UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| | |

þ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | | ¨ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the fiscal year ended December 31, 2013 | | For the transition period from to |

Commission File Number 1-9210

Occidental Petroleum Corporation

(Exact name of registrant as specified in its charter)

|

| | |

| State or other jurisdiction of incorporation or organization | | Delaware |

| I.R.S. Employer Identification No. | | 95-4035997 |

| Address of principal executive offices | | 10889 Wilshire Blvd., Los Angeles, CA |

| Zip Code | | 90024 |

| Registrant's telephone number, including area code | | (310) 208-8800 |

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| 9 1/4% Senior Debentures due 2019 | | New York Stock Exchange |

| Common Stock | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: (Note: Checking the box will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections). Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period as the registrant was required to submit and post files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. (See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act).

|

| | | | |

| | Large Accelerated Filer | þ | Accelerated Filer | ¨ |

| | Non-Accelerated Filer | ¨ | Smaller Reporting Company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2) Yes ¨ No þ

The aggregate market value of the voting common stock held by nonaffiliates of the registrant was approximately $70.6 billion, computed by reference to the closing price on the New York Stock Exchange composite tape of $89.23 per share of Common Stock on June 30, 2013. Shares of Common Stock held by each executive officer and director have been excluded from this computation in that such persons may be deemed to be affiliates. This determination of potential affiliate status is not a conclusive determination for other purposes.

At January 31, 2014, there were 794,747,955 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement, relating to its May 2, 2014 Annual Meeting of Stockholders, are incorporated by reference into Part III.

|

| | |

| TABLE OF CONTENTS |

| | Page |

| Part I | | |

| Items 1 and 2 | Business and Properties.......................................................................................................................................................... | |

| | General.............................................................................................................................................................................. | |

| | Oil and Gas Operations..................................................................................................................................................... | |

| | Chemical Operations......................................................................................................................................................... | |

| | | |

| | Capital Expenditures......................................................................................................................................................... | |

| | Employees......................................................................................................................................................................... | |

| | Environmental Regulation................................................................................................................................................. | |

| | Available Information......................................................................................................................................................... | |

| Item 1A | Risk Factors............................................................................................................................................................................. | |

| Item 1B | Unresolved Staff Comments.................................................................................................................................................... | |

| Item 3 | Legal Proceedings................................................................................................................................................................... | |

| Item 4 | Mine Safety Disclosures.......................................................................................................................................................... | |

| | Executive Officers.................................................................................................................................................................... | |

| Part II | | |

| Item 5 | | |

| Item 6 | Selected Financial Data.......................................................................................................................................................... | |

| Item 7 and 7A | | |

| | Strategy............................................................................................................................................................................. | |

| | Oil and Gas Segment........................................................................................................................................................ | |

| | Chemical Segment............................................................................................................................................................ | |

| | | |

| | Segment Results of Operations......................................................................................................................................... | |

| | | |

| | Taxes................................................................................................................................................................................. | |

| | | |

| | | |

| | Liquidity and Capital Resources........................................................................................................................................ | |

| | Off-Balance-Sheet Arrangements...................................................................................................................................... | |

| | Contractual Obligations..................................................................................................................................................... | |

| | | |

| | | |

| | Foreign Investments.......................................................................................................................................................... | |

| | | |

| | | |

| | | |

| | | |

| Item 8 | | |

| | | |

| | | |

| | | |

| | Consolidated Balance Sheets........................................................................................................................................... | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 9 | | |

| Item 9A | Controls and Procedures......................................................................................................................................................... | |

| | | |

| Part III | | |

| Item 10 | | |

| Item 11 | Executive Compensation........................................................................................................................................................ | |

| Item 12 | | |

| Item 13 | | |

| Item 14 | | |

| Part IV | | |

| Item 15 | | |

Part I

| |

| ITEMS 1 AND 2 | BUSINESS AND PROPERTIES |

In this report, "Occidental" means Occidental Petroleum Corporation, a Delaware corporation (OPC), or OPC and one or more entities in which it owns a controlling interest (subsidiaries). Occidental conducts its operations through various subsidiaries and affiliates. Occidental’s executive offices are located at 10889 Wilshire Boulevard, Los Angeles, California 90024; telephone (310) 208-8800.

GENERAL

Occidental’s principal businesses consist of three segments. The oil and gas segment explores for, develops and produces oil and condensate, natural gas liquids (NGL) and natural gas. The chemical segment (OxyChem) mainly manufactures and markets basic chemicals and vinyls. The midstream, marketing and other segment (midstream and marketing) gathers, processes, transports, stores, purchases and markets oil, condensate, NGLs, natural gas, carbon dioxide (CO2) and power. It also trades around its assets, including transportation and storage capacity, and trades oil, NGLs, gas and other commodities. Additionally, the midstream and marketing segment invests in entities that conduct similar activities.

For information regarding Occidental's segments, geographic areas of operation and current developments, including its recent strategic review and actions, see the information in the "Management’s Discussion and Analysis of Financial Condition and Results of Operations" (MD&A) section of this report and Note 16 to the Consolidated Financial Statements.

OIL AND GAS OPERATIONS

General

Occidental’s domestic oil and gas operations are located in California, Colorado, Kansas, New Mexico, North Dakota, Oklahoma and Texas. International operations are located in Bahrain, Bolivia, Colombia, Iraq, Libya, Oman, Qatar, the United Arab Emirates (UAE) and Yemen.

Proved Reserves and Sales Volumes

The table below shows Occidental’s total oil, NGLs and natural gas proved reserves and sales volumes in 2013, 2012 and 2011. See "MD&A — Oil and Gas Segment," and the information under the caption "Supplemental Oil and Gas Information" for certain details regarding Occidental’s proved reserves, the reserves estimation process, sales and production volumes, production costs and other reserves-related data.

Comparative Oil and Gas Proved Reserves and Sales Volumes

Oil, which includes condensate, and NGLs in millions of barrels; natural gas in billions of cubic feet (Bcf); barrels of oil equivalent (BOE) in millions.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | 2012 | | 2011 | |

| Proved Reserves | | Oil | | NGLs | | Gas | | BOE | (a) | Oil | | NGLs | | Gas | | BOE | (a) | Oil | | NGLs | | Gas | | BOE | (a) |

| United States | | 1,665 |

| | 274 |

| | 2,855 |

| | 2,415 |

| | 1,567 |

| | 216 |

| | 2,889 |

| | 2,265 |

| | 1,526 |

| | 225 |

| | 3,365 |

| | 2,313 |

| |

| International | | 482 |

| | 134 |

| | 2,711 |

| | 1,068 |

| | 469 |

| | 116 |

| | 2,679 |

| | 1,031 |

| | 482 |

| | 55 |

| | 1,958 |

| | 863 |

| |

| Total | | 2,147 |

| | 408 |

| | 5,566 |

| | 3,483 |

| | 2,036 |

| | 332 |

| | 5,568 |

| | 3,296 |

| | 2,008 |

| | 280 |

| | 5,323 |

| | 3,176 |

| |

| Sales Volumes | | | | | | | | | | | | | | | | | | | | | | | | | |

| United States | | 97 |

| | 28 |

| | 289 |

| | 173 |

| | 93 |

| | 27 |

| | 300 |

| | 170 |

| | 84 |

| | 25 |

| | 285 |

| | 156 |

| |

| International | | 75 |

| | 3 |

| | 163 |

| | 105 |

| | 78 |

| | 3 |

| | 170 |

| | 110 |

| | 80 |

| | 4 |

| | 162 |

| | 111 |

| |

| Total | | 172 |

| | 31 |

| | 452 |

| | 278 |

| | 171 |

| | 30 |

| | 470 |

| | 280 |

| | 164 |

| | 29 |

| | 447 |

| | 267 |

| |

Note: The detailed proved reserves information presented in accordance with Item 1202(a)(2) to Regulation S-K under the Securities Exchange Act of 1934 (Exchange Act) is provided on pages 78-81. Proved reserves are stated on a net basis after applicable royalties.

| |

| (a) | Natural gas volumes have been converted to BOE based on energy content of six thousand cubic feet (Mcf) of gas to one barrel of oil. Barrels of oil equivalence does not necessarily result in price equivalence. The price of natural gas on a barrel of oil equivalent basis is currently substantially lower than the corresponding price for oil and has been similarly lower for a number of years. For example, in 2013, the average prices of West Texas Intermediate (WTI) oil and New York Mercantile Exchange (NYMEX) natural gas were $97.97 per barrel and $3.66 per Mcf, respectively, resulting in an oil to gas ratio of over 25. |

Competition

As a producer of oil and condensate, NGLs and natural gas, Occidental competes with numerous other domestic and foreign private and government producers. Oil, NGLs and natural gas are commodities that are sensitive to prevailing global and, in certain cases local, current and anticipated market conditions. They are sold at current market prices or on a forward basis to refiners and other market participants. Occidental’s competitive strategy relies on increasing production through developing conventional and unconventional mature and underdeveloped fields, enhanced oil recovery (EOR) projects and strategic acquisitions. Occidental also competes to develop and produce its worldwide oil and gas reserves cost-effectively, maintain a skilled workforce and obtain quality services.

CHEMICAL OPERATIONS

General

OxyChem owns and operates manufacturing plants at 22 domestic sites in Alabama, Georgia, Illinois, Kansas, Louisiana, Michigan, New Jersey, New York, Ohio, Pennsylvania and Texas and at two international sites in Canada and Chile. During 2013 OxyChem sold its interest in a Brazilian joint venture. OxyChem expects to begin operating a 182,000-ton-per-year chlor-alkali plant in Tennessee during early 2014.

Competition

OxyChem competes with numerous other domestic and foreign chemical producers. For every product it manufactures and markets, OxyChem’s market position was first or second in the United States in 2013. OxyChem’s competitive strategy is to be a low-cost producer of its products in order to compete on price.

OxyChem produces the following products:

|

| | | | |

| | | | | |

| Principal Products | | Major Uses | | Annual Capacity |

| Basic Chemicals | | | | |

| Chlorine | | Raw material for ethylene dichloride (EDC), water treatment and pharmaceuticals | | 3.6 million tons |

| Caustic soda | | Pulp, paper and aluminum production | | 3.8 million tons |

| Chlorinated organics | | Refrigerants, silicones and pharmaceuticals | | 0.9 billion pounds |

| Potassium chemicals | | Fertilizers, batteries, soaps, detergents and specialty glass | | 0.4 million tons |

| EDC | | Raw material for vinyl chloride monomer (VCM) | | 2.1 billion pounds |

| Chlorinated isocyanurates | | Swimming pool sanitation and disinfecting products | | 131 million pounds |

| Sodium silicates | | Catalysts, soaps, detergents and paint pigments | | 0.6 million tons |

| Calcium chloride | | Ice melting, dust control, road stabilization and oil field services | | 0.7 million tons |

| Vinyls | | | | |

| VCM | | Precursor for polyvinyl chloride (PVC) | | 6.2 billion pounds |

| PVC | | Piping, building materials, and automotive and medical products | | 3.7 billion pounds |

| Other Chemicals | | | | |

| Resorcinol | | Tire manufacture, wood adhesives and flame retardant synergist | | 50 million pounds |

MIDSTREAM AND MARKETING OPERATIONS

General

Occidental's midstream and marketing operations primarily support and enhance its oil and gas and chemicals businesses and also provide similar services for third parties.

Competition

Occidental's midstream and marketing businesses operate in competitive and highly regulated markets. Occidental's domestic pipeline business competes with other midstream transportation companies to provide transportation services. The competitive strategy of

Occidental's domestic pipeline business is to ensure that its pipeline and gathering systems connect various production areas to multiple market locations. Transportation rates are regulated and tariff-based. In marketing its own and third-party production in the oil and gas business, Occidental strives to maximize realized value using its assets, including transportation and storage capacity. Other midstream and marketing operations also support Occidental's domestic and international oil and gas and chemical operations and include limited commodity trading. Occidental's marketing and trading business competes with other market participants on exchanges and through other bilateral transactions.

The midstream and marketing operations are conducted in the locations described below:

|

| | | | |

| | | | | |

| Location | | Description | | Capacity |

| Gas Plants | | | | |

| California, Texas, New Mexico and Colorado | | Occidental- and third-party-operated natural gas gathering, compression and processing systems, and CO2 processing | | 3.1 billion cubic feet per day |

| Pipelines | | | | |

| Texas, New Mexico and Oklahoma | | Common carrier oil pipeline and storage system | | 616,000 barrels of oil per day 5.8 million barrels of oil storage 2,800 miles of pipeline |

| Texas, New Mexico and Colorado | | CO2 fields and pipeline systems transporting CO2 to oil and gas producing locations | | 2.4 billion cubic feet per day |

| Dolphin Pipeline - Qatar and United Arab Emirates | | Equity investment in a natural gas pipeline | | 3.2 billion cubic feet of natural gas per day (a) |

| Western and Southern United States and Canada | | Equity investment in entity involved in pipeline transportation, storage, terminalling and marketing of oil, gas and related petroleum products | | 18,200 miles of pipeline and gathering systems (b) Storage for 121 million barrels of oil and other petroleum products and 97 billion cubic feet of natural gas (b) |

| Marketing and Trading | | | | |

| Texas, Connecticut, United Kingdom, Singapore and other | | Trades around its assets, including transportation and storage capacity, and purchases, markets and trades oil, NGLs, gas, power and other commodities | | Not applicable |

| Power Generation | | | | |

| California, Texas and Louisiana | | Occidental-operated power and steam generation facilities | | 1,800 megawatts per hour and 1.8 million pounds of steam per hour |

| |

| (a) | Pipeline currently transports 2.3 Bcf per day. Additional gas compression and customer contracts are required to reach capacity. |

| |

| (b) | Amounts are gross, including interests held by third parties. |

CAPITAL EXPENDITURES

For information on capital expenditures, see the information under the heading "Liquidity and Capital Resources” in the MD&A section of this report.

EMPLOYEES

Occidental employed approximately 12,900 people at December 31, 2013, 9,000 of whom were located in the United States. Occidental employed approximately 8,500 people in the oil and gas and midstream and marketing segments and 3,100 people in the chemical segment. An additional 1,300 people were employed in administrative and headquarters functions. Approximately 800 U.S.-

based employees and 1,200 foreign-based employees are represented by labor unions.

Occidental has a long-standing strict policy to provide fair and equal employment opportunities to all applicants and employees.

ENVIRONMENTAL REGULATION

For environmental regulation information, including associated costs, see the information under the heading "Environmental Liabilities and Expenditures" in the MD&A section of this report and "Risk Factors."

AVAILABLE INFORMATION

Occidental makes the following information available free of charge on its website at www.oxy.com:

| |

| Ø | Forms 10-K, 10-Q, 8-K and amendments to these forms as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (SEC); |

| |

| Ø | Other SEC filings, including Forms 3, 4 and 5; and |

| |

| Ø | Corporate governance information, including its corporate governance guidelines, board-committee charters and Code of Business Conduct. (See Part III, Item 10, of this report for further information.) |

Information contained on Occidental's website is not part of this report.

ITEM 1A RISK FACTORS

Volatile global and local commodity pricing strongly affects Occidental’s results of operations.

Occidental’s financial results correlate closely to the prices it obtains for its products, particularly oil and, to a lesser extent, natural gas and NGLs, and its chemical products.

Changes in consumption patterns, global and local (particularly for gas) economic conditions, inventory levels, production disruptions, the actions of OPEC, currency exchange rates, worldwide drilling and exploration activities, technological developments, weather, geophysical and technical limitations, transportation bottlenecks and other matters affect the supply and demand dynamics of oil, gas and NGLs, which, along with the effect of changes in market perceptions, contribute to price unpredictability and volatility.

The prices obtained for Occidental’s chemical products correlate strongly to the health of the United States and global economies, as well as chemical industry expansion and contraction cycles. Occidental also depends on feedstocks and energy to produce chemicals, which are commodities subject to significant price fluctuations.

Occidental's potential restructuring activities may affect its stock price.

Occidental has disclosed that it is performing a strategic review of its operations, which may result in a restructuring of its business activities. The outcome of this activity may affect the market value of Occidental's common stock. For example, Occidental may take different

actions than expected, receive less proceeds or retain more liabilities than anticipated in connection with any divestitures. Additionally, the restructuring activity may be viewed negatively by the market and result in a stock price drop.

Occidental may experience delays, cost overruns, losses or other unrealized expectations in development efforts and exploration activities.

Occidental bears the risks of equipment failures, construction delays, escalating costs or competition for services, materials, supplies or labor, property or border disputes, disappointing drilling results or reservoir performance and other associated risks that may affect its ability to profitably grow production, replace reserves and achieve its targeted returns.

Exploration is inherently risky and is subject to delays, misinterpretation of geologic or engineering data, unexpected geologic conditions or finding reserves of disappointing quality or quantity, which may result in significant losses.

Governmental actions and political instability may affect Occidental’s results of operations.

Occidental’s businesses are subject to the decisions of many federal, state, local and foreign governments and political interests. As a result, Occidental faces risks of:

| |

| Ø | new or amended laws and regulations, or interpretations of such laws and regulations, including those related to drilling, manufacturing or production processes (including well stimulation techniques such as hydraulic fracturing and acidization), labor and employment, taxes, royalty rates, permitted production rates, entitlements, import, export and use of raw materials, equipment or products, use or increased use of land, water and other natural resources, safety, security and environmental protection, all of which may restrict or prohibit activities of Occidental or its contractors, increase Occidental's costs or reduce demand for Occidental's products; |

| |

| Ø | refusal of, or delay in, the extension or grant of exploration, development or production contracts; and |

| |

| Ø | development delays and cost overruns due to approval delays for, or denial of, drilling and other permits. |

Occidental may experience adverse consequences, such as risk of loss or production limitations, because certain of its international operations are located in countries occasionally affected by political instability, nationalizations, corruption, armed conflict, terrorism, insurgency, civil unrest, security problems, labor unrest, OPEC production restrictions, equipment import restrictions and sanctions. Exposure to such risks may increase if a greater percentage of Occidental’s future oil and gas production or revenue comes from international sources.

Occidental's oil and gas business operates in highly competitive environments, which affect, among other things, its ability to make acquisitions to grow production and replace reserves.

Results of operations, reserves replacement and growth in oil and gas production depend, in part, on Occidental’s ability to profitably acquire additional reserves. Occidental has many competitors (including national oil companies), some of which: (i) are larger and better funded, (ii) may be willing to accept greater risks or (iii) have special competencies. Competition for reserves may make it more difficult to find attractive investment opportunities or require delay of reserve replacement efforts. In addition, during periods of low product prices, any cash conservation efforts may delay production growth and reserve replacement efforts.

Occidental’s acquisition activities also carry risks that it may: (i) not fully realize anticipated benefits due to less-than-expected reserves or production or changed circumstances, such as the deterioration of natural gas prices in recent years; (ii) bear unexpected integration costs or experience other integration difficulties; (iii) experience share price declines based on the market’s evaluation of the activity; or (iv) assume liabilities that are greater than anticipated.

Occidental’s oil and gas reserves are based on professional judgments and may be subject to revision.

Reported oil and gas reserves are an estimate based on periodic review of reservoir characteristics and recoverability, including production decline rates, operating performance and economic feasibility at the prevailing commodity prices as well as capital and operating costs. If Occidental were required to make significant negative reserve revisions, its results of operations and stock price could be adversely affected.

Concerns about climate change may affect Occidental’s operations.

The U.S. federal government and the state of California have adopted, and other jurisdictions are considering, legislation, regulations or policies that seek to control or reduce the production, use or emissions of “greenhouse gases” (GHG), to control or reduce the production or consumption of fossil fuels, and to increase the use of renewable or alternative energy sources. For example, California’s GHG cap-and-trade program currently applies to Occidental's operations in the state. The U.S. Environmental Protection Agency has begun to regulate certain GHG emissions from both stationary and mobile sources. The uncertain outcome and timing of existing and proposed international, national and state measures make it difficult to predict their business impact. However, Occidental could face risks of project execution, increased costs and taxes and lower demand for and restrictions or prohibition on the use of its products as a result of ongoing GHG reduction efforts.

Occidental’s businesses may experience catastrophic events.

The occurrence of events, such as earthquakes, hurricanes, floods, droughts, well blowouts, fires, explosions, chemical releases, industrial accidents, physical attacks and other events that cause operations to cease or be curtailed, may negatively affect Occidental’s businesses and the communities in which it operates. Third-party insurance may not provide adequate coverage or Occidental may be self-insured with respect to the related losses.

Cyber attacks could significantly affect Occidental.

Cyber attacks on businesses have escalated in recent years. Occidental relies on electronic systems and networks to control and manage its oil and gas, chemicals, trading and pipeline operations and has multiple layers of security to mitigate risks of cyber attack. If, however, Occidental were to experience an attack and its security measures failed, the potential consequences to its businesses and the communities in which it operates could be significant.

Occidental's oil and gas reserve additions may not continue at the same rate and its measure of full cycle cash margin may not be fully comparable to that of other companies.

Management expects improved recovery, extensions and discoveries to continue as main sources for reserve additions but factors, such as geology, government regulations and permits and the effectiveness of development plans, are partially or fully outside management's control and could cause results to differ materially from expectations. Occidental uses a measure referred to as full cycle cash margin to measure its performance in developing reserves at a profitable cost. The measure may not include all the costs associated with exploration and development related to reserves added for the period, or may include costs related to reserves added or to be added in other periods, and may differ from the calculations used by other companies.

Other risk factors.

Additional discussion of risks and uncertainties related to price and demand, litigation, environmental matters, oil and gas reserves estimation processes, impairments, derivatives, market risks and internal controls appears under the headings: "MD&A — Oil & Gas Segment — Proved Reserves" and "— Industry Outlook," "— Chemical Segment — Industry Outlook," "— Midstream and Marketing Segment — Industry Outlook," "— Lawsuits, Claims and Contingencies," "— Environmental Liabilities and Expenditures," "— Critical Accounting Policies and Estimates," "— Derivative Activities and Market Risk," and "Management's Annual Assessment of and Report on Internal Control Over Financial Reporting."

The risks described in this report are not the only risks facing Occidental and other risks, including risks deemed immaterial, may have material adverse effects.

| |

| ITEM 1B | UNRESOLVED STAFF COMMENTS |

Occidental has no unresolved SEC staff comments that have been outstanding more than 180 days at December 31, 2013.

ITEM 3 LEGAL PROCEEDINGS

The California Air Resources Board asserted a claim dated July 23, 2013, against an OPC subsidiary regarding reporting and emissions from four pieces of equipment at its facility in Long Beach, California. The subsidiary is evaluating the claim. Although this matter is a reportable

event, the financial impact is expected to be insignificant.

For information regarding other legal proceedings, see the information under the caption "Lawsuits, Claims and Other Contingencies" in the MD&A section of this report and in Note 9 to the Consolidated Financial Statements.

ITEM 4 MINE SAFETY DISCLOSURES

Not applicable.

EXECUTIVE OFFICERS

The current term of employment of each executive officer of Occidental will expire at the May 2, 2014, organizational meeting of the Board of Directors or when a successor is selected. The following table sets forth the executive officers of Occidental:

|

| | | | |

| Name | | Age at March 3, 2014 | | Positions with Occidental and Subsidiaries and Employment History |

| | | | | |

| Stephen I. Chazen | | 67 | | Chief Executive Officer since 2011 and President since 2007; 2010-2011, Chief Operating Officer; 1999-2010, Chief Financial Officer; Director since 2010. |

| | | | | |

| | | | | |

| William E. Albrecht | | 62 | | Vice President since 2008; Occidental Oil and Gas Corporation (OOGC): President — Oxy Oil & Gas, Americas since 2011; OOGC: President — Oxy Oil & Gas, USA 2008-2011. |

| | | | | |

| | | | | |

| Edward A. "Sandy" Lowe | | 62 | | Vice President since 2008; OOGC: President — Oxy Oil & Gas, International Production since 2009; 2008-2009, Executive Vice President — Oxy Oil & Gas, International Production and Engineering. |

| | | | | |

| | | | | |

| Willie C.W. Chiang | | 53 | | Executive Vice President, Operations since 2012; ConocoPhillips: 2011-2012, Senior Vice President, Refining, Marketing, Transportation and Commercial; 2008-2011, Senior Vice President, Refining, Marketing and Transportation. |

| | | | | |

| | | | | |

| Vicki A. Hollub | | 54 | | Vice President since 2013; OOGC: Executive Vice President — Oxy Oil & Gas, U.S. Operations since 2013; 2012-2013, Executive Vice President — Oxy Oil & Gas, California Operations; 2011-2012, President & General Manager of Oxy Permian CO2; 2009-2011, Operations Manager of Oxy Permian. |

| | | | | |

| | | | | |

| B. Chuck Anderson | | 54 | | Vice President since 2012; President of Occidental Chemical Corporation since 2006. |

| | | | | |

| | | | | |

| Cynthia L. Walker | | 37 | | Executive Vice President and Chief Financial Officer since 2012; Goldman, Sachs & Co.: 2010-2012, Managing Director; 2005-2010, Vice President. |

| | | | | |

| | | | | |

| James M. Lienert | | 61 | | Executive Vice President — Business Support since 2012; 2010-2012, Executive Vice President and Chief Financial Officer; 2006-2010, Executive Vice President — Finance and Planning. |

| | | | | |

| | | | | |

| Marcia E. Backus | | 59 | | Vice President and General Counsel since 2013; Vinson & Elkins: 1990-2013, Partner. |

| | | | | |

| | | | | |

| Roy Pineci | | 51 | | Vice President, Controller and Principal Accounting Officer since 2008. |

| | | | | |

| | | | | |

| Donald P. de Brier | | 73 | | Corporate Executive Vice President and Corporate Secretary since 2012; 1993-2012, Executive Vice President, General Counsel and Secretary. |

| | | | | |

Part II

| |

| ITEM 5 | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

TRADING PRICE RANGE AND DIVIDENDS

This section incorporates by reference the quarterly financial data appearing under the caption "Quarterly Financial Data (Unaudited)" after the Notes to the Consolidated Financial Statements, and the information appearing under the caption "Liquidity and Capital Resources" in the MD&A section of this report. Occidental’s common stock was held by approximately 30,000 stockholders of record at December 31, 2013, and by approximately 648,000 additional stockholders whose shares were held for them in street name or nominee accounts. The common stock is listed and traded on the New York Stock Exchange. The quarterly financial data set forth the range of trading prices for the common stock as reported on the composite tape of the New York Stock Exchange and quarterly dividend information.

The quarterly dividends declared on the common stock were $0.64 for each quarter of 2013 ($2.56 for the year). On February 13, 2014, a quarterly dividend of $0.72 per share was declared on the common stock, payable on April 15, 2014 to stockholders of record on March 10, 2014. The declaration of future dividends is a business decision made by the Board of Directors from time to time, and will depend on Occidental’s financial condition and other factors deemed relevant by the Board.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

All of Occidental's stock-based compensation plans for its employees and non-employee directors have been approved by the stockholders. The aggregate number of shares of Occidental common stock authorized for issuance under such plans is approximately 66 million, of which approximately 16 million had been issued through December 31, 2013. The following is a summary of the securities available for issuance under such plans:

|

| | | | | | | |

| a) | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | b) | Weighted-average exercise price of outstanding options, warrants and rights | | c) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities in column (a)) |

| | | | | | | | |

2,048,695 (1) | | 42.11 (2) | | 19,564,605 (3) |

| |

| (1) | Includes shares reserved to be issued pursuant to stock options (Options), stock appreciation rights (SARs) and performance-based awards. Shares for performance-based awards are included assuming maximum payout, but may be paid out at lesser amounts, or not at all, according to achievement of performance goals. |

| |

| (2) | Price applies only to the Options and SARs included in column (a). Exercise price is not applicable to the other awards included in column (a). |

| |

| (3) | A plan provision requires each share covered by an award (other than Options and SARs) to be counted as if three shares were issued in determining the number of shares that are available for future awards. Accordingly, the number of shares available for future awards may be less than the amount shown depending on the type of award granted. Additionally, under the plan, the amount shown may increase, depending on the award type, by the number of shares currently unvested or forfeitable, or three times that number as applicable, that (i) fail to vest, (ii) are forfeited or canceled, or (iii) correspond to the portion of any stock-based awards settled in cash. |

SHARE REPURCHASE ACTIVITIES

Occidental’s share repurchase activities for the year ended December 31, 2013, were as follows:

|

| | | | | | | | | | | | | | | | | | | | |

| Period | | Total Number of Shares Purchased | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs |

| First Quarter 2013 | | | — |

| | | | $ | — |

| | | | — |

| | | | | |

| Second Quarter 2013 | | | 239,444 |

| (a) | | | $ | 90.23 |

| | | | — |

| | | | | |

| Third Quarter 2013 | | | 410,000 |

| | | | $ | 87.28 |

| | | | 410,000 |

| | | | | |

| October 1-31, 2013 | | | 669,309 |

| (a) | | | $ | 95.29 |

| | | | 557,168 |

| | | | | |

| November 1-30, 2013 | | | 3,870,000 |

| | | | $ | 96.91 |

| | | | 3,870,000 |

| | | | | |

| December 1-31, 2013 | | | 5,452,239 |

| | | | $ | 93.10 |

| | | | 5,452,239 |

| | | | | |

| Fourth Quarter 2013 | | | 9,991,548 |

| | | | $ | 94.72 |

| | | | 9,879,407 |

| | | | | |

| Total 2013 | | | 10,640,992 |

| | | | $ | 94.34 |

| | | | 10,289,407 |

| | | | 6,966,168 (b) | |

| |

| (a) | Includes purchases from the trustee of Occidental's defined contribution savings plan that are not part of publicly announced plans or programs. |

| |

| (b) | Represents the number of shares remaining at year-end under Occidental's share repurchase program of 95 million. In February 2014, Occidental increased the number of shares authorized for its program by 30 million; however, the program does not obligate Occidental to acquire any specific number of shares and may be discontinued at any time. |

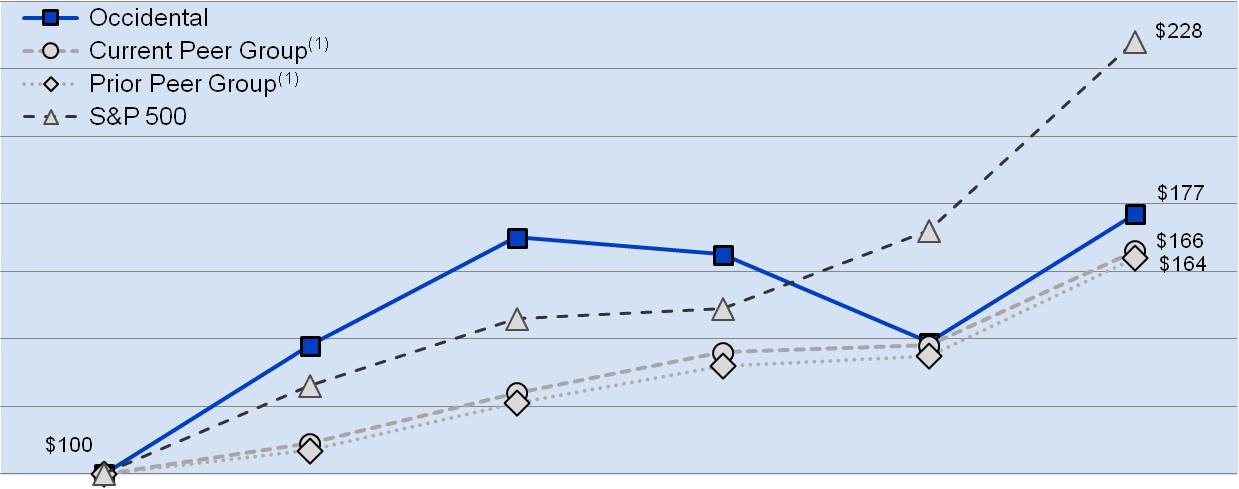

PERFORMANCE GRAPH

The following graph compares the yearly percentage change in Occidental’s cumulative total return on its common stock with the cumulative total return of the Standard & Poor's 500 Stock Index (S&P 500) and with that of Occidental’s current and prior peer groups over the five-year period ended on December 31, 2013. The graph assumes that $100 was invested at the beginning of the five-year period shown in the graph below in (i) Occidental common stock, (ii) the stock of the companies in the S&P 500 and (iii) each of the current and prior peer group companies' common stock weighted by their relative market values within the respective peer groups, and that all dividends were reinvested.

In 2013, Occidental revised its peer group (which includes Occidental) to ensure the companies continue to provide appropriate comparability to Occidental. Prior to the revision, Occidental's peer group consisted of Anadarko Petroleum Corporation, Apache Corporation, Canadian Natural Resources Limited, Chevron Corporation, ConocoPhillips, Devon Energy Corporation, EOG Resources Inc., ExxonMobil Corporation, Hess Corporation, Royal Dutch Shell plc, Total S.A. and Occidental. Occidental's current peer group consists of Anadarko Petroleum Corporation, Apache Corporation, Canadian Natural Resources Limited, Chevron Corporation, ConocoPhillips, Devon Energy Corporation, EOG Resources Inc., ExxonMobil Corporation, Hess Corporation, Marathon Oil Corporation, Total S.A. and Occidental.

|

| | | | | | | | | | | | | | | | | |

| | 12/31/2008 | | 12/31/2009 | | 12/31/2010 | | 12/31/2011 | | 12/31/2012 | | 12/31/2013 |

| $ | 100 | | $ | 138 | | $ | 170 | | $ | 165 | | $ | 139 | | $ | 177 |

| | | | | | | | | | | | | | | | | | |

| | 100 | | | 109 | | | 124 | | | 136 | | | 138 | | | 166 |

| | | | | | | | | | | | | | | | | | |

| | 100 | | | 107 | | | 121 | | | 132 | | | 135 | | | 164 |

| | | | | | | | | | | | | | | | | | |

| | 100 | | | 126 | | | 146 | | | 149 | | | 172 | | | 228 |

The information provided in this Performance Graph shall not be deemed "soliciting material" or "filed" with the Securities and Exchange Commission or subject to Regulation 14A or 14C under the Exchange Act, other than as provided in Item 201 to Regulation S-K under the Exchange Act, or subject to the liabilities of Section 18 of the Exchange Act and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act except to the extent Occidental specifically requests that it be treated as soliciting material or specifically incorporates it by reference.

_______________________

| |

| (1) | The cumulative total return of the peer group companies' common stock includes the cumulative total return of Occidental's common stock. |

| |

| ITEM 6 | SELECTED FINANCIAL DATA |

FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA

Dollar amounts in millions, except per-share amounts

|

| | | | | | | | | | | | | | | | | | | | |

| As of and for the years ended December 31, | | 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

RESULTS OF OPERATIONS (a) | | | | | | | | | | |

| Net sales | | $ | 24,455 |

| | $ | 24,172 |

| | $ | 23,939 |

| | $ | 19,045 |

| | $ | 14,814 |

|

| Income from continuing operations | | $ | 5,922 |

| | $ | 4,635 |

| | $ | 6,640 |

| | $ | 4,569 |

| | $ | 3,151 |

|

| Net income attributable to common stock | | $ | 5,903 |

| | $ | 4,598 |

| | $ | 6,771 |

| | $ | 4,530 |

| | $ | 2,915 |

|

| Basic earnings per common share from continuing operations | | $ | 7.35 |

| | $ | 5.72 |

| | $ | 8.16 |

| | $ | 5.62 |

| | $ | 3.88 |

|

| Basic earnings per common share | | $ | 7.33 |

| | $ | 5.67 |

| | $ | 8.32 |

| | $ | 5.57 |

| | $ | 3.59 |

|

| Diluted earnings per common share | | $ | 7.32 |

| | $ | 5.67 |

| | $ | 8.32 |

| | $ | 5.56 |

| | $ | 3.58 |

|

| | | | | | | | | | | |

FINANCIAL POSITION (a) | | | | | | | | | | |

| Total assets | | $ | 69,443 |

| | $ | 64,210 |

| | $ | 60,044 |

| | $ | 52,432 |

| | $ | 44,229 |

|

| Long-term debt, net | | $ | 6,939 |

| | $ | 7,023 |

| | $ | 5,871 |

| | $ | 5,111 |

| | $ | 2,557 |

|

| Stockholders’ equity | | $ | 43,372 |

| | $ | 40,048 |

| | $ | 37,620 |

| | $ | 32,484 |

| | $ | 29,159 |

|

| | | | | | | | | | | |

MARKET CAPITALIZATION (b) | | $ | 75,699 |

| | $ | 61,710 |

| | $ | 75,992 |

| | $ | 79,735 |

| | $ | 66,050 |

|

| | | | | | | | | | | |

| CASH FLOW | | | | | | | | | | |

| Operating: | | | | | | | | | | |

| Cash provided by operating activities | | $ | 12,927 |

| | $ | 11,312 |

| | $ | 12,281 |

| | $ | 9,566 |

| | $ | 5,946 |

|

| Investing: | | | | | | | | | | |

| Capital expenditures | | $ | (9,037 | ) | | $ | (10,226 | ) | | $ | (7,518 | ) | | $ | (3,940 | ) | | $ | (3,245 | ) |

| Cash provided (used) by all other investing activities, net | | $ | 844 |

| | $ | (2,429 | ) | | $ | (2,385 | ) | | $ | (5,355 | ) | | $ | (2,221 | ) |

| Financing: | | | | | | | | | | |

| Cash dividends paid | | $ | (1,553 | ) | (c) | $ | (2,128 | ) | (c) | $ | (1,436 | ) | | $ | (1,159 | ) | | $ | (1,063 | ) |

| Cash (used) provided by all other financing activities, net | | $ | (1,380 | ) | | $ | 1,282 |

| | $ | 261 |

| | $ | 2,242 |

| | $ | 30 |

|

| | | | | | | | | | | |

| DIVIDENDS PER COMMON SHARE | | $ | 2.56 |

| | $ | 2.16 |

| | $ | 1.84 |

| | $ | 1.47 |

| | $ | 1.31 |

|

| | | | | | | | | | | |

| WEIGHTED AVERAGE BASIC SHARES OUTSTANDING (thousands) | | 804,064 |

| | 809,345 |

| | 812,075 |

| | 812,472 |

| | 811,305 |

|

Note: Argentine operations were sold in February 2011 and have been reflected as discontinued operations for all applicable periods.

| |

| (a) | See the MD&A section of this report and the Notes to Consolidated Financial Statements for information regarding acquisitions and dispositions, discontinued operations and other items affecting comparability. |

| |

| (b) | Market capitalization is calculated by multiplying the year-end total shares of common stock outstanding, net of shares held as treasury stock, by the year-end closing stock price. |

| |

| (c) | The 2012 amount includes an accelerated fourth quarter dividend payment, which normally would have been accrued as of year-end 2012 and paid in the first quarter of 2013. |

ITEM 7 AND 7A

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A)

In this report, "Occidental" means Occidental Petroleum Corporation (OPC), or OPC and one or more entities in which it owns a controlling interest (subsidiaries). Occidental's principal businesses consist of three segments operated by OPC's subsidiaries and affiliates. The oil and gas segment explores for, develops and produces oil and condensate, natural gas liquids (NGL) and natural gas. The chemical segment (OxyChem) mainly manufactures and markets basic chemicals and vinyls. The

midstream, marketing and other segment (midstream and marketing) gathers, processes, transports, stores, purchases and markets oil, condensate, NGLs, natural gas, carbon dioxide (CO2) and power. It also trades around its assets, including transportation and storage capacity, and trades oil, NGLs, gas and other commodities. Additionally, the midstream and marketing segment invests in entities that conduct similar activities.

STRATEGY

General

Through its operations, Occidental aims to maximize total returns to stockholders using the following strategies:

| |

| Ø | Grow oil and gas segment production through development programs focused on large, long-lived conventional and unconventional oil and gas assets with long-term growth potential, and acquisitions; |

| |

| Ø | Allocate and deploy capital with a focus on achieving returns well in excess of Occidental's cost of capital; |

| |

| Ø | Provide consistent dividend growth; and |

| |

| Ø | Maintain financial discipline and a strong balance sheet. |

In conducting its business, Occidental accepts commodity, engineering and limited exploration risks. Occidental seeks to limit its financial and political risks.

To maximize returns, Occidental from time to time reviews its business strategy. In October 2013 and February 2014, Occidental’s Board of Directors authorized several actions resulting from a strategic review to streamline and focus operations in order to better execute Occidental’s long-term strategy and enhance value for shareholders. The authorized actions included:

| |

| Ø | Pursue the sale of a minority interest in the Middle East/North Africa operations in a financially efficient manner. |

| |

| Ø | Pursue strategic alternatives for select Midcontinent assets, including oil and gas interests in the Williston Basin, Hugoton Field, Piceance Basin and other Rocky Mountain assets. |

| |

| Ø | Pursue the sale of a portion of Occidental’s investment in the General Partner of Plains All-American Pipeline, L.P. (Plains Pipeline). |

| |

| Ø | Separation of its California assets into an independent and separately traded company. |

With respect to these initiatives, since October, Occidental:

| |

| Ø | Sold a portion of Plains Pipeline, while continuing to hold an approximate 25-percent interest; |

| |

| Ø | Made steady progress on discussions with key partners in countries where Occidental operates in the Middle East/North Africa region for the sale of a minority interest in its operations there; and |

| |

| Ø | Entered into an agreement to sell its Hugoton operations. |

The strategic review underway is expected to result in significant changes to Occidental’s asset mix. Occidental's capital program, production expectations and other elements of its future plans will be adjusted as related transactions are concluded. Proceeds resulting from these actions will largely be used to reduce Occidental's capitalization. In the fourth quarter of 2013 Occidental bought back almost 10 million shares of its own stock for approximately $0.9 billion using the proceeds from the

Plains Pipeline sale. Occidental also retired $0.6 billion of its debt in the fourth quarter.

Occidental prioritizes the use of its operating cash flows in the following order:

| |

| Ø | Base/Maintenance capital |

Capital is employed to operate all assets in a safe and environmentally sound manner. Management aims to develop Occidental's assets in a manner that would contribute substantially to earnings and cash flow after invested capital. The following describes the application of Occidental's overall strategy to each of its operating segments.

Oil and Gas

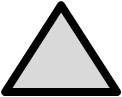

Segment Earnings

($ millions)

Occidental prefers to hold large, long-lived "legacy" oil and gas assets, like those in California and the Permian Basin, that tend to have enhanced secondary and tertiary recovery opportunities and economies of scale that lead to cost-effective production. Occidental also focuses a growing portion of its drilling activities on unconventional shale opportunities.

The oil and gas business seeks to increase its oil and gas production profitably and add new reserves at a pace ahead of production while minimizing costs incurred for finding and development of such reserves. The oil and gas business implements this strategy within the limits of the overall corporate strategy primarily by:

| |

| Ø | Deploying capital efficiently to fully develop areas where reserves are known to exist and increase production from mature and underdeveloped fields and from unconventional acreage by applying appropriate technology and advanced reservoir-management practices; |

| |

| Ø | Adding reserves through a combination of focused exploration and development programs conducted in Occidental's core areas, primarily in the United States but also in the Middle East/North Africa and Latin America; and |

| |

| Ø | Maintaining a disciplined approach to acquisitions and divestitures with an emphasis on transactions at attractive prices. |

Over the past several years, Occidental built a large portfolio of growth-oriented assets in the United States. In 2013, Occidental spent a much larger portion of its investment capital on the development of this portfolio. Acquisitions in 2013 were at a multi-year low of approximately $0.5 billion, all for domestic oil and gas properties. Compared to recent years, this reduced acquisition activity reflects Occidental's strategy to capitalize on the opportunities presented by its existing portfolio of assets.

Management currently believes Occidental's oil and gas segment growth will come domestically from higher oil production in California and the Permian Basin, and internationally from opportunities in key assets, mainly in Oman and Qatar, as well as the completion of the Al Hosn gas project in late 2014.

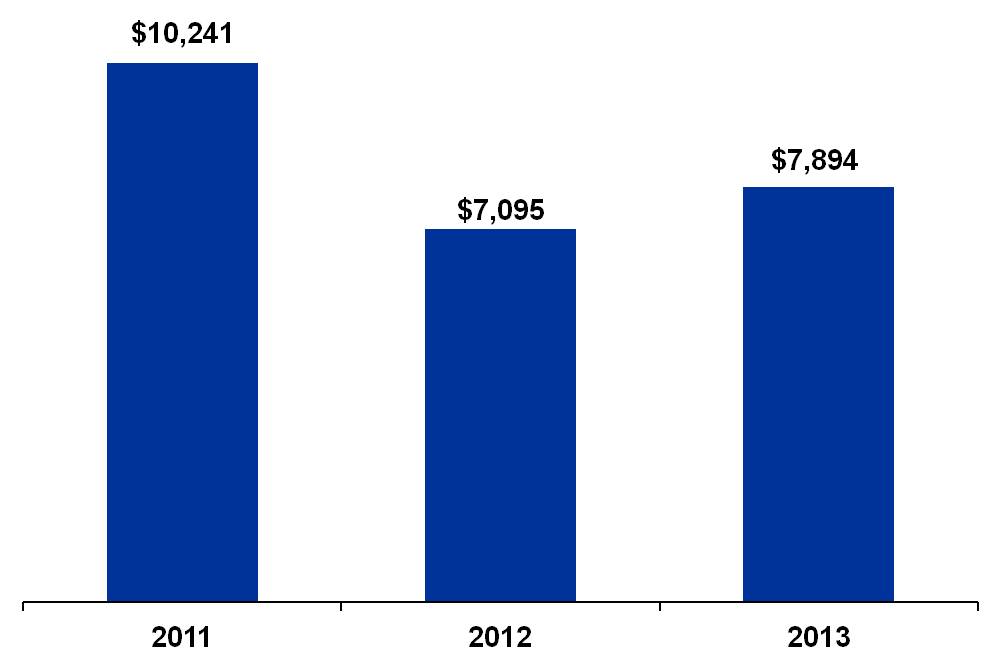

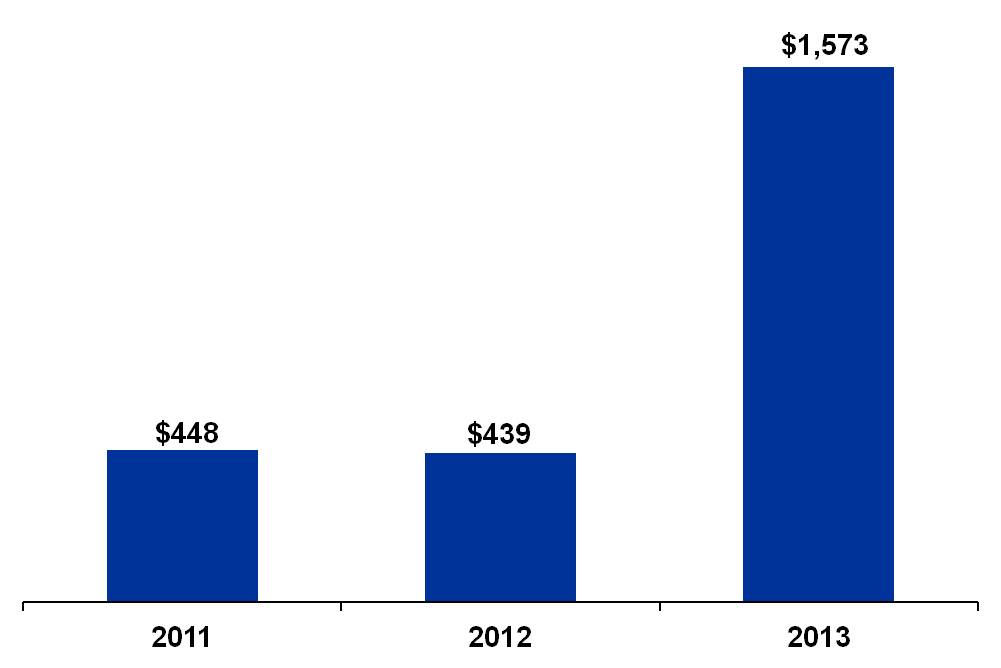

Chemical

Segment Earnings

($ millions)

The primary objective of the chemical business (OxyChem) is to generate cash flow in excess of its normal capital expenditure requirements and achieve above-cost-of-capital returns. The chemical segment's strategy is to be a low-cost producer in order to maximize its cash flow generation. OxyChem concentrates on the chlorovinyls chain beginning with chlorine, which is co-produced with caustic soda, and markets both to third parties. In addition, chlorine, together with ethylene, is converted through a series of intermediate products into PVC. OxyChem's focus on chlorovinyls allows it to maximize the benefits of integration and take advantage of economies of scale. Capital is employed to sustain production capacity and to

focus on projects and developments designed to improve the competitiveness of segment assets. Acquisitions and plant development opportunities may be pursued when they are expected to enhance the existing core chlor-alkali and PVC businesses or take advantage of other specific opportunities. OxyChem expects to begin operating the New Johnsonville, Tennessee chlor-alkali facility in early 2014. During the second quarter of 2013, Occidental sold its investment in Carbocloro, a Brazilian joint venture, for a pre-tax gain of $131 million. In the fourth quarter of 2013, OxyChem and Mexichem, S.A.B. de C.V. formed a 50/50 joint venture to construct and operate a 1.2-billion-pound per year capacity ethylene cracker with startup expected in 2017, and entered into related supply agreements.

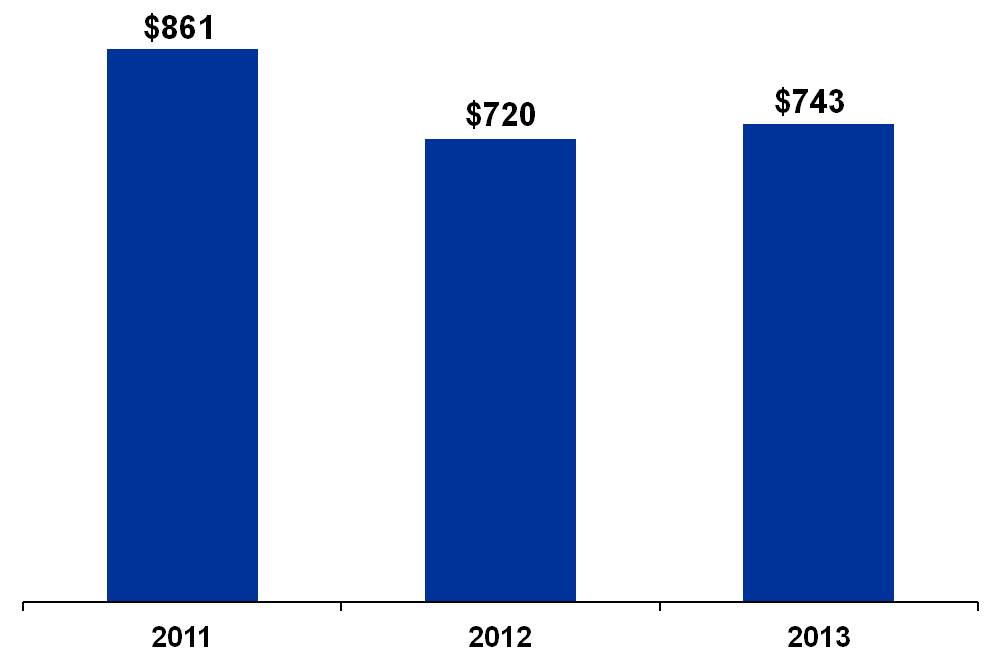

Midstream and Marketing

Segment Earnings

($ millions)

The midstream and marketing segment strives to maximize realized value by optimizing use of its assets, including its transportation and storage capacity, and by providing access to multiple markets. In order to generate returns, the segment evaluates opportunities across the value chain and uses its assets to provide services to other Occidental segments as well as third parties. In commodities trading, Occidental seeks to generate gains using net-long positions. The segment invests in and operates gas plants, co-generation facilities, pipeline systems and storage facilities. The segment also seeks to minimize the costs of gas, power and other commodities used in Occidental's businesses and to limit credit risk exposure. Capital is employed to sustain or, where appropriate, increase operational and transportation capacity and to improve the competitiveness of Occidental's assets. Occidental and Magellan Midstream Partners, L.P. (Magellan) are proceeding with the construction of the BridgeTex Pipeline, which will transport crude oil between the Permian region and the Gulf Coast refinery markets and is expected to begin service in mid-2014. In 2013, Occidental completed the sale of a portion of its investment in Plains Pipeline, resulting in a $1.0 billion pre-tax gain.

Key Performance Indicators

General

Occidental seeks to meet its strategic goals by continually measuring its success in its key performance metrics that drive total stockholder return. In addition to production growth and capital allocation and deployment discussed above, Occidental believes the following are its most significant metrics:

| |

| Ø | Return on equity (ROE) and return on capital employed (ROCE); |

Occidental also monitors other segment-specific indicators such as per-unit profit, production costs and finding and development costs, as well as health, environmental and safety measures such as the number of recordable injuries, and others.

Based on the $2.88 per share annual dividend rate announced in February 2014, Occidental’s dividend rate has increased by 476 percent since 2002. While its stockholders' equity increased by 8 percent for 2013 and 34 percent for the three-year period from 2011 through 2013, Occidental continued to deliver above-cost-of-capital returns as follows:

|

| | | | |

| | | Annual 2013 (a) | | Three-Year Annual Average 2011 - 2013 (b) |

| ROE | | 14.2% | | 15.0% |

| | {13.3%} | |

| ROCE | | 12.2% | | 13.1% |

| | {11.5%} | |

| |

| (a) | The top figures were calculated by dividing Occidental's 2013 net income (adding back after-tax interest expense for ROCE) by its average equity (using debt and equity for ROCE) during 2013. The bottom figures were calculated in the same manner as the top figures, except that they exclude the effects of Significant Items Affecting Earnings described on page 25. We provide this adjusted measure because we believe it would be useful to investors in evaluating and comparing Occidental's performance between periods, not as a substitute for the measure calculated using net income. |

| |

| (b) | The three-year averages were calculated by dividing Occidental's average net income (adding back after-tax interest expense for ROCE) over the three-year period by its average equity (using debt and equity for ROCE) over the same period. |

|

| | | | | | | | |

| | | 2013 | | 2012 |

Full cycle cash margin (a) | | $ | 34.16 |

| | $ | 21.28 |

|

| |

| (a) | Amounts were calculated by subtracting operating costs, taxes other than on income and general and administrative expenses for producing operations, all on a per BOE basis, from realized price for the year. Subtracted from this amount is the finding and development costs per BOE, calculated by dividing exploration and development costs incurred, including asset retirement obligations, but excluding acquisition costs, by proved reserve additions for the year from improved recovery, extensions, discoveries and revisions. Reserve additions include proved undeveloped reserves, for which estimated future development costs are included in amounts disclosed in the Supplemental Oil and Gas Information - Standardized Measure of Discounted Future Net Cash Flows. |

Debt Structure

In 2013, Occidental decreased its debt balance by $690 million, which reduced its debt-to-capitalization (debt and equity) ratio from 16 percent at year-end 2012 to 14 percent at year-end 2013.

OIL AND GAS SEGMENT

Business Environment

Oil and gas prices are the major variables that drive the industry’s short- and intermediate-term financial performance. The following table presents the average daily West Texas Intermediate (WTI), Brent and New York Mercantile Exchange (NYMEX) prices for 2013 and 2012:

|

| | | | | | | | |

| | | 2013 | | 2012 |

| WTI oil ($/barrel) | | $ | 97.97 |

| | $ | 94.21 |

|

| Brent oil ($/barrel) | | $ | 108.76 |

| | $ | 111.70 |

|

| NYMEX gas ($/Mcf) | | $ | 3.66 |

| | $ | 2.81 |

|

The following table presents Occidental's average realized prices as a percentage of WTI, Brent and NYMEX for 2013 and 2012:

|

| | | | | | |

| | | 2013 | | 2012 |

| Worldwide oil as a percentage of average WTI | | 102 | % | | 106 | % |

| Worldwide oil as a percentage of average Brent | | 92 | % | | 89 | % |

| Worldwide NGLs as a percentage of average WTI | | 42 | % | | 48 | % |

| Domestic natural gas as a percentage of NYMEX | | 92 | % | | 93 | % |

Average worldwide realized oil prices were flat in 2013 compared to 2012. Approximately 60 percent of Occidental’s oil production tracks world oil prices, such as Brent, and 40 percent tracks WTI. The average realized domestic natural gas price in 2013 increased 29 percent from 2012.

Prices and differentials can vary significantly, even on a short-term basis, making it impossible to predict realized prices with a reliable degree of certainty.

Operations

Domestic Interests

Occidental conducts its domestic operations through land leases, subsurface mineral rights it owns or a combination of both surface land and subsurface mineral rights it owns. Occidental's domestic oil and gas leases have a primary term ranging from one to ten years, which is extended through the end of production once it commences. Of the total 8.2 million net acres in which Occidental has interests, approximately 74 percent is leased, 25 percent is owned subsurface mineral rights and 1 percent is owned land with mineral rights.

Production-Sharing Contracts (PSC)

Occidental has interests that are operated under PSCs or similar contracts in Bahrain, Iraq, Libya, Oman, Qatar and Yemen. Under such contracts, Occidental records a share of production and reserves to recover certain production costs and an additional share for profit. In addition, Occidental's share of production and reserves from operations in Long Beach, California, and certain contracts in Colombia are subject to contractual

arrangements similar to a PSC. These contracts do not transfer any right of ownership to Occidental and reserves reported from these arrangements are based on Occidental’s economic interest as defined in the contracts. Occidental’s share of production and reserves from these contracts decreases when product prices rise and increases when prices decline. Overall, Occidental’s net economic benefit from these contracts is greater when product prices are higher.

Business Review

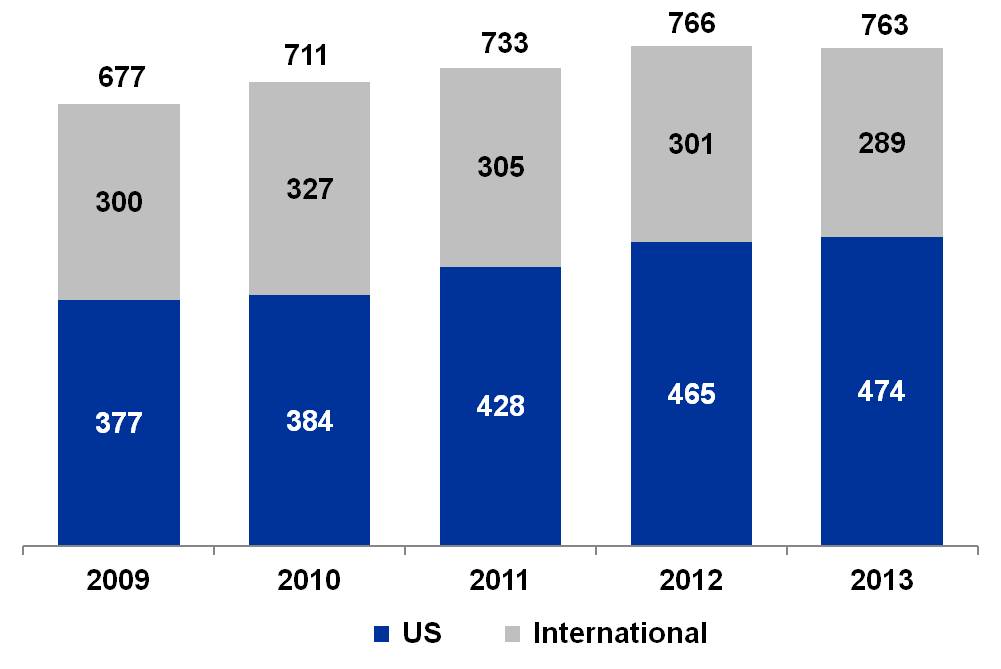

The following chart shows Occidental’s total volumes for the last five years:

Worldwide Production Volumes

(thousands BOE/day)

Notes:

| |

| • | Excludes volumes from the Argentine operations sold in 2011 and classified as discontinued operations. |

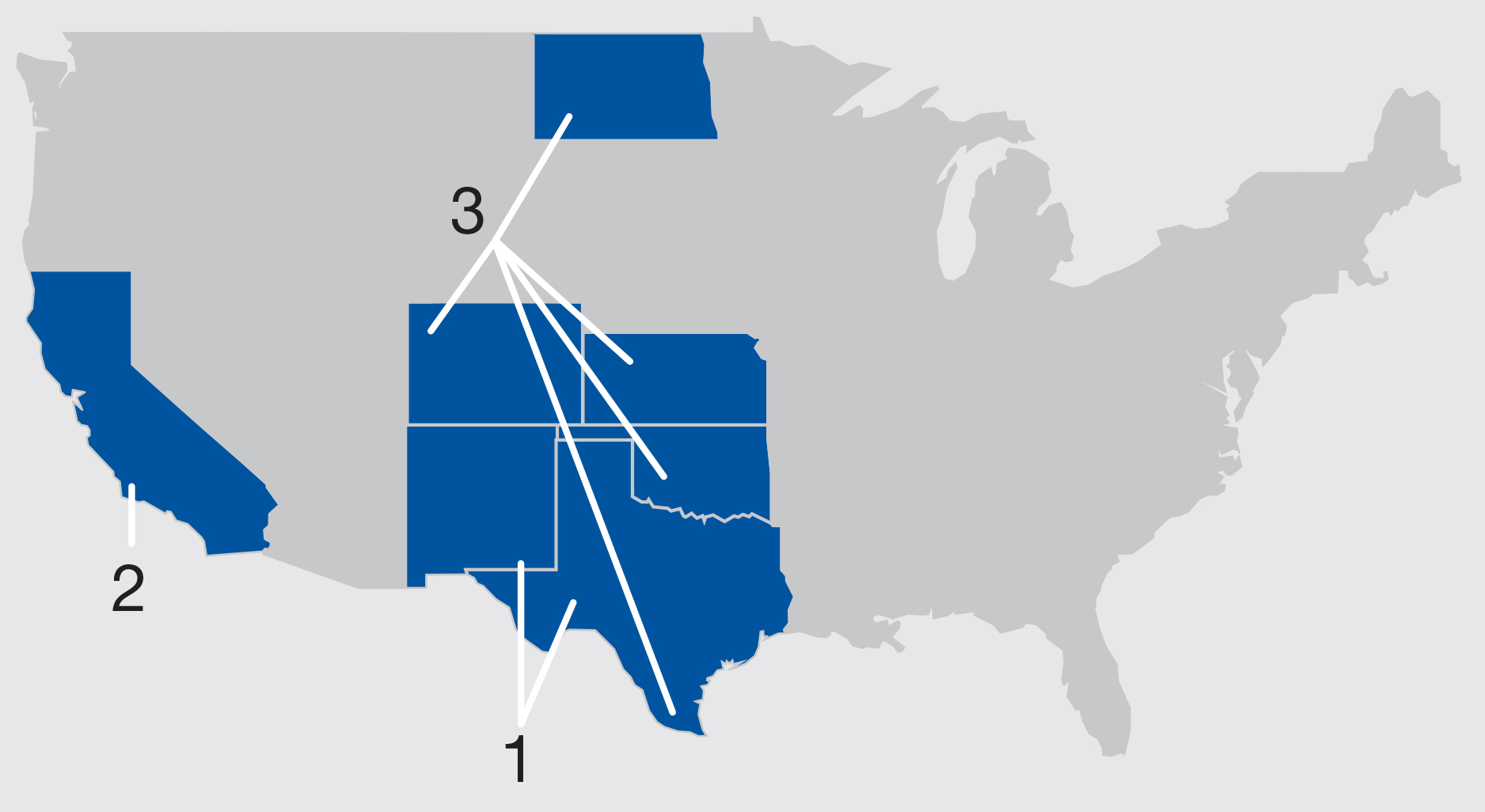

United States Assets

United States

| |

| 3. | Midcontinent and Other interests |

Permian Basin

Occidental's Permian Basin production is diversified across a large number of producing areas. The basin extends throughout southwest Texas and southeast New Mexico and is one of the largest and most active oil basins in the United States, accounting for approximately 15 percent of the total United States oil production. Occidental

is the largest operator and the largest producer of oil in the Permian Basin with an approximate 15 percent net share of the total oil production in the basin. Occidental also produces and processes natural gas and NGLs in the basin.

Occidental manages its Permian Basin operations through two business units: Permian EOR (enhanced oil recovery), which includes CO2 and waterfloods, and Permian Resources, which includes growth-oriented unconventional opportunities. During 2013, capital efficiency efforts reduced drilling costs per well by 25 percent for the Permian Basin operations while operating expenses decreased by $3.22 per barrel, or 17 percent. In addition, management began transitioning to a horizontal drilling program to take advantage of unconventional and shale opportunities. In the Permian Basin, Occidental spent over $1.7 billion of capital in 2013 with 64 percent spent on Permian Resources assets. In 2014, Permian Basin capital spending is expected to be slightly less than $2.2 billion. The entire $450 million increase will be spent on Permian Resources assets and will focus on growing oil production. Approximately 70 percent of the total capital to be spent in the Permian Basin will be for Permian Resources assets.

Occidental's Permian Resources operations are among its fastest-growing assets and held approximately 1.9 million net acres at the end of 2013, including acreage with prospective resource potential. The development program, largely begun in 2010, continued to increase in 2013, accounting for more than 285 wells drilled. In 2013, Permian Resources drilled 49 horizontal wells and expects this to increase in 2014 to approximately 172 of its 345 total planned wells. Production from this business unit comes from approximately 9,500 gross wells, of which 54 percent are operated by other producers. On a net basis, this represents approximately 4,400 wells, of which only 15 percent are operated by others.

The Permian EOR business unit operates a combination of CO2 and waterfloods which have similar development characteristics and ongoing monitoring and maintenance requirements. Approximately 74 percent of Occidental’s Permian EOR oil production is from fields that actively employ CO2 flood technology, an enhanced oil recovery technique. These CO2 flood operations make Occidental a world leader in the application of this technology. Occidental believes it has the ability to accelerate growth in the Permian EOR projects as more CO2 becomes available. Over the past several years, Occidental has focused more capital on waterfloods than CO2 developments. Of the $660 million in capital spending Permian EOR plans for 2014, 25 percent will be used for current waterflood development and the remainder for CO2 floods.

Occidental's share of production in the Permian Basin was approximately 212,000 BOE per day in 2013.

California

Occidental's California operations include interests in the San Joaquin Valley, the Wilmington and other fields in the Los Angeles Basin, and the Ventura and Sacramento Basins. Occidental is California's largest producer of natural gas and the largest oil and gas producer on a gross-

operated-BOE basis and has properties in approximately 130 fields. Occidental manages its California operations through separate teams focused on waterfloods; steam floods for heavy oil resources; and unconventional and other developing plays.

The main California objectives in 2013 were to deliver a predictable outcome, advance low-risk projects that contribute to long-term growth, reduce the cost structure, lower the base decline, create a more balanced portfolio and test exploration and development concepts. Occidental believes it achieved all of these objectives in 2013, notably progressing the development of its multi-year steam floods in Kern Front and Lost Hills, bringing its Huntington Beach Field waterflood redevelopment online, further developing its Wilmington Field, improving capital efficiency by 20 percent and reducing operating costs by $4.70 per BOE, or 20 percent.

Occidental increased the 2013 oil development capital spending to almost 90 percent of the total capital for California. Of the $1.5 billion of capital spent in 2013, 39 percent was for waterfloods, 22 percent for steam floods and 39 percent for unconventional and other developing plays. The 2014 program will continue efforts in each of these areas with increased efforts in horizontal wells in Occidental's waterfloods, new pilot projects in its steam floods and increased unconventional drilling. The allocation for the $1.9 billion 2014 capital program is expected to be similar to 2013. The 2014 capital strategy is to continue focusing the majority of capital spending on projects identified as low-decline, low-risk, and high-return that are expected to provide long-term growth and capitalize on recent exploration successes. Occidental drilled approximately 770 wells in California during 2013 and plans to drill approximately 1,050 wells in 2014, including 175 waterflood wells in the LA Basin, 420 wells for steam floods and 130 unconventional shale wells at Elk Hills.

Over the next several years, there will be some rebalancing between high-decline, such as Elk Hills, and low-decline assets. With the higher investments in water and steam floods, production from these fields is expected to grow faster. The investments being made in high-decline assets are expected to moderate their decline. As a result, the balance of assets in the California portfolio is expected to shift towards low-decline assets over time.

In addition, Occidental holds more than 2.3 million net acres in California, the large majority of which are net fee mineral interests. As a result, Occidental has a substantial inventory of properties available for future development and exploitation opportunities. Currently, approximately one-third of California production is from unconventional reservoirs and Occidental holds more than 1.1 million net acres for such resources. Occidental's share of production in California was approximately 154,000 BOE per day in 2013.

Midcontinent and Other

The Midcontinent and Other properties include interests in the Hugoton Field, the Piceance Basin, the Williston Basin, and the Eagle Ford Shale and other areas in South Texas. These properties are located in Kansas,

Oklahoma, Colorado, North Dakota and Texas. Occidental holds over 2.3 million net acres in the Midcontinent region, which includes 1.4 million net acres in a large concentration of gas reserves and production and royalty interests in the Hugoton area and approximately 168,000 net acres in the Piceance area. Occidental also holds approximately 176,000 net acres in South Texas, including 4,000 net acres in the Eagle Ford Shale. In addition, Occidental holds approximately 335,000 net acres of oil-producing and unconventional properties in the Williston Basin's Bakken, Three Forks and Pronghorn formations.

In Midcontinent and Other, Occidental drilled approximately 175 wells and produced approximately 108,000 BOE per day in 2013.

Other Developments

During its annual capital planning process in the fourth quarter of 2013, management determined that it would not pursue development of certain of its non-producing domestic oil and gas acreage based on product prices, availability of transportation capacity to market the products and regulatory and environmental considerations. As a result, Occidental recorded pre-tax impairment charges of $0.6 billion for the acreage.

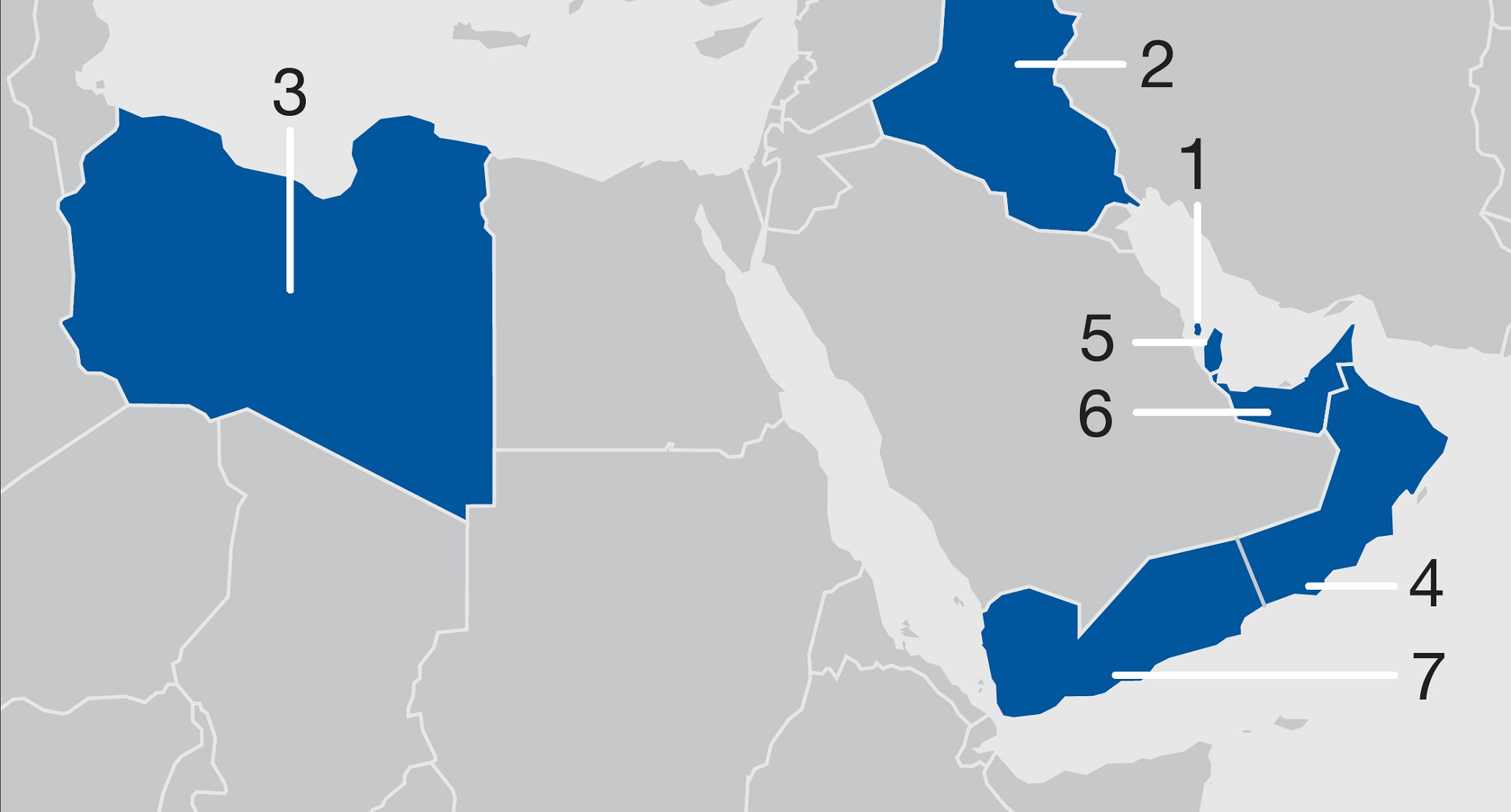

Middle East/North Africa Assets

Middle East/North Africa

Bahrain

In 2009, Occidental and other consortium members began operating the Bahrain Field under a 20-year development and production sharing agreement (DPSA). Occidental has a 48-percent working interest in the joint venture. Since handover of operations, the consortium has increased gross gas production capacity more than 50 percent from an initial level of 1.5 billion cubic feet per day to over 2.3 billion cubic feet per day and increased gross oil production from 26,000 barrels per day to 44,000 barrels per day. Occidental's share of production from Bahrain during 2013 was approximately 241 million cubic feet (MMcf) per day of gas and 3,000 barrels of oil per day.

Iraq

In 2010, Occidental and other consortium members signed a 20-year contract with the South Oil Company of Iraq to develop the Zubair Field. In 2013, the terms were improved reflecting a reduction in the targeted production level to 850,000 BOE per day and a five-year extension to 2035. Occidental's interest in this contract entitles Occidental to receive oil for cost recovery and a remuneration fee. Past delays in development plans have limited the amount of production from Iraq. Occidental does not know when development activities will reach desired levels. Occidental's share of production from Iraq was approximately 17,000 BOE per day in 2013.

Libya

Occidental participates with the Libyan National Oil Company in the Sirte Basin producing operations. These agreements continue through 2032. In 2013, production was disrupted for a significant portion of the year due to field and port strikes. Occidental does not know when operations will return to normal levels. The 2013 production volume was approximately 7,000 BOE per day.

Oman

In Oman, Occidental is the operator of Block 9 and Block 27, with a 65-percent working interest in each block; Block 53, with a 45-percent working interest; and Block 62, with a 48-percent working interest.

A 30-year PSC for the Mukhaizna Field (Block 53) was signed with the Government of Oman in 2005, pursuant to which Occidental assumed operation of the field. By the end of 2013, Occidental had drilled more than 2,100 new wells and continued implementation of a major steamflood project. In 2013, the average gross daily production was 123,000 BOE per day, which was over 15 times higher than the production rate in September 2005 when Occidental assumed operations.

The term for Block 9 continues through December 2015, with a 10-year extension right for certain areas, subject to government approval. The term for Block 27 expires in 2035.

In 2008, Occidental was awarded a 20-year contract for Block 62, subject to declaration of commerciality, where it is pursuing development and exploration opportunities targeting gas and condensate resources.

Occidental's share of production from Oman was approximately 74,000 BOE per day in 2013.

Qatar

In Qatar, Occidental is the operator at Idd El Shargi North Dome (ISND) and Idd El Shargi South Dome (ISSD), with a 100-percent working interest in each, and Al Rayyan (Block 12), with a 92.5-percent working interest. The terms for ISND, ISSD and Block 12 expire in 2019, 2022 and 2017, respectively.

In 2013, Occidental received approval from the Government of Qatar for the fifth phase of field development of the ISND Field, intended to improve the ultimate recovery in all existing contract reservoirs by drilling over 200 additional production, water injection and water source wells and installing associated facilities required to support the additional wells. Occidental's aggregate investment is expected to exceed $3 billion through 2019 with the goal of sustaining gross oil production levels at approximately 100,000 barrels per day during that period.

Occidental's Dolphin investment comprises two separate economic interests through which Occidental owns: (i) a 24.5-percent undivided interest in the upstream operations under a DPSA with the Government of Qatar to develop and produce natural gas and NGLs in Qatar’s North Field through mid-2032, with a provision to request a five-year extension; and (ii) a 24.5-percent interest in the stock of Dolphin Energy Limited (Dolphin Energy), which operates a pipeline and is discussed further in "Midstream and Marketing Segment – Pipeline Transportation."

Occidental's share of production from Qatar was approximately 105,000 BOE per day in 2013.

United Arab Emirates

In 2011, Occidental acquired a 40-percent participating interest in the Al Hosn gas project, joining with the Abu Dhabi National Oil Company (ADNOC) in a 30-year joint venture agreement. Once fully operational, the project is anticipated to produce over 500 MMcf per day of natural gas, of which Occidental’s net share would be over 200 MMcf per day. In addition, the project is expected to produce over 50,000 barrels per day of NGLs and condensate, of which Occidental’s net share would be over 20,000 barrels per day. Occidental’s 2013 capital expenditures for this project were approximately $950 million. A substantial portion of the total expenditures to date has been incurred in connection with plants and facilities and is included in the midstream and marketing segment. Occidental believes that its share of total 2014 capital for the project will be approximately $760 million. Initial production from this project is expected to commence in the fourth quarter of 2014.

Occidental conducts a majority of its Middle East business development activities through its office in Abu Dhabi, which also provides various support functions for Occidental’s Middle East/North Africa oil and gas operations.

Yemen