

| Deutsche Bank AG | | 3.150 | | 01/22/21 | | 15,373,000 | | 15,423,651 |

| Deutsche Bank AG | | 4.250 | | 02/04/21 | | 855,000 | | 859,755 |

| Deutsche Bank AG | | 4.250 | | 10/14/21 | | 7,057,000 | | 7,241,022 |

| Deutsche Bank AG | | 4.250 | | 10/14/21 | | 313,000 | | 321,162 |

| Drawbridge Special Opportunities Fund L.P. (g) | | 5.000 | | 08/01/21 | | 14,000,000 | | 14,192,482 |

| DXC Technology Co. | | 4.000 | | 04/15/23 | | 6,431,000 | | 6,848,232 |

| DXC Technology Co. | | 4.125 | | 04/15/25 | | 1,980,000 | | 2,166,809 |

| Eagle Bancorp, Inc. | | 5.750 | | 09/01/24 | | 1,825,000 | | 1,898,168 |

| Eagle Bancorp, Inc. (5.000% to 08/01/21, | | | | | | | | |

| then 3 month LIBOR + 3.850%) (d) | | 5.000 | | 08/01/26 | | 13,479,000 | | 13,525,386 |

See Notes to Financial Statements.

23

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2020 |

| | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS (continued) | | | | | | | | |

| | | | | | | | | |

| Corporate Bonds (continued) | | | | | | | | |

| EF Holdco Inc. / EF Cayman Holdings Ltd. (g) | | 5.500 | | 09/01/22 | | 3,500,000 | | $3,552,728 |

| Enstar Group Ltd. | | 4.500 | | 03/10/22 | | 27,476,000 | | 28,380,532 |

| Enterprise Products Operating LLC (3 month LIBOR + 2.7775%) (d) | | 3.024 | | 06/01/67 | | 8,538,000 | | 7,248,847 |

| Enterprise Products Operating LLC (5.250% to 08/16/27, | | | | | | | | |

| then 3 month LIBOR + 3.033%) (d) | | 5.250 | | 08/16/77 | | 6,666,000 | | 6,575,343 |

| Essex Portfolio LP | | 5.200 | | 03/15/21 | | 248,000 | | 248,398 |

| EverBank Financial Corp. (6.000% to 03/15/21, | | | | | | | | |

| then 3 month LIBOR + 4.704%) (d) | | 6.000 | | 03/15/26 | | 4,000,000 | | 4,010,609 |

| Everest Reinsurance Holdings Inc. (3 month LIBOR + 2.385%) (d) | | 2.606 | | 05/01/67 | | 24,705,000 | | 22,348,681 |

| F&M Financial Services Corp. (5.950% to 09/15/24, | | | | | | | | |

| then SOFRRATE + 4.840%) (d)(g) | | 5.950 | | 09/15/29 | | 9,000,000 | | 9,258,124 |

| Family Dollar Stores, Inc. | | 5.000 | | 02/01/21 | | 112,000 | | 112,761 |

| Federal Realty Investment Trust | | 2.550 | | 01/15/21 | | 500,000 | | 500,367 |

| FedNat Holding Co. | | 7.500 | | 03/15/29 | | 17,000,000 | | 17,446,760 |

| Fidelity Federal Bancorp (6.875% to 10/15/23, | | | | | | | | |

| then 3 month LIBOR + 3.790%) (d)(g) | | 6.875 | | 10/15/28 | | 6,500,000 | | 6,889,038 |

| Fidelity Federal Bancorp (6.000% to 11/01/24, | | | | | | | | |

| then SOFRRATE + 4.650%) (d)(g) | | 6.000 | | 11/01/29 | | 7,000,000 | | 7,357,079 |

| Fifth Third Bancorp (3 month LIBOR + 3.129%) (d)(f) | | 3.349 | | 12/31/20 | | 25,010,000 | | 23,218,784 |

| First Financial Bancorp (5.250% to 05/15/25, | | | | | | | | |

| then SOFRRATE + 5.090%) (d) | | 5.250 | | 05/15/30 | | 3,000,000 | | 3,094,990 |

| Flagstar Bancorp, Inc. | | 6.125 | | 07/15/21 | | 41,271,000 | | 41,433,398 |

| Flushing Financial Corp. (5.250% to 12/15/21, | | | | | | | | |

| then 3 month LIBOR + 3.440%) (d) | | 5.250 | | 12/15/26 | | 4,030,000 | | 4,071,023 |

| FPL Group, Inc. (3 month LIBOR + 2.0675%) (d) | | 2.293 | | 10/01/66 | | 9,285,000 | | 8,045,545 |

| General Electric Capital Corp. (3 month LIBOR + 0.380%) (d) | | 0.605 | | 05/05/26 | | 5,148,000 | | 4,905,925 |

| General Electric Co. (5.000% to 01/21/21, | | | | | | | | |

| then 3 month LIBOR + 3.330%) (d)(f) | | 5.000 | | 01/21/21 | | 46,706,000 | | 41,592,347 |

| Great Southern Bancorp, Inc. (5.250% to 08/15/21, | | | | | | | | |

| then 3 month LIBOR + 4.087%) (d) | | 5.250 | | 08/15/26 | | 6,450,000 | | 6,440,099 |

| Great Southern Bank (5.500% to 06/15/25, | | | | | | | | |

| then SOFRRATE + 5.325%) (d) | | 5.500 | | 06/15/30 | | 2,000,000 | | 2,130,207 |

| Hallmark Financial Services, Inc. | | 6.250 | | 08/15/29 | | 13,000,000 | | 7,800,000 |

| Hanmi Financial Corp. (5.450% to 03/30/22, | | | | | | | | |

| then 3 month LIBOR + 3.315%) (d) | | 5.450 | | 03/30/27 | | 8,600,000 | | 8,687,445 |

| Hilltop Holdings Inc. (5.750% to 05/15/25, then SOFRRATE + 5.680%) (d) | | 5.750 | | 05/15/30 | | 8,000,000 | | 8,052,688 |

| Home BancShares Inc. (5.625% to 04/15/22, | | | | | | | | |

| then 3 month LIBOR + 3.575%) (d) | | 5.625 | | 04/15/27 | | 6,083,000 | | 6,209,327 |

| Horizon Bancorp, Inc. (5.625% to 07/01/25, | | | | | | | | |

| then SOFRRATE + 5.490%) (d) | | 5.625 | | 07/01/30 | | 6,000,000 | | 6,058,045 |

| Hospitality Properties Trust | | 4.250 | | 02/15/21 | | 1,300,000 | | 1,300,000 |

| Hospitality Properties Trust | | 4.500 | | 03/15/25 | | 720,000 | | 684,000 |

| Hospitality Properties Trust | | 4.750 | | 10/01/26 | | 3,295,000 | | 3,096,641 |

| Hospitality Properties Trust | | 4.950 | | 02/15/27 | | 1,549,000 | | 1,477,359 |

| Hospitality Properties Trust | | 3.950 | | 01/15/28 | | 1,436,000 | | 1,292,400 |

| Howard Bancorp Inc. (6.000% to 12/06/23, | | | | | | | | |