UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-04710 |

| |

| Exact name of registrant as specified in charter: | | The Asia Pacific Fund, Inc. |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | | 100 Mulberry Street, |

| | | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | | Gateway Center 3, |

| | | 100 Mulberry Street, |

| | | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 973-367-7521 |

| |

| Date of fiscal year end: | | 3/31/2006 |

| |

| Date of reporting period: | | 9/30/2005 |

Item 1 – Reports to Stockholders – [ INSERT REPORT ]

The Asia Pacific Fund, Inc.

As of September 30, 2005 (Unaudited)

OUR TOLL-FREE LINE:

1-888-4-ASIA-PAC

For further information on the Fund, please call. In addition, the Fund makes available monthly portfolio information. If you would like to receive this information please call the toll-free number indicated above.

Statistics

| | |

Total Net Assets | | $185,019,228 |

Shares Outstanding | | 10,344,073 |

Net Asset Value | | $17.89 |

Equity | | 98.0%(a) |

Repurchase Agreement | | 2.0%(a) |

Total Returns (US Dollar terms)

| | | | |

| Period | | Market

Price(b) | | NAV(c) |

3 months ended 9/30/05 | | 6.3% | | 7.2% |

6 months ended 9/30/05 | | 10.6% | | 7.6% |

9 months ended 9/30/05 | | 10.7% | | 10.3% |

1 Year ended 9/30/05 | | 21.9% | | 23.9% |

3 Years ended 9/30/05 | | 99.1% | | 86.8% |

5 Years ended 9/30/05 | | 89.6% | | 55.1% |

10 Years ended 9/30/05 | | 42.5% | | 42.1% |

Since inception(d) | | 327.7% | | 404.1% |

Since inception(d) (annualized) | | 8.2% | | 9.2% |

Other Information

| | |

Ticker Symbol | | APB |

Primary Exchange | | NYSE |

Dividend Repurchase Program | | Yes |

Footnote section

| (a) | Expressed as a percentage of total investments. |

| (b) | Total investment return is calculated assuming a purchase of common stock at the current market value on the first day and a sale at the current market value on the last day of each period reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. These calculations do not include brokerage commissions. |

| (c) | This information represents the historical net asset value per share performance of The Asia Pacific Fund, Inc. Net asset value per share performance has been computed by the Investment Manager and, because it does not reflect market price, is not the same as total investment return. |

| (d) | Investment operations commenced on May 4, 1987. |

Portfolio Characteristics

(As of September 30, 2005)

Top Ten Equity Holdings

(% of Total Equity Investments)

| | |

Samsung Electronics Co. | | 4.6% |

Kookmin Bank | | 3.1% |

Hutchison Whampoa, Ltd. | | 2.7% |

PetroChina Co., Ltd. (Class “H” Shares) | | 2.5% |

POSCO | | 2.3% |

Hon Hai Precision Industry Co., Ltd. | | 2.2% |

S-Oil Corp. | | 2.2% |

Hana Bank | | 2.2% |

Shinsegae Co., Ltd. | | 2.2% |

China Netcom Group Corp., Ltd. | | 2.1% |

Equity Country Weightings

(% of Total Equity Investments)

| | | | | | |

Hong Kong | | 30.4% | | Malaysia | | 4.5% |

South Korea | | 30.3% | | Thailand | | 3.7% |

Taiwan | | 22.2% | | India | | 1.8% |

Singapore | | 7.1% | | | | |

Sector Breakdown: Top Ten Industries

(% of Total Equity Investments)

| | |

Information Technology | | 24.4% |

Banking | | 15.0% |

Industrials | | 13.7% |

Real Estate Developers | | 11.2% |

Consumer Discretionary | | 11.1% |

Materials | | 6.7% |

Energy | | 6.7% |

Telecommunications | | 3.2% |

Consumer Staples | | 2.9% |

Utilities | | 2.1% |

1

REPORT OF THE INVESTMENT MANAGER

For the period from March 31 to September 30, 2005

PERFORMANCE

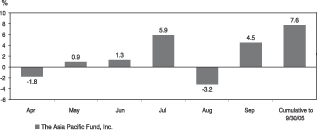

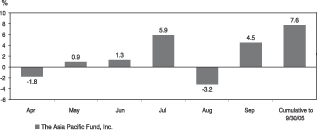

During the last six months the Fund’s net asset value (NAV) per share increased by US$1.27 from US$16.62 to US$17.89. In percentage terms the Fund’s total return performance was 7.6%. This compares with the return of its relevant benchmark index, the MSCI Combined Far East Free Ex-Japan Gross Index of 12.6%.

The chart below illustrates the Fund’s net asset value performance per share during the period:

Source: Baring Asset Management

Local Currencies vs the US Dollar

| | | | | | | | |

Currency US$/local rate

| | March 31,

2005

| | June 30,

2005

| | Sept.

30,

2005

| | March 31 -

Sept. 30,

2005

Change %

|

North Asia | | | | | | | | |

Chinese Renminbi | | 8.28 | | 8.28 | | 8.09 | | +2.3 |

Hong Kong Dollar | | 7.80 | | 7.77 | | 7.76 | | +0.5 |

South Korean Won | | 1,015 | | 1,033 | | 1,041 | | -2.5 |

New Taiwan Dollar | | 31.50 | | 31.61 | | 33.18 | | -5.1 |

ASEAN | | | | | | | | |

Malaysian Ringgit | | 3.80 | | 3.80 | | 3.77 | | +0.8 |

Philippine Peso | | 54.92 | | 55.92 | | 56.04 | | -2.0 |

Singaporean Dollar | | 1.65 | | 1.69 | | 1.69 | | -2.4 |

Thai Baht | | 39.11 | | 41.32 | | 41.06 | | -4.8 |

Indonesian Rupiah | | 9,470 | | 9,760 | | 10,290 | | -8.0 |

Indian Rupee | | 43.66 | | 43.48 | | 43.96 | | -0.7 |

Source: Factset (Baring Asset Management)

STOCK MARKET PERFORMANCE

March 31 to September 30, 2005

| | | | | | |

Country - Index

| | March 31 to

June 30, 2005

Market

Change %

US $

| | June 30 to

Sept. 30, 2005

Market

Change %

US $

| | March 31 to

Sept. 30, 2005

Market

Change %

US $

|

North Asia | | | | | | |

MSCI Korea | | 0.1 | | 22.0 | | 22.1 |

MSCI China | | 5.6 | | 14.2 | | 20.6 |

MSCI Hong Kong | | 8.1 | | 7.9 | | 16.7 |

MSCI Taiwan | | 5.9 | | -3.5 | | 2.1 |

ASEAN | | | | | | |

MSCI Malaysia Free | | 1.8 | | 6.5 | | 8.3 |

MSCI Singapore Free | | 3.1 | | 4.4 | | 7.6 |

MSCI Thailand Free | | -4.5 | | 11.3 | | 6.4 |

MSCI Indonesia Free | | 4.8 | | -6.9 | | -2.4 |

MSCI Philippines Free | | -2.7 | | -0.2 | | -3.0 |

South Asia | | | | | | |

MSCI India | | 12.0 | | 16.4 | | 30.3 |

MSCI Combined Far East Free Ex Japan | | 3.8 | | 8.5 | | 12.6 |

Source: Factset

COUNTRY ALLOCATION

(% of Net Assets)

| | | | | | | | | |

Country

| | March 31,

2005

| | | June 30,

2005

| | | Sept. 30,

2005

| |

North Asia | | 85.9 | % | | 89.7 | % | | 90.2 | % |

Hong Kong/China | | 32.7 | | | 30.9 | | | 33.0 | |

South Korea | | 31.2 | | | 29.6 | | | 33.0 | |

Taiwan | | 22.0 | | | 29.2 | | | 24.2 | |

ASEAN | | 19.1 | | | 16.4 | | | 16.6 | |

Indonesia | | 0.0 | | | 0.0 | | | 0.0 | |

Philippines | | 1.5 | | | 1.3 | | | 0.0 | |

Malaysia | | 5.4 | | | 5.4 | | | 4.8 | |

Singapore | | 4.6 | | | 4.6 | | | 7.8 | |

Thailand | | 7.6 | | | 5.1 | | | 4.0 | |

South Asia | | | | | | | | | |

India | | 3.3 | | | 1.8 | | | 1.9 | |

Borrowings | | (9.9 | ) | | (11.5 | ) | | (10.8 | ) |

Cash & Other | | 1.6 | | | 3.6 | | | 2.1 | |

2

MARKET, ASSET ALLOCATION AND FUND REVIEW

Following the stronger trend of global equity markets, Asian markets rose by 12.6% in USD terms, as measured by the Fund’s referenced benchmark, over the six month period to September 30, 2005.

Within Asia, India and the North Asian bloc (Korea, Hong Kong, China) led the rally, while Taiwan and most ASEAN markets lagged behind.

Key investment drivers in the current period included an improvement in equity investor sentiment around the world, boosted by expectations of a recovery in global growth, together with continuing strong growth from China. Investor enthusiasm more than offset the negative impact of high and rising oil prices, and tighter monetary conditions in the US. Within the Asian region, the Korean market was boosted by a continuing re-rating of equities relative to fixed income by domestic investors. The latter appeared to have shifted funds from the low-yielding money market deposits and bond portfolios to the more attractive equity market. High oil prices and better-than-expected results from China Mobile boosted the two dominant sectors of the Chinese market-energy and telecoms. Hong Kong continued to benefit from the domestic reflationary trend and from China’s strong economic growth. Despite positive new flows in the Taiwanese technology sector, the Taiwanese market remained sluggish because of the lack of participation from local investors. Small ASEAN markets were negatively impacted by rising oil prices and tighter monetary conditions. The Indian market prospered as strong economic growth translated into better-than-expected earnings growth. The market also appeared to benefit significantly from the formation of new Indian funds sourced out of Japan.

The global currency market was marked by two distinct events: first, the revaluation of the Chinese Renminbi in mid-July and the new-found strength of the US dollar. Under the pressure of the US and its Western trading partners, the Chinese government finally revalued the Renminbi by 2.1% versus the US dollar. It also announced that the Renminbi will now become more flexible, being allowed to vary up to 0.3% daily against an undisclosed trade weighted basket of currencies. An indirect consequence of the Renminbi change was a slight appreciation of other pegged exchange rates, including the HK dollar and the Malaysian Ringgit. Second, the strengthening of the US dollar resulted in a lowering of the value of most other floating currencies in Asia.

The overall strategy of the Fund over the period was based on a positive view of Asian equity markets. This is firstly reflected through the maintenance of leverage in the Fund. Secondly, the Fund Manager continued with a pro-growth and pro-cyclical bias in the portfolio, particularly in markets which are deemed not to be significantly impacted by the high oil prices and the tighter US monetary policy. This strategy translated into the following principal portfolio actions: the weighting of Singapore was raised in order to increase the Fund’s exposure to the domestic reflation beneficiaries, and similarly for Taiwan, where the Manager aimed to gain further exposure to the technology, materials and telecom sectors, as their valuations were deemed to be attractive with sound growth prospects. The Manager reduced the Fund’s investments in a number of ASEAN markets, including Thailand, Malaysia and The Philippines, based on concerns relating to the negative impact of high oil prices and deteriorating macro fundamentals including inflation and interest rates.

As far as the Fund’s performance is concerned, positive contributors, at the asset allocation level, included the leverage effect in a rising equity market, the large weighting in Korea and the nil weighting in Indonesia. At the stock selection level, Taiwan was a positive contributor while other markets detracted value. The latter was mainly attributed to the fact that a number of small- to mid-capitalization stocks in Korea, China, Hong Kong and Singapore were de-rated in the liquidity-driven rally, and as a result, did not perform as strongly as the aggregate Asian index’s returns.

OUTLOOK

Looking forward to the next six months, the Fund Manager expects Asian economies to continue to grow at a solid pace, led by China. In addition, liquidity conditions in Asia are expected to remain

3

supportive of equity markets. Relatively cheaper valuations of Asian equity markets compared to the US and other Western peers are expected to continue to appeal to long-term investors. As far as the direction of Asian equity markets is concerned, we expect key drivers to include the investors’ appetite for equities as an asset class in general, and Asian equities in particular, the extent to which the US Federal Reserve continues to tighten monetary policy, and the trend of oil prices.

Baring Asset Management (Asia) Limited

19th October 2005

4

THE ASIA PACIFIC FUND, INC.

Portfolio of Investments

September 30, 2005

(Unaudited)

| | | | | |

| Shares | | Description | | Value

(Note 1) |

| | | EQUITIES—108.7% | | | |

| | | HONG KONG—33.0% | | | |

| 435,000 | | ASM Pacific Technology, Ltd. | | $ | 2,105,648 |

| | | (Information Technology) | | | |

| 944,000 | | BOC Hong Kong Holdings, Ltd. | | | 1,892,296 |

| | | (Banking) | | | |

| 750,000 | | Cafe De Coral Holdings, Ltd. | | | 870,142 |

| | | (Consumer Discretionary) | | | |

| 331,000 | | Cheung Kong Holdings, Ltd. | | | 3,737,823 |

| | | (Real Estate Developers) | | | |

| 2,404,500 | | China Netcom Group Corp., Ltd. | | | 4,138,021 |

| | | (Telecommunications) | | | |

| 3,080,000 | | China Oilfield Services, Ltd. (Class “H” Shares) | | | 1,270,537 |

| | | (Energy) | | | |

| 3,276,000 | | China Shipping Development Co., Ltd. (Class “H” Shares) | | | 2,723,894 |

| | | (Industrials) | | | |

| 1,622,000 | | CNOOC, Ltd. | | | 1,170,915 |

| | | (Energy) | | | |

| 650,000 | | Cosco Pacific, Ltd. | | | 1,265,252 |

| | | (Industrials) | | | |

| 338,000 | | Esprit Holdings, Ltd. | | | 2,527,152 |

| | | (Consumer Discretionary) | | | |

| 1,871,000 | | Hang Lung Properties, Ltd. | | | 2,966,645 |

| | | (Real Estate Developers) | | | |

| 253,000 | | Henderson Land Development Co., Ltd. | | | 1,263,801 |

| | | (Real Estate Developers) | | | |

| 2,000,000 | | Hong Kong and China Gas Co., Ltd. | | | 4,125,120 |

| | | (Utilities) | | | |

| 1,285,000 | | Hongkong Land Holdings, Ltd. | | | 4,034,900 |

| | | (Real Estate Developers) | | | |

| 527,300 | | Hutchison Whampoa, Ltd. | | | 5,458,332 |

| | | (Industrials) | | | |

| | | | | |

| Shares | | Description | | Value

(Note 1) |

| 1,238,400 | | Kingboard Chemical Holdings, Ltd. | | $ | 3,089,075 |

| | | (Information Technology) | | | |

| 6,086,000 | | PetroChina Co., Ltd. (Class “H” Shares) | | | 5,099,551 |

| | | (Energy) | | | |

| 2,200,000 | | Ports Design, Ltd. | | | 2,495,698 |

| | | (Consumer Discretionary) | | | |

| 1,356,000 | | Sinopec Zhenhai Refining & Chemical Co., Ltd. (Class “H” Shares) | | | 1,485,817 |

| | | (Energy) | | | |

| 378,000 | | Swire-Pacific, Ltd. “A” | | | 3,481,614 |

| | | (Real Estate Developers) | | | |

| 779,000 | | Techtronic Industries Co., Ltd. | | | 1,983,313 |

| | | (Consumer Discretionary) | | | |

| 645,000 | | Wharf Holdings, Ltd. | | | 2,527,667 |

| | | (Real Estate Developers) | | | |

| 612,000 | | Weichai Power Co., Ltd. (Class “H” Shares) | | | 1,376,681 |

| | | | |

|

|

| | | (Industrials) | | | |

| | | | | | 61,089,894 |

| | | | |

|

|

| | |

| | | INDIA—1.9% | | | |

| 78,147 | | Housing Development Finance Corp., Ltd. | | | 1,848,380 |

| | | (Banking) | | | |

| 69,256 | | Ranbaxy Laboratories, Ltd. | | | 774,019 |

| | | (Health Care) | | | |

| 75,427 | | Tata Motors, Ltd. | | | 917,119 |

| | | | |

|

|

| | | (Industrials) | | | |

| | | | | | 3,539,518 |

| | | | |

|

|

| | |

| | | MALAYSIA—4.8% | | | |

| 1,340,000 | | Commerce Asset-Holdings Berhad | | | 1,990,979 |

| | | (Banking) | | | |

| 948,700 | | Malayan Banking Berhad | | | 2,919,852 |

| | | (Banking) | | | |

| 811,700 | | SP Setia Berhad | | | 835,605 |

| | | (Real Estate Developers) | | | |

See Notes to Financial Statements.

5

| | | | | |

| Shares | | Description | | Value

(Note 1) |

| | | MALAYSIA—(cont’d.) | | | |

| 696,000 | | Tanjong PLC | | $ | 2,677,633 |

| | | (Consumer Discretionary) | | | |

| 530,000 | | WTK Holdings Berhad | | | 534,359 |

| | | | |

|

|

| | | (Materials) | | | |

| | | | | | 8,958,428 |

| | | | |

|

|

| | |

| | | SINGAPORE—7.8% | | | |

| 2,000,000 | | ComfortDelGro Corp., Ltd. | | | 1,772,997 |

| | | (Industrials) | | | |

| 633,000 | | Cosco Corp. Singapore, Ltd. | | | 950,220 |

| | | (Industrials) | | | |

| 319,000 | | DBS Group Holdings, Ltd. | | | 2,978,753 |

| | | (Banking) | | | |

| 149,000 | | Keppel Corp., Ltd. | | | 1,118,348 |

| | | (Industrials) | | | |

| 845,000 | | Keppel Land, Ltd. | | | 1,847,759 |

| | | (Real Estate Developers) | | | |

| 1,830,000 | | Macquarie International Infrastructure Fund,

Ltd.(a) | | | 1,146,420 |

| | | (Industrials) | | | |

| 196,000 | | Overseas-Chinese Banking Corp. | | | 723,974 |

| | | (Banking) | | | |

| 146,000 | | Singapore Airlines, Ltd. | | | 1,000,916 |

| | | (Industrials) | | | |

| 700,577 | | Singapore Technologies Engineering, Ltd. | | | 1,051,662 |

| | | (Industrials) | | | |

| 2,599,000 | | Suntec REIT | | | 1,766,408 |

| | | | |

|

|

| | | (Real Estate Developers) | | | |

| | | | | | 14,357,457 |

| | | | |

|

|

| | | SOUTH KOREA—33.0% | | | |

| 33,420 | | Binggrae Co., Ltd. | | | 1,338,722 |

| | | (Consumer Staples) | | | |

| 18,420 | | Cheil Communications, Inc. | | | 3,530,427 |

| | | (Consumer Discretionary) | | | |

| 120,490 | | Hana Bank | | | 4,445,486 |

| | | (Banking) | | | |

| 84,020 | | Hanwha Chemical Corp. | | | 1,046,727 |

| | | (Materials) | | | |

| 74,370 | | Hyundai Engineering & Construction Co., Ltd.(a) | | | 2,351,902 |

| | | (Industrials) | | | |

| 27,250 | | Hyundai Mobis | | | 2,237,973 |

| | | (Consumer Discretionary) | | | |

| | | | | |

| Shares | | Description | | Value

(Note 1) |

| 44,910 | | Hyundai Motor Co. | | $ | 3,507,585 |

| | | (Consumer Discretionary) | | | |

| 106,919 | | Kookmin Bank | | | 6,301,407 |

| | | (Banking) | | | |

| 140,000 | | LG International Corp. | | | 2,072,832 |

| | | (Industrials) | | | |

| 38,720 | | LG.Philips LCD Co., Ltd.(a) | | | 1,599,264 |

| | | (Information Technology) | | | |

| 37,058 | | LG.Philips LCD Co., Ltd. (ADR)(a) | | | 761,913 |

| | | (Information Technology) | | | |

| 20,536 | | POSCO | | | 4,605,102 |

| | | (Materials) | | | |

| 16,268 | | Samsung Electronics Co. | | | 9,166,827 |

| | | (Information Technology) | | | |

| 63,230 | | Samsung Electro-Mechanics Co., Ltd. | | | 1,790,557 |

| | | (Information Technology) | | | |

| 195,400 | | Samsung Heavy Industries Co., Ltd. | | | 2,846,267 |

| | | (Industrials) | | | |

| 11,874 | | Shinsegae Co., Ltd. | | | 4,403,678 |

| | | (Consumer Staples) | | | |

| 54,670 | | S-Oil Corp. | | | 4,479,430 |

| | | (Energy) | | | |

| 120,590 | | Woongjin Coway Co., Ltd. | | | 2,421,045 |

| | | (Consumer Discretionary) | | | |

| 147,450 | | Woori Finance Holdings Co., Ltd. | | | 2,133,680 |

| | | | |

|

|

| | | (Banking) | | | |

| | | | | | 61,040,824 |

| | | | |

|

|

| | | TAIWAN—24.2% | | | |

| 2,349,208 | | Advanced Semiconductor Engineering, Inc. | | | 1,585,700 |

| | | (Information Technology) | | | |

| 222,178 | | Asia Optical Co., Inc. | | | 1,419,347 |

| | | (Information Technology) | | | |

| 486,200 | | Asustek Computer, Inc. | | | 1,303,937 |

| | | (Information Technology) | | | |

| 1,272,680 | | AU Optronics Corp. | | | 1,649,071 |

| | | (Information Technology) | | | |

| 129,409 | | Chi Mei Optoelectronics Corp. (GDR), 144A(b) | | | 1,410,558 |

| | | (Information Technology) | | | |

| 3,818,000 | | China Steel Corp. | | | 3,405,487 |

| | | (Materials) | | | |

See Notes to Financial Statements.

6

| | | | | |

| Shares | | Description | | Value

(Note 1) |

| | | TAIWAN—(cont’d.) | | | |

| 2,327,400 | | Far Eastern Textile, Ltd.(c) | | $ | 1,406,167 |

| | | (Industrials) | | | |

| 600,600 | | Foxconn Technology Co., Ltd. | | | 2,515,659 |

| | | (Information Technology) | | | |

| 964,956 | | Hon Hai Precision Industry Co., Ltd. | | | 4,492,495 |

| | | (Information Technology) | | | |

| 239,800 | | MediaTek, Inc. | | | 2,261,753 |

| | | (Information Technology) | | | |

| 1,251,000 | | Mitac International Corp. | | | 1,899,938 |

| | | (Information Technology) | | | |

| 2,160,608 | | Nanya Technology Corp. | | | 1,341,204 |

| | | (Information Technology) | | | |

| 3,553,828 | | Siliconware Precision Industries Co., Ltd | | | 3,587,508 |

| | | (Information Technology) | | | |

| 1,452,000 | | SinoPac Financial Holdings Co., Ltd. | | | 676,000 |

| | | (Diversified Financials) | | | |

| 3,420,646 | | Shin Kong Financial Holding Co., Ltd. | | | 2,886,143 |

| | | (Insurance) | | | |

| 2,475,900 | | Taiwan Cement Corp. | | | 1,563,035 |

| | | (Materials) | | | |

| 2,227,000 | | Taiwan Fertilizer Co., Ltd. | | | 2,382,321 |

| | | (Materials) | | | |

| 2,446,294 | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 3,929,049 |

| | | (Information Technology) | | | |

| 4,775,337 | | United Microelectronics Corp., Ltd. | | | 3,065,034 |

| | | (Information Technology) | | | |

| 3,046,505 | | Yuanta Core Pacific Securities Co. | | | 1,946,209 |

| | | | |

|

|

| | | (Diversified Financials) | | | |

| | | | | | 44,726,615 |

| | | | |

|

|

| | |

| | | THAILAND—4.0% | | | |

| 1,124,600 | | Bangkok Bank Co., Ltd. | | | 3,123,508 |

| | | (Banking) | | | |

| 1,163,400 | | Kasikornbank PCL | | | 1,899,082 |

| | | (Banking) | | | |

| 2,346,500 | | Shin Corp. PCL | | | 2,343,927 |

| | | | |

|

|

| | | (Telecommunications) | | | |

| | | | | | 7,366,517 |

| | | | |

|

|

| | | Total equities

(cost $154,366,570) | | | 201,079,253 |

| | | | |

|

|

| | | | | | | |

Principal

Amount (000) | | Description | | Value

(Note 1) | |

| | | | REPURCHASE AGREEMENT—2.2% | |

| | | | UNITED STATES | | | | |

| US$ | 4,126 | | State Street Bank & Trust Company, 1.75%, dated 09/30/05 due 10/03/05 in the amount of $4,126,602 (cost $4,126,000; collateralized by $2,965,000 U.S. Treasury Bonds,

8.00% due 11/15/21, approximate value of collateral including accrued interest $4,210,300) | | $ | 4,126,000 | |

| | | | | |

|

|

|

| | | | Total Investments—110.9% (cost $158,492,570; Note 4) | | | 205,205,253 | |

| | | | Liabilities in excess of other assets—(10.9%) | | | (20,186,025 | ) |

| | | | | |

|

|

|

| | | | Net Assets—100% | | | $185,019,228 | |

| | | | | |

|

|

|

The following annotations are used in the Portfolio of Investments:

| (a) | Non-income producing securities. |

| (b) | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted 144A securities are deemed to be liquid. |

| (c) | An Independent Director of the Fund is Chairman and Chief Executive Officer of this company. |

The following abbreviations are used in the Portfolio of Investments:

ADR—American Depository Receipt

GDR—Global Depository Receipt

REIT—Real Estate Investment Trust

The industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of September 30, 2005 was as follows:

| | | |

Information Technology | | 26.5 | % |

Banking | | 16.4 | |

Industrials | | 14.9 | |

Real Estate Developers | | 12.1 | |

Consumer Discretionary | | 12.0 | |

Energy | | 7.3 | |

Materials | | 7.3 | |

Telecommunications | | 3.5 | |

Consumer Staples | | 3.1 | |

Utilities | | 2.2 | |

Insurance | | 1.6 | |

Diversified Financials | | 1.4 | |

Health Care | | 0.4 | |

Repurchase Agreement | | 2.2 | |

| | |

|

|

| | | 110.9 | |

Liabilities in excess of other assets | | (10.9 | ) |

| | |

|

|

Total | | 100.0 | % |

| | |

|

|

See Notes to Financial Statements.

7

THE ASIA PACIFIC FUND, INC.

Statement of Assets and Liabilities

September 30, 2005

(Unaudited)

| | | |

| Assets | | | |

Investments, at value (cost $158,492,570) | | $ | 205,205,253 |

Cash | | | 14,766 |

Foreign currency (cost $319,663) | | | 317,201 |

Dividends and interest receivable | | | 545,665 |

| | |

|

|

Total assets | | | 206,082,885 |

| | |

|

|

| Liabilities | | | |

Loan payable (Note 6) | | | 20,000,000 |

Accrued expenses and other liabilities | | | 374,767 |

Deferred Thailand capital gains tax liability | | | 270,337 |

Loan interest payable | | | 213,122 |

Investment management fee payable | | | 129,472 |

Foreign withholding taxes payable | | | 38,549 |

Administration fee payable | | | 37,410 |

| | |

|

|

Total liabilities | | | 21,063,657 |

| | |

|

|

| Net Assets | | $ | 185,019,228 |

| | |

|

|

Net assets comprised: | | | |

Common stock, at par | | $ | 103,441 |

Paid-in capital in excess of par | | | 131,192,212 |

| | |

|

|

| | | | 131,295,653 |

Undistributed net investment income | | | 632,073 |

Accumulated net realized gains on investments and foreign currency transactions | | | 6,654,791 |

Net unrealized appreciation on investments and foreign currencies | | | 46,436,711 |

| | |

|

|

Net Assets, September 30, 2005 | | $ | 185,019,228 |

| | |

|

|

Net Assets Value per share:

($185,019,228 ÷ 10,344,073 shares of common stock outstanding) | | | $17.89 |

| | |

|

|

See Notes to Financial Statements.

THE ASIA PACIFIC FUND, INC.

Statement of Operations

Six Months Ended September 30, 2005

(Unaudited)

| | | | |

| Net Investment Income | | | | |

Income | | | | |

Dividends (net of foreign withholding taxes of $616,836) | | $ | 3,320,415 | |

Interest | | | 21,721 | |

| | |

|

|

|

Total income | | | 3,342,136 | |

| | |

|

|

|

Expenses | | | | |

Investment management fee | | | 769,878 | |

Loan interest expense (Note 6) | | | 343,986 | |

Administration fee | | | 221,090 | |

Custodian’s fees and expenses | | | 217,000 | |

Reports to shareholders | | | 113,000 | |

Legal fees and expenses | | | 90,000 | |

Director’s fees | | | 45,000 | |

Insurance expense | | | 34,000 | |

Audit fees and expenses | | | 23,000 | |

Transfer agent’s fees and expenses | | | 16,000 | |

Registration expenses | | | 13,000 | |

Miscellaneous | | | 69,625 | |

| | |

|

|

|

Total expenses | | | 1,955,579 | |

| | |

|

|

|

Net investment income | | | 1,386,557 | |

| | |

|

|

|

| Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency Transactions | | | | |

Net realized gain/(loss) on: | | | | |

Investments transactions (net of Thailand and India capital gains taxes of $43,626) | | | 12,532,186 | |

Foreign currency transactions | | | (180,016 | ) |

| | |

|

|

|

| | | | 12,352,170 | |

| | |

|

|

|

Net change in unrealized appreciation/(depreciation) on: | | | | |

Investments (net of change in deferred Thailand capital gains taxes of $30,517 ) | | | (640,092 | ) |

Foreign currencies | | | (12,475 | ) |

| | |

|

|

|

| | | | (652,567 | ) |

| | |

|

|

|

Net gain on investments and foreign currencies | | | 11,699,603 | |

| | |

|

|

|

| Net Increase in Net Assets Resulting From Operations | | $ | 13,086,160 | |

| | |

|

|

|

See Notes to Financial Statements.

8

THE ASIA PACIFIC FUND, INC.

Statement of Changes in Net Assets

(Unaudited)

| | | | | | | | |

Increase in

Net Assets | | Six Months

Ended

September 30,

2005

| | | Year Ended

March 31,

2005

| |

| | |

Operations | | | | | | | | |

| | |

Net investment income | | $ | 1,386,557 | | | $ | 1,829,104 | |

| | |

Net realized gain on investments and foreign currency transactions | | | 12,352,170 | | | | 15,839,433 | |

| | |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | (652,567 | ) | | | 1,680,979 | |

| | |

|

|

| |

|

|

|

| | |

Net increase in net assets resulting from operations | | | 13,086,160 | | | | 19,349,516 | |

| | |

Dividends from net investment income (Note 1) | | | — | | | | (1,551,611 | ) |

| | |

|

|

| |

|

|

|

| | |

Total increase | | | 13,086,160 | | | | 17,797,905 | |

| | |

| Net Assets | | | | | | | | |

| | |

Beginning of period | | | 171,933,068 | | | | 154,135,163 | |

| | |

|

|

| |

|

|

|

| | |

End of period(a) | | $ | 185,019,228 | | | $ | 171,933,068 | |

| | |

|

|

| |

|

|

|

(a) Includes undistributed net investment income of: | | $ | 632,073 | | | | — | |

| | |

|

|

| |

|

|

|

See Notes to Financial Statements.

THE ASIA PACIFIC FUND, INC.

Notes to Financial Statements

(Unaudited)

The Asia Pacific Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940 as a diversified, closed-end, management investment company. The Fund’s investment objective is to achieve long-term capital appreciation through investment of at least 80% of investable assets in equity securities of companies in the Asia Pacific countries.

Note 1. Accounting Policies | The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. |

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States, which may require the use of management estimates and assumptions. Actual results could differ from these assumptions.

Securities Valuation: Investments are stated at value. Securities for which the primary market is on an exchange are valued at the last sale price on such exchange or market on the day of valuation or, if there was no sale on such day, at the last bid price quoted on such day. Securities for which reliable market quotations are not readily available, or whose value have been affected by events occurring after the close of the security’s foreign market and before the Fund’s normal pricing time, are valued at fair value in accordance with the Board of Director’s approved fair valuation procedures. When determining the fair valuation of securities some of the factors influencing the valuation include, the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst, media or other reports or information regarding the issuer or the markets or industry in which it operates, other analytical data; and consistency with valuation of similar securities held by other funds managed by Baring Asset Management (Asia) Limited. Using fair value to price securities may result in a value that is different from a

9

security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

Short-term securities which mature in more than 60 days are valued at current market quotations. Short-term securities which mature in 60 days or less are valued at amortized cost.

In connection with transactions in repurchase agreements with U.S. financial institutions, it is the Fund’s policy that its custodian takes possession of the underlying securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market on a daily basis to ensure the adequacy of the collateral. If the seller defaults, and the value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

Foreign Currency Translation: The books and records of the Fund are maintained in United States dollars. Foreign currency amounts are translated into United States dollars on the following basis:

(i) market value of investment securities, other assets and liabilities—at the current rate of exchange.

(ii) purchases and sales of investment securities, income and expenses—at the rate of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the fiscal year, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of securities held at fiscal year end. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of portfolio securities sold during the fiscal year. Accordingly, these realized foreign currency gains (losses) are included in the reported net realized gains (losses) on investment transactions.

Net realized gains (losses) on foreign currency transactions represent net foreign exchange gains (losses) from sales and maturities of short-term securities, holding of foreign currencies, currency gains (losses) realized between the trade and settlement dates on security transactions, and the difference between the amounts of dividends, interest and foreign taxes recorded on the Fund’s books and the US dollar equivalent amounts actually received or paid. Net currency gains (losses) from valuing foreign currency denominated assets, other than investment securities, and liabilities at fiscal year end exchange rates are reflected as a component of unrealized appreciation on investments and foreign currencies.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of US companies as a result of, among other factors, the level of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

Security Transactions and Net Investment Income: Security transactions are recorded on the trade date. Realized and unrealized gains (losses) from security and foreign currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date, and interest income and expenses are recorded on an accrual basis. Expenses are recorded on the accrual basis which may require the use of certain estimates by management.

Dividends and Distributions: Dividends from net investment income, if any, are declared and paid at least annually. The Fund will distribute at least annually any net capital gains in excess of net capital loss carryforwards. Dividends and distributions are recorded on the ex-dividend date.

Income distributions and capital gain distributions are determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

Taxes: It is the Fund’s intention to continue to meet the requirements of the US Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to shareholders. Therefore, no federal income tax provision is required.

Withholding taxes on foreign dividends, interest and capital gains have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

10

Note 2. Investment Management and Administration Agreements On March 31, 2005, ING Group N.V., the parent company of Baring Asset Management (Asia) Limited (the “Investment Manager”) completed the sale of Baring Asset Management to Massachusetts Mutual Life Insurance Company (“MassMutual”). MassMutual is a diversified financial services business with one of the largest life insurance businesses in the US. The sale of Baring Asset Management to MassMutual resulted in a change of control of the Investment Manager, terminating the management agreement with the Fund as of that date. At a meeting on January 18, 2005, the Board of Directors approved both an interim management agreement with the Investment Manager, with a term of 150 days, and a longer-term management agreement with the Investment Manager. The longer-term agreement was subject to approval of, and was approved by, stockholders at this year’s Annual Meeting of Stockholders held in August 2005. The Fund also has an administration agreement with Prudential Investments LLC (the “Administrator”). |

The investment management fee, is computed weekly and payable monthly at the following annual rates: 1.00% of the Fund’s average weekly net assets up to $100 million and 0.70% of such assets in excess of $100 million.

The administration fee is also computed weekly and payable monthly at the following annual rates: 0.25% of the Fund’s average weekly net assets up to $200 million and 0.20% of such assets in excess of $200 million.

Pursuant to the agreements, the Investment Manager provides continuous supervision of the investment portfolio and the Administrator provides occupancy and certain clerical, administrative and accounting services for the Fund. Both the Investment Manager and the Administrator pay the cost of compensation of certain directors and officers of the Fund. The Fund bears all other costs and expenses.

Note 3. Portfolio Securities Purchases and sales of investment securities, other than short-term investments, for the six months ended September 30, 2005 aggregated $97,937,976 and $94,872,191 respectively. |

Note 4. Tax Information | As of March 31, 2005, the capital loss carryforward for tax purposes was approximately $5,668,800 of which $3,433,000 expires in 2007 and $2,235,800 expires in 2010. Accordingly, no capital gains distribution is expected to be paid to shareholders until net gains have been realized in excess of such carryforward. The Fund also incurred currency losses from November 1, 2004 to March 31, 2005 of approximately $80,600. |

The United States federal income tax basis of the Fund’s investments and the net unrealized appreciation on a tax basis as of September 30, 2005 were as follows:

| | | | | | | | | | |

Tax Basis

| | Appreciation

| | Depreciation

| | Total Net

Unrealized

Appreciation (Tax Basis)

|

| $ | 159,311,901 | | $ | 49,464,917 | | $ | 3,571,565 | | $ | 45,893,352 |

The difference between book basis and tax basis is attributable to deferred losses on wash sales and marking to market of unrealized gains on passive foreign investment companies.

Note 5. Capital | There are 30 million shares of $0.01 par value common stock authorized. |

During the year ended March 31, 2002, the Fund participated in a share repurchase program. The Fund repurchased 152,700 shares in the open market at an average market price of $8.46, representing a weighted average discount to NAV per share of 20.38%.

During the fiscal quarters ended September 30, 2002 and December 31, 2001, the Fund conducted tender offers. For the second fiscal quarter ended September 30, 2002, the Fund purchased 3,448,024 shares (25% of the total shares outstanding as of July 7, 2002) at a price of $10.66 per share, representing a discount to NAV per share of 5%. For the third fiscal quarter ended December 31, 2001, the Fund purchased 1,532,455 shares (10% of the total shares outstanding as of December 7, 2001) at a price of $9.56 per share, representing a discount to NAV per share of 10%.

11

Note 6. Borrowings The Fund is a party to a revolving loan facility with Barings (Guernsey) Limited, an affiliate and wholly-owned division of Northern Trust Corporation. The credit facility provides for a maximum commitment of the lower of $30,000,000 or 25% of the Fund’s net assets. Interest on any borrowings under the credit facility will be at 0.75% plus the current LIBOR. The purpose of the credit facility is to assist the Fund with its general cash flow requirements including the provision of portfolio leverage. During the six months ended September 30, 2005, the Fund had an average daily loan balance outstanding of approximately $17,102,000 and an average interest rate of 3.92%. As of September 30, 2005, the loan payable was $20,000,000. The total interest expense paid to the lender during the six months ended September 30, 2005 was $343,986. |

12

THE ASIA PACIFIC FUND, INC.

Financial Highlights

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

Per Share Operating

Performance: | | Six Months

Ended

September 30, 2005

| | | Year Ended March 31,

| |

| | | 2005

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| |

Net asset value, beginning of period | | $ | 16.62 | | | $ | 14.90 | | | $ | 9.10 | | | $ | 11.67 | | | $ | 10.05 | | | $ | 14.69 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net investment income (loss) | | | 0.13 | | | | 0.18 | | | | 0.09 | | | | 0.01 | | | | (0.03 | ) | | | (0.01 | ) |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 1.14 | | | | 1.69 | | | | 5.89 | | | | (2.77 | ) | | | 1.52 | | | | (4.87 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 1.27 | | | | 1.87 | | | | 5.98 | | | | (2.76 | ) | | | 1.49 | | | | (4.88 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less dividends and distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.15 | ) | | | (0.18 | ) | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total dividends and distributions | | | — | | | | (0.15 | ) | | | (0.18 | ) | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Increase resulting from share repurchase(e) | | | — | | | | — | | | | — | | | | — | | | | 0.02 | | | | 0.06 | |

Increase resulting from tender offer(e) | | | — | | | | — | | | | — | | | | 0.19 | | | | 0.11 | | | | 0.18 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net assets value, end of period | | $ | 17.89 | | | $ | 16.62 | | | $ | 14.90 | | | $ | 9.10 | | | $ | 11.67 | | | $ | 10.05 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Market value, end of period | | $ | 16.21 | | | $ | 14.65 | | | $ | 13.90 | | | $ | 8.10 | | | $ | 10.12 | | | $ | 7.86 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total investment return(a) | | | 7.64 | % | | | 6.48 | % | | | 73.83 | % | | | (19.96 | )% | | | 28.75 | % | | | (24.70 | )% |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses (including loan interest)(b) | | | 2.22 | %(c) | | | 2.01 | % | | | 2.06 | % | | | 2.25 | % | | | 2.24 | % | | | 1.81 | % |

Net investment income (loss) | | | 1.58 | %(c) | | | 1.18 | % | | | 0.74 | % | | | 0.09 | % | | | (0.31 | )% | | | (0.05 | )% |

| Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Average net assets (000 omitted) | | $ | 175,865 | | | $ | 155,484 | | | $ | 128,632 | | | $ | 122,681 | | | $ | 148,224 | | | $ | 214,819 | |

Portfolio turnover rate | | | 50 | %(d) | | | 73 | % | | | 73 | % | | | 34 | % | | | 49 | % | | | 52 | % |

Net assets, end of period (000 omitted) | | $ | 185,019 | | | $ | 171,933 | | | $ | 154,135 | | | $ | 94,127 | | | $ | 161,007 | | | $ | 155,579 | |

| (a) | Total investment return is calculated assuming a purchase of common stock at the current market value on the first day and a sale at the current market value on the last day of each fiscal period reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. These calculations do not include brokerage commissions. Total returns for periods of less than a full year are not annualized. |

| (b) | The expense ratio without interest expense would have been 1.83% for the six months ended September 30, 2005, and 1.94%, 2.03% and 2.24% for the fiscal years ended March 31, 2005, 2004 and 2003, respectively. |

| (e) | See Note 5 of Notes to Financial Statements. |

Contained above is selected data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for the periods indicated. This information has been determined based upon information provided in the financial statements and market price data for the Fund’s shares.

See Notes to Financial Statements.

13

Supplemental Proxy Information

The Annual Meeting of Stockholders of the Asia Pacific Fund, Inc. (the “Meeting”) was held on August 10, 2005.

The number of shares issued, outstanding and eligible to vote as of the record date of June 30, 2005 was 10,344,073 shares. Proxies representing 7,637,881 shares of Common Stock or 73.84% of the total outstanding shares voted in the following manner:

Proposal I: (Election of Class I Directors; Term Expiring in 2008)

| | | | |

| | | Total Vote For

Each Director

| | Total Vote Withheld

Each Director

|

Olarn Chaipravat | | 7,556,596.000 | | 81,285.000 |

Michael J. Downey | | 7,562,742.000 | | 75,139.000 |

Duncan M. McFarland | | 7,580,980.000 | | 56,901.000 |

The other directors, whose terms of office continued beyond the date of the Meeting, are Messrs. Brennan, Burns, Gunia, Hsu, Scholfield and Sibley.

Proposal II: (Approval of Investment Management Agreement between the Fund and Baring Asset Management (Asia) Limited)

| | | | |

FOR

| | AGAINST

| | ABSTAIN

|

7,494,454.000 | | 90,111.000 | | 53,316.000 |

Additional Information

The Fund is required to file its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) on Form N-Q for its first and third fiscal quarters and within 60 days of the fiscal quarter end. Once filed, the Fund’s Form N-Q is available without charge on the SEC’s website (http//www.sec.gov) or by calling the Fund toll free at 1-(888) 4-ASIA-PAC. You can also obtain copies of the Fund’s Form N-Q by visiting the SEC’s Public Reference Room in Washington, DC (please call the SEC at (800) 732-0330 for information on the operation of the Public Reference Room).

Information regarding the Fund’s proxy voting policies and procedures and its proxy voting record for the 12-month period ending June 30 of each year is filed with the SEC on Form N-PX no later than August 31 of each year. The Fund’s Form N-PX is available without charge, upon request, by calling the Fund at its toll free number 1-(888) 4-ASIA-PAC on the cover of this report and on the SEC’s website (http//www.sec.gov) or on or through the Fund’s website address (www.asiapacificfund.com).

14

Directors

Michael J. Downey, Chairman

David J. Brennan

Robert H. Burns

Olarn Chaipravat

Robert F. Gunia

Douglas Tong Hsu

Duncan M. McFarland

David G. P. Scholfield

Nicholas T. Sibley

Officers

Ronald G. M. Watt, President

Robert F. Gunia, Vice President and Treasurer

M. Sadiq Peshimam, Assistant Treasurer

Deborah A. Docs, Secretary

Lee D. Augsburger, Chief Compliance Officer

Investment Manager

Baring Asset Management (Asia) Limited

1901 Edinburgh Tower

15 Queen’s Road Central

Hong Kong

Administrator

Prudential Investments LLC

Gateway Center Three

100 Mulberry Street

Newark, NJ 07102-4077

Custodian

State Street Bank and Trust Company

One Heritage Drive

North Quincy, MA 02171

Transfer Agent

Equiserve Trust Company N.A.

P.O. Box 43011

Providence, RI 02940-3011

Independent Auditors

Ernst & Young LLP

5 Times Square

New York, NY 10036

Legal Counsel

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940 that the Fund may purchase, from time to time, shares of its common stock at market prices.

The accompanying financial statements as of September 30, 2005 were not audited and, accordingly, no opinion is expressed on them.

This report, including the financial statements herein, is transmitted to the shareholders of The Asia Pacific Fund, Inc. for their information. This is not a prospectus, circular or representation intended for use in the purchase of shares of the Fund or any securities mentioned in this report.

The Asia Pacific Fund, Inc.

Gateway Center Three

100 Mulberry Street

Newark, NJ 07102-4077

For general information on the Fund, please call (toll-free) the Altman Group, our shareholders’ servicing agent toll-free at:

1-(888) 4-ASIA-PAC

Current information about the Fund is available on its website (http://www.asiapacificfund.com). This website includes monthly updates of the Fund’s performance and other data as well as the Manager’s quarterly presentation of performance and asset allocations and comments on the current Asian outlook.

The Fund’s CUSIP number is 044901106

APBS

The Asia Pacific Fund, Inc.

Semi-Annual Report

September 30, 2005

www.asiapacificfund.com

Item 2 – Code of Ethics – Not applicable with semi-annual filing.

Item 3 – Audit Committee Financial Expert – Not applicable with semi-annual filing

Item 4 – Principal Accountant Fees and Services – Not applicable with semi-annual filing.

Item 5 – Audit Committee of Listed Registrants – Not applicable with semi-annual filing.

Item 6 – Schedule of Investments – The schedule is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7 – Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies – Not applicable with semi-annual filing.

Item 8 – Portfolio Managers of Closed-End Management Investment Companies – Not applicable with semi-annual filing.

Item 9 – Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers –

REGISTRANT PURCHASES OF EQUITY SECURITIES

| | | | | | | | |

Period

| | (a)

Total Number

of Shares (or

Units)

Purchased

| | (b)

Average Price

Paid per Share

(or Unit)

| | (c) Total Number of

Shares (or Units)

Purchased as Part of

Publicly Announced

Plans or Programs

| | (d)

Maximum Number (or

Approximate Dollar

Value) of Shares (or

Units) that May Yet Be

Purchased Under the

Plans or Programs

|

4/1/2005 through 4/30/2005 | | 0 | | 0.00 | | 0 | | 0 |

5/1/2005 through 5/31/2005 | | 0 | | 0.00 | | 0 | | 0 |

6/1/2005 through 6/30/2005 | | 0 | | 0.00 | | 0 | | 0 |

7/1/2005 through 7/31/2005 | | 0 | | 0.00 | | 0 | | 0 |

8/1/2005 through 8/31/2005 | | 0 | | 0.00 | | 0 | | 0 |

9/1/2005 through 9/30/2005 | | 0 | | 0.00 | | 0 | | 0 |

Total | | 0 | | 0.00 | | 0 | | 0 |

Item 10 – Submission of Matters to a Vote of Security Holders – Not applicable.

Item 11 – Controls and Procedures

| | (a) | It is the conclusion of the registrant’s principal executive officer and principal financial officer that the effectiveness of the registrant’s current disclosure controls and procedures (such disclosure controls and procedures having been evaluated within 90 days of the date of this filing) provide reasonable assurance that the information required to be disclosed by the registrant has been recorded, processed, summarized and reported within the time period specified in the Commission’s rules and forms and that the information required to be disclosed by the registrant has been accumulated and communicated to the registrant’s principal executive officer and principal financial officer in order to allow timely decisions regarding required disclosure. |

| | (b) | There has been no significant change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal half-year of the period covered by this report that has materially affected, or is likely to materially affect, the registrant’s internal control over financial reporting. |

Item 12 – Exhibits

| | (a) | (1) Code of Ethics – Not applicable with semi-annual filing. |

| | | (2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act – Attached hereto as Exhibit EX-99.CERT. |

| | | (3) Any written solicitation to purchase securities under Rule 23c-1. – Not applicable. |

| | (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act – Attached hereto as Exhibit EX-99.906CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| (Registrant) The Asia Pacific Fund, Inc. |

| |

| By (Signature and Title)* | | /s/ Deborah A. Docs

|

| | | Deborah A. Docs |

| | | Secretary |

|

| Date November 28, 2005 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | |

| By (Signature and Title)* | | /s/ Ronald G.M. Watt

|

| | | Ronald G.M. Watt |

| | | President and Principal Executive Officer |

|

| Date November 28, 2005 |

| |

| By (Signature and Title)* | | /s/ Robert F. Gunia

|

| | | Robert F. Gunia |

| | | Treasurer and Principal Financial Officer |

|

| Date November 28, 2005 |

| * | Print the name and title of each signing officer under his or her signature. |