Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (MD&A), dated effective as of February 9, 2006, should be read in conjunction with the audited Consolidated Financial Statements and Notes for the year ended December 31, 2005, included in the 2005 Financial Report and the 2005 Annual Information Form. Financial data has been prepared in accordance with Canadian generally accepted accounting principles (GAAP), unless otherwise specified. All dollar values are Canadian dollars, unless otherwise indicated. All oil and natural gas production and reserves volumes are stated before deduction of royalties, unless otherwise indicated. Graphs accompanying the text identify our “value drivers,” the key measures of performance in each segment of our business. A glossary of financial terms and ratios can be found on page 88 of this report.

NON-GAAP MEASURES

Cash flow, which is expressed before changes in non-cash working capital, is used by the Company to analyse operating performance, leverage and liquidity. Operating earnings, which represent net earnings excluding gains or losses on foreign currency translation, disposal of assets and unrealized gains or losses on the mark-to-market of the derivative contracts associated with the Buzzard acquisition, are used by the Company to evaluate operating performance. Cash flow and operating earnings do not have a standardized meaning prescribed by Canadian GAAP and, therefore, may not be comparable with the calculation of similar measures for other companies. For reconciliation of the operating earnings and cash flow amounts to the associated GAAP measures, refer to the tables on pages 10 and 12 respectively, of this MD&A.

BUSINESS ENVIRONMENT

Economic factors influencing Petro-Canada’s upstream financial performance include crude oil and natural gas prices, and foreign exchange, particularly the Canadian dollar/U.S. dollar rates. Prices for energy commodities are affected by a number of factors, including supply and demand balance, weather and political events. Factors influencing Downstream financial performance include the level and volatility of crude oil prices, industry refining margins, movements in crude oil price differentials, demand for refined petroleum products and the degree of market competition.

BUSINESS ENVIRONMENT IN 2005

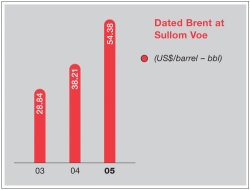

The year 2005 established another milestone in the history of commodity prices. The price of light crude, North Sea Brent (Brent) and West Texas Intermediate (WTI), and of North American natural gas reached new peaks, while light/heavy crude price differentials continued to widen to record levels.

The highest oil prices recorded in the history of the oil market were driven by steady demand growth from China and India; slower growth in Russian production; Iraqi export interruptions; and the impact of hurricanes Katrina and Rita on U.S. Gulf of Mexico production. At the same time, international and domestic light/heavy crude price differentials were substantially wider than in 2004 due to strong growth in output from the Organization of Petroleum Exporting Countries (OPEC); higher levels of heavy crude production in Mexico and Canada; and a prolonged U.S. refinery capacity shutdown due to significant damage from hurricanes.

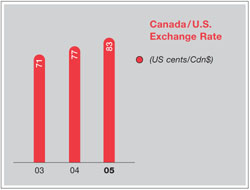

The appreciation of the Canadian dollar during 2005 dampened the positive impact of higher international prices on Canadian crude prices. The Canadian dollar averaged 83 cents US in 2005, compared with 77 cents US in 2004.

North American natural gas prices enjoyed another record year, despite weaker demand due to warm winter weather and inter-fuel substitution, which led to storage gas staying at comfortable levels in 2005. High Henry Hub gas prices reflected concerns about natural gas supply growth in North America and the impact of hurricanes on U.S. Gulf of Mexico production. Canadian natural gas prices improved in line with U.S. prices and averaged higher than in 2004, despite a widening of the price differential between the Henry and the AECO-C hubs and the negative impact of the strengthening Canadian dollar.

In the downstream sector, refined petroleum product sales in Canada declined by 1%, compared to growth of 3.9% in 2004. Most of the decline was due to lower motor gasoline, heating and heavy fuel oil sales. In contrast, diesel sales grew by 4.7% in 2005, building on growth of 6.1% in 2004.

Despite lower overall product sales, refining margins rose to very high levels in 2005. Heating fuel margins reached record levels in the summer of 2005. This was due to fears there would be inadequate inventories to meet demand during the 2005-06 winter season. Gasoline margins increased at the end of the third quarter due to the temporary shutdown of more than four million barrels per day (b/d) of refining capacity in the U.S. Gulf Coast damaged by hurricanes. Record wide light/heavy crude price differentials also contributed to higher margins.

Commodity Price Indicators and Exchange Rates

(averages for the years indicated) | | 2005 | 2004 | 2003 |

| | | | | |

Crude oil price indicators (per bbl) | | | | |

Dated Brent at Sullom Voe | US$ | 54.38 | 38.21 | 28.84 |

WTI at Cushing | US$ | 56.56 | 41.40 | 31.04 |

WTI/Brent price differential | US$ | 2.18 | 3.19 | 2.20 |

Brent/Maya price differential | US$ | 13.52 | 8.20 | 4.60 |

Edmonton Light | Cdn$ | 69.22 | 52.78 | 43.77 |

Edmonton Light/Lloydminster Blend (heavy) price differential | Cdn$ | 26.17 | 17.07 | 12.68 |

| Natural gas price indicators | | | | |

Henry Hub (per MMBtu) | US$ | 8.55 | 6.09 | 5.44 |

AECO-C spot(per thousand cubic feet - Mcf) | Cdn$ | 8.84 | 7.08 | 6.99 |

Henry Hub/AECO basis differential (per MMBtu) | US$ | 1.53 | 0.87 | 0.70 |

New York Harbour 3-2-1 refinery crack spread (per bbl) | US$ | 9.47 | 7.02 | 5.31 |

| US$ per Cdn$ exchange rate | US$ | 0.83 | 0.77 | 0.71 |

COMPETITIVE CONDITIONS

It is becoming increasingly challenging for the energy sector to find new sources of oil and gas. Petro-Canada is well positioned in this environment to compete for new opportunities which will develop upstream resources and grow production of oil and gas. The Company has an estimated 15 billion barrels of oil equivalent (boe) of resources from which to develop new production. Approximately two-thirds of the resource base is located in Alberta’s oil sands. As well, with four different upstream businesses operating in Canada and internationally, the Company has the flexibility to pursue a wider range of opportunities that an upstream business with only one kind of operation in a single geographical area. While the Company has wider operational scope, it remains medium-sized as measured by production levels. Petro-Canada is neither a small junior oil and gas company, nor a super major in the energy sector. This means Petro-Canada has the operational capability and balance sheet strength to invest in large projects, but even smaller acquisitions can impact the Company’s production levels and financial returns.

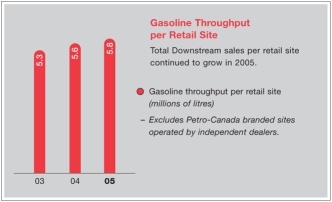

Petro-Canada is also well positioned to compete in petroleum product refining and marketing in Canada. The Company has a 16% share of the petroleum products market in Canada. Its 1,323 retail service station network has the highest gasoline sales per site in Canada’s urban market amongst the national integrated oil companies. It also has Canada’s largest commercial road transport network of 212 locations, and a bulk fuel sales channel.

The Company believes that its strong financial postion, track record of executing large capital projects and depth of management experience will enable it to continue to compete successfully in the current business environment.

OUTLOOK FOR BUSINESS ENVIRONMENT IN 2006

Prices for energy commodities are expected to remain volatile in 2006, reflecting the vagaries of weather, the level of industry inventories, and political and natural events. Slower growth in global oil demand and production gains from non-OPEC countries are expected to ease the upward pressure experienced by oil prices during 2005. The extent of the anticipated price correction will depend on OPEC adjustments to output to prevent prices from declining as global supply/demand conditions slacken.

Demand growth in North American natural gas markets is expected to be minimal due to warmer winter weather and continuing demand response to high natural gas prices, particularly in the industrial and power generation sectors. The resultant downward pressure on natural gas prices could be partially offset by the challenge to grow production, the slow recovery from production losses caused by the hurricanes and drilling difficulties in Western Canada due to warm winter temperatures.

In the industry’s downstream sector, 2006 refining margins are unlikely to remain at the high levels experienced in 2005 due to the expectation of slower growth in U.S. and Canadian refined product sales. However, another hurricane season or similar occurrence resulting in similar damage to key refining centres could drive such margins to higher than anticipated levels.

ECONOMIC SENSITIVITIES

The following table shows the estimated after-tax effects that changes in certain factors would have had on Petro-Canada’s 2005 net earnings from continuing operations had these changes occurred. Amounts are in Canadian dollars unless otherwise specified.

Sensitivities affecting net earnings

Factor1, 2 | | Change (+) | | Annual Net Earnings Impact | | Annual Net Earnings Impact | |

| | | | | | | (millions of dollars) | | | ($/share) 3 | |

Upstream | | | | | | | | | | |

Price received for crude oil and liquids4 | | $ | 1.00/bbl | | $ | 43 | | $ | 0.08 | |

| Price received for natural gas | | $ | 0.25/Mcf | | | 32 | | | 0.06 | |

Exchange rate: Cdn$/US$ refers to impact on upstream operating earnings from continuing operations5 | | $ | 0.01 | | | (36 | ) | | (0.07 | ) |

| Crude oil and liquids production | | | 1,000 b/d | | | 9 | | | 0.02 | |

| Natural gas production | | | 10 MMcf/d | | | 11 | | | 0.02 | |

Buzzard derivative contracts (unrealized)6 | | $ | 1.00/bbl | | | (19 | ) | | (0.04 | ) |

Downstream | | | | | | | | | | |

| New York Harbour 3-2-1 crack spread | | $ | 0.10 US/bbl | | | 6 | | | 0.01 | |

| Light/heavy crude price differential | | $ | 1.00 US/bbl | | | 7 | | | 0.01 | |

Corporate | | | | | | | | | | |

Exchange rate: Cdn$/US$ refers to impact of the revaluation of U.S. dollar denominated, long-term debt7 | | $ | 0.01 | | $ | 14 | | $ | 0.03 | |

1 The impact of a change in one factor may be compounded or offset by changes in other factors. This table does not consider the impact of any inter-relationship among the factors.

2 The impact of these factors is illustrative.

3 Per share amounts are quoted on a post-stock dividend basis.

4 This sensitivity is based upon an equivalent change in the price of WTI and Dated Brent.

5 A strengthening Canadian dollar versus the U.S. dollar has a negative effect on upstream earnings from continuing operations.

6 This item refers to gains or losses on the forward sales contracts for the future sale of 35.8 million barrels of Brent crude oil that were entered into in connection with the Company’s acquisition of an interest in the Buzzard field in the United Kingdom (U.K.) sector of the North Sea.

7 A strengthening Canadian dollar versus the U.S. dollar has a positive effect on corporate earnings because the Company holds U.S. denominated debt. The impact refers to gains or losses on $1.4 billion US of the Company’s U.S. denominated long-term debt and interest costs on U.S. denominated debt. Gains or losses on $1.1 billion US of the Company’s U.S. denominated long-term debt, associated with the self-sustaining International business segment and the U.S. Rockies operations included in the North American Natural Gas business segment, are deferred and included as part of shareholders’ equity.

BUSINESS STRATEGY

Petro-Canada has maintained a consistent strategy over the past six years. The two-pronged strategy is to improve the profitability of the base businesses by selecting the right assets and then driving for first quartile performance1, and to take a disciplined approach to profitable, long-term growth.

BASE BUSINESS PROFITABILITY

The Company wants to deliver first quartile performance amongst our benchmarked peers as measured in a number of ways, such as reliability and operating cost efficiency.

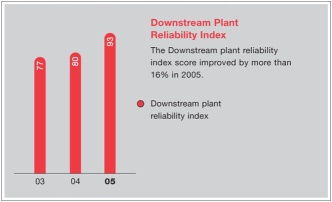

In 2005, management continued to make safety, environmental impact and reliability key priorities, resulting in performance improvements in all three areas. Total recordable injury frequency decreased by 18% in 2005. Environmental exceedances were reduced by 38%. Reliability2 at operated facilities improved substantially. In the Downstream business, the two refineries and lubricants plant ran at a reliability index rate of well over 90. The Terra Nova Floating Production Storage and Offloading vessel (FPSO) operated at 90% reliability after a fall turnaround. In Oil Sands, the MacKay River in situ plant ran at 98% reliability.

In 2006, Petro-Canada’s priorities for improving base business profitability include continuing to progress safety, environmental and reliability initiatives, and placing an increased focus on cost management. On the first priority, the Company will follow up on initiatives from a contractor safety forum and introduce a safety and health recognition program. Petro-Canada will also conduct a major turnaround at Terra Nova to reach and sustain first quartile reliability levels. The second priority, managing costs, is important given industry pressure for limited services and escalating prices. Employees have been asked to put an increased focus on cost efficiency. The business environment has also created a challenge in recruiting skilled employees. The human resources department is working on a detailed workforce plan to allow the Company to attract employees for growth in all areas of the business.

LONG-TERM PROFITABLE GROWTH

Petro-Canada is taking a disciplined approach to profitable, long-term growth by:

| • | expanding and exploiting the current portfolio of assets; |

| • | targeting acquisitions and new opportunities with a focus on long-life assets; and |

| • | developing an exploration program which balances risks and rewards to replace reserves over time. |

In 2005, the Company continued to expand and exploit the current portfolio of assets. In East Coast Oil, life-of-field estimates at Terra Nova, Hibernia and White Rose increased. In Oil Sands, an application was filed to expand the MacKay River in situ project. In North American Natural Gas, the business used its existing foundation in conventional production in Western Canada and the recently acquired U.S. Rockies platform to shift to production from unconventional sources. In the North Sea, the International business leveraged existing infrastructure and competencies to add the Pict project. International also strengthened its portfolio by selling its mature producing assets in Syria. This focus on expanding and exploiting the current portfolio is expected to continue in 2006. For example, production from another North Sea project called De Ruyter is expected to come on-stream, and MacKay River is expected to reach plateau production. It is anticipated that U.S. Rockies coal bed methane projects will begin to ramp up and production from the Far East Block at Terra Nova is expected in the first quarter of 2006.

Petro-Canada also continues to target acquisitions and new opportunities with a focus on long-life assets. In 2005, the Company’s main acquisition was a 55% interest and operatorship in the Fort Hills mining project. The Fort Hills oil sands mining leases are estimated to contain at least 2.8 billion bbls of bitumen recoverable resource (1.5 billion bbls net to Petro-Canada). The Company also made smaller acquisitions, such as a paraxylene facility next to the Montreal refinery, and some leases and facilities adjacent to the MacKay River in situ project. Also during 2005, Petro-Canada continued to develop its interests in other major upstream projects. These developments included the East Coast Oil White Rose project, which achieved first oil in the fourth quarter (27.5% interest), and the Buzzard project in the North Sea (29.9% interest), which is expected to come on-stream in late 2006. In 2006, the Company expects to continue to develop business development opportunities, particularly in the International business. These include the potential liquefied natural gas (LNG) project in Russia, and other opportunities in the Middle East and North Africa. In North America, Petro-Canada and its partner, TransCanada PipeLines Limited, will seek regulatory approval for the LNG re-gasification project at Gros-Cacouna, Quebec.

| 1 | References to first quartile operations in this report do not refer to industry-wide benchmarks or externally known measures. The Company has a variety of internal metrics which define and track first quartile operational performance. |

| 2 | Throughout this MD&A, the company refers to reliability within the five business units. These reliability rates are calculated using internal methods that vary among the business units and take various factors into account. There are no existing external or industry-wide standards used in calculating reliability rates, and, therefore, resulting calculations are not necessarily comparable to other companies in the oil and gas industry. |

Petro-Canada continues to build a substantive, balanced exploration program. Building a quality program takes time and maintaining a substansive portfolio of opportunities is an ongoing project. Internationally, in 2005, the Company made two discoveries in the U.K. Sector of the North Sea, drilled a successful apprassal well in Denmark and drilled two discoveries on existing concessions in Libya. Seismic programs were completed in Algeria, Syria and the Netherlands, and started in Trinidad and Tobago. The Company also added new exploration opportunities in the U.K. and Norwegian sectors of the North Sea, Trinidad and Tobago, and Morocco. Early in 2006, Petro-Canada added new, non-operated opportunities in Tunisia. The Company also added to its gas exploration portfolio in North America, pooling Alaskan acreage with another operator to increase the joint land position to 2.5 million acres and acquiring an additional licence in the Mackenzie Corridor, for a gross land position of about 560,000 acres. In 2006, Petro-Canada has prepared an 11-well International drilling plan in the Northwest Europe and North Africa/Near East regions and an extensive seismic program to firm up additional prospects that are focused on Trinidad and Tobago, and the U.K. sector of the North Sea.

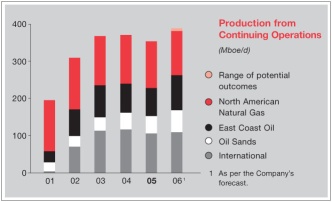

All together, Petro-Canada has a diverse portfolio of growth opportunities across all five businesses. In the next three years, near-term upstream projects will deliver average annual production growth of 8% to 11%. At the same time, the Downstream business is moving from a focus on investments to meet regulatory requirements to a focus on growth. As regulatory projects to produce cleaner-burning fuels are completed, the Downstream will invest in conversion projects, such as work to convert the conventional crude train at the Edmonton refinery to process oil sands feedstock. The Downstream is also investigating options to build a coker in Montreal. These Downstream projects are expected to lead to the next wave of earnings growth near the end of the decade. Further ahead, Petro-Canada is advancing the second wave of upstream growth projects, adding production from Oil Sands (the Fort Hills mine and upgrader, and MacKay River expansion), northern oil and gas in Alaska and the Mackenzie Delta/Corridor, the Hebron project in East Coast Oil and further exploration success.

RISK MANAGEMENT

PETRO-CANADA’S RISK PROFILE

Petro-Canada’s results are impacted by management’s strategy for handling risks in the business. These risks fall into four broad categories: business risks; operational risks; foreign risks; and market risks. Management believes each major risk requires a unique response based on Petro-Canada’s business strategy and financial tolerance. While some risks can be effectively managed through internal controls and business processes, others are managed through insurance and hedging. The Audit, Finance and Risk Committee of the Board of Directors has responsibility to oversee risk management1. The following describes Petro-Canada’s approach to managing major risks.

BUSINESS RISKS

Exploration

Petro-Canada’s future cash flows from continuing operations are highly dependent on its ability to offset natural declines as reserves are produced. Reserves can be added through successful exploration or acquisitions; however, as basins mature, replacement of reserves becomes more challenging and expensive. In some geographic areas, the Company may choose to allow its reserves to decline if replacement is uneconomic. In 2005, the Company replaced 111% of its production on a proved reserves basis, compared to 103% in 2004. The Company targets to fully replace proved reserves over a five-year period. Petro-Canada’s five-year proved replacement ratio was 161%2. There is no assurance Petro-Canada will successfully replace all production in any given year.

| 1 | Further detail regarding the Audit, Finance and Risk Committee can be found on page 73 of the Annual Information Form (AIF) and a copy of its Charter is attached as Schedule C in the AIF. |

| 2 | Proved reserves replacement ratio is calculated by dividing the year-over-year net change in proved reserves, before deducting production, by the annual production over the same period. The reserves replacement ratio is a general indicator of the Company’s reserves growth. It is only one of a number of metrics which can be used to analyse a company’s upstream business. |

Reserves Estimates

Estimates of economically recoverable oil and gas reserves are based upon a number of variables and assumptions that include geoscientific interpretation, commodity prices, operating and capital costs, and historical production from properties. Petro-Canada has well-established, corporate-wide reserves booking practices that have been continuously improved for more than a decade. PricewaterhouseCoopers LLP, as contract internal auditor, has tested aspects of the non-engineering control processes used in establishing reserves. As well, independent engineering firms assess a significant portion of reserves estimates every year. Over time, this means all of Petro-Canada’s reserves estimates are assessed by external evaluators. The Board of Directors also reviews and approves the Company’s annual reserves filings. More information on reserves booking practices can be found in the Company’s AIF.

Project Execution

Petro-Canada manages a number of different-sized projects to support continuing operations and future growth. Many projects are influenced by external factors beyond the Company’s control. These factors include items such as material costs, labour productivity, timely availability of skilled labour and currency fluctuations.

While Petro-Canada cannot control all project inputs, the Company is committed to continuing to improve its project management capability. Petro-Canada’s goal is to consistently and predictably deliver projects on time and on budget, and achieve defined expectations. Enhanced project management capability is expected to improve all elements of project execution, including safety and environmental performance, quality, cycle time and cost. By leveraging experience gained from major project developments, the Company has established project management “best practices.”

Non-Operated Interests

Other companies may manage the construction or operation of assets in which Petro-Canada has a significant interest. Business assets in which Petro-Canada has a major interest, but does not operate, include Hibernia (20% interest), Syncrude (12% interest), White Rose (27.5% interest) and Buzzard (29.9% interest). Major projects are managed through different forms of joint venture executive committees, resulting in Petro-Canada having some ability to influence these projects. As well, Petro-Canada has joint venture or other operating agreements which specify our expectations from third-party operators. Nevertheless, third-party operation and management of the Company’s assets could adversely affect Petro-Canada’s financial performance.

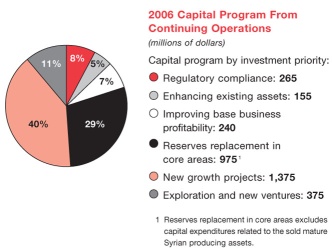

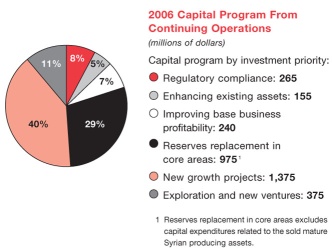

Environmental Regulations

Environmental risks in the oil and gas industry are significant. This situation has arisen because related laws and regulations are becoming more stringent in Canada and in other countries where Petro-Canada operates. Due to increased regulations, Petro-Canada is investing additional capital to satisfy new product specifications and/or address environmental issues. In 2006, the Company anticipates that it will invest $265 million of its capital expenditure program toward regulatory compliance, most of which will be incurred to modify refineries to produce low-sulphur distillates. Other environmental regulations may result in future increased operating costs as a result of creating a future liability when dismantling or remediating assets.

Petro-Canada conducts Life-Cycle Value Assessments (LCVA) to integrate and balance environmental, social and economic decisions related to major projects. A key component of the LCVA process is the assessment and planning for all life-cycle stages involved in constructing, manufacturing, distributing and eventually abandoning an asset or a product. This process encourages more comprehensive exploration of alternatives. The LCVA is a useful technique; however, its predictive capability is limited by assumptions that involve the reliance on the current regulatory regime or one that can be reasonably expected.

Emission of Greenhouse Gases

The Kyoto Protocol, ratified by the Government of Canada in December 2002 and effective as of February 16, 2005, requires signatory nations to reduce their emissions of carbon dioxide and other greenhouse gases. As a result, Petro-Canada may be required to reduce emissions of greenhouse gases from operations or to purchase emission-trading credits. While the details of implementation of the Kyoto Protocol in Canada have not been finalized, the impact on Petro-Canada could be higher capital expenditures and operating expenses. The Government of Canada may also impose higher vehicle fuel efficiency standards. The impact of this action could be to decrease the demand for gasoline and diesel fuels sold by Petro-Canada and depress the Company’s margins for refined products.

Petro-Canada is committed to reducing emissions. Additional detail will be available in the Company’s Report to the Community, which is expected to be released in the second quarter of 2006. The Report will be posted on www.petro-canada.ca. Through industry organizations, Petro-Canada continues to work with a number of regulatory groups and government associations to find a cost-effective approach which will minimize the negative financial impact of the Kyoto Protocol on the Company, while still reducing emissions. The level of influence these discussions and co-operative efforts have on the Government of Canada’s implementation plan may be quite limited.

Government Regulations

Petro-Canada’s operations are regulated by, and could be intervened upon by, a variety of governments around the world. Governments’ actions could impact the contracting of exploration and production interests, impose specific drilling obligations, and possibly expropriate or cancel contract rights. Governments may also regulate prices of commodities or refined products, or intervene through taxes, royalties and exploration rights.

Petro-Canada tries to mitigate the impact of government regulations by selecting operating environments with stable governments. To date, Petro-Canada has had a co-operative relationship with its regulators and the governments in the countries in which it operates. Most of the contact with regulators occurs through the Company’s management, regulatory affairs personnel in each business unit and a centralized corporate government relations department. Petro-Canada aims to have regular, constructive communication with regulators and governments so issues can be resolved in a mutually acceptable fashion. The Company also has a strong record of regulatory compliance within the jurisdictions where it operates. Petro-Canada operates in many different jurisdictions and derives revenue from several categories of products. This diversification makes financial performance less sensitive to the action of any single government. Nevertheless, Petro-Canada has limited ability to influence regulations which may have a material adverse effect on the Company.

Counterparties

In the normal course of business, Petro-Canada is exposed to credit risk resulting from the uncertainty of business partners’ or counterparties’ ability to fulfill their obligations. The Company has established internal credit policies and procedures that include financial assessments, exposure limits and processes to monitor and minimize the exposures against these limits. Where appropriate, Petro-Canada also uses netting and collateral arrangements to minimize risk.

OPERATIONAL RISKS

Exploring for, developing, producing, refining, transporting and marketing oil, natural gas and refined products involve significant operational hazards. These risks include well blowouts, fires, explosions, gaseous leaks, migration of harmful substances and oil spills. Any of these operational incidents could cause personal injury, environmental contamination, or damage and destruction of the Company’s assets. These incidents could also interrupt production.

Petro-Canada manages operational risks primarily through a Total Loss Management (TLM) system. TLM is an internally developed management system based on external “best practices” with standards for preventing operational incidents. Regular TLM audits test compliance with these standards.

The Company also purchases insurance to transfer the financial impact of some operational risks to high credit quality third-party insurers. Petro-Canada regularly evaluates its exposures related to operational risks and adjusts the nature of its coverage, including deductibles and limits. Although Petro-Canada maintains insurance in line with customary industry practices, the Company cannot and does not fully insure against all risks. Losses resulting from operational incidents could have a material adverse impact on the Company.

FOREIGN RISKS

Petro-Canada has significant operations in a number of countries that have varying political, economic and social systems. As a result, the Company’s operations and related assets are subject to potential risks of actions by governmental authorities, internal unrest, war, political disruption, economic and legal sanctions (such as restrictions against countries that the U.S. government may deem to sponsor terrorism), and changes in global trade policies. The Company’s operations may be restricted, disrupted or prohibited in any country in which these risks occur. Petro-Canada also has production in OPEC-member countries, which is constrained by OPEC quotas.

The Company continually evaluates exposure in any one country in the context of total operations. Investment may be limited to avoid excessive exposure in any one country or region. The Company also purchases political risk insurance to partially mitigate some political risks.

MARKET RISKS

More detailed quantification of the impact of some of the following risks can be found in the earnings sensitivities table on page four of the Business Environment section in the MD&A.

Commodity Prices

In Petro-Canada’s upstream businesses, significant market risk exposure exists due to changing commodity prices of crude oil and natural gas. Commodity prices are volatile and influenced by factors such as supply and demand fundamentals, geopolitical events, OPEC decisions and weather. In 2005, the monthly average Brent crude oil price ranged between $44.23 US/bbl and $64.12 US/bbl, and the AECO-C hub index ranged between $6.16 per gigajoule (GJ) and $12.08/GJ. These commodity prices also impact the refined products margins realized by the Downstream business, another significant market risk. In 2005, the benchmark monthly average New York Harbour 3-2-1 refinery crack spread per bbl ranged from $4.86 US/bbl to $21.74 US/bbl. Petro-Canada’s ability to maintain product margins in an environment of higher feedstock costs is contingent upon the Company’s ability to flow higher costs through to customers.

Petro-Canada generally does not hedge large volumes of production. Management believes commodity prices are volatile and difficult to predict. The business is managed so that the Company can substantially withstand the impact of a lower price environment, while maintaining the opportunity to capture significant upside when the price environment is higher. However, commodity prices and margins may be hedged occasionally to capture opportunities that represent extraordinary value and to ensure the economic value of an acquisition. For example, as part of the Company’s acquisition of an interest in the Buzzard field in the U.K. sector of the North Sea, the Company entered into a series of derivative contracts related to the future sale of Brent crude oil (see Derivative Instruments below). Certain Downstream physical transactions are routinely hedged for operational needs and to facilitate sales to customers.

Foreign Exchange

As energy commodity prices are primarily priced in U.S. dollars, a large portion of Petro-Canada’s revenue stream is affected by the Canada/U.S. exchange rate. As a result, the Company’s earnings are negatively affected by a strengthening Canadian dollar. The Company is also exposed to fluctuations in other foreign currencies, such as the euro and the British pound. Generally, Petro-Canada does not hedge foreign exchange exposures, although the Company partially mitigates the U.S. dollar exposure by denominating the majority of its debt obligations in U.S. dollars. Foreign exchange exposure related to asset acquisitions or divestitures, or project capital expenditures, may be hedged on a case-by-case basis.

Interest Rates

Petro-Canada targets a blend of fixed and floating rate debt. Generally, this strategy enables the Company to take advantage of lower interest rates on floating debt, while matching overall debt maturities with the life of cash-generating assets. The Company is exposed to fluctuations in the rate of interest it pays on floating rate debt. This interest rate exposure is within the Company’s risk tolerance.

Derivative Instruments

Petro-Canada’s Market Risk and Derivative Policy prohibits the use of derivative instruments for speculative purposes. Petro-Canada instead uses derivatives primarily to hedge physical transactions for operational needs and to facilitate sales to customers. The gains and losses associated with these financial instruments essentially offset gains and losses on the physical transactions. Except as specifically authorized by the Board of Directors, the term of hedging instruments cannot exceed 18 months. Monitoring and reporting of the derivatives portfolio includes periodic testing of the fair value of all outstanding derivatives. Fair values are determined by obtaining independent third-party quotes for the value of each derivative instrument. The objectives and strategies of all hedge transactions are documented and the effectiveness of the derivative instrument in offsetting a change in the value of the hedged exposure is assessed on a regular basis.

Effective January 1, 2004, the Company elected to discontinue hedge accounting for certain hedging programs. All derivatives that do not qualify as a hedge, or are not designated as a hedge, are accounted for using the mark-to-market accounting method. These derivatives are recorded in the balance sheet as either an asset or liability, with the fair value recognized in earnings in each reporting period. As a result, the realized and unrealized values of these transactions are recognized in Investment and Other Income.

During 2004, as part of the Company’s acquisition of an interest in the Buzzard field, the Company entered into a series of derivative contracts related to the future sale of Brent crude oil. The purpose of these transactions was to ensure value-added returns to Petro-Canada on this investment, even in the event of a material decrease in oil prices. These contracts effectively lock in an average forward price of approximately $26 US/bbl on a volume of 35,840,000 barrels. This volume represents approximately 50% of the Company’s share of estimated plateau production in the 2007-2010 time frame. As at December 31, 2005, this hedge had a mark-to-market unrealized loss of $767 million after-tax, of which $562 million was recognized in the income statement in 2005.

In 2005, other derivative instruments in place for refining supply and product purchases resulted in an increase in net earnings from continuing operations of about $4 million after-tax. This result compared with a decrease in net earnings from continuing operations of about $1 million in 2004.

CONSOLIDATED FINANCIAL RESULTS

ANALYSIS OF CONSOLIDATED EARNINGS AND CASH FLOW

Consolidated Financial Results

In 2005, Petro-Canada reached an agreement to sell the Company’s producing assets in Syria. The sale was closed on January 31, 2006. These assets and associated results are reported as discontinued operations and are excluded from continuing operations.

(millions of dollars, unless otherwise indicated) | | 2005 | | 2004 | | 2003 | |

Net earnings | | $ | 1,791 | | $ | 1,757 | | $ | 1,650 | |

| Net earnings from discontinued operations | | | 98 | | | 59 | | | 115 | |

Net earnings from continuing operations | | $ | 1,693 | | $ | 1,698 | | $ | 1,535 | |

Gain on foreign currency translation 1 | | | 73 | | | 63 | | | 239 | |

Unrealized loss on Buzzard derivative contracts 2 | | | (562 | ) | | (205 | ) | | - | |

| Gain on sale of assets | | | 34 | | | 11 | | | 29 | |

Operating earnings from continuing operations 3, 4 | | $ | 2,148 | | $ | 1,829 | | $ | 1,267 | |

| Stock-based compensation | | | (66 | ) | | (11 | ) | | (13 | ) |

Insurance premium surcharges 5 | | | (77 | ) | | - | | | - | |

| Income tax adjustments | | | 22 | | | 13 | | | 45 | |

| Oakville closure costs | | | 2 | | | (46 | ) | | (151 | ) |

| Terra Nova insurance proceeds | | | 2 | | | 31 | | | 17 | |

| Edmonton refinery conversion provision | | | - | | | - | | | (82 | ) |

| Kazakhstan impairment | | | - | | | - | | | (46 | ) |

| International provisions | | | - | | | - | | | 45 | |

Operating earnings from continuing operations adjusted for unusual items | | $ | 2,265 | | $ | 1,842 | | $ | 1,452 | |

Earnings per share from continuing operations (dollars) | | | | | | | | | | |

| - basic | | $ | 3.27 | | $ | 3.21 | | $ | 2.90 | |

| | | 3.22 | | | 3.17 | | | 2.87 | |

Earnings per share (dollars) | | | | | | | | | | |

| - basic | | $ | 3.45 | | $ | 3.32 | | $ | 3.11 | |

| - diluted | | | 3.41 | | | 3.28 | | | 3.08 | |

Cash flow from continuing operating activities before changes in non-cash working capital 4, 6 | | | 3,787 | | | 3,425 | | | 3,042 | |

Cash flow from continuing operating activities before changes in non-cash working capital per share (dollars) | | | 7.31 | | | 6.47 | | | 5.74 | |

| Debt | | | 2,913 | | | 2,580 | | | 2,229 | |

Cash and cash equivalents 7 | | | 789 | | | 170 | | | 635 | |

Average capital employed 7 | | $ | 11,860 | | $ | 10,533 | | $ | 9,268 | |

Return on capital employed (%) 7 | | | 16.0 | | | 17.5 | | | 19.0 | |

Operating return on capital employed (%) 7 | | | 19.8 | | | 18.8 | | | 16.1 | |

Return on equity (%) 7 | | | 19.7 | | | 21.5 | | | 24.9 | |

1 Foreign currency translation reflects gains or losses on U.S. dollar denominated long-term debt not associated with the self-sustaining International business unit and the U.S. Rockies operations included in the North American Natural Gas business unit.

2 As part of its acquisition of an interest in the Buzzard field in the U.K. sector of the North Sea in June 2004, the Company entered into derivative contracts for half of its share of estimated production for the first 3 ½ years. Unrealized mark-to-market losses are recorded each quarter because these transactions do not currently qualify for hedge accounting.

3 Operating earnings, which represent net earnings excluding gains or losses on foreign currency translation and on disposal of assets and the unrealized gains or losses associated with the Buzzard derivative contracts, is used by the Company to evaluate operating performance.

4 Operating earnings and cash flow do not have any standardized meaning prescribed by Canadian GAAP and, therefore, may not be comparable with the calculation of similar measures for other companies.

5 Insurance premium surcharges include accruals and surcharges for Oil Insurance Ltd. (OIL) and sEnergy Insurance Ltd. (sEnergy) policies. OIL is a mutual insurance company that insures against property damage in the energy sector. sEnergy is a mutual insurance company that provides business interruption and excess property insurance to the energy sector.

6 Cash flow, which is expressed before changes in non-cash working capital items relating to operating activities, is used by the Company to analyse operating performance, leverage and liquidity.

7 Includes discontinued operations.

2005 COMPARED WITH 2004

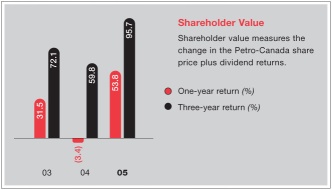

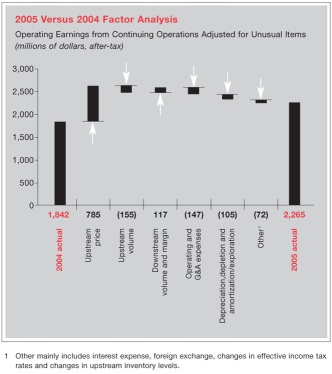

Operating earnings from continuing operations adjusted for unusual items rose 23% to $2,265 million in 2005, compared with $1,842 million in 2004. Higher realized commodity prices and Downstream margins were partially offset by lower upstream volumes, higher operating and exploration costs, and a stronger Canadian dollar.

In 2005, operating earnings from continuing operations included a number of unusual items: a $77 million insurance premium surcharge; a $66 million charge related to the mark-to-market of stock-based compensation; a $22 million positive adjustment related to income tax rate and other tax adjustments; a $2 million recovery related to the consolidation of the Eastern Canada refinery operations; and $2 million of insurance proceeds due to the delayed startup of Terra Nova. The insurance premium surcharge is reflected in operating costs and represents the Company’s share of anticipated payments to OIL and sEnergy related in part to hurricanes Katrina and Rita.

In 2004, operating earnings from continuing operations included a number of unusual items: a $46 million charge for additional depreciation and other charges related to the consolidation of Eastern Canada refinery operations and the closure of the Oakville refinery; $31 million of insurance proceeds due to the delayed startup of Terra Nova; a $13 million positive adjustment to future income taxes reflecting announced changes to Canadian provincial income tax rates; and a $11 million charge related to the mark-to-market of stock-based compensation.

Net earnings from continuing operations in 2005 were $1,693 million, down slightly from $1,698 million in 2004 primarily due to unrealized losses on Buzzard derivative contracts. Net earnings from continuing operations included gains or losses on foreign currency translation, unrealized losses on Buzzard derivative contracts and gains on asset sales.

QUARTERLY INFORMATION

Consolidated Quarterly Financial Results

(millions of dollars, unless otherwise indicated) | | 2005 | | 2004 | |

| | | | Quarter 1 | | | Quarter 2 | | | Quarter 3 | | | Quarter 4 | | | Quarter 1 | | | Quarter 2 | | | Quarter 3 | | | Quarter 4 | |

| Total revenue from continuing operations | | $ | 3,275 | | $ | 3,945 | | $ | 4,721 | | $ | 4,838 | | $ | 3,365 | | $ | 3,455 | | $ | 3,515 | | $ | 3,623 | |

| Operating earnings from continuing operations | | | 427 | | | 476 | | | 597 | | | 648 | | | 500 | | | 453 | | | 444 | | | 432 | |

| Net earnings from continuing operations | | | 110 | | | 322 | | | 593 | | | 668 | | | 496 | | | 375 | | | 393 | | | 434 | |

| Cash flow from continuing operating activities before changes in non-cash working capital | | | 801 | | | 869 | | | 1,001 | | | 1,116 | | | 840 | | | 801 | | | 818 | | | 966 | |

Earnings per share from continuing operations (dollars) | | | | | | | | | | | | | | | | | | | | | | | | | |

| - basic | | $ | 0.21 | | $ | 0.62 | | $ | 1.14 | | $ | 1.29 | | $ | 0.93 | | $ | 0.70 | | $ | 0.74 | | $ | 0.83 | |

| - diluted | | $ | 0.21 | | $ | 0.61 | | $ | 1.13 | | $ | 1.28 | | $ | 0.92 | | $ | 0.70 | | $ | 0.73 | | $ | 0.82 | |

Earnings per share (dollars) | | | | | | | | | | | | | | | | | | | | | | | | | |

| - basic | | $ | 0.23 | | $ | 0.66 | | $ | 1.19 | | $ | 1.38 | | $ | 0.96 | | $ | 0.74 | | $ | 0.77 | | $ | 0.85 | |

| - diluted | | $ | 0.22 | | $ | 0.66 | | $ | 1.17 | | $ | 1.36 | | $ | 0.95 | | $ | 0.73 | | $ | 0.76 | | $ | 0.83 | |

Revenue and net earnings variances from quarter to quarter resulted mainly from: fluctuations in commodity prices and refinery cracking margins; the impact on production and processed volumes from maintenance and other shutdowns at major facilities; and the level of exploration drilling activity. For further analysis of quarterly results, refer to Petro-Canada’s Quarterly Reports to shareholders available on the Company’s Web site at www.petro-canada.ca.

LIQUIDITY AND CAPITAL RESOURCES

Summary of Cash Flows

(millions of dollars) | | 2005 | | 2004 | | 2003 | |

Cash flow from continuing operating activities | | $ | 3,783 | | $ | 3,928 | | $ | 2,896 | |

| Increase (decrease) in non-cash working capital related to continuing operating activities and other | | | 4 | | | (503 | ) | | 146 | |

Cash flow from continuing operations | | $ | 3,787 | | $ | 3,425 | | $ | 3,042 | |

| Cash flow from discontinued operations | | | 245 | | | 204 | | | 247 | |

Cash flow | | | 4,032 | | | 3,629 | | | 3,289 | |

| Net cash inflows (outflows) from: | | | | | | | | | | |

Investing activities before changes in non-cash working capital | | | (3,595 | ) | | (4,591 | ) | | (2,214 | ) |

Financing activities before changes in non-cash working capital | | | (10 | ) | | (19 | ) | | (604 | ) |

| (Increase) decrease in non-cash working capital | | | 192 | | | 516 | | | (70 | ) |

| Increase (decrease) in cash and cash equivalents | | $ | 619 | | $ | (465 | ) | $ | 401 | |

Cash and cash equivalents at end of year | | $ | 789 | | $ | 170 | | $ | 635 | |

Cash and cash equivalents - discontinued operations | | $ | 68 | | $ | 206 | | $ | 227 | |

In 2005, cash flow from continuing operations was $3,787 million ($7.31/share), compared with $3,425 million ($6.47/share) in 2004. The increase in cash flow reflected higher operating earnings from continuing operations.

Financial Ratios

| | | 2005 | | 2004 | | 2003 | |

Interest coverage from continuing operations (times) | | | | | | | | | | |

Net earnings basis | | | 17.9 | | | 20.0 | | | 15.4 | |

EBITDAX basis | | | 25.4 | | | 29.2 | | | 24.4 | |

Cash flow basis | | | 28.9 | | | 30.4 | | | 23.0 | |

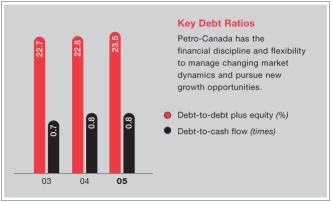

Debt-to-cash flow (times) 1 | | | 0.8 | | | 0.8 | | | 0.7 | |

Debt-to-debt plus equity (%) | | | 23.5 | | | 22.8 | | | 22.7 | |

1 From continuing operations.

Petro-Canada’s financing strategy ensures financial discipline and flexibility to support profitable growth in all business environments. Two key measures that Petro-Canada uses to measure the Company’s overall financial strength are debt-to-cash flow and debt-to-debt plus equity. Petro-Canada’s debt-to-cash flow from continuing operations ratio, the key short-term measure, was 0.8 times at December 31, 2005 and 2004. This was within the Company’s target range of no more than 2.0 times. Debt-to-debt plus equity, the long-term measure for capital structure, was 23.5% at year-end 2005, up from 22.8% at year-end 2004. This was slightly below the target range of 25% to 35% for both years. Petro-Canada has controls in place to ensure compliance with all financial covenants.

OPERATING ACTIVITIES

Excluding cash and cash equivalents, short-term notes payable and the current portion of long-term debt, the operating working capital deficiency including discontinued operations was $656 million as at December 31, 2005, compared with an operating working capital deficiency of $777 million as at December 31, 2004. The working capital deficiency was lower primarily due to an increase in accounts receivable, which was partially offset by an increase in current payables.

INVESTING ACTIVITIES

Capital and Exploration Expenditures

(millions of dollars) | | 2006 Outlook 1 | | 2005 | | 2004 | | 2003 | |

Upstream | | | | | | | | | | | | | |

| North American Natural Gas | | $ | 850 | | $ | 713 | | $ | 666 | | $ | 517 | |

| East Coast Oil | | | 305 | | | 314 | | | 275 | | | 344 | |

| Oil Sands | | | 355 | | | 772 | | | 397 | | | 443 | |

International 2 | | | 815 | | | 696 | | | 1,707 | 3 | | 400 | |

| | | $ | 2,325 | | $ | 2,495 | | $ | 3,045 | | $ | 1,704 | |

Downstream | | | | | | | | | | | | | |

| Refining and Supply | | $ | 840 | | $ | 883 | | $ | 656 | | $ | 296 | |

| Sales and Marketing | | | 150 | | | 108 | | | 171 | | | 117 | |

| Lubricants | | | 40 | | | 62 | | | 12 | | | 11 | |

| | | $ | 1,030 | | $ | 1,053 | | $ | 839 | | $ | 424 | |

Shared Services | | $ | 30 | | $ | 12 | | $ | 9 | | $ | 14 | |

Total property, plant and equipment and exploration | | $ | 3,385 | | $ | 3,560 | | $ | 3,893 | | $ | 2,142 | |

| Deferred charges and other assets | | | - | | | 70 | | | 36 | | | 147 | |

| Acquisition of Prima Energy Corporation | | | - | | | - | | | 644 | | | - | |

Total continuing operations | | $ | 3,385 | | $ | 3,630 | | $ | 4,573 | | $ | 2,289 | |

| Discontinued operations | | $ | 50 | | $ | 46 | | $ | 62 | | $ | 90 | |

Total | | $ | 3,435 | | $ | 3,676 | | $ | 4,635 | | $ | 2,379 | |

1 The 2006 outlook was previously released on December 15, 2005, with the exception of the separation of discontinued operations.

2 International excludes capital expenditures related to the Syrian producing assets, which are reflected as discontinued operations.

3 Includes $1,218 million for the Buzzard acquisition.

Capital and exploration expenditures were down 21% from $4,635 million in 2004 to $3,676 million in 2005, reflecting higher investment in existing long-life assets compared with 2004.

In 2006, it is planned that over 85% of the capital program for continuing operations will support delivering profitable growth and improving base business profitability. The remainder is expected to be directed toward complying with regulations and enhancing existing assets. This portion of the program was larger in 2005, primarily due to investments to produce clean-burning fuels in the Downstream business.

FINANCING ACTIVITIES AND DIVIDENDS

Sources of Capital Employed

(millions of dollars) | | 2005 | | 2004 | | 2003 | |

| Short-term notes payable | | $ | - | | $ | 299 | | $ | - | |

| Long-term debt, including current portion | | | 2,913 | | | 2,281 | | | 2,229 | |

| Shareholders’ equity | | | 9,488 | | | 8,739 | | | 7,588 | |

Total | | $ | 12,401 | | $ | 11,319 | | $ | 9,817 | |

Total debt increased to $2,913 million as at December 31, 2005, compared with $2,580 million at the previous year end. The increase in debt was associated with the issue of senior notes offset by repayment of short-term notes and a stronger Canadian dollar. There were no short-term notes payable outstanding as at December 31, 2005. Short-term notes payable as at December 31, 2004 consisted of $299 million of commercial paper.

2005 Financing Activities

During the second quarter, Petro-Canada completed a $600 million US offering of 5.95% 30-year senior notes. Net proceeds were used to repay existing short-term borrowing, with the balance used for working capital purposes. Under the accounts receivable securitization program, an additional $80 million in accounts receivable were sold in March 2005. Proceeds were used to repay short-term borrowing.

During the fourth quarter, Petro-Canada increased its syndicated committed credit facilities to $2,000 million from $1,500 million. As at December 31, 2005, the Company also had bilateral demand credit facilities of $408 million. A total of $1,141 million of the credit facilities were used for letters of credit and overdraft coverage as at December 31, 2005. The syndicated facilities also provide liquidity support to Petro-Canada’s commercial paper program. No commercial paper was outstanding at year-end 2005. The Company will continue to use its cash position, draw on bank lines and issue commercial paper as necessary to meet working capital and other financing requirements. Petro-Canada plans to meet remaining debt repayment commitments out of a combination of cash flow and debt refinancing.

The Company’s unsecured long-term debt securities are rated Baa2 by Moody’s Investor Services, BBB by Standard & Poor’s and A (low) by Dominion Bond Rating Service. The Company’s long-term debt ratings remained unchanged from year-end 2004.

In July 2005, the Company effected a two for one stock-split in the form of a stock dividend.

Returning Cash to Shareholders

Petro-Canada’s priority uses of cash are to fund the capital program and profitable growth opportunities, and to return cash to shareholders through dividends and a share buyback program.

Petro-Canada regularly reviews its dividend strategy to ensure the alignment of the dividend policy with shareholder expectations, and financial and growth objectives. Commencing with the fourth quarter dividend paid on October 1, 2005, the Company increased the quarterly dividend 33% to $0.20/share on a pre-stock dividend basis ($0.10/share on a post-stock dividend basis). Total dividends paid in 2005 were $181 million, compared with $159 million in 2004.

In 2004, Petro-Canada initiated a Normal Course Issuer Bid (NCIB) program, which was renewed in 2005. The current program, which extends to June 21, 2006, entitles the Company to purchase up to 5% of the outstanding common shares, subject to certain conditions. The majority of the proceeds from the sale of the mature Syrian producing assets, which closed in January 2006, are expected to be used to buy back shares under the NCIB program.

| Period | | Shares Repurchased 1 | | Average Price | | Total Cost | |

| | | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | |

| Full year | | | 8,333,400 | | | 13,736,164 | | $ | 41.54 | | $ | 32.51 | | $ | 346 million | | $ | 447 million | |

| 1 | Stated on a post-stock dividend basis. |

Off Balance Sheet

The Company has certain retail licensee agreements that qualify as variable interest entities as described in Note 26 to the Consolidated Financial Statements. These entities are not consolidated as Petro-Canada is not the primary beneficiary and the Company’s maximum exposure to losses from these arrangements would not be material. Other off balance sheet activities are limited to matters such as the accounts receivable securitization program, which does not meet the criteria for consolidation and guarantees.

Pension Plans

At year-end 2005, Petro-Canada’s defined benefit pension plans were underfunded by $378 million, compared to an underfunded position of $330 million at year-end 2004. The Company made cash contributions of $112 million and recorded a pension expense of $78 million before-tax in 2005. This compares with $93 million of cash contributions and $71 million of pension expense in 2004. Pension contributions of approximately $107 million are expected to be made in 2006.

Contractual Obligations - Summary

(millions of dollars)

| | | PAYMENTS DUE BY PERIOD | |

| | | Total | | 2006 | | 2007-2008 | | 2009-2010 | | 2011 and thereafter | |

Unsecured debentures and senior notes 1 | | $ | 6,439 | | $ | 175 | | $ | 351 | | $ | 351 | | $ | 5,562 | |

Capital lease obligations 1 | | | 158 | | | 17 | | | 25 | | | 22 | | | 94 | |

| Operating leases | | | 678 | | | 137 | | | 201 | | | 144 | | | 196 | |

| Transportation agreements | | | 1,719 | | | 200 | | | 319 | | | 257 | | | 943 | |

Product purchase/delivery obligations 2 | | | 2,103 | | | 115 | | | 245 | | | 249 | | | 1,494 | |

Exploration work commitments 3 | | | 162 | | | 52 | | | 49 | | | 60 | | | 1 | |

| Asset retirement obligations | | | 2,839 | | | 77 | | | 82 | | | 77 | | | 2,603 | |

Other long-term obligations 4, 5 | | | 2,567 | | | 126 | | | 207 | | | 965 | | | 1,269 | |

| Total contractual obligations | | $ | 16,665 | | $ | 899 | | $ | 1,479 | | $ | 2,125 | | $ | 12,162 | |

1 Obligations include related interest. For further details, see Note 18 to the 2005 Consolidated Financial Statements.

2 Excludes supply purchase agreements contracted at market prices, where the products could reasonably be re-sold into the market.

3 Excludes other amounts related to the Company’s expected future capital spending. Capital spending plans are reviewed and revised annually to reflect Petro-Canada’s strategy,

operating performance and economic conditions. For further information regarding future capital spending plans, refer to the business segment and investing activities discussions in

the sections of the 2005 MD&A.

4 Includes processing agreement with Suncor Energy Inc., receivables securitization program, pension funding obligations for the periods prior to the Company’s next required pension

plan valuation, and other obligations. Pension obligations beyond the next required pension valuation date were excluded due to the uncertainty as to the amount or timing of these

obligations.

5 Petro-Canada is involved in litigation and claims associated with normal operations. Management is of the opinion that any resulting settlements would not materially affect the

financial position of the Company. The table excludes amounts for these contingencies due to the uncertainty as to the amount or timing of any settlements.

During 2005, Petro-Canada’s total contractual obligations increased by approximately $3.3 billion, mainly due to the issuance of long-term debt, an increase in the estimate of asset retirement obligations, additional commitments for pipeline transportation, additional product purchase obligations and new commitments related to the Fort Hills project.

UPSTREAM

Petro-Canada’s upstream operations consist of four business segments: North American Natural Gas, with current production in Western Canada and the U.S. Rockies; East Coast Oil, with three major developments offshore Newfoundland and Labrador; Oil Sands operations in northeastern Alberta; and International, where the Company is active in three core areas: Northwest Europe; North Africa/Near East; and Northern Latin America. The diverse asset base provides a balanced portfolio and a platform for long-term growth.

NORTH AMERICAN NATURAL GAS

Business Summary And Strategy

North American Natural Gas explores for and produces natural gas, crude oil and natural gas liquids (NGL) in Western Canada and the U.S. Rockies. This business also markets natural gas in North America, has established resources in the Mackenzie Delta/Corridor and has landholdings in Alaska.

The North American Natural Gas strategy is to be a significant and sustainable market participant by accessing new and diverse natural gas supply sources in North America. Key features of the strategy include:

| • | transitioning further into unconventional gas plays; |

| • | optimizing core properties in Western Canada and developing coal bed methane and tight gas in the U.S. Rockies; |

| • | stepping out of traditional operating areas, with an increased focus on exploration; |

| • | developing LNG import capacity at Gros-Cacouna, Quebec; and |

| • | building the northern resource base for long-term growth. |

North American Natural Gas Financial Results

(millions of dollars) | | 2005 | | 2004 | | 2003 | |

Net earnings | | $ | 674 | | $ | 500 | | $ | 492 | |

| Gain on sale of assets | | | 14 | | | - | | | 33 | |

Operating earnings | | $ | 660 | | $ | 500 | | $ | 459 | |

| Insurance premium surcharges | | | (4 | ) | | - | | | - | |

| Income tax adjustments | | | 28 | | | 7 | | | 10 | |

Operating earnings adjusted for unusual items | | $ | 636 | | $ | 493 | | $ | 449 | |

| Cash flow from operating activities before changes in non-cash working capital | | $ | 1,193 | | $ | 882 | | $ | 942 | |

| Expenditures on property, plant and equipment and exploration | | $ | 713 | | $ | 666 | | $ | 517 | |

| Total assets | | $ | 3,763 | | $ | 3,477 | | $ | 2,341 | |

2005 Compared With 2004

North American Natural Gas contributed $636 million of operating earnings adjusted for unusual items, up 29% from $493 million in 2004. Strong realized natural gas prices and the addition of U.S. Rockies production were partially offset by Western Canada production declines, increased operating costs, and higher depreciation, depletion and amortization.

Net earnings for North American Natural Gas were $674 million in 2005, up from $500 million in 2004. Net earnings in 2005 included a $14 million gain on the sale of assets, a $4 million insurance premium surcharge and a $28 million positive adjustment to income tax rate and other tax adjustments. Net earnings in 2004 included a $7 million positive adjustment to reflect a reduction in provincial income tax rates.

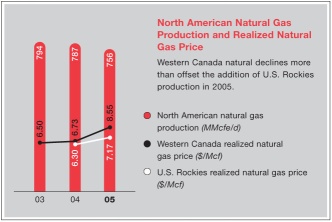

Oil and natural gas production averaged 756 million cubic feet/day of natural gas equivalent (MMcfe/d) in 2005, down from 787 MMcfe/d in 2004 as natural declines in Western Canada more than offset the addition of U.S. Rockies production. Natural gas commodity prices rose in 2005. The North American realized natural gas price averaged $8.47/Mcf in 2005, up 26% from $6.72/Mcf in 2004.

2005 Operating Review And Strategic Initiatives

The North American Natural Gas business is positioning for the future with an increased focus on unconventional gas plays, acquisition of land in the Far North and progress on the proposed Quebec LNG project.

2005 Operating Review

| | | 2005 | | 2004 | | 2003 | |

Production (MMcfe/d) | | | 756 | | | 787 | | | 794 | |

Western Canada realized natural gas price ($/Mcf) | | $ | 8.55 | | $ | 6.73 | | $ | 6.50 | |

U.S. Rockies realized natural gas price ($/Mcf) | | $ | 7.17 | | $ | 6.30 | | $ | - | |

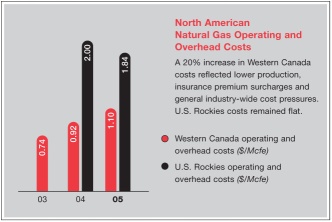

Western Canada operating and overhead costs ($/Mcfe) | | $ | 1.10 | | $ | 0.92 | | $ | 0.74 | |

U.S. Rockies operating and overhead costs ($/Mcfe) | | $ | 1.84 | | $ | 2.00 | | $ | - | |

Western Canada

Western Canada natural gas production averaged 704 MMcfe/d in 2005, down 8% from 764 MMcfe/d in 2004. Exploration and development drilling activity in Western Canada resulted in 373 gross successful wells, for an overall success rate of 94% in 2005. Western Canada operating and overhead costs were $1.10/Mcfe in 2005, up from $0.92/Mcfe in the previous year. The operating and overhead cost increase in Western Canada reflected lower production, insurance premium surcharges and general industry-wide cost pressures for materials, fuel and labour. The Company’s cost increases reflect industry-wide operating cost trends which have been rising approximately 15% per year.

U.S. Rockies

U.S. Rockies natural gas production averaged 52 MMcfe/d in 2005, compared to 23 MMcfe/d in 2004, which reflected the mid-year 2004 acquisition. Exploration and development drilling activity in the U.S. Rockies resulted in more than 300 development wells in 2005, up from 148 wells in 2004. In addition, Petro-Canada obtained 407 permits for new coal bed methane wells in 2005, with 292 applications submitted for consideration. Most of the new wells are currently in the de-watering phase. U.S. Rockies operating and overhead costs were $1.84/Mcfe in 2005, compared to $2.00/Mcfe in 2004.

2005 Strategic Initiatives

Petro-Canada advanced the proposed LNG import and re-gasification terminal at Gros-Cacouna, Quebec, by filing the Environmental Impact Statement in the second quarter of 2005.

During 2005, the Company continued to position itself for long-term North American supply by building its land position in the Mackenzie Corridor and by acquiring extensive acreage in Alaska in preparation for the proposed pipelines. Early in 2005, Petro-Canada and Anadarko Petroleum Corporation entered into a joint venture arrangement in the gas prospective North Slope region of the Brooks Range in Alaska. The two companies increased their joint land position to 2.5 million acres. In January 2006, BG (Alaska) E&P, Inc. joined the Foothills joint venture and each company now holds a one-third interest in the acreage. In the Mackenzie Corridor, Petro-Canada acquired two exploration licences covering 410,000 acres, with work commitment bids totalling approximately $35 million.

Capital expenditures in 2005 totalled $713 million, with $618 million for exploration and development of natural gas in Western Canada, $84 million for U.S. Rockies development and $11 million for other natural gas opportunities in North America.

Outlook

Production expectations in 2006:

| - | production to average about 720 MMcfe/d of natural gas, crude oil and NGL; and |

| - | unconventional gas production is expected to be about 25% of production. |

Action plans in 2006:

| - | drill approximately 500 gross wells in Western Canada and approximately 450 gross wells in the U.S. Rockies; |

| - | advance long-term opportunities in Northern Canada and Alaska; and |

| - | advance the re-gasification project at Gros-Cacouna to a project decision point. |

Capital spending plans in 2006:

| - | approximately $440 million for replacing reserves in Western Canada core areas; |

| - | approximately $150 million for new growth opportunities in the U.S. Rockies and LNG; |

| - | approximately $235 million directed to exploration in Western Canada, the U.S. Rockies and the Far North; and |

| - | approximately $25 million for environmental work and maintenance. |

The shift to longer-term projects, as well as declines in Western Canada, is expected to result in approximately a 5% drop in production in 2006, compared to 2005. Production is expected to increase in subsequent years as more capital is directed to bring on production from unconventional sources. In 2006, almost half of the North American Natural Gas capital spending program is expected to go to development of unconventional sources, including U.S. Rockies coal bed methane and deep tight gas, infill drilling in the Medicine Hat area and Western Canada tight sands. At the same time, the business is expected to step out of traditional operating areas with an increased focus on exploration.

The Company will also continue to advance long-term supply opportunities. A modest exploration program and land acquisition plan is expected in the Alaska and the Mackenzie Corridor until such time as pipeline timing becomes clear. As well, Petro-Canada is expected to continue to advance the Gros-Cacouna LNG project. The Company, along with its partner, TransCanada PipeLines Limited, is aiming to secure regulatory approval by late 2006. A joint provincial and federal government hearing is scheduled in 2006 and pre-construction engineering is proceeding in anticipation of regulatory approvals to allow for timely construction startup. The project continues to plan for a scheduled startup in late 2009.

Over the long term, the North American Natural Gas business strategy is to secure new supply for the North American market. The Company is transitioning current production from conventional sources to unconventional sources; building reserves and land position in the Mackenzie Delta/Corridor and Alaska; and progressing LNG through the re-gasification facility partnership in Quebec. The business intends to grow production from unconventional sources to 50% of production by 2010.

Link to Petro-Canada’s Corporate and Strategic Priorities

The North American Natural Gas business is aligned with Petro-Canada’s strategic priorities as outlined by its progress in 2005 and goals for 2006.

| 2005 PROGRESS | 2006 GOALS |

DELIVERING PROFITABLE GROWTH WITH A FOCUS ON OPERATED, LONG-LIFE ASSETS | § drilled 100 gross wells in Western Canada and 290 wells in the Western Canada Medicine Hat region1; § drilled 310 wells, added 37,000 net acres of land and obtained 407 permits for new coal bed methane wells in the U.S. Rockies; § filed regulatory application for the LNG facility at Gros-Cacouna; and § increased joint land position with partner in Alaska to 2.5 million acres and acquired 410,000 acres in the Mackenzie Corridor. | § create a stronger exploration focus; § expand growth of unconventional gas plays to about 25% of production; § optimize core asset concentric opportunities; and § advance exploration prospects in the Mackenzie Delta/Corridor and Alaska. |

DRIVING FOR FIRST QUARTILE OPERATION OF OUR ASSETS | § achieved better than 98% reliability at Western Canada facilities; and § conducted major turnarounds at Wildcat Hills, Wilson Creek and Gilby gas plants, with no lost-time incidents. | § achieve reliability rate approaching 99%; § conduct major turnaround of the Hanlan gas plant; and § continue to leverage costs through strategic alliances and preferred suppliers. |

CONTINUING TO WORK AT BEING A RESPONSIBLE COMPANY | § saw 44% increase in total recordable injury frequency compared to 2004. While contractor injury frequency improved, an upswing in employee injuries had a negative effect; § continued to reduce injury severity; § improved employee and contractor safety culture through the initial phase of behaviour-based safety programs; § proactively remediated and reclaimed old sites; and § saw slight increase in regulatory compliance exceedances compared to 2004. | § reduce total recordable injury frequency and regulatory exceedances; § continue safety culture improvements by rolling out the next phase of behaviour-based safety for employees and contractors; § drive for continuous improvement in contractor safety performance; § develop and implement stakeholder relations strategy; and § proactively remediate and reclaim old sites on a risked basis. |

| 1 | Only includes wells where Petro-Canada has a working interest. |

EAST COAST OIL

Business Summary and Strategy

Petro-Canada is positioned in every major oil development off Canada’s East Coast. The Company is the operator and holds the largest interest in Terra Nova (34%), as well as a 20% interest in nearby Hibernia and a 27.5% interest in White Rose.

The East Coast Oil strategy is to improve reliability and sustain profitable production well into the next decade. Key features of the strategy include:

| • | delivering top quartile safety and operating performance; |

| • | sustaining profitable production through reservoir extensions and add-ons; and |

| • | pursuing high potential development projects. |

East Coast Oil Financial Results

(millions of dollars) | | 2005 | | 2004 | | 2003 | |

Net earnings and operating earnings | | $ | 775 | | $ | 711 | | $ | 597 | |

| Insurance premium surcharges | | | (25 | ) | | - | | | - | |

| Income tax adjustments | | | (2 | ) | | 3 | | | 7 | |

| Terra Nova insurance proceeds | | | 2 | | | 31 | | | 17 | |

Operating earnings adjusted for unusual items | | $ | 800 | | $ | 677 | | $ | 573 | |

| Cash flow from operating activities before changes in non-cash working capital | | $ | 1,062 | | $ | 993 | | $ | 869 | |

| Expenditures on property, plant and equipment and exploration | | $ | 314 | | $ | 275 | | $ | 344 | |

| Total assets | | $ | 2,442 | | $ | 2,265 | | $ | 2,288 | |

2005 Compared With 2004

East Coast Oil contributed $800 million of operating earnings adjusted for unusual items, up 18% from $677 million in 2004. Strong realized prices were partially offset by lower production and increased operating costs.

Net earnings for East Coast Oil were $775 million in 2005, up from $711 million in 2004. Net earnings in 2005 included a $25 million insurance premium surcharge, a $2 million charge reflecting changes in income tax rates and $2 million of insurance proceeds due to the delayed startup of Terra Nova. Net earnings in 2004 included a $3 million positive adjustment to reflect a reduction in provincial income tax rates and $31 million of insurance proceeds related to the delayed startup of Terra Nova.

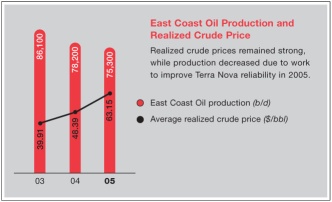

Realized crude prices remained strong, while production decreased due to work to improve Terra Nova reliability in 2005. East Coast Oil realized crude prices averaged $63.15/bbl in 2005, up from $48.39/bbl in 2004. Petro-Canada’s share of East Coast Oil production averaged 75,300 b/d in 2005, down from 78,200 b/d in 2004, mainly due to the 40-day planned turnaround at Terra Nova.

2005 Operating Review And Strategic Initiatives

White Rose achieved first oil and further improvements were made to Terra Nova’s reliability in 2005.

2005 Operating Review

| | | 2005 | | 2004 | | 2003 | |

Production (b/d) | | | | | | | | | | |

Hibernia | | | 39,800 | | | 40,800 | | | 40,600 | |

Terra Nova | | | 33,700 | | | 37,400 | | | 45,500 | |

White Rose | | | 1,800 | | | - | | | - | |

Average realized crude price ($/bbl) | | $ | 63.15 | | $ | 48.39 | | $ | 39.91 | |

Operating and overhead costs ($/bbl) | | $ | 4.52 | | $ | 2.89 | | $ | 2.88 | |

Petro-Canada’s share of Hibernia’s production averaged 39,800 b/d in 2005, down slightly from 40,800 b/d in 2004. The Hibernia platform continued to operate at first quartile levels during 2005, with slightly lower production reflecting normal reservoir decline rates.

At Terra Nova, the Company’s share of production averaged 33,700 b/d, down from 37,400 b/d in 2004. During the fourth quarter of 2005, Petro-Canada successfully completed a 40-day turnaround at Terra Nova. The turnaround included regulatory inspections on equipment and modifications to improve the reliability of the gas compression and injection systems. At the end of the turnaround, Terra Nova was operating at a 90% reliability rate. Royalty rates at Terra Nova increased in 2005 from 5% of gross revenues to a range of 27% to 29% of gross revenues in the fourth quarter of 2005. This increase reflected the provincial profit-sensitive royalty regime.

In November 2005, White Rose achieved first oil on budget and ahead of schedule. At year end, production rates averaged between 17,000 b/d to 19,000 b/d net to Petro-Canada.

East Coast Oil operating and overhead costs averaged $4.52/bbl in 2005, compared with $2.89/bbl in 2004. Operating costs for East Coast Oil have remained relatively flat, excluding insurance premium surcharges and startup costs for White Rose.

2005 Strategic Initiatives

Early in 2005, operator Chevron, Petro-Canada and the other joint venture participants signed a unitization and joint operating agreement to advance the joint evaluation of the Hebron, Ben Nevis and West Ben Nevis oilfields offshore Newfoundland and Labrador. Petro-Canada has a 23.9% interest in the development. These oilfields, collectively known as the Hebron development, are estimated to have total resources of approximately 580 million barrels (MMbbls) gross.

In 2005, the Canada-Newfoundland and Labrador Offshore Petroleum Board approved development of the Far East Block, an extension of the Terra Nova field.

Capital expenditures for exploration and development of crude oil offshore Canada’s East Coast were $314 million in 2005, including $167 million related to the development of the White Rose oilfield, $131 million for ongoing activities at Hibernia and Terra Nova, and $16 million for other East Coast Oil growth opportunities.

Outlook

Production expectations in 2006:

| - | East Coast Oil production is expected to average 94,000 b/d, reflecting a 70- to 90-day planned turnaround at Terra Nova and a 14-day planned turnaround at White Rose. |

Growth plans:

| - | achieve first quartile operating performance at Terra Nova; |

| - | continue development drilling of Terra Nova’s Far East Block; |

| - | delineation of the West White Rose Block at the White Rose field; and |

| - | achieve Hebron benefits agreement with Newfoundland and Labrador government and progress front-end engineering and design (FEED). |

Capital spending plans in 2006:

| - | approximately $275 million is expected to be spent on drilling to replace reserves at Hibernia, Terra Nova and White Rose, and on developing Terra Nova’s Far East Block; and |

| - | approximately $30 million is expected to fund growth opportunities such as the Hebron development, and exploration and new ventures. |