UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-4767

HERITAGE GROWTH AND INCOME TRUST

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

STEPHEN G. HILL, PRESIDENT

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

CLIFFORD J. ALEXANDER, ESQ.

Kirkpatrick & Lockhart Preston Gates Ellis, LLP

1601 K Street, NW

Washington, D.C. 20006

Registrant’s Telephone Number, including Area Code: (727) 573-3800

Date of fiscal year end: October 31

Date of reporting period: October 31, 2006

| Item 1. | Reports to Shareholders |

November 15, 2006

Dear Fellow Shareholders:

At the August 15, 2006 meeting of the Board of Trustees for the Heritage Funds, at the request of Heritage Asset Management, Inc., the Trustees voted and approved to change the fiscal year end to October 31 for the Capital Appreciation Trust, the Growth and Income Trust and the Heritage Income Trust - High Yield Bond Fund. We requested the change in the fiscal year end because we believe that the funds will benefit from lower expenses in addition to providing the shareholders more up to date performance information in the prospectus. This financial report covers the period since the prior fiscal year ended 2006, to the new fiscal year end, October 31, 2006. The table below provides the performance of the Class A shares returns for each fund and its comparative benchmark index for the applicable period covered by this report.

| | | | |

Period Total Returns | | Performance data presented in the table is

historical and does not guarantee future

results. The investment return and principal

value of an investment will fluctuate, and you

may have a gain or loss when you sell shares.

Current performance may be higher or lower

than the performance data quoted. To obtain

more current performance data as of the most

recent month end, please visit our website at

HeritageFunds.com. |

From 09/01/06 through 10/31/06 | | | |

Capital Appreciation Trust | | 3.78% | |

S&P 500 Index | | 5.22% | |

Russell 1000® Growth Index | | 6.36% | |

From 10/01/06 through 10/31/06 | | | |

Growth and Income Trust | | 2.52% | |

S&P 500 Index | | 3.26% | |

High Yield Bond Fund | | 1.40% | |

Citigroup High Yield Market IndexSM | | 1.43% | | |

All of the returns quoted include the effect of reinvested dividends. Please see the following page for a description of each fund’s benchmark index. The performance numbers quoted for Class A shares are shown without the imposition of a front-end sales charge and include the deduction of Fund expenses. If reflected, the imposition of a front-end sales charge would reduce the performance. Performance results for other classes of shares would differ based on expense ratios.

In the following pages, more detailed performance data is presented. In addition, the performance of each Fund is discussed in detail by each Fund’s portfolio managers, followed by additional financial statements and portfolio holding information. Please keep in mind that these views are not meant as investment advice and although some of the described portfolio holdings were viewed favorably, there is no guarantee a Fund will continue to hold these securities in the future.

I would like to take this opportunity to inform you that after twenty-one years of commitment to the Heritage Capital Appreciation Trust, Herb Ehlers will retire from Goldman Sachs Asset Management, the Fund’s subadviser, effective December 31, 2006. Over the years, Herb has built a very talented investment team comprised of nineteen portfolio managers and senior research analysts. The team will continue with their responsibilities and be accountable for portfolio decision-making for the Fund. Heritage has confidence in the team’s ability to continue to provide clients with an excellent investment management program. We appreciate Herb’s outstanding contributions to the Fund and wish him all the best in his future endeavors.

I would also like to remind you that your investment in any fund is subject to certain risks. For your convenience, we have included on the last two pages of this annual report, a list of these principal risk factors and their detailed explanations from the prospectus dated January 3, 2006. In addition to risks, we ask that you carefully consider the investment objectives, charges and expenses of each fund. Please contact Heritage at (800) 421-4184 or your financial advisor for a prospectus, which contains this and other important information about each Trust. Thank you for your support.

Sincerely,

Stephen G. Hill

President

1

Performance Table

The table below illustrates, for the periods indicated, the investment returns for each respective fund’s class of shares outstanding for the period ended October 31, 2006. Performance returns are calculated in conformance with SEC regulations which assumes the maximum front-end sales charge for Class A shares (4.75% for Capital Appreciation Trust and the Growth and Income Trust and 3.75% for the High Yield Bond Fund), a contingent deferred sales charge for Class B shares (4% for the one year period, 1% for the five year period and 0% for the life of Class B shares), the reinvestment of dividends for all the classes and the deduction of fund expenses.

| | | | | | | | | | | | | | | | | |

Total Returns (as of October 31, 2006) * | |

Share

Class | | Inception

Date | | Life

of

Fund | | | 1 -

Year | | | 3 -

Year | | | 5 -

Year | | | 10 - Year | |

Capital Appreciation Trust | |

Class A | | 12/12/85 | | 11.22 | % | | 8.95 | % | | 8.39 | % | | 5.92 | % | | 10.58 | % |

Class B | | 01/02/98 | | 7.11 | % | | 9.32 | % | | 8.45 | % | | 5.98 | % | | — | |

Class C | | 04/03/95 | | 11.35 | % | | 13.32 | % | | 9.30 | % | | 6.14 | % | | 10.36 | % |

Class I | | 03/21/06 | | 2.77 | % | | — | | | — | | | — | | | — | |

Class R-5 | | 10/02/06 | | 2.20 | % | | — | | | — | | | — | | | — | |

|

Growth and Income Trust | |

Class A | | 12/17/86 | | 8.15 | % | | 12.86 | % | | 10.95 | % | | 7.86 | % | | 6.06 | % |

Class B | | 01/02/98 | | 3.48 | % | | 13.57 | % | | 11.10 | % | | 7.94 | % | | — | |

Class C | | 04/03/95 | | 8.05 | % | | 17.57 | % | | 11.93 | % | | 8.10 | % | | 5.78 | % |

|

High Yield Bond Fund | |

Class A | | 03/01/90 | | 7.14 | % | | 5.23 | % | | 6.75 | % | | 8.88 | % | | 5.47 | % |

Class B | | 02/01/98 | | 4.29 | % | | 4.53 | % | | 6.63 | % | | 8.95 | % | | — | |

Class C | | 04/03/95 | | 6.07 | % | | 8.67 | % | | 7.49 | % | | 9.11 | % | | 5.30 | % |

| * | Returns for Life of Fund are annualized for classes of shares that have existed for one year or more. Returns for the 1-, 3-, 5-, and 10-year periods are annualized. |

Performance data presented in the table and the graphs is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month end, please visit our website at HeritageFunds.com.

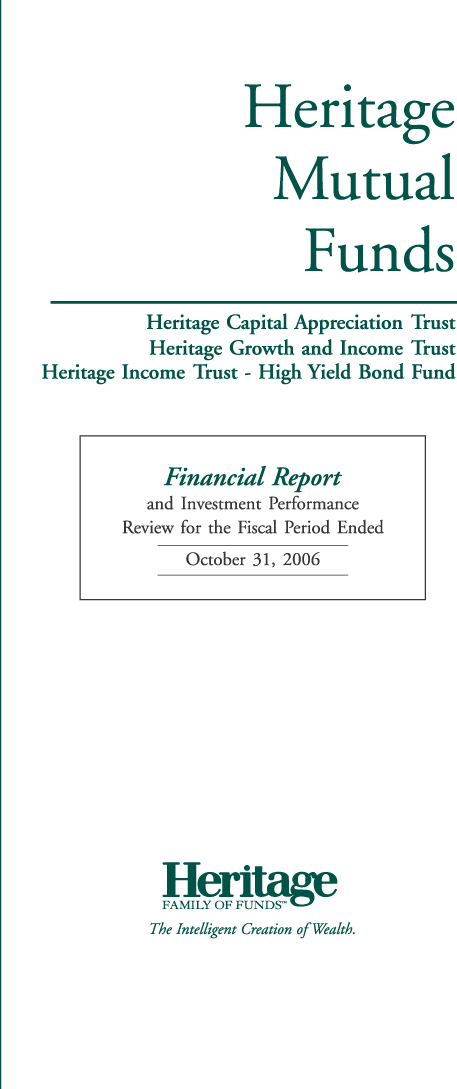

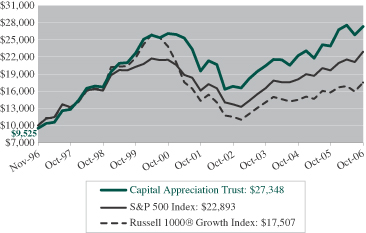

Investment in the Capital Appreciation Trust

from 11/01/96 to 10/31/06

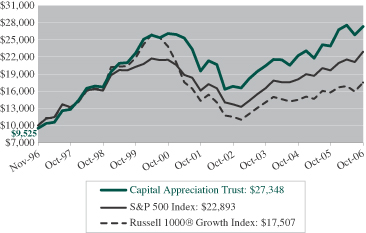

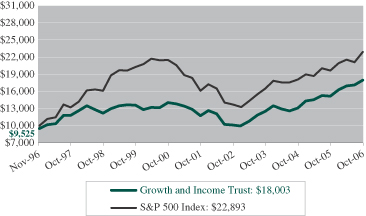

Investment in the Growth and Income Trust

from 11/01/96 to 10/31/06

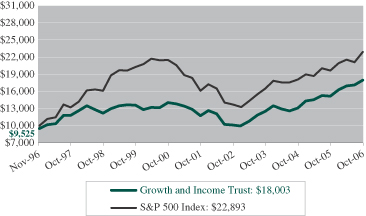

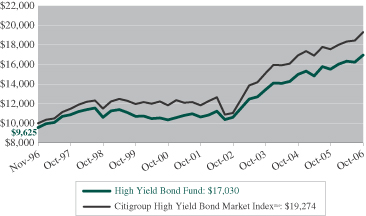

Investment in the High Yield Bond Fund

from 11/01/96 to 10/31/06

Performance Graph Information

For the periods indicated, each graph compares the growth of an initial hypothetical investment of $10,000 in the specified fund to that of its respective benchmark index. The growth of each fund is based on Class A shares only and reflect the effect of the maximum front-end sales charge of 4.75%; growth for other classes of shares will vary due to differences in fee structures and sales charges. The cumulative total return calculated for each fund and its benchmark index assumes the reinvestment of dividends. The graphs do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Index Descriptions

| | • | | S&P 500 Index is an unmanaged index of 500 widely held stocks that are considered representative of the U.S. stock market. |

| | • | | Russell 1000® Growth Index is constructed to provide a comprehensive and unbiased barometer of the large-cap growth market. |

| | • | | Citigroup High Yield Market IndexSM is a broad-based unmanaged index that measures the performance of below-investment grade debt issued by corporations domiciled in the U.S. or Canada. |

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.

Please consider the investment objectives, risks, charges and expenses of each fund carefully before investing. Contact Heritage at (800) 421-4184 or your financial advisor for a prospectus, which contains this and other important information about each fund. Read the prospectus carefully before you invest or send money.

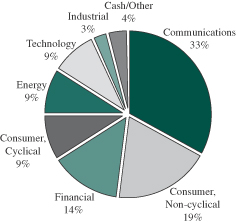

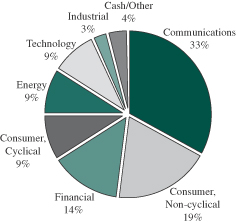

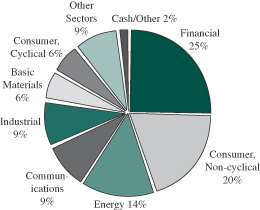

Sector Allocation for the Capital Appreciation Trust

October 31, 2006 (% of net assets)

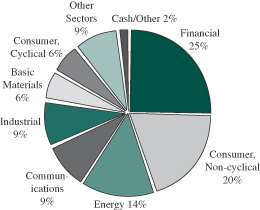

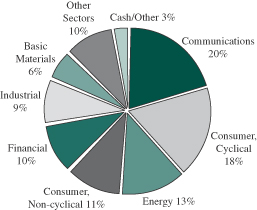

Sector Allocation for the Growth and Income Trust

October 31, 2006 (% of net assets)

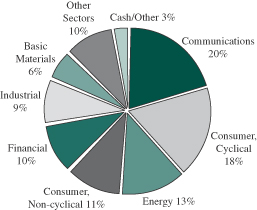

Sector Allocation for the High Yield Bond Fund

October 31, 2006 (% of net assets)

|

Discussion of Capital Appreciation Trust Performance |

During an interview conducted on November 20, 2006, Herbert Ehlers, Steven Barry, Gregory Ekizian, and David Shell, the portfolio managers of the Heritage Capital Appreciation Trust (the “Fund”), discussed the Fund’s performance for the two-month reporting period ended October 31, 2006. For performance returns, please see Stephen G. Hill’s letter on page one of this report.

| Q: | Describe the investment strategies used for the Fund during the reporting period. |

| A: | For more than 25 years, we have invested with the belief that as a business grows in value over time, the stock price will ultimately reflect that value. Our strategy therefore is centered on buying growth businesses at attractive valuations and maintaining the long-term perspective required to benefit from the power of compounding. Sounds sensible, right? Or does it sound old-fashioned? |

There is no doubt that there is a short-term orientation in today’s market, with an overload of information from financial news networks and the Internet as well as the proliferation of hedge funds that are measured monthly by clients. Underlying this short-term focus is the demand to achieve an immediate payoff on an investment, not one that may play out over several years. Consequently, stock prices are increasingly volatile in response to every piece of data, and market participants are seeking the information edge that will allow them to trade ahead of others to benefit from a short-term jump in a stock or avoidance of a short-term decline.

While our long-term mindset may seem out of sync in a short-term world, we know that a long-term approach still works, because the economic value of a business cannot be ascertained by the most recent data point. The value is instead the result of such factors as its future cash flows, margin structure, market share, return on equity, and so on. We believe value can only be determined by in-depth research, through which the vast amounts of information available to all can be synthesized into knowledge, and with experience into wisdom.

Most managers talk about research as part of their process, but research can take many forms, from looking up a statistic on Google to reading a published sell-side analyst report to running screens and analyzing the quantitative characteristics of stocks. These types of activities are relatively small parts of our research regimen. Our fundamental research is just that — fundamental. It starts with the hiring process, particularly in highly technical industries: to invest in pharmaceuticals and biotech we start by hiring a medical doctor; to invest in semiconductors we hire an electrical engineer. This way, we know we have analysts that are trained in the science of the business. Then those analysts get out to where the business gets done to understand all elements of trade. The goal of our research is not simply to analyze a stock, rather it is to become so immersed in the industries we cover that we fully understand how industries are changing and which businesses may be affected by this change. The result is our own expert opinion formulated through front-line research.

One aspect of our approach is that we often find ourselves engaged in “solutions-based research.” Through our in-depth research we can identify challenges facing companies and then figure out who is best positioned to provide solutions to these problems. These solutions-providers are often companies that are highly valued by their clients, so that they exhibit the characteristics such as pricing power and sustainable growth that we hold dear. These are also companies whose future growth opportunities may not be reflected in the numbers of their current financial statements, giving us insight into future growth and an advantage over those who define research as simply building models and performing due diligence on company management.

| Q: | How would you describe the overall U.S. market environment and condition during the reporting period? |

| A: | During the reporting period, the United States equity markets trended upward and posted positive returns. The S&P 500 Index closed higher than it has in the past six years and the Dow Jones Industrial Average hit a new record high. Energy prices rose modestly after pulling back during the third quarter and many companies reported better-than-expected earnings along with some positive earnings surprises. While the consumer discretionary and media sectors performed well during the two-month period, the consumer staples sector did not perform as strongly. The Federal Reserve Board left short-term interest rates unchanged for the third consecutive time, indicating growth and inflation may be moderating. |

| Q: | Describe the investment environment in which your investment approach can be expected to be successful. |

The Fund has representation in most sectors of the market. This strategy has the potential to underperform in markets where the advance is narrow in breadth, or with an emphasis on lower quality, speculative names. However, we believe it will

4

|

Discussion of Capital Appreciation Trust Performance (continued) |

outperform in most environments, especially where quality is favored over the long-term. Philosophically, our mantra “investing in high quality growth businesses at a discount to their worth,” combined with the importance of understanding the interaction between income statements, balance sheets, and cash flow statements has helped us weather periods of severe volatility. We invest in high-quality, fundamentally strong companies that have historically been able to gain market share from weaker competitors during downturns and disproportionately profit from increased spending in economic recoveries.

We have confidence in our businesses and the potential for the strategy to outperform as our holdings are recognized by investors. In several instances, on both a stock and sector level, the Fund is meaningfully different from the benchmark, thus representing potential sources of superior relative returns. We believe that the Fund remains of the highest quality and our companies are financially healthy as evidenced by the fact that virtually all of our businesses generate free cash flow.

| Q: | How did the Fund compare to the S&P 500 Index and the Russell 1000® Growth Index during the two-month period? |

| A: | The Fund’s underweight holdings in the Consumer Staples sector in comparison to the S&P 500 Index contributed to performance, as it was the worst performing sector in the market during the reporting period. The Fund’s overweight holdings in the Producer Goods & Services and Media sectors versus the S&P 500 Index contributed to returns as well. |

The Fund’s underweight holdings in the Technology sector detracted from performance in comparison to the Russell 1000® Growth Index. The Fund’s overweight holdings in the Utilities sector compared to the Russell 1000® Growth Index detracted from Fund performance, while its overweight in the Finance sector contributed to performance.

| Q: | Which securities hindered the Fund’s performance during the reporting period? |

| A: | The stock price of Yahoo!, Inc. began to fall after it warned of weakness in third-quarter sales due to slower than expected growth in auto and financial advertising spending. Nothing has changed regarding our long-term secular view on growth in online advertising and we believe Yahoo is one of the top franchises, along with Google, in this area. We believe that Project Panama, Yahoo’s new search platform, should help close the monetization gap with Google. We have taken advantage of the stock’s recent weakness by adding to the position as we believe Yahoo’s valuation is attractive. |

Linear Technology Corporation detracted from performance due to share price weakness that was largely driven by a negative pre-announcement from its closest competitor, Maxim Integrated Products, for the third quarter. In addition, Microchip, a microcontroller company with similar customer exposures to Linear, negatively pre-announced its September quarter shortly after Maxim. While Linear had not commented on how its own third quarter was trending, and its outlook for the fourth quarter, the market was assuming the company was likely to see some level of weakness as well.

Shares of wireless tower company Crown Castle International Corp. pulled back from previously strong performance after the company announced its acquisition of Global Signal Inc., a competitor in the industry. Investors are concerned because Global Signal’s growth is currently not as strong as Crown Castle’s. However, we believe that the acquisition will prove to be a good deal for Crown Castle. We believe Crown Castle has superior systems and management and once the synergies are realized we feel that Global Signal’s growth could be at least as strong as Crown Castle’s. In our view, there is a lot of potential upside to this acquisition that the market is not currently factoring in.

Caremark RX, Inc. detracted from returns as a result of weakness across pharmacy benefit managers (“PBMs”). The two main issues that affected PBMs during the reporting period were Wal-Mart’s announcement that it would be cutting prices to $4 on select generic drugs and news of a potential legal settlement yielding changes in average wholesale price (“AWP”), a pricing mechanism common in pharmacy contracts. We believe the promotional effort by Wal-Mart is immaterial to the PBMs as all their customers have insurance by default, while the Wal-Mart promotion is largely targeting uninsured pharmacy customers. In addition, co-pays for generics are typically around $5, therefore we do not anticipate Wal-Mart’s discount meaningful enough to alter the purchasing behavior of insured customers. Separately, AWP has been the benchmark by which contracted pharmacy reimbursement is set. All players in the supply chain have an incentive for this metric to be inflated as it can benefit their customers. Historically, the AWP markup had been 20%, but First Databank, one of three private companies that issues AWP, decided to increase the markup to 25%. A recent lawsuit against First Databank has resulted in the company agreeing to reverse the markup back to 20%. The risk to PBMs is that a reduction in AWP leads to lower margins if their contracts do not protect them from changes in this benchmark or provide flexibility for renegotiation. Furthermore, all PBMs have indicated that their contracts reserve a right to “renegotiate” their reimbursement if there is a major change to the reference price, or

5

|

Discussion of Capital Appreciation Trust Performance (continued) |

provide more direct insulation. We believe this issue is not likely to be as dislocating as sentiment and the equity markets have discounted. Also, as part of the settlement, First Databank has agreed to phase out AWP as a pricing metric over time, implying this issue may also be transitory.

| Q: | Which securities contributed positively to the Fund’s performance during the reporting period? |

| A: | McGraw-Hill Companies, Inc. aided returns as it reported higher fiscal third quarter earnings and boosted its 2006 revenue outlook in October. While the education market continued to show weakness, management attributed the company’s strength to improved cost management and performance within its financial services segment, Standard & Poor’s. McGraw-Hill also announced that it expects to post double-digit earnings growth in 2007. We continue to favor the ratings agency and believe it has strong fundamentals which should enable it to sustain double-digit growth rates in the long term as global economic growth, the spread of capitalism, and a shift from banks to debt issuance as a source of capital supports further securitization of financial assets. |

During the reporting period, Harrah Entertainment, Inc. received a $15 billion bid from two private equity firms, which drove shares of the company up 14%. While it is still unclear if the company will accept the offer, the deal indicates private equity firms’ newfound interest in the gaming sector. We took the opportunity to trim the position as we feel the value of the business is beginning to be fully recognized by the market. This event demonstrates how adherence to our discipline regarding a high quality business recently out of favor, can benefit the portfolio when other market participants realize the company’s long-term growth potential.

Microsoft Corporation’s stock was up and contributed to performance during the period as the company reported an 11% rise in both quarterly revenue and profit, which beat market expectations. The company cited continued strong demand for its server software and a sharp rise in sales of its Xbox 360 video-gaming units as the driving factors of its positive performance. We believe Microsoft is well positioned for future growth as it is preparing to release new versions of Microsoft Office and a new operating system called Windows Vista. The company is also pushing into new growth areas, such as its Xbox video game console, Zune digital-media player, and Internet-based online services, called Windows Live.

Freddie Mac’s performance continued to trend upward. The company began its turn around in the third quarter as overhang from accounting and political issues started to lift. We believe as Freddie’s regulator and Congress work through resolutions in these areas, the stock will likely trade based more on its strong fundamentals than political uncertainty. We believe that market sentiment has already started to shift in this direction.

| Q: | What steps do you take to manage the Fund’s portfolio investment risks? |

| A: | We attempt to manage risk in three key ways: thorough knowledge of high-quality companies, a consistent investment style, and disciplined portfolio construction. Our ability to identify excellent companies, which we believe are strategically poised for long-term growth, is a key component of our risk management process. We perform rigorous fundamental research on each of our investments to ensure that we understand the risks and rewards. We define risk as related to the probability of a permanent loss of capital rather than the volatility of returns and we assess the real business worth of each company that meets our rigorous standards. Our research includes extensive visits with company managements as well as customers, competitors, and suppliers, in-depth balance sheet and income statement analysis, analysis of company- and industry-specific risks and continual reassessment of the threats to portfolio holdings. Since we invest in high-quality growth companies whose stocks are attractively valued, we believe that we are inherently limiting our level of risk over the long-term. |

The second component of risk management is a consistent investment style, which has remained the same since its inception. Our team approach to investment management helps ensure that we maintain our defined style. Our portfolio characteristics, which have remained consistent over time, reflect our disciplined style adherence.

The third component of risk management is disciplined portfolio construction. An experienced senior portfolio management team, rather than any one individual, manages client portfolios. We actively monitor the individual stock, sector, and thematic exposure of our portfolios in order to adhere to the risk profile of each client. Our guidelines are as follows: we strive to have no more than 10% of the portfolio concentrated in any one stock holding and no more than 50% of the portfolio concentrated in any single sector. We strive to remain fully invested, aiming for less than 5% cash at all times.

6

|

Discussion of Heritage Growth and Income Trust Performance |

During an interview conducted on November 29, 2006, William V. Fries, CFA and Brad Kinkelaar, the portfolio managers of the Heritage Growth and Income Trust (the “Fund”), discussed the Fund’s performance for the one-month period ended October 31, 2006. For performance returns, please see Stephen G. Hill’s letter on page one of this report.

| Q: | Describe the investment strategies used for the Fund during the reporting period. |

| A: | During the reporting period, using a “bottom up”(a) method of analysis, the Fund’s portfolio was constructed from companies with at least one of the following overall characteristics: |

| | (1) | A forecasted long-term growth rate that is greater than inflation; |

| | (2) | Securities priced below estimated intrinsic value, illustrated by the Fund’s overall value indicators relative to the S&P 500 Index; |

| | (3) | Greater profitability and shareholder orientation than the overall market based on our analysis; |

| | (4) | Broadly diversified across industries and sectors, as well as diversified with holdings outside the United States; |

| | (5) | Weighted average market capitalization approximating that of the S&P 500 Index. |

| Q: | How would you describe the overall U.S. market environment and condition during the one-month period? |

| A: | October was another strong month for domestic equities. Economic data released during the month seemed to suggest a cooling economy (yet not recessionary) and lessening inflationary pressures, which is good news to stock investors. The strong move to lower crude prices during September was not only maintained, but continued in October with crude oil closing almost 7% lower than it started the month. The $58.40 per barrel crude oil price on October 31, 2006 was the first sub-$60 per barrel month-end close price since November of last year. This seems to be having two impacts on our economy: not only is it helping to control energy inclusive measures of inflation, but lower prices at the gas pump seem to be keeping the U.S. consumer out and shopping. Third quarter results for many companies were reported during October and corporate earnings are growing at a healthy clip. With around 400 of the S&P 500 companies having reported, share-weighted average earnings per share are up almost 23% when compared to last year. Furthermore, almost three quarters of these companies have reported positive surprises relative to expectations. |

All sectors in the U.S. market moved higher during the month, including energy, which supports our belief that our energy holdings are undervalued even if crude oil prices move somewhat lower. Healthcare, broadly, did not keep pace during October, but this is to be expected in a strong equity market, as many managers trying to “catch up” with positive benchmark performance likely liquidated some of their more defensive holdings. We continue to like our positions in the healthcare sector.

| Q: | How did the investment strategies used during this market environment affect the Fund’s performance when compared to the S&P 500 Index? |

| A: | During the month of October, the Fund performance fell short of the S&P 500 Index. This was primarily due to the performance of our holdings in the Energy and Health Care sectors. These two sectors were in the bottom three of performers for the period. We select stocks one at a time using a bottom up, fundamental analysis approach, and believe that these holdings will perform as expected over our investment time horizon. |

Relative to the S&P 500 Index, the Fund was underweight in consumer discretionary, information technology, industrials, and consumer staples. The Fund’s underweight position in consumer discretionary, which was the top performing sector in the S&P 500, created a negative allocation effect. Information technology was a strong performing sector for the market, but our experience there during the month was not as positive. We were negatively impacted by our underweight position, but more significantly, the specific stocks in the sector that we own did not perform as well as the rest of the sector this month. Industrials were not a strong performer in the broad market during the month, so the Fund was not impacted by its underweight position. However, again, the specific Fund holdings in this sector did not perform well during the month. The reverse situation existed within the consumer staples sector, where the specific Fund holdings dramatically outperformed the overall sector for the month.

| (a) | A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. The primary focus is the analysis of individual companies rather than the industry in which that company operates or the economy as a whole. |

7

|

Discussion of Heritage Growth and Income Trust Performance (continued) |

Relative to the S&P 500 Index, the Fund was overweight in the materials and energy sectors. In materials, the Fund benefited from the overweight position as the sector performed better than the overall market. In addition, the holdings in the Fund within the materials sector outperformed the overall sector, creating a positive selection effect. In the energy sector, the holdings in the Fund did not perform as well as the overall sector, creating a negative selection effect. The Fund also benefited during the month from strong performance in the financials and telecommunication sectors.

| Q: | Which securities negatively impacted the Fund’s performance during the one-month period? |

| A: | Caremark Rx Inc. stock price suffered from the perception that Wal-Mart’s generic prescription drug resale program will affect Caremark’s profitability. Pfizer Inc. is involved in an important clinical trial involving the results on the data surrounding its new drug, Lipitor. The ongoing trial hurt the company stock price. Precision Drilling Trust was affected by a proposed tax law change which would adversely affect Canadian trusts. The proposed change, if adopted, would not take effect for several years, allowing the trusts to maintain their current favorable tax treatment for the foreseeable future. Motorola Inc. maintained good business development and robust global handset unit and revenue growth for Motorola, but third-quarter results were generally below optimistic consensus expectations. Bank of New York Company Inc. did not perform strongly, but there does not appear to be any significant fundamental reason for the weak relative performance in October. AllianceBernstein Holding L.P. continued to benefit from robust assets flows, particularly for its global and style blend product offerings. Southern Copper Corporation experienced stabilization of copper prices during the month and renewed merger activity within the sector benefited the stock. Telefonica SA showed strong wireless results in the United Kingdom, through its Orange division, and solid cost controls benefited the stock. Altria Group Inc. benefited from potential separation of Kraft Foods from the Altria parent company. Fisher Scientific International Inc. benefited from improving visibility on the synergies of its merger with Thermo Electron. |

| Q: | Discuss how the investments in certain foreign countries/markets affected Fund performance. |

| A: | Consistent with the overall performance in the foreign markets in which the Fund is invested, the Fund’s specific holdings in the United Kingdom, Spain, Hong Kong, Greece, and Italy outperformed the broad U.S. market during the month of October and contributed positively to the Fund’s overall performance. The Fund’s holdings in Canada did not perform as well as the overall Canadian market, and contributed negatively to the Fund’s performance during the month. This was primarily because both of our Canadian holdings (Canadian Oil Sands Trust and Precision Drilling Trust) are in the energy sector, which underperformed relative to other areas of the market during the month. |

| Q: | What steps do you take to manage the Fund’s portfolio investment risks? |

| A: | We attempt to manage risk through diversification and stock selection. We are broadly diversified across market sectors, and over 25% of the Fund’s assets are invested in non-U.S. securities. In addition, we believe that the process of identifying companies at a discount through bottom-up fundamental research helps us to identify these potential risks and incorporate them into our evaluation of each stock’s risk/reward trade-off. |

The Fund is invested in forward currency contracts as a risk control measure. We evaluate currency risk on a stock-by-stock basis. We will hedge currencies utilizing forward contracts if deemed appropriate. We use currency hedging to protect the investment thesis for a given stock from being significantly undermined by dollar/foreign currency fluctuations.

During the reporting period, the Fund had very limited exposure to high yield securities. We attempt to manage the risks associated with these types of securities through comprehensive credit analysis techniques, including but not limited to cash flow analysis, balance sheet ratios, and competitive positioning. We used the results of our analysis to evaluate the risk/reward trade-off.

8

|

Discussion of Heritage Income Trust – High Yield Bond Performance |

During an interview conducted on November 22, 2006, with Investment Officers S. Kenneth Leech, Stephen A. Walsh and portfolio managers Michael C. Buchanan and Ian Edmonds, the investment team of the Heritage Income Trust - High Yield Bond Fund (the “Fund”), discussed the Fund’s performance for the one-month period ended October 31, 2006. For performance returns, please see Stephen G. Hill’s letter on page one of this report.

| Q: | Describe the investment strategy used for the Fund during the reporting period. |

| A: | Our goal is to manage the Fund to outperform the stated benchmark index while approximating benchmark risk. To meet this goal, we employ various strategies. These strategies include: capital structure allocation, industry and issuer over/under weightings and rating category rotation. During the reporting period, and since taking management responsibility for the Fund’s portfolio, we have actively pursued a strategy to ensure that the general structure of the Fund’s portfolio is consistent with our view of the market in terms of industry and issuer exposures. |

| Q: | How would you describe the high yield market environment and condition during October 2006? |

| A: | In general, high yield issuer fundamentals remain strong. Credit spreads have narrowed over the past four years for the broad high yield market from in excess of 1,000 basis points to less than 350 basis points. During this period corporate profitability and free cash flow have consistently posted double digit growth, net debt levels were reduced and the global high yield default rate declined from a historically high level to a historically low level. However, in light of increased shareholder and private equity firm activism and the potential for below trend economic growth for the rest of the year it would appear that the credit cycle has peaked. In our view, it is difficult to forecast any significant further credit spread tightening for the asset class. In our opinion, returns for the balance of the year will be driven more by lower treasury rates and coupon than capital appreciation. It is also our opinion that outperformance for the balance of 2006 will be largely driven by individual security/industry selection. |

The Citigroup High Yield IndexSM returned 1.43% for the period October 1, 2006 to October 31, 2006. The best performing industries included airlines and home builders which returned 3.34% and 3.21%, respectively. Airlines benefited from lower fuel costs, increased passenger traffic and higher fares. Performance for home builders was more a function of the fact that prices had been beat up so badly earlier in the year rather than any fundamental improvement. The worst performing industries included gaming and oil equipment which returned 0.45% and 0.46%, respectively. The gaming sector traded off due to the announcement that a private equity group had bid for Harrah’s Entertainment. The risk that other casino operators were now in play put pressure on the entire sector. Oil equipment performed poorly despite an improving fundamental and technical environment.

| Q: | How did the Fund compare to the Citigroup High Yield Market IndexSM during the one-month period? |

| A: | On a net basis, the Fund marginally underperformed the Citigroup High Yield Market IndexSM, it’s primary benchmark. As mentioned earlier, the relative overall quality, industry selection, and issuer exposures had no meaningful impact on relative performance as the dispersion of returns was muted in all of these areas. In addition, the average maturity of the Fund’s portfolio had no impact on relative performance. |

The overall credit quality of the Fund’s portfolio was on par with the market as measured by the Citigroup High Yield IndexSM and therefore had no meaningful impact on performance. A slight underweight to BB rated issues which returned 1.52% was offset by a slight underweight to B rated issues which returned 1.28% for the period. CCC rated issues returned the same as the benchmark, 1.43%. Similarly, industry allocation had no meaningful impact on relative performance. Overweights to out performing industries were offset by underweights to outperforming industries. For example, the fund was overweight in building product and cable, which returned 2.01% and 2.88% respectively, however, the positive impact to relative performance of these overweights was offset by overweights to gaming and oil equipment. Issue selection was also neutral to performance as eight of the funds top ten overweights underperformed while seven of the top ten underweights also underperformed.

9

|

Discussion of Heritage Income Trust – High Yield Bond Performance (continued) |

| Q: | Which securities hindered the Fund’s performance during the one-month period? |

| A: | The Fund’s overweight position in the gaming sector hurt relative performance. The unsolicited buyout offer of Harrah’s Entertainment by Apollo Management and Texas Pacific Group led private equity consortium had a negative impact on the fixed income securities of all casino operators. The funds overweights to Stations Casino hurt performance. In addition, the healthcare industry continues to remain under pressure in large part to the leveraged buyout of HCA Inc. An overweight to Tenet Healthcare also hurt performance. The energy sector continues to underperform and the Fund’s overweight to the sector and Pogo Producing in particular hurt performance. The Fund’s position in the securities mentioned was unchanged for the one-month period. |

| Q: | Which securities contributed positively to the Fund’s performance during the one-month period? |

| A: | The Fund benefited from overweight positions in five of the top ten performing issuers in the Citigroup High Yield IndexSM. The overweights included Charter Communications, Beazer Homes, Hovnanian Enterprises, Intelsat Bermuda and NRG Energy, Inc. Charter and Intelsat both posted better than expected results for the quarter. Beazer and Hovnanian rallied after the building industry had taken a beating in previous months. NRG management’s recently revised their forecast for 2007 (EBITDA over 30% to $2.1 billion). |

| Q: | What steps do you take to manage the Fund’s portfolio investment risks? |

We have a dedicated risk management team that oversees risk management and incorporates it into the investment process. The risk management team combines the best of technology and experience to develop useful risk management tools and procedures. These tools and procedures provide daily analysis for the investment team, ensuring the integration of professional risk management practices into the investment process. Furthermore, we have a risk management committee that is responsible for ensuring the risk management process is complete and monitored on a regular basis. Despite using a large number of independent models to evaluate the risk of different portfolios, we understand that quantitative models are only as good as the assumptions on which they are based. Therefore, the high-quality analysis and observation that comes with experience is applied to all model output, increasing the usefulness of the data.

Analysis of data is carried on throughout the trading day, and involves a thorough review of portfolio holdings and sector concentrations. Techniques such as factor analysis, key rate duration measurement and other analytic systems are also employed to evaluate portfolio risk. In addition, the investment team regularly performs scenario analysis and stress testing to analyze portfolio exposure to market factors. Tracking error is also monitored on a historical and a forward-looking basis.

10

Investment Portfolio | October 31, 2006 |

Heritage Capital Appreciation Trust

| | | | | |

| Shares | | | | Value |

| Common Stocks—96.2% (a) | | | |

| Advertising—2.1% | | | |

| 217,740 | | Lamar Advertising Company, Class “A”* | | $ | 12,559,243 |

| | | | | |

| Banks—1.0% | | | |

| 181,200 | | The Bank of New York Company, Inc. | | | 6,227,844 |

| | | | | |

| Beverages—4.2% | | | |

| 409,810 | | PepsiCo, Inc. | | | 25,998,346 |

| | | | | |

| Biotechnology—1.9% | | | |

| 142,200 | | Genentech Inc.* | | | 11,845,260 |

| | | | | |

| Commercial Services—6.0% | | | |

| 323,650 | | Moody’s Corporation | | | 21,457,995 |

| 689,148 | | The Western Union Company* | | | 15,195,713 |

| | | | | |

| | | | | 36,653,708 |

| | | | | |

| Diversified Manufacturer—3.0% | | | |

| 517,600 | | General Electric Company | | | 18,172,936 |

| | | | | |

| Financial Services—13.2% | | | |

| 330,798 | | American Express Company | | | 19,123,432 |

| 441,110 | | Freddie Mac | | | 30,432,179 |

| 1,722,629 | | The Charles Schwab Corporation | | | 31,386,300 |

| | | | | |

| | | | | 80,941,911 |

| | | | | |

| Food—1.2% | | | |

| 141,100 | | The Hershey Company | | | 7,465,601 |

| | | | | |

| Healthcare Products—2.3% | | | |

| 269,600 | | Stryker Corporation | | | 14,097,384 |

| | | | | |

| Internet—3.1% | | | |

| 717,900 | | Yahoo! Inc.* | | | 18,909,486 |

| | | | | |

| Lodging—6.2% | | | |

| 324,400 | | Harrah’s Entertainment, Inc. | | | 24,112,652 |

| 477,678 | | Hilton Hotels Corporation | | | 13,814,448 |

| | | | | |

| | | | | 37,927,100 |

| | | | | |

| Multimedia—8.9% | | | |

| 1,625,740 | | Entravision Communications Corporation,

Class “A”* | | | 11,932,932 |

| 553,440 | | The McGraw-Hill Companies, Inc. | | | 35,514,245 |

| 172,829 | | Viacom Inc., Class “B”* | | | 6,726,505 |

| | | | | |

| | | | | 54,173,682 |

| | | | | |

| Oil & Gas Services—9.2% | | | |

| 352,888 | | Baker Hughes Inc. | | | 24,366,916 |

| 505,300 | | Schlumberger Ltd. | | | 31,874,324 |

| | | | | |

| | | | | 56,241,240 |

| | | | | |

| | | | | |

| Shares | | | | Value |

| Common Stocks (continued) | | | |

| Pharmaceuticals—5.2% | | | |

| 525,103 | | Caremark Rx, Inc. | | | 25,850,821 |

| 111,800 | | Medco Health Solutions, Inc.* | | | 5,981,300 |

| | | | | |

| | | | | 31,832,121 |

| | | | | |

| Retail—2.4% | | | |

| 250,630 | | Target Corporation | | | 14,832,283 |

| | | | | |

| Semiconductors—1.5% | | | |

| 293,850 | | Linear Technology Corporation | | | 9,144,612 |

| | | | | |

| Software—5.2% | | | |

| 689,148 | | First Data Corporation | | | 16,711,839 |

| 519,850 | | Microsoft Corporation | | | 14,924,894 |

| | | | | |

| | | | | 31,636,733 |

| | | | | |

| Telecommunications—17.6% | | | |

| 669,450 | | American Tower Corporation, Class “A”* | | | 24,113,589 |

| 1,666,800 | | Crown Castle International Corporation* | | | 56,087,820 |

| 379,000 | | Motorola, Inc. | | | 8,739,740 |

| 506,440 | | QUALCOMM Inc. | | | 18,429,352 |

| | | | | |

| | | | | 107,370,501 |

| | | | | |

| Television, Cable & Radio—2.0% | | | |

| 446,961 | | Cablevision Systems Corporation, Class “A”* | | | 12,421,046 |

| | | | | |

| Total Common Stocks (cost $429,403,032) | | | 588,451,037 |

| | | | | |

| Repurchase Agreement—3.7% (a) | | | |

Repurchase Agreement with State Street Bank and Trust

Company, dated October 31, 2006 @ 5.0% to be repurchased

at $22,900,180 on November 1, 2006, collateralized by

$19,210,000 United States Treasury Bonds, 12.5% due August

15, 2014, (market value $23,629,475 including interest) (cost

$22,897,000) | | | 22,897,000 |

| | | | | |

Total Investment Portfolio

(cost $452,300,032) (b), 99.9% (a) | | | 611,348,037 |

| Other Assets and Liabilities, net, 0.1% (a) | | | 20,151 |

| | | | | |

| Net Assets, 100.0% | | $ | 611,368,188 |

| | | | | |

| * | Non-income producing security. |

| (a) | Percentages indicated are based on net assets. |

| (b) | The aggregate identified cost for federal income tax purposes is $453,431,571. Market value includes net unrealized appreciation of $7,916,466 which consists of aggregate gross unrealized appreciation for all securities in which there is an excess of market value over tax cost of $164,855,473 and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over market value of $6,939,007. |

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 11 |

Investment Portfolio | October 31, 2006 |

Heritage Growth and Income Trust

| | | | | |

| Shares | | | | Value |

| Common Stocks—93.2% (a) | | | |

| Domestic— 64.7% | | | |

| Agriculture—4.0% | | | |

| 61,600 | | Altria Group, Inc. | | $ | 5,009,928 |

| | | | | |

| Banks—5.6% | | | |

| 34,960 | | Bank of America Corporation | | | 1,883,295 |

| 78,500 | | The Bank of New York Company, Inc. | | | 2,698,045 |

| 73,500 | | U.S. Bancorp | | | 2,487,240 |

| | | | | |

| | | | | 7,068,580 |

| | | | | |

| Chemicals—2.5% | | | |

| 45,000 | | Air Products & Chemicals Inc. | | | 3,135,150 |

| | | | | |

| Commercial Services—1.2% | | | |

| 49,300 | | Macquarie Infrastructure Company Trust | | | 1,470,620 |

| | | | | |

| Diversified Manufacturer—4.6% | | | |

| 129,000 | | General Electric Company | | | 4,529,190 |

| 50,000 | | Reddy Ice Holdings, Inc. | | | 1,200,000 |

| | | | | |

| | | | | 5,729,190 |

| | | | | |

| Electric—4.9% | | | |

| 36,200 | | Dominion Resources, Inc. | | | 2,931,838 |

| 37,000 | | Entergy Corporation | | | 3,175,710 |

| | | | | |

| | | | | 6,107,548 |

| | | | | |

| Electronics—2.6% | | | |

| 38,800 | | Fisher Scientific International Inc.* | | | 3,322,057 |

| | | | | |

| Environmental Control—1.6% | | | |

| 463,955 | | Synagro Technologies, Inc. | | | 2,004,286 |

| | | | | |

| Financial Services—8.5% | | | |

| 50,100 | | AllianceBernstein Holding LP | | | 3,892,770 |

| 36,600 | | Citigroup Inc. | | | 1,835,856 |

| 35,600 | | Freddie Mac | | | 2,456,044 |

| 52,000 | | JPMorgan Chase & Co. | | | 2,466,880 |

| | | | | |

| | | | | 10,651,550 |

| | | | | |

| Healthcare Services—1.6% | | | |

| 26,100 | | WellPoint, Inc.* | | | 1,991,952 |

| | | | | |

| Mining—3.4% | | | |

| 81,974 | | Southern Copper Corporation | | | 4,211,824 |

| | | | | |

| Oil & Gas—6.1% | | | |

| 44,500 | | Chevron Corporation | | | 2,990,400 |

| 40,851 | | ConocoPhillips | | | 2,460,864 |

| 31,400 | | Exxon Mobil Corporation | | | 2,242,588 |

| | | | | |

| | | | | 7,693,852 |

| | | | | |

| Pharmaceuticals—6.8% | | | |

| 62,300 | | Caremark Rx, Inc. | | | 3,067,029 |

| 203,005 | | Pfizer Inc. | | | 5,410,083 |

| | | | | |

| | | | | 8,477,112 |

| | | | | |

| REIT—3.0% | | | |

| 164,700 | | Host Hotels & Resorts, Inc. | | | 3,797,982 |

| | | | | |

| | | | |

| Shares | | | | Value |

| Common Stocks (continued) | | |

| Retail—3.7% | | |

| 73,600 | | McDonald’s Corporation | | 3,085,312 |

| 26,300 | | Target Corporation | | 1,556,434 |

| | | | |

| | | | 4,641,746 |

| | | | |

| Software—3.1% | | |

| 135,500 | | Microsoft Corporation | | 3,890,205 |

| | | | |

| Telecommunications—1.5% | | |

| 80,400 | | Motorola, Inc. | | 1,854,024 |

| | | | |

| Total Domestic Common Stocks (cost $65,406,517) | | 81,057,606 |

| | | | |

| Foreign— 28.5% (b) | | |

| Banks—6.1% | | |

| 135,500 | | Banco Bilbao Vizcaya Argentaria, SA | | 3,263,438 |

| 178,000 | | Barclays PLC | | 2,397,950 |

| 183,800 | | Lloyds TSB Group PLC | | 1,960,460 |

| | | | |

| | | | 7,621,848 |

| | | | |

| Entertainment—2.3% | | |

| 80,245 | | OPAP SA | | 2,857,548 |

| | | | |

| Financial Services—1.9% | | |

| 440,900 | | China Merchants Holdings (International) Company Ltd. | | 1,287,812 |

| 83,900 | | W.P. Stewart & Co., Ltd. | | 1,157,820 |

| | | | |

| | | | 2,445,632 |

| | | | |

| Food—2.7% | | |

| 850,000 | | Fu Ji Food and Catering Services Holdings Ltd. | | 1,492,368 |

| 244,500 | | Tesco PLC | | 1,834,962 |

| | | | |

| | | | 3,327,330 |

| | | | |

| Oil & Gas—7.5% | | |

| 97,500 | | Canadian Oil Sands Trust | | 2,647,106 |

| 147,800 | | ENI SpA | | 4,472,864 |

| 79,400 | | Precision Drilling Trust | | 2,263,408 |

| | | | |

| | | | 9,383,378 |

| | | | |

| Pharmaceuticals—2.5% | | |

| 58,800 | | GlaxoSmithKline PLC, Sponsored ADR | | 3,131,100 |

| | | | |

| Telecommunications—5.5% | | |

| 237,200 | | Telefonica SA | | 4,568,056 |

| 887,535 | | Vodafone Group PLC | | 2,281,614 |

| | | | |

| | | | 6,849,670 |

| | | | |

| Total Foreign Common Stocks (cost $32,512,582) | | 35,616,506 |

| | | | |

| Total Common Stocks (cost $97,919,099) | | 116,674,112 |

| | | | |

| Preferred Stocks—1.2% (a) | | |

| Financial Services—1.2% | | |

| 60,000 | | Merrill Lynch & Co., Inc., 6.05% | | 1,546,200 |

| | | | |

| Total Preferred Stocks (cost $1,500,000) | | 1,546,200 |

| | | | |

| | | | |

| 12 | | The accompanying notes are an integral part of the financial statements. | | |

Investment Portfolio (continued) | October 31, 2006 |

Heritage Growth and Income Trust

| | | | | |

Principal

Amount | | | | Value |

| Convertible Bonds—4.1% (a) | | | |

| Pharmaceuticals—1.9% | | | |

| $2,400,000 | | Cubist Pharmaceuticals, Inc., 2.25%, 06/15/13 | | $ | 2,373,000 |

| | | | | |

| Telecommunications—2.2% | | | |

| 3,000,000 | | Level 3 Communications, Inc., 6.0%, 03/15/10 | | | 2,715,000 |

| | | | | |

| Total Convertible Bonds (cost $4,466,136) | | | 5,088,000 |

| | | | | |

| Corporate Bonds—0.8% (a) | | | |

| Pipelines—0.8% | | | |

| 1,000,000 | | El Paso Corporation, 7.375%, 12/15/12 | | | 1,027,500 |

| | | | | |

| Total Corporate Bonds (cost $820,577) | | | 1,027,500 |

| | | | | |

Total Investment Portfolio Excluding Repurchase Agreement

(cost $104,705,812) | | | 124,335,812 |

| | | | | |

| | | | | | |

| | | | | Value | |

| Repurchase Agreement—2.3% (a) | | | | |

Repurchase Agreement with State Street Bank and Trust

Company, dated October 31, 2006 @ 5.0% to be repurchased

at $2,901,403 on November 1, 2006, collateralized by

$2,435,000 United States Treasury Bonds, 12.5% due August

15, 2014, (market value $2,995,199 including interest) (cost

$2,901,000) | | | 2,901,000 | |

| | | | | | |

Total Investment Portfolio

(cost $107,606,812) (c), 101.6% (a) | | | 127,236,812 | |

| Other Assets and Liabilities, net, (1.6)% (a) | | | (1,962,308 | ) |

| | | | | | |

| Net Assets, 100.0% | | $ | 125,274,504 | |

| | | | | | |

| * | Non-income producing security. |

| (a) | Percentages indicated are based on net assets. |

| (b) | U.S. dollar denominated. |

| (c) | The aggregate identified cost for federal income tax purposes is $107,695,785. Market value includes net unrealized appreciation of $19,537,694 which consists of aggregate gross unrealized appreciation for all securities in which there is an excess of market value over tax cost of $21,216,322 and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over market value of $1,678,628. |

ADR—American Depository Receipt.

REIT—Real Estate Investment Trust.

|

| Forward Foreign Currency Contracts Outstanding October 31, 2006 |

| | |

| Heritage Growth and Income Trust | | |

| | | | | | | |

Contract To Deliver | | In Exchange For | | Delivery Date | | Unrealized Gain |

| GBP 1,500,000 | | USD 2,862,750 | | 12/05/06 | | $ | 1,383 |

GBP—Great Britain Pound

USD—United States Dollar

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 13 |

Investment Portfolio | October 31, 2006 |

Heritage Income Trust—High Yield Bond Fund

| | | | | |

Principal

Amount | | | | Value |

| Corporate Bonds—94.8% (a) | | | |

| Domestic—85.9% | | | |

| Advertising—1.5% | | | |

| $ 230,000 | | Affinion Group, Inc., 10.125%, 10/15/13 | | $ | 243,800 |

| 25,000 | | Affinion Group, Inc., 11.5%, 10/15/15 | | | 26,062 |

| 130,000 | | Lamar Media Corporation,

6.625%, 08/15/15 | | | 125,125 |

| 275,000 | | R.H. Donnelley Corporation, 144A,

10.875%, 12/15/12 | | | 300,781 |

| 50,000 | | R.H. Donnelley Corporation, Series “A-1”, 6.875%, 01/15/13 | | | 47,062 |

| 75,000 | | R.H. Donnelley Corporation, Series “A-2”, 6.875%, 01/15/13 | | | 70,594 |

| 100,000 | | R.H. Donnelley Corporation, Series “A-3”, 8.875%, 01/15/16 | | | 103,125 |

| | | | | |

| | | | | 916,549 |

| | | | | |

| Aerospace/Defense—2.0% | | | |

| 120,000 | | Alliant Techsystems, Inc., 6.75%, 04/01/16 | | | 119,100 |

| 375,000 | | Argo-Tech Corporation, 9.25%, 06/01/11 | | | 389,062 |

| 250,000 | | L-3 Communications Corporation,

7.625%, 06/15/12 | | | 259,688 |

| 235,000 | | Sequa Corporation, 9.0%, 08/01/09 | | | 247,925 |

| 145,000 | | TransDigm Inc., 144A, 7.75%, 07/15/14 | | | 148,988 |

| | | | | |

| | | | | 1,164,763 |

| | | | | |

| Agriculture—0.6% | | | |

| 50,000 | | Alliance One International, Inc.,

11.0%, 05/15/12 | | | 52,000 |

| 350,000 | | Hines Nurseries, Inc., 10.25%, 10/01/11 | | | 315,000 |

| | | | | |

| | | | | 367,000 |

| | | | | |

| Airlines—0.4% | | | |

| 190,000 | | Continental Airlines, Inc., Series “D”, 7.568%, 12/01/06 | | | 190,000 |

| 42,178 | | Continental Airlines, Inc., Series “981C”, 6.541%, 09/15/09 | | | 41,609 |

| | | | | |

| | | | | 231,609 |

| | | | | |

| Apparel—0.8% | | | |

| 440,000 | | Levi Strauss & Company, 9.75%, 01/15/15 | | | 466,400 |

| | | | | |

| Auto Manufacturers—4.4% | | | |

| 145,000 | | Ford Motor Company, 8.875%, 01/15/22 | | | 125,788 |

| 1,555,000 | | Ford Motor Company, 7.45%, 07/16/31 | | | 1,218,731 |

| 100,000 | | Ford Motor Company, 8.9%, 01/15/32 | | | 90,250 |

| 155,000 | | General Motors Corporation,

7.2%, 01/15/11 | | | 144,538 |

| 200,000 | | General Motors Corporation,

8.25%, 07/15/23 | | | 177,500 |

| 1,000,000 | | General Motors Corporation,

8.375%, 07/15/33 | | | 890,000 |

| | | | | |

| | | | | 2,646,807 |

| | | | | |

| Auto Parts & Equipment—1.2% | | | |

| 500,000 | | Breed Technologies, Inc.,

9.25%, 04/15/08 (c)(d)* | | | — |

| 185,000 | | Keystone Automotive Operations Inc.,

9.75%, 11/01/13 | | | 178,525 |

| | | | |

Principal

Amount | | | | Value |

| Corporate Bonds (continued) | | |

| Auto Parts & Equipment (continued) | | |

| 95,000 | | TRW Automotive Holdings Corporation,

11.0%, 02/15/13 | | 104,262 |

| 270,000 | | Visteon Corporation, 8.25%, 08/01/10 | | 257,850 |

| 205,000 | | Visteon Corporation, 7.0%, 03/10/14 | | 177,838 |

| | | | |

| | | | 718,475 |

| | | | |

| Broadcasting Services/Programs—0.3% | | |

| 65,000 | | XM Satellite Radio Holdings Inc., FRN

9.989%, 05/01/13 | | 61,100 |

| 135,000 | | XM Satellite Radio Holdings Inc.,

9.75%, 05/01/14 | | 128,250 |

| | | | |

| | | | 189,350 |

| | | | |

| Building Materials—1.5% | | |

| 350,000 | | Associated Materials Inc., 0.0% to 03/01/09, 11.25% to maturity (b), 03/01/14 | | 205,625 |

| 140,000 | | Associated Materials Inc.,

9.75%, 04/15/12 | | 143,150 |

| 175,000 | | Nortek, Inc., 8.5%, 09/01/14 | | 167,125 |

| 545,000 | | NTK Holdings, Inc., 0.0% to 09/01/09, 10.75% to maturity (b), 03/01/14 | | 373,325 |

| | | | |

| | | | 889,225 |

| | | | |

| Chemicals—2.4% | | |

| 150,000 | | Equistar Chemicals, LP and Equistar Funding Corporation,

10.625%, 05/01/11 | | 160,500 |

| 310,000 | | Georgia Gulf Corporation, 144A,

9.5%, 10/15/14 | | 305,350 |

| 125,000 | | Hexion U.S. Finance Corporation and Hexion Nova Scotia Finance, ULC, 144A,

9.75%, 11/15/14 | | 124,688 |

| 88,000 | | Lyondell Chemical Company,

9.5%, 12/15/08 | | 90,310 |

| 80,000 | | Lyondell Chemical Company,

8.0%, 09/15/14 | | 81,800 |

| 70,000 | | Lyondell Chemical Company,

8.25%, 09/15/16 | | 72,100 |

| 525,000 | | Millennium America Inc.,

9.25%, 06/15/08 | | 540,750 |

| 85,000 | | Westlake Chemical Corporation,

6.625%, 01/15/16 | | 81,388 |

| | | | |

| | | | 1,456,886 |

| | | | |

| Coal—0.4% | | |

| 215,000 | | International Coal Group, Inc., 144A,

10.25%, 07/15/14 | | 209,088 |

| | | | |

| Commercial Services—3.8% | | |

| 325,000 | | Allied Security Escrow Corporation,

11.375%, 07/15/11 | | 326,625 |

| 125,000 | | Ashtead Capital Inc., 144A,

9.0%, 08/15/16 | | 131,562 |

| 125,000 | | Brand Services, Inc., 12.0%, 10/15/12 | | 139,535 |

| 265,000 | | DynCorp International LLC and DIV Capital Corporation, Series “B”,

9.5%, 02/15/13 | | 275,600 |

| 150,000 | | Education Management Corporation, 144A,

8.75%, 06/01/14 | | 153,750 |

| 60,000 | | H&E Equipment Services, Inc., 144A, 8.375%, 07/15/16 | | 61,950 |

| | | | |

| 14 | | The accompanying notes are an integral part of the financial statements. | | |

Investment Portfolio (continued) | October 31, 2006 |

Heritage Income Trust—High Yield Bond Fund

| | | | | |

Principal

Amount | | | | Value |

| Corporate Bonds (continued) | | | |

| Commercial Services (continued) | | | |

| $ 645,000 | | Hertz Corporation, 144A,

10.5%, 01/01/16 | | $ | 707,888 |

| 120,000 | | Hertz Corporation, 144A,

8.875%, 01/01/14 | | | 125,400 |

| 255,000 | | Penhall International Corporation, 144A,

12.0%, 08/01/14 | | | 271,575 |

| 40,000 | | Service Corporation International,

7.875%, 02/01/13 | | | 41,200 |

| 20,000 | | Service Corporation International, 144A, 7.375%, 10/01/14 | | | 20,550 |

| | | | | |

| | | | | 2,255,635 |

| | | | | |

| Computers—1.1% | | | |

| 150,000 | | Activant Solutions Inc., 144A,

9.5%, 05/01/16 | | | 139,500 |

| 100,000 | | SunGard Data Systems Inc.,

9.125%, 08/15/13 | | | 103,750 |

| 365,000 | | SunGard Data Systems Inc.,

10.25%, 08/15/15 | | | 382,338 |

| | | | | |

| | | | | 625,588 |

| | | | | |

| Diversified Manufacturer—0.8% | | | |

| 145,000 | | Jacuzzi Brands, Inc., 9.625%, 07/01/10 | | | 155,331 |

| 151,000 | | Koppers Inc., 9.875%, 10/15/13 | | | 163,080 |

| 35,000 | | Nutro Products, Inc., 144A, FRN

9.40%, 10/15/13 | | | 35,962 |

| 90,000 | | Nutro Products, Inc., 144A,

10.75%, 04/15/14 | | | 96,750 |

| | | | | |

| | | | | 451,123 |

| | | | | |

| Electric—4.6% | | | |

| 175,000 | | Calpine Generating Company, LLC, 14.37% FRN, 04/01/11* | | | 186,812 |

| 35,000 | | Edison Mission Energy, 144A,

7.5%, 06/15/13 | | | 35,962 |

| 200,000 | | Edison Mission Energy, 144A,

7.75%, 06/15/16 | | | 206,500 |

| 87,675 | | Midwest Generation, LLC,

8.56%, 01/02/16 | | | 94,689 |

| 365,000 | | Mirant North America, LLC,

7.375%, 12/31/13 | | | 369,106 |

| 125,000 | | NRG Energy, Inc., 7.25%, 02/01/14 | | | 126,406 |

| 600,000 | | NRG Energy, Inc., 7.375%, 02/01/16 | | | 606,750 |

| 145,000 | | Orion Power Holdings, Inc.,

12.0%, 05/01/10 | | | 164,575 |

| 325,000 | | The AES Corporation, 9.5%, 06/01/09 | | | 348,156 |

| 250,000 | | The AES Corporation, 9.375%, 09/15/10 | | | 271,250 |

| 340,000 | | The AES Corporation, 7.75%, 03/01/14 | | | 356,150 |

| | | | | |

| | | | | 2,766,356 |

| | | | | |

| Entertainment—3.0% | | | |

| 40,000 | | AMC Entertainment Inc., Series “B”,

8.625%, 08/15/12 | | | 41,250 |

| 370,000 | | AMC Entertainment Inc., 11.0%, 02/01/16 | | | 409,312 |

| 275,000 | | Choctaw Resort Development Enterprise, 144A, 7.25%, 11/15/19 | | | 273,625 |

| 400,000 | | Herbst Gaming, Inc., 8.125%, 06/01/12 | | | 410,000 |

| | | | |

Principal

Amount | | | | Value |

| Corporate Bonds (continued) | | |

| Entertainment (continued) | | |

| 15,000 | | Isle of Capri Casinos, Inc., 9.0%, 03/15/12 | | 15,712 |

| 65,000 | | Isle of Capri Casinos, Inc., 7.0%, 03/01/14 | | 62,400 |

| 375,000 | | Pinnacle Entertainment, Inc.,

8.25%, 03/15/12 | | 380,625 |

| 25,000 | | River Rock Entertainment Authority,

9.75%, 11/01/11 | | 26,750 |

| 165,000 | | Warner Music Group Corporation, 7.375%, 04/15/14 | | 161,288 |

| | | | |

| | | | 1,780,962 |

| | | | |

| Environmental Control—0.3% | | |

| 150,000 | | Allied Waste North America, Inc., Series “B”,

7.25%, 03/15/15 | | 150,000 |

| 500,000 | | Safety-Kleen Services, Inc.,

9.25%, 06/01/08 (c)(d)* | | 500 |

| | | | |

| | | | 150,500 |

| | | | |

| Financial Services—7.3% | | |

| 493,850 | | Airplanes Pass Through Trust, Series “D”,

10.875%, 03/15/19 (c)(d)* | | — |

| 145,000 | | CCM Merger, Inc., 144A, 8.0%, 08/01/13 | | 139,744 |

| 85,000 | | CitiSteel USA, Inc., FRN

12.949%, 09/01/10 | | 87,762 |

| 57,635 | | CitiSteel USA, Inc., 144A, PIK

15.0%, 10/01/10 | | 62,246 |

| 140,000 | | E*TRADE Financial Corporation, 7.375%, 09/15/13 | | 143,850 |

| 65,000 | | E*TRADE Financial Corporation, 7.875%, 12/01/15 | | 68,738 |

| 275,000 | | Ford Motor Credit Company,

7.875%, 06/15/10 | | 268,349 |

| 293,000 | | Ford Motor Credit Company, 144A, FRN 10.64%, 06/15/11 | | 308,367 |

| 125,000 | | Ford Motor Credit Company,

9.875%, 08/10/11 | | 129,165 |

| 260,000 | | Ford Motor Credit Company,

7.0%, 10/01/13 | | 241,702 |

| 250,000 | | General Motors Acceptance Corporation, 6.875%, 08/28/12 | | 250,671 |

| 1,370,000 | | General Motors Acceptance Corporation, 8.0%, 11/01/31 | | 1,467,914 |

| 244,000 | | Global Cash Access Holdings, Inc. and Global Cash Finance Corporation,

8.75%, 03/15/12 | | 257,725 |

| 150,000 | | Hexion U.S. Finance Corporation and Hexion Nova Scotia Finance, ULC,

9.0%, 07/15/14 | | 168,750 |

| 80,000 | | Hughes Network Systems, LLC, 144A,

9.5%, 04/15/14 | | 82,800 |

| 40,000 | | Kansas City Southern Railway Company,

7.50%, 06/15/09 | | 40,450 |

| 700,000 | | Nebco Evans Holding Company,

12.375%, 07/15/07 (c)(d)* | | — |

| 275,000 | | Rainbow National Services LLC, 144A,

10.375%, 09/01/14 | | 305,938 |

| 100,000 | | UCAR Finance, Inc., 10.25%, 02/15/12 | | 105,125 |

| 195,000 | | Vanguard Health Holding Company II, LLC,

9.0%, 10/01/14 | | 188,662 |

| | | | |

| | | | 4,317,958 |

| | | | |

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 15 |

Investment Portfolio (continued) | October 31, 2006 |

Heritage Income Trust—High Yield Bond Fund

| | | | | |

Principal

Amount | | | | Value |

| Corporate Bonds (continued) | | | |

| Food—0.6% | | | |

| $ 350,000 | | Dole Food Company, Inc., 7.25%, 06/15/10 | | $ | 326,375 |

| 55,000 | | Dole Food Company Inc., 8.875%, 03/15/11 | | | 52,456 |

| | | | | |

| | | | | 378,831 |

| | | | | |

| Forest Products & Paper—1.5% | | | |

| 175,000 | | Appleton Papers Inc., 8.125%, 06/15/11 | | | 174,125 |

| 200,000 | | Appleton Papers Inc., Series “B”,

9.75%, 06/15/14 | | | 198,000 |

| 60,000 | | NewPage Corporation, FRN

11.739%, 05/01/12 | | | 64,800 |

| 105,000 | | NewPage Corporation, 10.0%, 05/01/12 | | | 109,988 |

| 80,000 | | NewPage Corporation, 12.0%, 05/01/13 | | | 83,600 |

| 65,000 | | P. H. Glatfelter Company, 144A,

7.125%, 05/01/16 | | | 64,809 |

| 75,000 | | Verso Paper Holdings LLC, 144A,

9.125%, 08/01/14 | | | 76,125 |

| 135,000 | | Verso Paper Holdings LLC, 144A,

11.375%, 08/01/16 | | | 137,025 |

| | | | | |

| | | | | 908,472 |

| | | | | |

| Healthcare Services—5.0% | | | |

| 325,000 | | Ameripath Inc., 10.5%, 04/01/13 | | | 349,375 |

| 225,000 | | Community Health Systems, Inc.,

6.5%, 12/15/12 | | | 215,156 |

| 380,000 | | DaVita Inc., 7.25% 03/15/15 | | | 378,100 |

| 675,000 | | HCA Inc., 6.5%, 02/15/16 | | | 534,938 |

| 100,000 | | HCA Inc., 7.5%, 11/15/95 | | | 74,072 |

| 450,000 | | IASIS Healthcare LLC and IASIS Capital Corporation, 8.75%, 06/15/14 | | | 434,812 |

| 133,000 | | Psychiatric Solutions, Inc.,

10.625%, 06/15/13 | | | 144,970 |

| 375,000 | | Tenet Healthcare Corporation,

7.375%, 02/01/13 | | | 332,344 |

| 200,000 | | Tenet Healthcare Corporation,

9.875%, 07/01/14 | | | 195,750 |

| 150,000 | | Tenet Healthcare Corporation,

9.25%, 02/01/15 | | | 142,312 |

| 85,000 | | Tenet Healthcare Corporation,

6.875%, 11/15/31 | | | 65,875 |

| 100,000 | | Triad Hospitals, Inc., 7.0%, 11/15/13 | | | 97,250 |

| | | | | |

| | | | | 2,964,954 |

| | | | | |

| Home Builders—1.2% | | | |

| 25,000 | | Beazer Homes USA, Inc., 6.875%, 07/15/15 | | | 23,500 |

| 205,000 | | Beazer Homes USA, Inc., 8.125%, 06/15/16 | | | 208,588 |

| 80,000 | | K. Hovnanian Enterprises, Inc.,

6.25%, 01/15/16 | | | 72,800 |

| 400,000 | | K. Hovnanian Enterprises, Inc.,

8.625%, 01/15/17 | | | 412,500 |

| | | | | |

| | | | | 717,388 |

| | | | | |

| Home Furnishings—1.4% | | | |

| 120,000 | | Norcraft Companies, L.P. and Norcraft Finance Corporation, 9.0%, 11/01/11 | | | 123,000 |

| 275,000 | | Norcraft Holdings LP and Norcraft Capital Corporation, 0.0% to 09/08,

9.75% to maturity (b), 09/01/12 | | | 227,562 |

| | | | |

Principal

Amount | | | | Value |

| Corporate Bonds (continued) | | |

| Home Furnishings (continued) | | |

| 325,000 | | Sealy Mattress Company,

8.25%, 06/15/14 | | 337,188 |

| 150,000 | | Simmons Bedding Company,

7.875%, 01/15/14 | | 148,125 |

| | | | |

| | | | 835,875 |

| | | | |

| Household Products—0.5% | | |

| 25,000 | | American Greetings Corporation, 7.375%, 06/01/16 | | 25,438 |

| 115,000 | | Playtex Products, Inc., 8.0%, 03/01/11 | | 119,888 |

| 100,000 | | Spectrum Brands, Inc., 8.5%, 10/01/13 | | 87,000 |

| 65,000 | | Spectrum Brands, Inc., 7.375%, 02/01/15 | | 52,650 |

| | | | |

| | | | 284,976 |

| | | | |

| Insurance—0.6% | | |

| 355,000 | | Crum & Forster Holdings Corporation,

10.375%, 06/15/13 | | 368,312 |

| | | | |

| Internet—0.3% | | |

| 165,000 | | FTD Inc., 7.75%, 02/15/14 | | 164,175 |

| | | | |

| Iron/Steel—0.3% | | |

| 165,000 | | RathGibson, Inc., 144A ,

11.25%, 02/15/14 | | 171,600 |

| | | | |

| Lodging—2.5% | | |

| 300,000 | | Caesars Entertainment, Inc.,

7.875%, 03/15/10 | | 306,750 |

| 265,000 | | Inn of the Mountain Gods Resort and Casino, 12.0%, 11/15/10 | | 283,550 |

| 175,000 | | MGM Mirage, 8.375%, 02/01/11 | | 181,781 |

| 320,000 | | Station Casinos, Inc., 7.75%, 08/15/16 | | 328,800 |

| 400,000 | | Turning Stone Casino Resort Enterprise, 144A, 9.125%, 12/15/10 | | 408,000 |

| | | | |

| | | | 1,508,881 |

| | | | |

| Metal Fabricate/Hardware—1.3% | | |

| 370,000 | | Metals USA, Inc., 11.125%, 12/01/15 | | 405,150 |

| 184,000 | | Mueller Group, Inc., 10.0%, 05/01/12 | | 200,560 |

| 205,000 | | Mueller Holdings (N.A.), Inc., 0.0% to 04/15/09, 14.75% to maturity (b), 04/15/14 | | 180,400 |

| | | | |

| | | | 786,110 |

| | | | |

| Office Furnishings—0.5% | | |

| 275,000 | | Interface, Inc., 9.5%, 02/01/14 | | 285,312 |

| | | | |

| Office/Business Equipment—0.5% | | |

| 290,000 | | Xerox Corporation, 6.75%, 02/01/17 | | 295,075 |

| | | | |

| Oil & Gas—6.3% | | |

| 310,000 | | Belden & Blake Corporation,

8.75%, 07/15/12 | | 316,200 |

| 450,000 | | Chesapeake Energy Corporation, 7.5%, 06/15/14 | | 460,688 |

| 15,000 | | Chesapeake Energy Corporation,

6.375%, 06/15/15 | | 14,475 |

| 45,000 | | Chesapeake Energy Corporation,

6.625%, 01/15/16 | | 44,044 |

| | | | | | |

| 16 | | The accompanying notes are an integral part of the financial statements. | | | | |

Investment Portfolio (continued) | October 31, 2006 |

Heritage Income Trust—High Yield Bond Fund

| | | | | |

Principal

Amount | | | | Value |

| Corporate Bonds (continued) | | | |

| Oil & Gas (continued) | | | |

| $ 40,000 | | Chesapeake Energy Corporation,

6.875%, 01/15/16 | | $ | 39,700 |

| 100,000 | | Chesapeake Energy Corporation, 6.5%, 08/15/17 | | | 94,250 |

| 520,000 | | Cimarex Energy Company and Magnum Hunter Resources, Inc., 9.6%, 03/15/12 | | | 548,600 |

| 45,000 | | Encore Acquisition Company,

6.0%, 07/15/15 | | | 41,062 |

| 140,000 | | Enterprise Products Operating L.P., 8.375%, 08/01/66 | | | 150,460 |

| 280,000 | | EXCO Resources, Inc., 7.25%, 01/15/11 | | | 269,500 |

| 600,000 | | Forest Oil Corporation, 8.0%, 12/15/11 | | | 621,000 |

| 115,000 | | Mariner Energy, Inc., 144A, 7.5%, 04/15/13 | | | 110,400 |

| 150,000 | | Petrohawk Energy Corporation, 144A, 9.125%, 07/15/13 | | | 153,000 |

| 90,000 | | Plains Exploration & Production Company, Series “B”, 8.75%, 07/01/12 | | | 95,625 |

| 180,000 | | Pogo Producing Company, 144A,

7.875%, 05/01/13 | | | 183,150 |

| 70,000 | | Pride International, Inc., 7.375%, 07/15/14 | | | 72,275 |

| 325,000 | | Stone Energy Corporation,

8.25%, 12/15/11 | | | 322,969 |

| 125,000 | | Swift Energy Company, 9.375%, 05/01/12 | | | 131,562 |

| 55,000 | | Whiting Petroleum Corporation,

7.0%, 02/01/14 | | | 54,175 |

| | | | | |

| | | | | 3,723,135 |

| | | | | |

| Oil & Gas Services—0.0% | | | |

| 10,000 | | Superior Energy Services Inc., 144A,

6.875%, 06/01/14 | | | 9,925 |

| | | | | |

| Packaging & Containers—1.8% | | | |

| 135,000 | | Berry Plastics Corporation, 144A, 8.875%, 09/15/14 | | | 136,350 |

| 295,000 | | Graham Packaging Holdings Company,

9.875%, 10/15/14 | | | 295,738 |

| 325,000 | | Graphic Packaging International Corporation, 8.5%, 08/15/11 | | | 333,938 |

| 25,000 | | Owens-Brockway Glass Container Inc.,

7.75%, 05/15/11 | | | 25,750 |

| 145,000 | | Owens-Brockway Glass Container Inc.,

8.75%, 11/15/12 | | | 152,975 |

| 115,000 | | Plastipak Holdings, Inc., 144A,

8.5%, 12/15/15 | | | 119,025 |

| 150,000 | | Radnor Holdings Corporation,

11.0%, 03/15/10 (c)* | | | 16,875 |

| | | | | |

| | | | | 1,080,651 |

| | | | | |

| Pharmaceuticals—0.4% | | | |

| 265,000 | | Leiner Health Products Inc.,

11.0%, 06/01/12 | | | 261,688 |

| | | | | |

| Pipelines—5.6% | | | |

| 25,000 | | Dynegy Holdings Inc., 8.375%, 05/01/16 | | | 25,688 |

| 300,000 | | Dynegy Holdings Inc., 7.625%, 10/15/26 | | | 279,000 |

| 375,000 | | El Paso Corporation,

7.875%, 06/15/12 | | | 390,938 |

| 525,000 | | El Paso Corporation, MTN,

7.8%, 08/01/31 | | | 547,312 |

| | | | |

Principal

Amount | | | | Value |

| Corporate Bonds (continued) | | |

| Pipelines (continued) | | |

| 725,000 | | El Paso Corporation, MTN,

7.75%, 01/15/32 | | 755,812 |

| 335,000 | | SemGroup, Ltd., 144A, 8.75%, 11/15/15 | | 337,512 |

| 125,000 | | The Williams Companies, Inc., 7.625%, 07/15/19 | | 131,562 |

| 310,000 | | The Williams Companies, Inc., 7.875%, 09/01/21 | | 327,825 |

| 500,000 | | The Williams Companies, Inc.,

8.75%, 03/15/32 | | 555,000 |

| | | | |

| | | | 3,350,649 |

| | | | |

| Printing & Publishing—0.9% | | |

| 100,000 | | Dex Media West LLC and Dex Media West Finance Co., Series “B”, 9.875%, 08/15/13 | | 108,625 |

| 210,000 | | Houghton Mifflin Company, 0.0% to 10/15/08, 11.5% to maturity (b), 10/15/13 | | 189,525 |

| 50,000 | | Houghton Mifflin Company,

9.875%, 02/01/13 | | 53,562 |

| 200,000 | | PRIMEDIA, Inc., 8.875%, 05/15/11 | | 198,500 |

| | | | |

| | | | 550,212 |

| | | | |

| Real Estate—0.2% | | |

| 25,000 | | Ashton Woods USA L.L.C. and Ashton Woods Finance Co., 9.50%, 10/01/15 | | 21,438 |

| 10,000 | | Forest City Enterprises, Inc.,

7.625%, 06/01/15 | | 10,150 |

| 120,000 | | Kimball Hill Inc., 10.5%, 12/15/12 | | 108,000 |

| | | | |

| | | | 139,588 |

| | | | |

| REITs—1.5% | | |

| 200,000 | | Host Marriott, LP, Series “I”,

9.5%, 01/15/07 | | 201,250 |

| 500,000 | | Host Marriott, LP, Series “O”, 6.375%, 03/15/15 | | 486,875 |

| 55,000 | | Ventas Realty, LP and Ventas Capital Corporation, 144A, 7.125%, 06/01/15 | | 56,581 |

| 50,000 | | Ventas Realty, LP and Ventas Capital Corporation, 6.5%, 06/01/16 | | 49,875 |

| 125,000 | | Ventas Realty, LP and Ventas Capital Corporation, 6.75%, 04/01/17 | | 125,938 |

| | | | |

| | | | 920,519 |

| | | | |

| Retail—2.8% | | |

| 55,000 | | AutoNation, Inc., 144A, FRN

7.374%, 04/15/13 | | 55,412 |

| 70,000 | | AutoNation, Inc., 7.0%, 04/15/14 | | 69,650 |

| 140,000 | | Blockbuster Inc., 9.0%, 09/01/12 | | 126,000 |

| 55,000 | | Brookstone Company, Inc.,

12.0%, 10/15/12 | | 53,075 |

| 40,000 | | Buffets, Inc., 144A, 12.5%, 11/01/14 | | 40,200 |

| 225,000 | | Carrols Corporation, 9.0%, 01/15/13 | | 227,812 |

| 50,000 | | EPL Finance Corporation, 144A, 11.75%, 11/15/13 | | 53,250 |

| 40,000 | | Eye Care Centers of America, Inc., 10.75%, 02/15/15 | | 43,700 |

| 175,000 | | Inergy, L.P. and Inergy Finance Corporation, 8.25%, 03/01/16 | | 181,562 |

| 25,000 | | Linens ‘n Things, Inc., FRN,

11.0%, 01/15/14 | | 24,500 |

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 17 |

Investment Portfolio (continued) | October 31, 2006 |

Heritage Income Trust—High Yield Bond Fund

| | | | | |

Principal

Amount | | | | Value |

| Corporate Bonds (continued) | | | |

| Retail (continued) | | | |