UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04722

FMI Mutual Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Wisconsin Avenue

Suite 2200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Ted D. Kellner

Fiduciary Management, Inc.

100 East Wisconsin Avenue

Suite 2200

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 226-4555

(Registrant's telephone number, including area code)

Date of fiscal year end: September 30

Date of reporting period: March 31, 2012

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

March 31, 2012

FMI Provident Trust

Strategy Fund

(FMIRX)

A NO-LOAD MUTUAL FUND

FMI Provident Trust Strategy Fund

April 2, 2012

Dear Fellow FMI Provident Trust Strategy Fund Shareholders,

The Fund (“FMIRX”) gained +11.74%(1) in the March quarter vs. the S&P 500’s +12.59%(2)(3) return. Since Provident was named portfolio manager on September 9, 2002, FMIRX gained +117.24% cumulatively vs. +88.89% for the S&P 500. Results since being named sub-advisor on September 9, 2002, represent a complete market cycle, which we define as a minimum of a seven-year period with a greater than 20% market decline and a greater than 30% market advance. Our equity exposure remains about 80% while the average market capitalization of the Fund continues to increase from $7.0B (March 2009) to $38.5B (March 2011) to $53.8B (February 2012) reflecting the improved relative valuation and earnings growth potential of large company stocks. The Leuthold Group reports since December 1999, large company stock valuations relative to small companies moved from a 65% premium (28X P/E vs. 17X) to a 16% discount (13X vs. 15.5X).

We are raising our GAAP S&P 500 2012 EPS estimate to $95 vs. 2011 EPS of $87, which maintains a 14.5X 2012 P/E despite the stock market’s strong first quarter advance. Investors continue to under participate in the rally with Businessweek reporting equity mutual fund outflows for five consecutive calendar years, the longest streak ever. More recently, since the October 2011 low, $1 billion was pulled out of equity mutual funds and $74B added to bond mutual funds, despite the S&P 500’s +28% surge. Finally, The Financial Times reports since 2000, UK pension funds and insurance companies reduced equities to less than 30% of total assets from 60%. Asset allocation trends matter because market tops coincide with peak investor participation and enthusiasm.

We attempt to flexibly allocate and actively select securities based on our ongoing analysis of economic, relative valuation, and company specific trends. During the quarter, we initiated a position in Helmerich & Payne, added to Apache, reduced Accenture, CME, and PNC, and eliminated Johnson Controls from the portfolio.

Thank you for your investment in, and support of, the FMI Provident Trust Strategy Fund.

Best Regards,

J. Scott Harkness, CFA

Portfolio Manager

| (1) | The Fund’s 1-year and annualized 5-year and 10-year returns through March 31, 2012 were: 2.76%, 3.99% and 7.12%, respectively. |

| (2) | The S&P 500’s 1-year and annualized 5-year and 10-year returns through March 31, 2012 were: 8.54%, 2.01% and 4.12%, respectively. |

| (3) | The S&P 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e., its market price per share times the number of shares outstanding). Stocks may be added or deleted from the Index from time to time. |

FMI Provident Trust Strategy Fund

This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Fund unless accompanied or preceded by the Fund’s current prospectus.

Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions.

Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

As of the Fund’s Prospectus dated January 31, 2012, the Fund’s annual operating expense ratio is 0.98%.

An investment cannot be made directly into an index.

For more information about the FMI Provident Trust Strategy Fund, call 1-800-811-5311 for a free prospectus. Please read the prospectus carefully to consider the investment objectives, risks, charges and expenses, before investing or sending money. The prospectus contains this and more information about the FMI Provident Trust Strategy Fund. Please read the prospectus carefully before investing.

Securities named in the Letter to Shareholders, but not listed in the Schedule of Investments are not held in the Fund as of the date of this disclosure. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual securities.

Risks associated with investing in the Fund are: Stock Market Risk, Asset Allocation Risk, Non-Diversification Risk, Small and Medium Capitalization Companies Risk, Credit Risk, Interest Rate Risk, Prepayment Risk and Market Timing Risk. For details regarding these risks, please refer to the Fund’s Prospectus dated January 31, 2012.

P/E- Price to Earnings ratio is a valuation ratio of a company’s current share price compared to its per-share earnings. Reference definition found at Investopedia.com

Distributed by Rafferty Capital Markets, LLC

100 E. Wisconsin Ave. • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

FMI Provident Trust Strategy Fund

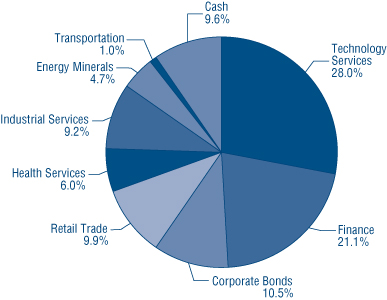

Industry Sectors as of March 31, 2012

As a shareholder of the FMI Provident Trust Strategy Fund, you incur ongoing costs, including management fees and other Fund expenses. You do not incur transaction costs such as sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees because the Fund does not charge these fees. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2011 through March 31, 2012.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

In addition to the costs highlighted and described below, the only Fund transaction costs you might currently incur would be wire fees ($15 per wire), if you choose to have proceeds from a redemption wired to your bank account instead of receiving a check. Additionally, U.S. Bank charges an annual processing fee ($15) if you maintain an IRA account with the Fund. To determine your total costs of investing in the Fund, you would need to add any applicable wire or IRA processing fees you’ve incurred during the period to the costs provided in the example below.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account | | Ending Account | | Expenses Paid During |

| | Value 10/01/11 | | Value 3/31/12 | | Period* 10/01/11-3/31/12 |

| FMI Provident Trust Strategy Fund Actual | $1,000.00 | | $1,206.00 | | $5.40 |

| Hypothetical (5% return before expenses) | $1,000.00 | | $1,020.10 | | $4.95 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.98%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period between October 1, 2011 and March 31, 2012). |

FMI Provident Trust Strategy Fund

STATEMENT OF ASSETS AND LIABILITIES

March 31, 2012 (Unaudited)

| ASSETS: | | | |

| Investments in securities, at value (cost $99,306,447) | | $ | 138,673,270 | |

| Cash | | | 13,898,127 | |

| Receivable from shareholders for purchases | | | 550,434 | |

| Receivable for investments sold | | | 352,595 | |

| Dividends & interest receivable | | | 84,293 | |

| Total assets | | $ | 153,558,719 | |

| LIABILITIES: | | | | |

| Payable to adviser for management fees | | $ | 66,807 | |

| Payable to shareholders for redemptions | | | 61,180 | |

| Other liabilities | | | 56,185 | |

| Total liabilities | | | 184,172 | |

| NET ASSETS: | | | | |

| Capital Stock, $0.01 par value; 300,000,000 shares authorized; 16,617,771 shares outstanding | | | 115,427,804 | |

| Net unrealized appreciation on investments | | | 39,366,823 | |

| Accumulated net realized loss on investments | | | (1,606,665 | ) |

| Undistributed net investment income | | | 186,585 | |

| Net assets | | | 153,374,547 | |

| Total liabilities and net assets | | $ | 153,558,719 | |

CALCULATION OF NET ASSET VALUE PER SHARE: | | | | |

| Net asset value, offering and redemption price per share ($153,374,547 ÷ 16,617,771 shares outstanding) | | $ | 9.23 | |

The accompanying notes to financial statements are an integral part of this statement.

SCHEDULE OF INVESTMENTS

March 31, 2012 (Unaudited)

| Shares | | | | | Cost | | | Value | |

| LONG-TERM INVESTMENTS — 90.4% (a) | | | | | | | |

| | | | | | | | |

| COMMON STOCKS — 79.9% (a) | | | | | | | |

| | | | | | | | |

| ENERGY MINERALS SECTOR — 4.7% | | | | | | | |

| | | Oil & Gas Production — 4.7% | | | | | | | |

| | 72,335 | | Apache Corporation | | | $ | 6,719,473 | | | $ | 7,265,327 | |

| | | | | | | | | | |

| FINANCE SECTOR — 21.1% | | | | | | | | | |

| | | | Finance/Rental/Leasing — 7.0% | | | | | | | | | |

| | 90,860 | | Visa Inc. | | | | 6,134,143 | | | | 10,721,480 | |

| | | | | | | | | | | | | |

| | | | Investment Banks/Brokers — 4.7% | | | | | | | | | |

| | 24,765 | | CME Group Inc. | | | | 6,463,263 | | | | 7,165,257 | |

| | | | | | | | | | | | | |

| | | | Investment Managers — 4.5% | | | | | | | | | |

| | 55,010 | | Franklin | | | | | | | | | |

| | | | Resources, Inc. | | | | 5,964,696 | | | | 6,822,890 | |

| | | | | | | | | | | | | |

| | | | Major Banks — 4.9% | | | | | | | | | |

| | 117,000 | | PNC Financial | | | | | | | | | |

| | | | Services Group, Inc. | | | | 6,237,632 | | | | 7,545,330 | |

| | | | | | | | | | |

| HEALTH SERVICES SECTOR — 6.0% | | | | | | | | | |

| | | | Health Industry Services — 6.0% | | | | | | | | | |

| | 170,000 | | Express Scripts, Inc.* | | | | 4,206,427 | | | | 9,210,600 | |

| | | | | | | | | | |

| INDUSTRIAL SERVICES SECTOR — 9.2% | | | | | | | | | |

| | | | Contract Drilling — 4.7% | | | | | | | | | |

| | 133,190 | | Helmerich & | | | | | | | | | |

| | | | Payne, Inc. | | | | 7,748,440 | | | | 7,185,601 | |

| | | | | | | | | | | | | |

| | | | Engineering & Construction — 4.5% | | | | | | | | | |

| | 156,000 | | Jacobs Engineering | | | | | | | | | |

| | | | Group Inc.* | | | | 5,618,398 | | | | 6,921,720 | |

| | | | | | | | | | |

| RETAIL TRADE SECTOR — 9.9% | | | | | | | | | |

| | | | Apparel/Footwear Retail — 7.1% | | | | | | | | | |

| | 274,140 | | The TJX | | | | | | | | | |

| | | | Companies, Inc. | | | | 4,481,682 | | | | 10,886,099 | |

| | | | | | | | | | | | | |

| | | | Home Improvement Chains — 2.8% | | | | | | | | | |

| | 80,000 | | Fastenal Co. | | | | 1,555,452 | | | | 4,328,000 | |

FMI Provident Trust Strategy Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2012 (Unaudited)

| Shares or | | | | | | | | | |

| Principal | | | | | | | | | |

| Amount | | | | | Cost | | | Value | |

| LONG-TERM INVESTMENTS — 90.4% (a) (Continued) | | | | | | | |

| | | | | | | | |

| COMMON STOCKS — 79.9% (a) (Continued) | | | | | | | |

| | | | | | | | |

| TECHNOLOGY SERVICES SECTOR — 28.0% | | | | | | | |

| | | Information Technology Services — 18.1% | | | | | | | |

| | 113,110 | | Accenture PLC | | | $ | 3,289,701 | | | $ | 7,295,595 | |

| | 157,648 | | Cognizant Technology | | | | | | | | | |

| | | | Solutions Corp.* | | | | 4,544,445 | | | | 12,131,014 | |

| | 145,600 | | Infosys Technologies | | | | | | | | | |

| | | | Ltd. SP-ADR | | | | 6,437,478 | | | | 8,303,568 | |

| | | | | | | | 14,271,624 | | | | 27,730,177 | |

| | | | Internet Software/Services — 4.8% | | | | | | | | | |

| | 11,545 | | Google Inc.* | | | | 5,970,560 | | | | 7,403,116 | |

| | | | | | | | | | | | | |

| | | | Packaged Software — 5.1% | | | | | | | | | |

| | 270,000 | | Oracle Corp. | | | | 6,852,490 | | | | 7,873,200 | |

| | | | | | | | | | |

| TRANSPORTATION SECTOR — 1.0% | | | | | | | | | |

| | | | Trucking — 1.0% | | | | | | | | | |

| | 99,880 | | Heartland | | | | | | | | | |

| | | | Express, Inc. | | | | 1,478,854 | | | | 1,444,265 | |

| | | | Total common stocks | | | | 83,703,134 | | | | 122,503,062 | |

| | | | | | | | | | |

| CORPORATE BONDS — 10.5% (a) | | | | | | | | | |

| $ | 3,800,000 | | JP Morgan Chase & Co., | | | | | | | | | |

| | | | 3.70%, due 01/20/15 | | | | 3,829,744 | | | | 4,006,910 | |

| | 2,315,000 | | Shell International | | | | | | | | | |

| | | | Finance B.V., | | | | | | | | | |

| | | | 3.10%, due 06/28/15 | | | | 2,343,097 | | | | 2,477,994 | |

| | 2,747,000 | | Westpac Banking Corp., | | | | | | | | | |

| | | | 3.00%, due 08/04/15 | | | | 2,747,257 | | | | 2,843,571 | |

| | 3,810,000 | | Hewlett Packard Co., | | | | | | | | | |

| | | | 3.00%, due 09/15/16 | | | | 3,817,830 | | | | 3,913,640 | |

| | 2,850,000 | | American Express | | | | | | | | | |

| | | | Credit Corp., | | | | | | | | | |

| | | | 2.80%, due 09/19/16 | | | | 2,865,385 | | | | 2,928,093 | |

| | | | Total corporate bonds | | | | 15,603,313 | | | | 16,170,208 | |

| | | | Total long-term | | | | | | | | | |

| | | | investments | | | | 99,306,447 | | | | 138,673,270 | |

| | | | Total investments | | | | | | | | | |

| | | | — 90.4% | | | $ | 99,306,447 | | | | 138,673,270 | |

| | | | Cash and receivables, | | | | | | | | | |

| | | | less liabilities | | | | | | | | | |

| | | | — 9.6% (a) | | | | | | | | 14,701,277 | |

| | | | TOTAL NET | | | | | | | | | |

| | | | ASSETS — 100.0% | | | | | | | $ | 153,374,547 | |

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

PLC – Public Limited Company

SP-ADR – Sponsored American Depositary Receipts

The accompanying notes to financial statements are an integral part of this schedule.

FMI Provident Trust Strategy Fund

STATEMENT OF OPERATIONS

For the Six Month Period Ending March 31, 2012 (Unaudited)

| INCOME: | | | |

| Dividends | | $ | 763,788 | |

| Interest | | | 251,252 | |

| Total income | | | 1,015,040 | |

EXPENSES: | | | | |

| Management fees | | | 471,430 | |

| Transfer agent fees | | | 83,031 | |

| Administrative and accounting services | | | 61,702 | |

| Registration fees | | | 21,669 | |

| Professional fees | | | 20,459 | |

| Other expenses | | | 16,843 | |

| Printing and postage expense | | | 10,966 | |

| Custodian fees | | | 7,919 | |

| Board of Directors fees | | | 7,000 | |

| Insurance expense | | | 2,738 | |

| Total expenses | | | 703,757 | |

| NET INVESTMENT INCOME | | | 311,283 | |

| NET REALIZED GAIN ON INVESTMENTS | | | 1,757,087 | |

| NET INCREASE IN UNREALIZED APPRECIATION ON INVESTMENTS | | | 24,190,461 | |

| NET GAIN ON INVESTMENTS | | | 25,947,548 | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 26,258,831 | |

STATEMENTS OF CHANGES IN NET ASSETSFor the Six Month Period Ending March 31, 2012 (Unaudited) and For the Year Ended September 30, 2011

| | | 2012 | | | 2011 | |

| OPERATIONS: | | | | | | |

| Net investment income (loss) | | $ | 311,283 | | | $ | (12,636 | ) |

| Net realized gain (loss) on investments | | | 1,757,087 | | | | (258,503 | ) |

| Net increase (decrease) in unrealized appreciation on investments | | | 24,190,461 | | | | (4,389,612 | ) |

| Net increase (decrease) in net assets from operations | | | 26,258,831 | | | | (4,660,751 | ) |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributions from net investment income ($0.00715 per share) | | | (124,698 | ) | | | — | |

| FUND SHARE ACTIVITIES: | | | | | | | | |

| Proceeds from shares issued (2,333,562 and 7,133,050 shares, respectively) | | | 20,026,012 | | | | 59,444,379 | |

| Net asset value of shares issued in distributions reinvested (14,959 shares) | | | 123,863 | | | | — | |

| Cost of shares redeemed (2,499,997 and 4,943,093 shares, respectively) | | | (21,391,770 | ) | | | (42,062,115 | ) |

| Net (decrease) increase in net assets derived from Fund share activities | | | (1,241,895 | ) | | | 17,382,264 | |

| TOTAL INCREASE | | | 24,892,238 | | | | 12,721,513 | |

| NET ASSETS AT THE BEGINNING OF THE PERIOD | | | 128,482,309 | | | | 115,760,796 | |

| NET ASSETS AT THE END OF THE PERIOD (Includes undistributed net | | | | | | | | |

| investment income of ($186,585 and $0, respectively) | | $ | 153,374,547 | | | $ | 128,482,309 | |

The accompanying notes to financial statements are an integral part of these statements.

FMI Provident Trust Strategy Fund

FINANCIAL HIGHLIGHTS

(Selected data for each share of the Fund outstanding throughout each period)

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| | | For the | | | | | | | | | | | | | | | | |

| | | Six Month | | | | | | | | | | | | | | | | |

| | | Period Ending | | | | | | | | | | | | | | | | |

| | | March 31, | | | Years Ended September 30, | |

| | | 2012 | | | | | | | | | 2009 | | | 2008 | | | 2007 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 7.66 | | | $ | 7.94 | | | $ | 7.36 | | | $ | 7.19 | | | $ | 8.13 | | | $ | 7.46 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.02 | | | | (0.00 | )* | | | 0.01 | | | | (0.00 | ) | | | 0.05 | | | | 0.09 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gains (losses) on investments | | | 1.56 | | | | (0.28 | ) | | | 0.58 | | | | 0.20 | | | | (0.91 | ) | | | 0.95 | |

| Total from investment operations | | | 1.58 | | | | (0.28 | ) | | | 0.59 | | | | 0.20 | | | | (0.86 | ) | | | 1.04 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | (0.01 | ) | | | — | | | | (0.01 | ) | | | (0.03 | ) | | | (0.08 | ) | | | (0.07 | ) |

| Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.30 | ) |

| Total from distributions | | | (0.01 | ) | | | — | | | | (0.01 | ) | | | (0.03 | ) | | | (0.08 | ) | | | (0.37 | ) |

| Net asset value, end of period | | $ | 9.23 | | | $ | 7.66 | | | $ | 7.94 | | | $ | 7.36 | | | $ | 7.19 | | | $ | 8.13 | |

| TOTAL RETURN | | | 20.60 | %** | | | (3.53 | %) | | | 8.04 | % | | | 2.87 | % | | | (10.69 | %) | | | 14.47 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000’s $) | | | 153,375 | | | | 128,482 | | | | 115,761 | | | | 99,866 | | | | 56,498 | | | | 60,254 | |

| Ratio of expenses (after reimbursement) | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets (a) | | | 0.98 | %*** | | | 0.98 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets (b) | | | 0.43 | %*** | | | (0.01 | %) | | | 0.07 | % | | | (0.04 | %) | | | 0.67 | % | | | 1.17 | % |

| Portfolio turnover rate | | | 12 | % | | | 28 | % | | | 51 | % | | | 47 | % | | | 78 | % | | | 52 | % |

| * | Amount less than $0.005 per share. |

| | (a) | Computed after giving effect to adviser’s expense limitation undertaking. If the Fund had paid all of its expenses for the years ended September 30, 2010, 2009, 2008 and 2007, the ratios would have been 1.07%, 1.17%, 1.20% and 1.23%, respectively. |

| | (b) | If the Fund had paid all of its expenses for the years ended September 30, 2010, 2009, 2008 and 2007, the ratios would have been 0.00%, (0.21%), 0.47% and 0.94%, respectively. |

The accompanying notes to financial statements are an integral part of this statement.

FMI Provident Trust Strategy Fund

NOTES TO FINANCIAL STATEMENTS

March 31, 2012 (Unaudited)

| (1) | Summary of Significant Accounting Policies — |

The following is a summary of significant accounting policies of the FMI Mutual Funds, Inc. (the “Company”), which is registered as an open-end management investment company under the Investment Company Act of 1940 (the “Act”), as amended. This Company consists of one non-diversified fund – FMI Provident Trust Strategy Fund (the “Fund”). The Company was incorporated under the laws of Wisconsin on May 23, 1986.

The investment objective of the Fund is to seek long-term growth of capital by investing mainly in a limited number of multi-capitalization growth stocks of U.S. companies.

| | (a) | Each security, excluding short-term investments with maturities of 60 days or less, is valued at the last sale price reported by the principal security exchange on which the issue is traded. Securities that are traded on the Nasdaq Markets are valued at the Nasdaq Official Closing Price, or if no sale is reported, the latest bid price. Securities which are traded over-the-counter, bonds and short-term securities with greater than 60 days to maturity are valued at the latest bid price. Securities for which quotations are not readily available are valued at fair value as determined by the investment adviser or the sub-adviser in accordance with procedures approved by the Board of Directors. The fair value of a security may differ from the last quoted price and the Fund may not be able to sell a security at the fair value. Market quotations may not be available, for example, if trading in particular securities has halted during the day and not resumed prior to the close of trading on the New York Stock Exchange. As of March 31, 2012, there were no securities that were internally fair valued. Variable rate demand notes are recorded at par value which approximates market value. Short-term investments with maturities of 60 days or less are valued at amortized cost which approximates value. For financial reporting purposes, investment transactions are recorded on the trade date. |

The Fund applies the provisions of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification “Fair Value Measurements and Disclosures” Topic 820 (“ASC 820”), which defines fair value as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date.

In determining fair value, the Fund uses various valuation approaches. ASC 820 establishes a fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by generally requiring that the most observable inputs be used when available. Observable inputs are those that market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s assumptions about the inputs market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The inputs or methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The fair value hierarchy is categorized into three levels based on the inputs as follows:

| | Level 1 — | Valuations based on unadjusted quoted prices in active markets for identical assets. |

| | Level 2 — | Valuations based on quoted prices for similar securities or in markets that are not active or for which all significant inputs are observable, either directly or indirectly. |

| | Level 3 — | Valuations based on inputs that are unobservable and significant to the overall fair value measurement. |

The following table summarizes the Fund’s investments as of March 31, 2012, based on the inputs used to value them:

| Valuation Inputs | | Investments in Securities | |

| Level 1 — Common Stocks | | $ | 122,503,062 | |

| Level 2 — Long-Term Corporate Bonds | | | 16,170,208 | |

| Level 3 — | | | — | |

| Total | | $ | 138,673,270 | |

It is the Fund’s policy to recognize transfers between levels at the end of the quarterly reporting period. There were no transfers between levels during the period ended March 31, 2012.

See the Schedule of Investments for investments detailed by industry classification.

FMI Provident Trust Strategy Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2012 (Unaudited)

| (1) | Summary of Significant Accounting Policies — (Continued) |

On May 12, 2011, the FASB issued Accounting Standards Update No. 2011-04 (“ASU No. 2011-04”) modifying ASC 820. At the same time, the International Accounting Standards Board (“IASB”) issued International Financial Reporting Standard (“IFRS”) 13, Fair Value Measurement. The objective of the FASB and IASB is convergence of their guidance on fair value measurements and disclosures. Specifically, the ASU requires reporting entities to: i) disclose the amounts of any transfers between Level 1 and Level 2, and the reasons for the transfers; ii) disclose for Level 3 fair value measurements: a) quantitative information about significant unobservable inputs used; b) a description of the valuation processes used by the reporting entity and; c) a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs if a change in those inputs might result in a significantly higher or lower fair value measurement. The effective date of ASU No. 2011-04 is for interim and annual periods beginning after December 15, 2011. ASU No. 2011-04 has been adopted by the Fund and there has been no material impact to the disclosures.

| | (b) | The Fund may purchase securities on a when-issued or delayed delivery basis. Although the payment and interest terms of these securities are established at the time the purchaser enters into the agreement, these securities may be delivered and paid for at a future date, generally within 45 days. The Fund records purchases of when-issued securities and reflects the value of such securities in determining net asset value in the same manner as other portfolio securities. For the six month period ending March 31, 2012 there were no such securities. |

| | (c) | Net realized gains and losses on sales of securities are computed on the identified cost basis. |

| | (d) | Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis. |

| | (e) | The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. |

| | (f) | No provision has been made for Federal income taxes since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all net investment company taxable income and net capital gains to shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. |

| | (g) | The Fund has reviewed all open tax years and major jurisdictions, which include Federal and the state of Wisconsin, and concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Open tax years are those that are open for exam by taxing authorities and, as of March 31, 2012, open Federal tax years include the tax years ended September 30, 2008 through 2011. The Fund has no examinations in progress and is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. |

| | (h) | The Fund may have investments in short-term variable rate demand notes, which are unsecured instruments. The Fund may be susceptible to credit risk with respect to these notes to the extent the issuer defaults on its payment obligation. The Fund’s policy is to monitor the creditworthiness of the issuer and nonperformance by these issuers is not anticipated. |

| | (i) | GAAP requires that permanent differences between income for financial reporting and tax purposes be reclassified in the capital accounts. During the fiscal year ended September 30, 2011, the reclassifications were as follows: |

| Undistributed Net | Accumulated Net | |

| Investment Income | Realized Loss | Paid In Capital |

| $12,635 | $ — | $(12,635) |

| (2) | Investment Adviser and Management Agreement and Transactions With Related Parties — |

The Fund has entered into a management agreement with Fiduciary Management, Inc. (“FMI”), with whom certain officers and a director of the Fund are affiliated, to serve as investment adviser and manager. Under the terms of the agreement, the Fund pays 0.75% on the first $30,000,000 of the daily net assets, 0.65% on the daily net assets in excess of $30,000,000 and less than $100,000,000 and 0.60% on the daily net assets over $100,000,000. The Fund is responsible for paying its proportionate share of the compensation, benefits and expenses of its Chief Compliance Officer. For administrative convenience, FMI initially makes these payments and is later reimbursed by the Fund.

FMI Provident Trust Strategy Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2012 (Unaudited)

| (2) | Investment Adviser and Management Agreement and Transactions With Related Parties — (Continued) |

The Adviser entered into a sub-advisory agreement with Provident Trust Company (“PTC”) to assist it in the day-to-day management of the Fund. PTC determines which securities will be purchased, retained or sold for the Fund. The Adviser pays PTC a fee equal to 0.60% of the daily net assets up to $30,000,000 and 0.50% of the daily net assets over $30,000,000.

FMI is contractually obligated to reimburse the Fund for expenses over 2.00% of the daily net assets of the Fund. In addition to the reimbursement required under the management agreement, FMI will voluntarily reimbursed the Fund for expenses over 1.00% of the Fund’s daily net assets. For the six month period ending March 31, 2012, there were no contractual or voluntary reimbursements required.

The Fund has entered into a Distribution Plan (the “Plan”), pursuant to Rule 12b-1 under the Act. The Plan provides that the Fund may incur certain costs which may not exceed the lesser of a monthly amount equal to 0.25% of the Fund’s daily net assets or the actual distribution costs incurred during the year. Amounts payable under the Plan are paid monthly for any activities or expenses primarily intended to result in the sale of shares of the Fund. For the six month period ending March 31, 2012, no such expenses were incurred.

Under the Fund’s organizational documents, each director, officer, employee or other agent of the Fund (including the Fund’s investment manager) is indemnified, to the extent permitted by the Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote.

At March 31, 2012, approximately 6% of the outstanding shares of the Fund are owned by an affiliate of the sub-advisor.

| (3) | Distributions to Shareholders — |

Net investment income and net realized gains, if any, are distributed to shareholders at least annually.

| (4) | Investment Transactions — |

For the six month period ending March 31, 2012, purchases and proceeds of sales of investment securities (excluding short-term securities) were $17,862,755 and $15,723,264, respectively.

| (5) | Income Tax Information — |

The following information for the Fund is presented on an income tax basis as of September 30, 2011:

| | | Gross | | Gross | | Net Unrealized | | Distributable | | Distributable |

| Cost of | | Unrealized | | Unrealized | | Appreciation | | Ordinary | | Long-Term |

| Investments | | Appreciation | | Depreciation | | on Investments | | Income | | Capital Gains |

| $103,554,289 | | $19,805,345 | | $(4,733,447) | | $15,071,898 | | $ — | | $ — |

The difference between the cost amounts for financial statement and federal income tax purposes, if any, is due primarily to timing differences in recognizing certain gains and losses in security transactions.

The tax components of dividends paid during the year ended September 30, 2011 and September 30, 2010, capital loss carryovers, which may be used to offset future capital gains, subject to Internal Revenue Code limitations (expiring in 2017), as of September 30, 2011, and tax basis post-October losses as of September 30, 2011, which are not recognized for tax purposes until the first day of the following fiscal year are:

| September 30, 2011 | | September 30, 2010 |

| Ordinary | | Long-Term | | Net Capital | | | | Ordinary | | Long-Term |

| Income | | Capital Gains | | Loss | | Post-October | | Income | | Capital Gains |

| Distributions | | Distributions | | Carryovers | | Losses | | Distributions | | Distributions |

| $ — | | $ — | | $3,033,857 | | $225,431 | | $162,272 | | $ — |

Since there were no ordinary distributions paid for the Fund for the year ended September 30, 2011, there were no distributions designated as qualifying for the dividends received deduction for corporate shareholders nor as qualified dividend income under the Jobs and Growth Tax Relief Act of 2003 (Unaudited).

FMI Provident Trust Strategy Fund

On December 16, 2011, the Board of Directors of the FMI Provident Trust Strategy Fund (“Directors”) approved the continuation of the Fund’s investment advisory agreement with Fiduciary Management, Inc. (“FMI”) and its sub-advisory agreement with Provident Trust Company (“PTC”). Prior to approving the continuation of the agreements, the Directors considered:

| | • | the nature, extent and quality of the services provided by FMI and PTC |

| | • | the investment performance of the Fund |

| | • | the cost of the services to be provided and profits to be realized by FMI and PTC from their relationship with the Fund |

| | • | the extent to which economies of scale would be realized as the Fund grew and whether fee levels reflect any economies of scale |

| | • | the expense ratio of the Fund |

| | • | the manner in which portfolio transactions for the Fund were conducted, including the use of soft dollars |

In considering the nature, extent and quality of the services provided by FMI and PTC, the Directors reviewed a report describing the portfolio management, shareholder communication and servicing, prospective shareholder assistance and regulatory compliance services provided by FMI and PTC to the Fund. The Directors concluded that FMI and PTC were providing essential services to the Fund. In particular, the Directors concluded that FMI and PTC were preparing reports to shareholders in addition to those required by law, and were providing services to the Fund that were in addition to the services investment advisers typically provided to non-mutual fund clients.

The Directors compared the performance of the Fund to the benchmark index over various periods of time and concluded that the performance of the Fund warranted the continuation of the agreements.

In concluding that the advisory fees payable by the Fund were reasonable, the Directors reviewed a report that concluded that FMI was realizing only a small profit from its relationship with the Fund because of the Fund’s small size. The Directors also reviewed reports comparing the Fund’s expense ratio and advisory fee paid by the Fund to those of other comparable mutual funds and concluded that the advisory fee paid by the Fund and the Fund’s expense ratio were within the range of comparable mutual funds. The Directors noted that the investment advisory fee was adjusted if economies of scale were realized as the Fund grew.

Finally, the Directors reviewed reports discussing the manner in which portfolio transactions for the Fund were conducted, including the use of soft dollars. Based on these reports, the Directors concluded that the research obtained by PTC was beneficial to the Fund and that PTC was executing the Fund’s portfolio transactions in a manner designed to obtain best execution for the Fund.

For additional information about the Directors and Officers or for a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, please call (800) 811-5311 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the website of the Securities and Exchange Commission (the “Commission”) at http://www.sec.gov. Information on how the Fund voted proxies relating to portfolio securities is available on the Fund’s website at http://www.fmifunds.com or the website of the Commission no later than August 31 for the prior 12 months ending June 30. The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the Commission’s website. The Fund’s Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C., and that information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

FMI Provident Trust Strategy Fund

100 East Wisconsin Avenue, Suite 2200

Milwaukee, Wisconsin 53202

www.fmifunds.com

414-226-4555

BOARD OF DIRECTORS

BARRY K. ALLEN

ROBERT C. ARZBAECHER

JOHN S. BRANDSER

GORDON H. GUNNLAUGSSON

PAUL S. SHAIN

INVESTMENT ADVISER

FIDUCIARY MANAGEMENT, INC.

100 East Wisconsin Avenue, Suite 2200

Milwaukee, Wisconsin 53202

PORTFOLIO MANAGER

PROVIDENT TRUST COMPANY

N16 W23217 Stone Ridge Drive, Suite 310

Waukesha, Wisconsin 53188

ADMINISTRATOR, ACCOUNTANT, TRANSFER

AGENT AND DIVIDEND DISBURSING AGENT

U.S. BANCORP FUND SERVICES, LLC

615 East Michigan Street

Milwaukee, Wisconsin 53202

800-811-5311 or 414-765-4124

CUSTODIAN

U.S. BANK, N.A.

DISTRIBUTOR

RAFFERTY CAPITAL MARKETS, LLC

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

PRICEWATERHOUSECOOPERS LLP

LEGAL COUNSEL

FOLEY & LARDNER LLP

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Schedule of Investments.

| (a) | The Schedule of Investments in securities of unaffiliated issuers is included as part of the report to shareholders filed under Item 1 of this Form. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

None.

Item 11. Controls and Procedures.

| (a) | The Registrant’s disclosure controls and procedures are periodically evaluated. As of April 30, 2012, the date of the last evaluation, the Registrant’s officers have concluded that the Registrant’s disclosure controls and procedures are adequate. |

| (b) | The Registrant’s internal controls are periodically evaluated. There were no changes in the Registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, such controls. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto. Not applicable. |

| | (2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith. |

| (3) | Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the Registrant to 10 or more persons. Not applicable to open-end investment companies. |

| (b) | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

FMI Mutual Funds, Inc.

Registrant

By /s/Ted D. Kellner

Ted D. Kellner, President, Principal Executive Officer

Date May 1, 2012

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

FMI Mutual Funds, Inc.

Registrant

By /s/Ted D. Kellner

Ted D. Kellner, President, Principal Executive Officer

Date May 1, 2012

FMI Mutual Funds, Inc.

Registrant

By /s/Ted D. Kellner

Ted D. Kellner, Treasurer, Principal Financial Officer

Date May 1, 2012