UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-4767

EAGLE GROWTH & INCOME FUND

(Formerly: Heritage Growth & Income Trust)

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 573-3800

STEPHEN G. HILL, PRESIDENT

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

FRANCINE J. ROSENBERGER, ESQ.

K&L Gates, LLP

1601 K Street, NW

Washington, D.C. 20006

Date of fiscal year end: October 31

Date of reporting period: October 31, 2008

| Item 1. | Reports to Shareholders |

Annual Report

and Investment Performance Review

for the fiscal year ended October 31, 2008

Eagle Capital Appreciation Fund

Eagle Growth & Income Fund

Eagle International Equity Fund

Eagle Large Cap Core Fund

Eagle Mid Cap Growth Fund

Eagle Mid Cap Stock Fund

Eagle Small Cap Growth Fund

Table of Contents

President’s Letter

Dear Fellow Shareholders:

I am pleased to present the annual report and investment performance review of the Eagle mutual funds for the fiscal year ended October 31, 2008 (the “reporting period”). The Heritage Family of Funds were renamed effective October 31, 2008.

As I write this letter, we are dealing with one of the worst financial crises on record. There has been unprecedented volatility in the global equity markets and unprecedented illiquidity in the debt markets. This crisis is driven by three main themes: a collapse in the housing market, the credit crisis and fears of a global recession.

The troubles in the housing market can be traced back to the model of mortgage financing that evolved over the past decade. The parties responsible for originating a mortgage generally sold that mortgage to an investment bank that securitized these loans and remarketed them to investors. In this model, the originators had incentives to issue mortgages without the same concern for credit quality that may have existed had they held these mortgages in their own accounts. This resulted in creative pricing models that brought unqualified buyers to the market which, in turn, helped drive home prices to unsustainable levels.

Simply put, the credit crisis is the result of many companies carrying too much debt. In some cases, this debt was not reflected on the balance sheets of the companies that had the ultimate exposure. Banks also set up structured investment vehicles (“SIVs”), which were essentially off-balance sheet subsidiaries. These SIVs bought high-risk assets and funded their operations in the commercial paper markets, the same way that good companies finance their everyday operating needs. As the market couldn’t discern good commercial paper from bad, the commercial paper market froze, with lending coming to a virtual standstill. The resulting failure of Lehman Brothers also caused a major money market fund to “break the buck,” prompting the U.S. Treasury to introduce a new guarantee program for money market funds.

The global economic boom of the past few years came to a halt this year as a slowdown pointed to signs of a global recession. In the United States, we have seen an economic contraction that can be dated back to the beginning of 2008.

In the past year, the financial services landscape has been reshaped as the government took control of Freddie Mac and Fannie Mae and other well-known firms either failed or were acquired in hastily arranged transactions in which the government acted as marriage broker. Financial institutions across the globe saw similar disruptions.

The U.S. Treasury and the Federal Reserve have taken many steps to inject capital into the commercial paper system and make credit available. Several lending and funding facilities have been introduced to improve liquidity and calm the markets, including the first ever guarantee program for money market fund

investors. Further, we saw unprecedented coordination among many of the world’s central banks in an effort to provide liquidity to the financial system.

As you would expect, the world’s equity markets performed poorly over the past year with virtually every major equity market index and business sector experiencing negative returns during the reporting period. In the commentaries that follow, each fund’s portfolio managers discuss the specific performance in their funds. While there can be no way to accurately predict short-term market movements, our portfolio managers generally are optimistic that there may be excellent long-term investment opportunities available today.

As I mentioned, the funds were renamed under the Eagle Family of Funds banner. Effective November 1, 2008, Eagle Asset Management, Inc. (“Eagle”) became the adviser to the Funds. This change was the result of an internal reorganization involving Eagle and Heritage Asset Management Inc., the previous adviser and affiliate of Eagle. This change allows us to provide investors with a more efficient way to access a broad range of investment products under a unified Eagle brand. Eagle, founded in 1976, provides an array of equity and fixed-income investing strategies to a variety of individual and institutional clients, both domestically and internationally and previously had served as a subadviser to many of the funds.

Along with this change, Eagle Boston Investment Management, Inc. (“EBIM”) is no longer managing a portion of the assets in the Eagle Small Cap Growth Fund. That Fund is now solely managed by Bert Boksen and Eric Mintz of Eagle. EBIM has been appointed as the subadviser to the Eagle Small Cap Core Value Fund, which began operations on November 3, 2008. All other portfolio management relationships remain the same under the Eagle brand.

I would like to remind you that investing in any mutual fund carries certain risks. The principal risk factors for each fund are described at the end of this report. Carefully consider the investment objectives, charges and expenses of any fund before you invest. Contact us at 800.421.4184 or eagleasset.com or your financial advisor for a prospectus, which contains this and other important information about the Eagle Family of Funds. Our website also has timely information about the Funds, including performance and portfolio holdings.

While our name has changed, our commitment to your financial well-being has not. We are grateful for your continued support and confidence in the Eagle Family of Funds.

Sincerely,

Stephen G. Hill

President

December 9, 2008

| | |

| Performance Summary and Commentary |

| Eagle Capital Appreciation Fund | | (formerly known as the Heritage Capital Appreciation Trust) |

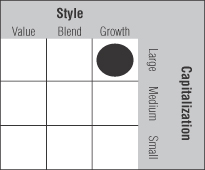

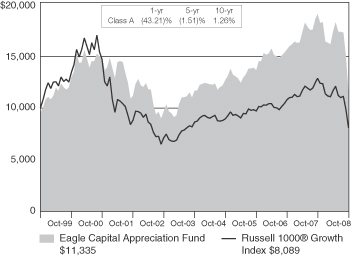

Investment highlights | The Eagle Capital Appreciation Fund (the “Fund”) invests primarily in common stocks. The Fund’s portfolio management team believes that wealth is created through the long-term ownership of a growing business. They take a “bottom-up” approach to investing based on first-hand, fundamental research. A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. The portfolio managers use an intensive research process and each company is analyzed as if they were going to own and operate that company indefinitely. Key characteristics of the companies in which the Fund currently seeks to invest may include: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2008 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

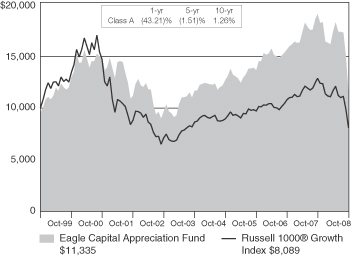

Performance summary | The Fund’s class A shares returned -40.38% (excluding front-end sales charges) during the fiscal year ended October 31, 2008, underperforming its benchmark index, the Russell 1000® Growth Index, which returned -36.95%. The Russell 1000® Growth Index measures performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values and is representative of U.S. securities exhibiting growth characteristics. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

The following graph shows the growth of a hypothetical $10,000 investment into the Fund’s class A shares as well as the Fund’s respective benchmark index. The table within the graph shows the investment returns of the Fund’s class A shares for the fiscal year ended October 31, 2008.

Growth of a $10,000 investment from 11/1/98 to 10/31/08 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an in investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Meet the managers | Steven M. Barry, David G. Shell, CFA and Gregory H. Ekizian, CFA are Chief Investment Officers and Portfolio Managers at Goldman Sachs Asset Management L.P. and have been responsible for the day-to-day management of the Fund since 2002. Mr. Shell and Mr. Ekizian have been affiliated with the Fund since 1987 and 1990, respectively; Mr. Barry joined the team in 1999. Mr. Shell and Mr. Ekizian are Chartered Financial Analysts and have 21 and 18 years investment experience, respectively. Mr. Barry has 22 years investment experience.

On November 20, 2008, the portfolio managers gave the following discussion of the Fund’s performance.

|

| Performance Summary and Commentary |

| Eagle Capital Appreciation Fund (cont’d) |

Q: How did the Fund’s performance compare to its benchmark index during the reporting period?

A: In several instances, on both a stock and sector level, the Fund is meaningfully different from its primary benchmark index, thus representing potential sources of positive or negative relative returns. The Fund’s sector weightings are a direct result of our bottom-up, research intensive approach to investing. For example, when compared to the Russell 1000® Growth Index, the Fund’s portfolio is underweight in cyclicals, as most of these businesses do not typically meet our investment criteria. That is because their revenues predominately depend on the increasing price of an underlying commodity.

While our growth strategy is based on a purely bottom-up approach to investing, we do pay attention to the weights in the Russell 1000® Growth Index so we are aware of any weighting differences that may exist. During the reporting period, the Fund’s underperformance compared to the primary benchmark index was due to select energy holdings and an underweight position in the consumer staples sector. On the upside, strong stock selection within the finance sector and an underweight position in the cyclical sector contributed positively to relative returns when compared to the Fund’s primary benchmark index.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: Crown Castle International, Inc. detracted from performance as the company’s stock has been hampered over the last several months along with the overall equity market. We continue to have high conviction in the company and its future growth prospects.

Amylin Pharmaceutical Inc.’s stock pulled back during the reporting period as negative headlines surrounding the company’s diabetes drug, Byetta, weighed on its performance. We continue to have conviction in Amylin as we believe Byetta Long-Acting-Release can be the best in class drug for the treatment of type II diabetes.

Suncor, Inc. detracted from performance as the energy sector sold off during the period with little regard to the differences between individual businesses. While many energy companies have struggled with the decline in crude oil prices and concerns around project financing, we believe that Suncor’s business remains strong and well positioned for future growth.

Also within the energy sector, oil well services company Schlumberger Ltd. detracted from performance. While the

company reported strong revenues during its third fiscal quarter, its stock price pulled back as the entire energy sector was down. We believe Schlumberger is different from other energy businesses as it has more of a “toll keeper-like” business model. We continue to hold the stock in the Fund.

Google, Inc. detracted from performance after the company reported slower than expected growth. Earlier this year, the company reported a decline in “paid-clicks” growth and the smallest year over year growth in the company’s history. Google has largely attributed the decline in “paid-clicks” to initiatives taken by the company that are intended to reduce fraudulent clicks. In our view, these actions raise the value and integrity of Google’s services by increasing the probability that clicks are enacted by serious buyers. We believe that these types of initiatives maintain Google’s dominant market position as an industry innovator and should allow the company to continue to increase revenue by finding new ways to sell ads and improve the quality of their services. We continue to hold the stock in the Fund.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: St. Jude Medical’s stock contributed to performance during the period, primarily driven by an anticipated rebound in the implantable cardioverter defibrillators market. While we continue to have conviction in the company’s fundamentals, we decided to sell the Fund’s position as we believed the stock had reached a relatively full valuation.

Genentech, Inc., the maker of blockbuster cancer drug Avastin, was a top contributor to Fund performance during the reporting period. Shares of Genentech were boosted in July after its majority shareholder, Roche Holdings, made an offer to acquire the company. Genentech responded by forming a special committee, consisting of three independent board members, to evaluate Roche’s proposal. While the takeover remains undecided, we continue to have conviction in Genentech as it has monopolies in several cancer treatments and a robust product portfolio, including Rituxan and Herceptin.

While Moody’s contributed to performance during the reporting period, we decided to exit the Fund’s position. Moody’s was being accused of trying to cover up an internal mistake of assigning improper ratings to some European Constant Proportion Debt Obligation issuances due to a computer model error. Although no wrong-doing has been proven, we believe this situation increases the potential regulatory and litigation risks facing Moodys and we sold the Fund’s position.

| | |

| Performance Summary and Commentary |

| Eagle Growth & Income Fund | | (formerly known as the Heritage Growth and Income Trust) |

Investment highlights | The Eagle Growth & Income Fund (the “Fund”) invests primarily in domestic equity securities (primarily common stocks). The Fund’s portfolio managers look for promising stocks that can be purchased at a discount to their estimate of each stock’s intrinsic value. They seek investments that deliver a competitive total return over multiple time horizons. Holdings are classified in three categories: Basic Value, Consistent Earners and Emerging Franchises as a means of structuring diversification. Dividends and dividend growth are a consideration in stock selection and may include stocks outside the traditional dividend paying areas.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

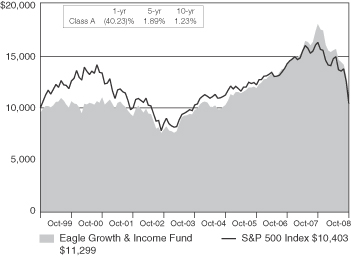

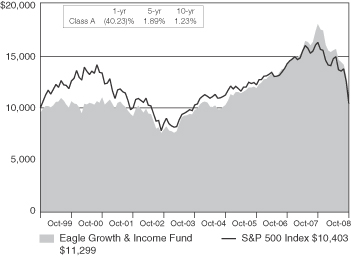

Performance summary | The Fund’s class A shares returned -37.25% (excluding front-end sales charges) during the fiscal year ended October 31, 2008, underperforming the Fund’s benchmark index, which returned -36.10% during the same period. The Fund’s benchmark index, the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”), is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

The following graph shows the growth of a hypothetical $10,000 investment into the Fund’s class A shares as well as the Fund’s respective benchmark index. The table within the graph shows the investment returns of the Fund’s class A shares for the fiscal year ended October 31, 2008.

Growth of a $10,000 investment from 11/1/98 to 10/31/08 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an in investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Meet the managers | William V. Fries, CFA, and Brad Kinkelaar are Managing Directors at Thornburg Investment Management, Inc. and Co-Portfolio Managers of the Fund. Mr. Fries has more than 32 years of investment experience and has been a Co-Portfolio Manager since 2001. Mr. Kinkelaar has 12 years of investment experience and has been a Co-Portfolio Manager since 2006.

On November 14, 2008, the portfolio managers gave the following discussion of the Fund’s performance.

Q: How did the Fund’s performance compare to its benchmark index during the reporting period?

A: There were a few factors that led to the Fund’s slight underperformance versus the S&P 500 Index during the reporting period. Stock selection in the consumer staples,

|

| Performance Summary and Commentary |

| Eagle Growth & Income Fund (cont’d) |

financials and information technology sectors hurt performance. Stock selection in the energy and utilities sectors was positive for the reporting period outperforming the benchmark index total return for those sectors. The Fund was also overweight versus the S&P 500 Index in the utilities sector, which contributed to the outperformance in this sector. When compared to the benchmark, the Fund was overweight in the materials sector and underweight in the industrials sector. While both the materials and industrials sectors underperformed, the Fund benefited from positive stock selection.

Every sector in the benchmark index showed negative performance. Financials, information technology, and energy were the weakest sectors for the benchmark during the reporting period. Despite the headlines highlighting the collapse of many storied financial institutions, the news from the financial sector was not universally bad, as the market perceived that dominant, well-capitalized firms actually stood to benefit from the contraction of players in the market. Over the course of the past twelve months, the Fund’s exposure to higher risk financial names dependent on wholesale financing had been reduced. As these positions were being reduced, they were replaced with franchises that were less reliant on leverage, which we felt could withstand the current credit crunch, and in fact gain market share once liquidity returned to the market. Telecommunication stocks, traditionally defensive areas of the market, fell by double digit percentages. Information technology stocks were also an area of weakness.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: Subsidiaries in Latin America are now worth less as the currencies there depreciated sharply which drove Telefonica SA’s stock price lower. The Fund still holds the stock for its utility-like business, attractive valuation and yield.

Despite the general equity market pullback, Hong Kong Exchanges & Clearing has seen its average daily turnover consistently rise over the last three years. The Fund continues to hold the stock because we believe it is well positioned to retain its important position among Asian securities exchanges.

The Fund’s position in CME Group Inc. performed poorly as volume growth in derivatives contracts has slowed dramatically in the short-term. The Fund sold its position in CME Group based on trading volumes below expectations which is likely to

cause earnings shortfall with resultant above average valuation a concern. The lack of dividend support was also a factor.

Hartford Financial Services’ stock price declined as assets under management in variable annuities underwritten by the firm fell along with the overall market. The Fund continues to hold the stock because we believe that Hartford will not have to raise dilutive equity capital and will be a beneficiary over the longer-term from an improved pricing cycle for life, property and casualty insurance.

Deterioration in the U.K. housing market was the primary reason that Persimmon PLC was a detractor to Fund performance. With the market tightening up more than expected, we sold Persimmon from the Fund because we felt its dividend was at risk.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: Stable business supported Philip Morris International’s stock better than most in this volatile market. The company continues to increase greatly in emerging markets and also benefitted from favorable currency valuations. The Fund continues to hold the stock.

Energy East Corporation was acquired by Iberdrola and the Fund’s shares were sold at a gain.

Visa Inc., acquired through its IPO, uses their vast payments network to process credit and debit transactions, benefiting from scale and a secular shift from paper to electronic transactions. We sold the Fund’s position in Visa because the stock reached our target price.

Over the past year, Cincinnati Financial Corporation has improved the diversification of its investment portfolio by substantially reducing its large holding in Fifth Third Bank. Although the company incurred losses from Hurricane Ike, we expect that insurance policy pricing will be more favorable in the future, making its stock valuation near book value compelling. We intend to hold the stock since it is well below our target price.

Chimera Investment Corporation was a recent investment that was bought through a secondary offering at a discount to market prices. We continue to like their opportunity to invest in the dislocated bond markets; therefore the Fund continues to hold the stock.

| | |

| Performance Summary and Commentary |

| Eagle International Equity Fund | | (formerly known as the International Equity Fund) |

Investment highlights | The Eagle International Equity Fund (the “Fund”) primarily invests in foreign equity securities. The Fund’s portfolio managers seek investment opportunities within the developed and emerging markets. In the developed markets, a “bottom-up” approach is adopted. A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. In the emerging markets, a “top-down” assessment consisting of currency/interest rate risks, political environments/leadership assessment, growth rates, structural reforms and risk (liquidity) is applied. A top-down method of analysis emphasizes the significance of economy and market cycles. In Japan, given the highly segmented nature of this market comprised of both strong global competitors and protected domestic industries, a hybrid approach encompassing both bottom-up and top-down analyses is conducted.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

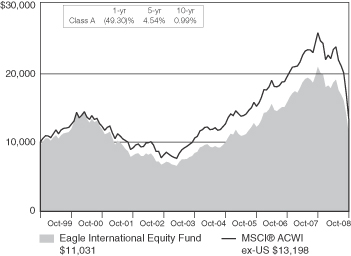

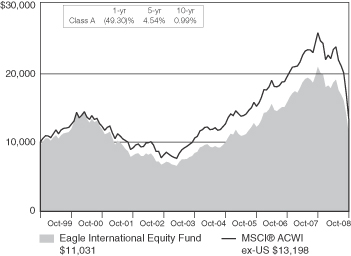

Performance summary | The Fund’s class A shares returned -46.77% (excluding front-end sales charges) during the fiscal year ended October 31, 2008, outperforming the Fund’s benchmark index, which returned -48.53% during the same period. The Fund’s benchmark index, the Morgan Stanley Capital International® All World Index ex-US (“MSCI® ACWI ex- US”), is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

The following graph shows the growth of a hypothetical $10,000 investment into the Fund’s class A shares as well as the Fund’s respective benchmark index. The table within the graph shows the investment returns of the Fund’s class A shares for the fiscal year ended October 31, 2008.

Growth of a $10,000 investment from 11/1/98 to 10/31/08 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an in investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Meet the managers | Richard C. Pell is Chief Executive Officer at Artio Global Investors Inc. and Chief Investment Officer of its subsidiary, Artio Global Management LLC (“Artio Global”). Mr. Pell has 24 years of investment experience. Rudolph-Riad Younes, CFA, is Head of International Equities at Artio Global and has 18 years of investment experience. Messrs. Pell and Younes have managed the Fund since 2002.

On November 14, 2008, the portfolio managers gave the following discussion of the Fund’s performance.

Q: How did the Fund’s performance compare to its benchmark index during the reporting period?

A: The Fund managed to outperform the MSCI® ACWI ex-US, although absolute returns for both the Fund and markets were heavily impacted by one of the worst financial crises on record. Our decision to hold higher cash levels in the Fund was rewarded amid what seemed to be free-falling equity markets. From a sector perspective, the Fund’s investments in the materials sector had the largest positive contribution to relative returns.

|

| Performance Summary and Commentary |

| Eagle International Equity Fund (cont’d) |

This contribution was partially due to our decision to reduce the Fund’s exposure to metals and mining companies, including positions in Russia which we originally purchased based on their inexpensive valuations. The Japanese market suffered declines less than that of other developed markets and the Fund’s underweight position compared to its benchmark index had a negative impact on relative results.

The Fund’s exposure in emerging markets hurt its performance, particularly investments in financial companies in Hungary, India, Cyprus, Ukraine and Poland, although positions in the Czech Republic helped. Elsewhere in emerging markets, compared to the benchmark index, the Fund’s underweight position in Asia, particularly South Korea and China was supportive of relative returns.

Stock selection in the utilities and industrials sectors detracted from the Fund’s relative returns versus the benchmark index. In the utilities sector, various positions across Europe and Russia impacted relative performance. Within the industrial sector, while it appeared the Hong Kong market experienced a favorable spillover effect from China earlier in the period, stock selection, primarily the Fund’s holdings in the gaming industry, detracted from relative returns. In addition, the Fund’s investments in the stocks of airport operators underperformed the benchmark index. On a positive note, the Fund’s positions in the healthcare sector outperformed the benchmark index.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: Earlier in the reporting period companies involved in the production of agricultural chemicals such as Potash Corp of Saskatchewan Inc. experienced a rapid rise in share price as the demand for crop nutrients rose. Then, a move to reduce the Fund’s exposure to commodities in general proved beneficial as the share price suffered a dramatic decline during the latter part of the reporting period. The stock is no longer held in the Fund.

The Fund’s position in Nestle, a more defensively positioned company, proved beneficial as the shares declined less than that of the benchmark index. The Fund continues to hold the Nestle shares as we have decided to increase the Fund’s positions in consumer staples companies such as food and beverage companies.

The Fund’s position in Total helped performance primarily due to outperformance of the stock in the final month of the reporting period. Although the Fund is underweight in energy relative to the benchmark index, the stock remains a Fund holding.

The Fund’s position in Telekomunikacja Polska, Poland’s largest phone operator, contributed positively to Fund performance. The company has been able to beat analyst estimates, as mobile services have helped to offset declines in fixed-line revenues. The Fund continues to hold the position.

The Fund’s positioning of Sanofi-Aventis during the period had a positive impact on relative returns. Although the performance was negative, it declined less than the benchmark index. The Fund continues to hold the position.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: The Fund’s position held in OTP Bank, Hungary’s largest lender, had a negative impact on the Fund’s performance. Banks in this region were not immune to the unfolding global financial turmoil and the stock price of OTP Bank declined. We believe that the global financial and economic turmoil that has impacted the Central and Eastern European economies will, in the short-to-medium term, slow growth from the overheated pace of the last few years. Countries such as Hungary have also felt the effects of foreign currency-denominated loans which recently became popular in the region. The Fund continues to hold the position.

Fraport is the operator of the Frankfurt airport. The global financial crisis is affecting airports as traffic declines amid slowing economic growth. This position remains in the Fund.

The Fund’s investment in BP PLC, Europe’s second-largest oil company, detracted from results. However, from a sector perspective, the energy sector had little effect on the Fund’s return. The Fund continues to hold BP PLC.

Bank Polska Kasa Opieki is Poland’s largest bank and a unit of UniCredit SpA in Italy. The stock underperformed and the Fund’s position detracted from the Fund’s performance. We maintain our preference for banks within the region, including Bank Polska, which rely on deposit collection for funding that is derived from the countries’ growing middle class.

Raiffeisen International Bank Holding AG, an Austrian bank with lending activities in Russia, suffered dramatic declines over the reporting period amid the credit crisis. The position is no longer held in the Fund.

Q: Are there other factors that affected Fund performance during the reporting period?

A: Our ability to utilize forward foreign currency contracts to hedge part of our European exposure back to the U.S. dollar proved beneficial as the U.S. dollar gained strength during the latter half of the reporting period.

| | |

| Performance Summary and Commentary |

| Eagle Large Cap Core Fund | | (formerly known as the Core Equity Fund) |

Investment highlights | The Eagle Large Cap Core Fund (the “Fund”) invests primarily in common stocks. When identifying investments for the Fund, the portfolio managers use a “bottom-up” research process that is combined with a proprietary relative-valuation discipline. A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. In general, the portfolio managers seek to select securities, that, at the time of purchase, typically have at least one of the following characteristics: projected earnings growth rate at or above the benchmark index, above-average earnings quality and stability, or a price-to-earnings ratio comparable to the benchmark index.

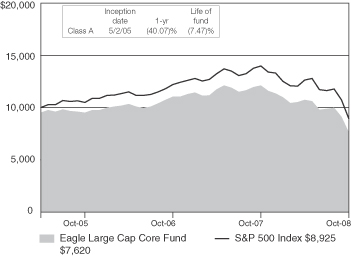

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

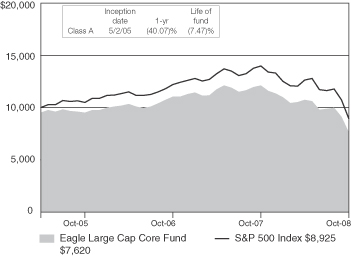

Performance summary | The Fund’s class A shares returned -37.08% (excluding front-end sales charges) during the fiscal year ended October 31, 2008, underperforming the Fund’s benchmark index, which returned -36.10% during the same period. The Fund’s benchmark index, the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”), is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

The following graph shows the growth of a hypothetical $10,000 investment into the Fund’s class A shares as well as the Fund’s respective benchmark index. The table within the graph shows the investment returns of the Fund’s class A shares for the fiscal year ended October 31, 2008.

Growth of a $10,000 investment from 5/2/05 to 10/31/08 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an in investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Meet the managers | Richard Skeppstrom, John “Jay” Jordan, Craig Dauer and Robert Marshall of Eagle Asset Management, Inc. (“Eagle”) have been Co-Portfolio Managers of the Fund since inception. Mr. Skeppstrom is a Managing Director of Eagle and has 17 years of investment experience. Mr. Jordan and Mr. Dauer are Chartered Financial Analysts and have 17 and 14 years of investing experience, respectively. Mr. Marshall has 21 years of investing experience.

On November 14, 2008, the portfolio managers gave the following discussion of the Fund’s performance.

Q: How did the Fund’s performance compare to its benchmark index during the reporting period?

A: Although all sectors in the S&P 500 Index posted negative returns over the Fund’s fiscal year, the consumer staples, healthcare, utilities, and energy sectors performed better than the financials, materials, information technology, industrials, telecommunication services, and consumer discretionary sectors.

|

| Performance Summary and Commentary |

| Eagle Large Cap Core Fund (cont’d) |

The Fund’s underperformance versus the S&P 500 Index was due to stock selection in the market-weighted financials and telecommunication services sectors. On the other hand, sectors of relative strength versus the benchmark index included the Fund’s overweight positions in the healthcare and consumer discretionary sectors, along with stock selection in market-weighted information technology and industrials sectors.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: American International Group stock was sold out of the Fund in September as capital market conditions deteriorated. The stock price declined as this leading international insurance company could not raise capital without suffering severe dilution.

The strength of General Electric’s global franchises, diversified end market exposure and AAA balance sheet was overwhelmed in the last year by the collapse in the credit markets. The resultant negative impact to earnings coupled with continued weakness in the credit markets resulted in a rerating downwards of GE’s stock. The Fund still holds the stock as we believe in its recovery potential.

Goldman Sachs’ share price fell in commiseration with the rest of the financial sector during the reporting period. We continue to believe that Goldman Sachs will be a survivor of the current financial turmoil, and that as the industry recovers, the company will be a major beneficiary of diminished competition. The Fund continued to own stock of Goldman Sachs at the end of the reporting period.

The Fund added to its position in Sprint Nextel over the reporting period based on our expectation of improving subscriber trends that to date have not occurred. Due to the importance of subscriber trends to profitability metrics, the stock price has reacted negatively to declining cash flows but is held in the Fund’s portfolio on the expectation of fundamental improvement.

As the credit crisis continued to unfold, Wachovia’s exposure to bad loans resulting from the Golden West acquisition grew. Because of an irrational deposit run, the company was forced by the FDIC to sell itself the end of September. While an agreement was initially reached for Citigroup to acquire its banking division, it now appears that Wells Fargo will acquire Wachovia in its entirety. The Fund sold its shares of Wachovia in early October.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: Adobe Systems’ stock, purchased into the Fund on October 24th, was a top performer as its price increase reflected the market rally that occurred during the final week of the reporting period. We believe that continuing secular growth trends in internet and mobile content development products, coupled with the continuing movement towards a paperless enterprise environment and its industry standard PDF document format, could continue to help support the stock’s valuation going forward. The fund continued to own Adobe’s stock at the end of the reporting period.

While sales of Apple’s notebook and desktop Mac products moderated a bit during its fiscal fourth quarter, sales of Apple’s new 3G iPhone significantly exceeded estimates. We continue to believe that the company’s consumer products franchise featuring the Mac, iPhone and iPod is a game changer, and that the company will continue to gain share on a global basis, despite the current macro headwinds. Apple has approximately $25 a share in net cash on the balance sheet, a strong cash position. The Fund continued to own the stock at the end of the reporting period.

In October, the Fund initiated a position in EOG Resources, a large independent oil and natural gas company, based on our belief that a combination of a solid production profile, a strong balance sheet and a favorable view of natural gas industry fundamentals. We believe that, at current levels, the stock reflects reasonable earnings expectations at an attractive valuation.

Back in March, we believed that JP Morgan Chase & Co’s large, well-run financial services franchise appeared to be undervalued and we initiated a position in the Fund. Its asset (loan) profile is somewhat different than the Fund’s other big bank holdings, and we believe this diversification is healthy for the Fund’s portfolio. The Fund continues to own most of the stock initially purchased.

Continued solid pricing power in the face of declining volumes allowed Waste Management to meet earnings expectations in a difficult environment. However, the stock was sold out of the Fund’s portfolio during the period due to concerns related to the sustainability of pricing and profit margins.

During the reporting period, the Fund held an average cash level of 9%. This above-normal position had the highest positive contribution to the Fund’s return due to significant stock market weakness during the period.

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Growth Fund | | (formerly known as the Diversified Growth Fund) |

Investment highlights | The Eagle Mid Cap Growth Fund (the “Fund”) primarily invests in equity securities. The Fund’s portfolio manager seeks to capture the significant long-term capital appreciation potential of mid-cap, rapidly growing companies. The portfolio manager uses a “bottom-up” investment approach through a proprietary research strategy that emphasizes the selection of mid-cap growth stocks that are reasonably priced. A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. Since stock performance of mid-cap companies have historically been less impressive than that of large-cap stocks, the Fund’s portfolio manager believes that conducting extensive research on mid cap companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s class A shares returned -35.68% (excluding front-end sales charges) during the fiscal year ended October 31, 2008, outperforming the Fund’s benchmark index, which returned -42.65% during the same period. The Fund’s benchmark index, the Russell Midcap® Growth Index, measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

The following graph shows the growth of a hypothetical $10,000 investment into the Fund’s class A shares as well as the Fund’s respective benchmark index. The table within the graph shows the investment returns of the Fund’s class A shares for the fiscal year ended October 31, 2008.

Growth of a $10,000 investment from 11/1/98 to 10/31/08 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an in investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Meet the managers | Bert L. Boksen, CFA, is the Managing Director of Eagle Asset Management’s mid- and small-cap growth strategies and is the Portfolio Manager of the Fund. Mr. Boksen has 31 years of investment experience. Christopher Sassouni, DMD, and Eric Mintz, CFA, have been Assistant Portfolio Managers since 2006 and 2008, respectively. Mr. Sassouni has 19 years of investment experience. Mr. Mintz is a Chartered Financial Analyst and has 13 years of investment experience.

On November 13, 2008, the portfolio managers gave the following discussion of the Fund’s performance.

Q: How did the Fund’s performance compare to its benchmark index during the reporting period?

A: The Fund significantly outperformed its benchmark index over the reporting period. Strong stock selection in the industrials, information technology and financials sectors benefited the Fund’s relative performance to its benchmark

|

| Performance Summary and Commentary |

| Eagle Mid Cap Growth Fund (cont’d) |

index. However, an overweight position in the industrials sector slightly detracted from relative returns. The Fund’s relative return in the energy and healthcare sectors trailed the benchmark index. In the energy sector, the sharp decline in commodities prices and concerns regarding the outlook for global growth pulled down relative returns. Investments in the healthcare equipment and supplies industry reduced healthcare relative returns.

On an absolute basis, all sectors in the Fund’s portfolio had negative returns for the fiscal year. The Fund’s strongest performing sectors on an absolute basis were financials and industrials. Detractors from the Fund’s performance during the reporting period on an absolute basis were investments in the energy and consumer discretionary sectors.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: Wachovia Corporation is a financial-services company that was purchased after the stock traded below what we believed to be fair value. The company was subsequently acquired by Wells Fargo and the stock was sold at a significant profit.

Delta Air Lines cut capacity and raised ticket prices as the price of oil peaked, which we believe means that the company may be poised for strong earnings as fuel costs decline. We are also positive on the synergies following the merger with Northwest Airlines. The Fund continues to own the stock.

Celgene Corporation is a profitable biotechnology company that continues to benefit from strong sales of its multiple myeloma drug, Revlimid. We continue to hold the stock in the Fund’s portfolio as we believe that the company is poised to benefit from its acquisition of Pharmion and a promising early stage pipeline.

Express Scripts is a pharmacy benefits manager. As the leader in generic drug prescriptions, the company continues to benefit from the shift to generic drugs as branded drug patents expire and increased generic utilization given the tough macroeconomic conditions. The Fund continues to own the stock.

Apollo Group provides post-secondary education, a sector with counter-cyclical tendencies. The company significantly exceeded third quarter earnings estimates through increased revenues and margins driven by increasing enrollments. The Fund continues to own the stock.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: Hologic Inc. is a women’s health medical-device company. Shares traded down due to soft product growth. The Fund continues to hold the stock as we are excited about the launch of the company’s next-generation digital mammography system and believe its recent acquisition of Cytyc gives Hologic access to additional women’s health channels.

Oceaneering International provides remote operated vehicles for subsea repair and construction of oil rigs. The stock traded down due to the decline in commodity prices. The Fund continues to hold the stock as the company has a large backlog of work and we believe the company is fundamentally strong.

Cognizant Technology Solutions provides a wide array of offshore information technology (“IT”) services. The Fund sold the stock during the third quarter as we became concerned about the continued shrinking IT budget and lack of visibility into future earnings for the company.

Ameriprise Financial offers financial planning, brokerage, banking and retirement products along with life and disability insurance. The stock has traded down due to industry pressure. We like the company, particularly in this environment because of its strong balance sheet and continue to hold the stock in the Fund’s portfolio.

LKQ Corporation provides aftermarket and recycled auto parts. We sold the stock from the Fund due to concerns that current headwinds would continue to hurt earnings; the company is struggling with shrinking earnings due to the declining price of commodities and the global slowdown causing delayed discretionary repairs and declining claims.

Q: Are there other factors that affected Fund performance during the reporting period?

A: During the third fiscal quarter of 2008, we had an uncharacteristically large amount of cash, reflecting sales in response to historic volatility in the market. The high cash levels during this period helped to cushion declines. We will be working to reinvest this cash as market conditions stabilize.

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Stock Fund | | (formerly known as the Mid Cap Stock Fund) |

Investment highlights | The Eagle Mid Cap Stock Fund (the “Fund”) primarily invests in stocks of mid-capitalization companies. The portfolio managers of the Fund employ a thorough, “bottom-up” stock-selection process to identify growing, mid-cap companies that are reasonably priced. A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. The portfolio managers seek to gain a comprehensive understanding of a company’s management, business plan, financials, real rate of growth and competitive threats and advantages.

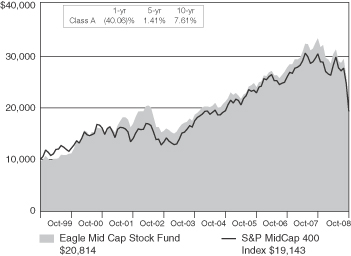

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

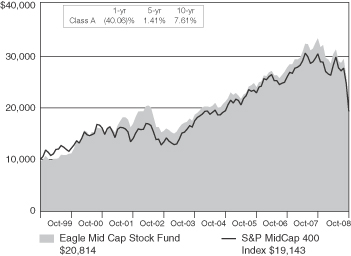

Performance summary | The Fund’s class A shares returned -37.04% (excluding front-end sales charges) during the fiscal year ended October 31, 2008, underperforming the Fund’s benchmark index, which returned -36.46% during the same period. The Fund’s benchmark index, the Standard & Poor’s MidCap 400 Index (“S&P MidCap 400”), is an unmanaged index that measures the performance of the mid-sized company segment of the U.S. market. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

The following graph shows the growth of a hypothetical $10,000 investment into the Fund’s class A shares as well as the Fund’s respective benchmark index. The table within the graph shows the investment returns of the Fund’s class A shares for the fiscal year ended October 31, 2008.

Growth of a $10,000 investment from 11/1/98 to 10/31/08 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an in investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Meet the managers | Todd L. McCallister, CFA, is a Managing Director at Eagle Asset Management, Inc. (“Eagle”) and Co-Portfolio Manager for the Fund. Mr. McCallister has 21 years of investment experience and has managed the Fund since its inception. Stacey Serafini Thomas, CFA, is a Vice President at Eagle and served as Assistant Portfolio Manager to the Fund from 2000 to 2005, before being named Co-Portfolio Manager. Ms. Thomas has more than 11 years of investment experience.

On November 11, 2008, the portfolio managers gave the following discussion of the Fund’s performance.

Q: How did the Fund’s performance compare to its benchmark index during the reporting period?

A: Every sector in the S&P MidCap 400 was very far into negative territory, yet the utilities and consumer staples sectors held some ground defensively and performed better than other sectors. The biggest declining sectors during the reporting period for the benchmark index were energy and telecommunication services. In relative comparison to the

|

| Performance Summary and Commentary |

| Eagle Mid Cap Stock Fund (cont’d) |

benchmark index, the Fund’s best performing sector was healthcare led by the equipment and supplies industry. In addition, the Fund’s positions in the telecommunication services and industrials sectors also outperformed the benchmark index mainly due to stock selection.

The Fund’s overall underperformance versus the S&P MidCap 400 can be attributed to stock selection in the utilities and energy sectors. In energy, our stock selection in the consumable fuels industry performed poorly. The Fund’s investments in the utilities sector were underweight compared to its benchmark index as the utilities sector performed relatively better than most sectors of the benchmark index.

In terms of absolute return, the Fund only recorded positive returns in one sector: telecommunication services. The Fund’s positions in information technology were the largest detractors from performance during the reporting period. Specifically, the semiconductor and information technology service industries pulled the Fund’s performance down the most.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: Service Corporation International, Inc. is the largest single provider of funeral, cremation and cemetery services in the country. The stock’s price declined in the reporting period over concerns over the company’s high debt level which could cause the company problems if it needed to go back to the capital markets. The Fund continued to hold the position at the end of the year because we believe that the industry should hold up defensively in this market.

SPX Corporation provides flow technology, test measurements, and thermal equipment. The stock has fared poorly recently as the strength of the U.S. dollar has hurt their international sales. In the past, the stock price has benefited from a hearty industrial economy and aggressive share repurchases. Both of these factors have worked against the stock’s price this year. The Fund continues to hold the position as we believe that stronger pricing will play a big part in this year.

Owens-Illinois, Inc. is the world’s largest maker of glass containers and one of the largest overall packaging manufacturers. The stock price declined due to management cutting free cash flow guidance in September. We believe inflationary concerns actually may put the company at a competitive advantage over lower-margin, U.S. market-oriented glass companies. Owens-Illinois trades at what we consider to be very attractive multiples and we continue to believe in its potential for strong earnings, free-cash-flow generation and margin expansion. The Fund continues to hold the stock.

Pioneer Natural Resources is an oil and gas exploration and production company that operates in the United States, Canada, South America and Africa. It traded down in sync with the rest of the energy sector, mostly on the substantial pullback in natural gas prices. The company has recently increased its long-term volume growth targets due primarily to a new shale discovery in Colorado. In addition, we think the company’s drilling efficiencies should result in margin expansion. We like Pioneer because it has material unbooked resources of two times its proved reserve base. We believe the company can grow production in mid-teens while shallow depletion rates should improve above average returns, so the Fund continues to hold the stock.

Liberty Media Corporation has been bought into the portfolio as an undervalued way to own DIRECTV. Liberty Media owns over a 50% share of DIRECTV yet, DIRECTV makes up 80% of the value of Liberty Media. Also, two strong contributors to the revenues are the regional sports channels and premium movie network channels such as Starz and Encore. The stock price declined with the market, creating what we believe to be significant potential for upside. The Fund continues to own the stock.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: DeVry Inc., which owns proprietary higher-education systems throughout the country, was the best performer for the Fund. We took advantage of an overreaction to credit fears and purchased this growth stock at very attractive levels. Before we did that, DeVry’s stock price traded down substantially on fears of potential credit losses within its private student-loan portfolio. In reality, its private-loan portfolio represents only 5% of revenue and the impact of losses from its sub-prime portfolio would be less than 0.5% of revenue.

TJX Companies Inc. retails off-price apparel and home fashions through its T.J. Maxx, Marshalls, HomeGoods and A.J. Wright stores. The company reported better-than-expected earnings, margins and same-store sales growth during the reporting period. We believe TJX’s stock price should benefit in a slower economic environment as it tends to benefit from consumer trade-down activity. In addition, TJX should gain access to more closeout deals and have lower inventory costs, as traditional retailers remain under pressure. We decided to sell the Fund’s position after it appreciated very highly in the summer, and we purchased it again after a price dip in the fall.

|

| Performance Summary and Commentary |

| Eagle Mid Cap Stock Fund (cont’d) |

Cellcom Israel posted strong results throughout the reporting period, with significant cost controls, earnings before interest, taxes, depreciation and amortization, margin expansion and strong subscriber additions. In addition, data revenue as a percentage of subscriber’s revenue, which we believe is the growth driver for Cellcom Israel, was the highest in the company’s history. The Fund maintains its position in the stock.

Steris Corporation is the leading creator of sterilization and surgical equipment for the U.S. healthcare industry. The company’s revenues were up 12% over last year. The management was able to expand operating margin by moving production to Mexico and streamlining existing production in

Europe. As a result, earnings per share grew 63% year over year. We believe that the company will continue to grow due to increased demand for surgical procedures and new hospital construction and we continue to hold the stock in the Fund.

Telus Corporation is a Canadian telecommunications company which has a wire line and wireless business unit. The company was rewarded for having a strong balance sheet as the credit markets went through dire problems. Telecommunications companies are seeing the Canadian wireless market as a place for growth because the market has 20% fewer participants than the U.S. market. The Fund continues to hold the stock.

| | |

| Performance Summary and Commentary |

| Eagle Small Cap Growth Fund | | (formerly known as the Small Cap Stock Fund) |

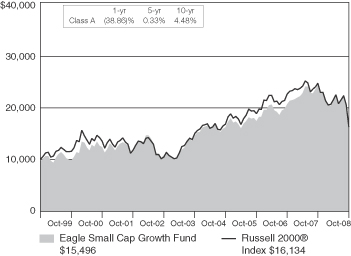

Investment highlights | The Eagle Small Cap Growth Fund (the “Fund”) primarily invests in stocks of small-capitalization companies. Using a “bottom-up” approach, the Fund’s portfolio managers seek to capture the significant long-term capital appreciation potential of small, rapidly growing companies. A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. The portfolio managers also look for small-cap growth companies that are reasonably priced. Since the small-cap sector historically has been less efficient than the large-cap sector, the portfolio managers believe that conducting extensive proprietary research on small-cap growth companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

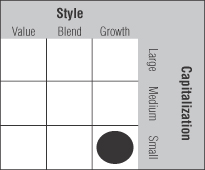

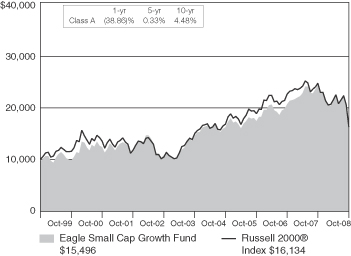

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s class A shares returned -35.81% (excluding front-end sales charges) during the fiscal year ended October 31, 2008, underperforming the Fund’s benchmark index, which returned -34.16% during the same period. The Fund’s benchmark index, the Russell 2000® Index, is an unmanaged index comprised of the 2,000 smallest companies in the Russell 3000® Index. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

The following graph shows the growth of a hypothetical $10,000 investment into the Fund’s class A shares as well as the Fund’s respective benchmark index. The table within the graph shows the investment returns of the Fund’s class A shares for the fiscal year ended October 31, 2008.

Growth of a $10,000 investment from 11/1/98 to 10/31/08 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an in investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Meet the managers | The Fund had two subadvisers during the fiscal year ended October 31, 2008. Eagle Asset Management, Inc. (“Eagle”) and Eagle Boston Investment Management, Inc. (“EBIM”), formerly known as Awad Asset Management, Inc., each managed a portion of the Fund’s investment portfolio and had different management styles.

Bert L. Boksen, CFA, is Managing Director of the small-cap equity strategy at Eagle as well as a Chartered Financial Analyst and has been responsible for the management of Eagle’s portion of the Fund since 1995. Mr. Boksen has 31 years of investment experience. Eric Mintz, CFA, has been Assistant Portfolio Manager since 2008. Mr. Mintz is a Chartered Financial Analyst and has 13 years of investment experience.

David M. Adams, Lead Portfolio Manager, and John McPherson, Co-Portfolio Manager, are Managing directors at EBIM and have been responsible for the EBIM portion of the Fund’s portfolio since 2007. EBIM was a subadviser to the Fund since its inception through October 31, 2008. Both Mr. Adams and Mr. McPherson have 18 years of investment experience.

On November 17, 2008, the portfolio managers gave the following discussion of the Fund’s performance.

|

| Performance Summary and Commentary |

| Eagle Small Cap Growth Fund (cont’d) |

Q: How did the Fund’s performance compare to its benchmark index during the reporting period?

A: No sectors of the market were spared from the selling pressures realized during this time period, as all ten of the commonly defined economic sectors for the Russell 2000® Index realized negative returns over the reporting period. The utilities and consumer staples sectors, which are typically considered defensive in nature, realized the smallest drops while the more cyclical in nature sectors, consumer technology and information technology, were among the worst performers for the benchmark index. Relative to the benchmark index, the Fund slightly underperformed during the reporting period. Consumer discretionary and information technology contributed most significantly due to strong stock selection. The Fund’s slight overweight position versus the benchmark index in information technology detracted mildly from returns. The Fund’s performance lagged the benchmark index in financials, industrials and energy sectors. After significant declines, the financial sector in the benchmark index strengthened in the third quarter relative to other sectors and the Fund failed to keep up. The industrials sector lagged due to the Fund’s professional services industry investments. In energy, the sharp decline in commodities prices and concerns regarding the outlook for global growth pulled down returns.

On an absolute basis, all sectors in the portfolio had negative returns for the year. The Fund’s strongest performing sector on an absolute basis was healthcare. Detractors from the Fund’s absolute performance for the reporting period were investments in the energy and materials sectors.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: OYO Geospace is a provider of seismic equipment for oil companies. OYO Geospace had been a big winner in previous reporting periods and the Fund trimmed some of its position at much higher prices; however, the stock price declined dramatically during the reporting period due to delays in receiving anticipated contracts. The Fund continues to hold the stock as we believe after the delays, the company’s new seismic products will be well-received.

FC Stone Group is an integrated commodity risk management group. After reporting several strong quarters of earnings and revenue growth, the dramatic surge in volatility across all commodities and tightening credit market conditions negatively impacted the company’s third quarter results. The Fund recently sold the stock after the company disclosed a $20 million loss.

The Providence Service Corporation is a provider of outsourced government sponsored social services as well as non-emergency transportation services to Medicaid populations. The stock’s drop in price over the reporting period was due to disappointing fundamental results triggered by the budgetary problems of government agencies, its primary customer base. The weakening general economy has pressured state operating budgets, resulting in the company not receiving contractually anticipated cost of living adjustments at a time when their own operating costs were rising, thus squeezing operating margins and profitability. The Fund no longer holds the stock.

LECG Corporation is a provider of legal and economic consulting services, primarily to large corporations. Internal restructuring initiatives that we anticipated would enhance profitability have been offset by what we believe to be a temporary slowdown in demand, driven in part by the slowing global economy. The Fund continues to hold the stock.

Aspen Technology provides process automation software to energy and chemicals companies. In an increasingly globally competitive market, companies in processing-oriented industries seek out ways to be more efficient with their operations. Aspen’s product offerings have long been considered among the best available solutions. Despite strong fundamental results and a favorable long-term outlook, the stock’s price fell due to Securities and Exchange Commission filing delays which caused it to be de-listed from NASDAQ. These delays are related to a change in auditors and the accounting treatment of certain expenses, which date back to a previous management team. While not being dismissive of the negative aspects of these issues, we view them as being immaterial to the long-term value of the underlying business and are confident that these issues will be favorably resolved in the not too distant future. The Fund continues to hold the stock.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: Comstock Resources is an oil and gas exploration and production company with operations focused in several onshore U.S. regions. The strong absolute and relative performance of the stock this year is due to an attractive acreage position, favorable exploration activity, strong production results and the well-timed sale of non-core, offshore assets that left the company with a virtually debt-free balance sheet. The Fund continues to hold the stock.

|

| Performance Summary and Commentary |

| Eagle Small Cap Growth Fund (cont’d) |

Merit Medical Systems designs, manufactures and markets disposable medical devices used primarily in interventional cardiology and radiology procedures. We believe that company-specific product development and manufacturing efficiency initiatives have combined to boost fundamental results more than investors had anticipated at the beginning of the reporting period. The Fund continues hold the stock.

Cubist Pharmaceuticals is a profitable biotechnology company that continues to benefit from strong sales of its anti-bacterial drug, Cubicin. We remain optimistic about the company as it has a strong position in the market place and is pursuing new

business opportunities to leverage its hospital sales force. The Fund continues to hold the stock.

Bucyrus International manufactures underground and surface mining equipment. The company continues to experience robust demand from its mining customers and has a large order backlog that provides visibility into continued earnings growth. In addition, we believe there is also potential upside due to an emerging drag line replacement cycle. The Fund continues to hold the stock.

The Fund benefited from its holding in CNET Networks, an interactive media company which was acquired by CBS for a 45% premium.

Investment Portfolios

| | | | | | |

| EAGLE CAPITAL APPRECIATION FUND | | | | | | |

| Common stocks—98.1% (a) | | | | Shares | | Value |

| Domestic—83.7% | | | | | | |

| Advertising—0.6% | | | | | | |

| Lamar Advertising Company, Class A* | | | | 188,584 | | $2,860,819 |

| | | |

| Apparel—2.2% | | | | | | |

| Coach, Inc.* | | | | 462,421 | | 9,525,873 |

| | | |

| Beverages—4.0% | | | | | | |

| PepsiCo, Inc. | | | | 314,209 | | 17,913,055 |

| | | |

| Biotechnology—4.0% | | | | | | |

| Amylin Pharmaceuticals Inc.* | | | | 650,980 | | 6,646,506 |

| Genentech Inc.* | | | | 134,100 | | 11,122,254 |

| | | |

| Commercial services—5.5% | | | | | | |

| The Western Union Company | | | | 923,628 | | 14,094,563 |

| Visa Inc., Class A | | | | 180,901 | | 10,012,870 |

| | | |

| Computers—1.7% | | | | | | |

| Dell Inc.* | | | | 623,800 | | 7,579,170 |

| | | |

| Electronics—4.7% | | | | | | |

| Thermo Fisher Scientific Inc.* | | | | 508,476 | | 20,644,126 |

| | | |

| Financial services—5.6% | | | | | | |

| CME Group Inc. | | | | 33,800 | | 9,536,670 |

| The Charles Schwab Corporation | | | | 795,629 | | 15,212,426 |

| | | |

| Healthcare products—7.6% | | | | | | |

| Baxter International Inc. | | | | 180,500 | | 10,918,445 |

| Johnson & Johnson | | | | 216,700 | | 13,292,378 |

| Zimmer Holdings Inc.* | | | | 203,405 | | 9,444,094 |

| | | |

| Internet—5.9% | | | | | | |

| Equinix Inc.* | | | | 224,195 | | 13,994,252 |

| Google Inc., Class A* | | | | 33,300 | | 11,966,688 |

| | | |

| Multimedia—2.2% | | | | | | |

| Entravision Communications Corporation, Class A* | | | | 1,625,740 | | 3,072,649 |

| Viacom Inc., Class B* | | | | 329,308 | | 6,658,608 |

| | | |

| Oil & gas—4.1% | | | | | | |

| Hess Corporation | | | | 301,055 | | 18,126,522 |

| | | |

| Pharmaceuticals—2.7% | | | | | | |

| Merck & Co., Inc. | | | | 379,900 | | 11,757,905 |

| | | |

| Real estate—1.3% | | | | | | |

| CB Richard Ellis Group Inc., Class A* | | | | 847,432 | | 5,940,498 |

| | | |

| Retail—3.7% | | | | | | |

| Target Corporation | | | | 412,400 | | 16,545,488 |

| | | |

| Software—10.9% | | | | | | |

| Activision Blizzard Inc.* | | | | 1,828,920 | | 22,788,343 |

| Electronic Arts Inc.* | | | | 271,978 | | 6,195,659 |

| Microsoft Corporation | | | | 853,850 | | 19,066,470 |

| | | |

| Telecommunications—17.0% | | | | | | |

| American Tower Corporation, Class A* | | | | 758,250 | | 24,499,058 |

| Crown Castle International Corporation* | | | | 1,486,735 | | 31,474,180 |

| QUALCOMM Inc. | | | | 502,940 | | 19,242,484 |

| Total domestic (cost $425,817,248) | | | | | | 370,132,053 |

| | | |

| Foreign—14.4% (b) | | | | | | |

| Computers—2.2% | | | | | | |

| Research In Motion Ltd.* | | | | 194,802 | | 9,823,865 |

| | | |

| Oil & gas—3.0% | | | | | | |

| Suncor Energy Inc. | | | | 545,240 | | 13,042,141 |

| | | | | | |

| | | | | | | |

| Common stocks—98.1% (a) | | | | Shares | | Value |

| Oil & gas services—5.0% | | | | | | |

| Schlumberger Ltd. | | | | 251,600 | | $12,995,140 |

| Weatherford International Ltd.* | | | | 540,511 | | 9,123,826 |

| | | |

| Pharmaceuticals—4.2% | | | | | | |

| Teva Pharmaceutical Industries Ltd., Sponsored ADR | | | | 437,965 | | 18,779,939 |

| Total foreign (cost $87,583,724) | | | | | | 63,764,911 |

| Total common stocks (cost $513,400,972) | | | | | | 433,896,964 |

| | | |

| Repurchase agreement—1.90% (a) | | | | | | |

| Repurchase agreement with Fixed Income Clearing Corporation dated October 31, 2008 @ 0.03% to be repurchased at $8,384,021 on November 3, 2008, collateralized by $6,105,000 United States Treasury Bonds, 9.125% due May 15, 2018 (market value $8,610,144 including interest) (cost $8,384,000) | | 8,384,000 |

| |

| Total investment portfolio (cost $521,784,972) 100.0% (a) | | 442,280,964 |

| | | |

| Other assets and liabilities, net, 0.0% (a) | | | | | | 25,122 |

| | | |

| Net assets, 100.0% | | | | | | $442,306,086 |

| |

* Non-income producing security. (a) Percentages indicated are based on net assets. (b) U.S. dollar denominated. | | |

| | | |

| ADR—American depository receipt. | | | | | | |

| | |

| |

| Sector allocation | | |

| Sector | | Percent of net assets |

| Communications | | 26% |

| Consumer, non-cyclical | | 24% |

| Technology | | 19% |

| Energy | | 12% |

| Financial | | 7% |

| Consumer, cyclical | | 6% |

| Industrial | | 4% |

| Cash/Other | | 2% |

| | | | | | |

| | | | |

| EAGLE GROWTH & INCOME FUND | | | | | | |

| Common stocks—77.0% (a) | | | | Shares | | Value |

| Domestic—54.1% | | | | | | |

| Agriculture—2.8% | | | | | | |

| Philip Morris International Inc. | | | | 61,600 | | $2,677,752 |

| | | |

| Airlines—0.5% | | | | | | |

| JetBlue Airways Corporation* | | | | 91,000 | | 505,050 |

| | | |

| Banks—1.3% | | | | | | |

| Fifth Third Bancorp | | | | 117,571 | | 1,275,645 |

| | | |

| Beverages—4.3% | | | | | | |

| Dr. Pepper Snapple Group Inc.* | | | | 85,205 | | 1,951,194 |

| The Coca-Cola Company | | | | 49,700 | | 2,189,782 |

| | |

| 18 | | The accompanying notes are an integral part of the financial statements |

Investment Portfolios

| | | | | | |

| EAGLE GROWTH & INCOME FUND (cont’d) | | | | | | |

| Common stocks—77.0% (a) | | | | Shares | | Value |

| Biotechnology—2.9% | | | | | | |

| Gilead Sciences, Inc.* | | | | 62,500 | | $2,865,625 |

| | | |

| Computers—4.2% | | | | | | |

| Apple Inc.* | | | | 13,910 | | 1,496,577 |

| Dell Inc.* | | | | 212,800 | | 2,585,520 |

| | | |

| Diversified manufacturer—0.1% | | | | | | |

| Reddy Ice Holdings, Inc. | | | | 21,306 | | 56,674 |

| | | |

| Electric—3.0% | | | | | | |

| Entergy Corporation | | | | 37,600 | | 2,934,680 |

| | | |

| Financial services—2.6% | | | | | | |

| JPMorgan Chase & Company | | | | 25,612 | | 1,056,495 |

| The Goldman Sachs Group Inc. | | | | 15,593 | | 1,442,352 |

| | | |

| Food—3.4% | | | | | | |

| Kraft Foods Inc., Class A | | | | 44,928 | | 1,309,202 |

| Sysco Corporation | | | | 76,000 | | 1,991,200 |

| | | |

| Healthcare products—1.9% | | | | | | |

| Varian Medical Systems, Inc.* | | | | 41,500 | | 1,888,665 |

| | | |

| Insurance—2.7% | | | | | | |

| Cincinnati Financial Corporation | | | | 85,400 | | 2,219,546 |

| Hartford Financial Services Group Inc. | | | | 37,500 | | 387,000 |

| | | |

| Machinery—1.1% | | | | | | |

| Joy Global Inc. | | | | 36,725 | | 1,064,290 |

| | | |

| Oil & gas—5.7% | | | | | | |

| Diamond Offshore Drilling, Inc. | | | | 33,500 | | 2,974,800 |